UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05361

Variable Insurance Products Fund V

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | June 30, 2010 |

This report on Form N-CSR relates solely to the Registrant's Freedom 2005 Portfolio, Freedom 2010 Portfolio, Freedom 2015 Portfolio, Freedom 2020 Portfolio, Freedom 2025 Portfolio, Freedom 2030 Portfolio, Freedom 2035 Portfolio, Freedom 2040 Portfolio, Freedom 2045 Portfolio, Freedom 2050 Portfolio, Freedom Income Portfolio, Freedom Lifetime Income I Portfolio, Freedom Lifetime Income II Portfolio, Freedom Lifetime Income III Portfolio, FundsManager 20% Portfolio, FundsManager 50% Portfolio, FundsManager 60%, FundsManager 70% Portfolio, FundsManager 85% Portfolio, Investor Freedom 2005 Portfolio, Investor Freedom 2010 Portfolio, Investor Freedom 2015 Portfolio, Investor Freedom 2020 Portfolio, Investor Freedom 2025 Portfolio, Investor Freedom 2030 Portfolio and Investor Freedom Income Portfolio series (each, a "Fund" and collectively, the "Funds").

Item 1. Reports to Stockholders

Fidelity® Variable Insurance Products:

Freedom Funds -

Income, 2005, 2010, 2015, 2020, 2025, 2030, 2035, 2040, 2045, 2050

Semiannual Report

June 30, 2010

(2_fidelity_logos) (Registered_Trademark)

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Semiannual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Semiannual Report

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2010 to June 30, 2010).

Actual Expenses

The first line of the accompanying table for each class of each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, each Fund, as a shareholder in underlying Fidelity Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Funds. These fees and expenses are not included in each Fund's annualized expense ratio used to calculate the expense estimates in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of each fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, each Fund, as a shareholder in underlying Fidelity Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Funds. These fees and expenses are not included in each Fund's annualized expense ratio used to calculate the expense estimates in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Annualized Expense Ratio | Beginning

Account Value

January 1, 2010 | Ending

Account Value

June 30, 2010 | Expenses Paid

During Period*

January 1, 2010

to June 30, 2010 |

VIP Freedom Income | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 1,010.50 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 1,010.50 | $ .50 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 1,009.60 | $ 1.25 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2005 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 990.40 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 989.30 | $ .49 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 989.30 | $ 1.23 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2010 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 987.70 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 985.70 | $ .49 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 985.60 | $ 1.23 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2015 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 985.20 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 985.20 | $ .49 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 984.10 | $ 1.23 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2020 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 973.70 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 974.70 | $ .49 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 973.60 | $ 1.22 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2025 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 966.10 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 965.00 | $ .49 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 964.90 | $ 1.22 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2030 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 957.30 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 957.30 | $ .49 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 957.20 | $ 1.21 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2035 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 950.00 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 949.90 | $ .48 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 949.20 | $ 1.21 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2040 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 949.20 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 948.40 | $ .48 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 947.70 | $ 1.21 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2045 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 946.40 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 945.70 | $ .48 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 945.70 | $ 1.21 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

VIP Freedom 2050 | | | | |

Initial Class | .00% | | | |

Actual | | $ 1,000.00 | $ 939.20 | $ .00 |

HypotheticalA | | $ 1,000.00 | $ 1,024.79 | $ .00 |

Service Class | .10% | | | |

Actual | | $ 1,000.00 | $ 939.20 | $ .48 |

HypotheticalA | | $ 1,000.00 | $ 1,024.30 | $ .50 |

Service Class 2 | .25% | | | |

Actual | | $ 1,000.00 | $ 938.50 | $ 1.20 |

HypotheticalA | | $ 1,000.00 | $ 1,023.55 | $ 1.25 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/ 365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Funds in which the Fund invests are not included in each Class' annualized expense ratio.

Semiannual Report

VIP Freedom Income Portfolio

Investment Changes (Unaudited)

Fund Holdings as of June 30, 2010 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Domestic Equity Funds | | |

