UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5360

Oppenheimer Main Street Funds

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: August 31

Date of reporting period: 8/31/2018

Item 1. Reports to Stockholders.

| | | | |

| | | Annual Report | | 8/31/2018 |

| | |

| |

| | |

Table of Contents

Class A Shares

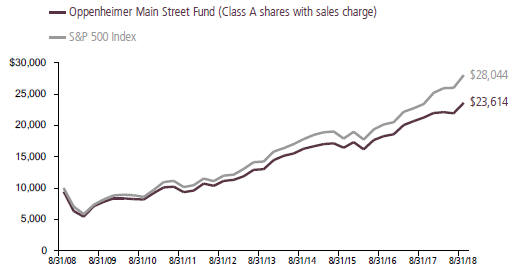

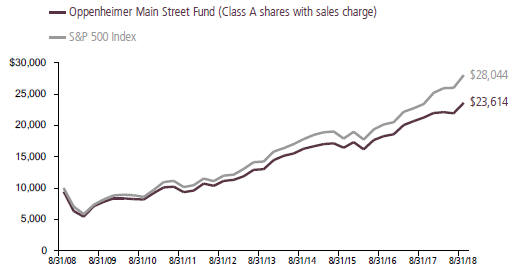

AVERAGE ANNUAL TOTAL RETURNS AT 8/31/18

| | | | | | |

| | | Class A Shares of the Fund | | |

| | | Without Sales Charge | | With Sales Charge | | S&P 500 Index |

1-Year | | 10.99% | | 4.61% | | 19.66% |

5-Year | | 12.66 | | 11.33 | | 14.52 |

10-Year | | 9.62 | | 8.97 | | 10.86 |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

2 OPPENHEIMER MAIN STREET FUND

Fund Performance Discussion

The Fund’s Class A shares (without sales charge) returned 10.99% during the reporting period. In comparison, the Fund underperformed the S&P 500 Index (the “Index”), which returned 19.66%. The Fund’s stock selection drove its underperformance versus the Index this reporting period. The most significant underperformers were the Information Technology, Industrials, Utilities, Consumer Staples, Consumer Discretionary, and Health Care sectors. The Fund outperformed the Index in the Financials and Telecommunication Services sectors due to stock selection. The majority of the reporting period’s underperformance was experienced over the first half of the reporting period. Performance has been more in-line with the Index over the second half of the reporting period.

MARKET OVERVIEW

Market fundamentals remain strong with the U.S. maintaining strong economic growth, low unemployment and low inflation. This was driven partly by inherent growth and partly by tax cuts. Earnings-per-share for the S&P 500 Index has also been strong. Even if one backs out the portion of earnings growth

related to tax reform and looks further up the income statement, pre-tax earnings growth and revenue growth have also been strong. In the short term, we expect the U.S. economy to continue to show decent economic growth driven by favorable ongoing consumer confidence, tax benefits and falling

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

3 OPPENHEIMER MAIN STREET FUND

regulatory hurdles. Rising home prices as well as technological innovation may also help drive the economy higher. Risks we are focused on include trade tariffs, interest rates, disruption of traditional business models and the narrowness of stock market rally in large-cap stocks.

As investors, it is important to know what is and what is not within one’s circle of competence. As such, we strive to keep the portfolio in an all-weather orientation. Whether interest rates, commodity prices, currencies or even whole economies go up or down, we seek to have a portfolio that has the potential to outperform no matter the environment.

We also believe we have the skills to identify company management teams that are likely to successfully execute on their plans. Lastly, we believe correctly valuing stocks and seeing what expectations the market is pricing in is also within our skillset. It is not by accident that we weight the portfolio more heavily towards companies that we see as having structural competitive advantages and/ or management teams that are executing (e.g. gaining market share, expanding profit margins), with at least reasonable stock valuations. Companies with these qualities generally have more stable earnings.

FUND REVIEW

Top detractors from the Fund’s performance during the reporting period included PG&E, Celgene, and Amazon.com.

PG&E is one of the largest utility companies in California. The stock has been under pressure since the start of the Northern California wildfires due to concerns that some of the company’s equipment may have played a role in some of the fires. The stock saw further pressure after the company announced they would be suspending the dividend to preserve cash for potential future claims. We exited our position.

Celgene is a biotechnology company that experienced significant weakness in the fourth quarter of 2017 that continued into 2018 after lowering earnings guidance for the quarter and longer term through 2020. This was primarily due to lower expected revenues from Otezla, a drug treating certain types of arthritis, which accounts for approximately 10% of the company’s revenues. Secondarily, there was disappointment due to the withdrawal of a pipeline drug. These concerns are amplified in the context of the company’s blockbuster drug, Revlimid (60+% of sales) facing patent expirations that start in 2022. The concerns appear overdone, however, as the company is on track to generate cumulative EPS of roughly three-fourths of its current stock price before the patent expiration.

Not owning shares of Amazon through the end of April was another top detractor, as the company continued its run of impressive performance and is one of the largest names in the S&P 500 Index. We reinitiated a position in the company at the very end of

4 OPPENHEIMER MAIN STREET FUND

April 2018 after previously selling the stock in early 2017. Since then, the company has continued to execute and fundamentals have strengthened.

Top contributors to the Fund’s performance this period included Motorola Solutions, Inc., O’Reilly Automotive, Inc., and Exact Sciences Corporation.

Motorola Solutions continues to display strong execution and continues to benefit from a favorable environment for public-safety spending. The company has had record backlogs with improved margins and return on invested capital.

O’Reilly has benefited from favorable comparisons versus a year ago, driven by a more normal winter causing greater demand for vehicle maintenance and parts during the spring repair season. An improvement in sales has also helped ease concerns around the threat of Amazon.

Exact Sciences focuses on the early detection and prevention of colorectal cancer through molecular diagnostics. The company saw initial strength after reporting strong first-quarter results, which saw strong adoption of Cologuard, the company’s non-invasive test for the early detection of colorectal cancer. The stock got an additional boost after the American Cancer Society updated its guidelines to recommend colorectal cancer screening at age 45 versus 50. More recently, the stock price got another significant boost after announcing a co-promotion deal with

Pfizer that will accelerate the usage of Cologuard.

STRATEGY & OUTLOOK

As we mentioned earlier, the risks we are focused on include trade tariffs, interest rates, disruption of traditional business models and the narrowness of the stock market rally in large-cap stocks. Regarding trade tariffs, we believe the market views it as a negotiating tactic and is implying that all will end well. A true escalation could severely hamper global growth and thereby stock prices. In addition, we are afraid companies are addicted to low interest rates. If interest rates were to rise materially, some companies’ historical decisions could look like misallocation of capital and negatively impact their stock prices. Innovation, while a positive for the overall economy over the long-term, creates short-term disruptions. Finally, there is risk around the growing disparity between stock prices of companies perceived as having “growth characteristics” irrespective of valuation versus the rest of the companies. History tells us that sooner or later, such narrow rallies typically result in investors crowding in a few stocks and ultimately result in meaningful declines of those stocks.

