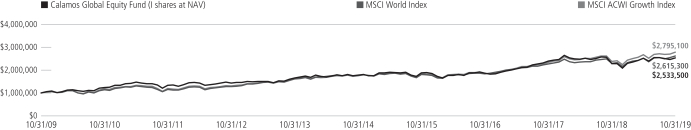

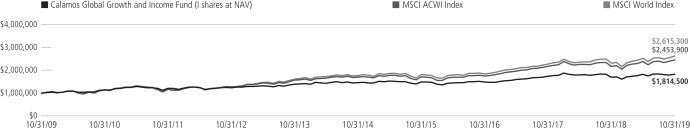

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

INVESTMENT COMPANY ACT FILE NUMBER: | | 811-05443 |

| |

| EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER: | | Calamos Investment Trust |

| |

ADDRESS OF PRINCIPAL EXECUTIVE OFFICES: | | 2020 Calamos Court, Naperville Illinois 60563-2787 |

| |

NAME AND ADDRESS OF AGENT FOR SERVICE: | | John P Calamos, Sr., Founder, Chairman and Global Chief Investment Officer Calamos Advisors LLC 2020 Calamos Court, Naperville, Illinois 60563-2787 |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (630) 245-7200

DATE OF FISCAL YEAR END: October 31, 2019

DATE OF REPORTING PERIOD: November 1, 2018 through October 31, 2019

ITEM 1. REPORT TO SHAREHOLDERS.

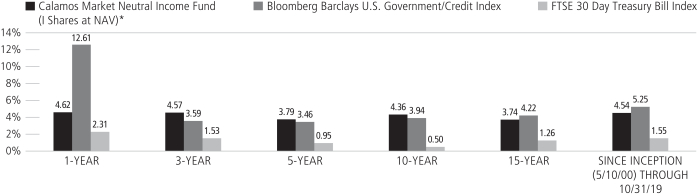

Experience and Foresight

About Calamos Investments

For over 40 years, we have helped investors like you manage and build wealth to meet long-term objectives. Because investors have different time horizons, risk tolerances and goals, we offer funds to suit a variety of asset allocation needs. Our 18 mutual funds include equity, fixed income, convertible and alternative funds. We offer U.S. funds as well as global and international choices.

We are dedicated to helping our clients build and protect wealth. We understand when you entrust us with your assets, you also entrust us with your achievements, goals and aspirations. We believe we best honor this trust by making investment decisions guided by integrity, discipline and our conscientious research.

We believe an active, risk-conscious approach is essential for wealth creation. In our early years, we pioneered the use of convertible securities as a means to control risk in volatile markets. We followed with strategies that combine convertibles and stocks, with the aim of participating in equity market upside with potentially less volatility than anall-stock portfolio. In the 1990s, we introduced our first stock fund, which invests in growth companies both large and small. Across our funds, our investment process seeks to manage risk at multiple levels and draws upon our experience investing through many market cycles. In a rapidly changing environment, we believe that this active management is essential.

We are global in our perspective. We believe globalization offers tremendous opportunities for countries and companies all over the world. In our U.S., global and international portfolios, we are seeking to capitalize on the potential growth of the global economy.

We believe there are opportunities in all markets. Our history traces back to the 1970s, a period of significant volatility and economic concerns. Since then, we have invested through multiple market cycles, each with its own challenges. Out of this experience comes our belief that the flipside of volatility is opportunity.

Letter to Shareholders

JOHN P. CALAMOS, SR.

Founder, Chairman and Global Chief Investment Officer

Dear Fellow Shareholder:

Welcome to your annual report for the 12-month period ended October 31, 2019. In this report, you will find commentary from the Calamos portfolio management teams, as well as a listing of portfolio holdings, financial statements and highlights, and detailed information about the performance and positioning of the Calamos Funds.

Market Review

Global stock, convertible security and fixed income markets posted solid gains during the annual reporting period.1 These advances were earned against a backdrop of volatility, sharp selloffs, and shifts in market leadership. Throughout the period, market sentiment fluctuated due to political uncertainties, concerns about the global economy and trade, and fears about the direction of monetary policy.

Market conditions were particularly inhospitable during the final months of 2018, as investors grew increasingly anxious that the Federal Reserve would raise short-term rates too quickly, potentially upending the U.S. economic expansion and slowing global growth. However, these concerns gave way to better sentiment as Federal Reserve comments soothed worries about additional short-term rate increases. As 2019 began, investors were in an upbeat frame of mind, encouraged not only by a dovish Fed, but also by earnings announcements, economic stimulus in China, a contained U.S. dollar, and hopes for a resolution to the U.S.-China trade dispute. Markets came under increased pressure again in May, but recovered in June as the Federal Reserve validated market expectations of renewed monetary accommodation.

During the third quarter of 2019, investor confidence faltered once again. Stocks struggled and bond yields fell as the Fed cut rates and market participants focused on political uncertainty, sluggish global economic data, and trade policy tensions. Against this backdrop, the market rotated away from higher growth stocks into cheaper stocks and yield oriented names. Volatility continued as the reporting period came to a close, as investors grappled with weaker-than-expected U.S. manufacturing data, softer U.S. retail sales and geopolitical challenges.

Outlook

We believe the global economy can expand further, although the pace is likely to be subdued. Political uncertainties, the trade dispute, and recessionary conditions in industrial

Letter to Shareholders

sectors create headwinds, but there are also tailwinds, such as accommodative monetary policy, low inflation, resilient U.S. consumption, and economic stimulus in China. We believe the probability of a near-term U.S. recession is low. While we are attentive to weakness in the U.S. manufacturing sector and the yield curve, the positives are more compelling: Unemployment is low, consumer balance sheets are healthy, and business-friendly fiscal policies such as deregulation continue to contribute to healthy earnings.

These conditions can set the stage for continued upside in the markets. Additionally, valuations for many securities remain attractive, in our view. Nevertheless, volatility will remain elevated through this phase of the cycle. Markets are likely to experience additional selloffs due to any number of headlines relating to a slowing global growth outlook, evolving central bank policies and an increasingly contentious political climate in the U.S.

In this environment, our teams are taking a highly selective, risk-managed approach, paying close attention to company fundamentals and valuations, as well as macroeconomic conditions and secular themes. As we have throughout the decades, we look through short-term market noise as we seek to capitalize on long-term opportunities in the markets.

Thoughts on Asset Allocation

Short-term volatility and uncertainty can be challenging, but it’s important to stay focused on your long-term goals. Investors who have a short-term mindset and shift their asset allocations in response to daily headlines may end up capturing the downside in the markets and missing the upside. The dangers of “timing” strategies may be especially pronounced in the sideways markets that we expect.

A far better approach is to work with your financial advisor to establish—and maintain—an asset allocation that is appropriately diversified to reflect your long-term goals and risk tolerance. If you are concerned about the potential impact of stock market volatility on your portfolio, your advisor may recommend funds that seek lower volatility participation in the stock market (like Calamos Convertible Fund or Calamos Growth and Income Fund) or short-duration bond strategies (such as Calamos Short-Term Bond Fund).

Your financial advisor may also propose using liquid alternative funds to enhance the risk/reward characteristics of your portfolio. Equity alternatives, such as Calamos Hedged Equity Fund and Calamos Phineus Long/Short Fund, employ a number of strategies to manage stock market risk. Fixed income alternatives, such as Calamos Market Neutral Income Fund, can offer potential benefits that traditional bond strategies cannot.

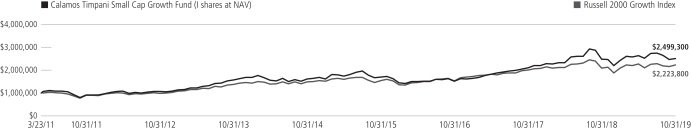

New Investment Choices to Enhance Diversification

A well-diversified portfolio also includes investments in companies from different countries, sectors and sizes. To help investors achieve diversification across the market capitalization spectrum, we acquired Timpani Capital

| | | | |

| 2 | | CALAMOS OPEN-END FAMILY OF FUNDS ANNUAL REPORT | | |

Letter to Shareholders

Management, a boutique small-and small/mid-cap (“smid”) manager with a time-tested process for sourcing compelling growth opportunities. We are excited to have grown the ranks of our investment organization with the seasoned Timpani team and believe their active, risk-conscious approach is an excellent fit for our investment culture. I invite you to learn more about our newest offerings by reading the commentaries for Calamos Timpani Small Cap Growth Fund and Calamos Timpani SMID Growth Fund.

Conclusion

As always, thank you for your continued trust in Calamos Investments. We are honored you have chosen us to help you pursue your financial objectives and we look forward to serving you in the years to come.

Sincerely,

John P. Calamos, Sr.

Founder, Chairman and Global Chief Investment Officer

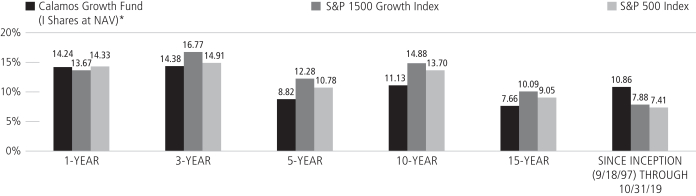

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-800-582-6959. Read it carefully before investing. Performance data represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Opinions are as of the publication date, subject to change and may not come to pass. Information is for informational purposes only and shouldn’t be considered investment advice.

Diversification and asset allocation do not guarantee a profit or protection against a loss.

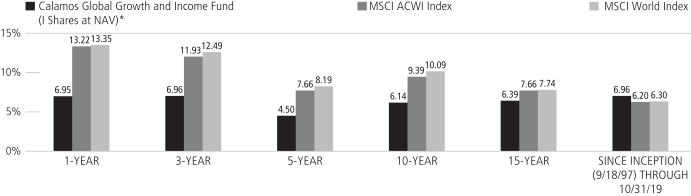

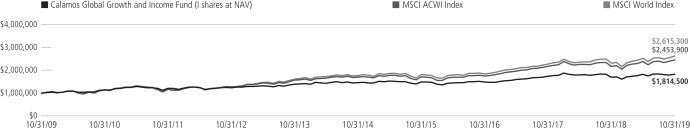

| 1 | The MSCI All Country World Index is a measure of global stock market performance, which returned 13.22% for the 12-month period ending October 31, 2019. The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. For the 12-month period, the index returned 14.33%. |

| | The ICE BofAML All U.S. Convertibles ex Mandatory Index represents the U.S. convertible securities market excluding mandatory convertibles. The index returned 12.39% for the 12-month period. The Thomson Reuters Global Convertible Bond Index is designed to broadly represent the global convertible bond market. The index returned 9.44% for the 12-month period. |

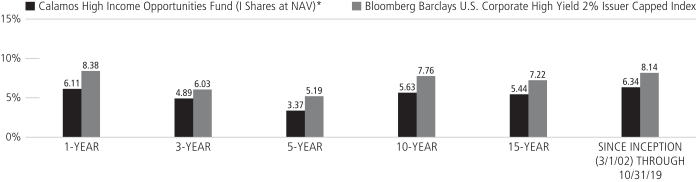

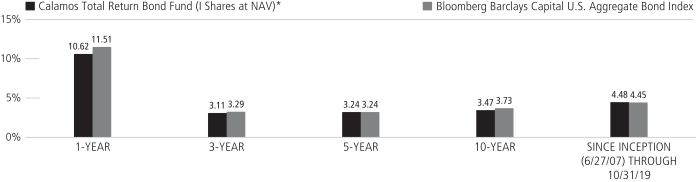

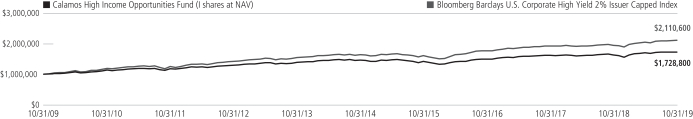

| | The Bloomberg Barclays U.S. Aggregate Bond Index is considered generally representative of the investment-grade bond market. For the 12-month period ending October 31, 2019, the index returned 11.51%. The Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index measures the performance of high yield corporate bonds with a maximum allocation of 2% to any one issuer. The index returned 8.38% for the 12-month period. The Bloomberg Barclays U.S. Government/Credit 1-3 Years Index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities of between 1 and 3 years and are publicly issued. The index returned 4.89% for the 12-month period. |

Duration is a measure of interest rate sensitivity.

Source: Lipper, Inc and Mellon Analytical Solutions, LLC. Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index. Investments in overseas markets pose special risks, including currency fluctuation and political risks. These risks are generally intensified for investments in emerging markets. Countries, regions, and sectors mentioned are presented to illustrate countries, regions, and sectors in which a fund may invest. Fund holdings are subject to change daily. The Funds are actively managed. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to accuracy or completeness, has been obtained from sources we believe to be reliable. There are certain risks involved with investing in convertible securities in addition to market risk, such as call risk, dividend risk, liquidity risk and default risk, which should be carefully considered prior to investing.

This information is being provided for informational purposes only and should not be considered investment advice or an offer to buy or sell any security in the portfolio. Investments in alternative strategies may not be suitable for all investors.

Calamos Market Neutral Income Fund

OVERVIEW

The Fund combines two complementary strategies with different responses to volatility: convertible arbitrage seeks alpha and uncorrelated returns, while hedged equity provides income from options writing and upside participation.

KEY FEATURES

| | ◾ | | Generates returns not dependent on interest rates, a key differentiator from traditional bond strategies. | |

| | ◾ | | Employs an absolute-return strategy with historically lower beta to fixed income and equity markets as well as lower volatility and limited drawdowns. | |

| | ◾ | | As one of the first alternative mutual funds, capitalizes on more than four decades of experience in the convertible space. | |

PORTFOLIO FIT

The fund may provide potential diversification, particularly in a low-interest-rate environment.

| | |

| FUND NASDAQ SYMBOLS |

| |

A Shares | | CVSIX |

C Shares | | CVSCX |

| |

I Shares | | CMNIX |

| |

|

| FUND CUSIP NUMBERS |

| |

A Shares | | 128119203 |

C Shares | | 128119849 |

| |

I Shares | | 128119880 |

| |

CALAMOS MARKET NEUTRAL INCOME FUND

INVESTMENT TEAM DISCUSSION

Please discuss the Fund’s strategy and role within an asset allocation.

Launched more than 25 years ago, the strategy is one of the first liquid alternative mutual funds and blends two main strategies—convertible arbitrage and hedged equity—with the aim of monetizing volatility. In addition to offering an attractive historical risk/reward profile, the Fund may enhance long-term portfolio diversification potential, especially in relation to fixed income securities.

Recently, bouts of elevated equity volatility underscore the value of diversification. Calamos Market Neutral Income Fund seeks to:

| • | | Potentially enhance an investor’s fixed income allocation. |

| • | | Actively pursue equity market upside while hedging downside risk. |

The end goal is consistent absolute total return over varying market cycles.

How has the Fund performed?

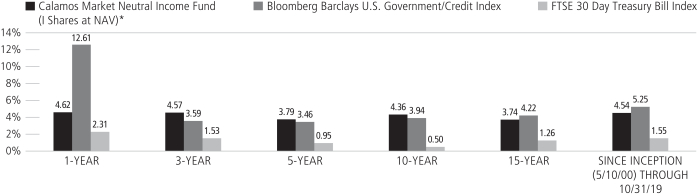

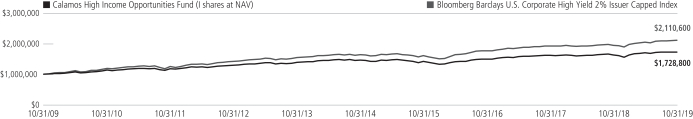

For the12-month period ended October 31, 2019, Calamos Market Neutral Income Fund returned 4.62% (Class I Shares at net asset value) versus a 12.61% return for the Bloomberg Barclays U.S. Government/Credit Bond Index and the 2.31% increase for the FTSE30-Day U.S. Treasury Bill Index.

For the1-year,3-year,5-year and10-year periods ended October 31, 2019, the Fund’s I Shares return ranked in the 33rd, 19th, 6th and 1st percentile, respectively, in the Morningstar Market Neutral category peer group.*

Both strategies utilized in the Fund, convertible arbitrage and hedged equity, contributed positively to performance during a period. Since the inception of Class I shares on May 10, 2000, the Fund gained 4.54% on an annualized basis. For the same period, the Bloomberg Barclays U.S. Government/Credit Bond Index gained 5.25%, while the FTSE30-Day U.S. Treasury Bill Index returned 1.55%.

What factors influenced performance?

The reporting period began with increased volatility, as investors grappled with Federal Reserve policy changes, global growth deceleration and heightened geopolitical risks. However, sentiment improved as the Federal Reserve became increasingly dovish, intermittent progress was reported on the U.S.-China trade imbroglio, and improved economic data provided encouragement. The Fund seeks to provide bond-like returns and bond-like volatility without bond-like risk exposures. The Fund seeks to “monetize volatility” though a combination of convertible arbitrage and hedged equity strategies.

The Cboe Volatility Index (VIX) declined from 22.23 at the beginning of the reporting period to 13.11 by the end, hitting a high of 36.07 on December 24, 2018. The increase in volatility was beneficial to the Fund because it afforded increased opportunities for

| * | Data is as of 10/31/19. Morningstar category percentile ranking is based on annualized total return for the1-year,3-year,5-year and10-year periods. Calamos Market Neutral Income Fund Class I Shares were in the 33rd, 19th, 6th, and 1st percentiles of 131, 110, 89 and 26 funds for the1-year,3-year,5-year and10-year periods, respectively, for the Morningstar Market Neutral category. |

| | | | |

| 4 | | CALAMOS OPEN-END FAMILY OF FUNDS ANNUAL REPORT | | |

Calamos Market Neutral Income Fund

rebalancing both the convertible arbitrage and hedged equity strategies. The convertible arbitrage portion of the Fund contributed positive monthly results, even when the market dropped dramatically in December 2018.

