OMB APPROVAL

OMB Number:

3235-0570

Expires: August

31, 2020

Estimated average

burden hours per

response: 20.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number:811-05371

Russell Investment Funds

(Exact name of registrant as specified in charter)

1301 2nd Avenue 18thFloor, Seattle Washington 98101

(Address of principal executive offices) (Zip code)

Mary Beth R. Albaneze, Secretary and Chief Legal Officer

1301 2nd Avenue

18thFloor

Seattle, Washington 98101

206-505-4846

______________________________________________

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-787-7354

Date of fiscal year end:December 31

Date of reporting period:January 1, 2018 to December 31, 2018

Item 1. Reports to Stockholders

Russell Investment Funds

Russell Investment Funds is

a series investment company

with nine different investment

portfolios referred to as Funds.

These financial statements report

on five of these Funds.

Russell Investment Funds

Annual Report

December 31, 2018

Table of Contents

|

| Page |

| To Our Shareholders | 3 |

| U. S. Strategic Equity Fund | 4 |

| U. S. Small Cap Equity Fund | 21 |

| International Developed Markets Fund | 45 |

| Strategic Bond Fund | 73 |

| Global Real Estate Securities Fund | 127 |

| Notes to Schedules of Investments | 149 |

| Notes to Financial Highlights | 152 |

| Notes to Financial Statements | 153 |

| Report of Independent Registered Public Accounting Firm | 172 |

| Tax Information | 173 |

| Affiliated Brokerage Transactions | 174 |

| Basis for Approval of Investment Advisory Contracts | 175 |

| Shareholder Requests for Additional Information | 176 |

| Disclosure of Information about Fund Trustees and Officers | 177 |

| Adviser, Money Managers and Service Providers | 181 |

Russell Investment Funds

Copyright © Russell Investments 2019. All rights reserved.

Russell Investments’ ownership is composed of a majority stake held by funds managed by TA Associates with

minority stakes held by funds managed by Reverence Capital Partners and Russell Investments’ management.

Frank Russell Company is the owner of the Russell trademark contained in this material and all trademark rights

related to the Russell trademarks, which the members of the Russell Investment group of companies are permitted

to use under license from Frank Russell Company. The members of the Russell Investments group of companies

are not affiliated in any manner with Frank Russell Company or any entity operation under the “FTSE RUSSELL”

brand.

Fund objectives, risks, charges and expenses should be carefully considered before in-

vesting. A prospectus containing this and other important information must precede or

accompany this material. Please read the prospectus carefully before investing.

Securities distributed through Russell Investments Financial Services, LLC, member FINRA and part

of Russell Investments.

Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance,

are not a guarantee of future performance, and are not indicative of any specific investment. Index return

information is provided by vendors and although deemed reliable, is not guaranteed by Russell Investments or its

affiliates.

Performance quoted represents past performance and does not guarantee future results. The investment return and

principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their

original cost. Current performance may be lower or higher than the performance data quoted.

To Our Shareholders

Fellow Investors,

Our primary focus is to improve the financial security of our investors. We believe that the combination of our investment

solutions, a sound plan and timely investment advice provides a great answer for those individuals seeking to navigate

the difficult world of investing. Your financial security is the reason we work hard to maintain a time-tested, disciplined

investment approach, focused on meeting our clients’ financial needs.

The recent past has demonstrated the value of a disciplined approach, as we have seen volatility increase and leadership

change quickly:

•For the calendar year of 2018, U.S. equities were headed to a stellar year ahead of the final quarter. Coming into October,

the S&P 500®Index was up 10.6% year-to-date—hitting an all-time high of 2,930.751on September 20. These gains were

erased in the final quarter as the U.S. market dropped 14.0%, ending 6.2% lower for the year – its worst since 2008.

•For the year of 2017, emerging markets equities were by far and away the top performing asset segment, up over 34.0%.

That all changed in 2018, as emerging markets were one of the worst performing asset classes, finishing the year down over

16.6%2. Bonds, the usual safe haven when equity markets begin to retreat, were down 1.2% for 2018, and slipped 1.1%

during October, when equities were decreasing as well.3It hurts when the equity diversifier is down along with equity

markets.

These types of volatile and non-conforming markets can make it difficult for individuals to stick to an investment plan.

It can be quite tempting to get distracted and try to move to those areas that have been working, abandoning those that

have not. Unfortunately, this can whipsaw the less-disciplined investor that falls into the harmful trap of buying high and

selling low. However, we believe this is the type of market in which our process shines.

We maintain our focus and look to position our funds for the environment ahead, not the one that has just passed. With

this in mind, we hold the following views on markets:

• We continue to believe in diversifying globally. International investments provide diversification relative to U.S.-

based investments as well as open the portfolio up to additional opportunities outside our borders.

• We believe in a modest tilt away from the U.S. due to relatively high valuations. We also believe in emerging

markets equity exposure, although slightly less than at the beginning of 2018, due to profit taking after 2017’s strong

performance. Within our bond exposure, we believe in diversifying across sectors and place less emphasis on below-

investment-grade credit risk, as credit spreads have tightened and that market segment has gotten riskier.

Looking forward to the year ahead, we believe that growth will remain on a positive track at least through the middle of

2019. As we approach late 2019/early 2020, the odds of an economic slowdown do increase as the current cycle is getting

quite long in the tooth. We will be watching events quite closely and positioning the portfolios to navigate the conditions

ahead.

At Russell Investments, our stated purpose is to improve people’s financial security. We have a long heritage of providing

multi-asset solutions to help investors like you reach your financial goals, whether you’re saving for retirement, already

there or building a college fund. Thank you for the trust you have placed in our firm. All of us at Russell Investments

appreciate the opportunity to help you achieve your own financial security.

President and Chief Executive Officer, Russell Investment Funds

1Source: Bloomberg

2MSCI Emerging Markets Index, USD. Source: Bloomberg.

3Bloomberg Barclays Global Aggregate Total Return Index Unhedged USD. Source: Bloomberg.

To Our Shareholders 3

Russell Investment Funds

U.S. Strategic Equity Fund

Portfolio Management Discussion and Analysis — December 31, 2018 (Unaudited)

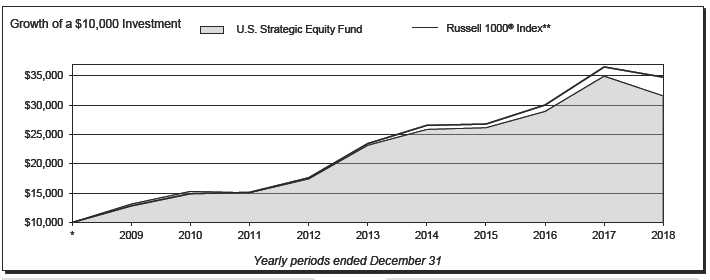

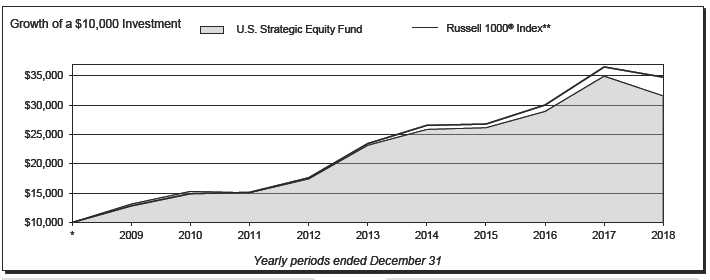

| | | | | | | |

| U. S. Strategic Equity Fund | | | | Russell 1000®Index** | | | |

| | | Total | | | | Total | |

| | | Return | | | | Return | |

| 1 Year | | (9.64 | )% | 1 Year | | (4.78 | )% |

| 5 Years | | 6.40 | %§ | 5 Years | | 8.21 | %§ |

| 10 Years | | 12.19 | %§ | 10 Years | | 13.28 | %§ |

4 U.S. Strategic Equity Fund

Russell Investment Funds

U.S. Strategic Equity Fund

Portfolio Management Discussion and Analysis, continued — December 31, 2018

(Unaudited)

| |

| The U. S. Strategic Equity Fund (the “Fund”) employs a multi- | global growth. During this sell off period, low volatility and value |

| manager approach whereby portions of the Fund are allocated | factors outperformed. The best performing sectors were areas |

| to different money manager strategies. Fund assets not allocated | traditionally considered to be defensive such as utilities and |

| to money managers are managed by Russell Investment | consumer staples. |

| Management, LLC (“RIM”), the Fund’s advisor. RIM may change | |

| the allocation of the Fund’s assets among money managers at | How did the investment strategies and techniques employed |

| any time. An exemptive order from the Securities and Exchange | by the Fund and its money managers affect its benchmark |

| Commission (“SEC”) permits RIM to engage or terminate a money | relative performance? |

| manager at any time, subject to approval by the Fund’s Board, | Over the period, the Fund maintained exposure to moderately |

| without a shareholder vote. Pursuant to the terms of the exemptive | priced securities with positive price momentum as well as |

| order, the Fund is required to notify its shareholders within 90 | companies with higher quality characteristics such as lower |

| days of when a money manager begins providing services. As of | financial leverage. Additionally, the Fund was tilted away from |

| December 31, 2018, the Fund had four money managers. | the largest market capitalization stocks due to valuation concerns. |

| | Overall, the Fund’s factor positioning was not rewarded as a tilt |

| What is the Fund’s investment objective? | toward companies trading at discounted valuation ratios and |

| The Fund seeks to provide long term capital growth. | tilt away from the most expensive, largest market capitalization |

| |

| How did the Fund perform relative to its benchmark for the | stocks detracted. However, the Fund’s tilt toward stocks with |

| fiscal year ended December 31, 2018? | positive price momentum was moderately beneficial. |

| For the fiscal year ended December 31, 2018, the Fund lost | From a sector standpoint, the Fund was positioned toward more |

| 9.64%. This is compared to the Fund’s benchmark, the Russell | pro-cyclical areas of the market which are expected to benefit |

| 1000®Index, which lost 4.78% during the same period. The | from a healthy domestic consumer, expansionary fiscal policy, |

| Fund’s performance includes operating expenses, whereas index | and the normalization of monetary policy, such as the consumer |

