| |

| SECURITIES AND EXCHANGE COMMISSION |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: | (811-05346) |

| | |

| Exact name of registrant as specified in charter: | Putnam Variable Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Stephen Tate, Vice President |

| | |

| | Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq. |

| | |

| | 1211 Avenue of the Americas |

| | |

| | Boston, Massachusetts 02199 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | December 31, 2024 |

| | |

| Date of reporting period: | January 1, 2024 – December 31, 2024 |

| |

| Item 1. Report to Stockholders: |

| |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: |

| | |

Putnam VT Government Money Market Fund | |

Class IA true |

| Annual Shareholder Report | December 31, 2024 |

|

This annual shareholder report contains important information about Putnam VT Government Money Market Fund for the period January 1, 2024, to December 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class IA1 | $45 | 0.44% |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

As of December 31, 2024, the seven-day current yield for Class IA shares of the Putnam VT Government Money Market Fund was 4.18% and the seven-day effective yield was 4.18%. The seven-day current yield represents net interest income generated by the Fund’s investments for the past seven days and assumes income is generated each week over a 365-day period. The seven-day effective yield assumes reinvestment of the coupon (interest payments) and will typically be slightly higher than the current yield because of the compounding effect on investment returns.

The Fund has maintained a shorter weighted average maturity (WAM) posture due to our view that the U.S. Federal Reserve (Fed) rate cutting cycle will be slower and shallower relative to market expectations. As a result, the Fund’s principal exposure is to overnight repurchase agreements that are collateralized by U.S. Treasuries and/or government agency mortgage-backed securities. Additionally, the Fund maintained term exposure in the 1 to 7-month maturity range with investments in U.S. Treasuries where we saw opportunities to lock in higher yields. The Fund eliminated its exposure to Federal Home Loan Bank and Federal Farm Credit Bank securities as spreads are now less attractive, in our view.

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

KEY FUND STATISTICS (as of December 31, 2024)

| |

Total Net Assets | $85,805,647 |

Total Number of Portfolio Holdings* | 7 |

Total Management Fee Paid | $214,499 |

| * | Includes derivatives, if applicable. |

| Putnam VT Government Money Market Fund | PAGE 1 | 38922-ATSIA-0225 |

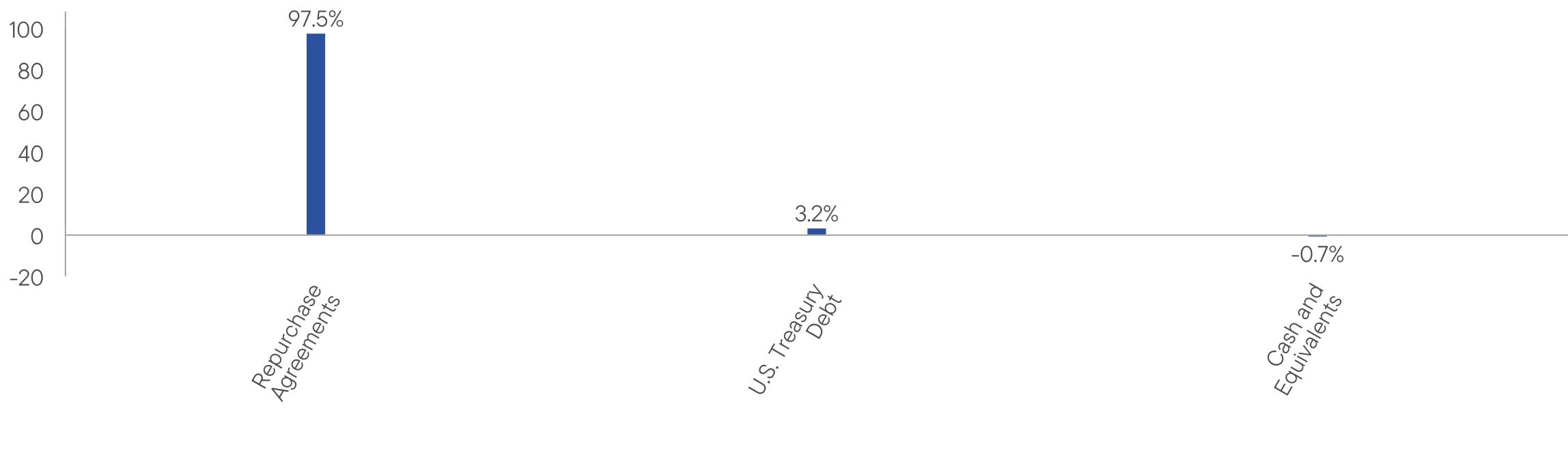

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

Portfolio Composition (% of Total Net Assets)

| Cash and Equivalents, if any, represent the market value weights of cash and other unclassified assets in the portfolio and may show a negative market value percentage as a result of the timing of trade-date and settlement-date transactions. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Templeton”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Templeton to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s then-current sub-advisor, Putnam Investments Limited (“PIL”), an indirect, wholly-owned subsidiary of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Templeton. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and a new sub-advisory contract with PIL. The new contracts were identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL in respect of your Fund. Franklin Advisers is a direct, wholly-owned subsidiary of Franklin Templeton. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

Effective November 1, 2024 (the “Effective Date”), PIL, a sub-advisor of the Fund prior to the Effective Date, merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Templeton (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory agreement between Franklin Advisers and PIL with respect to the Fund was terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Franklin Advisers and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by May 1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam VT Government Money Market Fund | PAGE 2 | 38922-ATSIA-0225 |

97.53.20.7

| | |

Putnam VT Government Money Market Fund | |

Class IB true |

| Annual Shareholder Report | December 31, 2024 |

|

This annual shareholder report contains important information about Putnam VT Government Money Market Fund for the period January 1, 2024, to December 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class IB1 | $71 | 0.69% |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

As of December 31, 2024, the seven-day current yield for Class IB shares of the Putnam VT Government Money Market Fund was 3.93% and the seven-day effective yield was 3.93%. The seven-day current yield represents net interest income generated by the Fund’s investments for the past seven days and assumes income is generated each week over a 365-day period. The seven-day effective yield assumes reinvestment of the coupon (interest payments) and will typically be slightly higher than the current yield because of the compounding effect on investment returns.

The Fund has maintained a shorter weighted average maturity (WAM) posture due to our view that the U.S. Federal Reserve (Fed) rate cutting cycle will be slower and shallower relative to market expectations. As a result, the Fund’s principal exposure is to overnight repurchase agreements that are collateralized by U.S. Treasuries and/or government agency mortgage-backed securities. Additionally, the Fund maintained term exposure in the 1 to 7-month maturity range with investments in U.S. Treasuries where we saw opportunities to lock in higher yields. The Fund eliminated its exposure to Federal Home Loan Bank and Federal Farm Credit Bank securities as spreads are now less attractive, in our view.