We continue to maintain our discipline around valuation. Additionally, while innovation is alive and well and helping generate economic growth, fundamental disruptions across market segments have been elevated. We are constantly monitoring potential disruption risk to our companies.

5 OPPENHEIMER MAIN STREET FUND

Despite a short-lived uptick in early 2018, volatility in the markets has been unusually low by historical standards but could increase. Traditionally, during periods of heightened market volatility, investors generally favor stocks of higher-quality companies—with greater consistency and stability of revenue and earnings—leading to relatively better stock performance of those companies. We think focusing on companies with competitive

| | |

| |

Manind Govil, CFA Portfolio Manager |

| |

| |

Paul Larson Portfolio Manager |

advantages and skilled management teams positions us well, should this environment come to pass. During times of economic volatility such companies frequently widen their lead over weaker competitors. We seek to invest in companies characterized by these qualities at compelling valuations and believe this disciplined approach is essential to generating superior long-term performance.

| | |

| |

Benjamin Ram Portfolio Manager |

6 OPPENHEIMER MAIN STREET FUND

Top Holdings and Allocations

TOP TEN COMMON STOCK HOLDINGS

| | | | |

| Microsoft Corp. | | | 5.6 | % |

| JPMorgan Chase & Co. | | | 3.7 | |

| UnitedHealth Group, Inc. | | | 3.7 | |

| Amazon.com, Inc. | | | 3.7 | |

| Apple, Inc. | | | 3.6 | |

| Merck & Co., Inc. | | | 2.9 | |

| Motorola Solutions, Inc. | | | 2.7 | |

| Facebook, Inc., Cl. A | | | 2.6 | |

| Suncor Energy, Inc. | | | 2.5 | |

| Lockheed Martin Corp. | | | 2.3 | |

Portfolio holdings and allocations are subject to change. Percentages are as of August 31, 2018, and are based on net assets.

TOP TEN COMMON STOCK INDUSTRIES

| | | | |

| Software | | | 7.3 | % |

| Capital Markets | | | 7.1 | |

| Health Care Providers & Services | | | 6.7 | |

| Specialty Retail | | | 5.8 | |

| Oil, Gas & Consumable Fuels | | | 5.5 | |

| IT Services | | | 5.2 | |

| Technology Hardware, Storage & Peripherals | | | 5.0 | |

| Commercial Banks | | | 5.0 | |

| Internet & Catalog Retail | | | 3.7 | |

| Pharmaceuticals | | | 2.9 | |

Portfolio holdings and allocations are subject to change. Percentages are as of August 31, 2018, and are based on net assets.

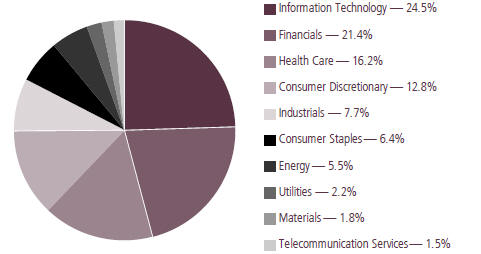

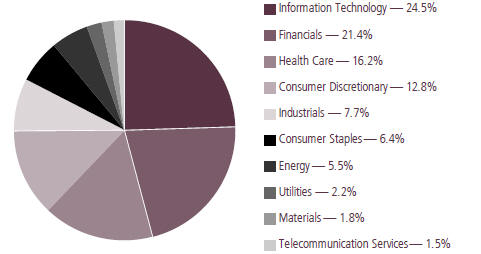

SECTOR ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of August 31, 2018, and are based on the total market value of common stocks.

For more current Fund holdings, please visit oppenheimerfunds.com.

7 OPPENHEIMER MAIN STREET FUND

Share Class Performance

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 8/31/18 | |

| | | Inception | | | | | | | | | |

| | | Date | | 1-Year | | | 5-Year | | | 10-Year | |

Class A (MSIGX) | | | 2/3/88 | | | | 10.99 | % | | | 12.66 | % | | | 9.62 | % |

Class C (MIGCX) | | | 12/1/93 | | | | 10.16 | | | | 11.82 | | | | 8.80 | |

Class I (OMSIX) | | | 12/29/11 | | | | 11.45 | | | | 13.13 | | | | 14.56 | * |

Class R (OMGNX) | | | 3/1/01 | | | | 10.70 | | | | 12.37 | | | | 9.34 | |

Class Y (MIGYX) | | | 11/1/96 | | | | 11.25 | | | | 12.93 | | | | 10.00 | |

|

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 8/31/18 | |

| | | Inception | | | | | | | | | |

| | | Date | | 1-Year | | | 5-Year | | | 10-Year | |

Class A (MSIGX) | | | 2/3/88 | | | | 4.61 | % | | | 11.33 | % | | | 8.97 | % |

Class C (MIGCX) | | | 12/1/93 | | | | 9.16 | | | | 11.82 | | | | 8.80 | |

Class I (OMSIX) | | | 12/29/11 | | | | 11.45 | | | | 13.13 | | | | 14.56 | * |

Class R (OMGNX) | | | 3/1/01 | | | | 10.70 | | | | 12.37 | | | | 9.34 | |

Class Y (MIGYX) | | | 11/1/96 | | | | 11.25 | | | | 12.93 | | | | 10.00 | |

*Shows performance since inception.

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75% and for Class C shares, the contingent deferred sales charge of 1% for the 1-year period. There is no sales charge for Class I, Class R and Class Y shares. Returns for periods of less than one year are cumulative and not annualized. See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

The Fund’s performance is compared to the performance of the S&P 500 Index. The S&P 500 Index is a capitalization-weighted index of 500 stocks intended to be a representative sample of leading companies in leading industries within the U.S. economy. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

8 OPPENHEIMER MAIN STREET FUND

The views in the Fund Performance Discussion represent the opinions of this Fund’s portfolio manager(s) and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the close of business on August 31, 2018, and are subject to change based on subsequent developments. The Fund’s portfolio and strategies are subject to change.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

9 OPPENHEIMER MAIN STREET FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended August 31, 2018.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended August 31, 2018” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

10 OPPENHEIMER MAIN STREET FUND

| | | | | | | | | | | | |

| Actual | | Beginning Account Value March 1, 2018 | | | Ending Account Value August 31, 2018 | | | Expenses Paid During 6 Months Ended August 31, 2018 |

Class A | | $ | 1,000.00 | | | $ | 1,067.40 | | | $ | 4.65 | |

Class C | | | 1,000.00 | | | | 1,063.50 | | | | 8.67 | |

Class I | | | 1,000.00 | | | | 1,069.70 | | | | 2.61 | |

Class R | | | 1,000.00 | | | | 1,066.30 | | | | 6.06 | |

Class Y | | | 1,000.00 | | | | 1,068.80 | | | | 3.45 | |

| | | |

| Hypothetical | | | | | | | | |

| (5% return before expenses) | | | | | | | | |

Class A | | | 1,000.00 | | | | 1,020.72 | | | | 4.54 | |

Class C | | | 1,000.00 | | | | 1,016.84 | | | | 8.47 | |

Class I | | | 1,000.00 | | | | 1,022.68 | | | | 2.55 | |

Class R | | | 1,000.00 | | | | 1,019.36 | | | | 5.92 | |

Class Y | | | 1,000.00 | | | | 1,021.88 | | | | 3.37 | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended August 31, 2018 are as follows:

| | | | |

Class | | Expense Ratios | |

Class A | | | 0.89 | % |

Class C | | | 1.66 | |

Class I | | | 0.50 | |

Class R | | | 1.16 | |

Class Y | | | 0.66 | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager and Transfer Agent. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