VIP Contrafund Portfolio Initial Class | 2.6 | 3.2 |

VIP Equity-Income Portfolio Initial Class | 3.0 | 3.7 |

VIP Growth & Income Portfolio Initial Class | 3.0 | 3.8 |

VIP Growth Portfolio Initial Class | 3.0 | 3.8 |

VIP Mid Cap Portfolio Initial Class | 1.1 | 1.3 |

VIP Value Portfolio Initial Class | 2.6 | 3.3 |

VIP Value Strategies Portfolio Initial Class | 1.1 | 1.4 |

| 16.4 | 20.5 |

Developed International Equity Funds | | |

VIP Overseas Portfolio Initial Class | 3.2 | 0.0 |

Emerging Markets Equity Funds | | |

VIP Emerging Markets Portfolio Initial Class | 0.3 | 0.0 |

High Yield Bond Funds | | |

VIP High Income Portfolio Initial Class | 5.0 | 5.1 |

Investment Grade Bond Funds | | |

VIP Investment Grade Bond Portfolio Initial Class | 35.1 | 34.7 |

Short-Term Funds | | |

VIP Money Market Portfolio Initial Class | 40.1 | 39.7 |

Net Other Assets | | |

Net Other Assets | (0.1) | 0.0* |

| 100.0 | 100.0 |

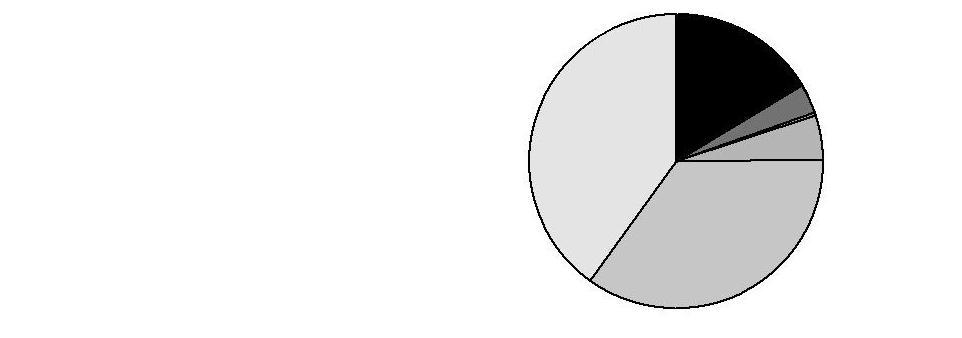

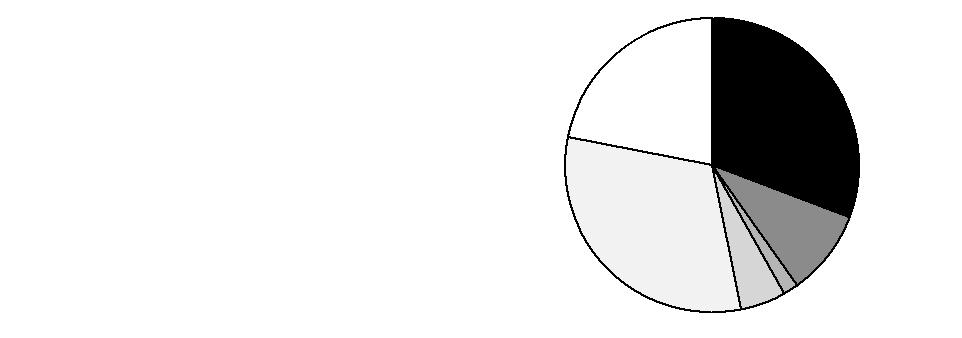

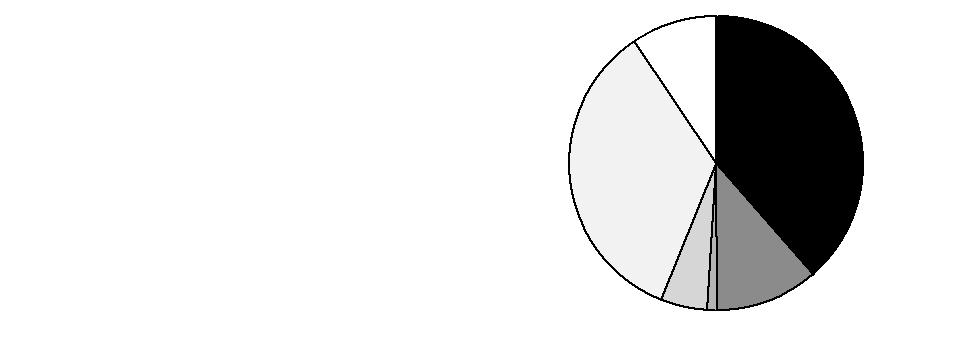

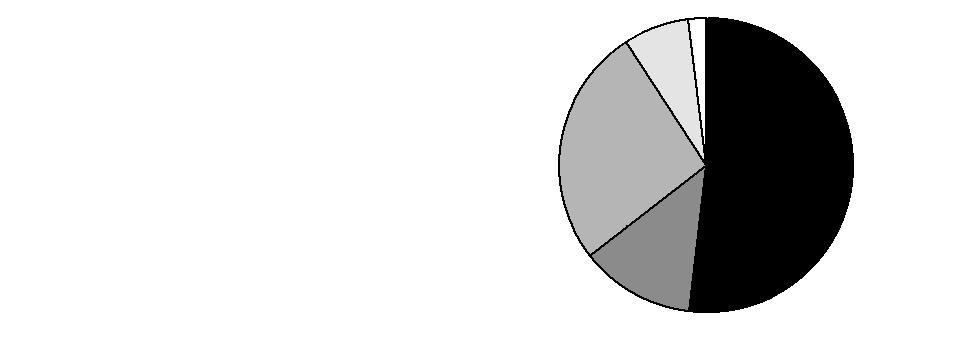

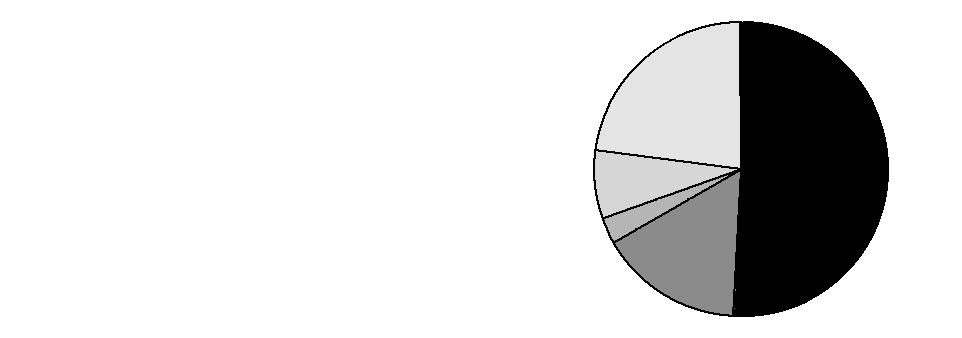

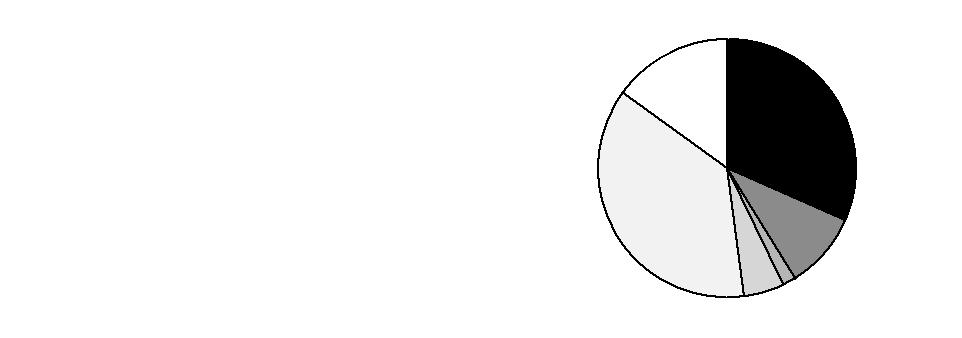

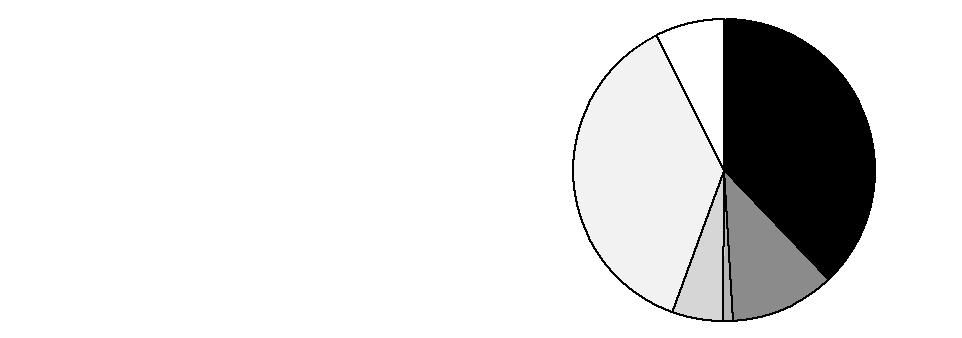

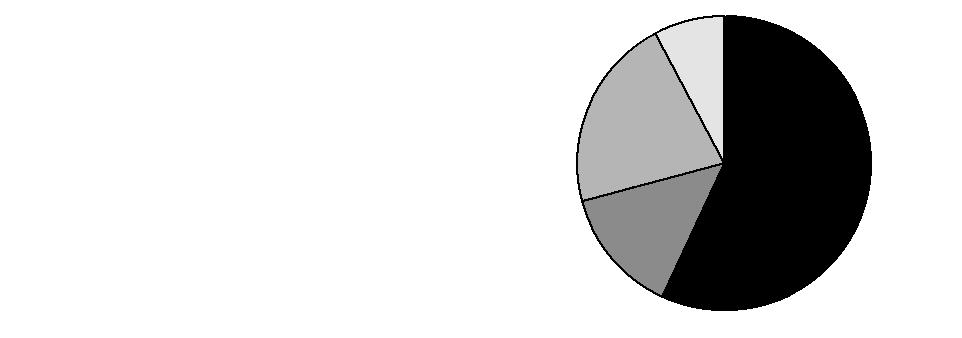

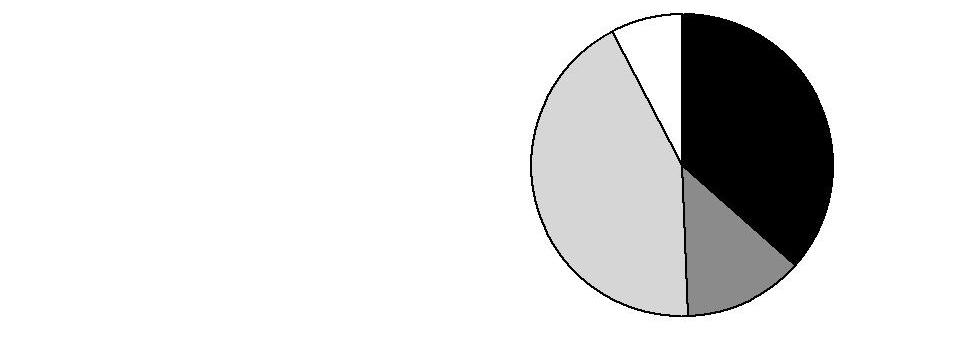

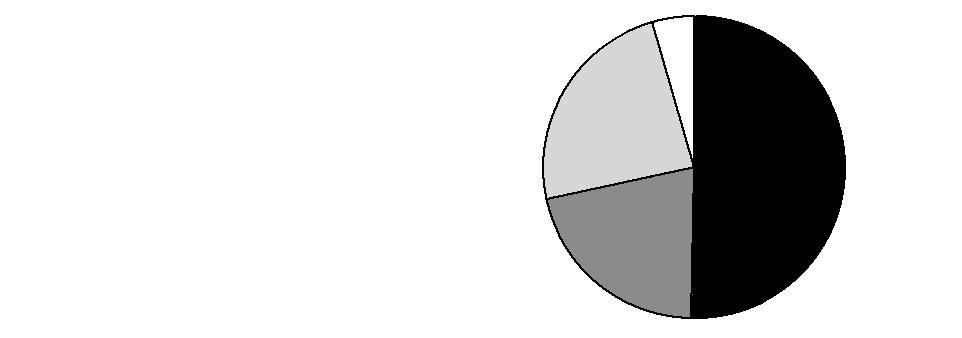

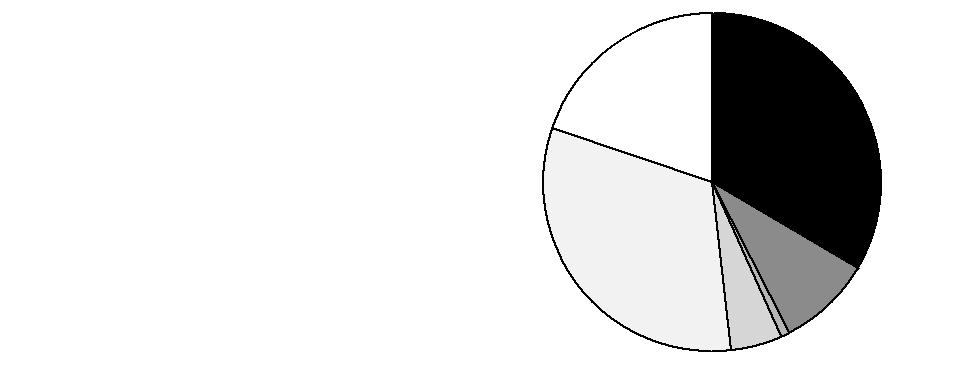

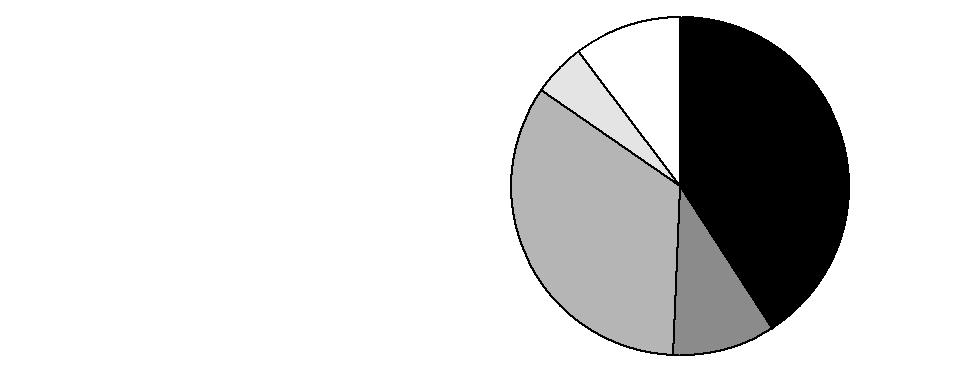

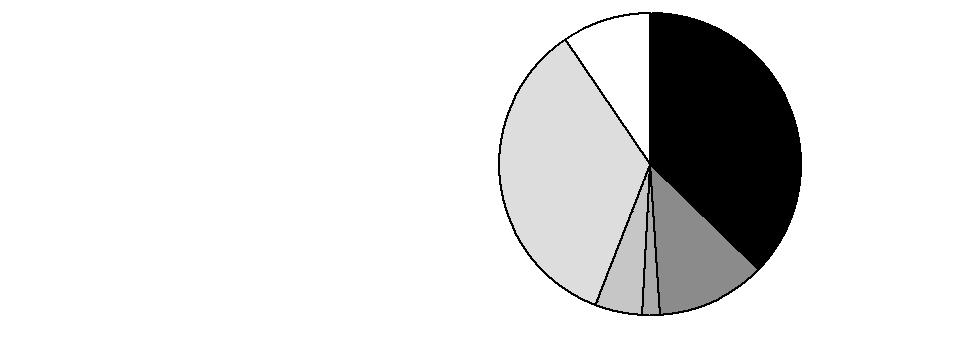

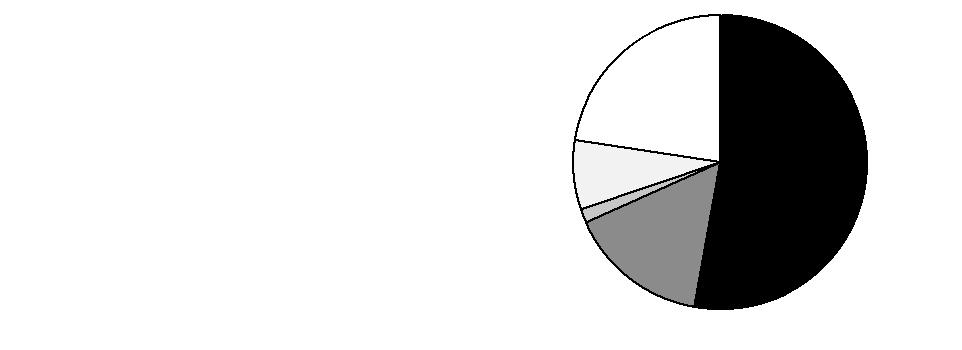

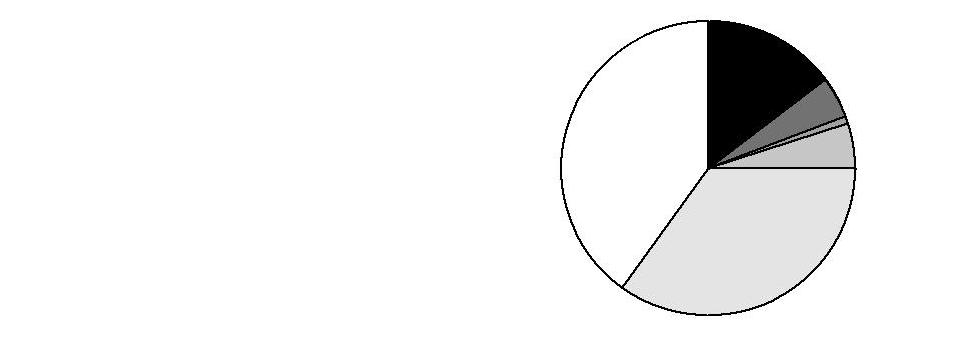

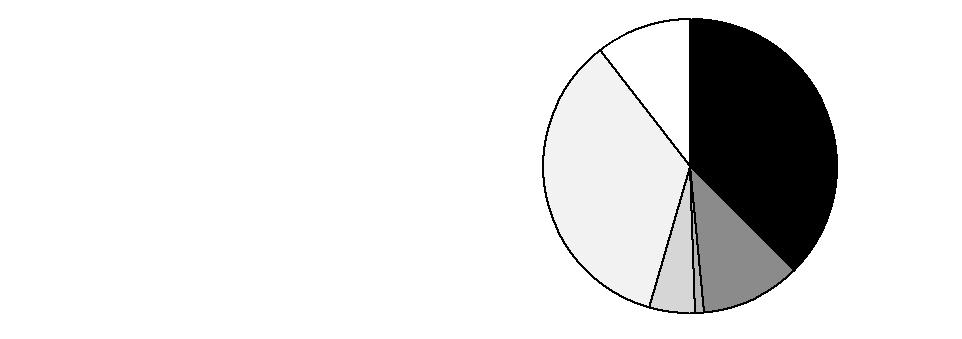

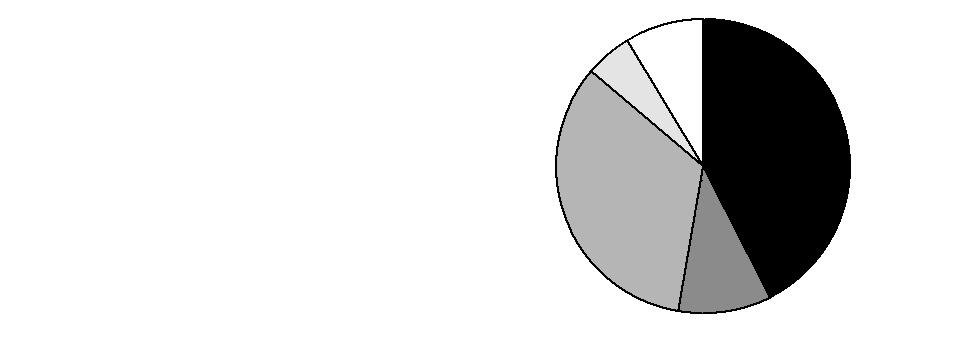

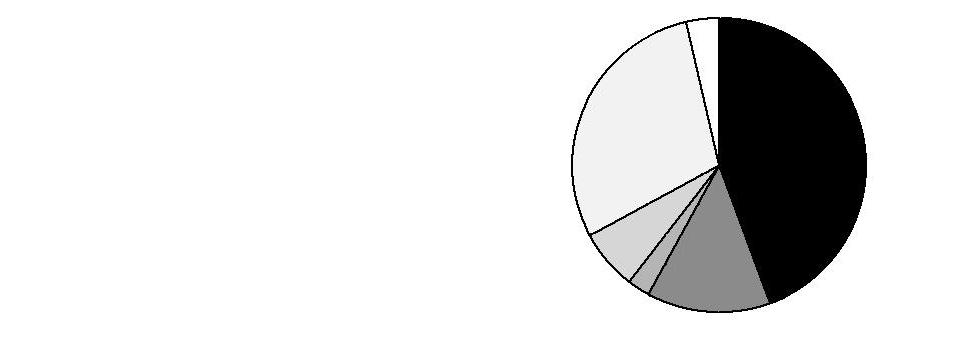

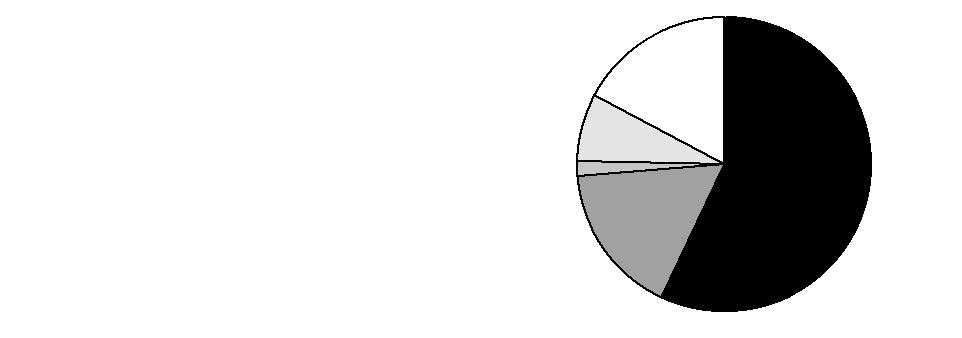

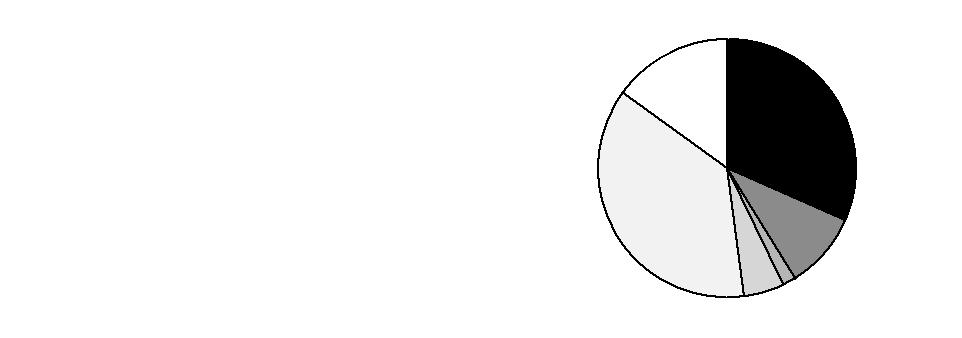

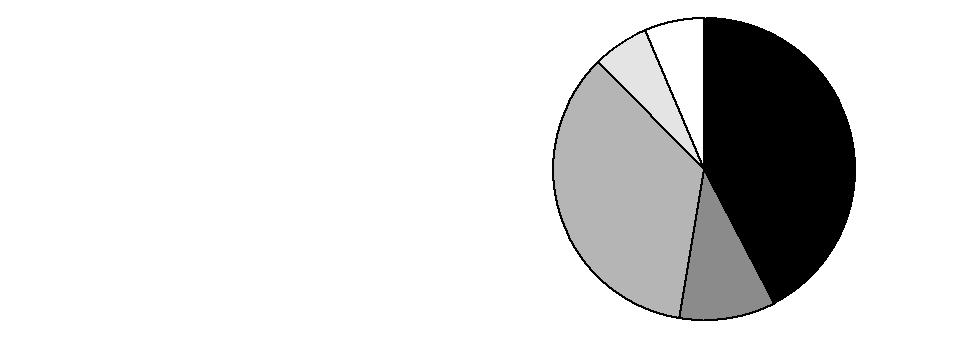

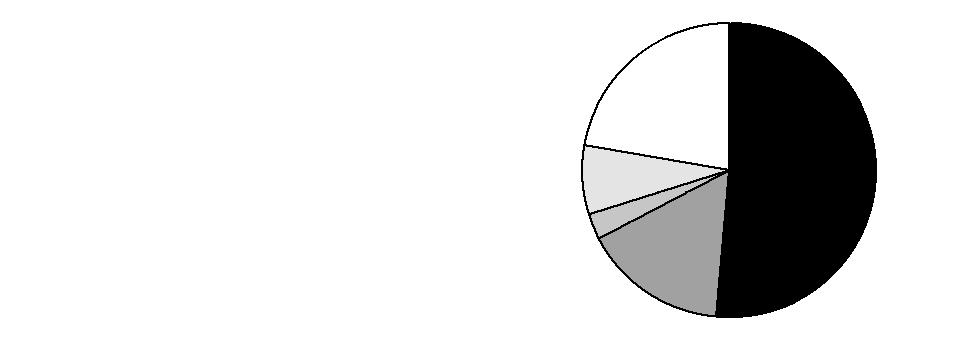

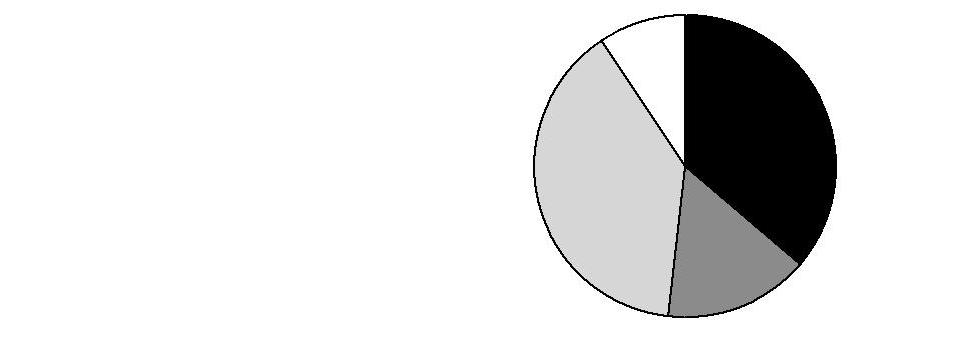

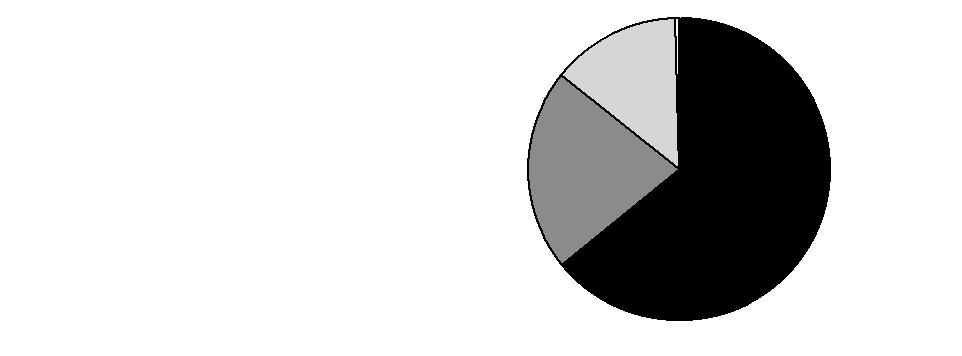

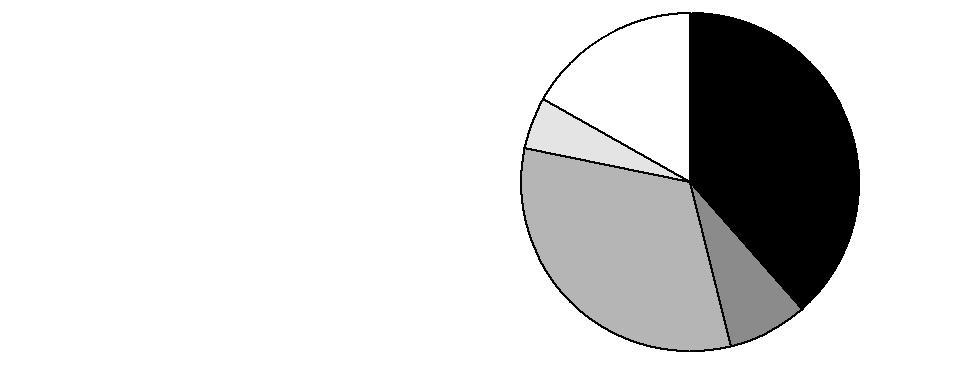

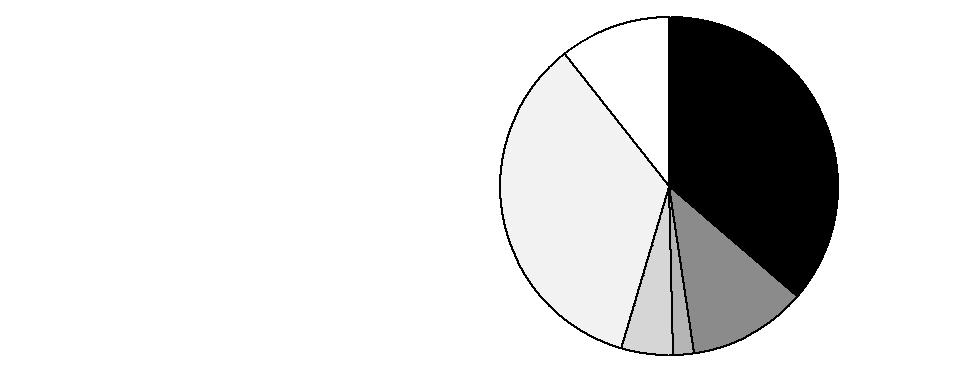

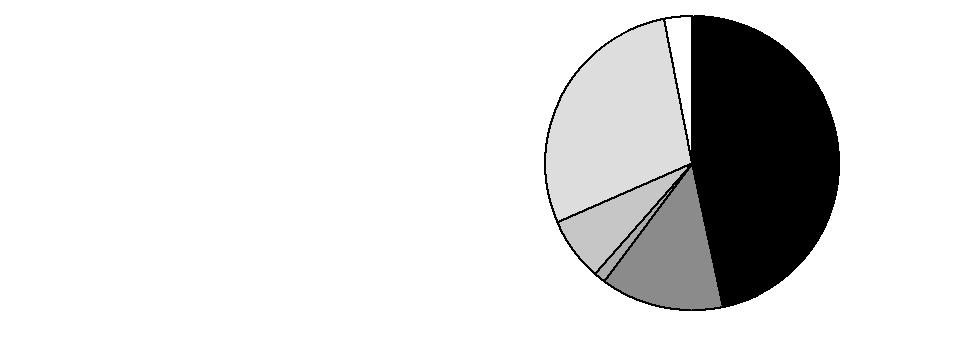

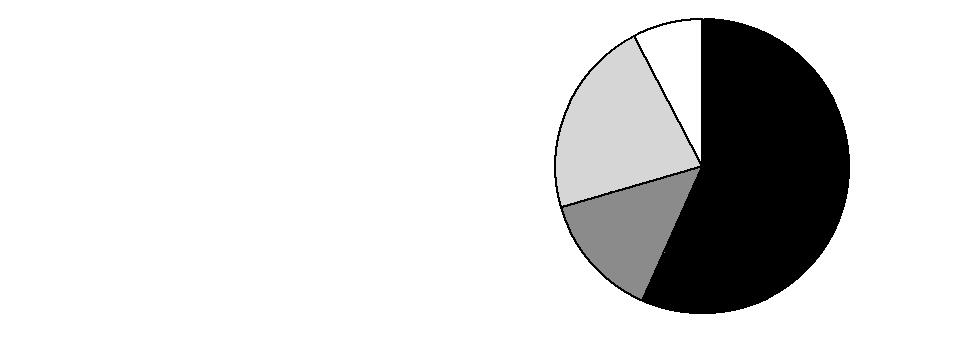

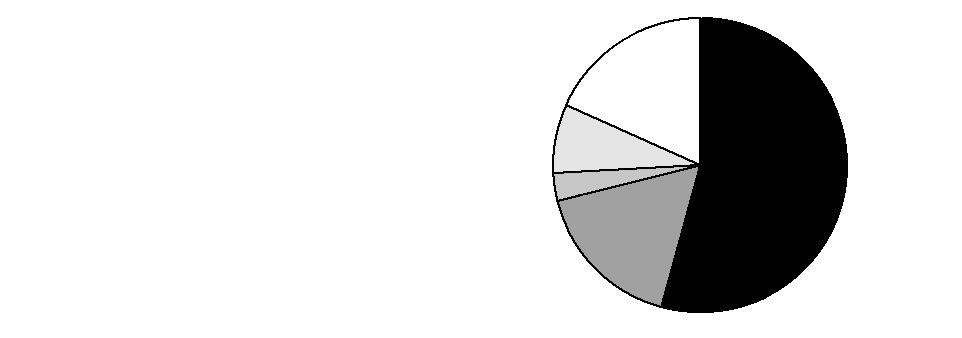

Asset Allocation (% of fund's net assets) |

Current |

| Domestic Equity Funds | 16.4% | |

| Developed International Equity Funds | 3.2% | |

| Emerging Markets Equity Funds | 0.3% | |

| High Yield Bond Funds | 5.0% | |

| Investment Grade Bond Funds | 35.1% | |

| Short-Term Funds | 40.1% | |

| Net Other Assets† (0.1)% | |

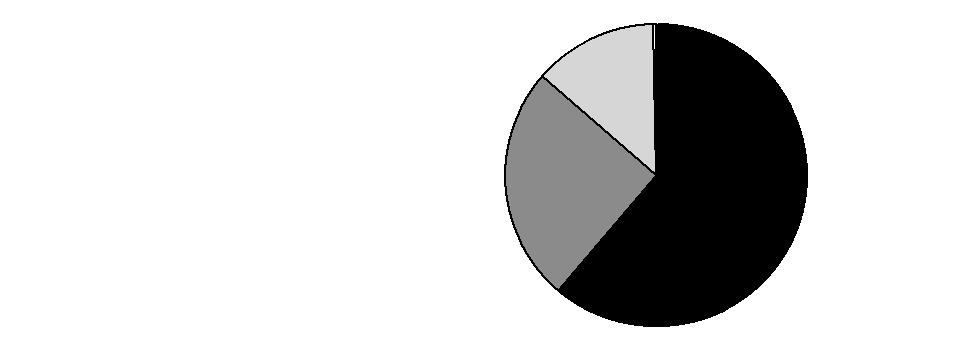

Six months ago |

| Domestic Equity Funds | 20.5% | |

| Investment Grade Bond Funds | 34.7% | |

| High Yield Bond Funds | 5.1% | |

| Short-Term Funds | 39.7% | |

Expected |

| Domestic Equity Funds | 14.6% | |

| Developed International Equity Funds | 4.6% | |

| Emerging Markets Equity Funds | 0.8% | |

| High Yield Bond Funds | 5.0% | |

| Investment Grade Bond Funds | 35.0% | |

| Short-Term Funds | 40.0% | |

The six months ago allocation is based on the fund's holdings as of December 31, 2009. The current allocation is based on the fund's holdings as of June 30, 2010. The expected allocation represents the fund's anticipated allocation at December 31, 2010. |

* Amount represents less than 0.1% |

† Net Other Assets are not included in the pie chart. |

Semiannual Report

VIP Freedom Income Portfolio

Investments June 30, 2010 (Unaudited)

Showing Percentage of Net Assets

Domestic Equity Funds - 16.4% |

| Shares | | Value |

Domestic Equity Funds - 16.4% |

VIP Contrafund Portfolio Initial Class | 23,030 | | $ 443,320 |

VIP Equity-Income Portfolio Initial Class | 33,074 | | 515,956 |

VIP Growth & Income Portfolio Initial Class | 50,624 | | 515,855 |

VIP Growth Portfolio Initial Class | 18,106 | | 516,391 |

VIP Mid Cap Portfolio Initial Class | 7,159 | | 185,130 |

VIP Value Portfolio Initial Class | 48,878 | | 442,836 |

VIP Value Strategies Portfolio Initial Class | 24,352 | | 184,585 |

TOTAL DOMESTIC EQUITY FUNDS (Cost $3,680,452) | 2,804,073 |

International Equity Funds - 3.5% |

| | | |

Developed International Equity Funds - 3.2% |

VIP Overseas Portfolio Initial Class | 41,204 | | 536,058 |

Emerging Markets Equity Funds - 0.3% |

VIP Emerging Markets Portfolio Initial Class | 6,549 | | 51,210 |

TOTAL INTERNATIONAL EQUITY FUNDS (Cost $616,147) | 587,268 |

Bond Funds - 40.1% |

| | | |

High Yield Bond Funds - 5.0% |

VIP High Income Portfolio Initial Class | 156,631 | | 856,772 |

Investment Grade Bond Funds - 35.1% |

VIP Investment Grade Bond Portfolio Initial Class | 456,120 | | 6,002,536 |

TOTAL BOND FUNDS (Cost $6,574,556) | 6,859,308 |

Short-Term Funds - 40.1% |

| | | |

VIP Money Market Portfolio Initial Class

(Cost $6,855,233) | 6,855,233 | | 6,855,233 |

TOTAL INVESTMENT PORTFOLIO - 100.1% (Cost $17,726,388) | | 17,105,882 |

NET OTHER ASSETS (LIABILITIES) - (0.1)% | | (15,150) |

NET ASSETS - 100% | $ 17,090,732 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

VIP Freedom Income Portfolio

Statement of Assets and Liabilities

| June 30, 2010 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (cost $17,726,388) - See accompanying schedule | | $ 17,105,882 |

Receivable for investments sold | | 188 |

Receivable for fund shares sold | | 206 |

Total assets | | 17,106,276 |

| | |

Liabilities | | |

Payable to custodian bank | $ 29 | |

Payable for investments purchased | 85 | |

Payable for fund shares redeemed | 14,100 | |

Distribution fees payable | 1,330 | |

Total liabilities | | 15,544 |

| | |

Net Assets | | $ 17,090,732 |

Net Assets consist of: | | |

Paid in capital | | $ 17,551,012 |

Undistributed net investment income | | 2,924 |

Accumulated undistributed net realized gain (loss) on investments | | 157,302 |

Net unrealized appreciation (depreciation) on investments | | (620,506) |

Net Assets | | $ 17,090,732 |

| | |

Initial Class:

Net Asset Value, offering price and redemption price per share ($10,626,715 ÷ 1,054,305 shares) | | $ 10.08 |

| | |

Service Class:

Net Asset Value, offering price and redemption price per share ($204,968 ÷ 20,330 shares) | | $ 10.08 |

| | |

Service Class 2:

Net Asset Value, offering price and redemption price per share ($6,259,049 ÷ 623,549 shares) | | $ 10.04 |

Statement of Operations

Six months ended June 30, 2010 (Unaudited) |

| | |

Investment Income | | |

Income distributions from underlying funds | | $ 11,326 |

| | |

Expenses | | |

Distribution fees | $ 8,402 | |

Independent trustees' compensation | 32 | |

Total expenses before reductions | 8,434 | |

Expense reductions | (32) | 8,402 |

Net investment income (loss) | | 2,924 |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | 280,665 | |

Capital gain distributions from underlying funds | 1,058 | 281,723 |

Change in net unrealized appreciation (depreciation) on underlying funds | | (66,627) |

