UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05407

Trust for Credit Unions

(Exact name of registrant as specified in charter)

4400 Computer Drive

Westborough, MA 01581

(Address of principal executive offices) (Zip code)

Jay E. Johnson Callahan Financial Services, Inc. 1001 Connecticut Avenue NW, Suite 1001 Washington, DC 20036 | Copies to: Michael P. Malloy Drinker Biddle & Reath LLP One Logan Square, Suite 2000 Philadelphia, PA 19103 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 342-5828

Date of fiscal year end: August 31

Date of reporting period: August 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Annual Report to Shareholders is attached herewith.

Ultra-Short Duration Government Portfolio

Short Duration Portfolio

Annual Report

August 31, 2017

The reports concerning the Trust for Credit Unions (“TCU” or the “Trust”) Portfolios included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the Portfolios in the future. These statements are based on Portfolio management’s predictions and expectations concerning certain future events and their expected impact on the Portfolios, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Portfolios. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

TCU files the complete schedule of portfolio holdings of each Portfolio with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Portfolios’ Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling I-800-SEC-0330.

An investment in a TCU Portfolio is not a credit union deposit and is not insured or guaranteed by the National Credit Union Share Insurance Fund, the National Credit Union Administration, or any other government agency.

The TCU Ultra-Short Duration Government Portfolio and the TCU Short Duration Portfolio are not money market funds. Investors in these Portfolios should understand that the net asset values of the Portfolios will fluctuate, which may result in a loss of the principal amount invested. The Portfolios’ net asset values and yields are not guaranteed by the U.S. government or by its agencies, instrumentalities or sponsored enterprises. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolios if held to maturity and not to the value of the Portfolios’ shares. The Portfolios’ investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

Holdings and allocations shown may not be representative of current or future investments. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities.

This material is not authorized for distribution unless preceded or accompanied by a current Prospectus. Investors should consider a Portfolio’s objectives, risks, and charges and expenses, and read the Prospectus carefully before investing or sending money. The Prospectus contains this and other information about the Portfolios.

Callahan Financial Services, Inc. is the distributor of the TCU Portfolios.

This report is for the information of the shareholders of the Trust. Its use in connection with any offering of shares of the Trust is authorized only in the case of a concurrent or prior delivery of the Trust’s current Prospectus.

Dear Credit Union Shareholders,

Credit unions continue to demonstrate tremendous momentum in performance and market impact. Through the first six months of 2017, membership has grown at the fastest rate ever with 4.5 million new members added since June 2016. Loans are on pace for their fourth consecutive year of double-digit growth, an unprecedented run. Despite the stock market continuing to reach new highs, share balances are rising at the fastest rate since the recession.

The balance sheet momentum is also evident in the broader market. Credit unions’ share of the auto finance market has reached a post-recession high of 18.9% through June 2017. The industry’s share of the U.S. mortgage lending market hit a new mid-year high of 8.2%. Most importantly for credit unions, member relationships are deepening with growth in product usage and average loan and share balances.

These results are influenced by a U.S. economy that continues to add jobs and post steady growth. The Federal Reserve has raised the target rate for federal funds twice so far in 2017, and expects to continue to raise rates into 2018. The increase in rates has lifted credit union investment yields to 1.54%, the highest level since 2011.

As credit unions establish new highs across multiple measures this year, 2017 is notable for the Trust for Credit Unions (“TCU”) as well. Our credit union shareholders approved the recommendation of the TCU Board of Trustees to appoint ALM First Financial Advisors, LLC (“ALM First”) as investment adviser in May. We are excited to begin our partnership with ALM First. Their more than 20 years of advisory work with credit unions provides them with unique insights into credit union balance sheet dynamics. Just like the TCU family of mutual funds, they have a demonstrated commitment to credit union success.

As discussed in the “Investment Adviser’s Discussion and Analysis” on pages 2 and 6, ALM First has repositioned the Ultra-Short Duration and Short Duration Portfolios since becoming adviser. Both Portfolios’ returns exceeded those of their benchmark indices for the period since April 16, 2017 when ALM First began serving as adviser. For the twelve-month period ended August 31, 2017, the cumulative total return of the TCU Shares of the Ultra-Short Duration Government Portfolio was 0.68% versus a 0.74% cumulative total return of the Portfolio’s blended benchmark. For the twelve-month period ended August 31, 2017, the cumulative total return of the TCU Shares of the Short Duration Portfolio was 0.55% versus a 0.28% cumulative total return for the Portfolio’s benchmark.

Please visit our website, www.TrustCU.com, for the most current information on the Portfolios, including performance and portfolio holdings. We appreciate your investment in the Trust for Credit Unions. Let us know if there are other ways in which we can help complement your credit union’s investment strategy.

Sincerely,

Jay E. Johnson

President and Treasurer

Trust for Credit Unions

1

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU ULTRA-SHORT DURATION GOVERNMENT PORTFOLIO

Investment Objective

The TCU Ultra-Short Duration Government Portfolio (“USDGP” or the “Portfolio”) seeks to achieve a high level of current income, consistent with low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. Under normal circumstances, at least 80% of the net assets (measured at the time of purchase) of USDGP will be invested in securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises. The Portfolio expects that a substantial portion of these securities will be mortgage-related securities. While there will be fluctuations in the net asset value (“NAV”) of the USDGP, the Portfolio is expected to have less interest rate risk and asset value fluctuation than funds investing primarily in longer-term mortgage-backed securities paying a fixed rate of interest. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. USDGP’s maximum duration is equal to that of a Two-Year U.S. Treasury Security, and its target duration is to be no shorter than that of the Six-Month U.S. Treasury Bill Index and no longer than that of the One-Year U.S. Treasury Note Index, each as reported by BofA Merrill Lynch.

Portfolio Management Discussion and Analysis

Below, ALM First Financial Advisors, LLC (“ALM First”) discusses the Portfolio’s performance and positioning for the Reporting Period.

Q. How did the Portfolio perform during the Reporting Period?

For the twelve-month period ended August 31, 2017, the cumulative total return of USDGP TCU shares was 0.68% versus a 0.74% cumulative total return of the Portfolio’s blended benchmark, the 9-Month U.S. Treasury Index (weighted average return of the Six-Month U.S. Treasury Bill Index (50%) and the One-Year U.S. Treasury Note Index (50%), as reported by BofA Merrill Lynch). ALM First began managing the Portfolio effective April 16, 2017. Since then, the cumulative total return of USDGP (TCU Shares) has been 0.55% versus 0.43% for the benchmark index and the cumulative total returns for the Six-Month U.S. Treasury Bill Index and the One-Year U.S. Treasury Note Index of 0.82% and 0.65%, respectively. The Portfolio’s net asset value (“NAV”) per share at the end of the Reporting Period was $9.47, versus $9.49 on August 31, 2016.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

One of the first actions undertaken by ALM First as investment adviser to the Portfolio was to align the duration of the Portfolio with that of the index in order to reduce under or over exposure to changes in interest rates relative to the index. The move into spread sectors such as Agency Mortgage-Backed Securities (“MBS”) and Commercial Mortgage Backed Securities (“CMBS”) has been a boon to performance as low levels of rate volatility have been a plus for the former and spread tightening has been a

tailwind for the latter. Allocations to floating rate Collateralized Mortgage Obligations (“CMO“s) and CMBS helped to generate outperformance as the front end of the curve increased by 25 bps. Treasury yields rose 49-64 bps across the curve during the period amid Federal Reserve rate hikes and higher growth/inflation expectations post-election. However, tempered investor expectations for inflation growth and fiscal reforms sparked curve flattening and a decline in implied rate volatility for much of 2017. Until April 2017, the Portfolio was underweight in MBS and CMBS, which was negative for performance relative to the benchmark given the aforementioned market conditions.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

CMO and CMBS floaters benefited from the increase in front end rates as the coupon reset higher. Low levels of both implied and realized rate volatility was a tailwind for MBS performance.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

Upon assuming management of the Portfolio, ALM First promptly aligned the duration of the Portfolio with that of the index which served to remove any over or under exposure to rate changes relative to the benchmark. Straying too far one way or the other from the benchmark’s duration is in essence betting on the direction of interest rates, which is not a consistently repeatable strategy. In terms of yield curve positioning, by being constructed as a barbell, the Portfolio was able to benefit from the flattening in the yield curve.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

During the Reporting Period, the largest changes in the Portfolio’s allocation were decreases in Treasuries and Agency debt with the Portfolio being repositioned into repurchase agreements and MBS securities.

Q. How was the Portfolio positioned relative to its benchmark index at the end of August 2017?

At the end of the Reporting Period, the Portfolio’s largest allocations were in Agency MBS securities.

Past performance does not guarantee future results, which may vary.

There is no guarantee that these objectives will be met.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the portfolio’s investments. Future investments may or may not be profitable.

2

THIS PAGE LEFT INTENTIONALLY BLANK

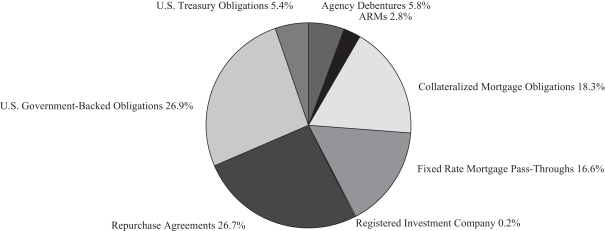

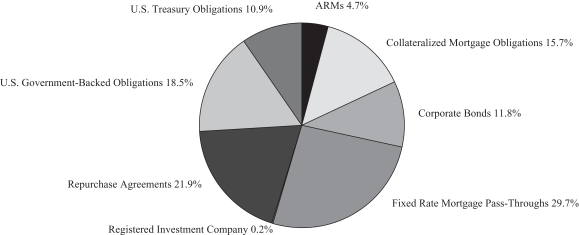

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU ULTRA-SHORT DURATION GOVERNMENT PORTFOLIO (Unaudited)

August 31, 2017*

August 31, 2016*

4

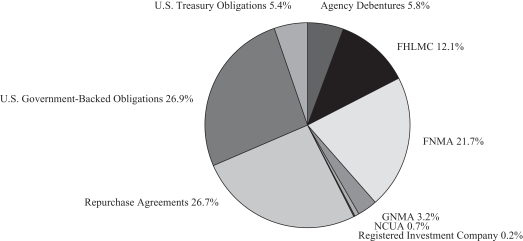

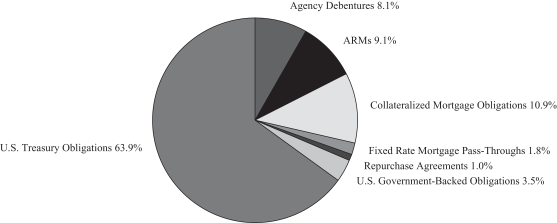

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU ULTRA-SHORT DURATION GOVERNMENT PORTFOLIO (Unaudited)

August 31, 2017*

August 31, 2016*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities, including cash. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

5

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU SHORT DURATION PORTFOLIO

Investment Objective

The TCU Short Duration Portfolio (“SDP” or the “Portfolio”) seeks to achieve a high level of current income, consistent with relatively low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. During normal market conditions, SDP intends to invest a substantial portion of its assets in mortgage-related securities, which include privately-issued mortgage-related securities rated, at the time of purchase, in one of the two highest rating categories by a Nationally Recognized Statistical Rating Organization (“NRSRO”) and mortgage-related securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises. Mortgage-related securities held by SDP may include adjustable rate and fixed rate mortgage pass-through securities, collateralized mortgage obligations and other multi-class mortgage-related securities, as well as other securities that are collateralized by or represent direct or indirect interests in mortgage-related securities or mortgage loans. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. SDP invests in obligations authorized under the Federal Credit Union Act with a maximum portfolio duration not to exceed that of a Three-Year U.S. Treasury Security and a target duration equal to that of its benchmark, the BofA Merrill Lynch Two-Year U.S. Treasury Note Index.

