UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

Goldman Sachs & Co. LLC | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: August 31

Date of reporting period: February 28, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | February 28, 2018 |

| | |

| | | | Financial Square FundsSM |

| | | | Federal Instruments |

| | | | Government |

| | | | Money Market |

| | | | Prime Obligations |

| | | | Treasury Instruments |

| | | | Treasury Obligations |

| | | | Treasury Solutions |

Goldman Sachs Financial Square Funds

| ∎ | | FEDERAL INSTRUMENTS FUND |

| ∎ | | TREASURY INSTRUMENTS FUND |

| ∎ | | TREASURY OBLIGATIONS FUND |

| ∎ | | TREASURY SOLUTIONS FUND |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

PORTFOLIO RESULTS

Goldman Sachs Financial Square Funds

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Money Market Portfolio Management Team discusses the Goldman Sachs Financial Square Funds’ (the “Funds”) performance and positioning for the six-month period ended February 28, 2018 (the “Reporting Period”).

| Q | | What economic and market factors most influenced the money markets as a whole during the Reporting Period? |

| A | | During the Reporting Period, noteworthy events influencing the front, or short-term, end of the money market yield curve included a Federal Reserve (“Fed”) interest rate hike and its start of balance sheet normalization as well as action by other central banks, including the European Central Bank’s (“ECB”) tapering of asset purchases. (Yield curve is a spectrum of interest rates based on maturities of varying lengths. Balance sheet normalization refers to the steps the Fed is taking to reverse quantitative easing and remove the substantial monetary accommodation it has provided to the economy since the financial crisis began in 2007.) |

| | | In December 2017, the Fed delivered its third rate hike of the calendar year, raising the targeted federal funds rate by 25 basis points to a range between 1.25% and 1.50%. (A basis point is 1/100th of a percentage point.) Policymakers cited ongoing strength in the U.S. labor market and a pickup in household spending and business fixed investment. The Fed’s dot plot, which shows rate projections of the members of the Fed’s Open Market Committee, indicated that three rate increases were on tap for 2018 and potentially two more in 2019. During February 2018, new Fed chair Jerome Power noted an improvement in the U.S. economic outlook since the Fed’s December 2017 policy meeting. His comments were met with a hawkish market reaction, with U.S. Treasury yields climbing amid raised market expectations for a shift in the Fed’s dot plot at its March 2018 meeting. (Hawkish tends to suggest higher interest rates; opposite of dovish.) |

| | | Outside the U.S., the ECB announced in October 2017 that it would reduce its monthly asset purchases from €60 billion to €30 billion for nine months beginning in January 2018, mainly by purchasing fewer sovereign government bonds. The ECB also said its policy rates would remain low for “an extended period of time, and well past the horizon of the net asset purchases.” Also in October 2017, the Bank of England reversed an emergency interest rate cut, made in August 2016 following the Brexit referendum, and signaled that future monetary policy tightening would be limited, gradual and dependent on the economic reaction to the U.K.’s eventual departure from the European Union. |

| Q | | What key factors were responsible for the performance of the Funds during the Reporting Period? |

| A | | The Funds’ yields rose during the Reporting Period, driven by the increase in money market yields, which occurred primarily because of the economic and market factors discussed above. The money market yield curve flattened, meaning yields on shorter-term maturities rose more than those on longer-term maturities. |

| Q | | How did you manage the Funds during the Reporting Period? |

| A | | Collectively, the Funds had investments in commercial paper, asset-backed commercial paper, U.S. Treasury securities, government agency securities, repurchase agreements (“repos”), government guaranteed paper, time deposits, certificates of deposit, floating rate securities, variable rate demand notes (“VRDNs”), municipal securities and floating rate securities during the Reporting Period. |

| | | In our commercial paper strategies (i.e., the Goldman Sachs Financial Square Money Market Fund and the Goldman Sachs Financial Square Prime Obligations Fund), we maintained a rather short weighted average maturity of approximately 35 days, as the Fed continued to signal the likelihood of a December 2017 interest rate hike. For the same reason, we maintained relatively short weighted average maturities of approximately 20 days in our government repo strategies (i.e., the Goldman Sachs Financial Square Government Fund, the Goldman Sachs Financial Square Treasury Obligations Fund and the Goldman Sachs Financial Square Treasury Solutions Fund) and of approximately 40 days in our government non-repo strategies (i.e., the Goldman Sachs Financial Square Federal Instruments Fund and the Goldman Sachs Financial Square Treasury Instruments Fund). During the fourth quarter of 2017 and in early 2018, we focused our Funds’ purchases on floating rate securities, asset-backed commercial paper and agency securities because, in our view, they could help us |

1

PORTFOLIO RESULTS

| | manage duration in the event of a more aggressive than market expected Fed interest rate hike scenario. (Duration is a measure of a portfolio’s sensitivity to changes in interest rates.) |

| Q | | How did you manage the Funds’ weighted average life during the Reporting Period? |

| A | | During the Reporting Period, we managed the weighted average life of the Funds below 120 days. In commercial paper strategies, we reduced the Funds’ weighted average life from approximately 82 days to approximately 64 days. In government repo and government non-repo strategies, we reduced the Funds’ weighted average life from approximately 115 days to approximately 104 days. The weighted average life of a money market fund is a measure of a money market fund’s price sensitivity to changes in liquidity and/or credit risk. |

| | | Under amendments to SEC Rule 2a-7 that became effective in May 2010, the maximum allowable weighted average life of a money market fund is 120 days. While one of the goals of the SEC’s money market fund rule is to reinforce conservative investment practices across the money market fund industry, our security selection process has long emphasized conservative investment choices. |

| Q | | Did you make any changes to the Funds’ portfolios during the Reporting Period? |

| A | | During the Reporting Period, we made adjustments to the Funds’ weighted average maturities and their allocations to specific investments based on then-current market conditions, our near-term view and anticipated and actual Fed monetary policy statements. |

| Q | | What is the Funds’ tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, we expected the U.S. to continue to take the lead in unwinding the ultra-accommodative monetary policy put in place following the global financial crisis. We think the Fed will raise rates three times in 2018 and continue balance sheet normalization. Although we believe the markets have interpreted Jerome Powell’s appointment as preserving continuity at the Fed, the high turnover on the Federal Open Market Committee could challenge the status quo, in our view, as Powell will need to build consensus among policymakers, some of whom have yet to be nominated. Elsewhere, we see scope for several developed markets’ central banks, including the Bank of Canada and Reserve Bank of New Zealand, to tighten monetary policy because of domestic economic strength in those nations. In contrast, we anticipate prolonged monetary policy accommodation in Europe and Japan, where core inflation appears to lack upward momentum. Overall, the Funds continue to be flexibly guided by shifting market conditions, and we have positioned them to seek to take advantage of anticipated interest rate movements. At the end of the Reporting Period, we viewed floating rate securities as offering value, and we intend to adjust duration guided by the context of market pricing in relation to our expectations. As always, we intend to continue to use our actively managed approach to seek the best possible return within the framework of our Funds’ investment guidelines and objectives. In addition, we will continue to manage interest, liquidity and credit risk daily. We will also continue to closely monitor economic data, Fed policy and any shifts in the money market yield curve, as we strive to navigate the interest rate environment. |

2

PORTFOLIO RESULTS

GOVERNMENT MONEY MARKET FUNDS

| | ∎ | | Federal Instruments Fund |

| | ∎ | | Treasury Instruments Fund |

| | ∎ | | Treasury Obligations Fund |

| | ∎ | | Treasury Solutions Fund |

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

INSTITUTIONAL MONEY MARKET FUNDS

You could lose money by investing in the Fund. Because the share price of the Fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. The Fund may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

3

FUND BASICS

Financial Square Funds

as of February 28, 2018

| | | | | | | | | | |

| | PERFORMANCE REVIEW1,2 | |

| | | September 1, 2017–February 28,

2018 | | Fund Total Return (based on NAV)4 Institutional Shares | | | iMoneyNet Institutional

Average5 | |

| | Federal Instruments | | | 0.51 | % | | | 0.87 | %6 |

| | Government | | | 0.52 | | | | 0.87 | 6 |

| | Money Market3 | | | 0.63 | | | | 1.11 | 7 |

| | Prime Obligations3 | | | 0.63 | | | | 1.11 | 7 |

| | Treasury Instruments | | | 0.51 | | | | 0.86 | 8 |

| | Treasury Obligations | | | 0.52 | | | | 0.85 | 9 |

| | | Treasury Solutions | | | 0.51 | | | | 0.85 | 9 |

The returns represent past performance. Past performance does not guarantee future results. The Funds’ investment returns will fluctuate. Current performance may be lower or higher than the performance quoted above. Please visit our Web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | 1 | | Each of the Prime Obligations, Treasury Obligations, Money Market, Treasury Instruments and Treasury Solutions Funds offers nine separate classes of shares (Institutional, Select, Preferred, Capital, Administration, Service, Cash Management, Premier and Resource), the Federal Instruments Fund offers eight separate classes of shares (Institutional, Select, Preferred, Capital, Administration, Service, Cash Management and Premier), and the Government Fund offers twelve separate classes of shares (Institutional, Select, Preferred, Capital, Administration, Service, Cash Management, Premier, Resource, Class R6, Class A and Class C), each of which is subject to different fees and expenses that affect performance and entitles shareholders to different services. The Institutional and Class R6 Shares do not have distribution and/or service (12b-1) or administration and/or service (non-12b-1) fees. The Select, Preferred, Capital, Administration, Service, Cash Management, Premier, Resource, Class A and Class C Shares offer financial institutions the opportunity to receive fees for providing certain distribution, administrative support and/or shareholder services (as applicable). As an annualized percentage of average daily net assets, these share classes pay combined distribution and/or service (12b-1), administration and/ or service (non-12b-1) fees (as applicable) at the following contractual rates: the Select Shares pay 0.03%, Preferred Shares pay 0.10%, Capital Shares pay 0.15%, Administration Shares pay 0.25%, Service Shares pay 0.50%, Cash Management Shares pay 0.80%, Premier Shares pay 0.35%, Resource Shares pay 0.65%, Class A Shares pay 0.25% and Class C Shares pay 1.00%. If these fees were reflected in the above performance, performance would have been reduced. In addition, the Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The investment adviser may contractually agree to waive or reimburse certain fees and expenses until a specified date. The investment adviser may also voluntarily waive certain fees and expenses, and such voluntary waivers may be discontinued or modified at any time without notice. The performance shown above reflects any waivers or reimbursements that were in effect for all or a portion of the periods shown. When waivers or reimbursements are in place, the Fund’s operating expenses are reduced and the Fund’s yield and total returns to the shareholder are increased. |

| | 3 | | As of February 8, 2018, the investment adviser has implemented a voluntary temporary fee waiver equal annually to 0.10% of the average daily net assets of Financial Square Prime Obligations Fund and Financial Square Money Market Fund. |

| | 4 | | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. A Fund’s total return reflects the reinvestment of dividends and other distributions. |

| | 5 | | Source: iMoneyNet, Inc. February 2018. |

| | 6 | | Government & Agencies Institutional–Category includes the most broadly based of the government institutional funds. These funds may generally invest in U.S. treasuries, U.S. agencies, repurchase agreements, or government-backed floating rate notes. |

| | 7 | | First Tier Institutional–Category includes only non-government institutional funds that also are not holding any second tier securities. Portfolio holdings of First Tier funds include U.S. Treasury, U.S. other, repurchase agreements, time deposits, domestic bank obligations, foreign bank obligations, first tier commercial paper, floating rate notes, and asset-backed commercial paper. |

| | 8 | | Treasury Institutional–Category includes only institutional government funds that hold 100 percent in U.S. Treasuries. |

| | 9 | | Treasury & Repo Institutional–Category includes only institutional government funds that hold U.S. Treasuries and repurchase agreements backed by the U.S. Treasury. |

4

FUND BASICS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS1,2,10 |

| | | For the period ended

December 31, 2017 | | SEC

7-Day

Current Yield11 | | | One Year | | | Five Years | | | Ten Years | | | Since

Inception | | | Inception Date |

| | Federal Instruments | | | 1.14 | % | | | 0.73 | % | | | N/A | | | | N/A | | | | 0.46 | % | | 10/30/15 |

| | Government | | | 1.21 | | | | 0.77 | | | | 0.22 | % | | | 0.40 | % | | | 2.63 | | | 4/6/93 |

| | Money Market | | | 1.43 | | | | 1.07 | | | | 0.36 | | | | 0.53 | | | | 2.70 | | | 5/18/94 |

| | Prime Obligations | | | 1.41 | | | | 1.08 | | | | 0.33 | | | | 0.50 | | | | 3.03 | | | 3/8/90 |

| | Treasury Instruments | | | 1.15 | | | | 0.72 | | | | 0.19 | | | | 0.26 | | | | 1.99 | | | 3/3/97 |

| | Treasury Obligations | | | 1.22 | | | | 0.74 | | | | 0.20 | | | | 0.28 | | | | 2.83 | | | 4/25/90 |

| | | Treasury Solutions | | | 1.14 | | | | 0.73 | | | | 0.19 | | | | 0.37 | | | | 2.18 | | | 2/28/97 |

| 10 | | The Standardized Total Returns are average annual or cumulative total returns (only if the performance period is one year or less) of Institutional Shares as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. The SEC 7-Day Current Yield is not a Standardized Total Return. |

| | | Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| | | The yields and returns represent past performance. Past performance does not guarantee future results. The Funds’ investment yields and returns will fluctuate as market conditions change. Current performance may be lower or higher than the performance quoted above. Please visit our Web site at www.GSAMFUNDS.com to obtain the most recent month-end yields and returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| 11 | | The SEC 7-Day Current Yield figures are as of 12/31/17 and are calculated in accordance with securities industry regulations and do not include net capital gains. SEC 7-Day Current Yield may differ slightly from the actual distribution rate of a given Fund because of the exclusion of distributed capital gains, which are non-recurring. The SEC 7-Day Current Yield more closely reflects a Fund’s current earnings than do the Standardized Total Return figures. |

5

YIELD SUMMARY

| | | | | | | | | | | | | | | | | | | | | | |

| | SUMMARY OF THE INSTITUTIONAL SHARES1,2 AS OF 2/28/18 | |

| | | Funds | | 7-Day Dist. Yield12 | | | SEC 7-Day Effective Yield13 | | | 30-Day Average Yield14 | | | Weighted Avg. Maturity (days)15 | | | Weighted Avg. Life (days)16 | |

| | Federal Instruments | | | 1.27 | % | | | 1.30 | % | | | 1.22 | % | | | 39 | | | | 118 | |

| | Government | | | 1.27 | | | | 1.29 | | | | 1.23 | | | | 26 | | | | 107 | |

| | Money Market3 | | | 1.63 | | | | 1.65 | | | | 1.56 | | | | 29 | | | | 64 | |

| | Prime Obligations3 | | | 1.62 | | | | 1.65 | | | | 1.56 | | | | 30 | | | | 64 | |

| | Treasury Instruments | | | 1.33 | | | | 1.35 | | | | 1.25 | | | | 40 | | | | 104 | |

| | Treasury Obligations | | | 1.28 | | | | 1.30 | | | | 1.22 | | | | 23 | | | | 111 | |

| | | Treasury Solutions | | | 1.32 | | | | 1.30 | | | | 1.22 | | | | 34 | | | | 119 | |

| | | The Yields represent past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance quoted above. |

| | | Yields reflect fee waivers and expense limitations in effect and will fluctuate as market conditions change. The yield quotations more closely reflect the current earnings of the Fund. Please visit our Web site at www.GSAMFUNDS.com to obtain the most recent month-end performance. |

| 12 | | The 7-Day Distribution Yield is an annualized measure of a Fund’s dividends per share, divided by the price per share. This yield can include capital gain/loss distribution, if any. This is not an SEC Yield. |

| 13 | | The SEC 7-Day Effective Yield of a Fund is calculated in accordance with securities industry regulations and do not include net capital gains. The SEC 7-Day Effective Yield assumes reinvestment of dividends for one year. |

| 14 | | The 30-Day Average Yield is a net annualized yield of 30 days back from the current date listed. This yield includes capital gain/loss distribution. |

| 15 | | A Fund’s weighted average maturity (WAM) is an average of the effective maturities of all securities held in the portfolio, weighted by each security’s percentage of net assets. This must not exceed 60 days as calculated under SEC Rule 2a-7. |

| 16 | | A Fund’s weighted average life (WAL) is an average of the final maturities of all securities held in the portfolio, weighted by each security’s percentage of net assets. This must not exceed 120 days as calculated under SEC Rule 2a-7. |

6

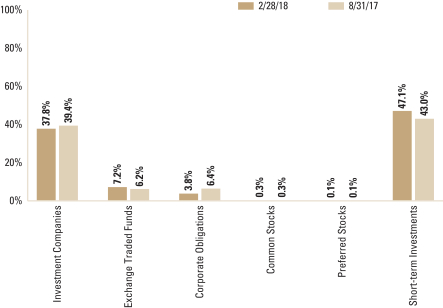

SECTOR ALLOCATIONS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | SECTOR ALLOCATIONS17 | |

| | | as of February 28, 2018 | | | | | | | | | | | | | | | | | | | |

| | | Security Type (Percentage of Net Assets) | | Federal Instruments | | | Government | | | Money Market | | | Prime Obligations | | | Treasury Instruments | | | Treasury Obligations | | | Treasury Solutions | |

| | Certificates of Deposit | | | — | | | | — | | | | 0.6 | % | | | 0.7 | % | | | — | | | | — | | | | — | |

| | Certificates of Deposit -Eurodollar | | | — | | | | — | | | | 1.0 | | | | — | | | | — | | | | — | | | | — | |

| | Certificates of Deposit - Yankeedollar | | | — | | | | — | | | | 7.1 | | | | 8.8 | | | | — | | | | — | | | | — | |

| | Commercial Paper & Corporate Obligations | | | — | | | | — | | | | 29.7 | | | | 35.2 | | | | — | | | | — | | | | — | |

| | Fixed Rate Municipal Debt Obligations | | | — | | | | — | | | | 4.6 | | | | 3.7 | | | | — | | | | — | | | | — | |

| | Repurchase Agreements | | | — | | | | 58.9 | % | | | 5.3 | | | | 4.5 | | | | — | | | | 62.5 | % | | | 35.4 | % |

| | Time Deposits | | | — | | | | — | | | | 25.1 | | | | 22.0 | | | | — | | | | — | | | | — | |

| | U.S. Government Agency Obligations | | | 54.2 | % | | | 17.7 | | | | — | | | | 0.5 | | | | — | | | | — | | | | — | |

| | U.S. Treasury Obligations | | | 55.4 | | | | 28.5 | | | | 1.8 | | | | 1.8 | | | | 103.9 | % | | | 44.4 | | | | 99.3 | |

| | Variable Rate Municipal Debt Obligations | | | — | | | | — | | | | 5.8 | | | | 5.8 | | | | — | | | | — | | | | — | |

| | | Variable Rate Obligations | | | — | | | | — | | | | 19.3 | | | | 18.2 | | | | — | | | | — | | | | — | |

| 17 | | Each Fund is actively managed and, as such, its portfolio composition may differ over time. The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the above table may not sum to 100% due to the exclusion of other assets and liabilities. |

7

SECTOR ALLOCATIONS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | SECTOR ALLOCATIONS18 | |

| | | As of August 31, 2017 | | | | | | | | | | | | | | | | | | | |

| | | Security Type (Percentage

of Net Assets) | | Federal Instruments | | | Government | | | Money Market | | | Prime Obligations | | | Treasury Instruments | | | Treasury Obligations | | | Treasury Solutions | |

| | Certificates of Deposit | | | — | | | | — | | | | 1.9 | % | | | 2.0 | % | | | — | | | | — | | | | — | |

| | Certificates of Deposit - Eurodollar | | | — | | | | — | | | | 2.3 | | | | — | | | | — | | | | — | | | | — | |

| | Certificates of Deposit - Yankeedollar | | | — | | | | — | | | | 9.8 | | | | 10.5 | | | | — | | | | — | | | | — | |

| | Commercial Paper & Corporate Obligations | | | — | | | | — | | | | 24.7 | | | | 22.9 | | | | — | | | | — | | | | — | |

| | Fixed Rate Municipal Debt Obligations | | | — | | | | — | | | | 2.5 | | | | 1.7 | | | | — | | | | — | | | | — | |

| | Repurchase Agreements | | | — | | | | 57.9 | % | | | 3.5 | | | | 1.7 | | | | — | | | | 63.0 | % | | | 64.1 | % |

| | Time Deposits | | | — | | | | — | | | | 14.6 | | | | 16.4 | | | | — | | | | — | | | | — | |

| | U.S. Government Agency Obligations | | | 34.6 | % | | | 26.2 | | | | — | | | | 0.6 | | | | — | | | | — | | | | — | |

| | U.S. Treasury Obligations | | | 62.9 | | | | 16.1 | | | | — | | | | — | | | | 101.1 | % | | | 37.1 | | | | 36.7 | |

| | Variable Rate Municipal Debt Obligations | | | — | | | | — | | | | 8.1 | | | | 9.6 | | | | — | | | | — | | | | — | |

| | | Variable Rate Obligations | | | — | | | | — | | | | 32.6 | | | | 34.6 | | | | — | | | | — | | | | — | |

| 18 | | Each Fund is actively managed and, as such, its portfolio composition may differ over time. The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the above table may not sum to 100% due to the exclusion of other assets and liabilities. |

8

Index Definitions

ICE® BofAML® U.S. Dollar Three-Month LIBOR Constant Maturity Index is based on the assumed purchase of a synthetic instrument having three months to maturity and with a coupon equal to the closing quote for three-month LIBOR. That issue is sold the following day (priced at a yield equal to the current day closing three-month LIBOR rate) and is rolled into a new three-month instrument. The index, therefore, will always have a constant maturity equal to exactly three months.

It is not possible to invest directly in an unmanaged index.

9

FINANCIAL SQUARE FEDERAL INSTRUMENTS FUND

Schedule of Investments

February 28, 2018 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Amortized

Cost | |

| U.S. Government Agency Obligations – 54.2% | |

| | Federal Farm Credit Bank (1 Mo. LIBOR – 0.09%) | |

| $ | 1,000,000 | | | | 1.557 | %(a) | | | 03/28/19 | | | $ | 1,000,000 | |

| | Federal Farm Credit Bank (3 Mo. LIBOR – 0.14%) | |

| | 1,800,000 | | | | 1.555 | (a) | | | 09/30/19 | | | | 1,799,857 | |

| | Federal Farm Credit Bank (3 Mo. U.S. T-Bill MMY + 0.07%) | |

| | 850,000 | | | | 1.717 | (a) | | | 11/29/19 | | | | 850,000 | |

| | Federal Farm Credit Bank (3 Mo. U.S. T-Bill MMY + 0.08%)(a) | |

| | 700,000 | | | | 1.727 | | | | 10/18/19 | | | | 699,966 | |

| | 750,000 | | | | 1.727 | | | | 12/26/19 | | | | 749,946 | |

| | Federal Farm Credit Bank (3 Mo. U.S. T-Bill MMY + 0.09%)(a) | |

| | 700,000 | | | | 1.742 | | | | 02/19/19 | | | | 699,946 | |

| | 900,000 | | | | 1.737 | | | | 07/05/19 | | | | 899,976 | |

| | Federal Farm Credit Bank (FEDL01 + 0.10%) | |

| | 20,000,000 | | | | 1.520 | (a) | | | 03/26/18 | | | | 20,002,265 | |

| | Federal Farm Credit Bank (Prime Rate – 3.08%)(a) | |

| | 250,000 | | | | 1.420 | | | | 06/27/19 | | | | 249,983 | |

| | 1,600,000 | | | | 1.420 | | | | 07/17/19 | | | | 1,599,779 | |

| | Federal Farm Credit Bank (Prime Rate – 3.12%) | |

| | 1,000,000 | | | | 1.380 | (a) | | | 01/24/19 | | | | 999,900 | |

| Federal Farm Credit Banks Funding Corporation

(1 Mo. LIBOR + 0.12%) |

|

| | 25,000,000 | | | | 1.711 | (a) | | | 03/21/18 | | | | 25,004,582 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.08%) | |

| | 14,000,000 | | | | 1.510 | (a) | | | 03/19/19 | | | | 14,000,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.09%) | |

| | 1,050,000 | | | | 1.498 | (a) | | | 01/14/19 | | | | 1,050,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.10%) | |

| | 5,900,000 | | | | 1.495 | (a) | | | 04/18/19 | | | | 5,900,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.14%) | |

| | 1,300,000 | | | | 1.450 | (a) | | | 05/18/18 | | | | 1,300,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.15%) | |

| | 1,900,000 | | | | 1.445 | (a) | | | 05/18/18 | | | | 1,900,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.16%)(a) | |

| | 5,300,000 | | | | 1.461 | | | | 05/25/18 | | | | 5,300,000 | |

| | 2,900,000 | | | | 1.471 | | | | 05/25/18 | | | | 2,900,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.17%) | |

| | 2,500,000 | | | | 1.456 | (a) | | | 05/25/18 | | | | 2,500,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.18%)(a) | |

| | 16,000,000 | | | | 1.405 | | | | 06/06/18 | | | | 16,000,000 | |

| | 4,000,000 | | | | 1.405 | | | | 06/07/18 | | | | 4,000,000 | |

| | 9,500,000 | | | | 1.404 | | | | 06/08/18 | | | | 9,500,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR + 0.01%)(a) | |

| | 4,800,000 | | | | 1.600 | | | | 06/19/18 | | | | 4,800,000 | |

| | 3,270,000 | | | | 1.658 | | | | 06/28/18 | | | | 3,270,000 | |

| | Federal Home Loan Bank (3 Mo. LIBOR – 0.16%)(a) | |

| | 2,100,000 | | | | 1.318 | | | | 03/01/18 | | | | 2,100,000 | |

| | 7,000,000 | | | | 1.321 | | | | 06/01/18 | | | | 7,000,000 | |

| | Federal Home Loan Bank (3 Mo. LIBOR – 0.17%)(a) | |

| | 2,410,000 | | | | 1.418 | | | | 03/15/18 | | | | 2,410,000 | |

| | 2,410,000 | | | | 1.430 | | | | 03/16/18 | | | | 2,409,995 | |

| | Federal Home Loan Bank (3 Mo. LIBOR – 0.22%)(a) | |

| | 700,000 | | | | 1.484 | | | | 07/09/18 | | | | 699,987 | |

| | 1,100,000 | | | | 1.489 | | | | 07/12/18 | | | | 1,099,980 | |

| | Federal Home Loan Bank Discount Notes | |

| | 15,600,000 | | | | 1.341 | | | | 03/09/18 | | | | 15,595,355 | |

| | 14,900,000 | | | | 1.364 | | | | 03/21/18 | | | | 14,888,949 | |

| | 75,000,000 | | | | 1.447 | | | | 03/23/18 | | | | 74,935,100 | |

| | 51,300,000 | | | | 1.367 | | | | 03/28/18 | | | | 51,248,520 | |

| | |

| | TOTAL U.S. GOVERNMENT | |

| | AGENCY OBLIGATIONS | | | $ | 299,364,086 | |

| | |

| U.S. Treasury Obligations – 55.4% | |

| | United States Treasury Bills | |

| $ | 5,000,000 | | | | 1.327 | % | | | 03/15/18 | | | $ | 4,997,472 | |

| | 9,200,000 | | | | 1.410 | | | | 03/22/18 | | | | 9,192,594 | |

| | 5,800,000 | | | | 1.513 | (b) | | | 03/29/18 | | | | 5,793,324 | |

| | 50,000,000 | | | | 1.528 | (b) | | | 03/29/18 | | | | 49,941,861 | |

| | 9,000,000 | | | | 1.463 | | | | 04/19/18 | | | | 8,982,483 | |

| | 9,900,000 | | | | 1.473 | | | | 04/19/18 | | | | 9,880,596 | |

| | 600,000 | | | | 1.432 | | | | 04/26/18 | | | | 598,693 | |

| | 1,200,000 | | | | 1.442 | | | | 04/26/18 | | | | 1,197,368 | |

| | 400,000 | | | | 1.571 | | | | 04/26/18 | | | | 399,045 | |

| | 600,000 | | | | 1.471 | (b) | | | 05/31/18 | | | | 597,824 | |

| | 100,000 | | | | 1.680 | (b) | | | 05/31/18 | | | | 99,586 | |

| | 800,000 | | | | 1.685 | (b) | | | 05/31/18 | | | | 796,673 | |

| | 5,000,000 | | | | 1.461 | | | | 06/07/18 | | | | 4,980,264 | |

| | 300,000 | | | | 1.494 | | | | 06/07/18 | | | | 298,787 | |

| | 1,200,000 | | | | 1.492 | | | | 06/14/18 | | | | 1,194,908 | |

| | 8,200,000 | | | | 1.497 | | | | 06/14/18 | | | | 8,165,082 | |

| | 19,300,000 | | | | 1.518 | | | | 06/21/18 | | | | 19,211,134 | |

| | 1,400,000 | | | | 1.538 | | | | 06/21/18 | | | | 1,393,467 | |

| | 400,000 | | | | 1.702 | | | | 06/21/18 | | | | 397,934 | |

| | 3,000,000 | | | | 1.611 | | | | 07/05/18 | | | | 2,983,515 | |

| | 200,000 | | | | 1.739 | | | | 07/05/18 | | | | 198,814 | |

| | 400,000 | | | | 1.744 | | | | 07/05/18 | | | | 397,620 | |

| | 1,200,000 | | | | 1.595 | | | | 07/12/18 | | | | 1,193,106 | |

| | 200,000 | | | | 1.601 | | | | 07/12/18 | | | | 198,847 | |

| | 800,000 | | | | 1.632 | | | | 07/19/18 | | | | 795,053 | |

| | 32,400,000 | | | | 1.871 | | | | 08/23/18 | | | | 32,113,350 | |

| | 100,000 | | | | 1.866 | (b) | | | 08/30/18 | | | | 99,082 | |

| | 800,000 | | | | 1.876 | (b) | | | 08/30/18 | | | | 792,619 | |

| | 13,400,000 | | | | 1.882 | (b) | | | 08/30/18 | | | | 13,276,028 | |

| | 100,000 | | | | 1.887 | (b) | | | 08/30/18 | | | | 99,072 | |

| United States Treasury Floating Rate Note (3 Mo. U.S. T-Bill

MMY + 0.05%) |

|

| | 600,000 | | | | 1.700 | (a) | | | 10/31/19 | | | | 600,080 | |

| United States Treasury Floating Rate Note (3 Mo. U.S. T-Bill

MMY + 0.06%) |

|

| | 8,100,000 | | | | 1.712 | (a) | | | 07/31/19 | | | | 8,106,381 | |

| United States Treasury Floating Rate Note (3 Mo. U.S. T-Bill

MMY + 0.07%) |

|

| | 3,100,000 | | | | 1.722 | (a) | | | 04/30/19 | | | | 3,102,311 | |

| United States Treasury Floating Rate Note (3 Mo. U.S. T-Bill

MMY + 0.14%) |

|

| | 10,900,000 | | | | 1.792 | (a) | | | 01/31/19 | | | | 10,919,959 | |

| United States Treasury Floating Rate Notes (3 Mo. U.S. T-Bill

MMY + 0.17%) (a) |

|

| | 81,700,000 | | | | 1.826 | | | | 07/31/18 | | | | 81,782,109 | |

| | 12,800,000 | | | | 1.822 | | | | 10/31/18 | | | | 12,818,302 | |

| United States Treasury Floating Rate Note (3 Mo. U.S. T-Bill

MMY + 0.19%) |

|

| | 7,500,000 | | | | 1.842 | (a) | | | 04/30/18 | | | | 7,503,309 | |

| | United States Treasury Note | |

| | 400,000 | | | | 0.750 | (b) | | | 07/31/18 | | | | 398,234 | |

| | |

| | TOTAL U.S. TREASURY | |

| | OBLIGATIONS | | | $ | 305,496,886 | |

| | |

| | TOTAL INVESTMENTS – 109.6% | | | $ | 604,860,972 | |

| | |

| LIABILITIES IN EXCESS OF OTHER

ASSETS – (9.6)% |

| | | (52,752,197 | ) |

| | |

| | NET ASSETS – 100.0% | | | $ | 552,108,775 | |

| | |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL SQUARE FEDERAL INSTRUMENTS FUND

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

(a) | | Variable or floating rate security. Except for floating rate notes (for which final maturity is disclosed), maturity date disclosed is the next interest reset date. Interest rate disclosed is that which is in effect on February 28, 2018. |

(b) | | All or a portion represents a forward commitment. |

Interest rates represent either the stated coupon rate, annualized yield on date of purchase for discounted securities, or, for floating rate securities, the current reset rate, which is based upon current interest rate indices.

Maturity dates represent either the final legal maturity date on the security, the demand date for puttable securities, the date of the next interest rate reset for variable rate securities, or the prerefunded date for those types of securities.

| | |

|

Investment Abbreviations: |

FEDL01 | | —US Federal Funds Effective Rate |

LIBOR | | —London Interbank Offered Rates |

MMY | | —Money Market Yield |

Prime | | —Federal Reserve Bank Prime Loan Rate US |

T-Bill | | —Treasury Bill |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

FINANCIAL SQUARE GOVERNMENT FUND

Schedule of Investments

February 28, 2018 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity Date | | | Amortized

Cost | |

| U.S. Government Agency Obligations – 17.7% | |

| | Federal Farm Credit Bank (1 Mo. LIBOR – 0.09%) | |

| $ | 148,000,000 | | | | 1.557 | %(a) | | | 03/28/19 | | | $ | 148,000,000 | |

| | Federal Farm Credit Bank (3 Mo. LIBOR – 0.14%) | |

| | 246,500,000 | | | | 1.555 | (a) | | | 09/30/19 | | | | 246,480,472 | |

| | Federal Farm Credit Bank (3 Mo. U.S. T-Bill MMY + 0.07%)(a) | |

| | 198,700,000 | | | | 1.717 | | | | 11/20/19 | | | | 198,689,772 | |

| | 98,500,000 | | | | 1.717 | | | | 11/29/19 | | | | 98,500,000 | |

| | Federal Farm Credit Bank (3 Mo. U.S. T-Bill MMY + 0.08%)(a) | |

| | 120,500,000 | | | | 1.727 | | | | 10/18/19 | | | | 120,494,097 | |

| | 98,600,000 | | | | 1.727 | | | | 12/26/19 | | | | 98,592,865 | |

| | Federal Farm Credit Bank (3 Mo. U.S. T-Bill MMY + 0.09%)(a) | |

| | 98,500,000 | | | | 1.742 | | | | 02/19/19 | | | | 98,492,326 | |

| | 118,700,000 | | | | 1.737 | | | | 07/05/19 | | | | 118,696,803 | |

| | Federal Farm Credit Bank (Prime Rate – 3.08%)(a) | |

| | 36,500,000 | | | | 1.420 | | | | 06/27/19 | | | | 36,497,542 | |

| | 216,800,000 | | | | 1.420 | | | | 07/17/19 | | | | 216,770,063 | |

| | Federal Farm Credit Bank (Prime Rate – 3.12%) | |

| | 123,000,000 | | | | 1.380 | (a) | | | 01/24/19 | | | | 122,987,757 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.05%) | |

| | 497,200,000 | | | | 1.533 | (a) | | | 07/13/18 | | | | 497,200,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.08%) | |

| | 1,900,000,000 | | | | 1.510 | (a) | | | 03/19/19 | | | | 1,900,000,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.09%) | |

| | 147,750,000 | | | | 1.498 | (a) | | | 01/14/19 | | | | 147,750,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.10%) | |

| | 903,750,000 | | | | 1.495 | (a) | | | 04/18/19 | | | | 903,750,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.14%) | |

| | 168,800,000 | | | | 1.450 | (a) | | | 05/18/18 | | | | 168,800,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.15%) | |

| | 241,300,000 | | | | 1.445 | (a) | | | 05/18/18 | | | | 241,300,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.16%)(a) | |

| | 739,500,000 | | | | 1.461 | | | | 05/25/18 | | | | 739,500,000 | |

| | 394,600,000 | | | | 1.471 | | | | 05/25/18 | | | | 394,600,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.17%) | |

| | 295,000,000 | | | | 1.456 | (a) | | | 05/25/18 | | | | 295,000,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR – 0.18%)(a) | |

| | 2,370,000,000 | | | | 1.405 | | | | 06/06/18 | | | | 2,370,000,000 | |

| | 492,500,000 | | | | 1.405 | | | | 06/07/18 | | | | 492,500,000 | |

| | 1,145,500,000 | | | | 1.404 | | | | 06/08/18 | | | | 1,145,500,000 | |

| | Federal Home Loan Bank (1 Mo. LIBOR + 0.01%)(a) | |

| | 741,200,000 | | | | 1.600 | | | | 06/19/18 | | | | 741,200,000 | |

| | 494,020,000 | | | | 1.658 | | | | 06/28/18 | | | | 494,020,000 | |

| | Federal Home Loan Bank (3 Mo. LIBOR – 0.16%) | |

| | 993,000,000 | | | | 1.321 | (a) | | | 06/01/18 | | | | 993,000,000 | |

| | Federal Home Loan Bank (3 Mo. LIBOR – 0.17%)(a) | |

| | 238,060,000 | | | | 1.418 | | | | 03/15/18 | | | | 238,060,000 | |

| | 238,060,000 | | | | 1.430 | | | | 03/16/18 | | | | 238,059,509 | |

| | Federal Home Loan Bank (3 Mo. LIBOR – 0.22%)(a) | |

| | 496,000,000 | | | | 1.455 | | | | 03/23/18 | | | | 496,000,000 | |

| | 98,700,000 | | | | 1.484 | | | | 07/09/18 | | | | 98,698,163 | |

| | 148,100,000 | | | | 1.489 | | | | 07/12/18 | | | | 148,097,281 | |

| | Federal Home Loan Bank Discount Note | |

| | 465,000,000 | | | | 1.447 | | | | 03/23/18 | | | | 464,597,620 | |

| | Overseas Private Investment Corp. (3 Mo. U.S. T-Bill + 0.00%)(a)(d) | |

| | 74,600,000 | | | | 1.600 | | | | 03/07/18 | | | | 74,600,000 | |

| | 180,240,535 | | | | 1.620 | | | | 03/07/18 | | | | 180,240,535 | |

| | 63,926,407 | | | | 1.650 | | | | 03/07/18 | | | | 63,926,407 | |

| | 337,571,248 | | | | 1.710 | | | | 03/07/18 | | | | 337,571,249 | |

| | |

| TOTAL U.S. GOVERNMENT

AGENCY OBLIGATIONS |

| | $ | 15,368,172,461 | |

| | |

| U.S. Treasury Obligations – 28.5% | |

| | United States Treasury Bills | |

| $ | 1,100,000 | | | | 1.327 | % | | | 03/15/18 | | | $ | 1,099,444 | |

| | 779,100,000 | | | | 1.513 | (b) | | | 03/29/18 | | | | 778,203,170 | |

| | 208,400,000 | | | | 1.515 | (b) | | | 03/29/18 | | | | 208,159,703 | |

| | 3,100,000,000 | | | | 1.528 | (b) | | | 03/29/18 | | | | 3,096,395,389 | |

| | 1,157,400,000 | | | | 1.463 | | | | 04/19/18 | | | | 1,155,147,251 | |

| | 1,452,700,000 | | | | 1.473 | | | | 04/19/18 | | | | 1,449,852,708 | |

| | 111,400,000 | | | | 1.432 | | | | 04/26/18 | | | | 111,157,396 | |

| | 190,100,000 | | | | 1.442 | | | | 04/26/18 | | | | 189,683,047 | |

| | 57,600,000 | | | | 1.571 | | | | 04/26/18 | | | | 57,462,464 | |

| | 88,100,000 | | | | 1.471 | (b) | | | 05/31/18 | | | | 87,780,430 | |

| | 36,500,000 | | | | 1.685 | (b) | | | 05/31/18 | | | | 36,348,226 | |

| | 30,600,000 | | | | 1.494 | | | | 06/07/18 | | | | 30,476,299 | |

| | 1,299,200,000 | | | | 1.497 | | | | 06/14/18 | | | | 1,293,667,574 | |

| | 1,666,400,000 | | | | 1.518 | | | | 06/21/18 | | | | 1,658,727,156 | |

| | 80,300,000 | | | | 1.702 | | | | 06/21/18 | | | | 79,885,295 | |

| | 6,200,000 | | | | 1.569 | | | | 06/28/18 | | | | 6,168,643 | |

| | 204,900,000 | | | | 1.611 | | | | 07/05/18 | | | | 203,774,075 | |

| | 14,400,000 | | | | 1.739 | | | | 07/05/18 | | | | 14,314,572 | |

| | 27,800,000 | | | | 1.744 | | | | 07/05/18 | | | | 27,634,590 | |

| | 37,300,000 | | | | 1.595 | | | | 07/12/18 | | | | 37,085,717 | |

| | 98,800,000 | | | | 1.601 | | | | 07/12/18 | | | | 98,230,583 | |

| | 68,300,000 | | | | 1.632 | | | | 07/19/18 | | | | 67,877,678 | |

| | 63,600,000 | | | | 1.637 | | | | 07/19/18 | | | | 63,205,503 | |

| | 4,845,700,000 | | | | 1.871 | | | | 08/23/18 | | | | 4,802,829,020 | |

| | 12,500,000 | | | | 1.866 | (b) | | | 08/30/18 | | | | 12,385,302 | |

| | 113,000,000 | | | | 1.876 | (b) | | | 08/30/18 | | | | 111,957,418 | |

| | 1,628,800,000 | | | | 1.882 | (b) | | | 08/30/18 | | | | 1,613,730,880 | |

| | 17,600,000 | | | | 1.887 | (b) | | | 08/30/18 | | | | 17,436,726 | |

| United States Treasury Floating Rate Note (3 Mo. U.S. T-Bill

MMY + 0.05%) |

|

| | 6,935,000,000 | | | | 1.700 | (a) | | | 10/31/19 | | | | 6,936,270,485 | |

| United States Treasury Floating Rate Note (3 Mo. U.S. T-Bill

MMY + 0.17%) |

|

| | 165,000,000 | | | | 1.822 | (a) | | | 10/31/18 | | | | 165,244,214 | |

| | United States Treasury Note | |

| | 217,000,000 | | | | 0.750 | (b) | | | 07/31/18 | | | | 216,036,234 | |

| | |

| TOTAL U.S. TREASURY

OBLIGATIONS |

| | $ | 24,628,227,192 | |

| | |

| TOTAL INVESTMENTS BEFORE

REPURCHASE AGREEMENTS |

| | $ | 39,996,399,653 | |

| | |

| | | | | | |

| Repurchase Agreements-Unaffiliated Issuers(c) – 58.3% | |

| | Barclays Capital, Inc. | |

| $ | 300,000,000 | | | | 1.350 | % | | | 03/01/18 | | | $ | 300,000,000 | |

| | Maturity Value: $300,011,250 | |

| Collateralized by Federal Home Loan Bank, 0.000%, due

05/02/18 and Federal Home Loan Mortgage Corp., 2.375%,

due 02/16/21. The aggregate market value of the collateral,

including accrued interest, was $306,000,297. |

|

| | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL SQUARE GOVERNMENT FUND

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Amortized

Cost | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | BNP Paribas | |

| $ | 305,000,000 | | | | 1.250 | % | | | 03/01/18 | | | $ | 305,000,000 | |

| | Maturity Value: $305,010,590 | |

| Collateralized by a U.S. Treasury Bond, 3.000%, due 11/15/44,

U.S. Treasury Interest-Only Stripped Securities, 0.000%, due

11/15/30 to 11/15/38 and U.S. Treasury Notes, 0.875% to

2.000%, due 12/31/18 to 11/15/22. The aggregate market value

of the collateral, including accrued interest, was $311,100,063. |

|

| | 890,000,000 | | | | 1.340 | | | | 03/01/18 | | | | 890,000,000 | |

| | Maturity Value: $890,993,833 | |

| | Settlement Date: 01/30/18 | |

| Collateralized by a U.S. Treasury Bond, 3.125%, due 11/15/41,

U.S. Treasury Interest-Only Stripped Securities, 0.000%, due

05/15/28 to 02/15/33 and U.S. Treasury Notes, 1.250% to

3.625%, due 10/31/18 to 11/15/26. The aggregate market value

of the collateral, including accrued interest, was $907,800,001. |

|

| | 35,900,000 | | | | 1.370 | | | | 03/01/18 | | | | 35,900,000 | |

| | Maturity Value: $35,901,366 | |

| Collateralized by Federal Farm Credit Bank, 1.875%, due

06/02/22, Federal Home Loan Mortgage Corp., 4.000% to

7.500%, due 04/01/28 to 08/01/47, Federal National Mortgage

Association, 2.500% to 7.000%, due 09/01/22 to 01/01/45, a

U.S. Treasury Interest-Only Stripped Security, 0.000%, due

05/15/20 and U.S. Treasury Notes, 0.875% to 1.750%, due

05/31/18 to 11/30/19. The aggregate market value of the

collateral, including accrued interest, was $36,919,307. |

|

| | 800,000,000 | | | | 1.380 | | | | 03/01/18 | | | | 800,000,000 | |

| | Maturity Value: $800,030,667 | |

| Collateralized by a U.S. Treasury Inflation-Indexed Note, 0.125%,

due 07/15/22. The market value of the collateral, including

accrued interest, was $816,000,000. |

|

| | 1,300,000,000 | | | | 1.380 | | | | 03/01/18 | | | | 1,300,000,000 | |

| | Maturity Value: $1,300,049,833 | |

| Collateralized by a U.S. Treasury Inflation-Indexed Note, 0.125%,

due 01/15/23. The market value of the collateral, including

accrued interest, was $1,326,000,000. |

|

| | 1,500,000,000 | | | | 1.380 | | | | 03/01/18 | | | | 1,500,000,000 | |

| | Maturity Value: $1,500,057,500 | |

| Collateralized by a U.S. Treasury Inflation-Indexed Note, 0.125%,

due 04/15/18. The market value of the collateral, including

accrued interest, was $1,530,000,000. |

|

| | 890,000,000 | | | | 1.340 | | | | 03/02/18 | | | | 890,000,000 | |

| | Maturity Value: $890,993,833 | |

| | Settlement Date: 01/31/18 | |

| Collateralized by U.S. Treasury Bonds, 2.750% to 9.125%, due

05/15/18 to 11/15/43, U.S. Treasury Inflation-Indexed Bonds,

2.000% to 2.375%, due 01/15/25 to 01/15/26, a U.S. Treasury

Inflation-Indexed Note, 0.125%, due 07/15/26, U.S. Treasury

Interest-Only Stripped Securities, 0.000%, due 02/15/25 to

11/15/42, U.S. Treasury Notes, 1.250% to 2.750%, due

10/31/18 to 01/31/24 and U.S. Treasury Principal-Only

Stripped Securities, 0.000%, due 11/15/27 to 11/15/45. The

aggregate market value of the collateral, including accrued

interest, was $907,799,998. |

|

| | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | BNP Paribas – (continued) | |

| 100,000,000 | | | | 1.340 | %(d) | | | 03/07/18 | | | | 100,000,000 | |

| | Maturity Value: $100,364,778 | |

| | Settlement Date: 12/14/17 | |

| Collateralized by U.S. Treasury Bills, 0.000%, due 05/17/18 to

08/09/18, a U.S. Treasury Bond, 3.125%, due 11/15/41, U.S.

Treasury Inflation-Indexed Bonds, 1.000% to 3.875%, due

04/15/29 to 02/15/48, a U.S. Treasury Inflation-Indexed Note,

0.375%, due 07/15/25, U.S. Treasury Interest-Only Stripped

Securities, 0.000%, due 11/15/28 to 05/15/41 and U.S. Treasury

Notes, 0.750% to 1.250%, due 02/15/19 to 01/31/20. The

aggregate market value of the collateral, including accrued

interest, was $102,000,001. |

|

| | 750,000,000 | | | | 1.350 | (d) | | | 03/07/18 | | | | 750,000,000 | |

| | Maturity Value: $750,843,750 | |

| | Settlement Date: 02/06/18 | |

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to

4.500%, due 01/01/27 to 12/01/47, Federal National Mortgage

Association, 2.000% to 5.000%, due 07/01/26 to 02/01/48,

Government National Mortgage Association, 2.500% to

4.500%, due 12/15/26 to 06/20/47, U.S. Treasury Bonds,

3.000% to 3.750%, due 11/15/43 to 11/15/44, U.S. Treasury

Inflation-Indexed Notes, 0.125% to 1.125%, due 01/15/21 to

07/15/22 and U.S. Treasury Notes, 0.750% to 1.500%, due

08/31/18 to 09/30/21. The aggregate market value of the

collateral, including accrued interest, was $771,144,694. |

|

| | 495,000,000 | | | | 1.360 | (d) | | | 03/07/18 | | | | 495,000,000 | |

| | Maturity Value: $495,579,700 | |

| | Settlement Date: 02/09/18 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to

7.500%, due 06/01/23 to 01/01/48, Federal National Mortgage

Association, 3.000% to 7.000%, due 08/01/18 to 02/01/57,

Government National Mortgage Association, 3.000% to

7.000%, due 08/15/29 to 04/20/47, a U.S. Treasury Bond,

3.750%, due 11/15/43, U.S. Treasury Notes, 1.000% to

2.000%, due 03/15/19 to 11/30/22 and a U.S. Treasury

Principal-Only Stripped Security, 0.000%, due 02/15/44. The

aggregate market value of the collateral, including accrued

interest, was $509,703,893. |

|

| | 500,000,000 | | | | 1.360 | (d) | | | 03/07/18 | | | | 500,000,000 | |

| | Maturity Value: $501,851,112 | |

| | Settlement Date: 12/14/17 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to

7.500%, due 01/01/28 to 11/01/47, Federal National Mortgage

Association, 3.000% to 6.000%, due 08/01/25 to 11/01/46,

Government National Mortgage Association, 2.500% to

7.000%, due 12/15/26 to 12/20/47, a U.S. Treasury Bill,

0.000%, due 06/14/18, U.S. Treasury Inflation-Indexed Bonds,

0.625% to 1.000%, due 02/15/43 to 02/15/48, a U.S. Treasury

Inflation-Indexed Note, 0.125%, due 04/15/18 and U.S.

Treasury Notes, 1.500% to 1.875%, due 08/31/18 to 12/31/19.

The aggregate market value of the collateral, including accrued

interest, was $513,272,548. |

|

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

FINANCIAL SQUARE GOVERNMENT FUND

Schedule of Investments (continued)

February 28, 2018 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Amortized

Cost | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | BNP Paribas (Overnight MBS + 0.02%) | |

| $ | 500,000,000 | | | | 1.390 | %(a)(d) | | | 03/01/18 | | | $ | 500,000,000 | |

| | Maturity Value: $514,498,468 | |

| | Settlement Date: 02/23/16 | |

| Collateralized by Federal Home Loan Bank, 0.875%, due

08/05/19, Federal Home Loan Mortgage Corp., 3.000% to

7.500%, due 08/01/25 to 09/01/47, Federal Home Loan

Mortgage Corp. Stripped Security, 0.000%, due 07/15/32,

Federal National Mortgage Association, 2.500% to 6.000%,

due 10/01/25 to 02/01/48, Government National Mortgage

Association, 3.000% to 5.000%, due 06/20/39 to 04/20/47, U.S.

Treasury Bonds, 3.125% to 3.750%, due 02/15/43 to 11/15/43,

a U.S. Treasury Inflation-Indexed Bond, 0.750%, due 02/15/42,

U.S. Treasury Interest-Only Stripped Securities, 0.000%, due

08/15/29 to 11/15/41 and U.S. Treasury Notes, 0.750% to

2.125%, due 04/30/18 to 03/31/24. The aggregate market value

of the collateral, including accrued interest, was $514,155,626. |

|

| | 550,000,000 | | | | 1.390 | (a)(d) | | | 03/01/18 | | | | 550,000,000 | |

| | Maturity Value: $565,799,662 | |

| | Settlement Date: 02/23/16 | |

| Collateralized by Federal Farm Credit Bank, 1.300%, due

02/01/19, Federal Home Loan Mortgage Corp., 3.000% to

4.500%, due 09/01/32 to 11/01/47, Federal Home Loan

Mortgage Corp. Stripped Security, 0.000%, due 07/15/32,

Federal National Mortgage Association, 3.000% to 5.000%,

due 01/01/27 to 12/01/47, Government National Mortgage

Association, 2.500% to 7.000%, due 10/15/26 to 11/20/47, a

U.S. Treasury Bill, 0.000%, due 07/05/18, U.S. Treasury

Bonds, 2.250% to 3.750%, due 11/15/43 to 08/15/46, a U.S.

Treasury Inflation-Indexed Bond, 2.375%, due 01/15/25, U.S.

Treasury Interest-Only Stripped Securities, 0.000%, due

08/15/23 to 05/15/45, U.S. Treasury Notes, 1.750% to 3.375%,

due 11/15/19 to 09/30/24 and U.S. Treasury Principal-Only

Stripped Securities, 0.000%, due 02/15/37 to 11/15/45. The

aggregate market value of the collateral, including accrued

interest, was $564,270,267. |

|

| | |

| | CIBC Wood Gundy Securities | |

| | 100,000,000 | | | | 1.350 | | | | 03/01/18 | | | | 100,000,000 | |

| | Maturity Value: $100,003,750 | |

| Collateralized by a U.S. Treasury Inflation-Indexed Bond,

3.625%, due 04/15/28 and U.S. Treasury Notes, 1.125% to

2.375%, due 01/15/19 to 05/15/27. The aggregate market value

of the collateral, including accrued interest, was $102,000,212. |

|

| | 2,000,000,000 | | | | 1.370 | | | | 03/01/18 | | | | 2,000,000,000 | |

| | Maturity Value: $2,000,076,111 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.000% to

8.500%, due 11/01/21 to 02/01/48, Federal National Mortgage

Association, 2.500% to 7.000%, due 08/01/18 to 02/01/48,

Government National Mortgage Association, 3.000% to

3.500%, due 11/20/46 to 08/20/47, a U.S. Treasury Bond,

2.875%, due 11/15/46, a U.S. Treasury Inflation-Indexed Bond,

3.625%, due 04/15/28 and U.S. Treasury Notes, 1.125% to

2.125%, due 01/15/19 to 02/15/25. The aggregate market value

of the collateral, including accrued interest, was

$2,058,968,818. |

|

| | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | Citibank N.A. | |

| 1,000,000,000 | | | | 1.390 | | | | 03/07/18 | | | | 1,000,000,000 | |

| | Maturity Value: $1,000,270,278 | |

| Collateralized by Federal Farm Credit Bank, 1.400% to 3.490%,

due 11/12/20 to 03/02/37, Federal Home Loan Bank, 1.530% to

1.538%, due 12/06/19 to 01/23/20, Federal Home Loan

Mortgage Corp., 2.500% to 11.000%, due 06/01/19 to

01/01/48, Federal National Mortgage Association, 2.500% to

11.000%, due 03/01/18 to 02/01/48, Government National

Mortgage Association, 2.500% to 9.000%, due 11/15/18 to

02/20/48, Tennessee Valley Authority, 3.500%, due 12/15/42, a

U.S. Treasury Bill, 0.000%, due 01/03/19, U.S. Treasury

Bonds, 3.625% to 7.625%, due 11/15/22 to 02/15/44, U.S.

Treasury Floating Rate Notes, 1.722% to 1.822%, due 10/31/18

to 04/30/19, U.S. Treasury Inflation-Indexed Bonds, 0.625% to

1.375%, due 02/15/43 to 02/15/47, U.S. Treasury Inflation-

Indexed Notes, 0.125% to 1.250%, due 07/15/20 to 07/15/26

and U.S. Treasury Notes, 0.750% to 3.625%, due 05/15/18 to

08/15/26. The aggregate market value of the collateral,

including accrued interest, was $1,020,000,009. |

|

| | |

| | Citigroup Global Markets, Inc. | |

| | 303,600,000 | | | | 1.370 | | | | 03/01/18 | | | | 303,600,000 | |

| | Maturity Value: $303,611,554 | |

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to

4.000%, due 04/01/27 to 01/01/44, Federal National Mortgage

Association, 4.500%, due 04/01/46, U.S. Treasury Bills,

0.000%, due 03/01/18 to 10/11/18, a U.S. Treasury Bond,

2.500%, due 02/15/45, U.S. Treasury Inflation-Indexed Bonds,

0.875% to 1.375%, due 02/15/44 to 02/15/47, U.S. Treasury

Notes, 0.875% to 2.750%, due 03/15/18 to 11/15/27 and U.S.

Treasury Principal-Only Stripped Securities, 0.000%, due

02/15/42 to 11/15/46. The aggregate market value of the

collateral, including accrued interest, was $309,672,006. |

|

| | |

| | Credit Agricole Corporate and Investment Bank | |

| | 100,000,000 | | | | 1.320 | | | | 03/01/18 | | | | 100,000,000 | |

| | Maturity Value: $100,003,667 | |

| Collateralized by U.S. Treasury Bonds, 2.500% to 3.000%, due

11/15/44 to 05/15/46, U.S. Treasury Notes, 1.250% to 1.625%,

due 11/30/18 to 10/31/23 and U.S. Treasury Principal-Only

Stripped Securities, 0.000%, due 05/15/44 to 08/15/44. The

aggregate market value of the collateral, including accrued

interest, was $102,000,021. |

|

| | 200,000,000 | | | | 1.320 | | | | 03/01/18 | | | | 200,000,000 | |

| | Maturity Value: $200,007,333 | |

| Collateralized by U.S. Treasury Bonds, 2.500% to 3.000%, due

11/15/44 to 05/15/46, U.S. Treasury Notes, 1.250% to 1.625%,

due 11/30/18 to 10/31/23 and U.S. Treasury Principal-Only

Stripped Securities, 0.000%, due 11/15/41 to 08/15/44. The

aggregate market value of the collateral, including accrued

interest, was $204,000,030. |

|

| | |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL SQUARE GOVERNMENT FUND

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Amortized

Cost | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | Credit Agricole Corporate and Investment Bank – (continued) | |

| $ | 500,000,000 | | | | 1.370 | % | | | 03/01/18 | | | $ | 500,000,000 | |

| | Maturity Value: $500,019,028 | |

| Collateralized by a U.S. Treasury Inflation-Indexed Note, 0.250%,

due 01/15/25 and U.S. Treasury Notes, 1.250% to 2.500%, due

12/15/18 to 11/15/24. The aggregate market value of the

collateral, including accrued interest, was $510,000,018. |

|

| | |

| | Daiwa Capital Markets America Inc. | |

| | 95,098,038 | | | | 1.400 | | | | 03/01/18 | | | | 95,098,038 | |

| | Maturity Value: $95,101,736 | |

| Collateralized by a U.S. Treasury Note, 1.375%, due 01/31/21.

The market value of the collateral, including accrued interest,

was $96,999,999. |

|

| | 104,901,962 | | | | 1.400 | | | | 03/01/18 | | | | 104,901,962 | |

| | Maturity Value: $104,906,042 | |

| Collateralized by a U.S. Treasury Note, 1.125%, due 05/31/19.

The market value of the collateral, including accrued interest,

was $107,000,001. |

|

| | 123,401,192 | | | | 1.400 | | | | 03/01/18 | | | | 123,401,192 | |

| | Maturity Value: $123,405,991 | |

| Collateralized by a U.S. Treasury Note, 8.125%, due 08/15/19.

The market value of the collateral, including accrued interest,

was $125,869,216. |

|

| | 143,382,351 | | | | 1.400 | | | | 03/01/18 | | | | 143,382,351 | |

| | Maturity Value: $143,387,927 | |

| Collateralized by a U.S. Treasury Note, 2.375%, due 08/15/24.

The market value of the collateral, including accrued interest,

was $146,249,998. |

|

| | 210,198,526 | | | | 1.400 | | | | 03/01/18 | | | | 210,198,526 | |

| | Maturity Value: $210,206,700 | |

| Collateralized by a U.S. Treasury Note, 1.875%, due 01/31/22.

The market value of the collateral, including accrued interest,

was $214,402,497. |

|

| | 286,029,408 | | | | 1.400 | | | | 03/01/18 | | | | 286,029,408 | |

| | Maturity Value: $286,040,531 | |

| Collateralized by a U.S. Treasury Note, 2.125%, due 03/31/24.

The market value of the collateral, including accrued interest,

was $291,749,996. |

|

| | 330,698,522 | | | | 1.400 | | | | 03/01/18 | | | | 330,698,522 | |

| | Maturity Value: $330,711,382 | |

| Collateralized by a U.S. Treasury Note, 2.125%, due 02/29/24.

The market value of the collateral, including accrued interest,

was $337,312,492. |

|

| | 380,392,152 | | | | 1.400 | | | | 03/01/18 | | | | 380,392,152 | |

| | Maturity Value: $380,406,945 | |

| Collateralized by a U.S. Treasury Note, 1.375%, due 04/30/21.

The market value of the collateral, including accrued interest,

was $387,999,995. |

|

| | 402,450,976 | | | | 1.400 | | | | 03/01/18 | | | | 402,450,976 | |

| | Maturity Value: $402,466,627 | |

| Collateralized by a U.S. Treasury Note, 3.625%, due 02/15/20.

The market value of the collateral, including accrued interest,

was $410,499,996. |

|

| | 423,446,873 | | | | 1.400 | | | | 03/01/18 | | | | 423,446,873 | |

| | Maturity Value: $423,463,340 | |

| Collateralized by a U.S. Treasury Bond, 3.750%, due 11/15/43.

The market value of the collateral, including accrued interest,

was $431,915,810. |

|

| | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | Deutsche Bank Securities, Inc. | |

| 250,000,000 | | | | 1.400 | | | | 03/01/18 | | | | 250,000,000 | |

| | Maturity Value: $250,009,722 | |

| Collateralized by U.S. Treasury Interest-Only Stripped Securities,

0.000%, due 08/15/18 to 02/15/28 and U.S. Treasury Principal-

Only Stripped Securities, 0.000%, due 05/15/18 to 11/15/27.

The aggregate market value of the collateral, including accrued

interest, was $254,999,999. |

|

| | |

| | Fixed Income Clearing Corp. | |

| | 415,000,000 | | | | 1.330 | | | | 03/01/18 | | | | 415,000,000 | |

| | Maturity Value: $415,015,332 | |

| Collateralized by U.S. Treasury Notes, 1.625% to 2.250%, due

11/15/24 to 05/15/26. The aggregate market value of the

collateral, including accrued interest, was $423,300,083. |

|

| | 825,000,000 | | | | 1.330 | | | | 03/01/18 | | | | 825,000,000 | |

| | Maturity Value: $825,030,479 | |

| Collateralized by U.S. Treasury Notes, 1.125% to 2.000%, due

01/31/19 to 01/31/22. The aggregate market value of the

collateral, including accrued interest, was $841,500,069. |

|

| | 415,000,000 | | | | 1.350 | | | | 03/01/18 | | | | 415,000,000 | |

| | Maturity Value: $415,015,563 | |

| Collateralized by a U.S. Treasury Bond, 3.000%, due 05/15/47

and U.S. Treasury Notes, 0.750% to 1.500%, due 09/30/18 to

12/31/18. The aggregate market value of the collateral,

including accrued interest, was $423,300,023. |

|

| | 9,150,000,000 | | | | 1.390 | | | | 03/01/18 | | | | 9,150,000,000 | |

| | Maturity Value: $9,150,353,292 | |

| Collateralized by U.S. Treasury Bonds, 2.500% to 3.375%, due

05/15/44 to 05/15/46, a U.S. Treasury Inflation-Indexed Note,

0.125%, due 04/15/20 and U.S. Treasury Notes, 1.500% to

3.625%, due 12/31/18 to 05/15/26. The aggregate market value

of the collateral, including accrued interest, was $9,333,000,089. |

|

| | |

| | HSBC Bank PLC | |

| | 600,000,000 | | | | 1.380 | | | | 03/01/18 | | | | 600,000,000 | |

| | Maturity Value: $600,023,000 | |

| Collateralized by a U.S. Treasury Bill, 0.000%, due 06/28/18,

U.S. Treasury Bonds, 0.750% to 4.500%, due 01/15/26 to

08/15/47 and U.S. Treasury Notes, 0.125% to 3.125%, due

04/15/18 to 01/15/26. The aggregate market value of the

collateral, including accrued interest, was $612,000,072. |

|

| | |

| | ING Financial Markets LLC | |

| | 250,000,000 | | | | 1.380 | | | | 03/01/18 | | | | 250,000,000 | |

| | Maturity Value: $250,009,583 | |

| Collateralized by Federal Home Loan Mortgage Corp., 3.500%,

due 08/01/42 and Federal National Mortgage Association,

3.000% to 4.500%, due 02/01/42 to 01/01/48. The aggregate

market value of the collateral, including accrued interest, was

$255,000,001. |

|

| | 300,000,000 | | | | 1.380 | | | | 03/01/18 | | | | 300,000,000 | |

| | Maturity Value: $300,011,500 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to

5.000%, due 04/01/26 to 01/01/48 and Federal National

Mortgage Association, 3.000% to 5.000%, due 03/01/21 to

02/01/48. The aggregate market value of the collateral,

including accrued interest, was $306,000,002. |

|

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 15 |

FINANCIAL SQUARE GOVERNMENT FUND

Schedule of Investments (continued)

February 28, 2018 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Amortized

Cost | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | ING Financial Markets LLC – (continued) | |

| $ | 100,000,000 | | | | 1.420 | %(e) | | | 03/22/18 | | | $ | 100,000,000 | |

| | Maturity Value: $100,386,556 | |

| | Settlement Date: 12/14/17 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.291% to

4.000%, due 09/01/30 to 10/01/47 and Federal National

Mortgage Association, 2.000% to 4.550%, due 11/01/25 to

02/01/48. The aggregate market value of the collateral,

including accrued interest, was $101,999,996. |

|

| | 300,000,000 | | | | 1.420 | (e) | | | 03/22/18 | | | | 300,000,000 | |

| | Maturity Value: $301,147,833 | |

| | Settlement Date: 12/15/17 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.370% to

5.070%, due 10/01/29 to 01/01/48 and Federal National

Mortgage Association, 2.000% to 5.000%, due 03/01/27 to

02/01/48. The aggregate market value of the collateral,

including accrued interest, was $306,000,000. |

|

| | 350,000,000 | | | | 1.420 | (e) | | | 03/22/18 | | | | 350,000,000 | |

| | Maturity Value: $351,339,139 | |

| | Settlement Date: 12/15/17 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.284% to

5.070%, due 07/01/25 to 11/01/47 and Federal National

Mortgage Association, 2.000% to 6.000%, due 02/01/21 to

02/01/48. The aggregate market value of the collateral,

including accrued interest, was $357,000,000. |

|

| | |

| | ING Financial Markets LLC (1 Mo. LIBOR – 0.11%) | |

| | 500,000,000 | | | | 1.469 | (a)(e) | | | 04/10/18 | | | | 500,000,000 | |

| | Maturity Value: $521,427,560 | |

| | Settlement Date: 05/26/15 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.248% to

4.000%, due 09/01/37 to 01/01/48 and Federal National

Mortgage Association, 2.000% to 5.540%, due 03/01/19 to

02/01/48. The aggregate market value of the collateral,

including accrued interest, was $509,999,999. |

|

| | 100,000,000 | | | | 1.473 | (a)(e) | | | 04/13/18 | | | | 100,000,000 | |

| | Maturity Value: $103,756,658 | |

| | Settlement Date: 10/08/15 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.780% to

4.000%, due 02/01/45 to 10/01/47 and Federal National

Mortgage Association, 2.000% to 4.500%, due 07/01/31 to

02/01/48. The aggregate market value of the collateral,

including accrued interest, was $101,999,998. |

|

| | 100,000,000 | | | | 1.484 | (a)(e) | | | 04/20/18 | | | | 100,000,000 | |

| | Maturity Value: $104,187,474 | |

| | Settlement Date: 07/09/15 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to

4.500%, due 11/01/26 to 12/01/47 and Federal National

Mortgage Association, 2.395% to 4.500%, due 08/01/31 to

09/01/47. The aggregate market value of the collateral,

including accrued interest, was $102,000,000. |

|

| | |

| | Joint Repurchase Agreement Account I | |

| | 400,000,000 | | | | 1.353 | | | | 03/01/18 | | | | 400,000,000 | |

| | Maturity Value: $400,015,034 | |

| | |

| | Joint Repurchase Agreement Account III | |

| | 9,803,200,000 | | | | 1.377 | | | | 03/01/18 | | | | 9,803,200,000 | |

| | Maturity Value: $9,803,574,893 | |

| | |

| | Merrill Lynch, Pierce, Fenner & Smith, Inc. | |

| | 87,900,000 | | | | 1.370 | | | | 03/01/18 | | | | 87,900,000 | |

| | Maturity Value: $87,903,345 | |

| Collateralized by U.S. Treasury Notes, 1.375% to 2.000%, due

07/31/18 to 11/15/21. The aggregate market value of the

collateral, including accrued interest, was $89,658,061. |

|

| | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | Merrill Lynch, Pierce, Fenner & Smith, Inc. – (continued) | |

| 17,600,000 | | | | 1.400 | | | | 03/01/18 | | | | 17,600,000 | |

| | Maturity Value: $17,600,684 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to

4.000%, due 04/01/28 to 09/01/47 and Government National

Mortgage Association, 3.500% to 4.000%, due 11/20/47 to

01/20/48. The aggregate market value of the collateral,

including accrued interest, was $18,128,000. |

|

| | 52,000,000 | | | | 1.400 | | | | 03/01/18 | | | | 52,000,000 | |

| | Maturity Value: $52,002,022 | |

| Collateralized by Government National Mortgage Association,

2.500% to 4.500%, due 02/20/33 to 02/20/48. The aggregate

market value of the collateral, including accrued interest, was

$53,560,001. |

|

| | |

| | Merrill Lynch, Pierce, Fenner & Smith, Inc. (OBFR + 0.01%) | |

| | 1,000,000,000 | | | | 1.430 | (a)(e) | | | 06/04/18 | | | | 1,000,000,000 | |

| | Maturity Value: $1,022,919,709 | |

| | Settlement Date: 11/04/16 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to

4.500%, due 03/01/26 to 03/01/48 and Federal National

Mortgage Association, 2.500% to 5.000%, due 12/01/28 to

02/01/48. The aggregate market value of the collateral,

including accrued interest, was $1,029,999,995. |

|

| | |

| | Mitsubishi UFJ Securities (USA), Inc. | |

| | 300,000,000 | | | | 1.370 | | | | 03/01/18 | | | | 300,000,000 | |

| | Maturity Value: $300,011,417 | |

| Collateralized by Federal Home Loan Mortgage Corp., 3.000% to

4.000%, due 01/01/21 to 02/01/47, Federal National Mortgage

Association, 2.500% to 7.000%, due 05/01/25 to 08/01/48 and

Government National Mortgage Association, 3.500% to

8.500%, due 12/20/30 to 01/20/48. The aggregate market value

of the collateral, including accrued interest, was $309,000,000. |

|

| | |

| | Mizuho Securities USA LLC | |

| | 250,000,000 | | | | 1.370 | | | | 03/01/18 | | | | 250,000,000 | |

| | Maturity Value: $250,009,514 | |

| Collateralized by Government National Mortgage Association,

4.000%, due 09/20/47. The market value of the collateral,

including accrued interest, was $257,500,000. |

|

| | |

| | Natixis-New York Branch | |

| | 600,000,000 | | | | 1.370 | | | | 03/01/18 | | | | 600,000,000 | |

| | Maturity Value: $600,022,833 | |

| Collateralized by Federal Home Loan Mortgage Corp., 4.000%,

due 01/01/48, Federal National Mortgage Association, 3.500%

to 5.500%, due 06/01/38 to 04/01/46, Government National

Mortgage Association, 5.000%, due 02/15/48, a U.S. Treasury

Bill, 0.000%, due 06/28/18, U.S. Treasury Bonds, 2.750% to

8.125%, due 05/15/21 to 08/15/42, U.S. Treasury Inflation-

Indexed Bonds, 0.750% to 2.500%, due 01/15/29 to 02/15/42,

U.S. Treasury Inflation-Indexed Notes, 0.125%, due 04/15/18

to 04/15/20 and U.S. Treasury Notes, 0.750% to 3.625%, due

08/31/18 to 05/15/26. The aggregate market value of the

collateral, including accrued interest, was $612,270,023. |

|

| | |

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL SQUARE GOVERNMENT FUND

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Amortized

Cost | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | Nomura Securities International, Inc. | |

| $ | 100,000,000 | | | | 1.380 | % | | | 03/01/18 | | | $ | 100,000,000 | |

| | Maturity Value: $100,003,833 | |

| Collateralized by Federal National Mortgage Association,

4.000%, due 07/01/47, Government National Mortgage

Association, 3.500%, due 02/20/48, a U.S. Treasury Bond,

6.000%, due 02/15/26, a U.S. Treasury Floating Rate Note,

1.652%, due 01/31/20, a U.S. Treasury Inflation-Indexed Bond,

1.000%, due 02/15/48, U.S. Treasury Interest-Only Stripped

Securities, 0.000%, due 08/15/19 to 05/15/42 and U.S. Treasury

Notes, 0.750% to 3.625%, due 04/30/18 to 09/30/21. The

aggregate market value of the collateral, including accrued

interest, was $102,473,820. |

|

| | 1,700,000,000 | | | | 1.400 | | | | 03/01/18 | | | | 1,700,000,000 | |

| | Maturity Value: $1,700,066,111 | |

| Collateralized by Federal Home Loan Mortgage Corp., 2.500% to

9.500%, due 03/01/18 to 01/01/48, Federal National Mortgage

Association, 2.000% to 8.500%, due 03/01/18 to 03/01/48,

Government National Mortgage Association, 2.100% to

9.000%, due 03/15/18 to 02/20/48, Tennessee Valley Authority,

0.000% to 2.875%, due 02/01/27 to 07/15/29, a U.S. Treasury

Inflation-Indexed Bond, 1.000%, due 02/15/46, a U.S. Treasury

Note, 2.000%, due 11/15/26 and a U.S. Treasury Principal-

Only Stripped Security, 0.000%, due 05/15/38. The aggregate

market value of the collateral, including accrued interest, was

$1,749,546,208. |

|

| | 1,000,000,000 | | | | 1.400 | | | | 03/07/18 | | | | 1,000,000,000 | |

| | Maturity Value: $1,000,272,222 | |

| Collateralized by Federal Farm Credit Bank, 1.501%, due

03/27/19, Federal Home Loan Mortgage Corp., 2.500% to

8.000%, due 05/01/18 to 03/01/48, Federal National Mortgage

Association, 2.500% to 9.500%, due 03/01/18 to 02/01/57,

Government National Mortgage Association, 3.500% to

5.000%, due 10/20/40 to 02/20/48 and a U.S. Treasury Note,

1.625%, due 11/15/22. The aggregate market value of the

collateral, including accrued interest, was $1,029,570,138. |

|

| | |

| | Norinchukin Bank | |

| | 415,000,000 | | | | 1.370 | | | | 03/01/18 | | | | 415,000,000 | |

| | Maturity Value: $416,437,168 | |

| | Settlement Date: 11/30/17 | |

| Collateralized by a U.S. Treasury Bond, 2.500%, due 02/15/45

and U.S. Treasury Inflation-Indexed Notes, 0.375% to 1.125%,

due 01/15/21 to 01/15/27. The aggregate market value of the

collateral, including accrued interest, was $423,300,053. |

|

| | 200,000,000 | | | | 1.390 | (e) | | | 03/07/18 | | | | 200,000,000 | |

| | Maturity Value: $200,687,278 | |

| | Settlement Date: 12/08/17 | |

| Collateralized by a U.S. Treasury Bond, 2.500%, due 02/15/45

and U.S. Treasury Inflation-Indexed Notes, 0.375% to 1.125%,

due 01/15/21 to 01/15/27. The aggregate market value of the

collateral, including accrued interest, was $204,000,014. |

|

| | 250,000,000 | | | | 1.410 | (e) | | | 03/14/18 | | | | 250,000,000 | |

| | Maturity Value: $250,881,250 | |

| | Settlement Date: 12/14/17 | |

| Collateralized by a U.S. Treasury Bond, 2.500%, due 02/15/45

and U.S. Treasury Inflation-Indexed Notes, 0.375% to 1.125%,

due 01/15/21 to 01/15/27. The aggregate market value of the

collateral, including accrued interest, was $255,000,071. |

|

| | |

| Repurchase Agreements-Unaffiliated Issuers(c) – (continued) | |

| | Norinchukin Bank – (continued) | |

| $ | 210,000,000 | | | | 1.410 | %(e) | | | 03/20/18 | | | $ | 210,000,000 | |

| | Maturity Value: $210,337,225 | |

| | Settlement Date: 02/07/18 | |

| Collateralized by a U.S. Treasury Bond, 2.500%, due 02/15/45

and U.S. Treasury Inflation-Indexed Notes, 0.375% to 1.125%,

due 01/15/21 to 01/15/27. The aggregate market value of the

collateral, including accrued interest, was $214,200,071. |

|

| | 210,000,000 | | | | 1.420 | (e) | | | 03/22/18 | | | | 210,000,000 | |

| | Maturity Value: $210,480,433 | |

| | Settlement Date: 01/23/18 | |

| Collateralized by a U.S. Treasury Bond, 2.500%, due 02/15/45

and U.S. Treasury Inflation-Indexed Notes, 0.375% to 1.125%,

due 01/15/21 to 01/15/27. The aggregate market value of the

collateral, including accrued interest, was $214,200,053. |

|

| | 210,000,000 | | | | 1.420 | (e) | | | 03/22/18 | | | | 210,000,000 | |

| | Maturity Value: $210,405,883 | |

| | Settlement Date: 02/01/18 | |

| Collateralized by a U.S. Treasury Bond, 2.500%, due 02/15/45

and U.S. Treasury Inflation-Indexed Notes, 0.375% to 1.125%,

due 01/15/21 to 01/15/27. The aggregate market value of the

collateral, including accrued interest, was $214,200,025. |

|

| | |

| | Northwestern Mutual Life Insurance Company | |

| | 242,187,500 | | | | 1.420 | | | | 03/01/18 | | | | 242,187,500 | |

| | Maturity Value: $242,197,053 | |

| Collateralized by a U.S. Treasury Note, 1.750%, due 11/15/20.

The market value of the collateral, including accrued interest,

was $247,031,250. |

|

| | |

| | Prudential Insurance Company of America (The) | |