| returns are unmanaged and do not include expenses of any kind. | discretionary, financials, industrials and energy sectors, while |

| | avoiding bond proxies. The overall impact of the pro-cyclical |

| For the fiscal year ended December 31, 2018, the Morningstar® | sector positioning was negative over the fiscal year. |

| Insurance Large Blend Category, a group of funds that Morningstar | |

| considers to have investment strategies similar to those of the | Stock selection by the Fund’s money managers was the primary |

| Fund, lost 5.95%. This result serves as a peer comparison and is | negative contributor to benchmark relative performance during |

| expressed net of operating expenses. | the period, led by underperforming holdings within the health |

| | care, information technology, and financials sectors. |

| RIM may assign a money manager a specific style or | |

| capitalization benchmark other than the Fund’s index. However, | The Fund employs discretionary and non-discretionary money |

| the Fund’s primary index remains the benchmark for the Fund | managers. The Fund’s discretionary money managers select the |

| and is representative of the aggregate of each money manager’s | individual portfolio securities for the assets assigned to them. |

| benchmark index. | The Fund’s non-discretionary money managers provide a model |

| | portfolio to RIM representing their investment recommendations, |

| How did market conditions affect the Fund’s performance? | based upon which RIM purchases and sells securities for the |

| The fiscal year ended December 31, 2018 saw the Fund | Fund. RIM manages assets not allocated to money manager |

| underperform the Russell 1000®Index and the Morningstar® | strategies and the Fund’s cash balances. |

| Large Blend peer group. The Russell 1000®Index lost 4.78% | With respect to certain of the Fund’s money managers, Jacobs |

| over the year, which is the first calendar year in the last decade | Levy Equity Management, Inc. (“Jacobs Levy”) was the best |

| when the index finished with a negative absolute return. During | performing manager for the period and slightly underperformed |

| the first three quarters of 2018, the U. S. equity market produced | the Russell 1000®Index. Sector allocation decisions detracted, |

| strong absolute returns. The rally was led by growth stocks with | including overweights to the financials and energy sectors. Stock |

| high price momentum and lower levels of financial leverage, | selection within the information technology and communication |

| particularly within the health care and technology sectors, as | services sectors was rewarded although selection within the |

| U. S. companies posted strong quarterly earnings results boosted | health care sector held back further gains. |

| by lower corporate tax rates. However, investor sentiment rotated | |

| heavily toward value and low volatility stocks in the final quarter | Suffolk Capital Management, LLC (“Suffolk”) was the worst |

| of 2018 as the U. S. equity market declined substantially amid | performing manager for the period and underperformed the |

| concerns over rising interest rates, trade wars, and decelerating | Russell 1000®Growth Index. Suffolk’s tilt toward stocks with high |

| | earnings variability was not rewarded. Sector allocation decisions |

U.S. Strategic Equity Fund 5

Russell Investment Funds

U.S. Strategic Equity Fund

Portfolio Management Discussion and Analysis, continued — December 31, 2018

(Unaudited)

| | |

| detracted, including overweights to the industrials and financials | | |

| sectors. Stock selection was the primary negative contributor | In June 2018, William Blair Investment Management, LLC, Mar |

| to performance over the period as underperforming holdings | Vista Investment Partners, LLC, and Barrow, Hanley, Mewhinney |

| within the health care, consumer discretionary, and information | & Strauss, LLC were terminated, and HS Management Partners, |

| technology sectors held back relative performance. | LLC and Brandywine Global Investment Management, LLC were |

| During the period, RIM utilized a positioning strategy to control | hired. These changes were made in order to increase concentration |

| Fund-level exposures and risks through the purchase of a stock | and the diversification of potential excess return sources within |

| portfolio. Using the output from a quantitative model, the strategy | the Fund. | |

| |

| seeks to position the portfolio to meet RIM’s overall preferred | Money Managers as of December 31, | |

| positioning with respect to Fund exposures along factor and | 2018 | Styles |

| industry dimensions. | | |

| | Brandywine Global Investment | |

| The Fund’s active positioning strategy provided exposure to | Management, LLC | Value |

| RIM’s strategic equity beliefs associated with value, momentum, | HS Management Partners, LLC | Growth |

| quality, and low volatility factors. During the fiscal year, the | Jacobs Levy Equity Management, Inc. | Market-Oriented |

| strategy underperformed the Russell 1000®Index as the value | Suffolk Capital Management, LLC | Growth |

| factor notably lagged in the U. S. equity market. The positioning | The views expressed in this report reflect those of the |

| strategy’s tilt toward stocks with positive price momentum and | portfolio managers only through the end of the period |

| overweights to the information technology and health care sectors | covered by the report. These views do not necessarily |

| were rewarded and helped to offset some of the underperformance. | represent the views of RIM, or any other person in RIM or |

| | any other affiliated organization. These views are subject to |

| During the period, RIM partially equitized the Fund’s cash using | change at any time based upon market conditions or other |

| index futures contracts to provide the Fund with greater market | events, and RIM disclaims any responsibility to update the |

| exposure. This had a negative impact on the Fund’s absolute | views contained herein. These views should not be relied |

| performance. | on as investment advice and, because investment decisions |

| Describe any changes to the Fund’s structure or the money | for a Russell Investment Funds (“RIF”) Fund are based on |

| manager line-up. | numerous factors, should not be relied on as an indication |

| | of investment decisions of any RIF Fund. |

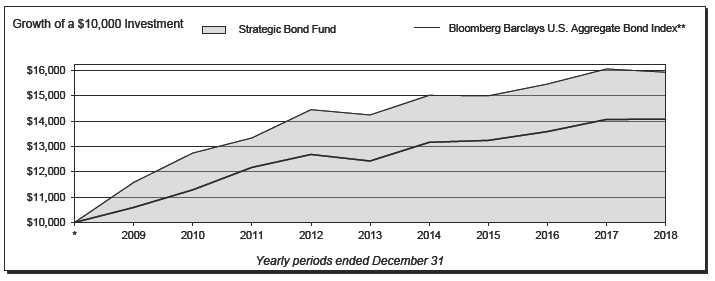

* Assumes initial investment on January 1, 2009.

** The Russell 1000®Index includes the 1,000 largest companies in the Russell 3000®Index. The Russell 1000®Index represents the universe of stocks from

which most active money managers typically select. The Russell 1000®Index return reflects adjustments from income dividends and capital gain distributions

reinvested as of the ex-dividend dates.

§ Annualized.

The performance shown in this section does not reflect any Insurance Company Separate Account or Policy Charges. Performance is historical and assumes

reinvestment of all dividends and capital gains. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more

or less than when purchased. Past performance is not indicative of future results. Additionally, the returns presented herein may differ from the performance reported

in the Financial Highlights as the returns herein are calculated in a manner consistent with standardized performance in accordance with Securities and Exchange

Commission rules, while the performance in the Financial Highlights has been calculated in accordance with U.S. Generally Accepted Accounting Principles (“U.S.

GAAP”).

6 U.S. Strategic Equity Fund

Russell Investment Funds

U.S. Strategic Equity Fund

Shareholder Expense Example — December 31, 2018 (Unaudited)

| | | | | | | |

| Fund Expenses | Please note that the expenses shown in the table are meant |

| The following disclosure provides important information | to highlight your ongoing costs only and do not reflect any |

| regarding the Fund’s Shareholder Expense Example | transactional costs. Therefore, the information under the heading |

| (“Example”) . | “Hypothetical Performance (5% return before expenses)” is |

| | useful in comparing ongoing costs only, and will not help you |

| Example | determine the relative total costs of owning different funds. In |

| As a shareholder of the Fund, you incur two types of costs: (1) | addition, if these transactional costs were included, your costs |

| transaction costs, and (2) ongoing costs, including advisory and | would have been higher. The fees and expenses shown in this |

| administrative fees and other Fund expenses. The Example is | section do not reflect any Insurance Company Separate Account |

| intended to help you understand your ongoing costs (in dollars) | Policy Charges. | | | | | | |

| of investing in the Fund and to compare these costs with the | | | | | | Hypothetical |

| ongoing costs of investing in other mutual funds. The Example | | | | | | Performance (5% |

| is based on an investment of $1,000 invested at the beginning of | | | | Actual | | return before |

| the period and held for the entire period indicated, which for this | | | Performance | | | expenses) |

| | Beginning Account Value | | | | | | |

| Fund is from July 1, 2018 to December 31, 2018. | July 1, 2018 | | $ | 1,000.00 | | $ | 1,000.00 |

| | Ending Account Value | | | | | | |

| Actual Expenses | December 31, 2018 | | $ | 885.10 | | $ | 1,020.92 |

| The information in the table under the heading “Actual | Expenses Paid During Period* | | $ | 4.04 | | $ | 4.33 |

| Performance” provides information about actual account values | | | | | | | |

| and actual expenses. You may use the information in this column, | * Expenses are equal to the Fund's annualized expense ratio of 0.85% |

| | (representing the six month period annualized), multiplied by the average |

| together with the amount you invested, to estimate the expenses | account value over the period, multiplied by 184/365 (to reflect the one-half |

| that you paid over the period. Simply divide your account value by | year period) . | | | | | | |

| $1,000 (for example, an $8,600 account value divided by $1,000 | | | | | | | |

| = 8.6), then multiply the result by the number in the first column | | | | | | | |

| in the row entitled “Expenses Paid During Period” to estimate | | | | | | | |

| the expenses you paid on your account during this period. | | | | | | | |

| |

| Hypothetical Example for Comparison Purposes | | | | | | | |

| The information in the table under the heading “Hypothetical | | | | | | | |

| Performance (5% return before expenses)” provides information | | | | | | | |

| about hypothetical account values and hypothetical expenses | | | | | | | |

| based on the Fund’s actual expense ratio and an assumed rate of | | | | | | | |

| return of 5% per year before expenses, which is not the Fund’s | | | | | | | |

| actual return. The hypothetical account values and expenses | | | | | | | |

| may not be used to estimate the actual ending account balance or | | | | | | | |

| expenses you paid for the period. You may use this information | | | | | | | |

| to compare the ongoing costs of investing in the Fund and other | | | | | | | |

