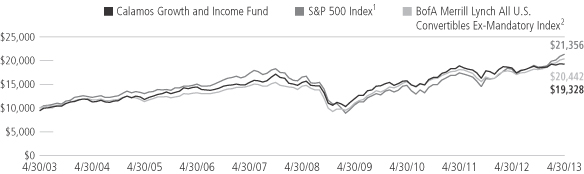

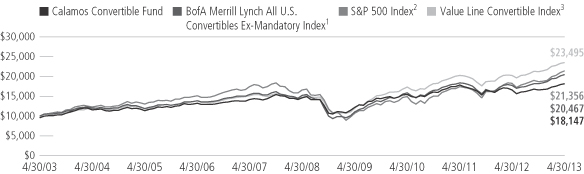

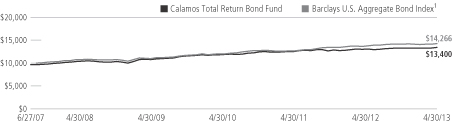

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

INVESTMENT COMPANY ACT FILE NUMBER: 811-05443

Calamos Investment Trust

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

2020 Calamos Court, Naperville

Illinois 60563-2787

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

John P Calamos, Sr., President,

Calamos Advisors LLC

2020 Calamos Court,

Naperville, Illinois

60563-2787

(NAME AND ADDRESS OF AGENT FOR SERVICE)

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (630) 245-7200

DATE OF FISCAL YEAR END: October 31, 2013

DATE OF REPORTING PERIOD: November 1, 2012 through April 30, 2013

Item 1. Report to Shareholders

Experience and Foresight

About Calamos Investments

For nearly 35 years, we have helped investors like you manage and build wealth to meet long-term objectives. Because investors have different time horizons, risk tolerances and goals, we offer funds to suit a variety of asset allocation needs. Our 13 mutual funds include equity, enhanced fixed income and alternative funds. We offer U.S. funds, as well as global and international choices.

We are dedicated to helping our clients build and protect wealth. We understand when you entrust us with your assets, you also entrust us with your achievements, goals and aspirations. We believe we best honor this trust by making investment decisions guided by integrity, by discipline and by our conscientious research.

We believe an active, risk-conscious approach is essential for wealth creation. In the 1970s, we pioneered the use of convertible securities as a means to control risk in volatile markets. We followed with strategies that combine convertibles and stocks, with the aim of participating in equity market upside with potentially less volatility than an all-stock portfolio. In the 1990s, we introduced our first stock fund, which invests in growth companies both large and small. Across our funds, our investment process seeks to manage risk at multiple levels and draws upon our experience investing through many market cycles. In a rapidly changing environment, we believe that this active management is essential.

We are global in our perspective. We believe globalization offers tremendous opportunities for countries and companies all over the world. In our U.S., global and international portfolios, we are seeking to capitalize on the potential growth of the global economy.

We believe there are opportunities in all markets. Our history traces back to the 1970s, a period of significant volatility and economic concerns. We have invested through multiple market cycles, each with its own challenges. Out of this experience comes our belief that the flipside of volatility is opportunity.

Letter to Shareholders

JOHN P. CALAMOS, SR.

CEO and Global Co-CIO

Dear Fellow Shareholder:

Welcome to your semiannual report for the six-month period ended April 30, 2013. In this report, you will find commentary from the Calamos Investment Management Team, as well as a listing of portfolio holdings, financial statements and highlights, and detailed information about the performance and positioning of the Calamos Funds.

Market Review

Today’s market conditions remind me of the often tumultuous 1970s, when macro events fueled uncertainty and volatility. This time around, however, massive accommodative monetary policy from the Federal Reserve and central banks around the world has supported the global equity markets and their overall recoveries. However, these aggressive easing policies have also driven government bond yields in developed markets to historic lows. As a result, the search for income continued to be a primary concern for many investors, contributing to distortions in the equity markets as well.

The U.S. stuck to its slow-growth trajectory, adding to its growing string of consecutive quarters of economic expansion. A recovering housing market and rising equity markets contributed to a “wealth effect” that carried through to retail and auto sales. Although sequestration cast a shadow at the end of the year that carried into 2013, the country managed to avoid the fiscal cliff, and the passage of a new continuing resolution has prevented a Washington shutdown.

Elsewhere, we continued to see underwhelming euro zone GDP and ongoing tensions between the haves and have-nots. Italy’s ill-fated election, as well as Cyprus’ woes and the EU’s missteps in addressing them, underscored the tensions in the EU and the complexities of the bailout-austerity cycle. There was better news coming out of Japan, however, as the Bank of Japan took steps during the period to reverse deflation, resulting in better factory output, consumer confidence and business sentiment for that key global economy.

Conditions were best in the U.S., as economic recovery continued at a slow and steady pace. U.S. stocks rallied to a double-digit performance, with the S&P 500 Index1 returning an impressive 14.42% for the period. Global markets also participated in the upswing, as the MSCI World Index2, a measure of developed market equity performance, posted a robust 13.78% gain. Meanwhile, emerging markets lagged their developed-market counterparts for the period amid concerns of slowing growth and less accommodative monetary policy in several key economies, but the MSCI Emerging Markets Index3 still managed a gain of 5.40%.

Letter to Shareholders

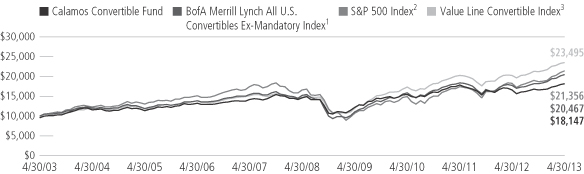

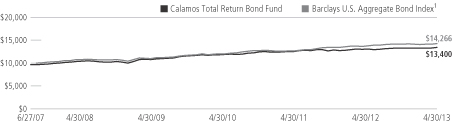

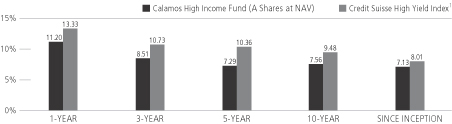

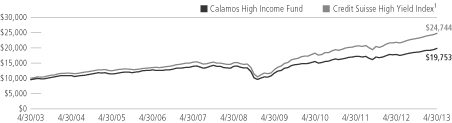

Many of the Calamos Funds utilize convertible securities, and this area of the market also enjoyed the six-month rally, as the BofA Merrill Lynch All U.S. Convertible Ex-Mandatory Index4 returned 12.69%, prompted by lower-quality higher yielding securities. High yield issuance continued to maintain a steady pace, while performance for the six-month period was also healthy, with a 7.21% return in the Credit Suisse High Yield Index5. The lower yielding U.S. bond market was more muted, however, as the Barclays Capital U.S. Aggregate Bond Index6 posted a gain of just 0.90%.

Global Outlook: Cautious Optimism

Our global outlook remains cautiously optimistic, and we believe, now more than ever, that active management and diversification are crucial to long-term investing success.

We expect the global economic recovery to continue at a measured pace, led by the U.S. and the emerging markets. Our greatest concerns relate to euro zone GDP and a potential slowdown in earnings growth, globally. We believe that valuations and long-term secular trends (including those related to the EM consumer) support our positioning. Recent housing and consumer data in the U.S. has been encouraging, and although some of China’s first quarter economic data (GDP and industrial production) has fallen short of estimates, numbers remain high in absolute terms and relative to developed markets.

On the back of central bank intervention and investors’ quest for income, valuations for areas such as staples have become stretched to a point that we believe merits caution. Meanwhile, we believe that the valuations of growth equities are attractive by many measures. For example, U.S. growth equities are highly compelling on the basis of free cash flow yields versus 10-year Treasury yields, as well as on a P/E basis versus value stocks. Many growth-rich but dividend-poor technology stocks are especially undervalued. After strong performance in the first half of 2012, we’ve seen the sector give some back, but the fundamentals still look attractive from both top-down and bottom-up perspectives.

