UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05407

Trust for Credit Unions

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street, 3rd Floor

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jay E. Johnson

Callahan Financial Services, Inc.

1001 Connecticut Avenue NW, Suite 1001

Washington, DC 20036

(Name and address of agent for service)

With Copies To:

Michael P. Malloy

Drinker Biddle & Reath LLP

One Logan Square, Suite 2000

Philadelphia, PA 19103

Registrant's telephone number, including area code: 1-800-342-5828

Date of fiscal year end: August 31

Date of reporting period: August 31, 2019

Item 1. Reports to Stockholders.

Ultra-Short Duration Portfolio

(formerly the Ultra-Short Duration Government Portfolio)

Short Duration Portfolio

Annual Report

August 31, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary or, if you are a direct investor, by calling Trust for Credit Unions at 1-800-342-5828 or Callahan Financial Services, Inc. at 1-800-237-5678.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Funds, you can call Trust for Credit Unions at 1-800-342-5828 or Callahan Financial Services, Inc. at 1-800-237-5678. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all Trust for Credit Unions Funds you hold.

The reports concerning the Trust for Credit Unions (“TCU” or the “Trust”) Portfolios included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the Portfolios in the future. These statements are based on Portfolio management’s predictions and expectations concerning certain future events and their expected impact on the Portfolios, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Portfolios. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

TCU files the complete schedule of portfolio holdings of each Portfolio with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Portfolios’ Forms N-Q are available on the SEC’s website at http://www.sec.gov.

An investment in a TCU Portfolio is not a credit union deposit and is not insured or guaranteed by the National Credit Union Share Insurance Fund, the National Credit Union Administration, or any other government agency. |

| The TCU Ultra-Short Duration Portfolio and the TCU Short Duration Portfolio are not money market funds. Investors in these Portfolios should understand that the net asset values of the Portfolios will fluctuate, which may result in a loss of the principal amount invested. The Portfolios’ net asset values and yields are not guaranteed by the U.S. government or by its agencies, instrumentalities or sponsored enterprises. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolios if held to maturity and not to the value of the Portfolios’ shares. The Portfolios’ investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility. |

Holdings and allocations shown may not be representative of current or future investments. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities.

This material is not authorized for distribution unless preceded or accompanied by a current Prospectus. Investors should consider a Portfolio’s objectives, risks, and charges and expenses, and read the Prospectus carefully before investing or sending money. The Prospectus contains this and other information about the Portfolios.

Callahan Financial Services, Inc. is the distributor of the TCU Portfolios.

| This report is for the information of the shareholders of the Trust. Its use in connection with any offering of shares of the Trust is authorized only in the case of a concurrent or prior delivery of the Trust’s current Prospectus. |

Dear Credit Union Shareholders,

Credit unions posted solid results through the first six months of 2019 as share growth picked up. The share portfolio has expanded 6.0% over the past year, up from the 5.4% recorded a year ago, to reach $1.3 trillion. With the loan-to-share ratio topping 83% at mid-year, liquidity management is a focus of many credit unions.

While share growth accelerated, loan growth slowed over the past year to 6.5%. After a record stretch of loan growth over the past 5 years, credit unions are seeing a slight slowdown in lending activity in 2019 versus last year with loan originations down 2.5% through June. Still, credit unions are on pace to originate the second highest loan volume on record. With 120 million members and the highest earnings and capital on record, the industry has a strong foundation for growth and impact.

The rise in share balances combined with slower loan growth resulted in cash and investment balances increasing 4.5% over the past 12 months. Credit unions are staying short with cash balances at the highest level ever at June 30, 2019, $122 billion. The yield on the investment portfolio reached 2.42%, the highest in 10 years. Credit unions have taken advantage of interest rate hikes by the U.S. Federal Reserve (the “Fed”) over the past few years, but since July, the Fed lowered the target range for federal funds twice. With the market expecting additional cuts before the end of the year, credit unions may see their investment yield turning lower as we head towards 2020.

The Trust for Credit Unions (“TCU”) responded to credit union investor needs via adjustments to the Ultra-Short Duration Portfolio (formerly the Ultra-Short Duration Government Portfolio) that went into effect as of December 31, 2018. The target duration was reduced from 9-months to 3-months, and ALM First Financial Advisors, LLC (“ALM First” or the “Investment Adviser”) has more flexibility in its securities allocation. The Investment Adviser’s Discussion and Analysis in this report provides perspective from ALM First on the positioning of the TCU portfolios. Please refer to the discussions for more information.

The cumulative total return for the TCU shares of the Ultra-Short Duration Portfolio was 2.22% for the twelve-month period ended August 31, 2019, underperforming its new benchmark, effective December 31, 2018, the ICE BofAML Three Month U.S. Treasury Bill Index. The cumulative total return for the TCU shares of the Short Duration Portfolio was 5.15% over the same period. The cumulative total return of the Short Duration Portfolio exceeded its benchmark, the ICE BofAML Two Year U.S. Treasury Note Index, over the same period.

TCU continues to look for ways to enhance shareholder value. U.S. Bank Global Fund Services (“U.S. Bank”) has brought new service capabilities and efficiencies to our Portfolios since they began serving as Administrator to TCU in 2018. The expense ratios of both TCU Portfolios has fallen over the past year due in part to our new partnership with U.S. Bank. We are pleased to be working with them.

Please visit our website, www.TrustCU.com, for the most current information on the Portfolios, including performance and portfolio holdings. We also host quarterly webinars in which ALM First discusses the current market environment and provides an update on TCU portfolio performance and positioning. Please check the website for the next scheduled date. We believe providing you with the most current information is a key element of TCU’s value.

The continued support of our credit union investors, including those in the Callahan Credit Union Financial Services LLLP partnership, is the foundation of our success. We also value our ongoing work with EasCorp in providing support services for TCU. Collaboration with organizations across the credit union system is an important component of our business model.

Thank you for your interest in TCU. If you have any questions or suggestions, please reach out to our team.

Sincerely,

Jay E. Johnson

President and Treasurer

Trust for Credit Unions

1

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU ULTRA-SHORT DURATION PORTFOLIO

Investment Objective

The TCU Ultra-Short Duration Portfolio (“USDP” or the “Portfolio”) (formerly the Ultra-Short Duration Government Portfolio) seeks to achieve a high level of current income, consistent with low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. Under normal circumstances, substantially all of the assets (and at least 80%, measured at the time of purchase) of USDP will be invested in fixed-income securities consisting of the following: (i) Securities issued or guaranteed as to principal and interest by the U.S. government or by its agencies, instrumentalities or sponsored enterprises (“U.S. Government Securities”) and related custodial receipts; (2) repurchase agreements secured with obligations authorized by the Federal Credit Union Act; and (3) U.S. dollar denominated bank notes issued or guaranteed by banks with total assets exceeding $1 billion with weighted average maturities of less than 5 years, but only to the extent permitted under the Federal Credit Union Act and the rules and regulations thereunder. The Portfolio expects that a substantial portion of these securities will be mortgage-related securities. The Portfolio may also invest in non-U.S. government related securities, including bank notes and repurchase agreements secured by non-U.S. government related collateral. While there will be fluctuations in the net asset value (“NAV”) of the USDP, the Portfolio is expected to have less interest rate risk and asset value fluctuation than funds investing primarily in longer-term mortgage-backed securities paying a fixed rate of interest. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. Prior to December 31, 2018, under normal circumstances, at least 80% of the net assets (measured at the time of purchase) of USDP were invested in securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises, and the Portfolio was named the Ultra-Short Duration Government Portfolio. USDP’s maximum duration is equal to that of a One-Year U.S. Treasury Security, and its target duration is approximately that of the Three-Month U.S. Treasury Bill Index as reported by ICE BofAML.

Portfolio Management Discussion and Analysis

Below, ALM First discusses the Portfolio’s performance and positioning for the Reporting Period.

Q. How did the Portfolio perform during the Reporting Period?

For the twelve-month period ended August 31, 2019, the cumulative total return of USDP TCU Shares was 2.22% versus a 2.84% cumulative total return of the Portfolio’s blended benchmark, the 9-Month U.S. Treasury Index (weighted average return of the Six-Month U.S. Treasury Bill Index (50%) and the One-Year U.S. Treasury Note Index (50%), as reported by ICE BofAML). The ICE BofAML Three-Month U.S. Treasury Bill Index (the “Index”) became the Portfolio’s primary benchmark effective December 31, 2018. For the twelve-month period ended August 31, 2019, the cumulative total return of the Index was 2.36%. The Portfolio’s net asset value (“NAV”) per share at the end of the Reporting Period was $9.38, a decline of 2 cents from August 31, 2018.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

During the twelve-month period ended August 31, 2019, the yield curve shifted lower and flatter. The front end fell 12 to 40 bps, while for maturities 2-years and greater, the curve moved lower by over 100 basis points. Over this same time frame, spreads on mortgage assets widened as a result of increased prepayment risk in the market stemming from lower interest rates. This period also saw an increase in interest rate volatility which was a drag on Agency Mortgage Backed Security (MBS) performance. Credit spreads widened throughout 2018 on fears of a slowdown in the global economy. 2019 saw a reversal of this trend, as a more supportive Fed and positive economic data buoyed investment grade credit.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

As mentioned above, widening spreads on mortgage assets including Agency MBS were a drag on the Portfolio’s performance. Tightening spreads in credit combined with the Portfolio’s allocation to Agency Commercial MBS (CMBS) helped to provide safe harbor during what was a rather tumultuous period for MBS. Floating-rate Agency Collateralized Mortgage Obligations (CMOs) and CMBS helped to buoy the Portfolio’s performance as the front end of the yield curve fell more slowly than the long end as is typical in an easing cycle.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

Since ALM First keeps the duration of the Portfolio aligned with that of the Index to avoid taking a position on the direction of interest rates, the Portfolio’s duration neither helped nor hurt its performance. The barbell structure of the Portfolio, with front end exposure coming from floating rate assets and repurchase agreements, was able to take advantage of relatively stable front-end rates as the coupons on CMO and CMBS floaters reset lower more slowly than the rest of the curve. The biggest impact to the Portfolio’s performance was the widening in asset spreads over the 12-month period.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

No

Q. How was the Portfolio positioned relative to its benchmark index at the end of August 2019?

At the end of the Reporting Period, the Portfolio’s largest allocations were in Agency MBS securities, which the Index has no allocation to since the Index is made up only of US Treasury securities.

Past performance does not guarantee future results, which may vary.

There is no guarantee that these objectives will be met.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the Portfolio’s investments. Future investments may or may not be profitable.