Net gain (loss) | | 215,096 |

Net increase (decrease) in net assets resulting from operations | | $ 218,020 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

| Six months ended June 30, 2010

(Unaudited) | Year ended

December 31, 2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 2,924 | $ 643,136 |

Net realized gain (loss) | 281,723 | 204,551 |

Change in net unrealized appreciation (depreciation) | (66,627) | 1,442,211 |

Net increase (decrease) in net assets resulting from operations | 218,020 | 2,289,898 |

Distributions to shareholders from net investment income | - | (651,988) |

Distributions to shareholders from net realized gain | (47,700) | (251,371) |

Total distributions | (47,700) | (903,359) |

Share transactions - net increase (decrease) | (2,675,236) | 4,138,154 |

Total increase (decrease) in net assets | (2,504,916) | 5,524,693 |

| | |

Net Assets | | |

Beginning of period | 19,595,648 | 14,070,955 |

End of period (including undistributed net investment income of $2,924 and undistributed net investment income of $0, respectively) | $ 17,090,732 | $ 19,595,648 |

Financial Highlights - Initial Class

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 10.00 | $ 9.14 | $ 10.80 | $ 10.71 | $ 10.36 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | .01 | .39 | .36 | .43 | .40 | .16 |

Net realized and unrealized gain (loss) | .10 | .96 | (1.48) | .22 | .32 | .30 |

Total from investment operations | .11 | 1.35 | (1.12) | .65 | .72 | .46 |

Distributions from net investment income | - | (.35) | (.37) | (.44) | (.32) | (.10) |

Distributions from net realized gain | (.03) | (.15) | (.17) | (.12) | (.05) | - |

Total distributions | (.03) | (.49)I | (.54) | (.56) | (.37) | (.10) |

Net asset value, end of period | $ 10.08 | $ 10.00 | $ 9.14 | $ 10.80 | $ 10.71 | $ 10.36 |

Total ReturnB,C,D | 1.05% | 14.95% | (10.45)% | 6.10% | 6.94% | 4.58% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .00%A | .00% | .00% | .00% | .00% | .00%A |

Expenses net of fee waivers, if any | .00%A | .00% | .00% | .00% | .00% | .00%A |

Expenses net of all reductions | .00%A | .00% | .00% | .00% | .00% | .00%A |

Net investment income (loss) | .12%A | 4.00% | 3.50% | 3.93% | 3.75% | 2.34%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 10,627 | $ 12,679 | $ 8,976 | $ 10,035 | $ 9,398 | $ 5,954 |

Portfolio turnover rate | 33%A | 32% | 55% | 56% | 44% | 12%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G For the period April 26, 2005 (commencement of operations) to December 31, 2005. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. I Total distributions of $.49 per share is comprised of distributions from net investment income of $.347 and distributions from net realized gain of $.146 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

VIP Freedom Income Portfolio

Financial Statements - continued

Financial Highlights - Service Class

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 10.00 | $ 9.14 | $ 10.81 | $ 10.71 | $ 10.36 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | -I | .37 | .35 | .42 | .39 | .16 |

Net realized and unrealized gain (loss) | .11 | .97 | (1.50) | .23 | .32 | .29 |

Total from investment operations | .11 | 1.34 | (1.15) | .65 | .71 | .45 |

Distributions from net investment income | - | (.33) | (.35) | (.43) | (.31) | (.09) |

Distributions from net realized gain | (.03) | (.15) | (.17) | (.12) | (.05) | - |

Total distributions | (.03) | (.48)J | (.52) | (.55) | (.36) | (.09) |

Net asset value, end of period | $ 10.08 | $ 10.00 | $ 9.14 | $ 10.81 | $ 10.71 | $ 10.36 |

Total ReturnB,C,D | 1.05% | 14.81% | (10.65)% | 6.10% | 6.83% | 4.51% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .10%A | .10% | .10% | .10% | .10% | .10%A |

Expenses net of fee waivers, if any | .10%A | .10% | .10% | .10% | .10% | .10%A |

Expenses net of all reductions | .10%A | .10% | .10% | .10% | .10% | .10%A |

Net investment income (loss) | .02%A | 3.90% | 3.40% | 3.83% | 3.65% | 2.24%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 205 | $ 163 | $ 258 | $ 414 | $ 391 | $ 366 |

Portfolio turnover rate | 33%A | 32% | 55% | 56% | 44% | 12%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G For the period April 26, 2005 (commencement of operations) to December 31, 2005. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. I Amount represents less than $.01 per share. J Total distributions of $.48 per share is comprised of distributions from net investment income of $.334 and distributions from net realized gain of $.146 per share. |

Financial Highlights - Service Class 2

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.97 | $ 9.12 | $ 10.78 | $ 10.69 | $ 10.36 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | (.01) | .36 | .33 | .40 | .37 | .15 |

Net realized and unrealized gain (loss) | .11 | .96 | (1.48) | .23 | .32 | .29 |

Total from investment operations | .10 | 1.32 | (1.15) | .63 | .69 | .44 |

Distributions from net investment income | - | (.33) | (.34) | (.42) | (.31) | (.08) |

Distributions from net realized gain | (.03) | (.15) | (.17) | (.12) | (.05) | - |

Total distributions | (.03) | (.47)I | (.51) | (.54) | (.36) | (.08) |

Net asset value, end of period | $ 10.04 | $ 9.97 | $ 9.12 | $ 10.78 | $ 10.69 | $ 10.36 |

Total ReturnB,C,D | .96% | 14.64% | (10.70)% | 5.92% | 6.61% | 4.41% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .25%A | .25% | .25% | .25% | .25% | .25%A |

Expenses net of fee waivers, if any | .25%A | .25% | .25% | .25% | .25% | .25%A |

Expenses net of all reductions | .25%A | .25% | .25% | .25% | .25% | .25%A |

Net investment income (loss) | (.13)%A | 3.76% | 3.25% | 3.68% | 3.50% | 2.09%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 6,259 | $ 6,753 | $ 4,836 | $ 3,589 | $ 1,061 | $ 365 |

Portfolio turnover rate | 33%A | 32% | 55% | 56% | 44% | 12%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G For the period April 26, 2005 (commencement of operations) to December 31, 2005. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. I Total distributions of $.47 per share is comprised of distributions from net investment income of $.326 and distributions from net realized gain of $.146 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

VIP Freedom 2005 Portfolio

Investment Changes (Unaudited)

Fund Holdings as of June 30, 2010 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Domestic Equity Funds | | |

