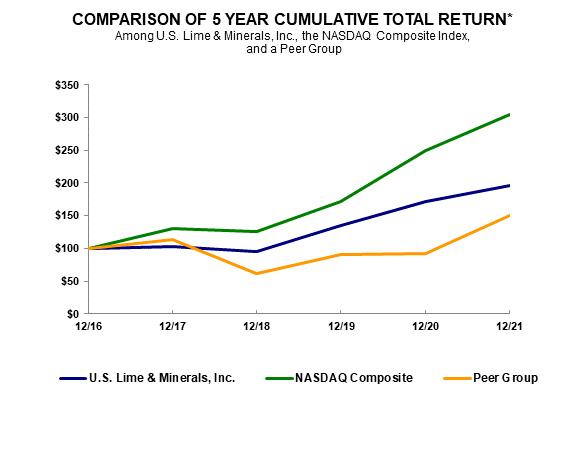

Our revenues increased 17.8% in 2021 compared to 2020. Revenues from our Lime and Limestone Operations increased 17.3% in 2021, compared to 2020, primarily due to increased demand from our construction, steel, environmental, industrial, roofing, and agriculture customers. Revenues in 2021 were also favorably impacted by an increase in average selling prices for our lime and limestone products of 0.9%.

Our gross profit increased 24.5% in 2021 compared to 2020. Gross profit from our Lime and Limestone Operations in 2021 increased 22.2%, compared to 2020, primarily due to the increased revenues discussed above and increased operating efficiencies, partially offset by higher energy costs.

Our net income increased $8.8 million, or 31.3%, in 2021, compared to 2020. Net income per fully diluted share increased to $6.54 in 2021, compared to $5.00 in 2020.

Cash flows from operations enabled us to make $29.9 million of capital investments in 2021. It also enabled us to pay $3.6 million in dividends in 2021 and increase our cash balances to $105.4 million as of December 31, 2021, compared to $83.6 million as of December 31, 2020. As of December 31, 2021, we had no debt outstanding.

On January 31, 2022, we announced that our Board of Directors had declared an increased regular quarterly cash dividend of $0.20 per share. The dividend is payable on March 18, 2022 to shareholders of record on February 25, 2022.

Absent a significant acquisition opportunity arising during 2022, we anticipate funding our operating and capital needs, our quarterly cash dividend, and the Mill Creek acquisition from our cash balances on hand and cash flows from operations.

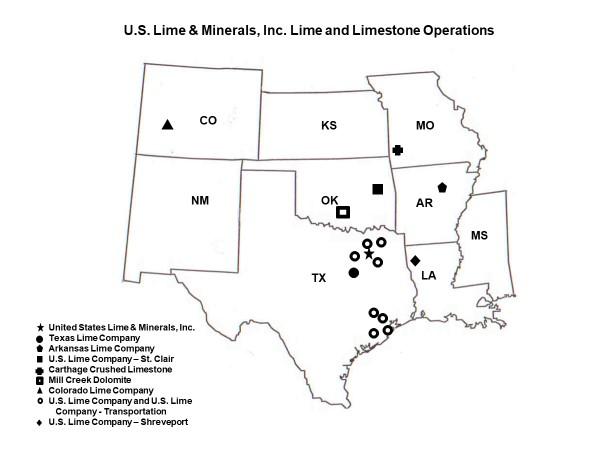

Lime and Limestone Operations.

In our Lime and Limestone Operations, we produce and sell PLS, aggregate, quicklime, hydrated lime and lime slurry. The principal factors affecting our success are the level of demand and prices for our products and whether we are able to maintain sufficient production levels and product quality while controlling costs.

Inclement weather conditions, such as winter ice and snow storms, cold weather, hurricanes, tornadoes and excessive rainfalls generally reduce the demand for lime and limestone products supplied to construction-related customers that account for a significant amount of our revenues. Inclement weather also interferes with our open-pit mining operations and can disrupt our plant production. In addition to weather, various maintenance, environmental, accident and other operational and construction issues can also disrupt our operations and increase our operating expenses.

Demand for our lime and limestone products in our market areas is also affected by general economic conditions, the pace of construction, the demand for steel, the level of oil and gas drilling in our markets, the level of governmental and private funding for highway construction and infrastructure, and utility plant usage of coal for power generation. Demand for our lime and limestone products from our construction, steel, environmental, industrial, roofing, and agriculture customers increased in 2021.

In 2020, the COVID-19 pandemic in the United States and related restrictions on business activities resulted in a general economic slowdown, which disproportionately impacted certain industries that purchase our products. We continue to monitor and assess the impact of the COVID-19 pandemic, including the emergence of new variants of the virus, implementation of new or enhanced pandemic-related restrictions, and the possibility of additional wide-spread or localized outbreaks of infections, any of which could have an adverse effect on our financial condition, results of operations, cash flows and competitive position.

Additionally, we are experiencing rising costs, especially energy and supplies costs, and supply chain delays and disruptions. If these issues persist, they could adversely affect our profitability in 2022. We are increasing the prices of our lime and limestone products in an effort to mitigate the impact of our increasing costs.

In 2014 and 2015, Texas approved two constitutional amendments authorizing a portion of oil and gas tax revenues to be deposited into the State Highway Fund, for certain other sales and use tax revenues to be directed to the State Highway Fund and, beginning in Texas’ fiscal 2020, for certain state motor vehicle sales and rental tax revenues to