2

THIS PAGE LEFT INTENTIONALLY BLANK

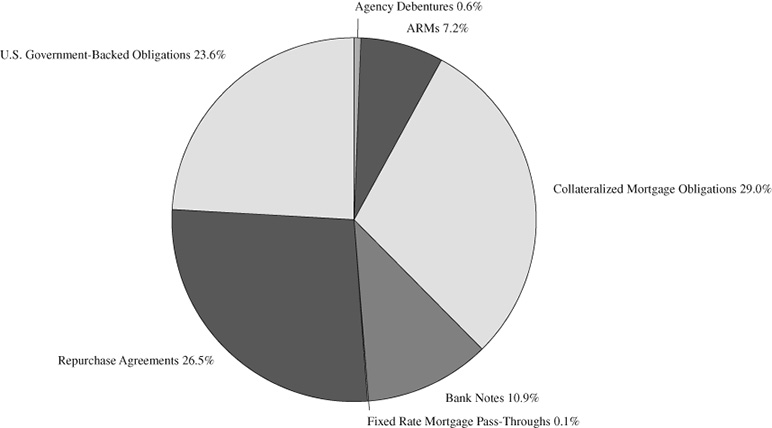

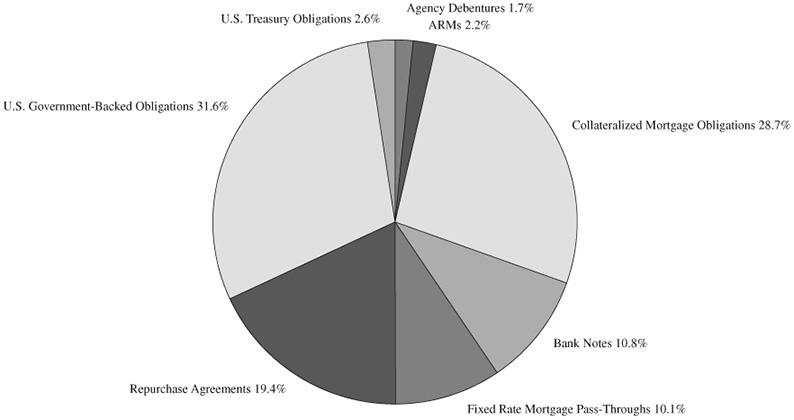

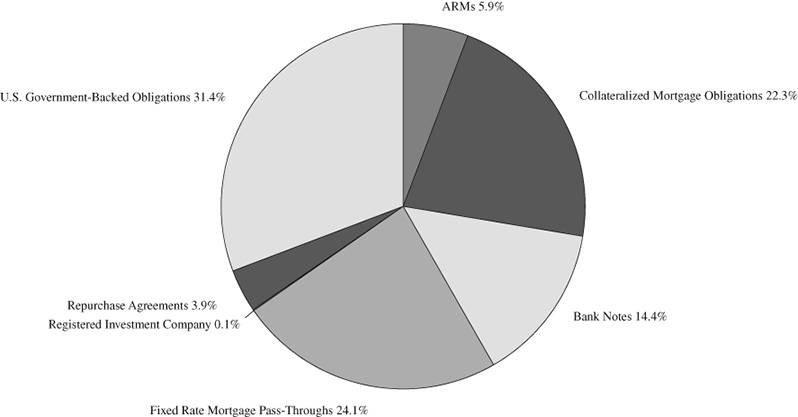

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU ULTRA-SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2019*

August 31, 2018*

4

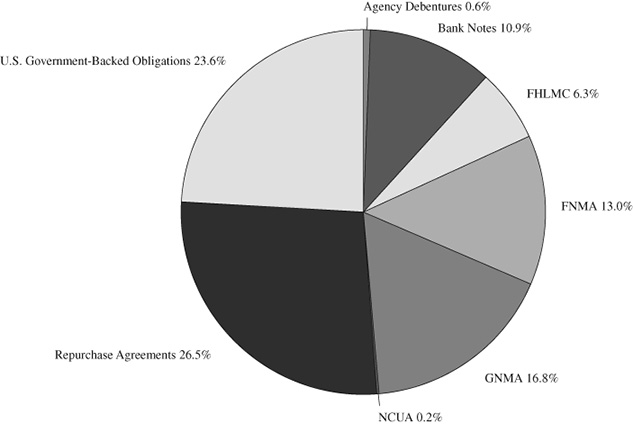

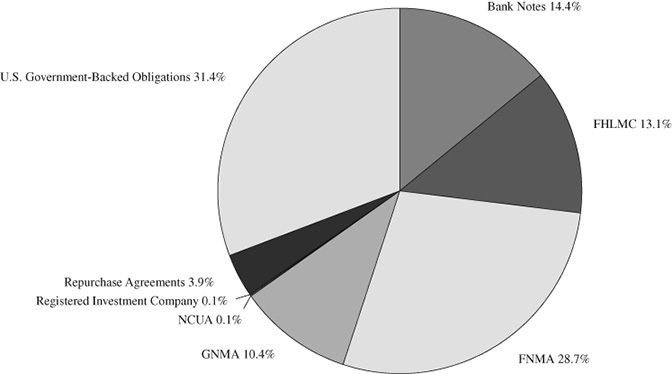

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU ULTRA-SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2019*

August 31, 2018*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities, including cash. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

5

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU SHORT DURATION PORTFOLIO

Investment Objective

The TCU Short Duration Portfolio (“SDP” or the “Portfolio”) seeks to achieve a high level of current income, consistent with relatively low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. During normal market conditions, SDP intends to invest a substantial portion of its assets in mortgage-related securities, which include privately-issued mortgage-related securities rated, at the time of purchase, in one of the two highest rating categories by a Nationally Recognized Statistical Rating Organization (“NRSRO”) and mortgage-related securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises. Mortgage-related securities held by SDP may include adjustable rate and fixed rate mortgage pass-through securities, collateralized mortgage obligations and other multi-class mortgage-related securities, as well as other securities that are collateralized by or represent direct or indirect interests in mortgage-related securities or mortgage loans. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. SDP invests in obligations authorized under the Federal Credit Union Act with a maximum portfolio duration not to exceed that of a Three-Year U.S. Treasury Security and a target duration equal to that of its benchmark, the ICE BofAML Two-Year U.S. Treasury Note Index.

Portfolio Management Discussion and Analysis

Below, ALM First discusses the Portfolio’s performance and positioning for the Reporting Period.

Q. How did the Portfolio perform during the Reporting Period?

The Portfolio’s cumulative total return for the twelve-month period ended August 31, 2019, was 5.15% for the TCU shares, versus a 4.38% cumulative total return for the ICE BofAML Two-Year U.S. Treasury Note Index. The Portfolio’s net asset value per share closed the Reporting Period at $9.75, versus $9.51 on August 31, 2018.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

During the twelve-month period ended August 31, 2019, the yield curve shifted lower and flatter. The front end fell 12 to 40 bps, while for maturities 2-years and greater, the curve moved lower by over 100 basis points. Over this same time frame, spreads on mortgage assets widened as a result of increased prepayment risk in the market stemming from lower interest rates. This period also saw an increase in interest rate volatility which was a drag on Agency Mortgage Backed Security (MBS) performance. Credit spreads widened throughout 2018 on fears of a slowdown in the global economy. 2019 saw a reversal of this trend, as a more supportive Fed and positive economic data buoyed investment grade credit.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

As mentioned above, widening spreads on mortgage assets including Agency MBS were a drag on the Portfolio’s performance. Tightening spreads in credit combined with the Portfolio’s allocation to Agency Commercial MBS (CMBS) helped to provide safe harbor during what was a rather tumultuous period for MBS. Floating-rate Agency Collateralized Mortgage Obligations (CMOs) and CMBS helped to buoy the Portfolio’s performance as the front end of the yield curve fell more slowly than the long end as is typical in an easing cycle.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

Since ALM First keeps the duration of the Portfolio aligned with that of the index to avoid taking a position on the direction of interest rates, the Portfolio’s duration neither helped nor hurt its performance. The barbell structure of the Portfolio, with front end exposure coming from floating rate assets and repurchase agreements, was able to take advantage of relatively stable front-end rates as the coupons on CMO and CMBS floaters reset lower more slowly than the rest of the curve. The biggest impact to the Portfolio’s performance was the widening in asset spreads over the 12-month period.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

No

Q. How was the Portfolio positioned at the end of August 2019?

At the end of the Reporting Period, the Portfolio’s largest allocations were in Agency MBS securities, which the index has no allocation to since the index is made up only of US Treasury securities.

Past performance does not guarantee future results, which may vary.

There is no guarantee that these objectives will be met.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the Portfolio’s investments. Future investments may or may not be profitable.

6

THIS PAGE LEFT INTENTIONALLY BLANK

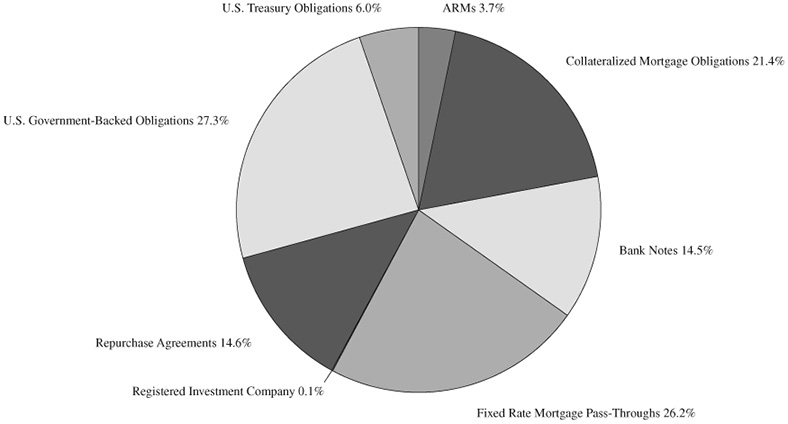

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2019*

August 31, 2018*

8

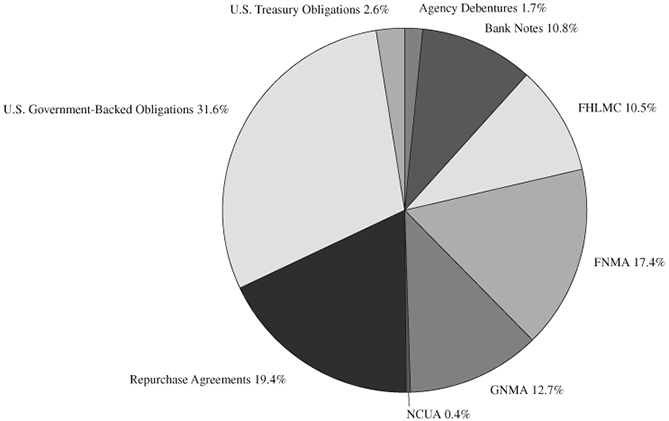

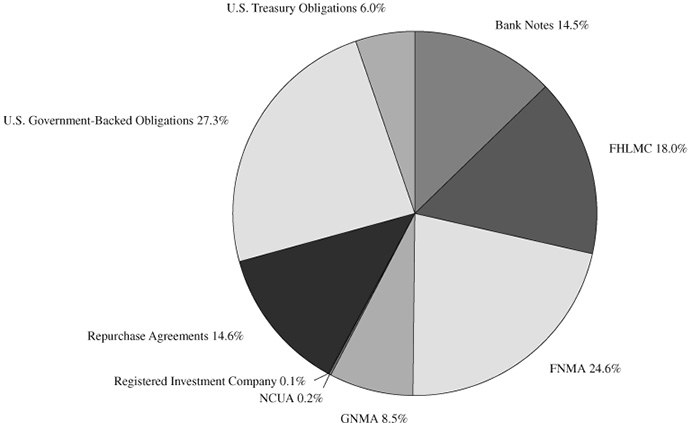

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2019*

August 31, 2018*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities, including cash. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

