UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| INVESTMENT COMPANY ACT FILE NUMBER: | 811-05443 |

| | |

| EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER: | Calamos Investment Trust |

| | |

| ADDRESS OF PRINCIPAL EXECUTIVE OFFICES: | 2020 Calamos Court, Naperville |

| | Illinois 60563-2787 |

| | |

| | |

| NAME AND ADDRESS OF AGENT FOR SERVICE: | John P Calamos, Sr., Founder, Chairman and

Global Chief Investment Officer |

| | Calamos Advisors LLC |

| | 2020 Calamos Court, |

| | Naperville, Illinois |

| | 60563-2787 |

| REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: | (630) 245-7200 |

| DATE OF FISCAL YEAR END: | October 31, 2024 |

| DATE OF REPORTING PERIOD: | November 1, 2023 through October 31, 2024 |

ITEM 1. REPORT TO SHAREHOLDERS.

TABLE OF CONTENTS

0000826732 calamos:CALAMOSINDEXSP500Index5118BroadBasedIndexMember 2016-01-31 0000826732 calamos:C000150496Member 2019-04-30 0000826732 calamos:C000011362Member calamos:SectorConsumerStaplesSectorMember 2024-10-31 0000826732 calamos:C000011373Member calamos:BroadcomIncFR11135F101CTIMember 2024-10-31 0000826732 calamos:CALAMOSINDEXBloombergUSAggregateBondIndex5194BroadBasedIndexMember 2020-06-30 0000826732 calamos:C000211096Member calamos:StrideIncFR86333M108CTIMember 2024-10-31 0000826732 calamos:CALAMOSINDEXSP500Index5107BroadBasedIndexMember 2014-12-31 2024-10-31 0000826732 calamos:CALAMOSINDEXBloombergUSAggregateBondIndex5143BroadBasedIndexMember 2023-02-28

Annual Shareholder Report - October 31, 2024

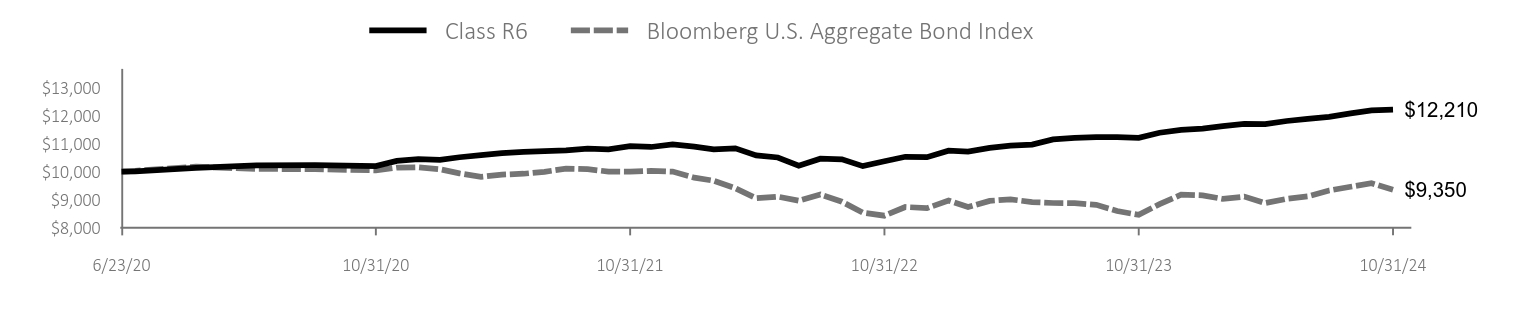

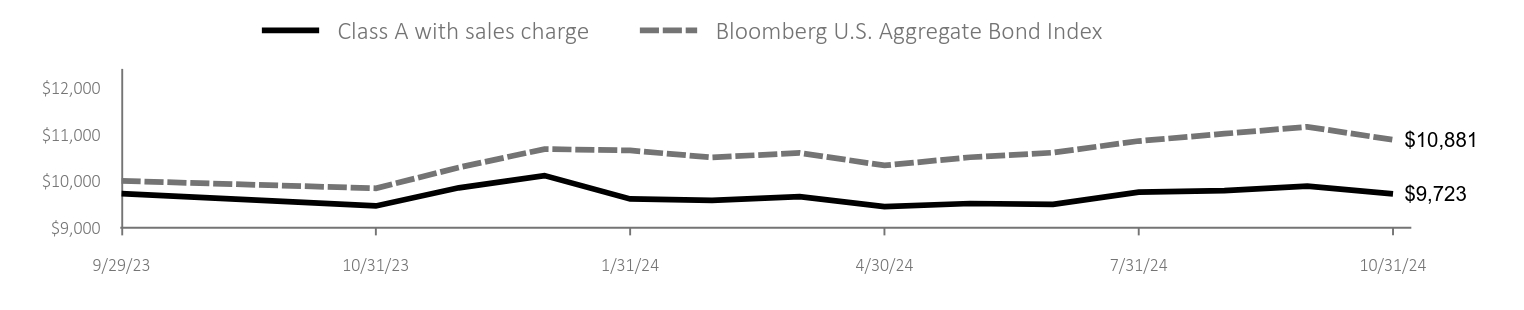

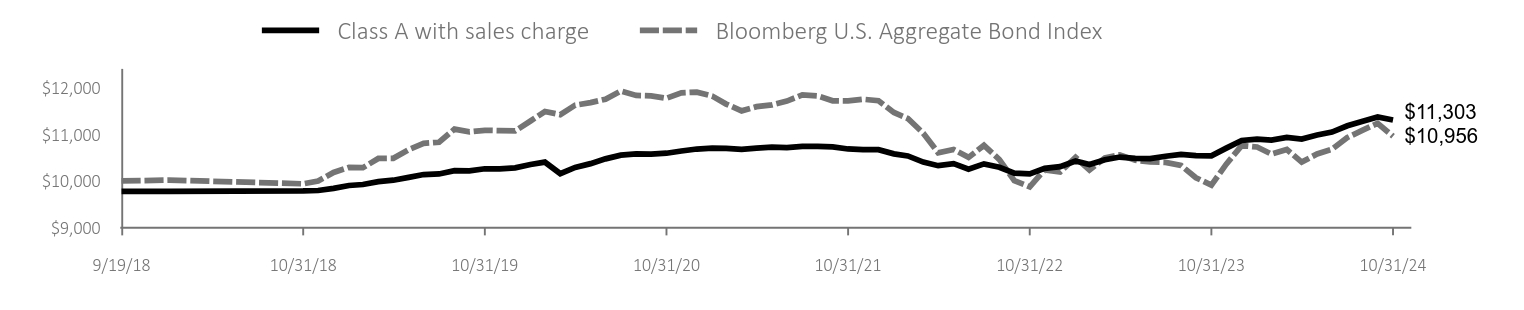

This annual shareholder report contains important information about the Calamos Convertible Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

| Class A | $124 | 1.13% |

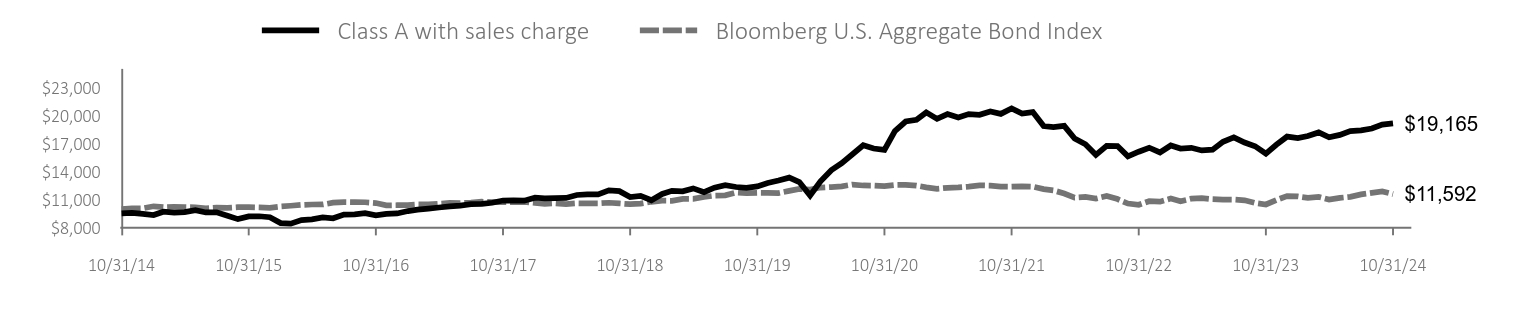

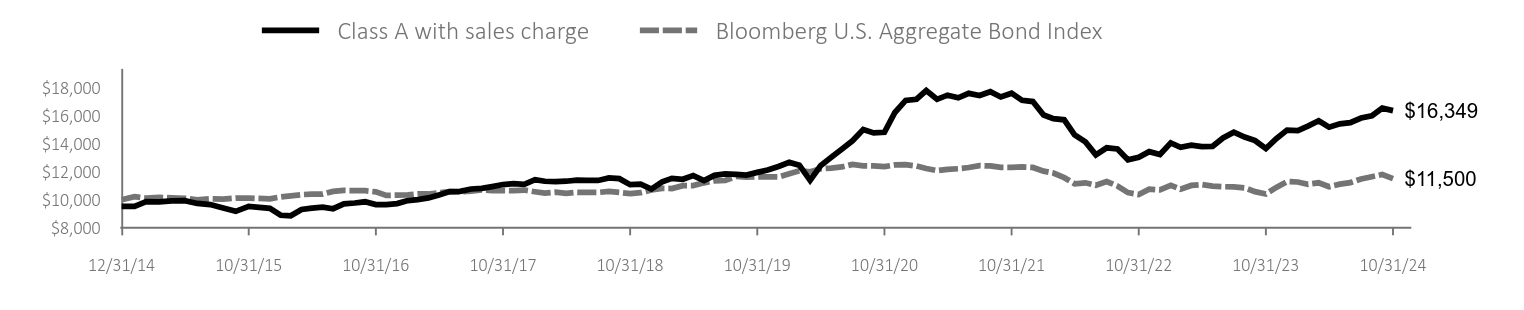

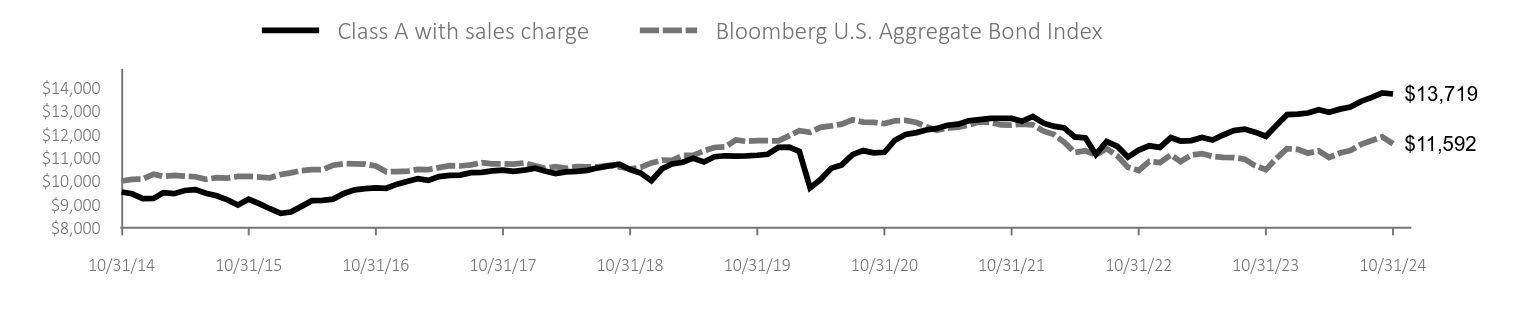

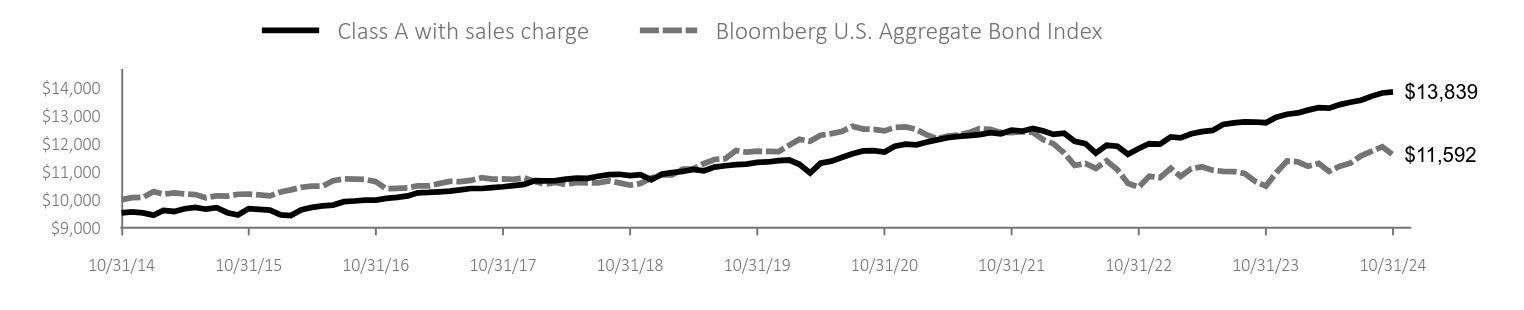

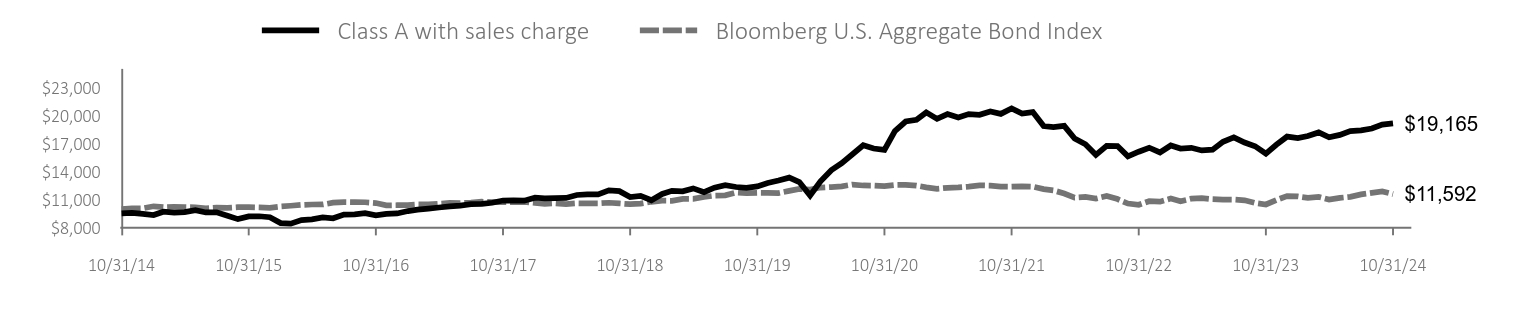

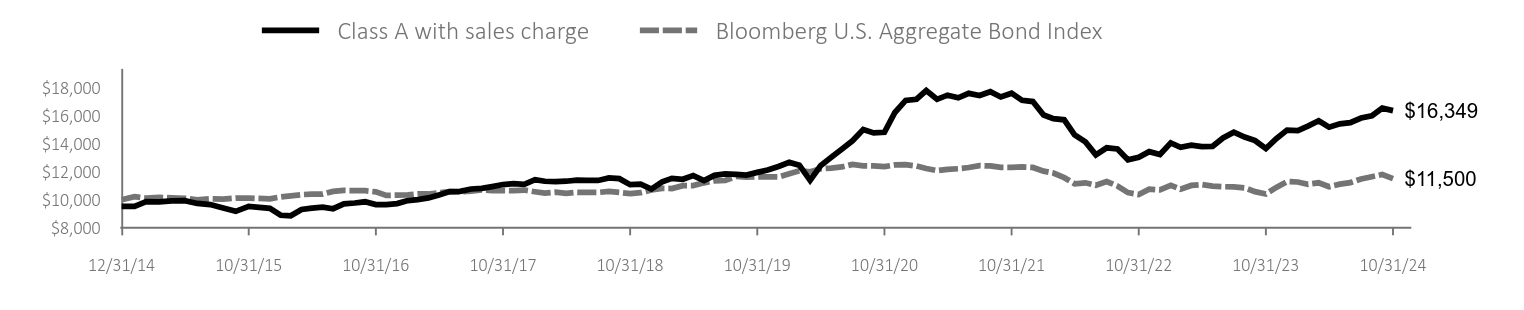

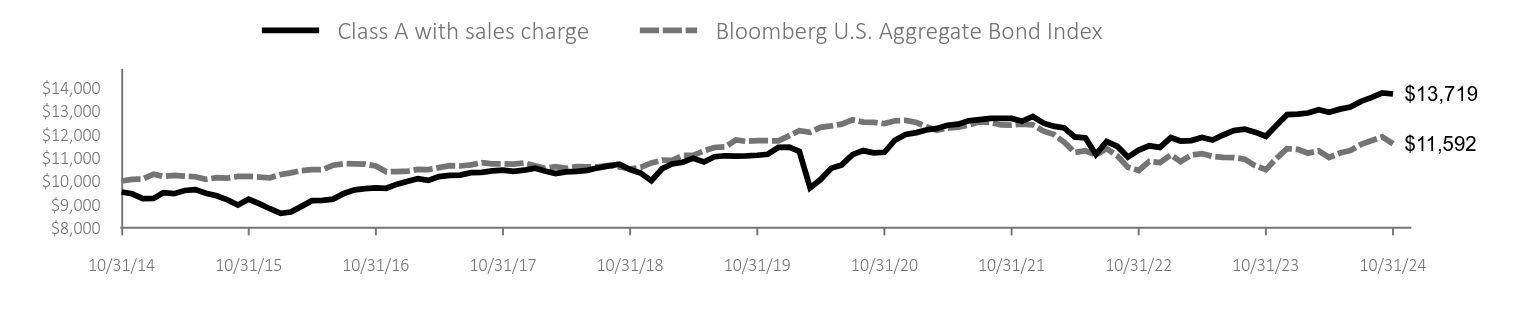

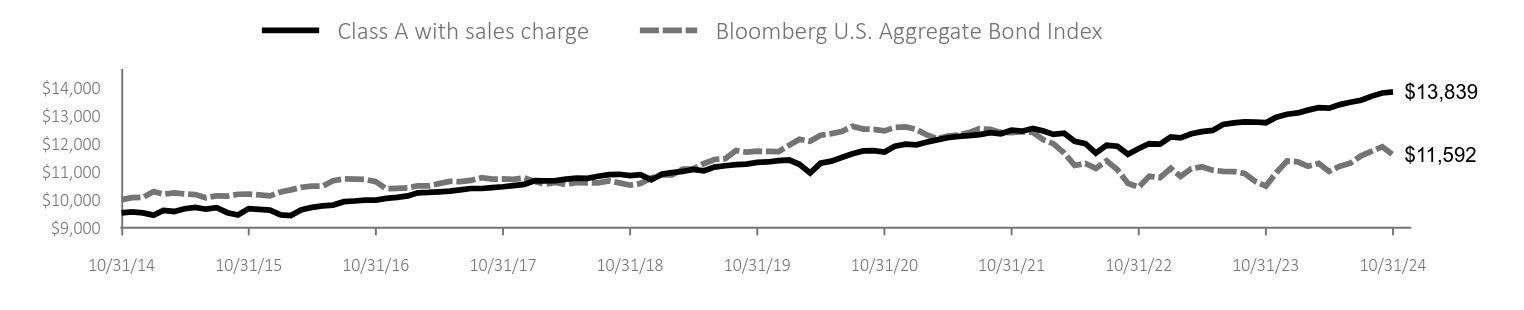

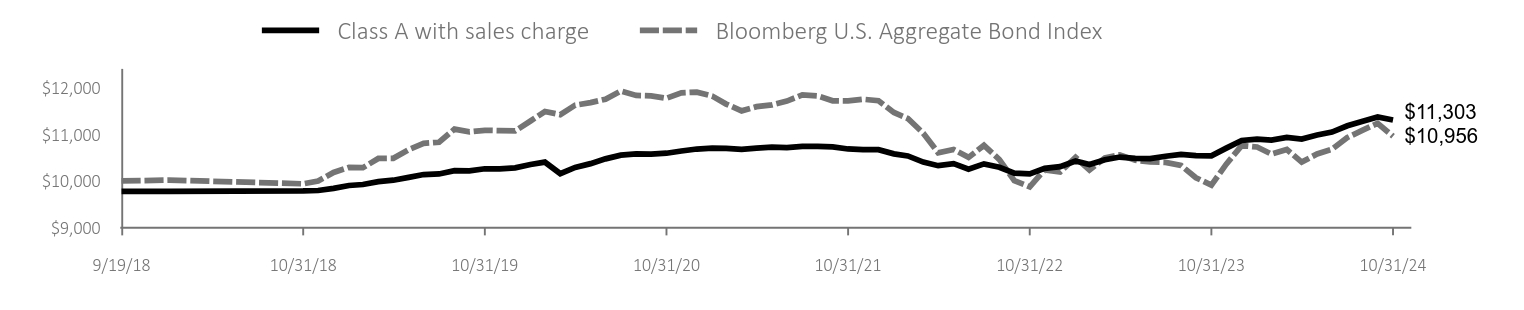

Against a backdrop of resilient economic growth and a Federal Reserve that pivoted to lower rates as inflation abated, the Fund made gains for the 12 months ended October 31, 2024 (“annual period”). As equities advanced, interest rates declined, and credit spreads narrowed, the Fund benefited from its emphasis on total-return-oriented convertibles and underweight in more credit-sensitive convertibles. The Fund’s underweight and selection in the materials sector as well as favorable selection in the industrials sector supported the result. The Fund’s underweight allocation and lagging selection in the communication services sector in addition to the trailing selection within the health care sector held back the result.

| Class A with sales charge | Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/31/14 | $9,524 | $9,999 |

| 11/30/14 | $9,575 | $10,070 |

| 12/31/14 | $9,485 | $10,080 |

| 1/31/15 | $9,360 | $10,291 |

| 2/28/15 | $9,712 | $10,194 |

| 3/31/15 | $9,610 | $10,242 |

| 4/30/15 | $9,676 | $10,205 |

| 5/31/15 | $9,877 | $10,180 |

| 6/30/15 | $9,628 | $10,069 |

| 7/31/15 | $9,644 | $10,139 |

| 8/31/15 | $9,270 | $10,125 |

| 9/30/15 | $8,919 | $10,193 |

| 10/31/15 | $9,209 | $10,195 |

| 11/30/15 | $9,225 | $10,168 |

| 12/31/15 | $9,122 | $10,135 |

| 1/31/16 | $8,495 | $10,275 |

| 2/29/16 | $8,432 | $10,348 |

| 3/31/16 | $8,816 | $10,443 |

| 4/30/16 | $8,897 | $10,483 |

| 5/31/16 | $9,093 | $10,485 |

| 6/30/16 | $9,011 | $10,674 |

| 7/31/16 | $9,405 | $10,741 |

| 8/31/16 | $9,423 | $10,729 |

| 9/30/16 | $9,548 | $10,723 |

| 10/31/16 | $9,331 | $10,641 |

| 11/30/16 | $9,478 | $10,389 |

| 12/31/16 | $9,523 | $10,404 |

| 1/31/17 | $9,783 | $10,424 |

| 2/28/17 | $9,925 | $10,494 |

| 3/31/17 | $10,035 | $10,489 |

| 4/30/17 | $10,160 | $10,570 |

| 5/31/17 | $10,284 | $10,651 |

| 6/30/17 | $10,373 | $10,640 |

| 7/31/17 | $10,511 | $10,686 |

| 8/31/17 | $10,558 | $10,782 |

| 9/30/17 | $10,667 | $10,730 |

| 10/31/17 | $10,906 | $10,737 |

| 11/30/17 | $10,912 | $10,723 |

| 12/31/17 | $10,887 | $10,772 |

| 1/31/18 | $11,208 | $10,648 |

| 2/28/18 | $11,146 | $10,547 |

| 3/31/18 | $11,177 | $10,615 |

| 4/30/18 | $11,183 | $10,536 |

| 5/31/18 | $11,499 | $10,611 |

| 6/30/18 | $11,567 | $10,598 |

| 7/31/18 | $11,567 | $10,600 |

| 8/31/18 | $11,989 | $10,669 |

| 9/30/18 | $11,910 | $10,600 |

| 10/31/18 | $11,281 | $10,516 |

| 11/30/18 | $11,411 | $10,579 |

| 12/31/18 | $10,942 | $10,773 |

| 1/31/19 | $11,613 | $10,888 |

| 2/28/19 | $11,945 | $10,881 |

| 3/31/19 | $11,887 | $11,090 |

| 4/30/19 | $12,205 | $11,093 |

| 5/31/19 | $11,802 | $11,290 |

| 6/30/19 | $12,282 | $11,432 |

| 7/31/19 | $12,537 | $11,457 |

| 8/31/19 | $12,353 | $11,754 |

| 9/30/19 | $12,254 | $11,691 |

| 10/31/19 | $12,411 | $11,727 |

| 11/30/19 | $12,781 | $11,721 |

| 12/31/19 | $13,041 | $11,712 |

| 1/31/20 | $13,355 | $11,938 |

| 2/29/20 | $12,884 | $12,153 |

| 3/31/20 | $11,441 | $12,081 |

| 4/30/20 | $12,960 | $12,296 |

| 5/31/20 | $14,156 | $12,353 |

| 6/30/20 | $14,904 | $12,431 |

| 7/31/20 | $15,864 | $12,617 |

| 8/31/20 | $16,824 | $12,515 |

| 9/30/20 | $16,473 | $12,508 |

| 10/31/20 | $16,330 | $12,452 |

| 11/30/20 | $18,344 | $12,574 |

| 12/31/20 | $19,359 | $12,592 |

| 1/31/21 | $19,534 | $12,501 |

| 2/28/21 | $20,334 | $12,321 |

| 3/31/21 | $19,641 | $12,167 |

| 4/30/21 | $20,151 | $12,263 |

| 5/31/21 | $19,778 | $12,303 |

| 6/30/21 | $20,151 | $12,390 |

| 7/31/21 | $20,075 | $12,528 |

| 8/31/21 | $20,425 | $12,504 |

| 9/30/21 | $20,174 | $12,396 |

| 10/31/21 | $20,753 | $12,393 |

| 11/30/21 | $20,204 | $12,429 |

| 12/31/21 | $20,369 | $12,397 |

| 1/31/22 | $18,867 | $12,130 |

| 2/28/22 | $18,771 | $11,995 |

| 3/31/22 | $18,893 | $11,662 |

| 4/30/22 | $17,530 | $11,219 |

| 5/31/22 | $16,922 | $11,292 |

| 6/30/22 | $15,790 | $11,114 |

| 7/31/22 | $16,755 | $11,386 |

| 8/31/22 | $16,737 | $11,064 |

| 9/30/22 | $15,632 | $10,586 |

| 10/31/22 | $16,127 | $10,449 |

| 11/30/22 | $16,553 | $10,833 |

| 12/31/22 | $16,044 | $10,785 |

| 1/31/23 | $16,795 | $11,116 |

| 2/28/23 | $16,472 | $10,829 |

| 3/31/23 | $16,549 | $11,104 |

| 4/30/23 | $16,260 | $11,171 |

| 5/31/23 | $16,339 | $11,050 |

| 6/30/23 | $17,186 | $11,010 |

| 7/31/23 | $17,667 | $11,003 |

| 8/31/23 | $17,107 | $10,932 |

| 9/30/23 | $16,713 | $10,654 |

| 10/31/23 | $15,925 | $10,486 |

| 11/30/23 | $16,871 | $10,961 |

| 12/31/23 | $17,743 | $11,381 |

| 1/31/24 | $17,583 | $11,349 |

| 2/29/24 | $17,806 | $11,189 |

| 3/31/24 | $18,191 | $11,292 |

| 4/30/24 | $17,674 | $11,007 |

| 5/31/24 | $17,924 | $11,194 |

| 6/30/24 | $18,329 | $11,300 |

| 7/31/24 | $18,419 | $11,564 |

| 8/31/24 | $18,606 | $11,730 |

| 9/30/24 | $19,031 | $11,887 |

| 10/31/24 | $19,165 | $11,592 |

AVERAGE ANNUAL TOTAL RETURNS (%)

| AATR | 1 YEAR | 5 YEARS | 10 YEARS |

|---|

| Class A without sales charge | 20.35 | 9.08 | 7.24 |

| Class A with sales charge | 17.63 | 8.59 | 6.72 |

| Bloomberg U.S. Aggregate Bond Index | 10.55 | -0.23 | 1.49 |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Visit https://www.calamos.com/funds/mutual/ for the most recent performance information.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $871,208,892 | 91 | 54% | $6,255,523 |

Annual Shareholder Report - October 31, 2024

WHAT DID THE FUND INVEST IN?

The Fund invests primarily in convertible securities of US companies and some foreign firms diversified across market sectors and credit quality. Although the Fund can invest across the convertible universe, it emphasizes convertibles with attractive risk-reward profiles issued by midsize companies with higher-quality balance sheets.

Sector weightings and top 10 holdings exclude, if any, cash or cash equivalents.

| Information Technology | 36.3 |

| Consumer Discretionary | 16.0 |

| Health Care | 10.9 |

| Industrials | 9.2 |

| Utilities | 8.5 |

| Financials | 5.6 |

| Communication Services | 5.1 |

| Consumer Staples | 2.3 |

| Real Estate | 1.4 |

| Energy | 1.1 |

| Boeing Company, 6.000%, 10/15/27 | 3.2 |

| Shift4 Payments, Inc., 0.000%, 12/15/25 | 3.1 |

| ON Semiconductor Corp., 0.500%, 03/01/29 | 2.2 |

| Royal Caribbean Cruises, Ltd., 6.000%, 08/15/25 | 2.2 |

| Alibaba Group Holding, Ltd., 0.500%, 06/01/31 | 2.1 |

| NextEra Energy Capital Holdings, Inc., 3.000%, 03/01/27 | 2.0 |

| Booking Holdings, Inc., 0.750%, 05/01/25 | 1.9 |

| Palo Alto Networks, Inc., 0.375%, 06/01/25 | 1.9 |

| MicroStrategy, Inc., 0.625%, 03/15/30 | 1.8 |

| Southern Company, 3.875%, 12/15/25 | 1.8 |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, please visit www.calamos.com/resources. You can also request information by contacting us at 800-582-6959.

