UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811‑05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Mark J. Czarniecki

Vice President and Secretary

901 Marquette Avenue

Minneapolis, Minnesota 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917‑7700

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

| Item 1. | Reports to Stockholders. |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Dividend Value Fund

Class A Shares/FFEIX

Annual Shareholder Report

This annual shareholder report contains important information about the Class A Shares of the Nuveen Dividend Value Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class A Shares | | $110 | | 0.96% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Dividend Value Fund returned 28.86% for Class A Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund underperformed the Russell 1000 Value Index, which returned 30.98%. • Top contributors to relative performance » Security selection in the information technology sector, led by out‑of‑benchmark positions in Broadcom Inc. and Taiwan Semiconductor Manufacturing Co., Ltd. » Security selection and an overweight to the industrials sector, led by an overweight to Westinghouse Air Brake Technologies Corporation. • Top detractors from relative performance » Security selection in the health care sector, including overweights to Humana Inc. and Merck & Co., Inc. » Security selection and an underweight to the financials sector, including lack of exposure to JPMorgan Chase & Co. » Security selection in the real estate sector, including overweights to EastGroup Properties, Inc. and Prologis, Inc. |

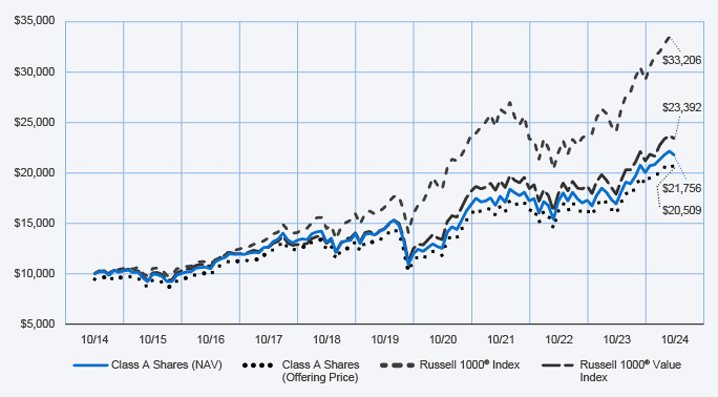

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class A Shares at NAV (excluding maximum sales charge) | | | 28.86 | % | | | 8.63 | % | | | 8.08 | % |

| | | | |

| Class A Shares at maximum sales charge (Offering Price) | | | 21.43 | % | | | 7.34 | % | | | 7.45 | % |

| | | | |

Russell 1000® Index | | | 38.07 | % | | | 15.00 | % | | | 12.75 | % |

| | | | |

Russell 1000® Value Index | | | 30.98 | % | | | 10.14 | % | | | 8.87 | % |

| | | | |

| Lipper Equity Income Funds Classification Average | | | 29.34 | % | | | 10.27 | % | | | 8.87 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 3,258,003,639 | |

| |

| Total number of portfolio holdings | | | 77 | |

| |

| Portfolio turnover (%) | | | 79% | |

| |

| Total management fees paid for the year | | $ | 19,386,443 | |

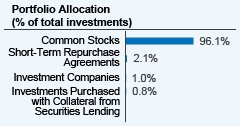

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670678887_AR_1024 4015316‑INV‑Y‑12/25 (A, C, R6, I) | | |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Dividend Value Fund

Class C Shares/FFECX

Annual Shareholder Report

This annual shareholder report contains important information about the Class C Shares of the Nuveen Dividend Value Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class C Shares | | $195 | | 1.71% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Dividend Value Fund returned 27.98% for Class C Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund underperformed the Russell 1000 Value Index, which returned 30.98%. • Top contributors to relative performance » Security selection in the information technology sector, led by out‑of‑benchmark positions in Broadcom Inc. and Taiwan Semiconductor Manufacturing Co., Ltd. » Security selection and an overweight to the industrials sector, led by an overweight to Westinghouse Air Brake Technologies Corporation. • Top detractors from relative performance » Security selection in the health care sector, including overweights to Humana Inc. and Merck & Co., Inc. » Security selection and an underweight to the financials sector, including lack of exposure to JPMorgan Chase & Co. » Security selection in the real estate sector, including overweights to EastGroup Properties, Inc. and Prologis, Inc. |

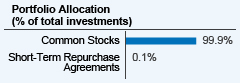

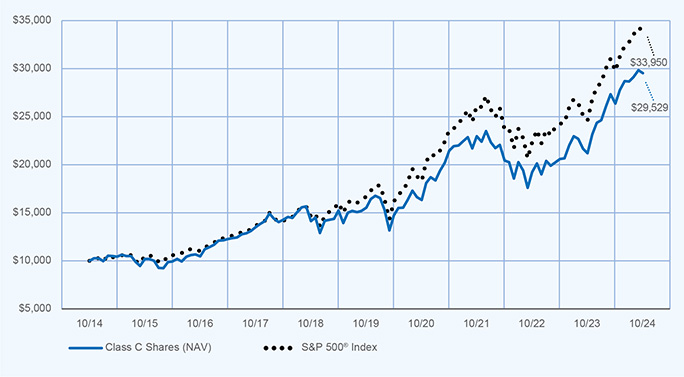

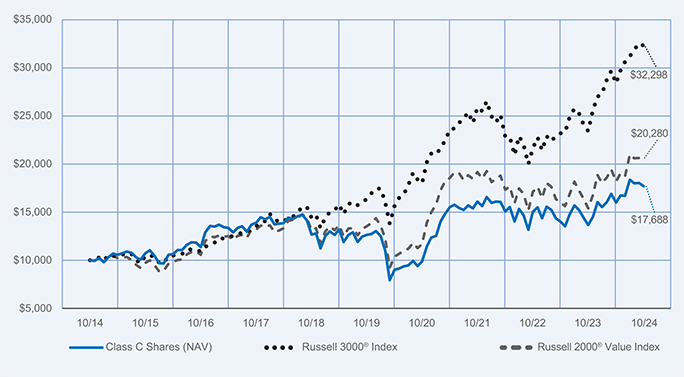

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class C Shares at NAV (excluding maximum sales charge) | | | 27.98 | % | | | 7.82 | % | | | 7.43 | % |

| | | | |

Russell 1000® Index | | | 38.07 | % | | | 15.00 | % | | | 12.75 | % |

| | | | |

Russell 1000® Value Index | | | 30.98 | % | | | 10.14 | % | | | 8.87 | % |

| | | | |

| Lipper Equity Income Funds Classification Average | | | 29.34 | % | | | 10.27 | % | | | 8.87 | % |

Class C Shares are subject to a contingent deferred sales charge if redeemed within 12 months of purchase, which will be reflected in total returns presented for less than one year.

