UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

INVESTMENT COMPANY ACT FILE NUMBER: 811-05443

Calamos Investment Trust

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

2020 Calamos Court, Naperville

Illinois 60563-2787

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

John P Calamos, Sr., President,

Calamos Advisors LLC

2020 Calamos Court,

Naperville, Illinois

60563-2787

(NAME AND ADDRESS OF AGENT FOR SERVICE)

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (630) 245-7200

DATE OF FISCAL YEAR END: October 31, 2012

DATE OF REPORTING PERIOD: November 1, 2011 through April 30, 2012

Item 1. Report to Shareholders

Experience and Foresight

About Calamos Investments

For more than 30 years, we have helped investors like you manage and build wealth to meet long-term objectives. Because investors have different time horizons, risk tolerances and goals, we offer funds to suit a variety of asset allocation needs. Our 13 mutual funds include equity, enhanced fixed income and alternative funds. We offer U.S. funds, as well as global and international choices.

We are dedicated to helping our clients build and protect wealth. We understand when you entrust us with your assets, you also entrust us with your achievements, goals and aspirations. We believe we best honor this trust by making investment decisions guided by integrity, by discipline and by our conscientious research.

We believe that an active, risk-conscious approach is essential for wealth creation. In the 1970s, we pioneered the use of convertible securities as a means to control risk in volatile markets. We followed with strategies that combine convertibles and stocks, with the aim of participating in equity market upside with potentially less volatility than an all-stock portfolio. In the 1990s, we introduced our first stock fund, which invests in growth companies both large and small. Across our funds, our investment process seeks to manage risk at multiple levels and draws upon our experience investing through many market cycles. In a rapidly changing environment, we believe that this active management is essential.

We are global in our perspective. We believe that globalization offers tremendous opportunities for countries and companies all over the world. In our U.S., global and international portfolios, we are seeking to capitalize on the potential growth of the global economy.

We believe there are opportunities in all markets. Our history traces back to the 1970s, a period of significant volatility and economic concerns. We have invested through multiple market cycles, each with its own challenges. Out of this experience comes our belief that the flipside of volatility is opportunity.

Letter to Shareholders

JOHN P. CALAMOS, SR.

CEO and Co-CIO

Dear Fellow Shareholder:

Welcome to your semiannual report for the six-month period ended April 30, 2012. In this report, you will find commentary from the Calamos Investment Management Team, as well as a listing of portfolio holdings, financial statements and highlights, and detailed information about the performance and positioning of the Calamos Funds.

Market Review

Entering the semiannual period, our view was that the U.S. economy was not headed for a double dip recession. During the period, improving economic data supported our constructive view. However, even as market sentiment improved and risk appetites increased, the global markets remained volatile. Sovereign debt pressures in the eurozone and the potential for slowing growth in emerging markets were of particular concern.

Overall, for the six-month period, global equity markets experienced significant gains. In the U.S., stocks rallied to a double-digit performance, with the S&P 500 Index1 returning an impressive 12.77% for the period. While the global equity markets didn’t quite match that pace, the MSCI World Index2, a measure of developed market equity performance, still managed to post a healthy 7.87% gain. Meanwhile, the emerging markets returned to positive territory with a gain of 4.02% in the MSCI Emerging Markets Index3.

Convertible securities also enjoyed the six-month rally, as the BofA Merrill Lynch All U.S. Convertible Ex-Mandatory Index4 returned 7.11%. In a demonstration of the strengthening economy, high yield issuance reached record levels in the first quarter of 2012, while performance for the six-month period was also robust, with a 6.77% return in the Credit Suisse High Yield Index5. The broad U.S. bond market, as measured by the Barclays Capital U.S. Aggregate Bond Index6, posted a 2.44% gain.

Opportunities in the Global Economy

While the strong performance over the semiannual period has been a welcome development, we know from experience that volatility can work both ways, and we therefore continue to actively monitor the global economy and the companies we have chosen for the funds. We expect slow but positive growth in the U.S. and in the global economy as a whole. We are prepared for ups and downs along the way and anticipate continued volatility in the global financial markets.

Letter to Shareholders

We believe the period’s strong showing serves as a timely reminder of the resilience of global growth equities as a long-term investment opportunity. Our valuation models show that growth continues to be priced at a large discount all around the world. Overall, our view is that equities represent the most compelling investment on an asset class basis. However, as in the past, trying to time when the equity markets will respond positively for a pronounced period is extremely difficult.

We have identified a number of important secular themes that we believe will drive global growth for years to come. The growth of a middle class in many emerging market regions is an exciting trend, and globally focused businesses are in the best position to capitalize on this increasingly prosperous new customer base. In addition, information technology firms—which comprise a substantial portion of the holdings in many of the Calamos funds—represent an excellent opportunity to take advantage of the growing needs of both global consumers and productivity-seeking businesses around the world.

We also see a considerable cyclical opportunity coming from global reflation activities as global stimulus efforts and increasing liquidity measures taken by the world’s central banks persist. Despite some pullback in the period, we continue to hold a favorable outlook for opportunities in areas such as energy and materials based on strong global demand for resources, especially within developing economies.

We believe that these prominent secular themes and cyclical factors will provide growth opportunities for companies all throughout the world, particularly those with geographically diversified revenues, strong global brands and healthy balance sheets. We believe that global companies may be less vulnerable to economic weakness in a particular country or region, and we are favoring companies domiciled in developed countries that are capitalizing on many of the growth trends currently available in emerging markets.

We also continue to think broadly in terms of how we invest to capitalize on these themes and companies. As noted earlier, we believe that growth equities remain among the most compelling investing opportunities, but we have also found attractive possibilities in the mid-grade corporate debt of these types of firms for investors seeking income-oriented total return. In addition, despite the low interest rate environment and resultant low new issuance for convertible securities, our decades of experience in this area have helped to uncover a number of worthwhile opportunities here as well.

Thinking Long-Term and Thinking Globally

Experience has shown us that volatility and uncertainty have always been, and will continue to be, big factors in investing. Yet it is that same experience that has taught us that while we may not be able to control market volatility or anticipate every potential event in the global economy, we can still find investing success over the long term with a disciplined approach that fully takes into account both risks and rewards. We believe that

| | | | |

| 2 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Letter to Shareholders

volatility and uncertainty do not constitute an argument to stay out of the markets, but rather a reason to rely on the same comprehensive approach to investing that has served us remarkably well over the past several decades.

While we may not be able to precisely time the arrival of the next true bull market, we believe that there are compelling choices for long-term investors. Our active, team-oriented investment process continues to seek out and analyze global opportunities that we believe will deliver long-term results to shareholders over full market cycles. Despite the challenges that exist, we are optimistic about the investing prospects we see in the coming months and years, and we believe that the wide array of Calamos Funds will provide the means to capitalize on those opportunities.

