UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Peter V. Bonanno, Esq. | | Geoffrey R.T. Kenyon, Esq. |

Goldman, Sachs & Co. | | Dechert LLP |

200 West Street | | 200 Clarendon Street |

New York, New York 10282 | | 27th Floor |

| | Boston, MA 02116-5021 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2012

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | April 30, 2012 |

| | |

| | | | Structured International Equity Funds |

| | | | Structured Emerging Markets Equity |

| | | | Structured International Equity |

| | | | Structured International Small Cap |

Goldman Sachs Structured International

Equity Funds

| n | | STRUCTURED EMERGING MARKETS EQUITY |

| n | | STRUCTURED INTERNATIONAL EQUITY |

| n | | STRUCTURED INTERNATIONAL SMALL CAP |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 2 | |

| |

Market Review | | | 3 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 6 | |

| |

Schedules of Investments | | | 21 | |

| |

Financial Statements | | | 46 | |

| |

Financial Highlights | | | 50 | |

| |

Notes to the Financial Statements | | | 56 | |

| |

Other Information | | | 72 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS STRUCTURED INTERNATIONAL EQUITY FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectus.

The Goldman Sachs Structured Emerging Markets Equity Fund invests primarily in a diversified portfolio of equity investments in emerging country issuers. The Fund’s investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular industry sectors and/or general economic conditions. Foreign and emerging markets securities may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuations and adverse economic and political developments. The securities markets of emerging countries have less government regulation and are subject to less extensive accounting and financial reporting requirements than the markets of more developed countries. Such securities are also subject to foreign custody risk. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all. The Investment Adviser’s use of quantitative models to execute investment strategy may fail to produce the intended result. Different investment styles (e.g., “quantitative”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

The Goldman Sachs Structured International Equity Fund invests primarily in a broadly diversified portfolio of equity investments in companies that are organized outside the United States or whose securities are principally traded outside the United States. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular industry sectors and/or general economic conditions. Foreign and emerging market securities may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments. The Investment Adviser’s use of quantitative models to execute investment strategy may fail to produce the intended result. Different investment styles (e.g., “quantitative”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

The Goldman Sachs Structured International Small Cap Fund invests primarily in a diversified portfolio of equity investments in non-U.S. small-capitalization companies. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular industry sectors and/or general economic conditions. Foreign and emerging market securities may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements.

1

GOLDMAN SACHS STRUCTURED INTERNATIONAL EQUITY FUNDS

Goldman Sachs’ Structured International Equity Investment Process

| n | | Comprehensive – We forecast returns on over 8,000 international stocks and 43 equity markets on a daily basis. |

| n | | Rigorous – We evaluate stocks and countries based on fundamental investment criteria that have outperformed historically. |

| n | | Objective – Our stock and country selection process is free from emotion that may lead to biased investment decisions. |

| n | | Our computer optimization process allocates risk to our best investment ideas and constructs funds that strive to neutralize systematic risks and deliver better returns. |

| n | | We use unique, proprietary risk models that are designed to be more precise, more focused and faster to respond because they seek to identify, track and manage risk specific to our process, using daily data. |

Fully invested, well-diversified international portfolio that seeks to:

| n | | Blend top-down market views with bottom-up stock selection. |

| n | | Maintain style, sector, risk and capitalization characteristics similar to the benchmark. |

| n | | Achieve excess returns by taking many small diversified stock positions. Additionally, in the GS Structured Emerging Markets Equity Fund and the GS Structured International Equity Fund we take intentional country bets. |

Enhancements Made to Proprietary Quantitative Model during the Six-Month Period Ended April 30, 2012

We continuously look for ways to improve our investment process. Accordingly, we introduced a number of enhancements to our proprietary quantitative model during the six-month period ended April 30, 2012.

We introduced a new short-term model to our stock selection process during the first quarter of 2012. We plan to use this short-term model, which forecasts potential returns using three-month to 12-month time horizons, to help us make long-term investment decisions and determine when to buy or sell securities. In addition, we implemented enhancements to our country/currency selection process. In seeking to make our models more effective in a variety of market environments, we enhanced the way we expressed our active views by modeling unhedged equity returns directly, rather than modeling our currency and currency-hedged equity views separately. This enhancement should help us match the Funds’ portfolios more closely with our optimal views. During the first calendar quarter, we also introduced country-specific views to increase the flexibility of our process. We believe the incorporation of these country-specific views should enhance performance consistency, especially during periods of unexpected market disruption.

2

MARKET REVIEW

Goldman Sachs Structured International

Equity Funds

Market Review

Global stock markets advanced during the six-month period ended April 30, 2012 (the “Reporting Period”), with a sharp rally during the first two months of 2012 more than offsetting weakness at the beginning and the end of the Reporting Period.

During November and December 2011, international equities and emerging market equities retreated in response to slowing global economic growth and the worsening of Europe’s sovereign debt crisis. Concern about the outlook for global economic growth was exacerbated by a drop in China’s inflation rate, which fell from 6.1% in September to 5.5% in October, and a slowdown in Chinese industrial production. In addition, the euro and many emerging market currencies declined against the U.S. dollar, further weakening equity returns as measured in U.S. dollars. The Greek and Italian governments were replaced by technocrats; credit conditions for banks tightened; and yields on Italian and Spanish government debt hovered near unsustainable levels. Japanese equities generally lagged the broader international equity market despite the announcement that Japan’s economy had grown at an annualized pace of 6% during the third quarter of 2011.

The international equity and emerging equity markets rallied broadly during January and February 2012, as sentiment about the global economy improved and investors started to rotate into riskier assets. Gains extended through March 2012 amidst growing optimism that the U.S. economy was recovering and that Europe might eventually be able to stem its sovereign debt crisis. Despite widespread downgrades of sovereign debt by Standard & Poor’s, European equity markets reflected optimism that a financial crisis could be averted through liquidity provided by the European Central Bank’s longer-term refinancing operation (“LTRO”) and the proposal of a “fiscal compact” for the European Monetary Union.

The emerging equity markets retreated during March, joined by the international equity markets in April, on questions about the strength of the U.S. economic recovery and increased political uncertainty in Europe. Weaker-than-expected economic data from China also renewed concerns about an economic slowdown in Asia. Japanese equities rose as the yen weakened significantly late in the Reporting Period, following the Bank of Japan’s surprise monetary policy easing in the form of increased asset purchases.

3

MARKET REVIEW

Emerging Markets Equity

The MSCI Emerging Markets Index (net, unhedged) (“MSCI Emerging Markets Index”) returned 3.93% during the Reporting Period. Sixteen of the 21 countries in the MSCI Emerging Markets Index were up for the Reporting Period, with Thailand (+25.66%) and the Philippines (+21.77%) recording the largest gains. China (+7.13%) was the largest contributor on the basis of impact, which takes both weightings and total returns into account.

Nine of the 10 sectors in the MSCI Emerging Markets Index were positive for the Reporting Period, with information technology (+15.86%) and consumer staples (+12.50%) gaining the most ground. The information technology sector was also the largest contributor to MSCI Emerging Markets Index returns on the basis of impact.

International Equity

The MSCI EAFE Index (unhedged and net of dividend withholding taxes) (“MSCI EAFE Index”) returned 2.44%* during the Reporting Period. Thirteen of the 22 countries in the MSCI EAFE Index were up for the Reporting Period, with Denmark (+23.13%) and Ireland (+19.35%) posting the largest gains. The U.K. (+6.43%) was the largest contributor on the basis of impact, which takes both weightings and total returns into account.

Seven of the 10 sectors in the MSCI EAFE Index recorded positive results for the Reporting Period, with consumer staples (+7.96%) and consumer discretionary (+7.14%) gaining the most. The consumer staples sector was also the largest contributor to MSCI EAFE Index returns on the basis of impact.

International Small Cap Equity

The MSCI EAFE Small Cap Index (unhedged and net of dividend withholding taxes) (“MSCI EAFE Small Cap Index”) advanced 6.04% during the Reporting Period. Eighteen of the 22 countries in the MSCI EAFE Small Cap Index were up for the Reporting Period, with the U.K. (+14.09%) and Denmark (+13.29%) posting the largest gains. The U.K. was also the largest contributor on the basis of impact, which takes both weightings and total returns into account.

Nine of the 10 sectors in the MSCI EAFE Small Cap Index recorded positive results for the Reporting Period, with information technology (+12.90%) and energy (+12.72%) gaining the most. The industrials (+7.78%) sector was the largest contributor to MSCI EAFE Small Cap Index returns on the basis of impact.

| *All | | index returns are expressed in U.S. dollar terms. |

4

MARKET REVIEW

Looking Ahead

We continue to believe that less expensive stocks are likely to outpace more expensive stocks. In addition, we expect stocks with good momentum to outperform those with poor momentum. We plan to focus on seeking companies about which fundamental research analysts are becoming more positive as well as profitable companies with sustainable earnings and a track record of using their capital to enhance shareholder value. As such, we anticipate remaining fully invested, with long-term performance likely to be the result of stock selection rather than sector or capitalization allocations.

We stand behind our investment philosophy that sound economic investment principles, coupled with a disciplined quantitative approach, can provide strong, uncorrelated returns over the long term. Our research agenda is robust, and we continue to enhance our existing models, add new proprietary forecasting signals, and improve our trading execution as we seek to provide the most value to our shareholders.

5

PORTFOLIO RESULTS

Structured Emerging Markets Equity Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team (the “Team”) discusses the Goldman Sachs Structured Emerging Markets Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 7.28%, 6.88%, 7.45% and 7.38%, respectively. These returns compare to the 3.93% cumulative total return of the Fund’s benchmark, the MSCI Emerging Markets Index (net, unhedged) (the “Index”), during the same period. |

| Q | | What key factors were most responsible for the Fund’s performance during the Reporting Period? |

| A | | We use two distinct strategies—a bottom-up stock selection strategy and a top-down country/currency selection strategy—to manage the Fund. These strategies are uncorrelated, that is, they tend to perform independently of each other over time, which enables us to greater diversify the portfolio. |

| | | During the Reporting Period, our country/currency selection strategy added to the Fund’s relative performance. Our stock selection strategy, which uses stock selection models based on five investment themes, also enhanced relative returns. We use these five investment themes to take a long-term view of market patterns and look for inefficiencies, selecting stocks for the Fund and overweighting or underweighting those stocks chosen by the model. Over time and by design, the performance of any one of our model’s investment themes tends to have a low correlation with the model’s other themes, demonstrating the diversification benefit of our theme-driven quantitative model. The variance in performance supports our research indicating that the diversification provided by our different investment themes is a significant investment advantage over the long term, even though the Fund may experience underperformance in the short term. Of course, diversification does not protect an investor from market risk nor does it ensure a profit. |

| Q | | Which investment themes helped and which hurt within the Team’s stock selection strategy? |

| A | | During the Reporting Period, our bottom-up stock selection strategy and four of its five investment themes added to the Fund’s relative results. |

| | | Sentiment, Momentum and Profitability contributed the most to relative performance. Our Sentiment theme reflects selected investment views and decisions of individuals and financial intermediaries, while Momentum predicts drift in stock prices caused by delayed investor reaction to company-specific information and information about related companies. Profitability assesses whether a company is earning more than its cost of capital. The Quality theme also added value. Quality evaluates whether the company’s earnings are coming from more persistent, cash-based sources, as opposed to accruals. |

| | | Valuation detracted from the Fund’s relative returns during the Reporting Period. Valuation attempts to capture potential mispricings of securities, typically by comparing a measure of the company’s intrinsic value to its market value. |

| Q | | How did the Fund’s sector allocations affect relative results? |

| A | | In constructing the portfolio, we focus on picking stocks rather than on making industry or sector bets. Consequently, the Fund is similar to the Index in terms of its sector allocation and style. Changes in its sector weights generally do not have a meaningful impact on relative returns. |

6

PORTFOLIO RESULTS

| Q | | Which stock positions contributed to the Fund’s relative returns during the Reporting Period? |

| A | | We seek to outpace the Index by overweighting stocks we expect to outperform and underweighting those we think may lag. We also build positions based on our thematic views. For example, the Fund aims to hold a basket of stocks with better Momentum characteristics than the benchmark. |

| | | Security selection in the information technology, financials and consumer discretionary sectors contributed positively during the Reporting Period. The Fund benefited from overweighted positions in Asustek Computer, a Taiwan-based maker of computers and computer components; Samsung Electronics, a South Korea-based electronics manufacturer; and Grupo Aeroportuario del Sueste, an airport operator in Mexico. We chose to overweight Asustek Computer because of our positive views on Momentum. The Fund was overweight Samsung Electronics based on our positive views on Sentiment. Our positive views on Valuation led us to an overweight in Grupo Aeroportuario del Sueste. |

| Q | | Which Fund positions detracted from results during the Reporting Period? |

| A | | Our stock picks in the consumer staples, materials and industrials sectors detracted from relative results during the Reporting Period. The Fund was hampered by overweighted positions in South Korean industrial conglomerate SK Holdings and Brazilian oil and gas company Petroleo Brasileiro. An underweighted position in Tencent Holdings, a Chinese Internet and wireless provider, also dampened returns. Our positive views on Valuation led to the Fund’s overweights in SK Holdings and Petroleo Brasileiro. We adopted the underweight to Tencent Holdings because of our negative views on Profitability. |

| Q | | What impact did the Team’s country/currency selection strategy have on the Fund’s relative performance during the Reporting Period? |

| A | | Our country/currency strategy added to the Fund’s relative returns during the Reporting Period. The Fund benefited from an overweighted position compared to the Index in Thailand. Underweighted positions in Brazil and Korea also contributed positively. The Fund was hampered by an overweighted position in Russia as well as underweighted positions in South Africa and Colombia. |

| | | We made our picks using our proprietary models, which are based on six investment themes specific to our country/ currency strategy—Valuation, Momentum, Risk Premium, Fund Flows, Macro and Visibility. Valuation favors equity and currency markets that appear cheap relative to accounting measures of value and purchasing power. The Momentum theme favors countries and currencies that have had strong recent outperformance. Risk Premium evaluates whether a country is overcompensating investors for various types of risk, while Fund Flows evaluates the strength of capital market inflows. Macro assesses a market’s macroeconomic environment and growth prospects. Finally, Visibility evaluates which markets are drawing the attention of technical traders. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund did not use derivatives or similar instruments during the Reporting Period. |

| Q | | What changes did you make to the Fund’s country weightings during the Reporting Period? |

| A | | We increased the Fund’s weightings relative to the Index in China, Thailand and Korea and decreased its weightings in India, Indonesia and Chile. |

| Q | | What were the Fund’s sector and country weightings at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund was overweight the consumer staples, industrials, information technology and consumer discretionary sectors compared to the Index. The Fund was underweight the materials, utilities, telecommunication services, energy, health care and financials sectors. |

| | | In terms of countries, the Fund was overweight China, Mexico, Russia, Malaysia, Korea, Thailand and the Philippines relative to the Index at the end of the Reporting Period. It was underweight South Africa, India, Taiwan, Chile, Turkey, Colombia, Brazil, Indonesia, Peru, the Czech Republic and Hungary. At the end of the Reporting Period, the Fund was relatively neutral compared to the Index in Poland, Morocco and Egypt. |