9

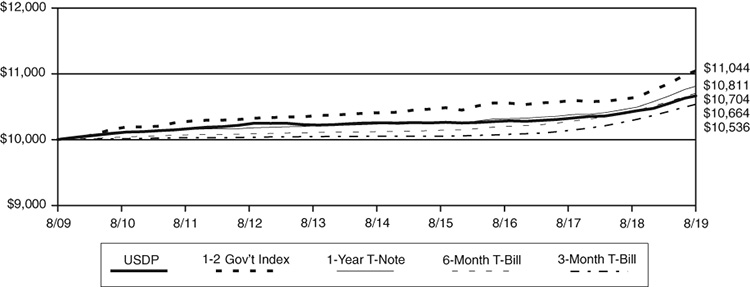

PORTFOLIO COMPARISON

TCU ULTRA-SHORT DURATION PORTFOLIO (Unaudited)

In accordance with the requirements of the Securities and Exchange Commission, the following data for the Ultra-Short Duration Portfolio is supplied for the period ended August 31, 2019. The Portfolio is compared to its benchmarks assuming the following initial investment:

| Initial | ||

Portfolio | Investment | Compare to: |

| Ultra-Short Duration (“USDP”) | $10,000 | Bloomberg Barclays Mutual Fund Short (1-2 year) Government |

| Index (“1-2 Gov’t Index”); ICE BofAML One-Year | ||

| U.S. Treasury Note Index (“1-Year T-Note”); ICE BofAML | ||

| 6-Month U.S. Treasury Bill Index (“6-Month T-Bill”); ICE BofAML | ||

| 3-Month U.S. Treasury Bill Index (“3-Month T-Bill”). |

Ultra-Short Duration Portfolio’s TCU Shares 10 Year Performance

Average Annual Total Return(a) | ||||

| One Year | Five Year | Ten Year | Since Inception | |

| TCU Shares | 2.22% | 0.80% | 0.64% | 2.67%(b) |

| Investor Shares | 2.19% | 0.76% | — | 0.56%(c) |

3-Month T-Bill (Performance since August 1, 1991)(d) | 2.36% | 0.95% | 0.52% | 2.68% |

9-Month U.S. Treasury Index (Performance since August 1, 1991)(e) | 2.84% | 1.12% | 0.73% | 3.06% |

(a) | ALM First began serving as investment adviser on April 16, 2017. Prior to that date, the Portfolio was advised by a different investment adviser. Performance of the Portfolio for periods prior to April 16, 2017 reflect management of the Portfolio by the previous investment adviser. |

(b) | The Portfolio’s TCU Shares commenced operations on July 10, 1991. |

(c) | The Portfolio’s Investor Shares commenced operations on November 30, 2012. |

(d) | The 3-Month T-Bill became the Portfolio’s primary benchmark effective December 31, 2018. |

(e) | Prior to December 31, 2018, the Portfolio’s primary benchmark was a blended benchmark, the 9-Month U.S. Treasury Index (weighted average return of the 6-Month T-Bill (50%) and the 1-Year T-Note (50%), as reported by ICE BofAML). |

The Bloomberg Barclays Mutual Fund Short (1-2 Year) Government Index, the ICE BofAML Three-Month U.S. Treasury Bill Index, the ICE BofAML Six-Month U.S. Treasury Bill Index and the ICE BofAML One-Year U.S. Treasury Note Index do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. Effective December 31, 2018 the ICE BofAML U.S. 3-Month Treasury Bill Index became the Portfolio’s primary benchmark to better reflect the current target duration and strategy of the Portfolio. The TCU Ultra-Short Duration Portfolio is not a money market fund. Investors in this Portfolio should understand that the net asset value of the Portfolio will fluctuate, which may result in a loss of the principal amount invested. The Portfolio’s net asset value and yield are not guaranteed by the U.S. government, the National Credit Union Administration, or any other U.S. government agency, instrumentality or sponsored enterprise. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolio if held to maturity and not to the value of the Portfolio’s shares. The Portfolio’s investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

10

PORTFOLIO COMPARISON

TCU ULTRA-SHORT DURATION PORTFOLIO (Unaudited) (continued)

All performance data shown represents past performance and should not be considered indicative of future performance, which will fluctuate as market conditions change. The investment return and principal value of an investment will fluctuate with changes in market conditions so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The chart and table above assume reinvestment of dividends and distributions. In addition to the investment adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting a portfolio. Please call 1-800-342-5828 or 1-800-CFS-5678 for the most recent month-end returns.

11

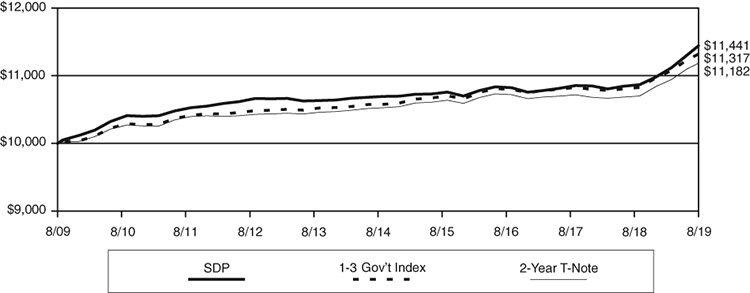

PORTFOLIO COMPARISON

TCU SHORT DURATION PORTFOLIO (Unaudited)

In accordance with the requirements of the Securities and Exchange Commission, the following data for the Short Duration Portfolio is supplied for the period ended August 31, 2019. The Portfolio is compared to its benchmarks assuming the following initial investment:

| Initial | ||

Portfolio | Investment | Compare to: |

| Short Duration (“SDP”) | $10,000 | Bloomberg Barclays Mutual Fund Short (1-3 year) Government |

| Index (“1-3 Gov’t Index”); ICE BofAML 2-Year | ||

| U.S. Treasury Note Index (“2-Year T-Note”). |

Short Duration Portfolio’s TCU Shares 10 Year Performance

Average Annual Total Return(a) | ||||

| One Year | Five Year | Ten Year | Since Inception | |

| TCU Shares | 5.15% | 1.37% | 1.36% | 3.32%(b) |

| Investor Shares | 5.12% | 1.34% | — | 1.02%(c) |

| 2-Year T-Note (Performance since October 9, 1992) | 4.38% | 1.22% | 1.12% | 3.46%(d) |

(a) | ALM First began serving as investment adviser on April 16, 2017. Prior to that date, the Portfolio was advised by a different investment adviser. Performance of the Portfolio for periods prior to April 16, 2017 reflect management of the Portfolio by the previous investment adviser. |

(b) | The Portfolio’s TCU Shares commenced operations on October 9, 1992. |

(c) | The Portfolio’s Investor Shares commenced operations on November 30, 2012. |

(d) | The Portfolio’s primary benchmark is the 2-Year T-Note. |

The Bloomberg Barclays Mutual Fund Short (1-3 Year) Government Index and the ICE BofAML Two-Year U.S. Treasury Note Index does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The TCU Short Duration Portfolio is not a money market fund. Investors in this Portfolio should understand that the net asset value of the Portfolio will fluctuate, which may result in a loss of the principal amount invested. The Portfolio’s net asset value and yield are not guaranteed by the U.S. government, the National Credit Union Administration, or any other U.S. government agency, instrumentality or sponsored enterprise. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolio if held to maturity and not to the value of the Portfolio’s shares. The Portfolio’s investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

All performance data shown represents past performance and should not be considered indicative of future performance, which will fluctuate as market conditions change. The investment return and principal value of an investment will fluctuate with changes in market conditions so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The chart and table above assume reinvestment of dividends and distributions. In addition to the investment adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting a portfolio. Please call 1-800-342-5828 or 1-800-CFS-5678 for the most recent month-end returns.

12

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments – August 31, 2019

| Par Value | Value | ||||||

| BANK NOTES – 10.92% | |||||||

| Financials – 10.92% | |||||||

| $ | 5,550,000 | BBVA USA, | |||||

| 3 Month LIBOR USD + 0.730% | |||||||

| 3.181%, 06/11/21 (a) | $ | 5,539,137 | |||||

| 3,000,000 | Branch Banking & Trust Co., | ||||||

| 3 Month LIBOR USD + 0.220% | |||||||

| 2.352%, 06/01/20 (a) | 3,001,589 | ||||||

| 1,750,000 | Capital One NA, | ||||||

| 3 Month LIBOR USD + 0.765% | |||||||

| 3.215%, 09/13/19 (a) | 1,750,423 | ||||||

| 4,200,000 | 2.350%, 01/31/20 | 4,200,910 | |||||

| 1,325,000 | 3 Month LIBOR USD + 0.820% | ||||||

| 3.007%, 08/08/22 (a) | 1,324,912 | ||||||

| 2,000,000 | Citibank NA, | ||||||

| 3 Month LIBOR USD + 0.600% | |||||||

| 2.736%, 05/20/22 (a) | 2,003,683 | ||||||

| 1,000,000 | Citizens Bank NA, | ||||||

| 2.250%, 10/30/20 | 1,001,425 | ||||||

| 5,000,000 | 3 Month LIBOR USD + 0.810% | ||||||

| 2.942%, 05/26/22 (a) | 5,007,740 | ||||||

| 2,350,000 | Discover Bank, | ||||||

| 3.100%, 06/04/20 | 2,362,316 | ||||||

| 4,000,000 | Manufacturers & Traders Trust Co., | ||||||

| 3 Month LIBOR USD + 0.610% | |||||||

| 2.734%, 05/18/22 (a) | 4,004,181 | ||||||

| 5,000,000 | Regions Bank, | ||||||

| 3 Month LIBOR USD + 0.380% | |||||||

| 2.972%, 04/01/21 (a) | 4,991,553 | ||||||

| 340,000 | 3 Month LIBOR USD + 0.500% | ||||||

| 2.676%, 08/13/21 (a) | 339,819 | ||||||

| 11,000,000 | Synchrony Bank, | ||||||

| 3 Month LIBOR USD + 0.625% | |||||||

| 3.226%, 03/30/20 (a) | 11,001,496 | ||||||

| 5,000,000 | Wells Fargo Bank NA, | ||||||

| 3 Month LIBOR USD + 0.510% | |||||||

| 2.788%, 10/22/21 (a) | 5,011,770 | ||||||

| 1,000,000 | 3 Month LIBOR USD + 0.620% | ||||||

| 2.752%, 05/27/22 (a) | 1,001,863 | ||||||

| Total Bank Notes | 52,542,817 | ||||||

| (Cost $52,580,104) | |||||||

| ASSET BACKED SECURITIES – 0.16% | |||||||

| Federal National Mortgage | |||||||

| Association REMIC – 0.14% | |||||||

| 49,082 | Series 2001-W4, Class AV1 | ||||||

| 1 Month LIBOR USD + 0.280% | |||||||

| 2.466%, 02/25/32 (a) | 48,596 | ||||||

| 86,890 | Series 2002-W2, Class AV1 | ||||||

| 1 Month LIBOR USD + 0.260% | |||||||

| 2.526%, 06/25/32 (a) | 84,270 | ||||||

| 545,779 | Series 2002-T7, Class A1 | ||||||

| 1 Month LIBOR USD + 0.110% | |||||||

| 2.331%, 07/25/32 (a) | 532,414 | ||||||

| 665,280 | |||||||

| National Credit | |||||||

| Union Administration – 0.02% | |||||||

| 119,388 | Series 2010-A1, Class A | ||||||

| 1 Month LIBOR USD + 0.350% | |||||||

| 2.563%, 12/07/20 (a)(b) | 119,109 | ||||||

| 119,109 | |||||||

| Total Asset Backed Securities | 784,389 | ||||||

| (Cost $801,148) | |||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS – 29.03% | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation REMIC – 6.19% | |||||||

