UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05407

Trust for Credit Unions

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street, 3rd Floor

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jay E. Johnson

Callahan Financial Services, Inc.

1001 Connecticut Avenue NW, Suite 1001

Washington, DC 20036

(Name and address of agent for service)

With Copies To:

Andrew E. Seaberg

Faegre Drinker Biddle & Reath LLP

One Logan Square, Suite 2000

Philadelphia, PA 19103

Registrant's telephone number, including area code: 1-800-342-5828

Date of fiscal year end: August 31

Date of reporting period: August 31, 2021

Item 1. Reports to Stockholders.

| (a) |

Ultra-Short Duration Portfolio

Short Duration Portfolio

Annual Report

August 31, 2021

The reports concerning the Trust for Credit Unions (“TCU” or the “Trust”) Portfolios included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the Portfolios in the future. These statements are based on Portfolio management’s predictions and expectations concerning certain future events and their expected impact on the Portfolios, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Portfolios. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

TCU files the complete schedule of portfolio holdings of each Portfolio with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-PORT. The Portfolios’ Forms N-PORT are available on the SEC’s website at http://www.sec.gov.

Information regarding how the Portfolios voted proxies relating to portfolio securities, if any, during the most recent 12-month period ended June 30 is available by August 31 of the relevant year: (i) without charge, upon request, by calling the Trust at 1-800-342-5828; and (ii) on the SEC’s website at http://www.sec.gov.

An investment in a TCU Portfolio is not a credit union deposit and is not insured or guaranteed by the National Credit Union Share Insurance Fund, the National Credit Union Administration, or any other government agency.

The TCU Ultra-Short Duration Portfolio and the TCU Short Duration Portfolio are not money market funds. Investors in these Portfolios should understand that the net asset values of the Portfolios will fluctuate, which may result in a loss of the principal amount invested. The Portfolios’ net asset values and yields are not guaranteed by the U.S. government or by its agencies, instrumentalities or sponsored enterprises. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolios if held to maturity and not to the value of the Portfolios’ shares. The Portfolios’ investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

Holdings and allocations shown may not be representative of current or future investments. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities.

This material is not authorized for distribution unless preceded or accompanied by a current Prospectus. Investors should consider a Portfolio’s objectives, risks, and charges and expenses, and read the Prospectus carefully before investing or sending money. The Prospectus contains this and other information about the Portfolios.

Callahan Financial Services, Inc. is the distributor of the TCU Portfolios.

This report is for the information of the shareholders of the Trust.

Its use in connection with any offering of shares of the Trust is

authorized only in the case of a concurrent or prior delivery of

the Trust’s current Prospectus.

Dear Credit Union Shareholders,

Credit unions are reporting a string of significant milestones at mid-year 2021: Industry assets of $2 trillion; membership increasing by five million over the past 12 months, with members directing more than $226 billion in net new share balances to their credit unions over the same period. Staying true to their purpose, credit unions originated more than $388 billion in loans to members in the first six months of 2021.

Each of these results are industry-wide records, and come during a period of economic uncertainty. As is typical during challenging times, credit unions’ position as trusted financial partners has been amplified since the beginning of the COVID-19 pandemic.

Although credit union lending activity is on a record pace for the second consecutive year, excess liquidity remains a challenge for credit union balance sheet and margin management. The Federal Reserve Bank of New York’s Survey of Consumer Expectations indicates that consumers used Federal stimulus payments to primarily shore up their savings and pay down debt. As a result, deposits rose at a record rate and growth in loan balances slowed. Credit unions’ loan-to-share ratio fell from 83.9% at the end of 2019 to 69.5% at mid-year 2021.

With the Federal Reserve maintaining the target range for the federal funds rate at 0% to 0.25% since March 2020, credit union CFO’s have been looking for investment options for their excess liquidity. The Trust for Credit Unions (“TCU”) Portfolios have been an attractive choice for a growing number of credit unions. TCU balances reached an all-time high in 2021 and rose 95% over the 12-months ended August 31, 2021. Balances in the Ultra-Short Duration Portfolio more than doubled while balances in the Short Duration Portfolio rose 77% during TCU’s fiscal year.

We believe that performance was a key factor of TCU’s growth. For the twelve-month period ended August 31, 2021, the cumulative total return of the TCU share class of the Ultra-Short Duration Portfolio was 0.44% versus a cumulative total return of the Portfolio’s benchmark, the ICE BofAML Three-Month U.S. Treasury Bill Index, of 0.08%. Over the same period, the TCU share class of the Short Duration Portfolio was -0.13% versus a 0.17% cumulative total return for the ICE BofAML Two-Year U.S. Treasury Note Index. The Investment Adviser’s Discussion and Analysis in this report provides perspective from ALM First, the Portfolios’ investment adviser, on the positioning of the TCU Portfolios. Please refer to their discussion for more information.

With interest rates expected to remain near historic lows into 2022, credit unions will continue to evaluate their investment choices. TCU will maintain its focus on delivering value to its investors with no minimum balances and mutual fund liquidity. Our business partners, including ALM First, U.S. Bank, Callahan Financial Services and Eascorp, will be working together to ensure our investors receive outstanding service.

TCU is a unique operation, led by and for credit unions. The credit unions in the Callahan Credit Union Financial Services LLLP partnership continue to provide important support of and market perspective to TCU. The TCU Board of Trustees provide oversight and guidance for this collaboration. I want to thank them for their contributions, particularly Gary Oakland, who stepped down as a TCU Trustee this year after more than 20 years of service. We are excited to welcome Lisa Ginter and Mark McWatters as Trustees and will no doubt benefit from their perspectives.

Please visit our website, www.TrustCU.com, for the most current information on the Portfolios, including performance and portfolio holdings. We also regularly host webinars in which ALM First discusses the current market environment and provides an update on TCU portfolio performance and positioning. Please check the website for the next scheduled date.

Thank you, our credit union shareholders, for your interest in and support of TCU. If you have any questions or suggestions, please reach out to our team.

Sincerely,

Jay E. Johnson

President and Treasurer

Trust for Credit Unions

1

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU ULTRA-SHORT DURATION PORTFOLIO

Investment Objective

The TCU Ultra-Short Duration Portfolio (“USDP” or the “Portfolio”) seeks to achieve a high level of current income, consistent with low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. Under normal circumstances, substantially all of the assets (and at least 80%, measured at the time of purchase) of USDP will be invested in fixed-income securities consisting of the following: (1) securities issued or guaranteed as to principal and interest by the U.S. government or by its agencies, instrumentalities or sponsored enterprises and related custodial receipts; (2) repurchase agreements secured with obligations authorized by the Federal Credit Union Act; and (3) U.S. dollar denominated bank notes issued or guaranteed by banks with total assets exceeding $1 billion with weighted average maturities of less than 5 years, but only to the extent permitted under the Federal Credit Union Act and the rules and regulations thereunder. The Portfolio expects that a substantial portion of these securities will be mortgage-related securities. The Portfolio may also invest in non-U.S. government related securities, including bank notes and repurchase agreements secured by non-U.S. government related collateral. While there will be fluctuations in the net asset value (“NAV”) of the USDP, the Portfolio is expected to have less interest rate risk and asset value fluctuation than funds investing primarily in longer-term mortgage-backed securities paying a fixed rate of interest. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. USDP invests in obligations authorized under the Federal Credit Union Act with a maximum portfolio duration not to exceed that of a One-Year U.S. Treasury Security and a target duration equal to that of its benchmark, the ICE BofAML Three-Month U.S. Treasury Note Index.

Portfolio Management Discussion and Analysis

Below, ALM First discusses the Portfolio’s performance and positioning for the twelve-month period ended August 31, 2021 (the “Reporting Period”).

Q. How did the Portfolio perform during the Reporting Period?

For the Reporting Period, the cumulative total return of USDP TCU Shares was 0.44% versus a 0.08% cumulative total return of the Portfolio’s benchmark, the ICE BofAML Three-Month U.S. Treasury Bill Index (the “Index”). The Portfolio’s NAV per share at the end of the Reporting Period was $9.43, versus $9.42 on August 31, 2020.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

Over the past twelve months, spreads on high-credit quality fixed-income securities continued to tighten, but the Portfolio’s outperformance relative to the index was a result of the carry (yield) advantage provided by the underlying securities. The Portfolio’s allocation to floating-rate Agency Collateralized Mortgage Obligations (CMOs), Agency Commercial Mortgage-Backed Securities (CMBS), are repo were the key drivers of the Portfolio’s performance as these sectors provided marginal income relative to the Index.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

As discussed above, the carry advantage provided by floating-rate CMOs and CMBS coupled with modest spread tightening that resulted from continued demand from investors flush with cash drove the Portfolio’s outperformance relative to the Index.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

Since ALM First keeps the duration of the Portfolio aligned with that of the Index to avoid taking a position on the direction of interest rates, the Portfolio’s duration neither helped nor hurt its performance.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

No

Q. How was the Portfolio positioned relative to its benchmark index at the end of August 2021?

At the end of the Reporting Period, the Portfolio’s largest allocations were in Agency Mortgage-Backed Securities, which the Index has no allocation to since the Index is made up only of US Treasury securities.

Past performance does not guarantee future results, which may vary.

There is no guarantee that these objectives will be met.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the Portfolio’s investments. Future investments may or may not be profitable.

