UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Mutual Funds | |

| | |

| | | For investors seeking the potential for long-term capital

appreciation. |

| | | | | | |

| | | | | | | Annual Report December 31, 2013 |

| | | | | | | | | | | | | | | | | | |

| | | | | | | Share Class / Ticker Symbol |

| | | Fund Name | | | | Class A | | Class B | | Class C | | Class R3 | | Class R6 | | Class I | | |

| | |

| | Nuveen Global Infrastructure Fund | | | | FGIAX | | — | | FGNCX | | FGNRX | | — | | FGIYX | | |

| | Nuveen Real Asset Income Fund | | | | NRIAX | | — | | NRICX | | — | | — | | NRIIX | | |

| | Nuveen Real Estate Securities Fund | | | | FREAX | | FREBX | | FRLCX | | FRSSX | | FREGX | | FARCX | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | |

| | |

| | Life is Complex. | | |

| | |

| | Nuveen makes things e-simple. | | |

| | |

| | It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. | | |

| | | | |

| | | | | | Free e-Reports right to your e-mail! | | |

| | | |

| | | | | | www.investordelivery.com If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account. |

| | | | |

| | | | or | | www.nuveen.com/accountaccess If you receive your Nuveen Fund distributions and statements directly from Nuveen. Must be preceded by or accompanied by a prospectus. NOT FDIC INSURED MAY LOSE VALUE

NO BANK GUARANTEE | | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Table of Contents

Chairman’s Letter to Shareholders

Dear Shareholders,

I am pleased to have this opportunity to introduce myself to you as the new independent chairman of the Nuveen Fund Board, effective July 1, 2013. I am honored to have been selected as chairman, with its primary responsibility to serve the interests of the Nuveen Fund shareholders. My predecessor, Robert Bremner, was the first independent director to serve as chairman of the Board and I, and my fellow Board members, plan to continue his legacy of strong independent oversight of your funds.

The global economy has hit major turning points over the last several months to a year. The developed world is gradually recovering from its financial crisis while the emerging markets appear to be struggling with the downshift of China’s growth potential. Japan is entering a new era of growth after decades of economic stagnation and many of the Eurozone nations appear to be exiting their recession. Despite the positive events, there are still potential risks. Middle East tensions, rising oil prices, defaults in Europe and fallout from the financial stress in emerging markets could all reverse the recent progress in the global economy.

On the domestic front, recent events such as the Federal Reserve decision to slow down its bond buying program beginning in January of 2014 and the federal budget compromise that would guide government spending into 2015 are both positives for the economy moving forward. Corporate fundamentals are strong as earnings per share and corporate cash are at the highest level in two decades. Unemployment is trending down and the housing market has experienced a rebound, each assisting the positive economic scenario. However, there are some issues to be watched. Interest rates are expected to increase but significant uncertainty about the timing remains. Partisan politics in Washington D.C. with their troublesome outcomes add to the uncertainties that could cause problems for the economy going forward.

In the near term, governments are focused on economic recovery and the growth of their economies, which could lead to an environment of attractive investment opportunities. Over the long term, the uncertainties mentioned earlier could hinder the potential growth. Because of this, Nuveen’s investment management teams work hard to balance return and risk with a range of investment strategies. I encourage you to read the following commentary on the management of your fund.

On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

February 21, 2014

Portfolio Managers’ Comments

Nuveen Global Infrastructure Fund

Nuveen Real Asset Income Fund

Nuveen Real Estate Securities Fund

These Funds feature portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments. For the Nuveen Global Infrastructure Fund, Jay L. Rosenberg has been the lead portfolio manager and John G. Wenker has been the co-portfolio manager since its inception in 2007. Tryg T. Sarsland was added as a co-portfolio manager to the Fund in December 2012. For the Nuveen Real Asset Income Fund, Jay has been the lead portfolio manager, while John and Jeffrey T. Schmitz, CFA, have co-managed the Fund since its inception in 2011. For the Nuveen Real Estate Securities Fund, John assumed portfolio management responsibilities in 1999, while Jay joined John as a lead portfolio manager of the Fund in 2005 and has served in that capacity since. In addition, co-portfolio manager Scott C. Sedlak joined the Nuveen Real Estate Securities Fund’s management team in 2011. On the following pages, the portfolio management teams for these Funds discuss economic and equity market conditions, key investment strategies and the Funds’ performance for the twelve-month reporting period ended December 31, 2013.

Shareholders should note that beginning January, 2014, the Nuveen Real Asset Income Fund began declaring a daily dividend that will be distributed to Shareholders on or near the first business day of the following month.

What factors affected the U.S. economy and the equity market during the twelve-month reporting period ended December 31, 2013?

During the first part of this reporting period, widespread uncertainty about the next step for the Federal Reserve’s (Fed) quantitative easing program and the potential impact on the economy and financial markets led to increased market volatility. After surprising the market in September 2013 with its decision to wait for additional evidence of an improving economy before making any adjustments to the program, the Fed announced on December 18th that it would begin tapering its monthly bond-buying program by $10 billion (to $75 billion) in January 2014.

Early in this reporting period, the outlook for the U.S. economy was clouded by uncertainty about global financial markets and the outcome of the “fiscal cliff.” The tax consequences of the fiscal cliff situation were averted through a last-minute deal that raised payroll taxes, but left in place a number of tax breaks. However, lawmakers failed to reach a resolution on $1.2 trillion in spending cuts intended to address the federal budget deficit. This triggered a program of automatic spending cuts (or sequestration) that impacted federal programs beginning March 1, 2013. Although Congress later passed legislation that established federal funding levels for the remainder of fiscal 2013, the federal budget for fiscal 2014 continued to be debated. On October 1, 2013, the start date for fiscal 2014, the federal government shut

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Portfolio Managers’ Comments (continued)

down for 16 days until an interim appropriations bill was signed into law, funding the government at sequestration levels through January 15, 2014, and suspending the debt limit until February 7, 2014. At the end of the reporting period, Congress passed a federal budget deal that would guide government spending into 2015 and defuse the chances of another shutdown. In addition to the ongoing political debate over federal spending, Chairman Bernanke’s June 2013 remarks about tapering the Fed’s asset purchase program touched off widespread uncertainty about the next step for the Fed’s quantitative easing program and about the potential impact on the economy and financial markets, leading to increased market volatility.

In the third quarter of 2013, the U.S. economy, as measured by the U.S. gross domestic product (GDP), grew at an annualized rate of 4.1%, up from 2.5% for the second quarter of 2013, continuing the pattern of positive economic growth for the tenth consecutive quarter. The Consumer Price Index (CPI) rose 1.5% year-over-year as of December 2013, while the core CPI (which excludes food and energy) increased 1.7% during the same period, staying within the Fed’s unofficial objective of 2.0% or lower for this inflation measure. Improvements in the labor markets continued to be slow, and unemployment remained above the Fed’s target of 6.5%. As of December 2013, the national unemployment rate was 6.7%, down from 7.0% in November 2013. The housing market continued to deliver good news, as the average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rose 13.7% for the twelve months ended November 2013 (most recent data available at the time this report was prepared), the largest twelve-month percentage gain for the index since February 2006.

For much of the reporting period, low interest rates and a fairly benign macro environment caused U.S. investors to move out the risk spectrum, resulting in robust flows into U.S. equity funds. Leading U.S. stock market indexes, including the S&P 500® Index, the Dow Jones Industrial Average and the Russell 2000® Index, each hit all-time highs during the reporting period. The S&P 500® Index gained 32.39% and the Dow Jones Industrial Average gained 29.65% during the reporting period.

Nuveen Global Infrastructure Fund

How did the Fund perform during the twelve-month reporting period ended December 31, 2013?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the one-year, five-year and since inception periods ended December 31, 2013. For the twelve-month reporting period ending December 31, 2013, the Fund’s Class A Shares at net asset value (NAV) outperformed the Lipper classification average, but underperformed the S&P Global Infrastructure Index.

What strategies were used to manage the Fund during this twelve-month reporting period? How did these strategies influence performance?

The Fund seeks to provide capital appreciation and income potential by investing primarily in equity securities issued by U.S. and non-U.S. companies that typically derive the majority of their value from owned or operated infrastructure assets. During the twelve-month reporting period, our strategy for managing the Fund remained consistent as we focused on buying global infrastructure companies that own and operate long life assets that have visible cash flows, strong balance sheets, manageable amounts of leverage and inelastic demand characteristics. We believe these types of companies will have ongoing access to capital and the best chances for producing sustainable and growing cash flow. The Fund is structured using a number of core infrastructure companies that we believe should provide long-term outperformance versus the market, combined with more opportunistic holdings that we believe are undervalued by the market in the short term. We have exposure around the globe to a mixture of holdings that represent significant value, as well as positions in companies that may prove to be more stable in a slowly growing global economy.

Over the twelve-month reporting period, the Fund benefited from strong stock selection and favorable weightings in several sectors, particularly electric utilities, master limited partnerships (MLPs), water and pipelines. The Fund’s returns were also aided by our long-term strategy to execute a great deal of caution in owning securities from regions where political, fiscal or monetary uncertainty is prominent. During the reporting period, this strategy was helpful in avoiding the electric utilities and water sectors in the U.K. as well as electric utilities in Brazil. We also continued to underweight European economies as political risk remained elevated in that region as it relates to infrastructure, especially in the energy and utility areas. Toll road and airport sectors contributed the most to the Fund’s modest underperformance versus the S&P Global Infrastructure Index. The Fund’s results were hindered by underweights to both of these sectors, as airports and toll roads were two of the stronger performing areas of the benchmark during the reporting period. A small cash position in a strongly advancing market environment was also a drag on the Fund’s return.

Electric utilities was the strongest relative performer as the Fund had a significant underweight in the sector, given our belief that growth and more pro-cyclical areas were likely to earn investor favor in an interest rate environment that was trending higher. We reduced the Fund’s exposure in the regulated electric utilities sector, which looked to have more potential downside risk as these names had not sold off as much as other interest rate sensitive names. We believed the Fund would have better total return investment opportunities in other sectors and that this proved beneficial to relative performance. More specifically, we continued to benefit from our ongoing underweight in euro zone electric utilities and avoidance of Brazilian utilities. Also, we noticed the political winds changing in the U.K. as more politicians began advocating for lower retail power prices. This caused us to move to large underweights in core U.K. positions in the Fund. Within the sector, we continued to focus on investing in stable, regulated companies with long-term contracts or concessions that are not as commodity price sensitive. At the same time, we attempted to avoid exposure in companies that derive their cash flows from spot market generation, or that could be significantly impacted by political and/or regulatory uncertainty.

The MLP sector was the Fund’s second largest contributor to performance and had a significant overweight compared to the benchmark. The Fund’s positive attribution from the MLP sector was fairly evenly split between the overweight to the group as well as stock selection within it. In terms of stock selection, we continued to focus on owning companies where greater than 75% of their earnings coming from fee-based structures and without a lot of commodity price sensitivity. We found good values among some smaller-cap names where we believe the growth potential may be underestimated by the market.

Security selection in water utilities also contributed to performance, which more than offset the negative impact of the Fund’s overweight in this underperforming sector. The Fund’s most significant outperformance came from three out-of-index holdings from China and the U.S. The strongest performer was China Everbright International Limited, a Chinese waste water treatment and alternative energy company that advanced strongly during the reporting period. The company is benefiting from a growing pipeline of new projects, including waste water treatment plants and incineration projects. Another benefactor of broad policy support for environmental services in China was Beijing Enterprises Water Group Limited. While a smaller weight in the portfolio, Beijing Enterprises Water is not represented in the benchmark; therefore, its relative impact was significant given its strong performance. A position in American Water Works Company, Inc., a smaller regional water utility in the U.S., also performed well. In addition, the Fund benefited from a lower-than-historical weight in U.K. water companies, which we avoided, similar to the electric utilities sector, due to some short-term regulatory noise creating uncertainty in the segment. In the pipeline segment, the Fund’s underweight was beneficial as this sector underperformed the overall benchmark return. However, favorable security selection added even more value as the Fund benefited from exposure to many different areas, particularly two larger positions in U.S. pipeline firms. Several out-of-index holdings in Hong Kong, Italy and an underweight to Canadian pipeline firms also

Portfolio Managers’ Comments (continued)

aided returns as regulatory delays and lower growth profiles of the larger operators in Canada hampered results, while smaller companies with higher expected growth outperformed. Within the sector, we increased weights in pipeline companies that have strong growth potential and in companies such as MLPs that will see accretion through the “drop down” of assets from parent companies.

In the more cyclical toll road sector, the Fund’s underweight to the sector, and particularly two European names that are large weights in the benchmark, hurt relative performance. The Fund had a significant underweight to the Spanish firm Abertis Infraestructuras SA due to its lofty valuation, which we believed was far overstated especially in light of the lackluster prospects for Spanish toll roads. However, Abertis Infraestructuras outperformed during the reporting period due to stock-specific technical reasons as the company continued to buy back shares, but also largely due to falling sovereign debt yields which lifted equities in general. We also had a substantial underweight to the Italian toll road company Atlantia S.p.A., which outperformed as Italian traffic numbers provided an upside surprise during the reporting period. In addition, a position in Brazilian toll road firm CCR S.A. detracted, in part because the Sao Paulo government agreed to halt toll increases in response to protests within the region.

The airport sector was also an area of underperformance, primarily due to the Fund’s underweight versus the benchmark as this segment produced very strong results during the reporting period. The Fund’s underweight was predicated on our belief that airport companies were not attractively valued and also faced a variety of concerning issues and risks. Most of the Fund’s shortfall in the sector resulted from an underweight to Aeroports de Paris SA, the company that runs the Charles De Gaulle airport in Paris. During the reporting period, the French government decided to sell a large part of its position in the airport, which caused it to modestly outperform.

