lapse of restrictions on transferability or substantial risk of forfeiture, but if the participant subsequently forfeits such stock or other property he or she would not be entitled to any tax deduction, including a capital loss, for the value of the stock or other property on which he or she previously paid tax. Such election must be made and filed with the Internal Revenue Service within 30 days after the receipt of such stock or other property.

Section 162(m) of the Code, as amended by the Tax Cuts and Jobs Act of 2017, generally disallows a public company’s annual income tax deduction for aggregate compensation in excess of $1 million paid to the chief executive officer, chief financial officer and certain other highly compensated executive officers. Previously, certain “performance-based compensation” was excluded from the $1 million deductibility cap; however, such exclusions were generally eliminated by the 2017 Act and awards under the amended and restated plan are subject to the deduction limitations of Section 162(m) limitations without regard to any underlying performance-based conditions.

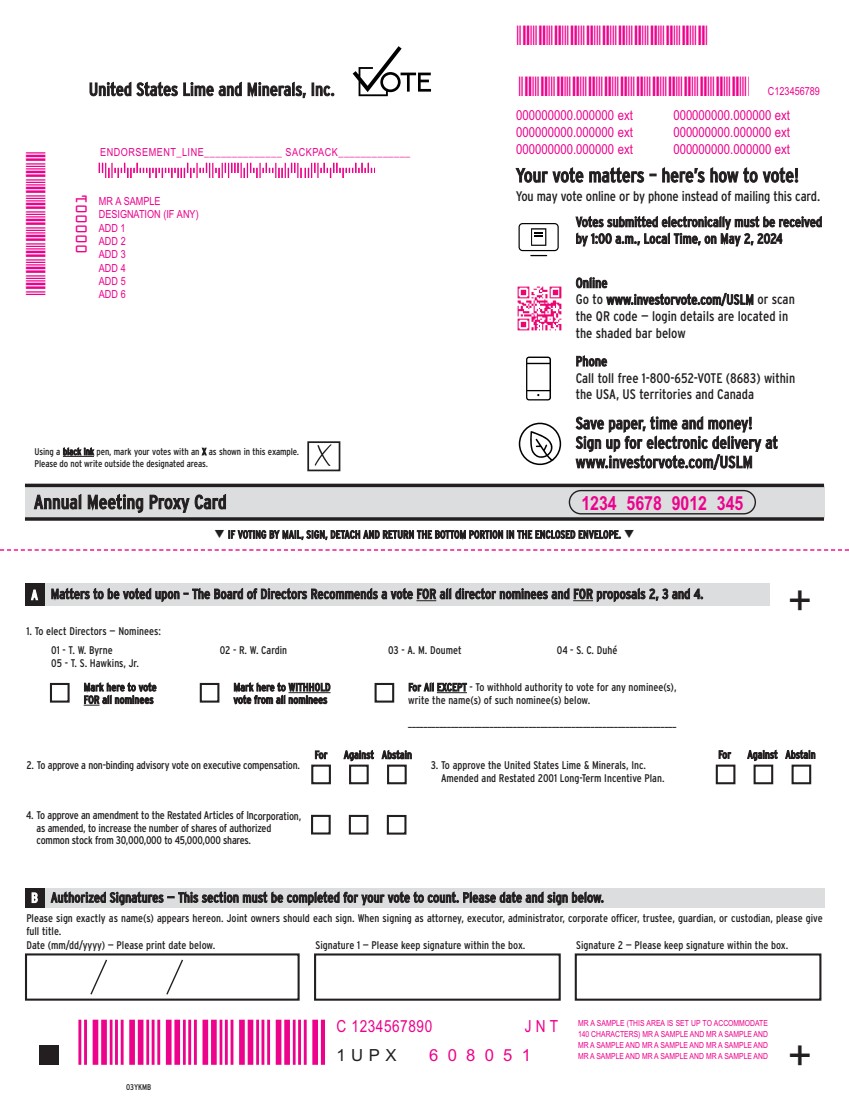

PROPOSAL 4: AMEND THE RESTATED ARTICLES TO INCREASE THE NUMBER OF SHARES OF AUTHORIZED COMMON STOCK FROM 30,000,000 TO 45,000,000

The company’s board of directors has adopted a resolution approving and declaring advisable, subject to shareholder approval, an amendment to Article SIXTH of the Restated Articles to increase the number of shares of the company’s authorized common stock from 30,000,000 shares to 45,000,000 shares.

If the increase in authorized shares to 45,000,000 is approved by the company’s shareholders, the company intends to file an amendment to the Restated Articles, substantially in the form of Exhibit B hereto, with the Texas Secretary of State as soon as practicable following shareholder approval. If the proposal is approved, it will have the effect of increasing the company’s authorized shares of common stock but will have no effect on the number of authorized shares of preferred stock.

Purpose of the Amendment

The company’s Restated Articles currently authorize the board to issue a maximum of 30,500,000 shares of the company’s capital stock, consisting of 30,000,000 shares of common stock, par value $0.10 per share, and 500,000 shares of preferred stock, par value $5.00 per share. As of the date hereof, we have no outstanding shares of preferred stock.

Of the 30,000,000 shares of common stock currently authorized, as of our record date, March 14, 2024, 6,736,566 shares were issued with 5,709,226 shares outstanding, and 1,027,340 shares held as treasury. Additionally, we have 75,245 shares reserved for issuance under the 2001 Plan, including 44,100 shares issuable upon exercise of outstanding stock options. If the shareholders approve Proposal 3, we would have 225,245 shares reserved for issuance under the 2001 plan, including 44,100 shares issuable upon exercise of outstanding stock options. Assuming Proposal 3 is approved, the company would have approximately 23,038,189 shares of unreserved common stock available for future issuance and, if this proposal to increase the authorized shares is approved by shareholders, the company would have 38,038,189 shares of unreserved common stock available for future issuance.

The primary purpose for increasing the authorized shares of common stock to 45,000,000 at this time is to provide sufficient authorized shares to allow for the stock split. The current number of shares of unreserved common stock available for future issuance would limit the size of the stock split. Board approval of the stock split, including the size of the stock split, will be determined following shareholder approval of the increase in the number of authorized shares of common stock.

As of the date hereof, the board currently intends to proceed with a stock split of up to 5-to-1, effected in the form of a stock dividend of up to 4 additional shares on each outstanding share. Given the 5,709,226 shares outstanding as of March 14, 2024, such a 5-for-1 stock split would result in the issuance of 22,836,904 additional outstanding shares, bringing the total outstanding shares to 28,546,130 post-split shares. In addition, under the adjustment provisions of the 2001 plan the total number of shares reserved for future issuance under the plan, including shares issuable upon exercise of outstanding stock option (assuming Proposal 3 is approved) would be 1,126,225 post-split shares.