7

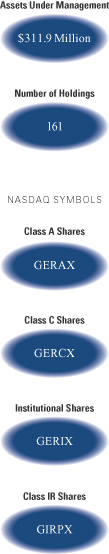

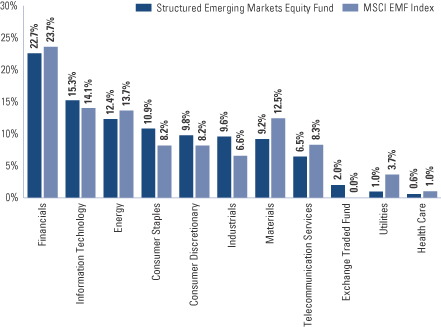

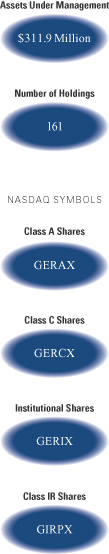

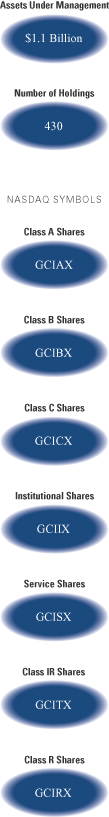

FUND BASICS

Structured Emerging Markets Equity Fund

as of April 30, 2012

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2011–April 30, 2012 | | Fund Total Return

(based on NAV)1 | | | MSCI EMF Index2 | |

| | Class A | | | 7.28 | % | | | 3.93 | % |

| | Class C | | | 6.88 | | | | 3.93 | |

| | Institutional | | | 7.45 | | | | 3.93 | |

| | | Class IR | | | 7.38 | | | | 3.93 | |

| | 1 | | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI Emerging Markets Index (net, unhedged) (the “MSCI EMF Index”) is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of May 30, 2011, the MSCI EMF Index consists of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/12 | | One Year | | | Since Inception | | | Inception Date |

| | Class A | | | -12.44 | % | | | -3.50 | % | | 10/5/07 |

| | Class C | | | -9.02 | | | | -2.89 | | | 10/5/07 |

| | Institutional | | | -7.02 | | | | -1.87 | | | 10/5/07 |

| | | Class IR | | | -7.20 | | | | 9.52 | | | 8/31/10 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

8

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.45 | % | | | 1.71 | % |

| | Class C | | | 2.20 | | | | 2.46 | |

| | Institutional | | | 1.05 | | | | 1.31 | |

| | | Class IR | | | 1.20 | | | | 1.46 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/125 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | Samsung Electronics Co. Ltd. | | | 5.6 | % | | Semiconductors &

Semiconductor Equipment | | South Korea |

| | Taiwan Semiconductor Manufacturing Co. Ltd. ADR | | | 2.6 | | | Semiconductors &

Semiconductor Equipment | | Taiwan |

| | Hyundai Motor Co. | | | 2.6 | | | Automobiles & Components | | South Korea |

| | Sberbank of Russia. | | | 2.3 | | | Banks | | Russia |

| | Bank of China Ltd. Class H | | | 2.3 | | | Banks | | China |

| | Petroleo Brasileiro SA Preference Shares | | | 2.3 | | | Energy | | Brazil |

| | Companhia de Bebidas das Americas Preference Shares ADR | | | 2.2 | | | Food, Beverage & Tobacco | | Brazil |

| | China Mobile Ltd. | | | 2.2 | | | Telecommunication Services | | Hong Kong |

| | China Petroleum & Chemical Corp. Class H | | | 2.1 | | | Energy | | China |

| | | China Construction Bank Corp. Class H | | | 2.0 | | | Banks | | China |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

9

FUND BASICS

| | |

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2012 | | |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The above graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of Exchange Traded Funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investments in the securities lending reinvestment vehicle, if any). Investment in the securities lending reinvestment vehicle represented 0.3% of the Fund’s net assets at April 30, 2012. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

10

PORTFOLIO RESULTS

Structured International Equity Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team (the “Team”) discusses the Goldman Sachs Structured International Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, Service, IR and R Shares generated cumulative total returns, without sales charges, of 4.37%, 3.90%, 3.88%, 4.57%, 4.21%, 4.34% and 4.23%, respectively. These returns compare to the 2.44% cumulative total return of the Fund’s benchmark, the MSCI EAFE Index (unhedged and net of dividend withholding taxes) (the “Index”), during the same period. |

| Q | | What key factors were most responsible for the Fund’s performance during the Reporting Period? |

| A | | We use two distinct strategies—a bottom-up stock selection strategy and a top-down country/currency selection strategy—to manage the Fund. These strategies are uncorrelated, that is, they tend to perform independently of each other over time, which enables us to greater diversify the portfolio. |

| | | During the Reporting Period, our country/currency selection strategy contributed positively to the Fund’s relative performance. Our bottom-up stock selection strategy, which uses stock selection based on six investment themes, dampened relative returns. We use these six investment themes to take a long-term view of market patterns and look for inefficiencies, selecting stocks for the Fund and overweighting or underweighting those stocks chosen by the model. Over time and by design, the performance of any one of our model’s investment themes tends to have a low correlation with the model’s other themes, demonstrating the diversification benefit of our theme-driven quantitative model. The variance in performance supports our research indicating that the diversification provided by our different investment themes is a significant investment advantage over the long term, even though the Fund may experience underperformance in the short term. Of course, diversification does not protect an investor from market risk nor does it ensure a profit. |

| Q | | Which investment themes helped and which hurt within the Team’s stock selection strategy? |

| A | | Our bottom-up stock selection strategy and its six investment themes hampered relative performance during the Reporting Period. Valuation and Quality were the Fund’s weakest-performing themes. Valuation attempts to capture potential mispricings of securities, typically by comparing a measure of the company’s intrinsic value to its market value. Quality evaluates whether the company’s earnings are coming from more persistent, cash-based sources, as opposed to accruals. |

| | | Profitability and Momentum contributed positively to relative results. Profitability assesses whether a company is earning more than its cost of capital. Momentum seeks to predict drifts in stock prices caused by delayed investor reaction to company-specific information and information about related companies. Sentiment, which reflects selected investment views and decisions of individuals and financial intermediaries, also added value. The impact of our Management theme was relatively neutral during the Reporting Period. Management assesses the characteristics, policies and strategic decisions of company management. |

| Q | | How did the Fund’s sector allocations affect relative performance? |

| A | | In constructing the portfolio, we focus on picking stocks rather than on making industry or sector bets. Consequently, the Fund is similar to the Index in terms of its sector allocation and style. Changes in its sector weights generally do not have a meaningful impact on relative returns. |

11

PORTFOLIO RESULTS

| Q | | Which stock positions contributed to the Fund’s relative returns during the Reporting Period? |

| A | | We seek to outpace the Index by overweighting stocks we expect to outperform and underweighting those we think may lag. We also build positions based on our thematic views. For example, the Fund aims to hold a basket of stocks with better Momentum characteristics than the benchmark. |

| | | Investments in the industrials, financials and consumer staples sectors added to the Fund’s relative performance during the Reporting Period. The Fund benefited from underweighted positions in Siemens, a German-based electronics and electrical engineering conglomerate, and in Royal Dutch Shell, an oil and gas company. An overweighted position in Swiss technology firm Oc Oerlikon also enhanced Fund returns versus the Index. We assumed the underweight to Siemens as a result of our negative views on Momentum and Valuation. Our negative views on Quality led to the Fund’s underweight in Royal Dutch Shell. We chose to overweight Oc Oerlikon because of our positive views on Valuation and Momentum. |

| Q | | Which Fund positions detracted from results during the Reporting Period? |

| A | | Security selection in the utilities, telecommunication services and information technology sectors dampened relative results during the Reporting Period. The Fund was hampered by overweighted positions in Vivendi, a French mass media and telecommunication company, and in Enel, an Italian power company. An underweighted position in Japanese automobile company Toyota Motor also detracted from returns. We adopted the overweights in Vivendi and Enel because of our positive views on Valuation. The Fund was underweight Toyota Motor as a result of our negative views on Management. |

| Q | | What impact did the Team’s country/currency selection strategy have on the Fund’s relative performance during the Reporting Period? |

| A | | Our country/currency selection strategy boosted relative performance during the Reporting Period. The Fund’s underweighted positions compared to the Index in Spain and France added to relative returns. An overweighted position in Italy was also advantageous. Detracting from relative performance were the Fund’s underweighted positions in Denmark and Belgium and its overweighted position in Germany. |