©2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

Calamos Investments LLC | 2020 Calamos Court | Naperville, IL 60563 | 800-582-6959 | www.calamos.com | CVTTSRA-A 24

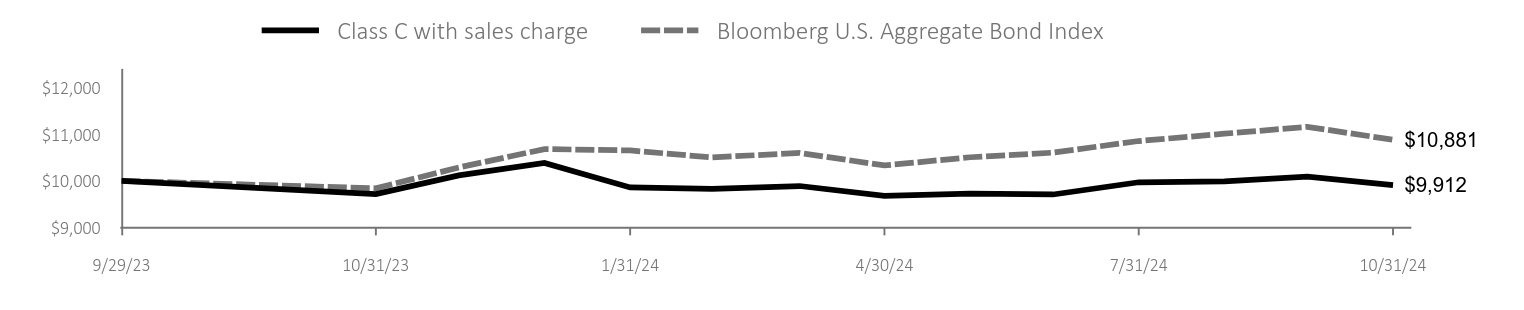

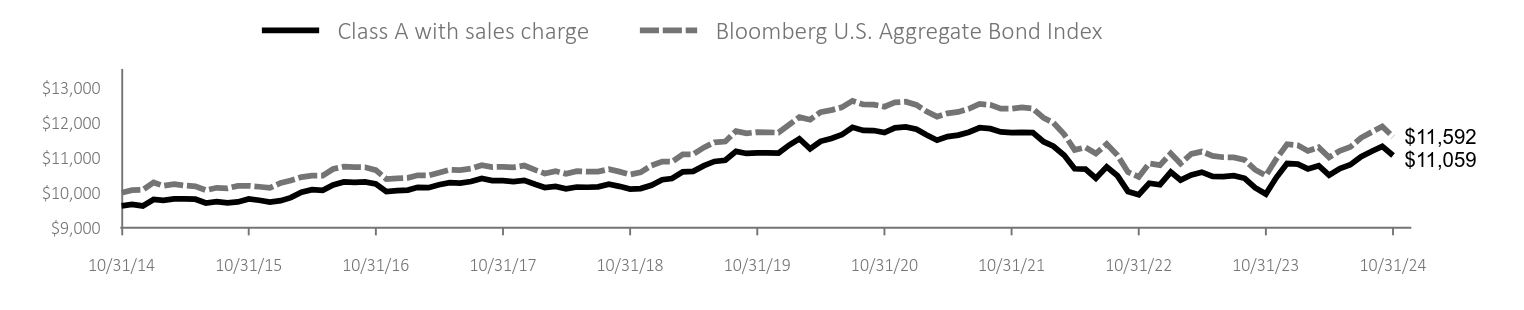

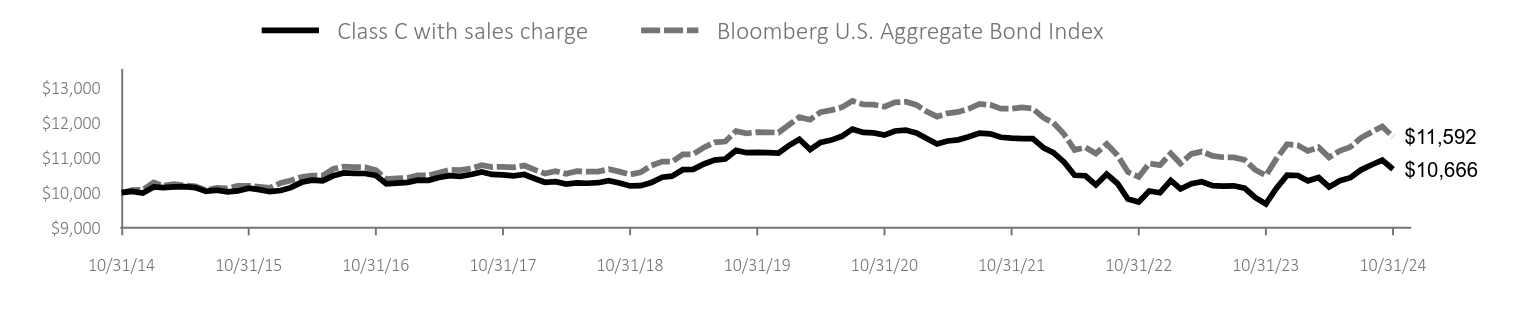

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the Calamos Convertible Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

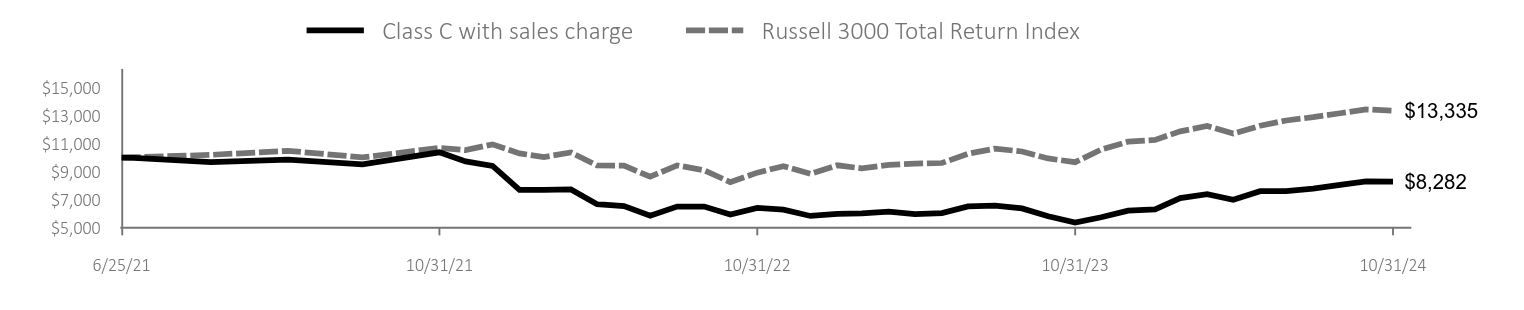

| Class C | $206 | 1.88% |

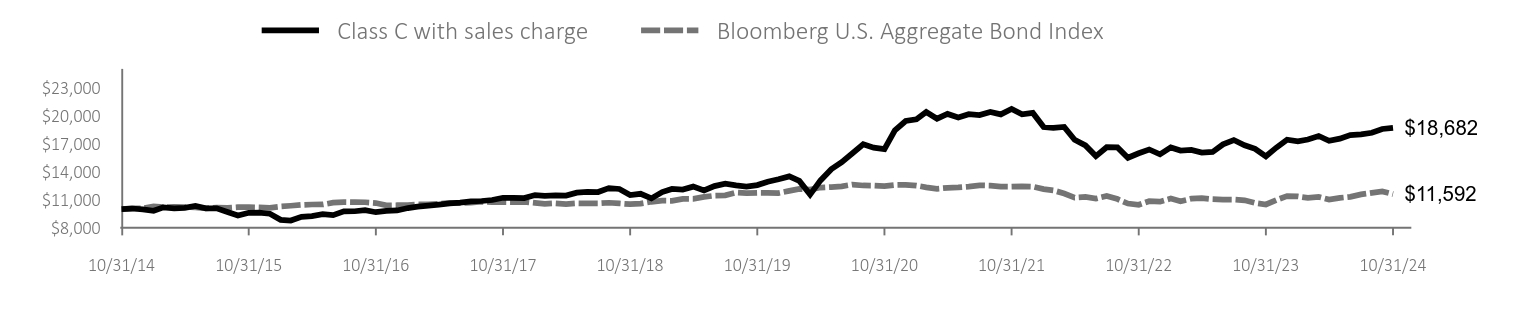

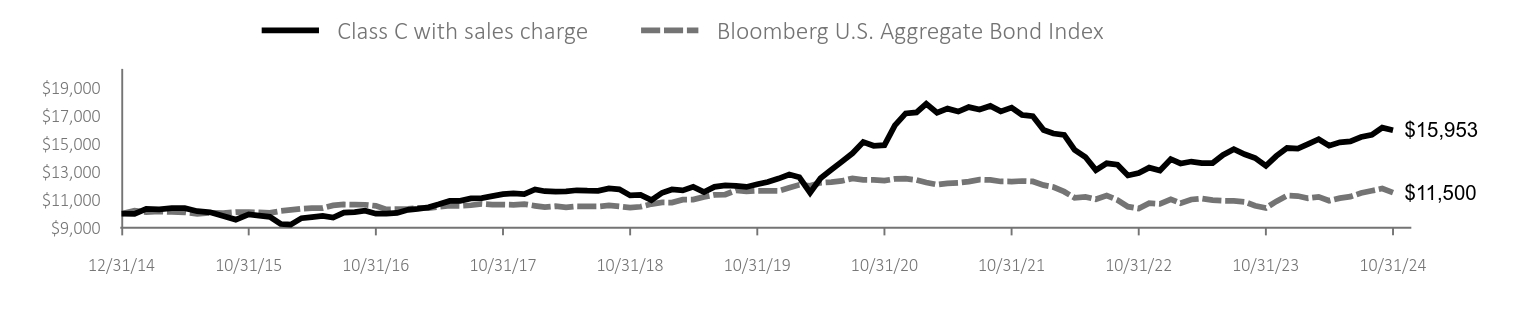

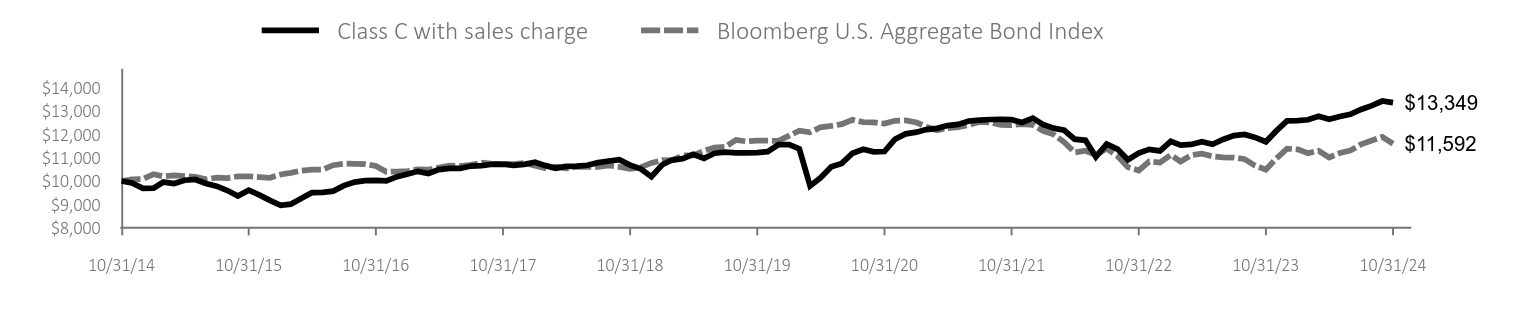

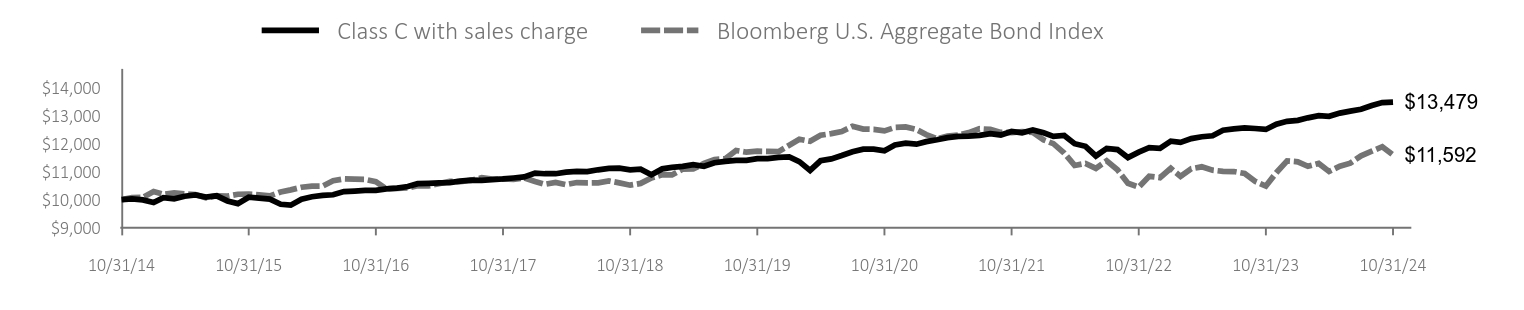

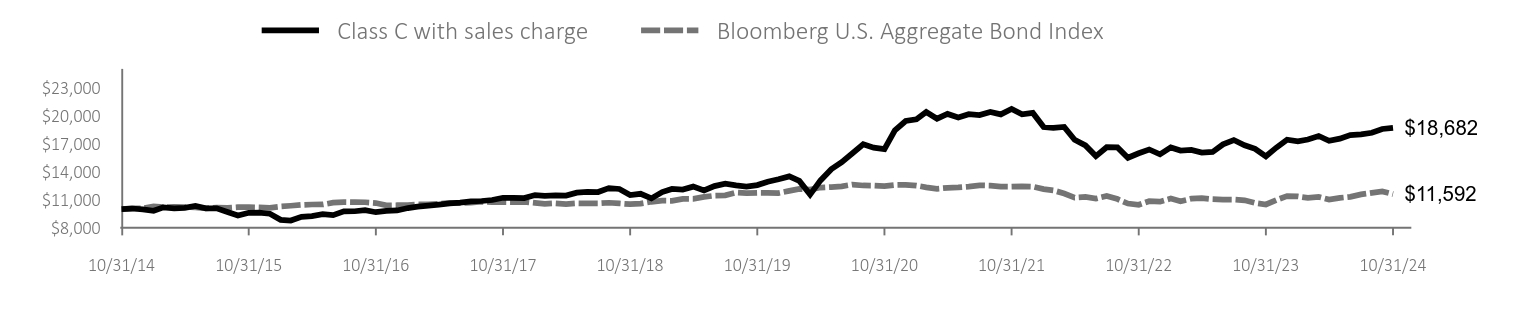

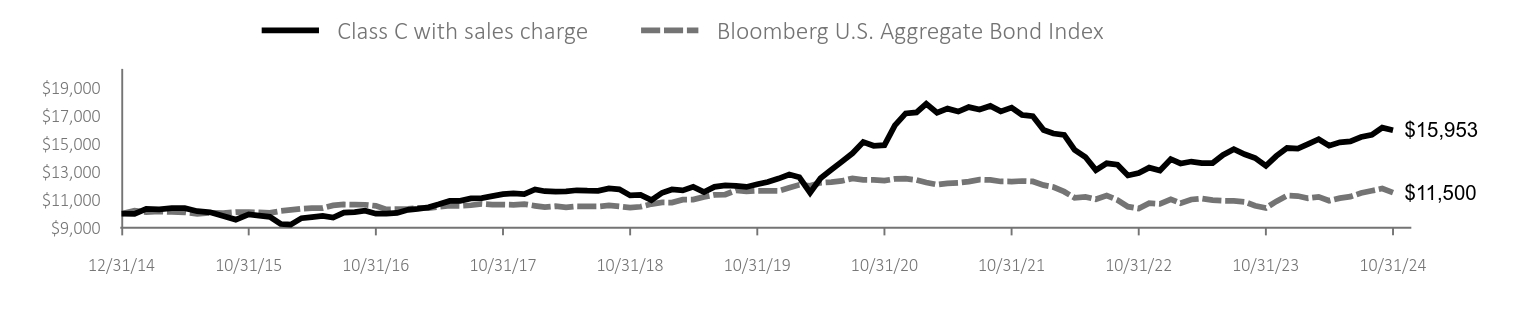

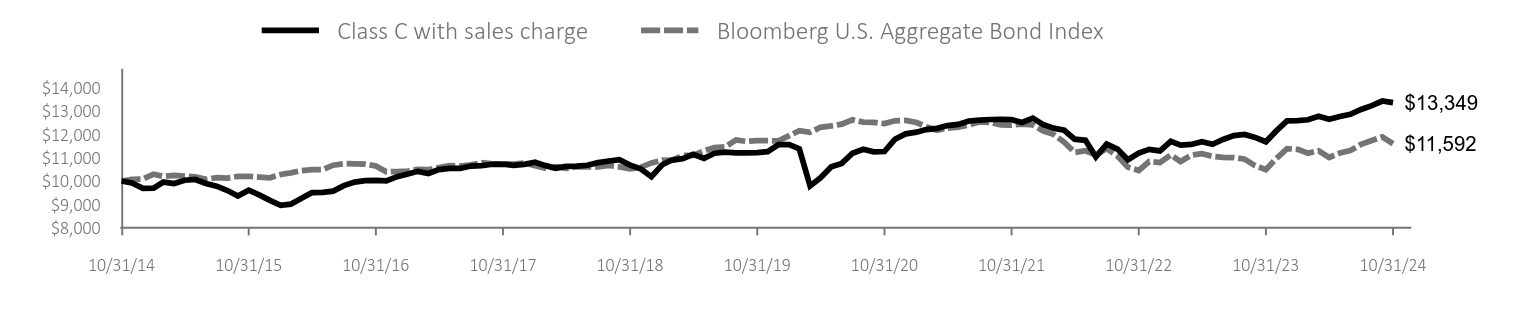

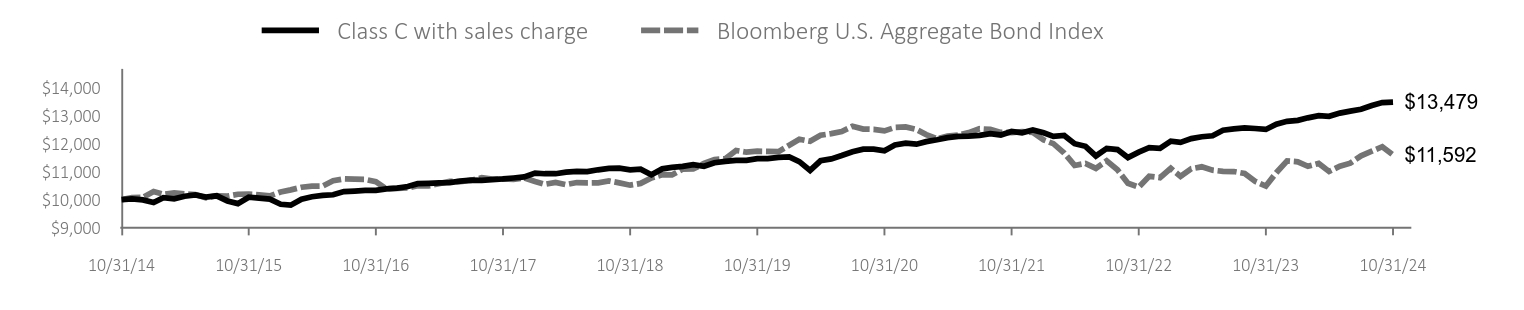

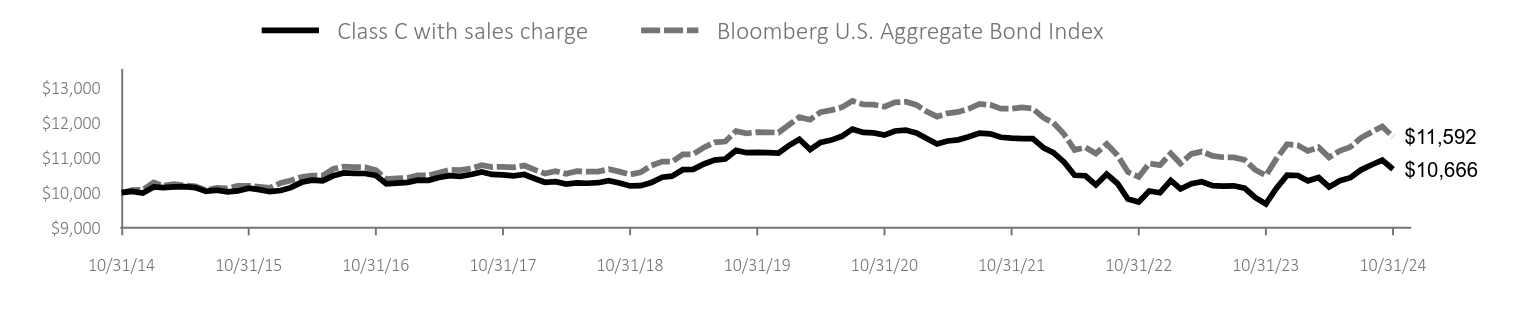

Against a backdrop of resilient economic growth and a Federal Reserve that pivoted to lower rates as inflation abated, the Fund made gains for the 12 months ended October 31, 2024 (“annual period”). As equities advanced, interest rates declined, and credit spreads narrowed, the Fund benefited from its emphasis on total-return-oriented convertibles and underweight in more credit-sensitive convertibles. The Fund’s underweight and selection in the materials sector as well as favorable selection in the industrials sector supported the result. The Fund’s underweight allocation and lagging selection in the communication services sector in addition to the trailing selection within the health care sector held back the result.

| Class C with sales charge | Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/31/14 | $10,000 | $9,999 |

| 11/30/14 | $10,054 | $10,070 |

| 12/31/14 | $9,951 | $10,080 |

| 1/31/15 | $9,814 | $10,291 |

| 2/28/15 | $10,180 | $10,194 |

| 3/31/15 | $10,059 | $10,242 |

| 4/30/15 | $10,123 | $10,205 |

| 5/31/15 | $10,330 | $10,180 |

| 6/30/15 | $10,064 | $10,069 |

| 7/31/15 | $10,076 | $10,139 |

| 8/31/15 | $9,676 | $10,125 |

| 9/30/15 | $9,306 | $10,193 |

| 10/31/15 | $9,599 | $10,195 |

| 11/30/15 | $9,610 | $10,168 |

| 12/31/15 | $9,495 | $10,135 |

| 1/31/16 | $8,843 | $10,275 |

| 2/29/16 | $8,770 | $10,348 |

| 3/31/16 | $9,162 | $10,443 |

| 4/30/16 | $9,241 | $10,483 |

| 5/31/16 | $9,440 | $10,485 |

| 6/30/16 | $9,349 | $10,674 |

| 7/31/16 | $9,749 | $10,741 |

| 8/31/16 | $9,761 | $10,729 |

| 9/30/16 | $9,885 | $10,723 |

| 10/31/16 | $9,658 | $10,641 |

| 11/30/16 | $9,805 | $10,389 |

| 12/31/16 | $9,845 | $10,404 |

| 1/31/17 | $10,104 | $10,424 |

| 2/28/17 | $10,246 | $10,494 |

| 3/31/17 | $10,353 | $10,489 |

| 4/30/17 | $10,470 | $10,570 |

| 5/31/17 | $10,600 | $10,651 |

| 6/30/17 | $10,676 | $10,640 |

| 7/31/17 | $10,818 | $10,686 |

| 8/31/17 | $10,856 | $10,782 |

| 9/30/17 | $10,961 | $10,730 |

| 10/31/17 | $11,202 | $10,737 |

| 11/30/17 | $11,202 | $10,723 |

| 12/31/17 | $11,168 | $10,772 |

| 1/31/18 | $11,494 | $10,648 |

| 2/28/18 | $11,417 | $10,547 |

| 3/31/18 | $11,447 | $10,615 |

| 4/30/18 | $11,441 | $10,536 |

| 5/31/18 | $11,754 | $10,611 |

| 6/30/18 | $11,823 | $10,598 |

| 7/31/18 | $11,816 | $10,600 |

| 8/31/18 | $12,239 | $10,669 |

| 9/30/18 | $12,147 | $10,600 |

| 10/31/18 | $11,499 | $10,516 |

| 11/30/18 | $11,627 | $10,579 |

| 12/31/18 | $11,138 | $10,773 |

| 1/31/19 | $11,814 | $10,888 |

| 2/28/19 | $12,148 | $10,881 |

| 3/31/19 | $12,083 | $11,090 |

| 4/30/19 | $12,395 | $11,093 |

| 5/31/19 | $11,981 | $11,290 |

| 6/30/19 | $12,453 | $11,432 |

| 7/31/19 | $12,708 | $11,457 |

| 8/31/19 | $12,519 | $11,754 |

| 9/30/19 | $12,405 | $11,691 |

| 10/31/19 | $12,558 | $11,727 |

| 11/30/19 | $12,922 | $11,721 |

| 12/31/19 | $13,183 | $11,712 |

| 1/31/20 | $13,489 | $11,938 |

| 2/29/20 | $13,001 | $12,153 |

| 3/31/20 | $11,542 | $12,081 |

| 4/30/20 | $13,060 | $12,296 |

| 5/31/20 | $14,264 | $12,353 |

| 6/30/20 | $15,008 | $12,431 |

| 7/31/20 | $15,964 | $12,617 |

| 8/31/20 | $16,920 | $12,515 |

| 9/30/20 | $16,555 | $12,508 |

| 10/31/20 | $16,402 | $12,452 |

| 11/30/20 | $18,415 | $12,574 |

| 12/31/20 | $19,415 | $12,592 |

| 1/31/21 | $19,585 | $12,501 |

| 2/28/21 | $20,375 | $12,321 |

| 3/31/21 | $19,663 | $12,167 |

| 4/30/21 | $20,166 | $12,263 |

| 5/31/21 | $19,779 | $12,303 |

| 6/30/21 | $20,135 | $12,390 |

| 7/31/21 | $20,050 | $12,528 |

| 8/31/21 | $20,383 | $12,504 |

| 9/30/21 | $20,119 | $12,396 |

| 10/31/21 | $20,692 | $12,393 |

| 11/30/21 | $20,127 | $12,429 |

| 12/31/21 | $20,277 | $12,397 |

| 1/31/22 | $18,773 | $12,130 |

| 2/28/22 | $18,666 | $11,995 |

| 3/31/22 | $18,773 | $11,662 |

| 4/30/22 | $17,409 | $11,219 |

| 5/31/22 | $16,799 | $11,292 |

| 6/30/22 | $15,657 | $11,114 |

| 7/31/22 | $16,613 | $11,386 |

| 8/31/22 | $16,586 | $11,064 |

| 9/30/22 | $15,480 | $10,586 |

| 10/31/22 | $15,958 | $10,449 |

| 11/30/22 | $16,365 | $10,833 |

| 12/31/22 | $15,851 | $10,785 |

| 1/31/23 | $16,588 | $11,116 |

| 2/28/23 | $16,251 | $10,829 |

| 3/31/23 | $16,322 | $11,104 |

| 4/30/23 | $16,029 | $11,171 |

| 5/31/23 | $16,100 | $11,050 |

| 6/30/23 | $16,917 | $11,010 |

| 7/31/23 | $17,378 | $11,003 |

| 8/31/23 | $16,819 | $10,932 |

| 9/30/23 | $16,428 | $10,654 |

| 10/31/23 | $15,638 | $10,486 |

| 11/30/23 | $16,561 | $10,961 |

| 12/31/23 | $17,403 | $11,381 |

| 1/31/24 | $17,232 | $11,349 |

| 2/29/24 | $17,439 | $11,189 |

| 3/31/24 | $17,808 | $11,292 |

| 4/30/24 | $17,295 | $11,007 |

| 5/31/24 | $17,520 | $11,194 |

| 6/30/24 | $17,907 | $11,300 |

| 7/31/24 | $17,988 | $11,564 |

| 8/31/24 | $18,159 | $11,730 |

| 9/30/24 | $18,555 | $11,887 |

| 10/31/24 | $18,682 | $11,592 |

AVERAGE ANNUAL TOTAL RETURNS (%)

| AATR | 1 YEAR | 5 YEARS | 10 YEARS |

|---|

| Class C without sales charge | 19.46 | 8.27 | 6.45 |

| Class C with sales charge | 18.46 | 8.27 | 6.45 |

| Bloomberg U.S. Aggregate Bond Index | 10.55 | -0.23 | 1.49 |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Visit https://www.calamos.com/funds/mutual/ for the most recent performance information.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $871,208,892 | 91 | 54% | $6,255,523 |

Annual Shareholder Report - October 31, 2024

WHAT DID THE FUND INVEST IN?

The Fund invests primarily in convertible securities of US companies and some foreign firms diversified across market sectors and credit quality. Although the Fund can invest across the convertible universe, it emphasizes convertibles with attractive risk-reward profiles issued by midsize companies with higher-quality balance sheets.

Sector weightings and top 10 holdings exclude, if any, cash or cash equivalents.

| Information Technology | 36.3 |

| Consumer Discretionary | 16.0 |

| Health Care | 10.9 |

| Industrials | 9.2 |

| Utilities | 8.5 |

| Financials | 5.6 |

| Communication Services | 5.1 |

| Consumer Staples | 2.3 |

| Real Estate | 1.4 |

| Energy | 1.1 |

| Boeing Company, 6.000%, 10/15/27 | 3.2 |

| Shift4 Payments, Inc., 0.000%, 12/15/25 | 3.1 |

| ON Semiconductor Corp., 0.500%, 03/01/29 | 2.2 |

| Royal Caribbean Cruises, Ltd., 6.000%, 08/15/25 | 2.2 |

| Alibaba Group Holding, Ltd., 0.500%, 06/01/31 | 2.1 |

| NextEra Energy Capital Holdings, Inc., 3.000%, 03/01/27 | 2.0 |

| Booking Holdings, Inc., 0.750%, 05/01/25 | 1.9 |

| Palo Alto Networks, Inc., 0.375%, 06/01/25 | 1.9 |

| MicroStrategy, Inc., 0.625%, 03/15/30 | 1.8 |

| Southern Company, 3.875%, 12/15/25 | 1.8 |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, please visit www.calamos.com/resources. You can also request information by contacting us at 800-582-6959.

©2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

Calamos Investments LLC | 2020 Calamos Court | Naperville, IL 60563 | 800-582-6959 | www.calamos.com | CVTTSRA-C 24

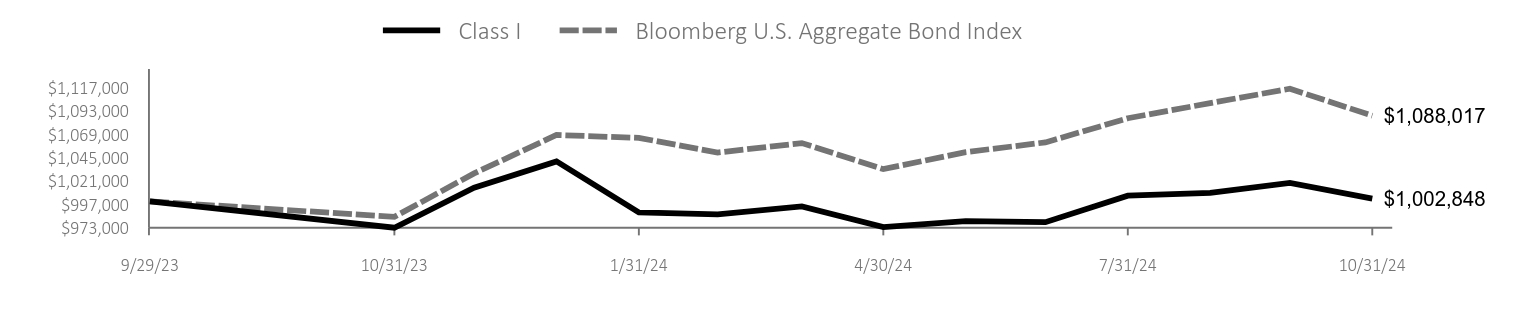

Annual Shareholder Report - October 31, 2024

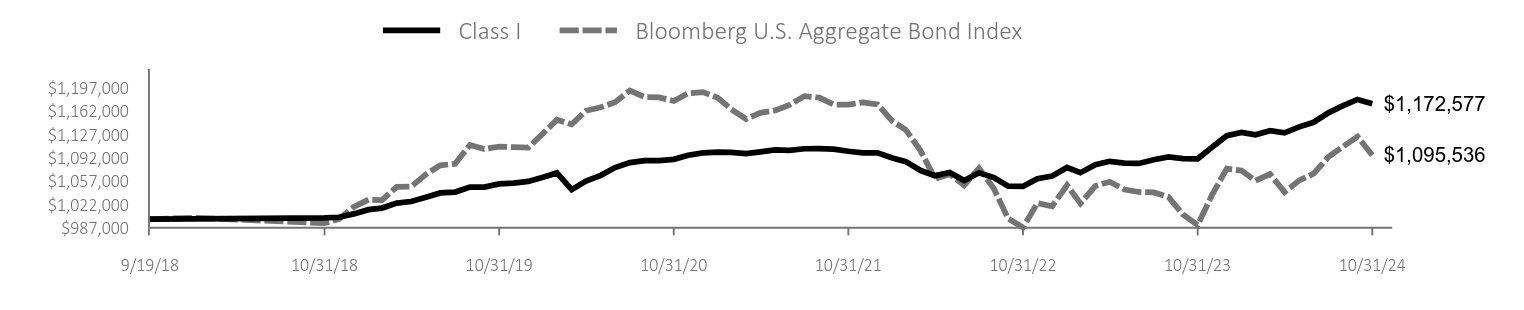

This annual shareholder report contains important information about the Calamos Convertible Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

