UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus | | Geoffrey R.T. Kenyon, Esq. |

Goldman, Sachs & Co. | | Dechert LLP |

200 West Street | | 100 Oliver Street |

New York, New York 10282 | | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: December 31

Date of reporting period: June 30, 2013

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | June 30, 2013 |

| | |

| | | | Select Satellite Funds |

| | | | Absolute Return Tracker |

| | | | Commodity Strategy |

| | | | Dynamic Allocation |

| | | | Managed Futures Strategy |

| | | | International Real Estate Securities |

| | | | Real Estate Securities |

Goldman Sachs Select Satellite Funds

| n | | ABSOLUTE RETURN TRACKER |

| n | | MANAGED FUTURES STRATEGY |

| n | | INTERNATIONAL REAL ESTATE SECURITIES |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 4 | |

| |

Schedules of Investments | | | 37 | |

| |

Financial Statements | | | 52 | |

| |

Financial Highlights | | | 58 | |

| |

Notes to Financial Statements | | | 70 | |

| |

Other Information | | | 103 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS SELECT SATELLITE FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectuses.

The Goldman Sachs Absolute Return Tracker Fund seeks to deliver long-term total return consistent with investment results that approximate the return and risk patterns of a diversified universe of hedge funds. The Fund’s Investment Adviser believes that hedge funds derive a large portion of their returns from exposure to sources of market risk (“Market Exposures”). The Fund uses a quantitative methodology in combination with a qualitative overlay to seek to identify the Market Exposures that approximate the return and risk patterns of specific hedge fund sub-strategies.

The Fund intends to invest in securities and other financial instruments that provide short and/or long exposure to the Market Exposures. However, from time to time, regulatory constraints or other considerations may prevent the Fund from precisely replicating the returns of the Market Exposures. The Fund does not intend to outperform market returns, even during periods of sustained increases in the prices of stocks and bonds. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. Over-the-counter transactions are subject to less government regulation and supervision. The Fund may also hold significant amounts of U.S. Treasury or short-term instruments. The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Foreign and emerging markets investments may be more volatile and less liquid than U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is subject to the risks associated with short selling of securities, which involves leverage of the Fund’s assets and presents various other risks. The Fund may be obligated to cover its short position at a higher price than the short price, resulting in a loss. Losses on short sales are potentially unlimited as a loss occurs when the value of a security sold short increases. The Fund is not appropriate for all investors. The Investment Adviser’s use of quantitative models to execute the Fund’s investment strategy may fail to produce the intended result. Different investment styles (e.g., “quantitative”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

The Goldman Sachs Commodity Strategy Fund seeks to maintain substantial economic exposure to the performance of the commodities markets. The Fund primarily gains exposure to the commodities markets by investing in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary primarily obtains its commodity exposure by investing in commodity-linked swaps (which may include total return swaps). The Subsidiary also invests in other instruments, including fixed income securities, either as investments or to serve as margin or collateral for its swap positions. The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. The Fund’s borrowing and use of derivates result in leverage, which can make the Fund more volatile. Over-the-counter transactions are subject to less government regulation and supervision. The Fund may hold significant amounts of U.S. Treasury or short-term investments. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Investments in mortgage-backed securities are subject to prepayment risk, the risk that in a declining interest rate environment the Fund’s underlying mortgages may be prepaid, causing the Fund to have to reinvest at lower interest rates. Foreign investments may be more volatile and less liquid than U.S. securities and are subject to the risks of

1

GOLDMAN SACHS SELECT SATELLITE FUNDS

currency fluctuations and adverse economic or political developments. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Dynamic Allocation Fund invests primarily in exchange-traded funds (“ETFs”) and derivative instruments, including futures and swaps, that provide exposure to a broad spectrum of asset classes, including but not limited to equities (both in U.S. and non-U.S. companies), fixed income (U.S. and non-U.S., investment grade and high yield) and commodities. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risk of default by a counterparty; and liquidity risk. The Fund’s borrowing and use of derivatives result in leverage, which can make the Fund more volatile. Over-the-counter transactions are subject to less government regulation and supervision. The Fund may also hold significant amounts of U.S. Treasury or short-term instruments. The Fund’s equity investments are subject to market risk, which means that the value of its investments may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The Fund’s fixed income investments are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. High yield, lower rated investments involve greater price volatility and present greater risks than higher rated fixed income securities. The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund’s investments in other investment companies (including ETFs) subject it to additional expenses. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Managed Futures Strategy Fund implements a trend-following strategy that takes long and/or short positions in a wide range of asset classes, including equities, fixed income, currencies, and commodities, to seek long-term absolute return. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity, interest rate, call, and extension risk. The Fund’s equity investments are subject to market risk, which means that the value of its investments may go up or down in response to the prospects of individual companies, particular industry sectors and/ or general economic conditions. Different investment styles tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes. Managed futures strategies have historically offered the potential for stronger performance in extreme bull and bear markets and weaker performance in range-bound and sharply reversing markets. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuation and adverse economic or political developments. The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Derivative investments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risk of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. Over-the-counter transactions are subject to less government regulation and supervision. The Fund’s borrowing and use of derivatives may result in leverage, which can make the Fund more volatile. The tax treatment of commodity-linked derivative

2

GOLDMAN SACHS SELECT SATELLITE FUNDS

instruments may be adversely affected by future legislation or regulatory developments. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

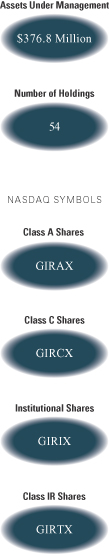

The Goldman Sachs International Real Estate Securities Fund invests primarily in a portfolio of equity investments in issuers that are primarily engaged in or related to the real estate industry outside the United States, including real estate investment trusts (“REITs”). Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. REITs whose underlying properties are concentrated in a particular industry or geographic region are also subject to risks affecting such industries and regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other factors. Foreign and emerging markets investments may be more volatile and less liquid than U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Because the Fund concentrates its investments in the real estate industry, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting this industry than if its investments were more diversified across different industries, and its performance may be substantially different from that of the broader stock market. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