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

KEY FUND STATISTICS (as of December 31, 2024)

| |

Total Net Assets | $85,805,647 |

Total Number of Portfolio Holdings* | 7 |

Total Management Fee Paid | $214,499 |

| * | Includes derivatives, if applicable. |

| Putnam VT Government Money Market Fund | PAGE 1 | 38922-ATSIB-0225 |

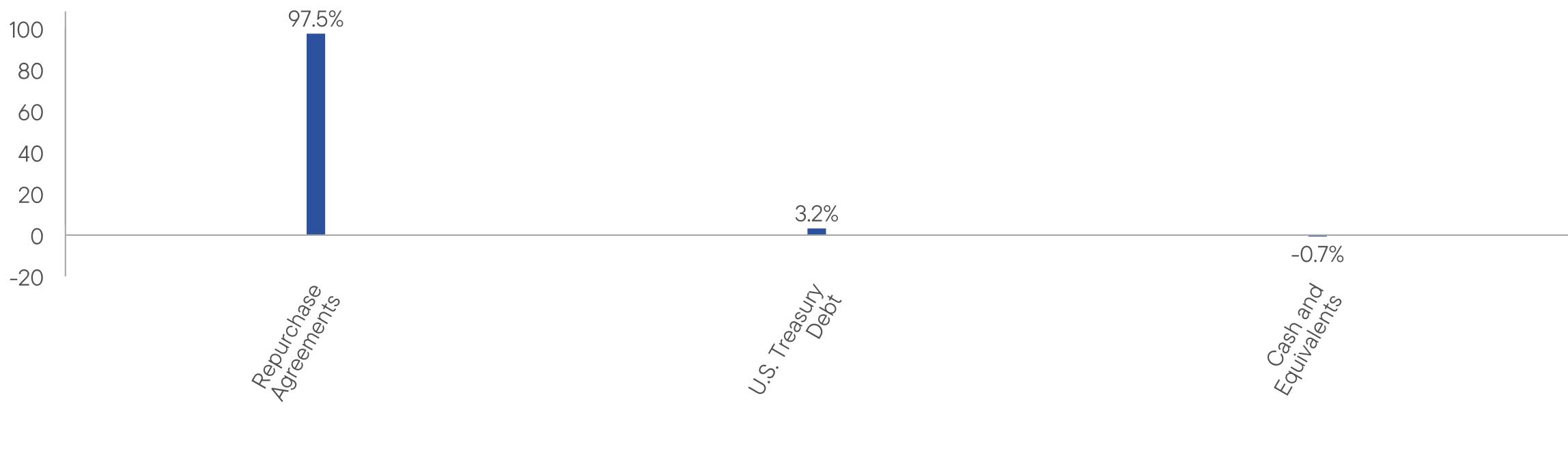

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

Portfolio Composition (% of Total Net Assets)

| Cash and Equivalents, if any, represent the market value weights of cash and other unclassified assets in the portfolio and may show a negative market value percentage as a result of the timing of trade-date and settlement-date transactions. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Templeton”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Templeton to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s then-current sub-advisor, Putnam Investments Limited (“PIL”), an indirect, wholly-owned subsidiary of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Templeton. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and a new sub-advisory contract with PIL. The new contracts were identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL in respect of your Fund. Franklin Advisers is a direct, wholly-owned subsidiary of Franklin Templeton. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

Effective November 1, 2024 (the “Effective Date”), PIL, a sub-advisor of the Fund prior to the Effective Date, merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Templeton (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory agreement between Franklin Advisers and PIL with respect to the Fund was terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Franklin Advisers and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by May 1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam VT Government Money Market Fund | PAGE 2 | 38922-ATSIB-0225 |

97.53.20.7

| |

| (a) The fund’s principal executive, financial and accounting officers are employees of Putnam Investment Management, LLC, the Fund’s investment manager, or Franklin Templeton. As such they are subject to a comprehensive Code of Ethics adopted and administered by Putnam Investment Management, LLC and Franklin Templeton which is designed to protect the interests of the firm and its clients. The Fund has adopted a Code of Ethics which incorporates the Code of Ethics of Franklin Templeton with respect to all of its officers and Trustees who are employees of Putnam Investment Management, LLC and Franklin Templeton. For this reason, the Fund has not adopted a separate code of ethics governing its principal executive, financial and accounting officers. |

| |

| (c) In connection with the acquisition of Putnam Investments by Franklin Templeton, the Putnam Investments Code of Ethics was amended effective January 1, 2024 to reflect revised compliance processes, including: (i) Compliance with the Putnam Investments Code of Ethics will be viewed as compliance with the Franklin Templeton Code for certain Putnam employees who are dual-hatted in Franklin Templeton advisory entities (ii) Certain Franklin Templeton employees are required to hold shares of Putnam mutual funds at Putnam Investor Services, Inc. and (iii) Certain provisions of the Putnam Investments Code of Ethics are amended that are no longer needed due to organizational changes. Effective March 4, 2024, the majority of legacy Putnam employees transitioned to Franklin Templeton policies outlined in the Franklin Templeton Code. |

| |

| Item 3. Audit Committee Financial Expert: |

| |

| The Funds’ Audit, Compliance and Risk Committee is comprised solely of Trustees who are “independent” (as such term has been defined by the Securities and Exchange Commission (“SEC”) in regulations implementing Section 407 of the Sarbanes-Oxley Act (the “Regulations”)). The Trustees believe that each member of the Audit, Compliance and Risk Committee also possesses a combination of knowledge and experience with respect to financial accounting matters, as well as other attributes, that qualifies him or her for service on the Committee. In addition, the Trustees have determined that each of Mr. McGreevey and Mr. Singh qualifies as an “audit committee financial expert” (as such term has been defined by the Regulations) based on their review of his or her pertinent experience and education.The SEC has stated, and the funds’ amended and restated agreement and Declaration of Trust provides, that the designation or identification of a person as an audit committee financial expert pursuant to this Item 3 of Form N-CSR does not impose on such person any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such person as a member of the Audit, Compliance and Risk Committee and the Board of Trustees in the absence of such designation or identification. |

| |

| Item 4. Principal Accountant Fees and Services: |

| |

| The following table presents fees billed in each of the last two fiscal years for services rendered to the fund by the fund’s independent auditor: |