Thematically in the Fund, we began to increase its beta later in the reporting period, looking for companies with stronger growth potential as a way to offset the impact that rising rates would have on their existing asset base. Overall this meant reductions in both the electric and gas utilities sectors and additions to the rail, waste and port sectors. As an example of moving toward more growth potential, we preferred companies in the gas utilities sector with pipeline assets that could continue to benefit from the domestic energy renaissance. We believe the additional cash flow derived from that asset base should better support their stock prices relative to gas companies that don’t have networks as robust as their competitors. From a country perspective, we modestly added to the Fund’s European exposure (with the exception of Spain) as sovereign debt yields and European Central Bank backing continued to be supportive of equities in those markets. At the same time, we reduced the Fund’s weight to the U.K. based on elevated political risk. The U.K.’s Labour party has moved retail energy policy to the forefront, calling for a tariff freeze on customer electricity charges if they are elected in the next cycle. That policy has created concerns about potential rate freezes for water utilities as well and those companies’ stock prices have also suffered as a result.

Nuveen Real Asset Income Fund

How did the Fund perform during the twelve-month reporting period ended December 31, 2013?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the one-year and since inception periods ended December 31, 2013. For the twelve-month reporting period ending December 31, 2013, the Fund’s Class A Shares at net asset value (NAV) outperformed the Real Asset Income Blend benchmark, but underperformed the Barclays U.S. Corporate High Yield Index and the Lipper classification average.

What strategies were used to manage the Fund during this twelve-month reporting period ended December 31, 2013? How did these strategies influence performance?

The Fund seeks to provide a high level of current income and the potential for capital appreciation by investing in a global portfolio of infrastructure and commercial real estate related securities (i.e. real assets) across the capital markets. These securities include a combination of infrastructure and real estate common stock, infrastructure and real estate preferred stock, and infrastructure and real estate related debt. Our goal is to combine these securities into a portfolio that provides investors with an attractive level of income and dampens levels of risk versus the broader equity market. We continued to select securities using an investment process that screens for companies and assets across the real assets market that provide higher yields. From the group of securities providing significant yields, we focus on owning those companies and securities with the highest total return potential in the Fund. Our process places a premium on finding securities whose revenues come from tangible assets with long-term concessions, contracts or leases and are therefore capable of producing steady, predictable and recurring cash flows. The Fund’s management team employs a bottom-up, fundamental approach to security selection and portfolio construction. We look for stable companies that demonstrate consistent and growing cash flow, strong balance sheets and histories of being good stewards of shareholder capital.

During the twelve-month reporting period, the Fund continued to generate a higher level of yield than its Real Asset Income Blend benchmark, while experiencing particularly favorable attribution from three of its five major segments. The Fund’s top-performing area for the reporting period included real estate investment trust (REIT) preferreds, followed by REIT common equity and infrastructure preferred/hybrids. REIT preferred and REIT common equity in particular showed strong results. The high yield portion of the Fund produced returns in line with the benchmark, while the infrastructure common equity portfolio detracted. The Fund also benefited from several strategic asset allocation shifts made during the reporting period.

The REIT preferred portion of the Fund produced strong results relative to its benchmark owing strictly to strong stock selection, which more than made up for our overweight to this underperforming sector. As measured by the BofA/Merrill Lynch REIT Preferred Stock Index, REIT preferreds produced a -11.46% return over the one-year period due to the long durations of many of these securities. However, prior to the Fed’s tapering discussion, we focused the Fund’s REIT preferred exposure almost exclusively on non-rated securities, which we believed would offer protection against rising interest rates as they had a much larger spread to Treasuries. Non-rated securities appeal to a much smaller pool of investors because they don’t have a preferred rating, which means we can often find pricing inefficiencies in the market, however, at the same time, can offer yields that are quite a bit more attractive than their rated counterparts. Although most of the Fund’s non-rated exposure was in cumulative preferred securities, we also own various convertible preferreds that offer an acceptable level of yield with the option of upside potential. The Fund’s non-rated securities did exhibit duration protection during the twelve-month reporting period as they outperformed rated preferred securities by a significant margin.

The Fund also outperformed in the REIT common equity arena due to strong security selection, again despite the headwinds caused by the sector’s underperformance and our overweight to this area. In this portion of the Fund, we experienced favorable returns from our out-of-index exposure to commercial mortgage REITs that originate floating rate mortgages. These securities strongly outperformed the return of the REIT common equity sector during the reporting period, as measured by the MSCI U.S. REIT Index. Well before the Fed began its tapering discussion, we believed REIT common equities were overvalued and moved into these commercial mortgage REITs (both common equity and convertible bonds) at prices that were close to book value. As interest rates rise, we believe these companies will continue to trade at larger premiums to book value as they undertake accretive transactions.

Portfolio Managers’ Comments (continued)

Our infrastructure preferred/hybrid portfolio also outperformed relative to the index as it benefited from our positioning for a rising interest rate environment. The majority of the Fund’s infrastructure preferred/hybrid portfolio was invested in non-U.S. hybrid securities that have a fixed-to-floating rate structure whereby they change to a floating rate security after five years. These securities outperformed because of their lower perceived duration risk compared to long-maturity perpetual preferred securities as rates moved higher.

The high yield portion of the Fund fell in line with the index during the reporting period. Investors returned to the asset class during the second half of the reporting period in the wake of the Fed’s “no taper” decision, after the segment’s dramatic sell-off in June. However, the high yield asset class still had net outflows of $3.4 billion, only the sixth time since 1984 that this market segment has posted withdrawals. The spread between high yield and Treasuries tightened by 110 basis points during the twelve-month period to end the year at 428 basis points. Given the benign credit environment seen over the course of the past two years, few investors were overly concerned with credit risk as most wanted to avoid interest rate risk. As a result, over the course of 2013 the lower quality tiers of high yield outpaced higher rated securities. The Fund’s high yield performance benefited from our overweights in the pipeline, health care and utilities sectors. However, a lack of exposure to the more economically sensitive areas of the industrials sector, which are not part of the Fund’s infrastructure/real estate mandate, detracted as those areas were the strongest performers.

The Fund’s only significant sector detractor on a relative basis during reporting the period was infrastructure common equity. The shortfall was due to a combination of an underweight position in what turned out to be the highest returning sector in our blended benchmark and our focus on the highest yielding areas within the sector. Infrastructure common equity makes up 33% of the benchmark, while the Fund had a smaller exposure in the asset class. As measured by the S&P Global Infrastructure Index, the sector returned 14.99% during the reporting period ended December 31, 2013. The reason we so significantly underweighted this segment versus the benchmark was because of our focus on the higher yielding names, which we correctly anticipated would have more sensitivity to rising rates. Our infrastructure common equity exposure focuses on securities that pay out the majority of their cash flows and that have more mature, stable assets and less cyclicality. Overall, during the reporting period, the higher beta, more cyclical names within the segment outperformed the higher yielding, more defensive names.

When the Fed mentioned the possibility of tapering last May, we believed that companies with higher potential growth and less sensitivity to interest rate moves would most likely outperform. Therefore, we made a concerted effort to begin shifting the Fund’s exposure toward companies that could generate growth, while still meeting our yield hurdles. This shift included reducing the Fund’s fixed income exposure and increasing its equity exposure (either common equity or convertible type investments). It has also meant moving toward more floating rate and fixed-to-floating rate hybrid securities, which also offer some interest rate protection.