We are also encouraged by trends in the U.S. and global convertible markets. Economic growth has supported increased issuance globally, and we continue to find attractively valued convertibles that offer the characteristics we seek—that is, a balance between equity participation and potential downside resilience.

A Global, Long-Term Perspective

Despite our broadly constructive outlook for equities and the global economy, we expect continued choppiness in the markets, and would not be surprised to see the equity market correct off recent highs, with overpriced sectors potentially coming under particular pressure. We believe this can create new buying opportunities, and we are carefully assessing opportunities across industries.

In this environment, we believe that maintaining long-term focus, global perspective and a commitment to diversified asset allocation are vital to investing success. We recognize that our role is to understand and adapt to the markets we are in, and we believe that our experience, proprietary research and active approach position us

| | | | |

| 2 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Letter to Shareholders

well in this regard. We continue to enhance our team and our approach, adding new resources, including a dedicated value investing team, additional specialized team members and more risk management capabilities.

As always, we appreciate the trust you have placed in us to manage your assets and help you achieve your financial goals. We encourage you to visit us at www.calamos.com or contact us at 800.582.6959 with any questions or concerns about our funds that are not addressed in this report.

Sincerely,

John P. Calamos, Sr.

CEO and Global Co-CIO,

Calamos Advisors LLC

Before investing, carefully consider a fund’s investment objectives, risks, charges and expenses. Please see the prospectus containing this and other information or call 800.582.6959. Please read the prospectus carefully. Performance data represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

| 1 | The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. Source: Lipper, Inc. |

| 2 | The MSCI World Index (U.S. Dollars) is a market-capitalization weighted index composed of companies representative of the market structure of developed market countries in North America, Europe and the Asia/Pacific region. Source: Lipper, Inc. |

| 3 | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index considered broadly representative of emerging market equity performance. The index represents companies within the constituent emerging markets that are available to investors worldwide. |

| 4 | The BofA Merrill Lynch All U.S. Convertibles Ex-Mandatory Index represents the U.S. convertible securities market excluding mandatory convertibles. |

| 5 | The Credit Suisse High Yield Index is an unmanaged index of approximately 1,600 issues with an average maturity range of seven to ten years with a minimum capitalization of $75 million. The Index is considered generally representative of the U.S. market for high yield bonds. |

| 6 | The Barclays U.S. Aggregate Bond Index is considered generally representative of the investment-grade bond market. Source: Lipper, Inc. |

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Investments in overseas markets pose special risks, including currency fluctuation and political risks. These risks are generally intensified for investments in emerging markets. Countries, regions, and sectors mentioned are presented to illustrate countries, regions, and sectors in which a fund may invest. Fund holdings are subject to change daily. The Funds are actively managed.

The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. There are certain risks involved with investing in convertible securities in addition to market risk, such as call risk, dividend risk, liquidity risk and default risk, that should be carefully considered prior to investing. This information is being provided for informational purposes only and should not be considered investment advice or an offer to buy or sell any security in the portfolio.

This report is intended for informational purposes only and should not be considered investment advice.

Calamos Growth Fund

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CVGRX |

B Shares | | CVGBX |

C Shares | | CVGCX |

I Shares | | CGRIX |

R Shares | | CGRRX |

| | | |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119302 |

B Shares | | 128119740 |

C Shares | | 128119856 |

I Shares | | 128119807 |

R Shares | | 128119435 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | Blends rigorous economic and broad themes analysis with intensive company and security research seeking to identify businesses with higher growth relative to peers | |

| | > | | Determines the quality and sustainability of a company’s growth by assessing its fundamentals and management among other factors | |

| | > | | Uses proprietary valuation models to ascertain a stock’s return potential | |

| | > | | Adheres to strict risk-management guidelines to determine portfolio construction | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | A portfolio that pursues the highest potential growth opportunities regardless of company size or industry | |

| | > | | A relatively aggressive yet diversified way to participate in the stock market’s long-term growth potential | |

CALAMOS GROWTH FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team, led by Global Co-Chief Investment Officers John P. Calamos, Sr. and Gary D. Black, discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2013.

Q. What is the Fund’s investment strategy?

A. Calamos Growth Fund invests in U.S. companies that we believe have the best prospects for sustainable and high relative growth. The Fund offers an attractive way to participate in long-term growth trends by focusing on companies with strong, enduring strategies, disciplined and forward-thinking management and solid long-term execution. We believe that there are many exciting growth trends within the global economy, and we have sought companies with good earnings prospects, high returns on invested capital, sustainable free cash flow, and low debt-to-capital ratios.

Q. How has the Fund performed?

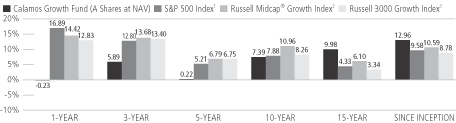

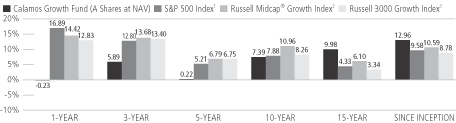

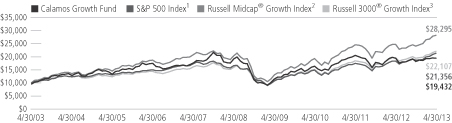

A. Because we believe equity funds are best utilized within asset allocations as long-term investments, we encourage investors to evaluate performance over multiple market cycles. Since its inception on September 4, 1990, the Fund has returned 12.96% on an annualized basis (Class A shares at net asset value). For this period, the broad equity market, as measured by the S&P 500 Index, returned 9.58%, while the Russell Midcap® Growth Index and the Russell 3000® Growth Index, returned 10.59% and 8.78%, respectively. The Russell 3000® Growth Index provides a point of comparison for the broad U.S. growth equity market, including companies of all capitalizations, while the Russell Midcap® Growth Index is a measure of mid-cap growth stocks, one segment of the Fund’s potential universe of investments.

For the six-month period ended April 30, 2013, Calamos Growth Fund returned 6.59% versus the S&P 500 Index gain of 14.42%. For this same period, the Russell Midcap® Growth Index rose 17.75% and the Russell 3000® Growth Index gained 13.93%.

Q. What factors influenced performance over the period?

A. The Fund trailed the Russell 3000® Growth Index as higher yielding and more defensive investments outperformed. Our focus on companies with cleaner balance sheets and globally diversified revenues was not rewarded in the period, as investors favored more leveraged growth and U.S.-focused businesses. In this environment, we continue to emphasize multinationals, which have greater flexibility to participate in global secular growth trends and to go where capital is treated best. The period also saw those companies with the highest current dividend yields yet slowest long-term projected growth outperform.

Sector performance within the market also illustrated that investors were focused on yield as opposed to growth over the six-month period. Signs of a rotation from defensive sectors to more cyclical growth areas (such as information technology, energy and industrials) appeared in the final weeks of the period, and corresponding performance within the Fund improved in kind.

In terms of specific sector performance, stock selection decisions within the consumer discretionary sector detracted from Fund returns. In particular, positioning within the Internet retail and specialty retail industries held back returns. Shares of some select

| | | | |

| 4 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Growth Fund

retailers delivered sales forecasts that fell short of expectations during the period, but we remain committed over the long term to companies with well-known brands, global business strategies and those with the ability to reach a geographically diversified customer base.

