Securities Act File No. [ ]

As filed with the Securities and Exchange Commission on November 17, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | |

| | Pre Effective Amendment No. | | q |

| | Post Effective Amendment No. | | q |

(Check appropriate box or boxes.)

GOLDMAN SACHS TRUST

(Exact Name of Registrant as Specified in Charter)

71 South Wacker Drive

Chicago, Illinois 60606

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code (312) 655-4400

CAROLINE L. KRAUS, ESQ.

Goldman, Sachs & Co.

200 West Street

New York, New York 10282

(Name and Address of Agent for Service)

COPY TO:

GEOFFREY R.T. KENYON, ESQ.

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

Title of Securities Being Registered: Class A, Class C, Institutional and Class IR Shares of Goldman Sachs International Small Cap Insights Fund, a series of the Registrant. The Registrant has registered an indefinite amount of securities pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended; accordingly, no fee is payable herewith in reliance upon Section 24(f).

It is proposed that this filing will become effective on December 17, 2015 pursuant to Rule 488 under the Securities Act of 1933.

GOLDMAN SACHS INTERNATIONAL SMALL CAP FUND

71 South Wacker Drive

Chicago, Illinois 60606

[•], 2015

Dear Shareholder:

We are writing to inform you of an important matter concerning your investment in the Goldman Sachs International Small Cap Fund (the “Acquired Fund”). At a meeting held on October 14-15, 2015, the Board of Trustees of the Acquired Fund (the “Board”) approved a reorganization pursuant to which the Acquired Fund will be reorganized with and into another series of the Goldman Sachs Trust – the Goldman Sachs International Small Cap Insights Fund (the “Surviving Fund,” and together with the Acquired Fund, the “Funds”). Shareholders were first notified of the reorganization on October 16, 2015 in a supplement to the Acquired Fund’s Prospectus and Summary Prospectus, each of which is currently dated February 27, 2015.

After careful consideration, the Board, including a majority of the Trustees who are not “interested persons” of the Funds, as that term is defined in the Investment Company Act of 1940, as amended, (the “Independent Trustees”), approved the reorganization. After considering the recommendation of Goldman Sachs Asset Management International (“GSAMI”), the investment adviser to the Acquired Fund, and Goldman Sachs Asset Management, L.P. (“GSAM”), the investment adviser to the Surviving Fund, the Board, including a majority of the Independent Trustees, concluded that: (i) the reorganization will benefit the shareholders of each Fund; (ii) the reorganization is in the best interests of each Fund; and (iii) the interests of the shareholders of each Fund will not be diluted as a result of the reorganization.

Effective on or about [February 5], 2016 (the “Closing Date”), you will own shares in the Surviving Fund equal in dollar value to your interest in the Acquired Fund on the Closing Date. No sales charge, redemption fees or other transaction fees will be imposed in the reorganization. The reorganization is intended to be a tax-free reorganization for Federal income tax purposes.

NO ACTION ON YOUR PART IS REQUIRED REGARDING THE REORGANIZATION. YOU WILL AUTOMATICALLY RECEIVE SHARES OF THE SURVIVING FUND IN EXCHANGE FOR YOUR SHARES OF THE ACQUIRED FUND AS OF THE CLOSING DATE. THE BOARD IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

If you have any questions regarding the attached Information Statement/Prospectus or other materials, please contact the Acquired Fund at 1-800-526-7384.

By Order of the Board of Trustees of the Goldman

Sachs Trust,

James A. McNamara

President

COMBINED INFORMATION STATEMENT

FOR

GOLDMAN SACHS INTERNATIONAL SMALL CAP FUND

(a series of the GOLDMAN SACHS TRUST)

AND

PROSPECTUS FOR

GOLDMAN SACHS INTERNATIONAL SMALL CAP INSIGHTS FUND

(a series of the GOLDMAN SACHS TRUST)

The address, telephone number and website of the Goldman Sachs International Small Cap Fund and the Goldman Sachs International Small Cap Insights Fund is:

71 South Wacker Drive

Chicago, Illinois 60606

1-800-526-7384

www.gsamfunds.com

Shares of the Goldman Sachs International Small Cap Insights Fund have not been approved or disapproved by the U.S. Securities and Exchange Commission (the “SEC”). The SEC has not passed upon the adequacy of this Information Statement/Prospectus. Any representation to the contrary is a criminal offense.

An investment in either the Goldman Sachs International Small Cap Fund (the “Acquired Fund”) or the Goldman Sachs International Small Cap Insights Fund (the “Surviving Fund,” and together with the Acquired Fund, the “Funds”) is not a bank deposit and is not insured or guaranteed by the U.S. Federal Deposit Insurance Corporation or any other government agency.

This Information Statement/Prospectus sets forth information about the Surviving Fund that an investor needs to know before investing. Please read this Information Statement/Prospectus carefully before investing and keep it for future reference.

The date of this Information Statement/Prospectus is [•], 2015.

For more complete information about each Fund, please read the Fund’s Prospectus and Statement of Additional Information, as they may be amended and/or supplemented. Each Fund’s Prospectus and Statement of Additional Information, and other additional information about each Fund, have been filed with the SEC (www.sec.gov) and are available upon written or oral request and without charge by writing to the address above or calling the following toll-free number: 1-800-526-7384.

INTRODUCTION

This combined information statement/prospectus, dated [•], 2015 (the “Information Statement/Prospectus”), is being furnished to shareholders of the Acquired Fund in connection with an Agreement and Plan of Reorganization between the Acquired Fund and the Surviving Fund (the “Plan”), pursuant to which the Acquired Fund will (i) transfer substantially all of its assets and liabilities attributable to each class of its shares to the Surviving Fund in exchange for shares of the Surviving Fund; and (ii) distribute to its shareholders a portion of the Surviving Fund shares to which each shareholder is entitled (as discussed below) in complete liquidation of the Acquired Fund (the “Reorganization”). At a meeting held on October 14-15, 2015, the Board of Trustees of the Funds (the “Board” or “Trustees”) approved the Plan. A copy of the Plan is attached to this Information Statement/Prospectus as Exhibit A. Shareholders should read this entire Information Statement/Prospectus, including the exhibits, carefully.

After considering the recommendation of Goldman Sachs Asset Management International (“GSAMI”), investment adviser to the Acquired Fund, and Goldman Sachs Asset Management, L.P. (“GSAM” and, together with GSAMI, the “Investment Advisers”), investment adviser to the Surviving Fund, the Board concluded that: (i) the Reorganization will benefit the shareholders of each Fund; (ii) the Reorganization is in the best interests of each Fund; and (iii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization.

NO ACTION IS REQUIRED REGARDING THE REORGANIZATION. AS DISCUSSED MORE FULLY BELOW, THE FUNDS ARE RELYING ON RULE 17a-8 UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED, AND, THEREFORE, SHAREHOLDERS OF THE ACQUIRED FUND ARE NOT BEING ASKED TO VOTE ON OR APPROVE THE PLAN. THE BOARD IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

Background to the Reorganization

GSAMI, an SEC-registered investment adviser, serves as investment adviser to the Acquired Fund, an investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). GSAM, an SEC-registered investment adviser, serves as investment adviser to the Surviving Fund, an investment company registered under the 1940 Act. GSAMI and GSAM serve as investment advisers to the Funds under the same Management Agreement, dated April 30, 1997. The Investment Advisers recommended to the Board that it approve the reorganization of the Acquired Fund with and into the Surviving Fund, an existing series of Goldman Sachs Trust (the “Trust”) because they believe that the Reorganization may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time and also would enable the combined Fund to be better positioned for asset growth. The Investment Advisers also believe that the Reorganization is preferable to liquidating the Acquired Fund, as it will provide you and other shareholders with the opportunity to invest in a fund that: (i) invests in a larger number, and therefore more diversified, group of non-U.S. small cap companies; and (ii) is part of the Goldman Sachs Funds – a large, diverse fund family. Moreover, the Surviving Fund has had higher performance than the Acquired Fund over the one-, three-, five-year and since-inception periods ended August 31, 2015 (the Surviving Fund commenced operations in 2007).

On October 14-15, 2015, the Board, including a majority of the Trustees who are not “interested persons” of the Funds, as that term is defined in the 1940 Act (the “Independent Trustees”), voted to approve the Reorganization. In approving the Reorganization, the Board, including a majority of the Independent Trustees, concluded that: (i) the Reorganization will benefit the shareholders of each Fund; (ii) the Reorganization is in the best interests of each Fund; and (iii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization. The Board also considered and approved the terms and conditions of the Plan.

At its meeting, the Board received and evaluated materials provided by the Investment Advisers regarding the Reorganization and its effect on the existing shareholders of the Funds. The Board also evaluated and

ii

discussed: (i) the material differences between each Fund’s investment objective, strategies, policies and risks; (ii) the specific terms of the Reorganization; and (iii) other information, such as the relative sizes of the Funds, the performance records of the Funds, the expenses of the Funds and the anticipated asset growth of the Funds in the foreseeable future. In addition, the Board considered additional factors, which are discussed in more detail below under “Why did the Board approve the Reorganization?”

The Independent Trustees were assisted in their consideration of the Reorganization by independent counsel.

Questions and Answers

How will the Reorganization affect me?

Under the terms of the Plan, the Acquired Fund will transfer substantially all of its assets to the Surviving Fund and the Surviving Fund will assume all of the liabilities of the Acquired Fund. Subsequently, the Acquired Fund will be liquidated and you will become a shareholder of the Surviving Fund. You will receive shares of the Surviving Fund that are equal in aggregate net asset value to the shares of the Acquired Fund that you held immediately prior to the Closing Date (as defined below). Shareholders of Service Class Shares of the Acquired Fund will receive Class A Shares of the Surviving Fund and shareholders of each other class of shares of the Acquired Fund will receive the corresponding class of the Surviving Fund, as follows:

| | | | |

Acquired Fund | | | | Surviving Fund |

| Class A | | ® | | Class A |

| Class C | | ® | | Class C |

| Service* | | ® | | Class A |

| Institutional | | ® | | Institutional |

| Class IR | | ® | | Class IR |

| | | | Class R6* |

| * | The Acquired Fund does not offer Class R6 Shares and the Surviving Fund does not offer Service Shares. The Acquired Fund’s Service Class shareholders will receive Class A Shares of the Surviving Fund. |

No sales charge, contingent deferred sales charge (“CDSC”), commission, redemption fee or other transactional fee will be charged as a result of the Reorganization.

When will the Reorganization occur?

The Reorganization is scheduled to occur on or about [February 5], 2016, but may occur on such earlier or later date as the parties agree in writing (the “Closing Date”).

How will the Reorganization affect the fees to be paid by the Surviving Fund, and how do they compare with the fees paid by the Acquired Fund?

For the fiscal year ended October 31, 2014, the Acquired Fund’s effective management fee (after giving effect to the current management fee waiver and breakpoints) was 0.90% and the Surviving Fund’s actual management fee was 0.85% (the Surviving Fund does not currently have a management fee waiver arrangement in place). Accordingly, shareholders of the Acquired Fund are expected to pay a lower actual management fee upon consummation of the Reorganization. The Acquired Fund’s gross expense ratio for the fiscal year ended October 31, 2014 (before giving effect to the current expense limitation arrangements) for Class A, Class C, Institutional, Service and Class IR Shares was 1.77%, 2.52%, 1.37%, 1.86% and 1.52%, respectively. It is estimated that post-Reorganization, the Surviving Fund’s gross expense ratio for Class A, Class C, Institutional and Class IR Shares will be 1.38%, 2.13%, 0.98% and 1.13%, respectively. The Acquired Fund’s net expense

iii

ratio for the fiscal year ended October 31, 2014 (after giving effect to the current fee waiver and expense limitation arrangements) for Class A, Class C, Institutional, Service and Class IR Shares was 1.38%, 2.12%, 0.97%, 1.47% and 1.09%, respectively. It is estimated that post-Reorganization, the Surviving Fund’s net expense ratio for Class A, Class C, Institutional and Class IR Shares will be 1.30%, 2.05%, 0.90% and 1.05%, respectively. Accordingly, shareholders of the Acquired Fund are expected to be subject to a lower gross and net expense ratio upon consummation of the Reorganization. Pro forma expense information is included in this Information Statement/Prospectus under “Summary – The Funds’ Fees and Expenses.”

Why did the Board approve the Reorganization?

In approving the Reorganization, the Board, including a majority of the Independent Trustees, concluded that: (i) the Reorganization is in the best interests of each Fund; and (ii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization. The Trustees also believe that the Reorganization offers a number of potential benefits. These potential benefits and considerations include the following:

| • | The Reorganization may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time and also would enable the combined Fund to be better positioned for asset growth. |

| • | The Reorganization is preferable to liquidating the Acquired Fund, which may be treated as a taxable event, as it will provide you and other shareholders with the opportunity to invest in a fund that invests in a larger number, and therefore more diversified, group of non-U.S. small cap companies. The Funds have a similar universe of permissible investments, however the Acquired Fund takes a fundamentally-driven approach to investing, whereas the Surviving Fund takes a quantitative approach. These differences, as well as other differences, are discussed in more detail below under “Summary – Comparison of the Acquired Fund with the Surviving Fund and Comparison of Principal Investment Risks of Investing in the Funds.” |

| • | The Surviving Fund has had higher performance than the Acquired Fund over the one-, three-, five-year and since-inception periods ended August 31, 2015 (the Surviving Fund commenced operations in 2007). |

| • | The Reorganization is expected to qualify as a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), and, therefore, you will not recognize gain or loss for federal income tax purposes on the exchange of your shares of the Acquired Fund for the shares of the Surviving Fund. Alternatively, liquidation of the Acquired Fund could give rise to a taxable event. |

Additional considerations are discussed in more detail below under “Summary – Reasons for the Reorganization and Board Considerations.”

Who bears the expenses associated with the Reorganization?

GSAM has agreed to pay the legal, auditor/accounting and other costs, including brokerage, trading taxes and other transaction costs, associated with each Fund’s participation in the Reorganization. GSAM estimates that these costs will be approximately $383,095.

Will the Investment Advisers benefit from the Reorganization?

Although reorganizing the Acquired Fund with and into the Surviving Fund (instead of liquidating the Acquired Fund) will benefit GSAM by managing a larger pool of assets, which will produce increased management fees that will accrue to GSAM, the Investment Advisers believe that the combined Fund would be better positioned for asset growth than the Acquired Fund on its own.

iv

What are the Federal income and other tax consequences of the Reorganization?

As a condition to the closing of the Reorganization, the Funds must receive an opinion of Dechert LLP to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Code. Accordingly, subject to the limited exceptions described below under the heading “Tax Status of the Reorganization,” it is expected that neither you nor a Fund will recognize gain or loss as a direct result of the Reorganization, and that the aggregate tax basis of the Surviving Fund shares that you receive in the Reorganization will be the same as the aggregate tax basis of the shares that you surrendered in the Reorganization.

In addition, in connection with the Reorganization, it is currently expected that a substantial portion of the Acquired Fund’s portfolio assets (approximately 95%) will be sold prior to the consummation of the Reorganization, which may result in the Acquired Fund realizing capital gains. It is currently estimated that such portfolio repositioning would have resulted in realized capital gains of approximately $0, if such sales occurred as of November 11, 2015. Taking into account capital losses and capital loss carryforwards expected to be available to offset such realized gains, it is currently estimated that the Acquired Fund will be required to distribute to its shareholders approximately $0 (approximately $0 per share) as a result of such portfolio repositioning, although the actual amount of such distribution could be higher or lower depending on market conditions and on transactions entered into by the Acquired Fund prior to the Closing Date. Shareholders of the Acquired Fund will generally be taxed on any resulting capital gain distributions. It is also estimated that such portfolio repositioning will result in brokerage and other transaction costs, including trading taxes, of approximately $212,020 (approximately 13 basis points).

