UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05361

Variable Insurance Products Fund V

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

William C. Coffey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2018 |

This report on Form N-CSR relates solely to the Registrant’s VIP Asset Manager Growth Portfolio, VIP Asset Manager Portfolio, VIP Bond Index Portfolio, VIP Freedom 2005 Portfolio, VIP Freedom 2010 Portfolio, VIP Freedom 2015 Portfolio, VIP Freedom 2020 Portfolio, VIP Freedom 2025 Portfolio, VIP Freedom 2030 Portfolio, VIP Freedom 2035 Portfolio, VIP Freedom 2040 Portfolio, VIP Freedom 2045 Portfolio, VIP Freedom 2050 Portfolio, VIP Freedom Income Portfolio, VIP Freedom Lifetime Income I Portfolio, VIP Freedom Lifetime Income II Portfolio, VIP Freedom Lifetime Income III Portfolio, VIP FundsManager 20% Portfolio, VIP FundsManager 50% Portfolio, VIP FundsManager 60% Portfolio, VIP FundsManager 70% Portfolio, VIP FundsManager 85% Portfolio, VIP Investment Grade Bond Portfolio, VIP Investor Freedom 2005 Portfolio, VIP Investor Freedom 2010 Portfolio, VIP Investor Freedom 2015 Portfolio, VIP Investor Freedom 2020 Portfolio, VIP Investor Freedom 2025 Portfolio, VIP Investor Freedom 2030 Portfolio, VIP Investor Freedom Income Portfolio, VIP Strategic Income Portfolio and VIP Target Volatility Portfolio series (each, a “Fund” and collectively, the “Funds”).

Item 1.

Reports to Stockholders

Fidelity® Variable Insurance Products: Asset Manager: Growth Portfolio

Annual Report December 31, 2018 |

|

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, and if your insurance carrier elects to participate, you may not be receiving paper copies of the Fund’s shareholder reports from the insurance company that offers your variable insurance product unless you specifically request paper copies from your financial professional or the administrator of your variable insurance product. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically, by contacting your financial professional or the administrator of your variable insurance product. If you own a Fidelity-administered variable insurance product, please visit fidelity.com/mailpreferences to make your election or call 1-800-343-3548.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial professional or the administrator of your variable insurance product. If you own a Fidelity-administered variable insurance product, please visit fidelity.com/mailpreferences to make your election or call 1-800-343-3548. Your election to receive reports in paper will apply to all funds available under your variable insurance product.

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company’s separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

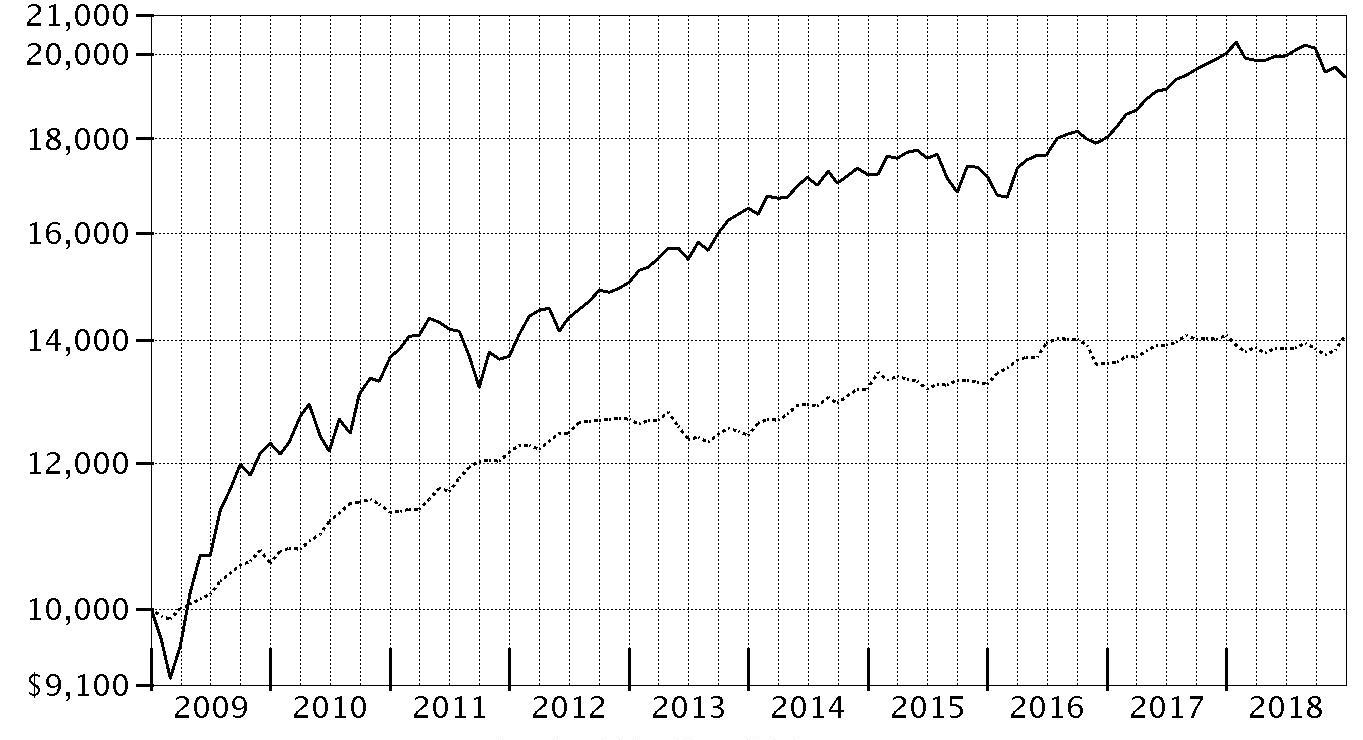

Average Annual Total Returns

| For the periods ended December 31, 2018 | Past 1 year | Past 5 years | Past 10 years |

