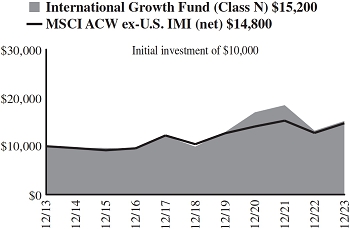

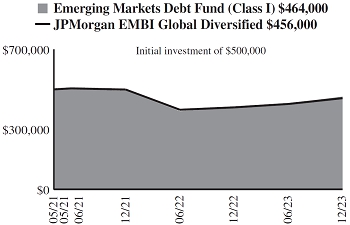

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| 150 North Riverside Plaza, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Stephanie G. Braming, Principal Executive Officer

William Blair Funds

150 North Riverside Plaza, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. December 31, 2023 Annual Reports transmitted to shareholders.

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | December 31, 2023 |

William Blair Funds

Annual Report | |

| | | | |

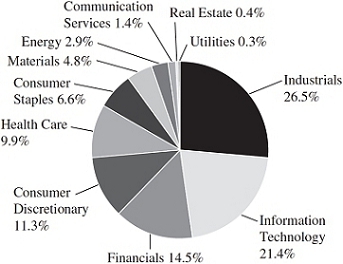

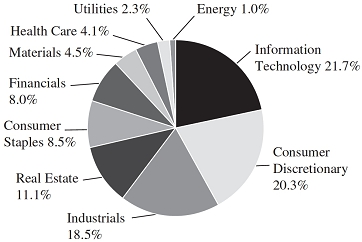

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| December 31, 2023 | William Blair Funds | 1 |

The views expressed in the commentary for each Fund reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The portfolio management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Statements involving predictions, assessments, analyses, or outlook for individual securities, industries, market sectors, and/or markets involve risks and uncertainties, and there is no guarantee they will come to pass.

This report is submitted for the general information of the shareholders of William Blair Funds. It is not authorized for distribution to prospective Fund investors unless accompanied or preceded by the Fund’s prospectus. Please carefully consider a Fund’s investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Fund’s prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

| 2 | Annual Report | December 31, 2023 |

U.S. Growth & Core Market Review and Outlook

U.S. equity indices had positive returns for the year ended December 31, 2023.

During the first half of the year, there was a wide range of performance across style and size dimensions. Despite investors’ concerns regarding regional bank failures and higher interest rates, positive developments such as robust jobs growth and moderating inflation rates provided a strong counterbalance for the market. Against this backdrop, the U.S. economy produced solid growth in the first half of the year as Gross Domestic Product (GDP) grew at an annualized rate of 2.1% in the second quarter, modestly below the first quarter’s expansion of 2.2%.

Mid-year, a brief equity market rally was fueled by optimism that the Federal Reserve (Fed) had guided the economy to a soft landing and policy tightening would soon come to an end. That enthusiasm, along with stock prices, faded as fears of persistent inflation caused investors to price in the prospect of an extended period of higher interest rates. U.S. Treasury yields marched higher, reaching multi-year highs, and the U.S. dollar strengthened as investors digested the Fed’s interest rate moves and forward-looking commentary.

U.S. equity indices advanced in the fourth quarter, with notable strength in November and December. This followed inflation data indicating continued moderation and a pivot to dovish comments from the Fed, which led to the belief that the Fed had reached peak interest rates, potentially leading to earlier rate cuts in 2024 than previously anticipated. In turn, U.S. Treasury yields retreated and stocks rallied over the final two months of the year.

Moderating U.S. inflation rates and the prospect of easing Fed policy has increased sentiment for a soft landing for the U.S. economy. However, the cumulative effect of the Fed’s two-year rate-hiking cycle is still unfolding. The transition to higher interest rates, and subsequently increased borrowing costs for consumers and businesses, may lead to slower than expected economic growth. Moderation in consumer spending and more limited pricing power for corporations, as inflation eases, pose potential headwinds for topline growth.

Against this backdrop, companies with strong balance sheets, durable business models, sustainable cash flow, and the ability to self-fund growth are likely to be in an advantaged position relative to peers. We believe our philosophy of identifying durable businesses whose stocks present attractive risk/reward opportunities should serve us well in a variety of economic environments, as it has historically.

| December 31, 2023 | William Blair Funds | 3 |

U.S. Value Market Review and Outlook

2023 was a year characterized by uncertainty in which investors faced an environment with little conviction nor a clear direction. After rising sharply in the second and third quarters, interest rates peaked in the fourth quarter fueled by the potential for a more accommodative Fed policy in 2024, which allowed investors to enjoy a broad-based relief rally in the fourth quarter. Similar to interest rates, oil prices peaked in late September and declined sharply throughout the fourth quarter. In the fourth quarter investors bid up cyclicals, small caps and lower quality names which had been lagging substantially in the first three quarters.

While we were pleased to witness the market rally in the fourth quarter, we are concerned that perhaps investors may be too optimistic in the near-term. For example, while the Fed specifically cited the potential for three future rate cuts, several datapoints suggest that the market is discounting six in 2024. Further, it seems inconsistent for the market to expect six rates cuts while at the same time expecting 11% earnings growth for the S&P 500 index. Said another way, if that many cuts do occur in 2024, it is probable that the economy will have significantly deteriorated.

Despite this caution (and the recent market increase), small-to-mid cap stocks trade at a discount to larger peers and we believe they are attractively valued on their own long-term history. We are also encouraged by the recent uptick in merger activity, a trend which typically favors smaller and mid-sized companies. Lastly, as always, we strive to identify high quality companies whose stock prices already reflect an excessive amount of skepticism. Therefore, in an environment where growth may be slowing and earnings estimates could be too high, we believe the Fund is well positioned. Historically, these periods have also provided fertile ground to find attractive investments and we are prepared to act quickly should the opportunity arise.

| 4 | Annual Report | December 31, 2023 |

| | Growth Fund |

| | |

| | The Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGER |

| | |

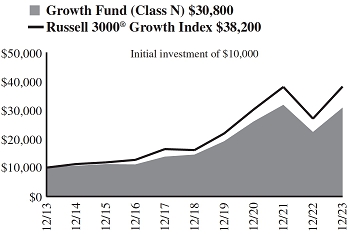

David C. Fording, CFA | The William Blair Growth Fund (Class N shares) (the “Fund”) posted a 37.76% increase, net of fees, for the year ended December 31, 2023. By comparison, the Fund’s benchmark index, the Russell 3000® Growth Index (the “Index”), increased 41.21%. During the year, the Fund trailed the robust 41.21% return of the Index, driven by a combination of style and stock-specific factors. From a style perspective, our typical bias toward small and mid-caps was a headwind as mega caps significantly outperformed. Within the Index, stocks over $100 billion in market capitalization returned 50.5%, as compared to the rest of the Index which returned 25.6%, a spread of approximately 25%. At the stock level, the top detractors were SBA Communications (Real Estate) and Nike (Consumer Discretionary). Shares of SBA Communications, one of the largest independent operators of wireless towers, lagged as carrier spending slowed and higher interest rates weighed on valuation. Shares of Nike lagged due to foreign exchange pressures and macro-economic headwinds, particularly as it relates to the company’s revenue exposure in China. Other notable underperforming holdings included Coca Cola (Consumer Staples), Estee Lauder (Consumer Staples) and UnitedHealth Group (Health Care). Not owning Tesla (Consumer Discretionary) also detracted from full year relative performance. In addition, stock selection in Communication Services and the Consumer sectors dampened performance as our holdings, in aggregate, lagged their sector peers. The top contributors for the year were Palo Alto Networks (Information Technology) and Advanced Micro Devices (Information Technology). Palo Alto, a leading network security company, benefited from strong growth in next generation security products amid a challenging security spend environment. Fabless semiconductor company Advanced Micro Devices outperformed on improvement in its data center segment as well as better investor appreciation of the company’s positioning to capitalize on opportunities in AI (Artificial Intelligence). Cameco (Energy), National Instruments (Information Technology) and MongoDB (Information Technology) were other strong performing holdings. Not owning AbbVie (Health Care) also added relative value as patent cliff concerns for the company’s Humira drug weighed on shares. Finally, positive stock selection in Industrials and among smaller market caps also benefited relative performance. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| December 31, 2023 | William Blair Funds | 5 |

Growth Fund

Performance Highlights (Unaudited)

Average Annual Total Returns through 12/31/2023

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | 37.76 | % | | | 5.77 | % | | | 16.25 | % | | | 11.92 | % | | | — | % |

| Class I | | | 38.15 | | | | 6.06 | | | | 16.57 | | | | 12.25 | | | | — | |

| Class R6 | | | 38.19 | | | | 6.12 | | | | — | | | | — | | | | 13.50 | |

| Russell 3000® Growth Index | | | 41.21 | | | | 8.08 | | | | 18.85 | | | | 14.33 | | | | 15.60 | |

| S&P 500® Index | | | 26.29 | | | | 10.00 | | | | 15.69 | | | | 12.03 | | | | 12.94 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to December 31, 2023. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500® Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on December 31, 2023. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

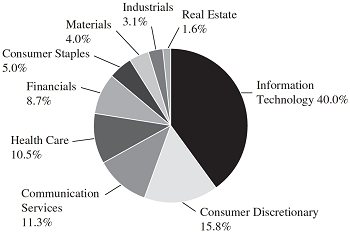

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 6 | Annual Report | December 31, 2023 |

Growth Fund

Portfolio of Investments, December 31, 2023 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—34.5% | | | | | | | | |

| * | Advanced Micro Devices, Inc. | | | 43,596 | | | $ | 6,426 | |

| * | Dynatrace, Inc. | | | 57,413 | | | | 3,140 | |

| | Microsoft Corp. | | | 63,473 | | | | 23,868 | |

| * | MongoDB, Inc. | | | 3,927 | | | | 1,606 | |

| * | Nice Ltd.—ADR | | | 13,960 | | | | 2,785 | |

| | NVIDIA Corp. | | | 22,505 | | | | 11,145 | |

| * | Palo Alto Networks, Inc. | | | 27,491 | | | | 8,107 | |

| | Power Integrations, Inc. | | | 18,480 | | | | 1,517 | |

| * | Pure Storage, Inc. | | | 83,588 | | | | 2,981 | |

| * | ServiceNow, Inc. | | | 8,324 | | | | 5,881 | |

| | Texas Instruments, Inc. | | | 25,488 | | | | 4,345 | |

| * | Tyler Technologies, Inc. | | | 7,409 | | | | 3,098 | |

| * | Vertex, Inc. | | | 68,484 | | | | 1,845 | |

| * | Workday, Inc. | | | 13,073 | | | | 3,609 | |

| * | Workiva, Inc. | | | 22,961 | | | | 2,331 | |

| | | | | | | | | 82,684 | |

| | Health Care—13.8% | | | | | | | | |

| | Abbott Laboratories | | | 41,707 | | | | 4,591 | |

| * | HealthEquity, Inc. | | | 23,372 | | | | 1,550 | |

| * | Intuitive Surgical, Inc. | | | 17,478 | | | | 5,896 | |

| * | Repligen Corp. | | | 15,047 | | | | 2,705 | |

| * | Treace Medical Concepts, Inc. | | | 149,338 | | | | 1,904 | |

| | UnitedHealth Group, Inc. | | | 18,173 | | | | 9,568 | |

| * | Veeva Systems, Inc. | | | 12,500 | | | | 2,407 | |

| | Zoetis, Inc. | | | 22,513 | | | | 4,443 | |

| | | | | | | | | 33,064 | |

| | Consumer Discretionary—12.6% | | | | | | | | |

| * | Amazon.com, Inc. | | | 116,810 | | | | 17,748 | |

| * | Bright Horizons Family Solutions, Inc. | | | 27,720 | | | | 2,613 | |

| * | Five Below, Inc. | | | 16,678 | | | | 3,555 | |

| | NIKE, Inc. | | | 35,758 | | | | 3,882 | |

| * | Skyline Champion Corp. | | | 31,353 | | | | 2,328 | |

| | | | | | | | | 30,126 | |

| | Communication Services—8.9% | | | | | | | | |

| * | Alphabet, Inc. | | | 122,143 | | | | 17,062 | |

| | Warner Music Group Corp. | | | 89,166 | | | | 3,191 | |

| * | ZipRecruiter, Inc. | | | 68,284 | | | | 949 | |

| | | | | | | | | 21,202 | |

| | Financials—8.7% | | | | | | | | |

| | Apollo Global Management, Inc. | | | 35,672 | | | | 3,324 | |

| | Carlyle Group, Inc. | | | 77,524 | | | | 3,154 | |

| | Everest Group Ltd.† | | | 7,420 | | | | 2,624 | |

| | Mastercard, Inc. | | | 27,548 | | | | 11,750 | |

| | | | | | | | | 20,852 | |

| | | | Shares or | | | | |

| | | | Principal | | | | |

| | Issuer | | Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Industrials—7.8% | | | | | | | | |

| * | ACV Auctions, Inc. | | | 204,822 | | | $ | 3,103 | |

| | Brink’s Co. | | | 44,826 | | | | 3,942 | |

| * | Chart Industries, Inc. | | | 15,982 | | | | 2,179 | |

| * | Copart, Inc. | | | 106,445 | | | | 5,216 | |

| * | Kornit Digital Ltd.† | | | 70,053 | | | | 1,342 | |

| * | Verra Mobility Corp. | | | 121,692 | | | | 2,803 | |

| | | | | | | | | 18,585 | |

| | Consumer Staples—6.0% | | | | | | | | |

| | Coca-Cola Co. | | | 80,746 | | | | 4,758 | |

| | Estee Lauder Cos., Inc. | | | 9,926 | | | | 1,452 | |

| | Lancaster Colony Corp. | | | 15,791 | | | | 2,627 | |

| * | Performance Food Group Co. | | | 47,086 | | | | 3,256 | |

| * | Vital Farms, Inc. | | | 138,398 | | | | 2,172 | |

| | | | | | | | | 14,265 | |

| | Energy—4.1% | | | | | | | | |

| | Cameco Corp. | | | 86,277 | | | | 3,718 | |

| * | Green Plains, Inc. | | | 62,677 | | | | 1,581 | |

| | New Fortress Energy, Inc. | | | 82,644 | | | | 3,118 | |

| | Whitecap Resources, Inc. | | | 226,335 | | | | 1,522 | |

| | | | | | | | | 9,939 | |

| | Real Estate—1.2% | | | | | | | | |

| * | CoStar Group, Inc. | | | 32,640 | | | | 2,852 | |

| | Materials—1.0% | | | | | | | | |

| | Crown Holdings, Inc. | | | 26,318 | | | | 2,424 | |

| | Total Common Stocks—98.6%

(cost $124,885) | | | | | | | 235,993 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 2.300% dated 12/29/23, due 01/02/24, repurchase price $2,735, collateralized by U.S. Treasury Note, 4.375%, due 08/15/26, valued at $2,789 | | | $2,734 | | | | 2,734 | |

| | Total Repurchase Agreement—1.1%

(cost $2,734) | | | | | | | 2,734 | |

| | Total Investments—99.7%

(cost $127,619) | | | | | | | 238,727 | |

| | Cash and other assets, less liabilities—0.3% | | | | | | | 665 | |

| | Net assets—100.0% | | | | | | $ | 239,392 | |

ADR = American Depository Receipt

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| December 31, 2023 | William Blair Funds | 7 |

| | Large Cap Growth Fund |

| | |

| | The Large Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

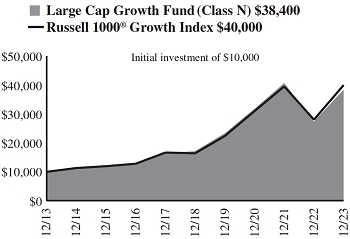

James S. Golan, CFA

David P. Ricci, CFA | The William Blair Large Cap Growth Fund (Class N shares) (the “Fund”) posted a 40.11% increase, net of fees, for the year ended December 31, 2023. By comparison, the Fund’s benchmark index, the Russell 1000® Growth Index (the “Index”), increased 42.68%. The Fund lagged the Index for the full year period. Relative performance was primarily driven by stock-specific dynamics. Performance of the Index was dominated by a small number of growth companies with large weights, particularly those perceived to be beneficiaries of Generative Artificial Intelligence (“Generative AI”) whose stocks have appreciated primarily on valuation multiple expansion. Among the larger sources of underperformance as compared to the Index came from our underweight to NVIDIA (Information Technology) and not owning Tesla (Consumer Discretionary). Shares of fabless semiconductor company NVIDIA advanced as artificial intelligence applications were used more broadly and demand is expected to continue to accelerate. While we established a position in the stock during the period, our underweight exposure from earlier in the year was a detractor from relative performance. As it relates to Tesla, while decelerating sales and price cuts have negatively impacted earnings expectations as we expected, the stock appreciated primarily on speculation that Tesla is positioned to be a beneficiary of Generative AI. Within the Fund, our top detractors for the period included Estee Lauder (Consumer Staples), UnitedHealth (Health Care), Nike (Consumer Discretionary) and Costar Group (Real Estate). Estee Lauder, a leader in the prestige beauty market that manufactures and sells premium beauty products in more than 150 countries across a variety of channels, reported decelerating growth in the highly profitable Asia travel retail segment, which put pressure on margins. UnitedHealth, a provider of health care coverage, software and data consultancy services, underperformed due to forward guidance that indicated lower-than-expected Medicare Advantage membership growth and a higher-than-expected medical loss ratio. Our top individual contributors for the period included Palo Alto Networks (Information Technology), Salesforce (Information Technology), Advanced Micro Devices (Information Technology), Amazon (Consumer Discretionary) and Copart (Industrials). Palo Alto, a leading network security company, benefited from strong demand in a challenging security spend environment. Salesforce, the market leader in sales and customer relationship management software, reported strong margin expansion. Furthermore, not owning AbbVie, a pharmaceutical company, was a positive contributor to performance. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| 8 | Annual Report | December 31, 2023 |

Large Cap Growth Fund

Performance Highlights (Unaudited)

Average Annual Total Returns through 12/31/2023

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | 40.11 | % | | | 6.52 | % | | | 17.51 | % | | | 14.40 | % | | | — | % |

| Class I | | | 40.48 | | | | 6.80 | | | | 17.80 | | | | 14.70 | | | | — | |

| Class R6 | | | 40.56 | | | | 6.86 | | | | — | | | | — | | | | 14.79 | |

| Russell 1000® Growth Index | | | 42.68 | | | | 8.86 | | | | 19.50 | | | | 14.86 | | | | 16.27 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to December 31, 2023. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2023. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

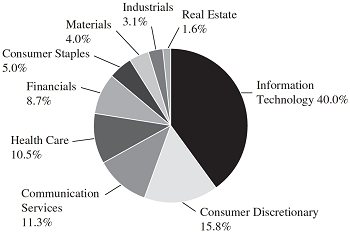

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| December 31, 2023 | William Blair Funds | 9 |

Large Cap Growth Fund

Portfolio of Investments, December 31, 2023 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—39.9% | | | | | | | | |

| | Accenture PLC† | | | 170,740 | | | $ | 59,914 | |

| * | Advanced Micro Devices, Inc. | | | 250,358 | | | | 36,905 | |

| | Intuit, Inc. | | | 76,700 | | | | 47,940 | |

| | Lam Research Corp. | | | 44,050 | | | | 34,503 | |

| | Microsoft Corp. | | | 608,630 | | | | 228,869 | |

| | NVIDIA Corp. | | | 187,710 | | | | 92,958 | |

| * | Palo Alto Networks, Inc. | | | 134,850 | | | | 39,765 | |

| * | Salesforce, Inc. | | | 166,680 | | | | 43,860 | |

| * | ServiceNow, Inc. | | | 55,060 | | | | 38,899 | |

| | Texas Instruments, Inc. | | | 164,490 | | | | 28,039 | |

| | | | | | | | | 651,652 | |

| | Consumer Discretionary—15.7% | | | | | | | | |

| * | Amazon.com, Inc. | | | 921,600 | | | | 140,028 | |

| * | Chipotle Mexican Grill, Inc. | | | 17,780 | | | | 40,662 | |

| | NIKE, Inc. | | | 223,560 | | | | 24,272 | |

| * | O’Reilly Automotive, Inc. | | | 30,020 | | | | 28,521 | |

| | Starbucks Corp. | | | 234,390 | | | | 22,504 | |

| | | | | | | | | 255,987 | |

| | Communication Services—11.2% | | | | | | | | |

| * | Alphabet, Inc. | | | 1,110,320 | | | | 155,101 | |

| * | Live Nation Entertainment, Inc. | | | 300,612 | | | | 28,137 | |

| | | | | | | | | 183,238 | |

| | Health Care—10.5% | | | | | | | | |

| | Agilent Technologies, Inc. | | | 117,000 | | | | 16,266 | |

| * | Intuitive Surgical, Inc. | | | 128,310 | | | | 43,287 | |

| | UnitedHealth Group, Inc. | | | 119,800 | | | | 63,071 | |

| * | Veeva Systems, Inc. | | | 79,810 | | | | 15,365 | |

| | Zoetis, Inc. | | | 167,840 | | | | 33,127 | |

| | | | | | | | | 171,116 | |

| | Financials—8.6% | | | | | | | | |

| | Apollo Global Management, Inc. | | | 309,351 | | | | 28,828 | |

| | Carlyle Group, Inc. | | | 696,300 | | | | 28,332 | |

| | Mastercard, Inc. | | | 195,800 | | | | 83,511 | |

| | | | | | | | | 140,671 | |

| | Consumer Staples—4.9% | | | | | | | | |

| | Costco Wholesale Corp. | | | 72,110 | | | | 47,598 | |

| * | Monster Beverage Corp. | | | 579,110 | | | | 33,363 | |

| | | | | | | | | 80,961 | |

| | Materials—4.0% | | | | | | | | |

| | Linde PLC† | | | 88,300 | | | | 36,266 | |

| | Martin Marietta Materials, Inc. | | | 57,870 | | | | 28,872 | |

| | | | | | | | | 65,138 | |

| | Industrials—3.0% | | | | | | | | |

| * | Copart, Inc. | | | 727,220 | | | | 35,634 | |

| * | Uber Technologies, Inc. | | | 232,370 | | | | 14,307 | |

| | | | | | | | | 49,941 | |

| | Real Estate—1.6% | | | | | | | | |

| * | CoStar Group, Inc. | | | 296,830 | | | | 25,940 | |

| | Total Common Stocks—99.4%

(cost $1,134,334) | | | | | | | 1,624,644 | |

| | | | | | | | |

| | Issuer | | Principal

Amount | | | Value | |

| | | | | | | | |

| | Repurchase Agreement | | | | | | |

| | Fixed Income Clearing Corporation, 2.300% dated 12/29/23, due 01/02/24, repurchase price $7,344, collateralized by U.S. Treasury Inflation-Indexed Note, 0.125%, due 07/15/31, valued at $7,489 | | | $7,342 | | | $ | 7,342 | |

| | Total Repurchase Agreement—0.5%

(cost $7,342) | | | | | | | 7,342 | |

| | Total Investments—99.9%

(cost $1,141,676) | | | | | | | 1,631,986 | |

| | Cash and other assets, less liabilities—0.1% | | | | | | | 2,116 | |

| | Net assets—100.0% | | | | | | $ | 1,634,102 | |

† = U.S. listed foreign security

* = Non-income producing security

See accompanying Notes to Financial Statements.

| 10 | Annual Report | December 31, 2023 |

| | Mid Cap Value Fund |

| | |

| | The Mid Cap Value Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

William Heaphy, CFA

Matthew Fleming, CFA | The William Blair Mid Cap Value Fund (Class I shares) (the “Fund”) posted a 13.21% increase, net of fees, for the year ended December 31, 2023. By comparison, the Fund’s benchmark index, the Russell Midcap® Value Index, increased 12.71%. The Fund’s relative outperformance during the year was driven by the combination of stock selection and sector allocations. Specifically, the Fund was positively impacted by its stock selection and sector allocations in 7 of the 11 economic sectors. The Information Technology sector was the largest contributor to relative performance for the year as strong returns from Technology Hardware & Equipment and Semiconductors & Semiconductor Equipment. Jabil Inc. was a top contributor in this sector and increased over 80% during the year upon divesting its mobility business. The divestiture was well received by the market as the business is now much less cyclical, less exposed to Apple, growing faster, and more focused on longer cycle products which we believe will improve margins over time. The Fund also benefitted from strong selection during the year within the Materials, Consumer Staples, and Financials sectors. Stock selection within these sectors was broad-based, but Westlake Chemical Corp, Molson Coors Beverage Co., and KKR & Co. Inc. all contributed meaningfully to relative performance. Conversely, the largest detractor of relative performance during the year was the Fund’s underweight position to the Building Products subsector within Industrials. This subsector soared over 60% for the year on the heels of mortgage rates rising in response to the Federal Reserve’s rate hiking cycle which caused a slowdown in existing housing sales. Unfortunately, the Fund was underweight the Building Products subsector as the valuations for this group were prohibitively elevated. The largest disappointment to relative performance for the year was stock selection within the Consumer Discretionary sector, specifically its Specialty Retailing investments. Specialty retailer Advance Auto Parts, Inc. declined substantially upon its much worse-than-expected quarterly results. While this stock has been disappointing, we continue to believe that the long-term thesis is intact, and that the position has significant future potential given its current valuation and new management team. Please refer to the U.S. Value Market Review and Outlook relating to the Fund on page 4. |

| December 31, 2023 | William Blair Funds | 11 |

Mid Cap Value Fund

Performance Highlights (Unaudited)

| Average Annual Total Returns through 12/31/2023 |

| | | 1 Year | | Since

Inception(a) |

| Class I. | | | 13.21 | % | | | 2.82 | % |

| Class R6 | | | 13.14 | | | | 2.87 | |

| Russell Midcap® Value Index | | | 12.71 | | | | 3.22 | |

| (a) | Since inception is for the period from March 16, 2022 (Commencement of Operations) to December 31, 2023. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell Midcap® Value Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values.