As always, we appreciate the trust you have placed in us to manage your assets and help you achieve your financial goals. We encourage you to visit us at calamos.com or contact us at 800.582.6959 with any questions or concerns about our funds that are not addressed in this report.

Sincerely,

John P. Calamos, Sr.

CEO and Co-CIO,

Calamos Advisors LLC

Before investing, carefully consider a fund’s investment objectives, risks, charges and expenses. Please see the prospectus containing this and other information or call 800.582.6959. Please read the prospectus carefully.

Performance data represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

| 1 | The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. Source: Lipper, Inc. |

| 2 | The MSCI World Index (U.S. Dollars) is a market-capitalization weighted index composed of companies representative of the market structure of developed market countries in North America, Europe and the Asia/Pacific region. Source: Lipper, Inc. |

| 3 | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index considered broadly representative of emerging market equity performance. The index represents companies within the constituent emerging markets that are available to investors worldwide. |

4 The BofA Merrill Lynch All U.S. Convertibles Ex-Mandatory Index represents the U.S. convertible securities market excluding mandatory convertibles.

| 5 | The Credit Suisse High Yield Index is an unmanaged index of approximately 1,600 issues with an average maturity range of seven to ten years with a minimum capitalization of $75 million. The Index is considered generally representative of the U.S. market for high-yield bonds. |

| 6 | The Barclays Capital U.S. Aggregate Bond Index is considered generally representative of the investment-grade bond market. Source: Lipper, Inc. |

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Investments in overseas markets pose special risks, including currency fluctuation and political risks. These risks are generally intensified for investments in emerging markets. Countries, regions, and sectors mentioned are presented to illustrate countries, regions, and sectors in which a fund may invest. Fund holdings are subject to change daily. The Funds are actively managed.

The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. There are certain risks involved with investing in convertible securities in addition to market risk, such as call risk, dividend risk, liquidity risk and default risk, that should be carefully considered prior to investing. This information is being provided for informational purposes only and should not be considered investment advice or an offer to buy or sell any security in the portfolio.

This report is intended for informational purposes only and should not be considered investment advice.

Calamos Growth Fund

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CVGRX |

B Shares | | CVGBX |

C Shares | | CVGCX |

I Shares | | CGRIX |

R Shares | | CGRRX |

| | | |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119302 |

B Shares | | 128119740 |

C Shares | | 128119856 |

I Shares | | 128119807 |

R Shares | | 128119435 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | Blends rigorous economic and broad themes analysis with intensive company and security research seeking to identify businesses with higher growth relative to peers | |

| | > | | Determines the quality and sustainability of a company’s growth by assessing its fundamentals and management among other factors | |

| | > | | Uses proprietary valuation models to ascertain a stock’s return potential | |

| | > | | Adheres to strict risk-management guidelines to determine portfolio construction | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | A portfolio that pursues the highest potential growth opportunities regardless of company size or industry | |

| | > | | A relatively aggressive yet diversified way to participate in the stock market’s long-term growth potential | |

CALAMOS GROWTH FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2012.

Q. What is the Fund’s investment strategy?

A. Calamos Growth Fund invests in U.S. companies that we believe have the best prospects for sustainable and high relative growth. The Fund offers an attractive way to participate in long-term growth trends by focusing on companies with global strategies, global brands and geographically diversified revenues. We believe that there are many exciting growth trends within the global economy and we have sought companies with good earnings prospects, high returns on invested capital, sustainable free cash flow, and low debt-to-capital ratios. We believe that many stocks of U.S. multinational companies are presently trading at extremely attractive prices, based on a variety of measures.

Q. How has the Fund performed?

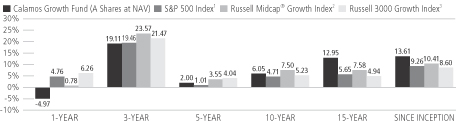

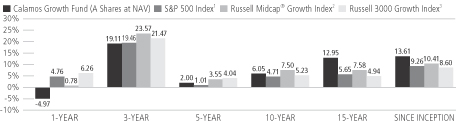

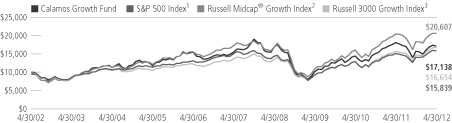

A. Because we believe equity funds are best utilized within asset allocations as long-term investments, we encourage investors to evaluate performance over multiple market cycles. Since its inception on September 4, 1990, the Fund has returned 13.61% on an annualized basis (Class A shares at net asset value). For this period, the broad equity market, as measured by the S&P 500 Index, returned 9.26%, while the Russell Midcap® Growth Index and the Russell 3000® Growth Index, returned 10.41% and 8.60%, respectively. The Russell 3000® Growth Index provides a point of comparison for the broad U.S. growth equity market, including companies of all capitalizations, while the Russell Midcap® Growth Index is a measure of mid-cap growth stocks, one segment of the Fund’s potential universe of investments.

For the semiannual period ended April 30, 2012, the Growth Fund returned 9.24% versus the Russell 3000® Growth Index return of 13.86%. For this same period, the Russell Midcap® Growth Index rose 12.26% and the S&P 500 Index returned 12.77%.

Q. What factors influenced performance over the semiannual period?

A. Relative performance for the Fund trailed the benchmark Russell 3000® Growth Index during the six-month period. Much of that underperformance occurred during the first two months of the period, as fundamentals were often overlooked and global macro issues and short-term considerations drove market results. The market environment at this time was defined by general risk aversion, with “risk-off” sectors (defensive, non-cyclicals) performing the best. Our preference for higher growing and more cyclical investments, while still attractively valued, was not rewarded early in the period and hindered Fund performance. We believe that valuations of U.S. growth equities remain compelling and offer particularly attractive risk/reward characteristics.

In terms of sector performance, the Fund’s holdings within the materials sector trailed the stronger Russell 3000® Growth Index returns. Most notably, holdings related to gold mining and production contributed to lag, as firms incurred rising input and extraction costs during the period. We continue to believe the sector will be supported

| | | | |

| 4 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Growth Fund

by increased demand for resources from emerging market regions, as well as by reflation efforts and accommodative global central bank policies. We are focused on long-term opportunities within the diversified metals and mining, fertilizers and agricultural chemicals and gold industries.

Security selection within the energy sector detracted from returns during the period. Select holdings in the equipment and services and exploration and production industries were weak, as reservations about the global macro environment resulted in uncertain earnings forecasts. In addition, companies that derive a part of their business from natural gas were under pressure, as prices for the commodity fell and costs escalated. We continue to look favorably on the long-term opportunities in the energy sector, particularly given the ongoing global stimulus and liquidity from the world’s central banks. We believe holdings within the sector should continue to benefit from reflation efforts, as well as from long-term secular themes, such as strong global demand for energy resources, especially within developing economies. Our research focus remains on the oil and gas equipment and services, drilling and exploration and production industries.

While the Fund’s underweight position to the industrials sector contributed favorably to relative performance in the period, security selection within the sector trailed the stronger index returns. In particular, holdings in the electrical equipment and freight and logistics industries lagged. We believe there are attractive long-term opportunities in the sector, most notably those associated with the global infrastructure build-out. We are focused on those companies in industries such as industrial machinery, construction and equipment that we believe offer compelling growth potential at reasonable valuations. We are particularly interested in those companies that are positioned to benefit from the growth in emerging market regions.

The information technology sector posted one of the strongest performances within the benchmark Russell 3000® Growth Index for the period. In the Fund, an overweight allocation enhanced returns while security selection was strong, yet trailed that of the index. We maintain conviction in the sector due to the higher cash flows, lower debt levels and cleaner balance sheets we see in many companies. In addition, we expect these companies to thrive in the future as they develop solutions to improve and enhance productivity and business performance. The sector continues to profit from many of the long-term secular growth themes we have identified, including strong business and consumer demand for products and services that provide access to information and entertainment. Many companies are also benefiting from frequent innovations that bring together many different technologies, strengthening connectivity for individuals and businesses.

The Fund’s strong security selection within the health care sector was a positive contributor to performance in the period. Specifically, holdings within the health care equipment and supplies and pharmaceuticals industries outperformed. Our focus remains on corporate performance, cash flows and fundamentals. Because health care spending is not as dependent on robust economic growth, we view the Fund’s health care holdings as providing defensive characteristics. We are especially attracted to those companies furthest removed from increased government regulation, such as those in the health care equipment industry.

An underweight allocation and strong security selection within the consumer staples sector also contributed favorably to Fund performance in the period. Although the

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 41.3 | % |

Consumer Discretionary | | | 14.1 | |

Health Care | | | 9.9 | |

Energy | | | 9.3 | |

Materials | | | 7.8 | |

Industrials | | | 7.7 | |

Consumer Staples | | | 3.3 | |

Financials | | | 2.7 | |

Telecommunication Services | | | 0.6 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

Calamos Growth Fund

Fund’s absolute allocation to the sector is low, the companies that we did invest in performed particularly well in the period, especially those in the beverages and food products industries. In regard to the underweight position, names within the consumer staples sector tend to be more defensive and exhibit lower growth characteristics. Within the sector, we strive to invest in companies with growing niche brands and those with strong global operations.

ANNUALIZED RETURN: SINCE INCEPTION (9/4/90) THROUGH 4/30/12

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class A shares at net asset value and does not include the Fund’s maximum front-end sales charge of 4.75%—had it been included, the Fund’s return would have been lower. The Fund also offers Class B, Class C, Class I and Class R shares, the performance of which may vary. Performance shown reflects an expense reimbursement that improved results. Source: State Street Corporation and Lipper, Inc.

Q. What changes were made over the course of the reporting period?

A. We maintain our emphasis on firms with globally diversified revenues and strong brands that are poised to benefit from global growth opportunities. After the strong and rapid market advance of the past several months, we believe a continued focus on risk management and valuation sensitivity is most appropriate. As such, during the period we aimed to reduce price-risk in select names and take some cyclicality out of the Fund, especially from those sectors related to reflation, such as industrials and energy. While these sectors were reduced, we continue to believe that the reflation theme can provide good long-term opportunities, given strong signals from the Federal Reserve and other global central banks that they would remain accommodative and provide a backstop for the markets, if necessary.

The Fund’s largest allocations in absolute terms include the information technology, consumer discretionary and health care sectors. The Fund’s largest overweight allocation is to the information technology sector, while the Fund’s allocation to consumer staples remains notably underweight.

Among the sector positioning changes during the period, allocations to the technology and health care sectors increased, while positioning in the industrials and energy sectors decreased, as stated above.

| | | | |

| 6 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Growth Fund

Q. What is the outlook for U.S. growth stocks and the Fund?

We remain optimistic about the prospects of U.S. growth stocks and we have positioned the Fund accordingly. Our active approach is uncovering opportunities supported by long-term secular trends such as globalization, the growth and maturation of the emerging middle class, as well as productivity enhancement capabilities in a globally competitive environment. We believe large multinational companies with globally diversified revenues and access to capital are poised to capitalize on both secular and cyclical trends. Overall, growth equities remain especially attractive to us, as investors continue to discount the growth of future cash flows, while growth premiums remain historically low.

Calamos Growth Fund

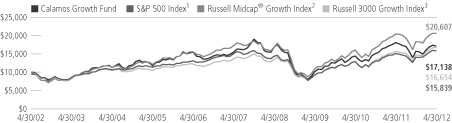

GROWTH OF $10,000: FOR 10-YEAR PERIOD ENDED 4/30/12

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/12

| | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | | 1

YEAR | | | 5

YEARS | | | 10 YEARS

OR ^SINCE

INCEPTION | |

| Class A Shares – Inception 9/4/90 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 9.24 | % | | | -4.97 | % | | | 2.00 | % | | | 6.05 | % |

With Sales Charge | | | 4.05 | | | | -9.49 | | | | 1.02 | | | | 5.53 | |

| |

| Class B Shares – Inception 9/11/00 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 8.85 | | | | -5.68 | | | | 1.24 | | | | 5.41 | |

With Sales Charge | | | 3.85 | | | | -10.18 | | | | 0.90 | | | | 5.41 | |

| |

| Class C Shares – Inception 9/3/96 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 8.85 | | | | -5.68 | | | | 1.24 | | | | 5.26 | |

With Sales Charge | | | 7.85 | | | | -6.58 | | | | 1.24 | | | | 5.26 | |

| |

| Class I Shares – Inception 9/18/97 | | | 9.39 | | | | -4.73 | | | | 2.26 | | | | 6.32 | |

| |

| Class R Shares – Inception 3/1/07 | | | 9.12 | | | | -5.21 | | | | 1.75 | | | | 2.97 | ^ |

| |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

Performance of the Growth Fund includes the effects of an overpayment of dividends and/or capital gains distributions to shareholders of certain share Classes of the Fund (and a corresponding capital contribution by Calamos Asset Management, Inc., the predecessor to Calamos Advisors LLC), which increased certain return figures.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2000. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

| 1 | The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. Index data shown for the Since Inception Growth of $10,000 graph is from 8/31/90, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

| 2 | The Russell Midcap® Growth Index measures the performance of mid-sized companies with growth characteristics. Index data shown for the Annualized Return Since Inception graph is from 8/31/90, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

| 3 | The Russell 3000® Growth Index measures the performance of companies with higher price-to-book ratios and higher forecasted growth values. Index data shown for the Annualized Return Since Inception graph is from 8/31/90, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 8 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Value Fund

CALAMOS VALUE FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2012.

Q. What is the Fund’s investment strategy?

A. Calamos Value Fund invests in U.S. companies where we believe the stock price has been temporarily depressed due to one-time events or market sentiment that we expect to change. The Fund provides a value-oriented complement to a growth-oriented portfolio. Our goal is to purchase stocks at discounts to our estimates of intrinsic business value. We analyze cash flows and return on invested capital to determine intrinsic business value.

This Fund’s investment strategy differs from some other value funds in that we will not invest in a company solely because it is “cheap.” Before we buy a stock, we need to see a potential catalyst, or believe that some other factor will arise that will lead to the company receiving more favorable recognition in the market. We want to see companies with compelling strategies for improving their cash flows, balance sheet health and overall market position.

Q. How has the Fund performed?

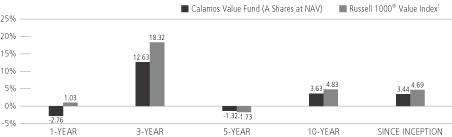

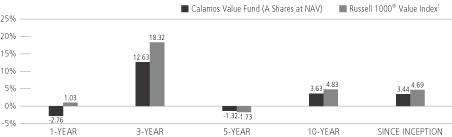

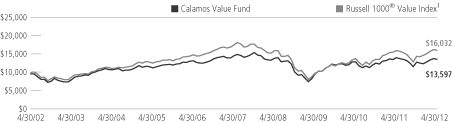

A. Because we believe equity funds are best utilized within asset allocations as long-term investments, we encourage investors to evaluate performance over longer time periods. Since its inception on January 2, 2002, the Fund has returned 3.44% on an annualized basis (Class A shares at net asset value) versus 4.69% for the Russell 1000® Value Index. For the semiannual period ended April 30, 2012, the Fund returned 6.67% versus 11.62% for the Russell 1000® Value Index.

Q. What factors influenced performance over the semiannual period?

A. The Fund’s underweight position and security selection within the financial sector hampered performance in the period. Index returns were boosted by companies within the commercial banks and consumer finance industries, which came after weaker performance in these industries during the final months of last year. We remain cautious and underweight relative to the index and have generally avoided large parts of the sector due to increased regulations globally and significant business risks remaining in many financial institutions. However, we have found favorable opportunities within globally diversified asset managers and selected insurers that we believe have lower underlying credit risk.

While our underweight position to the energy sector added to Fund returns, lagging selection detracted from performance during the period. Select holdings in the equipment and services and exploration and production industries were particularly weak, as reservations about the global macro environment resulted in uncertain earnings forecasts. In addition, companies that derive a part of their business from natural gas were under pressure as prices for the commodity fell and costs escalated. We continue to look favorably on the long-term opportunities in the energy sector, particularly given the ongoing global stimulus and liquidity from the world’s central

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CVAAX |

B Shares | | CVABX |

C Shares | | CVACX |

I Shares | | CVAIX |

R Shares | | CVARX |

| | | |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119666 |

B Shares | | 128119658 |

C Shares | | 128119641 |

I Shares | | 128119633 |

R Shares | | 128119419 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | Invests in companies that are deemed to be trading well below their intrinsic values but possess identifiable potential catalysts that can spur them to normal levels | |

| | > | | Companies under consideration must possess risk-mitigating characteristics, such as sound financials and branded products within their industry | |

| | > | | Employs qualitative (bottom-up) research to help determine how an issuer’s stock is valued relative to calculations of intrinsic worth | |

| | > | | Utilizes top-down portfolio construction to pursue macro-level economic themes and support diversification among industries and sectors | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | A vehicle for building assets to meet medium-range to long-range financial goals | |

| | > | | A value-oriented complement to a growth-oriented portfolio | |

Calamos Value Fund

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 34.2 | % |

Health Care | | | 15.8 | |

Consumer Staples | | | 14.4 | |

Consumer Discretionary | | | 12.7 | |

Financials | | | 9.5 | |

Energy | | | 6.3 | |

Industrials | | | 4.1 | |

Materials | | | 2.2 | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

banks. We believe the Fund’s holdings within the sector should continue to benefit from reflation efforts, as well as from long-term secular themes such as strong global demand for energy resources, especially within emerging economies. Our research focus remains on the oil and gas equipment and services, drilling and exploration and production industries.

The Fund’s overweight allocation to the consumer discretionary sector was additive to performance, as this sector was the top performing area within the index during the reporting period. Security selection within the sector was positive, yet lagged the stronger returns of the index and detracted from relative performance. We continue to have conviction in our holdings and believe they are well-positioned to benefit from global secular trends. Broadly within the sector, we are attracted to global businesses with strong brands and diversified revenues, as well as those servicing a growing and maturing consumer base within the emerging markets.

A lack of exposure (0% allocation) to the utilities sector added value to the Fund, as its more defensive nature held back returns in a strong market rally and made this one of the worst performing areas within the index during the reporting period. Utilities remain a highly regulated area where we do not typically find many attractive risk/reward opportunities.

Q. What changes were made to the Fund’s portfolio over the course of the reporting period?

A. We maintain our emphasis on firms with globally diversified revenues and strong brands that are poised to benefit from long-term secular trends. After a strong and rapid market advance over several months, we believed a continued focus on risk management and valuation sensitivity was most appropriate. As such, during the reporting period we aimed to reduce price-risk in select names and to take some cyclicality out of the Fund, especially from those sectors related to reflation, such as industrials and energy. While these sectors were reduced, we continue to believe that the reflation theme can provide good long-term opportunities, given strong signals from the Federal Reserve and other global central banks that they would remain accommodative and provide a backstop for the markets, if necessary.

The Fund’s largest allocations in absolute terms include the information technology, health care and consumer staples sectors. Relative to the Russell 1000® Value Index, the Fund’s largest overweight allocation is to the information technology sector, while allocation to the financial sector remains notably underweight.

Among the sector positioning changes during the reporting period were increased allocations to the information technology and health care sectors, while positioning in the industrials and energy sectors decreased, as noted above.

Q. What is your outlook for the Fund?

We remain optimistic about the prospects of globalization and we have positioned the Fund accordingly. Our active approach is uncovering opportunities supported by long-term secular trends, such as the evolution and maturation of the emerging middle class, as well as productivity enhancement capabilities in a globally competitive environment. We believe large multinational companies with diversified revenue bases and access to capital are poised to take advantage of both secular and cyclical trends. Overall, equities remain especially attractive to us, as we continue to find many companies trading at significant discounts to their underlying fundamentals and future cash flows.

| | | | |

| 10 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Value Fund

ANNUALIZED RETURN: SINCE INCEPTION (1/2/02) THROUGH 4/30/12

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class A shares at net asset value and does not include the Fund’s maximum front-end sales charge of 4.75%—had it been included, the Fund’s return would have been lower. The Fund also offers Class B, Class C, Class I and Class R shares, the performance of which may vary. Performance shown reflects an expense reimbursement that improved results. Source: State Street Corporation and Lipper, Inc.

Calamos Value Fund

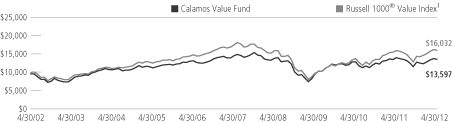

GROWTH OF $10,000: FOR 10-YEAR PERIOD ENDED 4/30/12

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/12

| | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | | 1

YEAR | | | 5

YEARS | | | 10 YEARS

OR ^SINCE

INCEPTION | |

| Class A Shares – Inception 1/2/02 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 6.67 | % | | | -2.76 | % | | | -1.32 | % | | | 3.63 | % |

With Sales Charge | | | 1.61 | | | | -7.41 | | | | -2.28 | | | | 3.12 | |

| |

| Class B Shares – Inception 1/2/02 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 6.29 | | | | -3.46 | | | | -2.05 | | | | 3.02 | |

With Sales Charge | | | 1.29 | | | | -8.29 | | | | -2.41 | | | | 3.02 | |

| |

| Class C Shares – Inception 1/2/02 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 6.30 | | | | -3.47 | | | | -2.06 | | | | 2.85 | |

With Sales Charge | | | 5.30 | | | | -4.43 | | | | -2.06 | | | | 2.85 | |

| |

| Class I Shares – Inception 3/1/02 | | | 6.81 | | | | -2.47 | | | | -1.07 | | | | 3.89 | |

| |

| Class R Shares – Inception 3/1/07 | | | 6.54 | | | | -3.02 | | | | -1.57 | | | | -0.59 | ^ |

| |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2004. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graph does not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

| 1 | The Russell 1000® Value Index measures the performance of those companies in the Russell 1000® Index with lower price-to-book ratios and lower forecasted growth values. Index data shown is from 12/31/01, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 12 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Blue Chip Fund

CALAMOS BLUE CHIP FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2012.

Q. What is the Fund’s investment strategy?

A. Calamos Blue Chip Fund invests in large-cap equities that we believe have the best prospects for growth. The Fund offers an attractive way to participate in long-term growth trends in the large cap space by focusing on well-known businesses with established operations and good prospects for sustainable growth. We believe these “blue chip” companies may offer a higher degree of stability compared to smaller, less-tested companies. While the Fund invests primarily in U.S.-domiciled businesses, we favor companies with global presence and geographically diversified revenues that we believe are positioned to capitalize on global economic growth and global secular trends.

Q. How has the Fund performed?

A. Because we believe equity funds are best utilized within asset allocations as long-term investments, we encourage investors to evaluate performance over longer time periods. Since its inception on December 1, 2003, the Fund has returned 4.81% on an annualized basis (Class A shares at net asset value) versus a 5.34% return for the S&P 500 Index and the Russell 1000® Growth Index return of 5.87%. For the most recent six-month reporting period ended April 30, 2012, Calamos Blue Chip Fund returned 10.67%, versus 12.77% for the S&P 500 Index and 14.13% for the Russell 1000® Growth Index.

Q. What factors influenced performance over the semiannual period?

A. An overweight position and lagging selection within the energy sector detracted from returns during the period. Select holdings in the equipment and services and exploration and production industries were particularly weak, as reservations about the global macro environment resulted in uncertain earnings forecasts. In addition, companies deriving a part of their business from natural gas were under pressure, as prices for the commodity fell and costs escalated. We continue to look favorably on the long-term opportunities in the energy sector, particularly given the ongoing global stimulus and liquidity from the world’s central banks. We believe our holdings within the sector should continue to benefit from reflation efforts, as well as from long-term secular themes such as strong global demand for energy resources, especially within emerging economies. Our research focus remains on the oil and gas equipment and services, drilling and exploration & production industries.

The Fund’s holdings within the materials sector trailed the stronger Russell 1000® Growth Index returns, holding back relative performance in the period. Most notably, holdings related to gold mining and production contributed to the lag, as these firms incurred rising input and extraction costs during the period. Many of these gold-related holdings are now priced with very low growth assumptions, making valuations attractive. We continue to believe the sector will be supported by increased demand for resources from emerging market regions, as well as by reflation efforts and

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CBCAX |

B Shares | | CBCBX |

C Shares | | CBXCX |

I Shares | | CBCIX |

R Shares | | CBCRX |

| | | |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119625 |

B Shares | | 128119617 |

C Shares | | 128119591 |

I Shares | | 128119583 |

R Shares | | 128119427 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | Invest in larger, established companies with balance sheet strength that can also help mitigate downside risk | |

| | > | | We look for businesses with diversified product lines that can increase productivity to maintain growth | |

| | > | | Apply proprietary models to determine return potential of companies | |

| | > | | Each security is further vetted within the context of the portfolio | |

| | > | | We seek to identify long-term secular themes that can drive growth for decades. Investment candidates emerge from the intersection of our top-down (overlay of macroeconomic themes) and bottom-up analysis | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | A vehicle for building assets to meet medium- to long-range financial goals | |

| | > | | A larger-cap growth offering of diversified companies providing broad market participation | |

Calamos Blue Chip Fund

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 41.2 | % |

Consumer Discretionary | | | 13.7 | |

Health Care | | | 12.1 | |

Energy | | | 10.6 | |

Industrials | | | 6.8 | |

Consumer Staples | | | 5.4 | |

Materials | | | 5.0 | |

Financials | | | 2.3 | |

Telecommunication Services | | | 1.3 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

accommodative global central bank policies. We are focused on long-term opportunities within the diversified metals & mining, fertilizers and agricultural chemicals and gold industries.

Security selection within the consumer discretionary sector was additive to performance in the reporting period. The Fund’s top holdings within the sector are in the Internet retail industry, and after declining in the beginning of the period these companies bounced back and have performed particularly well. We continue to have conviction in these names and believe they are well-positioned to benefit from global secular trends. Broadly within the sector, we are attracted to global businesses with strong brands and diversified revenues, as well as those servicing a growing and maturing consumer base within the emerging markets.

Strong security selection within the health care sector was a positive contributor to performance in the period. Specifically, Fund holdings within the health care equipment and supplies and pharmaceuticals industries outperformed. Our focus remains on corporate performance, cash flows and fundamentals. Because health care spending is not as dependant on robust economic growth, we view the Fund’s health care holdings as providing defensive characteristics. We are especially attracted to those companies furthest removed from increased government regulation, such as those in the health care equipment industry.

Q. What changes were made to the Fund’s portfolio over the course of the reporting period?

A. We maintain our emphasis on firms with globally diversified revenues and strong brands that are poised to benefit from global growth opportunities. After a strong and rapid market advance over several months, we believed a continued focus on risk management and valuation sensitivity was most appropriate. As such, during the reporting period we aimed at reducing price-risk in select names and taking some cyclicality out of the fund, especially from those sectors related to reflation, such as industrials and energy. While these sectors were reduced, we continue to believe that the reflation theme can provide good long-term opportunities. The Federal Reserve and other global central banks have shown strong signals that they would remain accommodative and provide a backstop for the markets if necessary.

The Fund’s largest allocations in absolute terms include the information technology, consumer discretionary and health care sectors. Relative to the Russell 1000® Growth Index, the Fund’s largest overweight allocation is to the information technology sector, while allocations to consumer staples and industrials remain notably underweight.

Among the positioning changes during the reporting period, allocations to the consumer discretionary and consumer staples sectors increased, while positioning in the industrials and energy sectors decreased, as stated above.

| | | | |

| 14 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Blue Chip Fund

Q. What is your outlook for large cap growth equities and the Fund?

We remain optimistic about the prospects of large cap growth equities and we have positioned the Fund accordingly. Our active approach is uncovering opportunities supported by long-term secular trends such as globalization, the growth and maturation of the emerging middle class, as well as productivity enhancement capabilities in a globally competitive environment. We believe large multinational companies with globally diversified revenues and access to capital are poised to capitalize on both secular and cyclical trends. Overall, large cap growth equities remain especially attractive to us, as investors continue to discount the growth of future cash flows, while growth premiums remain historically low.

Calamos Blue Chip Fund

GROWTH OF $10,000: SINCE INCEPTION (12/1/03) THROUGH 4/30/12

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/12

| | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | | 1

YEAR | | | 5

YEARS | | | SINCE

INCEPTION | |

| Class A Shares – Inception 12/1/03 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 10.67 | % | | | -1.08 | % | | | 1.79 | % | | | 4.81 | % |

With Sales Charge | | | 5.39 | | | | -5.78 | | | | 0.81 | | | | 4.20 | |

| |

| Class B Shares – Inception 12/1/03 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 10.27 | | | | -1.89 | | | | 1.03 | | | | 4.06 | |

With Sales Charge | | | 5.27 | | | | -6.79 | | | | 0.65 | | | | 4.06 | |

| |

| Class C Shares – Inception 12/1/03 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 10.26 | | | | -1.81 | | | | 1.03 | | | | 4.03 | |

With Sales Charge | | | 9.26 | | | | -2.79 | | | | 1.03 | | | | 4.03 | |

| |

| Class I Shares – Inception 12/1/03 | | | 10.75 | | | | -0.86 | | | | 2.05 | | | | 5.08 | |

| |

| Class R Shares – Inception 3/1/07 | | | 10.50 | | | | -1.38 | | | | 1.54 | | | | 2.51 | |

| |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2004. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graph does not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

| 1 | The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. Index data shown for the Since Inception Growth of $10,000 graph is from 11/30/03, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

| 2 | The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price to-book ratios and higher forecasted growth values. Index data shown for the Since Inception Growth of $10,000 graph is from 11/30/03, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 16 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Discovery Growth Fund

CALAMOS DISCOVERY GROWTH FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2012.

Q. What is the Fund’s investment strategy?

A. Calamos Discovery Growth Fund invests in small cap and mid cap (“SMID”) equities that we believe have the best prospects for growth. The Fund offers a relatively aggressive yet diversified way to get exposure to the SMID space and participate in the long-term growth potential of the U.S. stock market. While Discovery Growth is one of our newer funds, it is managed by the same investment team and draws upon the same research process that we use for all of our other funds. Our investment process is designed to identify companies with higher growth profiles and greater returns on invested capital relative to peers. We favor companies with geographically diversified revenues that are participating in long-term global growth trends.

We expect to concentrate on small cap companies that, if successful, will grow into mid caps. We have the flexibility to continue holding these successful mid cap companies. We believe that a mid cap company that has successfully grown from a small cap has demonstrated the potential of its business model and its ability to deliver sustained earnings growth.

Q. How has the Fund performed?

A. For the semiannual period ended April 30, 2012, the Discovery Growth Fund returned 4.98% (Class A shares at net asset value), versus 11.72% for the Russell 2500™ Growth Index. Since its inception on June 1, 2010, the Fund gained 13.08%, versus the 19.65% return for the index.

Q. What factors influenced performance over the semiannual period?

A. The Fund’s security selection within the energy sector was the largest detractor from performance during the semiannual period. Select holdings in the equipment & services and exploration & production industries lagged the index. In particular, those holdings with a larger portion of their business related to natural gas production suffered due to lower prices and higher costs. Despite the weakness in the period, we have a favorable long-term view of the opportunities in the energy sector, particularly as global stimulus and liquidity from the world’s central banks persist. We believe the portfolio’s holdings within the sector will benefit from long-term secular themes, such as strong global demand for energy resources, especially within developing economies.

The Fund’s relative security selection in the consumer discretionary sector also detracted from returns during the period. Holdings within the Internet retail industry underperformed, in particular. We favor an opportunistic approach in this sector and continue seeking companies with high growth potential, often including those with an in-demand category niche and a scalable business model.

The Fund’s security selection within the industrials sector trailed the stronger index returns and thus hampered results. In particular, holdings in the machinery industry lagged as concerns about a slowing pace of global growth negatively impacted

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CADGX |

B Shares | | CBDGX |

C Shares | | CCDGX |

I Shares | | CIDGX |

R Shares | | CRDGX |

| | | |

|

| FUND CUSIP NUMBERS |

A Shares | | 128120102 |

B Shares | | 128120201 |

C Shares | | 128120300 |

I Shares | | 128120409 |

R Shares | | 128120508 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | Focus on small cap and mid cap companies | |

| | > | | Blends rigorous economic and broad themes analysis with intensive company and security research seeking to identify businesses with higher growth relative to peers | |

| | > | | Seeks to determine the quality and sustainability of a company’s growth by assessing its fundamentals and management among other factors | |

| | > | | Uses proprietary valuation models to ascertain a stock’s return potential | |

| | > | | Adheres to strict risk-management guidelines in constructing the portfolio and assessing a security’s fit within the portfolio | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | Exposure to small cap and mid cap companies | |

| | > | | A relatively aggressive yet diversified way to participate in the U.S. stock market’s long-term growth potential | |

Calamos Discovery Growth Fund

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 37.3 | % |

Industrials | | | 15.8 | |

Health Care | | | 14.5 | |

Consumer Discretionary | | | 9.5 | |

Materials | | | 7.9 | |

Energy | | | 4.8 | |

Financials | | | 4.0 | |

Consumer Staples | | | 1.7 | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

holdings. We believe there are attractive long-term opportunities in the sector, most notably those associated with the global infrastructure build-out. We are focused on those companies in industries such as industrial machinery, construction and equipment that we believe offer compelling global growth potential. We are particularly interested in those companies positioned to benefit from the growth in emerging economies.

Relative security selection in the information technology sector contributed the most to performance during the semiannual period. We maintain high conviction in information technology due to the higher growth potential and secular demand trends that make the sector appealing relative to the broad market. The Fund’s holdings in technology are positioned to benefit from many long-term themes we have identified, including the demand for the latest connectivity devices, the need for information and entertainment, and the increased emphasis on productivity enhancement in a low-growth economy.

Strong security selection within the health care sector was also a positive contributor to performance in the period. Specifically, the Fund’s holdings within the health care equipment and health care technology industries outperformed due to strong growth fundamentals. We are especially attracted to those companies with strong volume growth trends, as well as those relatively less affected by increased government regulation, such as companies in health care technology and biotechnology.

Q. How is the Fund positioned?

A. The Fund’s largest allocations, in absolute terms, are in the information technology and health care sectors. Details discussing our positioning in these sectors are discussed above.

Relative to the Russell 2500™ Growth Index, the Fund’s largest underweight allocations are to the financial and consumer discretionary sectors. We continue to hold a low weight in financials due to our belief that sector growth dynamics are changing for the worse. Government regulations, both existing and proposed, make it difficult for firms in this sector to reestablish the level of growth and cash flow margins that were attainable in the past. Within consumer discretionary, we continue to be opportunistic and seek companies delivering high relative growth, but also with business models able to withstand a challenging economic landscape.

Q. What is your outlook for small and mid cap equities and the Fund?

A. The Fund’s holdings of small to mid cap growth companies continue to deliver strong fundamentals. These companies are generating strong earnings growth with high returns on invested capital while using less debt relative to holdings in the index. With respect to valuations, small to mid cap growth equities remain compelling as investors continue to place very little investment premium on growth companies relative to value. Historically, when investor sentiment shifts and companies are once again rewarded for higher long-term growth potential, the expansion in earnings multiples can be significant.

| | | | |

| 18 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Discovery Growth Fund

As we consider the macroeconomic environment going forward, we remain optimistic about positive, but slow, economic growth domestically and globally. We believe a robust pickup in economic growth is hindered by long-term fiscal challenges and the necessary deleveraging process still underway. Still, the forces of globalization, world demographic changes and business and consumer trends all continue to offer very attractive investment opportunities for small to mid cap growth investors. We believe the Fund is well-positioned to provide access to these secular trends and we expect the portfolio to benefit from our experienced, consistent and selective investment approach.

Calamos Discovery Growth Fund

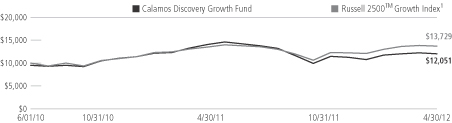

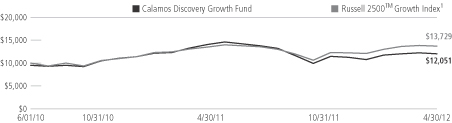

GROWTH OF $10,000: SINCE INCEPTION (6/1/10) THROUGH 4/30/12

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/12

| | | | | | | | | | | | |

| | | 6

MONTHS | | | 1

YEAR | | | SINCE

INCEPTION | |

| Class A Shares – Inception 6/1/10 | | | | | | | | | | | | |

Without Sales Charge | | | 4.98 | % | | | -17.60 | % | | | 13.08 | % |

With Sales Charge | | | 0.00 | | | | -21.49 | | | | 10.23 | |

| |

| Class B Shares – Inception 6/1/10 | | | | | | | | | | | | |

Without Sales Charge | | | 4.61 | | | | -18.16 | | | | 12.26 | |

With Sales Charge | | | -0.39 | | | | -22.26 | | | | 10.37 | |

| |

| Class C Shares – Inception 6/1/10 | | | | | | | | | | | | |

Without Sales Charge | | | 4.61 | | | | -18.16 | | | | 12.26 | |

With Sales Charge | | | 3.61 | | | | -18.98 | | | | 12.26 | |

| |

| Class I Shares – Inception 6/1/10 | | | 5.14 | | | | -17.38 | | | | 13.37 | |

| |

| Class R Shares – Inception 6/1/10 | | | 4.91 | | | | -17.75 | | | | 12.82 | |

| |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graphs do not reflect the income taxes you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

| 1 | The Russell 2500™ Growth Index measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Source: Lipper, Inc. |

Index returns assume reinvestments of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 20 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos International Growth Fund

CALAMOS INTERNATIONAL GROWTH FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2012.

Q. What is the Fund’s investment strategy?

A. Calamos International Growth Fund invests in an equity portfolio representing non-U.S. companies of all sizes and industries that offer high relative and sustainable growth potential. This is a non-U.S. strategy for diversification and access to international growth companies, with an active growth focus. Our investment criteria favor companies that we believe offer the best prospects for growth. These companies are typically characterized by high earnings growth, healthy balance sheets and high return on invested capital. In the current environment, we are emphasizing companies with global presence and geographically diversified revenue streams. We believe that such companies offer more attractive prospects than those more dependent on a single economy.

We have the flexibility to invest across sectors in companies domiciled in developed and developing markets. We favor companies based in markets that are moving toward a greater level of economic freedom, which we believe is a catalyst for wealth creation.

Q. How has the Fund performed?

A. Because we believe equity funds are best utilized within asset allocations as long-term investments, we encourage investors to evaluate performance over longer time periods. Since its inception on March 16, 2005, the Fund has returned 8.80% on an annualized basis (Class A shares at net asset value), versus the MSCI EAFE Growth Index, which returned 3.92% for the same period. For the six-month period ended April 30, 2012, the Fund gained 6.19% versus a 5.00% return for the MSCI EAFE Growth Index.

Q. What factors influenced performance over the semiannual period?

A. In the information technology sector selection was notably positive, particularly within the semiconductors and semiconductors equipment industries. We maintain conviction in this sector due to the higher cash flows, lower debt levels and cleaner balance sheets we see in many IT companies. We also expect these companies to benefit from many of the long-term secular themes we have identified, including an increased demand for gadgets and electronics as well as productivity enhancement.

An overweight position and strong security selection within the health care sector also contributed to relative returns during the period, as names within the pharmaceuticals and health care equipment and supplies industries strongly outperformed those within the index. Our focus within this sector remains on companies that have displayed strong corporate performance, healthy cash flows, strong fundamentals and those that are more insulated from the impacts of health care reform.