In terms of the Fund’s asset class weights, its infrastructure preferred/hybrid exposure remained about the same during the reporting period. We sold some of the Fund’s perpetual securities that had the most duration risk, while increasing its weight in hybrid securities. In the REIT preferred space, we reduced exposure, particularly early in the reporting period before the segment’s sell-off, due to the duration risk posed by these securities. However, the Fund’s REIT preferred exposure remained overweight versus the blended benchmark’s. We increased exposure in the infrastructure common equity sector, while still remaining significantly below the benchmark’s allocation. The Fund’s REIT common equity exposure decreased during the reporting period, but with more exposure within the sector to floating rate mortgage REITs. With the continued prospect of higher rates, we believed commercial mortgage REITs could participate in that market instead of presenting only duration risk. Within the high yield portfolio, we maintained approximately the

same weight throughout the reporting period. Our trades were focused on finding attractive opportunities further down the credit spectrum in CCC-rated securities versus taking longer duration bets with securities in the higher BB-rated category. At the end of the reporting period, we owned high yield securities spread across the U.S., emerging markets and European markets and diversified among a number of real asset categories, with the greatest concentrations in the industrial, pipeline, utility, hospital and technology infrastructure sectors.

We also slightly increased the Fund’s overall U.S. exposure during the reporting period as a result of the increase in U.S. domiciled equity and commercial mortgage REITs. However, our long-term target for geographic distribution in the Fund remains at roughly 50% U.S. exposure and 50% non-U.S. exposure.

Nuveen Real Estate Securities Fund

How did the Fund perform during the twelve-month reporting period ended December 31, 2013?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the one-year, five-year and ten-year periods ended December 31, 2013. For the twelve-month reporting period ending December 31, 2013, the Fund’s Class A Shares at net asset value (NAV) underperformed the MSCI U.S. REIT Index and the Lipper classification average.

What strategies were used to manage the Fund during this twelve-month reporting period ended December 31, 2013 ? How did these strategies influence performance?

The Fund seeks to provide above average income potential and long-term capital appreciation by investing in income producing common stocks of publicly traded companies engaged in the real estate industry. During the twelve-month reporting period, we continued to implement the Fund’s strategy of investing on a relative value basis with a focus on individual stocks rather than economic or market cycles. We also continued to invest the Fund in a fairly sector neutral manner, with a goal of providing a well-diversified portfolio of public real estate stocks to our shareholders. A sector neutral approach reduces the impact of any one property type on performance. Additionally, we continued to invest in a broader universe of stocks than our benchmark index to access more dynamic parts of the commercial real estate cycle.

The public commercial real estate sector significantly underperformed the broad U.S. stock market by nearly 30% in 2013 as the MSCI U.S. REIT Index was up 2.47% versus the S&P 500® Index gain of 32.39%. The headwinds in the REIT sector were largely interest rate induced as the market experienced a back-up in yields near the end of the second quarter, when the Fed began discussing the potential tapering of its monthly bond purchases, which subsequently continued through the end of the year. However, REIT fundamentals generally remained rather stable in the face of the interest rate move experienced over this time frame. The majority of REITs generally have solid balance sheets and growing dividend yields as they pass through much of the income growth they have experienced to shareholders. Payout ratios increased significantly over the year and dividends continued to experience growth. Relative to historic averages, REITs still enjoy a very low cost of capital and the outlook for operating fundamentals is largely unchanged. We believe net operating income across the space looks set for another year of growth above long-term averages, while supply in most major property sectors continues to be well contained.

Several sectors detracted during the reporting period, including hotel REITs, student housing, malls and net lease, and led to the Fund’s underperformance relative to its benchmark and Lipper peers. The hotel REIT sector as a whole continued to perform well relative to other real estate sectors, posting the strongest one-year returns during a difficult period for REITs overall. Thematically in the Fund, our preference for select service and smaller names within the group

Portfolio Managers’ Comments (continued)

hurt performance relative to the benchmark. While group bookings showed some improvement during the reporting period, we were concerned about the relatively disappointing results from the group side where the larger, full service hotels have greater exposure. Therefore, our preference was to have a greater weight in the select service segment, which has much less exposure to group business. This theme detracted from the Fund’s performance relative to the benchmark during the reporting period with the bulk of the underperformance coming from our underweight to the largest player in the space, Host Hotels & Resorts, Inc.

In student housing, the Fund’s significant overweight to American Campus Communities, Inc., was primarily responsible for its shortfall. This very high quality, well-managed company underperformed as its lease signings substantially lagged the previous year’s level. While we continued to have confidence in American Campus’ ability to catch up to the prior year’s numbers, the market lacked that confidence and sold the stock off sharply starting in the second quarter. Based on its attractive valuation and our belief that the market had oversold the name, we held our position but it continued to underperform throughout the remainder of the year.

The Fund’s underperformance in the mall sector was primarily due to its overweight position in this underperforming sector. The net lease sector was also a detractor to the Fund’s relative results, despite the fact it represents a relatively small part of the index. The Fund’s shortfall was primarily due to its underweight position in the sector. After a considerably strong run, we had reduced select holdings in the net lease space based on valuation. We believed their valuations were not supported by the group’s lower growth profile as they generally have rather high payout ratios. These companies also typically have longer leases and are less able to quickly adjust their lease rates as interest rates rise, which hurts their profitability outlook. However, our underweight to net lease as a whole hindered the Fund as the sector significantly outperformed the broader index during the reporting period.

On the other hand, the Fund’s performance benefited from three sectors: industrial, self-storage and mortgage REITs. Within industrials, stock selection across the sector and an overweight position drove our favorable results, as the group outperformed the overall REIT universe. The Fund benefited from a combination of overweight positions in a few smaller companies with strong expected growth rates, along with mild overweight exposure to some higher-yielding names.

In self-storage, the Fund’s strong relative performance resulted from overweight positions in three of the four names that make up the entirety of the sector. The Fund’s overweight was predicated on our belief that the underlying fundamentals within the group were the strongest within the investment universe. Self-storage REITs maintained the strongest net operating income growth. Supply within the group was well contained with very little development on the horizon and REITs, with their superior size, access to inexpensive capital and ability to leverage operating efficiencies, continued to seek out external growth opportunities that may be accretive to their businesses. We believed this backdrop, combined with the shorter lease terms that govern self-storage assets, would put them in an advantageous position relative to other sectors, especially in the face of rising interest rates. Indeed, self-storage was the one of the stronger performing sectors within real estate.

Mortgage REITs were the next largest contributor of relative performance versus the benchmark. Although the Fund maintained a small exposure to the group, the MSCI U.S. REIT Index has virtually no exposure to the sector. Our holdings in this sector are concentrated in commercial mortgage REITs rather than residential mortgage REITs. The Fund’s holdings contributed nicely to returns both from an absolute as well as a relative perspective. As a group, mortgage REITs significantly outperformed the overall benchmark return during the reporting period.

