UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Christopher M. Rohrbachar

Vice President and Secretary

333 West Wacker Drive,

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: June 30

Date of reporting period: June 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Nuveen Income Funds

| | | | | | | | | | | | |

| Fund Name | | Class A | | Class C | | Class R3 | | Class R6 | | Class I | | Class T |

| Nuveen Core Bond Fund | | FAIIX | | NTIBX | | — | | NTIFX | | FINIX | | FIDTX |

| Nuveen Core Plus Bond Fund | | FAFIX | | FFAIX | | FFISX | | FPCFX | | FFIIX | | FFITX |

| Nuveen High Income Bond Fund | | FJSIX | | FCSIX | | FANSX | | — | | FJSYX | | FCPTX |

| Nuveen Inflation Protected Securities Fund | | FAIPX | | FCIPX | | FRIPX | | FISFX | | FYIPX | | FIFTX |

| Nuveen Short Term Bond Fund | | FALTX | | FBSCX | | NSSRX | | NSSFX | | FLTIX | | NSATX |

| Nuveen Strategic Income Fund | | FCDDX | | FCBCX | | FABSX | | FSFRX | | FCBYX | | FSFTX |

Annual Report

Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your email!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

Must be preceded by or accompanied by a prospectus.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

Table

of Contents

3

Chairman’s Letter to Shareholders

Dear Shareholders,

I am honored to serve as the new independent chairman of the Nuveen Fund Board, effective July 1, 2018. I’d like to gratefully acknowledge the stewardship of my predecessor William J. Schneider and, on behalf of my fellow Board members, reinforce our commitment to the legacy of strong, independent oversight of your Funds.

The increase in market volatility this year reflects greater uncertainty among investors. The global economic outlook is less clear cut than it was in 2017. U.S. growth is again decoupling from that of the rest of the world, and the U.S. dollar and interest rates have risen in response. Trade concern rhetoric and the imposition of tariffs between the U.S. and its major trading partners has recently dampened business sentiment and could pose a risk to growth expectations going forward. A host of other geopolitical concerns, including the ongoing Brexit and North American Free Trade Agreement negotiations, North Korea relations and rising populism around the world, remain on the horizon.

Despite these risks, global growth remains intact, albeit at a slower pace, providing support to corporate earnings. Fiscal stimulus, an easing regulatory environment and robust consumer spending recently helped boost the U.S. economy’s momentum. Subdued inflation pressures have kept central bank policy accommodative, even as Europe moves closer to winding down its monetary stimulus and the Federal Reserve remains on a moderate tightening course.

Headlines and political noise will continue to obscure underlying fundamentals at times and cause temporary bouts of volatility. We encourage you to work with your financial advisor to evaluate your goals, timeline and risk tolerance if short-term market fluctuations are a concern. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chairman of the Board

August 24, 2018

4

Portfolio Managers’

Comments

Nuveen Core Bond Fund

Nuveen Core Plus Bond Fund

Nuveen High Income Bond Fund

Nuveen Inflation Protected Securities Fund

Nuveen Short Term Bond Fund

Nuveen Strategic Income Fund

These Funds feature portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen, LLC. In this report, the various portfolio management teams for the Funds discuss the economy and financial markets, key investment strategies and the Funds’ performance for the twelve-month reporting period ended June 30, 2018.

The management teams include:

Nuveen Core Bond Fund

Jeffrey J. Ebert, Wan-Chong Kung, CFA, and Jason J. O’Brien, CFA, have been part of the management team for the Fund since 2000, 2002 and 2016, respectively. Portfolio manager Chris J. Neuharth retired from Nuveen Asset Management, LLC on June 1, 2018.

Nuveen Core Plus Bond Fund

Timothy A. Palmer, CFA, has managed the Fund since 2003. Wan-Chong Kung, CFA, Jeffrey J. Ebert and Douglas M. Baker, CFA, joined the Fund as portfolio managers in 2001, 2005 and 2016, respectively. Portfolio manager Chris J. Neuharth retired from Nuveen Asset Management, LLC on June 1, 2018.

Nuveen High Income Bond Fund

John T. Fruit, CFA, has managed the Fund since 2006. Jeffrey T. Schmitz, CFA, has been part of the management team for the Fund since 2008.

Nuveen Inflation Protected Securities Fund

Wan-Chong Kung, CFA, has managed the Fund since its inception in 2004 and Chad W. Kemper joined the Fund as a portfolio manager in 2010.

Nuveen Short Term Bond Fund

Peter L. Agrimson, CFA, Jason J. O’Brien, CFA, and Mackenzie S. Meyer have been on the management team since 2011, 2016 and 2016, respectively. Portfolio manager Chris J. Neuharth retired from Nuveen Asset Management, LLC on June 1, 2018.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments (continued)

Nuveen Strategic Income Fund

Timothy A. Palmer, CFA, has managed the Fund since 2005. Jeffrey J. Ebert, Marie A. Newcome, CFA, and Douglas M. Baker, CFA, joined the Fund as co-portfolio managers in 2000, 2011 and 2016, respectively.

What factors affected the U.S. economy and financial markets during the twelve-month annual reporting period ended June 30, 2018?

After maintaining a moderate pace of growth for most of the twelve-month reporting period, the U.S. economy accelerated in the second quarter of 2018. In the April to June period, economic stimulus from tax cuts and deregulation helped lift the economy to its fastest pace since 2014. The “advance” estimate by the Bureau of Economic Analysis reported U.S. gross domestic product (GDP) grew at an annualized rate of 4.1% in the second quarter, up from 2.2% in the first quarter, 2.3% in the fourth quarter of 2017 and 2.8% in the third quarter of 2017. GDP is the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. The boost in economic activity during the second quarter of 2018 was attributed to robust spending by consumers, businesses and the government, as well as a temporary increase in exports, as farmers rushed soybean shipments ahead of China’s retaliatory tariffs.

Consumer spending, the largest driver of the economy, remained well supported by low unemployment, wage gains and, in the second quarter, tax cuts. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 4.0% in June 2018 from 4.3% in June 2017 and job gains averaged around 198,000 per month for the past twelve months. While the jobs market has continued to tighten, wage growth has remained lackluster during this economic recovery. Although the January jobs report revealed an unexpected pick-up in wages, the trend moderated in subsequent months. The Consumer Price Index (CPI) increased 2.9% over the twelve-month reporting period ended June 30, 2018 on a seasonally adjusted basis, as reported by the Bureau of Labor Statistics. The core CPI (which excludes food and energy) increased 2.3% during the same period, slightly above the Federal Reserve’s (Fed) unofficial longer term inflation objective of 2.0%.

Low mortgage rates and low inventory continued to drive home prices higher. Although mortgage rates have started to nudge higher, they remained relatively low by historical standards. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 6.4% annual gain in May 2018 (most recent data available at the time this report was prepared). The 10-City and 20-City Composites reported year-over- year increases of 6.1% and 6.5%, respectively.

With the U.S. economy delivering a sustainable growth rate and employment strengthening, the Fed’s policy making committee continued to incrementally raise its main benchmark interest rate. The most recent increase, in June 2018, was the seventh rate hike since December 2015. Fed Chair Janet Yellen’s term expired in February 2018, and incoming Chairman Jerome Powell indicated he would likely maintain the Fed’s gradual pace of interest rate hikes. At the June meeting, the Fed increased its projection to four interest rate increases in 2018, from three increases projected at the March meeting, indicating its confidence in the economy’s health. In addition, in October 2017, the Fed began reducing its balance sheet by allowing a small amount of maturing Treasury and mortgage securities to roll off without reinvestment. The market expects the pace to remain moderate and predictable, with minimal market disruption.

