A NO-LOAD

MUTUAL FUND

ANNUAL REPORT

Dated September 30, 2016

November 14, 2016

Dear Shareholders,

We are pleased to present the Annual Report of Concorde Funds, Inc. for the fiscal year ended September 30, 2016.

Concorde Wealth Management Fund

Concorde Wealth Management Fund (the “Fund”), managed by Concorde Investment Management, produced a net return of 6.01% for the 6 months ended September 2016 and 10.12% for the fiscal year ending that same date. The Fund, which typically invests in a modest allocation to small and medium size equities, had a relatively strong performance year given exposure to oil related equities, gold, technology, and consumer defensive related equities.

The Concorde Value Fund reorganized this year into the Fund. The stated goal is to seek “total return, from both appreciation of value and generation of current income, within the context of preservation of capital”. The Fund’s allocation strategy changed from all equity to more of a balanced fund holding stocks, bonds, some other funds, and eventual exposure to private equity deals. The Fund increased in asset size to $17.5 million and reduced certain fees which will result in reduced overall expense load to the Fund. One thing to note when reviewing performance numbers below is the Fund completed the Reorganization in July of 2016 and added significant assets that mostly stayed in cash for the quarter. While the Fund was up 3.55% overall during the quarter ended September 2016, approximately half the Fund assets were in cash and fixed income during that period which was a drag on performance when compared to all equity indexes below.

The current macroeconomic backdrop remains one that invokes a more defensive posture than normal and that is reflected in the Fund’s bias to larger and historically more stable companies that would be expected to cope with difficult times better than smaller organizations. The option writing strategy that we instituted during 2015 resulted in realized gains of $26,894 which may not be material to the size of the Fund, but it was a positive impact to the performance.

| | | | Annualized | Annualized |

| | 6 Months | Full Fiscal Year | 5 Years Ending | 10 Years Ending |

| | April 2016 - Sept 2016 | Oct 2015 - Sept 2016 | Sept 2016 | Sept 2016 |

| Concorde Wealth | | | | |

| Management Fund | 6.01% | 10.12% | 10.76% | 1.78% |

| Barclays Aggregate Bond Index | 2.68% | 5.19% | 3.08% | 4.79% |

| Russell 3000 Index | 6.06% | 12.60% | 14.04% | 5.24% |

| Concorde Wealth Management | | | | |

| Blended Index | 4.15% | 8.79% | 8.62% | 5.94% |

| S&P 500 Index | 6.40% | 15.43% | 16.37% | 7.24% |

| Russell 3000 Value Index | 8.62% | 16.38% | 16.09% | 5.84% |

Performance across the major S&P 500 market sectors resulted in an up fiscal year. The overperformance of larger, dividend paying equities is reflected in the Total Return index returns. Utilities and Technology have been solid performers while financials lagged the market waiting for rate hikes or signals of reduced regulatory burden.

One of the most interesting aspects about the market for the fiscal year being reported is investors search for yield. Given investors were not getting the investment yield from bonds, investors began piling in to large dividend paying stocks. The Market ended 2015 declining due to the Federal Reserve raising rates in December 2015, in addition to other factors. After bottoming during February 2016, down almost 10% to start the year, stocks rebounded through the end of September. As a reminder, we look for long term value and took the opportunity to add to existing positions or exit positions when we deem shares have been fully valued or new risks make the investment no longer tenable. While that will impact performance over the short term, we always encourage investors to focus on the long term and we will always take long term performance views over short term.

Results varied widely among the large number of Fund holdings. In 2015 we swapped Speedway Motor Sports for International Speedway and the Company was up over 7% on the year. Two long term Fund holdings, Walt Disney Co. and Hanesbrand were down during the FY due to differing concerns. Hanes struggled in part due to its debt load and acquisitions. The management team for Hanes has an excellent track record for managing acquisitions and we believe this instance will be no different. Disney struggled this year over concerns about cord cutting and how reduced ESPN subscription through content delivery systems will affect results in the future. One concept we remain committed to is content over delivery and there is no better content company than Disney. Lowes and Fortune Brands Home & Security both performed well and we feel they will continue to perform well as housing continues to recover.

The energy holdings contributed a set of positive results after being a negative contributor in 2014 and 2015. The Funds 2015 position adds in Cimarex and Halliburton lead the way in their returns. Cimarex was up over 30% and Halliburton over 22%. Halliburton is a tier 1 name in oil field services and will contribute to excellent long term performance of the Fund. The Fund exited its position in Devon during the first quarter of 2016 due to the leverage position and equity offering that took place. Hindsight is 20/20 and the equity offering, while dilutive to existing shareholders, contributed to the thesis that the Company would be able to manage its debt levels through the low-price environment. Texas Pacific Land was our largest gain on the year at 67.66% increase and is a direct result of its location in the Permian. TPL owns royalty interests throughout Texas and has become a big beneficiary of fracking and new oil discoveries in the state. Just in September, Apache(not a Fund holding) announced a 2 billion barrel find in Reeves county in far West Texas which TPL shows in its Annual Report that the company has royalty interests in. We continue to believe TPL will be an excellent long term performer for the Fund.

The Fund held smaller exposures in the healthcare and consumer defensive sectors than the typical market allocation during the year. Healthsouth was a position that was added during 2015 as healthcare is a long-term growth sector. One concern post-election is related to the Affordable Care Act and its impact on hospital stocks and HLS’ business seems to have less exposure to ACA-related uncertainty, as its patient base is principally from Medicare. Medicaid expansion rollback is a bigger long term issue for the home health business, but this is still a fairly small portion of HLS’ overall business.

In consumer defensive, Johnson & Johnson was up almost 30% over the year. The other holding in this sector was AB InBev, which performed great during the year, up 20%. We have taken significant profits in AB InBev as it has risen the last two years and the stock continues to warrant a modest allocation. In September 2015, AB InBev approached SAB Miller about a possible acquisition and the Department of Justice approved the deal in July of this year and it closed just after the end of the FY of the Fund. The new company will have $55 billion in annual sales.

The Fund’s financial services holdings remained steady during the year and performed in line with a mid-single digit positive contribution. Individual stock appreciation was divergent among the holdings which are all in some segment of insurance. American International Group was up mid-single digits. Aon PLC, primarily involved in corporate insurance brokerage along with employee benefits consulting, continues to perform well globally and generates significant cash flow. The stock was up 25% on the year.

Union Pacific is our only Industrial holding and stock price increased 12.6% after a decline in the mid-teens the previous year. Increasing oil production along with tempered expectations about the economy’s slow growth about the domestic economy contributed to the stock’s performance as did the Company’s dividend.

Technology investments were strong during the year. IBM is a name that continues to face headwinds as they transform their business to have higher service components. The Company performed well during the year; however, we exited the position in early October. Microsoft, a long Fund holding, increased over 31% during the year as good business results and continued focus on shareholder friendly capital management all maintained investor demand. We have taken some profits as the stock has appreciated, but a position is still warranted as our valuation target has also risen. The Fund added Amazon during the year as our analysis in the future free cashflow of the Company showed us that the stock was materially undervalued. While a historical growth stock, the Company now occupies both realms as a growth and value stock given its free cash flow and its untapped markets and increased cloud performance.

Thank you for your continued support. We will continue to strive for the highest professional standards of performance and stewardship in the management of the Fund.

| | Best regards, |

| | |

| |  |

| | |

| | Gregory B. Wood |

| | Chief Compliance Officer |

| | Concorde Investment Management |

| Concorde Wealth Management Fund |

| Performance Comparison |

Change in Value of $10,000 Investment |

| AVERAGE ANNUAL TOTAL RETURN |

| 1 Year | | 10.12% |

| 3 Years | | 5.27% |

| 5 Years | | 10.76% |

| 10 Years | | 1.78% |

| NOTE: | The chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on September 30, 2006. Returns reflect the reinvestment of dividends and capital gain distributions. The performance data and graph do not reflect the deduction of taxes that a shareholder may pay on dividends, capital gain distributions or redemption of Fund shares. Past performance is not predictive of future performances. |

| | |

| | The Concorde Wealth Management Blended Index consists of 45% equities represented by the Russell 3000 Index, 45% bonds represented by the Barclays Intermediate Aggregate Bond Index, 5% short-term investments represented by Bank of America Merrill Lynch 1-3 Year Treasuries, and 5% commodities represented by Barclays U.S. Treasury Inflation Protection Security. The Russell 3000 Index measures the performance of the largest 3,000 U.S. Companies representing approximately 98% of the investable U.S. equity market. The Barclays Aggregate Bond Index measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass throughs), ABS, and CMBS. The Concorde Wealth Management Blended Index, Russell 3000 Index, and Barclay Aggregate Bond Index are replacing the Russell 3000 Value Index and the S&P 500 because the Fund believes that, due to the Reorganization of the Fund, the composition of these indices better reflect the Fund’s holdings for comparison reasons. The Russell 3000 Value Index measures the performance of the Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. The average annual returns of the Russell 3000 Value Index for the one year, five year, and ten year periods ended September 30, 2016 were 16.38%, 16.09% and 5.84%, respectively. The S&P 500 consists of 500 selected stocks, most of which are listed on the New York Stock Exchange. It is a widely recognized unmanaged index of stock prices. The average annual returns of the S&P 500 for the one year, five year, and ten year periods ended September 30, 2016 were 15.43%, 16.37% and 7.24%, respectively. |

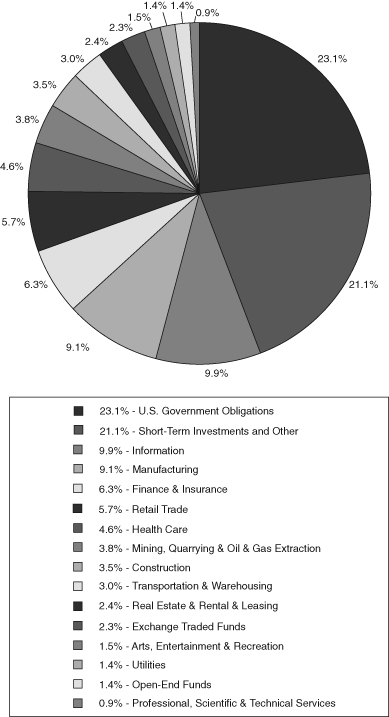

CONCORDE WEALTH MANAGEMENT FUND

PORTFOLIO HOLDINGS BY SECTOR

September 30, 2016

The portfolio's holdings and allocations are subject to change. The percentages are of net assets as of September 30, 2016.

CONCORDE WEALTH MANAGEMENT FUND

SCHEDULE OF INVESTMENTS IN SECURITIES

September 30, 2016

| | | Shares or | | | Fair | | | Percent of | |

| | | Principal Amount | | | Value | | | Net Assets | |

| | | | | | | | | | |

| COMMON STOCKS - 40.00% | | | | | | | | | |

| ARTS, ENTERTAINMENT & RECREATION | | | | | | | | | |

| Speedway Motorsports, Inc. | | | 15,000 | | | $ | 267,900 | | | | 1.49 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| FINANCE & INSURANCE | | | | | | | | | | | | |

| American International Group, Inc. | | | 6,000 | | | | 356,040 | | | | 1.98 | |

| Aon Corp. (a) | | | 4,200 | | | | 472,458 | | | | 2.63 | |

| | | | | | | | 828,498 | | | | 4.61 | |

| | | | | | | | | | | | | |

| HEALTH CARE | | | | | | | | | | | | |

| HCA Holdings, Inc. (b) | | | 5,500 | | | | 415,965 | | | | 2.31 | |

| HealthSouth Corp. | | | 7,775 | | | | 315,432 | | | | 1.76 | |

| | | | | | | | 731,397 | | | | 4.07 | |

| | | | | | | | | | | | | |

| INFORMATION | | | | | | | | | | | | |

| Comcast Corp. - Class A | | | 4,900 | | | | 325,066 | | | | 1.81 | |

| Discovery Communications, Inc. (b) | | | 13,500 | | | | 355,185 | | | | 1.98 | |

| Microsoft Corp. | | | 8,000 | | | | 460,800 | | | | 2.56 | |

| Oracle Corp. | | | 10,000 | | | | 392,800 | | | | 2.19 | |

| The Walt Disney Co. | | | 2,700 | | | | 250,722 | | | | 1.39 | |

| | | | | | | | 1,784,573 | | | | 9.93 | |

| | | | | | | | | | | | | |

| MANUFACTURING | | | | | | | | | | | | |

| Anheuser Busch InBev NV - ADR (a) | | | 2,600 | | | | 341,666 | | | | 1.90 | |

| Fortune Brands Home & Security, Inc. | | | 4,700 | | | | 273,070 | | | | 1.52 | |

| Johnson & Johnson | | | 2,900 | | | | 342,577 | | | | 1.90 | |

| Valero Energy Corp. | | | 4,000 | | | | 212,000 | | | | 1.18 | |

| | | | | | | | 1,169,313 | | | | 6.50 | |

| | | | | | | | | | | | | |

| MINING, QUARRYING & OIL & GAS EXTRACTION | | | | | | | | | | | | |

| Cimarex Energy Co. | | | 2,530 | | | | 339,956 | | | | 1.89 | |

| Halliburton Co. | | | 7,500 | | | | 336,600 | | | | 1.87 | |

| | | | | | | | 676,556 | | | | 3.76 | |

| | | | | | | | | | | | | |

| PROFESSIONAL, SCIENTIFIC & TECHNICAL SERVICES | | | | | | | | | | | | |

| International Business Machines Corp. | | | 1,000 | | | | 158,850 | | | | 0.88 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| RETAIL TRADE | | | | | | | | | | | | |

| Amazon.com, Inc. (b) | | | 320 | | | | 267,939 | | | | 1.49 | |

| Hanesbrands, Inc. | | | 8,500 | | | | 214,625 | | | | 1.19 | |

| Lowe’s Companies, Inc. | | | 5,000 | | | | 361,050 | | | | 2.01 | |

| Staples, Inc. | | | 21,600 | | | | 184,680 | | | | 1.03 | |

| | | | | | | | 1,028,294 | | | | 5.72 | |

The accompanying notes are an integral part of these financial statements.

CONCORDE WEALTH MANAGEMENT FUND

SCHEDULE OF INVESTMENTS IN SECURITIES (continued)

September 30, 2016

| | | Shares or | | | Fair | | | Percent of | |

| | | Principal Amount | | | Value | | | Net Assets | |

| | | | | | | | | | |

| COMMON STOCKS (continued) | | | | | | | | | |

| TRANSPORTATION & WAREHOUSING | | | | | | | | | |

| Union Pacific Corp. | | | 5,600 | | | $ | 546,168 | | | | 3.04 | % |

| TOTAL COMMON STOCKS (Cost $4,192,118) | | | | | | | 7,191,549 | | | | 40.00 | |

| | | | | | | | | | | | | |

| EXCHANGE TRADED FUNDS - 2.25% | | | | | | | | | | | | |

| Sprott Physical Gold Trust (a)(b) | | | 37,000 | | | | 405,150 | | | | 2.25 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $340,420) | | | | | | | 405,150 | | | | 2.25 | |

| | | | | | | | | | | | | |

| OPEN-END FUNDS - 1.38% | | | | | | | | | | | | |

| Deutsche CROCI International Fund - Class S | | | 6,069 | | | | 248,058 | | | | 1.38 | |

| TOTAL OPEN-END FUNDS (Cost $250,000) | | | | | | | 248,058 | | | | 1.38 | |

| | | | | | | | | | | | | |

| REITS - 2.42% | | | | | | | | | | | | |

| REAL ESTATE & RENTAL & LEASING | | | | | | | | | | | | |

| Medical Properties Trust, Inc. | | | 15,000 | | | | 221,550 | | | | 1.23 | |

| Prologis, Inc. | | | 4,000 | | | | 214,160 | | | | 1.19 | |

| TOTAL REITS (Cost $334,071) | | | | | | | 435,710 | | | | 2.42 | |

| | | | | | | | | | | | | |

| ROYALTY TRUSTS - 3.53% | | | | | | | | | | | | |

| CONSTRUCTION | | | | | | | | | | | | |

| Texas Pacific Land Trust | | | 2,700 | | | | 634,770 | | | | 3.53 | |

| TOTAL ROYALTY TRUSTS (Cost $390,001) | | | | | | | 634,770 | | | | 3.53 | |

| | | | | | | | | | | | | |

| CONVERTIBLE PREFERRED STOCKS - 2.88% | | | | | | | | | | | | |

| MANUFACTURING | | | | | | | | | | | | |

| Allergan PLC (a) | | | 325 | | | | 267,030 | | | | 1.49 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| UTILITIES | | | | | | | | | | | | |

| Kinder Morgan, Inc. | | | 5,000 | | | | 250,350 | | | | 1.39 | |

| TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $552,810) | | | | | | | 517,380 | | | | 2.88 | |

| | | | | | | | | | | | | |

| CORPORATE BONDS - 3.40% | | | | | | | | | | | | |

| FINANCE & INSURANCE | | | | | | | | | | | | |

| Discover Financial Services, 3.85%, 11/21/2022 | | | 150,000 | | | | 155,607 | | | | 0.87 | |

| Ford Motor Credit Co., LLC, 2.40%, 09/20/2021 | | | 150,000 | | | | 149,229 | | | | 0.83 | |

| | | | | | | | 304,836 | | | | 1.70 | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

CONCORDE WEALTH MANAGEMENT FUND

SCHEDULE OF INVESTMENTS IN SECURITIES (continued)

September 30, 2016

| | | Shares or | | | Fair | | | Percent of | |

| | | Principal Amount | | | Value | | | Net Assets | |

| | | | | | | | | | |

| CORPORATE BONDS (continued) | | | | | | | | | |

| HEALTH CARE | | | | | | | | | |

| DaVita, Inc., 5.75%, 08/15/2022 | | | 100,000 | | | $ | 104,750 | | | | 0.58 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| MANUFACTURING | | | | | | | | | | | | |

| NCR Corp., 4.625%, 02/15/2021 | | | 200,000 | | | | 202,000 | | | | 1.12 | |

| TOTAL CORPORATE BONDS (Cost $615,911) | | | | | | | 611,586 | | | | 3.40 | |

| | | | | | | | | | | | | |

| U.S. GOVERNMENT OBLIGATIONS - 23.09% | | | | | | | | | | | | |

| Federal National Mortgage Association, 1.55%, 09/30/2021 | | | 200,000 | | | | 199,528 | | | | 1.11 | |

| Federal Home Loan Banks, 1.03%, 05/28/2019 | | | 150,000 | | | | 149,692 | | | | 0.83 | |

| United States Treasury Notes | | | | | | | | | | | | |

| 1.375%, Note due 01/31/2021 | | | 1,400,000 | | | | 1,415,313 | | | | 7.87 | |

| 1.625%, Note due 02/15/2026 | | | 400,000 | | | | 400,687 | | | | 2.23 | |

| 2.75%, Note due 02/15/2019 | | | 1,900,000 | | | | 1,986,093 | | | | 11.05 | |

| TOTAL U.S. GOVERNMENT OBLIGATIONS (Cost $4,160,752) | | | | | | | 4,151,313 | | | | 23.09 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 16.21% | | | | | | | | | | | | |

| Fidelity Institutional Money Market Funds - | | | | | | | | | | | | |

| Government Portfolio, 0.27% (c) | | | 728,754 | | | | 728,755 | | | | 4.06 | |

| Morgan Stanley Institutional Liquidity Funds - | | | | | | | | | | | | |

| Government Portfolio, 0.29% (c) | | | 728,754 | | | | 728,754 | | | | 4.05 | |

| Morgan Stanley Institutional Liquidity Funds - | | | | | | | | | | | | |

| Treasury Portfolio, 0.22% (c) | | | 728,754 | | | | 728,755 | | | | 4.05 | |

| The Government & Agency Portfolio - | | | | | | | | | | | | |

| Institutional Class, 0.31% (c) | | | 728,754 | | | | 728,754 | | | | 4.05 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $2,915,018) | | | | | | | 2,915,018 | | | | 16.21 | |

| | | | | | | | | | | | | |

| Total Investments in Securities (Cost $13,751,101) - 95.16% | | | | | | | 17,110,534 | | | | 95.16 | |

| Other Assets in Excess of Liabilities - 4.84% | | | | | | | 871,052 | | | | 4.84 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 17,981,586 | | | | 100.00 | % |

Notes:

ADR American Depositary Receipt

PLC Public Limited Company

REIT Real Estate Investment Trust

| (a) | Foreign issued security listed directly on a U.S. securities exchange. |

| (b) | Presently non-income producing. |

| (c) | Rate shown is the 7-day yield as of September 30, 2016. |

The accompanying notes are an integral part of these financial statements.

CONCORDE WEALTH MANAGEMENT FUND

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2016

| ASSETS | | | |

| Investments in securities, at fair value (cost $13,751,101) | | $ | 17,110,534 | |

| Cash | | | 314,863 | |

| Dividends and interest receivable | | | 23,673 | |

| Receivable for capital shares sold | | | 577,000 | |

| Prepaid expense | | | 3,868 | |

| Other asset | | | 3,343 | |

| TOTAL ASSETS | | | 18,033,281 | |

| | | | | |

| LIABILITIES | | | | |

| Investment advisory fee payable | | | 9,697 | |

| Accrued expenses | | | 41,330 | |

| Accrued director’s fees | | | 668 | |

| TOTAL LIABILITIES | | | 51,695 | |

| NET ASSETS | | $ | 17,981,586 | |

| | | | | |

| Composition of Net Assets: | | | | |

| Net capital paid in on shares of capital stock | | $ | 14,686,883 | |

| Accumulated net investment loss | | | (64,730 | ) |

| Accumulated net realized gain | | | — | |

| Net unrealized appreciation on: | | | | |

| Investments | | | 3,359,433 | |

| NET ASSETS | | $ | 17,981,586 | |

| Capital shares outstanding | | | 1,258,001 | |

| Net asset value, offering price and redemption price per share | | $ | 14.29 | |

| | | | | |

The accompanying notes are an integral part of these financial statements.

CONCORDE WEALTH MANAGEMENT FUND

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2016(1)

| Investment Income | | | |

| Dividends (net of foreign withholding taxes and issuance fees of $2,045) | | $ | 199,530 | |

| Interest | | | 4,455 | |

| Total investment income | | | 203,985 | |

| | | | | |

| Expenses | | | | |

| Investment advisory fees (Note 7) | | | 87,250 | |

| Administration fees (Note 8) | | | 36,313 | |

| Professional fees | | | 32,288 | |

| Fund accounting fees (Note 8) | | | 29,157 | |

| Transfer agent fees (Note 8) | | | 16,155 | |

| Other expenses | | | 12,172 | |

| Sub-transfer agent fees (Note 8) | | | 11,389 | |

| Printing, postage and delivery | | | 7,652 | |

| Insurance expense | | | 5,220 | |

| Custody fees (Note 8) | | | 4,832 | |

| Directors fees and expenses | | | 3,908 | |

| Federal and state registration fees | | | 1,245 | |

| Total expenses | | | 247,581 | |

| NET INVESTMENT LOSS | | | (43,596 | ) |

| REALIZED AND UNREALIZED GAIN FROM INVESTMENTS | | | | |

| Net realized gain from: | | | | |

| Investments | | | 3,438 | |

| Options written | | | 26,894 | |

| Capital gain distribution from investment company | | | 8,561 | |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | 983,758 | |

| NET REALIZED AND UNREALIZED GAIN FROM INVESTMENTS | | | 1,022,651 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 979,055 | |

| (1) | For periods prior to July 23, 2016, financial and other information shown herein for the Fund is that of the Concorde Value Fund, the “Predecessor Fund” (See Note 1 in the accompanying notes to these financials statements). |

The accompanying notes are an integral part of these financial statements.

CONCORDE WEALTH MANAGEMENT FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | Sep. 30, 2016(1) | | | Sep. 30, 2015(1) | |

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | | | | | | |

| Net investment loss | | $ | (43,596 | ) | | $ | (44,125 | ) |

| Net realized gain from: | | | | | | | | |

| Investments | | | 3,438 | | | | 748,170 | |

| Options written | | | 26,894 | | | | 24,678 | |

| Capital gain distribution from investment company | | | 8,561 | | | | — | |

| Net change in unrealized appreciation on: | | | | | | | | |

| Investments | | | 983,758 | | | | (1,572,430 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 979,055 | | | | (843,707 | ) |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | |

| Net realized gains on investments | | | (553,913 | ) | | | (953,218 | ) |

| Total distributions to shareholders | | | (553,913 | ) | | | (953,218 | ) |

| CAPITAL SHARE TRANSACTIONS-NET (Note 3) | | | 8,418,536 | | | | (947,014 | ) |

| Total increase (decrease) in net assets | | | 8,843,678 | | | | (2,743,939 | ) |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 9,137,908 | | | | 11,881,847 | |

| End of year (including undistributed net investment | | | | | | | | |

| loss of $(64,730) and $(37,962), respectively) | | $ | 17,981,586 | | | $ | 9,137,908 | |

| (1) | For periods prior to July 23, 2016, financial and other information shown herein for the Fund is that of the Concorde Value Fund, the “Predecessor Fund” (See Note 1 in the accompanying notes to these financials statements). |

The accompanying notes are an integral part of these financial statements.

CONCORDE WEALTH MANAGEMENT FUND

FINANCIAL HIGHLIGHTS

| | | Year Ended September 30, | |

| | | 2016(1) | | | 2015(1) | | | 2014(1) | | | 2013(1) | | | 2012(1) | |

| PER SHARE OPERATING | | | | | | | | | | | | | | | |

| PERFORMANCE | | | | | | | | | | | | | | | |

| (for a share of capital stock outstanding | | | | | | | | | | | | | | | |

| throughout the year): | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 13.79 | | | $ | 16.50 | | | $ | 14.22 | | | $ | 12.34 | | | $ | 9.97 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(2) | | | (0.06 | ) | | | (0.07 | ) | | | (0.02 | ) | | | 0.03 | | | | 0.02 | |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 1.40 | | | | (1.29 | ) | | | 2.33 | | | | 1.87 | | | | 2.35 | |

| Total from investment operations | | | 15.13 | | | | (1.36 | ) | | | 2.31 | | | | 1.90 | | | | 2.37 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | (0.03 | ) | | | (0.02 | ) | | | — | |

| Net realized gains | | | (0.84 | ) | | | (1.35 | ) | | | — | | | | — | | | | — | |

| Total distributions | | | (0.84 | ) | | | (1.35 | ) | | | (0.03 | ) | | | (0.02 | ) | | | — | |

| Net asset value, end of year | | $ | 14.29 | | | $ | 13.79 | | | $ | 16.50 | | | $ | 14.22 | | | $ | 12.34 | |

| TOTAL RETURN | | | 10.12 | % | | | (8.90 | )% | | | 16.29 | % | | | 15.46 | % | | | 23.77 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 17,982 | | | $ | 9,138 | | | $ | 11,882 | | | $ | 11,279 | | | $ | 11,027 | |

| Ratio of expenses to average net assets | | | 2.48 | % | | | 2.28 | % | | | 2.06 | % | | | 2.09 | % | | | 2.12 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (0.44 | )% | | | (0.40 | )% | | | (0.16 | )% | | | 0.24 | % | | | 0.19 | % |

| Portfolio turnover rate | | | 28 | % | | | 57 | % | | | 32 | % | | | 34 | % | | | 19 | % |

| (1) | For periods prior to July 23, 2016, financial and other information shown herein for the Fund is that of the Concorde Value Fund, the “Predecessor Fund” (See Note 1 in the accompanying notes to these financials statements). |

| (2) | Based on average shares outstanding during the year. |

The accompanying notes are an integral part of these financial highlights.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 1 – | Nature of Business and Reorganization and Summary of Significant Accounting Policies |

NATURE OF BUSINESS AND REORGANIZATION

Concorde Wealth Management Fund (the “Fund”), is a non-diversified separate series of Concorde Funds, Inc. (the “Company”). Each series is organized as a class of common stock under the Company’s articles of incorporation. The Company was incorporated in the state of Texas in September of 1987, and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. Each capital share in the Fund represents an equal, proportionate interest in the net assets of the Fund with each other capital share in such series and no interest in any other series. The Company may establish multiple series, each of which would be organized as a class of common stock under the Company’s articles of incorporation. The Company presently has no series other than the Fund.

The primary investment objective of the Fund is to seek total return, from both appreciation of value and generation of current income, within the context of preservation of capital. The Fund is subject to various investment restrictions as set forth in the Statement of Additional Information.

On July 22, 2016 the shareholders of the Concorde Value Fund, a diversified former separate series of the Company (the “Predecessor Fund”), approved a Plan of Acquisition and Liquidation (the “Reorganization”) between the Fund and the Predecessor Fund. Pursuant to the Reorganization, the Fund acquired all of the assets and liabilities of the Predecessor Fund in exchange for shares of the Fund after the close of business on July 22, 2016. The Fund issued 681,656 shares in exchange for the net assets of the Predecessor Fund valued at $9,666,396. The Fund had no assets, liabilities, shares issued or operations prior to the Reorganization. As a result of the Reorganization, the Predecessor Fund ceased to operate and its shareholders became shareholders of the Fund. The primary investment objective of the Predecessor Fund was to produce long-term growth of capital. As a result of the Reorganization, the Fund is the accounting successor of the Predecessor Fund. For periods prior to July 23, 2016, financial and other information shown herein for the Fund is that of the Predecessor Fund.

SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States. The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standard Board Accounting Standard Codification 946, Financial Services – Investment Companies.

VALUATION OF SECURITIES

All investments in securities are recorded at their estimated fair value, as described in Note 2.

FEDERAL INCOME TAXES

The Company’s policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all its taxable income to its shareholders. The Company also intends to distribute sufficient net investment income and net

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 1 – | Nature of Business and Reorganization and Summary of Significant Accounting Policies (continued) |

capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. Therefore, no federal income tax or excise provision is required.

Net investment income (loss), net realized gains (losses) and the cost of investments in securities may differ for financial statement and income tax purposes. The character of distributions from net investment income or net realized gains may differ from their ultimate characterization for income tax purposes. Also, due to the timing of dividend distributions, the year in which amounts are distributed may differ from the year that the income or realized gains were recorded by the Fund. Permanent book and tax basis differences, if any, result in reclassifications to certain components of net assets. Permanent differences are primarily related to net operating losses and distributions in excess. For the year ended September 30, 2016, the Fund decreased accumulated net investment loss by $16,828, decreased net capital paid in on shares of capital stock by $14,733, and decreased accumulated net realized gain by $2,095. These reclassifications have no effect on net assets, results of operations or net asset value per share.

Management has reviewed all open tax years and major tax jurisdictions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed or expected to be taken on a tax return. The tax returns of the Company for the prior three years are open for examination.

SECURITY TRANSACTIONS AND RELATED INCOME

Security transactions are accounted for on the trade date, the day securities are purchased or sold. Realized gains and losses from securities transactions are reported on an identified cost basis. Dividend income is recognized on the ex-dividend date, and interest income is recognized on an accrual basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities.

DIVIDENDS AND DISTRIBUTIONS

Distributions to shareholders are determined in accordance with income tax regulations and recorded on the ex-dividend date. The Fund intends to distribute all of its net investment income, if any, as dividends to its shareholders on an annual basis. The Fund intends to distribute all of its capital gains, if any, on an annual basis. Distributions from net investment income and capital gains, if any, are generally declared and paid in December. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 1 – | Nature of Business and Reorganization and Summary of Significant Accounting Policies (continued) |

USE OF ESTIMATES

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

OPTION WRITING

To generate additional income or hedge against a possible loss in the value of securities it holds, the Fund may write covered call options. When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from investments. The difference between the premium and amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether the Fund has realized a gain or loss. The Fund as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option.

The objective, as stated above, is to hedge against a possible decline in the value of securities and to generate additional income when we feel certain securities are locked in a trading range. With regards to hedging against a possible decline, we will sell covered calls with strike prices below the price of a security at the time of writing the call. Regarding additional income, the Fund will sell calls on certain securities that are within a trading range.

| Note 2 – | Securities Valuation |

The Company’s Board of Directors (the “Board”) has adopted methods for valuing securities and other derivative instruments including in circumstances in which market quotes are not readily available, and has delegated authority to the Company’s investment advisor, Concorde Financial Corporation d/b/a Concorde Investment Management (“Concorde”) to apply those methods in making fair value determinations. All fair value determinations made by Concorde are subject to oversight by the Board.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| | Level 1 – | Quoted unadjusted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the date of measurement. |

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 2 – | Securities Valuation (continued) |

| | Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| | | |

| | Level 3 – | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use in valuing the asset or liability based on the best available information. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Equity Securities – Equity securities, usually common stocks, foreign issued common stocks, exchange traded funds, real estate investment trusts, royalty trusts, and preferred stocks traded on a national securities exchange are valued at the last sale price on the exchange on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any reported sales, at the mean between the last available bid and asked price. To the extent, these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Mutual Funds – Mutual funds are generally priced at the ending net asset value provided by the service agent of the Funds and are categorized in Level 1 of the fair value hierarchy.

Debt Securities – Bonds, notes, and U.S. government obligations are valued at an evaluated bid price obtained from an independent pricing service that uses a matrix pricing method or other analytical models. Demand notes are stated at amortized cost, which approximates fair value. These securities will generally be categorized in Level 2 of the fair value hierarchy.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 2 – | Securities Valuation (continued) |

Short-Term Securities – Short-term equity investments, including money market funds, are valued in the manner specified above for equity securities. Fixed income securities with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity, are valued by an independent pricing service that uses a matrix pricing method or other analytical models. Short-term securities are generally classified in Level 1 or Level 2 of the fair value hierarchy depending on the inputs used and market activity levels for specific securities.

Derivative Instruments – Listed derivatives, including options, rights, and warrants that are actively traded are valued based on quoted prices from the exchange. If there is no such reported sale on the valuation date, the mean between the highest bid and lowest asked quotations at the close of the exchanges will be used. These securities will generally be categorized in Level 1 of the fair value hierarchy.

All other assets of the Fund are valued in such manner as the Board in good faith deems appropriate to reflect their fair value.

Securities for which market quotations are not readily available or if the closing price does not represent fair value, are valued at fair value as determined in good faith following procedures approved by the Board. Factors used in determining fair value vary by investment type and may include: trading volume of security and markets, value of other like securities and news events with direct bearing to security or market. Depending on the relative significance of the valuation inputs, these securities may be categorized in either Level 2 or Level 3 of the fair value hierarchy.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 2 – | Securities Valuation (continued) |

The following table summarizes the inputs used to value the Fund’s investments measured at fair value as of September 30, 2016:

| | Categories | | Level 1 | | | Level 2 | | | Level 3 | | | Fair Value | |

| | Common Stocks | | | | | | | | | | | | |

| | Arts, Entertainment & Recreation | | $ | 267,900 | | | $ | — | | | $ | — | | | $ | 267,900 | |

| | Finance & Insurance | | | 828,498 | | | | — | | | | — | | | | 828,498 | |

| | Health Care | | | 731,397 | | | | — | | | | — | | | | 731,397 | |

| | Information | | | 1,784,573 | | | | — | | | | — | | | | 1,784,573 | |

| | Manufacturing | | | 1,169,313 | | | | — | | | | — | | | | 1,169,313 | |

| | Mining, Quarrying & Oil & Gas Extraction | | | 676,556 | | | | — | | | | — | | | | 676,556 | |

| | Professional, Scientific & Technical Services | | | 158,850 | | | | — | | | | — | | | | 158,850 | |

| | Retail Trade | | | 1,028,294 | | | | — | | | | — | | | | 1,028,294 | |

| | Transportation & Warehousing | | | 546,168 | | | | — | | | | — | | | | 546,168 | |

| | Total Common Stocks | | | 7,191,549 | | | | — | | | | — | | | | 7,191,549 | |

| | Exchange Traded Funds | | | 405,150 | | | | — | | | | — | | | | 405,150 | |

| | Open-End Funds | | | 248,058 | | | | — | | | | — | | | | 248,058 | |

| | REITS | | | | | | | | | | | | | | | | |

| | Real Estate & Rental & Leasing | | | 435,710 | | | | — | | | | — | | | | 435,710 | |

| | Royalty Trusts | | | | | | | | | | | | | | | | |

| | Construction | | | 634,770 | | | | — | | | | — | | | | 634,770 | |

| | Convertible Preferred Stocks | | | | | | | | | | | | | | | | |

| | Manufacturing | | | 267,030 | | | | — | | | | — | | | | 267,030 | |

| | Utilities | | | 250,350 | | | | — | | | | — | | | | 250,350 | |

| | Total Convertible Preferred Stocks | | | 517,380 | | | | — | | | | — | | | | 517,380 | |

| | Corporate Bonds | | | | | | | | | | | | | | | | |

| | Finance & Insurance | | | — | | | | 304,836 | | | | — | | | | 304,836 | |

| | Health Care | | | — | | | | 104,750 | | | | — | | | | 104,750 | |

| | Manufacturing | | | — | | | | 202,000 | | | | — | | | | 202,000 | |

| | Total Corporate Bonds | | | — | | | | 611,586 | | | | — | | | | 611,586 | |

| | U.S. Government Obligations | | | — | | | | 4,151,313 | | | | — | | | | 4,151,313 | |

| | Short-Term Investments | | | 2,915,018 | | | | — | | | | — | | | | 2,915,018 | |

| | Total Investments | | $ | 12,347,635 | | | $ | 4,762,899 | | | $ | — | | | $ | 17,110,534 | |

Transfers between levels are recognized at the end of the reporting period. There were no transfers between levels. There were no Level 3 investments held by the Fund during the year ended September 30, 2016.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 3 – | Derivative Instruments |

The following contains information about the Fund’s use of derivative instruments and how derivative instruments affect the Fund’s financial position and operations.

Transactions in option contracts written during the year ended September 30, 2016 were as follows:

| | | | Number of | | | Premiums | |

| | | | Contracts | | | Received | |

| | Options outstanding at September 30, 2015 | | | 0 | | | $ | 0 | |

| | Options written | | | 473 | | | | 43,305 | |

| | Options terminated in | | | | | | | | |

| | closing purchase transactions | | | (220 | ) | | | (23,368 | ) |

| | Options expired | | | (233 | ) | | | (16,887 | ) |

| | Options exercised | | | (20 | ) | | | (3,050 | ) |

| | Options outstanding at September 30, 2016 | | | 0 | | | $ | 0 | |

The average monthly fair values of options written during the year ended September 30, 2016 for the Fund was $1,903.

The Fund did not hold any derivatives as of September 30, 2016.

The effect of derivative instruments on the Statement of Operations for the year ended

September 30, 2016 was as follows:

| | Amount of Realized Gain |

| | (Loss) on Derivatives |

| Derivatives not accounted for as hedging instruments | Options Written | Total |

| Equity Contracts | $26,894 | $26,894 |

| | | |

| | Change in Unrealized Appreciation |

| | (Depreciation) on Derivatives |

| Derivatives not accounted for as hedging instruments | Options Written | Total |

| Equity Contracts | $— | $— |

| Note 4 – | Capital Share Transactions |

As of September 30, 2016, 30,000,000 shares of $1 par value capital stock were authorized, of which 10,000,000 shares are classified as the Fund’s series. As of September 30, 2016, capital paid-in aggregated $14,686,883.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 4 – | Capital Share Transactions (continued) |

Transactions in shares of capital stock for the years ended September 30, 2016 and September 30, 2015 were as follows:

| | | Year Ended | | | Year Ended | |

| | | September 30, 2016 | | | September 30, 2015 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | 593,107 | | | $ | 8,405,931 | | | | 17,087 | | | $ | 261,280 | |

| Shares issued in reinvestment of distributions | | | 41,275 | | | | 553,913 | | | | 63,506 | | | | 953,218 | |

| | | 634,382 | | | | 8,959,844 | | | | 80,593 | | | | 1,214,498 | |

| Shares redeemed | | | (39,225 | ) | | | (541,308 | ) | | | (137,675 | ) | | | (2,161,512 | ) |

| Net increase (decrease) | | | 595,157 | | | $ | 8,418,536 | | | | (57,082 | ) | | $ | (947,014 | ) |

| Note 5 – | Investment Transactions |

Purchases and sales of investment securities, excluding U.S. government obligations and short-term investments, for the Fund during the year, were $3,446,424 and $2,645,162, respectively.

Purchases and sales/maturities of long-term U.S. government obligations for the Fund during the year were $3,811,288 and $0, respectively.

The Fund in the normal course of business makes investments in financial instruments and derivatives where the risk of potential loss exists due to changes in the market (market risk), or failure or inability of the counterparty to a transaction to perform (credit and counterparty risk). See below for a detailed description of select principal risks.

American Depositary Receipts (“ADRs”) and Global Depository Receipts (“GDRs”) Risk. ADRs and GDRs may be subject to some of the same risks as direct investment in foreign companies, which includes international trade, currency, political, regulatory and diplomatic risks. In a sponsored ADR arrangement, the foreign issuer assumes the obligation to pay some or all of the depositary’s transaction fees. Under an unsponsored ADR arrangement, the foreign issuer assumes no obligations and the depositary’s transaction fees are paid directly by the ADR holders. Because unsponsored ADR arrangements are organized independently and without the cooperation of the issuer of the underlying securities, available information concerning the foreign issuer may not be as current as for sponsored ADRs and voting rights with respect to the deposited securities are not passed through. GDRs can involve currency risk since, unlike ADRs, they may not be U.S. dollar-denominated.

Convertible Securities Risk. A convertible security is a fixed-income security (a debt instrument or a preferred stock) which may be converted at a stated price within a specified period of time into a certain quantity of the common stock of the same or a different issuer. Convertible securities are senior to common stock in an issuer’s capital structure, but are subordinated to any senior debt securities. While providing a fixed-income stream (generally higher in yield than the income derivable

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 6 – | Principal Risks (continued) |

from common stock but lower than that afforded by a similar non-convertible security), a convertible security also gives an investor the opportunity, through its conversion feature, to participate in the capital appreciation of the issuing company depending upon a market price advance in the convertible security’s underlying common stock.

Debt/Fixed Income Securities Risk. An increase in interest rates typically causes a fall in the value of the debt securities in which the Fund may invest. The value of the Fund may change in response to changes in the credit ratings of the Fund’s portfolio of debt securities. Interest rates in the United States are at, or near, historic lows, which may increase the Fund’s exposure to risks associated with rising interest rates. Moreover, rising interest rates or lack of market participants may lead to decreased liquidity in the bond and loan markets, making it more difficult for the Fund to sell its holdings at a time when the Fund’s manager might wish to sell. Lower rated securities (“junk bonds”) are generally subject to greater risk of loss than higher rated securities. Debt securities are also subject to prepayment risk when interest rates decrease. Prepayment risk is the risk that the borrower will prepay some or all of the principal owed to the issuer. If prepayment occurs, the Fund may have to replace the security by investing the proceeds in a less attractive security.

Emerging Markets Risk. The Fund may invest in emerging markets, which may carry more risk than investing in developed foreign markets. Risks associated with investing in emerging markets include limited information about companies in these countries, greater political and economic uncertainties compared to developed foreign markets, underdeveloped securities markets and legal systems, potentially high inflation rates, and the influence of foreign governments over the private sector.

Equity and General Market Risk. Equities, such as common stocks, or other equity related investments are susceptible to general stock market fluctuations and to volatile increases and decreases in value. The stock market may experience declines or stocks in the Fund’s portfolio may not meet the financial expectations of the Fund or other market participants. The Fund’s net asset value and investment return will fluctuate based upon changes in the value of its portfolio securities.

ETF Risk. ETFs may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the Fund can generate brokerage expenses. Shareholders of the Fund will indirectly be subject to the fees and expenses of the individual ETFs in which the Fund invests, in addition to the Fund’s own fees and expenses.

Foreign Securities Risk. The Fund may invest in foreign securities and is subject to risks associated with foreign markets, such as adverse political, currency, social and economic developments, accounting standards or governmental supervision that is not consistent with that to which U.S. companies are subject, limited information about foreign companies, less liquidity in foreign markets and less protection.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 6 – | Principal Risks (continued) |

High Yield Risk. The Fund’s investment program permits it to invest in non-investment grade debt obligations, sometimes referred to as “junk bonds” (hereinafter referred to as “lower-quality securities”). Lower-quality securities are those securities that are rated lower than investment grade and unrated securities believed by Concorde to be of comparable quality. Although these securities generally offer higher yields than investment grade securities with similar maturities, lower-quality securities involve greater risks, including the possibility of default or bankruptcy. In general, they are regarded to be more speculative with respect to the issuer’s capacity to pay interest and repay principal.

Investments in Other Investment Companies Risk. Shareholders of the Fund will indirectly be subject to the fees and expenses of the other investment companies in which the Fund invests and these fees and expenses are in addition to the fees and expenses that Fund shareholders directly bear in connection with the Fund’s own operations. In addition, shareholders will be exposed to the investment risks associated with investments in the other investment companies.

Liquidity Risk. Certain securities held by the Fund may be difficult (or impossible) to sell at the time and at the price the Fund would like. As a result, the Fund may have to hold these securities longer than it would like and may forego other investment opportunities. There is the possibility that the Fund may lose money or be prevented from realizing capital gains if it cannot sell a security at a particular time and price.

Master Limited Partnership (“MLP”) Risk. Securities of master limited partnerships are listed and traded on U.S. securities exchanges. The value of an MLP fluctuates based predominately on its financial performance, as well as changes in overall market conditions. Investments in MLPs involve risks that differ from investments in common stocks, including risks related to the fact that investors have limited control of and limited rights to vote on matters affecting the MLP; risks related to potential conflicts of interest between the MLP and the MLP’s general partner; cash flow risks; dilution risks; and risks related to the general partner’s right to require investors to sell their holdings at an undesirable time or price. In addition, MLPs may be subject to state taxation in certain jurisdictions, which may reduce the amount of income an MLP pays to its investors. The securities of certain MLPs may trade in lower volumes due to their smaller capitalizations, and may be subject to more abrupt or erratic price movements and lower market liquidity. MLPs are generally considered interest-rate sensitive investments. During periods of interest rate volatility, these investments may not provide attractive returns. In addition, if the tax treatment of an MLP changes, the Fund’s after-tax return from its MLP investment would be materially reduced.

Non-Diversification Risk. Because the Fund is non-diversified (meaning that compared to diversified mutual funds, the Fund may invest a greater percentage of its assets in a particular issuer), the Fund’s shares may be more susceptible to adverse changes in the value of a particular security than would be the shares of a diversified mutual fund. Thus, the Fund is more sensitive to economic, business and political changes which may result in greater price fluctuations of the Fund’s shares.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 6 – | Principal Risks (continued) |

Private Equity Risk. The sale or transfer of private equity investments may be limited or prohibited by contract or law. Private equity securities are generally valued in good faith following procedures approved by the Board as they are not traded frequently. The Fund may be required to hold such positions for several years, if not longer, regardless of valuation, which may cause the Fund to be less liquid.

Private Placement Risk. The Fund may invest in privately issued securities of domestic common and preferred stock, convertible debt securities, ADRs and REITS, including those which may be resold only in accordance with Rule 144A under the Securities Act of 1933, as amended. Privately issued securities are restricted securities that are not publicly traded. Delay or difficulty in selling such securities may result in a loss to the Fund.

REIT and Real Estate Risk. The value of the Fund’s investments in REITS may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs.

Security Selection Risk. Concorde may misjudge the risk and/or return potential of a security. This misjudgment can result in a loss or a significant deviation relative to its benchmarks.

Smaller and Medium Capitalization Company Risk. Securities of smaller and medium-sized companies may be more volatile and more difficult to liquidate during market down turns than securities of larger companies. Additionally the price of smaller companies may decline more in response to selling pressures.

Style Risk. Concorde follows an investing style that favors value investments. The value investing style may, over time, go in and out of favor. At times when the value investing style is out of favor, the Fund may underperform other funds that use different investing styles. Investors should be prepared to tolerate volatility in Fund returns.

| Note 7 – | Investment Advisory Fees and Transactions with Affiliate |

The Company has an Investment Advisory Agreement with Concorde to act as the Fund’s investment advisor. Concorde provides the Fund with investment management and advisory services consistent with the Fund’s investment objectives, policies and restrictions, supervises the purchase and sale of investment transactions and administers the business and administrative operations of the Fund. For such services, Concorde received an annual fee of 0.90% through July 22, 2016, at which time it was reduced to 0.80% of the Fund’s average daily net assets, computed daily and paid on a monthly basis. The investment advisory fee was $87,250 for the year ended September 30, 2016, of which $9,697 was payable at September 30, 2016. Certain officers and directors of the Company are also officers, directors and/or employees of Concorde.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 8 – | Service Organizations |

U.S. Bancorp Fund Services, LLC (“USBFS”) provides the Fund with administrative, fund accounting, and transfer agent services. U.S. Bank, N.A., (“USB”) an affiliate of USBFS, serves as the Fund’s custodian. Fees paid to USBFS and USB during the year ended September 30, 2016, were $81,625 and $4,832, respectively.

Due to the Reorganization, the Company entered into new administrative, fund accounting, and transfer agent agreements with USBFS and a new custody agreement with USB in July 2016. Pursuant to the agreements, should the Company elect to terminate any of these agreements prior to the end of the initial three year term, the Company agrees to pay certain monthly, and other fees, through the remaining lives of any of the terminated agreements.

The Company has an administrative agreement with National Financial Services, LLC (“NFS”). The agreement provides for monthly payments by the Fund to NFS for providing certain shareholder services (sub-transfer agent fees). Sub-transfer agent fees incurred by the Fund to NFS for the year ended September 30, 2016 were $11,389.

| Note 9 – | Federal Tax Information |

At September 30, 2016, the Fund’s investments and components of accumulated earnings (losses) on a tax basis were as follows:

| | Cost of Investments | | $ | 13,815,831 | |

| | Gross tax unrealized appreciation | | | 3,630,408 | |

| | Gross tax unrealized depreciation | | | (335,705 | ) |

| | Net tax unrealized appreciation | | $ | 3,294,703 | |

| | Undistributed ordinary income | | | — | |

| | Undistributed long-term gain | | | — | |

| | Total distributable earnings | | $ | — | |

| | Other accumulated losses | | $ | — | |

| | Net accumulated earnings | | $ | 3,294,703 | |

The difference between book basis and tax basis unrealized appreciation is attributable to the realization for tax purposes of the unrealized gain on investment in a passive foreign investment company.

At September 30, 2016, the Fund had no tax basis capital loss carryovers to offset future capital gains. The Fund did not utilize a capital loss carryover during the year ended September 30, 2016. The Fund had no late year loss deferrals and no post-October loss.