| Initial Class | (7.65)% | 3.55% | 9.33% |

| Service Class | (7.75)% | 3.45% | 9.23% |

| Service Class 2 | (7.88)% | 3.28% | 9.04% |

| Investor Class | (7.72)% | 3.47% | 9.24% |

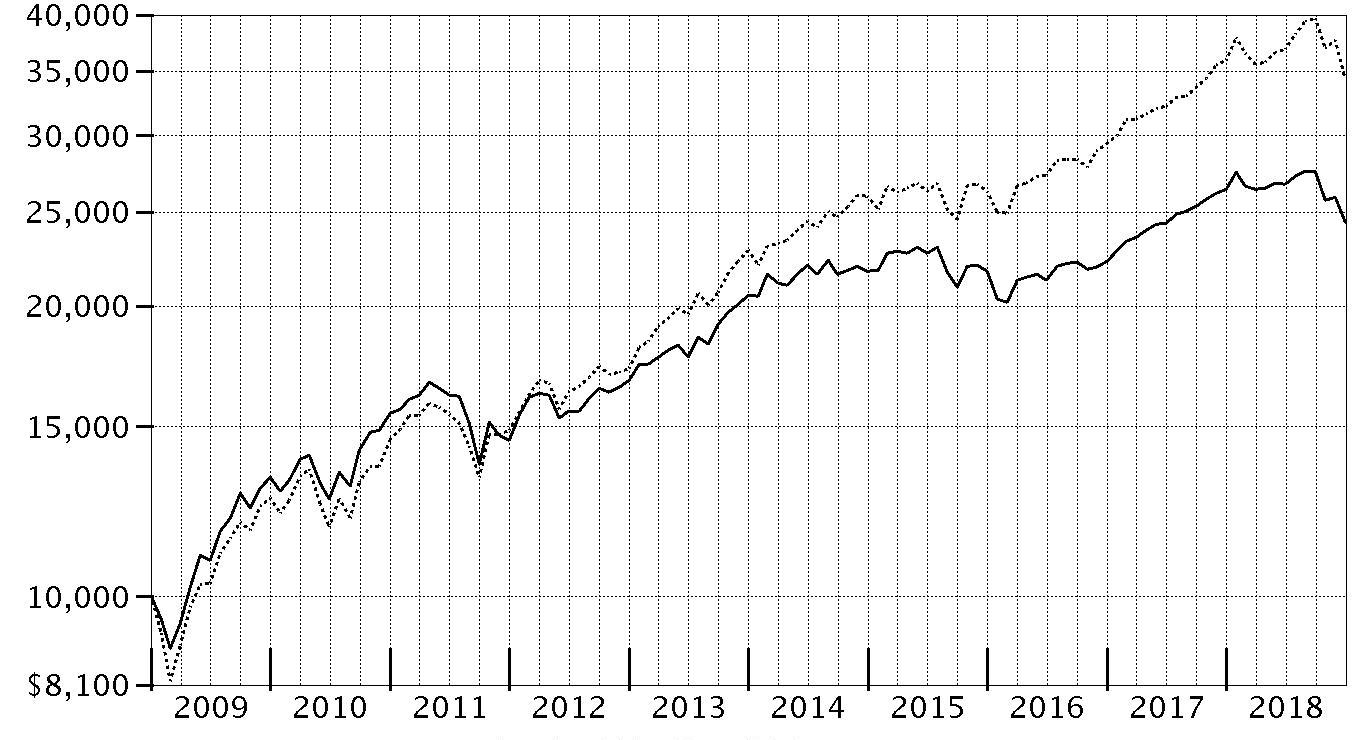

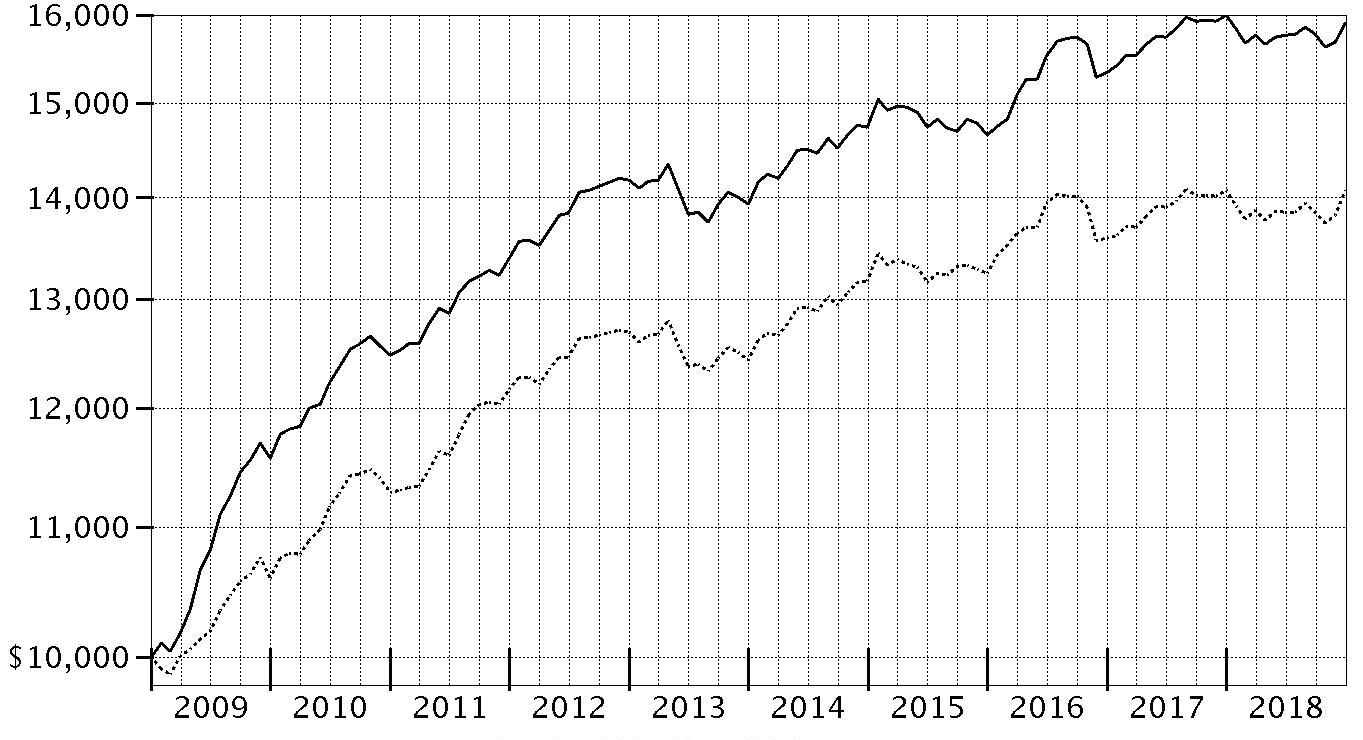

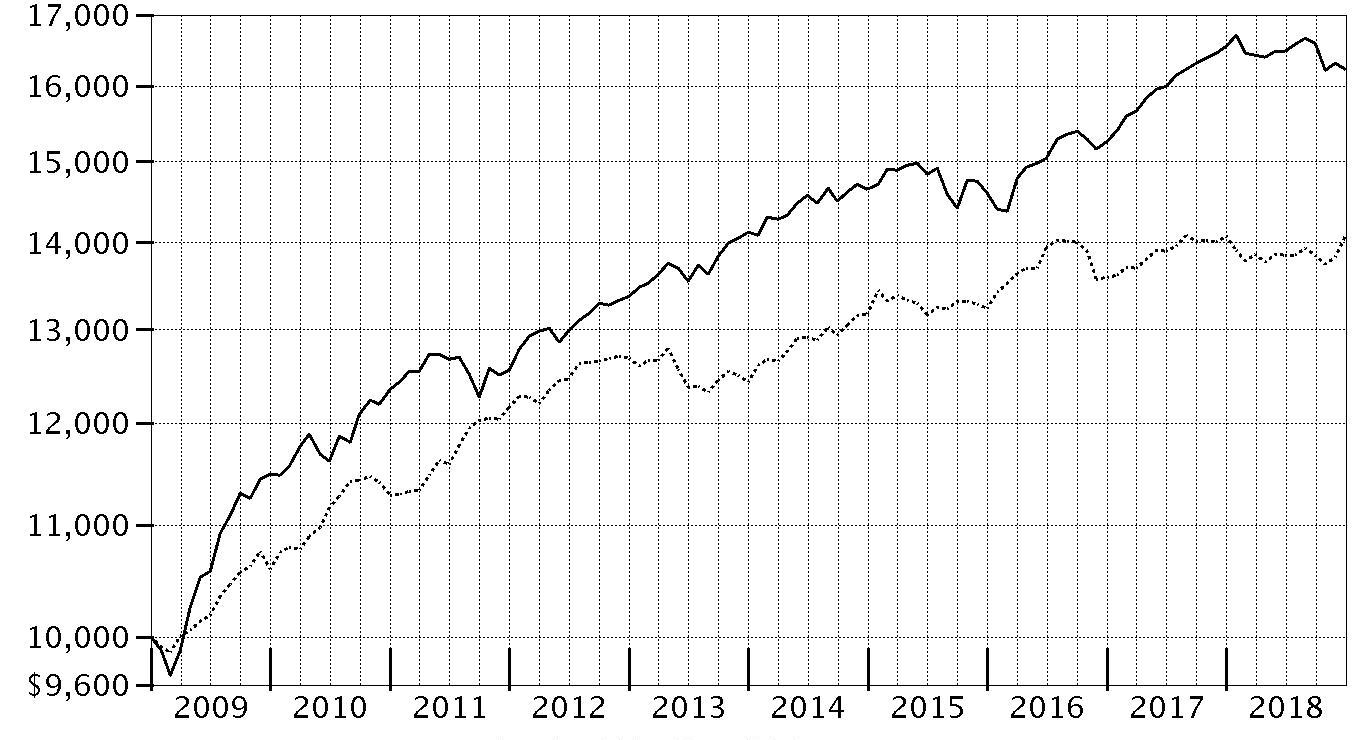

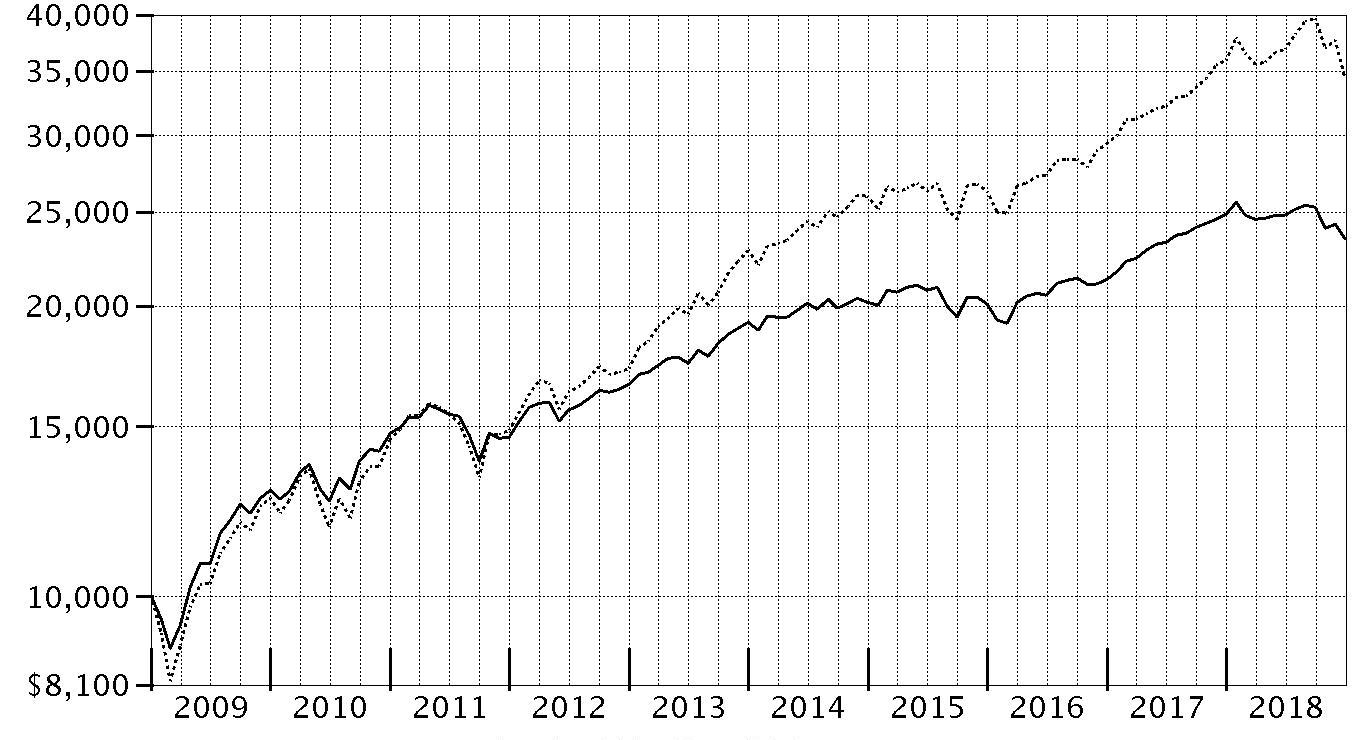

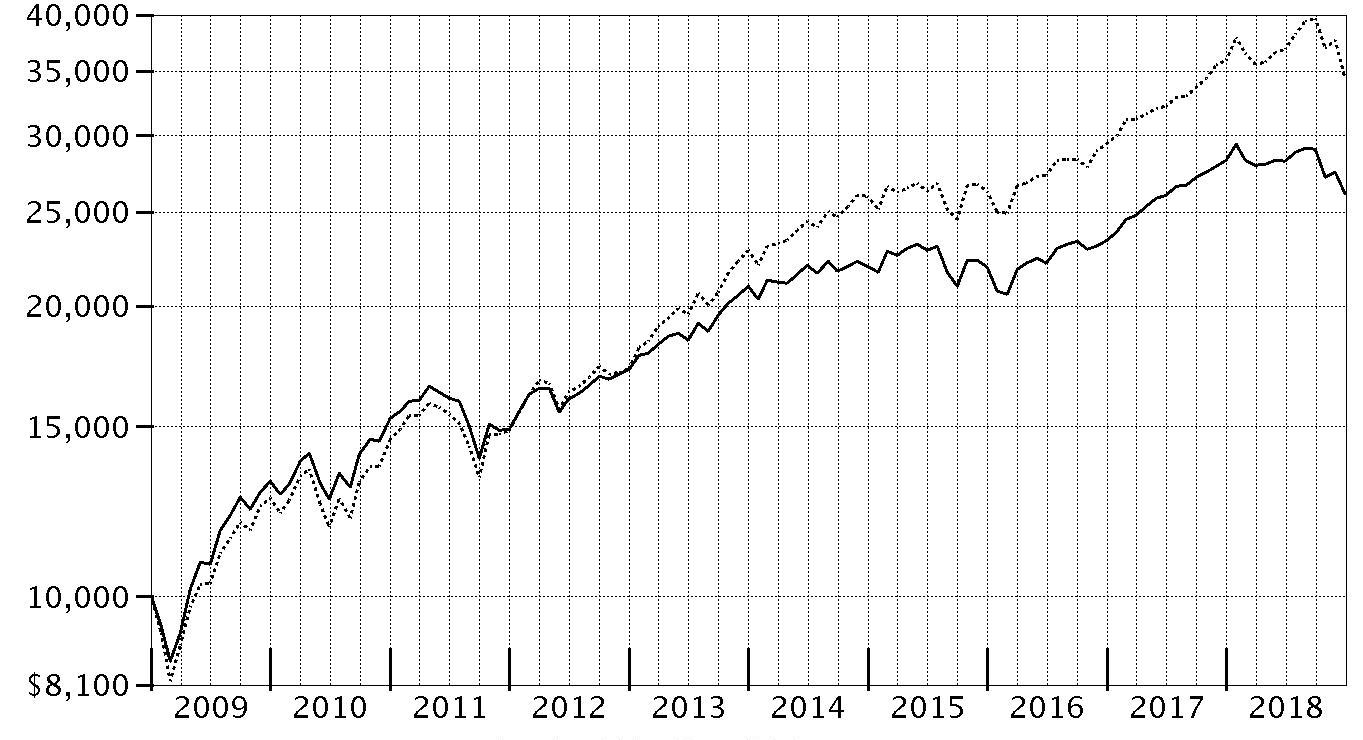

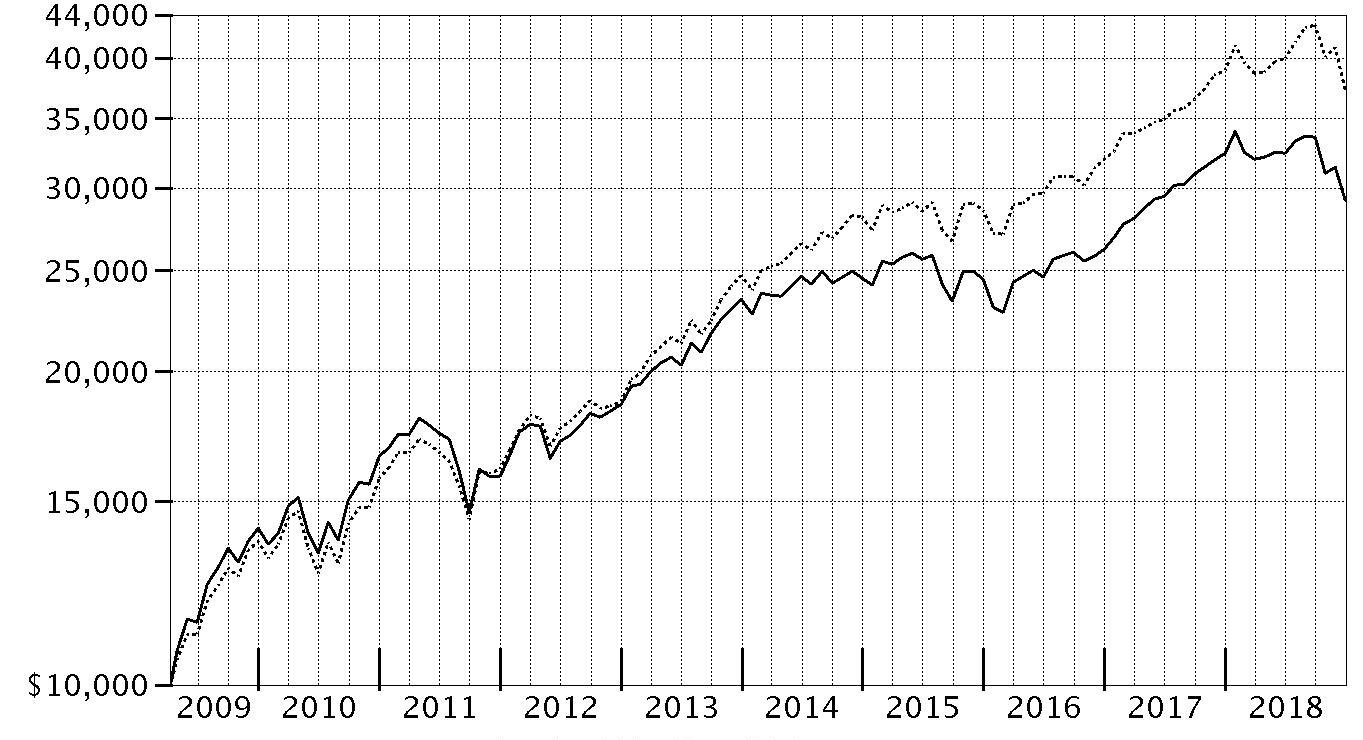

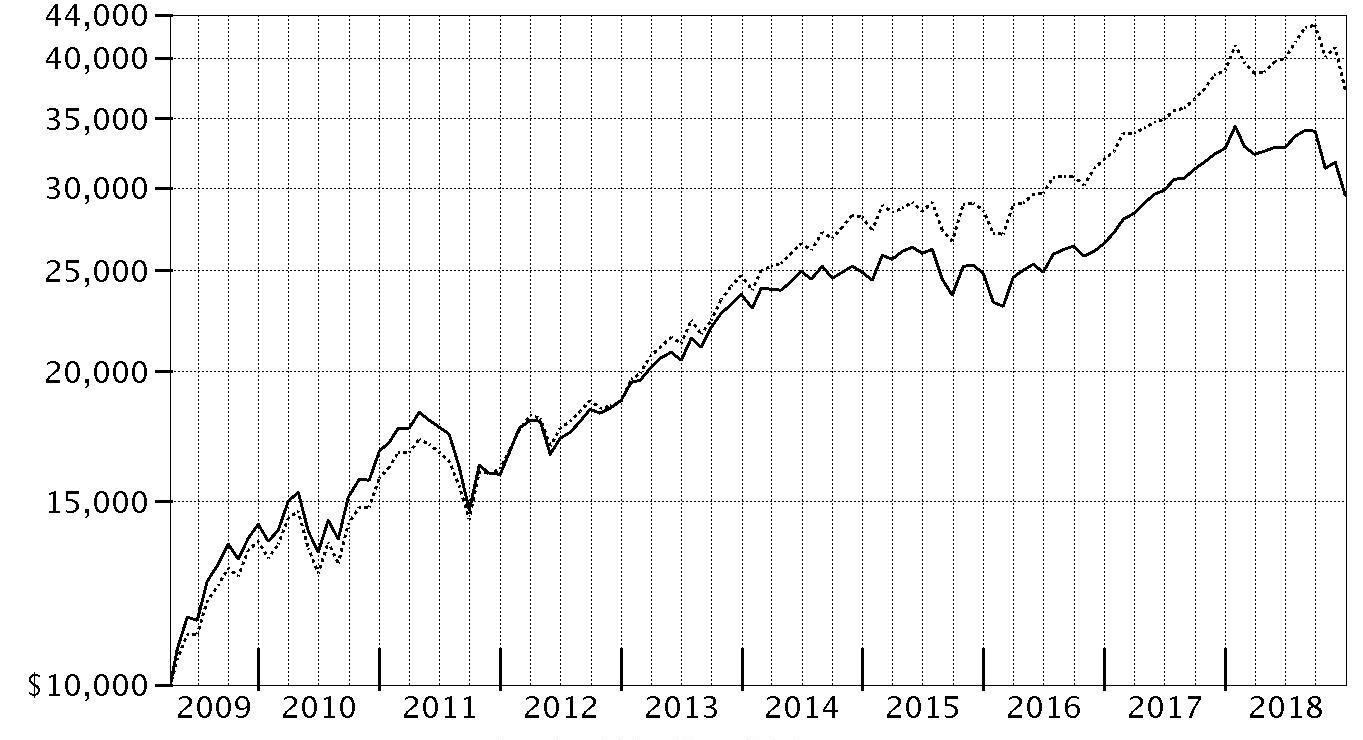

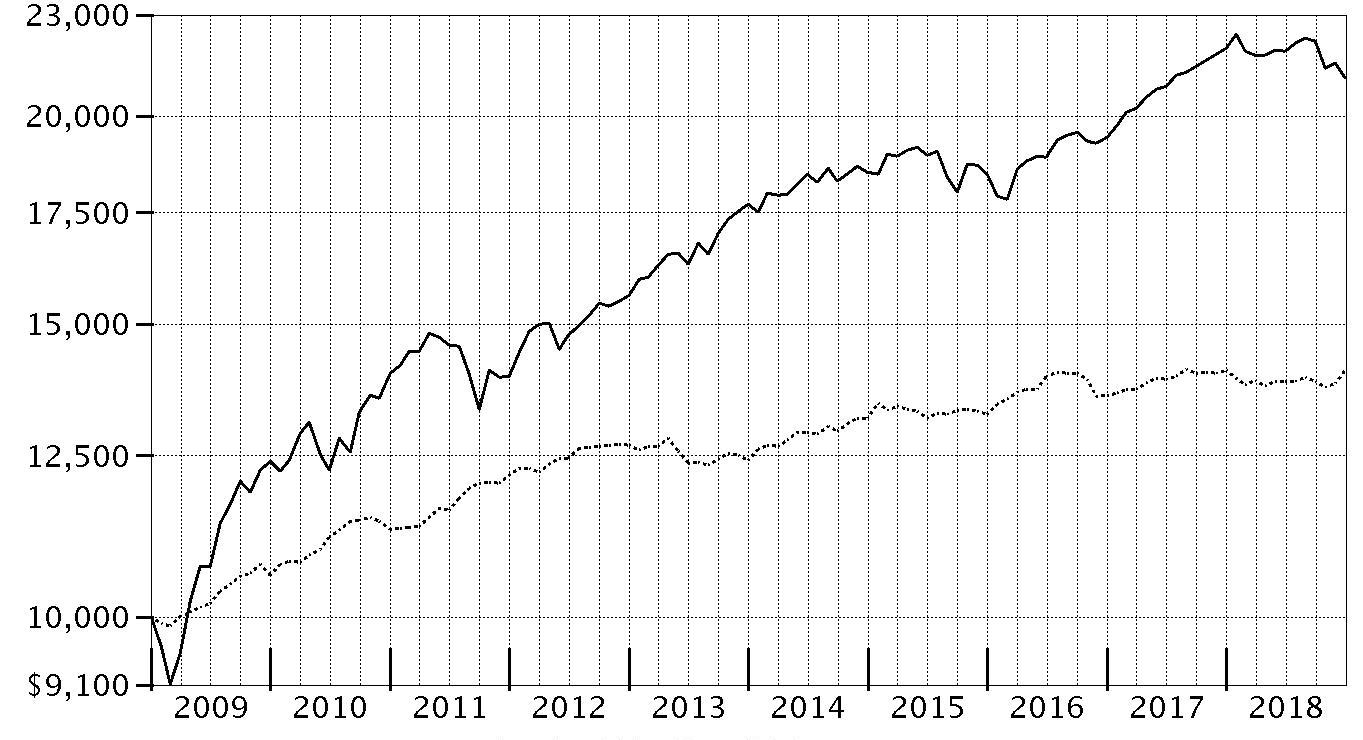

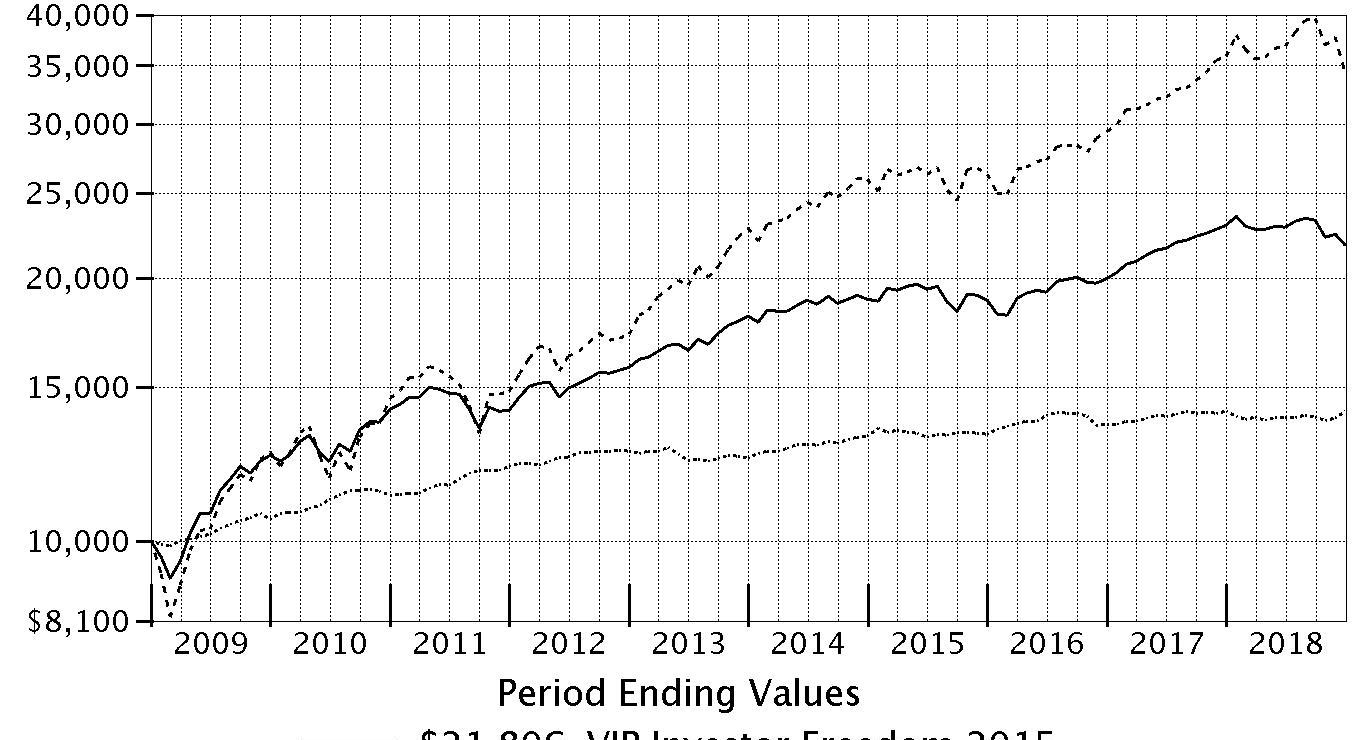

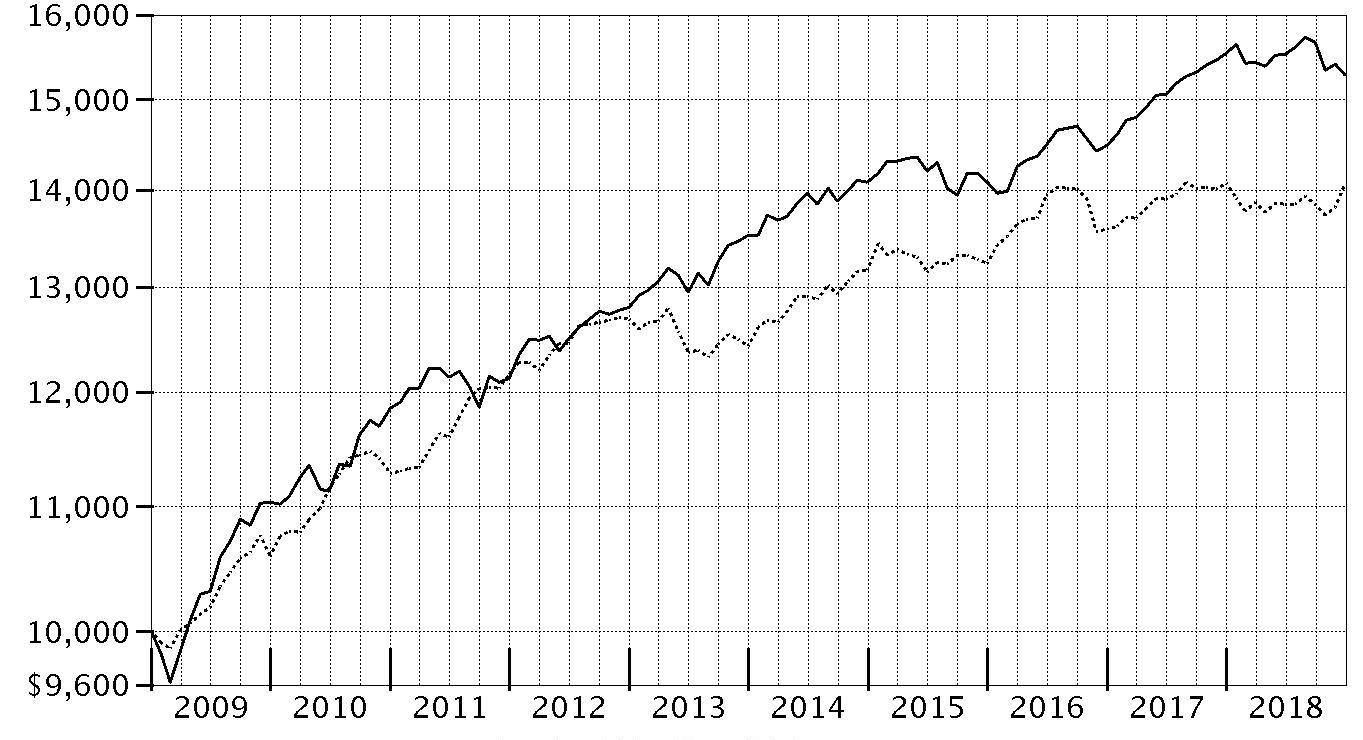

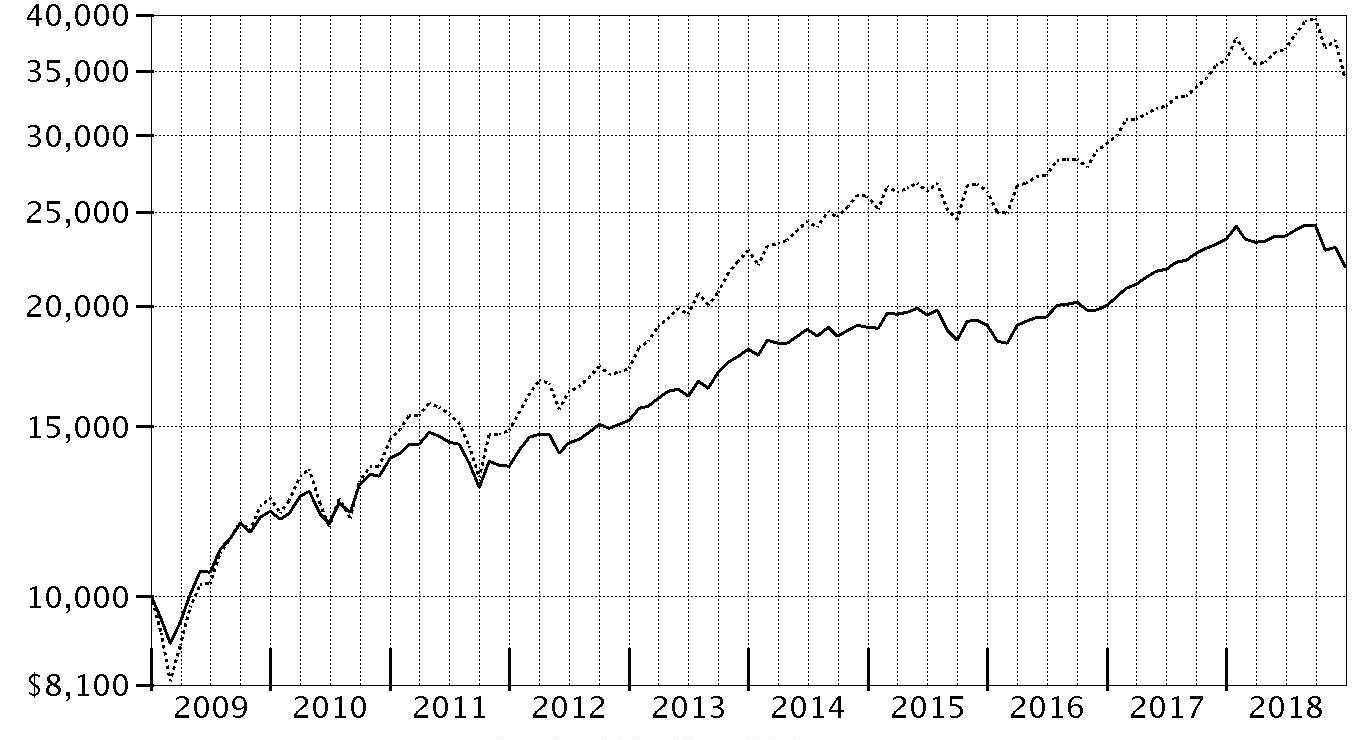

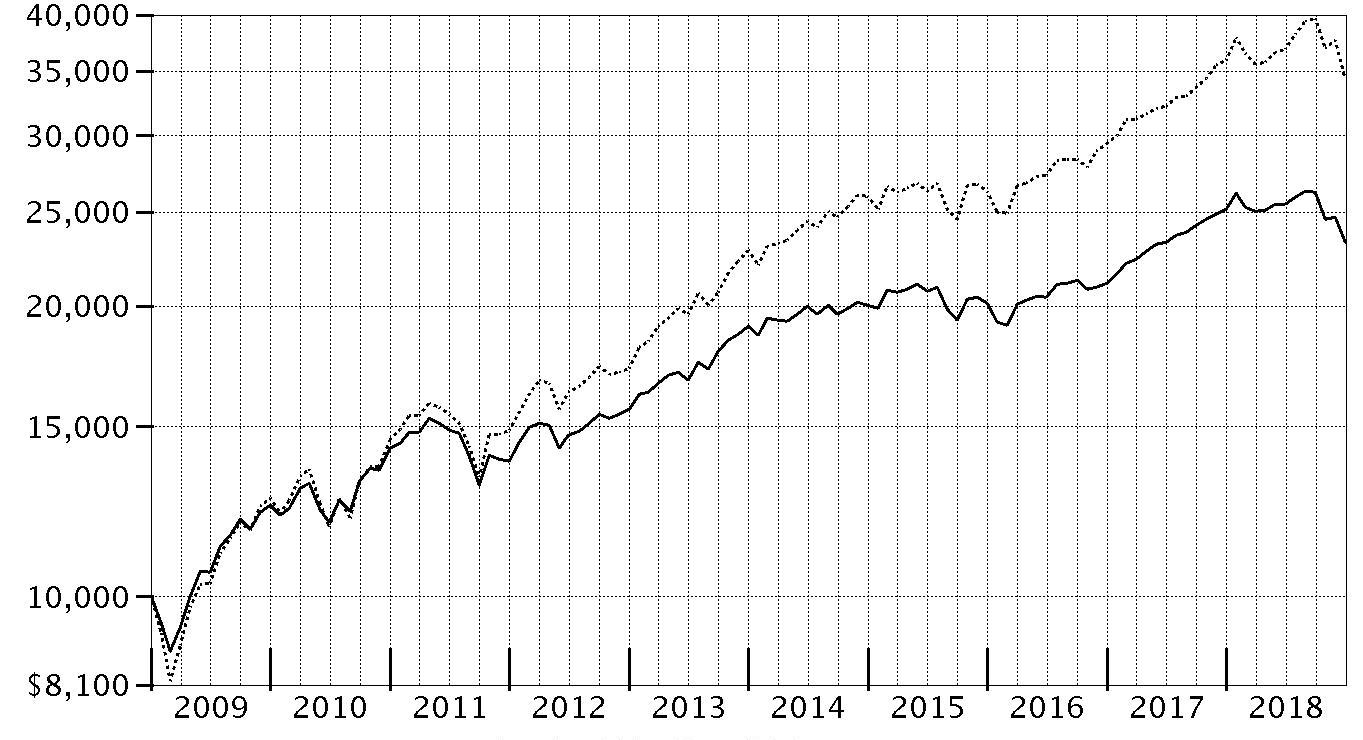

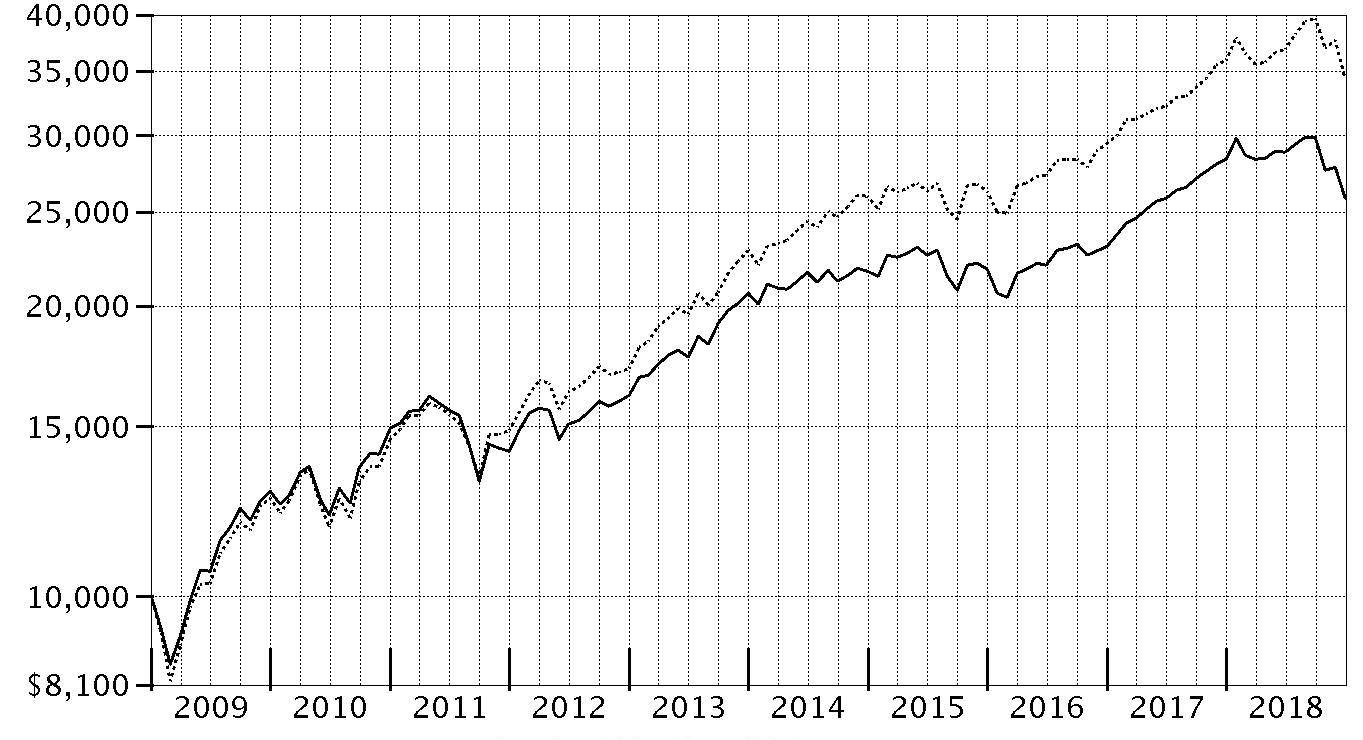

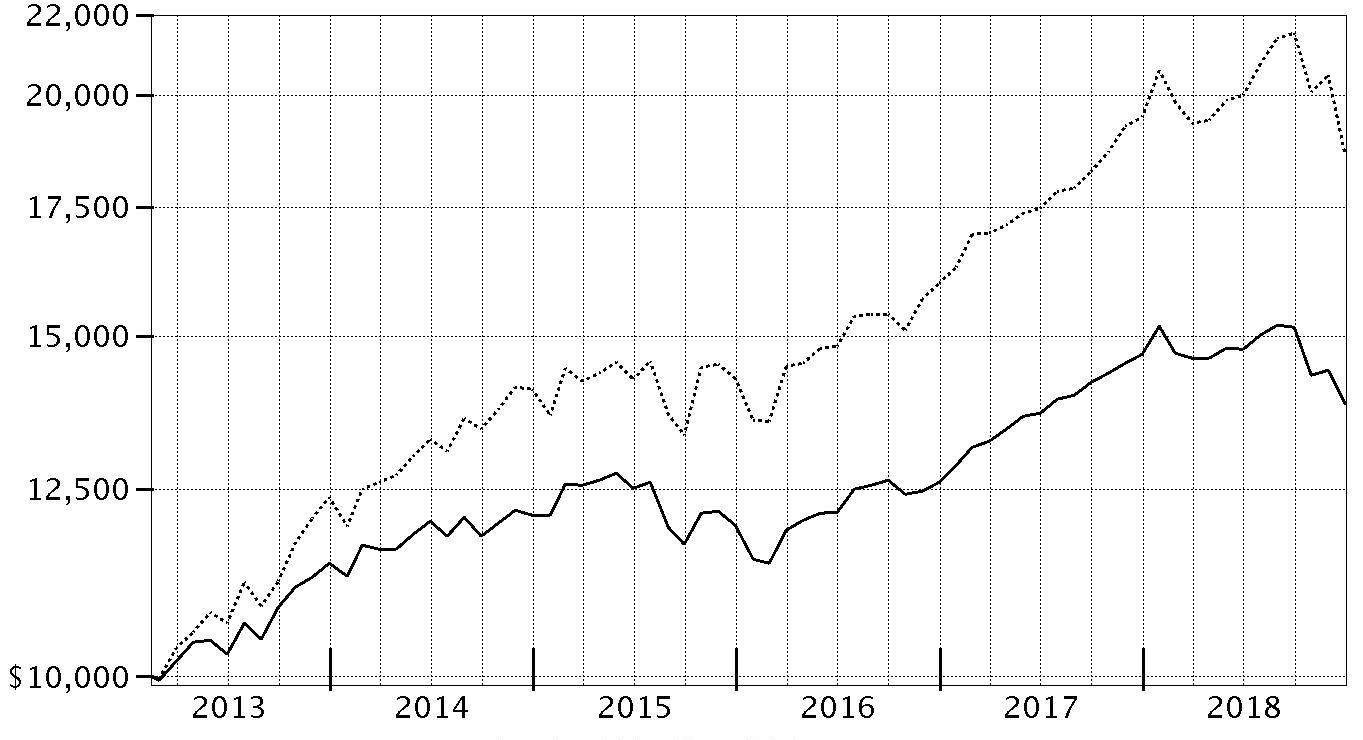

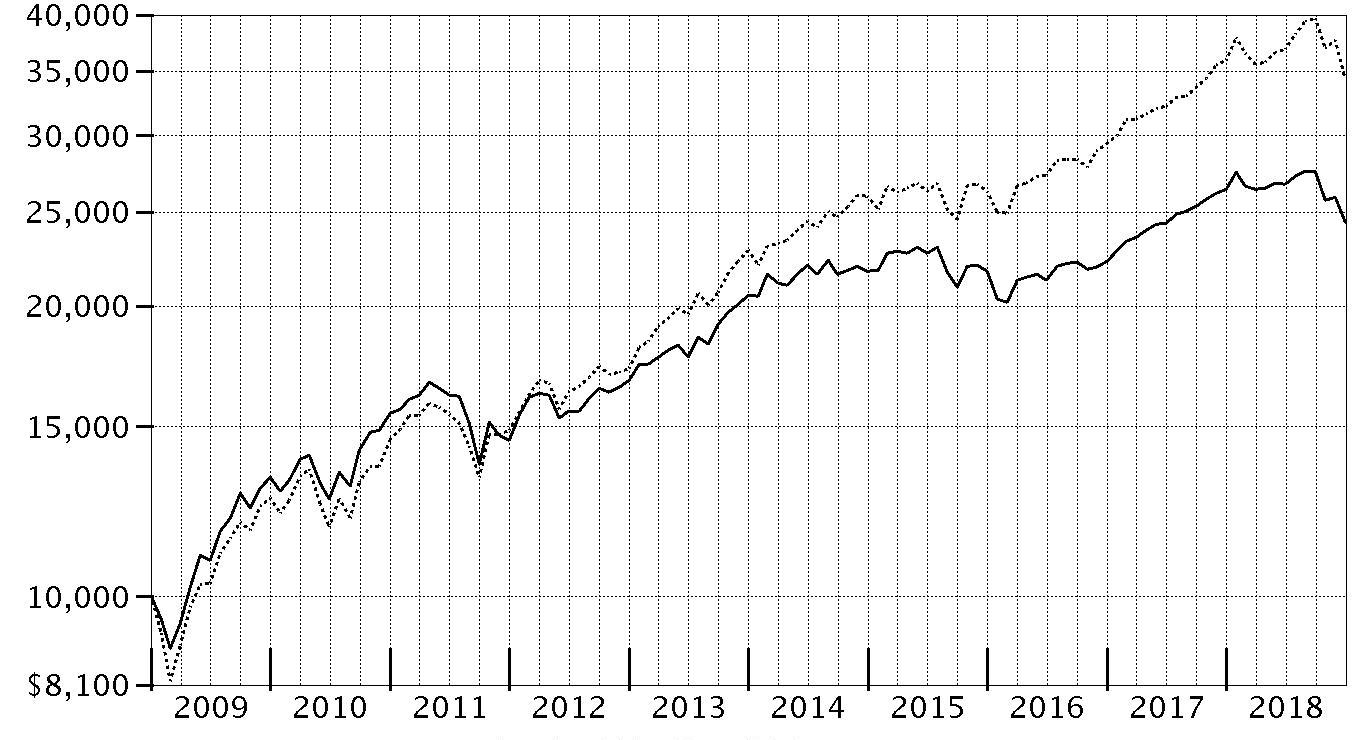

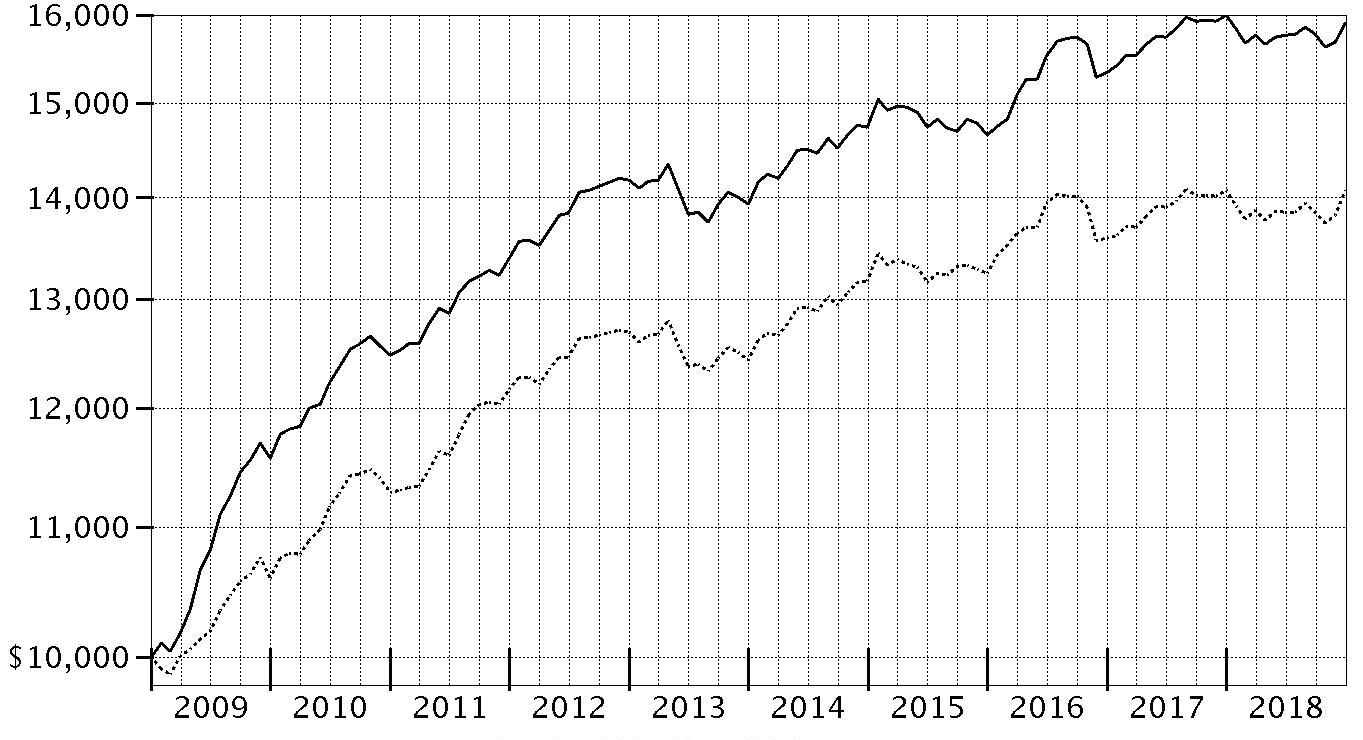

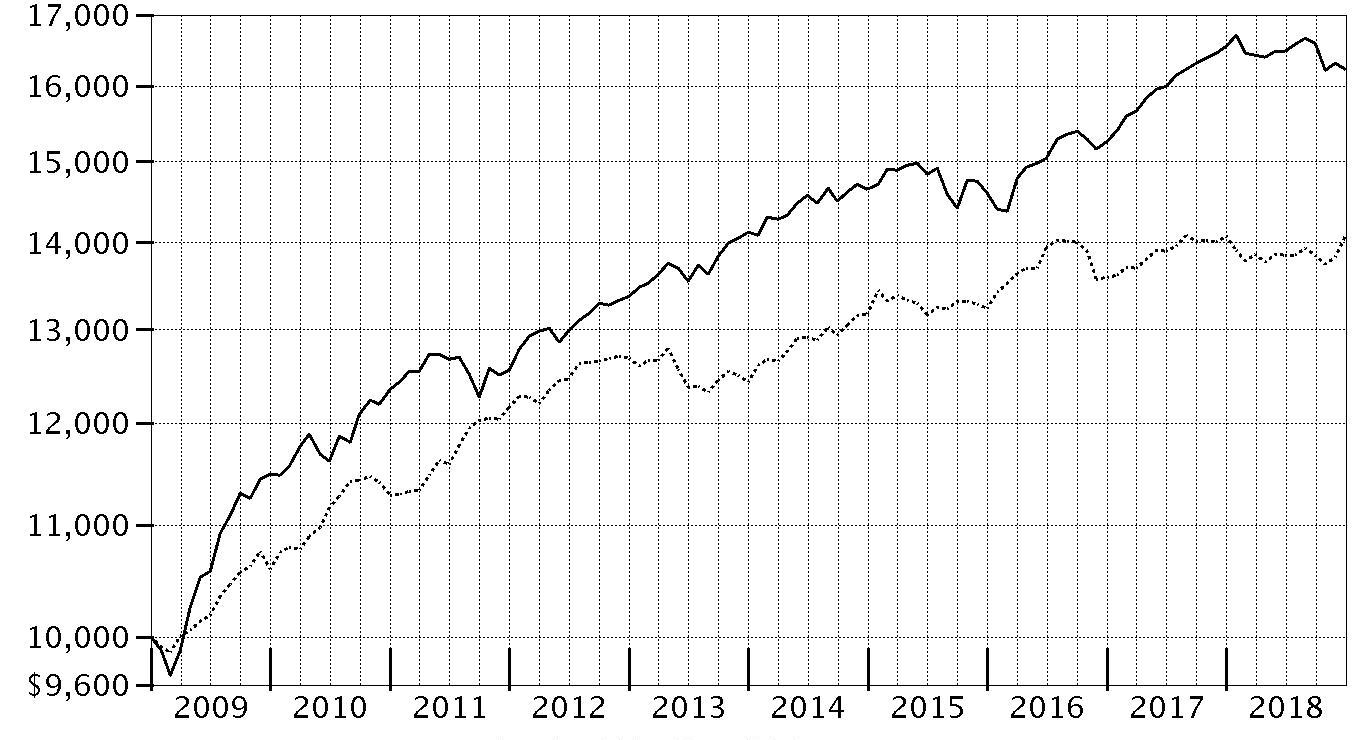

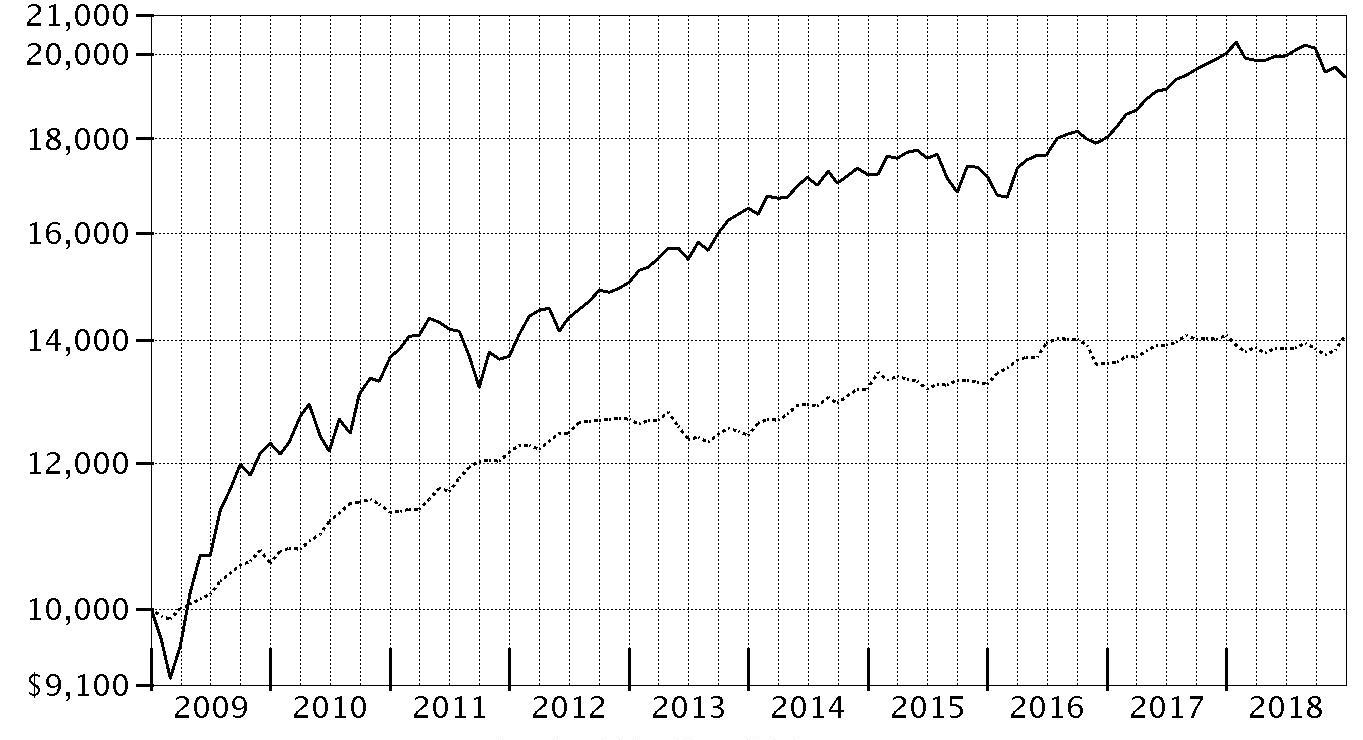

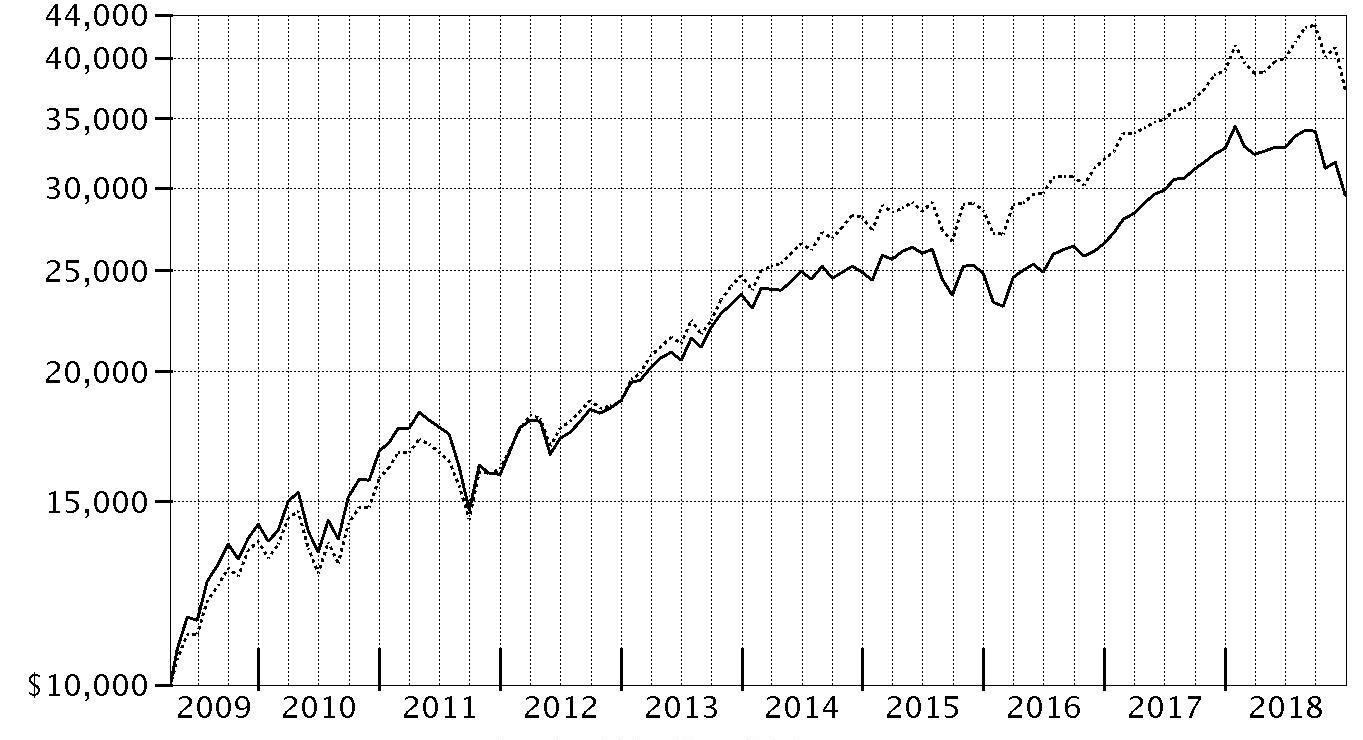

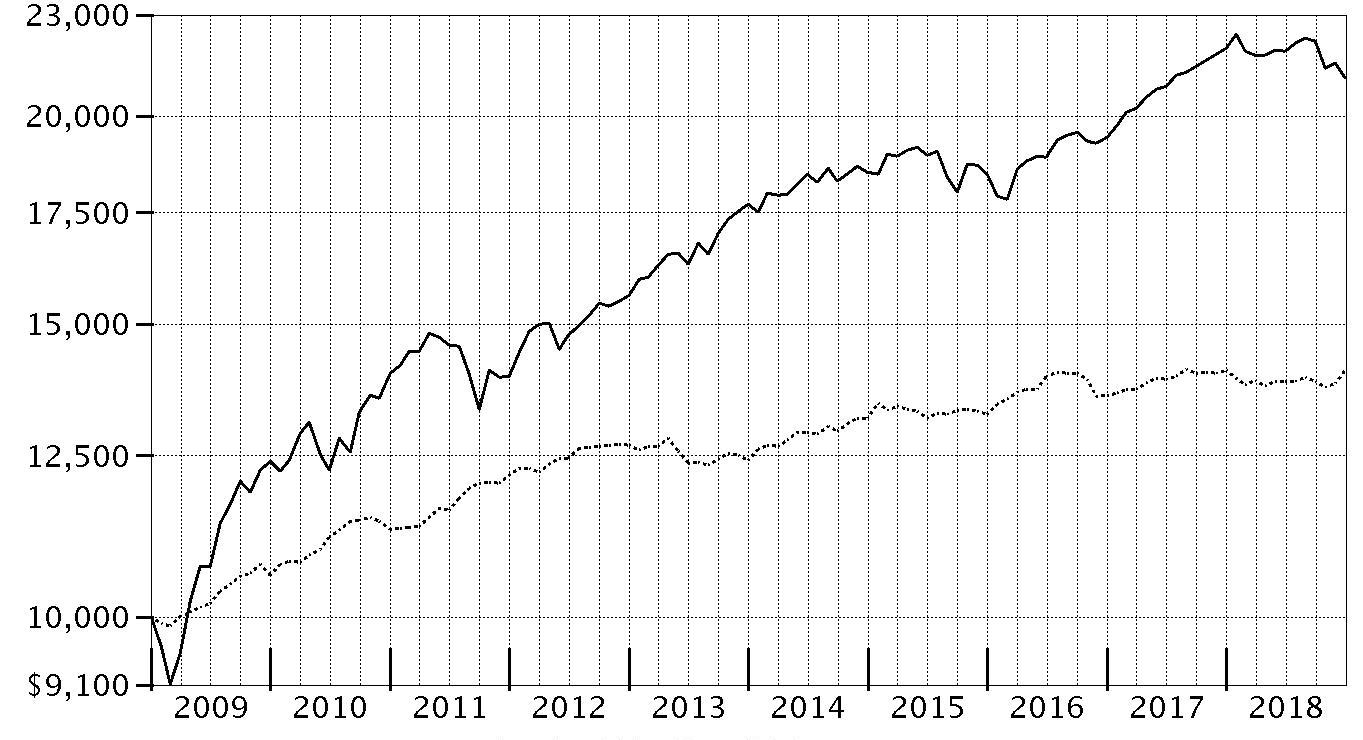

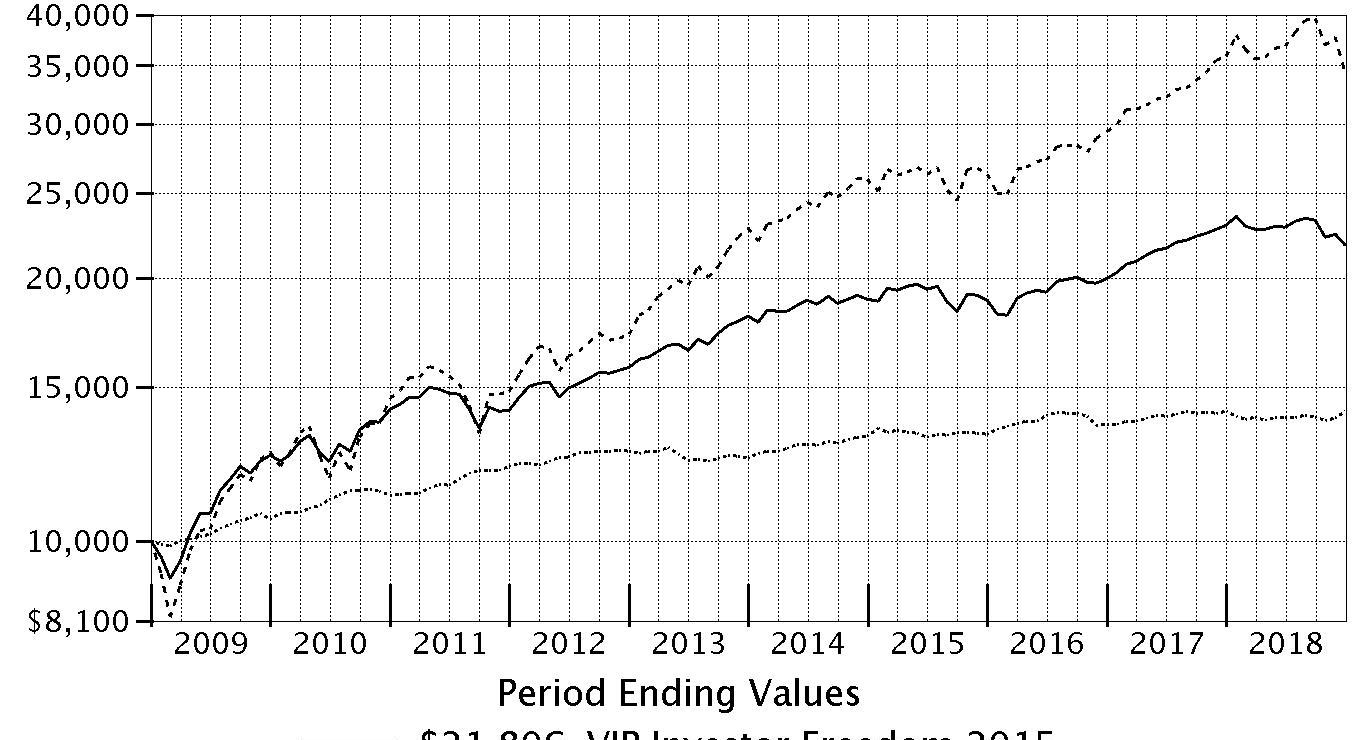

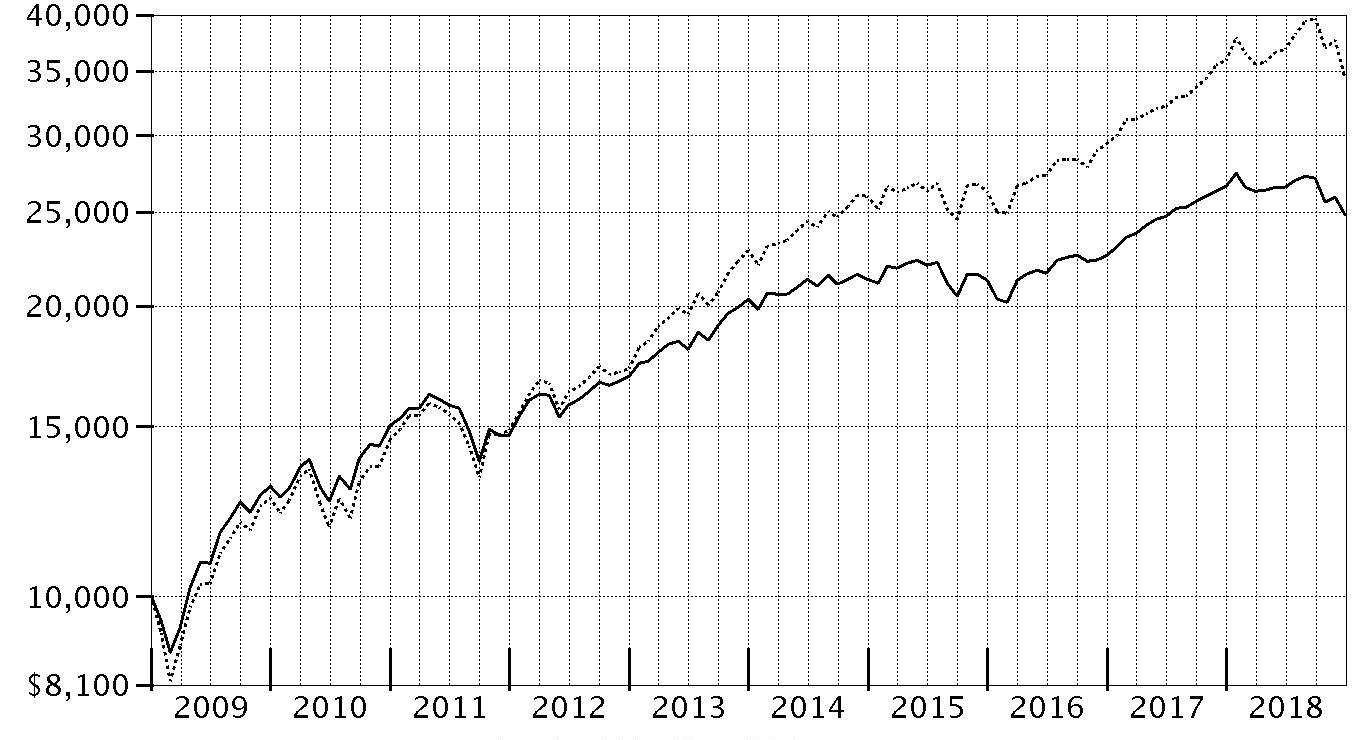

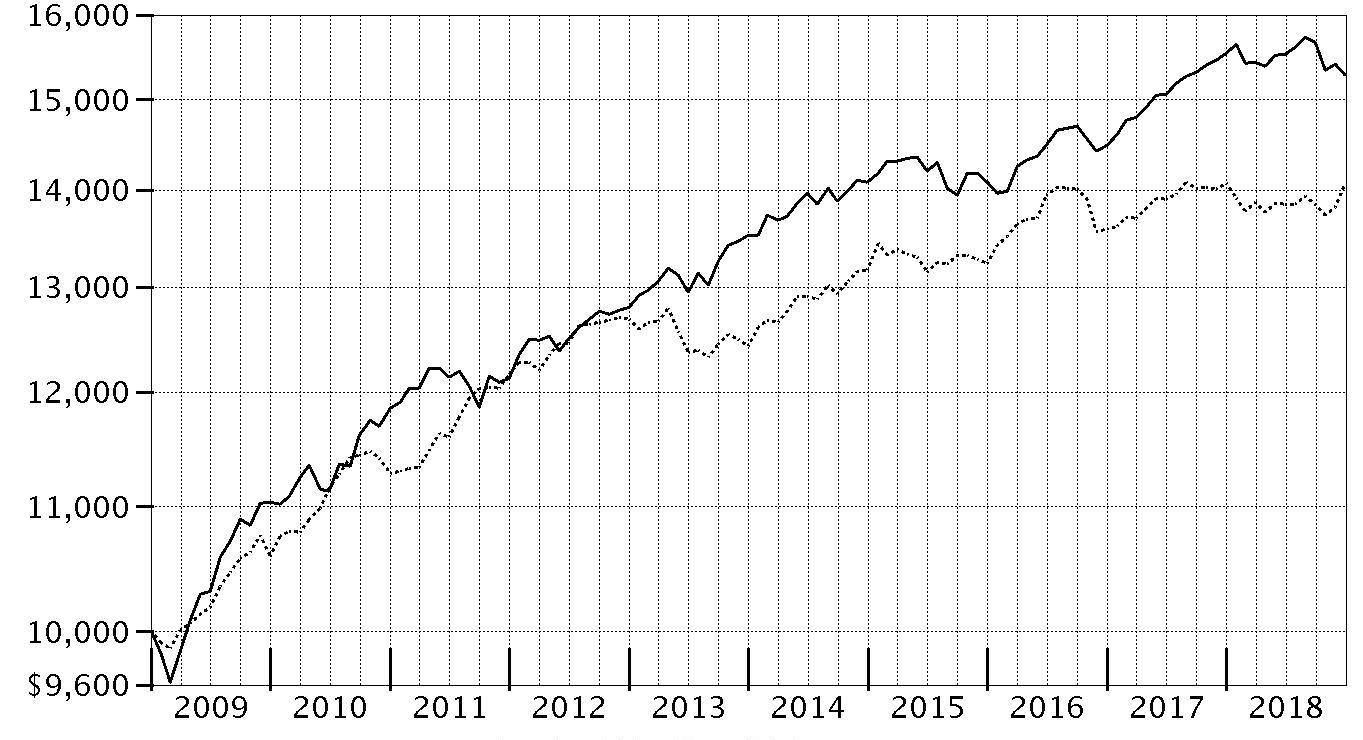

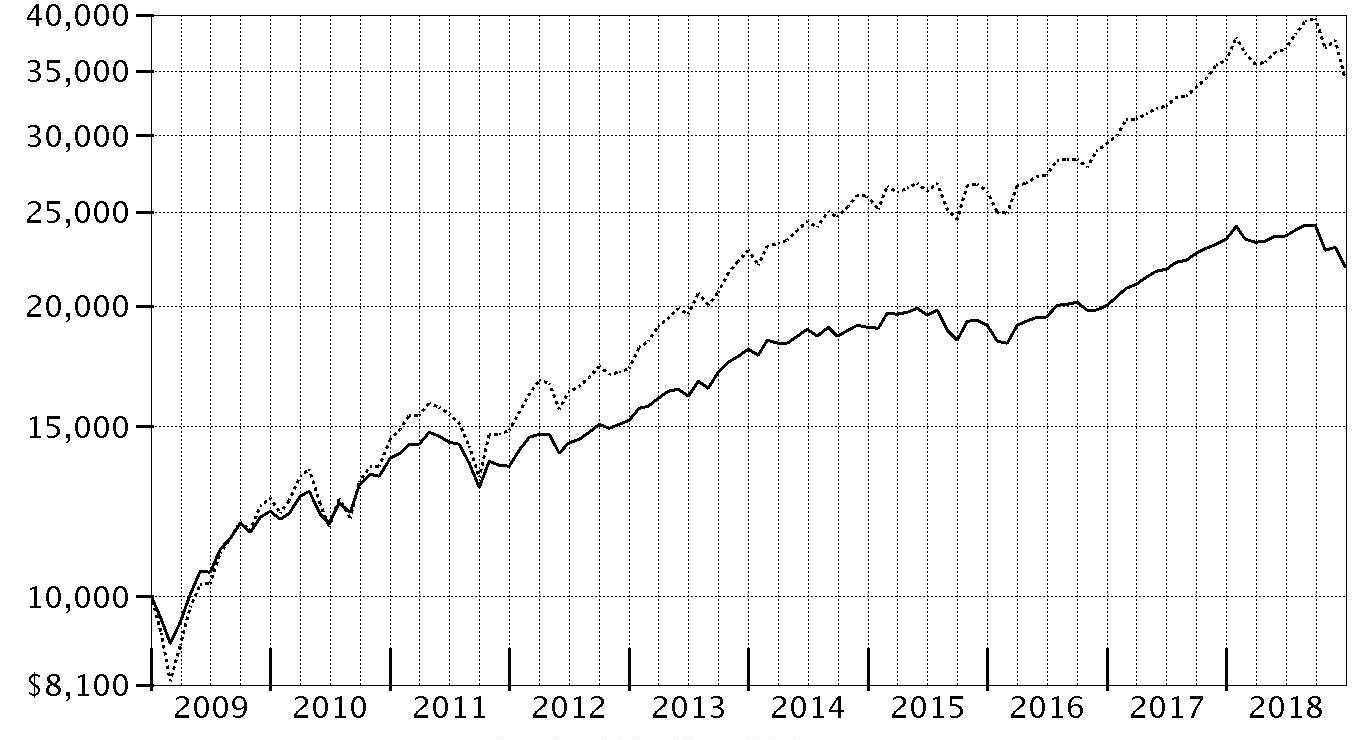

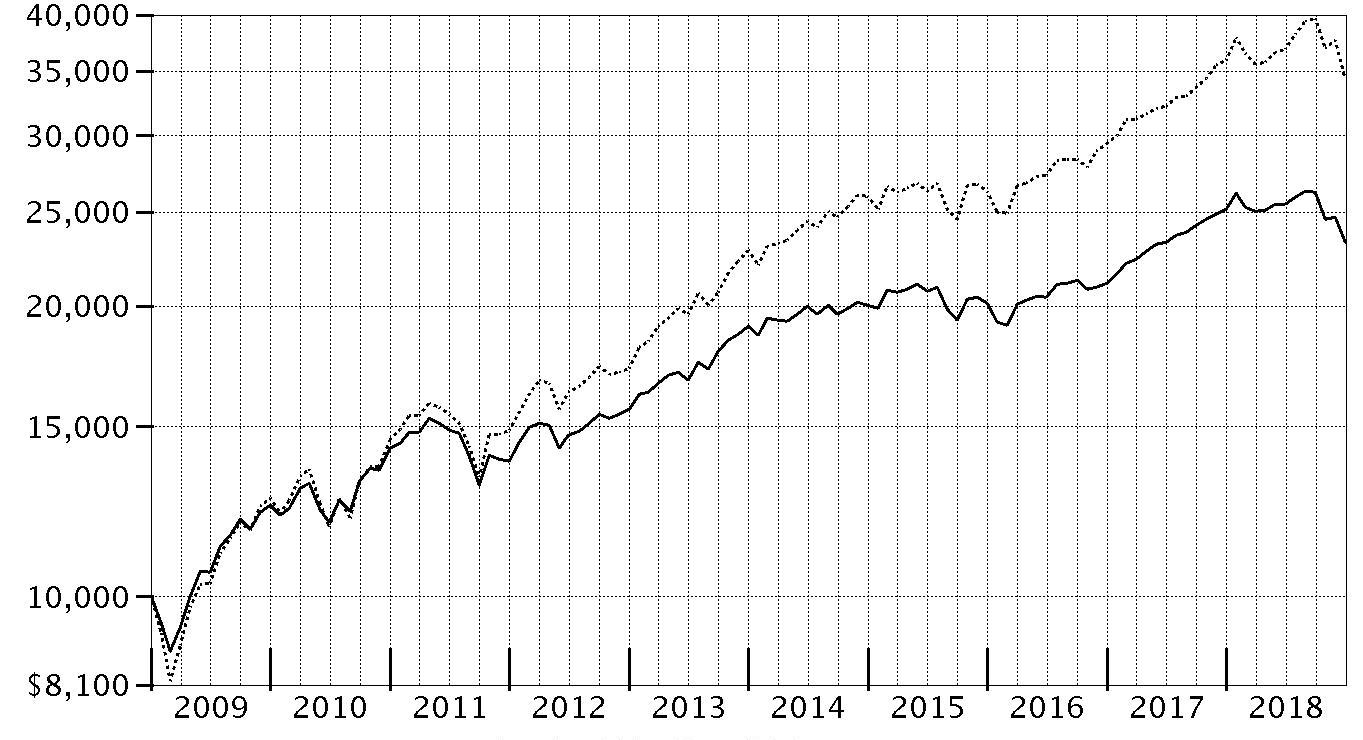

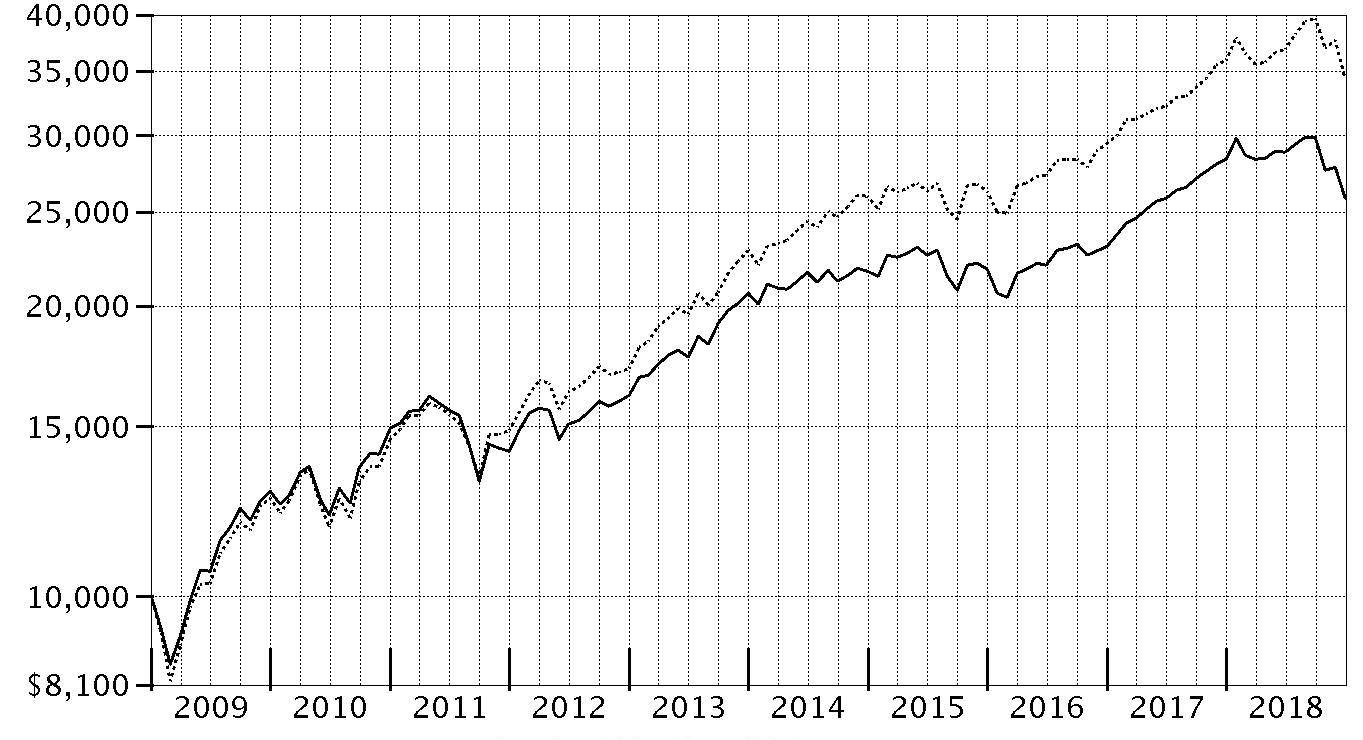

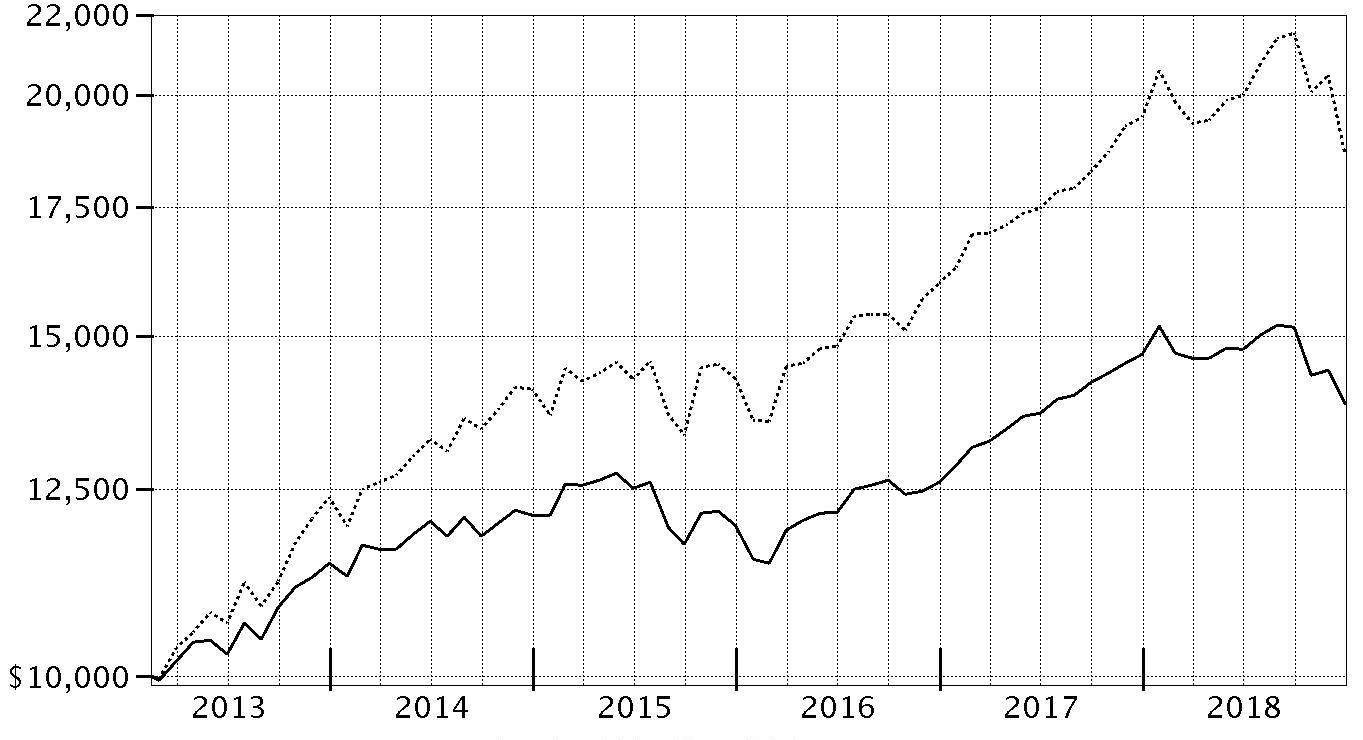

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in VIP Asset Manager: Growth Portfolio - Initial Class on December 31, 2008.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values |

| $24,410 | VIP Asset Manager: Growth Portfolio - Initial Class |