As is typical for the strategy from a management perspective, variations in the Fund were on the margin and were generated from the bottom up, affecting individual company holdings. After a meaningful period of outperformance by smaller, more highly leveraged companies, we believed that select high quality, larger-cap names appeared attractively valued. While we always keep the Fund diversified by sector and market capitalization, we have a quality bias as we go forward in 2014. Thematically within the Fund, we shifted to a bias toward companies that operate under shorter lease terms to help decrease the interest rate sensitivity of the portfolio. We believe these companies will benefit from the ability to re-price leases more quickly in what we anticipate will be an environment of modestly upward trending interest rates in 2014. For example, we added to the Fund’s self-storage weight and maintained lighter exposures to companies with longer lease profiles like net-lease and health care. Companies that operate under longer term leases and those that have been owned as bond proxies due to their high dividends remain under pressure.

Risk Considerations

Risk Considerations

Nuveen Global Infrastructure Fund

Mutual fund investing involves risk; principal loss is possible. Concentration in infrastructure-related securities involves sector risk and concentration risk, particularly greater exposure to adverse economic, regulatory, political, legal, liquidity, and tax risks associated with MLPs and REITS. Foreign investments involve additional risks including currency fluctuations and economic and political instability. These risks are magnified in emerging markets. Common stocks are subject to market risk or the risk of decline. Small- and mid-cap stocks are subject to greater price volatility. The use of derivatives involves substantial financial risks and transaction costs. The fund’s potential investment in other investment companies means shareholders bear their proportionate share of fund expenses and indirectly, the expenses of other investment companies. Fund investments in ETFs may involve tracking error. Preferred securities may involve greater credit risk than other debt instruments.

Nuveen Real Asset Income Fund

Mutual fund investing involves risk; principal loss is possible. Equity investments such as those held by the fund, are subject to market risk, call risk, derivatives risk, other investment companies risk, common stock risk, and tax risks associated with MLPs. Concentration in specific sectors may involve greater risk and volatility than more diversified investments: real estate sector involves the risk of exposure to economic downturns and changes in real estate values, rents, property taxes, interest rates and tax laws; infrastructure-related securities may involve greater exposure to adverse economic, regulatory, political, legal, and other changes affecting such securities. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity, and differing legal and accounting standards. These risks are magnified in emerging markets. Investments in small- and mid-cap companies are subject to greater volatility. In addition, the fund will bear its proportionate share of any fees and expenses paid by the ETFs in which it invests.

Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk and income risk. As interest rates rise, bond prices fall. Below investment grade or high yield debt securities are subject to liquidity risk and heightened credit risk. Preferred securities are subordinated to bonds and other debt instruments in a company’s capital structure and therefore are subject to greater credit risk. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk and adverse economic developments.

Nuveen Real Estate Securities Fund

Mutual fund investing involves risk; principal loss is possible. Common stocks and REITs such as those held in the fund involve market risk, concentration risk, sector risk, and non-diversification risk. The real estate industry is greatly affected by economic downturns that may persist as well as changes in property values, taxes, and regulatory developments. Foreign investments involve additional risks including currency fluctuations, and economic or political instability. These risks are magnified in emerging markets. The use of derivatives involves substantial financial risks and transaction costs. Small cap stocks may experience more volatility than large cap stocks.

Dividend Information

For Nuveen Real Estate Securities Fund, dividends from net investment income, if any, are normally declared and paid quarterly. In addition, any capital gains are normally distributed at least once each year. During the fiscal year ended December 31, 2013 for Nuveen Real Estate Securities Fund, re-characterization of distributions reported by the REITs, significantly offset net investment income. As a result, and as outlined in the table below, a portion of the Fund’s distributions originally characterized as net investment income has now been re-characterized as a return of capital.

Nuveen Real Estate Securities Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

As of December 31, 2013 | |

| Class A

Shares |

| |

| Class B

Shares |

| |

| Class C

Shares |

| |

| Class R3

Shares |

| |

| Class R6

Shares |

| |

| Class I

Shares |

|

Inception date | | | 9/29/95 | | | | 9/29/95 | | | | 2/1/00 | | | | 9/24/01 | | | | 4/30/13 | | | | 6/30/95 | |

Fiscal year (calendar year) ended December 31, 2013 | | | | | | | | | | | | | | | | | | | | | | | | |

Per share distribution: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | $ | 0.29 | | | $ | 0.12 | | | $ | 0.12 | | | $ | 0.24 | | | $ | 0.23 | | | $ | 0.35 | |

From net realized capital gains | | | 1.35 | | | | 1.35 | | | | 1.35 | | | | 1.35 | | | | 1.35 | | | | 1.35 | |

Return of capital | | | 0.13 | | | | 0.13 | | | | 0.13 | | | | 0.13 | | | | 0.13 | | | | 0.13 | |

Total per share distribution | | $ | 1.77 | | | $ | 1.60 | | | $ | 1.60 | | | $ | 1.72 | | | $ | 1.71 | | | $ | 1.83 | |

Net Asset Value (NAV) | | $ | 19.46 | | | $ | 18.98 | | | $ | 19.03 | | | $ | 19.72 | | | $ | 19.72 | | | $ | 19.70 | |

Distribution rate on NAV | | | 9.10 | % | | | 8.43 | % | | | 8.41 | % | | | 8.72 | % | | | 8.67 | % | | | 9.29 | % |

Average annual total returns: | | | | | | | | | | | | | | | | | | | | | | | | |

1-Year on NAV | | | 1.04 | % | | | 0.29 | % | | | 0.25 | % | | | 0.75 | % | | | (10.88) | %* | | | 1.32 | % |

5-Year on NAV | | | 16.85 | % | | | 15.98 | % | | | 15.97 | % | | | 16.56 | % | | | N/A | | | | 17.15 | % |

10-Year on NAV | | | 9.74 | % | | | 8.92 | % | | | 8.92 | % | | | 9.48 | % | | | N/A | | | | 10.02 | % |

N/A – Not applicable.

* Represents the since inception (cumulative) total return on NAV.

Fund Performance and Expense Ratios

The Fund Performance and Expense Ratios for each Fund are shown on the following six pages.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between certain Funds and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Note 7—Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for the Funds’ Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect the Funds’ total operating expenses (before fee waiver and/or expense reimbursements, if any) as shown in the Funds’ most recent prospectus. The expense ratios include management fees and other fees and expenses.

THIS PAGE INTENTIONALLY LEFT BLANK

Fund Performance and Expense Ratios (continued)

Nuveen Global Infrastructure Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of December 31, 2013

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | Since

Inception* | |

Class A Shares at NAV | | | 14.73% | | | | 14.41% | | | | 4.51% | |

Class A Shares at maximum Offering Price | | | 8.16% | | | | 13.07% | | | | 3.49% | |

S&P Global Infrastructure Index** | | | 14.99% | | | | 11.17% | | | | 0.99% | |

Lipper Specialty/Miscellaneous Funds Classification Average** | | | 7.16% | | | | 14.16% | | | | 3.03% | |

| | | |

Class C Shares | | | 13.90% | | | | 13.59% | | | | 13.70% | |

Class R3 Shares | | | 14.40% | | | | 14.03% | | | | 14.16% | |

Class I Shares | | | 15.03% | | | | 14.69% | | | | 4.76% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Gross Expense Ratios | | | 1.42% | | | | 2.18% | | | | 1.65% | | | | 1.17% | |

Net Expense Ratios | | | 1.24% | | | | 1.99% | | | | 1.49% | | | | 0.99% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through April 30, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 1.00% of the average daily net assets of any class of Fund shares. The expense limitation expiring April 30, 2014 may be terminated or modified prior to that date only with the approval of the Board of Directors of the Fund.

