UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Peter V. Bonanno, Esq. | | Geoffrey R.T. Kenyon, Esq. |

Goldman, Sachs & Co. | | Dechert LLP |

200 West Street | | 200 Clarendon Street |

New York, New York 10282 | | 27th Floor |

| | Boston, MA 02116-5021 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2012

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | April 30, 2012 |

| | |

| | | | Fundamental International Equity Funds |

| | | | Concentrated International Equity International Small Cap Strategic International Equity |

Goldman Sachs Fundamental International

Equity Funds

| n | | CONCENTRATED INTERNATIONAL EQUITY |

| n | | INTERNATIONAL SMALL CAP |

| n | | STRATEGIC INTERNATIONAL EQUITY |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 2 | |

| |

Market Review | | | 3 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 5 | |

| |

Schedule of Investments | | | 23 | |

| |

Financial Statements | | | 30 | |

| |

Financial Highlights | | | 34 | |

| |

Notes to the Financial Statements | | | 40 | |

| |

Other Information | | | 52 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS FUNDAMENTAL EQUITY INTERNATIONAL FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectus.

The Goldman Sachs Concentrated International Equity Fund invests primarily in a diversified portfolio of equity investments in companies that are organized outside the United States or whose securities are principally traded outside the United States. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular industry sectors and/or general economic conditions. Foreign and emerging market securities may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments. Because the Fund may invest heavily in specific countries or regions, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events which may occur in those countries or regions.

The Goldman Sachs International Small Cap Fund invests primarily in a diversified portfolio of equity investments in non-U.S. small-capitalization companies. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular industry sectors and/or general economic conditions. Foreign and emerging market securities may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements.

The Goldman Sachs Strategic International Equity Fund invests primarily in a diversified portfolio of equity investments in companies that are organized outside the United States or whose securities are principally traded outside the United States. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular industry sectors and/or general economic conditions. Foreign and emerging market securities may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments.

1

GOLDMAN SACHS FUNDAMENTAL EQUITY INTERNATIONAL FUNDS

What Differentiates Goldman Sachs’ Fundamental

International Equity Investment Process?

Goldman Sachs’ Fundamental International Equity investment process is based on the belief that strong, consistent results are best achieved through expert stock selection, performed by research teams working together on a global scale. Our deep, diverse and experienced team of research analysts and portfolio managers combines local insights with global, industry-specific expertise to identify its best investment ideas.

| n | | Fundamental research teams based on the ground in London, Melbourne, Hong Kong, Mumbai, Sao Paulo, Seoul, Shanghai, Singapore and Tokyo focus on long-term business and management quality |

| n | | Analysts collaborate regularly to leverage regional and industry-specific research and insights |

| n | | Global perspective is informed by local market expertise |

| n | | A common valuation framework, focusing on long-term earnings power, ensures consistency when valuing and comparing a company to its peers globally |

| n | | Team of experienced Research Analysts is regionally aligned and has sector expertise |

| n | | Team leverages the research of the approximately 55+ regional investment professionals |

| n | | Decision-making process is informed by active participation in the global research process |

| n | | Security selections are aligned with level of investment conviction |

| n | | Risk monitoring considers whether investment and other risks to the Funds are intended and justified |

| n | | Dedicated portfolio construction team assists in ongoing monitoring and adjustment of the Funds |

International equity portfolios that strive to offer:

| | n | | Access to markets across the world | |

| | n | | Disciplined approach to stock selection | |

| | n | | Optimal risk/return profiles | |

2

MARKET REVIEW

Goldman Sachs Fundamental Equity

International Funds

Market Review

Overall, international equities advanced during the six-month period ended April 30, 2012 (the “Reporting Period”). The Morgan Stanley Capital International (MSCI) Europe, Australasia, Far East (EAFE) Index (net, unhedged) (the “MSCI EAFE Index”) posted a return of 2.44%.* The modest gains reflect shifting investor sentiment during the Reporting Period, primarily toward the European sovereign debt crisis and global economic growth prospects.

International equities retreated during the last two months of 2011, as Europe’s sovereign debt crisis worsened. The euro’s depreciation against the U.S. dollar further weakened returns as measured in U.S. dollars. During these two months, the Greek and Italian governments were replaced by technocrats; credit conditions for banks tightened; and yields on Italian and Spanish government debt hovered near unsustainable levels. Japanese equities generally lagged the broader international equity market despite the announcement that its economy grew at an annualized pace of 6% during the third quarter of 2011.

The international equity markets then rallied broadly in January, led by many of the worst performing sectors in 2011. Gains extended through March 2012 amidst growing optimism that the U.S. economy was recovering and that Europe might eventually be able to stem its sovereign debt crisis. Despite widespread downgrades of sovereign debt by Standard & Poor’s, European equity markets reflected improved sentiment that a widespread financial crisis would be averted through liquidity provided by the European Central Bank’s longer-term refinancing operation (“LTRO”) and the proposal of a “fiscal compact” for the European Monetary Union. The international equity market retreated in April amidst questions about the strength of the U.S. economic recovery and increasing political uncertainty in Europe. Japanese equities rose as the yen weakened significantly late in the Reporting Period, following the Bank of Japan’s surprise monetary policy easing in the form of increased asset purchases.

For the Reporting Period overall, the European peripheral countries significantly underperformed the MSCI EAFE Index. Sector performance varied widely. The telecommunication services, utilities and information technology sectors declined during the Reporting Period, while all other sectors gained, led by consumer discretionary, consumer staples and health care.

Looking Ahead

Virtually all agree that international equity performance will continue to be heavily influenced by the European sovereign debt crisis during the months ahead. There is an extraordinarily wide range of possible outcomes, only one of which being the potential break-up of the European Monetary Union, which would, in our view, mean significant risk to international equity investment portfolios. Until a resolution is found, the underlying factors causing the sovereign debt crisis will likely continue to make it difficult for investors to assess risks with confidence, thereby hindering equity market performance. On the other hand, resolution of the sovereign debt crisis would likely lift European and global equities broadly. We do believe that a solution will ultimately emerge, but the process may well take time.

| *All | | index returns are expressed in U.S. dollar terms. |

3

MARKET REVIEW

Our challenge as investors is to seek ways in which we can take advantage of this opportunity of market uncertainty without taking undue risk. For example, we believe a number of high quality cyclical stocks were trading at discounted valuations at the end of the Reporting Period simply because they are based in Europe. At the same time, we found financial stocks, particularly banks, to have too much inherent risk at the end of the Reporting Period despite their potential for significant outperformance on news of a crisis resolution. Additionally, stocks in many traditionally defensive industries were trading at the end of the Reporting Period at valuations we believed did not offer a compelling reward for risk and could actually see declines should a European plan emerge.