| | | We made our picks using our proprietary models, which are based on five investment factors specific to our country/ currency strategy—Valuation, Momentum, Risk Premium, Fund Flows and Macro. Valuation favors equity and currency markets that appear cheap relative to accounting measures of value and purchasing power. The Momentum factor favors countries and currencies that have had strong recent outperformance. Risk Premium evaluates whether a country is overcompensating investors for various types of risk, while Fund Flows evaluates the strength of capital market inflows. Finally, Macro assesses a market’s macroeconomic environment and growth prospects. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we used financial futures contracts to equitize the Fund’s cash holdings. In other words, we put the Fund’s cash holdings to work by using them as collateral for the purchase of financial futures contracts. |

| Q | | What changes did you make to the Fund’s country weightings during the Reporting Period? |

| A | | During the Reporting Period, we increased the Fund’s weightings relative to the Index in Switzerland, Hong Kong and Norway. We decreased its weightings compared to the Index in France, Japan and Italy. |

| Q | | What were the Fund’s sector and country weightings at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund was overweight consumer staples, consumer discretionary, health care and financials compared to the Index. It was underweight the telecommunication services, information technology, materials and industrials sectors. The Fund was relatively neutral versus the Index in the energy and utilities sectors at the end of the Reporting Period. |

| | | In terms of countries, the Fund was overweight relative to the Index in Hong Kong, the U.K., Switzerland, Norway, Germany, Belgium, Denmark and Singapore at the end of the Reporting Period. It was underweight Australia, France, Japan, Spain, Italy, Sweden, the Netherlands and Ireland. Compared to the Index, the Fund was relatively neutral in Israel, New Zealand, Greece, Finland, Austria and Portugal at the end of the Reporting Period. |

12

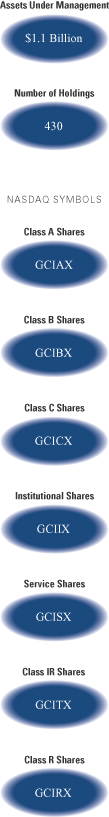

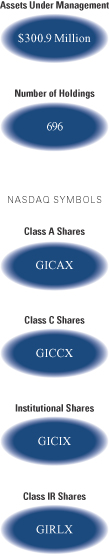

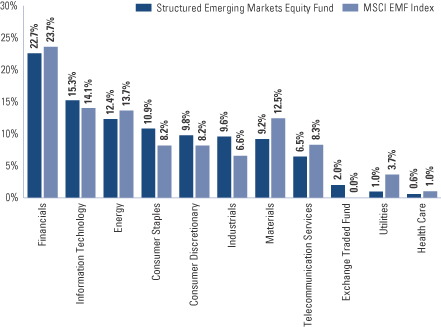

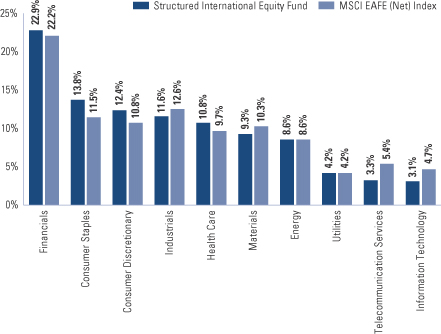

FUND BASICS

Structured International Equity Fund

as of April 30, 2012

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2011–April 30, 2012 | | Fund Total Return

(based on NAV)1 | | | MSCI EAFE (Net) Index2 | |

| | Class A | | | 4.37 | % | | | 2.44 | % |

| | Class B | | | 3.90 | | | | 2.44 | |

| | Class C | | | 3.88 | | | | 2.44 | |

| | Institutional | | | 4.57 | | | | 2.44 | |

| | Service | | | 4.21 | | | | 2.44 | |

| | Class IR | | | 4.34 | | | | 2.44 | |

| | | Class R | | | 4.23 | | | | 2.44 | |

| | 1 | | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The unmanaged Morgan Stanley Capital International (MSCI) Europe, Australasia, Far East (EAFE) (Net) Index (unhedged, with dividends reinvested) (the “Index”) is a market capitalization-weighted composite of securities in 22 developed markets (as of May 30, 2011). The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/12 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -14.60 | % | | | -6.47 | % | | | 4.27 | % | | | 2.07 | % | | 8/15/97 |

| | Class B | | | -14.80 | | | | -6.49 | | | | 4.29 | | | | 2.18 | | | 8/15/97 |

| | Class C | | | -11.24 | | | | -6.08 | | | | 4.15 | | | | 1.85 | | | 8/15/97 |

| | Institutional | | | -9.25 | | | | -5.01 | | | | 5.34 | | | | 3.00 | | | 8/15/97 |

| | Service | | | -9.72 | | | | -5.47 | | | | 4.82 | | | | 2.50 | | | 8/15/97 |

| | Class IR | | | -9.40 | | | | N/A | | | | N/A | | | | -7.34 | | | 11/30/07 |

| | | Class R | | | -9.81 | | | | N/A | | | | N/A | | | | -7.74 | | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert automatically to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Returns for Class B Shares for the period after conversion reflect the performance of Class A Shares. Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

13

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.25 | % | | | 1.31 | % |

| | Class B | | | 2.00 | | | | 2.06 | |

| | Class C | | | 2.00 | | | | 2.06 | |

| | Institutional | | | 0.85 | | | | 0.91 | |

| | Service | | | 1.35 | | | | 1.41 | |

| | Class IR | | | 1.00 | | | | 1.06 | |

| | | Class R | | | 1.50 | | | | 1.56 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/125 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | Roche Holding AG | | | 3.9 | % | | Pharmaceuticals, Biotechnology

& Life Sciences | | Switzerland |

| | HSBC Holdings PLC | | | 2.7 | | | Banks | | United Kingdom |

| | British American Tobacco PLC | | | 2.3 | | | Food, Beverage & Tobacco | | United Kingdom |

| | Deutsche Post AG (Registered) | | | 2.0 | | | Transportation | | Germany |

| | Statoil ASA | | | 1.9 | | | Energy | | Norway |

| | Novartis AG (Registered) | | | 1.9 | | | Pharmaceuticals, Biotechnology

& Life Sciences | | Switzerland |

| | Swedish Match AB | | | 1.8 | | | Food, Beverage & Tobacco | | Sweden |

| | Nestle SA (Registered) | | | 1.8 | | | Food, Beverage & Tobacco | | Switzerland |

| | Nissan Motor Co. Ltd | | | 1.7 | | | Automobiles & Components | | Japan |

| | | Royal Dutch Shell PLC Class A | | | 1.7 | | | Energy | | Netherlands |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

14

FUND BASICS

| | |

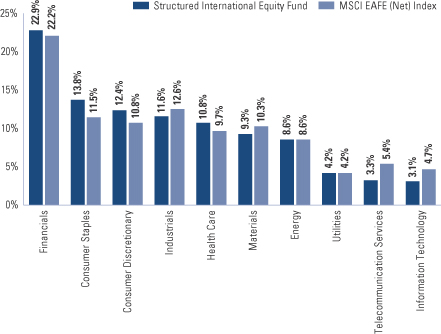

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2012 | | |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investments in the securities lending reinvestment vehicle, if any). Investment in the securities lending reinvestment vehicle represented 4.2% of the Fund’s net assets at April 30, 2012. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