VIP Contrafund Portfolio Initial Class | 5.3 | 6.1 |

VIP Equity-Income Portfolio Initial Class | 6.2 | 7.0 |

VIP Growth & Income Portfolio Initial Class | 6.1 | 7.0 |

VIP Growth Portfolio Initial Class | 6.2 | 7.1 |

VIP Mid Cap Portfolio Initial Class | 2.2 | 2.5 |

VIP Value Portfolio Initial Class | 5.3 | 6.2 |

VIP Value Strategies Portfolio Initial Class | 2.2 | 2.6 |

| 33.5 | 38.5 |

Developed International Equity Funds | | |

VIP Overseas Portfolio Initial Class | 9.0 | 7.6 |

Emerging Markets Equity Funds | | |

VIP Emerging Markets Portfolio Initial Class | 0.8 | 0.0 |

High Yield Bond Funds | | |

VIP High Income Portfolio Initial Class | 5.0 | 5.0 |

Investment Grade Bond Funds | | |

VIP Investment Grade Bond Portfolio Initial Class | 31.9 | 32.1 |

Short-Term Funds | | |

VIP Money Market Portfolio Initial Class | 19.8 | 16.8 |

Net Other Assets | | |

Net Other Assets | 0.0* | 0.0* |

| 100.0 | 100.0 |

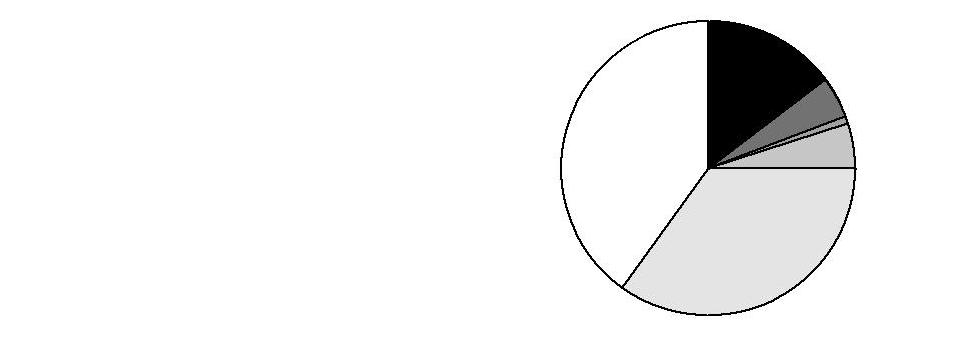

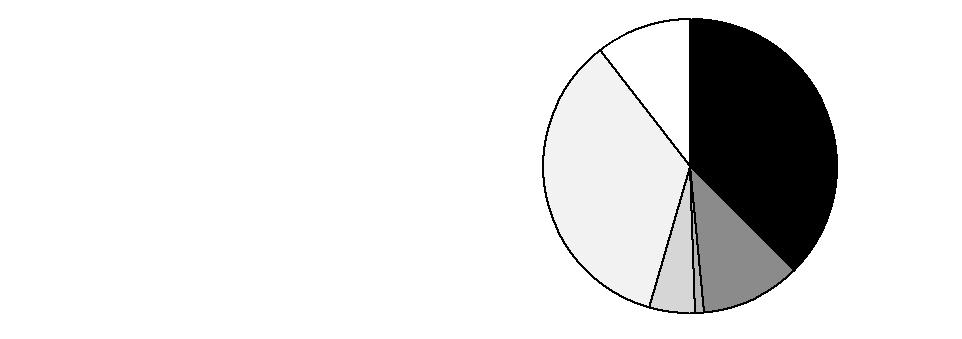

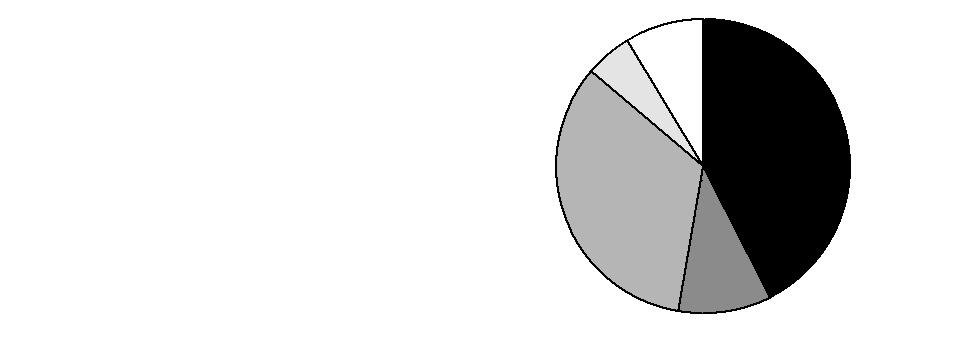

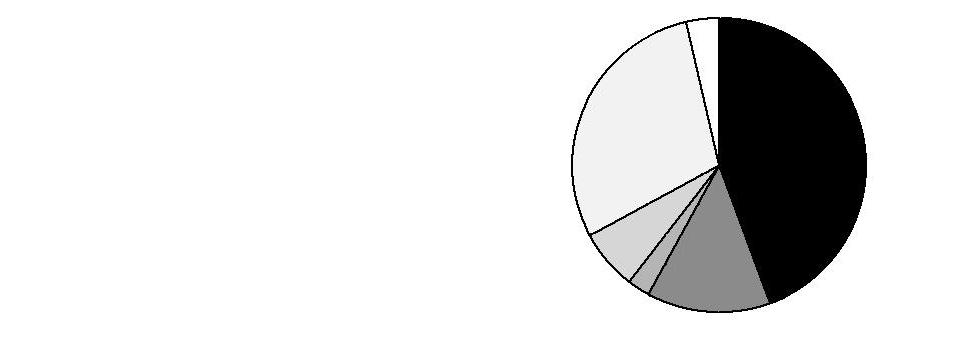

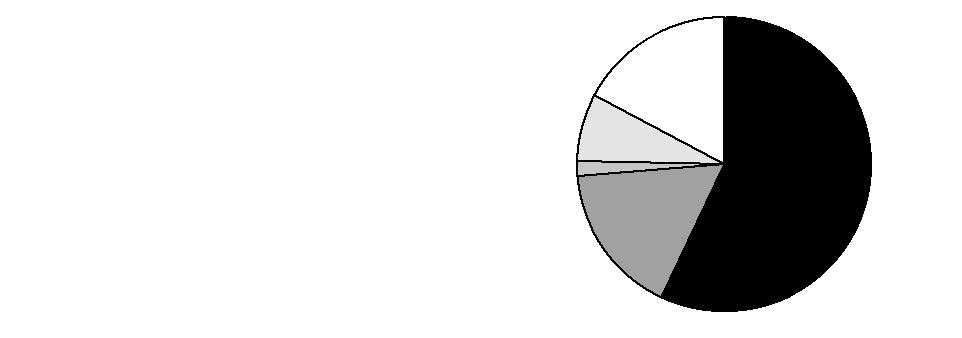

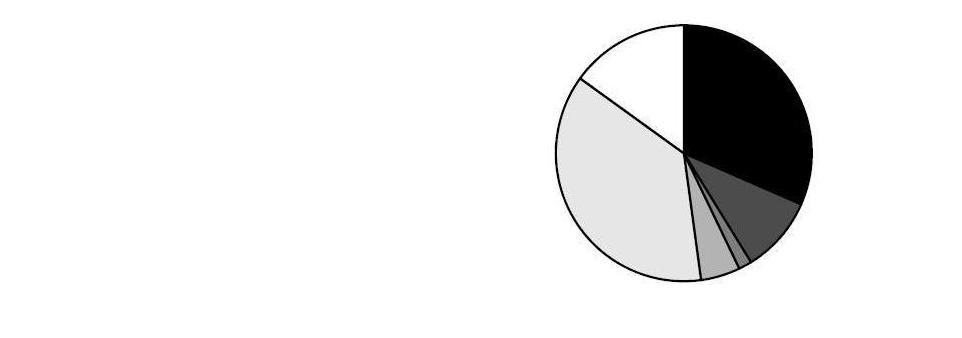

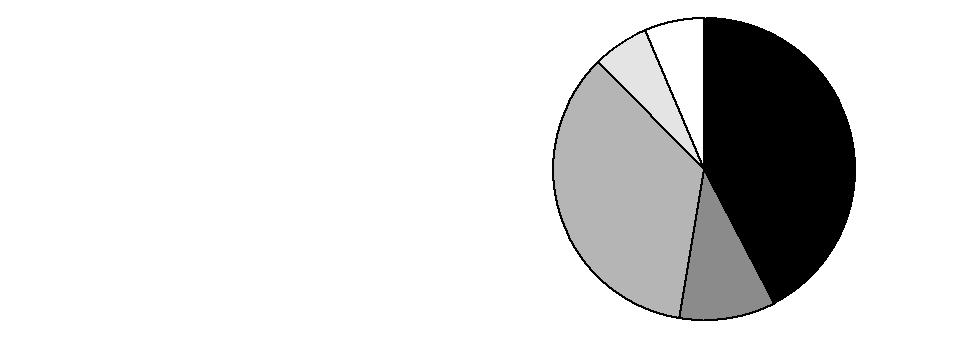

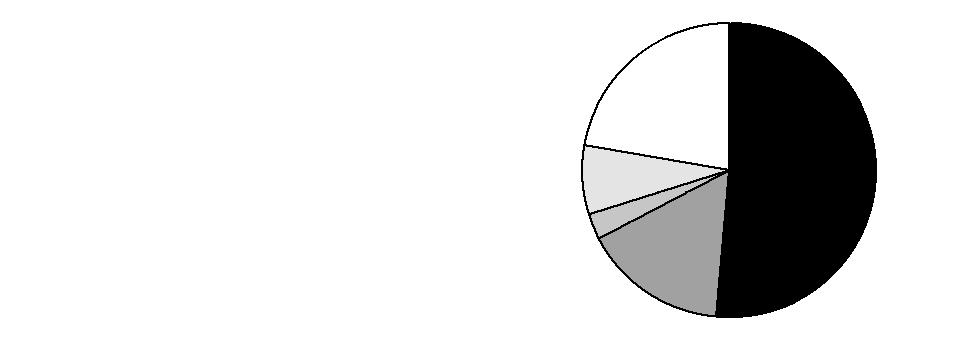

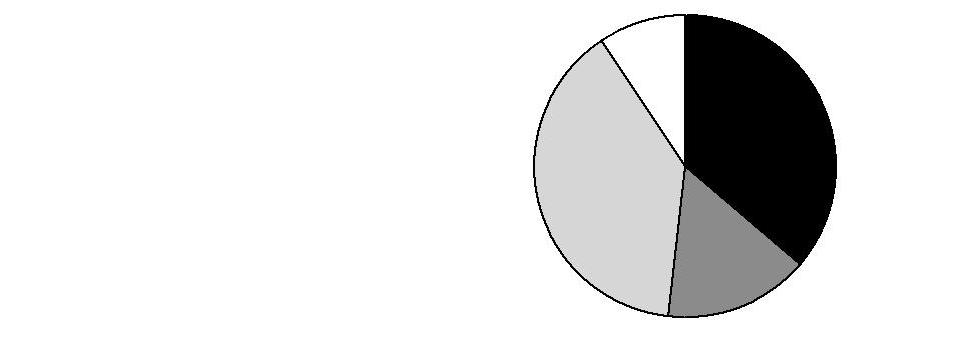

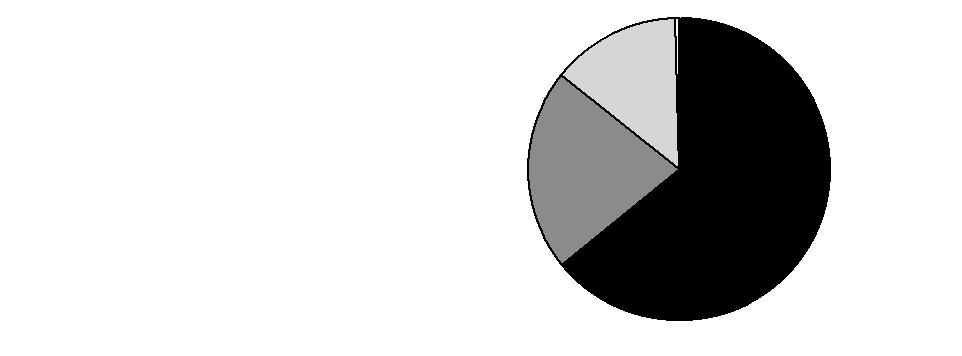

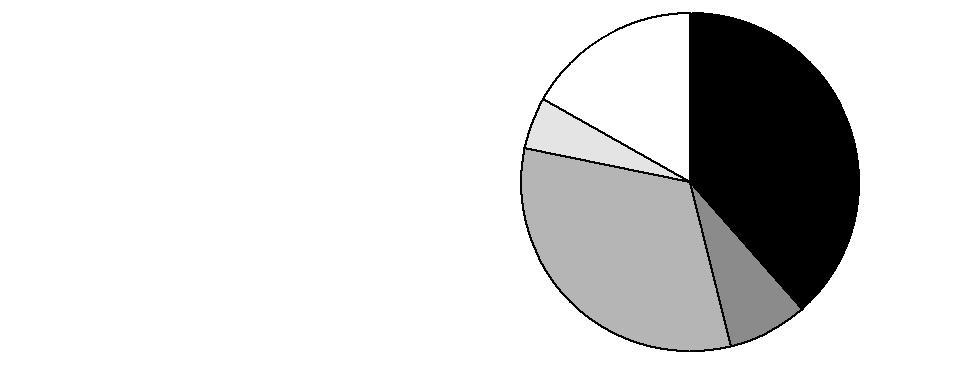

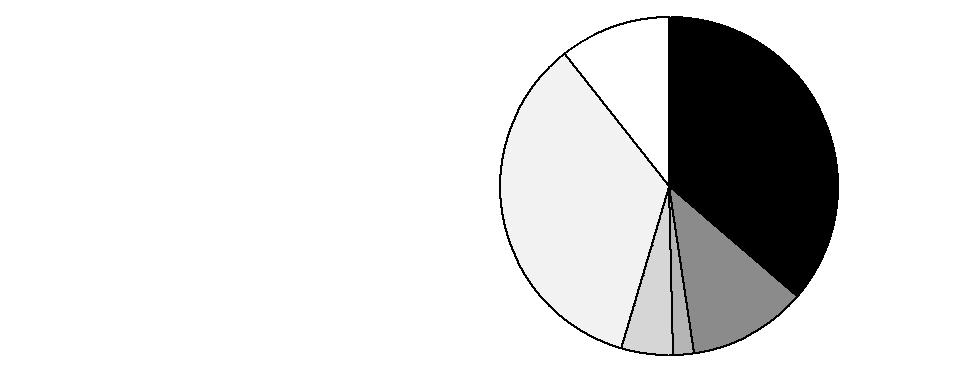

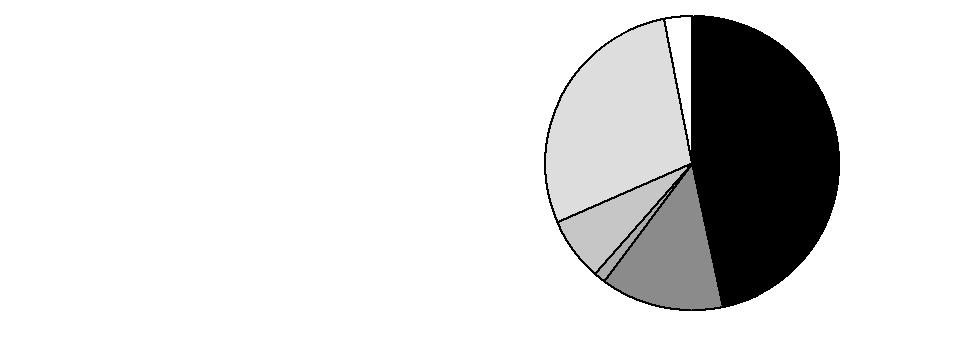

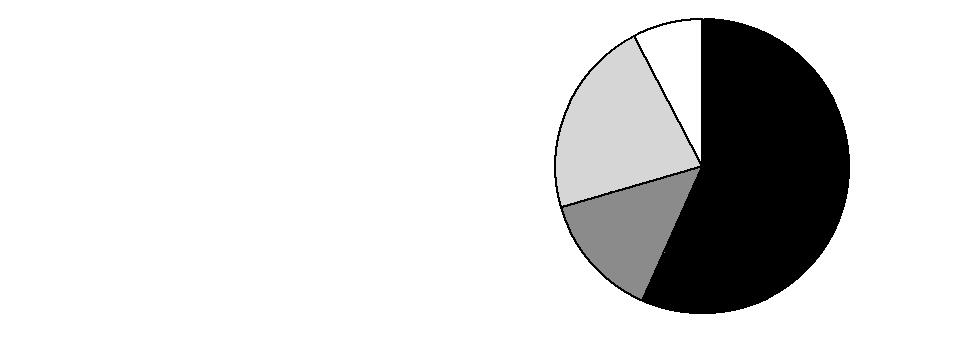

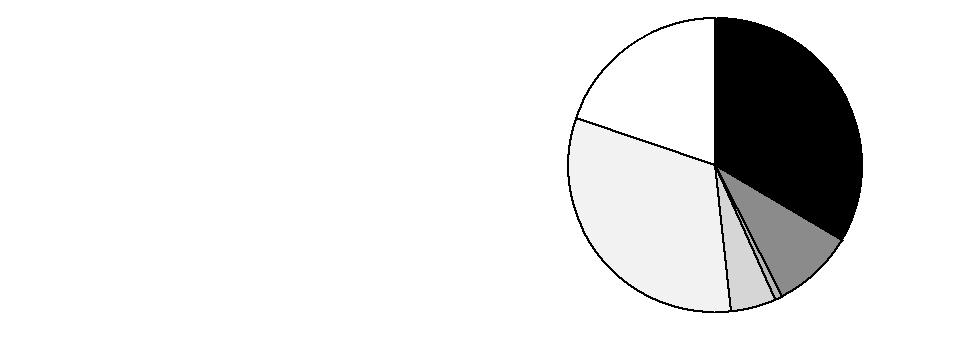

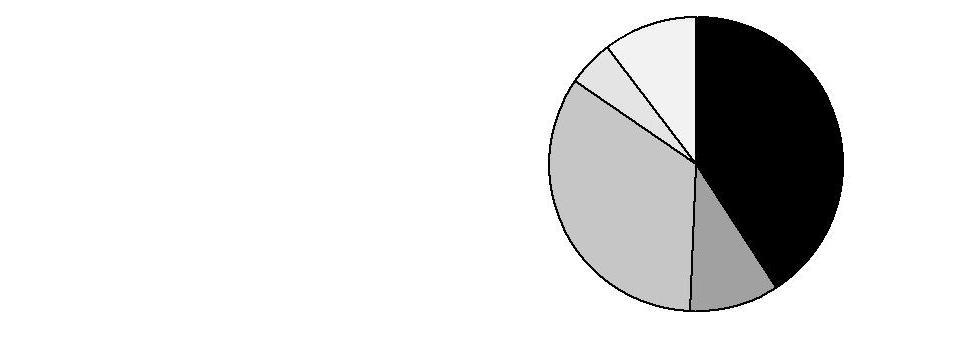

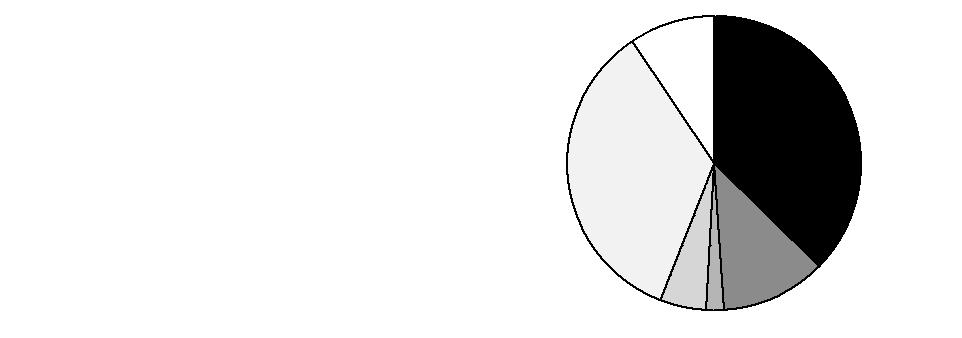

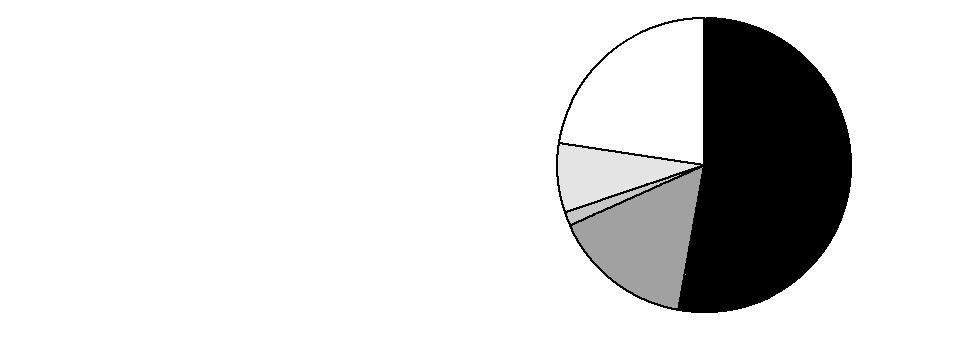

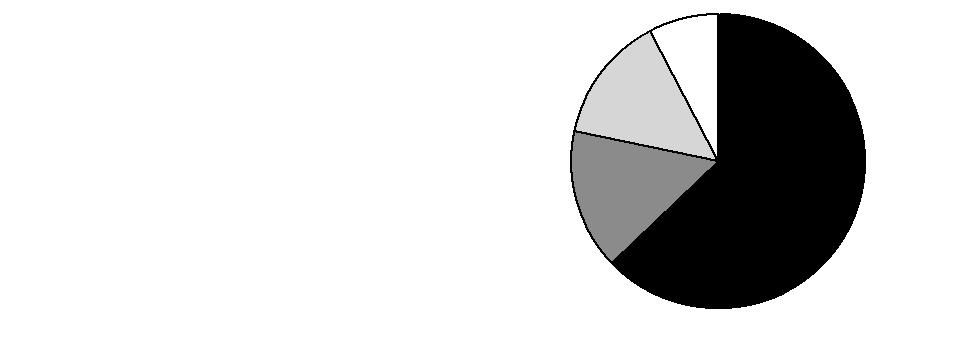

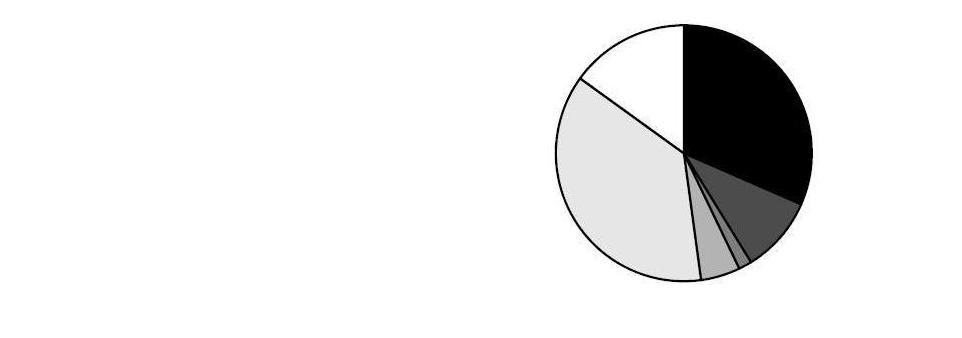

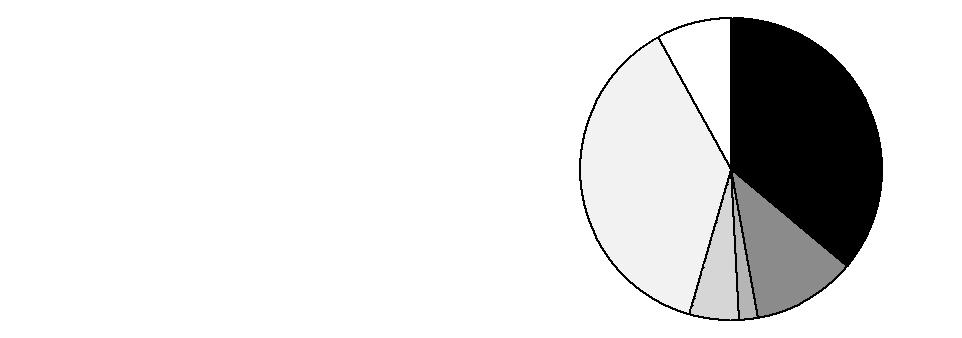

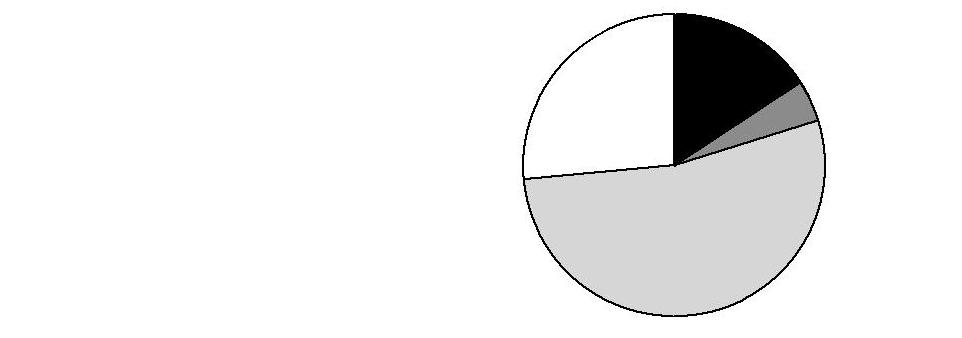

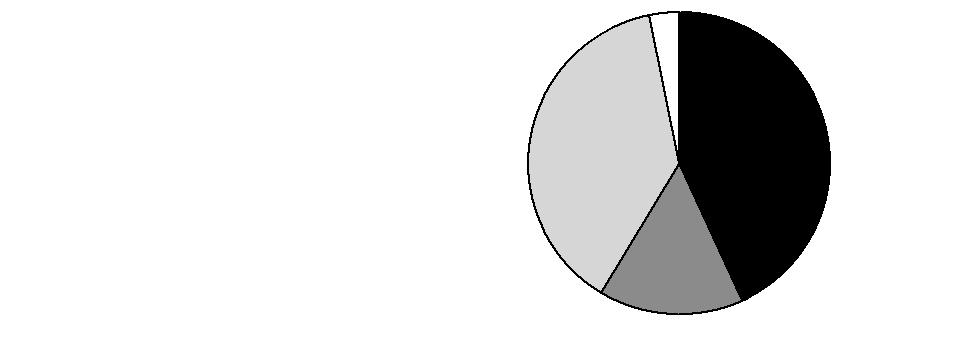

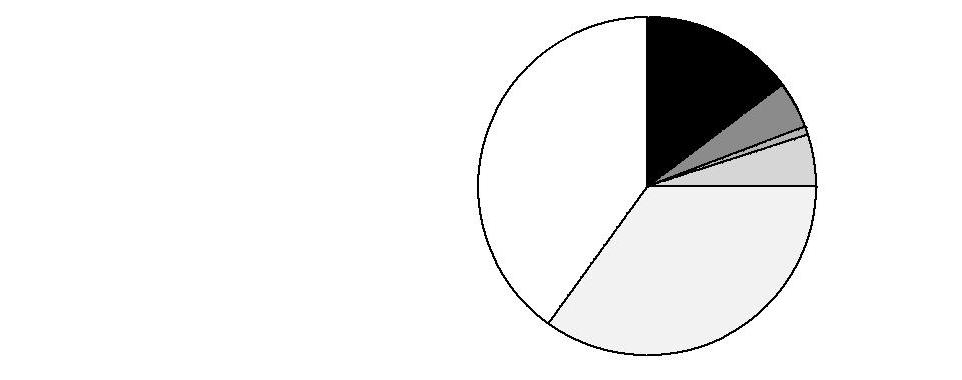

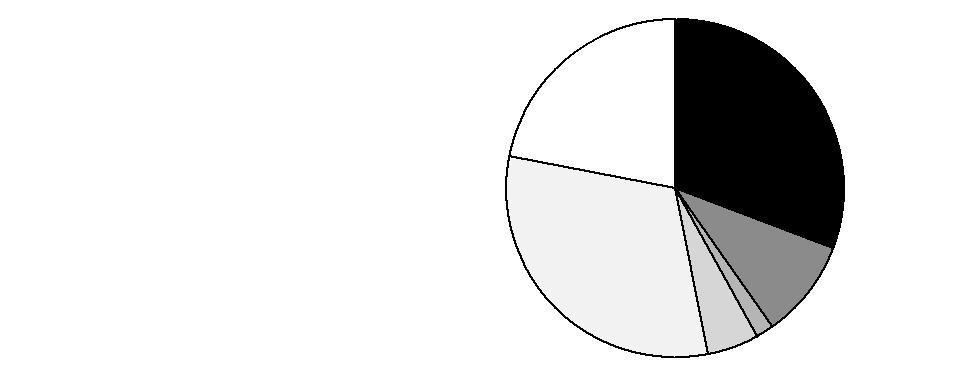

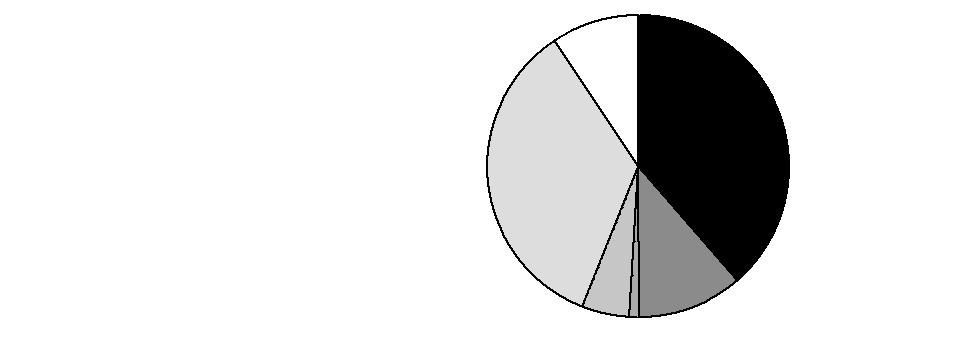

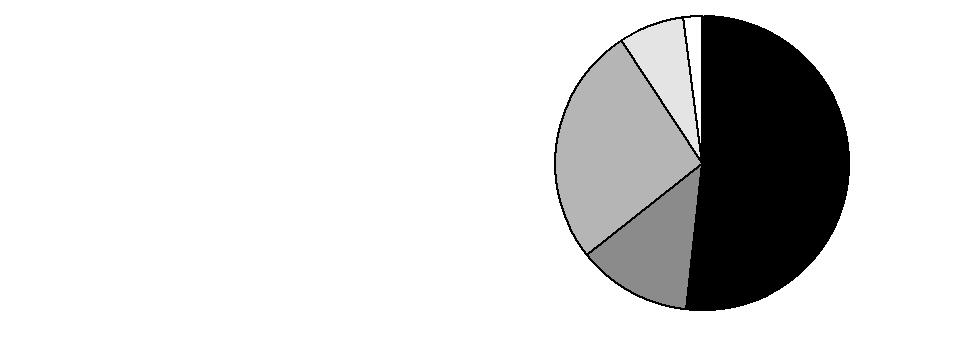

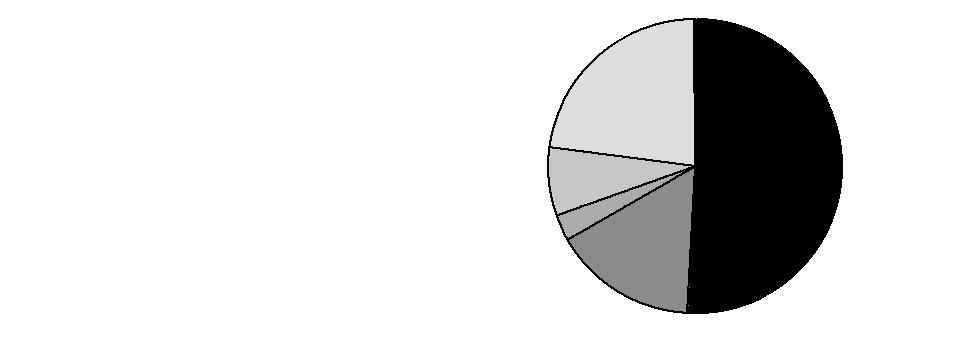

Asset Allocation (% of fund's net assets) |

Current |

| Domestic Equity Funds | 33.5% | |

| Developed International Equity Funds | 9.0% | |

| Emerging Markets Equity Funds | 0.8% | |

| High Yield Bond Funds | 5.0% | |

| Investment Grade Bond Funds | 31.9% | |

| Short-Term Funds | 19.8% | |

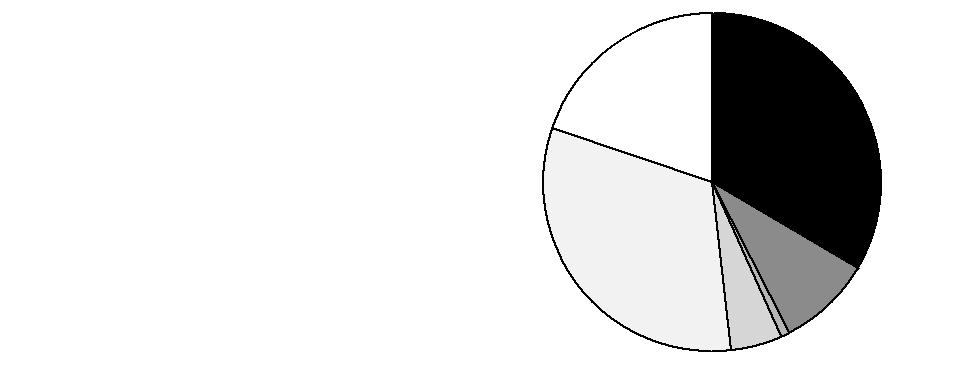

Six months ago |

| Domestic Equity Funds | 38.5% | |

| Developed International Equity Funds | 7.6% | |

| Investment Grade Bond Funds | 32.1% | |

| High Yield Bond Funds | 5.0% | |

| Short-Term Funds | 16.8% | |

Expected |

| Domestic Equity Funds | 30.8% | |

| Developed International Equity Funds | 9.5% | |

| Emerging Markets Equity Funds | 1.7% | |

| High Yield Bond Funds | 5.0% | |

| Investment Grade Bond Funds | 31.2% | |

| Short-Term Funds | 21.8% | |

The fund invests according to an asset allocation strategy that becomes increasingly conservative over time. The six months ago allocation is based on the fund's holdings as of December 31, 2009. The current allocation is based on the fund's holdings as of June 30, 2010. The expected allocation represents the fund's anticipated allocation at December 31, 2010. |

* Amount represents less than 0.1% |

Semiannual Report

VIP Freedom 2005 Portfolio

Investments June 30, 2010 (Unaudited)

Showing Percentage of Net Assets

Domestic Equity Funds - 33.5% |

| Shares | | Value |

Domestic Equity Funds - 33.5% |

VIP Contrafund Portfolio Initial Class | 15,444 | | $ 297,289 |

VIP Equity-Income Portfolio Initial Class | 22,156 | | 345,637 |

VIP Growth & Income Portfolio Initial Class | 33,913 | | 345,569 |

VIP Growth Portfolio Initial Class | 12,129 | | 345,928 |

VIP Mid Cap Portfolio Initial Class | 4,797 | | 124,049 |

VIP Value Portfolio Initial Class | 32,778 | | 296,964 |

VIP Value Strategies Portfolio Initial Class | 16,317 | | 123,684 |

TOTAL DOMESTIC EQUITY FUNDS (Cost $2,631,947) | 1,879,120 |

International Equity Funds - 9.8% |

| | | |

Developed International Equity Funds - 9.0% |

VIP Overseas Portfolio Initial Class | 38,731 | | 503,888 |

Emerging Markets Equity Funds - 0.8% |

VIP Emerging Markets Portfolio Initial Class | 6,176 | | 48,297 |

TOTAL INTERNATIONAL EQUITY FUNDS (Cost $771,454) | 552,185 |

Bond Funds - 36.9% |

| | | |

High Yield Bond Funds - 5.0% |

VIP High Income Portfolio Initial Class | 51,531 | | 281,874 |

Investment Grade Bond Funds - 31.9% |

VIP Investment Grade Bond Portfolio Initial Class | 136,011 | | 1,789,905 |

TOTAL BOND FUNDS (Cost $1,997,169) | 2,071,779 |

Short-Term Funds - 19.8% |

| | | |

VIP Money Market Portfolio Initial Class

(Cost $1,113,015) | 1,113,015 | | 1,113,015 |

TOTAL INVESTMENT PORTFOLIO - 100.0% (Cost $6,513,585) | | 5,616,099 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | | (58) |

NET ASSETS - 100% | $ 5,616,041 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

VIP Freedom 2005 Portfolio

Statement of Assets and Liabilities

| June 30, 2010 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (cost $6,513,585) - See accompanying schedule | | $ 5,616,099 |

Receivable for investments sold | | 121 |

Total assets | | 5,616,220 |

| | |

Liabilities | | |

Payable to custodian bank | $ 1 | |

Payable for investments purchased | 14 | |

Payable for fund shares redeemed | 115 | |

Distribution fees payable | 49 | |

Total liabilities | | 179 |

| | |

Net Assets | | $ 5,616,041 |

Net Assets consist of: | | |

Paid in capital | | $ 6,701,542 |

Undistributed net investment income | | 3,512 |

Accumulated undistributed net realized gain (loss) on investments | | (191,527) |