2

THIS PAGE LEFT INTENTIONALLY BLANK

3

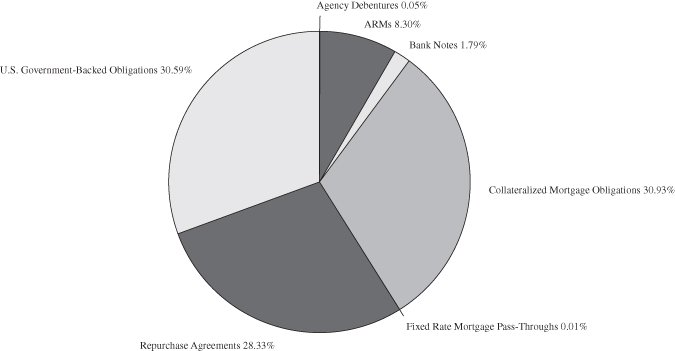

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU ULTRA-SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2021*

August 31, 2020*

4

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU ULTRA-SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2021*

August 31, 2020*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities, including cash. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

5

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU SHORT DURATION PORTFOLIO

Investment Objective

The TCU Short Duration Portfolio (“SDP” or the “Portfolio”) seeks to achieve a high level of current income, consistent with relatively low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. During normal market conditions, SDP intends to invest a substantial portion of its assets in mortgage-related securities, which include mortgage-related securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises. Mortgage-related securities held by SDP may include adjustable rate and fixed rate mortgage pass-through securities, collateralized mortgage obligations and other multi-class mortgage-related securities, as well as other securities that are collateralized by or represent direct or indirect interests in mortgage-related securities or mortgage loans. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. SDP invests in obligations authorized under the Federal Credit Union Act with a target duration that is equal to that of the ICE BofAML Two-Year U.S. Treasury Note Index and its maximum duration is that of a Three-Year U.S. Treasury Security.

Portfolio Management Discussion and Analysis

Below, ALM First discusses the Portfolio’s performance and positioning for the twelve-month period ended August 31, 2021 (the “Reporting Period”).

Q. How did the Portfolio perform during the Reporting Period?

The Portfolio’s cumulative total return for the Reporting Period was -0.13% for TCU shares, versus a 0.17% cumulative total return for the ICE BofAML Two-Year U.S. Treasury Note Index (the “Index”). The Portfolio’s net asset value per share closed the Reporting Period at $9.83, versus $9.91 on August 31, 2020.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

The yield curve, as measured by the spread between the 10-year and 2-year parts of the Treasury curve, ended the Reporting Period 52 basis points steeper, with most of the move coming from an increase in the yield on the 10-year. The year-over-year change belies the steepening somewhat, as March of 2021 saw the spread between the 10-year and 2-year hit a 5-year high. While the Portfolio has an effective duration of roughly 2%, right on top of the Index, the Portfolio’s yield curve exposure is not the same as the 2-year note. The Portfolio has sensitivities to the long-end of the curve due to its allocation to fixed-rate Agency Mortgage-Backed Securities (MBS) and Agency Commercial Mortgage-Backed Securities (CMBS). The sharp increase in long-end rates hurt the performance of these types of assets relative to the Index which saw little movement in rates.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

As mentioned above, the Portfolio’s exposure to changes in long-end rates through its allocation to agency CMBS and MBS were the catalysts of the negative return experienced over the Reporting Period. Both asset classes experienced spread tightening over the Reporting Period, but it was not enough to override the price declines driven by the steepening.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

Since ALM First keeps the duration of the Portfolio aligned with that of the Index to avoid taking a position on the direction of interest rates, the Portfolio’s duration neither helped nor hurt its performance. As discussed above, the Portfolio’s exposure to the long-end of the curve led to underperformance relative to the Index.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

No

Q. How was the Portfolio positioned at the end of August 2021?

At the end of the Reporting Period, the Portfolio’s largest allocations were in Agency MBS securities, which the Index has no allocation to since the index is made up only of US Treasury securities.

Past performance does not guarantee future results, which may vary.

There is no guarantee that these objectives will be met.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the Portfolio’s investments. Future investments may or may not be profitable.

6

THIS PAGE LEFT INTENTIONALLY BLANK

7

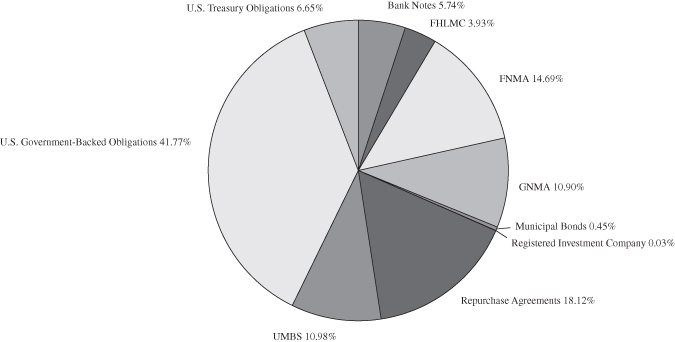

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2021*

August 31, 2020*

8

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2021*

August 31, 2020*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities, including cash. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

9

PORTFOLIO COMPARISON

TCU ULTRA-SHORT DURATION PORTFOLIO (Unaudited)

In accordance with the requirements of the Securities and Exchange Commission, the following data for the Ultra-Short Duration Portfolio is supplied for the period ended August 31, 2021. The Portfolio is compared to its benchmarks assuming the following initial investment:

| Initial | ||

Portfolio | Investment | Compare to: |

| Ultra-Short Duration (“USDP”) | $10,000 | ICE BofAML 3-Month U.S. Treasury Bill Index (“3-Month T-Bill”); |

| ICE BofAML 6-Month U.S. Treasury Bill Index (“6-Month T-Bill”). |

Ultra-Short Duration Portfolio’s(1) TCU Shares 10 Year Performance

Average Annual Total Return(a) | ||||

| One Year | Five Year | Ten Year | Since Inception | |

| TCU Shares | 0.44% | 1.24% | 0.71% | 2.58%(b) |

| Investor Shares | 0.41% | 1.21% | — | 0.70%(c) |

| 3-Month T-Bill (Performance since August 1, 1991) | 0.08% | 1.17% | 0.63% | 2.54% |

(1) | The Portfolio changed its investment strategy effective December 31, 2018. Information for periods prior to December 31, 2018 does not reflect the current investment strategy. |

(a) | ALM First began serving as investment adviser on April 16, 2017. Prior to that date, the Portfolio was advised by a different investment adviser. Performance of the Portfolio for periods prior to April 16, 2017 reflect management of the Portfolio by the previous investment adviser. |

(b) | The Portfolio’s TCU Shares commenced operations on July 10, 1991. |

(c) | The Portfolio’s Investor Shares commenced operations on November 30, 2012. |

The ICE BofAML Three-Month U.S. Treasury Bill Index and the ICE BofAML Six-Month U.S. Treasury Bill Index do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The TCU Ultra-Short Duration Portfolio is not a money market fund. Investors in this Portfolio should understand that the net asset value of the Portfolio will fluctuate, which may result in a loss of the principal amount invested. The Portfolio’s net asset value and yield are not guaranteed by the U.S. government, the National Credit Union Administration, or any other U.S. government agency, instrumentality or sponsored enterprise. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolio if held to maturity and not to the value of the Portfolio’s shares. The Portfolio’s investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

All performance data shown represents past performance and should not be considered indicative of future performance, which will fluctuate as market conditions change. The investment return and principal value of an investment will fluctuate with changes in market conditions so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The chart and table above assume reinvestment of dividends and distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. In addition to the investment adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting a portfolio. Please call 1-800-342-5828 or 1-800-CFS-5678 for the most recent month-end returns.

10

PORTFOLIO COMPARISON

TCU SHORT DURATION PORTFOLIO (Unaudited)

In accordance with the requirements of the Securities and Exchange Commission, the following data for the Short Duration Portfolio is supplied for the period ended August 31, 2021. The Portfolio is compared to its benchmarks assuming the following initial investment:

| Initial | ||

Portfolio | Investment | Compare to: |

| Short Duration (“SDP”) | $10,000 | ICE BofAML 2-Year U.S. Treasury Note Index (“2-Year T-Note”); |

| Bloomberg Barclays Mutual Fund Short (1-3 Year) Government | ||

| Index (“1-3 Gov’t Index”). |

Short Duration Portfolio’s TCU Shares 10 Year Performance

Average Annual Total Return(a) | ||||

| One Year | Five Year | Ten Year | Since Inception | |

| TCU Shares | -0.13% | 1.85% | 1.18% | 3.22%(b) |

| Investor Shares | -0.06% | 1.84% | — | 1.20%(c) |

| 2-Year T-Note (Performance since October 9, 1992) | 0.17% | 1.56% | 1.06% | 3.34%(d) |

(a) | ALM First began serving as investment adviser on April 16, 2017. Prior to that date, the Portfolio was advised by a different investment adviser. Performance of the Portfolio for periods prior to April 16, 2017 reflect management of the Portfolio by the previous investment adviser. |

(b) | The Portfolio’s TCU Shares commenced operations on October 9, 1992. |

(c) | The Portfolio’s Investor Shares commenced operations on November 30, 2012. |

(d) | The Portfolio’s primary benchmark is the 2-Year T-Note. |

The Bloomberg Barclays Mutual Fund Short (1-3 Year) Government Index and the ICE BofAML Two-Year U.S. Treasury Note Index does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The TCU Short Duration Portfolio is not a money market fund. Investors in this Portfolio should understand that the net asset value of the Portfolio will fluctuate, which may result in a loss of the principal amount invested. The Portfolio’s net asset value and yield are not guaranteed by the U.S. government, the National Credit Union Administration, or any other U.S. government agency, instrumentality or sponsored enterprise. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolio if held to maturity and not to the value of the Portfolio’s shares. The Portfolio’s investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

All performance data shown represents past performance and should not be considered indicative of future performance, which will fluctuate as market conditions change. The investment return and principal value of an investment will fluctuate with changes in market conditions so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The chart and table above assume reinvestment of dividends and distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. In addition to the investment adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting a portfolio. Please call 1-800-342-5828 or 1-800-CFS-5678 for the most recent month-end returns.

