UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5361

Variable Insurance Products Fund V

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2011 |

This report on Form N-CSR relates solely to the Registrant's Asset Manager Portfolio, Asset Manager: Growth Portfolio, Freedom 2005 Portfolio, Freedom 2010 Portfolio, Freedom 2015 Portfolio, Freedom 2020 Portfolio, Freedom 2025 Portfolio, Freedom 2030 Portfolio, Freedom 2035 Portfolio, Freedom 2040 Portfolio, Freedom 2045 Portfolio, Freedom 2050 Portfolio, Freedom Income Portfolio, Freedom Lifetime Income I Portfolio, Freedom Lifetime Income II Portfolio, Freedom Lifetime Income III Portfolio, FundsManager 20% Portfolio, FundsManager 50% Portfolio, FundsManager 60%, FundsManager 70% Portfolio, FundsManager 85% Portfolio, Investment Grade Bond Portfolio, Investor Freedom 2005 Portfolio, Investor Freedom 2010 Portfolio, Investor Freedom 2015 Portfolio, Investor Freedom 2020 Portfolio, Investor Freedom 2025 Portfolio, Investor Freedom 2030 Portfolio, Investor Freedom Income Portfolio and Strategic Income Portfolio series (each, a "Fund" and collectively, the "Funds").

Item 1. Reports to Stockholders

Fidelity® Variable Insurance Products:

Asset Manager Portfolio

Annual Report

December 31, 2011

Contents

Performance | (Click Here) | How the fund has done over time. |

Management's Discussion of Fund Performance | (Click Here) | The Portfolio Manager's review of fund performance and strategy. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

Trustees and Officers | (Click Here) | |

Distributions | (Click Here) | |

Board Approval of Investment Advisory Contracts and Management Fees | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

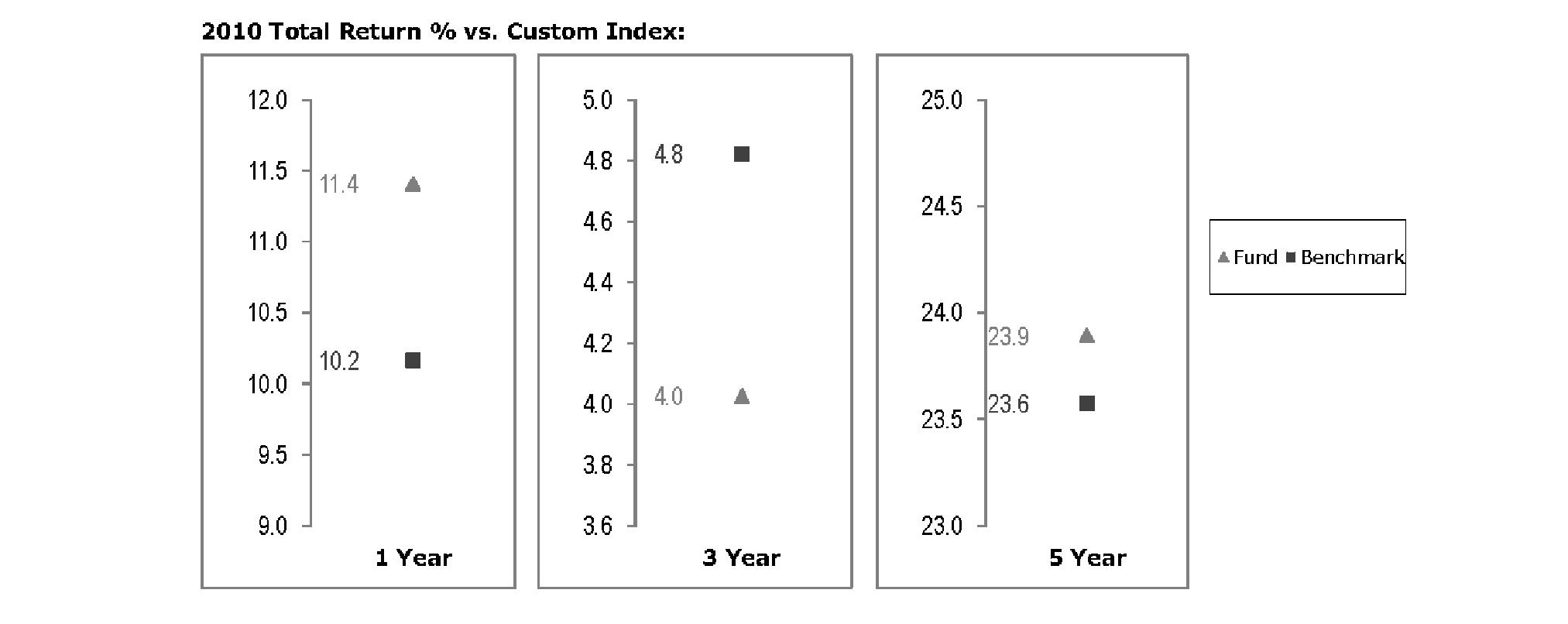

Annual Report

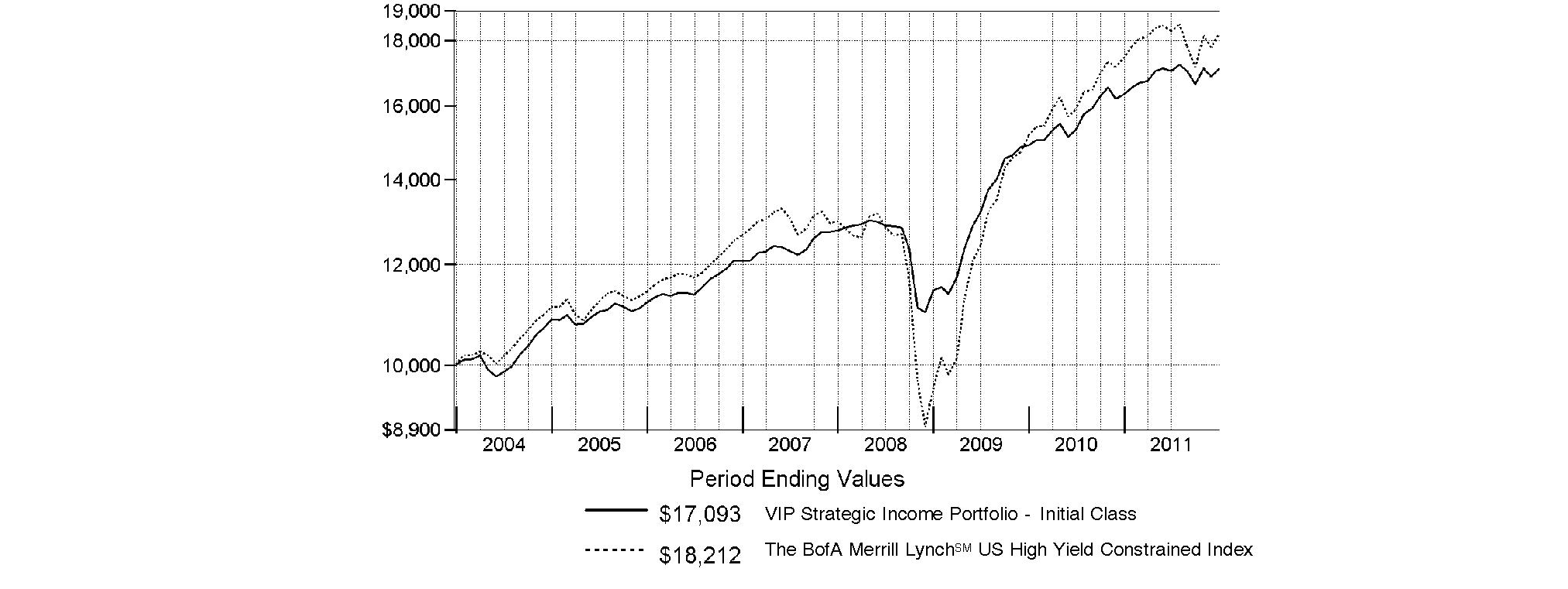

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

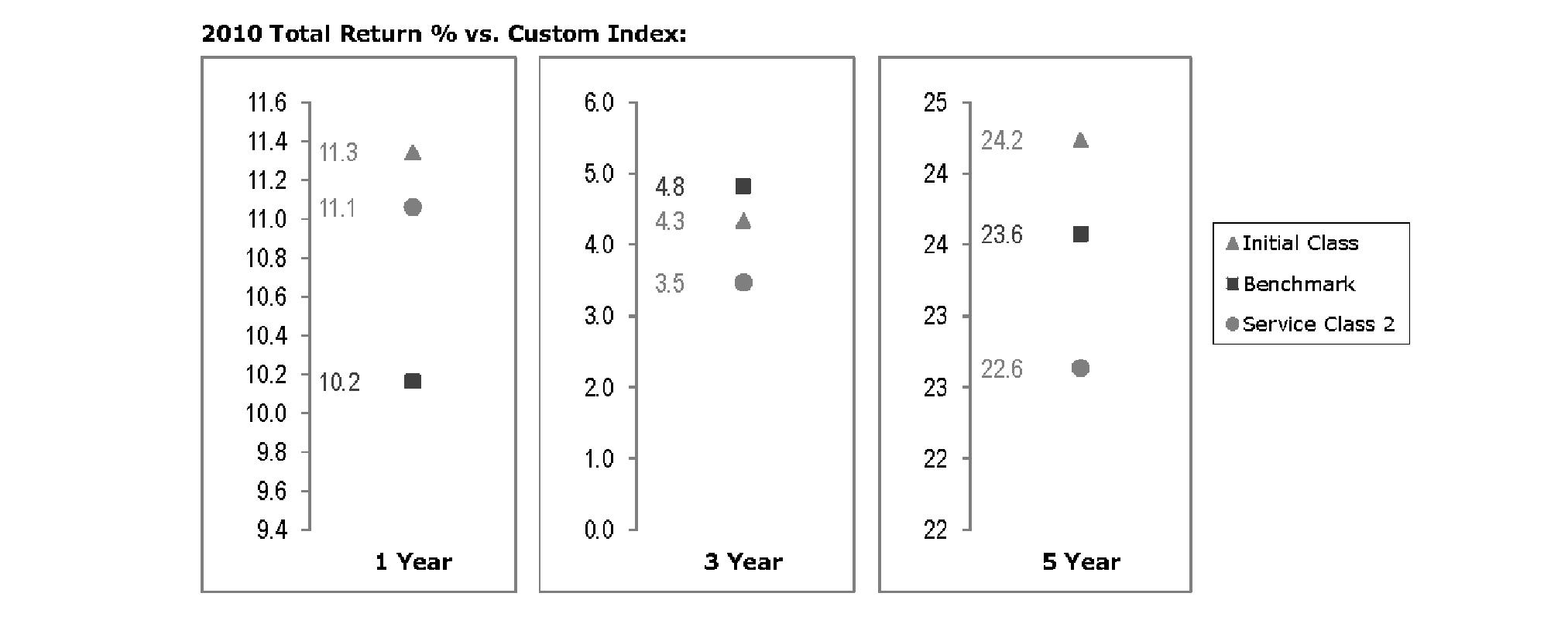

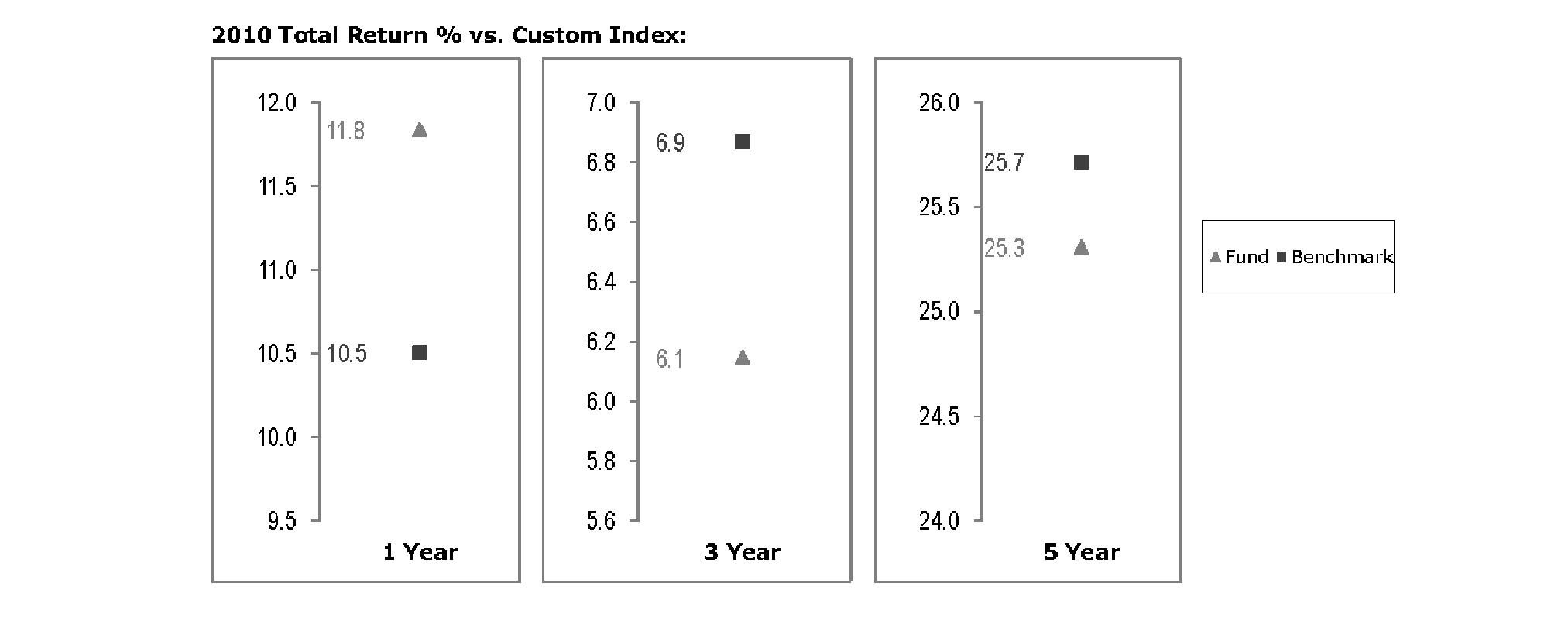

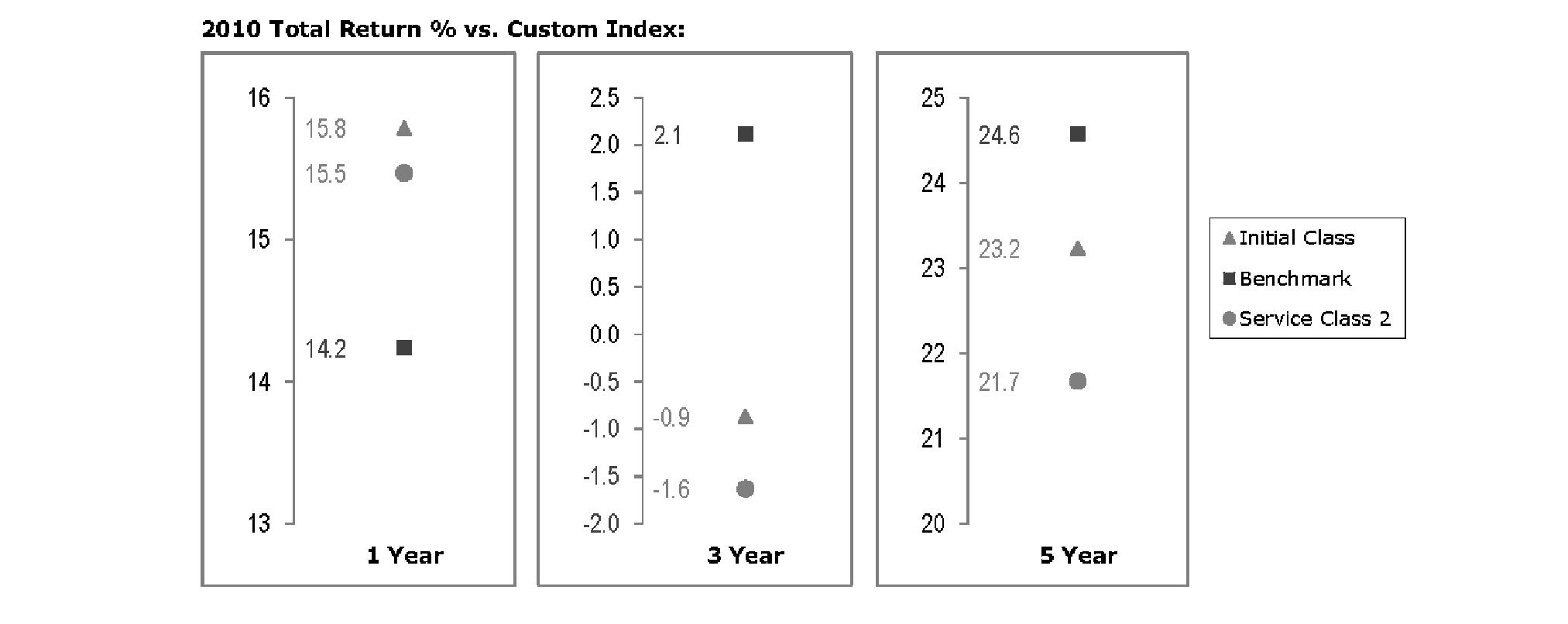

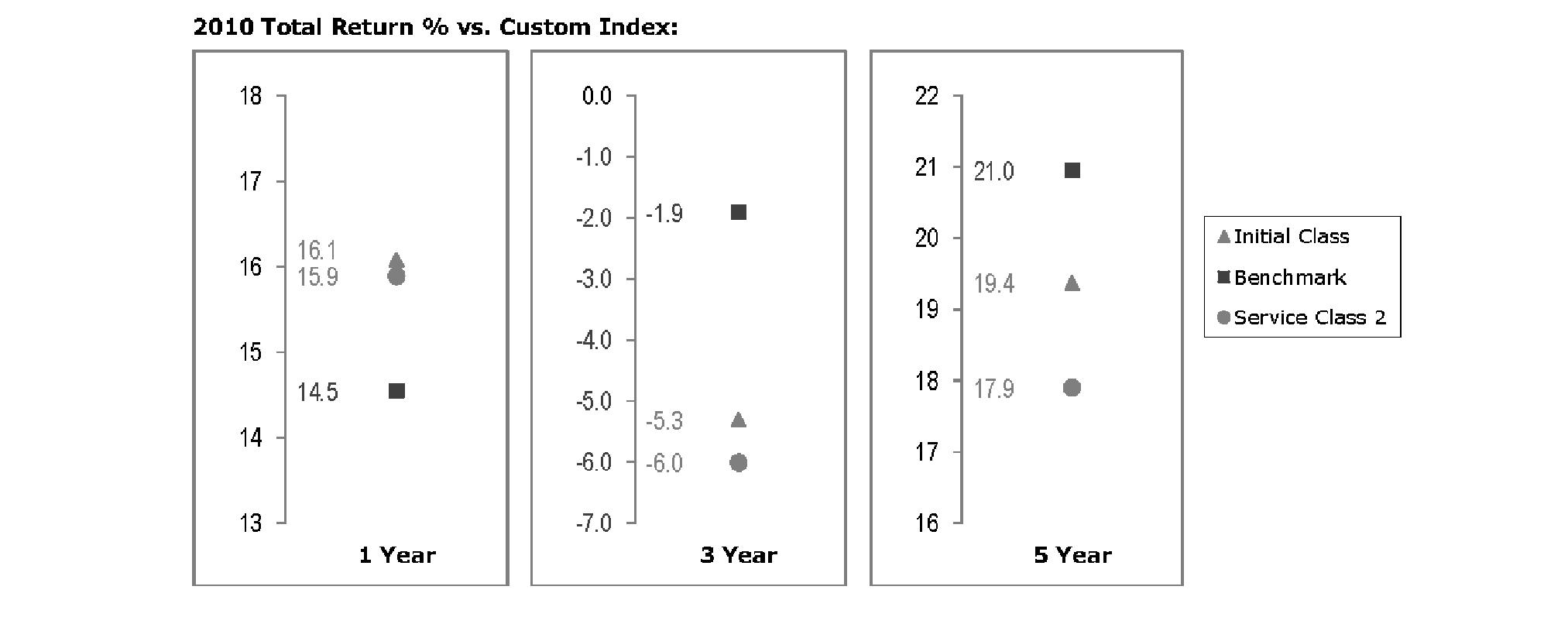

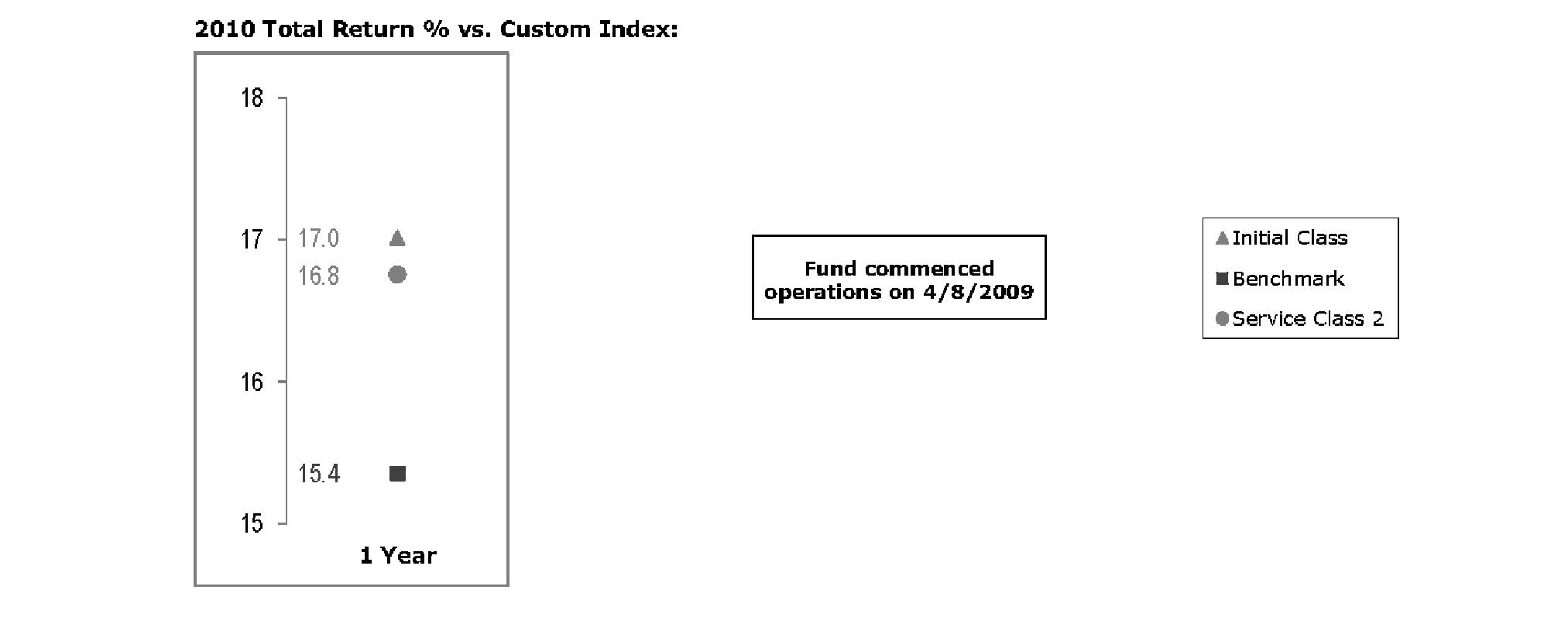

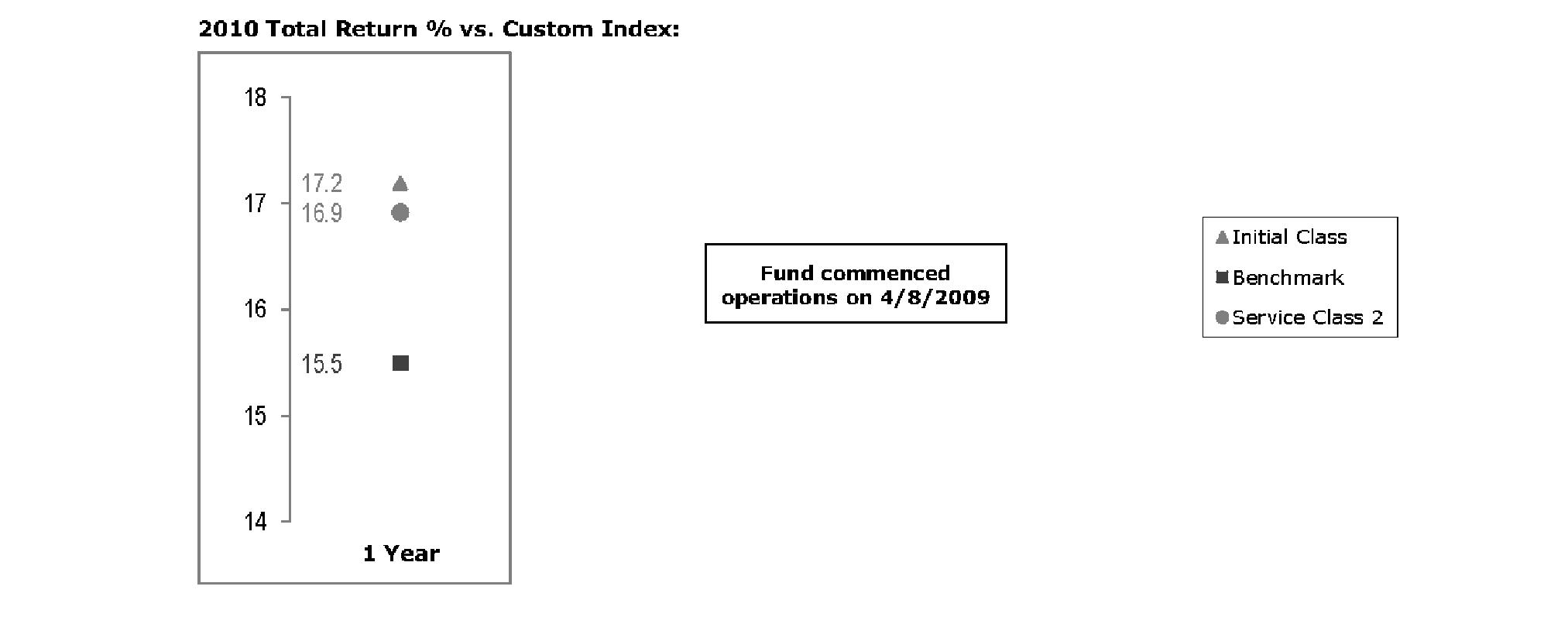

Average Annual Total Returns

Periods ended December 31, 2011 | Past 1

year | Past 5

years | Past 10

years |

VIP Asset Manager Portfolio - Initial Class | -2.56% | 3.43% | 4.14% |

VIP Asset Manager Portfolio - Service Class | -2.69% | 3.30% | 4.03% |

VIP Asset Manager Portfolio - Service Class 2 | -2.82% | 3.15% | 3.87% |

VIP Asset Manager Portfolio - Investor Class A | -2.72% | 3.32% | 4.06% |

A The initial offering of Investor Class shares took place on July 21, 2005. Returns prior to July 21, 2005 are those of Initial Class. Had Investor Class's transfer agent fee been reflected, returns prior to July 21, 2005 would have been lower.