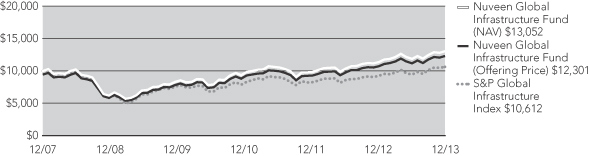

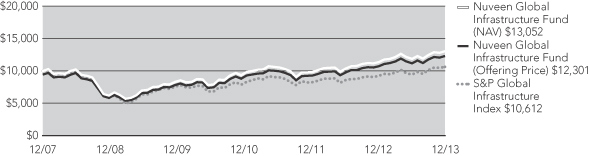

Growth of an Assumed $10,000 Investment as of December 31, 2013 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| * | Since inception returns for Class A and Class I Shares, and for the comparative index and Lipper classification average, are from 12/17/07; since inception returns for Class C and Class R3 Shares are from 11/03/08. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

Fund Performance and Expense Ratios (continued)

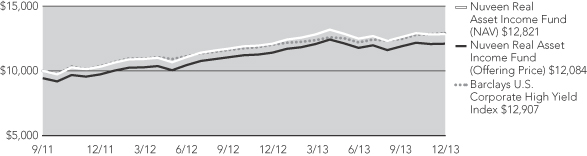

Nuveen Real Asset Income Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of December 31, 2013

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception* | |

Class A Shares at NAV | | | 6.13% | | | | 11.42% | |

Class A Shares at maximum Offering Price | | | 0.02% | | | | 8.58% | |

Barclays U.S. Corporate High Yield Index** | | | 7.44% | | | | 11.73% | |

Real Asset Income Blend** | | | 3.79% | | | | 9.50% | |

Lipper Global Flexible Portfolio Funds Classification Average** | | | 8.90% | | | | 9.34% | |

| | |

Class C Shares | | | 5.38% | | | | 10.61% | |

Class I Shares | | | 6.40% | | | | 11.69% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class I | |

Gross Expense Ratios | | | 1.65% | | | | 2.30% | | | | 1.49% | |

Net Expense Ratios | | | 1.17% | | | | 1.92% | | | | 0.92% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through April 30, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.95% of the average daily net assets of any class of Fund shares. The expense limitation expiring April 30, 2014, may be terminated or modified prior to that date only with the approval of the Board of Directors of the Fund.

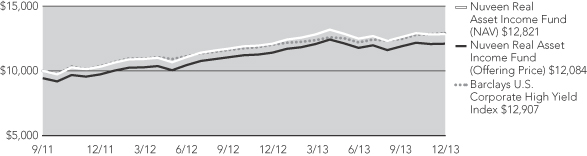

Growth of an Assumed $10,000 Investment as of December 31, 2013 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| * | Since inception returns are from 9/13/11. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

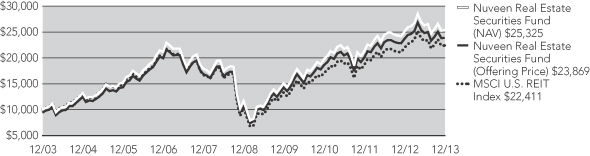

Fund Performance and Expense Ratios (continued)

Nuveen Real Estate Securities Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of December 31, 2013

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | 1.04% | | | | 16.85% | | | | 9.74% | |

Class A Shares at maximum Offering Price | | | (4.76)% | | | | 15.48% | | | | 9.09% | |

MSCI U.S. REIT Index* | | | 2.47% | | | | 16.73% | | | | 8.40% | |

Lipper Real Estate Funds Classification Average* | | | 1.70% | | | | 16.41% | | | | 7.77% | |

| | | |

Class B Shares w/o CDSC | | | 0.29% | | | | 15.98% | | | | 8.92% | |

Class B Shares w/CDSC | | | (4.33)% | | | | 15.87% | | | | 8.92% | |

Class C Shares | | | 0.25% | | | | 15.97% | | | | 8.92% | |

Class R3 Shares | | | 0.75% | | | | 16.56% | | | | 9.48% | |

Class I Shares | | | 1.32% | | | | 17.15% | | | | 10.02% | |

| | | | |

| | | Cumulative | |

| | | Since

Inception** | |

Class R6 Shares | | | (10.88)% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class R6 Shares have no sales charge and are available only to certain limited categories of investors as described in the prospectus. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class B | | | Class C | | | Class R3 | | | Class R6 | | | Class I | |

Expense Ratios | | | 1.28% | | | | 2.03% | | | | 2.03% | | | | 1.53% | | | | 0.90% | | | | 1.03% | |

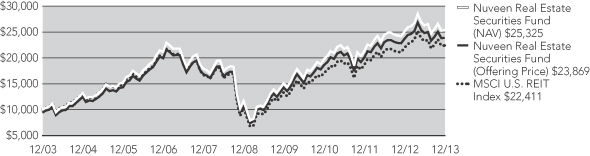

Growth of an Assumed $10,000 Investment as of December 31, 2013 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| * | Refer to the Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

| ** | Since inception return for Class R6 Shares is from 4/30/13. |

Holding Summaries December 31, 2013

This data relates to the securities held in each Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

Nuveen Global Infrastructure Fund

Portfolio Allocation1

| | | | |

Common Stocks | | | 94.1% | |

Real Estate Investment Trust Common Stocks | | | 2.9% | |

Investment Companies | | | 0.3% | |

Short-Term Investments | | | 1.7% | |

Other2 | | | 1.0% | |

Country Allocation1

| | | | |

United States4 | | | 41.0% | |

Canada | | | 9.4% | |

Hong Kong | | | 6.6% | |

France | | | 5.5% | |

Australia | | | 5.5% | |

Italy | | | 4.8% | |

United Kingdom | | | 3.6% | |

Singapore | | | 3.0% | |

New Zealand | | | 2.6% | |

Other5 | | | 18.0% | |

Portfolio Composition1

| | | | |

Transportation Infrastructure | | | 25.0% | |

Oil, Gas & Consumable Fuels | | | 20.5% | |

Multi-Utilities | | | 13.9% | |

Electric Utilities | | | 10.9% | |

Gas Utilities | | | 6.7% | |

Road & Rail | | | 4.9% | |

Short-Term Investments | | | 1.7% | |

Other3 | | | 16.4% | |

Top Five Common Stock & Real Estate Investment Trust Common Stock Holdings1

| | | | |

Enbridge Inc. | | | 3.9% | |

Spectra Energy Corporation | | | 2.9% | |

National Grid PLC, Sponsored ADR | | | 2.9% | |

Atlantia SpA | | | 2.8% | |

Transurban Group | | | 2.7% | |

| 1 | As a percentage of net assets. Holdings are subject to change. |

| 2 | Other assets less liabilities, which includes borrowings as presented in the Fund’s Portfolio of Investments. |

| 3 | Includes other assets less liabilities, which includes borrowings as presented in the Fund’s Portfolio of Investments and all industries less than 4.9% of net assets. |