11

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments – August 31, 2021

| Par Value | Value | ||||||

| BANK NOTES – 1.79% | |||||||

| Financials – 1.79% | |||||||

$ | 5,000,000 | Citizens Bank NA, | |||||

3 Month LIBOR USD + 0.810% | |||||||

0.932%, 05/26/22 (a) | $ | 5,028,100 | |||||

3,975,000 | 3 Month LIBOR USD + 0.950% | ||||||

1.096%, 03/29/23 (a) | 4,019,495 | ||||||

3,000,000 | Manufacturers & Traders Trust Co., | ||||||

3 Month LIBOR USD + 0.610% | |||||||

0.735%, 05/18/22 (a) | 3,012,358 | ||||||

13,965,000 | PNC Bank NA, | ||||||

3 Month LIBOR USD + 0.325% | |||||||

0.453%, 02/24/23 (a) | 13,980,465 | ||||||

5,000,000 | Truist Bank, | ||||||

SOFR + 0.730% | |||||||

0.776%, 03/09/23 (a) | 5,035,164 | ||||||

10,000,000 | US Bank NA, | ||||||

3 Month LIBOR USD + 0.440% | |||||||

0.571%, 05/23/22 (a) | 10,026,778 | ||||||

5,000,000 | Wells Fargo Bank NA, | ||||||

3 Month LIBOR USD + 0.510% | |||||||

0.648%, 10/22/21 (a) | 5,002,274 | ||||||

13,829,000 | 3 Month LIBOR USD + 0.660% | ||||||

0.783%, 09/09/22 (a) | 13,840,154 | ||||||

| Total Bank Notes | 59,944,788 | ||||||

(Cost $59,681,823) | |||||||

| ASSET BACKED SECURITIES* – 0.01% | |||||||

| Federal National Mortgage | |||||||

| Association REMIC – 0.01% | |||||||

41,699 | Series 2001-W4, Class AV1 | ||||||

1 Month LIBOR USD + 0.140% | |||||||

0.224%, 02/25/32 (a) | 41,322 | ||||||

61,487 | Series 2002-W2, Class AV1 | ||||||

1 Month LIBOR USD + 0.130% | |||||||

0.214%, 06/25/32 (a) | 59,737 | ||||||

353,075 | Series 2002-T7, Class A1 | ||||||

1 Month LIBOR USD + 0.220% | |||||||

0.304%, 07/25/32 (a) | 345,658 | ||||||

| Total Asset Backed Securities | 446,717 | ||||||

(Cost $456,260) | |||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS – 30.93% | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation REMIC – 2.81% | |||||||

852 | Series 1222, Class P | ||||||

H15T10Y -0.400% | |||||||

0.820%, 03/15/22 (a)(b) | 850 | ||||||

2,729 | Series 1250, Class J | ||||||

7.000%, 05/15/22 (b) | 2,773 | ||||||

1,930 | Series 1448, Class F | ||||||

1 Month LIBOR USD + 1.400% | |||||||

1.496%, 12/15/22 (a)(c) | 1,941 | ||||||

347,379 | Series 2977, Class M | ||||||

5.000%, 05/15/25 (b) | 363,355 | ||||||

1,135,268 | Series 3702, Class FG | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.546%, 08/15/32 (a)(d) | 1,149,887 | ||||||

1,176,628 | Series 3346, Class FT | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.446%, 10/15/33 (a)(b)(d) | 1,183,383 | ||||||

827,947 | Series 3208, Class FH | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.496%, 08/15/36 (a) | 834,756 | ||||||

67,058 | Series 3231, Class FB | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.446%, 10/15/36 (a) | 67,568 | ||||||

41,710 | Series 3314, Class FC | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.496%, 12/15/36 (a) | 42,118 | ||||||

663,797 | Series 4248, Class QF | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.596%, 06/15/39 (a)(d) | 671,358 | ||||||

190,325 | Series 3545, Class FA | ||||||

1 Month LIBOR USD + 0.850% | |||||||

0.946%, 06/15/39 (a) | 194,866 | ||||||

10,743,122 | Series 4942, Class FB | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.596%, 04/15/40 (a)(d) | 10,866,274 | ||||||

267,158 | Series 3827, Class KF | ||||||

1 Month LIBOR USD + 0.370% | |||||||

0.466%, 03/15/41 (a) | 269,470 | ||||||

38,396 | Series 3868, Class FA | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.496%, 05/15/41 (a) | 38,794 | ||||||

52,811 | Series 4109, Class EC | ||||||

2.000%, 12/15/41 (c)(d) | 52,988 | ||||||

6,673,922 | Series 4606, Class FL | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.596%, 12/15/44 (a)(d) | 6,747,921 | ||||||

2,112,739 | Series 4566, Class FA | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.596%, 04/15/46 (a) | 2,133,619 | ||||||

2,461,446 | Series 4689, Class FD | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.446%, 06/15/47 (a) | 2,468,846 | ||||||

3,312,440 | Series 4748, Class DF | ||||||

1 Month LIBOR USD + 0.300% | |||||||

0.396%, 08/15/47 (a)(b) | 3,314,011 | ||||||

3,031,620 | Series 4735, Class FB | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.446%, 12/15/47 (a) | 3,035,465 | ||||||

5,993,511 | Series 4795, Class FB | ||||||

1 Month LIBOR USD + 0.300% | |||||||

0.396%, 06/15/48 (a) | 5,984,667 | ||||||

See accompanying notes to financial statements.

12

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2021

| Par Value | Value | ||||||

| Federal Home Loan Mortgage | |||||||

| Corporation REMIC – (continued) | |||||||

$ | 6,394,390 | Series 4907, Class AF | |||||

1 Month LIBOR USD + 0.500% | |||||||

0.584%, 09/25/48 (a)(d) | $ | 6,450,014 | |||||

3,719,554 | Series 4875, Class F | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.546%, 04/15/49 (a)(b) | 3,741,059 | ||||||

7,609,211 | Series 4980, Class FP | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 07/25/49 (a) | 7,651,768 | ||||||

4,428,919 | Series 4906, Class QF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 09/25/49 (a) | 4,458,191 | ||||||

6,118,678 | Series 4937, Class MF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 12/25/49 (a) | 6,164,264 | ||||||

4,776,743 | Series 4982, Class F | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 06/25/50 (a)(b) | 4,810,541 | ||||||

8,289,354 | Series 4981, Class GF | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 06/25/50 (a) | 8,320,414 | ||||||

5,267,698 | Series 4981, Class JF | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 06/25/50 (a) | 5,293,409 | ||||||

7,635,339 | Series 4336, Class FA | ||||||

1 Month LIBOR USD + 0.550% | |||||||

0.646%, 02/15/54 (a)(d) | 7,734,471 | ||||||

94,049,041 | |||||||

| Federal National Mortgage | |||||||

| Association REMIC – 3.10% | |||||||

10,287 | Series 1992-137, Class F | ||||||

1 Month LIBOR USD + 1.000% | |||||||

1.084%, 08/25/22 (a) | 10,286 | ||||||

17,672 | Series 1993-27, Class F | ||||||

1 Month LIBOR USD + 1.150% | |||||||

1.234%, 02/25/23 (a)(e) | 17,807 | ||||||

13,374 | Series 1998-21, Class F | ||||||

H15T1Y + 0.350% | |||||||

0.440%, 03/25/28 (a) | 13,318 | ||||||

88,266 | Series 2000-16, Class ZG | ||||||

8.500%, 06/25/30 (c) | 107,109 | ||||||

80,680 | Series 2000-32, Class Z | ||||||

7.500%, 10/18/30 | 95,752 | ||||||

115,863 | Series 2006-45, Class TF | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 06/25/36 (a) | 116,884 | ||||||

165,938 | Series 2006-76, Class QF | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 08/25/36 (a)(b) | 167,387 | ||||||

151,627 | Series 2006-79, Class PF | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 08/25/36 (a)(b) | 152,963 | ||||||

359,770 | Series 2006-111, Class FA | ||||||

1 Month LIBOR USD + 0.380% | |||||||

0.464%, 11/25/36 (a) | 362,917 | ||||||

150,785 | Series 2007-75, Class VF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 08/25/37 (a) | 152,555 | ||||||

144,599 | Series 2007-92, Class OF | ||||||

1 Month LIBOR USD + 0.570% | |||||||

0.654%, 09/25/37 (a) | 146,991 | ||||||

152,637 | Series 2007-86, Class FC | ||||||

1 Month LIBOR USD + 0.570% | |||||||

0.654%, 09/25/37 (a) | 155,201 | ||||||

314,686 | Series 2007-85, Class FC | ||||||

1 Month LIBOR USD + 0.540% | |||||||

0.624%, 09/25/37 (a) | 318,991 | ||||||

201,123 | Series 2007-99, Class FD | ||||||

1 Month LIBOR USD + 0.600% | |||||||

0.684%, 10/25/37 (a) | 204,527 | ||||||

18,847 | Series 2009-84, Class WF | ||||||

1 Month LIBOR USD + 1.100% | |||||||

1.184%, 10/25/39 (a) | 19,431 | ||||||

342,671 | Series 2010-123, Class FL | ||||||

1 Month LIBOR USD + 0.430% | |||||||

0.514%, 11/25/40 (a)(b) | 345,855 | ||||||

918,755 | Series 2011-110, Class FE | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 04/25/41 (a)(b) | 914,460 | ||||||

340,985 | Series 2011-63, Class FG | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 07/25/41 (a) | 346,720 | ||||||

360,128 | Series 2012-38, Class JE | ||||||

3.250%, 04/25/42 (b) | 382,717 | ||||||

2,340,646 | Series 2013-92, Class FA | ||||||

1 Month LIBOR USD + 0.550% | |||||||

0.634%, 09/25/43 (a) | 2,368,697 | ||||||

882,904 | Series 2013-118, Class FB | ||||||

1 Month LIBOR USD + 0.520% | |||||||

0.604%, 12/25/43 (a) | 890,645 | ||||||

1,375,202 | Series 2015-30, Class AB | ||||||

3.000%, 05/25/45 | 1,460,758 | ||||||

3,323,394 | Series 2016-62, Class FH | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 09/25/46 (a) | 3,357,227 | ||||||

8,525,812 | Series 2016-83, Class FK | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.584%, 11/25/46 (a) | 8,631,701 | ||||||

2,476,179 | Series 2017-39, Class FT | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 05/25/47 (a) | 2,487,333 | ||||||

3,041,146 | Series 2017-112, Class FC | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.434%, 01/25/48 (a) | 3,055,719 | ||||||

See accompanying notes to financial statements.