| funds. To do so, compare this 5% hypothetical example with the | | | | | | | |

| 5% hypothetical examples that appear in the shareholder reports | | | | | | | |

| of other funds. | | | | | | | |

U.S. Strategic Equity Fund 7

Russell Investment Funds

U.S. Strategic Equity Fund

Schedule of Investments — December 31, 2018

| | | | | | | |

| Amounts in thousands(except share amounts) | | Amounts in thousands(except share amounts) | |

| | | Principal | Fair | | | Principal | Fair |

| | Amount ($) or | Value | | Amount ($) or | Value |

| | | Shares | $ | | | Shares | $ |

| Common Stocks - 95.2% | | | | CVS Health Corp. | | 21,315 | 1,397 |

| Consumer Discretionary - 22.5% | | | | Heineken NV - ADR | | 37,908 | 1,667 |

| Aaron's, Inc. Class A | | 2,130 | 90 | Ingredion, Inc. | | 7,576 | 692 |

| Amazon. com, Inc. (Æ) | | 5,507 | 8,271 | JM Smucker Co. (The) | | 2,418 | 226 |

| AutoZone, Inc. (Æ) | | 452 | 379 | Kraft Heinz Co. (The) | | 3,589 | 154 |

| Best Buy Co. , Inc. | | 6,830 | 362 | Molson Coors Brewing Co. Class B | | 25,737 | 1,445 |

| Carnival Corp. | | 3,778 | 186 | Mondelez International, Inc. Class A | | 16,753 | 671 |

| Chipotle Mexican Grill, Inc. Class A(Æ) | | 298 | 129 | Monster Beverage Corp. (Æ) | | 4,200 | 207 |

| Comcast Corp. Class A | | 124,776 | 4,249 | Nestle SA - ADR | | 52,137 | 4,221 |

| Costco Wholesale Corp. | | 7,768 | 1,583 | PepsiCo, Inc. | | 13,426 | 1,484 |

| Darden Restaurants, Inc. | | 10,950 | 1,093 | Philip Morris International, Inc. | | 2,234 | 149 |

| Diageo PLC - ADR | | 16,245 | 2,304 | Post Holdings, Inc. (Æ) | | 1,144 | 102 |

| Domino's Pizza, Inc. | | 2,538 | 629 | Procter & Gamble Co. (The) | | 10,970 | 1,008 |

| DR Horton, Inc. | | 27,139 | 941 | Seaboard Corp. | | 35 | 124 |

| Dunkin' Brands Group, Inc. | | 16,356 | 1,049 | Tyson Foods, Inc. Class A | | 18,252 | 975 |

| eBay, Inc. (Æ) | | 160,509 | 4,505 | Walgreens Boots Alliance, Inc. | | 4,031 | 275 |

| Ford Motor Co. | | 141,900 | 1,086 | | | | |

| General Motors Co. | | 133,949 | 4,480 | | | | 24,999 |

| Hilton Worldwide Holdings, Inc. | | 5,870 | 421 | | | | |

| Home Depot, Inc. (The) | | 20,061 | 3,447 | Energy - 5.7% | | | |

| | | | | Anadarko Petroleum Corp. | | 6,502 | 285 |

| Lions Gate Entertainment Corp. Class A(Ñ) | | 83,143 | 1,339 | Arch Coal, Inc. Class A | | 1,400 | 116 |

| Lowe's Cos. , Inc. | | 14,200 | 1,312 | BP PLC - ADR | | 60,971 | 2,313 |

| LVMH Moet Hennessy Louis Vuitton SE | | | | Canadian Natural Resources, Ltd. | | 86,739 | 2,093 |

| - ADR(Ñ) | | 31,331 | 1,832 | | | | |

| Madison Square Garden Co. (The) Class A(Æ) | 1,942 | 520 | Chevron Corp. | | 23,070 | 2,509 |

| Magna International, Inc. Class A | | 37,413 | 1,700 | Concho Resources, Inc. (Æ) | | 1,192 | 123 |

| Marriott International, Inc. Class A | | 38,873 | 4,220 | ConocoPhillips | | 33,080 | 2,062 |

| McDonald's Corp. | | 21,739 | 3,860 | Devon Energy Corp. | | 57,868 | 1,304 |

| MGM Resorts International | | 57,228 | 1,388 | Diamondback Energy, Inc. | | 3,687 | 342 |

| Mohawk Industries, Inc. (Æ) | | 8,854 | 1,036 | EOG Resources, Inc. | | 9,280 | 809 |

| Netflix, Inc. (Æ) | | 2,964 | 793 | Exxon Mobil Corp. | | 17,903 | 1,221 |

| Norwegian Cruise Line Holdings, Ltd. (Æ) | | 27,170 | 1,152 | Halliburton Co. | | 26,800 | 712 |

| PulteGroup, Inc. | | 29,589 | 769 | Kinder Morgan, Inc. | | 43,108 | 663 |

| PVH Corp. | | 13,822 | 1,285 | Marathon Petroleum Corp. | | 10,181 | 601 |

| Royal Caribbean Cruises, Ltd. | | 14,785 | 1,446 | National Oilwell Varco, Inc. | | 10,960 | 282 |

| Starbucks Corp. | | 47,145 | 3,036 | Noble Energy, Inc. | | 1,720 | 32 |

| Tapestry, Inc. | | 41,893 | 1,414 | Occidental Petroleum Corp. | | 14,450 | 887 |

| Target Corp. | | 8,220 | 543 | Oceaneering International, Inc. (Æ) | | 29,087 | 352 |

| Tiffany & Co. | | 39,492 | 3,179 | Phillips 66 | | 15,805 | 1,362 |

| TJX Cos. , Inc. | | 26,420 | 1,182 | Pioneer Natural Resources Co. | | 2,960 | 389 |

| Tupperware Brands Corp. | | 17,300 | 546 | Schlumberger, Ltd. | | 57,475 | 2,074 |

| Ulta Salon Cosmetics & Fragrance, Inc. (Æ) | | 9,056 | 2,217 | Valero Energy Corp. | | 16,570 | 1,242 |

| Wal-Mart Stores, Inc. | | 46,118 | 4,296 | �� | | | 21,773 |

| Walt Disney Co. (The) | | 54,284 | 5,952 | | | | |

| Weight Watchers International, Inc. (Æ) | | 43,353 | 1,671 | Financial Services - 15.5% | | | |

| Williams-Sonoma, Inc. (Ñ) | | 62,260 | 3,141 | Aflac, Inc. | | 4,324 | 197 |

| Yum! Brands, Inc. | | 5,200 | 478 | Alliance Data Systems Corp. | | 1,421 | 213 |

| | | | | Allstate Corp. (The) | | 9,800 | 810 |

| | | | 85,511 | American Express Co. | | 4,465 | 426 |

| | | | | American Homes 4 Rent Class A(ö) | | 11,300 | 224 |

| Consumer Staples - 6.6% | | | | Ameriprise Financial, Inc. | | 5,470 | 571 |

| Altria Group, Inc. | | 7,639 | 377 | | | | |

| Anheuser-Busch InBev SA - ADR(Ñ) | | 40,905 | 2,692 | Banco Santander SA - ADR | | 235,238 | 1,054 |

| Archer-Daniels-Midland Co. | | 31,140 | 1,276 | Bank of America Corp. | | 102,894 | 2,536 |

| Bunge, Ltd. | | 3,300 | 176 | Bank of New York Mellon Corp. (The) | | 58,571 | 2,757 |

| Coca-Cola Co. (The) | | 112,435 | 5,324 | Berkshire Hathaway, Inc. Class B(Æ) | | 10,441 | 2,132 |

| ConAgra Foods, Inc. | | 3,950 | 84 | Blackstone Group, LP (The) | | 122,264 | 3,645 |

| Constellation Brands, Inc. Class A | | 1,697 | 273 | BNP Paribas SA - ADR | | 35,600 | 802 |

See accompanying notes which are an integral part of the financial statements.

8 U.S. Strategic Equity Fund

Russell Investment Funds

U.S. Strategic Equity Fund

Schedule of Investments, continued — December 31, 2018

| | | | | | | |

| Amounts in thousands(except share amounts) | | Amounts in thousands(except share amounts) | |

| | | Principal | Fair | | | Principal | Fair |

| | Amount ($) or | Value | | Amount ($) or | Value |

| | | Shares | $ | | | Shares | $ |

| Broadridge Financial Solutions, Inc. | | 3,530 | 340 | Willis Towers Watson PLC(Æ) | | 1,540 | 234 |

| Capital One Financial Corp. | | 11,216 | 848 | | | | 58,890 |

| CBRE Group, Inc. Class A(Æ) | | 7,890 | 316 | | | | |

| Charles Schwab Corp. (The) | | 85,914 | 3,567 | Health Care - 9.7% | | | |

| Chubb, Ltd. | | 2,935 | 379 | Aerie Pharmaceuticals, Inc. (Æ) | | 30,855 | 1,114 |

| Citigroup, Inc. | | 89,323 | 4,649 | Agilent Technologies, Inc. | | 4,649 | 314 |

| Citizens Financial Group, Inc. | | 17,630 | 524 | Alkermes PLC(Æ) | | 5,800 | 171 |

| CME Group, Inc. Class A | | 13,953 | 2,625 | Allergan PLC | | 7,440 | 994 |

| Comerica, Inc. | | 7,526 | 517 | Allscripts Healthcare Solutions, Inc. (Æ) | | 14,028 | 135 |

| Cullen/Frost Bankers, Inc. | | 3,189 | 280 | AmerisourceBergen Corp. Class A | | 2,500 | 186 |

| Discover Financial Services | | 11,584 | 683 | Anthem, Inc. (Æ) | | 9,752 | 2,561 |

| E*Trade Financial Corp. | | 27,681 | 1,215 | Baxter International, Inc. | | 4,676 | 308 |

| Equinix, Inc. (Æ)(ö) | | 2,048 | 722 | Becton Dickinson and Co. | | 1,597 | 360 |

| Equity Residential(ö) | | 7,980 | 527 | Bristol-Myers Squibb Co. | | 34,241 | 1,780 |

| Everest Re Group, Ltd. | | 1,220 | 266 | Cardinal Health, Inc. | | 12,037 | 537 |

| Fidelity National Information Services, Inc. | | 3,180 | 326 | Celgene Corp. (Æ) | | 49,173 | 3,151 |

| First BanCorp | | 2,600 | 22 | Centene Corp. (Æ) | | 5,809 | 670 |

| First Data Corp. Class A(Æ) | | 58,400 | 988 | Cerner Corp. (Æ) | | 3,624 | 190 |

| FleetCor Technologies, Inc. (Æ) | | 1,872 | 348 | Cigna Corp. | | 7,441 | 1,413 |

| Global Payments, Inc. | | 2,576 | 266 | Cooper Cos. , Inc. (The) | | 914 | 233 |

| Goldman Sachs Group, Inc. (The) | | 7,598 | 1,269 | Eli Lilly & Co. | | 10,192 | 1,180 |

| Hartford Financial Services Group, Inc. | | 8,270 | 368 | Encompass Health Corp. (Æ) | | 3,148 | 194 |

| Intercontinental Exchange, Inc. | | 5,680 | 428 | Gilead Sciences, Inc. | | 11,059 | 692 |

| Invesco, Ltd. | | 55,073 | 922 | HCA Healthcare, Inc. | | 2,141 | 266 |

| Jack Henry & Associates, Inc. | | 2,990 | 378 | Horizon Pharma PLC(Æ) | | 33,681 | 658 |

| JPMorgan Chase & Co. | | 39,375 | 3,843 | Humana, Inc. | | 4,315 | 1,236 |

| KeyCorp | | 14,872 | 220 | IDEXX Laboratories, Inc. (Æ) | | 1,060 | 197 |

| KKR & Co. , Inc. Class A | | 110,306 | 2,165 | Intuitive Surgical, Inc. (Æ) | | 1,413 | 677 |

| M&T Bank Corp. | | 5,030 | 720 | Jazz Pharmaceuticals PLC(Æ) | | 3,938 | 488 |

| MasterCard, Inc. Class A | | 12,870 | 2,428 | Johnson & Johnson | | 10,757 | 1,388 |

| Morgan Stanley | | 6,732 | 267 | Laboratory Corp. of America Holdings(Æ) | | 3,461 | 437 |

| Nasdaq, Inc. | | 2,400 | 196 | McKesson Corp. | | 2,417 | 267 |

| New York Community Bancorp, Inc. | | 23,200 | 218 | MEDNAX, Inc. (Æ) | | 4,546 | 150 |

| Northern Trust Corp. | | 8,240 | 689 | Medtronic PLC | | 21,093 | 1,919 |

| Park Hotels & Resorts, Inc. (ö) | | 8,866 | 230 | Merck & Co. , Inc. | | 8,770 | 670 |

| PNC Financial Services Group, Inc. (The) | | 2,337 | 273 | Mylan NV(Æ) | | 21,900 | 600 |

| Popular, Inc. | | 5,770 | 272 | Pfizer, Inc. | | 32,095 | 1,401 |

| Progressive Corp. (The) | | 9,430 | 569 | Portola Pharmaceuticals, Inc. (Æ)(Ñ) | | 17,994 | 351 |

| Prudential Financial, Inc. | | 12,653 | 1,032 | Quest Diagnostics, Inc. | | 2,522 | 210 |

| Raymond James Financial, Inc. | | 5,215 | 388 | Regeneron Pharmaceuticals, Inc. (Æ) | | 929 | 347 |

| Rayonier, Inc. (ö) | | 6,450 | 179 | Sage Therapeutics, Inc. (Æ) | | 15,150 | 1,451 |

| Santander Consumer USA Holdings, Inc. | | 54,308 | 955 | Steris PLC | | 1,800 | 192 |

| SLM Corp. (Æ) | | 52,300 | 435 | Stryker Corp. | | 1,019 | 160 |

| State Street Corp. | | 10,831 | 683 | Thermo Fisher Scientific, Inc. | | 6,335 | 1,418 |

| SunTrust Banks, Inc. | | 12,983 | 655 | United Therapeutics Corp. (Æ) | | 329 | 36 |

| Synchrony Financial | | 6,454 | 151 | UnitedHealth Group, Inc. | | 10,606 | 2,643 |

| Synovus Financial Corp. | | 4,620 | 148 | Universal Health Services, Inc. Class B | | 2,506 | 292 |

| T Rowe Price Group, Inc. | | 1,426 | 132 | Vertex Pharmaceuticals, Inc. (Æ) | | 5,726 | 949 |

| TD Ameritrade Holding Corp. | | 1,682 | 82 | WellCare Health Plans, Inc. (Æ) | | 2,950 | 696 |

| Total System Services, Inc. | | 3,600 | 293 | West Pharmaceutical Services, Inc. | | 2,461 | 241 |

| Travelers Cos. , Inc. (The) | | 7,234 | 867 | Zimmer Biomet Holdings, Inc. | | 7,760 | 805 |

| US Bancorp | | 9,117 | 417 | Zoetis, Inc. Class A | | 5,063 | 433 |

| VICI Properties, Inc. (ö) | | 2,900 | 54 | | | | |

| Visa, Inc. Class A | | 6,500 | 858 | | | | 36,761 |

| Voya Financial, Inc. | | 9,475 | 380 | | | | |

| Wells Fargo & Co. | | 15,570 | 717 | Materials and Processing - 3.2% | | | |

| | | | | Air Products & Chemicals, Inc. | | 1,540 | 246 |

See accompanying notes which are an integral part of the financial statements.

U.S. Strategic Equity Fund 9

Russell Investment Funds

U.S. Strategic Equity Fund

Schedule of Investments, continued — December 31, 2018

| | | | | | | |

| Amounts in thousands(except share amounts) | | Amounts in thousands(except share amounts) | |

| | | Principal | Fair | | | Principal | Fair |

| | Amount ($) or | Value | | Amount ($) or | Value |

| | | Shares | $ | | | Shares | $ |

| Ashland Global Holdings, Inc. | | 5,580 | 396 | Navistar International Corp. (Æ) | | 2,600 | 67 |

| Cabot Corp. | | 4,750 | 204 | Northrop Grumman Corp. | | 1,732 | 424 |

| Crown Holdings, Inc. (Æ) | | 24,426 | 1,015 | Paychex, Inc. | | 4,100 | 267 |

| DowDuPont, Inc. | | 17,552 | 939 | Pentair PLC | | 2,400 | 91 |

| Eastman Chemical Co. | | 14,095 | 1,030 | Quanta Services, Inc. | | 49,505 | 1,490 |

| Ecolab, Inc. | | 7,093 | 1,045 | Raytheon Co. | | 11,213 | 1,719 |

| FMC Corp. | | 18,148 | 1,342 | Rockwell Automation, Inc. | | 9,062 | 1,364 |

| Huntsman Corp. | | 24,729 | 477 | Roper Technologies, Inc. | | 900 | 240 |

| Ingersoll-Rand PLC | | 1,985 | 181 | Ryder System, Inc. | | 4,900 | 236 |

| LyondellBasell Industries NV Class A | | 2,129 | 177 | Southwest Airlines Co. | | 4,000 | 186 |

| Nucor Corp. | | 5,481 | 284 | Terex Corp. | | 4,230 | 117 |

| Reliance Steel & Aluminum Co. | | 2,978 | 212 | Textron, Inc. | | 11,700 | 538 |

| Royal Gold, Inc. | | 3,792 | 325 | United Technologies Corp. | | 21,307 | 2,268 |

| Sherwin-Williams Co. (The) | | 4,582 | 1,804 | Waters Corp. (Æ) | | 1,204 | 227 |

| Steel Dynamics, Inc. | | 3,526 | 106 | XPO Logistics, Inc. (Æ) | | 21,825 | 1,245 |

| Westrock Co. | | 50,905 | 1,923 | | | | 33,478 |

| WR Grace & Co. | | 3,180 | 206 | | | | |

| | | | 11,912 | Technology - 20.5% | | | |

| | | | | Adobe, Inc. (Æ) | | 2,457 | 556 |

| Producer Durables - 8.8% | | | | Alibaba Group Holding, Ltd. - ADR(Æ) | | 9,554 | 1,310 |

| 3M Co. | | 1,529 | 291 | Alphabet, Inc. Class A(Æ) | | 3,335 | 3,485 |

| Accenture PLC Class A | | 2,166 | 305 | Alphabet, Inc. Class C(Æ) | | 11,085 | 11,480 |

| AECOM(Æ) | | 50,331 | 1,334 | Amdocs, Ltd. | | 7,940 | 465 |

| AerCap Holdings NV(Æ) | | 24,613 | 975 | Amphenol Corp. Class A | | 4,385 | 355 |

| AGCO Corp. | | 8,460 | 471 | Ansys, Inc. (Æ) | | 1,675 | 239 |

| American Airlines Group, Inc. | | 52,040 | 1,671 | Apple, Inc. | | 44,870 | 7,078 |

| Arconic, Inc. | | 11,100 | 187 | Applied Materials, Inc. | | 45,934 | 1,504 |

| Automatic Data Processing, Inc. | | 2,544 | 334 | Arrow Electronics, Inc. (Æ) | | 8,468 | 584 |

| Babcock & Wilcox Co. (The) Class W(Æ) | | 2,137 | 82 | Aspen Technology, Inc. (Æ) | | 6,130 | 504 |

| Boeing Co. (The) | | 11,800 | 3,805 | Avaya Holdings Corp. (Æ) | | 13,100 | 191 |

| Booz Allen Hamilton Holding Corp. Class A | | 3,400 | 153 | Avnet, Inc. | | 5,770 | 208 |

| Carlisle Cos. , Inc. | | 1,426 | 143 | Broadcom, Inc. | | 5,048 | 1,284 |

| Caterpillar, Inc. | | 6,975 | 886 | Cirrus Logic, Inc. (Æ) | | 6,350 | 211 |

| CoStar Group, Inc. (Æ) | | 987 | 333 | Cisco Systems, Inc. | | 112,344 | 4,868 |