Net unrealized appreciation (depreciation) on investments | | (897,486) |

Net Assets | | $ 5,616,041 |

| | |

Initial Class:

Net Asset Value, offering price and redemption price per share ($5,318,737 ÷ 579,881 shares) | | $ 9.17 |

| | |

Service Class:

Net Asset Value, offering price and redemption price per share ($134,237 ÷ 14,634 shares) | | $ 9.17 |

| | |

Service Class 2:

Net Asset Value, offering price and redemption price per share ($163,067 ÷ 17,777 shares) | | $ 9.17 |

Statement of Operations

Six months ended June 30, 2010 (Unaudited) |

| | |

Investment Income | | |

Income distributions from underlying funds | | $ 3,039 |

| | |

Expenses | | |

Distribution fees | $ 250 | |

Independent trustees' compensation | 11 | |

Total expenses before reductions | 261 | |

Expense reductions | (11) | 250 |

Net investment income (loss) | | 2,789 |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | (57,318) | |

Capital gain distributions from underlying funds | 706 | (56,612) |

Change in net unrealized appreciation (depreciation) on underlying funds | | 26,698 |

Net gain (loss) | | (29,914) |

Net increase (decrease) in net assets resulting from operations | | $ (27,125) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

| Six months ended

June 30, 2010 (Unaudited) | Year ended

December 31, 2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 2,789 | $ 259,416 |

Net realized gain (loss) | (56,612) | 156,333 |

Change in net unrealized appreciation (depreciation) | 26,698 | 944,768 |

Net increase (decrease) in net assets resulting from operations | (27,125) | 1,360,517 |

Distributions to shareholders from net investment income | - | (259,101) |

Distributions to shareholders from net realized gain | (58,026) | (199,216) |

Total distributions | (58,026) | (458,317) |

Share transactions - net increase (decrease) | (1,487,099) | (227,175) |

Total increase (decrease) in net assets | (1,572,250) | 675,025 |

| | |

Net Assets | | |

Beginning of period | 7,188,291 | 6,513,266 |

End of period (including undistributed net investment income of $3,512 and undistributed net investment income of $723, respectively) | $ 5,616,041 | $ 7,188,291 |

Financial Highlights - Initial Class

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.34 | $ 8.14 | $ 11.59 | $ 11.41 | $ 10.74 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | -I | .34 | .34 | .38 | .31 | .09 |

Net realized and unrealized gain (loss) | (.09) | 1.48 | (3.06) | .60 | .72 | .71 |

Total from investment operations | (.09) | 1.82 | (2.72) | .98 | 1.03 | .80 |

Distributions from net investment income | - | (.35) | (.34) | (.34) | (.31) | (.06) |

Distributions from net realized gain | (.08) | (.26) | (.39) | (.47) | (.05) | - |

Total distributions | (.08) | (.62)K | (.73) | (.80)J | (.36) | (.06) |

Net asset value, end of period | $ 9.17 | $ 9.34 | $ 8.14 | $ 11.59 | $ 11.41 | $ 10.74 |

Total ReturnB,C,D | (.96)% | 23.02% | (23.83)% | 8.65% | 9.59% | 7.98% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .00%A | .00% | .00% | .00% | .00% | .00%A |

Expenses net of fee waivers, if any | .00%A | .00% | .00% | .00% | .00% | .00%A |

Expenses net of all reductions | .00%A | .00% | .00% | .00% | .00% | .00%A |

Net investment income (loss) | .09%A | 3.95% | 3.29% | 3.20% | 2.82% | 1.24%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 5,319 | $ 6,833 | $ 5,993 | $ 9,203 | $ 7,871 | $ 5,284 |

Portfolio turnover rate | 41%A | 50% | 51% | 51% | 56% | 43%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G For the period April 26, 2005 (commencement of operations) to December 31, 2005. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. I Amount represents less than $.01 per share. J Total distributions of $.80 per share is comprised of distributions from net investment income of $.335 and distributions from net realized gain of $.465 per share. K Total distributions of $.62 per share is comprised of distributions from net investment income of $.353 and distributions from net realized gain of $.262 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Service Class

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005H |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.35 | $ 8.14 | $ 11.59 | $ 11.41 | $ 10.74 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | -G | .33 | .33 | .37 | .30 | .08 |

Net realized and unrealized gain (loss) | (.10) | 1.48 | (3.06) | .60 | .72 | .71 |

Total from investment operations | (.10) | 1.81 | (2.73) | .97 | 1.02 | .79 |

Distributions from net investment income | - | (.34) | (.33) | (.32) | (.30) | (.05) |

Distributions from net realized gain | (.08) | (.26) | (.39) | (.47) | (.05) | - |

Total distributions | (.08) | (.60)K | (.72) | (.79)J | (.35) | (.05) |

Net asset value, end of period | $ 9.17 | $ 9.35 | $ 8.14 | $ 11.59 | $ 11.41 | $ 10.74 |

Total ReturnB,C,D | (1.07)% | 23.00% | (23.95)% | 8.55% | 9.48% | 7.91% |

Ratios to Average Net AssetsF,I | | | | | | |

Expenses before reductions | .10%A | .10% | .10% | .10% | .10% | .10%A |

Expenses net of fee waivers, if any | .10%A | .10% | .10% | .10% | .10% | .10%A |

Expenses net of all reductions | .10%A | .10% | .10% | .10% | .10% | .10%A |

Net investment income (loss) | (.01)%A | 3.85% | 3.19% | 3.10% | 2.72% | 1.14%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 134 | $ 172 | $ 250 | $ 449 | $ 414 | $ 378 |

Portfolio turnover rate | 41%A | 50% | 51% | 51% | 56% | 43%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G Amount represents less than .01%. H For the period April 26, 2005 (commencement of operations) to December 31, 2005. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. J Total distributions of $.79 per share is comprised of distributions from net investment income of $.323 and distributions from net realized gain of $.465 per share. K Total distributions of $.60 per share is comprised of distributions from net investment income of $.341 and distributions from net realized gain of $.262 per share. |

Financial Highlights - Service Class 2

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.35 | $ 8.14 | $ 11.59 | $ 11.41 | $ 10.74 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | (.01) | .32 | .31 | .35 | .29 | .07 |

Net realized and unrealized gain (loss) | (.09) | 1.48 | (3.06) | .60 | .71 | .71 |

Total from investment operations | (.10) | 1.80 | (2.75) | .95 | 1.00 | .78 |

Distributions from net investment income | - | (.32) | (.31) | (.31) | (.28) | (.04) |

Distributions from net realized gain | (.08) | (.26) | (.39) | (.47) | (.05) | - |

Total distributions | (.08) | (.59)J | (.70) | (.77)I | (.33) | (.04) |

Net asset value, end of period | $ 9.17 | $ 9.35 | $ 8.14 | $ 11.59 | $ 11.41 | $ 10.74 |

Total ReturnB,C,D | (1.07)% | 22.78% | (24.12)% | 8.40% | 9.34% | 7.80% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .25%A | .25% | .25% | .25% | .25% | .25%A |

Expenses net of fee waivers, if any | .25%A | .25% | .25% | .25% | .25% | .25%A |

Expenses net of all reductions | .25%A | .25% | .25% | .25% | .25% | .25%A |

Net investment income (loss) | (.16)%A | 3.70% | 3.04% | 2.95% | 2.57% | 1.00%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 163 | $ 183 | $ 271 | $ 456 | $ 413 | $ 377 |

Portfolio turnover rate | 41%A | 50% | 51% | 51% | 56% | 43%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G For the period April 26, 2005 (commencement of operations) to December 31, 2005. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. I Total distributions of $.77 per share is comprised of distributions from net investment income of $.306 and distributions from net realized gain of $.465 per share. J Total distributions of $.59 per share is comprised of distributions from net investment income of $.324 and distributions from net realized gain of $.262 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

VIP Freedom 2010 Portfolio

Investment Changes (Unaudited)

Fund Holdings as of June 30, 2010 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Domestic Equity Funds | | |

VIP Contrafund Portfolio Initial Class | 5.9 | 6.5 |

VIP Equity-Income Portfolio Initial Class | 6.9 | 7.4 |

VIP Growth & Income Portfolio Initial Class | 6.9 | 7.5 |

VIP Growth Portfolio Initial Class | 6.9 | 7.6 |

VIP Mid Cap Portfolio Initial Class | 2.5 | 2.6 |

VIP Value Portfolio Initial Class | 5.9 | 6.5 |

VIP Value Strategies Portfolio Initial Class | 2.5 | 2.7 |

| 37.5 | 40.8 |

Developed International Equity Funds | | |

VIP Overseas Portfolio Initial Class | 11.0 | 9.9 |

Emerging Markets Equity Funds | | |

VIP Emerging Markets Portfolio Initial Class | 1.0 | 0.0 |

High Yield Bond Funds | | |

VIP High Income Portfolio Initial Class | 5.0 | 5.1 |

Investment Grade Bond Funds | | |

VIP Investment Grade Bond Portfolio Initial Class | 35.1 | 33.9 |

Short-Term Funds | | |

VIP Money Market Portfolio Initial Class | 10.4 | 10.3 |

Net Other Assets | | |

Net Other Assets | 0.0* | 0.0* |

| 100.0 | 100.0 |

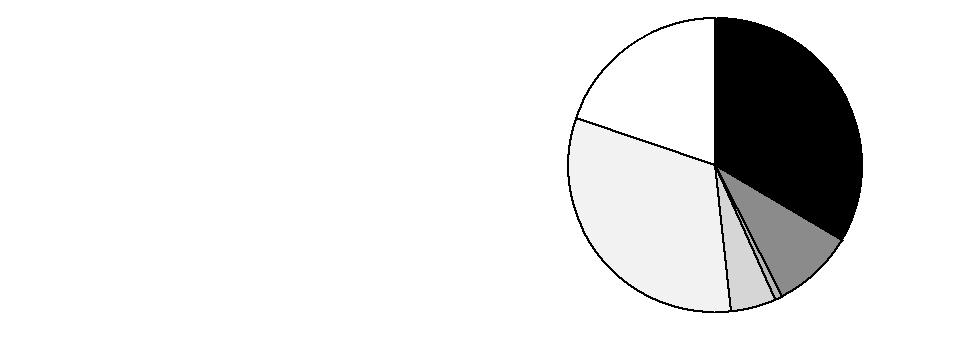

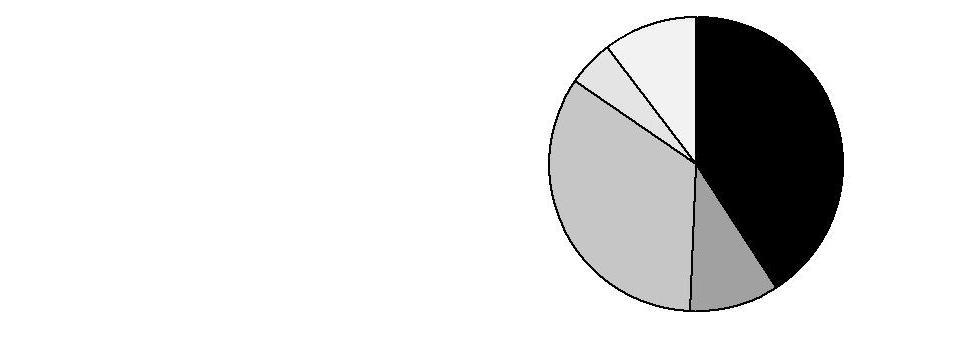

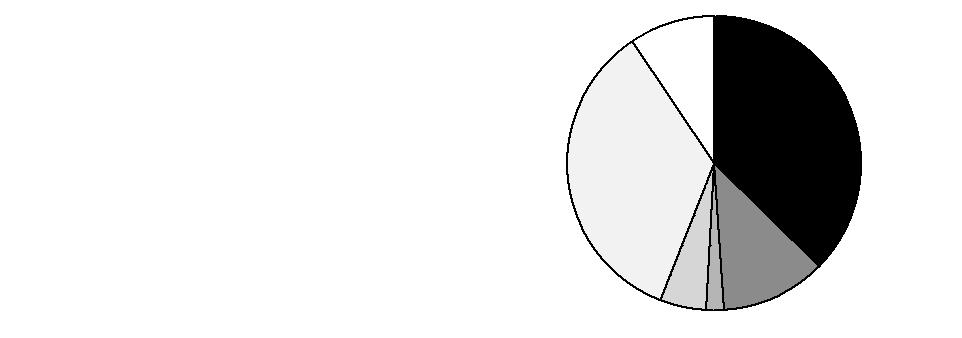

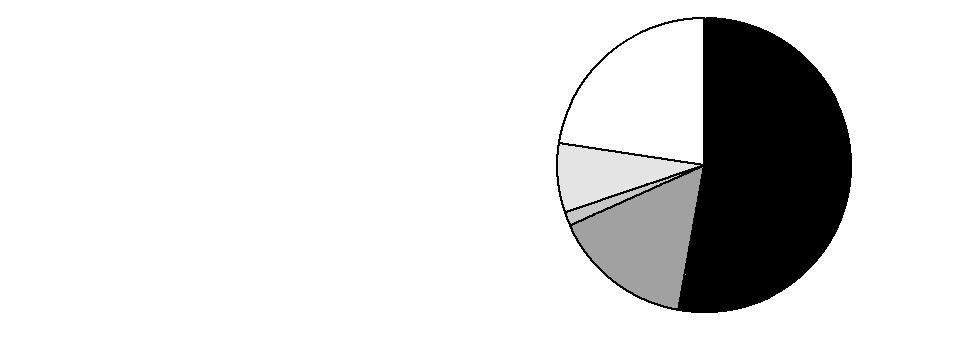

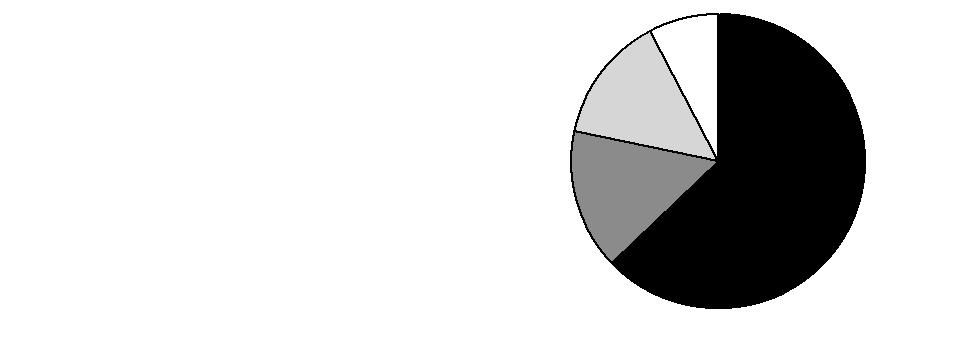

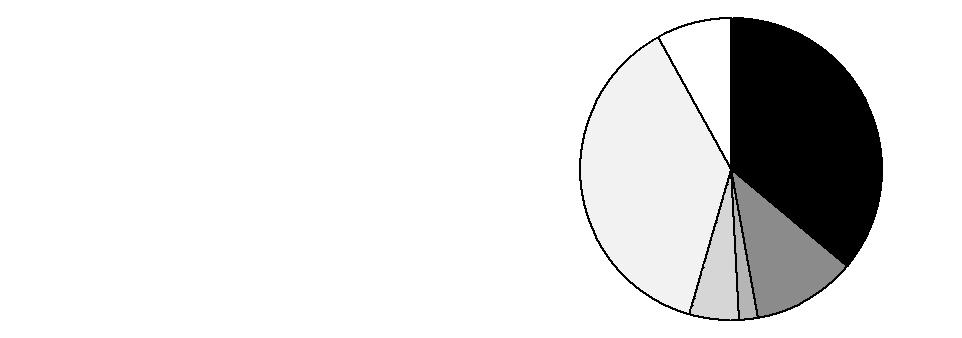

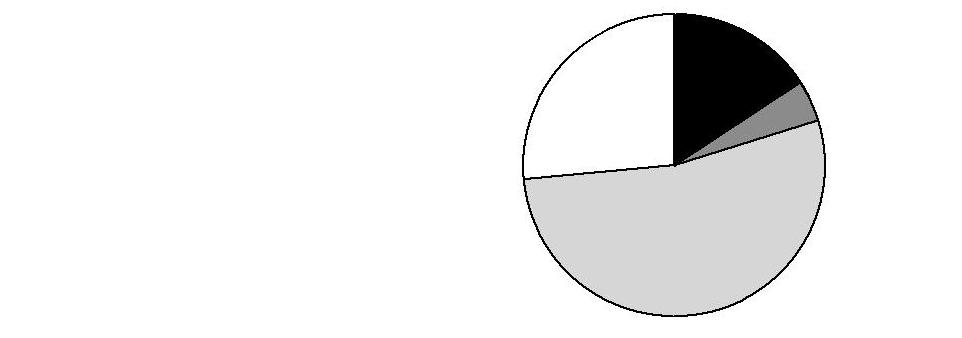

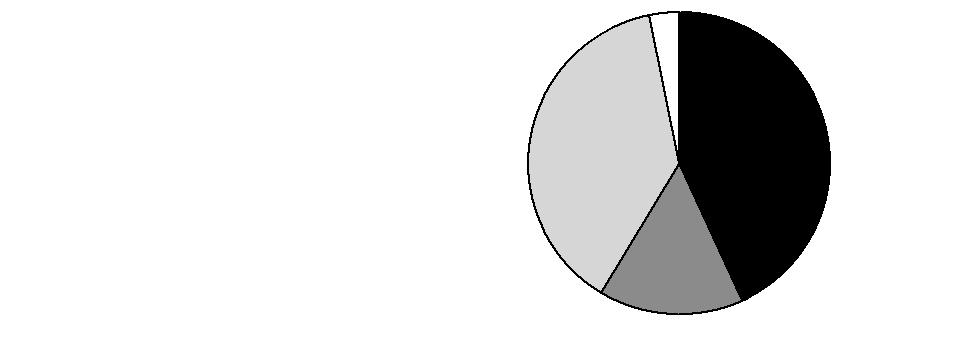

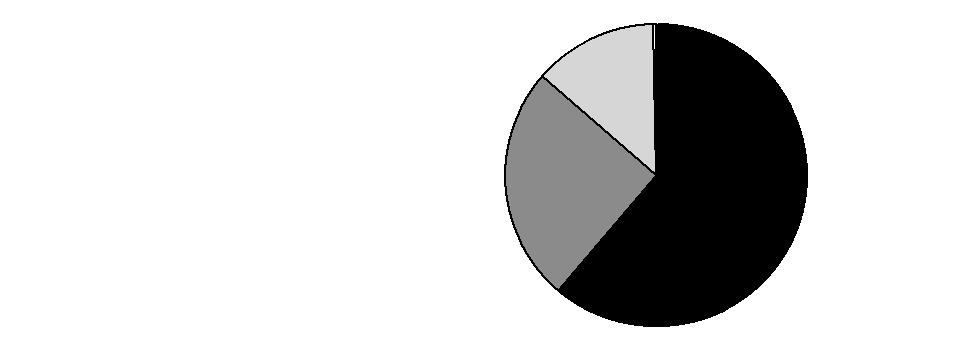

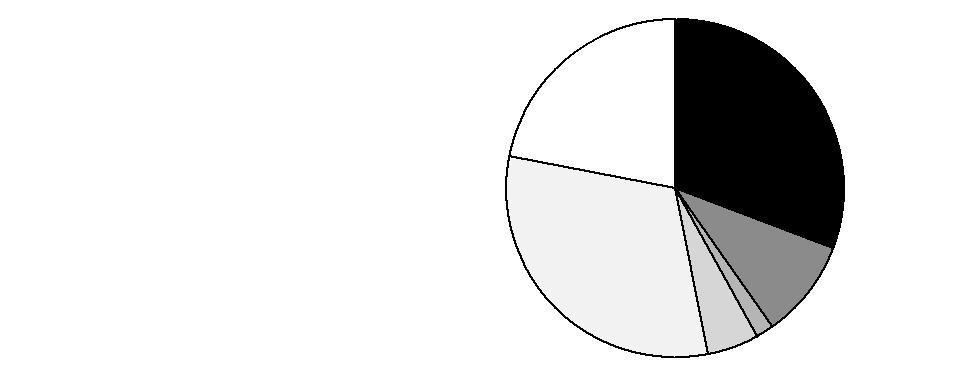

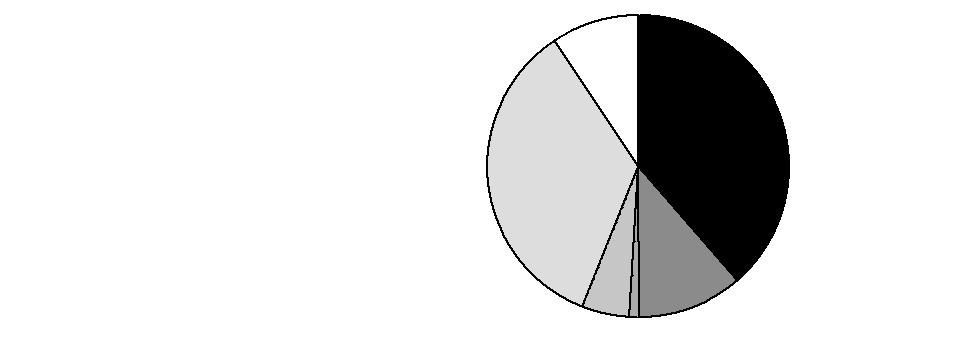

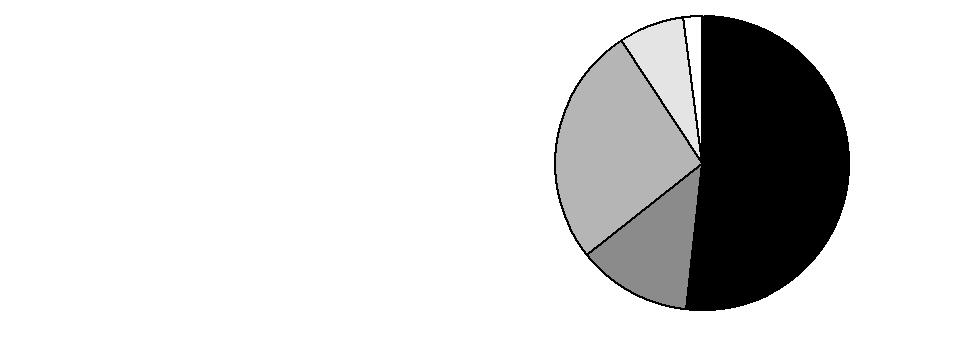

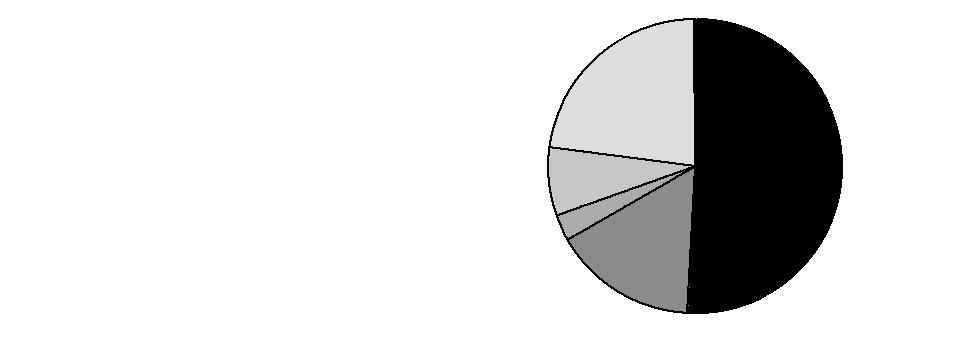

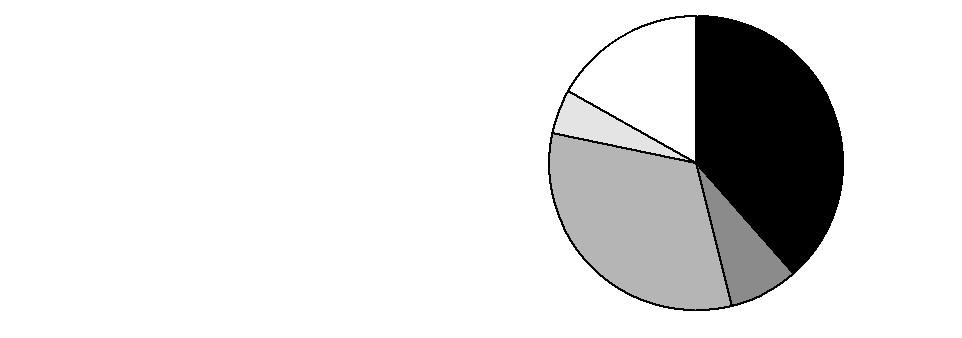

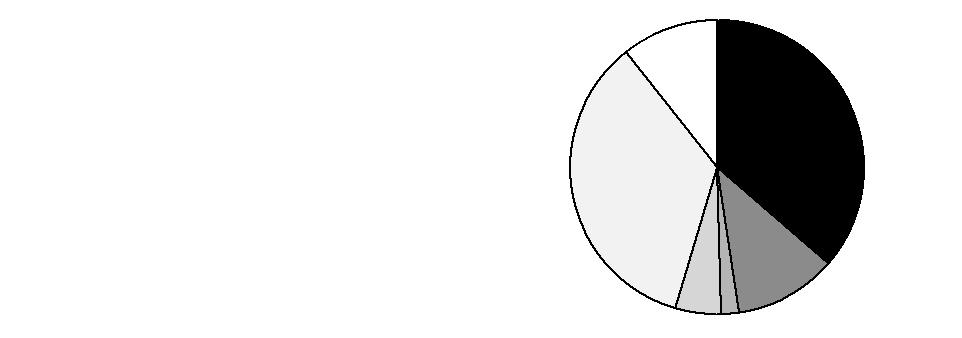

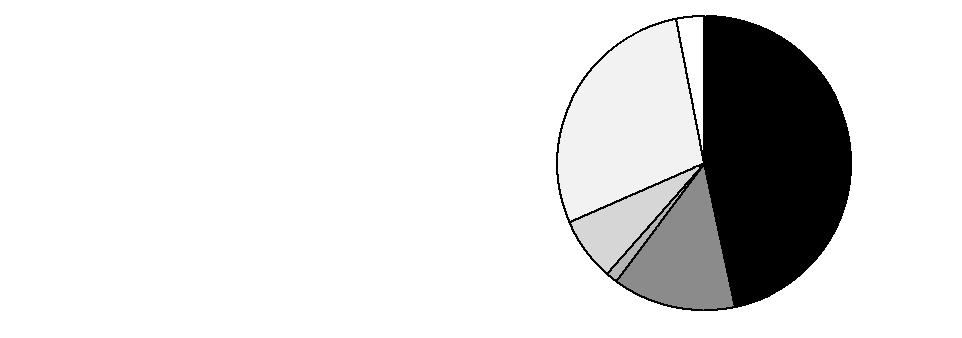

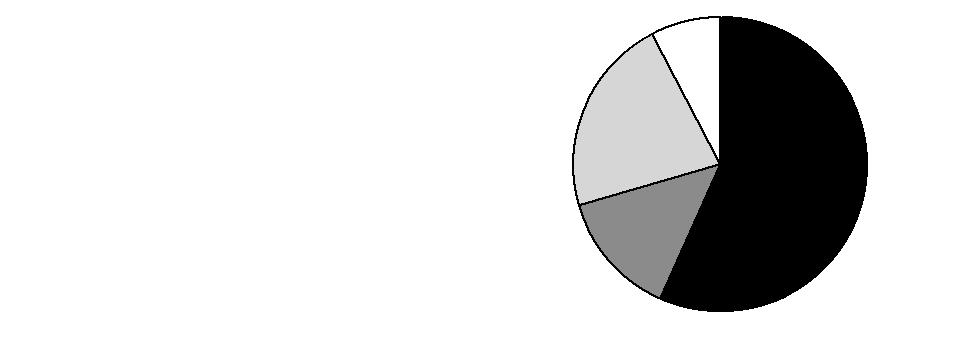

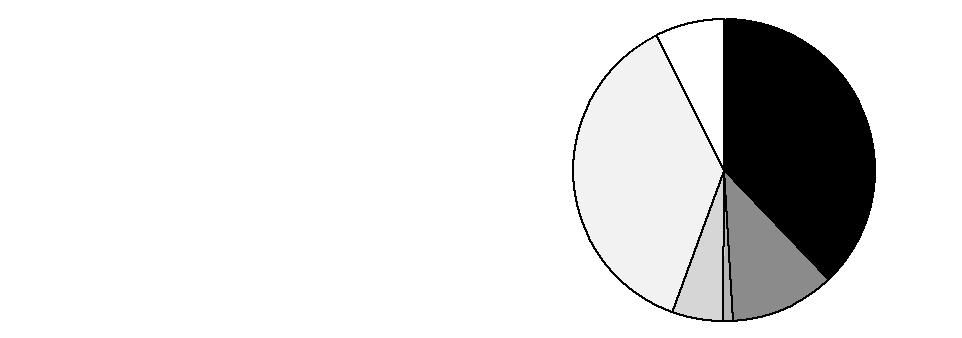

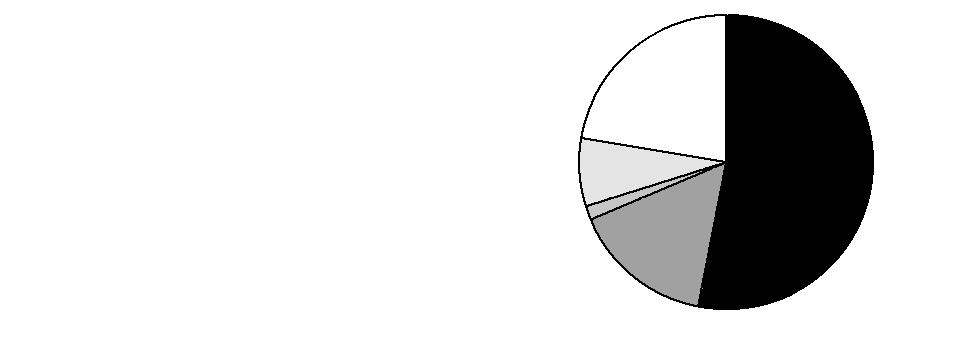

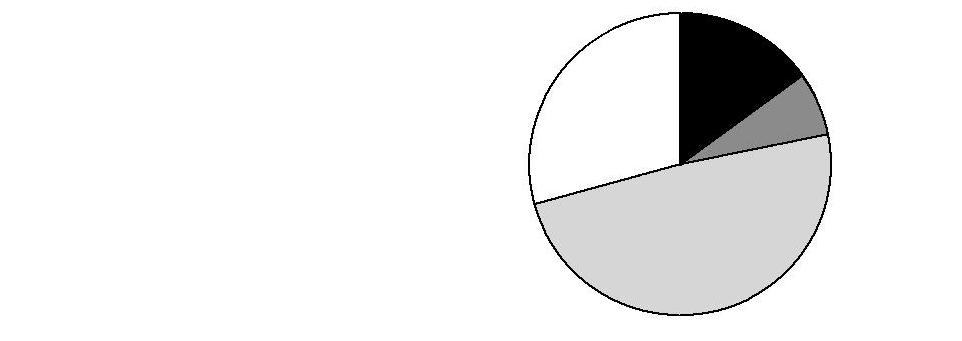

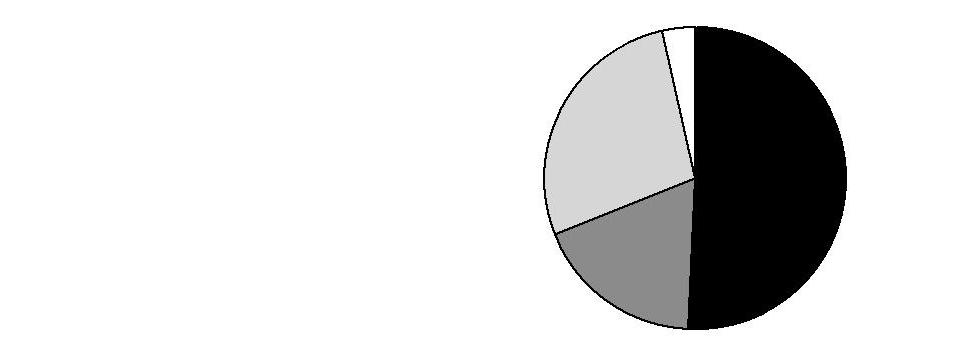

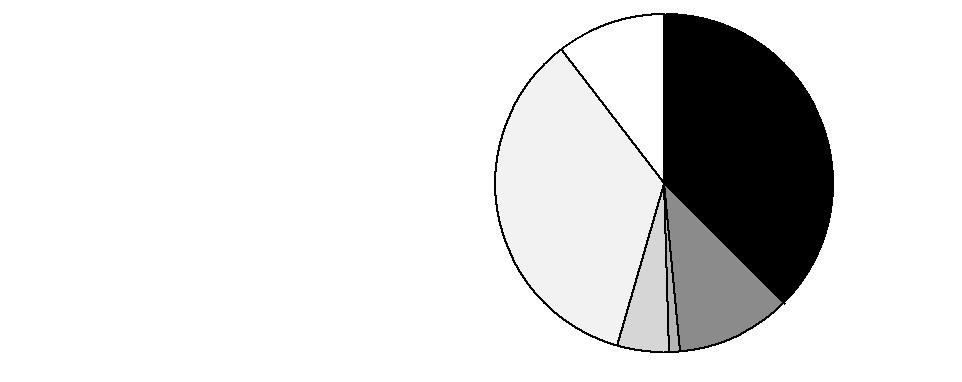

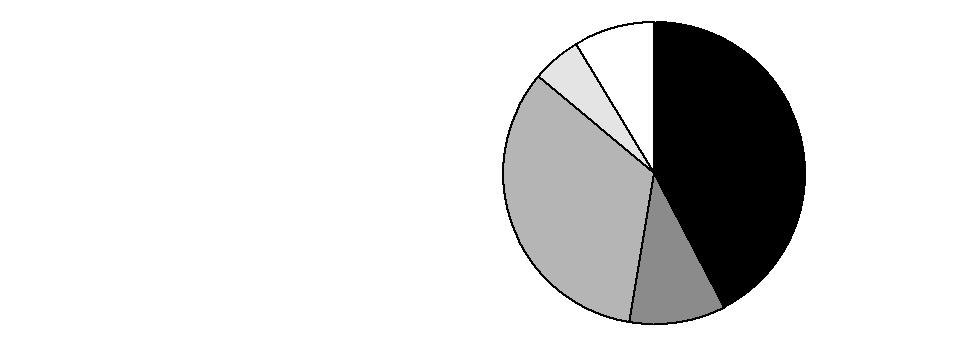

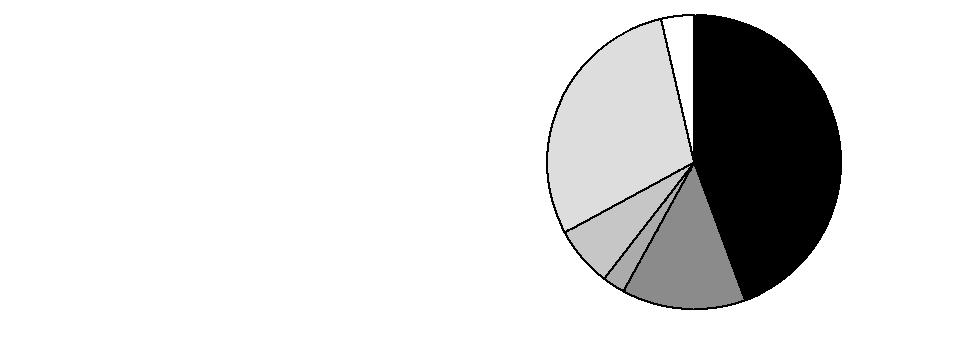

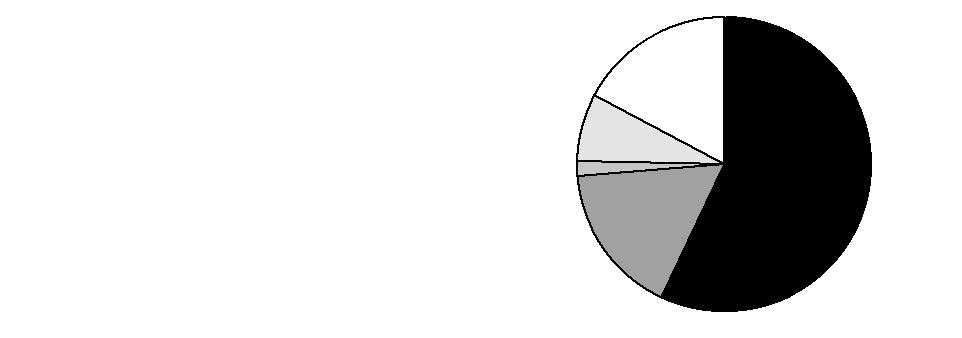

Asset Allocation (% of fund's net assets) |

Current |

| Domestic Equity Funds | 37.5% | |

| Developed International Equity Funds | 11.0% | |

| Emerging Markets Equity Funds | 1.0% | |

| High Yield Bond Funds | 5.0% | |

| Investment Grade Bond Funds | 35.1% | |

| Short-Term Funds | 10.4% | |

Six months ago |

| Domestic Equity Funds | 40.8% | |

| Developed International Equity Funds | 9.9% | |

| Investment Grade Bond Funds | 33.9% | |

| High Yield Bond Funds | 5.1% | |

| Short-Term Funds | 10.3% | |

| Cash Equivalents | 0.0%* | |

Expected |

| Domestic Equity Funds | 36.3% | |

| Developed International Equity Funds | 11.3% | |

| Emerging Markets Equity Funds | 2.0% | |

| High Yield Bond Funds | 5.0% | |

| Investment Grade Bond Funds | 34.8% | |

| Short-Term Funds | 10.6% | |

The fund invests according to an asset allocation strategy that becomes increasingly conservative over time. The six months ago allocation is based on the fund's holdings as of December 31, 2009. The current allocation is based on the fund's holdings as of June 30, 2010. The expected allocation represents the fund's anticipated allocation at December 31, 2010. |

* Amount represents less than 0.1% |

Semiannual Report

VIP Freedom 2010 Portfolio

Investments June 30, 2010 (Unaudited)

Showing Percentage of Net Assets

Domestic Equity Funds - 37.5% |

| Shares | | Value |

Domestic Equity Funds - 37.5% |

VIP Contrafund Portfolio Initial Class | 399,553 | | $ 7,691,389 |

VIP Equity-Income Portfolio Initial Class | 573,803 | | 8,951,320 |

VIP Growth & Income Portfolio Initial Class | 878,271 | | 8,949,582 |

VIP Growth Portfolio Initial Class | 314,123 | | 8,958,780 |

VIP Mid Cap Portfolio Initial Class | 124,461 | | 3,218,551 |

VIP Value Portfolio Initial Class | 848,022 | | 7,683,079 |

VIP Value Strategies Portfolio Initial Class | 423,374 | | 3,209,173 |

TOTAL DOMESTIC EQUITY FUNDS (Cost $64,617,696) | 48,661,874 |

International Equity Funds - 12.0% |

| | | |

Developed International Equity Funds - 11.0% |

VIP Overseas Portfolio Initial Class | 1,095,013 | | 14,246,113 |

Emerging Markets Equity Funds - 1.0% |

VIP Emerging Markets Portfolio Initial Class | 174,423 | | 1,363,987 |

TOTAL INTERNATIONAL EQUITY FUNDS (Cost $21,264,936) | 15,610,100 |

Bond Funds - 40.1% |

| | | |

High Yield Bond Funds - 5.0% |

VIP High Income Portfolio Initial Class | 1,191,926 | | 6,519,837 |

Investment Grade Bond Funds - 35.1% |

VIP Investment Grade Bond Portfolio Initial Class | 3,461,062 | | 45,547,577 |

TOTAL BOND FUNDS (Cost $50,305,196) | 52,067,414 |

Short-Term Funds - 10.4% |

| | | |

VIP Money Market Portfolio Initial Class

(Cost $13,498,115) | 13,498,115 | | 13,498,115 |

TOTAL INVESTMENT PORTFOLIO - 100.0% (Cost $149,685,943) | | 129,837,503 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | | (21,856) |

NET ASSETS - 100% | $ 129,815,647 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

VIP Freedom 2010 Portfolio

Statement of Assets and Liabilities

| June 30, 2010 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (cost $149,685,943) - See accompanying schedule | | $ 129,837,503 |

Receivable for fund shares sold | | 1,424,384 |

Total assets | | 131,261,887 |

| | |

Liabilities | | |

Payable to custodian bank | $ 94 | |

Payable for investments purchased | 1,346,009 | |

Payable for fund shares redeemed | 79,479 | |

Distribution fees payable | 20,658 | |

Total liabilities | | 1,446,240 |

| | |

Net Assets | | $ 129,815,647 |

Net Assets consist of: | | |

Paid in capital | | $ 150,180,778 |

Accumulated net investment loss | | (60,468) |

Accumulated undistributed net realized gain (loss) on investments | | (456,223) |

Net unrealized appreciation (depreciation) on investments | | (19,848,440) |

Net Assets | | $ 129,815,647 |

| | |

Initial Class:

Net Asset Value, offering price and redemption price per share ($20,150,307 ÷ 2,102,130 shares) | | $ 9.59 |

| | |

Service Class:

Net Asset Value, offering price and redemption price per share ($18,566,772 ÷ 1,939,410 shares) | | $ 9.57 |

| | |

Service Class 2:

Net Asset Value, offering price and redemption price per share ($91,098,568 ÷ 9,551,289 shares) | | $ 9.54 |

Statement of Operations

Six months ended June 30, 2010 (Unaudited) |

| | |

Investment Income | | |

Income distributions from underlying funds | | $ 54,111 |

Interest | | 3 |

Total income | | 54,114 |

| | |

Expenses | | |

Distribution fees | $ 123,111 | |

Independent trustees' compensation | 223 | |

Total expenses before reductions | 123,334 | |

Expense reductions | (223) | 123,111 |

Net investment income (loss) | | (68,997) |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | 560,664 | |

Capital gain distributions from underlying funds | 14,069 | 574,733 |

Change in net unrealized appreciation (depreciation) on underlying funds | | (2,370,119) |

Net gain (loss) | | (1,795,386) |

Net increase (decrease) in net assets resulting from operations | | $ (1,864,383) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

| Six months ended June 30, 2010

(Unaudited) | Year ended

December 31, 2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (68,997) | $ 4,477,224 |

Net realized gain (loss) | 574,733 | 1,326,323 |

Change in net unrealized appreciation (depreciation) | (2,370,119) | 18,322,740 |

Net increase (decrease) in net assets resulting from operations | (1,864,383) | 24,126,287 |

Distributions to shareholders from net investment income | - | (4,479,938) |

Distributions to shareholders from net realized gain | (792,343) | (871,550) |

Total distributions | (792,343) | (5,351,488) |

Share transactions - net increase (decrease) | 4,247,425 | 980,260 |

Total increase (decrease) in net assets | 1,590,699 | 19,755,059 |

| | |

Net Assets | | |

Beginning of period | 128,224,948 | 108,469,889 |

End of period (including accumulated net investment loss of $60,468 and undistributed net investment income of $8,529, respectively) | $ 129,815,647 | $ 128,224,948 |

Financial Highlights - Initial Class

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.77 | $ 8.23 | $ 11.96 | $ 11.59 | $ 10.78 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | -I | .38 | .35 | .36 | .28 | .11 |

Net realized and unrealized gain (loss) | (.12) | 1.60 | (3.32) | .64 | .78 | .72 |

Total from investment operations | (.12) | 1.98 | (2.97) | 1.00 | 1.06 | .83 |

Distributions from net investment income | - | (.37) | (.31) | (.30) | (.20) | (.05) |

Distributions from net realized gain | (.06) | (.07) | (.45) | (.33) | (.05) | - |

Total distributions | (.06) | (.44) | (.76) | (.63) | (.25) | (.05) |

Net asset value, end of period | $ 9.59 | $ 9.77 | $ 8.23 | $ 11.96 | $ 11.59 | $ 10.78 |

Total ReturnB,C,D | (1.23)% | 24.27% | (25.05)% | 8.71% | 9.82% | 8.33% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .00%A | .00% | .00% | .00% | .00% | .00%A |

Expenses net of fee waivers, if any | .00%A | .00% | .00% | .00% | .00% | .00%A |

Expenses net of all reductions | .00%A | .00% | .00% | .00% | .00% | .00%A |

Net investment income (loss) | .08%A | 4.22% | 3.27% | 2.95% | 2.48% | 1.56%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 20,150 | $ 21,197 | $ 24,962 | $ 26,629 | $ 20,992 | $ 13,343 |

Portfolio turnover rate | 30%A | 28% | 34% | 21% | 24% | 24%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G For the period April 26, 2005 (commencement of operations) to December 31, 2005. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. I Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

VIP Freedom 2010 Portfolio

Financial Statements - continued

Financial Highlights - Service Class

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.77 | $ 8.23 | $ 11.95 | $ 11.58 | $ 10.77 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | -I | .37 | .33 | .35 | .27 | .10 |

Net realized and unrealized gain (loss) | (.14) | 1.60 | (3.30) | .64 | .78 | .72 |

Total from investment operations | (.14) | 1.97 | (2.97) | .99 | 1.05 | .82 |

Distributions from net investment income | - | (.36) | (.30) | (.29) | (.19) | (.05) |

Distributions from net realized gain | (.06) | (.07) | (.45) | (.33) | (.05) | - |

Total distributions | (.06) | (.43) | (.75) | (.62) | (.24) | (.05) |

Net asset value, end of period | $ 9.57 | $ 9.77 | $ 8.23 | $ 11.95 | $ 11.58 | $ 10.77 |

Total ReturnB,C,D | (1.43)% | 24.15% | (25.08)% | 8.65% | 9.78% | 8.17% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .10%A | .10% | .10% | .10% | .10% | .10%A |

Expenses net of fee waivers, if any | .10%A | .10% | .10% | .10% | .10% | .10%A |

Expenses net of all reductions | .10%A | .10% | .10% | .10% | .10% | .10%A |

Net investment income (loss) | (.02)%A | 4.12% | 3.17% | 2.85% | 2.39% | 1.46%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 18,567 | $ 19,238 | $ 17,137 | $ 19,295 | $ 5,984 | $ 764 |

Portfolio turnover rate | 30%A | 28% | 34% | 21% | 24% | 24%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G For the period April 26, 2005 (commencement of operations) to December 31, 2005. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. I Amount represents less than $.01 per share. |

Financial Highlights - Service Class 2

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.74 | $ 8.21 | $ 11.92 | $ 11.56 | $ 10.76 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | (.01) | .35 | .32 | .33 | .25 | .09 |

Net realized and unrealized gain (loss) | (.13) | 1.60 | (3.29) | .64 | .78 | .72 |

Total from investment operations | (.14) | 1.95 | (2.97) | .97 | 1.03 | .81 |

Distributions from net investment income | - | (.35) | (.29) | (.28) | (.18) | (.05) |

Distributions from net realized gain | (.06) | (.07) | (.45) | (.33) | (.05) | - |

Total distributions | (.06) | (.42) | (.74) | (.61) | (.23) | (.05) |

Net asset value, end of period | $ 9.54 | $ 9.74 | $ 8.21 | $ 11.92 | $ 11.56 | $ 10.76 |

Total ReturnB,C,D | (1.44)% | 23.95% | (25.17)% | 8.42% | 9.58% | 8.07% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .25%A | .25% | .25% | .25% | .25% | .25%A |

Expenses net of fee waivers, if any | .25%A | .25% | .25% | .25% | .25% | .25%A |

Expenses net of all reductions | .25%A | .25% | .25% | .25% | .25% | .25%A |

Net investment income (loss) | (.17)%A | 3.97% | 3.02% | 2.70% | 2.24% | 1.31%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 91,099 | $ 87,791 | $ 66,370 | $ 62,510 | $ 38,662 | $ 9,702 |

Portfolio turnover rate | 30%A | 28% | 34% | 21% | 24% | 24%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G For the period April 26, 2005 (commencement of operations) to December 31, 2005. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

VIP Freedom 2015 Portfolio

Investment Changes (Unaudited)

Fund Holdings as of June 30, 2010 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Domestic Equity Funds | | |

VIP Contrafund Portfolio Initial Class | 6.1 | 6.7 |

VIP Equity-Income Portfolio Initial Class | 7.1 | 7.7 |

VIP Growth & Income Portfolio Initial Class | 7.1 | 7.8 |

VIP Growth Portfolio Initial Class | 7.1 | 7.9 |

VIP Mid Cap Portfolio Initial Class | 2.6 | 2.8 |

VIP Value Portfolio Initial Class | 6.1 | 6.8 |

VIP Value Strategies Portfolio Initial Class | 2.5 | 2.8 |

| 38.6 | 42.5 |

Developed International Equity Funds | | |

VIP Overseas Portfolio Initial Class | 11.3 | 10.3 |

Emerging Markets Equity Funds | | |

VIP Emerging Markets Portfolio Initial Class | 1.1 | 0.0 |

High Yield Bond Funds | | |

VIP High Income Portfolio Initial Class | 5.1 | 5.3 |

Investment Grade Bond Funds | | |

VIP Investment Grade Bond Portfolio Initial Class | 34.6 | 33.4 |

Short-Term Funds | | |

VIP Money Market Portfolio Initial Class | 9.3 | 8.5 |

Net Other Assets | | |

Net Other Assets | 0.0* | 0.0* |

| 100.0 | 100.0 |

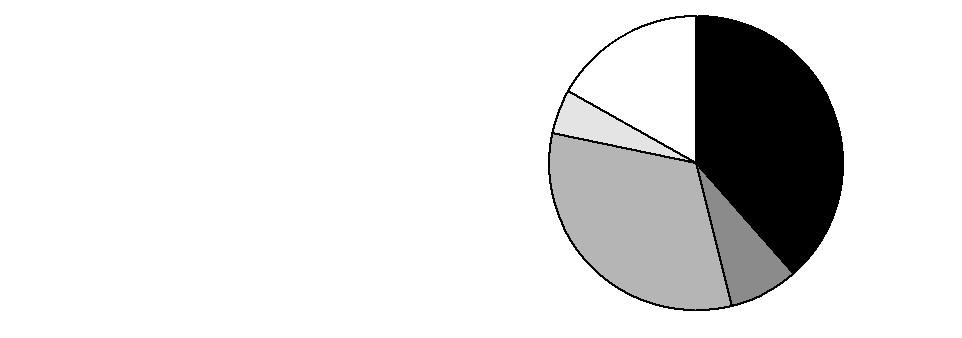

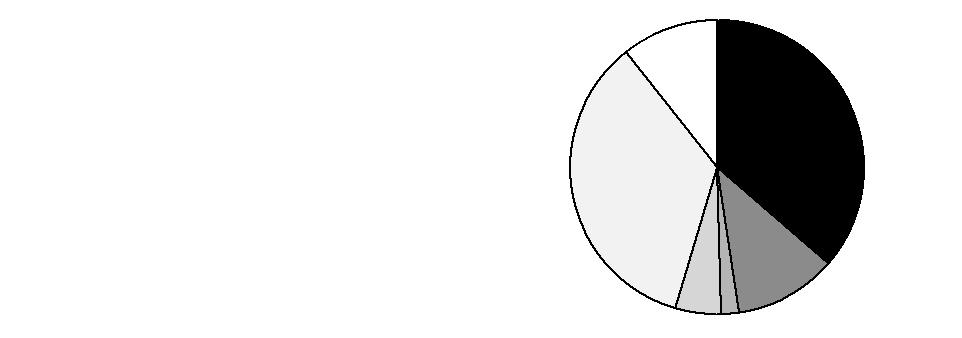

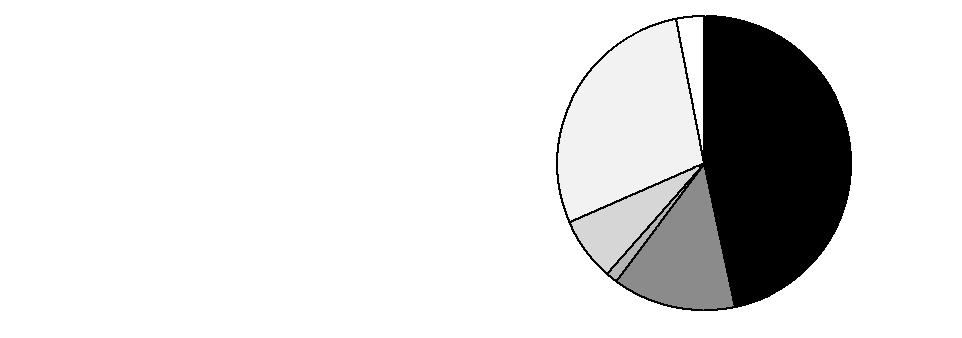

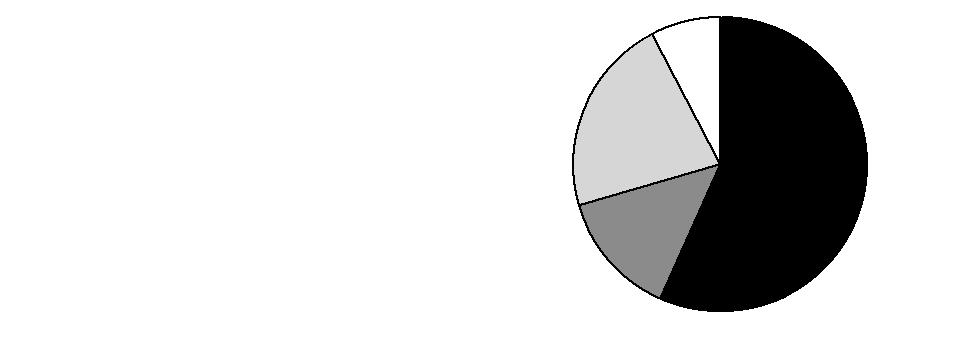

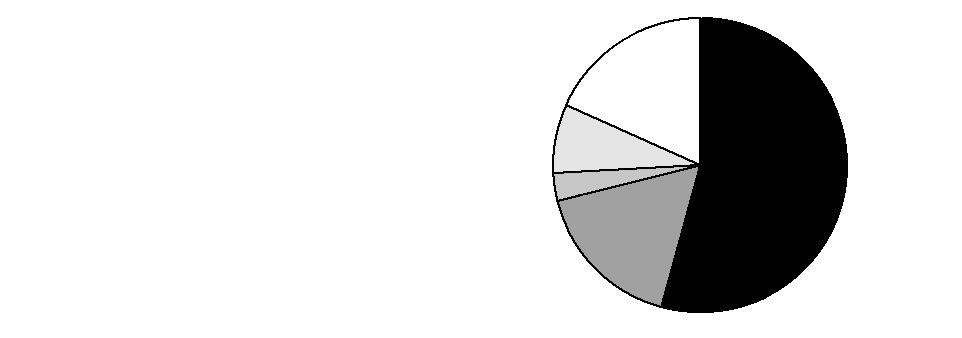

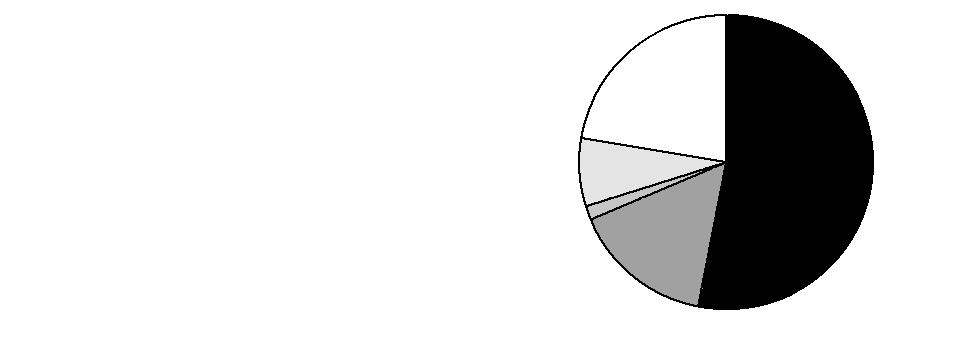

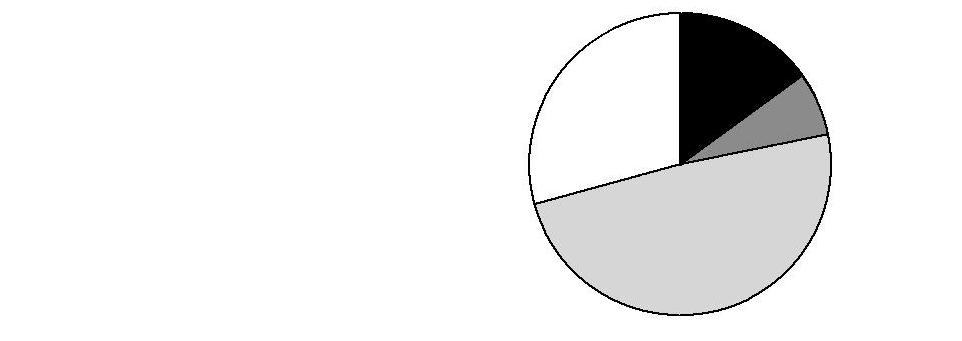

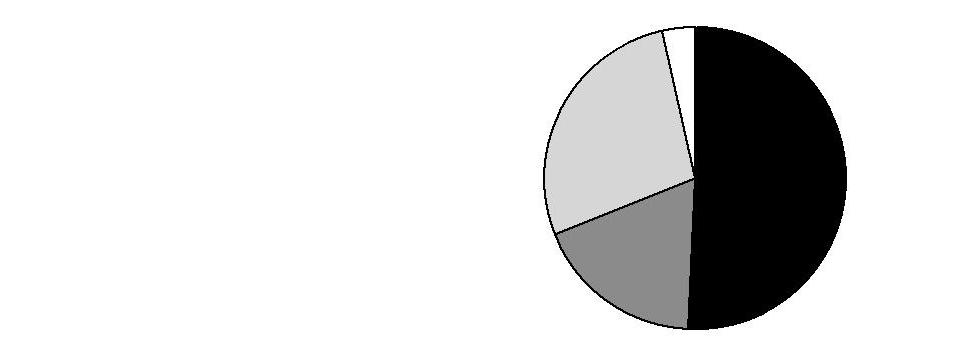

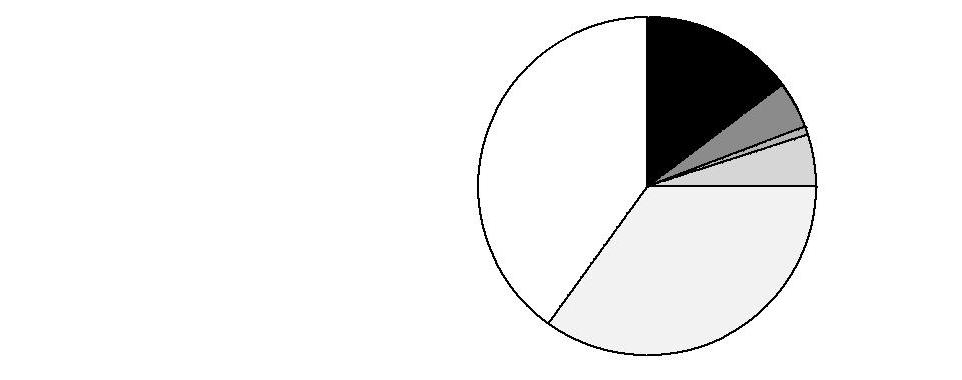

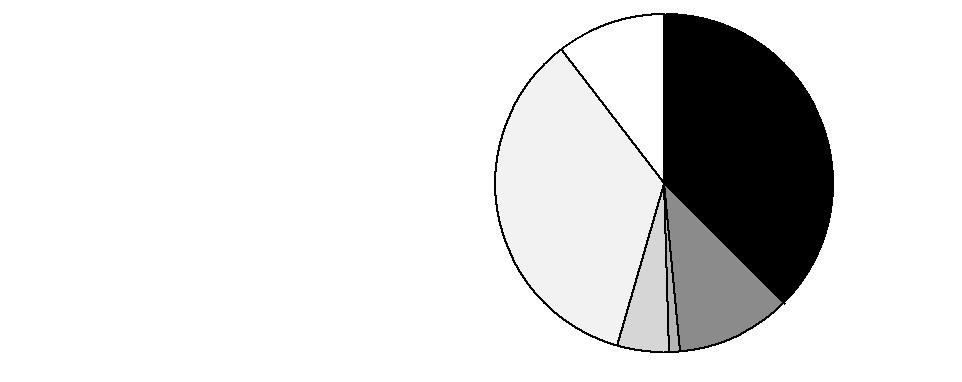

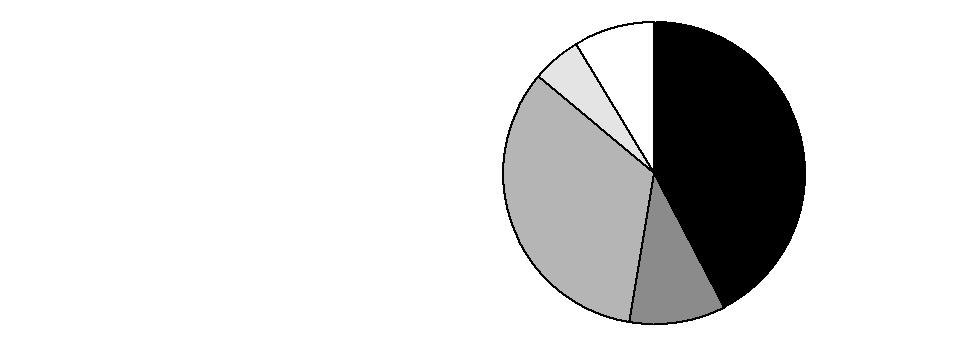

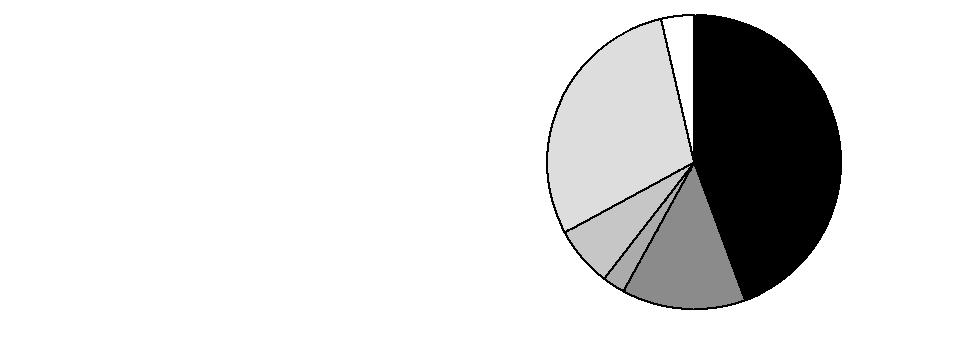

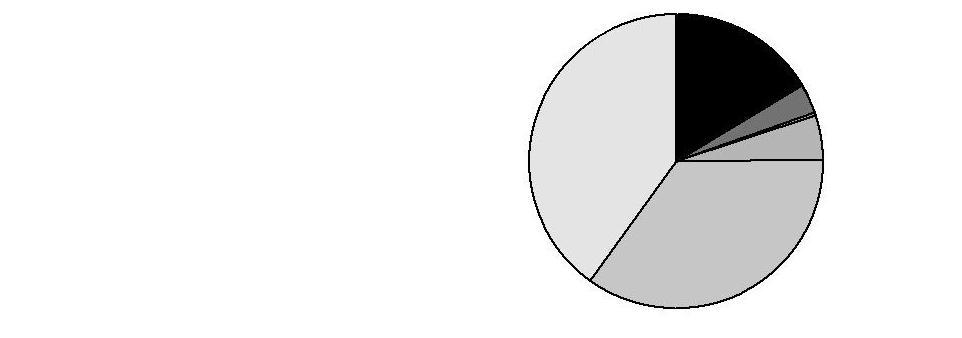

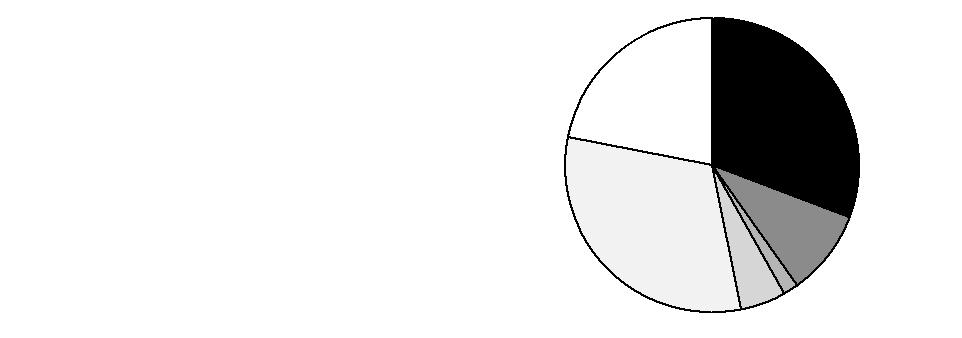

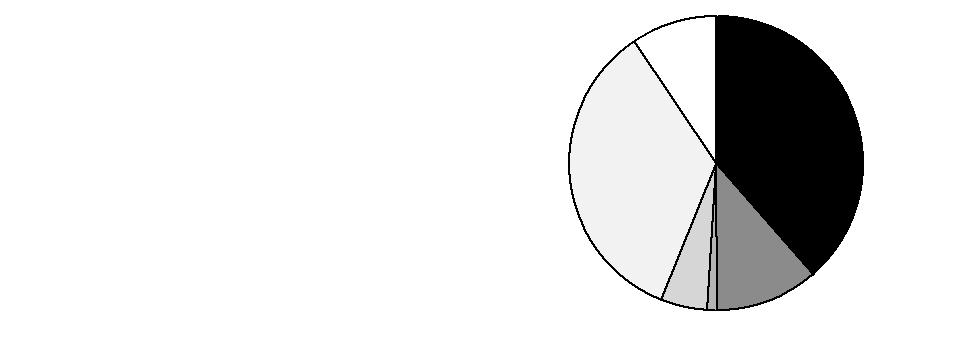

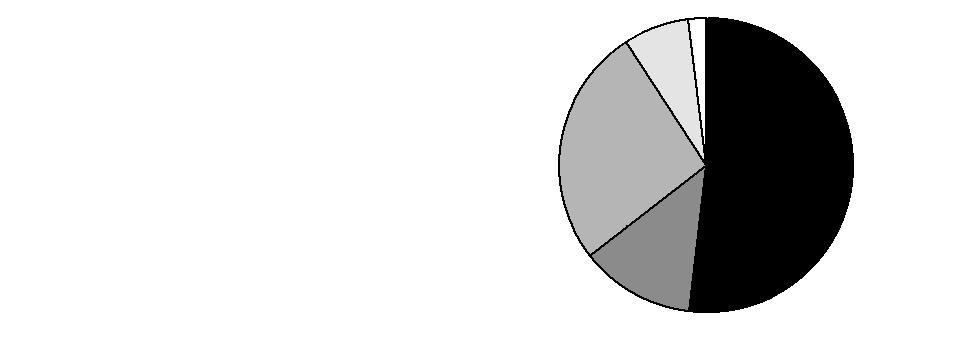

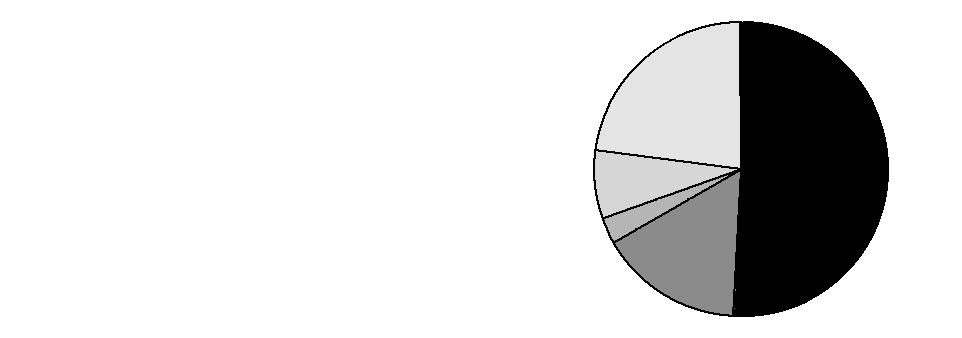

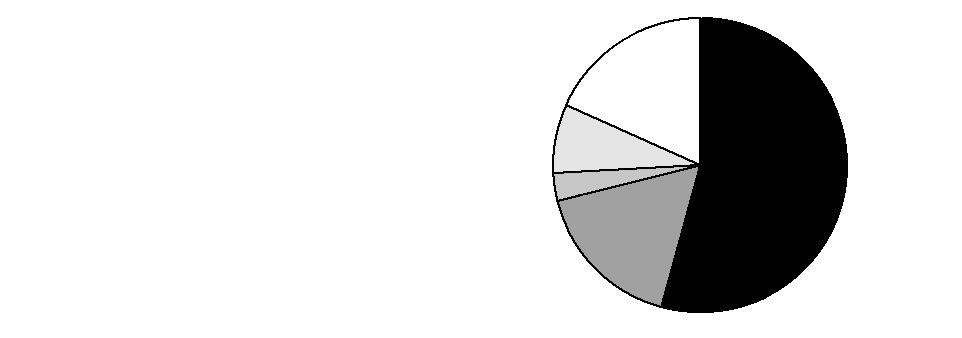

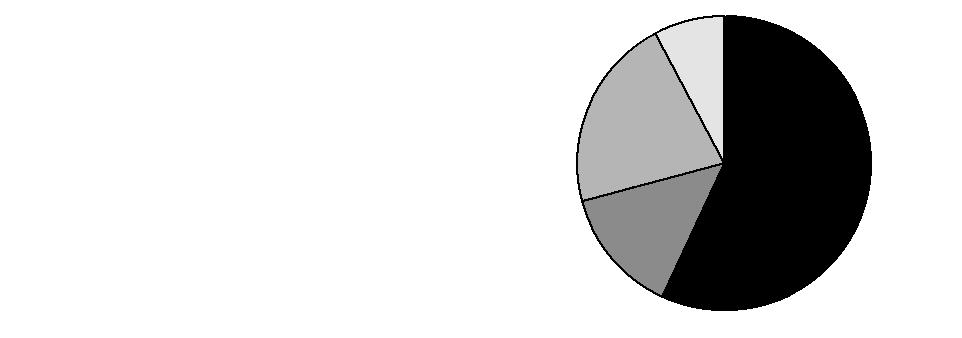

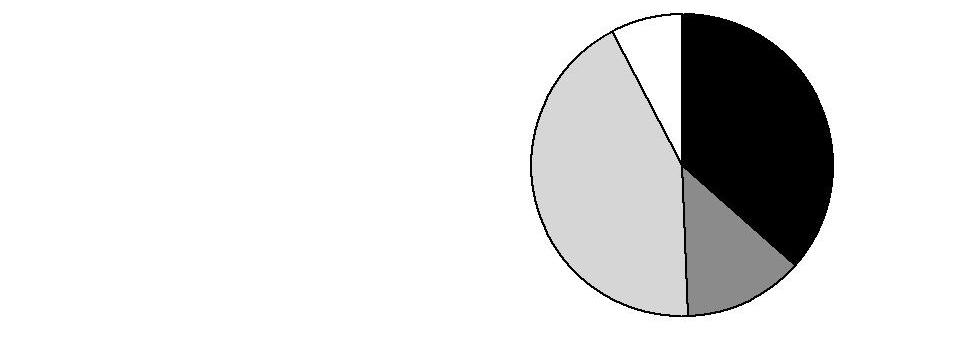

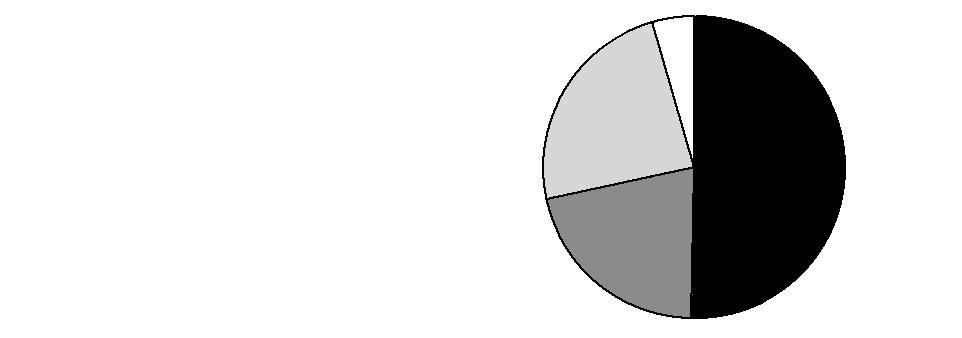

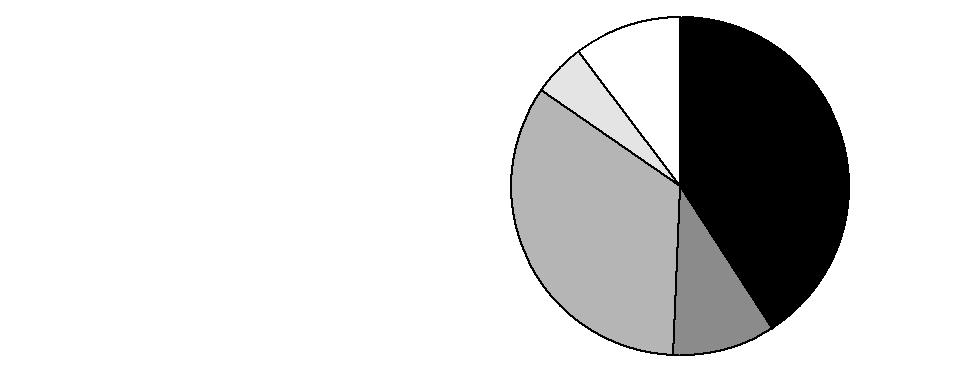

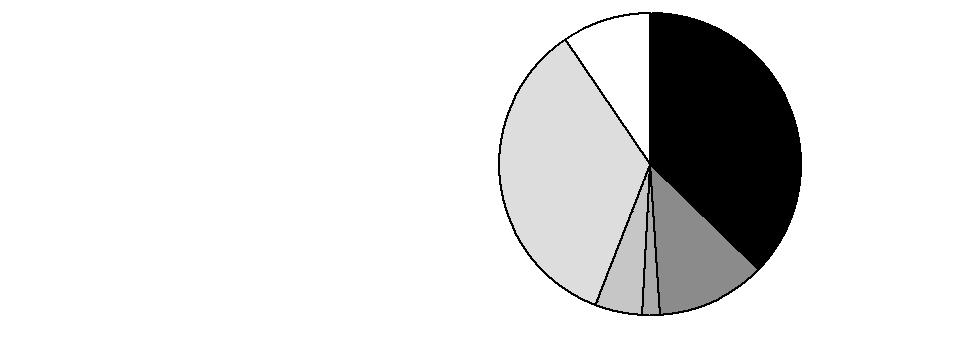

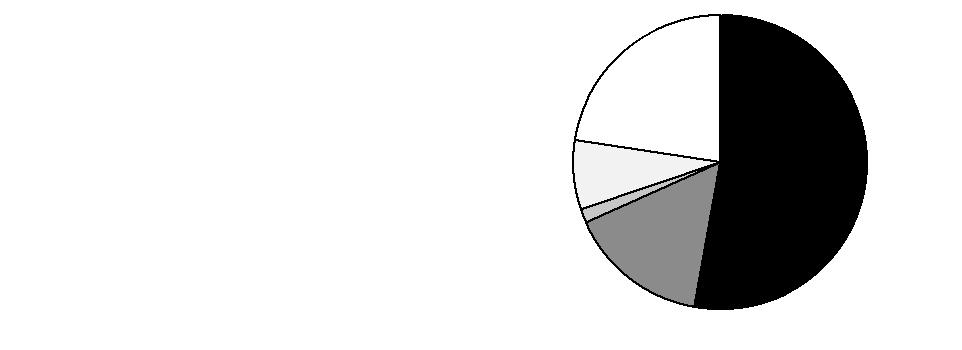

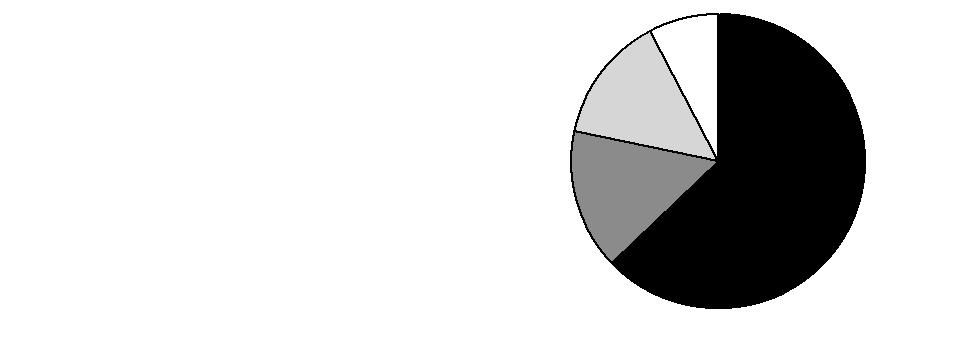

Asset Allocation (% of fund's net assets) |

Current |

| Domestic Equity Funds | 38.6% | |

| Developed International Equity Funds | 11.3% | |

| Emerging Markets Equity Funds | 1.1% | |

| High Yield Bond Funds | 5.1% | |

| Investment Grade Bond Funds | 34.6% | |

| Short-Term Funds | 9.3% | |

Six months ago |

| Domestic Equity Funds | 42.5% | |

| Developed International Equity Funds | 10.3% | |

| Investment Grade Bond Funds | 33.4% | |

| High Yield Bond Funds | 5.3% | |

| Short-Term Funds | 8.5% | |

Expected |

| Domestic Equity Funds | 37.3% | |

| Developed International Equity Funds | 11.6% | |

| Emerging Markets Equity Funds | 2.0% | |

| High Yield Bond Funds | 5.1% | |

| Investment Grade Bond Funds | 34.6% | |

| Short-Term Funds | 9.4% | |

The fund invests according to an asset allocation strategy that becomes increasingly conservative over time. The six months ago allocation is based on the fund's holdings as of December 31, 2009. The current allocation is based on the fund's holdings as of June 30, 2010. The expected allocation represents the fund's anticipated allocation at December 31, 2010. |

* Amount represents less than 0.1% |

Semiannual Report

VIP Freedom 2015 Portfolio

Investments June 30, 2010 (Unaudited)

Showing Percentage of Net Assets

Domestic Equity Funds - 38.6% |

| Shares | | Value |

Domestic Equity Funds - 38.6% |

VIP Contrafund Portfolio Initial Class | 265,326 | | $ 5,107,531 |

VIP Equity-Income Portfolio Initial Class | 381,054 | | 5,944,444 |

VIP Growth & Income Portfolio Initial Class | 583,246 | | 5,943,278 |

VIP Growth Portfolio Initial Class | 208,606 | | 5,949,451 |

VIP Mid Cap Portfolio Initial Class | 82,477 | | 2,132,865 |

VIP Value Portfolio Initial Class | 563,130 | | 5,101,954 |

VIP Value Strategies Portfolio Initial Class | 280,552 | | 2,126,585 |

TOTAL DOMESTIC EQUITY FUNDS (Cost $40,115,730) | 32,306,108 |

International Equity Funds - 12.4% |

| | | |

Developed International Equity Funds - 11.3% |

VIP Overseas Portfolio Initial Class | 728,914 | | 9,483,165 |

Emerging Markets Equity Funds - 1.1% |

VIP Emerging Markets Portfolio Initial Class | 116,715 | | 912,710 |

TOTAL INTERNATIONAL EQUITY FUNDS (Cost $13,392,384) | 10,395,875 |

Bond Funds - 39.7% |

| | | |

High Yield Bond Funds - 5.1% |

VIP High Income Portfolio Initial Class | 785,240 | | 4,295,264 |

Investment Grade Bond Funds - 34.6% |

VIP Investment Grade Bond Portfolio Initial Class | 2,198,487 | | 28,932,092 |

TOTAL BOND FUNDS (Cost $31,990,867) | 33,227,356 |

Short-Term Funds - 9.3% |

| | | |

VIP Money Market Portfolio Initial Class

(Cost $7,751,146) | 7,751,146 | | 7,751,146 |

TOTAL INVESTMENT PORTFOLIO - 100.0% (Cost $93,250,127) | | 83,680,485 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | | (8,769) |

NET ASSETS - 100% | $ 83,671,716 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

VIP Freedom 2015 Portfolio

Statement of Assets and Liabilities

| June 30, 2010 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (cost $93,250,127) - See accompanying schedule | | $ 83,680,485 |

Receivable for investments sold | | 1,107 |

Receivable for fund shares sold | | 8,847 |

Receivable from investment adviser for expense reductions | | 13 |

Total assets | | 83,690,452 |

| | |

Liabilities | | |

Payable to custodian bank | $ 83 | |

Payable for investments purchased | 1,576 | |

Payable for fund shares redeemed | 7,145 | |

Distribution fees payable | 9,932 | |

Total liabilities | | 18,736 |

| | |

Net Assets | | $ 83,671,716 |

Net Assets consist of: | | |

Paid in capital | | $ 93,702,223 |

Accumulated net investment loss | | (14,913) |

Accumulated undistributed net realized gain (loss) on investments | | (445,952) |

Net unrealized appreciation (depreciation) on investments | | (9,569,642) |

Net Assets | | $ 83,671,716 |

| | |

Initial Class:

Net Asset Value, offering price and redemption price per share ($35,840,316 ÷ 3,733,785 shares) | | $ 9.60 |

| | |

Service Class:

Net Asset Value, offering price and redemption price per share ($1,916,819 ÷ 199,854 shares) | | $ 9.59 |

| | |

Service Class 2:

Net Asset Value, offering price and redemption price per share ($45,914,581 ÷ 4,806,794 shares) | | $ 9.55 |

Statement of Operations

Six months ended June 30, 2010 (Unaudited) |

| | |

Investment Income | | |

Income distributions from underlying funds | | $ 33,641 |

Interest | | 1 |

Total income | | 33,642 |

| | |

Expenses | | |

Distribution fees | $ 58,332 | |

Independent trustees' compensation | 143 | |

Total expenses before reductions | 58,475 | |

Expense reductions | (143) | 58,332 |

Net investment income (loss) | | (24,690) |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | 97,657 | |

Capital gain distributions from underlying funds | 9,367 | 107,024 |

Change in net unrealized appreciation (depreciation) on underlying funds | | (1,474,604) |

Net gain (loss) | | (1,367,580) |

Net increase (decrease) in net assets resulting from operations | | $ (1,392,270) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

| Six months ended June 30, 2010

(Unaudited) | Year ended

December 31, 2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (24,690) | $ 2,636,979 |

Net realized gain (loss) | 107,024 | 778,497 |

Change in net unrealized appreciation (depreciation) | (1,474,604) | 11,395,277 |

Net increase (decrease) in net assets resulting from operations | (1,392,270) | 14,810,753 |

Distributions to shareholders from net investment income | - | (2,643,534) |

Distributions to shareholders from net realized gain | (294,722) | (904,007) |

Total distributions | (294,722) | (3,547,541) |

Share transactions - net increase (decrease) | 4,009,227 | 17,317,820 |

Total increase (decrease) in net assets | 2,322,235 | 28,581,032 |

| | |

Net Assets | | |

Beginning of period | 81,349,481 | 52,768,449 |

End of period (including accumulated net investment loss of $14,913 and undistributed net investment income of $9,777, respectively) | $ 83,671,716 | $ 81,349,481 |

Financial Highlights - Initial Class

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.78 | $ 8.19 | $ 12.29 | $ 11.93 | $ 10.95 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | -I | .38 | .33 | .37 | .27 | .11 |

Net realized and unrealized gain (loss) | (.14) | 1.67 | (3.61) | .73 | .94 | .90 |

Total from investment operations | (.14) | 2.05 | (3.28) | 1.10 | 1.21 | 1.01 |

Distributions from net investment income | - | (.34) | (.30) | (.36) | (.14) | (.06) |

Distributions from net realized gain | (.04) | (.12) | (.52) | (.38) | (.09) | - |

Total distributions | (.04) | (.46) | (.82)J | (.74) | (.23) | (.06) |

Net asset value, end of period | $ 9.60 | $ 9.78 | $ 8.19 | $ 12.29 | $ 11.93 | $ 10.95 |

Total ReturnB,C,D | (1.48)% | 25.28% | (27.03)% | 9.33% | 11.04% | 10.11% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .00%A | .00% | .00% | .00% | .00% | .00%A |

Expenses net of fee waivers, if any | .00%A | .00% | .00% | .00% | .00% | .00%A |

Expenses net of all reductions | .00%A | .00% | .00% | .00% | .00% | .00%A |

Net investment income (loss) | .08%A | 4.21% | 3.11% | 2.93% | 2.34% | 1.50%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 35,840 | $ 37,291 | $ 25,977 | $ 33,780 | $ 23,712 | $ 13,930 |

Portfolio turnover rate | 32%A | 23% | 27% | 18% | 24% | 38%A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Amounts do not include the activity of the underlying funds. G For the period April 26, 2005 (commencement of operations) to December 31, 2005. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class but do not include expenses of the investment companies in which the Fund invests. I Amount represents less than $.01 per share. J Total distributions of $.82 per share is comprised of distributions from net investment income of $.302 and distributions from net realized gain of $.515 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Service Class

| Six months ended

June 30, 2010 | Years ended December 31, |

| (Unaudited) | 2009 | 2008 | 2007 | 2006 | 2005G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.77 | $ 8.19 | $ 12.29 | $ 11.93 | $ 10.95 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss)E | -I | .37 | .31 | .35 | .26 | .10 |

Net realized and unrealized gain (loss) | (.14) | 1.66 | (3.60) | .74 | .94 | .90 |

Total from investment operations | (.14) | 2.03 | (3.29) | 1.09 | 1.20 | 1.00 |

Distributions from net investment income | - | (.33) | (.29) | (.35) | (.13) | (.05) |

Distributions from net realized gain | (.04) | (.12) | (.52) | (.38) | (.09) | - |

Total distributions | (.04) | (.45) | (.81)J | (.73) | (.22) | (.05) |

Net asset value, end of period | $ 9.59 | $ 9.77 | $ 8.19 | $ 12.29 | $ 11.93 | $ 10.95 |

Total ReturnB,C,D | (1.48)% | 25.06% | (27.10)% | 9.23% | 10.94% | 10.04% |

Ratios to Average Net AssetsF,H | | | | | | |

Expenses before reductions | .10%A | .10% | .10% | .10% | .10% | .10%A |

Expenses net of fee waivers, if any | .10%A | .10% | .10% | .10% | .10% | .10%A |

Expenses net of all reductions | .10%A | .10% | .10% | .10% | .10% | .10%A |

Net investment income (loss) | (.02)%A | 4.12% | 3.01% | 2.83% | 2.24% | 1.40%A |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 1,917 | $ 1,524 | $ 936 | $ 477 | $ 427 | $ 385 |

Portfolio turnover rate | 32%A | 23% | 27% | 18% | 24% | 38%A |