13

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2021

| Par Value | Value | ||||||

| Federal National Mortgage | |||||||

| Association REMIC – (continued) | |||||||

$ | 1,060,484 | Series 2008-22, Class FD | |||||

1 Month LIBOR USD + 0.840% | |||||||

0.924%, 04/25/48 (a)(d) | $ | 1,087,467 | |||||

5,752,693 | Series 2019-25, Class PF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 06/25/49 (a)(b) | 5,828,568 | ||||||

5,660,637 | Series 2019-33, Class CF | ||||||

1 Month LIBOR USD + 0.470% | |||||||

0.554%, 07/25/49 (a) | 5,707,236 | ||||||

1,534,045 | Series 2019-35, Class EF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 07/25/49 (a) | 1,546,733 | ||||||

6,265,464 | Series 2019-50, Class CF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 09/25/49 (a)(b) | 6,313,287 | ||||||

5,291,295 | Series 2019-61, Class F | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.584%, 11/25/49 (a)(b) | 5,322,850 | ||||||

4,177,797 | Series 2020-17, Class PF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 03/25/50 (a)(b) | 4,204,303 | ||||||

8,371,008 | Series 2020-26, Class GF | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.584%, 05/25/50 (a)(b) | 8,447,424 | ||||||

8,646,350 | Series 2020-38, Class NF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 06/25/50 (a) | 8,687,873 | ||||||

18,089,834 | Series 2020-34, Class F | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 06/25/50 (a) | 18,334,376 | ||||||

4,045,423 | Series 2017-96, Class FA | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 12/25/57 (a) | 4,071,230 | ||||||

7,716,266 | Series 2018-72, Class FB | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.434%, 10/25/58 (a) | 7,763,317 | ||||||

103,598,615 | |||||||

| Government National | |||||||

| Mortgage Association – 25.02% | |||||||

4,881,399 | Series 2019-054, Class HF | ||||||

1 Month SOFR + 0.400% | |||||||

0.450%, 04/20/44 (a) | 4,869,582 | ||||||

1,445,715 | Series 2016-H24, Class BF | ||||||

12 Month LIBOR USD + 0.230% | |||||||

0.588%, 11/20/66 (a) | 1,437,813 | ||||||

1,946,940 | Series 2017-H03, Class FA | ||||||

12 Month LIBOR USD + 0.310% | |||||||

0.644%, 12/20/66 (a) | 1,942,507 | ||||||

3,128,643 | Series 2017-H07, Class FC | ||||||

1 Month LIBOR USD + 0.520% | |||||||

0.623%, 03/20/67 (a) | 3,150,602 | ||||||

2,644,186 | Series 2017-H09, Class FJ | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.603%, 03/20/67 (a) | 2,656,179 | ||||||

6,732,161 | Series 2017-H11, Class FV | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.603%, 05/20/67 (a) | 6,770,775 | ||||||

1,426,855 | Series 2017-H16, Class F | ||||||

12 Month LIBOR USD + 0.050% | |||||||

0.295%, 08/20/67 (a) | 1,410,398 | ||||||

7,997,925 | Series 2018-H01, Class FG | ||||||

12 Month LIBOR USD + 0.150% | |||||||

0.484%, 01/20/68 (a) | 7,925,495 | ||||||

3,477,793 | Series 2018-H01, Class FC | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.503%, 01/20/68 (a) | 3,487,458 | ||||||

7,107,011 | Series 2018-H11, Class FJ | ||||||

12 Month LIBOR USD + 0.080% | |||||||

0.327%, 06/20/68 (a) | 7,030,090 | ||||||

6,473,013 | Series 2018-H15, Class FG | ||||||

12 Month LIBOR USD + 0.150% | |||||||

0.599%, 08/20/68 (a) | 6,404,760 | ||||||

1,205,760 | Series 2018-H17, Class DF | ||||||

12 Month LIBOR USD + 0.100% | |||||||

0.533%, 10/20/68 (a) | 1,191,416 | ||||||

1,583,582 | Series 2018-H17, Class FT | ||||||

12 Month LIBOR USD + 0.200% | |||||||

0.633%, 10/20/68 (a) | 1,571,337 | ||||||

3,465,533 | Series 2019-H04, Class FB | ||||||

1 Month LIBOR USD + 0.550% | |||||||

0.653%, 03/20/69 (a) | 3,509,753 | ||||||

10,891,640 | Series 2019-H14, Class EF | ||||||

1 Month LIBOR USD + 0.440% | |||||||

0.543%, 05/20/69 (a) | 10,904,828 | ||||||

6,011,792 | Series 2020-H04, Class FL | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.603%, 05/20/69 (a) | 6,052,776 | ||||||

3,250,403 | Series 2019-H15, Class NF | ||||||

1 Month LIBOR USD + 0.630% | |||||||

0.733%, 05/20/69 (a) | 3,305,772 | ||||||

6,389,929 | Series 2019-H10, Class FC | ||||||

1 Month LIBOR USD + 0.650% | |||||||

0.753%, 06/20/69 (a) | 6,483,919 | ||||||

3,494,067 | Series 2019-H15, Class EF | ||||||

1 Month LIBOR USD + 0.630% | |||||||

0.733%, 09/20/69 (a) | 3,555,391 | ||||||

4,206,174 | Series 2019-H19, Class FC | ||||||

1 Month LIBOR USD + 0.750% | |||||||

0.853%, 10/20/69 (a) | 4,297,548 | ||||||

4,290,252 | Series 2019-H16, Class FA | ||||||

1 Month LIBOR USD + 0.700% | |||||||

0.803%, 10/20/69 (a) | 4,382,888 | ||||||

See accompanying notes to financial statements.

14

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2021

| Par Value | Value | ||||||

| Government National | |||||||

| Mortgage Association – (continued) | |||||||

$ | 7,891,005 | Series 2019-H20, Class AF | |||||

1 Month LIBOR USD + 0.650% | |||||||

0.753%, 11/20/69 (a) | $ | 8,037,606 | |||||

11,393,593 | Series 2020-H04, Class AF | ||||||

1 Month LIBOR USD + 0.750% | |||||||

0.853%, 02/20/70 (a) | 11,669,804 | ||||||

16,352,579 | Series 2020-H04, Class FH | ||||||

1 Month LIBOR USD + 0.600% | |||||||

0.703%, 02/20/70 (a) | 16,620,231 | ||||||

7,591,185 | Series 2020-H05, Class FK | ||||||

1 Month LIBOR USD + 0.610% | |||||||

0.698%, 03/20/70 (a) | 7,716,449 | ||||||

44,550,786 | Series 2021-H03, Class FA | ||||||

30-day Average SOFR + 0.380% | |||||||

0.430%, 04/20/70 (a) | 44,648,036 | ||||||

13,999,790 | Series 2020-H09, Class FD | ||||||

1 Month LIBOR USD + 0.800% | |||||||

0.888%, 05/20/70 (a) | 14,403,476 | ||||||

13,035,419 | Series 2020-H10, Class FA | ||||||

1 Month LIBOR USD + 0.550% | |||||||

0.638%, 06/20/70 (a) | 13,216,381 | ||||||

5,266,936 | Series 2020-H13, Class FK | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.588%, 07/20/70 (a) | 5,297,600 | ||||||

16,725,730 | Series 2020-H12, Class GF | ||||||

1 Month LIBOR USD + 0.530% | |||||||

0.618%, 07/20/70 (a) | 16,931,030 | ||||||

18,458,157 | Series 2020-H16, Class LF | ||||||

1 Month LIBOR USD + 1.050% | |||||||

1.138%, 09/20/70 (a) | 19,299,151 | ||||||

28,858,142 | Series 2020-H16, Class FK | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.538%, 09/20/70 (a) | 29,093,449 | ||||||

11,646,691 | Series 2020-H22, Class HF | ||||||

2.276%, 10/20/70 (a) | 12,578,162 | ||||||

13,689,706 | Series 2021-H01, Class F | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.488%, 11/20/70 (a) | 13,751,594 | ||||||

24,747,006 | Series 2021-H11, Class FA | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 12/20/70 (a) | 26,569,240 | ||||||

24,697,793 | Series 2021-H04, Class FD | ||||||

30-day Average SOFR + 1.150% | |||||||

1.200%, 12/20/70 (a) | 26,036,394 | ||||||

14,886,981 | Series 2021-H03, Class JF | ||||||

30-day Average SOFR + 1.250% | |||||||

1.300%, 01/20/71 (a) | 15,810,023 | ||||||

16,486,021 | Series 2021-H04, Class FA | ||||||

30-day Average SOFR + 1.250% | |||||||

1.300%, 02/20/71 (a) | 17,490,262 | ||||||

15,561,088 | Series 2021-H04, Class BF | ||||||

30-day Average SOFR + 0.600% | |||||||

0.650%, 02/20/71 (a) | 15,868,238 | ||||||

19,844,243 | Series 2021-H04, Class FB | ||||||

30-day Average SOFR + 1.200% | |||||||

1.250%, 02/20/71 (a) | $ | 21,019,706 | |||||

21,464,755 | Series 2021-H03, Class FJ | ||||||

30-day Average SOFR + 1.150% | |||||||

1.200%, 02/20/71 (a) | 22,522,929 | ||||||

25,581,499 | Series 2021-H04, Class FC | ||||||

30-day Average SOFR + 1.150% | |||||||

1.200%, 02/20/71 (a) | 26,967,507 | ||||||

18,388,416 | Series 2021-H05, Class HF | ||||||

30-day Average SOFR + 0.550% | |||||||

0.600%, 02/20/71 (a) | 18,658,645 | ||||||

23,565,659 | Series 2021-H05, Class JF | ||||||

30-day Average SOFR + 0.750% | |||||||

0.800%, 03/20/71 (a) | 24,182,422 | ||||||

25,008,202 | Series 2021-H06, Class LF | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 03/20/71 (a) | 26,991,182 | ||||||