15

PORTFOLIO RESULTS

Structured International Small Cap Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team (the “Team”) discusses the Goldman Sachs Structured International Small Cap Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 6.56%, 6.19%, 6.78% and 6.65%, respectively. These returns compare to the 6.04% cumulative total return of the Fund’s benchmark, the MSCI EAFE Small Cap Index (unhedged and net of dividend withholding taxes) (the “Index”), during the same period. |

| Q | | What key factors were most responsible for the Fund’s performance during the Reporting Period? |

| A | | As expected, and in keeping with our investment approach, our quantitative model and its six investment themes had the greatest impact on relative performance. We use these themes to take a long-term view of market patterns and look for inefficiencies, selecting stocks for the Fund and overweighting or underweighting those stocks chosen by the model. Over time and by design, the performance of any one of our model’s investment themes tends to have a low correlation with the model’s other themes, demonstrating the diversification benefit of our theme-driven quantitative model. The variance in performance supports our research indicating that the diversification provided by our different investment themes is a significant investment advantage over the long term, even though the Fund may experience underperformance in the short term. Of course, diversification does not protect an investor from market risk nor does it ensure a profit. |

| | | Overall, our investment themes added to the Fund’s relative returns during the Reporting Period. Momentum was our best-performing theme. Momentum seeks to predict drifts in stock prices caused by delayed investor reaction to company-specific information and information about related companies. Sentiment, Profitability and Quality also enhanced relative performance. Our Sentiment theme reflects selected investment views and decisions of individuals and financial intermediaries. Profitability assesses whether a company is earning more than its cost of capital, while the Quality theme evaluates whether the company’s earnings are coming from more persistent, cash-based sources, as opposed to accruals. |

| | | Valuation and Management detracted from the Fund’s relative results. Valuation attempts to capture potential mispricings of securities, typically by comparing a measure of the company’s intrinsic value to its market value. Management assesses the characteristics, policies and strategic decisions of company management. |

| Q | | How did the Fund’s sector allocations affect relative performance? |

| A | | In constructing the portfolio, we focus on picking stocks rather than on making industry or sector bets. Consequently, the Fund is similar to the Index in terms of its sector allocation and style. Changes in its sector weights generally do not have a meaningful impact on relative performance. |

| Q | | Which stock positions contributed to the Fund’s relative returns during the Reporting Period? |

| A | | We seek to outpace the Index by overweighting stocks we expect to outperform and underweighting those we think may lag. We also build positions based on our thematic views. For example, the Fund aims to hold a basket of stocks with better Momentum characteristics than the benchmark. |

| | | Our stock picks in the consumer discretionary, consumer staples and information technology sectors contributed positively to the Fund’s results versus the Index during the Reporting Period. The Fund benefited from overweighted positions in Kvaerner ASA, a Norway-based engineering and construction services company; Bodycote, a U.K.-based provider of thermal processing services; and Forbo Holding, a German manufacturer of flooring, bonding and movement systems. The overweights in Kvaerner Asa and Forbo Holding were the result of our positive views on Valuation. Our positive views on Momentum led to the Fund’s overweight in Bodycote. |

16

PORTFOLIO RESULTS

| Q | | Which Fund positions detracted from results during the Reporting Period? |

| A | | Investments in the energy, industrials and materials sectors detracted from the Fund’s relative performance during the Reporting Period. The Fund was hindered by its overweighted positions in Heritage Oil, a U.K.-based oil and gas exploration company; Nexans, a French maker of cables and cabling systems; and Petroplus Holding, an independent oil refiner based in the Netherlands. We assumed the overweights in Nexans and Petroplus Holdings because of our positive views on Valuation. The Fund was overweight Heritage Oil based on our positive views on Momentum. |

| Q | | What impact did country selection have on the Fund’s relative performance during the Reporting Period? |

| A | | To construct the portfolio, we focus on security selection rather than on making country bets. As a result, the Fund is similar to the Index in terms of its country allocation; changes in its country weightings are generally the result of our stock picking. That said, the Fund benefited during the Reporting Period from overweighted positions relative to the Index in German and Hong Kong stocks and an underweighted position in Norwegian stocks. The Fund was hampered by its overweighted position in French stocks as well as by underweighted positions in the stocks of Austria and the Netherlands. Security selection in all six countries added to returns. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we used financial futures contracts to equitize the Fund’s cash holdings. In other words, we put the Fund’s cash holdings to work by using them as collateral for the purchase of financial futures contracts. |

| Q | | What changes did you make to the Fund’s country weightings during the Reporting Period? |

| A | | The largest shifts we made during the Reporting Period were to increase the Fund’s weightings relative to the Index in Australia, Finland and New Zealand and to decrease the Fund’s weightings in Japan, the U.K. and Portugal. |

| Q | | What were the Fund’s sector and country weightings at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund was overweight the consumer staples, energy, consumer discretionary, industrials and financials sectors compared to the Index. The Fund was underweight the health care, information technology, materials, telecommunication services and utilities sectors relative to the Index at the end of the Reporting Period. |

| | | In terms of countries, the Fund was overweight Australia, Sweden, Finland, Italy, Germany, the U.K., Denmark and Norway relative to the Index. It was underweight Japan, Switzerland, Greece, the Netherlands, Portugal, Ireland, Spain, France and Belgium. At the end of the Reporting Period, the Fund was relatively neutral compared to the Index in Hong Kong, Austria, Israel, Singapore and New Zealand. |

17

FUND BASICS

Structured International Small Cap Fund

as of April 30, 2012

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2011–April 30, 2012 | | Fund Total Return (based on NAV)1 | | | MSCI EAFE Small Cap Index2 | |

| | Class A | | | 6.56 | % | | | 6.04 | % |

| | Class C | | | 6.19 | | | | 6.04 | |

| | Institutional | | | 6.78 | | | | 6.04 | |

| | | Class IR | | | 6.65 | | | | 6.04 | |

| | 1 | | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charge. |

| | 2 | | The MSCI EAFE Small Cap (Net) Index (unhedged and net of dividend withholding taxes) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the US and Canada. MSCI selects the most liquid securities across developed markets relative to their market capitalization, and targets for index inclusion 40% of the full market capitalization of the eligible small cap universe within each industry group, within each country. Its returns include net reinvested dividends but, unlike Fund returns, do not reflect the payment of sales commissions or other expenses incurred in the purchase or sale of the securities included in the Index. It is not possible to invest directly in an index. |

| | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/12 | | One Year | | | Since Inception | | Inception Date |

| | Class A | | | -10.09 | % | | -2.70% | | 9/28/07 |

| | Class C | | | -6.44 | | | -2.16 | | 9/28/07 |

| | Institutional | | | -4.45 | | | -1.06 | | 9/28/07 |

| | | Class IR | | | -4.58 | | | 15.53 | | 8/31/10 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

18

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.30 | % | | | 1.47 | % |

| | Class C | | | 2.05 | | | | 2.22 | |

| | Institutional | | | 0.90 | | | | 1.07 | |

| | | Class IR | | | 1.05 | | | | 1.22 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/125 |

| | | Holding | | % of Total Net Assets | | | Line of Business | | Country |

| | EnQuest PLC | | | 1.1 | % | | Energy | | United Kingdom |

| | Croda International PLC | | | 1.0 | | | Materials | | United Kingdom |

| | Etablissements Maurel et

Prom | | | 0.8 | | | Energy | | France |

| | John Wood Group PLC | | | 0.8 | | | Energy | | United Kingdom |

| | PSP Swiss Property AG

(Registered) | | | 0.7 | | | Real Estate | | Switzerland |

| | Bilfinger Berger SE | | | 0.7 | | | Capital Goods | | Germany |

| | Lancashire Holdings Ltd. | | | 0.7 | | | Insurance | | Bermuda |

| | Kemira OYJ | | | 0.7 | | | Materials | | Finland |

| | KYORIN Holdings, Inc. | | | 0.7 | | | Pharmaceuticals,

Biotechnology & Life Sciences | | Japan |

| | | Nexans SA | | | 0.7 | | | Capital Goods | | France |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

19

FUND BASICS

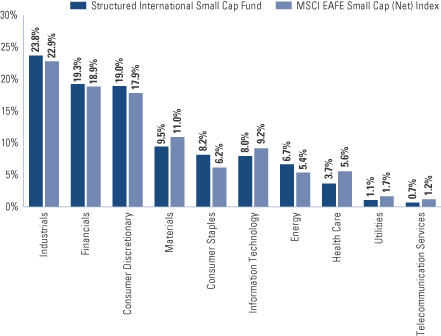

|

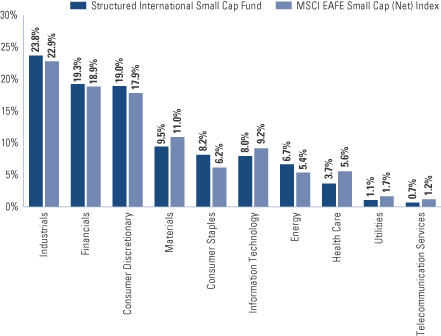

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2012 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investments in the securities lending reinvestment vehicle, if any). Investment in the securities lending reinvestment vehicle represented 5.0% of the Fund’s net assets at April 30, 2012. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

20

GOLDMAN SACHS STRUCTURED EMERGING MARKETS EQUITY FUND

Schedule of Investments

April 30, 2012 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – 97.4% | |

| Brazil – 12.6% | |

| | 62,300 | | | Banco do Brasil SA (Banks) | | $ | 770,681 | |

| | 193,800 | | | Banco do Estado do Rio Grande do Sul SA Preference B Shares (Banks) | | | 1,679,603 | |

| | 696,900 | | | BM&FBovespa SA (Diversified Financials) | | | 3,919,297 | |

| | 163,700 | | | Companhia de Bebidas das Americas Preference Shares ADR (Food, Beverage & Tobacco) | | | 6,872,126 | |

| | 277,400 | | | Cosan SA Industria e Comercio (Food, Beverage & Tobacco) | | | 4,817,008 | |

| | 18,300 | | | Eletropaulo Metropolitana Eletricidade de Sao Paulo SA Preference Shares (Utilities) | | | 279,951 | |

| | 224,100 | | | Gerdau SA ADR (Materials) | | | 2,104,299 | |

| | 43,100 | | | JBS SA (Food, Beverage & Tobacco)* | | | 169,583 | |

| | 506,900 | | | Klabin SA Preference Shares (Materials) | | | 2,430,588 | |

| | 630,100 | | | Petroleo Brasileiro SA Preference Shares (Energy) | | | 7,037,657 | |

| | 157,800 | | | Telefonica Brasil SA ADR (Telecommunication Services) | | | 4,492,566 | |

| | 223,100 | | | Vale SA Preference A Shares (Materials) | | | 4,851,399 | |

| | | | | | | | |

| | | | | | | 39,424,758 | |

| | |

| China – 16.2% | |

| | 6,243,000 | | | Agricultural Bank of China Ltd. Class H (Banks) | | | 2,952,623 | |

| | 2,200 | | | Baidu, Inc. ADR (Software & Services)* | | | 291,940 | |

| | 17,045,000 | | | Bank of China Ltd. Class H (Banks) | | | 7,097,910 | |

| | 2,393,000 | | | Bank of Communications Co. Ltd. Class H (Banks) | | | 1,841,471 | |

| | 234,000 | | | China BlueChemical Ltd. Class H (Materials) | | | 166,775 | |

| | 8,211,000 | | | China Citic Bank Corp. Ltd. Class H (Banks) | | | 5,202,664 | |

| | 5,079,000 | | | China Communications Construction Co. Ltd. Class H (Capital Goods) | | | 5,060,726 | |

| | 7,889,000 | | | China Construction Bank Corp. Class H (Banks) | | | 6,122,212 | |

| | 410,500 | | | China Merchants Bank Co. Ltd. Class H (Banks) | | | 886,355 | |

| | 794,000 | | | China Minsheng Banking Corp. Ltd. Class H (Banks) | | | 821,621 | |

| | 6,028,000 | | | China Petroleum & Chemical Corp. Class H (Energy) | | | 6,402,404 | |

| | 176,000 | | | China Shenhua Energy Co. Ltd. Class H (Energy) | | | 777,225 | |

| | 620,000 | | | China Southern Airlines Co. Ltd. Class H (Transportation)* | | | 277,842 | |

| | 1,571,000 | | | Country Garden Holdings Co. Ltd. (Real Estate) | | | 677,518 | |

| | |

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – (continued) | |

| China – (continued) | |

| | 1,296,000 | | | Dongfeng Motor Group Co. Ltd. Class H (Automobiles & Components) | | $ | 2,534,802 | |

| | 1,364,000 | | | Evergrande Real Estate Group Ltd. (Real Estate)(a) | | | 783,054 | |

| | 455,500 | | | Great Wall Motor Co. Ltd. Class H (Automobiles & Components) | | | 977,564 | |

| | 642,400 | | | Guangzhou R&F Properties Co. Ltd. Class H (Real Estate) | | | 853,320 | |

| | 566,000 | | | Harbin Electric Co. Ltd. Class H (Capital Goods) | | | 587,672 | |

| | 322,000 | | | Lenovo Group Ltd. (Technology Hardware & Equipment) | | | 307,937 | |

| | 3,022,000 | | | PetroChina Co. Ltd. Class H (Energy) | | | 4,507,909 | |

| | 1,651,000 | | | Soho China Ltd. (Real Estate) | | | 1,279,851 | |

| | | | | | | | |

| | | | | | | 50,411,395 | |

| | |

| Egypt – 0.2% | |

| | 304,160 | | | Telecom Egypt Co. (Telecommunication Services) | | | 652,571 | |

| | |

| Hong Kong – 4.8% | |

| | 448,000 | | | China Everbright Ltd. (Diversified Financials) | | | 707,166 | |

| | 607,500 | | | China Mobile Ltd. (Telecommunication Services) | | | 6,721,091 | |

| | 1,488,000 | | | China Overseas Land & Investment Ltd. (Real Estate) | | | 3,215,592 | |

| | 1,749,000 | | | Citic Pacific Ltd. (Capital Goods) | | | 2,870,286 | |

| | 1,482,000 | | | Guangdong Investment Ltd. (Utilities) | | | 1,087,396 | |

| | 477,000 | | | KWG Property Holding Ltd. (Real Estate) | | | 312,368 | |

| | | | | | | | |

| | | | | | | 14,913,899 | |

| | |

| India – 3.6% | |

| | 58,196 | | | Bajaj Holdings and Investment Ltd. (Diversified Financials) | | | 932,110 | |

| | 725,469 | | | Hexaware Technologies Ltd. (Software & Services) | | | 1,780,332 | |

| | 73,984 | | | India Cements Ltd. (Materials) | | | 118,690 | |

| | 210,447 | | | Indiabulls Financial Services Ltd. (Diversified Financials) | | | 967,262 | |

| | 1,708,050 | | | Indiabulls Infrastructure and Power Ltd. (Utilities)* | | | 339,341 | |

| | 751,094 | | | Indian Bank (Banks) | | | 3,147,716 | |

| | 113,953 | | | Jubilant Life Sciences Ltd. (Pharmaceuticals, Biotechnology & Life Sciences) | | | 391,091 | |

| | 406,469 | | | Oil & Natural Gas Corp. Ltd. (Energy) | | | 2,079,566 | |

| | 419,831 | | | Satyam Computer Services Ltd. (Software & Services)* | | | 613,628 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

GOLDMAN SACHS STRUCTURED EMERGING MARKETS EQUITY FUND

Schedule of Investments (continued)

April 30, 2012 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – (continued) | |

| India – (continued) | |

| | 439,961 | | | Sterlite Industries India Ltd. (Materials) | | $ | 886,687 | |

| | | | | | | | |

| | | | | | | 11,256,423 | |

| | |

| Indonesia – 1.9% | |

| | 2,064,000 | | | PT Bank Negara Indonesia (Persero) Tbk (Banks) | | | 900,404 | |

| | 3,130,500 | | | PT Bank Rakyat Indonesia (Persero) Tbk (Banks) | | | 2,253,750 | |

| | 2,741,000 | | | PT Indofood Sukses Makmur Tbk (Food, Beverage & Tobacco) | | | 1,440,335 | |

| | 846,000 | | | PT Kalbe Farma Tbk (Pharmaceuticals, Biotechnology & Life Sciences) | | | 369,353 | |

| | 2,183,500 | | | PT Perusahaan Perkebunan London Sumatra Indonesia Tbk (Food, Beverage & Tobacco) | | | 692,549 | |

| | 80,000 | | | PT Semen Gresik (Persero) Tbk (Materials) | | | 105,438 | |

| | 1,500 | | | PT Unilever Indonesia Tbk (Household & Personal Products) | | | 3,236 | |

| | | | | | | | |

| | | | | | | 5,765,065 | |

| | |

| Luxembourg – 0.1% | |

| | 62,175 | | | Brait SE (Diversified Financials)* | | | 194,894 | |

| | |

| Malaysia – 5.3% | |

| | 944,400 | | | AMMB Holdings Berhad (Diversified Financials) | | | 1,948,082 | |

| | 2,468,400 | | | DRB-Hicom Berhad (Automobiles & Components) | | | 2,071,744 | |

| | 526,100 | | | Genting Berhad (Consumer Services) | | | 1,793,240 | |

| | 2,920,900 | | | Genting Malaysia Berhad (Consumer Services) | | | 3,697,709 | |

| | 26,700 | | | Genting Plantations Berhad (Food, Beverage & Tobacco) | | | 82,754 | |

| | 33,900 | | | Hong Leong Financial Group Berhad (Banks) | | | 133,538 | |

| | 1,405,800 | | | Kulim Malaysia Berhad (Food, Beverage & Tobacco) | | | 1,960,633 | |

| | 19,600 | | | PPB Group Berhad (Food, Beverage & Tobacco) | | | 108,312 | |

| | 241,200 | | | RHB Capital Berhad (Banks) | | | 586,214 | |

| | 2,051,300 | | | Telekom Malaysia Berhad (Telecommunication Services) | | | 3,641,445 | |

| | 229,700 | | | UMW Holdings Berhad (Automobiles & Components) | | | 595,155 | |

| | | | | | | | |

| | | | | | | 16,618,826 | |

| | |

| Mexico – 7.5% | |

| | 84,405 | | | America Movil SAB de CV Series L ADR (Telecommunication Services) | | | 2,249,393 | |

| | 490,435 | | | Cemex SAB de CV ADR (Materials) | | | 3,545,845 | |

| | 27,200 | | | Coca-Cola Femsa SAB de CV ADR (Food, Beverage & Tobacco)* | | | 2,881,840 | |

| | |

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – (continued) | |

| Mexico – (continued) | |

| | 14,130 | | | Fomento Economico Mexicano SAB de CV ADR (Food, Beverage & Tobacco) | | $ | 1,148,204 | |

| | 135,600 | | | Gruma SAB de CV Series B (Food, Beverage & Tobacco)* | | | 375,801 | |

| | 48,040 | | | Grupo Aeroportuario del Pacifico SAB de CV ADR (Transportation) | | | 1,859,628 | |

| | 60,810 | | | Grupo Aeroportuario del Sureste SAB de CV ADR (Transportation) | | | 4,980,947 | |

| | 129,900 | | | Grupo Carso SAB de CV Series A-1 (Capital Goods) | | | 433,799 | |

| | 7,695 | | | Grupo Elektra SA de CV (Retailing) | | | 476,081 | |

| | 432,800 | | | Grupo Mexico SAB de CV Series B (Materials) | | | 1,335,352 | |

| | 345,300 | | | Grupo Modelo SAB de CV Series C (Food, Beverage & Tobacco) | | | 2,438,528 | |

| | 535,100 | | | Inmuebles Carso SAB de CV Series B-1 (Diversified Financials)* | | | 472,415 | |

| | 201,700 | | | Minera Frisco SAB de CV Series A-1 (Materials)* | | | 872,395 | |

| | 143,000 | | | Wal-Mart de Mexico SAB de CV Series V (Food & Staples Retailing) | | | 408,934 | |

| | | | | | | | |

| | | | | | | 23,479,162 | |

| | |

| Philippines – 1.5% | |

| | 495,190 | | | BDO Unibank, Inc. (Banks) | | | 774,308 | |

| | 433,380 | | | Metropolitan Bank & Trust Co. (Banks) | | | 934,263 | |

| | 31,340 | | | Philippine Long Distance Telephone Co. ADR (Telecommunication Services) | | | 1,902,965 | |

| | 607,700 | | | Universal Robina Corp. (Food, Beverage & Tobacco) | | | 933,690 | |

| | | | | | | | |

| | | | | | | 4,545,226 | |

| | |

| Poland – 1.2% | |

| | 87,448 | | | KGHM Polska Miedz SA (Materials) | | | 3,866,673 | |

| | |

| Russia – 8.4% | |

| | 43,156,700 | | | Federal Hydrogenerating Co. (Utilities) | | | 1,532,111 | |

| | 132,250 | | | Gazprom Neft ADR (Energy) | | | 3,275,947 | |

| | 634,439 | | | OAO Gazprom ADR (Energy) | | | 7,348,112 | |

| | 72,970 | | | OAO Lukoil ADR (Energy) | | | 4,489,204 | |

| | 13,319 | | | OAO Tatneft ADR (Energy) | | | 494,393 | |

| | 125,450 | | | OJSC Surgutneftegas ADR (Energy)(a) | | | 1,256,538 | |

| | 760,084 | | | OJSC Surgutneftegas Preference Shares (Energy) | | | 504,489 | |

| | 2,250,000 | | | Sberbank of Russia (Banks) | | | 7,198,816 | |

| | 54,600 | | | Sberbank of Russia Preference Shares (Banks)* | | | 127,423 | |

| | | | | | | | |

| | | | | | | 26,227,033 | |

| | |

| South Africa – 4.8% | |

| | 99,460 | | | ABSA Group Ltd. (Banks) | | | 2,049,739 | |

| | |

| | |

| 22 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS STRUCTURED EMERGING MARKETS EQUITY FUND

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – (continued) | |

| South Africa – (continued) | |

| | 549,608 | | | AVI Ltd. (Food, Beverage & Tobacco) | | $ | 3,410,137 | |

| | 33,965 | | | DataTec Ltd. (Technology Hardware & Equipment) | | | 199,425 | |

| | 434,903 | | | FirstRand Ltd. (Diversified Financials) | | | 1,414,405 | |

| | 129,141 | | | Imperial Holdings Ltd. (Retailing) | | | 2,808,041 | |

| | 62,955 | | | JD Group Ltd. (Retailing) | | | 393,835 | |

| | 3,217 | | | Kumba Iron Ore Ltd. (Materials) | | | 227,824 | |

| | 27,115 | | | Lewis Group Ltd. (Retailing) | | | 263,398 | |

| | 82,006 | | | Liberty Holdings Ltd. (Insurance) | | | 930,594 | |

| | 140,795 | | | MMI Holdings Ltd. (Insurance) | | | 317,119 | |

| | 35,778 | | | MTN Group Ltd. (Telecommunication Services) | | | 625,680 | |

| | 101,499 | | | Pick’n Pay Holdings Ltd. (Food & Staples Retailing) | | | 255,270 | |

| | 32,640 | | | Resilient Property Income Fund Ltd. (Real Estate) | | | 165,466 | |

| | 512,160 | | | Super Group Ltd. (Retailing)* | | | 968,534 | |

| | 46,524 | | | The Foschini Group Ltd. (Retailing) | | | 771,236 | |

| | 10,467 | | | Tongaat Hulett Ltd. (Food, Beverage & Tobacco) | | | 141,304 | |

| | | | | | | | |

| | | | | | | 14,942,007 | |

| | |

| South Korea – 16.4% | |

| | 1,098 | | | AmorePacific Group (Household & Personal Products) | | | 275,983 | |

| | 43,475 | | | Daelim Industrial Co. Ltd. (Capital Goods) | | | 4,001,918 | |

| | 13,320 | | | Daewoo Shipbuilding & Marine Engineering Co. Ltd. (Capital Goods) | | | 370,529 | |

| | 10,226 | | | Doosan Heavy Industries & Construction Co. Ltd. (Capital Goods) | | | 479,419 | |

| | 2,573 | | | E-Mart Co. Ltd. (Food & Staples Retailing) | | | 610,562 | |

| | 6,490 | | | Hana Financial Group, Inc. (Banks) | | | 221,252 | |

| | 8,080 | | | Handsome Co. Ltd. (Consumer Durables & Apparel) | | | 271,887 | |

| | 13,630 | | | Hanwha Chemical Corp. (Materials) | | | 266,767 | |

| | 1,269 | | | Honam Petrochemical Corp. (Materials) | | | 303,231 | |

| | 34,560 | | | Hyundai Motor Co. (Automobiles & Components) | | | 8,158,589 | |

| | 4,144 | | | Hyundai Motor Co. Preference Shares (Automobiles & Components) | | | 290,436 | |

| | 168,420 | | | LG Display Co. Ltd. (Technology Hardware & Equipment)* | | | 3,717,937 | |

| | 46,209 | | | LG Electronics, Inc. (Consumer Durables & Apparel) | | | 2,851,047 | |

| | 21,650 | | | LG Fashion Corp. (Consumer Durables & Apparel) | | | 718,610 | |

| | 48,773 | | | LG International Corp. (Capital Goods) | | | 1,988,541 | |

| | 337 | | | Lotte Chilsung Beverage Co. Ltd. (Food, Beverage & Tobacco) | | | 380,022 | |

| | |

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – (continued) | |

| South Korea – (continued) | |

| | 625 | | | Namyang Dairy Products Co. Ltd. (Food, Beverage & Tobacco) | | $ | 359,474 | |

| | 481 | | | OCI Co. Ltd. (Materials) | | | 90,428 | |

| | 912 | | | POSCO (Materials) | | | 302,126 | |

| | 14,362 | | | Samsung Electronics Co. Ltd. (Semiconductors & Semiconductor Equipment) | | | 17,578,533 | |

| | 2,168 | | | Samsung Electronics Co. Ltd. Preference Shares (Semiconductors & Semiconductor Equipment) | | | 1,545,055 | |

| | 16,714 | | | Samyang Holdings Corp. (Food, Beverage & Tobacco) | | | 886,478 | |

| | 2,715 | | | Sindoh Co. Ltd. (Technology Hardware & Equipment) | | | 132,151 | |

| | 41,299 | | | SK Holdings Co. Ltd. (Capital Goods) | | | 4,396,880 | |

| | 125,660 | | | SK Networks Co. Ltd. (Capital Goods) | | | 1,033,195 | |

| | | | | | | | |

| | | | | | | 51,231,050 | |

| | |

| Taiwan – 7.9% | |

| | 539,880 | | | Asustek Computer, Inc. (Technology Hardware & Equipment) | | | 5,423,401 | |

| | 790,000 | | | China Motor Corp. (Automobiles & Components) | | | 649,641 | |

| | 2,831,900 | | | China Petrochemical Development Corp. (Materials) | | | 2,843,429 | |

| | 563,000 | | | Compal Electronics, Inc. (Technology Hardware & Equipment) | | | 644,544 | |

| | 800,000 | | | Forhouse Corp. (Semiconductors & Semiconductor Equipment) | | | 449,133 | |

| | 2,480,000 | | | Systex Corp. (Software & Services) | | | 2,535,070 | |

| | 526,800 | | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR (Semiconductors & Semiconductor Equipment) | | | 8,207,544 | |

| | 7,459,000 | | | United Microelectronics Corp. (Semiconductors & Semiconductor Equipment) | | | 3,901,603 | |

| | | | | | | | |

| | | | | | | 24,654,365 | |

| | |

| Thailand – 5.0% | |

| | 752,700 | | | Airports of Thailand PCL (Transportation) | | | 1,514,360 | |

| | 139,900 | | | Bangchak Petroleum PCL (Energy) | | | 115,682 | |

| | 844,500 | | | Bangkok Bank PCL (Banks) | | | 5,314,704 | |

| | 335,200 | | | Bangkok Dusit Medical Services PCL Class F (Health Care Equipment & Services) | | | 1,001,525 | |

| | 2,013,800 | | | Charoen Pokphand Foods PCL (Food, Beverage & Tobacco) | | | 2,662,353 | |

| | 1,409,900 | | | PTT Global Chemical PCL (Materials) | | | 3,150,341 | |

| | 22,700 | | | PTT PCL (Energy) | | | 258,885 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 23 |

GOLDMAN SACHS STRUCTURED EMERGING MARKETS EQUITY FUND

Schedule of Investments (continued)

April 30, 2012 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – (continued) | |

| Thailand – (continued) | |

| | 13,200 | | | Siam Makro PCL (Food & Staples Retailing) | | $ | 164,010 | |

| | 310,000 | | | Supalai PCL (Real Estate) | | | 165,009 | |

| | 2,400,900 | | | TPI Polene PCL (Materials) | | | 1,099,706 | |

| | | | | | | | |

| | | | | | | 15,446,575 | |

| | |

| Turkey – 0.0% | |

| | 47,049 | | | Ulker Biskuvi Sanayi AS (Food, Beverage & Tobacco) | | | 142,566 | |

| | |

| | TOTAL COMMON STOCKS | | | | |

| | (Cost $266,461,873) | | $ | 303,772,488 | |

| | |

| | | | | | | | |

| | Exchange Traded Fund – 1.9% | |

| Other – 1.9% | |

| | 143,908 | | | Vanguard MSCI Emerging Markets | | $ | 6,120,407 | |

| | (Cost $6,177,852) | | | | |

| | |

| TOTAL INVESTMENTS BEFORE

SECURITIES LENDING REINVESTMENT

VEHICLE | | | | |

| | (Cost $272,639,725) | | $ | 309,892,895 | |

| | |

| | | | | | | | |

Shares | | Rate | | | Value | |

| | | | | | | | |

| Securities Lending Reinvestment Vehicle(b)(c) – 0.3% | |

Goldman Sachs Financial Square Money Market Fund — FST Shares | |

| 840,000 | | | 0.182 | % | | $ | 840,000 | |

| (Cost $840,000) | | | | | |

| |

| TOTAL INVESTMENTS – 99.6% | |

| (Cost $273,479,725) | | | $ | 310,732,895 | |

| |

OTHER ASSETS IN EXCESS OF LIABILITIES – 0.4% | | | | 1,193,818 | |

| |

| NET ASSETS – 100.0% | | | $ | 311,926,713 | |

| |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Non-income producing security. |

(a) | | All or a portion of security is on loan. |

(b) | | Variable rate security. Interest rate disclosed is that which is in effect at April 30, 2012. |

(c) | | Represents an affiliated issuer. |

| | |

|

Investment Abbreviation: |

ADR | | —American Depositary Receipt |

|

| | |

| 24 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS STRUCTURED INTERNATIONAL EQUITY FUND

Schedule of Investments

April 30, 2012 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – 98.3% | |

| Australia – 3.4% | |

| | 12,412 | | | ASX Ltd. (Diversified Financials) | | $ | 412,653 | |

| | 60,587 | | | Australia & New Zealand Banking Group Ltd. (Banks) | | | 1,500,938 | |

| | 111,364 | | | AWE Ltd. (Energy) | | | 200,916 | |

| | 504,303 | | | Beach Energy Ltd. (Energy) | | | 730,771 | |

| | 68,017 | | | BHP Billiton Ltd. (Materials) | | | 2,523,924 | |

| | 8,493 | | | Brickworks Ltd. (Materials) | | | 92,033 | |

| | 10,362 | | | Cabcharge Australia Ltd. (Commercial & Professional Services) | | | 68,859 | |

| | 2,819 | | | Campbell Brothers Ltd. (Commercial & Professional Services) | | | 200,031 | |

| | 91,230 | | | Charter Hall Office REIT (REIT) | | | 293,726 | |