UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Peter V. Bonanno, Esq. | | Geoffrey R.T. Kenyon, Esq. |

Goldman, Sachs & Co. | | Dechert LLP |

200 West Street | | 200 Clarendon Street |

New York, New York 10282 | | 27th Floor |

| | Boston, MA 02116-5021 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2012

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | April 30, 2012 |

| | |

| | | | Single Country Funds |

| | | | Brazil Equity |

| | | | China Equity |

| | | | India Equity |

| | | | Korea Equity |

Goldman Sachs Single Country Funds

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 4 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 5 | |

| |

Schedule of Investments | | | 29 | |

| |

Financial Statements | | | 36 | |

| |

Financial Highlights | | | 40 | |

| |

Notes to Financial Statements | | | 48 | |

| |

Other Information | | | 64 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS SINGLE COUNTRY FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectus.

The Goldman Sachs Brazil Equity Fund invests primarily in a portfolio of equity investments that are tied economically to Brazil or in issuers that participate in the markets of Brazil. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions. Foreign and emerging markets securities, including Brazilian securities, may be more volatile and less liquid than U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments. Such securities are also subject to foreign custody risk. Because of its exposure to Brazil, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events which may occur in Brazil. The Fund may concentrate its investments in a specific industry (only in the event that that industry represents 20% or more of the Fund’s benchmark index at the time of investment), subjecting it to greater risk of loss as a result of adverse economic, business or other developments affecting that industry. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” mutual funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs China Equity Fund invests primarily in a portfolio of equity investments that are tied economically to China or in issuers that participate in the markets of China. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions. Foreign and emerging markets securities, including Chinese securities, may be more volatile and less liquid than U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments. Such securities are also subject to foreign custody risk. Because of its exposure to China, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events which may occur in China. The Fund may concentrate its investments in a specific industry (only in the event that that industry represents 20% or more of the Fund’s benchmark index at the time of investment), subjecting it to greater risk of loss as a result of adverse economic, business or other developments affecting that industry. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. The Fund’s investments in participation notes are subject to the same risks associated with the underlying asset or market, as well as counterparty risk. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” mutual funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

1

GOLDMAN SACHS SINGLE COUNTRY FUNDS

The Goldman Sachs India Equity Fund invests primarily in a portfolio of equity investments that are tied economically to India or in issuers that participate in the markets of India, primarily by investing in a wholly-owned subsidiary of the Fund organized under the laws of the Republic of Mauritius (the “Subsidiary”). The Subsidiary invests directly in equity investments in India or in issuers that substantially participate in the markets of India, and has the same investment objective and strategies as the Fund. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions. Foreign and emerging markets securities, including Indian securities, may be more volatile and less liquid than U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments. Such securities are also subject to foreign custody risk. Because of its exposure to India, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events which may occur in India. The Fund may concentrate its investments in a specific industry (only in the event that that industry represents 20% or more of the Fund’s benchmark index at the time of investment), subjecting it to greater risk of loss as a result of adverse economic, business or other developments affecting that industry. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. The Fund’s investments in participation notes are subject to the same risks associated with the underlying asset or market, as well as counterparty risk. The securities of small- and mid-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all.

By investing in the Subsidiary, the Fund will be exposed to the risks associated with the Subsidiary’s investments. The Fund invests through the Subsidiary to seek to obtain the benefits of favorable tax treatment of its investments pursuant to a treaty between India and the Republic of Mauritius. Any change in the provisions of the treaty or its applicability to the Subsidiary could result in the imposition of withholding and other taxes on the Subsidiary by India, which would reduce the return to the Fund on its investments. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” mutual funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Korea Equity Fund invests primarily in a concentrated portfolio of equity investments that are tied economically to Korea or in issuers that participate in the markets of Korea. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions. Foreign and emerging markets securities, including Korean securities, may be more volatile and less liquid than U.S. securities and will be subject to the risks of currency fluctuations and adverse economic or political developments. Such securities are also subject to foreign custody risk. Because of its exposure to Korea, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events which may occur in Korea. The Fund may concentrate its investments in a specific industry (only in the event that that industry represents 20% or more of the Fund’s benchmark index at the time of investment), subjecting it to greater risk of loss as a result of adverse economic, business or other developments affecting that industry. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. The Fund’s investments in participation notes are subject to the same risks associated with the underlying asset or market, as well as counterparty risk. The securities of small- and mid-capitalization companies involve greater risks than those associated with

2

GOLDMAN SACHS SINGLE COUNTRY FUNDS

larger, more established companies and may be subject to more abrupt or erratic price movements. At times, the Fund may be unable to sell certain of its investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” mutual funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

3

GOLDMAN SACHS SINGLE COUNTRY FUNDS

What Differentiates Goldman Sachs’ Single Country Funds Investment Process?

Goldman Sachs’ Single Country Funds investment process is based on the belief that strong, consistent results are best achieved through expert stock selection, performed by our dedicated Emerging Markets Team that works together on a global scale. Our deep, diverse and experienced team of research analysts and portfolio managers combines local insights with global, industry-specific expertise to identify its best investment ideas

| n | | The Emerging Markets Equity research team, based in London, Shanghai, Hong Kong, Seoul, Singapore, Sao Paulo and Mumbai, focuses on companies with strong or improving business fundamentals, trading at attractive valuations |

| n | | Proprietary, bottom-up research is the key driver of our investment process |

| n | | Analysts collaborate regularly to leverage regional and industry-specific research and insights |

| n | | Members of each local investment team are aligned by sector and are responsible for finding ideas with the best risk-adjusted upside in their respective areas of coverage |

| n | | The decision-making process includes active participation in frequent and regular research meetings |

| n | | The Emerging Markets Equity team benefits from the country and currency expertise of our Global Emerging Markets Debt and Currency teams |

| n | | Security selections are aligned with levels of investment conviction and risk-adjusted upside |

| n | | Continual risk monitoring identifies various risks at the stock and portfolio level and assesses whether they are intended and justified |

| n | | Dedicated portfolio construction team assists in ongoing monitoring and adjustment of the Funds’ portfolios |