34,846,525 | Series 2021-H05, Class FJ | ||||||

30-day Average SOFR + 0.750% | |||||||

0.800%, 03/20/71 (a) | 35,624,819 | ||||||

28,329,023 | Series 2021-H05, Class FK | ||||||

30-day Average SOFR + 0.730% | |||||||

0.780%, 03/20/71 (a) | 29,117,284 | ||||||

28,813,219 | Series 2021-H09, Class GF | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 04/20/71 (a) | 30,630,492 | ||||||

25,012,945 | Series 2021-H06, Class PF | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 04/20/71 (a) | 27,020,626 | ||||||

23,135,893 | Series 2021-H06, Class FN | ||||||

30-day Average SOFR + 0.900% | |||||||

0.950%, 04/20/71 (a) | 23,962,171 | ||||||

27,733,155 | Series 2021-H07, Class FL | ||||||

30-day Average SOFR + 0.950% | |||||||

1.000%, 04/20/71 (a) | 28,521,630 | ||||||

28,248,633 | Series 2021-H08, Class FP | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 04/20/71 (a) | 29,987,054 | ||||||

28,040,689 | Series 2021-H08, Class NF | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 04/20/71 (a) | 30,266,618 | ||||||

24,870,696 | Series 2021-H10, Class FB | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 06/20/71 (a) | 26,906,850 | ||||||

25,016,257 | Series 2021-H11, Class FM | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 07/20/71 (a) | 27,087,353 | ||||||

836,845,701 | |||||||

| Total Collateralized | |||||||

| Mortgage Obligations | 1,034,493,357 | ||||||

(Cost $1,031,998,652) | |||||||

See accompanying notes to financial statements.

15

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2021

| Par Value | Value | ||||||

| MORTGAGE-BACKED OBLIGATIONS – 8.30% | |||||||

| Federal Home Loan | |||||||

| Mortgage Corporation – 0.01% | |||||||

$ | 5,684 | 6 Month LIBOR USD + 1.625% | |||||

1.875%, 11/01/22 (a) | $ | 5,732 | |||||

1,706 | 6 Month LIBOR USD + 1.095% | ||||||

1.314%, 11/01/22 (a) | 1,711 | ||||||

7,138 | 6 Month LIBOR USD + 2.233% | ||||||

2.482%, 10/01/24 (a) | 7,178 | ||||||

176,378 | H15T3Y+2.540% | ||||||

3.303%, 08/01/28 (a) | 177,423 | ||||||

34,990 | H15T1Y+1.920% | ||||||

3.045%, 05/01/31 (a) | 35,416 | ||||||

227,460 | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation Gold – 0.00% | |||||||

864 | 3.500%, 10/01/22 | 922 | |||||

157 | 4.500%, 07/01/23 | 164 | |||||

1,086 | |||||||

| Federal National Mortgage | |||||||

| Association – 7.98% | |||||||

48,869 | 5.000%, 03/01/27 | 50,912 | |||||

15,313 | COFI + 1.250% | ||||||

2.215%, 07/01/27 (a) | 15,411 | ||||||

38,642 | COFI + 1.500% | ||||||

4.684%, 01/01/29 (a) | 39,570 | ||||||

6,101 | COFI + 1.500% | ||||||

4.668%, 02/01/29 (a) | 6,251 | ||||||

5,000,000 | 1 Month LIBOR USD + 0.520% | ||||||

0.611%, 05/01/29 (a) | 4,997,658 | ||||||

5,000,000 | 1 Month LIBOR USD + 0.580% | ||||||

0.671%, 06/01/29 (a) | 4,997,878 | ||||||

16,703 | COFI + 1.841% | ||||||

2.147%, 08/01/29 (a) | 16,711 | ||||||

20,000,000 | 1 Month LIBOR USD + 0.600% | ||||||

0.691%, 06/01/30 (a) | 19,991,864 | ||||||

20,000,000 | 1 Month LIBOR USD + 0.590% | ||||||

0.681%, 07/01/30 (a) | 19,991,579 | ||||||

31,131,000 | 30-day Average SOFR + 0.390% | ||||||

0.440%, 12/01/30 (a) | 31,130,159 | ||||||

27,375,000 | 30-day Average SOFR + 0.420% | ||||||

0.470%, 01/01/31 (a) | 27,376,092 | ||||||

23,790,000 | 30-day Average SOFR + 0.370% | ||||||

0.420%, 01/01/31 (a) | 23,788,250 | ||||||

16,500,000 | 30-day Average SOFR + 0.380% | ||||||

0.430%, 01/01/31 (a) | 16,499,243 | ||||||

34,270,000 | 30-day Average SOFR + 0.390% | ||||||

0.440%, 01/01/31 (a) | 34,269,224 | ||||||

27,350,000 | 30-day Average SOFR + 0.420% | ||||||

0.470%, 01/01/31 (a) | 27,351,253 | ||||||

30,870,000 | 30-day Average SOFR + 0.350% | ||||||

0.400%, 01/01/31 (a) | 30,866,520 | ||||||

20,100,000 | 30-day Average SOFR + 0.250% | ||||||

0.300%, 04/01/31 (a) | 20,092,481 | ||||||

40,848 | 12 Month LIBOR USD + 1.755% | ||||||

2.005%, 07/01/32 (a) | 41,021 | ||||||

7,772 | 6.000%, 08/01/32 | 8,745 | |||||

158,340 | H15T1Y+2.625% | ||||||

2.700%, 09/01/32 (a) | 158,300 | ||||||

15,165 | 12 Month LIBOR USD + 1.225% | ||||||

1.725%, 01/01/33 (a) | 15,283 | ||||||

15,907 | H15T1Y+2.234% | ||||||

2.344%, 06/01/33 (a) | 16,903 | ||||||

254,846 | COFI + 1.250% | ||||||

4.596%, 08/01/33 (a) | 285,934 | ||||||

1,084 | 6.000%, 11/01/33 | 1,265 | |||||

124,089 | H15T1Y+2.042% | ||||||

2.167%, 04/01/34 (a) | 132,263 | ||||||

372,294 | COFI + 1.250% | ||||||

1.556%, 08/01/34 (a) | 368,597 | ||||||

27,040 | 6.000%, 09/01/34 | 30,530 | |||||

126,822 | 12 Month LIBOR USD + 1.714% | ||||||

2.009%, 07/01/37 (a) | 132,834 | ||||||

93,551 | 6.500%, 11/01/37 | 99,893 | |||||

21,820 | 6.000%, 06/01/38 | 24,726 | |||||

17,936 | 6.000%, 09/01/38 | 20,240 | |||||

8,858 | 6.000%, 09/01/38 | 10,350 | |||||

5,972 | 6.000%, 11/01/38 | 6,708 | |||||

1,579 | 6.000%, 10/01/39 | 1,772 | |||||

1,603,435 | 12 Month LIBOR USD + 1.702% | ||||||

2.073%, 07/01/40 (a) | 1,688,562 | ||||||

1,724,229 | 12 Month LIBOR USD + 1.755% | ||||||

2.098%, 02/01/42 (a) | 1,818,493 | ||||||

303,653 | 12 Month LIBOR USD + 1.743% | ||||||

2.044%, 05/01/42 (a) | 319,819 | ||||||

311,383 | COFI + 1.250% | ||||||

1.556%, 08/01/44 (a) | 308,070 | ||||||

266,971,364 | |||||||

| Government National | |||||||

| Mortgage Association – 0.31% | |||||||

7,397 | 7.000%, 04/15/26 | 7,931 | |||||

73,921 | H15T1Y+2.000% | ||||||

2.375%, 04/20/34 (a) | 74,357 | ||||||

281,753 | H15T1Y+1.500% | ||||||

1.875%, 06/20/34 (a) | 293,494 | ||||||

418,834 | H15T1Y+1.500% | ||||||

2.250%, 08/20/34 (a) | 436,221 | ||||||

19,221 | H15T1Y+1.500% | ||||||

1.875%, 05/20/42 (a) | 20,028 | ||||||

16,586 | H15T1Y+1.500% | ||||||

1.875%, 06/20/42 (a) | 17,277 | ||||||

91,715 | H15T1Y+1.500% | ||||||

2.250%, 07/20/42 (a) | 95,412 | ||||||

9,728 | H15T1Y+1.500% | ||||||

2.125%, 10/20/42 (a) | 10,121 | ||||||

17,985 | H15T1Y+1.500% | ||||||

2.125%, 12/20/42 (a) | 18,702 | ||||||

See accompanying notes to financial statements.

16

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2021

| Par Value | Value | ||||||

| Government National | |||||||

| Mortgage Association – (continued) | |||||||

$ | 1,736,813 | 12 Month LIBOR USD + 1.720% | |||||

2.076%, 11/20/68 (a) | $ | 1,829,171 | |||||

3,680,729 | 12 Month LIBOR USD + 1.839% | ||||||

2.166%, 06/20/69 (a) | 3,906,646 | ||||||

3,400,431 | 12 Month LIBOR USD + 1.516% | ||||||

1.899%, 09/20/69 (a) | 3,547,978 | ||||||

10,257,338 | |||||||

| Total Mortgage-Backed Obligations | 277,457,248 | ||||||

(Cost $277,398,192) | |||||||

| AGENCY DEBENTURES – 0.05% | |||||||

| Other Agency Debentures – 0.05% | |||||||

1,750,000 | Sri Lanka Government AID Bond | ||||||

3 Month LIBOR USD + 0.300% | |||||||

0.428%, 11/01/24 (a)(f)(g) | 1,750,000 | ||||||

| Total Agency Debentures | 1,750,000 | ||||||

(Cost $1,750,000) | |||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS – 30.59% | |||||||

FHLMC, Multifamily Structured | |||||||

Pass Through Certificates | |||||||

801,977 | Series K-F29, Class A | ||||||

1 Month LIBOR USD + 0.360% | |||||||

0.451%, 02/25/24 (a)(d) | 804,073 | ||||||

260,038 | Series K-BF1, Class A | ||||||

1 Month LIBOR USD + 0.390% | |||||||

0.481%, 07/25/24 (a)(d) | 259,607 | ||||||

8,000,000 | Series K-047, Class A2 | ||||||

3.329%, 05/25/25 (a)(c)(d) | 8,715,327 | ||||||

3,305,813 | Series K-F49, Class A | ||||||

1 Month LIBOR USD + 0.340% | |||||||

0.431%, 06/25/25 (a)(d) | 3,313,027 | ||||||

8,865,311 | Series K-F55, Class A | ||||||

1 Month LIBOR USD + 0.510% | |||||||

0.601%, 11/25/25 (a)(d) | 8,911,588 | ||||||

4,493,123 | Series K-F62, Class A | ||||||

1 Month LIBOR USD + 0.480% | |||||||

0.571%, 04/25/26 (a)(d) | 4,516,294 | ||||||

7,872,583 | Series K-F77, Class AL | ||||||

1 Month LIBOR USD + 0.700% | |||||||

0.791%, 02/25/27 (a)(d) | 7,950,079 | ||||||

485,157 | Series K-F30, Class A | ||||||

1 Month LIBOR USD + 0.370% | |||||||

0.461%, 03/25/27 (a)(d) | 485,633 | ||||||

8,069,000 | Series K-F81, Class AL | ||||||

1 Month LIBOR USD + 0.360% | |||||||

0.451%, 06/25/27 (a)(d) | 8,120,765 | ||||||

3,137,945 | Series K-F81, Class AS | ||||||

30-day Average SOFR + 0.400% | |||||||

0.450%, 06/25/27 (a)(d) | 3,148,022 | ||||||

1,253,215 | Series K-F86, Class AS | ||||||

30-day Average SOFR + 0.320% | |||||||

0.370%, 08/25/27 (a)(d) | 1,256,013 | ||||||

45,000,000 | Series K-F107, Class AS | ||||||

30-day Average SOFR + 0.250% | |||||||

0.300%, 03/25/28 (a)(c)(d) | 45,053,987 | ||||||

3,055,059 | Series K-F50, Class A | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.491%, 07/25/28 (a)(d) | 3,070,581 | ||||||

2,966,457 | Series K-F52, Class A | ||||||

1 Month LIBOR USD + 0.420% | |||||||

0.511%, 09/25/28 (a)(d) | 2,993,661 | ||||||

2,448,460 | Series K-F56, Class A | ||||||

1 Month LIBOR USD + 0.560% | |||||||

0.651%, 11/25/28 (a)(d) | 2,475,182 | ||||||

9,586,237 | Series K-F65, Class A | ||||||

1 Month LIBOR USD + 0.520% | |||||||

0.611%, 07/25/29 (a)(d) | 9,669,614 | ||||||

4,772,616 | Series K-F66, Class A | ||||||

1 Month LIBOR USD + 0.520% | |||||||

0.611%, 07/25/29 (a)(d) | 4,806,409 | ||||||

10,000,000 | Series K-S12, Class A | ||||||

1 Month LIBOR USD + 0.650% | |||||||

0.741%, 08/25/29 (a)(d) | 10,014,844 | ||||||

5,000,000 | Series K-S13, Class A | ||||||

1 Month LIBOR USD + 0.660% | |||||||

0.751%, 09/25/29 (a)(d) | 5,067,546 | ||||||

19,255,616 | Series K-F73, Class AL | ||||||

1 Month LIBOR USD + 0.600% | |||||||

0.691%, 11/25/29 (a)(c)(d) | 19,415,382 | ||||||

15,000,000 | Series K-L06, Class AFL | ||||||

1 Month LIBOR USD + 0.370% | |||||||

0.461%, 12/25/29 (a)(d) | 15,117,705 | ||||||

9,953,494 | Series K-F75, Class AL | ||||||

1 Month LIBOR USD + 0.510% | |||||||

0.601%, 12/25/29 (a)(d) | 10,077,310 | ||||||

4,479,072 | Series K-F75, Class AS | ||||||

SOFR + 0.550% | |||||||

0.600%, 12/25/29 (a)(d) | 4,518,761 | ||||||

19,831,836 | Series K-F76, Class AL | ||||||

1 Month LIBOR USD + 0.600% | |||||||

0.691%, 01/25/30 (a)(d) | 19,985,878 | ||||||

19,831,836 | Series K-F76, Class AS | ||||||

SOFR + 0.610% | |||||||

0.660%, 01/25/30 (a)(d) | 19,928,575 | ||||||

19,755,632 | Series K-F78, Class AL | ||||||

1 Month LIBOR USD + 0.800% | |||||||

0.891%, 03/25/30 (a)(d) | 19,973,562 | ||||||

25,000,000 | Series K-S14, Class AS | ||||||

30-day Average SOFR + 0.370% | |||||||

0.420%, 04/25/30 (a)(d) | 25,077,942 | ||||||

29,182,457 | Series K-F79, Class AS | ||||||

30-day Average SOFR + 0.580% | |||||||

0.630%, 05/25/30 (a)(d) | 29,374,145 | ||||||

13,861,667 | Series K-F79, Class AL | ||||||

1 Month LIBOR USD + 0.470% | |||||||

0.561%, 05/25/30 (a)(d) | 13,983,611 | ||||||

See accompanying notes to financial statements.

17

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2021

| Par Value | Value | ||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS – (continued) | |||||||

$ | 15,912,790 | Series K-F82, Class AL | |||||

1 Month LIBOR USD + 0.370% | |||||||

0.461%, 06/25/30 (a)(d) | $ | 15,964,852 | |||||

12,055,144 | Series K-F82, Class AS | ||||||

30-day Average SOFR + 0.420% | |||||||

0.470%, 06/25/30 (a)(d) | 12,095,742 | ||||||

25,000,000 | Series K-F83, Class AL | ||||||

1 Month LIBOR USD + 0.360% | |||||||

0.451%, 06/25/30 (a)(d) | 25,081,727 | ||||||

20,306,200 | Series K-F84, Class AL | ||||||

1 Month LIBOR USD + 0.300% | |||||||

0.391%, 07/25/30 (a)(d) | 20,356,726 | ||||||

30,000,000 | Series K-F87, Class AL | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.441%, 08/25/30 (a) | 30,073,452 | ||||||

28,783,149 | Series K-F88, Class AL | ||||||

1 Month LIBOR USD + 0.330% | |||||||

0.421%, 09/25/30 (a)(d) | 28,856,186 | ||||||

22,140,884 | Series K-F88, Class AS | ||||||

30-day Average SOFR + 0.350% | |||||||

0.400%, 09/25/30 (a)(d) | 22,216,252 | ||||||

48,158,994 | Series K-F89, Class AS | ||||||

30-day Average SOFR + 0.370% | |||||||

0.420%, 09/25/30 (a)(d) | 48,321,911 | ||||||

41,398,628 | Series K-F90, Class AS | ||||||

30-day Average SOFR + 0.380% | |||||||

0.430%, 09/25/30 (a)(d) | 41,654,322 | ||||||

22,500,000 | Series K-F92, Class AL | ||||||

1 Month LIBOR USD + 0.330% | |||||||

0.421%, 10/25/30 (a)(d) | 22,557,557 | ||||||

21,993,707 | Series K-F91, Class AS | ||||||

30-day Average SOFR + 0.380% | |||||||

0.430%, 10/25/30 (a)(d) | 22,070,891 | ||||||

30,000,000 | Series K-F94, Class AL | ||||||

1 Month LIBOR USD + 0.300% | |||||||

0.391%, 11/25/30 (a)(d) | 30,048,120 | ||||||

36,500,000 | Series K-F97, Class AS | ||||||

30-day Average SOFR + 0.250% | |||||||

0.300%, 12/25/30 (a)(d) | 36,531,934 | ||||||

47,500,000 | Series K-F104, Class AS | ||||||

30-day Average SOFR + 0.250% | |||||||

0.300%, 01/25/31 (a)(d) | 47,565,878 | ||||||

50,000,000 | Series K-F106, Class AS | ||||||

30-day Average SOFR + 0.250% | |||||||

0.300%, 01/25/31 (a)(d) | 50,069,505 | ||||||

50,000,000 | Series K-F103, Class AS | ||||||

30-day Average SOFR + 0.240% | |||||||

0.290%, 01/25/31 (a)(d) | 50,044,850 | ||||||

50,000,000 | Series K-F105, Class AS | ||||||

30-day Average SOFR + 0.250% | |||||||

0.300%, 02/25/31 (a)(d) | 50,069,210 | ||||||

65,000,000 | Series K-F108, Class AS | ||||||

30-day Average SOFR + 0.250% | |||||||

0.300%, 02/25/31 (a)(d) | 65,057,811 | ||||||

23,800,000 | Series K-F110, Class AS | ||||||

30-day Average SOFR + 0.240% | |||||||

0.290%, 03/25/31 (a)(d) | 23,821,222 | ||||||

47,500,000 | Series K-F109, Class AS | ||||||

30-day Average SOFR + 0.240% | |||||||

0.290%, 03/25/31 (a)(d) | 47,542,807 | ||||||

25,000,000 | Series K-F117, Class AS | ||||||

30-day Average SOFR + 0.240% | |||||||

0.290%, 06/25/31 (a)(d) | 25,027,515 | ||||||

| Total U.S. Government-Backed | |||||||

| Obligations | 1,023,113,593 | ||||||

(Cost $1,019,949,976) | |||||||

| REPURCHASE AGREEMENTS – 28.33% | |||||||

75,000,000 | RBC Capital Markets, 0.320%, | ||||||

Dated 08/31/2021, matures 10/05/2021, | |||||||

repurchase price $75,023,333 (collateralized | |||||||

by $67,485,000 par amount of Domestic | |||||||

Municipal Securities of 2.888% to 5.000% | |||||||

due 03/01/30 to 09/01/50, | |||||||

total market value $78,442,519) | 75,000,000 | ||||||

51,527,000 | Amherst Pierpoint Securities, 0.488%, | ||||||

Dated 08/23/2021, matures 09/07/2021, | |||||||

repurchase price $51,537,475 (collateralized | |||||||

by $51,156,494 par amount of GNMA | |||||||

securities of 2.000% to 2.500%, due 09/20/51, | |||||||

total market value $52,788,515) | 51,527,000 | ||||||

97,502,000 | Amherst Pierpoint Securities, 0.485%, | ||||||

Dated 08/31/2021, matures 09/09/2021, | |||||||

repurchase price $97,513,813 (collateralized | |||||||

by $97,071,976 par amount of GNMA | |||||||

securities of 2.000% to 2.500%, due 09/20/51, | |||||||

total market value $99,490,432) | 97,502,000 | ||||||

183,717,000 | Amherst Pierpoint Securities, 0.487%, | ||||||

Dated 08/19/2021, matures 09/17/2021, | |||||||

repurchase price $183,788,999 (collateralized | |||||||

by $183,426,145 par amount of GNMA | |||||||

securities of 1.500% to 3.000%, due 09/20/51, | |||||||

total market value $187,706,354) | 183,717,000 | ||||||

100,366,000 | Amherst Pierpoint Securities, 0.487%, | ||||||

Dated 08/19/2021, matures 09/20/2021, | |||||||

repurchase price $100,409,402 (collateralized | |||||||

by $98,555,345 par amount of GNMA | |||||||

securities of 2.500% to 3.500%, due 09/20/51, | |||||||

total market value $102,678,752) | 100,366,000 | ||||||

See accompanying notes to financial statements.

18

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2021

| Par Value | Value | ||||||

| REPURCHASE AGREEMENTS – (continued) | |||||||

$ | 142,060,000 | Amherst Pierpoint Securities, 0.488%, | |||||

Dated 08/20/2021, matures 09/21/2021, | |||||||

repurchase price $142,121,670 (collateralized | |||||||

by $139,559,477 par amount of GNMA | |||||||

securities of 2.000% to 4.000%, | |||||||

due 09/20/36 to 09/20/51, | |||||||

total market value $144,737,692) | $ | 142,060,000 | |||||

227,660,000 | INTL FCStone Financial, Inc., 0.150%, | ||||||

Dated 08/31/2021, matures 09/01/2021, | |||||||

repurchase price $227,660,949 (collateralized | |||||||

by $456,426,733 par amount of Government | |||||||

Agencies, GNMA, FNMA, and FHLMC | |||||||

securities of 0.400% to 8.500% | |||||||

due 11/01/21 to 07/20/71, | |||||||

total market value $231,746,938) | 227,660,000 | ||||||

70,000,000 | Amherst Pierpoint Securities, 0.450%, | ||||||

Dated 08/06/2021, matures 11/04/2021, | |||||||

repurchase price $70,078,750 (collateralized | |||||||

by $105,368,418 par amount of United States | |||||||

Treasury Bills, GNMA, FNMA, and FHLMC | |||||||

securities of 0.125% to 6.500%, | |||||||

due 07/31/23 to 07/20/71, | |||||||

total market value $71,176,277) | 70,000,000 | ||||||

| Total Repurchase Agreements | 947,832,000 | ||||||

(Cost $947,832,000) | |||||||

| Total Investments – 100.00% | 3,345,037,703 | ||||||

(Cost $3,339,066,903) | |||||||

| Net Other Assets | |||||||

| and Liabilities – 0.00% | 112,737 | ||||||

| Net Assets – 100.00% | $ | 3,345,150,440 | |||||

| * | See Note A. |

| (a) | Variable rate securities. Interest rates disclosed are those which are in effect at August 31, 2021. Maturity date shown is the date of the next coupon rate reset or actual maturity. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. For those variable rate securities which are based on published reference and spread, the reference rate and spread are indicated in the description in the Portfolio of Investments. See also, Explanation of Abbreviations and Acronyms below. |

| (b) | The security has PAC (Planned Amortization Class) collateral. |

| (c) | The security has Sequential collateral. |

| (d) | The security has Structured collateral. |

| (e) | The security has Support collateral. |

| (f) | Security has been valued at fair market value as determined in good faith by or under the direction of the Board of Trustees of the Trust. As of August 31, 2021, this security amounted to $1,750,000 or 0.05% of net assets. Investment categorized as a significant unobservable input (Level 3). |

| (g) | Illiquid security. The total market value of this security was $1,750,000, representing 0.05% of net assets. |

Explanation of Abbreviations and Acronyms:

COFI | 11th District Cost of Funds Index |

FHLMC | Federal Home Loan Mortgage Corporation |

FNMA | Federal National Mortgage Association |

GNMA | Government National Mortgage Association |

H15T1Y | 1 Year US Treasury Yield Curve Constant Maturity Rate |

H15T3Y | 3 Year US Treasury Yield Curve Constant Maturity Rate |

H15T10Y | 10 Year US Treasury Yield Curve Constant Maturity Rate |

LIBOR | London Interbank Offered Rate |

REMIC | Real Estate Mortgage Investment Conduit |

SOFR | Secured Overnight Financing Rate |

USD | U.S. Dollar |

See accompanying notes to financial statements.

19

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments – August 31, 2021

| Par Value | Value | ||||||

| BANK NOTES – 5.74% | |||||||

| Financials – 5.74% | |||||||

$ | 4,000,000 | BBVA USA, | |||||

2.500%, 08/27/24 | $ | 4,211,692 | |||||

19,430,000 | Capital One Bank USA NA, | ||||||

SOFR + 0.616% | |||||||

2.014%, 01/27/23 (a) | 19,559,489 | ||||||

5,421,000 | Citibank NA, | ||||||

3.650%, 01/23/24 | 5,811,232 | ||||||

20,000,000 | Discover Bank, | ||||||

2.450%, 09/12/24 | 20,894,317 | ||||||

1,500,000 | Fifth Third Bank, | ||||||

2.875%, 10/01/21 | 1,500,000 | ||||||

2,000,000 | KeyBank NA, | ||||||

3 Month LIBOR USD + 0.660% | |||||||

0.786%, 02/01/22 (a) | 2,005,435 | ||||||

4,900,000 | 1.250%, 03/10/23 | 4,970,173 | |||||

3,000,000 | PNC Bank NA, | ||||||

2.550%, 12/09/21 | 3,013,415 | ||||||

8,450,000 | Truist Bank, | ||||||

2.150%, 12/06/24 | 8,837,489 | ||||||

5,000,000 | US Bank NA, | ||||||

3 Month LIBOR USD + 0.440% | |||||||

0.571%, 05/23/22 (a) | 5,013,389 | ||||||

5,000,000 | Wells Fargo Bank NA, | ||||||

3 Month LIBOR USD + 0.510% | |||||||

0.648%, 10/22/21 (a) | 5,002,274 | ||||||

5,000,000 | 3.550%, 08/14/23 | 5,301,161 | |||||

| Total Bank Notes | 86,120,066 | ||||||

(Cost $85,851,018) | |||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS – 13.87% | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation REMIC – 0.84% | |||||||

4,503 | Series 1448, Class F | ||||||

1 Month LIBOR USD + 1.400% | |||||||

1.496%, 12/15/22 (a)(b) | 4,528 | ||||||

77,942 | Series 2868, Class AV | ||||||

5.000%, 08/15/24 (b)(c) | 81,344 | ||||||

77,170 | Series 1980, Class Z | ||||||

7.000%, 07/15/27 (b) | 87,315 | ||||||

976,175 | Series 3346, Class FT | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.446%, 10/15/33 (a)(c)(d) | 981,780 | ||||||

784,108 | Series 3471, Class FB | ||||||

1 Month LIBOR USD + 1.000% | |||||||

1.096%, 08/15/35 (a) | 807,091 | ||||||

1,246,908 | Series 3208, Class FA | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.496%, 08/15/36 (a) | 1,257,163 | ||||||

418,961 | Series 3208, Class FH | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.496%, 08/15/36 (a) | 422,407 | ||||||

291,675 | Series 3367, Class YF | ||||||

1 Month LIBOR USD + 0.550% | |||||||

0.646%, 09/15/37 (a) | 296,576 | ||||||

1,031,829 | Series 3371, Class FA | ||||||

1 Month LIBOR USD + 0.600% | |||||||

0.696%, 09/15/37 (a) | 1,049,474 | ||||||

416,617 | Series 4248, Class QF | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.596%, 06/15/39 (a)(c) | 421,362 | ||||||

167,629 | Series 3827, Class KF | ||||||

1 Month LIBOR USD + 0.370% | |||||||

0.466%, 03/15/41 (a) | 169,079 | ||||||

42,081 | Series 4109, Class EC | ||||||

2.000%, 12/15/41 (b)(c) | 42,222 | ||||||

910,047 | Series 4272, Class FD | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.446%, 11/15/43 (a) | 916,870 | ||||||

1,334,784 | Series 4606, Class FL | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.596%, 12/15/44 (a)(c) | 1,349,584 | ||||||

1,104,359 | Series 4784, Class PK | ||||||

3.500%, 06/15/45 (d) | 1,124,199 | ||||||

3,071,057 | Series 4968, Class NP | ||||||

6.500%, 04/25/50 (d) | 3,570,739 | ||||||

12,581,733 | |||||||

| Federal National Mortgage | |||||||

| Association REMIC – 2.38% | |||||||

16 | Series G92-44, Class Z | ||||||

8.000%, 07/25/22 | 16 | ||||||

2,125,843 | Series 2013-57, Class DK | ||||||

3.500%, 06/25/33 | 2,312,717 | ||||||

167,696 | Series 2006-45, Class TF | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 06/25/36 (a) | 169,175 | ||||||

196,335 | Series 2006-76, Class QF | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 08/25/36 (a)(d) | 198,050 | ||||||

113,089 | Series 2007-75, Class VF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

0.534%, 08/25/37 (a) | 114,417 | ||||||

135,420 | Series 2010-123, Class FL | ||||||

1 Month LIBOR USD + 0.430% | |||||||

0.514%, 11/25/40 (a)(d) | 136,678 | ||||||

300,795 | Series 2011-110, Class FE | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 04/25/41 (a)(d) | 299,389 | ||||||

295,260 | Series 2015-92, Class PA | ||||||

2.500%, 12/25/41 (c)(d) | 308,181 | ||||||

288,857 | Series 2012-38, Class JE | ||||||

3.250%, 04/25/42 (d) | 306,975 | ||||||

See accompanying notes to financial statements.

20

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2021

| Par Value | Value | ||||||

| Federal National Mortgage | |||||||

| Association REMIC – (continued) | |||||||

$ | 773,732 | Series 2012-71, Class FL | |||||

1 Month LIBOR USD + 0.500% | |||||||

0.584%, 07/25/42 (a) | $ | 782,249 | |||||

2,067,556 | Series 2013-101, Class FE | ||||||

1 Month LIBOR USD + 0.600% | |||||||

0.684%, 10/25/43 (a) | 2,104,408 | ||||||

3,149,471 | Series 2013-101, Class CF | ||||||

1 Month LIBOR USD + 0.600% | |||||||

0.684%, 10/25/43 (a) | 3,205,408 | ||||||

3,585,151 | Series 2016-62, Class FH | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 09/25/46 (a) | 3,621,649 | ||||||

3,942,704 | Series 2016-83, Class FK | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.584%, 11/25/46 (a) | 3,991,672 | ||||||

2,476,179 | Series 2017-39, Class FT | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.484%, 05/25/47 (a) | 2,487,333 | ||||||

2,540,053 | Series 2017-112, Class FC | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.434%, 01/25/48 (a) | 2,552,224 | ||||||

823,264 | Series 2008-22, Class FD | ||||||

1 Month LIBOR USD + 0.840% | |||||||

0.924%, 04/25/48 (a)(c) | 844,210 | ||||||

8,060,162 | Series 2020-18, Class KD | ||||||

6.500%, 03/25/50 | 9,415,592 | ||||||

2,956,512 | Series 2018-72, Class FB | ||||||

1 Month LIBOR USD + 0.350% | |||||||

0.434%, 10/25/58 (a) | 2,974,540 | ||||||

35,824,883 | |||||||

| Government National | |||||||

| Mortgage Association – 10.65% | |||||||

12,253,698 | Series 2020-176, Class MT | ||||||

5.000%, 11/20/50 | 14,072,030 | ||||||

2,644,186 | Series 2017-H09, Class FJ | ||||||

1 Month LIBOR USD + 0.500% | |||||||

0.603%, 03/20/67 (a) | 2,656,179 | ||||||

3,128,643 | Series 2017-H07, Class FC | ||||||

1 Month LIBOR USD + 0.520% | |||||||

0.623%, 03/20/67 (a) | 3,150,602 | ||||||

3,477,793 | Series 2018-H01, Class FC | ||||||

1 Month LIBOR USD + 0.400% | |||||||

0.503%, 01/20/68 (a) | 3,487,458 | ||||||

6,119,412 | Series 2018-H09, Class FC | ||||||

12 Month LIBOR USD + 0.150% | |||||||

0.431%, 06/20/68 (a) | 6,060,948 | ||||||

7,107,011 | Series 2018-H11, Class FJ | ||||||

12 Month LIBOR USD + 0.080% | |||||||

0.327%, 06/20/68 (a) | 7,030,090 | ||||||

6,389,929 | Series 2019-H10, Class FC | ||||||

1 Month LIBOR USD + 0.650% | |||||||

0.753%, 06/20/69 (a) | 6,483,919 | ||||||

22,275,393 | Series 2021-H03, Class FA | ||||||

30-day Average SOFR + 0.380% | |||||||

0.430%, 04/20/70 (a) | 22,324,018 | ||||||

4,666,375 | Series 2020-H09, Class DF | ||||||

1 Month LIBOR USD + 0.640% | |||||||

0.728%, 05/20/70 (a) | 4,756,421 | ||||||

12,508,611 | Series 2021-H05, Class HF | ||||||

30-day Average SOFR + 0.550% | |||||||

0.600%, 02/20/71 (a) | 12,692,433 | ||||||

11,891,748 | Series 2021-H05, Class JF | ||||||

30-day Average SOFR + 0.750% | |||||||

0.800%, 03/20/71 (a) | 12,202,980 | ||||||

23,110,962 | Series 2021-H07, Class FL | ||||||

30-day Average SOFR + 0.950% | |||||||

1.000%, 04/20/71 (a) | 23,768,025 | ||||||

12,513,038 | Series 2021-H06, Class FN | ||||||

30-day Average SOFR + 0.900% | |||||||

0.950%, 04/20/71 (a) | 12,959,930 | ||||||

19,798,948 | Series 2021-H10, Class FB | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 06/20/71 (a) | 21,419,880 | ||||||

6,324,356 | Series 2021-H11, Class FM | ||||||

30-day Average SOFR + 1.500% | |||||||

1.550%, 07/20/71 (a) | 6,847,949 | ||||||

159,912,862 | |||||||

| Total Collateralized | |||||||

| Mortgage Obligations | 208,319,478 | ||||||

(Cost $207,343,164) | |||||||

| MORTGAGE-BACKED OBLIGATIONS – 26.63% | |||||||

| Federal Home Loan | |||||||

| Mortgage Corporation – 2.09% | |||||||

63,635 | 12 Month LIBOR USD + 1.840% | ||||||

2.222%, 11/01/34 (a) | 64,412 | ||||||

1,928,554 | 3.000%, 11/01/34 | 2,036,923 | |||||

119,698 | H15T1Y + 2.250% | ||||||

2.355%, 08/01/35 (a) | 127,604 | ||||||

150,454 | 12 Month LIBOR USD + 1.769% | ||||||

2.122%, 05/01/36 (a) | 156,941 | ||||||

24,591,485 | 2.000%, 07/01/36 | 25,467,848 | |||||

97,864 | 12 Month LIBOR USD + 1.890% | ||||||

2.265%, 03/01/42 (a) | 103,545 | ||||||

3,197,593 | 3.000%, 02/01/47 | 3,426,382 | |||||

31,383,655 | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation Gold – 1.00% | |||||||

715 | 3.500%, 10/01/22 | 763 | |||||

4,381,727 | 2.000%, 12/01/31 | 4,551,708 | |||||

48,254 | 5.000%, 08/01/35 | 55,033 | |||||

8,137 | 5.000%, 12/01/35 | 9,273 | |||||

1,926,042 | 3.000%, 01/01/37 | 2,031,578 | |||||

2,089,582 | 3.000%, 02/01/37 | 2,206,232 | |||||

See accompanying notes to financial statements.

21

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 202

| Par Value | Value | ||||||

| Federal Home Loan Mortgage | |||||||

| Corporation Gold – (continued) | |||||||

$ | 2,669,726 | 3.500%, 02/01/37 | $ | 2,874,983 | |||

67,139 | 5.000%, 03/01/37 | 76,577 | |||||

2,386,624 | 3.500%, 03/01/37 | 2,569,814 | |||||

146,820 | 5.000%, 05/01/37 | 167,468 | |||||

129,547 | 5.000%, 02/01/38 | 148,305 | |||||

42,486 | 5.000%, 03/01/38 | 48,619 | |||||

33,698 | 5.000%, 09/01/38 | 38,552 | |||||

116,401 | 5.000%, 12/01/38 | 132,948 | |||||

77,314 | 5.000%, 01/01/39 | 88,439 | |||||

15,000,292 | |||||||

| Federal National | |||||||

| Mortgage Association – 12.31% | |||||||

4,440,717 | 2.545%, 08/01/22 (a) | 4,483,212 | |||||

20,000,000 | 3.100%, 01/01/26 | 21,790,063 | |||||

10,498,160 | 2.435%, 08/01/26 | 11,145,062 | |||||

39,095 | 5.000%, 03/01/27 | 40,730 | |||||

27,591 | 7.000%, 08/01/28 | 27,683 | |||||

21,834 | 7.000%, 08/01/28 | 21,907 | |||||

40,903 | 7.000%, 11/01/28 | 43,520 | |||||

5,233,000 | 1 Month LIBOR USD + 0.520% | ||||||

0.611%, 05/01/29 (a) | 5,230,549 | ||||||