| $34,303 | S&P 500® Index |

Management's Discussion of Fund Performance

Market Recap: The global economy remained in expansion in 2018, but growth became less synchronous and more uneven. Meanwhile, global monetary policy became a headwind, and this uncertainty spurred an increase in volatility among risk assets. This was particularly true in the latter part of the year due to several factors including China entering a growth recession, emerging late-cycle conditions in the U.S., falling commodity prices, China-U.S. trade-policy uncertainty and the U.K.’s planned “Brexit” from the European Union. Against this backdrop, U.S. equities, as measured by the S&P 500

® index returned -4.38% in 2018. Sector-wise, seven of the 11 major sectors in the S&P 500

® lost ground this period. Falling crude-oil prices caused energy stocks (-18%) to suffer most, while slowing global growth concerns felled the materials (-15%), industrials (-13%) and financials (-13%) sectors. Conversely, health care (+6%) led the way, followed by the utilities (+4%), information technology (+3%) and consumer discretionary (+2%) sectors. Overseas, equities suffered a pronounced, broad-based correction, returning -14.04% for the year, according to the MSCI ACWI ex USA Index. Among regions in the index, Asia-Pacific (-11%) and Japan (-13%) held up best, whereas resource-rich Canada (-17%), Europe (-14%) and emerging markets (-14%) lagged. In terms of fixed income, investment-grade bonds were roughly flat for the 12 months, according to the Bloomberg Barclays U.S. Aggregate Bond Index. Late in the year, concerns about global growth pushed Treasury yields lower and credit spreads wider. Short-term debt led most U.S. investment-grade sectors, followed by asset-backed securities and agency bonds while corporate credit produced negative returns according to Bloomberg Barclays.

Comments from Lead Portfolio Manager Geoff Stein and Co-Portfolio Manager Avishek Hazrachoudhury: For the year, the fund’s share classes returned roughly -8%, trailing the -5.30% result of the Fidelity Asset Manager 70% Composite Index℠. The fund underperformed the Composite benchmark primarily because of weak U.S. stock selection during the final quarter of 2018. More specifically, security selection within information technology had the greatest negative impact. Picks among international developed-markets (DM) equities also notably detracted from performance, while choices in emerging-markets (EM) stocks produced moderately negative relative results. Overall, asset allocation aided performance versus the benchmark, driven by equity positioning. Underweighted exposure to international stocks fueled the fund’s positive equity allocation results, as both DM and EM lagged U.S. equities, primarily due to a strengthening U.S. dollar. Conversely, our small allocation to commodities modestly hampered our equity strategy, largely due to falling oil prices. Our fixed-income allocation strategy – underweighting cash and investment-grade bonds to help fund various out-of-benchmark positions – detracted versus the Composite benchmark and partially offset the performance benefit provided by our equity