Stock selection within the materials sector also weighed on performance. On an industry level, an overweight allocation to and selection within the metals and mining industry (primarily gold miners) detracted from returns. We had maintained an overweight to the sector because we believe increased demand for resources from emerging market regions and accommodative global central bank policies can provide a tailwind to select industries.

The Fund’s selection within the energy sector detracted from performance. Specifically, holdings within the oil-and-gas equipment and services industry underperformed those of the benchmark. Our focus within the sector remains on the oil-and-gas exploration-and-production and equipment-and-services industries. These particular industries possess relatively stronger growth fundamentals that are less tied to the price of underlying commodities. As in materials, we believe that slow but continued global economic growth (including rebounding economic data in emerging markets), and global accommodative monetary policy can support opportunities within the energy sector. Investor preference for onshore energy production hindered the returns of the offshore companies, yet many of these maintain strong growth characteristics and attractive valuations.

While the Fund’s average overweight positioning within the health care sector helped performance, security selection within the sector hindered. Holdings within the pharmaceuticals and health care equipment industries underperformed, as investors favored the more defensive, slower-growth, higher yielding big pharmaceutical companies. Within health care, we seek investments with strong corporate fundamentals, attractive near-term catalysts, leading market share positions, the opportunity to participate in the growth of the emerging markets, as well as those that are furthest removed from government regulations.

The information technology sector was one of the worst performing areas over the period, and the Fund’s overweight allocation detracted from performance. However, security selection within the sector contributed favorably on a relative basis. We continue to focus on companies with solid balance sheets, globally diversified revenue bases and productivity enhancement capabilities. As long-term investors, we maintain conviction in technology because we believe many companies in the sector stand to benefit from long-term secular growth themes, including persistent innovation, enhanced mobility and global connectivity.

Q. What changes were made over the course of the reporting period?

A. We recognize that our role as a Fund manager is to understand and adapt to the markets we are in, and we remain committed to improving performance. In many ways, the Fund was positioned too defensively throughout much of 2012, with an emphasis on higher-quality balance sheets and the use of metals and mining companies and oil businesses as a cautious view on government currency operations. In 2013, the Fund reflected changes away from that stance, yet the market’s preference for low-growth businesses and high dividend yields proved to be out of favor with a higher-growth bias.

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 36.1 | % |

Consumer Discretionary | | | 19.0 | |

Industrials | | | 13.6 | |

Health Care | | | 12.6 | |

Energy | | | 6.6 | |

Consumer Staples | | | 5.6 | |

Financials | | | 4.8 | |

Materials | | | 0.9 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

Calamos Growth Fund

We continue to focus on secular themes related to mobility and connectivity within technology, and on strong global brands within the consumer sectors. We are also attracted to companies tied to the global infrastructure build-out, as well as those that are considered productivity enhancers. Growth prospects remain compelling for multinational firms whose businesses are closely tied to emerging market consumer spending and the evolution of high-tech manufacturing.

On a sector basis, we have found the most opportunity within the information technology, consumer discretionary and industrials sectors. Relative to the Russell 3000® Growth Index, the Fund’s largest overweight allocation is to information technology, while it remains underweight relative to the consumer staples sector.

Among positioning changes during the period, we reduced the Fund’s allocation to information technology, primarily through the sale of companies where we believed that fundamentals and near-term growth catalysts had deteriorated. We remain committed to the vast growth opportunities within the sector overall, however, and therefore maintain an overweight allocation. We also pared the allocation to the materials sector during the period. We eliminated Fund holdings within the gold metals and mining industry due to higher costs, poor earnings and our desire to add names with improving near-term growth opportunities.

Based on the strength we see in infrastructure build-out and high-tech manufacturing trends, we increased the Fund’s allocation to the industrials sector, adding companies broadly across industries, including construction and engineering, railroads and airlines. Many companies in the sector are compelling from both valuation and fundamental perspectives. Our focus is on companies capitalizing on global manufacturing, especially in areas such as the machinery and construction and engineering industries, where the project pipeline is attractive. We also increased the portfolio’s allocation to the consumer discretionary sector, adding positions within the home improvement and apparel retail industries.

Q. What is the outlook for U.S. growth stocks and the Fund?

A. We continue to have a constructive view of U.S. growth stocks, particularly larger multinational firms, and we remain committed to improving Fund performance.

In our view, equity valuations continue to be attractive relative to cash flows, forward earnings expectations and the fixed income market, and growth equity premiums are even more appealing. In other words, the markets are still are not paying a premium for growth stocks. Investors continue to favor yield over growth, but we believe that stock prices have become too high for many of the companies paying high dividends.

In this environment, we maintain a preference for higher growth investments in the Fund. Despite near-term concerns and heightened choppiness in the global markets, we believe that our focus on U.S. multinational businesses remains appropriate for long-term investors. We favor businesses that we believe are capable of succeeding within a slower growth environment.

| | | | |

| 6 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Growth Fund

ANNUALIZED RETURN: SINCE INCEPTION (9/4/90) THROUGH 4/30/13

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class A shares at net asset value and does not include the Fund’s maximum front-end sales charge of 4.75%—had it been included, the Fund’s return would have been lower. The Fund also offers Class B, Class C, Class I and Class R shares, the performance of which may vary. Performance shown reflects an expense reimbursement that improved results. Source: State Street Corporation and Lipper, Inc.

Calamos Growth Fund

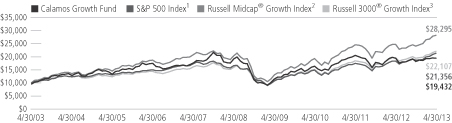

GROWTH OF $10,000: FOR 10-YEAR PERIOD ENDED 4/30/13

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/13

| | | | | | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | 1

YEAR | | 5

YEARS | | 10 YEARS

OR ^SINCE

INCEPTION |

Class A Shares – Inception 9/4/90 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 6.59 | % | | | | -0.23 | % | | | | 0.22 | % | | | | 7.39 | % |

With Sales Charge | | | | 1.53 | | | | | -4.97 | | | | | -0.75 | | | | | 6.87 | |

Class B Shares – Inception 9/11/00 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 6.19 | | | | | -0.98 | | | | | -0.53 | | | | | 6.75 | |

With Sales Charge | | | | 1.28 | | | | | -5.56 | | | | | -0.88 | | | | | 6.75 | |

Class C Shares – Inception 9/3/96 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 6.19 | | | | | -0.97 | | | | | -0.53 | | | | | 6.59 | |

With Sales Charge | | | | 5.22 | | | | | -1.87 | | | | | -0.53 | | | | | 6.59 | |

Class I Shares – Inception 9/18/97 | | | | 6.72 | | | | | 0.02 | | | | | 0.47 | | | | | 7.66 | |

Class R Shares – Inception 3/1/07 | | | | 6.46 | | | | | -0.46 | | | | | -0.03 | | | | | 2.41 | ^ |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2000. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

| 1 | The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. Index data shown for the Annualized Return Since Inception graph is from 8/31/90, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

| 2 | The Russell Midcap® Growth Index measures the performance of mid-sized companies with growth characteristics. Index data shown for the Annualized Return Since Inception graph is from 8/31/90, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

| 3 | The Russell 3000® Growth Index measures the performance of companies with higher price-to-book ratios and higher forecasted growth values. Index data shown for the Annualized Return Since Inception graph is from 8/31/90, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 8 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Value Fund

CALAMOS VALUE FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team, led by Global Co-Chief Investment Officers John P. Calamos, Sr. and Gary D. Black, discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2013.