| Danaher Corp. | | 2,308 | 238 | Citrix Systems, Inc. | | 11,784 | 1,207 |

| Deere & Co. | | 9,545 | 1,424 | Cloudera, Inc. (Æ) | | 6,700 | 74 |

| Delta Air Lines, Inc. | | 54,535 | 2,722 | Cognizant Technology Solutions Corp. Class | | | |

| Eaton Corp. PLC | | 5,900 | 405 | A | | 7,329 | 465 |

| EMCOR Group, Inc. | | 2,700 | 161 | CommVault Systems, Inc. (Æ) | | 1,500 | 89 |

| Expeditors International of Washington, Inc. | | 2,600 | 177 | Cornerstone OnDemand, Inc. (Æ) | | 5,600 | 282 |

| FedEx Corp. | | 7,183 | 1,159 | Dell Technologies, Inc. Class C(Æ)(Ñ) | | 22,552 | 1,102 |

| Fluor Corp. | | 13,850 | 446 | DXC Technology Co. | | 27,170 | 1,445 |

| General Dynamics Corp. | | 2,050 | 322 | Electronic Arts, Inc. (Æ) | | 3,996 | 315 |

| HD Supply Holdings, Inc. (Æ) | | 4,040 | 152 | F5 Networks, Inc. (Æ) | | 1,238 | 201 |

| HEICO Corp. | | 4,806 | 372 | Facebook, Inc. Class A(Æ) | | 54,590 | 7,156 |

| Honeywell International, Inc. | | 2,595 | 343 | FireEye, Inc. (Æ) | | 9,700 | 157 |

| Huntington Ingalls Industries, Inc. | | 860 | 164 | Fortinet, Inc. (Æ) | | 5,300 | 373 |

| Insperity, Inc. | | 1,640 | 153 | Genpact, Ltd. | | 11,764 | 318 |

| Itron, Inc. (Æ) | | 1,600 | 76 | Hewlett Packard Enterprise Co. | | 60,235 | 796 |

| JB Hunt Transport Services, Inc. | | 3,000 | 279 | HP, Inc. (Æ) | | 67,498 | 1,381 |

| Johnson Controls International PLC(Æ) | | 6,560 | 195 | International Business Machines Corp. | | 2,500 | 284 |

| KBR, Inc. | | 2,300 | 35 | Intuit, Inc. | | 781 | 154 |

| L3 Technologies, Inc. | | 1,749 | 304 | IPG Photonics Corp. (Æ) | | 7,239 | 820 |

| Landstar System, Inc. | | 4,780 | 457 | Jabil Circuit, Inc. | | 15,580 | 386 |

| Lockheed Martin Corp. | | 7,299 | 1,911 | Juniper Networks, Inc. | | 35,639 | 959 |

| McGraw Hill Financial, Inc. | | 1,053 | 179 | KLA-Tencor Corp. | | 16,673 | 1,492 |

| National Instruments Corp. | | 7,820 | 355 | Leidos Holdings, Inc. | | 4,039 | 213 |

See accompanying notes which are an integral part of the financial statements.

10 U.S. Strategic Equity Fund

Russell Investment Funds

U.S. Strategic Equity Fund

Schedule of Investments, continued — December 31, 2018

| | | | | | | | | |

| Amounts in thousands(except share amounts) | | | | Amounts in thousands(except share amounts) | | | |

| | | Principal | | Fair | | Principal | | Fair | |

| | Amount ($) or | | Value | | Amount ($) or | | Value | |

| | | Shares | | $ | | Shares | | $ | |

| Marvell Technology Group, Ltd. | | 121,321 | | 1,964 | | (cost $9,290) | | 9,290 | |

| Microchip Technology, Inc. (Ñ) | | 10,187 | | 733 | | | | | |

| Micron Technology, Inc. (Æ) | | 56,858 | | 1,804 | | | | | |

| Microsoft Corp. | | 126,421 | | 12,840 | | Total Investments 102.2% | | | |

| Nuance Communications, Inc. (Æ) | | 17,800 | | 235 | | (identified cost $397,260) | | 387,818 | |

| Oracle Corp. | | 4,608 | | 208 | | | | | |

| Palo Alto Networks, Inc. (Æ) | | 610 | | 115 | | Other Assets and Liabilities, Net | | | |

| QUALCOMM, Inc. | | 24,087 | | 1,371 | - | (2.2%) | | (8,242 | ) |

| Red Hat, Inc. (Æ) | | 955 | | 168 | | Net Assets - 100.0% | | 379,576 | |

| Salesforce. com, Inc. (Æ) | | 2,434 | | 333 | | | | | |

| Symantec Corp. | | 20,100 | | 380 | | | | | |

| Synopsys, Inc. (Æ) | | 8,900 | | 750 | | | | | |

| Tableau Software, Inc. Class A(Æ) | | 2,520 | | 302 | | | | | |

| Tech Data Corp. (Æ) | | 500 | | 41 | | | | | |

| Teradata Corp. (Æ) | | 4,520 | | 173 | | | | | |

| Texas Instruments, Inc. | | 414 | | 39 | | | | | |

| Twitter, Inc. (Æ) | | 11,540 | | 332 | | | | | |

| Varonis Systems, Inc. (Æ) | | 1,000 | | 53 | | | | | |

| VeriSign, Inc. (Æ) | | 1,930 | | 286 | | | | | |

| Viavi Solutions, Inc. Class W(Æ) | | 10,100 | | 102 | | | | | |

| VMware, Inc. Class A | | 1,494 | | 205 | | | | | |

| Western Digital Corp. | | 11,476 | | 424 | | | | | |

| Xilinx, Inc. | | 4,330 | | 369 | | | | | |

| Zynga, Inc. Class A(Æ) | | 98,500 | | 387 | | | | | |

| | | | | 77,605 | | | | | |

| |

| Utilities - 2.7% | | | | | | | | | |

| AT&T, Inc. | | 162,690 | | 4,642 | | | | | |

| Centennial Resource Development, Inc. Class | | | | | | | | | |

| A(Æ)(Ñ) | | 16,021 | | 177 | | | | | |

| CenterPoint Energy, Inc. | | 10,069 | | 284 | | | | | |

| Consolidated Edison, Inc. | | 5,097 | | 390 | | | | | |

| Duke Energy Corp. | | 5,223 | | 451 | | | | | |

| Evergy, Inc. | | 8,841 | | 502 | | | | | |

| Exelon Corp. | | 19,137 | | 863 | | | | | |

| Hawaiian Electric Industries, Inc. | | 11,933 | | 437 | | | | | |

| NRG Energy, Inc. | | 7,700 | | 305 | | | | | |

| PG&E Corp. (Æ) | | 6,300 | | 150 | | | | | |

| Pinnacle West Capital Corp. | | 2,890 | | 246 | | | | | |

| PPL Corp. | | 13,723 | | 389 | | | | | |

| UGI Corp. | | 5,759 | | 307 | | | | | |

| Verizon Communications, Inc. | | 14,306 | | 804 | | | | | |

| WEC Energy Group, Inc. (Æ) | | 4,732 | | 328 | | | | | |

| | | | | 10,275 | | | | | |

| |

| Total Common Stocks | | | | | | | | | |

| (cost $370,645) | | | | 361,204 | | | | | |

| |

| Short-Term Investments - 4.6% | | | | | | | | | |

| U. S. Cash Management Fund(@) | | 17,326,127 | (8) | 17,324 | | | | | |

| Total Short-Term Investments | | | | | | | | | |

| (cost $17,325) | | | | 17,324 | | | | | |

| |

| Other Securities - 2.4% | | | | | | | | | |

| U. S. Cash Collateral Fund(×)(@) | | 9,289,808 | (8) | 9,290 | | | | | |

| Total Other Securities | | | | | | | | | |

See accompanying notes which are an integral part of the financial statements.

U.S. Strategic Equity Fund 11

Russell Investment Funds

U.S. Strategic Equity Fund

Schedule of Investments, continued — December 31, 2018

| | | | | | | |

| Futures Contracts | | | | | | | |

| Amounts in thousands(except contract amounts) | | | | | | | |

| | | | | | | Value and | |

| | | | | | | Unrealized | |

| | | | | | | Appreciation | |

| | | Number of | Notional | Expiration | (Depreciation) | |

| | | Contracts | Amount | Date | $ | |

| Long Positions | | | | | | | |

| S&P 500 E-Mini Index Futures | | 82 | USD | 10,271 | 03/19 | (237 | ) |

| Total Value and Unrealized Appreciation (Depreciation) on Open Futures Contracts (å) | | | | | (237 | ) |

| | | | | | | | | | | | | | | | |

| Presentation of Portfolio Holdings | | | | | | | | | | | | | | |

| Amounts in thousands | | | | | | | | | | | | | | | | |

| | | | | | | | | Fair Value | | | | | | | | |

| | | | | | | | | | | Practical | | | | | | |

| Portfolio Summary | | Level 1 | | | Level 2 | | Level 3 | Expedient (a) | | Total | | % of Net Assets | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Consumer Discretionary | $ | 85,511 | | $ | | — | $ | — | $ | — | $ | 85,511 | | | 22.5 | |

| Consumer Staples | | 24,999 | | | | — | | — | | — | | 24,999 | | | 6.6 | |

| Energy | | 21,773 | | | | — | | — | | — | | 21,773 | | | 5.7 | |

| Financial Services | | 58,890 | | | | — | | — | | — | | 58,890 | | | 15.5 | |

| Health Care | | 36,761 | | | | — | | — | | — | | 36,761 | | | 9.7 | |

| Materials and Processing | | 11,912 | | | | — | | — | | — | | 11,912 | | | 3.2 | |

| Producer Durables | | 33,478 | | | | — | | — | | — | | 33,478 | | | 8.8 | |

| Technology | | 77,605 | | | | — | | — | | — | | 77,605 | | | 20.5 | |

| Utilities | | 10,275 | | | | — | | — | | — | | 10,275 | | | 2.7 | |

| Short-Term Investments | | — | | | | — | | — | | 17,324 | | 17,324 | | | 4.6 | |

| Other Securities | | — | | | | — | | — | | 9,290 | | 9,290 | | | 2.4 | |

| Total Investments | | 361,204 | | | | — | | — | | 26,614 | | 387,818 | | | 102.2 | |

| Other Assets and Liabilities, Net | | | | | | | | | | | | | | | (2.2 | ) |

| | | | | | | | | | | | | | | | 100.0 | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| A | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Futures Contracts | | (237 | ) | | | — | | — | | — | | (237 | ) | | (0.1 | ) |

| Total Other Financial Instruments* | $ | (237 | ) | $ | | — | $ | — | $ | — | $ | (237 | ) | | | |

* Futures and foreign currency exchange contract values reflect the unrealized appreciation (depreciation) on the investments.

(a) Certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified

in the fair value levels. The fair value amounts presented in the table are intended to permit reconciliation to the amounts presented in the Schedule of

Investments.

For a description of the Levels, see note 2 in the Notes to Financial Statements.

For a disclosure on transfers between Levels 1, 2 and 3 during the period ended December 31, 2018, see note 2 in the Notes to

Financial Statements.

See accompanying notes which are an integral part of the financial statements.

12 U.S. Strategic Equity Fund

Russell Investment Funds

U.S. Strategic Equity Fund

Fair Value of Derivative Instruments — December 31, 2018

Amounts in thousands

| | | | |

| | | | Equity | |

| Derivatives not accounted for as hedging instruments | Contracts | |

| |

| Location: Statement of Assets and Liabilities - Liabilities | | | |

| Variation margin on futures contracts* | | $ | 237 | |

| |

| | | | Equity | |

| Derivatives not accounted for as hedging instruments | Contracts | |

| |

| Location: Statement of Operations- Net realized gain (loss) | | | |

| Futures contracts | | $ | (7 | ) |

| |

| Location: Statement of Operations- Net change in unrealized appreciation (depreciation) | | | |

| Futures contracts | | $ | (180 | ) |

* Includes cumulative appreciation/depreciation of futures contracts as reported in the Schedule of Investments. Only variation margin is reported within the

Statement of Assets and Liabilities.

For further disclosure on derivatives see note 2 in the Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

U.S. Strategic Equity Fund 13

Russell Investment Funds

U.S. Strategic Equity Fund

Balance Sheet Offsetting of Financial and Derivative Instruments —

December 31, 2018

| | | | | | | | |

| Amounts in thousands | | | | | | | | |

| |

| Offsetting of Financial Assets and Derivative Assets | | | | | | | |

| | | | | Gross | Net Amounts |

| | | | | Amounts | | of Assets |

| | | | Gross | Offset in the | Presented in |

| | | Amounts of | Statement of | the Statement |

| | | Recognized | Assets and | of Assets and |

| Description | Location: Statement of Assets and Liabilities - Assets | | Assets | Liabilities | | Liabilities |

| Securities on Loan* | Investments, at fair value | $ | 9,169 | | $ | — | $ | 9,169 |

| Total Financial and Derivative Assets | | | 9,169 | | | — | | 9,169 |

| Financial and Derivative Assets not subject to a netting agreement | | — | | | — | | — |

| Total Financial and Derivative Assets subject to a netting agreement | $ | 9,169 | | $ | — | $ | 9,169 |

| | | | | | | | | | |

| Financial Assets, Derivative Assets, and Collateral Held by Counterparty | | | | | | | | | |

| | | | Gross Amounts Not Offset in | | |

| | | | the Statement of Assets and | | |

| | | | | | Liabilities | | | | |

| |

| | Net Amounts | | | | | | | | |

| | | of Assets | | | | | | | | |

| | Presented in | | | | | | | | |

| | the Statement | Financial and | | | | | |

| | of Assets and | Derivative | Collateral | | | |

| Counterparty | | Liabilities | Instruments | Received^ | Net Amount |

| Citigroup | | 1,208 | | $ | — | $ | 1,208 | | $ | — |

| Credit Suisse | | 2,781 | | | — | | 2,781 | | | — |

| Fidelity | | 165 | | | — | | 165 | | | — |

| ING | | 2,323 | | | — | | 2,323 | | | — |

| JPMorgan Chase | | 252 | | | — | | 252 | | | — |

| Merrill Lynch | | 2,440 | | | — | | 2,440 | | | — |

| Total | $ | 9,169 | | $ | — | $ | 9,169 | | $ | — |

* Fair value of securities on loan as reported in the footnotes to the Statement of Assets and Liabilities.

^ Collateral received or pledged amounts may not reconcile to those disclosed in the Statement of Assets and Liabilities due to the inclusion of off-Balance

Sheet collateral and adjustments made to exclude overcollateralization.

For further disclosure on derivatives and counterparty risk see note 2 in the Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

14 U.S. Strategic Equity Fund

Russell Investment Funds

U.S. Strategic Equity Fund

I

Statement of Assets and Liabilities — December 31, 2018

| | | |

| Amounts in thousands | | | |

| Assets | | | |

| Investments, at identified cost | $ | 397,260 | |

| Investments, at fair value(*)(>) | | 387,818 | |

| Receivables: | | | |

| Dividends and interest | | 447 | |

| Dividends from affiliated funds | | 34 | |

| Investments sold | | 740 | |

| Fund shares sold | | 18 | |

| Variation margin on futures contracts | | 808 | |

| Total assets | | 389,865 | |

| |

| Liabilities | | | |

| Payables: | | | |

| Investments purchased | | 326 | |

| Fund shares redeemed | | 89 | |

| Accrued fees to affiliates | | 263 | |

| Other accrued expenses | | 85 | |

| Variation margin on futures contracts | | 236 | |

| Payable upon return of securities loaned | | 9,290 | |

| Total liabilities | | 10,289 | |

| |

| Net Assets | $ | 379,576 | |

| | | |

| Net Assets Consist of: | | | |

| Total distributable earnings (losses) | $ | (13,769 | ) |

| Shares of beneficial interest | | 289 | |

| Additional paid-in capital | | 393,056 | |

| Net Assets | $ | 379,576 | |

| |

| Net Asset Value,offering and redemption price per share: | | | |

| Net asset value per share:(#) | $ | 13.12 | |

| Net assets | $ | 379,575,889 | |

| Shares outstanding ($. 01 par value) | | 28,931,614 | |

| Amounts in thousands | | | |

| (*) Securities on loan included in investments | $ | 9,169 | |

| (>) Investments in affiliates, U. S. Cash Management Fund and U. S. Cash Collateral Fund | $ | 26,614 | |

| |

| (#) Net asset value per share equals net assets divided by shares of beneficial interest outstanding. | | | |

See accompanying notes which are an integral part of the financial statements.

U.S. Strategic Equity Fund 15

Russell Investment Funds

U.S. Strategic Equity Fund

Statement of Operations — For the Period Ended December 31, 2018

| | | |

| Amounts in thousands | | | |

| Investment Income | | | |

| Dividends | $ | 7,670 | |

| Dividends from affiliated funds | | 306 | |

| Interest | | 2 | |

| Securities lending income (net) | | 3 | |

| Total investment income | | 7,981 | |

| |

| Expenses | | | |

| Advisory fees | | 3,275 | |

| Administrative fees | | 224 | |

| Custodian fees | | 73 | |

| Transfer agent fees | | 20 | |

| Professional fees | | 83 | |

| Trustees’ fees | | 17 | |

| Printing fees | | 64 | |

| Miscellaneous | | 26 | |

| Total expenses | | 3,782 | |

| Net investment income (loss) | | 4,199 | |

| |

| Net Realized and Unrealized Gain (Loss) | | | |

| Net realized gain (loss) on: | | | |

| Investments | | 63,774 | |

| Investments in affiliated funds | | (1 | ) |

| Futures contracts | | (7 | ) |

| Net realized gain (loss) | | 63,766 | |

| Net change in unrealized appreciation (depreciation) on: | | | |

| Investments | | (106,926 | ) |

| Futures contracts | | (180 | ) |

| Net change in unrealized appreciation (depreciation) | | (107,106 | ) |

| Net realized and unrealized gain (loss) | | (43,340 | ) |

| Net Increase (Decrease) in Net Assets from Operations | $ | (39,141 | ) |

See accompanying notes which are an integral part of the financial statements.

16 U.S. Strategic Equity Fund

Russell Investment Funds

U.S. Strategic Equity Fund

Statements of Changes in Net Assets

| | | | | | |

| | For the Periods Ended December 31, | |

| Amounts in thousands | | 2018 | | | 2017 | |

| Increase (Decrease) in Net Assets | | | | | | |

| Operations | | | | | | |

| Net investment income (loss) | $ | 4,199 | | $ | 4,332 | |

| Net realized gain (loss) | | 63,766 | | | 45,648 | |

| Net change in unrealized appreciation (depreciation) | | (107,106 | ) | | 36,963 | |

| Net increase (decrease) in net assets from operations | | (39,141 | ) | | 86,943 | |

| |

| Distributions(i) | | | | | | |

| To shareholders | | (85,895 | ) | | (48,933 | ) |

| Net decrease in net assets from distributions | | (85,895 | ) | | (48,933 | ) |

| |

| Share Transactions* | | | | | | |

| Net increase (decrease) in net assets from share transactions | | 42,885 | | | (19,336 | ) |

| Total Net Increase (Decrease) in Net Assets | | (82,151 | ) | | 18,674 | |

| |

| Net Assets | | | | | | |

| Beginning of period | | 461,727 | | | 443,053 | |

| End of period (ii) | $ | 379,576 | | $ | 461,727 | |

(i) Presentation of prior year distributions differ from what were reported in the 2017 Annual Report due to the implementation of a new SEC disclosure requirement.

For the period ended December 31, 2017, distributions from net investment income (in thousands) were $4,792. For the same period, distributions from net realized

gain (in thousands) were $44,141.

(ii) Prior year undistributed (overdistributed) net investment income included in net assets for the period ended December 31, 2017 were $999. The parenthetical

reference is excluded in the current year due to an amendment to the SEC disclosure requirement.

* Share transaction amounts (in thousands) for the periods ended December 31, 2018 and December 31, 2017 were as follows:

| | | | | | | | | | | | |

| | | 2018 | | | | 2017 | | |

| | | Shares | | | Dollars | | | Shares | | | Dollars | |

| |

| Proceeds from shares sold | | 255 | | $ | 4,570 | | | 1,301 | | $ | 22,933 | |

| Proceeds from reinvestment of distributions | | 6,333 | | | 85,895 | | | 2,691 | | | 48,933 | |

| Payments for shares redeemed | | (2,574 | ) | | (47,580 | ) | | (5,019 | ) | | (91,202 | ) |

| Total increase (decrease) | | 4,014 | | $ | 42,885 | | | (1,027 | ) | $ | (19,336 | ) |

See accompanying notes which are an integral part of the financial statements.

U.S. Strategic Equity Fund 17

Russell Investment Funds

U.S. Strategic Equity Fund

Financial Highlights — For the Periods Ended

For a Share Outstanding Throughout Each Period.

| | | | | | | | | | | | | | | | |

| | | $ | | $ | | $ | | | $ | | | $ | | | $ | |

| | Net Asset Value, | | Net | | Net Realized | | | Total from | | | Distributions | | | Distributions | |

| | Beginning of | Investment | | and Unrealized | | | Investment | | | from Net | | | from Net | |

| | | Period | Income (Loss)(a)(b) | | Gain (Loss) | | | Operations | | | Investment Income | | | Realized Gain | |

| December 31, 2018 | | 18.53 | | . 17 | | (1.97 | ) | | (1.80 | ) | | (. 21 | ) | | (3.40 | ) |

| December 31, 2017 | | 17.08 | | . 17 | | 3.29 | | | 3.46 | | | (. 19 | ) | | (1.82 | ) |

| December 31, 2016 | | 16.64 | | . 19 | | 1.53 | | | 1.72 | | | (. 17 | ) | | (1.11 | ) |

| December 31, 2015 | | 18.11 | | . 15 | | . 05 | | | . 20 | | | (. 15 | ) | | (1.52 | ) |

| December 31, 2014 | | 18.85 | | . 22 | | 1.94 | | | 2.16 | | | (. 22 | ) | | (2.68 | ) |

| | | | | | | | | | | | | | | | | |

See accompanying notes which are an integral part of the financial statements.

18 U.S. Strategic Equity Fund

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | % | | % | | % | |

| | | | | $ | | | | | $ | | | Ratio of Expenses | | Ratio of Expenses | Ratio of Net | |

| | | | | Net Asset Value, | | % | | | Net Assets, | | | to Average | | to Average | Investment Income | % |

| | $ | | | End of | | Total | | | End of Period | | | Net Assets, | | Net Assets, | to Average | Portfolio |

| Total Distributions | | | Period | | Return(d) | | | (000 | ) | | Gross(e) | | Net(b)(e) | Net Assets(b) | Turnover Rate |

| (3.61 | ) | | 13.12 | | (9.64 | ) | | 379,576 | | | . 84 | | . 84 | | . 93 | 150 |

| (2.01 | ) | | 18.53 | | 20.80 | | | 461,727 | | | . 83 | | . 83 | | . 94 | 80 |

| (1.28 | ) | | 17.08 | | 10.64 | | | 443,053 | | | . 83 | | . 83 | | 1.15 | 101 |

| (1.67 | ) | | 16.64 | | 1.11 | | | 454,341 | | | . 84 | | . 84 | | . 84 | 99 |

| (2.90 | ) | | 18.11 | | 11.70 | | | 488,531 | | | . 86 | | . 86 | | 1.13 | 101 |

See accompanying notes which are an integral part of the financial statements.

U.S. Strategic Equity Fund 19

Russell Investment Funds

U.S. Strategic Equity Fund

Related Party Transactions, Fees and Expenses

Accrued fees payable to affiliates for the period ended December 31, 2018 were as follows:

| | |

| Advisory fees | $ | 241,911 |

| Administration fees | | 16,569 |

| Transfer agent fees | | 1,458 |

| Trustee fees | | 2,681 |

| | $ | 262,619 |

Transactions (amounts in thousands) during the period ended December 31, 2018 with Underlying Funds which are, or were, an

affiliated company are as follows:

| | | | | | | | | | | | | | | | | | |

| | | Fair Value, | | | | | | | | Change in | | | | | | | | |

| | Beginning of | | | | Realized Gain | | Unrealized | Fair Value, End | | | Income | Capital Gains |

| | | Period | | Purchases | | Sales | | (Loss) | | Gain (Loss) | of Period | Distributions | Distributions |

| U. S. Cash Management Fund | $ | 27,698 | $ | 92,772 | $ | 103,145 | $ | (1 | ) $ | — | $ | 17,324 | | $ | 306 | | $ | — |

| U. S. Cash Collateral Fund | | — | | 21,066 | | 11,776 | | —$ | | — | | 9,290 | | | 2 | | | — |

| | $ | 27,698 | $ | 113,838 | $ | 114,921 | $ | (1 | ) $ | — | $ | 26,614 | | $ | 308 | | $ | — |

Federal Income Taxes

At December 31, 2018, the cost of investments and net unrealized appreciation (depreciation), undistributed ordinary income and

undistributed long-term capital gains for income tax purposes were as follows:

| | | | | |

| Cost of Investments | $ | | | 401,340,061 | |

| Unrealized Appreciation | $ | | | 45,012,193 | |

| Unrealized Depreciation | | | | (58,533,970 | ) |

| Net Unrealized Appreciation (Depreciation) | $ | | | (13,521,777 | ) |

| Undistributed Long-Term Capital Gains | | | | | |

| (Capital Loss Carryforward) | $ | | 4,221,431 | |

| Tax Composition of Distributions | | | | | |

| Ordinary Income | $ | | 19,913,216 | |

| Long-Term Capital Gains | $ | | 65,982,476 | |

Net investment income and net realized gains (losses) in the financial statements may differ from taxable net investment income and

net realized gains (losses). Capital accounts within the financial statements are adjusted for permanent book-tax differences. Book-tax

differences are primarily due to foreign currency gains and losses, reclassifications of dividends, differences in treatment of income

from swaps, net operating losses, investments in partnerships, investments in passive foreign investment companies (PFICs), tax

straddle transaction, use of tax equalization and foreign capital gains taxes. These adjustments have no impact on the net assets. At

December 31, 2018, the Statement of Assets and Liabilities have been adjusted by the following amounts (in thousands):

| | | |

| Total distributable earnings (losses) | $ | 2 | |

| Additional paid-in capital | | (2 | ) |

As permitted by tax regulations, the Fund intends to defer a net realized capital loss of $4,468,733 incurred from November 1, 2018 to

December 31, 2018, and treat it as arising in the fiscal year 2019.

See accompanying notes which are an integral part of the financial statements.

20 U.S. Strategic Equity Fund

Russell Investment Funds

U.S. Small Cap Equity Fund

Portfolio Management Discussion and Analysis — December 31, 2018 (Unaudited)

| | | | | | | |

| U. S. Small Cap Equity Fund | | | | Russell 2000®Index** | | | |

| | | Total | | | | Total | |

| | | Return | | | | Return | |

| 1 Year | | (11.97 | )% | 1 Year | | (11.01 | )% |

| 5 Years | | 2.60 | %§ | 5 Years | | 4.41 | %§ |

| 10 Years | | 11.23 | %§ | 10 Years | | 11.97 | %§ |

| |

| | | | | U. S. Small Cap Equity Linked Benchmark*** | | |

| | | | | | | Total | |

| | | | | | | Return | |

| | | | | 1 Year | | (11.01 | )% |

| | | | | 5 Years | | 4.41 | %§ |

| | | | | 10 Years | | 12.90 | %§ |

U.S. Small Cap Equity Fund 21

Russell Investment Funds

U.S. Small Cap Equity Fund

Portfolio Management Discussion and Analysis, continued — December 31, 2018

(Unaudited)

| |

| The U. S. Small Cap Equity Fund (the “Fund”) employs a multi- | performing sectors were areas traditionally considered to be |

| manager approach whereby portions of the Fund are allocated to | defensive such as utilities and consumer staples. |

| different money manager strategies. Fund assets not allocated | |

| to money managers are managed by Russell Investment | How did the investment strategies and techniques employed |

| Management, LLC (“RIM”), the Fund’s advisor. RIM may change | by the Fund and its money managers affect its benchmark |

| the allocation of the Fund's assets at any time. An exemptive | relative performance? |

| order from the Securities and Exchange Commission (“SEC”) | Over the period, the Fund maintained exposure to small and |

| permits RIM to engage or terminate a money manager at any time, | micro capitalization stocks trading at discounted valuations as |

| subject to approval by the Fund’s Board, without a shareholder | well as companies with higher quality characteristics such as |

| vote. Pursuant to the terms of the exemptive order, the Fund | lower financial leverage, higher profitability, and lower earnings |

| is required to notify its shareholders within 90 days of when a | variability. Within the U. S. small cap market, a preference for |

| money manager begins providing services. As of December 31, | value over growth stocks negatively impacted benchmark relative |

| 2018, the Fund had eight money managers. | performance for the first nine months of the period but was |

| | heavily rewarded during the market decline in the final three |

| What is the Fund’s investment objective? | months of the year as high growth and momentum stocks trading |

| The Fund seeks to provide long term capital growth. | at expensive valuation levels sold off most aggressively. The |

| |

| How did the Fund perform relative to its benchmark for the | Fund’s quality positioning was also additive as companies with |

| fiscal year ended December 31, 2018? | lower earnings variability outperformed. |

| For the fiscal year ended December 31, 2018, the Fund lost | From a sector standpoint, the Fund was positioned toward |

| 11.97%. This is compared to the Fund’s benchmark, the Russell | areas expected to benefit from a healthy domestic consumer, |

| 2000®Index, which lost 11.01% during the same period. The | expansionary fiscal policy, and the normalization of monetary |

| Fund’s performance includes operating expenses, whereas index | policy, such as the consumer discretionary, consumer staples, |

| returns are unmanaged and do not include expenses of any kind. | financials, and industrials sectors. The Fund moderately |

| | benefitted from overweights to consumer discretionary and |

| For the fiscal year ended December 31, 2018, the Morningstar® | consumer staples, while overweights to financials and industrials |