Fiscal year ended | Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

December 31, 2024 | $37,347 | $ — | $3,319 | $ — |

December 31, 2023 | $36,518 | $ — | $3,319 | $ — |

| |

| For the fiscal years ended December 31, 2024 and December 31, 2023, the fund’s independent auditor billed aggregate non-audit fees in the amounts of $867,555 and $363,451 respectively, to the fund, the fund’s investment manager and any entity controlling, controlled by or under common control with the fund’s investment manager that provides ongoing services to the fund. |

| |

| Audit Fees represent fees billed for the fund’s last two fiscal years relating to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements. |

| |

| Audit-Related Fees represent fees billed in the fund’s last two fiscal years for services traditionally performed by the fund’s auditor, including accounting consultation for proposed transactions or concerning financial accounting and reporting standards and other audit or attest services not required by statute or regulation. |

| |

| Tax Fees represent fees billed in the fund’s last two fiscal years for tax compliance, tax planning and tax advice services. Tax planning and tax advice services include assistance with tax audits, employee benefit plans and requests for rulings or technical advice from taxing authorities. |

| |

| Pre-Approval Policies of the Audit, Compliance and Risk Committee. The Audit, Compliance and Risk Committee of the Putnam funds has determined that, as a matter of policy, all work performed for the funds by the funds’ independent auditors will be pre-approved by the Committee itself and thus will generally not be subject to pre-approval procedures. |

| |

| The Audit, Compliance and Risk Committee also has adopted a policy to pre-approve the engagement by the fund’s investment manager and certain of its affiliates of the funds’ independent auditors, even in circumstances where pre-approval is not required by applicable law. Any such requests by the fund’s investment manager or certain of its affiliates are typically submitted in writing to the Committee and explain, among other things, the nature of the proposed engagement, the estimated fees, and why this work should be performed by that particular audit firm as opposed to another one. In reviewing such requests, the Committee considers, among other things, whether the provision of such services by the audit firm are compatible with the independence of the audit firm. |

| |

| The following table presents fees billed by the fund’s independent auditor for services required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2–01 of Regulation S-X. |

Fiscal year ended | Audit-Related Fees | Tax Fees | All Other Fees | Total Non-Audit Fees |

December 31, 2024 | $ — | $791,963 | $72,273 | $864,236 |

December 31, 2023 | $ — | $360,132 | $ — | $360,132 |

| |

| Item 5. Audit Committee of Listed Registrants |

| |

| The registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements and Other Important Information in Item 7 below. |

| |

| Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Putnam

VT Government Money Market

Fund

Financial Statements and Other Important Information

Annual | December 31, 2024

Table of Contents

| | Financial Statements and Other Important Information—Annual | franklintempleton.com |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Putnam Variable Trust and Shareholders of

Putnam VT Government Money Market Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the fund's portfolio, of Putnam VT Government Money Market Fund (one of the funds constituting Putnam Variable Trust, referred to hereafter as the “Fund”) as of December 31, 2024, the related statement of operations for the year ended December 31, 2024, the statement of changes in net assets for each of the two years in the period ended December 31, 2024, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2024 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2024 and the financial highlights for each of the five years in the period ended December 31, 2024 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2024 by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 14, 2025

We have served as the auditor of one or more investment companies in the Putnam Funds family of funds since at least 1957. We have not been able to determine the specific year we began serving as auditor.

| Putnam VT Government Money Market Fund | 1 |

| The fund’s portfolio 12/31/24 |

| | REPURCHASE AGREEMENTS (97.2%)* | Principal amount | Value |

| | Interest in $27,800,000 tri-party repurchase agreement dated 12/31/2024 with Goldman, Sachs & Co. LLC due 1/2/2025 — maturity value of $27,806,888 for an effective yield of 4.460% (collateralized by Agency Mortgage-Backed Securities with a coupon rate of 5.500% and a due date of 9/1/2053, valued at $28,356,001) | $27,800,000 | $27,800,000 |

| | Interest in $300,000,000 joint tri-party repurchase agreement dated 12/31/2024 with JPMorgan Securities, LLC due 1/2/2025 — maturity value of $27,806,888 for an effective yield of 4.460% (collateralized by Agency Mortgage-Backed Securities with coupon rates ranging from 1.500% to 7.000% and due dates ranging from 10/1/2029 to 7/1/2056, valued at $306,075,820) | 27,800,000 | 27,800,000 |

| | Interest in $574,000,000 joint tri-party repurchase agreement dated 12/31/2024 with HSBC Securities (USA), Inc. due 1/2/2025 — maturity value of $27,781,882 for an effective yield of 4.460% (collateralized by Agency Mortgage-Backed Securities with coupon rates ranging from 1.500% to 7.000% and due dates ranging from 6/1/2033 to 12/1/2054, valued at $585,625,069) | 27,775,000 | 27,775,000 |

| | Total repurchase agreements (cost $83,375,000) | $83,375,000 |

| | U.S. TREASURY OBLIGATIONS (3.2%)* | Yield (%) | Maturity date | Principal amount | Value |

| | U.S. Treasury Bills | 5.190 | 1/16/25 | $750,000 | $748,440 |

| | U.S. Treasury FRN | 4.476 | 1/31/25 | 650,000 | 650,037 |

| | U.S. Treasury FRN | 4.445 | 4/30/25 | 700,000 | 700,078 |

| | U.S. Treasury FRN | 4.401 | 7/31/25 | 650,000 | 649,848 |

| | Total U.S. treasury obligations (cost $2,748,403) | $2,748,403 |

| | TOTAL INVESTMENTS |

| | Total investments (cost $86,123,403) | $86,123,403 |

| | Key to holding’s abbreviations |

| | FRN | Floating Rate Notes: The rate shown is the current interest rate or yield at the close of the reporting period. Rates may be subject to a cap or floor. For certain securities, the rate may represent a fixed rate currently in place at the close of the reporting period. |

| | Notes to the fund’s portfolio |

| | Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from January 1, 2024 through December 31, 2024 (the reporting period). Within the following notes to the portfolio, references to “Franklin Advisers” represent Franklin Advisers, Inc., the fund’s investment manager, a direct wholly-owned subsidiary of Franklin Resources, Inc., and references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures. |

| * | Percentages indicated are based on net assets of $85,805,647. |

| | The dates shown on debt obligations are the original maturity dates. |

| | ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows: |

| | Level 1: Valuations based on quoted prices for identical securities in active markets. |

| | Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly. |

| | Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement. |

| | The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period: |

| | | Valuation inputs |

| | Investments in securities: | Level 1 | Level 2 | Level 3 |

| | Repurchase agreements | $— | $83,375,000 | $— |

| | U.S. treasury obligations | — | 2,748,403 | — |

| | Totals by level | $— | $86,123,403 | $— |

The accompanying notes are an integral part of these financial statements.

| 2 |

| Putnam VT Government Money Market Fund |

Financial statements

Statement of assets and liabilities

12/31/24

| Assets | |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $2,748,403) | $2,748,403 |

| Repurchase agreements (identified cost $83,375,000) | 83,375,000 |

| Cash | 10,435 |

| Interest and other receivables | 73,875 |

| Receivable for shares of the fund sold | 114,001 |

| Total assets | 86,321,714 |

| | |

| Liabilities | |

| Payable for shares of the fund repurchased | 344,791 |

| Payable for compensation of Manager (Note 2) | 18,904 |

| Payable for custodian fees (Note 2) | 7,533 |

| Payable for investor servicing fees (Note 2) | 9,615 |

| Payable for Trustee compensation and expenses (Note 2) | 70,481 |

| Payable for administrative services (Note 2) | 658 |

| Payable for distribution fees (Note 2) | 8,813 |

| Payable for auditing and tax fees | 40,679 |

| Other accrued expenses | 14,593 |

| Total liabilities | 516,067 |

| Net assets | $85,805,647 |

| | |

| Represented by | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $85,800,580 |

| Total distributable earnings (Note 1) | 5,067 |

| Total — Representing net assets applicable to capital shares outstanding | $85,805,647 |

| | |

| Computation of net asset value Class IA | |

| Net assets | $42,955,988 |

| Number of shares outstanding | 42,952,401 |

| Net asset value, offering price and redemption price per share (net assets divided by number of shares outstanding) | $1.00 |

| | |

| Computation of net asset value Class IB | |

| Net assets | $42,849,659 |

| Number of shares outstanding | 42,848,166 |

| Net asset value, offering price and redemption price per share (net assets divided by number of shares outstanding) | $1.00 |

The accompanying notes are an integral part of these financial statements.

| Putnam VT Government Money Market Fund | 3 |

Statement of operations

Year ended 12/31/24

| Investment income | |

| Interest | $4,185,612 |

| Total investment income | 4,185,612 |

| | |

| Expenses | |

| Compensation of Manager (Note 2) | 214,499 |

| Investor servicing fees (Note 2) | 55,824 |

| Custodian fees (Note 2) | 10,400 |

| Trustee compensation and expenses (Note 2) | 3,605 |

| Distribution fees (Note 2) | 92,471 |

| Administrative services (Note 2) | 1,446 |

| Auditing and tax fees | 40,852 |

| Other | 23,816 |

| Total expenses | 442,913 |

| Expense reduction (Note 2) | (767) |

| Net expenses | 442,146 |

| Net investment income | 3,743,466 |

| Net increase in net assets resulting from operations | $3,743,466 |

The accompanying notes are an integral part of these financial statements.

| 4 | Putnam VT Government Money Market Fund |

Statement of changes in net assets

| | Year ended 12/31/24 | Year ended 12/31/23 |

| Increase in net assets | | |

| Operations: | | |

| Net investment income | $3,743,466 | $3,221,010 |

| Net increase in net assets resulting from operations | 3,743,466 | 3,221,010 |

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | |

| Class IA | (2,056,231) | (1,829,142) |

| Class IB | (1,683,838) | (1,394,181) |

| Increase from capital share transactions (Note 4) | 6,488,323 | 6,470,116 |

| Total increase in net assets | 6,491,720 | 6,467,803 |

| Net assets: | | |

| Beginning of year | 79,313,927 | 72,846,124 |

| End of year | $85,805,647 | $79,313,927 |

The accompanying notes are an integral part of these financial statements.

| Putnam VT Government Money Market Fund | 5 |

Financial highlights

(For a common share outstanding throughout the period)

| INVESTMENT OPERATIONS: | LESS DISTRIBUTIONS: | RATIOS AND SUPPLEMENTAL DATA: |

| Period ended | Net asset value, beginning of period | Net investment income (loss) | Net realized gain (loss) on investments | Total from investment operations | From net investment income | Total distributions | Net asset value, end of period | Total return at net asset value (%)a,b | Net assets, end of period (in thousands) | Ratio of expenses to average net assets (%)a,c | Ratio of net investment income (loss) to average net assets (%) |

| Class IA |

| 12/31/24 | $1.00 | .0482 | — | .0482 | (.0481) | (.0481) | $1.00 | 4.93 | $42,956 | .44 | 4.81 |

| 12/31/23 | 1.00 | .0459 | — | .0459 | (.0460) | (.0460) | 1.00 | 4.70 | 41,775 | .47 | 4.60 |

| 12/31/22 | 1.00 | .0129 | —d | .0129 | (.0128) | (.0128) | 1.00 | 1.29 | 41,354 | .35e | 1.28e |

| 12/31/21 | 1.00 | .0001 | —d | .0001 | (.0001) | (.0001) | 1.00 | .01 | 40,968 | .07e | .01e |

| 12/31/20 | 1.00 | .0024 | —d | .0024 | (.0024) | (.0024) | 1.00 | .24 | 48,536 | .26e | .22e |

| Class IB |

| 12/31/24 | $1.00 | .0457 | — | .0457 | (.0456) | (.0456) | $1.00 | 4.67 | $42,850 | .69 | 4.56 |

| 12/31/23 | 1.00 | .0434 | — | .0434 | (.0435) | (.0435) | 1.00 | 4.44 | 37,539 | .72 | 4.35 |

| 12/31/22 | 1.00 | .0112 | —d | .0112 | (.0112) | (.0112) | 1.00 | 1.12 | 31,492 | .51e | 1.08e |

| 12/31/21 | 1.00 | .0001 | —d | .0001 | (.0001) | (.0001) | 1.00 | .01 | 34,424 | .07e | .01e |

| 12/31/20 | 1.00 | .0019 | —d | .0019 | (.0019) | (.0019) | 1.00 | .19 | 38,903 | .32e | .20e |

| a | The charges and expenses at the insurance company separate account level are not reflected. |

| b | Total return assumes dividend reinvestment. |

| c | Includes amounts paid through expense offset arrangements, if any (Note 2). Also excludes acquired fund fees and expenses, if any. |

| d | Amount represents less than $0.0001 per share. |

| e | Reflects a voluntary waiver of certain fund expenses in effect during the period relating to the enhancement of certain annualized net yields of the fund. As a result of such waivers, the expenses of each class reflect a reduction of the following amounts as a percentage of average net assets (Note 2): |

| | 12/31/22 | 12/31/21 | 12/31/20 |

| Class IA | 0.13% | 0.37% | 0.18% |

| Class IB | 0.21 | 0.62 | 0.38 |

The accompanying notes are an integral part of these financial statements.

| 6 |

| Putnam VT Government Money Market Fund |

Notes to financial statements 12/31/24

Unless otherwise noted, the “reporting period” represents the period from January 1, 2024 through December 31, 2024. The following table defines commonly used references within the Notes to financial statements:

| References to | Represent |

| 1940 Act | Investment Company Act of 1940, as amended |

| Franklin Advisers | Franklin Advisers, Inc., a direct wholly-owned subsidiary of Franklin Templeton, and the fund’s investment manager for periods on or after July 15, 2024 |

| Franklin Distributors | Franklin Distributors, LLC, an indirect wholly-owned subsidiary of Franklin Templeton, and the fund’s distributor and principal underwriter for periods on or after August 2, 2024 |

| Franklin Templeton | Franklin Resources, Inc. |

| Franklin Templeton Services | Franklin Templeton Services, LLC, a wholly-owned subsidiary of Franklin Templeton |

| FTIML | Franklin Templeton Investment Management Limited |

| JPMorgan | JPMorgan Chase Bank, N.A. |

| PIL | Putnam Investments Limited, an indirect wholly-owned subsidiary of Franklin Templeton |

| PSERV | Putnam Investor Services, Inc., a wholly-owned subsidiary of Franklin Templeton |

| Putnam Management | Putnam Investment Management, LLC, an indirect wholly-owned subsidiary of Franklin Templeton, and the fund’s investment manager for periods prior to July 15, 2024 |

| Putnam Retail Management | Putnam Retail Management Limited Partnership, an indirect wholly-owned subsidiary of Franklin Templeton, and the fund’s distributor and principal underwriter for periods prior to August 2, 2024 |

| SEC | Securities and Exchange Commission |

| State Street | State Street Bank and Trust Company |

Putnam VT Government Money Market Fund (the fund) is a diversified series of Putnam Variable Trust (the Trust), a Massachusetts business trust registered under the 1940 Act as an open-end management investment company. The goal of the fund is to seek as high a rate of current income as the fund’s investment manager believes is consistent with preservation of capital and maintenance of liquidity. The fund invests at least 99.5 percent of the fund’s total assets in cash, U.S. government securities and repurchase agreements that are fully collateralized by U.S. government securities or cash. The fund invests mainly in debt securities that are obligations of the U.S. government, its agencies and instrumentalities and accordingly are backed by the full faith and credit of the United States (e.g., U.S. Treasury bills) or by the credit of a federal agency or government-sponsored entity (e.g., securities issued by Fannie Mae and Freddie Mac). The U.S. government securities in which the fund invests may also include variable and floating rate instruments and when-issued and delayed delivery securities (i.e., payment or delivery of the securities occurs at a future date for a predetermined price). Under normal circumstances, the fund invests at least 80% of the fund’s net assets in U.S. government securities and repurchase agreements that are fully collateralized by U.S. government securities. This policy may be changed only after 60 days’ notice to shareholders. The securities purchased by the fund are subject to quality, maturity, diversification and other requirements pursuant to rules promulgated by the SEC. The fund’s investment manager may consider, among other factors, credit and interest rate risks and characteristics of the issuer or counterparty, as well as general market conditions, when deciding whether to buy or sell investments.

The fund offers class IA and class IB shares of beneficial interest. Class IA shares are offered at net asset value and are not subject to a distribution fee. Class IB shares are offered at net asset value and pay an ongoing distribution fee, which is identified in Note 2.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

The fund has entered into contractual arrangements with an investment adviser, administrator, distributor, shareholder servicing agent and custodian, who each provide services to the fund. Unless expressly stated otherwise, shareholders are not parties to, or intended beneficiaries of these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the fund.

Under the Trust’s Agreement and Declaration of Trust, any claims asserted by a shareholder against or on behalf of the Trust (or its series), including claims against Trustees and Officers, must be brought in courts located within the Commonwealth of Massachusetts.

Note 1: Significant accounting policies

The fund follows the accounting and reporting guidance in Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP), including, but not limited to, ASC 946. The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Investment income, realized gains and losses and expenses of the fund are borne pro-rata based on the relative net assets of each class to the total net assets of the fund, except that each class bears expenses unique to that class (including the distribution fees applicable to such classes). Each class votes as a class only with respect to its own distribution plan or other matters on which a class vote is required by law or determined by the Trustees. Shares of each class would receive their pro-rata share of the net assets of the fund, if the fund were liquidated. In addition, the Trustees declare separate dividends on each class of shares.

Security valuation Portfolio securities and other investments are valued using policies and procedures adopted by the Board of Trustees (Trustees). The Trustees have formed a Pricing Committee to oversee the implementation of these procedures. Under compliance policies and procedures approved by the Trustees, the Trustees have designated the fund’s investment manager as the valuation designee and has responsibility for oversight of valuation. The investment manager is assisted by the fund’s administrator in performing this responsibility, including leading the cross-functional Valuation Committee (VC). The VC is responsible for making fair value determinations, evaluating the effectiveness of the pricing policies of the fund and reporting to the Trustees.

The valuation of the fund’s portfolio instruments is determined by means of the amortized cost method (which approximates fair value) as set forth in Rule 2a–7 under the 1940 Act. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity and is generally categorized as a Level 2 security.

Joint trading account Pursuant to an exemptive order from the SEC, the fund may transfer uninvested cash balances into a joint trading account along with the cash of other registered investment companies and certain other accounts managed by Franklin Advisers. These balances may be invested in issues of short-term investments having maturities of up to 90 days.

Repurchase agreements The fund, or any joint trading account, through its custodian, receives delivery of the underlying securities, the fair value of which at the time of purchase is required to be in an amount at least equal to the resale price, including accrued interest. Collateral for certain tri-party repurchase agreements, which totaled $85,056,547 at the end of the reporting period, is held at the counterparty’s custodian in a segregated account for the benefit of the fund and the counterparty. Franklin Advisers is responsible for determining that the value of these underlying securities is at all times at least equal to the resale price, including accrued interest. In the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Interest income, including amortization and accretion of premiums and discounts, is recorded on the accrual basis. Gains or losses on securities sold are determined on the identified cost basis.

| Putnam VT Government Money Market Fund |

| 7 |

Interfund lending The fund, along with other Putnam funds, may participate in an interfund lending program pursuant to an exemptive order issued by the SEC. This program allows the fund to lend to other Putnam funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. Interest earned or paid on the interfund lending transaction will be based on the average of certain current market rates. During the reporting period, the fund did not utilize the program.

Lines of credit Prior to January 31, 2025, the fund participated, along with other Putnam funds, in a $320 million syndicated unsecured committed line of credit, provided by State Street ($160 million) and JPMorgan ($160 million), and a $235.5 million unsecured uncommitted line of credit, provided by State Street. Borrowings could be made for temporary or emergency purposes, including the funding of shareholder redemption requests and trade settlements. Interest is charged to the fund based on the fund’s borrowing at a rate equal to 1.25% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the committed line of credit and 1.30% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the uncommitted line of credit. A closing fee equal to 0.04% of the committed line of credit and 0.04% of the uncommitted line of credit was paid by the participating funds and a $75,000 fee was paid by the participating funds to State Street as agent of the syndicated committed line of credit. In addition, a commitment fee of 0.21% per annum on any unutilized portion of the committed line of credit is allocated to the participating funds based on their relative net assets and paid quarterly. During the reporting period, the fund had no borrowings against these arrangements.

Effective January 31, 2025, the fund, together with other U.S. registered and foreign investment funds managed by an affiliate of Franklin Templeton are borrowers in a joint syndicated senior unsecured credit facility totaling $2.995 billion, which matures on January 30, 2026.

Federal taxes It is the policy of the fund to distribute all of its taxable income within the prescribed time period and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicable to regulated investment companies.

The fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (ASC 740). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The fund did not have a liability to record for any unrecognized tax benefits in the accompanying financial statements. No provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains. Each of the fund’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

Distributions to shareholders Income dividends are recorded daily by the fund and are paid monthly. Distributions from capital gains, if any, are paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. For the reporting period, there were no material temporary or permanent differences. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations. At the close of the reporting period, the fund required no such reclassifications.

Tax cost of investments includes adjustments to net unrealized appreciation (depreciation) which may not necessarily be final tax cost basis adjustments, but closely approximate the tax basis unrealized gains and losses that may be realized and distributed to shareholders. The tax basis components of distributable earnings and the federal tax cost as of the close of the reporting period were as follows:

| Undistributed ordinary income | $3,882 |

The aggregate identified cost on a financial reporting and tax basis is the same.

Expenses of the Trust Expenses directly charged or attributable to any fund will be paid from the assets of that fund. Generally, expenses of the Trust will be allocated among and charged to the assets of each fund on a basis that the Trustees deem fair and equitable, which may be based on the relative assets of each fund or the nature of the services performed and relative applicability to each fund.

Beneficial interest At the close of the reporting period, insurance companies or their separate accounts were record owners of all but a de minimis number of the shares of the fund. Approximately 37.5% of the fund is owned by accounts of one insurance company.

Note 2: Management fee, administrative services and other transactions

Effective July 15, 2024, Putnam Management transferred its management contract with the fund to Franklin Advisers. As a result of the transfer, Franklin Advisers replaced Putnam Management as the investment adviser of the fund. In connection with the transfer, the fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers.

In addition, Putnam Management transferred to Franklin Advisers the sub-management contract between Putnam Management and PIL in respect of the fund.

The fund pays Franklin Advisers a management fee (based on the fund’s average net assets and computed and paid monthly) at annual rates that may vary based on the average of the aggregate net assets of all open-end mutual funds sponsored by Putnam Management (including open-end funds managed by affiliates of Putnam Management that have been deemed to be sponsored by Putnam Management for this purpose) (excluding net assets of such funds that are invested in, or that are invested in by, other such funds to the extent necessary to avoid “double counting” of those assets). Such annual rates may vary as follows:

| 0.440% | of the first $5 billion, |

| 0.390% | of the next $5 billion, |

| 0.340% | of the next $10 billion, |

| 0.290% | of the next $10 billion, |

| 0.240% | of the next $50 billion, |

| 0.220% | of the next $50 billion, |

| 0.210% | of the next $100 billion and |

| 0.205% | of any excess thereafter. |

For the reporting period, the management fee represented an effective rate (excluding the impact from any expense waivers in effect) of 0.269% of the fund’s average net assets.

Franklin Advisers has contractually agreed, through April 30, 2026, to waive fees and/or reimburse the fund’s expenses to the extent necessary to limit the cumulative expenses of the fund, exclusive of brokerage, interest, taxes, investment-related expenses, extraordinary expenses, acquired fund fees and expenses and payments under the fund’s investor servicing contract, investment management contract and distribution plan, on a fiscal year-to-date basis to an annual rate of 0.20% of the fund’s average net assets over such fiscal year-to-date period. During the reporting period, the fund’s expenses were not reduced as a result of this limit.

Franklin Advisers may from time to time voluntarily undertake to waive fees and/or reimburse certain fund expenses in order to enhance the annualized net yield for the fund. Any such waiver or reimbursement would be voluntary and may be modified or discontinued by Franklin Advisers at any time without notice. For the reporting period, Franklin Advisers did not waive any specific distribution fees from the fund.

Effective July 15, 2024, Franklin Advisers retained Putnam Management as sub-advisor for the fund pursuant to a new sub-advisory agreement. Pursuant to the agreement, Putnam Management provides certain advisory and related services to the fund. Franklin Advisers pays a monthly fee to Putnam Management based on the costs of Putnam Management in providing these services to the fund, which may include a mark-up not to exceed 15% over such costs.

Effective November 1, 2024, FTIML is authorized by the Trustees to manage a separate portion of the assets of the fund as determined by Franklin Advisers from time to time. FTIML did not manage any portion of the assets of the fund during the reporting period. If Franklin Advisers were to engage the services of FTIML, Franklin Advisers (and not the fund) would pay a monthly sub-management fee to FTIML for its services at an annual rate of 0.20% of the average net assets of the portion of the fund managed by FTIML.

Prior to November 1, 2024, PIL was authorized by the Trustees to manage a separate portion of the assets of the fund as determined by Franklin Advisers from time to time. PIL did not manage any portion of the assets of the fund during the reporting period. If Franklin Advisers had engaged the services of PIL, Franklin Advisers (and not the fund) would have paid a quarterly sub-management fee to PIL for its services at an annual rate of 0.20% of the average net assets of the portion of the fund managed by PIL. Effective November 1, 2024, PIL merged into FTIML, and PIL investment professionals became employees of FTIML.

| 8 |

| Putnam VT Government Money Market Fund |

Effective June 1, 2024, Franklin Templeton Services provides certain administrative services to the fund. The fee for those services is paid by the fund’s investment manager based on the fund’s average daily net assets and is not an additional expense of the fund.

The fund reimburses Franklin Advisers an allocated amount for the compensation and related expenses of certain officers of the fund and their staff who provide administrative services to the fund. The aggregate amount of all such reimbursements is determined annually by the Trustees.

Custodial functions for the fund’s assets are provided by State Street. Custodian fees are based on the fund’s asset level, the number of its security holdings and transaction volumes.

PSERV, an affiliate of Franklin Advisers, provides investor servicing agent functions to the fund. PSERV was paid a monthly fee for investor servicing at an annual rate of 0.07% of the fund’s average daily net assets. During the reporting period, the expenses for each class of shares related to investor servicing fees were as follows:

| Class IA | $29,943 |

| Class IB | 25,881 |

| Total | $55,824 |

The fund has entered into expense offset arrangements with PSERV and State Street whereby PSERV’s and State Street’s fees are reduced by credits allowed on cash balances. For the reporting period, the fund’s expenses were reduced by $767 under the expense offset arrangements.

Each Independent Trustee of the fund receives an annual Trustee fee, of which $55 as a quarterly retainer, has been allocated to the fund, and an additional fee for each Trustees meeting attended. Trustees also are reimbursed for expenses they incur relating to their services as Trustees.