The markets also continued to react to geopolitical news. Protectionist rhetoric had been garnering attention across Europe, as anti-European Union (EU) sentiment featured prominently (although did not win a majority) in the Dutch, French and German elections in 2017. Italy’s 2018 elections resulted in a hung parliament, and several months of negotiations resulted in a populist, euro-skeptic coalition government. The U.S. moved forward with tariffs on imported goods from China, as well as on steel and aluminum from Canada, Mexico and Europe. These countries announced retaliatory measures in kind, intensifying concerns about trade issues, although the U.S. and the Europe Union announced in July they would refrain from further tariffs while they negotiate trade terms. Meanwhile, in March the U.K. and EU agreed in principle to the Brexit transition terms, but political instability in the U.K. in July has clouded the outlook. The U.S. Treasury imposed additional sanctions on Russia in April, and re-imposed sanctions on Iran after President Trump decided to withdraw from the 2015 nuclear agreement. The threat of a nuclear North Korea eased somewhat as the leaders of South Korea and North Korea met during April and jointly announced a commitment toward peace, while the U.S.-North Korea summit yielded an agreement with few additional details.

6

What strategies were used to manage the Funds during the twelve-month reporting period and how did these strategies influence performance?

All of the Funds continued to employ the same fundamental investment strategies and tactics used previously, although implementation of those strategies depended on the individual characteristics of the portfolios, as well as market conditions. The Funds’ management teams use a highly collaborative, research-driven approach that we believe offers the best opportunity to achieve consistent, superior long-term performance on a risk-adjusted basis across the full range of market environments. During the reporting period, the Funds were generally positioned for an environment of continued moderate economic growth. Nonetheless, during the reporting period we made smaller scaled shifts on an ongoing basis that were geared toward improving each Fund’s profile in response to changing conditions and valuations. These strategic moves are discussed in more detail within each Fund’s section of this report.

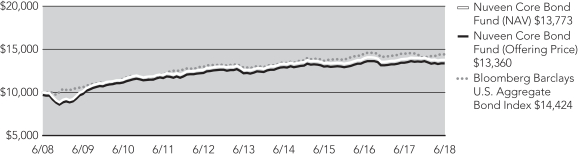

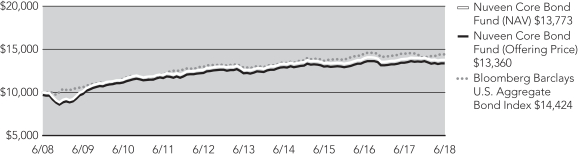

Nuveen Core Bond Fund

The Fund’s Class A Shares at net asset value (NAV) underperformed both the Bloomberg Barclays U.S. Aggregate Bond Index and the Lipper Core Bond Funds Classification Average for the twelve-month reporting period. U.S. Treasury rates were broadly range-bound for the first few months of the reporting period, before moving sharply higher starting in December 2017 and through the first two months of 2018, responding to developments surrounding Fed policy and strength in the U.S. economy.

The U.S. Treasury yield curve flattened dramatically with the 30-year Treasury yield ending the reporting period only 14 basis points higher, while the two-year Treasury yield increased by 114 basis points, reaching its highest level of this cycle. The yield of the benchmark 10-year Treasury surpassed 3% in April and May 2018 before drifting lower to end the reporting period at 2.85%. During the reporting period, several catalysts contributed to the flatter yield curve, including stronger economic data, the Fed’s rate hikes, continued low inflation and a supply imbalance in the U.S. Treasury market caused by dramatically increased issuance of shorter maturity (two- and three-year) bonds.

Investment grade bonds enjoyed fairly strong performance in the first half of the reporting period as corporate earnings continued to exceed expectations, overall credit fundamentals were constructive and demand was strong, particularly from overseas investors searching for higher yields. Credit spreads continued to contract and reached their tightest levels since 2007 by early February 2018. Corporate bond issuance remained elevated with several industries taking advantage of tight spreads and low rates to fund merger and acquisition (M&A) activity and share buybacks. However, the tide turned for the sector in the latter part of the reporting period as protectionist U.S. trade policy, geopolitical concerns and rising interest rates fueled an increase in equity market volatility and risk asset underperformance. Spreads widened fairly significantly in the investment grade corporate sector, exacerbated by weakening overseas demand and heavy supply. Credit fundamentals remained very strong with top-line revenue, earnings growth and free cash flow paving the way for disciplined balance sheet action by companies.

In the mortgage-backed securities (MBS) sector, range-bound rates and relatively low levels of volatility in the first half of the reporting period provided a solid backdrop. In October 2017, the Fed began reducing its monthly reinvestments in MBS by $4 billion per month, but the runoff was easily absorbed by banks, real estate investment trusts (REITs) and foreign buyers. At the beginning of 2018, a spike in market volatility, higher rates and the Fed’s continued reduction combined to create a more difficult environment for the MBS segment. However, the market was able to modestly recover in the final months of the reporting period after volatility lessened and the segment experienced better-than-expected demand from banks and money managers.

Asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) outpaced Treasuries during the reporting period as solid credit performance and strong demand supported both segments. Issuance was modestly ahead of the previous year’s pace, but was easily absorbed by investors looking for high quality yield in shorter maturity securities. Improving economic conditions continued to support consumer balance sheets and commercial real estate fundamentals.

Throughout the reporting period, we maintained the Fund’s positioning with a broad overweight to non-government spread sectors and a bias toward income generation through diversified holdings in the investment grade credit and securitized sectors. The main drag on the Fund’s performance during the reporting period was its exposure to MBS. We continued to position the Fund with a modest underweight to these securities, which was detrimental since the sector outperformed the index. Also, security selection in

7

Portfolio Managers’ Comments (continued)

the MBS sector was a drag on performance because we targeted our underweight in the Government National Mortgage Association (Ginnie Mae) segment, which recovered and outperformed the broader index. However, the Fund’s remaining securitized exposures in CMBS and ABS each added incrementally to performance. In the ABS sector, we emphasized high quality, short maturity securities, which benefited from strong investor demand for yield at the short end of the yield curve for most of the reporting period. In the Fund’s CMBS exposure, our security selection was favorable because our non-AAA rated, investment grade CMBS outperformed the broader index.

For the reporting period as a whole, the Fund’s overweight to investment grade credit contributed positively to performance. The Fund was also aided by security selection within its investment grade corporate exposure. Results in the sector were driven by a meaningful overweight to BBB rated credits, as well as bottom-up credit selection within financials. The BBB overweight proved rewarding because lower quality issues led in excess returns until late in the reporting period, driven by favorable economic conditions and strong demand for yield from investors. Our financial positions in aggregate also outperformed the index.

In addition, our interest rate positioning benefited the Fund’s performance throughout the reporting period. As noted above, the yield curve flattened significantly as short-term rates rose much more than longer-term rates driven by steady economic data and the three Fed rate hikes. We had positioned the Fund with a shorter duration than the benchmark for the majority of the reporting period, which lessened its interest rate sensitivity, focused on the front of the yield curve. This shorter duration stance benefited the Fund’s performance given the higher rates. Our yield curve positioning also proved beneficial. We positioned the Fund for a flatter curve for much of the reporting period by underweighting securities at the front end of the curve out to ten years and overweighting securities with maturities longer than ten years.

Despite the spike in market volatility during the reporting period, we continued to manage the Fund with many of the same overarching investment themes, focusing on generating above-market income and managing credit risk. We invested primarily in securities from the investment grade corporate and securitized sectors, with an emphasis on bottom-up security selection. Although credit spreads widened from the tight levels reached in early 2018, the fundamental and technical backdrops for the sector remained positive. Therefore, as the reporting period concluded, we maintained the Fund’s overweight position in investment grade credit and more specifically an overweight in BBB rated credits versus the benchmark. We also stayed the course with the Fund’s overweight positions in the financial and industrial sectors.

