| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-05346) |

| | |

| Exact name of registrant as specified in charter: | Putnam Variable Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Stephen Tate, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | December 31, 2022 |

| | |

| Date of reporting period: | January 1, 2022 – December 31, 2022 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Message from the Trustees

February 10, 2023

Dear Shareholder:

As an investor, you might be happy to see 2022 in the rearview mirror. High inflation and aggressive interest-rate increases from the U.S. Federal Reserve contributed to market volatility and negative returns for stocks and bonds. Fortunately, toward the end of the year, we saw both inflation levels and Fed actions begin to moderate somewhat.

Although we still face high inflation and uncertainty on how much the economy will slow because of higher interest rates, we believe financial market performance might be better in 2023 as compared with 2022. Historically, stocks and bonds have recovered from bear markets like the one we are experiencing. Be assured that our investment teams are actively researching securities with attractive potential and working to keep portfolio risks in check.

Thank you for investing with Putnam.

Performance summary (as of 12/31/22)

Investment objective

As high a rate of current income as Putnam Investment Management, LLC believes is consistent with preservation of capital and maintenance of liquidity

Net asset value December 31, 2022

| |

| Class IA: $1.00 | Class IB: $1.00 |

Annualized total return at net asset value (as of 12/31/22)

| | | |

| | | | Lipper VP |

| | | | (Underlying |

| | | | Funds) — U.S. |

| | | | Government |

| | | | Money Market |

| | Class IA shares | Class IB shares | Funds category |

| | (2/1/88) | (4/30/98) | median |

| 1 year | 1.29% | 1.12% | 1.26% |

| 5 years | 0.95 | 0.81 | 0.93 |

| 10 years | 0.53 | 0.43 | 0.51 |

| Life of fund | 2.80 | 2.71 | 2.82 |

| Current rate (as of 12/31/22) | | |

| Current 7-day | | | |

| yield | 3.80% | 3.55% | |

For a portion of the periods, the fund had expense limitations or waivers, without which returns would have been lower.

Lipper peer group median is provided by Lipper, a Refinitiv company.

The 7-day yield is the most common gauge for measuring money market mutual fund performance. Yield reflects current performance more closely than total return.

Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. All total return figures are at net asset value and exclude contract charges and expenses, which are added to the variable annuity contracts to determine total return at unit value. Had these charges and expenses been reflected, performance would have been lower. Performance of class IB shares before their inception is derived from the historical performance of class IA shares, adjusted to reflect the higher operating expenses applicable to such shares. For more recent performance, contact your variable annuity provider who can provide you with performance that reflects the charges and expenses at your contract level.

Portfolio composition

Allocations are shown as a percentage of the fund’s net assets. Cash and net other assets, if any, represent the market value weights of cash and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of any interest accruals, the exclusion of as-of trades, if any, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time.

| |

| Putnam VT Government Money Market Fund | 1 |

Report from your fund’s managers

How was the money market environment for the 12-month reporting period ended December 31, 2022?

Faced with persistently high inflation, the Federal Reserve raised the federal funds target rate seven times in 2022, from 0.00%–0.25% to 4.00%–4.25%. The Russia-Ukraine War and Covid-19-related lock-downs in China heightened political and economic uncertainty, further weighing on sentiment. The U.S. Treasury market underwent a substantial adjustment due to the Fed’s actions and market expectations. At times, yields on some shorter-term U.S. Treasuries rose above those of longer-term bonds. The Fed’s sharp interest-rate increases over such a short period were beneficial for money market investors. [Shorter-term interest rates tend to be more responsive to changes in the Fed’s benchmark rate than longer-term rates.] As a result of the heightened interest, money market mutual fund assets reached a record $5.2 trillion in December 2022.

While the SEC considered further reforms to rule 2a-7, the process stalled due to some industry commentary on the specific rules and other issues, including the cryptocurrency collapse. As short-term U.S. Treasury rates remained unattractive compared with the amount of interest-rate hikes being projected, government funds continued to utilize the Federal Reserve’s Reverse Repurchase Agreement Program in record volumes.

How did Putnam VT Government Money Market Fund perform for the reporting period?

For the 12-month reporting period, the fund’s class IA shares returned 1.29%, edging out the 1.26% median return of its Lipper peer group, Lipper VP (Underlying Funds) — U.S. Government Money Market Funds.

What was your strategy during the reporting period?

As the pace of interest-rate hikes accelerated during the period, U.S. Treasuries became highly sought after for their perceived stability and liquidity. As a result, we viewed their pricing as unattractive for much of the period. Rather, we focused on increasing the fund’s exposure to repurchase agreements [repos] that are collateralized by U.S. Treasuries and/or government agency mortgage-backed securities. Selectively, we added term exposure in the 9- to 12-month maturity range with investments in U.S. government-sponsored enterprises where we saw opportunities to lock in higher yields. Holdings in the Federal Home Loan Bank System and the Federal Home Loan Mortgage Corporation exemplify our strategy in this market.

At period-end, the fund held most of its assets in repos [86%]. U.S. government agency securities [13%] and short-term U.S. Treasury notes [1%] composed the remaining balance of the portfolio’s assets.

These strategies shortened the weighted average maturity [WAM] of the fund’s portfolio from 33 days on December 31, 2021, to 15 days at period-end. [WAM represents the average life of all the money market securities held in the portfolio.] The fund’s weighted average life [WAL] declined from 50 days to 24 days for the same period. [WAL represents the average length of time for all the money market securities held in the portfolio to pay off principal at maturity.]

What are your thoughts about Fed policy in 2023?

The Fed’s official dot plot released in December 2022, which policymakers use to signal their outlook for the path of interest rates, showed 17 of 19 committee members targeting rates above 5% in 2023. It also showed an expected terminal federal funds rate of 5.1%. Our expectation is the Fed will hike interest rates a few more times in early 2023, likely in 25-basis-point increments. We believe that once the policy rate reaches 5.00% to 5.25% in early 2023, the Fed may choose to pause interest-rate hikes. We also believe the Fed may choose to maintain higher interest rates for longer than the market anticipates to avoid repeating the mistakes of the 1970s.

Where our view generally differs from the market is the timing of Fed interest-rate reductions. Currently, the market is starting to price in reductions in the second half of 2023. However, we believe the Fed will likely maintain interest rates for longer, as we do not believe the U.S. economy will enter a recession until early 2024 given the resilience of the consumer and the tight labor market. In a sustained higher-rate environment, we believe our fund, and money market funds in general, will continue to capture the higher yields.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice. Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Consider these risks before investing: You can lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time..

The values of money market investments usually rise and fall in response to changes in interest rates. Interest-rate risk is generally lowest for investments with short maturities (a significant part of the fund’s investments). Changes in the financial condition of an issuer or counterparty, changes in specific economic or political conditions that affect a particular type of issuer, and changes in general economic or political conditions can increase the risk of default by an issuer or coun-terparty, which can affect a security’s or instrument’s credit quality or value. The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political, or financial market conditions; investor sentiment and market perceptions; government actions; geopolitical events or changes; and factors related to a specific issuer, geography, industry, or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings.

| |

| 2 | Putnam VT Government Money Market Fund |

Certain securities in which the fund may invest, including securities issued by certain U.S. government agencies and U.S. government-sponsored enterprises, are not guaranteed by the U.S. government or supported by the full faith and credit of the United States. Mortgage-backed investments carry the risk that they may increase in value less when interest rates decline and decline in value more when interest rates rise. We may have to invest the proceeds from prepaid investments, including mortgage- and asset-backed investments, in other investments with less attractive terms and yields.