strategy. Underweighting cash in the portfolio hurt, since it was the best performer across all the asset classes we invest in. The fund's underweighting in investment-grade debt was a further dampener, primarily because some of the alternative bond sectors we invested in didn’t perform as well as expected. Looking ahead, we have a broadly neutral view toward stocks, but believe international markets – particularly EM – may offer more attractive opportunities than the U.S.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Note to shareholders: Avishek Hazrachoudhury joined Geoff Stein as Co-Manager of the fund on April 28, 2018.

Investment Summary (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds.

Top Ten Stocks as of December 31, 2018

| | % of fund's net assets |

| Apple, Inc. | 1.9 |

| Microsoft Corp. | 1.9 |

| Amazon.com, Inc. | 1.1 |

| Alphabet, Inc. Class A | 1.0 |

| UnitedHealth Group, Inc. | 0.7 |

| Roche Holding AG (participation certificate) | 0.6 |

| Becton, Dickinson & Co. | 0.5 |

| AstraZeneca PLC (United Kingdom) | 0.5 |

| Adobe, Inc. | 0.5 |

| The Boeing Co. | 0.5 |

| | 9.2 |

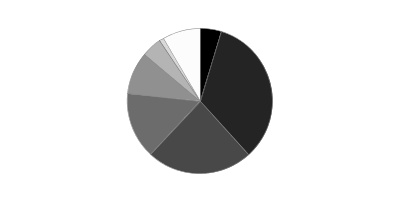

Top Market Sectors as of December 31, 2018

| (stocks only) | % of fund's net assets |

| Information Technology | 10.4 |

| Financials | 10.0 |

| Health Care | 8.4 |

| Investment Companies | 6.6 |

| Consumer Discretionary | 6.4 |

| Industrials | 6.2 |

| Communication Services | 4.9 |

| Consumer Staples | 4.4 |

| Energy | 3.4 |

| Real Estate | 2.6 |

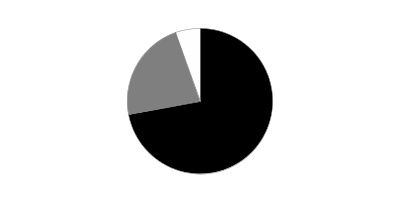

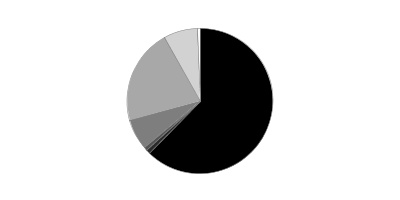

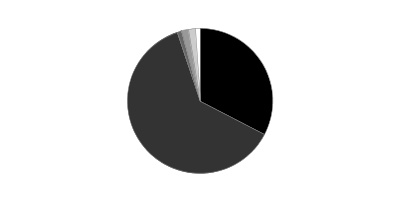

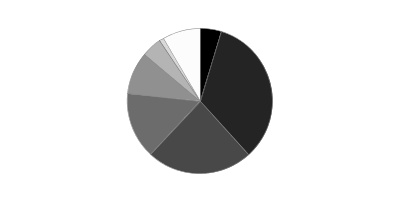

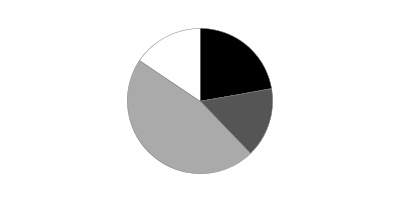

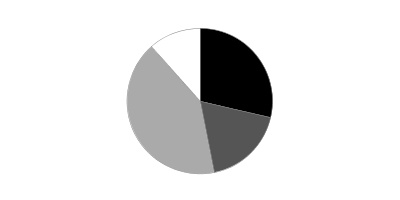

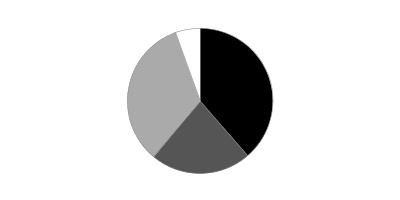

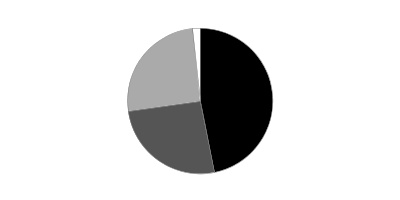

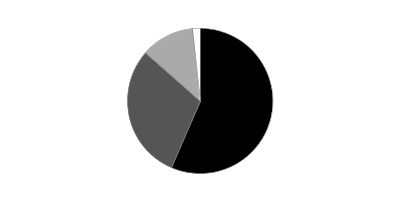

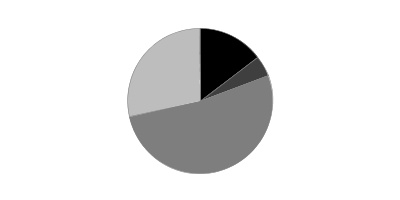

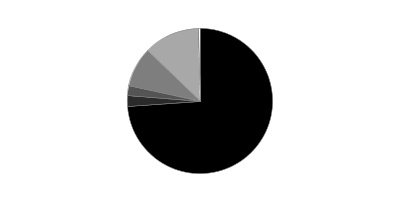

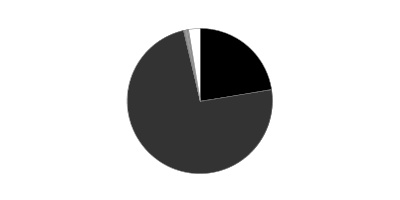

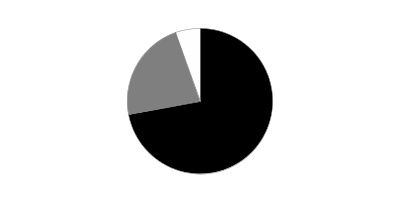

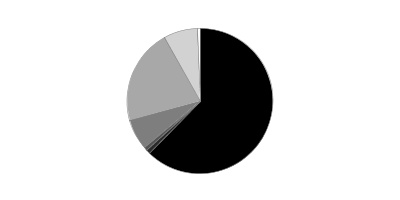

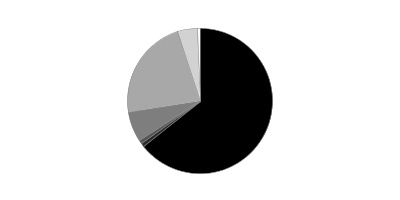

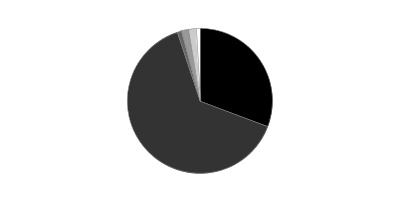

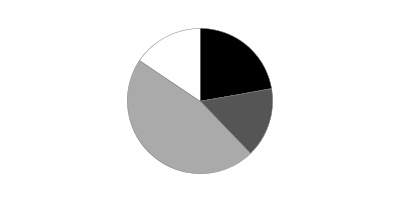

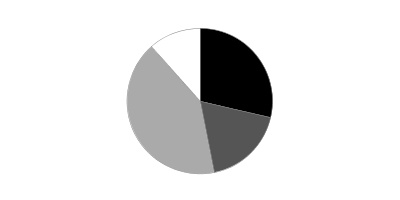

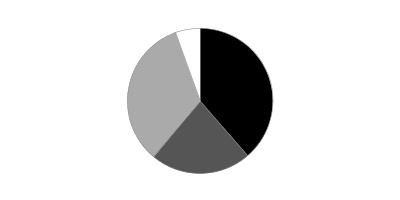

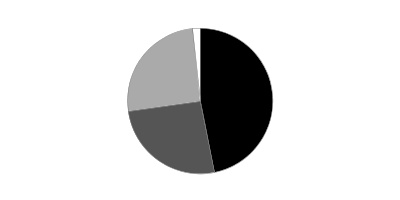

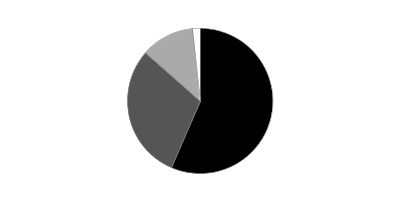

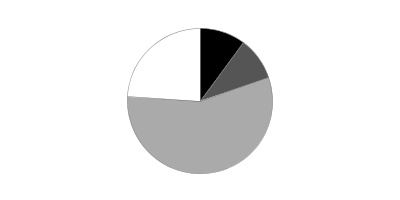

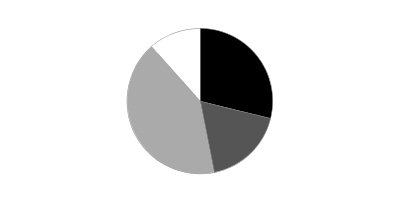

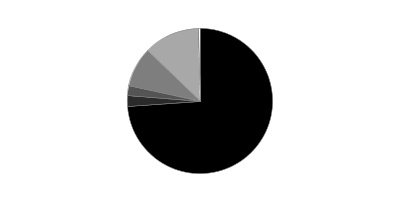

Asset Allocation (% of fund's net assets)

| As of December 31, 2018* |

| | Stock Class and Equity Futures** | 72.0% |

| | Bonds | 22.6% |

| | Short-Term Class | 5.4% |

* Foreign investments - 22.0%

** Includes investment in Fidelity® Commodity Strategy Central Fund of 0.7%

Asset allocations in the pie chart reflects the categorization of assets as defined in the Fund's prospectus in effect as of the time periods indicated above. Financial Statement categorizations conform to accounting standards and will differ from the pie chart. Percentages are adjusted for the effect of future contracts and swap contracts, if applicable.

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying Fidelity Central Funds, other than the Commodity Strategy and Money Market Central Funds, is available at institutional.fidelity.com.

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments.

Schedule of Investments December 31, 2018

Showing Percentage of Net Assets

| U.S. Treasury Obligations - 0.1% | | | |

| | | Principal Amount | Value |

| U.S. Treasury Bills, yield at date of purchase 2.36% to 2.39% 3/21/19 to 3/28/19 (a) | | | |

| (Cost $188,986) | | 190,000 | 188,980 |

| | | Shares | Value |

|

| Fixed-Income Funds - 24.5% | | | |

| Fidelity Emerging Markets Debt Central Fund (b) | | 112,065 | $1,020,915 |

| Fidelity Floating Rate Central Fund (b) | | 21,235 | 2,090,602 |

| Fidelity High Income Central Fund 1 (b) | | 43,565 | 3,842,872 |

| Fidelity Inflation-Protected Bond Index Central Fund (b) | | 76,633 | 7,470,174 |

| Fidelity International Credit Central Fund (b) | | 13,824 | 1,311,077 |

| Fidelity VIP Investment Grade Central Fund (b) | | 290,037 | 29,673,651 |

| iShares 20+ Year Treasury Bond ETF | | 27,776 | 3,375,062 |

| TOTAL FIXED-INCOME FUNDS | | | |

| (Cost $48,796,270) | | | 48,784,353 |

|

| Money Market Funds - 7.7% | | | |

| Fidelity Cash Central Fund, 2.42% (c) | | 10,404,631 | 10,406,712 |

| Fidelity Money Market Central Fund, 2.65% (c) | | 150,312 | 150,312 |

| Fidelity Securities Lending Cash Central Fund 2.41% (c)(d) | | 4,731,520 | 4,731,993 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $15,289,015) | | | 15,289,017 |

|

| Equity Funds - 69.9% | | | |

| Domestic Equity Funds - 48.5% | | | |

| Fidelity Commodity Strategy Central Fund (b) | | 295,200 | 1,369,730 |

| Fidelity Communication Services Central Fund (b) | | 42,869 | 7,214,391 |

| Fidelity Consumer Discretionary Central Fund (b) | | 32,921 | 9,362,394 |

| Fidelity Consumer Staples Central Fund (b) | | 35,385 | 5,886,298 |

| Fidelity Energy Central Fund (b) | | 46,930 | 4,467,763 |

| Fidelity Financials Central Fund (b) | | 198,891 | 17,255,789 |

| Fidelity Health Care Central Fund (b) | | 36,899 | 14,253,091 |

| Fidelity Industrials Central Fund (b) | | 37,653 | 8,748,390 |

| Fidelity Information Technology Central Fund (b) | | 64,101 | 19,976,403 |

| Fidelity Materials Central Fund (b) | | 13,560 | 2,453,816 |

| Fidelity Real Estate Equity Central Fund (b) | | 8,976 | 872,167 |

| Fidelity Utilities Central Fund (b) | | 18,910 | 3,217,606 |

| iShares S&P 500 Index ETF | | 5,388 | 1,355,675 |

|

| TOTAL DOMESTIC EQUITY FUNDS | | | 96,433,513 |

|

| International Equity Funds - 21.4% | | | |

| Fidelity Emerging Markets Equity Central Fund (b) | | 33,867 | 6,442,240 |

| Fidelity International Equity Central Fund (b) | | 356,996 | 24,536,329 |

| iShares Core MSCI Emerging Markets ETF | | 120,059 | 5,660,782 |

| iShares MSCI EAFE Index ETF | | 22,583 | 1,327,429 |

| iShares MSCI Japan ETF (e) | | 92,673 | 4,697,594 |

|

| TOTAL INTERNATIONAL EQUITY FUNDS | | | 42,664,374 |

|

| TOTAL EQUITY FUNDS | | | |

| (Cost $144,916,736) | | | 139,097,887 |

| TOTAL INVESTMENT IN SECURITIES - 102.2% | | | |

| (Cost $209,191,007) | | | 203,360,237 |

| NET OTHER ASSETS (LIABILITIES) - (2.2)% | | | (4,348,160) |

| NET ASSETS - 100% | | | $199,012,077 |

| Futures Contracts | | | | | |

| | Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) |

| Purchased | | | | | |

| Equity Index Contracts | | | | | |

| ICE E-mini MSCI Emerging Markets Index Contracts (United States) | 68 | March 2019 | $3,287,120 | $(324) | $(324) |

The notional amount of futures purchased as a percentage of Net Assets is 1.7%

Security Type Abbreviations

ETF – Exchange-Traded Fund

Legend

(a) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $188,980.

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-Q and is available upon request or at the SEC's website at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, other than the Commodity Strategy Central Fund, is available at fidelity.com and/or institutional.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

(e) Security or a portion of the security is on loan at period end.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $86,995 |

| Fidelity Commodity Strategy Central Fund | 108,596 |

| Fidelity Communication Services Central Fund | 75,162 |

| Fidelity Consumer Discretionary Central Fund | 446,358 |

| Fidelity Consumer Staples Central Fund | 740,404 |

| Fidelity Emerging Markets Debt Central Fund | 62,450 |

| Fidelity Emerging Markets Equity Central Fund | 630,036 |

| Fidelity Energy Central Fund | 109,230 |

| Fidelity Financials Central Fund | 1,259,377 |

| Fidelity Floating Rate Central Fund | 117,938 |

| Fidelity Health Care Central Fund | 935,862 |

| Fidelity High Income Central Fund 1 | 228,949 |

| Fidelity Industrials Central Fund | 596,422 |

| Fidelity Inflation-Protected Bond Index Central Fund | 216,571 |

| Fidelity Information Technology Central Fund | 4,174,076 |

| Fidelity International Credit Central Fund | 44,526 |

| Fidelity International Equity Central Fund | 2,062,054 |

| Fidelity Materials Central Fund | 258,675 |

| Fidelity Money Market Central Fund | 16,669 |

| Fidelity Real Estate Equity Central Fund | 49,895 |

| Fidelity Securities Lending Cash Central Fund | 2,736 |

| Fidelity Utilities Central Fund | 344,293 |

| Fidelity VIP Investment Grade Central Fund | 1,008,054 |

| Total | $13,575,328 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations if applicable.

Fiscal year to date information regarding the Fund’s investments in non-Money Market Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period | Purchases(a) | Sales Proceeds(a) | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Commodity Strategy Central Fund | $4,618,829 | $1,468,400 | $4,285,958 | $302,455 | $(733,996) | $1,369,730 | 0.5% |

| Fidelity Communication Services Central Fund | 2,102,367 | 6,033,424 | 293,170 | (6,221) | (622,009) | 7,214,391 | 0.5% |

| Fidelity Consumer Discretionary Central Fund | 11,085,370 | 1,578,283 | 2,995,088 | 275,100 | (581,271) | 9,362,394 | 0.5% |

| Fidelity Consumer Staples Central Fund | 7,114,905 | 1,448,729 | 885,849 | (37,093) | (1,754,394) | 5,886,298 | 0.5% |

| Fidelity Emerging Markets Debt Central Fund | 1,152,461 | 110,772 | 128,761 | (3,021) | (110,536) | 1,020,915 | 0.8% |

| Fidelity Emerging Markets Equity Central Fund | 8,905,698 | 1,073,251 | 1,590,206 | 21,268 | (1,967,771) | 6,442,240 | 1.1% |

| Fidelity Energy Central Fund | 6,081,328 | 758,347 | 826,501 | (20,478) | (1,524,933) | 4,467,763 | 0.5% |

| Fidelity Financials Central Fund | 20,492,187 | 3,466,299 | 2,805,897 | (62,497) | (3,834,303) | 17,255,789 | 0.6% |

| Fidelity Floating Rate Central Fund | 2,229,350 | 214,584 | 257,521 | (2,732) | (93,079) | 2,090,602 | 0.1% |

| Fidelity Health Care Central Fund | 14,107,635 | 2,389,053 | 2,529,954 | 179,105 | 107,252 | 14,253,091 | 0.5% |

| Fidelity High Income Central Fund 1 | 4,328,513 | 1,265,183 | 1,400,198 | 118,953 | (469,579) | 3,842,872 | 0.9% |

| Fidelity Industrials Central Fund | 10,645,928 | 1,919,576 | 1,545,207 | (29,785) | (2,242,122) | 8,748,390 | 0.5% |

| Fidelity Inflation-Protected Bond Index Central Fund | 7,620,576 | 2,378,789 | 2,303,422 | 23,352 | (249,121) | 7,470,174 | 0.7% |

| Fidelity Information Technology Central Fund | 25,074,285 | 8,607,233 | 7,899,720 | (76,209) | (5,729,186) | 19,976,403 | 0.5% |

| Fidelity International Credit Central Fund | -- | 1,443,590 | 93,790 | (390) | (38,333) | 1,311,077 | 0.8% |

| Fidelity International Equity Central Fund | 35,274,088 | 3,446,985 | 7,420,731 | 410,524 | (7,174,537) | 24,536,329 | 1.1% |

| Fidelity Materials Central Fund | 3,266,226 | 619,695 | 413,064 | (26,745) | (992,296) | 2,453,816 | 0.5% |

| Fidelity Real Estate Equity Central Fund | 1,040,939 | 89,998 | 153,147 | 306 | (105,929) | 872,167 | 0.8% |

| Fidelity Utilities Central Fund | 3,084,957 | 687,892 | 509,273 | 18,636 | (64,606) | 3,217,606 | 0.5% |

| Fidelity VIP Investment Grade Central Fund | 39,083,985 | 6,947,323 | 15,176,037 | (342,633) | (838,987) | 29,673,651 | 0.6% |

| | $207,309,627 | $45,947,406 | $53,513,494 | $741,895 | $(29,019,736) | $171,465,698 | |

(a) Includes the value of shares purchased or redeemed through in-kind transactions, if applicable. See the Notes to Financial Statements for additional details.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2018, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| U.S. Government and Government Agency Obligations | $188,980 | $-- | $188,980 | $-- |

| Fixed-Income Funds | 48,784,353 | 48,784,353 | -- | -- |

| Money Market Funds | 15,289,017 | 15,289,017 | -- | -- |

| Equity Funds | 139,097,887 | 139,097,887 | -- | -- |

| Total Investments in Securities: | $203,360,237 | $203,171,257 | $188,980 | $-- |

| Derivative Instruments: | | | | |

| Liabilities | | | | |

| Futures Contracts | $(324) | $(324) | $-- | $-- |

| Total Liabilities | $(324) | $(324) | $-- | $-- |

| Total Derivative Instruments: | $(324) | $(324) | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of December 31, 2018. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| Equity Risk | | |

| Futures Contracts(a) | $0 | $(324) |

| Total Equity Risk | 0 | (324) |

| Total Value of Derivatives | $0 | $(324) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in net unrealized appreciation (depreciation).

Other Information

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds. Percentages in the below tables are adjusted for the effect of TBA Sale Commitments.

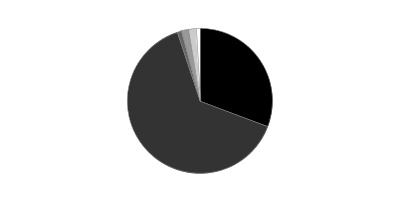

The composition of credit quality ratings as a percentage of Total Net Assets is as follows (Unaudited):

| U.S. Government and U.S. Government Agency Obligations | 13.4% |

| AAA,AA,A | 1.5% |

| BBB | 3.7% |

| BB | 2.4% |

| B | 1.3% |

| CCC,CC,C | 0.4% |

| D | 0.0% |

| Not Rated | 0.8% |

| Equities | 69.6% |

| Short-Term Investments and Net Other Assets | 6.9% |

| | 100.0% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

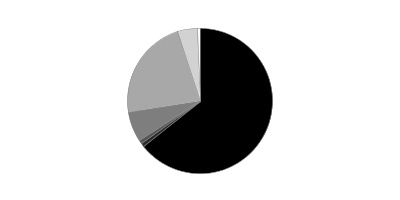

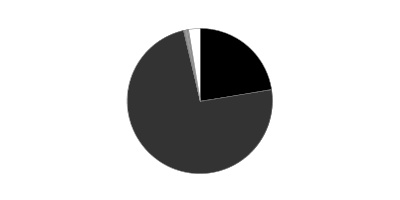

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 78.0% |

| United Kingdom | 3.0% |

| Japan | 2.4% |

| Switzerland | 1.7% |

| Canada | 1.7% |

| Framce | 1.5% |

| Netherlands | 1.5% |

| Germany | 1.4% |

| Cayman Islands | 1.2% |

| Others (Individually Less Than 1%) | 7.6% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | December 31, 2018 |

| Assets | | |

Investment in securities, at value (including securities loaned of $4,612,790) — See accompanying schedule:

Unaffiliated issuers (cost $17,257,659) | $16,605,522 | |

| Fidelity Central Funds (cost $191,933,348) | 186,754,715 | |

| Total Investment in Securities (cost $209,191,007) | | $203,360,237 |

| Cash | | 432,847 |

| Receivable for investments sold | | 1,389,881 |

| Receivable for fund shares sold | | 54,596 |

| Dividends receivable | | 3,501 |

| Distributions receivable from Fidelity Central Funds | | 19,704 |

| Prepaid expenses | | 335 |

| Other receivables | | 3,426 |

| Total assets | | 205,264,527 |

| Liabilities | | |

| Payable for investments purchased | $1,316,606 | |

| Payable for fund shares redeemed | 39,872 | |

| Accrued management fee | 91,347 | |

| Distribution and service plan fees payable | 842 | |

| Payable for daily variation margin on futures contracts | 11,900 | |

| Other affiliated payables | 26,407 | |

| Other payables and accrued expenses | 33,476 | |

| Collateral on securities loaned | 4,732,000 | |

| Total liabilities | | 6,252,450 |

| Net Assets | | $199,012,077 |

| Net Assets consist of: | | |

| Paid in capital | | $193,904,949 |

| Total distributable earnings (loss) | | 5,107,128 |

| Net Assets | | $199,012,077 |

| Net Asset Value and Maximum Offering Price | | |

| Initial Class: | | |

| Net Asset Value, offering price and redemption price per share ($89,477,331 ÷ 5,339,208 shares) | | $16.76 |

| Service Class: | | |

| Net Asset Value, offering price and redemption price per share ($2,621,382 ÷ 157,668 shares) | | $16.63 |

| Service Class 2: | | |

| Net Asset Value, offering price and redemption price per share ($2,903,710 ÷ 175,695 shares) | | $16.53 |

| Investor Class: | | |

| Net Asset Value, offering price and redemption price per share ($104,009,654 ÷ 6,244,083 shares) | | $16.66 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended December 31, 2018 |

| Investment Income | | |

| Dividends | | $412,344 |

| Interest | | 4,413 |

| Income from Fidelity Central Funds | | 4,290,522 |

| Total income | | 4,707,279 |

| Expenses | | |

| Management fee | $1,218,206 | |

| Transfer agent fees | 239,077 | |

| Distribution and service plan fees | 11,866 | |

| Accounting and security lending fees | 111,229 | |

| Custodian fees and expenses | 1,319 | |

| Independent trustees' fees and expenses | 1,045 | |

| Audit | 57,554 | |

| Legal | 8,494 | |

| Miscellaneous | 1,504 | |

| Total expenses before reductions | 1,650,294 | |

| Expense reductions | (4,362) | |

| Total expenses after reductions | | 1,645,932 |

| Net investment income (loss) | | 3,061,347 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 1,024,872 | |

| Fidelity Central Funds | 751,689 | |

| Futures contracts | 544,025 | |

| Capital gain distributions from Fidelity Central Funds | 9,284,806 | |

| Total net realized gain (loss) | | 11,605,392 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (2,247,049) | |

| Fidelity Central Funds | (29,019,802) | |

| Assets and liabilities in foreign currencies | (115) | |

| Futures contracts | (15,747) | |

| Total change in net unrealized appreciation (depreciation) | | (31,282,713) |

| Net gain (loss) | | (19,677,321) |

| Net increase (decrease) in net assets resulting from operations | | $(16,615,974) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended December 31, 2018 | Year ended December 31, 2017 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $3,061,347 | $2,770,748 |

| Net realized gain (loss) | 11,605,392 | 12,409,284 |

| Change in net unrealized appreciation (depreciation) | (31,282,713) | 21,813,931 |

| Net increase (decrease) in net assets resulting from operations | (16,615,974) | 36,993,963 |

| Distributions to shareholders | (11,946,072) | – |

| Distributions to shareholders from net investment income | – | (2,705,207) |

| Distributions to shareholders from net realized gain | – | (28,042,611) |

| Total distributions | (11,946,072) | (30,747,818) |

| Share transactions - net increase (decrease) | (2,518,429) | 19,986,287 |

| Total increase (decrease) in net assets | (31,080,475) | 26,232,432 |

| Net Assets | | |

| Beginning of period | 230,092,552 | 203,860,120 |

| End of period | $199,012,077 | $230,092,552 |

| Other Information | | |

| Undistributed net investment income end of period | | $65,534 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

VIP Asset Manager: Growth Portfolio Initial Class

| Years ended December 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $19.21 | $18.81 | $18.90 | $19.15 | $18.30 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .26 | .25 | .24 | .27 | .23 |

| Net realized and unrealized gain (loss) | (1.69) | 2.97 | .20 | (.27) | .85 |

| Total from investment operations | (1.43) | 3.22 | .44 | – | 1.08 |

| Distributions from net investment income | (.28) | (.24) | (.26) | (.24) | (.21) |

| Distributions from net realized gain | (.74) | (2.58) | (.26) | (.01) | (.02) |

| Total distributions | (1.02) | (2.82) | (.53)B | (.25) | (.23) |

| Net asset value, end of period | $16.76 | $19.21 | $18.81 | $18.90 | $19.15 |

| Total ReturnC,D | (7.65)% | 18.73% | 2.52% | .03% | 5.87% |

| Ratios to Average Net AssetsE,F | | | | | |

| Expenses before reductions | .68% | .69% | .71% | .70% | .70% |

| Expenses net of fee waivers, if any | .68% | .69% | .71% | .70% | .70% |

| Expenses net of all reductions | .68% | .69% | .70% | .69% | .70% |

| Net investment income (loss) | 1.40% | 1.32% | 1.31% | 1.37% | 1.19% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $89,477 | $106,903 | $99,882 | $108,324 | $122,484 |

| Portfolio turnover rateG | 32% | 29% | 142% | 49% | 38% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $.53 per share is comprised of distributions from net investment income of $.263 and distributions from net realized gain of $.264 per share.

C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses of any underlying non-money market Fidelity Central Funds ranged from less than .005% to .07%.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

VIP Asset Manager: Growth Portfolio Service Class

| Years ended December 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $19.07 | $18.68 | $18.79 | $19.03 | $18.19 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .24 | .23 | .22 | .25 | .21 |

| Net realized and unrealized gain (loss) | (1.68) | 2.96 | .18 | (.26) | .84 |

| Total from investment operations | (1.44) | 3.19 | .40 | (.01) | 1.05 |

| Distributions from net investment income | (.26) | (.22) | (.25) | (.22) | (.19) |

| Distributions from net realized gain | (.74) | (2.58) | (.26) | (.01) | (.02) |

| Total distributions | (1.00) | (2.80) | (.51) | (.23) | (.21) |

| Net asset value, end of period | $16.63 | $19.07 | $18.68 | $18.79 | $19.03 |

| Total ReturnB,C | (7.75)% | 18.70% | 2.34% | (.03)% | 5.75% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .78% | .79% | .81% | .80% | .80% |

| Expenses net of fee waivers, if any | .78% | .79% | .81% | .80% | .80% |

| Expenses net of all reductions | .78% | .79% | .80% | .79% | .80% |

| Net investment income (loss) | 1.30% | 1.22% | 1.21% | 1.27% | 1.09% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $2,621 | $3,018 | $2,698 | $2,877 | $3,265 |

| Portfolio turnover rateF | 32% | 29% | 142% | 49% | 38% |

A Calculated based on average shares outstanding during the period.

B Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses of any underlying non-money market Fidelity Central Funds ranged from less than .005% to .07%.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

VIP Asset Manager: Growth Portfolio Service Class 2

| Years ended December 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $18.95 | $18.58 | $18.70 | $18.94 | $18.10 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .21 | .20 | .19 | .21 | .17 |

| Net realized and unrealized gain (loss) | (1.67) | 2.94 | .18 | (.25) | .84 |

| Total from investment operations | (1.46) | 3.14 | .37 | (.04) | 1.01 |

| Distributions from net investment income | (.22) | (.20) | (.23) | (.19) | (.15) |

| Distributions from net realized gain | (.74) | (2.57) | (.26) | (.01) | (.02) |

| Total distributions | (.96) | (2.77) | (.49) | (.20) | (.17) |

| Net asset value, end of period | $16.53 | $18.95 | $18.58 | $18.70 | $18.94 |

| Total ReturnB,C | (7.88)% | 18.49% | 2.18% | (.18)% | 5.55% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .93% | .94% | .96% | .96% | 1.01% |

| Expenses net of fee waivers, if any | .93% | .94% | .96% | .96% | 1.01% |

| Expenses net of all reductions | .93% | .94% | .95% | .95% | 1.00% |

| Net investment income (loss) | 1.15% | 1.07% | 1.06% | 1.11% | .88% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $2,904 | $3,755 | $3,425 | $3,533 | $3,573 |

| Portfolio turnover rateF | 32% | 29% | 142% | 49% | 38% |

A Calculated based on average shares outstanding during the period.

B Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses of any underlying non-money market Fidelity Central Funds ranged from less than .005% to .07%.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

VIP Asset Manager: Growth Portfolio Investor Class

| Years ended December 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $19.10 | $18.71 | $18.82 | $19.06 | $18.22 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .25 | .23 | .22 | .25 | .21 |

| Net realized and unrealized gain (loss) | (1.69) | 2.97 | .18 | (.25) | .85 |

| Total from investment operations | (1.44) | 3.20 | .40 | – | 1.06 |

| Distributions from net investment income | (.26) | (.23) | (.25) | (.23) | (.20) |

| Distributions from net realized gain | (.74) | (2.58) | (.26) | (.01) | (.02) |

| Total distributions | (1.00) | (2.81) | (.51) | (.24) | (.22) |

| Net asset value, end of period | $16.66 | $19.10 | $18.71 | $18.82 | $19.06 |

| Total ReturnB,C | (7.72)% | 18.68% | 2.35% | .01% | 5.79% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .76% | .77% | .79% | .78% | .78% |

| Expenses net of fee waivers, if any | .76% | .77% | .79% | .78% | .78% |

| Expenses net of all reductions | .76% | .77% | .79% | .77% | .78% |

| Net investment income (loss) | 1.32% | 1.24% | 1.23% | 1.29% | 1.11% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $104,010 | $116,417 | $97,855 | $106,942 | $86,687 |

| Portfolio turnover rateF | 32% | 29% | 142% | 49% | 38% |

A Calculated based on average shares outstanding during the period.

B Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses of any underlying non-money market Fidelity Central Funds ranged from less than .005% to .07%.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended December 31, 2018

1. Organization.

VIP Asset Manager: Growth Portfolio (the Fund) is a fund of Variable Insurance Products Fund V (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares, Service Class shares, Service Class 2 shares and Investor Class shares. All classes have equal rights and voting privileges, except for matters affecting a single class. Certain Underlying Funds incurred name changes since their most recent shareholder report. The names of the Underlying Funds are those in effect at period end.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the Fund. These strategies are consistent with the investment objectives of the Fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the Fund. The following summarizes the Fund's investment in each Fidelity Central Fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio(a) |

| Fidelity Commodity Strategy Central Fund | Geode Capital Management, LLC (Geode) | Seeks to provide investment returns that correspond to the performance of the commodities market. | Investment in commodity-related investments through a wholly-owned subsidiary organized under the laws of the Cayman Islands

Futures | .06% |

| Fidelity Equity Central Funds | FMR Co., Inc. (FMRC) | Each fund seeks capital appreciation by investing primarily in common stocks, with a concentration in a particular industry. | Foreign Securities

Restricted Securities | Less than .005% to .01% |

| Fidelity Emerging Markets Debt Central Fund | FMRC | Seeks high total return by normally investing in debt securities of issuers in emerging markets and other debt investments that are tied economically to emerging markets. | Foreign Securities

Restricted Securities

| .01% |

| Fidelity Emerging Markets Equity Central Fund | FMRC | Seeks capital appreciation by investing primarily in equity securities of issuers in emerging markets. | Foreign Securities

Futures

| .07% |

| Fidelity International Equity Central Fund | FMRC | Seeks capital appreciation by investing primarily in non-U.S. based common stocks, including securities of issuers located in emerging markets. | Delayed Delivery & When Issued Securities

Foreign Securities

Futures

Restricted Securities

| .01% |

| Fidelity Floating Rate Central Fund | FMRC | Seeks a high level of income by normally investing in floating rate loans and other floating rate securities. | Loans & Direct Debt Instruments

Restricted Securities | Less than .005% |

| Fidelity High Income Central Fund 1 | FMRC | Seeks a high level of income and may also seek capital appreciation by investing primarily in debt securities, preferred stocks, and convertible securities, with an emphasis on lower-quality debt securities. | Loans & Direct Debt Instruments

Restricted Securities | Less than .005% |

| Fidelity Inflation-Protected Bond Index Central Fund | Fidelity Investment Money Management, Inc. (FIMM) | Seeks to provide investment results that correspond to the performance of the inflation-protected United States Treasury market, and may invest in derivatives. | | Less than .005% |

| Fidelity VIP Investment Grade Central Fund | FIMM | Seeks a high level of current income by normally investing in investment-grade debt securities and repurchase agreements. | Delayed Delivery & When Issued Securities

Repurchase Agreements

Restricted Securities

Swaps

| Less than .005% |

| Fidelity Real Estate Equity Central Fund | FMRC | Seeks above-average income and long-term capital growth by investing primarily in equity securities of issuers in the real estate industry. | Foreign Securities

Restricted Securities

| Less than .005% to .01% |

| Fidelity International Credit Central Fund | FMRC | Seeks a high level of current income by normally investing in debt securities of foreign issuers, including debt securities of issuers located in emerging markets. Foreign currency exposure is hedged utilizing foreign currency contracts. | Foreign Securities

Futures

Options

Restricted Securities

Swaps

| .01% |

| Fidelity Money Market Central Funds | FIMM | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

(a) Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at institutional.fidelity.com. A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows. Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Exchange-Traded Funds (ETFs) are valued at their last sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of December 31, 2018, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known. Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the Fidelity Central Funds. Although not included in the Fund's expenses, the Fund indirectly bears its proportionate share of the Fidelity Central Funds' expenses through the impact of these expenses on each Fidelity Central Fund's NAV.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of December 31, 2018, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to the short-term distributions from the Fidelity Central Funds, futures contracts, market discount, deferred trustees compensation and losses deferred due to wash sales and excise tax regulations.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $4,595,195 |

| Gross unrealized depreciation | (9,620,121) |

| Net unrealized appreciation (depreciation) | $(5,024,926) |

| Tax Cost | $208,385,163 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed long-term capital gain | $11,143,012 |

| Net unrealized appreciation (depreciation) on securities and other investments | $(5,024,898) |

The Fund intends to elect to defer to its next fiscal year $591,591 of capital losses recognized during the period November 1, 2018 to December 31, 2018.

The tax character of distributions paid was as follows:

| | December 31, 2018 | December 31, 2017 |

| Ordinary Income | $5,170,450 | $ 9,340,144 |

| Long-term Capital Gains | 6,775,622 | 21,407,674 |

| Total | $11,946,072 | $ 30,747,818 |

New Rule Issuance. During August 2018, the U.S. Securities and Exchange Commission issued Final Rule Release No. 33-10532, Disclosure Update and Simplification. This Final Rule includes amendments specific to registered investment companies that are intended to eliminate overlap in disclosure requirements between Regulation S-X and GAAP. In accordance with these amendments, certain line-items in the Fund's financial statements have been combined or removed for the current period as outlined in the table below.

| Financial Statement | Current Line-Item Presentation | Prior Line-Item Presentation |

| Statement of Assets and Liabilities | Total distributable earnings (loss) | Undistributed/Distributions in excess of/Accumulated net investment income (loss)

Accumulated/Undistributed net realized gain (loss)

Net unrealized appreciation (depreciation) |

| Statement of Changes in Net Assets | N/A - removed | Undistributed/Distributions in excess of/Accumulated net investment income (loss) end of period |

| Statement of Changes in Net Assets | Distributions to shareholders | Distributions to shareholders from net investment income

Distributions to shareholders from net realized gain |

| Distributions to Shareholders Note to Financial Statements | Distributions to shareholders | Distributions to shareholders from net investment income

Distributions to shareholders from net realized gain |

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment.

|

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Statement of Operations.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end and is representative of volume of activity during the period. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments.

5. Purchases and Redemptions of Underlying Fund Shares.

Purchases and redemptions of the Underlying Fund shares, including in-kind transactions, aggregated $70,522,638 and $78,225,514, respectively.

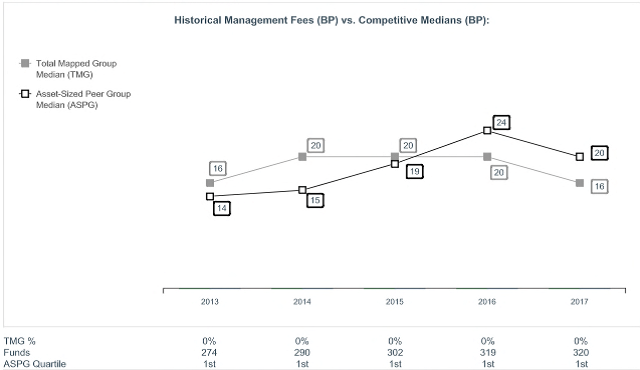

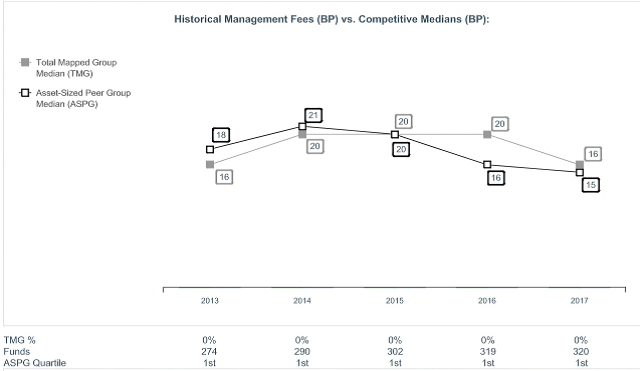

6. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .24% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .54% of the Fund's average net assets.

The investment adviser pays a portion of the management fees received from the Fund to the Fidelity Central Funds' investment advisers, who are also affiliates, for managing the assets of the Fidelity Central Funds.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate 12b-1 Plans for each Service Class of shares. Each Service Class pays Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, a service fee. For the period, the service fee is based on an annual rate of .10% of Service Class' average net assets and .25% of Service Class 2's average net assets.

For the period, total fees, all of which were re-allowed to insurance companies for the distribution of shares and providing shareholder support services, were as follows:

| Service Class | $2,905 |

| Service Class 2 | 8,961 |

| | $11,866 |

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing, and shareholder servicing agent. FIIOC receives an asset-based fee with respect to each class. Each class pays a fee for transfer agent services, typesetting and printing and mailing of shareholder reports, excluding mailing of proxy statements, equal to an annual rate of class-level average net assets. The annual rate for Investor Class is .15% and the annual rate for all other classes is .07%. For the period, transfer agent fees for each class were as follows:

| Initial Class | $66,060 |

| Service Class | 1,879 |

| Service Class 2 | 2,318 |

| Investor Class | 168,820 |

| | $239,077 |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions. For the period, the fees were equivalent to an annual rate of .05%.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $191 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

Reallocation of Underlying Fund Investments. During the period, the investment adviser reallocated portions of investments of the Fund. This involved taxable redemptions of Fidelity Consumer Discretionary Central Fund and Fidelity Information Technology Central Fund for investments, including accrued interest, with a value of $5,291,161 and a non-taxable exchange of those investments, including accrued interest, for 28,806 shares of Fidelity Communication Services Central Fund (formerly Fidelity Telecom Services Central Fund). Net realized gain of $140,418 on redemptions from Fidelity Consumer Discretionary Central Fund and Fidelity Information Technology Central Fund in connection with the reallocation is included in the Statement of Operations as "Net realized gain (loss) on Fidelity Central Funds". Fidelity Communication Services Central Fund, Fidelity Consumer Discretionary Central Fund and Fidelity Information Technology Central Fund are affiliated investment companies managed by FMR.

7. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $624 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

8. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $2,736. During the period, there were no securities loaned to FCM.

9. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $1,759 for the period. In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $324.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $2,279.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Year ended

December 31, 2018 | Year ended

December 31, 2017 |

| Distributions to shareholders | | |

| Initial Class | $5,474,519 | $– |

| Service Class | 154,464 | – |

| Service Class 2 | 182,137 | – |

| Investor Class | 6,134,952 | – |

| Total | $11,946,072 | $– |

| From net investment income | | |

| Initial Class | $– | $1,291,934 |

| Service Class | – | 34,278 |

| Service Class 2 | – | 37,438 |

| Investor Class | – | 1,341,557 |

| Total | $– | $2,705,207 |

| From net realized gain | | |

| Initial Class | $– | $13,574,774 |

| Service Class | – | 360,108 |

| Service Class 2 | – | 472,265 |

| Investor Class | – | 13,635,464 |

| Total | $– | $28,042,611 |

11. Share Transactions.

Transactions for each class of shares were as follows:

| | Shares | Shares | Dollars | Dollars |

| | Year ended December 31, 2018 | Year ended December 31, 2017 | Year ended December 31, 2018 | Year ended December 31, 2017 |

| Initial Class | | | | |

| Shares sold | 98,417 | 144,059 | $1,851,440 | $2,698,610 |