Portfolio Management Discussion and Analysis

Below, ALM First Financial Advisors, LLC (“ALM First”) discusses the Portfolio’s performance and positioning for the Reporting Period.

Q. How did the Portfolio perform during the Reporting Period?

The Portfolio’s cumulative total return for the twelve-month period ended August 31, 2017, was 0.55% for TCU Shares, versus a 0.28% cumulative total return for the BofA Merrill Lynch Two-Year U.S. Treasury Note Index. ALM First began managing the Portfolio effective April 16, 2017. Since then, the cumulative total return of SDP TCU Shares has been 0.86% versus 0.46% for the index. The Portfolio’s net asset value per share closed the Reporting Period at $9.67, versus $9.72 on August 31, 2016.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

Over the course of 2017, fixed income performance has been robust, especially for barbell strategies. As the yield curve flattened throughout the year, floating-rate Collateralized Mortgage Obligations (“CMO“s) and Commercial Mortgage Backed Securities (“CMBS”) benefitted from the increase in the front end of the yield curve, while longer duration assets fixed-rate Agency CMBS benefitted from spread tightening as well as a decline in the long end of the yield curve. Prior to the adviser change in April, the Portfolio was overweight in Treasuries with a weighted duration just below the index. At the same time, the Portfolio allocations to Mortgage Backed Securities (“MBS”), CMBS, and floating-rate

securities were relatively low, which weighed on performance relative to the benchmark amid the aforementioned curve flattening and lower rate volatility.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

Fixed-rate Agency CMBS performed very well in 2017 due to a combination of spread tightening as well as the aforementioned flattening in the yield curve. Despite the specter of the Federal Reserve reducing its MBS portfolio, the asset class has done well over the year as rate volatility has remained low, which has been a boon to the Portfolio.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

Upon assuming management of the Portfolio, ALM First aligned the duration of the Portfolio with that of the index which served to remove any over or under exposure to rate changes relative to the benchmark. Straying too far one way or the other from the benchmark’s duration is in essence betting on the direction of interest rates, which is not a consistently repeatable strategy. In terms, of yield curve positioning, by being constructed as a barbell, the Portfolio was able to benefit from the flattening in the yield curve.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

During the Reporting Period, the largest change in the Portfolio’s allocation was a decrease in Treasury and Agency Debt with the proceeds of this decline being allocated into Agency MBS and National Credit Union Association Regulation 703.14 permissible bank level corporate debt.

Q. How was the Portfolio positioned at the end of August 2017?

At the end of the Reporting Period, the Portfolio’s largest allocations were in Agency MBS.

Past performance does not guarantee future results, which may vary.

There is no guarantee that these objectives will be met.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the portfolio’s investments. Future investments may or may not be profitable.

6

THIS PAGE LEFT INTENTIONALLY BLANK

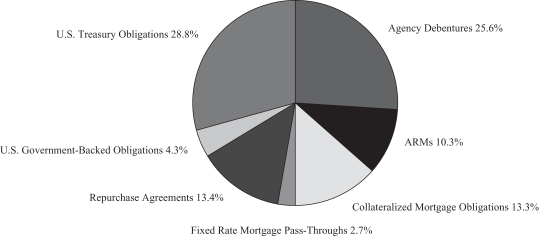

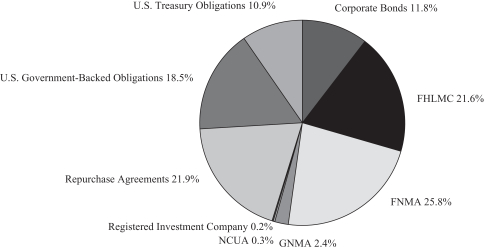

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2017*

August 31, 2016*

8

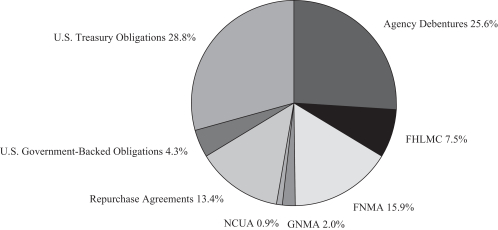

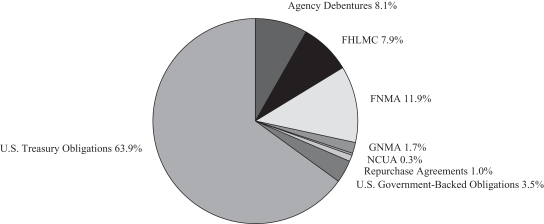

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2017*

August 31, 2016*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities, including cash. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

9

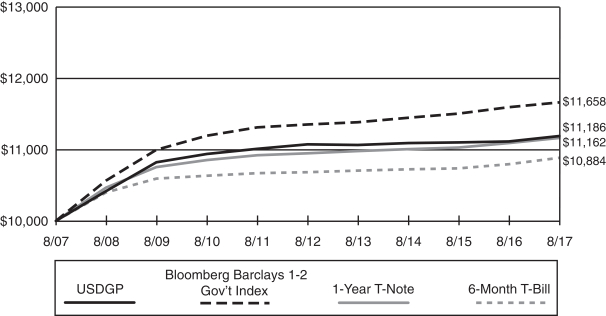

PERFORMANCE COMPARISON

TCU ULTRA-SHORT DURATION GOVERNMENT PORTFOLIO (Unaudited)

In accordance with the requirements of the Securities and Exchange Commission, the following data for the Ultra-Short Duration Government Portfolio is supplied for the period ended August 31, 2017. The Portfolio is compared to its benchmarks assuming the following initial investment:

Portfolio | Initial | Compare to: | ||

Ultra-Short Duration Government (“USDGP”) | $10,000 | Bloomberg Barclays Mutual Fund Short (1-2 year) Government Index (“Barclays 1-2 Gov’t Index”); BofA Merrill Lynch One-Year U.S. Treasury Note Index (“1-Year T-Note”); BofA Merrill Lynch 6-Month U.S. Treasury Bill Index (“6-Month T-Bill”). |

Ultra-Short Duration Government Portfolio’s TCU Shares 10 Year Performance

| Average Annual Total Return | ||||||||

| One Year | Five Year | Ten Year | Since Inception | |||||

TCU Shares | 0.68% | 0.21% | 1.13% | 2.76%(a) | ||||

Investor Shares | 0.64% | — | — | 0.15%(b) | ||||

| (a) | The Ultra-Short Duration Government Portfolio’s TCU Shares commenced operations on July 10, 1991. |

| (b) | The Ultra-Short Duration Government Portfolio’s Investor Shares commenced operations on November 30, 2012. |

The BofA Merrill Lynch Six-Month U.S. Treasury Bill Index and the BofA Merrill Lynch One-Year U.S. Treasury Note Index do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The TCU Ultra-Short Duration Government Portfolio is not a money market fund. Investors in this Portfolio should understand that the net asset value of the Portfolio will fluctuate, which may result in a loss of the principal amount invested. The Portfolio’s net asset value and yield are not guaranteed by the U.S. government, the National Credit Union Administration, or any other U.S. government agency, instrumentality or sponsored enterprise. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolio if held to maturity and not to the value of the Portfolio’s shares. The Portfolio’s investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

All performance data shown represents past performance and should not be considered indicative of future performance, which will fluctuate as market conditions change. The investment return and principal value of an investment will fluctuate with changes in market conditions so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The chart and table above assume reinvestment of dividends and distributions. In addition to the investment adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting a portfolio. Please call 1-800-342-5828 or 1-800-CFS-5678 for the most recent month-end returns.

10

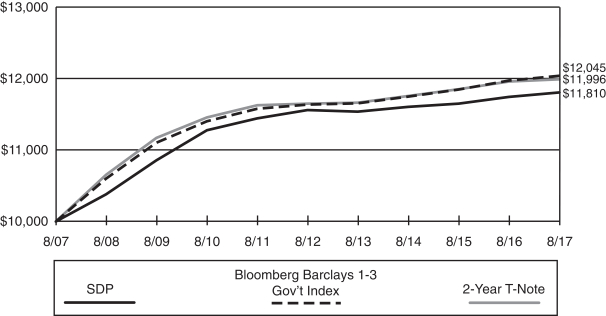

PERFORMANCE COMPARISON

TCU SHORT DURATION PORTFOLIO (Unaudited)

In accordance with the requirements of the Securities and Exchange Commission, the following data for the Short Duration Portfolio is supplied for the period ended August 31, 2017. The Portfolio is compared to its benchmarks assuming the following initial investment:

Portfolio | Initial | Compare to: | ||

Short Duration (“SDP”) | $10,000 | Bloomberg Barclays Mutual Fund Short (1-3 year) Government Index (“Barclays 1-3 Gov’t Index”); BofA Merrill Lynch 2-Year U.S. Treasury Note Index (“2-Year T-Note”). |

Short Duration Portfolio’s TCU Shares 10 Year Performance

| Average Annual Total Return | ||||||||

| One Year | Five Year | Ten Year | Since Inception | |||||

TCU Shares | 0.55% | 0.42% | 1.68% | 3.38%(a) | ||||

Investor Shares | 0.52% | — | — | 0.38%(b) | ||||

| (a) | The Short Duration Portfolio’s TCU Shares commenced operations on October 9, 1992. |

| (b) | The Short Duration Portfolio’s Investor Shares commenced operations on November 30, 2012. |

The BofA Merrill Lynch Two-Year U.S. Treasury Note Index does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The TCU Short Duration Portfolio is not a money market fund. Investors in this Portfolio should understand that the net asset value of the Portfolio will fluctuate, which may result in a loss of the principal amount invested. The Portfolio’s net asset value and yield are not guaranteed by the U.S. government, the National Credit Union Administration, or any other U.S. government agency, instrumentality or sponsored enterprise. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolio if held to maturity and not to the value of the Portfolio’s shares. The Portfolio’s investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

All performance data shown represents past performance and should not be considered indicative of future performance, which will fluctuate as market conditions change. The investment return and principal value of an investment will fluctuate with changes in market conditions so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The chart and table above assume reinvestment of dividends and distributions. In addition to the investment adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting a portfolio. Please call 1-800-342-5828 or 1-800-CFS-5678 for the most recent month-end returns.

11

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Government Portfolio

Portfolio of Investments – August 31, 2017

Par Value | Value | |||||||

ASSET-BACKED SECURITIES - 0.24% | ||||||||

Federal National Mortgage Association - 0.24% |

| |||||||

| $ | 82,524 | Series 2001-W4, Class AV1 1–M LIBOR + 0.280%, 1.565%, 02/25/32 (a) | $ | 81,326 | ||||

| 111,120 | Series 2002-W2, Class AV1 1–M LIBOR + 0.260%, 1.544%, 06/25/32 (a) | 107,558 | ||||||

| 725,318 | Series 2002-T7, Class A1 1–M LIBOR + 0.220%, 1.454%, 07/25/32 (a) | 727,234 | ||||||

|

| |||||||

| 916,118 | ||||||||

|

| |||||||

Total Asset-Backed Securities | 916,118 | |||||||

|

| |||||||

(Cost $919,004) | ||||||||

COLLATERALIZED MORTGAGE OBLIGATIONS - 18.29% | ||||||||

Federal Home Loan Mortgage Corporation REMIC - 3.75% |

| |||||||

| 4,139 | Series 1009, Class D 1–M LIBOR + 0.600%, 1.827%, 10/15/20 (a) | 4,146 | ||||||

| 11,831 | Series 1066, Class P 1–M LIBOR + 0.900%, 2.127%, 04/15/21 (a) | 11,913 | ||||||

| 16,670 | Series 1222, Class P T10Y - 0.400%, 1.870%, 03/15/22 (a) (b) | 16,690 | ||||||

| 40,008 | Series 1250, Class J 7.000%, 05/15/22 (b) | 42,074 | ||||||

| 14,828 | Series 1448, Class F 1–M LIBOR + 1.400%, 2.627%, 12/15/22 (a) (c) | 15,077 | ||||||

| 287,074 | Series 3777, Class DA 3.500%, 10/15/24 (c) | 291,030 | ||||||

| 1,671,188 | Series 2977, Class M 5.000%, 05/15/25 (b) | 1,784,811 | ||||||

| 2,690,601 | Series 3346, Class FT 1–M LIBOR + 0.350%, 1.577%, 10/15/33 (a) (b) | 2,696,691 | ||||||

| 203,232 | Series 3033, Class CI 5.500%, 01/15/35 (b) | 205,074 | ||||||

| 1,852,827 | Series 3208, Class FH 1–M LIBOR + 0.400%, 1.627%, 08/15/36 (a) | 1,862,083 | ||||||

| 167,144 | Series 3231, Class FB 1–M LIBOR + 0.350%, 1.577%, 10/15/36 (a) | 167,557 | ||||||

| 103,692 | Series 3314, Class FC 1–M LIBOR + 0.400%, 1.627%, 12/15/36 (a) | 104,097 | ||||||

| 1,026,470 | Series 4248, Class QF 1–M LIBOR + 0.500%, 1.727%, 06/15/39 (a) | 1,034,628 | ||||||

| 824,763 | Series 3545, Class FA 1–M LIBOR + 0.850%, 2.077%, 06/15/39 (a) | 833,288 | ||||||

| 2,152,303 | Series 4316, Class FY 1–M LIBOR + 0.400%, 1.627%, 11/15/39 (a) (c) | 2,157,779 | ||||||

Par Value | Value | |||||||

Federal Home Loan Mortgage Corporation REMIC - (continued) |

| |||||||

| $ | 661,323 | Series 3827, Class KF 1–M LIBOR + 0.370%, 1.597%, 03/15/41 (a) | $ | 663,120 | ||||

| 98,096 | Series 3868, Class FA 1–M LIBOR + 0.400%, 1.627%, 05/15/41 (a) | 98,459 | ||||||

| 58,104 | Series 4109, Class EC 2.000%, 12/15/41 (c) | 51,933 | ||||||

| 2,110,396 | Series 4606, Class FL 1–M LIBOR + 0.500%, 1.727%, 12/15/44 (a) | 2,125,227 | ||||||

|

| |||||||

| 14,165,677 | ||||||||

|

| |||||||

Federal National Mortgage Association REMIC - 11.31% |

| |||||||

| 37,367 | Series 1990-145, Class A 1.850%, 12/25/20 (a) | 37,459 | ||||||

| 121,602 | Series 1991-67, Class J 7.500%, 08/25/21 (b) | 128,395 | ||||||

| 115,540 | Series 1992-137, Class F 1–M LIBOR + 1.000%, 2.234%, 08/25/22 (a) | 116,770 | ||||||

| 139,224 | Series 1993-27, Class F 1–M LIBOR + 1.150%, 2.384%, 02/25/23 (a) (d) | 141,051 | ||||||

| 76,571 | Series 1998-21, Class F T1Y + 0.350%, 1.570%, 03/25/28 (a) | 76,425 | ||||||

| 667,728 | Series 2011-137, Class A 4.000%, 06/25/29 (c) | 677,943 | ||||||

| 199,463 | Series 2000-16, Class ZG 8.500%, 06/25/30 (c) | 241,051 | ||||||

| 164,994 | Series 2000-32, Class Z 7.500%, 10/18/30 | 187,260 | ||||||

| 270,515 | Series 2006-45, Class TF 1–M LIBOR + 0.400%, 1.634%, 06/25/36 (a) | 271,695 | ||||||

| 286,532 | Series 2006-76, Class QF 1–M LIBOR + 0.400%, 1.634%, 08/25/36 (a) (b) | 287,774 | ||||||

| 339,487 | Series 2006-79, Class PF 1–M LIBOR + 0.400%, 1.634%, 08/25/36 (a) (b) | 341,002 | ||||||

| 793,324 | Series 2006-111, Class FA 1–M LIBOR + 0.380%, 1.614%, 11/25/36 (a) | 795,281 | ||||||

| 335,142 | Series 2007-75, Class VF 1–M LIBOR + 0.450%, 1.684%, 08/25/37 (a) | 337,118 | ||||||

| 692,909 | Series 2007-85, Class FC 1–M LIBOR + 0.540%, 1.774%, 09/25/37 (a) | 699,005 | ||||||

| 357,586 | Series 2007-86, Class FC 1–M LIBOR + 0.570%, 1.804%, 09/25/37 (a) | 360,685 | ||||||

| 344,151 | Series 2007-92, Class OF 1–M LIBOR + 0.570%, 1.804%, 09/25/37 (a) | 347,260 | ||||||

| 440,889 | Series 2007-99, Class FD 1–M LIBOR + 0.600%, 1.834%, 10/25/37 (a) | 445,265 | ||||||

See accompanying notes to financial statements.

12

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Government Portfolio

Portfolio of Investments (continued) – August 31, 2017

Par Value | Value | |||||||

Federal National Mortgage Association REMIC - (continued) |

| |||||||

| $ | 1,963,842 | Series 2007-114, Class A7 1–M LIBOR + 0.200%, 1.434%, 10/27/37 (a) (c) | $ | 1,948,327 | ||||

| 60,580 | Series 2009-84, Class WF 1–M LIBOR + 1.100%, 2.334%, 10/25/39 (a) | 61,554 | ||||||

| 1,931,177 | Series 2014-19, Class FA 1–M LIBOR + 0.400%, 1.634%, 11/25/39 (a) (c) | 1,935,902 | ||||||

| 2,164,012 | Series 2014-19, Class FJ 1–M LIBOR + 0.400%, 1.634%, 11/25/39 (a) (c) | 2,169,402 | ||||||

| 900,762 | Series 2010-123, Class FL 1–M LIBOR + 0.430%, 1.664%, 11/25/40 (a) (b) | 903,900 | ||||||

| 3,774,725 | Series 2011-110, Class FE 1–M LIBOR + 0.400%, 1.634%, 04/25/41 (a) (b) | 3,786,440 | ||||||

| 453,838 | Series 2011-63, Class FG 1–M LIBOR + 0.450%, 1.684%, 07/25/41 (a) | 456,191 | ||||||

| 873,337 | Series 2012-38, Class JE 3.250%, 04/25/42 (b) | 899,123 | ||||||

| 3,316,945 | Series 2015-30, Class AB 3.000%, 05/25/45 | 3,409,104 | ||||||

| 6,896,299 | Series 2016-62, Class FH 1–M LIBOR + 0.400%, 1.634%, 09/25/46 (a) | 6,924,274 | ||||||

| 7,571,678 | Series 2016-83, Class FK 1–M LIBOR + 0.500%, 1.734%, 11/25/46 (a) | 7,560,999 | ||||||

| 4,833,202 | Series 2017-39, Class FT 1–M LIBOR + 0.400%, 1.634%, 05/25/47 (a) | 4,849,311 | ||||||

| 2,324,389 | Series 2008-22, Class FD 1–M LIBOR + 0.840%, 2.074%, 04/25/48 (a) | 2,361,027 | ||||||

|

| |||||||

| 42,756,993 | ||||||||

|

| |||||||

Government National Mortgage Association - 2.52% |

| |||||||

| 4,799,144 | Series 2017-H09, Class FJ 1–M LIBOR + 0.500%, 1.724%, 03/20/67 (a) | 4,792,481 | ||||||

| 4,727,685 | Series 2017-H07, Class FC 1–M LIBOR + 0.520%, 1.744%, 03/20/67 (a) | 4,724,010 | ||||||

|

| |||||||

| 9,516,491 | ||||||||

|

| |||||||

National Credit Union Administration - 0.71% |

| |||||||

| 328,103 | Series 2010-R2, Class 1A 1–M LIBOR + 0.370%, 1.601%, 11/06/17 (a) | 328,167 | ||||||

| 331,191 | Series 2011-R1, Class 1A 1–M LIBOR + 0.450%, 1.681%, 01/08/20 (a) | 331,890 | ||||||

| 1,178,352 | Series 2011-R2, Class 1A 1–M LIBOR + 0.400%, 1.631%, 02/06/20 (a) | 1,180,055 | ||||||

| 21,838 | Series 2011-R4, Class 1A 1–M LIBOR + 0.380%, 1.607%, 03/06/20 (a) | 21,838 | ||||||