11 OPPENHEIMER MAIN STREET FUND

STATEMENT OF INVESTMENTS August 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks—99.6% | | | | | |

Consumer Discretionary—12.8% | | | | | |

Auto Components—0.6% | | | | | |

Aptiv plc | | | 657,812 | | | $ | 57,894,034 | |

Hotels, Restaurants & Leisure—0.8% | | | | | |

McDonald’s Corp. | | | 522,890 | | | | 84,828,445 | |

Household Durables—0.2% | | | | | |

NVR, Inc.1 | | | 9,030 | | | | 24,096,104 | |

Internet & Catalog Retail—3.7% | | | | | |

Amazon.com, Inc.1 | | | 183,640 | | | | 369,614,064 | |

Media—1.7% | | | | | |

Comcast Corp., Cl. A | | | 4,638,468 | | | | 171,576,931 | |

Specialty Retail—5.8% | | | | | | | | |

| Best Buy Co., Inc. | | | 2,579,670 | | | | 205,238,545 | |

| Lowe’s Cos., Inc. | | | 1,994,500 | | | | 216,901,875 | |

| O’Reilly Automotive, Inc.1 | | | 354,440 | | | | 118,886,265 | |

| Ulta Beauty, Inc.1 | | | 182,660 | | | | 47,491,600 | |

| | | | | | | 588,518,285 | |

Consumer Staples—6.4% | | | | | | | | |

Beverages—1.6% | | | | | |

PepsiCo, Inc. | | | 1,441,233 | | | | 161,432,509 | |

Food Products—1.2% | | | | | |

Kraft Heinz Co. (The) | | | 2,128,340 | | | | 124,018,372 | |

Household Products—2.1% | | | | | |

Church & Dwight Co., Inc. | | | 3,763,540 | | | | 212,941,093 | |

Tobacco—1.5% | | | | | |

Philip Morris International, Inc. | | | 1,889,888 | | | | 147,203,376 | |

Energy—5.5% | | | | | | | | |

Oil, Gas & Consumable Fuels—5.5% | | | | | |

| Exxon Mobil Corp. | | | 1,236,020 | | | | 99,091,723 | |

| Magellan Midstream Partners LP2 | | | 2,919,168 | | | | 199,233,216 | |

| Suncor Energy, Inc. | | | 6,219,630 | | | | 256,124,364 | |

| | | | | | | 554,449,303 | |

Financials—21.3% | | | | | | | | |

Capital Markets—7.1% | | | | | | | | |

| Bank of New York Mellon Corp. (The) | | | 3,244,370 | | | | 169,193,896 | |

CME Group, Inc., Cl. A | | | 927,720 | | | | 162,100,516 | |

| | | | | | | | |

| | | Shares | | | Value | |

Capital Markets (Continued) | | | | | |

| Intercontinental Exchange, Inc. | | | 2,738,610 | | | $ | 208,764,240 | |

| S&P Global, Inc. | | | 839,188 | | | | 173,753,875 | |

| | | | | | | | 713,812,527 | |

Commercial Banks—5.0% | | | | | |

| JPMorgan Chase & Co. | | | 3,318,730 | | | | 380,260,084 | |

| SunTrust Banks, Inc. | | | 1,773,131 | | | | 130,431,516 | |

| | | | | | | 510,691,600 | |

Consumer Finance—1.2% | | | | | | | | |

Discover Financial Services | | | 1,539,595 | | | | 120,273,161 | |

Diversified Financial Services—2.7% | | | | | |

| AXA Equitable Holdings, Inc. | | | 6,122,198 | | | | 140,504,444 | |

| Berkshire Hathaway, Inc., Cl. B1 | | | 634,190 | | | | 132,368,137 | |

| | | | | | | 272,872,581 | |

Insurance—2.6% | | | | | |

| Marsh & McLennan Cos., Inc. | | | 1,714,680 | | | | 145,113,369 | |

| Progressive Corp. (The) | | | 1,795,140 | | | | 121,225,804 | |

| | | | | | | 266,339,173 | |

Real Estate Investment Trusts (REITs)—2.7% | | | | | |

| Mid-America Apartment Communities, Inc. | | | 1,302,383 | | | | 134,874,783 | |

| Prologis, Inc. | | | 2,116,320 | | | | 142,174,378 | |

| | | | | | | 277,049,161 | |

Health Care—16.1% | | | | | |

Biotechnology—2.5% | | | | | | | | |

| Celgene Corp.1 | | | 505,916 | | | | 47,783,766 | |

| Exact Sciences Corp.1 | | | 1,204,610 | | | | 90,213,243 | |

| Gilead Sciences, Inc. | | | 1,582,770 | | | | 119,863,172 | |

| | | | | | | 257,860,181 | |

Health Care Equipment & Supplies—1.7% | | | | | |

| Boston Scientific Corp.1 | | | 2,911,100 | | | | 103,518,716 | |

| Zimmer Biomet Holdings, Inc. | | | 592,300 | | | | 73,226,049 | |

| | | | | | | 176,744,765 | |

Health Care Providers & Services—6.7% | | | | | |

DaVita, Inc.1 | | | 2,931,320 | | | | 203,111,163 | |

12 OPPENHEIMER MAIN STREET FUND

| | | | | | | | |

| | | Shares | | | Value | |

Health Care Providers & Services (Continued) | |

| Laboratory Corp. of America Holdings1 | | | 587,310 | | | $ | 101,528,280 | |

| UnitedHealth Group, Inc. | | | 1,380,507 | | | | 370,610,909 | |

| | | | | | | | 675,250,352 | |

| Health Care Technology—0.7% | | | | | |

Cerner Corp.1 | | | 1,104,650 | | | | 71,923,762 | |

| Life Sciences Tools & Services—1.6% | | | | | |

Agilent Technologies, Inc. | | | 2,394,970 | | | | 161,756,274 | |

| Pharmaceuticals—2.9% | | | | | |

Merck & Co., Inc. | | | 4,261,060 | | | | 292,266,105 | |

| Industrials—7.7% | | | | | | | | |

| Aerospace & Defense—2.3% | | | | | |

Lockheed Martin Corp. | | | 736,091 | | | | 235,850,917 | |

| Airlines—0.4% | | | | | |

Alaska Air Group, Inc. | | | 540,590 | | | | 36,484,419 | |

| Commercial Services & Supplies—1.0% | | | | | |

Republic Services, Inc., Cl. A | | | 1,391,900 | | | | 102,109,784 | |

| Machinery—1.1% | | | | | |

Illinois Tool Works, Inc. | | | 831,490 | | | | 115,477,331 | |

| Professional Services—0.5% | | | | | |

Nielsen Holdings plc | | | 2,005,865 | | | | 52,152,490 | |

| Road & Rail—1.4% | | | | | |

Union Pacific Corp. | | | 906,980 | | | | 136,609,328 | |

| Trading Companies & Distributors—1.0% | | | | | |

Fastenal Co. | | | 1,794,830 | | | | 104,746,279 | |

| Information Technology—24.4% | | | | | |

| Communications Equipment—2.7% | | | | | |

Motorola Solutions, Inc. | | | 2,101,370 | | | | 269,731,853 | |

| Internet Software & Services—2.6% | | | | | |

Facebook, Inc., Cl. A1 | | | 1,492,150 | | | | 262,215,520 | |

| IT Services—5.2% | |

| Amdocs Ltd. | | | 2,482,433 | | | | 162,053,226 | |

| DXC Technology Co. | | | 1,576,490 | | | | 143,602,474 | |

| First Data Corp., Cl. A1 | | | 3,526,910 | | | | 90,712,125 | |

| | | | | | | | |

| | | Shares | | | Value | |

IT Services (Continued) | |

| Visa, Inc., Cl. A | | | 883,340 | | | $ | 129,753,813 | |

| | | | | | | | 526,121,638 | |

Semiconductors & Semiconductor Equipment—1.6% | |

| Applied Materials, Inc. | | | 2,436,910 | | | | 104,835,868 | |

| Microchip Technology, Inc. | | | 698,500 | | | | 60,091,955 | |

| | | | | | | | 164,927,823 | |

| Software—7.3% | |

| Activision Blizzard, Inc. | | | 1,459,250 | | | | 105,211,925 | |

| Microsoft Corp. | | | 5,056,460 | | | | 567,992,152 | |

| ServiceNow, Inc.1 | | | 346,970 | | | | 68,131,029 | |

| | | | | | | | 741,335,106 | |

Technology Hardware, Storage & | | | | | |

Peripherals—5.0% | | | | | | | | |

| Apple, Inc. | | | 1,589,285 | | | | 361,768,945 | |

| NetApp, Inc. | | | 979,830 | | | | 85,059,042 | |

| Western Digital Corp. | | | 1,047,650 | | | | 66,253,386 | |

| | | | | | | | 513,081,373 | |

Materials—1.8% | | | | | | | | |

Chemicals—1.8% | | | | | | | | |

| Ecolab, Inc. | | | 738,720 | | | | 111,162,586 | |

| PPG Industries, Inc. | | | 677,140 | | | | 74,851,055 | |

| | | | | | | | 186,013,641 | |

Telecommunication Services—1.5% | | | | | |

Diversified Telecommunication Services—1.5% | |

Verizon Communications, Inc. | | | 2,731,420 | | | | 148,507,305 | |

Utilities—2.1% | | | | | | | | |

Electric Utilities—1.0% | | | | | |

Duke Energy Corp. | | | 1,251,120 | | | | 101,640,989 | |

Multi-Utilities—1.1% | | | | | | | | |

| National Grid plc | | | 11,056,934 | | | | 116,172,878 | |

| Total Common Stocks (Cost $7,712,559,487) | | | | | | | 10,106,590,832 | |

13 OPPENHEIMER MAIN STREET FUND

STATEMENT OF INVESTMENTS Continued

| | | | | | | | |

| | | Shares | | | Value |

| Investment Company—0.2% | | | | | | | | |

Oppenheimer Institutional Government Money Market Fund, Cl. E, 1.91%3,4 (Cost $22,711,516) | | | 22,711,516 | | | $ | 22,711,516 | |

| Total Investments, at Value (Cost $7,735,271,003) | | | 99.8% | | | | 10,129,302,348 | |

Net Other Assets (Liabilities) | | | 0.2 | | | | 24,935,813 | |

Net Assets | | | 100.0% | | | $ | 10,154,238,161 | |

| | | | |

Footnotes to Statement of Investments

1. Non-income producing security.

2. Security is a Master Limited Partnership.

3. Rate shown is the 7-day yield at period end.

4. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Shares

August 31, 2017 | | | Gross Additions | | | Gross Reductions | | | Shares

August 31, 2018 | |

Investment Company | | | | | | | | | | | | | | | | | | | | |

| Oppenheimer Institutional Government Money Market Fund, Cl. E | | | | | | | 34,362,131 | | | | 2,137,382,900 | | | | 2,149,033,515 | | | | 22,711,516 | |

| | | | | |

| | | | | | Value | | | Income | | | Realized Gain (Loss) | | | Change in

Unrealized Gain (Loss) | |

Investment Company | | | | | | | | | | | | | | | | | | | | |

| Oppenheimer Institutional Government Money Market Fund, Cl. E | | $ | | | | | 22,711,516 | | | $ | 2,622,099 | | | $ | — | | | $ | — | |

See accompanying Notes to Financial Statements.

14 OPPENHEIMER MAIN STREET FUND

STATEMENT OF ASSETS AND LIABILITIES August 31, 2018

| | |

| Assets | | |

Investments, at value—see accompanying statement of investments: | | |

Unaffiliated companies (cost $7,712,559,487) | | $ 10,106,590,832 |

Affiliated companies (cost $22,711,516) | | 22,711,516 |

| | | 10,129,302,348 |

Cash | | 3,670,168 |

Receivables and other assets: | | |

Investments sold | | 47,856,701 |

Dividends | | 14,786,698 |

Shares of beneficial interest sold | | 3,092,393 |

Other | | 874,308 |

Total assets | | 10,199,582,616 |

| Liabilities | | |

Payables and other liabilities: | | |

Investments purchased | | 37,174,946 |

Shares of beneficial interest redeemed | | 5,485,507 |

Distribution and service plan fees | | 1,801,662 |

Trustees’ compensation | | 708,971 |

| Shareholder communications | | 22,143 |

Other | | 151,226 |

Total liabilities | | 45,344,455 |

Net Assets | | $ 10,154,238,161 |

| | |

| | |

| Composition of Net Assets | | |

| Par value of shares of beneficial interest | | $ 188,159 |

| Additional paid-in capital | | 6,625,921,381 |

| Accumulated net investment income | | 45,581,127 |

| Accumulated net realized gain on investments and foreign currency transactions | | 1,088,516,149 |

Net unrealized appreciation on investments | | 2,394,031,345 |

Net Assets | | $ 10,154,238,161 |

| | |

15 OPPENHEIMER MAIN STREET FUND

STATEMENT OF ASSETS AND LIABILITIES Continued

| | | | |

| Net Asset Value Per Share | | | | |

| |

Class A Shares: | | | | |

| |

| Net asset value and redemption price per share (based on net assets of $7,579,158,557 and 139,553,907 shares of beneficial interest outstanding) | | $ | 54.31 | |

| |

Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | | $ | 57.62 | |

| |

Class C Shares: | | | | |

| |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $810,070,658 and 15,804,073 shares of beneficial interest outstanding) | | $ | 51.26 | |

| |

Class I Shares: | | | | |

| |

Net asset value, redemption price and offering price per share (based on net assets of $720,854,025 and 13,380,182 shares of beneficial interest outstanding) | | $ | 53.87 | |

| |

Class R Shares: | | | | |

| |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $223,732,781 and 4,201,120 shares of beneficial interest outstanding) | | $ | 53.26 | |

| |

Class Y Shares: | | | | |

| |

| Net asset value, redemption price and offering price per share (based on net assets of $820,422,140 and 15,219,809 shares of beneficial interest outstanding) | | $ | 53.90 | |

See accompanying Notes to Financial Statements.

16 OPPENHEIMER MAIN STREET FUND

STATEMENT OF

OPERATIONS For the Year Ended August 31, 2018

| | | | |

| Investment Income | | | | |

| |

Dividends: | | | | |

| |

Unaffiliated companies (net of foreign withholding taxes of $1,348,841) | | $ | 175,069,580 | |

| |

Affiliated companies | | | 2,622,099 | |

| |

Interest | | | 90,946 | |

| |

Total investment income | | | 177,782,625 | |

| | |

| Expenses | | | | |

| |

Management fees | | | 45,949,640 | |

Distribution and service plan fees: | | | | |

| |

Class A | | | 16,949,013 | |

| |

Class B1 | | | 134,712 | |

| |

Class C | | | 8,066,628 | |

| |

Class R | | | 1,035,273 | |

Transfer and shareholder servicing agent fees: | | | | |

| |

Class A | | | 15,128,136 | |

| |

Class B1 | | | 28,964 | |

| |

Class C | | | 1,654,778 | |

| |

Class I | | | 221,521 | |

| |

Class R | | | 427,109 | |

| |

| Class Y | | | 1,689,545 | |

Shareholder communications: | | | | |

| |

Class A | | | 74,067 | |

| |

Class B1 | | | 1,631 | |

| |

Class C | | | 8,996 | |

| |

Class I | | | 8,914 | |

| |

Class R | | | 2,388 | |

| |

Class Y | | | 8,464 | |

Borrowing fees | | | 358,263 | |

Trustees’ compensation | | | 290,537 | |

Custodian fees and expenses | | | 61,336 | |

| |

Other | | | 545,529 | |

| |

Total expenses | | | 92,645,444 | |

| |

Less waivers and reimbursements of expenses | | | (655,990 | ) |

| |

Net expenses | | | 91,989,454 | |

| | |

Net Investment Income | | | 85,793,171 | |

| Realized and Unrealized Gain (Loss) | | | | |

| |

Net realized gain (loss) on: | | | | |

| |

Investment transactions in unaffiliated companies | | | 1,269,892,956 | |

| |

Foreign currency transactions | | | (255,649 | ) |

| | | | |

| |

Net realized gain | | | 1,269,637,307 | |

| |

Net change in unrealized appreciation/depreciation on investment transactions in unaffiliated companies | | | (309,357,269 | ) |

| |

Net Increase in Net Assets Resulting from Operations | | | $ 1,046,073,209 | |

| | | | |

1. Effective June 1, 2018, all Class B shares converted to Class A shares.

See accompanying Notes to Financial Statements.

17 OPPENHEIMER MAIN STREET FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended | | Year Ended |

| | | August 31, 2018 | | August 31, 2017 |

| | | |

| Operations | | | | | | | | |

| | |

Net investment income | | $ | 85,793,171 | | | $ | 93,318,958 | |

| | |

Net realized gain | | | 1,269,637,307 | | | | 645,985,492 | |

| | |

Net change in unrealized appreciation/depreciation | | | (309,357,269 | ) | | | 566,722,334 | |

| |

| | | | |

Net increase in net assets resulting from operations | | | 1,046,073,209 | | | | 1,306,026,784 | |

| | | |

| Dividends and/or Distributions to Shareholders | | | | | | | | |

| | |

Dividends from net investment income: | | | | | | | | |

| | |

Class A | | | (76,069,217 | ) | | | (59,068,015 | ) |

| | |

Class B1 | | | — | | | | — | |

| | |

Class C | | | (2,728,068 | ) | | | (3,140,270 | ) |

| | |

Class I | | | (10,319,526 | ) | | | (10,010,420 | ) |

| | |

Class R | | | (1,776,695 | ) | | | (1,236,820 | ) |

| | |

Class Y | | | (10,103,634 | ) | | | (8,678,283 | ) |

| |

| | | | |

| | | | (100,997,140 | ) | | | (82,133,808 | ) |

| | |

Distributions from net realized gain: | | | | | | | | |

| | |

Class A | | | (454,549,290 | ) | | | (103,171,052 | ) |

| | |

Class B1 | | | (1,368,357 | ) | | | (1,113,801 | ) |

| | |

Class C | | | (52,975,504 | ) | | | (14,060,839 | ) |

| | |

Class I | | | (44,766,718 | ) | | | (12,535,678 | ) |

| | |

Class R | | | (12,858,282 | ) | | | (2,641,225 | ) |

| | |

Class Y | | | (49,630,735 | ) | | | (12,404,503 | ) |

| |

| | | | |

| | | (616,148,886 | ) | | | (145,927,098 | ) |

| | | |

| Beneficial Interest Transactions | | | | | | | | |

| | |

Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | |

| | |

Class A | | | (103,968,779 | ) | | | 1,165,143,938 | |

| | |

Class B1 | | | (35,711,160 | ) | | | (42,332,535 | ) |

| | |

Class C | | | (39,533,678 | ) | | | 28,978,213 | |

| | |

Class I | | | (59,681,315 | ) | | | 79,024,386 | |

| | |

Class R | | | 27,467,399 | | | | 37,720,326 | |

| | |

Class Y | | | 12,211,065 | | | | 57,472,762 | |

| | | | |

| | | (199,216,468 | ) | | | 1,326,007,090 | |

| | | |

| Net Assets | | | | | | | | |

| | |

Total increase | | | 129,710,715 | | | | 2,403,972,968 | |

| | |

Beginning of period | | | 10,024,527,446 | | | | 7,620,554,478 | |

| |

| | | | |

End of period (including accumulated net investment income of $45,581,127 and $62,393,523, respectively) | | | $ 10,154,238,161 | | | | $ 10,024,527,446 | |

| | | | |

1. Effective June 1, 2018, all Class B shares converted to Class A shares.

See accompanying Notes to Financial Statements.

18 OPPENHEIMER MAIN STREET FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Class A | | Year Ended

August 31,

2018 | | | Year Ended

August 31,

2017 | | | Year Ended

August 31,

2016 | | | Year Ended

August 31,

2015 | | | Year Ended

August 29,

20141 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $52.61 | | | | $46.57 | | | | $47.64 | | | | $52.73 | | | | $42.39 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income2 | | | 0.45 | | | | 0.53 | | | | 0.50 | | | | 0.35 | | | | 0.29 | |

Net realized and unrealized gain | | | 5.08 | | | | 6.90 | | | | 4.41 | | | | 0.26 | | | | 10.36 | |

| Total from investment operations | | | 5.53 | | | | 7.43 | | | | 4.91 | | | | 0.61 | | | | 10.65 | |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.55) | | | | (0.51) | | | | (0.43) | | | | (0.35) | | | | (0.31) | |

Distributions from net realized gain | | | (3.28) | | | | (0.88) | | | | (5.55) | | | | (5.35) | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (3.83) | | | | (1.39) | | | | (5.98) | | | | (5.70) | | | | (0.31) | |

Net asset value, end of period | | | $54.31 | | | | $52.61 | | | | $46.57 | | | | $47.64 | | | | $52.73 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 10.99% | | | | 16.27% | | | | 11.22% | | | | 0.99% | | | | 25.20% | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $7,579,158 | | | | $7,436,792 | | | | $5,488,385 | | | | $5,163,000 | | | | $5,429,874 | |

| Average net assets (in thousands) | | | $7,436,076 | | | | $6,450,132 | | | | $5,225,636 | | | | $5,404,461 | | | | $5,096,996 | |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.87% | | | | 1.08% | | | | 1.12% | | | | 0.70% | | | | 0.60% | |

Expenses excluding specific expenses listed below | | | 0.90% | | | | 0.93% | | | | 0.93% | | | | 0.93% | | | | 0.92% | |

Interest and fees from borrowings | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00% | |

Total expenses6 | | | 0.90% | | | | 0.93% | | | | 0.93% | | | | 0.93% | | | | 0.92% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.89% | | | | 0.91% | | | | 0.93%7 | | | | 0.93%7 | | | | 0.92%7 | |

Portfolio turnover rate | | | 56% | | | | 40% | | | | 39% | | | | 43% | | | | 52% | |

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

| | Year Ended August 31, 2018 | | | 0.90 | % | | |

| | Year Ended August 31, 2017 | | | 0.93 | % | | |

| | Year Ended August 31, 2016 | | | 0.93 | % | | |

| | Year Ended August 31, 2015 | | | 0.93 | % | | |

| | Year Ended August 29, 2014 | | | 0.92 | % | | |

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

19 OPPENHEIMER MAIN STREET FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | |

| Class C | | Year Ended

August 31,

2018 | | | Year Ended

August 31,

2017 | | | Year Ended

August 31,

2016 | | | Year Ended

August 31,

2015 | | | Year Ended

August 29,

20141 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $49.85 | | | | $44.24 | | | | $45.51 | | | | $50.63 | | | | $40.74 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)2 | | | 0.05 | | | | 0.15 | | | | 0.16 | | | | (0.02) | | | | (0.07) | |

Net realized and unrealized gain | | | 4.81 | | | | 6.54 | | | | 4.21 | | | | 0.25 | | | | 9.96 | |

| Total from investment operations | | | 4.86 | | | | 6.69 | | | | 4.37 | | | | 0.23 | | | | 9.89 | |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.17) | | | | (0.20) | | | | (0.09) | | | | 0.00 | | | | 0.00 | |

Distributions from net realized gain | | | (3.28) | | | | (0.88) | | | | (5.55) | | | | (5.35) | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (3.45) | | | | (1.08) | | | | (5.64) | | | | (5.35) | | | | 0.00 | |

Net asset value, end of period | | | $51.26 | | | | $49.85 | | | | $44.24 | | | | $45.51 | | | | $50.63 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 10.16% | | | | 15.39% | | | | 10.39% | | | | 0.23% | | | | 24.28% | |

| | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $810,071 | | | | $826,928 | | | | $705,167 | | | | $641,863 | | | | $677,274 | |

| Average net assets (in thousands) | | | $812,864 | | | | $773,972 | | | | $660,113 | | | | $670,954 | | | | $641,903 | |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.11% | | | | 0.32% | | | | 0.36% | | | | (0.05)% | | | | (0.15)% | |

Expenses excluding specific expenses listed below | | | 1.67% | | | | 1.68% | | | | 1.69% | | | | 1.68% | | | | 1.67% | |

Interest and fees from borrowings | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00% | |

Total expenses6 | | | 1.67% | | | | 1.68% | | | | 1.69% | | | | 1.68% | | | | 1.67% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.66% | | | | 1.67% | | | | 1.69%7 | | | | 1.68%7 | | | | 1.67%7 | |

Portfolio turnover rate | | | 56% | | | | 40% | | | | 39% | | | | 43% | | | | 52% | |

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

| | Year Ended August 31, 2018 | | | 1.67 | % | | |

| | Year Ended August 31, 2017 | | | 1.68 | % | | |

| | Year Ended August 31, 2016 | | | 1.69 | % | | |

| | Year Ended August 31, 2015 | | | 1.68 | % | | |

| | Year Ended August 29, 2014 | | | 1.67 | % | | |

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

20 OPPENHEIMER MAIN STREET FUND

| | | | | | | | | | |

| Class I | | Year Ended

August 31,

2018 | | Year Ended

August 31,

2017 | | Year Ended

August 31,

2016 | | Year Ended

August 31,

2015 | | Year Ended

August 29,

20141 |

| Per Share Operating Data | | | | | | | | | | |

Net asset value, beginning of period | | $52.22 | | $46.25 | | $47.36 | | $52.47 | | $42.33 |

Income (loss) from investment operations: | | | | | | | | | | |

Net investment income2 | | 0.66 | | 0.73 | | 0.67 | | 0.56 | | 0.51 |

Net realized and unrealized gain | | 5.03 | | 6.83 | | 4.42 | | 0.25 | | 10.30 |

| | |

| Total from investment operations | | 5.69 | | 7.56 | | 5.09 | | 0.81 | | 10.81 |

Dividends and/or distributions to shareholders: | | | | | | | | | | |

Dividends from net investment income | | (0.76) | | (0.71) | | (0.65) | | (0.57) | | (0.67) |

Distributions from net realized gain | | (3.28) | | (0.88) | | (5.55) | | (5.35) | | 0.00 |

| | |

| Total dividends and/or distributions to shareholders | | (4.04) | | (1.59) | | (6.20) | | (5.92) | | (0.67) |

Net asset value, end of period | | $53.87 | | $52.22 | | $46.25 | | $47.36 | | $52.47 |

| | |

| | | | | | | | | | |

| Total Return, at Net Asset Value3 | | 11.45% | | 16.76% | | 11.72% | | 1.41% | | 25.73% |

| | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $720,854 | | $756,378 | | $589,459 | | $277,749 | | $295,519 |

| Average net assets (in thousands) | | $738,222 | | $698,501 | | $335,376 | | $288,411 | | $203,534 |

Ratios to average net assets:4 | | | | | | | | | | |

Net investment income | | 1.27% | | 1.49% | | 1.50% | | 1.13% | | 1.05% |

Expenses excluding specific expenses listed below | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% |

Interest and fees from borrowings | | 0.00%5 | | 0.00%5 | | 0.00%5 | | 0.00%5 | | 0.00% |

| | |

Total expenses6 | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | 0.50%7 | | 0.50%7 | | 0.50%7 | | 0.50%7 | | 0.50%7 |

Portfolio turnover rate | | 56% | | 40% | | 39% | | 43% | | 52% |

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

Year Ended August 31, 2018 | | | 0.50 | % | | |

Year Ended August 31, 2017 | | | 0.50 | % | | |

Year Ended August 31, 2016 | | | 0.50 | % | | |

Year Ended August 31, 2015 | | | 0.50 | % | | |

Year Ended August 29, 2014 | | | 0.50 | % | | |

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

21 OPPENHEIMER MAIN STREET FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | |

| Class R | | Year Ended

August 31,

2018 | | | Year Ended

August 31,

2017 | | | Year Ended

August 31,

2016 | | | Year Ended

August 31,

2015 | | | Year Ended

August 29,

20141 | |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $51.70 | | | | $45.82 | | | | $46.95 | | | | $52.05 | | | | $41.85 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income2 | | | 0.31 | | | | 0.40 | | | | 0.38 | | | | 0.22 | | | | 0.16 | |

Net realized and unrealized gain | | | 4.98 | | | | 6.77 | | | | 4.36 | | | | 0.26 | | | | 10.23 | |

| | | | |

Total from investment operations | | | 5.29 | �� | | | 7.17 | | | | 4.74 | | | | 0.48 | | | | 10.39 | |

| | | | | |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.45) | | | | (0.41) | | | | (0.32) | | | | (0.23) | | | | (0.19) | |

Distributions from net realized gain | | | (3.28) | | | | (0.88) | | | | (5.55) | | | | (5.35) | | | | 0.00 | |

| | | | |

| Total dividends and/or distributions to shareholders | | | (3.73) | | | | (1.29) | | | | (5.87) | | | | (5.58) | | | | (0.19) | |

Net asset value, end of period | | | $53.26 | | | | $51.70 | | | | $45.82 | | | | $46.95 | | | | $52.05 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 10.70% | | | | 15.99% | | | | 10.94% | | | | 0.73% | | | | 24.88% | |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $223,733 | | | | $189,337 | | | | $132,365 | | | | $115,038 | | | | $118,479 | |

| Average net assets (in thousands) | | | $210,534 | | | | $158,013 | | | | $119,719 | | | | $118,942 | | | | $114,029 | |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.61% | | | | 0.82% | | | | 0.86% | | | | 0.45% | | | | 0.34% | |

Expenses excluding specific expenses listed below | | | 1.17% | | | | 1.18% | | | | 1.19% | | | | 1.18% | | | | 1.17% | |

Interest and fees from borrowings | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00% | |

| | | | |

Total expenses6 | | | 1.17% | | | | 1.18% | | | | 1.19% | | | | 1.18% | | | | 1.17% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.16% | | | | 1.17% | | | | 1.19%7 | | | | 1.18%7 | | | | 1.17%7 | |

Portfolio turnover rate | | | 56% | | | | 40% | | | | 39% | | | | 43% | | | | 52% | |

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

| | Year Ended August 31, 2018 | | | 1.17 | % | | |

| | Year Ended August 31, 2017 | | | 1.18 | % | | |

| | Year Ended August 31, 2016 | | | 1.19 | % | | |

| | Year Ended August 31, 2015 | | | 1.18 | % | | |

| | Year Ended August 29, 2014 | | | 1.17 | % | | |

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

22 OPPENHEIMER MAIN STREET FUND

| | | | | | | | | | | | | | | | | | | | |

| Class Y | | Year Ended

August 31,

2018 | | | Year Ended

August 31,

2017 | | | Year Ended

August 31,

2016 | | | Year Ended

August 31,

2015 | | | Year Ended

August 29,

20141 | |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $52.25 | | | | $46.26 | | | | $47.37 | | | | $52.48 | | | | $42.30 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income2 | | | 0.57 | | | | 0.64 | | | | 0.62 | | | | 0.46 | | | | 0.40 | |

Net realized and unrealized gain | | | 5.03 | | | | 6.85 | | | | 4.37 | | | | 0.26 | | | | 10.32 | |

| Total from investment operations | | | 5.60 | | | | 7.49 | | | | 4.99 | | | | 0.72 | | | | 10.72 | |

Dividends and/or distributions to shareholders: | | | | |

Dividends from net investment income | | | (0.67) | | | | (0.62) | | | | (0.55) | | | | (0.48) | | | | (0.54) | |

Distributions from net realized gain | | | (3.28) | | | | (0.88) | | | | (5.55) | | | | (5.35) | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (3.95) | | | | (1.50) | | | | (6.10) | | | | (5.83) | | | | (0.54) | |

Net asset value, end of period | | | $53.90 | | | | $52.25 | | | | $46.26 | | | | $47.37 | | | | $52.48 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 11.25% | | | | 16.55% | | | | 11.49% | | | | 1.23% | | | | 25.52% | |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $820,422 | | | | $778,910 | | | | $632,805 | | | | $664,474 | | | | $664,996 | |

| Average net assets (in thousands) | | | $832,356 | | | | $725,736 | | | | $618,333 | | | | $693,669 | | | | $655,922 | |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 1.10% | | | | 1.32% | | | | 1.39% | | | | 0.94% | | | | 0.84% | |

Expenses excluding specific expenses listed below | | | 0.67% | | | | 0.69% | | | | 0.69% | | | | 0.69% | | | | 0.67% | |

Interest and fees from borrowings | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00% | |

Total expenses6 | | | 0.67% | | | | 0.69% | | | | 0.69% | | | | 0.69% | | | | 0.67% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.66% | | | | 0.68% | | | | 0.69%7 | | | | 0.69%7 | | | | 0.67%7 | |

Portfolio turnover rate | | | 56% | | | | 40% | | | | 39% | | | | 43% | | | | 52% | |

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

| | Year Ended August 31, 2018 | | | 0.67 | % | | |

| | Year Ended August 31, 2017 | | | 0.69 | % | | |

| | Year Ended August 31, 2016 | | | 0.69 | % | | |

| | Year Ended August 31, 2015 | | | 0.69 | % | | |

| | Year Ended August 29, 2014 | | | 0.67 | % | | |

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

23 OPPENHEIMER MAIN STREET FUND

NOTES TO FINANCIAL STATEMENTS August 31, 2018

1. Organization

Oppenheimer Main Street Fund (the “Fund”) is a separate series of Oppenheimer Main Street Funds, a diversified open-end management investment company registered under the Investment Company Act of 1940 (“1940 Act”), as amended. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI.

The Fund offers Class A, Class C, Class I, Class R and Class Y shares, and previously offered Class B shares for new purchase through June 29, 2012. Subsequent to that date, no new purchases of Class B shares were permitted. Reinvestment of dividend and/or capital gain distributions and exchanges of Class B shares into and from other Oppenheimer funds were permitted through May 31, 2018. Effective June 1, 2018 (the “Conversion Date”), all Class B shares converted to Class A shares. Class A shares are sold at their offering price, which is normally net asset value plus a front-end sales charge. Class C and Class R shares are sold, and Class B shares were sold, without a front-end sales charge but may be subject to a contingent deferred sales charge (“CDSC”). Class R shares are sold only through retirement plans. Retirement plans that offer Class R shares may impose charges on those accounts. Class I and Class Y shares are sold to certain institutional investors or intermediaries without either a front-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class I and Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, C and R shares have, and Class B shares had, separate distribution and/or service plans under which they pay, and Class B shares paid, fees. Class I and Class Y shares do not pay such fees. Previously issued Class B shares automatically converted to Class A shares 72 months after the date of purchase.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

2. Significant Accounting Policies

Security Valuation. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Foreign Currency Translation. The books and records of the Fund are maintained in U.S. dollars. Any foreign currency amounts are translated into U.S. dollars on the following basis:

(1) Value of investment securities, other assets and liabilities — at the exchange rates prevailing at market close as described in Note 3.

(2) Purchases and sales of investment securities, income and expenses — at the rates of

24 OPPENHEIMER MAIN STREET FUND

2. Significant Accounting Policies (Continued)

exchange prevailing on the respective dates of such transactions.

Although the net assets and the values are presented at the foreign exchange rates at market close, the Fund does not isolate the portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses from investments shown in the Statement of Operations.

For securities, which are subject to foreign withholding tax upon disposition, realized and unrealized gains or losses on such securities are recorded net of foreign withholding tax.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign withholding tax reclaims recorded on the Fund’s books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in the exchange rate.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. GAAP, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as determined necessary by the Manager.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the securities received. Withholding taxes on foreign dividends, if any, and capital gains taxes on foreign investments, if any, have been provided for in accordance with the Fund’s understanding of the applicable tax rules and regulations. Interest income, if any, is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Return of Capital Estimates. Distributions received from the Fund’s investments in Master Limited Partnerships (MLPs) and Real Estate Investments Trusts (REITs), generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates. Such estimates are based on historical information available from each MLP, REIT and other industry sources. These estimates may subsequently be revised

25 OPPENHEIMER MAIN STREET FUND

NOTES TO FINANCIAL STATEMENTS Continued

2. Significant Accounting Policies (Continued)

based on information received from MLPs and REITs after their tax reporting periods are concluded.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, based on the negative rolling average balance at an average Federal Funds Rate plus 0.50%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three preceding fiscal reporting period ends. The Fund has analyzed its tax positions for the fiscal year ended August 31, 2018, including open tax years, and does not believe there are any uncertain tax positions requiring recognition in the Fund’s financial statements.

The tax components of capital shown in the following table represent distribution requirements the Fund must satisfy under the income tax regulations, losses the Fund may be able to offset against income and gains realized in future years and unrealized appreciation or depreciation of securities and other investments for federal income tax purposes.

26 OPPENHEIMER MAIN STREET FUND

2. Significant Accounting Policies (Continued)

| | | | | | | | | | | | |

Undistributed Net Investment Income | | Undistributed Long-Term Gain | | | Accumulated Loss Carryforward1,2,3 | | | Net Unrealized Appreciation Based on cost of Securities and Other Investments for Federal Income Tax Purposes | |

$52,573,671 | | | $1,090,490,623 | | | | $3,256,724 | | | | $2,389,030,023 | |

1. The Fund had $3,256,724 of straddle losses which were deferred.

2. During the reporting period, the Fund did not utilize any capital loss carryforward.

3. During the previous reporting period, the Fund utilized $157,584 of capital loss carryforward to offset capital gains realized in that fiscal year.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains are determined in accordance with federal income tax requirements, which may differ from the character of net investment income or net realized gains presented in those financial statements in accordance with U.S. GAAP. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

Accordingly, the following amounts have been reclassified for the reporting period. Net assets of the Fund were unaffected by the reclassifications.

| | | | | | | | |

Increase to Paid-in Capital | | Reduction to Accumulated

Net Investment

Income | | | Reduction to Accumulated Net

Realized Gain on Investments4 | |

$97,024,079 | | | $1,608,427 | | | | $95,415,652 | |

4. $97,031,508, including $96,520,769 of long-term capital gain, was distributed in connection with Fund share redemptions.

The tax character of distributions paid during the reporting periods:

| | | | | | | | |

| | | Year Ended August 31, 2018 | | | Year Ended August 31, 2017 | |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 229,335,542 | | | $ | 91,085,859 | |

Long-term capital gain | | | 487,810,484 | | | | 136,975,047 | |

| | | | |

Total | | $ | 717,146,026 | | | $ | 228,060,906 | |

| | | | |

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes at period end are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized

27 OPPENHEIMER MAIN STREET FUND

NOTES TO FINANCIAL STATEMENTS Continued

2. Significant Accounting Policies (Continued)

gain or loss.

| | | | |

Federal tax cost of securities | | $ | 7,740,272,325 | |

| | | | |

Gross unrealized appreciation | | $ | 2,539,086,581 | |

Gross unrealized depreciation | | | (150,056,558) | |

| | | | |

Net unrealized appreciation | | $ | 2,389,030,023 | |

| | | | |

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

New Accounting Pronouncement. In March 2017, Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”), ASU 2017-08. This provides guidance related to the amortization period for certain purchased callable debt securities held at a premium. The ASU is effective for annual periods beginning after December 15, 2018, and interim periods within those annual periods. The Manager is evaluating the impacts of these changes on the financial statements.

3. Securities Valuation

The Fund calculates the net asset value of its shares as of 4:00 P.M. Eastern Time, on each day the New York Stock Exchange (the “Exchange”) is open for trading, except in the case of a scheduled early closing of the Exchange, in which case the Fund will calculate net asset value of the shares as of the scheduled early closing time of the Exchange.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a fair valuation for any security for which market quotations are not readily available. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at least quarterly or more frequently, if necessary.

Valuation Methods and Inputs

Securities are valued primarily using unadjusted quoted market prices, when available, as supplied by third party pricing services or broker-dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Equity securities traded on a securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the official closing price on the principal exchange on which the security is traded, as identified by the Manager, prior to the time when the Fund’s assets are valued. If the official closing price is unavailable, the security

28 OPPENHEIMER MAIN STREET FUND

3. Securities Valuation (Continued)

is valued at the last sale price on the principal exchange on which it is traded, or if no sales occurred, the security is valued at the mean between the quoted bid and asked prices. Over-the-counter equity securities are valued at the last published sale price, or if no sales occurred, at the mean between the quoted bid and asked prices. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the time when the Fund’s assets are valued.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Securities for which market quotations are not readily available, or when a significant event has occurred that would materially affect the value of the security, are fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Those standardized fair valuation methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs may be used in determining the value of each of the Fund’s investments as of the reporting period end.

These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

29 OPPENHEIMER MAIN STREET FUND

NOTES TO FINANCIAL STATEMENTS Continued

3. Securities Valuation (Continued)

The Fund classifies each of its investments in investment companies which are publicly offered as Level 1. Investment companies that are not publicly offered, if any, are classified as Level 2 in the fair value hierarchy.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities at period end based on valuation input level:

| | | | | | | | | | | | | | | | |