The fund has adopted a Trustee Fee Deferral Plan (the Deferral Plan) which allows the Trustees to defer the receipt of all or a portion of Trustees fees payable from July 1, 1995 through December 31, 2023. The deferred fees remain invested in certain Putnam funds until distribution in accordance with the Deferral Plan.

The fund has adopted an unfunded noncontributory defined benefit pension plan (the Pension Plan) covering all Trustees of the fund who have served as a Trustee for at least five years and were first elected prior to 2004. Benefits under the Pension Plan are equal to 50% of the Trustee’s average annual attendance and retainer fees for the three years ended December 31, 2005. The retirement benefit is payable during a Trustee’s lifetime, beginning the year following retirement, for the number of years of service through December 31, 2006. Pension expense for the fund is included in Trustee compensation and expenses in the Statement of operations. Accrued pension liability is included in Payable for Trustee compensation and expenses in the Statement of assets and liabilities. The Trustees have terminated the Pension Plan with respect to any Trustee first elected after 2003.

The fund has adopted a distribution plan (the Plan) with respect to its class IB shares pursuant to Rule 12b–1 under the 1940 Act. The purpose of the Plan is to compensate Franklin Distributors, or prior to August 2, 2024, Putnam Retail Management, for services provided and expenses incurred in distributing shares of the fund. The Plan provides for payment by the fund to Franklin Distributors and to Putnam Retail Management at an annual rate of up to 0.35% of the average net assets attributable to the fund’s class IB shares. The Trustees have approved payment by the fund at an annual rate of 0.25% of the average net assets attributable to the fund’s class IB shares. The expenses related to distribution fees during the reporting period are included in Distribution fees in the Statement of operations and were paid out as follows:

| Franklin Distributors | $38,915 |

| Putnam Retail Management | 53,556 |

| Total | $92,471 |

Note 3: Purchases and sales of securities

During the reporting period, the cost of purchases and the proceeds from sales (including maturities) of investment securities (all short-term obligations) aggregated $17,283,161,275 and $17,276,676,720, respectively. The fund may purchase or sell investments from or to other Putnam funds in the ordinary course of business, which can reduce the fund’s transaction costs, at prices determined in accordance with SEC requirements and policies approved by the Trustees. During the reporting period, purchases or sales from or to other Putnam funds, if any, did not represent more than 5% of the fund’s total cost of purchases and/or total proceeds from sales.

Note 4: Capital shares

At the close of the reporting period, there were an unlimited number of shares of beneficial interest authorized. Subscriptions and redemptions are presented at the omnibus level. Transactions in capital shares were as follows:

| | Class IA shares | Class IB shares |

| | Year ended 12/31/24 | Year ended 12/31/23 | Year ended 12/31/24 | Year ended 12/31/23 |

| | Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount |

| Shares sold | 24,098,021 | $24,098,021 | 18,302,582 | $18,302,582 | 14,642,690 | $14,642,690 | 14,281,480 | $14,281,480 |

| Shares issued in connection with reinvestment of distributions | 2,056,231 | 2,056,231 | 1,829,142 | 1,829,142 | 1,683,838 | 1,683,838 | 1,394,181 | 1,394,181 |

| | 26,154,252 | 26,154,252 | 20,131,724 | 20,131,724 | 16,326,528 | 16,326,528 | 15,675,661 | 15,675,661 |

| Shares repurchased | (24,975,084) | (24,975,084) | (19,710,438) | (19,710,438) | (11,017,373) | (11,017,373) | (9,626,831) | (9,626,831) |

| Net increase | 1,179,168 | $1,179,168 | 421,286 | $421,286 | 5,309,155 | $5,309,155 | 6,048,830 | $6,048,830 |

Note 5: Market, credit and other risks

In the normal course of business, the fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to changes in the market (market risk) or failure of the contracting party to the transaction to perform (credit risk). The fund may be exposed to additional credit risk that an institution or other entity with which the fund has unsettled or open transactions will default.

| Putnam VT Government Money Market Fund |

| 9 |

Note 6: Offsetting of financial and derivative assets and liabilities

The following table summarizes any derivatives, repurchase agreements and reverse repurchase agreements, at the end of the reporting period, that are subject to an enforceable master netting agreement or similar agreement. For securities lending transactions or borrowing transactions associated with securities sold short, if any, see Note 1. For financial reporting purposes, the fund does not offset financial assets and financial liabilities that are subject to the master netting agreements in the Statement of assets and liabilities.

| | | | | |

| | Goldman, Sachs & Co. | HSBC Bank USA, National Association | JPMorgan Securities LLC | Total |

| Assets: | | | | |

| Repurchase agreements ** | $27,800,000 | $27,775,000 | $27,800,000 | $83,375,000 |

| Total Assets | $27,800,000 | $27,775,000 | $27,800,000 | $83,375,000 |

| Total Financial and Derivative Net Assets | $27,800,000 | $27,775,000 | $27,800,000 | $83,375,000 |

| Total collateral received (pledged) †## | $27,800,000 | $27,775,000 | $27,800,000 | |

| Net amount | $— | $— | $— | |

| Controlled collateral received (including TBA commitments)** | $— | $— | $— | $— |

| Uncontrolled collateral received | $28,356,001 | $28,337,520 | $28,363,026 | $85,056,547 |

| Collateral (pledged) (including TBA commitments)** | $— | $— | $— | $— |

| ** | Included with Investments in securities on the Statement of assets and liabilities. |

| † | Additional collateral may be required from certain brokers based on individual agreements. |

| ## | Any over-collateralization of total financial and derivative net assets is not shown. Collateral may include amounts related to unsettled agreements. |

Note 7: Operating segments

The fund has adopted the Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2023-07, Segment Reporting (Topic 280) - Improvements to Reportable Segment Disclosures. The update is limited to disclosure requirements and does not impact the fund’s financial position or results of operations.

The fund operates as a single operating segment, which is an investment portfolio. The fund’s investment manager serves as the Chief Operating Decision Maker (CODM), evaluating fund-wide results and performance under a unified investment strategy. The CODM uses these measures to assess fund performance and allocate resources effectively. Internal reporting provided to the CODM aligns with the accounting policies and measurement principles used in the financial statements.

