UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Copies to:

| | |

Robert Griffith, Esq. Goldman Sachs & Co. LLC 200 West Street New York, NY 10282 | | Stephen H. Bier, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Shareholders for the Goldman Sachs Income Builder Fund and Goldman Sachs Rising Dividend Growth Fund is filed herewith.

Annual Shareholder Report

October 31, 2024

Goldman Sachs Income Builder Fund

This annual shareholder report contains important information about Goldman Sachs Income Builder Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $87 | 0.79% |

How did the Fund perform and what affected its performance?

U.S. equity and fixed income markets were volatile but broadly generated gains as inflation eased and the Federal Reserve began cutting interest rates. Further boosting investor sentiment was optimism about an economic soft landing, favorable corporate earnings reports, improved equity market breadth and AI excitement.

Top Contributors to Performance:

The Fund benefited from its asset allocation positioning, with exposure to both U.S. equities and non-U.S. developed markets equities contributing positively. Exposure to MLP energy infrastructure securities and global infrastructure securities further added to returns. In fixed income, the Fund’s focus on high yield corporate bonds bolstered performance, as high yield corporate bonds broadly outpaced investment grade corporate bonds.

Within the equity sleeve, the Fund was aided by out-of-benchmark positions in Blackstone, a U.S. provider of investment and fund management services, and in Taiwan Semiconductor Manufacturing, a Taiwanese semiconductor foundry. An overweight in U.S. technology company Dell Technologies was also advantageous.

The fixed income sleeve was helped by its cross sector positioning, with investments in high yield corporate bonds, bank loans and investment grade corporate bonds adding to results. Exposure to lower quality credits also contributed positively. Within investment grade corporate bonds, an emphasis on intermediate-term maturities was positive as was selection among financial and industrial credits. The fixed income sleeve also benefited from our duration positioning strategy, as yields rose during the annual period.

Top Detractors from Performance:

The performance of the equity sleeve was hurt by its out-of-benchmark investments in Nestle, a Switzerland-based food and beverage company; Shell, a British oil and gas company; and Rio Tinto, a British-Australian metals and mining company.

Within the fixed income sleeve, individual issue selection among high yield industrial credits detracted slightly from returns.

Information Technology-SS & OW

Communication Service-SS & OW

Consumer Discretionary-SS & UW

The above represents sectors.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

Goldman Sachs Income Builder Fund

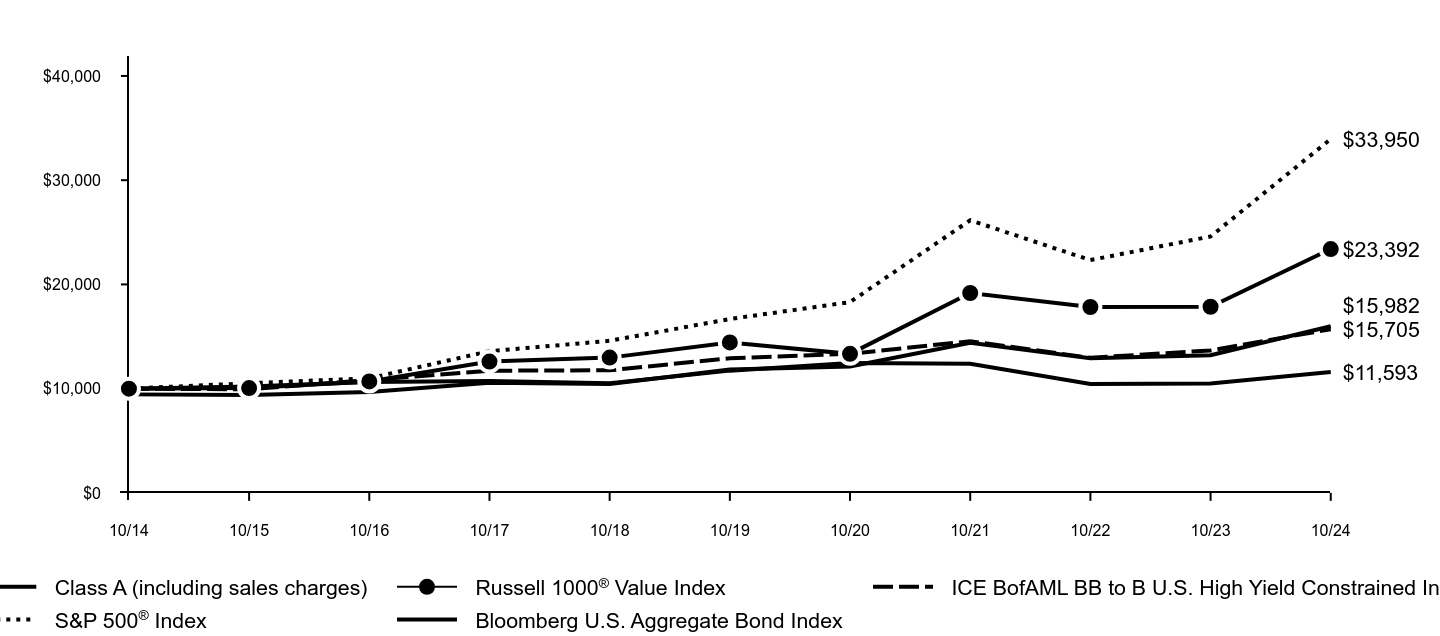

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class A (including sales charges) | Russell 1000® Value Index | ICE BofAML BB to B U.S. High Yield Constrained Index | S&P 500® Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/14 | $9,450 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,384 | $10,053 | $9,940 | $10,520 | $10,196 |

| 10/16 | $9,669 | $10,693 | $10,827 | $10,994 | $10,642 |

| 10/17 | $10,560 | $12,595 | $11,721 | $13,593 | $10,737 |

| 10/18 | $10,451 | $12,977 | $11,760 | $14,591 | $10,517 |

| 10/19 | $11,845 | $14,432 | $12,918 | $16,681 | $11,728 |

| 10/20 | $12,117 | $13,340 | $13,343 | $18,301 | $12,454 |

| 10/21 | $14,408 | $19,178 | $14,551 | $26,155 | $12,394 |

| 10/22 | $12,918 | $17,836 | $12,960 | $22,334 | $10,451 |

| 10/23 | $13,215 | $17,860 | $13,664 | $24,599 | $10,488 |

| 10/24 | $15,982 | $23,392 | $15,705 | $33,950 | $11,593 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A excluding sales charges | 20.94% | 6.17% | 5.39% |

| Class A including sales charges | 14.30% | 4.97% | 4.80% |

Russell 1000® Value Index | 30.98% | 10.13% | 8.86% |

| ICE BofAML BB to B U.S. High Yield Constrained Index | 14.94% | 3.98% | 4.61% |

S&P 500® Index | 38.02% | 15.25% | 12.99% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg U.S. Aggregate Bond Index.

Goldman Sachs Income Builder Fund

| Total Net Assets | $2,484,821,905 |

| # of Portfolio Holdings | 816 |

| Portfolio Turnover Rate | 30% |

| Total Net Advisory Fees Paid | $9,798,671 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Banks | 8.5% |

| Pipelines | 4.4% |

| Insurance | 3.4% |

| Software | 3.3% |

| Media | 3.1% |

| Oil Field Services | 3.1% |

| Pharmaceuticals | 2.8% |

| Diversified Financial Services | 2.7% |

| Oil, Gas & Consumable Fuels | 2.4% |

| Other | 64.1% |

Goldman Sachs Income Builder Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell®”, is/are trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Income Builder Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Income Builder Fund

This annual shareholder report contains important information about Goldman Sachs Income Builder Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| C | $169 | 1.54% |

How did the Fund perform and what affected its performance?

U.S. equity and fixed income markets were volatile but broadly generated gains as inflation eased and the Federal Reserve began cutting interest rates. Further boosting investor sentiment was optimism about an economic soft landing, favorable corporate earnings reports, improved equity market breadth and AI excitement.

Top Contributors to Performance:

The Fund benefited from its asset allocation positioning, with exposure to both U.S. equities and non-U.S. developed markets equities contributing positively. Exposure to MLP energy infrastructure securities and global infrastructure securities further added to returns. In fixed income, the Fund’s focus on high yield corporate bonds bolstered performance, as high yield corporate bonds broadly outpaced investment grade corporate bonds.

Within the equity sleeve, the Fund was aided by out-of-benchmark positions in Blackstone, a U.S. provider of investment and fund management services, and in Taiwan Semiconductor Manufacturing, a Taiwanese semiconductor foundry. An overweight in U.S. technology company Dell Technologies was also advantageous.

The fixed income sleeve was helped by its cross sector positioning, with investments in high yield corporate bonds, bank loans and investment grade corporate bonds adding to results. Exposure to lower quality credits also contributed positively. Within investment grade corporate bonds, an emphasis on intermediate-term maturities was positive as was selection among financial and industrial credits. The fixed income sleeve also benefited from our duration positioning strategy, as yields rose during the annual period.

Top Detractors from Performance:

The performance of the equity sleeve was hurt by its out-of-benchmark investments in Nestle, a Switzerland-based food and beverage company; Shell, a British oil and gas company; and Rio Tinto, a British-Australian metals and mining company.

Within the fixed income sleeve, individual issue selection among high yield industrial credits detracted slightly from returns.

Information Technology-SS & OW

Communication Service-SS & OW

Consumer Discretionary-SS & UW

The above represents sectors.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

Goldman Sachs Income Builder Fund

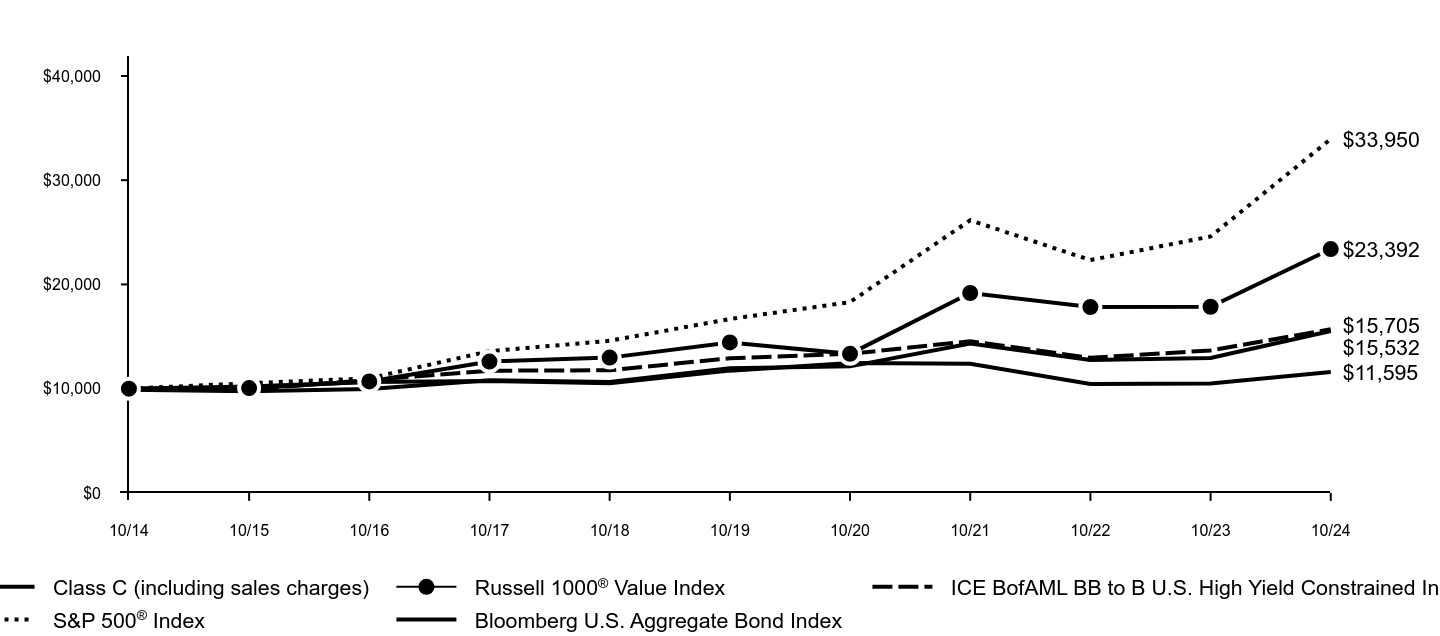

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class C (including sales charges) | Russell 1000® Value Index | ICE BofAML BB to B U.S. High Yield Constrained Index | S&P 500® Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/14 | $9,900 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,757 | $10,053 | $9,940 | $10,520 | $10,196 |

| 10/16 | $9,977 | $10,693 | $10,827 | $10,994 | $10,642 |

| 10/17 | $10,816 | $12,595 | $11,721 | $13,593 | $10,737 |

| 10/18 | $10,628 | $12,977 | $11,760 | $14,591 | $10,517 |

| 10/19 | $11,950 | $14,432 | $12,918 | $16,681 | $11,728 |

| 10/20 | $12,138 | $13,340 | $13,343 | $18,301 | $12,454 |

| 10/21 | $14,324 | $19,178 | $14,551 | $26,155 | $12,394 |

| 10/22 | $12,749 | $17,836 | $12,960 | $22,334 | $10,451 |

| 10/23 | $12,943 | $17,860 | $13,664 | $24,599 | $10,488 |

| 10/24 | $15,532 | $23,392 | $15,705 | $33,950 | $11,595 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class C excluding sales charges | 20.00% | 5.38% | 4.60% |

| Class C including sales charges | 18.96% | 5.38% | 4.60% |

Russell 1000® Value Index | 30.98% | 10.13% | 8.86% |

| ICE BofAML BB to B U.S. High Yield Constrained Index | 14.94% | 3.98% | 4.61% |

S&P 500® Index | 38.02% | 15.25% | 12.99% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg U.S. Aggregate Bond Index.

Goldman Sachs Income Builder Fund

| Total Net Assets | $2,484,821,905 |

| # of Portfolio Holdings | 816 |

| Portfolio Turnover Rate | 30% |

| Total Net Advisory Fees Paid | $9,798,671 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Banks | 8.5% |

| Pipelines | 4.4% |

| Insurance | 3.4% |

| Software | 3.3% |

| Media | 3.1% |

| Oil Field Services | 3.1% |

| Pharmaceuticals | 2.8% |

| Diversified Financial Services | 2.7% |

| Oil, Gas & Consumable Fuels | 2.4% |

| Other | 64.1% |

Goldman Sachs Income Builder Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell®”, is/are trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Income Builder Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Income Builder Fund

This annual shareholder report contains important information about Goldman Sachs Income Builder Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| P | $50 | 0.45% |

How did the Fund perform and what affected its performance?

U.S. equity and fixed income markets were volatile but broadly generated gains as inflation eased and the Federal Reserve began cutting interest rates. Further boosting investor sentiment was optimism about an economic soft landing, favorable corporate earnings reports, improved equity market breadth and AI excitement.

Top Contributors to Performance:

The Fund benefited from its asset allocation positioning, with exposure to both U.S. equities and non-U.S. developed markets equities contributing positively. Exposure to MLP energy infrastructure securities and global infrastructure securities further added to returns. In fixed income, the Fund’s focus on high yield corporate bonds bolstered performance, as high yield corporate bonds broadly outpaced investment grade corporate bonds.

Within the equity sleeve, the Fund was aided by out-of-benchmark positions in Blackstone, a U.S. provider of investment and fund management services, and in Taiwan Semiconductor Manufacturing, a Taiwanese semiconductor foundry. An overweight in U.S. technology company Dell Technologies was also advantageous.

The fixed income sleeve was helped by its cross sector positioning, with investments in high yield corporate bonds, bank loans and investment grade corporate bonds adding to results. Exposure to lower quality credits also contributed positively. Within investment grade corporate bonds, an emphasis on intermediate-term maturities was positive as was selection among financial and industrial credits. The fixed income sleeve also benefited from our duration positioning strategy, as yields rose during the annual period.

Top Detractors from Performance:

The performance of the equity sleeve was hurt by its out-of-benchmark investments in Nestle, a Switzerland-based food and beverage company; Shell, a British oil and gas company; and Rio Tinto, a British-Australian metals and mining company.

Within the fixed income sleeve, individual issue selection among high yield industrial credits detracted slightly from returns.

Information Technology-SS & OW

Communication Service-SS & OW

Consumer Discretionary-SS & UW

The above represents sectors.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

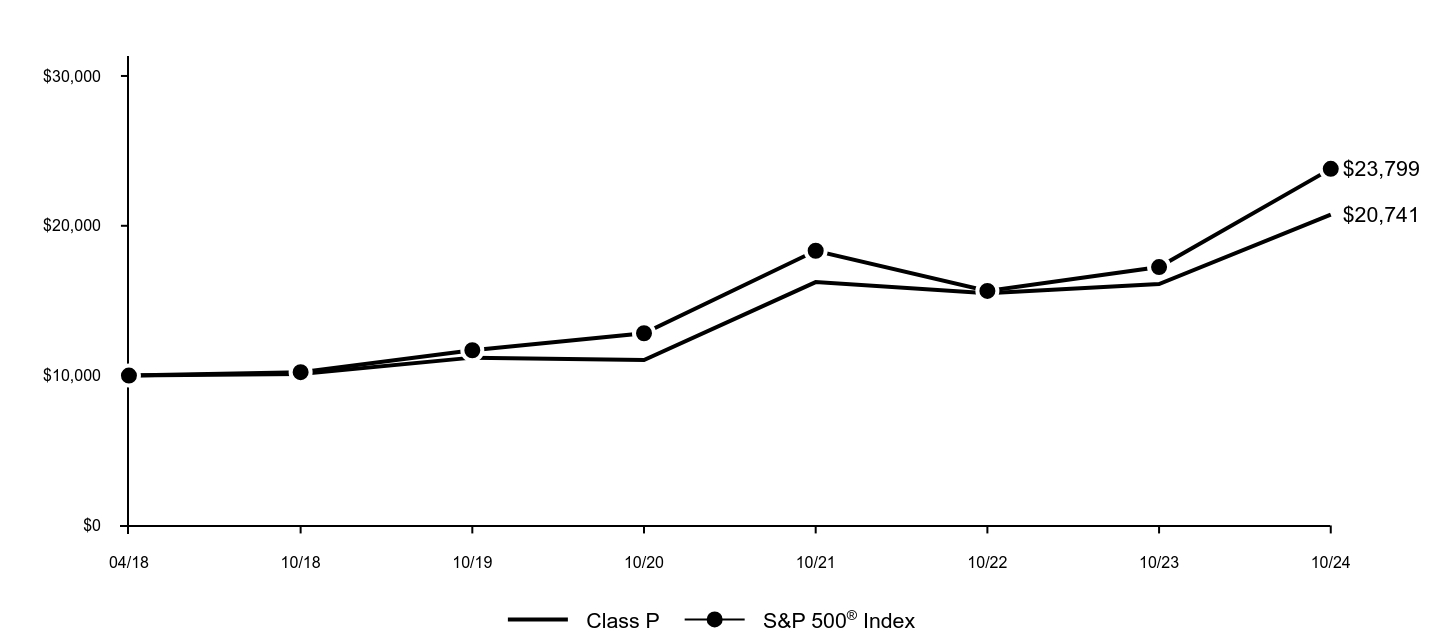

Goldman Sachs Income Builder Fund

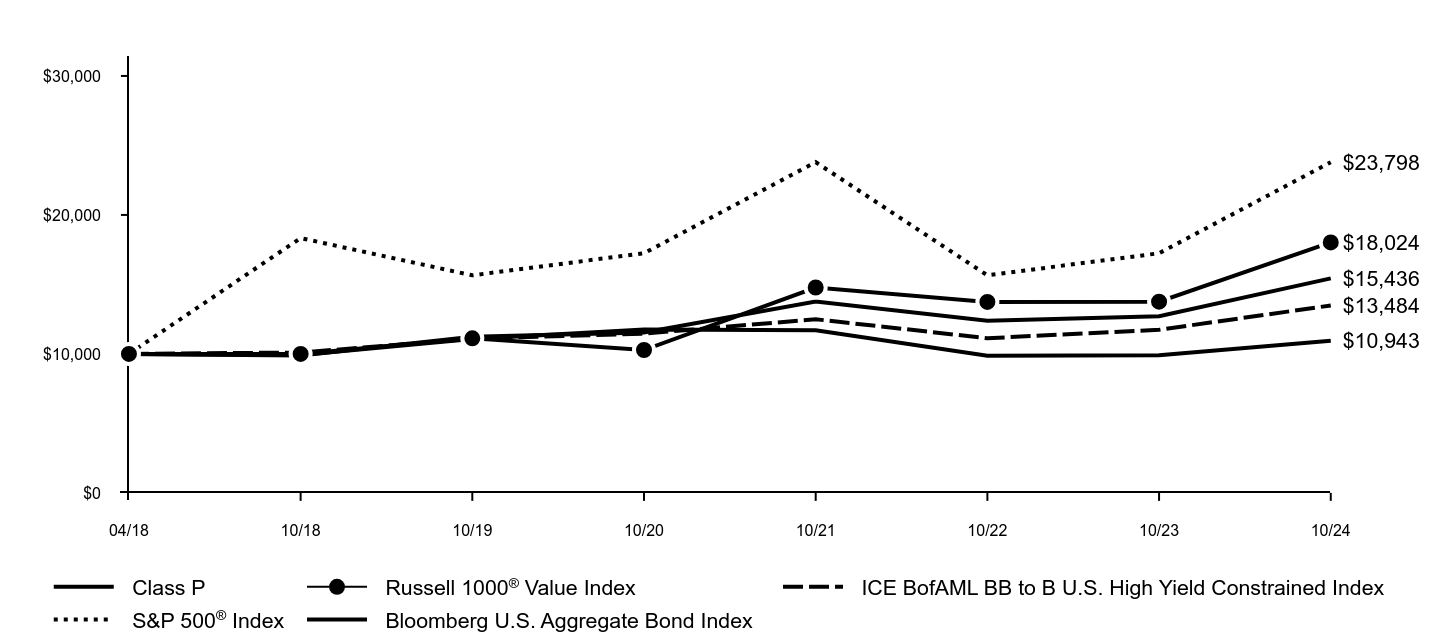

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class P | Russell 1000® Value Index | ICE BofAML BB to B U.S. High Yield Constrained Index | S&P 500® Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 04/18 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/18 | $9,882 | $9,999 | $10,098 | $18,334 | $9,927 |

| 10/19 | $11,243 | $11,120 | $11,091 | $15,655 | $11,070 |

| 10/20 | $11,546 | $10,279 | $11,457 | $17,243 | $11,755 |

| 10/21 | $13,776 | $14,777 | $12,494 | $23,798 | $11,698 |

| 10/22 | $12,391 | $13,743 | $11,128 | $15,655 | $9,864 |

| 10/23 | $12,716 | $13,761 | $11,732 | $17,243 | $9,900 |

| 10/24 | $15,436 | $18,024 | $13,484 | $23,798 | $10,943 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 4/16/18 |

|---|

| Class P | 21.39% | 6.54% | 6.85% |

Russell 1000® Value Index | 30.98% | 10.13% | 9.94% |

| ICE BofAML BB to B U.S. High Yield Constrained Index | 14.94% | 3.98% | 4.67% |

S&P 500® Index | 38.02% | 15.25% | 14.15% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.38% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg U.S. Aggregate Bond Index.

Goldman Sachs Income Builder Fund

| Total Net Assets | $2,484,821,905 |

| # of Portfolio Holdings | 816 |

| Portfolio Turnover Rate | 30% |

| Total Net Advisory Fees Paid | $9,798,671 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Banks | 8.5% |

| Pipelines | 4.4% |

| Insurance | 3.4% |

| Software | 3.3% |

| Media | 3.1% |

| Oil Field Services | 3.1% |

| Pharmaceuticals | 2.8% |

| Diversified Financial Services | 2.7% |

| Oil, Gas & Consumable Fuels | 2.4% |

| Other | 64.1% |

Goldman Sachs Income Builder Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell®”, is/are trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Income Builder Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Income Builder Fund

This annual shareholder report contains important information about Goldman Sachs Income Builder Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $50 | 0.45% |

How did the Fund perform and what affected its performance?

U.S. equity and fixed income markets were volatile but broadly generated gains as inflation eased and the Federal Reserve began cutting interest rates. Further boosting investor sentiment was optimism about an economic soft landing, favorable corporate earnings reports, improved equity market breadth and AI excitement.

Top Contributors to Performance:

The Fund benefited from its asset allocation positioning, with exposure to both U.S. equities and non-U.S. developed markets equities contributing positively. Exposure to MLP energy infrastructure securities and global infrastructure securities further added to returns. In fixed income, the Fund’s focus on high yield corporate bonds bolstered performance, as high yield corporate bonds broadly outpaced investment grade corporate bonds.

Within the equity sleeve, the Fund was aided by out-of-benchmark positions in Blackstone, a U.S. provider of investment and fund management services, and in Taiwan Semiconductor Manufacturing, a Taiwanese semiconductor foundry. An overweight in U.S. technology company Dell Technologies was also advantageous.

The fixed income sleeve was helped by its cross sector positioning, with investments in high yield corporate bonds, bank loans and investment grade corporate bonds adding to results. Exposure to lower quality credits also contributed positively. Within investment grade corporate bonds, an emphasis on intermediate-term maturities was positive as was selection among financial and industrial credits. The fixed income sleeve also benefited from our duration positioning strategy, as yields rose during the annual period.

Top Detractors from Performance:

The performance of the equity sleeve was hurt by its out-of-benchmark investments in Nestle, a Switzerland-based food and beverage company; Shell, a British oil and gas company; and Rio Tinto, a British-Australian metals and mining company.

Within the fixed income sleeve, individual issue selection among high yield industrial credits detracted slightly from returns.

Information Technology-SS & OW

Communication Service-SS & OW

Consumer Discretionary-SS & UW

The above represents sectors.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

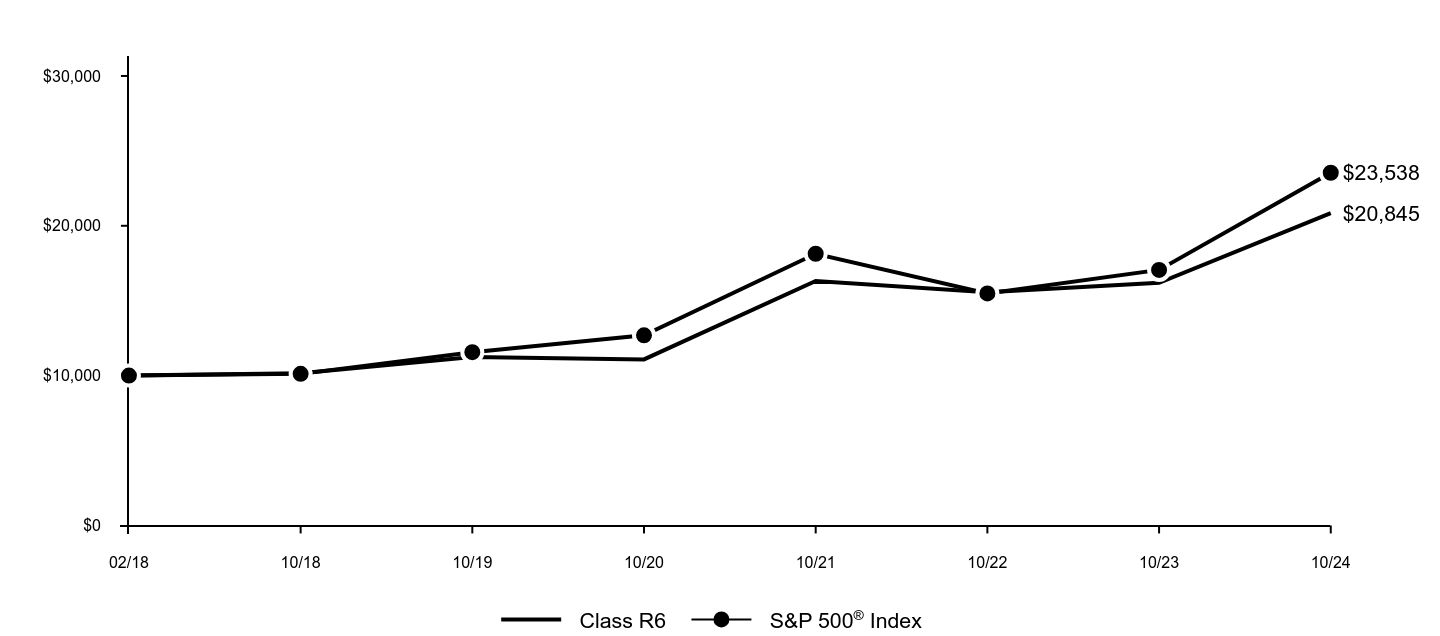

Goldman Sachs Income Builder Fund

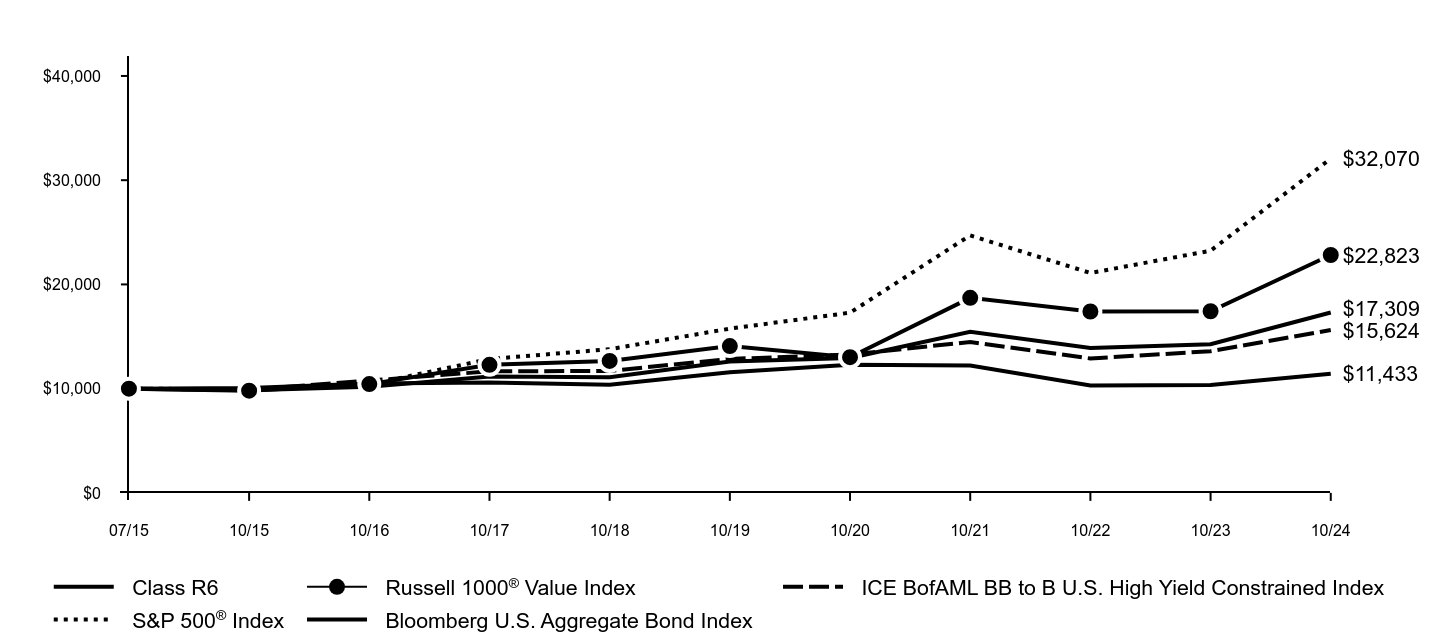

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class R6 | Russell 1000® Value Index | ICE BofAML BB to B U.S. High Yield Constrained Index | S&P 500® Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 07/15 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,837 | $9,809 | $9,889 | $9,937 | $10,055 |

| 10/16 | $10,170 | $10,434 | $10,771 | $10,385 | $10,494 |

| 10/17 | $11,156 | $12,289 | $11,660 | $12,840 | $10,589 |

| 10/18 | $11,087 | $12,662 | $11,700 | $13,783 | $10,372 |

| 10/19 | $12,608 | $14,081 | $12,851 | $15,757 | $11,566 |

| 10/20 | $12,948 | $13,016 | $13,274 | $17,287 | $12,281 |

| 10/21 | $15,454 | $18,712 | $14,476 | $24,706 | $12,223 |

| 10/22 | $13,901 | $17,402 | $12,893 | $21,096 | $10,306 |

| 10/23 | $14,265 | $17,426 | $13,594 | $23,236 | $10,343 |

| 10/24 | $17,309 | $22,823 | $15,624 | $32,070 | $11,433 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 7/31/15 |

|---|

| Class R6 | 21.34% | 6.54% | 6.10% |

Russell 1000® Value Index | 30.98% | 10.13% | 9.32% |

| ICE BofAML BB to B U.S. High Yield Constrained Index | 14.94% | 3.98% | 4.94% |

S&P 500® Index | 38.02% | 15.25% | 13.41% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.46% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg U.S. Aggregate Bond Index.

Goldman Sachs Income Builder Fund

| Total Net Assets | $2,484,821,905 |

| # of Portfolio Holdings | 816 |

| Portfolio Turnover Rate | 30% |

| Total Net Advisory Fees Paid | $9,798,671 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Banks | 8.5% |

| Pipelines | 4.4% |

| Insurance | 3.4% |

| Software | 3.3% |

| Media | 3.1% |

| Oil Field Services | 3.1% |

| Pharmaceuticals | 2.8% |

| Diversified Financial Services | 2.7% |

| Oil, Gas & Consumable Fuels | 2.4% |

| Other | 64.1% |

Goldman Sachs Income Builder Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell®”, is/are trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Income Builder Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Income Builder Fund

GSBIX: Institutional Class

This annual shareholder report contains important information about Goldman Sachs Income Builder Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $51 | 0.46% |

How did the Fund perform and what affected its performance?

U.S. equity and fixed income markets were volatile but broadly generated gains as inflation eased and the Federal Reserve began cutting interest rates. Further boosting investor sentiment was optimism about an economic soft landing, favorable corporate earnings reports, improved equity market breadth and AI excitement.

Top Contributors to Performance:

The Fund benefited from its asset allocation positioning, with exposure to both U.S. equities and non-U.S. developed markets equities contributing positively. Exposure to MLP energy infrastructure securities and global infrastructure securities further added to returns. In fixed income, the Fund’s focus on high yield corporate bonds bolstered performance, as high yield corporate bonds broadly outpaced investment grade corporate bonds.

Within the equity sleeve, the Fund was aided by out-of-benchmark positions in Blackstone, a U.S. provider of investment and fund management services, and in Taiwan Semiconductor Manufacturing, a Taiwanese semiconductor foundry. An overweight in U.S. technology company Dell Technologies was also advantageous.

The fixed income sleeve was helped by its cross sector positioning, with investments in high yield corporate bonds, bank loans and investment grade corporate bonds adding to results. Exposure to lower quality credits also contributed positively. Within investment grade corporate bonds, an emphasis on intermediate-term maturities was positive as was selection among financial and industrial credits. The fixed income sleeve also benefited from our duration positioning strategy, as yields rose during the annual period.

Top Detractors from Performance:

The performance of the equity sleeve was hurt by its out-of-benchmark investments in Nestle, a Switzerland-based food and beverage company; Shell, a British oil and gas company; and Rio Tinto, a British-Australian metals and mining company.

Within the fixed income sleeve, individual issue selection among high yield industrial credits detracted slightly from returns.

Information Technology-SS & OW

Communication Service-SS & OW

Consumer Discretionary-SS & UW

The above represents sectors.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

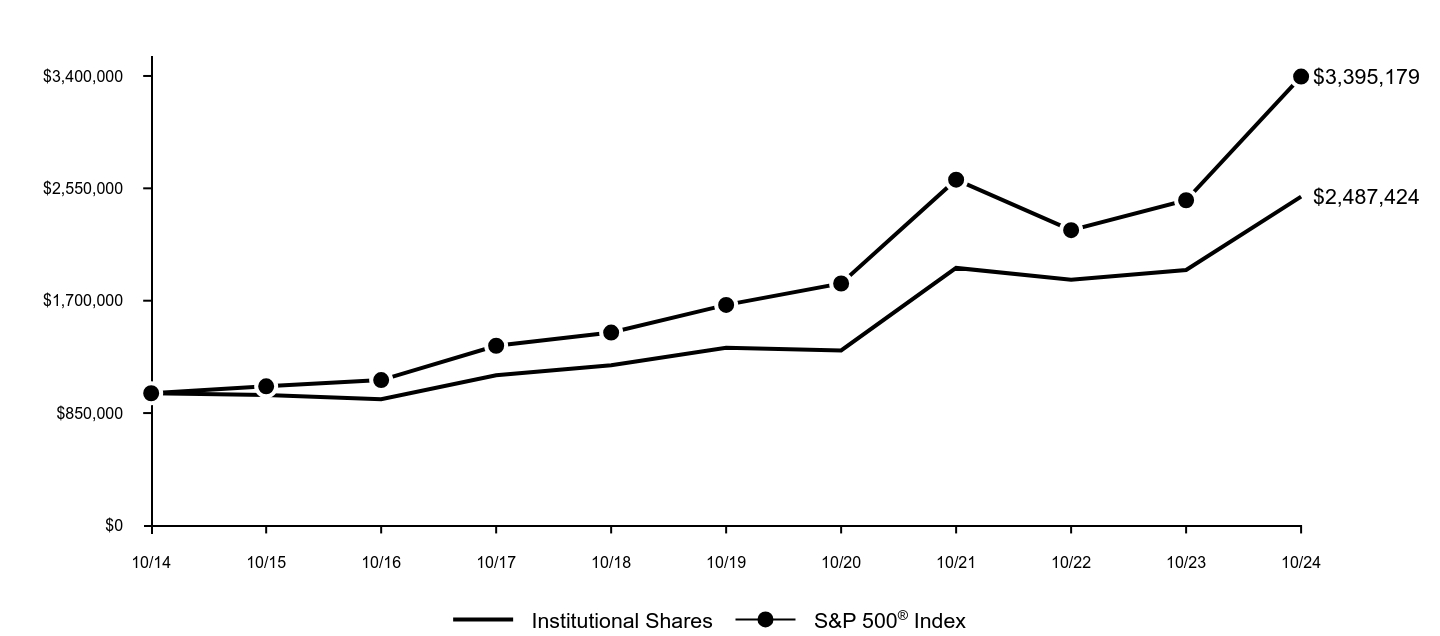

Goldman Sachs Income Builder Fund

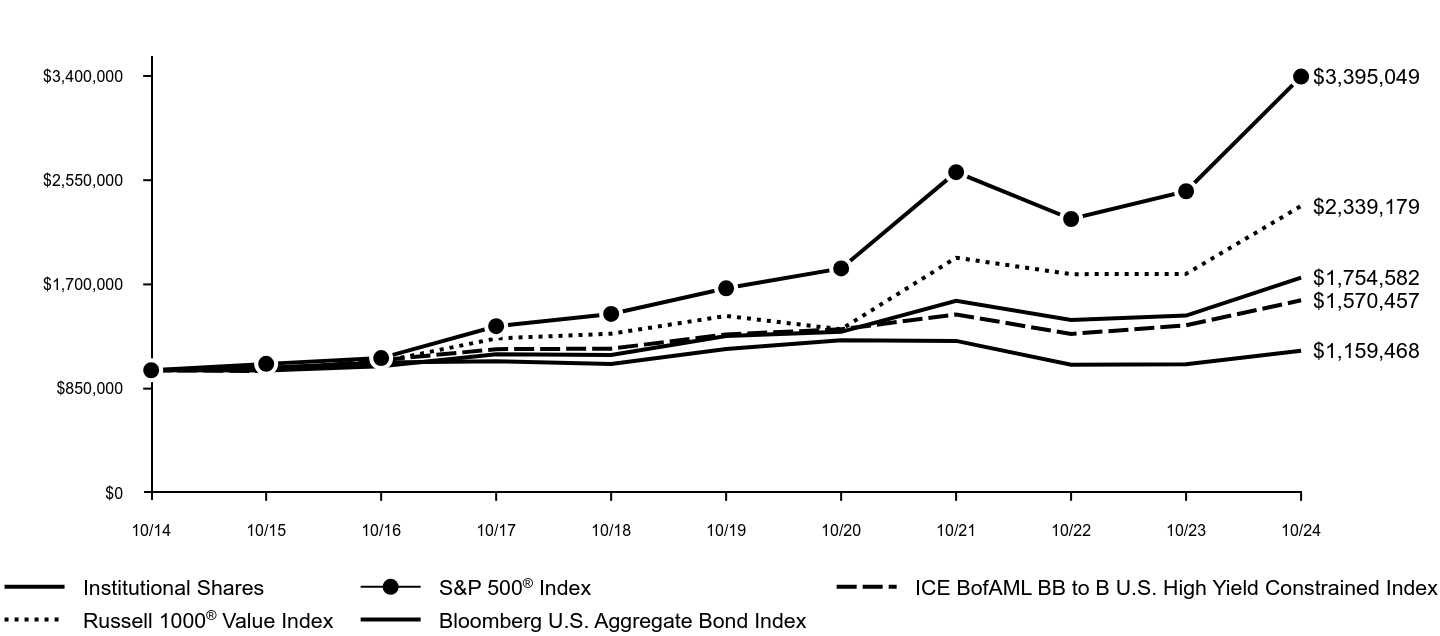

The following graph assumes an initial $1,000,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Institutional Shares | S&P 500® Index | ICE BofAML BB to B U.S. High Yield Constrained Index | Russell 1000® Value Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/14 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 |

| 10/15 | $997,500 | $1,051,995 | $994,000 | $1,005,293 | $1,019,600 |

| 10/16 | $1,031,714 | $1,099,431 | $1,082,692 | $1,069,338 | $1,064,157 |

| 10/17 | $1,131,172 | $1,359,252 | $1,172,057 | $1,259,476 | $1,073,734 |

| 10/18 | $1,124,045 | $1,459,106 | $1,176,000 | $1,297,700 | $1,051,722 |

| 10/19 | $1,278,714 | $1,668,140 | $1,291,756 | $1,443,212 | $1,172,776 |

| 10/20 | $1,313,111 | $1,830,125 | $1,334,286 | $1,334,028 | $1,245,370 |

| 10/21 | $1,566,410 | $2,615,504 | $1,455,076 | $1,917,755 | $1,239,393 |

| 10/22 | $1,409,456 | $2,233,351 | $1,295,955 | $1,783,566 | $1,045,056 |

| 10/23 | $1,446,243 | $2,459,876 | $1,366,379 | $1,785,954 | $1,048,818 |

| 10/24 | $1,754,582 | $3,395,049 | $1,570,457 | $2,339,179 | $1,159,468 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Shares | 21.32% | 6.53% | 5.78% |

Russell 1000® Value Index | 30.98% | 10.13% | 8.86% |

| ICE BofAML BB to B U.S. High Yield Constrained Index | 14.94% | 3.98% | 4.61% |

S&P 500® Index | 38.02% | 15.25% | 12.99% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg U.S. Aggregate Bond Index.

Goldman Sachs Income Builder Fund

| Total Net Assets | $2,484,821,905 |

| # of Portfolio Holdings | 816 |

| Portfolio Turnover Rate | 30% |

| Total Net Advisory Fees Paid | $9,798,671 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Banks | 8.5% |

| Pipelines | 4.4% |

| Insurance | 3.4% |

| Software | 3.3% |

| Media | 3.1% |

| Oil Field Services | 3.1% |

| Pharmaceuticals | 2.8% |

| Diversified Financial Services | 2.7% |

| Oil, Gas & Consumable Fuels | 2.4% |

| Other | 64.1% |

Goldman Sachs Income Builder Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell®”, is/are trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Income Builder Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Income Builder Fund

This annual shareholder report contains important information about Goldman Sachs Income Builder Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor | $60 | 0.54% |

How did the Fund perform and what affected its performance?

U.S. equity and fixed income markets were volatile but broadly generated gains as inflation eased and the Federal Reserve began cutting interest rates. Further boosting investor sentiment was optimism about an economic soft landing, favorable corporate earnings reports, improved equity market breadth and AI excitement.

Top Contributors to Performance:

The Fund benefited from its asset allocation positioning, with exposure to both U.S. equities and non-U.S. developed markets equities contributing positively. Exposure to MLP energy infrastructure securities and global infrastructure securities further added to returns. In fixed income, the Fund’s focus on high yield corporate bonds bolstered performance, as high yield corporate bonds broadly outpaced investment grade corporate bonds.

Within the equity sleeve, the Fund was aided by out-of-benchmark positions in Blackstone, a U.S. provider of investment and fund management services, and in Taiwan Semiconductor Manufacturing, a Taiwanese semiconductor foundry. An overweight in U.S. technology company Dell Technologies was also advantageous.

The fixed income sleeve was helped by its cross sector positioning, with investments in high yield corporate bonds, bank loans and investment grade corporate bonds adding to results. Exposure to lower quality credits also contributed positively. Within investment grade corporate bonds, an emphasis on intermediate-term maturities was positive as was selection among financial and industrial credits. The fixed income sleeve also benefited from our duration positioning strategy, as yields rose during the annual period.

Top Detractors from Performance:

The performance of the equity sleeve was hurt by its out-of-benchmark investments in Nestle, a Switzerland-based food and beverage company; Shell, a British oil and gas company; and Rio Tinto, a British-Australian metals and mining company.

Within the fixed income sleeve, individual issue selection among high yield industrial credits detracted slightly from returns.

Information Technology-SS & OW

Communication Service-SS & OW

Consumer Discretionary-SS & UW

The above represents sectors.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

Goldman Sachs Income Builder Fund

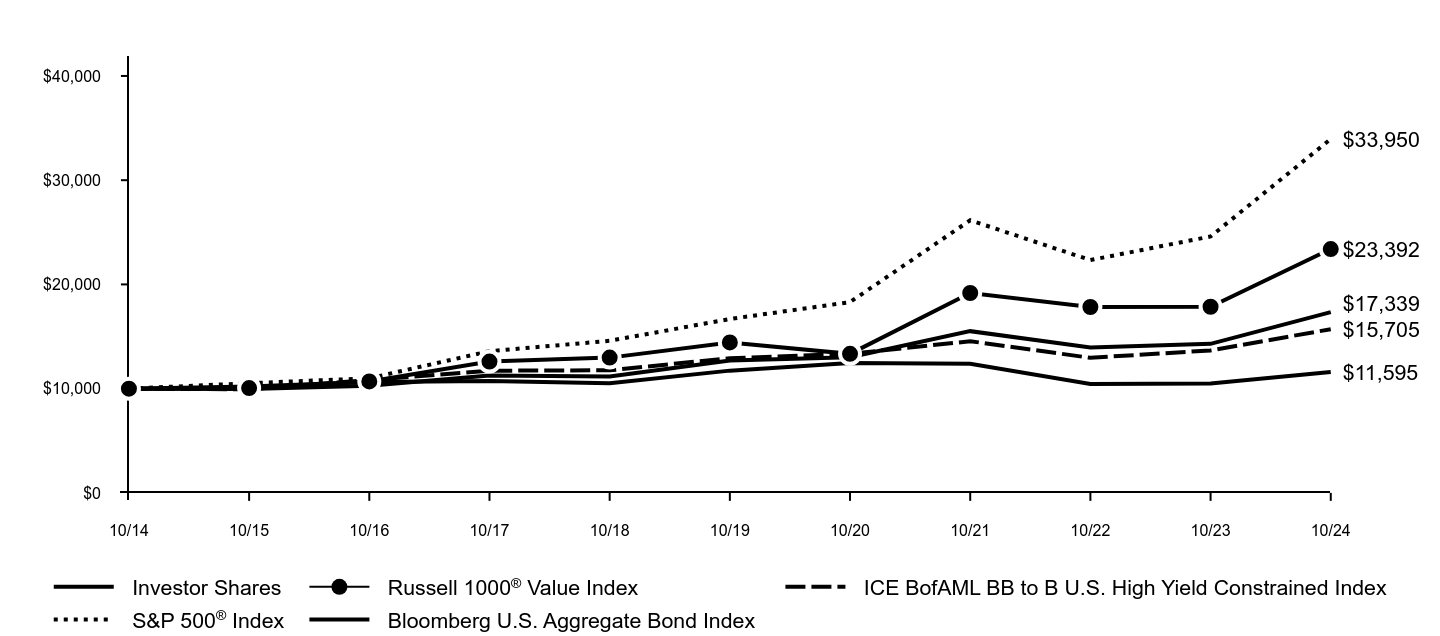

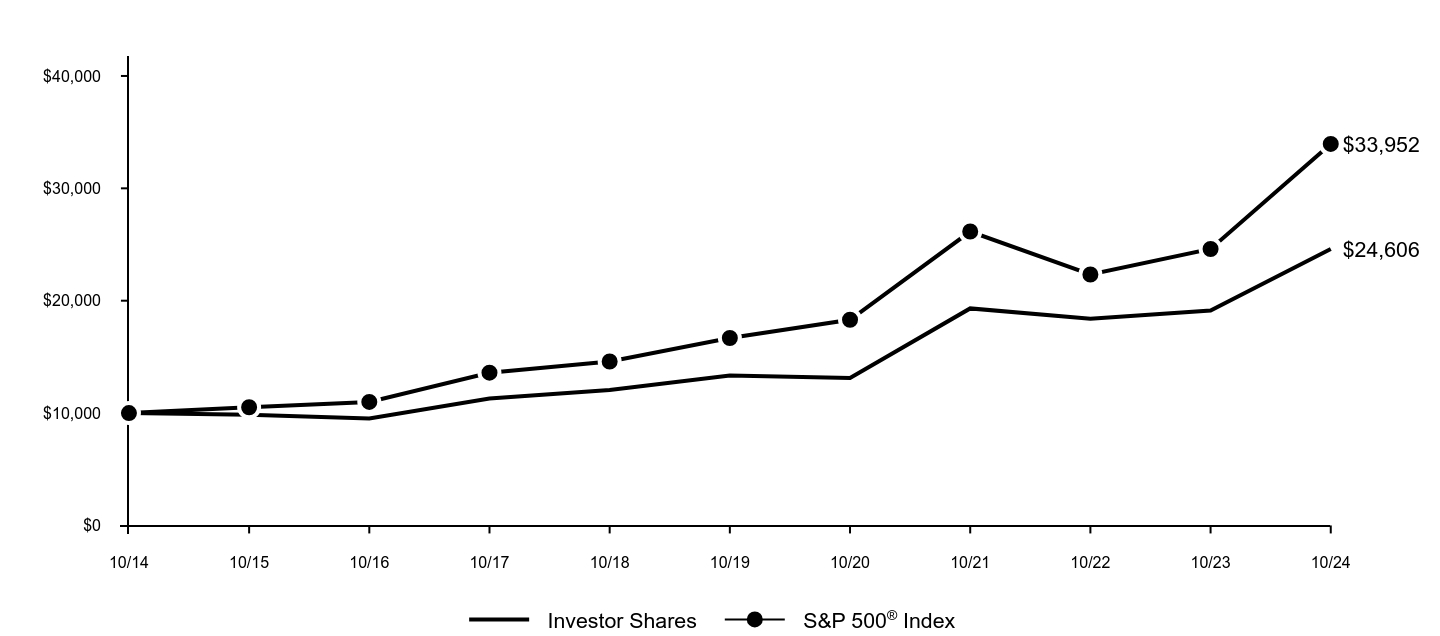

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Investor Shares | Russell 1000® Value Index | ICE BofAML BB to B U.S. High Yield Constrained Index | S&P 500® Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,955 | $10,053 | $9,940 | $10,520 | $10,196 |

| 10/16 | $10,283 | $10,693 | $10,827 | $10,994 | $10,642 |

| 10/17 | $11,260 | $12,595 | $11,721 | $13,593 | $10,737 |

| 10/18 | $11,174 | $12,977 | $11,760 | $14,591 | $10,517 |

| 10/19 | $12,692 | $14,432 | $12,918 | $16,681 | $11,728 |

| 10/20 | $13,015 | $13,340 | $13,343 | $18,301 | $12,454 |

| 10/21 | $15,516 | $19,178 | $14,551 | $26,155 | $12,394 |

| 10/22 | $13,950 | $17,836 | $12,960 | $22,334 | $10,451 |

| 10/23 | $14,298 | $17,860 | $13,664 | $24,599 | $10,488 |

| 10/24 | $17,339 | $23,392 | $15,705 | $33,950 | $11,595 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Investor Shares | 21.27% | 6.43% | 5.65% |

Russell 1000® Value Index | 30.98% | 10.13% | 8.86% |

| ICE BofAML BB to B U.S. High Yield Constrained Index | 14.94% | 3.98% | 4.61% |

S&P 500® Index | 38.02% | 15.25% | 12.99% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg U.S. Aggregate Bond Index.

Goldman Sachs Income Builder Fund

| Total Net Assets | $2,484,821,905 |

| # of Portfolio Holdings | 816 |

| Portfolio Turnover Rate | 30% |

| Total Net Advisory Fees Paid | $9,798,671 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Banks | 8.5% |

| Pipelines | 4.4% |

| Insurance | 3.4% |

| Software | 3.3% |

| Media | 3.1% |

| Oil Field Services | 3.1% |

| Pharmaceuticals | 2.8% |

| Diversified Financial Services | 2.7% |

| Oil, Gas & Consumable Fuels | 2.4% |

| Other | 64.1% |

Goldman Sachs Income Builder Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell®”, is/are trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Income Builder Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Rising Dividend Growth Fund

This annual shareholder report contains important information about Goldman Sachs Rising Dividend Growth Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $115 | 1.01% |

How did the Fund perform and what affected its performance?

The broad U.S. equity market was volatile but strong amid a soft economic landing, disinflation, better market breadth, AI excitement and a Fed shift to monetary policy easing beginning September 2024. Energy-related equities lagged but performed well given supportive commodity prices and effective management teams.

Top Contributors to Performance:

Underweight positions in information technology giants Microsoft and Apple and overweights in materials science company Corning, high-tech connectors manufacturer Amphenol and financials company Discover Financial Services were the top individual contributors to the Fund’s performance relative to the S&P 500 ex-Energy Index.

Security selection contributed most positively to results within the Fund’s MLP & Infrastructure Sleeve relative to the Alerian MLP Index (MLP Index). Top individual contributors included out-of-MLP Index positions in Targa Resources Corp., a midstream provider of natural gas and natural gas liquids, and DT Midstream, Inc., an owner and operator of natural gas infrastructure. An underweight to USA Compression Partners LP, a natural gas compression services provider, also helped.

Top Detractors from Performance:

Stock selection detracted most from results within the dividend-paying growers portion of the Fund relative to the S&P 500 ex-Energy Index, especially within the information technology and communication services sectors.

Underweight positions in semiconductor company NVIDIA and social media platform operator Meta Platforms and overweights in health insurance company Humana, cosmetics seller Estee Lauder and athletic apparel retailer NIKE detracted most from the Fund’s results relative to the S&P 500 ex-Energy Index.

Underweight positions in midstream oil & gas company NuStar Energy L.P., petroleum and energy marketing company Global Partners LP and midstream oil & gas company Western Midstream Partners, LP detracted most from the Fund’s results relative to the MLP Index. NuStar Energy LP was removed from the MLP Index in May 2024 upon its acquisition by Sunoco.

Gathering & Processing–SS & OW

Natural Gas Pipeline Transportation–SS & OW

Hydrocarbon Production & Mining–OW

The above represents MLP Index sub-industries.

KEY

SS – Security Selection

OW - Overweight

Goldman Sachs Rising Dividend Growth Fund

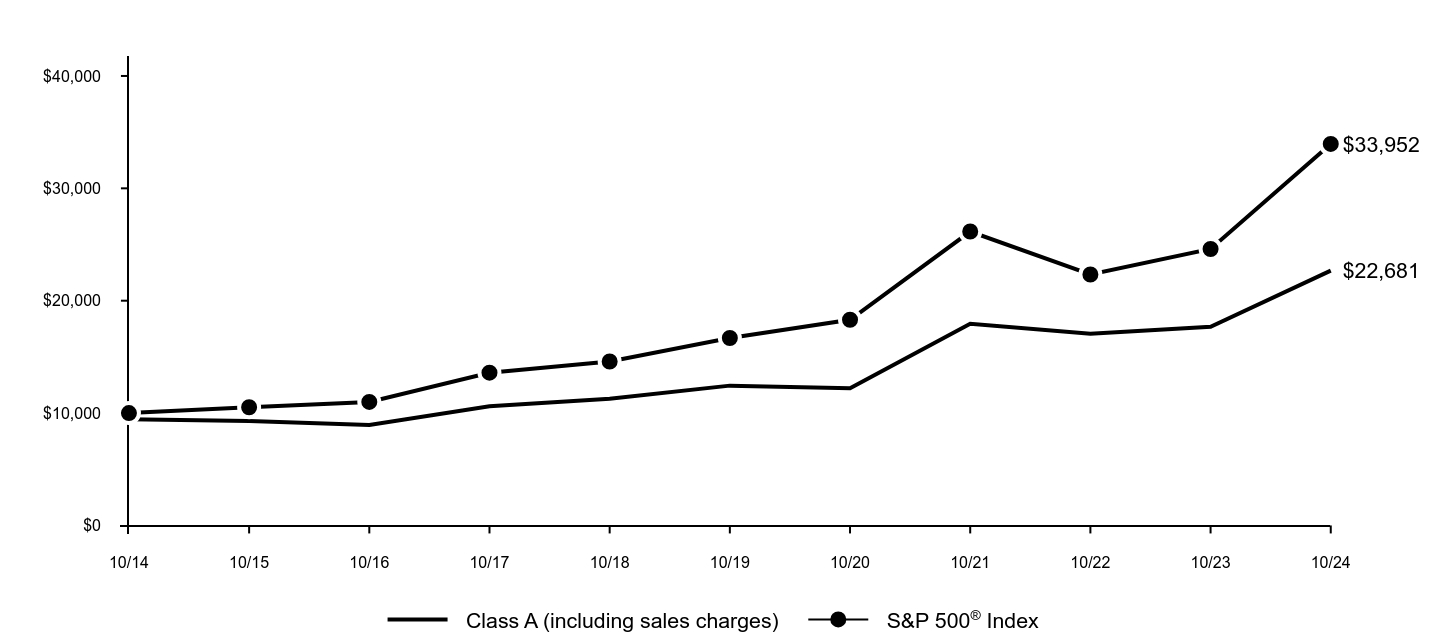

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class A (including sales charges) | S&P 500® Index |

|---|

| 10/14 | $9,450 | $10,000 |

| 10/15 | $9,287 | $10,520 |

| 10/16 | $8,942 | $10,994 |

| 10/17 | $10,604 | $13,592 |

| 10/18 | $11,269 | $14,591 |

| 10/19 | $12,442 | $16,682 |

| 10/20 | $12,218 | $18,302 |

| 10/21 | $17,946 | $26,156 |

| 10/22 | $17,051 | $22,334 |

| 10/23 | $17,683 | $24,599 |

| 10/24 | $22,681 | $33,952 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A excluding sales charges | 28.26% | 12.74% | 9.14% |

| Class A including sales charges | 21.23% | 11.48% | 8.52% |

S&P 500® Index | 38.02% | 15.25% | 12.99% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Rising Dividend Growth Fund

| Total Net Assets | $479,296,685 |

| # of Portfolio Holdings | 117 |

| Portfolio Turnover Rate | 42% |

| Total Net Advisory Fees Paid | $3,144,106 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Information Technology | 27.2% |

| Energy | 15.0% |

| Financials | 11.7% |

| Health Care | 9.8% |

| Consumer Discretionary | 8.5% |

| Industrials | 7.5% |

| Communication Services | 6.5% |

| Consumer Staples | 4.8% |

| Utilities | 2.3% |

| Other | 6.5% |

Goldman Sachs Rising Dividend Growth Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The S&P 500 (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Goldman Sachs. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Rising Dividend Growth Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Rising Dividend Growth Fund

This annual shareholder report contains important information about Goldman Sachs Rising Dividend Growth Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| C | $200 | 1.76% |

How did the Fund perform and what affected its performance?

The broad U.S. equity market was volatile but strong amid a soft economic landing, disinflation, better market breadth, AI excitement and a Fed shift to monetary policy easing beginning September 2024. Energy-related equities lagged but performed well given supportive commodity prices and effective management teams.

Top Contributors to Performance:

Underweight positions in information technology giants Microsoft and Apple and overweights in materials science company Corning, high-tech connectors manufacturer Amphenol and financials company Discover Financial Services were the top individual contributors to the Fund’s performance relative to the S&P 500 ex-Energy Index.

Security selection contributed most positively to results within the Fund’s MLP & Infrastructure Sleeve relative to the Alerian MLP Index (MLP Index). Top individual contributors included out-of-MLP Index positions in Targa Resources Corp., a midstream provider of natural gas and natural gas liquids, and DT Midstream, Inc., an owner and operator of natural gas infrastructure. An underweight to USA Compression Partners LP, a natural gas compression services provider, also helped.

Top Detractors from Performance:

Stock selection detracted most from results within the dividend-paying growers portion of the Fund relative to the S&P 500 ex-Energy Index, especially within the information technology and communication services sectors.

Underweight positions in semiconductor company NVIDIA and social media platform operator Meta Platforms and overweights in health insurance company Humana, cosmetics seller Estee Lauder and athletic apparel retailer NIKE detracted most from the Fund’s results relative to the S&P 500 ex-Energy Index.

Underweight positions in midstream oil & gas company NuStar Energy L.P., petroleum and energy marketing company Global Partners LP and midstream oil & gas company Western Midstream Partners, LP detracted most from the Fund’s results relative to the MLP Index. NuStar Energy LP was removed from the MLP Index in May 2024 upon its acquisition by Sunoco.

Gathering & Processing–SS & OW

Natural Gas Pipeline Transportation–SS & OW

Hydrocarbon Production & Mining–OW

The above represents MLP Index sub-industries.

KEY

SS – Security Selection

OW - Overweight

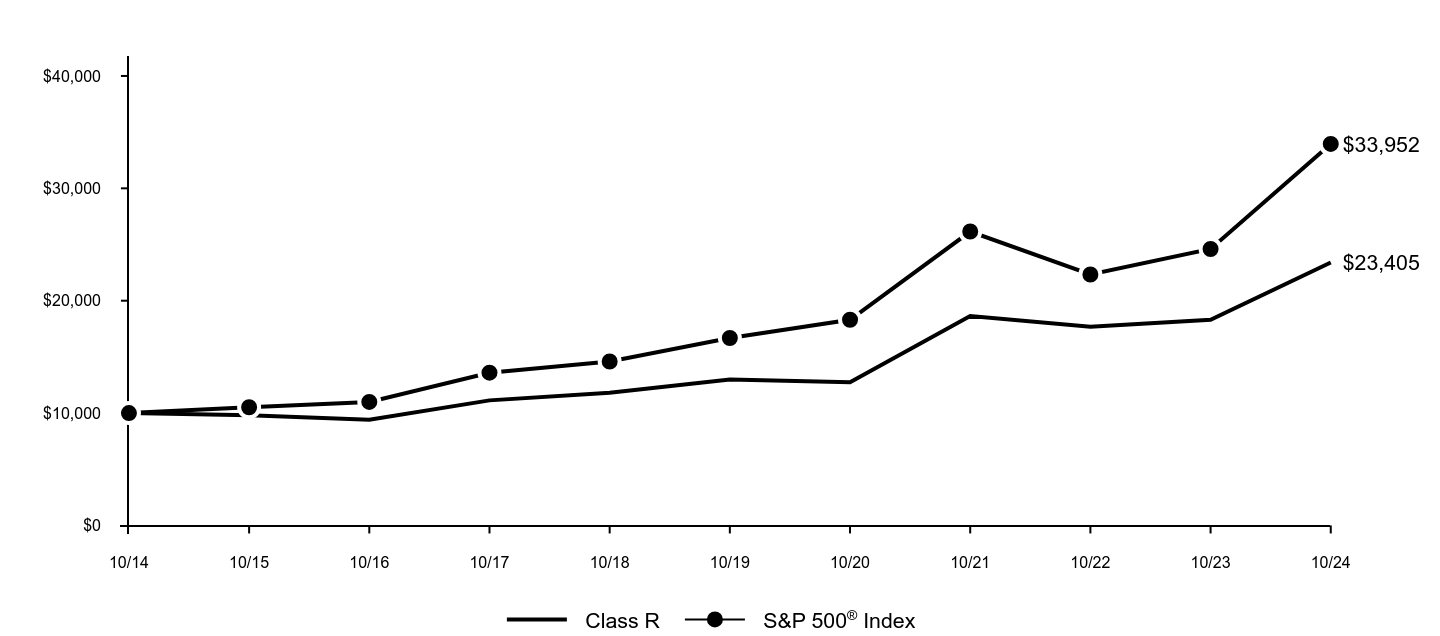

Goldman Sachs Rising Dividend Growth Fund

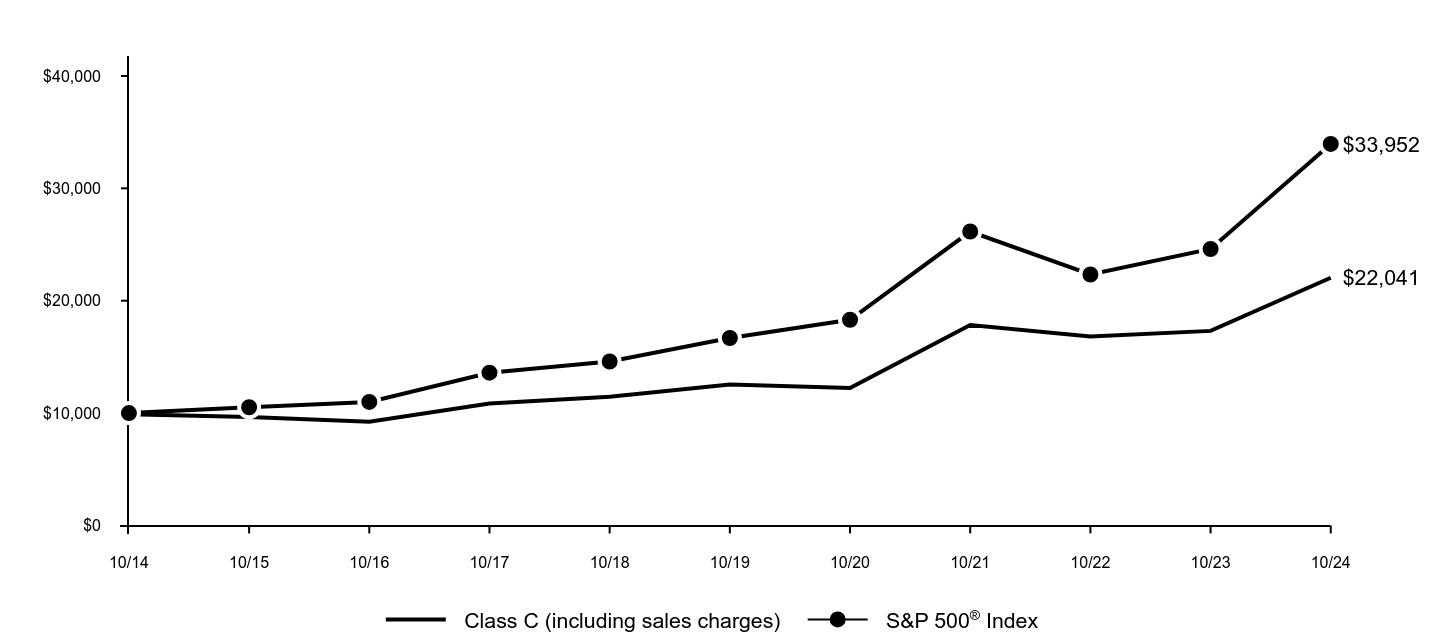

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class C (including sales charges) | S&P 500® Index |

|---|

| 10/14 | $9,900 | $10,000 |

| 10/15 | $9,658 | $10,520 |

| 10/16 | $9,229 | $10,994 |

| 10/17 | $10,860 | $13,592 |

| 10/18 | $11,456 | $14,591 |

| 10/19 | $12,551 | $16,682 |

| 10/20 | $12,236 | $18,302 |

| 10/21 | $17,832 | $26,156 |

| 10/22 | $16,825 | $22,334 |

| 10/23 | $17,313 | $24,599 |

| 10/24 | $22,041 | $33,952 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class C excluding sales charges | 27.31% | 11.91% | 8.32% |

| Class C including sales charges | 26.25% | 11.91% | 8.32% |

S&P 500® Index | 38.02% | 15.25% | 12.99% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.