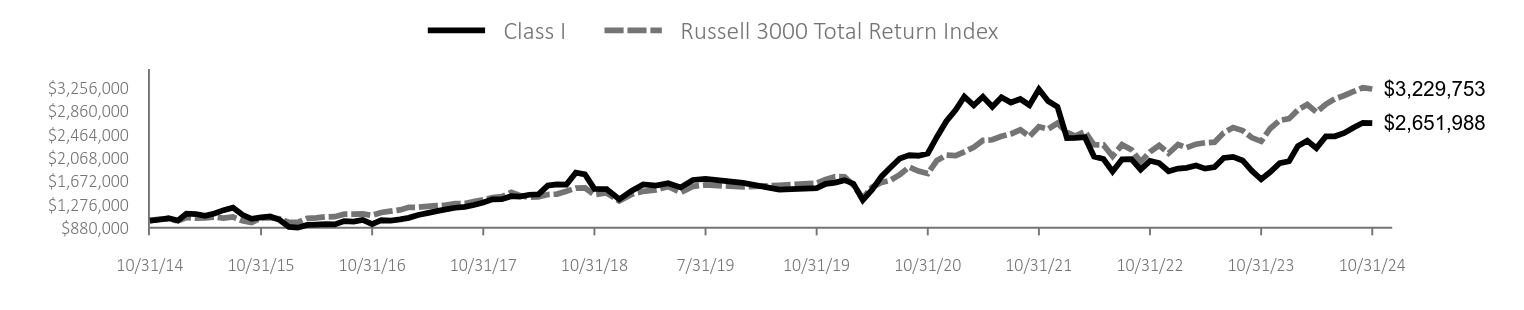

| Class I | $97 | 0.88% |

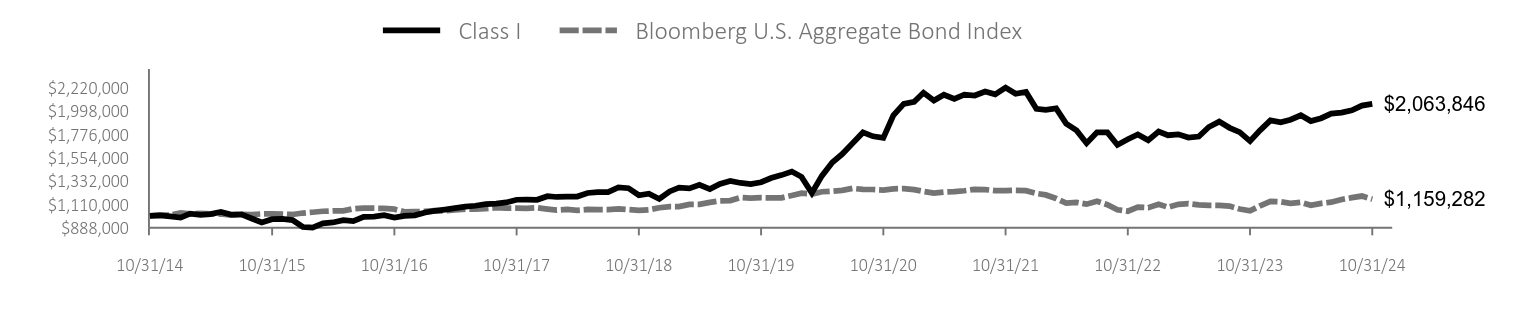

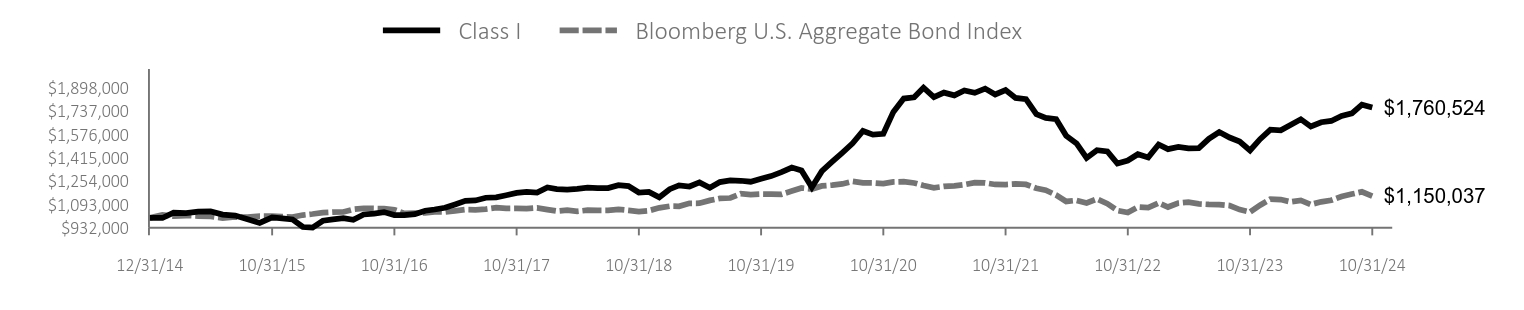

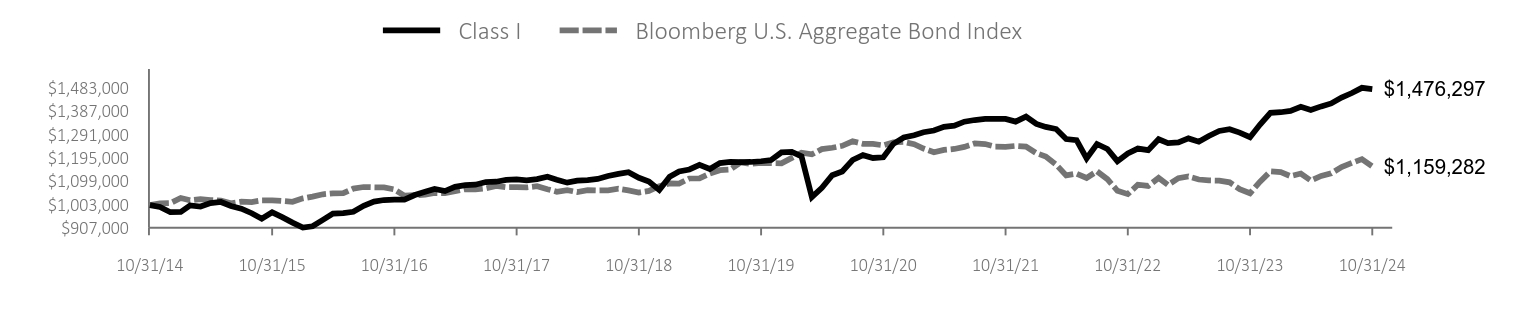

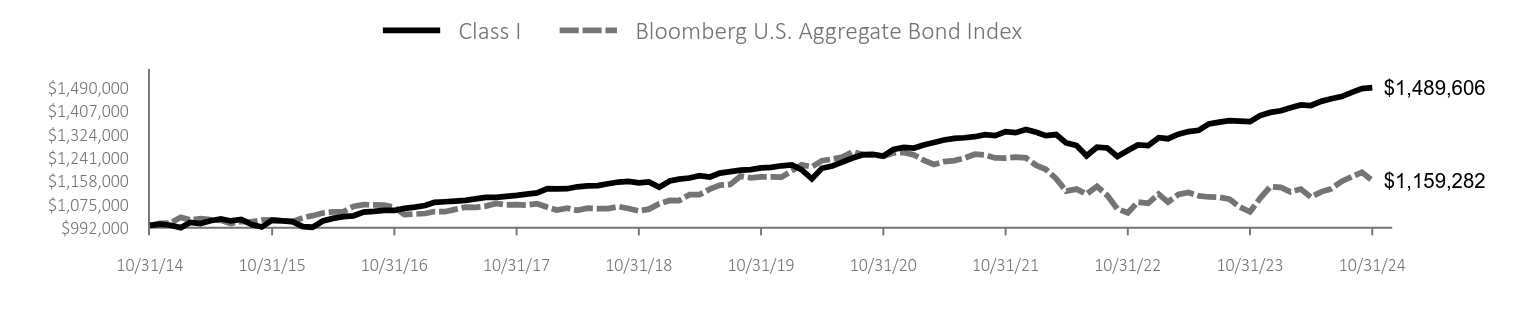

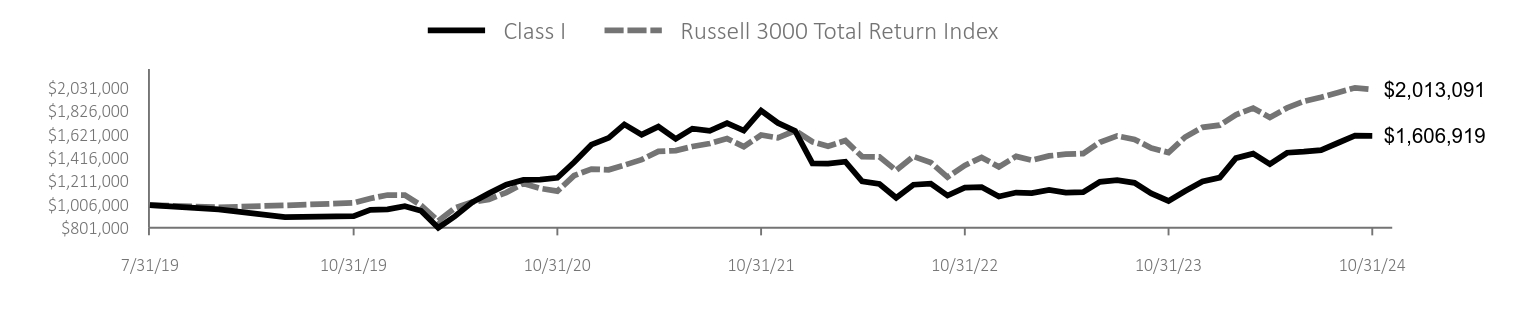

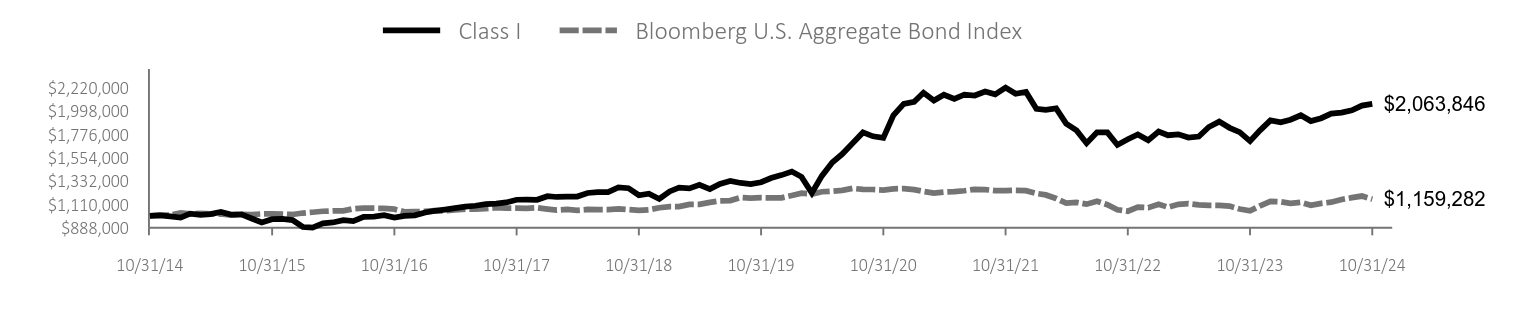

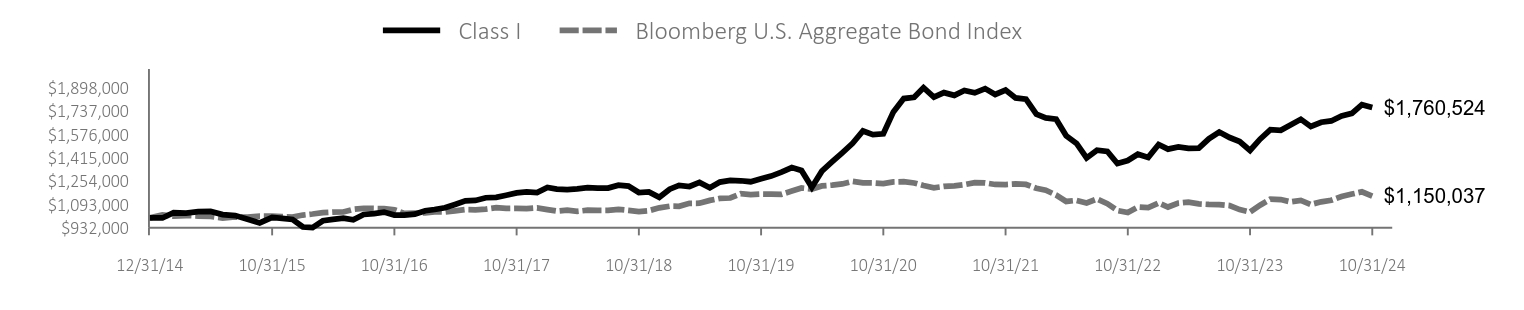

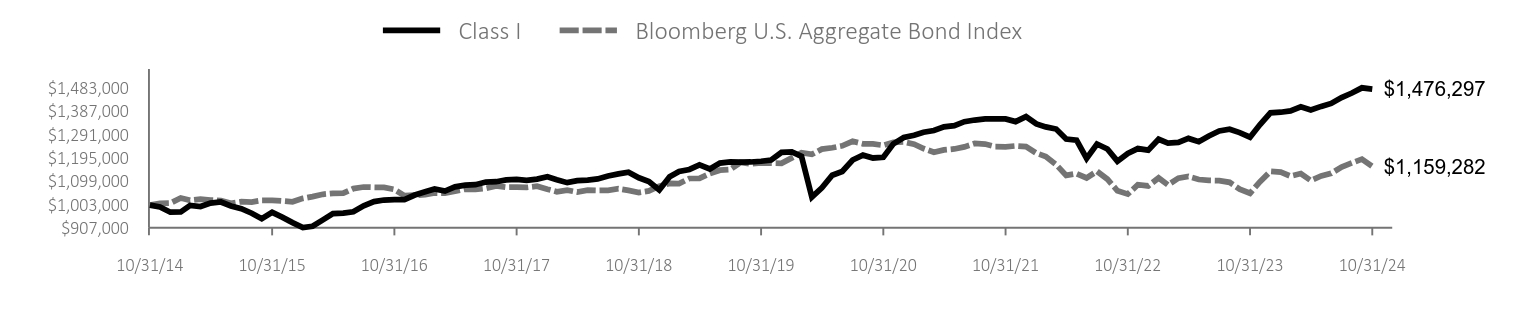

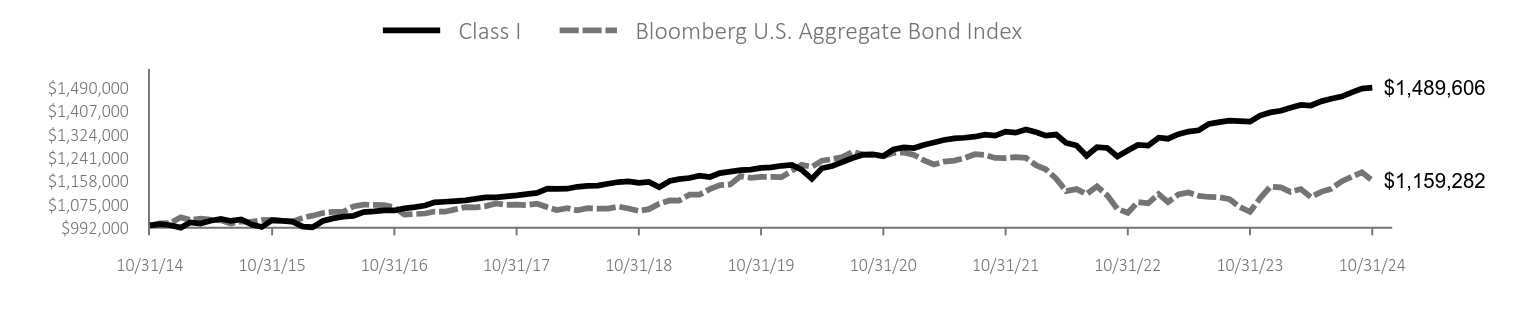

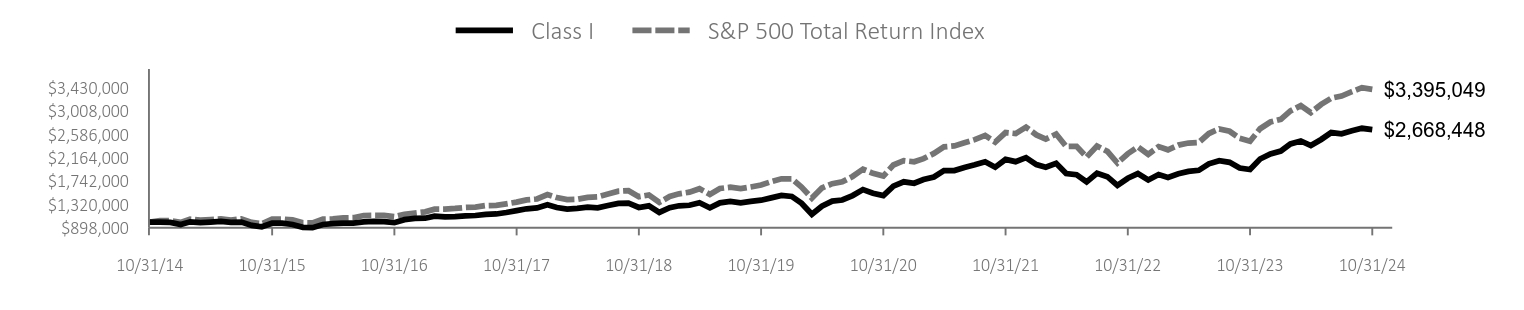

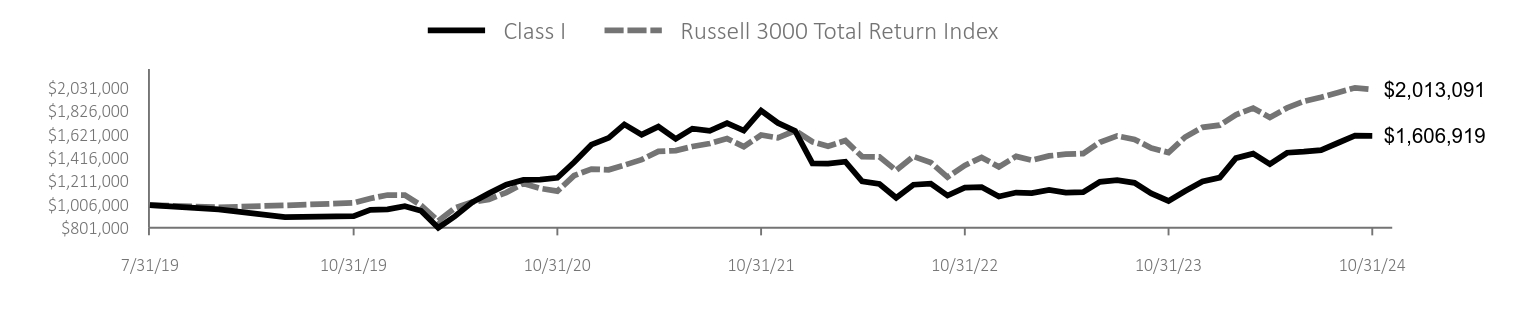

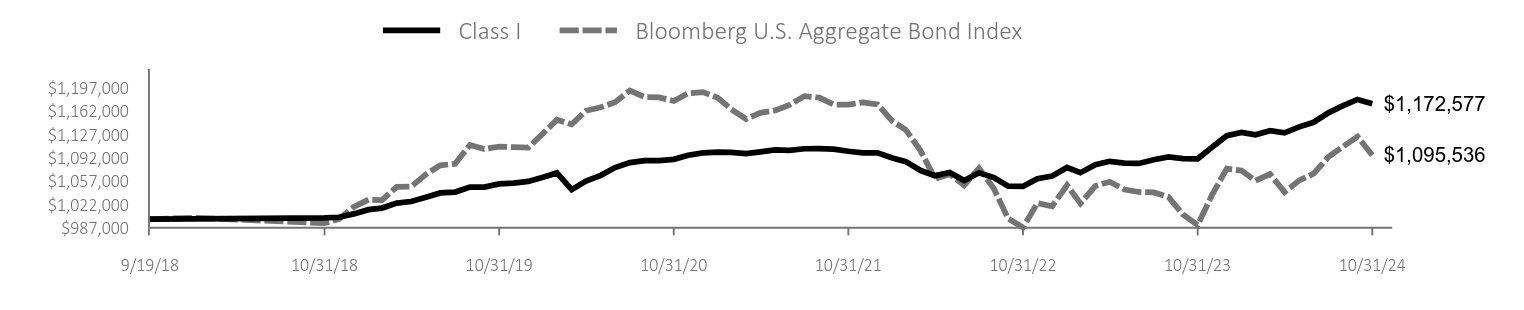

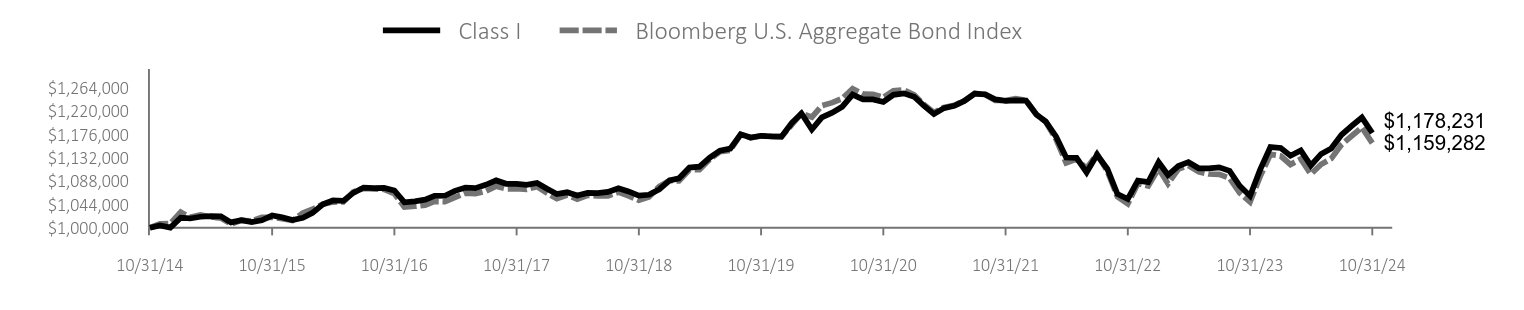

Against a backdrop of resilient economic growth and a Federal Reserve that pivoted to lower rates as inflation abated, the Fund made gains for the 12 months ended October 31, 2024 (“annual period”). As equities advanced, interest rates declined, and credit spreads narrowed, the Fund benefited from its emphasis on total-return-oriented convertibles and underweight in more credit-sensitive convertibles. The Fund’s underweight and selection in the materials sector as well as favorable selection in the industrials sector supported the result. The Fund’s underweight allocation and lagging selection in the communication services sector in addition to the trailing selection within the health care sector held back the result.

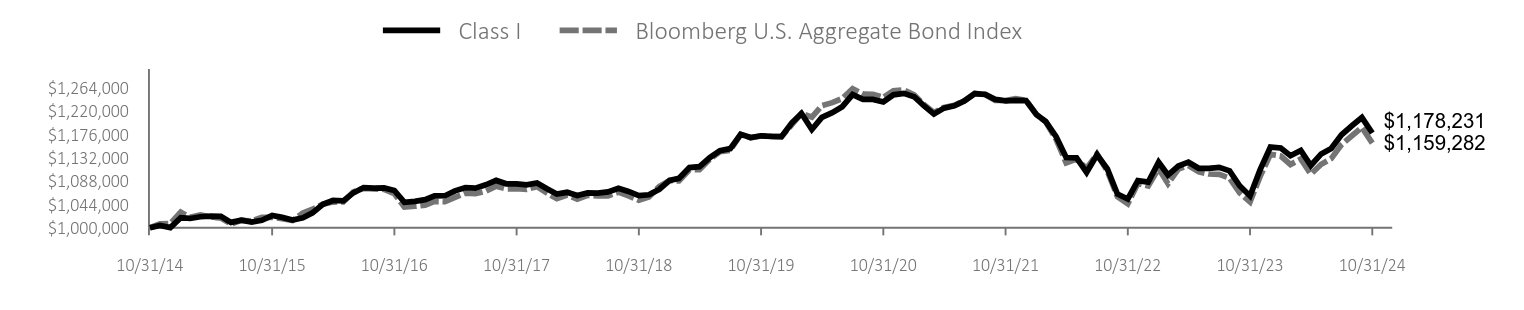

| Class I | Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/31/14 | $1,000,000 | $1,000,001 |

| 11/30/14 | $1,005,875 | $1,007,097 |

| 12/31/14 | $996,222 | $1,008,039 |

| 1/31/15 | $983,730 | $1,029,175 |

| 2/28/15 | $1,021,206 | $1,019,500 |

| 3/31/15 | $1,010,146 | $1,024,232 |

| 4/30/15 | $1,017,073 | $1,020,558 |

| 5/31/15 | $1,038,485 | $1,018,099 |

| 6/30/15 | $1,012,833 | $1,006,997 |

| 7/31/15 | $1,014,741 | $1,013,998 |

| 8/31/15 | $975,297 | $1,012,540 |

| 9/30/15 | $938,555 | $1,019,389 |

| 10/31/15 | $968,852 | $1,019,563 |

| 11/30/15 | $970,786 | $1,016,867 |

| 12/31/15 | $960,192 | $1,013,583 |

| 1/31/16 | $895,287 | $1,027,528 |

| 2/29/16 | $888,596 | $1,034,819 |

| 3/31/16 | $929,308 | $1,044,310 |

| 4/30/16 | $938,037 | $1,048,321 |

| 5/31/16 | $958,852 | $1,048,590 |

| 6/30/16 | $950,013 | $1,067,431 |

| 7/31/16 | $991,965 | $1,074,180 |

| 8/31/16 | $993,995 | $1,072,953 |

| 9/30/16 | $1,007,353 | $1,072,321 |

| 10/31/16 | $984,755 | $1,064,120 |

| 11/30/16 | $1,000,505 | $1,038,951 |

| 12/31/16 | $1,005,804 | $1,040,415 |

| 1/31/17 | $1,032,819 | $1,042,457 |

| 2/28/17 | $1,048,058 | $1,049,464 |

| 3/31/17 | $1,060,243 | $1,048,911 |

| 4/30/17 | $1,073,487 | $1,057,008 |

| 5/31/17 | $1,087,428 | $1,065,141 |

| 6/30/17 | $1,096,465 | $1,064,072 |

| 7/31/17 | $1,111,169 | $1,068,652 |

| 8/31/17 | $1,116,770 | $1,078,233 |

| 9/30/17 | $1,128,292 | $1,073,100 |

| 10/31/17 | $1,153,537 | $1,073,722 |

| 11/30/17 | $1,154,939 | $1,072,342 |

| 12/31/17 | $1,152,852 | $1,077,264 |

| 1/31/18 | $1,187,038 | $1,064,857 |

| 2/28/18 | $1,179,764 | $1,054,765 |

| 3/31/18 | $1,184,208 | $1,061,530 |

| 4/30/18 | $1,184,208 | $1,053,633 |

| 5/31/18 | $1,217,813 | $1,061,150 |

| 6/30/18 | $1,225,952 | $1,059,845 |

| 7/31/18 | $1,226,686 | $1,060,098 |

| 8/31/18 | $1,271,439 | $1,066,920 |

| 9/30/18 | $1,262,953 | $1,060,050 |

| 10/31/18 | $1,196,598 | $1,051,675 |

| 11/30/18 | $1,210,607 | $1,057,950 |

| 12/31/18 | $1,161,156 | $1,077,385 |

| 1/31/19 | $1,232,507 | $1,088,830 |

| 2/28/19 | $1,268,182 | $1,088,198 |

| 3/31/19 | $1,261,852 | $1,109,092 |

| 4/30/19 | $1,295,956 | $1,109,376 |

| 5/31/19 | $1,254,178 | $1,129,070 |

| 6/30/19 | $1,304,426 | $1,143,247 |

| 7/31/19 | $1,331,761 | $1,145,763 |

| 8/31/19 | $1,312,968 | $1,175,454 |

| 9/30/19 | $1,302,849 | $1,169,194 |

| 10/31/19 | $1,320,014 | $1,172,716 |

| 11/30/19 | $1,359,494 | $1,172,116 |

| 12/31/19 | $1,387,633 | $1,171,300 |

| 1/31/20 | $1,421,247 | $1,193,842 |

| 2/29/20 | $1,371,257 | $1,215,330 |

| 3/31/20 | $1,217,849 | $1,208,176 |

| 4/30/20 | $1,379,940 | $1,229,655 |

| 5/31/20 | $1,507,359 | $1,235,377 |

| 6/30/20 | $1,587,468 | $1,243,163 |

| 7/31/20 | $1,689,829 | $1,261,730 |

| 8/31/20 | $1,793,058 | $1,251,543 |

| 9/30/20 | $1,756,022 | $1,250,859 |

| 10/31/20 | $1,741,258 | $1,245,274 |

| 11/30/20 | $1,955,767 | $1,257,492 |

| 12/31/20 | $2,064,381 | $1,259,224 |

| 1/31/21 | $2,083,935 | $1,250,196 |

| 2/28/21 | $2,169,602 | $1,232,145 |

| 3/31/21 | $2,096,040 | $1,216,757 |

| 4/30/21 | $2,150,979 | $1,226,370 |

| 5/31/21 | $2,111,870 | $1,230,376 |

| 6/30/21 | $2,150,979 | $1,239,020 |

| 7/31/21 | $2,143,529 | $1,252,875 |

| 8/31/21 | $2,181,707 | $1,250,490 |

| 9/30/21 | $2,154,993 | $1,239,662 |

| 10/31/21 | $2,218,321 | $1,239,320 |

| 11/30/21 | $2,159,650 | $1,242,989 |

| 12/31/21 | $2,177,013 | $1,239,809 |

| 1/31/22 | $2,017,719 | $1,213,098 |

| 2/28/22 | $2,007,966 | $1,199,564 |

| 3/31/22 | $2,020,970 | $1,166,236 |

| 4/30/22 | $1,875,764 | $1,121,979 |

| 5/31/22 | $1,811,829 | $1,129,212 |

| 6/30/22 | $1,690,457 | $1,111,498 |

| 7/31/22 | $1,793,533 | $1,138,656 |

| 8/31/22 | $1,792,448 | $1,106,486 |

| 9/30/22 | $1,674,016 | $1,058,676 |

| 10/31/22 | $1,728,332 | $1,044,963 |

| 11/30/22 | $1,773,957 | $1,083,392 |

| 12/31/22 | $1,719,288 | $1,078,507 |

| 1/31/23 | $1,801,315 | $1,111,687 |

| 2/28/23 | $1,766,317 | $1,082,945 |

| 3/31/23 | $1,775,093 | $1,110,450 |

| 4/30/23 | $1,744,431 | $1,117,183 |

| 5/31/23 | $1,753,192 | $1,105,018 |

| 6/30/23 | $1,844,249 | $1,101,075 |

| 7/31/23 | $1,895,844 | $1,100,311 |

| 8/31/23 | $1,836,565 | $1,093,284 |

| 9/30/23 | $1,795,086 | $1,065,499 |

| 10/31/23 | $1,710,339 | $1,048,685 |

| 11/30/23 | $1,812,695 | $1,096,174 |

| 12/31/23 | $1,907,085 | $1,138,135 |

| 1/31/24 | $1,889,146 | $1,135,008 |

| 2/29/24 | $1,913,812 | $1,118,973 |

| 3/31/24 | $1,955,927 | $1,129,307 |

| 4/30/24 | $1,900,910 | $1,100,780 |

| 5/31/24 | $1,927,857 | $1,119,442 |

| 6/30/24 | $1,971,510 | $1,130,044 |

| 7/31/24 | $1,981,643 | $1,156,439 |

| 8/31/24 | $2,003,036 | $1,173,053 |

| 9/30/24 | $2,048,040 | $1,188,762 |

| 10/31/24 | $2,063,846 | $1,159,282 |

AVERAGE ANNUAL TOTAL RETURNS (%)

| AATR | 1 YEAR | 5 YEARS | 10 YEARS |

|---|

| Class I | 20.67 | 9.35 | 7.51 |

| Bloomberg U.S. Aggregate Bond Index | 10.55 | -0.23 | 1.49 |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Visit https://www.calamos.com/funds/mutual/ for the most recent performance information.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $871,208,892 | 91 | 54% | $6,255,523 |

Annual Shareholder Report - October 31, 2024

WHAT DID THE FUND INVEST IN?

The Fund invests primarily in convertible securities of US companies and some foreign firms diversified across market sectors and credit quality. Although the Fund can invest across the convertible universe, it emphasizes convertibles with attractive risk-reward profiles issued by midsize companies with higher-quality balance sheets.

Sector weightings and top 10 holdings exclude, if any, cash or cash equivalents.

| Information Technology | 36.3 |

| Consumer Discretionary | 16.0 |

| Health Care | 10.9 |

| Industrials | 9.2 |

| Utilities | 8.5 |

| Financials | 5.6 |

| Communication Services | 5.1 |

| Consumer Staples | 2.3 |

| Real Estate | 1.4 |

| Energy | 1.1 |

| Boeing Company, 6.000%, 10/15/27 | 3.2 |

| Shift4 Payments, Inc., 0.000%, 12/15/25 | 3.1 |

| ON Semiconductor Corp., 0.500%, 03/01/29 | 2.2 |

| Royal Caribbean Cruises, Ltd., 6.000%, 08/15/25 | 2.2 |

| Alibaba Group Holding, Ltd., 0.500%, 06/01/31 | 2.1 |

| NextEra Energy Capital Holdings, Inc., 3.000%, 03/01/27 | 2.0 |

| Booking Holdings, Inc., 0.750%, 05/01/25 | 1.9 |

| Palo Alto Networks, Inc., 0.375%, 06/01/25 | 1.9 |

| MicroStrategy, Inc., 0.625%, 03/15/30 | 1.8 |

| Southern Company, 3.875%, 12/15/25 | 1.8 |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, please visit www.calamos.com/resources. You can also request information by contacting us at 800-582-6959.