Q. What is the Fund’s investment strategy?

A. We believe that superior returns can be earned over time by investing in good businesses at value prices, actively managing positions to source incremental returns and limit losses and holding stocks only until they are appropriately valued. The Fund seeks to invest in the stocks of companies that are not broken, just a bit battered, and to own them while their stock prices reflect a view more dire than ours. A unifying theme at Calamos is that growth in cash flows drives growth in stock prices. Growth can come in two forms—secular long-term growth and short-term cyclical growth. Strong long-term secular growth companies are generally too expensive for this Fund’s discipline, so the team focuses on misunderstood and mispriced slower-growing companies with the expectation that the stock market’s negative sentiment for them will abate relatively soon. Often this means we are only temporary owners of a business, as we aim to own it only for as long as it is undervalued. A strong business will usually not remain misunderstood and undervalued by the stock market forever, but over time can recover and become fully valued.

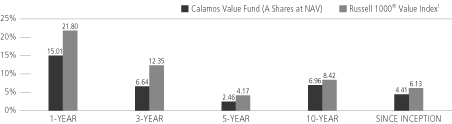

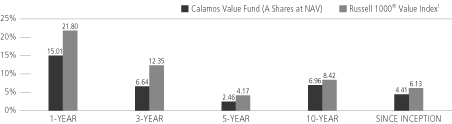

Q. How has the Fund performed?

A. Because we believe equity funds are best utilized within asset allocations as long-term investments, we encourage investors to evaluate performance over longer time periods. Since its inception on January 2, 2002, the Fund has returned 4.41% on an annualized basis (Class A shares at net asset value) versus 6.10% for the Russell 1000® Value Index. For the six-month period ended April 30, 2013, the Fund returned 13.59% versus 16.31% for the Russell 1000® Value Index.

This semiannual period represents the first full six-month term during which the Calamos Value Fund was completely managed by the new Value Team, which brought its extensive value-specific experience to Calamos in July of 2012.

Q. What factors influenced performance over the period?

A. The Fund’s focus on companies with strong free cash flows and resilient business models produced stable returns in the six-month period, but fell short of the Russell 1000® Value Index performance. The Fund’s overweight in the industrials sector, based on an expected pickup in manufacturing activity, supported performance, as economic data showed improvement and Fund names benefited from exposure to the crude-by-rail theme.

The Fund’s preference for consumer names with strong brands that drive sustainable cash flows and operating margins proved beneficial, as the consumer proved a bit more resilient than some expected. While we have seen a steady rally in U.S. equities thus far in 2013, the early year preference for high-beta cyclical names gave way to a focus on defensive high yielding names (that is, dividend-paying stocks) in the latter part of the period. Since we take an agnostic view of dividends as a use of cash, the Fund lagged the move upward as it was underweighted in high yielding groups like consumer staples and utilities.

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CVAAX |

B Shares | | CVABX |

C Shares | | CVACX |

I Shares | | CVAIX |

R Shares | | CVARX |

| | | |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119666 |

B Shares | | 128119658 |

C Shares | | 128119641 |

I Shares | | 128119633 |

R Shares | | 128119419 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | Seeks to buy good businesses trading at value prices, including those demonstrating sustainable return on invested capital, price/cash flow, and a potential catalyst for change in 3-9 months | |

| | > | | Focuses on finding strong businesses with the potential to drive superior returns | |

| | > | | Looks to deliver absolute returns and manage downside risk and capital loss by using active portfolio management to source incremental returns and protect capital | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | A vehicle for building assets to meet medium-range to long-range financial goals | |

| | > | | A value-oriented complement to a growth-oriented portfolio | |

Calamos Value Fund

| | | | |

| SECTOR WEIGHTINGS | |

Financials | | | 26.7 | % |

Energy | | | 16.1 | |

Consumer Discretionary | | | 15.9 | |

Industrials | | | 14.2 | |

Health Care | | | 8.8 | |

Consumer Staples | | | 5.6 | |

Materials | | | 5.0 | |

Information Technology | | | 3.3 | |

Other | | | 0.2 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

Q. What changes were made to the Fund’s portfolio over the course of the reporting period?

A. Our focus continues to be on investments in companies with strong sustainable cash flows driven by some combination of management expertise, proprietary technology, niche market focus, barriers to competitive entry and/or powerful brand names that are trading at a discount to intrinsic value. What we are looking for in a company does not change—market prices do. As is our active nature, we scaled out of names that approached our price targets and re-invested the cash in new opportunities.

We made additions to the energy, health care and consumer discretionary sectors. The increase in energy was the largest change, as we added to the Fund’s exposure in large cap integrated oil names, moving from an underweight to a slight overweight at the end of the reporting period, as we continue to see the shale gas revolution as a long-term trend. In health care, the Fund’s increase was a result of adding a large pharmaceutical company, with no major sells during the period. Our preference on the health care front is to continue to avoid HMOs, while preferring drug and medical device names for their more stable margin and cash flow profiles. In consumer discretionary, we continued to add exposure to media content providers, who we feel have strong pricing power in this environment and are benefiting from increasing numbers of access providers adding new revenue streams to the traditional cable distribution model. The consumer discretionary sector continues to be the largest overweight in the Fund.

We decreased the Fund’s exposure in industrials, financials and information technology during the period. In industrials, we have shifted the focus of investments away from the extended valuations in railroads and toward construction and agricultural names, which looked a bit battered after the March reporting period. We slightly reduced the Fund’s exposure in the financials sector, though it continues to be its largest sector from an absolute standpoint. We made changes in the market cap of the Fund’s bank exposure during the period, favoring large cap global banks and alternative asset managers as a nice play on continuing improvements in the investment environment. There were minimal changes made in consumer staples, materials, telecommunication services and utilities during the reporting period, all of which remained underweight versus the benchmark.

Q. What is your outlook for the value equities and the Fund?

A. Throughout the stock market, companies with cash are in demand, as investors seek not only nice dividends today but also the opportunity to grow that dividend in the future. A focus on current yield has morphed into a focus on growth in payouts, at least for now. We believe that in the near term the market will continue to favor large companies with excess cash on their balance sheets and lots of free cash flow that they can put toward dividends and buybacks.

We believe that our active approach to value is well suited to the current market environment. Specifically, we believe that our focus on misunderstood and mispriced slower-growing companies has unearthed a number of compelling opportunities for the Fund.

| | | | |

| 10 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Value Fund

ANNUALIZED RETURN: SINCE INCEPTION (1/2/02) THROUGH 4/30/13

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class A shares at net asset value and does not include the Fund’s maximum front-end sales charge of 4.75%—had it been included, the Fund’s return would have been lower. The Fund also offers Class B, Class C, Class I and Class R shares, the performance of which may vary. Performance shown reflects an expense reimbursement that improved results. Source: State Street Corporation and Lipper, Inc.

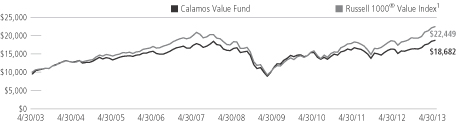

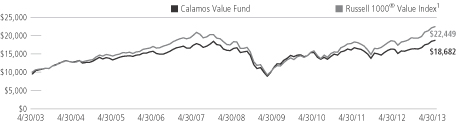

Calamos Value Fund

GROWTH OF $10,000: FOR 10-YEAR PERIOD ENDED 4/30/13

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/13

| | | | | | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | 1

YEAR | | 5

YEARS | | 10 YEARS

OR ^SINCE

INCEPTION |

Class A Shares – Inception 1/2/02 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 13.59 | % | | | | 15.01 | % | | | | 2.46 | % | | | | 6.96 | % |

With Sales Charge | | | | 8.16 | | | | | 9.53 | | | | | 1.47 | | | | | 6.45 | |

Class B Shares – Inception 1/2/02 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 13.18 | | | | | 14.09 | | | | | 1.69 | | | | | 6.33 | |

With Sales Charge | | | | 8.18 | | | | | 9.09 | | | | | 1.31 | | | | | 6.33 | |

Class C Shares – Inception 1/2/02 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 13.27 | | | | | 14.19 | | | | | 1.70 | | | | | 6.16 | |

With Sales Charge | | | | 12.27 | | | | | 13.19 | | | | | 1.70 | | | | | 6.16 | |

Class I Shares – Inception 3/1/02 | | | | 13.71 | | | | | 15.29 | | | | | 2.72 | | | | | 7.24 | |

Class R Shares – Inception 3/1/07 | | | | 13.48 | | | | | 14.72 | | | | | 2.20 | | | | | 1.75 | ^ |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2004. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graph does not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

| 1 | The Russell 1000® Value Index measures the performance of those companies in the Russell 1000® Index with lower price-to-book ratios and lower forecasted growth values. Index data shown for the Annualized Return Since Inception graph is from 12/31/01, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 12 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Focus Growth Fund

CALAMOS FOCUS GROWTH FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team, led by Global Co-Chief Investment Officers John P. Calamos, Sr. and Gary D. Black, discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2013.

Q. What is the Fund’s investment strategy?

A. Calamos Blue Chip Fund changed its name to Calamos Focus Growth Fund effective March 1, 2013, reflecting its more focused approach to investing primarily in U.S.-based, large cap companies that we believe have the best prospects for sustainable for growth. We believe these “blue chip” companies may offer a higher degree of stability compared to smaller, less-tested companies, and that our more focused approach to this area may provide an opportunity for investors to diversify their equity allocation with a more concentrated strategy. While the Fund invests primarily in U.S.-domiciled businesses, we continue to favor companies with a global presence and geographically diversified revenues that we believe are positioned to capitalize on global economic growth and global secular trends.

Q. How has the Fund performed?

A. Because we believe equity funds are best utilized within asset allocations as long-term investments, we encourage investors to evaluate performance over longer time periods. Since its inception on December 1, 2003, the Fund has returned 4.62% on an annualized basis (Class A shares at net asset value) versus a 6.51% return for the S&P 500 Index and a 6.57% return for the Russell 1000® Growth Index. For the six-month period ended April 30, 2013, the Calamos Focus Growth Fund returned 7.67% versus 14.42% for the S&P 500 Index and 13.71% for the Russell 1000® Growth Index.

Q. What factors influenced performance over the period?

A. Higher yielding and more defensive investments outperformed in the market. Our focus on companies with cleaner balance sheets and globally diversified revenues was not rewarded, as investors favored more leveraged growth and U.S.-focused businesses. In this environment, we continue to emphasize multinationals, which have greater flexibility to participate in global secular growth trends and to go where capital is treated best. The period also saw those companies with higher dividend yields and slower long-term projected growth outperform.

Sector performance within the market also illustrated that investors were focused on yield as opposed to growth over the six-month period. While market sentiment was defensive on a sector level, investors were less concerned about balance sheet strength in an overall environment boasting easier access to capital. Signs of a rotation from defensive sectors to more cyclical growth areas (such as information technology, energy and industrials) appeared in the final weeks of the period, and corresponding performance within the Fund improved in kind.

The Fund’s security selection within the energy sector detracted from performance in the period. Specifically, holdings within the oil-and-gas equipment and services industry underperformed those of the benchmark. Our focus within the sector remains on the oil-and-gas equipment-and-services and exploration-and-production industries. These

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CBCAX |

B Shares | | CBCBX |

C Shares | | CBXCX |

I Shares | | CBCIX |

R Shares | | CBCRX |

| | | |

|

| FUND CUSIP NUMBERS |

A Shares | | 128119625 |

B Shares | | 128119617 |

C Shares | | 128119591 |

I Shares | | 128119583 |

R Shares | | 128119427 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | A growth-oriented large cap portfolio with 38 holdings | |

| | > | | Seeks to capitalize on higher-growth businesses with attractive fundamentals | |

| | > | | Active management blending investment themes and fundamental research | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | A vehicle for building assets to meet medium- to long-range financial goals | |

| | > | | A larger-cap growth offering of diversified companies providing broad market participation | |

Calamos Focus Growth Fund

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 40.6 | % |

Consumer Discretionary | | | 16.3 | |

Health Care | | | 12.4 | |

Industrials | | | 11.5 | |

Consumer Staples | | | 7.1 | |

Energy | | | 6.3 | |

Financials | | | 4.9 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

particular industries possess relatively stronger growth fundamentals that are less tied to the price of underlying commodities. We believe that slow but continued global economic growth (including rebounding economic data in emerging markets), and global accommodative monetary policy can support opportunities within the energy sector.

Positioning within the materials sector also hampered performance. On an industry level, an overweight allocation to and selection within the metals and mining industry (primarily gold miners) detracted from returns, and we have since eliminated the Fund’s metals and mining holdings. We continue to believe some areas of the sector will be supported by increased demand for resources from emerging market regions, as well as by reflation efforts and accommodative global central bank policies.

An underweight allocation and security selection within the consumer discretionary sector detracted from performance. In particular, positioning within the Internet retail, media and specialty retail industries held back returns. Shares of some select retailers delivered sales forecasts that fell short of expectations during the period.

While the Fund’s average overweight positioning within the health care sector helped performance, security selection hindered relative returns. While positive, the Fund’s returns within the sector failed to match those within the Russell 1000® Growth Index. Specifically, holdings within the pharmaceuticals and health care equipment industries underperformed, as investors favored the more defensive, slower-growth, higher yielding big pharmaceutical companies.

Q. What changes were made to the Fund’s portfolio over the course of the reporting period?

A. We continue to focus on secular themes related to mobility and connectivity within information technology, and on strong global brands within the consumer sectors. We are also attracted to companies tied to the global infrastructure build-out, as well as those that are considered productivity enhancers. Growth prospects remain compelling for multinational firms whose businesses are closely tied to emerging market consumer spending and the evolution of high-tech manufacturing.

On a sector basis, we have found the most opportunity within the information technology, consumer discretionary and health care sectors. Relative to the Russell 1000® Growth Index, the Fund’s largest overweight allocation is to information technology, while it remains underweight relative to the consumer staples sector.

Among the positioning changes during the period, we increased the Fund’s allocation to the industrials sector based on the strength we see in infrastructure build-out and high-tech manufacturing trends. Many companies in the sector are compelling from both valuation and fundamental perspectives. Our focus is on companies capitalizing on global manufacturing trends related to areas such as the construction and electrical component and equipment industries, where the project pipeline is attractive. We also increased the portfolio’s allocation to the consumer discretionary sector, adding to positions where near-term growth catalysts are strong and revenues are globally diversified.

We eliminated the Fund’s allocation to the materials sector, ending the period with a 0% weighting. We sold holdings within the gold metals and mining industry due to higher costs, poor earnings and our goal of adding companies with improving near-term growth opportunities. We will look to opportunistically add names to the sector, should they demonstrate improving fundamentals, sustainable growth and attractive valuations.

| | | | |

| 14 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Focus Growth Fund

Q. What is your outlook for large cap growth equities and the Fund?

A. We continue to have a constructive view of large cap U.S. growth stocks, particularly multinational firms, and we remain committed to improving Fund performance. We believe a focused approach, guided by our proprietary research, will serve the Fund well.

In our view, equity valuations continue to be attractive relative to cash flows, forward earnings projections and the fixed income market, and growth equity premiums are even more appealing. In other words, the markets are still are not paying a premium for growth stocks. Investors continue to favor yield over growth, but we believe that stock prices have become too high for many of the companies paying high dividends.

In this environment, we maintain a preference for larger cap, higher-growth investments in the Fund. Despite near-term concerns and heightened choppiness in the global markets, we believe that our focus on U.S. multinational businesses remains appropriate for long-term investors. We favor businesses that we believe are capable of succeeding within a slower-growth environment, and we believe the Fund’s more focused approach will help us to concentrate our efforts on our highest conviction names.

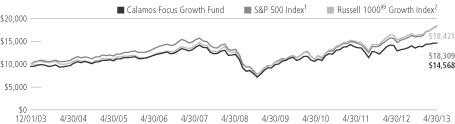

Calamos Focus Growth Fund

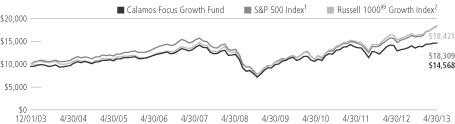

GROWTH OF $10,000: SINCE INCEPTION (12/1/03) THROUGH 4/30/13

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/13

| | | | | | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | 1

YEAR | | 5

YEARS | | SINCE

INCEPTION |

Class A Shares – Inception 12/1/03 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 7.67 | % | | | | 3.03 | % | | | | 2.51 | % | | | | 4.62 | % |

With Sales Charge | | | | 2.58 | | | | | -1.84 | | | | | 1.51 | | | | | 4.08 | |

Class B Shares – Inception 12/1/03 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 7.26 | | | | | 2.31 | | | | | 1.74 | | | | | 3.95 | |

With Sales Charge | | | | 2.26 | | | | | -2.69 | | | | | 1.37 | | | | | 3.95 | |

Class C Shares – Inception 12/1/03 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 7.26 | | | | | 2.23 | | | | | 1.74 | | | | | 3.84 | |

With Sales Charge | | | | 6.26 | | | | | 1.23 | | | | | 1.74 | | | | | 3.84 | |

Class I Shares – Inception 12/1/03 | | | | 7.78 | | | | | 3.33 | | | | | 2.77 | | | | | 4.89 | |

Class R Shares – Inception 3/1/07 | | | | 7.52 | | | | | 2.77 | | | | | 2.25 | | | | | 2.55 | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2004. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graph does not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

| 1 | The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. Index data shown for the Since Inception Growth of $10,000 graph is from 11/30/03, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

| 2 | The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price to-book ratios and higher forecasted growth values. Index data shown for the Since Inception Growth of $10,000 graph is from 11/30/03, since comparative index data is only available for full monthly periods. Source: Lipper, Inc. |

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 16 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos Discovery Growth Fund

CALAMOS DISCOVERY GROWTH FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team, led by Global Co-Chief Investment Officers John P. Calamos, Sr. and Gary D. Black, discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2013.

Q. What is the Fund’s investment strategy?

A. Calamos Discovery Growth Fund invests in small cap and mid cap (“SMID”) equities that we believe have the best prospects for growth. The Fund offers a relatively aggressive yet diversified way to get exposure to the SMID space and participate in the long-term growth potential of the U.S. stock market. While Discovery Growth is one of our newer funds, it is managed by the same investment team and draws upon the same research process that we use for all of our other funds. Our investment process is designed to identify companies with higher growth profiles and greater returns on invested capital relative to peers. We favor companies with geographically diversified revenues that are participating in long-term global growth trends.

We expect to concentrate on small cap companies that, if successful, will grow into mid caps. We have the flexibility to continue holding these successful mid cap companies. We believe that a mid cap company that has successfully grown from a small cap has demonstrated the potential of its business model and its ability to deliver sustained earnings growth.

Q. How has the Fund performed?

A. For the six-month period ended April 30, 2013, the Calamos Discovery Growth Fund returned 7.19% (Class A shares at net asset value) versus 16.79% for the Russell 2500™ Growth Index. Since its inception on June 1, 2010, the Fund gained 8.50% versus an 18.06% return for the index.

Q. What factors influenced performance over the period?

A. Our focus on companies with cleaner balance sheets and globally diversified revenues was not rewarded, as investors favored more leveraged growth, and were less concerned about balance sheet strength in an overall low cost of capital environment. We continue to emphasize those companies with greater flexibility to participate in secular growth trends and the ability to go where capital is treated best.

We see many of the most compelling growth opportunities in companies in the information technology sector, where we find innovative products and strong balance sheets, as well as participation in secular themes, such as productivity enhancement and constant communication and connectivity. We continue to believe many companies in the technology sector stand to benefit from long-term secular growth themes, including persistent innovation, enhanced mobility and global connectivity. In addition, as investors lengthen their view from extremely short-term time horizons, we believe these businesses trading at attractive valuations will be rewarded. However, IT was one of the worst performing areas within the Russell 2500™ Growth Index over the period, and the Fund’s average overweight allocation detracted from performance. Stock selection decisions within the sector also hampered returns, specifically positioning within the semiconductors and software industries.

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CADGX |

B Shares | | CBDGX |

C Shares | | CCDGX |

I Shares | | CIDGX |

R Shares | | CRDGX |

| | | |

|

| FUND CUSIP NUMBERS |

A Shares | | 128120102 |

B Shares | | 128120201 |

C Shares | | 128120300 |

I Shares | | 128120409 |

R Shares | | 128120508 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | Focus on small cap and mid cap companies | |

| | > | | Blends rigorous economic and broad themes analysis with intensive company and security research seeking to identify businesses with higher growth relative to peers | |

| | > | | Seeks to determine the quality and sustainability of a company’s growth by assessing its fundamentals and management among other factors | |

| | > | | Uses proprietary valuation models to ascertain a stock’s return potential | |

| | > | | Adheres to strict risk-management guidelines in constructing the portfolio and assessing a security’s fit within the portfolio | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | Exposure to small cap and mid cap companies | |

| | > | | A relatively aggressive yet diversified way to participate in the U.S. stock market’s long-term growth potential | |

Calamos Discovery Growth Fund

| | | | |

| SECTOR WEIGHTINGS | |

Information Technology | | | 19.8 | % |

Health Care | | | 17.7 | |

Consumer Discretionary | | | 16.1 | |

Industrials | | | 15.5 | |

Financials | | | 10.2 | |

Energy | | | 8.7 | |

Materials | | | 5.2 | |

Consumer Staples | | | 3.9 | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

The Fund’s security selection within the health care sector hindered returns, specifically companies within the biotechnology and health care technology industries.

The Fund’s security selection within the industrials sector also detracted from relative returns, specifically as positioning within the machinery and trading companies and distributors industries underperformed. Our focus is on companies capitalizing on global manufacturing, especially in areas such as the machinery, aerospace and defense and commercial services industries, where project pipelines are attractive.

Stock selection within the financials sector trailed index returns and detracted from performance in the period. The Fund’s positioning within the capital markets and real estate management and development industries underperformed.

Q. How is the Fund positioned?

A. The Fund’s largest allocations in absolute terms include the information technology, consumer discretionary and industrials sectors. Relative to the Russell 2500™ Growth Index, the portfolio’s largest overweight allocation is to the energy sector, while the Fund is underweight relative to the consumer discretionary sector. Within consumer discretionary, we seek to invest in companies delivering higher relative growth and those that exhibit fundamentals that are able to stand up to a volatile and challenging economic environment.

Among positioning changes during the period, we reduced the Fund’s allocation to information technology, mainly by selling companies where we believed that fundamentals and near-term growth catalysts had deteriorated. However, we remain committed to the vast growth opportunities within the sector overall for the reasons outlined above. We added to the Fund’s allocation within the health care sector during the period, where positions were added within the biotechnology and health care services industries. Within health care, we seek investments that offer strong corporate fundamentals, attractive near-term catalysts and leading market share positions. We are also attracted to innovative companies pursuing growth opportunities within the emerging markets, as well as those that are furthest removed from government regulation. In addition, we increased the Fund’s allocation to the financials and energy sectors during the period. In regard to financials, we believe the relative appeal of the sector has improved. Loan growth, better prospects in the housing market and healthier consumer balance sheets support our more positive view.

Q. What is your outlook for small and mid cap equities and the Fund?

A. In our view, small and mid cap equities continue to be attractive and growth equity premiums are even more appealing. With respect to valuations, small to mid cap growth equities remain compelling, as investors continue to place very little investment premium on growth companies relative to value. We remain constructive, and believe these companies remain well positioned as the economic recovery continues. Investors continue to favor yield over growth, but we believe that stock prices have become too high for many of the companies paying high dividends.

In this environment, we maintain a preference for higher-growth investments in the Fund, and those that we believe are capable of succeeding within a slower-growth landscape. Despite near-term concerns and heightened choppiness in the global markets, we believe that our focus on companies generating strong earnings growth and high returns on invested capital remains appropriate for long-term investors.

| | | | |

| 18 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

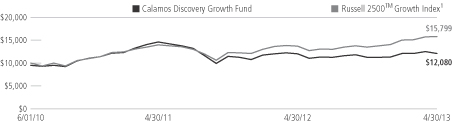

Calamos Discovery Growth Fund

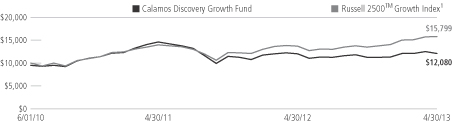

GROWTH OF $10,000: SINCE INCEPTION (6/1/10) THROUGH 4/30/13

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/13

| | | | | | | | | | | | | | | |

| | | 6

MONTHS | | 1

YEAR | | SINCE

INCEPTION |

Class A Shares – Inception 6/1/2010 | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 7.19 | % | | | | 0.24 | % | | | | 8.50 | % |

With Sales Charge | | | | 2.10 | | | | | -4.52 | | | | | 6.70 | |

Class B Shares – Inception 6/1/2010 | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 6.79 | | | | | -0.48 | | | | | 7.72 | |

With Sales Charge | | | | 1.79 | | | | | -5.46 | | | | | 6.82 | |

Class C Shares – Inception 6/1/2010 | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 6.70 | | | | | -0.48 | | | | | 7.72 | |

With Sales Charge | | | | 5.70 | | | | | -1.48 | | | | | 7.72 | |

Class I Shares – Inception 6/1/2010 | | | | 7.32 | | | | | 0.55 | | | | | 8.80 | |

Class R Shares – Inception 6/1/2010 | | | | 7.05 | | | | | 0.00 | | | | | 8.25 | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graphs do not reflect the income taxes you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

| 1 | The Russell 2500™ Growth Index measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Source: Lipper, Inc. |

Index returns assume reinvestments of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

Calamos International Growth Fund

| | |

| FUND NASDAQ SYMBOLS |

A Shares | | CIGRX |

B Shares | | CIGBX |

C Shares | | CIGCX |

I Shares | | CIGIX |

R Shares | | CIGFX |

| | | |

| |

| FUND CUSIP NUMBERS | | |

A Shares | | 128119575 |

B Shares | | 128119567 |

C Shares | | 128119559 |

I Shares | | 128119542 |

R Shares | | 128119393 |

| | | |

FUND OBJECTIVE

Long-term capital growth

INVESTMENT STRATEGY

| | > | | Applies bottom-up research and top-down analysis to target securities of non-U.S. companies that display acceleration in revenue growth, earnings growth and return on capital | |

| | > | | Conducts extensive balance sheet and income statement analysis to determine the intrinsic value of companies under consideration | |

| | > | | Emphasizes countries espousing free-market principles | |

INVESTOR PROFILE

This Fund may be suitable for investors who seek:

| | > | | To diversify beyond the domestic market by investing in overseas growth stocks, potentially increasing long-term capital growth | |

| | > | | An equity portfolio representing companies of all sizes and industries that offer high relative and sustainable growth potential | |

CALAMOS INTERNATIONAL GROWTH FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team, led by Global Co-Chief Investment Officers John P. Calamos, Sr. and Gary D. Black, discusses the Fund’s performance, strategy and positioning during the six-month period ended April 30, 2013.

Q. What is the Fund’s investment strategy?

A. Calamos International Growth Fund invests in an equity portfolio of non-U.S. companies of all sizes and industries that offer high relative and sustainable growth potential. This is a strategy for diversification and access to international growth companies, with an active growth focus. Our investment criteria favor companies that we believe offer the best prospects for growth. These companies are typically characterized by high earnings growth, healthy balance sheets and high return on invested capital. In the current environment, we are emphasizing companies with global presence and geographically diversified revenue streams. We believe that such companies offer more attractive prospects than those more dependent on a single economy.

We have the flexibility to invest across sectors, in companies domiciled in developed and developing markets. We favor companies based in markets that are moving toward a greater level of economic freedom, which we believe is a catalyst for wealth creation.

Q. How has the Fund performed?

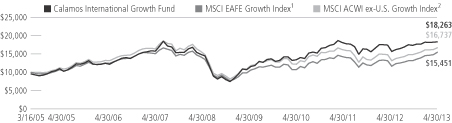

A. Because we believe equity funds are best utilized within asset allocations as long-term investments, we encourage investors to evaluate performance over longer time periods. Since its inception on March 16, 2005, the Fund has returned 8.34% on an annualized basis (Class A shares at net asset value) versus a 5.50% return in the MSCI EAFE Growth Index and a 6.17% return in the MSCI ACWI ex-U.S. Growth Index over the same period. For the six-month period ended April 30, 2013, the Fund gained 5.49% versus a 17.44% return for the MSCI EAFE Growth Index and a 13.43% return in the MSCI ACWI ex-U.S. Growth Index.

Q. What factors influenced performance over the period?

A. There was a significant bias to more defensive areas within the non-U.S. equity market that illustrated investors were more focused on yield than growth within their equity allocations. However, we maintained a preference for higher-quality companies with clean balance sheets and globally diversified revenues.

We believe that the valuations of some dividend-oriented stocks have become stretched as investors have sought income in a global low-rate environment. However, our focus on risk management has precluded our ownership of a number of these companies during the period.

We continue to see many of the most compelling growth opportunities in companies in the information technology sector, where we find innovative products and strong balance sheets. Within IT, we are favoring businesses that exhibit higher cash flows, cleaner balance sheets and lower debt levels, and we believe technology firms will benefit from many of the long-term secular growth themes we have identified. However, the Fund’s stock selection decisions within the sector held back returns, as holdings within the electronic equipment and semiconductors industries lagged.

| | | | |

| 20 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos International Growth Fund

Security selection within the materials sector also hindered returns, particularly the Fund’s allocation to the gold mining industry, which was challenged by higher costs of extraction and production during the period, as well as the rising prices of mining infrastructure.

The Fund’s underweight position to financials hampered performance, as this was the best performing sector within the MSCI ACWI ex-U.S. Growth Index during the time period.

From a geographic standpoint, the Fund’s holdings within Canada and an underweight position to Japan detracted from performance during the six-month period. Japan has recently taken unprecedented steps to stimulate its economy, including doubling the money in circulation in the next two years and implementing an inflation target of 2%. While we have already seen some of the positive effects of these measures, we believe that much of this has already been priced into the market and we are therefore not jumping headfirst into this area. While resulting from bottom-up analysis rather than a top-down preference for individual countries, stock selection within Switzerland, China and Ireland aided performance.

Q. How is the Fund positioned?

A. The Fund is positioned to focus on higher secular growth businesses, such as those within the information technology and health care sectors. We continue to favor companies with global operations, as well as those able to tap into the growth occurring within emerging market economies.

The Fund’s largest allocations in absolute terms include the information technology, health care, consumer staples and energy sectors. Relative to the MSCI ACWI ex-U.S. Growth Index, the Fund’s largest overweight allocation is to the information technology sector, and it is underweight to the consumer staples and financials sectors.

Among the positioning changes that were made during the time period, we reduced the Fund’s allocation to materials, eliminating positions in gold miners. In light of our more constructive view on the global markets, we opportunistically reduced our exposure to gold, which was originally used to guard against the potential for a systemic market shock and a weakening of the dollar.

We increased the Fund’s exposure to the financials sector. While we remain conscious of the risks associated within this area, we have been adding to our allocation as a reflection of our now cautiously optimistic global equity outlook.

The Fund’s allocation to emerging markets was increased. While emerging markets have retreated more recently, we still believe there is significant growth potential within these economies. The Fund’s holdings within emerging market regions are typically larger, more established companies that display geographically diverse revenue streams. The Fund is underweight to Japan, as explained in the previous section.

Q. What is your outlook for international equities and the Fund?

A. We see many exciting opportunities among international equities and for the Fund. While we realize there may be shorter-term periods of volatility and near-term concerns, improving global GDP growth and continued accommodative monetary policy should continue to fuel equity markets. Multinational businesses are exhibiting strong profit growth. In our view, equity valuations continue to be attractive relative to cash flows and fixed income, and growth equity premiums are even more appealing.

| | | | |

| SECTOR WEIGHTINGS | | | |

Information Technology | | | 32.9 | % |

Health Care | | | 17.3 | |

Consumer Staples | | | 11.0 | |

Energy | | | 9.5 | |

Consumer Discretionary | | | 9.1 | |

Financials | | | 7.2 | |

Industrials | | | 5.1 | |

Materials | | | 2.9 | |

Telecommunication Services | | | 0.6 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

Calamos International Growth Fund

We continue to focus on secular themes related to mobility and connectivity within technology, and strong global brands within the consumer sectors. We are also attracted to companies tied to the global infrastructure build-out, as well as those able to deliver productivity enhancements. We strive to invest in global multinational companies with diversified revenue bases, and those positioned to benefit from the growing middle class in emerging economies. We expect policy uncertainty and market fluctuations will continue, but generally improving economic data, attractive valuations and robust secular trends support our active and risk-aware approach to accessing long-term opportunities.

| | | | |

| 22 | | CALAMOS FAMILY OF FUNDS SEMIANNUAL REPORT | | |

Calamos International Growth Fund

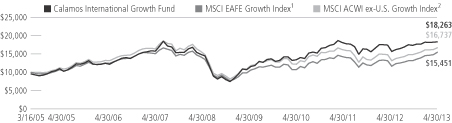

GROWTH OF $10,000: SINCE INCEPTION (3/16/05) THROUGH 4/30/13

AVERAGE ANNUAL TOTAL RETURN† AS OF 4/30/13

| | | | | | | | | | | | | | | | | | | | |

| | | 6

MONTHS | | 1

YEAR | | 5

YEARS | | SINCE

INCEPTION |

Class A Shares – Inception 3/16/05 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 5.49 | % | | | | 5.13 | % | | | | 2.25 | % | | | | 8.34 | % |

With Sales Charge | | | | 0.49 | | | | | 0.15 | | | | | 1.26 | | | | | 7.69 | |

| Class B Shares – Inception 3/16/05 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 5.17 | | | | | 4.34 | | | | | 1.49 | | | | | 7.55 | |

With Sales Charge | | | | 0.17 | | | | | -0.66 | | | | | 1.11 | | | | | 7.55 | |

Class C Shares – Inception 3/16/05 | | | | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 5.17 | | | | | 4.35 | | | | | 1.50 | | | | | 7.53 | |

With Sales Charge | | | | 4.17 | | | | | 3.35 | | | | | 1.50 | | | | | 7.53 | |

Class I Shares – Inception 3/16/05 | | | | 5.70 | | | | | 5.40 | | | | | 2.52 | | | | | 8.62 | |

Class R Shares – Inception 3/1/07 | | | | 5.37 | | | | | 4.82 | | | | | 2.00 | | | | | 4.55 | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2005. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class B and C shares have been adjusted for the contingent deferred sales charge (CDSC). |

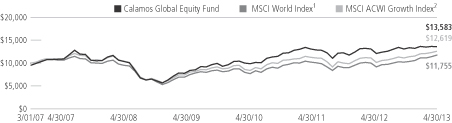

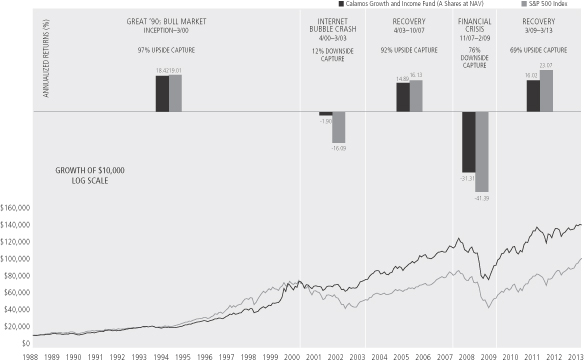

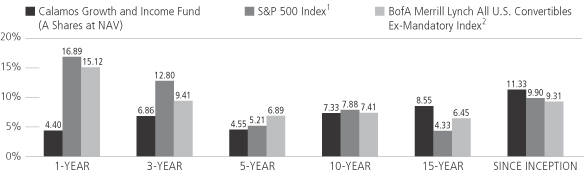

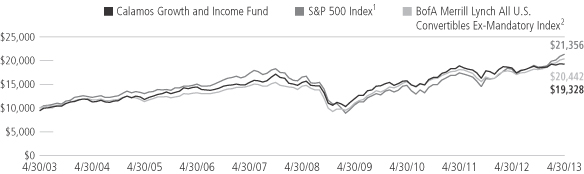

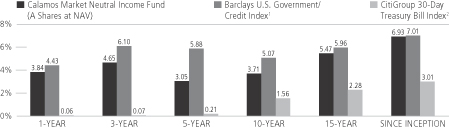

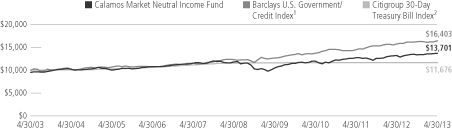

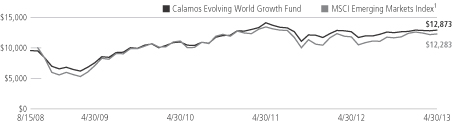

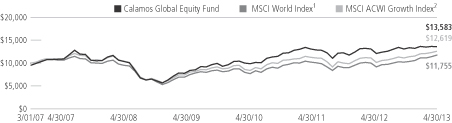

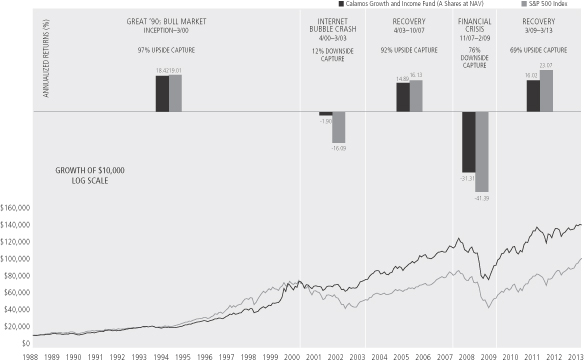

NOTES: