EX-99.(17)(d)

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | April 30, 2015 |

| | |

| | | | Fundamental International Equity Funds |

| | | | Focused International Equity |

| | | | International Small Cap |

| | | | Strategic International Equity |

Goldman Sachs Fundamental International

Equity Funds

| n | | FOCUSED INTERNATIONAL EQUITY |

| n | | INTERNATIONAL SMALL CAP |

| n | | STRATEGIC INTERNATIONAL EQUITY |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS FUNDAMENTAL INTERNATIONAL EQUITY FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectus.

The Goldman Sachs Focused International Equity Fund invests primarily in a diversified portfolio of equity investments in companies that are organized outside the United States or whose securities are principally traded outside the United States. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Because the Fund may invest in a relatively small number of issuers, the Fund is subject to greater risk of loss.

The Goldman Sachs International Small Cap Fund invests primarily in a diversified portfolio of equity investments in non-U.S. small-capitalization companies. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. The securities of mid- and small-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements.

The Goldman Sachs Strategic International Equity Fund invests primarily in a diversified portfolio of equity investments in companies that are organized outside the United States or whose securities are principally traded outside the United States. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments.

3

GOLDMAN SACHS FUNDAMENTAL INTERNATIONAL EQUITY FUNDS

What Differentiates Goldman Sachs’ Fundamental International Equity Investment Process?

Goldman Sachs’ Fundamental International Equity investment process is based on the belief that strong, consistent results are best achieved through expert stock selection, performed by research teams working together on a global scale. Our deep, diverse and experienced team of research analysts and portfolio managers combines local insights with global, industry-specific expertise to identify its high conviction investment ideas.

| n | | Fundamental research teams based in the United States, United Kingdom, Japan, China, Korea, Singapore, Brazil and India and focusing on long-term business and management quality |

| n | | Analysts collaborate regularly to leverage regional and industry-specific research and insights |

| n | | Global perspective is informed by local market expertise |

| n | | A common valuation framework, focusing on long-term earnings power, ensures consistency when valuing and comparing a company to its peers globally |

| n | | Team of experienced Research Analysts is regionally aligned and has sector expertise |

| n | | Team leverages the research of the approximately 80+ regional investment professionals |

| n | | Decision-making process is informed by active participation in the global research process |

| n | | Security selections are aligned with level of investment conviction |

| n | | Risk monitoring considers whether investment and other risks to the Funds are intended and justified |

| n | | Dedicated portfolio construction team assists in ongoing monitoring and adjustment of the Funds |

International equity portfolios that strive to offer:

| | n | | Access to markets across the world | |

| | n | | Disciplined approach to stock selection | |

| | n | | Optimal risk/return profiles | |

4

MARKET REVIEW

Goldman Sachs Fundamental Equity International Funds

Market Review

International equities gained solid ground during the six-month period ended April 30, 2015 (the “Reporting Period”). The MSCI® Europe, Australasia, Far East (EAFE) Index (net, unhedged) (the “MSCI® EAFE Index”) posted a return of 6.81%.* Central bank policy, currency movements and the sharp decline in oil prices were some of the biggest themes dominating the international equities markets during the Reporting Period.

Both the European Central Bank (“ECB”) and the Bank of Japan (“BoJ”) employed easy monetary policy in an effort to stimulate economic growth. With interest rates near zero in both regions, both the euro and the yen fell against the U.S. dollar, which helped increase exports, an important source of revenue to companies in Europe and Japan. The euro sank to a 12-year low against the U.S. dollar in March 2015 before rebounding slightly in April 2015, and the impact of depreciation was already noticeable in many European corporate earnings reports, many of which were better than expected. Japanese companies also began to benefit from the weak yen. Strong equity markets in both regions reflected optimism that the monetary stimulus would stave off deflation and promote economic growth. While progress was slow, a number of economic indicators in both regions appeared to be improving toward the end of the Reporting Period.

As for oil prices, the international Brent crude oil benchmark price fell rather steadily from a high of $115 per barrel in June 2014 to a low of $47 per barrel in January 2015 before rebounding to almost $70 per barrel by the end of April 2015. The low price of crude oil forced many energy companies to lower their earnings projections. As a result, the energy sector, and those countries’ equity markets most closely tied to the commodities markets, declined most during the Reporting Period. The utilities sector also posted a negative return during the Reporting Period.

However, market participants perceived the combination of lower energy prices, aggressive monetary stimulus and improving economies as beneficial for consumers in Europe and Japan. As consumer confidence and consumer spending slowly improved during the Reporting Period, the stocks of many consumer-oriented companies rose in anticipation of increased consumption. The consumer discretionary sector was the best performing sector in the MSCI® EAFE Index during the Reporting Period. The information technology, health care and industrials sectors also outperformed the MSCI® EAFE Index amidst robust global merger and acquisition activity.

From a country and region perspective, Denmark, Ireland, Hong Kong and Japan were the best performing individual country constituents of the MSCI® EAFE Index for the Reporting Period overall, while China, Norway, Australia and Spain were weakest.

Looking Ahead

As the equity bull market enters its seventh year, we believe the global economy may be nearing several inflection points and new equity market leaders may well emerge. For example, the U.S. economy has strengthened to the point where the Federal Reserve (the “Fed”) is preparing to raise interest rates for the first time since June 2006. The euro has depreciated to match the ECB’s near zero interest rate Policy, and European banks are lending again after years of deleveraging. In Japan, inflation is taking hold, wages are rising and

| *All | | index returns are expressed in U.S. dollar terms. |

5

MARKET REVIEW

consumption may be about to pick up. It is widely anticipated that India’s re-accelerating Gross Domestic Product (“GDP”) growth will likely eclipse China’s slowing economic growth rate this year. In our view, the macroeconomic themes behind many of these changes — diverging monetary policies, currency movements, low oil prices and structural reforms — affect nearly every company’s earnings and stock price in a different way.

Naturally, we believe new equity market leaders are likely to emerge from the changing economic landscape. But the best performing stocks and stock markets may not necessarily be in the countries or industries with the highest economic growth, and yesterday’s laggards are not always ready to be tomorrow’s leaders. Furthermore, earnings multiples have crept up, leaving few bargains, in our opinion. Indeed, because earnings multiples have already expanded, we believe earnings growth will become an increasingly important driver of stock performance in the months ahead. The sometimes offsetting or contradicting effects of macroeconomic conditions are likely to make top-down calls more difficult, but we believe the true impact may be revealed in corporate earnings. In our view, more expensive equities, lower return expectations and offsetting macroeconomic influences create a stock-picker’s market and one in which portfolios that outperform may look different from the broader market. Even when sector and country weightings are similar, a closer look may reveal differentiation through concentration, market capitalization, quality or other characteristics. The past year or so was challenging for most active managers, but we think that is about to change.

In all, we think global equity returns for calendar year 2015 may be slightly below their long-term average, but still are likely to compare favorably with other asset classes. As always, we maintain our focus on seeking companies that we believe will generate long-term growth in today’s ever-changing market conditions.

6

PORTFOLIO RESULTS

Goldman Sachs Focused International Equity Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Equity Team discusses the Goldman Sachs Focused International Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of 5.64%, 5.26%, 5.85%, 5.58% and 5.74%, respectively. These returns compare to the 6.81% cumulative total return of the Fund’s benchmark, the MSCI® Europe, Australasia, Far East (EAFE) Index (Net, USD, Unhedged) (the “MSCI® Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund generated solid absolute gains, but its underperformance to the MSCI® Index during the Reporting Period can be primarily attributed to individual stock selection. Sector and country allocation also detracted. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | The biggest detractors from Fund performance relative to the MSCI® Index during the Reporting Period were Aurizon Holdings, Hana Financial Group and Mediatek. |

| | Aurizon Holdings, an Australian railroad operator to the mining industry, performed poorly, as the slowing Chinese economy raised concerns that commodities freight volumes may come under pressure despite the long-term nature of the company’s contracts with its mining customers. We sold the Fund’s position in Aurizon Holdings by the end of the Reporting Period. |

| | Hana Financial Group detracted from the Fund’s relative returns during the Reporting Period. The South Korean banking group performed poorly due to earnings downgrades driven by the slowdown in the South Korean economy. The economic slowdown led to rate cuts by the nation’s central bank, which, in turn, pressured banks’ margins and also increased their competition. |

| | Mediatek is a Taiwanese semiconductor company focusing on low-end handsets for emerging markets. Its shares came under pressure as the growth in mobile phone sales in Mediatek’s key Asian markets slowed due to sluggish economies as well as due to a move to fourth generation devices, a market that Mediatek is expected to only start supplying later in 2015. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The greatest contributors to Fund performance relative to the MSCI® Index during the Reporting Period were Mitsubishi UFJ Financial Group, Novo-Nordisk and BG Group. |

| | Japanese banking group Mitsubishi UFJ Financial Group was the top positive contributor to the Fund’s relative results during the Reporting Period. It performed well on the back of strong results, driven by a gradual recovery in its Japanese business and robust growth in its international businesses, especially in Asia and the U.S. Additionally, Mitsubishi UFJ Financial Group announced increased shareholder distributions via a higher dividend and share buy-backs. |

7

PORTFOLIO RESULTS

| | Danish multinational pharmaceuticals company Novo-Nordisk was a strong positive contributor during the Reporting Period. In January 2015, Novo-Nordisk announced that its sales volumes were up 8% in local currency in the fourth quarter of 2014, with the majority of growth coming from North America. Its stock also responded well to positive Phase II results for its oral diabetes drug GLP-1 in February 2015 and its currently ongoing talks with regulators about potentially initiating Phase III. If realized, many believe Phase III trials would be a major opportunity for Novo-Nordisk, as the oral administration of the drug should appeal to more patients than the use of injections, allowing the company to take market share. (Phase II is when a drug or treatment is given to a larger group of people to see if it is effective and to further evaluate its safety. Phase III is when a drug or treatment is given to large groups of people to confirm its effectiveness, monitor side effects, compare it to commonly used treatments and collect information that will allow the drug or treatment to be used safely.) At the end of March 2015, the company also announced its decision to resubmit new applications for its drugs Tresiba and Ryzodeg for U.S. Food and Drug Administration (“FDA”) approval. The market saw this as positive, as approval would remove the overhang on the company’s stock stemming from the growth uncertainty of the company’s insulin drug portfolio. |

| | Shares of BG Group, a U.K.-listed oil and gas exploration company, rose upon its acceptance of a takeover offer from its larger rival Royal Dutch Shell at a 55% premium. Royal Dutch Shell is particularly interested in BG Group’s oil assets in the promising pre-salt basin off the coast of Brazil as well as its leading franchise in global liquid natural gas production and trading. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The sectors that detracted most from the Fund’s relative results during the Reporting Period were consumer discretionary, information technology and consumer staples, where stock selection in each weighed most negatively on performance. Having a slightly underweighted allocation to the strongly performing consumer discretionary sector also dampened relative results. |

| | The sectors that contributed most positively to the Fund’s performance relative to the MSCI® Index during the Reporting Period were financials, health care and energy, each due primarily to effective stock selection. |

| Q | | Which countries most affected the Fund’s performance during the Reporting Period? |

| A | | Typically, the Fund’s individual stock holdings will significantly influence the Fund’s performance within a particular country or region relative to the MSCI® Index. This effect may be even more pronounced in a concentrated portfolio or in countries that represent only a modest proportion of the MSCI® Index. |

| | That said, the countries that detracted most from the Fund’s performance during the Reporting Period were Japan, South Korea and Germany, where stock selection and country allocation overall hurt. Effective stock selection in France, Switzerland and the U.K. boosted the Fund’s relative returns most. Having a modestly overweighted allocation to Switzerland also helped, as its equity market outpaced the MSCI® Index during the Reporting Period. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We established new Fund positions during the Reporting Period in French global advertising company Publicis Groupe, French banking group Societe Generale and Japanese diversified financing services company ORIX. |

| | We initiated a Fund position in Publicis Groupe during the fourth quarter of 2014. Its stock had been weak earlier in 2014 given concerns around the European economy and the company’s acquisition of U.S. technology company Sapient, which was initially poorly received by the market. We saw it as an opportunity to buy into what we perceived as a steadily growing company with strong cash generation. |

| | We established a Fund position in Societe Generale in the first quarter of 2015. Its stock had been a significant laggard compared to other European banks for more than a year, and its relative valuation appeared attractive to us at 0.8x price/ tangible book value vs. 1.1x for the sector. We believed that concerns around weakness in the bank’s Russian business and continued re-regulation of banks were well priced in already. At the time of purchase, we believed the gradual recovery of the European economy should lead to upgrades to the growth outlook for the bank. |

8

PORTFOLIO RESULTS

| | We purchased a Fund position in ORIX, which provides and operates corporate financing, leasing, real estate related business, principal investment and retail business. We expect return on equity to improve as ORIX rebalances its business portfolio and focuses more on return on net assets. Also, we believe capital gain is likely to be maintained at current levels for the next several years. In addition, we believed at the time of purchase that ORIX had an attractive valuation, which looked undervalued considering anticipated net income growth going forward. |

| | In addition to the sale of Aurizon, already mentioned, we sold the Fund’s positions in Intesa Sanpaolo and Credit Suisse during the Reporting Period. |

| | We exited the Fund’s position in Intesa Sanpaolo, one of the leading banks in Italy, taking profits. While we still like the trends in peripheral European nation banks, such as rising net interest margins on the back of lower funding costs and loss provisions, we thought valuations were getting stretched. Performance of Intesa Sanpaolo was strong in the first quarter of 2015, and we considered it appropriate to sell out and redeploy capital into what we considered to be more attractive investment opportunities elsewhere. |

| | We eliminated the Fund’s position in Swiss bank Credit Suisse toward the end of 2014, as we saw what we believed to be better opportunities elsewhere. We had turned more cautious around new money inflows into Credit Suisse’s private bank, as we believed weakness in emerging markets economies could slow wealth creation. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In this Fund, both sector weightings and country allocations are largely the result of our bottom-up stock selection process rather than any top-down macroeconomic views or regional, country, sector or industry bets. We seek to outpace the MSCI® Index by overweighting stocks that we expect to outperform and underweighting those we think may lag. Consequently, changes in its sector or country weightings are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to information technology, health care, consumer staples, materials and consumer discretionary increased relative to the MSCI® |

| | Index during the Reporting Period, while its relative exposure to financials, industrials, energy and telecommunication services decreased. From a country perspective, several changes were made. Among them, the Fund’s exposure to Japan, France and Spain increased relative to the MSCI® Index during the Reporting Period, while its relative exposure to the U.K., Switzerland, Italy and Sweden decreased. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | There were no material changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | | How was the Fund positioned relative to the MSCI® Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had more exposure to South Korea, France, Spain, Taiwan, Japan and Ireland and less exposure to the U.K., Germany, Australia, Switzerland and Sweden relative to the MSCI® Index. At the end of the Reporting Period, the Fund held neutral positions relative to the MSCI® Index in several countries and had no position at all in several other countries and regions, most notably China, Hong Kong, Italy, the Netherlands and Singapore. |

| | From a sector allocation perspective, the Fund had overweight positions relative to the MSCI® Index in information technology and industrials at the end of the Reporting Period. On the same date, the Fund had underweighted positions compared to the MSCI® Index in financials, telecommunication services and consumer staples and was rather neutrally weighted compared to the MSCI® Index in materials, energy, utilities, consumer discretionary and health care. |

| | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

9

FUND BASICS

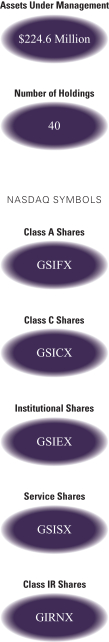

Focused International Equity Fund

as of April 30, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2014–April 30, 2015 | | Fund Total Return

(based on NAV)1 | | | MSCI® EAFE Index

(Net, USD, Unhedged)2 | |

| | Class A | | | 5.64 | % | | | 6.81 | % |

| | Class C | | | 5.26 | | | | 6.81 | |

| | Institutional | | | 5.85 | | | | 6.81 | |

| | Service | | | 5.58 | | | | 6.81 | |

| | | Class IR | | | 5.74 | | | | 6.81 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI® EAFE Index (Net, USD, Unhedged) is a market capitalization-weighted composite of securities in 22 developed markets. The Index approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction for withholding tax, applying the rate to non- resident individuals who do not benefit from double taxation treaties. MSCI® Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. The Index is unmanaged and the figures for the Index do not include any deduction for fees or expenses. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -11.97 | % | | | 3.53 | % | | | 2.27 | % | | | 4.42 | % | | 12/01/92 |

| | Class C | | | -8.49 | | | | 3.92 | | | | 2.09 | | | | 1.73 | | | 8/15/97 |

| | Institutional | | | -6.50 | | | | 5.13 | | | | 3.26 | | | | 4.21 | | | 2/07/96 |

| | Service | | | -6.95 | | | | 4.60 | | | | 2.74 | | | | 4.68 | | | 3/06/96 |

| | | Class IR | | | -6.61 | | | | N/A | | | | N/A | | | | 7.28 | | | 8/31/10 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.32 | % | | | 1.63 | % |

| | Class C | | | 2.07 | | | | 2.38 | |

| | Institutional | | | 0.92 | | | | 1.23 | |

| | Service | | | 1.42 | | | | 1.73 | |

| | | Class IR | | | 1.07 | | | | 1.38 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 29, 2016, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/155 |

| | | Holding | | % of Net Assets | | | Line of Business | | Country |

| | Computershare Ltd. | | | 4.0 | % | | Software & Services | | Australia |

| | Bayer AG (Registered) | | | 4.0 | | | Pharmaceuticals,

Biotechnology & Life Sciences | | Germany |

| | Banco Popular Espanol SA | | | 3.6 | | | Banks | | Spain |

| | Sanofi | | | 3.2 | | | Pharmaceuticals,

Biotechnology & Life Sciences | | France |

| | Publicis Groupe SA | | | 3.2 | | | Media | | France |

| | Reckitt Benckiser Group PLC | | | 3.2 | | | Household & Personal

Products | | United Kingdom |

| | Societe Generale SA | | | 3.1 | | | Banks | | France |

| | ORIX Corp. | | | 3.1 | | | Diversified Financials | | Japan |

| | Iberdrola SA | | | 3.1 | | | Utilities | | Spain |

| | | BG Group PLC | | | 3.0 | | | Energy | | United Kingdom |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

11

FUND BASICS

|

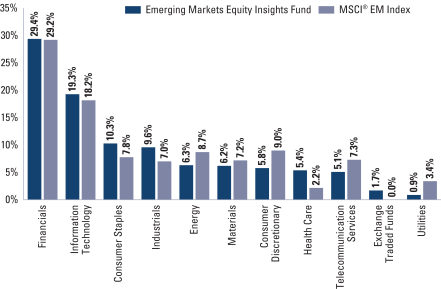

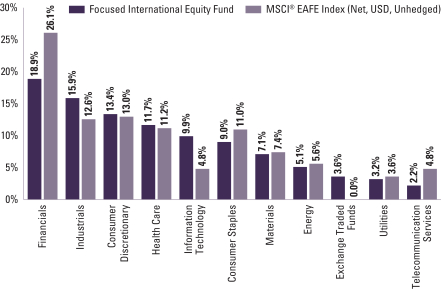

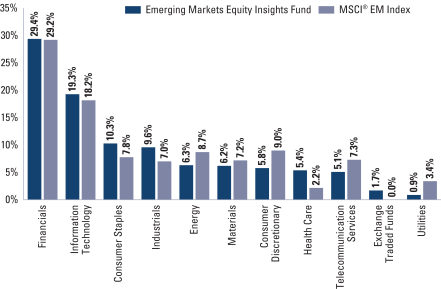

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2015 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of exchange traded funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

12

PORTFOLIO RESULTS

Goldman Sachs International Small Cap Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Equity Team discusses the Goldman Sachs International Small Cap Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of 7.96%, 7.59%, 8.19%, 7.95% and 8.13%, respectively. These returns compare to the 9.60% cumulative total return of the Fund’s benchmark, the Standard and Poor’s (S&P) Developed Ex-U.S. Small Cap Index (Net, USD, Unhedged) (the “S&P Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund generated solid absolute gains, but its underperformance to the S&P Index during the Reporting Period can be primarily attributed to individual stock selection. Sector and country allocation also detracted. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | The biggest detractors from Fund performance relative to the S&P Index during the Reporting Period were Brocolli, Aryzta and En-Japan. |

| | Brocolli, a Japanese manufacturer of character-themed goods, such as trading card games, books, CDs and stationery items, detracted most from the Fund’s relative results during the Reporting Period. Its stock underperformed the S&P Index due mainly to a connection issue on a new network game that was launched in December 2014. Investors had expected the launch of the new smartphone game to be a catalyst for rapid earnings growth in the next fiscal year. However, given the technical glitch, the number of downloads was not increasing. We decided to sell the Fund’s position in Brocolli by the end of the Reporting Period. |

| | Aryzta, a Swiss-based global specialty bakery supplier, also detracted from the Fund’s relative performance during the Reporting Period. The company reported a disappointing set of fourth quarter 2014 results, highlighting an unexpected drop in performance in the U.S. Furthermore, the stock suffered when the company announced a poorly-received acquisition at the end of March 2015. |

| | En-Japan is a Japan-based Internet-based recruiting solutions provider. Its underperformance to the S&P Index during the Reporting Period can be attributed back to the first quarter of 2014 when the company formally announced a downward revision of its earnings forecast for its fiscal year 2014 due to a 360 million Japanese yen charge for the planned closure of its existing new graduate recruitment website and planned migration into a new service. The company saw a period of better performance between May and September 2014, but its stock underperformed again in the last quarter of 2014 due to profit taking sell offs after its outperformance since May 2014. We sold the Fund’s position in En-Japan by the end of the Reporting Period. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The greatest contributors to Fund performance relative to the S&P Index during the Reporting Period were Gategroup Holding, OCI Materials and Disco. |

| | Gategroup Holding, a Swiss-based global airline catering company, was the greatest positive contributor to the Fund’s relative performance during the Reporting Period. The company benefited from lower oil prices, which, in turn, stimulated airline volumes. Additionally, activist shareholders began to try to increase the company’s focus on cost control and the emerging market growth opportunity, which may provide an added catalyst in the future. At the end of the Reporting Period, we continued to like the stock and believe the company has room for improved top-line, or |

13

PORTFOLIO RESULTS

| | revenue, growth as airlines become less focused on reducing food content as part of their service. |

| | South Korean-based materials manufacturer OCI Materials was also a strong contributor to the Fund’s relative results. OCI Materials’ products are used in the manufacturing process of semiconductors, thin film transistor liquid crystal displays (“TFT-LCD”) and solar cells and film deposition. With approximately 50% exposure each to the semiconductor and LCD industries, as measured by client mix, both businesses have been showing strong order flows — increasingly so from the semiconductor industry. In our view, incremental volume increases may come from potential capacity expansion within OCI Materials, which we believe likely, as talks with major clients indicate there may be an industry-wide supply shortage in the next six to 12 months without any immediate capital expenditure decisions. |

| | Disco is a Japanese manufacturer of abrasive and precision industrial machinery for cutting and grinding. Its stock price rose, as analysts revised their forecasts up incorporating potential margin improvement with a favorable currency effect. In addition, new orders for dicing machines were expected to bottom out from the first calendar quarter, led by strong high-end smartphone demand. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The biggest detractors from the Fund’s relative results during the Reporting Period were financials, consumer discretionary and utilities, where stock selection overall hurt relative performance. The sectors that contributed most to the Fund’s performance relative to the S&P Index were industrials, information technology and energy, due primarily to effective stock selection in each. |

| Q | | Which countries most affected the Fund’s performance during the Reporting Period? |

| A | | Typically, the Fund’s individual stock holdings will significantly influence the Fund’s performance within a particular country or region relative to the S&P Index. This effect may be even more pronounced in countries that represent only a modest proportion of the S&P Index. |

| | That said, the Fund’s stock selection in South Korea and China detracted most from the Fund’s performance during the Reporting Period. Both stock selection and having an underweighted allocation to the strongly performing Hong Kong equity market also hurt performance. Conversely, the countries that contributed most positively to the Fund’s performance during the Reporting Period were Japan, Australia and Switzerland, where stock selection proved particularly effective. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy, but we used index futures on an opportunistic basis to ensure the portfolio remained almost fully exposed to equities following cash inflows or stock sales. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We established Fund positions in Otsuka, GMO Internet and PSP Swiss Property during the Reporting Period. |

| | We initiated a Fund position in Otsuka, a Japan-based large information technology service company that sells software and hardware to mid- and small-sized companies. We believe Otsuka should continue to be stable in the system integration business segment because the industry has a high barrier to entry. Without selling larger numbers of software packages, the system integration business has faced challenges. First, its pricing has been declining due to severe deflation in Japan. Second, its results are related to capital expenditure of its customers, so there is still a cyclicality, though less than that for large companies. Also, we expect Otsuka’s core businesses, such as hardware supply and service, to continue to grow going forward. |

| | We established a Fund position in GMO Internet, a Japanese company that provides whole Internet-related services to customers. The company offers domain, server, Internet security and settlement services through its web infrastructure and e-commerce business segments. We expect to see earnings recover in its fiscal year 2015 based on an increase of commercial transactions via the Internet. GMO Internet’s share price had underperformed in 2014, and in our view, its valuation was attractive at the time of purchase. |

| | We bought shares of PSP Swiss Property, a real estate company that owns commercial buildings in Switzerland, primarily in Zurich and Geneva, and generates revenue by collecting rent on these buildings. Its stock, in our view, has an attractive dividend yield of almost 4%, especially compared to the Swiss 10-year bond at a yield of less than 0.2%. With European quantitative easing getting underway |

14

PORTFOLIO RESULTS

| | and the very low interest rate environment that persists, we believe PSP Swiss Property is well positioned to benefit from investor demand for yield. We also believe it offers attractive upside potential. |

| | In addition to those sales mentioned earlier, we eliminated the Fund’s positions in M3, Unite Group and Seiko Holdings during the Reporting Period. |

| | We eliminated the Fund’s position in M3, a Japanese supplier of medical information services for doctors through the Internet. In addition to top-line growth, growth expectations for both new business in Japan and overseas sales pushed its share price higher. Indeed, its share price doubled since December 2013 and thus we decided to sell out of the position, taking profits. |

| | We sold the Fund’s position in Unite Group, the largest student housing operator in the U.K. We had bought its stock, as the student housing sector was undersupplied, which was leading to high rental growth. The thesis subsequently played out, and the stock performed well. At the time of sale, we felt the supply in the student housing sector had picked up, and while we believed Unite Group is still a good business, we felt such sentiment was being reflected in its then-current stock price and thus the upside potential in its stock price may be limited. |

| | Seiko Holdings designs, manufactures and sells electronic devices, watches and clocks in Japan and overseas. Its stock price rose on investors’ expectations for the company to benefit from increasing consumption of inbound tourism as well as on its attractive valuation. In addition, the company has grown sales of watches in both domestic and overseas markets as a result of its efforts to reinforce its brand power, which led to improving profitability. We sold the Fund’s position in Seiko Holdings, taking profits. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In this Fund, both sector weightings and country allocations are largely the result of our bottom-up stock selection process rather than any top-down macroeconomic views or industry bets. We seek to outpace the S&P Index by overweighting stocks that we expect to outperform and underweighting those we think may lag. Consequently, changes in its sector or country weightings are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to industrials, consumer discretionary and information technology increased relative to the S&P Index during the Reporting Period, while its relative exposure to financials, materials, health care and telecommunication services decreased. From a country perspective, among the changes made during the Reporting Period were the Fund’s increased exposure to France relative to the S&P Index during the Reporting Period and its decreased relative exposure to the U.K. and Sweden. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | During the Reporting Period, Aidan Farrell, managing director and lead portfolio manager of the Fund left the firm. Gaurav Rege, former co-lead portfolio manager, was named lead portfolio manager of the Fund. |

| Q | | How was the Fund positioned relative to the S&P Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had more exposure to the U.K., China, Taiwan, Portugal and Italy and less exposure to Sweden, Germany, Spain and France relative to the S&P Index. At the end of the Reporting Period, the Fund held neutral positions relative to the S&P Index in several countries, most notably Japan and Canada, and had no position at all in several other countries and regions, most notably Hong Kong. |

| | From a sector allocation perspective, the Fund had an overweighted position relative to the S&P Index in information technology at the end of the Reporting Period. On the same date, the Fund had underweighted positions compared to the S&P Index in financials and consumer staples and was rather neutrally weighted relative to the S&P Index in health care, energy, utilities, materials, industrials and consumer discretionary. The Fund had no exposure to the telecommunication services sector at the end of the Reporting Period. |

| | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

15

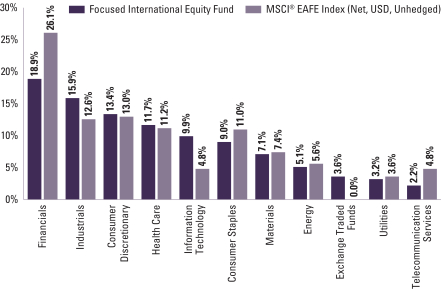

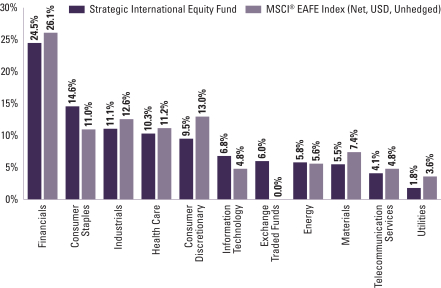

FUND BASICS

International Small Cap Fund

as of April 30, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2014–April 30, 2015 | | Fund Total Return

(based on NAV)1 | | | S&P Developed

Ex-U.S. Small Cap

Index (Net, USD, Unhedged)2 | |

| | Class A | | | 7.96 | % | | | 9.60 | % |

| | Class C | | | 7.59 | | | | 9.60 | |

| | Institutional | | | 8.19 | | | | 9.60 | |

| | Service | | | 7.95 | | | | 9.60 | |

| | | Class IR | | | 8.13 | | | | 9.60 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P Developed Ex-U.S. Small Cap Index (Net, USD, Unhedged) is the small capitalization stock component of the S&P Developed Broad Market Index (BMI). The BMI is a float-weighted index that spans 22 countries (inclusive of the US) and includes the listed shares of all companies with an available market capitalization (float) of at least $100 million at the annual rebalance. At rebalance, companies are deleted from the index if their float falls below $75 million. The Small Cap Ex-U.S. is defined as those stocks falling in the bottom 15% of the cumulative available capital in each country. The Index reflects returns net of withholding taxes applied to foreign investors, calculated daily based on tax rates that would be applied to a Luxembourg-based investor. The Index is unmanaged and the figures for the Index do not include any deduction for fees or expenses. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | |

| | | For the period ended 3/31/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date | |

| | Class A | | | -7.77 | % | | | 8.31 | % | | | 4.13 | % | | | 5.64 | % | | | 5/01/98 | |

| | Class C | | | -4.11 | | | | 8.72 | | | | 3.95 | | | | 5.31 | | | | 5/01/98 | |

| | Institutional | | | -2.03 | | | | 10.01 | | | | 5.17 | | | | 6.52 | | | | 5/01/98 | |

| | Service | | | -2.50 | | | | 9.44 | | | | 4.62 | | | | 5.97 | | | | 5/01/98 | |

| | | Class IR | | | -2.20 | | | | N/A | | | | N/A | | | | 11.88 | | | | 8/31/10 | |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

16

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.38 | % | | | 1.77 | % |

| | Class C | | | 2.12 | | | | 2.52 | |

| | Institutional | | | 0.97 | | | | 1.37 | |

| | Service | | | 1.47 | | | | 1.86 | |

| | | Class IR | | | 1.09 | | | | 1.52 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 29, 2016, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/155 |

| | | Holding | | % of Net Assets | | | Line of Business | | Country |

| | Inchcape PLC | | | 1.4 | % | | Retailing | | United Kingdom |

| | Actelion Ltd. (Registered) | | | 1.3 | | | Pharmaceuticals,

Biotechnology & Life Sciences | | Switzerland |

| | Julius Baer Group Ltd. | | | 1.3 | | | Diversified Financials | | Switzerland |

| | Brenntag AG | | | 1.2 | | | Capital Goods | | Germany |

| | Regus PLC | | | 1.2 | | | Commercial &

Professional Services | | Luxembourg |

| | Persimmon PLC | | | 1.2 | | | Consumer Durables &

Apparel | | United Kingdom |

| | Gategroup Holding AG | | | 1.1 | | | Commercial &

Professional Services | | Switzerland |

| | Big Yellow Group PLC | | | 1.1 | | | Real Estate Investment

Trust | | United Kingdom |

| | GEA Group AG | | | 1.1 | | | Capital Goods | | Germany |

| | | CTT-Correios de Portugal SA | | | 1.1 | | | Transportation | | Portugal |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

17

FUND BASICS

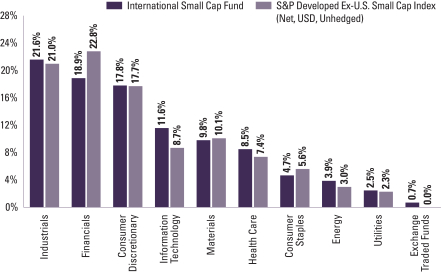

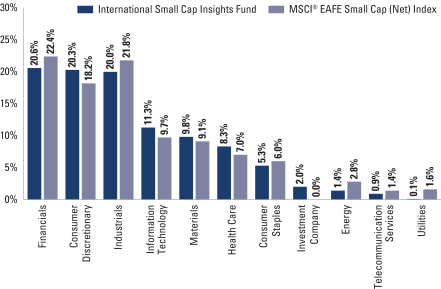

|

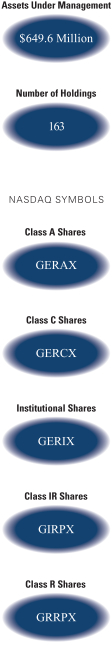

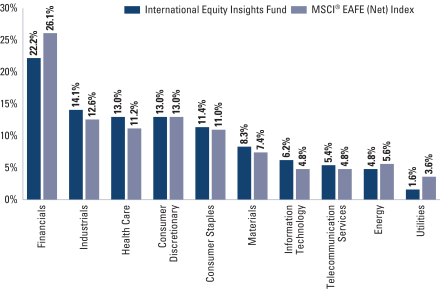

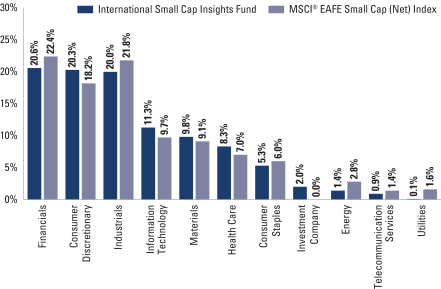

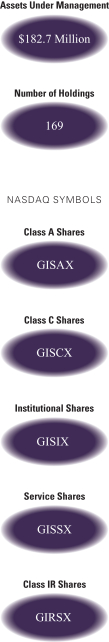

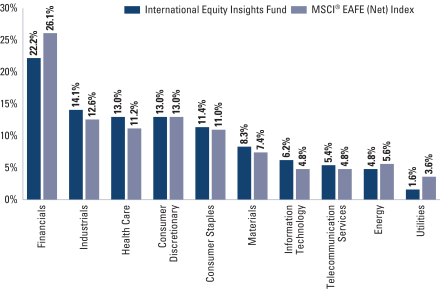

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2015 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of exchange traded funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

18

PORTFOLIO RESULTS

Goldman Sachs Strategic International Equity Fund

Investment Objective

The Fund seeks long-term growth of capital.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Equity Team discusses the Goldman Sachs Strategic International Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of 5.26%, 4.87%, 5.52%, 5.44% and 5.11%, respectively. These returns compare to the 6.81% cumulative total return of the Fund’s benchmark, the MSCI® Europe, Australasia, Far East (EAFE) Index (Net, USD, Unhedged) (the “MSCI® Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund generated solid absolute gains, but its underperformance to the MSCI® Index during the Reporting Period can be primarily attributed to individual stock selection. Sector and country allocation also detracted. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Among the biggest detractors from Fund performance relative to the MSCI® Index during the Reporting Period were Drax Group, Magnit and Total. |

| | Drax Group, a British utilities company, detracted most from the Fund’s relative returns during the Reporting Period. The company’s poor performance can be attributed largely to the negative impact of falling oil prices on the U.K. power price. We sold the Fund’s position in the stock by the end of the Reporting Period. |

| | Magnit, the largest food retailer in Russia, detracted from the Fund’s relative returns during the Reporting Period. The European and U.S. sanctions on Russia — as well as the drop in oil prices — pushed the Russian economy into recession. |

| | The company reported solid results for the fourth quarter of 2014 but was dragged lower by these geopolitical factors and by the sharp fall in the ruble. Still, as the dominant player within the food retail industry in Russia, we believe Magnit can benefit from current weakness by gaining market share using its scale to source cheaper products and by continuing to grow its store footprint. |

| | French integrated oil company Total detracted from the Fund’s relative performance. Total’s share price decline can be tied to oil prices, which fell dramatically during the Reporting Period. At the end of the Reporting Period, Total remained our top pick amongst large global integrated oil companies given what we consider to be its attractive valuation, near-years production growth, falling capital expenditure profile and cost cutting measures — along with low expectations for the company seemingly embedded in consensus estimates. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The greatest contributors to Fund performance relative to the MSCI® Index during the Reporting Period were Mitsubishi UFJ Financial Group, Pola Orbis Holding and Just Eat. |

| | Japanese banking group Mitsubishi UFJ Financial Group was the top positive contributor to the Fund’s relative results during the Reporting Period. It performed strongly on the back of strong results, driven by a gradual recovery in its Japanese business and strong growth in its international businesses, especially in Asia and the U.S. Additionally, Mitsubishi UFJ Financial Group announced increased |

19

PORTFOLIO RESULTS

| | shareholder distributions via a higher dividend and share buy-backs. |

| | Japanese consumer goods company Pola Orbis Holding was another top contributor to the Fund’s relative results during the Reporting Period. Pola Orbis Holding reported strong fourth quarter 2014 domestic sales and showed resilient sales in China, its other key market. The market also seemed to like the company’s focus on shareholder returns with a high dividend pay-out ratio and a return on equity target that is gradually rising towards 8%. |

| | Just Eat, a U.K.-based online marketplace for restaurant delivery and a new purchase for the Fund during the Reporting Period, was a strong positive contributor during the Reporting Period. The company continued to take market share in its biggest market, i.e. the U.K., and also grew in smaller markets, such as Canada, France, Spain and Italy. Additionally, the company announced good fourth quarter 2014 results with growth ahead of consensus expectations. At the end of the Reporting Period, we continued to like the growth potential and strong positioning of Just Eat. We took advantage of a recent placing by private equity to increase the Fund’s position in the stock. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The biggest detractors from the Fund’s results during the Reporting Period were consumer discretionary, information technology and utilities, where weak stock selection hurt most. Having an underweighted allocation to consumer discretionary, which outpaced the MSCI® Index during the Reporting Period, also dampened results. |

| | The sectors that contributed most to the Fund’s performance relative to the MSCI® Index were financials, health care and consumer staples. Stock selection in all three sectors proved effective during the Reporting Period. |

| Q | | Which countries most affected the Fund’s performance during the Reporting Period? |

| A | | Typically, the Fund’s individual stock holdings will significantly influence the Fund’s performance within a particular country or region relative to the MSCI® Index. This effect may be even more pronounced in countries that represent only a modest proportion of the MSCI® Index. |

| | That said, the countries that detracted most from the Fund’s relative performance were Spain, Russia and South Korea. Stock selection overall in Spain proved disappointing. Having exposure to Russia and South Korea, each of which are not components of the MSCI® Index and each of which underperformed the MSCI® Index, also hurt. Conversely, effective individual stock selection in Switzerland and Italy contributed most positively to the Fund’s results relative to the MSCI® Index. Having an underweighted allocation to Australia, which underperformed the MSCI® Index, also boosted the Fund’s relative results. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | During the Reporting Period, we purchased Fund positions in French banking group Societe Generale, U.K. insurer Aviva and Irish specialty pharmaceuticals company Shire. |

| | We established a Fund position in Societe Generale in the first quarter of 2015. Its stock had been a significant laggard compared to other European banks for more than a year, and its relative valuation appeared attractive to us at 0.8x price/ tangible book value vs. 1.1x for the sector. We believed that concerns around weakness in the bank’s Russian business and around continued re-regulation of banks were well priced in already. At the time of purchase, we believed the gradual recovery of the European economy would lead to upgrades to the growth outlook for the bank. |

| | We initiated a Fund position in Aviva, as its share price weakened at the end of 2014 when the company announced its acquisition of Friends Life, one of its competitors. We think the market misjudged the deal. We believe the deal should allow Aviva to generate cost synergies and improve its cash flow going forward. |

| | We purchased a Fund position in Shire during the Reporting Period, and the company proved to be a strong performer during the Reporting Period, as the stock recovered from a sharp decline in share price in October 2014 when pharmaceuticals company Abbvie decided to pull its offer to buy the company. We had taken advantage of the sell-off to re-initiate a position, as we believed the company had once again become undervalued. (We had sold the Fund’s position |

20

PORTFOLIO RESULTS

| | in Shire in July 2014 after the agreed takeover offer by Abbvie.) Shire performed well during the Reporting Period, as it reported strong fourth quarter 2014 earnings, confirming the resilience of its existing business. Additionally, the company announced in January 2015 its acquisition of NPS Pharmaceutical, which added two assets that complemented Shire’s orphan drug business. (An orphan drug is a pharmaceutical agent that has been developed specifically to treat a rare medical condition, the condition itself being referred to as an orphan disease. The assignment of orphan status to a disease and to any drugs developed to treat it is a matter of public policy in many countries. |

| | In addition to the sales already mentioned, we sold out of the Fund’s positions in Aurizon Holdings, LM Ericsson Telefon and Credit Saison during the Reporting Period. |

| | Aurizon Holdings, an Australian railroad operator to the mining industry, performed poorly, as the slowing Chinese economy raised concerns that commodities freight volumes may come under pressure despite the long-term nature of the company’s contracts with its mining customers. We sold the Fund’s position in Aurizon Holdings by the end of the Reporting Period. |

| | We sold the Fund’s position in LM Ericsson Telefon, a Swedish communication networks manufacturer, because we are concerned that the end of the mobile network fourth generation upgrade cycle in the U.S. may not be offset by the continuation of this upgrade cycle in Europe and emerging market nations, which are lower margin geographies than the U.S. |

| | We eliminated the Fund’s position in Credit Saison, a Japanese consumer finance company, because we believe an increase in repayment of excessive interest charged in previous years and an increase in costs to upgrade its information technology systems will likely hurt its earnings in the next few quarters despite an acceleration of its top line, or revenue, growth. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In this Fund, both sector weightings and country allocations are largely the result of our bottom-up stock selection process rather than any top-down macroeconomic views or regional, country, sector or industry bets. We seek to outpace the MSCI® Index by overweighting stocks that we expect to outperform and underweighting those we think may lag. Consequently, changes in its sector or country weightings are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to consumer discretionary increased relative to the MSCI® Index during the Reporting Period, while its relative exposure to financials and materials decreased. From a country perspective, the Fund’s exposure to the U.K. increased relative to the MSCI® Index during the Reporting Period, while its relative exposure to Italy decreased. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | There were no material changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | | How was the Fund positioned relative to the MSCI® Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had more exposure to Belgium, South Korea, Ireland, Switzerland, Taiwan and Sweden relative to the MSCI® Index and less exposure to the U.K., Australia, Italy and the Netherlands relative to the MSCI® Index. At the end of the Reporting Period, the Fund held neutral positions relative to the MSCI® Index in several countries, most notably Japan and France, and had no position at all in several other countries and regions, most notably Hong Kong. |

| | From a sector allocation perspective, the Fund had overweight positions relative to the MSCI® Index in consumer staples and information technology at the end of the Reporting Period. On the same date, the Fund had underweighted positions compared to the MSCI® Index in consumer discretionary, financials, materials, industrials, utilities and health care and rather neutral positions relative to the MSCI® Index in energy and telecommunication services. |

| | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

21

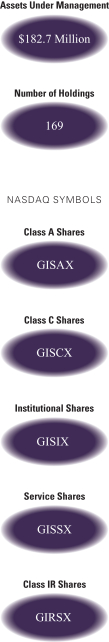

FUND BASICS

Strategic International Equity Fund

as of April 30, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2014–April 30, 2015 | | Fund Total Return (based on NAV)1 | | | MSCI® EAFE Index (Net, USD, Unhedged)2 | |

| | Class A | | | 5.26 | % | | | 6.81 | % |

| | Class C | | | 4.87 | | | | 6.81 | |

| | Institutional | | | 5.52 | | | | 6.81 | |

| | Class IR | | | 5.44 | | | | 6.81 | |

| | | Class R | | | 5.11 | | | | 6.81 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI® EAFE Index (Net, USD, Unhedged) is a market capitalization-weighted composite of securities in 22 developed markets. The Index approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction for withholding tax, applying the rate to non- resident individuals who do not benefit from double taxation treaties. MSCI® Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. The Index is unmanaged and the figures for the Index do not include any deduction for fees or expenses. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/15 | | One Year | | | Five Years | | | Since Inception | | | Inception Date |

| | Class A | | | -7.46 | % | | | 4.52 | % | | | -1.05 | % | | 6/25/07 |

| | Class C | | | -3.75 | | | | 4.92 | | | | -1.07 | | | 6/25/07 |

| | Institutional | | | -1.71 | | | | 6.11 | | | | 0.05 | | | 6/25/07 |

| | Class IR | | | -1.87 | | | | 6.06 | | | | -1.04 | | | 11/30/07 |

| | | Class R | | | -2.37 | | | | 5.44 | | | | -1.60 | | | 11/30/07 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

22

FUND BASICS

| | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | 1.35% | | | 1.79 | % |

| | Class C | | 2.10 | | | 2.54 | |

| | Institutional | | 0.95 | | | 1.39 | |

| | Class IR | | 1.09 | | | 1.54 | |

| | | Class R | | 1.60 | | | 2.04 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 29, 2016, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/155 |

| | | Holding | | % of Net Assets | | | Line of Business | | Country |

| | iShares MSCI Japan Fund | | | 4.8 | % | | Exchange Traded Fund | | United States |

| | Novartis AG (Registered) | | | 3.1 | | | Pharmaceuticals, Biotechnology & Life Sciences | | Switzerland |

| | Anheuser-Busch InBev NV | | | 2.8 | | | Food, Beverage & Tobacco | | Belgium |

| | Vodafone Group PLC | | | 2.8 | | | Telecommunication Services | | United Kingdom |

| | Nidec Corp. | | | 2.2 | | | Capital Goods | | Japan |

| | Mitsubishi UFJ Financial Group, Inc. | | | 2.2 | | | Banks | | Japan |

| | Beiersdorf AG | | | 2.2 | | | Household & Personal Products | | Germany |

| | UBS Group AG | | | 2.2 | | | Diversified Financials | | Switzerland |

| | BG Group PLC | | | 2.0 | | | Energy | | United Kingdom |

| | | Bayer AG (Registered) | | | 2.0 | | | Pharmaceuticals, Biotechnology & Life Sciences | | Germany |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

23

FUND BASICS

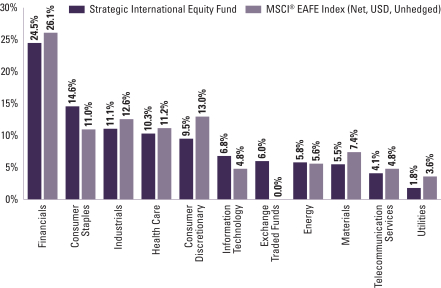

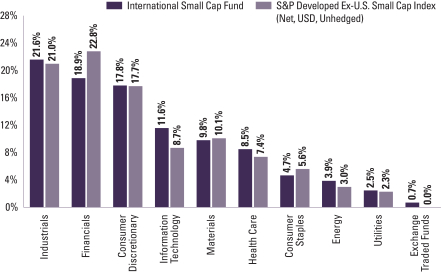

|

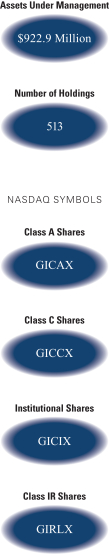

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2015 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of exchange traded funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

24

GOLDMAN SACHS FOCUSED INTERNATIONAL EQUITY FUND

Schedule of Investments

April 30, 2015 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – 91.3% | |

| | Australia – 4.0% | |

| | 935,489 | | | Computershare Ltd. (Software & Services) | | $ | 9,074,616 | |

| | |

| | Belgium – 2.1% | |

| | 31,294 | | | Solvay SA (Materials) | | | 4,607,886 | |

| | |

| | Denmark – 2.0% | |

| | 79,772 | | | Novo Nordisk A/S Class B (Pharmaceuticals, Biotechnology & Life Sciences) | | | 4,478,454 | |

| | |

| | France – 13.4% | |

| | 84,501 | | | Publicis Groupe SA (Media) | | | 7,087,147 | |

| | 227,169 | | | Rexel SA (Capital Goods) | | | 4,281,375 | |

| | 62,412 | | | Safran SA (Capital Goods) | | | 4,560,280 | |

| | 70,048 | | | Sanofi (Pharmaceuticals, Biotechnology & Life Sciences) | | | 7,130,221 | |

| | 140,571 | | | Societe Generale SA (Banks) | | | 7,027,805 | |

| | | | | | | | |

| | | | | | | 30,086,828 | |

| | |

| | Germany – 5.9% | |

| | 62,015 | | | Bayer AG (Registered) (Pharmaceuticals, Biotechnology & Life Sciences)* | | | 8,925,980 | |

| | 50,821 | | | Beiersdorf AG (Household & Personal Products) | | | 4,420,701 | |

| | | | | | | | |

| | | | | | | 13,346,681 | |

| | |

| | Ireland – 3.4% | |

| | 821,772 | | | C&C Group PLC (Food, Beverage & Tobacco) | | | 3,329,884 | |

| | 52,957 | | | Shire PLC (Pharmaceuticals, Biotechnology & Life Sciences) | | | 4,303,478 | |

| | | | | | | | |

| | | | | | | 7,633,362 | |

| | |

| | Japan – 22.9% | |

| | 94,900 | | | Dentsu, Inc. (Media) | | | 4,423,735 | |

| | 172,000 | | | Hoya Corp. (Technology Hardware & Equipment) | | | 6,629,034 | |

| | 475,400 | | | Isuzu Motors Ltd. (Automobiles & Components) | | | 6,300,864 | |

| | 294,000 | | | Kubota Corp. (Capital Goods) | | | 4,601,399 | |

| | 676,400 | | | Mitsubishi UFJ Financial Group, Inc. (Banks) | | | 4,805,382 | |

| | 64,000 | | | Nidec Corp. (Capital Goods) | | | 4,787,508 | |

| | 448,700 | | | ORIX Corp. (Diversified Financials) | | | 6,900,289 | |

| | 85,700 | | | Pola Orbis Holdings, Inc. (Household & Personal Products) | | | 4,446,657 | |

| | 1,193,000 | | | Sumitomo Osaka Cement Co. Ltd. (Materials) | | | 3,885,543 | |

| | 634,200 | | | Tokyu Fudosan Holdings Corp. (Real Estate) | | | 4,712,705 | |

| | | | | | | | |

| | | | | | | 51,493,116 | |

| | |

| | Common Stocks – (continued) | |

| | Netherlands – 1.8% | |

| | 127,779 | | | Royal Dutch Shell PLC Class A (Energy) | | $ | 4,028,906 | |

| | |

| | South Korea – 4.7% | |

| | 145,128 | | | Hana Financial Group, Inc. (Banks) | | | 4,271,971 | |

| | 135,136 | | | Kia Motors Corp. (Automobiles & Components) | | | 6,227,312 | |

| | | | | | | | |

| | | | | | | 10,499,283 | |

| | |

| | Spain – 6.6% | |

| | 1,539,600 | | | Banco Popular Espanol SA (Banks) | | | 8,010,626 | |

| | 1,030,847 | | | Iberdrola SA (Utilities) | | | 6,899,758 | |

| | | | | | | | |

| | | | | | | 14,910,384 | |

| | |

| | Sweden – 2.0% | |

| | 326,312 | | | Volvo AB Class B (Capital Goods) | | | 4,508,067 | |

| | |

| | Switzerland – 9.8% | |

| | 19,551 | | | Syngenta AG (Registered) (Materials) | | | 6,542,347 | |

| | 9,831 | | | The Swatch Group AG (Consumer Durables & Apparel) | | | 4,395,001 | |

| | 223,163 | | | UBS Group AG (Diversified Financials)* | | | 4,458,202 | |

| | 110,641 | | | Wolseley PLC (Capital Goods) | | | 6,543,797 | |

| | | | | | | | |

| | | | | | | 21,939,347 | |

| | |

| | Taiwan – 2.4% | |

| | 414,000 | | | MediaTek, Inc. (Semiconductors & Semiconductor Equipment) | | | 5,321,634 | |

| | |

| | United Kingdom – 10.3% | |

| | 373,590 | | | BG Group PLC (Energy) | | | 6,767,042 | |

| | 1,122,838 | | | Melrose Industries PLC (Capital Goods) | | | 4,556,466 | |

| | 79,498 | | | Reckitt Benckiser Group PLC (Household & Personal Products) | | | 7,075,675 | |

| | 1,330,281 | | | Vodafone Group PLC (Telecommunication Services) | | | 4,686,858 | |

| | | | | | | | |

| | | | | | | 23,086,041 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $212,037,271) | | $ | 205,014,605 | |

| | |

| | | | | | | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 25 |

GOLDMAN SACHS FOCUSED INTERNATIONAL EQUITY FUND

Schedule of Investments (continued)

April 30, 2015 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | Exchange Traded Funds – 3.4% | |

| | United States – 3.4% | |

| | 67,383 | | | iShares MSCI EAFE Fund | | $ | 4,481,644 | |

| | 247,236 | | | iShares MSCI Japan Fund | | | 3,179,455 | |

| | |

| | TOTAL EXCHANGE TRADED FUNDS | |

| | (Cost $7,532,113) | | $ | 7,661,099 | |

| | |

| | TOTAL INVESTMENTS – 94.7% | | | | |

| | (Cost $219,569,384) | | $ | 212,675,704 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 5.3% | | | 11,900,702 | |

| | |

| | NET ASSETS – 100.0% | | $ | 224,576,406 | |

| | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Non-income producing security. |

| | |

| 26 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INTERNATIONAL SMALL CAP FUND

Schedule of Investments

April 30, 2015 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – 94.9% | |

| | Australia – 5.0% | |

| | 379,124 | | | Aveo Group (Real Estate) | | $ | 826,932 | |

| | 25,876 | | | Caltex Australia Ltd. (Energy) | | | 721,678 | |

| | 156,296 | | | Computershare Ltd. (Software & Services) | | | 1,516,133 | |

| | 378,543 | | | Echo Entertainment Group Ltd. (Consumer Services) | | | 1,351,610 | |

| | 86,728 | | | GrainCorp Ltd. Class A (Food, Beverage & Tobacco) | | | 676,086 | |

| | 342,194 | | | Macquarie Atlas Roads Group (Transportation) | | | 877,291 | |

| | 141,185 | | | Navitas Ltd. (Consumer Services) | | | 513,836 | |

| | 57,298 | | | Seek Ltd. (Commercial & Professional Services) | | | 732,880 | |

| | 120,732 | | | Super Retail Group Ltd. (Retailing) | | | 939,830 | |

| | 165,941 | | | Treasury Wine Estates Ltd. (Food, Beverage & Tobacco) | | | 727,778 | |

| | 173,472 | | | Veda Group Ltd. (Commercial & Professional Services) | | | 313,046 | |

| | | | | | | | |

| | | | | | | 9,197,100 | |

| | |

| | Belgium – 0.6% | |

| | 31,563 | | | bpost SA (Transportation) | | | 905,180 | |

| | 929 | | | Cie d’Entreprises CFE (Capital Goods) | | | 100,517 | |

| | 40,230 | | | Rezidor Hotel Group AB (Consumer Services) | | | 171,379 | |

| | | | | | | | |

| | | | | | | 1,177,076 | |

| | |

| | Canada – 7.7% | |

| | 36,376 | | | Aimia, Inc. (Media) | | | 404,010 | |

| | 109,587 | | | Alamos Gold, Inc. (Materials) | | | 757,526 | |

| | 18,374 | | | Algonquin Power & Utilities Corp. (Utilities) | | | 149,703 | |

| | 11,838 | | | Amaya, Inc. (Consumer Services)* | | | 276,989 | |

| | 255,454 | | | B2Gold Corp. (Materials)* | | | 400,172 | |

| | 3,031 | | | Boardwalk Real Estate Investment Trust (REIT) | | | 152,643 | |

| | 17,730 | | | Bonterra Energy Corp. (Energy) | | | 566,802 | |

| | 16,964 | | | Canadian Solar, Inc. (Semiconductors & Semiconductor Equipment)* | | | 600,526 | |

| | 22,137 | | | Canadian Western Bank (Banks) | | | 575,580 | |

| | 5,510 | | | CCL Industries, Inc. Class B (Materials) | | | 633,479 | |

| | 70,271 | | | Celestica, Inc. (Technology Hardware & Equipment)* | | | 857,929 | |

| | 7,900 | | | Cogeco Cable, Inc. (Media) | | | 452,523 | |

| | 48,041 | | | Element Financial Corp. (Diversified Financials)* | | | 688,860 | |

| | 58,055 | | | Enerflex Ltd. (Energy) | | | 778,558 | |

| | 9,462 | | | FirstService Corp. (Real Estate) | | | 619,402 | |

| | 12,952 | | | Home Capital Group, Inc. (Banks) | | | 511,209 | |

| | 10,103 | | | Laurentian Bank of Canada (Banks) | | | 404,371 | |

| | 3,665 | | | MacDonald Dettwiler & Associates Ltd. (Capital Goods) | | | 290,952 | |