©2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

Calamos Investments LLC | 2020 Calamos Court | Naperville, IL 60563 | 800-582-6959 | www.calamos.com | CVTTSRA-I 24

Calamos Dividend Growth Fund

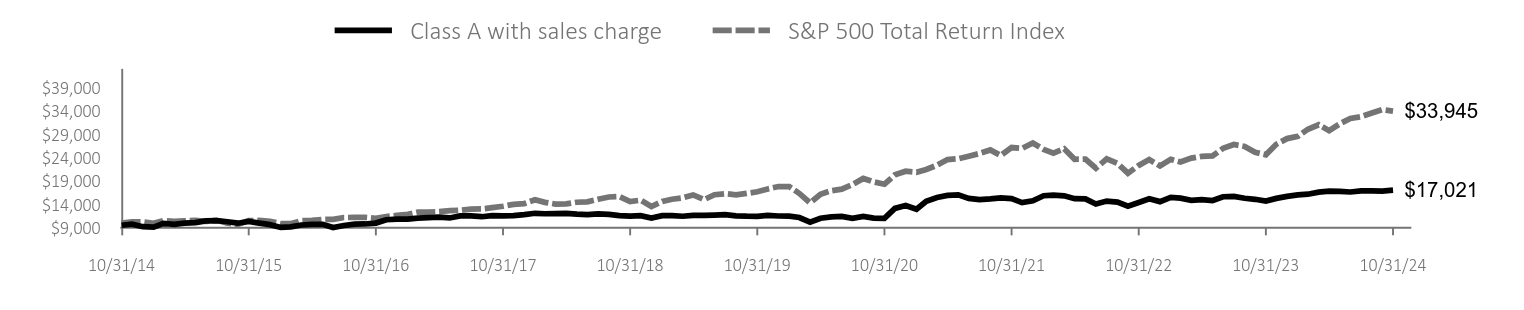

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the Calamos Dividend Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

| Class A | $158 | 1.35% |

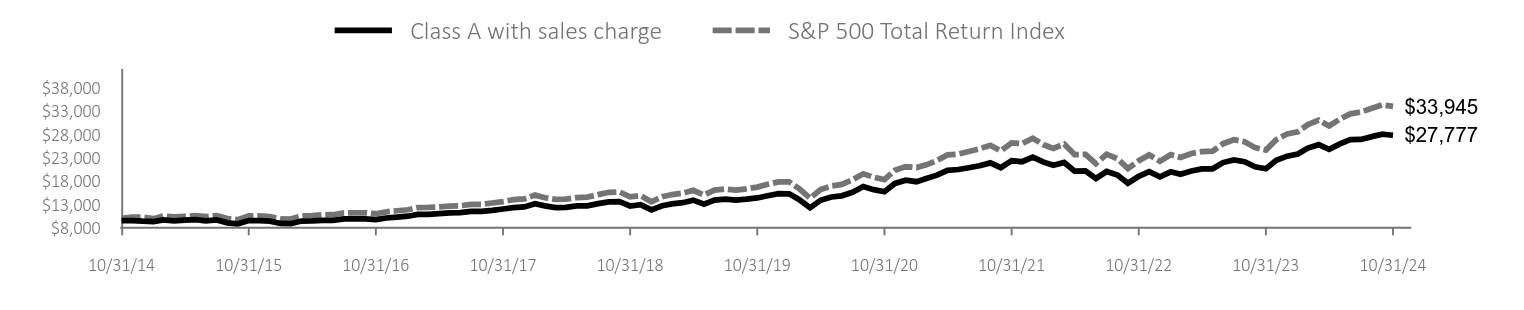

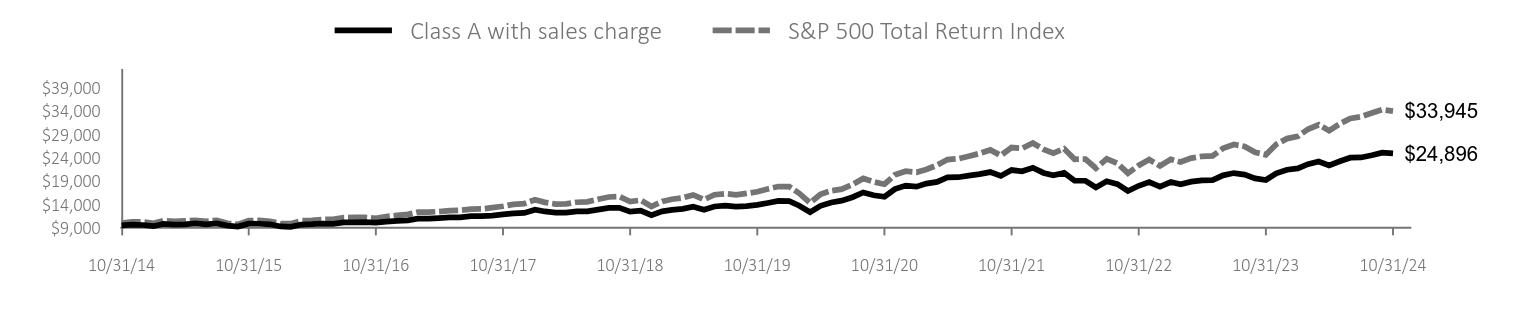

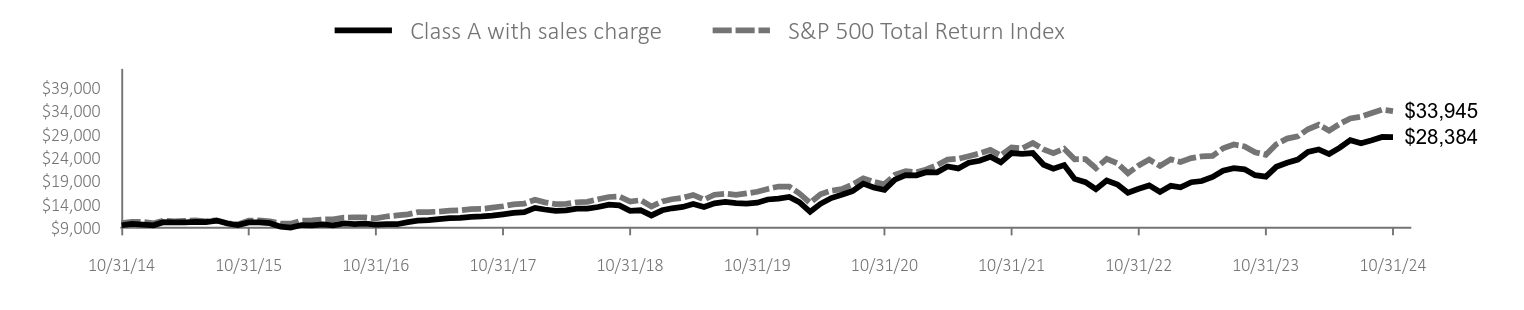

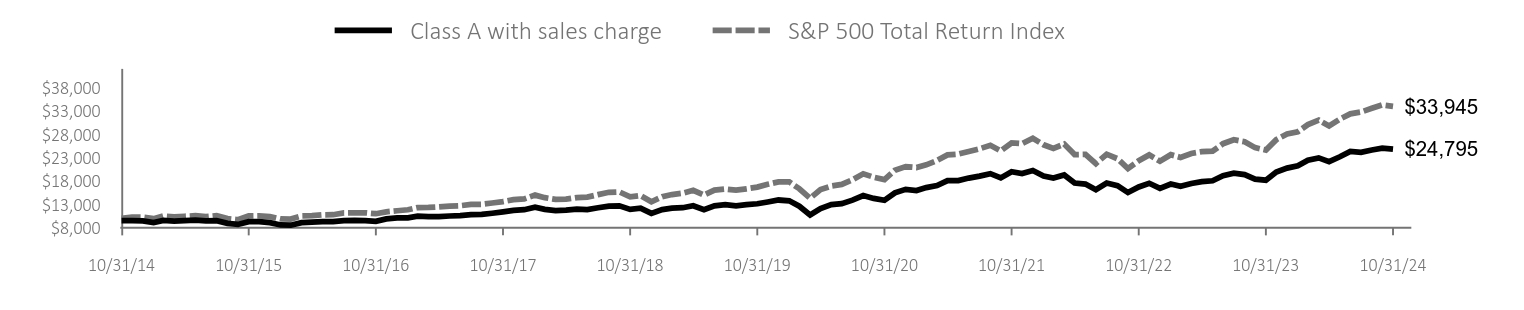

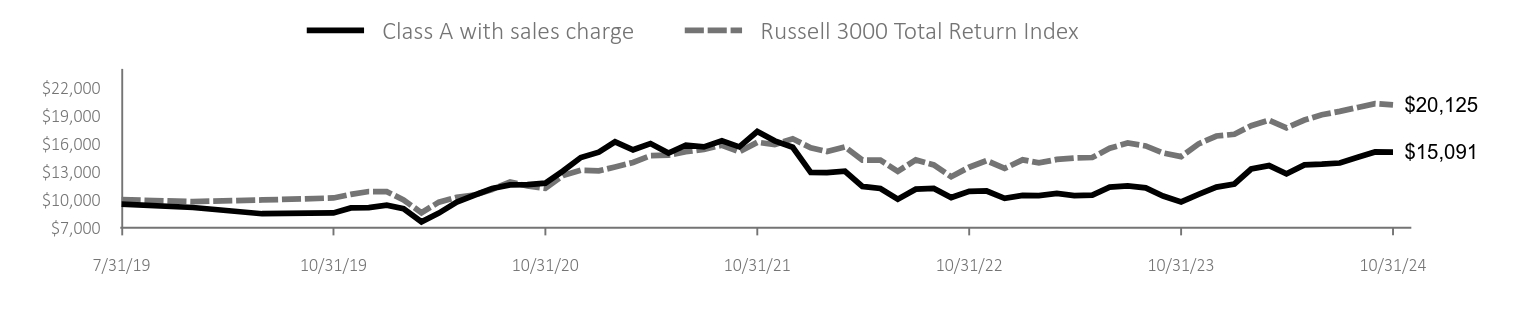

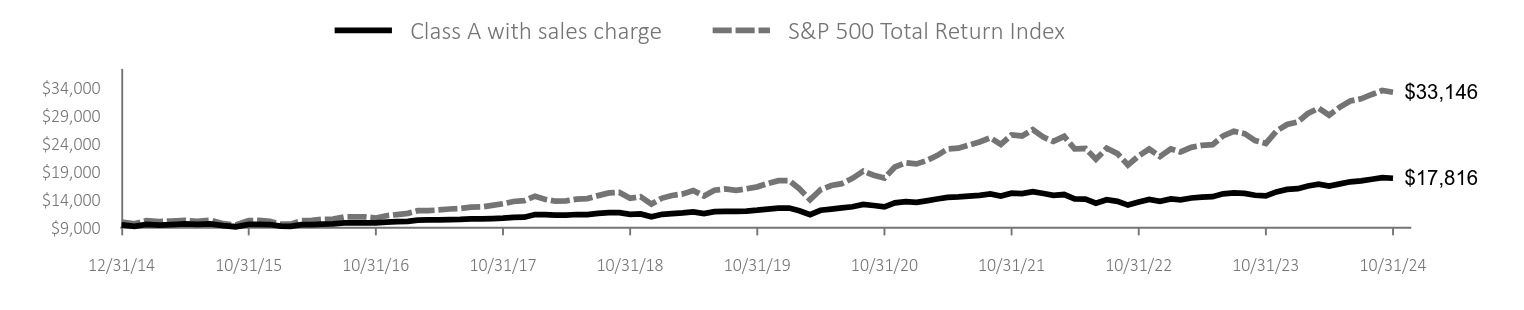

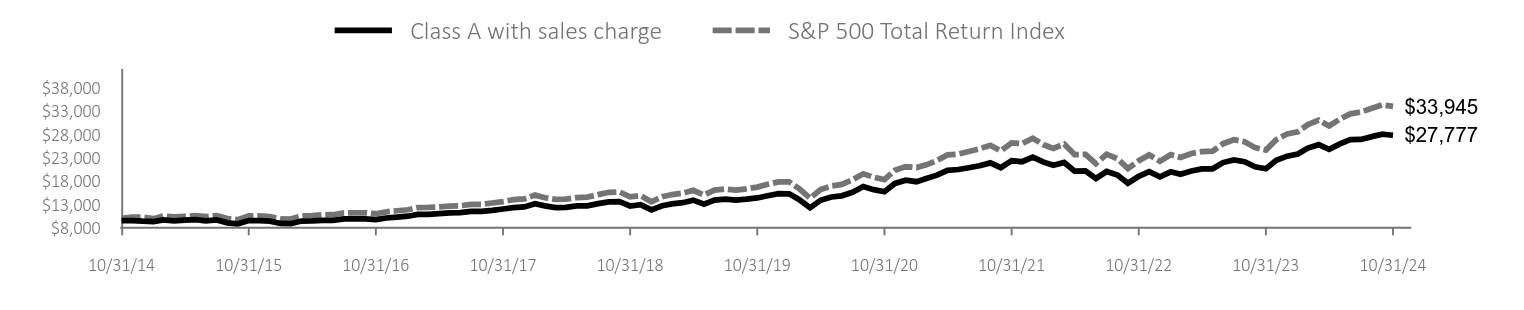

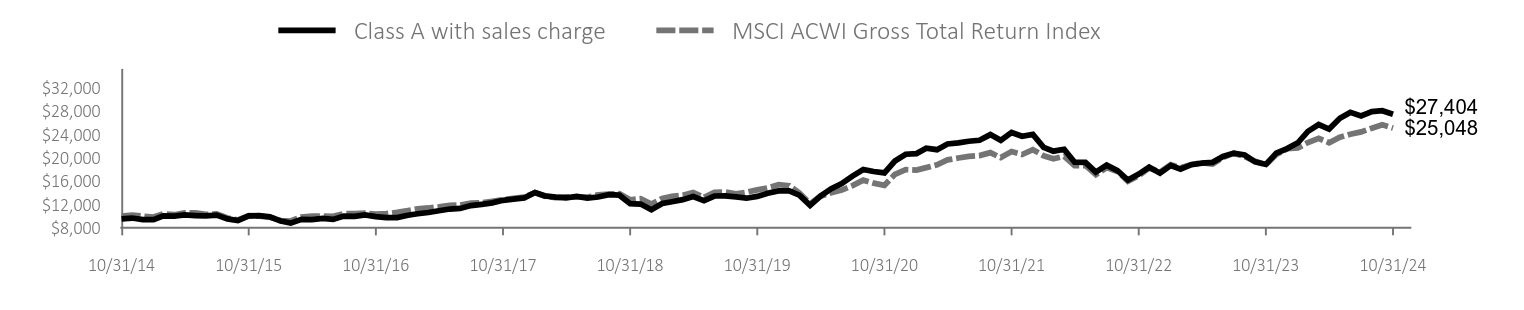

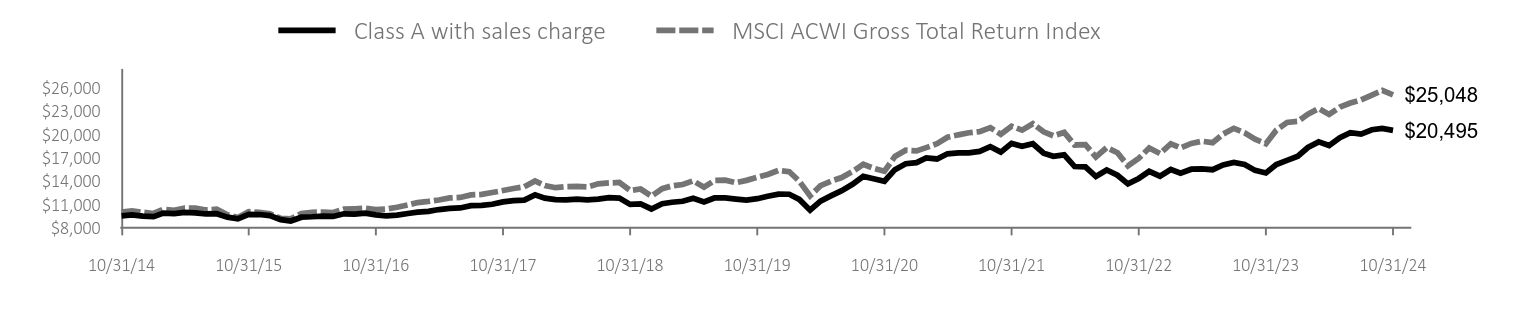

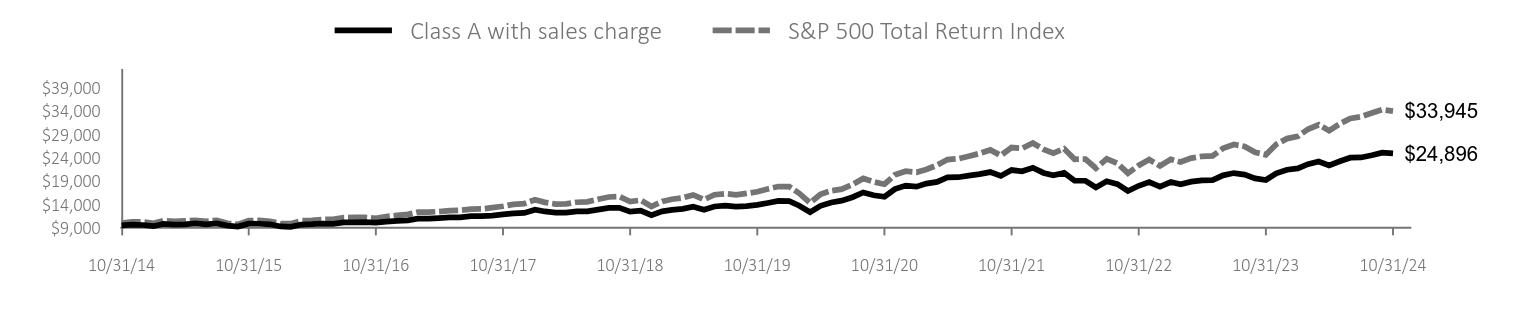

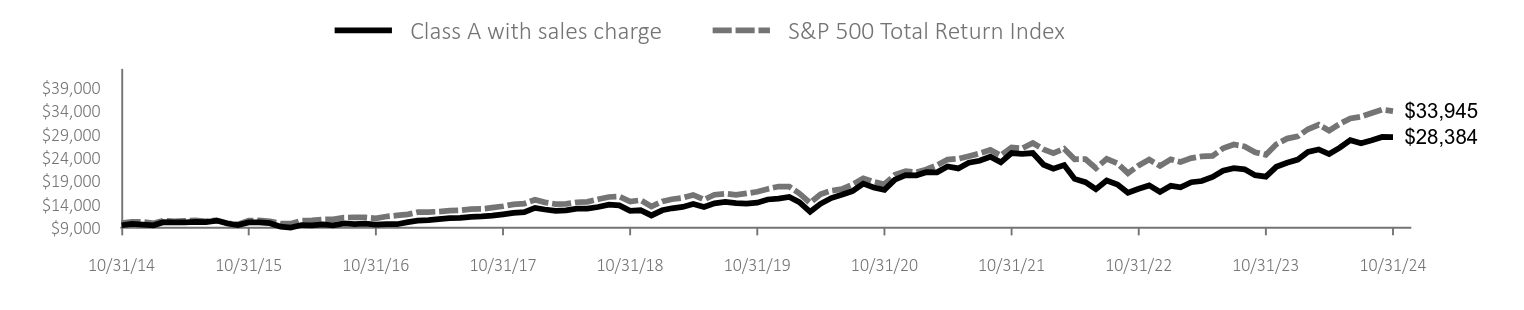

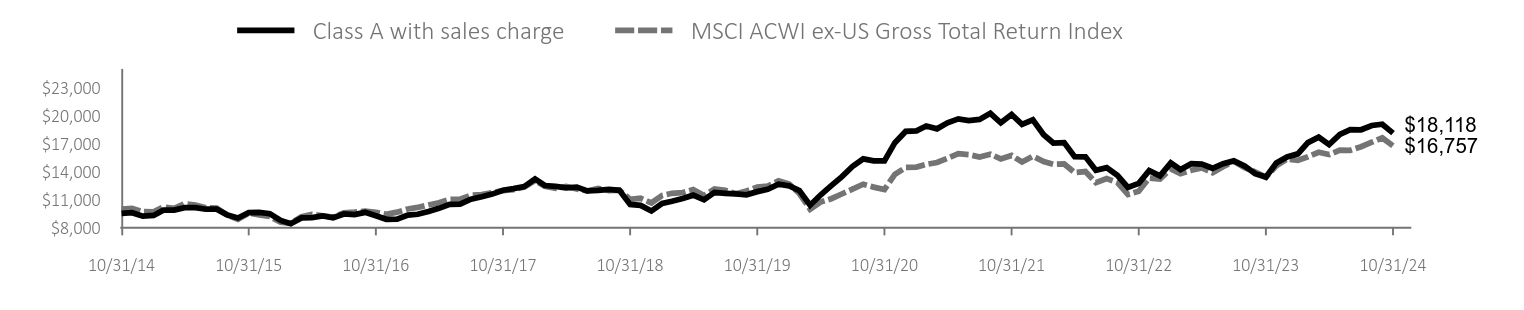

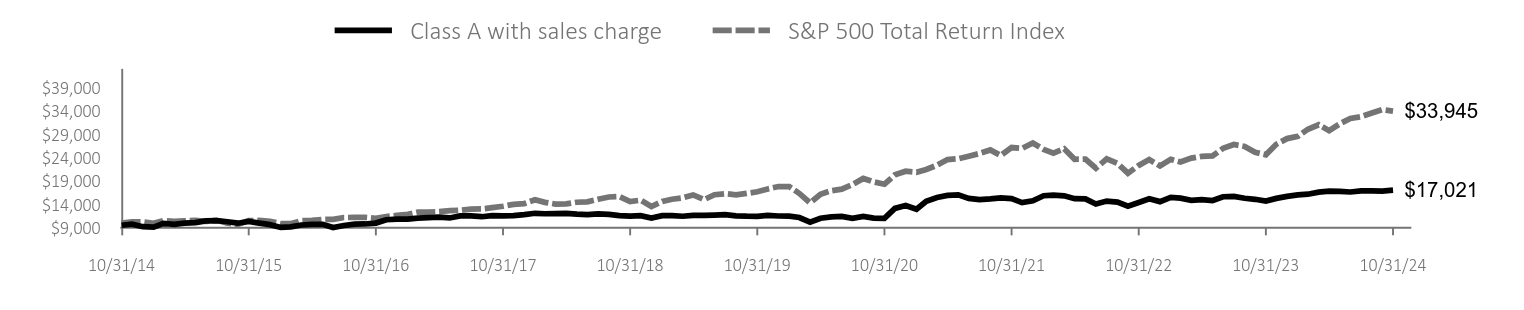

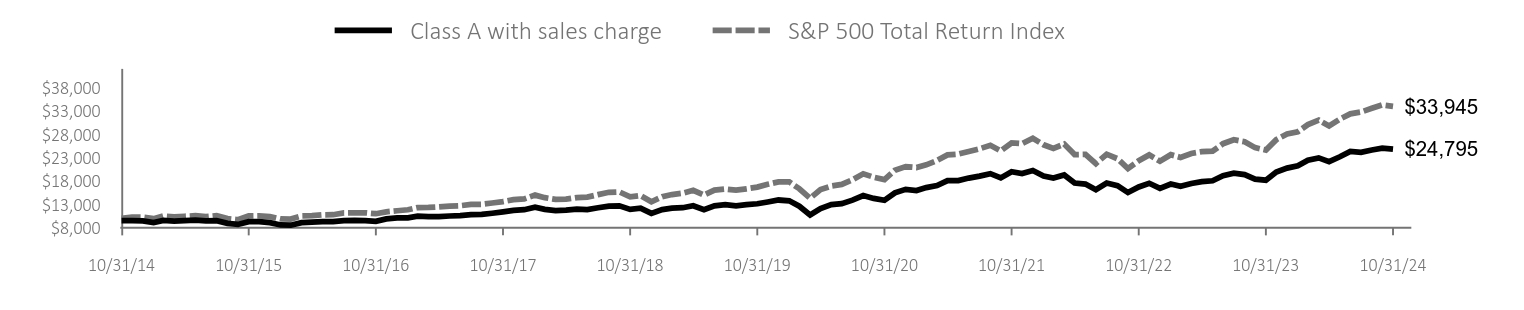

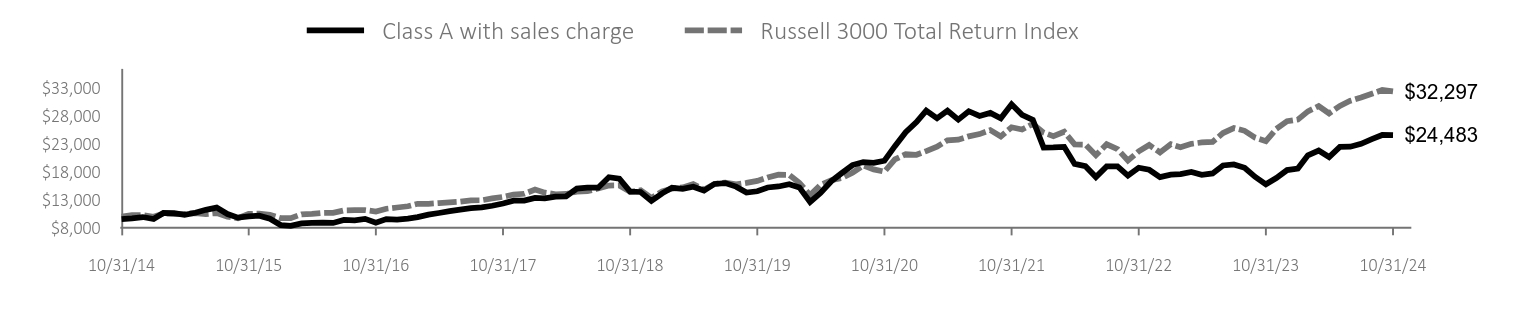

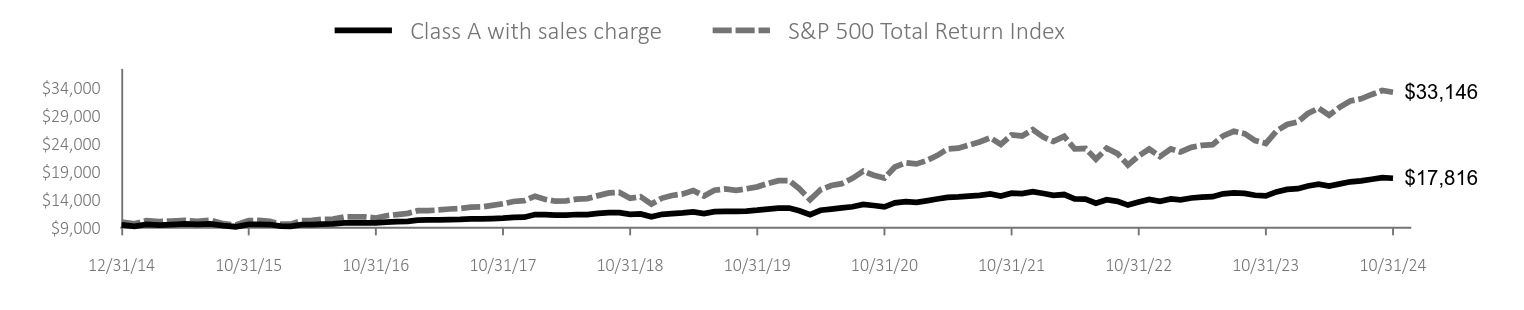

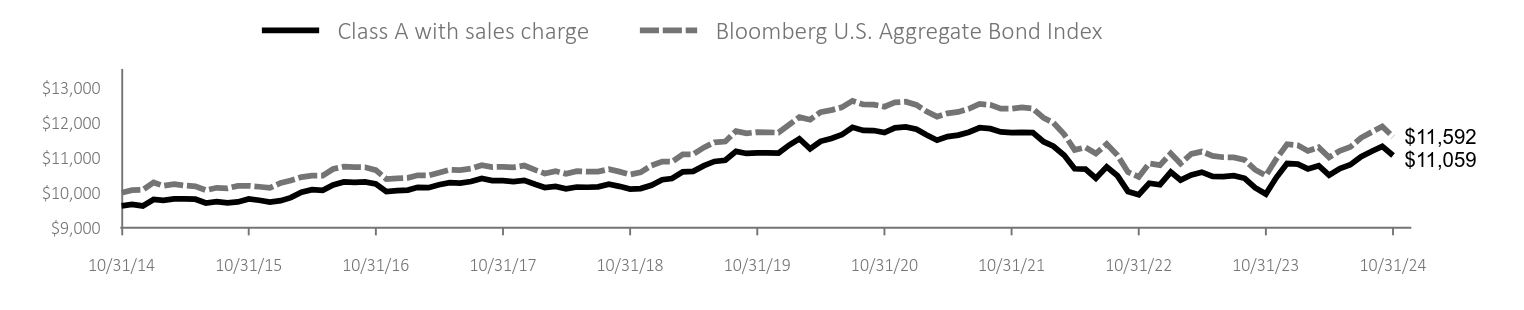

For the 12 months ended October 31, 2024 (“annual period”), the Fund generated robust returns as the portfolio’s growth stocks were strongly in favor. During the period, investors broadly benefited from resilient economic growth in the US and a Federal Reserve that pivoted from interest rate hikes to lowering rates as inflation was largely tamed. The largest stocks by market capitalization in the US equity market received much attention and made impressive gains during the period. AI-related names saw significant growth in cash flows and earnings, and the Fund was marginally overweight those securities. Holdings in information technology and consumer staples notably contributed to performance, while holdings in industrials were a drag on performance.

| Class A with sales charge | S&P 500 Total Return Index |

|---|

| 10/31/14 | $9,523 | $9,999 |

| 11/30/14 | $9,541 | $10,267 |

| 12/31/14 | $9,398 | $10,242 |

| 1/31/15 | $9,307 | $9,934 |

| 2/28/15 | $9,652 | $10,505 |

| 3/31/15 | $9,470 | $10,339 |

| 4/30/15 | $9,606 | $10,438 |

| 5/31/15 | $9,733 | $10,572 |

| 6/30/15 | $9,452 | $10,368 |

| 7/31/15 | $9,661 | $10,585 |

| 8/31/15 | $9,053 | $9,946 |

| 9/30/15 | $8,845 | $9,700 |

| 10/31/15 | $9,543 | $10,518 |

| 11/30/15 | $9,534 | $10,550 |

| 12/31/15 | $9,394 | $10,383 |

| 1/31/16 | $8,909 | $9,868 |

| 2/29/16 | $8,862 | $9,855 |

| 3/31/16 | $9,427 | $10,523 |

| 4/30/16 | $9,446 | $10,564 |

| 5/31/16 | $9,586 | $10,754 |

| 6/30/16 | $9,567 | $10,782 |

| 7/31/16 | $9,876 | $11,179 |

| 8/31/16 | $9,876 | $11,195 |

| 9/30/16 | $9,872 | $11,197 |

| 10/31/16 | $9,750 | $10,993 |

| 11/30/16 | $10,079 | $11,400 |

| 12/31/16 | $10,284 | $11,625 |

| 1/31/17 | $10,462 | $11,846 |

| 2/28/17 | $10,867 | $12,316 |

| 3/31/17 | $10,870 | $12,330 |

| 4/30/17 | $11,030 | $12,457 |

| 5/31/17 | $11,190 | $12,632 |

| 6/30/17 | $11,218 | $12,711 |

| 7/31/17 | $11,473 | $12,972 |

| 8/31/17 | $11,501 | $13,012 |

| 9/30/17 | $11,707 | $13,281 |

| 10/31/17 | $12,009 | $13,591 |

| 11/30/17 | $12,310 | $14,007 |

| 12/31/17 | $12,436 | $14,163 |

| 1/31/18 | $13,121 | $14,974 |

| 2/28/18 | $12,661 | $14,422 |

| 3/31/18 | $12,322 | $14,056 |

| 4/30/18 | $12,373 | $14,109 |

| 5/31/18 | $12,659 | $14,449 |

| 6/30/18 | $12,660 | $14,538 |

| 7/31/18 | $13,162 | $15,079 |

| 8/31/18 | $13,530 | $15,571 |

| 9/30/18 | $13,583 | $15,659 |

| 10/31/18 | $12,641 | $14,589 |

| 11/30/18 | $12,938 | $14,886 |

| 12/31/18 | $11,817 | $13,542 |

| 1/31/19 | $12,695 | $14,627 |

| 2/28/19 | $13,102 | $15,097 |

| 3/31/19 | $13,354 | $15,390 |

| 4/30/19 | $13,890 | $16,013 |

| 5/31/19 | $13,033 | $14,996 |

| 6/30/19 | $13,922 | $16,053 |

| 7/31/19 | $14,115 | $16,283 |

| 8/31/19 | $13,890 | $16,025 |

| 9/30/19 | $14,096 | $16,325 |

| 10/31/19 | $14,364 | $16,679 |

| 11/30/19 | $14,848 | $17,284 |

| 12/31/19 | $15,289 | $17,806 |

| 1/31/20 | $15,253 | $17,799 |

| 2/29/20 | $13,991 | $16,334 |

| 3/31/20 | $12,272 | $14,316 |

| 4/30/20 | $13,870 | $16,152 |

| 5/31/20 | $14,568 | $16,921 |

| 6/30/20 | $14,820 | $17,257 |

| 7/31/20 | $15,566 | $18,231 |

| 8/31/20 | $16,805 | $19,541 |

| 9/30/20 | $16,143 | $18,798 |

| 10/31/20 | $15,686 | $18,299 |

| 11/30/20 | $17,466 | $20,302 |

| 12/31/20 | $18,166 | $21,082 |

| 1/31/21 | $17,840 | $20,869 |

| 2/28/21 | $18,531 | $21,445 |

| 3/31/21 | $19,236 | $22,384 |

| 4/30/21 | $20,266 | $23,579 |

| 5/31/21 | $20,448 | $23,743 |

| 6/30/21 | $20,827 | $24,298 |

| 7/31/21 | $21,257 | $24,875 |

| 8/31/21 | $21,870 | $25,631 |

| 9/30/21 | $20,853 | $24,439 |

| 10/31/21 | $22,339 | $26,151 |

| 11/30/21 | $22,118 | $25,970 |

| 12/31/21 | $23,107 | $27,134 |

| 1/31/22 | $22,017 | $25,730 |

| 2/28/22 | $21,338 | $24,959 |

| 3/31/22 | $21,961 | $25,886 |

| 4/30/22 | $20,106 | $23,629 |

| 5/31/22 | $20,134 | $23,672 |

| 6/30/22 | $18,520 | $21,718 |

| 7/31/22 | $20,021 | $23,721 |

| 8/31/22 | $19,270 | $22,753 |

| 9/30/22 | $17,529 | $20,658 |

| 10/31/22 | $18,987 | $22,330 |

| 11/30/22 | $19,992 | $23,578 |

| 12/31/22 | $18,901 | $22,220 |

| 1/31/23 | $19,953 | $23,616 |

| 2/28/23 | $19,427 | $23,040 |

| 3/31/23 | $20,124 | $23,886 |

| 4/30/23 | $20,564 | $24,258 |

| 5/31/23 | $20,607 | $24,364 |

| 6/30/23 | $21,929 | $25,974 |

| 7/31/23 | $22,511 | $26,808 |

| 8/31/23 | $22,113 | $26,381 |

| 9/30/23 | $21,033 | $25,123 |

| 10/31/23 | $20,621 | $24,595 |

| 11/30/23 | $22,426 | $26,841 |

| 12/31/23 | $23,299 | $28,061 |

| 1/31/24 | $23,758 | $28,532 |

| 2/29/24 | $25,019 | $30,056 |

| 3/31/24 | $25,761 | $31,023 |

| 4/30/24 | $24,767 | $29,756 |

| 5/31/24 | $25,938 | $31,231 |

| 6/30/24 | $26,843 | $32,352 |

| 7/31/24 | $26,873 | $32,746 |

| 8/31/24 | $27,481 | $33,540 |

| 9/30/24 | $28,000 | $34,256 |

| 10/31/24 | $27,777 | $33,945 |

AVERAGE ANNUAL TOTAL RETURNS (%)

| AATR | 1 YEAR | 5 YEARS | 10 YEARS |

|---|

| Class A without sales charge | 34.70 | 14.10 | 11.30 |

| Class A with sales charge | 28.34 | 12.99 | 10.76 |

| S&P 500 Total Return Index | 38.06 | 15.27 | 13.00 |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Visit https://www.calamos.com/funds/mutual/ for the most recent performance information.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $20,644,697 | 114 | 24% | $190,896 |

Calamos Dividend Growth Fund

Annual Shareholder Report - October 31, 2024

WHAT DID THE FUND INVEST IN?