| 487 | Series 1009, Class D | ||||||

| 1 Month LIBOR USD + 0.600% | |||||||

| 2.795%, 10/15/20 (a) | 481 | ||||||

| 4,130 | Series 1066, Class P | ||||||

| 1 Month LIBOR USD + 0.900% | |||||||

| 3.095%, 04/15/21 (a) | 4,078 | ||||||

| 6,513 | Series 1222, Class P | ||||||

| 10 Year CMT Rate -0.400% | |||||||

| 1.330%, 03/15/22 (a)(c) | 6,471 | ||||||

| 19,352 | Series 1250, Class J | ||||||

| 7.000%, 05/15/22 (c) | 20,174 | ||||||

| 5,114 | Series 1448, Class F | ||||||

| 1 Month LIBOR USD + 1.400% | |||||||

| 3.595%, 12/15/22 (a)(d) | 5,201 | ||||||

| 877,871 | Series 2977, Class M | ||||||

| 5.000%, 05/15/25 (c) | 920,489 | ||||||

| 1,786,395 | Series 3702, Class FG | ||||||

| 1 Month LIBOR USD + 0.450% | |||||||

| 2.645%, 08/15/32 (a)(b) | 1,791,422 | ||||||

| 1,803,933 | Series 3346, Class FT | ||||||

| 1 Month LIBOR USD + 0.350% | |||||||

| 2.545%, 10/15/33 (a)(b)(c) | 1,802,617 | ||||||

| 1,298,201 | Series 3208, Class FH | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.595%, 08/15/36 (a) | 1,301,231 | ||||||

| 107,216 | Series 3231, Class FB | ||||||

| 1 Month LIBOR USD + 0.350% | |||||||

| 2.545%, 10/15/36 (a) | 107,135 | ||||||

| 68,813 | Series 3314, Class FC | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.595%, 12/15/36 (a) | 68,892 | ||||||

| 361,600 | Series 3545, Class FA | ||||||

| 1 Month LIBOR USD + 0.850% | |||||||

| 3.045%, 06/15/39 (a) | 368,685 | ||||||

| 762,979 | Series 4248, Class QF | ||||||

| 1 Month LIBOR USD + 0.500% | |||||||

| 2.695%, 06/15/39 (a)(b) | 765,826 | ||||||

| 1,179,242 | Series 4316, Class FY | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.595%, 11/15/39 (a)(d) | 1,181,239 | ||||||

| 430,704 | Series 3827, Class KF | ||||||

| 1 Month LIBOR USD + 0.370% | |||||||

| 2.565%, 03/15/41 (a) | 431,224 | ||||||

See accompanying notes to financial statements.

13

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2019

| Par Value | Value | ||||||

| Federal Home Loan Mortgage | |||||||

| Corporation REMIC – (continued) | |||||||

| $ | 63,434 | Series 3868, Class FA | |||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.595%, 05/15/41 (a) | $ | 62,739 | |||||

| 57,051 | Series 4109, Class EC | ||||||

| 2.000%, 12/15/41 (b)(d) | 54,325 | ||||||

| 1,523,200 | Series 4606, Class FL | ||||||

| 1 Month LIBOR USD + 0.500% | |||||||

| 2.695%, 12/15/44 (a)(b) | 1,529,824 | ||||||

| 3,299,761 | Series 4566, Class FA | ||||||

| 1 Month LIBOR USD + 0.500% | |||||||

| 2.695%, 04/15/46 (a) | 3,305,861 | ||||||

| 8,975,726 | Series 4748, Class DF | ||||||

| 1 Month LIBOR USD + 0.300% | |||||||

| 2.495%, 08/15/47 (a)(c) | 8,915,402 | ||||||

| 7,133,825 | Series 4875, Class F | ||||||

| 1 Month LIBOR USD + 0.450% | |||||||

| 2.645%, 04/15/49 (a)(c) | 7,128,902 | ||||||

| 29,772,218 | |||||||

| Federal National Mortgage | |||||||

| Association REMIC – 8.23% | |||||||

| 715 | Series 1990-145, Class A | ||||||

| 3.667%, 12/25/20 (a) | 717 | ||||||

| 32,810 | Series 1991-67, Class J | ||||||

| 7.500%, 08/25/21 (c) | 33,625 | ||||||

| 50,106 | Series 1992-137, Class F | ||||||

| 1 Month LIBOR USD + 1.000% | |||||||

| 3.145%, 08/25/22 (a) | 50,626 | ||||||

| 66,038 | Series 1993-27, Class F | ||||||

| 1 Month LIBOR USD + 1.150% | |||||||

| 3.295%, 02/25/23 (a)(e) | 67,063 | ||||||

| 39,737 | Series 1998-21, Class F | ||||||

| 1 Year CMT Rate + 0.350% | |||||||

| 2.330%, 03/25/28 (a) | 39,881 | ||||||

| 129,395 | Series 2000-16, Class ZG | ||||||

| 8.500%, 06/25/30 (d) | 156,487 | ||||||

| 121,058 | Series 2000-32, Class Z | ||||||

| 7.500%, 10/18/30 | 142,155 | ||||||

| 183,044 | Series 2006-45, Class TF | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.545%, 06/25/36 (a) | 183,297 | ||||||

| 242,699 | Series 2006-76, Class QF | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.545%, 08/25/36 (a)(c) | 243,049 | ||||||

| 234,215 | Series 2006-79, Class PF | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.545%, 08/25/36 (a)(c) | 234,533 | ||||||

| 551,959 | Series 2006-111, Class FA | ||||||

| 1 Month LIBOR USD + 0.380% | |||||||

| 2.525%, 11/25/36 (a) | 552,889 | ||||||

| 229,240 | Series 2007-75, Class VF | ||||||

| 1 Month LIBOR USD + 0.450% | |||||||

| 2.595%, 08/25/37 (a) | 230,059 | ||||||

| 235,870 | Series 2007-92, Class OF | ||||||

| 1 Month LIBOR USD + 0.570% | |||||||

| 2.715%, 09/25/37 (a) | 235,402 | ||||||

| 245,669 | Series 2007-86, Class FC | ||||||

| 1 Month LIBOR USD + 0.570% | |||||||

| 2.715%, 09/25/37 (a) | 247,847 | ||||||

| 458,066 | Series 2007-85, Class FC | ||||||

| 1 Month LIBOR USD + 0.540% | |||||||

| 2.685%, 09/25/37 (a) | 461,504 | ||||||

| 313,685 | Series 2007-99, Class FD | ||||||

| 1 Month LIBOR USD + 0.600% | |||||||

| 2.745%, 10/25/37 (a) | 316,876 | ||||||

| 30,504 | Series 2009-84, Class WF | ||||||

| 1 Month LIBOR USD + 1.100% | |||||||

| 3.245%, 10/25/39 (a) | 31,186 | ||||||

| 1,091,113 | Series 2014-19, Class FA | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.545%, 11/25/39 (a)(d) | 1,094,423 | ||||||

| 1,080,391 | Series 2014-19, Class FJ | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.545%, 11/25/39 (a)(d) | 1,082,589 | ||||||

| 602,682 | Series 2010-123, Class FL | ||||||

| 1 Month LIBOR USD + 0.430% | |||||||

| 2.575%, 11/25/40 (a)(c) | 602,952 | ||||||

| 2,491,362 | Series 2011-110, Class FE | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.545%, 04/25/41 (a)(c) | 2,493,200 | ||||||

| 512,583 | Series 2011-63, Class FG | ||||||

| 1 Month LIBOR USD + 0.450% | |||||||

| 2.595%, 07/25/41 (a) | 513,709 | ||||||

| 747,087 | Series 2012-38, Class JE | ||||||

| 3.250%, 04/25/42 (c) | 766,907 | ||||||

| 2,261,016 | Series 2015-30, Class AB | ||||||

| 3.000%, 05/25/45 | 2,349,621 | ||||||

| 4,716,482 | Series 2016-62, Class FH | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.545%, 09/25/46 (a) | 4,720,324 | ||||||

| 5,545,369 | Series 2016-83, Class FK | ||||||

| 1 Month LIBOR USD + 0.500% | |||||||

| 2.645%, 11/25/46 (a) | 5,572,960 | ||||||

| 3,844,098 | Series 2017-39, Class FT | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.545%, 05/25/47 (a) | 3,847,475 | ||||||

| 4,470,166 | Series 2017-112, Class FC | ||||||

| 1 Month LIBOR USD + 0.350% | |||||||

| 2.495%, 01/25/48 (a) | 4,468,609 | ||||||

| 1,434,383 | Series 2008-22, Class FD | ||||||

| 1 Month LIBOR USD + 0.840% | |||||||

| 2.985%, 04/25/48 (a)(b) | 1,453,880 | ||||||

| 7,438,906 | Series 2019-25, Class PF | ||||||

| 1 Month LIBOR USD + 0.450% | |||||||

| 2.595%, 06/25/49 (a)(c) | 7,441,580 | ||||||

| 39,635,425 | |||||||

See accompanying notes to financial statements.

14

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2019

| Par Value | Value | ||||||

| Government National | |||||||

| Mortgage Association – 14.41% | |||||||

| $ | 1,893,644 | Series 2016-H24, Class BF | |||||

| 12 Month LIBOR USD + 0.230% | |||||||

| 3.155%, 11/20/66 (a) | $ | 1,882,793 | |||||

| 2,491,830 | Series 2017-H03, Class FA | ||||||

| 12 Month LIBOR USD + 0.310% | |||||||

| 3.430%, 12/20/66 (a) | 2,492,535 | ||||||

| 3,804,558 | Series 2017-H09, Class FJ | ||||||

| 1 Month LIBOR USD + 0.500% | |||||||

| 2.880%, 03/20/67 (a) | 3,807,282 | ||||||

| 4,002,452 | Series 2017-H07, Class FC | ||||||

| 1 Month LIBOR USD + 0.520% | |||||||

| 2.900%, 03/20/67 (a) | 4,008,867 | ||||||

| 8,989,306 | Series 2017-H11, Class FV | ||||||

| 1 Month LIBOR USD + 0.500% | |||||||

| 2.880%, 05/20/67 (a) | 8,995,967 | ||||||

| 4,492,586 | Series 2018-H01, Class FC | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.780%, 01/20/68 (a) | 4,477,311 | ||||||

| 9,848,525 | Series 2018-H01, Class FG | ||||||

| 12 Month LIBOR USD + 0.150% | |||||||

| 3.270%, 01/20/68 (a) | 9,730,651 | ||||||

| 9,354,651 | Series 2018-H11, Class FJ | ||||||

| 12 Month LIBOR USD + 0.080% | |||||||

| 2.590%, 06/20/68 (a) | 9,235,843 | ||||||

| 9,904,899 | Series 2018-H15, Class FG | ||||||

| 12 Month LIBOR USD + 0.150% | |||||||

| 3.030%, 08/20/68 (a) | 9,762,860 | ||||||

| 4,999,258 | Series 2019-H04, Class FB | ||||||

| 1 Month LIBOR USD + 0.550% | |||||||

| 2.930%, 03/20/69 (a) | 4,970,209 | ||||||

| 9,981,051 | Series 2019-H10, Class FC | ||||||

| 1 Month LIBOR USD + 0.650% | |||||||

| 3.030%, 06/20/69 (a) | 9,966,042 | ||||||

| 69,330,360 | |||||||

| National Credit Union | |||||||

| Administration – 0.20% | |||||||

| 133,579 | Series 2011-R1, Class 1A | ||||||

| 1 Month LIBOR USD + 0.450% | |||||||

| 2.679%, 01/08/20 (a)(b) | 133,603 | ||||||

| 626,409 | Series 2011-R2, Class 1A | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.629%, 02/06/20 (a)(b) | 626,410 | ||||||

| 212,104 | Series 2011-R3, Class 1A | ||||||

| 1 Month LIBOR USD + 0.400% | |||||||

| 2.611%, 03/11/20 (a)(b) | 212,405 | ||||||

| 972,418 | |||||||

| Total Collateralized | |||||||

| Mortgage Obligations | 139,710,421 | ||||||

| (Cost $139,924,398) | |||||||

| MORTGAGE-BACKED OBLIGATIONS – 7.07% | |||||||

| Federal Home Loan | |||||||

| Mortgage Corporation – 0.09% | |||||||

| 25,453 | 6 Month LIBOR USD + 1.382% | ||||||

| 4.035%, 11/01/22 (a) | 25,793 | ||||||

| 10,896 | 6 Month LIBOR USD + 1.156% | ||||||

| 3.793%, 11/01/22 (a) | 10,947 | ||||||

| 11,145 | 6 Month LIBOR USD + 2.228% | ||||||

| 4.857%, 10/01/24 (a) | 11,295 | ||||||

| 272,635 | H15T3Y + 2.558% 4.370%, 08/01/28 (a) | ||||||

| 275,164 | |||||||

| 5,707 | H15T1Y + 1.618% 4.048%, 07/01/29 (a) | ||||||

| 5,819 | |||||||

| 79,852 | H15T1Y + 1.998% 4.469%, 05/01/31 (a) | ||||||

| 81,725 | |||||||

| 410,743 | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation Gold – 0.00% | |||||||

| 10 | 5.500%, 01/01/20 | 10 | |||||

| 617 | 4.500%, 10/01/20 | 634 | |||||

| 716 | 3.500%, 12/01/20 | 742 | |||||

| 4,818 | 3.500%, 10/01/22 | 4,991 | |||||

| 575 | 4.500%, 07/01/23 | 598 | |||||

| 6,975 | |||||||

| Federal National Mortgage | |||||||

| Association – 4.63% | |||||||

| 7,295 | 11th District Cost of Funds Index + 1.250% | ||||||

| 6.864%, 12/01/19 (a) | 7,270 | ||||||

| 263 | 5.000%, 01/01/20 | 271 | |||||

| 12,149 | 3.500%, 09/01/20 | 12,578 | |||||

| 1,170 | 3.500%, 10/01/20 | 1,211 | |||||

| 5,788 | 3.500%, 03/01/21 | 5,993 | |||||

| 9,680 | H15T1Y + 2.000% 6.821%, 02/01/22 (a) | ||||||

| 9,766 | |||||||

| 8,411 | H15BDI6M + 2.425% 5.925%, 10/01/25 (a) | ||||||

| 8,259 | |||||||

| 326 | H15T1Y + 2.195% 4.755%, 02/01/27 (a) | ||||||

| 326 | |||||||

| 130,164 | 5.000%, 03/01/27 | 134,881 | |||||

| 26,264 | 11th District Cost of Funds Index + 1.250% 2.738%, 07/01/27 (a) | ||||||

| 26,228 | |||||||

| 49,767 | 11th District Cost of Funds Index + 1.500% 4.684%, 01/01/29 (a) | ||||||

| 50,760 | |||||||

| 11,762 | 11th District Cost of Funds Index + 1.500% 4.667%, 02/01/29 (a) | ||||||

| 12,189 | |||||||

| 5,000,000 | 1 Month LIBOR USD + 0.520% 2.744%, 05/01/29 (a) | ||||||

| 4,987,571 | |||||||

| 5,000,000 | 1 Month LIBOR USD + 0.580% 2.804%, 06/01/29 (a) | ||||||

| 4,988,219 | |||||||

| 32,735 | 11th District Cost of Funds Index + 1.799% 2.943%, 08/01/29 (a) | ||||||

| 32,640 | |||||||

| 46,708 | 12 Month LIBOR USD + 1.755% 4.255%, 07/01/32 (a) | ||||||

| 47,618 | |||||||

| 8,806 | 6.000%, 08/01/32 | 9,712 | |||||

See accompanying notes to financial statements.

15

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2019

| Par Value | Value | ||||||

| Federal National Mortgage | |||||||

| Association – (continued) | |||||||

| $ | 184,659 | H15T1Y + 2.625% 5.152%, 09/01/32 (a) | |||||

| $ | 192,836 | ||||||

| 22,123 | 12 Month LIBOR USD + 1.225% | ||||||

| 4.100%, 01/01/33 (a) | 22,852 | ||||||

| 25,036 | H15T1Y + 2.222% 4.757%, 06/01/33 (a) | ||||||

| 26,434 | |||||||

| 407,686 | 11th District Cost of Funds Index + 1.250% | ||||||

| 4.607%, 08/01/33 (a) | 432,390 | ||||||

| 1,631 | 6.000%, 11/01/33 | 1,862 | |||||

| 225,904 | H15T1Y + 2.068% 4.566%, 04/01/34 (a) | ||||||

| 238,348 | |||||||

| 190,936 | 11th District Cost of Funds Index + 1.250% 2.391%, 07/01/34 (a) | ||||||

| 187,846 | |||||||

| 418,392 | 11th District Cost of Funds Index + 1.250% 2.391%, 08/01/34 (a) | ||||||

| 412,524 | |||||||

| 43,993 | 6.000%, 09/01/34 | 48,812 | |||||

| 2,246 | 6.000%, 10/01/34 | 2,520 | |||||

| 218,715 | 12 Month LIBOR USD + 1.746% 4.607%, 07/01/37 (a) | ||||||

| 230,517 | |||||||

| 98,838 | 6.500%, 11/01/37 | 103,985 | |||||

| 23,379 | 6.000%, 06/01/38 | 25,843 | |||||

| 19,024 | 6.000%, 09/01/38 | 20,984 | |||||

| 9,437 | 6.000%, 09/01/38 | 10,612 | |||||

| 6,431 | 6.000%, 11/01/38 | 7,079 | |||||

| 4,768 | 6.000%, 10/01/39 | 5,249 | |||||

| 4,251,457 | 12 Month LIBOR USD + 1.692% 4.561%, 07/01/40 (a) | ||||||

| 4,393,235 | |||||||

| 4,327,313 | 12 Month LIBOR USD + 1.753% 4.668%, 02/01/42 (a) | ||||||

| 4,494,556 | |||||||

| 723,989 | 12 Month LIBOR USD + 1.745% 4.684%, 05/01/42 (a) | ||||||

| 752,795 | |||||||

| 348,727 | 11th District Cost of Funds Index + 1.250% 2.391%, 08/01/44 (a) | ||||||

| 343,993 | |||||||

| 22,290,764 | |||||||

| Government National | |||||||

| Mortgage Association – 2.35% | |||||||

| 16,686 | 7.000%, 04/15/26 | 17,941 | |||||

| 141,634 | H15T1Y + 2.000% 4.375%, 04/20/34 (a) | ||||||

| 142,587 | |||||||

| 575,636 | H15T1Y + 1.500% 3.875%, 06/20/34 (a) | ||||||

| 600,218 | |||||||

| 525,625 | H15T1Y + 1.500% 3.750%, 08/20/34 (a) | ||||||

| 548,160 | |||||||

| 49,966 | H15T1Y + 1.500% 3.875%, 05/20/42 (a) | ||||||

| 51,547 | |||||||

| 38,080 | H15T1Y + 1.500% 3.875%, 06/20/42 (a) | ||||||

| 39,287 | |||||||

| 183,802 | H15T1Y + 1.500% 3.750%, 07/20/42 (a) | ||||||

| 188,451 | |||||||

| 18,138 | H15T1Y + 1.500% 4.125%, 10/20/42 (a) | ||||||

| 18,661 | |||||||

| 39,592 | H15T1Y + 1.500% 4.125%, 12/20/42 (a) | ||||||

| 40,727 | |||||||

| 3,051,399 | 12 Month LIBOR USD + 1.784% 4.836%, 11/20/68 (a) | ||||||

| 3,318,807 | |||||||

| 5,821,044 | 12 Month LIBOR USD + 1.843% 4.644%, 06/20/69 (a) | ||||||

| 6,357,550 | |||||||

| 11,323,936 | |||||||

| Total Mortgage-Backed Obligations | 34,032,418 | ||||||

| (Cost $33,928,395) | |||||||

| AGENCY DEBENTURES – 0.57% | |||||||

| Other Agency Debentures – 0.57% | |||||||

| 2,750,000 | Sri Lanka Government AID Bond | ||||||

3 Month LIBOR USD + 0.300% 2.444%, 11/01/24 (a)(f)(g) | |||||||

| 2,750,000 | |||||||

| Total Agency Debentures | 2,750,000 | ||||||

| (Cost $2,750,000) | |||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS – 23.63% | |||||||

| FREMF Mortgage Trust | |||||||

| 6,945,000 | Series 2010-K6, Class B | ||||||

| 5.539%, 12/25/46 (a)(h) | 6,997,181 | ||||||

| FREMF Multifamily Aggregation | |||||||

| Risk Transfer Trust | |||||||

| 21,339,000 | Series 2017-KT01, Class A | ||||||

1 Month LIBOR USD + 0.320% 2.487%, 02/25/20 (a) | |||||||

| 21,338,618 | |||||||

| FHLMC, Multifamily Structured | |||||||

| Pass Through Certificates | |||||||

| 254,027 | Series K-712, Class A2 | ||||||

| 1.869%, 11/25/19 (b)(d) | 253,527 | ||||||

| 1,112,411 | Series K-P02, Class A2 | ||||||

| 2.355%, 04/25/21 (a)(b)(d) | 1,110,359 | ||||||

| 2,021,290 | Series K-F29, Class A | ||||||

1 Month LIBOR USD + 0.360% 2.584%, 02/25/24 (a)(b) | |||||||

| 2,013,625 | |||||||

| 7,910,902 | Series K-F31, Class A | ||||||

1 Month LIBOR USD + 0.370% 2.594%, 04/25/24 (a)(b) | |||||||

| 7,876,344 | |||||||

| 1,000,000 | Series K-BF1, Class A | ||||||

1 Month LIBOR USD + 0.390% 2.614%, 07/25/24 (a)(b) | |||||||

| 999,999 | |||||||

| 8,715,669 | Series K-F49, Class A | ||||||

1 Month LIBOR USD + 0.340% 2.564%, 06/25/25 (a)(b) | |||||||

| 8,663,881 | |||||||

| 15,000,000 | Series K-F55, Class A | ||||||

1 Month LIBOR USD + 0.510% 2.734%, 11/25/25 (a)(b) | |||||||

| 14,990,647 | |||||||

| 7,250,000 | Series K-F62, Class A | ||||||

1 Month LIBOR USD + 0.480% 2.704%, 04/25/26 (a)(b) | |||||||

| 7,249,995 | |||||||

| 9,769,920 | Series K-F64, Class A | ||||||

1 Month LIBOR USD + 0.440% 2.664%, 06/25/26 (a)(b) | |||||||

| 9,733,293 | |||||||

See accompanying notes to financial statements.