Emerging markets equity portfolios that strive to offer:

| | n | | Access to Brazil, China, India and Korea equity markets | |

| | n | | Disciplined approach to stock selection | |

| | n | | Optimal risk/return profiles | |

4

PORTFOLIO RESULTS

Goldman Sachs Brazil Equity Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs Brazil Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of -6.74%, -7.15%, -6.59% and -6.60%, respectively. These returns compare to the -0.75% cumulative total return of the Fund’s benchmark, the MSCI Brazil 10/40 Index (net, total return, unhedged, USD) (the “Index”), during the same time period. |

| Q | | What economic and market factors most influenced Brazil’s equity market as a whole during the Reporting Period? |

| A | | In contrast to the prior fiscal year, when the primary factors impacting the Brazilian equity market were external macroeconomic ones, the main economic and market factors influencing Brazil’s equity market during this Reporting Period were domestic. |

| | | During the Reporting Period, the Brazilian central bank continued an acute monetary easing cycle, having cut its overnight rate from 12.50% to 9.00%. There seemed to be a change in the government and central bank approach to the nation’s inflation target regime in that they appeared to no longer be aiming at the previously stated target of 4.50% but instead using a band of 2.50% to 6.50% in an effort to keep interest rates lower and stimulate economic growth. Furthermore, the communications of the central bank, via its meeting minutes, became ambiguous, making it hard for investors to interpret what may happen to interest rates going forward. That said, at the end of the Reporting Period, the interest rate curve appeared to be pricing in further interest rate cuts, with the overnight rates reaching 8.00%. |

| | | The Brazilian central bank also strongly intervened in the foreign exchange market during the Reporting Period, seemingly in an effort to contain appreciation of the Brazilian real. The government stated that it believes such a strategy will help make its domestic industry more competitive. During the Reporting Period, after many interventions by the Brazilian central bank, the real depreciated by 12% versus the U.S. dollar. |

| | | On the macroeconomic front, industrial production in Brazil was quite sluggish during the Reporting Period, pointing to a slower economy. We expect the first half of 2012 to be weak for the Brazilian economy but for economic activity to recover during the second half of the calendar year. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s underperformance of the Index during the Reporting Period can be primarily attributed to allocation decisions. Individual stock selection also detracted, though to a lesser degree. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Among the stocks that detracted most from the Fund’s results relative to the Index were positions in education company Anhanguera Educacional Participacoes, retailer Magazine Luiza and real estate company PDG Realty—each components of the consumer discretionary sector. Another stock that detracted significantly from the Fund’s performance during the Reporting Period was a position in diversified financials company Itau/Itausa. |

| | | Anhanguera Educacional Participacoes is Brazil’s leading private, for-profit professional education company. During the Reporting Period, the company suffered from larger than expected costs linked to a recent acquisition it made. Despite causing disappointing short-term results, we believed at the end of the Reporting Period that these non-recurring costs are part of the company’s growing pains and should lead to future profitability. |

| | | Similarly, shares of Magazine Luiza, one of the largest household appliance retail chains in Brazil, declined during the Reporting Period as the company incurred non-operating costs from some of its stores and was instructed by its partner bank to increase provisions at its financial arm. Such instruction came despite a good track record of loan repayment. At the end of the Reporting Period, Magazine Luiza continued to be the Fund’s highest conviction name in the Brazilian consumer discretionary sector. We believe the company should exhibit strong growth in the sector going |

5

PORTFOLIO RESULTS

| | forward and benefit from the turnaround of its recent acquisitions, with better margins and lower financing costs. |

| | | PDG Realty, the largest real estate company in Brazil, was another detractor from the Fund’s relative performance during the Reporting Period. Its shares declined due to market expectations of weak fourth calendar quarter results. The company’s results were adversely affected by overrunning costs for some of its projects and goodwill adjustments related to prior acquisitions. The company had weak fourth quarter 2011 results, which included a notable cost overrun on some of its projects. We believe that there might be further cost overruns in future quarters as well. Since superior execution and financial control were main theses for the Fund to invest in this company, given that these attributes had set it apart from other companies in the sector, we decided to sell out of the Fund’s position in PDG Realty. |

| | | The Fund’s overweighted position in Itau/Itausa detracted, as the financials company underperformed along with the broad financials sector. The economic slowdown in Brazil was greater than expected during the Reporting Period, pressuring conditions in terms of default behavior and payment capabilities, thus impacting the financials sector overall. Adding uncertainty to prospects of future profitability of the financials sector—and public-owned banks in particular—were headlines toward the end of the Reporting Period regarding the Brazilian government’s request of banks to reduce credit spreads and to lower lending rates to individuals and corporations. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | Among the Fund’s best-performing individual stocks relative to the Index were holdings in packaging company Klabin and steel producer Gerdau. |

| | | Klabin, the leading manufacturer of packaging paper and board in Brazil, was the top contributor to the Fund’s performance during the Reporting Period. Its stock rose after the company reported better than expected third quarter 2011 results, which showed increasing revenues. The stock was further supported by weakness in the Brazilian real, as a significant share of the company’s revenues is tied to the U.S. dollar. At the end of the Reporting Period, we believed that Klabin offers strong growth potential over the long term attributable to an aggressive cost cutting program and capacity expansion introduced by the new management of the company. We also think that should the Brazilian |

| | economy grow as anticipated, the company is likely to shift some of its focus to the domestic market, thus improving its revenue mix. |

| | | Gerdau is one of the largest steel producers globally, with approximately 20 metric tons of installed capacity as well as operations in the U.S., Brazil, Latin America and Europe. About half of its earnings come from Brazil and about 40% from the U.S. It produces only long steel used in construction, infrastructure and industry. As the U.S. economy recovered at a somewhat greater pace during the Reporting Period than in the months prior, Gerdau benefited, and its stock, which was at what many considered to be an attractive valuation, recovered. Virtually all of its contracts with store owners are hinged to inflation rates. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than making industry or sector bets and thus all sector weightings are the result of fundamental stock selection. |

| | | The biggest detractors from the Fund’s relative results during the Reporting Period were the financials and consumer discretionary sectors, each due primarily to poor stock selection. Having overweighted allocations to consumer discretionary and financials, each of which lagged the Index, also hurt. Financials suffered initially from weaker than expected fourth quarter 2011 results, wherein nonperforming loans continued to grow. Subsequently, the sector performed poorly as the Brazilian government forced banks in which it owns a large stake, such as Banco do Brasil and Caixa Economica Federal, to reduce the interest rate spread they pass to clients on certain loans. This directly affects banks’ profitability and may compel private banks to reduce their spreads in order to remain competitive. The full impact of these new government policies has not yet been observed, but the uncertainty of such intervention brought a material overhang to the sector during the Reporting Period. In consumer discretionary, overweighted positions in Anhanguera Educacional Participacoes, Magazine Luiza and PDG Realty, each already mentioned, hurt the Fund’s results. |

| | | The sectors that contributed most to the Fund’s performance relative to the Index were materials and health care. In materials, our stock selection was particularly effective, with an overweighted position in Klabin, already discussed, the greatest contributor. In health care, the Fund benefited from our exiting its positions in Amil Participacoes and |

6

PORTFOLIO RESULTS

| | Diagnosticos da America at what proved to be an opportune time. As the economy slowed, the health care sector, closely linked to Gross Domestic Product (“GDP”) growth, suffered. There was also an overhang on the health care sector as a result of news that regulators might be increasingly harsh in enforcing antitrust policies thereby slowing down merger and acquisition activity. Furthermore, Diagnosticos da America, the laboratory diagnostic company which the Fund sold out of early in the Reporting Period, subsequently reported weak results and a change in management, bringing more uncertainty to the company’s stock. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | While the Fund invested in forward foreign exchange contracts for the purpose of portfolio construction, no derivatives or similar instruments were invested in as a part of the Fund’s active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | During the Reporting Period, we established a new Fund position in CCR, a private infrastructure conglomerate. The company’s businesses consist of highway concessions, electronic payment methods, vehicular inspection services and passenger rail transport. Our investment thesis on CCR includes our belief that the company can offer a high dividend yield and its performance is leveraged to GDP growth. |

| | | We added to the Fund’s position in Magazine Luiza on weakness during the Reporting Period. While the company performed poorly during the Reporting Period, we believe it continued to have the most attractive valuation among Brazilian retailers, and it has consistently grown more than its competitors. Despite increased provision in its financial arm, as requested by its partner bank, customers continued to show good default behavior. Further, we believe the company presents strong upside potential in its valuation, and so we took advantage of what we believe to be short-term weakness to increase the Fund’s position in the stock. |

| | | As discussed above, we sold the Fund’s positions in PDG Realty, Amil Participacoes and Diagnosticos da America during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | During the Reporting Period, we reduced the Fund’s overweighted position in financials as a result of the overhang in the sector discussed earlier. We also reduced the |

| | Fund’s allocation to health care, as a result of regulators being stricter on merger and acquisition activity and several companies struggling to deliver results. We maintained the Fund’s overweighted exposures to materials and consumer discretionary, as we believe these sectors continue to offer attractive valuations and should be poised to benefit from the pick up in economic activity we anticipate for the second half of 2012. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted positions relative to the Index in materials and consumer discretionary. On the same date, the Fund had underweighted positions compared to the Index in the consumer staples, telecommunication services, energy, information technology, industrials, utilities, and financials sectors and had no position at all in the health care sector. |

| Q | | What is the Fund’s tactical view and strategy going forward? |

| A | | Despite the delicate scenario in Europe, we believe the world’s economy should see a recovery in the coming months. In our view, economic activity, led by China and the U.S., is likely to pick up in the second half of 2012 and help drive global economic growth. Consequently, we expect commodity prices to remain at high levels and businesses in basic materials to gain from this momentum. |

| | | We expect the Brazilian economy to speed up during the second half of 2012, a reflection of the monetary easing and the government policies implemented to stimulate consumption. We believe inflation in Brazil should close 2012 within the upper limit of the target band. Unemployment in the country reached historical lows during the Reporting Period in a tight labor market. Thus, considering this landscape, it is our view that more cyclical sectors and companies with a strong focus on the domestic market may perform well, including financials and consumer discretionary, which each have a high sensitivity to interest rates. The risk to these sectors, although we do not believe it will materialize, is a possible overheating of the economy that results in higher than expected inflation and potentially the implementation of measures by the government to control it. |

| | | Perhaps most important is that at the end of the Reporting Period, Brazilian equities offered what we considered to be compelling valuations, with equities trading at historical average (that is, a price/earnings ratio of 10x) despite lower interest rates. |

7

FUND BASICS

Brazil Equity Fund

as of April 30, 2012

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2011–April 30, 2012 | | Fund Total Return (based on NAV)1 | | | MSCI Brazil 10/40 Index2 | |

| | Class A | | | -6.74 | % | | | -0.75 | % |

| | Class C | | | -7.15 | | | | -0.75 | |

| | Institutional | | | -6.59 | | | | -0.75 | |

| | | Class IR | | | -6.60 | | | | -0.75 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI Brazil 10/40 Index (net, total return, unhedged, USD) offers a representation of the Brazilian market by targeting all companies with a market capitalization within the top 85% of the Brazilian investable equity universe, subject to a global minimum size requirement. It is not possible to invest directly in an index. |

| | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | | | |

| | | For the period ended 3/31/12 | | Since Inception | | | Inception Date |

| | Class A | | | -27.50 | % | | 4/29/11 |

| | Class C | | | -24.56 | | | 4/29/11 |

| | Institutional | | | -23.00 | | | 4/29/11 |

| | | Class IR | | | -23.10 | | | 4/29/11 |

| | 3 | | The Standardized Total Returns are cumulative total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

8

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.90 | % | | | 19.75 | % |

| | Class C | | | 2.65 | | | | 20.50 | |

| | Institutional | | | 1.50 | | | | 19.35 | |

| | | Class IR | | | 1.65 | | | | 19.50 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/125 |

| | | Holding | | % of Total Net Assets | | | Line of Business |

| | Banco Bradesco SA ADR | | | 6.2 | % | �� | Commercial Banks |

| | Petroleo Brasileiro SA ADR | | | 6.1 | | | Oil, Gas & Consumable Fuels |

| | Companhia Energetica de Minas Gerais | | | 4.8 | | | Electric Utilities |

| | iShares MSCI Brazil Index Fund | | | 4.7 | | | Exchange Traded Fund |

| | Bradespar SA | | | 4.7 | | | Metals & Mining |

| | Klabin SA | | | 4.3 | | | Containers & Packaging |

| | BM&FBOVESPA SA | | | 4.3 | | | Diversified Financial Services |

| | Telefonica Brasil SA | | | 4.2 | | | Diversified Telecommunication

Services |

| | Itausa – Investimentos Itau SA | | | 4.0 | | | Commercial Banks |

| | | Itau Unibanco Holding SA ADR | | | 3.8 | | | Commercial Banks |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

9

FUND BASICS

|

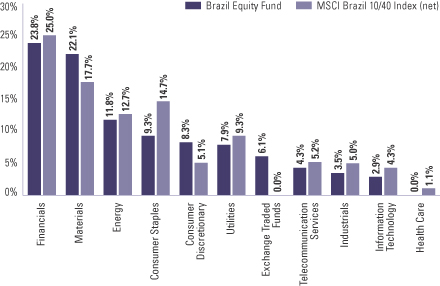

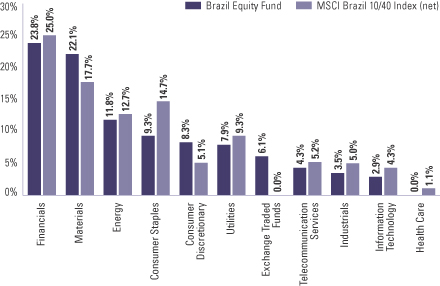

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2012 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The above graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of Exchange Traded Funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

10

PORTFOLIO RESULTS

China Equity Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs China Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 5.87%, 5.54%, 6.10% and 6.01%, respectively. These returns compare to the 6.85% cumulative total return of the Fund’s benchmark, the MSCI China Index (net, total return, unhedged, USD) (the “Index”), during the same time period. |

| Q | | What economic and market factors most influenced China’s equity market as a whole during the Reporting Period? |

| A | | China’s offshore equity market, as measured by the Index, outperformed both emerging market peers and developed equity markets broadly, as measured by the MSCI Emerging Markets Index and MSCI EAFE Index, respectively. |

| | | During the first half of the Reporting Period, the performance of the Chinese offshore equity market reflected fear of contagion from Europe’s sovereign debt crisis as well as concerns about a slowing domestic and global economy. However, the market rebounded and had a strong rally in January and February 2012, driven primarily by expectations of China’s recovery post the Chinese New Year, positive developments in the European sovereign debt situation and encouraging U.S. economic data. In March, investor sentiment turned weak again following a softer Gross Domestic Product (“GDP”) growth forecast from the Chinese government of 7.5% for 2012, the first time in recent years that such estimates had been under 8%. |

| | | Until March, the closely watched Consumer Price Index (“CPI”), which measures inflation, trended downward, lightening investors’ expectations on further monetary policy easing. However, March CPI data rebounded and surprised the market. A package of measures was announced by the Chinese government to help small and medium enterprises, including tax breaks and easier access to bank loans. The People’s Bank of China announced two reserve requirement ratio cuts of 50 basis points each during the Reporting Period. (A basis point is 1/100th of a percentage point.) |

| | | The annual sessions of the National People’s Congress and Chinese People’s Political Consultative Conference were held between March 5 and March 14, 2012. The government set several working targets this year during the conferences, including CPI of around 4%, registered urban unemployment rate below 4.6%, a deficit of 800 billion yuan and increased volume of total exports and imports by approximately 10%. In addition, Premier Wen commented that China would continue to implement a proactive fiscal policy with increasing spending on areas important to people’s well being as well as a prudent monetary policy with broad money supply increased by 14%. |

| | | The majority of Chinese companies reported their fiscal year 2011 earnings in March. Approximately 30% of them missed market expectations due to demand slowdown during the fourth quarter of 2011 and due to cost increases. In April 2012, the Chinese government announced the nation’s first quarter GDP, which showed that growth had moderated to 8.1%, which was below expectations. Such GDP data supported the likelihood that the country’s monetary policy would remain loose. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s underperformance of the Index during the Reporting Period can be primarily attributed to individual stock selection. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Among the stocks that detracted most from the Fund’s results relative to the Index were positions in telecommunications equipment company ZTE, power generator and electric motor manufacturer Dongfang Electric and coal company China Shenhua Energy. |

| | | Shares of ZTE sold off during the Reporting Period, as the company reported weak results for the second half of 2011 due to a one-off valuation loss on its euro cash holdings following currency depreciation. Investors’ concerns about a potential lawsuit and compensation to wireless equipment |

11

PORTFOLIO RESULTS

| | manufacturer Telefonaktiebolaget LM Ericsson also weighed on the stock during the Reporting Period. |

| | | Dongfang Electric, which is one of the largest enterprises in China involved in the production of power-generation equipment and nuclear energy projects, saw its stock underperform during the Reporting Period. Nuclear equipment orders did not pick up during the first quarter of 2012 contrary to the market’s expectation. The company’s stock also declined as the expectations of power tariff increases diminished. |

| | | China Shenhua Energy, the country’s biggest coal producer, lagged the Index due to its defensive characteristics amid market rotation toward higher volatility names during the second half of the Reporting Period. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | Among the Fund’s best-performing individual stocks relative to the Index were holdings in China Petroleum & Chemical (“Sinopec”), Guangzhou Pharmaceutical and China Minsheng Bank. |

| | | Sinopec is one of the major petroleum companies in China. The company’s refining efficiency was improving, which helped its fiscal year 2011 earnings. In a related manner, weakness in crude oil prices during the first half of the Reporting Period was viewed as positive, potentially giving the company an opportunity to turn around its refining business. Sinopec’s shares also performed well during the Reporting Period on robust growth for the company in its other business segments, such as chemicals. |

| | | Guangzhou Pharmaceutical is principally engaged in the manufacturing and distribution of Chinese patent medicines, the distribution of western drugs, Chinese pharmaceutical products and medical apparatus as well as the research and development of natural drugs and biological medicines. Trading in the company resumed on March 28, 2012, after being suspended for more than three months. The company announced a merger plan with its sister company, Baiyunshan, which is anticipated to substantially boost earnings per share and return on equity of the new entity. As the market reacted positively to the plan, the company’s shares soared during the Reporting Period. |

| | | China Minsheng Bank, the first bank in China that is majority owned by non-government enterprises, has a relatively high exposure to small and medium enterprise loans. As monetary easing expectations set in during the |

| | Reporting Period, particularly with regard to small and medium enterprise loans, the bank’s shares rallied strongly. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The biggest detractors from the Fund’s relative results during the Reporting Period were the consumer staples, utilities and industrials sectors, each due primarily to poor stock selection. |

| | | The sectors that contributed most to the Fund’s performance relative to the Index were health care, consumer discretionary and energy, each driven primarily by effective stock selection. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We established a Fund position in China CITIC Bank, China’s seventh largest lender in terms of total assets, during the Reporting Period. We believe the stock may benefit from potential monetary policy easing, and the stock, in our view, had an attractive valuation at the time of purchase. |

| | | We added to the Fund’s position in CNOOC, a Chinese producer of crude oil and natural gas, as we believed that being mainly involved in upstream production activities, it would benefit from robust oil prices from the first quarter of 2012. (Upstream production activities generally include those operations stages in the oil and gas industry that involve exploration and production.) |

| | | We trimmed the Fund’s position in Sinopec, China’s largest oil and gas refiner. As mentioned above, weakness in crude oil prices during the first half of the Reporting Period was seen as a positive opportunity for the company to turn around its refining business. However, rising oil prices starting from the first quarter of 2012 were likely, in our view, to have a negative impact on Sinopec’s margins in the refinery sector. We used the proceeds from this reduced position to fund the add-on to the Fund’s position in CNOOC. |

| | | We eliminated the Fund’s position in China Longyuan Power, the largest wind power producer in China, as we were concerned that poorer than expected wind conditions would |

12

PORTFOLIO RESULTS

| | lead to earnings disappointment for the company. We also saw fewer positive catalysts for company growth ahead. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | Throughout the Reporting Period, we remained focused on individual stock selection, with sector positioning being a secondary, closely-monitored effect. That said, the Fund’s exposure relative to the Index in financials and information technology increased, and its allocations relative to the Index to utilities and consumer staples decreased. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted positions relative to the Index in information technology, materials and energy. On the same date, the Fund had underweighted positions compared to the Index in the financials, consumer staples and telecommunication services sectors, rather neutral exposure relative to the Index in health care, industrials and consumer discretionary, and no position at all in the utilities sector. |

| Q | | What is the Fund’s tactical view and strategy going forward? |

| A | | At the end of the Reporting Period, we maintained our view that China’s offshore equity market presented attractive risk-reward opportunities for long-term investors. In our view, China has experienced a paradigm shift through upgrading of its industrial sector, through a deepening of its sources of growth into domestic consumption and services from fixed assets investments, and through development of its central and western region. This paradigm shift, we believe, augurs well for better sustainability in its economic growth profile. |

| | | In the near term, the trajectory of China’s offshore equity market may remain volatile, as China moves through this economic transition phase, and policy visibility may still be clouded pending changes in leadership across government and corporate platforms. External factors, such as global economic weakness and oil price swings, could also create jitters in China’s offshore equity market in the months ahead. |

| | For 2012, we believe that China’s economy should be on track to achieve high single-digit growth, drawing from robust underlying momentum from domestic-driven activities. We believe these economic activities will likely be most dominant during the second half of 2012. At the margin, improved liquidity conditions and credit |

| | accessibility, as compared with 2011, should, we believe, provide support to corporate activities. |

| | | Of course, there are macro-risks to our view ahead. There may be inflationary pressures from rising oil prices. High profile allegations of corporate governance misconduct can lead to stock price volatility. A contagion effect from global economic weakness also remains a risk. |

| | | Going forward, our strategy is to continue to seek opportunities to add to high quality names that we believe may benefit from China’s next phase of growth. More specifically, going forward, we intend to seek high quality companies with franchise value, resource accessibility, distribution capability and cost competitiveness. In our view, such opportunities are likely to be found most in the industrial, consumer-oriented and information technology sectors. |

13

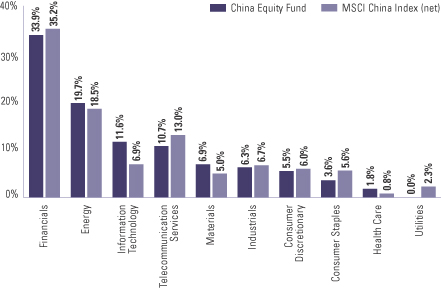

FUND BASICS

China Equity Fund

as of April 30, 2012

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2011– April 30, 2012 | | Fund Total Return (based on NAV)1 | | | MSCI China Index2 | |

| | Class A | | | 5.87 | % | | | 6.85 | % |

| | Class C | | | 5.54 | | | | 6.85 | |

| | Institutional | | | 6.10 | | | | 6.85 | |

| | | Class IR | | | 6.01 | | | | 6.85 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI China Index (net, total return, unhedged, USD) is a free-float adjusted market capitalization weighted index that is designed to measure the equity market performance of China. As of May 31, 2011, the MSCI China Index consisted of 141 constituents. It is not possible to invest directly in an index. |

| | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | | | | | | |

| | | For the period ended 3/31/12 | | Since Inception | | | Inception Date |

| | Class A | | | -25.01 | % | | 4/29/11 |

| | Class C | | | -21.91 | | | 4/29/11 |

| | Institutional | | | -20.37 | | | 4/29/11 |

| | | Class IR | | | -20.45 | | | 4/29/11 |

| | 3 | | The Standardized Total Returns are cumulative total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

14

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | | | | | | | | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.90 | % | | | 10.09 | % |

| | Class C | | | 2.65 | | | | 10.84 | |

| | Institutional | | | 1.50 | | | | 9.69 | |

| | | Class IR | | | 1.65 | | | | 9.84 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/125 |

| | | Holding | | % of Total

Net Assets | | | Line of Business |

| | China Construction Bank Corp. Class H | | | 11.8 | % | | Commercial Banks |

| | China Mobile Ltd. | | | 8.5 | | | Wireless Telecommunication

Services |

| | Industrial and Commercial Bank of China Ltd. Class H | | | 7.7 | | | Commercial Banks |

| | CNOOC Ltd. | | | 7.2 | | | Oil, Gas & Consumable

Fuels |

| | PetroChina Co. Ltd. Class H | | | 6.6 | | | Oil, Gas & Consumable

Fuels |

| | China Pacific Insurance (Group) Co. Ltd. Class H | | | 5.6 | | | Insurance |

| | China Overseas Land & Investment Ltd. | | | 5.1 | | | Real Estate Management &

Development |

| | Tencent Holdings Ltd. | | | 4.9 | | | Internet Software & Services |

| | China Shenhua Energy Co. Ltd. Class H | | | 4.8 | | | Oil, Gas & Consumable

Fuels |

| | | Belle International Holdings Ltd. | | | 3.9 | | | Specialty Retail |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

15

FUND BASICS

|

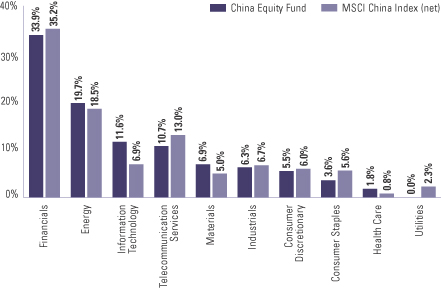

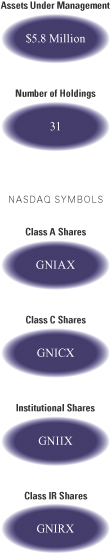

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2012 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The above graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

16

PORTFOLIO RESULTS

India Equity Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs India Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of -1.26%, -1.61%, -1.14% and -1.15%, respectively. These returns compare to the -9.62% cumulative total return of the Fund’s benchmark, the MSCI India IMI Index (net, total return, unhedged, USD) (the “Index”), during the same time period. |

| Q | | What economic and market factors most influenced India’s equity market as a whole during the Reporting Period? |

| A | | India’s equity market declined during the Reporting Period overall, largely driven by slowing domestic growth estimates and softening leading economic indicators. In addition, the Indian rupee declined to record lows versus the U.S. dollar, particularly depressing fourth quarter 2011 returns when expressed in U.S. dollars. The Indian equity market rebounded somewhat during the first quarter of 2012 amidst growing optimism on the state of the global economy and containment of Europe’s sovereign debt crisis. However, enthusiasm for the Indian equity market during the first calendar quarter was tempered as the nation’s economy grew 6.1% during the fourth quarter of 2011, the slowest rate in three years. A poor showing in recent elections for the current party in power also muted first quarter 2012 market performance. Toward the end of the Reporting Period, the Indian equity market retreated again on concerns over domestic and global economic growth. In April 2012, India’s central bank cut interest rates for the first time in three years in an effort to stem slowing domestic growth. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s outperformance of the Index during the Reporting Period can be primarily attributed to individual stock selection. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | Among the Fund’s best-performing individual stocks relative to the Index were holdings in refiner Reliance Industries, pharmaceuticals company Wockhardt and automotive parts manufacturer Bosch India. |

| | | Reliance Industries was the top contributor to the Fund’s results during the Reporting Period, as the Fund had a significantly underweighted position in this company’s underperforming stock. Its shares performed poorly due to the significant downtrend in global refining margins as well as in petrochemical price spreads, which may well adversely impact the company’s earnings. We sold the Fund’s position in Reliance Industries by the end of the Reporting Period. |

| | | Wockhardt’s shares surged during the Reporting Period when the company received approval during the first quarter of 2012 for the marketing and distribution of a nasal spray product in the U.S. market. The news led to improved earnings visibility. |

| | | Bosch is a subsidiary of Robert Bosch Gmbh, a leading auto component manufacturer with dominant presence in diesel engines, automotive accessories and auto electrical components. Bosch’s shares gained significantly during the Reporting Period, as the company has been able to maintain its revenue momentum driven by its diverse customer mix, its technological excellence and monopolistic edge. Positive earnings momentum over the past several quarters also aided its stock’s strong performance. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Among the stocks that detracted most from the Fund’s results relative to the Index were positions in commercial bank State Bank of India, state controlled coal miner Coal India and gold financing company Muthoot Finance. |

17

PORTFOLIO RESULTS

| | | The Fund’s underweighted position in State Bank of India detracted from its performance relative to the Index, as its stock performed comparatively well during the Reporting Period. The country’s biggest lender reported better than expected fourth quarter 2011 results on the back of improved net interest margins. Also, management commentary about asset quality stress possibly peaking during the fourth quarter of 2011 supported its share price rally. |

| | | Coal India disappointed as the Indian cabinet approved the Mines and Minerals Development and Regulatory (“MMDR”) bill that requires coal mining companies to share 26% of their 2010 mining profits for development of local areas and as compensation for people affected by coal mining operations damaged by heavy rains. Also, non-executive wage hike negotiations were being carried out with the local mining unions during the Reporting Period, which served as an overhang on Coal India’s stock. There was also a diversion of some e-auction coal to volumes sold under a fuel supply agreement, which created, in the eyes of many, wrong precedent and policy uncertainty. We sold the Fund’s position in Coal India by the end of the Reporting Period. (E-auction coal is coal distributed under electronic route in India, a policy introduced for the benefit of small consumers who cannot enter into long-term contracts due to small requirements.) |

| | | Muthoot Finance, which is not a component of the Index, underperformed the Index during the Reporting Period, and thus the Fund’s position detracted. Muthoot Finance underperformed as the Reserve Bank of India came out with a guideline capping loan to value of loans against gold jewelry to 60%. (Loan to value is the ratio of the fair market value of an asset to the value of the loan that will finance the purchase. Loan to value tells the lender if potential losses due to nonpayment may be recouped by selling the asset.) Investors expected that this would have a negative impact on growth as well as margins for gold loan companies such as Muthoot Finance. We sold the Fund’s position in Muthoot Finance by the end of the Reporting Period. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The sectors that contributed most to the Fund’s performance relative to the Index were consumer discretionary, financials and information technology, each due primarily to strong stock selection. Having an overweighted allocation to consumer discretionary also boosted results, as the sector significantly outpaced the Index during the Reporting Period. |

| | The only two sectors to detract from the Fund’s relative results during the Reporting Period were utilities and consumer staples. In utilities, underperformance was attributable to poor stock selection. Having an underweighted position in the comparatively strong consumer staples sector detracted from the Fund’s relative results during the Reporting Period. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy, but we used index futures, on an opportunistic basis, to ensure the Fund remained almost fully exposed to equities following cash inflows or stock sales. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We initiated a Fund position during the Reporting Period in Blue Dart Express, a courier service and integrated express package distribution company. We liked the company because it has expressed a desire to increase domestic capacity, which could help increase its market share amid economic slowdown concerns. Also, the company was able to register good third quarter 2011 numbers, and we expect this momentum to continue into results of quarters ahead. |

| | | We established a Fund position in HDFC Bank, India’s second largest private bank, which has a track record of generating consistently strong earnings growth over the past ten years. The bank is also the most profitable Indian bank based on return on assets and is expected to generate a compelling return on equity. We believe HDFC Bank should continue to have stronger earnings visibility and less risk on its asset quality than its peers. The stock actually rallied during the Reporting Period because of its solid earnings results and thus proved to be a strong contributor to the Fund’s results. |

| | | We trimmed the Fund’s position in information technology services provider Infosys. Infosys builds software programs and provides back-office support to clients. We reduced the Fund’s holding in Infosys as its earnings guidance for the first quarter of 2012 was disappointing. |

18

PORTFOLIO RESULTS

| | | We eliminated the Fund’s position in Indraprastha Gas, a company involved in gas supply to the domestic and commercial sectors. We sold out of the Fund’s position on the back of reports about a potential cap on compressed natural gas marketing margins earned by gas utilities, including Indraprastha Gas, which, in turn, led to greater uncertainty about the company’s earnings growth trajectory going forward. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | Throughout the Reporting Period, we remained focused on individual stock selection, with sector positioning being a secondary, closely-monitored effect. That said, the Fund’s exposure relative to the Index in consumer discretionary, industrials and consumer staples increased, and its allocations relative to the Index to information technology, materials, energy, telecommunication services and utilities decreased. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted positions relative to the Index in consumer discretionary, industrials, financials and information technology. On the same date, the Fund had underweighted positions compared to the Index in the utilities, health care and consumer staples sectors, a relatively neutral position compared to the Index in materials, and no positions at all in the energy and telecommunications services sectors. |

| Q | | What is the Fund’s tactical view and strategy going forward? |

| A | | At the end of the Reporting Period, we maintained a positive outlook on India equities. India remains one of the fastest growing economies in the world, driven by favorable demographics, rapidly rising incomes and consumption, and significant spending on transformational infrastructure. In addition, Indian companies overall remained healthy, with high levels of profitability, amongst the highest returns on capital in the world and low levels of leverage. |

| | | We are faced with an uncertain global economic environment. Disorderly efforts to resolve sovereign default crises in Europe, spikes in commodity prices, continued political uncertainty at home and government inaction remain risks to Indian equities. That said, however, we believe Indian equities could prove resilient amidst such conditions for three main reasons. First, India’s economic growth comes primarily from domestic consumption and investment to modernize infrastructure. As a result, it is our view that the Indian economy is relatively more insulated from the global turmoil. Second, the outlook for weak global Gross Domestic Product (“GDP”) growth prevalent at the end of the Reporting Period has reduced pressure on commodity prices and could continue to ease inflationary pressures over the next few months. As a result, we believe the Reserve Bank of India is unlikely to raise interest rates further. Indeed, with inflation showing signs of declining, the Reserve Bank of India may start easing monetary policy, which should help, we believe, in stimulating corporate investments and overall economic growth. Third, with key state assembly elections completed in February 2012, the government of India is now expected to move forward on key economic reforms, which could boost broad investor sentiment. |

19

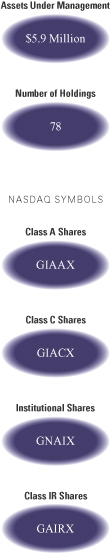

FUND BASICS

India Equity Fund

as of April 30, 2012

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2011–April 30, 2012 | | Fund Total Return

(based on NAV)1 | | | MSCI India IMI Index2 | |

| | Class A | | | -1.26 | % | | | -9.62 | % |

| | Class C | | | -1.61 | | | | -9.62 | |

| | Institutional | | | -1.14 | | | | -9.62 | |

| | | Class IR | | | -1.15 | | | | -9.62 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI India IMI Index (net, total return, unhedged, USD) is a free float-adjusted market capitalization index that is designed to measure equity market performance of India. The IMI (Investable Market Indices) include large, mid cap, small cap and micro cap segments and provide exhaustive coverage of these segments. It is not possible to invest directly in an index. |

| | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/12 | | Since Inception | | | Inception Date |

| | Class A | | | -16.35 | % | | 6/30/11 |

| | Class C | | | -12.88 | | | 6/30/11 |

| | Institutional | | | -11.20 | | | 6/30/11 |

| | | Class IR | | | -11.30 | | | 6/30/11 |

| | 3 | | The Standardized Total Returns are cumulative total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | | The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Website at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

20

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.90 | % | | | 28.76 | % |

| | Class C | | | 2.65 | | | | 29.51 | |

| | Institutional | | | 1.50 | | | | 28.36 | |

| | | Class IR | | | 1.65 | | | | 28.51 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2013, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/125 | | | | | | |

| | | Holding | | % of Total

Net Assets | | | Line of Business |

| | HDFC Bank Ltd. | | | 9.6 | % | | Commercial Banks |

| | Tata Consultancy Services Ltd. | | | 5.8 | | | IT Services |

| | Cognizant Technology Solutions Corp. Class A | | | 4.0 | | | IT Services |

| | Tata Motors Ltd. Class A | | | 3.9 | | | Automobiles |

| | Bosch Ltd. | | | 3.7 | | | Auto Components |

| | Titan Industries Ltd. | | | 3.0 | | | Textiles, Apparel & |

| | | | | | | | Luxury Goods |

| | Oracle Financial Sevices Software Ltd. | | | 2.9 | | | Software |

| | IndusInd Bank Ltd. | | | 2.6 | | | Commercial Banks |

| | Yes Bank Ltd. | | | 2.5 | | | Commercial Banks |

| | | ICICI Bank Ltd. | | | 2.4 | | | Commercial Banks |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

21

FUND BASICS

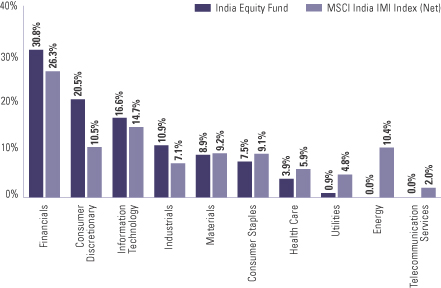

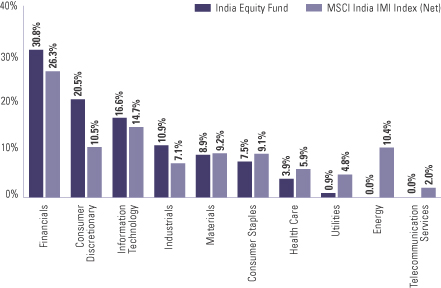

|

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2012 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The above graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

22

PORTFOLIO RESULTS

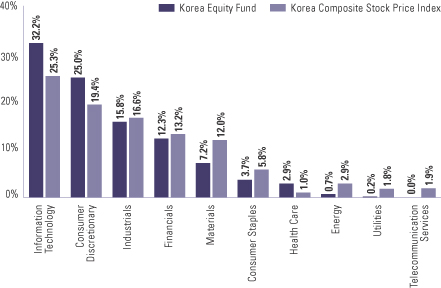

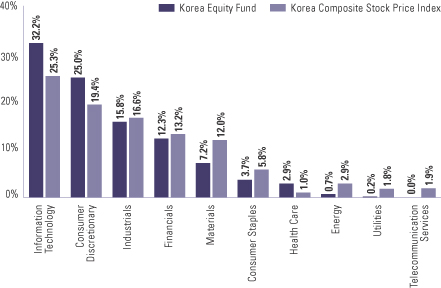

Korea Equity Fund

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs Korea Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2012 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 1.02%, 0.60%, 1.22% and 1.12%, respectively. These returns compare to the 1.81% cumulative total return of the Fund’s benchmark, the Korea Composite Stock Price Index (unhedged, USD) (the “Index”), during the same time period. |

| Q | | What economic and market factors most influenced Korea’s equity market as a whole during the Reporting Period? |

| A | | South Korea’s equity market retreated toward the end of 2011 amidst concerns regarding slowing global economic growth, deterioration in Europe’s sovereign debt crisis and uncertainty over the transfer of power in North Korea following the death of its leader Kim Jong Il. In addition, the won’s depreciation against the U.S. dollar reduced equity market returns expressed in U.S. dollars. South Korean equity market performance then rebounded in the early months of 2012 to reflect a number of positive economic data points announced during the first quarter. These data points included 3.3% Gross Domestic Product (“GDP”) growth in the fourth quarter of 2011 along with strong export trends and increasing industrial production and manufacturers’ confidence. However, increased political uncertainty in Europe, questions about the pace of the U.S. economic recovery and slowing economic momentum in some growth and emerging markets dampened sentiment on the global economy again and hurt export-oriented markets, such as that of South Korea, in April. |

| | | For the Reporting Period overall, information technology stocks led South Korea’s equity market performance, benefiting from strong global trends and merger and acquisition speculation during the Reporting Period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s underperformance of the Index during the Reporting Period can be primarily attributed to individual stock selection. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Among the stocks that detracted most from the Fund’s results relative to the Index were positions in electronic equipment manufacturer Samsung Electronics, online game developer and distributor JCEntertainment and tool manufacturer Y G-1. |

| | | Samsung Electronics detracted from the Fund’s results as it held an underweighted position in the strongly performing stock. Samsung Electronics had great success with its Galaxy series, and its sales expectations for 2012 were increasing with global fanfare for the series. Despite semiconductor weakness, the top line of Samsung Electronics’ balance sheet was solid thanks to its mobile-related products, including mobile DRAMs (dynamic random access memory, a type of memory that stores each bit of data in a separate capacitor within an integrated circuit), smart phones and tablets. |

| | | JCEntertainment detracted from the Fund’s performance relative to the Index during the Reporting Period, as concerns of potential regulatory risk clouded share price performance. Specifically, the company faced the possibility of a Korean law being enacted that would limit the amount of time teenagers can spend on computer games in order to curtail teenager violence in schools. In our view, this potential risk is low, as the proposed regulation may be too difficult to implement in reality. Even if the proposed regulation is passed and enacted, we feel it should not have a negative impact on JCEntertainment because most of its revenue is generated from casual game users that do not require long hours to play. Furthermore, we believe future revenue may increase as a result of expansion into China and the introduction of a new mobile game called “Rule the Sky.” |

23

PORTFOLIO RESULTS

| | | Y G-1, a manufacturer of end mill, drill and cutting tools, saw its share price decline during the Reporting Period due to dilution from an unexpected bond with warrant issue without proper communication with investors. (A bond with warrant is a standard bond that is issued with attached warrants (that is, long-dated options), which can often be detached and traded separately. By selling the package, the issuer lowers its effective cost of capital. The bond, which can be denominated in one of various currencies and carry a maturity ranging from 1 to 10 years, is typically issued at par value, but its ongoing value with warrants retained depends on the intrinsic value and time value of the warrants. While attached warrants can be issued on a range of references, they are often linked to the price of the issuer.) We began to take profits from this position as our confidence in its management was compromised. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | Among the Fund’s best-performing individual stocks relative to the Index were holdings in flexible printed circuit boards manufacturer Interflex, specialty chemicals company Wonik Materials and hotel operator Hotel Shilla. |

| | | Shares of Interflex rallied during the Reporting Period in anticipation of stronger than expected fourth quarter 2011 and first quarter 2012 earnings driven, in turn, by global market share gain from its key customers in the smart phone and tablet personal computers fields, namely Samsung Electronics and Apple. Potential customer expansion to Research in Motion or Nokia and an improvement in profitability from a higher utilization rate and product mix improvement further supported Interflex’s share price during the Reporting Period. |

| | | Wonik Materials supplies high purity specialty gases. We bought into the stock via its initial public offering subscription during the Reporting Period but sold out of the position very soon afterwards as it had already reached our target price. |

| | | Hotel Shilla is one of the top two duty free players in South Korea. Its duty free operations have been the beneficiary of surging numbers of Chinese tourists, which led to 30% annual growth in recent years. Furthermore, Hotel Shilla was a beneficiary of the restructuring of Samsung Electronics’ corporate governance, as the hotel operator was expected to be one of Samsung Electronics’ core vendors. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The biggest detractors from the Fund’s relative results were the information technology, financials and industrials sectors, each due primarily to poor stock selection. |