Par Value | Value | |||||||

National Credit Union Administration - (continued) |

| |||||||

| $ | 441,226 | Series 2011-R3, Class 1A 1–M LIBOR + 0.400%, 1.629%, 03/11/20 (a) | $ | 441,899 | ||||

| 229,038 | Series 2010-R1, Class 1A 1–M LIBOR + 0.450%, 1.681%, 10/07/20 (a) | 229,566 | ||||||

| 146,353 | Series 2010-A1, Class A 1–M LIBOR + 0.350%, 1.579%, 12/07/20 (a) | 146,459 | ||||||

|

| |||||||

| 2,679,874 | ||||||||

|

| |||||||

Total Collateralized Mortgage Obligations | 69,119,035 | |||||||

|

| |||||||

(Cost $68,940,560) | ||||||||

MORTGAGE-BACKED OBLIGATIONS - 19.23% | ||||||||

Federal Home Loan Mortgage Corporation - 0.20% |

| |||||||

| 1,945 | H15T3Y + 2.095%, 3.095%, 11/01/18 (a) | 1,945 | ||||||

| 128,777 | H15T1Y + 2.136%, 6.880%, 11/01/19 (a) | 132,198 | ||||||

| 16,640 | 6–M LIBOR + 1.155%, 2.558%, 11/01/22 (a) | 16,781 | ||||||

| 58,135 | 6–M LIBOR + 1.225%, 2.597%, 11/01/22 (a) | 58,640 | ||||||

| 14,867 | 6–M LIBOR + 2.226%, 3.601%, 10/01/24 (a) | 15,396 | ||||||

| 13,265 | H15T3Y + 2.151%, 3.111%, 10/01/25 (a) | 13,393 | ||||||

| 365,738 | H15T3Y + 2.552%, 3.506%, 08/01/28 (a) | 380,868 | ||||||

| 23,366 | H15T1Y + 1.618%, 2.668%, 07/01/29 (a) | 23,854 | ||||||

| 104,467 | H15T1Y + 2.010%, 3.017%, 05/01/31 (a) | 108,805 | ||||||

|

| |||||||

| 751,880 | ||||||||

|

| |||||||

Federal Home Loan Mortgage Corporation Gold - 8.22% |

| |||||||

| 2,008 | 5.000%, 10/01/17 | 2,058 | ||||||

| 4,755 | 5.000%, 11/01/17 | 4,875 | ||||||

| 147,613 | 4.500%, 05/01/18 | 150,902 | ||||||

| 287,145 | 4.500%, 06/01/18 | 293,544 | ||||||

| 24,975 | 5.500%, 01/01/20 | 25,683 | ||||||

| 348,513 | 4.500%, 10/01/20 | 356,280 | ||||||

| 8,306 | 3.500%, 12/01/20 | 8,694 | ||||||

| 5,210,208 | 5.500%, 09/01/22 | 5,465,385 | ||||||

| 15,922 | 3.500%, 10/01/22 | 16,667 | ||||||

| 1,218 | 4.500%, 07/01/23 | 1,290 | ||||||

| 9,352,279 | 2.500%, 07/01/28 | 9,542,861 | ||||||

| 4,545,926 | 4.000%, 07/01/29 | 4,766,230 | ||||||

| 10,000,000 | 3.500%, 10/01/32 | 10,450,194 | ||||||

|

| |||||||

| 31,084,663 | ||||||||

|

| |||||||

Federal National Mortgage Association - 10.14% |

| |||||||

| 2,206 | H15BIN6M + 2.000%, 2.682%, 11/01/17 (a) | 2,204 | ||||||

| 744 | H15BIN6M + 2.250%, 2.932%, 11/01/17 (a) | 743 | ||||||

| 10,738 | H15BDI6M + 2.000%, 2.590%, 03/01/18 (a) | 10,750 | ||||||

| 1,904,114 | 2.800%, 03/01/18 | 1,902,718 | ||||||

See accompanying notes to financial statements.

13

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Government Portfolio

Portfolio of Investments (continued) – August 31, 2017

Par Value | Value | |||||||

Federal National Mortgage Association - (continued) |

| |||||||

| $ | 4,127,500 | 3.620%, 03/01/18 (a) | $ | 4,129,535 | ||||

| 1,906 | 2.885%, 06/01/18 (a) | 1,907 | ||||||

| 56,743 | COF 11 + 1.250%, 2.721%, 10/01/18 (a) | 56,757 | ||||||

| 3,126 | H15T1Y + 1.750%, 2.742%, 05/01/19 (a) | 3,131 | ||||||

| 47,164 | COF 11 + 1.250%, 6.864%, 12/01/19 (a) | 47,512 | ||||||

| 13,107 | H15BIN6M + 1.750%, 2.683%, 01/01/20 (a) | 13,129 | ||||||

| 1,792 | 5.000%, 01/01/20 | 1,834 | ||||||

| 18,409 | H15T1Y + 2.845%, 6.686%, 05/01/20 (a) | 18,965 | ||||||

| 65,037 | 3.500%, 09/01/20 | 67,898 | ||||||

| 5,743 | 3.500%, 10/01/20 | 5,995 | ||||||

| 19,048 | 3.500%, 03/01/21 | 19,886 | ||||||

| 57,273 | H15T1Y + 2.000%, 6.713%, 02/01/22 (a) | 59,881 | ||||||

| 9,954,274 | 2.730%, 08/01/22 | 10,263,640 | ||||||

| 1,120 | H15T3Y + 2.195%, 3.195%, 01/01/23 (a) | 1,120 | ||||||

| 1,905 | H15T1Y + 1.940%, 2.565%, 03/01/24 (a) | 1,904 | ||||||

| 16,803 | H15BDI6M + 2.425%, 5.925%, 10/01/25 (a) | 17,841 | ||||||

| 28,315 | H15T1Y + 2.013%, 3.641%, 02/01/27 (a) | 28,501 | ||||||

| 283,626 | 5.000%, 03/01/27 | 301,600 | ||||||

| 40,459 | COF 11 + 1.250%, 2.222%, 07/01/27 (a) | 40,733 | ||||||

| 4,696 | H15T1Y + 1.750%, 2.930%, 07/01/27 (a) | 4,828 | ||||||

| 9,601,138 | 3.000%, 10/01/28 | 9,931,500 | ||||||

| 73,095 | COF 11 + 1.500%, 4.667%, 01/01/29 (a) | 77,928 | ||||||

| 21,116 | COF 11 + 1.500%, 4.673%, 02/01/29 (a) | 22,512 | ||||||

| 111,112 | COF 11 + 1.770%, 2.427%, 08/01/29 (a) | 112,304 | ||||||

| 4,561,840 | 4.000%, 03/01/31 | 4,796,773 | ||||||

| 75,261 | H15T1Y + 2.255%, 3.380%, 07/01/32 (a) | 79,496 | ||||||

| 51,800 | 12–M LIBOR + 1.755%, 3.505%, 07/01/32 (a) | 54,543 | ||||||

| 9,675 | 6.000%, 08/01/32 | 10,871 | ||||||

| 208,226 | H15T1Y + 2.625%, 3.513%, 09/01/32 (a) | 221,079 | ||||||

| 61,604 | 12–M LIBOR + 1.225%, 2.600%, 01/01/33 (a) | 63,457 | ||||||

| 43,766 | H15T1Y + 2.216%, 3.148%, 06/01/33 (a) | 46,072 | ||||||

| 632,867 | COF 11 + 1.250%, 4.613%, 08/01/33 (a) | 674,716 | ||||||

| 2,783 | 6.000%, 11/01/33 | 3,180 | ||||||

| 427,926 | H15T1Y + 2.076%, 2.838%, 04/01/34 (a) | 448,733 | ||||||

| 452,732 | COF 11 + 1.250%, 1.907%, 07/01/34 (a) | 456,895 | ||||||

| 458,915 | COF 11 + 1.250%, 1.907%, 08/01/34 (a) | 463,153 | ||||||

| 63,508 | 6.000%, 09/01/34 | 72,228 | ||||||

Par Value | Value | |||||||

Federal National Mortgage Association - (continued) |

| |||||||

| $ | 3,109 | 6.000%, 10/01/34 | $ | 3,524 | ||||

| 9,205 | 6.000%, 07/01/36 | 10,608 | ||||||

| 438,088 | 12–M LIBOR + 1.789%, 3.538%, 07/01/37 (a) | 460,268 | ||||||

| 103,359 | 6.500%, 11/01/37 | 111,802 | ||||||

| 41,206 | 6.000%, 06/01/38 | 47,212 | ||||||

| 65,455 | 6.000%, 09/01/38 | 75,021 | ||||||

| 16,000 | 6.000%, 11/01/38 | 18,325 | ||||||

| 5,195 | 6.000%, 10/01/39 | 5,968 | ||||||

| 2,588,438 | 12–M LIBOR + 1.752%, 2.442%, 05/01/42 (a) | 2,668,922 | ||||||

| 382,692 | COF 11 + 1.250%, 1.907%, 08/01/44 (a) | 386,264 | ||||||

|

| |||||||

| 38,326,366 | ||||||||

|

| |||||||

Government National Mortgage Association - 0.67% |

| |||||||

| 24,455 | 7.000%, 04/15/26 | 26,677 | ||||||

| 155,436 | H15T1Y + 2.000%, 3.125%, 04/20/34 (a) | 162,899 | ||||||

| 943,492 | H15T1Y + 1.500%, 2.625%, 06/20/34 (a) | 971,385 | ||||||

| 716,303 | H15T1Y + 1.500%, 2.125%, 08/20/34 (a) | 737,040 | ||||||

| 87,119 | H15T1Y + 1.500%, 2.625%, 05/20/42 (a) | 89,543 | ||||||

| 69,833 | H15T1Y + 1.500%, 2.625%, 06/20/42 (a) | 71,779 | ||||||

| 334,781 | H15T1Y + 1.500%, 2.125%, 07/20/42 (a) | 343,646 | ||||||

| 35,556 | H15T1Y + 1.500%, 2.250%, 10/20/42 (a) | 36,479 | ||||||

| 77,284 | H15T1Y + 1.500%, 2.250%, 12/20/42 (a) | 79,254 | ||||||

|

| |||||||

| 2,518,702 | ||||||||

|

| |||||||

Total Mortgage-Backed Obligations | 72,681,611 | |||||||

|

| |||||||

(Cost $72,389,987) | ||||||||

AGENCY DEBENTURES - 5.83% | ||||||||

Federal Home Loan Bank - 4.84% |

| |||||||

| 15,000,000 | 3–M LIBOR + 0.020%, 1.182%, 09/01/17 (a) | 15,000,000 | ||||||

| 3,310,000 | 0.875%, 08/05/19 | 3,277,274 | ||||||

|

| |||||||

| 18,277,274 | ||||||||

|

| |||||||

Other Agency Debentures - 0.99% | ||||||||

| 3,750,000 | Sri Lanka Government Aid Bond 3–M LIBOR + 0.300%, 1.469%, 11/01/24 (a) (e) | 3,750,000 | ||||||

|

| |||||||

| 3,750,000 | ||||||||

|

| |||||||

Total Agency Debentures | 22,027,274 | |||||||

|

| |||||||

(Cost $22,055,902) | ||||||||

U.S. TREASURY OBLIGATIONS - 5.37% | ||||||||

United States Treasury Notes & Bonds - 5.37% |

| |||||||

| 5,000,000 | 0.875%, 10/15/17 | 4,998,928 | ||||||

| 1,000,000 | 0.750%, 10/31/17 | 999,480 | ||||||

| 6,000,000 | 1.875%, 10/31/17 | 6,007,894 | ||||||

| 8,300,000 | 1.056%, 11/24/17 (f) | 8,281,276 | ||||||

|

| |||||||

Total U.S. Treasury Obligations | 20,287,578 | |||||||

|

| |||||||

(Cost $20,289,939) | ||||||||

See accompanying notes to financial statements.

14

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Government Portfolio

Portfolio of Investments (continued) – August 31, 2017

Par Value | Value | |||||||

U.S. GOVERNMENT-BACKED OBLIGATIONS - 26.88% | ||||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| $ | 5,500,000 | Series K009, Class A2, 3.808%, 08/25/20 (c) | $ | 5,793,628 | ||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 9,468,224 | Series K031, Class A1, 2.778%, 09/25/22 (c) | 9,698,353 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 2,175,867 | Series K049, Class A1, 2.475%, 03/25/25 (c) | 2,197,331 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 1,657,569 | Series K703, Class A2, 2.699%, 05/25/18 (c) | 1,665,675 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 7,987,519 | Series K705, Class A2, 2.303%, 09/25/18 (c) | 8,032,391 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 4,915,295 | Series K706, Class A2, 2.323%, 10/25/18 (c) | 4,945,404 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 5,000,000 | Series K707, Class A2, 2.220%, 12/25/18 (c) | 5,029,224 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 2,059,407 | Series K712, Class A2, 1.869%, 11/25/19 (c) | 2,066,751 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 1,500,000 | Series K713, Class A2, 2.313%, 03/25/20 (c) | 1,518,848 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 1,000,000 | Series KBF1, Class A, 1–M LIBOR + 0.390%, 1.622%, 07/25/24 (a) (c) | 1,000,000 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 937,806 | Series KF02, Class A1, 1–M LIBOR + 0.380%, 1.612%, 07/25/20 (a) (c) | 937,727 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 988,545 | Series KF03, Class A, 1–M LIBOR + 0.340%, 1.572%, 01/25/21 (a) (c) | 988,231 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 4,944,907 | Series KF29, Class A, 1–M LIBOR + 0.360%, 1.592%, 02/25/24 (a) (c) | 4,947,999 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 4,999,611 | Series KF30, Class A, 1–M LIBOR + 0.370%, 1.602%, 03/25/27 (a) (c) | 5,005,085 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 13,930,000 | Series KF31, Class A, 1–M LIBOR + 0.370%, 1.602%, 04/25/24 (a) (c) | 13,940,870 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 3,439,609 | Series KL1P, Class A1P, 2.544%, 10/25/25 (c) (e) | 3,499,264 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 7,028,191 | Series KLH3, Class A, 1–M LIBOR + 0.700%, 1.932%, 11/25/22 (a) (c) | 7,060,108 | ||||||

| FHLMC, Multifamily Structured Pass Through Certificates | ||||||||

| 7,748,930 | Series KP02, Class A2, 2.355%, 04/25/21 (a) (c) | 7,850,313 | ||||||

Par Value | Value | |||||||

U.S. GOVERNMENT-BACKED OBLIGATIONS - (continued) | ||||||||

| FNMA | ||||||||

| $ | 2,341,017 | Series 2014-M10, Class ASQ2, 2.171%, 09/25/19 (a) (c) | $ | 2,362,963 | ||||

| FNMA | ||||||||

| 8,308,162 | Series 2014-M5, Class ASQ2, 2.034%, 03/25/19 (c) | 8,338,498 | ||||||

| FNMA | ||||||||

| 4,689,832 | Series 2017-M5, Class FA, 1–M LIBOR + 0.490%, 1.776%, 04/25/24 (a) (c) | 4,695,556 | ||||||

|

| |||||||

Total U.S. Government-Backed Obligations | 101,574,219 | |||||||

|

| |||||||

(Cost $101,483,722) | ||||||||

REPURCHASE AGREEMENTS - 26.73% | ||||||||

| 8,000,000 | Amherst Pierpont Securities, 1.26%, Dated 08/31/17, matures 09/01/2017, repurchase price $8,000,280 (collateralized by $8,697,702 par amount of FNMA and Federal National Mortgage Backed Securities with interest rates of 2.844% to 9.250% due 11/15/19 to 06/01/47, total market value $8,162,436) | 8,000,000 | ||||||

| 20,000,000 | Amherst Pierpont Securities, 1.63%, Dated 08/25/17, matures 09/25/2017, repurchase price $20,028,072 (collateralized by $24,925,832 par amount of a GNMA, FNMA, and Federal National Mortgage Backed Securities with interest rates of 2.098% to 5.500% due 10/01/29 to 11/15/56, total market value $20,497,768) | 20,000,000 | ||||||

| 25,000,000 | Amherst Pierpont Securities, 1.19%, Dated 08/28/17, matures 09/28/2017, repurchase price $25,025,618 (collateralized by $61,089,998 par amount of SBA, GNMA, FNMA, and Federal National Mortgage Backed Securities with interest rates of 1.781% to 5.870% due 11/30/17 to 04/20/67, total market value $25,631,727) | 25,000,000 | ||||||

| 10,000,000 | Amherst Pierpont Securities, 1.25%, Dated 08/04/17, matures 10/17/2017, repurchase price $10,025,694 (collateralized by $10,483,175 par amount of SBA, GNMA, FNMA, and Federal National Mortgage Backed Securities with interest rates of 1.800% to 5.250% due 01/25/23 to 08/20/47, total market value $10,246,817) | 10,000,000 | ||||||

| 38,000,000 | Amherst Pierpont Securities, 1.23%, Dated 08/22/17, matures 11/22/2017, repurchase price $38,119,447 (collateralized by $60,029,856 par amount of a GNMA, FNMA and Federal National Mortgage Backed Securities with interest rates of 0.000% to 6.859% due 01/15/30 to 09/25/57, total market value $39,115,063) | 38,000,000 | ||||||

|

| |||||||

Total Repurchase Agreements | 101,000,000 | |||||||

|

| |||||||

(Cost $101,000,000) | ||||||||

See accompanying notes to financial statements.

15

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Government Portfolio

Portfolio of Investments (continued) – August 31, 2017

Number of Shares | Value | |||||||

REGISTERED INVESTMENT COMPANY - 0.16% | ||||||||

| 603,053 | Dreyfus Government Cash Management Fund, 0.93% (g) | $ | 603,053 | |||||

|

| |||||||

Total Registered Investment Company | 603,053 | |||||||

|

| |||||||

(Cost $603,053) | ||||||||

Total Investments - 102.73% | 388,208,888 | |||||||

|

| |||||||

(Cost $387,682,167) | ||||||||

Net Other Assets and | (10,305,801 | ) | ||||||

|

| |||||||

Net Assets - 100.00% | $ | 377,903,087 | ||||||

|

| |||||||

| (a) | Variable rate securities. Interest rates disclosed are those which are in effect at August 31, 2017. Maturity date shown is the date of the next coupon rate reset or actual maturity. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. For those variable rate securities which are based on published reference rates, see Explanation of Abbreviations and Acronyms below. |

| (b) | The security has PAC (Planned Amortization Class) collateral. |

| (c) | The security has Sequential collateral. |

| (d) | The security has Support collateral. |

| (e) | Security has been valued at fair market value as determined in good faith by or under the direction of the Board of Trustees of the Trust. As of August 31, 2017, this security amounted to $3,750,000 or 0.99% of net assets. Investment categorized as a significant unobservable input (Level 3). |

| (f) | Discount Note. Rate shown is yield at time of purchase. |

| (g) | Rate periodically changes. Rate disclosed is the daily yield on August 31, 2017. |

Explanation of Abbreviations and Acronyms:

COF 11 | Cost of Funds for the 11th District of San Francisco | |

FHLMC | Federal Home Loan Mortgage Corporation | |

FNMA | Federal National Mortgage Association | |

GNMA | Government National Mortgage Association | |

H15BDI6M | US Treasury Bill 3 Month Auction High Discount Rate | |

H15BIN6M | US Treasury Bill 6 Month Auction Investment Rate | |

H15T1Y | US Treasury Yield Curve Rate T-Note Constant Maturity 1 Year | |

H15T3Y | US Treasury Yield Curve Rate T-Note Constant Maturity 3 Year | |

LIBOR | London Interbank Offered Rate | |

REMIC | Real Estate Mortgage Investment Conduit | |

SBA | Small Business Administration | |

T1Y | US Treasury Yield Curve Rate T-Note Constant Maturity 1 Year | |

T10Y | US Treasury Yield Curve Rate T-Note Constant Maturity 10 Year | |

1–M | One Month | |

3–M | Three Months | |

6–M | Six Months | |

12–M | Twelve Months |

See accompanying notes to financial statements.

16

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments – August 31, 2017

Par Value | Value | |||||||

CORPORATE BONDS - 11.81% | ||||||||

Financials - 11.81% |

| |||||||

| $ | 5,000,000 | Capital One Bank USA NA, 2.150%, 11/21/18 | $ | 5,017,115 | ||||

| 4,000,000 | Capital One NA, 2.950%, 07/23/21 | 4,066,161 | ||||||

| 10,000,000 | Citibank NA, 2.000%, 03/20/19 | 10,050,187 | ||||||

| 6,250,000 | 3–M LIBOR + 0.230%, 1.541%, 11/09/18 (a) | 6,255,436 | ||||||

| 1,000,000 | Citizens Bank NA, 2.200%, 05/26/20 | 1,003,074 | ||||||

| 7,000,000 | Fifth Third Bank, 2.875%, 10/01/21 | 7,165,601 | ||||||

| 5,000,000 | Manufacturers & Traders Trust Co., 3–M LIBOR + 0.610%, 1.927%, 05/18/22 (a) | 5,006,929 | ||||||

| 5,592,000 | PNC Bank NA, 2.150%, 04/29/21 | 5,607,516 | ||||||

| 3,000,000 | 2.550%, 12/09/21 | 3,040,585 | ||||||

| 1,000,000 | 3–M LIBOR + 0.360%, 1.676%, 05/19/20 (a) | 1,003,524 | ||||||

| 1,175,000 | Wells Fargo Bank NA, 1.750%, 05/24/19 | 1,175,781 | ||||||

|

| |||||||

Total Corporate Bonds | 49,391,909 | |||||||

|

| |||||||

(Cost $49,214,216) |

| |||||||

COLLATERALIZED MORTGAGE OBLIGATIONS - 15.73% | ||||||||

Federal Home Loan Mortgage Corporation REMIC - 4.79% |

| |||||||

| 34,599 | Series 1448, Class F 1–M LIBOR + 1.400%, 2.627%, 12/15/22 (a) (b) | 35,179 | ||||||

| 376,415 | Series 2868, Class AV 5.000%, 08/15/24 (b) | 401,575 | ||||||

| 237,053 | Series 3777, Class DA 3.500%, 10/15/24 (b) | 240,320 | ||||||

| 190,316 | Series 1980, Class Z 7.000%, 07/15/27 (b) | 216,821 | ||||||

| 2,232,225 | Series 3346, Class FT 1–M LIBOR + 0.350%, 1.577%, 10/15/33 (a) (c) | 2,237,278 | ||||||

| 1,893,283 | Series 3471, Class FB 1–M LIBOR + 1.000%, 2.227%, 08/15/35 (a) | 1,932,841 | ||||||

| 2,790,402 | Series 3208, Class FA 1–M LIBOR + 0.400%, 1.627%, 08/15/36 (a) | 2,804,341 | ||||||

| 937,575 | Series 3208, Class FH 1–M LIBOR + 0.400%, 1.627%, 08/15/36 (a) | 942,259 | ||||||

| 592,485 | Series 3367, Class YF 1–M LIBOR + 0.550%, 1.777%, 09/15/37 (a) | 596,014 | ||||||

| 2,225,780 | Series 3371, Class FA 1–M LIBOR + 0.600%, 1.827%, 09/15/37 (a) | 2,247,125 | ||||||

| 958,503 | Series 4248, Class QF 1–M LIBOR + 0.500%, 1.727%, 06/15/39 (a) | 966,121 | ||||||

Par Value | Value | |||||||

Federal Home Loan Mortgage Corporation REMIC - (continued) |

| |||||||

| $ | 2,136,478 | Series 4316, Class FY 1–M LIBOR + 0.400%, 1.627%, 11/15/39 (a) (b) | $ | 2,141,913 | ||||

| 414,948 | Series 3827, Class KF 1–M LIBOR + 0.370%, 1.597%, 03/15/41 (a) | 416,075 | ||||||

| 46,298 | Series 4109, Class EC 2.000%, 12/15/41 (b) | 41,381 | ||||||

| 1,847,707 | Series 4272, Class FD 1–M LIBOR + 0.350%, 1.577%, 11/15/43 (a) | 1,849,122 | ||||||

| 2,954,555 | Series 4606, Class FL 1–M LIBOR + 0.500%, 1.727%, 12/15/44 (a) | 2,975,317 | ||||||

|

| |||||||

| 20,043,682 | ||||||||

|

| |||||||

Federal National Mortgage Association REMIC - 8.41% |

| |||||||

| 199 | Series 1988-12, Class A 4.686%, 02/25/18 (a) | 199 | ||||||

| 131,499 | Series 2009-70, Class TM 4.000%, 08/25/19 | 132,431 | ||||||

| 131,850 | Series 2009-70, Class TN 4.000%, 08/25/19 | 132,785 | ||||||

| 3,276 | Series G92-44, Class Z 8.000%, 07/25/22 | 3,614 | ||||||

| 391,535 | Series 2006-45, Class TF 1–M LIBOR + 0.400%, 1.634%, 06/25/36 (a) | 393,243 | ||||||

| 416,329 | Series 2006-76, Class QF 1–M LIBOR + 0.400%, 1.634%, 08/25/36 (a) (c) | 418,133 | ||||||

| 251,356 | Series 2007-75, Class VF 1–M LIBOR + 0.450%, 1.684%, 08/25/37 (a) | 252,839 | ||||||

| 2,191,234 | Series 2007-114, Class A7 1–M LIBOR + 0.200%, 1.434%, 10/27/37 (a) (b) | 2,173,923 | ||||||

| 1,903,390 | Series 2014-19, Class FA 1–M LIBOR + 0.400%, 1.634%, 11/25/39 (a) (b) | 1,908,047 | ||||||

| 2,149,681 | Series 2014-19, Class FJ 1–M LIBOR + 0.400%, 1.634%, 11/25/39 (a) (b) | 2,155,035 | ||||||

| 355,971 | Series 2010-123, Class FL 1–M LIBOR + 0.430%, 1.664%, 11/25/40 (a) (c) | 357,211 | ||||||

| 1,235,823 | Series 2011-110, Class FE 1–M LIBOR + 0.400%, 1.634%, 04/25/41 (a) (c) | 1,239,658 | ||||||

| 616,740 | Series 2015-92, Class PA 2.500%, 12/25/41 (c) | 622,936 | ||||||

| 700,498 | Series 2012-38, Class JE 3.250%, 04/25/42 (c) | 721,181 | ||||||

| 2,223,637 | Series 2012-71, Class FL 1–M LIBOR + 0.500%, 1.734%, 07/25/42 (a) | 2,237,854 | ||||||

| 7,698,194 | Series 2016-62, Class FH 1–M LIBOR + 0.400%, 1.634%, 09/25/46 (a) | 7,729,422 | ||||||

See accompanying notes to financial statements.

17

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2017

Par Value | Value | |||||||

Federal National Mortgage Association REMIC - (continued) |

| |||||||

| $ | 8,032,787 | Series 2016-83, Class FK 1–M LIBOR + 0.500%, 1.734%, 11/25/46 (a) | $ | 8,021,457 | ||||

| 4,833,202 | Series 2017-39, Class FT 1–M LIBOR + 0.400%, 1.634%, 05/25/47 (a) | 4,849,311 | ||||||

| 1,804,445 | Series 2008-22, Class FD 1–M LIBOR + 0.840%, 2.074%, 04/25/48 (a) | 1,832,888 | ||||||

|

| |||||||

| 35,182,167 | ||||||||

|

| |||||||

Government National Mortgage Association - 2.27% |

| |||||||

| 4,799,144 | Series 2017-H09, Class FJ 1–M LIBOR + 0.500%, 1.724%, 03/20/67 (a) | 4,792,481 | ||||||

| 4,727,685 | Series 2017-H07, Class FC 1–M LIBOR + 0.520%, 1.744%, 03/20/67 (a) | 4,724,010 | ||||||

|

| |||||||

| 9,516,491 | ||||||||

|

| |||||||

National Credit Union Administration - 0.26% |

| |||||||

| 571,322 | Series 2011-R2, Class 1A 1–M LIBOR + 0.400%, 1.631%, 02/06/20 (a) | 572,148 | ||||||

| 21,838 | Series 2011-R4, Class 1A 1–M LIBOR + 0.380%, 1.607%, 03/06/20 (a) | 21,838 | ||||||

| 493,136 | Series 2011-R3, Class 1A 1–M LIBOR + 0.400%, 1.629%, 03/11/20 (a) | 493,887 | ||||||

|

| |||||||

| 1,087,873 | ||||||||

|

| |||||||

Total Collateralized Mortgage Obligations | 65,830,213 | |||||||

|

| |||||||

(Cost $65,652,779) | ||||||||

MORTGAGE-BACKED OBLIGATIONS - 34.34% | ||||||||

Federal Home Loan Mortgage Corporation - 0.55% |

| |||||||

| 141,123 | 12–M LIBOR + 1.735%, 3.360%, 01/01/34 (a) | 148,568 | ||||||

| 95,944 | 12–M LIBOR + 1.840%, 3.406%, 11/01/34 (a) | 99,658 | ||||||

| 495,832 | H15T1Y + 2.250%, 3.094%, 08/01/35 (a) | 523,543 | ||||||

| 493,681 | 12–M LIBOR + 1.768%, 3.493%, 05/01/36 (a) | 518,457 | ||||||

| 984,665 | 12–M LIBOR + 1.890%, 2.589%, 03/01/42 (a) | 1,018,945 | ||||||

|

| |||||||

| 2,309,171 | ||||||||

|

| |||||||

Federal Home Loan Mortgage Corporation Gold - 16.26% |

| |||||||

| 2,119 | 5.000%, 10/01/17 | 2,173 | ||||||

| 5,019 | 5.000%, 11/01/17 | 5,146 | ||||||

| 647 | 8.000%, 11/01/17 | 648 | ||||||

| 9,524 | 5.500%, 03/01/18 | 9,590 | ||||||

| 2,309 | 5.500%, 04/01/18 | 2,327 | ||||||

| 121,301 | 4.500%, 05/01/18 | 124,004 | ||||||

| 5,701 | 6.500%, 05/01/18 | 5,732 | ||||||

| 238,120 | 4.500%, 06/01/18 | 243,427 | ||||||

| 1,016 | 6.000%, 10/01/18 | 1,140 | ||||||

Par Value | Value | |||||||

Federal Home Loan Mortgage Corporation Gold - (continued) |

| |||||||

| $ | 345 | 6.000%, 11/01/18 | $ | 387 | ||||

| 114,575 | 5.500%, 02/01/19 | 117,136 | ||||||

| 26,445 | 5.500%, 01/01/20 | 27,194 | ||||||

| 470,365 | 5.000%, 04/01/20 | 485,910 | ||||||

| 288,635 | 4.500%, 10/01/20 | 295,068 | ||||||

| 6,875 | 3.500%, 12/01/20 | 7,196 | ||||||

| 13,179 | 3.500%, 10/01/22 | 13,795 | ||||||

| 3,948,245 | 3.500%, 05/01/30 | 4,153,311 | ||||||

| 9,664,852 | 2.000%, 12/01/31 | 9,568,918 | ||||||

| 15,000,000 | 3.000%, 10/01/32 TBA (d) | 15,474,674 | ||||||

| 10,000,000 | 3.500%, 10/01/32 TBA (d) | 10,450,194 | ||||||

| 150,684 | 5.000%, 08/01/35 | 164,649 | ||||||

| 18,237 | 5.000%, 12/01/35 | 19,864 | ||||||

| 4,862,800 | 3.000%, 01/01/37 | 4,991,104 | ||||||

| 4,888,513 | 3.000%, 02/01/37 | 5,017,609 | ||||||

| 7,561,320 | 3.500%, 02/01/37 | 7,912,875 | ||||||

| 6,970,361 | 3.500%, 03/01/37 | 7,294,446 | ||||||

| 188,798 | 5.000%, 03/01/37 | 206,066 | ||||||

| 374,302 | 5.000%, 05/01/37 | 409,534 | ||||||

| 284,881 | 5.000%, 02/01/38 | 312,265 | ||||||

| 82,089 | 5.000%, 03/01/38 | 89,169 | ||||||

| 83,050 | 5.000%, 09/01/38 | 90,972 | ||||||

| 285,579 | 5.000%, 12/01/38 | 312,718 | ||||||

| 184,167 | 5.000%, 01/01/39 | 201,741 | ||||||

|

| |||||||

| 68,010,982 | ||||||||

|

| |||||||

Federal National Mortgage Association - 17.37% |

| |||||||

| 1,125,158 | 2.800%, 03/01/18 | 1,124,333 | ||||||

| 60,496 | 5.500%, 05/01/18 | 61,148 | ||||||

| 11,331 | 5.500%, 06/01/18 | 11,463 | ||||||

| 16,448 | 5.500%, 10/01/18 | 16,753 | ||||||

| 41,961 | 5.500%, 11/01/18 | 42,641 | ||||||

| 2,180 | 5.500%, 12/01/18 | 2,225 | ||||||

| 53,681 | 3.500%, 09/01/20 | 56,042 | ||||||

| 4,740 | 3.500%, 10/01/20 | 4,949 | ||||||

| 15,722 | 3.500%, 03/01/21 | 16,414 | ||||||

| 9,954,274 | 2.730%, 08/01/22 | 10,263,640 | ||||||

| 226,900 | 5.000%, 03/01/27 | 241,280 | ||||||

| 103,360 | 7.000%, 08/01/28 | 118,592 | ||||||

| 248,656 | 7.000%, 11/01/28 | 287,106 | ||||||

| 9,750,146 | 2.000%, 02/01/32 | 9,663,859 | ||||||

| 154,409 | 2.500%, 02/01/32 | 156,722 | ||||||

| 19,242 | 7.000%, 02/01/32 | 21,648 | ||||||

| 34,331 | H15T1Y + 2.235%, 3.004%, 05/01/32 (a) | 36,114 | ||||||

| 95,368 | 7.000%, 05/01/32 | 111,249 | ||||||

| 15,000,000 | 3.500%, 09/01/32 TBA (d) | 15,658,008 | ||||||

| 213,836 | H15T1Y + 2.625%, 3.513%, 09/01/32 (a) | 227,035 | ||||||

| 9,825 | 7.000%, 09/01/32 | 10,578 | ||||||

| 15,000,000 | 2.500%, 10/01/32 TBA (d) | 15,188,672 | ||||||

| 458,753 | H15T1Y + 2.215%, 3.275%, 07/01/33 (a) | 484,377 | ||||||

| 253,455 | 12–M LIBOR + 1.563%, 3.063%, 11/01/33 (a) | 265,325 | ||||||

| 323,011 | H15T1Y + 2.215%, 2.819%, 12/01/33 (a) | 339,876 | ||||||

| 135,124 | 12–M LIBOR + 1.715%, 3.320%, 03/01/34 (a) | 140,052 | ||||||

| 381,481 | 12–M LIBOR + 1.555%, 3.305%, 04/01/34 (a) | 399,604 | ||||||

See accompanying notes to financial statements.

18

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2017

Par Value | Value | |||||||

Federal National Mortgage Association - (continued) |

| |||||||

| $ | 168,277 | H15T1Y + 2.185%, 3.310%, 08/01/34 (a) | $ | 177,754 | ||||

| 1,223 | 6.000%, 09/01/34 | 1,394 | ||||||

| 212,400 | 12–M LIBOR + 1.695%, 3.181%, 10/01/34 (a) | 223,757 | ||||||

| 150,947 | 12–M LIBOR + 1.649%, 3.274%, 03/01/35 (a) | 156,199 | ||||||

| 323,693 | 12–M LIBOR + 1.720%, 3.470%, 04/01/35 (a) | 341,634 | ||||||

| 423,916 | H15T1Y + 2.313%, 3.068%, 05/01/35 (a) | 449,859 | ||||||

| 384,391 | 12–M LIBOR + 1.428%, 3.143%, 05/01/35 (a) | 400,288 | ||||||

| 187,075 | 12–M LIBOR + 1.525%, 3.316%, 05/01/35 (a) | 195,996 | ||||||

| 330,366 | 6–M LIBOR + 1.412%, 2.787%, 06/01/35 (a) | 340,084 | ||||||

| 2,754,904 | 4.000%, 06/01/35 | 2,937,975 | ||||||

| 214,486 | 6–M LIBOR + 1.513%, 2.888%, 08/01/35 (a) | 221,598 | ||||||

| 671,888 | 12–M LIBOR + 1.750%, 3.500%, 08/01/35 (a) | 711,736 | ||||||

| 452,312 | 12–M LIBOR + 2.432%, 4.056%, 09/01/35 (a) | 482,917 | ||||||

| 261,961 | H15T1Y + 2.085%, 2.940%, 10/01/35 (a) | 274,993 | ||||||

| 974,256 | 12–M LIBOR + 1.559%, 3.172%, 11/01/35 (a) | 1,020,041 | ||||||

| 442,235 | 12–M LIBOR + 1.737%, 3.487%, 03/01/36 (a) | 465,195 | ||||||

| 468,360 | 12MTA + 2.439%, 3.249%, 04/01/36 (a) | 493,301 | ||||||

| 90,564 | 5.000%, 10/01/39 | 99,730 | ||||||

| 3,327,992 | 12–M LIBOR + 1.752%, 2.440%, 05/01/42 (a) | 3,431,471 | ||||||

| 1,187,299 | 12–M LIBOR + 1.700%, 2.774%, 06/01/42 (a) | 1,225,823 | ||||||

| 1,798,342 | 12–M LIBOR + 1.679%, 2.258%, 10/01/42 (a) | 1,850,396 | ||||||

| 2,155,673 | 12–M LIBOR + 1.606%, 2.628%, 12/01/44 (a) | 2,212,415 | ||||||

|

| |||||||

| 72,664,261 | ||||||||

|

| |||||||

Government National Mortgage Association - 0.16% |

| |||||||

| 95,941 | H15T1Y + 1.500%, 2.625%, 05/20/42 (a) | 98,611 | ||||||

| 79,465 | H15T1Y + 1.500%, 2.625%, 06/20/42 (a) | 81,680 | ||||||

| 370,779 | H15T1Y + 1.500%, 2.125%, 07/20/42 (a) | 380,598 | ||||||

| 40,461 | H15T1Y + 1.500%, 2.250%, 10/20/42 (a) | 41,510 | ||||||

| 86,453 | H15T1Y + 1.500%, 2.250%, 12/20/42 (a) | 88,657 | ||||||

|

| |||||||

| 691,056 | ||||||||

|

| |||||||

Total Mortgage-Backed Obligations | 143,675,470 | |||||||

|

| |||||||

(Cost $142,662,909) | ||||||||

Par Value | Value | |||||||

U.S. TREASURY OBLIGATIONS - 10.91% | ||||||||

United States Treasury Notes & Bonds - 10.91% |

| |||||||

| $ | 6,810,000 | 1.000%, 03/15/18 | $ | 6,804,148 | ||||

| 8,950,000 | 1.250%, 11/15/18 | 8,948,602 | ||||||

| 9,500,000 | 1.250%, 12/31/18 | 9,495,547 | ||||||

| 15,730,000 | 1.250%, 01/31/19 | 15,720,783 | ||||||

| 4,700,000 | 0.875%, 06/15/19 | 4,663,465 | ||||||

|

| |||||||

Total U.S. Treasury Obligations | 45,632,545 | |||||||

|

| |||||||

(Cost $45,746,244) | ||||||||

U.S. GOVERNMENT-BACKED OBLIGATIONS - 18.49% | ||||||||

| FHLMC, Multifamily Structured Pass Thru Certificates | ||||||||

| 12,928,750 | Series K064, Class A1 2.891%, 10/25/26 (a) (b) | 13,336,746 | ||||||

| 1,462,561 | Series K703, Class A2 2.699%, 05/25/18 (b) | 1,469,713 | ||||||

| 2,487,163 | Series K726, Class A1 2.596%, 08/25/23 (b) | 2,541,469 | ||||||

| 5,000,000 | Series K726, Class AM 2.985%, 04/25/24 (b) | 5,178,553 | ||||||

| 971,790 | Series KF03, Class A 1–M LIBOR + 0.340%, 1.572%, 01/25/21 (a) (b) | 971,481 | ||||||

| 1,250,000 | Series KF27, Class A 1–M LIBOR + 0.420%, 1.652%, 12/25/26 (a) (b) | 1,251,176 | ||||||

| 4,944,907 | Series KF29, Class A 1–M LIBOR + 0.360%, 1.592%, 02/25/24 (a) (b) | 4,947,999 | ||||||

| 9,999,223 | Series KF30, Class A 1–M LIBOR + 0.370%, 1.602%, 03/25/27 (a) (b) | 10,010,170 | ||||||

| 9,969,513 | Series KJ14, Class A1 2.197%, 11/25/23 (b) | 9,962,344 | ||||||

| 3,439,609 | Series KL1P, Class A1P 2.544%, 10/25/25 (b) (e) | 3,499,264 | ||||||

| 7,028,191 | Series KLH3, Class A 1–M LIBOR + 0.700%, 1.932%, 11/25/22 (a) (b) | 7,060,108 | ||||||

| 8,543,692 | Series KP02, Class A2 2.355%, 04/25/21 (a) (b) | 8,655,473 | ||||||

| FNMA | ||||||||

| 2,804,005 | Series 2014-M5, Class ASQ2, 2.034%, 03/25/19 (b) | 2,814,243 | ||||||

| FHLMC, Multifamily Aggregation Risk Transfer Trust | ||||||||

| 5,635,000 | Series 2017-KT01, Class A, 1–M LIBOR + 0.320%, 1.556%, 02/25/20 (a) (b) | 5,647,527 | ||||||

|

| |||||||

Total U.S. Government-Backed Obligations | 77,346,266 | |||||||

|

| |||||||

(Cost $77,046,888) | ||||||||

See accompanying notes to financial statements.

19

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2017

Par Value | Value | |||||||

REPURCHASE AGREEMENTS - 21.92% | ||||||||

| $ | 21,000,000 | Amherst Pierpont Securities, 1.16%, Dated 08/21/17, matures 09/05/2017, repurchase price $21,010,150 (collateralized by $23,363,782 par amount of a SBA, GNMA, FNMA, and Federal National Mortgage Backed Securities, with interest rates of 1.800% to 5.250% due 01/25/23 to 07/01/47, total market value $21,468,687) | $ | 21,000,000 | ||||

| 39,700,000 | Amherst Pierpont Securities, 1.22%, Dated 08/16/17, matures 09/18/2017, repurchase price $39,744,398 (collateralized by $51,939,364 par amount of a RFCSP Strip Principal, GNMA, Federal National Mortgage Backed Securities and a United States Treasury Note, with interest rates of 0.000% to 9.250% due 10/31/18 to 06/20/47, total market value $40,817,470) | 39,700,000 | ||||||

| 10,000,000 | Amherst Pierpont Securities, 1.25%, Dated 08/04/17, matures 10/17/17, repurchase price $10,025,694 (collateralized by $10,218,998 par amount of a SBA, GNMA, and Federal National Mortgage Backed Securities, with interest rates of 2.125% to 5.000% due 06/20/23 to 07/01/47, total market value $10,294,354) | 10,000,000 | ||||||

| 21,000,000 | Amherst Pierpont Securities, 1.26%, Dated 08/31/17, matures 09/01/2017, repurchase price $21,000,735 (collateralized by $35,042,293 par amount of SBA, GNMA, FNMA and Federal National Mortgage Backed Securities, with interest rates of 1.714% to 5.870% due 01/25/19 to 04/20/45, total market value $21,558,034) | 21,000,000 | ||||||

|

| |||||||

Total Repurchase Agreements | 91,700,000 | |||||||

|

| |||||||

(Cost $91,700,000) | ||||||||

Number of |

| |||||||

REGISTERED INVESTMENT COMPANY - 0.22% | ||||||||

| 911,183 | Dreyfus Government Cash Management Fund, 0.93% (e) | 911,183 | ||||||

|

| |||||||

Total Registered Investment Company | 911,183 | |||||||

|

| |||||||

(Cost $911,183) | ||||||||

Total Investments - 113.42% | 474,487,586 | |||||||

|

| |||||||

(Cost $472,934,219) | ||||||||

Net Other Assets and | (56,144,716 | ) | ||||||

|

| |||||||

Net Assets - 100.00% | $ | 418,342,870 | ||||||

|

| |||||||

| (a) | Variable rate securities. Interest rates disclosed are those which are in effect at August 31, 2017. Maturity date shown is the date of the next coupon rate reset or actual maturity. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. For those variable rate securities which are based on published reference rates, see Explanation of Abbreviations and Acronyms below. |

| (b) | The security has Sequential collateral. |

| (c) | The security has PAC (Planned Amortization Class) collateral. |

| (d) | Represents or includes a TBA (To Be Announced) transaction. |

| (e) | Rate periodically changes. Rate disclosed is the daily yield on August 31, 2017. |

Explanation of Abbreviations and Acronyms:

12MTA | Federal Reserve US 12-Month Cumulative Average 1 Year Constant Maturity Treasury | |

FHLMC | Federal Home Loan Mortgage Corporation | |

FNMA | Federal National Mortgage Association | |

GNMA | Government National Mortgage Association | |

H15T1Y | US Treasury Yield Curve Rate T-Note Constant Maturity 1 Year | |

LIBOR | London Interbank Offered Rate | |

REMIC | Real Estate Mortgage Investment Conduit | |

RFCSP | Resolution Funding Corporation Strip | |

SBA | Small Business Administration | |

1–M | One Month | |

3–M | Three Months | |

6–M | Six Months | |

12–M | Twelve Months |

See accompanying notes to financial statements.

20

TRUST FOR CREDIT UNIONS

Statements of Assets and Liabilities

August 31, 2017

| Ultra-Short Duration Government Portfolio | Short Duration Portfolio | |||||||

ASSETS: | ||||||||

INVESTMENTS: | ||||||||

Investments and repurchase agreements at cost | $ | 387,682,167 | $ | 472,934,219 | ||||

|

|

|

| |||||

Investments at value | $ | 287,208,888 | $ | 382,787,586 | ||||

Repurchase agreements at value | 101,000,000 | 91,700,000 | ||||||

|

|

|

| |||||

Total investments and repurchase agreements at value | 388,208,888 | 474,487,586 | ||||||

|

|

|

| |||||

Cash | 267 | 681 | ||||||

RECEIVABLES: | ||||||||

Interest | 528,312 | 881,836 | ||||||

Investment securities sold | 18,373 | 25,317,968 | ||||||

Other assets | 27,502 | 30,065 | ||||||

|

|

|

| |||||

Total Assets | 388,783,342 | 500,718,136 | ||||||

|

|

|

| |||||

LIABILITIES: | ||||||||

PAYABLES: | ||||||||

Dividends | 265,627 | 337,555 | ||||||

Investment securities purchased | — | 25,098,145 | ||||||

TBA investment securities purchased | 10,436,126 | 56,754,769 | ||||||

Advisory fees | 30,384 | 33,670 | ||||||

Administration fees | 16,034 | 17,768 | ||||||

Distribution fees | 364 | 564 | ||||||

Accrued expenses | 131,720 | 132,795 | ||||||

|

|

|

| |||||

Total Liabilities | 10,880,255 | 82,375,266 | ||||||

|

|

|

| |||||

NET ASSETS | $ | 377,903,087 | $ | 418,342,870 | ||||

|

|

|

| |||||

NET ASSETS CONSIST OF: | ||||||||

Paid-in capital | $ | 385,639,284 | $ | 426,241,857 | ||||

Accumulated undistributed net investment income | 276,770 | 117,960 | ||||||

Accumulated net realized loss on investment transactions | (8,539,688 | ) | (9,570,314 | ) | ||||

Net unrealized appreciation on investments | 526,721 | 1,553,367 | ||||||

|

|

|

| |||||

TOTAL NET ASSETS | $ | 377,903,087 | $ | 418,342,870 | ||||

|

|

|

| |||||

TCU Shares: | ||||||||

Net Assets | $ | 363,611,938 | $ | 396,152,082 | ||||

Total shares outstanding, $0.001 par value (unlimited number of shares authorized) | 38,408,085 | 40,961,191 | ||||||

|

|

|

| |||||

Net asset value, offering and redemption price per share (net assets/shares outstanding) | $ | 9.47 | $ | 9.67 | ||||

|

|

|

| |||||

Investor Shares: | ||||||||

Net Assets | $ | 14,291,149 | $ | 22,190,788 | ||||

Total Shares outstanding, $0.001 par value (unlimited number of shares authorized) | 1,509,564 | 2,294,475 | ||||||

|

|

|

| |||||

Net asset value, offering and redemption price per share (net assets/shares outstanding) | $ | 9.47 | $ | 9.67 | ||||

|

|

|

| |||||

See accompanying notes to financial statements.

21

TRUST FOR CREDIT UNIONS

Statements of Operations

For the Year Ended August 31, 2017

| Ultra-Short Duration Government Portfolio | Short Duration Portfolio | |||||||

INVESTMENT INCOME: | ||||||||

Interest | $ | 4,348,972 | $ | 5,728,735 | ||||

|

|

|

| |||||

EXPENSES: | ||||||||

Advisory fees | 517,273 | 570,515 | ||||||

Administration fees | 190,914 | 210,523 | ||||||

Legal fees | 192,850 | 210,436 | ||||||

Audit and tax fees | 36,305 | 36,305 | ||||||

Custody fees | 56,773 | 58,120 | ||||||

Accounting fees | 168,158 | 185,000 | ||||||

Compliance fees | 63,137 | 65,595 | ||||||

Trustees’ fees | 96,405 | 106,129 | ||||||

Printing fees | 27,608 | 30,270 | ||||||

Transfer agent fees | 97,996 | 99,418 | ||||||

Distribution and Service (12b-1) Fees Investor Shares | 4,325 | 6,633 | ||||||

Other expenses | 111,203 | 122,650 | ||||||

|

|

|

| |||||

Total operating expenses | 1,562,947 | 1,701,594 | ||||||

|

|

|

| |||||

Trustees’ fees waived | (14,457 | ) | (15,919 | ) | ||||

Compliance fees waived | (6,021 | ) | (6,982 | ) | ||||

Legal fees waived | (2,000 | ) | (2,196 | ) | ||||

|

|

|

| |||||

Total expense reductions | (22,478 | ) | (25,097 | ) | ||||

|

|

|

| |||||

Net operating expenses | 1,540,469 | 1,676,497 | ||||||

|

|

|

| |||||

Net Investment Income | 2,808,503 | 4,052,238 | ||||||

|

|

|

| |||||

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND | ||||||||

Net Realized Gain (Loss) on Investment Transactions | 66,738 | (1,229,905 | ) | |||||

Net Change in Unrealized Appreciation (Depreciation) of: | ||||||||

Investments | (613,271 | ) | (330,687 | ) | ||||

TBA Sale Commitments | 1,289 | — | ||||||

|

|

|

| |||||

Net Realized and Unrealized Loss on Investments and TBA Sale Commitments | (545,244 | ) | (1,560,592 | ) | ||||

|

|

|

| |||||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS: | $ | 2,263,259 | $ | 2,491,646 | ||||

|

|

|

| |||||

See accompanying notes to financial statements.

22

TRUST FOR CREDIT UNIONS

Statements of Changes in Net Assets

| Ultra-Short Duration Government Portfolio | Short Duration Portfolio | |||||||||||||||

| Year Ended August 31, 2017 | Year Ended August 31, 2016 | Year Ended August 31, 2017 | Year Ended August 31, 2016 | |||||||||||||

Investment Activities: | ||||||||||||||||

Operations: | ||||||||||||||||

Net investment income | $ | 2,808,503 | $ | 1,561,029 | $ | 4,052,238 | $ | 3,198,430 | ||||||||

Net realized gain (loss) on investment transactions | 66,738 | (283,039 | ) | (1,229,905 | ) | 446,164 | ||||||||||

Net change in unrealized depreciation of investments and TBA sale commitments | (611,982 | ) | (588,682 | ) | (330,687 | ) | (19,215 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||

Net increase in net assets resulting from operations | 2,263,259 | 689,308 | 2,491,646 | 3,625,379 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Distributions to Shareholders: | ||||||||||||||||

From net investment income | ||||||||||||||||

TCU Shares | (3,232,664 | ) | (2,209,994 | ) | (4,230,342 | ) | (3,693,546 | ) | ||||||||

Investor Shares | (122,370 | ) | (77,957 | ) | (227,712 | ) | (193,652 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||

Total Distributions | (3,355,034 | ) | (2,287,951 | ) | (4,458,054 | ) | (3,887,198 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||

From Shares Transactions: | ||||||||||||||||

TCU Shares: | ||||||||||||||||

Proceeds from sale of shares | 5,000,000 | 31,662,040 | 5,000,000 | 31,000,000 | ||||||||||||

Reinvestment of dividends and distributions | 1,229,001 | 1,021,932 | 1,433,111 | 1,913,003 | ||||||||||||