CONCORDE WEALTH MANAGEMENT FUND

NOTES TO FINANCIAL STATEMENTS

| Note 9 – | Federal Tax Information (continued) |

The tax character of distributions paid during the years ended September 30, 2016 and September 30, 2015 was as follows:

| | | | September 30, 2016 | | | September 30, 2015 | |

| | Ordinary income | | $ | 25,675 | | | $ | — | |

| | Long-term capital gain | | $ | 528,238 | | | $ | 953,218 | |

| | | | $ | 553,913 | | | $ | 953,218 | |

| Note 10 – | Subsequent Events |

Management has evaluated the Fund’s events and transactions that occurred subsequent to September 30, 2016 through November 17, 2016, the date of issuance of the Fund’s financial statements. There were no events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Fund’s financial statements.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and

Board of Directors of

Concorde Funds, Inc.

We have audited the accompanying statement of assets and liabilities of Concorde Wealth Management Fund, a series of Concorde Funds, Inc. (Company), including the schedule of investments in securities, as of September 30, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2016, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Concorde Wealth Management Fund, a series of Concorde Funds, Inc. as of September 30, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

| |  |

| | BRAD A. KINDER, CPA |

Flower Mound, Texas

November 17, 2016

BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

At its meeting held on May 13, 2016, the Board of Directors (the “Board”) of Concorde Funds, Inc. (the “Company”) including all the Directors who are not “interested persons” (as defined in the Investment Company Act of 1940) considered and then voted to approve the investment advisory agreement (the “Advisory Agreement”) between Concorde Financial Corporation (the “Advisor”) and the Company, on behalf of the Concorde Wealth Management Fund (the “Fund”). In connection with its approval of the Advisory Agreement, the Board reviewed and discussed the specific services provided by the Advisor. The Board considered the following factors:

The Advisor:

| | 1) | Provides daily investment management for the Concorde Wealth Management Fund. In providing investment management, Concorde Financial Corporation will oversee the trading of securities and the rebalancing of the portfolio. |

| | | |

| | 2) | Retains the services of the Fund’s Chief Compliance Officer and will make all reasonable efforts to insure that the Fund is in compliance with the securities laws. |

| | | |

| | 3) | Provide responsive customer and shareholder servicing which consists of responding to shareholder inquiries received, including specific mutual fund account information, in addition to calls directed to the transfer agent call center. |

| | | |

| | 4) | Oversees distribution of the Fund through third-party broker/dealers and independent financial institutions. |

| | | |

| | 5) | Oversees those third party service providers that support the Fund in providing fund accounting, fund administration, transfer agency and custodial services. |

The Board also: (i) compared the performance of the Fund to benchmark indices over various periods of time and concluded that the performance of the Fund, articulately on a risk-adjusted basis, warranted the continuation of the Advisory Agreement; (ii) compared the expense ratios of funds similar in asset size and investment objective to those of the Fund and concluded the expenses of the Fund were reasonable and warranted continuation of the Advisory Agreement; (iii) considered the fees charged by Concorde Financial Corporation to those of funds similar in asset size and investment objective to the Fund and concluded the advisory fees of the Fund were reasonable and warranted continuation of the Advisory Agreement; and (iv) considered the profitability of Concorde Financial Corporation with respect to the Fund, and concluded that the profits were reasonable and not excessive when compared to profitability guidelines set forth in relevant court cases.

The Board then discussed economies of scale and breakpoints and determined that the Fund, managed by Concorde Financial Corporation, has not yet grown in size, nor has the marketplace demonstrated significant rapid potential growth to any extent, that would warrant the imposition of breakpoints.

The Board reviewed the Fund’s expense ratios and comparable expense ratios for similar funds. The Board used data from Morningstar, as presented in the charts in the Board Materials, showing funds classified by Morningstar as Moderate Allocation Funds, similar in nature to the Concorde Wealth Management Fund. The Board determined that the total expense ratio of the Fund falls within the range of the ratios of other funds in the Moderate Allocation classification. The Board also referenced Concorde Financial Corporation’s Form ADV and a draft of the Investment Advisory Agreement. They also referenced a Concorde Investment Management Fee and Service Agreement to compare fees charged by the Advisor to their other clients versus what they charge the Fund. After further discussion and upon a motion duly made and seconded, the Directors, including a majority of Directors who are not “interested persons,” as defined by the 1940 Act, of the Corporation unanimously approved the Advisory Agreement.

ADDITIONAL INFORMATION (Unaudited)

PROXY VOTING POLICIES AND PROCEDURES

For a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to the portfolio securities, please call (972) 701-5400 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the Securities and Exchange Commission at http://www.sec.gov.

PROXY VOTING RECORDS

Information on how the Fund voted proxies relating to portfolio securities during the twelve month period ending June 30, 2016 is available without charge, upon request, by calling (972) 701-5400. Furthermore, you can obtain the Fund’s proxy voting records on the Securities and Exchange Commission’s website at http://www.sec.gov.

QUARTERLY FILINGS ON FORM N-Q

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal quarter on Form N-Q. The Fund’s Form N-Q is available (i) without charge, upon request, by calling (972) 701-5400, (ii) on the Securities and Exchange Commission’s website at http://www.sec.gov, or (iii) at the Securities and Exchange Commission’s public reference room

HOUSEHOLD DELIVERY OF SHAREHOLDER DOCUMENTS

In an effort to decrease costs, the FUND intends to reduce the number of duplicate prospectuses and Annual and Semi-Annual Reports you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders we reasonably believe are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-800-294-1699 to request individual copies of these documents. One the FUND receives notice to stop householding, we will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

FEDERAL TAX DISTRIBUTION INFORMATION

The Fund has designated 100% of the dividends declared from net investment income during the year ended September 30, 2016, as qualified dividend income under the Jobs Growth and Tax Reconciliation Act of 2003. Additionally, for corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended September 30, 2016 was 100%.

MATTERS SUBMITTED TO A SHAREHOLDER VOTE

A special meeting of shareholders of the Concorde Value Fund was held on July 22, 2016, and the following matters were approved by the Fund’s voting shares:

ADDITIONAL INFORMATION (Unaudited) (continued)

To approve the Plan of Acquisition and Liquidation

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

To approve the non-diversification policy

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

To approve the Concorde Wealth Management Fund’s Rule 12b-1 Plan

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

To approve the Concorde Wealth Management Fund’s fundamental investment restrictions:

a. borrowing

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

b. concentration

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

c. underwriting

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

d. lending

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

ADDITIONAL INFORMATION (Unaudited) (continued)

e. investments in real estate

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

f. investments in commodities

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

g. senior securities

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

h. short selling and margin

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

i. investments in warrants

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

j. investments for the purpose of exercising control

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

k. investing in issuers in which an officer or director of the Company is an officer or director of the issuer

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

ADDITIONAL INFORMATION (Unaudited) (continued)

l. investing in issuers in which officers or directors of the Company have

a specified level of ownership

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

m. To approve the elimination of the fundamental investment policy on investments in new issuers

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

n. oil, gas and mineral investments

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

o. investments in illiquid securities

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

To approve the proposal to adjourn the special meeting to permit further solicitation of proxies in the event there are not sufficient votes at the time of the special meeting to approve the Plan of Acquisition and Liquidation

For: 590,781

Against: 0

Abstain: 0

Nonvotes: 95,518

FUND EXPENSES (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and exchange fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six month period ended September 30, 2016.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.