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 3,258,003,639 | |

| |

| Total number of portfolio holdings | | | 77 | |

| |

| Portfolio turnover (%) | | | 79% | |

| |

| Total management fees paid for the year | | $ | 19,386,443 | |

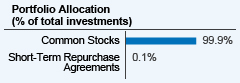

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670678317_AR_1024 4015316‑INV‑Y‑12/25 (A, C, R6, I) | | |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Dividend Value Fund

Class R6 Shares/FFEFX

Annual Shareholder Report

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Dividend Value Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class R6 Shares | | $71 | | 0.62% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Dividend Value Fund returned 29.28% for Class R6 Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund underperformed the Russell 1000 Value Index, which returned 30.98%. • Top contributors to relative performance » Security selection in the information technology sector, led by out‑of‑benchmark positions in Broadcom Inc. and Taiwan Semiconductor Manufacturing Co., Ltd. » Security selection and an overweight to the industrials sector, led by an overweight to Westinghouse Air Brake Technologies Corporation. • Top detractors from relative performance » Security selection in the health care sector, including overweights to Humana Inc. and Merck & Co., Inc. » Security selection and an underweight to the financials sector, including lack of exposure to JPMorgan Chase & Co. » Security selection in the real estate sector, including overweights to EastGroup Properties, Inc. and Prologis, Inc. |

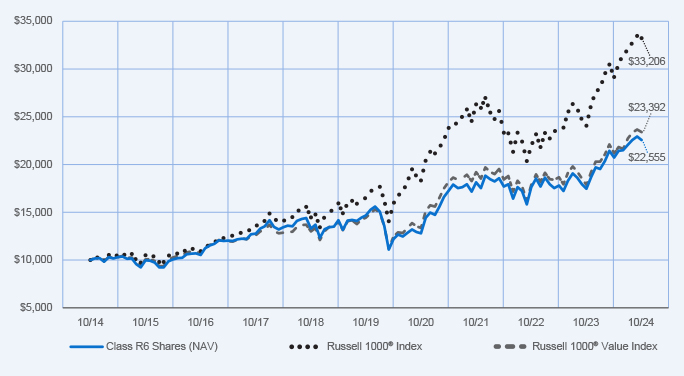

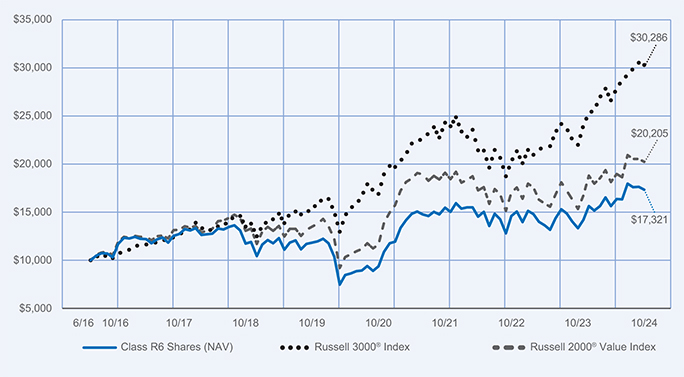

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class R6 Shares at NAV | | | 29.28 | % | | | 9.01 | % | | | 8.47 | % |

| | | | |

Russell 1000® Index | | | 38.07 | % | | | 15.00 | % | | | 12.75 | % |

| | | | |

Russell 1000® Value Index | | | 30.98 | % | | | 10.14 | % | | | 8.87 | % |

| | | | |

| Lipper Equity Income Funds Classification Average | | | 29.34 | % | | | 10.27 | % | | | 8.87 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 3,258,003,639 | |

| |

| Total number of portfolio holdings | | | 77 | |

| |

| Portfolio turnover (%) | | | 79% | |

| |

| Total management fees paid for the year | | $ | 19,386,443 | |

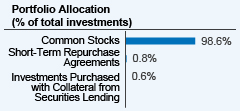

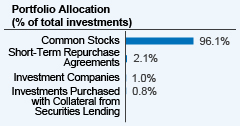

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670690130_AR_1024 4015316‑INV‑Y‑12/25 (A, C, R6, I) | | |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Dividend Value Fund

Class I Shares/FAQIX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Dividend Value Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class I Shares | | $81 | | 0.71% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Dividend Value Fund returned 29.19% for Class I Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund underperformed the Russell 1000 Value Index, which returned 30.98%. • Top contributors to relative performance » Security selection in the information technology sector, led by out‑of‑benchmark positions in Broadcom Inc. and Taiwan Semiconductor Manufacturing Co., Ltd. » Security selection and an overweight to the industrials sector, led by an overweight to Westinghouse Air Brake Technologies Corporation. • Top detractors from relative performance » Security selection in the health care sector, including overweights to Humana Inc. and Merck & Co., Inc. » Security selection and an underweight to the financials sector, including lack of exposure to JPMorgan Chase & Co. » Security selection in the real estate sector, including overweights to EastGroup Properties, Inc. and Prologis, Inc. |

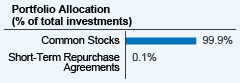

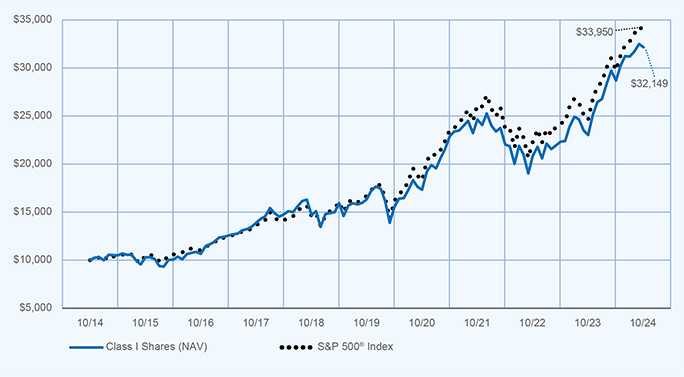

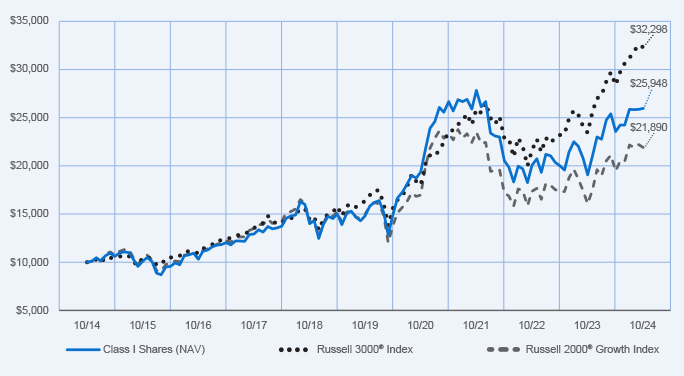

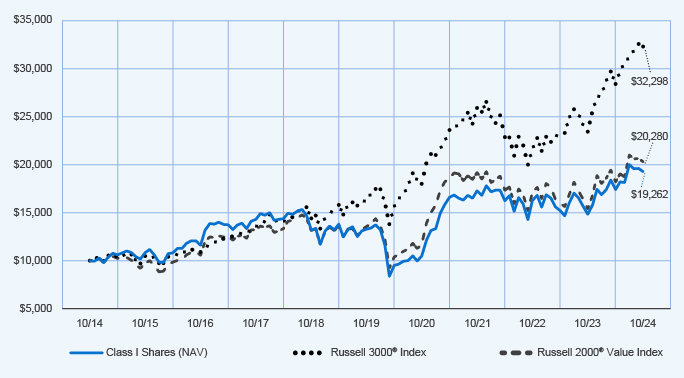

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class I Shares at NAV | | | 29.19 | % | | | 8.88 | % | | | 8.35 | % |

| | | | |

Russell 1000® Index | | | 38.07 | % | | | 15.00 | % | | | 12.75 | % |

| | | | |

Russell 1000® Value Index | | | 30.98 | % | | | 10.14 | % | | | 8.87 | % |

| | | | |

| Lipper Equity Income Funds Classification Average | | | 29.34 | % | | | 10.27 | % | | | 8.87 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 3,258,003,639 | |

| |

| Total number of portfolio holdings | | | 77 | |

| |

| Portfolio turnover (%) | | | 79% | |

| |

| Total management fees paid for the year | | $ | 19,386,443 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670678879_AR_1024 4015316‑INV‑Y‑12/25 (A, C, R6, I) | | |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Large Cap Select Fund

Class A Shares/FLRAX

Annual Shareholder Report

This annual shareholder report contains important information about the Class A Shares of the Nuveen Large Cap Select Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Class A Shares | | $123 | | 1.03% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Large Cap Select Fund returned 39.42% for Class A Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund outperformed the S&P 500 Index, which returned 38.02%. • Top contributors to relative performance » Security selection in the industrials sector, led by overweights to Westinghouse Air Brake Technologies Corporation and Parker-Hannifin Corporation. » Security selection in the information technology sector, led by an overweight to Broadcom Inc. and an out‑of‑benchmark position in Taiwan Semiconductor Manufacturing Co., Ltd. » Security selection in the consumer discretionary sector, led by overweights to Royal Caribbean Group and Expedia Group, Inc. • Top detractors from relative performance » Security selection in the health care sector, including overweights to Humana Inc. and Elevance Health, Inc. » Security selection in the energy sector, including overweights to Valero Energy Corporation and ConocoPhillips. |

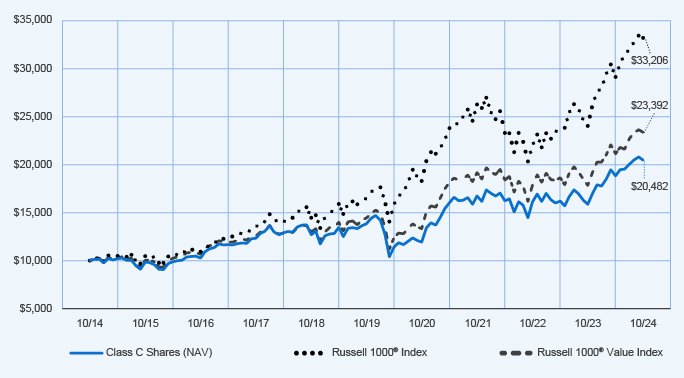

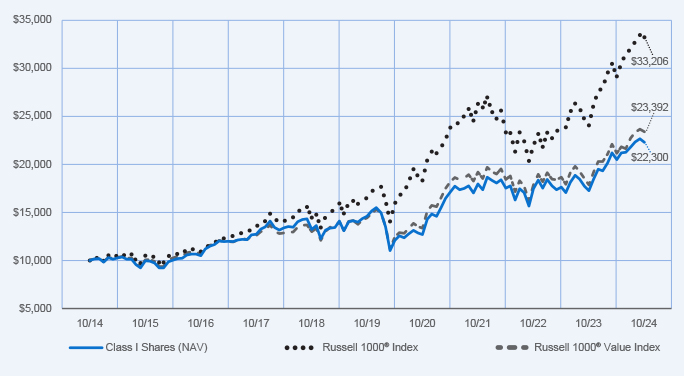

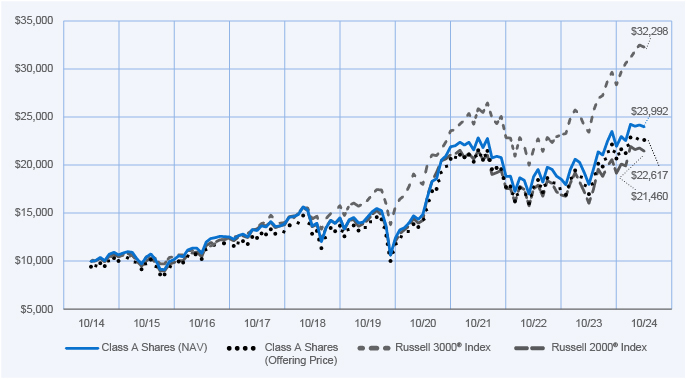

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class A Shares at NAV (excluding maximum sales charge) | | | 39.42 | % | | | 14.22 | % | | | 12.11 | % |

| | | | |

| Class A Shares at maximum sales charge (Offering Price) | | | 31.42 | % | | | 12.88 | % | | | 11.45 | % |

| | | | |

S&P 500® Index | | | 38.02 | % | | | 15.27 | % | | | 13.00 | % |

| | | | |

| Lipper Large‑Cap Core Funds Classification Average | | | 35.60 | % | | | 14.12 | % | | | 11.84 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 47,179,391 | |

| |

| Total number of portfolio holdings | | | 59 | |

| |

| Portfolio turnover (%) | | | 76% | |

| |

| Total management fees paid for the year | | $ | 301,629 | |

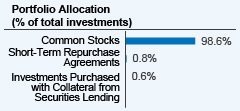

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670690296_AR_1024 4015315‑INV‑Y‑12/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Large Cap Select Fund

Class C Shares/FLYCX

Annual Shareholder Report

This annual shareholder report contains important information about the Class C Shares of the Nuveen Large Cap Select Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Class C Shares | | $212 | | 1.78% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Large Cap Select Fund returned 38.38% for Class C Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund outperformed the S&P 500 Index, which returned 38.02%. • Top contributors to relative performance » Security selection in the industrials sector, led by overweights to Westinghouse Air Brake Technologies Corporation and Parker-Hannifin Corporation. » Security selection in the information technology sector, led by an overweight to Broadcom Inc. and an out‑of‑benchmark position in Taiwan Semiconductor Manufacturing Co., Ltd. » Security selection in the consumer discretionary sector, led by overweights to Royal Caribbean Group and Expedia Group, Inc. • Top detractors from relative performance » Security selection in the health care sector, including overweights to Humana Inc. and Elevance Health, Inc. » Security selection in the energy sector, including overweights to Valero Energy Corporation and ConocoPhillips. |

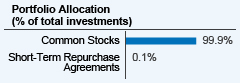

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class C Shares at NAV (excluding maximum sales charge) | | | 38.38 | % | | | 13.37 | % | | | 11.44 | % |

| | | | |

S&P 500® Index | | | 38.02 | % | | | 15.27 | % | | | 13.00 | % |

| | | | |

| Lipper Large‑Cap Core Funds Classification Average | | | 35.60 | % | | | 14.12 | % | | | 11.84 | % |

Class C Shares are subject to a contingent deferred sales charge if redeemed within 12 months of purchase, which will be reflected in total returns presented for less than one year.

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 47,179,391 | |

| |

| Total number of portfolio holdings | | | 59 | |

| |

| Portfolio turnover (%) | | | 76% | |

| |

| Total management fees paid for the year | | $ | 301,629 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en-us/mutual-funds/prospectuses or upon request at (800) 257-8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670690312_AR_1024 4015315‑INV‑Y‑12/25 (A, C, I) | |  |

| | |

| | Annual Shareholder Report October 31, 2024 |

Nuveen Large Cap Select Fund

Class I Shares/FLRYX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Large Cap Select Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Class I Shares | | $94 | | 0.78% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Large Cap Select Fund returned 39.76% for Class I Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund outperformed the S&P 500 Index, which returned 38.02%. • Top contributors to relative performance » Security selection in the industrials sector, led by overweights to Westinghouse Air Brake Technologies Corporation and Parker-Hannifin Corporation. » Security selection in the information technology sector, led by an overweight to Broadcom Inc. and an out‑of‑benchmark position in Taiwan Semiconductor Manufacturing Co., Ltd. » Security selection in the consumer discretionary sector, led by overweights to Royal Caribbean Group and Expedia Group, Inc. • Top detractors from relative performance » Security selection in the health care sector, including overweights to Humana Inc. and Elevance Health, Inc. » Security selection in the energy sector, including overweights to Valero Energy Corporation and ConocoPhillips. |

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class I Shares at NAV | | | 39.76 | % | | | 14.50 | % | | | 12.39 | % |

| | | | |

S&P 500® Index | | | 38.02 | % | | | 15.27 | % | | | 13.00 | % |

| | | | |

| Lipper Large‑Cap Core Funds Classification Average | | | 35.60 | % | | | 14.12 | % | | | 11.84 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 47,179,391 | |

| |

| Total number of portfolio holdings | | | 59 | |

| |

| Portfolio turnover (%) | | | 76% | |

| |

| Total management fees paid for the year | | $ | 301,629 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670690338_AR_1024 4015315‑INV‑Y‑12/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Mid Cap Growth Opportunities Fund

Class A Shares/FRSLX

Annual Shareholder Report

This annual shareholder report contains important information about the Class A Shares of the Nuveen Mid Cap Growth Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class A Shares | | $132 | | 1.15% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Mid Cap Growth Opportunities Fund returned 29.53% for Class A Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund significantly underperformed the Russell Mid Cap Growth Index, which returned 38.67%. • Top contributors to relative performance » Security selection in industrials, led by an out‑of‑benchmark position in MasTec, Inc. and an overweight to Axon Enterprise Inc. » Security selection in communication services, led by an overweight to Trade Desk, Inc. • Top detractors from relative performance » Security selection and an overweight in health care, including an overweight to Inspire Medical Systems, Inc. and out‑of‑benchmark positions in argenx SE and Lantheus Holdings Inc. » Security selection in information technology, including an overweight to Five9, Inc. and an underweight to Palantir Technologies Inc. » Security selection in financials, including an out‑of‑benchmark position in FirstCash Holdings, Inc. and an overweight to Everest Group, Ltd. |

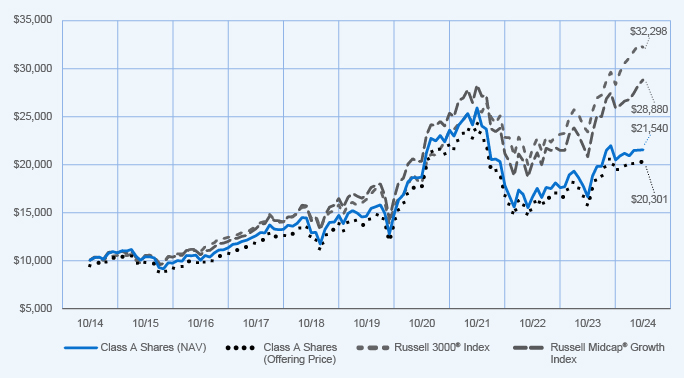

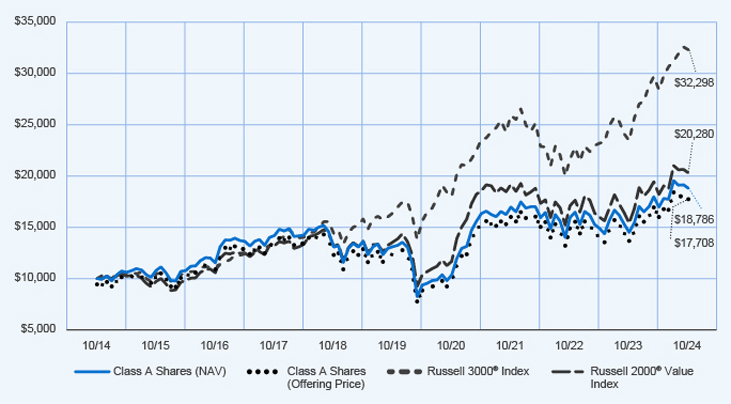

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class A Shares at NAV (excluding maximum sales charge) | | | 29.53 | % | | | 8.12 | % | | | 7.98 | % |

| | | | |

| Class A Shares at maximum sales charge (Offering Price) | | | 22.07 | % | | | 6.85 | % | | | 7.34 | % |

| | | | |

Russell 3000® Index | | | 37.86 | % | | | 14.60 | % | | | 12.44 | % |

| | | | |

Russell Midcap® Growth Index | | | 38.67 | % | | | 11.46 | % | | | 11.19 | % |

| | | | |

| Lipper Mid‑Cap Growth Funds Classification Average | | | 33.43 | % | | | 9.59 | % | | | 9.78 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 181,281,098 | |

| |

| Total number of portfolio holdings | | | 65 | |

| |

| Portfolio turnover (%) | | | 58% | |

| |

| Total management fees paid for the year | | $ | 1,471,403 | |

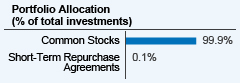

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670690718_AR_1024 4015312‑INV‑Y‑12/25 (A, I, R6) | | |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Mid Cap Growth Opportunities Fund

Class R6 Shares/FMEFX

Annual Shareholder Report

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Mid Cap Growth Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class R6 Shares | | $94 | | 0.82% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Mid Cap Growth Opportunities Fund returned 30.03% for Class R6 Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund significantly underperformed the Russell Mid Cap Growth Index, which returned 38.67%. • Top contributors to relative performance » Security selection in industrials, led by an out‑of‑benchmark position in MasTec, Inc. and an overweight to Axon Enterprise Inc. » Security selection in communication services, led by an overweight to Trade Desk, Inc. • Top detractors from relative performance » Security selection and an overweight in health care, including an overweight to Inspire Medical Systems, Inc. and out‑of‑benchmark positions in argenx SE and Lantheus Holdings Inc. » Security selection in information technology, including an overweight to Five9, Inc. and an underweight to Palantir Technologies Inc. » Security selection in financials, including an out‑of‑benchmark position in FirstCash Holdings, Inc. and an overweight to Everest Group, Ltd. |

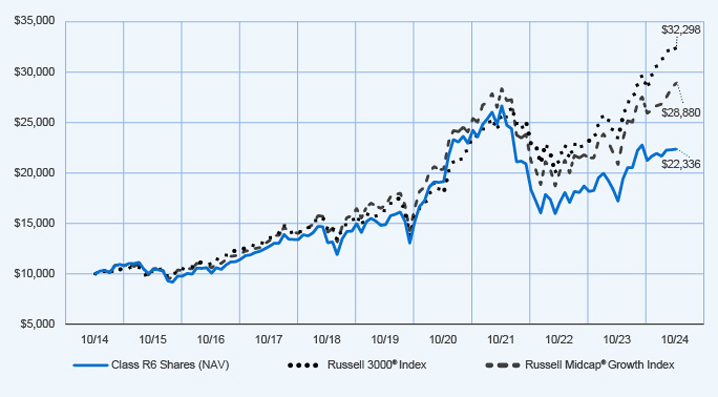

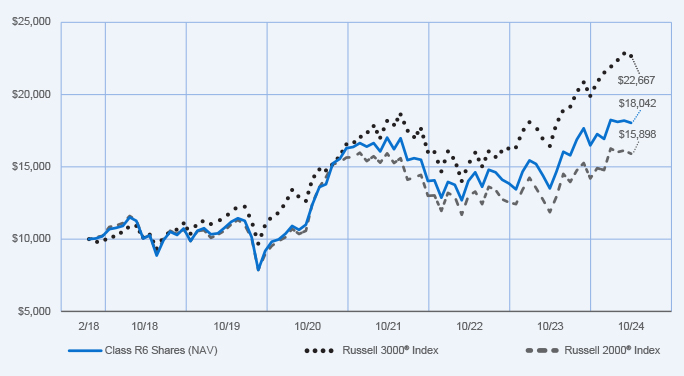

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class R6 Shares at NAV | | | 30.03 | % | | | 8.48 | % | | | 8.37 | % |

| | | | |

Russell 3000® Index | | | 37.86 | % | | | 14.60 | % | | | 12.44 | % |

| | | | |

Russell Midcap® Growth Index | | | 38.67 | % | | | 11.46 | % | | | 11.19 | % |

| | | | |

| Lipper Mid‑Cap Growth Funds Classification Average | | | 33.43 | % | | | 9.59 | % | | | 9.78 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 181,281,098 | |

| |

| Total number of portfolio holdings | | | 65 | |

| |

| Portfolio turnover (%) | | | 58% | |

| |

| Total management fees paid for the year | | $ | 1,471,403 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670690114_AR_1024 4015312‑INV‑Y‑12/25 (A, I, R6) | |  |

| | |

| | Annual Shareholder Report October 31, 2024 |

Nuveen Mid Cap Growth Opportunities Fund

Class I Shares/FISGX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Mid Cap Growth Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Class I Shares | | $103 | | 0.90% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Mid Cap Growth Opportunities Fund returned 29.92% for Class I Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund significantly underperformed the Russell Mid Cap Growth Index, which returned 38.67%. • Top contributors to relative performance » Security selection in industrials, led by an out‑of‑benchmark position in MasTec, Inc. and an overweight to Axon Enterprise Inc. » Security selection in communication services, led by an overweight to Trade Desk, Inc. • Top detractors from relative performance » Security selection and an overweight in health care, including an overweight to Inspire Medical Systems, Inc. and out‑of‑benchmark positions in argenx SE and Lantheus Holdings Inc. » Security selection in information technology, including an overweight to Five9, Inc. and an underweight to Palantir Technologies Inc. » Security selection in financials, including an out‑of‑benchmark position in FirstCash Holdings, Inc. and an overweight to Everest Group, Ltd. |

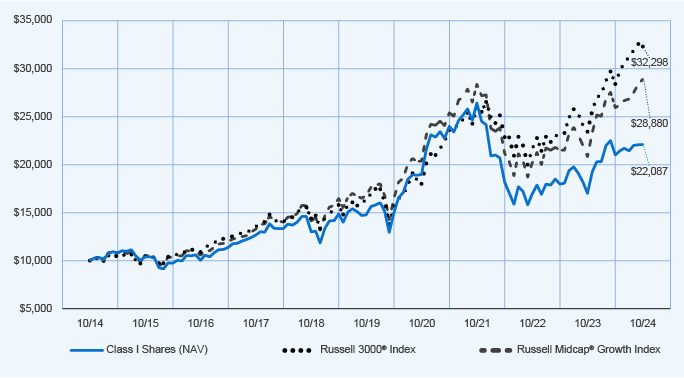

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class I Shares at NAV | | | 29.92 | % | | | 8.39 | % | | | 8.25 | % |

| | | | |

Russell 3000® Index | | | 37.86 | % | | | 14.60 | % | | | 12.44 | % |

| | | | |

Russell Midcap® Growth Index | | | 38.67 | % | | | 11.46 | % | | | 11.19 | % |

| | | | |

| Lipper Mid‑Cap Growth Funds Classification Average | | | 33.43 | % | | | 9.59 | % | | | 9.78 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 181,281,098 | |

| |

| Total number of portfolio holdings | | | 65 | |

| |

| Portfolio turnover (%) | | | 58% | |

| |

| Total management fees paid for the year | | $ | 1,471,403 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670690759_AR_1024 4015312‑INV‑Y‑12/25 (A, I, R6) | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Mid Cap Value 1 Fund

(Formerly known as Nuveen Mid Cap Value Fund)

Class A Shares/FASEX

Annual Shareholder Report

This annual shareholder report contains important information about the Class A Shares of the Nuveen Mid Cap Value 1 Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class A Shares | | $129 | | 1.14% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Mid Cap Value 1 Fund returned 25.98% for Class A Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund significantly underperformed the Russell Mid Cap Value Index, which returned 34.03%. • Top contributors to relative performance » Security selection in the industrials sector, led by an overweight to Parker-Hannifin Corporation. » An overweight to Jefferies Financial Group Inc. • Top detractors from relative performance » Security selection in the information technology sector, including an overweight to VeriSign, Inc. » Security selection in the real estate sector, including an overweight to Invitation Homes, Inc. And an out‑of‑benchmark position in Apple Hospitality REIT Inc. » Security selection in the health care sector, including an out‑of‑benchmark position in Option Care Health Inc. and overweights to Humana Inc. and Jazz Pharmaceuticals Public Limited Company. |

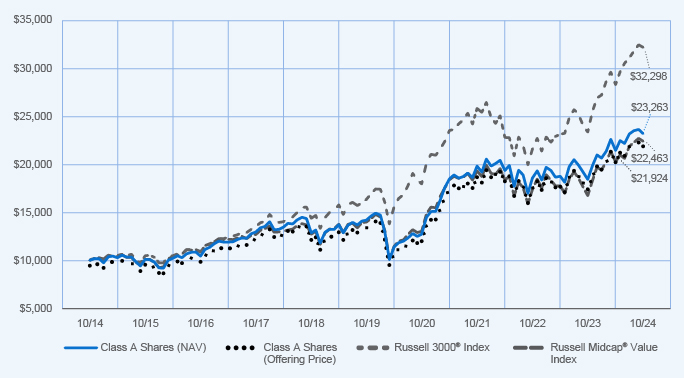

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class A Shares at NAV (excluding maximum sales charge) | | | 25.98 | % | | | 10.42 | % | | | 8.81 | % |

| | | | |

| Class A Shares at maximum sales charge (Offering Price) | | | 18.73 | % | | | 9.12 | % | | | 8.17 | % |

| | | | |

Russell 3000® Index | | | 37.86 | % | | | 14.60 | % | | | 12.44 | % |

| | | | |

Russell Midcap® Value Index | | | 34.03 | % | | | 9.93 | % | | | 8.43 | % |

| | | | |

| Lipper Mid‑Cap Value Funds Classification Average | | | 28.70 | % | | | 10.00 | % | | | 8.00 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 444,497,977 | |

| |

| Total number of portfolio holdings | | | 71 | |

| |

| Portfolio turnover (%) | | | 20% | |

| |

| Total management fees paid for the year | | $ | 3,405,899 | |

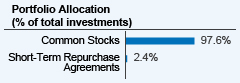

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from Nuveen Mid Cap Value Fund to Nuveen Mid Cap Value 1 Fund. | |

| | • | | Fund merger: The Fund has been approved for merger into Nuveen Mid Cap Value Fund by the Funds’ Board of Directors/Trustees. Merger is pending shareholder approval. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670678853_AR_1024 4015313‑INV‑Y‑12/25 (A, C, I, R6) | |  |

| | |

| | Annual Shareholder Report October 31, 2024 |

Nuveen Mid Cap Value 1 Fund

(Formerly known as Nuveen Mid Cap Value Fund)

Class C Shares/FACSX

Annual Shareholder Report

This annual shareholder report contains important information about the Class C Shares of the Nuveen Mid Cap Value 1 Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Class C Shares | | $213 | | 1.89% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Mid Cap Value 1 Fund returned 25.06% for Class C Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund significantly underperformed the Russell Mid Cap Value Index, which returned 34.03%. • Top contributors to relative performance » Security selection in the industrials sector, led by an overweight to Parker-Hannifin Corporation. » An overweight to Jefferies Financial Group Inc. • Top detractors from relative performance » Security selection in the information technology sector, including an overweight to VeriSign, Inc. » Security selection in the real estate sector, including an overweight to Invitation Homes, Inc. And an out‑of‑benchmark position in Apple Hospitality REIT Inc. » Security selection in the health care sector, including an out‑of‑benchmark position in Option Care Health Inc. and overweights to Humana Inc. and Jazz Pharmaceuticals Public Limited Company. |

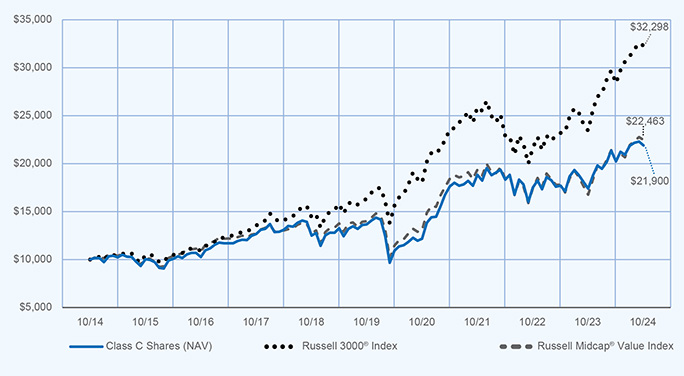

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class C Shares at NAV (excluding maximum sales charge) | | | 25.06 | % | | | 9.59 | % | | | 8.15 | % |

| | | | |

Russell 3000® Index | | | 37.86 | % | | | 14.60 | % | | | 12.44 | % |

| | | | |

Russell Midcap® Value Index | | | 34.03 | % | | | 9.93 | % | | | 8.43 | % |

| | | | |

| Lipper Mid‑Cap Value Funds Classification Average | | | 28.70 | % | | | 10.00 | % | | | 8.00 | % |

Class C Shares are subject to a contingent deferred sales charge if redeemed within 12 months of purchase, which will be reflected in total returns presented for less than one year.

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 444,497,977 | |

| |

| Total number of portfolio holdings | | | 71 | |

| |

| Portfolio turnover (%) | | | 20% | |

| |

| Total management fees paid for the year | | $ | 3,405,899 | |

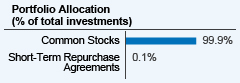

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from Nuveen Mid Cap Value Fund to Nuveen Mid Cap Value 1 Fund. | |

| | • | | Fund merger: The Fund has been approved for merger into Nuveen Mid Cap Value Fund by the Funds’ Board of Directors/Trustees. Merger is pending shareholder approval. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670678333_AR_1024 4015313‑INV‑Y‑12/25 (A, C, I, R6) | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Mid Cap Value 1 Fund

(Formerly known as Nuveen Mid Cap Value Fund)

Class R6 Shares/FMVQX

Annual Shareholder Report

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Mid Cap Value 1 Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class R6 Shares | | $86 | | 0.76% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

Performance Highlights • The Nuveen Mid Cap Value 1 Fund returned 26.47% for Class R6 Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund significantly underperformed the Russell Mid Cap Value Index, which returned 34.03%. • Top contributors to relative performance » Security selection in the industrials sector, led by an overweight to Parker-Hannifin Corporation. » An overweight to Jefferies Financial Group Inc. • Top detractors from relative performance » Security selection in the information technology sector, including an overweight to VeriSign, Inc. » Security selection in the real estate sector, including an overweight to Invitation Homes, Inc. And an out‑of‑benchmark position in Apple Hospitality REIT Inc. » Security selection in the health care sector, including an out‑of‑benchmark position in Option Care Health Inc. and overweights to Humana Inc. and Jazz Pharmaceuticals Public Limited Company. |

How did the Fund perform over the period since inception?

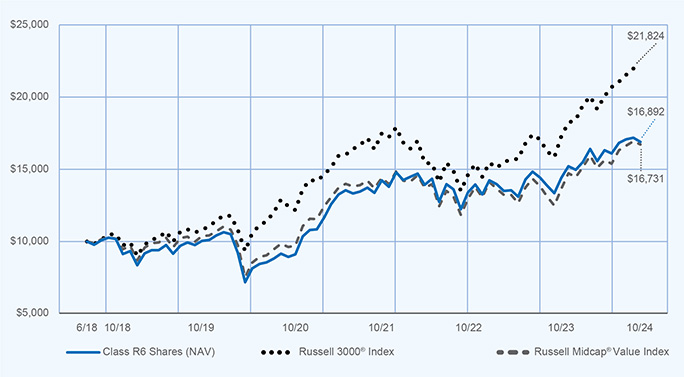

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 20, 2018 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | Since

Inception

(6/20/18) | |

| | | | |

| Class R6 Shares at NAV | | | 26.47 | % | | | 10.85 | % | | | 8.59 | % |

| | | | |

Russell 3000® Index | | | 37.86 | % | | | 14.60 | % | | | 13.05 | % |

| | | | |

Russell Midcap® Value Index | | | 34.03 | % | | | 9.93 | % | | | 8.42 | % |

| | | | |

| Lipper Mid‑Cap Value Funds Classification Average | | | 28.70 | % | | | 10.00 | % | | | 7.87 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en-us/mutual-funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 444,497,977 | |

| |

| Total number of portfolio holdings | | | 71 | |

| |

| Portfolio turnover (%) | | | 20% | |

| |

| Total management fees paid for the year | | $ | 3,405,899 | |

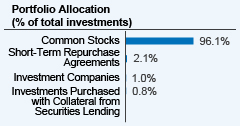

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from Nuveen Mid Cap Value Fund to Nuveen Mid Cap Value 1 Fund. | |

| | • | | Fund merger: The Fund has been approved for merger into Nuveen Mid Cap Value Fund by the Funds’ Board of Directors/Trustees. Merger is pending shareholder approval. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670693555_AR_1024 4015313‑INV‑Y‑12/25 (A, C, I, R6) | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Mid Cap Value 1 Fund

(Formerly known as Nuveen Mid Cap Value Fund)

Class I Shares/FSEIX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Mid Cap Value 1 Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Class I Shares | | $101 | | 0.89% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Mid Cap Value 1 Fund returned 26.33% for Class I Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund significantly underperformed the Russell Mid Cap Value Index, which returned 34.03%. • Top contributors to relative performance » Security selection in the industrials sector, led by an overweight to Parker-Hannifin Corporation. » An overweight to Jefferies Financial Group Inc. • Top detractors from relative performance » Security selection in the information technology sector, including an overweight to VeriSign, Inc. » Security selection in the real estate sector, including an overweight to Invitation Homes, Inc. And an out‑of‑benchmark position in Apple Hospitality REIT Inc. » Security selection in the health care sector, including an out‑of‑benchmark position in Option Care Health Inc. and overweights to Humana Inc. and Jazz Pharmaceuticals Public Limited Company. |

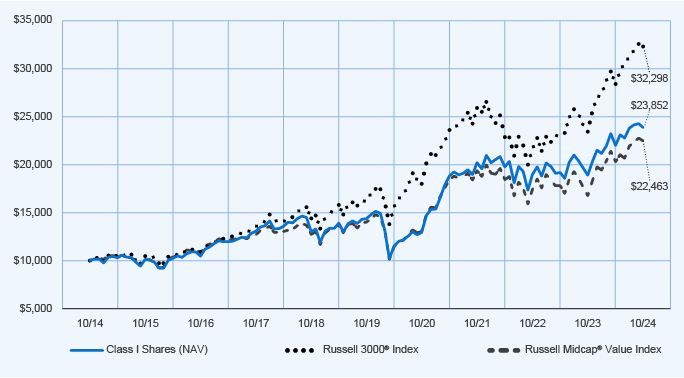

How did the Fund perform over the last 10 years?

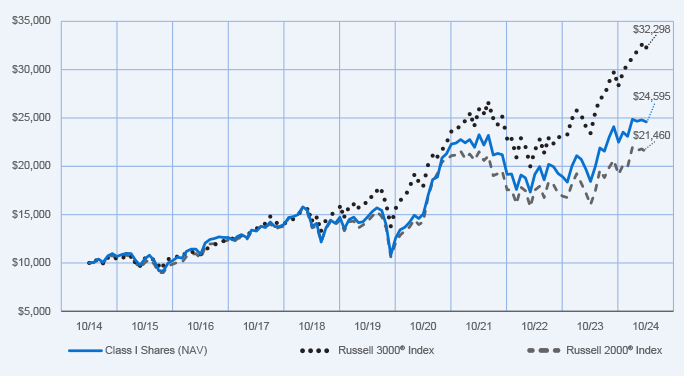

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class I Shares at NAV | | | 26.33 | % | | | 10.70 | % | | | 9.08 | % |

| | | | |

Russell 3000® Index | | | 37.86 | % | | | 14.60 | % | | | 12.44 | % |

| | | | |

Russell Midcap® Value Index | | | 34.03 | % | | | 9.93 | % | | | 8.43 | % |

| | | | |

| Lipper Mid‑Cap Value Funds Classification Average | | | 28.70 | % | | | 10.00 | % | | | 8.00 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 444,497,977 | |

| |

| Total number of portfolio holdings | | | 71 | |

| |

| Portfolio turnover (%) | | | 20% | |

| |

| Total management fees paid for the year | | $ | 3,405,899 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from Nuveen Mid Cap Value Fund to Nuveen Mid Cap Value 1 Fund. | |

| | • | | Fund merger: The Fund has been approved for merger into Nuveen Mid Cap Value Fund by the Funds’ Board of Directors/Trustees. Merger is pending shareholder approval. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670678663_AR_1024 4015313‑INV‑Y‑12/25 (A, C, I, R6) | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Small Cap Growth Opportunities Fund

Class A Shares/FRMPX

Annual Shareholder Report

This annual shareholder report contains important information about the Class A Shares of the Nuveen Small Cap Growth Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class A Shares | | $143 | | 1.21% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Small Cap Growth Opportunities Fund returned 35.95% for Class A Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund underperformed the Russell 2000 Growth Index, which returned 36.49%. • Top contributors to relative performance » Security selection in the financials sector, led by out‑of‑benchmark positions in Evercore Inc. and Shift4 Payments, Inc. » Security selection in the consumer staples sector, led by an overweight to e.l.f. Beauty, Inc. » Security selection in the information technology sector, led by overweights to Q2 Holdings, Inc., Commvault Systems, Inc. and Onto Innovation, Inc. • Top detractors from relative performance » Security selection in the consumer discretionary sector, including an overweight to Arhaus, Inc. » An overweight to Array Technologies Inc. » Security selection in the health care sector, including overweights to AtriCure, Inc. and SI‑BONE, Inc. and no exposure to Viking Therapeutics, Inc. earlier in the year when the shares rose sharply. |

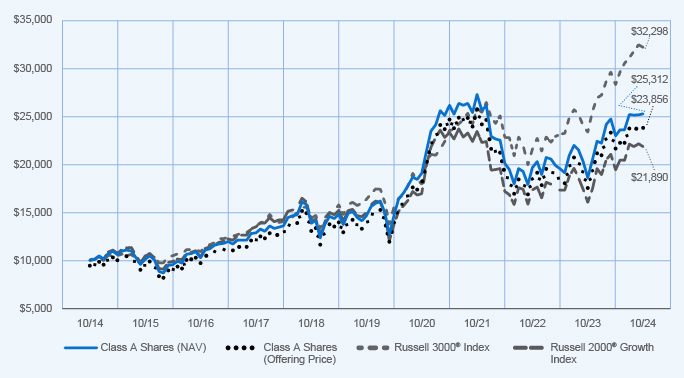

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (November 1, 2014 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | | | |

| Class A Shares at NAV (excluding maximum sales charge) | | | 35.95 | % | | | 11.62 | % | | | 9.73 | % |

| | | | |

| Class A Shares at maximum sales charge (Offering Price) | | | 28.12 | % | | | 10.31 | % | | | 9.08 | % |

| | | | |

Russell 3000® Index | | | 37.86 | % | | | 14.60 | % | | | 12.44 | % |

| | | | |

Russell 2000® Growth Index | | | 36.49 | % | | | 7.92 | % | | | 8.15 | % |

| | | | |

| Lipper Small‑Cap Growth Funds Classification Average | | | 34.18 | % | | | 8.99 | % | | | 9.12 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 238,947,002 | |

| |

| Total number of portfolio holdings | | | 83 | |

| |

| Portfolio turnover (%) | | | 67% | |

| |

| Total management fees paid for the year | | $ | 1,785,554 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

670690767_AR_1024 4015317‑INV‑Y‑12/25 (A, I, R6) | | |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Small Cap Growth Opportunities Fund

Class R6 Shares/FMPFX

Annual Shareholder Report

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Small Cap Growth Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en-us/mutual-funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class R6 Shares | | $97 | | 0.82% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Small Cap Growth Opportunities Fund returned 36.41% for Class R6 Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund performed in line with the Russell 2000 Growth Index, which returned 36.49%. • Top contributors to relative performance » Security selection in the financials sector, led by out‑of‑benchmark positions in Evercore Inc. and Shift4 Payments, Inc. » Security selection in the consumer staples sector, led by an overweight to e.l.f. Beauty, Inc. » Security selection in the information technology sector, led by overweights to Q2 Holdings, Inc., Commvault Systems, Inc. and Onto Innovation, Inc. • Top detractors from relative performance » Security selection in the consumer discretionary sector, including an overweight to Arhaus, Inc. » An overweight to Array Technologies Inc. » Security selection in the health care sector, including overweights to AtriCure, Inc. and SI‑BONE, Inc. and no exposure to Viking Therapeutics, Inc. earlier in the year when the shares rose sharply. |

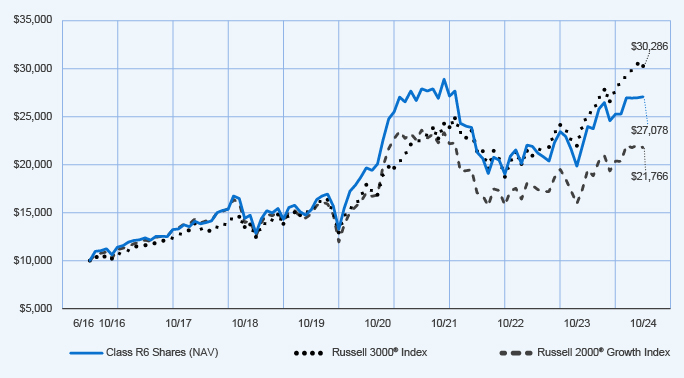

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 30, 2016 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1-Year | | | 5-Year | | | Since

Inception

(6/30/16) | |

| | | | |

| Class R6 Shares at NAV | | | 36.41 | % | | | 12.08 | % | | | 12.69 | % |

| | | | |

Russell 3000® Index | | | 37.86 | % | | | 14.60 | % | | | 14.22 | % |

| | | | |

Russell 2000® Growth Index | | | 36.49 | % | | | 7.92 | % | | | 9.78 | % |

| | | | |

| Lipper Small‑Cap Growth Funds Classification Average | | | 34.18 | % | | | 8.99 | % | | | 11.06 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to https://www.nuveen.com/en-us/mutual-funds/prospectuses or call (800) 257-8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 238,947,002 | |

| |

| Total number of portfolio holdings | | | 83 | |

| |

| Portfolio turnover (%) | | | 67% | |

| |

| Total management fees paid for the year | | $ | 1,785,554 | |

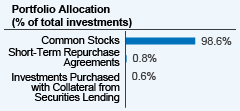

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en-us/mutual-funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257-8787.

| | |

670693845_AR_1024 4015317‑INV‑Y‑12/25 (A, I, R6) | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Small Cap Growth Opportunities Fund

Class I Shares/FIMPX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Small Cap Growth Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Class I Shares | | $113 | | 0.96% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

Performance Highlights • The Nuveen Small Cap Growth Opportunities Fund returned 36.29% for Class I Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund performed in line with the Russell 2000 Growth Index, which returned 36.49%. • Top contributors to relative performance » Security selection in the financials sector, led by out‑of‑benchmark positions in Evercore Inc. and Shift4 Payments, Inc. » Security selection in the consumer staples sector, led by an overweight to e.l.f. Beauty, Inc. » Security selection in the information technology sector, led by overweights to Q2 Holdings, Inc., Commvault Systems, Inc. and Onto Innovation, Inc. • Top detractors from relative performance » Security selection in the consumer discretionary sector, including an overweight to Arhaus, Inc. » An overweight to Array Technologies Inc. Security selection in the health care sector, including overweights to AtriCure, Inc. and SI‑BONE, Inc. and no exposure to Viking Therapeutics, Inc. earlier in the year when the shares rose sharply. |

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.