The Fund is broadly diversified by sector, favoring investments in dividend-paying equities and high-cash-generating businesses. Our preference for companies with stronger cash flows, improving or superior fundamentals, and upside intrinsic values worked well over the year. Dividend-paying equities often provide a sense of stability, and “quality” was a favored attribute.

Sector weightings and top 10 holdings exclude, if any, cash or cash equivalents.

| Information Technology | 30.5 |

| Financials | 15.2 |

| Consumer Discretionary | 10.8 |

| Health Care | 9.7 |

| Communication Services | 8.4 |

| Industrials | 7.4 |

| Consumer Staples | 5.5 |

| Utilities | 3.6 |

| Energy | 3.4 |

| Materials | 2.7 |

| Real Estate | 1.3 |

| Other | 1.2 |

| NVIDIA Corp. | 7.2 |

| Apple, Inc. | 6.9 |

| Microsoft Corp. | 6.5 |

| Alphabet, Inc. - Class C | 3.8 |

| Amazon.com, Inc. | 3.7 |

| Meta Platforms, Inc. - Class A | 2.5 |

| Broadcom, Inc. | 2.3 |

| JPMorgan Chase & Company | 1.9 |

| Eli Lilly & Company | 1.8 |

| Mastercard, Inc. - Class A | 1.6 |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, please visit www.calamos.com/resources. You can also request information by contacting us at 800-582-6959.

©2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

Calamos Investments LLC | 2020 Calamos Court | Naperville, IL 60563 | 800-582-6959 | www.calamos.com | DVGTSRA-A 24

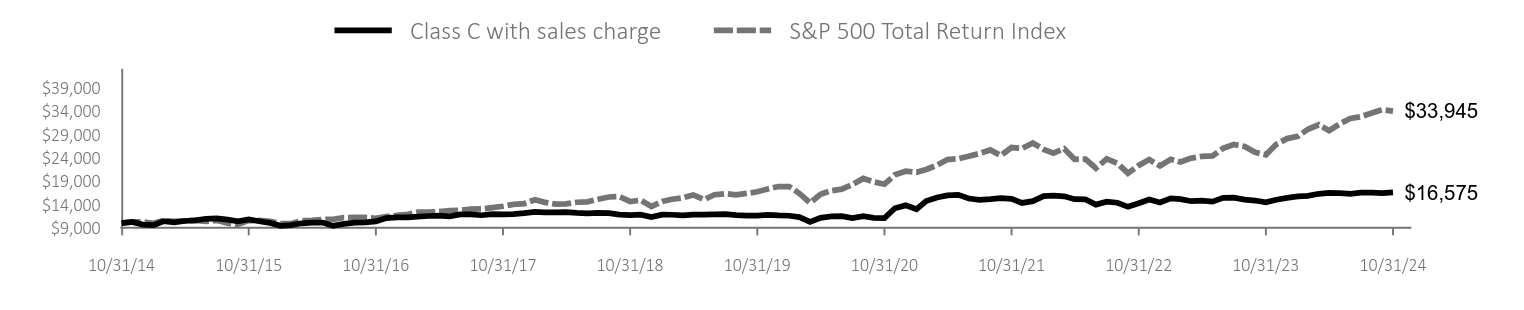

Calamos Dividend Growth Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the Calamos Dividend Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

| Class C | $245 | 2.10% |

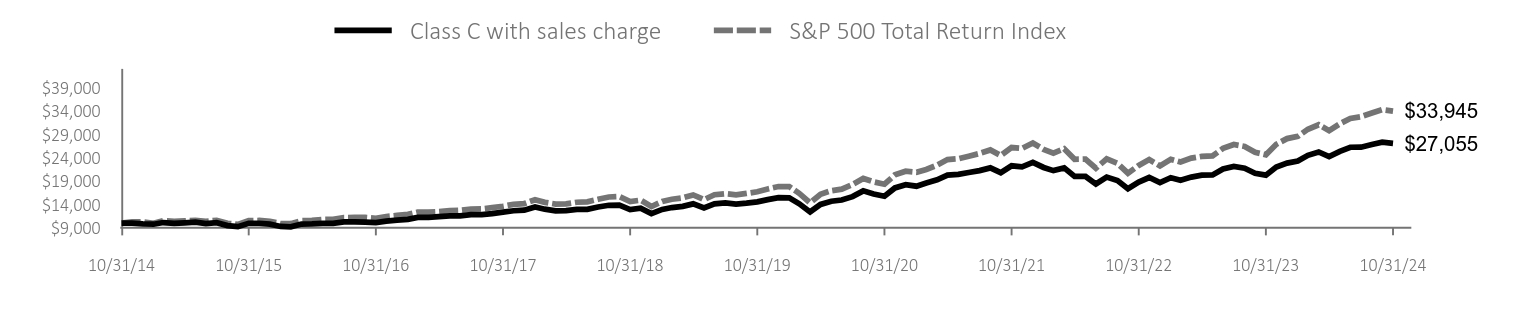

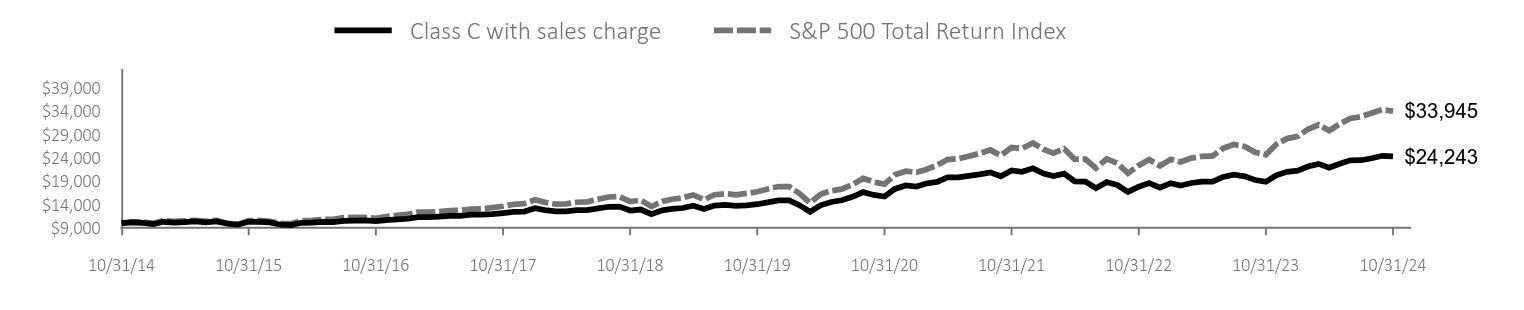

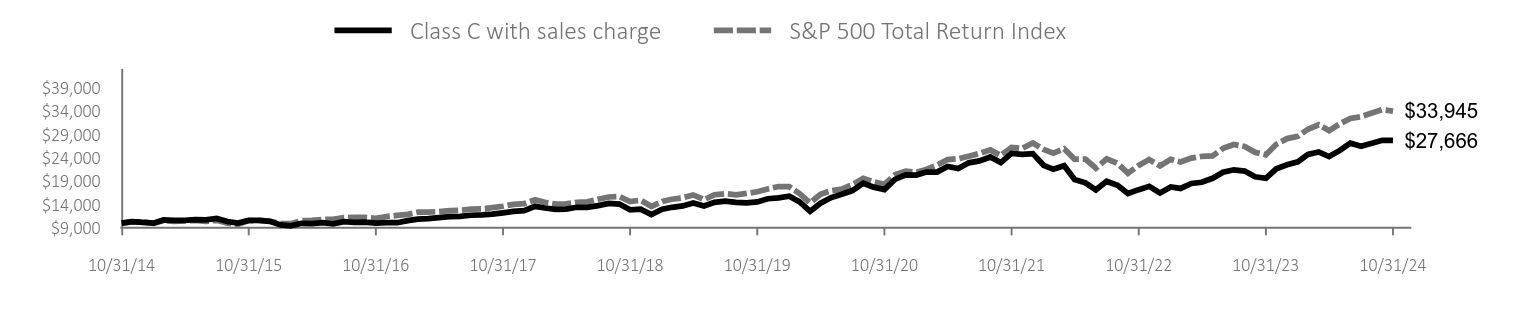

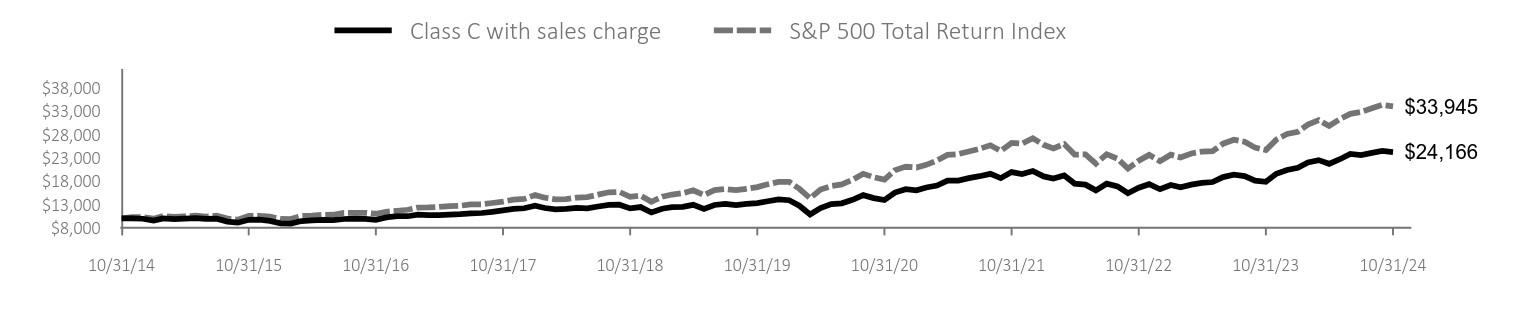

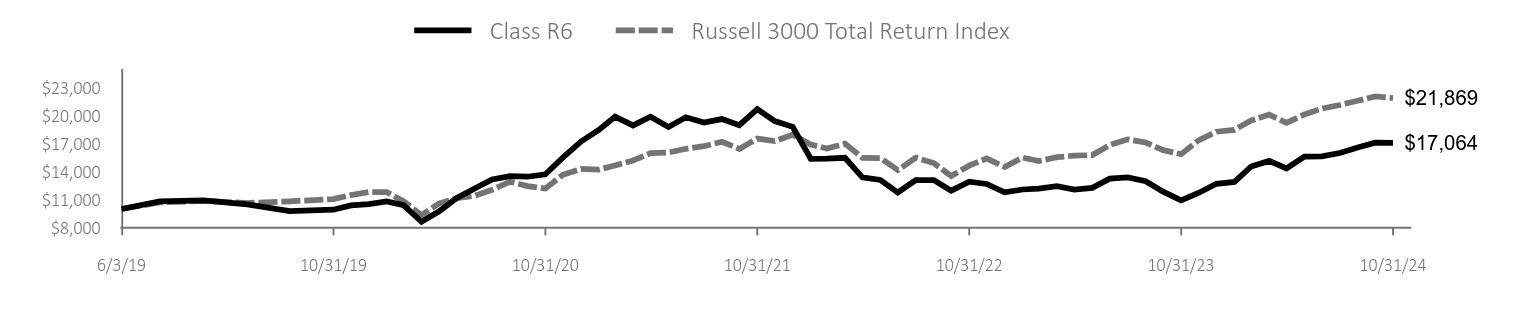

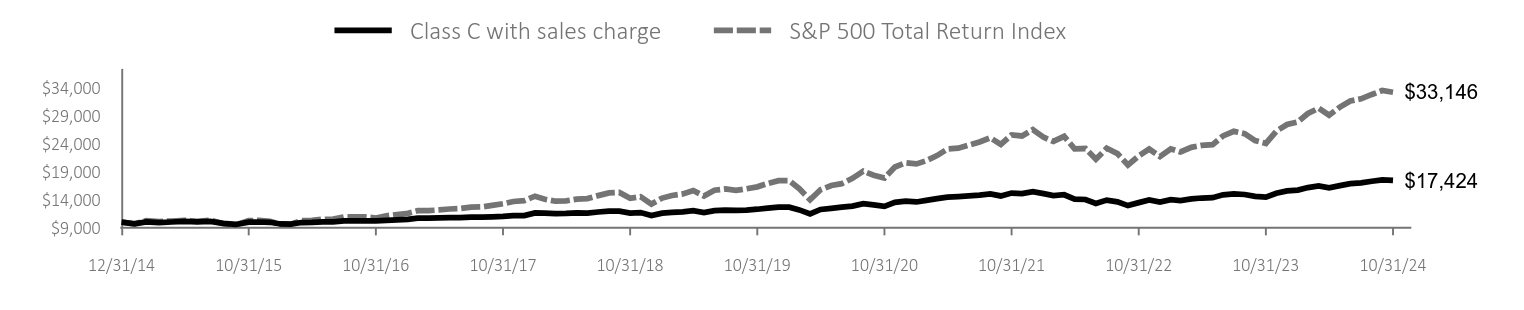

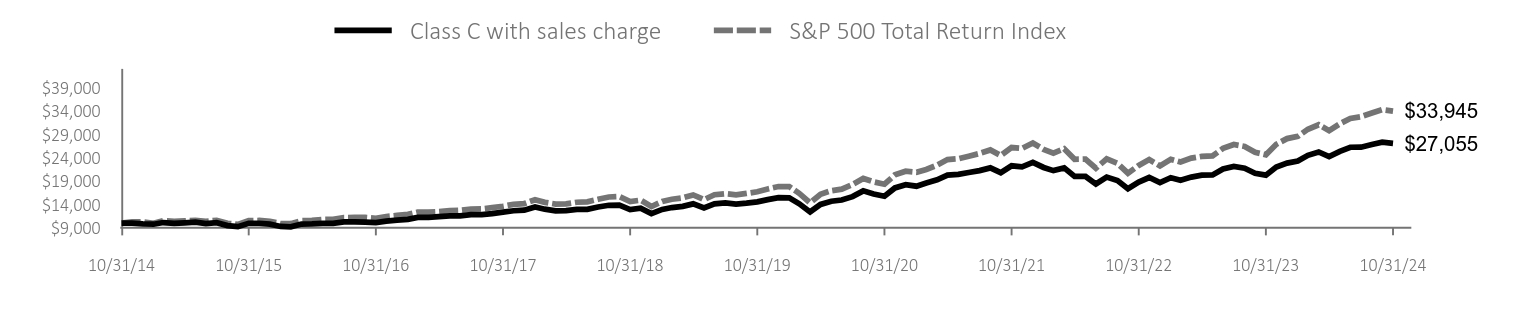

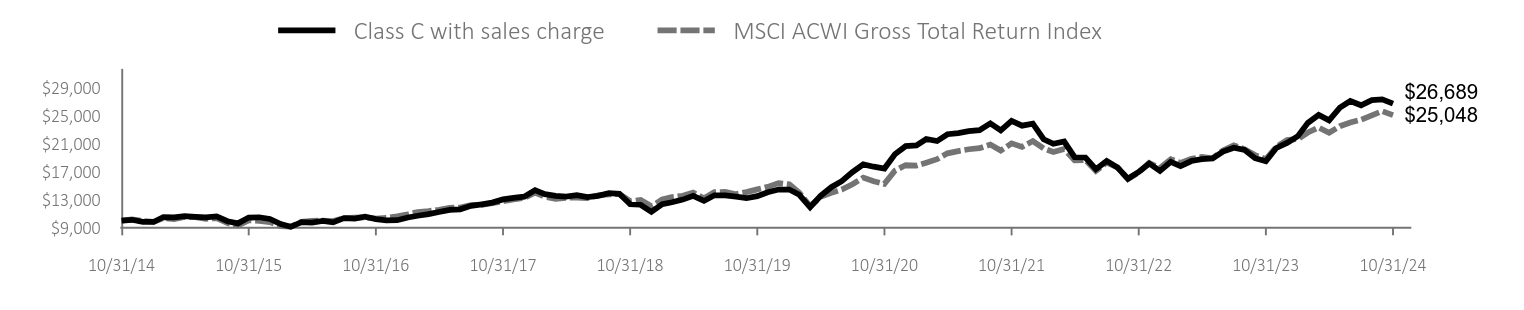

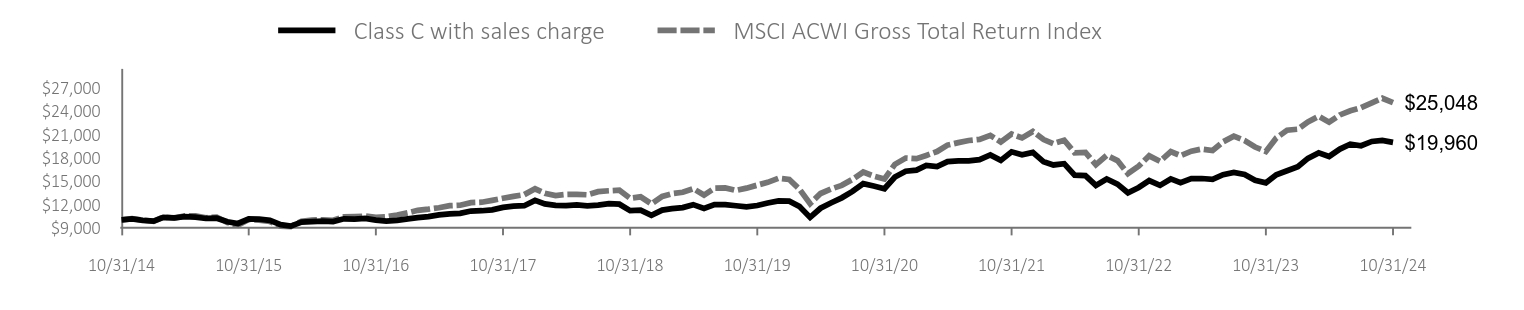

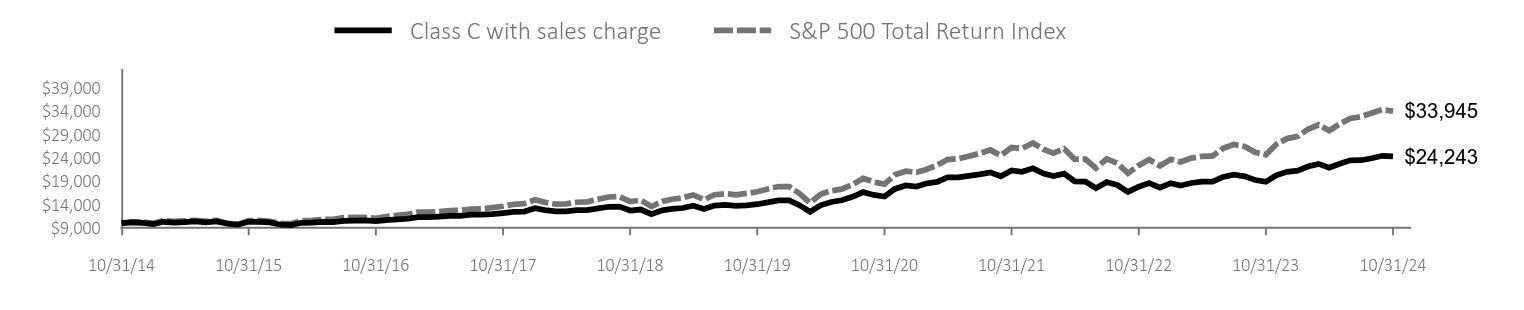

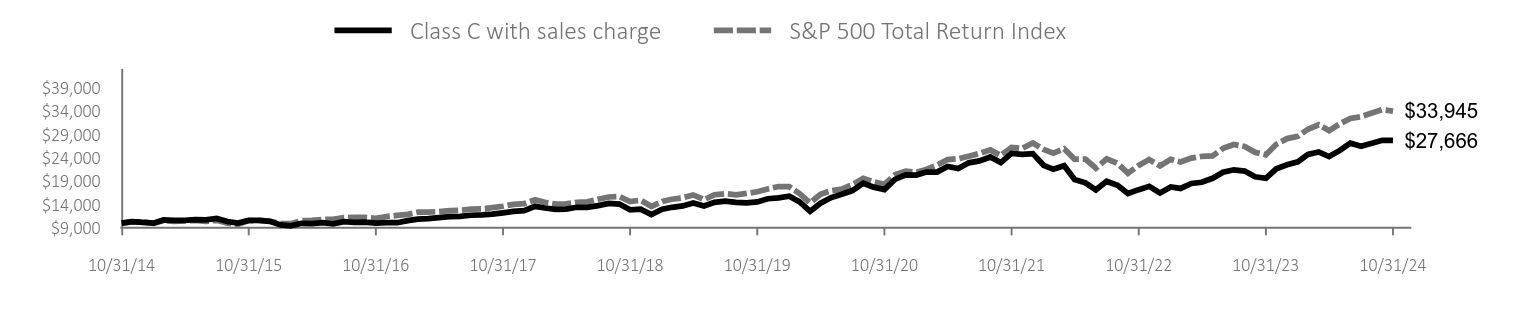

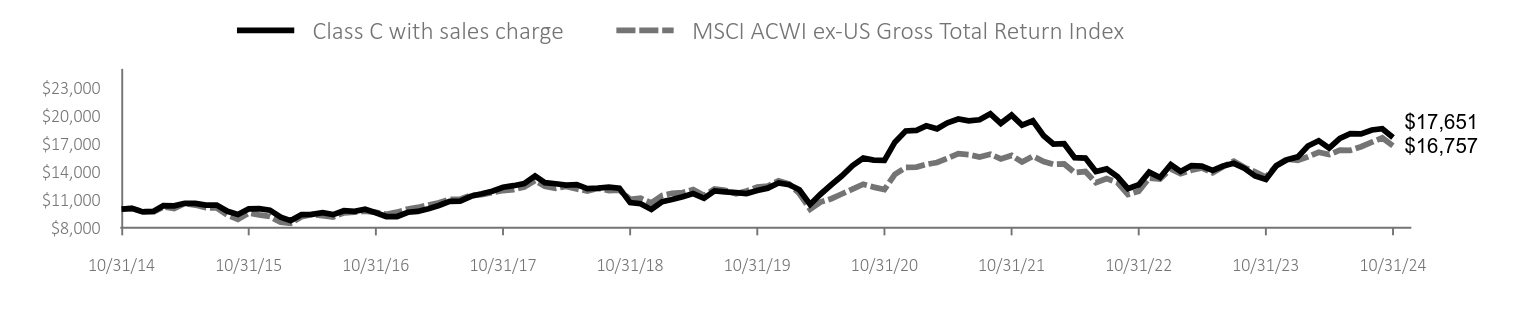

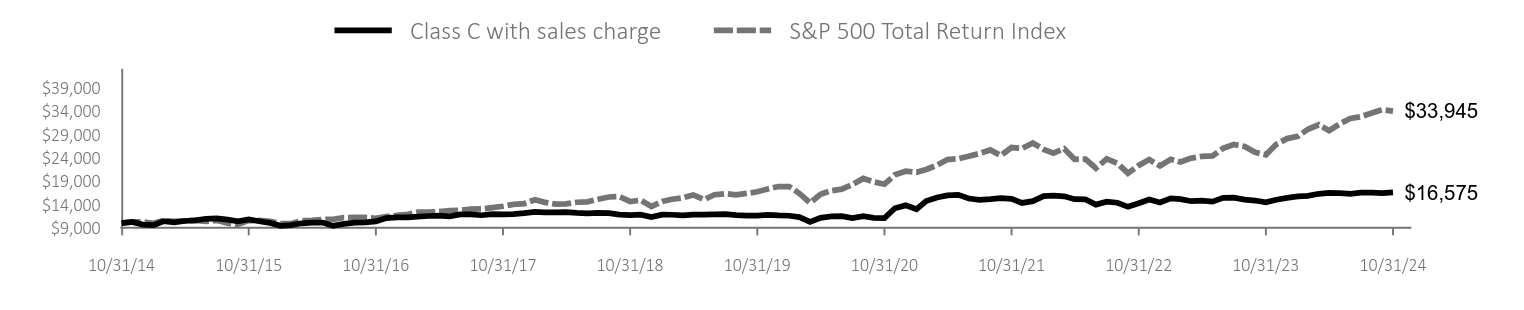

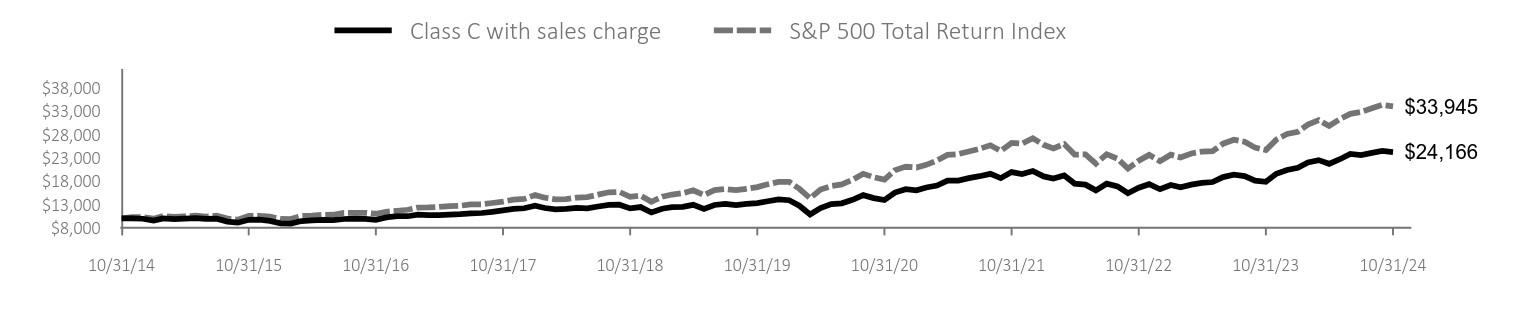

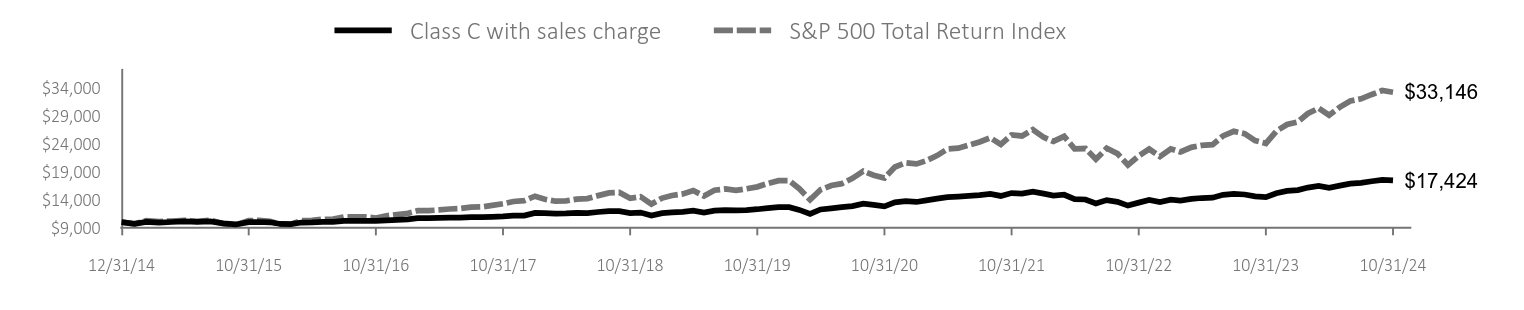

For the 12 months ended October 31, 2024 (“annual period”), the Fund generated robust returns as the portfolio’s growth stocks were strongly in favor. During the period, investors broadly benefited from resilient economic growth in the US and a Federal Reserve that pivoted from interest rate hikes to lowering rates as inflation was largely tamed. The largest stocks by market capitalization in the US equity market received much attention and made impressive gains during the period. AI-related names saw significant growth in cash flows and earnings, and the Fund was marginally overweight those securities. Holdings in information technology and consumer staples notably contributed to performance, while holdings in industrials were a drag on performance.

| Class C with sales charge | S&P 500 Total Return Index |

|---|

| 10/31/14 | $10,000 | $9,999 |

| 11/30/14 | $10,000 | $10,267 |

| 12/31/14 | $9,841 | $10,242 |

| 1/31/15 | $9,746 | $9,934 |

| 2/28/15 | $10,108 | $10,505 |

| 3/31/15 | $9,908 | $10,339 |

| 4/30/15 | $10,041 | $10,438 |

| 5/31/15 | $10,175 | $10,572 |

| 6/30/15 | $9,870 | $10,368 |

| 7/31/15 | $10,080 | $10,585 |

| 8/31/15 | $9,450 | $9,946 |

| 9/30/15 | $9,221 | $9,700 |

| 10/31/15 | $9,937 | $10,518 |

| 11/30/15 | $9,917 | $10,550 |

| 12/31/15 | $9,775 | $10,383 |

| 1/31/16 | $9,265 | $9,868 |

| 2/29/16 | $9,207 | $9,855 |

| 3/31/16 | $9,783 | $10,523 |

| 4/30/16 | $9,803 | $10,564 |

| 5/31/16 | $9,940 | $10,754 |

| 6/30/16 | $9,925 | $10,782 |

| 7/31/16 | $10,229 | $11,179 |

| 8/31/16 | $10,229 | $11,195 |

| 9/30/16 | $10,216 | $11,197 |

| 10/31/16 | $10,078 | $10,993 |

| 11/30/16 | $10,412 | $11,400 |

| 12/31/16 | $10,621 | $11,625 |

| 1/31/17 | $10,798 | $11,846 |

| 2/28/17 | $11,211 | $12,316 |

| 3/31/17 | $11,201 | $12,330 |

| 4/30/17 | $11,358 | $12,457 |

| 5/31/17 | $11,516 | $12,632 |

| 6/30/17 | $11,544 | $12,711 |

| 7/31/17 | $11,800 | $12,972 |

| 8/31/17 | $11,820 | $13,012 |

| 9/30/17 | $12,026 | $13,281 |

| 10/31/17 | $12,322 | $13,591 |

| 11/30/17 | $12,627 | $14,007 |

| 12/31/17 | $12,744 | $14,163 |

| 1/31/18 | $13,448 | $14,974 |

| 2/28/18 | $12,958 | $14,422 |

| 3/31/18 | $12,606 | $14,056 |

| 4/30/18 | $12,659 | $14,109 |

| 5/31/18 | $12,936 | $14,449 |

| 6/30/18 | $12,936 | $14,538 |

| 7/31/18 | $13,426 | $15,079 |

| 8/31/18 | $13,799 | $15,571 |

| 9/30/18 | $13,853 | $15,659 |

| 10/31/18 | $12,883 | $14,589 |

| 11/30/18 | $13,171 | $14,886 |

| 12/31/18 | $12,024 | $13,542 |

| 1/31/19 | $12,913 | $14,627 |

| 2/28/19 | $13,313 | $15,097 |

| 3/31/19 | $13,557 | $15,390 |

| 4/30/19 | $14,102 | $16,013 |

| 5/31/19 | $13,224 | $14,996 |

| 6/30/19 | $14,113 | $16,053 |

| 7/31/19 | $14,291 | $16,283 |

| 8/31/19 | $14,057 | $16,025 |

| 9/30/19 | $14,257 | $16,325 |

| 10/31/19 | $14,524 | $16,679 |

| 11/30/19 | $15,002 | $17,284 |

| 12/31/19 | $15,439 | $17,806 |

| 1/31/20 | $15,389 | $17,799 |

| 2/29/20 | $14,110 | $16,334 |

| 3/31/20 | $12,371 | $14,316 |

| 4/30/20 | $13,973 | $16,152 |

| 5/31/20 | $14,669 | $16,921 |

| 6/30/20 | $14,917 | $17,257 |

| 7/31/20 | $15,650 | $18,231 |

| 8/31/20 | $16,880 | $19,541 |

| 9/30/20 | $16,209 | $18,798 |

| 10/31/20 | $15,737 | $18,299 |

| 11/30/20 | $17,513 | $20,302 |

| 12/31/20 | $18,200 | $21,082 |

| 1/31/21 | $17,876 | $20,869 |

| 2/28/21 | $18,565 | $21,445 |

| 3/31/21 | $19,239 | $22,384 |

| 4/30/21 | $20,264 | $23,579 |

| 5/31/21 | $20,426 | $23,743 |

| 6/30/21 | $20,804 | $24,298 |

| 7/31/21 | $21,222 | $24,875 |

| 8/31/21 | $21,803 | $25,631 |

| 9/30/21 | $20,777 | $24,439 |

| 10/31/21 | $22,248 | $26,151 |

| 11/30/21 | $22,018 | $25,970 |

| 12/31/21 | $22,988 | $27,134 |

| 1/31/22 | $21,886 | $25,730 |

| 2/28/22 | $21,210 | $24,959 |

| 3/31/22 | $21,798 | $25,886 |

| 4/30/22 | $19,960 | $23,629 |

| 5/31/22 | $19,960 | $23,672 |

| 6/30/22 | $18,343 | $21,718 |

| 7/31/22 | $19,828 | $23,721 |

| 8/31/22 | $19,078 | $22,753 |

| 9/30/22 | $17,344 | $20,658 |

| 10/31/22 | $18,770 | $22,330 |

| 11/30/22 | $19,740 | $23,578 |

| 12/31/22 | $18,662 | $22,220 |

| 1/31/23 | $19,693 | $23,616 |

| 2/28/23 | $19,162 | $23,040 |

| 3/31/23 | $19,825 | $23,886 |

| 4/30/23 | $20,252 | $24,258 |

| 5/31/23 | $20,282 | $24,364 |

| 6/30/23 | $21,563 | $25,974 |

| 7/31/23 | $22,123 | $26,808 |

| 8/31/23 | $21,725 | $26,381 |

| 9/30/23 | $20,650 | $25,123 |

| 10/31/23 | $20,238 | $24,595 |

| 11/30/23 | $21,990 | $26,841 |

| 12/31/23 | $22,826 | $28,061 |

| 1/31/24 | $23,256 | $28,532 |

| 2/29/24 | $24,487 | $30,056 |

| 3/31/24 | $25,194 | $31,023 |

| 4/30/24 | $24,195 | $29,756 |

| 5/31/24 | $25,333 | $31,231 |

| 6/30/24 | $26,209 | $32,352 |

| 7/31/24 | $26,225 | $32,746 |

| 8/31/24 | $26,794 | $33,540 |

| 9/30/24 | $27,286 | $34,256 |

| 10/31/24 | $27,055 | $33,945 |

AVERAGE ANNUAL TOTAL RETURNS (%)

| AATR | 1 YEAR | 5 YEARS | 10 YEARS |

|---|

| Class C without sales charge | 33.69 | 13.25 | 10.47 |

| Class C with sales charge | 32.69 | 13.25 | 10.47 |

| S&P 500 Total Return Index | 38.06 | 15.27 | 13.00 |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Visit https://www.calamos.com/funds/mutual/ for the most recent performance information.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $20,644,697 | 114 | 24% | $190,896 |

Calamos Dividend Growth Fund

Annual Shareholder Report - October 31, 2024

WHAT DID THE FUND INVEST IN?