Why are shareholders not being asked to vote on the Reorganization?

The Trust’s Declaration of Trust and applicable state law do not require shareholder approval of the Reorganization. Moreover, Rule 17a-8 under the 1940 Act does not require shareholder approval of the Reorganization, provided certain conditions are met. Because applicable legal requirements do not require shareholder approval under these circumstances and the Board has determined that the Reorganization is in the best interests of each Fund, shareholders are not being asked to vote on the Reorganization.

Where can I get more information?

| | |

| Each Fund’s current prospectus and any applicable supplements. | | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384 or on the Funds’ website (www.gsamfunds.com). |

| |

| Each Fund’s current statement of additional information and any applicable supplements. | | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384 or on the Funds’ website (www.gsamfunds.com). |

| |

| Each Fund’s most recent annual and semi-annual reports to shareholders. | | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384 or on the Funds’ website (www.gsamfunds.com). |

v

| | |

| A statement of additional information for this Information Statement/Prospectus, dated [•], 2015 (the “SAI”). The SAI contains additional information about the Surviving Fund. | | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384. The SAI is incorporated by reference into this Information Statement/Prospectus. |

| |

| To ask questions about this Information Statement/Prospectus. | | Call the toll-free telephone number: 1-800-526-7384. |

Each Fund’s: (i) prospectus and statement of additional information, dated February 27, 2015 (with respect to the Acquired Fund) and July 31, 2015 (with respect to the Surviving Fund), and any supplements thereto, (ii) April 30, 2015 Semi-Annual Report, and (iii) October 31, 2014 Annual Report, are incorporated by reference into this Information Statement/Prospectus, which means they are considered legally a part of this Information Statement/Prospectus. The materials have been filed with the SEC (www.sec.gov) and are available upon written or oral request and without charge by writing to the address above or calling the following toll-free number: 1-800-526-7384.

vi

TABLE OF CONTENTS

i

GOLDMAN SACHS INTERNATIONAL SMALL CAP FUND

AND

GOLDMAN SACHS INTERNATIONAL SMALL CAP INSIGHTS FUND

SUMMARY

The following is a summary of more complete information appearing later in this Information Statement/Prospectus or incorporated by reference herein. You should read carefully the entire Information Statement/Prospectus, including the form of Agreement and Plan of Reorganization attached as Exhibit A, because it contains details that are not in the summary.

Comparison of the Acquired Fund with the Surviving Fund

Although each Fund seeks to achieve its investment objective by investing in a diversified portfolio of non-U.S. small-cap companies, there are some important differences between the principal investment strategies of the Surviving Fund and those of the Acquired Fund. These differences are discussed in more detail in the side-by-side chart below to facilitate comparison.

| | | | |

| | | The Acquired Fund | | The Surviving Fund |

| Type of fund | | The Funds are diversified under the 1940 Act. |

| | |

| Investment objective | | The Acquired Fund seeks long-term capital appreciation. | | The Surviving Fund seeks long-term growth of capital. |

| | |

| How will each Fund seek to achieve its investment objective? | | The Acquired Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase) (“Net Assets”) in a diversified portfolio of equity investments in non-U.S. small-cap companies. Such equity investments may include exchange-traded funds (“ETFs”), futures and other instruments with similar economic exposures. Non-U.S. small-cap companies are companies: • With public stock market capitalizations within the range of the market capitalization of companies constituting the Standard and Poor’s (S&P) Developed Ex-U.S. Small Cap Index (Net, USD, Unhedged) at the time of investment, which as of December 31, 2014 was between $2 million and $17 billion; and • That are organized outside the United States or whose securities are principally traded outside the United States. The Acquired Fund seeks to achieve its investment objective by investing in issuers that are considered by the Investment Adviser | | The Surviving Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase) (“Net Assets”) in a broadly diversified portfolio of equity investments in small-cap non-U.S. issuers. The Surviving Fund seeks to maximize its expected return, while maintaining risk, style, and capitalization characteristics similar to the Morgan Stanley Capital International (“MSCI”) Europe, Australasia, Far East (“EAFE”) Small Cap Index (Net, USD, Unhedged). The MSCI EAFE Small Cap Index (Net, USD, Unhedged) is designed to measure equity market performance of the small capitalization segments of developed markets, excluding the United States and Canada. The Surviving Fund seeks to maximize its expected return while maintaining these and other characteristics similar to the benchmark. The Surviving Fund may also invest in the securities of issuers in emerging countries, and fixed income securities that are considered to be cash equivalents. |

1

| | | | |

| | | The Acquired Fund | | The Surviving Fund |

| | |

| | to be strategically positioned for long-term growth through its evaluation of factors such as a company’s financial position relative to peers, current financial condition, competitive position in its industry, ability to capitalize on future growth, and equity valuation. The Acquired Fund’s investments are selected using a strong valuation discipline to purchase what the Investment Adviser believes are well-positioned, cash-generating businesses run by shareholder-oriented management teams. | | |

| | |

| How are each Fund’s investments allocated? | | The Acquired Fund’s assets are invested in at least three foreign countries. The Acquired Fund expects to invest a substantial portion of its assets in securities of companies in the developed countries of Western Europe, Japan and Asia, but may also invest in securities of issuers located in Australia, Canada, New Zealand and in emerging countries. From time to time, the Acquired Fund’s investments in a particular developed country may exceed 25% of its investment portfolio. The Acquired Fund may invest in equity investments outside the market capitalization range specified above and in fixed income securities, such as government, corporate and bank debt obligations. | | The Surviving Fund uses a quantitative style of management, in combination with a qualitative overlay that emphasizes fundamentally-based stock selection, careful portfolio construction and efficient implementation. The Surviving Fund’s investments are selected using fundamental research and a variety of quantitative techniques based on certain investment themes, including, among others, Momentum, Valuation and Profitability. The Momentum theme seeks to predict drifts in stock prices caused by delayed investor reaction to company-specific information and information about related companies. The Valuation theme attempts to capture potential mispricings of securities, typically by comparing a measure of the company’s intrinsic value to its market value. The Profitability theme seeks to assess whether a company is earning more than its cost of capital. The Investment Adviser may, in its discretion, make changes to its quantitative techniques, or use other quantitative techniques that are based on the Investment Adviser’s proprietary research. |

| | |

| What is each Fund’s limit with respect to an investment in a single industry or group of industries? | | The Acquired Fund may not invest 25% or more of its total assets in the securities of one or more issuers conducting their principal business activities in the same industry (excluding the U.S. Government or any of its agencies or instrumentalities). | | The Surviving Fund may not invest 25% or more of its total assets in the securities of one or more issuers conducting their principal business activities in the same industry (excluding the U.S. Government or any of its agencies or instrumentalities). |

| | |

| Benchmark | | Standard and Poor’s (S&P) Developed Ex-U.S. Small Cap Index (Net, USD, Unhedged). | | MSCI EAFE Small Cap Index (Net, USD, Unhedged). |

2

| | | | |

| | | The Acquired Fund | | The Surviving Fund |

| Fund turnover | | Each Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example above, but will be reflected in the Fund’s performance. The Acquired Fund’s portfolio turnover rate for the fiscal year ended October 31, 2014 was 100% of the average value of its portfolio. The Surviving Fund’s portfolio turnover rate for the fiscal year ended October 31, 2014 was 129% of the average value of its portfolio. |

| | |

| Investment Adviser | | GSAMI serves as the investment adviser of Acquired Fund. | | GSAM serves as the investment adviser of Surviving Fund. |

| | |

| Fund management team | | Suneil Mahindru, Managing Director, Chief Investment Officer of International Equity, has managed the Acquired Fund since 2015. Suneil Mahindru is the Chief Investment Officer of International Equity, overseeing the portfolio management and investment research for the Global and International Equity accounts of Goldman Sachs. Mr. Mahindru joined the Investment Adviser in September 1996 as an investment analyst and was named Managing Director in 2007. Prior to joining Goldman Sachs, he spent three years at CIN Investment Ltd. as an analyst. The SAI provides additional information about the portfolio managers’ compensation and other accounts managed by the portfolio managers. | | Ron Hua, CFA, Managing Director, Chief Investment Officer of Quantitative Investment Strategies – Equity Insights Strategies, has managed the Surviving Fund since 2011. Mr. Hua is the Chief Investment Officer of Equity Insights Strategies for GSAM’s QIS team. Mr. Hua joined GSAM as a partner in 2011, and oversees all research, portfolio management and trading for the QIS quantitative equity business. Prior to joining the firm, Ron was the Chief Investment Officer and Head of Research for Equity Investments at PanAgora Asset Management (2004-2011). In that capacity, Ron was responsible for all equity strategies, was the architect of PanAgora’s Dynamic Equity Contextual Modeling Approach and served as a member of PanAgora’s Management and Investment Committees. Len Ioffe, CFA, Managing Director and Senior Portfolio Manager, has managed the Surviving Fund since 2007. Mr. Ioffe joined the Investment Adviser as an associate in 1995 and has been a portfolio manager since 1996. Osman Ali, CFA, Managing Director, has managed the Surviving Fund since 2013. Mr. Ali joined the Investment Adviser in 2003 and has been a member of the research and portfolio management team within the QIS team since 2005. |

3

| | | | |

| | | The Acquired Fund | | The Surviving Fund |

| | |

| | | | Takashi Suwabe, Managing Director, has managed the Surviving Fund since 2013; and Denis Suvorov, CFA, Vice President, has managed the Fund since 2012. Mr. Suwabe is co-head of active equity research in the QIS team. He joined the Investment Adviser in 2004 and has been a member of the QIS team since 2009. Previously, Mr. Suwabe worked at Nomura Securities and Nomura Research Institute. Denis Suvorov, CFA, Vice President, has managed the Surviving Fund since 2012. Mr. Suvorov joined the Investment Adviser as a vice president in 2011 and has been a portfolio manager since 2011. Between 2007 and 2011 he was a portfolio manager at Numeric Investors, LLC. The SAI provides additional information about the portfolio managers’ compensation and other accounts managed by the portfolio managers. |

| |

| Fiscal year end | | October 31 |

As the above table indicates, despite certain similarities, there are some notable differences between the principal investment strategies of the Surviving Fund and those of the Acquired Fund. The Funds have different portfolio management teams, which employ separate investment philosophies. In this regard, the Acquired Fund takes a fundamentally-driven approach to investing, whereas the Surviving Fund takes a quantitative approach.

The Surviving Fund’s principal investment strategies, including the additional markets to which you would be exposed as a shareholder of the Surviving Fund, may impact performance and the risk/return profile of your investment. The investment philosophy of the Funds, as well as additional information on portfolio risks, securities and techniques, is described in more detail in Exhibit B.

Comparison of Principal Investment Risks of Investing in the Funds

The Acquired Fund and Surviving Fund have substantially similar investment objectives. The Acquired Fund’s investment objective is to “seek long-term capital appreciation,” whereas the Surviving Fund’s investment objective is to “seek long-term growth of capital.” Both Funds have a policy to invest at least 80% of their net assets in a diversified portfolio of equity investments in non-U.S. small-cap companies. The Funds have a similar universe of permissible investments, however the Acquired Fund takes a fundamentally-driven approach to investing, whereas the Surviving Fund takes a quantitative approach. In addition, both Funds are “diversified” under the 1940 Act.

Loss of money is a risk of investing in the Funds. An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. A

4

Fund should not be relied upon as a complete investment program. Stated allocations may be subject to change. There can be no assurance that a Fund will achieve its investment objective. Investment in the Funds involves substantial risks which prospective investors should consider carefully before investing.

| | |

| Principal investment risks applicable to each Fund | | Foreign and Emerging Countries Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. Loss may also result from the imposition of exchange controls, sanctions, confiscations and other government restrictions by the United States or other governments, or from problems in registration, settlement or custody. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. To the extent the Fund also invests in securities of issuers located in emerging countries, these risks may be more pronounced. Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s net asset value (“NAV”) and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio. Market Risk. The value of the securities in which the Fund invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets. Mid-Cap and Small-Cap Risk. Investments in mid-capitalization and small-capitalization companies involve greater risks than those associated with larger, more established companies. These securities may be subject to more abrupt or erratic price movements and may lack sufficient market liquidity, and these issuers often face greater business risks. Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced periods of substantial price volatility in the past and may do so again in the future. |

| |

| Principal investment risks applicable to the Acquired Fund only | | None |

| |

| Principal investment risks applicable to the Surviving Fund only | | Investment Style Risk. Different investment styles (e.g., “growth”, “value” or “quantitative”) tend to shift in and out of favor depending upon market and economic conditions and investor sentiment. The Fund may outperform or underperform other funds that invest in similar asset classes but employ different investment styles. |

5

| | |

| |

| | Management Risk. A strategy used by the Investment Adviser may fail to produce the intended results. The Investment Adviser attempts to execute a complex strategy for the Fund using proprietary quantitative models. Investments selected using these models may perform differently than expected as a result of the factors used in the models, the weight placed on each factor, changes from the factors’ historical trends, and technical issues in the construction and implementation of the models (including, for example, data problems and/or software issues). There is no guarantee that the Investment Adviser’s use of these quantitative models will result in effective investment decisions for the Fund. Additionally, commonality of holdings across quantitative money managers may amplify losses. Portfolio Turnover Rate Risk. A high rate of portfolio turnover (100% or more) involves correspondingly greater expenses which must be borne by the Fund and its shareholders, and is also likely to result in short-term capital gains taxable to shareholders. |

Additional information on portfolio risks, securities and techniques is described in more detail in Exhibit B. An additional discussion of these risks is included in the “Risks of the Funds” section of the current prospectus of the Funds, which is incorporated herein by reference. The materials have been filed with the SEC (www.sec.gov) and are available upon written or oral request and without charge by writing to the address above or calling the following toll-free number: 1-800-526-7384.

The Funds’ Fees and Expenses

Shareholders of both Funds pay various fees and expenses, either directly or indirectly. The tables below show the fees and expenses that you would pay if you were to buy and hold shares of each Fund. The expenses in the tables appearing below are based on the expenses of the Funds for the twelve-month period ended October 31, 2014. For financial statement purposes, the Surviving Fund will be the accounting survivor of the Reorganization. As the accounting survivor, the Surviving Fund’s operating history will be used for financial reporting purposes. The tables also show the pro forma expenses of the combined Fund after giving effect to the Reorganization based on pro forma net assets as of October 31, 2014.

Class A Shares

| | | | | | | | | | | | |

| | | International Small

Cap Fund

(Class A Shares) | | | International Small Cap

Insights Fund

(Class A Shares) | | | International Small Cap

Insights Fund

(Combined Fund Class A –

Pro Forma) | |

Shareholder fees (paid directly from your investment) | |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | | | 5.50 | % | | | 5.50 | % | | | 5.50 | % |

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds)1 | | | None | | | | None | | | | None | |

6

| | | | | | | | | | | | |

| | | International Small

Cap Fund

(Class A Shares) | | | International Small Cap

Insights Fund

(Class A Shares) | | | International Small Cap

Insights Fund

(Combined Fund Class A –

Pro Forma) | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

Management Fees | | | 1.10 | % | | | 0.85 | % | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

Other Expenses2 | | | 0.42 | % | | | 0.29 | % | | | 0.28 | % |

Service Fees | | | None | | | | None | | | | None | |

Shareholder Administration Fees | | | None | | | | None | | | | None | |

All Other Expenses | | | 0.42 | % | | | 0.29 | % | | | 0.28 | % |

Total Annual Fund Operating Expenses | | | 1.77 | % | | | 1.39 | % | | | 1.38 | % |

Fee Waiver and Expense Limitation3 | | | (0.39 | )% | | | (0.09 | )% | | | (0.08 | )% |

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation4 | | | 1.38 | % | | | 1.30 | % | | | 1.30 | % |

Class C Shares

| | | | | | | | | | | | |

| | | International Small

Cap Fund

(Class C Shares) | | | International Small Cap

Insights Fund

(Class C Shares) | | | International Small Cap

Insights Fund (Combined

Fund Class C – Pro Forma) | |

Shareholder fees (paid directly from your investment) | |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds)1 | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

Management Fees | | | 1.10 | % | | | 0.85 | % | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % |

Other Expenses2 | | | 0.67 | % | | | 0.55 | % | | | 0.53 | % |

Service Fees | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

Shareholder Administration Fees | | | None | | | | None | | | | None | |

All Other Expenses | | | 0.42 | % | | | 0.30 | % | | | 0.28 | % |

Total Annual Fund Operating Expenses | | | 2.52 | % | | | 2.15 | % | | | 2.13 | % |

Fee Waiver and Expense Limitation3 | | | (0.40 | )% | | | (0.10 | )% | | | (0.08 | )% |

Total Annual Fund Operating Expenses After Expense Limitation4 | | | 2.12 | % | | | 2.05 | % | | | 2.05 | % |

7

Institutional Shares

| | | | | | | | | | | | |

| | | International Small

Cap Fund

(Institutional Shares) | | | International Small Cap

Insights Fund

(Institutional Shares) | | | International Small Cap

Insights Fund

(Combined Fund Institutional

Shares – Pro Forma) | |

Shareholder fees (paid directly from your investment) | |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds) | | | None | | | | None | | | | None | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

Management Fees | | | 1.10 | % | | | 0.85 | % | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees | | | None | | | | None | | | | None | |

Other Expenses2 | | | 0.27 | % | | | 0.14 | % | | | 0.13 | % |

Service Fees | | | None | | | | None | | | | None | |

Shareholder Administration Fees | | | None | | | | None | | | | None | |

All Other Expenses | | | 0.27 | % | | | 0.14 | % | | | 0.13 | % |

Total Annual Fund Operating Expenses | | | 1.37 | % | | | 0.99 | % | | | 0.98 | % |

Fee Waiver and Expense Limitation3 | | | (0.40 | )% | | | (0.09 | )% | | | (0.08 | )% |

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation4 | | | 0.97 | % | | | 0.90 | % | | | 0.90 | % |

Service Shares

| | | | | | | | | | | | |

| | | International Small

Cap Fund

(Service Shares) 5 | | | International Small Cap

Insights Fund

(Service Shares) | | | International Small Cap

Insights Fund

(Combined Fund Class A

Shares – Pro Forma) | |

Shareholder fees (paid directly from your investment) | |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | | | None | | | | N/A | | | | 5.50 | % |

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds) | | | None | | | | N/A | | | | None | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

Management Fees | | | 1.10 | % | | | N/A | | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees | | | 0.25 | % | | | N/A | | | | 0.25 | % |

Other Expenses2 | | | 0.51 | % | | | N/A | | | | 0.28 | % |

Service Fees | | | None | | | | N/A | | | | None | |

Shareholder Administration Fees | | | 0.25 | % | | | N/A | | | | None | |

All Other Expenses | | | 0.26 | % | | | N/A | | | | 0.28 | % |

Total Annual Fund Operating Expenses | | | 1.86 | % | | | N/A | | | | 1.38 | % |

Fee Waiver and Expense Limitation3 | | | (0.39 | )% | | | N/A | | | | (0.08 | )% |

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation4 | | | 1.47 | % | | | N/A | | | | 1.30 | % |

8

Class IR Shares

| | | | | | | | | | | | |

| | | International Small

Cap Fund

(Class IR Shares) | | | International Small Cap

Insights Fund

(Class IR Shares) | | | International Small Cap

Insights Fund

(Combined Fund Class IR –

Pro Forma) | |

Shareholder fees (paid directly from your investment) | |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds) | | | None | | | | None | | | | None | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

Management Fees | | | 1.10 | % | | | 0.85 | % | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees | | | None | | | | None | | | | None | |

Other Expenses2 | | | 0.42 | % | | | 0.29 | % | | | 0.28 | % |

Service Fees | | | None | | | | None | | | | None | |

Shareholder Administration Fees | | | None | | | | None | | | | None | |

All Other Expenses | | | 0.42 | % | | | 0.29 | % | | | 0.28 | % |

Total Annual Fund Operating Expenses | | | 1.52 | % | | | 1.14 | % | | | 1.13 | % |

Fee Waiver and Expense Limitation3 | | | (0.43 | )% | | | (0.09 | )% | | | (0.08 | )% |

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation4 | | | 1.09 | % | | | 1.05 | % | | | 1.05 | % |

| 1 | A contingent deferred sales charge (“CDSC”) of 1% is imposed on Class C Shares redeemed within 12 months of purchase. |

| 2 | The differences in the “Other Expenses” ratios across the share classes are the result of, among other things, contractual differences in transfer agency fees and the effect of mathematical rounding on the daily accrual of certain expenses, particularly in respect of small share classes. |

| 3 | With respect to the Acquired Fund, the Investment Adviser has agreed to waive a portion of its management fees in order to achieve an effective net management fee rate of 0.90% as an annual percentage rate of the average daily net assets of the Acquired Fund through at least February 28, 2016, and prior to such date, the Investment Adviser may not terminate this arrangement without the approval of the Board of Trustees. The Investment Adviser has agreed to reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees and shareholder administration fees (as applicable), taxes, interest, brokerage fees, shareholder meeting, litigation, indemnification and extraordinary expenses) to 0.034% and 0.014% of average daily net assets for the Acquired Fund and Surviving Fund, respectively. These arrangements will remain in effect through at least February 28, 2016 (with respect to the Acquired Fund) and July 31, 2016 (with respect to the Surviving Fund), and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Board of Trustees. The expense limitations may be modified or terminated by the Investment Adviser at its discretion and without shareholder approval after such date, although the Investment Adviser does not presently intend to do so. |

| 4 | The Acquired Fund’s “Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation” have been restated to reflect the fee waiver and expense limitation currently in effect. |

| 5 | Shareholders of Service Class Shares of the Acquired Fund will receive Class A Shares of the Surviving Fund. Accordingly, the Service Class Pro Forma fee and expense figures reflect the Pro Forma figures set forth in the Class A Shares table above. Shareholders will not be subject to the sales charge associated with Class A Shares. |

9

Expense Example

This Example is intended to help you compare the cost of investing in each Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in each Fund for the time periods indicated and then redeem all of your applicable shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, and that each Fund’s operating expenses remain the same (except that the Example incorporates the expense limitation agreements for only the first year). Pro forma expenses are included assuming a Reorganization of the Funds. The examples are for comparison purposes only and are not a representation of either Fund’s actual expenses or returns, either past or future. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | International Small Cap

Fund | | | International Small Cap

Insights Fund | | | International Small Cap

Insights Fund

(Combined Fund – Pro Forma) | |

| | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | |

Class A | | $ | 683 | | | $ | 1,041 | | | $ | 1,422 | | | $ | 2,489 | | | $ | 675 | | | $ | 957 | | | $ | 1,261 | | | $ | 2,119 | | | $ | 675 | | | $ | 955 | | | $ | 1,256 | | | $ | 2,110 | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Assuming complete redemption at end of period | | $ | 315 | | | $ | 747 | | | $ | 1,305 | | | $ | 2,826 | | | $ | 308 | | | $ | 663 | | | $ | 1,145 | | | $ | 2,475 | | | $ | 308 | | | $ | 659 | | | $ | 1,137 | | | $ | 2,456 | |

Assuming no redemption | | $ | 215 | | | $ | 747 | | | $ | 1,305 | | | $ | 2,826 | | | $ | 208 | | | $ | 663 | | | $ | 1,145 | | | $ | 2,475 | | | $ | 208 | | | $ | 659 | | | $ | 1,137 | | | $ | 2,456 | |

Institutional Class | | $ | 99 | | | $ | 394 | | | $ | 712 | | | $ | 1,612 | | | $ | 92 | | | $ | 306 | | | $ | 538 | | | $ | 1,205 | | | $ | 92 | | | $ | 304 | | | $ | 534 | | | $ | 1,194 | |

Service Class | | $ | 150 | | | $ | 547 | | | $ | 970 | | | $ | 2,148 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

Class IR | | $ | 111 | | | $ | 438 | | | $ | 788 | | | $ | 1,776 | | | $ | 107 | | | $ | 353 | | | $ | 619 | | | $ | 1,378 | | | $ | 107 | | | $ | 351 | | | $ | 615 | | | $ | 1,367 | |

The Funds’ Past Performance

Upon consummation of the Reorganization, the Surviving Fund will be the accounting and performance survivor.

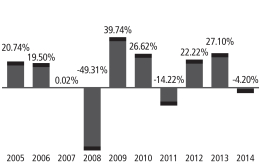

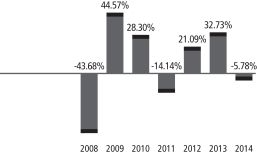

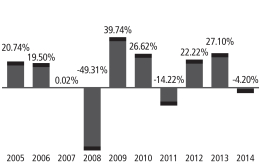

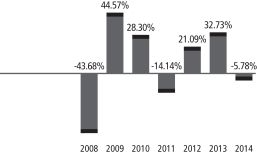

The bar chart and table below provide an indication of the risks of investing in each Fund by showing: (i) changes in the performance of each Fund’s Institutional Shares from year to year; and (ii) how the average annual total returns of each Fund’s Class A, Class C, Institutional, Service (Acquired Fund only) and Class IR Shares compare to those of a broad-based securities market index.

Each Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone number on the front cover of this Information Statement/Prospectus.

10

Acquired Fund Past Performance

| | |

| |

| TOTAL RETURN | | CALENDAR YEAR (INSTITUTIONAL) |

| |

The total return for Institutional Shares for the 9-month period ended September 30, 2015 was 0.80%. Best Quarter Q2 ‘09 +27.59% Worst Quarter Q3 ‘08 –23.12% | |  |

| |

AVERAGE ANNUAL TOTAL RETURN

| | | | | | | | | | | | | | | | |

For the period ended December 31, 2014 | | 1 Year | | | 5 Years | | | 10 Years | | | Since

Inception | |

Class A Shares (Inception 5/1/98) | | | | | | | | | | | | | | | | |

Returns Before Taxes | | | (9.85 | )% | | | 8.38 | % | | | 4.10 | % | | | 5.44 | % |

Returns After Taxes on Distributions | | | (0.01 | )% | | | 8.22 | % | | | 3.73 | % | | | 5.01 | % |

Returns After Taxes on Distributions and Sale of Fund Shares | | | (5.17 | )% | | | 6.79 | % | | | 3.27 | % | | | 4.41 | % |

S&P Developed Ex-U.S. Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (3.77 | )% | | | 8.08 | % | | | 6.42 | % | | | 6.74 | % |

| | | | | | | | | | | | | | | | |

Class C Shares (Inception 5/1/98) | | | | | | | | | | | | | | | | |

Returns Before Taxes | | | (6.26 | )% | | | 8.79 | % | | | 3.91 | % | | | 5.11 | % |

S&P Developed Ex-U.S. Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (3.77 | )% | | | 8.08 | % | | | 6.42 | % | | | 6.74 | % |

| | | | | | | | | | | | | | | | |

Institutional Shares (Inception 5/1/98) | | | | | | | | | | | | | | | | |

Returns Before Taxes | | | (4.20 | )% | | | 10.09 | % | | | 5.13 | % | | | 6.33 | % |

S&P Developed Ex-U.S. Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (3.77 | )% | | | 8.08 | % | | | 6.42 | % | | | 6.74 | % |

| | | | | | | | | | | | | | | | |

Service Shares (Inception 5/1/98) | | | | | | | | | | | | | | | | |

Returns Before Taxes | | | (4.69 | )% | | | 9.50 | % | | | 4.59 | % | | | 5.78 | % |

S&P Developed Ex-U.S. Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (3.77 | )% | | | 8.08 | % | | | 6.42 | % | | | 6.74 | % |

| | | | | | | | | | | | | | | | |

Class IR Shares (Inception 8/31/10) | | | | | | | | | | | | | | | | |

Returns Before Taxes | | | (4.33 | )% | | | N/A | | | | N/A | | | | 11.42 | % |

S&P Developed Ex-U.S. Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (3.77 | )% | | | N/A | | | | N/A | | | | 9.91 | % |

| | | | | | | | | | | | | | | | |

11

Surviving Fund Past Performance

| | |

| |

| TOTAL RETURN | | CALENDAR YEAR (INSTITUTIONAL) |

| |

The total return for Institutional Shares for the 9-month period ended September 30, 2015 was 3.73%. Best Quarter Q2 ‘09 +34.33% Worst Quarter Q3 ‘08 –24.08% | |  |

AVERAGE ANNUAL TOTAL RETURN

| | | | | | | | | | | | |

For the period ended December 31, 2014 | | 1 Year | | | 5 Years | | | Since

Inception | |

Class A Shares (Inception 09/28/07) | | | | | | | | | | | | |

Returns Before Taxes | | | (11.33 | )% | | | 9.08 | % | | | 1.95 | % |

Returns After Taxes on Distributions | | | (11.89 | )% | | | 8.23 | % | | | 1.26 | % |

Returns After Taxes on Distributions and Sale of Fund Shares | | | (5.95 | )% | | | 7.07 | % | | | 1.41 | % |

MSCI EAFE Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (4.95 | )% | | | 8.63 | % | | | 1.55 | % |

| | | | | | | | | | | | |

Class C Shares (Inception 09/28/07) | | | | | | | | | | | | |

Returns Before Taxes | | | (7.73 | )% | | | 9.52 | % | | | 2.02 | % |

MSCI EAFE Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (4.95 | )% | | | 8.63 | % | | | 1.55 | % |

| | | | | | | | | | | | |

Institutional Shares (Inception 09/28/07) | | | | | | | | | | | | |

Returns Before Taxes | | | (5.78 | )% | | | 10.78 | % | | | 3.16 | % |

MSCI EAFE Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (4.95 | )% | | | 8.63 | % | | | 1.55 | % |

| | | | | | | | | | | | |

Class IR Shares (Inception 08/31/10) | | | | | | | | | | | | |

Returns Before Taxes | | | (5.91 | )% | | | N/A | | | | 12.22 | % |

MSCI EAFE Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (4.95 | )% | | | N/A | | | | 10.53 | % |

| | | | | | | | | | | | |

Class R6 Shares (Inception 7/31/15)* | | | | | | | | | | | | |

Returns | | | (5.78 | )% | | | 10.78 | % | | | 3.16 | % |

MSCI EAFE Small Cap Index

(Net, USD, Unhedged; reflects no deduction for fees or expenses) | | | (4.95 | )% | | | 8.63 | % | | | 1.55 | % |

| | | | | | | | | | | | |

| * | Class R6 Shares commenced operations on July 31, 2015. Prior to that date, the performance of the Class R6 Shares is that of the Institutional Shares. Performance prior to July 31, 2015 has not been adjusted to reflect the lower expenses of Class R6 Shares. Class R6 Shares would have had similar returns (because these share classes represent interests in the same portfolio of securities) that differed only to the extent that Class R6 Shares and Institutional Shares have different expenses. |

The after-tax returns are for Class A Shares only. The after-tax returns for Class C, Institutional and Class IR Shares will vary. After-tax returns are calculated using the historical highest individual federal marginal

12

income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Reasons for the Reorganization and Board Considerations

The Investment Advisers recommended to the Board that it approve the reorganization of the Acquired Fund with and into the Surviving Fund, an existing series of the Trust because they believe that the Reorganization may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time and also would enable the combined Fund be better positioned for asset growth. The Investment Advisers also believe that the Reorganization is preferable to liquidating the Acquired Fund, which may be treated as a taxable event, as it will provide you and other shareholders with the opportunity to invest in a fund that: (i) invests in a larger number, and therefore more diversified, group of non-U.S. small cap companies; and (ii) is part of the Goldman Sachs Funds – a large, diverse fund family. Moreover, the Surviving Fund has had higher performance than the Acquired Fund over the one-, three-, five-year and since-inception periods ended August 31, 2015 (the Surviving Fund commenced operations in 2007).

On October 14-15, 2015, the Board, including a majority of the Independent Trustees, voted to approve the Reorganization. In approving the Reorganization, the Board, including a majority of the Independent Trustees, concluded that: (i) the Reorganization will benefit the shareholders of each Fund; (ii) the Reorganization is in the best interests of each Fund; and (iii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization.

At its meeting, the Board received and evaluated materials provided by the Investment Advisers regarding the Reorganization and its effect on the existing shareholders of the Funds. The Board also evaluated and discussed: (i) the material differences between each Fund’s investment objective, strategies, policies and risks; (ii) the specific terms of the Reorganization; and (iii) other information, such as the relative sizes of the Funds, the performance records of the Funds, the expenses of the Funds and the anticipated asset growth of the Funds in the foreseeable future.

The Trustees also believe that the Reorganization offers a number of potential benefits. These potential benefits and considerations include the following:

| | • | | The Reorganization may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time and also would enable the combined Fund to be better positioned for asset growth. |

| | • | | The Reorganization is preferable to liquidating the Acquired Fund, which may be treated as a taxable event, as it will provide you and other shareholders with the opportunity to invest in a fund that invests in a larger number, and therefore more diversified, group of non-U.S. small cap companies. The Funds have a similar universe of permissible investments. The Funds have different portfolio management teams, which employ separate investment philosophies. In this regard, the Acquired Fund takes a fundamentally-driven approach to investing, whereas the Surviving Fund takes a quantitative approach. These differences, as well as other differences, are discussed in more detail above under “Summary – Comparison of the Acquired Fund with the Surviving Fund and Comparison of Principal Investment Risks of Investing in the Funds.” |

| | • | | The Reorganization is expected to qualify as a “reorganization” within the meaning of Section 368 of the Code, and, therefore, you will not recognize gain or loss for federal income tax purposes on the exchange of your shares of the Acquired Fund for the shares of the Surviving Fund. Alternatively, liquidation of the Acquired Fund could give rise to a taxable event. |

13

| | • | | No sales charge, CDSC, commission, redemption fee or other transactional fee will be charged as a result of the Reorganization. |

| | • | | The Surviving Fund’s effective management fee and management fee schedule are lower than the Acquired Fund’s management fees at every breakpoint. |

| | • | | The Reorganization is expected to result in a lower net expense ratio for Acquired Fund Shareholders. |

| | • | | The Surviving Fund has had higher performance than the Acquired Fund over the one-, three-, five-year and since-inception periods ended August 31, 2015 (the Surviving Fund commenced operations in 2007). |

| | • | | GSAM has agreed to pay the legal, auditor/accounting and other costs, including brokerage, trading taxes and other transaction costs, associated with each Fund’s participation in the Reorganization. GSAM estimates that these costs will be approximately $383,095. |

The Board concluded that the Reorganization and the Agreement and Plan of Reorganization likely would benefit the Funds and their shareholders and that each should be approved.

Buying, Selling and Exchanging Shares of the Funds

The minimum initial investment for Class A and Class C Shares of each Fund is, generally, $1,000. The minimum initial investment for Institutional Shares of each Fund is, generally, $1,000,000 for individual or certain institutional investors, alone or in combination with other assets under the management of the Investment Adviser and its affiliates. There is no minimum for initial purchases of Class IR Shares of each Fund. Those share classes with a minimum initial investment requirement do not impose it on certain employee benefit plans, and Institutional Shares do not impose it on certain investment advisers investing on behalf of other accounts.

For each Fund, the minimum subsequent investment for Class A and Class C shareholders is $50, except for certain employee benefit plans, for which there is no minimum. There is no minimum subsequent investment for Institutional or Class IR shareholders. You may purchase and redeem (sell) shares of the Fund on any business day through certain banks, trust companies, brokers, dealers, investment advisers and other financial institutions (“Authorized Institutions”).

If you purchase a Fund through an Authorized Institution, the Fund and/or its related companies may pay the Authorized Institution for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Authorized Institution and your salesperson to recommend a Fund over another investment. Ask your salesperson or visit your Authorized Institution’s website for more information.

The procedures for making purchases, redemptions and exchanges of the Acquired Fund are identical to those of the Surviving Fund. Please see the “Shareholder Guide” in Exhibit C to this Information Statement/Prospectus for additional information on making purchases, redemptions and exchanges.

OTHER IMPORTANT INFORMATION CONCERNING THE REORGANIZATION

Fund Securities and Portfolio Repositioning

If the Reorganization is effected, management will analyze and evaluate the portfolio securities of the Acquired Fund being transferred to the Surviving Fund. However, each Fund’s portfolio securities are subject to adjustments in the ordinary course of business prior to, or in anticipation of, the Reorganization. In connection with the Reorganization, it is currently expected that a substantial portion of the Acquired Fund’s portfolio assets (approximately 95%) will be sold prior to the consummation of the Reorganization. Actual portfolio sales will depend on portfolio composition, market conditions and other factors at the time of, or prior to, the

14

Reorganization and will be at the discretion of the Investment Advisers. The extent and duration to which the portfolio securities of the Acquired Fund will be maintained by the Surviving Fund will be determined consistent with the Surviving Fund’s investment objective, strategies and policies, any restrictions imposed by the Code and in the best interests of each Fund’s shareholders (including former shareholders of the Acquired Fund). Subject to market conditions at the time of any such disposition, the disposition of the portfolio securities by the Funds may result in a capital gain or loss for the Funds. The actual tax consequences of any disposition of portfolio securities will vary depending upon the specific security(ies) being sold and the Surviving Fund’s ability to use any available tax loss carryforwards. It is currently estimated that such portfolio repositioning would have resulted in realized capital gains of approximately $0, if such sales occurred as of November 11, 2015. Taking into account capital losses and capital loss carryforwards expected to be available to offset such realized gains, it is currently estimated that the Acquired Fund will be required to distribute to its shareholders approximately $0 (approximately $0 per share) as a result of such portfolio repositioning, although the actual amount of such distribution could be higher or lower depending on market conditions and on transactions entered into by the Acquired Fund prior to the Closing Date. Shareholders of the Acquired Fund will generally be taxed on any resulting capital gain distributions. It is also currently estimated that such portfolio repositioning will result in brokerage and other transaction costs, including trading taxes, of approximately $212,020 (approximately 13 basis points). However, GSAM has agreed to pay these brokerage and other transaction costs.

Final Distribution of Acquired Fund

Prior to the Closing Date, the Acquired Fund will pay its shareholders a cash distribution consisting of any undistributed investment company taxable income and/or any undistributed realized net capital gains, including any net gains realized from any sales of assets prior to the Closing Date. These distributions will be taxable to shareholders that are subject to tax. It is currently estimated that such portfolio repositioning would have resulted in realized capital gains of approximately $0, if such sales occurred as of November 11, 2015. Taking into account capital losses and capital loss carryforwards expected to be available to offset such realized gains, it is currently estimated that the Acquired Fund will be required to distribute to its shareholders approximately $0 (approximately $0 per share) as a result of such portfolio repositioning, although the actual amount of such distribution could be higher or lower depending on market conditions and on transactions entered into by the Acquired Fund prior to the Closing Date. Shareholders of the Acquired Fund will generally be taxed on any resulting capital gain distributions.

Tax Capital Loss Carryforwards

Federal income tax law permits a regulated investment company to carry forward its net capital losses for a period of up to eight taxable years. (Net capital losses that arise in a tax year beginning after December 22, 2010 will generally be able to be carried forward without limit.) As of October 31, 2014, the Acquired Fund had estimated capital loss carryforwards of $8,401,592. Additionally, as of October 31, 2014, the Surviving Fund did not have any loss carryforwards. The amount of the Funds’ capital loss carryovers as of the date of the Reorganization may differ substantially from these amounts. The Surviving Fund’s ability to use the capital loss carryovers of the Acquired Fund, if any, to offset gains of Surviving Fund in a given tax year after the Reorganization are expected to be limited by loss limitation rules under Federal tax law. If capital loss carryovers of the Acquired Fund are limited by those rules, it is possible that the limitations could result in all or a portion of Acquired Fund’s capital loss carryovers, if any, eventually expiring unused. The impact of those loss limitation rules will depend on the relative sizes of, and the losses and gains in, the Funds at the time of the Reorganization and thus cannot be calculated precisely at this time.

The ability of the Surviving Fund to use capital losses to offset gains (even in the absence of the Reorganization) depends on factors other than loss limitations, such as the future realization of capital gains or losses.

15

CAPITALIZATION

The following table sets forth the capitalization of the Funds as of April 30, 2015. The table also sets forth the pro forma combined capitalization of the combined Fund as if the Reorganization had occurred on April 30, 2015. If the Reorganization is consummated, the net assets, net asset value per share and shares outstanding on the Closing Date will vary from the information below due to changes in the market value of the portfolio securities of the Funds between April 30, 2015 and the Closing Date, changes in the amount of undistributed net investment income and net realized capital gains of the Funds during that period resulting from income and distributions, and changes in the accrued liabilities of the Funds during the same period.

| | | | | | | | | | | | | | | | |

| | | The Acquired Fund

(April 30, 2015) | | | The Surviving Fund

(April 30, 2015) | | | Adjustments | | | Surviving

Fund –

Pro Forma

(April 30, 2015) | |

Net Assets | | | | | | | | | | | | | | | | |

Class A Shares | | $ | 15,534,545 | | | $ | 162,995,220 | | | $ | 1,297,454 | | | $ | 179,827,219 | |

Class C Shares | | $ | 3,804,393 | | | $ | 25,043,938 | | | | N/A | | | $ | 28,848,331 | |

Institutional Shares | | $ | 156,524,448 | | | $ | 708,194,953 | | | | N/A | | | $ | 864,719,401 | |

Service Shares1 | | $ | 1,297,454 | | | | N/A | | | $ | (1,297,454 | ) | | | N/A | |

Class IR Shares | | $ | 5,495,154 | | | $ | 26,709,817 | | | | N/A | | | $ | 32,204,971 | |

Net Asset Value Per Share | | | | | | | | | | | | | | | | |

Class A Shares | | $ | 20.05 | | | $ | 10.67 | | | | N/A | | | $ | 10.67 | |

Class C Shares | | $ | 19.28 | | | $ | 10.38 | | | | N/A | | | $ | 10.38 | |

Institutional Shares | | $ | 20.63 | | | $ | 10.66 | | | | N/A | | | $ | 10.66 | |

Service Shares1 | | $ | 19.79 | | | | N/A | | | $ | (19.79 | ) | | | N/A | |

Class IR Shares | | $ | 20.57 | | | $ | 10.63 | | | | N/A | | | $ | 10.63 | |

Shares Outstanding | | | | | | | | | | | | | | | | |

Class A Shares | | | 774,649 | | | | 15,279,861 | | | | 802,858 | | | | 16,857,368 | |

Class C Shares | | | 197,300 | | | | 2,411,765 | | | | 169,212 | | | | 2,778,277 | |

Institutional Shares | | | 7,587,871 | | | | 66,416,721 | | | | 7,095,473 | | | | 81,100,065 | |

Service Shares1 | | | 65,574 | | | | N/A | | | | (65,574 | ) | | | N/A | |

Class IR Shares | | | 267,191 | | | | 2,512,719 | | | | 249,757 | | | | 3,029,667 | |

| 1 | As noted above, Service Class shareholders of the Acquired Fund will receive Class A Shares of the Surviving Fund. |

It is impossible to predict how many shares of the Surviving Fund will actually be received and distributed by the Acquired Fund on the Closing Date. The table should not be relied upon to determine the amount of the Surviving Fund shares that will actually be received and distributed.

TERMS OF THE AGREEMENT AND PLAN OF REORGANIZATION

The description of the Plan contained herein includes the material provisions of the Plan, but this description is qualified in its entirety by the attached form copy of the Plan.

Timing. The Reorganization is scheduled to occur on or about [February 5], 2016 (i.e., Closing Date), but may occur on such earlier or later date as the parties agree in writing.

Transfer and Valuation of the Assets. The Plan contemplates the transfer of substantially all of the assets of the Acquired Fund to, and the assumption of the liabilities of the Acquired Fund by, the Surviving Fund, in exchange for the applicable shares of the Surviving Fund having an aggregate net asset value equal to the aggregate net asset value of the applicable shares of the Acquired Fund on the Closing Date. The Acquired Fund

16

would then distribute to its shareholders the portion of the Surviving Fund shares to which each such shareholder is entitled. Thereafter, the Acquired Fund would be liquidated. All computations of value will be made by JPMorganChase Bank, N.A., in its capacity as administrator for the Acquired Fund.

Conditions to Closing the Reorganization. The obligation of each Fund to consummate the Reorganization is subject to the satisfaction of certain conditions, including the Fund’s performance of all of its obligations under the Plan, the receipt of certain documents and financial statements from the Funds and the receipt of all consents, orders and permits necessary to consummate the Reorganization. The Funds’ obligations are also subject to the receipt of a favorable opinion of Dechert LLP as to the U.S. federal income tax consequences of the Reorganization.

Termination of the Plan. The Plan may be terminated and the Reorganization may be abandoned by resolution of the Board at any time prior to the Closing Date, if circumstances should develop that, in the opinion of the Board, make proceeding with the Plan inadvisable.

Cost of the Reorganization. GSAM (or an affiliate) has agreed to pay the legal and other costs associated with each Fund’s participation in the Reorganization.

TAX STATUS OF THE REORGANIZATION

The Reorganization is conditioned upon the receipt of an opinion from Dechert LLP, counsel to the Trust, substantially to the effect that, for federal income tax purposes:

| | • | | The transfer to the Surviving Fund of substantially all of the Acquired Fund’s assets in exchange solely for the issuance of the Surviving Fund shares to the Acquired Fund and the assumption of all of the Acquired Fund’s liabilities by the Surviving Fund, followed by the distribution of the Surviving Fund shares to the Acquired Fund shareholders in complete liquidation of the Acquired Fund, will constitute a “reorganization” within the meaning of Section 368(a) of the Code; |

| | • | | No gain or loss will be recognized by the Acquired Fund upon: (i) the transfer of substantially all of its assets to the Surviving Fund as described above or (ii) the distribution by the Acquired Fund of Surviving Fund shares to the Acquired Fund’s shareholders in complete liquidation of the Acquired Fund, except for (A) any gain or loss that may be recognized on the transfer of “section 1256 contracts” as defined in Section 1256(b) of the Code, and (B) any gain that may be recognized on the transfer of stock in a “passive foreign investment company” as defined in Section 1297(a) of the Code; |