| | | | |

| | | | 1095 Avenue of the Americas New York, NY 10036-6797 +1 212 698 3500 Main +1 212 698 3599 Fax www.dechert.com |

| | |

| | | | MICHAEL M. PIRI michael.piri@dechert.com +1 212 641 5674 Direct +1 212 698 3599 Fax |

February 22, 2022

VIA EDGAR CORRESPONDENCE

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, NE

Washington, D.C. 20549

Attn: Mr. David Orlic

| Re: | William Blair Funds (the “Registrant”) |

| | Post-Effective Amendment No. 144 under the Securities Act of 1933 and Amendment No. 145 under the Investment Company Act of 1940 |

| | (File Nos. 033-17463; 811-05344) on Form N-1A |

Dear Mr. Orlic:

This letter responds to the comments you provided to Andrew Pfau, John Raczek, and David Cihak, each of William Blair Investment Management, LLC (“Adviser”), and Stephanie A. Capistron, of Dechert LLP, and me in a telephonic discussion on February 8, 2022 with respect to your review of Post-Effective Amendment No. 144 (the “Amendment”) to the Registrant’s registration statement filed with the U.S. Securities and Exchange Commission on December 23, 2021. The Amendment was filed pursuant to Rule 485(a) under the Securities Act of 1933 for the purpose of implementing certain changes as a result of the William Blair Small Cap Value Fund’s (the “Fund”) acquisition of the assets and assumption of the liabilities of the ICM Small Company Portfolio in a reorganization effective July 16, 2021. We have reproduced your comments below, followed by the Registrant’s responses. Capitalized terms have the meanings attributed to such terms in the registration statement.

Comment 1. Please file your responses via the EDGAR portal at least five business days prior to the effectiveness date (the “Effectiveness Date”) of the Fund’s definitive registration statement on Form N-1A filed pursuant to Rule 485(b) (“485(b) Filing”).

Response 1. The Registrant confirms that its responses will be filed via EDGAR at least five business days prior to the Effectiveness Date of the 485(b) Filing.

| | | | |

| | | | February 22, 2022 Page 2 |

Comment 2. Please confirm that the 485(b) Filing will be complete (i.e., all bracketed and blank information will be completed) and please file via EDGAR correspondence a completed copy of the Fund’s “Annual Fund Operating Expenses” table, expense examples and performance information five business days prior to the Effectiveness Date.

Response 2. The Registrant confirms that the 485(b) Filing will be complete and the requested information has been provided in Appendix A to this response letter.

Comment 3. With respect to the footnote to the Fund’s Annual Fund Operating Expenses table, please supplementally confirm whether amounts waived or reimbursed under the expense limitation arrangement for the Fund are subject to recoupment by the Adviser.

Response 3. The Registrant supplementally confirms that amounts waived or reimbursed under the expense limitation arrangement are not subject to recoupment.

Comment 4. In the “Summary – Fund Performance History – Average Annual Returns” section of the Fund’s prospectus there appears to be duplicative disclosure. Please consider revising as appropriate.

Response 4. The Registrant has revised the Fund’s prospectus in response to the Staff’s comment.

Comment 5. The “Investment Objective and Strategies” sub-section of the “ADDITIONAL INFORMATION REGARDING INVESTMENT OBJECTIVE AND STRATEGIES” section of the Fund’s Prospectus states that the Adviser’s “assessment of current and prospective portfolio holdings typically integrates an analysis of applicable environmental, social and governance (collectively, “ESG”) factors.” Please consider (i) revising the related disclosure under “ESG Investing” to provide examples of the ESG factors utilized and (ii) inserting an ESG-related risk factor if appropriate in light of the Fund’s intended investment strategy.

Response 5. The Registrant believes that the current disclosure regarding consideration of ESG factors is appropriately included in response to the Form N-1A requirement to summarize “how the Fund’s adviser decides which securities to buy and sell” in accordance with Item 9(b)(2) of Form N-1A. As indicated in the Fund’s Prospectus, “ESG factors are considered based on criteria developed by the Fund’s investment team, and they are integrated with other relevant factors to provide a holistic assessment of companies. The Adviser seeks to ensure that the investment team is fully aware of companies’ ESG risks and opportunities by integrating ESG factors into the investment process in a systematic manner. The emphasis on ESG factors depends on the

| | | | |

| | | | February 22, 2022 Page 3 |

importance of these factors to the relevant industry and the unique circumstances of each company.”

The Registrant believes the disclosure, including the level of detail, is appropriate as drafted. The Registrant respectfully notes that the Fund does not hold itself out as an ESG-focused fund and that ESG factors are among the many factors that the Adviser and its investment team consider in evaluating an investment. Accordingly, the Registrant does not believe it is appropriate to overemphasize the ESG-related factors that the Adviser and its investment team consider relative to other factors considered as part of its investment process.

* * *

We believe that the foregoing has been responsive to the Staff’s comments. Please call the undersigned at (212) 641-5674 if you wish to discuss this correspondence further.

Sincerely,

/s/ Michael M. Piri

Michael M. Piri

| cc: | Andrew Pfau, William Blair Funds |

| | Stephanie A. Capistron, Dechert LLP |

| | | | |

| | | | February 22, 2022 Page 4 |

Appendix A

Annual Fund Operating Expenses

Shareholder Fees (fees paid directly from your investment):

| | | | | | |

| | | Class N | | Class I | | Class R6 |

Maximum Sales Charge (Load) Imposed on Purchases | | None | | None | | None |

Redemption Fee | | None | | None | | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| | | | | | |

| | | Class N | | Class I | | Class R6 |

Management Fee | | 0.75% | | 0.75% | | 0.75% |

Distribution (Rule 12b-1) Fee | | 0.25% | | None | | None |

Other Expenses | | 0.17% | | 0.12% | | 0.03% |

| | | | | | |

Total Annual Fund Operating Expenses | | 1.17% | | 0.87% | | 0.78% |

Fee Waiver and/or Expense Reimbursement* | | 0.02% | | N/A | | N/A |

| | | | | | |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement** | | 1.15% | | 0.87% | | 0.78% |

| * | William Blair Investment Management, LLC (the “Adviser”) has entered into a contractual agreement with the Fund to waive fees and/or reimburse expenses in order to limit the Fund’s operating expenses (excluding interest expenses, taxes, brokerage commissions, acquired fund fees and expenses, dividend and interest expenses on short sales, other investment-related costs and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of the Fund’s business) to 1.15% of average daily net assets for Class N until April 30, 2023. The Adviser may not terminate this arrangement prior to April 30, 2023 without the approval of the Fund’s Board of Trustees. |

| ** | The Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement does not equal the net expense ratio to average daily net assets in the Financial Highlights section of this prospectus because the expense information has been restated to reflect current fees and contractual expense limits. |

| | | | |

| | | | February 22, 2022 Page 5 |

Expense Example

| | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Class N | | $177 | | $370 | | $642 | | $1,419 |

Class I | | 89 | | 278 | | 482 | | 1,073 |

Class R6 | | 80 | | 249 | | 433 | | 966 |

Fund Performance

FUND PERFORMANCE HISTORY: The information below provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for the periods indicated compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. On July 16, 2021, the Fund acquired the assets and assumed the liabilities of the Predecessor Fund, a series of The Advisors’ Inner Circle Fund, in a reorganization (the “Reorganization”). In the Reorganization, former shareholders of the Predecessor Fund received Class I shares of the Fund. The Predecessor Fund was advised by Investment Counselors of Maryland, LLC, which was acquired by the Adviser. The Predecessor Fund’s (Institutional Class shares) performance and financial history has been adopted by Class I shares of the Fund following the Reorganization and will be used going forward from the date of the Reorganization. The performance of Class I shares of the Fund therefore reflects the performance of the Predecessor Fund. The performance of the Predecessor Fund has not been restated to reflect the annual operating expenses of Class I shares of the Fund, which were different than those of the Predecessor Fund. Because the Fund had different fees and expenses than the Predecessor Fund, the Fund would therefore have had different performance results. The Predecessor Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future and does not guarantee future results. For more recent performance information, go to www.williamblairfunds.com or call 1-800-635-2886.

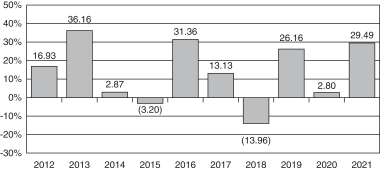

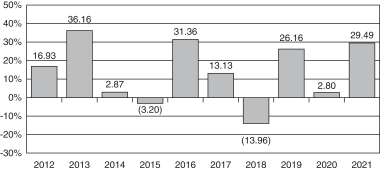

Annual Total Returns. The bar chart below provides an illustration of how the Fund’s performance has varied in each of the last ten calendar years for Class I shares.

| | | | |

| | Highest Quarterly

Return | | Lowest Quarterly

Return |

| | 29.75% (4Q20) | | (35.02%) (1Q20) |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Average Annual Total Returns (For the periods ended December 31, 2021). The table below shows returns on a before-tax and after-tax basis for Class I shares. After-tax returns are calculated using the

| | | | |

| | | | February 22, 2022 Page 6 |

historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than the “Return Before Taxes” because the investor is assumed to be able to use the capital loss on the sale of Fund shares to offset other taxable capital gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Because the Predecessor Fund did not offer share classes other than Institutional Class shares, no performance information is shown for Class R6 or Class N shares of the Fund. Performance information for those classes will be provided after a full calendar year of performance history following the Reorganization is available.

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class I Shares | | | | | | | | | | | | |

Return Before Taxes | | | 29.49% | | | | 10.33% | | | | 13.03% | |

Return After Taxes on Distributions | | | 24.71% | | | | 7.96% | | | | 10.50% | |

Return After Taxes on Distributions and Sale of Fund Shares | | | 19.14% | | | | 7.52% | | | | 10.01% | |

Russell 2000® Value Index (reflects no deduction for fees, expenses or taxes) | | | 28.27% | | | | 9.07% | | | | 12.03% | |