The Fund is broadly diversified by sector, favoring investments in dividend-paying equities and high-cash-generating businesses. Our preference for companies with stronger cash flows, improving or superior fundamentals, and upside intrinsic values worked well over the year. Dividend-paying equities often provide a sense of stability, and “quality” was a favored attribute.

Sector weightings and top 10 holdings exclude, if any, cash or cash equivalents.

| Information Technology | 30.5 |

| Financials | 15.2 |

| Consumer Discretionary | 10.8 |

| Health Care | 9.7 |

| Communication Services | 8.4 |

| Industrials | 7.4 |

| Consumer Staples | 5.5 |

| Utilities | 3.6 |

| Energy | 3.4 |

| Materials | 2.7 |

| Real Estate | 1.3 |

| Other | 1.2 |

| NVIDIA Corp. | 7.2 |

| Apple, Inc. | 6.9 |

| Microsoft Corp. | 6.5 |

| Alphabet, Inc. - Class C | 3.8 |

| Amazon.com, Inc. | 3.7 |

| Meta Platforms, Inc. - Class A | 2.5 |

| Broadcom, Inc. | 2.3 |

| JPMorgan Chase & Company | 1.9 |

| Eli Lilly & Company | 1.8 |

| Mastercard, Inc. - Class A | 1.6 |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, please visit www.calamos.com/resources. You can also request information by contacting us at 800-582-6959.

©2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

Calamos Investments LLC | 2020 Calamos Court | Naperville, IL 60563 | 800-582-6959 | www.calamos.com | DVGTSRA-C 24

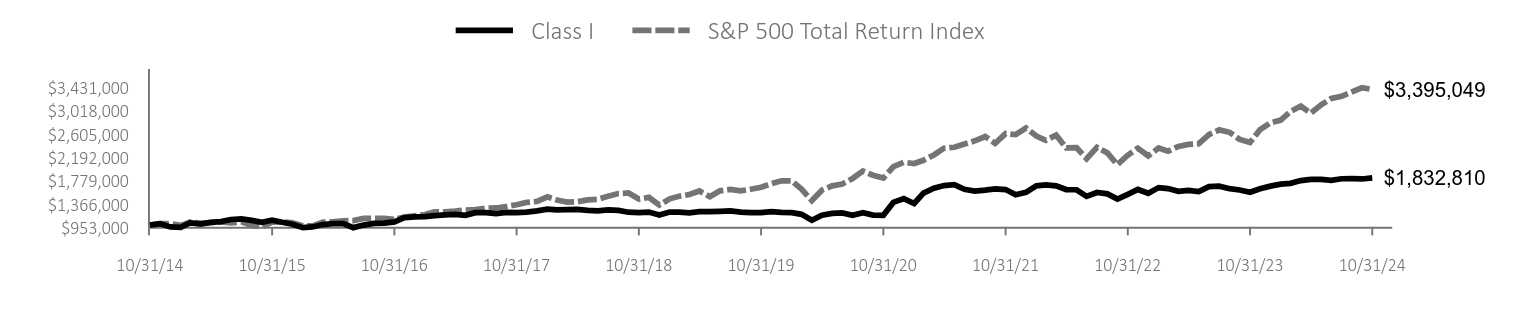

Calamos Dividend Growth Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the Calamos Dividend Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

| Class I | $129 | 1.10% |

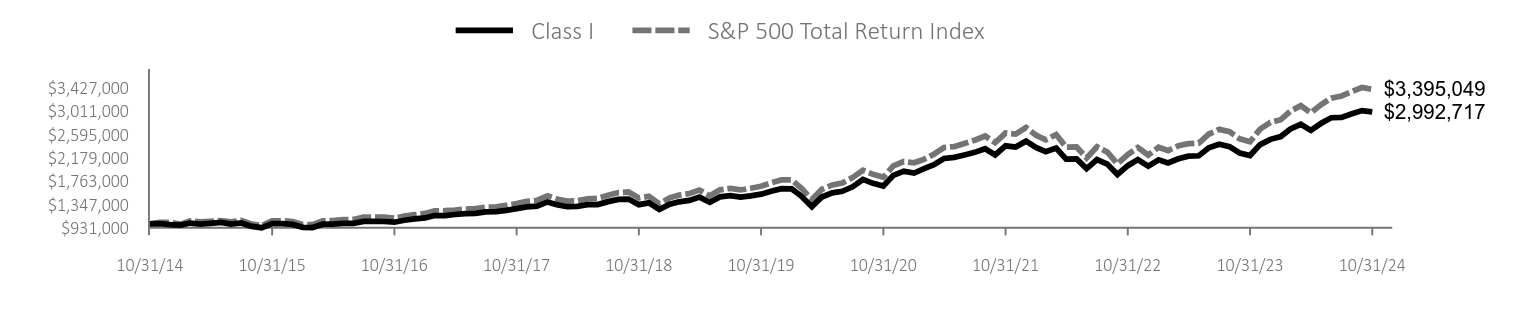

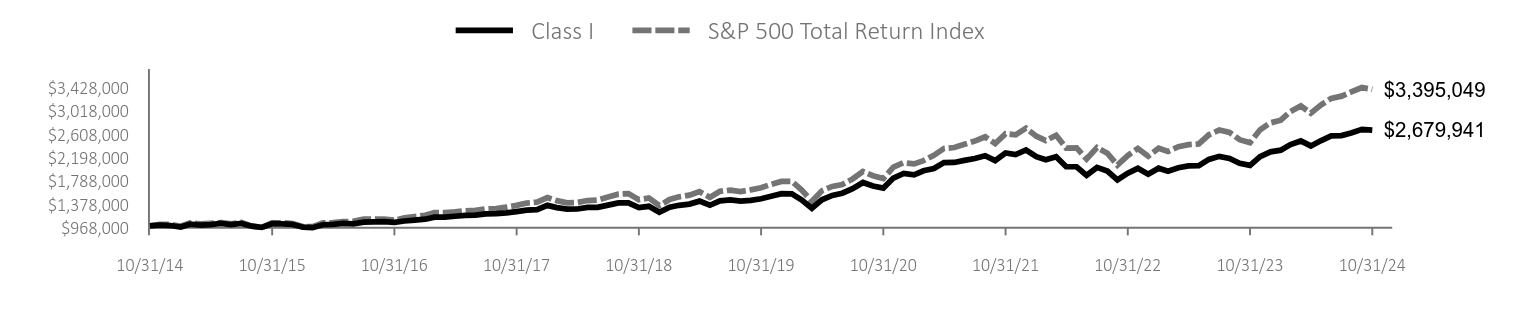

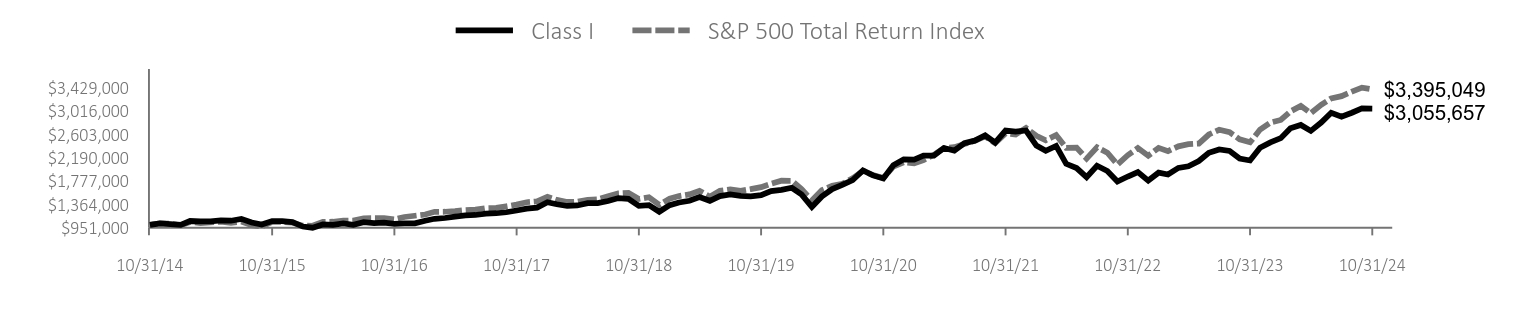

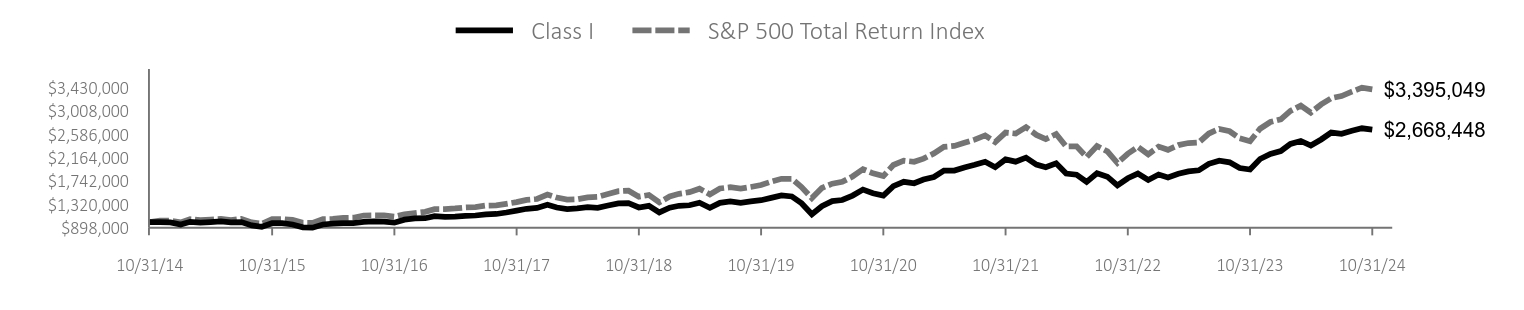

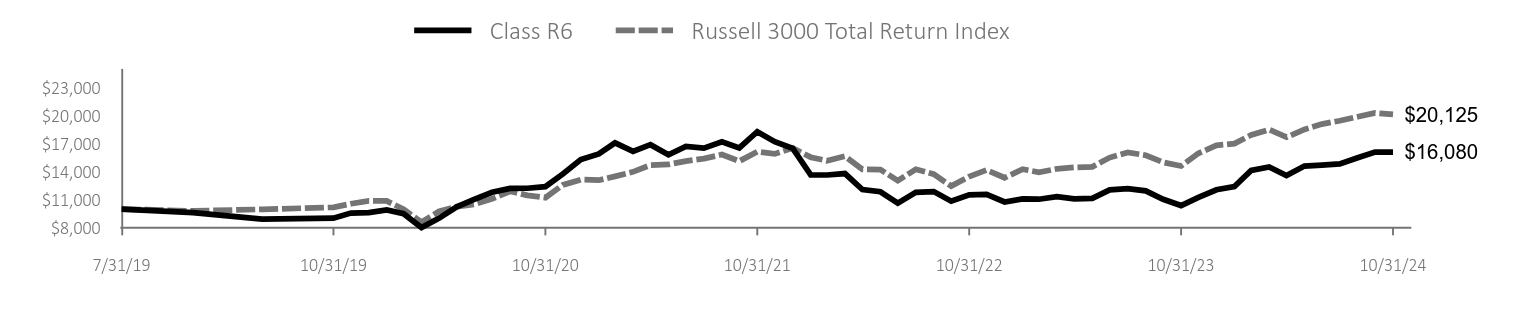

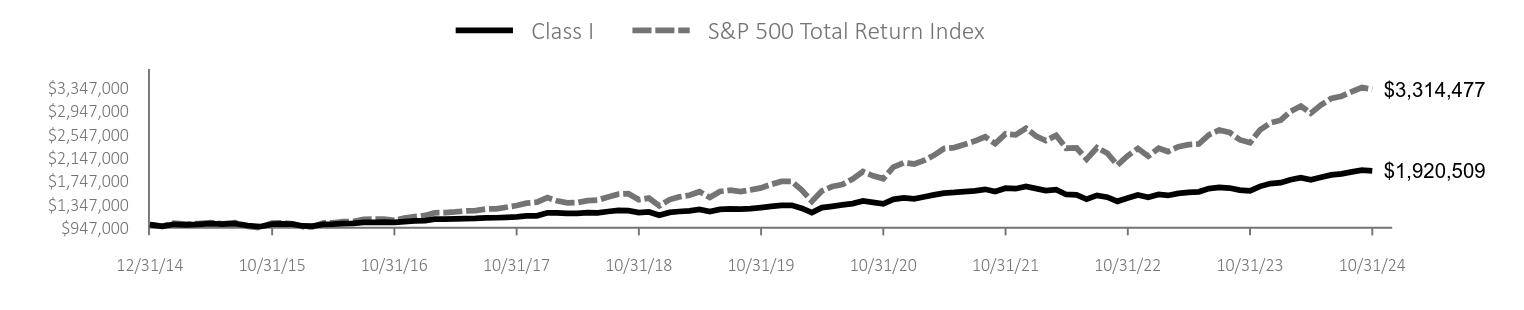

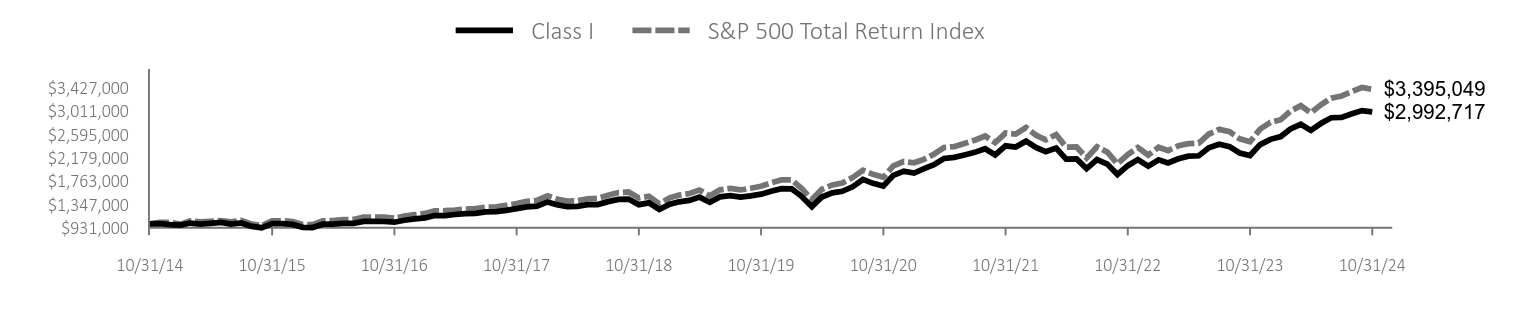

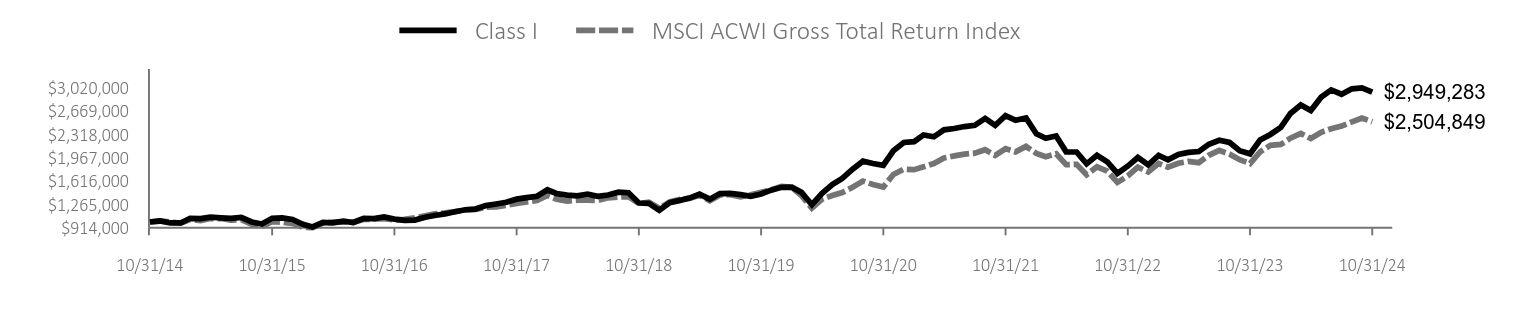

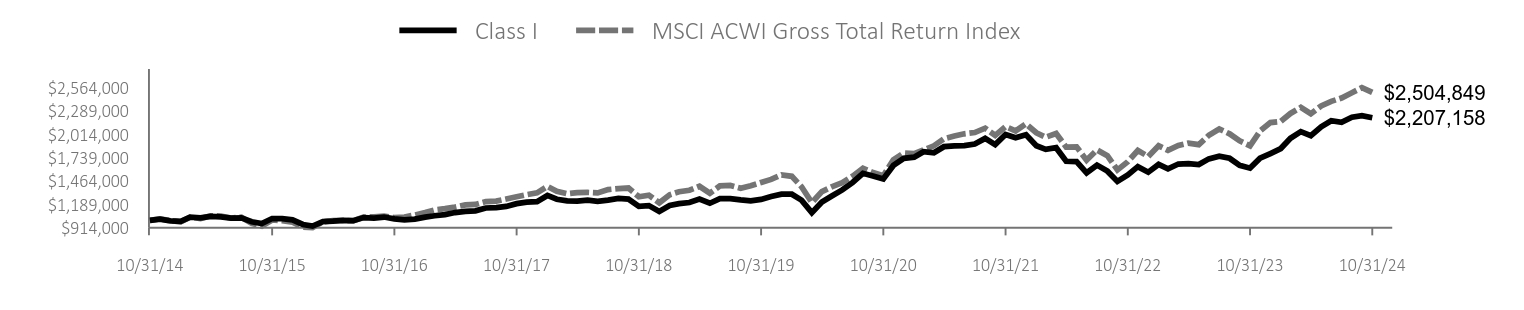

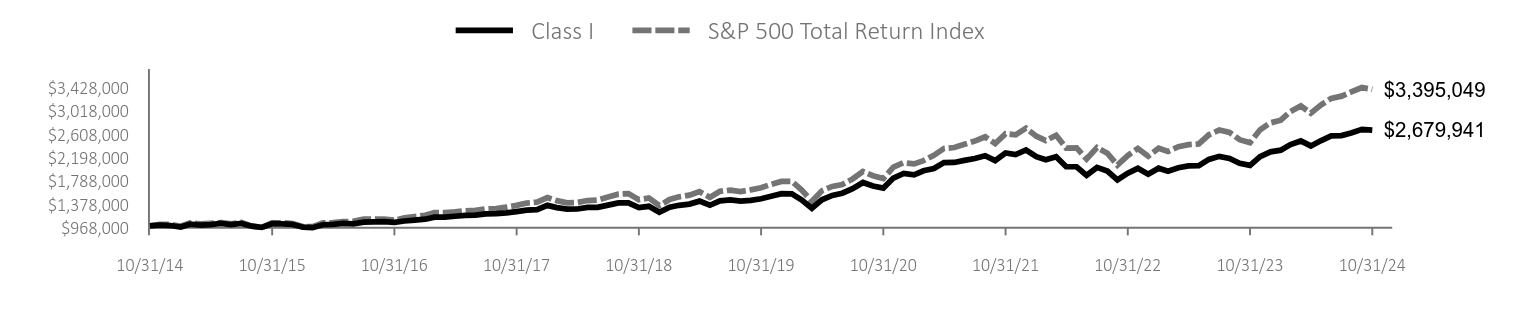

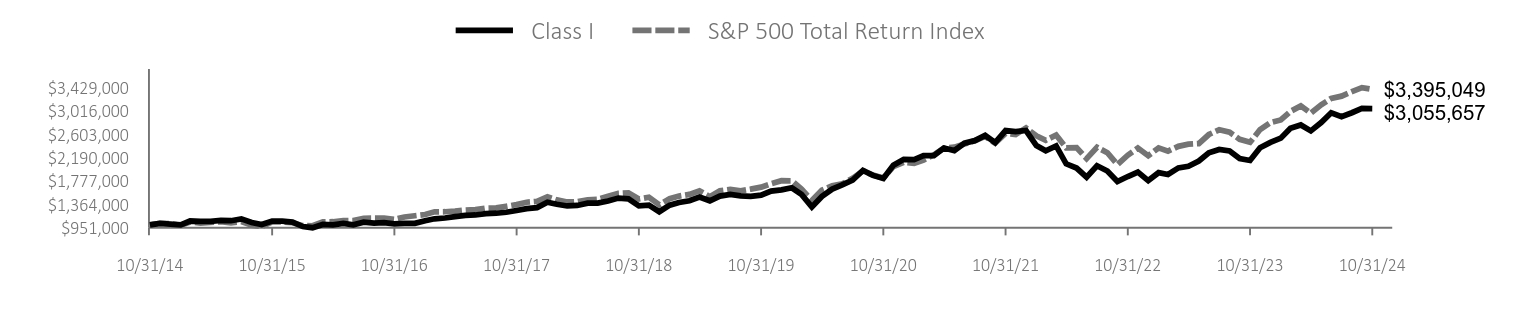

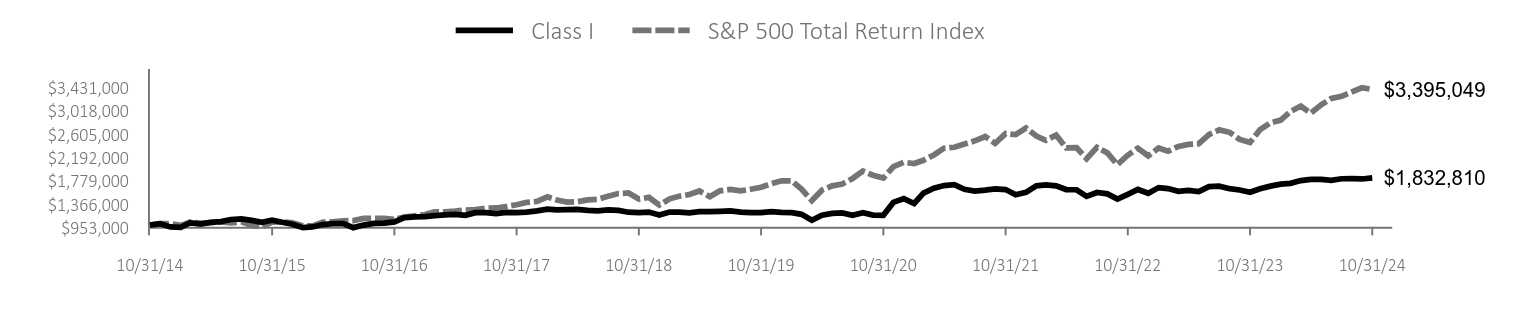

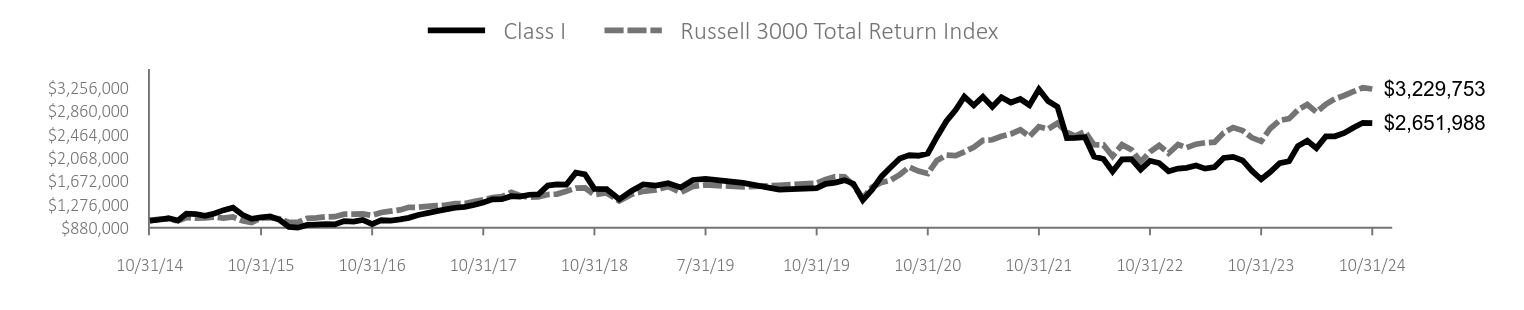

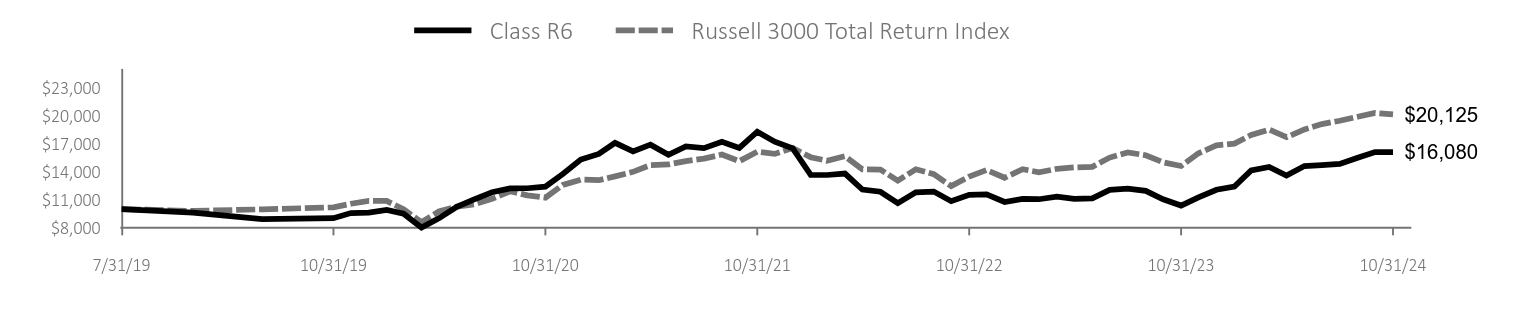

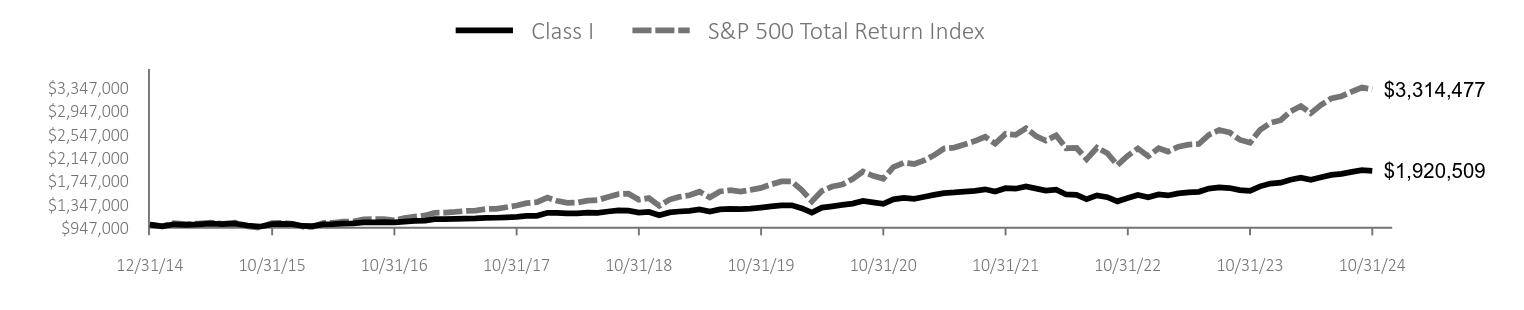

For the 12 months ended October 31, 2024 (“annual period”), the Fund generated robust returns as the portfolio’s growth stocks were strongly in favor. During the period, investors broadly benefited from resilient economic growth in the US and a Federal Reserve that pivoted from interest rate hikes to lowering rates as inflation was largely tamed. The largest stocks by market capitalization in the US equity market received much attention and made impressive gains during the period. AI-related names saw significant growth in cash flows and earnings, and the Fund was marginally overweight those securities. Holdings in information technology and consumer staples notably contributed to performance, while holdings in industrials were a drag on performance.

| Class I | S&P 500 Total Return Index |

|---|

| 10/31/14 | $1,000,000 | $1,000,000 |

| 11/30/14 | $1,001,854 | $1,026,895 |

| 12/31/14 | $986,583 | $1,024,308 |

| 1/31/15 | $978,013 | $993,558 |

| 2/28/15 | $1,014,200 | $1,050,661 |

| 3/31/15 | $996,106 | $1,034,044 |

| 4/30/15 | $1,009,439 | $1,043,965 |

| 5/31/15 | $1,023,723 | $1,057,389 |

| 6/30/15 | $994,202 | $1,036,919 |

| 7/31/15 | $1,016,105 | $1,058,645 |

| 8/31/15 | $953,253 | $994,772 |

| 9/30/15 | $931,350 | $970,158 |

| 10/31/15 | $1,004,677 | $1,051,995 |

| 11/30/15 | $1,003,725 | $1,055,123 |

| 12/31/15 | $989,302 | $1,038,482 |

| 1/31/16 | $938,266 | $986,949 |

| 2/29/16 | $934,341 | $985,617 |

| 3/31/16 | $993,402 | $1,052,479 |

| 4/30/16 | $995,371 | $1,056,560 |

| 5/31/16 | $1,010,139 | $1,075,533 |

| 6/30/16 | $1,008,778 | $1,078,321 |

| 7/31/16 | $1,042,339 | $1,118,077 |

| 8/31/16 | $1,042,339 | $1,119,648 |

| 9/30/16 | $1,041,607 | $1,119,857 |

| 10/31/16 | $1,028,736 | $1,099,430 |

| 11/30/16 | $1,063,390 | $1,140,148 |

| 12/31/16 | $1,086,585 | $1,162,683 |

| 1/31/17 | $1,104,463 | $1,184,735 |

| 2/28/17 | $1,148,165 | $1,231,778 |

| 3/31/17 | $1,148,160 | $1,233,213 |

| 4/30/17 | $1,166,054 | $1,245,879 |

| 5/31/17 | $1,182,953 | $1,263,412 |

| 6/30/17 | $1,186,603 | $1,271,298 |

| 7/31/17 | $1,213,526 | $1,297,439 |

| 8/31/17 | $1,216,517 | $1,301,412 |

| 9/30/17 | $1,239,119 | $1,328,257 |

| 10/31/17 | $1,270,097 | $1,359,252 |

| 11/30/17 | $1,303,074 | $1,400,939 |

| 12/31/17 | $1,316,211 | $1,416,515 |

| 1/31/18 | $1,389,875 | $1,497,616 |

| 2/28/18 | $1,341,127 | $1,442,420 |

| 3/31/18 | $1,304,838 | $1,405,763 |

| 4/30/18 | $1,311,346 | $1,411,157 |

| 5/31/18 | $1,341,716 | $1,445,140 |

| 6/30/18 | $1,342,630 | $1,454,035 |

| 7/31/18 | $1,394,771 | $1,508,146 |

| 8/31/18 | $1,434,963 | $1,557,288 |

| 9/30/18 | $1,441,427 | $1,566,152 |

| 10/31/18 | $1,341,343 | $1,459,105 |

| 11/30/18 | $1,372,892 | $1,488,839 |

| 12/31/18 | $1,254,819 | $1,354,412 |

| 1/31/19 | $1,348,191 | $1,462,948 |

| 2/28/19 | $1,391,460 | $1,509,921 |

| 3/31/19 | $1,417,761 | $1,539,260 |

| 4/30/19 | $1,475,885 | $1,601,584 |

| 5/31/19 | $1,384,710 | $1,499,806 |

| 6/30/19 | $1,479,056 | $1,605,508 |

| 7/31/19 | $1,499,598 | $1,628,584 |

| 8/31/19 | $1,476,773 | $1,602,785 |

| 9/30/19 | $1,498,395 | $1,632,774 |

| 10/31/19 | $1,528,134 | $1,668,138 |

| 11/30/19 | $1,579,606 | $1,728,690 |

| 12/31/19 | $1,626,373 | $1,780,867 |

| 1/31/20 | $1,622,531 | $1,780,169 |

| 2/29/20 | $1,489,348 | $1,633,628 |

| 3/31/20 | $1,305,667 | $1,431,852 |

| 4/30/20 | $1,477,364 | $1,615,407 |

| 5/31/20 | $1,551,681 | $1,692,345 |

| 6/30/20 | $1,579,479 | $1,726,003 |

| 7/31/20 | $1,659,030 | $1,823,324 |

| 8/31/20 | $1,791,188 | $1,954,384 |

| 9/30/20 | $1,720,235 | $1,880,123 |

| 10/31/20 | $1,672,736 | $1,830,125 |

| 11/30/20 | $1,862,732 | $2,030,458 |

| 12/31/20 | $1,937,840 | $2,108,526 |

| 1/31/21 | $1,904,429 | $2,087,238 |

| 2/28/21 | $1,978,212 | $2,144,792 |

| 3/31/21 | $2,053,386 | $2,238,725 |

| 4/30/21 | $2,163,364 | $2,358,203 |

| 5/31/21 | $2,182,854 | $2,374,673 |

| 6/30/21 | $2,224,618 | $2,430,111 |

| 7/31/21 | $2,271,950 | $2,487,837 |

| 8/31/21 | $2,335,988 | $2,563,481 |

| 9/30/21 | $2,227,402 | $2,444,255 |

| 10/31/21 | $2,387,497 | $2,615,503 |

| 11/30/21 | $2,365,223 | $2,597,381 |

| 12/31/21 | $2,471,241 | $2,713,786 |

| 1/31/22 | $2,354,645 | $2,573,356 |

| 2/28/22 | $2,283,475 | $2,496,304 |

| 3/31/22 | $2,348,588 | $2,588,992 |

| 4/30/22 | $2,151,736 | $2,363,228 |

| 5/31/22 | $2,154,765 | $2,367,562 |

| 6/30/22 | $1,982,141 | $2,172,135 |

| 7/31/22 | $2,144,165 | $2,372,415 |

| 8/31/22 | $2,063,910 | $2,275,665 |

| 9/30/22 | $1,877,659 | $2,066,077 |

| 10/31/22 | $2,035,140 | $2,233,350 |

| 11/30/22 | $2,142,651 | $2,358,160 |

| 12/31/22 | $2,027,198 | $2,222,295 |

| 1/31/23 | $2,139,735 | $2,361,931 |

| 2/28/23 | $2,083,467 | $2,304,301 |

| 3/31/23 | $2,157,985 | $2,388,902 |

| 4/30/23 | $2,205,129 | $2,426,190 |

| 5/31/23 | $2,211,212 | $2,436,736 |

| 6/30/23 | $2,354,165 | $2,597,745 |

| 7/31/23 | $2,416,517 | $2,681,196 |

| 8/31/23 | $2,373,935 | $2,638,508 |

| 9/30/23 | $2,259,877 | $2,512,709 |

| 10/31/23 | $2,215,774 | $2,459,875 |

| 11/30/23 | $2,408,913 | $2,684,525 |

| 12/31/23 | $2,503,721 | $2,806,485 |

| 1/31/24 | $2,552,939 | $2,853,645 |

| 2/29/24 | $2,689,476 | $3,006,018 |

| 3/31/24 | $2,770,446 | $3,102,735 |

| 4/30/24 | $2,662,486 | $2,976,004 |

| 5/31/24 | $2,789,498 | $3,123,570 |

| 6/30/24 | $2,887,932 | $3,235,649 |

| 7/31/24 | $2,892,695 | $3,275,035 |

| 8/31/24 | $2,957,789 | $3,354,475 |

| 9/30/24 | $3,014,944 | $3,426,117 |

| 10/31/24 | $2,992,717 | $3,395,049 |

AVERAGE ANNUAL TOTAL RETURNS (%)

| AATR | 1 YEAR | 5 YEARS | 10 YEARS |

|---|

| Class I | 35.06 | 14.39 | 11.59 |

| S&P 500 Total Return Index | 38.06 | 15.27 | 13.00 |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Visit https://www.calamos.com/funds/mutual/ for the most recent performance information.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $20,644,697 | 114 | 24% | $190,896 |

Calamos Dividend Growth Fund

Annual Shareholder Report - October 31, 2024

WHAT DID THE FUND INVEST IN?