In our view, an improving global economy should help support international corporate earnings during the months ahead, as most regions are anticipated to benefit from strong export trends. Even in Europe, more than half of corporate revenues came from outside of Europe and the U.K. during the Reporting Period. We expect a rebound in Japanese corporate earnings and economic growth in calendar 2012 as issues from 2011 — the Tohoku earthquake and tsunami, the floods in Thailand and the record high levels of the yen — recede. In addition, we believe the 12 trillion yen fiscal stimulus package initiated by the Bank of Japan, the second largest such package in Japan’s history, should promote reconstruction demand in Tohoku and boost Japan’s overall economic growth. Furthermore, following the Tohoku earthquake, many Japanese companies began to expand their overseas business more rapidly through local production and through mergers and acquisitions. We believe this international expansion strategy should benefit many Japanese companies, as they seek to build market share in the faster growing Asian markets.

Given this view, we believe individual company performance — that is, picking the right stocks — will continue to be critical to generating returns in a more challenging international equity market environment. Corporate profit margins in many international regions were at historically high levels during the Reporting Period, which was a concern to us in 2011 and remains a risk for 2012. With this in mind, we intend to seek companies that we believe have the ability to sustain, or possibly increase, their profit margins through unique business models, market share gains or other opportunities. As fundamental equity investors, we expect to be looking for companies that may be currently misunderstood or mispriced by the market — such as those judged solely because of their European domicile — but that have what we consider to be unique opportunities to grow their businesses, capture market share and/or sustain profit margins. As always, we maintain our focus on seeking companies that we believe will generate long-term growth in today’s ever-changing market conditions.

4

PORTFOLIO RESULTS

Concentrated International Equity Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Equity Team discusses the Goldman Sachs Concentrated International Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of 5.17%, 4.82%, 4.78%, 5.45%, 5.18% and 5.29%, respectively. These returns compare to the 2.44% cumulative total return of the Fund’s benchmark, the MSCI EAFE Index (net, unhedged, with dividends reinvested) (the “MSCI Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s outperformance of the MSCI Index during the Reporting Period can be primarily attributed to individual stock selection. In addition, payments received by the Fund relating to a regulatory settlement that the Fund was authorized to participate in also contributed to performance. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The greatest contributors to Fund performance relative to the MSCI Index during the Reporting Period were Scania, Nokian Renkaat and UCB. |

| | | The Fund’s holding in Swedish truck manufacturer Scania was the greatest contributor to its relative performance during the Reporting Period. Shares of the company increased particularly strongly in the first quarter of 2012 after the market was buoyed by comments from its Chief Executive Officer, highlighting that he thought demand for trucks had troughed in January and so would hopefully begin to improve. |

| | | Finnish winter tire manufacturer Nokian Renkaat performed particularly well after the company announced strong results with better than expected guidance for 2012. Russian car sales were strong during the Reporting Period, which proved to be a good leading indicator for Nokian Renkaat tire demand. |

| | | The Fund’s position in Belgium-based biopharmaceutical manufacturing company UCB performed well, as the company’s share price gradually increased during the first quarter of 2012. While there were no specific company news items that drove its share price up during the Reporting Period, we believe the share price increase showed that investors have started to look at the growth prospects of UCB. In our view, 2013 should be the trough year for the company, and the company should subsequently see sustainable double-digit growth driven by an attractive product pipeline. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | The biggest detractors from Fund performance relative to the MSCI Index during the Reporting Period were Nintendo, EDF and Nippon Paper Group. |

| | | Japanese consumer electronics company Nintendo was the biggest detractor from the Fund’s results during the Reporting Period. Shares of Nintendo lagged primarily because of a weaker outlook for its new handheld game platform “3DS.” Company management had commented that Nintendo’s profits should recover during the next year as hardware cost reduction efforts proceed. However, such a recovery looked weaker than expected given the company’s recent sales trends, especially in the U.S. and Europe. |

| | | Shares of French energy company EDF were challenged in the run up to the French elections and in anticipation of the possibility of a Socialist party win. EDF’s share price was also hampered at the start of 2012 after reports that the company would have to invest approximately 10 billion euros in safety improvements following a review by the French nuclear safety regulator. We believe the market overreacted, and the outcome for EDF, regardless of who wins the French elections, will likely not be as bad as implied by its share price at the end of the Reporting Period. Indeed, at the end of the Reporting Period, we continued to like the company and believed that EDF should continue to improve its operational efficiency and produce higher nuclear output. We therefore sought to take advantage of the recent weakness in EDF’s share price to add to the Fund’s position in the company. |

5

PORTFOLIO RESULTS

| | | Japan-based paper manufacturing business Nippon Paper Group disappointed due mainly to a downward revision in its earnings forecast. The share price of its equity method affiliate in China, Lee & Man Paper Manufacturing, sharply declined after Nippon Paper Group increased its stake in the company in August 2011. In turn, such a share price decline forced Nippon Paper Group to post the impairment loss of Lee & Man Paper Manufacturing in its first half results announcement. Given that Nippon Paper Group had been a strong performer earlier in 2011, this negative news gave investors the opportunity to take profits. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The sectors that contributed most to the Fund’s performance relative to the MSCI Index were financials, telecommunication services and consumer discretionary, due primarily to effective stock selection in each. The Fund’s underweighted allocation to the telecommunication services sector, which lagged the MSCI Index, also contributed positively to the Fund’s performance during the Reporting Period. |

| | | The biggest detractors from the Fund’s relative results during the Reporting Period were information technology, materials and utilities, where stock selection in each of these sectors weighed negatively on performance. It is worth noting that the Fund’s underweighted positioning in the materials sector, which lagged the MSCI Index, actually contributed positively to relative returns, but this was more than offset by the detracting effect of stock selection within the sector. |

| Q | | Which countries most affected the Fund’s performance during the Reporting Period? |

| A | | Typically, the Fund’s individual stock holdings will significantly influence the Fund’s performance within a particular country or region relative to the MSCI Index. This effect may be even more pronounced in a concentrated portfolio or in countries that represent only a modest proportion of the MSCI Index. |

| | | That said, effective stock selection and the Fund’s overall positioning in Spain, Finland and France contributed most positively to its returns relative to the MSCI Index. The countries that detracted most from the Fund’s performance during the Reporting Period were Hong Kong, the Netherlands and the Czech Republic. Stock selection in Hong Kong and the Netherlands and the Fund’s positioning in Hong Kong and the Czech Republic weighed negatively on performance. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy, but we used index futures on an opportunistic basis, to ensure the Fund remained almost fully exposed to equities following cash inflows or stock sales. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | During the Reporting Period, we purchased Sumitomo Mitsui Financial Group, BP and Deutsche Bank for the Fund, as we believed these are quality companies with attractive valuations. |

| | | We initiated a Fund position in Japanese financial company Sumitomo Mitsui Financial Group during the Reporting Period. The performance of the financial sector was bolstered by the European Central Bank’s December announcement regarding additional enhanced credit support measures implemented to support bank lending and liquidity in the euro area money market. We also liked the stock as we expected solid third quarter results and share buybacks to further buoy the banking industry. |

| | | We decided to establish a Fund position in U.K.-based integrated oil company BP based on its attractive relative valuation, expectations for positive earnings revisions and strong cash flow generation. Furthermore, we thought the risk of further Macondo provisioning requirements was reducing and thus that the company may possibly turn out to be over-provisioned. That is, BP has set aside a certain amount of finances to provide for ultimate fines, penalties and economic compensation related to its role in the Macondo oil well spill, to be determined upon conclusion of a trial that may still last for years to come. Macondo is the well involved in the disastrous Gulf of Mexico oil spill in 2010. |

| | | During the first quarter of 2012, we initiated a Fund position in one of Europe’s largest investment banks, Deutsche Bank. The investment bank is broadly diversified, and we believe the company should benefit from an anticipated recovery in investment banking activities should markets stabilize and confidence return. |

| | | During the Reporting Period, we sold out of the Fund’s positions in Nissan Motor, Mitsubishi UFJ Financial Group and Admiral Group. |

6

PORTFOLIO RESULT

| | | We eliminated the Fund’s positions in Japanese vehicle, forklift and marine product manufacturer Nissan Motor and Japanese financial services company Mitsubishi UFJ Financial Group and used the proceeds to invest in stocks we believed offered higher upside potential and what we considered to be better risk/reward opportunities. |

| | | U.K. auto insurance company Admiral Group’s share price performed well during the first quarter of 2012, recovering from lows experienced toward the end of 2011. We decided to sell out of this name after such strong performance as we saw greater potential upside in other insurance companies. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In this Fund, both sector weightings and country allocations are largely the result of our bottom-up stock selection process rather than any top-down macroeconomic views or industry bets. That said, there were no notable changes in the Fund’s sector or country weightings during the Reporting Period. |

| Q | | How was the Fund positioned relative to the MSCI Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had more exposure to the United Kingdom, Switzerland and Sweden and less exposure to the Netherlands, Australia and Hong Kong relative to the MSCI Index. At the end of the Reporting Period, the Fund held neutral positions relative to the MSCI Index in several countries, most notably Greece. |

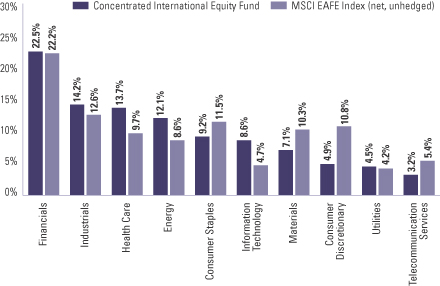

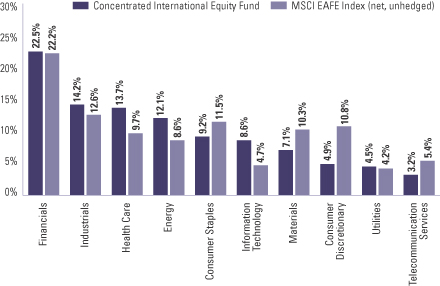

| | | From a sector allocation perspective, the Fund had significant overweight positions relative to the MSCI Index in health care, information technology, industrials and energy at the end of the Reporting Period. On the same date, the Fund had underweighted positions compared to the MSCI Index in consumer discretionary, materials, consumer staples and telecommunication services and rather neutral positions relative to the MSCI Index in utilities and financials. |

| | | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

7

FUND BASICS

Concentrated International Equity Fund

as of April 30, 2012

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2011–April 30, 2012 | | Fund Total Return

(based on NAV)1 | | | MSCI EAFE (Net)

Index (unhedged)2 | |

| | Class A | | | 5.17 | % | | | 2.44 | % |

| | Class B | | | 4.82 | | | | 2.44 | |

| | Class C | | | 4.78 | | | | 2.44 | |

| | Institutional | | | 5.45 | | | | 2.44 | |

| | Service | | | 5.18 | | | | 2.44 | |

| | | Class IR | | | 5.29 | | | | 2.44 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI EAFE Index (net, unhedged, with dividends reinvested) is a market capitalization- weighted composite of securities in 22 developed markets. The Index approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction for withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. The Index is unmanaged and the figures for the Index do not include any deduction for fees or expenses. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/12 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -13.94 | % | | | -6.84 | % | | | 1.92 | % | | | 3.87 | % | | 12/01/92 |

| | Class B | | | -14.13 | | | | -6.85 | | | | 1.92 | | | | 2.15 | | | 5/01/96 |

| | Class C | | | -10.53 | | | | -6.49 | | | | 1.78 | | | | 0.64 | | | 8/15/97 |

| | Institutional | | | -8.59 | | | | -5.41 | | | | 2.96 | | | | 3.43 | | | 2/07/96 |

| | Service | | | -9.05 | | | | -5.89 | | | | 2.44 | | | | 4.19 | | | 3/06/96 |

| | | Class IR | | | -8.72 | | | | N/A | | | | N/A | | | | 5.32 | | | 8/31/10 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert automatically to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Returns for Class B Shares for the period after conversion reflect the performance of Class A Shares. Because Institutional, Service and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

8

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.51 | % | | | 1.70 | % |

| | Class B | | | 2.26 | | | | 2.45 | |

| | Class C | | | 2.26 | | | | 2.45 | |

| | Institutional | | | 1.11 | | | | 1.30 | |

| | Service | | | 1.61 | | | | 1.80 | |

| | | Class IR | | | 1.26 | | | | 1.45 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/125 |

| | | Holding | | % of Total Net Assets | | | Line of Business | | Country |

| | HSBC Holdings PLC | | | 4.2 | % | | Banks | | United Kingdom |

| | Novartis AG (Registered) | | | 3.7 | | | Pharmaceuticals, Biotechnology & Life Sciences | | Switzerland |

| | Sumitomo Mitsui Financial Group, Inc. | | | 3.4 | | | Banks | | Japan |

| | Vodafone Group PLC | | | 3.2 | | | Telecommunication Services | | United Kingdom |

| | BP PLC | | | 3.2 | | | Energy | | United Kingdom |

| | Rio Tinto PLC | | | 3.0 | | | Materials | | United Kingdom |

| | Telefonaktiebolaget LM Ericsson Class B | | | 2.9 | | | Technology Hardware & Equipment | | Sweden |

| | ENI SpA | | | 2.9 | | | Energy | | Italy |

| | Deutsche Bank AG (Registered) | | | 2.7 | | | Diversified Financials | | Germany |

| | | Aryzta AG | | | 2.7 | | | Food, Beverage & Tobacco | | Switzerland |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

9

FUND BASICS

| | |

| | FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| | | As of April 30, 2012 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

10

PORTFOLIO RESULTS

International Small Cap Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Equity Team discusses the Goldman Sachs International Small Cap Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of 7.91%, 7.51%, 7.53%, 8.27%, 7.82% and 8.05%, respectively. These returns compare to the 4.26% cumulative total return of the Fund’s benchmark, the S&P Developed ex-US Small Cap Index (net) (the “S&P Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s outperformance of the S&P Index during the Reporting Period can be primarily attributed to individual stock selection. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The greatest contributors to Fund performance relative to the S&P Index during the Reporting Period were Interflex, Aberdeen Asset Management and Sankei Building. |

| | | During the Reporting Period, the greatest contributor to the Fund’s relative performance was South Korean flexible printed circuit boards manufacturer Interflex. Within the information technology sector, shares of Interflex rallied in anticipation of stronger than expected 2012 estimated earnings, driven by global market share gain from its key customers in the smart phone and tablet personal computers fields, namely Samsung Electronics and Apple. Potential customer expansion to Research in Motion or Nokia and an improvement in profitability from a higher utilization rate and product mix improvement further supported Interflex’s share price during the Reporting Period. |

| | | Aberdeen Asset Management is a U.K.-based diversified asset manager with significant exposure to the emerging markets. The company performed particularly well during the first quarter of 2012 given continuing redistribution of assets under management to its higher margin products and due to a valuation that was widely seen as only at a small premium to the asset management sector. |

| | | Within Japan, the Fund’s best individual contributor during the Reporting Period was Sankei Building, a property leasing provider. The company performed well after the announcement of a takeover bid from its primary stakeholder, Fuji Media. Fuji Media announced its intentions to buy the rest of its stake for more than double the closing price on that day. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | The biggest detractors from Fund performance relative to the S&P Index during the Reporting Period were Iamgold, JCEntertainment and D’Ieteren. |

| | | The Fund’s holding in Canadian gold producer Iamgold was the greatest detractor from the Fund’s relative returns during the Reporting Period. The gold producer performed poorly in January and February 2012 despite positive movement in the underlying price of gold bullion and better performance by the company’s peers. Iamgold’s disappointing performance resulted partially from difficulty selling its Niobium mine and partially due to a slight decline in reserves and resources reported at its fourth quarter 2011 results. Following these events, the stock price fell in line with the declining gold price and other gold equities. Further, Iamgold is exposed to Mali through its interest in the Sadiola gold mine, which did not help sentiment toward the company, as Mali is experiencing several troubles, including a major food crisis and a military coup. |

| | | JCEntertainment, a South Korean online game developer and distributor, detracted from the Fund’s performance relative to the S&P Index during the Reporting Period, as concerns of potential regulatory risk clouded share price performance. Specifically, the company faced the possibility of a Korean law being enacted that would limit the amount of time teenagers can spend on computer games in order to curtail teenager violence in schools. In our view, this potential risk is low, as the proposed regulation is unconstitutional, we believe, and too difficult to implement in reality. Even if the proposed regulation is passed and enacted, we feel it should not have a negative impact on JCEntertainment because most of its revenue is generated from casual game users that do not require long hours to play. Furthermore, we believe |

11

PORTFOLIO RESULTS

| | future revenue may increase as a result of expansion into China and the introduction of a new mobile game called “Rule the Sky.” |

| | | Belgium-based D’Ieteren, an international auto services business with dominant market share in auto glass repair and replacement via its Belron division, was a top detractor from the Fund’s results during the Reporting Period. D’Ieteren has typically been a defensive business exhibiting strong growth and improved market share. However, while market share continued to improve during the Reporting Period, the auto glass repair and replacement market was weaker than expected. Factors such as benign weather conditions and fewer miles driven in the face of higher fuel prices weighed on demand. In turn, management guidance for 2012 disappointed against expectations, and D’Ieteren’s share price declined. Although the valuation of D’Ieteren remained attractive, in our view, this factor alone was not sufficient to outweigh the negative momentum in the company’s Belron division. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The sectors that contributed most to the Fund’s performance relative to the S&P Index were financials, materials and industrials, due primarily to effective stock selection in each. The Fund’s underweighted allocation to financials, which lagged the S&P Index during the Reporting Period, also contributed positively to performance. |

| | | The biggest detractors from the Fund’s results during the Reporting Period were consumer discretionary, telecommunication services and energy, where stock selection hurt relative performance. |

| Q | | Which countries most affected the Fund’s performance during the Reporting Period? |

| A | | Typically, the Fund’s individual stock holdings will significantly influence the Fund’s performance within a particular country or region relative to the S&P Index. This effect may be even more pronounced in countries that represent only a modest proportion of the S&P Index. |

| | | That said, the Fund’s overall positioning in the United Kingdom, South Korea and Spain contributed most positively to the Fund’s performance during the Reporting Period. The countries that detracted most from the Fund’s performance during the Reporting Period were Sweden, Belgium and Australia. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy, but we used index futures on an opportunistic basis, to ensure the portfolio remained almost fully exposed to equities following cash inflows or stock sales. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We purchased several companies for the Fund during the Reporting Period that we viewed as quality companies with compelling long-term prospects trading at attractive valuations. For example, we established a Fund position in indoor golf software provider Golfzon as it has a dominant market position and is changing its business structure from hardware sales via its golf simulators to a fee-based business. During the Reporting Period, the company had a 98% market share in South Korea with approximately 4,000 indoor golf courses and earned revenues on a “per play” basis. At the end of the Reporting Period, we had conviction in the company as we believed it should benefit from domestic consumer income growth, as the number of golfers in South Korea is expected to grow with the country crossing the $20,000 GDP per capita mark. We further expect the company to benefit from expansion into other countries, including Japan and Canada. |

| | | We initiated a Fund position in South Korean food and bioscience company CJ CheilJedang. The bioscience business of the company has become more meaningful for revenues and operating profit due to capacity expansion, price increases, market share gain and agricultural inflation. We believe the company may also benefit as the food business expects a gradual recovery due to lower raw materials costs. Further, the processed food business showed stable growth as single or two-person families are growing to become the majority of South Korean households. This demographic is increasingly dependent on processed food for their convenience. |

12

PORTFOLIO RESULTS

| | | Another new purchase for the Fund during the Reporting Period was Amadeus. Headquartered in Spain, Amadeus provides two information technology-based services to the travel industry: (a) a distribution system for hundreds of airlines across the world to thousands of travel agents and (b) an outsourced technology platform for the core customer-facing functions of an airline. In our view, the company should benefit going forward from strong growth in the latter-mentioned business as it signs on airlines. It already has signed airlines, which we believe should help the division grow by 60% by 2013. Also, as the largest provider of its services, the company should continue, we think, to benefit as airlines outsource their technology needs. |

| | | We sold out of the Fund’s positions in Millicom International Cellular, Himart and Cookson during the Reporting Period. |

| | | After a period of what we considered to be moderate performance, we sold the Fund’s position in Millicom International Cellular, an emerging market telecommunica- tions operator with operations based in South America and in Africa, in order to fund what we believe to be a more attractive idea. |

| | | In the consumer area, Himart, a South Korean online shopping mall, disappointed following news of allegations of embezzlement and tax evasion by its chairperson. We sold the Fund’s position in Himart as a result of this situation and in order to redeploy the capital into what we considered more compelling opportunities. |

| | | U.K.-based Cookson is an international industrial materials company with exposure to the steel and electronics industries, among others. Having come under pressure during the third quarter of 2011 due to macroeconomic fears centered on Europe, Cookson’s share price subsequently rallied sharply as those macroeconomic fears subsided. Investor concerns over the cyclicality of the business were also assuaged in February when the company’s full-year 2011 numbers were released. We sold the Fund’s position in Cookson following an especially strong period for the company’s share price. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In this Fund, both sector weightings and country allocations are largely the result of our bottom-up stock selection process rather than any top-down macroeconomic views or industry bets. That said, there were no notable changes in the Fund’s sector or country weightings during the Reporting Period. |

| Q | | How was the Fund positioned relative to the S&P Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had more exposure to the United Kingdom, China and Ireland and less exposure to France, Sweden and Hong Kong relative to the S&P Index. At the end of the Reporting Period, the Fund held neutral positions relative to the S&P Index in several countries, most notably Canada. |

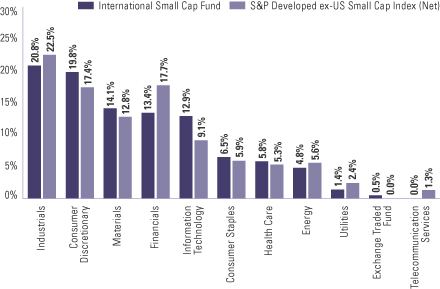

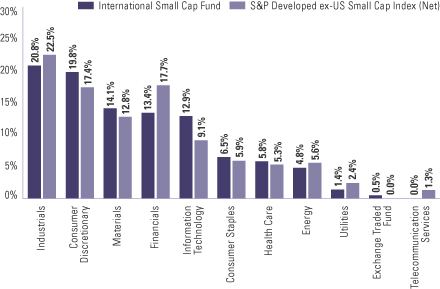

| | | From a sector allocation perspective, the Fund had overweighted positions relative to the S&P Index in information technology, materials and consumer discretionary at the end of the Reporting Period. On the same date, the Fund had underweighted positions compared to the S&P Index in financials and industrials, and rather neutral positions relative to the Index in health care, consumer staples, energy and utilities. The Fund had no position at all in telecommunication services. |

| | | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

13

FUND BASICS

International Small Cap Fund

as of April 30, 2012

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2011–April 30, 2012 | | Fund Total Return

(based on NAV)1 | | | S&P Developed

ex-US Small Cap

Index (Net)2 | |

| | Class A | | | 7.91 | % | | | 4.26 | % |

| | Class B | | | 7.51 | | | | 4.26 | |

| | Class C | | | 7.53 | | | | 4.26 | |

| | Institutional | | | 8.27 | | | | 4.26 | |

| | Service | | | 7.82 | | | | 4.26 | |

| | | Class IR | | | 8.05 | | | | 4.26 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P Developed ex-US Small Cap Index (net) is the small capitalization stock component of the S&P Developed Broad Market Index (BMI). The BMI is a float-weighted index that spans 22 countries (inclusive of the US) and includes the listed shares of all companies with an available market capitalization (float) of at least $100 million at the annual rebalance. At rebalance, companies are deleted from the index if their float falls below $75 million. The Small Cap ex-US is defined as those stocks falling in the bottom 15% of the cumulative available capital in each country. The Index reflects returns net of withholding taxes applied to foreign investors, calculated daily based on tax rates that would be applied to a Luxembourg-based investor. The Index is unmanaged and the figures for the Index do not include any deduction for fees or expenses. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/12 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -10.01 | % | | | -5.26 | % | | | 6.17 | % | | | 4.67 | % | | 5/01/98 |

| | Class B | | | -10.16 | | | | -5.25 | | | | 6.17 | | | | 4.77 | | | 5/01/98 |

| | Class C | | | -6.43 | | | | -4.88 | | | | 6.03 | | | | 4.44 | | | 5/01/98 |

| | Institutional | | | -4.24 | | | | -3.74 | | | | 7.28 | | | | 5.65 | | | 5/01/98 |

| | Service | | | -4.86 | | | | -4.25 | | | | 6.73 | | | | 5.10 | | | 5/01/98 |

| | | Class IR | | | -4.55 | | | | N/A | | | | N/A | | | | 14.55 | | | 8/31/10 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert automatically to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Returns for Class B Shares for the period after conversion reflect the performance of Class A Shares. Because Institutional, Service and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

14

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.58 | % | | | 1.94 | % |

| | Class B | | | 2.33 | | | | 2.69 | |

| | Class C | | | 2.33 | | | | 2.69 | |

| | Institutional | | | 1.18 | | | | 1.54 | |

| | Service | | | 1.68 | | | | 2.04 | |

| | | Class IR | | | 1.33 | | | | 1.69 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/125 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | Travis Perkins PLC | | | 1.2 | % | | Capital Goods | | United Kingdom |

| | Dufry AG (Registered) | | | 1.2 | | | Retailing | | Switzerland |

| | Lindt & Spruengli AG | | | 1.2 | | | Food, Beverage & Tobacco | | Switzerland |

| | Golfzon Co. Ltd. | | | 1.1 | | | Software & Services | | South Korea |

| | Aberdeen Asset Management PLC | | | 1.1 | | | Diversified Financials | | United Kingdom |

| | Hiscox Ltd. | | | 1.1 | | | Insurance | | Bermuda |

| | MTU Aero Engines Holding AG | | | 1.1 | | | Capital Goods | | Germany |

| | Telecity Group PLC | | | 1.1 | | | Software & Services | | United Kingdom |

| | Pfeiffer Vacuum Technology AG | | | 1.0 | | | Capital Goods | | Germany |

| | | CJ CheilJedang Corp. | | | 1.0 | | | Food, Beverage & Tobacco | | South Korea |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

15

FUND BASICS

| | |

| | FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| | | As of April 30, 2012 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of Exchange Traded Funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

16

PORTFOLIO RESULTS

Strategic International Equity Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Equity Team discusses the Goldman Sachs Strategic International Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, B, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of 5.65%, 5.37%, 5.23%, 5.88%, 5.81% and 5.57%, respectively. These returns compare to the 2.44% cumulative total return of the Fund’s benchmark, the MSCI EAFE Index (net, unhedged, with dividends reinvested) (the “MSCI Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s outperformance of the MSCI Index during the Reporting Period can be primarily attributed to individual stock selection. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The greatest contributors to Fund performance relative to the MSCI Index during the Reporting Period were Nokian Renkaat, Scania and Remy Cointreau. |

| | | Finnish winter tire manufacturer Nokian Renkaat performed particularly well after the company announced strong results with better than expected guidance for 2012. Russian car sales were strong during the Reporting Period, which proved to be a good leading indicator for Nokian Renkaat tire demand. |

| | | The Fund’s holding in Swedish truck manufacturer Scania was a key contributor to its relative performance during the Reporting Period. Shares of the company increased particularly strongly in the first quarter of 2012 after the market was buoyed by comments from its Chief Executive Officer, highlighting that he thought demand for trucks had troughed in January and so would hopefully begin to improve. |

| | | French alcohol manufacturer Remy Cointreau was a top contributor to the Fund’s results during the Reporting Period. The company posted results that surpassed expectations, as strong sales growth was driven by its premium products, most notably VSPO and XO qualities of Remy Martin cognac. At the end of the Reporting Period, we continued to like this company as its products were becoming more popular and affordable in regions such as Asia, Russia and the Middle East. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Among the biggest detractors from Fund performance relative to the MSCI Index during the Reporting Period were EDF, Admiral Group and Nintendo. |

| | | Shares of French energy company EDF were challenged in the run up to the French elections and in anticipation of the possibility of a Socialist party win. EDF’s share price was also hampered at the start of 2012 after reports that the company would have to invest approximately 10 billion euros in safety improvements following a review by the French nuclear safety regulator. We believe the market overreacted and the outcome for EDF, regardless of who wins the French elections, will likely not be as bad as implied by its share price at the end of the Reporting Period. Indeed, at the end of the Reporting Period, we continued to like the company and believed that EDF should continue to improve its operational efficiency and produce higher nuclear output. We therefore sought to take advantage of the recent weakness in EDF’s share price to add to the Fund’s position in the company. |

17

PORTFOLIO RESULTS

| | | Admiral Group, a direct sales U.K. auto insurer, was a top detractor from the Fund’s results during the Reporting Period within both the financials sector and the portfolio overall. Though Admiral Group had performed well during the first half of 2011, investors’ perception in October that the stock was defensive hurt it in a strong market and strong financials sector. Admiral Group’s share price also experienced weakness during the second half of 2011 due to investor concerns of upward revisions to loss ratio estimates for the 2009 and 2010 underwriting years highlighted in the company’s half year results report. Further, there was high profile political pressure on the U.K. auto insurance industry broadly regarding lawyer referral fees and industry price increases. Additionally, in November, the company announced that its underwriting results relating to large bodily injury claims had deteriorated compared to the first half of the year. In the early stages of claims development, actuarial estimates of losses can vary significantly from where they ultimately settle, so, in our view, it remains to be seen whether Admiral Group’s recent poor claims experience is true deterioration or merely “noise.” That said, we sold the Fund’s position in Admiral Group by the end of the Reporting Period. |

| | | A position in Japanese consumer electronics company Nintendo detracted from the Fund’s results during the Reporting Period. Shares of Nintendo lagged primarily because of a weaker outlook for its new handheld game platform “3DS.” Company management had commented that Nintendo’s profits should recover during the next year as hardware cost reduction efforts proceed. However, such a recovery looked weaker than expected given the company’s recent sales trends, especially in the U.S. and Europe. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The sectors that contributed most to the Fund’s performance relative to the MSCI Index were financials, telecommunication services and industrials. Stock selection in all three sectors proved effective during the Reporting Period. The Fund’s underweighted exposure in financials and telecommunication services, each of which underperformed the MSCI Index during the Reporting Period, also contributed positively to relative performance. |

| | | The only detractor at the sector level from the Fund’s relative results during the Reporting Period was information technology. Both stock selection and the Fund’s overweighted allocation to this lagging sector weighed negatively on performance. |

| Q | | Which countries most affected the Fund’s performance during the Reporting Period? |

| A | | Typically, the Fund’s individual stock holdings will significantly influence the Fund’s performance within a particular country or region relative to the MSCI Index. This effect may be even more pronounced in countries that represent only a modest proportion of the MSCI Index. |

| | | That said, effective individual stock selection in Italy and Finland and the Fund’s overweighted positioning in the relatively strong South Korean equity market contributed most positively to the Fund’s returns relative to the MSCI Index. Conversely, the countries that detracted most from the Fund’s performance during the Reporting Period were Hong Kong, Japan and the United Kingdom. Stock selection in all three countries and the Fund’s underweighted positioning in the comparatively strong Hong Kong equity market weighed negatively on relative performance. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy, but we used index futures on an opportunistic basis, to ensure the portfolio remained almost fully exposed to equities following cash inflows or stock sales. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | During the Reporting Period, we purchased Kubota, Westpac Banking and Deutsche Bank for the Fund, as we believed these are quality companies with attractive valuations. |

| | | We established a Fund position in Kubota, a Japanese agricultural machinery manufacturer, on optimism that U.S. housing starts would improve in 2012 and on expectations of a rebound in tractor demand in Thailand this year. We think U.S. tractor demand at below 120 horsepower, Kubota’s primary area of business, continues to recover gradually from its 2009 bottom, and we expect Kubota to benefit from the market recovery. |

18

PORTFOLIO RESULTS

| | | Westpac Banking, the second largest bank in Australia and New Zealand, was introduced to the Fund during the Reporting Period. We believe this conservatively run bank is purely focused on servicing Australia and New Zealand, unlike its peers, and on retail and commercial banking. Attributes of the company that we find compelling include a strong capital base and a good funding profile. In addition, its loan book has consistently experienced better asset quality versus peers due to its focus on safer mortgages. In our view, a strong cost discipline helps the company earn a consistently high return on equity. Furthermore, we believed at the time of purchase that the company’s valuation was attractive for a bank of this quality in a global context. |

| | | During the first quarter of 2012, we initiated a Fund position in one of Europe’s largest investment banks, Deutsche Bank. The investment bank is broadly diversified, and we believe the company should benefit from an anticipated recovery in investment banking activities should markets stabilize and confidence return. |

| | | During the Reporting Period, we sold out of the Fund’s positions in Admiral Group, Nissan Motor and BASF. |

| | | U.K. auto insurance company Admiral Group’s share price performed well during the first quarter of 2012, recovering from lows experienced toward the end of 2011. We decided to sell out of this name after such strong performance as we saw greater potential upside in other insurance companies. |

| | | We eliminated the Fund’s position in Japanese vehicle, forklift and marine product manufacturer Nissan Motor and used the proceeds to invest in stocks we believed offered higher upside potential and what we considered to be better risk/reward opportunities. |

| | | We decided to sell out of the Fund’s position in German-based chemical company BASF in order to take profits, as the stock had performed well since it bottomed in October 2011. We reallocated the capital into one of the world’s leading suppliers of standard and specialty fertilizers, K&S, a company we believe to have comparatively greater potential upside. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In this Fund, both sector weightings and country allocations are largely the result of our bottom-up stock selection process rather than any top-down macroeconomic views or industry bets. That said, during the Reporting Period, there were no notable changes in the Fund’s sector or country weightings during the Reporting Period. |

| Q | | How was the Fund positioned relative to the MSCI Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had more exposure to the United Kingdom, Switzerland and South Korea and less exposure to Spain, Hong Kong and Australia relative to the MSCI Index. At the end of the Reporting Period, the Fund held neutral positions relative to the MSCI Index in several countries, most notably France and Finland. |

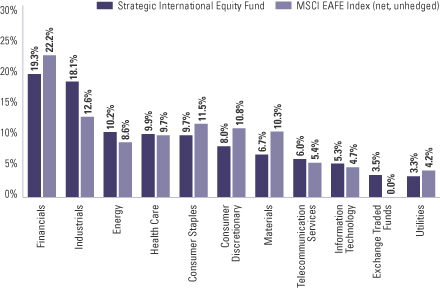

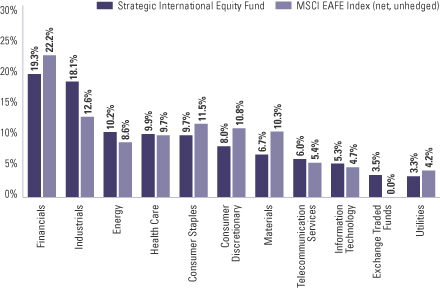

| | | From a sector allocation perspective, the Fund had overweight positions relative to the MSCI Index in industrials and energy at the end of the Reporting Period. On the same date, the Fund had underweighted positions compared to the MSCI Index in materials, financials, consumer staples and consumer discretionary and rather neutral positions relative to the MSCI Index in telecommunication services, information technology, health care and utilities. |

| | | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

19

FUND BASICS

Strategic International Equity Fund

as of April 30, 2012

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2011–April 30, 2012 | | Fund Total Return (based on NAV)1 | | | MSCI EAFE (Net)

Index (unhedged)2 | |

| | Class A | | | 5.65 | % | | | 2.44 | % |

| | Class B | | | 5.37 | | | | 2.44 | |

| | Class C | | | 5.23 | | | | 2.44 | |

| | Institutional | | | 5.88 | | | | 2.44 | |

| | Class IR | | | 5.81 | | | | 2.44 | |

| | | Class R | | | 5.57 | | | | 2.44 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI EAFE Index (net, unhedged, with dividends reinvested) is a market capitalization-weighted composite of securities in 22 developed markets. The Index approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction for withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. The Index is unmanaged and the figures for the Index do not include any deduction for fees or expenses. It is not possible to invest directly in an index. |

| | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/12 | | One Year | | | Since Inception | | Inception Date |

| | Class A | | | -11.73 | % | | -6.76% | | 6/25/07 |

| | Class B | | | -11.96 | | | -6.79 | | 6/25/07 |

| | Class C | | | -8.22 | | | -6.37 | | 6/25/07 |

| | Institutional | | | -6.21 | | | -5.30 | | 6/25/07 |

| | Class IR | | | -6.30 | | | -7.47 | | 11/30/07 |

| | | Class R | | | -6.90 | | | -8.03 | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares, the assumed contingent deferred sales charge for Class B Shares (5% maximum declining to 0% after six years) and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Class B Shares convert automatically to Class A Shares on or about the fifteenth day of the last month of the calendar quarter that is eight years after purchase. Returns for Class B Shares for the period after conversion reflect the performance of Class A Shares. Because Institutional, Class R and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund’s Class B Shares are no longer available for purchase by new or existing shareholders (although current Class B shareholders may continue to reinvest income and capital gains distributions into Class B Shares, and Class B shareholders may continue to exchange their shares for Class B Shares of certain other Goldman Sachs Funds). |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

20

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.48 | % | | | 1.81 | % |

| | Class B | | | 2.23 | | | | 2.56 | |

| | Class C | | | 2.23 | | | | 2.56 | |

| | Institutional | | | 1.08 | | | | 1.41 | |

| | Class IR | | | 1.23 | | | | 1.56 | |

| | | Class R | | | 1.73 | | | | 2.06 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/125 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | HSBC Holdings PLC | | | 3.5 | % | | Banks | | United Kingdom |

| | Novartis AG (Registered) | | | 3.3 | | | Pharmaceuticals, Biotechnology & Life Sciences | | Switzerland |

| | Reed Elsevier PLC | | | 2.8 | | | Media | | United Kingdom |

| | Vodafone Group PLC | | | 2.7 | | | Telecommunication Services | | United Kingdom |

| | Sumitomo Mitsui | | | 2.5 | | | Banks | | Japan |

| | Financial Group, Inc. | | | | | | | | |

| | BP PLC | | | 2.5 | | | Energy | | United Kingdom |

| | Kubota Corp. | | | 2.1 | | | Capital Goods | | Japan |

| | Mitsui & Co. Ltd. | | | 2.1 | | | Capital Goods | | Japan |

| | Rio Tinto PLC | | | 2.0 | | | Materials | | United Kingdom |

| | | ENI SpA | | | 2.0 | | | Energy | | Italy |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

21

FUND BASICS

|

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2012 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of Exchange Traded Funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

22

GOLDMAN SACHS CONCENTRATED INTERNATIONAL EQUITY FUND

Schedule of Investments

April 30, 2012 (Unaudited)

| | | | | | | | |

| Shares | | | Description | | Value | |

| | Common Stocks – 98.9% | |

| Australia – 6.6% | |

| | 148,672 | | | Ansell Ltd. (Health Care Equipment & Services) | | $ | 2,288,815 | |

| | 370,579 | | | Computershare Ltd. (Software & Services) | | | 3,232,076 | |

| | 155,800 | | | Westpac Banking Corp. (Banks) | | | 3,671,617 | |

| | | | | | | | |

| | | | | | | 9,192,508 | |

| | |

| Belgium – 2.3% | |

| | 69,410 | | | UCB SA (Pharmaceuticals, Biotechnology & Life Sciences) | | | 3,245,632 | |

| | |

| China – 0.8% | |

| | 1,719,000 | | | China Citic Bank Corp. Ltd. Class H (Banks) | | | 1,089,195 | |

| | |

| Czech Republic – 1.3% | |

| | 45,300 | | | CEZ AS (Utilities) | | | 1,826,612 | |

| | |

| France – 7.4% | |

| | 100,639 | | | EDF SA (Utilities) | | | 2,132,134 | |

| | 90,850 | | | Safran SA (Capital Goods) | | | 3,367,349 | |

| | 92,300 | | | Societe Generale SA (Banks) | | | 2,185,133 | |

| | 52,980 | | | Total SA (Energy) | | | 2,543,232 | |

| | | | | | | | |

| | | | | | | 10,227,848 | |

| | |

| Germany – 8.2% | |

| | 45,450 | | | Bayer AG (Registered) (Pharmaceuticals, Biotechnology & Life Sciences) | | | 3,202,584 | |

| | 87,310 | | | Deutsche Bank AG (Registered) (Diversified Financials) | | | 3,790,397 | |

| | 68,281 | | | GEA Group AG (Capital Goods) | | | 2,255,168 | |

| | 87,649 | | | ThyssenKrupp AG (Materials) | | | 2,078,624 | |

| | | | | | | | |

| | | | | | | 11,326,773 | |

| | |

| Hong Kong – 1.1% | |

| | 428,928 | | | AIA Group Ltd. (Insurance) | | | 1,517,921 | |

| | |

| Italy – 2.9% | |

| | 182,013 | | | ENI SpA (Energy) | | | 4,044,296 | |

| | |

| Japan – 21.5% | |

| | 553,000 | | | Isuzu Motors Ltd. (Automobiles & Components) | | | 3,157,294 | |

| | 146,400 | | | JS Group Corp. (Capital Goods) | | | 2,874,772 | |

| | 349,000 | | | Kubota Corp. (Capital Goods) | | | 3,368,942 | |

| | 283,000 | | | Mitsubishi Electric Corp. (Capital Goods) | | | 2,486,039 | |

| | 154,000 | | | Mitsubishi Estate Co. Ltd. (Real Estate) | | | 2,722,465 | |

| | 14,500 | | | Nintendo Co. Ltd. (Software & Services) | | | 1,957,267 | |

| | 98,500 | | | Otsuka Holdings Co. Ltd. (Pharmaceuticals, Biotechnology & Life Sciences) | | | 2,968,558 | |

| | 108,700 | | | Seven & I Holdings Co. Ltd. (Food & Staples Retailing) | | | 3,290,370 | |

| | 147,200 | | | Sumitomo Mitsui Financial Group, Inc. (Banks) | | | 4,710,221 | |

| | |

| | | | | | | | |

| Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| Japan – (continued) | |

| | 471,000 | | | Tokyo Gas Co. Ltd. (Utilities) | | $ | 2,272,859 | |

| | | | | | | | |

| | | | | | | 29,808,787 | |

| | |

| Spain – 1.8% | |

| | 120,590 | | | Amadeus IT Holding SA Class A (Software & Services) | | | 2,468,706 | |

| | |

| Sweden – 5.4% | |

| | 166,892 | | | Scania AB Class B (Capital Goods) | | | 3,410,437 | |

| | 412,177 | | | Telefonaktiebolaget LM Ericsson Class B (Technology Hardware & Equipment)* | | | 4,086,101 | |

| | | | | | | | |

| | | | | | | 7,496,538 | |

| | |

| Switzerland – 11.5% | |

| | 73,417 | | | Aryzta AG (Food, Beverage & Tobacco)* | | | 3,698,200 | |

| | 60,253 | | | Julius Baer Group Ltd. (Diversified Financials)* | | | 2,309,595 | |

| | 92,694 | | | Novartis AG (Registered) (Pharmaceuticals, Biotechnology & Life Sciences) | | | 5,118,215 | |

| | 11,830 | | | Sulzer AG (Registered) (Capital Goods) | | | 1,703,750 | |

| | 243,420 | | | UBS AG (Registered) (Diversified Financials)* | | | 3,039,876 | |

| | | | | | | | |

| | | | | | | 15,869,636 | |

| | |

| United Kingdom – 28.1% | |

| | 63,682 | | | Anglo American PLC (Materials) | | | 2,460,976 | |

| | 113,750 | | | BG Group PLC (Energy) | | | 2,683,953 | |

| | 611,000 | | | BP PLC (Energy) | | | 4,413,926 | |

| | 639,248 | | | HSBC Holdings PLC (Banks) | | | 5,770,605 | |

| | 68,421 | | | Imperial Tobacco Group PLC (Food, Beverage & Tobacco) | | | 2,736,187 | |

| | 50,293 | | | Reckitt Benckiser Group PLC (Household & Personal Products) | | | 2,927,725 | |

| | 422,844 | | | Reed Elsevier PLC (Media) | | | 3,499,059 | |

| | 75,025 | | | Rio Tinto PLC (Materials) | | | 4,205,511 | |

| | 195,802 | | | Smith & Nephew PLC (Health Care Equipment & Services) | | | 1,927,314 | |

| | 117,779 | | | Tullow Oil PLC (Energy) | | | 2,938,410 | |

| | 39,148 | | | Victrex PLC (Materials) | | | 922,521 | |

| | 1,596,833 | | | Vodafone Group PLC (Telecommunication Services) | | | 4,419,972 | |

| | | | | | | | |

| | | | | | | 38,906,159 | |

| | |

| | TOTAL INVESTMENTS – 98.9% | | | | |

| | (Cost $138,471,036) | | $ | 137,020,611 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 1.1% | | | 1,532,120 | |

| | |

| | NET ASSETS – 100.0% | | $ | 138,552,731 | |

| | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Non-income producing security. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 23 |

GOLDMAN SACHS INTERNATIONAL SMALL CAP FUND

Schedule of Investments

April 30, 2012 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – 94.5% | |

| Australia – 6.5% | |

| | 38,221 | | | Ansell Ltd. (Health Care Equipment & Services) | | $ | 588,415 | |

| | 102,435 | | | Atlas Iron Ltd. (Materials) | | | 295,097 | |

| | 123,055 | | | Boart Longyear Ltd. (Capital Goods) | | | 530,302 | |

| | 52,520 | | | Computershare Ltd. (Software & Services) | | | 458,063 | |

| | 206,748 | | | DUET Group (Utilities) | | | 396,918 | |

| | 62,653 | | | Echo Entertainment Group Ltd. (Consumer Services) | | | 291,857 | |

| | 158,791 | | | Evolution Mining Ltd. (Materials)* | | | 288,978 | |

| | 125,260 | | | GPT Group (REIT) | | | 426,447 | |

| | 13,654 | | | Iluka Resources Ltd. (Materials) | | | 238,514 | |

| | 48,525 | | | Iress Market Technology Ltd. (Software & Services) | | | 339,240 | |

| | 133,444 | | | Myer Holdings Ltd. (Retailing) | | | 325,315 | |

| | 75,027 | | | PanAust Ltd. (Materials)* | | | 251,475 | |

| | | | | | | | |

| | | | | | | 4,430,621 | |

| | |

| Austria – 0.8% | |

| | 10,021 | | | Andritz AG (Capital Goods) | | | 524,949 | |

| | |