Selection within the materials sector hampered relative performance during the time period, as names within the metals and mining industry—most notably the portfolio’s

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CIGRX |

B Shares | | CIGBX |

C Shares | | CIGCX |

I Shares | | CIGIX |

R Shares | | CIGFX |

| | | |

| |

| FUND CUSIP NUMBERS | | |

A Shares | | 128119575 |

B Shares | | 128119567 |

C Shares | | 128119559 |

I Shares | | 128119542 |

R Shares | | 128119393 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | Applies bottom-up research and top-down analysis to target securities of non-U.S. companies that display acceleration in revenue growth, earnings growth and return on capital | |

| | > | | Conducts extensive balance sheet and income statement analysis to determine the intrinsic value of companies under consideration | |

| | > | | Emphasizes countries espousing free-market principles | |

| | > | | Seeks to outperform the MSCI EAFE Growth Index1 over the long term with less volatility | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | To diversify beyond the domestic market by investing in overseas growth stocks, potentially increasing long-term capital growth | |

| | > | | An equity portfolio representing companies of all sizes and industries that offer high relative and sustainable growth potential | |

Calamos International Growth Fund

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 32.5 | % |

Materials | | | 13.6 | |

Health Care | | | 13.3 | |

Energy | | | 10.3 | |

Consumer Staples | | | 9.5 | |

Consumer Discretionary | | | 6.2 | |

Telecommunication Services | | | 3.4 | |

Industrials | | | 3.3 | |

Financials | | | 0.9 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

allocation to gold—lagged the index. We continue to believe this sector will be supported by increased demand for resources from emerging market regions, as well as reflation efforts and accommodative global central bank policies.

From a geographic standpoint, the Fund’s holdings within Israel, Denmark and the United Kingdom contributed to relative returns. Additionally, the portfolio’s holdings within emerging market areas, most notably within Brazil and South Korea, also aided performance. The Fund’s holdings within Canada detracted value during the period.

Q. How is the Fund positioned?

The Fund is currently positioned with large allocations to the information technology, materials and health care sectors. Details regarding positioning within these sectors have been discussed above. The Fund’s largest underweight allocations are to the financial and industrials sectors. We have generally held a low weight within financials and remain cautious due to increased regulations as well as the ongoing European debt crisis. Within industrials, we are attracted to those companies in areas such as industrial machinery, construction and equipment that offer solid growth potential and which stand to benefit from the global infrastructure build-out. We are particularly interested in those companies that are positioned to benefit from continued growth within emerging market economies.

From a geographic standpoint, the portfolio is currently underweight to Japan relative to the index based on our assessment of macroeconomic factors and valuations. Additionally, the Fund’s allocation to emerging markets was slightly increased during the time period, as we are favoring these areas due to their higher growth potential and rapidly growing middle class.

During the time period, the Fund’s allocation to health care increased, while its investments within the industrials sector were reduced. Within health care, our focus remains on companies that have displayed strong corporate performance, healthy cash flows and strong fundamentals. While we continue to favor the industrials sector from a thematic standpoint and believe the global infrastructure build-out lends itself to this area, we believe that valuations have richened and have therefore chosen to reduce the portfolio’s holdings within this sector.

Q. What is your outlook for international equities and the Fund?

We expect continued growth in the global economy as a whole, and believe that a number of themes (including increasing wealth and middle class consumption within emerging market countries) will provide growth opportunities for companies all throughout the world. However, we also believe that despite these trends, global markets remain volatile and an overall challenging investment environment.

Although we expect continued volatility and uneven economic global growth, we believe that international growth equities remain an attractive area for long-term investment. We have positioned this Fund to emphasize companies with geographically diversified revenues, strong global brands and healthy balance sheets. We believe that multinational companies may be less vulnerable to economic weakness in a particular country or region, and are therefore favoring companies domiciled in developed countries that are capitalizing on many of the growth trends currently available in emerging markets.

| | | | |

| 22 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos International Growth Fund

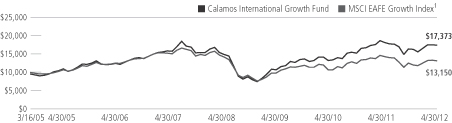

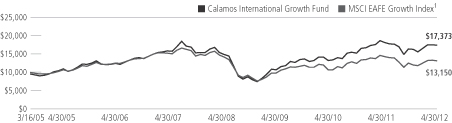

GROWTH OF $10,000: SINCE INCEPTION (3/16/05) THROUGH 4/30/12

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/12

| | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | | 1

YEAR | | | 5

YEARS | | | SINCE

INCEPTION | |

| Class A Shares – Inception 3/16/05 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 6.19 | % | | | -6.53 | % | | | 3.07 | % | | | 8.80 | % |

With Sales Charge | | | 1.17 | | | | -10.95 | | | | 2.08 | | | | 8.06 | |

| |

| Class B Shares – Inception 3/16/05 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 5.81 | | | | -7.22 | | | | 2.31 | | | | 7.99 | |

With Sales Charge | | | 0.81 | | | | -11.86 | | | | 1.94 | | | | 7.99 | |

| |

| Class C Shares – Inception 3/16/05 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | 5.81 | | | | -7.17 | | | | 2.31 | | | | 7.99 | |

With Sales Charge | | | 4.81 | | | | -8.10 | | | | 2.31 | | | | 7.99 | |

| |

| Class I Shares – Inception 3/16/05 | | | 6.38 | | | | -6.26 | | | | 3.34 | | | | 9.08 | |

| |

| Class R Shares – Inception 3/1/07 | | | 6.13 | | | | -6.69 | | | | 2.83 | | | | 4.50 | |

| |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2005. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graph does not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

| 1 | The MSCI EAFE Growth Index measures developed market growth equity performance (excluding the U.S. and Canada). Source: MSCI Barra. |

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

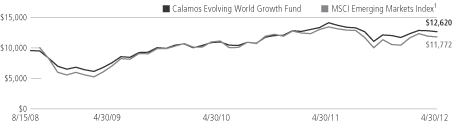

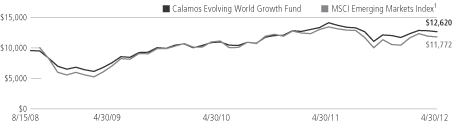

Calamos Evolving World Growth Fund

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CNWGX |

B Shares | | CNWZX |

C Shares | | CNWDX |

I Shares | | CNWIX |

R Shares | | CNWRX |

| | | |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119161 |

B Shares | | 128119153 |

C Shares | | 128119146 |

I Shares | | 128119138 |

R Shares | | 128119120 |

| | | |

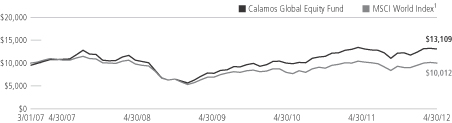

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY