0000822977gsam:C000025571Memberoef:ConsumerDiscretionarySectorMember2024-10-310000822977gsam:C000025529Membergsam:OtherSectorMember2024-10-310000822977gsam:Russell2000GrowthIndex44457AdditionalIndexMember2013-11-012014-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Copies to:

| | |

Robert Griffith, Esq. Goldman Sachs & Co. LLC 200 West Street New York, NY 10282 | | Stephen H. Bier, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Shareholders for the Goldman Sachs Large Cap Growth Insights Fund, Goldman Sachs Large Cap Value Insights Fund, Goldman Sachs Small Cap Equity Insights Fund, Goldman Sachs Small Cap Growth Insights Fund, Goldman Sachs Small Cap Value Insights Fund, Goldman Sachs U.S. Equity Insights Fund, Goldman Sachs China Equity Fund, Goldman Sachs Emerging Markets Equity Fund, Goldman Sachs ESG Emerging Markets Equity Fund, Goldman Sachs International Equity ESG Fund, Goldman Sachs International Equity Income Fund, Goldman Sachs Emerging Markets Equity ex. China Fund, Goldman Sachs Emerging Markets Equity Insights Fund, Goldman Sachs International Equity Insights Fund, and Goldman Sachs International Small Cap Insights Fund is filed herewith.

Annual Shareholder Report

October 31, 2024

Goldman Sachs Emerging Markets Equity Insights Fund

This annual shareholder report contains important information about Goldman Sachs Emerging Markets Equity Insights Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $155 | 1.39% |

How did the Fund perform and what affected its performance?

The broad emerging markets equity market experienced volatility but performed strongly, supported by the view that U.S. interest rates were likely to fall more quickly than earlier anticipated and as global economic data was encouraging. China’s market was pressured by economic slowdown and a troubled real estate sector but surged in September 2024 after its central bank implemented monetary stimulus measures and property sector supportive policies. Emerging markets equities fell in October due to global market volatility and a strengthening U.S. dollar.

Top Contributors to Performance:

Stock selection in the industrials, consumer staples and energy sectors added to the Fund’s returns versus the MSCI Emerging Markets Index. To select stocks for the Fund, we use a quantitative model and four investment themes, overweighting or underweighting those chosen by the model.

Among individual stock positions, the Fund benefited from overweights in Trip.com Group, Hanmi Semiconductor and Kia.

The overweight in Trip.com Group, a China-based travel agency holding company, was driven largely by the High Quality Business Models and Sentiment Analysis investment themes.

The Fund’s overweight in Taiwan-based Hanmi Semiconductor was based on our Market Themes & Trends, High Quality Business Models and Sentiment Analysis investment themes.

The Fund was overweight Kia, a South Korean auto maker, mainly due to our High Quality Business Models investment theme.

Top Detractors from Performance:

Stock selection in information technology, utilities and communication services detracted from relative performance.

The Fund was hurt most by an underweight in Taiwan Semiconductor Manufacturing, an overweight in Samsung Electronics and an underweight in PDD Holdings.

The Fund was underweight Taiwan Semiconductor Manufacturing, a Taiwan-based semiconductor foundry, mostly because of our High Quality Business Models and Market Themes & Trends investment themes.

The overweight in South Korean electronics manufacturer Samsung Electronics was based mainly on our Market Themes & Trends and High Quality Business Models investment themes.

The Fund’s underweight in PDD Holdings, a China-based commerce group, was the result of our Market Themes & Trends, Sentiment Analysis and High Quality Business Models investment themes.

Country positioning held back the Fund’s relative performance, with underweights in China, Turkey and Brazil detracting most.

High Quality Business Models

The above represents investment themes.

Goldman Sachs Emerging Markets Equity Insights Fund

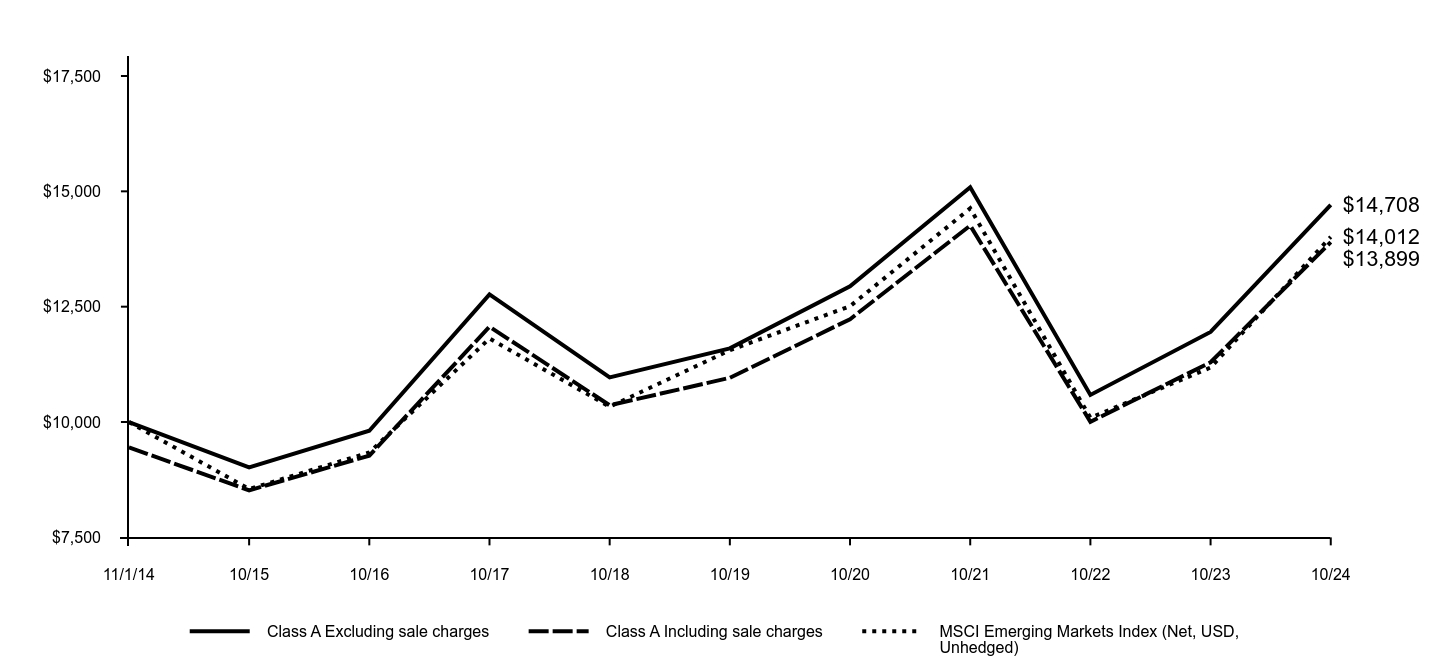

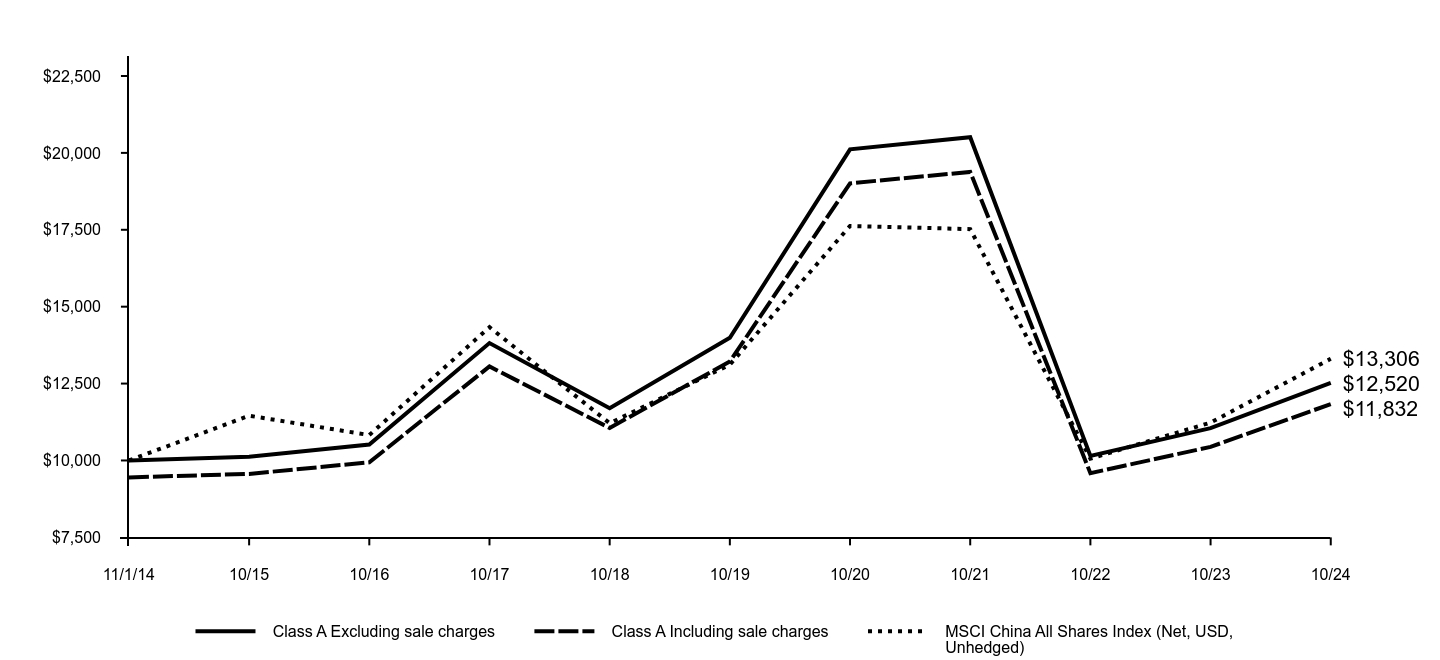

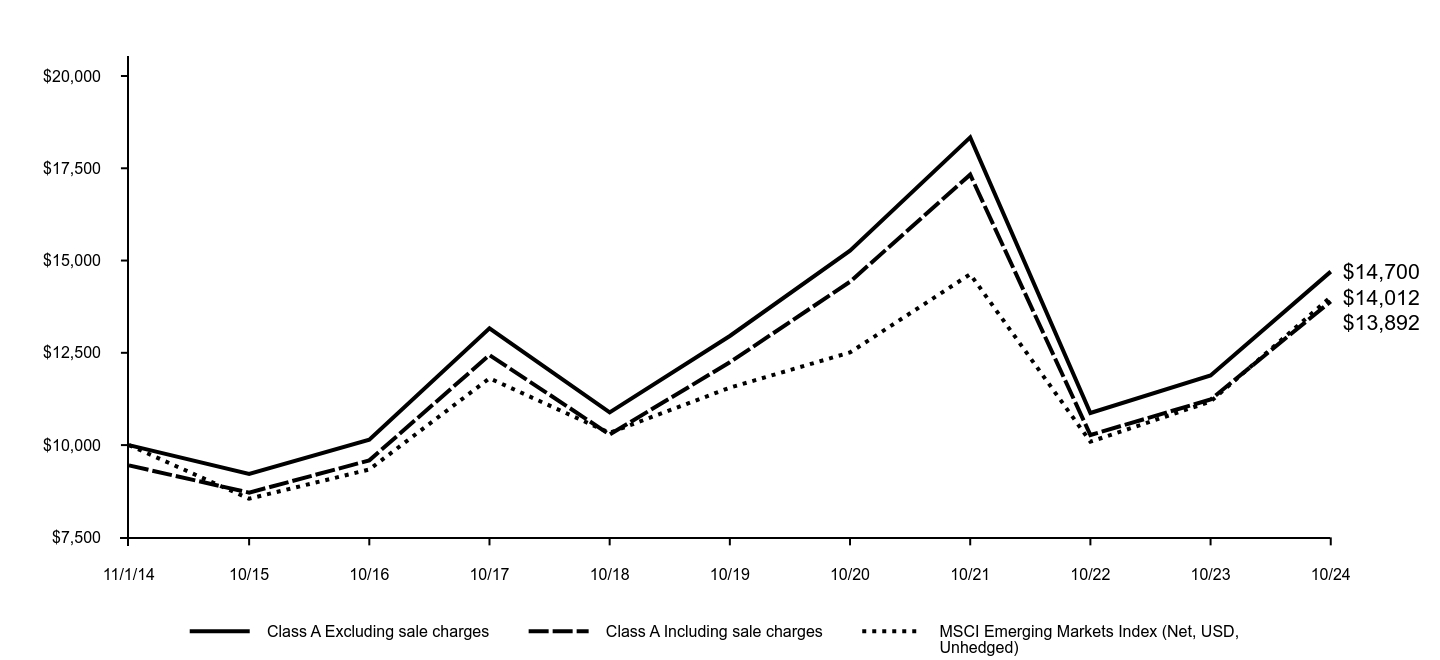

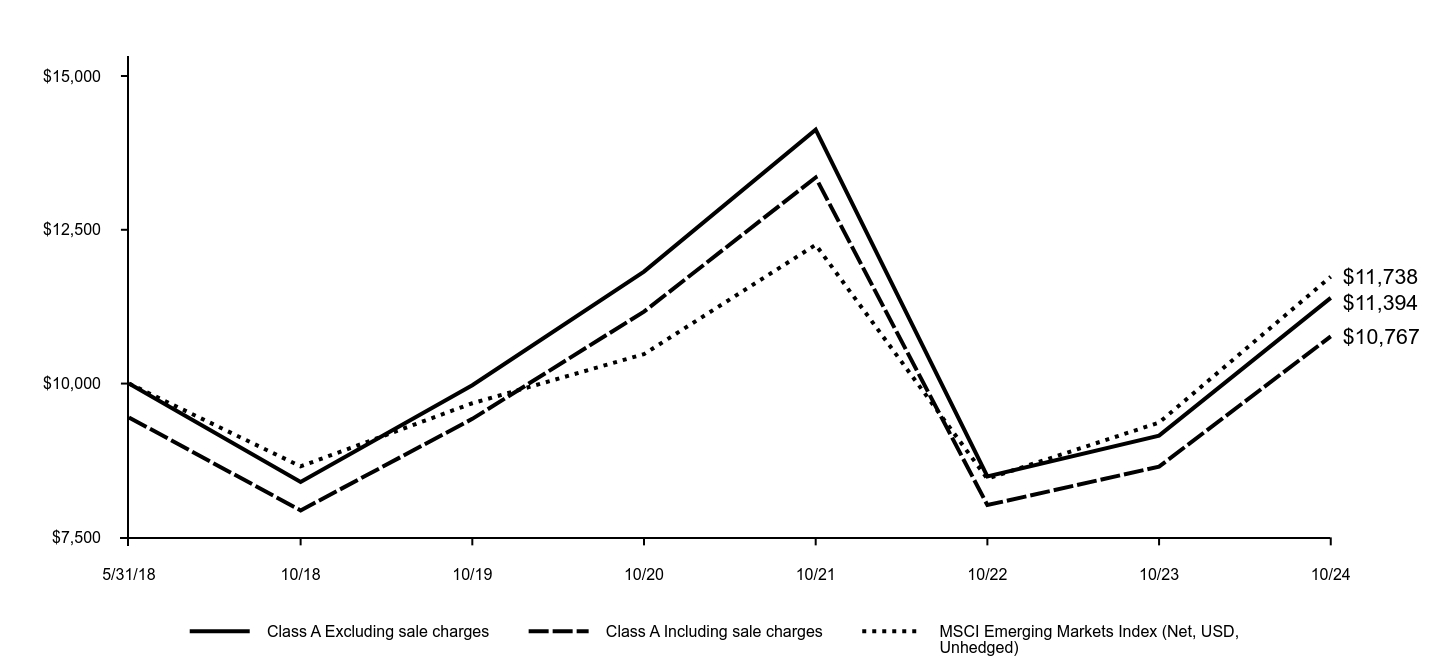

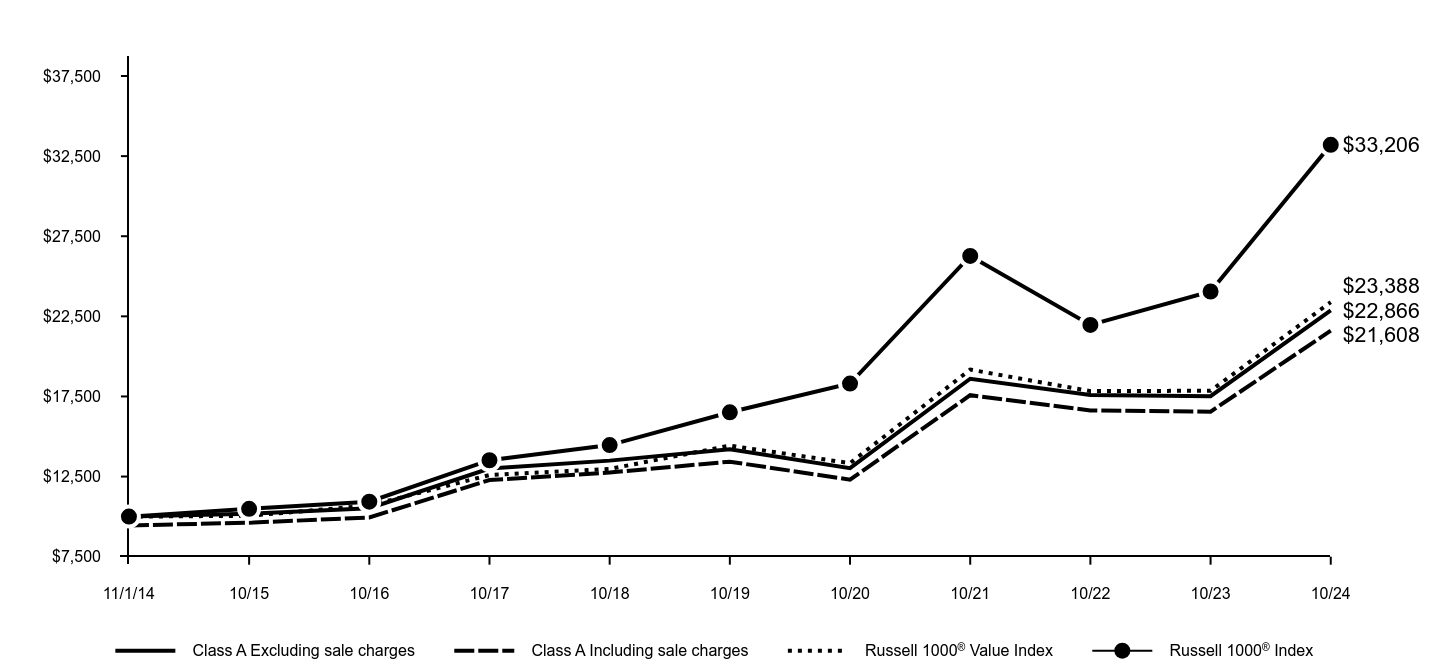

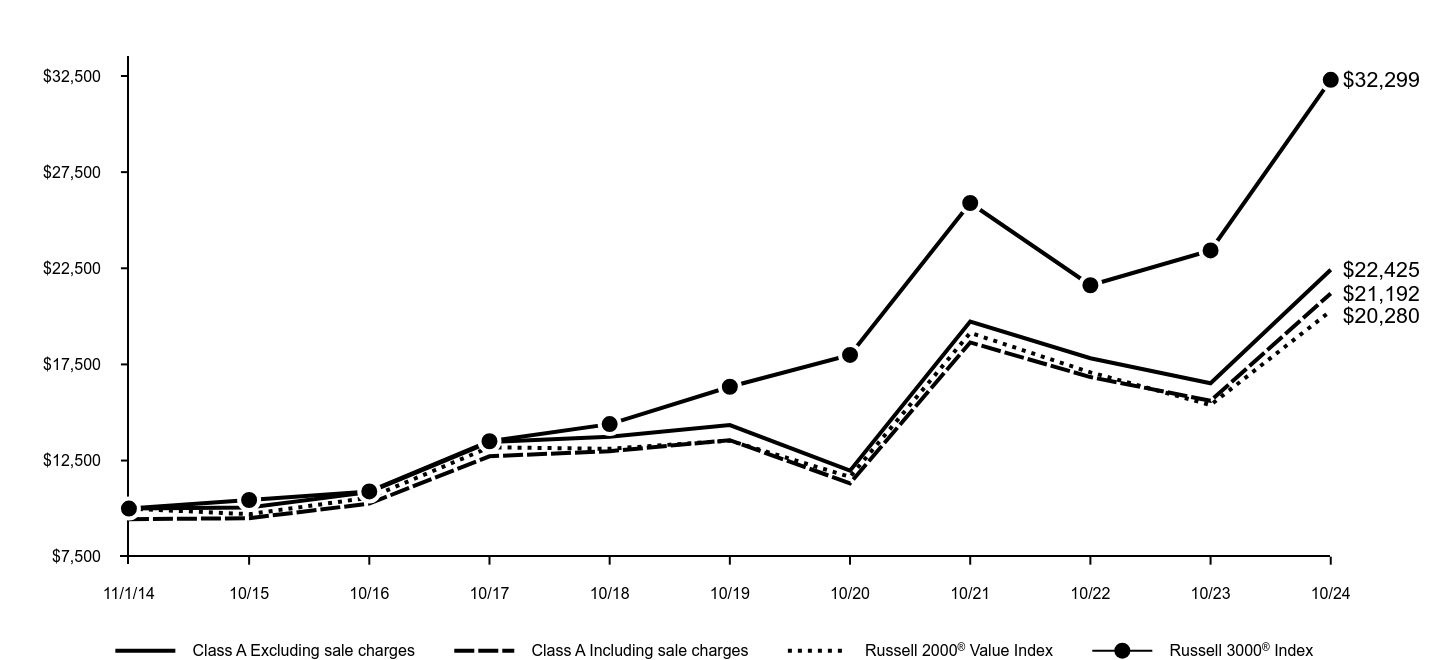

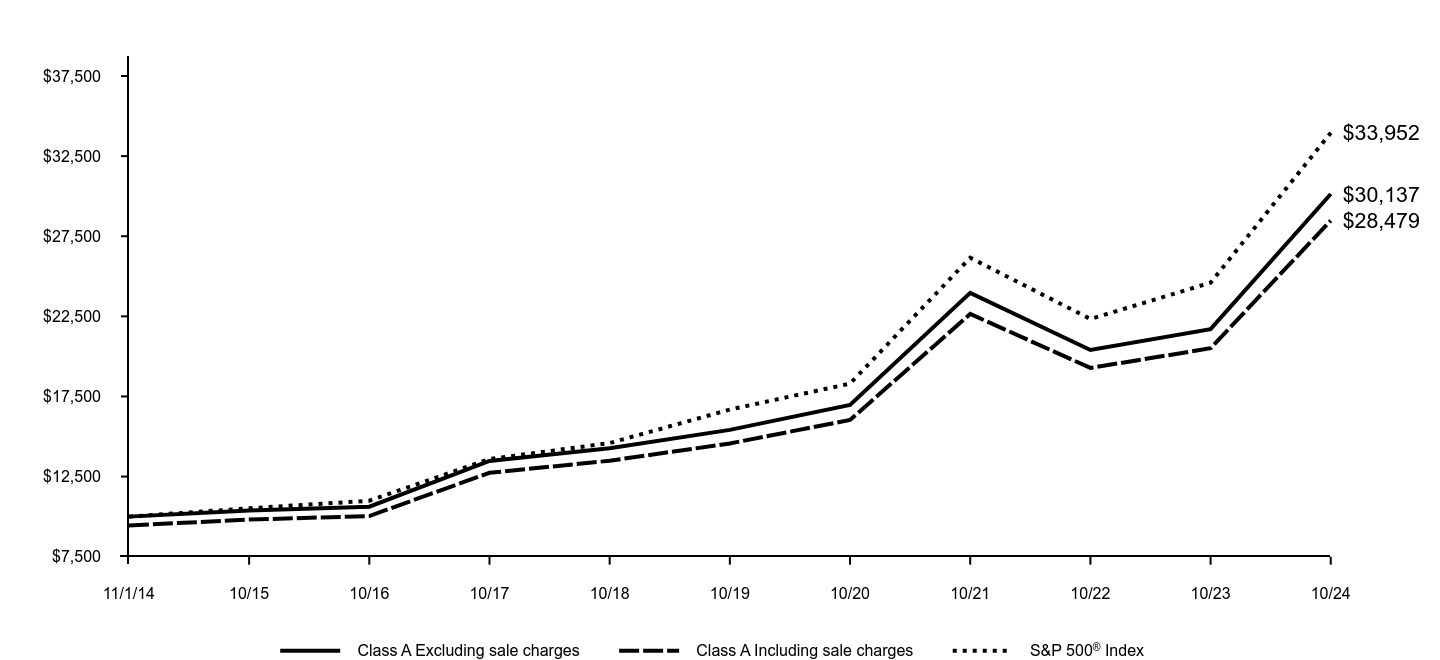

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class A Excluding sale charges | Class A Including sale charges | MSCI Emerging Markets Index (Net, USD, Unhedged) |

|---|

| 11/1/14 | $10,000 | $9,450 | $10,000 |

| 10/15 | $9,016 | $8,520 | $8,547 |

| 10/16 | $9,810 | $9,271 | $9,339 |

| 10/17 | $12,768 | $12,066 | $11,810 |

| 10/18 | $10,967 | $10,363 | $10,331 |

| 10/19 | $11,596 | $10,958 | $11,556 |

| 10/20 | $12,940 | $12,228 | $12,510 |

| 10/21 | $15,088 | $14,258 | $14,631 |

| 10/22 | $10,587 | $10,005 | $10,091 |

| 10/23 | $11,952 | $11,295 | $11,181 |

| 10/24 | $14,708 | $13,899 | $14,012 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A Excluding sale charges | 23.06% | 4.86% | 3.93% |

| Class A Including sale charges | 16.32% | 3.69% | 3.35% |

| MSCI Emerging Markets Index (Net, USD, Unhedged) | 25.32% | 3.93% | 3.43% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Emerging Markets Equity Insights Fund

Key Fund Statistics (as of October 31, 2024)

| Total Net Assets | $2,152,192,361 |

| # of Portfolio Holdings | 382 |

| Portfolio Turnover Rate | 168% |

| Total Net Advisory Fees Paid | $19,529,355 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-526-7384.

During the period, the Fund’s classification changed from non-diversified to diversified. The Fund was previously registered as a non-diversified investment company.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Financials | 23.9% |

| Information Technology | 20.0% |

| Consumer Discretionary | 11.4% |

| Communication Services | 11.1% |

| Industrials | 7.9% |

| Health Care | 6.7% |

| Materials | 4.8% |

| Consumer Staples | 4.0% |

| Utilities | 3.3% |

| Other | 4.9% |

Goldman Sachs Emerging Markets Equity Insights Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications make any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Emerging Markets Equity Insights Fund

38144N585-AR-1024 Class A

Annual Shareholder Report

October 31, 2024

Goldman Sachs Emerging Markets Equity Insights Fund

This annual shareholder report contains important information about Goldman Sachs Emerging Markets Equity Insights Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| C | $238 | 2.14% |

How did the Fund perform and what affected its performance?

The broad emerging markets equity market experienced volatility but performed strongly, supported by the view that U.S. interest rates were likely to fall more quickly than earlier anticipated and as global economic data was encouraging. China’s market was pressured by economic slowdown and a troubled real estate sector but surged in September 2024 after its central bank implemented monetary stimulus measures and property sector supportive policies. Emerging markets equities fell in October due to global market volatility and a strengthening U.S. dollar.

Top Contributors to Performance:

Stock selection in the industrials, consumer staples and energy sectors added to the Fund’s returns versus the MSCI Emerging Markets Index. To select stocks for the Fund, we use a quantitative model and four investment themes, overweighting or underweighting those chosen by the model.

Among individual stock positions, the Fund benefited from overweights in Trip.com Group, Hanmi Semiconductor and Kia.

The overweight in Trip.com Group, a China-based travel agency holding company, was driven largely by the High Quality Business Models and Sentiment Analysis investment themes.

The Fund’s overweight in Taiwan-based Hanmi Semiconductor was based on our Market Themes & Trends, High Quality Business Models and Sentiment Analysis investment themes.

The Fund was overweight Kia, a South Korean auto maker, mainly due to our High Quality Business Models investment theme.

Top Detractors from Performance:

Stock selection in information technology, utilities and communication services detracted from relative performance.

The Fund was hurt most by an underweight in Taiwan Semiconductor Manufacturing, an overweight in Samsung Electronics and an underweight in PDD Holdings.

The Fund was underweight Taiwan Semiconductor Manufacturing, a Taiwan-based semiconductor foundry, mostly because of our High Quality Business Models and Market Themes & Trends investment themes.

The overweight in South Korean electronics manufacturer Samsung Electronics was based mainly on our Market Themes & Trends and High Quality Business Models investment themes.

The Fund’s underweight in PDD Holdings, a China-based commerce group, was the result of our Market Themes & Trends, Sentiment Analysis and High Quality Business Models investment themes.

Country positioning held back the Fund’s relative performance, with underweights in China, Turkey and Brazil detracting most.

High Quality Business Models

The above represents investment themes.

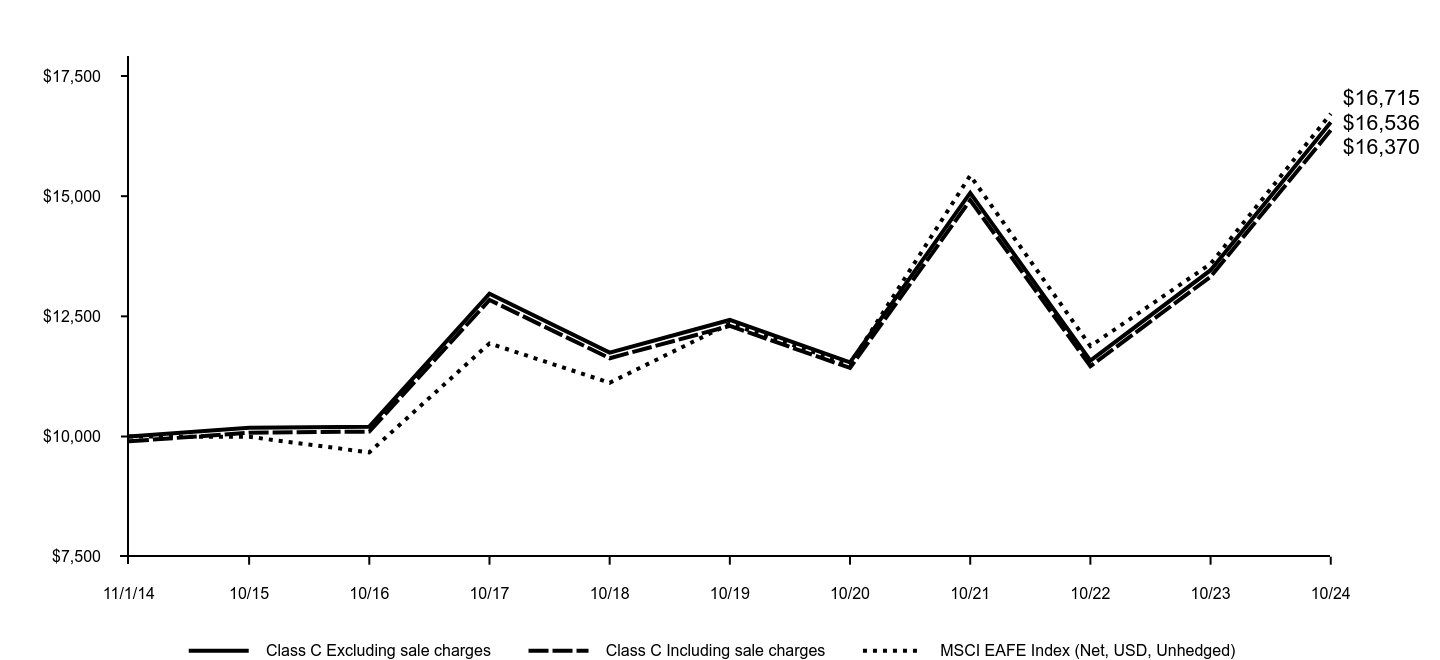

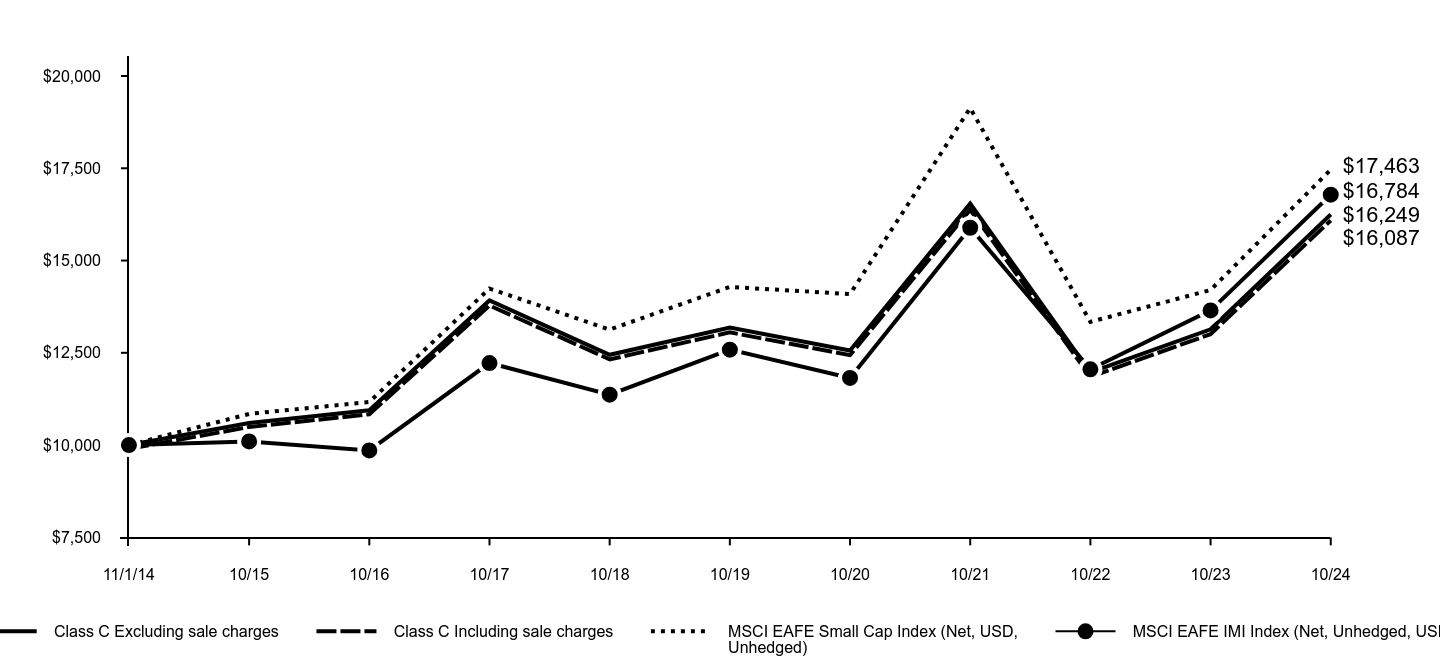

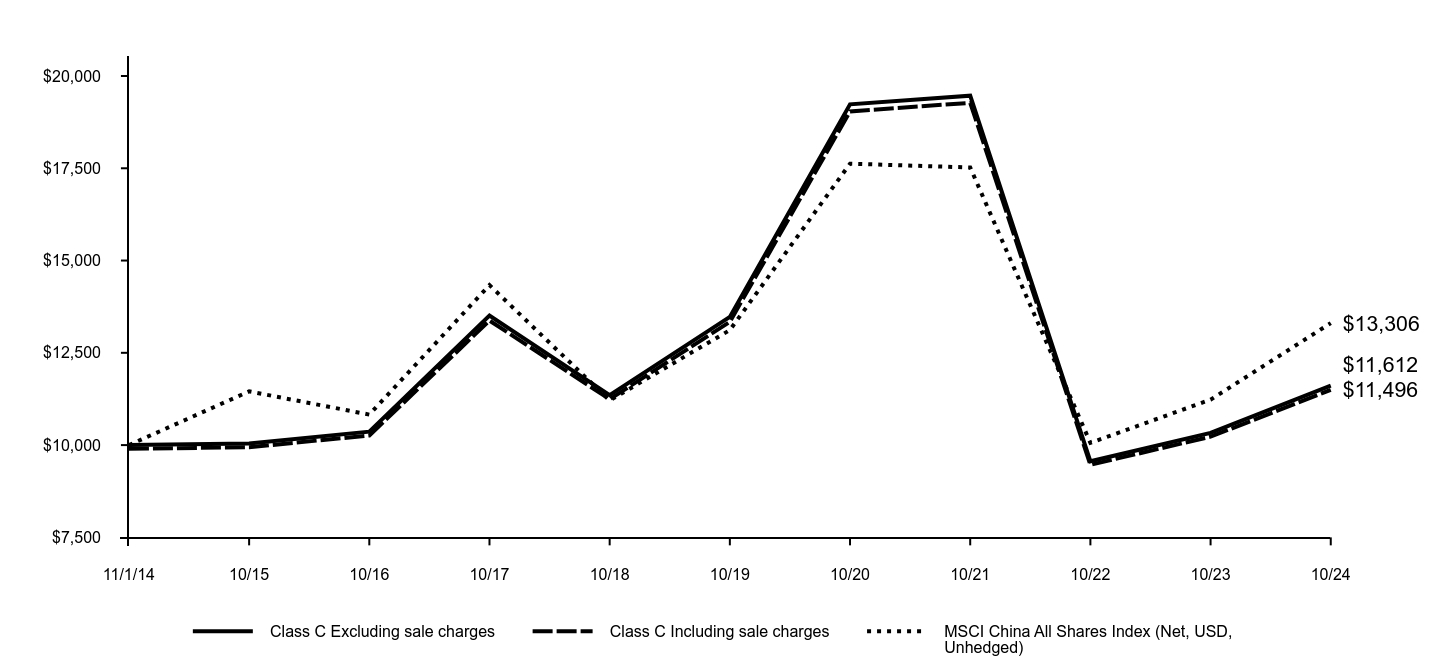

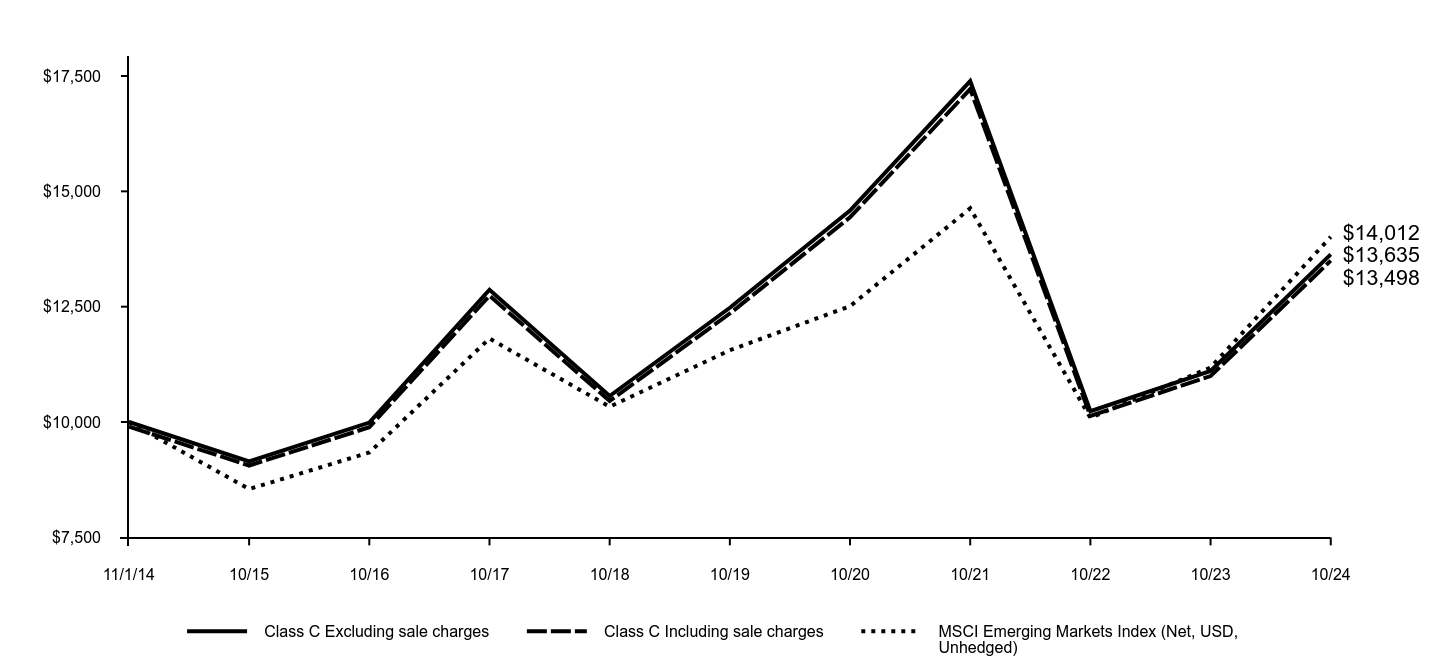

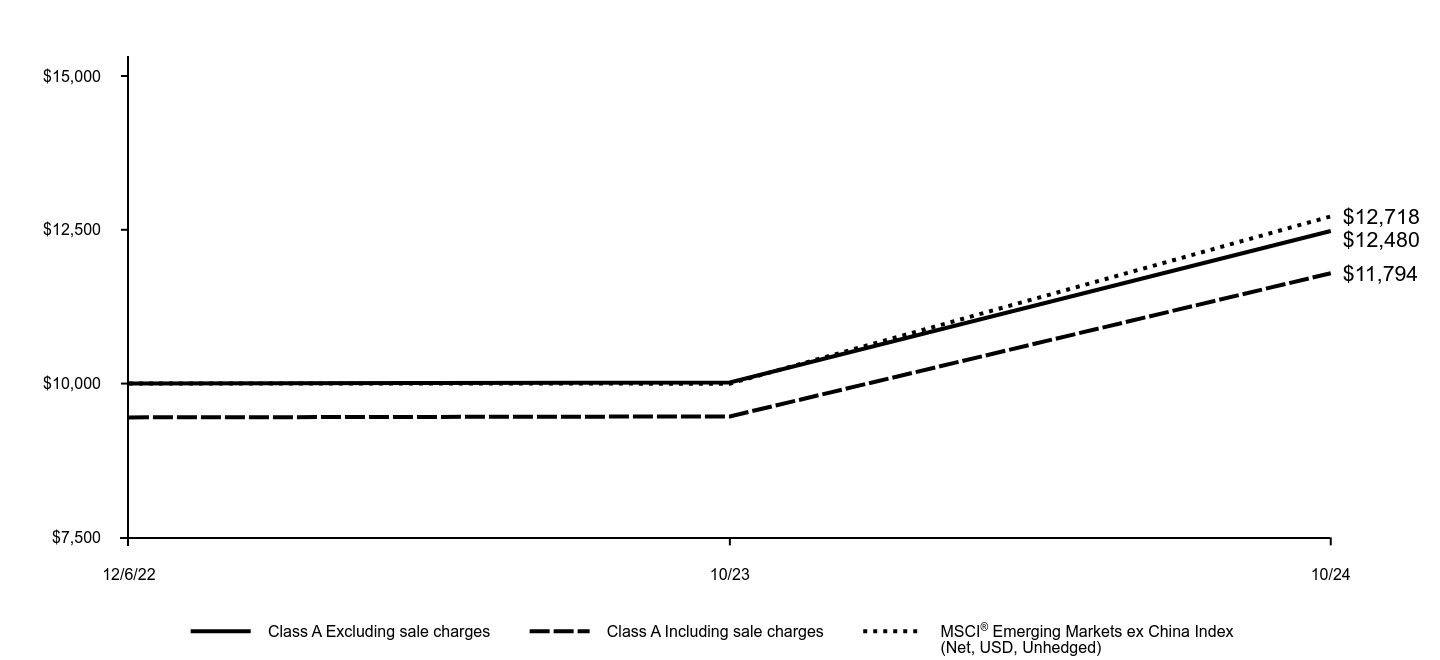

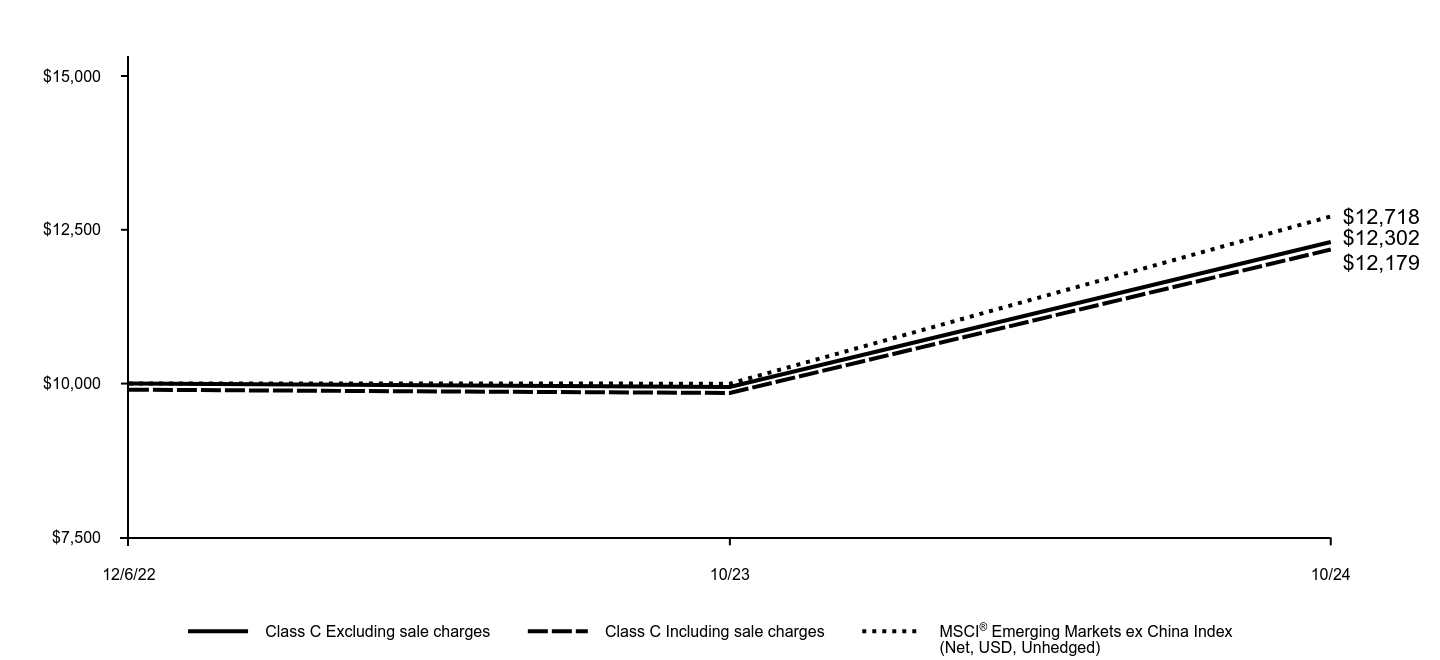

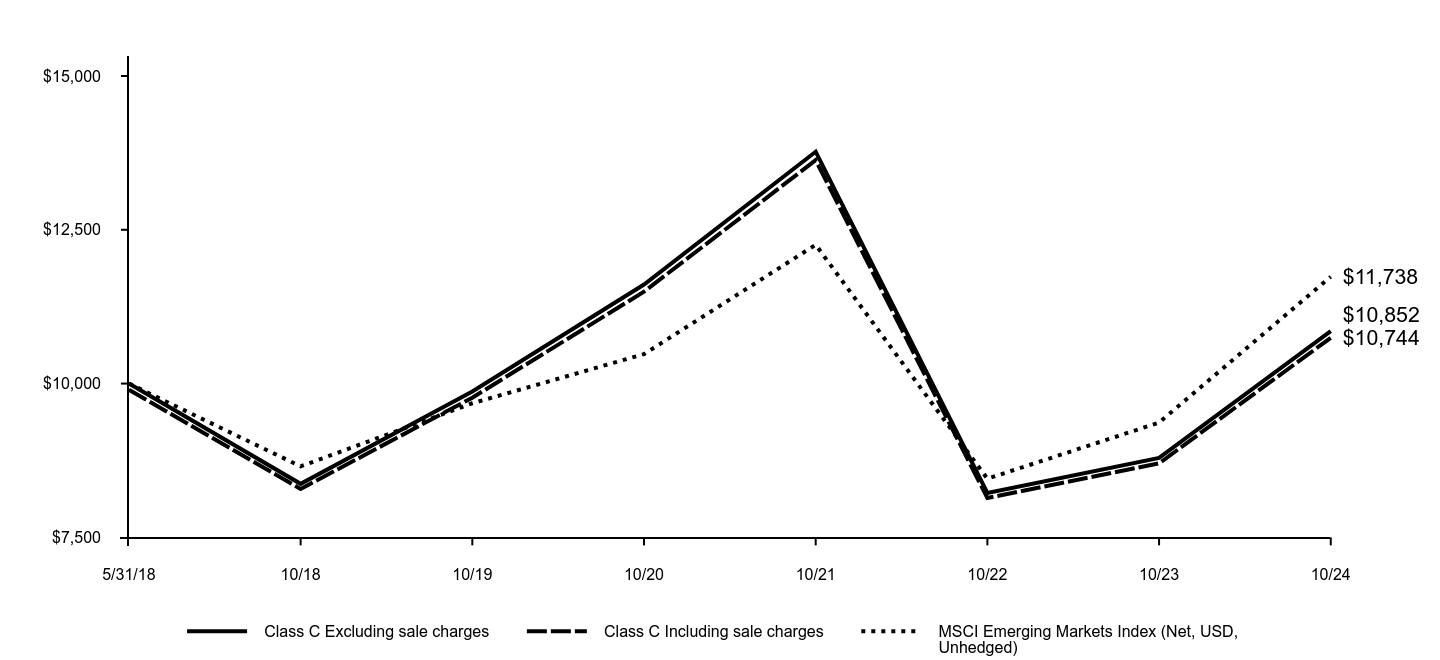

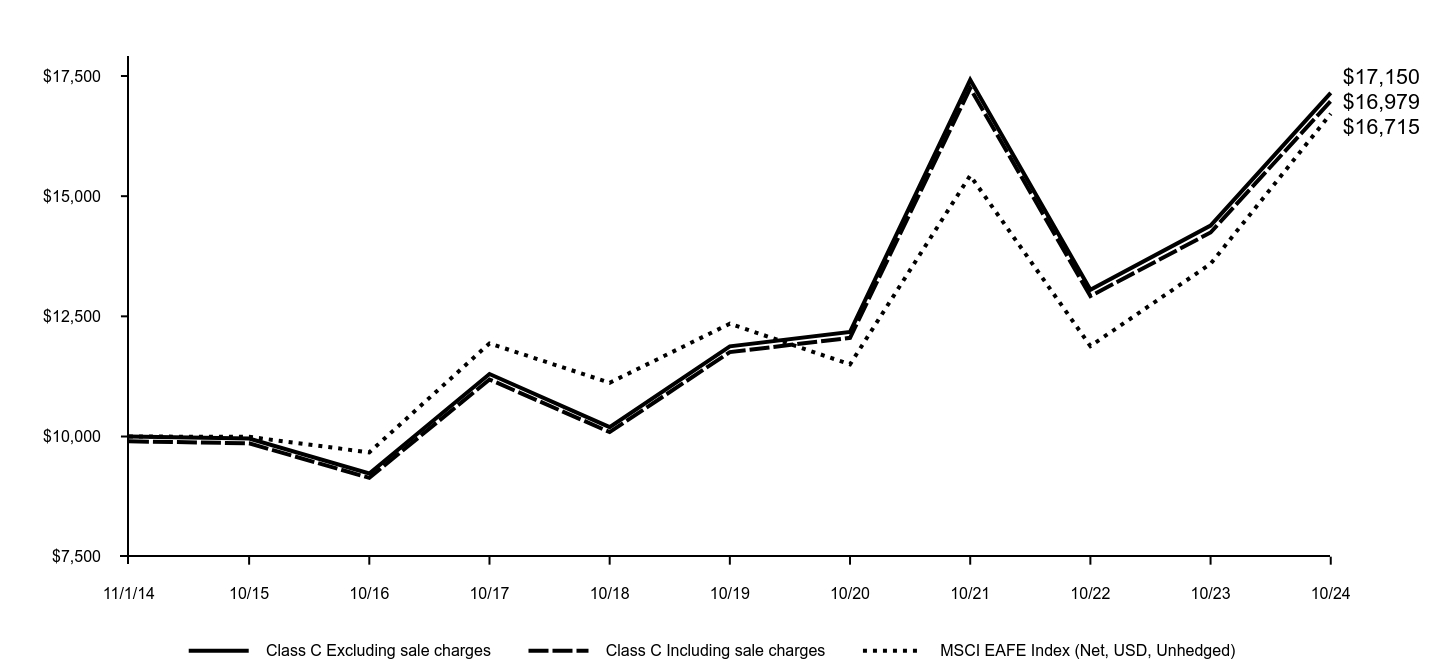

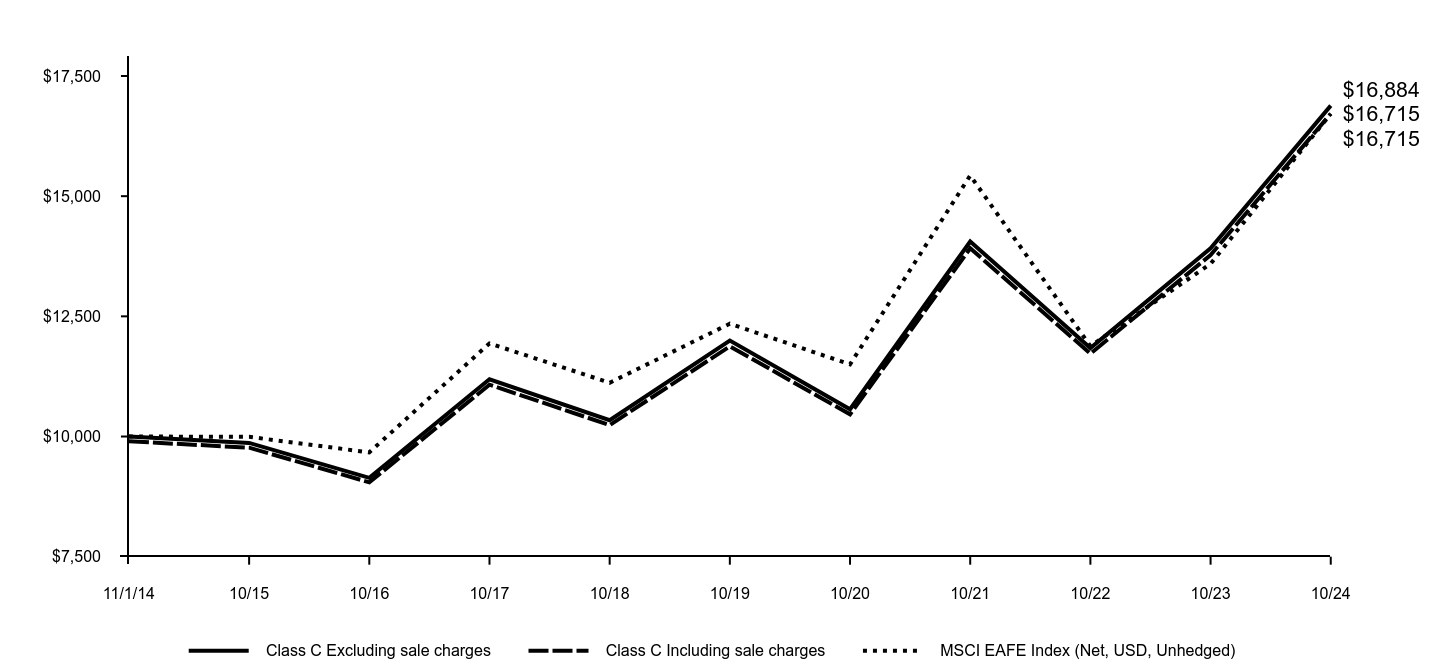

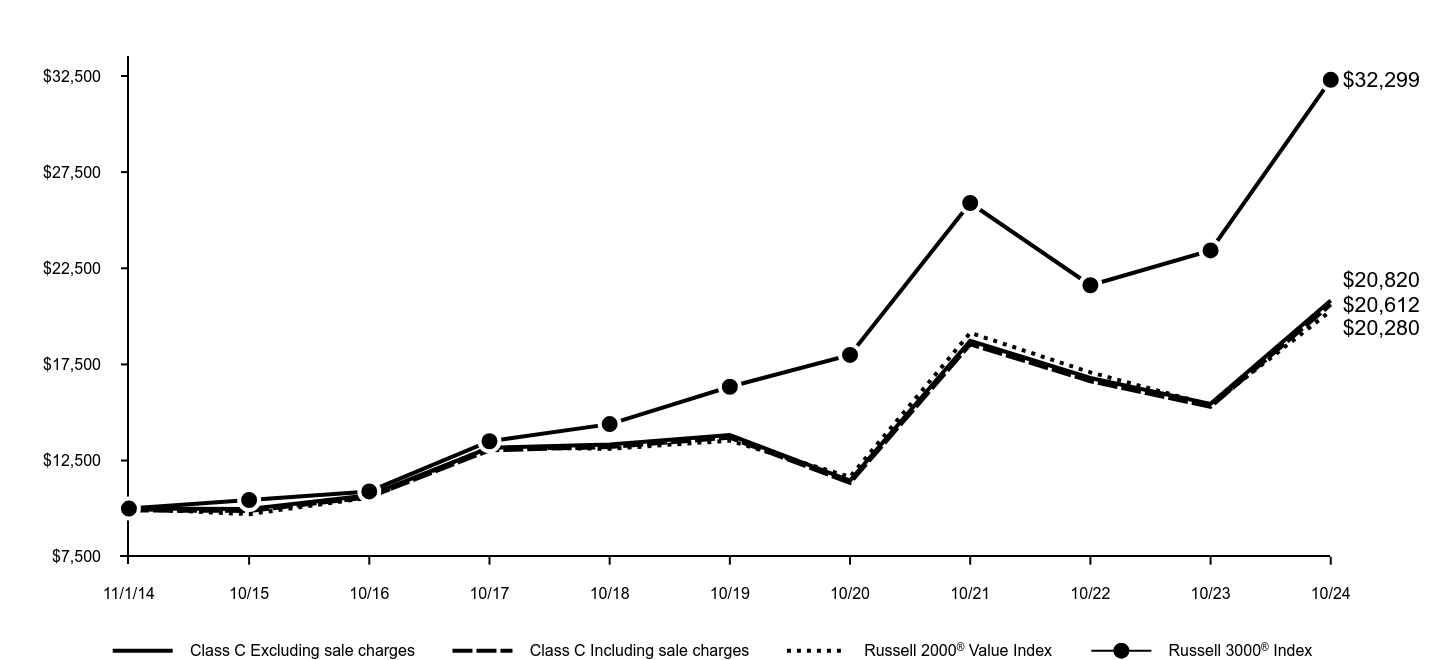

Goldman Sachs Emerging Markets Equity Insights Fund

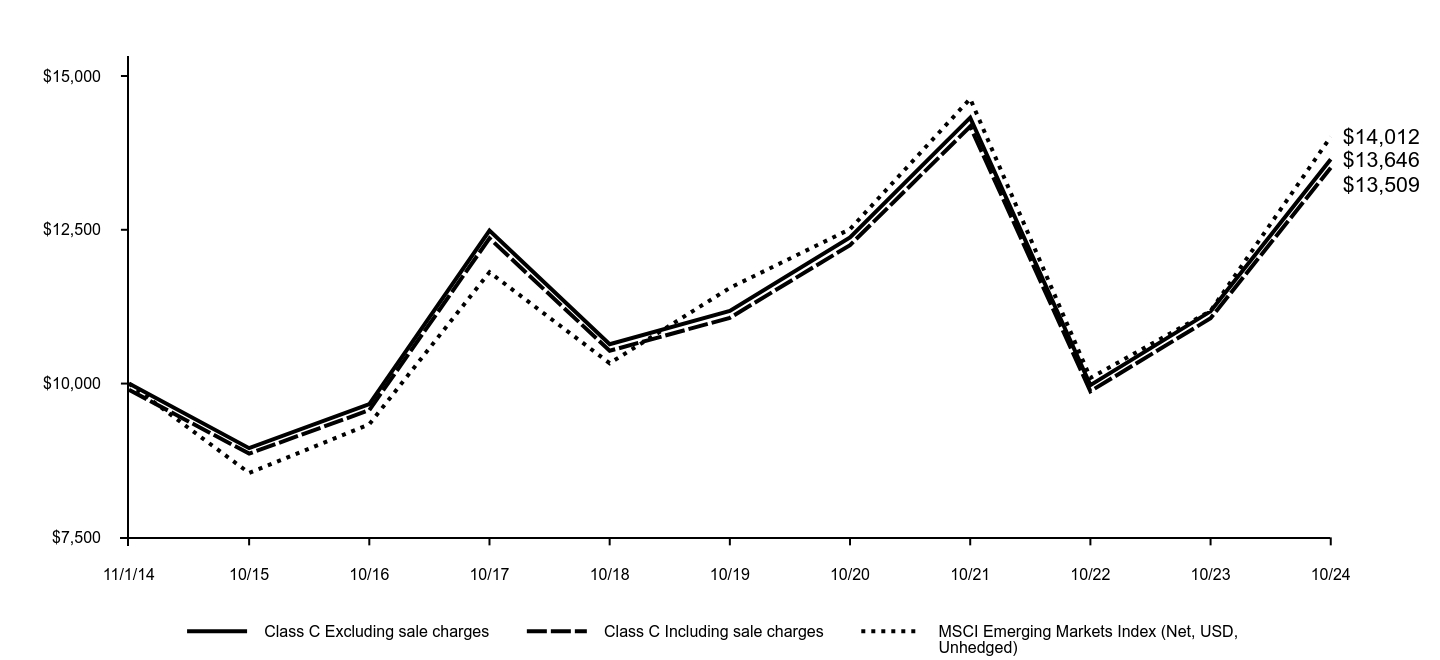

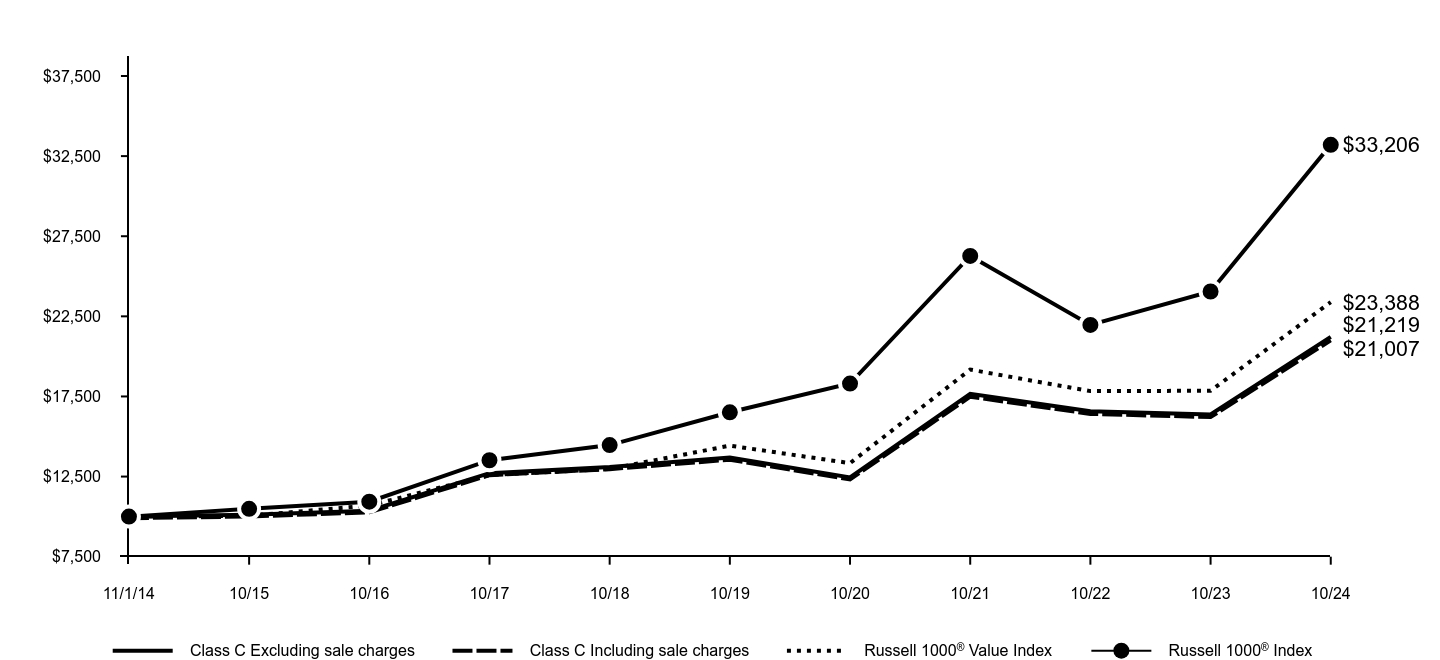

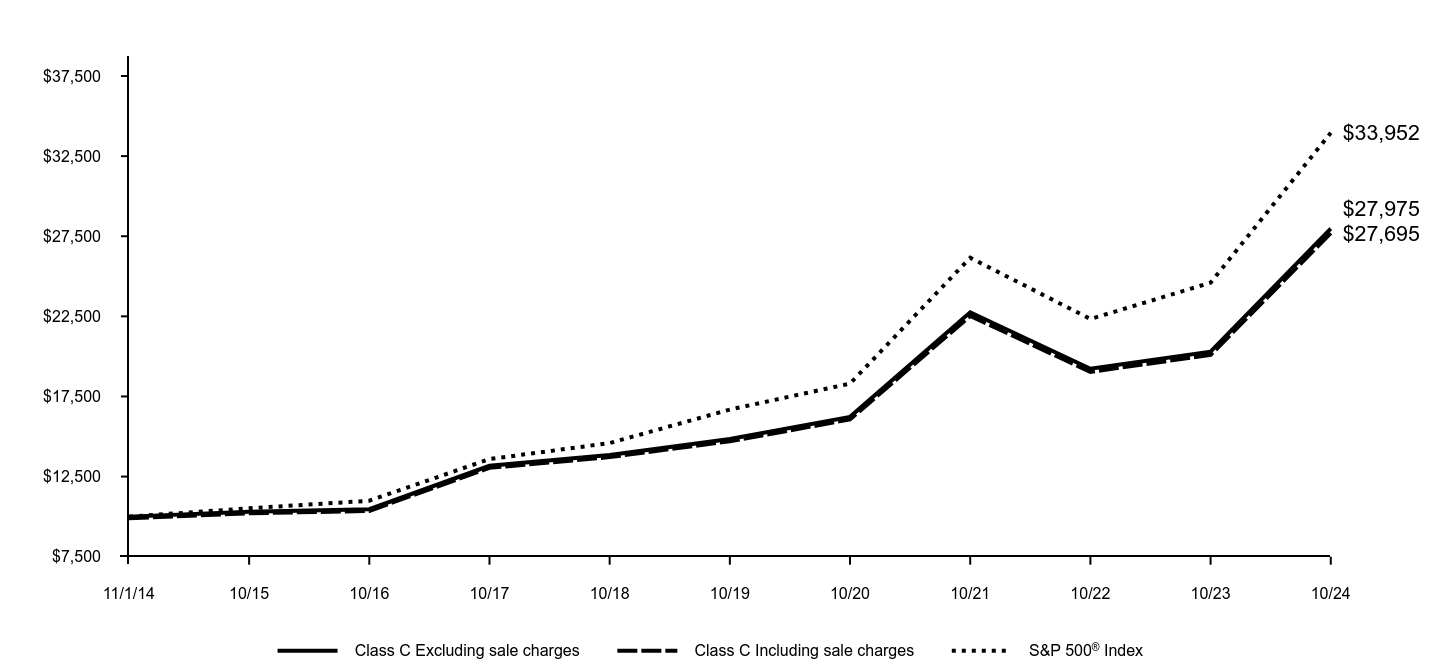

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class C Excluding sale charges | Class C Including sale charges | MSCI Emerging Markets Index (Net, USD, Unhedged) |

|---|

| 11/1/14 | $10,000 | $9,900 | $10,000 |

| 10/15 | $8,950 | $8,861 | $8,547 |

| 10/16 | $9,665 | $9,568 | $9,339 |

| 10/17 | $12,487 | $12,362 | $11,810 |

| 10/18 | $10,639 | $10,533 | $10,331 |

| 10/19 | $11,181 | $11,069 | $11,556 |

| 10/20 | $12,375 | $12,251 | $12,510 |

| 10/21 | $14,323 | $14,179 | $14,631 |

| 10/22 | $9,974 | $9,875 | $10,091 |

| 10/23 | $11,174 | $11,062 | $11,181 |

| 10/24 | $13,646 | $13,509 | $14,012 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class C Excluding sale charges | 22.12% | 4.06% | 3.15% |

| Class C Including sale charges | 21.10% | 4.06% | 3.15% |

| MSCI Emerging Markets Index (Net, USD, Unhedged) | 25.32% | 3.93% | 3.43% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Emerging Markets Equity Insights Fund

Key Fund Statistics (as of October 31, 2024)

| Total Net Assets | $2,152,192,361 |

| # of Portfolio Holdings | 382 |

| Portfolio Turnover Rate | 168% |

| Total Net Advisory Fees Paid | $19,529,355 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-526-7384.

During the period, the Fund’s classification changed from non-diversified to diversified. The Fund was previously registered as a non-diversified investment company.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Financials | 23.9% |

| Information Technology | 20.0% |

| Consumer Discretionary | 11.4% |

| Communication Services | 11.1% |

| Industrials | 7.9% |

| Health Care | 6.7% |

| Materials | 4.8% |

| Consumer Staples | 4.0% |

| Utilities | 3.3% |

| Other | 4.9% |

Goldman Sachs Emerging Markets Equity Insights Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications make any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Emerging Markets Equity Insights Fund

38144N577-AR-1024 Class C

Annual Shareholder Report

October 31, 2024

Goldman Sachs Emerging Markets Equity Insights Fund

Institutional Class: GERIX

This annual shareholder report contains important information about Goldman Sachs Emerging Markets Equity Insights Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $119 | 1.06% |

How did the Fund perform and what affected its performance?

The broad emerging markets equity market experienced volatility but performed strongly, supported by the view that U.S. interest rates were likely to fall more quickly than earlier anticipated and as global economic data was encouraging. China’s market was pressured by economic slowdown and a troubled real estate sector but surged in September 2024 after its central bank implemented monetary stimulus measures and property sector supportive policies. Emerging markets equities fell in October due to global market volatility and a strengthening U.S. dollar.

Top Contributors to Performance:

Stock selection in the industrials, consumer staples and energy sectors added to the Fund’s returns versus the MSCI Emerging Markets Index. To select stocks for the Fund, we use a quantitative model and four investment themes, overweighting or underweighting those chosen by the model.

Among individual stock positions, the Fund benefited from overweights in Trip.com Group, Hanmi Semiconductor and Kia.

The overweight in Trip.com Group, a China-based travel agency holding company, was driven largely by the High Quality Business Models and Sentiment Analysis investment themes.

The Fund’s overweight in Taiwan-based Hanmi Semiconductor was based on our Market Themes & Trends, High Quality Business Models and Sentiment Analysis investment themes.

The Fund was overweight Kia, a South Korean auto maker, mainly due to our High Quality Business Models investment theme.

Top Detractors from Performance:

Stock selection in information technology, utilities and communication services detracted from relative performance.

The Fund was hurt most by an underweight in Taiwan Semiconductor Manufacturing, an overweight in Samsung Electronics and an underweight in PDD Holdings.

The Fund was underweight Taiwan Semiconductor Manufacturing, a Taiwan-based semiconductor foundry, mostly because of our High Quality Business Models and Market Themes & Trends investment themes.

The overweight in South Korean electronics manufacturer Samsung Electronics was based mainly on our Market Themes & Trends and High Quality Business Models investment themes.

The Fund’s underweight in PDD Holdings, a China-based commerce group, was the result of our Market Themes & Trends, Sentiment Analysis and High Quality Business Models investment themes.

Country positioning held back the Fund’s relative performance, with underweights in China, Turkey and Brazil detracting most.

High Quality Business Models

The above represents investment themes.

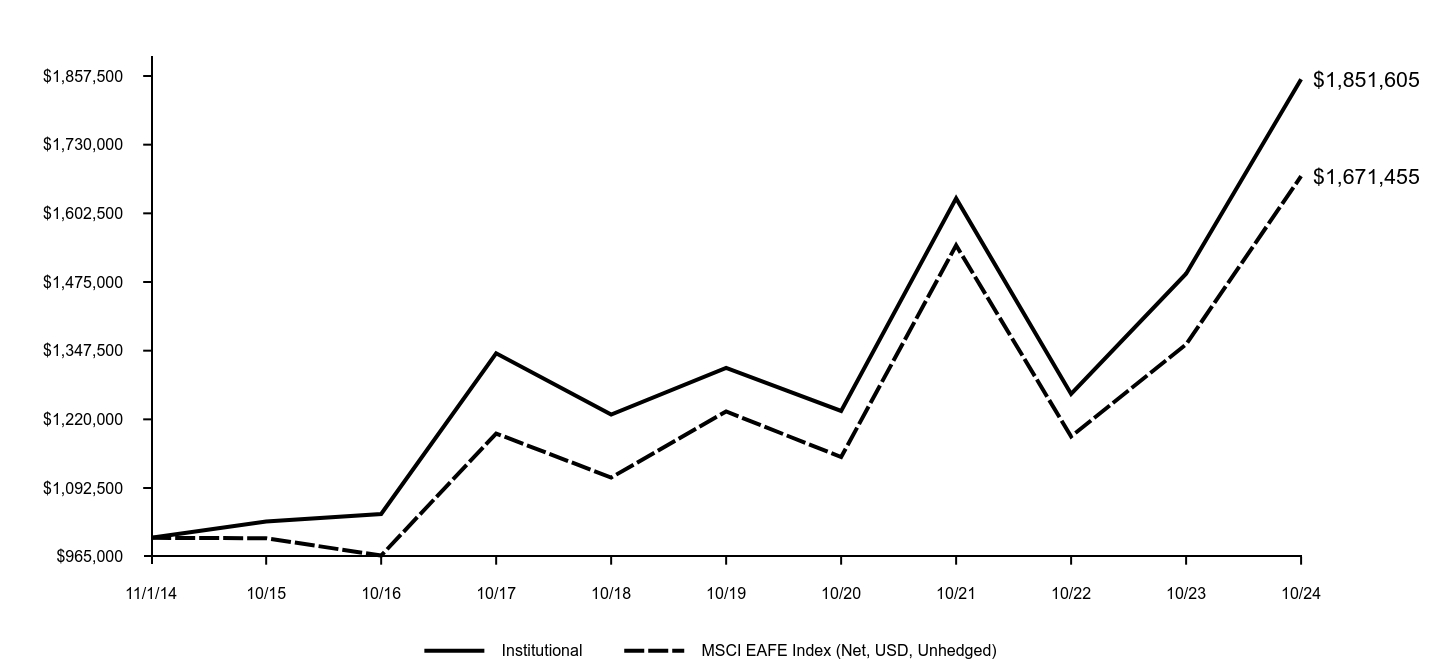

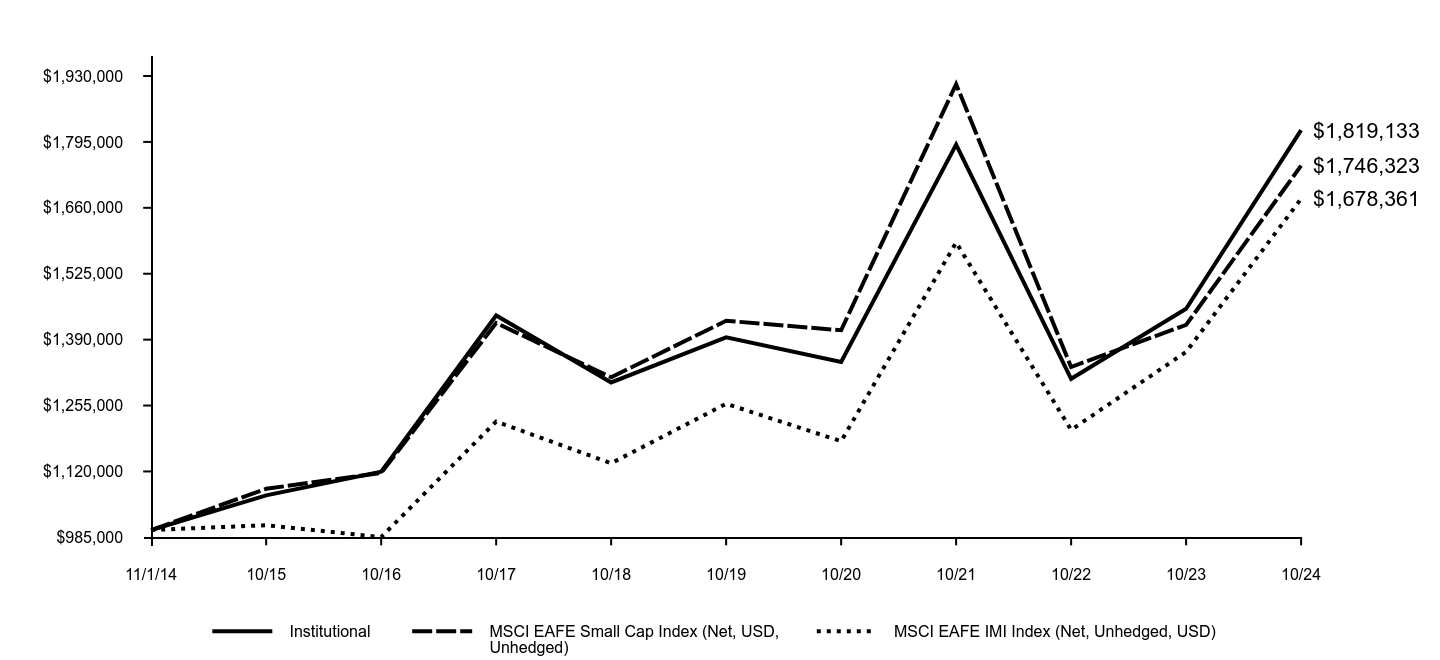

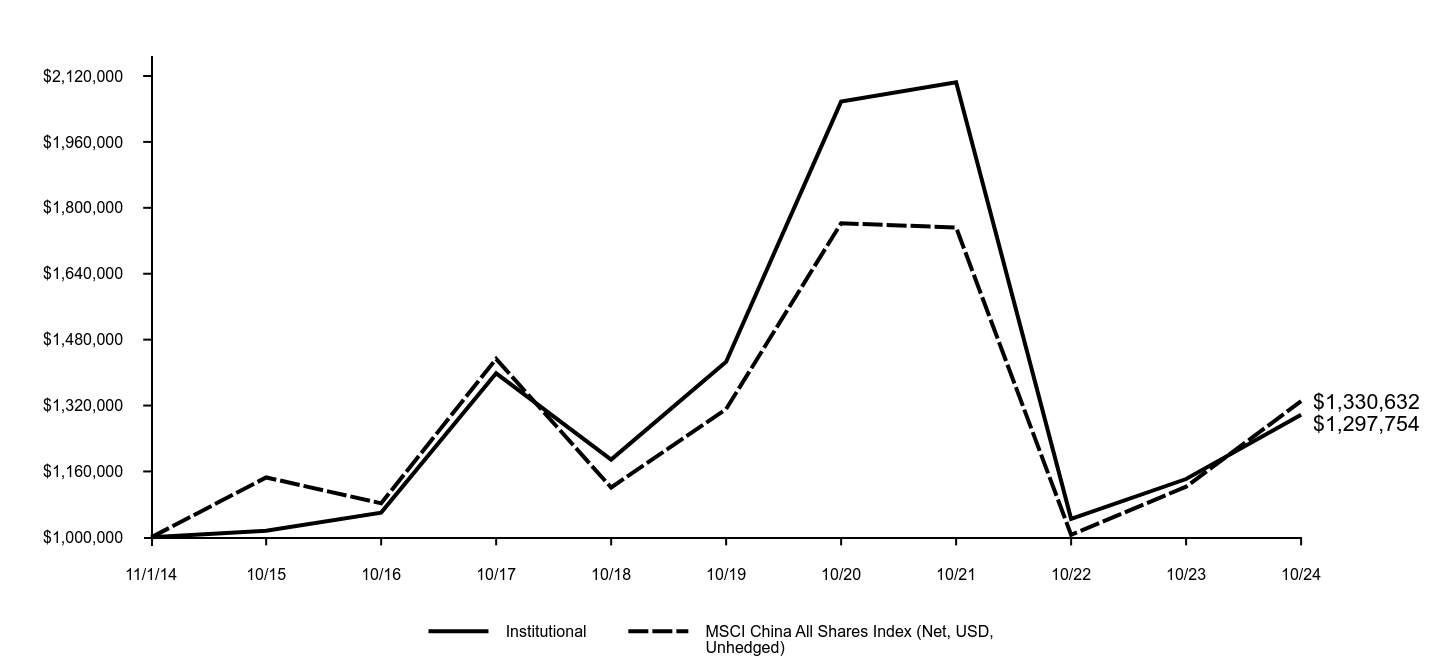

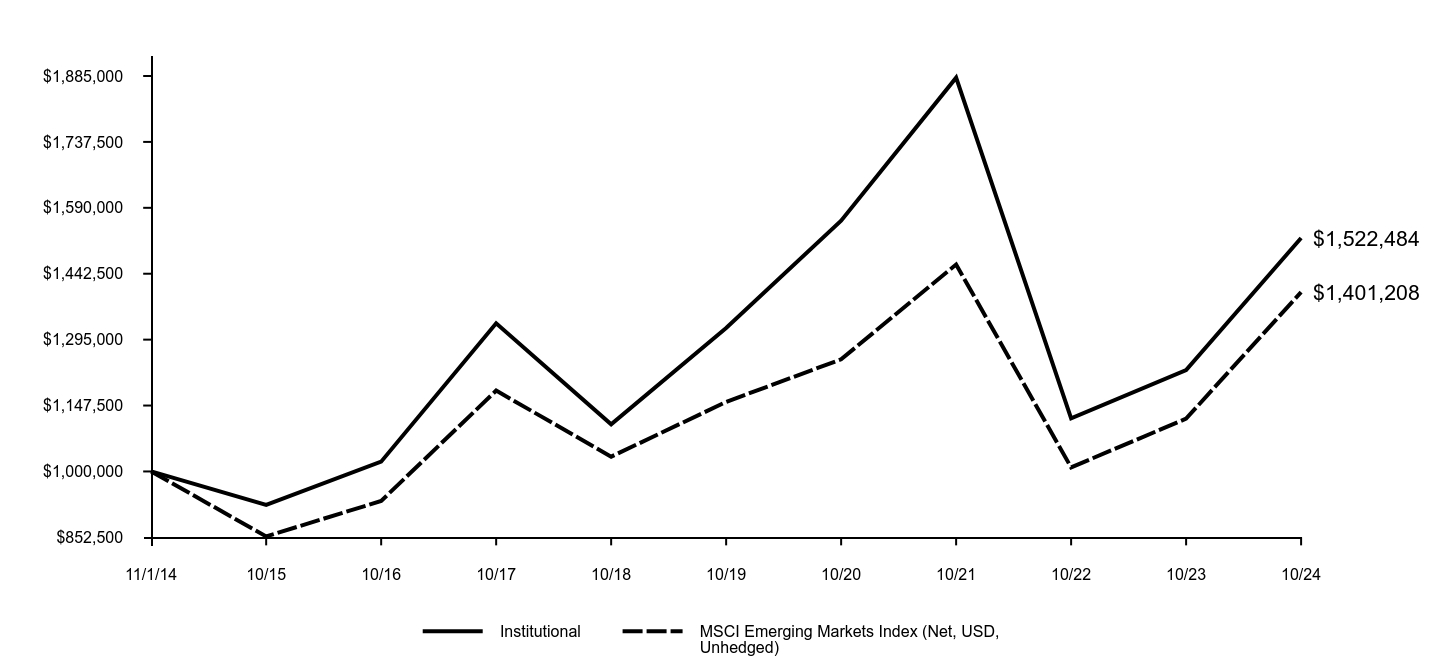

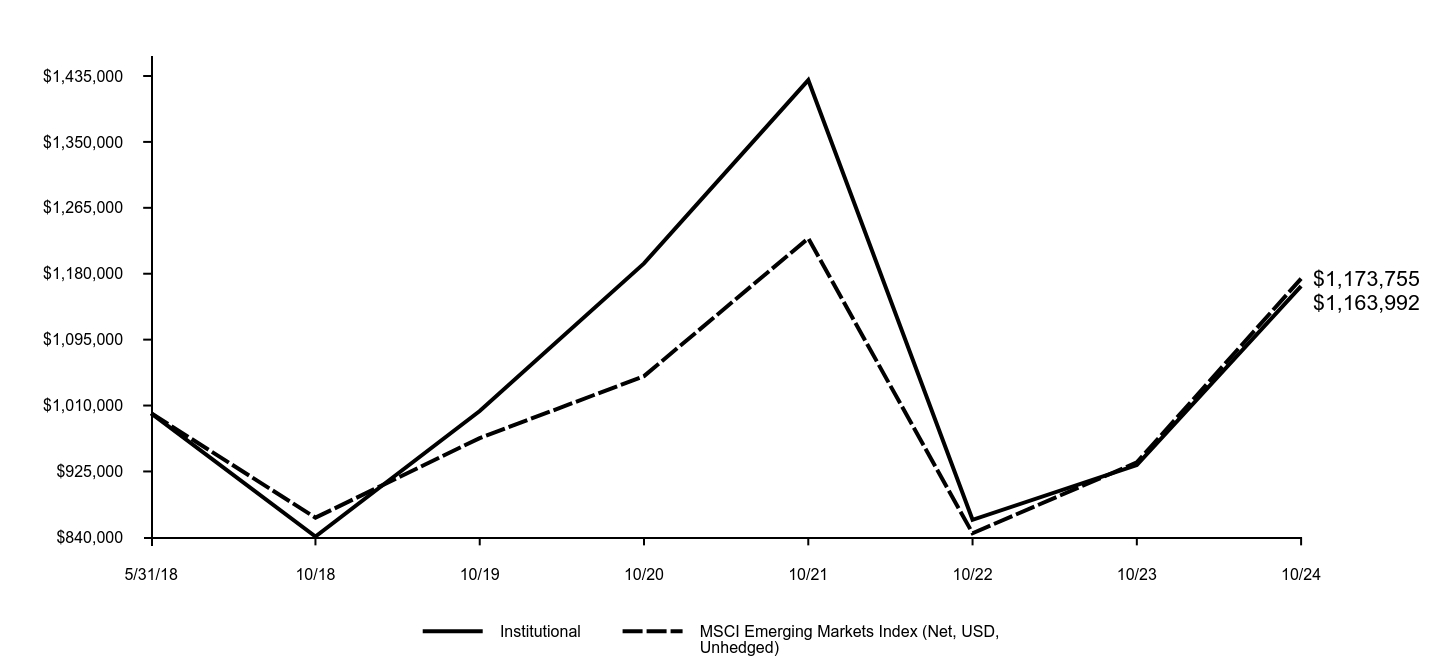

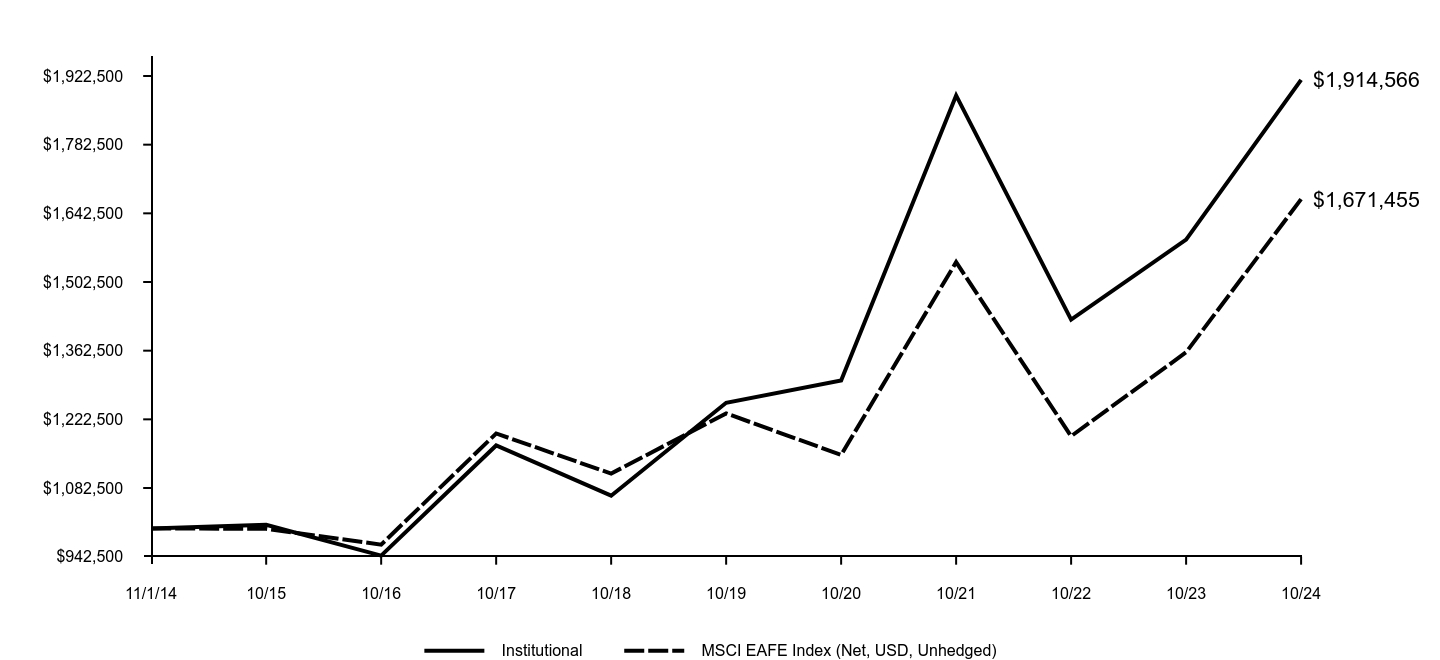

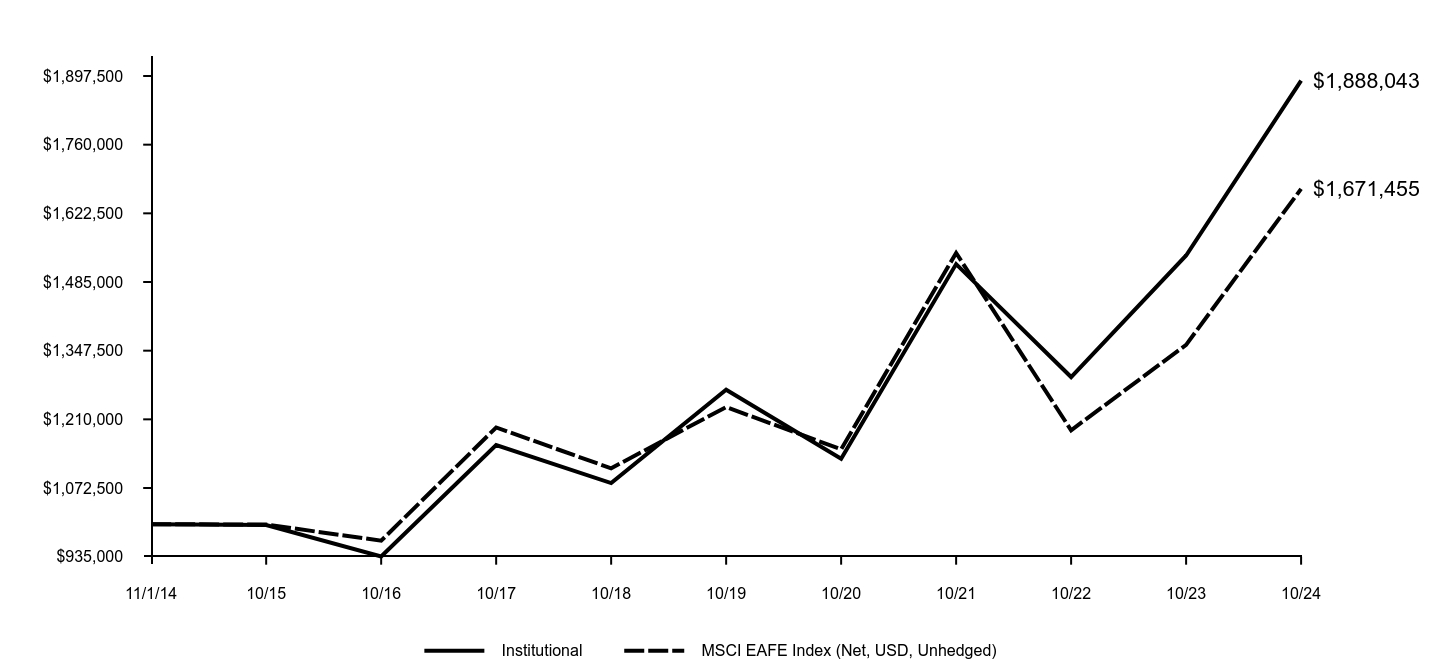

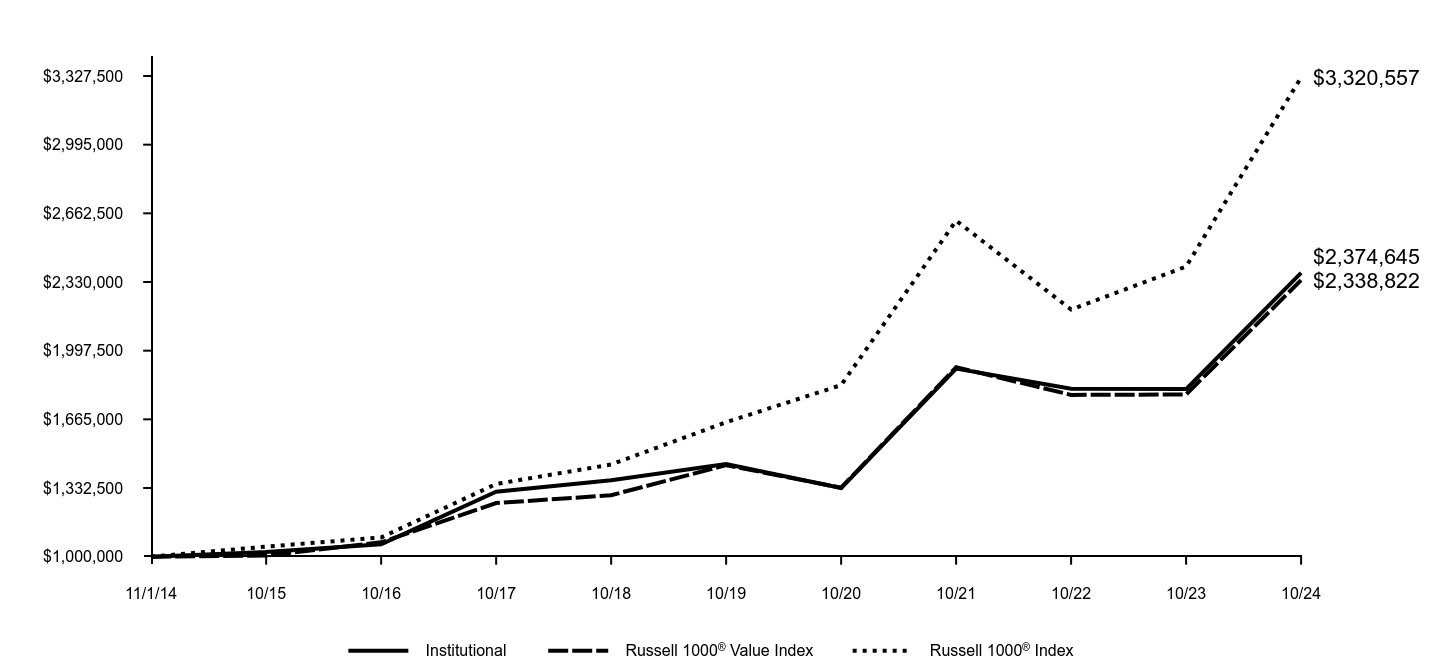

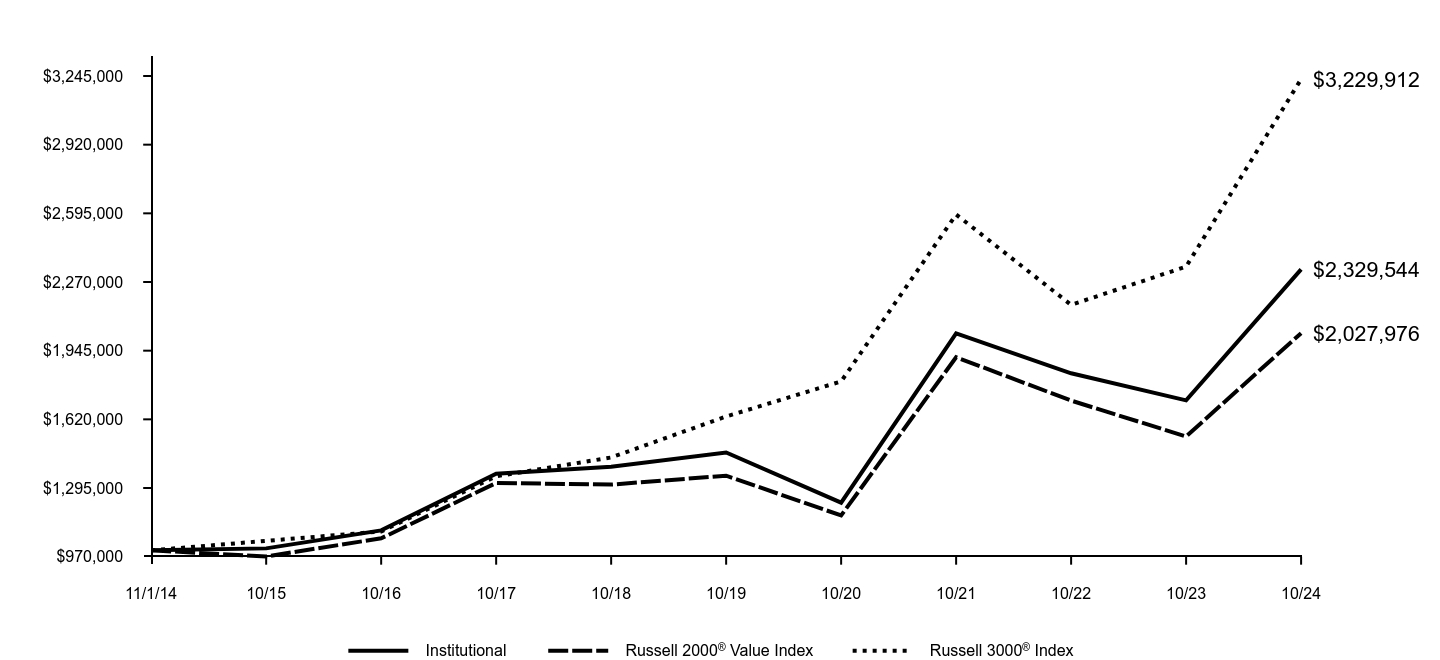

Goldman Sachs Emerging Markets Equity Insights Fund

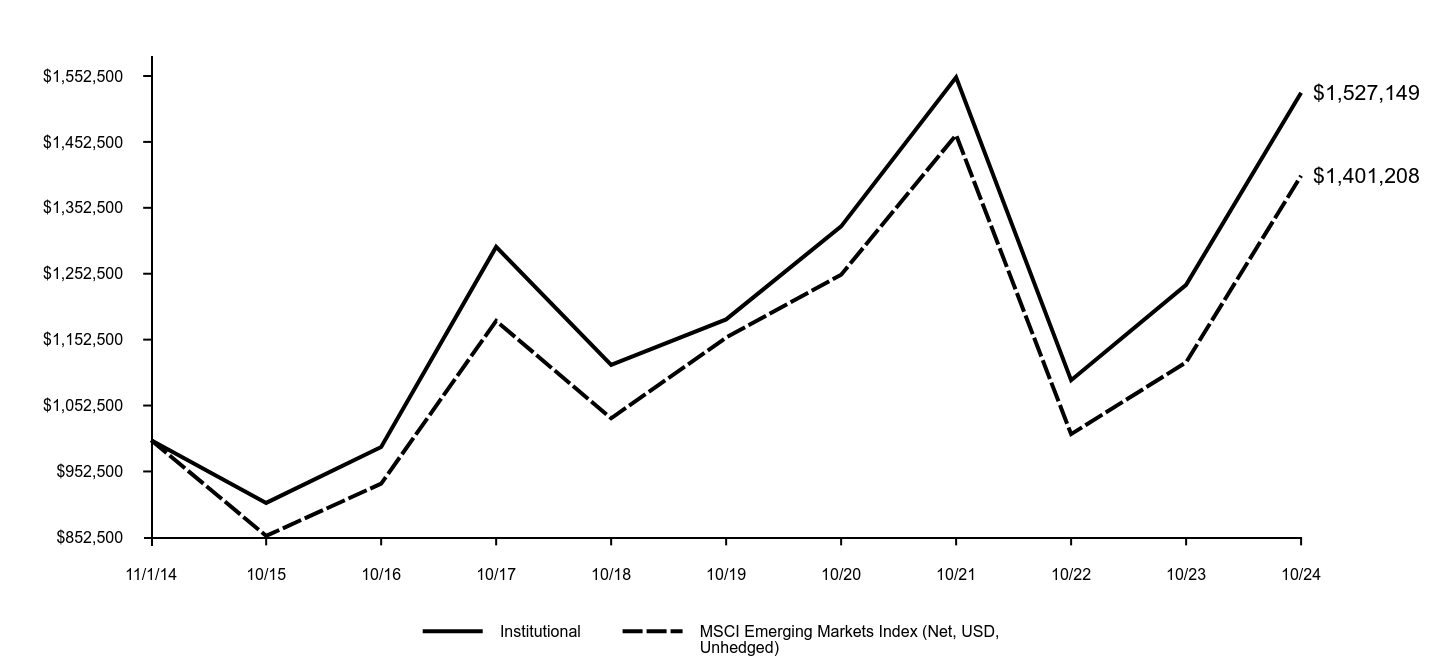

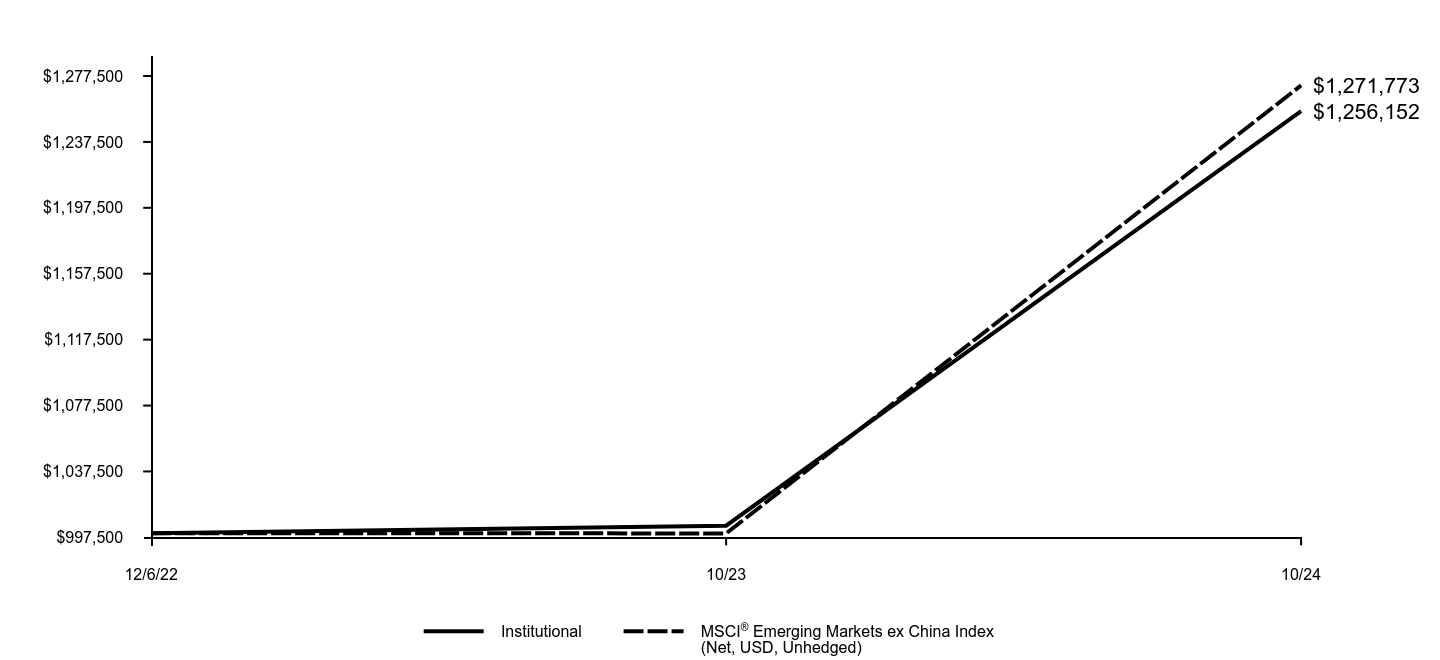

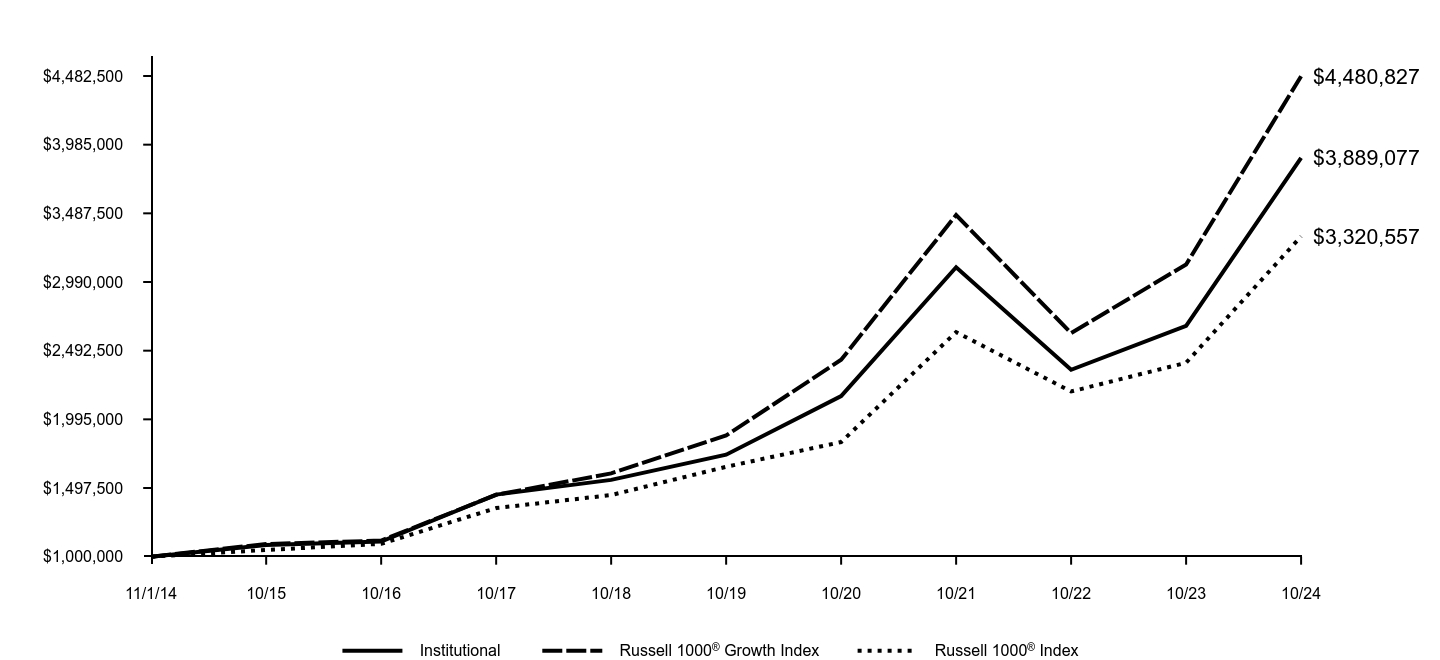

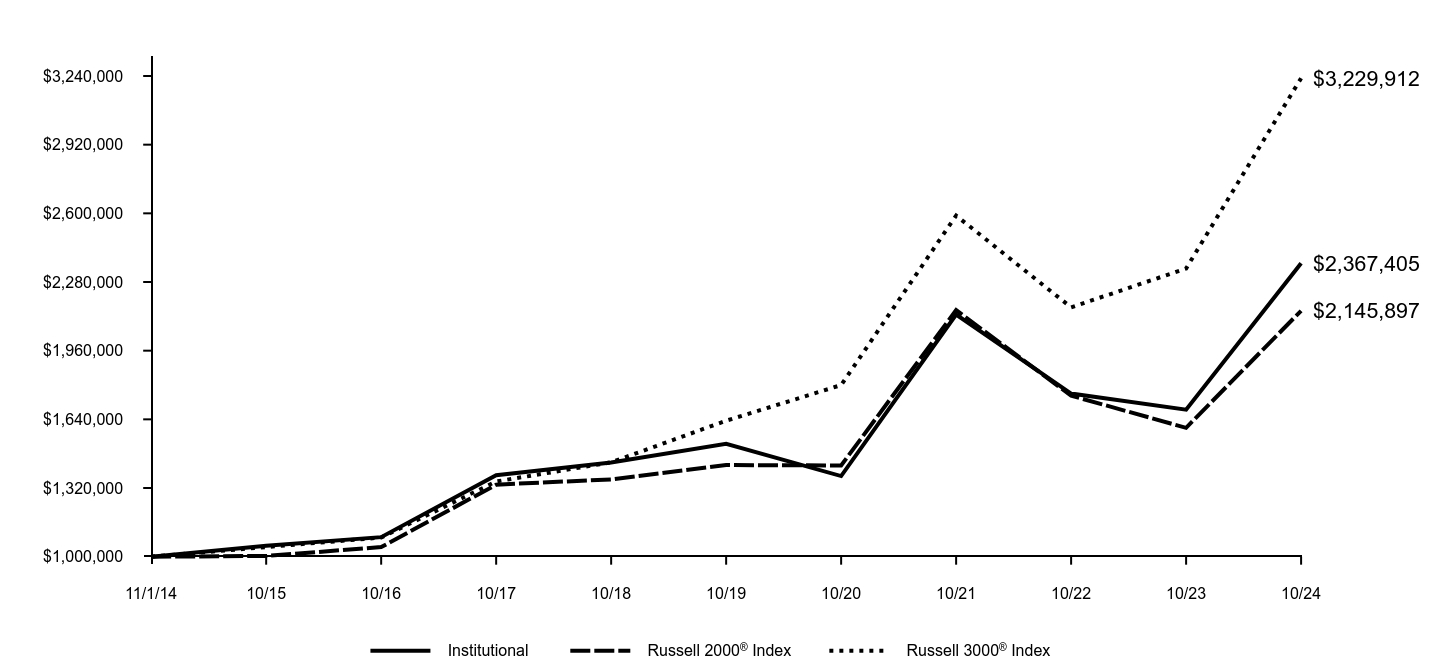

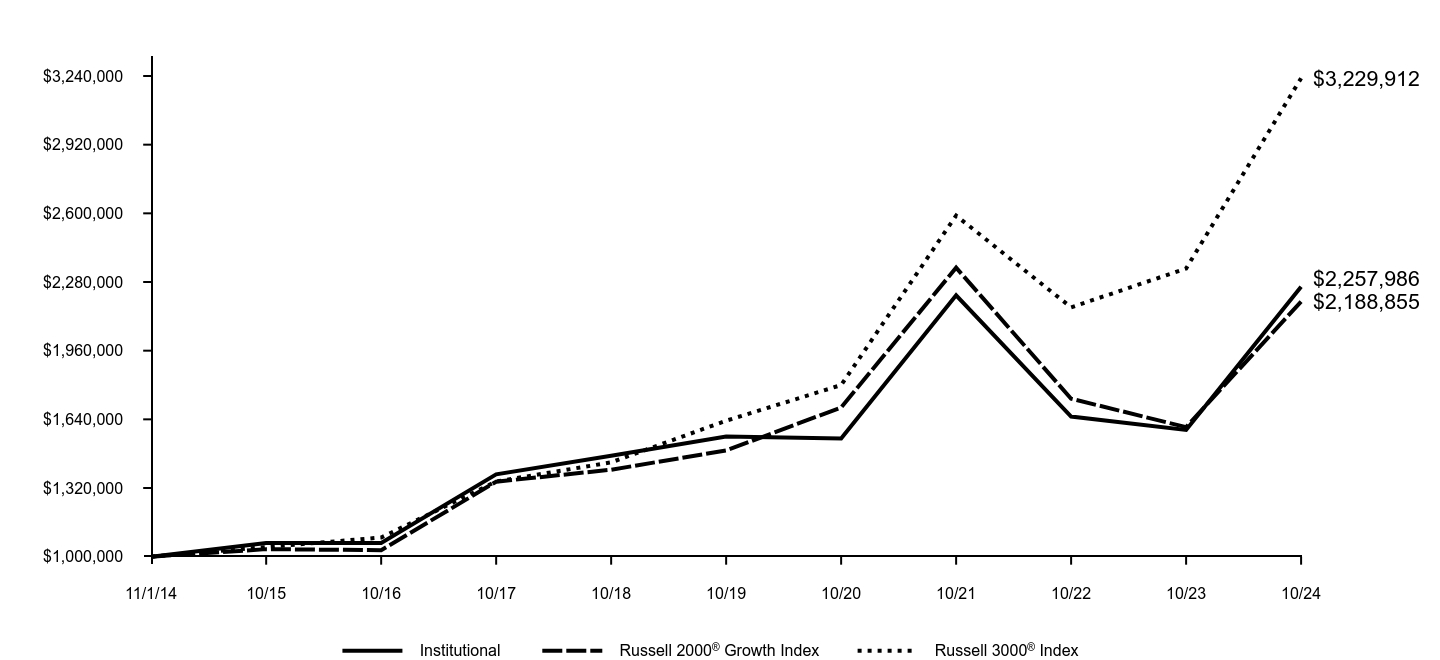

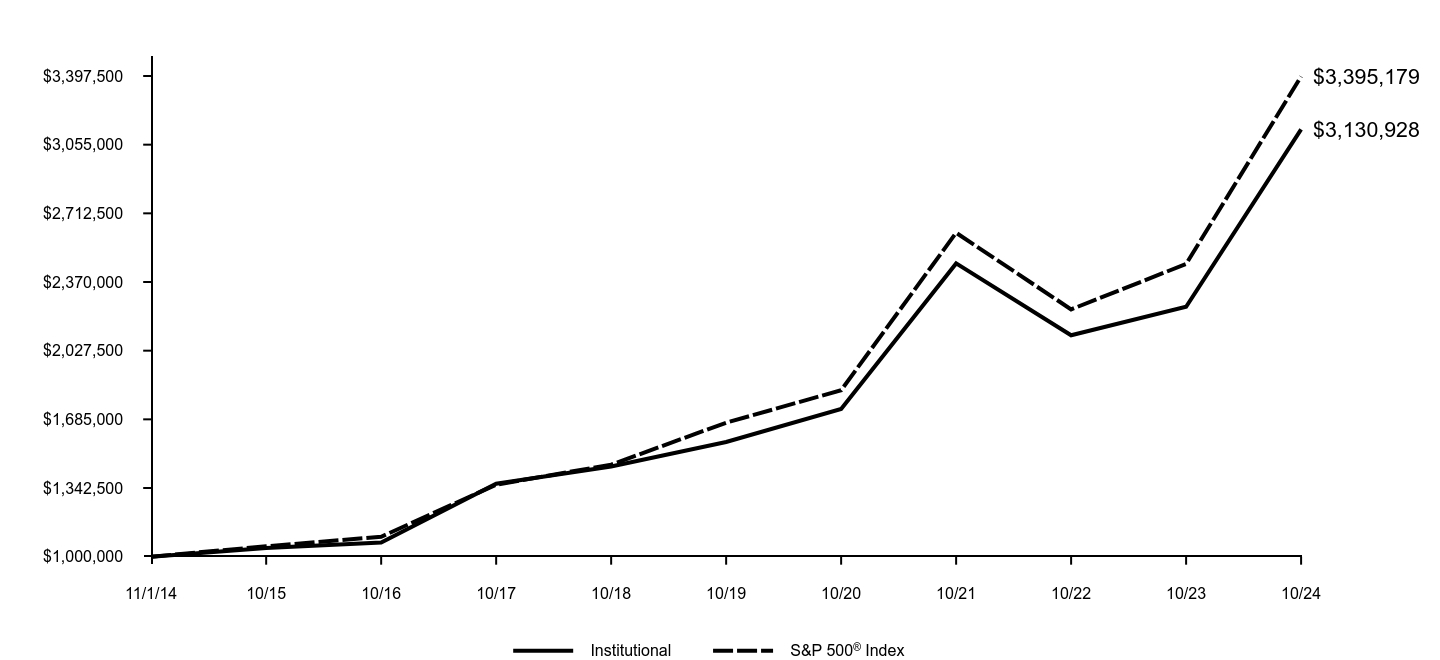

The following graph assumes an initial $1,000,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Institutional | MSCI Emerging Markets Index (Net, USD, Unhedged) |

|---|

| 11/1/14 | $1,000,000 | $1,000,000 |

| 10/15 | $904,800 | $854,700 |

| 10/16 | $989,670 | $933,931 |

| 10/17 | $1,293,202 | $1,180,955 |

| 10/18 | $1,114,352 | $1,033,100 |

| 10/19 | $1,183,219 | $1,155,625 |

| 10/20 | $1,324,377 | $1,250,964 |

| 10/21 | $1,550,448 | $1,463,128 |

| 10/22 | $1,090,896 | $1,009,119 |

| 10/23 | $1,235,657 | $1,118,104 |

| 10/24 | $1,527,149 | $1,401,208 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Institutional | 23.59% | 5.23% | 4.32% |

| MSCI Emerging Markets Index (Net, USD, Unhedged) | 25.32% | 3.93% | 3.43% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Emerging Markets Equity Insights Fund

Key Fund Statistics (as of October 31, 2024)

| Total Net Assets | $2,152,192,361 |

| # of Portfolio Holdings | 382 |

| Portfolio Turnover Rate | 168% |

| Total Net Advisory Fees Paid | $19,529,355 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

During the period, the Fund’s classification changed from non-diversified to diversified. The Fund was previously registered as a non-diversified investment company.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Financials | 23.9% |

| Information Technology | 20.0% |

| Consumer Discretionary | 11.4% |

| Communication Services | 11.1% |

| Industrials | 7.9% |

| Health Care | 6.7% |

| Materials | 4.8% |

| Consumer Staples | 4.0% |

| Utilities | 3.3% |

| Other | 4.9% |

Goldman Sachs Emerging Markets Equity Insights Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications make any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Emerging Markets Equity Insights Fund

38144N569-AR-1024 Institutional Class

Annual Shareholder Report

October 31, 2024

Goldman Sachs Emerging Markets Equity Insights Fund

This annual shareholder report contains important information about Goldman Sachs Emerging Markets Equity Insights Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor | $127 | 1.14% |

How did the Fund perform and what affected its performance?

The broad emerging markets equity market experienced volatility but performed strongly, supported by the view that U.S. interest rates were likely to fall more quickly than earlier anticipated and as global economic data was encouraging. China’s market was pressured by economic slowdown and a troubled real estate sector but surged in September 2024 after its central bank implemented monetary stimulus measures and property sector supportive policies. Emerging markets equities fell in October due to global market volatility and a strengthening U.S. dollar.

Top Contributors to Performance:

Stock selection in the industrials, consumer staples and energy sectors added to the Fund’s returns versus the MSCI Emerging Markets Index. To select stocks for the Fund, we use a quantitative model and four investment themes, overweighting or underweighting those chosen by the model.

Among individual stock positions, the Fund benefited from overweights in Trip.com Group, Hanmi Semiconductor and Kia.

The overweight in Trip.com Group, a China-based travel agency holding company, was driven largely by the High Quality Business Models and Sentiment Analysis investment themes.

The Fund’s overweight in Taiwan-based Hanmi Semiconductor was based on our Market Themes & Trends, High Quality Business Models and Sentiment Analysis investment themes.

The Fund was overweight Kia, a South Korean auto maker, mainly due to our High Quality Business Models investment theme.

Top Detractors from Performance:

Stock selection in information technology, utilities and communication services detracted from relative performance.

The Fund was hurt most by an underweight in Taiwan Semiconductor Manufacturing, an overweight in Samsung Electronics and an underweight in PDD Holdings.

The Fund was underweight Taiwan Semiconductor Manufacturing, a Taiwan-based semiconductor foundry, mostly because of our High Quality Business Models and Market Themes & Trends investment themes.

The overweight in South Korean electronics manufacturer Samsung Electronics was based mainly on our Market Themes & Trends and High Quality Business Models investment themes.

The Fund’s underweight in PDD Holdings, a China-based commerce group, was the result of our Market Themes & Trends, Sentiment Analysis and High Quality Business Models investment themes.

Country positioning held back the Fund’s relative performance, with underweights in China, Turkey and Brazil detracting most.

High Quality Business Models

The above represents investment themes.

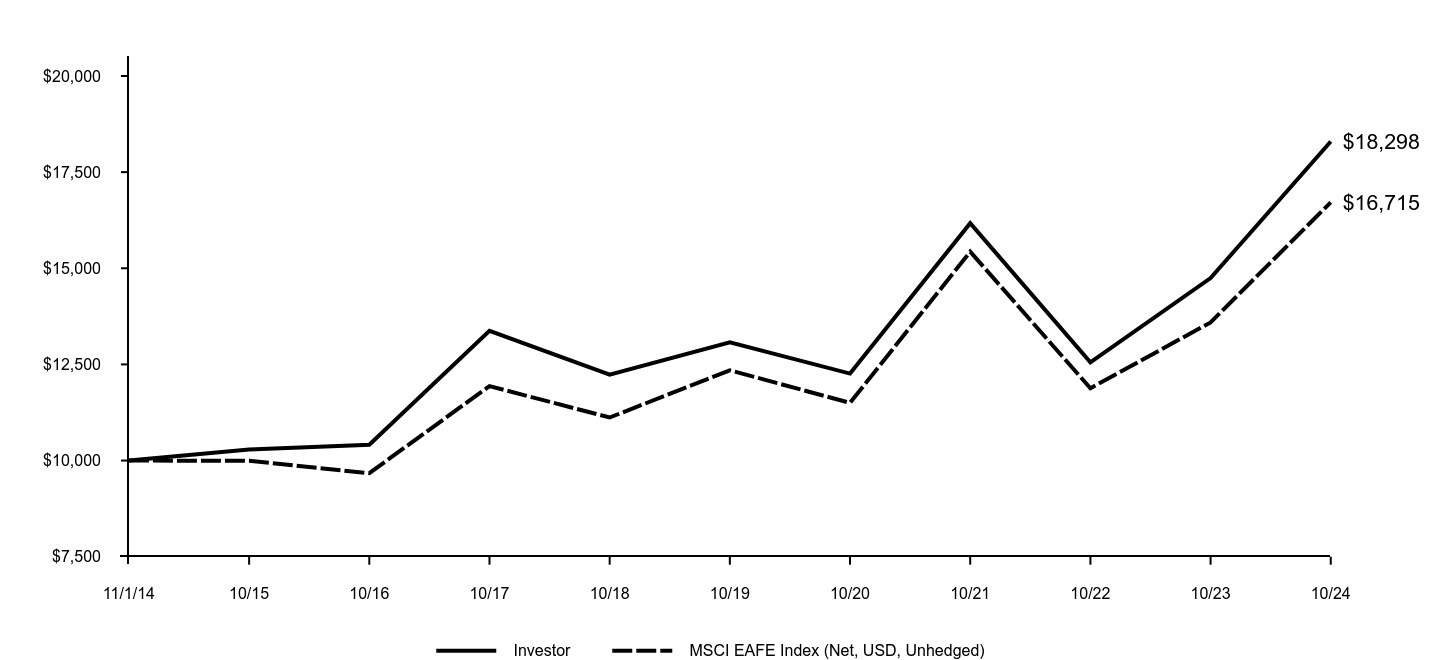

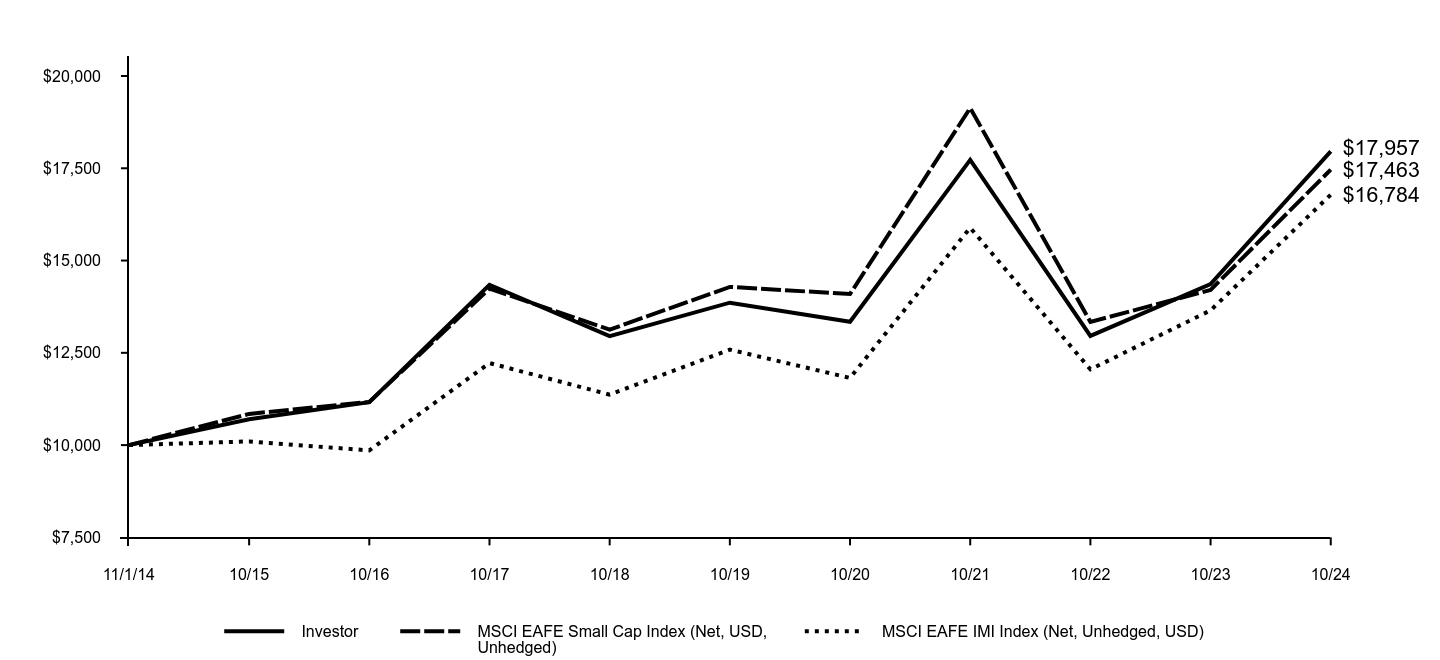

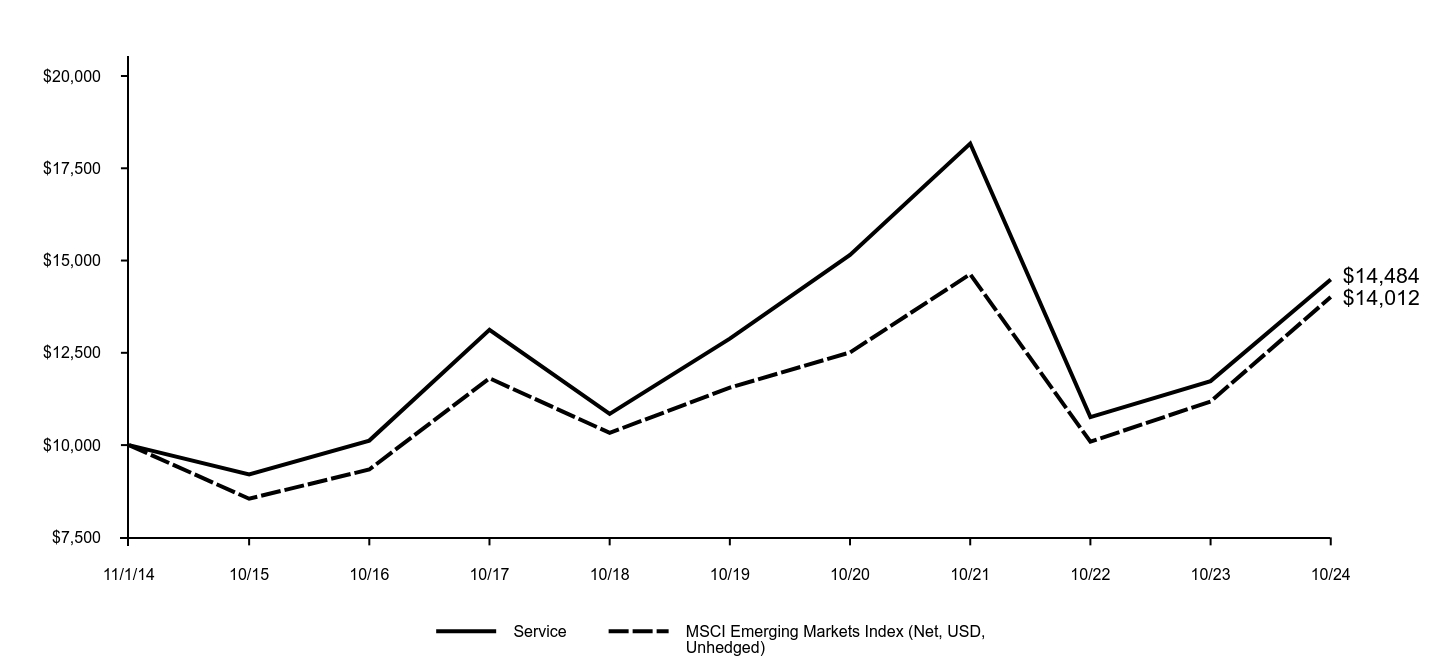

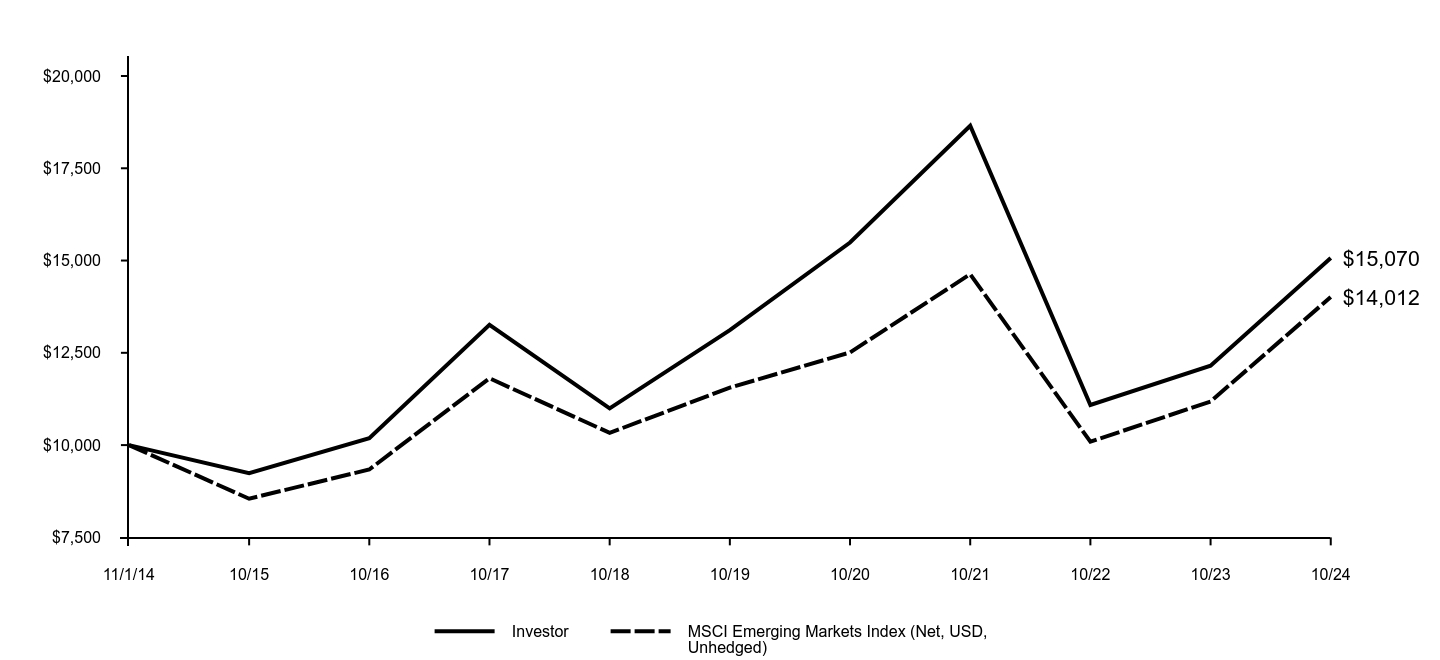

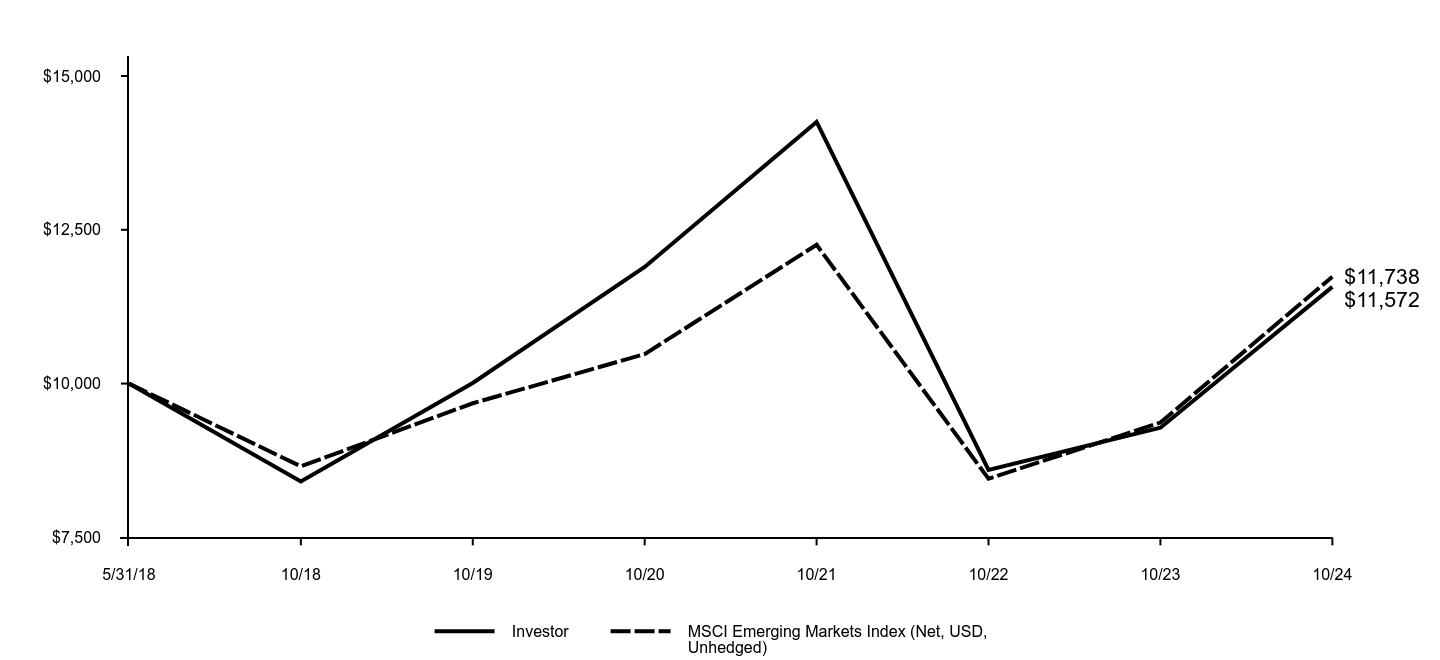

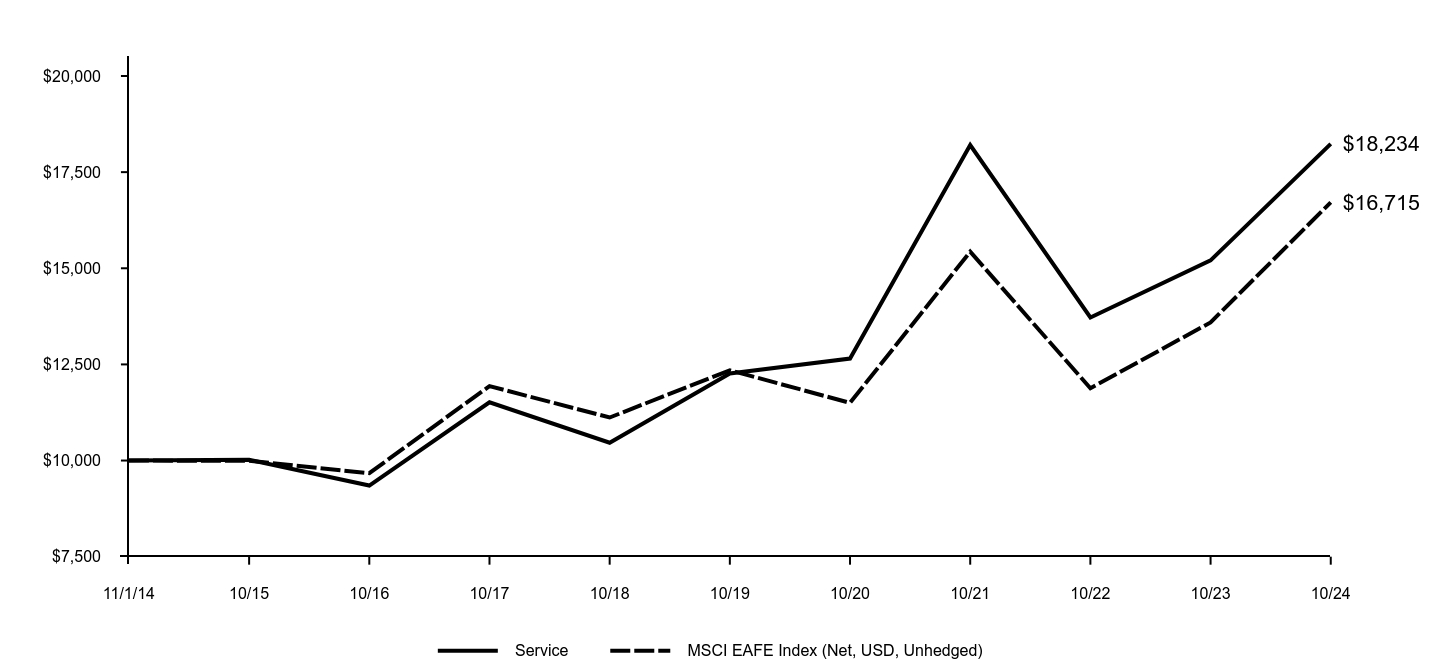

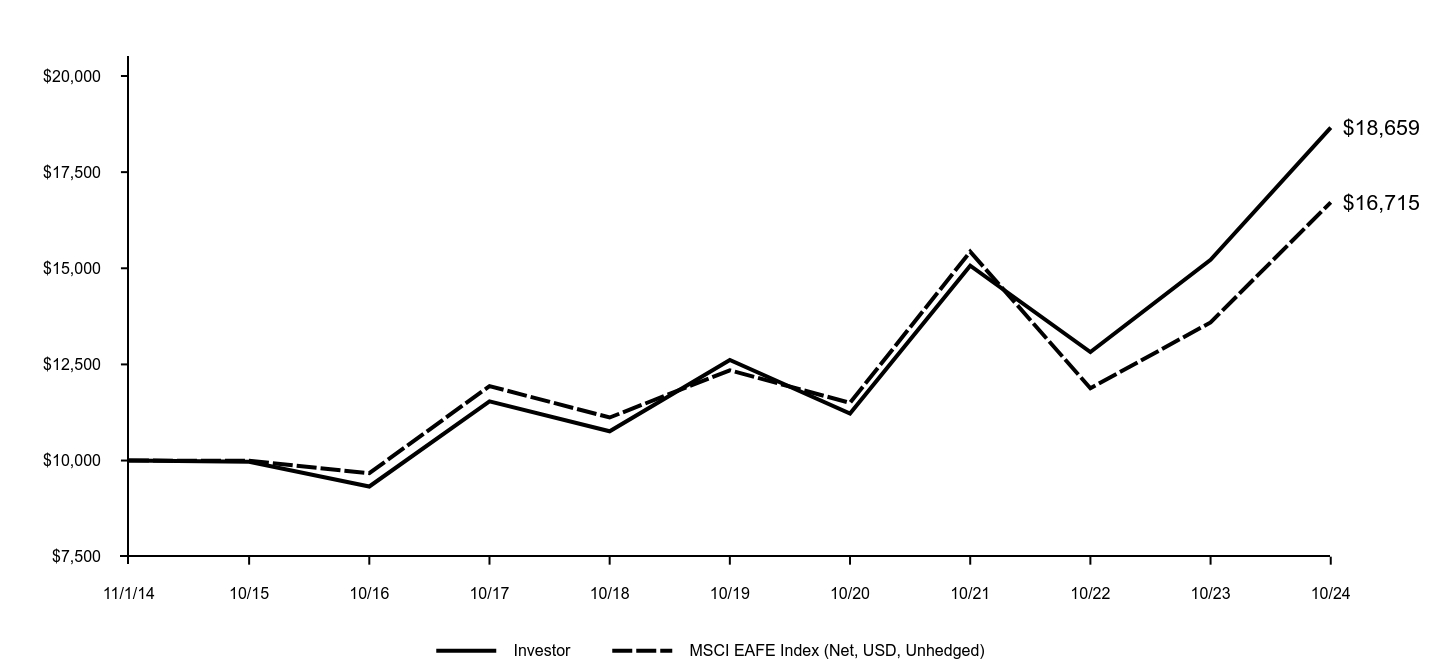

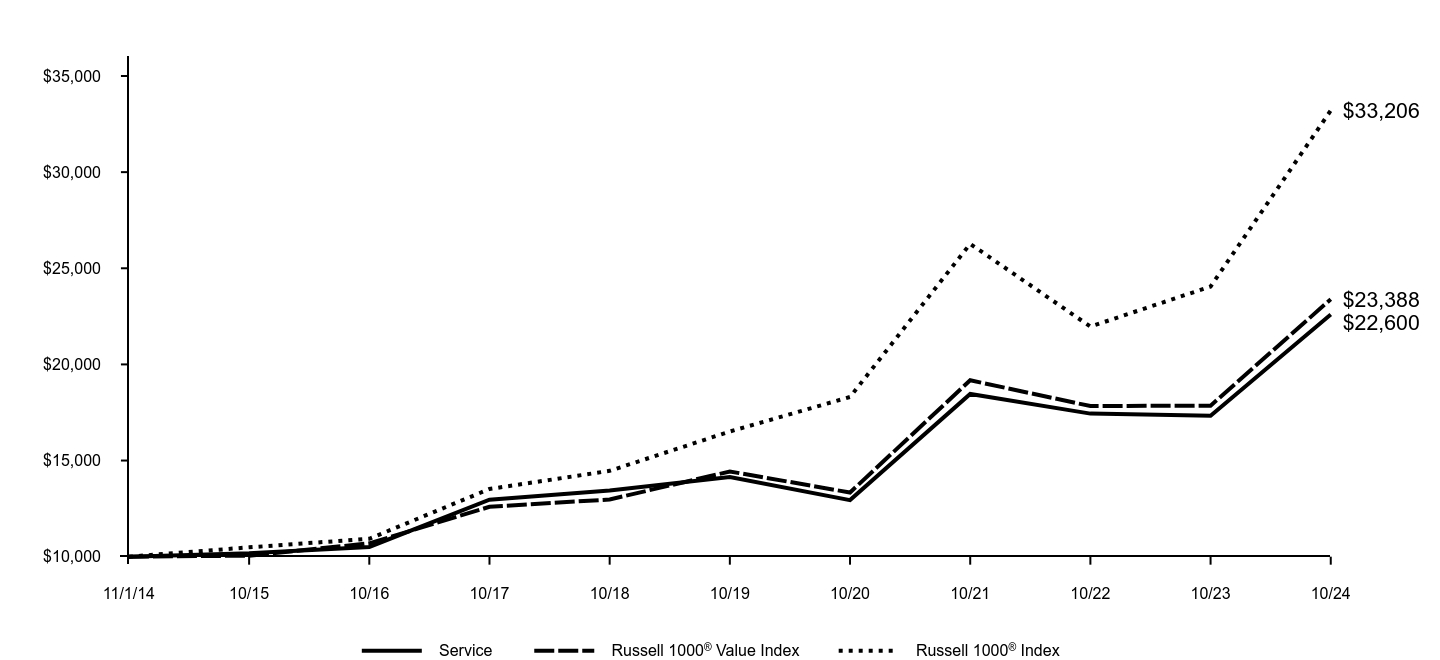

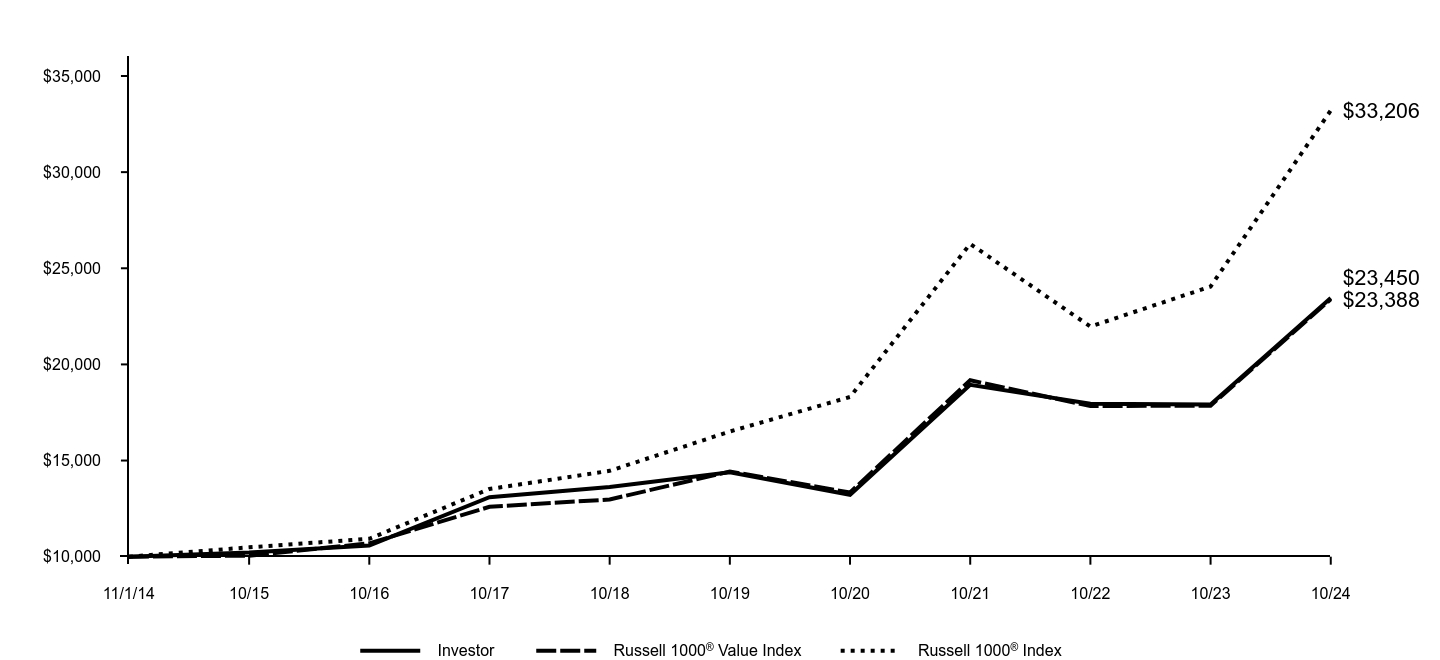

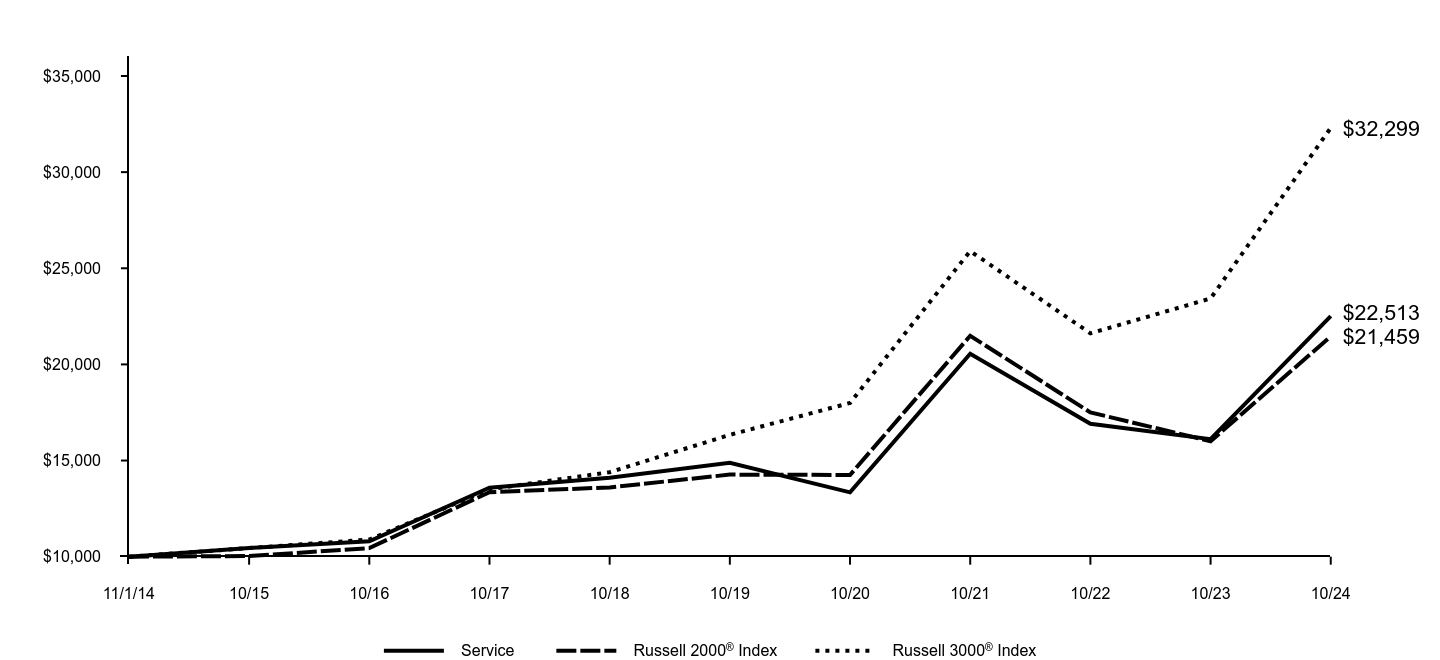

Goldman Sachs Emerging Markets Equity Insights Fund

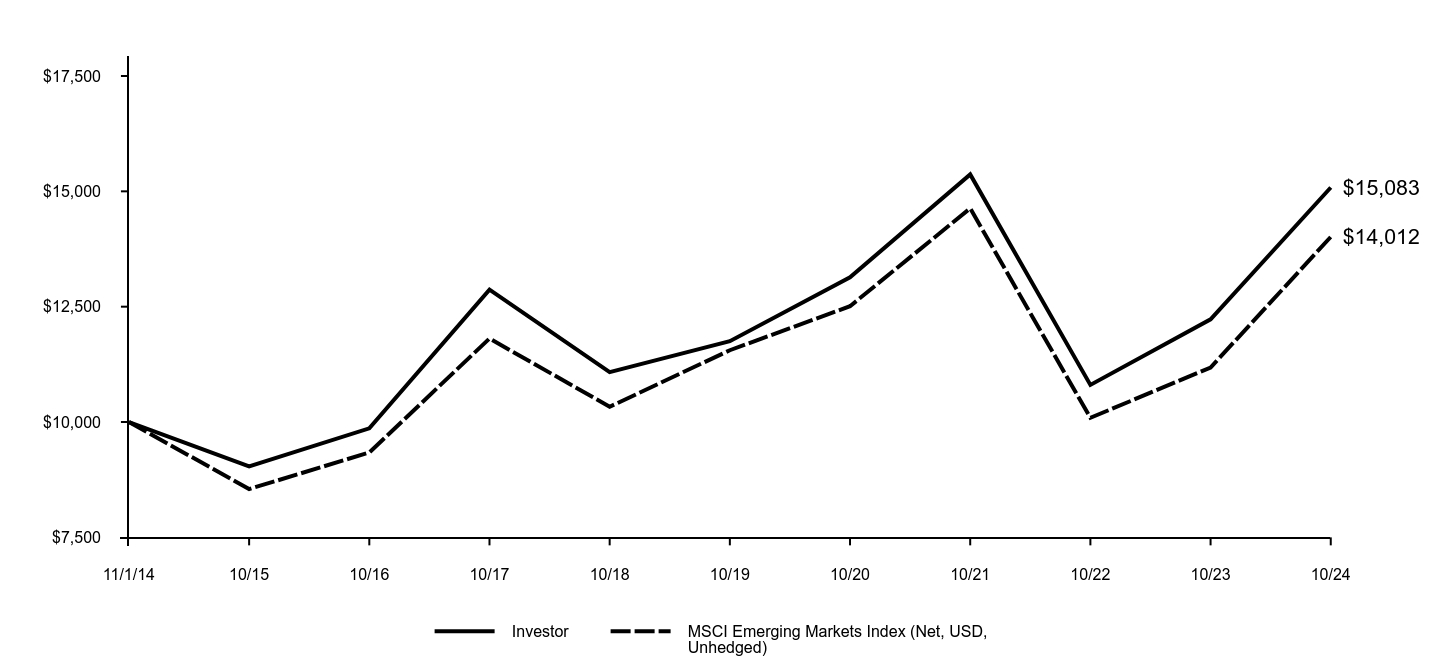

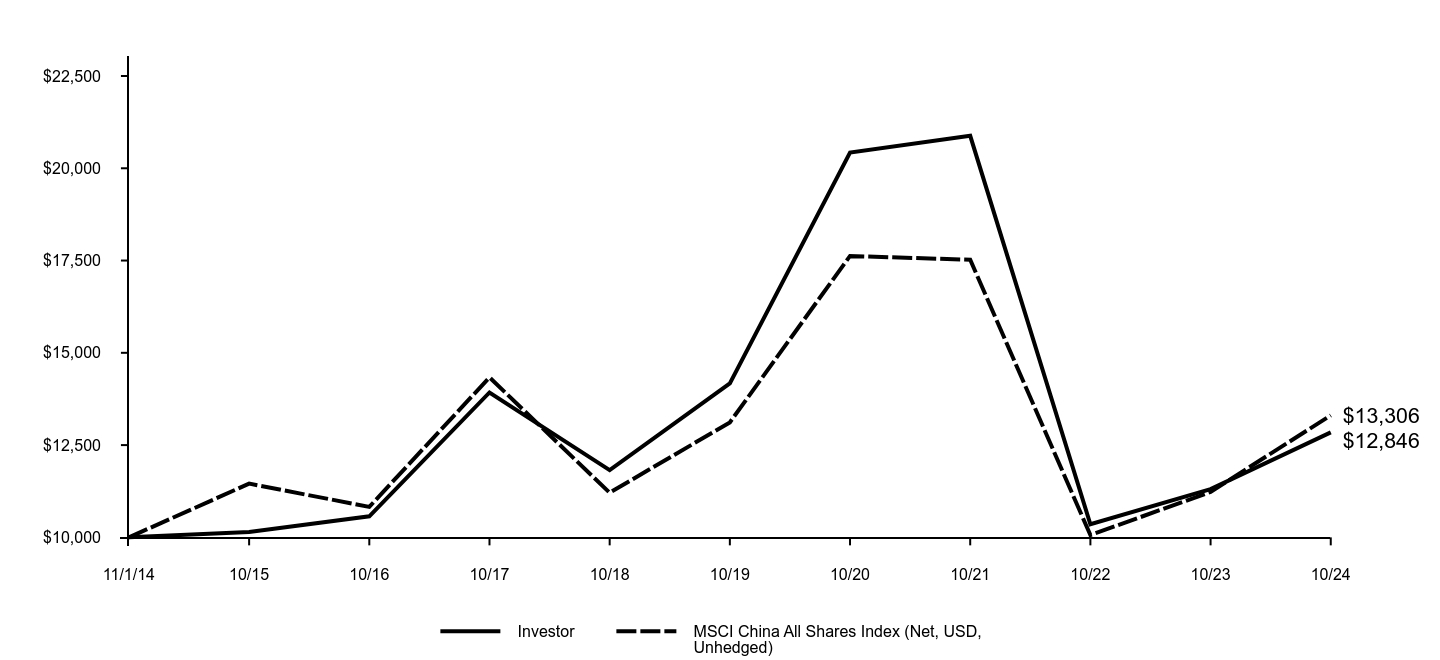

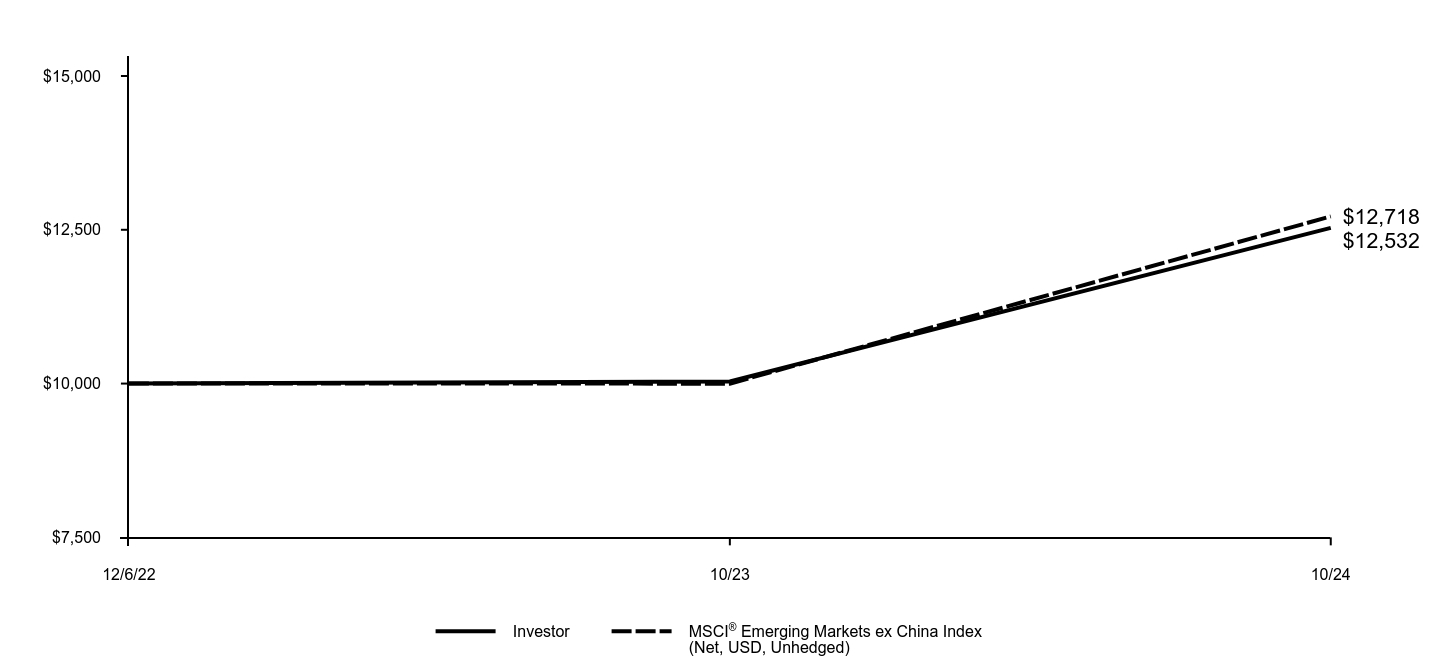

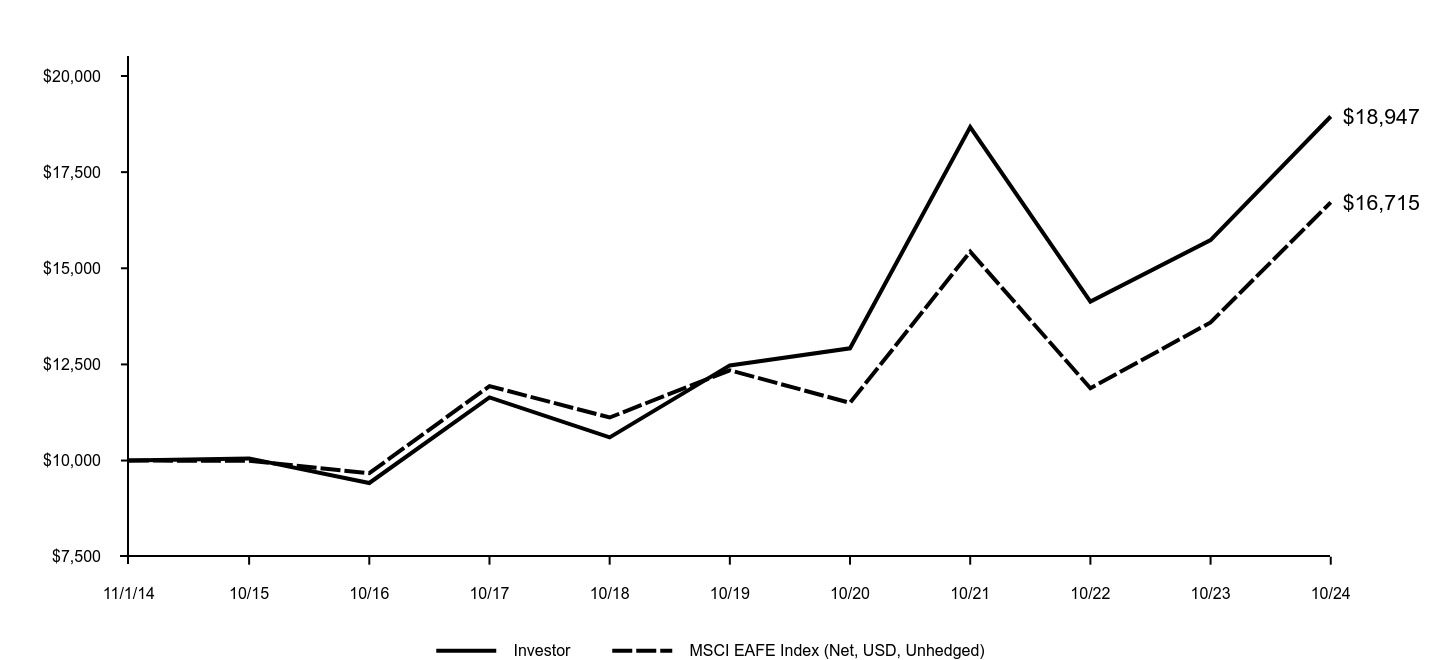

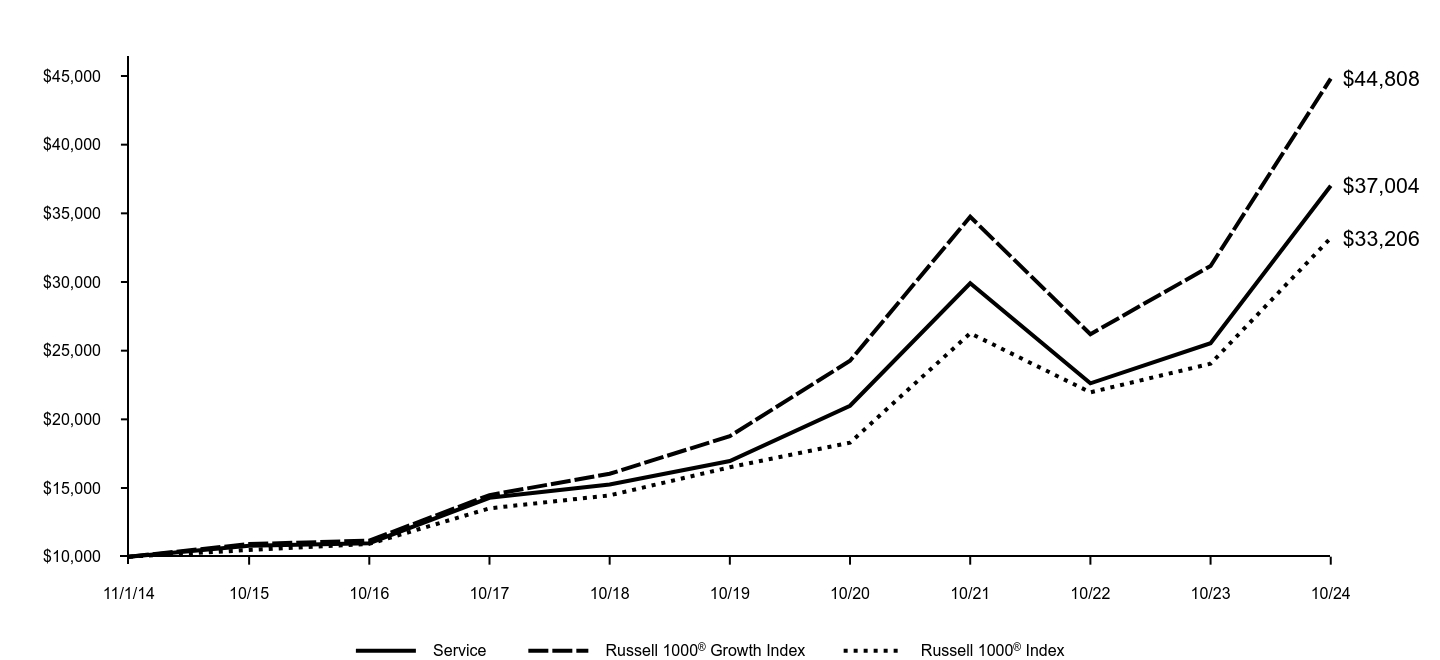

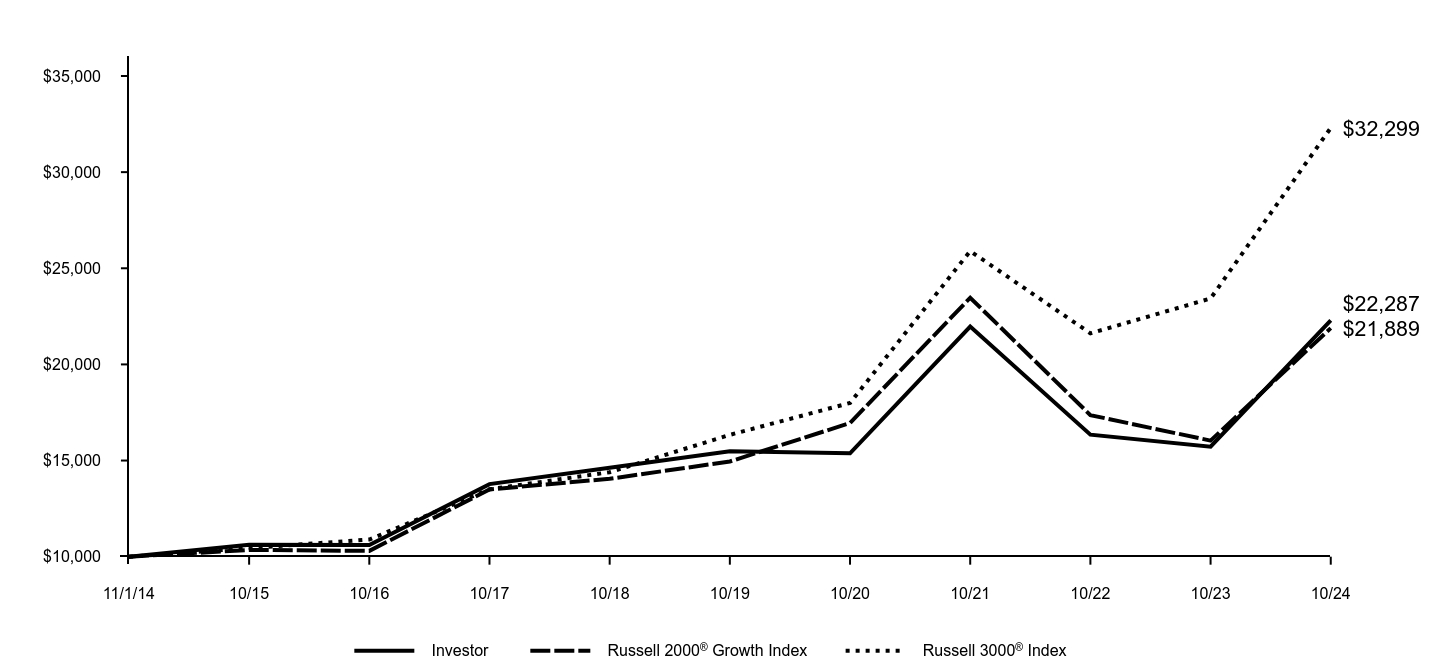

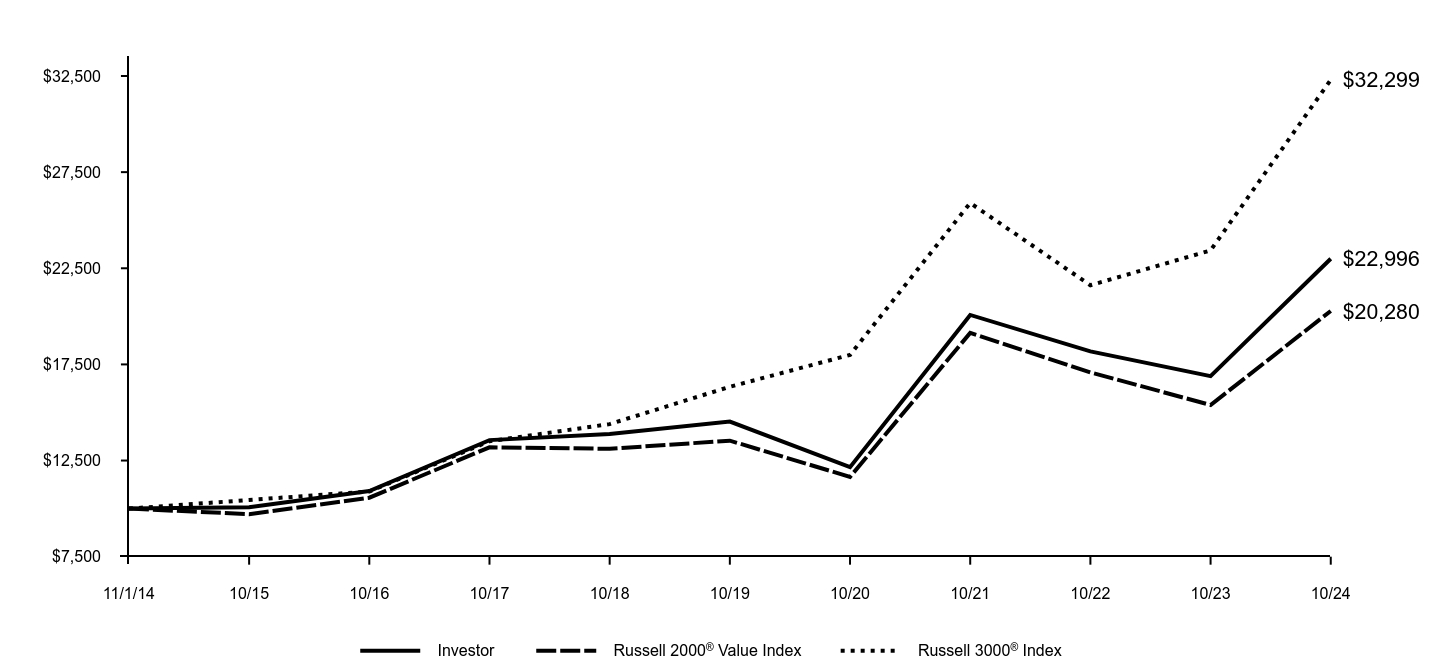

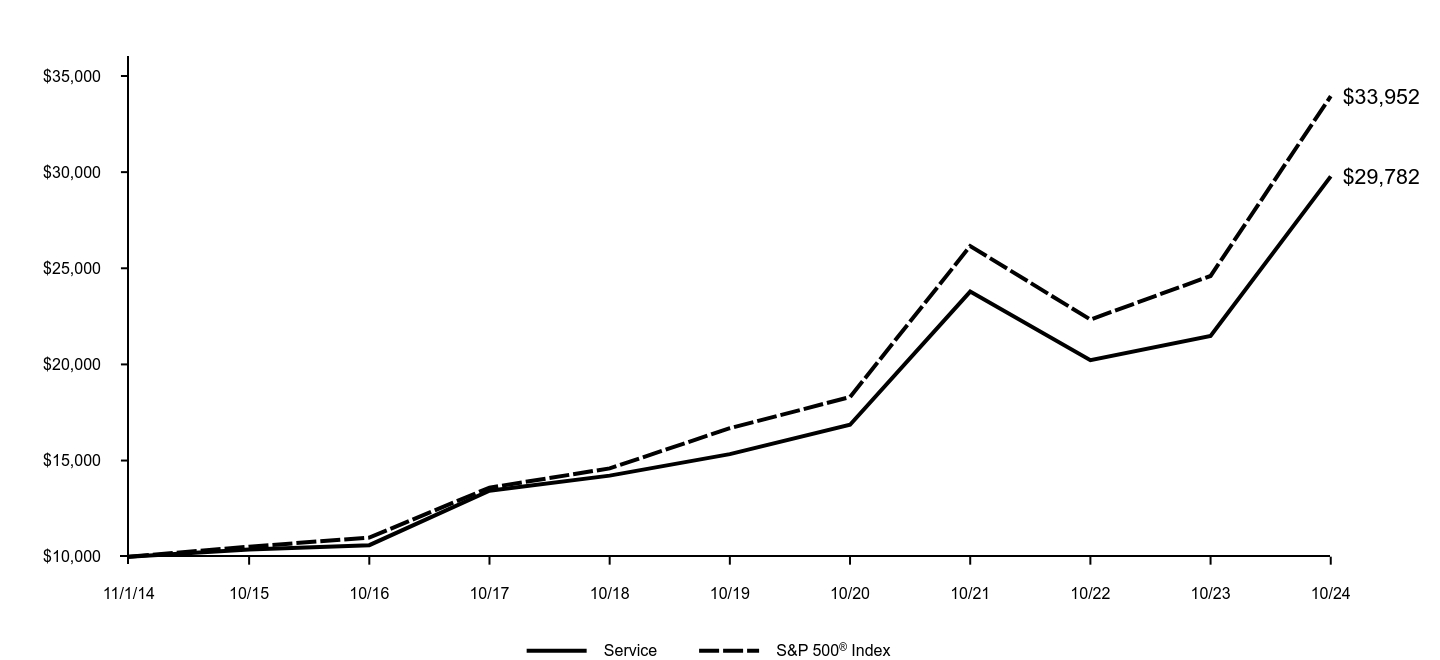

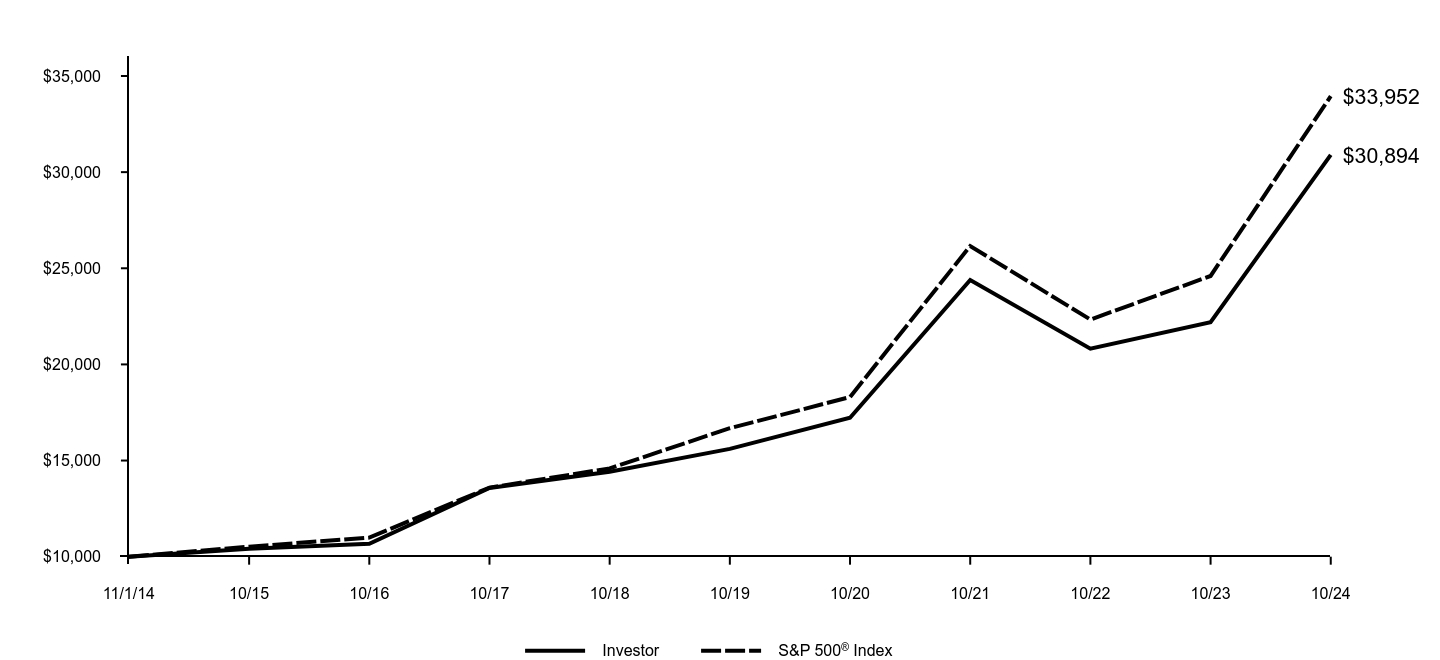

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Investor | MSCI Emerging Markets Index (Net, USD, Unhedged) |

|---|

| 11/1/14 | $10,000 | $10,000 |

| 10/15 | $9,037 | $8,547 |

| 10/16 | $9,864 | $9,339 |

| 10/17 | $12,869 | $11,810 |

| 10/18 | $11,081 | $10,331 |

| 10/19 | $11,752 | $11,556 |

| 10/20 | $13,138 | $12,510 |

| 10/21 | $15,366 | $14,631 |

| 10/22 | $10,804 | $10,091 |

| 10/23 | $12,225 | $11,181 |

| 10/24 | $15,083 | $14,012 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Investor | 23.37% | 5.11% | 4.19% |

| MSCI Emerging Markets Index (Net, USD, Unhedged) | 25.32% | 3.93% | 3.43% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Emerging Markets Equity Insights Fund

Key Fund Statistics (as of October 31, 2024)

| Total Net Assets | $2,152,192,361 |

| # of Portfolio Holdings | 382 |

| Portfolio Turnover Rate | 168% |

| Total Net Advisory Fees Paid | $19,529,355 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

During the period, the Fund’s classification changed from non-diversified to diversified. The Fund was previously registered as a non-diversified investment company.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Financials | 23.9% |

| Information Technology | 20.0% |

| Consumer Discretionary | 11.4% |

| Communication Services | 11.1% |

| Industrials | 7.9% |

| Health Care | 6.7% |

| Materials | 4.8% |

| Consumer Staples | 4.0% |

| Utilities | 3.3% |

| Other | 4.9% |

Goldman Sachs Emerging Markets Equity Insights Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications make any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Emerging Markets Equity Insights Fund

38145C562-AR-1024 Investor Class

Annual Shareholder Report

October 31, 2024

Goldman Sachs Emerging Markets Equity Insights Fund

This annual shareholder report contains important information about Goldman Sachs Emerging Markets Equity Insights Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $117 | 1.05% |

How did the Fund perform and what affected its performance?

The broad emerging markets equity market experienced volatility but performed strongly, supported by the view that U.S. interest rates were likely to fall more quickly than earlier anticipated and as global economic data was encouraging. China’s market was pressured by economic slowdown and a troubled real estate sector but surged in September 2024 after its central bank implemented monetary stimulus measures and property sector supportive policies. Emerging markets equities fell in October due to global market volatility and a strengthening U.S. dollar.

Top Contributors to Performance:

Stock selection in the industrials, consumer staples and energy sectors added to the Fund’s returns versus the MSCI Emerging Markets Index. To select stocks for the Fund, we use a quantitative model and four investment themes, overweighting or underweighting those chosen by the model.

Among individual stock positions, the Fund benefited from overweights in Trip.com Group, Hanmi Semiconductor and Kia.

The overweight in Trip.com Group, a China-based travel agency holding company, was driven largely by the High Quality Business Models and Sentiment Analysis investment themes.

The Fund’s overweight in Taiwan-based Hanmi Semiconductor was based on our Market Themes & Trends, High Quality Business Models and Sentiment Analysis investment themes.

The Fund was overweight Kia, a South Korean auto maker, mainly due to our High Quality Business Models investment theme.

Top Detractors from Performance:

Stock selection in information technology, utilities and communication services detracted from relative performance.

The Fund was hurt most by an underweight in Taiwan Semiconductor Manufacturing, an overweight in Samsung Electronics and an underweight in PDD Holdings.

The Fund was underweight Taiwan Semiconductor Manufacturing, a Taiwan-based semiconductor foundry, mostly because of our High Quality Business Models and Market Themes & Trends investment themes.

The overweight in South Korean electronics manufacturer Samsung Electronics was based mainly on our Market Themes & Trends and High Quality Business Models investment themes.

The Fund’s underweight in PDD Holdings, a China-based commerce group, was the result of our Market Themes & Trends, Sentiment Analysis and High Quality Business Models investment themes.

Country positioning held back the Fund’s relative performance, with underweights in China, Turkey and Brazil detracting most.

High Quality Business Models

The above represents investment themes.

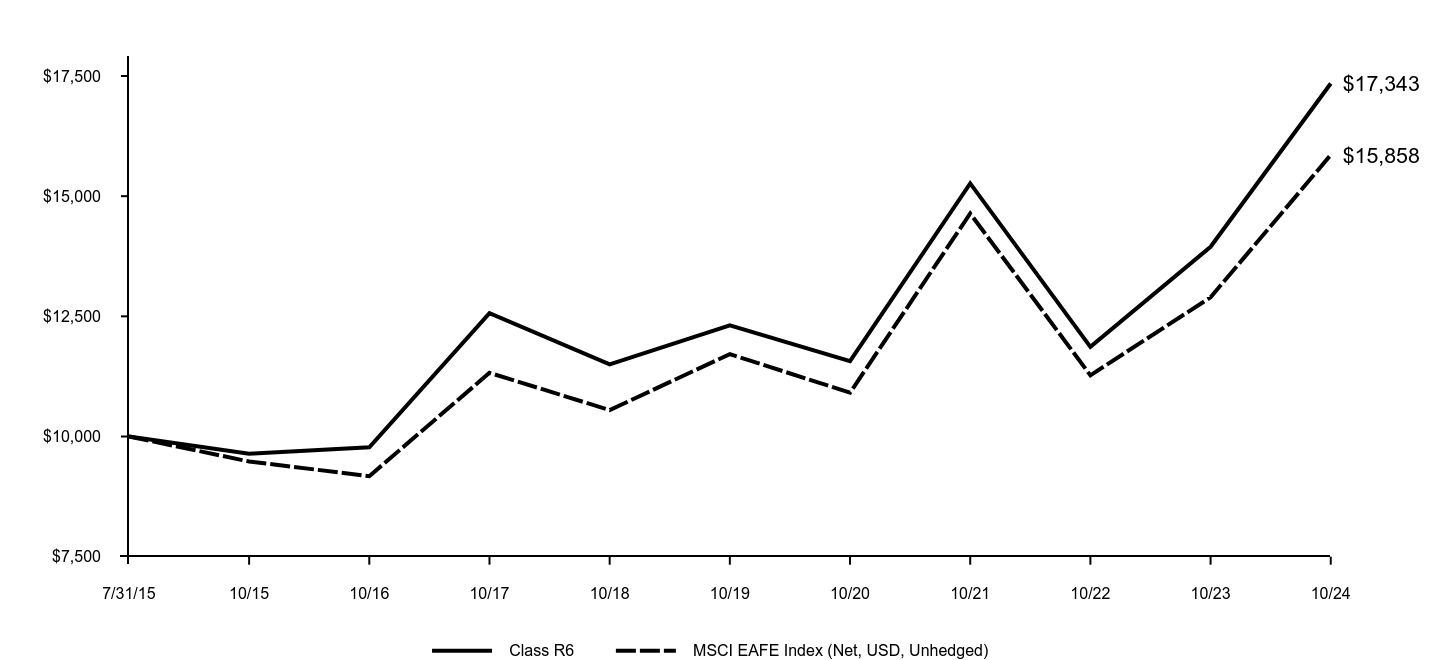

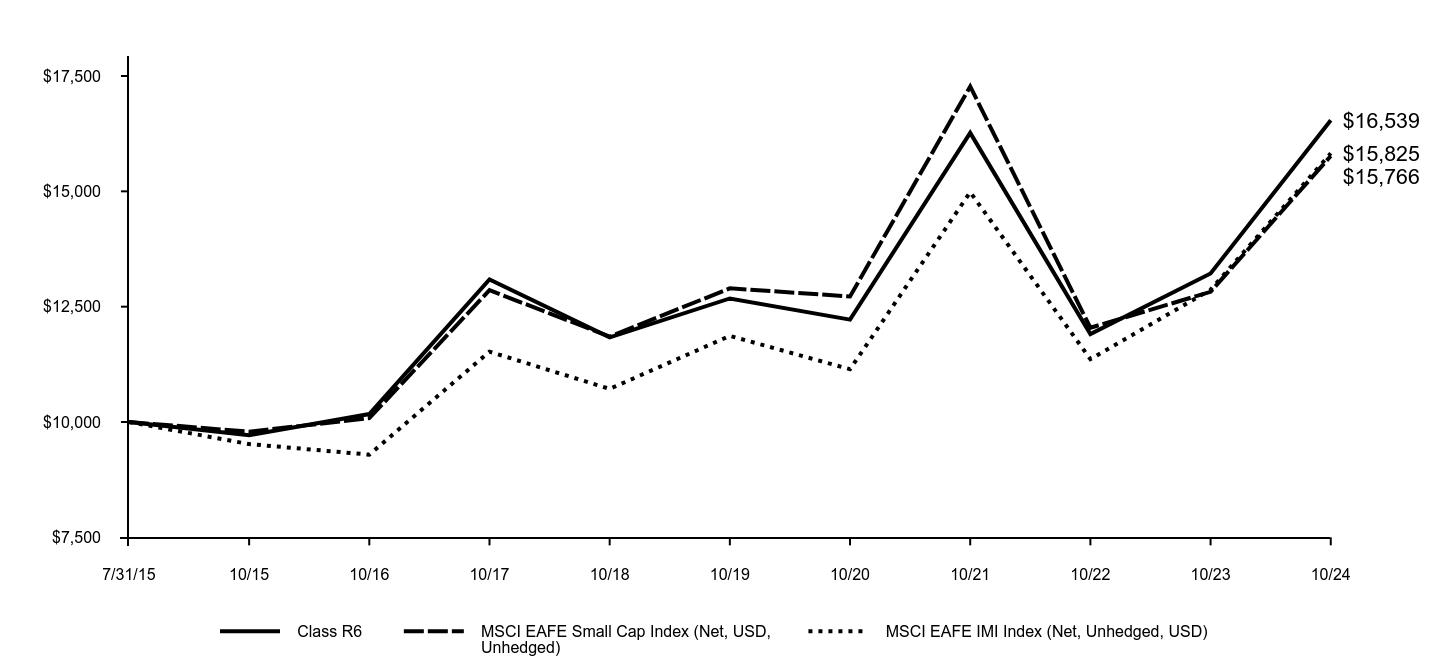

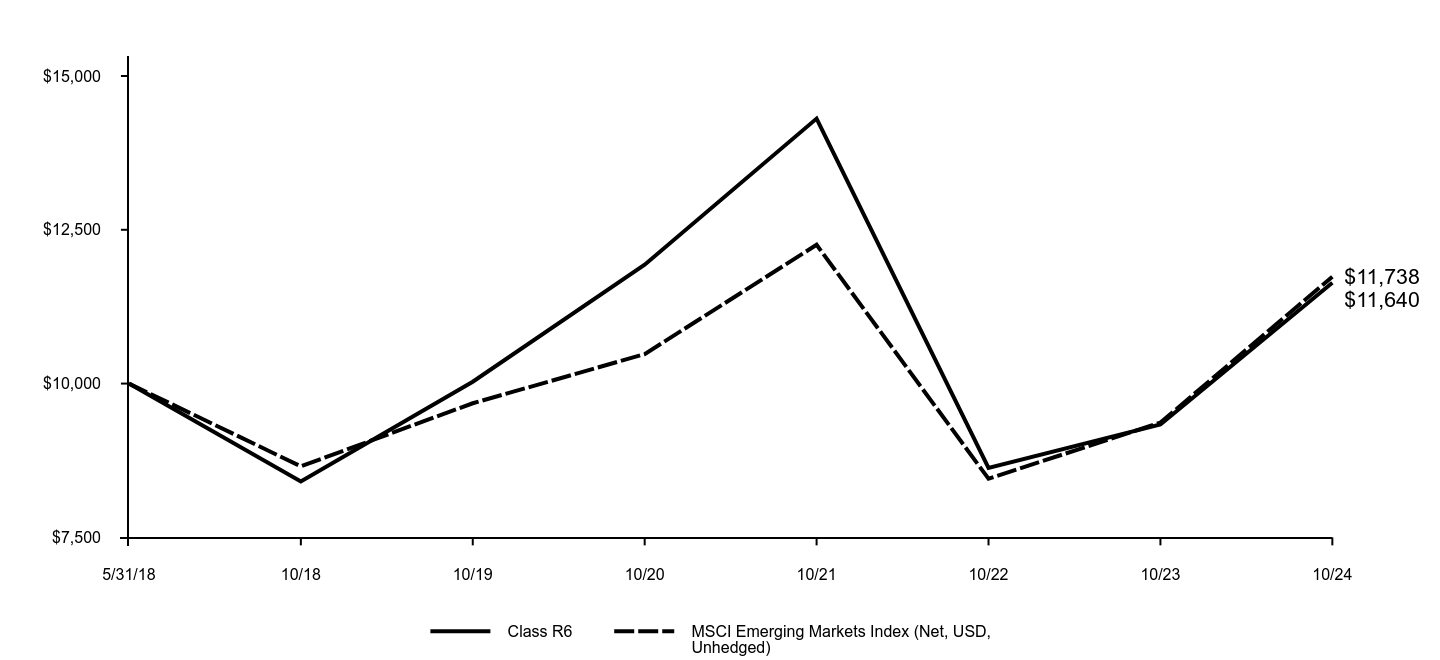

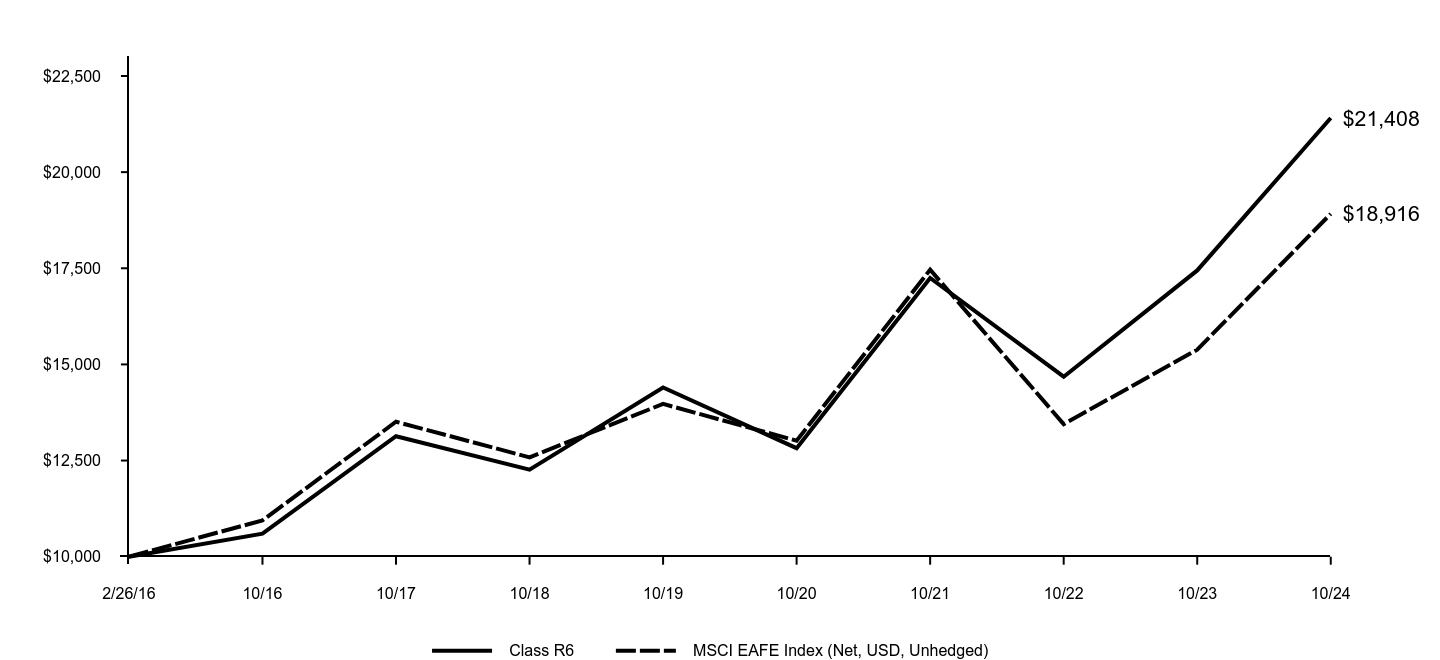

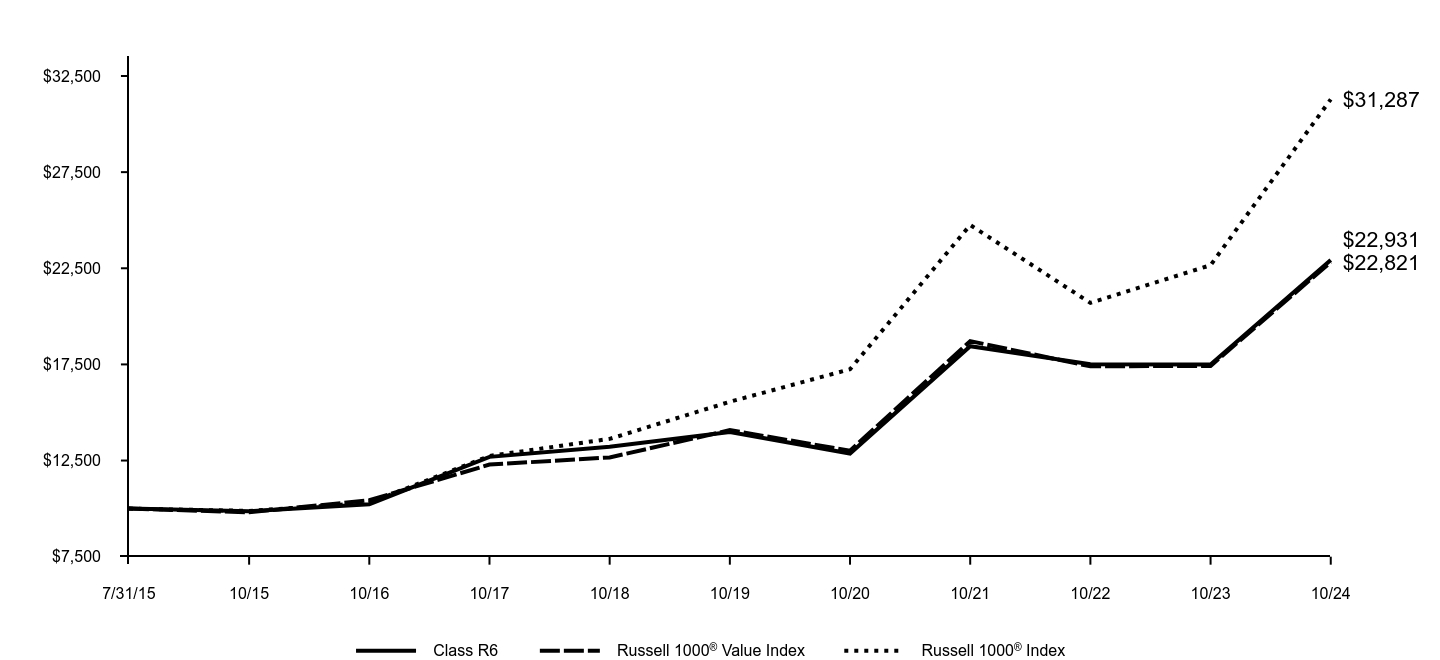

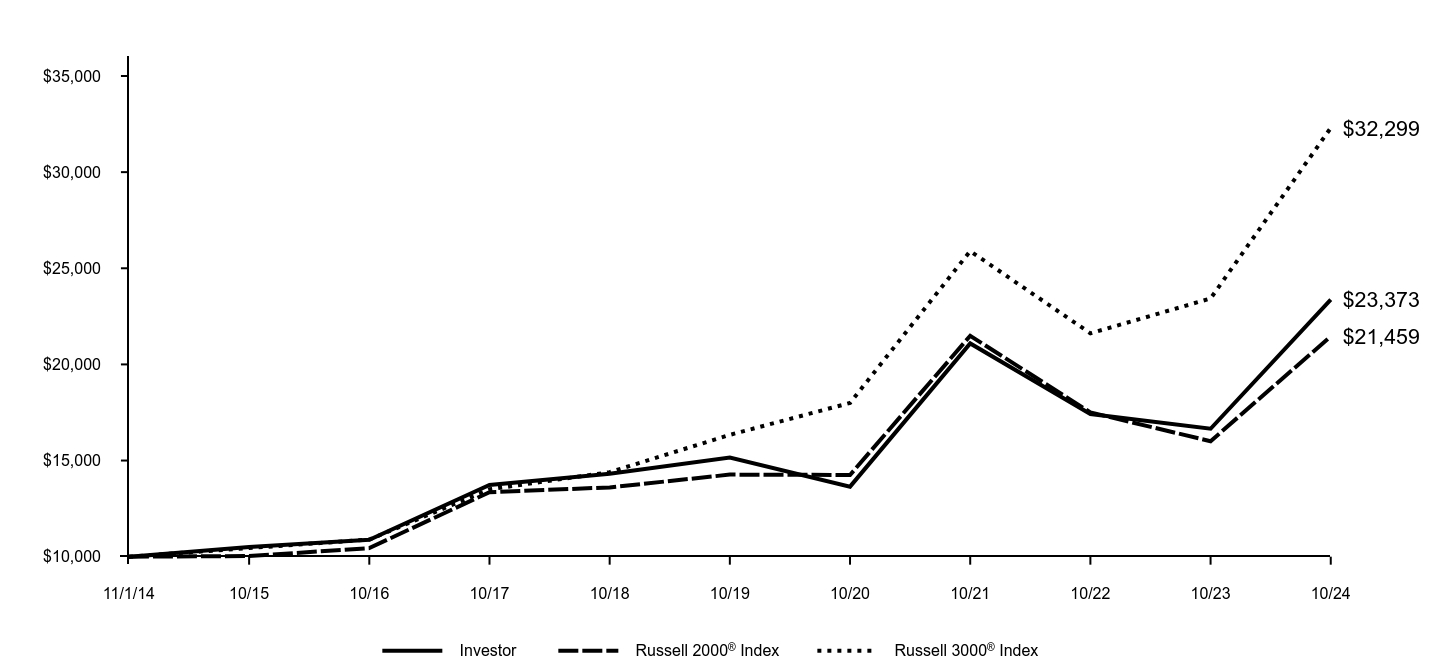

Goldman Sachs Emerging Markets Equity Insights Fund

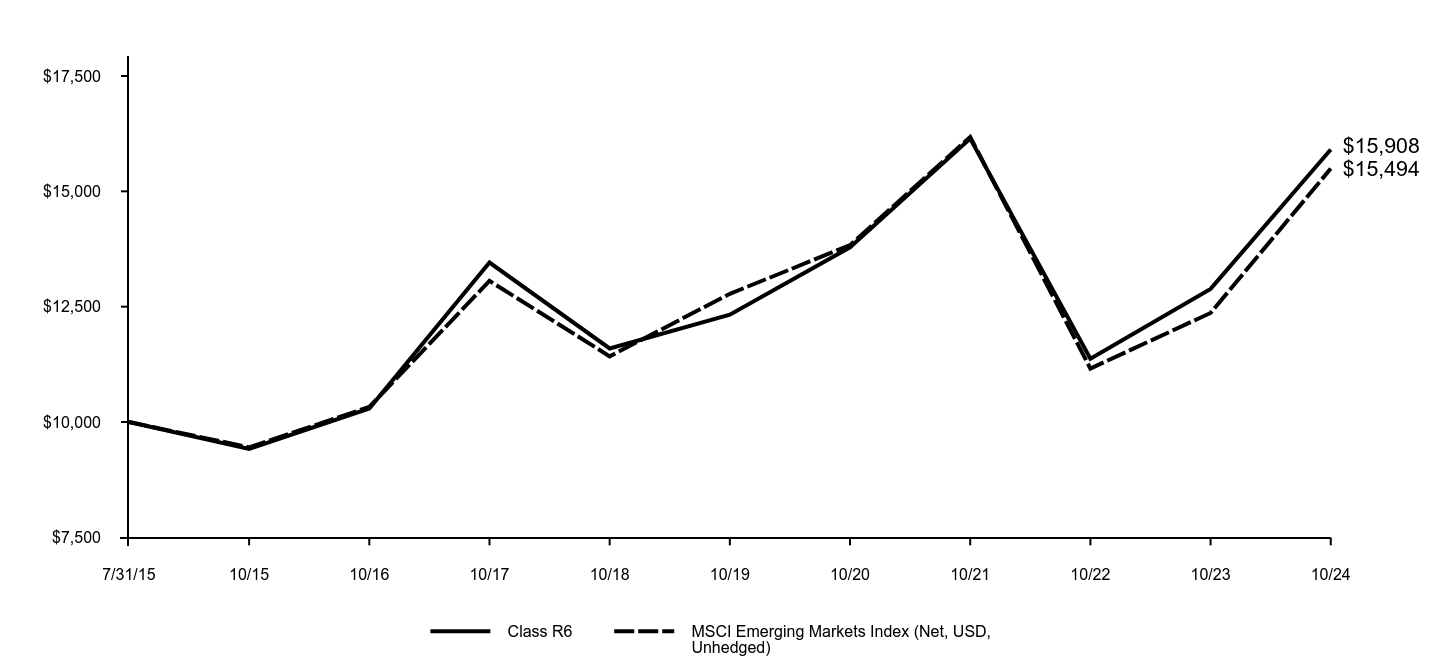

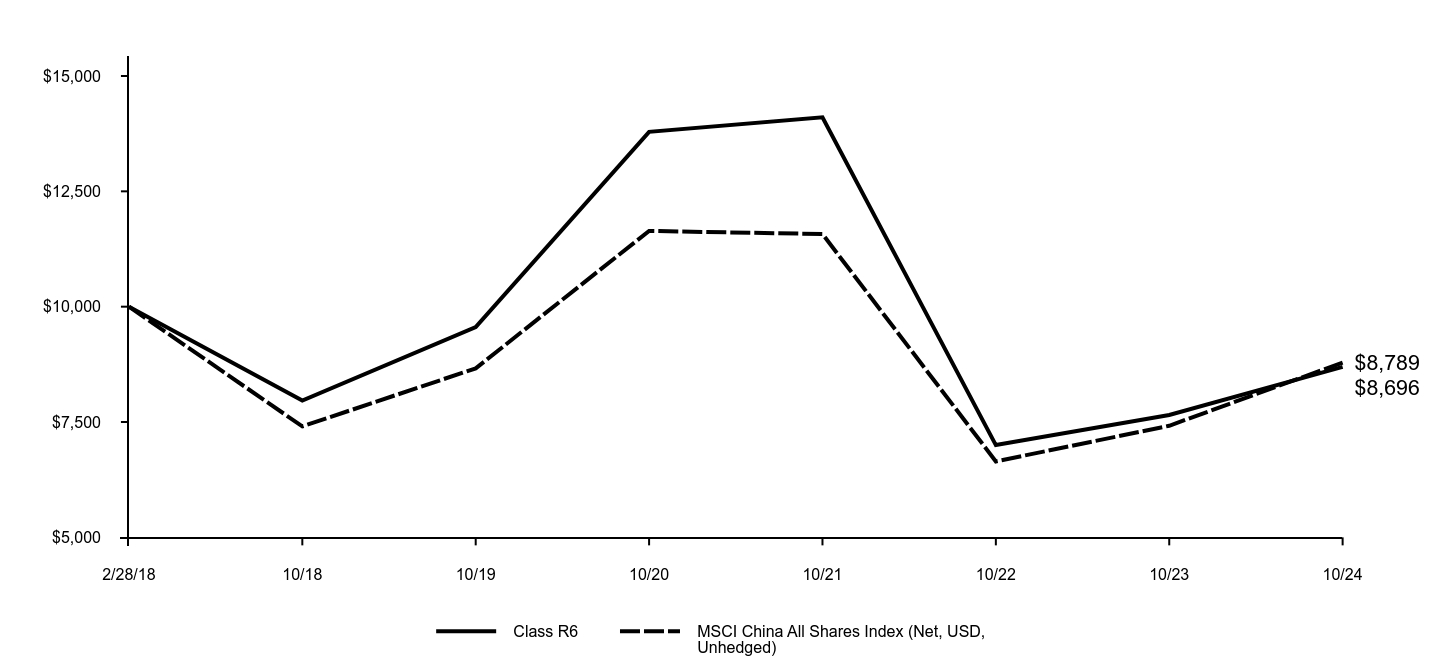

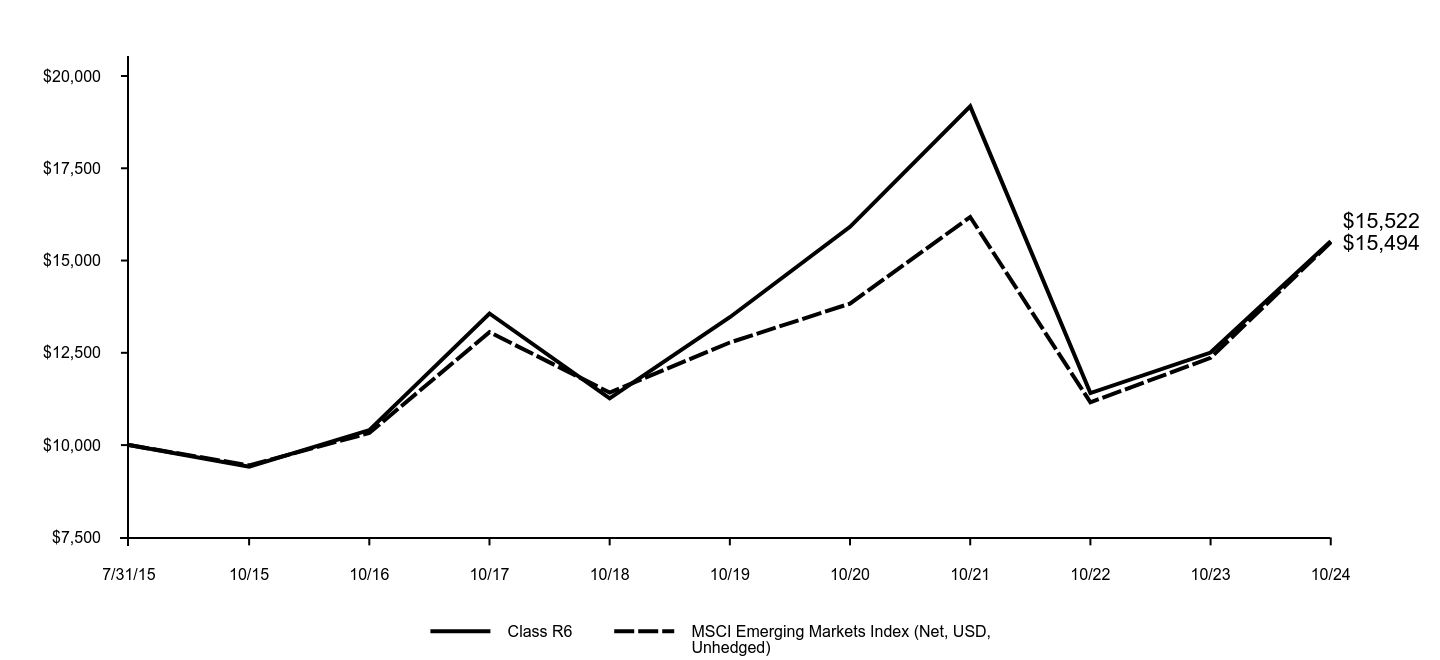

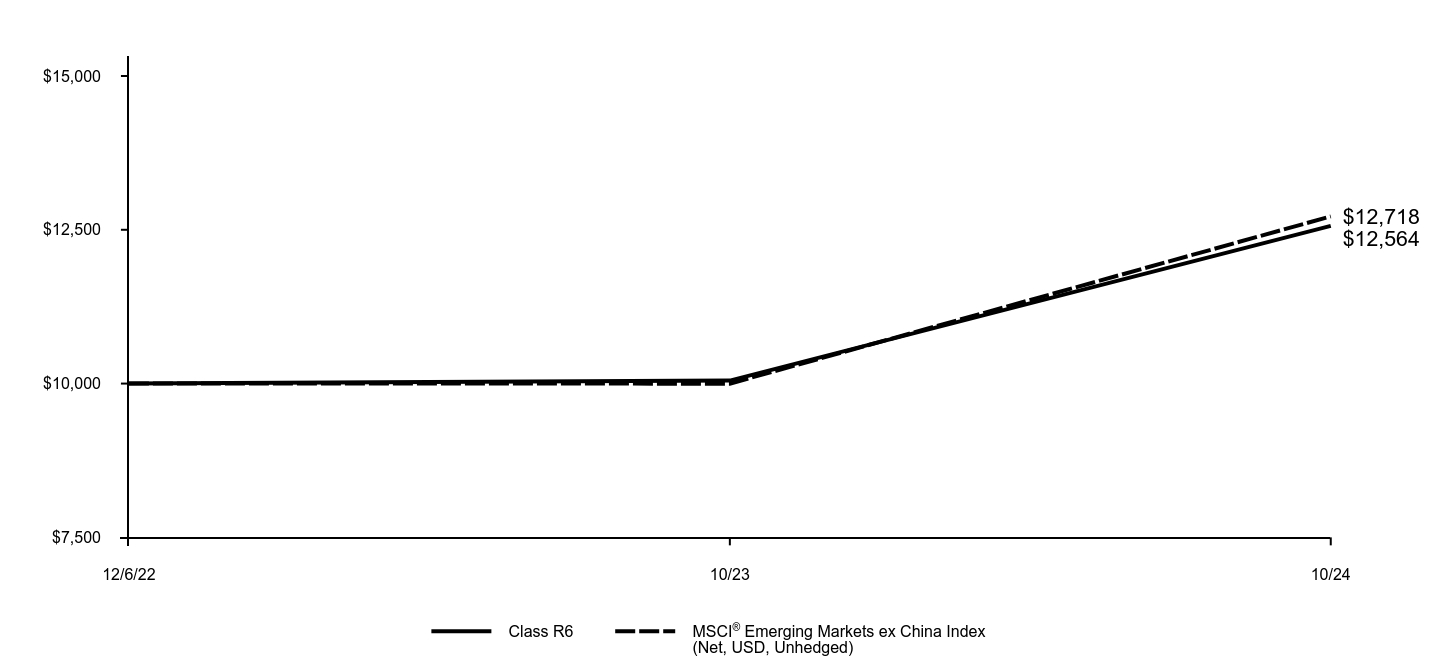

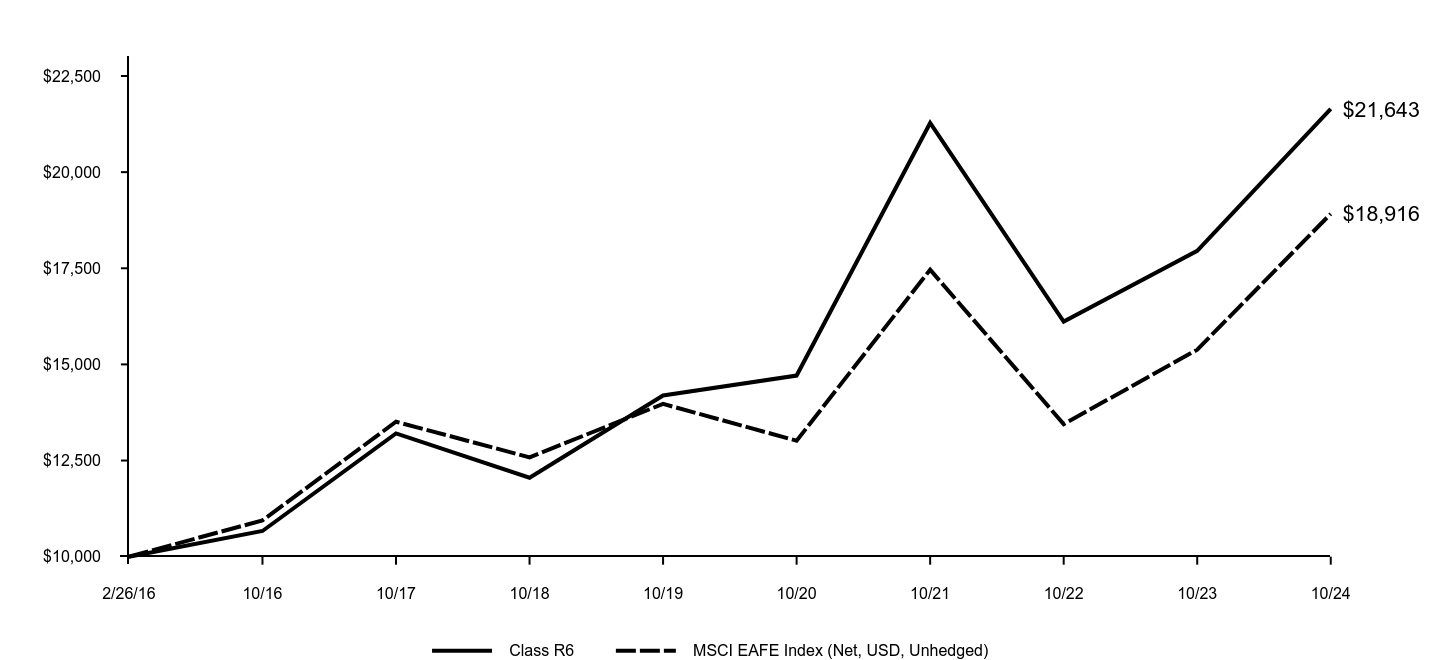

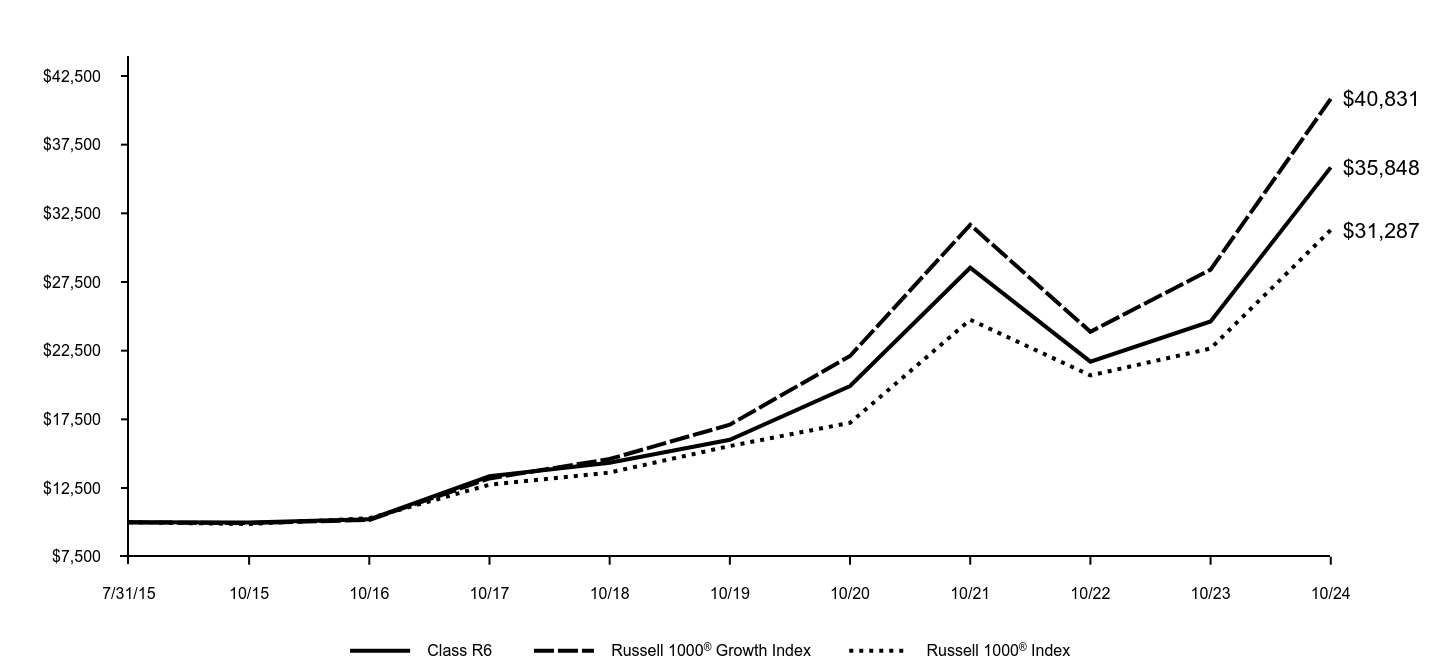

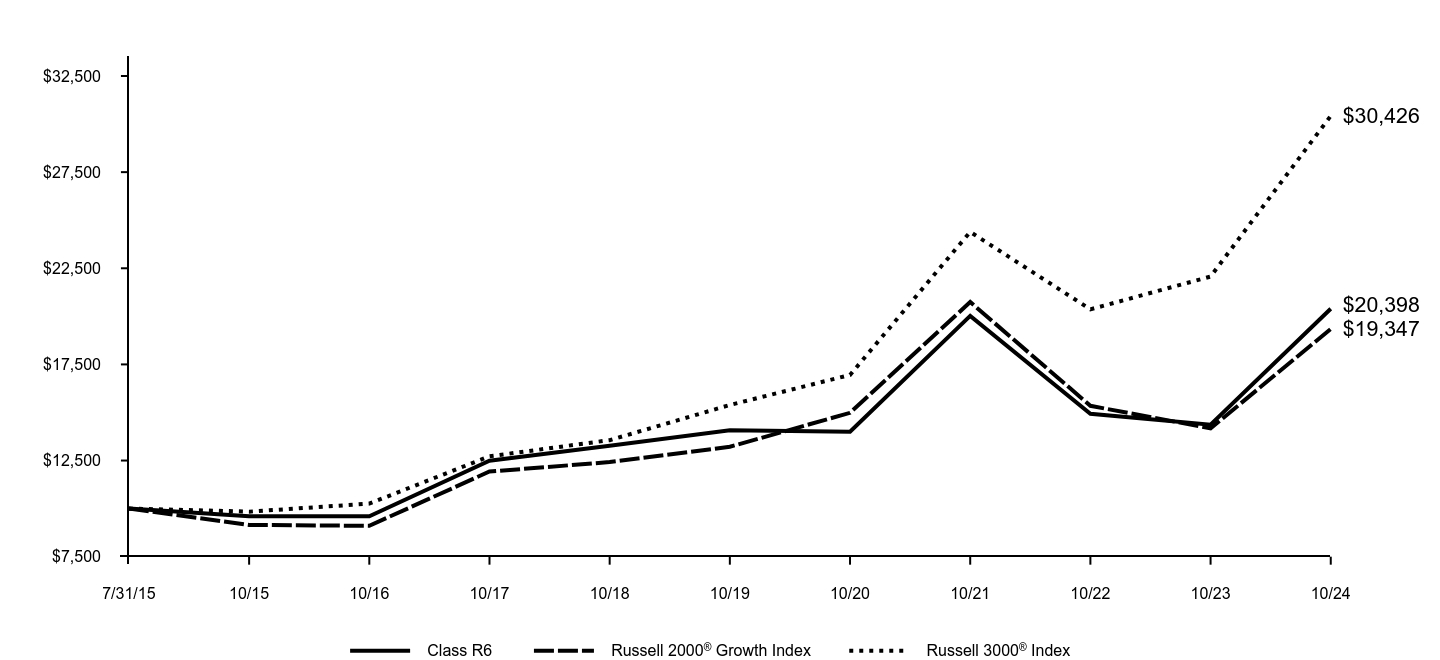

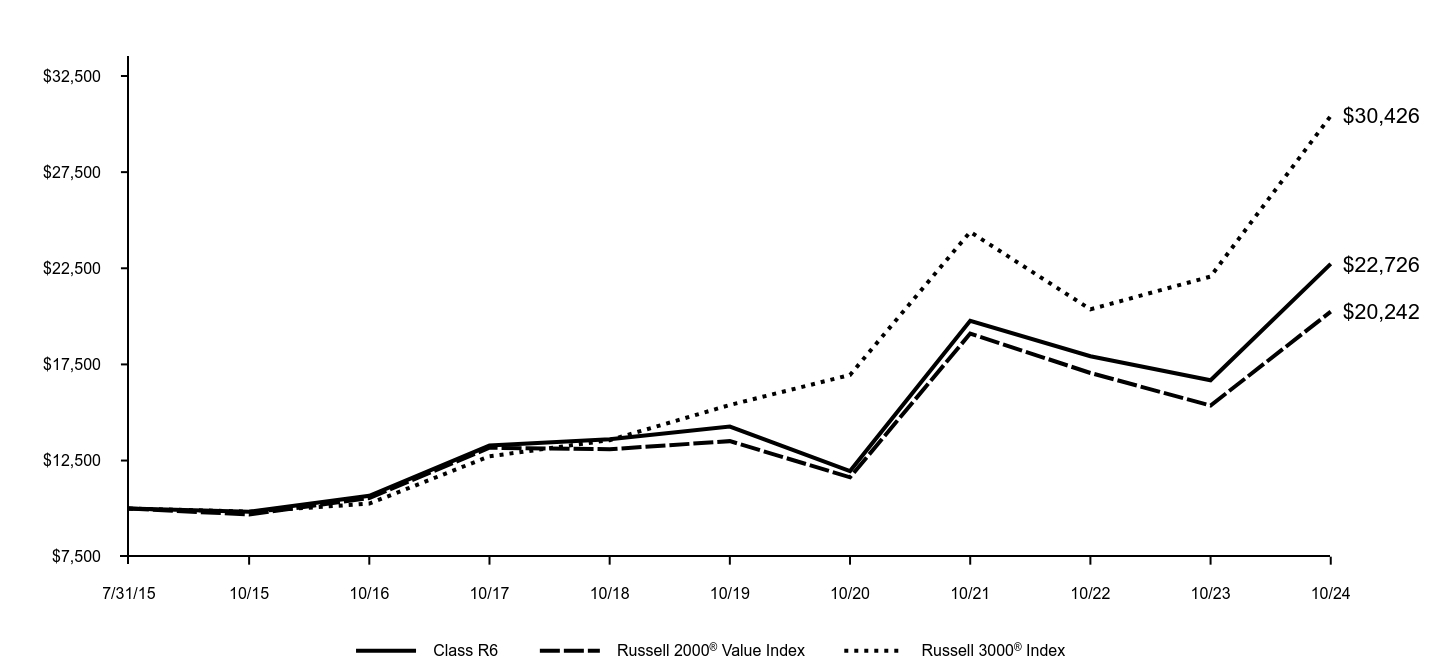

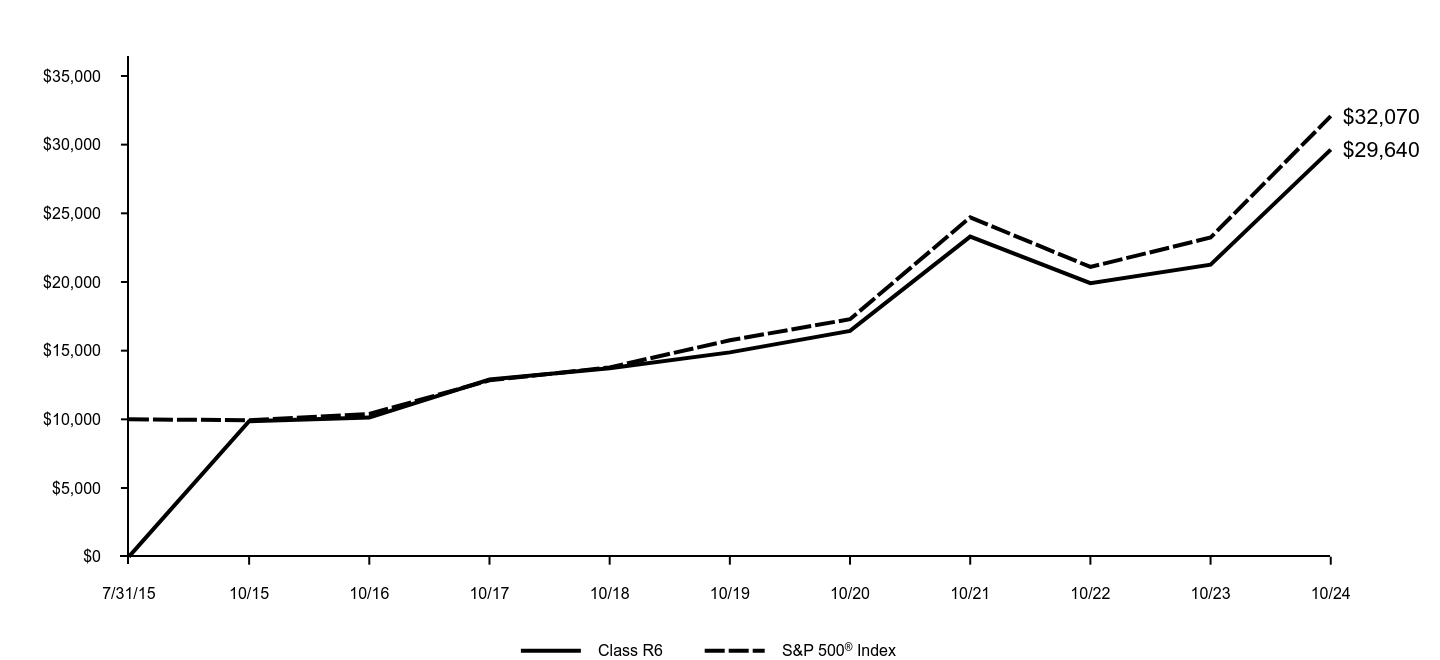

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class R6 | MSCI Emerging Markets Index (Net, USD, Unhedged) |

|---|

| 7/31/15 | $10,000 | $10,000 |

| 10/15 | $9,417 | $9,451 |

| 10/16 | $10,293 | $10,327 |

| 10/17 | $13,457 | $13,059 |

| 10/18 | $11,594 | $11,424 |

| 10/19 | $12,327 | $12,779 |

| 10/20 | $13,787 | $13,833 |

| 10/21 | $16,144 | $16,179 |

| 10/22 | $11,374 | $11,159 |

| 10/23 | $12,885 | $12,364 |

| 10/24 | $15,908 | $15,494 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception |

|---|

| Class R6 (Commenced July 31, 2015) | 23.46% | 5.23% | 5.14% |

| MSCI Emerging Markets Index (Net, USD, Unhedged) | 25.32% | 3.93% | 4.84% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Emerging Markets Equity Insights Fund

Key Fund Statistics (as of October 31, 2024)

| Total Net Assets | $2,152,192,361 |

| # of Portfolio Holdings | 382 |

| Portfolio Turnover Rate | 168% |

| Total Net Advisory Fees Paid | $19,529,355 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

During the period, the Fund’s classification changed from non-diversified to diversified. The Fund was previously registered as a non-diversified investment company.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Financials | 23.9% |

| Information Technology | 20.0% |

| Consumer Discretionary | 11.4% |

| Communication Services | 11.1% |

| Industrials | 7.9% |

| Health Care | 6.7% |

| Materials | 4.8% |

| Consumer Staples | 4.0% |

| Utilities | 3.3% |

| Other | 4.9% |

Goldman Sachs Emerging Markets Equity Insights Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications make any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Emerging Markets Equity Insights Fund

38147X259-AR-1024 Class R6

Annual Shareholder Report

October 31, 2024

Goldman Sachs Emerging Markets Equity Insights Fund

This annual shareholder report contains important information about Goldman Sachs Emerging Markets Equity Insights Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R | $183 | 1.64% |

How did the Fund perform and what affected its performance?

The broad emerging markets equity market experienced volatility but performed strongly, supported by the view that U.S. interest rates were likely to fall more quickly than earlier anticipated and as global economic data was encouraging. China’s market was pressured by economic slowdown and a troubled real estate sector but surged in September 2024 after its central bank implemented monetary stimulus measures and property sector supportive policies. Emerging markets equities fell in October due to global market volatility and a strengthening U.S. dollar.

Top Contributors to Performance:

Stock selection in the industrials, consumer staples and energy sectors added to the Fund’s returns versus the MSCI Emerging Markets Index. To select stocks for the Fund, we use a quantitative model and four investment themes, overweighting or underweighting those chosen by the model.

Among individual stock positions, the Fund benefited from overweights in Trip.com Group, Hanmi Semiconductor and Kia.

The overweight in Trip.com Group, a China-based travel agency holding company, was driven largely by the High Quality Business Models and Sentiment Analysis investment themes.

The Fund’s overweight in Taiwan-based Hanmi Semiconductor was based on our Market Themes & Trends, High Quality Business Models and Sentiment Analysis investment themes.

The Fund was overweight Kia, a South Korean auto maker, mainly due to our High Quality Business Models investment theme.

Top Detractors from Performance:

Stock selection in information technology, utilities and communication services detracted from relative performance.

The Fund was hurt most by an underweight in Taiwan Semiconductor Manufacturing, an overweight in Samsung Electronics and an underweight in PDD Holdings.

The Fund was underweight Taiwan Semiconductor Manufacturing, a Taiwan-based semiconductor foundry, mostly because of our High Quality Business Models and Market Themes & Trends investment themes.

The overweight in South Korean electronics manufacturer Samsung Electronics was based mainly on our Market Themes & Trends and High Quality Business Models investment themes.

The Fund’s underweight in PDD Holdings, a China-based commerce group, was the result of our Market Themes & Trends, Sentiment Analysis and High Quality Business Models investment themes.

Country positioning held back the Fund’s relative performance, with underweights in China, Turkey and Brazil detracting most.

High Quality Business Models

The above represents investment themes.

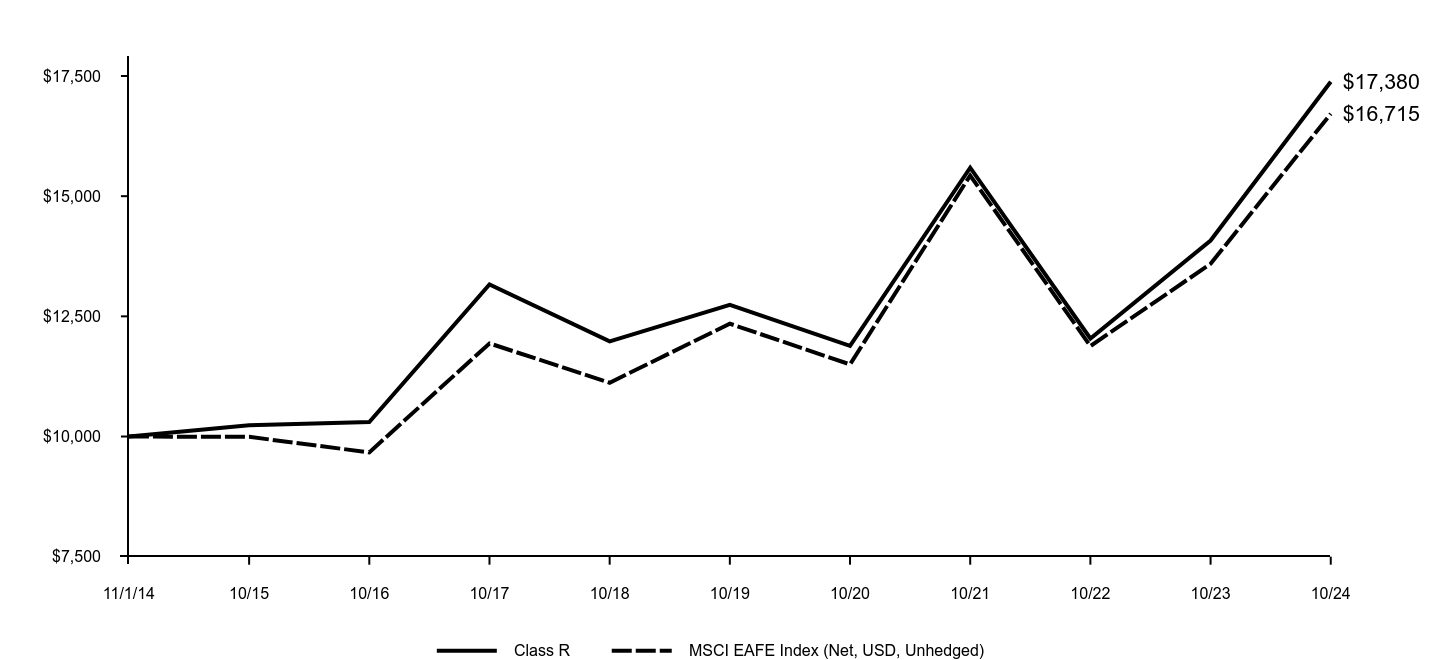

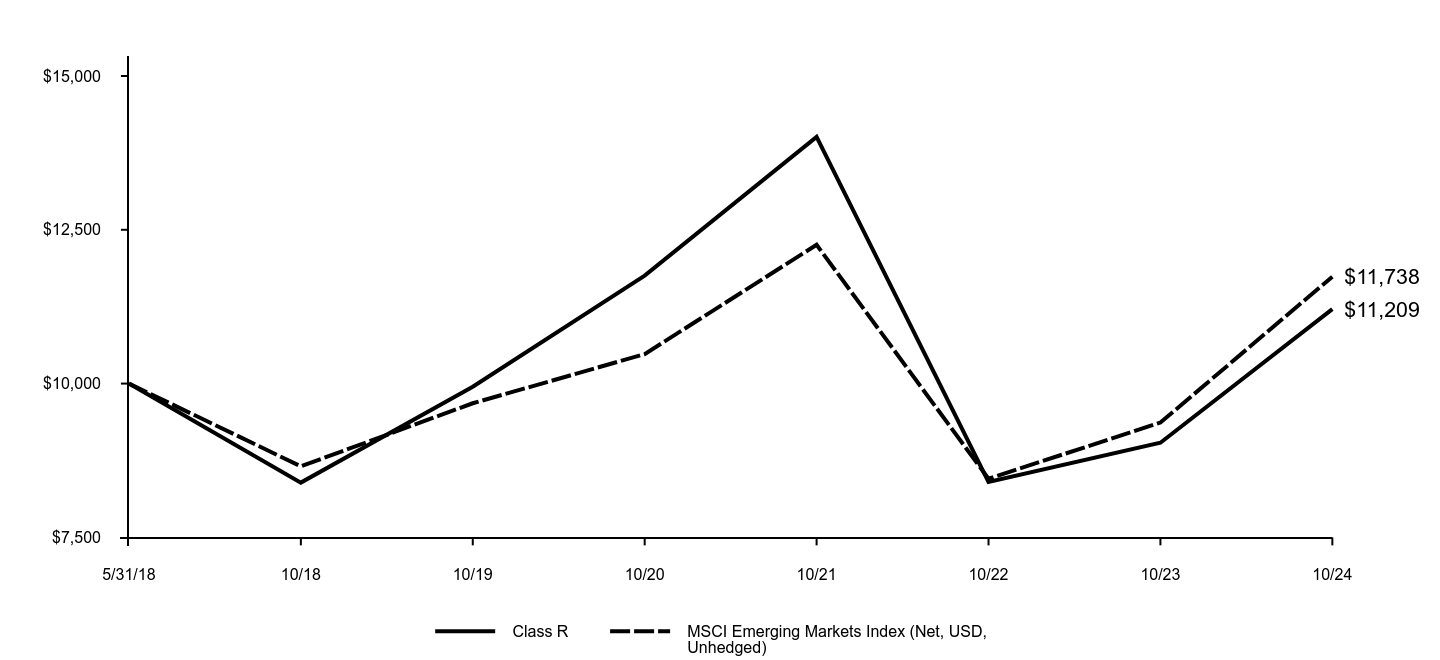

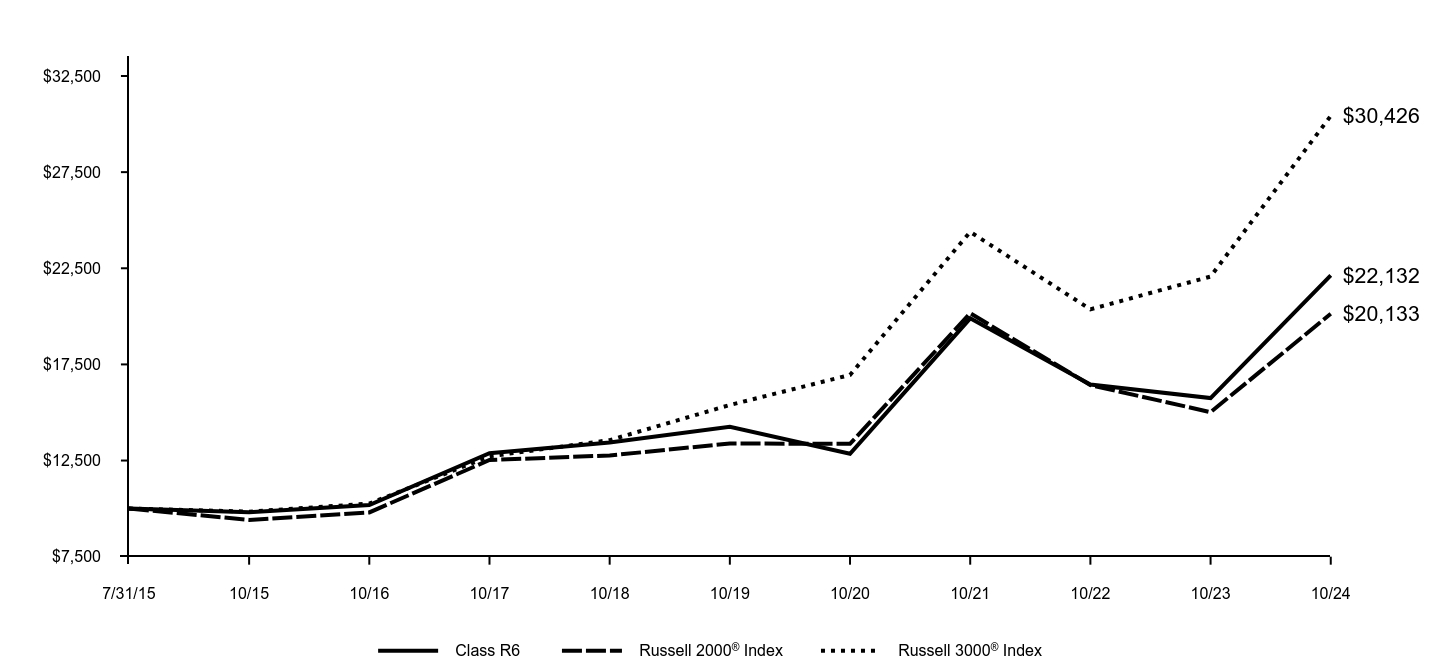

Goldman Sachs Emerging Markets Equity Insights Fund

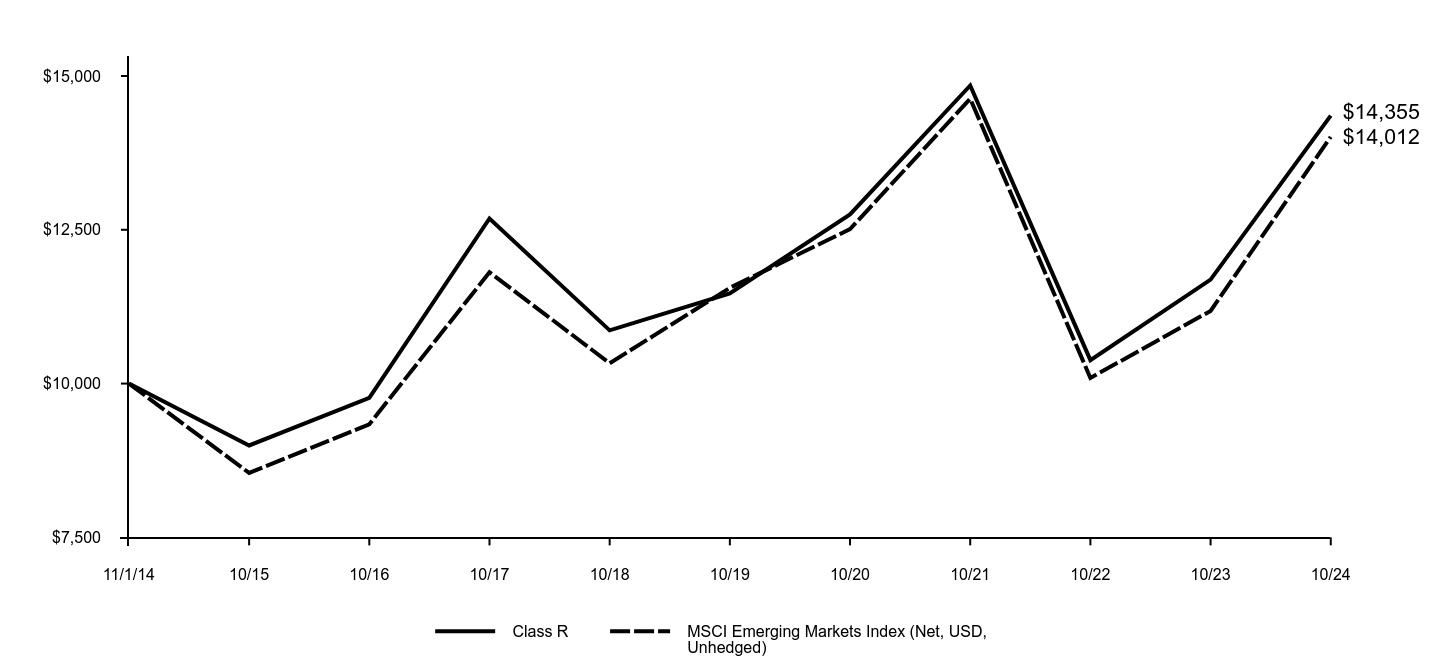

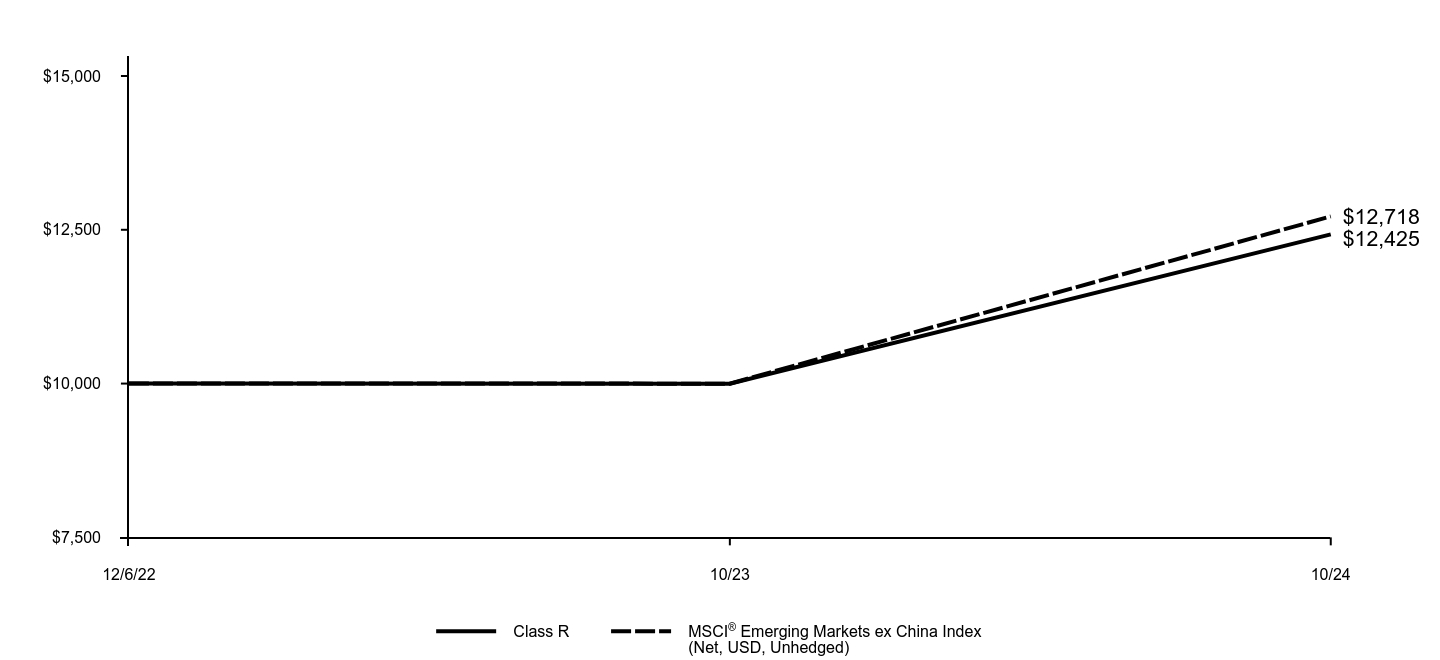

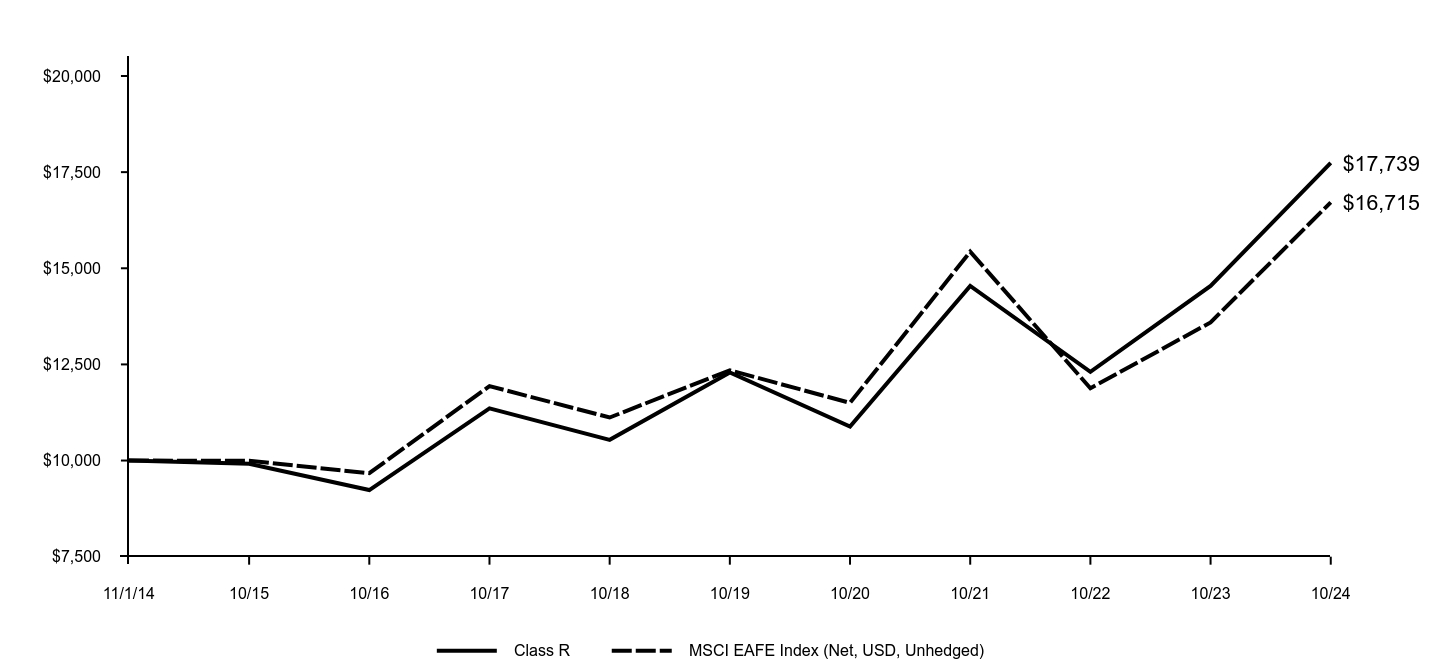

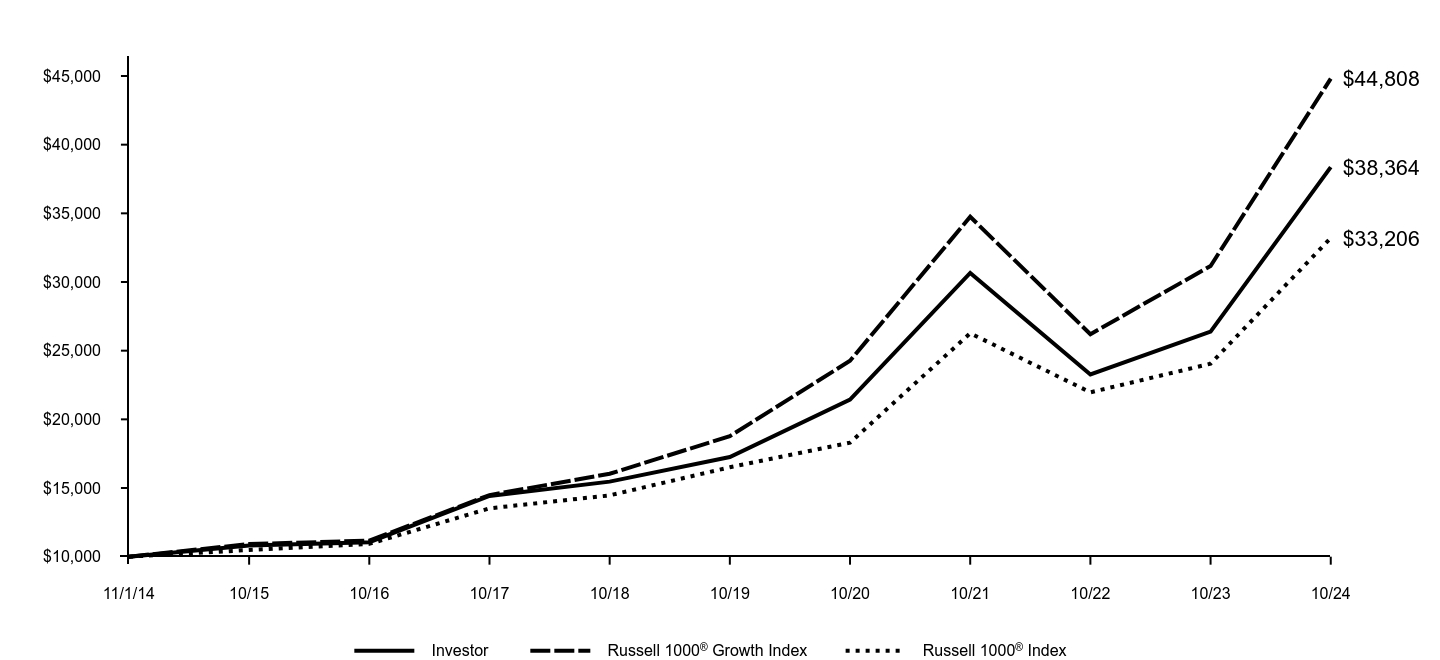

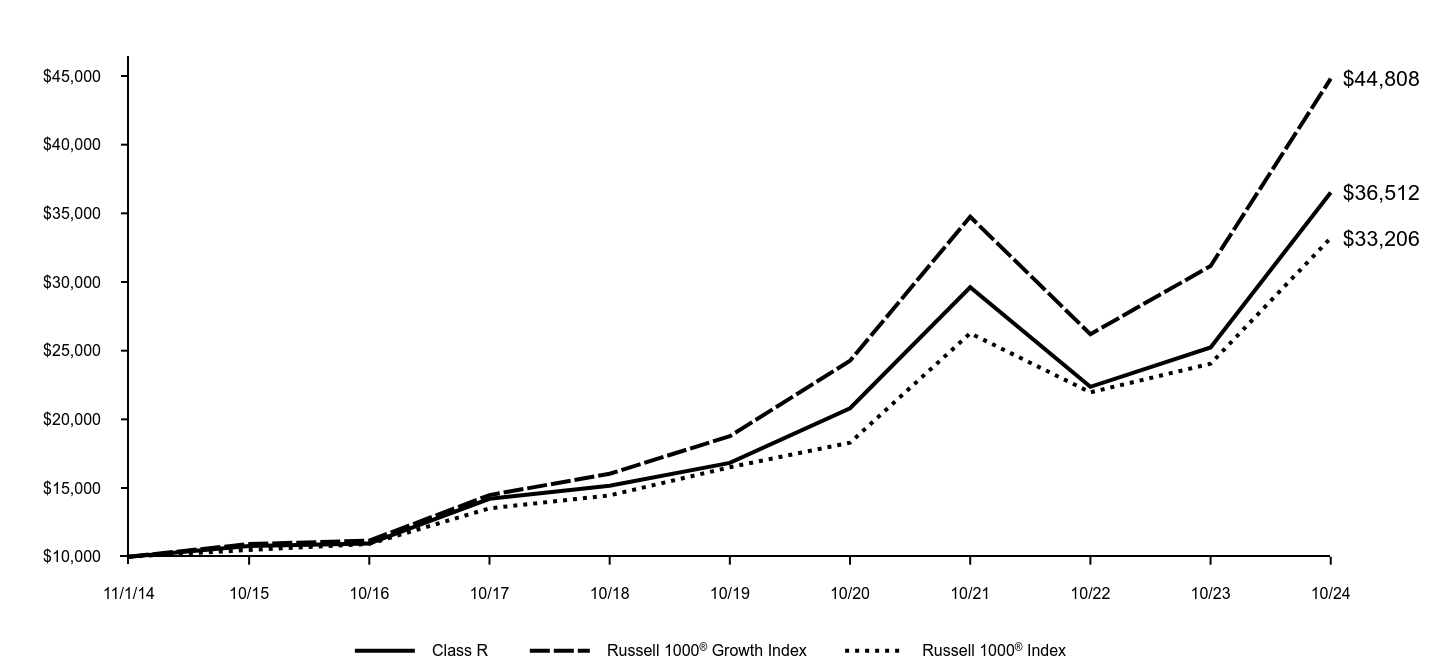

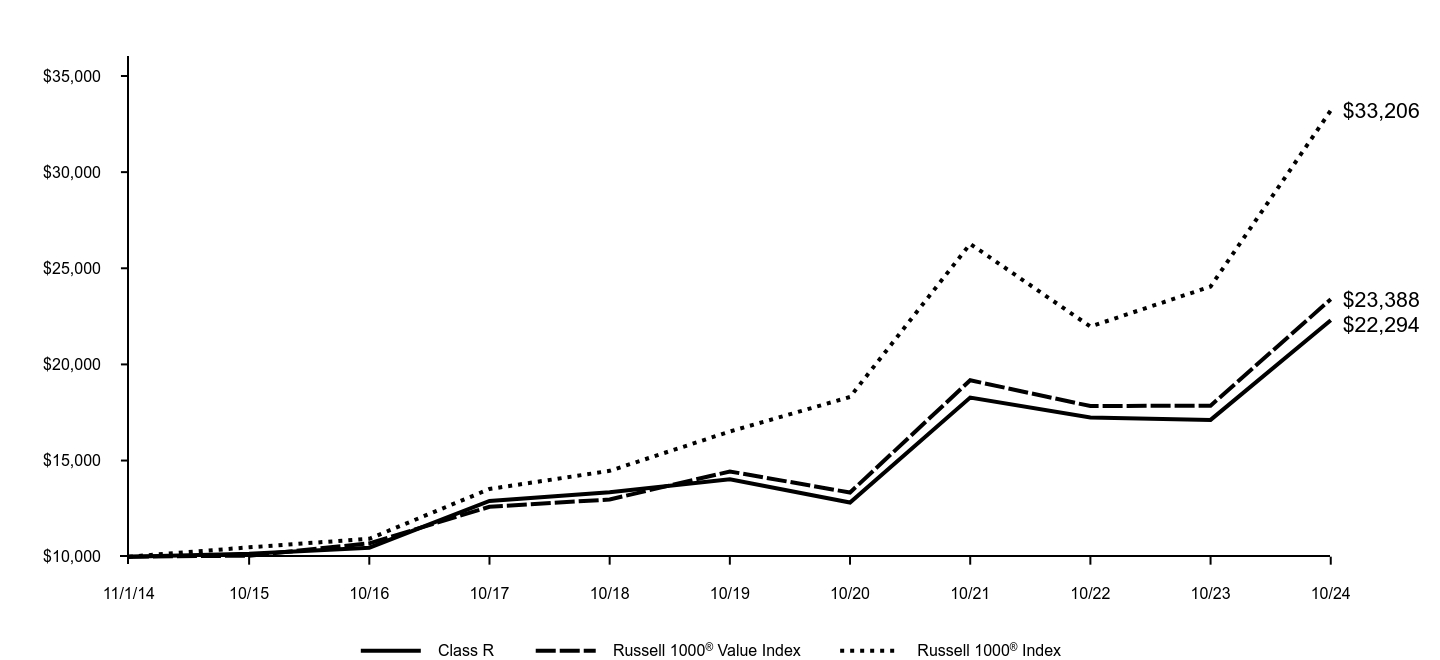

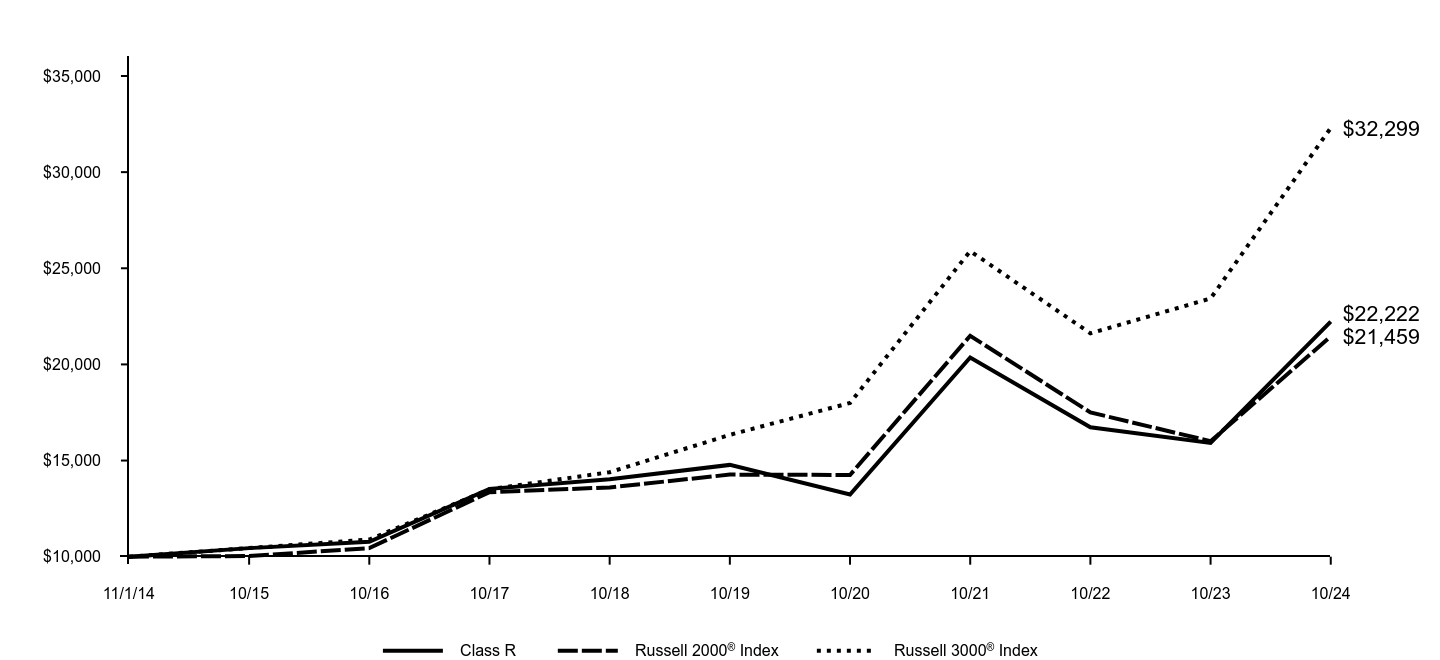

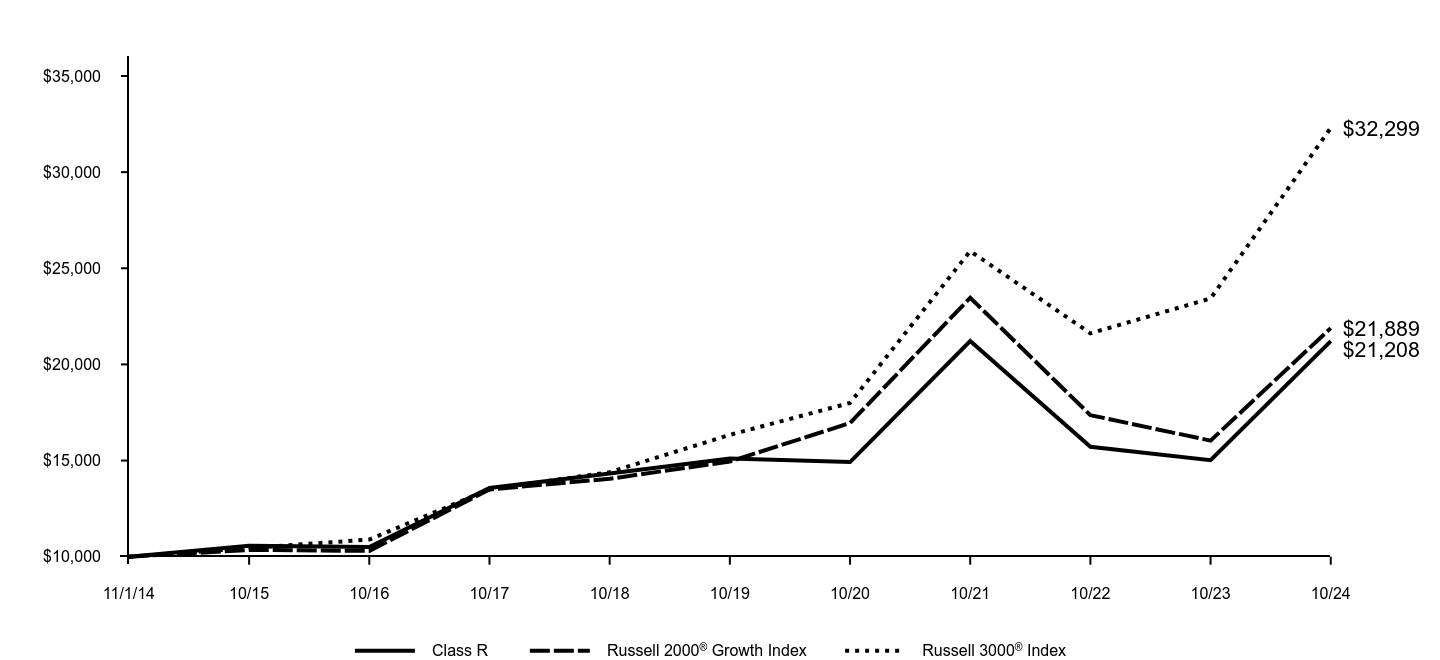

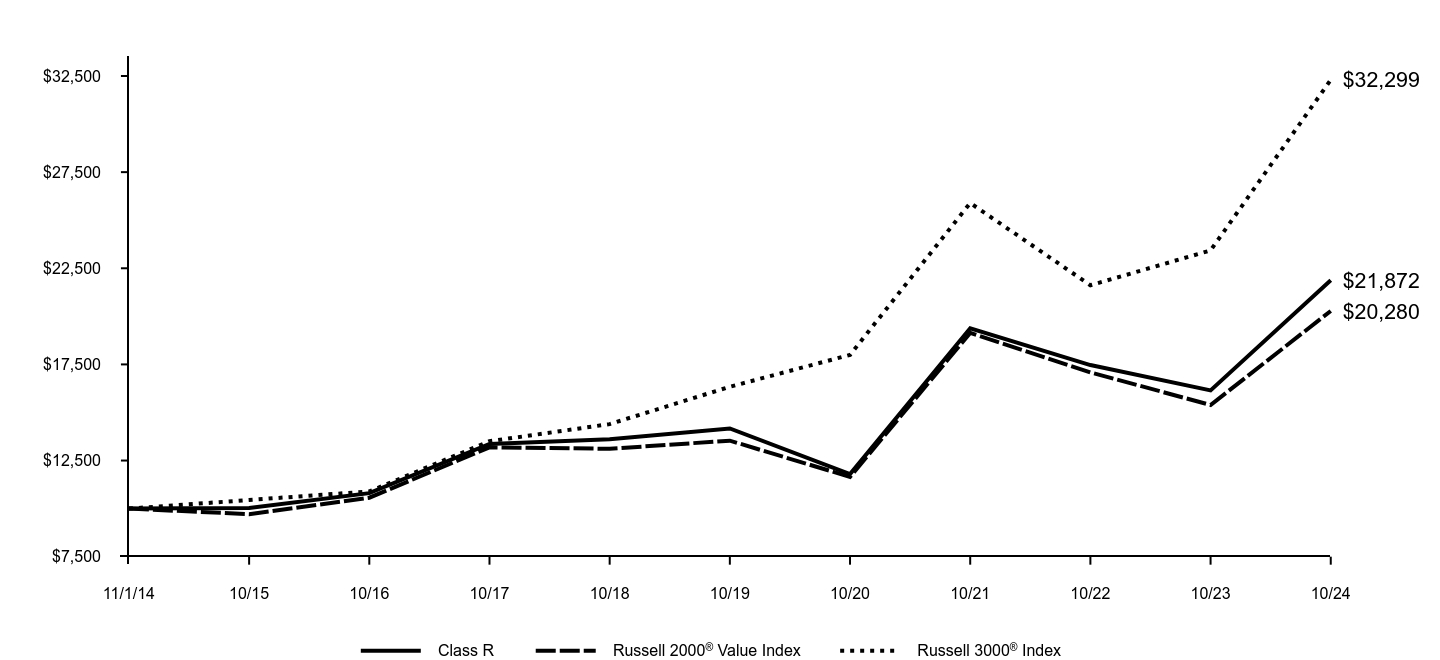

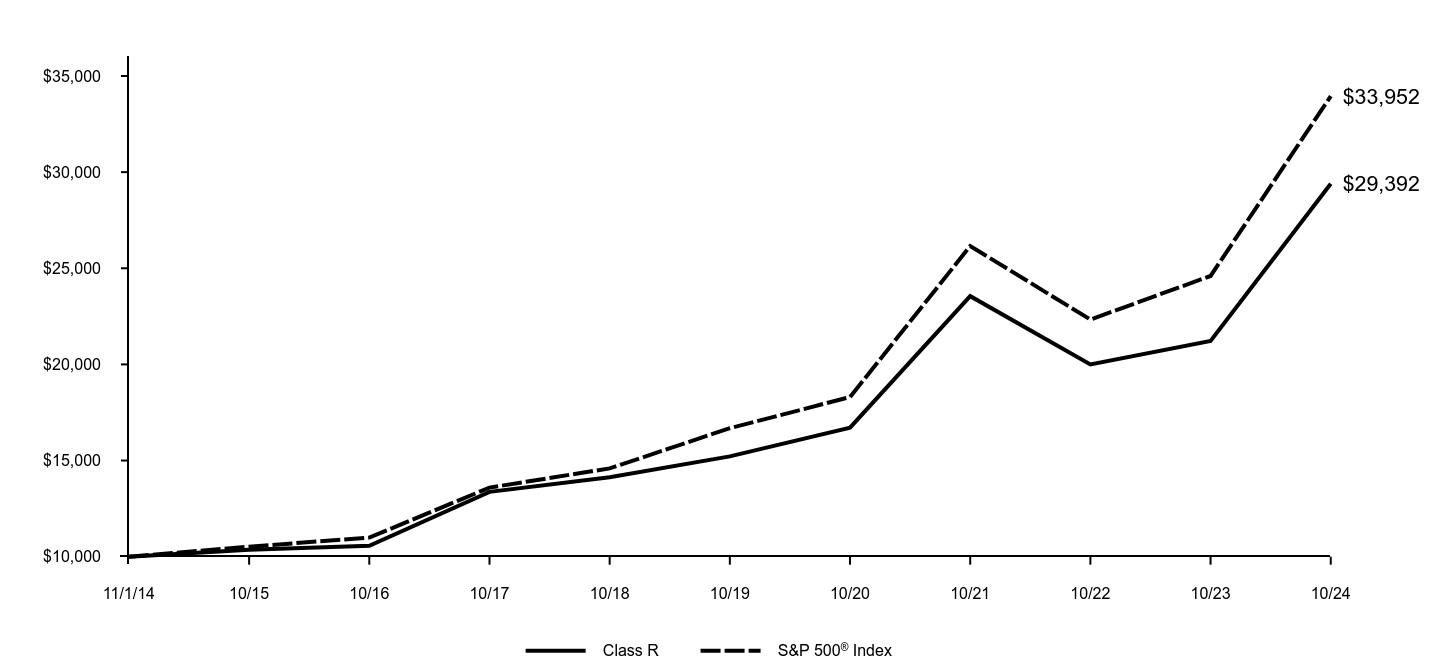

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class R | MSCI Emerging Markets Index (Net, USD, Unhedged) |

|---|

| 11/1/14 | $10,000 | $10,000 |

| 10/15 | $8,994 | $8,547 |

| 10/16 | $9,768 | $9,339 |

| 10/17 | $12,684 | $11,810 |

| 10/18 | $10,865 | $10,331 |

| 10/19 | $11,465 | $11,556 |

| 10/20 | $12,751 | $12,510 |

| 10/21 | $14,846 | $14,631 |

| 10/22 | $10,381 | $10,091 |

| 10/23 | $11,690 | $11,181 |

| 10/24 | $14,355 | $14,012 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class R | 22.80% | 4.59% | 3.68% |

| MSCI Emerging Markets Index (Net, USD, Unhedged) | 25.32% | 3.93% | 3.43% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Emerging Markets Equity Insights Fund

Key Fund Statistics (as of October 31, 2024)

| Total Net Assets | $2,152,192,361 |

| # of Portfolio Holdings | 382 |

| Portfolio Turnover Rate | 168% |

| Total Net Advisory Fees Paid | $19,529,355 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

During the period, the Fund’s classification changed from non-diversified to diversified. The Fund was previously registered as a non-diversified investment company.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Financials | 23.9% |

| Information Technology | 20.0% |

| Consumer Discretionary | 11.4% |

| Communication Services | 11.1% |

| Industrials | 7.9% |

| Health Care | 6.7% |

| Materials | 4.8% |

| Consumer Staples | 4.0% |

| Utilities | 3.3% |

| Other | 4.9% |

Goldman Sachs Emerging Markets Equity Insights Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications make any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Emerging Markets Equity Insights Fund

38145L224-AR-1024 Class R

Annual Shareholder Report

October 31, 2024

Goldman Sachs Emerging Markets Equity Insights Fund

This annual shareholder report contains important information about Goldman Sachs Emerging Markets Equity Insights Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| P | $117 | 1.05% |

How did the Fund perform and what affected its performance?

The broad emerging markets equity market experienced volatility but performed strongly, supported by the view that U.S. interest rates were likely to fall more quickly than earlier anticipated and as global economic data was encouraging. China’s market was pressured by economic slowdown and a troubled real estate sector but surged in September 2024 after its central bank implemented monetary stimulus measures and property sector supportive policies. Emerging markets equities fell in October due to global market volatility and a strengthening U.S. dollar.

Top Contributors to Performance:

Stock selection in the industrials, consumer staples and energy sectors added to the Fund’s returns versus the MSCI Emerging Markets Index. To select stocks for the Fund, we use a quantitative model and four investment themes, overweighting or underweighting those chosen by the model.

Among individual stock positions, the Fund benefited from overweights in Trip.com Group, Hanmi Semiconductor and Kia.

The overweight in Trip.com Group, a China-based travel agency holding company, was driven largely by the High Quality Business Models and Sentiment Analysis investment themes.

The Fund’s overweight in Taiwan-based Hanmi Semiconductor was based on our Market Themes & Trends, High Quality Business Models and Sentiment Analysis investment themes.

The Fund was overweight Kia, a South Korean auto maker, mainly due to our High Quality Business Models investment theme.

Top Detractors from Performance:

Stock selection in information technology, utilities and communication services detracted from relative performance.

The Fund was hurt most by an underweight in Taiwan Semiconductor Manufacturing, an overweight in Samsung Electronics and an underweight in PDD Holdings.

The Fund was underweight Taiwan Semiconductor Manufacturing, a Taiwan-based semiconductor foundry, mostly because of our High Quality Business Models and Market Themes & Trends investment themes.

The overweight in South Korean electronics manufacturer Samsung Electronics was based mainly on our Market Themes & Trends and High Quality Business Models investment themes.

The Fund’s underweight in PDD Holdings, a China-based commerce group, was the result of our Market Themes & Trends, Sentiment Analysis and High Quality Business Models investment themes.

Country positioning held back the Fund’s relative performance, with underweights in China, Turkey and Brazil detracting most.

High Quality Business Models

The above represents investment themes.

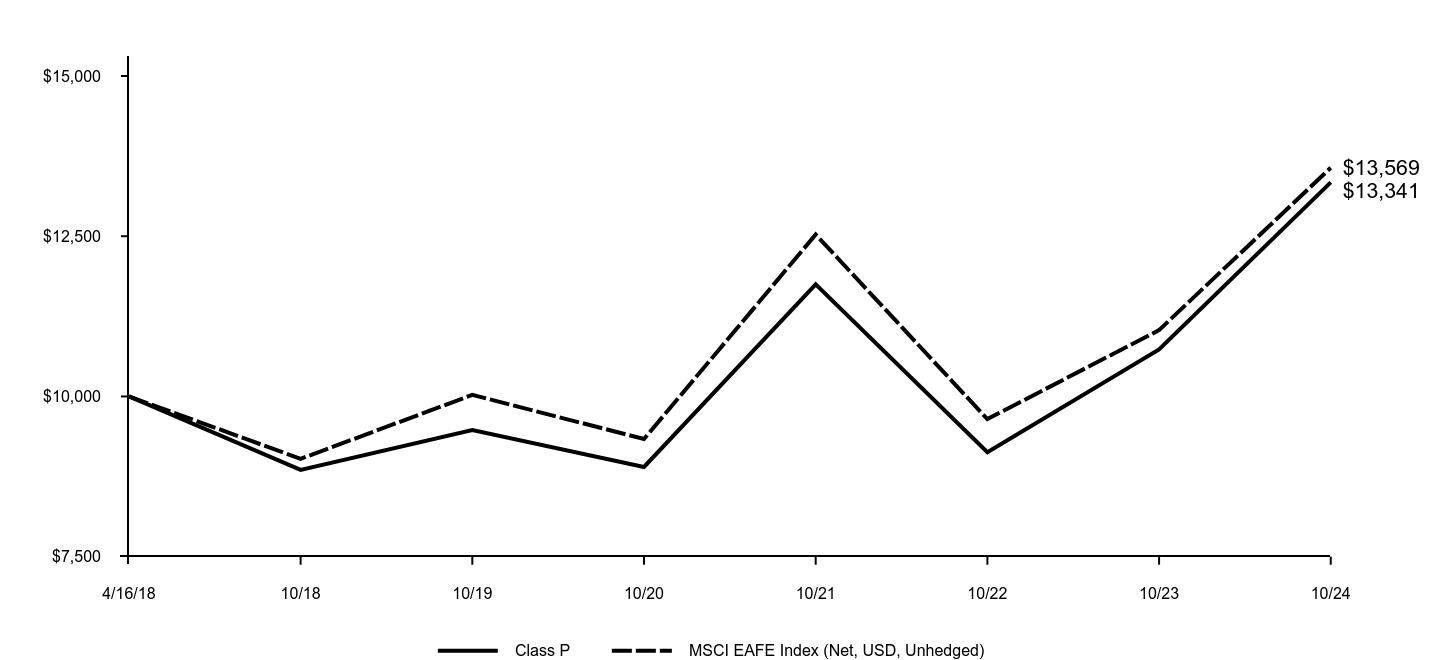

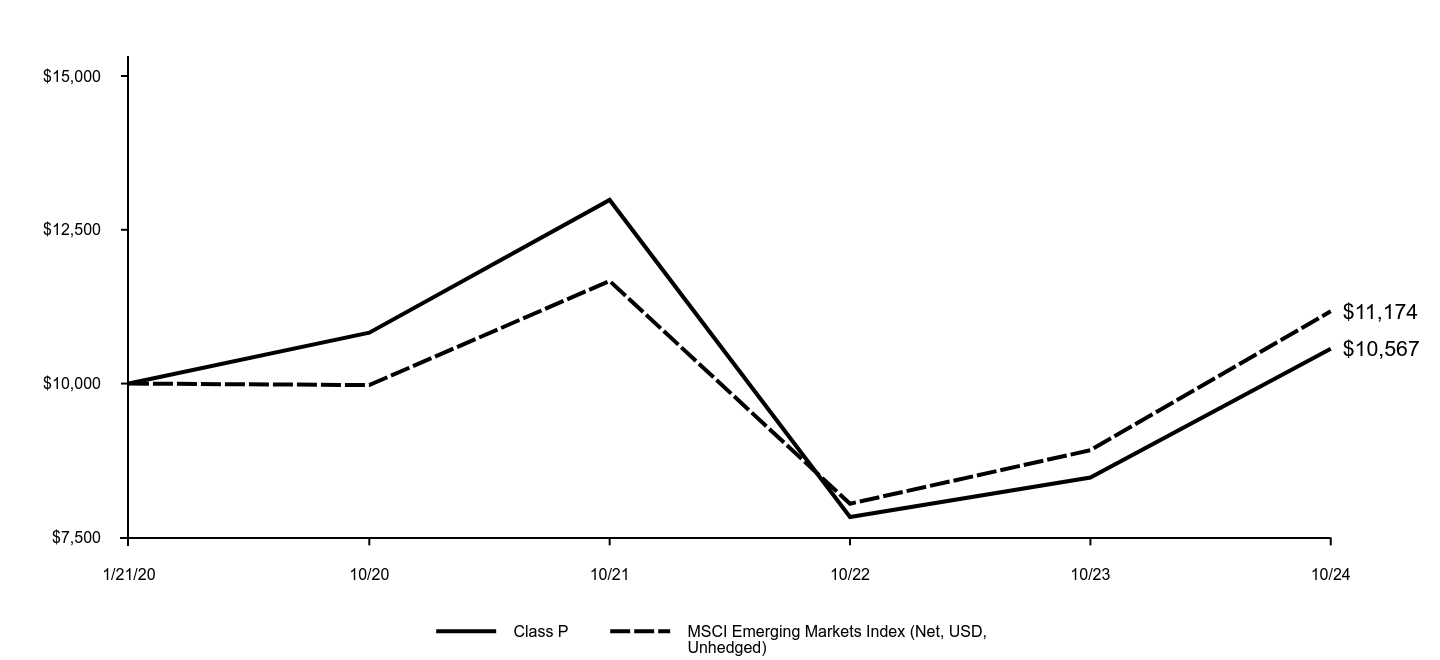

Goldman Sachs Emerging Markets Equity Insights Fund

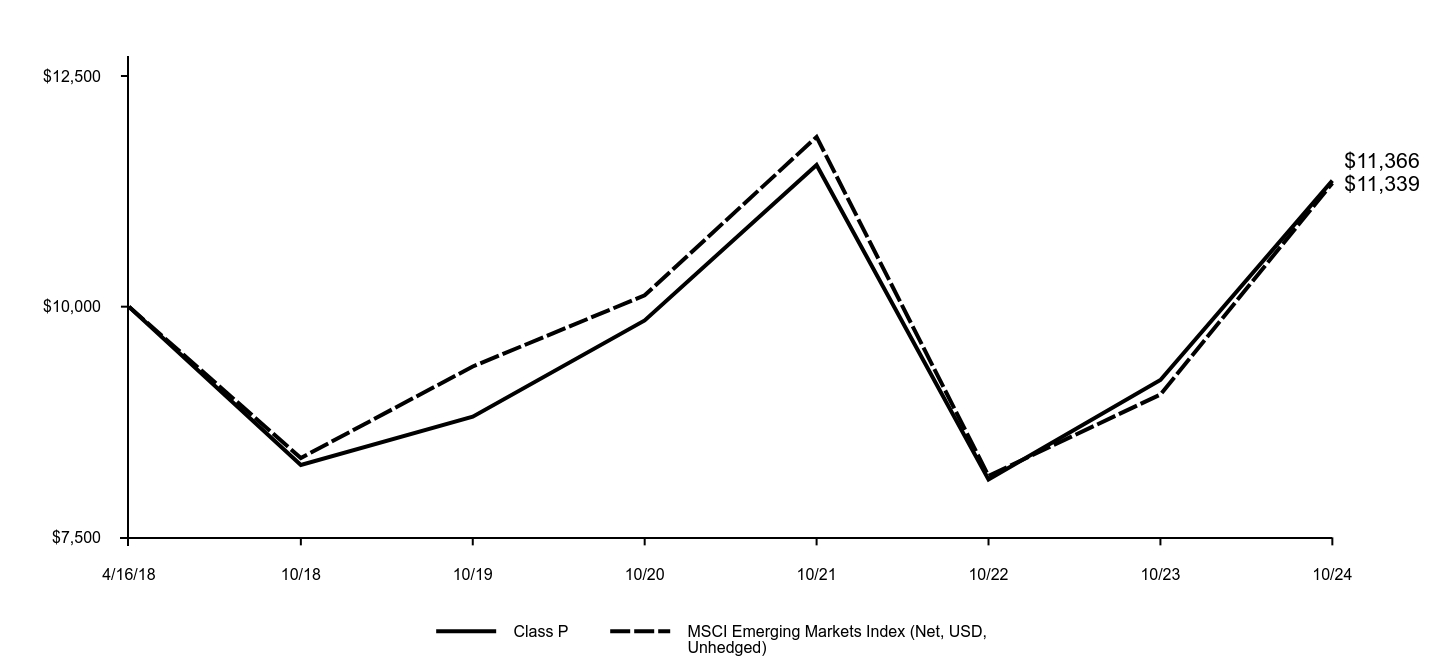

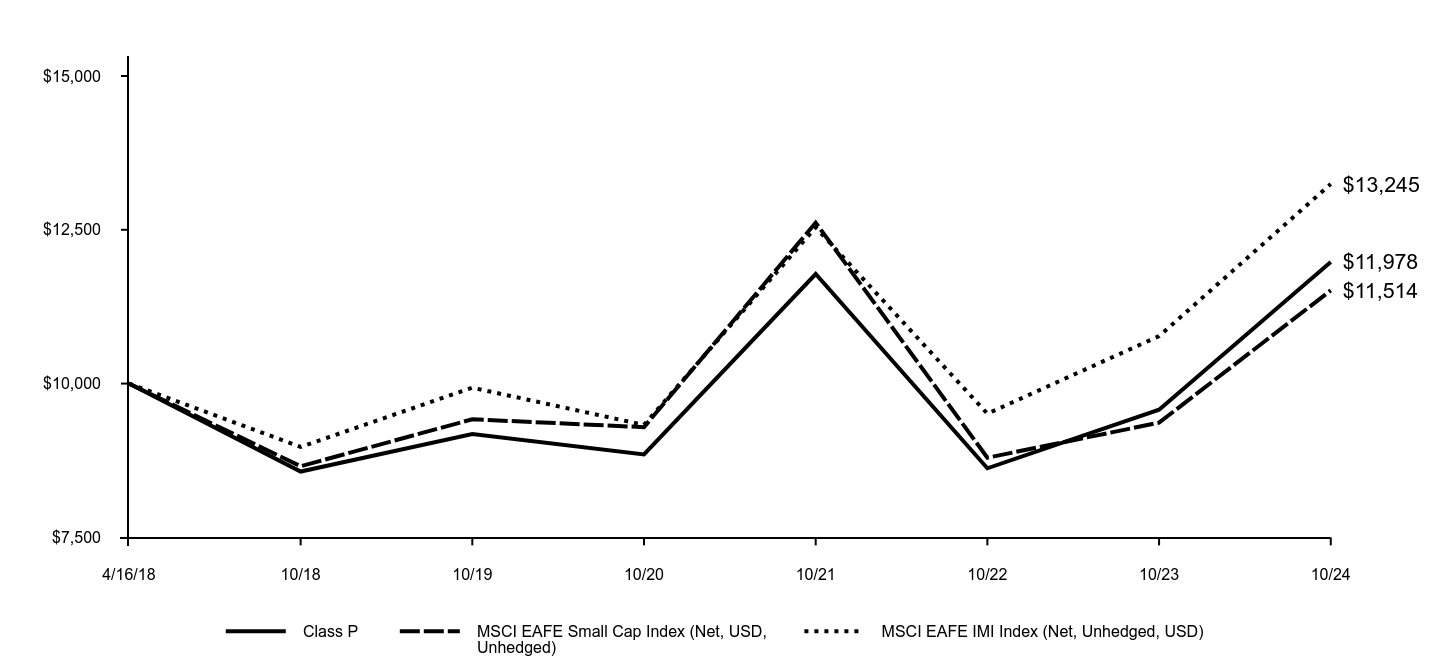

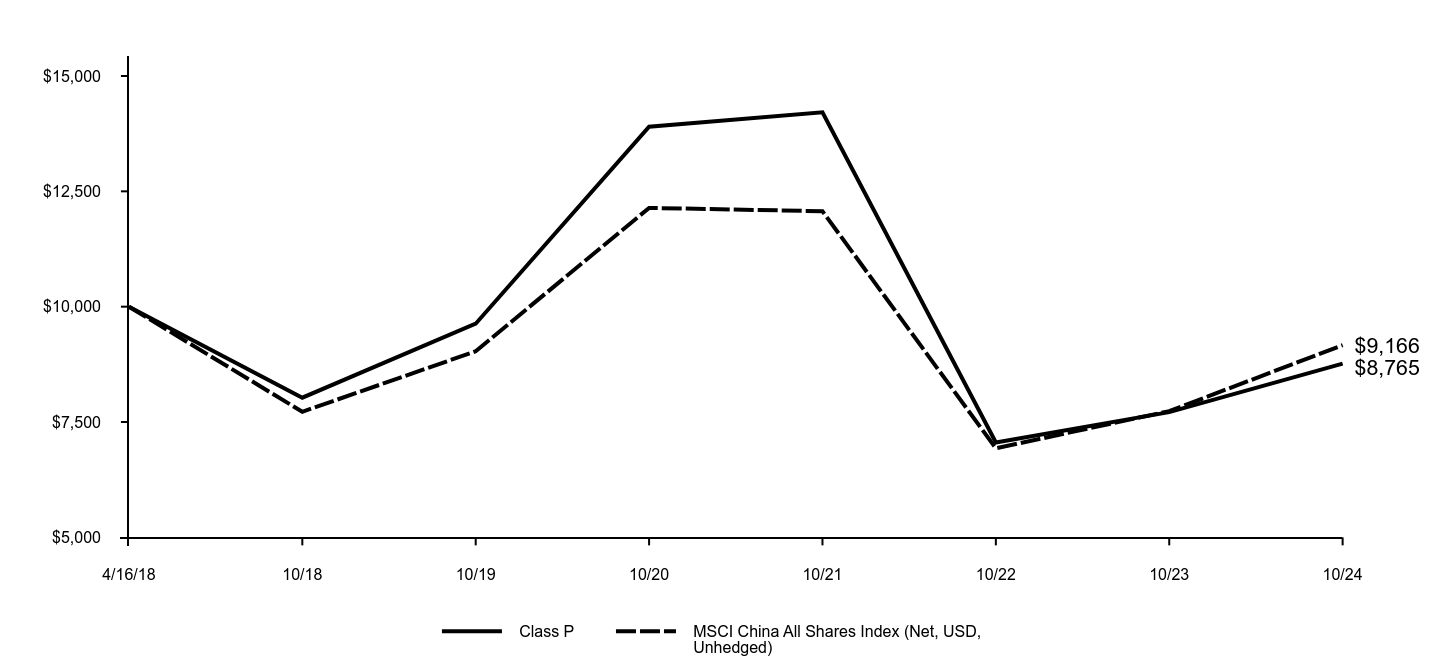

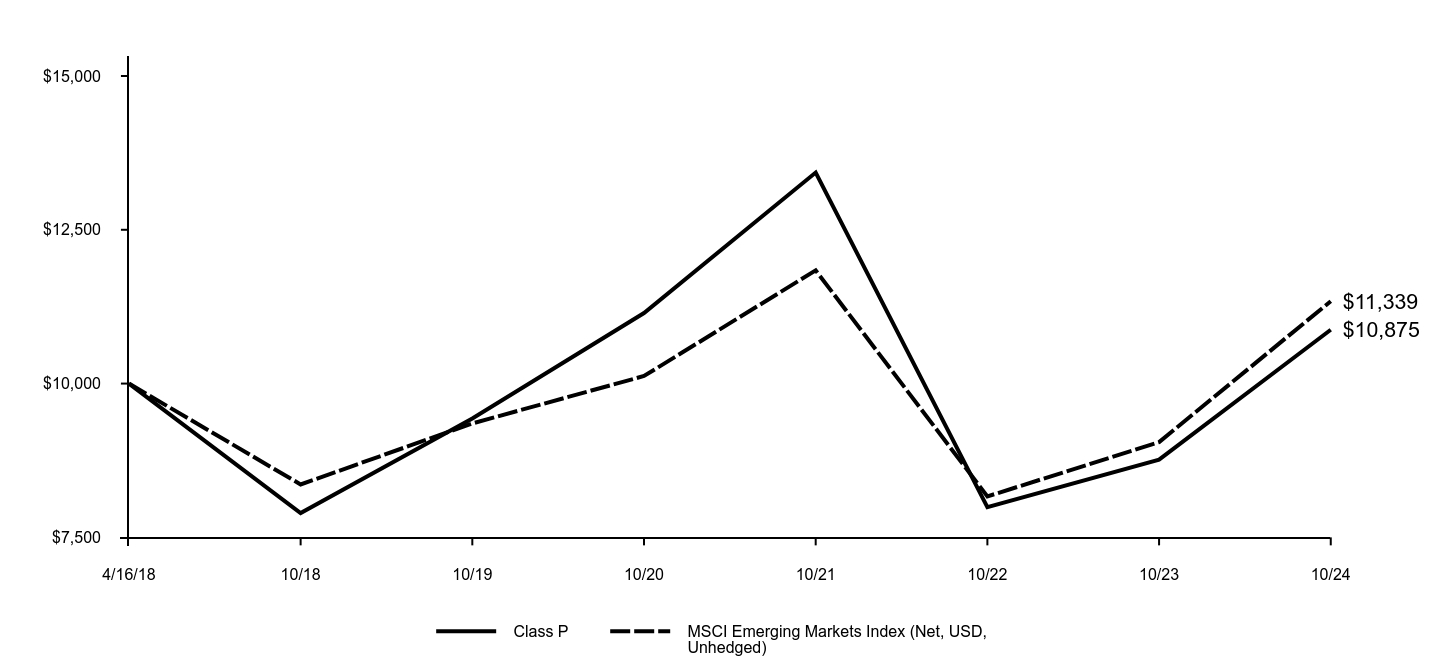

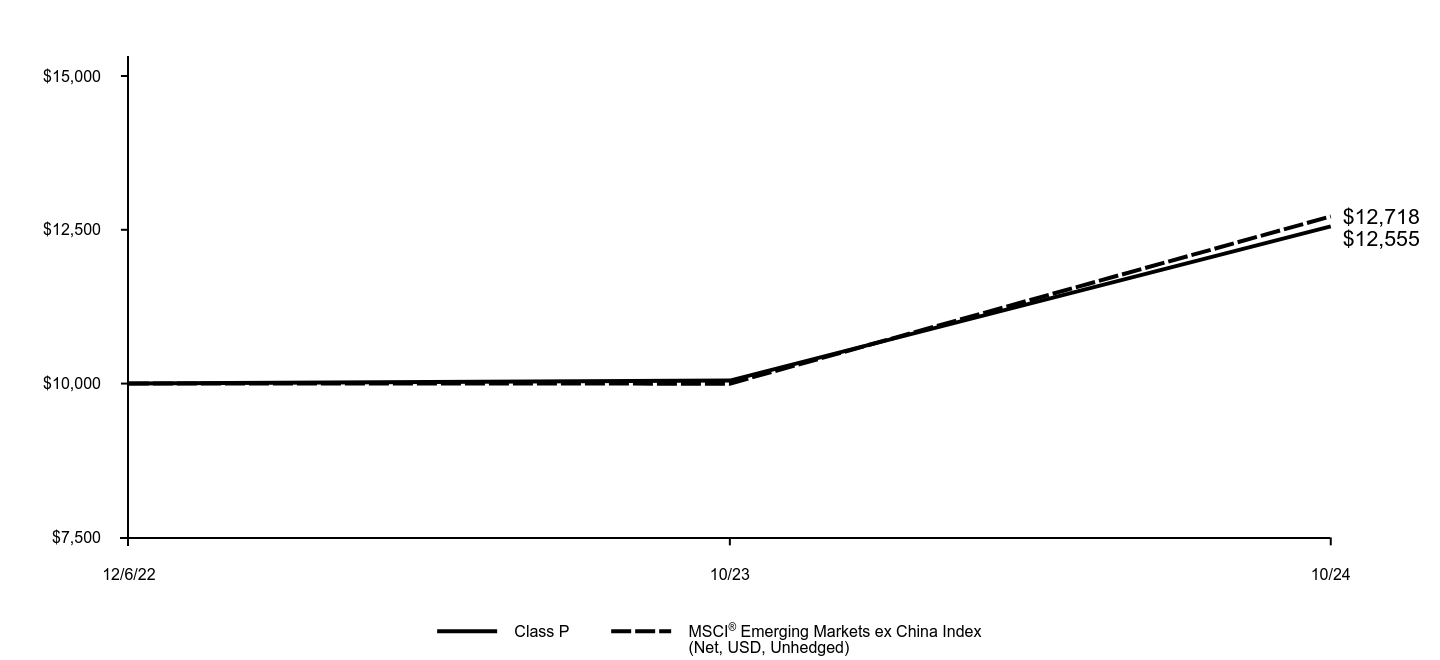

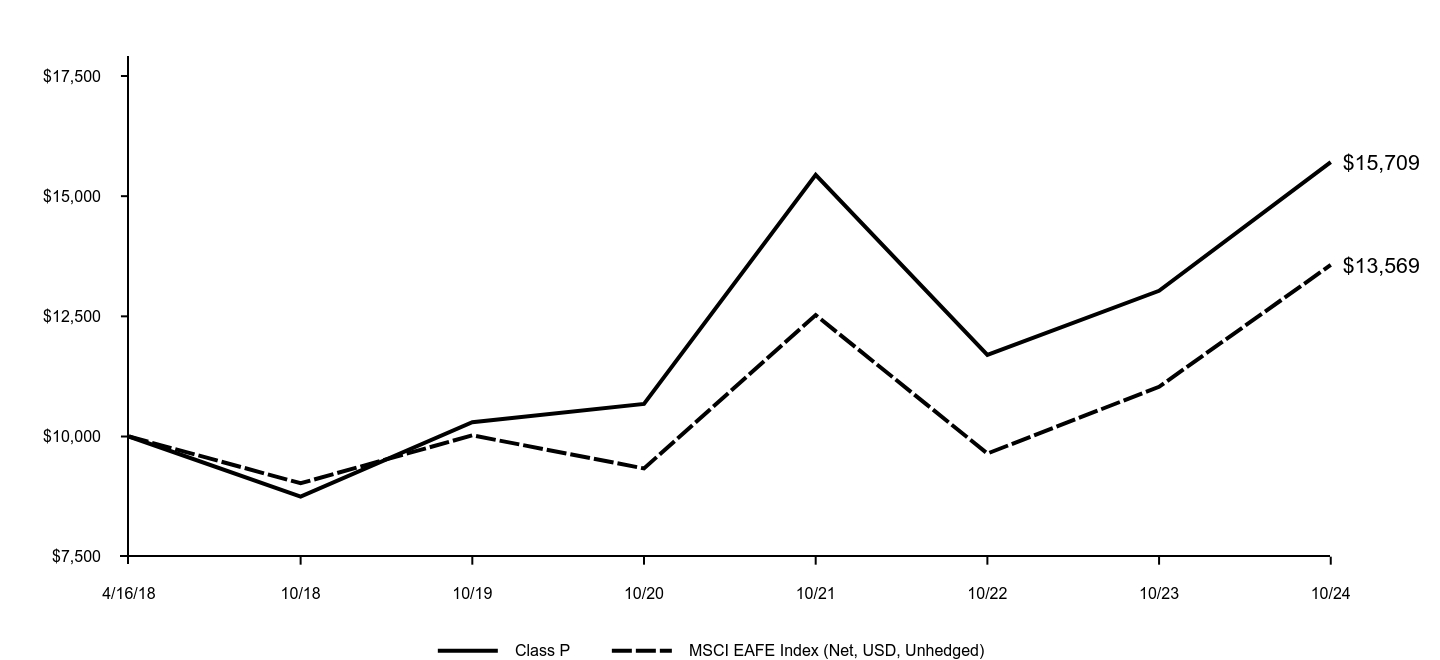

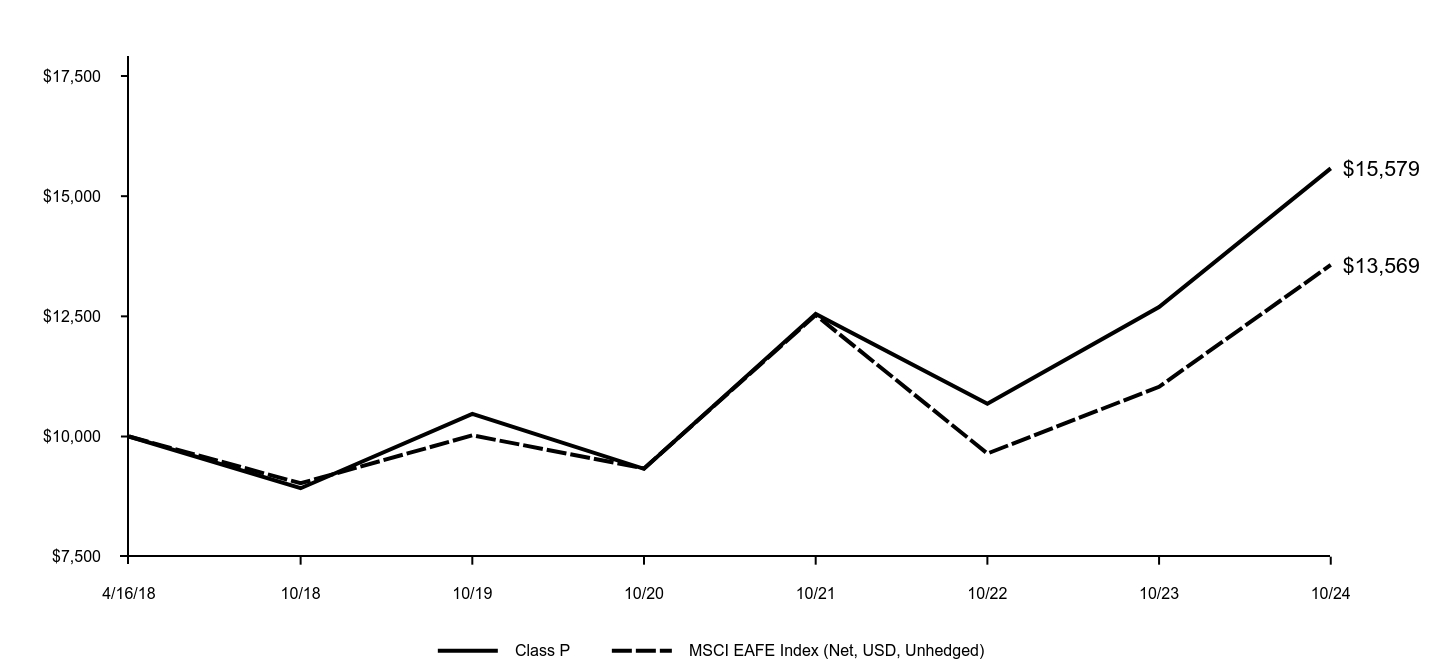

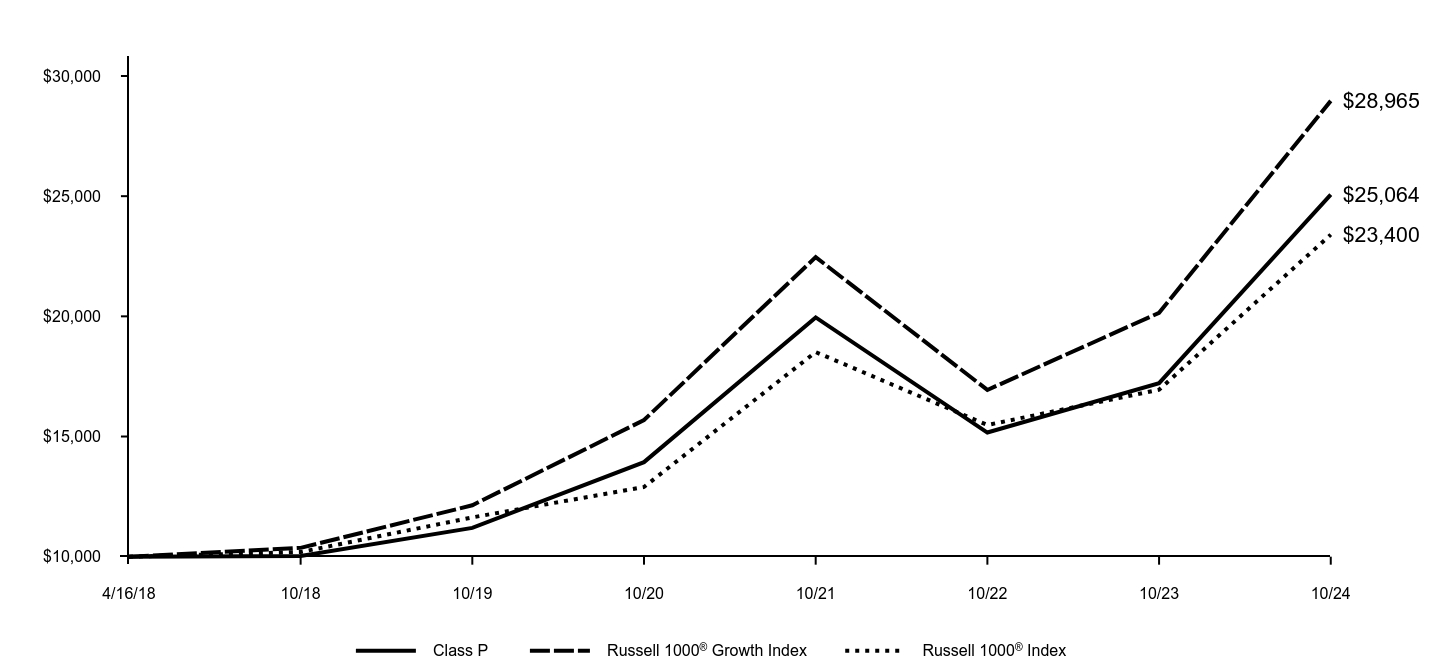

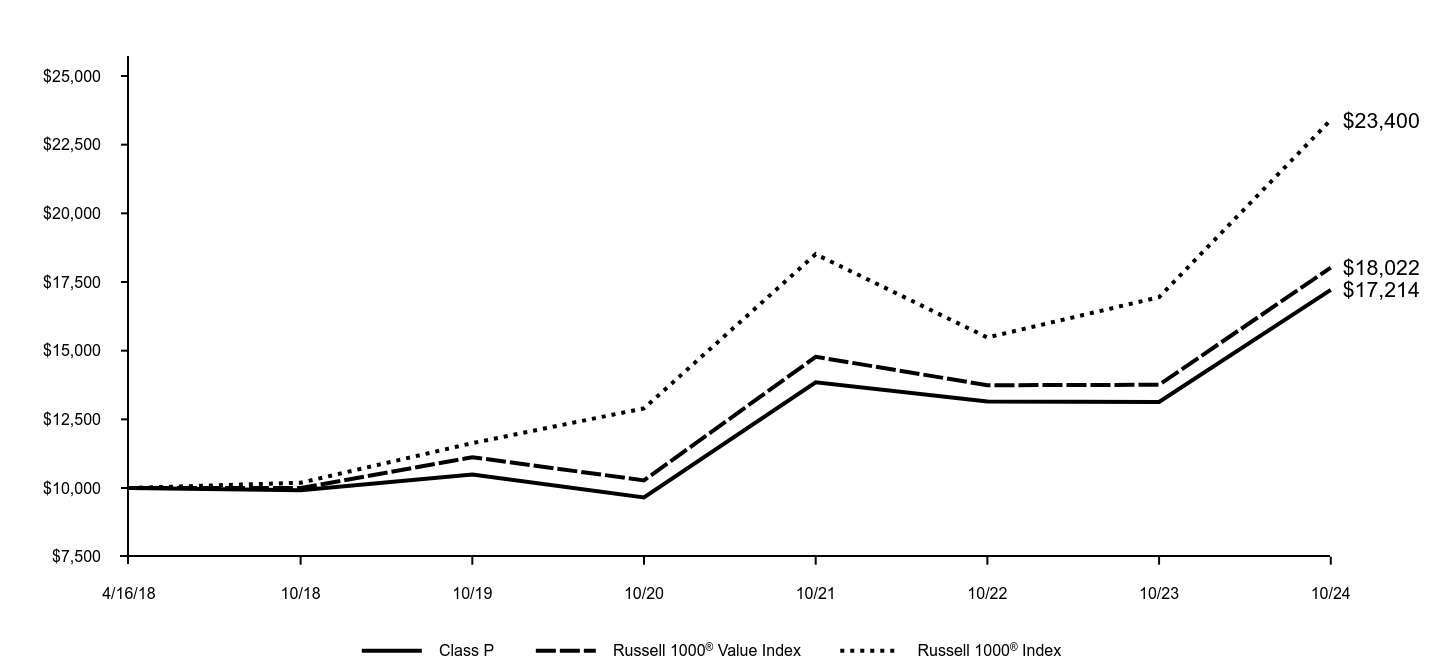

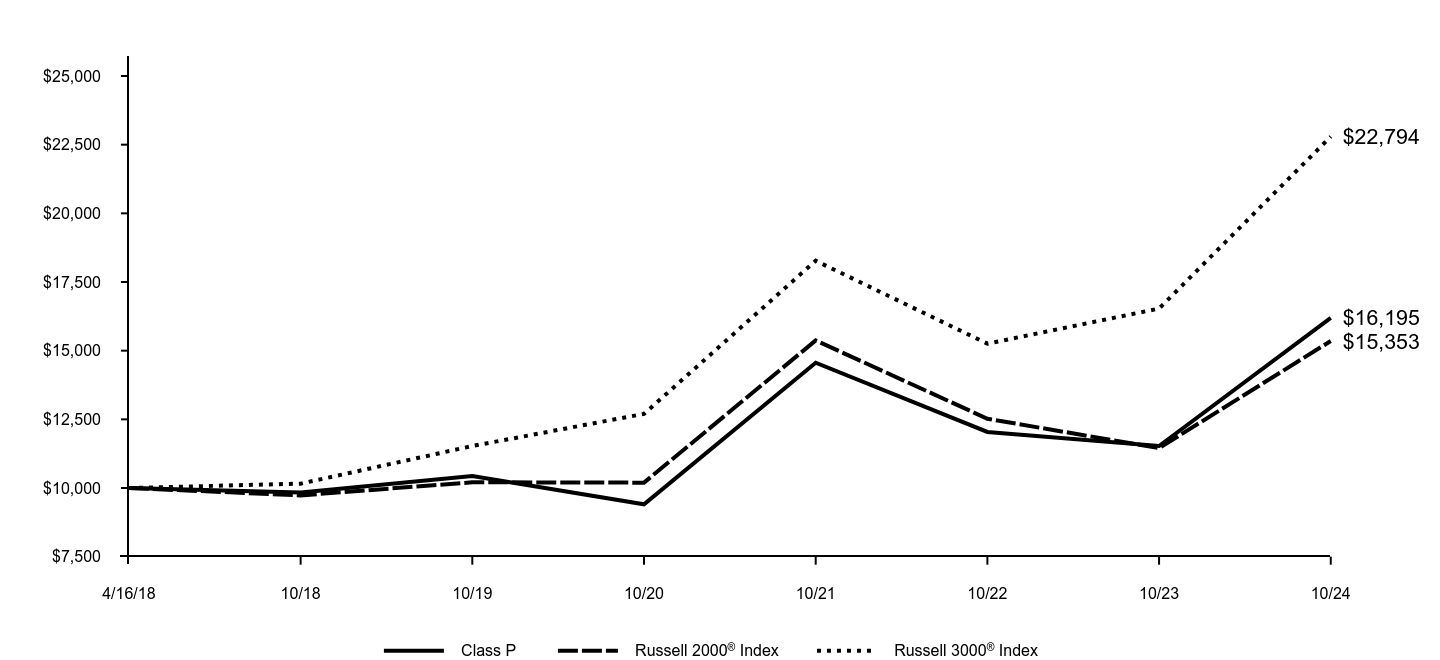

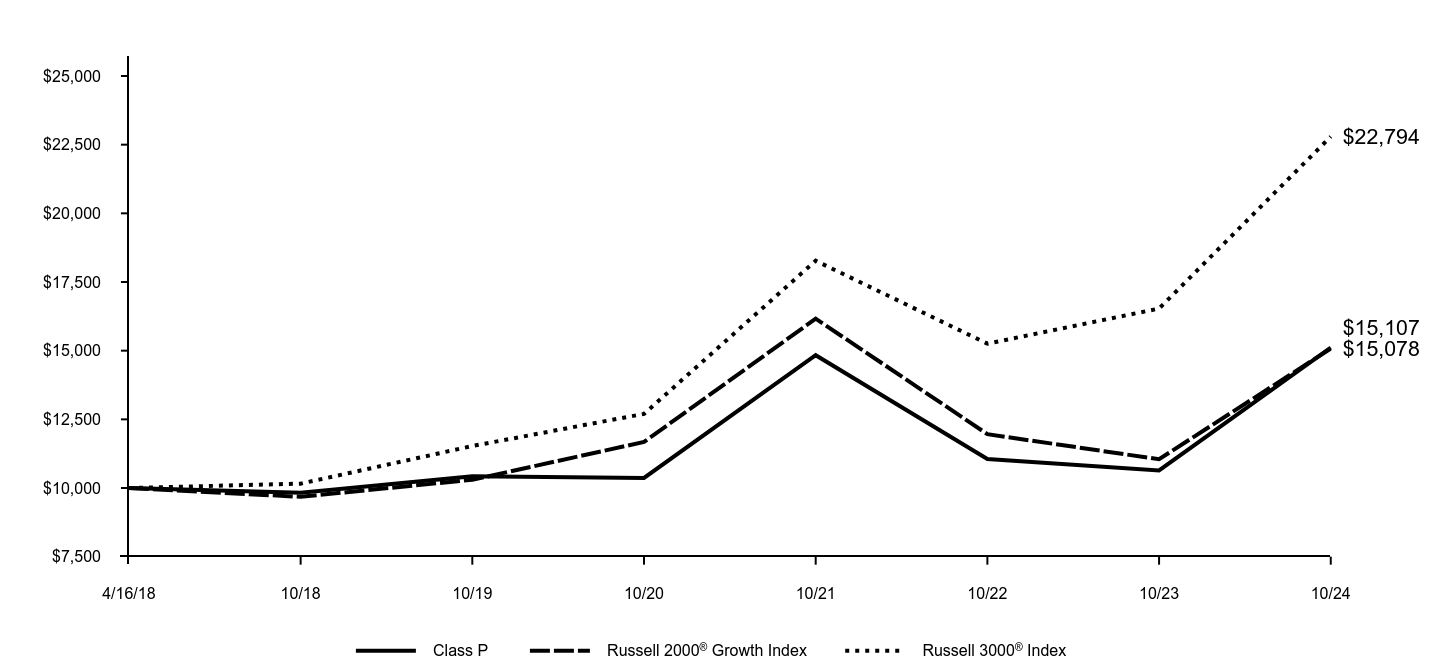

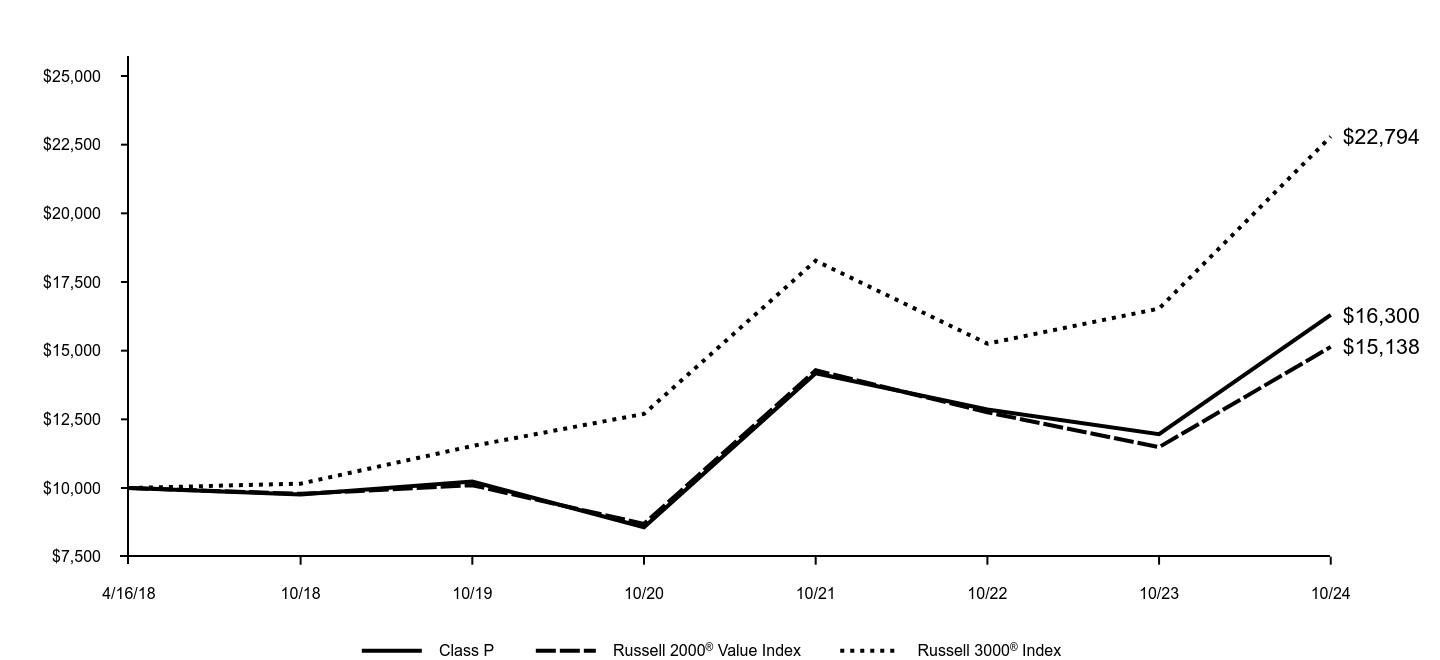

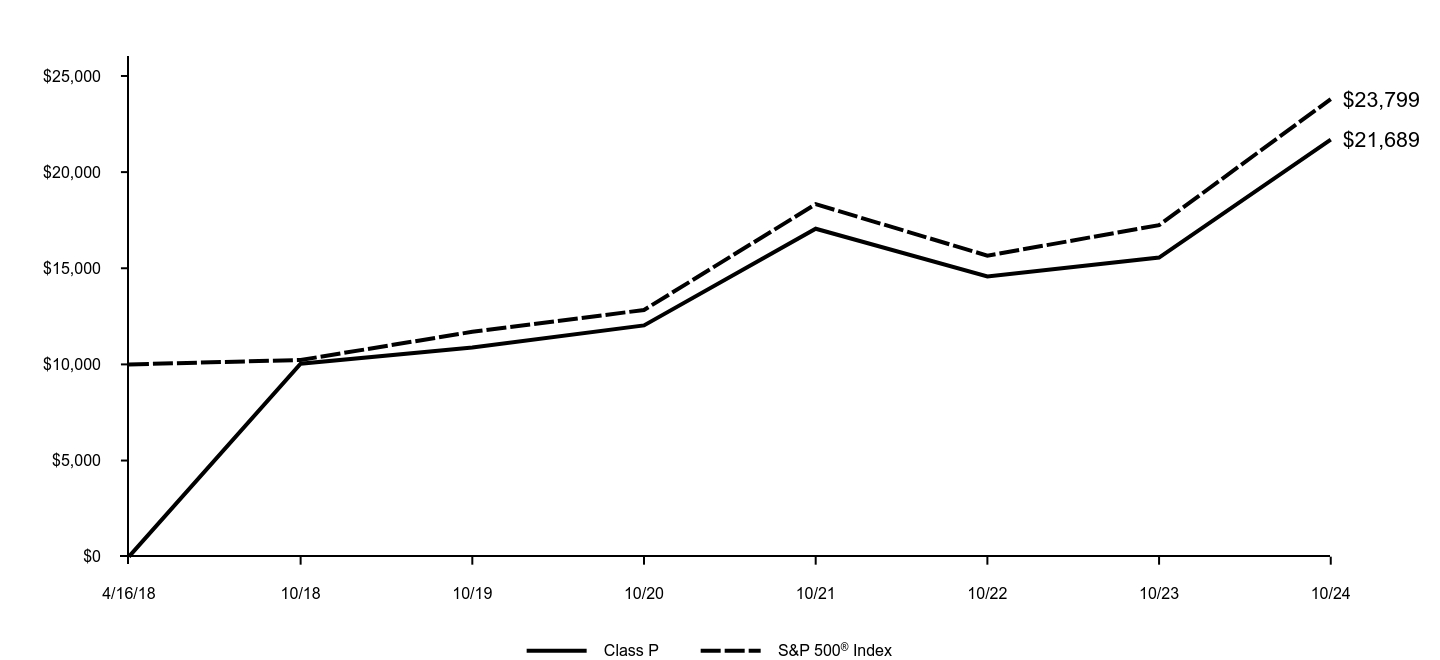

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class P | MSCI Emerging Markets Index (Net, USD, Unhedged) |

|---|

| 4/16/18 | $10,000 | $10,000 |

| 10/18 | $8,284 | $8,360 |

| 10/19 | $8,808 | $9,352 |

| 10/20 | $9,851 | $10,123 |

| 10/21 | $11,536 | $11,840 |

| 10/22 | $8,127 | $8,166 |

| 10/23 | $9,206 | $9,048 |

| 10/24 | $11,366 | $11,339 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception |

|---|

| Class P (Commenced April 16, 2018) | 23.47% | 5.22% | 1.97% |

| MSCI Emerging Markets Index (Net, USD, Unhedged) | 25.32% | 3.93% | 1.94% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Emerging Markets Equity Insights Fund

Key Fund Statistics (as of October 31, 2024)

| Total Net Assets | $2,152,192,361 |

| # of Portfolio Holdings | 382 |

| Portfolio Turnover Rate | 168% |

| Total Net Advisory Fees Paid | $19,529,355 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

During the period, the Fund’s classification changed from non-diversified to diversified. The Fund was previously registered as a non-diversified investment company.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Financials | 23.9% |

| Information Technology | 20.0% |

| Consumer Discretionary | 11.4% |

| Communication Services | 11.1% |

| Industrials | 7.9% |

| Health Care | 6.7% |

| Materials | 4.8% |

| Consumer Staples | 4.0% |

| Utilities | 3.3% |

| Other | 4.9% |

Goldman Sachs Emerging Markets Equity Insights Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications make any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Emerging Markets Equity Insights Fund

38150B848-AR-1024 Class P

Annual Shareholder Report

October 31, 2024

Goldman Sachs International Equity Insights Fund

This annual shareholder report contains important information about Goldman Sachs International Equity Insights Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $132 | 1.18% |

How did the Fund perform and what affected its performance?

The broad international equity market was volatile amid prolonged higher interest rates, persistent inflation, a weak consumer and heightened geopolitical concerns but performed strongly overall as waning inflation globally led a number of central banks to ease monetary policy. Further boosting investor sentiment was generally positive economic data, favorable corporate earnings reports, excitement over artificial intelligence capabilities and economic stimulus in China. International equities fell in October, pressured by U.S. election results uncertainty.

Top Contributors to Performance:

Stock selection in the industrials, information technology and energy sectors contributed positively to the Fund’s performance versus the MSCI EAFE Index. To select stocks for the Fund, we use a quantitative model and four investment themes, overweighting or underweighting those chosen by the model.

Regarding individual stock positions, the Fund was helped by an overweight in SCREEN Holdings, an underweight in Toyota Motor and an overweight in ABB.

The overweight in SCREEN Holdings, a Japanese semiconductor and electronics company, was driven mostly by our Sentiment Analysis and Market Themes & Trends investment themes.

The Fund was underweight Japan’s auto maker Toyota Motor primarily because of our Fundamental Mispricings investment theme.

The overweight in ABB, a Swiss/Swedish electrical engineering firm, was largely due to our High Quality Business Models and Market Themes & Trends investment themes.

The Fund benefited from its country positioning, with underweights in France, Germany and Italy contributing most positively.

Top Detractors from Performance:

Stock selection in the materials, communication services and utilities sectors detracted modestly from relative performance.

The Fund was hampered by overweight positions in Honda Motor, Genmab and Panasonic Holdings.

The overweight in Japan-based auto maker Honda Motor was based mainly on our Fundamental Mispricings investment theme.

The Fund was overweight Denmark-based biotechnology firm Genmab primarily because of our Sentiment Analysis investment theme.

Our Fundamental Mispricings and Market Themes & Trends investment themes were largely responsible for the Fund’s overweight in Japanese electronics company Panasonic Holdings.

High Quality Business Models

The above represents investment themes.

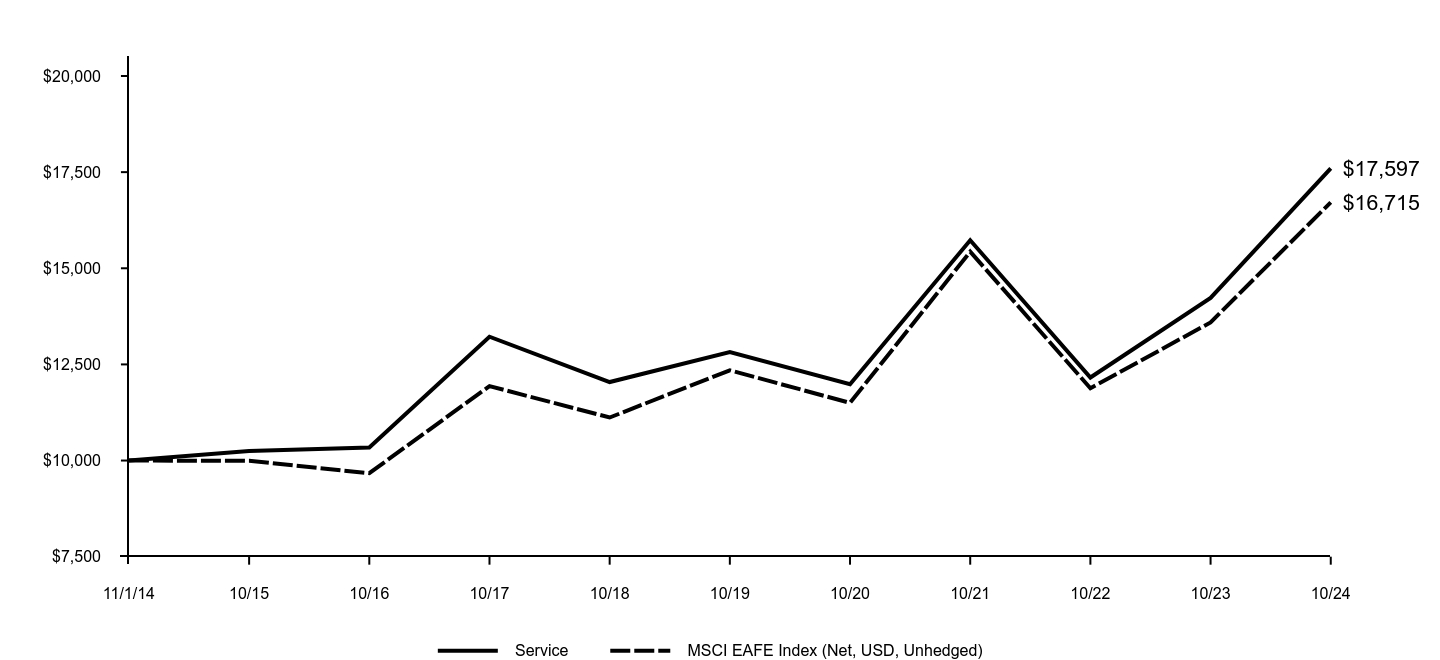

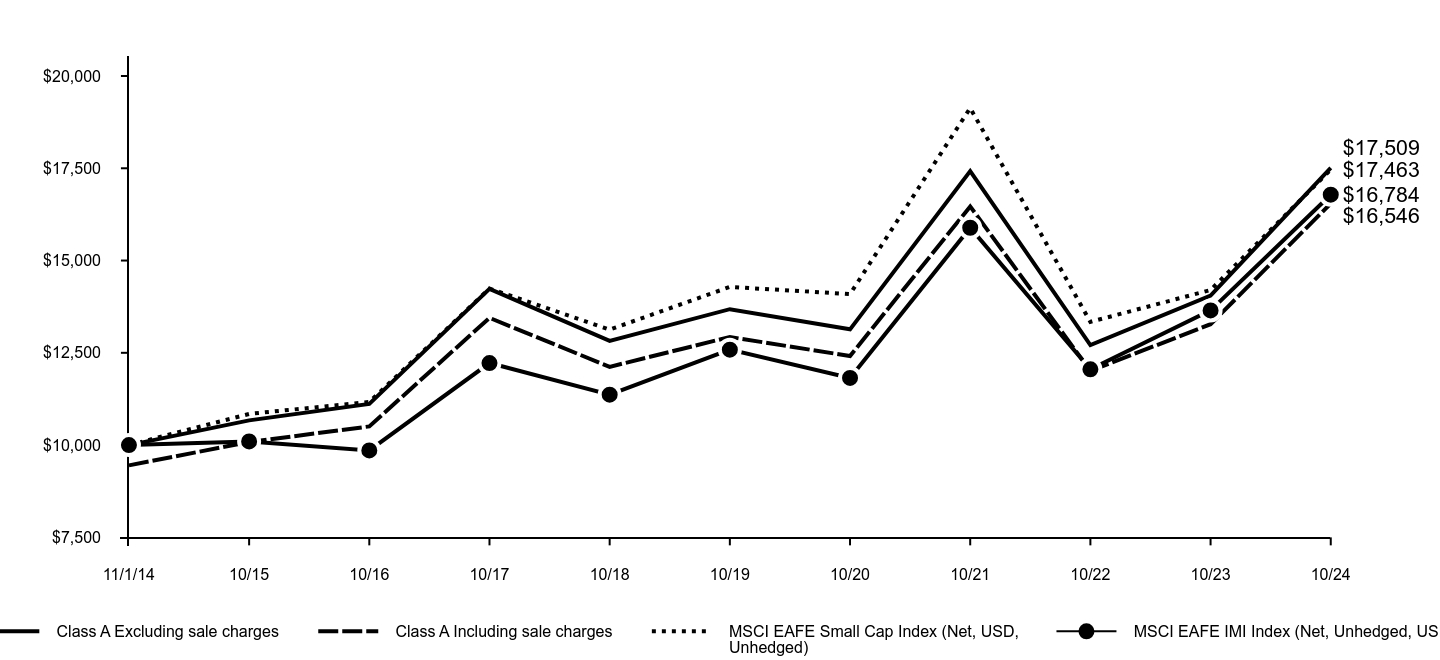

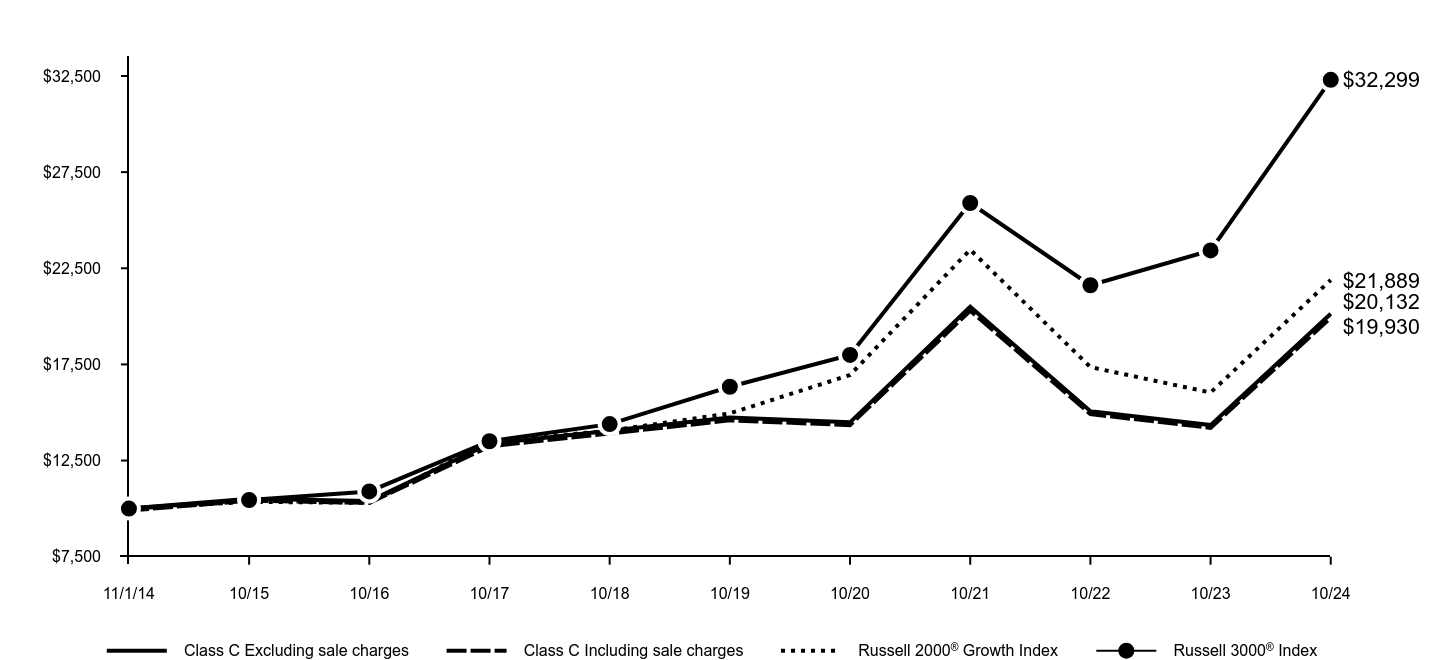

Goldman Sachs International Equity Insights Fund

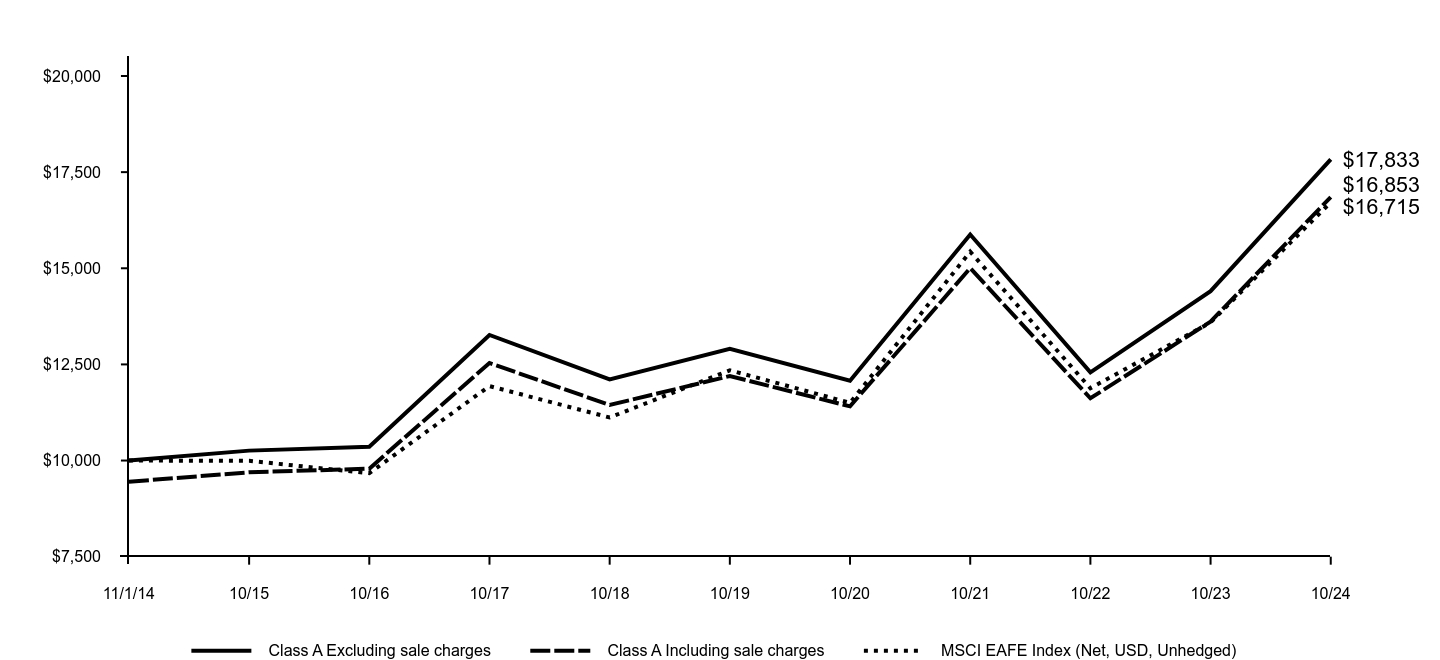

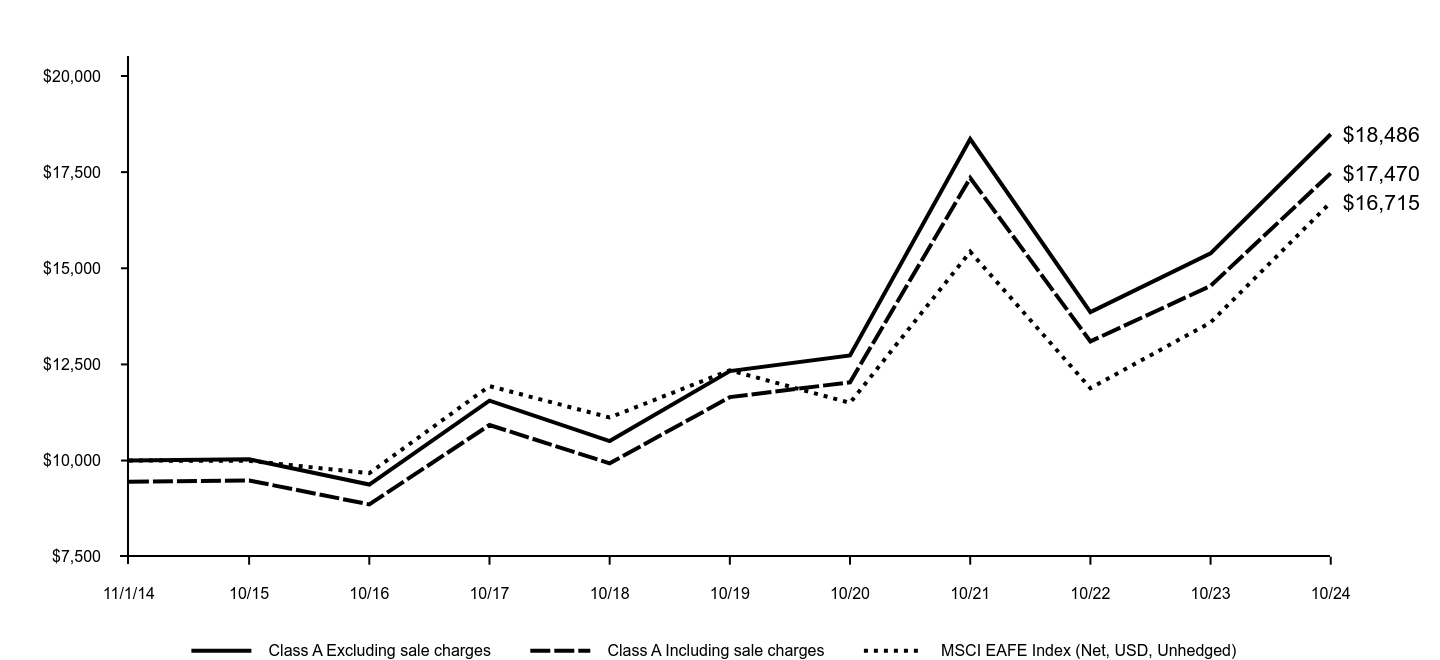

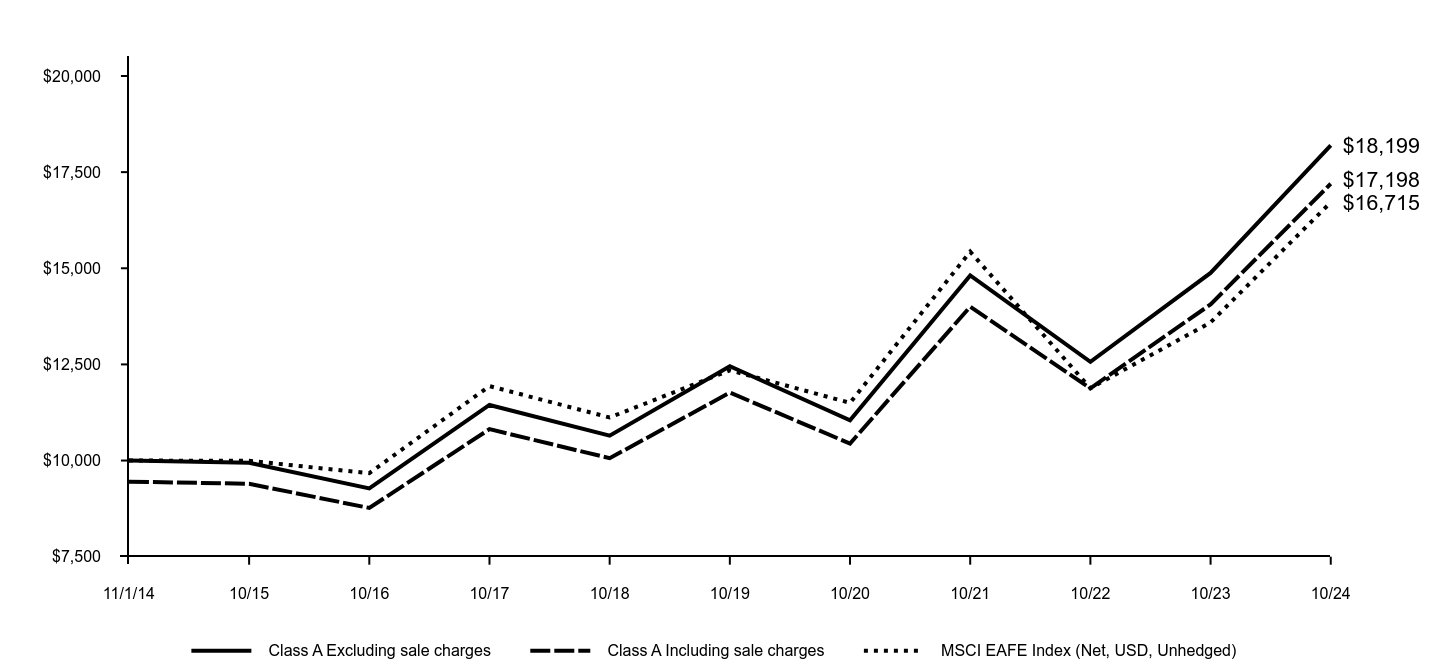

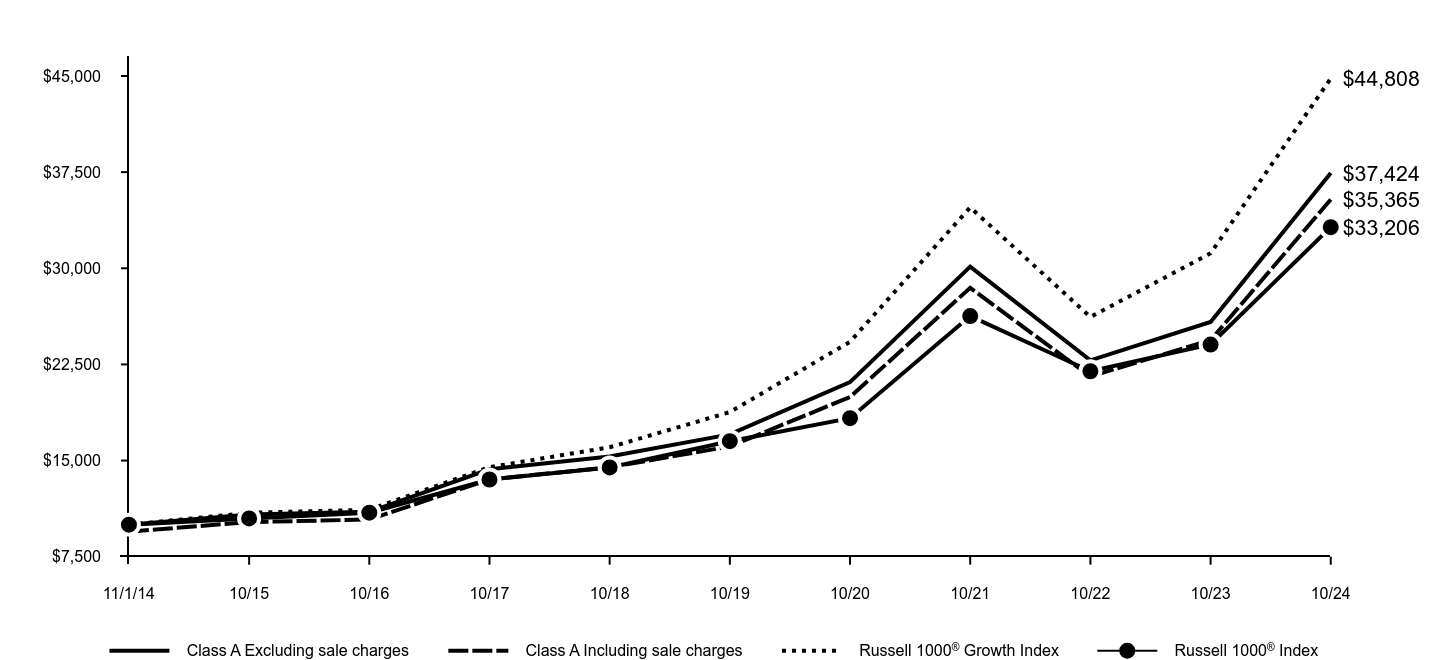

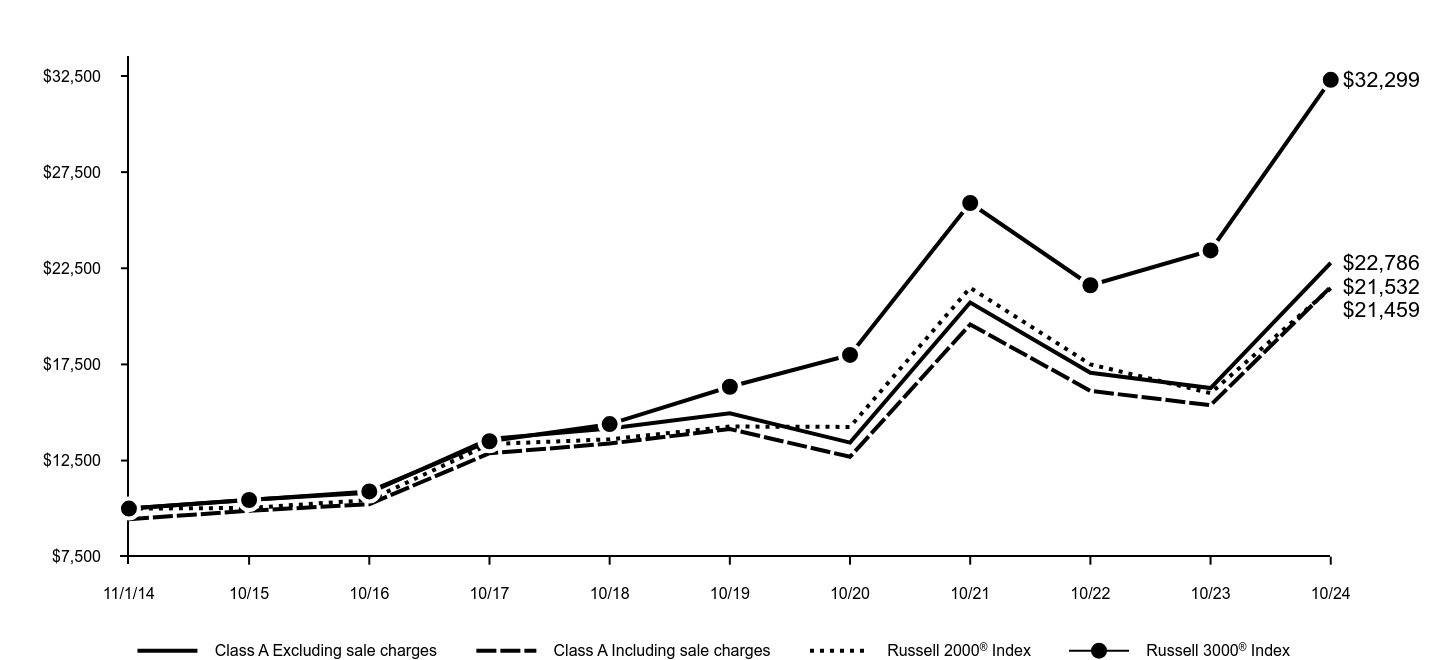

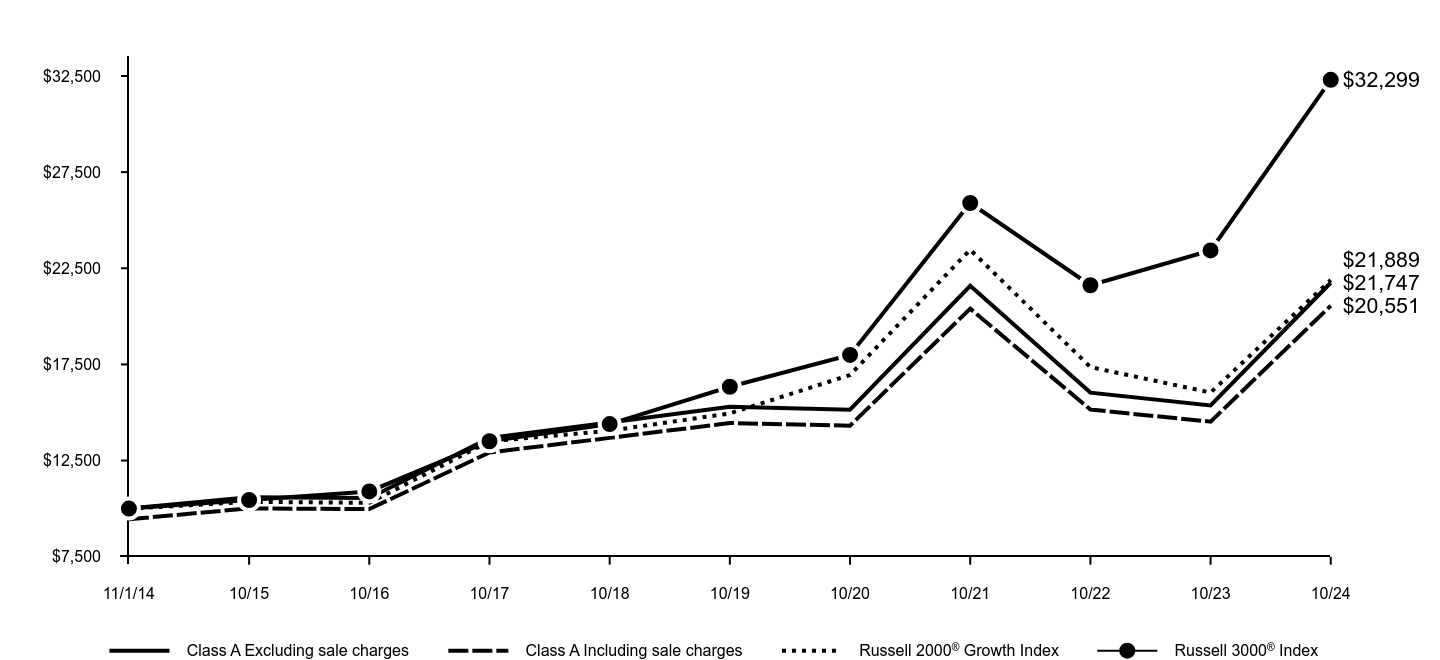

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class A Excluding sale charges | Class A Including sale charges | MSCI EAFE Index (Net, USD, Unhedged) |

|---|

| 11/1/14 | $10,000 | $9,450 | $10,000 |

| 10/15 | $10,258 | $9,694 | $9,993 |

| 10/16 | $10,359 | $9,789 | $9,670 |

| 10/17 | $13,266 | $12,537 | $11,937 |

| 10/18 | $12,111 | $11,445 | $11,119 |

| 10/19 | $12,908 | $12,198 | $12,347 |

| 10/20 | $12,074 | $11,410 | $11,500 |

| 10/21 | $15,877 | $15,004 | $15,430 |

| 10/22 | $12,295 | $11,619 | $11,881 |

| 10/23 | $14,406 | $13,614 | $13,592 |

| 10/24 | $17,833 | $16,853 | $16,715 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A Excluding sale charges | 23.79% | 6.67% | 5.95% |

| Class A Including sale charges | 16.96% | 5.46% | 5.35% |

| MSCI EAFE Index (Net, USD, Unhedged) | 22.97% | 6.24% | 5.27% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs International Equity Insights Fund

Key Fund Statistics (as of October 31, 2024)

| Total Net Assets | $1,810,894,504 |

| # of Portfolio Holdings | 310 |

| Portfolio Turnover Rate | 167% |

| Total Net Advisory Fees Paid | $13,170,398 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Financials | 22.3% |

| Industrials | 18.2% |

| Health Care | 13.6% |

| Consumer Discretionary | 10.8% |

| Information Technology | 7.9% |

| Consumer Staples | 7.8% |

| Materials | 6.9% |

| Communication Services | 3.2% |

| Real Estate | 2.3% |

| Other | 4.2% |

Goldman Sachs International Equity Insights Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.