| | | | |

| | | | 1095 Avenue of the Americas New York, NY 10036-6797 +1 212 698 3500 Main +1 212 698 3599 Fax www.dechert.com MICHAEL M. PIRI michael.piri@dechert.com +1 212 641 5674 Direct +1 212 698 3599 Fax |

April 21, 2023

VIA EDGAR CORRESPONDENCE

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, NE

Washington, D.C. 20549

Attn: Ms. Deborah L. O’Neal

| Re: | William Blair Funds (the “Registrant”) |

| | Post-Effective Amendment No. 149 under the Securities Act of 1933 and Amendment |

| | No. 150 under the Investment Company Act of 1940 |

| | (File Nos. 033-17463; 811-05344) on Form N-1A |

Dear Ms. O’Neal:

This letter responds to the comments you provided to me via e-mail on April 11, 2023 with respect to your review of Post-Effective Amendment No. 149 (the “Amendment”) to the Registrant’s registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) on February 27, 2023. The Amendment was filed pursuant to Rule 485(a) under the Securities Act of 1933 for the purpose of amending the William Blair Emerging Markets Debt Fund’s (the “Fund”) investment objective and strategy. We have reproduced your comments below, followed by the Registrant’s responses. Capitalized terms have the meanings attributed to such terms in the Amendment.

Comment 1. Please include a completed fee table, cost example, and performance presentation with the comment response letter, which should be filed via the EDGAR portal at least one week prior to the effectiveness date (“Effectiveness Date”) of the Fund’s definitive registration statement on Form N-1A filed pursuant to Rule 485(b) (“485(b) Filing”).

Response 1. The requested information has been provided in Appendix I to this response letter.

Comment 2. The SEC staff (“Staff”) reminds the Registrant that the fee waiver in respect of the Fund must be in place not less than one year from the Effectiveness Date of the 485(b) Filing.

Response 2. The Registrant acknowledges the comment.

| | | | |

| | | | April 21, 2023 Page 2 |

Comment 3. Please supplementally confirm in the comment response letter that there will be no reimbursement of the fee waiver in respect of the Fund to the Adviser after May 25, 2024.

Response 3. The Registrant supplementally confirms that there will be no reimbursement of the fee waiver in respect of the Fund to the Adviser after May 25, 2024.

Comment 4. Please revise the footnote to the fee table by providing an ending date (i.e., May 25, 2024) for recoupment of previously waived fees and reimbursed expenses by the Adviser.

Response 4. The Registrant has incorporated this comment.

Comment 5. The Principal Investment Strategies disclosure states, “The Fund invests in assets denominated in the currencies of economically developed and politically stable countries that are members of the Organisation for Economic Co-operation and Development (OECD), as well as in assets denominated local currency.” Supplementally, please explain how this strategy is consistent with the Fund’s plan to invest 80% in debt instruments that are economically tied to emerging market countries.

Response 5. As disclosed in the Prospectus, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in debt instruments that are economically tied to emerging market countries. Emerging markets debt instruments can be denominated in a “hard currency” (such as the U.S. dollar or currencies of other OECD member countries) or the local currency of the emerging market. Whether denominated in hard currencies or local currencies, such debt instruments are economically tied to emerging markets given that the issuer is an emerging markets issuer.

Comment 6. In the LIBOR Transition Risk disclosure, please confirm (i) the percentage of Fund assets that pay interest based on LIBOR (“LIBOR Assets”), and (ii) the percentage of LIBOR Assets that will mature prior to June 30, 2023 (i.e., the day that the one-day, one-month, six-month, and one-year USD LIBOR rates will cease publication).

Response 6. The Registrant supplementally confirms to the Staff that the Fund does not hold any LIBOR Assets but does hold instruments tied to other interbank offered rates that are not tied to LIBOR. Given the Fund’s lack of exposure to LIBOR Assets, the Registrant has removed LIBOR

| | | | |

| | | | April 21, 2023 Page 3 |

Transition Risk from its Item 4 principal risks and has revised the LIBOR Transition Risk in the Item 9 disclosure as follows:

LIBOR Transition Risk. The Fund may invest in securities or derivatives that are based on the London Interbank Offered Rate(LIBOR) (“LIBOR”) or other interbank offered rates (“IBORs”). LIBOR transition risk is the risk that the transition away from LIBOR to alternative interest rate benchmarks is not orderly, occurs over various time periods or has unintended consequences. In 2017, the United Kingdom’s (“UK”) Financial Conduct Authority (“FCA”) announced plans to discontinue supporting LIBOR and transition away from LIBOR. At the end of 2021, certain LIBORs were discontinued, but the most widely used USD LIBORs may continue to be provided on a representative basis until June 30, 2023. The FCA may require that the benchmark administrator of LIBOR continue to produce USD LIBOR on a synthetic non-representative basis until September 2024, although it is unclear what the impact of such a synthetic rate may be on the securities or derivatives in which the Fund may invest. In addition, in connection with supervisory guidance from U.S. regulators, U.S. regulated entities have ceased to enter into most new LIBOR contracts. There remains uncertainty regarding the future use of LIBOR and the nature of any replacement rate, and any potential effects of the transition away from LIBOR on the Fund or on certain instruments in which the Fund invests are not known. Various financial industry groups have been planning for that transition and certain regulators and industry groups have taken actions to establish alternative reference rates (e.g., the Secured Overnight Financing Rate (“SOFR”), which measures the cost of overnight borrowings through repurchase agreement transactions collateralized with U.S. Treasury securities and is intended to replace U.S. dollar LIBOR). The transition process may involve, among other things, an increase in volatility or illiquidity of markets for instruments that currently rely on LIBOR, a reduction in the value of certain instruments held by the Fund or a reduction in the effectiveness of related Fund transactions such as hedges. Various enacted legislation, including federally and in states such as New York, may affect the transition of LIBOR-based instruments as well by permitting trustees and calculation agents to transition instruments with no LIBOR transition language to an alternative reference rate selected under such legislation. Those statutes include safe harbors from liability, which may limit the recourse the Fund may have if the alternative reference rate does not fully compensate the Fund for the transition of an instrument from LIBOR. It is uncertain what effect, if any, such legislation will have on the LIBOR transition. The effect of discontinuation of LIBOR on the Fund’s existing investments and obligations will depend on, among other things, (1) existing fallback provisions in individual contracts, (2) the impact of regulatory and legislative responses with respect to the LIBOR transition and (3) whether, how, and when industry participants develop and widely adopt new reference rates and fallbacks for both legacy and new products or instruments. The Fund may invest in securities or derivatives that are based on other IBORs that may be similarly discontinued. Any such effects, as well as other unforeseen effects, could result in losses to the Fund.

| | | | |

| | | | April 21, 2023 Page 4 |

* * �� *

We believe that the foregoing has been responsive to the Staff’s comments. Please call the undersigned at (212) 641-5674 if you wish to discuss this correspondence further.

Sincerely,

/s/ Michael M. Piri

Michael M. Piri

| cc: | Daniel Carey, William Blair Funds |

| | Andrew Pfau, William Blair Funds |

| | Stephanie A. Capistron, Dechert LLP |

| | | | |

| | | | April 21, 2023 Page 5 |

Appendix I

Expense Tables & Expense Examples

FEES AND EXPENSES: This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees (fees paid directly from your investment):

| | | | |

| | | Class I | | Class R6 |

Maximum Sales Charge (Load) Imposed on Purchases | | None | | None |

Redemption Fee | | None | | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| | | | |

| | | Class I | | Class R6 |

Management Fee | | 0.65% | | 0.65% |

Distribution (Rule 12b-1) Fee | | None | | None |

Other Expenses | | 0.63% | | 0.55% |

| | | | |

Total Annual Fund Operating Expenses | | 1.28% | | 1.20% |

Fee Waiver and/or Expense Reimbursement* | | 0.58% | | 0.55% |

| | | | |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | | 0.70% | | 0.65% |

| * | William Blair Investment Management, LLC (the “Adviser”) has entered into a contractual agreement with the Fund to waive fees and/or reimburse expenses in order to limit the Fund’s operating expenses (excluding interest expenses, taxes, brokerage commissions, acquired fund fees and expenses, dividend and interest expenses on short sales, other investment-related costs and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of the Fund’s business) to 0.70% and 0.65% of average daily net assets for Class I and Class R6 shares, respectively, until April 30, 2024. The Adviser may not terminate this contractual agreement prior to April 30, 2024 without the approval of the Fund’s Board of Trustees. The Adviser is entitled to recoupment of previously waived fees and reimbursed expenses for a period of three years subsequent to the Fund’s commencement of operations (i.e., May |

| | | | |

| | | | April 21, 2023 Page 6 |

| | 25, 2024) to the extent that such recoupment does not cause the annual Fund operating expenses (after the recoupment is taken into account) to exceed both (1) the expense limit in place when such amounts were waived or reimbursed and (2) the Fund’s current expense limitation. |

Example: This example is intended to help you compare the cost of investing in shares of the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and the Fund’s operating expenses remain the same. The figures reflect the expense limitation for the first year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Class I | | $72 | | $349 | | $647 | | $1,494 |

Class R6 | | 66 | | 326 | | 607 | | 1,406 |

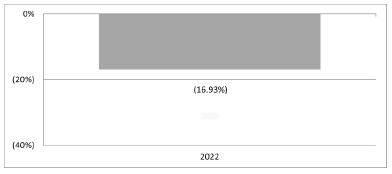

FUND PERFORMANCE HISTORY: The information below provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for the periods indicated compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. For more recent performance information, go to www.williamblairfunds.com or call 1-800-635-2886.

Annual Total Returns. The bar chart below provides an illustration of how the Fund’s performance has varied in each of the calendar years since the Fund’s inception for Class I shares.

| | |

Highest Quarterly Return 9.81% (4Q22) | | Lowest Quarterly Return (13.36)% (2Q22) |

Average Annual Total Returns (For the periods ended December 31, 2022). The table below shows returns on a before-tax and after-tax basis for Class I shares and on a before-tax basis for Class R6 shares. After-tax returns for Class R6 shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than the “Return Before Taxes” because the investor is assumed to be able to use the capital loss on the sale of Fund shares to offset other taxable capital gains. Actual after-tax returns depend on an investor’s tax situation and

| | | | |

| | | | April 21, 2023 Page 7 |

may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

| | | | | | | | |

| | | 1 Year | | | Since Fund Inception

(May 25, 2021) | |

Class I Shares | | | | | | | | |

Return Before Taxes | | | (16.93)% | | | | (11.69)% | |

Return After Taxes on Distributions | | | (19.21)% | | | | (13.82)% | |

Return After Taxes on Distributions and Sale of Fund Shares | | | (10.01)% | | | | (9.62)% | |

Class R6 Shares | | | | | | | | |

Return Before Taxes | | | (16.95)% | | | | (11.66)% | |

JPMorgan Emerging Markets Bond Index (EMBI) Global Diversified

(reflects no deduction for fees, expenses or taxes) | | | (17.78)% | | | | (11.62)% | |