Our investment techniques, analyses, and judgments may not produce the outcome we intend. The investments we select for the fund may not perform as well as other securities that we do not select for the fund. We, or the fund’s other service providers, may experience disruptions or operating errors that could have a negative effect on the fund.

Your fund’s managers also manage other accounts advised by Putnam Management or an affiliate, including retail mutual fund counterparts to the funds in Putnam Variable Trust.

| |

| Putnam VT Government Money Market Fund | 3 |

Understanding your fund’s expenses

As an investor in a variable annuity product that invests in a registered investment company, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, which are not shown in this section and would result in higher total expenses. Charges and expenses at the insurance company separate account level are not reflected. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The two left-hand columns of the Expenses per $1,000 table show the expenses you would have paid on a $1,000 investment in your fund from 7/1/22 to 12/31/22. They also show how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses. To estimate the ongoing expenses you paid over the period, divide your account value by $1,000, then multiply the result by the number in the first line for the class of shares you own.

Compare your fund’s expenses with those of other funds

The two right-hand columns of the Expenses per $1,000 table show your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All shareholder reports of mutual funds and funds serving as variable annuity vehicles will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expense ratios

| | |

| | Class IA | Class IB |

| Total annual operating expenses for the fiscal | | |

| year ended 12/31/21 | 0.44% | 0.69% |

| Annualized expense ratio for the six-month | | |

| period ended 12/31/22* | 0.45% | 0.70% |

Fiscal year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

*Expense ratios for each class are for the fund’s most recent fiscal half year. As a result of this, ratios may differ from expense ratios based on one-year data in the financial highlights.

Expenses per $1,000

| | | | | | | | |

| | | | | | | Expenses and value for a |

| | | Expenses and value for a | | $1,000 investment, assuming |

| | | $1,000 investment, assuming | | a hypothetical 5% annualized |

| | | actual returns for the | | return for the 6 months |

| | | 6 months ended 12/31/22 | | ended 12/31/22 | | |

| | | Class IA | | Class IB | | Class IA | | Class IB |

| Expenses paid | | | | | | | | |

| per $1,000*† | | $2.28 | | $3.55 | | $2.29 | | $3.57 |

| Ending value | | | | | | | | |

| (after | | | | | | | | |

| expenses) | | $1,012.20 | | $1,010.90 | | $1,022.94 | | $1,021.68 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 12/31/22. The expense ratio may differ for each share class.

†Expenses based on actual returns are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period (184); and then dividing that result by the number of days in the year (365). Expenses based on a hypothetical 5% return are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period (184); and then dividing that result by the number of days in the year (365).

| |

| 4 | Putnam VT Government Money Market Fund |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Putnam Variable Trust and Shareholders of

Putnam VT Government Money Market Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the fund’s portfolio, of Putnam VT Government Money Market Fund (one of the funds constituting Putnam Variable Trust, referred to hereafter as the “Fund”) as of December 31, 2022, the related statement of operations for the year ended December 31, 2022, the statement of changes in net assets for each of the two years in the period ended December 31, 2022, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2022 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2022 and the financial highlights for each of the five years in the period ended December 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 10, 2023

We have served as the auditor of one or more investment companies in the Putnam Investments family of funds since at least 1957. We have not been able to determine the specific year we began serving as auditor.

| |

| Putnam VT Government Money Market Fund | 5 |

The fund’s portfolio 12/31/22

| | |

| | Principal | |

| REPURCHASE AGREEMENTS (85.7%)* | amount | Value |

| | | |

| Interest in $381,541,000 joint tri-party | | |

| repurchase agreement dated 12/30/2022 with | | |

| BofA Securities, Inc. due 1/3/2023 — maturity | | |

| value of $20,844,955 for an effective yield | | |

| of 4.300% (collateralized by Agency Mortgage- | | |

| Backed Securities with coupon rates ranging | | |

| from 2.000% to 5.400% and due dates ranging | | |

| from 3/20/2030 to 2/15/2065, valued | | |

| at $389,171,821) | $20,835,000 | $20,835,000 |

| Interest in $431,889,000 joint tri-party | | |

| repurchase agreement dated 12/30/2022 with | | |

| Citigroup Global Markets, Inc. due 1/3/2023 — | | |

| maturity value of $20,809,938 for an effective | | |

| yield of 4.300% (collateralized by Agency | | |

| Mortgage-Backed Securities and U.S. Treasuries | | |

| (including strips) with coupon rates ranging | | |

| from 2.100% to 6.500% and due dates ranging | | |

| from 7/15/2025 to 3/15/2064, valued | | |

| at $440,526,804) | 20,800,000 | 20,800,000 |

| Interest in $498,700,000 joint tri-party | | |

| repurchase agreement dated 12/30/2022 with | | |

| Royal Bank of Canada due 1/3/2023 — maturity | | |

| value of $20,809,938 for an effective yield | | |

| of 4.300% (collateralized by Agency Mortgage- | | |

| Backed Securities with coupon rates ranging | | |

| from 0.250% to 6.000% and due dates ranging | | |

| from 7/31/2025 to 9/1/2052, valued | | |

| at $508,917,110) | 20,800,000 | 20,800,000 |

| Total repurchase agreements (cost $62,435,000) | $62,435,000 |

| | | | | |

| U.S. GOVERNMENT AGENCY | Yield | | Maturity | Principal | |

| OBLIGATIONS (12.9%)* | (%) | | date | amount | Value |

| Federal Farm Credit Banks | | | | | |

| Funding Corporation FRB | 4.620 | | 6/9/23 | $850,000 | $851,052 |

| Federal Farm Credit Banks | | | | | |

| Funding Corporation FRB | 4.360 | | 1/20/23 | 750,000 | 750,011 |

| Federal Farm Credit Banks | | | | | |

| Funding Corporation | | | | | |

| unsec. bonds | 3.021 | | 5/10/23 | 750,000 | 742,399 |

| Federal Home Loan Banks | | | | | |

| discount notes | 4.586 | | 4/21/23 | 500,000 | 493,125 |

| Federal Home Loan Banks | | | | | |

| discount notes | 4.389 | | 2/28/23 | 650,000 | 645,455 |

| | | | | |

| U.S. GOVERNMENT AGENCY | Yield | | Maturity | Principal | |

| OBLIGATIONS (12.9%)* cont. | (%) | | date | amount | Value |

| | | | | | |

| Federal Home Loan Banks | | | | | |

| discount notes | 4.229 | | 4/14/23 | $350,000 | $345,854 |

| Federal Home Loan Banks | | | | | |

| discount notes | 4.070 | | 3/31/23 | 750,000 | 742,602 |

| Federal Home Loan Banks | | | | | |

| discount notes | 4.029 | | 3/24/23 | 325,000 | 322,076 |

| Federal Home Loan Banks | | | | | |

| discount notes | 3.558 | | 3/1/23 | 1,275,000 | 1,267,690 |

| Federal Home Loan Banks | | | | | |

| discount notes | 3.150 | | 3/27/23 | 750,000 | 744,528 |

| Federal Home Loan Mortgage | | | | | |

| Corporation unsec. notes | 3.015 | | 6/19/23 | 600,000 | 599,273 |

| Federal Home Loan Mortgage | | | | | |

| Corporation unsec. notes | 2.984 | | 5/5/23 | 750,000 | 743,411 |

| Federal National Mortgage | | | | | |

| Association unsec. notes | 4.235 | | 9/12/23 | 400,000 | 396,362 |

| Federal National Mortgage | | | | | |

| Association unsec. notes | 3.112 | | 5/22/23 | 750,000 | 741,808 |

| Total U.S. government agency obligations | | |

| (cost $9,385,646) | | | | | $9,385,646 |

| |

| U.S. TREASURY | Yield | | Maturity | Principal | |

| OBLIGATIONS (1.0%)* | (%) | | date | amount | Value |

| | | | | | |

| U.S. Treasury Notes | 4.477 | | 10/31/24 | $700,000 | $699,052 |

| Total U.S. treasury obligations (cost $699,052) | | $699,052 |

| |

| Total investments (cost $72,519,698) | | | | $72,519,698 |

Key to holding’s abbreviations

| |

| FRB | Floating Rate Bonds: The rate shown is the current interest rate |

| | at the close of the reporting period. Rates may be subject to a cap |

| | or floor. For certain securities, the rate may represent a fixed rate |

| | currently in place at the close of the reporting period. |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from January 1, 2022 through December 31, 2022 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures.

* Percentages indicated are based on net assets of $72,846,124.

The dates shown on debt obligations are the original maturity dates.

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | |

| | | | Valuation inputs | | |

| Investments in securities: | Level 1 | Level 2 | Level 3 |

| Repurchase agreements | $— | $62,435,000 | $— |

| U.S. government agency obligations | — | 9,385,646 | — |

| U.S. treasury obligations | — | 699,052 | — |

| Totals by level | $— | $72,519,698 | $— |

The accompanying notes are an integral part of these financial statements.

| |

| 6 | Putnam VT Government Money Market Fund |

Statement of assets and liabilities

12/31/22

| |

| Assets | |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $10,084,698) | $10,084,698 |

| Repurchase agreements (identified cost $62,435,000) | 62,435,000 |

| Cash | 7,842 |

| Interest and other receivables | 79,915 |

| Receivable for shares of the fund sold | 560,519 |

| Total assets | 73,167,974 |

| |

| Liabilities | |

| Payable for shares of the fund repurchased | 158,556 |

| Payable for compensation of Manager (Note 2) | 17,034 |

| Payable for custodian fees (Note 2) | 4,568 |

| Payable for investor servicing fees (Note 2) | 8,376 |

| Payable for Trustee compensation and expenses (Note 2) | 77,111 |

| Payable for administrative services (Note 2) | 884 |

| Payable for distribution fees (Note 2) | 6,713 |

| Payable for auditing and tax fees | 36,260 |

| Other accrued expenses | 12,348 |

| Total liabilities | 321,850 |

| | |

| Net assets | $72,846,124 |

| |

| Represented by | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $72,842,141 |

| Total distributable earnings (Note 1) | 3,983 |

| Total — Representing net assets applicable to capital shares outstanding | $72,846,124 |

| Computation of net asset value Class IA | |

| Net assets | $41,354,308 |

| Number of shares outstanding | 41,351,947 |

| Net asset value, offering price and redemption price per share (net assets divided by number of shares outstanding) | $1.00 |

| | |

| Computation of net asset value Class IB | |

| Net assets | $31,491,816 |

| Number of shares outstanding | 31,490,181 |

| Net asset value, offering price and redemption price per share (net assets divided by number of shares outstanding) | $1.00 |

The accompanying notes are an integral part of these financial statements.

| |

| Putnam VT Government Money Market Fund | 7 |

Statement of operations

Year ended 12/31/22

| |

| Investment income | |

| Interest | $1,206,825 |

| Total investment income | 1,206,825 |

| |

| Expenses | |

| Compensation of Manager (Note 2) | 208,487 |

| Investor servicing fees (Note 2) | 52,431 |

| Custodian fees (Note 2) | 8,993 |

| Trustee compensation and expenses (Note 2) | 3,206 |

| Distribution fees (Note 2) | 81,949 |

| Administrative services (Note 2) | 2,394 |

| Auditing and tax fees | 36,563 |

| Other | 42,534 |

| Fees waived and reimbursed by Manager (Note 2) | (122,653) |

| Total expenses | 313,904 |

| Expense reduction (Note 2) | (224) |

| Net expenses | 313,680 |

| | |

| Net investment income | 893,145 |

| | |

| Realized gain | |

| Net realized gain on: | |

| Securities from unaffiliated issuers (Notes 1 and 3) | 1,026 |

| Total net realized gain | 1,026 |

| | |

| Net gain on investments | 1,026 |

| | |

| Net increase in net assets resulting from operations | $894,171 |

Statement of changes in net assets

| | |

| | Year ended | Year ended |

| | 12/31/22 | 12/31/21 |

| Decrease in net assets | | |

| Operations: | | |

| Net investment income | $893,145 | $6,904 |

| Net realized gain on investments | 1,026 | 1,924 |

| Net increase in net assets resulting from operations | 894,171 | 8,828 |

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | |

| Class IA | (536,260) | (3,634) |

| Class IB | (353,766) | (3,270) |

| Decrease from capital share transactions (Note 4) | (2,550,058) | (12,048,253) |

| Total decrease in net assets | (2,545,913) | (12,046,329) |

| Net assets: | | |

| Beginning of year | 75,392,037 | 87,438,366 |

| End of year | $72,846,124 | $75,392,037 |

The accompanying notes are an integral part of these financial statements.

| |

| 8 | Putnam VT Government Money Market Fund |

Financial highlights

(For a common share outstanding throughout the period)

| | | | | | | | | | | |

| | | | | | LESS | RATIOS AND |

| INVESTMENT OPERATIONS: | DISTRIBUTIONS: | SUPPLEMENTAL DATA: |

| Period ended | Net asset value,

beginning

of period | Net investment

income (loss) | Net realized

gain (loss)

on investments | Total from

investment

operations | From net

investment

income | Total

distributions | Net asset value,

end of period | Total return

at net asset value

(%)a,b | Net assets,

end of period

(in thousands) | Ratio of expenses

to average

net assets (%)a,c | Ratio

of net investment

income (loss)

to average

net assets (%) |

| Class IA | | | | | | | | | | | |

| 12/31/22 | $1.00 | .0129 | —d | .0129 | (.0128) | (.0128) | $1.00 | 1.29 | $41,354 | .35 e | 1.28e |

| 12/31/21 | 1.00 | .0001 | —d | .0001 | (.0001) | (.0001) | 1.00 | .01 | 40,968 | .07e | .01e |

| 12/31/20 | 1.00 | .0024 | —d | .0024 | (.0024) | (.0024) | 1.00 | .24 | 48,536 | .26e | .22 e |

| 12/31/19 | 1.00 | .0179 | —d | .0179 | (.0179) | (.0179) | 1.00 | 1.81 | 44,065 | .45 | 1.79 |

| 12/31/18 | 1.00 | .0142 | — | .0142 | (.0142) | (.0142) | 1.00 | 1.43 | 48,473 | .45 | 1.41 |

| Class IB | | | | | | | | | | | |

| 12/31/22 | $1.00 | .0112 | —d | .0112 | (.0112) | (.0112) | $1.00 | 1.12 | $31,492 | .51e | 1.08e |

| 12/31/21 | 1.00 | .0001 | —d | .0001 | (.0001) | (.0001) | 1.00 | .01 | 34,424 | .07e | .01e |

| 12/31/20 | 1.00 | .0019 | —d | .0019 | (.0019) | (.0019) | 1.00 | .19 | 38,903 | .32 e | .20e |

| 12/31/19 | 1.00 | .0154 | —d | .0154 | (.0154) | (.0154) | 1.00 | 1.55 | 42,137 | .70 | 1.55 |

| 12/31/18 | 1.00 | .0117 | — | .0117 | (.0117) | (.0117) | 1.00 | 1.18 | 44,834 | .70 | 1.17 |

a The charges and expenses at the insurance company separate account level are not reflected.

b Total return assumes dividend reinvestment.

c Includes amounts paid through expense offset arrangements, if any (Note 2). Also excludes acquired fund fees and expenses, if any.

d Amount represents less than $0.0001 per share.

e Reflects a voluntary waiver of certain fund expenses in effect during the period relating to the enhancement of certain annualized net yields of the fund. As a result of such waivers, the expenses of each class reflect a reduction of the following amounts as a percentage of average net assets (Note 2):

| | | | | |

| | 12/31/22 | 12/31/21 | 12/31/20 | | |

| Class IA | 0.13% | 0.37% | 0.18% | | |

| Class IB | 0.21 | 0.62 | 0.38 | | |

The accompanying notes are an integral part of these financial statements.

| |

| Putnam VT Government Money Market Fund | 9 |

Notes to financial statements 12/31/22

Within the following Notes to financial statements, references to “State Street” represent State Street Bank and Trust Company, references to “the SEC” represent the Securities and Exchange Commission, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “OTC”, if any, represent over-the-counter. Unless otherwise noted, the “reporting period” represents the period from January 1, 2022 through December 31, 2022.

Putnam VT Government Money Market Fund (the fund) is a diversified series of Putnam Variable Trust (the Trust), a Massachusetts business trust registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The goal of the fund is to seek as high a rate of current income as Putnam Management believes is consistent with preservation of capital and maintenance of liquidity. The fund invests at least 99.5 percent of the fund’s total assets in cash, U.S. government securities and repurchase agreements that are fully collateralized by U.S. government securities or cash. The fund invests mainly in debt securities that are obligations of the U.S. government, its agencies and instrumentalities and accordingly are backed by the full faith and credit of the United States (e.g., U.S. Treasury bills) or by the credit of a federal agency or government-sponsored entity (e.g., securities issued by Fannie Mae and Freddie Mac). The U.S. government securities in which the fund invests may also include variable and floating rate instruments and when-issued and delayed delivery securities (i.e., payment or delivery of the securities occurs at a future date for a predetermined price). Under normal circumstances, the fund invests at least 80% of the fund’s net assets in U.S. government securities and repurchase agreements that are fully collateralized by U.S. government securities. This policy may be changed only after 60 days’ notice to shareholders. The securities purchased by the fund are subject to quality, maturity, diversification and other requirements pursuant to rules promulgated by the SEC. Putnam Management may consider, among other factors, credit and interest rate risks and characteristics of the issuer or counterparty, as well as general market conditions, when deciding whether to buy or sell investments.

The fund offers class IA and class IB shares of beneficial interest. Class IA shares are offered at net asset value and are not subject to a distribution fee. Class IB shares are offered at net asset value and pay an ongoing distribution fee, which is identified in Note 2.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

The fund has entered into contractual arrangements with an investment adviser, administrator, distributor, shareholder servicing agent and custodian, who each provide services to the fund. Unless expressly stated otherwise, shareholders are not parties to, or intended beneficiaries of these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the fund.

Under the fund’s Amended and Restated Agreement and Declaration of Trust, any claims asserted against or on behalf of the Putnam Funds, including claims against Trustees and Officers, must be brought in state and federal courts located within the Commonwealth of Massachusetts.

Note 1 — Significant accounting policies

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Investment income, realized gains and losses and expenses of the fund are borne pro-rata based on the relative net assets of each class to the total net assets of the fund, except that each class bears expenses unique to that class (including the distribution fees applicable to such classes). Each class votes as a class only with respect to its own distribution plan or other matters on which a class vote is required by law or determined by the Trustees. Shares of each class would receive their pro-rata share of the net assets of the fund, if the fund were liquidated. In addition, the Trustees declare separate dividends on each class of shares.

Security valuation Portfolio securities and other investments are valued using policies and procedures adopted by the Board of Trustees. The Trustees have formed a Pricing Committee to oversee the implementation of these procedures and have delegated responsibility for valuing the fund’s assets in accordance with these procedures to Putnam Management. Putnam Management has established an internal Valuation Committee that is responsible for making fair value determinations, evaluating the effectiveness of the pricing policies of the fund and reporting to the Pricing Committee.

The valuation of the fund’s portfolio instruments is determined by means of the amortized cost method (which approximates fair value) as set forth in Rule 2a–7 under the Investment Company Act of 1940. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity and is generally categorized as a Level 2 security.

Joint trading account Pursuant to an exemptive order from the SEC, the fund may transfer uninvested cash balances into a joint trading account along with the cash of other registered investment companies and certain other accounts managed by Putnam Management. These balances may be invested in issues of short-term investments having maturities of up to 90 days.

Repurchase agreements The fund, or any joint trading account, through its custodian, receives delivery of the underlying securities, the fair value of which at the time of purchase is required to be in an amount at least equal to the resale price, including accrued interest. Collateral for certain tri-party repurchase agreements, which totaled $63,693,841 at the end of the reporting period, is held at the counterparty’s custodian in a segregated account for the benefit of the fund and the counterparty. Putnam Management is responsible for determining that the value of these underlying securities is at all times at least equal to the resale price, including accrued interest. In the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Interest income, including amortization and accretion of premiums and discounts, is recorded on the accrual basis. Gains or losses on securities sold are determined on the identified cost basis.

Interfund lending The fund, along with other Putnam funds, may participate in an interfund lending program pursuant to an exemptive order issued by the SEC. This program allows the fund to lend to other Putnam funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. Interest earned or paid on the interfund lending transaction will be based on the average of certain current market rates. During the reporting period, the fund did not utilize the program.

Lines of credit The fund participates, along with other Putnam funds, in a $100 million ($317.5 million prior to October 14, 2022) unsecured committed line of credit and a $235.5 million unsecured uncommitted line of credit, both provided by State Street. Borrowings may be made for temporary or emergency purposes, including the funding of shareholder redemption requests and trade settlements. Interest is charged to the fund based on the fund’s borrowing at a rate equal to 1.25% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the committed line of credit and 1.30% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the uncommitted line of credit. A closing fee equal to 0.04% of the committed line of credit and 0.04% of the uncommitted line of credit has been paid by the participating funds. In addition, a commitment fee of 0.21% per annum on any unutilized portion of the committed line of credit is allocated to the participating funds based on their relative net assets and paid quarterly. During the reporting period, the fund had no borrowings against these arrangements.

Federal taxes It is the policy of the fund to distribute all of its taxable income within the prescribed time period and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicable to regulated investment companies.

The fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (ASC 740). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The fund did not have a liability to record for any unrecognized tax

| |

| 10 | Putnam VT Government Money Market Fund |

benefits in the accompanying financial statements. No provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains. Each of the fund’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

Distributions to shareholders Income dividends are recorded daily by the fund and are paid monthly. Distributions from capital gains, if any, are paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. For the reporting period, there were no material temporary or permanent differences. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations. At the close of the reporting period, the fund required no such reclassifications.

The tax basis components of distributable earnings as of the close of the reporting period were as follows:

| |

| Undistributed ordinary income | $3,130 |

| Undistributed short-term gain | 864 |

The aggregate identified cost on a financial reporting and tax basis is the same.

Expenses of the Trust Expenses directly charged or attributable to any fund will be paid from the assets of that fund. Generally, expenses of the Trust will be allocated among and charged to the assets of each fund on a basis that the Trustees deem fair and equitable, which may be based on the relative assets of each fund or the nature of the services performed and relative applicability to each fund.

Beneficial interest At the close of the reporting period, insurance companies or their separate accounts were record owners of all but a de minimis number of the shares of the fund. Approximately 31.2% of the fund is owned by accounts of one insurance company.

Note 2 — Management fee, administrative services and other transactions

The fund pays Putnam Management a management fee (based on the fund’s average net assets and computed and paid monthly) at annual rates that may vary based on the average of the aggregate net assets of all open-end mutual funds sponsored by Putnam Management (excluding net assets of funds that are invested in, or that are invested in by, other Putnam funds to the extent necessary to avoid “double counting” of those assets). Such annual rates may vary as follows:

| |

| 0.440% | of the first $5 billion, |

| 0.390% | of the next $5 billion, |

| 0.340% | of the next $10 billion, |

| 0.290% | of the next $10 billion, |

| 0.240% | of the next $50 billion, |

| 0.220% | of the next $50 billion, |

| 0.210% | of the next $100 billion and |

| 0.205% | of any excess thereafter. |

For the reporting period, the management fee represented an effective rate (excluding the impact from any expense waivers in effect) of 0.278% of the fund’s average net assets.

Putnam Management has contractually agreed, through April 30, 2024, to waive fees and/or reimburse the fund’s expenses to the extent necessary to limit the cumulative expenses of the fund, exclusive of brokerage, interest, taxes, investment-related expenses, extraordinary expenses, acquired fund fees and expenses and payments under the fund’s investor servicing contract, investment management contract and distribution plan, on a fiscal year-to-date basis to an annual rate of 0.20% of the fund’s average net assets over such fiscal year-to-date period. During the reporting period, the fund’s expenses were not reduced as a result of this limit.

Putnam Management may from time to time voluntarily undertake to waive fees and/or reimburse certain fund expenses in order to enhance the annualized net yield for the fund. Any such waiver or reimbursement would be voluntary and may be modified or discontinued by Putnam Management at any time without notice. For the reporting period, Putnam Management waived $122,653 as a result of this waiver, which includes $28,820 of class IB specific distribution fees from the fund.

Putnam Investments Limited (PIL), an affiliate of Putnam Management, is authorized by the Trustees to manage a separate portion of the assets of the fund as determined by Putnam Management from time to time. PIL did not manage any portion of the assets of the fund during the reporting period. If Putnam Management were to engage the services of PIL, Putnam Management would pay a quarterly sub-management fee to PIL for its services at an annual rate of 0.20% (prior to July 1, 2022, the annual rate was 0.25%) of the average net assets of the portion of the fund managed by PIL.

The fund reimburses Putnam Management an allocated amount for the compensation and related expenses of certain officers of the fund and their staff who provide administrative services to the fund. The aggregate amount of all such reimbursements is determined annually by the Trustees.

Custodial functions for the fund’s assets are provided by State Street. Custody fees are based on the fund’s asset level, the number of its security holdings and transaction volumes.

Putnam Investor Services, Inc., an affiliate of Putnam Management, provides investor servicing agent functions to the fund. Putnam Investor Services, Inc. was paid a monthly fee for investor servicing at an annual rate of 0.07% of the fund’s average daily net assets. During the reporting period, the expenses for each class of shares related to investor servicing fees were as follows:

| |

| Class IA | $29,484 |

| Class IB | 22,947 |

| Total | $52,431 |

The fund has entered into expense offset arrangements with Putnam Investor Services, Inc. and State Street whereby Putnam Investor Services, Inc.’s and State Street’s fees are reduced by credits allowed on cash balances. For the reporting period, the fund’s expenses were reduced by $224 under the expense offset arrangements.

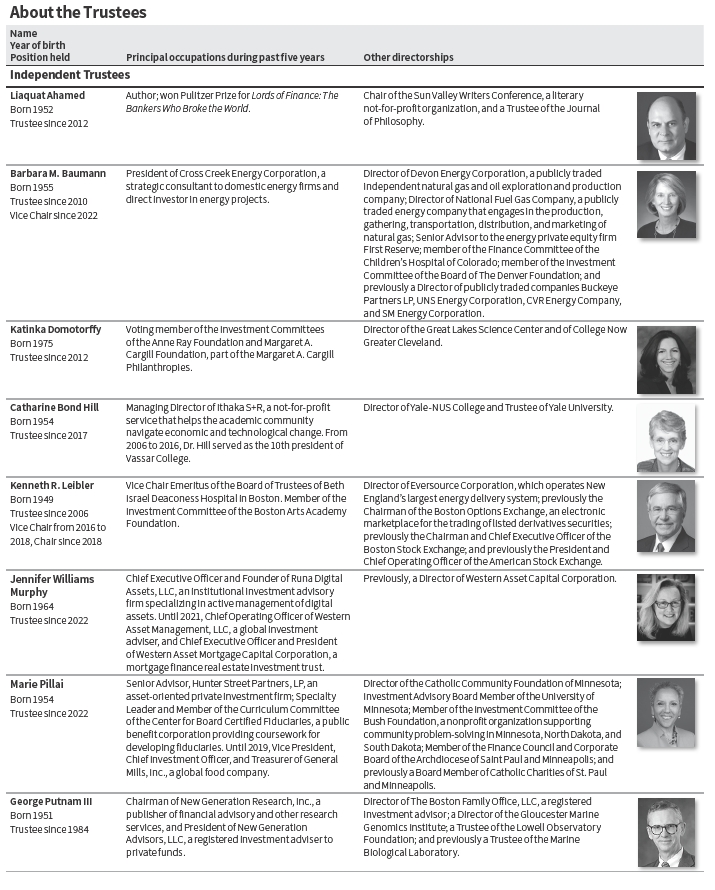

Each Independent Trustee of the fund receives an annual Trustee fee, of which $69, as a quarterly retainer, has been allocated to the fund, and an additional fee for each Trustees meeting attended. Trustees also are reimbursed for expenses they incur relating to their services as Trustees.

The fund has adopted a Trustee Fee Deferral Plan (the Deferral Plan) which allows the Trustees to defer the receipt of all or a portion of Trustees fees payable on or after July 1, 1995. The deferred fees remain invested in certain Putnam funds until distribution in accordance with the Deferral Plan.

The fund has adopted an unfunded noncontributory defined benefit pension plan (the Pension Plan) covering all Trustees of the fund who have served as a Trustee for at least five years and were first elected prior to 2004. Benefits under the Pension Plan are equal to 50% of the Trustee’s average annual attendance and retainer fees for the three years ended December 31, 2005. The retirement benefit is payable during a Trustee’s lifetime, beginning the year following retirement, for the number of years of service through December 31, 2006. Pension expense for the fund is included in Trustee compensation and expenses in the Statement of operations. Accrued pension liability is included in Payable for Trustee compensation and expenses in the Statement of assets and liabilities. The Trustees have terminated the Pension Plan with respect to any Trustee first elected after 2003.

The fund has adopted a distribution plan (the Plan) with respect to its class IB shares pursuant to Rule 12b–1 under the Investment Company Act of 1940. The purpose of the Plan is to compensate Putnam Retail Management Limited Partnership, an indirect wholly-owned subsidiary of Putnam Investments, LLC, for services provided and expenses incurred in distributing shares of the fund. The Plan provides for payment by the fund to Putnam Retail Management Limited Partnership at an annual rate of up to 0.35% of the average net assets attributable to the fund’s class IB shares. The Trustees have approved payment by the fund at an annual rate of 0.25% of the average net assets attributable to the fund’s class IB shares. The expenses related to distribution fees during the reporting period are included in Distribution fees in the Statement of operations.

Note 3 — Purchases and sales of securities

During the reporting period, the cost of purchases and the proceeds from sales (including maturities) of investment securities (all short-term obligations) aggregated $15,328,564,803 and $15,331,245,000, respectively. The fund may purchase or sell investments from or to other Putnam funds in the ordinary course of business, which can reduce the fund’s transaction costs, at prices determined in accordance with SEC requirements and policies approved by the Trustees. During the reporting period, purchases or sales from or to other Putnam funds, if any, did not represent more than 5% of the fund’s total cost of purchases and/or total proceeds from sales.

| |

| Putnam VT Government Money Market Fund | 11 |

Note 4 — Capital shares

At the close of the reporting period, there were an unlimited number of shares of beneficial interest authorized. Subscriptions and redemptions are presented at the omnibus level. Transactions in capital shares were as follows:

| | | | | | | | |

| | | Class IA shares | | | Class IB shares | |

| | Year ended 12/31/22 | Year ended 12/31/21 | Year ended 12/31/22 | Year ended 12/31/21 |

| | Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount |

| Shares sold | 33,679,958 | $33,679,958 | 20,749,519 | $20,749,519 | 6,689,682 | $6,689,682 | 8,135,740 | $8,135,740 |

| Shares issued in connection with | | | | | | | | |

| reinvestment of distributions | 536,260 | 536,260 | 3,634 | 3,634 | 353,766 | 353,766 | 3,270 | 3,270 |

| | 34,216,218 | 34,216,218 | 20,753,153 | 20,753,153 | 7,043,448 | 7,043,448 | 8,139,010 | 8,139,010 |

| Shares repurchased | (33,832,505) | (33,832,505) | (28,321,532) | (28,321,532) | (9,977,219) | (9,977,219) | (12,618,884) | (12,618,884) |

| Net increase (decrease) | 383,713 | $383,713 | (7,568,379) | $(7,568,379) | (2,933,771) | $(2,933,771) | (4,479,874) | $(4,479,874) |

Note 5 — Market, credit and other risks

In the normal course of business, the fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to changes in the market (market risk) or failure of the contracting party to the transaction to perform (credit risk). The fund may be exposed to additional credit risk that an institution or other entity with which the fund has unsettled or open transactions will default.

On July 27, 2017, the United Kingdom’s Financial Conduct Authority (“FCA”), which regulates LIBOR, announced its intention to cease compelling banks to provide the quotations needed to sustain LIBOR after 2021. ICE Benchmark Administration, the administrator of LIBOR, ceased publication of most LIBOR settings on a representative basis at the end of 2021 and is expected to cease publication of a majority of U.S. dollar LIBOR settings on a representative basis after June 30, 2023. In addition, global regulators have announced that, with limited exceptions, no new LIBOR-based contracts should be entered into after 2021. LIBOR has historically been a common benchmark interest rate index used to make adjustments to variable-rate loans. It is used throughout global banking and financial industries to determine interest rates for a variety of financial instruments and borrowing arrangements. Actions by regulators have resulted in the establishment of alternative reference rates to LIBOR in most major currencies. Various financial industry groups have been planning for the transition away from LIBOR, but there are obstacles to converting certain longer-term securities and transactions to new reference rates. Markets are developing slowly and questions around liquidity in these rates and how to appropriately adjust these rates to mitigate any economic value transfer at the time of transition remain a significant concern. Neither the effect of the transition process nor its ultimate success can yet be known. The transition process might lead to increased volatility and illiquidity in markets that rely on LIBOR to determine interest rates. It could also lead to a reduction in the value of some LIBOR-based investments and reduce the effectiveness of related transactions, such as hedges. While some LIBOR-based instruments may contemplate a scenario where LIBOR is no longer available by providing for an alternative rate-setting methodology, not all may have such provisions and there may be significant uncertainty regarding the effectiveness of any such alternative methodologies. Since the usefulness of LIBOR as a benchmark could deteriorate during the transition period, these effects could occur at any time.

The Covid-19 pandemic and efforts to contain its spread have resulted in, among other effects, significant market volatility, exchange trading suspensions and closures, declines in global financial markets, higher default rates, significant changes in fiscal and monetary policies, and economic downturns and recessions. The effects of the Covid-19 pandemic have negatively affected, and may continue to negatively affect, the global economy, the economies of the United States and other individual countries, the financial performance of individual issuers, sectors, industries, asset classes, and markets, and the value, volatility, and liquidity of particular securities and other assets. The effects of the Covid-19 pandemic also are likely to exacerbate other risks that apply to the fund, which could negatively impact the fund’s performance and lead to losses on your investment in the fund. The duration of the Covid-19 pandemic and its effects cannot be determined with certainty.

Note 6 — Offsetting of financial and derivative assets and liabilities

The following table summarizes any derivatives, repurchase agreements and reverse repurchase agreements, at the end of the reporting period, that are subject to an enforceable master netting agreement or similar agreement. For securities lending transactions or borrowing transactions associated with securities sold short, if any, see Note 1. For financial reporting purposes, the fund does not offset financial assets and financial liabilities that are subject to the master netting agreements in the Statement of assets and liabilities.

| | | | |

| | | Citigroup Global | | |

| | BofA Securities, Inc. | Markets, Inc. | Royal Bank of Canada | Total |

| Assets: | | | | |

| Repurchase agreements** | $20,835,000 | $20,800,000 | $20,800,000 | $62,435,000 |

| Total Assets | $20,835,000 | $20,800,000 | $20,800,000 | $62,435,000 |

| Total Financial and Derivative Net Assets | $20,835,000 | $20,800,000 | $20,800,000 | $62,435,000 |

| Total collateral received (pledged)†## | $20,835,000 | $20,800,000 | $20,800,000 | |

| Net amount | $— | $— | $— | |

| Controlled collateral received (including | | | | |

| TBA commitments)** | $— | $— | $— | $— |

| Uncontrolled collateral received | $21,251,700 | $21,216,001 | $21,226,140 | $63,693,841 |

| Collateral (pledged) (including | | | | |

| TBA commitments)** | $— | $— | $— | $— |

** Included with Investments in securities on the Statement of assets and liabilities.

† Additional collateral may be required from certain brokers based on individual agreements.

## Any over-collateralization of total financial and derivative net assets is not shown. Collateral may include amounts related to unsettled agreements.

| |

| 12 | Putnam VT Government Money Market Fund |

| |

| Putnam VT Government Money Market Fund | 13 |

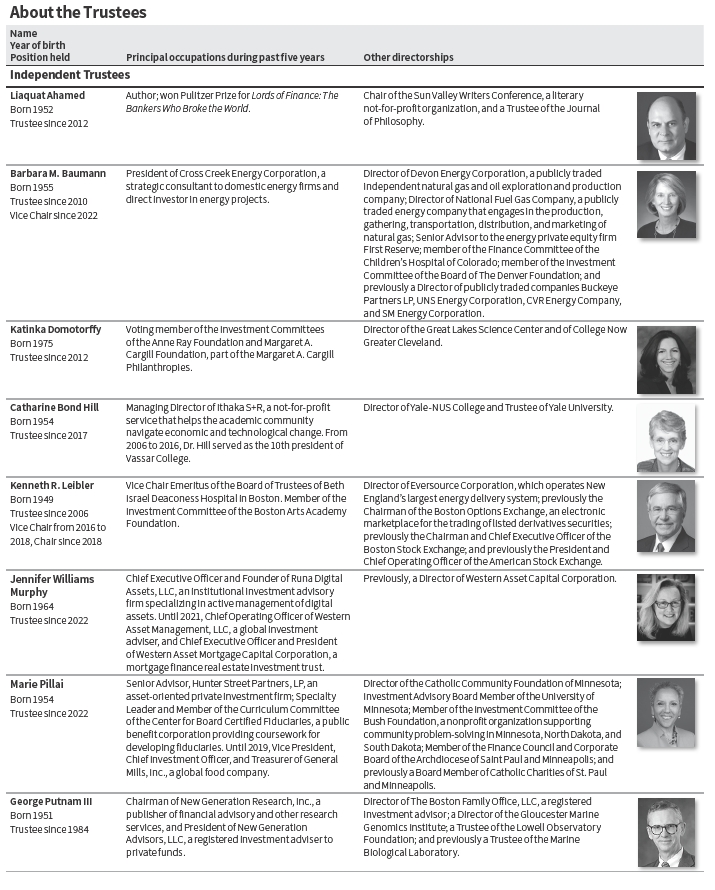

*Mr. Reynolds is an “interested person” (as defined in the Investment Company Act of 1940) of the fund and Putnam Investments. He is President and Chief Executive Officer of Putnam Investments, as well as the President of your fund and each of the other Putnam funds.

The address of each Trustee is 100 Federal Street, Boston, MA 02110.

As of December 31, 2022, there were 92 mutual funds, 4 closed-end funds, and 7 exchange-traded funds in the Putnam funds complex. Each Trustee serves as Trustee of all funds in the Putnam funds complex.

Each Trustee serves for an indefinite term, until his or her resignation, retirement at age 75, removal, or death.

| |

| 14 | Putnam VT Government Money Market Fund |

Officers

In addition to Robert L. Reynolds, the other officers of the fund are shown below:

| | |

| James F. Clark (Born 1974) | Richard T. Kircher (Born 1962) | Janet C. Smith (Born 1965) |

| Vice President and Chief Compliance Officer | Vice President and BSA Compliance Officer | Vice President, Principal Financial |

| Since 2016 | Since 2019 | Officer, Principal Accounting Officer, |

| Chief Compliance Officer and Chief Risk Officer, | Assistant Director, Operational Compliance, | and Assistant Treasurer |

| Putnam Investments, and Chief Compliance | Putnam Investments and Putnam | Since 2007 |

| Officer, Putnam Management | Retail Management | Head of Fund Administration Services, Putnam |

| | | Investments and Putnam Management |

| Nancy E. Florek (Born 1957) | Susan G. Malloy (Born 1957) | |

| Vice President, Director of Proxy Voting | Vice President and Assistant Treasurer | Stephen J. Tate (Born 1974) |

| and Corporate Governance, Assistant Clerk, | Since 2007 | Vice President and Chief Legal Officer |

| and Assistant Treasurer | Head of Accounting and Middle Office Services, | Since 2021 |

| Since 2000 | Putnam Investments and Putnam Management | General Counsel, Putnam Investments, Putnam |

| | | Management, and Putnam Retail Management |

| Michael J. Higgins (Born 1976) | Denere P. Poulack (Born 1968) | |

| Vice President, Treasurer, and Clerk | Assistant Vice President, Assistant Clerk, | Mark C. Trenchard (Born 1962) |

| Since 2010 | and Assistant Treasurer | Vice President |

| | Since 2004 | Since 2002 |

| Jonathan S. Horwitz (Born 1955) | | Director of Operational Compliance, Putnam |

| Executive Vice President, Principal Executive | | Investments and Putnam Retail Management |

| Officer, and Compliance Liaison | | |

| Since 2004 | | |

The principal occupations of the officers for the past five years have been with the employers as shown above, although in some cases they have held different positions with such employers. The address of each officer is 100 Federal Street, Boston, MA 02110.

| |

| Putnam VT Government Money Market Fund | 15 |

|

| This page intentionally left blank. |

| |

| 16 | Putnam VT Government Money Market Fund |

Other important information

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2022, are available in the Individual Investors section of putnam.com and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund files monthly portfolio information with the SEC on Form N-MFP. The fund’s Form N-MFP reports are available on the SEC’s website at www.sec.gov. For information on the fund’s portfolio, you may also visit the Putnam Investments website, putnam.com/individual/annuities, where the fund’s portfolio holdings and related portfolio information may be viewed monthly beginning no later than five business days after the end of each month.

Fund information

| | |

| Investment Manager | Investor Servicing Agent | Trustees |

| Putnam Investment Management, LLC | Putnam Investments | Kenneth R. Leibler, Chair |

| 100 Federal Street | Mailing address: | Barbara M. Baumann, Vice Chair |

| Boston, MA 02110 | P.O. Box 219697 | Liaquat Ahamed |

| | Kansas City, MO 64121-9697 | Katinka Domotorffy |

| Investment Sub-Advisor | 1-800-225-1581 | Catharine Bond Hill |

| Putnam Investments Limited | | Jennifer Williams Murphy |

| 16 St James’s Street | Custodian | Marie Pillai |

| London, England SW1A 1ER | State Street Bank and Trust Company | George Putnam III |

| | | Robert L. Reynolds |

| Marketing Services | Legal Counsel | Manoj P. Singh |

| Putnam Retail Management | Ropes & Gray LLP | Mona K. Sutphen |

| Limited Partnership | | |

| 100 Federal Street | Independent Registered | |

| Boston, MA 02110 | Public Accounting Firm | |

| | PricewaterhouseCoopers LLP | |

The fund’s Statement of Additional Information contains additional information about the fund’s Trustees and is available without charge upon request by calling 1-800-225-1581.

| |

| Putnam VT Government Money Market Fund | 17 |

| |

| This report has been prepared for the shareholders | |

| of Putnam VT Government Money Market Fund. | VTAN039 332116 2/23 |

| |

| (a) The fund’s principal executive, financial and accounting officers are employees of Putnam Investment Management, LLC, the Fund’s investment manager. As such they are subject to a comprehensive Code of Ethics adopted and administered by Putnam Investments which is designed to protect the interests of the firm and its clients. The Fund has adopted a Code of Ethics which incorporates the Code of Ethics of Putnam Investments with respect to all of its officers and Trustees who are employees of Putnam Investment Management, LLC. For this reason, the Fund has not adopted a separate code of ethics governing its principal executive, financial and accounting officers. |

| |

| (c) In January 2023, the Code of Ethics of Putnam Investments and Code of Ethics of Putnam Funds were amended. The key changes to the Putnam Investments Code of Ethics are as follows: (i) Prohibition on investments in a single stock ETFs and (ii) Revision to the 7-day blackout rule for Analysts. The key change to the Putnam Funds Code of Ethics was that the provisions of the Code of Ethics for employees of PanAgora Asset Management, inc. and any of its subsidiaries are excluded from the Putnam Funds’ Code of Ethics. |

| |

| Item 3. Audit Committee Financial Expert: |

| |

| The Funds’ Audit, Compliance and Risk Committee is comprised solely of Trustees who are “independent” (as such term has been defined by the Securities and Exchange Commission (“SEC”) in regulations implementing Section 407 of the Sarbanes-Oxley Act (the “Regulations”)). The Trustees believe that each member of the Audit, Compliance and Risk Committee also possesses a combination of knowledge and experience with respect to financial accounting matters, as well as other attributes, that qualifies him or her for service on the Committee. In addition, the Trustees have determined that each of Dr. Hill, Ms. Murphy and Mr. Singh qualifies as an “audit committee financial expert” (as such term has been defined by the Regulations) based on their review of his or her pertinent experience and education.The SEC has stated, and the funds’ amended and restated agreement and Declaration of Trust provides, that the designation or identification of a person as an audit committee financial expert pursuant to this Item 3 of Form N-CSR does not impose on such person any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such person as a member of the Audit, Compliance and Risk Committee and the Board of Trustees in the absence of such designation or identification. |

| |

| Item 4. Principal Accountant Fees and Services: |

| |

| The following table presents fees billed in each of the last two fiscal years for services rendered to the fund by the fund’s independent auditor: |

| | | | | |

| Fiscal year ended | Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

|

|

| | | | | |

| December 31, 2022 | $33,300 | $ — | $3,223 | $ — |

| December 31, 2021 | $33,958 | $ — | $3,073 | $ — |

| |

| For the fiscal years ended December 31, 2022 and December 31, 2021, the fund’s independent auditor billed aggregate non-audit fees in the amounts of $245,234 and $296,493 respectively, to the fund, Putnam Management and any entity controlling, controlled by or under common control with Putnam Management that provides ongoing services to the fund. |

| |

| Audit Fees represent fees billed for the fund’s last two fiscal years relating to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements. |

| |

| Audit-Related Fees represent fees billed in the fund’s last two fiscal years for services traditionally performed by the fund’s auditor, including accounting consultation for proposed transactions or concerning financial accounting and reporting standards and other audit or attest services not required by statute or regulation. |

| |

| Tax Fees represent fees billed in the fund’s last two fiscal years for tax compliance, tax planning and tax advice services. Tax planning and tax advice services include assistance with tax audits, employee benefit plans and requests for rulings or technical advice from taxing authorities. |

| |

| Pre-Approval Policies of the Audit, Compliance and Risk Committee. The Audit, Compliance and Risk Committee of the Putnam funds has determined that, as a matter of policy, all work performed for the funds by the funds’ independent auditors will be pre-approved by the Committee itself and thus will generally not be subject to pre-approval procedures. |

| |

| The Audit, Compliance and Risk Committee also has adopted a policy to pre-approve the engagement by Putnam Management and certain of its affiliates of the funds’ independent auditors, even in circumstances where pre-approval is not required by applicable law. Any such requests by Putnam Management or certain of its affiliates are typically submitted in writing to the Committee and explain, among other things, the nature of the proposed engagement, the estimated fees, and why this work should be performed by that particular audit firm as opposed to another one. In reviewing such requests, the Committee considers, among other things, whether the provision of such services by the audit firm are compatible with the independence of the audit firm. |

| |

| The following table presents fees billed by the fund’s independent auditor for services required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2–01 of Regulation S-X. |

| | | | | |

| Fiscal year ended | Audit-Related Fees | Tax Fees | All Other Fees | Total Non-Audit Fees |

|

|

| December 31, 2022 | $ — | $242,011 | $ — | $ — |

| December 31, 2021 | $ — | $293,420 | $ — | $ — |

| |

| Item 5. Audit Committee of Listed Registrants |

| |

| Item 6. Schedule of Investments: |

| |

| The registrant’s schedule of investments in unaffiliated issuers is included in the report to shareholders in Item 1 above. |

| |

| Item 7. Disclosure of Proxy Voting Policies and Procedures For Closed-End Management Investment Companies: |

| |

| Item 8. Portfolio Managers of Closed-End Investment Companies |

| |

| Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers: |

| |

| Item 10. Submission of Matters to a Vote of Security Holders: |

| |

| Item 11. Controls and Procedures: |

| |

| (a) The registrant’s principal executive officer and principal financial officer have concluded, based on their evaluation of the effectiveness of the design and operation of the registrant’s disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the design and operation of such procedures are generally effective to provide reasonable assurance that information required to be disclosed by the registrant in this report is recorded, processed, summarized and reported within the time periods specified in the Commission’s rules and forms. |

| |

| (b) Changes in internal control over financial reporting: Not applicable |

| |

| Item 12. Disclosures of Securities Lending Activities for Closed-End Management Investment Companies: |

| |

| (a)(1) The Code of Ethics of The Putnam Funds, which incorporates the Code of Ethics of Putnam Investments, is filed herewith. |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. |

| |

| By (Signature and Title): |

| |

| /s/ Janet C. Smith

Janet C. Smith

Principal Accounting Officer

|

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| |

| By (Signature and Title): |

| |

| /s/ Jonathan S. Horwitz

Jonathan S. Horwitz

Principal Executive Officer

|

| |

| By (Signature and Title): |

| |

| /s/ Janet C. Smith

Janet C. Smith

Principal Financial Officer

|