High quality income from securitized sectors continued to play a role in the Fund’s positioning. Despite the year-to-date negative excess returns and wider spreads in the MBS area, we maintained our negative view regarding the sector. Volatility rose from the previous lows and the Fed continued to reduce its footprint in the mortgage market, both of which we believed would continue to pressure the sector. At the end of the reporting period, we were continuing to strategically position the Fund with a modest underweight to the MBS sector. Meanwhile, the CMBS sector has outperformed credit year-to-date in 2018 as spreads have not widened to the same degree. Fundamentals remain positive and supply in the sector is still manageable. That said, we did not believe valuations were all that compelling at the end of the reporting period, so we will be diligent when looking for spots to add to the Fund’s current CMBS overweight. In the ABS market, the widening in swap spreads provided a nice opportunity to add short-maturity, high quality ABS at attractive yield levels. Fundamentals remained solid and demand for bonds at the front end of the curve was strong. Valuations ended the reporting period at the tighter end of their recent range, despite higher volumes in the new issue market. Therefore, similar to the CMBS sector, we maintained the Fund’s overweight, but will continue to select our ABS investments carefully.

After shifting closer to a neutral duration partway through the reporting period, we moved the Fund back to a shorter duration versus the benchmark toward the end of the reporting period. We thought this was prudent with the Fed indicating a potentially faster pace of rate hikes and with economic data generally on the stronger side. We also continued to tactically trade securities along the yield curve with a bias toward a flatter curve. Although near term we could see a modest steepening in the curve, longer term we want the Fund to be positioned to benefit from a flatter curve.

In addition, we continued to use various derivative instruments in the Fund during the reporting period. We used U.S. Treasury note and bond futures as part of an overall construction strategy to manage the Fund’s duration and yield curve exposure. The effect of these activities during the reporting period was positive.

8

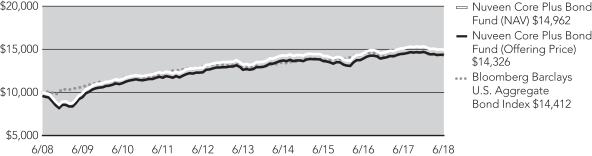

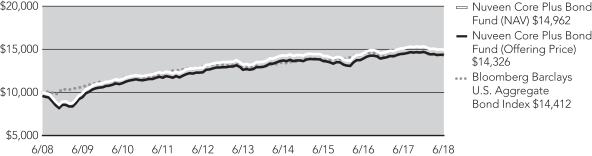

Nuveen Core Plus Bond Fund

The Fund’s Class A Shares at net asset value (NAV) underperformed both the Bloomberg Barclays U.S. Aggregate Bond Index and the Lipper Core Plus Bond Funds Classification Average for the twelve-month reporting period. U.S. Treasury rates were broadly range-bound for the first few months of the reporting period, before moving sharply higher starting in December and through the first two months of 2018, responding to developments surrounding Fed policy and strength in the U.S. economy.

The U.S. Treasury yield curve flattened dramatically with the 30-year Treasury yield ending the reporting period only 14 basis points higher, while the two-year Treasury yield increased by 114 basis points, reaching its highest level of this cycle. The yield of the benchmark 10-year Treasury surpassed 3% in April and May 2018 before drifting lower to end the reporting period at 2.85%. During the reporting period, several catalysts contributed to the flatter yield curve, including stronger economic data, the Fed’s rate hikes, continued low inflation and a supply imbalance in the U.S. Treasury market caused by dramatically increased issuance of shorter maturity (two- and three-year) bonds.

Investment grade bonds enjoyed fairly strong performance in the first half of the reporting period as corporate earnings continued to exceed expectations, overall credit fundamentals were constructive and demand was strong, particularly from overseas investors searching for higher yields. Credit spreads continued to contract and reached their tightest levels since 2007 by early February 2018. Corporate bond issuance remained elevated with several industries taking advantage of tight spreads and low rates to fund merger and acquisition (M&A) activity and share buybacks. However, the tide turned for the sector in the latter part of the reporting period as protectionist U.S. trade policy, geopolitical concerns and rising interest rates fueled an increase in equity market volatility and risk asset underperformance. Spreads widened fairly significantly in the investment grade corporate sector, exacerbated by weakening overseas demand and heavy supply. Credit fundamentals remained very strong with top-line revenue, earnings growth and free cash flow paving the way for disciplined balance sheet action by companies. In overseas markets, spreads for non-U.S. credit generally tracked the U.S. until late in the reporting period when European stress caused underperformance. Dollar-pay emerging market (EM) credit was strong early, before underperforming all other sectors in 2018 amid interest rate pressures, local policy missteps and investor outflows.

High yield credit also performed well in the first half of the reporting period with the segment continuing to benefit from low market volatility, accelerating global growth and double-digit corporate earnings growth. Funding and refinancing conditions also remained largely supportive of the segment, resulting in a high level of refinancing activity that helped to extend the current credit cycle. Despite a spike in early 2018 driven by a bout of risk aversion that spread from the technology sector in equities to risk assets more broadly, the sector continued to perform well given its income advantage and strong economic conditions. Low default levels and light net new issue activity were also supportive of the sector. For the reporting period as a whole, high yield spreads versus Treasuries narrowed despite continued rate hikes and persistent outflows from high yield mutual funds, although they did widen somewhat from the 10-year lows reached in April 2018. The segment outperformed the majority of fixed income alternatives during the reporting period.

In the mortgage-backed securities (MBS) sector, range-bound rates and relatively low levels of volatility in the first half of the reporting period provided a solid backdrop. In October 2017, the Fed began reducing its monthly reinvestments in MBS by $4 billion per month, but the runoff was easily absorbed by banks, real estate investment trusts (REITs) and foreign buyers. At the beginning of 2018, a spike in market volatility, higher rates and the Fed’s continued reduction combined to create a more difficult environment for the MBS segment. However, the market was able to modestly recover in the final months of the reporting period after volatility lessened and the segment experienced better-than-expected demand from banks and money managers.

Asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) outpaced Treasuries during the reporting period as solid credit performance and strong demand supported both segments. Issuance was modestly ahead of the previous year’s pace, but was easily absorbed by investors looking for high quality yield in shorter maturity securities. Improving economic conditions continued to support consumer balance sheets and commercial real estate fundamentals.

Emerging market debt began the reporting period on a strong note supported by the risk-on, low volatility market environment and robust investor flows into the segment. Through the end of December 2017, broad strength in both emerging and developed economies and higher commodity prices outweighed potential concerns from continued policy normalization and balance sheet

9

Portfolio Managers’ Comments (continued)

reduction from the Fed and other central banks. However, in the second half of the reporting period, the sector experienced broad-based repricing after concerns about the monetary policy normalization of major central banks, less synchronized global growth, trade tensions and slowing Chinese growth depressed risk appetites and led to significant outflows. Country specific political and policy risks in Argentina, Brazil and Turkey added to the negative global backdrop. Local EM markets were hurt by the strong U.S. dollar and elevated market volatility with bond yields, especially in higher yielding countries, rising due to heavy investor positioning and currency pressures. The Argentine peso and Turkish lira were the worst performing currencies.

With rates rising in the U.S., developed global bond markets generally outperformed, supported by moderating economic growth, continued low or declining inflation in many markets and ongoing capital flows. The ECB emphasized continued accommodation and promised to leave rates unchanged until at least late 2019, reassuring investors and driving outperformance in Europe. Canada increased interest rates three times, which removed the cuts made in 2015 in response to the oil collapse. The Bank of England raised rates in November for the first time in a decade, but then delayed a second planned hike in May 2018. With this backdrop, yield curves flattened significantly and developed markets generally outperformed the U.S. Peripheral European yield spreads spiked late in the reporting period due to uncertainties surrounding trade issues and the Italian government. The dollar declined for most of the reporting period, but reversed course late given ongoing rate hikes, strong U.S. growth and economic divergence versus most other economies. The U.S. Dollar Index ended the reporting period roughly 1% lower after declining by nearly 8% mid-period.

The Fund modestly underperformed both the Bloomberg Barclays U.S. Aggregate Bond Index and the Lipper Core Plus Bond Funds Classification Average during the reporting period. The performance shortfall occurred in the second half of the reporting period and was driven by the broad underperformance in investment grade corporates and preferred securities as spreads on these sectors moved wider amid market pressure. While we continued to make adjustments to the portfolio to manage risk and take advantage of opportunities, we maintained the Fund’s positioning with a broad overweight to credit sectors and a bias toward income generation through diversified holdings. In light of the ongoing constructive macroeconomic backdrop and solid fundamentals, we continued to see value in these sectors, particularly following recent spread widening. Likewise, we maintained the Fund’s large underweight in Treasuries, given our constructive economic view and the relatively unattractive duration and yield profile of that sector, as well as an underweight to MBS.

The most significant detractor from performance was the Fund’s overweight to preferred and contingent capital (CoCo) securities, which came under pressure later in the reporting period due to increased market volatility amid expected increases in interest rates and perceived increased risk to European banks from the Italian political turmoil. Early in the reporting period, the sector performed well on the back of strong bank fundamentals, attractive valuations and limited supply, factors we expect to benefit the sector again in the future. Nonetheless, this positioning hindered performance during the reporting period.

A reduced weight in high yield, along with hedges in the sector, resulted in a small negative impact on performance from the sector for the reporting period. Although fundamentals remained positive, we carried reduced positions and employed hedges during the reporting period due to richening valuations. On balance, these moves negatively impacted performance.

Our overall interest rate positioning had a marginally negative effect on performance. The Fund experienced some benefit from our slightly defensive duration stance, which lessened its sensitivity to rising short-term rates. However, the positive impact was more than offset by negative results from yield curve positioning. We were positioned with an overweight to intermediate maturities due to the issue selection and sector composition of our holdings. This was the segment of the yield curve where rates rose the most.

On the other hand, the largest positive contributor to the Fund’s performance during the reporting period was security selection within the Fund’s investment grade corporate exposure. Results in the sector were driven by a meaningful overweight to BBB rated credits, as well as bottom-up credit selection within industrials. This proved rewarding because lower-quality issues led in excess returns until late in the reporting period, driven by favorable economic conditions and strong demand for yield from investors. The Fund’s broader non-corporate sector exposures were also modestly beneficial. Specifically, positions in two securitized sectors, CMBS and ABS, each added incrementally to performance. Currency positioning was not a factor because positions were currency hedged and the impact from non-U.S. bonds was a small positive owing to positions in German government bonds.

We took advantage of market opportunities to add to sectors and issues at attractive valuations during the reporting period. We increased the Fund’s overweight to investment grade corporates after the sector suffered from issuance pressure and removed high

10

yield sector hedges after the sector cheapened significantly amid market volatility. We believed sound fundamentals, demand for income and continued risk appetite remained supportive for credit sectors, although valuations and uncertainty made it compelling for us to upgrade quality at the margin. We remained overweight in both CMBS and ABS, given solid fundamentals and the yield associated with these high-quality sectors. We added incrementally to CMBS, while reducing exposure to the MBS sector to fund purchases in other sectors. We maintained the Fund’s underweight in MBS given opportunities elsewhere and risks associated with reduced Fed investment.

With global interest rates remaining low and spreads to the U.S. somewhat stretched, we kept global bond positioning at the low end of the Fund’s range. We maintained a positioning in German Bunds given their liquidity, stability and currency-hedged yield. We continued to maintain the Fund’s large underweight in Treasuries given our constructive economic view and income focus. Because we expect modest upward pressure on Treasury yields, we further reduced the Fund’s duration, adding to our defensive interest rate posture. We continued to expect the U.S. dollar to remain supported, and therefore have a bias to hedge foreign currency exposure.

During the reporting period, we also continued to use various derivative instruments. We used Treasury note and bond futures as part of an overall construction strategy to manage the Fund’s duration and yield curve exposure. These derivative positions had a positive impact on performance during the reporting period.

We used forward foreign currency exchange contracts to manage the Fund’s foreign currency exposure. For example, the Fund may reduce unwanted currency exposure from the Fund’s bond portfolio, or may take long forward positions in select currencies in an attempt to benefit from the potential price appreciation. These positions had a negligible impact on performance during the reporting period.

The Fund also entered into credit default swaps to take on credit risk and earn a commensurate credit spread. The effect of these activities on performance was negative during the reporting period.

The Fund also purchased a small amount of call options on futures during the reporting period. The call options had a negligible impact on performance and these positions were terminated prior to the end of the reporting period.

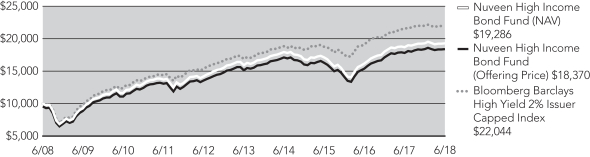

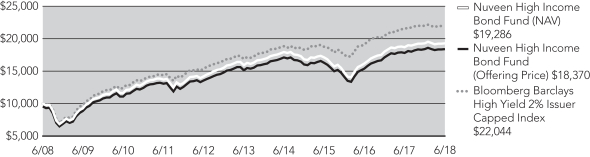

Nuveen High Income Bond Fund

The Fund’s Class A Shares at net asset value (NAV) outperformed both the Bloomberg Barclays High Yield 2% Issuer Capped Index and the Lipper High Yield Funds Classification Average for the twelve-month reporting period. In the first half of the reporting period, the high yield segment continued to benefit from low market volatility, accelerating global growth and double-digit corporate earnings growth. Funding and refinancing conditions also remained largely supportive of the segment, resulting in a high level of refinancing activity that helped to extend the current credit cycle. However, despite this favorable macro backdrop in the first half of the reporting period, overall returns for the high yield market were kept in check by historically tight spreads versus Treasuries, outflows from the asset class and mixed effects from tax reform. The high yield sector also had disproportionate exposure to some of 2017’s more fundamentally and secularly challenged industries such as retail, auto rentals and hospitals.

At the start of 2018, a string of volatility-inducing episodes created headwinds for the high yield asset class. Concerns over an uptick in inflation and a swifter-than-expected lift-off in Treasury yields acted as the initial catalyst for the sell-off in risk assets. Next, headline risk stemming from the Trump administration’s restrictive trade policies and a sell-off among large-cap technology stocks helped exacerbate market volatility, the former of which seemed to pose a bigger concern for corporate fundamentals. Despite these headwinds, high yield bonds remained fairly resilient and recovered in the final months of the reporting period. The strengthening U.S. economy and solid global growth conditions helped keep fundamentals firm for the high yield asset class, while the segment continued to benefit from a strong technical backdrop, especially when compared to the investment grade market. Net new issuance for high yield bonds year-to-date through June 30th ran about 30% lower than 2017, and the excess amount of cash coming in the form of coupons, calls and maturities far outpaced the volume of new issuance. Although default activity increased modestly, much of that was due to the March bankruptcy filing of iHeart Communications (Clear Channel), a large index constituent that was stressed for some time. Without that episode, high yield defaults would be trending lower than the end of 2017.

Despite continued rate hikes and persistent outflows from high yield mutual funds, high yield spreads versus Treasuries were fairly resilient during the reporting period, narrowing slightly from 385 basis points over Treasuries to 381 basis points by June 30, 2018,

11

Portfolio Managers’ Comments (continued)

although they reached their tightest level in 10 years in mid-April of 335 basis points over Treasuries. The high yield segment outperformed the majority of other fixed income asset classes during the reporting period, returning 2.62% as measured by the benchmark Bloomberg Barclays High Yield 2% Issuer Capped Bond Index. Within the high yield market, spreads tightened the most for the lower rated securities based on improving fundamentals and less sensitivity to interest rates. The CCC rated segment outperformed with a 6.84% return for the reporting period and outpaced both single B rated securities (2.99%) and BBs (0.60%). Much of the strength in lower rated securities was due to the rebound in energy and commodity prices, which helped lead to outperformance in energy bonds (8.11%) and metals/mining bonds (3.95%). Elsewhere from a sector standpoint, the weak spots within U.S. high yield were communications, consumer cyclical and health care, most notably hospitals. Besides energy and basic materials, other strong performers were cyclical sectors such as transportation and industrials.

The Fund’s outperformance during the reporting period was mainly driven by the better environment for risk appetites that led to a significant improvement in market liquidity and the outperformance of lower quality credit. The Fund generally benefited from its broader down-in-quality positioning as well as relative strength in a number of industrial sectors. We maintained the Fund’s overweight to CCC rated securities throughout the reporting period, and corresponding underweight to BB rated securities, with a keen focus on bottom-up fundamental research. This positioning was the most significant contributor to performance because lower quality securities held up better as Treasury yields rose, but was even more important in the second half of the reporting period where the market saw little variation in the performance among sectors. The rate volatility the market experienced, particularly since February, continued to have a disproportionately negative effect on BB rated securities, given their longer durations. At the same time, the incremental yield provided by CCC rated securities better insulated them against the rise in Treasury rates. Strength among higher volatility energy names also helped CCC rated bonds outperform the overall index and single B rated securities in particular. We emphasized lower quality debt because we believed the segment would continue to perform well during an environment of strong credit conditions and potentially higher interest rates. Low volatility and a sideways-to-tighter move in spreads are consistent with an extension of the credit cycle. Long economic expansions are typically good news for credit because higher free cash flow from sustained economic growth improves company balance sheets and generally leads to credit rating upgrades.

In terms of sector exposures, the Fund’s performance was aided by our overweights to cyclical areas of the market that continued to perform well, including energy (oilfield services) and transportation services as well as security selection in consumer cyclical. Although the Fund’s overall energy exposure was roughly in line with the benchmark weighting, we benefited from our security selection and slight bias to lower-rated energy issues. Underweight positions in the technology and communications sectors were also positive contributors. The Fund maintained a small underweight to retail. Although retailers continued to have their challenges, the sector enjoyed a bit of a rebound later in the reporting period from previously oversold conditions.

On the negative side, the biggest detractor to the Fund’s performance was an overweight to the basic materials sector, and specifically to the commodity and metals/mining areas that are more exposed to the negative impacts from the recent trade issues and tariff issues. Despite the overall strength in cyclical areas, security selection in metals and mining detracted, including exposure to two distressed coal credits. The coal sector was pressured by environmental regulation and low natural gas prices. However, by the end of the reporting period, the Fund’s remaining exposure to troubled coal credits was very negligible because we had cut exposure to almost zero. Exposure to European financial preferred securities, which had been a source of outperformance earlier in the reporting period, also proved to be a drag due to volatility and downward pressure in the segment caused by political developments in Italy.

While we continued to overweight and find selective opportunities in improving CCC rated credits, we started to find long-term value in BB rated securities that had underperformed. CCCs have outperformed BBs rather meaningfully with the spread ratio, as measured by yield-to-worst, hitting three-year lows toward the end of the reporting period. Given the worries over escalating trade issues and other sources of external pressure on risk markets, it seemed reasonable to marginally upgrade overall portfolio quality while the opportunity cost of doing so wasn’t that significant.

One side effect benefit of the weakness in the BB rated segment was the growing supply of bonds trading at a discount to par. Typically, low dollar price bonds have better recovery prospects and potentially more limited downside than their higher coupon and higher dollar price counterparts. Therefore, toward the end of the reporting period, we took advantage of the opportunity to add some of these discounted BB rated bonds to the Fund’s portfolio. We continue to favor a barbell approach to credit risk because we believe the economy is still doing well enough to support valuations in select CCC rated securities. If risk aversion increases in the

12

market, then BBs should benefit and outperform. However, based on our current outlook, we still believe lower quality bonds could perform well because of the segment’s attractive incremental yield and potential for price gains.

We believe the continued global economic expansion should be constructive for cyclical sectors such as chemicals, paper, mining, energy, homebuilding and other consumer cyclicals. Therefore, we maintained the Fund’s overweights to those sectors at the end of the reporting period. Although the chemical, paper and mining segments underperformed later in the reporting period due to some weakness in Chinese macro data and the threat of escalating trade issues, our overall views on maintaining the Fund’s overweight in cyclicals has not changed. In the case of oilfield services, we believe higher crude prices and contracting drilling activity may lead to a more meaningful sector recovery in 2019-2020.

During the reporting period, we also continued to use various derivative instruments. We used U.S. Treasury note and bond futures as part of an overall portfolio construction strategy to manage the Fund’s duration and yield curve exposure. The effect of these activities during the reporting period was negligible.

We used foreign currency exchange contracts to manage the Fund’s foreign currency exposures. During the reporting period, these instruments were used primarily for hedging purposes to reduce unwanted currency exposure from the Fund’s bond portfolio. These positions had a negligible impact on performance during the reporting period.

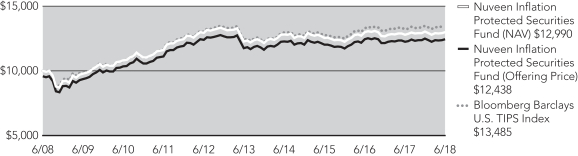

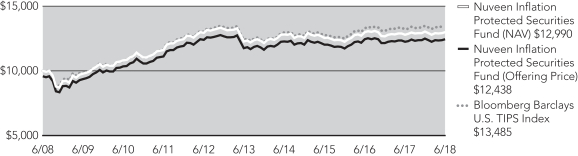

Nuveen Inflation Protected Securities Fund

The Fund’s Class A Shares at net asset value (NAV) underperformed both the Bloomberg Barclays U.S. TIPS Index and the Lipper Inflation-Protected Bond Funds Classification Average for the twelve-month reporting period. U.S. Treasury rates were broadly range-bound for the first few months of the reporting period, before moving sharply higher starting in December and through the first two months of 2018, responding to developments surrounding Fed policy and strength in the U.S. economy.

The U.S. Treasury yield curve flattened dramatically with the 30-year Treasury yield ending the reporting period only 14 basis points higher, while the two-year Treasury yield increased by 114 basis points, reaching its highest level of this cycle. The yield of the benchmark 10-year Treasury surpassed 3% in April and May 2018 before drifting lower to end the reporting period at 2.85%. During the reporting period, several catalysts contributed to the flatter yield curve, including stronger economic data, the Fed’s rate hikes, continued low inflation and a supply imbalance in the U.S. Treasury market caused by dramatically increased issuance of shorter maturity (two- and three-year) bonds.

The Treasury inflation-protected securities (TIPS) market remained well supported as inflation readings came in near expectations to slightly stronger, the Fed made further upward revisions to its inflation forecasts, tariff war concerns escalated and energy prices rose. Despite some increase in U.S. inflation measures, however, broader inflation risk remained fairly benign. Real yields moved significantly higher (and therefore prices were lower) at the front end of the yield curve, while the long end of the TIPS curve traded in a narrow range causing the overall real yield curve to flatten during the reporting period. For five-year TIPS, real yields increased 44 basis points, ending the reporting period at 0.66%. Yields for 10-year TIPS began the reporting period at 0.68% and traded as low as 0.25% and as high as 0.94% before ending only modestly higher at 0.74%. Meanwhile, yields for 30-year TIPS fell 12 basis points to 0.87% by the end of June 2018.

Although flows into the TIPS asset class leveled off as the reporting period progressed, they remained supportive for the segment, helping breakeven spreads move wider (or improve) across the TIPS yield curve. (Breakeven spreads measure the difference between the yields of nominal Treasuries versus TIPS with the same maturity.) In fact, partway through the reporting period, breakeven spreads reached their widest level since 2014 for the 10-year part of the curve, indicating greater investor interest in inflation protection. Supported by higher inflation expectations and rising energy prices, the TIPS sector significantly outperformed nominal Treasuries producing a 2.11% return as measured by the Bloomberg Barclays U.S. TIPS Index, versus -0.65% for the Bloomberg Barclays U.S. Treasury Index.

Investment grade bonds enjoyed fairly strong performance in the first half of the reporting period as corporate earnings continued to exceed expectations, overall credit fundamentals were constructive and demand was strong, particularly from overseas investors searching for higher yields. Credit spreads continued to contract and reached their tightest levels since 2007 by early February 2018.

13

Portfolio Managers’ Comments (continued)

Corporate bond issuance remained elevated with several industries taking advantage of tight spreads and low rates to fund merger and acquisition (M&A) activity and share buybacks. However, the tide turned for the sector in the latter part of the reporting period as protectionist U.S. trade policy, geopolitical concerns and rising interest rates fueled an increase in equity market volatility and risk asset underperformance. Spreads widened fairly significantly in the investment grade corporate sector, exacerbated by weakening overseas demand and heavy supply. Credit fundamentals remained very strong with top-line revenue, earnings growth and free cash flow paving the way for disciplined balance sheet action by companies.

High yield credit also performed well in the first half of the reporting period with the segment continuing to benefit from low market volatility, accelerating global growth and double-digit corporate earnings growth. Funding and refinancing conditions also remained largely supportive of the segment, resulting in a high level of refinancing activity that helped to extend the current credit cycle. Despite a spike in early 2018 driven by a bout of risk aversion that spread from the technology sector in equities to risk assets more broadly, the sector continued to perform well given its income advantage and strong economic conditions. Low default levels and light net new issue activity were also supportive of the sector. For the reporting period as a whole, high yield spreads versus Treasuries narrowed despite continued rate hikes and persistent outflows from high yield mutual funds, although they did widen somewhat from the 10-year lows reached in April 2018. The segment outperformed the majority of fixed income alternatives during the reporting period.

In the mortgage-backed securities (MBS) sector, range-bound rates and relatively low levels of volatility in the first half of the reporting period provided a solid backdrop. In October, the Fed began reducing its monthly reinvestments in MBS by $4 billion per month, but the runoff was easily absorbed by banks, real estate investment trusts (REITs) and foreign buyers. At the beginning of 2018, a spike in market volatility, higher rates and the Fed’s continued reduction combined to create a more difficult environment for the MBS segment. However, the market was able to modestly recover in the final months of the reporting period after volatility lessened and the segment experienced better-than-expected demand from banks and money managers.

Asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) outpaced Treasuries during the reporting period as solid credit performance and strong demand supported both segments. Issuance was modestly ahead of the previous year’s pace, but was easily absorbed by investors looking for high-quality yield in shorter maturity securities. Improving economic conditions continued to support consumer balance sheets and commercial real estate fundamentals.

The Fund’s results during the reporting period were slightly hindered by our underweight position in TIPS and modest exposures to non-government spread sectors, including ABS, CMBS, high yield credit and investment grade credit. With the exception of high yield, the rest of these sectors underperformed the TIPS segment to varying degrees during the reporting period. Although we slightly increased the Fund’s TIPS exposure from approximately 85% of the Fund’s assets to more than 88% of the portfolio by June 30, 2018, our position still represented a significant underweight versus the index’s 100% TIPS exposure.

On the positive side, the Fund benefited from our interest rate positioning throughout the reporting period. As noted above, both the nominal and TIPS yield curves flattened during the reporting period as short-term rates rose fairly significantly while longer term rates in both segments were more range bound. We had positioned the Fund with a shorter duration than the benchmark throughout the reporting period and increased the short further as the fiscal year progressed. This shorter duration stance lessened the Fund’s interest rate sensitivity, which proved beneficial in light of the rising short-term rates. The Fund ended the reporting period with a duration of 7.06 years, which was shorter than the 7.59 year duration of the Bloomberg Barclays U.S. TIPS Index. Also, our yield curve positioning was biased toward the long end of the curve, which slightly aided the Fund’s results.

We slightly increased the Fund’s TIPS weighting throughout the reporting period and, in turn, lowered the Fund’s very modest nominal Treasury exposure to zero, given the relatively unattractive duration and yield profile of the Treasury sector. Although we believed that TIPS breakeven spreads were near fair value at the end of the reporting period, we remained underweight in inflation with a corresponding overweight to spread sectors in order to provide some diversification to the portfolio. The Fund’s non-government spread sector exposure continued to include modest weights in ABS, CMBS, MBS, high yield credit and investment grade credit. Within this portion of the Fund, we continued to use our bottom-up strategy to identify names where we believed the portfolio was being compensated accordingly for the risk. In terms of spread sector weightings, we slightly lowered the Fund’s exposure to corporate securities, both high yield and investment grade, during the reporting period. Although corporate and

14

consumer credit fundamentals were steady and benefiting from the economic backdrop, credit spread valuations compressed close to their tightest levels in years. While we did not see a catalyst for a large near-term widening, we believed these levels warranted a more balanced overall risk posture. We used the proceeds to slightly increase the Fund’s allocations across the MBS, CMBS and ABS segments, given solid fundamentals and the yield associated with these high quality sectors.

We positioned the portfolio with a short duration throughout the reporting period and increased the short further as the reporting period progressed and real rates retraced from their recent highs. We will continue to position the portfolio defensively, but will look to be opportunistic in managing duration as market conditions shift.

We also used U.S. Treasury note and bond futures as part of an overall portfolio construction strategy to manage the Fund’s duration and yield curve exposure. These derivative positions had a negligible impact on performance during the reporting period.

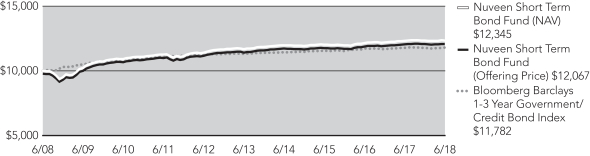

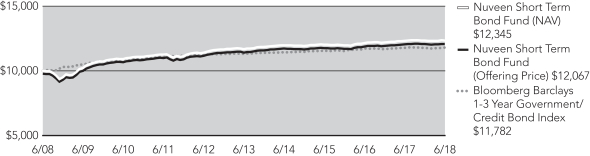

Nuveen Short Term Bond Fund

The Fund’s Class A Shares at net asset value (NAV) outperformed the Bloomberg Barclays 1-3 Year Government/Credit Bond Index and underperformed the Lipper Short Investment Grade Debt Funds Classification Average for the twelve-month reporting period. U.S. Treasury rates were broadly range-bound for the first few months of the reporting period, before moving sharply higher starting in December and through the first two months of 2018, responding to developments surrounding Fed policy and strength in the U.S. economy.

The U.S. Treasury yield curve flattened dramatically during the reporting period. At the long end of the yield curve, the 30-year Treasury yield ended the reporting period only 14 basis points higher at 2.98%. At the short end, the two-year Treasury yield increased by 114 basis points and reached 2.52%, its highest level of this cycle. The yield of the benchmark 10-year Treasury surpassed 3% in April and May 2018 before drifting lower to end the reporting period at 2.85%. During the reporting period, several catalysts contributed to the flatter yield curve, including stronger economic data, three rate hikes by the Fed, continued low inflation and a supply imbalance in the U.S. Treasury market caused by dramatically increased issuance of shorter maturity (two- and three-year) bonds. The return of the Fund’s shorter duration benchmark, the Bloomberg Barclays 1-3 Year Government/Credit Index, was 0.21%.

In the corporate market, investment grade bonds enjoyed fairly strong performance in the first half of the reporting period as corporate earnings continued to exceed expectations, overall credit fundamentals were constructive and demand was strong, particularly from overseas investors searching for higher yields. Credit spreads continued to contract and reached their tightest levels since 2007 by early February 2018. Corporate bond issuance remained elevated with several industries taking advantage of tight spreads and low rates to fund merger and acquisition (M&A) activity and share buybacks. However, the tide turned for the sector in the latter part of the reporting period as protectionist U.S. trade policy, geopolitical concerns and rising interest rates fueled an increase in equity market volatility and risk asset underperformance. Spreads widened fairly significantly in the investment grade corporate sector from the multi-year tight levels reached in early February, exacerbated by weakening overseas demand and heavy supply. However, in the final months of the reporting period, spreads moved modestly tighter once again. For the reporting period as a whole, short investment grade credit modestly outperformed Treasuries. That being said, credit fundamentals remained very strong with top-line revenue, earnings growth and free cash flow paving the way for disciplined balance sheet action by companies. Leverage, particularly for lower quality investment grade credit, continued to steadily decline.

In the securitized sectors, short-duration residential mortgage-backed securities (MBS) outperformed based on continued strong fundamentals and saw tighter spreads during the reporting period. Demand for the sector remained strong due to incremental spread and low correlation to broader markets. The commercial mortgage-backed securities (CMBS) sector performed well during the reporting period as heavy supply was met with strong investor demand. Traditional consumer asset-backed securities (ABS) provided stable performance during the reporting period. The liquid, high quality nature of the sector remained appealing to investors during periods of increased market volatility. In addition, floating rate exposure across the sectors proved beneficial during the reporting period as rates rose. Securitized sectors, in aggregate, posted positive excess returns versus Treasuries.

Generally speaking, the most significant driver of the Fund’s outperformance relative to the Bloomberg Barclays 1-3 Year Government/Credit Bond Index was its broad overweight to shorter maturity securities in the securitized sectors and a corresponding underweight to Treasuries. Typically around 45% of the Fund’s portfolio is allocated to securitized products, broadly diversified

15

Portfolio Managers’ Comments (continued)

across the residential MBS, CMBS and ABS sectors. Securitized sectors provided stable spreads during the uptick in volatility during February 2018, while providing incremental yield versus Treasuries during the reporting period. An overweight position in investment grade credit was also a slight benefit to performance as a result of tighter spreads during the first half of the reporting period.

The Fund also benefited significantly from our interest rate strategy. Throughout the reporting period, we maintained the Fund’s defensive positioning to limit its sensitivity to rising rates with a duration between 0.1 and 0.4 years shorter than the benchmark. As noted above, rates at the short end of the Treasury yield curve moved meaningfully higher during the reporting period, while longer-term rates remained range bound. Therefore, the Fund’s defensive duration stance relative to its benchmark had a favorable impact on performance. On the other hand, although the yield curve flattened during the reporting period, our yield curve positioning did not have a noticeable effect on performance.

Additionally, the Fund’s modest exposure to short-duration, high yield credit contributed to relative performance due primarily to the higher income levels of these securities. The Fund’s high yield exposure is focused on bonds rated BB and single-B with two- to four-year maturities.

Throughout the reporting period, we continued to focus our efforts on generating income by maintaining the Fund’s overweight to the investment grade credit sector. However, given the spread tightening in the market during the first half of the reporting period, we modestly lowered exposure to the sector. At the same time, we allowed the Fund’s high yield weighting to drift slightly lower through maturities and tenders. Because we expect the Fed’s tightening path to continue, we favored financials as well as higher quality securities over lower rated securities. We ended the reporting period with approximately 37% of the portfolio allocated to investment grade credit and 3% to high yield credit.

In aggregate, we slightly increased the Fund’s weightings in the securitized sectors, ending the reporting period at approximately 48% of the portfolio. In the ABS segment, we added incrementally to high quality, floating rate securities for their greater stability and return benefit in a rising rate environment. Toward the end of the reporting period, we also added incrementally to MBS exposure after we saw some spread widening that we viewed as technical in nature. As an offset, we slightly lowered the Fund’s CMBS weighting because we did not believe the risk/reward scenario was as compelling in that sector versus other short-duration sectors.

Short-term interest rates moved meaningfully higher after the Fed hiked three times during the reporting period. Given the strengthening economic growth throughout the reporting period and the Fed’s commitment to policy normalization, we maintained the Fund’s shorter duration than its benchmark. However, due to the magnitude of the increase in short-term rates, we covered a portion of the Fund’s short duration position relative to the benchmark. We targeted a portfolio duration that was around 1.5 to 1.8 years during the reporting period.

In addition, we used U.S. Treasury note futures as part of an overall portfolio construction strategy to manage the Fund’s duration and yield curve exposure. These derivative positions had a negative impact on performance during the reporting period.

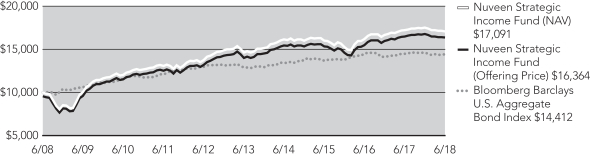

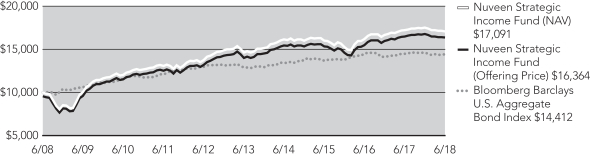

Nuveen Strategic Income Fund

The Fund’s Class A Shares at net asset value (NAV) underperformed both the Bloomberg Barclays U.S. Aggregate Bond Index and the Lipper Multi-Sector Income Funds Classification Average for the twelve-month reporting period. U.S. Treasury rates were broadly range-bound for the first few months of the reporting period, before moving sharply higher starting in December and through the first two months of 2018, responding to developments surrounding Fed policy and strength in the U.S. economy.

The U.S. Treasury yield curve flattened dramatically with the 30-year Treasury yield ending the reporting period only 14 basis points higher, while the two-year Treasury yield increased by 114 basis points, reaching its highest level of this cycle. The yield of the benchmark 10-year Treasury surpassed 3% in April and May 2018 before drifting lower to end the reporting period at 2.85%. During the reporting period, several catalysts contributed to the flatter yield curve, including stronger economic data, the Fed’s rate hikes, continued low inflation and a supply imbalance in the U.S. Treasury market caused by dramatically increased issuance of shorter maturity (two- and three-year) bonds.

16

Investment grade bonds enjoyed fairly strong performance in the first half of the reporting period as corporate earnings continued to exceed expectations, overall credit fundamentals were constructive and demand was strong, particularly from overseas investors searching for higher yields. Credit spreads continued to contract and reached their tightest levels since 2007 by early February 2018. Corporate bond issuance remained elevated with several industries taking advantage of tight spreads and low rates to fund merger and acquisition (M&A) activity and share buybacks. However, the tide turned for the sector in the latter part of the reporting period as protectionist U.S. trade policy, geopolitical concerns and rising interest rates fueled an increase in equity market volatility and risk asset underperformance. Spreads widened fairly significantly in the investment grade corporate sector, exacerbated by weakening overseas demand and heavy supply. Credit fundamentals remained very strong with top-line revenue, earnings growth and free cash flow paving the way for disciplined balance sheet action by companies. In overseas markets, spreads for non-U.S. credit generally tracked the U.S. until late in the reporting period when European stress caused underperformance. Dollar-pay emerging market (EM) credit was strong early, before underperforming all other sectors in 2018 amid interest rate pressures, local policy missteps and investor outflows.

High yield credit also performed well in the first half of the reporting period with the segment continuing to benefit from low market volatility, accelerating global growth and double-digit corporate earnings growth. Funding and refinancing conditions also remained largely supportive of the segment, resulting in a high level of refinancing activity that helped to extend the current credit cycle. Despite a spike in early 2018 driven by a bout of risk aversion that spread from the technology sector in equities to risk assets more broadly, the sector continued to perform well given its income advantage and strong economic conditions. Low default levels and light net new issue activity were also supportive of the sector. For the reporting period as a whole, high yield spreads versus Treasuries narrowed despite continued rate hikes and persistent outflows from high yield mutual funds, although they did widen somewhat from the 10-year lows reached in April 2018. The segment outperformed the majority of fixed income alternatives during the reporting period.

In the mortgage-backed securities (MBS) sector, range-bound rates and relatively low levels of volatility in the first half of the reporting period provided a solid backdrop. In October 2017, the Fed began reducing its monthly reinvestments in MBS by $4 billion per month, but the runoff was easily absorbed by banks, real estate investment trusts (REITs) and foreign buyers. At the beginning of 2018, a spike in market volatility, higher rates and the Fed’s continued reduction combined to create a more difficult environment for the MBS segment. However, the market was able to modestly recover in the final months of the reporting period after volatility lessened and the segment experienced better-than-expected demand from banks and money managers.

Asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) outpaced Treasuries during the reporting period as solid credit performance and strong demand supported both segments. Issuance was modestly ahead of the previous year’s pace, but was easily absorbed by investors looking for high quality yield in shorter maturity securities. Improving economic conditions continued to support consumer balance sheets and commercial real estate fundamentals.

Emerging market debt began the reporting period on a strong note supported by the risk-on, low volatility market environment and robust investor flows into the segment. Through the end of December 2017, broad strength in both emerging and developed economies and higher commodity prices outweighed potential concerns from continued policy normalization and balance sheet reduction from the Fed and other central banks. However, in the second half of the reporting period, the sector experienced broad-based repricing after concerns about the monetary policy normalization of major central banks, less synchronized global growth, trade tensions and slowing Chinese growth depressed risk appetites and led to significant outflows. Country specific political and policy risks in Argentina, Brazil and Turkey added to the negative global backdrop. Local EM markets were hurt by the strong U.S. dollar and elevated market volatility with bond yields, especially in higher yielding countries, rising due to heavy investor positioning and currency pressures. The Argentine peso and Turkish lira were the worst performing currencies.

With rates rising in the U.S., developed global bond markets generally outperformed, supported by moderating economic growth, continued low or declining inflation in many markets and ongoing capital flows. The ECB emphasized continued accommodation and promised to leave rates unchanged until at least late 2019, reassuring investors and driving outperformance in Europe. The Bank of Canada increased interest rates three times, which removed the cuts made in 2015 in response to the oil collapse. The Bank of England raised rates in November 2017 for the first time in a decade, but then delayed a second planned hike in May 2018. With this backdrop, yield curves flattened significantly and developed markets generally outperformed the U.S. Peripheral European yield

17

Portfolio Managers’ Comments (continued)

spreads spiked late in the reporting period due to uncertainties surrounding trade issues and the Italian government. The dollar declined for most of the reporting period, but reversed course late given ongoing rate hikes, strong U.S. growth and economic divergence versus most other economies. The U.S. Dollar Index ended the reporting period roughly 1% lower after declining by nearly 8% mid-period.

The Fund’s performance shortfall occurred in the second half of the reporting period and was driven by the broad underperformance of preferred securities and investment grade corporates as spreads on these sectors moved wider amid market pressure. While we continued to make adjustments to the portfolio to manage risk and take advantage of opportunities, we maintained the Fund’s positioning with a broad overweight to credit sectors and a bias toward income generation through diversified holdings. In light of the ongoing constructive macroeconomic backdrop and solid fundamentals, we continued to see value in these sectors, particularly following recent spread widening. Likewise, we maintained the Fund’s large underweight in Treasuries, given our constructive economic view and the relatively unattractive duration and yield profile of that sector, as well as an underweight to MBS.

The most significant detractor from performance was the Fund’s overweight to preferred and contingent capital (CoCo) securities, which came under pressure later in the reporting period due to increased market volatility amid expected increases in interest rates and perceived increased risk to European banks from the Italian political turmoil. Early in the reporting period, the sector performed well on the back of strong bank fundamentals, attractive valuations and limited supply, factors we expect to benefit the sector again in the future. Nonetheless, this positioning hindered performance during this time frame.

Our overall interest rate positioning had a marginally negative effect on performance. The Fund experienced some benefit from our slightly defensive duration stance, which lessened its sensitivity to rising short-term rates. However, the positive impact was more than offset by negative results from yield curve positioning. We were positioned with an overweight to intermediate maturities due to the issue selection and sector composition of our holdings. This was the segment of the yield curve where rates rose the most.

The largest positive contributor to the Fund’s performance during the reporting period was positioning in non-dollar bonds, driven by the outperformance of German Bunds versus U.S. Treasuries. We took advantage of the sell-off in German bonds as U.S. rates rose, while both economic fundamentals and ECB policy remained constructive, despite prevailing market concerns. This position was currency hedged, given the firming U.S. dollar and the yield advantage associated with hedging. Other smaller non-U.S. positions also added value. Additionally, security selection within the Fund’s investment grade corporate exposure proved beneficial during the reporting period. Results in the sector were aided by a meaningful overweight to BBB rated credits, as well as bottom-up credit selection within industrials. This proved rewarding because lower quality issues led in excess returns until late in the reporting period, driven by favorable economic conditions and strong demand for yield from investors. The Fund’s broader non-corporate sector exposures were also modestly beneficial. Specifically, positions in two securitized sectors, CMBS and ABS, each added slightly to performance. High yield corporates added marginally to performance, driven by security selection. Currency positioning was a slight positive, owing to our positioning for a stronger dollar.

We took advantage of market opportunities to add to sectors and issues at attractive valuations during the reporting period. We added fairly substantially to the Fund’s high yield weighting later in the reporting period after the sector cheapened significantly amid market volatility by removing sector hedges and adding individual issues. We also increased the Fund’s overweight to investment grade corporates late in the reporting period after the sector suffered from issuance pressure, having previously taken profits in the sector earlier in the reporting period. We believed sound fundamentals, demand for income and continued risk appetite remained supportive for credit sectors, although valuations and uncertainty made it compelling for us to upgrade quality at the margin. We marginally reduced exposure to U.S. dollar-denominated EM sovereign bonds later in the reporting period given a deterioration in technical factors that was not yet reflected in valuations. We remained overweight in both CMBS and ABS, given solid fundamentals and the yield associated with these high quality sectors. We added incrementally to CMBS, while reducing exposure to the MBS sector to fund purchases in other sectors. We maintained the Fund’s underweight in MBS given opportunities elsewhere and risks associated with reduced Fed investment.

We remained overweight in German Bunds given their liquidity, stability and currency-hedged yield, although we reduced this position following its strong outperformance. We continued to maintain the Fund’s large underweight in Treasuries given our constructive

18

economic view and income focus. Because we expect modest upward pressure on Treasury yields, we further reduced the Fund’s duration, adding to our defensive interest rate posture. We continued to expect the U.S. dollar to remain supported, and therefore have a bias to hedge foreign currency exposure.