| Insurance Small Blend Category, a group of funds that Morningstar | slightly detracted. The Fund remained underweight the health |

| considers to have investment strategies similar to those of the | care sector which was viewed as the most expensive segment of |

| Fund, lost 12.42%. This result serves as a peer comparison and is | the U. S. small cap market, but this also detracted over the period. |

| expressed net of operating expenses. | |

| | The impact of stock selection by the Fund’s money managers |

| RIM may assign a money manager a specific style or | was mixed during the period. Outperforming holdings within the |

| capitalization benchmark other than the Fund’s index. However, | health care and consumer staples sectors were rewarded, while |

| the Fund’s primary index remains the benchmark for the Fund | underperforming holdings within the industrials and consumer |

| and is representative of the aggregate of each money manager’s | discretionary sectors offset gains. |

| benchmark index. | |

| | The Fund employs discretionary and non-discretionary money |

| How did market conditions affect the Fund’s performance? | managers. The Fund’s discretionary money managers select the |

| The fiscal year ended December 31, 2018 saw the Fund | individual portfolio securities for the assets assigned to them. |

| underperform the Russell 2000®Index and outperform the | The Fund’s non-discretionary money managers provide a model |

| Morningstar®Insurance Small Blend peer group. During the | portfolio to RIM representing their investment recommendations, |

| first three quarters of 2018, the U. S. small cap equity market | based upon which RIM purchases and sells securities for the |

| produced strong absolute returns. The rally was led by growth | Fund. RIM manages assets not allocated to money manager |

| stocks with high price momentum and lower levels of financial | strategies and the Fund’s cash balances. |

| leverage, particularly within the health care and technology | With respect to certain of the Fund’s money managers, Timpani |

| sectors, as U. S. companies posted strong quarterly earnings | Capital Management LLC was the best performing money |

| results boosted by lower corporate tax rates. However, investor | manager for the fiscal year and outperformed the Russell 2000® |

| sentiment rotated heavily toward value and low volatility stocks | Growth Index. Stock selection within the health care, information |

| in the final quarter of 2018 as the U. S. small cap equity market | technology, and materials sectors positively impacted benchmark |

| declined substantially amid concerns over rising interest rates, | relative performance. Sector allocation was also positive due |

| trade wars, and decelerating global growth. During this sell off | to an overweight to the information technology sector and an |

| period, low volatility and value factors outperformed. The best | underweight to the energy sector. From a factor perspective, an |

22 U.S. Small Cap Equity Fund

Russell Investment Funds

U.S. Small Cap Equity Fund

Portfolio Management Discussion and Analysis, continued — December 31, 2018

(Unaudited)

| | | |

| overweight to companies with lower levels of financial leverage | Describe any changes to the Fund’s structure or the money |

| and a tilt toward companies with high forecasted earnings growth | manager line-up. | | |

| was also beneficial. | In December 2018, Snow Capital Management L. P. was |

| Snow Capital Management L. P. underperformed the Russell 2000® | terminated and Boston Partners Global Investors, Inc. and Jacobs |

| Value Index and faced the strongest headwinds over the portion of | Levy Equity Management, Inc. were hired. These changes were |

| the fiscal year that it was included in the Fund. Underperforming | driven by RIM’s higher confidence in the prospective excess |

| holdings within the health care and industrials sectors detracted | return potential of the incoming managers and RIM’s belief that |

| value. The money manager’s contrarian investment philosophy | the more distinct substyles of the new managers would increase |

| led to a tilt towards stocks with low valuation and low momentum | Fund diversification. | | |

| which was not beneficial. Additionally, underweights to the | | | |

| utilities and real estate sectors negatively impacted performance. | Money Managers as of December 31, |

| | 2018 | | Styles |

| During the period, RIM utilized a positioning strategy to control | Ancora Advisor, LLC | | Small Cap Core |

| Fund-level exposures and risks through the purchase of a stock | Boston Partners Global Investors, Inc. | Micro/Small Cap Value |

| portfolio. Using the output from a quantitative model, the strategy | Copeland Capital Management LLC | Small Cap Dividend |

| seeks to position the portfolio to meet RIM’s overall preferred | | | Growth |

| positioning with respect to Fund exposures along factor and | DePrince, Race & Zollo, Inc. | | Small Cap Value |

| | Falcon Point Capital, LLC | | Micro/Small Cap Growth |

| industry dimensions. | Jacobs Levy Equity Management, Inc. | Small Cap Core |

| The Fund’s active positioning strategy provided exposure to | Penn Capital Management Company, Inc. | Micro/Small Cap Core |

| RIM’s strategic equity beliefs associated with value, quality, | Timpani Capital Management, LLC | Small Cap Growth |

| and low volatility factors. During the fiscal year, the strategy | The views expressed in this report reflect those of the |

| outperformed the Russell 2000®Index as both quality and low | portfolio managers onlythroughthe end of the period |

| volatility factors notably outperformed in the U. S. small cap equity | covered by the report.These views do not necessarily |

| market. However, the impact of value positioning was a headwind | represent the views of RIM, or any other person in RIM or |

| to benchmark relative performance. From a sector perspective, | any other affiliated organization. These views are subject to |

| the positioning strategy was overweight the financials and energy | change at any time based upon market conditions or other |

| sectors and underweight the materials and industrials sectors, | events, and RIM disclaims any responsibility to update the |

| which slightly detracted. | views contained herein. These views should not be relied |

| | on as investment advice and, because investment decisions |

| During the period, RIM partially equitized the Fund’s cash using | for a Russell Investment Funds (“RIF”) Fund are based on |

| index futures contracts to provide the Fund with greater market | numerous factors, should not be relied on as an indication |

| exposure. This had a negative impact on the Fund’s absolute | of investment decisions of any RIF Fund. |

| performance. | | | |

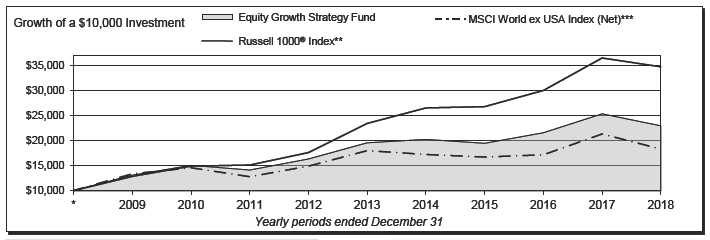

* Assumes initial investment on January 1, 2009.

** Russell 2000®Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000®Index is a subset of the Russell 3000®

Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a

combination of their market cap and current index membership. The Russell 2000®Index is constructed to provide a comprehensive and unbiased small-cap

opportunity barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap

opportunity set.

*** The U.S. Small Cap Equity Linked Benchmark provides a means to compare the Fund’s average annual returns to a secondary benchmark that takes into account

historical changes in the Fund’s primary benchmark. The U.S. Small Cap Equity Linked Benchmark represents the returns of the Russell 2500TMIndex through

April 30, 2012 and the returns of the Russell 2000®Index thereafter.

§ Annualized.

The performance shown in this section does not reflect any Insurance Company Separate Account or Policy Charges. Performance is historical and assumes

reinvestment of all dividends and capital gains. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more

or less than when purchased. Past performance is not indicative of future results. Additionally, the returns presented herein may differ from the performance reported

in the Financial Highlights as the returns herein are calculated in a manner consistent with standardized performance in accordance with Securities and Exchange

Commission rules, while the performance in the Financial Highlights has been calculated in accordance with U.S. Generally Accepted Accounting Principles (“U.S.

GAAP”).

U.S. Small Cap Equity Fund 23

Russell Investment Funds

U.S. Small Cap Equity Fund

Shareholder Expense Example — December 31, 2018 (Unaudited)

| | | | | | | |

| Fund Expenses | Please note that the expenses shown in the table are meant |

| The following disclosure provides important information | to highlight your ongoing costs only and do not reflect any |

| regarding the Fund’s Shareholder Expense Example | transactional costs. Therefore, the information under the heading |

| (“Example”) . | “Hypothetical Performance (5% return before expenses)” is |

| | useful in comparing ongoing costs only, and will not help you |

| Example | determine the relative total costs of owning different funds. In |

| As a shareholder of the Fund, you incur two types of costs: (1) | addition, if these transactional costs were included, your costs |

| transaction costs, and (2) ongoing costs, including advisory and | would have been higher. The fees and expenses shown in this |

| administrative fees and other Fund expenses. The Example is | section do not reflect any Insurance Company Separate Account |

| intended to help you understand your ongoing costs (in dollars) | Policy Charges. | | | | | | |

| of investing in the Fund and to compare these costs with the | | | | | | Hypothetical |

| ongoing costs of investing in other mutual funds. The Example | | | | | | Performance (5% |

| is based on an investment of $1,000 invested at the beginning of | | | | Actual | | return before |

| the period and held for the entire period indicated, which for this | | | Performance | | | expenses) |

| | Beginning Account Value | | | | | | |

| Fund is from July 1, 2018 to December 31, 2018. | July 1, 2018 | | $ | 1,000.00 | | $ | 1,000.00 |

| | Ending Account Value | | | | | | |

| Actual Expenses | December 31, 2018 | | $ | 825.50 | | $ | 1,019.96 |

| The information in the table under the heading “Actual | Expenses Paid During Period* | | $ | 4.79 | | $ | 5.30 |

| Performance” provides information about actual account values | | | | | | | |

| and actual expenses. You may use the information in this column, | * Expenses are equal to the Fund's annualized expense ratio of 1.04% |

| | (representing the six month period annualized), multiplied by the average |

| together with the amount you invested, to estimate the expenses | account value over the period, multiplied by 184/365 (to reflect the one-half |

| that you paid over the period. Simply divide your account value by | year period) . | | | | | | |

| $1,000 (for example, an $8,600 account value divided by $1,000 | | | | | | | |

| = 8.6), then multiply the result by the number in the first column | | | | | | | |

| in the row entitled “Expenses Paid During Period” to estimate | | | | | | | |

| the expenses you paid on your account during this period. | | | | | | | |

| |

| Hypothetical Example for Comparison Purposes | | | | | | | |