Elevated option skew1 was present during the majority of the reporting period, though it declined as volatility spiked in December. The elevated option skew provided an affordable opportunity to use call and put spreads to create a favorable upside/downside risk/reward profile.

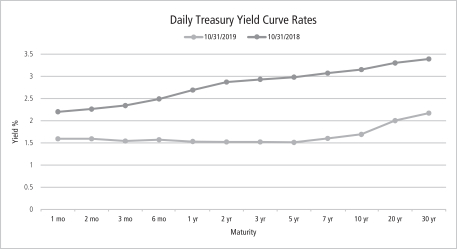

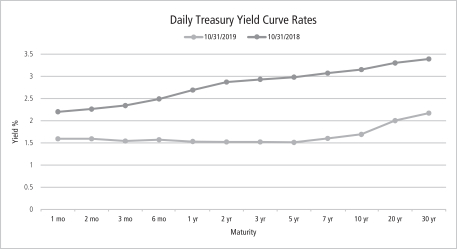

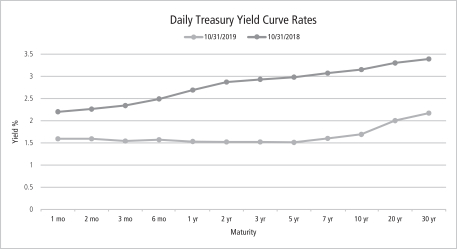

After hiking interest rates four times during the previous fiscal year, the Federal Reserve hiked interest rates once in December before pausing. As investors grew wary of a Fed that might overtighten, the Fed announced that it had changed its expectation for zero additional 2019 rate increases and that it would reduce the amount of balance sheet normalization. In this environment, the3-year Treasury yield declined from 2.93% to 2.24%, while the5-year Treasury yield moved from 2.98% to 2.28%. The10-year U.S. Treasury yield decreased from 3.15% to 2.51%. While the Fund doesn’t have significant interest rate exposure, this may also mean that we do not have interest rate opportunity either. Declining interest rates over the reporting period supported the Bloomberg Barclay’s U.S. Government/Credit Index outperformance relative to the Fund. However, the Fund has outperformed the index over the past five years with a lower standard deviation2 and a negative correlation to bonds.

How is the Fund positioned?

At the end of the reporting period, the Fund had a roughly equal allocation between the convertible arbitrage (52.6%) and hedged equity (47.4%) strategies. Our outlook projects similar though complementary risk-adjusted returns for both strategies going forward. Within convertible arbitrage, robust new convertible issuance has provided opportunities to invest in many new convertibles with favorable terms and valuations.

In regards to our call positioning, skew in the options market presented an attractive opportunity to utilize call and put spreads, which provided a positive impact on the portfolio’s risk/reward. By using slightlycloser-to-the-money calls, buyingout-of-the-money calls, and addingnear-the-money put spreads we are able to construct a more effective hedge that still has a delta3 and profile similar to our historical baseline positioning. When volatility and flatter option skew becomes more prevalent in the market, our typical baseline positioning looks more appealing. We continue to monitor the options market for the best opportunities available and will actively adjust our positioning as conditions warrant.

What are your closing thoughts for Fund shareholders?

The latter stages of the economic cycle are generally accompanied by increased bouts of volatility and this certainly appears to be the case at this point highlighted by the 13.5% fourth quarter 2018 decline for the S&P 500 Index followed by the 13.7% rebound in the first quarter of 2019. The Fund derives benefits from “volatility in volatility,” and heightened periods of volatility are expected from a variety of potential sources. Trade disputes, global growth concerns, geopolitical tensions, and speculation surrounding an inverted yield curve are just a few of the factors that may stoke

| 1 | Volatility Skew is the difference in implied volatility between out-of-the-money options, at-the-money options, and in-the-money options. Volatility skew, which is affected by sentiment and the supply-and-demand relationship, helps fund managers determine whether to write calls or puts. |

| 2 | Standard Deviation is a measure of volatility. |

| 3 | Delta is the ratio of the change in price of an option to the change in price of the underlying asset. |

| | | | |

| SECTOR WEIGHTINGS | |

| |

Information Technology | | | 33.1 | % |

Health Care | | | 12.9 | |

| |

Consumer Discretionary | | | 12.2 | |

Financials | | | 9.8 | |

| |

Communication Services | | | 9.6 | |

Industrials | | | 6.1 | |

| |

Consumer Staples | | | 4.5 | |

Utilities | | | 3.5 | |

| |

Real Estate | | | 3.3 | |

Energy | | | 2.6 | |

| |

Other | | | 2.2 | |

Materials | | | 2.0 | |

Asset Allocation weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

Calamos Market Neutral Income Fund

volatility. A backdrop of rising interest rates has diminished given the Federal Reserve’s recent dovish policy pivot but we continue to see diversification benefits of including the Fund within a fixed income allocation. Investors likely are not owning bonds based

on the amount of yield provided. Rather, investors look to the stability of bonds during increased market volatility. Given the uncertainty over global central bank interest rate policies, including the Fund in an investment portfolio should provide a means of reducing equity sensitivity. An allocation to the Fund can also provide stability in a market environment that turns increasingly volatile for both stocks and bonds. Investors are facing a dilemma in terms of how to reduce equity sensitivity without embracing the interest rate sensitivity of the bond market. Calamos Market Neutral Income Fund has historically provided bond-like returns and bond-like risk without having bond-like interest rate sensitivity. The Fund also has demonstrated lower correlations to other asset classes.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

ANNUALIZED RETURN: SINCE INCEPTION (5/10/00) THROUGH 10/31/19

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class I shares at net asset value. The Fund also offers Class A and Class C shares, the performance of which may vary. Source: State Street Corporation, Lipper, Inc., and Mellon Analytical Solutions, LLC.

| * | Annual returns for Class I shares are provided because Class I shares represent the largest percentage of assets in the Calamos Family of Funds. |

| | | | |

| 6 | | CALAMOS OPEN-END FAMILY OF FUNDS ANNUAL REPORT | | |

Calamos Market Neutral Income Fund

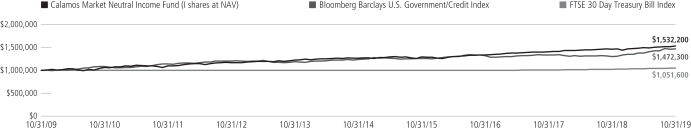

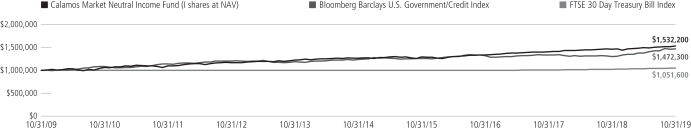

GROWTH OF $1,000,000: FOR THE 10-YEAR PERIOD ENDED 10/31/19

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/19

| | | | | | | | | | | | | | | |

| | | 1

YEAR | | 5

YEARS | | 10 YEARS |

Class A Shares – Inception 9/4/90 | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 4.32 | % | | | | 3.52 | % | | | | 4.10 | % |

With Sales Charge | | | | 1.98 | | | | | 2.52 | | | | | 3.59 | |

Class C Shares – Inception 2/16/00 | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 3.56 | | | | | 2.76 | | | | | 3.33 | |

With Sales Charge | | | | 2.56 | | | | | 2.76 | | | | | 3.33 | |

Class I Shares – Inception 5/10/00 | | | | 4.62 | | | | | 3.79 | | | | | 4.36 | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

As of the prospectus dated 3/1/19, the Fund’s gross expense ratio for Class A shares is 1.26%; C shares is 2.01% and Class I shares is 1.00%. The expense ratios shown above may differ from the more recent expense ratios reported in the Financial Highlights section of this report.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until March 31, 2000. Load-adjusted returns are adjusted for the maximum front-end sales load of 2.25% for Class A shares and returns for Class C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

The Bloomberg Barclays U.S. Government/Credit Index is comprised of long-term government and investment-grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market.

The FTSE 30 Day Treasury Bill Index is an unmanaged index generally considered representative of the performance of short-term money instruments. U.S. Treasury Bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the repayment of principal and interest at maturity.

The Cboe Volatility Index (VIX) is a leading measure of market expectations of near-term volatility conveyed by S&P 500 Index (SPX) option prices.

The Morningstar Market Neutral Category represents funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

The Fund’s use of derivative instruments involves investment risks and transaction costs to which the Fund would not be subject absent the use of these instruments and, accordingly, may result in losses greater than if they had not been used. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large impact on Fund performance.

Calamos Hedged Equity Fund

OVERVIEW

The Fund blends a core long-equity portfolio with an actively managed option overlay. Tactical management creates opportunities to add alpha from option market dynamics and equity market volatility.

KEY FEATURES

| | ◾ | | Our investment approach is highly responsive to dynamic market conditions, unlike many less active option-based strategies. | |

| | ◾ | | The investment team seeks to take advantage of opportunities the market presents, with a focus on being favorably positioned for as many outcomes as possible. | |

PORTFOLIO FIT

The Fund’s options-based risk-management strategy can provide upside participation in equity markets while limiting downside exposure, thereby improving the quality of the ride.

| | |

| FUND NASDAQ SYMBOLS |

| |

A Shares | | CAHEX |

C Shares | | CCHEX |

| |

I Shares | | CIHEX |

| | | |

|

| FUND CUSIP NUMBERS |

| |

A Shares | | 128120698 |

C Shares | | 128120680 |

| |

I Shares | | 128120672 |

| | | |

CALAMOS HEDGED EQUITY FUND

INVESTMENT TEAM DISCUSSION

Please discuss the Fund’s strategy and role within an asset allocation.

Calamos Hedged Equity Fund is designed to dampen volatility within an equity allocation.

| • | | The Fund’s investment approach is highly responsive to dynamic market conditions, a key differentiator versus many less-active option-based strategies. |

| • | | The Fund’s strategy blends a core long equity portfolio with an actively managed option overlay. Tactical management creates opportunities to add alpha from option market dynamics and equity market volatility. |

| • | | As an equity substitute, the strategy seeks to provide better upside/downside asymmetry than long-only equities. |

| • | | The Fund seeks to take advantage of market opportunities by being favorably positioned for as many outcomes as possible. |

How has the Fund performed?

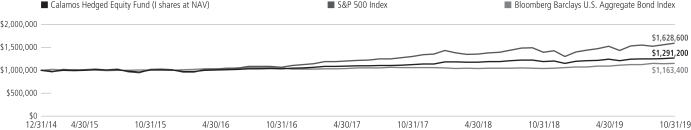

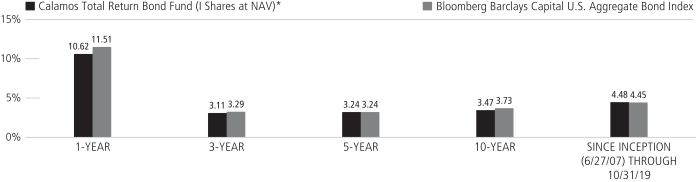

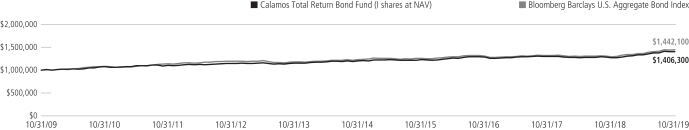

For the12-month period ended October 31, 2019, Calamos Hedged Equity Fund gained 7.01% (Class I shares at net asset value) versus the S&P 500 Index gain of 14.33% and the Bloomberg Barclays U.S. Aggregate Bond Index 11.51% increase. Since its inception on December 31, 2014, the Fund gained 5.43% on an annualized basis (Class I shares at net asset value) versus 10.62% for the S&P 500 Index and 3.18% for the Bloomberg Barclays U.S. Aggregate Bond Index.

In this strategy, we utilize covered call writing, protective puts, as well as put and call spreads for income and protection on our proprietary basket of equities that represents the broad stock market. Through active management, we are attempting to derive better risk-adjusted returns versus holding the index passively.

What factors influenced performance during the reporting period?

The Fund’s fiscal year was characterized by several bouts of volatility in January, May, August and October. This was conducive to the Fund’s actively managed approach, whereby we had the ability to “monetize volatility” through frequent rebalancing of our option hedges. The equity market began 2019 in negative territory, as investors had growing concerns regarding lower corporate earnings revisions, growing trade tensions with global trading partners, specifically China and the EU, as well as a pivoting Fed looking to now claw back the rate hike of late 2018. What also challenged the markets throughout 2019 were worries surrounding negative global interest rates and uncertainty regarding the midterm elections. The S&P 500 Index shook this off and bounced off its low of January 3 at 2447.89 to the new high of 3037.56 on October 31. This environment provided favorable opportunities to monetize volatility, as we rebalanced our option hedges, improved risk/reward positioning, and locked in profits.

The Cboe Volatility Index (VIX) decreased from its January 2 high of 28.53 to a low of 13.22 on October 31. Elevated option skew1 was present through the first, second and fourth quarters, where we had the Cboe SKEW Index above 125, which indicated that the market was pricing in a higher probability of outlier returns to the downside as more significant during those periods. Skew describes asymmetry from the normal distribution in a set of statistical data.

| 1 | Volatility Skew is the difference in implied volatility between out-of-the-money options, at-the-money options, and in-the-money options. Volatility skew, which is affected by sentiment and the supply-and-demand relationship, provides information that helps fund managers determine whether to write calls or puts. |

| | | | |

| 8 | | CALAMOS OPEN-END FAMILY OF FUNDS ANNUAL REPORT | | |

Calamos Hedged Equity Fund

The Fund benefited by using call and put spreads while the option markets had steep skew, which provided an affordable opportunity to create a favorable upside/downside risk/reward profile.

The Fund’s use of derivative instruments, including select equity options, index options, and foreign currency forward hedges, had minimal impact on the performance figures for the12-month period

How is the Fund positioned?

Option Positioning. Skew in the options market presented an attractive opportunity to utilize call and put spreads, which benefited the portfolio’s risk/reward. By using slightlycloser-to-the-money calls, buyingout-of-the-money calls, and adding near the money put spreads, we constructed a more effective hedge with equity sensitivity similar to our historical baseline positioning. Moreover, we frequently adjusted the call and put quantities to maintain a balanced risk/reward. This positioning provided additional protection over and above our typical 40% to 50% put notional minimum while adding upside participation potential. Thetrade-off has been a reduction in the income we received. However, given the low volatility and high skew in the options market, we felt this arrangement was warranted and opportunistic for the Fund.

More recently, however, lower volatility and heightened option skew has made our baseline positioning look more challenging. We continue to monitor the options market for the best opportunities available and will actively adjust our positioning as conditions warrant.

At the end of October, our call spread positioning included calls written of 78% (10% in the money) and long calls of 48% (0.17% out of the money “OTM”). The Fund’s net put protection consisted of 70% long puts (10% OTM) and 6% puts sold short (7% OTM).

Sector Positioning. At the end of the reporting period and relative to the S&P 500 Index, the equity basket was slightly overweight to information technology, consumer discretionary and communication services. The portfolio had slight underweight positions to utilities, real estate and materials.

Market Cap Positioning. Relative to the S&P 500 Index, the portfolio maintained a heavier relative weight to larger-capitalization (>$20 billion) holdings and a lighter weight to small andmid-capitalization ($5 billion to $20 billion) names.

What closing thoughts do you have for Fund shareholders?

We expect heightened volatility from a variety of sources going forward. President Trump’s recent focus on balancing trade through tariffs may continue to fuel volatility as investors attempt to determine the magnitude, duration and retaliatory pain of impending tariffs. In addition, investor speculation on when and to what degree global central banks and U.S. Federal Reserve stall quantitative easing could stoke volatility. As we continue to expect volatility in the equity markets, we remain enthusiastic about this environment being favorable to our current positioning in the Calamos Hedged Equity Fund. Should the equity markets continue to advance, we think the Fund is poised to participate in this upside while providing income to purchase downside protection. Conversely, should markets retreat, we believe the put protection will serve to provide a measure of downside protection and resilience.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

| | | | |

| SECTOR WEIGHTINGS | | | |

| |

Information Technology | | | 22.8 | % |

Health Care | | | 14.2 | |

| |

Financials | | | 13.5 | |

Communication Services | | | 10.7 | |

| |

Consumer Discretionary | | | 10.5 | |

Industrials | | | 9.2 | |

| |

Consumer Staples | | | 7.4 | |

Other | | | 5.2 | |

| |

Energy | | | 4.4 | |

Utilities | | | 3.4 | |

| |

Real Estate | | | 3.2 | |

Materials | | | 2.4 | |

Asset Allocation weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

Calamos Hedged Equity Fund

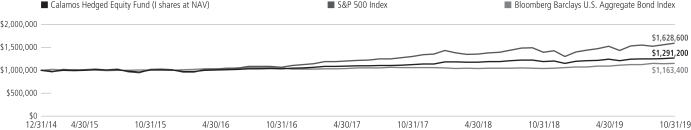

GROWTH OF $1,000,000: SINCE INCEPTION (12/31/14) THROUGH 10/31/19

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/19

| | | | | | | | | | |

| | | 1

YEAR | | SINCE

INCEPTION |

Class A Shares – Inception 12/31/2014 | | | | | | | | | | |

Without Sales Charge | | | | 6.65 | % | | | | 5.12 | % |

With Sales Charge | | | | 1.59 | | | | | 4.07 | |

Class C Shares – Inception 12/31/2014 | | | | | | | | | | |

Without Sales Charge | | | | 5.88 | | | | | 4.36 | |

With Sales Charge | | | | 4.88 | | | | | 4.36 | |

Class I Shares – Inception 12/31/2014 | | | | 7.01 | | | | | 5.43 | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

As of the prospectus dated 3/1/19, the Fund’s gross expense ratio for Class A shares is 1.48%; Class C is 2.31% and Class I is 1.27%. The Fund’s Investment Adviser has contractually agreed to reimburse the Fund expenses through 3/1/22 to the extent necessary so that Total Annual Fund Operating Expenses (excluding taxes, interest, short interest, short dividend expenses, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) of Class A, Class C, and Class I are limited to 1.25%, 2.00%, 1.00% of average net assets, respectively. Calamos Advisors may recapture previously waived expense amounts within the same fiscal year for any day where the respective Fund’s expense ratio falls below the contractual expense limit up to the expense limit for that day. This undertaking is binding on Calamos Advisors and any of its successors and assigns. This agreement is not terminable by either party. The expense ratios shown above may differ from the more recent expense ratios reported in the Financial Highlights section of this report.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown includes the effects of an expense reimbursement that improved results. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares and returns for Class C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market.

The Bloomberg Barclays U.S. Aggregate Bond Index is considered generally representative of the investment-grade bond market.

The Cboe Volatility Index (VIX) is a leading measure of market expectations of near-term volatility conveyed by S&P 500 Index (SPX) option prices.

The Cboe SKEW Index essentially tracks the willingness of investors to pay up for downside protection on the S&P 500 Index.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

The Fund’s use of derivative instruments involves investment risks and transaction costs to which the Fund would not be subject absent the use of these instruments and, accordingly, may result in losses greater than if they had not been used. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large impact on Fund performance.

| | | | |

| 10 | | CALAMOS OPEN-END FAMILY OF FUNDS ANNUAL REPORT | | |

Calamos Phineus Long/Short Fund

CALAMOS PHINEUS LONG/SHORT FUND

INVESTMENT TEAM DISCUSSION

What is the essence of the investment approach?

Through a global long/short structure, the Fund invests in publicly listed equity securities. Components of the strategy include:

A fundamental global approach that blendstop-down andbottom-up considerations. Company analysis is integrated with industry, thematic and macro research.

An inclusive frameworkfor identifying potential returns and associated risks. The framework accounts for company, industry, style, country and market factors.

Flexible capital allocation allowing for all investment styles, market caps and geographic regions. The investment universe is global, liquid and scalable. Exposure levels and investment styles depend upon market conditions and the economic cycle.

How has the Fund performed?

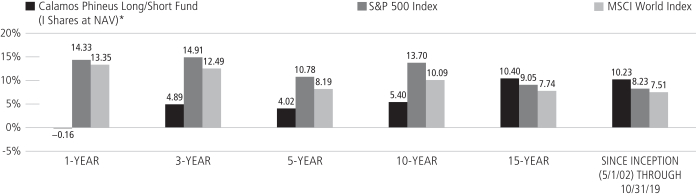

For the12-month period ended October 31, 2019, Calamos Phineus Long/Short Fund returned-0.16% (Class I shares at net asset value). The MSCI World Index rose 13.35% and the S&P 500 Index gained 14.33% over the same period.

Our approach in 2019 has been consistent with our view that equities face an environment of intensifying fundamental vulnerabilities. This view is based on a U.S. economy that was about to encounter the effects of tight monetary policy, slowing or contracting leading economic indicators, an uncertain trade environment, unwinding global supply chains, and tough year-over-year comparisons versus a 2018 buoyed by tax reform. The Fund’s long and short exposures have been roughly balanced for the majority of the year, which helped our relative performance into calendaryear-end 2018, but detracted from performance in 2019 through period end, as the market has shrugged off deteriorating economic data in favor of a dovish Fed and ashort-term trade truce.

Since its inception on May 1, 2002, the Fund has returned 10.23% on an annualized basis (Class I shares at net asset value), markedly outperforming both the MSCI World and S&P 500 Indexes, which returned 7.51% and 8.23%, respectively, over the same period.

What factors influenced performance during the reporting period?

The Fund’s largest contributors were long investments in the information technology and financials sectors, while long exposure in energy and a short position hedge on the SPDR S&P 500 ETF TRUST hindered performance. Notable contributors during the period included long positions in First Solar, Inc. (Information Technology), Facebook (Communication Services), and Air Products & Chemicals (Materials). Detractors included short positions in an S&P 500 ETF (Market Hedge) and Flour Corp. (Industrials) as well as a short call position on the SPY US 02/15/19 C265.

FUND OVERVIEW

The Fund seeks strong risk-adjusted and absolute returns across the global equity universe. The Fund uses a global long/short strategy to invest in publicly listed equity securities.

KEY FEATURES

| | ◾ | | Fundamental global approach blends top-down and bottom-up considerations. | |

| | ◾ | | Flexible asset allocation allows for all investment styles, market caps and geographic regions depending on the market environment. | |

| | ◾ | | Comprehensive approach assesses stock, industry, style, country and market factors. | |

| | ◾ | | Includes knowledge-based sectors such as technology, communications, media, financials and health care. | |

PORTFOLIO FIT

The Fund seeks to provide strong risk-adjusted returns via an alternative solution that complements and diversifies a global or U.S. equity allocation.

| | |

| FUND NASDAQ SYMBOLS |

| |

A Shares | | CPLSX |

C Shares | | CPCLX |

| |

I Shares | | CPLIX |

| | | |

|

| FUND CUSIP NUMBERS |

| |

A Shares | | 128120656 |

C Shares | | 128120649 |

| |

I Shares | | 128120631 |

| | | |

Calamos Phineus Long/Short Fund

| | | | |

| SECTOR WEIGHTINGS | |

| |

Financials | | | 26.9 | % |

Health Care | | | 16.3 | |

| |

Industrials | | | 13.9 | |

Communication Services | | | 12.0 | |

| |

Consumer Discretionary | | | 6.5 | |

Information Technology | | | 5.7 | |

| |

Other | | | 4.8 | |

Materials | | | 3.3 | |

| |

Consumer Staples | | | 2.7 | |

Energy | | | 2.2 | |

Asset Allocation weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

How is the Fund positioned in the context of the global economic cycle?

Our largest sector exposure remains in financials, a sector with many high-quality attractively valued names that are rapidly returning cash to shareholders. After a period of underperformance relative to the broader market due to the extraordinary decline in longer-dated rates, we believe that bond prices have climaxed and financials will be a primary beneficiary going forward. The group’s beta is relatively high because of exposure to cyclical factors such as loan growth and credit quality, but this has been an area of strength for the U.S. economy—particularly as it relates to the U.S. consumer.

Regarding industrials, we have been selective and have favored companies within the aerospace and defense industry, which benefited from increased defense spending by the government and the “defensive” nature of their businesses. We continue to emphasize businesses less exposed outside the U.S. due to the recessionary conditions that have reared up in recent months.

We have maintained a presence in health care, though are conscious of the rising political and litigation concerns that will be an overhang in 2020. We have been tactical and selective in our exposure, preferring those companies less exposed to drug pricing pressures—a risk that we do not see abating in the foreseeable future. This has led us to favor diversified and health services companies. We have also tactically added to managed care stocks that have suffered from overly bearish sentiment related to unlikely tail risks such as a single payer “Medicare for All” system completely supplanting the current system.

We are incrementally negative on the consumer staples sector, where valuations have become too high relative to underlying earnings prospects. They should perform well as long as investors remain obsessed with recession risk. However, it is too late to favor defensives, and we look to reduce them in coming months. We continue to be focused on more discretionary names that are inearly-to-middle innings of turnarounds.

Europe has been a zone of instability for investors for quite some time, but political tensions are reaching the end game and we expect a positive resolution: a workable (not “hard”) exit for the UK. We have bought call options on a UK equity index on the view that the removal of the “no deal” threat effectively eliminates the chances of a consumer recession in Europe and should broadly favor sterling and UK equities. With respect to emerging markets, outperformance is reliant on a weaker USD—which is unlikely unless we see further easing from the Federal Reserve. We maintain no direct exposure in the area.

What are your closing thoughts for the coming year?

Through 2019, investor sentiment has been dour with theend-cycle themes of global industrial recession and weakened corporate profitability in addition to the U.S.-China trade confrontation. Remarkably, U.S. equities have again approached their former highs at the top of our 2400 to 3000 trading range within the S&P 500 Index. Amid broadening signs of economic vulnerability, the obvious explanation for this resilience relates to the belief that neither the Federal Reserve nor Trump will accept any deflation in financial asset prices.

We should consider how the fundamental landscape might unfold positively in 2020 and thus, justify this resilience of U.S. equities. Investors are hoping for some reflation led by an improved global output cycle, which could imply an imminent trough in the earnings cycle. This expectation seems premature as there are no signs of actual reflation, just “expectations of reflation.” The latest improvement in investor sentiment has been partial and fragile; the best-performing sectors since the prior peak in July have been defensive rather than risk on.

| | | | |

| 12 | | CALAMOS OPEN-END FAMILY OF FUNDS ANNUAL REPORT | | |

Calamos Phineus Long/Short Fund

For now, the slowdown in world growth and the downward revisions in profits remain very apparent. The “China problem” appears intractable and has broad implications for the global economy including the corporate sector. Without a tangible improvement in the U.S.-China relationship, it is hard to imagine a genuine recovery of global growth in 2020. Active investors are defensively positioned, yet are inclined to look to the new year with the hope that the worst is past.

The important message for clients is one of discontinuity, creating an unattractive asymmetry of risk across the Developed equity markets. Central banks have again proven supportive of financial assets, yet economic vulnerabilities will stay high in coming quarters. We believe equities will be vulnerable in early 2020 to the realization that the structural themes of thisend-cycle will prevent a global cyclical recovery of any significance in 2020. We think this will be the key debate in coming months.

Reflecting these crosscurrents, our strategy has not changed and we believe low net equity exposures are warranted for now. The S&P 500 Index remains near the top of our 2400 to 3000 trading range. This remains a zone of major resistance for further gains and we see little evidence that the earning cycle can trough before Q1 2020.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

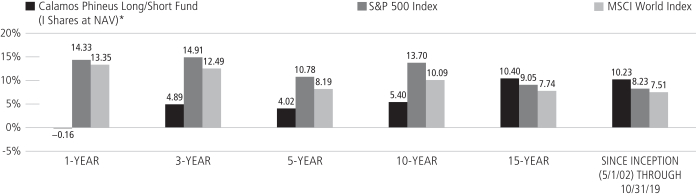

ANNUALIZED RETURN: SINCE INCEPTION (5/1/02) THROUGH 10/31/19

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class I shares at net asset value. The Fund also offers Class A and Class C shares, the performance of which may vary. Source: Morningstar, Inc.

The performance shown for periods prior to April 6, 2016 is the performance of a predecessor investment vehicle (the “Predecessor Fund”). The Predecessor Fund was reorganized into the Fund on April 6, 2016, the date upon which the Fund commenced operations. On October 1, 2015, the parent company of Calamos Advisors, purchased Phineus Partners LP, the prior investment adviser to the Predecessor Fund (“Phineus”), and Calamos Advisors served as the Predecessor Fund’s investment adviser between October 1, 2015 until it was reorganized into the Fund. Phineus and Calamos Advisors managed the Predecessor Fund using investment policies, objectives, guidelines and restrictions that were in all material respects equivalent to those of the Fund. Phineus and Calamos Advisors managed the Predecessor Fund in this manner either directly or indirectly by investing all of the Predecessor Fund’s assets in a master fund structure. The Predecessor Fund performance information has been adjusted to reflect Class A, Class C and Class I shares, expenses. However, the Predecessor Fund was not a registered mutual fund and thus was not subject to the same investment and tax restrictions as the Fund. If it had been, the Predecessor Fund’s performance may have been lower.

| * | Annual returns for Class I shares are provided because Class I shares represent the largest percentage of assets in the Calamos Family of Funds. |

Calamos Phineus Long/Short Fund

GROWTH OF $1,000,000: FOR THE 10-YEAR PERIOD ENDED 10/31/19

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/19

| | | | | | | | | | | | | | | |

| | | 1

YEAR | | 5

YEAR | | 10 YEARS |

Class A Shares (With Predecessor) – Inception 5/1/2002 | | | | | | | | | | | | | | | |

Without Sales Charge | | | | -0.45 | % | | | | 3.74 | % | | | | 5.12 | % |

With Sales Charge | | | | -5.21 | | | | | 2.73 | | | | | 4.61 | |

Class C Shares (With Predecessor) – Inception 5/1/2002 | | | | | | | | | | | | | | | |

Without Sales Charge | | | | -1.15 | | | | | 2.98 | | | | | 4.35 | |

With Sales Charge | | | | -2.10 | | | | | 2.98 | | | | | 4.35 | |

Class I Shares (With Predecessor) – Inception 5/1/2002 | | | | -0.16 | | | | | 4.02 | | | | | 5.40 | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

As of the prospectus dated 3/1/19, the Fund’s gross expense ratio for Class A shares is 2.32%; Class C shares is 3.07% and Class I shares is 2.04%. The expense ratios shown above may differ from the more recent expense ratios reported in the Financial Highlights section of this report.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Performance shown reflects the effects of an expense reimbursement that improved results and was in effect until October 31, 2016. Load-adjusted returns are adjusted for the maximum front-end sales load of 4.75% for Class A shares. Returns for Class C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graph does not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. Source: Lipper, Inc.

The MSCI World Index (U.S. Dollars) is a market-capitalization weighted index composed of companies representative of

the market structure of developed market countries in North America, Europe and the Asia/Pacific region.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 14 | | CALAMOS OPEN-END FAMILY OF FUNDS ANNUAL REPORT | | |

Calamos Convertible Fund

CALAMOS CONVERTIBLE FUND

INVESTMENT TEAM DISCUSSION

How has the Fund performed?

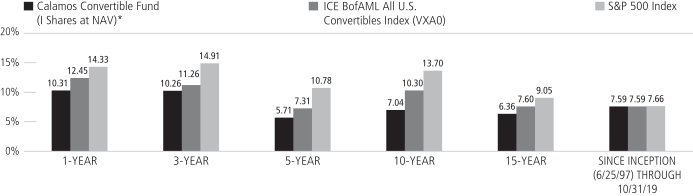

For the12-month period ended October 31, 2019, Calamos Convertible Fund had a positive return of 10.31% (Class I shares at net asset value) versus the ICE BofAML All U.S. Convertibles Index, the Fund’s benchmark, increase of 12.45%. Given our focus on convertibles displaying balanced risk/reward attributes, the Fund was significantly underweight to convertibles displaying the most equity sensitivity, which outperformed during the period. For the same period, the S&P 500 Index gained 14.33%.

Since Class I shares inception on June 25, 1997, the Fund returned 7.59% on an annualized basis compared with an annualized gain of 7.59% for the ICE BofAML All U.S. Convertibles Index and a 7.66% annualized return for the S&P 500 Index.

What factors influenced performance during the reporting period?

Convertibles and equities rose through a market environment characterized by periods of volatility spurred by investor concerns regarding Federal Reserve policy changes, heightened geopolitical risk, the U.S.-China trade dispute, and global growth deceleration. Nevertheless, the markets seemed to shake off such concerns as the Federal Reserve became increasingly dovish and cut interest rates three times during the last four months of the reporting period. As interest rates declined, investors favored equities from defensive sectors over growth sectors, especially defensive areas offering relatively high dividend yields. This was prevalent over the last two months of the reporting period and challenged the convertible market relative to the broader equity market because of the low percentage of convertible assets in these defensive areas.

While the Fund captured 70% of the S&P 500 Index’s 14.33%one-year return, the Fund also demonstrated attractive risk/reward attributes during significant drawdowns. Two market declines exceeded 5% during the reporting period. When the market, as measured by the S&P 500 Index, dropped 14.72% from December 3 to December 24, the Fund’s I shares held up well and declined 7.03% (48% downside participation). When the market declined 5.32% from July 15 to August 24, the Fund I shares declined just 2.18% (representing 41% downside participation).

The Fund did lag the ICE BofAML All U.S. Convertibles Index during the period driven largely by trailing security selection and the cash allocation that we maintain for investing in new opportunities and providing daily liquidity.

Our preference for balanced convertibles led us to be relatively underweight to the most equity sensitive convertibles in the market. Equity-sensitive convertibles as measured by the ICE BofAML Equity Alternative U.S. Convertible Index (VEQU) returned 17.4% and strongly outperformed convertibles with more balanced risk/reward attributes (+14.6%), as measured by the ICE BofAML Total Return U.S. Convertibles Index, and those with the most credit sensitivity (+8.5%), the ICE BofAML Yield Alternative U.S. Convertibles Index.

OVERVIEW

The Fund invests primarily in convertible securities of U.S. companies that are diversified across market sectors and credit quality.

KEY FEATURES

| | ◾ | | Leverages more than four decades of research and experience in convertible security investing. | |

| | ◾ | | Provides diversification across market sectors and credit quality, emphasizing midsize companies with higher-quality balance sheets. | |

| | ◾ | | Seeks to provide upside participation in equity markets with less exposure to downside than an equity-only portfolio over a full market cycle. | |

| | ◾ | | Takes environmental, social and governance (ESG) factors into account, evaluating whether they impact a company’s cash flow, risk profile and long-term returns. | |

PORTFOLIO FIT

When used in conjunction with an equity allocation, the Fund offers a way potentially to manage risk by employing securities that engage in upside equity movements with limited downside participation.

| | |

| FUND NASDAQ SYMBOLS |

| |

A Shares | | CCVIX |

C Shares | | CCVCX |

| |

I Shares | | CICVX |

| |

|

| FUND CUSIP NUMBERS |

| |

A Shares | | 128119401 |

C Shares | | 128119823 |

| |

I Shares | | 128119864 |

| |

Calamos Convertible Fund

| | | | |

| SECTOR WEIGHTINGS | |

| |

Information Technology | | | 37.6 | % |

Health Care | | | 17.4 | |

| |

Communication Services | | | 11.0 | |

Consumer Discretionary | | | 10.1 | |

| |

Financials | | | 8.4 | |

Utilities | | | 5.0 | |

| |

Industrials | | | 3.1 | |

Real Estate | | | 2.6 | |

| |

Energy | | | 0.4 | |

| | | | | |

Asset Allocation weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

Economic Sector Contributors

Energy. Security selection in the energy sector provided support to performance. Energy was the worst-performing sector in the convertible market during the period and our selection within the oil & gas exploration and oil & gas equipment & services industries held up much better than names in the benchmark index.

Consumer Staples.A lack of participation in the consumer staples sector also lifted portfolio results. The sector is relatively small within the U.S. convertible market (just 1.2% of the index on average during the reporting period) and securities in the sector lagged.

Economic Sector Detractors

Information Technology. Security selection within the information technology sector held back return, as portfolio holdings within the semiconductors, semiconductor equipment, and systems software industries lagged.

Consumer Discretionary. Security selection in consumer discretionary also detracted from Fund return. Portfolio holdings in automobile manufacturers notably underperformed.

How is the fund positioned?

From a sector standpoint, the fund’s largest absolute weights are within information technology and health care where we believe thematic tailwinds coupled with solid demand promote outperformance. The smallest weights are in energy, materials and consumer staples. We have been selective to cyclical areas given deteriorating economic data and their policy dependent outcome. We maintain relative overweight positions in the application software and health care equipment industries. Relative to the convertible index, the fund holds underweight allocations to financials and real estate, with mortgage REITs (financials) and specialized REITs (real estate) among the underweight industries. We continue to actively manage the portfolio and remain selective within the most equity-sensitive portion of the market, while allocating the majority of capital to the balanced portion where we see the optimal risk/reward tradeoff. Balanced convertible structures also help protect against shorter-term uncertainty.

What are your closing thoughts for Fund shareholders?

Volatility in the financial markets is likely to continue driven by geopolitical headlines, the outlook for global growth, central bank policies and the upcoming U.S. election. We continue to view convertibles as an attractive way to manage through the risk with lower volatility and shallower drawdowns. The resurgence of new convertible issuance has demonstrated that the convertible market continues to be a preferred source for accessing capital for growth companies. While we are monitoring the recent market rotations between growth and value, the accompanying volatility can provide compellingbottom-up opportunities in select companies, which can outperform regardless of the economic cycle.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

| | | | |

| 16 | | CALAMOS OPEN-END FAMILY OF FUNDS ANNUAL REPORT | | |

Calamos Convertible Fund

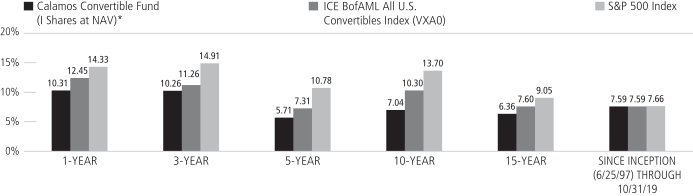

ANNUALIZED RETURN: SINCE INCEPTION (6/25/97) THROUGH 10/31/19

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Performance is for the Fund’s Class I shares at net asset value. The Fund also offers Class A and Class C shares, the performance of which may vary. Source: State Street Corporation, Lipper, Inc., and Mellon Analytical Solutions, LLC.

| * | Annual returns for Class I shares are provided because Class I shares represent the largest percentage of assets in the Calamos Family of Funds. |

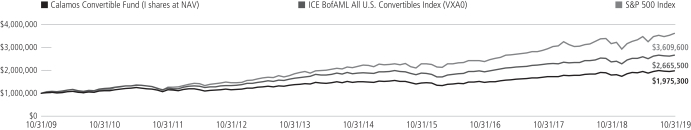

Calamos Convertible Fund

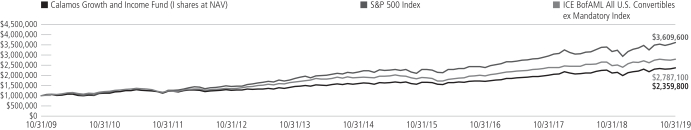

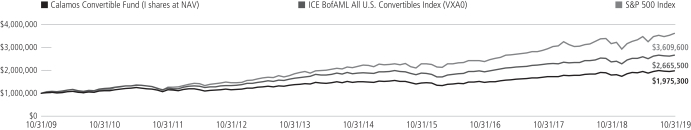

GROWTH OF $1,000,000: FOR THE 10-YEAR PERIOD ENDED 10/31/19

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/19

| | | | | | | | | | | | | | | |

| | | 1

YEAR | | 5

YEARS | | 10 YEARS |

Class A Shares – Inception 6/21/85 | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 10.02 | % | | | | 5.44 | % | | | | 6.77 | % |

With Sales Charge | | | | 7.52 | | | | | 4.41 | | | | | 6.25 | |

Class C Shares – Inception 7/5/96 | | | | | | | | | | | | | | | |

Without Sales Charge | | | | 9.21 | | | | | 4.66 | | | | | 5.97 | |

With Sales Charge | | | | 8.25 | | | | | 4.66 | | | | | 5.97 | |

Class I Shares – Inception 6/25/97 | | | | 10.31 | | | | | 5.71 | | | | | 7.04 | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

As of the prospectus dated 3/1/19, the Fund’s gross expense ratio for Class A shares is 1.17%; Class C is 1.92% and Class I is 0.92%. The expense ratios shown above may differ from the more recent expense ratios reported in the Financial Highlights section of this report.

| † | Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions. Load-adjusted returns are adjusted for the maximum front-end sales load of 2.25% for Class A shares and returns for Class C shares have been adjusted for the contingent deferred sales charge (CDSC). |

NOTES:

The graphs do not reflect the income of taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends and adjustment for the maximum sales charge for Class A shares. The performance of other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes.

The ICE BofAML All U.S. Convertibles Index is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities. Since inception data for the index is shown from 6/30/97, since data is only available for full monthly periods. Source: Lipper, Inc.

The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market.

Due to their structural complexities, the attributes of convertibles may vary. Therefore, they are typically categorized as Yield Alternatives represented by the U.S. CV Index (VYLD), Total Return Alternatives represented by the U.S. CV Index (VTOT), or Equity Alternatives represented by the U.S. CV Index (VEQU).

The ICE BofAML Total Return U.S. Convertibles Index is a subset of ICE BofAML All U.S. Convertibles Index including securities with a delta greater than or equal to 0.4 and less than 0.8 (VTOT).

The ICE BofAML Yield Alternative U.S. Convertibles Index (VYLD) is a subset of ICE BofAML All U.S. Convertibles Index including securities with a delta less than 0.4 (exhibiting bond-like characteristics).

The ICE BofAML Equity Alternative U.S. Convertibles Index (VEQU) is a subset of ICE BofAML All U.S. Convertibles Index including securities with a delta of 0.8 and greater (exhibiting stock-like characteristics).

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

| | | | |

| 18 | | CALAMOS OPEN-END FAMILY OF FUNDS ANNUAL REPORT | | |

Calamos Global Convertible Fund

CALAMOS GLOBAL CONVERTIBLE FUND

INVESTMENT TEAM DISCUSSION

How has the Fund performed?

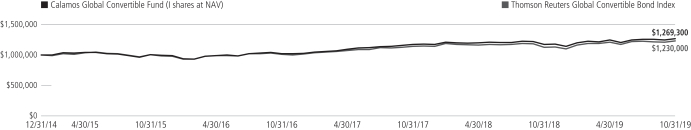

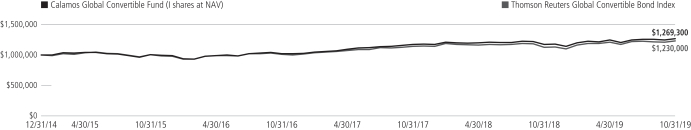

For the12-month period ended October 31, 2019, Calamos Global Convertible Fund returned 8.09% (Class I shares at net asset value) versus the Thomson Reuters Global Convertible Bond Index return of 9.44%. We believe balanced convertibles offer the most attractive investment opportunity, given their combination of upside potential and downside protection. This approach led us to underweight the most equity-sensitive and credit-sensitive convertibles in favor of those with balanced risk/reward attributes. Although this tack held back relative return during the period, we believe the Fund’s longer-term performance affirms this strategy. Since its inception on December 31, 2014, the Fund increased 5.06% (Class I shares at net asset value) annualized versus a 4.38% gain for the Thomson Reuters Global Convertible Bond Index.

What factors influenced performance during the reporting period?

Convertibles and equities rose through a market environment characterized by periods of volatility spurred by investor concerns regarding Federal Reserve policy changes, heightened geopolitical risk, the U.S.-China trade dispute, and global growth deceleration. Nevertheless, the markets seemed to shake off such concerns as the Federal Reserve became increasingly dovish and cut interest rates three times during the last four months of the reporting period. As interest rates declined, investors favored equities from defensive sectors over growth sectors, especially defensive areas offering relatively high dividend yields. This was prevalent over the last two months of the reporting period and challenged the convertible market relative to the broader equity market because of the low percentage of convertible assets in these defensive areas.

The reporting period saw three greater than 4% declines in the MSCI World index, representing the developed market, during the reporting period before bouncing back each time. From November 10 to December 20, 2018, the MSCI World Index fell 9.5%. From May 5 to May 29, the index fell 4.9%. And from July 24 to August 25, the index fell 5.0%. While the Fund captured 59% of the MSCI World Index’s 13.35%one-year return, the Fund averaged just 36% downside during the above-mentioned period declines.

The volatile market environment was most conducive to global convertibles with balanced risk/reward characteristics. These convertibles rose 14.8% on average and outperformed those with the most credit sensitivity (+6.3%) and the most equity sensitivity (+11.0%), based on delta1 ranges within the benchmark index. Our approach led us to underweight the most equity-sensitive and credit-sensitive convertibles in favor of those with balanced risk/reward attributes and this tack somewhat hindered the Fund’s relative performance during the period.

Economic Sector Contributors

Health Care.An underweight allocation and security selection in the sector boosted performance during the period. The portfolio benefited from strong relative performance in the life sciences tools & services and health care equipment industries. The portfolio also held a relatively light allocation to the underperforming biotechnology industry.

| 1 | Delta is the ratio of the change in price of a convertible to the change in price of the underlying stock. |

OVERVIEW

The Fund invests in global convertible securities, striving to balance risk/reward while providing growth and income.

KEY FEATURES

| | ◾ | | Provides broadly diversified exposure to the global convertible bond universe. | |

| | ◾ | | Leverages more than 40 years of research in convertible security investing. | |

| | ◾ | | Seeks to provide upside participation in equity markets with less exposure to downside than an equity-only portfolio over a full market cycle. | |

| | ◾ | | Blends global investment themes and fundamental research via active management. | |

| | ◾ | | Takes environmental, social and governance (ESG) factors into account, evaluating whether they impact a company’s cash flow, risk profile and long-term returns. | |

PORTFOLIO FIT

Consisting of convertible securities that can participate in upside equity movements with potentially limited downside exposure, the Fund can provide a means to manage risk in conjunction with an equity allocation. The Fund can also serve a role within a fixed income allocation, as convertibles have performed well during periods of rising interest rates and inflation.

| | |

| FUND NASDAQ SYMBOLS |

| |

A Shares | | CAGCX |

C Shares | | CCGCX |

| |

I Shares | | CXGCX |

| |

|

| FUND CUSIP NUMBERS |

| |

A Shares | | 128120748 |

C Shares | | 128120730 |

| |

I Shares | | 128120722 |

| |

Calamos Global Convertible Fund

| | | | |

| SECTOR WEIGHTINGS | | | |

| |

Information Technology | | | 27.3 | % |

Financials | | | 12.7 | |

| |

Communication Services | | | 10.3 | |

Consumer Discretionary | | | 10.0 | |

| |

Health Care | | | 8.0 | |

Energy | | | 4.5 | |

| |

Industrials | | | 3.8 | |

Materials | | | 3.7 | |

| |

Consumer Staples | | | 3.2 | |

Real Estate | | | 3.1 | |

| |

Utilities | | | 2.8 | |

| | | | | |

Sector weightings are subject to change daily and are calculated as a percentage of net assets. The table excludes cash or cash equivalents, any government/sovereign bonds or broad based index hedging securities the Fund may hold.

Information Technology. An overweight allocation and security selection in information technology was also supportive to period results. Selection in application software outperformed, and the portfolio benefited from a relatively heavy weight to the strong-performing internet services & infrastructure industry.

Economic Sector Detractors

Consumer Discretionary. Security selection in consumer discretionary detracted from the Fund’s period return. Holdings in the automobile manufacturers and the apparel, accessories & luxury goods industries lagged.

Real Estate. Security selection in real estate also hindered the12-month result. The portfolio held a relatively heavy allocation to the underperforming real estate operating companies industry and selection in this area was also disappointing.

Geographic Influences

Regionally, the best performance within the Thomson Reuters Global Convertible Bond Index occurred in Emerging Europe & South Africa, the U.S. and Emerging Latin America. Canada, Europe and Japan saw lackluster period results. A heavier positioning and security selection within the U.S. added value, as did an underweight allocation to Europe and security selection in Emerging Asia. Conversely, an underweight allocation and selection in emerging Latin America held back the period result.

How is the Fund positioned?

The volatility that arose during the period provided opportunities to rebalance the portfolio. We were able to reduce convertibles that had become overly equity sensitive with convertibles offering improved risk/reward attributes. We continue to believe that balanced convertibles offer the most attractive opportunity, given their combination of upside potential and downside protection, and have positioned the portfolio accordingly.

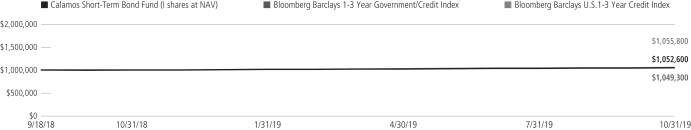

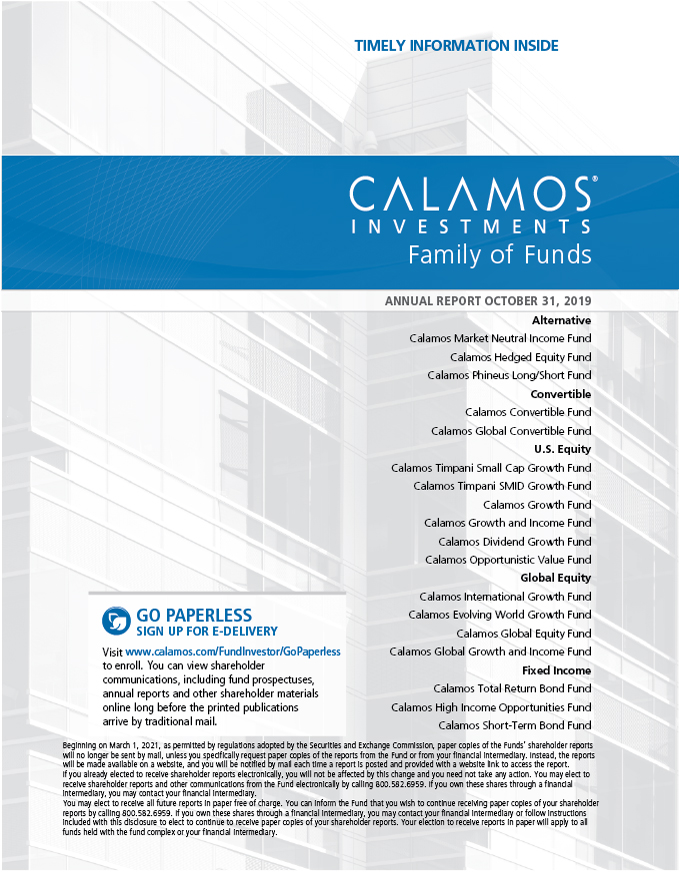

From a sector standpoint, information technology and communication services represent the largest weights, while utilities and industrials represent the smallest weights. Within the information technology sector, we are seeing the best opportunities in application software (especially cloud-based technologies) as well as semiconductors. In communication services, we have favored companies specializing in interactive media and cable and satellite. In industrials, we have utilized synthetic convertible structures in aerospace where we have partnered LEAPs with U.S. Treasury notes. Consumer staples represents a very small allocation within the convertible market. Relative to the Thomson Reuters Global Convertible Bond Index, the largest overweight allocations are information technology and financials, while industrials and health care represent the most significant underweights.