This report identifies the Fund’s investments on December 31, 2023. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

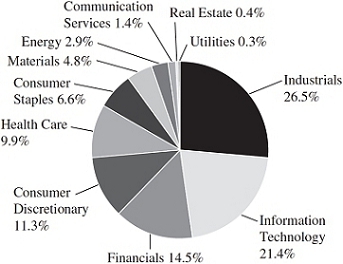

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 12 | Annual Report | December 31, 2023 |

Mid Cap Value Fund

Portfolio of Investments, December 31, 2023 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Industrials—17.8% | | | | | | | | |

| | Acuity Brands, Inc. | | | 146 | | | $ | 30 | |

| | AGCO Corp. | | | 218 | | | | 26 | |

| * | Alaska Air Group, Inc. | | | 662 | | | | 26 | |

| | Allegion PLC† | | | 187 | | | | 24 | |

| | Flowserve Corp. | | | 684 | | | | 28 | |

| | ITT, Inc. | | | 122 | | | | 14 | |

| | Johnson Controls International PLC† | | | 378 | | | | 22 | |

| | Knight-Swift Transportation Holdings, Inc. | | | 430 | | | | 25 | |

| | Snap-on, Inc. | | | 120 | | | | 35 | |

| | Timken Co. | | | 372 | | | | 30 | |

| | | | | | | | | 260 | |

| | Consumer Discretionary—12.5% | | | | | | | | |

| | Advance Auto Parts, Inc. | | | 345 | | | | 21 | |

| | BorgWarner, Inc. | | | 710 | | | | 26 | |

| | Brunswick Corp. | | | 262 | | | | 25 | |

| | LKQ Corp. | | | 511 | | | | 25 | |

| | Ralph Lauren Corp. | | | 231 | | | | 33 | |

| | Toll Brothers, Inc. | | | 309 | | | | 32 | |

| | Whirlpool Corp. | | | 165 | | | | 20 | |

| | | | | | | | | 182 | |

| | Information Technology—12.4% | | | | | | | | |

| | Amdocs Ltd.† | | | 288 | | | | 25 | |

| * | Check Point Software Technologies Ltd.† | | | 186 | | | | 28 | |

| | Cognizant Technology Solutions Corp. | | | 366 | | | | 28 | |

| * | Flex Ltd.† | | | 906 | | | | 28 | |

| | Hewlett Packard Enterprise Co. | | | 1,493 | | | | 25 | |

| | Jabil, Inc. | | | 164 | | | | 21 | |

| | Skyworks Solutions, Inc. | | | 229 | | | | 26 | |

| | | | | | | | | 181 | |

| | Financials—11.9% | | | | | | | | |

| * | Arch Capital Group Ltd.† | | | 264 | | | | 20 | |

| | East West Bancorp, Inc. | | | 348 | | | | 25 | |

| | Hartford Financial Services Group, Inc. | | | 330 | | | | 26 | |

| | Huntington Bancshares, Inc. | | | 1,571 | | | | 20 | |

| | Invesco Ltd.† | | | 1,440 | | | | 26 | |

| | KKR & Co., Inc. | | | 339 | | | | 28 | |

| | Willis Towers Watson PLC† | | | 117 | | | | 28 | |

| | | | | | | | | 173 | |

| | Health Care—11.5% | | | | | | | | |

| | Cencora, Inc. | | | 138 | | | | 28 | |

| * | Centene Corp. | | | 336 | | | | 25 | |

| | Encompass Health Corp. | | | 361 | | | | 24 | |

| * | Envista Holdings Corp. | | | 805 | | | | 19 | |

| * | Henry Schein, Inc. | | | 196 | | | | 15 | |

| * | Hologic, Inc. | | | 139 | | | | 10 | |

| | Laboratory Corp. of America Holdings | | | 115 | | | | 26 | |

| | Viatris, Inc. | | | 1,789 | | | | 20 | |

| | | | | | | | | 167 | |

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Materials—7.3% | | | | | | | | |

| * | Axalta Coating Systems Ltd.† | | | 827 | | | $ | 28 | |

| | Crown Holdings, Inc. | | | 298 | | | | 27 | |

| | Huntsman Corp. | | | 987 | | | | 25 | |

| | PPG Industries, Inc. | | | 181 | | | | 27 | |

| | | | | | | | | 107 | |

| | Energy—6.9% | | | | | | | | |

| | APA Corp. | | | 636 | | | | 23 | |

| | Coterra Energy, Inc. | | | 777 | | | | 20 | |

| | Diamondback Energy, Inc. | | | 163 | | | | 25 | |

| | Phillips 66 | | | 240 | | | | 32 | |

| | | | | | | | | 100 | |

| | Real Estate—6.7% | | | | | | | | |

| | Camden Property Trust | | | 186 | | | | 18 | |

| | Host Hotels & Resorts, Inc. | | | 1,485 | | | | 29 | |

| | Regency Centers Corp. | | | 378 | | | | 25 | |

| | VICI Properties, Inc. | | | 773 | | | | 25 | |

| | | | | | | | | 97 | |

| | Consumer Staples—5.1% | | | | | | | | |

| | Ingredion, Inc. | | | 266 | | | | 29 | |

| | Molson Coors Beverage Co. | | | 403 | | | | 24 | |

| | Tyson Foods, Inc. | | | 404 | | | | 22 | |

| | | | | | | | | 75 | |

| | Utilities—3.4% | | | | | | | | |

| | Entergy Corp. | | | 243 | | | | 25 | |

| | PPL Corp. | | | 939 | | | | 25 | |

| | | | | | | | | 50 | |

| | Communication Services—0.9% | | | | | | | | |

| * | Warner Bros Discovery, Inc. | | | 1,193 | | | | 14 | |

| | Total Common Stocks—96.4%

(cost $1,332) | | | | | | | 1,406 | |

| | Total Investments—96.4%

(cost $1,332) | | | | | | | 1,406 | |

| | Cash and other assets, | | | | | | | | |

| | less liabilities—3.6% | | | | | | | 52 | |

| | Net assets—100.0% | | | | | | $ | 1,458 | |

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| December 31, 2023 | William Blair Funds | 13 |

| | Small-Mid Cap Core Fund |

| | |

| | The Small-Mid Cap Core Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe, CFA  Ward D. Sexton, CFA | The William Blair Small-Mid Cap Core Fund (Class I shares) (the “Fund”) posted a 13.26% increase, net of fees, for the year ended December 31, 2023. By comparison, the Fund’s benchmark index, the Russell 2500TM Index (the “Index”), increased 17.42%. During the year, the Fund lagged the Index, primarily driven by stock-specific dynamics. The Fund’s top individual detractors included National Vision Holdings (Consumer Discretionary), Veradigm (Health Care), Globus Medical (Health Care), Mercury Systems (Industrials) and Hannon Armstrong (Financials). National Vision Holdings, the largest value optical retailer in the U.S., was negatively impacted by a shortage in optometrists, resulting in a lack of available exam slots and pressuring revenue and margins in the near term. Additionally, shares of National Vision were pressured as Walmart announced that it had ended its contract with the company. A delay in Veradigm’s, a healthcare information technology company, filings, as well as a management change, weighed on shares of the company. Stock selection in Consumer Discretionary, Information Technology and Health Care also dampened relative performance. In terms of positives, stock selection in Energy, including our position in Cameco, and in Industrials, including our positions in Builders FirstSource and Axon Enterprise, contributed positively to relative returns. Shares of Builders FirstSource, a materials manufacturer and distributor for home builders, benefited from demand strength in the multi-family unit end market, as well as continued share repurchases. Cameco, a company focused on the mining, trading, and processing of uranium, reported strong quarterly results and the company continues to enter favorable long-term contracts against the backdrop of continued upward pressure on uranium spot prices. Other top individual contributors included Verra Mobility (Industrials) and Goosehead Insurance (Financials). Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| 14 | Annual Report | December 31, 2023 |

Small-Mid Cap Core Fund

Performance Highlights (Unaudited)

| Average Annual Total Returns through 12/31/2023 |

| | | 1 Year | | 3 Year | | Since

Inception(a) |

| Class I | | | 13.26 | % | | | 5.94 | % | | | 10.56 | % |

| Class R6 | | | 13.30 | | | | 5.98 | | | | 10.59 | |

| Russell 2500TM Index | | | 17.42 | | | | 4.24 | | | | 9.57 | |

| (a) | Since inception is for the period from October 1, 2019 (Commencement of Operations) to December 31, 2023. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500TMIndex measures the performance of those Russell 2500 companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2023. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| December 31, 2023 | William Blair Funds | 15 |

Small-Mid Cap Core Fund

Portfolio of Investments, December 31, 2023 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Industrials—22.8% | | | | | | | | |

| * | ACV Auctions, Inc. | | | 179,544 | | | $ | 2,720 | |

| * | Atkore, Inc. | | | 10,397 | | | | 1,664 | |

| * | Axon Enterprise, Inc. | | | 12,645 | | | | 3,267 | |

| | Brink’s Co. | | | 34,565 | | | | 3,040 | |

| * | Builders FirstSource, Inc. | | | 17,889 | | | | 2,986 | |

| | BWX Technologies, Inc. | | | 61,904 | | | | 4,750 | |

| * | Casella Waste Systems, Inc. | | | 43,896 | | | | 3,751 | |

| * | Chart Industries, Inc. | | | 19,313 | | | | 2,633 | |

| * | ExlService Holdings, Inc. | | | 69,237 | | | | 2,136 | |

| * | GXO Logistics, Inc. | | | 47,244 | | | | 2,889 | |

| | Lincoln Electric Holdings, Inc. | | | 6,671 | | | | 1,451 | |

| * | Mercury Systems, Inc. | | | 91,745 | | | | 3,355 | |

| * | Shoals Technologies Group, Inc. | | | 78,091 | | | | 1,214 | |

| Tecnoglass, Inc.† | | | 33,391 | | | | 1,526 | |

| * | Trex Co., Inc. | | | 22,422 | | | | 1,856 | |

| * | Verra Mobility Corp. | | | 135,950 | | | | 3,131 | |

| * | WillScot Mobile Mini Holdings Corp. | | | 55,203 | | | | 2,457 | |

| | | | | | | | | 44,826 | |

| | Health Care—14.8% | | | | | | | | |

| * | Acadia Healthcare Co., Inc. | | | 27,411 | | | | 2,131 | |

| * | Avantor, Inc. | | | 50,355 | | | | 1,150 | |

| | Bio-Techne Corp. | | | 25,499 | | | | 1,968 | |

| * | Certara, Inc. | | | 87,337 | | | | 1,536 | |

| | Chemed Corp. | | | 5,926 | | | | 3,465 | |

| | Encompass Health Corp. | | | 54,911 | | | | 3,664 | |

| * | Globus Medical, Inc. | | | 33,983 | | | | 1,811 | |

| * | Insulet Corp. | | | 14,407 | | | | 3,126 | |

| * | Merit Medical Systems, Inc. | | | 52,452 | | | | 3,984 | |

| * | Neogen Corp. | | | 113,682 | | | | 2,286 | |

| * | Repligen Corp. | | | 7,310 | | | | 1,314 | |

| * | Sotera Health Co. | | | 85,237 | | | | 1,436 | |

| * | Veradigm, Inc. | | | 118,473 | | | | 1,243 | |

| | | | | | | | | 29,114 | |

| | Financials—12.9% | | | | | | | | |

| * | BRP Group, Inc. | | | 7,777 | | | | 187 | |

| | Carlyle Group, Inc. | | | 94,817 | | | | 3,858 | |

| | Columbia Banking System, Inc. | | | 109,232 | | | | 2,914 | |

| | East West Bancorp, Inc. | | | 44,894 | | | | 3,230 | |

| * | Euronet Worldwide, Inc. | | | 10,495 | | | | 1,065 | |

| | Everest Group Ltd.† | | | 7,875 | | | | 2,785 | |

| | Tradeweb Markets, Inc. | | | 27,035 | | | | 2,457 | |

| | Virtu Financial, Inc. | | | 128,933 | | | | 2,612 | |

| | Western Alliance Bancorp | | | 56,575 | | | | 3,722 | |

| | Wintrust Financial Corp. | | | 26,082 | | | | 2,419 | |

| | | | | | | | | 25,249 | |

| | Consumer Discretionary—11.9% | | | | | | | | |

| | ADT, Inc. | | | 233,334 | | | | 1,591 | |

| * | Boot Barn Holdings, Inc. | | | 13,612 | | | | 1,045 | |

| * | Bright Horizons Family Solutions, Inc. | | | 40,032 | | | | 3,773 | |

| * | Garrett Motion, Inc. | | | 178,351 | | | | 1,725 | |

| * | Grand Canyon Education, Inc. | | | 15,954 | | | | 2,106 | |

| | Installed Building Products, Inc. | | | 9,349 | | | | 1,709 | |

| * | National Vision Holdings, Inc. | | | 110,614 | | | | 2,315 | |

| | Pool Corp. | | | 7,655 | | | | 3,052 | |

| * | Revolve Group, Inc. | | | 40,592 | | | | 673 | |

| | Signet Jewelers Ltd.† | | | 20,736 | | | | 2,224 | |

| * | Skyline Champion Corp. | | | 41,148 | | | | 3,056 | |

| | | | | | | | | 23,269 | |

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Information Technology—10.0% | | | | | | | | |

| * | Alarm.com Holdings, Inc. | | | 21,162 | | | $ | 1,367 | |

| * | Ambarella, Inc.† | | | 15,920 | | | | 976 | |

| * | Calix, Inc. | | | 36,589 | | | | 1,598 | |

| * | Clearwater Analytics Holdings, Inc. | | | 92,001 | | | | 1,843 | |

| | Cognex Corp. | | | 29,770 | | | | 1,243 | |

| * | Dynatrace, Inc. | | | 48,534 | | | | 2,654 | |

| | Entegris, Inc. | | | 14,775 | | | | 1,770 | |

| * | JFrog Ltd.† | | | 48,377 | | | | 1,674 | |

| * | Lattice Semiconductor Corp. | | | 19,666 | | | | 1,357 | |

| * | Nice Ltd.—ADR | | | 12,980 | | | | 2,590 | |

| * | Onto Innovation, Inc. | | | 8,494 | | | | 1,299 | |

| * | Pure Storage, Inc. | | | 33,696 | | | | 1,202 | |

| | | | | | | | | 19,573 | |

| | Materials—7.9% | | | | | | | | |

| | Berry Global Group, Inc. | | | 47,839 | | | | 3,224 | |

| | CF Industries Holdings, Inc. | | | 31,953 | | | | 2,540 | |

| | Crown Holdings, Inc. | | | 34,302 | | | | 3,159 | |

| | Eagle Materials, Inc. | | | 12,441 | | | | 2,523 | |

| | FMC Corp. | | | 19,919 | | | | 1,256 | |

| | Sylvamo Corp. | | | 58,313 | | | | 2,864 | |

| | | | | | | | | 15,566 | |

| | Real Estate—6.3% | | | | | | | | |

| | Agree Realty Corp. | | | 35,190 | | | | 2,215 | |

| | Americold Realty Trust, Inc. | | | 105,083 | | | | 3,181 | |

| | Equity LifeStyle Properties, Inc. | | | 43,790 | | | | 3,089 | |

| | Healthcare Realty Trust, Inc. | | | 146,318 | | | | 2,521 | |

| | Pebblebrook Hotel Trust | | | 90,524 | | | | 1,447 | |

| | | | | | | | | 12,453 | |

| | Energy—6.1% | | | | | | | | |

| | Cameco Corp. | | | 62,884 | | | | 2,710 | |

| * | Green Plains, Inc. | | | 50,667 | | | | 1,278 | |

| | New Fortress Energy, Inc. | | | 89,349 | | | | 3,371 | |

| | TechnipFMC PLC† | | | 144,563 | | | | 2,912 | |

| | Whitecap Resources, Inc. | | | 246,444 | | | | 1,657 | |

| | | | | | | | | 11,928 | |

| | Consumer Staples—3.9% | | | | | | | | |

| | Inter Parfums, Inc. | | | 17,670 | | | | 2,544 | |

| | Lancaster Colony Corp. | | | 14,380 | | | | 2,393 | |

| | Primo Water Corp. | | | 177,468 | | | | 2,671 | |

| | | | | | | | | 7,608 | |

| | Utilities—1.5% | | | | | | | | |

| | IDACORP, Inc. | | | 29,198 | | | | 2,871 | |

| | Communication Services—1.0% | | | | | | | | |

| * | Live Nation Entertainment, Inc. | | | 10,968 | | | | 1,026 | |

| * | ZipRecruiter, Inc. | | | 64,508 | | | | 897 | |

| | | | | | | | | 1,923 | |

| | Total Common Stocks—99.1%

(cost $177,590) | | | | | | | 194,380 | |

See accompanying Notes to Financial Statements.

| 16 | Annual Report | December 31, 2023 |

Small-Mid Cap Core Fund

Portfolio of Investments, December 31, 2023 (all dollar amounts in thousands)

| | | | | | | |

| Issuer | | Principal

Amount | | | Value | |

| | | | | | | | | |

| Repurchase Agreement | | | | | | | | |

| Fixed Income Clearing Corporation, 2.300% dated 12/29/23, due 01/02/24, repurchase price $1,865, collateralized by U.S. Treasury Note, 3.875%, due 12/31/27, valued at $1,902 | | | $1,864 | | | $ | 1,864 | |

Total Repurchase Agreement—0.9%

(cost $1,864) | | | | | | | 1,864 | |

Total Investments—100.0%

(cost $179,454) | | | | | | | 196,244 | |

| Liabilities, plus cash and other assets—(0.0)% | | | | | | | (64 | ) |

| Net assets—100.0% | | | | | | $ | 196,180 | |

ADR = American Depository Receipt

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| December 31, 2023 | William Blair Funds | 17 |

| | Small-Mid Cap Growth Fund |

| | |

| | The Small-Mid Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe, CFA

Nicholas Zimmerman, CFA | The William Blair Small-Mid Cap Growth Fund (Class N shares) (the “Fund”) posted a 17.64% increase, net of fees, for the year ended December 31, 2023. By comparison, the Fund’s benchmark index, the Russell 2500TM Growth Index (the “Index”), increased 18.93%. During the year, the Fund’s performance was primarily driven by a combination of style factors and stock-specific dynamics. From a style perspective, our typical underweight to unprofitable companies was a modest tailwind. From a stock-specific perspective, selection in Industrials, including our positions in Builders FirstSource and Axon Enterprise, and in Energy, including our position in Cameco, contributed positively to relative returns. Shares of Builders FirstSource, a materials manufacturer and distributor for home builders, benefited from demand strength in the multi-family unit end market, as well as continued share repurchases. Cameco, a company focused on the mining, trading, and processing of uranium, reported strong quarterly results and the company continues to enter favorable long-term contracts against the backdrop of continued upward pressure on uranium spot prices. Other top contributors included National Instruments (Information Technology) and Guidewire Software (Information Technology). Stock selection in Consumer Discretionary, including our positions in National Vision Holdings and Planet Fitness and Information Technology, including our position in Wolfspeed, Inc. was a detractor in the period. National Vision Holdings, Inc., the largest value optical retailer in the U.S., was negatively impacted by a shortage in optometrists, resulting in a lack of available exam slots and pressuring revenue and margins in the near term. Additionally, shares of National Vision were pressured as Walmart announced that it had ended its contract with the company. Other top individual detractors included Mercury Systems (Industrials) and Lancaster Colony (Consumer Staples). Shares of Mercury Systems, a provider of sensor processing subsystems, declined on near-term profit pressures amidst manufacturing and supply chain challenges. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| 18 | Annual Report | December 31, 2023 |

Small-Mid Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Returns through 12/31/2023 |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | 17.64 | % | | | (0.69 | )% | | | 11.02 | % | | | 9.82 | % | | | — | % |

| Class I | | | 17.93 | | | | (0.44 | ) | | | 11.30 | | | | 10.10 | | | | — | |

| Class R6 | | | 17.95 | | | | (0.39 | ) | | | — | | | | — | | | | 7.73 | |

| Russell 2500TM Growth Index | | | 18.93 | | | | (2.68 | ) | | | 11.43 | | | | 8.78 | | | | 7.65 | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to December 31, 2023. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500TM Growth Index measures the performance of those Russell 2500 companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2023. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

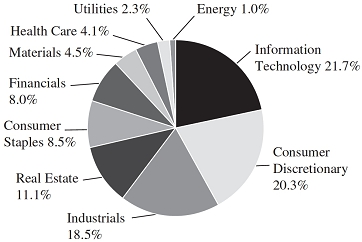

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| December 31, 2023 | William Blair Funds | 19 |

Small-Mid Cap Growth Fund

Portfolio of Investments, December 31, 2023 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Health Care—25.4% | | | | | | | | |

| * | Acadia Healthcare Co., Inc. | | | 419,280 | | | $ | 32,603 | |

| * | Amicus Therapeutics, Inc. | | | 1,712,900 | | | | 24,306 | |

| | Bio-Techne Corp. | | | 359,000 | | | | 27,701 | |

| * | Blueprint Medicines Corp. | | | 277,604 | | | | 25,606 | |

| * | Certara, Inc. | | | 832,083 | | | | 14,636 | |

| * | Charles River Laboratories International, Inc. | | | 71,237 | | | | 16,841 | |

| | Chemed Corp. | | | 75,066 | | | | 43,895 | |

| | Encompass Health Corp. | | | 704,717 | | | | 47,019 | |

| * | Evolent Health, Inc. | | | 726,000 | | | | 23,980 | |

| * | Globus Medical, Inc. | | | 235,395 | | | | 12,544 | |

| * | HealthEquity, Inc. | | | 333,308 | | | | 22,098 | |

| * | Insmed, Inc. | | | 615,951 | | | | 19,088 | |

| * | Inspire Medical Systems, Inc. | | | 121,342 | | | | 24,685 | |

| * | Insulet Corp. | | | 136,346 | | | | 29,584 | |

| * | Merit Medical Systems, Inc. | | | 474,426 | | | | 36,037 | |

| * | Neogen Corp. | | | 1,131,900 | | | | 22,763 | |

| * | Penumbra, Inc. | | | 142,786 | | | | 35,916 | |

| * | Repligen Corp. | | | 148,700 | | | | 26,736 | |

| * | Twist Bioscience Corp. | | | 552,373 | | | | 20,361 | |

| | | | | | | | | 506,399 | |

| | Industrials—19.9% | | | | | | | | |

| | Advanced Drainage Systems, Inc. | | | 266,700 | | | | 37,509 | |

| * | Axon Enterprise, Inc. | | | 159,358 | | | | 41,167 | |

| | Brink’s Co. | | | 360,738 | | | | 31,727 | |

| * | Builders FirstSource, Inc. | | | 179,456 | | | | 29,958 | |

| | BWX Technologies, Inc. | | | 631,052 | | | | 48,420 | |

| * | Casella Waste Systems, Inc. | | | 311,261 | | | | 26,600 | |

| * | Chart Industries, Inc. | | | 168,755 | | | | 23,006 | |

| * | ExlService Holdings, Inc. | | | 501,200 | | | | 15,462 | |

| | HEICO Corp. | | | 207,356 | | | | 29,536 | |

| * | Mercury Systems, Inc. | | | 857,492 | | | | 31,358 | |

| | Regal Rexnord Corp. | | | 93,100 | | | | 13,781 | |

| * | Shoals Technologies Group, Inc. | | | 747,930 | | | | 11,623 | |

| * | SiteOne Landscape Supply, Inc. | | | 100,300 | | | | 16,299 | |

| * | Trex Co., Inc. | | | 324,421 | | | | 26,859 | |

| * | WillScot Mobile Mini Holdings Corp. | | | 304,600 | | | | 13,555 | |

| | | | | | | | | 396,860 | |

| | Information Technology—18.0% | | | | | | | | |

| * | Alarm.com Holdings, Inc. | | | 328,841 | | | | 21,250 | |

| * | Ambarella, Inc.† | | | 213,600 | | | | 13,092 | |

| * | Clearwater Analytics Holdings, Inc. | | | 924,669 | | | | 18,521 | |

| | Cognex Corp. | | | 422,147 | | | | 17,620 | |

| * | Dynatrace, Inc. | | | 710,286 | | | | 38,845 | |

| | Entegris, Inc. | | | 145,776 | | | | 17,467 | |

| * | Guidewire Software, Inc. | | | 377,455 | | | | 41,158 | |

| * | Lattice Semiconductor Corp. | | | 213,500 | | | | 14,729 | |

| * | Nice Ltd. —ADR | | | 158,568 | | | | 31,636 | |

| * | Novanta, Inc.† | | | 148,654 | | | | 25,035 | |

| * | SPS Commerce, Inc. | | | 84,600 | | | | 16,399 | |

| * | Super Micro Computer, Inc. | | | 84,600 | | | | 24,048 | |

| * | Tenable Holdings, Inc. | | | 558,188 | | | | 25,710 | |

| * | Tyler Technologies, Inc. | | | 78,100 | | | | 32,655 | |

| * | Varonis Systems, Inc. | | | 480,932 | | | | 21,777 | |

| | | | | | | | | 359,942 | |

| | Consumer Discretionary—9.6% | | | | | | | | |

| * | Bright Horizons Family Solutions, Inc. | | | 268,278 | | | | 25,283 | |

| * | Burlington Stores, Inc. | | | 89,761 | | | | 17,457 | |

| * | Five Below, Inc. | | | 186,400 | | | | 39,733 | |

| * | National Vision Holdings, Inc. | | | 1,293,276 | | | | 27,068 | |

| | Pool Corp. | | | 106,800 | | | | 42,582 | |

| * | Revolve Group, Inc. | | | 815,092 | | | | 13,514 | |

| * | TopBuild Corp. | | | 69,700 | | | | 26,086 | |

| | | | | | | | | 191,723 | |

| | Issuer | | Shares or

Principal

Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Financials—8.0% | | | | | | | | |

| | Carlyle Group, Inc. | | | 1,110,300 | | | $ | 45,178 | |

| * | Euronet Worldwide, Inc. | | | 98,280 | | | | 9,974 | |

| | Everest Group Ltd.† | | | 55,400 | | | | 19,588 | |

| * | Flywire Corp. | | | 820,603 | | | | 18,997 | |

| | Tradeweb Markets, Inc. | | | 298,680 | | | | 27,144 | |

| | Virtu Financial, Inc. | | | 968,836 | | | | 19,629 | |

| | Western Alliance Bancorp | | | 292,716 | | | | 19,258 | |

| | | | | | | | | 159,768 | |

| | Consumer Staples—6.2% | | | | | | | | |

| * | elf Beauty, Inc. | | | 300,100 | | | | 43,317 | |

| * | Freshpet, Inc. | | | 505,179 | | | | 43,829 | |

| | Lancaster Colony Corp. | | | 220,030 | | | | 36,611 | |

| | | | | | | | | 123,757 | |

| | Energy—5.7% | | | | | | | | |

| | Cameco Corp. | | | 572,162 | | | | 24,660 | |

| * | Kosmos Energy Ltd. | | | 2,348,900 | | | | 15,761 | |

| | New Fortress Energy, Inc. | | | 871,612 | | | | 32,886 | |

| | Noble Corp. PLC† | | | 298,000 | | | | 14,352 | |

| | TechnipFMC PLC† | | | 585,900 | | | | 11,800 | |

| | Whitecap Resources, Inc. | | | 2,181,800 | | | | 14,668 | |

| | | | | | | | | 114,127 | |

| | Materials—3.8% | | | | | | | | |

| | CF Industries Holdings, Inc. | | | 336,531 | | | | 26,754 | |

| | Crown Holdings, Inc. | | | 340,687 | | | | 31,374 | |

| | Eagle Materials, Inc. | | | 86,400 | | | | 17,526 | |

| | | | | | | | | 75,654 | |

| | Communication Services—1.2% | | | | | | | | |

| * | Live Nation Entertainment, Inc. | | | 261,000 | | | | 24,430 | |

| | Real Estate—1.1% | | | | | | | | |

| | FirstService Corp. | | | 128,968 | | | | 20,904 | |

| | Total Common Stocks—98.9%

(cost $1,661,590) | | | | | | | 1,973,564 | |

| | |

| | Rights | | | | | | | | |

| | Health Care—0.0% | | | | | | | | |

| * | Abiomed, Inc. CVR** | | | 80,133 | | | | — | |

| | Total Rights—0.0%

(cost $82) | | | | | | | — | |

| | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 2.300% dated 12/29/23, due 01/02/24, repurchase price $27,828, collateralized by U.S. Treasury Note, 3.875%, due 12/31/27, valued at $28,377 | | | $27,820 | | | | 27,820 | |

| | Total Repurchase Agreement—1.4%

(cost $27,820) | | | | | | | 27,820 | |

| | Total Investments—100.3%

(cost $1,689,492) | | | | | | | 2,001,384 | |

| | Liabilities, plus cash and other assets—(0.3)% | | | | | | | (6,189 | ) |

| | Net assets—100.0% | | | | | | $ | 1,995,195 | |

ADR = American Depository Receipt

CVR = Contingent Value Right

* = Non-income producing security

** = Fair valued pursuant to the Fund’s Valuation Procedures. This holding represents 0.00% of the Fund’s net assets at December 31, 2023.

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| 20 | Annual Report | December 31, 2023 |

| | Small-Mid Cap Value Fund |

| | |

| | The Small-Mid Cap Value seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

William Heaphy, CFA

Matthew Fleming, CFA | The William Blair Small-Mid Cap Value Fund (Class I shares) (the “Fund”) posted a 6.45% increase, net of fees, for the period from inception on August 17, 2023 to December 31, 2023. By comparison, the Fund’s benchmark index, the Russell 2500® Value Index (the “Index”), increased 10.56%. The Fund’s relative underperformance during the period was driven by the combination of stock selection and style observations during the partial period. From a style perspective, the Index witnessed a strong rebound in the fourth quarter. This rally gained momentum and continued to broaden out in December in response to an increasingly “soft landing” narrative being priced into equity markets. In fact, the 10-year Treasury yield finished the year below 4% which helped propel small-mid cap value stocks in the fourth quarter. While the Fund delivered strong absolute performance, relative performance was challenged to keep pace with the Index. Strong inflows into the asset class in the back half of the year caused lower capitalization and lower quality stocks to outperform during this more speculative environment. Stock selection was the largest detractor of relative performance for the Fund as investors gravitated to stocks which do not meet our quality bias. At the sector level, the Fund’s Industrial holdings were a large contributor to relative performance in the partial period. Several of the Fund’s Industrials holdings posted significant returns, including Armstrong World Industries Inc., MillerKnoll Inc., and Acuity Brands. The Fund benefitted from a substantial underweight to the poorly performing Utilities, Energy, Communication Services, and Health Care sectors during the partial period. Conversely, the largest source of relative underperformance were the Fund’s Consumer Discretionary holdings. Specifically, the Fund’s Specialty Retail investments were a disappointment, decreasing over 12% in the partial period. The largest source of this underperformance was Advance Auto Parts, Inc. which declined substantially upon its much worse-than-expected quarterly results. While this stock has been disappointing, we continue to believe that the long-term thesis is intact, and that the position has significant future potential given its current valuation and new management team. The Fund’s Information Technology sector holdings struggled to keep pace with Index constituents and was another source of relative underperformance. Software developer Verint Systems suffered a large decline on the heels of reporting a lull in new orders. Like other software companies, many of Verint’s customers are spending more cautiously, but trading now at just eight times more subdued earnings estimates, the shares offer a compelling value. Similarly, electronics manufacturer Methode and communication equipment company NetScout Systems each declined as they incurred operational issues during an already challenging sales environment. Please refer to the U.S. Value Market Review and Outlook relating to the Fund on page 4. |

| December 31, 2023 | William Blair Funds | 21 |

Small-Mid Cap Value Fund

Performance Highlights (Unaudited)

| Average Annual Total Returns through 12/31/2023 |

| | | Since

Inception(a) |

| Class I | | | 6.45 | % |

| Class R6 | | | 6.50 | |

| Russell 2500® Value Index | | | 10.56 | |

| (a) | Since inception is for the period from August 17, 2023 (Commencement of Operations) to December 31, 2023. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500® Value Index measures the performance of the small to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500® companies with lower price-to-book ratios and lower forecasted growth values.

This report identifies the Fund’s investments on December 31, 2023. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 22 | Annual Report | December 31, 2023 |

Small-Mid Cap Value Fund

Portfolio of Investments, December 31, 2023 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Industrials—22.5% | | | | | | | | |

| | ABM Industries, Inc. | | | 483 | | | $ | 22 | |

| | Acuity Brands, Inc. | | | 116 | | | | 24 | |

| | AGCO Corp. | | | 170 | | | | 21 | |

| * | Alaska Air Group, Inc. | | | 519 | | | | 20 | |

| | Allegion PLC† | | | 136 | | | | 17 | |

| | Armstrong World Industries, Inc. | | | 228 | | | | 22 | |

| | Flowserve Corp. | | | 598 | | | | 25 | |

| | Hillenbrand, Inc. | | | 417 | | | | 20 | |

| * | Hub Group, Inc. | | | 309 | | | | 28 | |

| | Knight-Swift Transportation Holdings, Inc. | | | 357 | | | | 21 | |

| | Korn Ferry | | | 296 | | | | 17 | |

| | Maximus, Inc. | | | 267 | | | | 22 | |

| | MillerKnoll, Inc. | | | 547 | | | | 15 | |

| * | OPENLANE, Inc. | | | 927 | | | | 14 | |

| | Rush Enterprises, Inc. | | | 141 | | | | 7 | |

| | Snap-on, Inc. | | | 78 | | | | 22 | |

| | Terex Corp. | | | 312 | | | | 18 | |

| | Timken Co. | | | 245 | | | | 20 | |

| | | | | | | | | 355 | |

| | Consumer Discretionary—14.7% | | | | | | | | |

| * | Adient PLC† | | | 465 | | | | 17 | |

| | Advance Auto Parts, Inc. | | | 276 | | | | 17 | |

| | Bloomin’ Brands, Inc. | | | 733 | | | | 21 | |

| | BorgWarner, Inc. | | | 558 | | | | 20 | |

| | Brunswick Corp. | | | 206 | | | | 20 | |

| | Carter’s, Inc. | | | 301 | | | | 23 | |

| | Cracker Barrel Old Country Store, Inc. | | | 178 | | | | 14 | |

| | LKQ Corp. | | | 408 | | | | 19 | |

| | Ralph Lauren Corp. | | | 184 | | | | 26 | |

| * | Taylor Morrison Home Corp. | | | 460 | | | | 24 | |

| | Whirlpool Corp. | | | 130 | | | | 16 | |

| | Winnebago Industries, Inc. | | | 220 | | | | 16 | |

| | | | | | | | | 233 | |

| | Information Technology—12.7% | | | | | | | | |

| | Amdocs Ltd.† | | | 226 | | | | 20 | |

| | Belden, Inc. | | | 236 | | | | 18 | |

| * | Check Point Software Technologies Ltd.† | | | 149 | | | | 23 | |

| | Hewlett Packard Enterprise Co. | | | 1,134 | | | | 19 | |

| * | IPG Photonics Corp. | | | 199 | | | | 22 | |

| | Jabil, Inc. | | | 129 | | | | 16 | |

| | Kulicke & Soffa Industries, Inc. | | | 352 | | | | 19 | |

| | Methode Electronics, Inc. | | | 119 | | | | 3 | |

| * | Perficient, Inc. | | | 263 | | | | 17 | |

| * | Qorvo, Inc. | | | 189 | | | | 21 | |

| * | Verint Systems, Inc. | | | 830 | | | | 23 | |

| | | | | | | | | 201 | |

| | Materials—10.4% | | | | | | | | |

| * | Axalta Coating Systems Ltd.† | | | 799 | | | | 27 | |

| | Commercial Metals Co. | | | 414 | | | | 21 | |

| | Crown Holdings, Inc. | | | 240 | | | | 22 | |

| | Greif, Inc. | | | 261 | | | | 17 | |

| | Huntsman Corp. | | | 776 | | | | 20 | |

| | Minerals Technologies, Inc. | | | 254 | | | | 18 | |

| | Orion SA† | | | 768 | | | | 21 | |

| | Silgan Holdings, Inc. | | | 418 | | | | 19 | |

| | | | | | | | | 165 | |

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Real Estate—9.3% | | | | | | | | |

| | Camden Property Trust | | | 128 | | | $ | 13 | |

| | Elme Communities | | | 900 | | | | 13 | |

| | Empire State Realty Trust, Inc. | | | 1,966 | | | | 19 | |

| | Four Corners Property Trust, Inc. | | | 697 | | | | 18 | |

| | Host Hotels & Resorts, Inc. | | | 1,128 | | | | 22 | |

| | Kite Realty Group Trust | | | 932 | | | | 21 | |

| | Regency Centers Corp. | | | 297 | | | | 20 | |

| | STAG Industrial, Inc. | | | 551 | | | | 21 | |

| | | | | | | | | 147 | |

| | Financials—8.5% | | | | | | | | |

| | Ameris Bancorp | | | 412 | | | | 22 | |

| | Eastern Bankshares, Inc. | | | 1,225 | | | | 17 | |

| | Invesco Ltd.† | | | 1,148 | | | | 20 | |

| | Pacific Premier Bancorp, Inc. | | | 632 | | | | 18 | |

| | Pinnacle Financial Partners, Inc. | | | 262 | | | | 23 | |

| * | Texas Capital Bancshares, Inc. | | | 241 | | | | 16 | |

| | Webster Financial Corp. | | | 355 | | | | 18 | |

| | | | | | | | | 134 | |

| | Health Care—6.9% | | | | | | | | |

| | Encompass Health Corp. | | | 317 | | | | 21 | |

| * | Envista Holdings Corp. | | | 640 | | | | 15 | |

| | Laboratory Corp. of America Holdings | | | 92 | | | | 21 | |

| * | Lantheus Holdings, Inc. | | | 265 | | | | 17 | |

| * | QuidelOrtho Corp. | | | 254 | | | | 19 | |

| | Viatris, Inc. | | | 1,501 | | | | 16 | |

| | | | | | | | | 109 | |

| | Energy—4.9% | | | | | | | | |

| * | Expro Group Holdings NV† | | | 1,022 | | | | 16 | |

| | Matador Resources Co. | | | 421 | | | | 24 | |

| | PBF Energy, Inc. | | | 339 | | | | 15 | |

| | SM Energy Co. | | | 587 | | | | 23 | |

| | | | | | | | | 78 | |

| | Consumer Staples—4.9% | | | | | | | | |

| | Ingredion, Inc. | | | 210 | | | | 23 | |

| | Molson Coors Beverage Co. | | | 317 | | | | 20 | |

| | Spectrum Brands Holdings, Inc. | | | 218 | | | | 17 | |

| * | TreeHouse Foods, Inc. | | | 437 | | | | 18 | |

| | | | | | | | | 78 | |

| | Utilities—2.2% | | | | | | | | |

| | Northwestern Energy Group, Inc. | | | 289 | | | | 15 | |

| | Spire, Inc. | | | 306 | | | | 19 | |

| | | | | | | | | 34 | |

| | Communication Services—0.9% | | | | | | | | |

| | John Wiley & Sons, Inc. | | | 437 | | | | 14 | |

| | Total Common Stocks—97.9%

(cost $1,458) | | | | | | | 1,548 | |

| | Total Investments—97.9%

(cost $1,458) | | | | | | | 1,548 | |

| | Cash and other assets, less liabilities—2.1% | | | | | | | 33 | |

| | Net assets—100.0% | | | | | | $ | 1,581 | |

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| December 31, 2023 | William Blair Funds | 23 |

| | Small Cap Growth Fund |

| | |

| | The Small Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Ward D. Sexton, CFA

Mark C. Thompson, CFA | The William Blair Small Cap Growth Fund (Class N shares) (the “Fund”) posted a 16.06% increase, net of fees, for the year ended December 31, 2023. By comparison, the Fund’s benchmark index, the Russell 2000® Growth Index (the “Index”), increased 18.66%. The Fund lagged the Index in the full year period after performing approximately in line over the first 10 months of the year. Relative performance was driven by stock-specific dynamics, as well as style factors late in the year. The Fund lagged in November and December, when the Index was up approximately 22%, in part due to our typical underweight to speculative Biotech. From a stock-specific perspective, our top individual detractors for the year included National Vision Holdings (Consumer Discretionary), Veradigm (Health Care), Globus Medical (Health Care), Treace Medical Concepts (Health Care) and Mercury Systems (Industrials). National Vision Holdings, the largest value optical retailer in the U.S., was negatively impacted by a shortage of optometrists, resulting in a lack of available exam slots which pressured revenue and margins in the near term. Additionally, shares of National Vision Holdings were pressured as Walmart announced that it had ended its contract with the company. Shares of Veradigm, a healthcare information technology company, were impacted by filing delays and management changes. Stock selection in Health Care and Industrials also dampened relative returns. In terms of positives, our top individual contributors included Cameco (Energy), Winmark (Consumer Discretionary), Western Alliance Bancorp (Financials), Brink’s Co. (Industrials) and Vertex (Information Technology). Cameco, a company focused on the mining, trading, and processing of uranium, a key input into nuclear power generation, reported strong results throughout the year and the company continued to enter favorable long-term contracts at attractive prices. Winmark, a franchisor of retail stores, reported strong revenue and store opening growth. Positive stock selection in Information Technology and Energy also aided relative performance. Please refer to the U.S. Growth & Core Market Review and Outlook relating to the Fund on page 3. |

| 24 | Annual Report | December 31, 2023 |

Small Cap Growth Fund

Performance Highlights (Unaudited)

Average Annual Total Returns through 12/31/2023

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(a) |

| Class N | | | 16.06 | % | | | 0.91 | % | | | 11.69 | % | | | 9.65 | % | | | — | % |

| Class I | | | 16.35 | | | | 1.17 | | | | 11.96 | | | | 9.92 | | | | — | |

| Class R6 | | | 16.44 | | | | 1.24 | | | | — | | | | — | | | | 8.75 | |

| Russell 2000® Growth Index | | | 18.66 | | | | (3.50 | ) | | | 9.22 | | | | 7.16 | | | | 5.80 | |

| | |

| (a) | Since inception is for the period from May 2, 2019 (Commencement of Operations) to December 31, 2023. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. Smaller capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are not subject to a sales load. Class I shares are not subject to a sales load or distribution (Rule 12b-1) fees. Class R6 shares are not subject to a sales load, distribution (Rule 12b-1) fees, or sub-transfer agent fees.