16

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2019

| Par Value | Value | ||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS – (continued) | |||||||

| $ | 2,395,473 | Series K-F30, Class A | |||||

1 Month LIBOR USD + 0.370% 2.594%, 03/25/27 (a)(b) | |||||||

| $ | 2,382,737 | ||||||

| 4,760,883 | Series K-F50, Class A | ||||||

1 Month LIBOR USD + 0.400% 2.624%, 07/25/28 (a)(b) | |||||||

| 4,742,271 | |||||||

| 6,173,925 | Series K-F52, Class A | ||||||

1 Month LIBOR USD + 0.420% 2.644%, 09/25/28 (a)(b) | |||||||

| 6,154,614 | |||||||

| 2,932,659 | Series K-F56, Class A | ||||||

1 Month LIBOR USD + 0.560% 2.784%, 11/25/28 (a)(b) | |||||||

| 2,933,585 | |||||||

| 10,000,000 | Series K-F65, Class A | ||||||

1 Month LIBOR USD + 0.520% 2.744%, 07/25/29 (a)(b) | |||||||

| 9,999,977 | |||||||

| 5,000,000 | Series K-F66, Class A | ||||||

1 Month LIBOR USD + 0.520% 2.744%, 07/25/29 (a)(b) | |||||||

| 5,000,000 | |||||||

| FNMA | |||||||

| 1,239,757 | Series 2017-M5, Class FA | ||||||

1 Month LIBOR USD + 0.490% 2.788%, 04/25/24 (a) | |||||||

| 1,241,371 | |||||||

| Total U.S. Government-Backed | |||||||

| Obligations | 113,682,024 | ||||||

| (Cost $113,915,774) | |||||||

| REPURCHASE AGREEMENTS – 26.48% | |||||||

| 42,000,000 | RBC Capital Markets, 2.420%, Dated | ||||||

| 08/30/19, matures 10/04/19, repurchase | |||||||

| price $42,098,817 (collateralized by | |||||||

| $37,448,452 par amount of Domestic | |||||||

Municipal Securities of 5.000% to 5.250% due 12/15/32 to 01/01/43, total market | |||||||

| value $44,924,588) | 42,000,000 | ||||||

| 9,000,000 | Amherst Pierpoint Securities, 2.511%, Dated 08/09/19, matures 09/10/19, repurchase | ||||||

| price $9,020,090 (collateralized by | |||||||

| $14,882,927 par amount of Asset Backed | |||||||

| Securities, United States Treasury Bills, | |||||||

| Government Agencies, FNMA, FHLMC, | |||||||

GNMA, and CMO Securities of 2.220% to 4.762% due 04/30/21 to 06/20/69, | |||||||

| total market value $9,456,463) | 9,000,000 | ||||||

| 10,000,000 | Amherst Pierpoint Securities, 2.482%, Dated 08/19/19, matures 09/19/19, repurchase | ||||||

| price $10,021,373 (collateralized by | |||||||

| $10,904,114 par amount of United States | |||||||

| Treasury Bills, Asset Backed Securities, | |||||||

| FNMA, FHLMC, GNMA, and CMO Securities | |||||||

of 0.125% to 4.500% due 11/15/20 to 02/25/59, total market value $10,669,989) | |||||||

| 10,000,000 | |||||||

| 15,400,000 | INTL FCStone Financial, Inc., 2.230%, Dated 08/30/2019, matures 09/03/2019, | ||||||

| repurchase price $15,403,816 (collateralized | |||||||

| by $16,475,216 par amount of GNMA and | |||||||

FNMA Securities of 3.000% to 5.000% due 12/01/32 to 07/20/49, | |||||||

| total market value $15,658,714) | 15,400,000 | ||||||

| 15,000,000 | Amherst Pierpoint Securities, 2.480%, Dated 08/01/19, matures 09/03/19, repurchase | ||||||

| price $15,034,100 (collateralized by $24,955,531 | |||||||

| par amount of United States Treasury Bills, | |||||||

| GNMA FNMA, and FHLMC Securities of | |||||||

| 2.000% to 4.300% due 01/15/26 to 09/01/49, | |||||||

| total market value $15,286,779) | 15,000,000 | ||||||

| 36,000,000 | Amherst Pierpoint Securities, 2.513%, Dated 08/08/19, matures 09/09/19, repurchase | ||||||

| price $36,080,408 (collateralized by | |||||||

| $44,864,340 par amount of United States | |||||||

| Treasury Bills, Asset Backed Securities, | |||||||

| FNMA, FHLMC, and CMO Securities of | |||||||

| 2.250% to 4.000% due 04/30/21 to 02/25/59, | |||||||

| total market value $38,307,646) | 36,000,000 | ||||||

| Total Repurchase Agreements | 127,400,000 | ||||||

| (Cost $127,400,000) | |||||||

| Total Investments – 97.86% | 470,902,069 | ||||||

| (Cost $471,299,819) | |||||||

| Net Other Assets | |||||||

| and Liabilities – 2.14% | 10,296,400 | ||||||

| Net Assets – 100.00% | $ | 481,198,469 | |||||

| (a) | Variable rate securities. Interest rates disclosed are those which are in effect at August 31, 2019. Maturity date shown is the date of the next coupon rate reset or actual maturity. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. For those variable rate securities which are based on published reference and spread, the reference rate and spread are indicated in the description in the Portfolio of Investments. See also, Explanation of Abbreviations and Acronyms below. |

| (b) | The security has Structured collateral. |

| (c) | The security has PAC (Planned Amortization Class) collateral. |

| (d) | The security has Sequential collateral. |

| (e) | The security has Support collateral. |

| (f) | Security has been valued at fair market value as determined in good faith by or under the direction of the Board of Trustees of the Trust. As of August 31, 2019, this security amounted to $2,750,000 or 0.57% of net assets. Investment categorized as a significant unobservable input (Level 3). |

| (g) | Illiquid security. The total market value of this security was $2,750,000, representing 0.57% of net assets. |

| (h) | Securities issued pursuant to Rule 144A under the Securities Act of 1933. Such securities are deemed to be liquid and the aggregate value, $6,997,181, represents 1.45% of net assets. |

See accompanying notes to financial statements.

17

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2019

Explanation of Abbreviations and Acronyms:

| CMO | Collateralized Mortgage Obligation |

| CMT | Constant Maturity Treasury |

| FHLMC | Federal Home Loan Mortgage Corporation |

| FNMA | Federal National Mortgage Association |

| FREMF | Freddie Mac Multifamily Fixed-Rate Mortgage Loans |

| GNMA | Government National Mortgage Association |

| H15BDI6M | US Treasury Bill 3 Month Auction High Discount Rate |

| H15T1Y | US Treasury Yield Curve Rate T-Note Constant Maturity 1 Year |

| H15T3Y | US Treasury Yield Curve Rate T-Note Constant Maturity 3 Year |

| LIBOR | London Interbank Offered Rate |

| REMIC | Real Estate Mortgage Investment Conduit |

| USD | U.S. Dollar |

See accompanying notes to financial statements.

18

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments – August 31, 2019

| Par Value | Value | ||||||

| BANK NOTES – 14.37% | |||||||

| Financials – 14.37% | |||||||

| $ | 2,000,000 | Associated Bank NA, | |||||

| 3.500%, 08/13/21 | $ | 2,042,295 | |||||

| 5,000,000 | BBVA USA, | ||||||

3 Month LIBOR USD + 0.730% 3.181%, 06/11/21 (a) | |||||||

| 4,990,213 | |||||||

| 4,000,000 | Capital One NA, | ||||||

| 2.950%, 07/23/21 | 4,050,302 | ||||||

| 2,500,000 | 2.250%, 09/13/21 | 2,503,495 | |||||

| 2,575,000 | Citizens Bank NA, | ||||||

3 Month LIBOR USD + 0.570% 2.702%, 05/26/20 (a) | |||||||

| 2,582,764 | |||||||

| 1,000,000 | 2.200%, 05/26/20 | 999,833 | |||||

| 2,000,000 | 2.250%, 10/30/20 | 2,002,851 | |||||

| 1,500,000 | Fifth Third Bank, | ||||||

| 2.875%, 10/01/21 | 1,522,990 | ||||||

| 5,500,000 | Huntington National Bank, | ||||||

| 3.250%, 05/14/21 | 5,594,112 | ||||||

| 2,000,000 | KeyBank NA, | ||||||

3 Month LIBOR USD + 0.660% 2.913%, 02/01/22 (a) | |||||||

| 2,009,288 | |||||||

| 11,250,000 | Manufacturers & Traders Trust Co., | ||||||

3 Month LIBOR USD + 0.610% 2.734%, 05/18/22 (a) | |||||||

| 11,261,759 | |||||||

| 3,000,000 | PNC Bank NA, | ||||||

| 2.550%, 12/09/21 | 3,034,323 | ||||||

| 5,200,000 | Regions Bank, | ||||||

3 Month LIBOR USD + 0.380% 2.972%, 04/01/21 (a) | |||||||

| 5,191,215 | |||||||

| 5,000,000 | Synchrony Bank, | ||||||

3 Month LIBOR USD + 0.625% 3.226%, 03/30/20 (a) | |||||||

| 5,000,680 | |||||||

| 5,000,000 | Wells Fargo Bank NA, | ||||||

3 Month LIBOR USD + 0.510% 2.788%, 10/22/21 (a) | |||||||

| 5,011,770 | |||||||

| Total Bank Notes | 57,797,890 | ||||||

| (Cost $57,514,927) | |||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS – 22.32% | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation REMIC – 4.52% | |||||||

| 11,932 | Series 1448, Class F | ||||||

1 Month LIBOR USD + 1.400% 3.595%, 12/15/22 (a)(b) | |||||||

| 12,135 | |||||||

| 202,924 | Series 2868, Class AV | ||||||

| 5.000%, 08/15/24 (b)(c) | 212,645 | ||||||

| 138,750 | Series 1980, Class Z | ||||||

| 7.000%, 07/15/27 (b) | 156,942 | ||||||

| 1,496,612 | Series 3346, Class FT | ||||||

1 Month LIBOR USD + 0.350% 2.545%, 10/15/33 (a)(c)(d) | |||||||

| 1,495,520 | |||||||

| 1,284,771 | Series 3471, Class FB | ||||||

1 Month LIBOR USD + 1.000% 3.195%, 08/15/35 (a) | |||||||

| 1,306,878 | |||||||

| 1,955,123 | Series 3208, Class FA | ||||||

1 Month LIBOR USD + 0.400% 2.595%, 08/15/36 (a) | |||||||

| 1,959,685 | |||||||

| 656,921 | Series 3208, Class FH | ||||||

1 Month LIBOR USD + 0.400% 2.595%, 08/15/36 (a) | |||||||

| 658,454 | |||||||

| 398,140 | Series 3367, Class YF | ||||||

1 Month LIBOR USD + 0.550% 2.745%, 09/15/37 (a) | |||||||

| 401,240 | |||||||

| 1,578,663 | Series 3371, Class FA | ||||||

1 Month LIBOR USD + 0.600% 2.795%, 09/15/37 (a) | |||||||

| 1,593,569 | |||||||

| 712,459 | Series 4248, Class QF | ||||||

1 Month LIBOR USD + 0.500% 2.695%, 06/15/39 (a)(c) | |||||||

| 715,118 | |||||||

| 1,170,571 | Series 4316, Class FY | ||||||

1 Month LIBOR USD + 0.400% 2.595%, 11/15/39 (a)(b) | |||||||

| 1,172,553 | |||||||

| 270,246 | Series 3827, Class KF | ||||||

1 Month LIBOR USD + 0.370% 2.565%, 03/15/41 (a) | |||||||

| 270,572 | |||||||

| 45,458 | Series 4109, Class EC | ||||||

| 2.000%, 12/15/41 (b)(c) | 43,286 | ||||||

| 1,317,118 | Series 4272, Class FD | ||||||

1 Month LIBOR USD + 0.350% 2.545%, 11/15/43 (a) | |||||||

| 1,314,523 | |||||||

| 2,132,480 | Series 4606, Class FL | ||||||

1 Month LIBOR USD + 0.500% 2.695%, 12/15/44 (a)(c) | |||||||

| 2,141,754 | |||||||

| 4,555,798 | Series 4784, Class PK | ||||||

| 3.500%, 06/15/45 (d) | 4,730,023 | ||||||

| 18,184,897 | |||||||

| Federal National Mortgage | |||||||

| Association REMIC – 7.44% | |||||||

| 1,170 | Series G92-44, Class Z | ||||||

| 8.000%, 07/25/22 | 1,223 | ||||||

| 3,194,350 | Series 2013-57, Class DK | ||||||

| 3.500%, 06/25/33 | 3,411,153 | ||||||

| 264,933 | Series 2006-45, Class TF | ||||||

1 Month LIBOR USD + 0.400% 2.545%, 06/25/36 (a) | |||||||

| 265,298 | |||||||

| 287,158 | Series 2006-76, Class QF | ||||||

1 Month LIBOR USD + 0.400% 2.545%, 08/25/36 (a)(d) | |||||||

| 287,572 | |||||||

| 171,930 | Series 2007-75, Class VF | ||||||

1 Month LIBOR USD + 0.450% 2.595%, 08/25/37 (a) | |||||||

| 172,545 | |||||||

| 931,936 | Series 2014-19, Class FA | ||||||

1 Month LIBOR USD + 0.400% 2.545%, 11/25/39 (a)(b) | |||||||

| 934,763 | |||||||

| 1,073,236 | Series 2014-19, Class FJ | ||||||

1 Month LIBOR USD + 0.400% 2.545%, 11/25/39 (a)(b) | |||||||

| 1,075,419 | |||||||

See accompanying notes to financial statements.

19

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2019

| Par Value | Value | ||||||

| Federal National Mortgage | |||||||

| Association REMIC – (continued) | |||||||

| $ | 238,173 | Series 2010-123, Class FL | |||||

1 Month LIBOR USD + 0.430% 2.575%, 11/25/40 (a)(d) | |||||||

| $ | 238,280 | ||||||

| 815,658 | Series 2011-110, Class FE | ||||||

1 Month LIBOR USD + 0.400% 2.545%, 04/25/41 (a)(d) | |||||||

| 816,259 | |||||||

| 462,778 | Series 2015-92, Class PA | ||||||

| 2.500%, 12/25/41 (c)(d) | 475,579 | ||||||

| 599,234 | Series 2012-38, Class JE | ||||||

| 3.250%, 04/25/42 (d) | 615,131 | ||||||

| 1,457,319 | Series 2012-71, Class FL | ||||||

1 Month LIBOR USD + 0.500% 2.645%, 07/25/42 (a) | |||||||

| 1,463,822 | |||||||

| 5,543,511 | Series 2016-62, Class FH | ||||||

1 Month LIBOR USD + 0.400% 2.545%, 09/25/46 (a) | |||||||

| 5,548,027 | |||||||

| 5,883,078 | Series 2016-83, Class FK | ||||||

1 Month LIBOR USD + 0.500% 2.645%, 11/25/46 (a) | |||||||

| 5,912,348 | |||||||

| 3,844,098 | Series 2017-39, Class FT | ||||||

1 Month LIBOR USD + 0.400% 2.545%, 05/25/47 (a) | |||||||

| 3,847,475 | |||||||

| 3,733,611 | Series 2017-112, Class FC | ||||||

1 Month LIBOR USD + 0.350% 2.495%, 01/25/48 (a) | |||||||

| 3,732,311 | |||||||

| 1,113,525 | Series 2008-22, Class FD | ||||||

1 Month LIBOR USD + 0.840% 2.985%, 04/25/48 (a)(c) | |||||||

| 1,128,660 | |||||||

| 29,925,865 | |||||||

| Government National Mortgage | |||||||

| Association – 10.23% | |||||||

| 3,804,558 | Series 2017-H09, Class FJ | ||||||

1 Month LIBOR USD + 0.500% 2.880%, 03/20/67 (a) | |||||||

| 3,807,282 | |||||||

| 4,002,452 | Series 2017-H07, Class FC | ||||||

1 Month LIBOR USD + 0.520% 2.900%, 03/20/67 (a) | |||||||

| 4,008,867 | |||||||

| 4,492,586 | Series 2018-H01, Class FC | ||||||

1 Month LIBOR USD + 0.400% 2.780%, 01/20/68 (a) | |||||||

| 4,477,311 | |||||||

| 9,788,854 | Series 2018-H09, Class FC | ||||||

12 Month LIBOR USD + 0.150% 2.887%, 06/20/68 (a) | |||||||

| 9,665,451 | |||||||

| 9,354,651 | Series 2018-H11, Class FJ | ||||||

12 Month LIBOR USD + 0.080% 2.590%, 06/20/68 (a) | |||||||

| 9,235,843 | |||||||

| 9,981,051 | Series 2019-H10, Class FC | ||||||

1 Month LIBOR USD + 0.650% 3.030%, 06/20/69 (a) | |||||||

| 9,966,042 | |||||||

| 41,160,796 | |||||||

| National Credit Union | |||||||

| Administration – 0.13% | |||||||

| 303,714 | Series 2011-R2, Class 1A | ||||||

1 Month LIBOR USD + 0.400% 2.629%, 02/06/20 (a)(c) | |||||||

| 303,714 | |||||||

| 237,058 | Series 2011-R3, Class 1A | ||||||

1 Month LIBOR USD + 0.400% 2.611%, 03/11/20 (a)(c) | |||||||

| 237,394 | |||||||

| 541,108 | |||||||

| Total Collateralized Mortgage | |||||||

| Obligations | 89,812,666 | ||||||

| (Cost $89,619,521) | |||||||

| MORTGAGE-BACKED OBLIGATIONS – 29.94% | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation – 1.47% | |||||||

| 25,110 | 12 Month LIBOR USD + 1.735% 4.735%, 01/01/34 (a) | ||||||

| 26,257 | |||||||

| 73,252 | 12 Month LIBOR USD + 1.840% 4.659%, 11/01/34 (a) | ||||||

| 76,905 | |||||||

| 250,283 | H15T1Y+ 2.250% 4.812%, 08/01/35 (a) | ||||||

| 264,339 | |||||||

| 334,411 | 12 Month LIBOR USD + 1.770% 4.794%, 05/01/36 (a) | ||||||

| 352,159 | |||||||

| 266,539 | 12 Month LIBOR USD + 1.890% 4.910%, 03/01/42 (a) | ||||||

| 276,622 | |||||||

| 4,760,047 | 3.000%, 02/01/47 | 4,896,154 | |||||

| 5,892,436 | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation Gold – 7.09% | |||||||

| 11 | 5.500%, 01/01/20 | 11 | |||||

| 23,640 | 5.000%, 04/01/20 | 24,377 | |||||

| 511 | 4.500%, 10/01/20 | 525 | |||||

| 593 | 3.500%, 12/01/20 | 614 | |||||

| 3,988 | 3.500%, 10/01/22 | 4,131 | |||||

| 7,419,164 | 2.000%, 12/01/31 | 7,408,233 | |||||

| 91,563 | 5.000%, 08/01/35 | 101,870 | |||||

| 12,205 | 5.000%, 12/01/35 | 13,589 | |||||

| 3,927,905 | 3.000%, 01/01/37 | 4,045,774 | |||||

| 3,954,085 | 3.000%, 02/01/37 | 4,072,712 | |||||

| 5,821,483 | 3.500%, 02/01/37 | 6,051,170 | |||||

| 5,442,575 | 3.500%, 03/01/37 | 5,656,707 | |||||

| 122,355 | 5.000%, 03/01/37 | 136,088 | |||||

| 248,869 | 5.000%, 05/01/37 | 277,173 | |||||

| 209,061 | 5.000%, 02/01/38 | 232,383 | |||||

| 76,800 | 5.000%, 03/01/38 | 85,251 | |||||

| 56,485 | 5.000%, 09/01/38 | 62,851 | |||||

| 192,652 | 5.000%, 12/01/38 | 214,370 | |||||

| 125,973 | 5.000%, 01/01/39 | 140,191 | |||||

| 28,528,020 | |||||||

| Federal National Mortgage | |||||||

| Association – 21.29% | |||||||

| 10,028 | 3.500%, 09/01/20 | 10,382 | |||||

| 965 | 3.500%, 10/01/20 | 1,000 | |||||

| 4,777 | 3.500%, 03/01/21 | 4,946 | |||||

See accompanying notes to financial statements.

20

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2019

| Par Value | Value | ||||||

| Federal National Mortgage | |||||||

| Association – (continued) | |||||||

| $ | 7,164,623 | 2.669%, 08/01/22 | $ | 7,361,248 | |||

| 104,132 | 5.000%, 03/01/27 | 107,905 | |||||

| 26,296 | 7.000%, 08/01/28 | 26,312 | |||||

| 34,181 | 7.000%, 08/01/28 | 34,355 | |||||

| 125,971 | 7.000%, 11/01/28 | 136,596 | |||||

| 5,233,000 | 1 Month LIBOR USD + 0.520% 2.744%, 05/01/29 (a) | ||||||

| 5,219,992 | |||||||

| 117,645 | 2.500%, 02/01/32 | 119,326 | |||||

| 13,928 | 7.000%, 02/01/32 | 15,618 | |||||

| 28,511 | H15T1Y+ 2.235% 4.735%, 05/01/32 (a) | ||||||

| 28,582 | |||||||

| 82,452 | 7.000%, 05/01/32 | 90,358 | |||||

| 189,634 | H15T1Y+ 2.625% 5.152%, 09/01/32 (a) | ||||||

| 198,031 | |||||||

| 8,956 | 7.000%, 09/01/32 | 9,010 | |||||

| 10,056,555 | 4.000%, 04/01/33 | 10,694,468 | |||||

| 271,240 | H15T1Y+ 2.215% 4.602%, 07/01/33 (a) | ||||||

| 286,412 | |||||||

| 150,378 | 12 Month LIBOR USD + 1.537% 4.412%, 11/01/33 (a) | ||||||

| 154,772 | |||||||

| 241,463 | H15T1Y+ 2.215% 4.721%, 12/01/33 (a) | ||||||

| 251,533 | |||||||

| 4,073,533 | 4.500%, 01/01/34 | 4,295,157 | |||||

| 1,318,048 | 4.500%, 01/01/34 | 1,391,071 | |||||

| 51,052 | 12 Month LIBOR USD + 1.715% 4.340%, 03/01/34 (a) | ||||||

| 53,381 | |||||||

| 238,988 | 12 Month LIBOR USD + 1.545% 4.452%, 04/01/34 (a) | ||||||

| 250,496 | |||||||

| 83,029 | H15T1Y+ 2.185% 4.435%, 08/01/34 (a) | ||||||

| 88,186 | |||||||

| 989 | 6.000%, 09/01/34 | 1,132 | |||||

| 96,627 | 12 Month LIBOR USD + 1.637% 4.491%, 10/01/34 (a) | ||||||

| 100,849 | |||||||

| 68,208 | 12 Month LIBOR USD + 1.632% 4.632%, 03/01/35 (a) | ||||||

| 71,019 | |||||||

| 75,578 | 12 Month LIBOR USD + 1.720% 4.720%, 04/01/35 (a) | ||||||

| 79,144 | |||||||

| 220,329 | H15T1Y+ 2.313% 4.822%, 05/01/35 (a) | ||||||

| 233,052 | |||||||

| 170,232 | 12 Month LIBOR USD + 1.439% 4.456%, 05/01/35 (a) | ||||||

| 176,914 | |||||||

| 128,141 | 6 Month LIBOR USD + 1.412% 4.107%, 06/01/35 (a) | ||||||

| 131,554 | |||||||

| 1,831,218 | 4.000%, 06/01/35 | 1,929,152 | |||||

| 312,791 | 12 Month LIBOR USD + 1.750% 4.408%, 08/01/35 (a) | ||||||

| 329,654 | |||||||

| 178,201 | 6 Month LIBOR USD + 1.514% 4.114%, 08/01/35 (a) | ||||||

| 184,388 | |||||||

| 179,022 | 12 Month LIBOR USD + 2.435% 4.906%, 09/01/35 (a) | ||||||

| 192,179 | |||||||

| 145,429 | H15T1Y+ 2.085% 4.271%, 10/01/35 (a) | ||||||

| 152,723 | |||||||

| 552,917 | 12 Month LIBOR USD + 1.558% 4.341%, 11/01/35 (a) | ||||||

| 572,642 | |||||||

| 241,470 | 12 Month LIBOR USD + 1.737% 4.804%, 03/01/36 (a) | ||||||

| 253,721 | |||||||

| 292,595 | 12MTA + 2.489% 4.926%, 04/01/36 (a) | ||||||

| 309,112 | |||||||

| 4,412,560 | 4.500%, 12/01/38 | 4,672,175 | |||||

| 63,540 | 5.000%, 10/01/39 | 70,263 | |||||

| 930,843 | 12 Month LIBOR USD + 1.745% 4.680%, 05/01/42 (a) | ||||||

| 967,880 | |||||||

| 619,397 | 12 Month LIBOR USD + 1.700% 4.561%, 06/01/42 (a) | ||||||

| 643,207 | |||||||

| 1,009,617 | 12 Month LIBOR USD + 1.679% 2.397%, 10/01/42 (a) | ||||||

| 1,046,125 | |||||||

| 821,975 | 12 Month LIBOR USD + 1.595% 4.151%, 12/01/44 (a) | ||||||

| 845,476 | |||||||

| 4,485,176 | 12 Month LIBOR USD + 1.610% 3.184%, 04/01/47 (a) | ||||||

| 4,608,819 | |||||||

| 4,552,833 | 12 Month LIBOR USD + 1.607% 3.059%, 09/01/47 (a) | ||||||

| 4,677,870 | |||||||

| 13,398,017 | 4.500%, 06/01/48 | 14,140,870 | |||||

| 4,859,061 | 3.500%, 04/01/49 | 5,018,912 | |||||

| 5,057,753 | 4.000%, 05/01/49 | 5,275,431 | |||||

| 8,000,000 | 3.000%, 09/01/49 | 8,158,015 | |||||

| 85,671,415 | |||||||

| Government National | |||||||

| Mortgage Association – 0.09% | |||||||

| 55,026 | H15T1Y+ 1.500% 3.875%, 05/20/42 (a) | ||||||

| 56,767 | |||||||

| 43,333 | H15T1Y+ 1.500% 3.875%, 06/20/42 (a) | ||||||

| 44,706 | |||||||

| 203,565 | H15T1Y+ 1.500% 3.750%, 07/20/42 (a) | ||||||

| 208,714 | |||||||

| 20,640 | H15T1Y+ 1.500% 4.125%, 10/20/42 (a) | ||||||

| 21,235 | |||||||

| 44,289 | H15T1Y+ 1.500% 4.125%, 12/20/42 (a) | ||||||

| 45,559 | |||||||

| 376,981 | |||||||

| Total Mortgage-Backed Obligations | 120,468,852 | ||||||

| (Cost $118,398,325) | |||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS – 31.35% | |||||||

| FRESB, Multifamily Mortgage Pass | |||||||

| Through Certificates | |||||||

| 5,986,499 | Series 2019-SB60, Class A10H | ||||||

1 Month LIBOR USD + 3.500% 3.500%, 01/25/39 (a) | |||||||

| 6,411,099 | |||||||

| FHLMC, Multifamily Structured | |||||||

| Pass Through Certificates | |||||||

| 1,226,504 | Series K-P02, Class A2 | ||||||

| 2.355%, 04/25/21 (a)(b)(c) | 1,224,242 | ||||||

| 4,167,000 | Series K-031, Class A2 | ||||||

| 3.300%, 04/25/23 (a)(b)(c) | 4,371,879 | ||||||

| 1,928,216 | Series K-726, Class A1 | ||||||

| 2.596%, 08/25/23 (b)(c) | 1,952,022 | ||||||

See accompanying notes to financial statements.

21

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2019

| Par Value | Value | ||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS – (continued) | |||||||

| $ | 701,012 | Series K-727, Class A1 | |||||

| 2.632%, 10/25/23 (b)(c) | $ | 709,519 | |||||

| 2,021,290 | Series K-F29, Class A | ||||||

1 Month LIBOR USD + 0.360% 2.584%, 02/25/24 (a)(c) | |||||||

| 2,013,625 | |||||||

| 5,000,000 | Series K-726, Class AM | ||||||

| 2.985%, 04/25/24 (b)(c) | 5,236,097 | ||||||

| 10,000,000 | Series K-728, Class AM | ||||||

| 3.133%, 08/25/24 (a)(b)(c) | 10,549,050 | ||||||

| 4,707,430 | Series K-F49, Class A | ||||||

1 Month LIBOR USD + 0.340% 2.564%, 06/25/25 (a)(c) | |||||||

| 4,679,458 | |||||||

| 10,175,000 | Series K-C02, Class A2 | ||||||

| 3.370%, 07/25/25 (b)(c) | 10,760,506 | ||||||

| 12,000,000 | Series K-733, Class AM | ||||||

| 3.750%, 09/25/25 (b)(c) | 13,127,814 | ||||||

| 5,000,000 | Series K-734, Class AM | ||||||

| 3.435%, 02/25/26 (a)(b)(c) | 5,438,322 | ||||||

| 787,693 | Series K-F27, Class A | ||||||

1 Month LIBOR USD + 0.420% 2.644%, 12/25/26 (a)(c) | |||||||

| 784,984 | |||||||

| 5,000,000 | Series K-J24, Class A2 | ||||||

| 2.821%, 09/25/27 (b)(c) | 5,271,766 | ||||||

| 5,000,000 | Series K-070, Class A2 | ||||||

| 3.303%, 11/25/27 (a)(c) | 5,479,411 | ||||||

| 1,132,213 | Series K-091, Class A1 | ||||||

| 3.339%, 10/25/28 (b)(c) | 1,225,358 | ||||||

| 9,627,244 | Series K-S10, Class A10 | ||||||

1 Month LIBOR USD + 0.610% 2.834%, 10/25/28 (a)(c) | |||||||

| 9,603,557 | |||||||

| 6,842,871 | Series K-F56, Class A | ||||||

1 Month LIBOR USD + 0.560% 2.784%, 11/25/28 (a)(c) | |||||||

| 6,845,031 | |||||||

| 8,000,000 | Series K-087, Class A2 | ||||||

| 3.771%, 12/25/28 (b)(c) | 9,125,491 | ||||||

| 5,000,000 | Series K-F59, Class A | ||||||

1 Month LIBOR USD + 0.540% 2.764%, 02/25/29 (a)(c) | |||||||

| 4,999,996 | |||||||

| 5,000,000 | Series K-091, Class AM | ||||||

| 3.566%, 03/25/29 (b)(c) | 5,607,727 | ||||||

| 5,000,000 | Series K-093, Class AM | ||||||

| 2.726%, 05/25/29 (b)(c) | 5,265,092 | ||||||

| FNMA | |||||||

| 2,716,234 | Series 2013-M6, Class 2A | ||||||

| 2.605%, 03/25/23 (a) | 2,778,146 | ||||||

| 2,543,747 | Series 2018-M1, Class A1 | ||||||

| 3.085%, 12/25/27 (a)(b) | 2,670,102 | ||||||

| Total U.S. Government-Backed | |||||||

| Obligations | 126,130,294 | ||||||

| (Cost $120,462,786) | |||||||

| REPURCHASE AGREEMENTS – 3.90% | |||||||

| 15,700,000 | INTL FCStone Financial, Inc., 2.23%, Dated 08/30/2019, matures 09/03/2019, | ||||||

| repurchase price $15,703,890 (collateralized | |||||||

| 15,700,000 by $18,536,777 par amount of | |||||||

| United States Treasury Bills, GNMA, FNMA, | |||||||

and FHLMC Securities of 0.000% to 7.000% due 09/12/19 to 07/20/49, | |||||||

| total market value $15,966,205) | 15,700,000 | ||||||

| Total Repurchase Agreements | 15,700,000 | ||||||

| (Cost $15,700,000) | |||||||

| REGISTERED INVESTMENT COMPANY – 0.05% | |||||||

| 192,151 | First American Government | ||||||

| Obligations Fund – Class X | |||||||

| 2.025%, 12/01/31 (e) | 192,151 | ||||||

| Total Registered Investment Company | 192,151 | ||||||

| (Cost $192,151) | |||||||

| Total Investments – 101.93% | 410,101,853 | ||||||

| (Cost $401,887,710) | |||||||

| Net Other Assets | |||||||

| and Liabilities – (1.93)% | (7,773,020 | ) | |||||

| Net Assets – 100.00% | $ | 402,328,833 | |||||