For information regarding segment assets, segment profit or loss, and significant expenses, refer to the Statement of assets and liabilities and the Statement of operations, along with the related notes to the financial statements. The fund’s portfolio provides details of the fund’s investments that generate returns such as interest, dividends, and realized and unrealized gains or losses. Performance metrics, including portfolio turnover and expense ratios, are disclosed in the Financial highlights.

| 10 |

| Putnam VT Government Money Market Fund |

Changes in and disagreements with accountants

Not applicable

Results of any shareholder votes

Not applicable

Remuneration paid to directors, officers, and others

Remuneration paid to directors, officers, and others is included in the Notes to financial statements above.

| Putnam VT Government Money Market Fund |

| 11 |

Board approval of management and subadvisory agreements (Unaudited)

At its meeting on September 27, 2024, the Board of Trustees of your fund, including all of the Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Putnam mutual funds, closed-end funds and exchange-traded funds (collectively, the “funds”) (the “Independent Trustees”), approved a new Sub-Advisory Agreement with respect to your fund (the “New FTIML Sub-Advisory Agreement”) between Franklin Advisers, Inc. (“Franklin Advisers”) and its affiliate, Franklin Templeton Investment Management Limited (“FTIML”). Franklin Advisers and FTIML are each direct or indirect, wholly-owned subsidiaries of Franklin Resources, Inc. (“Franklin Templeton”). (Because FTIML is an affiliate of Franklin Advisers and Franklin Advisers remains fully responsible for all services provided by FTIML, the Trustees did not attempt to evaluate FTIML as a separate entity.)

The Board of Trustees, with the assistance of its Contract Committee (which consists solely of Independent Trustees) and its independent legal counsel (as that term is defined in Rule 0-1(a)(6)(i) under the 1940 Act), requested and evaluated all information it deemed reasonably necessary under the circumstances in connection with its review of the New FTIML Sub-Advisory Agreement. At its September 2024 meeting, the Contract Committee met with representatives of Franklin Templeton, and separately in executive session, to consider the information provided. At the September Trustees’ meetings, the Contract Committee also met in executive session with the other Independent Trustees to discuss its observations and recommendations. Throughout this process, the Contract Committee was assisted by the members of the Board of Trustees’ independent staff and by independent legal counsel for the Independent Trustees.

Considerations in connection with the Trustees’ approval of the New FTIML Sub-Advisory Agreement

The Trustees considered the proposed New FTIML Sub-Advisory Agreement in connection with the planned November 1, 2024 merger (the “Merger”) of Putnam Investments Limited (“PIL”), an affiliate of Franklin Advisers and a sub-adviser to your fund prior to the Merger, with and into FTIML. The Trustees considered that, in connection with the Merger, PIL investment professionals would become employees of FTIML, and, upon consummation of the Merger, PIL would cease to exist as a separate legal entity.

The Trustees noted that Franklin Templeton viewed the Merger as a further step in the integration of the legacy Putnam and Franklin Templeton organizations, offering potential operational efficiencies and enhanced investment resources for the funds. The Trustees also considered, among other factors, that:

• The Merger and the New FTIML Sub-Advisory Agreement would not result in any reduction or material change in the nature or the level of the sub-advisory services provided to the funds;

• The PIL portfolio managers who are responsible for the day-to-day management of the applicable funds would be the same immediately prior to, and immediately after, the Merger, and these investment personnel would have access to the same research and other resources to support their respective investment advisory functions and operate under the same conditions both immediately before and after the Merger;

• Despite a change in the sub-advisory fee structure for certain funds, the New FTIML Sub-Advisory Agreement would not result in an increase in the advisory fee rates payable by each fund, as Franklin Advisers would be responsible for overseeing the investment advisory services provided to the applicable funds by FTIML under the New FTIML Sub-Advisory Agreement and would compensate FTIML for such services out of the fees it receives under each fund’s Management Contract with Franklin Advisers; and

• The terms of the New FTIML Sub-Advisory Agreement were substantially similar to those under the sub-management contract between Franklin Advisers and PIL with respect to the fund (the “PIL Sub-Management Contract”). 1

The Trustees also considered that, prior to the Merger, counsel to Franklin Advisers and FTIML had provided a legal opinion that the Merger and the appointment of FTIML as sub-adviser to the funds would not result in an “assignment” under the 1940 Act of the PIL Sub-Management Contract and that the New FTIML Sub-Advisory Agreement did not require shareholder approval.

The Trustees also took into account that they had most recently approved the fund’s PIL Sub-Management Contract in June 2024. Because, other than the parties to the contract, the revised sub-advisory fee structure for certain funds, and certain other non-substantive changes to contractual terms, the New FTIML Sub-Advisory Agreement was substantially similar to the PIL Sub-Management Contract, the Trustees relied to a considerable extent on their previous approval of the PIL Sub-Management Contract.

Board of Trustees’ Conclusions

After considering the factors described above, as well as other factors, the Board of Trustees, including all of the Independent Trustees, concluded that the fees payable under the New FTIML Sub-Advisory Agreement represented reasonable compensation in light of the nature and quality of the services that would be provided to the funds, and determined to approve the New FTIML Sub-Advisory Agreement for your fund. These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor.

1 The New PIL Sub-Management Contract was operative until the effective date of the Merger, November 1, 2024, and was replaced by the New FTIML Sub-Advisory Agreement effective as of that date.

| 12 |

| Putnam VT Government Money Market Fund |

| |

| | |

| © 2024 Franklin Templeton. All rights reserved. | 38922-AFSOI 2/25 |

| |

| Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies. |

| |

| Included in Item 7 above. |

| |

| Item 9. Proxy Disclosure for Open-End Management Investment Companies. |

| |

| Included in Item 7 above. |

| |

| Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies. |

| |

| Included in Item 7 above. |

| |

| Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract. |

| |

| Included in Item 7 above. |

| |

| Item 12. Disclosure of Proxy Voting Policies and Procedures For Closed-End Management Investment Companies: |

| |

| Item 13. Portfolio Managers of Closed-End Investment Companies |

| |

| Item 14. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers: |

| |

| Item 15. Submission of Matters to a Vote of Security Holders: |

| |

| Item 16. Controls and Procedures: |

| |

| (a) The registrant’s principal executive officer and principal financial officer have concluded, based on their evaluation of the effectiveness of the design and operation of the registrant’s disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the design and operation of such procedures are generally effective to provide reasonable assurance that information required to be disclosed by the registrant in this report is recorded, processed, summarized and reported within the time periods specified in the Commission’s rules and forms. |

| |

| (b) Changes in internal control over financial reporting: Not applicable |

| |

| Item 17. Disclosures of Securities Lending Activities for Closed-End Investment Companies: |

| |

| Item 18. Recovery of Erroneously Awarded Compensation. |

| |

| (a)(1) The Code of Ethics of The Putnam Funds and Franklin Templeton are filed herewith. |

| |

| (a)(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed. |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. |

| |

| By (Signature and Title): |

| |

| Jeffrey White

Principal Accounting Officer |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| |

| By (Signature and Title): |

| |

| Jonathan S. Horwitz

Principal Executive Officer |

| |

| By (Signature and Title): |

| |

| Jeffrey White

Principal Financial Officer |