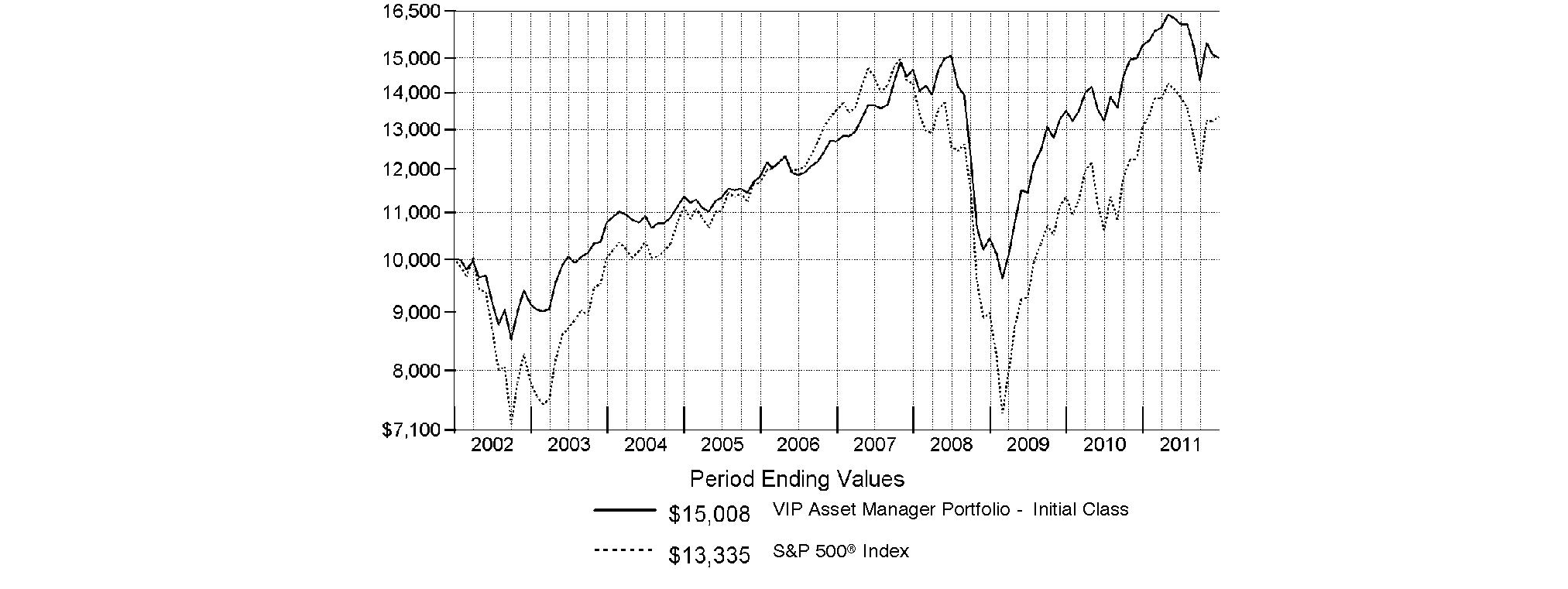

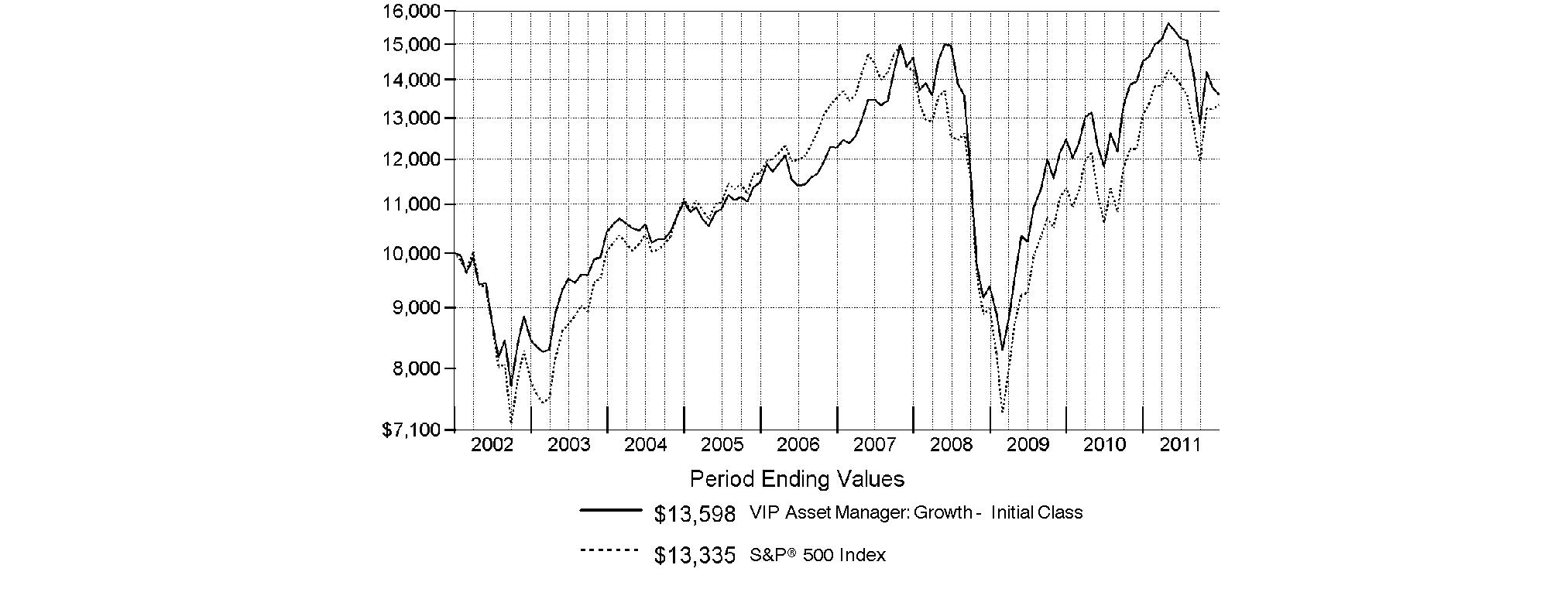

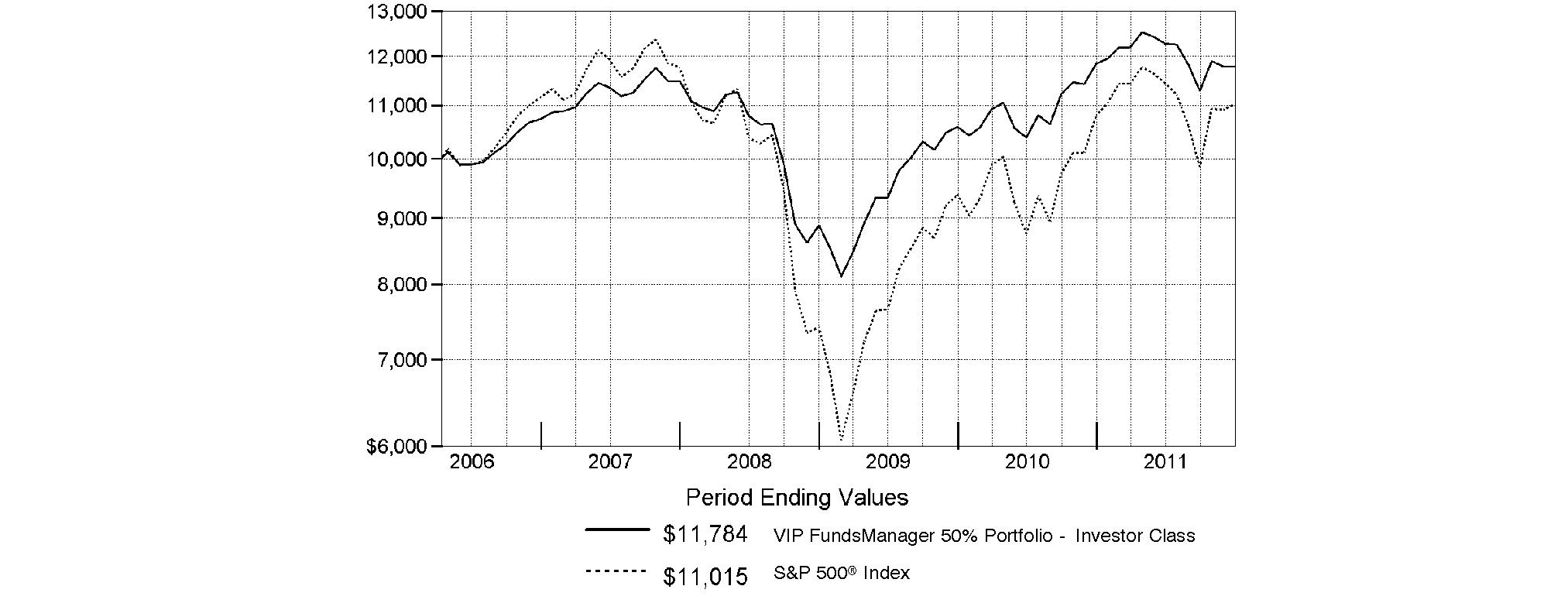

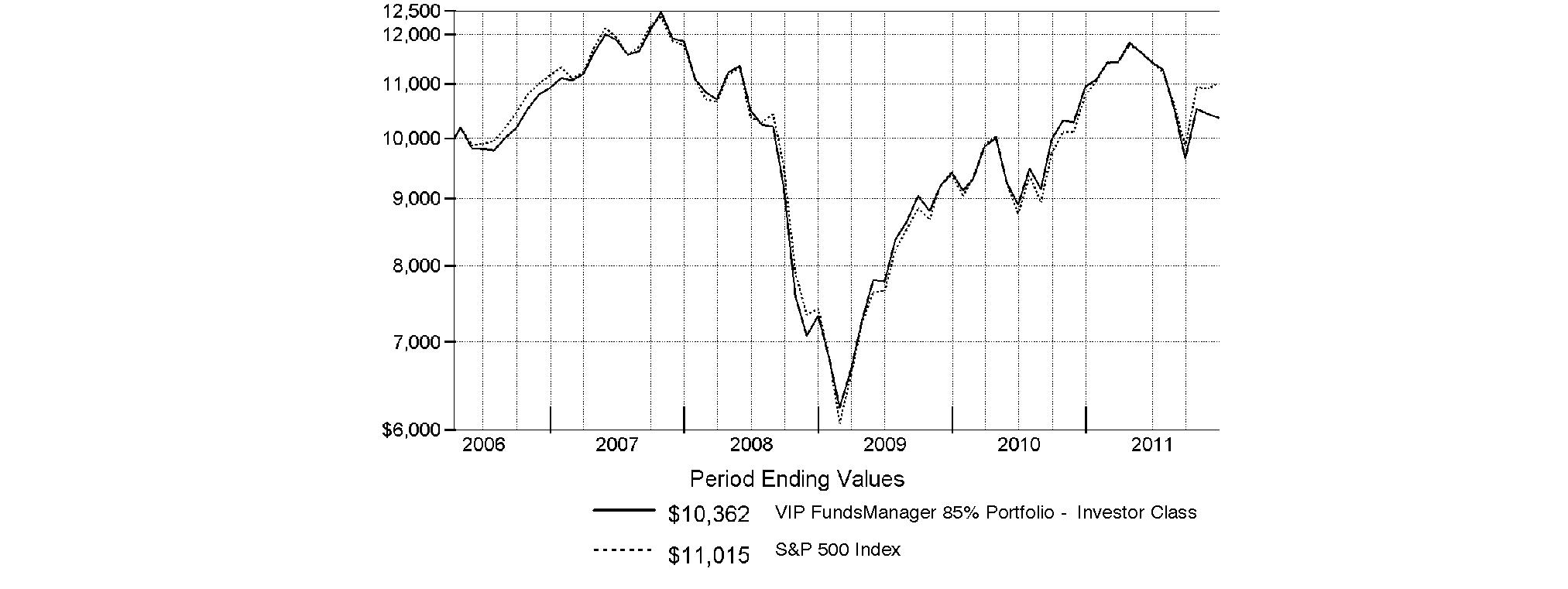

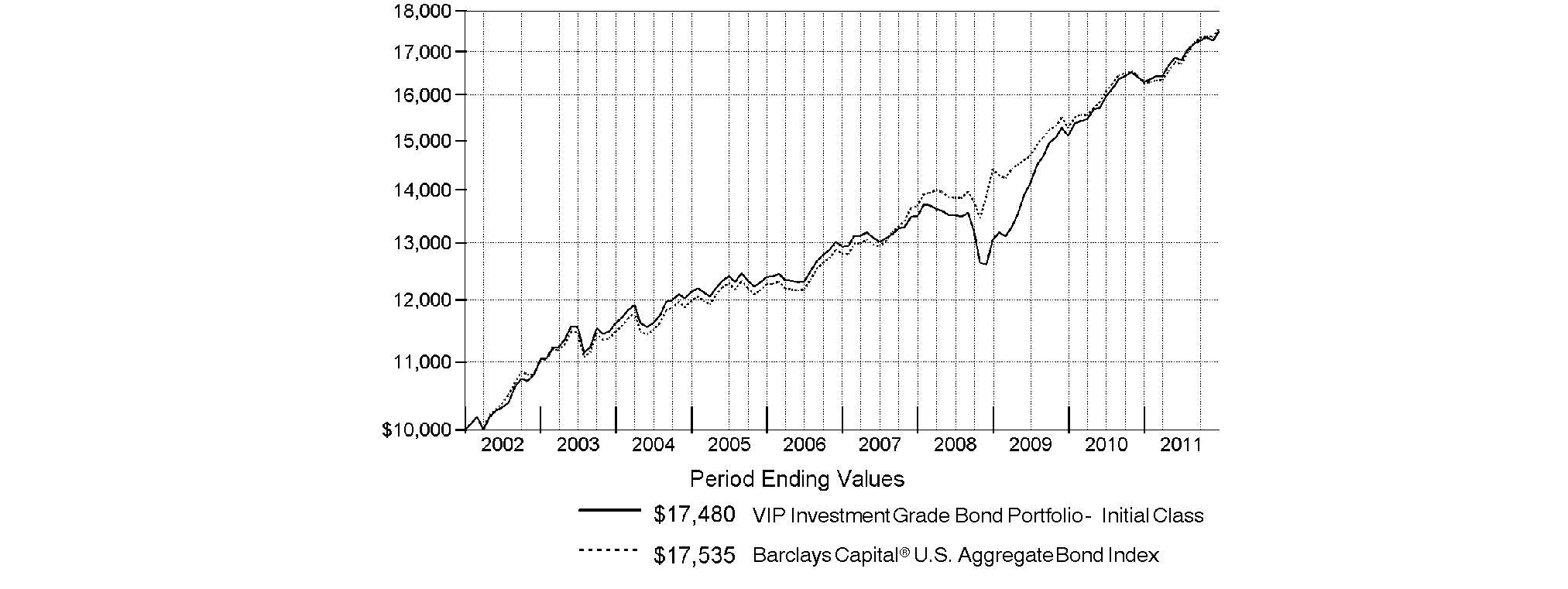

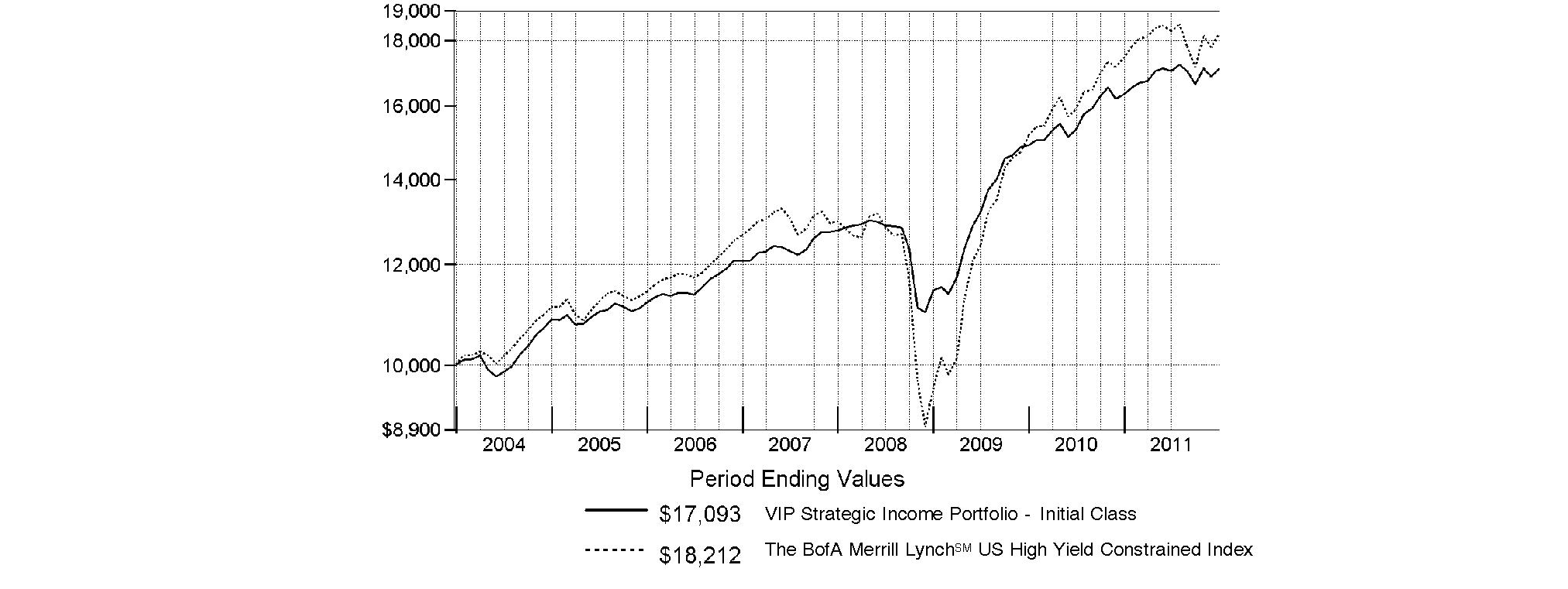

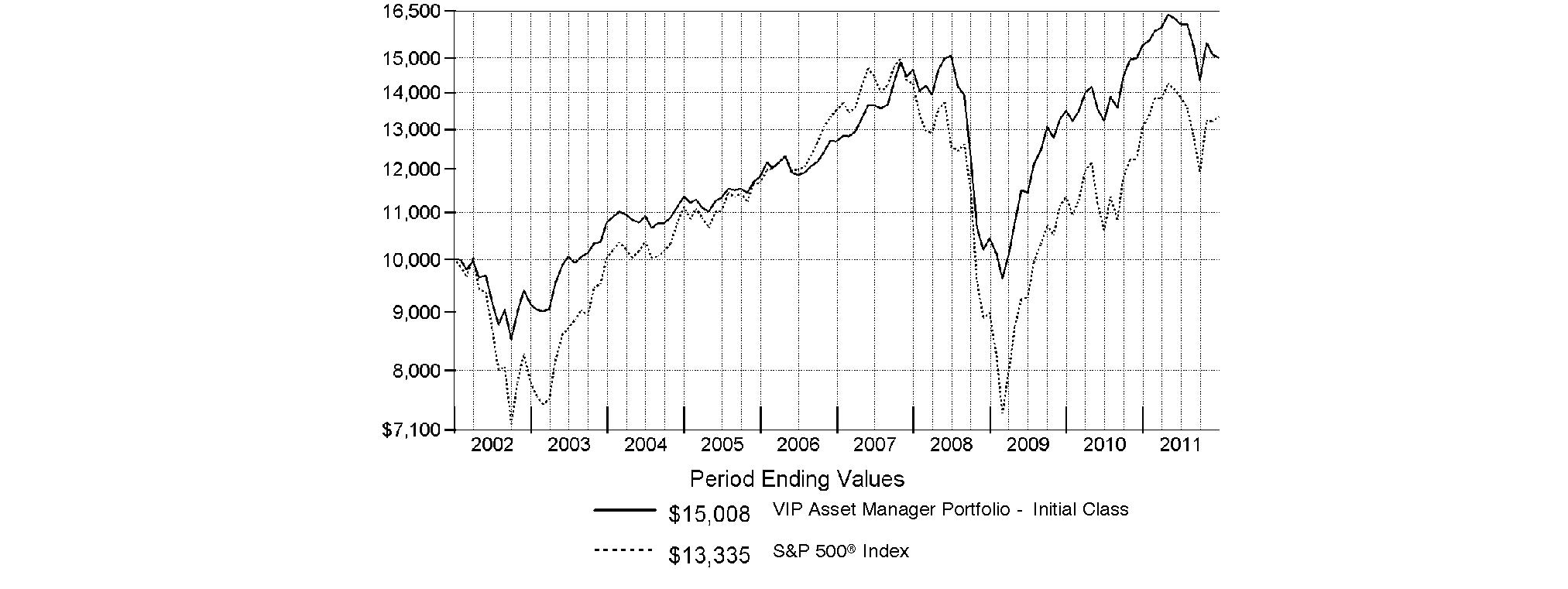

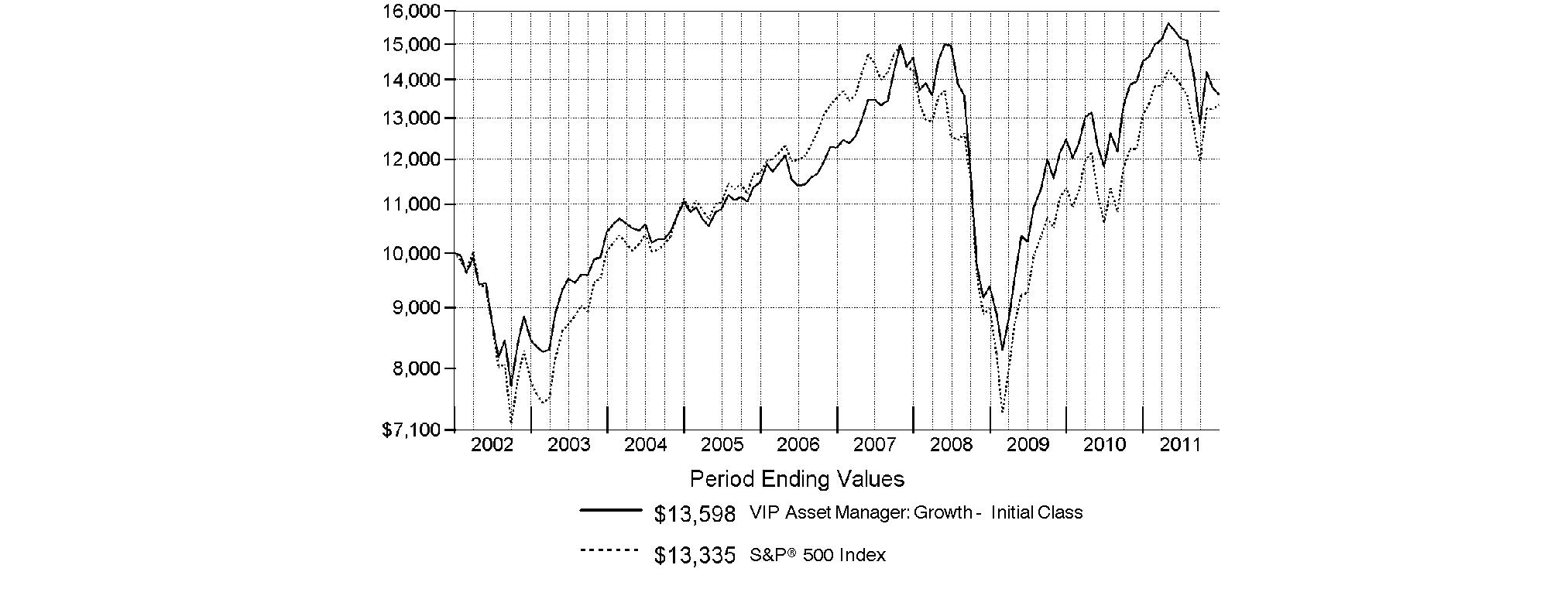

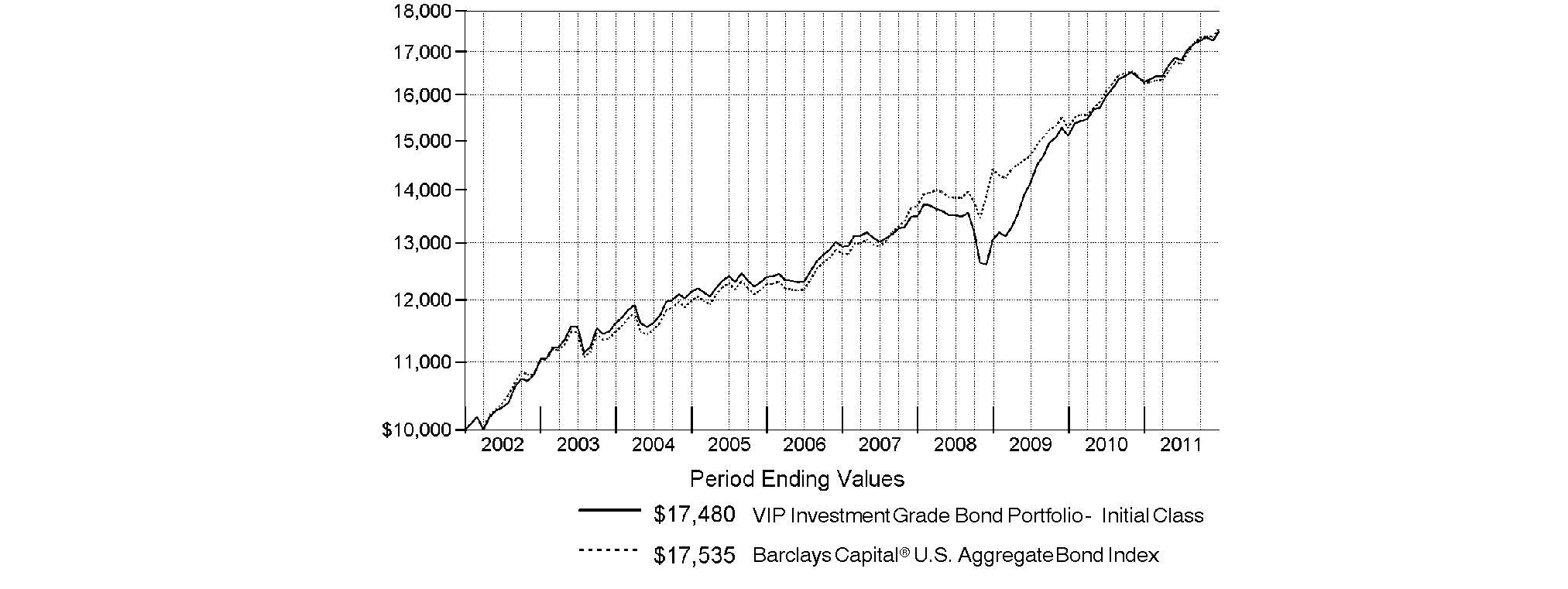

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in VIP Asset Manager Portfolio - Initial Class on December 31, 2001. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Market Recap: Extreme market volatility took center stage during the 12 months ending December 31, 2011, stealing the spotlight from signs of progress in the global economy. Early in the year, aggressive monetary stimulus by the U.S. federal government, improving credit-market conditions and solid corporate earnings buoyed most major asset classes. As the period progressed, however, fresh worries about sovereign debt in Europe, inflation in China, gridlock over raising the debt ceiling in the U.S. - along with Standard & Poor's early-August downgrade of the nation's long-term sovereign credit rating - and a dimmed outlook for global growth punctured investor confidence and ignited market instability. Domestic equities, as measured by the broad-based S&P 500® Index, gained 2.11%, easily outpacing the 13.61% decline of MSCI® ACWI® (All Country World Index) ex USA Index, a proxy for foreign stocks. Within the MSCI index, emerging markets declined the most (-18%), with investments here generally held back by a stronger U.S. dollar. The U.K. (-3%) fared better than the rest of Europe (-15%), which was the second-worst-performing index component. Bolstered by periodic flights to quality, U.S. investment-grade bonds posted a 7.84% advance, as reflected by the Barclays Capital® U.S. Aggregate Bond Index, outperforming the 4.37% gain of high-yield securities, as represented by The BofA Merrill LynchSM US High Yield Constrained Index. Hampered by financial woes in Europe, the sovereign debt of major developed markets outside the U.S. rose 4.86%, according to the Citigroup® Non-USD Group-of-Seven (G7) Equal Weighted Index, while the JPMorgan Emerging Markets Bond Index Global (EMBI Global) advanced 8.46%, despite the currency head wind.

Comments from Geoff Stein, Portfolio Manager of VIP Asset Manager Portfolio: For the year ending December 31, 2011, the fund's share classes underperformed the 1.92% return of the Fidelity Asset Manager 50% Composite Index. (For specific portfolio results, please see the performance section of this report.) Poor domestic equity security selection overwhelmed the modest benefit of favorable weighting decisions here, and was, by far, the biggest reason for the fund's underperformance. The U.S. equity subportfolio suffered the most during the third quarter when investors moved out of growth and cyclical stocks, which represented the bulk of its holdings, in favor of defensive sectors, such as utilities, consumer staples and health care. Various factors drove this shift, but the overriding one was a growing fear that the sovereign debt crisis in Europe might spin out of control. On a sector basis, energy, information technology, consumer discretionary and industrials all had a significant negative impact on the subportfolio's results during the year, mainly because of stock selection. Adverse positioning in materials and health care, along with underexposure to utilities, also hurt. Modest out-of-benchmark exposure to emerging-markets (EM) equities also hampered performance. EM stocks responded to the global flight from risk with greater volatility than either U.S. or foreign developed-markets equities, and performed considerably worse in U.S. dollar terms. A small allocation to commodities was another detractor, as this economically sensitive asset class struggled amid heightened concern about a global economic slowdown. On the plus side, underweighting foreign developed-markets equities outweighed weak security selection in that category. I continued to have a dim view of European markets, given the sharp fiscal and economic contrasts between core and peripheral eurozone countries. Additionally, I thought the euro was relatively unattractive and, since we do not hedge foreign currency exposure, wanted to limit the fund's allocation to it. In the investment-grade bond central fund, out-of-index holdings in Treasury Inflation-Protected Securities (TIPS) provided a nice boost, as did my well-timed tactical allocation to the asset class. I added the TIPS position during the summer, in time to benefit from the bouts of investor risk aversion that ensued during the remainder of the period. Lastly, out-of-benchmark allocations to high-yield bonds and floating-rate bank-loan securities were additional contributors.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2011 to December 31, 2011).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Annualized Expense Ratio | Beginning

Account Value

July 1, 2011 | Ending

Account Value

December 31, 2011 | Expenses Paid

During Period*

July 1, 2011 to

December 31, 2011 |

Initial Class | .63% | | | |

Actual | | $ 1,000.00 | $ 934.80 | $ 3.07 |

HypotheticalA | | $ 1,000.00 | $ 1,022.03 | $ 3.21 |

Service Class | .75% | | | |

Actual | | $ 1,000.00 | $ 934.00 | $ 3.66 |

HypotheticalA | | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Service Class 2 | .90% | | | |

Actual | | $ 1,000.00 | $ 933.60 | $ 4.39 |

HypotheticalA | | $ 1,000.00 | $ 1,020.67 | $ 4.58 |

Investor Class | .71% | | | |

Actual | | $ 1,000.00 | $ 934.40 | $ 3.46 |

HypotheticalA | | $ 1,000.00 | $ 1,021.63 | $ 3.62 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

Annual Report

Investment Changes (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds. |

Top Five Stocks as of December 31, 2011 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Apple, Inc. | 2.2 | 1.4 |

Chevron Corp. | 0.9 | 0.9 |

United Continental Holdings, Inc. | 0.8 | 0.8 |

Schlumberger Ltd. | 0.6 | 0.8 |

Pioneer Natural Resources Co. | 0.6 | 0.5 |

| 5.1 | |

Top Five Bond Issuers as of December 31, 2011 |

(with maturities greater than one year) | % of fund's

net assets | % of fund's net assets

6 months ago |

U.S. Treasury Obligations | 9.8 | 9.8 |

Fannie Mae | 8.8 | 8.6 |

Freddie Mac | 2.8 | 1.8 |

Ginnie Mae | 2.5 | 2.7 |

Citigroup, Inc. | 0.2 | 0.3 |

| 24.1 | |

Top Five Market Sectors as of December 31, 2011 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Consumer Discretionary | 12.5 | 9.9 |

Financials | 11.1 | 10.4 |

Energy | 9.2 | 9.1 |

Information Technology | 8.2 | 8.8 |

Industrials | 5.5 | 7.3 |

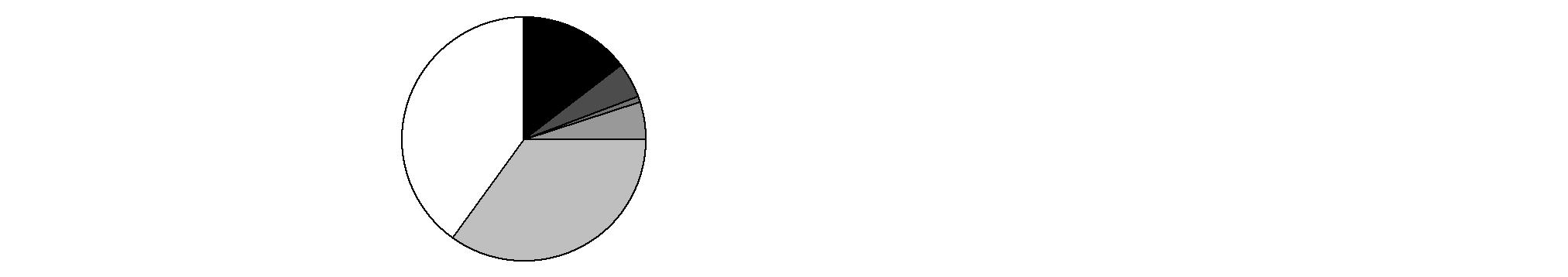

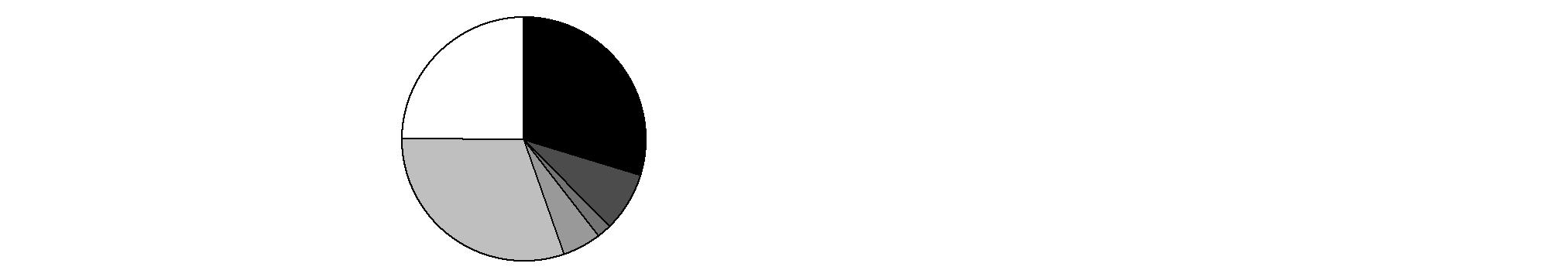

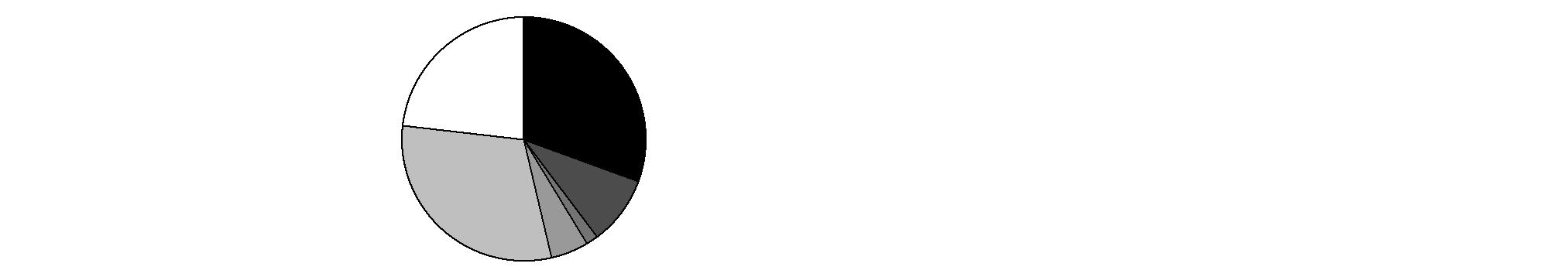

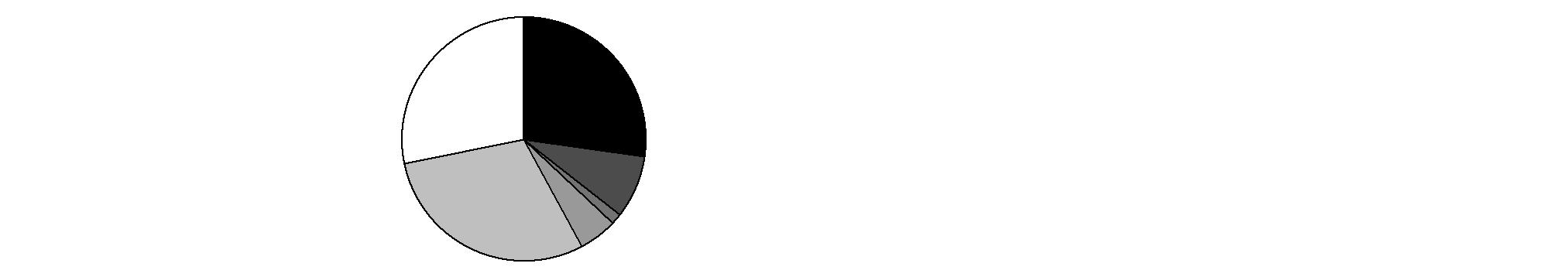

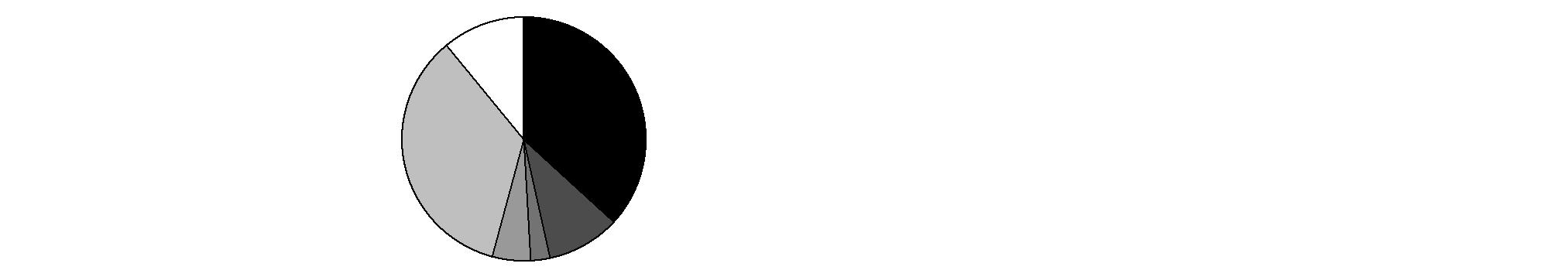

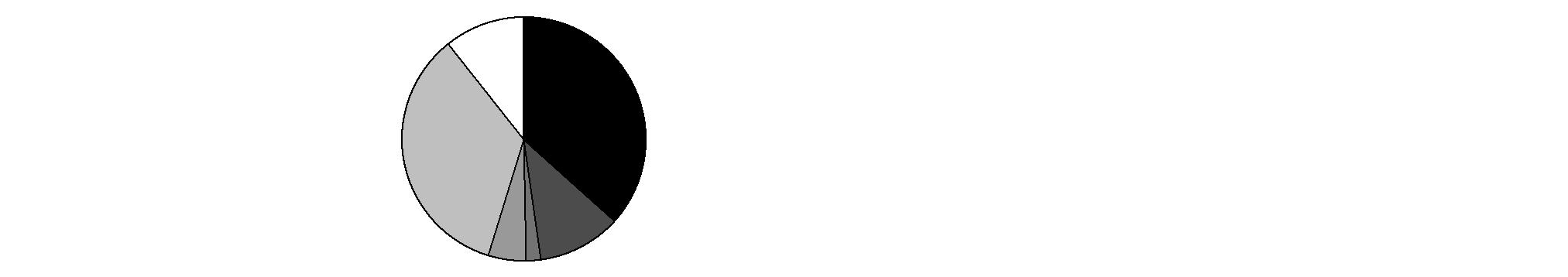

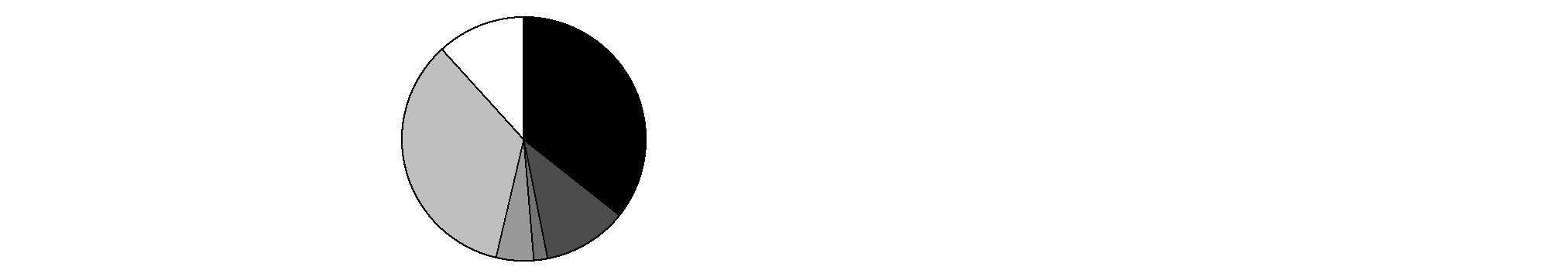

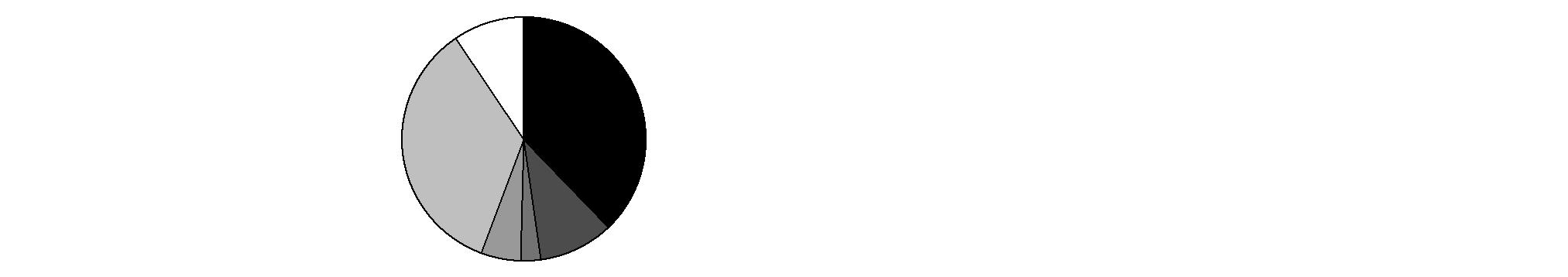

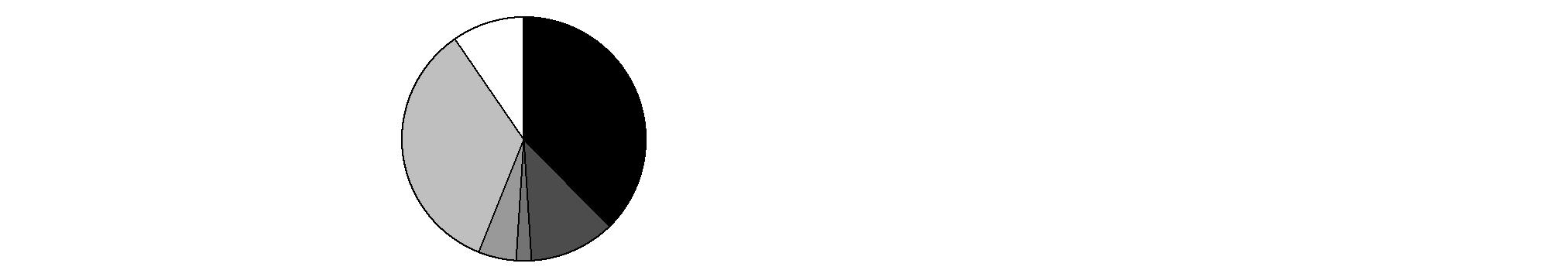

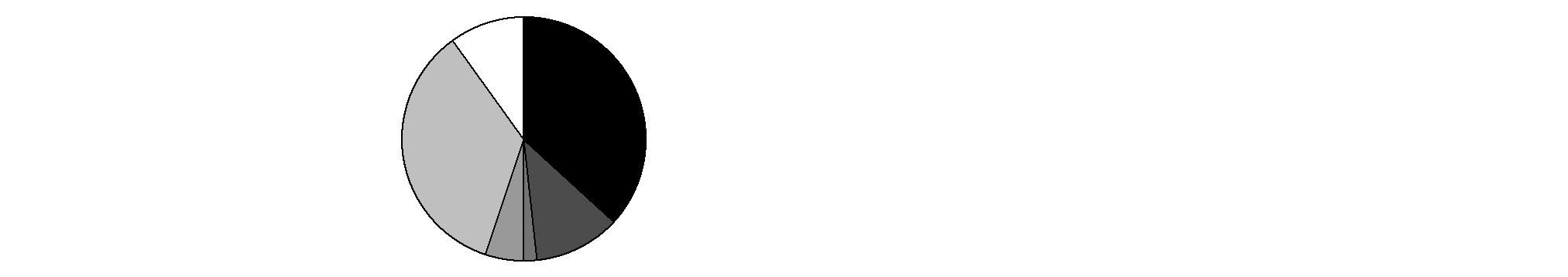

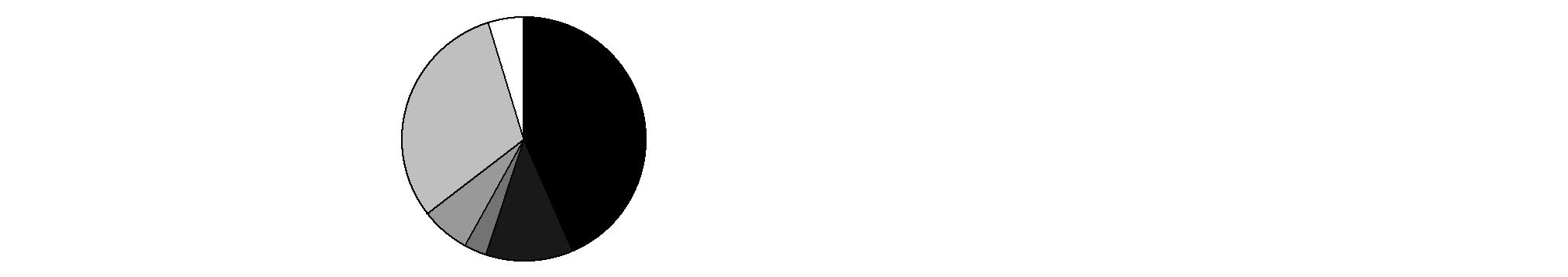

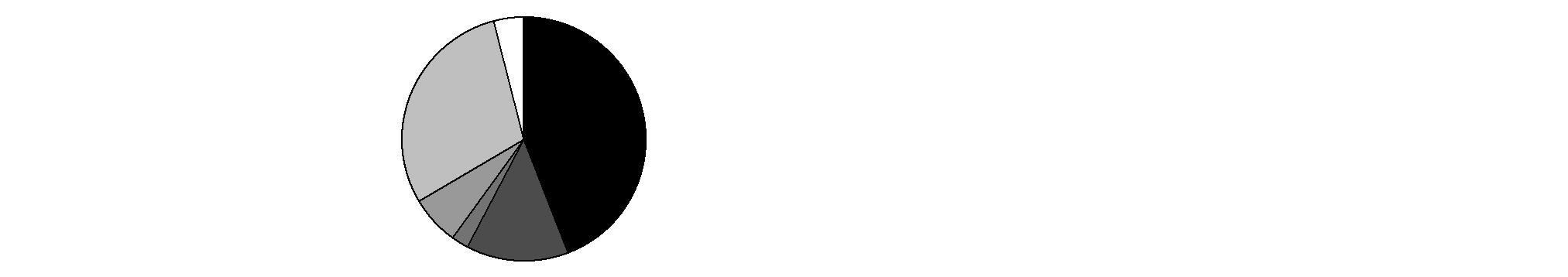

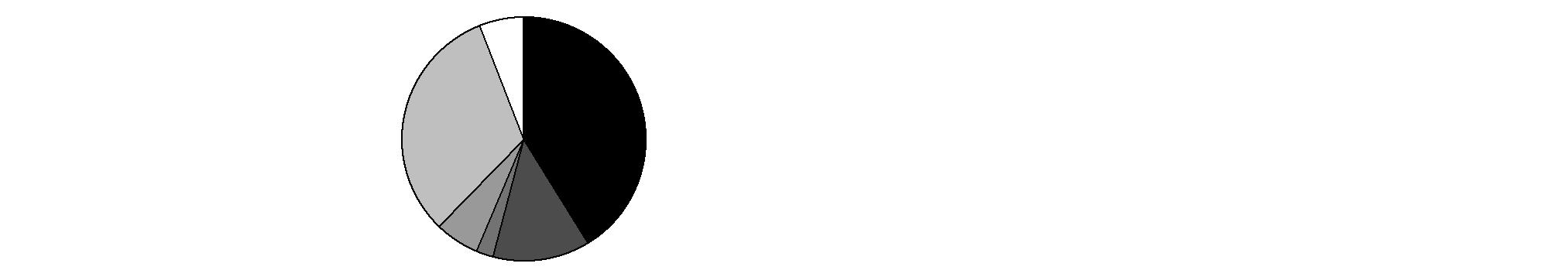

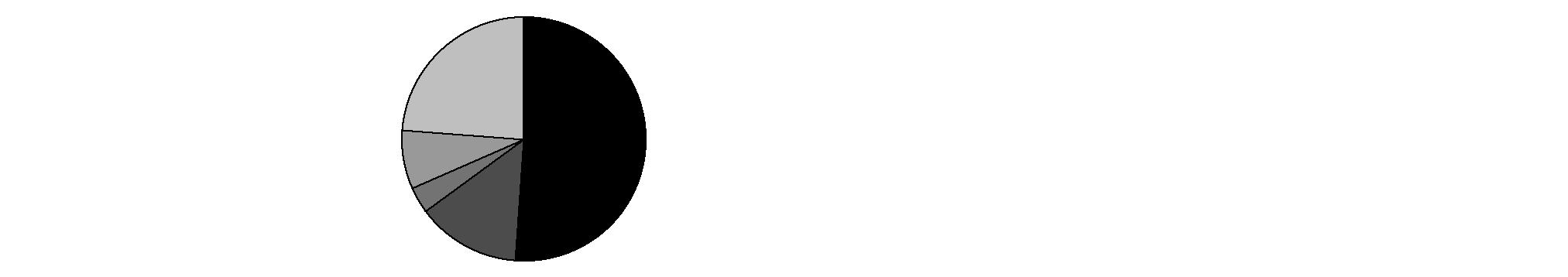

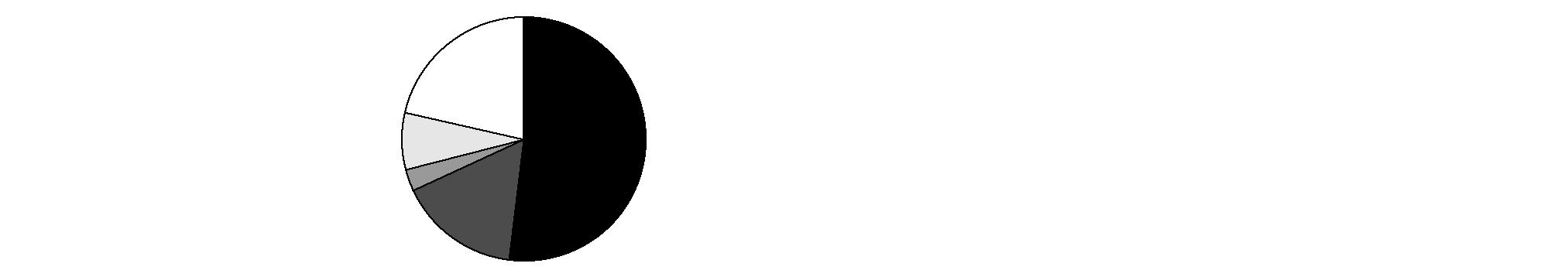

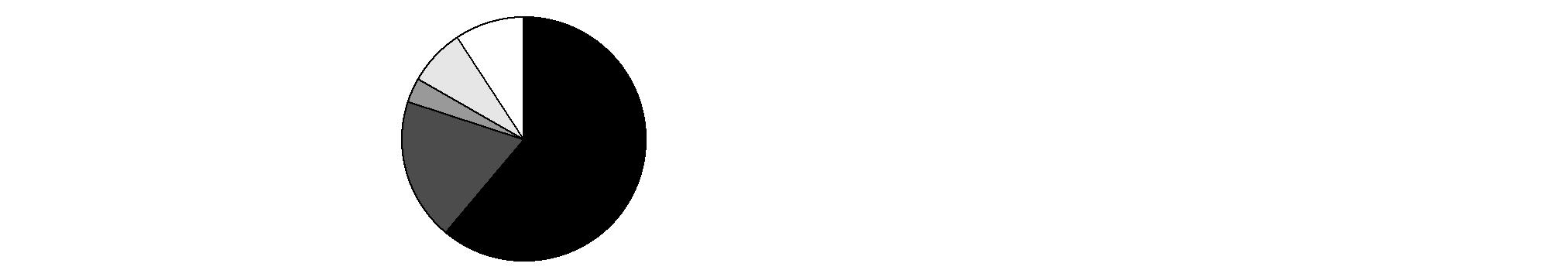

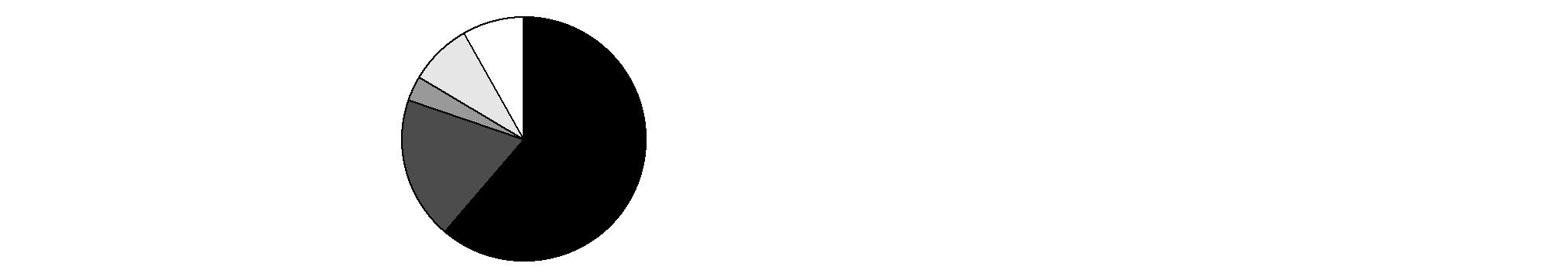

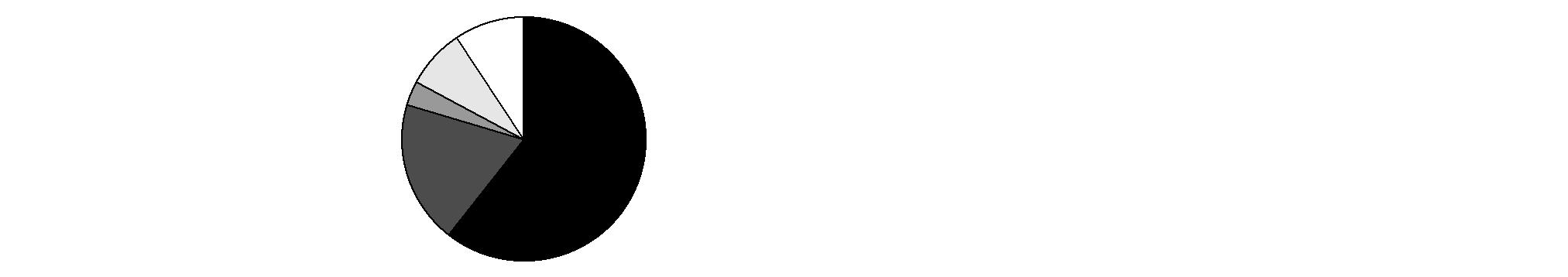

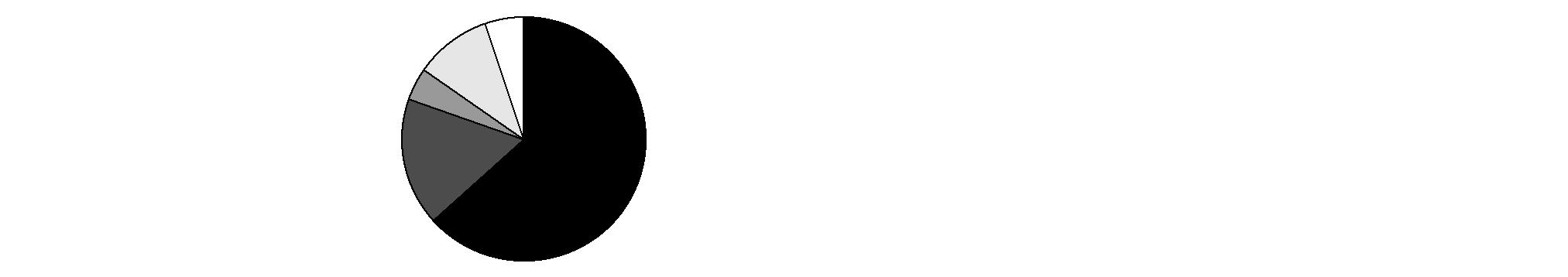

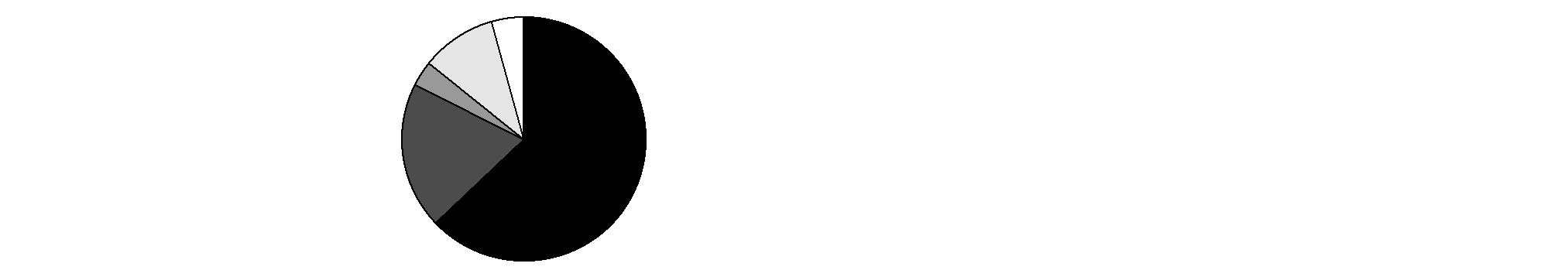

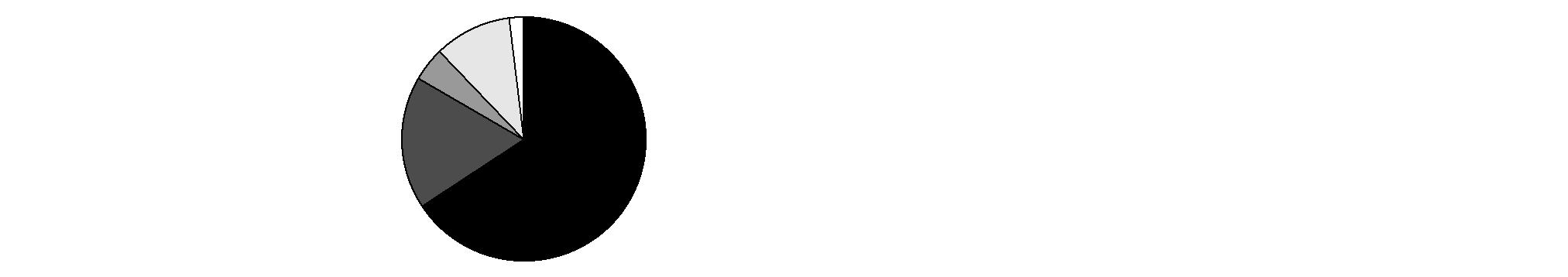

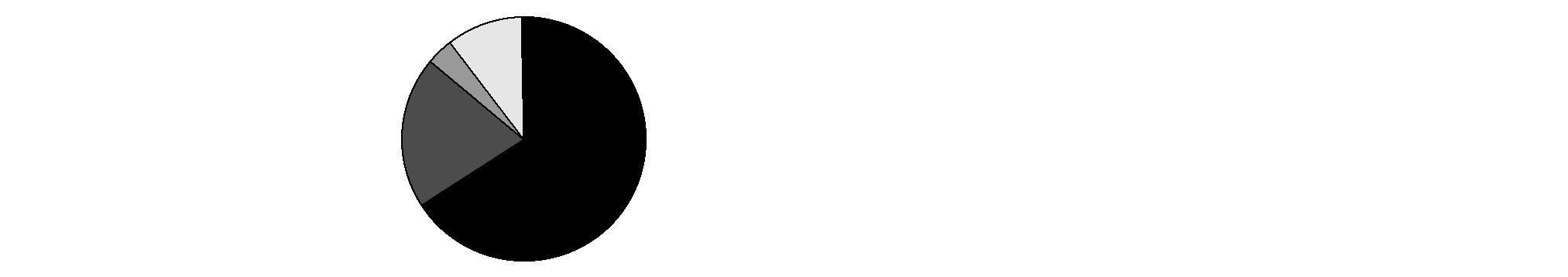

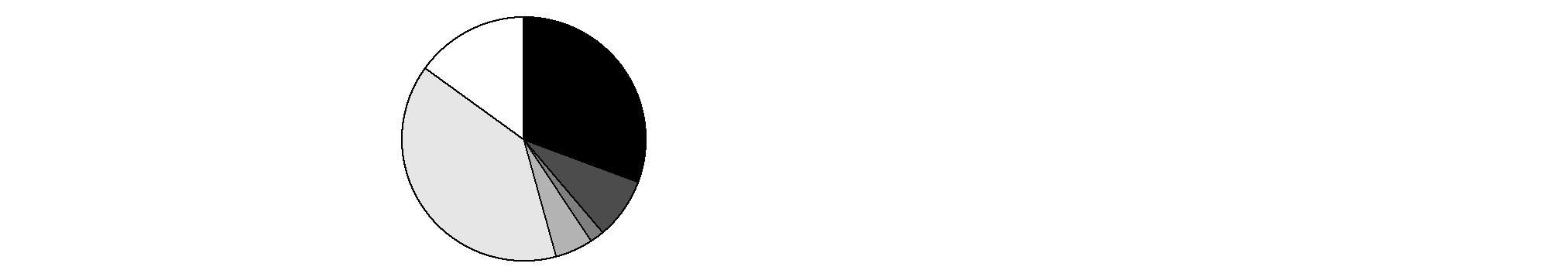

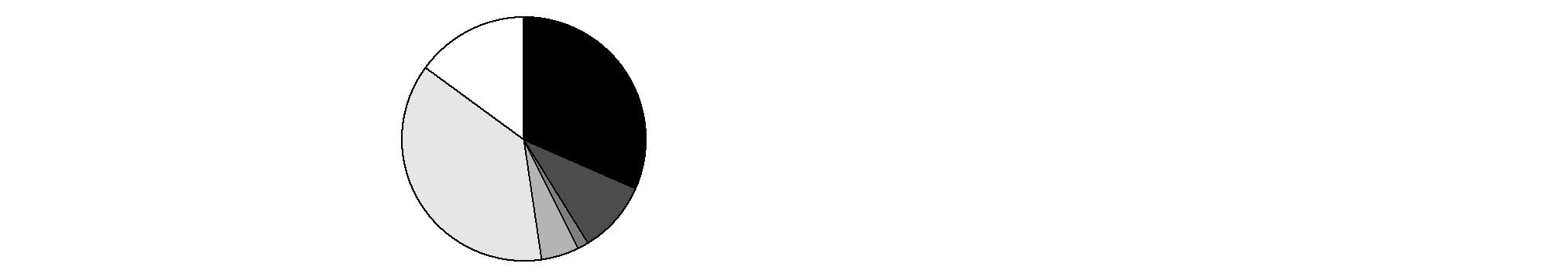

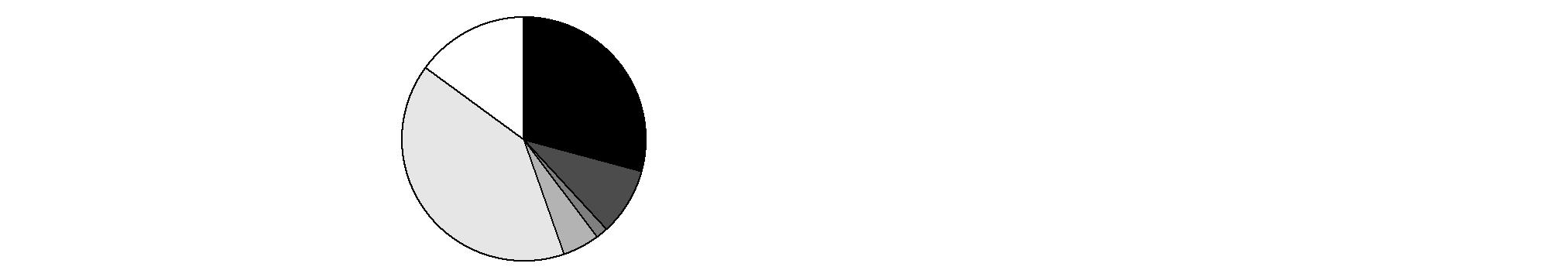

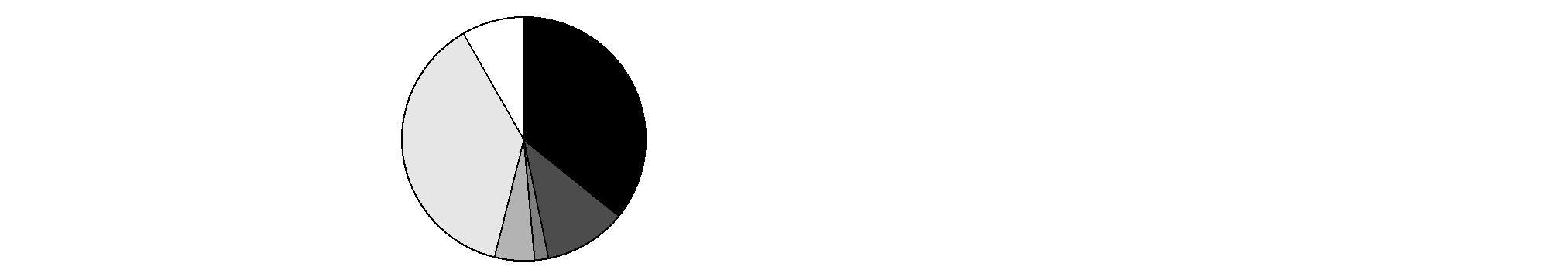

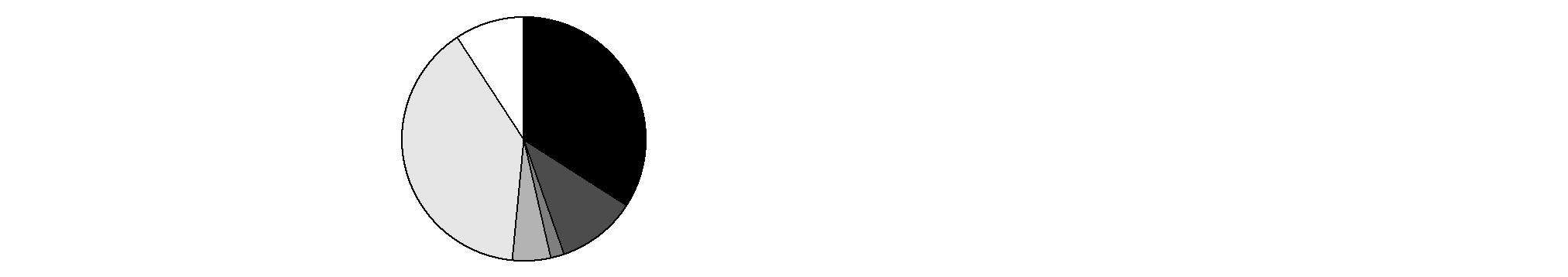

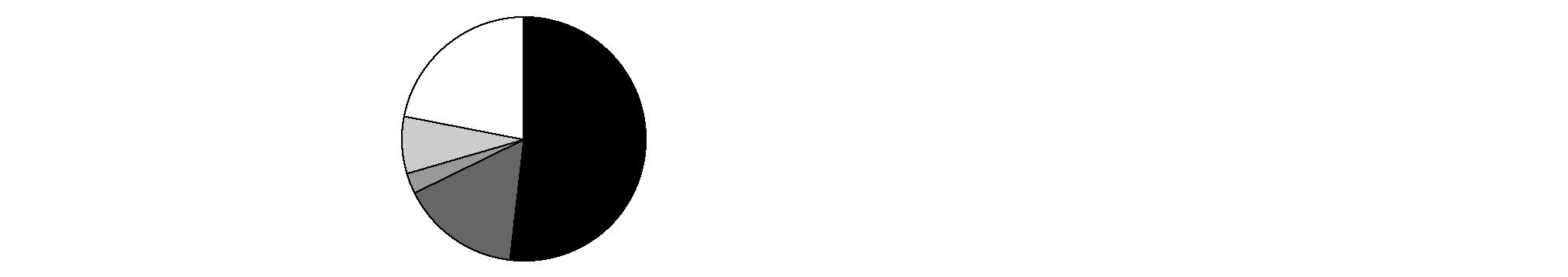

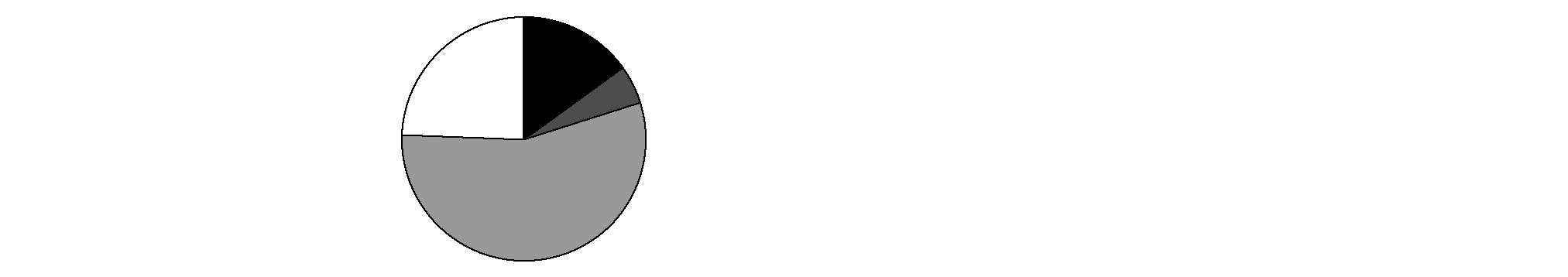

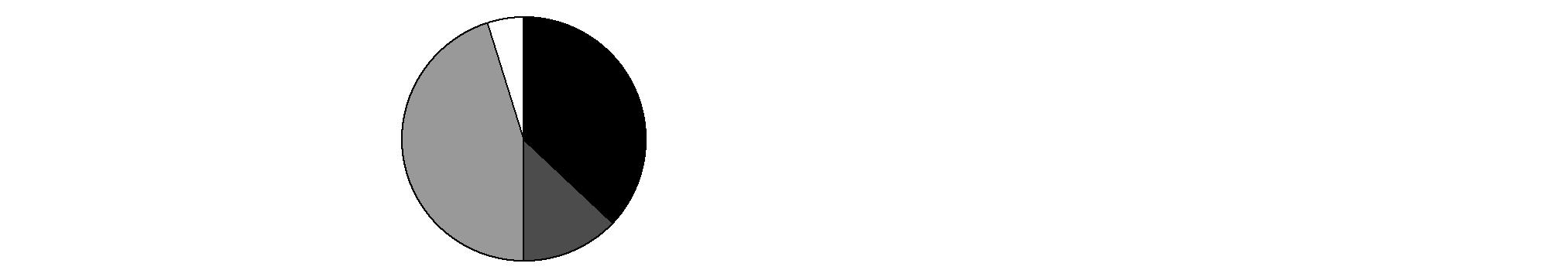

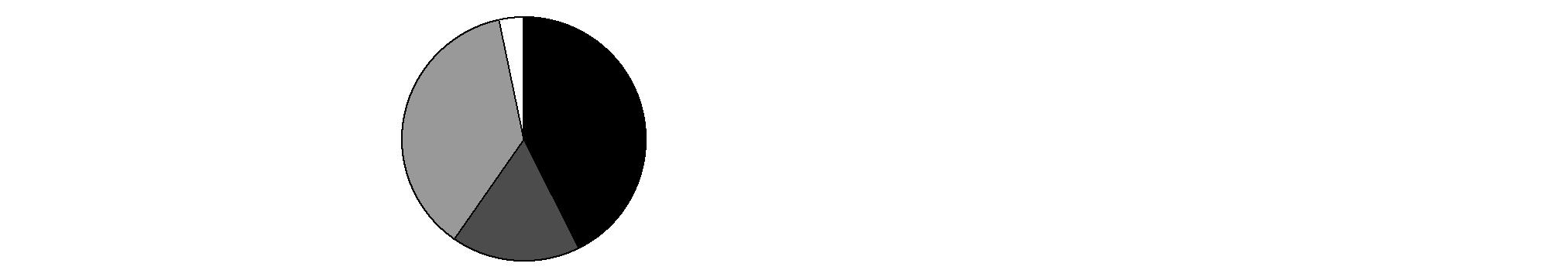

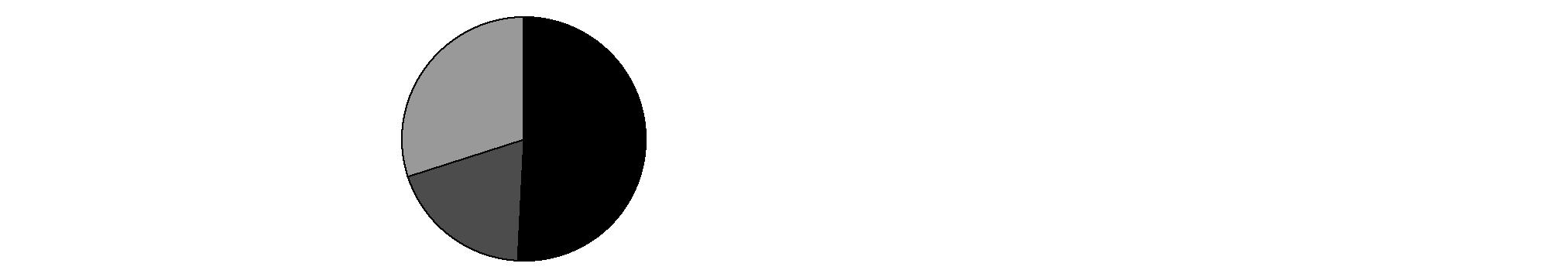

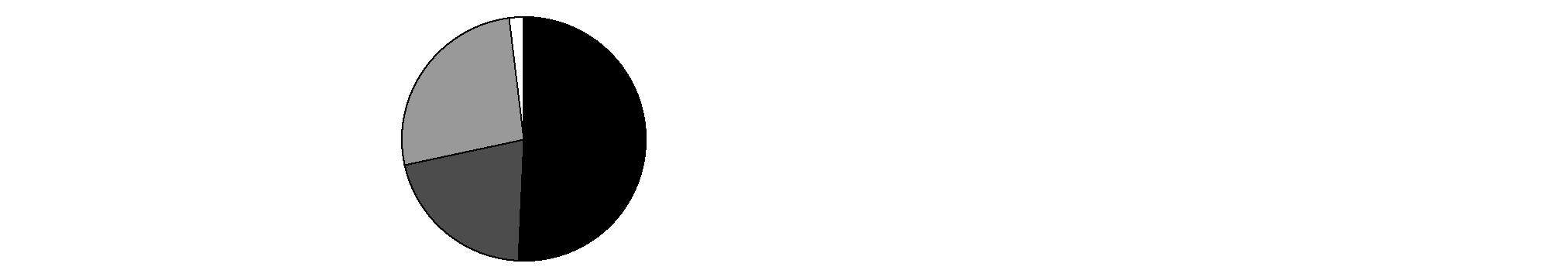

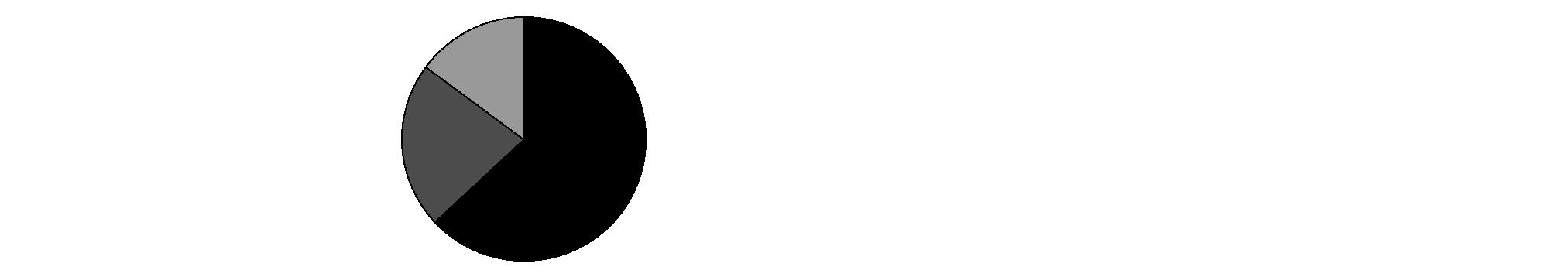

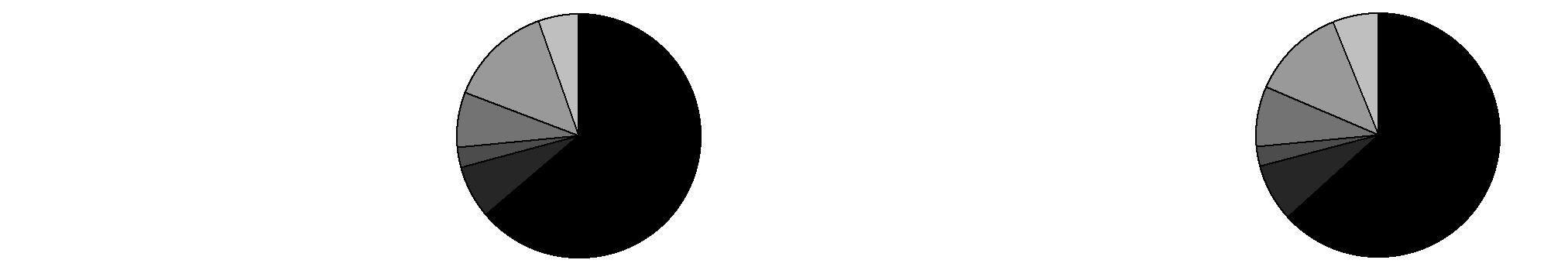

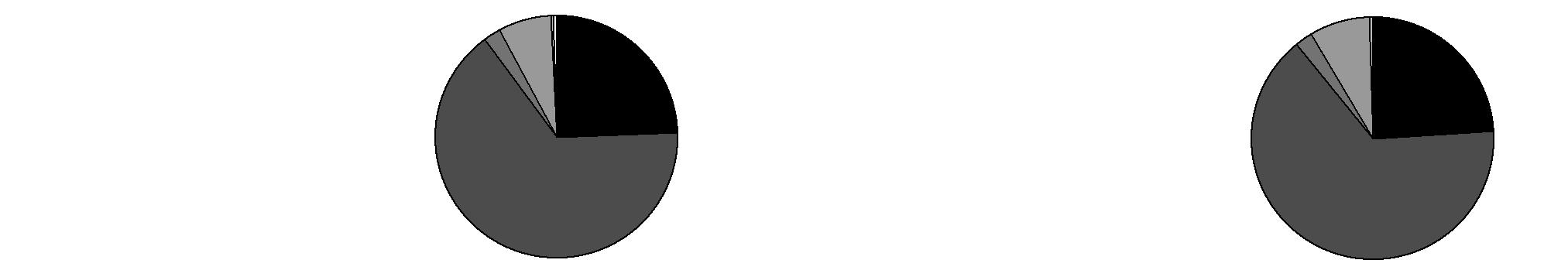

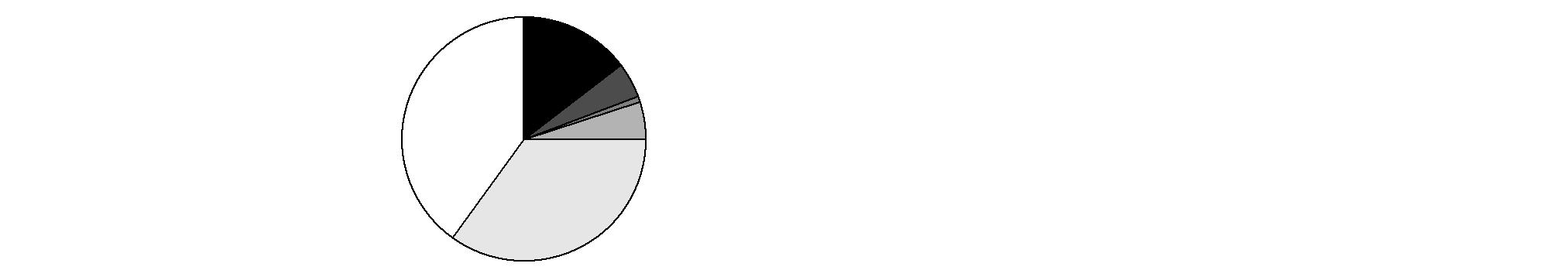

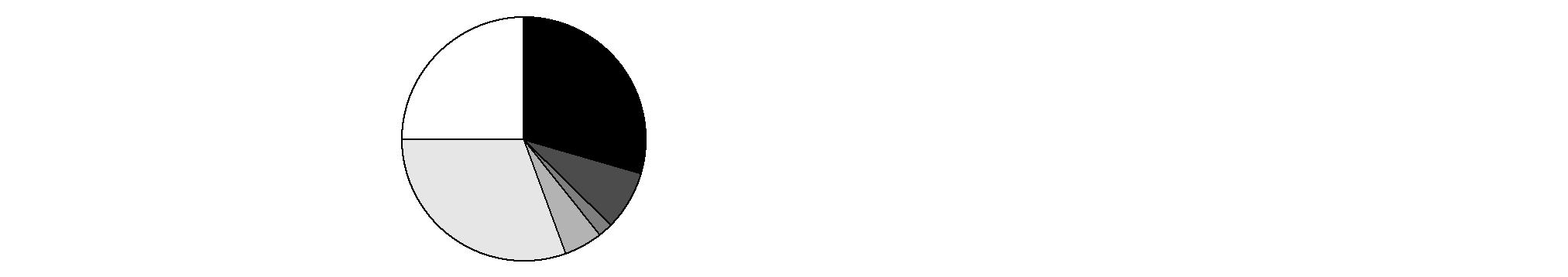

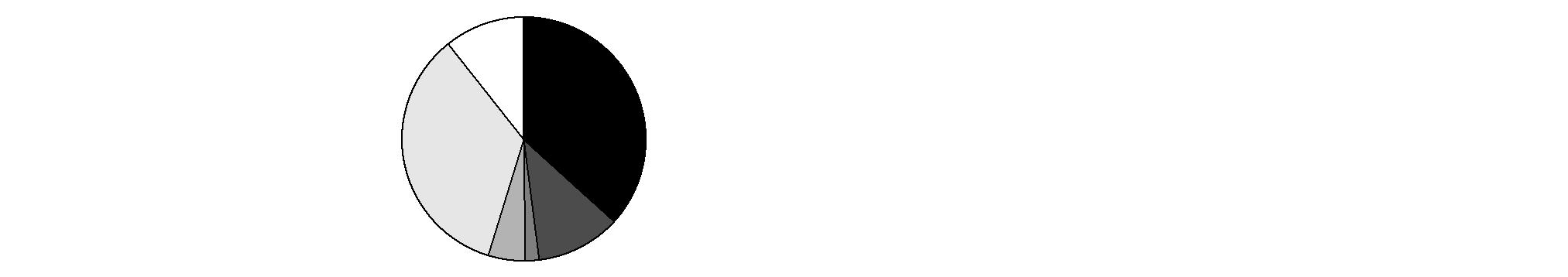

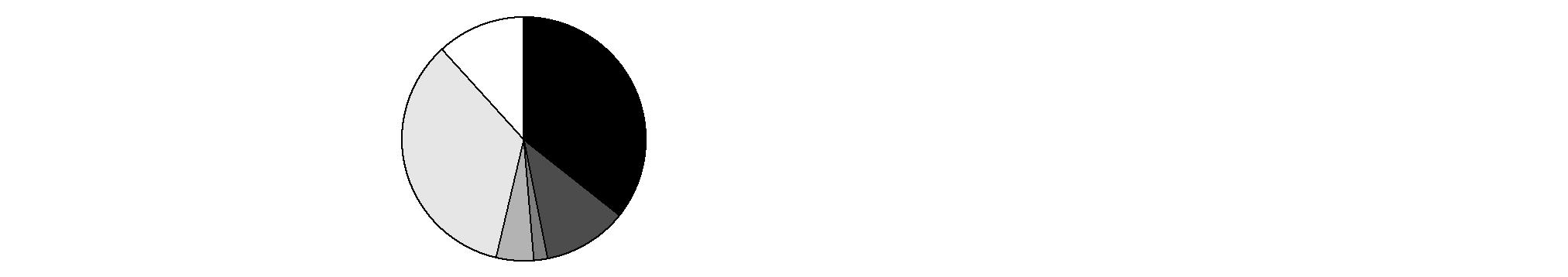

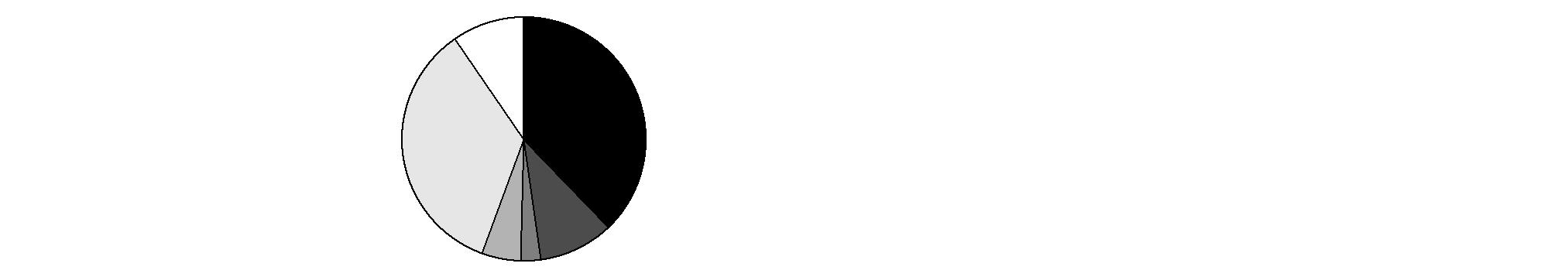

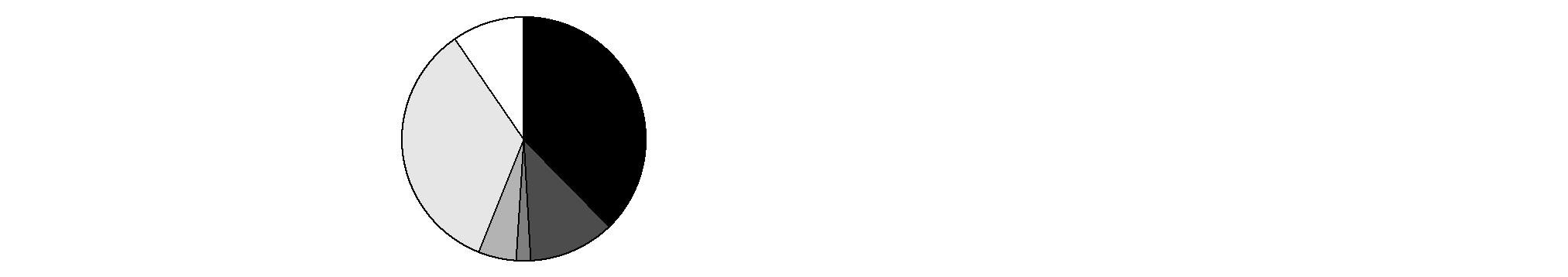

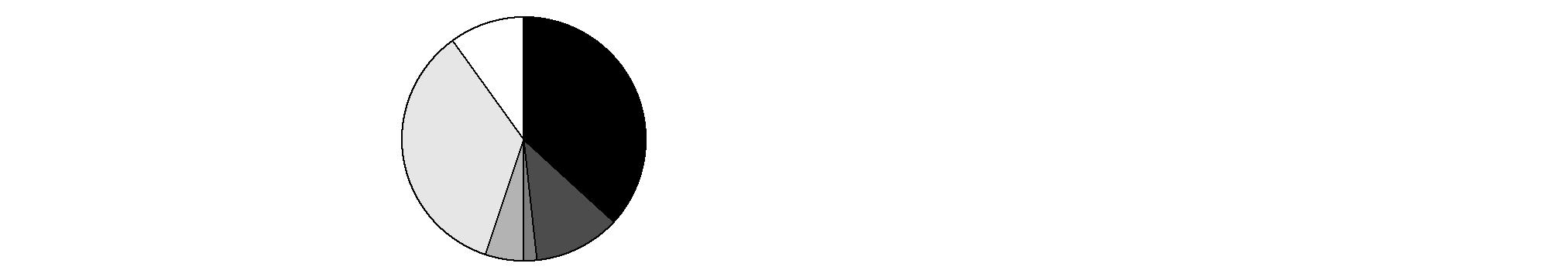

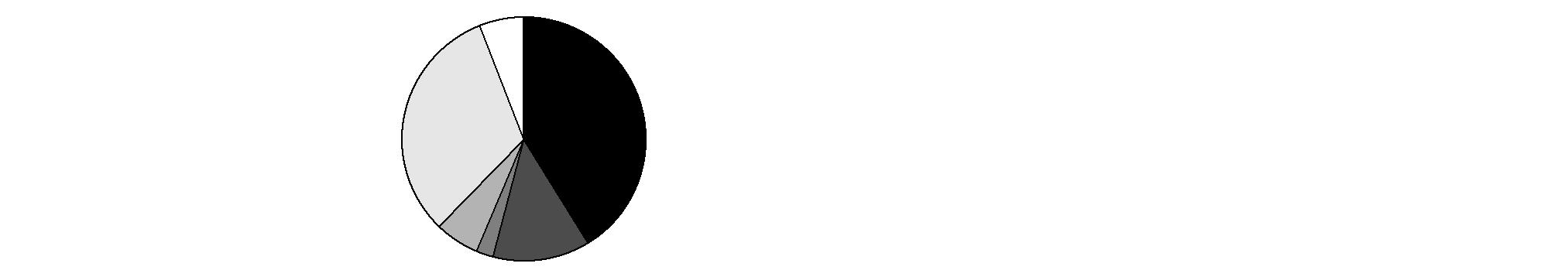

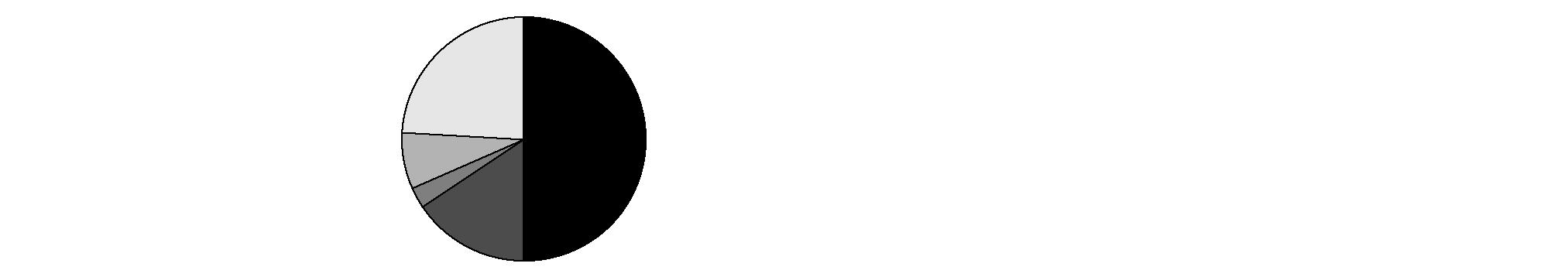

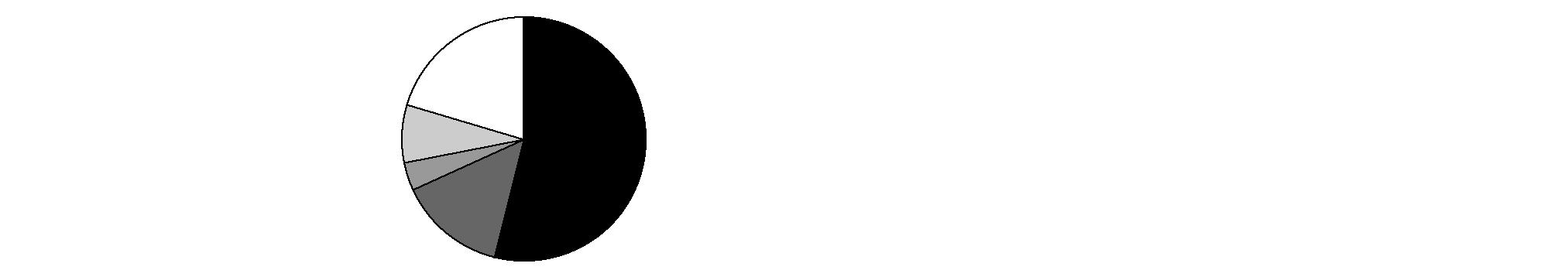

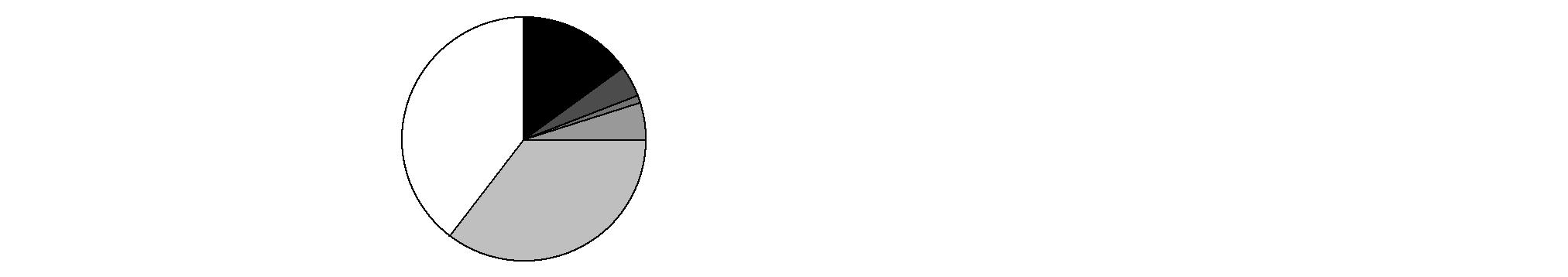

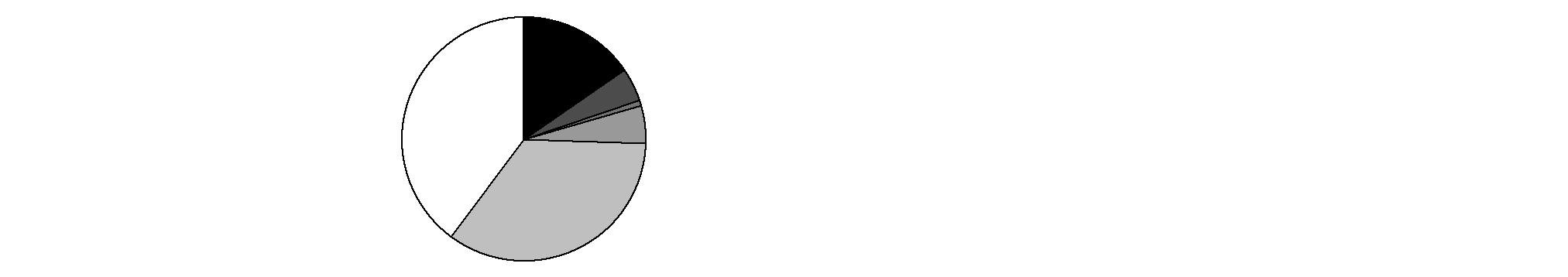

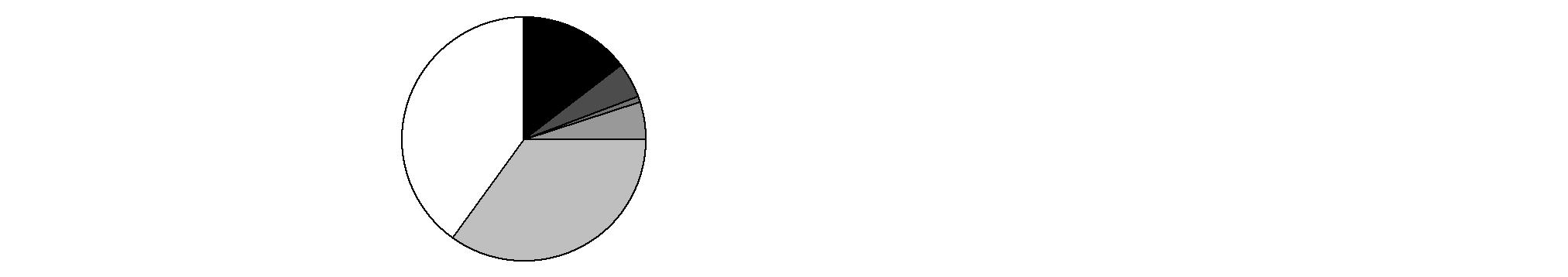

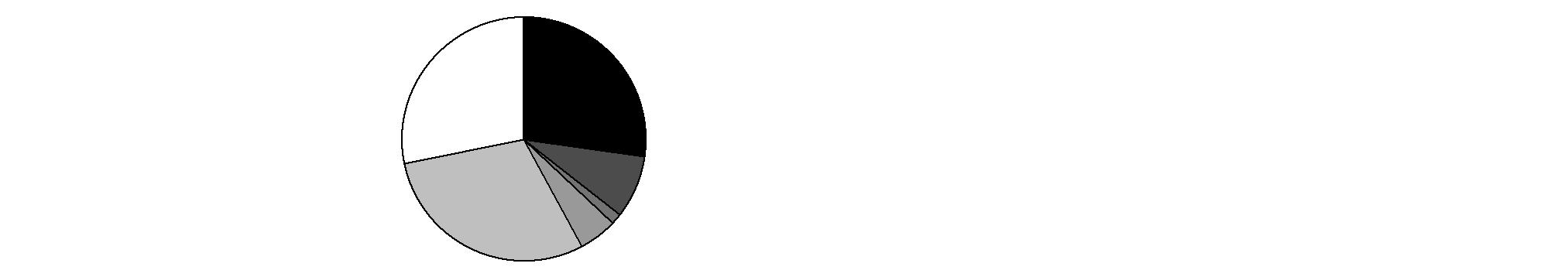

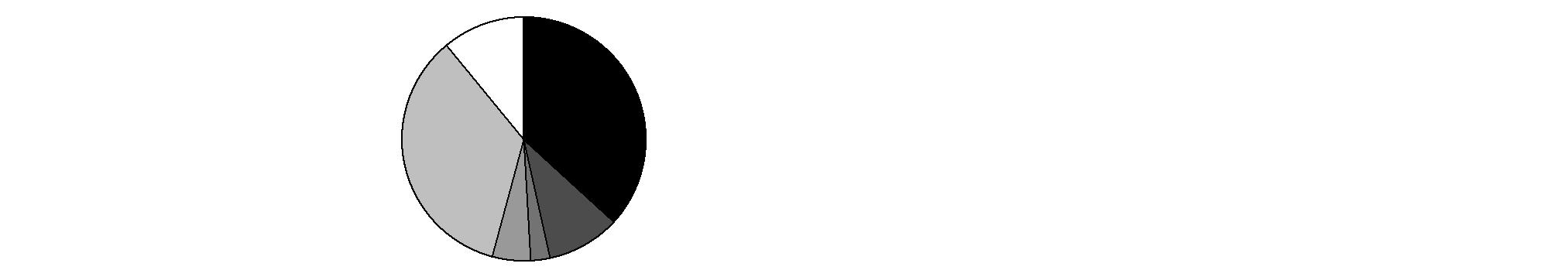

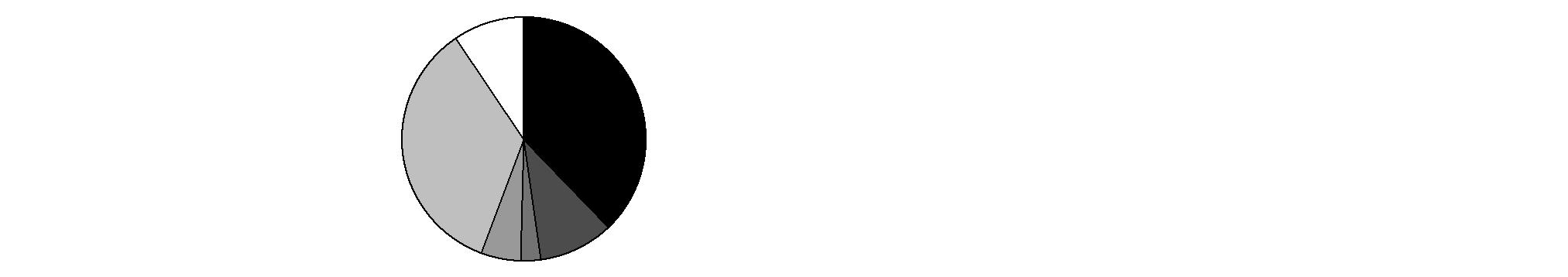

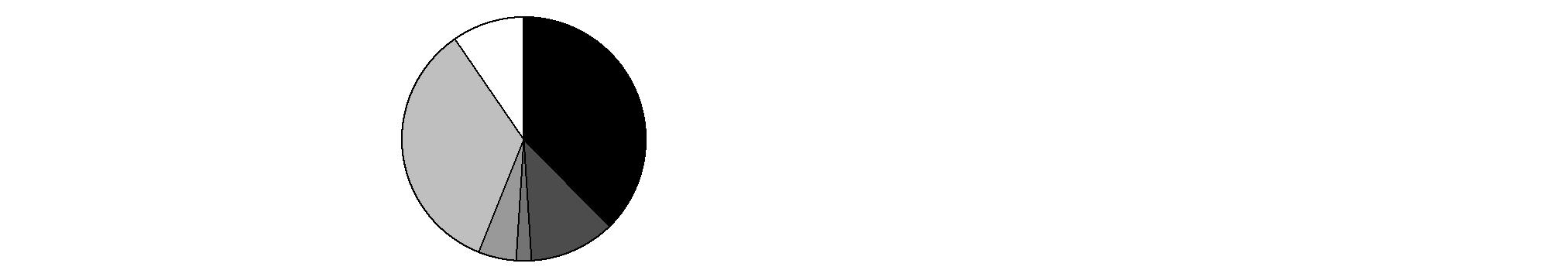

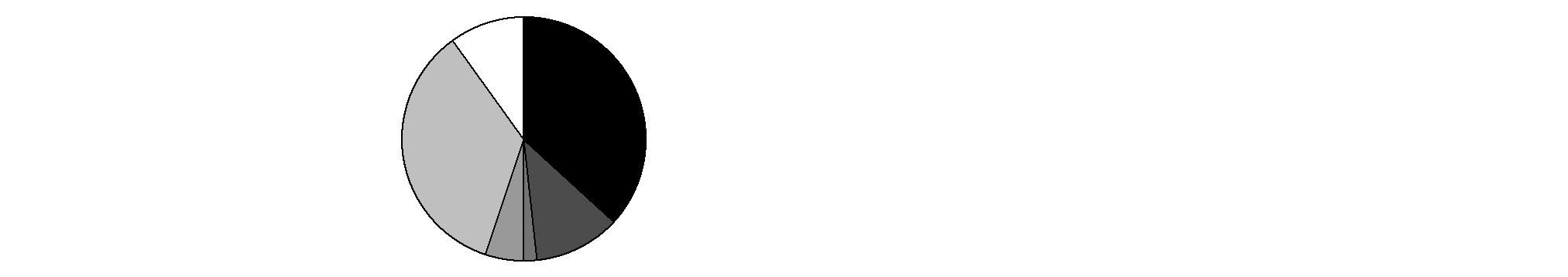

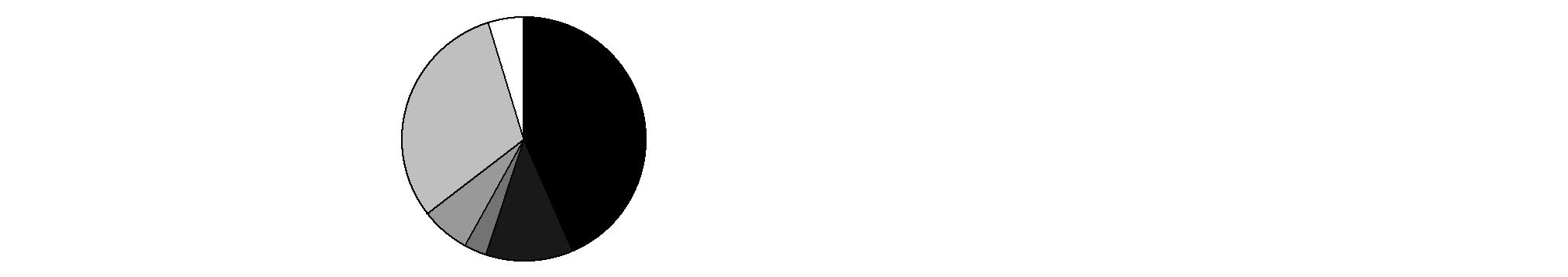

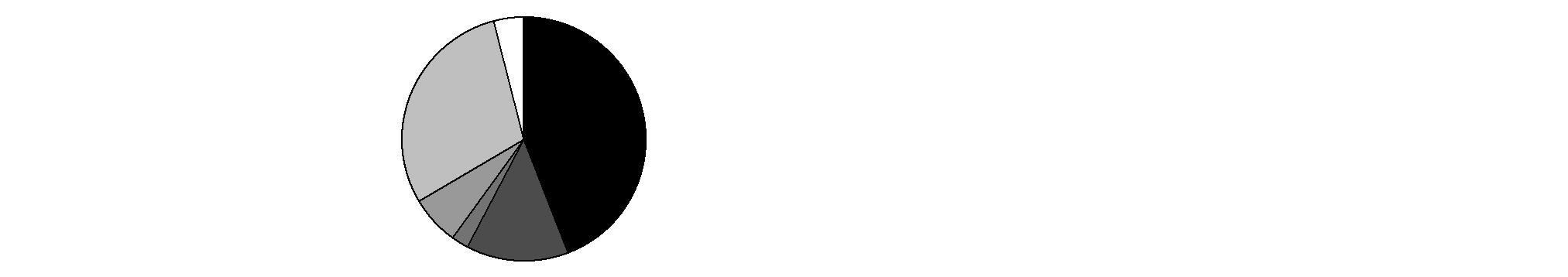

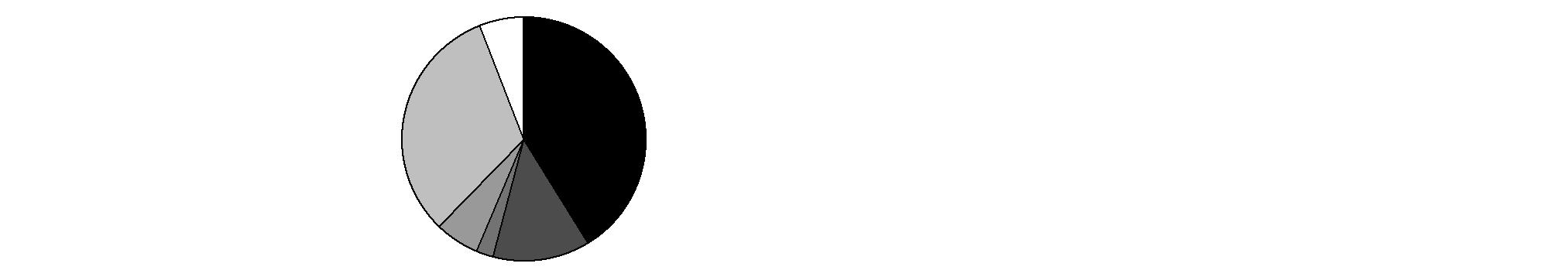

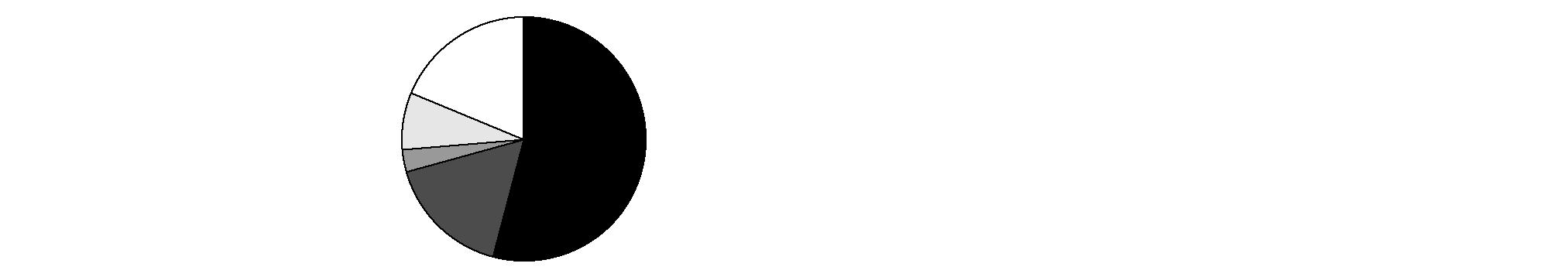

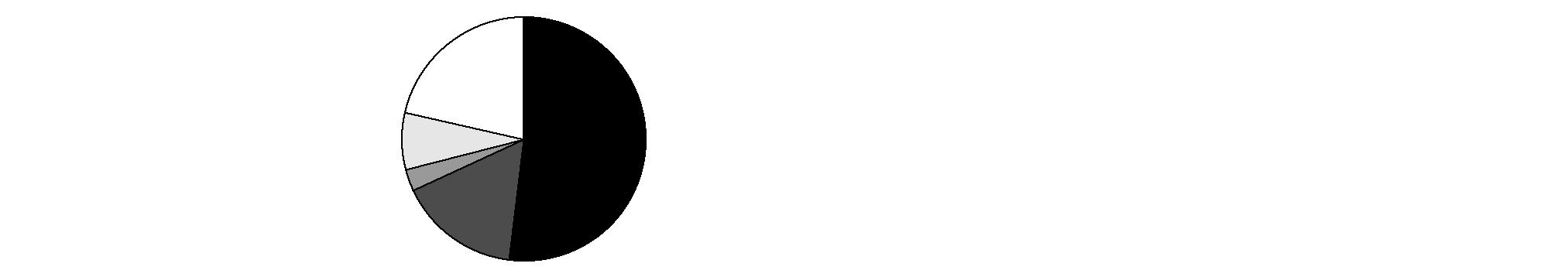

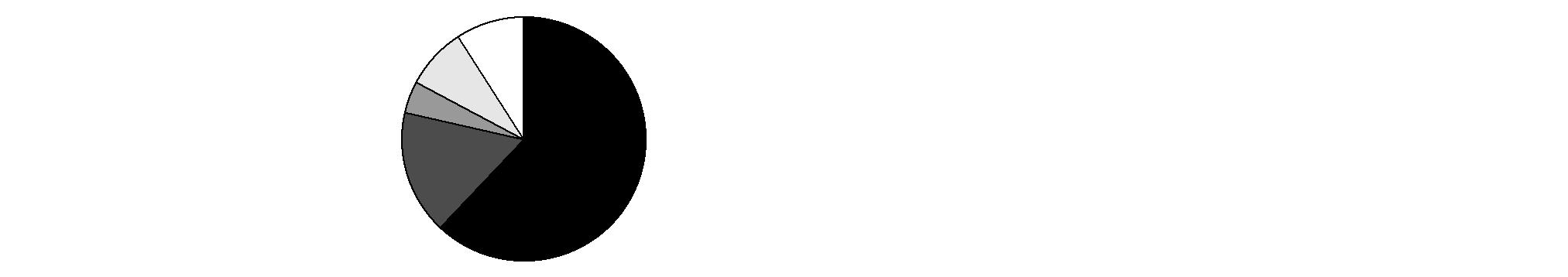

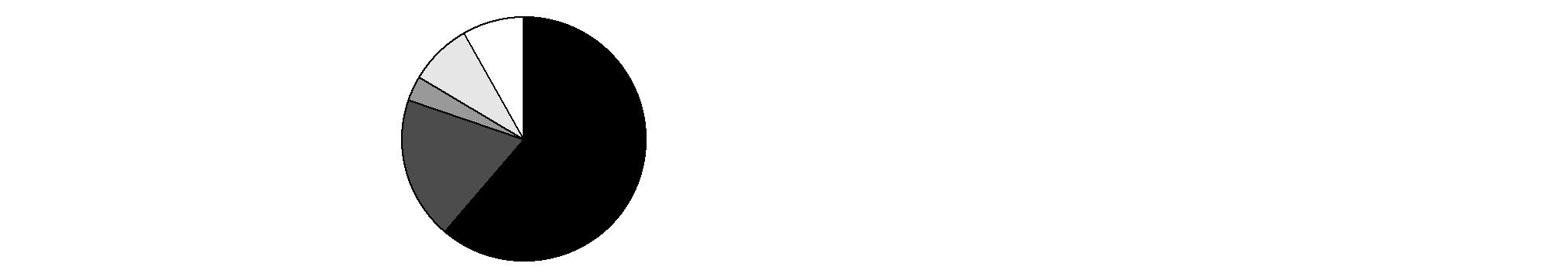

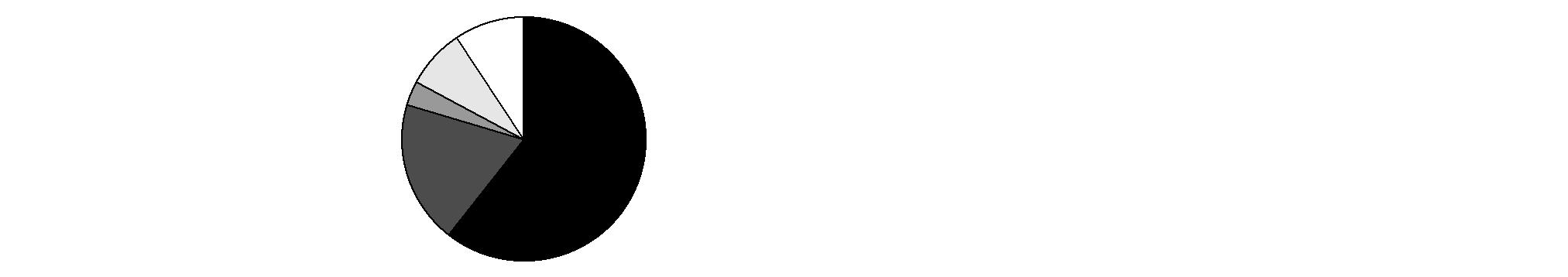

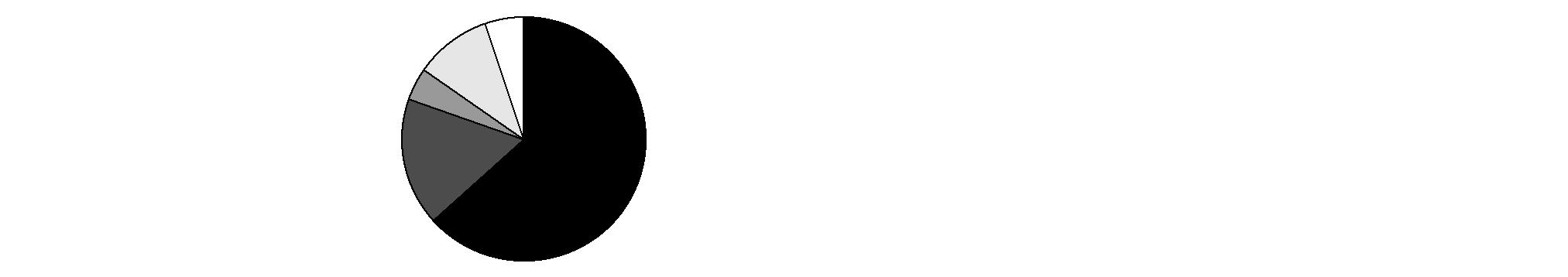

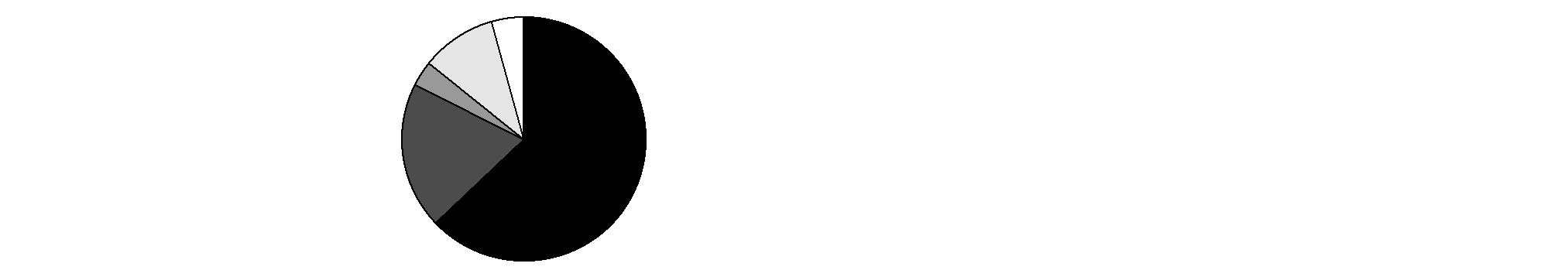

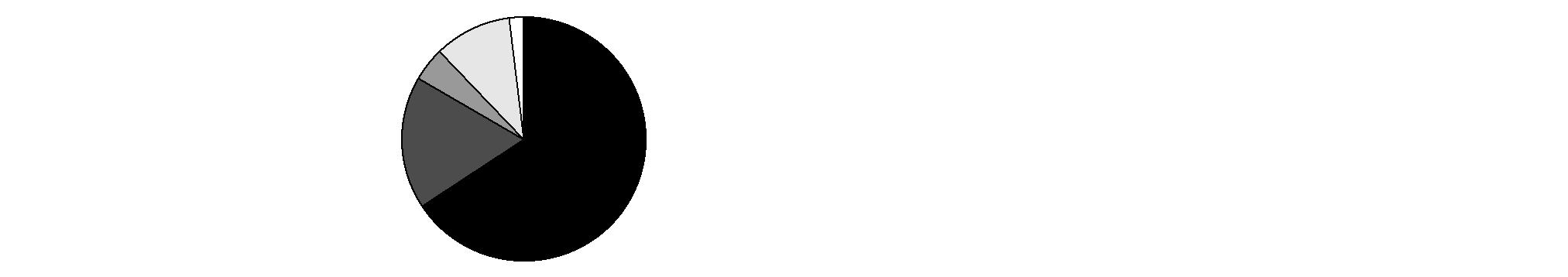

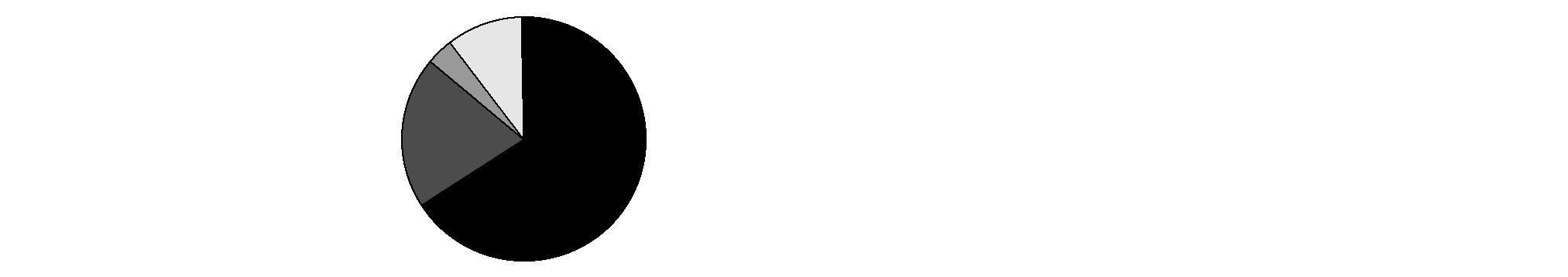

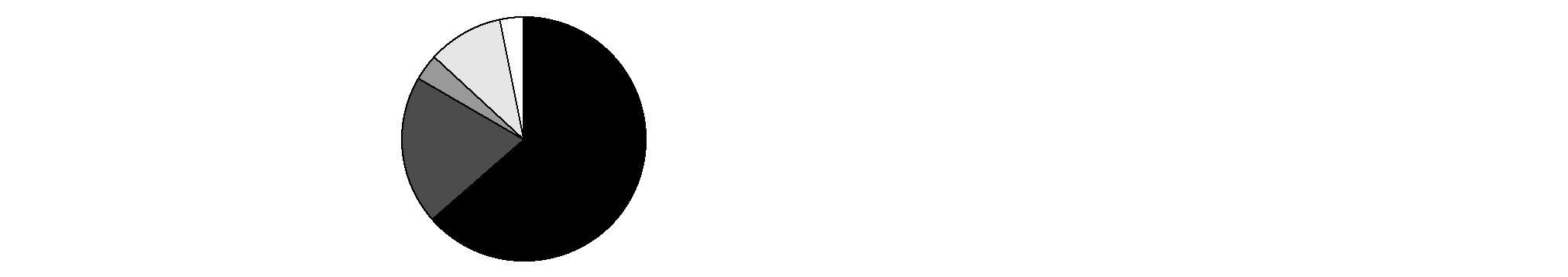

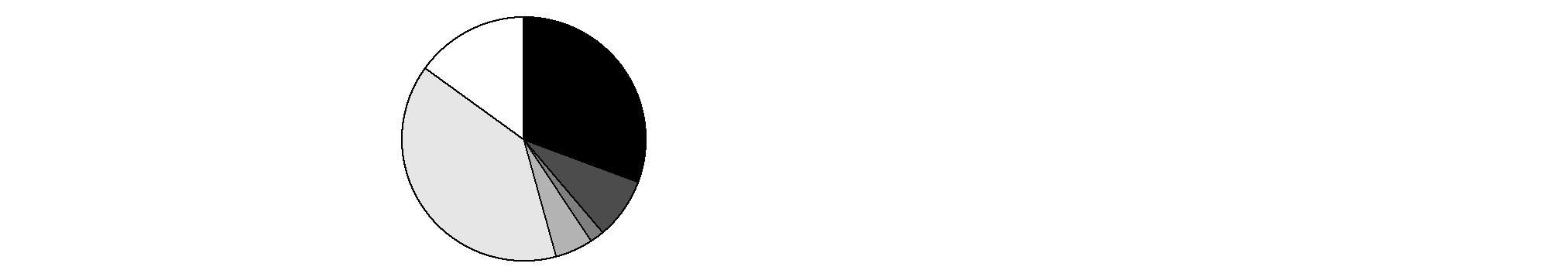

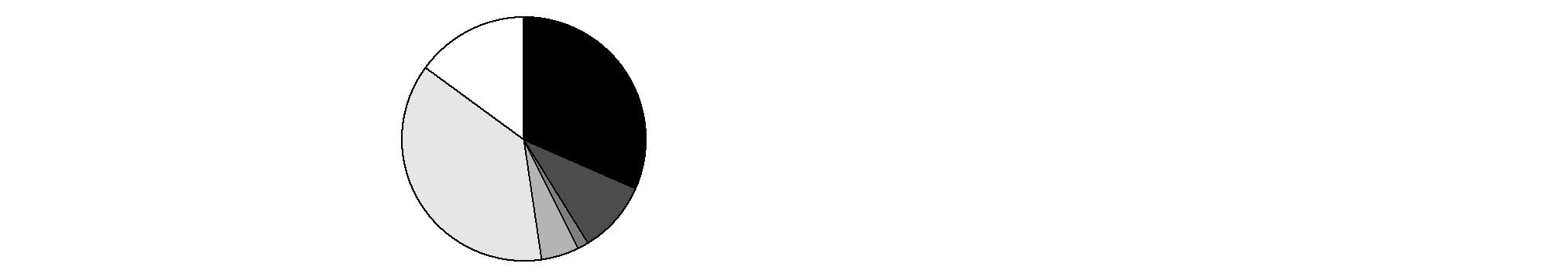

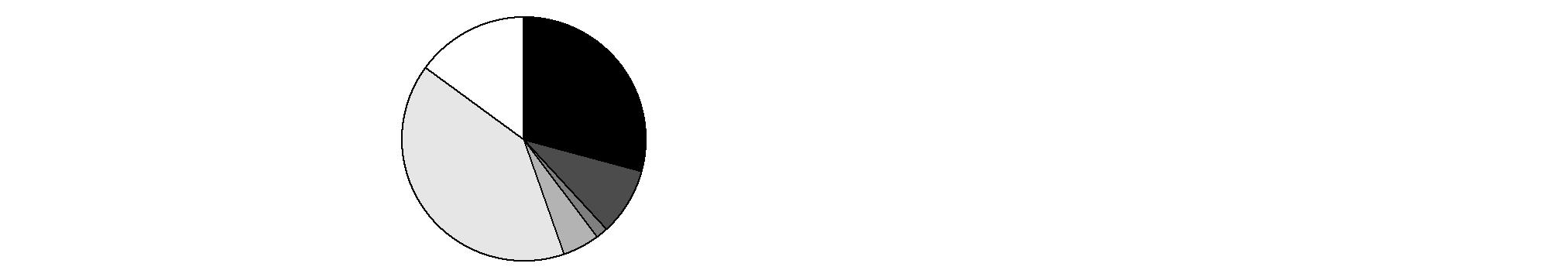

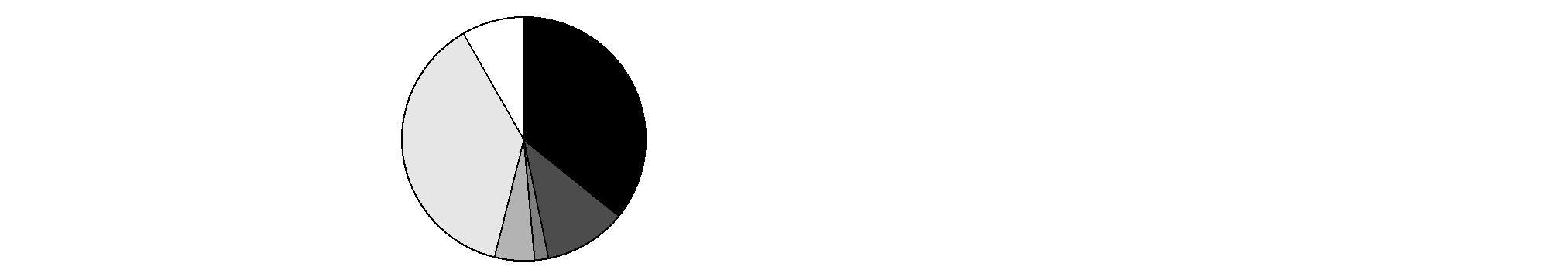

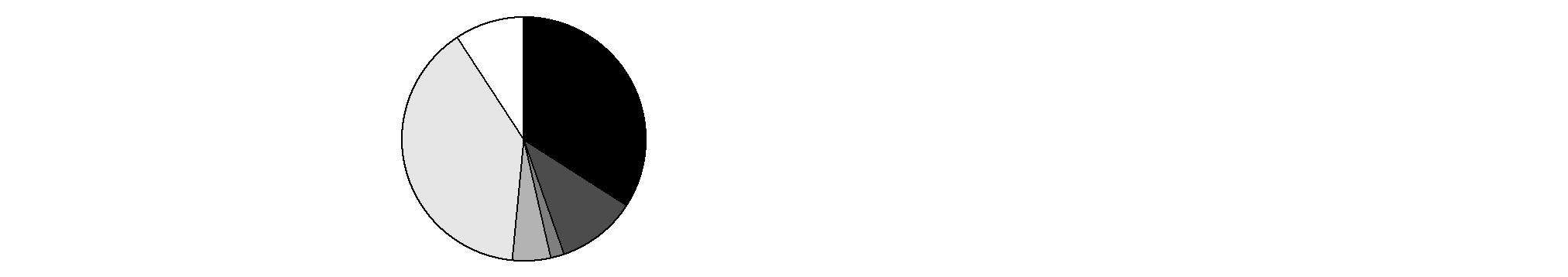

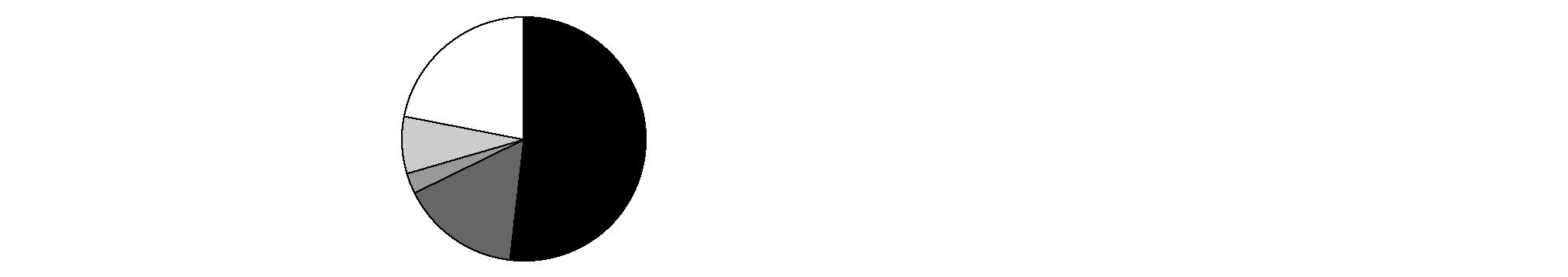

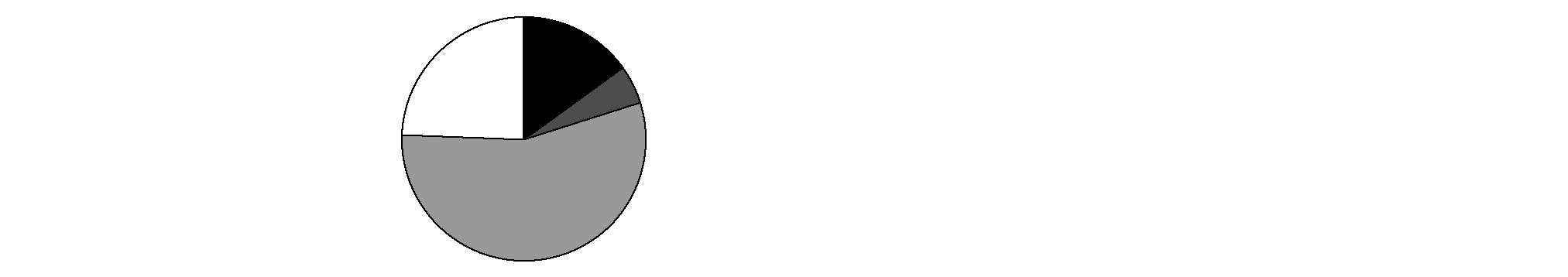

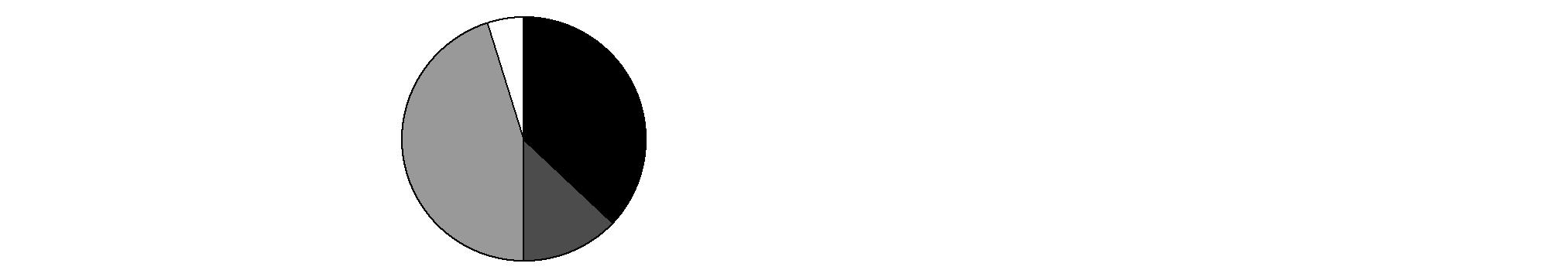

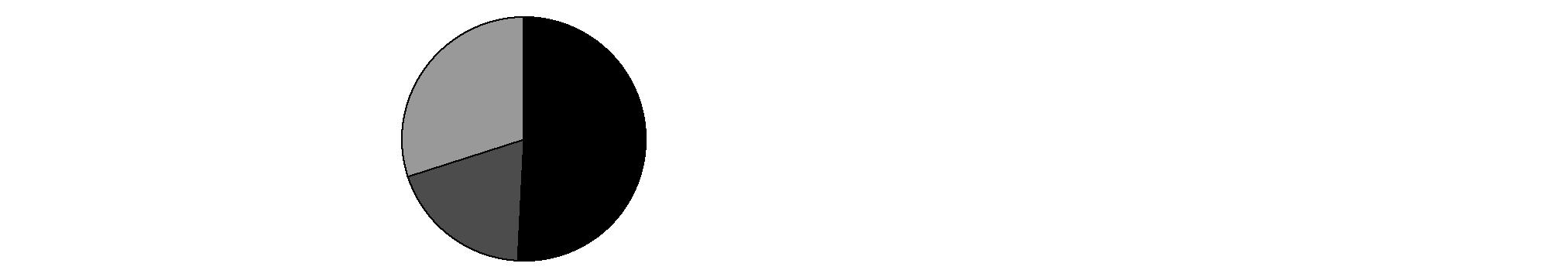

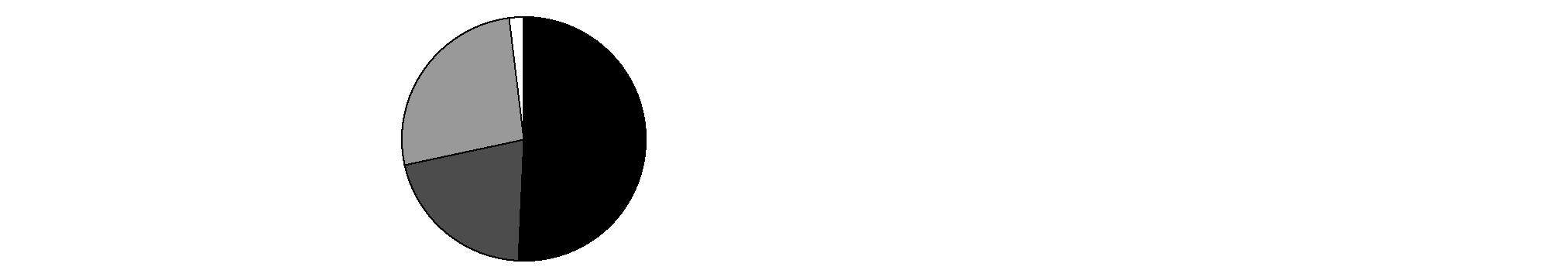

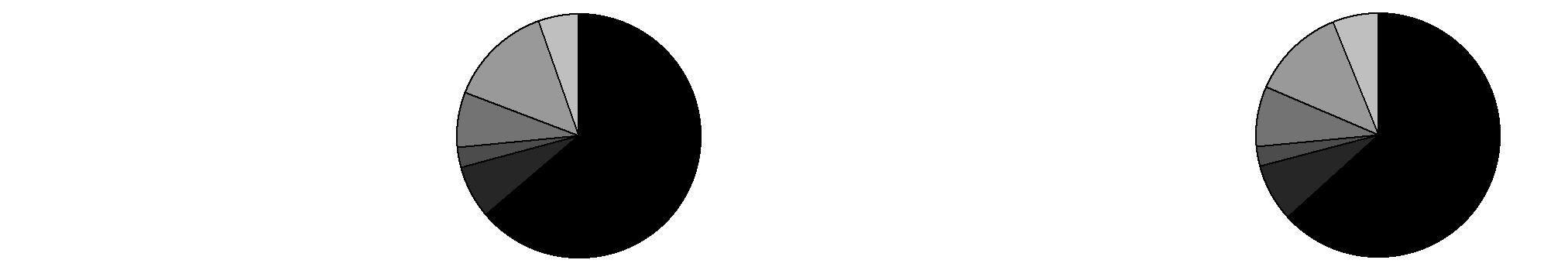

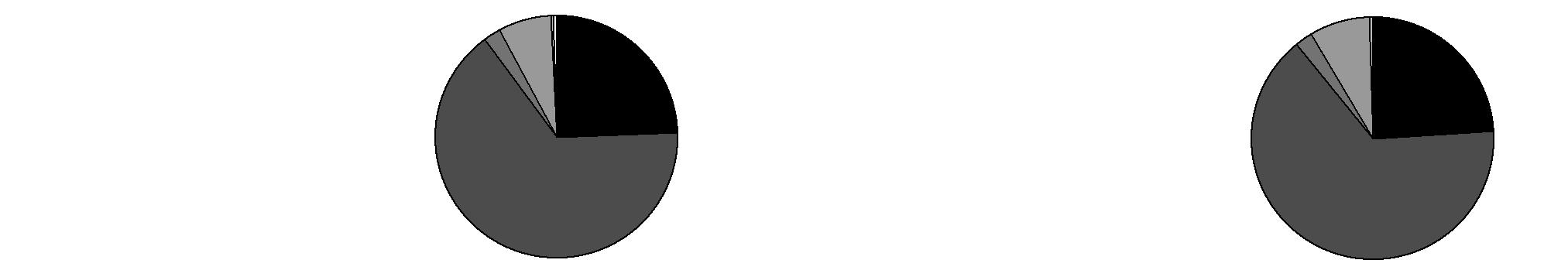

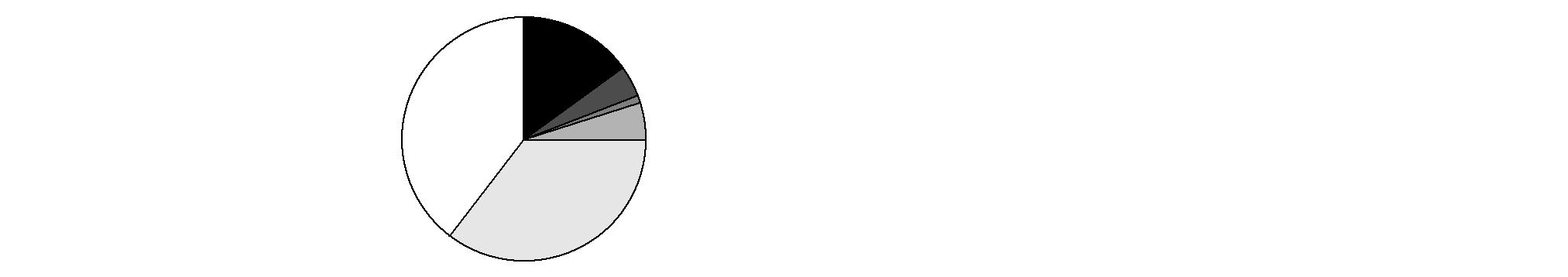

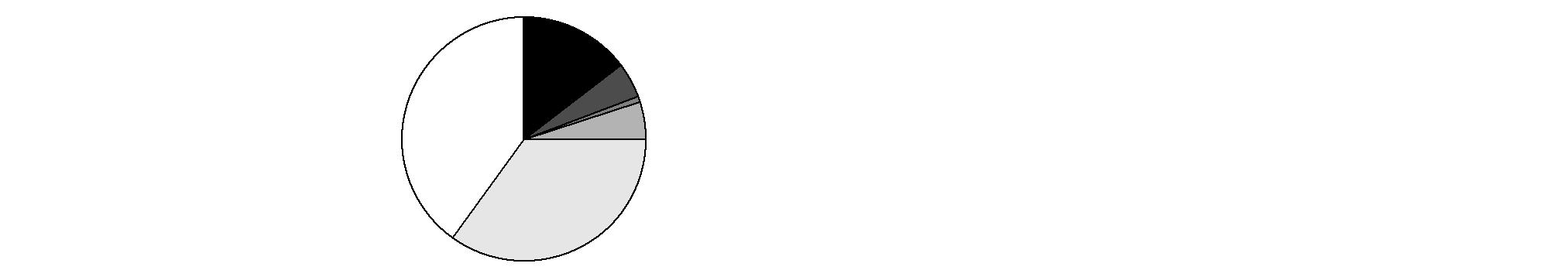

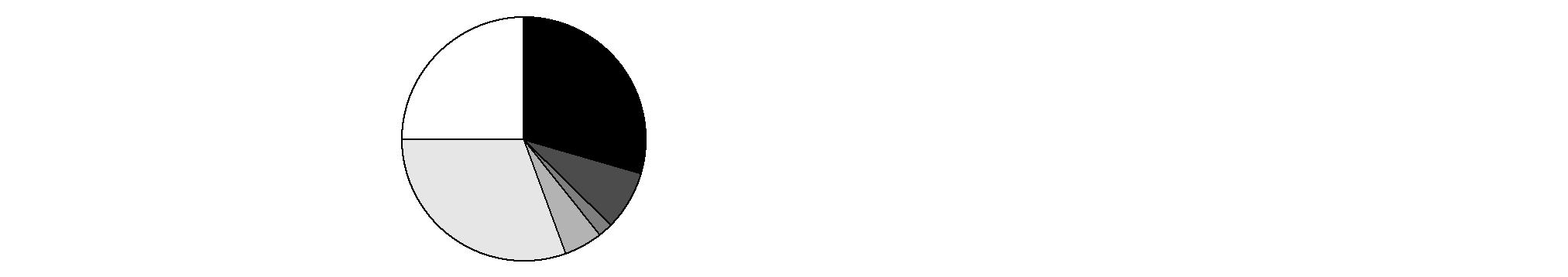

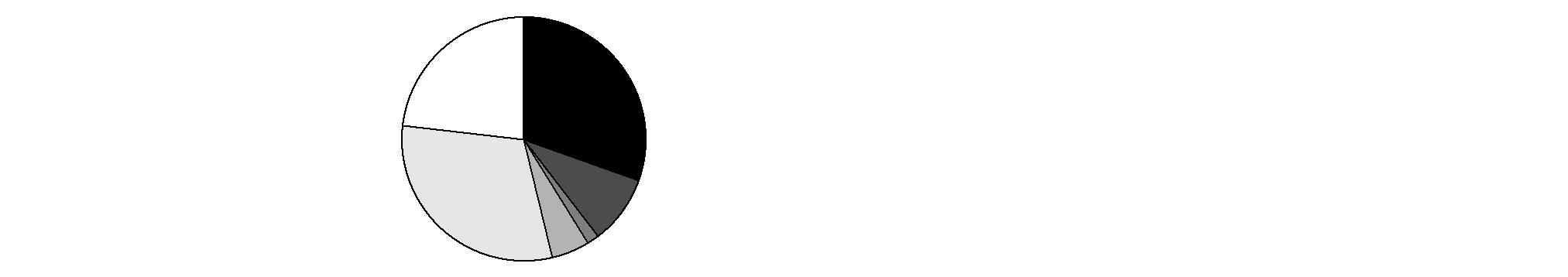

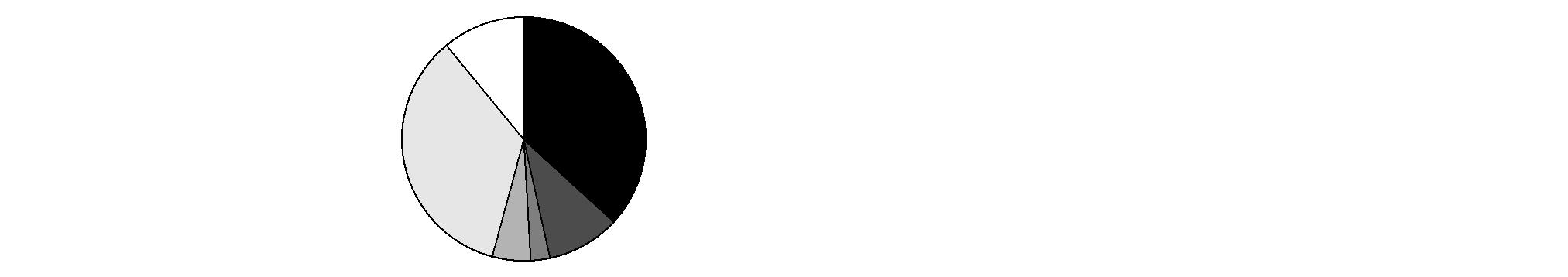

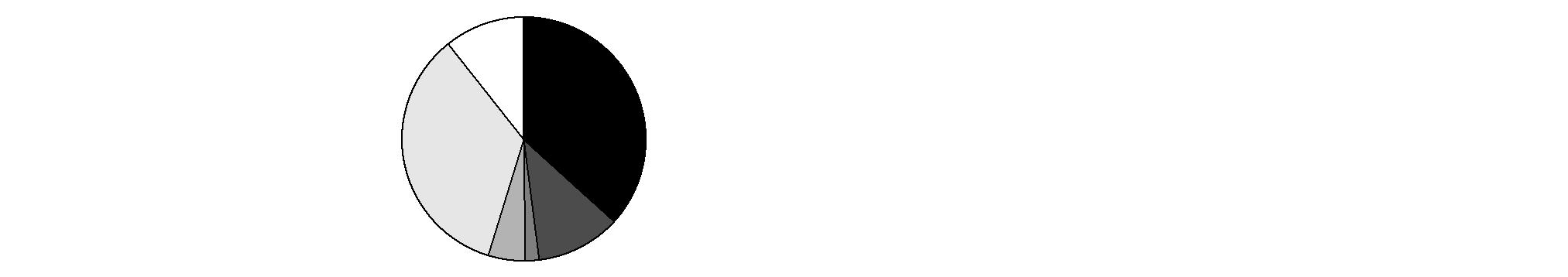

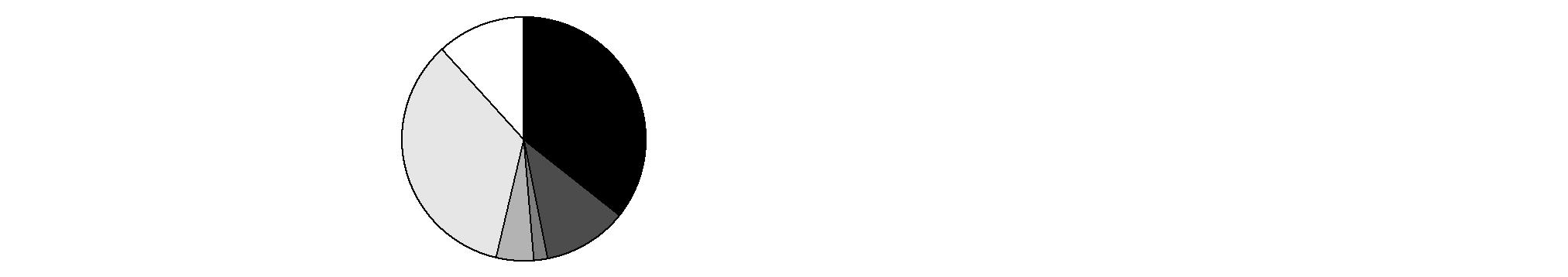

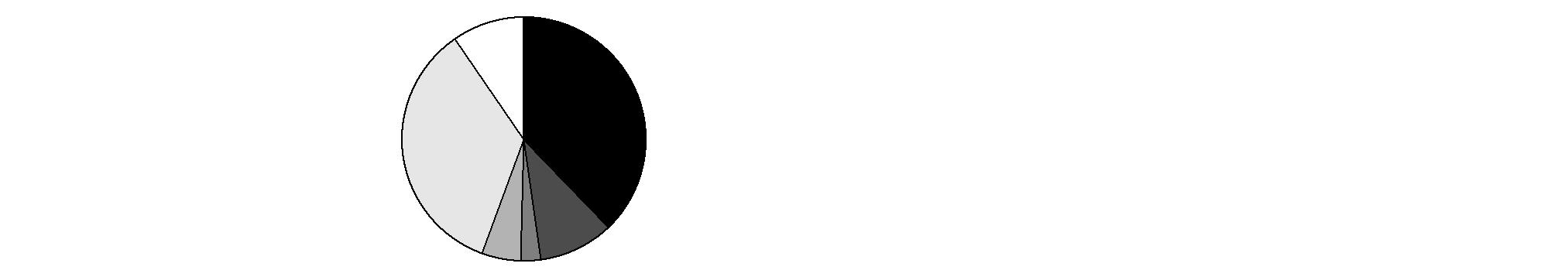

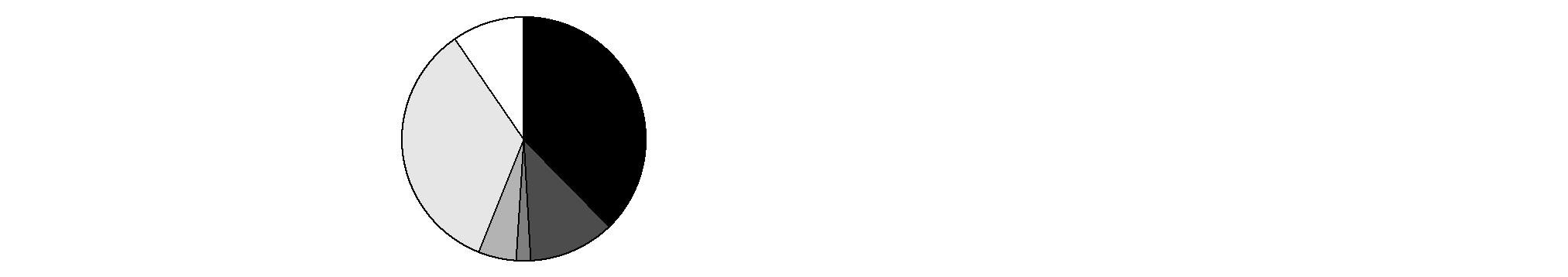

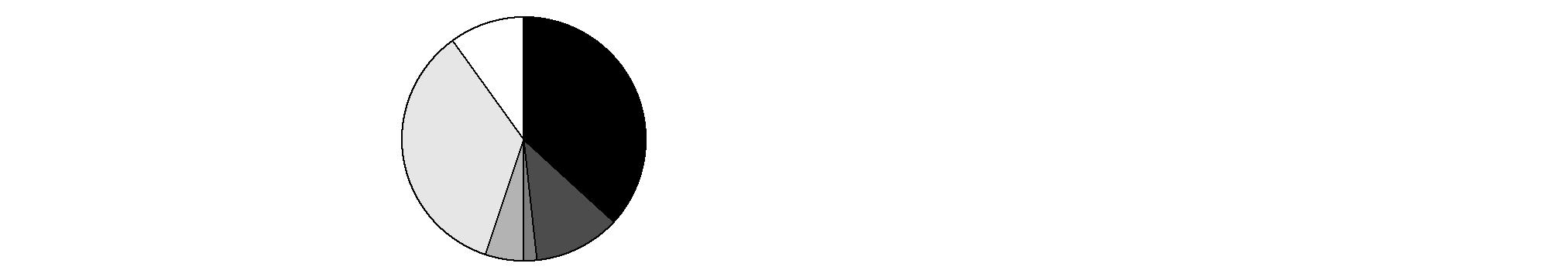

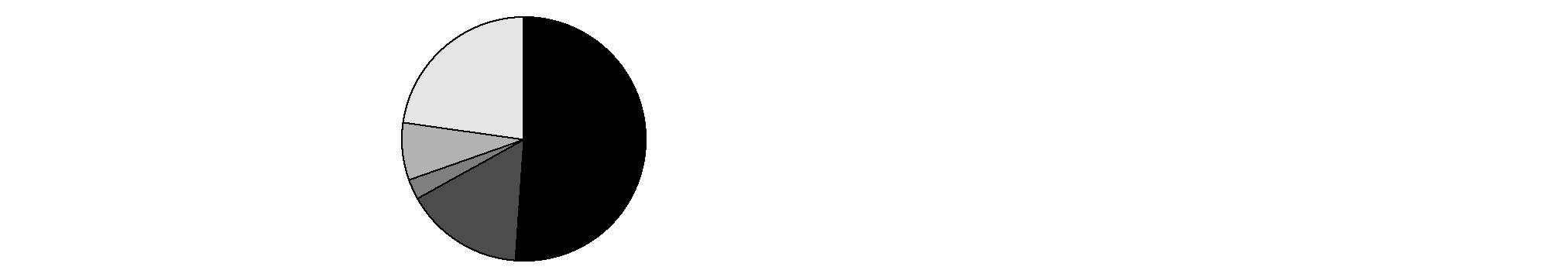

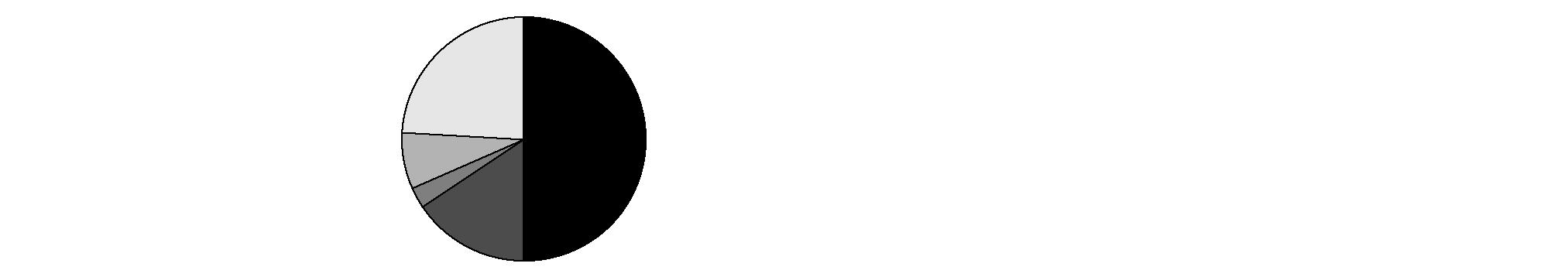

Asset Allocation (% of fund's net assets) |

As of December 31, 2011 * | As of June 30, 2011 ** |

| Stock Class and

Equity Futures*** 46.1% | |  | Stock Class and

Equity Futures**** 50.3% | |

| Bond Class 45.3% | |  | Bond Class 42.2% | |

| Short-Term Class 8.6% | |  | Short-Term Class 7.5% | |

* Foreign investments | 18.0% | | ** Foreign investments | 23.0% | |

*** Includes investment in Fidelity Commodity Strategy Central Fund of 1.4%.

**** Includes investment in Fidelity Commodity Strategy Central Fund of 1.0%.

Asset allocations in the pie charts reflect the categorization of assets as defined in the fund's prospectus in effect as of the time periods indicated above. Financial Statement categorizations conform to accounting standards and will differ from the pie chart. Percentages are adjusted for the effect of futures contracts and swap contracts, if applicable.

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying Fidelity Central Funds, other than the Commodity Strategy and Money Market Central Funds, is available at advisor.fidelity.com.

Annual Report

Investments December 31, 2011

Showing Percentage of Net Assets

Common Stocks - 33.0% |

| Shares | | Value |

CONSUMER DISCRETIONARY - 9.1% |

Auto Components - 0.7% |

Autoliv, Inc. | 49,400 | | $ 2,642,406 |

BorgWarner, Inc. (a) | 32,400 | | 2,065,176 |

TRW Automotive Holdings Corp. (a) | 131,200 | | 4,277,120 |

| | 8,984,702 |

Automobiles - 0.4% |

Ford Motor Co. | 489,300 | | 5,264,868 |

Diversified Consumer Services - 0.3% |

Anhanguera Educacional Participacoes SA | 55,400 | | 597,649 |

Weight Watchers International, Inc. | 50,000 | | 2,750,500 |

| | 3,348,149 |

Hotels, Restaurants & Leisure - 0.5% |

Arcos Dorados Holdings, Inc. | 61,400 | | 1,260,542 |

Panera Bread Co. Class A (a) | 20,400 | | 2,885,580 |

Yum! Brands, Inc. | 30,200 | | 1,782,102 |

| | 5,928,224 |

Household Durables - 0.7% |

Gafisa SA sponsored ADR | 241,200 | | 1,109,520 |

KB Home | 197,600 | | 1,327,872 |

PulteGroup, Inc. (a) | 707,500 | | 4,464,325 |

Toll Brothers, Inc. (a) | 67,500 | | 1,378,350 |

| | 8,280,067 |

Internet & Catalog Retail - 0.2% |

Amazon.com, Inc. (a) | 6,000 | | 1,038,600 |

Groupon, Inc. Class A (a)(d) | 78,700 | | 1,623,581 |

| | 2,662,181 |

Media - 0.7% |

CBS Corp. Class B | 129,100 | | 3,503,774 |

The Walt Disney Co. | 160,700 | | 6,026,250 |

| | 9,530,024 |

Multiline Retail - 1.1% |

Dollar General Corp. (a) | 16,300 | | 670,582 |

Dollar Tree, Inc. (a) | 33,300 | | 2,767,563 |

Lojas Renner SA | 26,000 | | 675,537 |

Macy's, Inc. | 191,600 | | 6,165,688 |

Target Corp. | 63,100 | | 3,231,982 |

| | 13,511,352 |

Specialty Retail - 2.1% |

Dick's Sporting Goods, Inc. | 34,300 | | 1,264,984 |

Home Depot, Inc. | 122,600 | | 5,154,104 |

Limited Brands, Inc. | 147,000 | | 5,931,450 |

PetSmart, Inc. | 25,600 | | 1,313,024 |

Tiffany & Co., Inc. | 14,300 | | 947,518 |

TJX Companies, Inc. | 85,000 | | 5,486,750 |

Vitamin Shoppe, Inc. (a) | 21,800 | | 869,384 |

Williams-Sonoma, Inc. | 145,000 | | 5,582,500 |

| | 26,549,714 |

|

| Shares | | Value |

Textiles, Apparel & Luxury Goods - 2.4% |

Arezzo Industria e Comercio SA | 91,700 | | $ 1,141,821 |

Burberry Group PLC | 69,200 | | 1,273,614 |

Coach, Inc. | 38,700 | | 2,362,248 |

Deckers Outdoor Corp. (a) | 91,300 | | 6,899,541 |

Fossil, Inc. (a) | 44,000 | | 3,491,840 |

Michael Kors Holdings Ltd. | 7,800 | | 212,550 |

Michael Kors Holdings Ltd. | 103,132 | | 2,529,312 |

Prada SpA | 110,800 | | 501,458 |

PVH Corp. | 29,900 | | 2,107,651 |

Ralph Lauren Corp. | 14,900 | | 2,057,392 |

Under Armour, Inc. Class A (sub. vtg.) (a) | 13,800 | | 990,702 |

Vera Bradley, Inc. (a)(d) | 70,200 | | 2,263,950 |

VF Corp. | 31,400 | | 3,987,486 |

| | 29,819,565 |

TOTAL CONSUMER DISCRETIONARY | | 113,878,846 |

CONSUMER STAPLES - 1.2% |

Beverages - 0.3% |

Hansen Natural Corp. (a) | 43,700 | | 4,026,518 |

Food & Staples Retailing - 0.1% |

Drogasil SA | 98,506 | | 685,714 |

Food Products - 0.4% |

Green Mountain Coffee Roasters, Inc. (a) | 121,100 | | 5,431,335 |

Personal Products - 0.4% |

Hengan International Group Co. Ltd. | 320,000 | | 2,993,330 |

Nu Skin Enterprises, Inc. Class A | 50,200 | | 2,438,214 |

| | 5,431,544 |

TOTAL CONSUMER STAPLES | | 15,575,111 |

ENERGY - 6.1% |

Energy Equipment & Services - 1.6% |

Baker Hughes, Inc. | 95,600 | | 4,649,984 |

Carbo Ceramics, Inc. (d) | 14,800 | | 1,825,284 |

Halliburton Co. | 145,100 | | 5,007,401 |

McDermott International, Inc. (a) | 98,500 | | 1,133,735 |

Schlumberger Ltd. | 119,013 | | 8,129,778 |

| | 20,746,182 |

Oil, Gas & Consumable Fuels - 4.5% |

Anadarko Petroleum Corp. | 51,300 | | 3,915,729 |

Cabot Oil & Gas Corp. | 19,800 | | 1,502,820 |

Chevron Corp. | 104,000 | | 11,065,600 |

Concho Resources, Inc. (a) | 62,300 | | 5,840,625 |

Continental Resources, Inc. (a) | 101,500 | | 6,771,065 |

Hess Corp. | 22,500 | | 1,278,000 |

HollyFrontier Corp. | 63,000 | | 1,474,200 |

Kosmos Energy Ltd. | 62,000 | | 760,120 |

Marathon Oil Corp. | 52,500 | | 1,536,675 |

Oasis Petroleum, Inc. (a) | 81,100 | | 2,359,199 |

Occidental Petroleum Corp. | 73,500 | | 6,886,950 |

Common Stocks - continued |

| Shares | | Value |

ENERGY - continued |

Oil, Gas & Consumable Fuels - continued |

Pioneer Natural Resources Co. | 84,000 | | $ 7,516,320 |

Whiting Petroleum Corp. (a) | 111,800 | | 5,219,942 |

| | 56,127,245 |

TOTAL ENERGY | | 76,873,427 |

FINANCIALS - 1.3% |

Capital Markets - 0.8% |

Apollo Global Management LLC Class A | 347,200 | | 4,308,752 |

Morgan Stanley | 411,100 | | 6,219,943 |

| | 10,528,695 |

Diversified Financial Services - 0.4% |

Citigroup, Inc. | 174,100 | | 4,580,571 |

Real Estate Management & Development - 0.1% |

CBRE Group, Inc. (a) | 78,100 | | 1,188,682 |

TOTAL FINANCIALS | | 16,297,948 |

HEALTH CARE - 3.6% |

Biotechnology - 0.7% |

Alexion Pharmaceuticals, Inc. (a) | 62,300 | | 4,454,450 |

Clovis Oncology, Inc. | 14,000 | | 197,260 |

Inhibitex, Inc. (a) | 60,000 | | 656,400 |

InterMune, Inc. (a) | 23,500 | | 296,100 |

Vertex Pharmaceuticals, Inc. (a) | 105,800 | | 3,513,618 |

| | 9,117,828 |

Health Care Providers & Services - 1.8% |

Accretive Health, Inc. (a) | 91,200 | | 2,095,776 |

HMS Holdings Corp. (a) | 84,900 | | 2,715,102 |

Humana, Inc. | 73,000 | | 6,395,530 |

UnitedHealth Group, Inc. | 121,400 | | 6,152,552 |

WellPoint, Inc. | 75,200 | | 4,982,000 |

| | 22,340,960 |

Health Care Technology - 0.1% |

SXC Health Solutions Corp. (a) | 26,200 | | 1,473,364 |

Pharmaceuticals - 1.0% |

Elan Corp. PLC sponsored ADR (a) | 301,500 | | 4,142,610 |

Shire PLC sponsored ADR | 30,300 | | 3,148,170 |

Valeant Pharmaceuticals International, Inc. (Canada) | 100,450 | | 4,700,950 |

| | 11,991,730 |

TOTAL HEALTH CARE | | 44,923,882 |

INDUSTRIALS - 3.2% |

Airlines - 1.6% |

Copa Holdings SA Class A | 32,900 | | 1,930,243 |

Delta Air Lines, Inc. (a) | 856,125 | | 6,926,051 |

|

| Shares | | Value |

Gol Linhas Aereas Inteligentes SA: | | | |

rights 1/26/12 (a) | 5,205 | | $ 0 |

sponsored ADR (d) | 104,500 | | 692,835 |

United Continental Holdings, Inc. (a) | 559,770 | | 10,562,860 |

| | 20,111,989 |

Building Products - 0.2% |

Owens Corning (a) | 68,500 | | 1,967,320 |

Commercial Services & Supplies - 0.0% |

Swisher Hygiene, Inc. | 135,158 | | 505,491 |

Electrical Equipment - 0.1% |

Roper Industries, Inc. | 18,200 | | 1,581,034 |

Machinery - 0.7% |

Caterpillar, Inc. | 12,800 | | 1,159,680 |

Dover Corp. | 18,500 | | 1,073,925 |

Kennametal, Inc. | 54,400 | | 1,986,688 |

Parker Hannifin Corp. | 32,200 | | 2,455,250 |

Sandvik AB | 33,100 | | 406,240 |

WABCO Holdings, Inc. (a) | 11,300 | | 490,420 |

Weg SA | 81,700 | | 823,490 |

| | 8,395,693 |

Professional Services - 0.3% |

Qualicorp SA | 108,000 | | 970,910 |

Robert Half International, Inc. | 102,600 | | 2,919,996 |

| | 3,890,906 |

Trading Companies & Distributors - 0.3% |

Air Lease Corp.: | | | |

Class A (a)(e) | 59,100 | | 1,401,261 |

Class A | 59,300 | | 1,406,003 |

Mills Estruturas e Servicos de Engenharia SA | 95,400 | | 906,280 |

| | 3,713,544 |

TOTAL INDUSTRIALS | | 40,165,977 |

INFORMATION TECHNOLOGY - 6.8% |

Communications Equipment - 0.7% |

Cisco Systems, Inc. | 339,500 | | 6,138,160 |

HTC Corp. | 32,150 | | 527,606 |

QUALCOMM, Inc. | 14,900 | | 815,030 |

Riverbed Technology, Inc. (a) | 59,200 | | 1,391,200 |

| | 8,871,996 |

Computers & Peripherals - 2.2% |

Apple, Inc. (a) | 68,300 | | 27,661,500 |

Fusion-io, Inc. | 10,100 | | 244,420 |

| | 27,905,920 |

Internet Software & Services - 1.2% |

Active Network, Inc. | 51,500 | | 700,400 |

Bankrate, Inc. (d) | 68,600 | | 1,474,900 |

Cornerstone OnDemand, Inc. (d) | 66,800 | | 1,218,432 |

Facebook, Inc. Class B (h) | 8,621 | | 215,525 |

Google, Inc. Class A (a) | 9,600 | | 6,200,640 |

Rackspace Hosting, Inc. (a) | 54,100 | | 2,326,841 |

Common Stocks - continued |

| Shares | | Value |

INFORMATION TECHNOLOGY - continued |

Internet Software & Services - continued |

Renren, Inc. ADR (d) | 33,100 | | $ 117,505 |

VeriSign, Inc. | 49,400 | | 1,764,568 |

YouKu.com, Inc. ADR (a)(d) | 20,200 | | 316,534 |

| | 14,335,345 |

IT Services - 0.6% |

Cognizant Technology Solutions Corp. Class A (a) | 77,300 | | 4,971,163 |

MasterCard, Inc. Class A | 7,700 | | 2,870,714 |

| | 7,841,877 |

Semiconductors & Semiconductor Equipment - 0.8% |

Altera Corp. | 36,900 | | 1,368,990 |

ASML Holding NV | 84,600 | | 3,535,434 |

Freescale Semiconductor Holdings I Ltd. | 121,800 | | 1,540,770 |

KLA-Tencor Corp. | 24,300 | | 1,172,475 |

NXP Semiconductors NV (a) | 173,300 | | 2,663,621 |

| | 10,281,290 |

Software - 1.3% |

Ariba, Inc. (a) | 21,511 | | 604,029 |

Citrix Systems, Inc. (a) | 55,100 | | 3,345,672 |

CommVault Systems, Inc. (a) | 23,900 | | 1,021,008 |

Informatica Corp. (a) | 110,700 | | 4,088,151 |

Jive Software, Inc. | 3,200 | | 51,200 |

RealPage, Inc. (a) | 54,500 | | 1,377,215 |

salesforce.com, Inc. (a) | 9,100 | | 923,286 |

Taleo Corp. Class A (a) | 40,200 | | 1,555,338 |

VMware, Inc. Class A (a) | 36,700 | | 3,053,073 |

Zynga, Inc. | 22,400 | | 210,784 |

| | 16,229,756 |

TOTAL INFORMATION TECHNOLOGY | | 85,466,184 |

MATERIALS - 1.4% |

Chemicals - 1.1% |

Celanese Corp. Class A | 83,000 | | 3,674,410 |

Dow Chemical Co. | 101,600 | | 2,922,016 |

LyondellBasell Industries NV Class A | 46,600 | | 1,514,034 |

Rockwood Holdings, Inc. (a) | 40,500 | | 1,594,485 |

The Mosaic Co. | 37,400 | | 1,886,082 |

Westlake Chemical Corp. | 51,700 | | 2,080,408 |

| | 13,671,435 |

Metals & Mining - 0.3% |

First Quantum Minerals Ltd. | 115,900 | | 2,281,810 |

Genel Energy PLC | 73,100 | | 879,898 |

| | 3,161,708 |

TOTAL MATERIALS | | 16,833,143 |

|

| Shares | | Value |

TELECOMMUNICATION SERVICES - 0.3% |

Wireless Telecommunication Services - 0.3% |

American Tower Corp. Class A | 51,600 | | $ 3,096,516 |

TOTAL COMMON STOCKS (Cost $381,842,132) |

413,111,034

|

Investment Companies - 2.5% |

| | | |

iShares Barclays TIPS Bond ETF

(Cost $30,964,304) | 273,300 | |

31,891,377

|

Fixed-Income Funds - 43.8% |

| | | |

Fidelity Emerging Markets Debt Central Fund (g) | 737,763 | | 7,362,876 |

Fidelity Floating Rate Central Fund (g) | 510,657 | | 50,197,537 |

Fidelity High Income Central Fund 1 (g) | 421,571 | | 40,230,514 |

Fidelity VIP Investment Grade Central Fund (g) | 4,181,369 | | 450,082,516 |

TOTAL FIXED-INCOME FUNDS (Cost $524,471,789) |

547,873,443

|

Equity Funds - 12.9% |

| | | |

Domestic Equity Funds - 1.4% |

Fidelity Commodity Strategy Central Fund (g) | 1,642,711 | | 17,527,726 |

International Equity Funds - 11.5% |

Fidelity Emerging Markets Equity Central Fund (g) | 131,671 | | 22,958,221 |

Fidelity International Equity Central Fund (g) | 2,021,563 | | 121,293,806 |

TOTAL INTERNATIONAL EQUITY FUNDS | | 144,252,027 |

TOTAL EQUITY FUNDS (Cost $194,472,961) |

161,779,753

|

U.S. Treasury Obligations - 0.2% |

| Principal Amount | | |

U.S. Treasury Bills, yield at date of purchase 0.01% 2/23/12 (f)

(Cost $2,749,938) | | $ 2,750,000 | |

2,749,951

|

Money Market Funds - 8.1% |

| Shares | | Value |

| | | |

Fidelity Cash Central Fund, 0.11% (b) | 85,533,317 | | $ 85,533,317 |

Fidelity Money Market Central Fund, 0.39% (b) | 10,373,893 | | 10,373,893 |

Fidelity Securities Lending Cash Central Fund, 0.13% (b)(c) | 5,907,973 | | 5,907,973 |

TOTAL MONEY MARKET FUNDS (Cost $101,815,183) |

101,815,183

|

TOTAL INVESTMENT PORTFOLIO - 100.5% (Cost $1,236,316,307) | 1,259,220,741 |

NET OTHER ASSETS (LIABILITIES) - (0.5)% | (6,886,306) |

NET ASSETS - 100% | $ 1,252,334,435 |

Futures Contracts |

| Expiration Date | | Underlying Face Amount at Value | | Unrealized Appreciation/(Depreciation) |

Purchased |

Equity Index Contracts |

77 CME E-mini S&P 500 Index Contracts | March 2012 | | $ 4,822,510 | | $ (1,656) |

|

The face value of futures purchased as a percentage of net assets is 0.4% |

Security Type Abbreviations |

ETFs - Exchange-Traded Funds |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $1,401,261 or 0.1% of net assets. |

(f) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At the period end, the value of securities pledged amounted to $499,991. |

(g) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-Q and is available upon request or at the SEC's web site at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro rata share of securities and other investments held indirectly through its investment in underlying Fidelity Central Funds, other than the Commodity Strategy and Money Market Central Funds, is available at advisor.fidelity.com. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's web site or upon request. |

(h) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $215,525 or 0.0% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Acquisition Cost |

Facebook, Inc. Class B | 5/19/11 | $ 215,930 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

| |

Fund | Income earned |

Fidelity Cash Central Fund | $ 75,386 |

Fidelity Commodity Strategy Central Fund | 11,259 |

Fidelity Emerging Markets Debt Central Fund | 349,874 |

Fidelity Emerging Markets Equity Central Fund | 442,984 |

Fidelity Floating Rate Central Fund | 2,149,726 |

Fidelity High Income Central Fund 1 | 3,464,817 |

Fidelity International Equity Central Fund | 4,753,912 |

Fidelity Money Market Central Fund | 77,804 |

Fidelity Securities Lending Cash Central Fund | 107,210 |

Fidelity VIP Investment Grade Central Fund | 17,801,249 |

Total | $ 29,234,221 |

Additional information regarding the Fund's fiscal year to date purchases and sales, including the ownership percentage, of the non Money Market Central Funds is as follows: |

Fund | Value,

beginning of

period | Purchases | Sales

Proceeds | Value,

end of

period | % ownership,

end of

period |

Fidelity Commodity Strategy Central Fund | $ 22,829,987 | $ 26,549,557 | $ 28,964,427 | $ 17,527,726 | 1.6% |

Fidelity Emerging Markets Debt Central Fund | - | 7,379,457 | - | 7,362,876 | 6.6% |

Fidelity Emerging Markets Equity Central Fund | 44,864,395 | 746,664 | 15,499,678 | 22,958,221 | 8.2% |

Fidelity Floating Rate Central Fund | 45,723,024 | 13,697,848 | 8,408,001 | 50,197,537 | 1.8% |

Fidelity High Income Central Fund 1 | 52,973,765 | 3,464,169 | 15,208,618 | 40,230,514 | 8.1% |

Fidelity International Equity Central Fund | 162,878,293 | 15,803,760 | 31,835,959 | 121,293,806 | 8.4% |

Fidelity VIP Investment Grade Central Fund | 494,551,472 | 54,815,665 | 111,415,118 | 450,082,516 | 11.9% |

Total | $ 823,820,936 | $ 122,457,120 | $ 211,331,801 | $ 709,653,196 | |

Other Information |

The following is a summary of the inputs used, as of December 31, 2011, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 113,878,846 | $ 111,349,534 | $ 2,529,312 | $ - |

Consumer Staples | 15,575,111 | 15,575,111 | - | - |

Energy | 76,873,427 | 76,873,427 | - | - |

Financials | 16,297,948 | 16,297,948 | - | - |

Health Care | 44,923,882 | 44,923,882 | - | - |

Industrials | 40,165,977 | 40,165,977 | - | - |

Information Technology | 85,466,184 | 85,250,659 | - | 215,525 |

Materials | 16,833,143 | 16,833,143 | - | - |

Telecommunication Services | 3,096,516 | 3,096,516 | - | - |

Investment Companies | 31,891,377 | 31,891,377 | - | - |

U.S. Government and Government Agency Obligations | 2,749,951 | - | 2,749,951 | - |

Fixed-Income Funds | 547,873,443 | 547,873,443 | - | - |

Money Market Funds | 101,815,183 | 101,815,183 | - | - |

Equity Funds | 161,779,753 | 161,779,753 | - | - |

Total Investments in Securities: | $ 1,259,220,741 | $ 1,253,725,953 | $ 5,279,263 | $ 215,525 |

Derivative Instruments: | | | | |

Liabilities | | | | |

Futures Contracts | $ (1,656) | $ (1,656) | $ - | $ - |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value: |

Investments in Securities: | |

Beginning Balance | $ 1,211,550 |

Total Realized Gain (Loss) | - |

Total Unrealized Gain (Loss) | (405) |

Cost of Purchases | 215,930 |

Proceeds of Sales | - |

Amortization/Accretion | - |

Transfers in to Level 3 | - |

Transfers out of Level 3 | (1,211,550) |

Ending Balance | $ 215,525 |

The change in unrealized gain (loss) for the period attributable to Level 3 securities held at December 31, 2011 | $ (405) |

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations. |

Value of Derivative Instruments |

The following table is a summary of the Fund's value of derivative instruments by risk exposure as of December 31, 2011. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements. |

Risk Exposure /

Derivative Type | Value |

| Asset | Liability |

Equity Risk | | |

Futures Contracts (a) | $ - | $ (1,656) |

Total Value of Derivatives | $ - | $ (1,656) |

(a) Reflects cumulative appreciation/(depreciation) on futures contracts as disclosed on the Schedule of Investments. Only the period end variation margin is separately disclosed on the Statement of Assets and Liabilities. |

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds. |

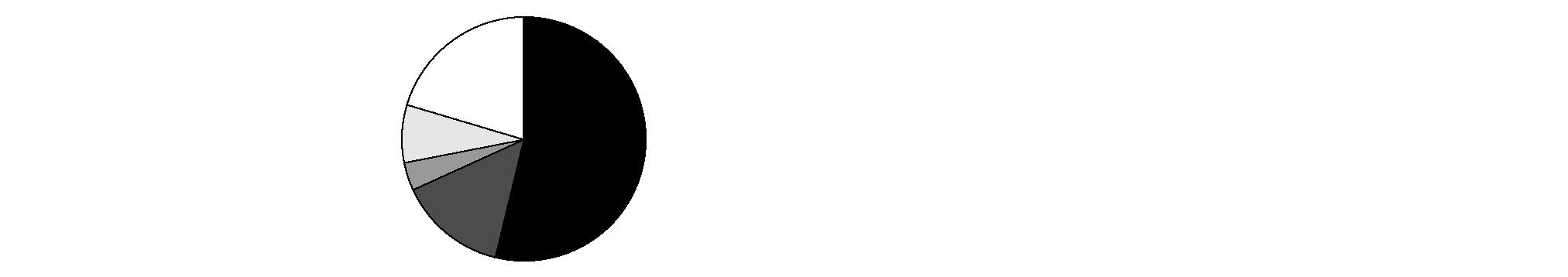

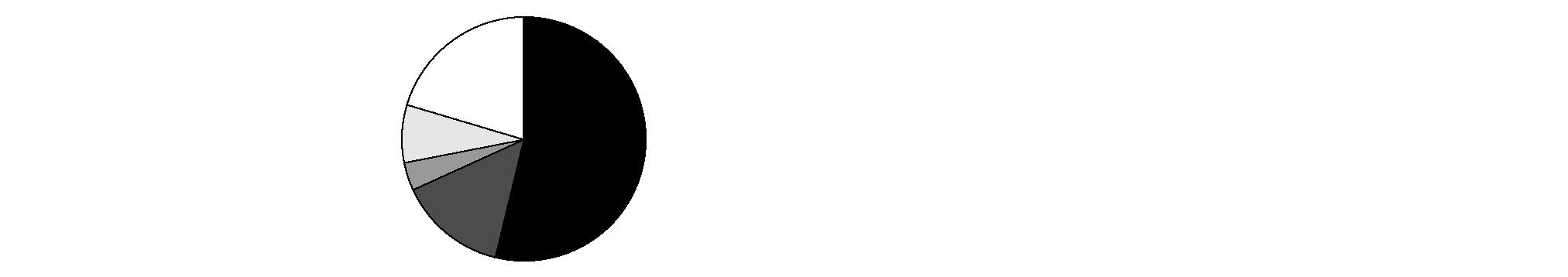

The composition of credit quality ratings as a percentage of net assets is as follows (Unaudited): |

U.S. Government and U.S. Government Agency Obligations | 24.1% |

AAA,AA,A | 6.4% |

BBB | 5.3% |

BB | 2.8% |

B | 4.3% |

CCC,CC,C | 0.5% |

D | 0.0%** |

Not Rated | 0.8% |

Equities * | 48.5% |

Short-Term Investments and Net Other Assets | 7.3% |

| 100.0% |

* Includes investment in Fidelity Commodity Strategy Central Fund of 1.4%. |

** Amount represents less than 0.1% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. Percentages are adjusted for the effect of futures contracts, if applicable. |

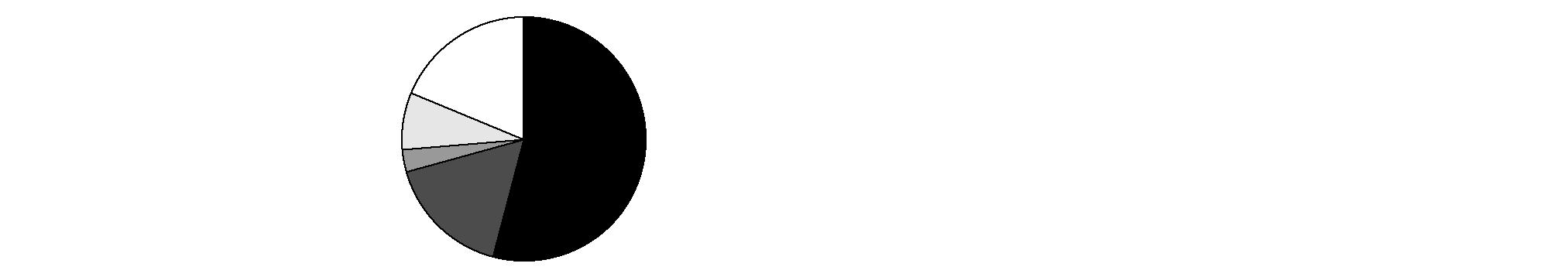

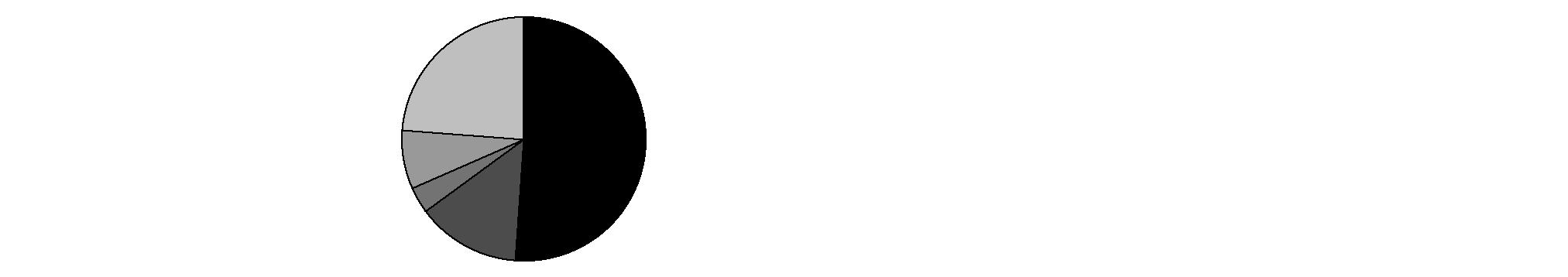

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: (Unaudited) |

United States of America | 82.0% |

United Kingdom | 2.9% |

Japan | 1.6% |

Brazil | 1.4% |

Canada | 1.2% |

Others (Individually Less Than 1%) | 10.9% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

| December 31, 2011 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $5,723,701) - See accompanying schedule: Unaffiliated issuers (cost $415,556,374) | $ 447,752,362 | |

Fidelity Central Funds (cost $820,759,933) | 811,468,379 | |

Total Investments (cost $1,236,316,307) | | $ 1,259,220,741 |

Cash | | 23,405 |

Foreign currency held at value (cost $20) | | 20 |

Receivable for investments sold | | 117,471 |

Receivable for fund shares sold | | 133,998 |

Dividends receivable | | 401,987 |

Distributions receivable from Fidelity Central Funds | | 59,045 |

Prepaid expenses | | 3,529 |

Other receivables | | 74,982 |

Total assets | | 1,260,035,178 |

| | |

Liabilities | | |

Payable for fund shares redeemed | 1,028,197 | |

Accrued management fee | 533,011 | |

Distribution and service plan fees payable | 7,455 | |

Payable for daily variation margin on futures contracts | 18,482 | |

Other affiliated payables | 120,786 | |

Other payables and accrued expenses | 84,839 | |

Collateral on securities loaned, at value | 5,907,973 | |

Total liabilities | | 7,700,743 |

| | |

Net Assets | | $ 1,252,334,435 |

Net Assets consist of: | | |

Paid in capital | | $ 1,267,463,219 |

Distributions in excess of net investment income | | (52,107) |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (37,978,169) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 22,901,492 |

Net Assets | | $ 1,252,334,435 |

Statement of Assets and Liabilities - continued

| December 31, 2011 |

| | |

Initial Class:

Net Asset Value, offering price and redemption price per share ($1,108,494,466 ÷ 80,333,985 shares) | | $ 13.80 |

| | |

Service Class:

Net Asset Value, offering price and redemption price per share ($8,042,439 ÷ 586,579 shares) | | $ 13.71 |

| | |

Service Class 2:

Net Asset Value, offering price and redemption price per share ($32,507,838 ÷ 2,396,028 shares) | | $ 13.57 |

| | |

Investor Class:

Net Asset Value, offering price and redemption price per share ($103,289,692 ÷ 7,514,889 shares) | | $ 13.74 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended December 31, 2011 |

| | |

Investment Income | | |

Dividends | | $ 5,330,125 |

Interest | | 655 |

Income from Fidelity Central Funds | | 29,234,221 |

Total income | | 34,565,001 |

| | |

Expenses | | |

Management fee | $ 6,942,504 | |

Transfer agent fees | 1,092,364 | |

Distribution and service plan fees | 97,657 | |

Accounting and security lending fees | 553,775 | |

Custodian fees and expenses | 30,187 | |

Independent trustees' compensation | 5,263 | |

Appreciation in deferred trustee compensation account | 13 | |

Audit | 50,425 | |

Legal | 10,678 | |

Miscellaneous | 13,596 | |

Total expenses before reductions | 8,796,462 | |

Expense reductions | (142,804) | 8,653,658 |

Net investment income (loss) | | 25,911,343 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 68,606,154 | |

Fidelity Central Funds | 6,508,074 | |

Foreign currency transactions | (130,537) | |

Futures contracts | (789,641) | |

Capital gain distributions from Fidelity Central Funds | 8,341,557 | |

Total net realized gain (loss) | | 82,535,607 |

Change in net unrealized appreciation (depreciation) on: Investment securities | (140,550,894) | |

Assets and liabilities in foreign currencies | (2,290) | |

Futures contracts | (154,488) | |

Total change in net unrealized appreciation (depreciation) | | (140,707,672) |

Net gain (loss) | | (58,172,065) |

Net increase (decrease) in net assets resulting from operations | | $ (32,260,722) |

Statement of Changes in Net Assets

| Year ended

December 31, 2011 | Year ended

December 31, 2010 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 25,911,343 | $ 23,180,903 |

Net realized gain (loss) | 82,535,607 | 111,599,649 |

Change in net unrealized appreciation (depreciation) | (140,707,672) | 46,878,640 |

Net increase (decrease) in net assets resulting from operations | (32,260,722) | 181,659,192 |

Distributions to shareholders from net investment income | (25,842,847) | (22,808,550) |

Distributions to shareholders from net realized gain | (6,349,020) | (6,928,726) |

Total distributions | (32,191,867) | (29,737,276) |

Share transactions - net increase (decrease) | (108,450,453) | (91,985,209) |

Total increase (decrease) in net assets | (172,903,042) | 59,936,707 |

| | |

Net Assets | | |

Beginning of period | 1,425,237,477 | 1,365,300,770 |

End of period (including Distributions in excess of net investment income of $52,107 and undistributed net investment income of $13,054, respectively) | $ 1,252,334,435 | $ 1,425,237,477 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Initial Class

Years ended December 31, | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 14.54 | $ 13.00 | $ 10.31 | $ 16.58 | $ 15.71 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .28 | .23 | .26 | .36 | .44 |

Net realized and unrealized gain (loss) | (.66) | 1.62 | 2.73 | (4.75) | 1.88 |

Total from investment operations | (.38) | 1.85 | 2.99 | (4.39) | 2.32 |

Distributions from net investment income | (.29) | (.24) | (.28) | (.37) | (1.00) |

Distributions from net realized gain | (.07) | (.07) | (.02) | (1.51) | (.45) |

Total distributions | (.36) | (.31) | (.30) | (1.88) | (1.45) |

Net asset value, end of period | $ 13.80 | $ 14.54 | $ 13.00 | $ 10.31 | $ 16.58 |

Total ReturnA,B | (2.56)% | 14.26% | 29.11% | (28.76)% | 15.57% |

Ratios to Average Net AssetsD,F | | | | | |

Expenses before reductions | .63% | .63% | .67% | .63% | .63% |

Expenses net of fee waivers, if any | .63% | .63% | .67% | .63% | .63% |

Expenses net of all reductions | .62% | .62% | .66% | .63% | .62% |

Net investment income (loss) | 1.91% | 1.72% | 2.31% | 2.62% | 2.75% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 1,108,494 | $ 1,279,306 | $ 1,249,955 | $ 1,093,133 | $ 1,791,647 |

Portfolio turnover rateE | 56% | 54% | 95% | 90% | 99% |

A Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

Financial Highlights - Service Class

Years ended December 31, | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 14.45 | $ 12.92 | $ 10.25 | $ 16.48 | $ 15.61 |

Income from Investment Operations | | | | | |

Net investment income (loss)C | .26 | .22 | .25 | .34 | .42 |

Net realized and unrealized gain (loss) | (.65) | 1.60 | 2.71 | (4.71) | 1.86 |

Total from investment operations | (.39) | 1.82 | 2.96 | (4.37) | 2.28 |

Distributions from net investment income | (.28) | (.22) | (.27) | (.35) | (.96) |

Distributions from net realized gain | (.07) | (.07) | (.02) | (1.51) | (.45) |

Total distributions | (.35) | (.29) | (.29) | (1.86) | (1.41) |

Net asset value, end of period | $ 13.71 | $ 14.45 | $ 12.92 | $ 10.25 | $ 16.48 |

Total ReturnA,B | (2.69)% | 14.14% | 28.94% | (28.82)% | 15.36% |

Ratios to Average Net AssetsD,F | | | | | |

Expenses before reductions | .75% | .75% | .79% | .75% | .74% |

Expenses net of fee waivers, if any | .74% | .74% | .79% | .75% | .74% |

Expenses net of all reductions | .74% | .73% | .78% | .75% | .74% |

Net investment income (loss) | 1.79% | 1.60% | 2.18% | 2.50% | 2.63% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 8,042 | $ 8,613 | $ 8,230 | $ 7,413 | $ 13,530 |

Portfolio turnover rateE | 56% | 54% | 95% | 90% | 99% |

A Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Service Class 2

Years ended December 31, | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 14.30 | $ 12.79 | $ 10.15 | $ 16.34 | $ 15.47 |

Income from Investment Operations | | | | | |

Net investment income (loss)C | .24 | .19 | .23 | .32 | .39 |

Net realized and unrealized gain (loss) | (.65) | 1.59 | 2.68 | (4.67) | 1.85 |

Total from investment operations | (.41) | 1.78 | 2.91 | (4.35) | 2.24 |

Distributions from net investment income | (.25) | (.20) | (.25) | (.33) | (.92) |

Distributions from net realized gain | (.07) | (.07) | (.02) | (1.51) | (.45) |

Total distributions | (.32) | (.27) | (.27) | (1.84) | (1.37) |

Net asset value, end of period | $ 13.57 | $ 14.30 | $ 12.79 | $ 10.15 | $ 16.34 |

Total ReturnA,B | (2.82)% | 13.96% | 28.76% | (28.95)% | 15.24% |

Ratios to Average Net AssetsD,F | | | | | |

Expenses before reductions | .90% | .90% | .93% | .90% | .89% |

Expenses net of fee waivers, if any | .89% | .89% | .93% | .90% | .89% |

Expenses net of all reductions | .89% | .88% | .92% | .89% | .89% |

Net investment income (loss) | 1.64% | 1.46% | 2.04% | 2.36% | 2.48% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 32,508 | $ 39,148 | $ 39,475 | $ 37,360 | $ 59,670 |

Portfolio turnover rateE | 56% | 54% | 95% | 90% | 99% |

A Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

Financial Highlights - Investor Class

Years ended December 31, | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 14.49 | $ 12.96 | $ 10.28 | $ 16.53 | $ 15.67 |

Income from Investment Operations | | | | | |

Net investment income (loss)C | .27 | .22 | .25 | .34 | .42 |

Net realized and unrealized gain (loss) | (.67) | 1.61 | 2.73 | (4.72) | 1.87 |

Total from investment operations | (.40) | 1.83 | 2.98 | (4.38) | 2.29 |

Distributions from net investment income | (.28) | (.23) | (.28) | (.36) | (.98) |

Distributions from net realized gain | (.07) | (.07) | (.02) | (1.51) | (.45) |

Total distributions | (.35) | (.30) | (.30) | (1.87) | (1.43) |

Net asset value, end of period | $ 13.74 | $ 14.49 | $ 12.96 | $ 10.28 | $ 16.53 |

Total ReturnA,B | (2.72)% | 14.16% | 29.01% | (28.79)% | 15.38% |

Ratios to Average Net AssetsD,F | | | | | |

Expenses before reductions | .71% | .72% | .77% | .73% | .75% |

Expenses net of fee waivers, if any | .71% | .71% | .77% | .73% | .75% |

Expenses net of all reductions | .70% | .70% | .76% | .72% | .74% |

Net investment income (loss) | 1.82% | 1.63% | 2.21% | 2.53% | 2.63% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 103,290 | $ 98,171 | $ 67,641 | $ 51,264 | $ 46,555 |

Portfolio turnover rateE | 56% | 54% | 95% | 90% | 99% |

A Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended December 31, 2011

1. Organization.

VIP Asset Manager Portfolio (the Fund) is a fund of Variable Insurance Products Fund V (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares, Service Class shares, Service Class 2 shares and Investor Class shares. All classes have equal rights and voting privileges, except for matters affecting a single class. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but do not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on their investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the Fund. These strategies are consistent with the investment objectives of the Fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the Fund. The following summarizes the Fund's investment in each Fidelity Central Fund.

Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio* |

Fidelity Commodity Strategy Central Fund | FMR Co., Inc. (FMRC) | Seeks to provide investment returns that correspond to the performance of the commodities market. | Investment in wholly-owned subsidiary organized under the laws of the Cayman Islands Repurchase Agreements Restricted Securities | .05% |

Fidelity Emerging Markets Debt Central Fund | FMRC | Seeks high total return by normally investing in debt securities of issuers in emerging markets and other debt investments that are tied economically to emerging markets. | Foreign Securities Repurchase Agreements Restricted Securities | .02% |

Fidelity Emerging Markets Equity Central Fund | FMRC | Seeks capital appreciation by investing primarily in equity securities of issuers in emerging markets. | Foreign Securities Repurchase Agreements Restricted Securities | .12% |

Fidelity International Equity Central Fund | FMRC | Seeks capital appreciation by investing primarily in non-U.S. based common stocks, including securities of issuers located in emerging markets. | Foreign Securities Repurchase Agreements Restricted Securities | .02% |

Fidelity Floating Rate Central Fund | FMRC | Seeks a high level of income by normally investing in floating rate loans and other floating rate securities. | Loans & Direct Debt Instruments Repurchase Agreements Restricted Securities | .00%** |

Fidelity High Income Central Fund 1 | FMRC | Seeks a high level of income and may also seek capital appreciation by investing primarily in debt securities, preferred stocks, and convertible securities, with an emphasis on lower-quality debt securities. | Loans & Direct Debt Instruments Repurchase Agreements Restricted Securities | .00%** |

VIP Investment Grade Central Fund | Fidelity Investments Money Management, Inc. (FIMM) | Seeks a high level of current income by normally investing in investment-grade debt securities and repurchase agreements. | Delayed Delivery & When Issued Securities Repurchase Agreements Restricted Securities Swap Agreements | .00%** |

Fidelity Money Market Central Funds | FIMM | Seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | .00%** |

* Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

** Amount represents less than 0.01%.

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at advisor.fidelity.com. A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including security valuation policies) of those funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC web site or upon request.

Annual Report

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Fund uses independent pricing services approved by the Board of Trustees to value its investments. When current market prices or quotations are not readily available or reliable, valuations may be determined in good faith in accordance with procedures adopted by the Board of Trustees. Factors used in determining value may include market or security specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The value used for net asset value (NAV) calculation under these procedures may differ from published prices for the same securities.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of December 31, 2011, as well as a roll forward of Level 3 securities, is included at the end of the Fund's Schedule of Investments. Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when significant market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-traded funds (ETFs) and certain indexes as well as quoted prices for similar securities are used and are categorized as Level 2 in the hierarchy in these circumstances. Utilizing these techniques may result in transfers between Level 1 and Level 2. For restricted equity securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities. For U.S. government and government agency obligations, pricing services utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices and are generally categorized as Level 2 in the hierarchy. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. ETFs are valued at their last sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board of Trustees believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day and are categorized as Level 1 in the hierarchy.

New Accounting Pronouncements. In May 2011, the Financial Accounting Standards Board issued Accounting Standard Update No. 2011-04, Fair Value Measurement (Topic 820) - Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The update is effective during interim and annual periods beginning after December 15, 2011 and will result in additional disclosure for transfers between levels as well as expanded disclosure for securities categorized as Level 3 under the fair value hierarchy.

In December 2011, the Financial Accounting Standards Board issued Accounting Standard Update No. 2011-11, Disclosures about Offsetting Assets and Liabilities. The update creates new disclosure requirements requiring entities to disclose both gross and net information for derivatives and other financial instruments that are either offset in the Statement of Assets and Liabilities or subject to an enforceable master netting arrangement or similar agreement. The disclosure requirements are effective for annual reporting periods beginning on or after January 1, 2013. Management is currently evaluating the impact of the update's adoption on the Fund's financial statement disclosures.

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known. Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the Fidelity Central Funds. Although not included in the Fund's expenses, the Fund indirectly bears its proportionate share of the Fidelity Central Funds' expenses through the impact of these expenses on each Fidelity Central Fund's NAV. Based on their most recent shareholder report date, expenses of the Fidelity Central Funds ranged from 0.00% to 0.12%.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company, including distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required. As of December 31, 2011, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. A fund's tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to short-term gain distributions from the Fidelity Central Funds, in-kind transactions, futures transactions, foreign currency transactions, market discount, partnerships, partnerships (including allocations from Fidelity Central Funds), deferred trustees compensation, capital loss carryforwards, and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 116,128,920 |

Gross unrealized depreciation | (72,615,754) |

Net unrealized appreciation (depreciation) on securities and other investments | $ 43,513,166 |

| |

Tax Cost | $ 1,215,707,575 |

Annual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax-based components of distributable earnings as of period end were as follows:

Capital loss carryforward | $ (46,050,301) |

Net unrealized appreciation (depreciation) | $ 43,511,880 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. Capital loss carryforwards were as follows:

Fiscal year of expiration | |

2016 | $ (12,728,760) |

2017 | (33,321,541) |

Total with expiration | $ (46,050,301) |

The tax character of distributions paid was as follows:

| December 31, 2011 | December 31, 2010 |

Ordinary Income | $ 32,191,867 | $ 29,737,276 |

4. Operating Policies.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

5. Derivative Instruments.