The Fund is broadly diversified by sector, favoring investments in dividend-paying equities and high-cash-generating businesses. Our preference for companies with stronger cash flows, improving or superior fundamentals, and upside intrinsic values worked well over the year. Dividend-paying equities often provide a sense of stability, and “quality” was a favored attribute.

Sector weightings and top 10 holdings exclude, if any, cash or cash equivalents.

| Information Technology | 30.5 |

| Financials | 15.2 |

| Consumer Discretionary | 10.8 |

| Health Care | 9.7 |

| Communication Services | 8.4 |

| Industrials | 7.4 |

| Consumer Staples | 5.5 |

| Utilities | 3.6 |

| Energy | 3.4 |

| Materials | 2.7 |

| Real Estate | 1.3 |

| Other | 1.2 |

| NVIDIA Corp. | 7.2 |

| Apple, Inc. | 6.9 |

| Microsoft Corp. | 6.5 |

| Alphabet, Inc. - Class C | 3.8 |

| Amazon.com, Inc. | 3.7 |

| Meta Platforms, Inc. - Class A | 2.5 |

| Broadcom, Inc. | 2.3 |

| JPMorgan Chase & Company | 1.9 |

| Eli Lilly & Company | 1.8 |

| Mastercard, Inc. - Class A | 1.6 |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, please visit www.calamos.com/resources. You can also request information by contacting us at 800-582-6959.

©2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

Calamos Investments LLC | 2020 Calamos Court | Naperville, IL 60563 | 800-582-6959 | www.calamos.com | DVGTSRA-I 24

Calamos Evolving World Growth Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the Calamos Evolving World Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

| Class A | $151 | 1.30% |

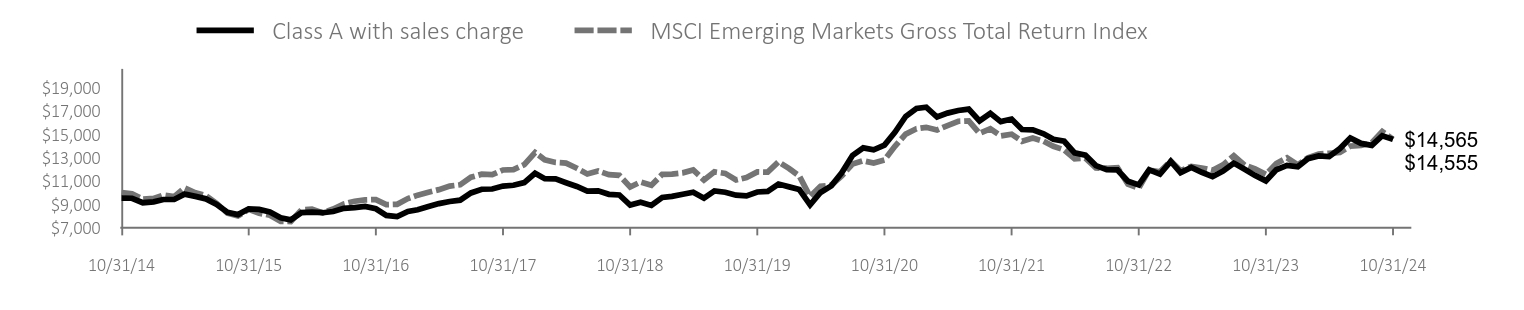

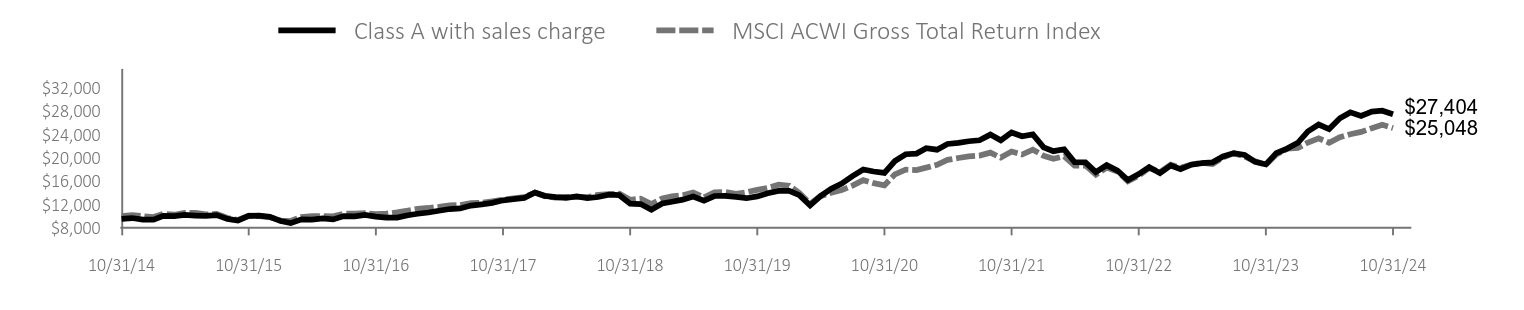

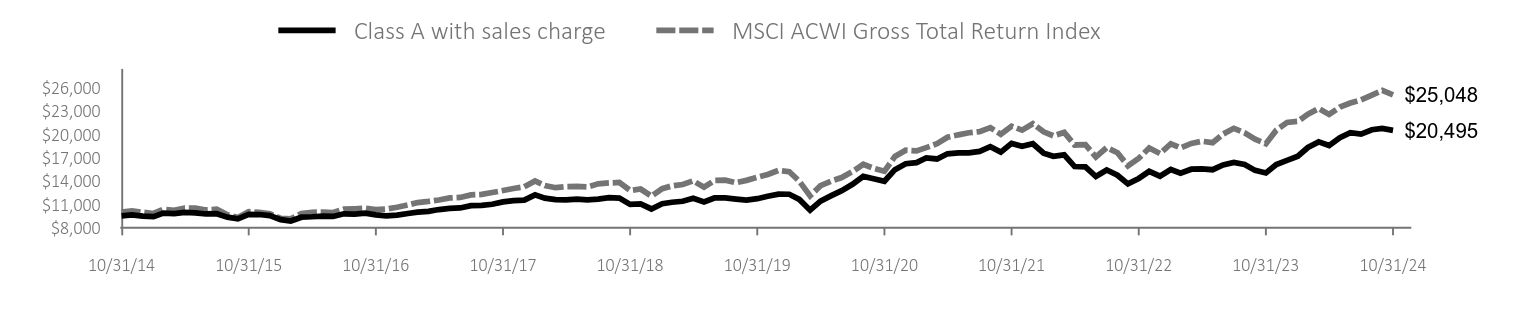

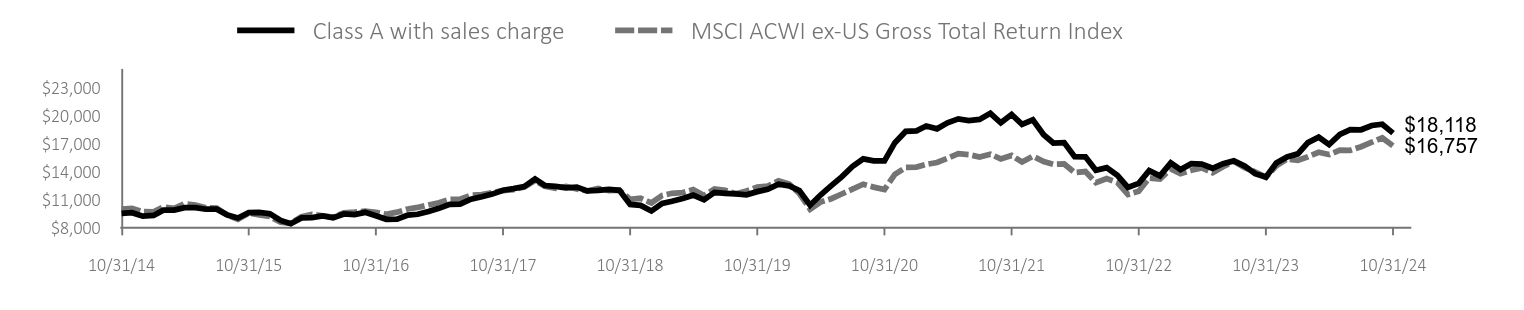

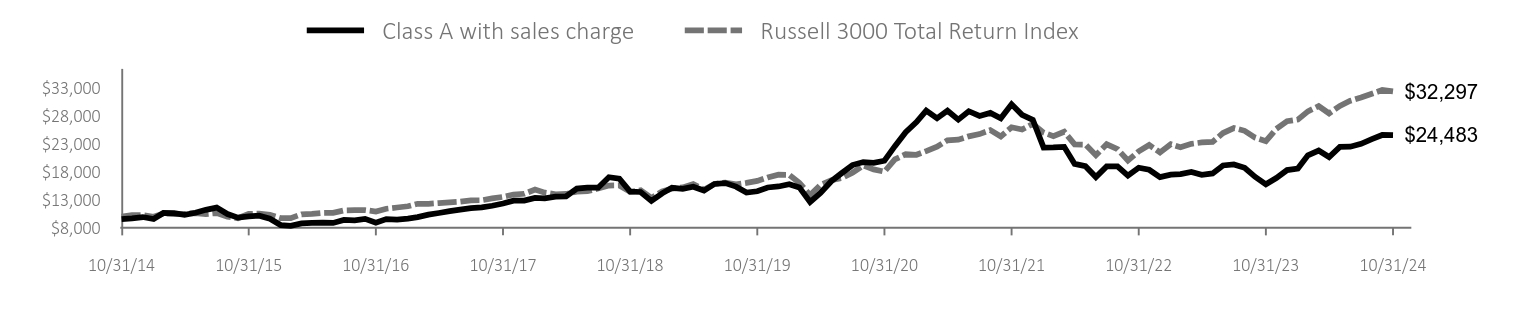

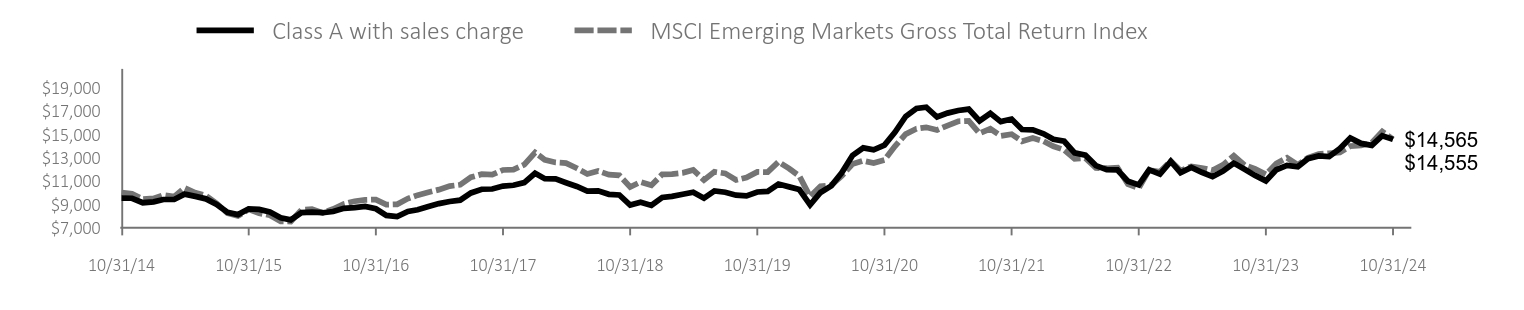

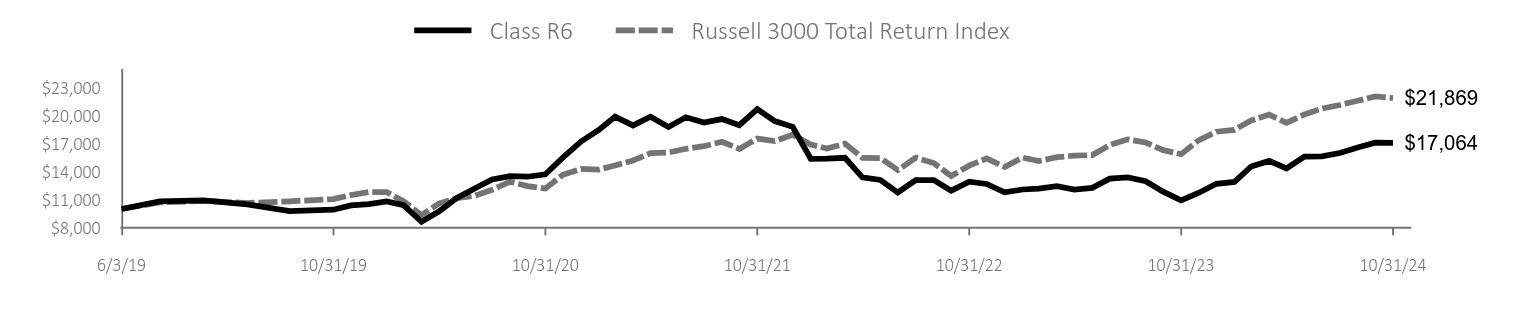

For the 12 months ended October 31, 2024 (“annual period”), the Fund generated strong returns in emerging markets. The Fund’s investments in companies with higher growth and quality characteristics and a wider universe of equities and convertible securities supported the Fund’s returns over the period. Fund holdings in consumer discretionary and industrials performed well, reflecting large addressable markets, rising earnings, and healthy balance sheets, while holdings in health care and financials lagged over the period. From a geographic view, holdings in India and Korea contributed to outperformance, while positions in China and the Philippines trailed.

| Class A with sales charge | MSCI Emerging Markets Gross Total Return Index |

|---|

| 10/31/14 | $9,528 | $10,001 |

| 11/30/14 | $9,521 | $9,895 |

| 12/31/14 | $9,137 | $9,444 |

| 1/31/15 | $9,208 | $9,501 |

| 2/28/15 | $9,414 | $9,797 |

| 3/31/15 | $9,414 | $9,659 |

| 4/30/15 | $9,877 | $10,405 |

| 5/31/15 | $9,677 | $9,990 |

| 6/30/15 | $9,471 | $9,738 |

| 7/31/15 | $9,001 | $9,069 |

| 8/31/15 | $8,311 | $8,252 |

| 9/30/15 | $8,119 | $8,007 |

| 10/31/15 | $8,617 | $8,578 |

| 11/30/15 | $8,567 | $8,244 |

| 12/31/15 | $8,346 | $8,065 |

| 1/31/16 | $7,841 | $7,543 |

| 2/29/16 | $7,670 | $7,531 |

| 3/31/16 | $8,289 | $8,529 |

| 4/30/16 | $8,325 | $8,578 |

| 5/31/16 | $8,282 | $8,259 |

| 6/30/16 | $8,389 | $8,597 |

| 7/31/16 | $8,660 | $9,035 |

| 8/31/16 | $8,717 | $9,263 |

| 9/30/16 | $8,824 | $9,384 |

| 10/31/16 | $8,624 | $9,408 |

| 11/30/16 | $8,054 | $8,975 |

| 12/31/16 | $7,955 | $9,001 |

| 1/31/17 | $8,396 | $9,494 |

| 2/28/17 | $8,539 | $9,786 |

| 3/31/17 | $8,816 | $10,035 |

| 4/30/17 | $9,066 | $10,257 |

| 5/31/17 | $9,244 | $10,562 |

| 6/30/17 | $9,358 | $10,676 |

| 7/31/17 | $9,977 | $11,321 |

| 8/31/17 | $10,291 | $11,577 |

| 9/30/17 | $10,312 | $11,534 |

| 10/31/17 | $10,561 | $11,939 |

| 11/30/17 | $10,632 | $11,964 |

| 12/31/17 | $10,862 | $12,399 |

| 1/31/18 | $11,660 | $13,434 |

| 2/28/18 | $11,197 | $12,816 |

| 3/31/18 | $11,176 | $12,581 |

| 4/30/18 | $10,848 | $12,528 |

| 5/31/18 | $10,528 | $12,087 |

| 6/30/18 | $10,129 | $11,593 |

| 7/31/18 | $10,157 | $11,858 |

| 8/31/18 | $9,858 | $11,540 |

| 9/30/18 | $9,801 | $11,483 |

| 10/31/18 | $8,932 | $10,484 |

| 11/30/18 | $9,188 | $10,917 |

| 12/31/18 | $8,911 | $10,634 |

| 1/31/19 | $9,587 | $11,566 |

| 2/28/19 | $9,680 | $11,593 |

| 3/31/19 | $9,865 | $11,693 |

| 4/30/19 | $10,043 | $11,941 |

| 5/31/19 | $9,530 | $11,078 |

| 6/30/19 | $10,150 | $11,779 |

| 7/31/19 | $10,036 | $11,645 |

| 8/31/19 | $9,780 | $11,080 |

| 9/30/19 | $9,723 | $11,295 |

| 10/31/19 | $10,057 | $11,773 |

| 11/30/19 | $10,114 | $11,757 |

| 12/31/19 | $10,733 | $12,642 |

| 1/31/20 | $10,496 | $12,053 |

| 2/29/20 | $10,266 | $11,419 |

| 3/31/20 | $8,961 | $9,663 |

| 4/30/20 | $10,015 | $10,549 |

| 5/31/20 | $10,582 | $10,633 |

| 6/30/20 | $11,701 | $11,420 |

| 7/31/20 | $13,179 | $12,450 |

| 8/31/20 | $13,832 | $12,729 |

| 9/30/20 | $13,660 | $12,528 |

| 10/31/20 | $14,062 | $12,788 |

| 11/30/20 | $15,166 | $13,971 |

| 12/31/20 | $16,521 | $15,005 |

| 1/31/21 | $17,202 | $15,469 |

| 2/28/21 | $17,311 | $15,588 |

| 3/31/21 | $16,469 | $15,356 |

| 4/30/21 | $16,806 | $15,741 |

| 5/31/21 | $17,026 | $16,109 |

| 6/30/21 | $17,150 | $16,143 |

| 7/31/21 | $16,140 | $15,066 |

| 8/31/21 | $16,784 | $15,465 |

| 9/30/21 | $16,074 | $14,856 |

| 10/31/21 | $16,294 | $15,004 |

| 11/30/21 | $15,400 | $14,394 |

| 12/31/21 | $15,367 | $14,671 |

| 1/31/22 | $15,037 | $14,395 |

| 2/28/22 | $14,559 | $13,966 |

| 3/31/22 | $14,397 | $13,655 |

| 4/30/22 | $13,398 | $12,898 |

| 5/31/22 | $13,207 | $12,958 |

| 6/30/22 | $12,310 | $12,108 |

| 7/31/22 | $11,972 | $12,088 |

| 8/31/22 | $11,943 | $12,143 |

| 9/30/22 | $10,980 | $10,725 |

| 10/31/22 | $10,664 | $10,394 |

| 11/30/22 | $11,957 | $11,937 |

| 12/31/22 | $11,589 | $11,776 |

| 1/31/23 | $12,669 | $12,707 |

| 2/28/23 | $11,715 | $11,884 |

| 3/31/23 | $12,159 | $12,249 |

| 4/30/23 | $11,744 | $12,112 |

| 5/31/23 | $11,367 | $11,912 |

| 6/30/23 | $11,848 | $12,376 |

| 7/31/23 | $12,529 | $13,155 |

| 8/31/23 | $11,996 | $12,348 |

| 9/30/23 | $11,478 | $12,030 |

| 10/31/23 | $11,004 | $11,564 |

| 11/30/23 | $11,959 | $12,492 |

| 12/31/23 | $12,328 | $12,985 |

| 1/31/24 | $12,210 | $12,383 |

| 2/29/24 | $12,900 | $12,974 |

| 3/31/24 | $13,137 | $13,301 |

| 4/30/24 | $13,085 | $13,363 |

| 5/31/24 | $13,776 | $13,443 |

| 6/30/24 | $14,681 | $13,982 |

| 7/31/24 | $14,213 | $14,033 |

| 8/31/24 | $14,043 | $14,264 |

| 9/30/24 | $14,867 | $15,223 |

| 10/31/24 | $14,555 | $14,565 |

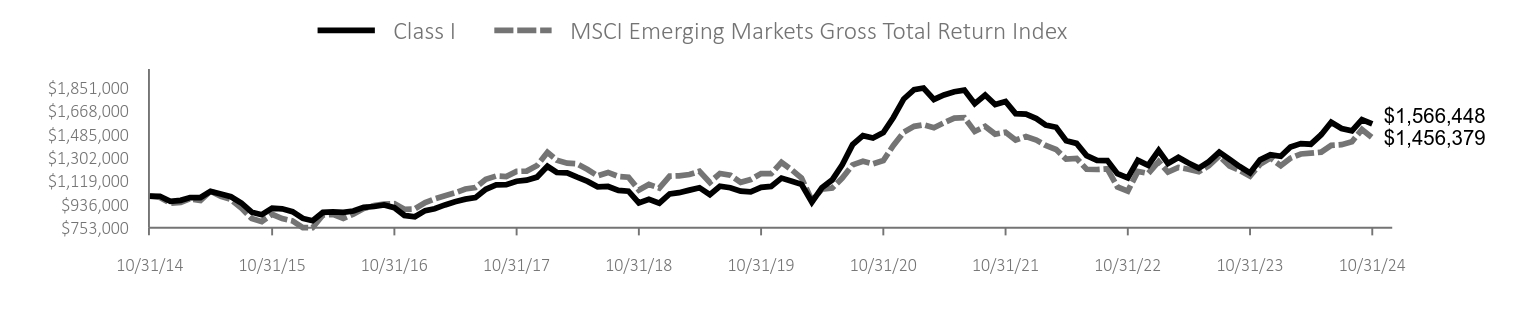

AVERAGE ANNUAL TOTAL RETURNS (%)

| AATR | 1 YEAR | 5 YEARS | 10 YEARS |

|---|

| Class A without sales charge | 32.27 | 7.67 | 4.33 |

| Class A with sales charge | 26.00 | 6.64 | 3.82 |

| MSCI Emerging Markets Gross Total Return Index | 25.95 | 4.35 | 3.83 |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Visit https://www.calamos.com/funds/mutual/ for the most recent performance information.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $396,642,147 | 69 | 140% | $4,181,196 |

Calamos Evolving World Growth Fund

Annual Shareholder Report - October 31, 2024

WHAT DID THE FUND INVEST IN?

The Fund employs an active, risk-managed strategy to invest in emerging market growth opportunities. The Fund invests in common stocks and draws on our experience in convertible securities to actively manage risk. The Fund invests in emerging markets and developed-market domiciled companies with significant revenue exposure to emerging markets.

Sector weightings and top 10 holdings exclude, if any, cash or cash equivalents.

| Consumer Discretionary | 31.7 |

| Information Technology | 22.3 |

| Financials | 15.7 |

| Industrials | 10.0 |

| Consumer Staples | 5.9 |

| Real Estate | 3.5 |

| Communication Services | 3.4 |

| Health Care | 3.4 |

| Materials | 3.0 |

| Energy | 2.0 |

| Taiwan Semiconductor Manufacturing Company, Ltd. | 11.7 |

| Alibaba Group Holding, Ltd., 0.500%, 06/01/31 | 4.7 |

| Trip.com Group, Ltd., 0.750%, 06/15/29 | 3.6 |

| Tencent Holdings, Ltd. | 3.1 |

| NU Holdings Ltd. - Class A | 3.0 |

| JD.com, Inc., 0.250%, 06/01/29 | 2.6 |

| Amber Enterprises India, Ltd. | 2.4 |

| Meritz Financial Group, Inc. | 2.3 |

| Hon Hai Precision Industry Company, Ltd., 0.000%, 08/05/26 | 2.3 |

| Hanwha Aerospace Company, Ltd. | 2.3 |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, please visit www.calamos.com/resources. You can also request information by contacting us at 800-582-6959.

©2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

Calamos Investments LLC | 2020 Calamos Court | Naperville, IL 60563 | 800-582-6959 | www.calamos.com | EWGTSRA-A 24

Calamos Evolving World Growth Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the Calamos Evolving World Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

| Class C | $237 | 2.05% |

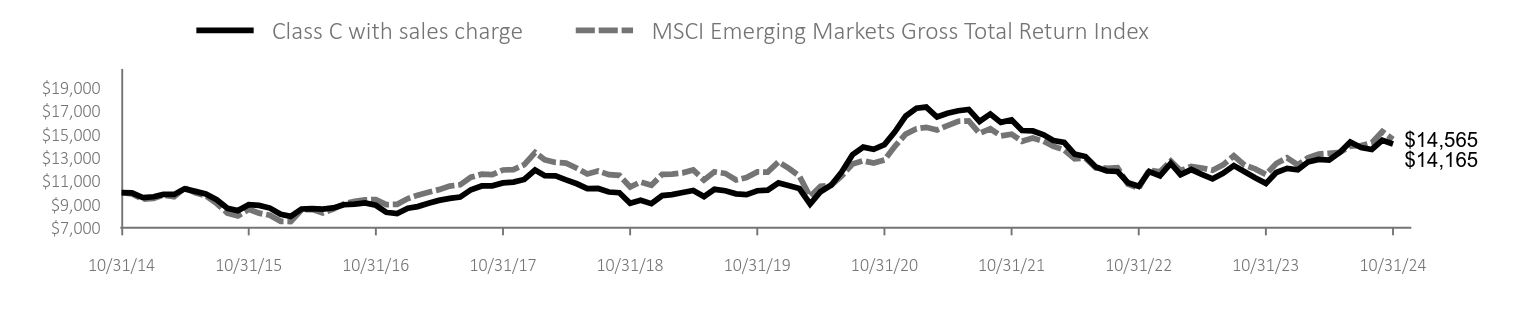

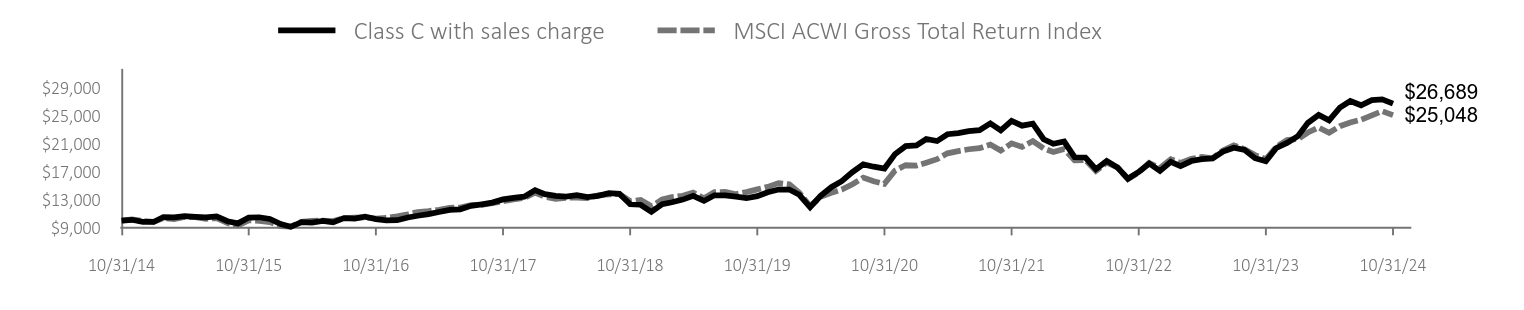

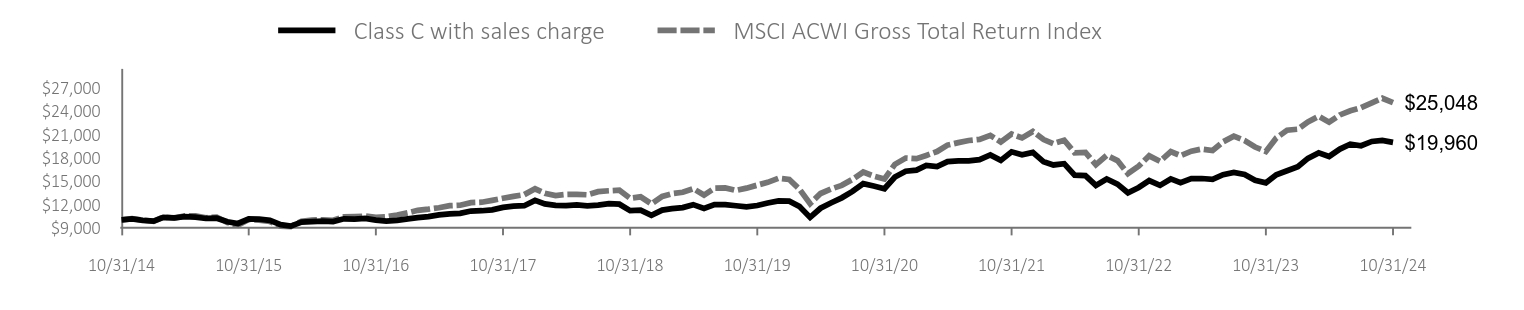

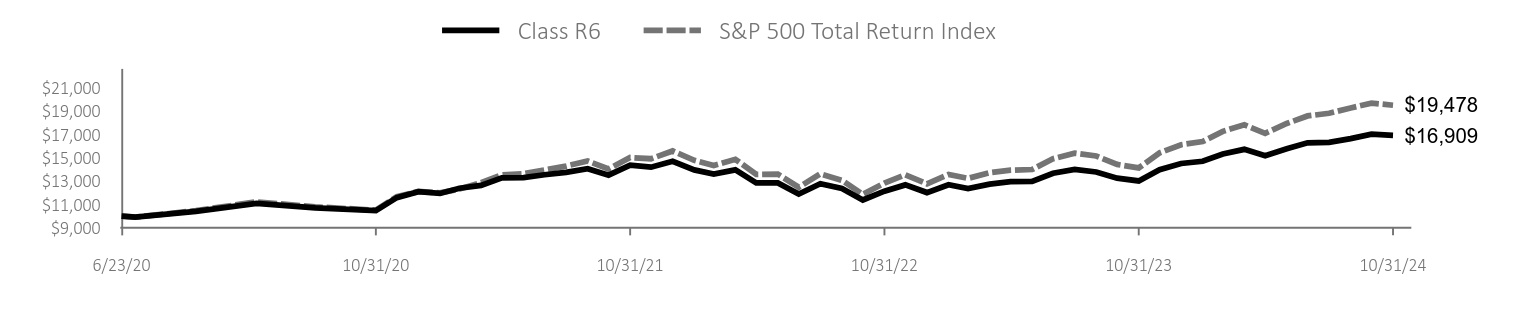

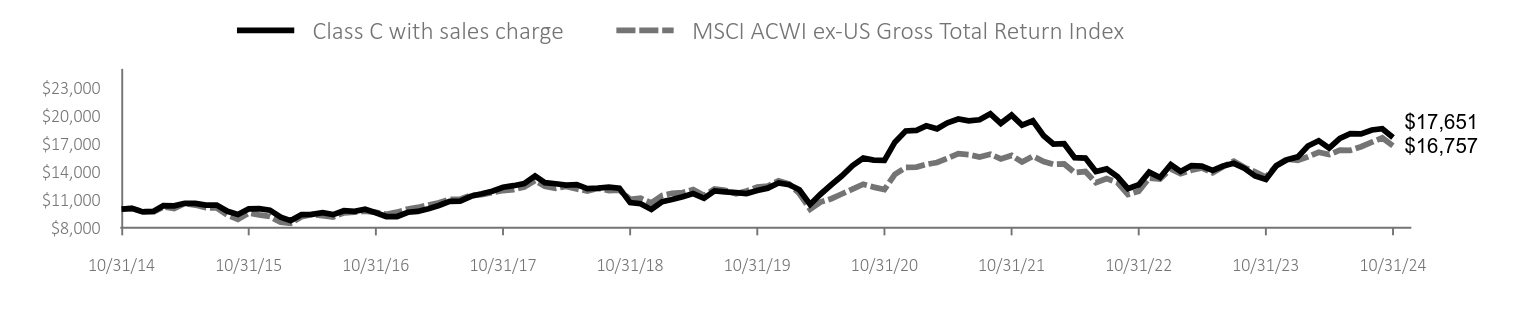

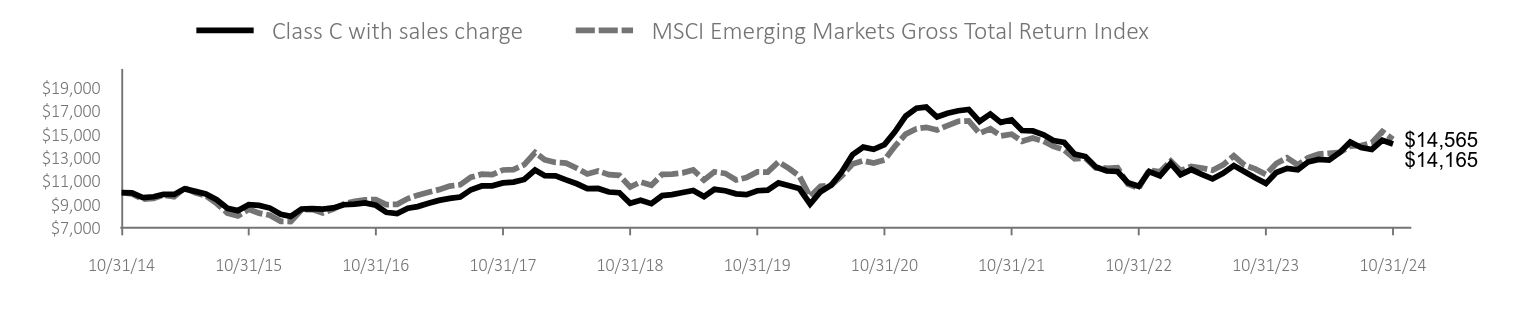

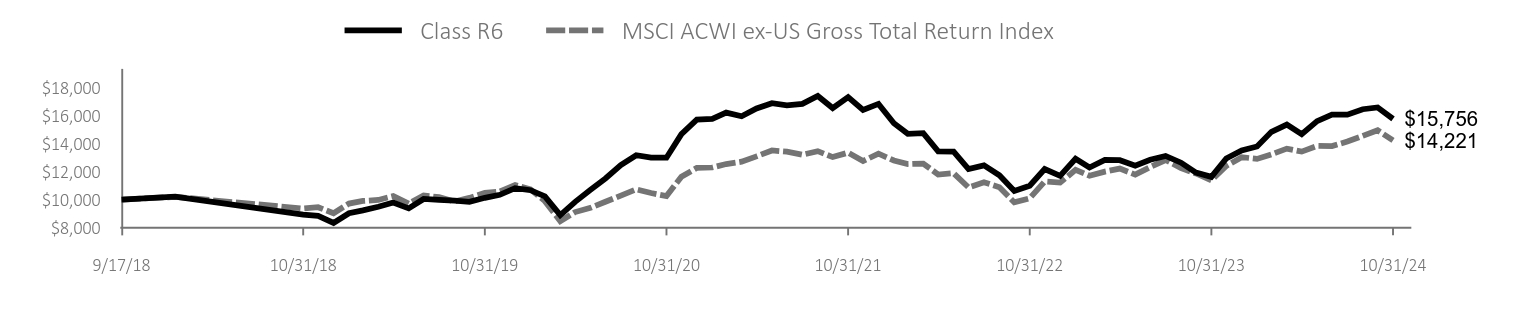

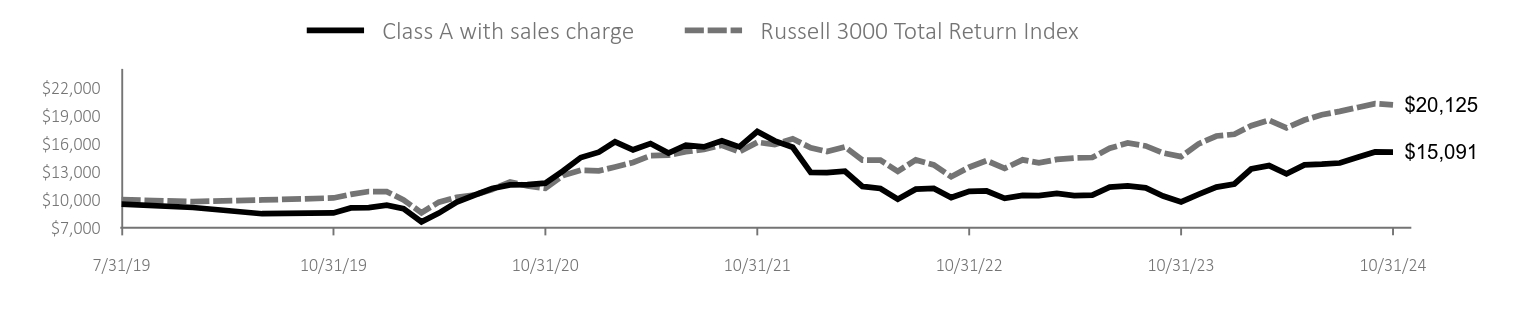

For the 12 months ended October 31, 2024 (“annual period”), the Fund generated strong returns in emerging markets. The Fund’s investments in companies with higher growth and quality characteristics and a wider universe of equities and convertible securities supported the Fund’s returns over the period. Fund holdings in consumer discretionary and industrials performed well, reflecting large addressable markets, rising earnings, and healthy balance sheets, while holdings in health care and financials lagged over the period. From a geographic view, holdings in India and Korea contributed to outperformance, while positions in China and the Philippines trailed.

| Class C with sales charge | MSCI Emerging Markets Gross Total Return Index |

|---|

| 10/31/14 | $10,000 | $10,001 |

| 11/30/14 | $9,985 | $9,895 |

| 12/31/14 | $9,569 | $9,444 |

| 1/31/15 | $9,647 | $9,501 |

| 2/28/15 | $9,855 | $9,797 |

| 3/31/15 | $9,847 | $9,659 |

| 4/30/15 | $10,326 | $10,405 |

| 5/31/15 | $10,110 | $9,990 |

| 6/30/15 | $9,886 | $9,738 |

| 7/31/15 | $9,392 | $9,069 |

| 8/31/15 | $8,666 | $8,252 |

| 9/30/15 | $8,465 | $8,007 |

| 10/31/15 | $8,975 | $8,578 |

| 11/30/15 | $8,913 | $8,244 |

| 12/31/15 | $8,681 | $8,065 |

| 1/31/16 | $8,148 | $7,543 |

| 2/29/16 | $7,971 | $7,531 |

| 3/31/16 | $8,604 | $8,529 |

| 4/30/16 | $8,635 | $8,578 |

| 5/31/16 | $8,588 | $8,259 |

| 6/30/16 | $8,689 | $8,597 |

| 7/31/16 | $8,967 | $9,035 |

| 8/31/16 | $9,021 | $9,263 |

| 9/30/16 | $9,129 | $9,384 |

| 10/31/16 | $8,921 | $9,408 |

| 11/30/16 | $8,318 | $8,975 |

| 12/31/16 | $8,210 | $9,001 |

| 1/31/17 | $8,666 | $9,494 |

| 2/28/17 | $8,805 | $9,786 |

| 3/31/17 | $9,090 | $10,035 |

| 4/30/17 | $9,338 | $10,257 |

| 5/31/17 | $9,515 | $10,562 |

| 6/30/17 | $9,623 | $10,676 |

| 7/31/17 | $10,249 | $11,321 |

| 8/31/17 | $10,573 | $11,577 |

| 9/30/17 | $10,581 | $11,534 |

| 10/31/17 | $10,836 | $11,939 |

| 11/30/17 | $10,905 | $11,964 |

| 12/31/17 | $11,129 | $12,399 |

| 1/31/18 | $11,940 | $13,434 |

| 2/28/18 | $11,454 | $12,816 |

| 3/31/18 | $11,431 | $12,581 |

| 4/30/18 | $11,091 | $12,528 |

| 5/31/18 | $10,759 | $12,087 |

| 6/30/18 | $10,342 | $11,593 |

| 7/31/18 | $10,357 | $11,858 |

| 8/31/18 | $10,056 | $11,540 |

| 9/30/18 | $9,994 | $11,483 |

| 10/31/18 | $9,098 | $10,484 |

| 11/30/18 | $9,353 | $10,917 |

| 12/31/18 | $9,060 | $10,634 |

| 1/31/19 | $9,747 | $11,566 |

| 2/28/19 | $9,832 | $11,593 |

| 3/31/19 | $10,017 | $11,693 |

| 4/30/19 | $10,187 | $11,941 |

| 5/31/19 | $9,662 | $11,078 |

| 6/30/19 | $10,288 | $11,779 |

| 7/31/19 | $10,164 | $11,645 |

| 8/31/19 | $9,901 | $11,080 |

| 9/30/19 | $9,832 | $11,295 |

| 10/31/19 | $10,164 | $11,773 |

| 11/30/19 | $10,218 | $11,757 |

| 12/31/19 | $10,836 | $12,642 |

| 1/31/20 | $10,589 | $12,053 |

| 2/29/20 | $10,349 | $11,419 |

| 3/31/20 | $9,029 | $9,663 |

| 4/30/20 | $10,079 | $10,549 |

| 5/31/20 | $10,651 | $10,633 |

| 6/30/20 | $11,770 | $11,420 |

| 7/31/20 | $13,246 | $12,450 |

| 8/31/20 | $13,894 | $12,729 |

| 9/30/20 | $13,709 | $12,528 |

| 10/31/20 | $14,103 | $12,788 |

| 11/30/20 | $15,200 | $13,971 |

| 12/31/20 | $16,549 | $15,005 |

| 1/31/21 | $17,220 | $15,469 |

| 2/28/21 | $17,323 | $15,588 |

| 3/31/21 | $16,470 | $15,356 |

| 4/30/21 | $16,794 | $15,741 |

| 5/31/21 | $17,007 | $16,109 |

| 6/30/21 | $17,118 | $16,143 |

| 7/31/21 | $16,099 | $15,066 |

| 8/31/21 | $16,731 | $15,465 |

| 9/30/21 | $16,012 | $14,856 |

| 10/31/21 | $16,225 | $15,004 |

| 11/30/21 | $15,325 | $14,394 |

| 12/31/21 | $15,278 | $14,671 |

| 1/31/22 | $14,946 | $14,395 |

| 2/28/22 | $14,457 | $13,966 |

| 3/31/22 | $14,291 | $13,655 |

| 4/30/22 | $13,296 | $12,898 |

| 5/31/22 | $13,091 | $12,958 |

| 6/30/22 | $12,199 | $12,108 |

| 7/31/22 | $11,851 | $12,088 |

| 8/31/22 | $11,812 | $12,143 |

| 9/30/22 | $10,856 | $10,725 |

| 10/31/22 | $10,541 | $10,394 |

| 11/30/22 | $11,812 | $11,937 |

| 12/31/22 | $11,441 | $11,776 |

| 1/31/23 | $12,499 | $12,707 |

| 2/28/23 | $11,543 | $11,884 |

| 3/31/23 | $11,978 | $12,249 |

| 4/30/23 | $11,567 | $12,112 |

| 5/31/23 | $11,180 | $11,912 |

| 6/30/23 | $11,646 | $12,376 |

| 7/31/23 | $12,317 | $13,155 |

| 8/31/23 | $11,780 | $12,348 |

| 9/30/23 | $11,267 | $12,030 |

| 10/31/23 | $10,793 | $11,564 |

| 11/30/23 | $11,725 | $12,492 |

| 12/31/23 | $12,080 | $12,985 |

| 1/31/24 | $11,954 | $12,383 |

| 2/29/24 | $12,617 | $12,974 |

| 3/31/24 | $12,846 | $13,301 |

| 4/30/24 | $12,783 | $13,363 |

| 5/31/24 | $13,446 | $13,443 |

| 6/30/24 | $14,331 | $13,982 |

| 7/31/24 | $13,865 | $14,033 |

| 8/31/24 | $13,691 | $14,264 |

| 9/30/24 | $14,481 | $15,223 |

| 10/31/24 | $14,165 | $14,565 |

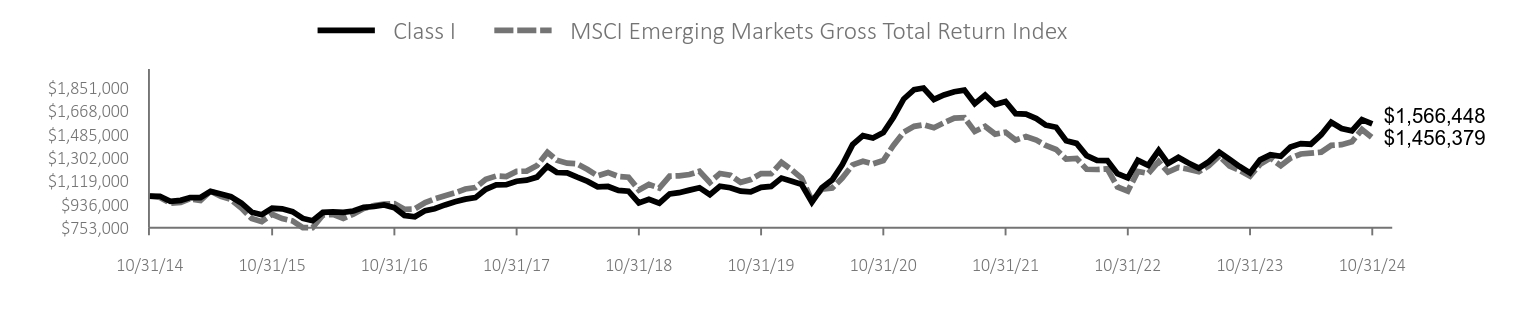

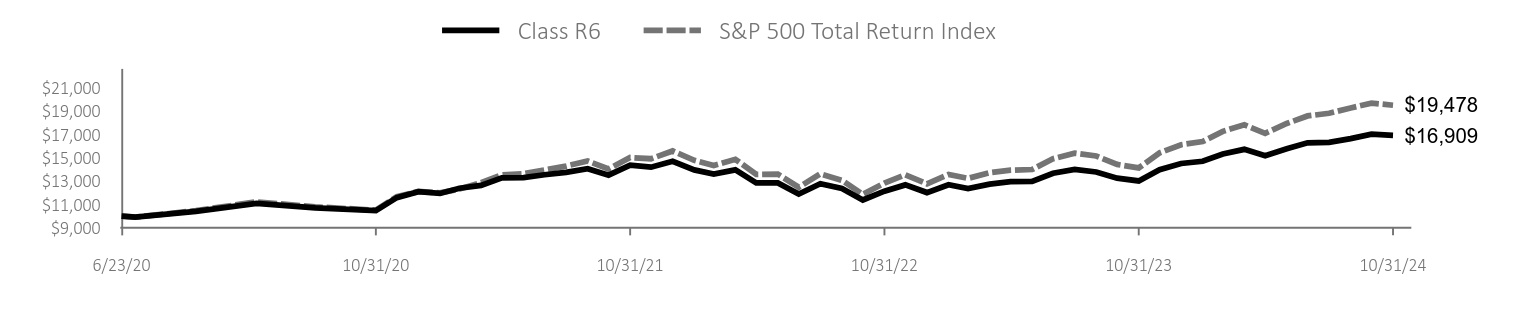

AVERAGE ANNUAL TOTAL RETURNS (%)

| AATR | 1 YEAR | 5 YEARS | 10 YEARS |

|---|

| Class C without sales charge | 31.24 | 6.86 | 3.54 |

| Class C with sales charge | 30.24 | 6.86 | 3.54 |

| MSCI Emerging Markets Gross Total Return Index | 25.95 | 4.35 | 3.83 |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Visit https://www.calamos.com/funds/mutual/ for the most recent performance information.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $396,642,147 | 69 | 140% | $4,181,196 |

Calamos Evolving World Growth Fund

Annual Shareholder Report - October 31, 2024

WHAT DID THE FUND INVEST IN?

The Fund employs an active, risk-managed strategy to invest in emerging market growth opportunities. The Fund invests in common stocks and draws on our experience in convertible securities to actively manage risk. The Fund invests in emerging markets and developed-market domiciled companies with significant revenue exposure to emerging markets.

Sector weightings and top 10 holdings exclude, if any, cash or cash equivalents.

| Consumer Discretionary | 31.7 |

| Information Technology | 22.3 |

| Financials | 15.7 |

| Industrials | 10.0 |

| Consumer Staples | 5.9 |

| Real Estate | 3.5 |

| Communication Services | 3.4 |

| Health Care | 3.4 |

| Materials | 3.0 |

| Energy | 2.0 |

| Taiwan Semiconductor Manufacturing Company, Ltd. | 11.7 |

| Alibaba Group Holding, Ltd., 0.500%, 06/01/31 | 4.7 |

| Trip.com Group, Ltd., 0.750%, 06/15/29 | 3.6 |

| Tencent Holdings, Ltd. | 3.1 |

| NU Holdings Ltd. - Class A | 3.0 |

| JD.com, Inc., 0.250%, 06/01/29 | 2.6 |

| Amber Enterprises India, Ltd. | 2.4 |

| Meritz Financial Group, Inc. | 2.3 |

| Hon Hai Precision Industry Company, Ltd., 0.000%, 08/05/26 | 2.3 |

| Hanwha Aerospace Company, Ltd. | 2.3 |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, please visit www.calamos.com/resources. You can also request information by contacting us at 800-582-6959.

©2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

Calamos Investments LLC | 2020 Calamos Court | Naperville, IL 60563 | 800-582-6959 | www.calamos.com | EWGTSRA-C 24

Calamos Evolving World Growth Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the Calamos Evolving World Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

| Class I | $122 | 1.05% |

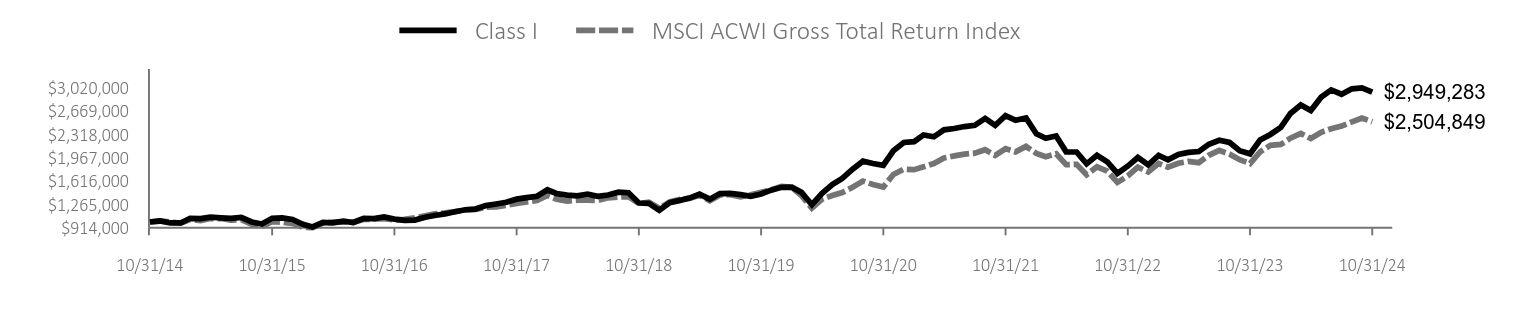

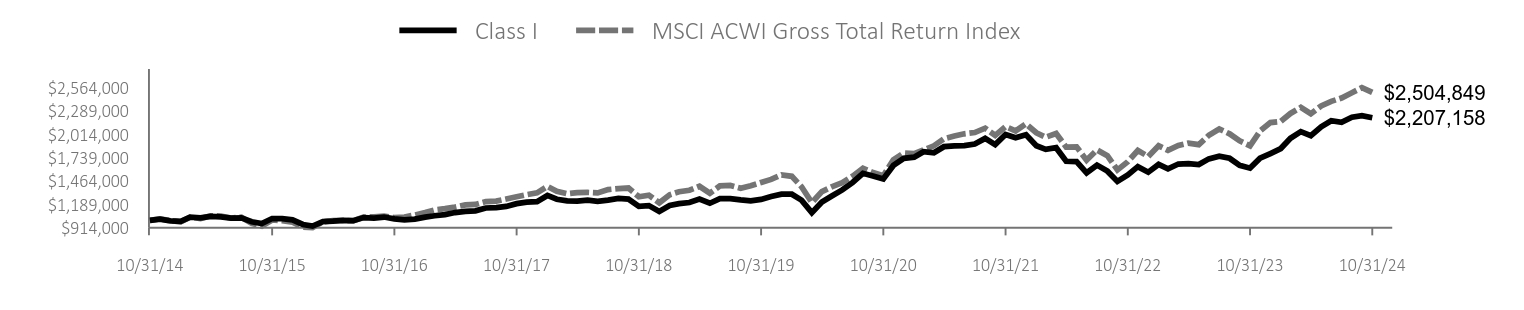

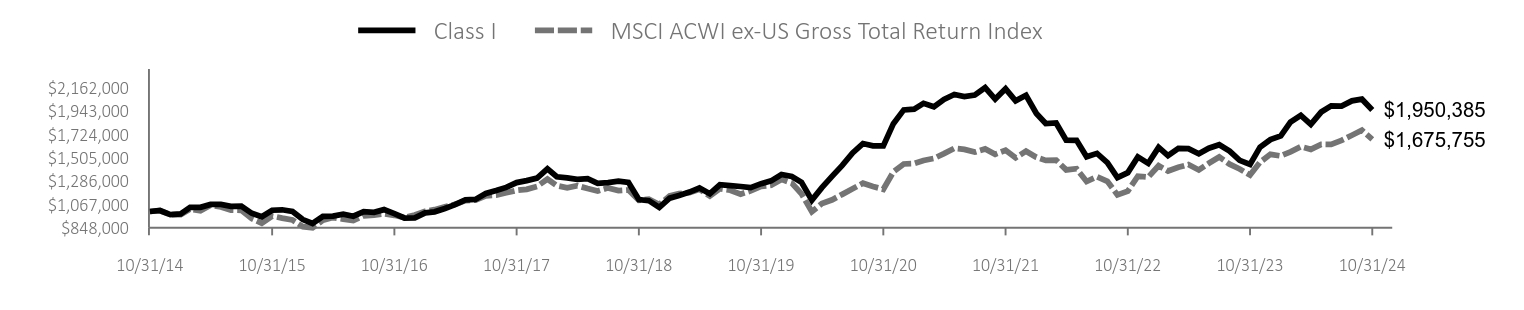

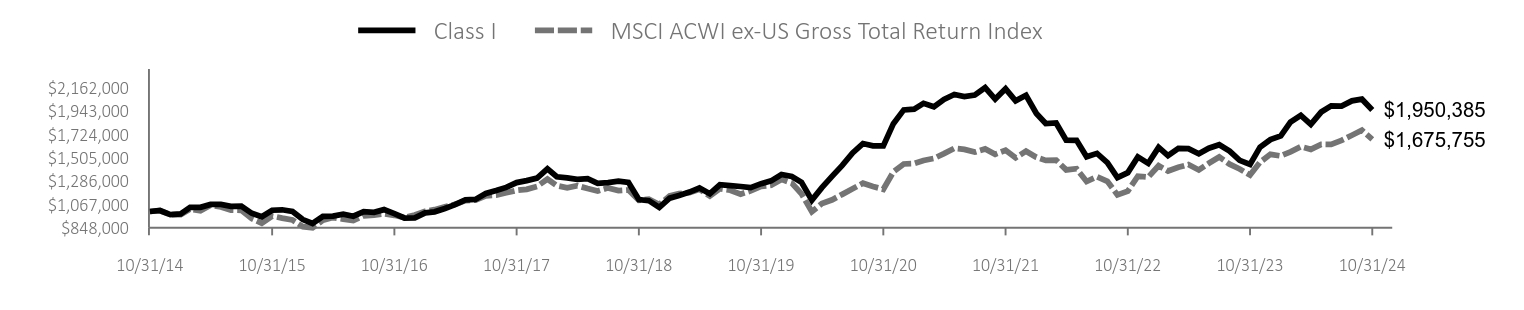

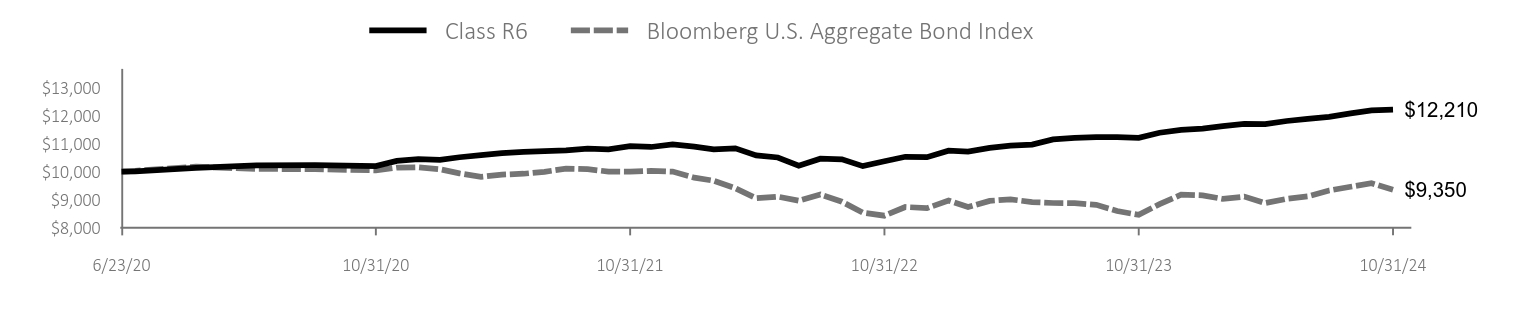

For the 12 months ended October 31, 2024 (“annual period”), the Fund generated strong returns in emerging markets. The Fund’s investments in companies with higher growth and quality characteristics and a wider universe of equities and convertible securities supported the Fund’s returns over the period. Fund holdings in consumer discretionary and industrials performed well, reflecting large addressable markets, rising earnings, and healthy balance sheets, while holdings in health care and financials lagged over the period. From a geographic view, holdings in India and Korea contributed to outperformance, while positions in China and the Philippines trailed.

| Class I | MSCI Emerging Markets Gross Total Return Index |

|---|

| 10/31/14 | $1,000,000 | $1,000,000 |

| 11/30/14 | $999,277 | $989,483 |

| 12/31/14 | $959,313 | $944,348 |

| 1/31/15 | $967,494 | $950,085 |

| 2/28/15 | $989,059 | $979,620 |

| 3/31/15 | $989,059 | $965,883 |

| 4/30/15 | $1,037,397 | $1,040,420 |

| 5/31/15 | $1,017,318 | $998,953 |

| 6/30/15 | $995,752 | $973,774 |

| 7/31/15 | $946,671 | $906,867 |

| 8/31/15 | $874,537 | $825,162 |

| 9/30/15 | $854,458 | $800,632 |

| 10/31/15 | $906,514 | $857,799 |

| 11/30/15 | $901,308 | $824,395 |

| 12/31/15 | $878,613 | $806,488 |

| 1/31/16 | $825,613 | $754,213 |

| 2/29/16 | $807,697 | $753,058 |

| 3/31/16 | $872,641 | $852,897 |

| 4/30/16 | $877,120 | $857,705 |

| 5/31/16 | $872,641 | $825,879 |

| 6/30/16 | $883,839 | $859,697 |

| 7/31/16 | $912,952 | $903,455 |

| 8/31/16 | $918,924 | $926,210 |

| 9/30/16 | $930,867 | $938,393 |

| 10/31/16 | $909,966 | $940,714 |

| 11/30/16 | $849,500 | $897,467 |

| 12/31/16 | $839,050 | $900,073 |

| 1/31/17 | $886,825 | $949,372 |

| 2/28/17 | $901,754 | $978,504 |

| 3/31/17 | $931,614 | $1,003,451 |

| 4/30/17 | $956,994 | $1,025,631 |

| 5/31/17 | $976,403 | $1,056,163 |

| 6/30/17 | $988,347 | $1,067,511 |

| 7/31/17 | $1,054,037 | $1,132,004 |

| 8/31/17 | $1,088,376 | $1,157,679 |

| 9/30/17 | $1,089,869 | $1,153,337 |

| 10/31/17 | $1,116,742 | $1,193,841 |

| 11/30/17 | $1,124,954 | $1,196,304 |

| 12/31/17 | $1,149,268 | $1,239,866 |

| 1/31/18 | $1,233,983 | $1,343,299 |

| 2/28/18 | $1,185,253 | $1,281,536 |

| 3/31/18 | $1,183,004 | $1,258,039 |

| 4/30/18 | $1,148,518 | $1,252,709 |

| 5/31/18 | $1,115,532 | $1,208,616 |

| 6/30/18 | $1,073,550 | $1,159,208 |

| 7/31/18 | $1,075,799 | $1,185,694 |

| 8/31/18 | $1,045,062 | $1,153,981 |

| 9/30/18 | $1,039,064 | $1,148,239 |

| 10/31/18 | $946,853 | $1,048,341 |

| 11/30/18 | $974,591 | $1,091,623 |

| 12/31/18 | $945,354 | $1,063,361 |

| 1/31/19 | $1,017,323 | $1,156,548 |

| 2/28/19 | $1,027,069 | $1,159,252 |

| 3/31/19 | $1,047,311 | $1,169,208 |

| 4/30/19 | $1,066,053 | $1,194,043 |

| 5/31/19 | $1,012,076 | $1,107,779 |

| 6/30/19 | $1,078,048 | $1,177,818 |

| 7/31/19 | $1,066,053 | $1,164,390 |

| 8/31/19 | $1,039,064 | $1,107,951 |

| 9/30/19 | $1,033,067 | $1,129,467 |

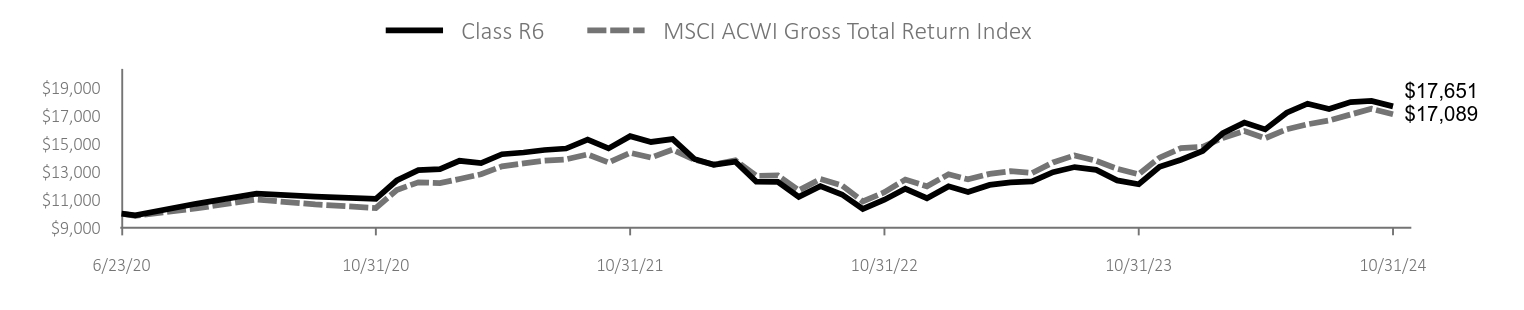

| 10/31/19 | $1,069,052 | $1,177,213 |