| 4 | Includes short-term investments and other assets less liabilities, which includes borrowings as presented in the Fund’s Portfolio of Investments. |

| 5 | Includes all countries less than 2.6% of net assets. |

Nuveen Real Asset Income Fund

Portfolio Allocation1

| | | | |

Common Stocks | | | 22.6% | |

Real Estate Investment Trust Common Stocks | | | 19.0% | |

Convertible Preferred Securities | | | 3.0% | |

$25 Par (or similar) Retail Structures | | | 24.0% | |

Convertible Bonds | | | 2.3% | |

Corporate Bonds | | | 19.0% | |

$1,000 Par (or similar) Institutional Structures | | | 4.5% | |

Common Stock Right | | | –%6 | |

Investment Companies | | | 1.0% | |

Short-Term Investments | | | 3.5% | |

Other2 | | | 1.1% | |

Country Allocation1

| | | | |

United States4 | | | 69.6% | |

Australia | | | 6.1% | |

United Kingdom | | | 4.2% | |

Hong Kong | | | 3.6% | |

Other5 | | | 16.5% | |

Portfolio Composition1

| | | | |

Real Estate Investment Trust | | | 23.4% | |

Electric Utilities | | | 11.2% | |

Oil, Gas & Consumable Fuels | | | 8.1% | |

Transportation Infrastructure | | | 7.3% | |

Specialized | | | 6.8% | |

Multi-Utillities | | | 6.6% | |

Mortgage | | | 4.1% | |

Retail | | | 3.4% | |

Health Care Providers & Services | | | 3.2% | |

Diversified | | | 2.5% | |

Common Stock Right | | | –%6 | |

Short-Term Investments | | | 3.5% | |

Other3 | | | 19.9% | |

Top Five Common Stock & Real Estate Investment Trust Common Stock Holdings1

| | | | |

National Grid PLC, Sponsored ADR | | | 2.9% | |

Atlantia SpA | | | 2.5% | |

Hutchison Port Holdings Trust | | | 1.8% | |

Transurban Group | | | 1.7% | |

Liberty Property Trust | | | 1.6% | |

| 1 | As a percentage of net assets. Holdings are subject to change. |

| 2 | Other assets less liabilities. |

| 3 | Includes other assets less liabilities and all industries less than 2.5% of net assets. |

| 4 | Includes short-term investments and other assets less liabilities. |

| 5 | Includes all countries less than 3.6% of net assets. |

| 6 | Rounds to less than 0.1%. |

Holding Summaries December 31, 2013 (continued)

Nuveen Real Estate Securities Fund

Portfolio Allocation1

| | | | |

Common Stocks | | | 1.7% | |

Real Estate Investment Trust Common Stocks | | | 97.2% | |

$25 Par (or similar) Retail Structures | | | 0.1% | |

Convertible Bonds | | | 0.2% | |

Investment Companies | | | 0.1% | |

Other2 | | | 0.7% | |

Portfolio Composition1

| | | | |

Retail | | | 28.0% | |

Specialized | | | 26.7% | |

Office | | | 12.9% | |

Residential | | | 12.7% | |

Diversified | | | 8.4% | |

Industrial | | | 8.1% | |

Other3 | | | 3.2% | |

Top Five Common Stock & Real Estate Investment Trust Common Stock Holdings1

| | | | |

Simon Property Group, Inc. | | | 11.3% | |

Public Storage, Inc. | | | 6.2% | |

Prologis Inc. | | | 5.8% | |

Boston Properties, Inc. | | | 4.2% | |

Vornado Realty Trust | | | 3.5% | |

| 1 | As a percentage of net assets. Holdings are subject to change. |

| 2 | Other assets less liabilities, which includes investments purchased with collateral from securities lending and borrowings as presented in the Fund’s Portfolio of Investments. |

| 3 | Includes other assets less liabilities, which includes investments purchased with collateral from securities lending and borrowings as presented in the Fund’s Portfolio of Investments and all industries less than 8.1% of net assets. |

Expense Examples

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held through the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

Nuveen Global Infrastructure Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | Hypothetical Performance

(5% annualized return before expenses) | |

| | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | |

Beginning Account Value (7/01/13) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value (12/31/13) | | $ | 1,102.30 | | | $ | 1,097.40 | | | $ | 1,100.80 | | | $ | 1,103.10 | | | $ | 1,019.00 | | | $ | 1,015.22 | | | $ | 1,017.74 | | | $ | 1,020.27 | |

Expenses Incurred During Period | | $ | 6.52 | | | $ | 10.47 | | | $ | 7.84 | | | $ | 5.19 | | | $ | 6.26 | | | $ | 10.06 | | | $ | 7.53 | | | $ | 4.99 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.23%, 1.98%, 1.48% and 0.98% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Expense Examples (continued)

Nuveen Real Asset Income Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | Hypothetical Performance

(5% annualized return before expenses) | |

| | | A Shares | | | C Shares | | | I Shares | | | A Shares | | | C Shares | | | I Shares | |

Beginning Account Value (7/01/13) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value (12/31/13) | | $ | 1,026.40 | | | $ | 1,023.00 | | | $ | 1,027.70 | | | $ | 1,019.31 | | | $ | 1,015.53 | | | $ | 1,020.57 | |

Expenses Incurred During Period | | $ | 5.98 | | | $ | 9.79 | | | $ | 4.70 | | | $ | 5.96 | | | $ | 9.75 | | | $ | 4.69 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.17%, 1.92% and 0.92% for Classes A, C and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Nuveen Real Estate Securities Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | Hypothetical Performance

(5% annualized return before expenses) | |

| | | A Shares | | | B Shares | | | C Shares | | | R3 Shares | | | R6 Shares | | | I Shares | | | A Shares | | | B Shares | | | C Shares | | | R3 Shares | | | R6 Shares | | | I Shares | |

Beginning Account Value (7/01/13) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value (12/31/13) | | $ | 963.00 | | | $ | 959.50 | | | $ | 959.20 | | | $ | 961.90 | | | $ | 965.30 | | | $ | 964.40 | | | $ | 1,018.80 | | | $ | 1,015.07 | | | $ | 1,015.02 | | | $ | 1,017.54 | | | $ | 1,020.82 | | | $ | 1,020.06 | |

Expenses Incurred During Period | | $ | 6.28 | | | $ | 9.93 | | | $ | 9.98 | | | $ | 7.52 | | | $ | 4.31 | | | $ | 5.05 | | | $ | 6.46 | | | $ | 10.21 | | | $ | 10.26 | | | $ | 7.73 | | | $ | 4.43 | | | $ | 5.19 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.27%, 2.01%, 2.02%, 1.52%, 0.87% and 1.02% for Classes A, B, C, R3, R6 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Report of Independent Registered

Public Accounting Firm

To the Board of Directors and Shareholders of

Nuveen Global Infrastructure Fund

Nuveen Real Asset Income Fund

Nuveen Real Estate Securities Fund:

In our opinion, the accompanying statements of assets and liabilities, including the portfolios of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Nuveen Global Infrastructure Fund, Nuveen Real Asset Income Fund, and Nuveen Real Estate Securities Fund (hereinafter referred to as the “Funds”) at December 31, 2013, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period then ended and the financial highlights for each of the two years in the period then ended and for the two months ended December 31, 2011 for Nuveen Global Infrastructure Fund and Nuveen Real Estate Securities Fund and for the periods presented for Nuveen Real Asset Income Fund, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2013 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion. The financial statement highlights for each of the three years in the period ended October 31, 2011 of the Nuveen Global Infrastructure Fund and Nuveen Real Estate Securities Fund were audited by other auditors whose report dated December 28, 2011 expressed an unqualified opinion on those statements, except for the reclassification of certain financial statement line items in the financial highlights for the year ended October 31, 2011 for the Nuveen Real Estate Securities Fund as to which the date is February 29, 2012.

PRICEWATERHOUSECOOPERS LLP

Chicago, IL

February 27, 2014

Portfolio of Investments December 31, 2013

Nuveen Global Infrastructure Fund

| | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | | |

| | | | LONG-TERM INVESTMENTS – 97.3% | | | | | | | | | | |

| | | | | |

| | | | COMMON STOCKS – 94.1% | | | | | | | | | | |

| | | | | |

| | | | Air Freight & Logistics – 1.4% | | | | | | | | | | |

| | | | | |

| | 188,021 | | | BPost SA | | | | | | | | $ | 3,675,579 | |

| | | | | |

| | 28,893 | | | Oesterreichische Post AG | | | | | | | | | 1,382,444 | |

| | | | | |

| | 3,956,464 | | | Singapore Post Limited | | | | | | | | | 4,154,138 | |

| | | | Total Air Freight & Logistics | | | | | | | | | 9,212,161 | |

| | | | | |

| | | | Commercial Services & Supplies – 4.3% | | | | | | | | | | |

| | | | | |

| | 2,999,886 | | | China Everbright International Limited | | | | | | | | | 4,015,684 | |

| | | | | |

| | 449,463 | | | Covanta Holding Corporation | | | | | | | | | 7,977,968 | |

| | | | | |

| | 218,078 | | | IESI_BFC Limited | | | | | | | | | 5,397,431 | |

| | | | | |

| | 1,251,483 | | | K-Green Trust | | | | | | | | | 1,036,332 | |

| | | | | |

| | 55,449 | | | SP Plus Corporation, (2) | | | | | | | | | 1,443,892 | |

| | | | | |

| | 184,149 | | | Waste Connections Inc. | | | | | | | | | 8,034,421 | |

| | | | Total Commercial Services & Supplies | | | | | | | | | 27,905,728 | |

| | | | | |

| | | | Construction & Engineering – 1.4% | | | | | | | | | | |

| | | | | |

| | 122,850 | | | Ferrovial SA | | | | | | | | | 2,377,060 | |

| | | | | |

| | 83,427 | | | Promotora y Operadora de Infraestructura SAB de CV (Pinfra), (2) | | | | | | | | | 996,920 | |

| | | | | |

| | 90,628 | | | Vinci S.A | | | | | | | | | 5,949,605 | |

| | | | Total Construction & Engineering | | | | | | | | | 9,323,585 | |

| | | | | |

| | | | Electric Utilities – 10.9% | | | | | | | | | | |

| | | | | |

| | 314,066 | | | Alupar Investimento SA, (2) | | | | | | | | | 2,163,218 | |

| | | | | |

| | 33,280 | | | American Electric Power Company, Inc. | | | | | | | | | 1,555,507 | |

| | | | | |

| | 116,117 | | | Brookfield Infrastructure Partners LP | | | | | | | | | 4,554,109 | |

| | | | | |

| | 243,568 | | | Cheung Kong Infrastructure Holdings Limited | | | | | | | | | 1,537,554 | |

| | | | | |

| | 220,064 | | | Duke Energy Corporation | | | | | | | | | 15,186,617 | |

| | | | | |

| | 1,312 | | | Edison International | | | | | | | | | 60,746 | |

| | | | | |

| | 184,894 | | | EDP Energias do Brasil SA | | | | | | | | | 889,497 | |

| | | | | |

| | 15,169 | | | Elia System Operator SA NV | | | | | | | | | 703,254 | |

| | | | | |

| | 486,209 | | | Energa SA, (2) | | | | | | | | | 2,563,781 | |

| | | | | |

| | 148,616 | | | Enersis SA | | | | | | | | | 2,227,754 | |

| | | | | |

| | 102,029 | | | Fortis Incorporated | | | | | | | | | 2,924,719 | |

| | | | | |

| | 94,412 | | | Hafslund ASA, Class B Shares | | | | | | | | | 723,815 | |

| | | | | |

| | 1,147,832 | | | Infratil Limited | | | | | | | | | 2,142,834 | |

| | | | | |

| | 38,642 | | | ITC Holdings Corporation | | | | | | | | | 3,702,676 | |

| | | | | |

| | 90,522 | | | NextEra Energy Inc. | | | | | | | | | 7,750,494 | |

| | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | | |

| | | | Electric Utilities (continued) | | | | | | | | | | |

| | | | | |

| | 97,837 | | | OGE Energy Corp. | | | | | | | | $ | 3,316,674 | |

| | | | | |

| | 174,516 | | | Pinnacle West Capital Corporation | | | | | | | | | 9,235,387 | |

| | | | | |

| | 104,510 | | | Power Assets Holdings Limited | | | | | | | | | 830,899 | |

| | | | | |

| | 1,161,525 | | | Power Grid Corporation of India Limited | | | | | | | | | 1,875,941 | |

| | | | | |

| | 80,065 | | | Scottish and Southern Energy PLC | | | | | | | | | 1,816,405 | |

| | | | | |

| | 1,610,108 | | | Spark Infrastructure Group | | | | | | | | | 2,336,198 | |

| | | | | |

| | 564,775 | | | Terna-Rete Elettrica Nazionale SpA | | | | | | | | | 2,821,933 | |

| | | | Total Electric Utilities | | | | | | | | | 70,920,012 | |

| | | | | |

| | | | Gas Utilities – 6.4% | | | | | | | | | | |

| | | | | |

| | 16,181 | | | ENN Energy Holdings Limited | | | | | | | | | 119,673 | |

| | | | | |

| | 43,357 | | | GAIL India Limited, GDR | | | | | | | | | 1,441,187 | |

| | | | | |

| | 1,932,746 | | | Hong Kong and China Gas Company Limited | | | | | | | | | 4,431,635 | |

| | | | | |

| | 828,534 | | | Infraestructura Energetica Nova SAB de CV | | | | | | | | | 3,310,582 | |

| | | | | |

| | 59,842 | | | Laclede Group Inc. | | | | | | | | | 2,725,205 | |

| | | | | |

| | 100,858 | | | ONEOK, Inc. | | | | | | | | | 6,271,350 | |

| | | | | |

| | 460,636 | | | Petronas Gas Berhad | | | | | | | | | 3,414,514 | |

| | | | | |

| | 37,115 | | | Piedmont Natural Gas Company | | | | | | | | | 1,230,733 | |

| | | | | |

| | 90,968 | | | Rubis | | | | | | | | | 5,761,056 | |

| | | | | |

| | 888,262 | | | Snam Rete Gas S.p.A | | | | | | | | | 4,968,597 | |

| | | | | |