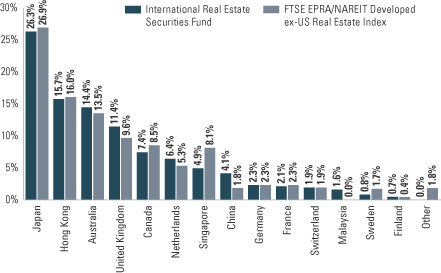

The Goldman Sachs Real Estate Securities Fund invests primarily in a portfolio of equity investments in issuers that are primarily engaged in or related to the real estate industry outside the United States, including real estate investment trusts (“REITs”). Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. REITs whose underlying properties are concentrated in a particular industry or geographic region are also subject to risks affecting such industries and regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other factors. Foreign and emerging markets investments may be more volatile and less liquid than U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Because the Fund concentrates its investments in the real estate industry, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting this industry than if its investments were more diversified across different industries, and its performance may be substantially different from that of the broader stock market. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

3

PORTFOLIO RESULTS

Goldman Sachs Absolute Return Tracker Fund

Investment Objective

The Fund’s investment objective is to seek to deliver long-term total return consistent with investment results that approximate the return and risk patterns of a diversified universe of hedge funds. The Fund’s Investment Adviser believes that hedge funds derive a large portion of their returns from exposure to sources of market risk (“Market Exposures”). The Fund uses a quantitative methodology in combination with a qualitative overlay to seek to identify the Market Exposures that approximate the return and risk patterns of specific hedge fund sub-strategies.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs Absolute Return Tracker Fund’s (the “Fund”) performance and positioning for the six-month period ended June 30, 2013 (“the Reporting Period”).(a)

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of 1.34%, 0.92%, 1.65%, 1.55% and 1.24%, respectively. These returns compare to the 3.16% cumulative total returns of the Fund’s benchmark, the HFRX Global Hedge Fund Index(b), during the same time period. |

| Q | | What economic and market factors most influenced the hedge fund asset class as a whole during the Reporting Period? |

| A | | Hedge funds, as measured by the HFRX Global Hedge Fund Index, overall generated positive absolute returns during the Reporting Period. |

| | During the Reporting Period, hedge funds were affected predominantly by the performance of global equities and global bonds. Global developed market equities had strong performance during the first quarter of 2013 but pulled back in the second calendar quarter on concerns around slowing global economic growth. The exception was the S&P 500 Index, as representative of the U.S. equity market, which performed well during both quarters of the Reporting Period. Emerging market equities performed poorly during the |

| (a) | | Effective as of June 28, 2013, the Fund made certain enhancements to its investment process. These enhancements are described below. |

| (b) | | The HFRX Global Hedge Fund Index is a trademark of Hedge Fund Research, Inc. (“HFR”). HFR has not participated in the formation of the Fund. HFR does not endorse or approve the Fund or make any recommendation with respect to investing in the Fund. |

| | Reporting Period, primarily based on slowing economic growth in China. Global bonds fell in both quarters of the Reporting Period, particularly following Federal Reserve (“Fed”) Chair Bernanke’s mid-May 2013 “tapering” comments, which fueled fears about rising interest rates. A decline in precious metals prices negatively impacted hedge fund performance overall. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | We believe hedge funds derive a large portion of their returns from exposure to sources of market risk, such as equity, fixed income and commodity asset classes, rather than manager skill. (The component of hedge fund return that is attributable to market risk exposure, rather than manager skill, is referred to as the “beta” component.) We selected the Fund’s investments using a quantitative algorithm (or methodology) that seeks to identify the beta component of hedge fund returns and gain exposure to these sources of market risk and their related returns. The Fund invests in securities and other financial instruments that provide short or long exposure to market factors that represent these sources of market risk and return (the “Component Market Factors”). The Component Market Factors include but are not limited to U.S. and non-U.S. equity indices (“Equities”); fixed income indices (“Fixed Income”); credit indices (“Credit”); commodity indices (“Commodities”) and volatility indices (“Volatility”). |

4

PORTFOLIO RESULTS

| | During the Reporting Period, Equities were the primary driver of performance. Positioning in Fixed Income also contributed positively to the Fund’s absolute returns during the Reporting Period. Positioning in Commodities detracted. |

| | On an absolute basis, the Fund’s biggest positive contributors were long exposures to the S&P 500 Index, the Russell 2000 Index and the TOPIX (Tokyo Stock Price Index). The Fund’s largest detractors from absolute returns were long exposures to the S&P GSCI® Precious Metals Index and the MSCI Emerging Markets Index. |

| Q | | How was the Fund positioned within the Equities category during the Reporting Period? |

| A | | Throughout the Reporting Period, the Fund maintained a net long exposure to global equities, which contributed positively to the Fund’s results overall. The Fund’s long exposure to the S&P 500 Index was the primary driver of the Fund’s positive returns, as U.S. equities performed well, with the S&P 500 Index up 13.82% for the Reporting Period. Long exposure via underlying indices to international equities contributed modestly, with long exposure to developed market equities contributing to performance and long exposure to emerging market equities detracting. |

| Q | | How did developments within the Fixed Income category affect the Fund’s absolute return? |

| A | | The yield on the 10-year U.S. Treasury rose approximately 66 basis points (a basis point is 1/100th of a percentage point) during the Reporting Period. Much of that increase came following Fed Chair Bernanke’s May 22 comments when he signaled the Fed may “taper” asset purchases. In turn, volatility heightened in June in both the equity and bond markets. The yield on the 10-year U.S. Treasury surged from 2.03% to 2.52% from May 22 to June 30. |

| | The Fund maintained its net short position in the 10-year U.S. Treasury throughout the Reporting Period. As interest rates rose, such positioning contributed modestly to the Fund’s absolute return. Please note that a short exposure to this Component Market Factor of the Fund usually generates positive results when 10-year Treasury note prices decline and their yields rise and vice versa. |

| Q | | Was the Fund positioned net long or short in the Commodities category during the Reporting Period? |

| A | | The Fund held a net long exposure in the Commodities category during the Reporting Period via a position in precious metals, as measured by the S&P GSCI® Precious Metals Index. The Fund’s exposure to precious metals detracted from its performance, as the S&P GSCI® Precious Metals Index posted a decline of 28.42% for the Reporting Period. Despite economic growth remaining lackluster at best elsewhere in the world, robust domestic economic data suggested the U.S. retains solid economic momentum in spite of the substantial fiscal tightening that occurred during the Reporting Period. The combination of Fed Chair Bernanke’s comments, which were interpreted as relatively hawkish, and a strengthening U.S. dollar caused gold prices to decline, while assets considered more risky, such as equities, trended higher. During the Reporting Period, gold and silver declined 27.22% and 35.99%, respectively, as measured by the S&P GSCI® Gold Index and S&P GSCI® Silver Index, respectively. |

| Q | | How did other Component Market Factors affect the Fund’s results? |

| A | | Other Component Market Factors, including Credit and Volatility, have not been statistically significant factors in explaining hedge fund performance for some time now. As a result, they were not part of the Fund during the Reporting Period. |

| Q | | Was the Fund invested in any other asset classes during the Reporting Period? |

| A | | The Fund had a net long exposure to cash throughout the Reporting Period. Given that short-term interest rates were anchored at extremely low levels, such positioning contributed modestly but positively to the Fund’s performance. |

5

PORTFOLIO RESULTS

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund used exchange-traded index futures contracts to gain exposure to U.S. large-cap and small-cap equities, non-U.S. developed market equities including those in Europe, the U.K. and Japan, and the 10-year U.S. Treasury Index. The Fund used commodity index-linked structured notes to gain exposure to the S&P GSCI® Precious Metals Index. The Fund used currency forward contracts to gain exposure to select currencies of non-U.S. developed markets, including the pound, euro and yen. The Fund used a swap to gain exposure to emerging market equities. |

| Q | | Were there any changes made in the Fund’s investment strategy during the Reporting Period? |

| A | | Although certain enhancements were made to the Fund’s quantitative methodologies after the Reporting Period, as discussed below, there were no changes made in the Fund’s investment strategy during the Reporting Period. That said, within the Fund’s portfolio, the Fund’s long exposure to equities gradually increased during the Reporting Period overall. The Fund’s short exposure to fixed income also increased gradually. The Fund gradually became less long precious metals. The Fund’s exposure to currencies remained fairly consistent throughout the Reporting Period. Each of these changes was made as a result of our analysis of the hedge fund industry’s returns. No active decisions were made based on any economic or financial market outlooks. |

| Q | | How was the Fund positioned at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund was positioned long in Equities and Commodities (precious metals) and short in Fixed Income. The Fund also had net long positions in currencies, cash and cash equivalents at the end of the Reporting Period. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | After 33 years of distinguished service, Don Mulvihill, CIO of Customized Beta Strategies within the Quantitative Investment Strategies (“QIS”) team, decided to retire from the firm at the end of June 2013. Gary Chropuvka assumed Mr. Mulvihill’s role as Head of the Customized Beta Strategies business, overseeing the team’s tax-efficient, rules-based and customized beta investment strategies. Mr. Chropuvka brings extensive experience having joined QIS in 1999 with Mr. Mulvihill to manage the team’s tax-efficient investment strategies. All of Mr. Mulvihill’s direct investment responsibilities were performed within a co-lead or team leadership structure and follow processes that provide continuity in day-to-day investment decision-making in each portfolio. |

| Q | | What is the Fund’s tactical view and strategy going forward? |

| A | | We continuously attempt to make enhancements to the investment process we use in the Fund. As part of the Fund’s evolution, we have decided to increase the granularity of our process. That is, instead of replicating the broad hedge fund universe, effective the end of June 2013, we will now be replicating individual hedge fund sub-strategies. Though the Fund has been successful in replicating the hedge fund industry, our hope is these enhancements to our quantitative methodology will allow us to track the hedge fund industry even more closely. For additional details, please see the Fund’s prospectus dated April 30, 2013 which was updated to reflect these enhancements with a supplement dated June 14, 2013. |

6

FUND BASICS

Absolute Return Tracker Fund

as of June 30, 2013

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2013–June 30, 2013 | | Fund Total Return (based on NAV)1 | | | HFRX Global Hedge Fund Index2 | |

| | Class A | | | 1.34 | % | | | 3.16 | % |

| | Class C | | | 0.92 | | | | 3.16 | |

| | Institutional | | | 1.65 | | | | 3.16 | |

| | Class IR | | | 1.55 | | | | 3.16 | |

| | | Class R | | | 1.24 | | | | 3.16 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies, including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. The index is investable through products managed by HFR Asset Management, LLC that track HFRX Indices. The HFRX Global Hedge Fund Index is a trademark of Hedge Fund Research, Inc. (“HFR”). HFR has not participated in the formation of the Fund. HFR does not endorse or approve the Fund or make any recommendation with respect to investing in the Fund. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/13 | | One Year | | | Five Years | | Since Inception | | Inception Date |

| | Class A | | | -2.43 | % | | -2.04% | | -2.50% | | 5/30/08 |

| | Class C | | | 1.49 | | | -1.65 | | -2.15 | | 5/30/08 |

| | Institutional | | | 3.72 | | | -0.50 | | -1.00 | | 5/30/08 |

| | Class IR | | | 3.52 | | | -0.65 | | -1.15 | | 5/30/08 |

| | | Class R | | | 3.01 | | | -1.17 | | -1.66 | | 5/30/08 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares, and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | | | | | | | | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.55 | % | | | 1.59 | % |

| | Class C | | | 2.30 | | | | 2.34 | |

| | Institutional | | | 1.15 | | | | 1.19 | |

| | Class IR | | | 1.30 | | | | 1.34 | |

| | | Class R | | | 1.80 | | | | 1.84 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least April 30, 2014, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

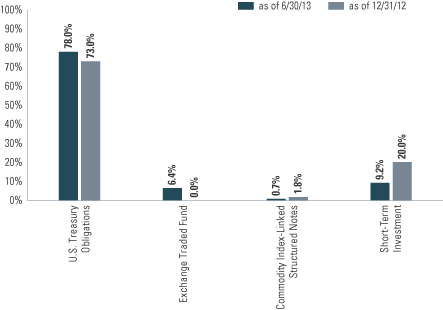

| | 5 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. Short-term investments represent investments in repurchase agreements. Underlying sector allocations of exchange traded funds (“ETFs”) held by the Fund are not reflected in the graph above. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

8

GOLDMAN SACHS COMMODITY STRATEGY FUND

What Differentiates the Goldman Sachs Commodity Investment Process?

At Goldman Sachs Asset Management, L.P. (“GSAM”), the goal of our commodity investment process is to provide consistent, strong performance by actively managing our portfolios within a research-intensive, risk-managed framework.

Goldman Sachs’ Commodity Investment Process

Our commodity investment process emphasizes the importance of both short-term, tactical opportunities and long-term investment views. Our team-based approach to managing the Fund ensures continuity and idea sharing among some of the industry’s most experienced fixed income specialists. We pursue strong, consistent performance across commodity markets through:

The Goldman Sachs Commodity Strategy Fund primarily gains exposure to the performance of the commodity markets through investment in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary invests primarily in commodity-linked swaps (which may include total return swaps), as well as other commodity-linked securities and derivative instruments that provide exposure to the performance of the commodities markets, and in fixed income and debt instruments. The Fund’s portfolio is designed to provide exposure that corresponds to the investment return of assets that trade in the commodity markets without direct investment in physical commodities.

The Fund implements enhanced cash strategies that capitalize on GSAM’s global fixed income expertise. The Fixed Income Team will employ the full spectrum of capabilities offered, including bottom-up strategies (credit, mortgages, governments /municipals, high yield, and emerging markets debt) and top-down strategies (duration, cross-sector, currency and country) in an attempt to enhance the return of the Fund.

A Commodity Fund that:

| n | | Provides exposure to the commodity markets without direct investment in physical commodities |

| n | | Utilizes commodity-linked swaps that provide economic exposure to movements in commodity prices |

9

PORTFOLIO RESULTS

Goldman Sachs Commodity Strategy Fund

Investment Objective

The Fund seeks long-term total return.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Commodities Team discusses the Goldman Sachs Commodity Strategy Fund’s (the “Fund”) performance and positioning for the six-month period ended June 30, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of -6.63%, -7.14%, -6.61%, -6.60% and -6.85%, respectively. These returns compare to the -5.41% cumulative total return of the Fund’s benchmark, the S&P GSCI® Total Return Index, formerly the Goldman Sachs Commodity Index (the “S&P GSCI®”), during the same period. |

| Q | | What economic and market factors most influenced the commodities markets as a whole during the Reporting Period? |

| A | | Commodities markets, as measured by the S&P GSCI®, faced a challenging Reporting Period, wherein every subsector and most individual commodities generated negative returns as impacted by three primary factors. |

| | The first was China and its impact on industrial metals. During the Reporting Period, concerns that slowing economic growth in China, the largest user of industrial metals, would dampen demand impacted not only the industrial metals subsector but weighed on virtually all commodities. The Chinese government’s plans to rebalance the economy in such a way that growth is driven more by higher household income and consumption and less by investment funded by rising government and government-related debt was widely interpreted to mean that Chinese infrastructure spending is likely to slow. In turn, such a slowdown, many believed, would significantly impact the overall demand for industrial metals. |

| | The second factor influencing the commodities markets as a whole was U.S. Federal Reserve (“Fed”) policy and its impact on precious metals. In the U.S., improving trends in the labor market, despite the substantial fiscal tightening that occurred during the Reporting Period and the hawkish interpretation of Fed Chair Bernanke’s comments, supported the idea the Fed will likely begin “tapering” its quantitative easing program in the next few months and could stop its asset purchases completely by mid-2014. In response, assets traditionally considered safe havens, such as gold and silver, saw their prices decline steeply during the latter part of the Reporting Period accompanied by large outflows from precious metals-related exchange-traded funds. |

| | The third major factor impacting the commodities markets during the Reporting Period was the strength of the U.S. dollar. While the resilience of the U.S. economy is a distinct positive, it was accompanied during the Reporting Period by an increase in interest rates, which supported the U.S. dollar. The U.S. Dollar Index (“DXY”) rallied 4.22% versus a basket of global currencies during the Reporting Period. (The DXY is a measure of the general international value of the U.S. dollar as calculated by averaging the exchange rates between the U.S. dollar and six major world currencies.) All else being equal, a rallying U.S. dollar is a headwind for dollar-denominated assets like commodities, whose value in U.S. dollar terms declines as the currency strengthens. |

| Q | | Which commodity subsectors were strongest during the Reporting Period? |

| A | | As mentioned earlier, all commodity subsectors, as measured by the S&P GSCI®, posted negative returns during the Reporting Period. That said, during the Reporting Period, the energy component of the S&P GSCI® was the least poorly performing subsector, posting a return of -2.39%. The S&P GSCI® Energy Index was supported by West Texas Intermediate (“WTI”) crude oil, which was up 2.75% and outperformed Brent crude oil during the Reporting Period, as measured by the S&P GSCI® Crude Oil Index. During the |

10

PORTFOLIO RESULTS

| | Reporting Period, the Brent premium over WTI narrowed to $6 per barrel from more than $19 per barrel at the start of 2013. WTI’s outperformance was driven by ongoing expectations of a relief in elevated crude oil inventories at Cushing, Oklahoma, the delivery point for the WTI futures contract. Some of this outperformance was offset by Brent crude oil, which fell 4.94% during the Reporting Period, as measured by the S&P GSCI® Brent Crude Oil Index, on disappointing economic growth data, especially out of China. |

| Q | | Which commodity subsectors were weakest during the Reporting Period? |

| A | | The precious metals subsector was the weakest during the Reporting Period, with the S&P GSCI® Precious Metals Index returning -28.42%. Gold and silver declined 27.22% and 35.99%, respectively, as measured by the S&P GSCI® Gold Index and S&P GSCI® Silver Index, respectively. Despite economic growth remaining lackluster at best elsewhere in the world, robust domestic economic data suggested the U.S. retains solid economic momentum in spite of the substantial fiscal tightening that occurred during the Reporting Period. In combination with Fed Chair Bernanke’s comments, which were interpreted as relatively hawkish, as well as the strengthening U.S. dollar, gold prices declined, while assets considered more risky, such as equities, trended higher. |

| | Briefly, the remaining commodities subsectors performed as follows — the S&P GSCI® Industrials Metals Index returned -16.27%; the S&P GSCI® Agriculture Index returned -9.03%; and the S&P GSCI® Livestock Index returned -5.20% during the Reporting Period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund generated returns that underperformed the S&P GSCI®. Both our enhanced roll-timing strategies via exposure to commodity index-linked swaps and our enhanced cash management strategy detracted from results during the Reporting Period. |

| Q | | How did the Fund’s enhanced roll-timing strategies impact performance during the Reporting Period? |

| A | | Our enhanced roll-timing strategies detracted from the Fund’s performance via exposure to commodity index swaps. We employ an approach whereby we do not take active views on individual commodities but rather gain Fund exposure to commodities through investments whose performance is linked to commodity indices. |

| | We often implement commodity roll-timing strategies by deviating from the S&P GSCI® roll convention, which typically calls for rolling forward exposure at the front, or near-month, end of the futures curve on a monthly basis. The roll occurs during business days 5 through 9. To the extent our team believes fundamental or technical developments will impact the futures roll-timing decision, we will incorporate those views into the portfolio by electing to roll positions earlier, later, forward or in different weights versus the S&P GSCI® roll. Roll-timing strategies employed may include 1) alternative roll date modifications, which avoid the market impact of plain vanilla S&P GSCI® rolls during business days 5 to 9; 2) forward exposure roll modifications, which avoid the market impact of plain vanilla S&P GSCI® rolls and move exposure out the curve to mitigate the returns impact often associated with persistent contango; and 3) seasonal roll modifications, which attempt to take advantage of seasonal relationships in commodity markets to seek to increase returns. (Contango is defined as a common market condition in which futures prices get progressively higher in the distant delivery months, often reflecting carrying costs. In other words, the nearby contract is trading at a lower price than the futures contract, such that one is rolling each month at a higher price.) During most of the Reporting Period, we employed a forward roll-timing strategy that rolled commodity exposures underlying the S&P GSCI® a few months out on the futures curve instead of rolling at the very front of the futures curve. |

| | Our six-month deferred positioning within WTI crude oil was the primary driver of the Fund’s underperformance during the Reporting Period. As mentioned earlier, WTI rallied 2.75% during the Reporting Period, as measured by the S&P GSCI® Crude Oil Index. At the same time, the WTI futures curve also strengthened materially, moving from a state of contango to backwardation as deferred WTI futures underperformed nearby futures. (Backwardation is a market condition in which a futures price is lower in the distant delivery months than in the near delivery months.) The primary reason for this curve move was the expectations for significant inventory draws at Cushing, Oklahoma, the delivery point for the WTI futures contract, based on expansion of the infrastructure connecting the midcontinent and the U.S. Gulf Coast. More recently, concerns of a light |

11

PORTFOLIO RESULTS

| | sweet crude oil shortage in the U.S. midcontinent also contributed to the move in the WTI futures curve. Light sweet crude oil is what is deliverable into the NYMEX (New York Mercantile Exchange) WTI futures contract. The supply glut in Cushing, Oklahoma had been created by increased production flowing to the Midwest from Canada, North Dakota and Texas. This increased production flow had more than offset flows out of the midcontinent to the Gulf Coast due to the lack of connectivity between refineries and the midcontinent. |

| | Conversely, deferred positioning in natural gas offset, though modestly, some of the underperformance from the Fund’s deferred positioning in WTI crude oil, as longer-dated futures outperformed nearby futures during the Reporting Period, leading our deferred futures position to outperform. |

| Q | | How did you implement the Fund’s enhanced cash management strategy? |

| A | In addition to seeking value through management of the commodities portion of the Fund’s portfolio, we also attempt to add a modest amount of excess return through thoughtful management of collateral held in the Fund. The cash portion of the Fund’s portfolio is typically allocated to high-grade collateral that includes U.S. Treasury securities, agency debentures, mortgage-backed securities and short-term fixed income instruments. During the Reporting Period, we favored high quality government and agency securities for the Fund’s collateral allocation. However, our out-of-benchmark allocations implemented via our enhanced cash management strategy detracted from Fund performance during the Reporting Period. |

| | Holdings in U.S. Treasury inflation-protected securities (“TIPS”) detracted most from the Fund’s performance. TIPS sold off on the Fed’s announcement it may start scaling back its quantitative easing program, a large asset purchase program, later in 2013. The announcement sent both nominal interest rates and real interest rates higher. In turn, the increase in rates pressured the prices of TIPS, which were held in the Fund, lower. Real interest rates and inflation expectations are two of the most important inputs to the prices of TIPS. (Real interest rates are interest rates that have been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower, and the real yield to the lender. The real interest rate of an investment is calculated as the amount by which the nominal interest rate is higher than the inflation rate.) |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | As mentioned earlier in some detail, the Fund used commodity index-linked total return swaps in implementing our enhanced roll-timing strategies in order to gain exposure to the commodities markets. In implementing our enhanced cash management strategy, the Fund used futures, interest rate swaps and forward sale contracts, which are agency mortgage-backed derivatives used in purchasing a future issuance of agency mortgage-backed securities. |

| Q | | Did you make any changes in the Fund’s strategy or allocations during the Reporting Period? |

| A | | The Fund continued to hold exposure to the commodities markets primarily in the form of swaps linked to the S&P GSCI®. During the Reporting Period, we did not make any significant adjustments to the Fund, maintaining our six months deferred position in WTI crude oil and natural gas, with the remaining commodities in the same contract as the S&P GSCI®. |

| | Our forward positioning in WTI crude oil was driven by what might be considered an idiosyncratic issue in the U.S. midcontinent, where we believed high oil inventories at the physical delivery point of the NYMEX WTI futures contract, namely Cushing, Oklahoma, would likely weigh on the front of the WTI crude oil futures curve. In this environment, we would expect the deferred futures contract to outperform nearby futures. Despite the market expectation for significant inventory draws at Cushing, at the end of the Reporting Period, we remained skeptical of the magnitude and duration of these draws. |

| | In natural gas, the Fund was in the deferred part of the futures curve in order to reduce the impact on the portfolio of rolling futures. |

| Q | | How was the Fund positioned at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund’s overall commodity positioning was generally in line with the weightings of the S&P GSCI®. The Fund, at the end of the Reporting Period, held exposure to the commodities underlying the S&P GSCI® through plain vanilla swaps in the Subsidiary and held no deferred commodity exposure. (The |

12

PORTFOLIO RESULTS

| | Subsidiary has the same objective as the Fund but unlike the Fund may invest without limitation in commodity index-linked securities, such as swaps and futures, that provide exposure to the performance of the commodity markets.) |

| | The cash portion of the Fund’s portfolio was allocated across various fixed income sectors, with an emphasis on the higher quality, lower volatility segments of the market, such as U.S. government and government-sponsored bonds. |

| Q | | What is the Fund’s view and strategy going forward? |

| A | | We believe there is significant uncertainty regarding the global macroeconomic environment in 2013. We expect the U.S. will likely continue to experience modest economic growth underpinned by a strengthening housing market. However, we are less optimistic about the outlook for economic growth in Europe and Asia. Given this view, we expect commodity returns to be primarily driven by supply and demand dynamics specific to each market. |

13

FUND BASICS

Commodity Strategy Fund

as of June 30, 2013

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2013–June 30, 2013 | | Fund Total Return

(based on NAV)1 | | | S&P GSCI2 | |

| | Class A | | | -6.63 | % | | | -5.41 | % |

| | Class C | | | -7.14 | | | | -5.41 | |

| | Institutional | | | -6.61 | | | | -5.41 | |

| | Class IR | | | -6.60 | | | | -5.41 | |

| | | Class R | | | -6.85 | | | | -5.41 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P GSCI is an unmanaged composite index of commodity sector returns, representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. Individual components qualify for inclusion in the GSCI on the basis of liquidity and are weighted by their respective world production quantities. The figures for the Index do not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/13 | | One Year | | | Five Years | | Since Inception | | Inception Date |

| | Class A | | | -4.46 | % | | -16.73% | | -5.63% | | 3/30/07 |

| | Class C | | | -1.76 | | | -16.63 | | -5.67 | | 3/30/07 |

| | Institutional | | | 0.27 | | | -15.82 | | -4.67 | | 3/30/07 |

| | Class IR | | | 0.21 | | | -15.75 | | -7.97 | | 11/30/07 |

| | | Class R | | | -0.19 | | | -16.17 | | -8.43 | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 4.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds. com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.98 | % | | | 1.13 | % |

| | Class C | | | 1.73 | | | | 1.88 | |

| | Institutional | | | 0.64 | | | | 0.79 | |

| | Class IR | | | 0.73 | | | | 0.88 | |

| | | Class R | | | 1.23 | | | | 1.38 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least April 30, 2014, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

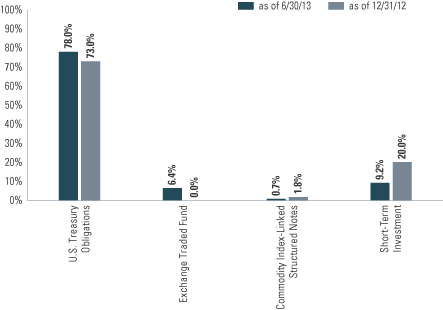

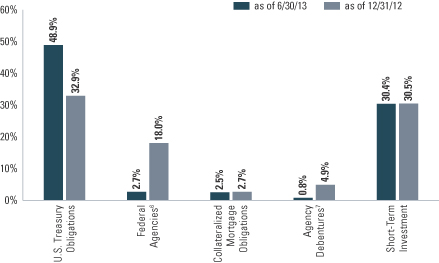

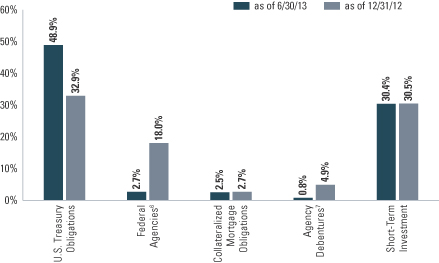

| | 5 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent investment in investment companies other than those that are exchange traded. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 6 | | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the United States Government. |

| | 7 | | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

15

PORTFOLIO RESULTS

Goldman Sachs Dynamic Allocation Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs Dynamic Allocation Fund’s (the “Fund”) performance and positioning for the six-month period ended June 30, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of -0.47%, -0.86%, -0.19%, -0.28% and -0.56%, respectively. These returns compare to the 0.14%, 6.40% and -1.17% cumulative total returns of the Fund’s benchmarks, the Bank of America Merrill Lynch USD LIBOR 1-Month Constant Maturity Index (LUS1) (the “LIBOR 1-Month Index”), the Morgan Stanley Capital International All Country World Index Investable Market Index (net, unhedged) (“MSWI ACWI IMI”) and the Barclays Global Aggregate Bond Index (USD, hedged) (“Barclays Bond Index”), respectively, during the same time period. The Dynamic Allocation Fund Composite Index, comprised of the MSWI ACWI IMI (60%) and Barclays Bond Index (40%), returned 3.35% during the same period. |

| | The Fund’s overall annualized volatility was 8.5% during the Reporting Period, while the overall annualized volatility of the S&P® 500 Index during the same time period was 12.13%. |

| Q | | What strategic, risk-based factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund seeks to achieve its investment objective by investing primarily in exchange-traded funds (“ETFs”), futures, swaps and other derivatives that provide exposure to a broad spectrum of asset classes, including but not limited to equities (both in U.S. and non-U.S. companies), fixed income (U.S. and non-U.S., investment grade and high yield) and commodities. Our team manages the Fund dynamically by changing its allocations to these asset classes based on our tactical views and in response to changing market conditions. Our team uses a disciplined, rigorous and quantitative approach, in combination with a qualitative overlay, in allocating to the asset classes in which the Fund invests. Allocations are adjusted within the Fund at least monthly based on continuous analysis to help determine which investments are relatively attractive and provide the best opportunities for growth in any given period of time. Since the markets represented by each investment are constantly changing, so are the Fund’s allocations. |

| | Overall, the Fund’s return from strategic, risk-based allocations was relatively flat for the Reporting Period. The Fund’s strategic, risk-based allocations to U.S. equities and developed market non-U.S. equities contributed most to its performance. These positive contributors were largely offset by strategic, risk-based allocations to commodities, emerging market equities and U.S. fixed income, which detracted. |

| Q | | How did the Goldman Sachs Market Sentiment Indicator factor into risk allocation decisions that were made during the Reporting Period? |

| A | | The Goldman Sachs Market Sentiment Indicator (“MSI”) is a proprietary tool that analyzes how the markets will potentially respond to future global changes in financial, economic and sociopolitical events. With the help of the MSI, the Fund seeks to mitigate risk in unstable markets by reducing volatility. |

16

PORTFOLIO RESULTS

| | The MSI was triggered at the tail end of May 2013, prompting us to rein in exposures across the entirety of the Fund’s portfolio. Not surprisingly, as most risky assets sold off during May 2013, the MSI had detected heightened levels of overall market distress, hence leading us to pull back on the Fund’s overall volatility level. During June 2013, we twice moved to further reduce overall portfolio risk, such that the Fund’s overall risk target at the end of June was approximately 40% lower than before the MSI was triggered. |

| Q | | What tactical allocation decisions were the primary contributors to and detractors from performance during the Reporting Period? |

| A | | For the Reporting Period overall, the Fund’s tactical allocations contributed positively, albeit modestly, to its performance. The Fund’s top tactical positive contributors to results were underweighted positions in emerging market equities and U.S. fixed income. Only partially offsetting these positive contributors were the Fund’s underweighted positions in U.S. large-cap equities and commodities, which detracted. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund invested in futures and credit default swaps to achieve exposure to equities (both in U.S. and non-U.S. companies) and fixed income (U.S. and non-U.S., investment grade and high yield) during the Reporting Period. The Fund also used commodity index-linked structured notes to gain exposure to commodities. |

| Q | | What changes did you make within the Fund during the Reporting Period? |

| A | | As mentioned earlier, we moved to rein in exposures across the entirety of the Fund’s portfolio, as our MSI was triggered at the tail end of May. Overall, we saw a reduction in exposure across fixed income and commodities in the portfolio. We moved to reduce exposures in both asset classes during the Reporting Period not only because of their heightened risk but also because, from a return forecasting perspective, our tactical positioning was leading us to reduce exposure in fixed income and commodities, driven largely by poor momentum. For example, the Fund’s exposure to U.S. Treasury inflation-protected securities (“TIPS”) peaked during the Reporting Period at just above 50% of the Fund’s total net assets in February 2013 but since dropped to approximately 11% of total net assets at the end of June 2013. The Fund’s commodities allocation similarly decreased from a nearly 40% allocation at the beginning of 2013 to approximately 11% of the Fund’s total net assets at the end of the Reporting Period. |

| | Even within equities, we were making exposure adjustments rather rapidly. We were favoring U.S. equities by the fourth quarter of 2012, topping out Fund exposure during the Reporting Period at approximately 45% of the Fund’s total net assets by the latter half of the first quarter of 2013. Since then, we trimmed that position slightly, as markets appeared to level off and as risk levels rose. By the end of June 2013, the Fund’s overall U.S. equity exposure declined to under 15% of total net assets. The Fund’s exposure to emerging markets was also reined in, wherein we maintained less than half the exposure the Fund had at the beginning of the second quarter of 2013 by the end of the Reporting Period. By the end of June 2013, the Fund maintained less than 2% of its total net assets in emerging market equities. |

| Q | | What is the Fund’s tactical asset allocation view and strategy for the months ahead? |

| A | | At the end of June 2013, the Fund’s largest overweight on a tactical basis was in U.S. fixed income, a view driven by supportive macroeconomic conditions, strong momentum and attractive valuations. Conversely, we were bearish on developed non-U.S. fixed income due to what we considered to be less supportive macroeconomic conditions and weak momentum. |

| | We continue to believe the Fund’s dynamic allocation approach is important because it can adapt to changing markets, seeking what we believe are the best opportunities for investment and attempting to mitigate risk when the markets become unstable. There is no guarantee that the Fund’s dynamic management strategy will cause it to achieve its investment objective. |

17

FUND BASICS

Dynamic Allocation Fund

as of June 30, 2013

| | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2013–

June 30, 2013 | | Fund Total

Return

(based on NAV)1 | | | BofA Merrill

Lynch USD

LIBOR

1-Month Index2 | | | MSCI All

Country

World Index

Investable

Market Index3 | | | Barclays

Global

Aggregate

Bond Index4 | | | Dynamic

Allocation Fund

Composite

Index5 | |

| | Class A | | | -0.47 | % | | | 0.14 | % | | | 6.40 | % | | | -1.17 | % | | | 3.35 | % |

| | Class C | | | -0.86 | | | | 0.14 | | | | 6.40 | | | | -1.17 | | | | 3.35 | |

| | Institutional | | | -0.19 | | | | 0.14 | | | | 6.40 | | | | -1.17 | | | | 3.35 | |

| | Class IR | | | -0.28 | | | | 0.14 | | | | 6.40 | | | | -1.17 | | | | 3.35 | |

| | | Class R | | | -0.56 | | | | 0.14 | | | | 6.40 | | | | -1.17 | | | | 3.35 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Bank of America Merrill Lynch USD 1-Month LIBOR Constant Maturity Index tracks the performance of a synthetic asset paying Libor to a stated maturity. The Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The MSCI All Country World Index Investable Market Index (“MSCI ACWI IMI Index”) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI IMI Index consists of 45 country indices comprising 24 developed and 21 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 4 | | The Barclays Global Aggregate Bond Index provides a broad-based measure of the global investment-grade fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The index also includes Eurodollar and Euro-Yen corporate bonds, Canadian government, agency and corporate securities, and USD investment grade 144A securities. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 5 | | The Dynamic Allocation Fund Composite Index is comprised 60% of the MSCI ACWI IMI Index and 40% of the Barclays Global Aggregate Bond Index. |

18

FUND BASICS

| | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS6 |

| | | For the period ended 6/30/13 | | One Year | | | Since Inception | | Inception Date |

| | Class A | | | -1.62 | % | | 1.91% | | 1/5/10 |

| | Class C | | | 2.39 | | | 2.83 | | 1/5/10 |

| | Institutional | | | 4.65 | | | 4.01 | | 1/5/10 |

| | Class IR | | | 4.48 | | | 3.85 | | 1/5/10 |

| | | Class R | | | 3.96 | | | 3.34 | | 1/5/10 |

| | 6 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.goldmansachsfunds.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS7 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.42 | % | | | 1.52 | % |

| | Class C | | | 2.17 | | | | 2.27 | |

| | Institutional | | | 1.01 | | | | 1.11 | |

| | Class IR | | | 1.18 | | | | 1.28 | |

| | | Class R | | | 1.68 | | | | 1.78 | |

| | 7 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least April 30, 2014, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

19

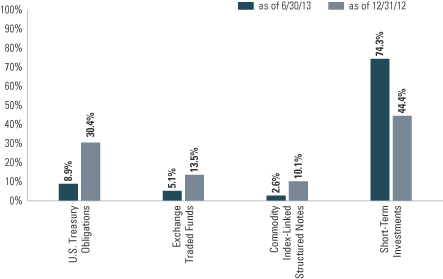

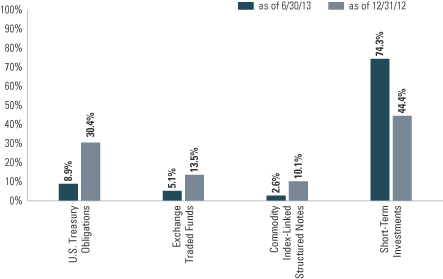

FUND BASICS

| | 8 | | The Fund is actively managed and, as such, its composition may differ over time. The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. Underlying sector allocations of exchange traded funds (“ETFs”) held by the Fund are not reflected in the graph above. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Short-term investments represent investment in investment companies other than those that are exchange traded. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

20

PORTFOLIO RESULTS

Goldman Sachs Managed Futures Strategy Fund

Investment Objective

The Fund seeks to generate long-term absolute return.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs Managed Futures Strategy Fund’s (the “Fund”) performance and positioning for the six-month period ended June 30, 2013 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of -9.48%, -9.83%, -9.36%, -9.37% and -9.69%, respectively. These returns compare to the 0.14% cumulative total return of the Fund’s benchmark, the Bank of America Merrill Lynch USD LIBOR 1-Month Constant Maturity Index (LUS1) (the “LIBOR 1-Month Index”), during the same time period. |

| | The Fund’s overall annualized volatility was 8.44% during the Reporting Period, while the overall annualized volatility of the S&P® 500 Index during the same time period was 12.13%. |

| Q | | What were the primary contributors to and detractors from the Fund’s performance during the Reporting Period? |

| A | | The Fund implements a trend-following strategy that takes long and/or short positions in a wide range of asset classes, including equities, fixed income and currencies, among others, to seek long-term absolute return. The Fund seeks to achieve its investment objective by investing primarily in a portfolio of equities, equity index futures, bonds, bond futures, equity swaps, interest rate swaps, currency forwards and non-deliverable forwards, options, exchange-traded funds (“ETFs”) and structured securities. As a result of the Fund’s use of derivatives, the Fund may also hold significant amounts of U.S. Treasuries or short-term investments. The Fund’s investments are made without restriction as to issuer capitalization, country, currency, maturity or credit rating. Negative Fund performance for the Reporting Period overall can be attributed to the latter half of the second calendar quarter, i.e., mostly to May and June 2013. |

| | During the first quarter of 2013, a strong surge in equity market returns resulted in positive contributions from various long positions in global equity markets. This was offset, however, by long positions in fixed income securities, which detracted from performance. |

| | The second calendar quarter got off to a good start with short-term and medium-term fixed income positions contributing to relative returns in April 2013. Developed market equity long positions contributed too, albeit to a lesser extent. |

| | The latter part of the second calendar quarter proved to be challenging on the heels of Federal Reserve (“Fed”) Chair Bernanke’s Congressional testimony on May 22, 2013 and subsequent “tapering” language at the Fed meeting on June 19, 2013. Moreover, heightened volatility across equity and fixed income markets coincided with a sell-off in more risky assets globally, particularly in emerging market securities. In May 2013, positions in fixed income securities as well as long-term yield curve, or slope, movements hurt the Fund’s performance. Within fixed income, exposure to U.S. and Canadian bonds particularly detracted. In June 2013, the two major detractors from Fund performance were its long positions in developed market equities and our yield curve steepening bias. Long positions in emerging market equities and short-term interest rates also detracted, but to a lesser extent. Among developed market equities, the Fund’s long positions in Italy and Sweden detracted most from performance. Among emerging market equities, the |

21

PORTFOLIO RESULTS

| | Fund’s long positions in South Africa and Turkey detracted most. Positive performance from short positions in the equity markets of Chile and South Korea did help in June 2013, but not enough to offset the detractors. The Fund’s yield curve steepening view hurt most in the Eurozone and the U.K. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used derivatives, including futures, swaps and forwards, to implement long and short positions. The Fund invested in futures and currency forwards to achieve exposure to equities (both in U.S. and non-U.S. companies) and currencies (U.S. and non-U.S. currencies), respectively. The Fund used interest rate swaps and currency forwards to achieve exposure to fixed income. |

| Q | | What changes did you make within the Fund during the Reporting Period? |

| A | | At the start of the Reporting Period, the Fund held long positions in all asset classes in the Fund’s investment universe, with especially meaningful exposures in developed market and emerging market equities along with short-term and medium-term bonds. The Fund held a relatively small positive exposure to developed market currencies. As developed market currencies declined throughout the Reporting Period, we quickly moved to a net short Fund position in this asset class by February 2013, which was then maintained through the remainder of the Reporting Period. We similarly moved to rein in the Fund’s exposures in emerging market currencies and emerging market equities, eventually moving to short positions in both asset classes by the end of the second calendar quarter. |

| Q | | What is the Fund’s tactical asset allocation view and strategy for the months ahead? |

| A | | At the end of June 2013, the Fund had net long exposures to developed market equities and short-term interest rates, while maintaining short exposure to emerging market equities, developed market and emerging market currencies, and medium-term and long-term fixed income. |

| | Going into the second half of 2013, we intend to continue to be short global currencies and emerging market equities in the Fund. We also expect to maintain the Fund’s short positions in medium-term and long-term bonds. At the end of the Reporting Period, we favored less risky assets, such as developed market equities and short-term bonds. |

| | We intend to continue to seek to identify price trends in various asset classes over short-, medium- and long-term horizons via a proprietary investment model. Upon identifying a trend in a given instrument or asset, the Fund will take a long or short position in the instrument or asset. Long positions benefit from an increase in price of the underlying instrument or asset, while short positions benefit from a decrease in price of the underlying instrument or asset. The size of the Fund’s position in an instrument or asset is primarily related to the strength of the overall trend identified by the investment model. We continue to believe that the Fund’s trend-following strategy is important because it can adapt to changing markets, seeking what we believe are the best opportunities for investment and attempting to mitigate risk when the markets become unstable. There is no guarantee that the Fund’s trend-following strategy will cause it to achieve its investment objective. |

22

FUND BASICS

Managed Futures Strategy Fund

as of June 30, 2013

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2013–June 30, 2013 | | Fund Total Return

(based on NAV)1 | | | BofA Merrill Lynch USD LIBOR

1-Month Index2 | |

| | Class A | | | -9.48 | % | | | 0.14 | % |

| | Class C | | | -9.83 | | | | 0.14 | |

| | Institutional | | | -9.36 | | | | 0.14 | |

| | Class IR | | | -9.37 | | | | 0.14 | |

| | | Class R | | | -9.69 | | | | 0.14 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |