Exhibit 99.1 Business Update October 30, 2019

Forward-Looking Statements Statements contained in this presentation about future performance, including, without limitation, operating results, capital expenditures, rate base growth, dividend policy, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results include, but are not limited to the: • ability of SCE to recover its costs through regulated rates, including costs related to uninsured wildfire-related and mudslide-related liabilities and costs incurred to prevent future wildfires; • ability to obtain sufficient insurance at a reasonable cost, including insurance relating to SCE's nuclear facilities and wildfire-related claims, and to recover the costs of such insurance or, in the event liabilities exceed insured amounts, the ability to recover uninsured losses from customers or other parties; • risks associated with AB 1054 effectively mitigating the significant risk faced by California investor-owned utilities related to liability for damages arising from catastrophic wildfires where utility facilities are a substantial cause, including SCE's ability to maintain a valid safety certification, SCE's ability to recover uninsured wildfire-related costs from the Wildfire Insurance Fund, the longevity of the Wildfire Insurance Fund, and the CPUC's interpretation of and actions under AB 1054; • ability of SCE to implement its WMP, including effectively implementing Public Safety Power Shut-Offs when appropriate; • decisions and other actions by the CPUC, the FERC, the NRC and other regulatory and legislative authorities, including decisions and actions related to determinations of authorized rates of return or return on equity, the recoverability of wildfire-related and mudslide-related costs, wildfire mitigation efforts, and delays in regulatory and legislative actions; • ability of Edison International or SCE to borrow funds and access the bank and capital markets on reasonable terms; • actions by credit rating agencies to downgrade Edison International or SCE's credit ratings or to place those ratings on negative watch or outlook; • risks associated with the decommissioning of San Onofre, including those related to public opposition, permitting, governmental approvals, on-site storage of spent nuclear fuel, delays, contractual disputes, and cost overruns; • extreme weather-related incidents and other natural disasters (including earthquakes and events caused, or exacerbated, by climate change, such as wildfires), which could cause, among other things, public safety issues, property damage and operational issues; • risks associated with cost allocation resulting in higher rates for utility bundled service customers because of possible customer bypass or departure for other electricity providers such as CCAs and Electric Service Providers; • risks inherent in SCE's transmission and distribution infrastructure investment program, including those related to project site identification, public opposition, environmental mitigation, construction, permitting, power curtailment costs (payments due under power contracts in the event there is insufficient transmission to enable acceptance of power delivery), changes in the CAISO's transmission plans, and governmental approvals; and • risks associated with the operation of transmission and distribution assets and power generating facilities, including public and employee safety issues, the risk of utility assets causing or contributing to wildfires, failure, availability, efficiency, and output of equipment and facilities, and availability and cost of spare parts. Other important factors are discussed under the headings “Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. October 30, 2019 1

Table of Contents Updated (U) or New (N) from July 2019 Business Page Update EIX Shareholder Value 3 U SCE Highlights, SCE Long-Term Growth Drivers 4-5 U Capital Expenditures and Rate Base History and Forecast 6-9 N,U California’s GHG Emissions Overview, SCE’s Pathway 2045 Highlights 10-11 N,U 2019 Wildfire Legislation Update, Wildfire Risk and Mitigation Summaries 12-14 U Key Regulatory Proceedings 15 U 2021 General Rate Case Overview and Timeline 16-17 N CPUC and FERC Cost of Capital Summary 18 U CPUC Cost of Capital (2013-2019) 19 U Distribution and Transmission Capital Expenditure Detail 20-23 U Operational Excellence 24 U EIX Responding to Industry Change, Edison Energy Group Summary 25-26 U 2019 EIX Core Earnings Guidance 27 U Annual Dividends Per Share 28 Appendix EIX’s 2018 Sustainability Report Highlights 30 SCE Regulatory Framework 31 SCE Historical Capital Expenditures 32 Credit Ratings Summary 33 Power Grid of the Future 34 SCE Customer Demand Trends, Bundled Revenue Requirement, SAR Historical Growth, Rate and Bills Comparison 35-38 U CCA Overview, Residential Rate Reform and Other 39-42 U Third Quarter and YTD 2019 Earnings Summary, Results of Operations, Non-GAAP Reconciliations 43-49 N,U October 30, 2019 2

EIX Strategy Should Produce Long-Term Value Sustained Earnings and Dividend Electric-Led Clean Energy Future Growth Led by SCE SCE Rate Base Growth Drives Earnings EIX Vision • 7-8% average annual rate base • Lead transformation of the electric growth through 2023 power industry • SCE earnings expected to track rate • Focus on clean energy, efficient base growth over the long term electrification, grid of the future and customers’ technology choice Constructive Regulatory Structure Wires-Focused SCE Strategy • Decoupling of electricity sales • Infrastructure replacement – safety • Balancing accounts and reliability • Forward-looking ratemaking • Grid resiliency and safety Sustainable Dividend Growth • Grid modernization – California’s low- • Target payout ratio of 45-55% of SCE carbon goals earnings • Operational excellence Edison Energy Strategy • Services for large commercial and industrial customers October 30, 2019 3

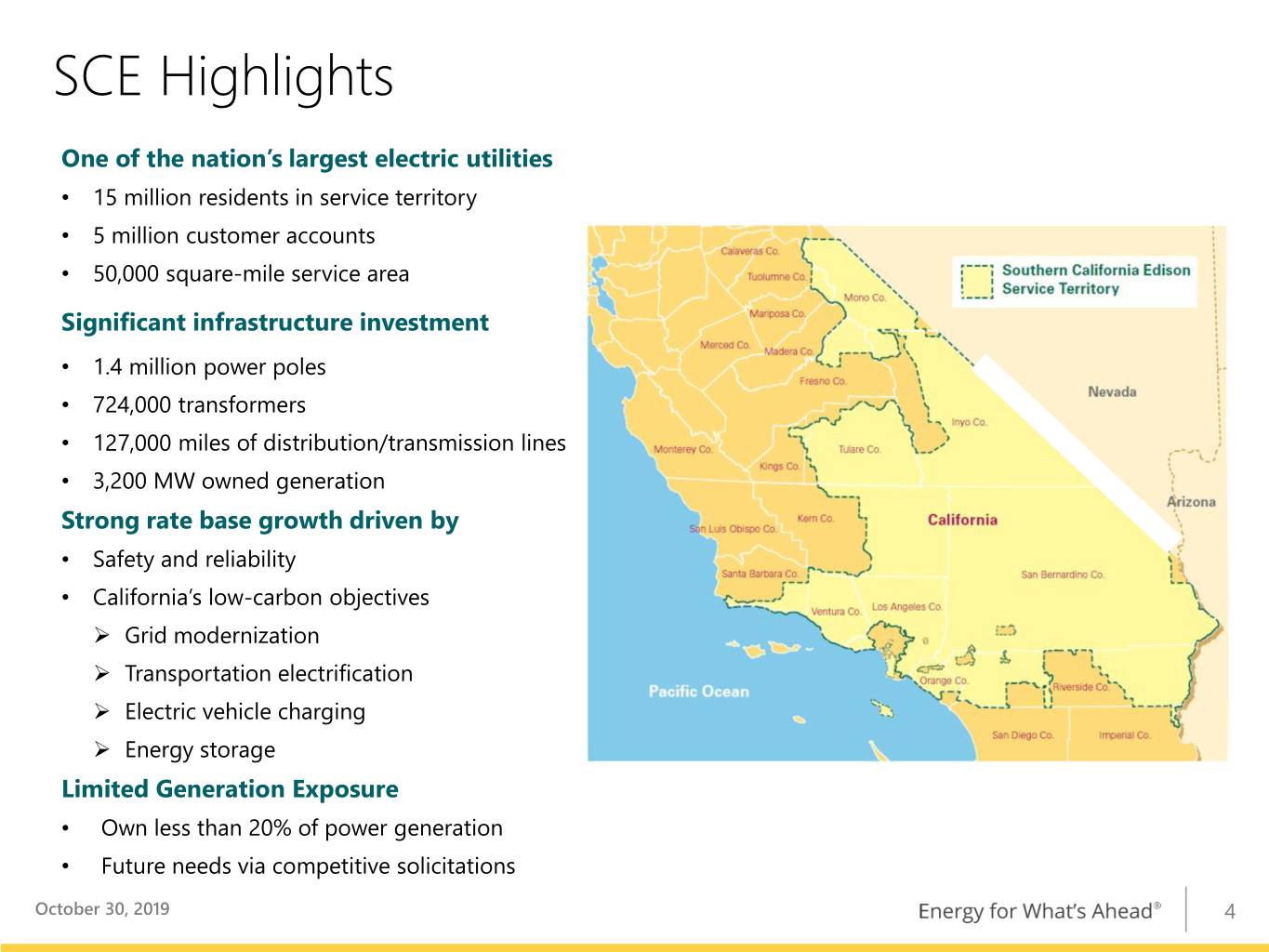

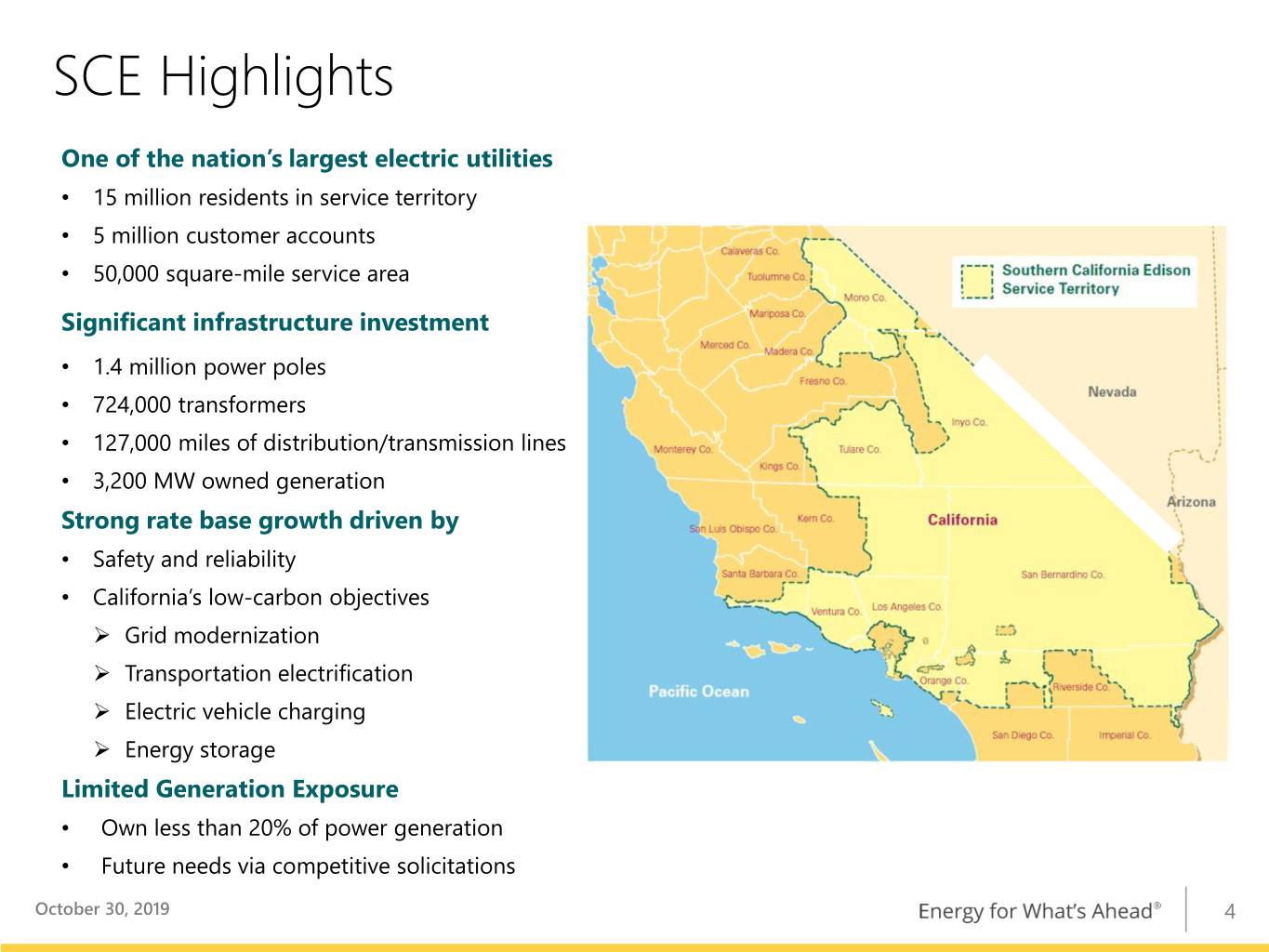

SCE Highlights One of the nation’s largest electric utilities • 15 million residents in service territory • 5 million customer accounts • 50,000 square-mile service area Significant infrastructure investment • 1.4 million power poles • 724,000 transformers • 127,000 miles of distribution/transmission lines • 3,200 MW owned generation Strong rate base growth driven by • Safety and reliability • California’s low-carbon objectives Grid modernization Transportation electrification Electric vehicle charging Energy storage Limited Generation Exposure • Own less than 20% of power generation • Future needs via competitive solicitations October 30, 2019 4

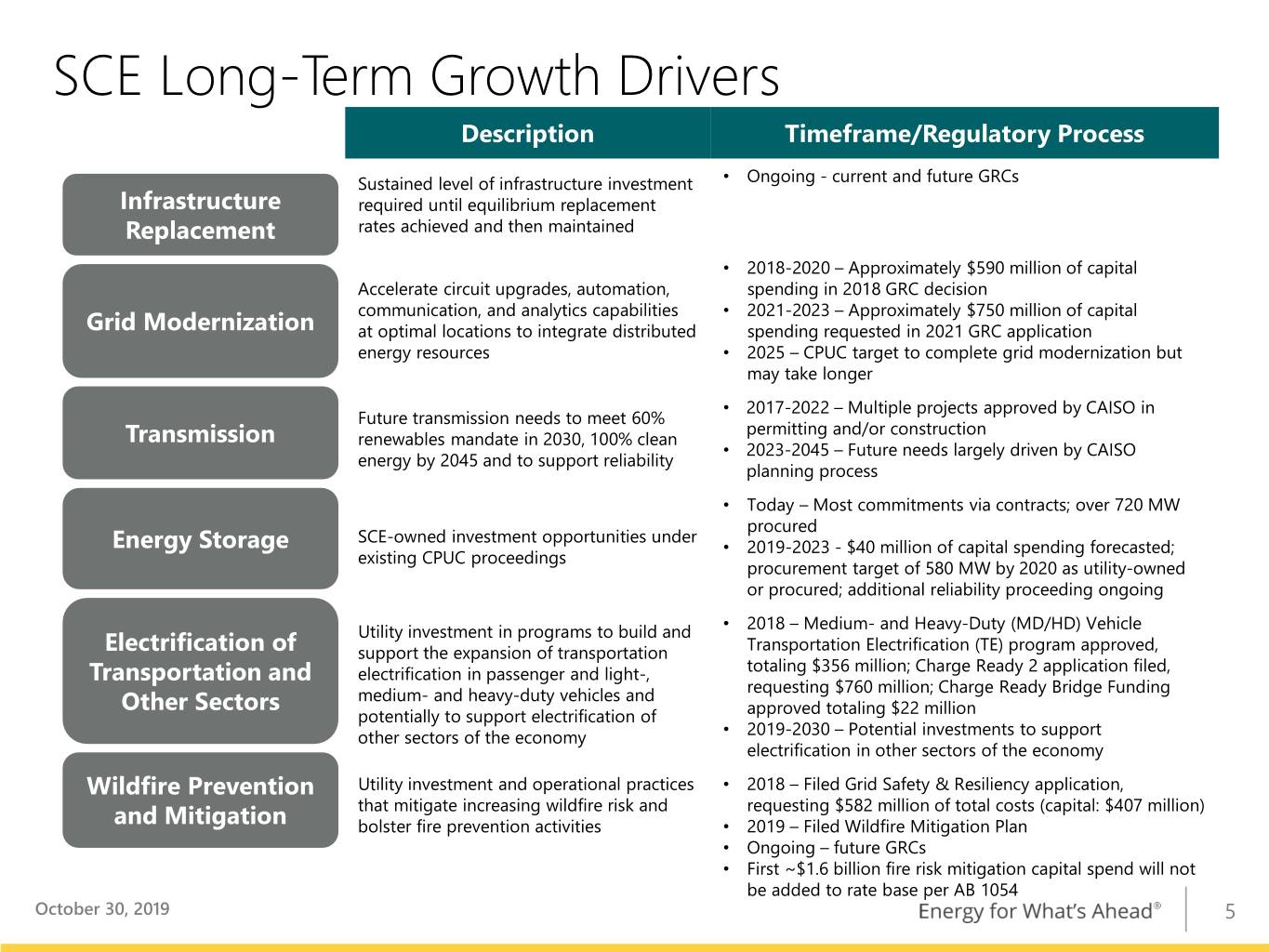

SCE Long-Term Growth Drivers Description Timeframe/Regulatory Process • Sustained level of infrastructure investment Ongoing - current and future GRCs Infrastructure required until equilibrium replacement Replacement rates achieved and then maintained • 2018-2020 – Approximately $590 million of capital Accelerate circuit upgrades, automation, spending in 2018 GRC decision communication, and analytics capabilities • 2021-2023 – Approximately $750 million of capital Grid Modernization at optimal locations to integrate distributed spending requested in 2021 GRC application energy resources • 2025 – CPUC target to complete grid modernization but may take longer • 2017-2022 – Multiple projects approved by CAISO in Future transmission needs to meet 60% permitting and/or construction Transmission renewables mandate in 2030, 100% clean • 2023-2045 – Future needs largely driven by CAISO energy by 2045 and to support reliability planning process • Today – Most commitments via contracts; over 720 MW procured SCE-owned investment opportunities under Energy Storage • 2019-2023 - $40 million of capital spending forecasted; existing CPUC proceedings procurement target of 580 MW by 2020 as utility-owned or procured; additional reliability proceeding ongoing • Utility investment in programs to build and 2018 – Medium- and Heavy-Duty (MD/HD) Vehicle Electrification of support the expansion of transportation Transportation Electrification (TE) program approved, Transportation and electrification in passenger and light-, totaling $356 million; Charge Ready 2 application filed, requesting $760 million; Charge Ready Bridge Funding Other Sectors medium- and heavy-duty vehicles and potentially to support electrification of approved totaling $22 million • other sectors of the economy 2019-2030 – Potential investments to support electrification in other sectors of the economy Wildfire Prevention Utility investment and operational practices • 2018 – Filed Grid Safety & Resiliency application, that mitigate increasing wildfire risk and requesting $582 million of total costs (capital: $407 million) and Mitigation bolster fire prevention activities • 2019 – Filed Wildfire Mitigation Plan • Ongoing – future GRCs • First ~$1.6 billion fire risk mitigation capital spend will not be added to rate base per AB 1054 October 30, 2019 5

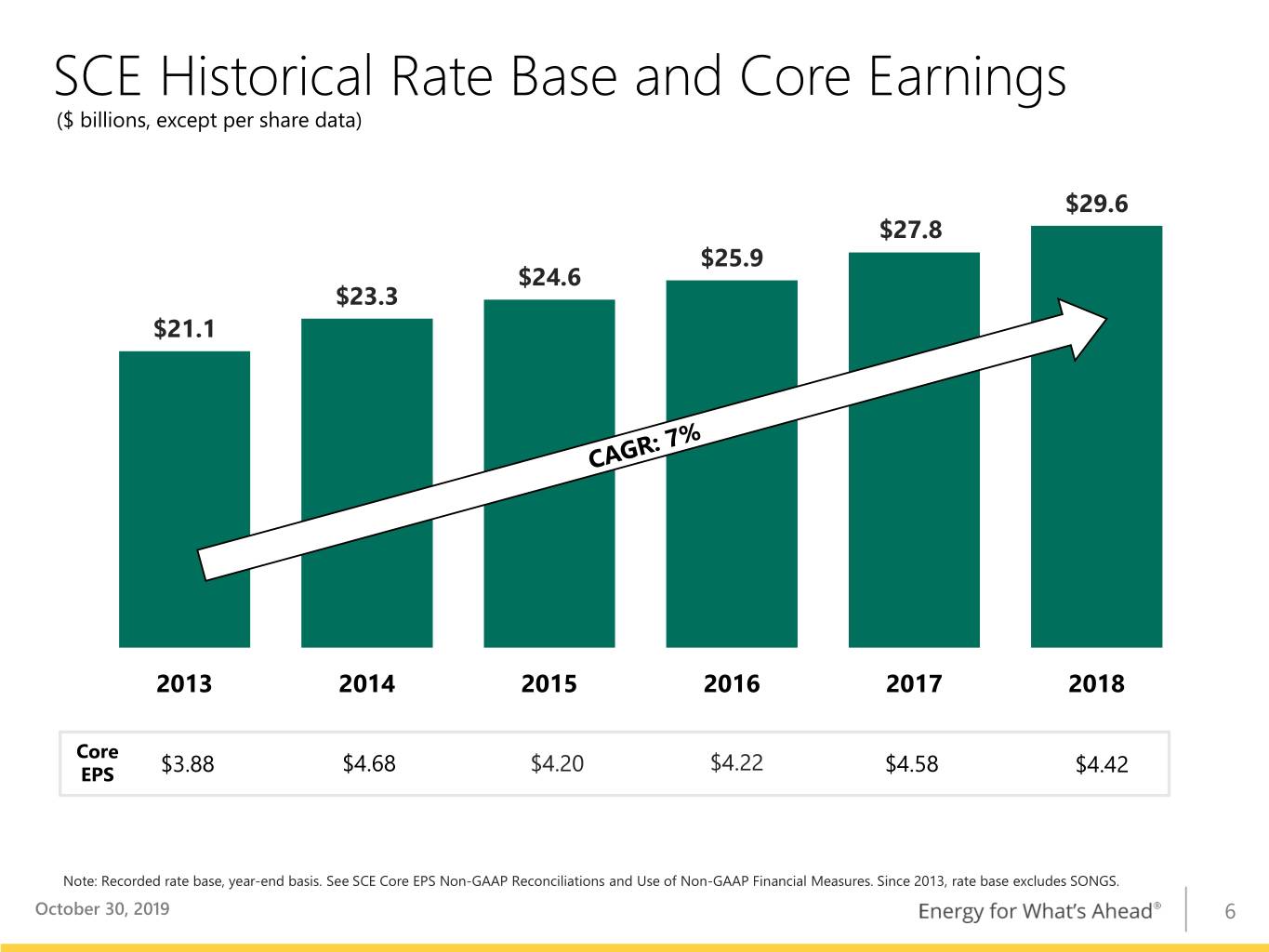

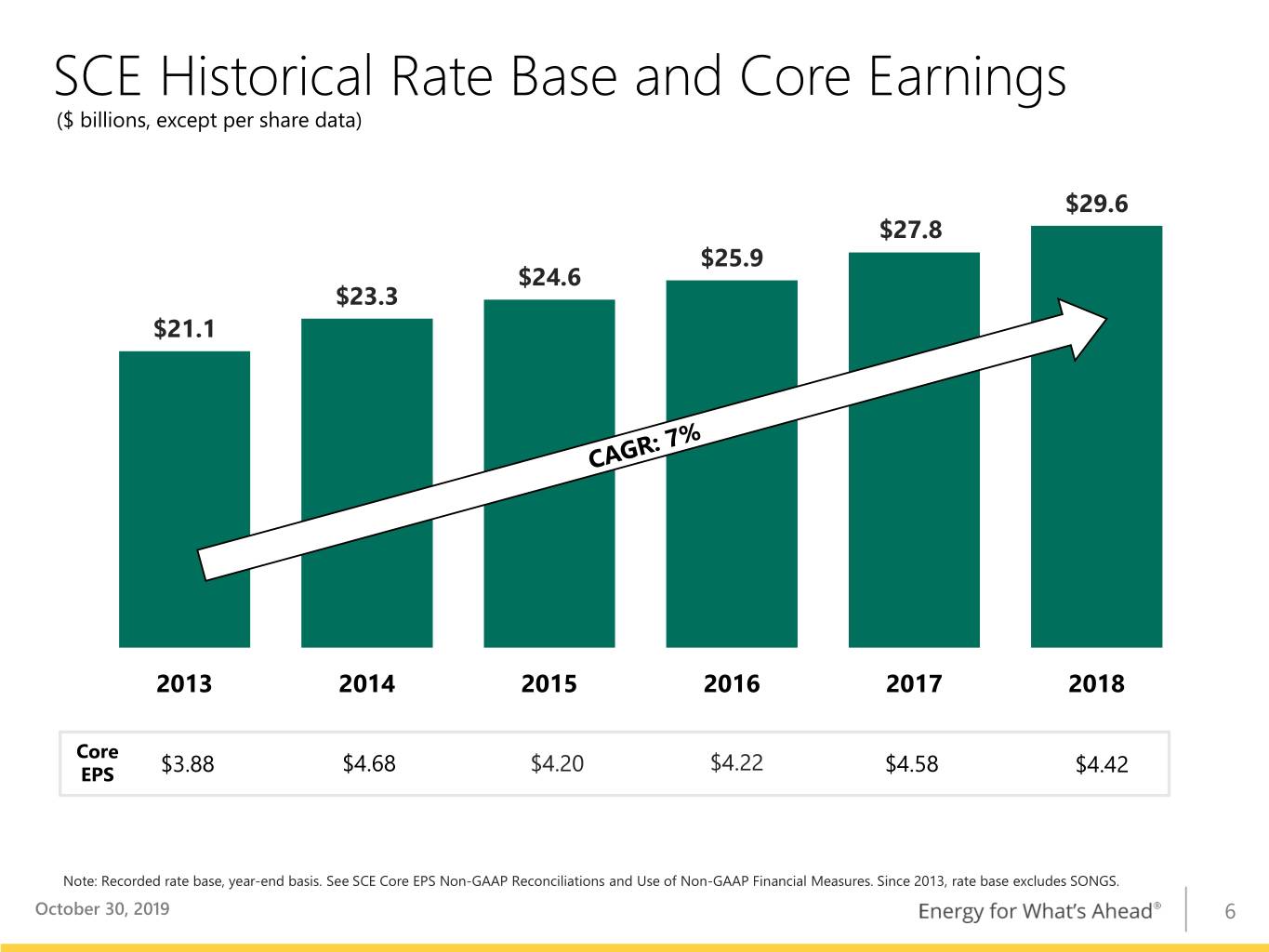

SCE Historical Rate Base and Core Earnings ($ billions, except per share data) $29.6 $27.8 $25.9 $24.6 $23.3 $21.1 2013 2014 2015 2016 2017 2018 Core $4.22 EPS $3.88 $4.68 $4.20 $4.58 $4.42 Note: Recorded rate base, year-end basis. See SCE Core EPS Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures. Since 2013, rate base excludes SONGS. October 30, 2019 6

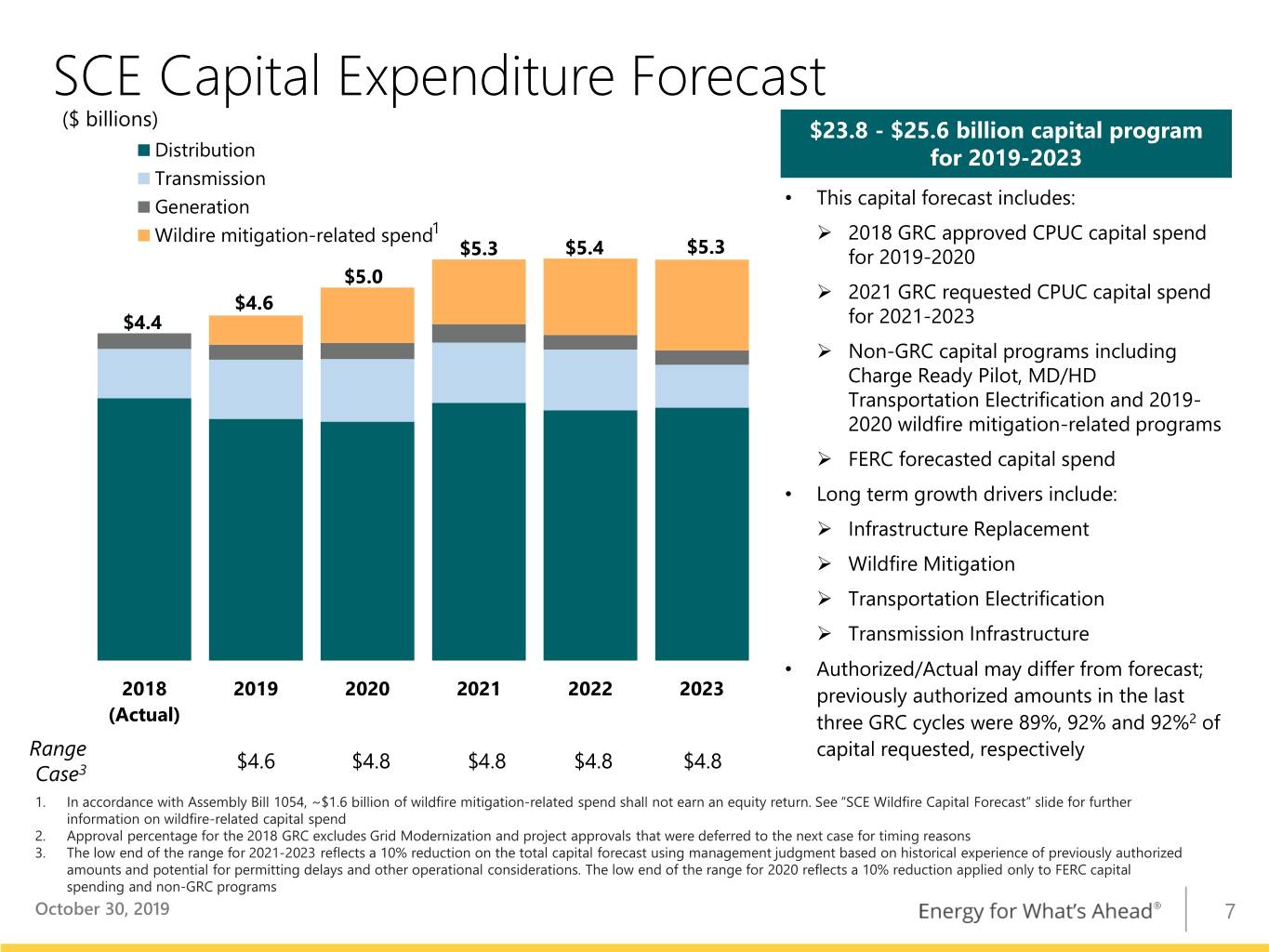

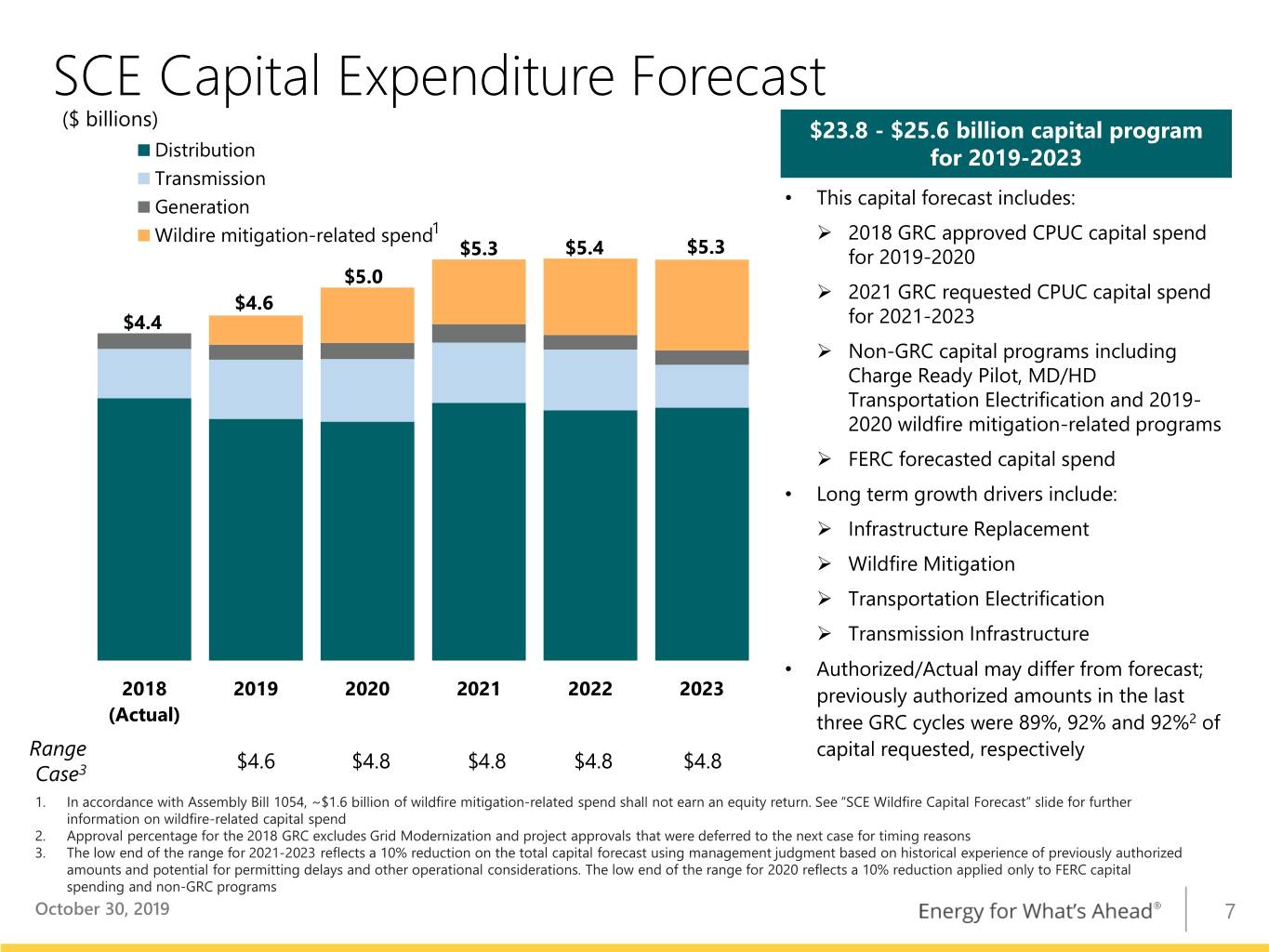

SCE Capital Expenditure Forecast ($ billions) $23.8 - $25.6 billion capital program Distribution for 2019-2023 Transmission • Generation This capital forecast includes: Wildire mitigation-related spend1 2018 GRC approved CPUC capital spend $5.3 $5.4 $5.3 for 2019-2020 $5.0 2021 GRC requested CPUC capital spend $4.6 $4.4 for 2021-2023 Non-GRC capital programs including Charge Ready Pilot, MD/HD Transportation Electrification and 2019- 2020 wildfire mitigation-related programs FERC forecasted capital spend • Long term growth drivers include: Infrastructure Replacement Wildfire Mitigation Transportation Electrification Transmission Infrastructure • Authorized/Actual may differ from forecast; 2018 2019 2020 2021 2022 2023 previously authorized amounts in the last (Actual) three GRC cycles were 89%, 92% and 92%2 of Range capital requested, respectively Case3 $4.6 $4.8 $4.8 $4.8 $4.8 1. In accordance with Assembly Bill 1054, ~$1.6 billion of wildfire mitigation-related spend shall not earn an equity return. See “SCE Wildfire Capital Forecast” slide for further information on wildfire-related capital spend 2. Approval percentage for the 2018 GRC excludes Grid Modernization and project approvals that were deferred to the next case for timing reasons 3. The low end of the range for 2021-2023 reflects a 10% reduction on the total capital forecast using management judgment based on historical experience of previously authorized amounts and potential for permitting delays and other operational considerations. The low end of the range for 2020 reflects a 10% reduction applied only to FERC capital spending and non-GRC programs October 30, 2019 7

SCE Rate Base Forecast ($ billions) $40.8 $38.2 $36.0 $33.4 $30.7 $28.5 $26.2 Range Case 1 CAGR 2017 2018 2019 2020 2021 2022 2023 Range 6.9% Case2 $30.7 $33.2 $35.3 $36.9 $39.0 1. Morongo Transmission holds an option to invest up to $400 million in the West of Devers Transmission Project, or half of the estimated cost of the transmission facilities only, at the in-service date, estimated to be 2021. In the table above, the rate base has been reduced to reflect this option. Capital forecast includes 100% of the project spend 2. Rate base forecast range case reflects capital expenditure forecast range Note: Weighted-average year basis. FERC based on latest forecast and represents approximately 20% of total rate base throughout the forecast period. CPUC excludes the ~$1.6 billion of SCE’s fire risk mitigation capital expenditures in accordance with Assembly Bill 1054. CPUC also excludes the “rate-base offset” adjustment related to the 2015 GRC write off of the regulatory asset for 2012-2014 incremental tax repairs and rate base associated with projects or programs that have not yet been approved. October 30, 2019 8

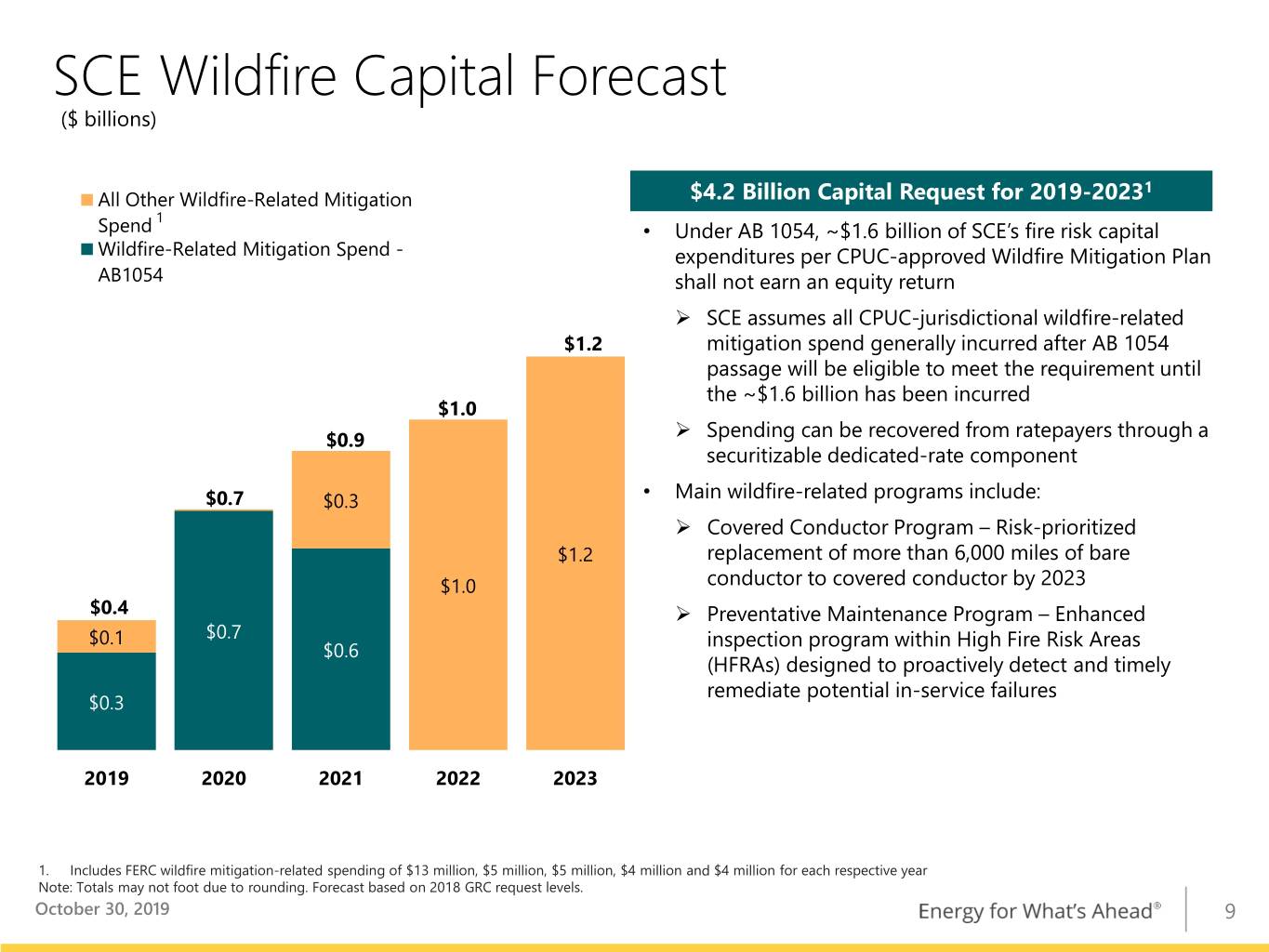

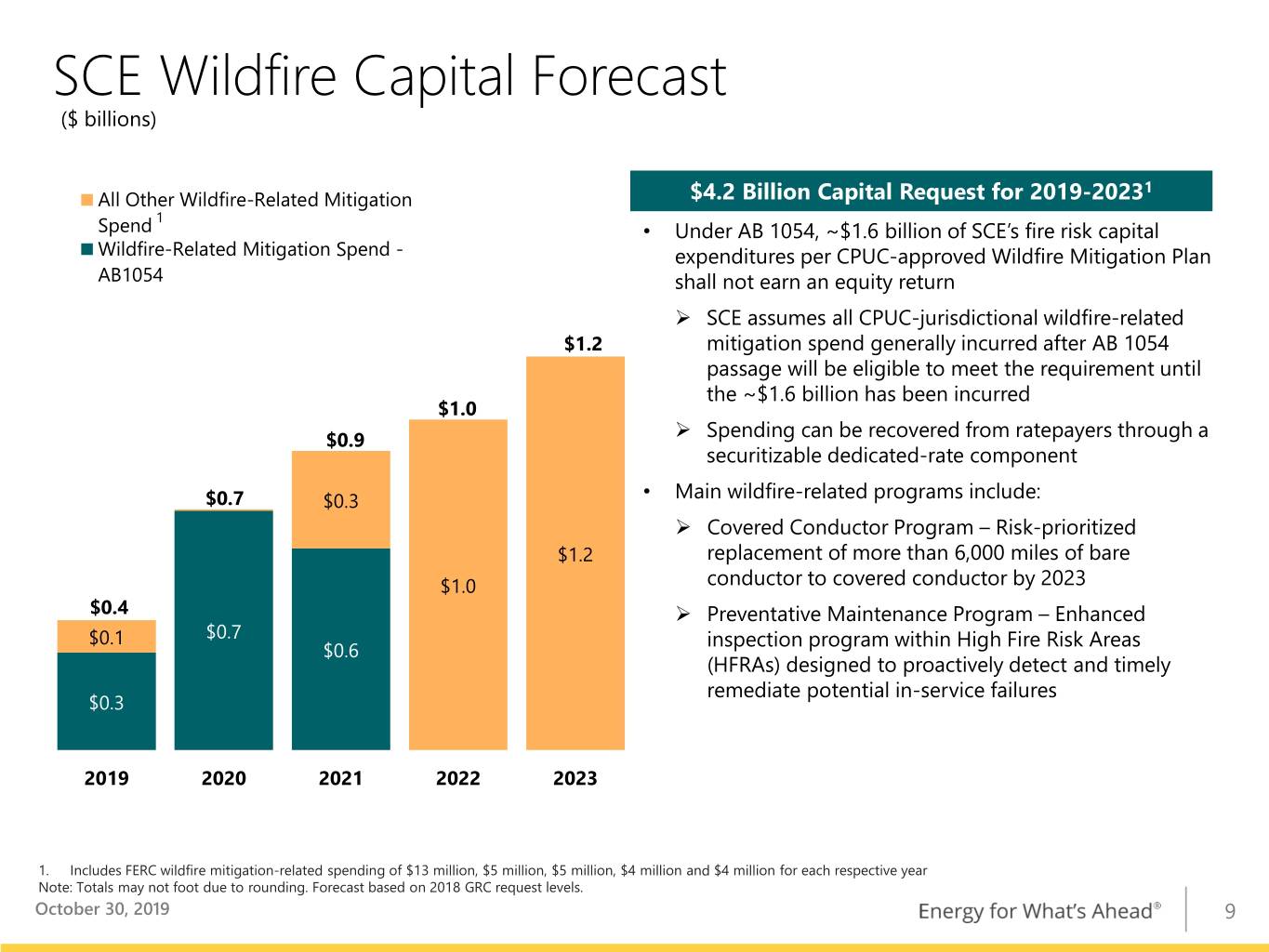

SCE Wildfire Capital Forecast ($ billions) 1 All Other Wildfire-Related Mitigation $4.2 Billion Capital Request for 2019-2023 1 Spend • Under AB 1054, ~$1.6 billion of SCE’s fire risk capital Wildfire-Related Mitigation Spend - expenditures per CPUC-approved Wildfire Mitigation Plan AB1054 shall not earn an equity return SCE assumes all CPUC-jurisdictional wildfire-related $1.2 mitigation spend generally incurred after AB 1054 passage will be eligible to meet the requirement until the ~$1.6 billion has been incurred $1.0 $0.9 Spending can be recovered from ratepayers through a securitizable dedicated-rate component • $0.7 $0.3 Main wildfire-related programs include: Covered Conductor Program – Risk-prioritized $1.2 replacement of more than 6,000 miles of bare $1.0 conductor to covered conductor by 2023 $0.4 Preventative Maintenance Program – Enhanced $0.1 $0.7 inspection program within High Fire Risk Areas $0.6 (HFRAs) designed to proactively detect and timely remediate potential in-service failures $0.3 2019 2020 2021 2022 2023 1. Includes FERC wildfire mitigation-related spending of $13 million, $5 million, $5 million, $4 million and $4 million for each respective year Note: Totals may not foot due to rounding. Forecast based on 2018 GRC request levels. October 30, 2019 9

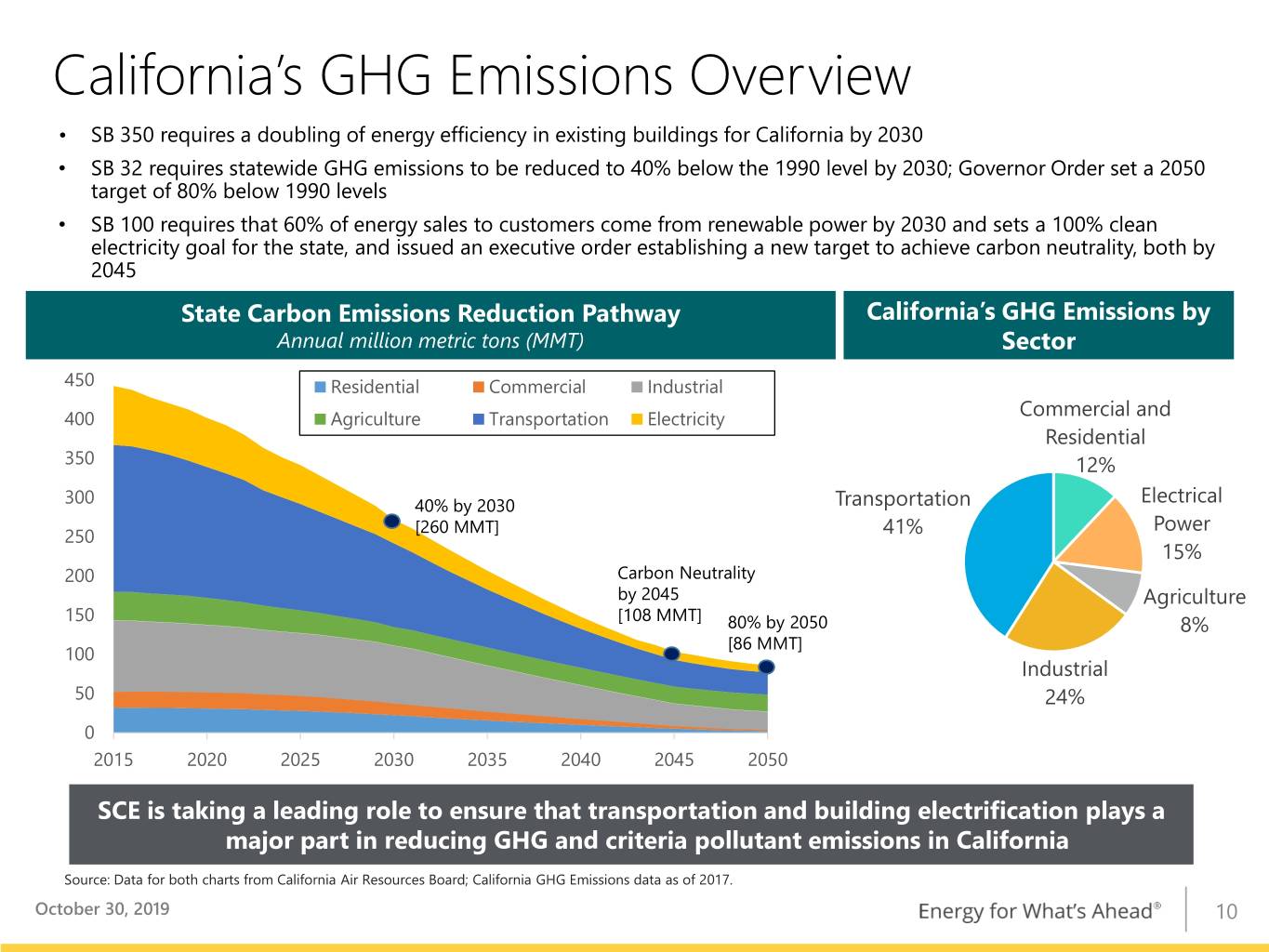

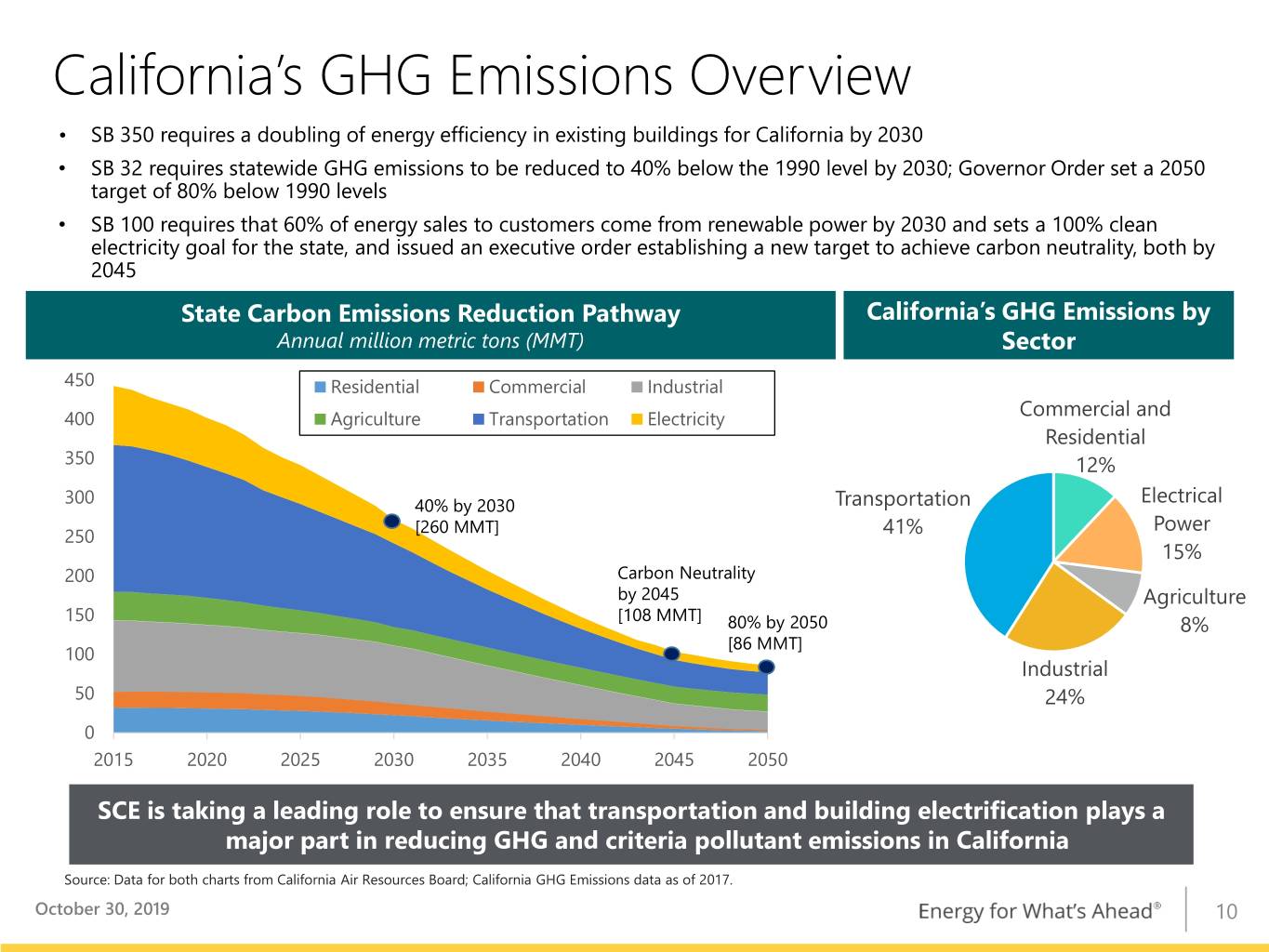

California’s GHG Emissions Overview • SB 350 requires a doubling of energy efficiency in existing buildings for California by 2030 • SB 32 requires statewide GHG emissions to be reduced to 40% below the 1990 level by 2030; Governor Order set a 2050 target of 80% below 1990 levels • SB 100 requires that 60% of energy sales to customers come from renewable power by 2030 and sets a 100% clean electricity goal for the state, and issued an executive order establishing a new target to achieve carbon neutrality, both by 2045 State Carbon Emissions Reduction Pathway California’s GHG Emissions by Annual million metric tons (MMT) Sector 450 Residential Commercial Industrial 400 Agriculture Transportation Electricity Commercial and Residential 350 12% 300 40% by 2030 Transportation Electrical [260 MMT] Power 250 41% 15% 200 Carbon Neutrality by 2045 Agriculture 150 [108 MMT] 80% by 2050 8% [86 MMT] 100 Industrial 50 24% 0 2015 2020 2025 2030 2035 2040 2045 2050 SCE is taking a leading role to ensure that transportation and building electrification plays a major part in reducing GHG and criteria pollutant emissions in California Source: Data for both charts from California Air Resources Board; California GHG Emissions data as of 2017. October 30, 2019 10

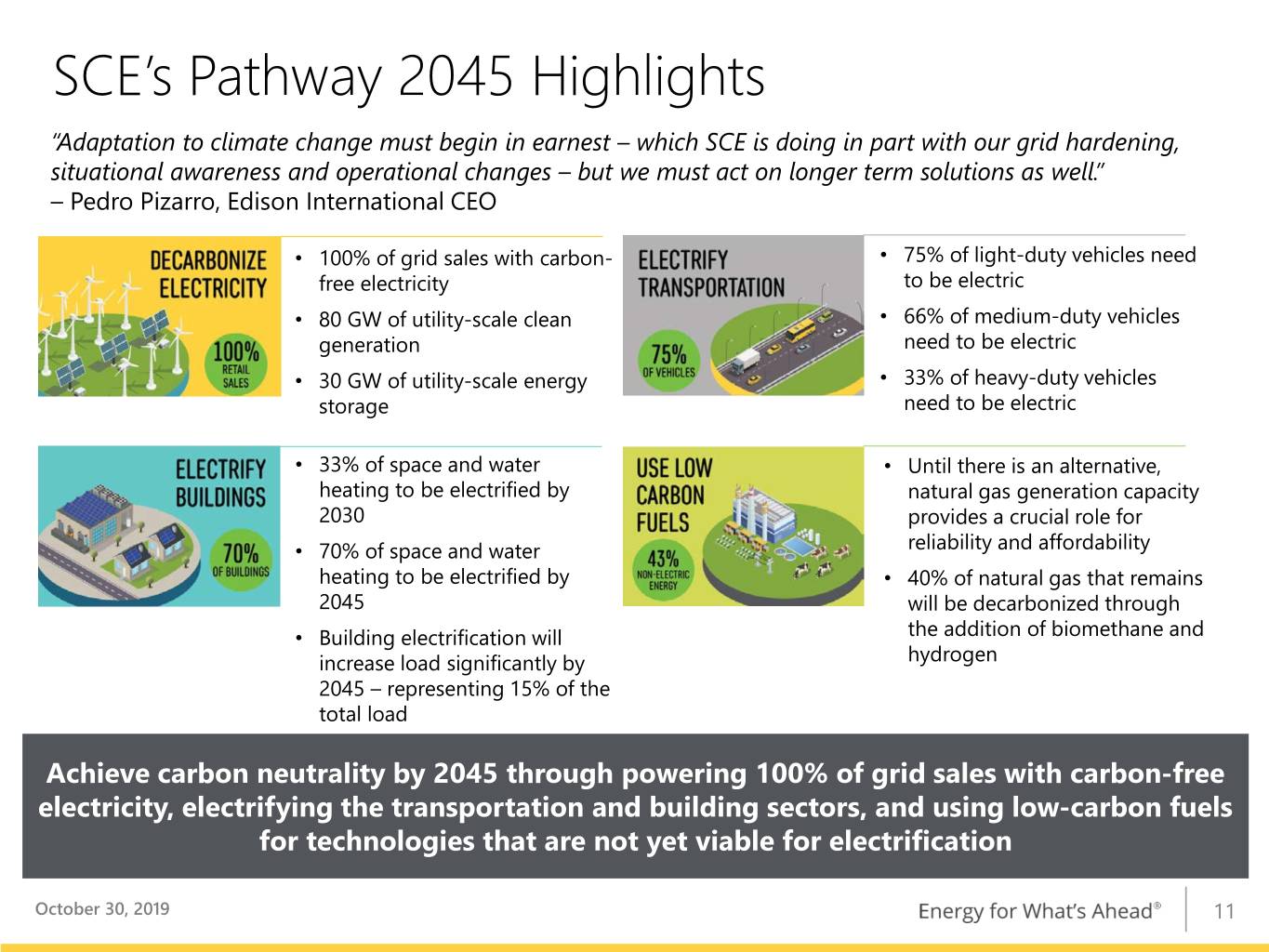

SCE’s Pathway 2045 Highlights “Adaptation to climate change must begin in earnest – which SCE is doing in part with our grid hardening, situational awareness and operational changes – but we must act on longer term solutions as well.” – Pedro Pizarro, Edison International CEO • 100% of grid sales with carbon- • 75% of light-duty vehicles need free electricity to be electric • 80 GW of utility-scale clean • 66% of medium-duty vehicles generation need to be electric • 30 GW of utility-scale energy • 33% of heavy-duty vehicles storage need to be electric • 33% of space and water • Until there is an alternative, heating to be electrified by natural gas generation capacity 2030 provides a crucial role for • 70% of space and water reliability and affordability heating to be electrified by • 40% of natural gas that remains 2045 will be decarbonized through • Building electrification will the addition of biomethane and increase load significantly by hydrogen 2045 – representing 15% of the total load Achieve carbon neutrality by 2045 through powering 100% of grid sales with carbon-free electricity, electrifying the transportation and building sectors, and using low-carbon fuels for technologies that are not yet viable for electrification October 30, 2019 11

2019 Wildfire Legislation Update Summary of Assembly Bill 1054 and Assembly Bill 111 Safety • Creates Wildfire Safety Division1 to provide additional wildfire safety oversight Oversight • Initial safety certification issued by CPUC Executive Director within 30 days of IOU request requires: 1) an approved wildfire and mitigation plan; 2) utility to be in good safety standing; 3) established board safety committee with relevant safety experience; Certification and 4) board-level reporting to the CPUC on safety issues • Subsequent annual safety certifications issued by Wildfire Safety Division1 also require: 5) approved executive compensation structure that promotes safety, ensures public safety and utility financial stability; 6) compensation limits on executive officer contracts; and 7) implementation of, and reporting to the CPUC on wildfire mitigation plans, safety culture assessments and board safety committee recommendations Cost • Provided a utility is “safety certified” and elects to participate in the wildfire “insurance” fund (described below), establishes a Recovery FERC-like prudence standard to guide recovery of costs arising from catastrophic wildfires occurring after bill enactment Standard • Prudence is based on reasonable utility conduct with potential for full or partial recovery, considering factors within and beyond a utility’s control • FERC-like standard assumes utility is prudent, unless intervenors create serious doubt, shifting burden to the utility to prove prudence Wildfire • Establishes a wildfire fund to help wildfire victims and affected communities recover and rebuild more quickly Fund • Wildfire “insurance” fund is an insurance-like fund that more broadly socializes wildfire costs; utilities participation is voluntary • Fund includes a $10.5 billion ratepayer contribution through the financing of a 15-year extension of the Department of Water Resources bond charge; wildfire insurance fund also includes $10.5 billion contribution from utility shareholders • All three IOUs have elected to participate. PG&E must emerge from bankruptcy by June 30, 2020 to participate SCE’s shareholders initially contributed approximately $2.4 billion on September 10 and expect to contribute approximately $95 million annually on January 1 for 10 years2 Mitigation • First $1.6 billion of SCE’s fire risk mitigation capital expenditures as approved in wildfire mitigation plans shall not earn an equity CapEx return, but can be recovered from ratepayers through a securitizable dedicated rate component2 Liability Cap • While fund remains solvent, wildfire cost disallowances capped over each trailing 3-year period to 20% of T&D equity rate base • Must be safety certified and not found to be acting with willful or conscious disregard of the safety of others 1. Wildfire Safety Division created within CPUC until duties transferred to newly formed Office of Energy Infrastructure Safety on or after July 2021 2. Excluded from measurement of regulatory capital structure October 30, 2019 12

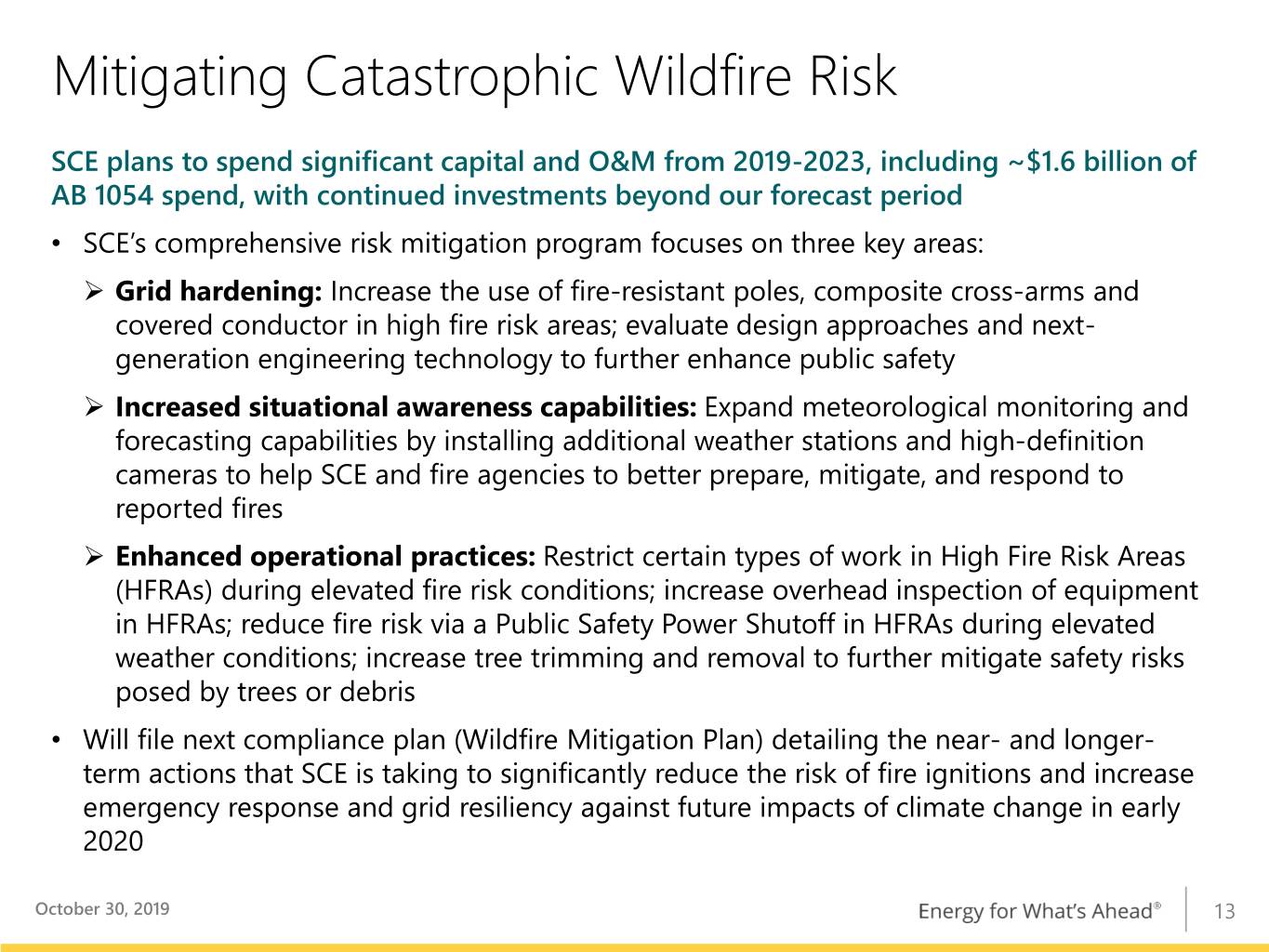

Mitigating Catastrophic Wildfire Risk SCE plans to spend significant capital and O&M from 2019-2023, including ~$1.6 billion of AB 1054 spend, with continued investments beyond our forecast period • SCE’s comprehensive risk mitigation program focuses on three key areas: Grid hardening: Increase the use of fire-resistant poles, composite cross-arms and covered conductor in high fire risk areas; evaluate design approaches and next- generation engineering technology to further enhance public safety Increased situational awareness capabilities: Expand meteorological monitoring and forecasting capabilities by installing additional weather stations and high-definition cameras to help SCE and fire agencies to better prepare, mitigate, and respond to reported fires Enhanced operational practices: Restrict certain types of work in High Fire Risk Areas (HFRAs) during elevated fire risk conditions; increase overhead inspection of equipment in HFRAs; reduce fire risk via a Public Safety Power Shutoff in HFRAs during elevated weather conditions; increase tree trimming and removal to further mitigate safety risks posed by trees or debris • Will file next compliance plan (Wildfire Mitigation Plan) detailing the near- and longer- term actions that SCE is taking to significantly reduce the risk of fire ignitions and increase emergency response and grid resiliency against future impacts of climate change in early 2020 October 30, 2019 13

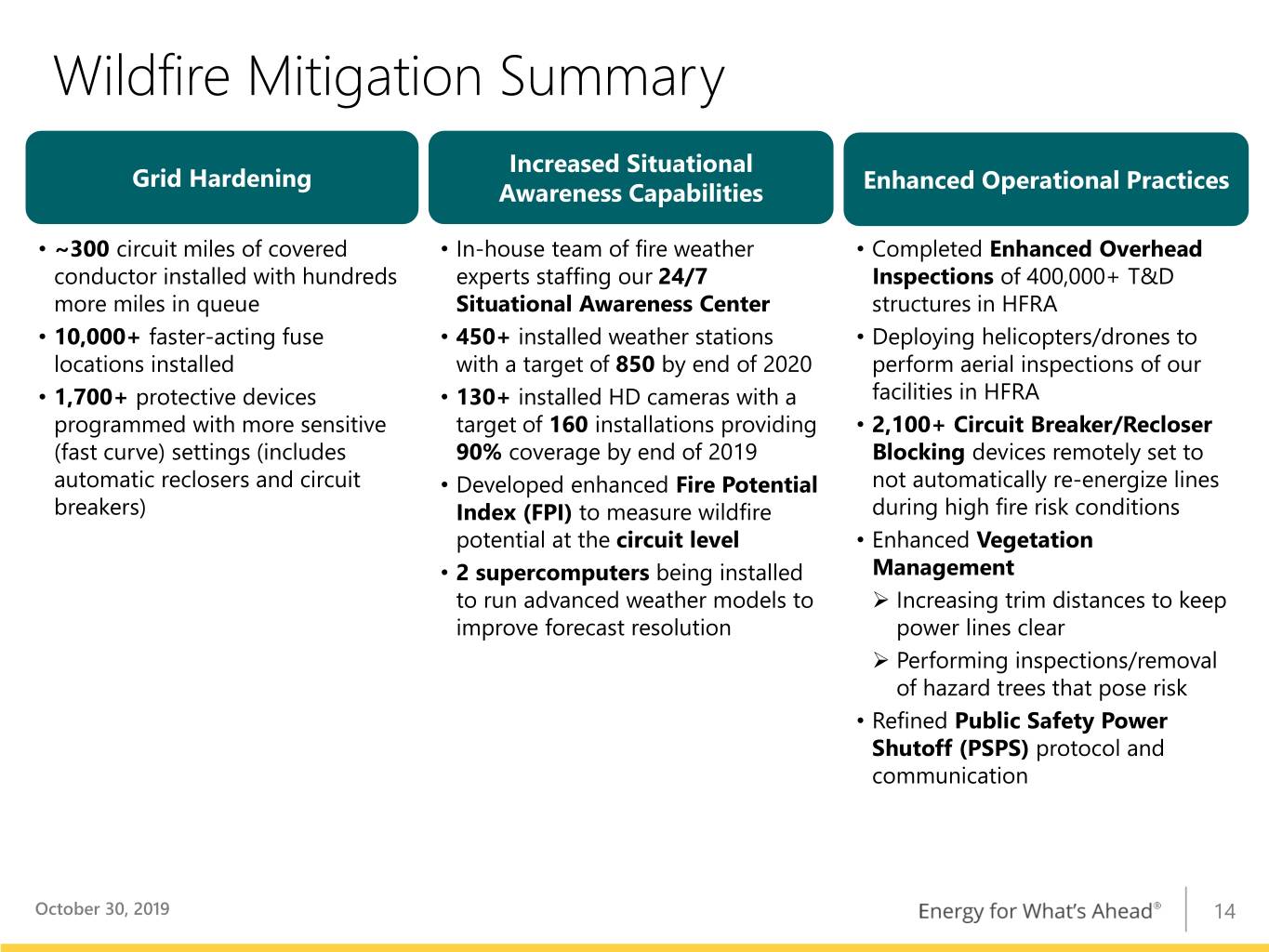

Wildfire Mitigation Summary Increased Situational Grid Hardening Enhanced Operational Practices Awareness Capabilities • ~300 circuit miles of covered • In-house team of fire weather • Completed Enhanced Overhead conductor installed with hundreds experts staffing our 24/7 Inspections of 400,000+ T&D more miles in queue Situational Awareness Center structures in HFRA • 10,000+ faster-acting fuse • 450+ installed weather stations • Deploying helicopters/drones to locations installed with a target of 850 by end of 2020 perform aerial inspections of our • 1,700+ protective devices • 130+ installed HD cameras with a facilities in HFRA programmed with more sensitive target of 160 installations providing • 2,100+ Circuit Breaker/Recloser (fast curve) settings (includes 90% coverage by end of 2019 Blocking devices remotely set to automatic reclosers and circuit • Developed enhanced Fire Potential not automatically re-energize lines breakers) Index (FPI) to measure wildfire during high fire risk conditions potential at the circuit level • Enhanced Vegetation • 2 supercomputers being installed Management to run advanced weather models to Increasing trim distances to keep improve forecast resolution power lines clear Performing inspections/removal of hazard trees that pose risk • Refined Public Safety Power Shutoff (PSPS) protocol and communication October 30, 2019 14

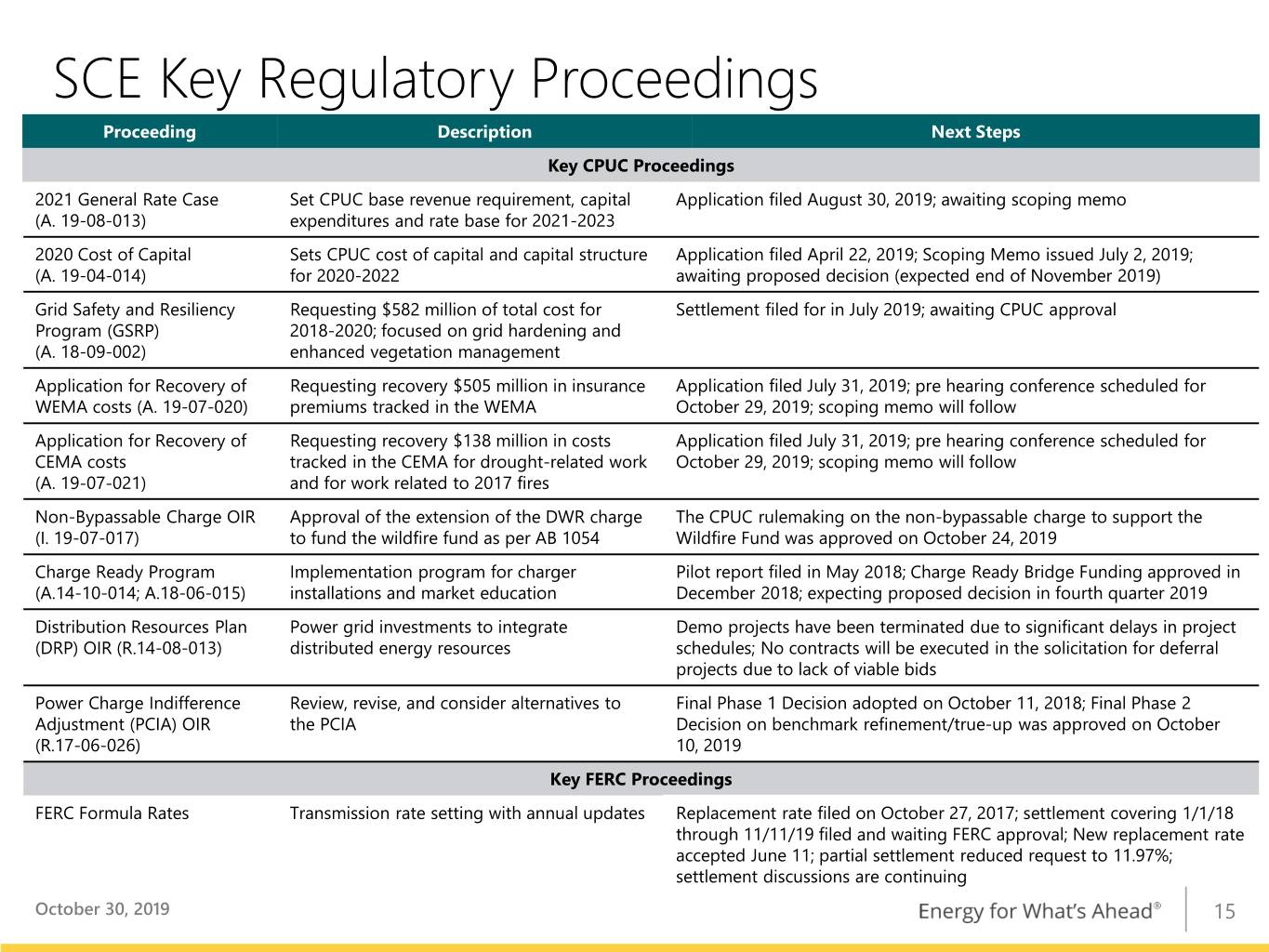

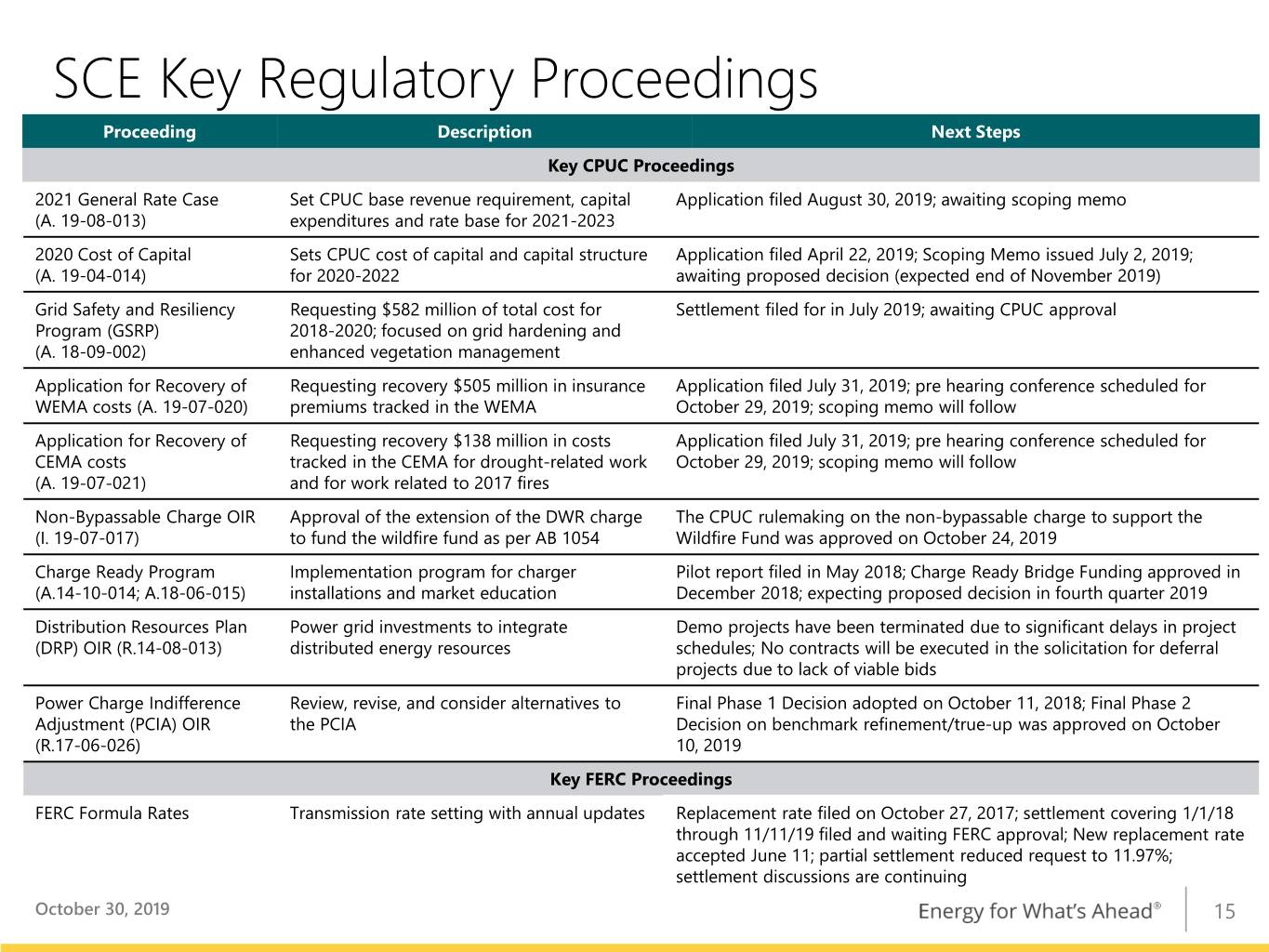

SCE Key Regulatory Proceedings Proceeding Description Next Steps Key CPUC Proceedings 2021 General Rate Case Set CPUC base revenue requirement, capital Application filed August 30, 2019; awaiting scoping memo (A. 19-08-013) expenditures and rate base for 2021-2023 2020 Cost of Capital Sets CPUC cost of capital and capital structure Application filed April 22, 2019; Scoping Memo issued July 2, 2019; (A. 19-04-014) for 2020-2022 awaiting proposed decision (expected end of November 2019) Grid Safety and Resiliency Requesting $582 million of total cost for Settlement filed for in July 2019; awaiting CPUC approval Program (GSRP) 2018-2020; focused on grid hardening and (A. 18-09-002) enhanced vegetation management Application for Recovery of Requesting recovery $505 million in insurance Application filed July 31, 2019; pre hearing conference scheduled for WEMA costs (A. 19-07-020) premiums tracked in the WEMA October 29, 2019; scoping memo will follow Application for Recovery of Requesting recovery $138 million in costs Application filed July 31, 2019; pre hearing conference scheduled for CEMA costs tracked in the CEMA for drought-related work October 29, 2019; scoping memo will follow (A. 19-07-021) and for work related to 2017 fires Non-Bypassable Charge OIR Approval of the extension of the DWR charge The CPUC rulemaking on the non-bypassable charge to support the (I. 19-07-017) to fund the wildfire fund as per AB 1054 Wildfire Fund was approved on October 24, 2019 Charge Ready Program Implementation program for charger Pilot report filed in May 2018; Charge Ready Bridge Funding approved in (A.14-10-014; A.18-06-015) installations and market education December 2018; expecting proposed decision in fourth quarter 2019 Distribution Resources Plan Power grid investments to integrate Demo projects have been terminated due to significant delays in project (DRP) OIR (R.14-08-013) distributed energy resources schedules; No contracts will be executed in the solicitation for deferral projects due to lack of viable bids Power Charge Indifference Review, revise, and consider alternatives to Final Phase 1 Decision adopted on October 11, 2018; Final Phase 2 Adjustment (PCIA) OIR the PCIA Decision on benchmark refinement/true-up was approved on October (R.17-06-026) 10, 2019 Key FERC Proceedings FERC Formula Rates Transmission rate setting with annual updates Replacement rate filed on October 27, 2017; settlement covering 1/1/18 through 11/11/19 filed and waiting FERC approval; New replacement rate accepted June 11; partial settlement reduced request to 11.97%; settlement discussions are continuing October 30, 2019 15

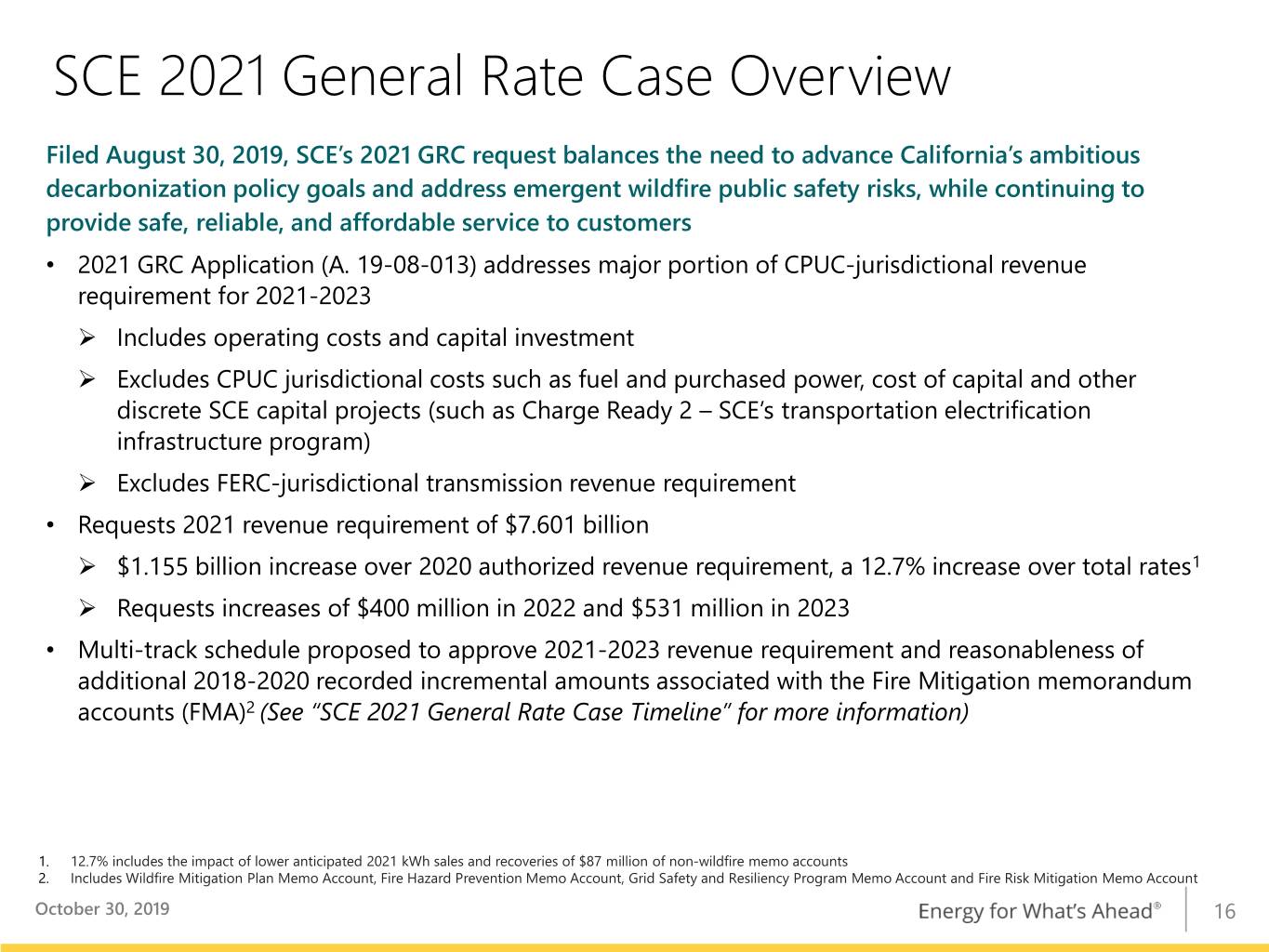

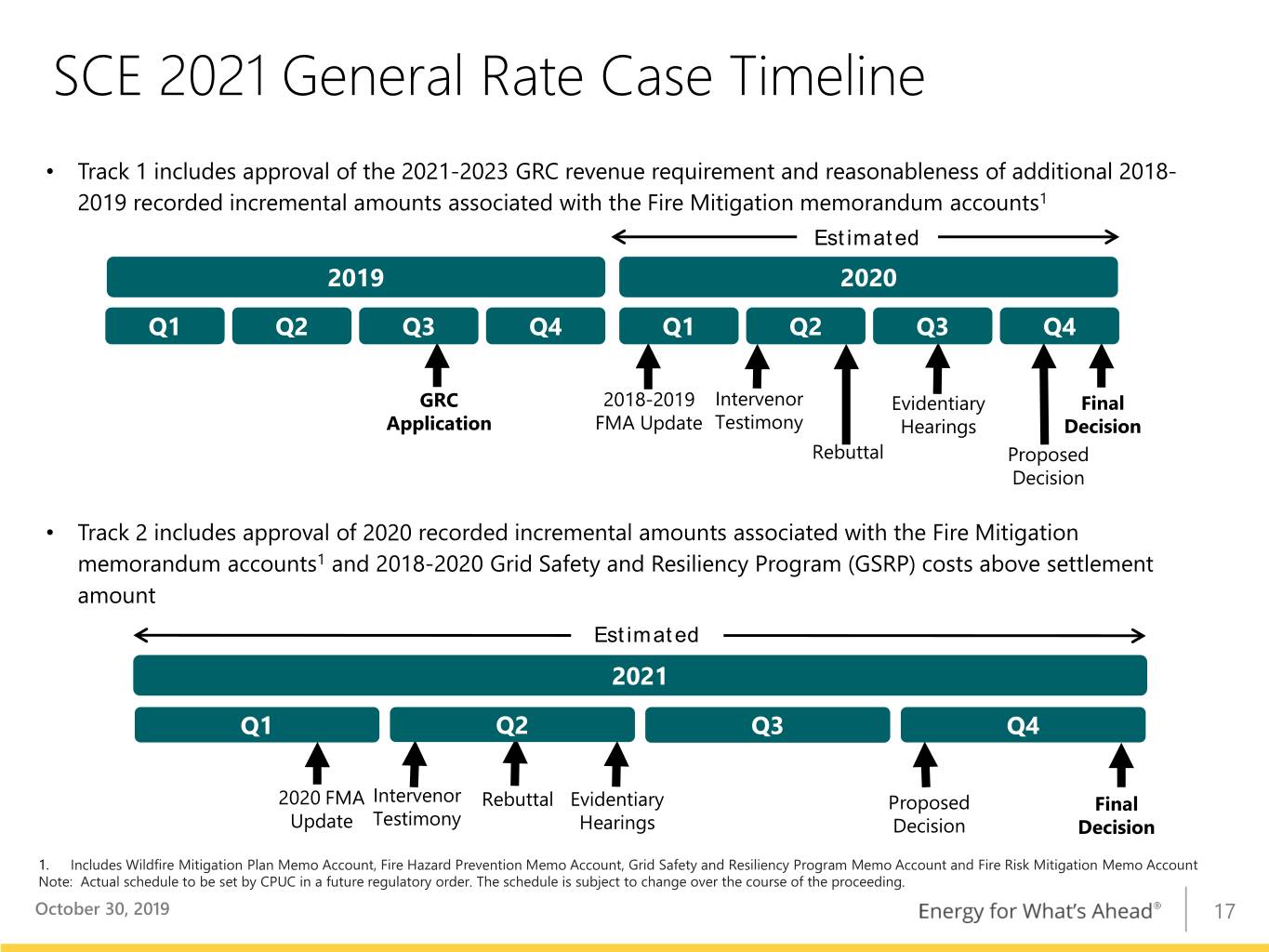

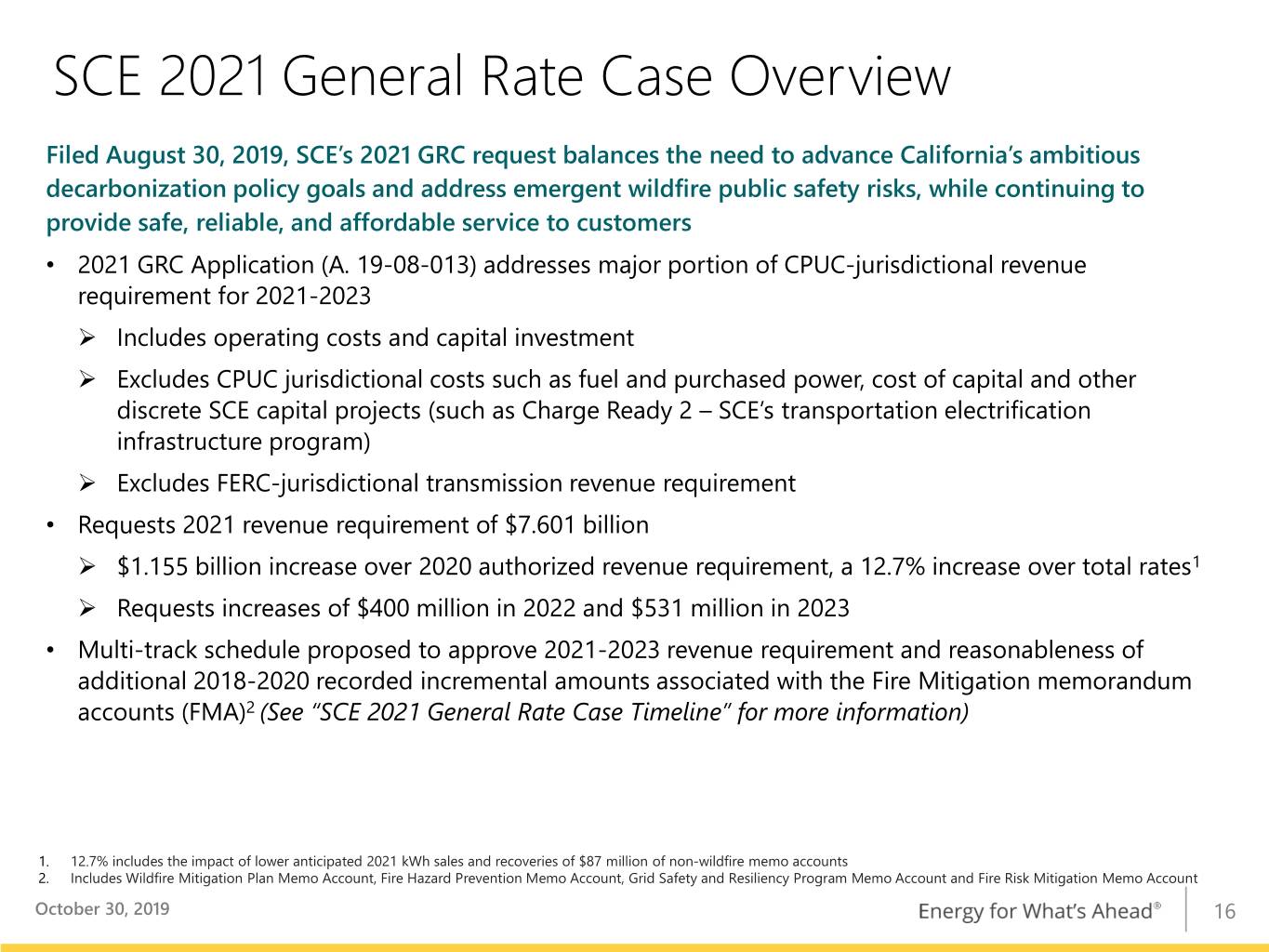

SCE 2021 General Rate Case Overview Filed August 30, 2019, SCE’s 2021 GRC request balances the need to advance California’s ambitious decarbonization policy goals and address emergent wildfire public safety risks, while continuing to provide safe, reliable, and affordable service to customers • 2021 GRC Application (A. 19-08-013) addresses major portion of CPUC-jurisdictional revenue requirement for 2021-2023 Includes operating costs and capital investment Excludes CPUC jurisdictional costs such as fuel and purchased power, cost of capital and other discrete SCE capital projects (such as Charge Ready 2 – SCE’s transportation electrification infrastructure program) Excludes FERC-jurisdictional transmission revenue requirement • Requests 2021 revenue requirement of $7.601 billion $1.155 billion increase over 2020 authorized revenue requirement, a 12.7% increase over total rates1 Requests increases of $400 million in 2022 and $531 million in 2023 • Multi-track schedule proposed to approve 2021-2023 revenue requirement and reasonableness of additional 2018-2020 recorded incremental amounts associated with the Fire Mitigation memorandum accounts (FMA)2 (See “SCE 2021 General Rate Case Timeline” for more information) 1. 12.7% includes the impact of lower anticipated 2021 kWh sales and recoveries of $87 million of non-wildfire memo accounts 2. Includes Wildfire Mitigation Plan Memo Account, Fire Hazard Prevention Memo Account, Grid Safety and Resiliency Program Memo Account and Fire Risk Mitigation Memo Account October 30, 2019 16

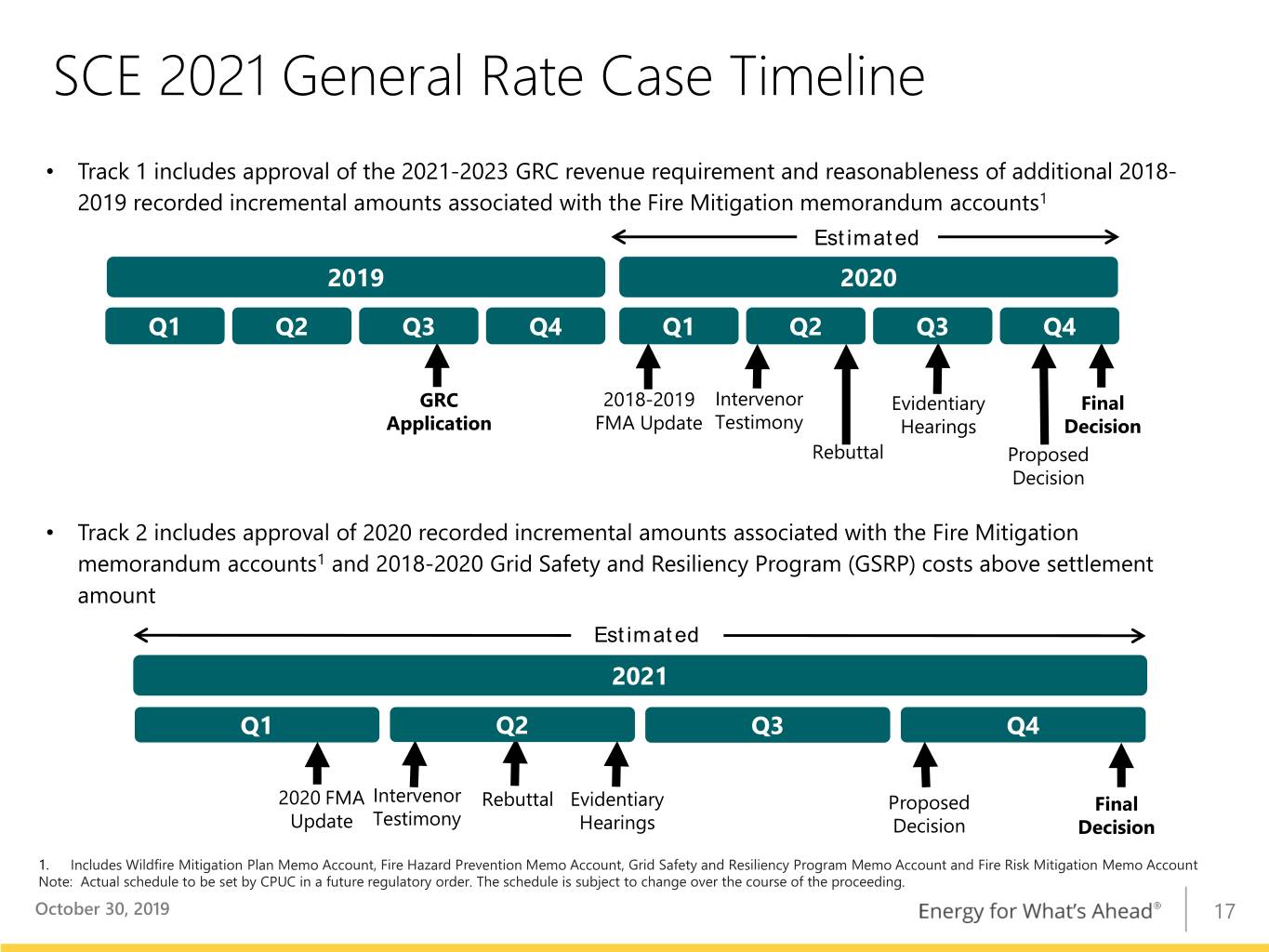

SCE 2021 General Rate Case Timeline • Track 1 includes approval of the 2021-2023 GRC revenue requirement and reasonableness of additional 2018- 2019 recorded incremental amounts associated with the Fire Mitigation memorandum accounts1 Estimated 2019 2020 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 GRC 2018-2019 Intervenor Evidentiary Final Application FMA Update Testimony Hearings Decision Rebuttal Proposed Decision • Track 2 includes approval of 2020 recorded incremental amounts associated with the Fire Mitigation memorandum accounts1 and 2018-2020 Grid Safety and Resiliency Program (GSRP) costs above settlement amount Estimated 2021 Q1 Q2 Q3 Q4 2020 FMA Intervenor Rebuttal Evidentiary Proposed Final Update Testimony Hearings Decision Decision 1. Includes Wildfire Mitigation Plan Memo Account, Fire Hazard Prevention Memo Account, Grid Safety and Resiliency Program Memo Account and Fire Risk Mitigation Memo Account Note: Actual schedule to be set by CPUC in a future regulatory order. The schedule is subject to change over the course of the proceeding. October 30, 2019 17

CPUC and FERC Cost of Capital Summary CPUC Cost of Capital FERC Rate Case Component % Cost Weighted Cost Breakdown of Return on Equity (ROE) Cost Conventional ROE 10.60% Conventional ROE 11.12% Wildfire Risk ROE 0.85% Wildfire Risk ROE 0.85% Common Equity 52.0% 11.45% 5.95% Requested ROE + 11.97% Long-Term Debt 43.0% 4.74% 2.04% CAISO adder + 0.50% Preferred Equity 5.0% 5.70% 0.29% Incentive Projects Varies Total 100.0% 8.28% • Litigated proceeding, separate from GRC, • New Rate Case filed on April 11th filed on April 22nd • Updated formula rate becomes effective • Request for three-year period starting November 12, 2019 if accepted by FERC, January 1, 2020 subject to refund • SCE, PG&E, SDG&E, and SoCalGas • Capital structure at FERC is based on concurrently filed applications; recorded level vs. CPUC “authorized” applications were consolidated into one proceeding approach • Proposed trigger mechanism for adjusting the cost of capital between proceedings (similar to current mechanism) October 30, 2019 18

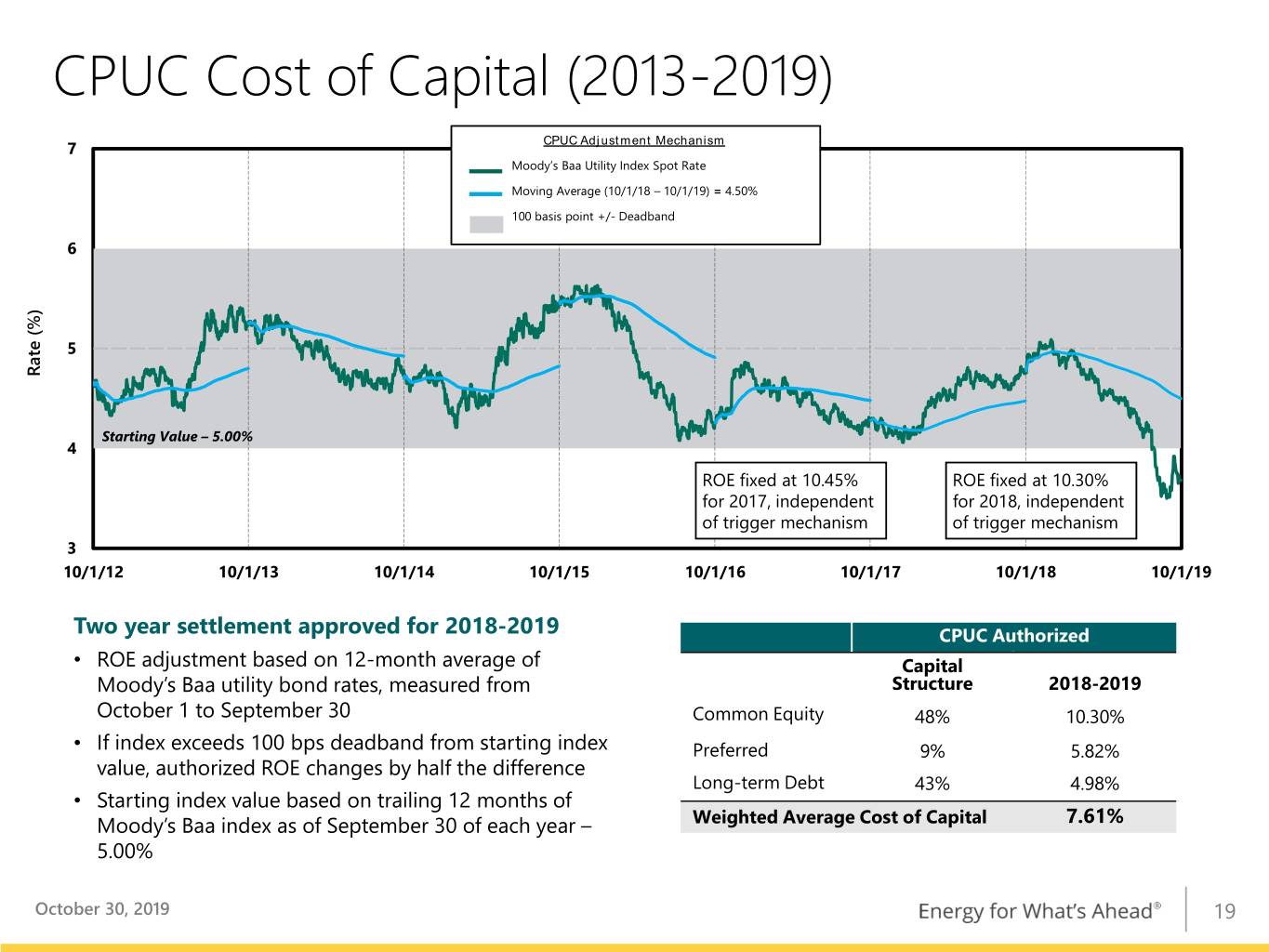

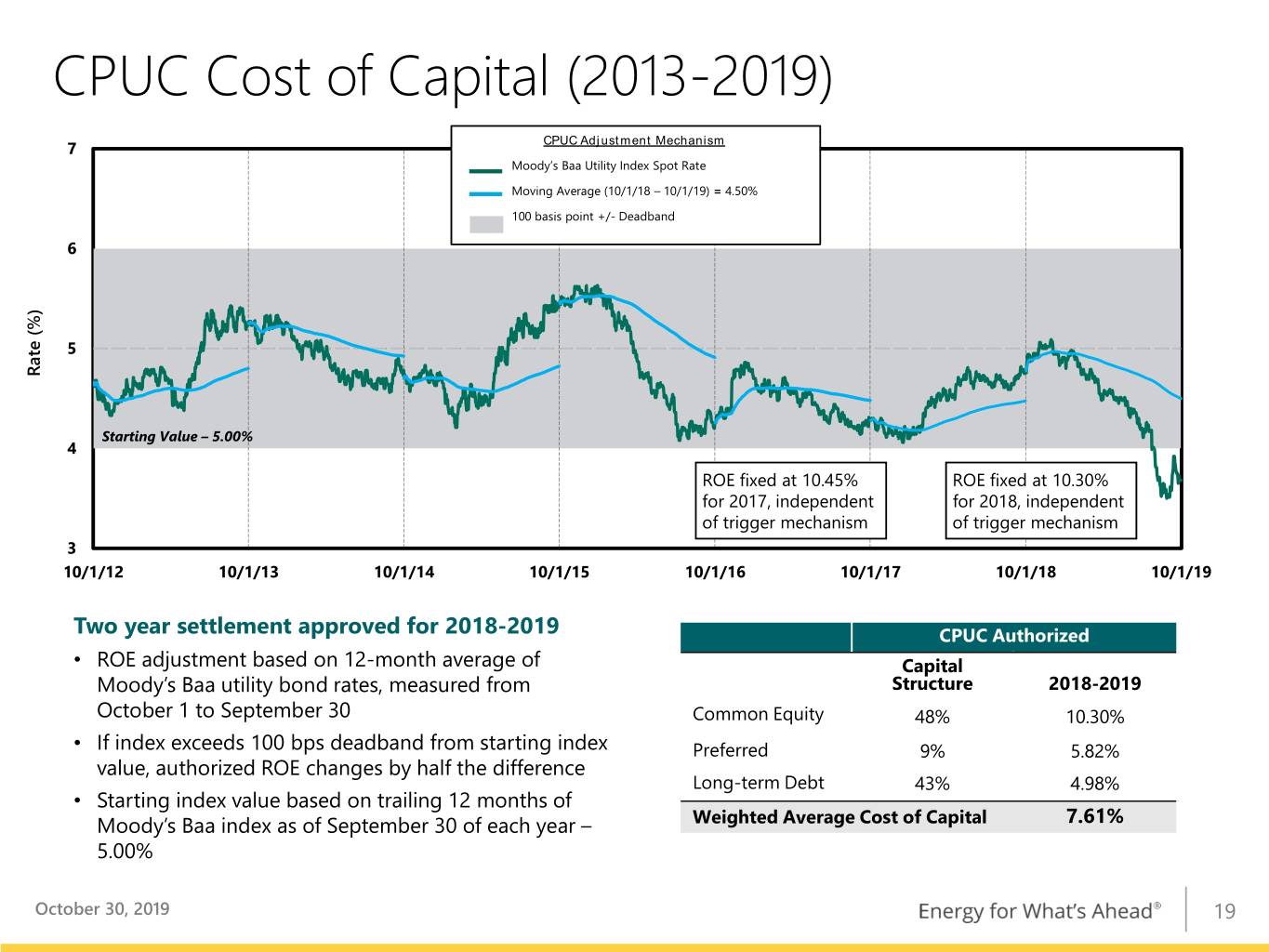

CPUC Cost of Capital (2013-2019) CPUC Adjustment Mechanism 7 Moody’s Baa Utility Index Spot Rate Moving Average (10/1/18 – 10/1/19) = 4.50% 100 basis point +/- Deadband 6 5 Rate (%) Starting Value – 5.00% 4 ROE fixed at 10.45% ROE fixed at 10.30% for 2017, independent for 2018, independent of trigger mechanism of trigger mechanism 3 10/1/12 10/1/13 10/1/14 10/1/15 10/1/16 10/1/17 10/1/18 10/1/19 Two year settlement approved for 2018-2019 CPUC Authorized • ROE adjustment based on 12-month average of Capital Moody’s Baa utility bond rates, measured from Structure 2018-2019 October 1 to September 30 Common Equity 48% 10.30% • If index exceeds 100 bps deadband from starting index Preferred 9% 5.82% value, authorized ROE changes by half the difference Long-term Debt 43% 4.98% • Starting index value based on trailing 12 months of Moody’s Baa index as of September 30 of each year – Weighted Average Cost of Capital 7.61% 5.00% October 30, 2019 19

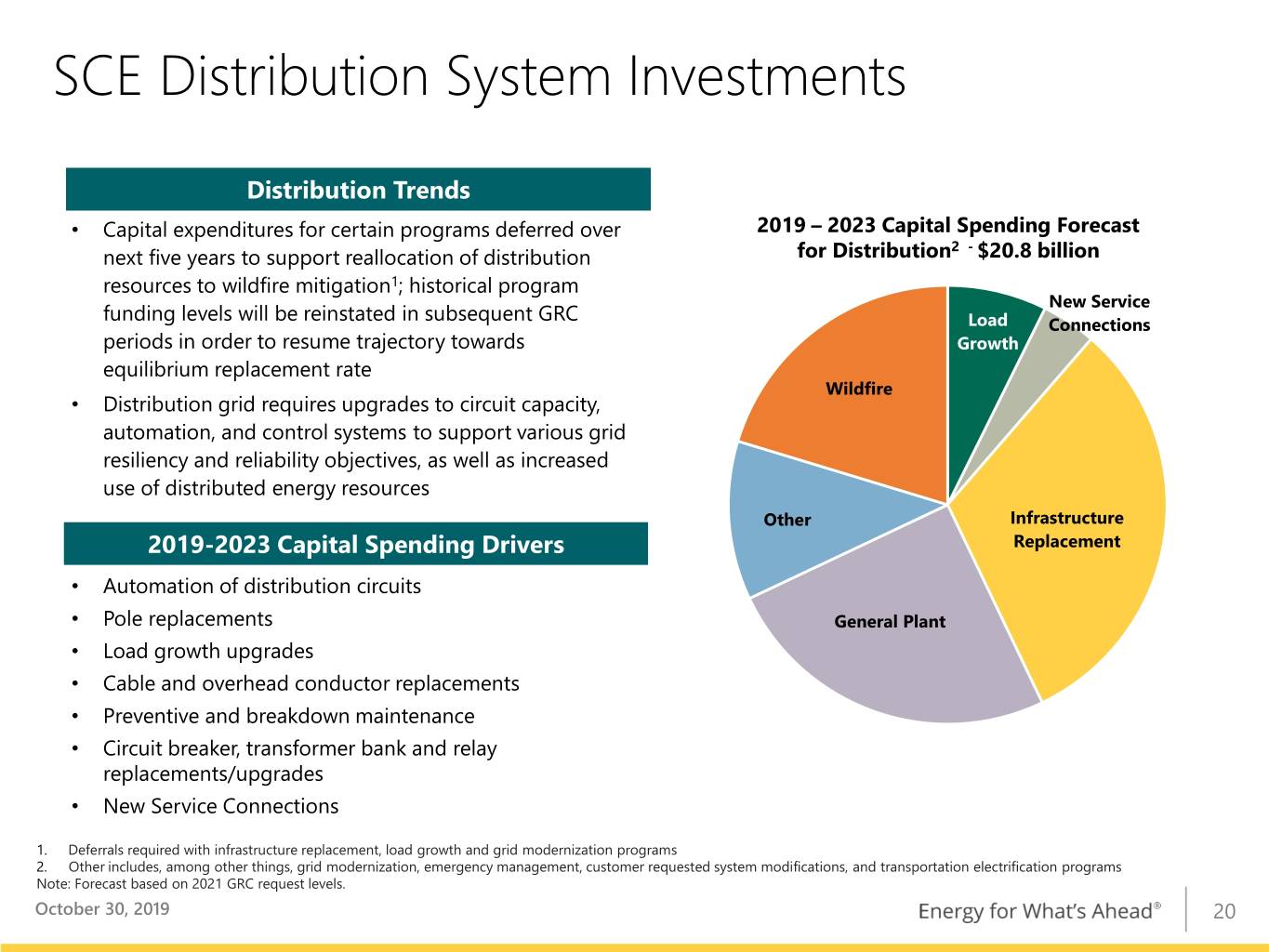

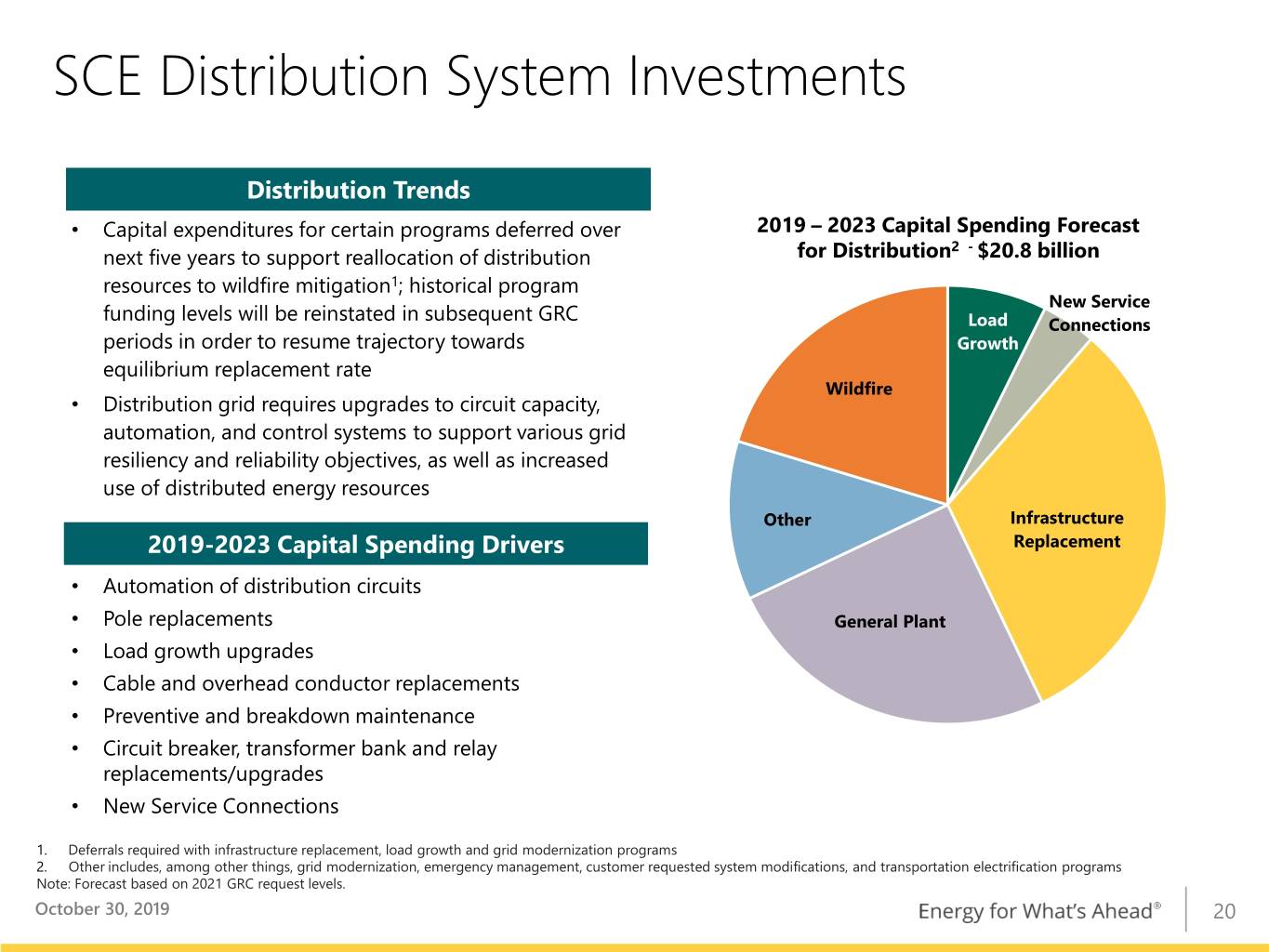

SCE Distribution System Investments Distribution Trends • Capital expenditures for certain programs deferred over 2019 – 2023 Capital Spending Forecast 2 - next five years to support reallocation of distribution for Distribution $20.8 billion resources to wildfire mitigation1; historical program New Service funding levels will be reinstated in subsequent GRC Load Connections periods in order to resume trajectory towards Growth equilibrium replacement rate Wildfire • Distribution grid requires upgrades to circuit capacity, automation, and control systems to support various grid resiliency and reliability objectives, as well as increased use of distributed energy resources Other Infrastructure 2019-2023 Capital Spending Drivers Replacement • Automation of distribution circuits • Pole replacements General Plant • Load growth upgrades • Cable and overhead conductor replacements • Preventive and breakdown maintenance • Circuit breaker, transformer bank and relay replacements/upgrades • New Service Connections 1. Deferrals required with infrastructure replacement, load growth and grid modernization programs 2. Other includes, among other things, grid modernization, emergency management, customer requested system modifications, and transportation electrification programs Note: Forecast based on 2021 GRC request levels. October 30, 2019 20

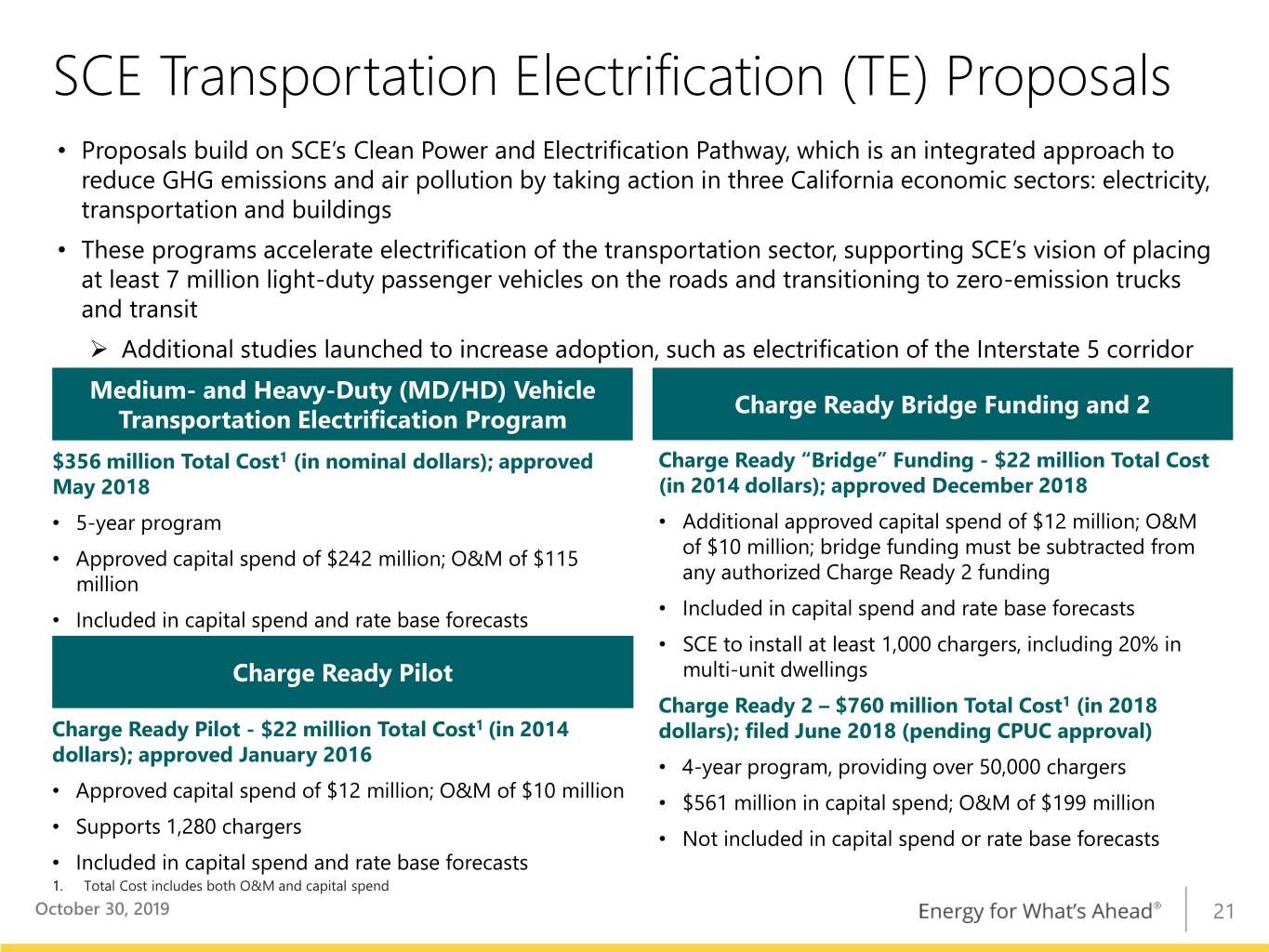

SCE Transportation Electrification (TE) Proposals • Proposals build on SCE’s Clean Power and Electrification Pathway, which is an integrated approach to reduce GHG emissions and air pollution by taking action in three California economic sectors: electricity, transportation and buildings • These programs accelerate electrification of the transportation sector, supporting SCE’s vision of placing at least 7 million light-duty passenger vehicles on the roads and transitioning to zero-emission trucks and transit Additional studies launched to increase adoption, such as electrification of the Interstate 5 corridor Medium- and Heavy-Duty (MD/HD) Vehicle Charge Ready Bridge Funding and 2 Transportation Electrification Program $356 million Total Cost1 (in nominal dollars); approved Charge Ready “Bridge” Funding - $22 million Total Cost May 2018 (in 2014 dollars); approved December 2018 • 5-year program • Additional approved capital spend of $12 million; O&M of $10 million; bridge funding must be subtracted from • Approved capital spend of $242 million; O&M of $115 any authorized Charge Ready 2 funding million • Included in capital spend and rate base forecasts • Included in capital spend and rate base forecasts • SCE to install at least 1,000 chargers, including 20% in Charge Ready Pilot multi-unit dwellings Charge Ready 2 – $760 million Total Cost1 (in 2018 Charge Ready Pilot - $22 million Total Cost1 (in 2014 dollars); filed June 2018 (pending CPUC approval) dollars); approved January 2016 • 4-year program, providing over 50,000 chargers • Approved capital spend of $12 million; O&M of $10 million • $561 million in capital spend; O&M of $199 million • Supports 1,280 chargers • Not included in capital spend or rate base forecasts • Included in capital spend and rate base forecasts 1. Total Cost includes both O&M and capital spend October 30, 2019 21

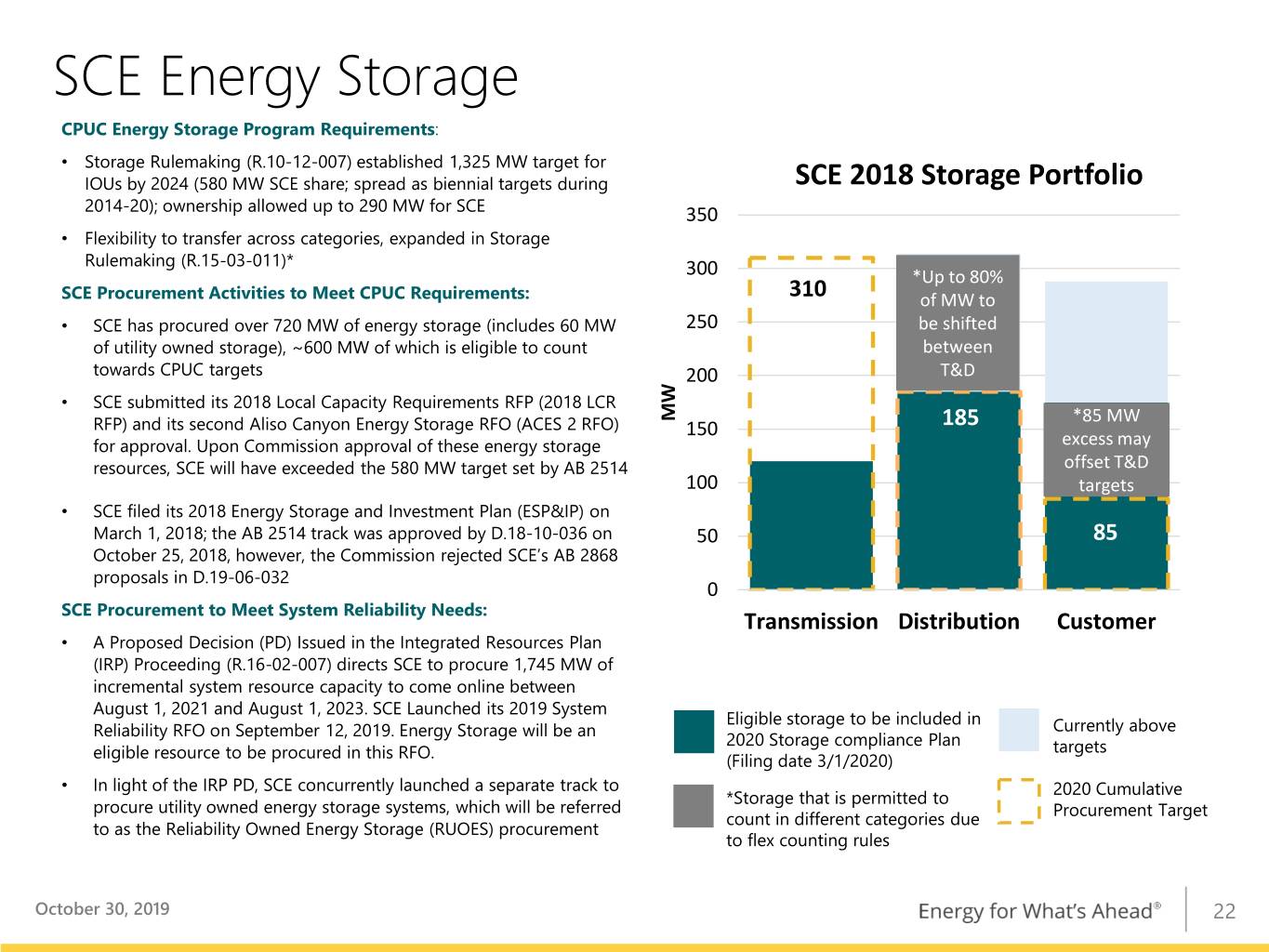

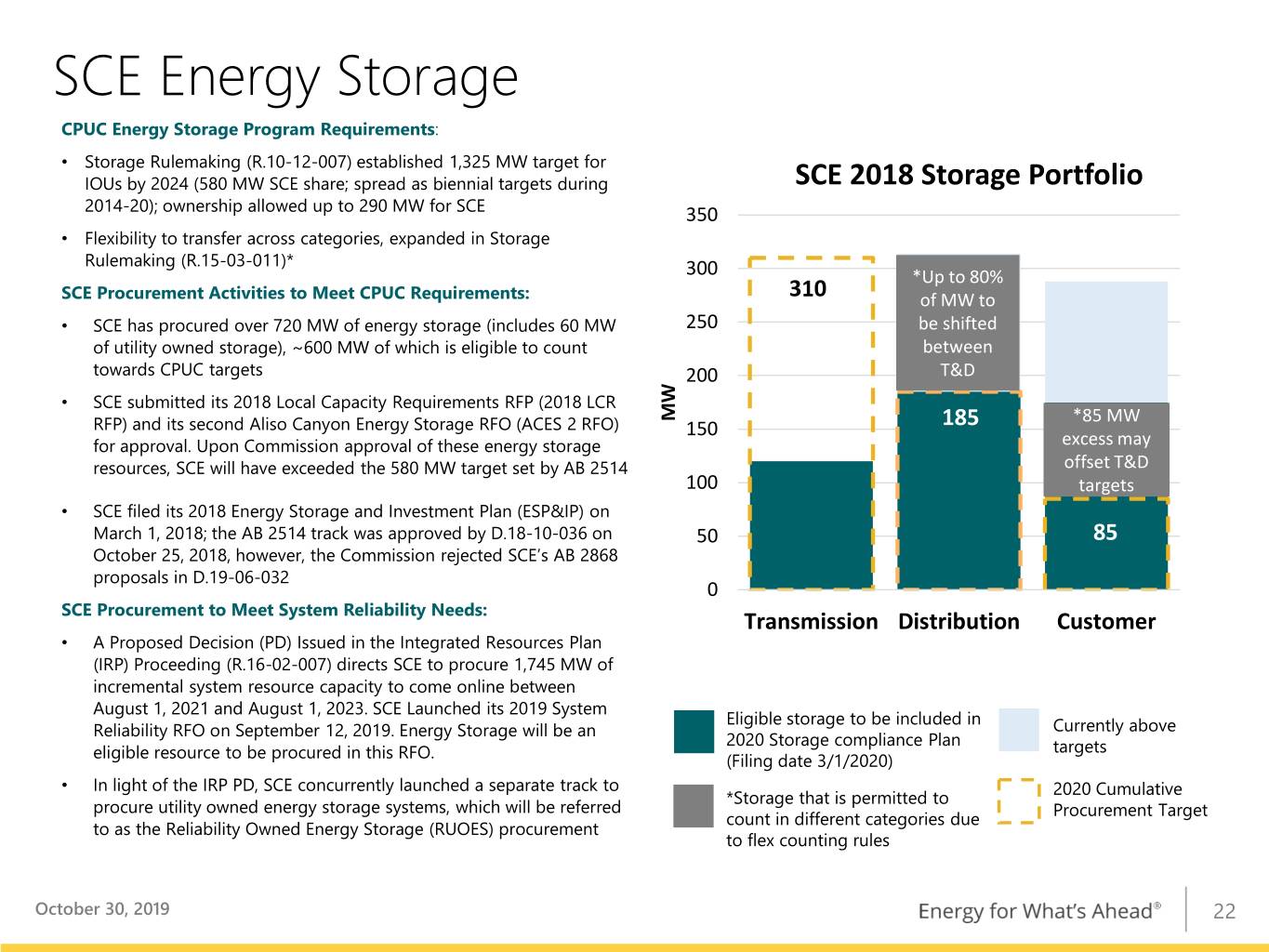

SCE Energy Storage CPUC Energy Storage Program Requirements: • Storage Rulemaking (R.10-12-007) established 1,325 MW target for IOUs by 2024 (580 MW SCE share; spread as biennial targets during SCE 2018 Storage Portfolio 2014-20); ownership allowed up to 290 MW for SCE 350 • Flexibility to transfer across categories, expanded in Storage Rulemaking (R.15-03-011)* 300 *Up to 80% SCE Procurement Activities to Meet CPUC Requirements: 310 of MW to • SCE has procured over 720 MW of energy storage (includes 60 MW 250 be shifted of utility owned storage), ~600 MW of which is eligible to count between towards CPUC targets 200 T&D • SCE submitted its 2018 Local Capacity Requirements RFP (2018 LCR MW *85 MW RFP) and its second Aliso Canyon Energy Storage RFO (ACES 2 RFO) 150 185 for approval. Upon Commission approval of these energy storage excess may resources, SCE will have exceeded the 580 MW target set by AB 2514 offset T&D 100 targets • SCE filed its 2018 Energy Storage and Investment Plan (ESP&IP) on March 1, 2018; the AB 2514 track was approved by D.18-10-036 on 50 85 October 25, 2018, however, the Commission rejected SCE’s AB 2868 proposals in D.19-06-032 0 SCE Procurement to Meet System Reliability Needs: Transmission Distribution Customer • A Proposed Decision (PD) Issued in the Integrated Resources Plan (IRP) Proceeding (R.16-02-007) directs SCE to procure 1,745 MW of incremental system resource capacity to come online between August 1, 2021 and August 1, 2023. SCE Launched its 2019 System Eligible storage to be included in Reliability RFO on September 12, 2019. Energy Storage will be an Currently above 2020 Storage compliance Plan targets eligible resource to be procured in this RFO. (Filing date 3/1/2020) • In light of the IRP PD, SCE concurrently launched a separate track to 2020 Cumulative *Storage that is permitted to procure utility owned energy storage systems, which will be referred Procurement Target count in different categories due to as the Reliability Owned Energy Storage (RUOES) procurement to flex counting rules October 30, 2019 22

SCE Large Transmission Projects Summary of Large Transmission Projects Remaining Investment Estimated In-Service Project Name Total Cost5 (as of September 30, 2019) Date West of Devers1,2 $848 million $416 million 2021 Mesa Substation1 $646 million $296 million 2022 Alberhill System3 $486 million $446 million — 3 Riverside Transmission Reliability4 $451 million $441 million 2024 Eldorado-Lugo-Mohave Upgrade $257 million $180 million 2021 FERC Cost of Capital 11.2% ROE from January 1, 2018 to November 12, 2019: • ROE = Base (plus incentives) of 10.7% + CAISO Participation Application for FERC Formula recovery mechanism post November 12, 2019 was filed April 11, 2019 Requested 50 bp CAISO adder; approved, but application for rehearing requested by CPUC 1. CPUC approved 2. Morongo Transmission holds an option to invest up to $400 million, or half of the estimated cost of the transmission facilities only, at the in-service date. If the option is exercised, SCE’s rate base would be offset by that amount 3. In August 2018, the CPUC approved the revised alternate decision which left the proceeding open and directed SCE to supplement the existing record with additional analysis as it relates to the Project need and alternatives. Potential revisions to the Project have not been reflected in the total cost of the Project or estimated in service date 4. Riverside Transmission Reliability Project total cost is currently estimated to be $451 million, however costs could increase depending on the final route alternative selected 5. Total Costs are nominal direct expenditures, subject to CPUC and FERC cost recovery approval. SCE regularly evaluates the cost and schedule based on permitting processes, given that SCE continues to see delays in securing project approvals October 30, 2019 23

SCE Operational Excellence Defining Excellence Measuring Excellence Top Quartile • Employee and public safety • Safety metrics • Reliability • System performance and reliability (SAIDI and SAIFI) • Customer service • Customer satisfaction • Cost efficiency calculation based on Optimize internal voice-of-customer surveys • Capital productivity • O&M cost per customer • Purchased power cost • Reduce system rate growth • Digitization with O&M / purchased High performing, continuous power cost reductions improvement culture Ongoing Operational Excellence Efforts October 30, 2019 24

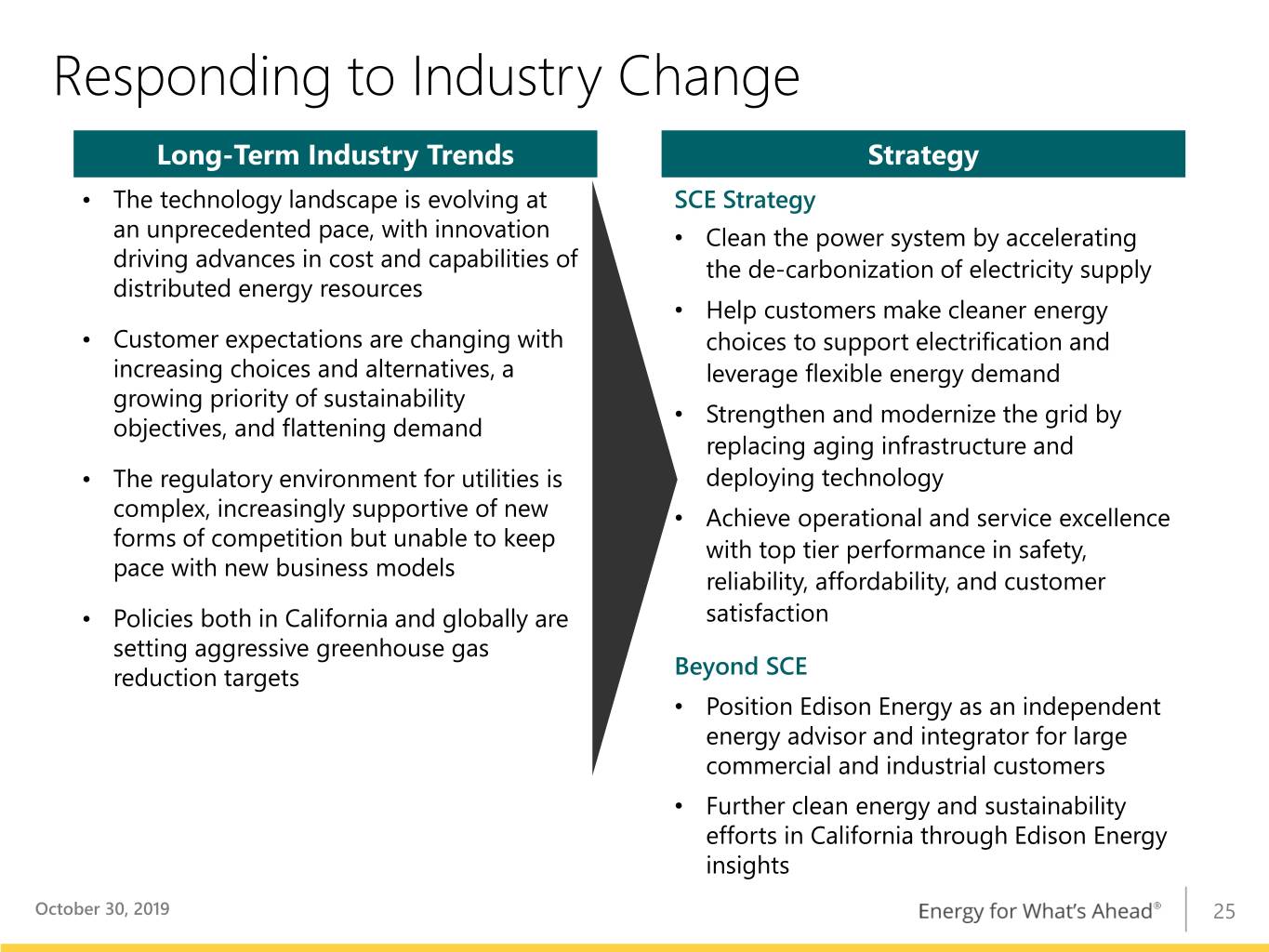

Responding to Industry Change Long-Term Industry Trends Strategy • The technology landscape is evolving at SCE Strategy an unprecedented pace, with innovation • Clean the power system by accelerating driving advances in cost and capabilities of the de-carbonization of electricity supply distributed energy resources • Help customers make cleaner energy • Customer expectations are changing with choices to support electrification and increasing choices and alternatives, a leverage flexible energy demand growing priority of sustainability • Strengthen and modernize the grid by objectives, and flattening demand replacing aging infrastructure and • The regulatory environment for utilities is deploying technology complex, increasingly supportive of new • Achieve operational and service excellence forms of competition but unable to keep with top tier performance in safety, pace with new business models reliability, affordability, and customer • Policies both in California and globally are satisfaction setting aggressive greenhouse gas reduction targets Beyond SCE • Position Edison Energy as an independent energy advisor and integrator for large commercial and industrial customers • Further clean energy and sustainability efforts in California through Edison Energy insights October 30, 2019 25

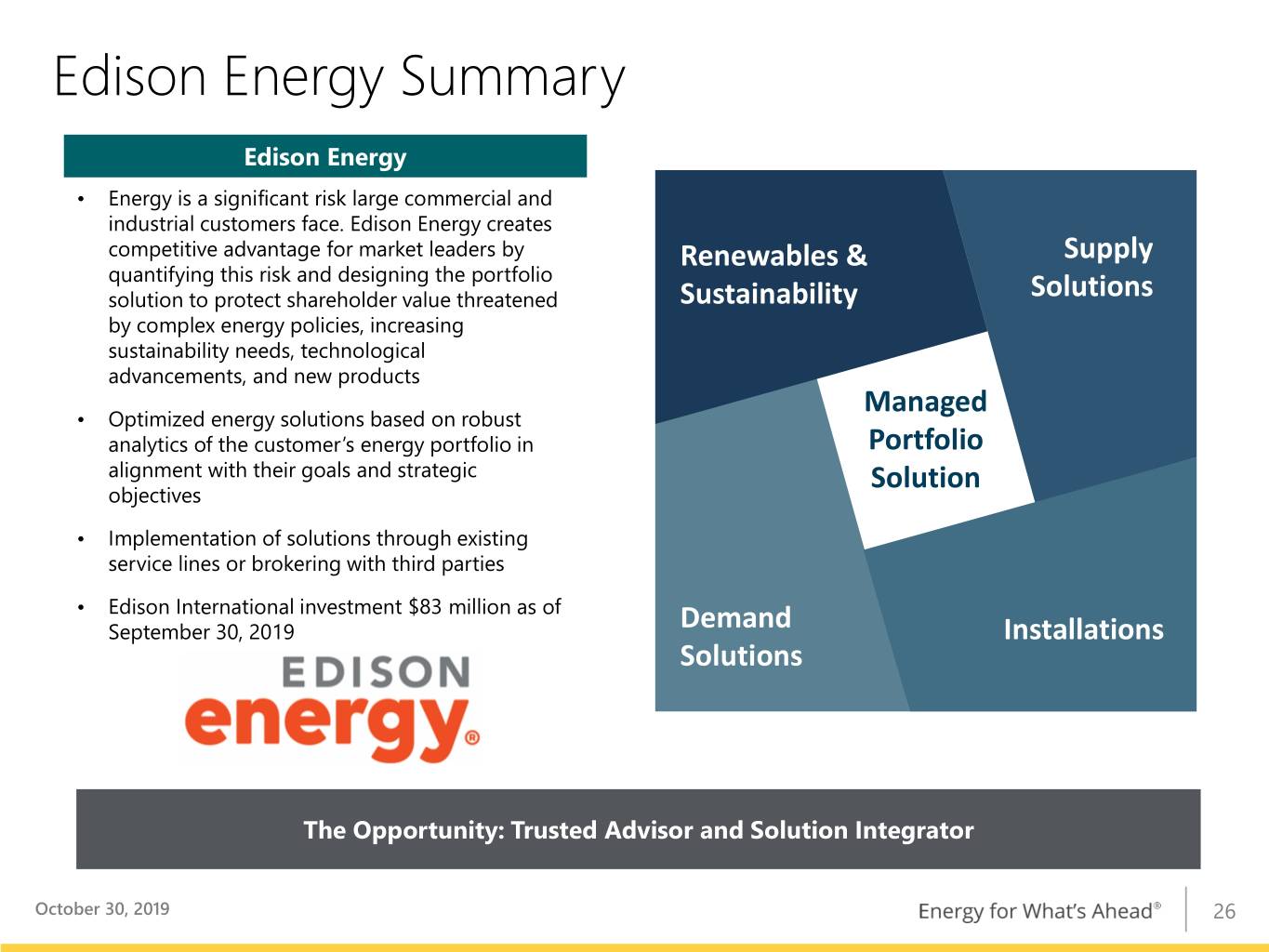

Edison Energy Summary Edison Energy • Energy is a significant risk large commercial and industrial customers face. Edison Energy creates competitive advantage for market leaders by Renewables & Supply quantifying this risk and designing the portfolio solution to protect shareholder value threatened Sustainability Solutions by complex energy policies, increasing sustainability needs, technological advancements, and new products Managed • Optimized energy solutions based on robust analytics of the customer’s energy portfolio in Portfolio alignment with their goals and strategic Solution objectives • Implementation of solutions through existing service lines or brokering with third parties • Edison International investment $83 million as of September 30, 2019 Demand Installations Solutions The Opportunity: Trusted Advisor and Solution Integrator October 30, 2019 26

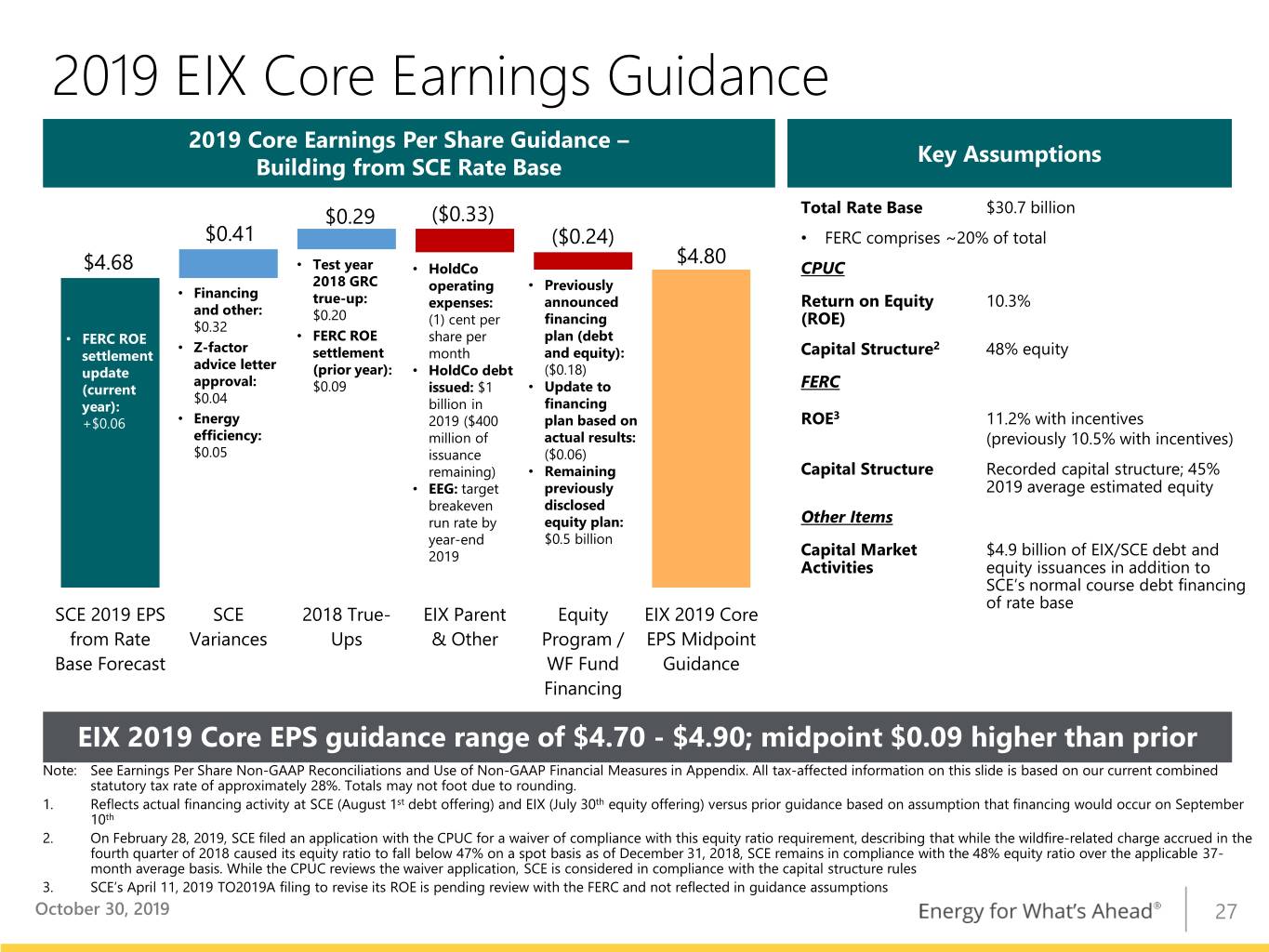

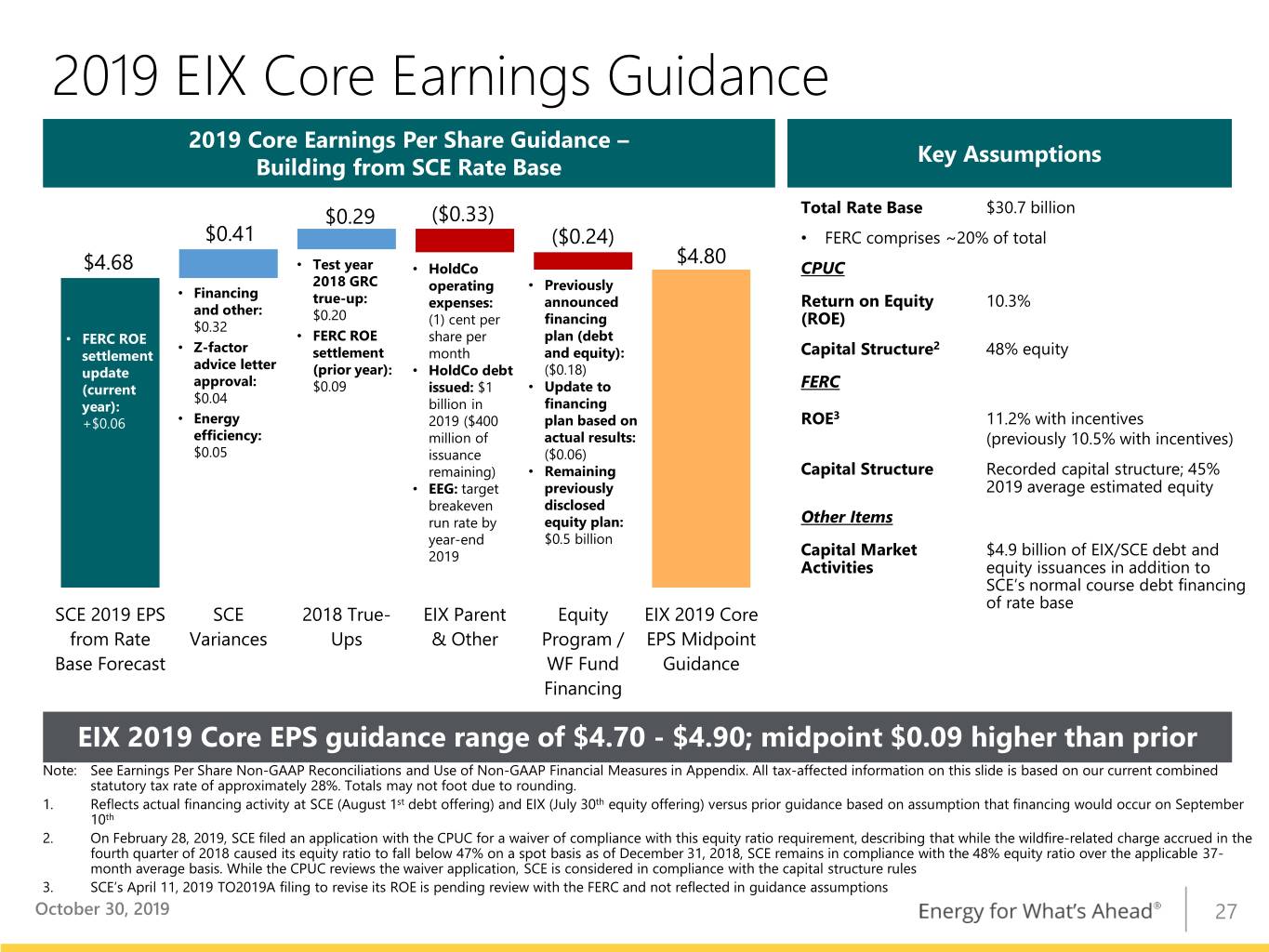

2019 EIX Core Earnings Guidance 2019 Core Earnings Per Share Guidance – Key Assumptions Building from SCE Rate Base $0.29 ($0.33) Total Rate Base $30.7 billion $0.41 ($0.24) • FERC comprises ~20% of total $4.80 $4.68 • Test year • HoldCo CPUC 2018 GRC operating • Previously • Financing true-up: expenses: announced 10.3% and other: Return on Equity $0.20 (1) cent per financing $0.32 (ROE) • FERC ROE • FERC ROE share per plan (debt • Z-factor 2 settlement settlement month and equity): Capital Structure 48% equity advice letter update (prior year): • HoldCo debt ($0.18) approval: FERC (current $0.09 issued: $1 • Update to $0.04 year): billion in financing 3 +$0.06 • Energy 2019 ($400 plan based on ROE 11.2% with incentives efficiency: million of actual results: (previously 10.5% with incentives) $0.05 issuance ($0.06) remaining) • Remaining Capital Structure Recorded capital structure; 45% • EEG: target previously 2019 average estimated equity breakeven disclosed run rate by equity plan: Other Items year-end $0.5 billion 2019 Capital Market $4.9 billion of EIX/SCE debt and Activities equity issuances in addition to SCE’s normal course debt financing of rate base SCE 2019 EPS SCE 2018 True- EIX Parent Equity EIX 2019 Core from Rate Variances Ups & Other Program / EPS Midpoint Base Forecast WF Fund Guidance Financing EIX 2019 Core EPS guidance range of $4.70 - $4.90; midpoint $0.09 higher than prior Note: See Earnings Per Share Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. All tax-affected information on this slide is based on our current combined statutory tax rate of approximately 28%. Totals may not foot due to rounding. 1. Reflects actual financing activity at SCE (August 1st debt offering) and EIX (July 30th equity offering) versus prior guidance based on assumption that financing would occur on September 10th 2. On February 28, 2019, SCE filed an application with the CPUC for a waiver of compliance with this equity ratio requirement, describing that while the wildfire-related charge accrued in the fourth quarter of 2018 caused its equity ratio to fall below 47% on a spot basis as of December 31, 2018, SCE remains in compliance with the 48% equity ratio over the applicable 37- month average basis. While the CPUC reviews the waiver application, SCE is considered in compliance with the capital structure rules 3. SCE’s April 11, 2019 TO2019A filing to revise its ROE is pending review with the FERC and not reflected in guidance assumptions October 30, 2019 27

EIX Annual Dividends Per Share Fifteen Consecutive Years of Dividend Growth 1 $2.42 $2.45 $2.17 $1.92 $1.67 $1.42 $1.35 $1.28 $1.30 $1.22 $1.24 $1.26 $1.16 $1.08 $1.00 $0.80 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Target dividend growth within target payout ratio of 45-55% of SCE’s earnings 1. 2019 dividend annualized based on December 6, 2018 declaration October 30, 2019 28

Appendix October 30, 2019 29

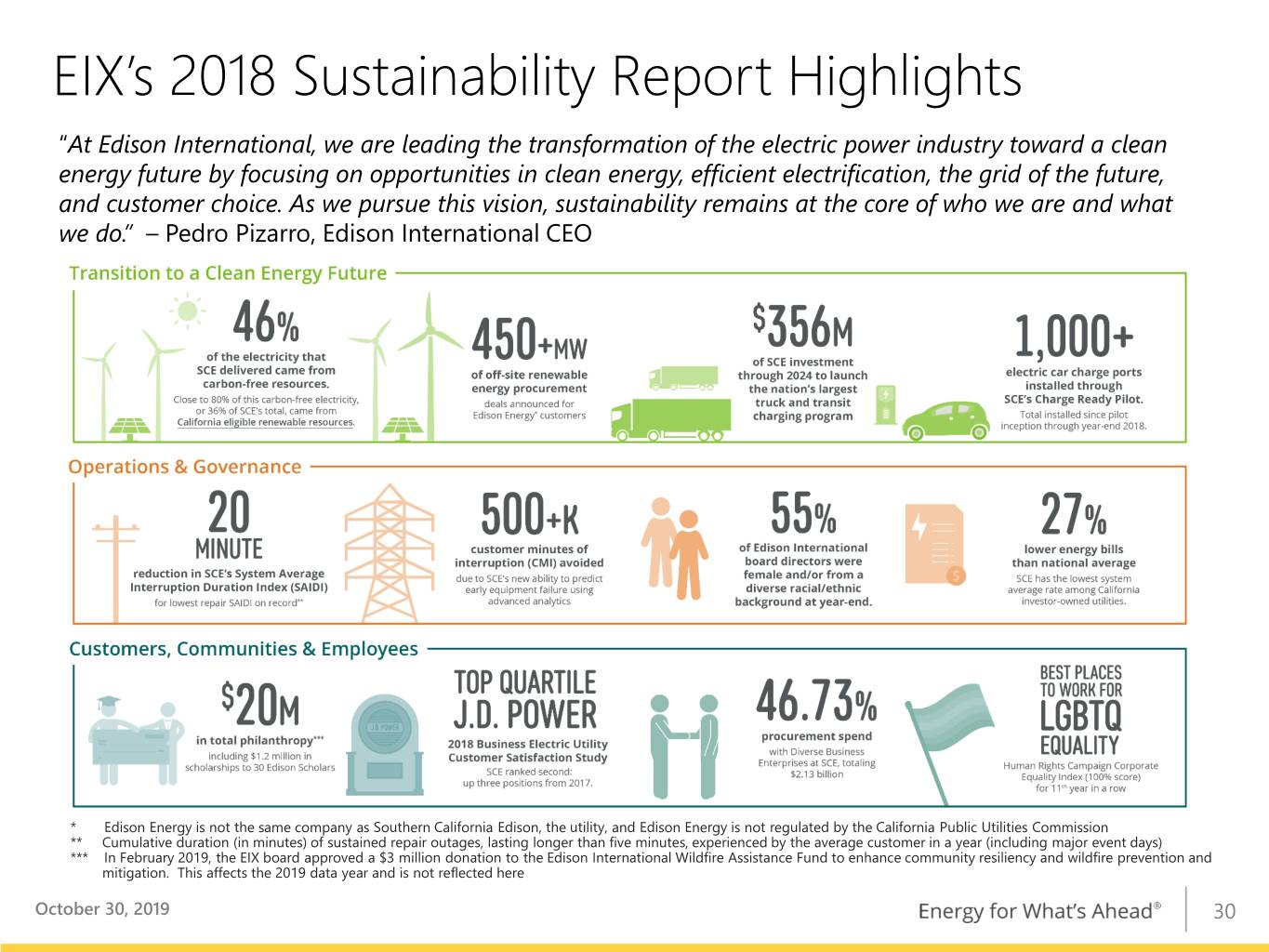

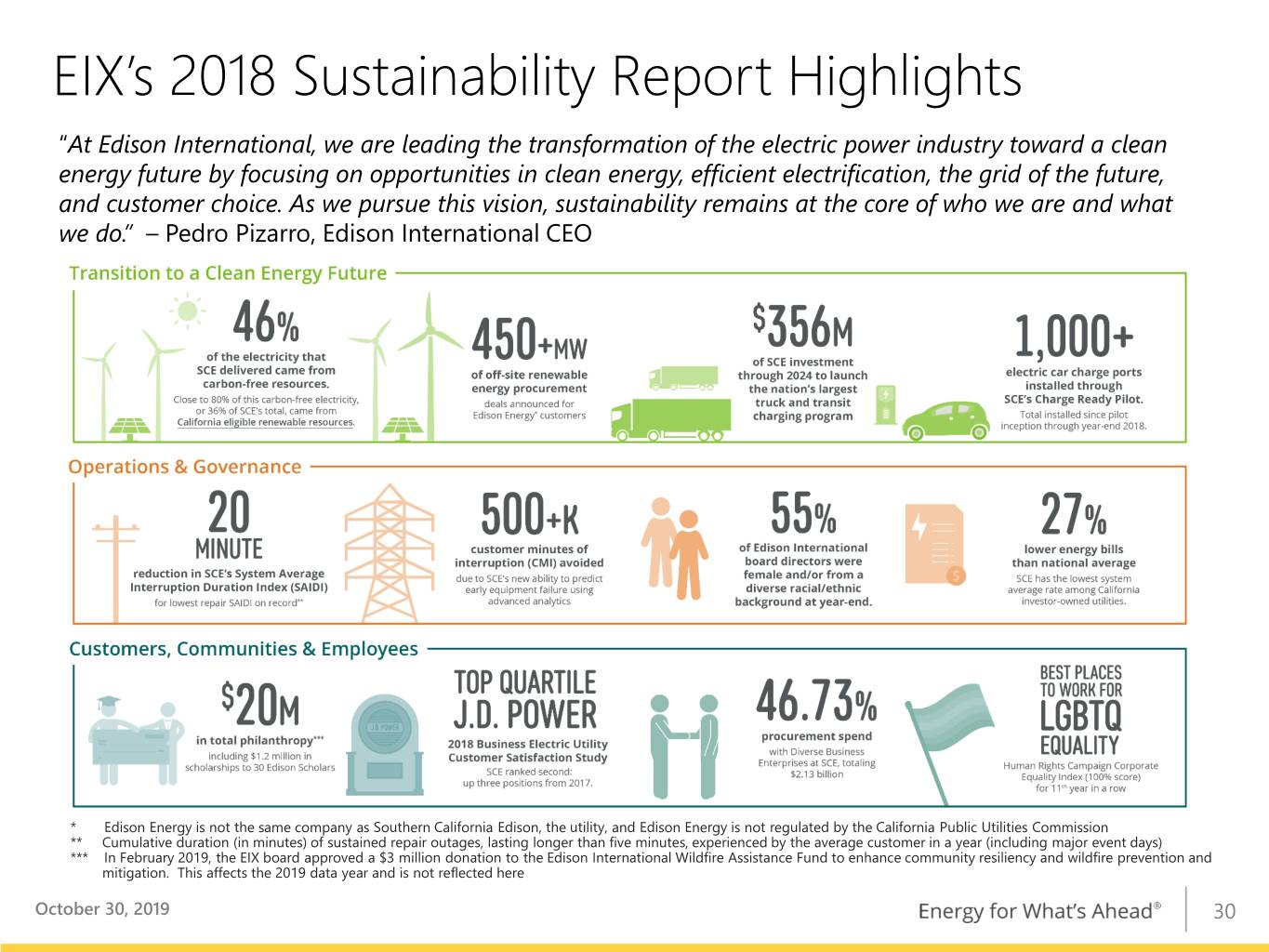

EIX’s 2018 Sustainability Report Highlights “At Edison International, we are leading the transformation of the electric power industry toward a clean energy future by focusing on opportunities in clean energy, efficient electrification, the grid of the future, and customer choice. As we pursue this vision, sustainability remains at the core of who we are and what w e d o .” – Pedro Pizarro, Edison International CEO * Edison Energy is not the same company as Southern California Edison, the utility, and Edison Energy is not regulated by the California Public Utilities Commission ** Cumulative duration (in minutes) of sustained repair outages, lasting longer than five minutes, experienced by the average customer in a year (including major event days) *** In February 2019, the EIX board approved a $3 million donation to the Edison International Wildfire Assistance Fund to enhance community resiliency and wildfire prevention and mitigation. This affects the 2019 data year and is not reflected here October 30, 2019 30

SCE Decoupled Regulatory Framework Regulatory Mechanism Key Benefits Decoupling of Revenues from • Earnings not affected by variability of retail electricity sales Sales • Differences between amounts collected and authorized levels either billed or refunded • Promotes energy conservation • Stabilizes revenues during economic cycles Major Balancing Accounts • Cost-recovery related balancing accounts represented more • Sales than 59% of costs • Fuel and Purchased power • Trigger mechanism for fuel and purchased power adjustments • Energy efficiency at 5% variance level • Pension expense Advanced Long-Term • Upfront contract approvals and prudency standards provide Procurement Planning greater certainty of cost recovery (subject to compliance- related reasonableness review) Forward-looking Ratemaking • Forward and test year GRC with three-year rate cycle • Separate cost of capital mechanism October 30, 2019 31

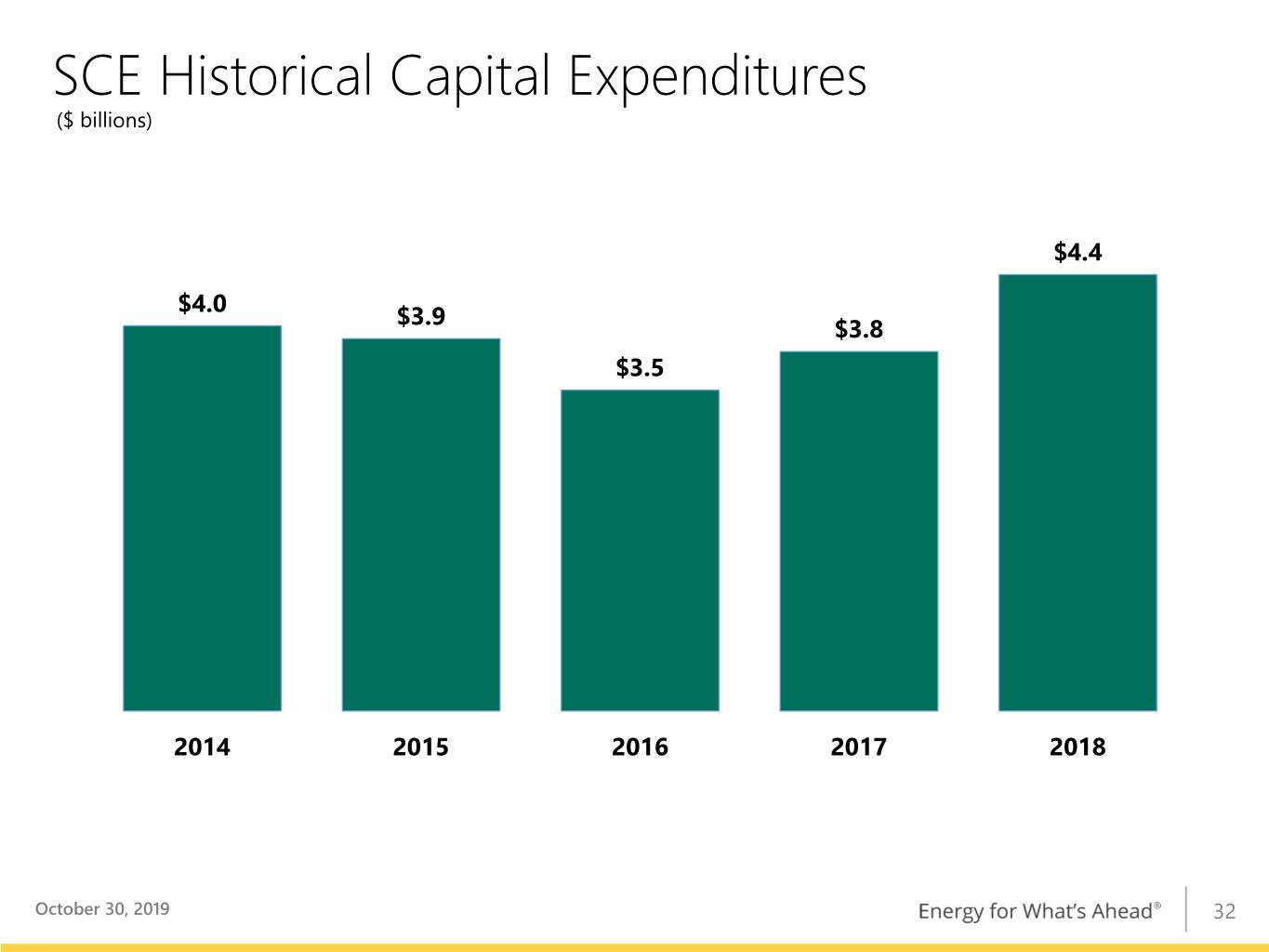

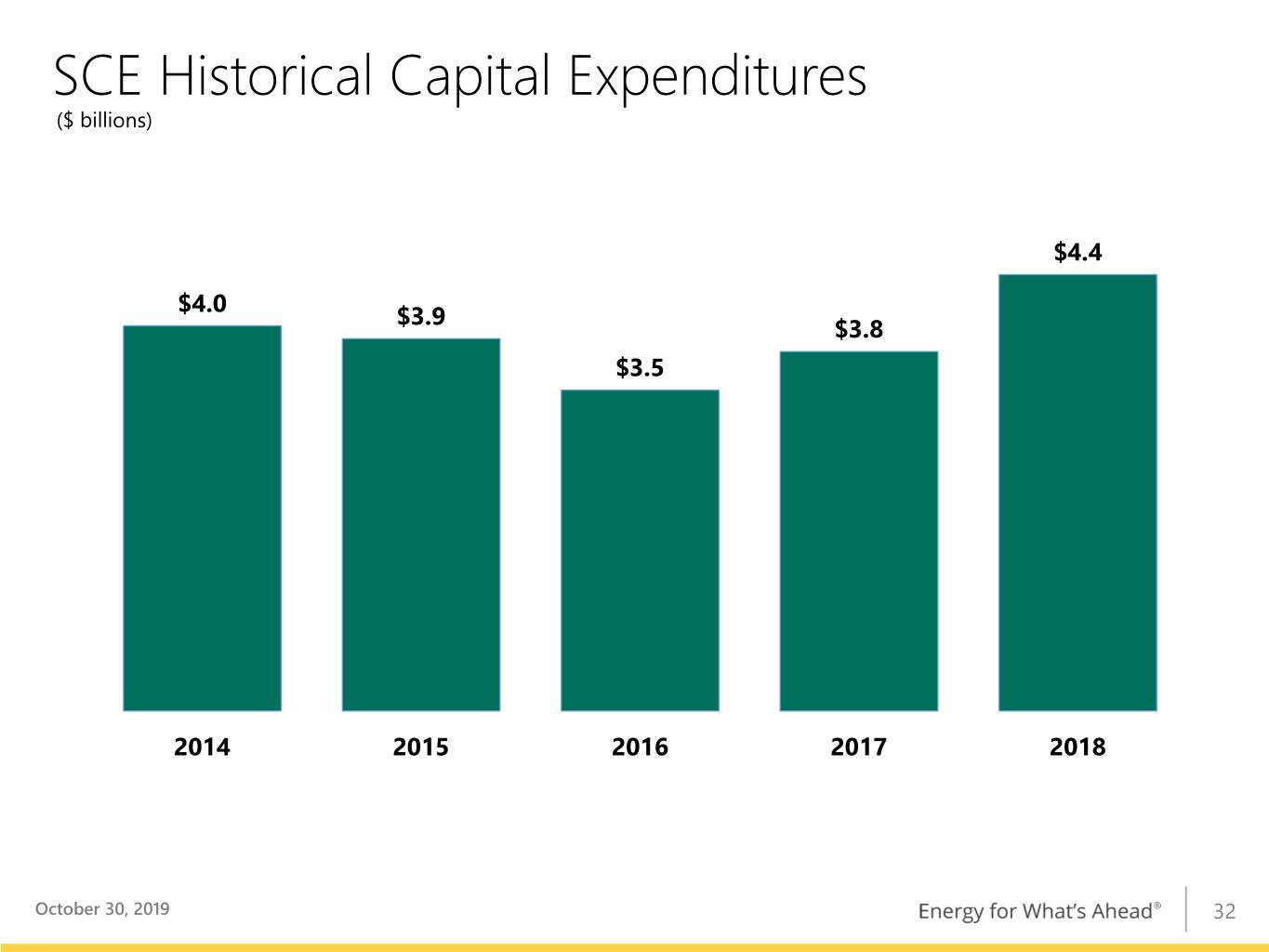

SCE Historical Capital Expenditures ($ billions) $4.4 $4.0 $3.9 $3.8 $3.5 2014 2015 2016 2017 2018 October 30, 2019 32

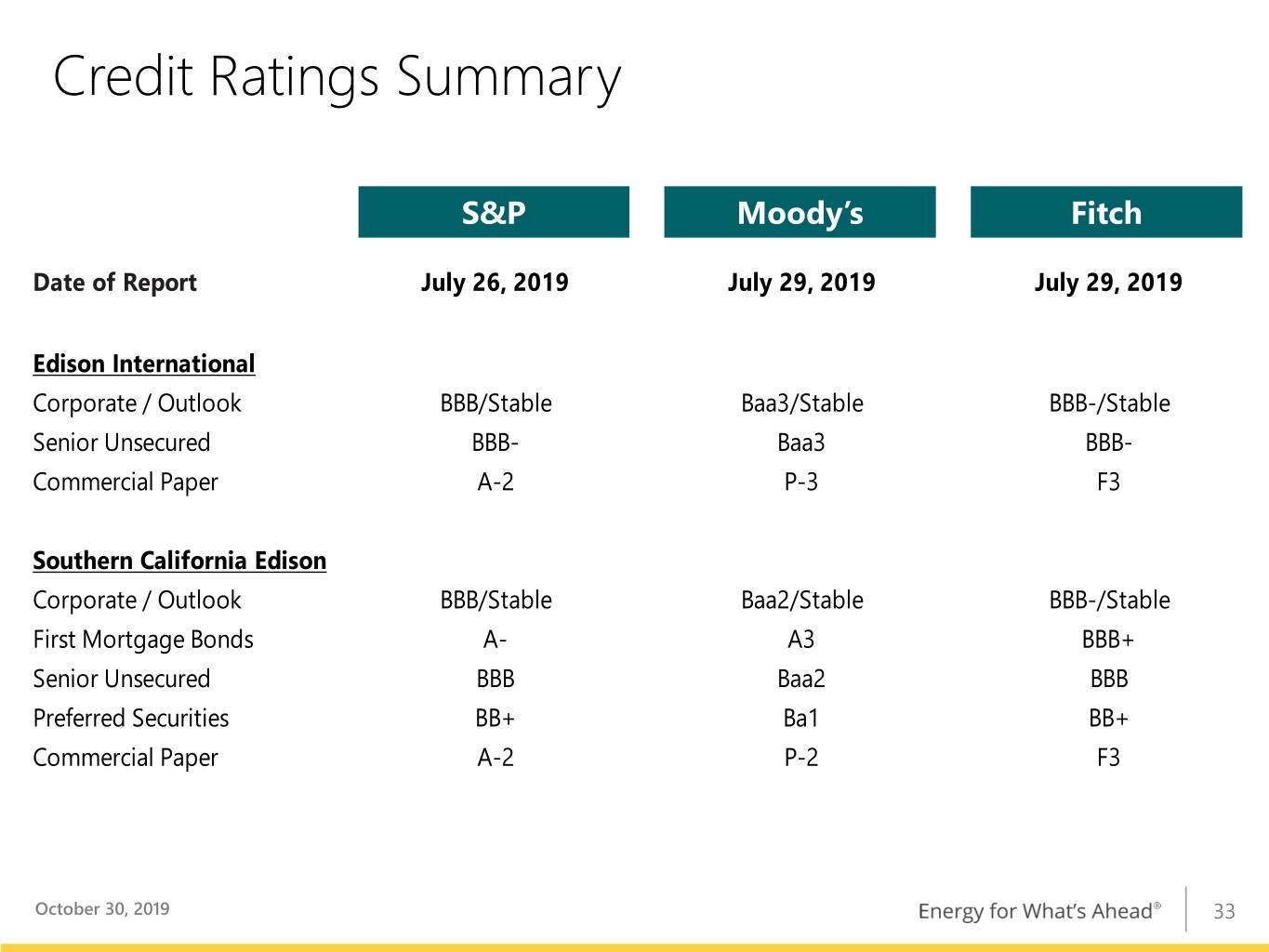

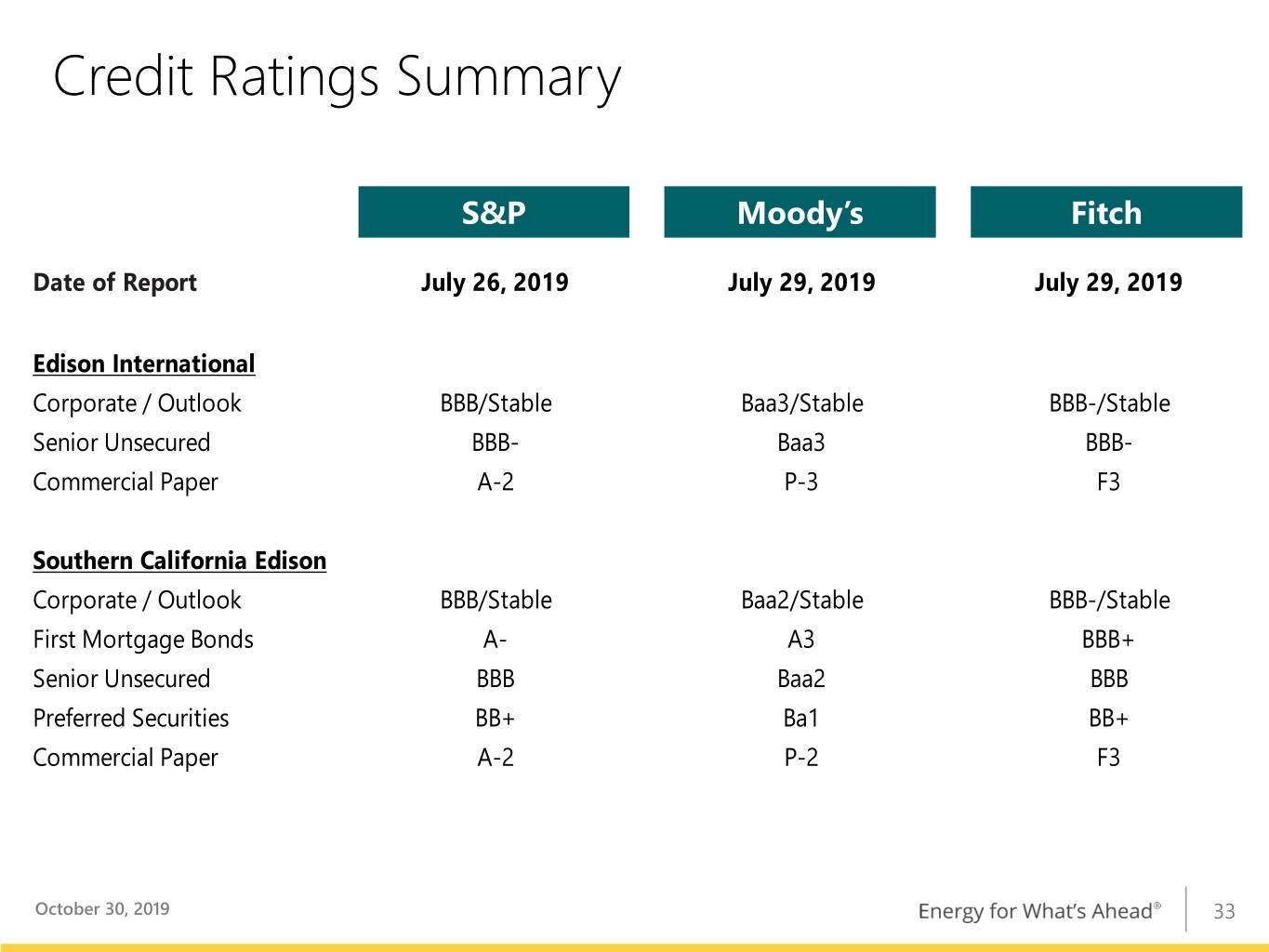

Credit Ratings Summary S&P Moody’s Fitch Date of Report July 26, 2019 July 29, 2019 July 29, 2019 Edison International Corporate / Outlook BBB/Stable Baa3/Stable BBB-/Stable Senior Unsecured BBB- Baa3 BBB- Commercial Paper A-2 P-3 F3 Southern California Edison Corporate / Outlook BBB/Stable Baa2/Stable BBB-/Stable First Mortgage Bonds A- A3 BBB+ Senior Unsecured BBB Baa2 BBB Preferred Securities BB+ Ba1 BB+ Commercial Paper A-2 P-2 F3 October 30, 2019 33

Distribution Power Grid of the Future Current State Future State One-Way Electricity Flow Variable, Two-Way Electricity Flow • System designed to distribute electricity • Distribution system at the center of the from large central generating plants power grid • Voltage centrally maintained • System designed to manage fluctuating • Increasing integration of distributed resources and customer demand energy resources • Digital monitoring and control devices and • Limited situational awareness and advanced communications systems to visualization tools for power grid improve safety and reliability, and integrate operators DERs • Improved data management and power Renewable Generation Mandates grid operations and cyber risk mitigation Subsidized Residential Solar • Integrated utility distribution with distributed energy resources planning Limited Electric Vehicle Charging Infrastructure Maximize Distributed Resources and Electric Vehicle Adoption • Distribution power grid infrastructure design supports customer choice and greater resiliency October 30, 2019 34

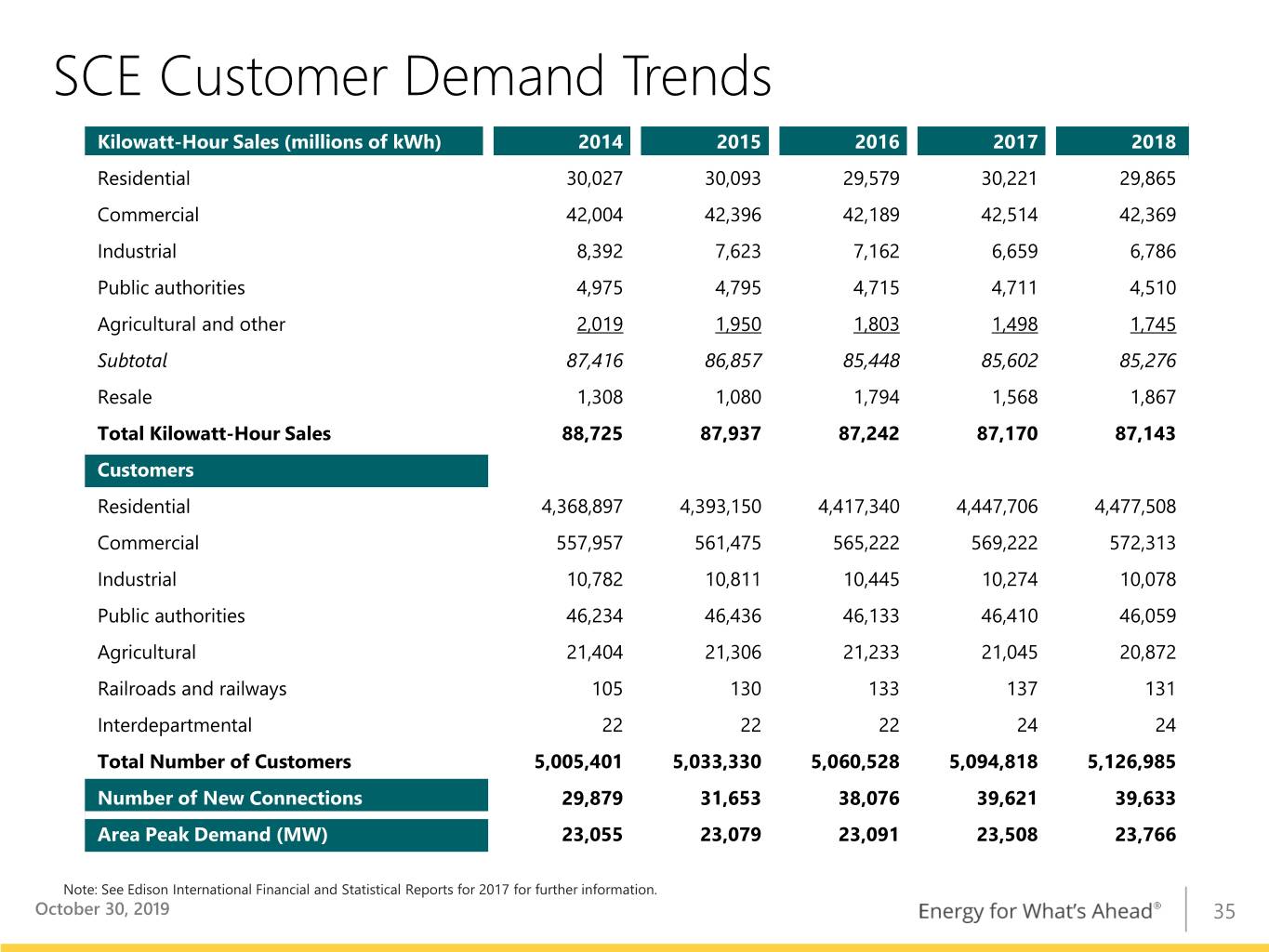

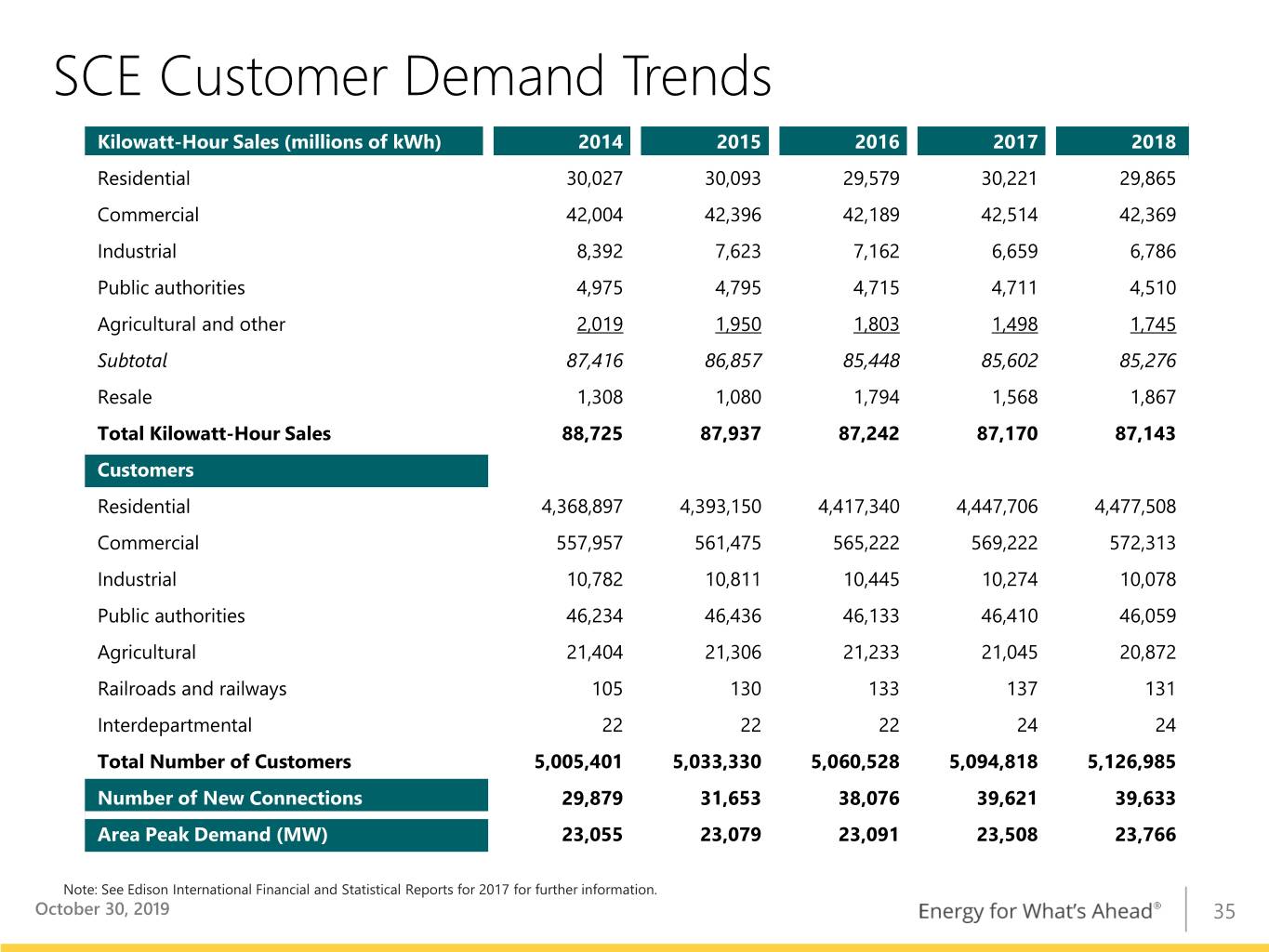

SCE Customer Demand Trends Kilowatt-Hour Sales (millions of kWh) 2014 2015 2016 2017 2018 Residential 30,027 30,093 29,579 30,221 29,865 Commercial 42,004 42,396 42,189 42,514 42,369 Industrial 8,392 7,623 7,162 6,659 6,786 Public authorities 4,975 4,795 4,715 4,711 4,510 Agricultural and other 2,019 1,950 1,803 1,498 1,745 Subtotal 87,416 86,857 85,448 85,602 85,276 Resale 1,308 1,080 1,794 1,568 1,867 Total Kilowatt-Hour Sales 88,725 87,937 87,242 87,170 87,143 Customers Residential 4,368,897 4,393,150 4,417,340 4,447,706 4,477,508 Commercial 557,957 561,475 565,222 569,222 572,313 Industrial 10,782 10,811 10,445 10,274 10,078 Public authorities 46,234 46,436 46,133 46,410 46,059 Agricultural 21,404 21,306 21,233 21,045 20,872 Railroads and railways 105 130 133 137 131 Interdepartmental 22 22 22 24 24 Total Number of Customers 5,005,401 5,033,330 5,060,528 5,094,818 5,126,985 Number of New Connections 29,879 31,653 38,076 39,621 39,633 Area Peak Demand (MW) 23,055 23,079 23,091 23,508 23,766 Note: See Edison International Financial and Statistical Reports for 2017 for further information. October 30, 2019 35

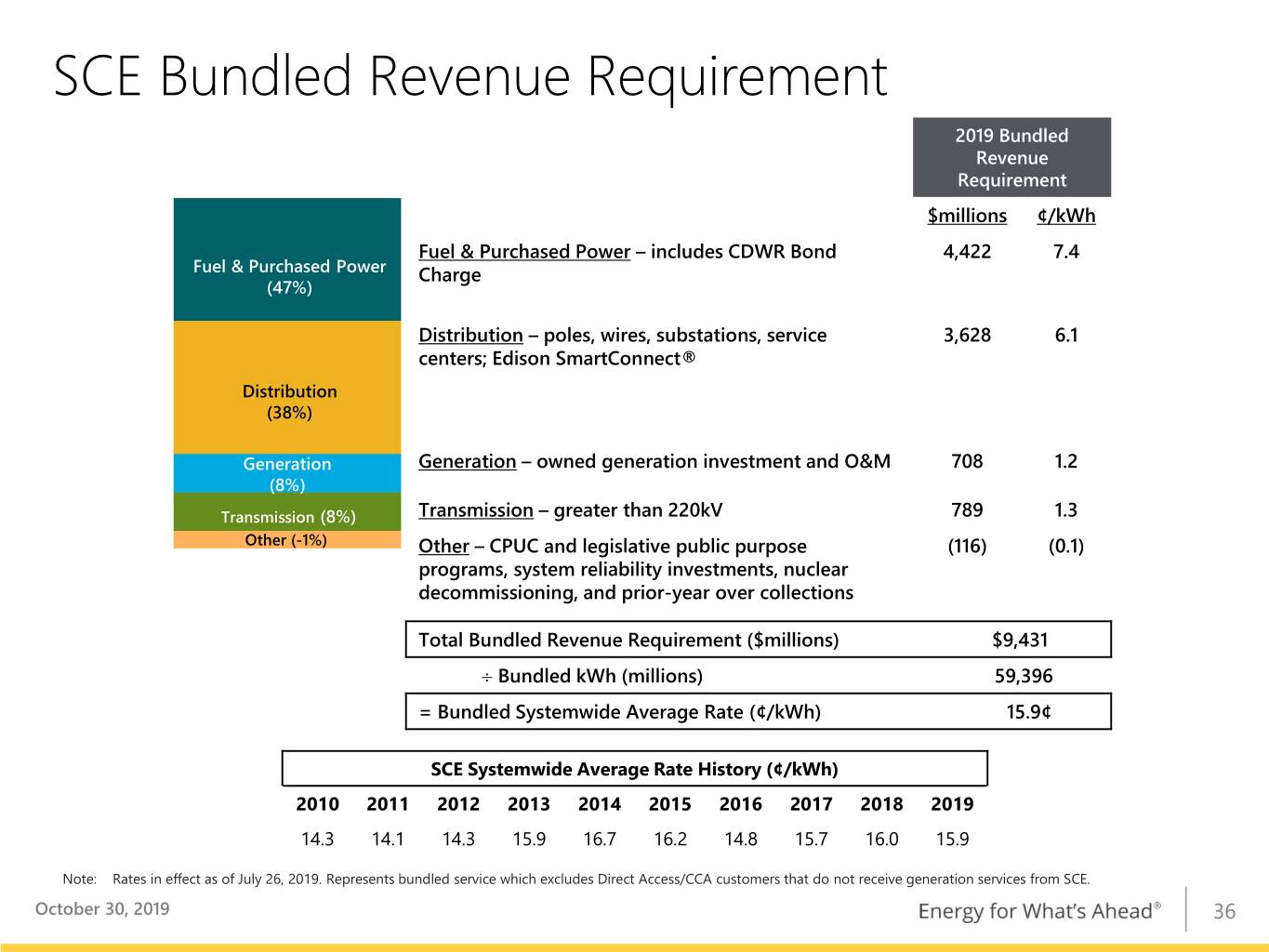

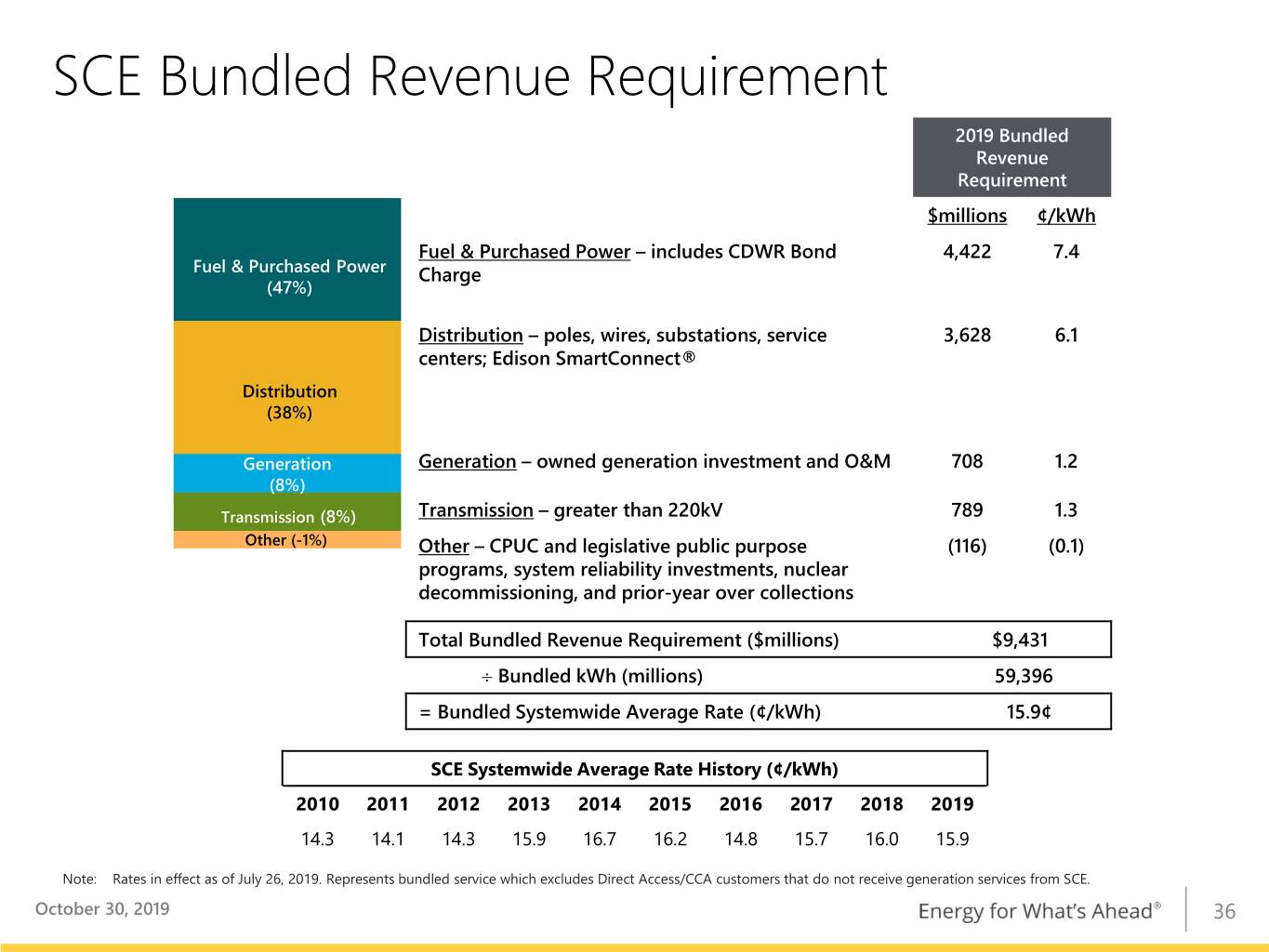

SCE Bundled Revenue Requirement 2019 Bundled Revenue Requirement $millions ¢/kWh Fuel & Purchased Power – includes CDWR Bond 4,422 7.4 Fuel & Purchased Power Charge (47%) Distribution – poles, wires, substations, service 3,628 6.1 centers; Edison SmartConnect® Distribution (38%) Generation Generation – owned generation investment and O&M 708 1.2 (8%) Transmission (8%) Transmission – greater than 220kV 789 1.3 Other (-1%) Other – CPUC and legislative public purpose (116) (0.1) programs, system reliability investments, nuclear decommissioning, and prior-year over collections Total Bundled Revenue Requirement ($millions) $9,431 ÷ Bundled kWh (millions) 59,396 = Bundled Systemwide Average Rate (¢/kWh) 15.9¢ SCE Systemwide Average Rate History (¢/kWh) 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 14.3 14.1 14.3 15.9 16.7 16.2 14.8 15.7 16.0 15.9 Note: Rates in effect as of July 26, 2019. Represents bundled service which excludes Direct Access/CCA customers that do not receive generation services from SCE. October 30, 2019 36

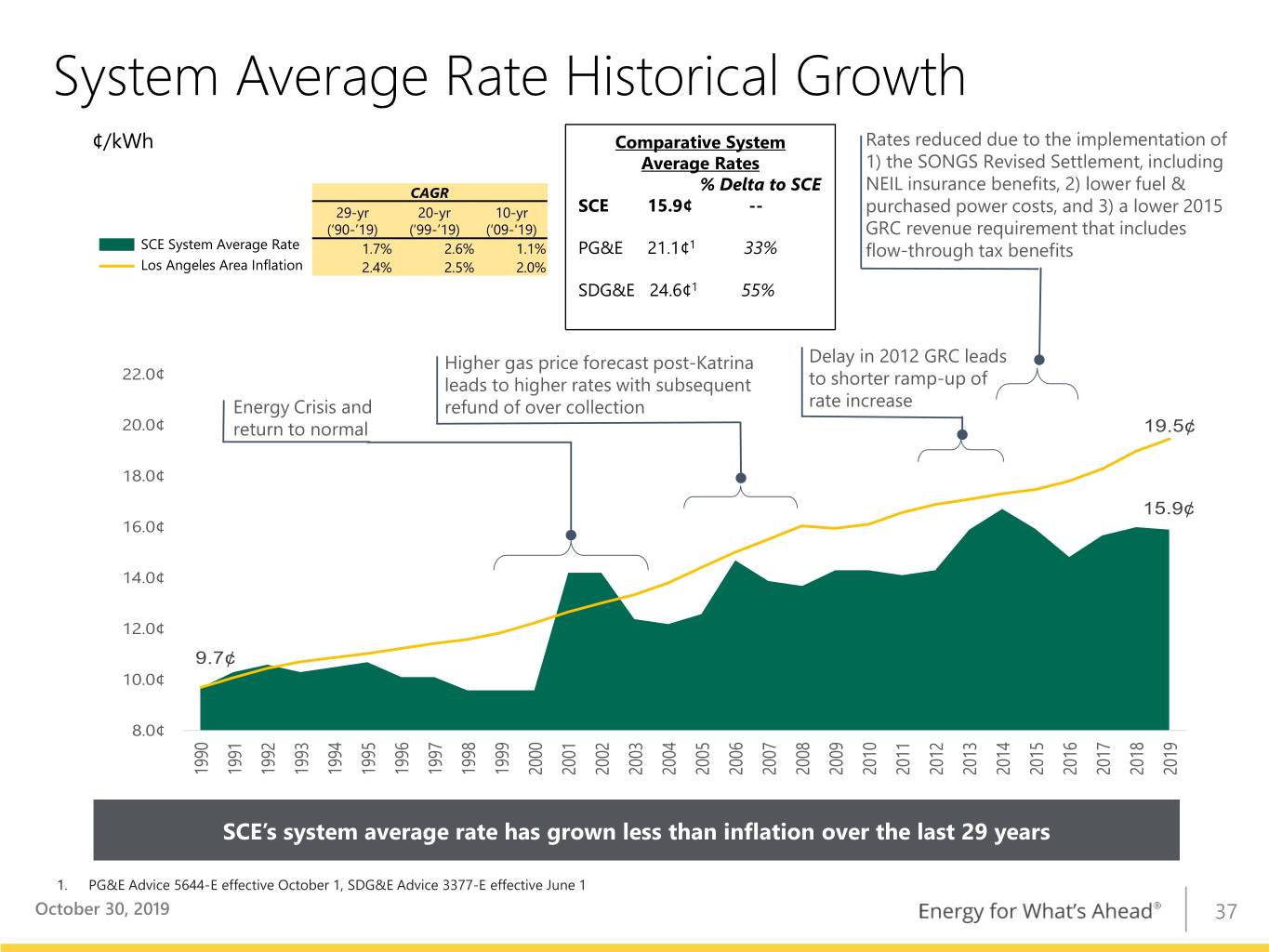

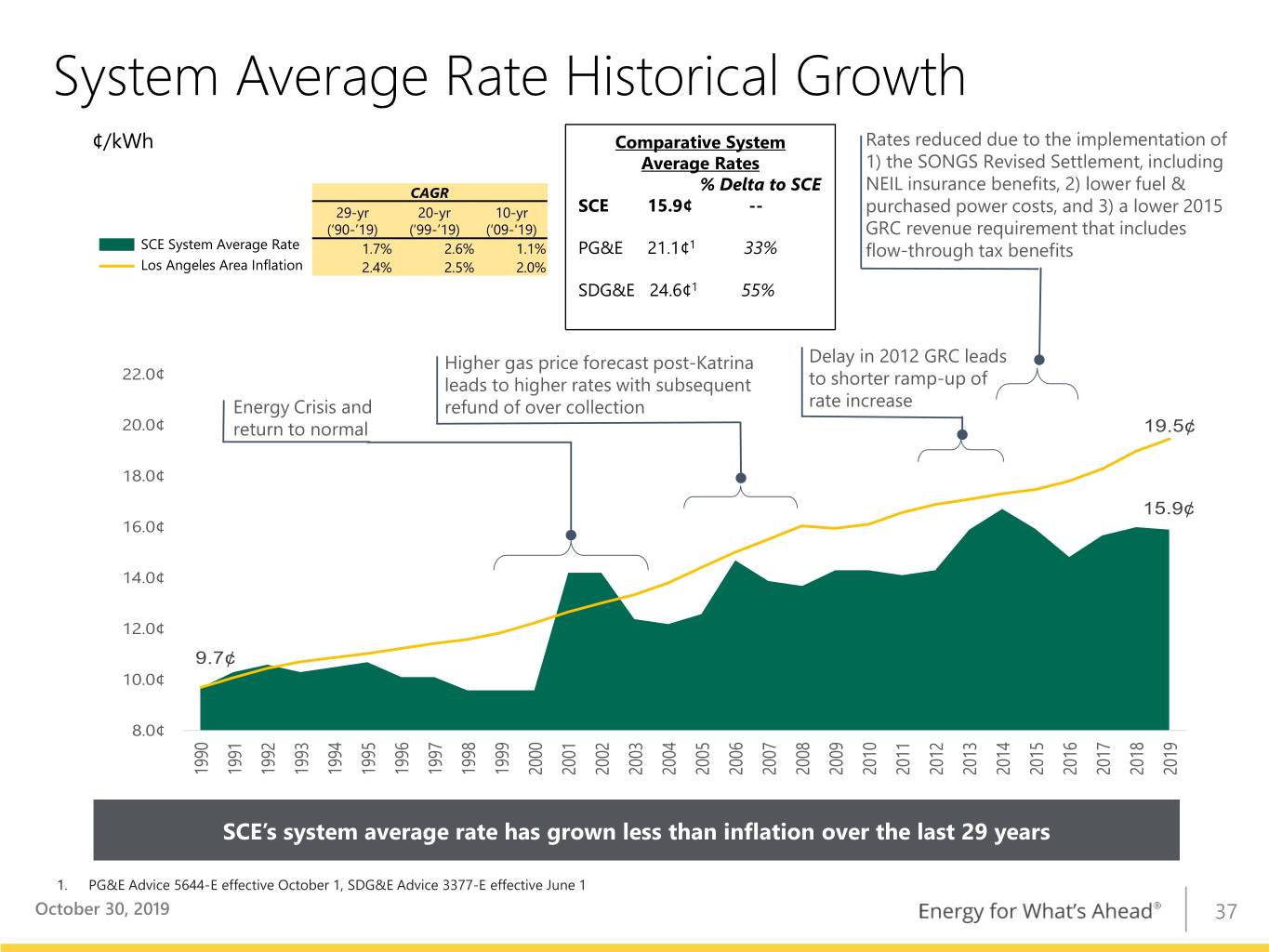

System Average Rate Historical Growth ¢/kWh Comparative System Rates reduced due to the implementation of Average Rates 1) the SONGS Revised Settlement, including CAGR % Delta to SCE NEIL insurance benefits, 2) lower fuel & 29-yr 20-yr 10-yr SCE 15.9¢ -- purchased power costs, and 3) a lower 2015 (‘90-’19) (‘99-’19) (‘09-'19) GRC revenue requirement that includes SCE System Average Rate 1.7% 2.6% 1.1% PG&E 21.1¢1 33% flow-through tax benefits Los Angeles Area Inflation 2.4% 2.5% 2.0% SDG&E 24.6¢1 55% Higher gas price forecast post-Katrina Delay in 2012 GRC leads 22.0¢ leads to higher rates with subsequent to shorter ramp-up of Energy Crisis and refund of over collection rate increase 20.0¢ return to normal 19.5¢ 18.0¢ 15.9¢ 16.0¢ 14.0¢ 12.0¢ 9.7¢ 10.0¢ 8.0¢ 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 SCE’s system average rate has grown less than inflation over the last 29 years 1. PG&E Advice 5644-E effective October 1, SDG&E Advice 3377-E effective June 1 October 30, 2019 37

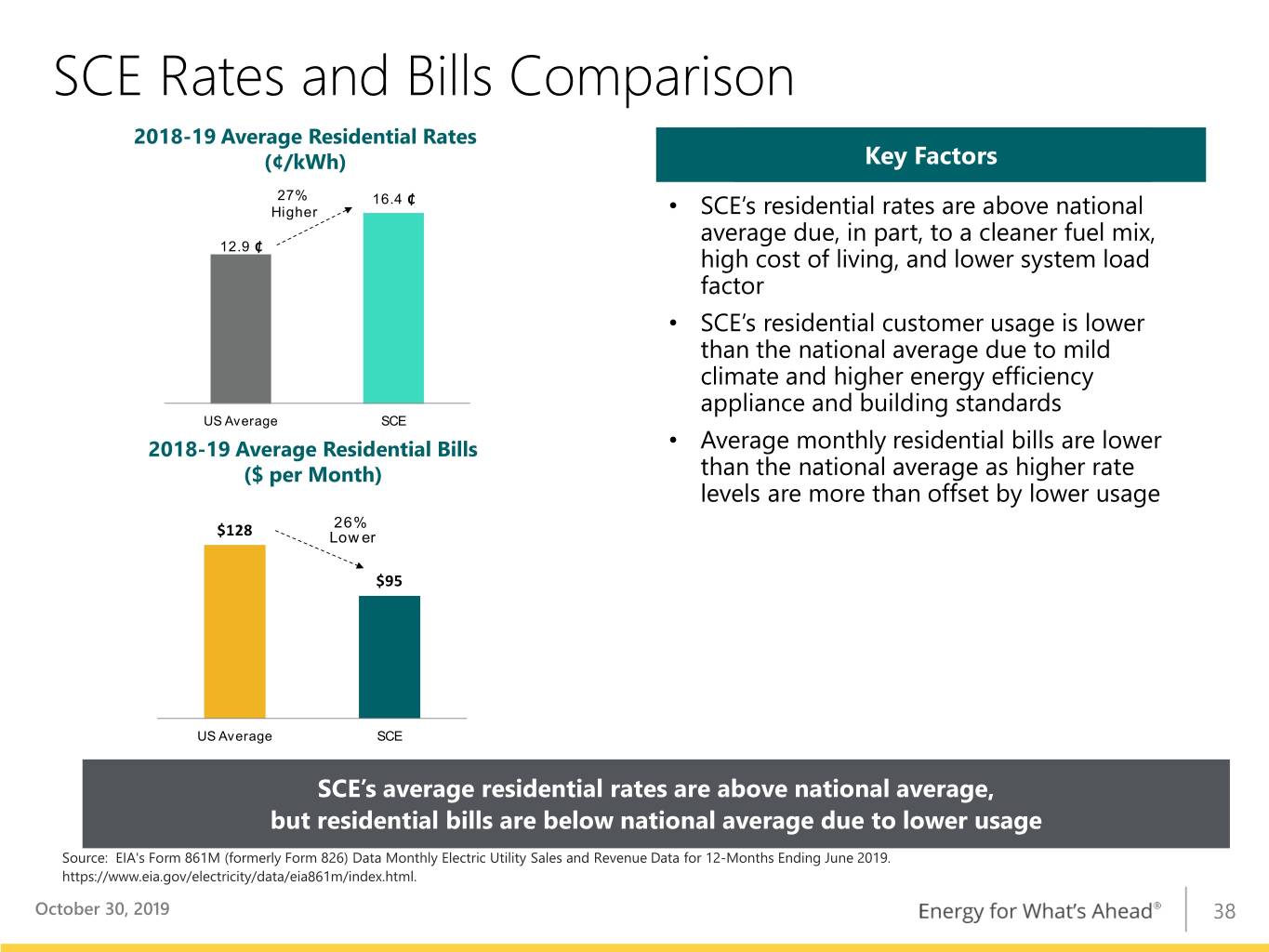

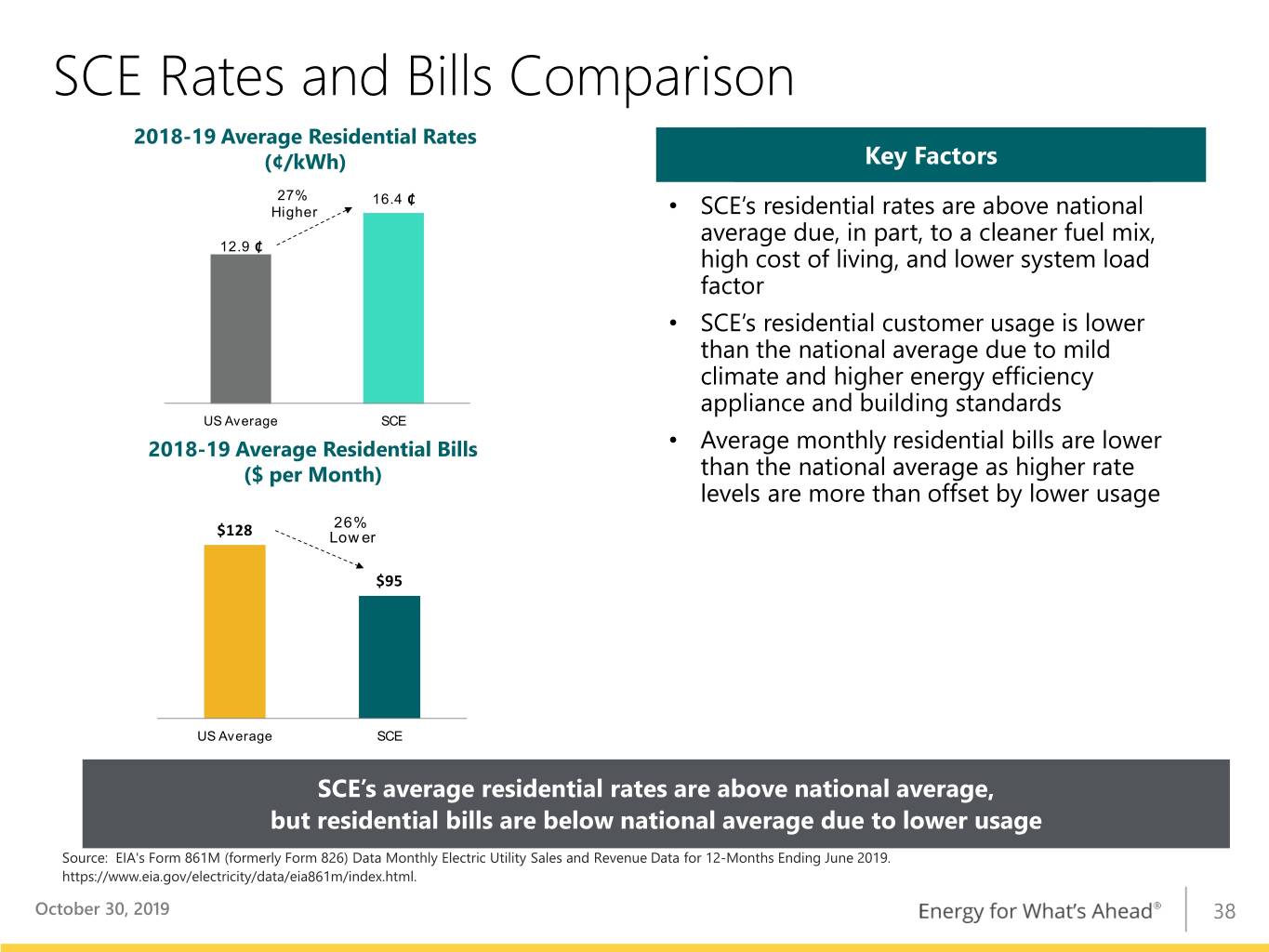

SCE Rates and Bills Comparison 2018-19 Average Residential Rates (¢/kWh) KeyKey Factors Factors 27% 16.4 ₵ Higher • SCE’s residential rates are above national 12.9 ₵ average due, in part, to a cleaner fuel mix, high cost of living, and lower system load factor • SCE’s residential customer usage is lower than the national average due to mild climate and higher energy efficiency appliance and building standards US Average SCE 2018-19 Average Residential Bills • Average monthly residential bills are lower ($ per Month) than the national average as higher rate levels are more than offset by lower usage 26% $128 Lower $95 US Average SCE SCE’s average residential rates are above national average, but residential bills are below national average due to lower usage Source: EIA's Form 861M (formerly Form 826) Data Monthly Electric Utility Sales and Revenue Data for 12-Months Ending June 2019. https://www.eia.gov/electricity/data/eia861m/index.html. October 30, 2019 38

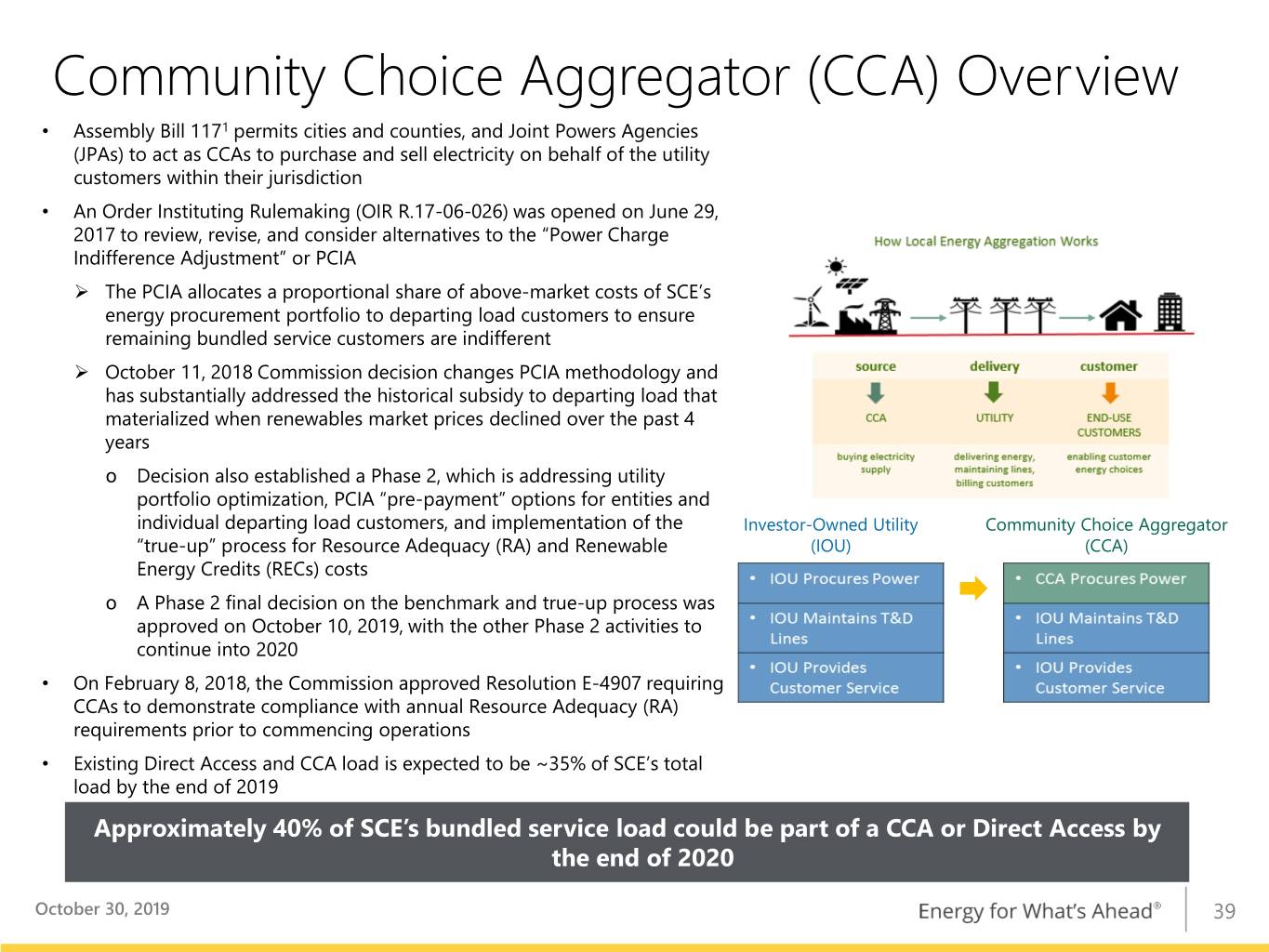

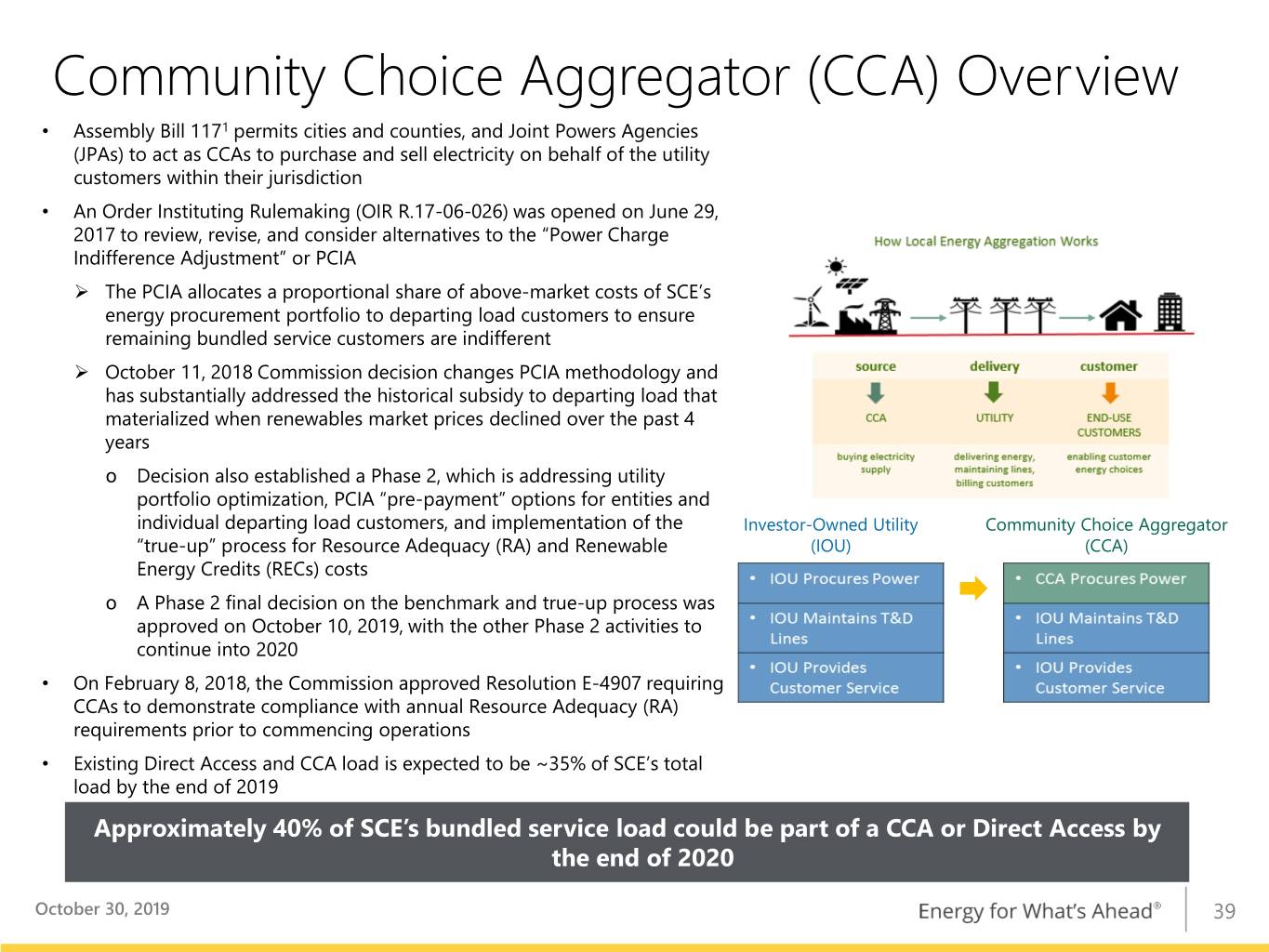

Community Choice Aggregator (CCA) Overview • Assembly Bill 1171 permits cities and counties, and Joint Powers Agencies (JPAs) to act as CCAs to purchase and sell electricity on behalf of the utility customers within their jurisdiction • An Order Instituting Rulemaking (OIR R.17-06-026) was opened on June 29, 2017 to review, revise, and consider alternatives to the “Power Charge Indifference Adjustment” or PCIA The PCIA allocates a proportional share of above-market costs of SCE’s energy procurement portfolio to departing load customers to ensure remaining bundled service customers are indifferent October 11, 2018 Commission decision changes PCIA methodology and has substantially addressed the historical subsidy to departing load that materialized when renewables market prices declined over the past 4 years o Decision also established a Phase 2, which is addressing utility portfolio optimization, PCIA “pre-payment” options for entities and individual departing load customers, and implementation of the Investor-Owned Utility Community Choice Aggregator “true-up” process for Resource Adequacy (RA) and Renewable (IOU) (CCA) Energy Credits (RECs) costs o A Phase 2 final decision on the benchmark and true-up process was approved on October 10, 2019, with the other Phase 2 activities to continue into 2020 • On February 8, 2018, the Commission approved Resolution E-4907 requiring CCAs to demonstrate compliance with annual Resource Adequacy (RA) requirements prior to commencing operations • Existing Direct Access and CCA load is expected to be ~35% of SCE’s total load by the end of 2019 Approximately 40% of SCE’s bundled service load could be part of a CCA or Direct Access by the end of 2020 October 30, 2019 39

Residential Rate Design OIR Decision • CPUC Order Instituting Ratemaking R. 12-06-013 comprehensively reviewed residential rate structure, including a future transition to Time of Use (TOU) rates In March 2018, SCE began to migrate 400,000 residential customers to TOU rate structures Remaining eligible residential customers to be migrated beginning October 2020 • July 2015 CPUC Decision D. 15-07-001 includes: Transition to 2 tiered rate structure, coupled with Super-User Electric (SUE) Surcharge1 “Super User Electric Surcharge” for usage 400% above baseline (~3% of all usage) Minimum bills of approximately $10/month (applied to delivery revenue only) Non-CARE2, Unbundled Rates January 2014 2019 Fixed Charge: Fixed Charge: (Single-Family) $0.94/month (Single-Family) $0.94/month (Multi-Family) $0.73/month (Multi-Family) $0.73/month Minimum Bill: $10.54/month 2.19 1.20 2.10 2.30 1.25 1.00 1.00 (3%) (11%) (16%) (22%) (37%) (51% of system usage) (60% of system usage) Tiered Rate Level Tiered Rate Level (Relative to Tier 1 Rate) (Relative to Tier 1 Rate) Tier 1: Tier 2: Tier 3: Tier 4: Tier 1: Tier 2: SUE: 100% 101-130% 131-200% >200% 100% 101-400% >400% Usage Level (% of Baseline) Usage Level (% of Baseline) 1. Completed in 2019 2. SCE’s California Alternate Rates for Energy (CARE) program is an income-qualifying program that reduces energy bills for eligible customers by about 30% October 30, 2019 40

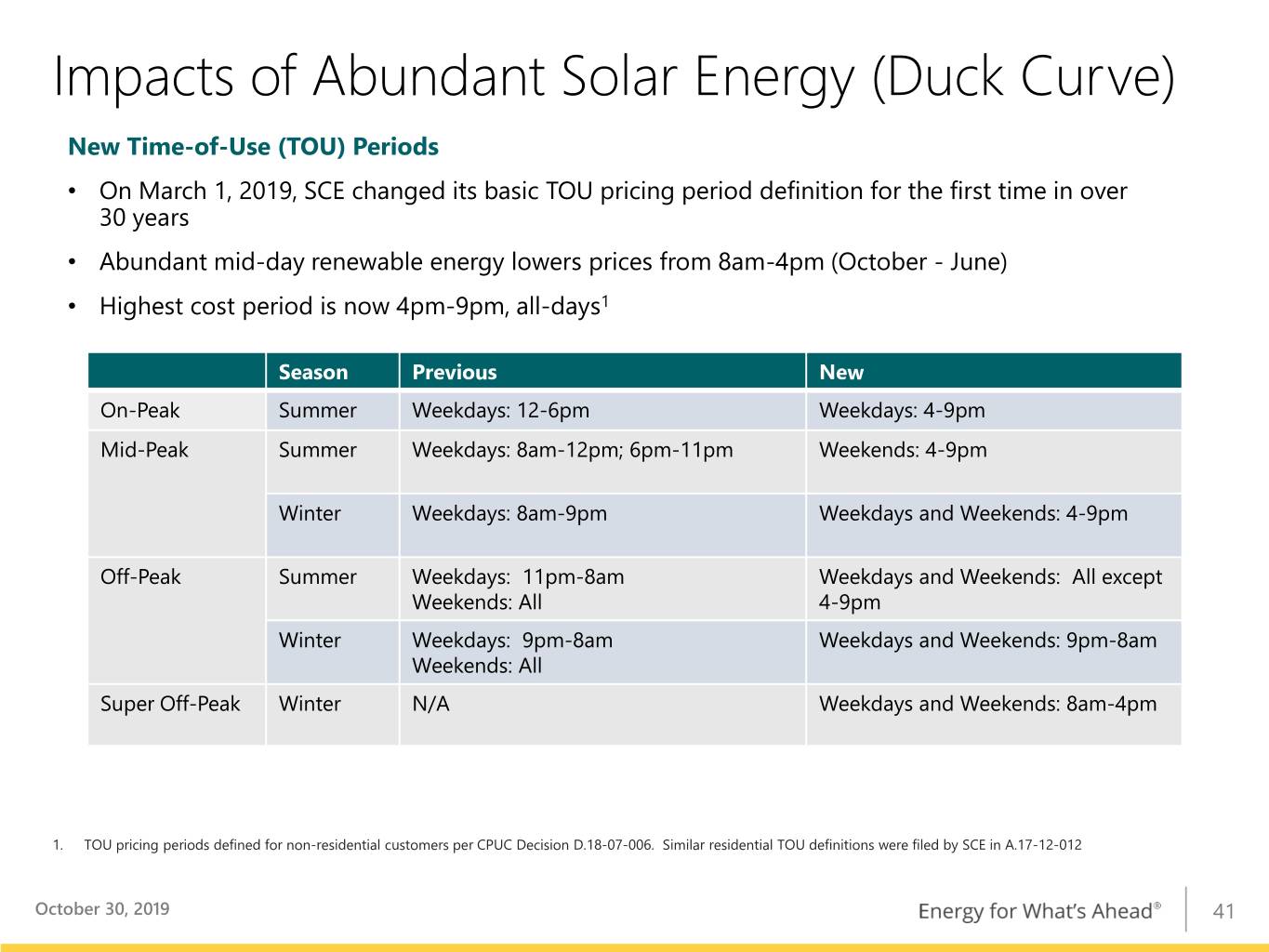

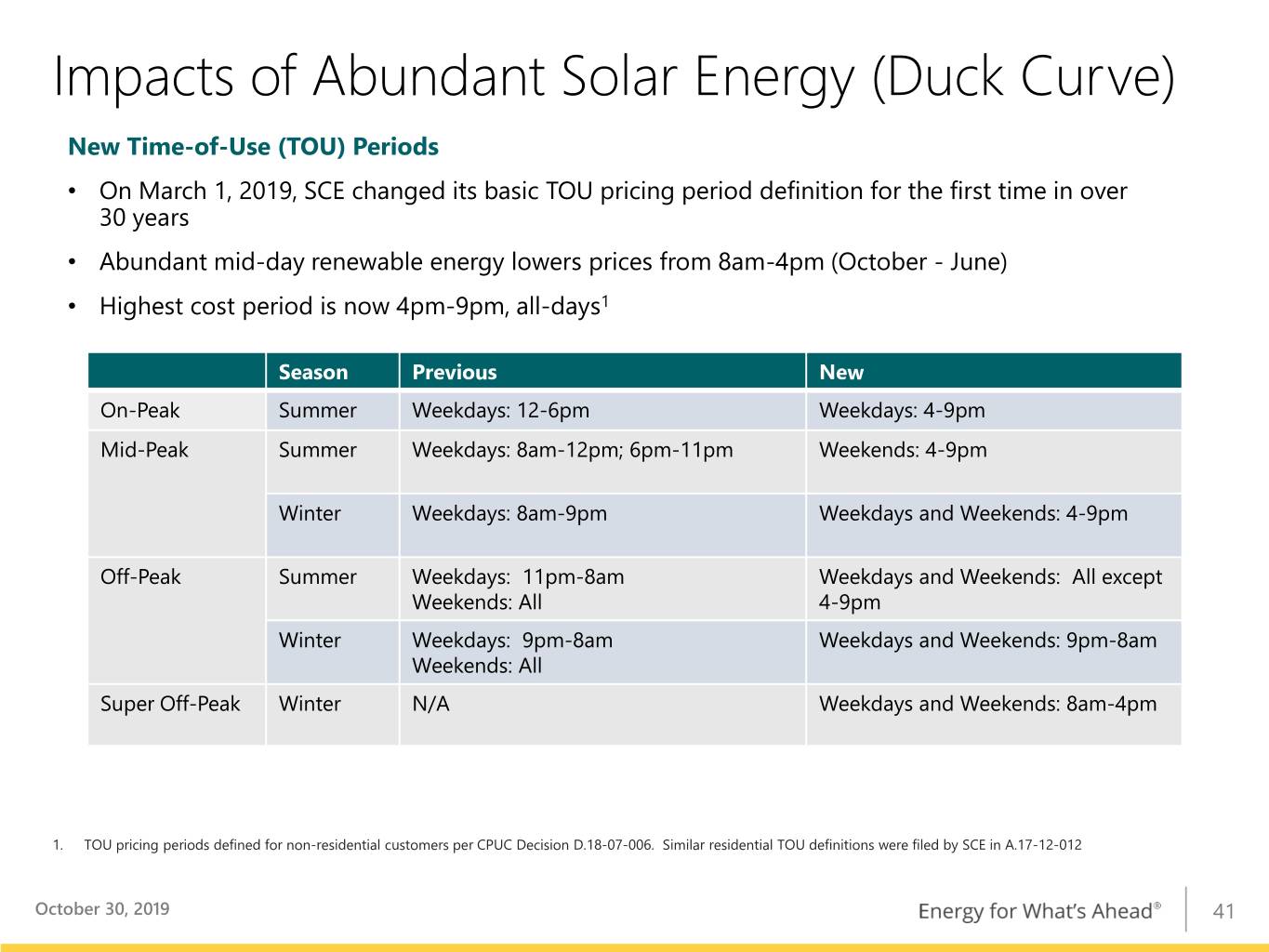

Impacts of Abundant Solar Energy (Duck Curve) New Time-of-Use (TOU) Periods • On March 1, 2019, SCE changed its basic TOU pricing period definition for the first time in over 30 years • Abundant mid-day renewable energy lowers prices from 8am-4pm (October - June) • Highest cost period is now 4pm-9pm, all-days1 Season Previous New On-Peak Summer Weekdays: 12-6pm Weekdays: 4-9pm Mid-Peak Summer Weekdays: 8am-12pm; 6pm-11pm Weekends: 4-9pm Winter Weekdays: 8am-9pm Weekdays and Weekends: 4-9pm Off-Peak Summer Weekdays: 11pm-8am Weekdays and Weekends: All except Weekends: All 4-9pm Winter Weekdays: 9pm-8am Weekdays and Weekends: 9pm-8am Weekends: All Super Off-Peak Winter N/A Weekdays and Weekends: 8am-4pm 1. TOU pricing periods defined for non-residential customers per CPUC Decision D.18-07-006. Similar residential TOU definitions were filed by SCE in A.17-12-012 October 30, 2019 41

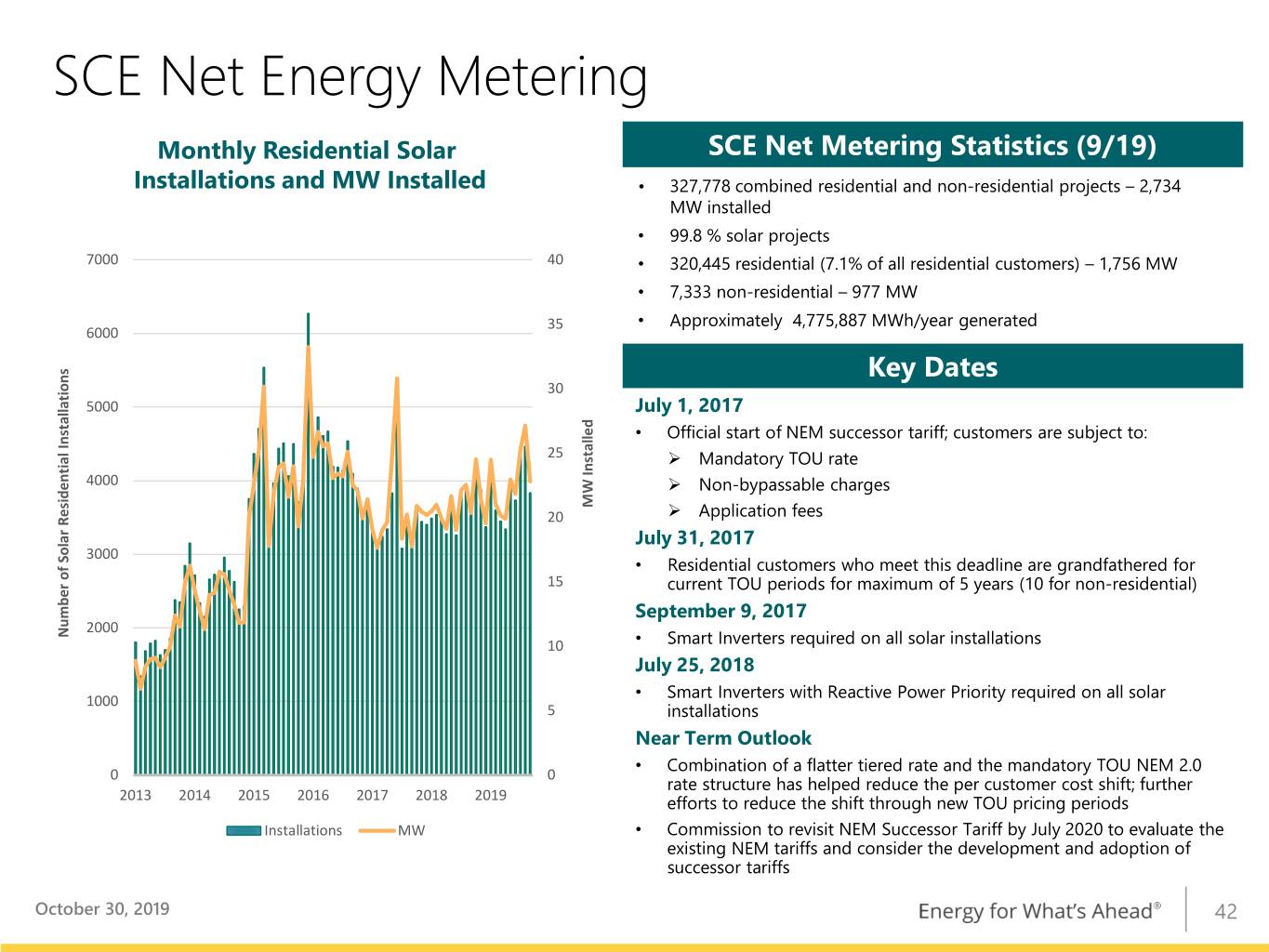

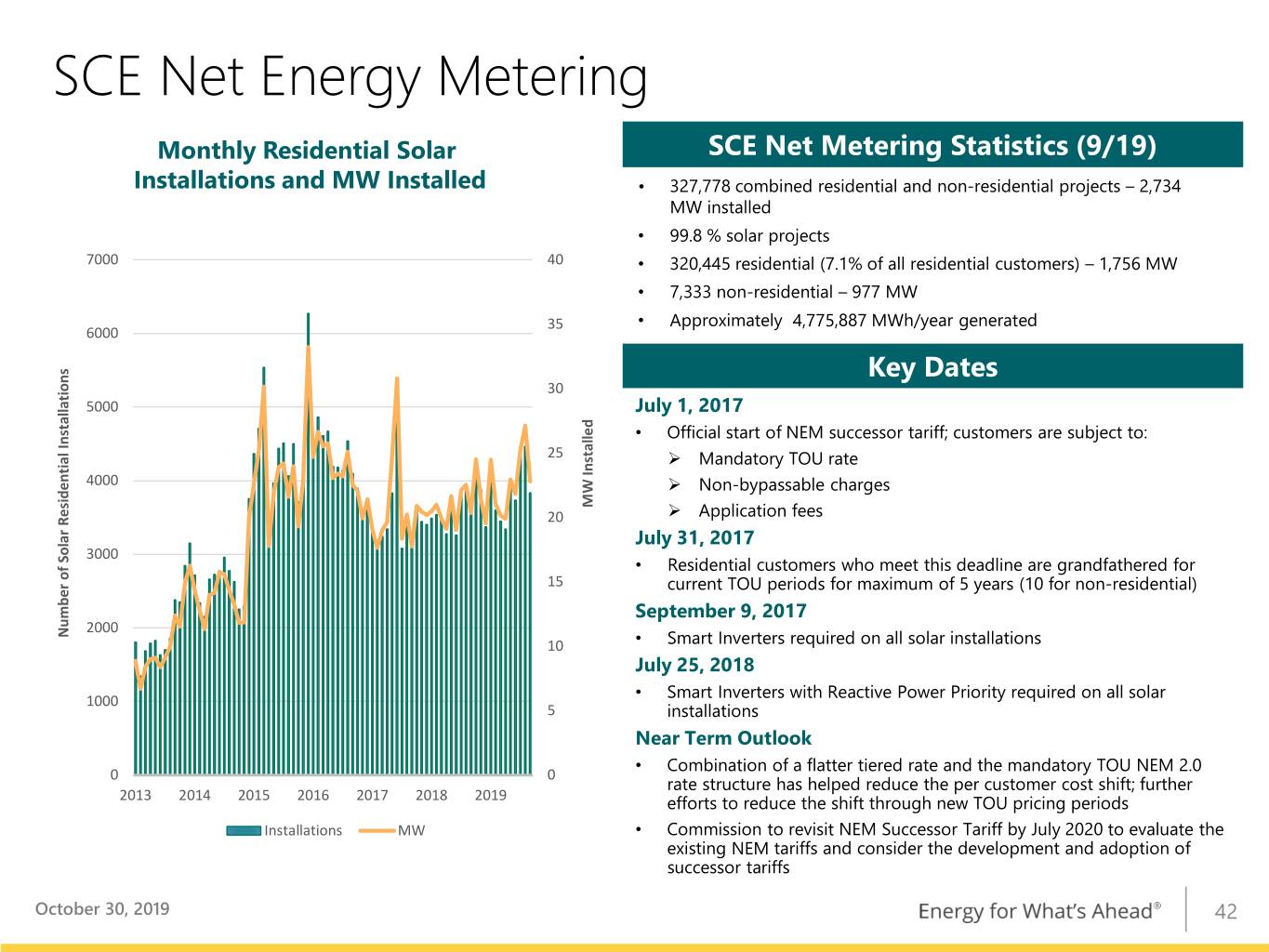

SCE Net Energy Metering Monthly Residential Solar SCE Net Metering Statistics (9/19) Installations and MW Installed • 327,778 combined residential and non-residential projects – 2,734 MW installed • 99.8 % solar projects 7000 40 • 320,445 residential (7.1% of all residential customers) – 1,756 MW • 7,333 non-residential – 977 MW 35 • Approximately 4,775,887 MWh/year generated 6000 Key Dates 30 5000 July 1, 2017 • Official start of NEM successor tariff; customers are subject to: 25 Mandatory TOU rate 4000 Non-bypassable charges MW Installed 20 Application fees July 31, 2017 3000 • Residential customers who meet this deadline are grandfathered for 15 current TOU periods for maximum of 5 years (10 for non-residential) September 9, 2017 2000 Number of Solar Residential Solar Residential of Number Installations 10 • Smart Inverters required on all solar installations July 25, 2018 1000 • Smart Inverters with Reactive Power Priority required on all solar 5 installations Near Term Outlook 0 0 • Combination of a flatter tiered rate and the mandatory TOU NEM 2.0 2013 2014 2015 2016 2017 2018 2019 rate structure has helped reduce the per customer cost shift; further efforts to reduce the shift through new TOU pricing periods Installations MW • Commission to revisit NEM Successor Tariff by July 2020 to evaluate the existing NEM tariffs and consider the development and adoption of successor tariffs October 30, 2019 42

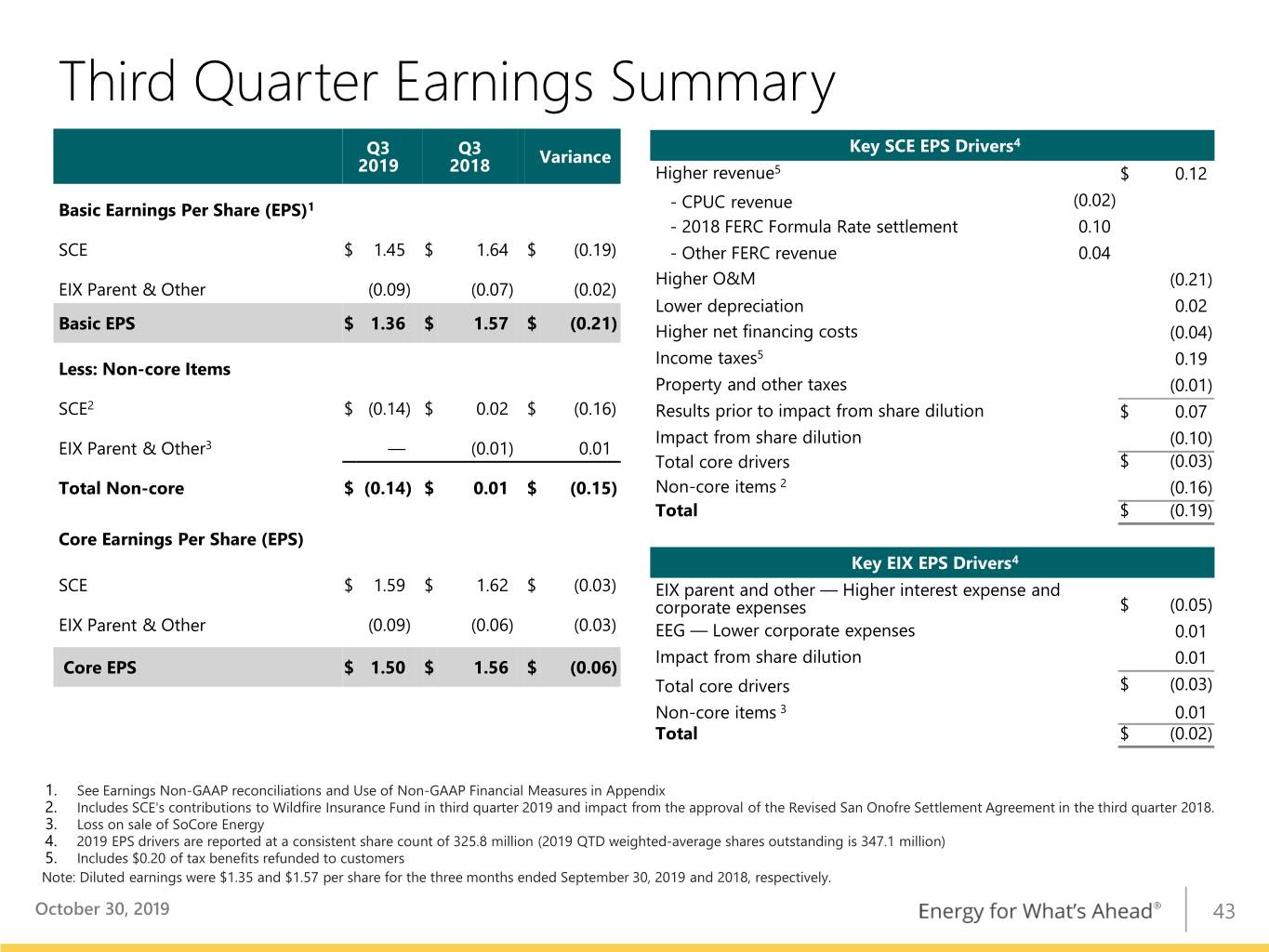

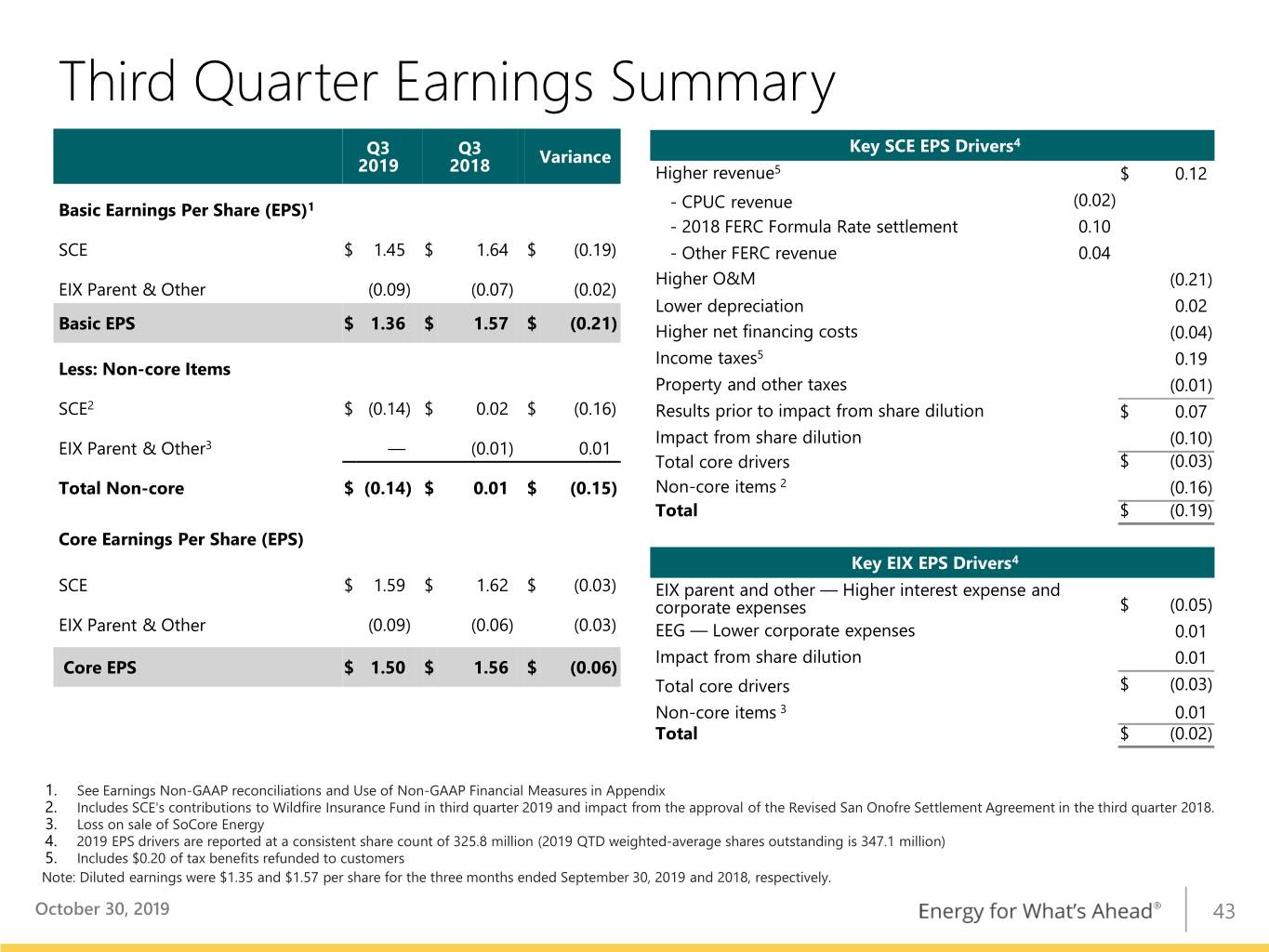

Third Quarter Earnings Summary Key SCE EPS Drivers4 Q3 Q3 Variance 2019 2018 Higher revenue5 $ 0.12 (0.02) Basic Earnings Per Share (EPS)1 - CPUC revenue - 2018 FERC Formula Rate settlement 0.10 SCE $ 1.45 $ 1.64 $ (0.19) - Other FERC revenue 0.04 Higher O&M (0.21) EIX Parent & Other (0.09) (0.07) (0.02) Lower depreciation 0.02 Basic EPS $ 1.36 $ 1.57 $ (0.21) Higher net financing costs (0.04) Income taxes5 0.19 Less: Non-core Items Property and other taxes (0.01) SCE2 $ (0.14) $ 0.02 $ (0.16) Results prior to impact from share dilution $ 0.07 Impact from share dilution (0.10) EIX Parent & Other3 — (0.01) 0.01 Total core drivers $ (0.03) Total Non-core $ (0.14) $ 0.01 $ (0.15) Non-core items 2 (0.16) Total $ (0.19) Core Earnings Per Share (EPS) Key EIX EPS Drivers4 SCE $ 1.59 $ 1.62 $ (0.03) EIX parent and other — Higher interest expense and corporate expenses $ (0.05) EIX Parent & Other (0.09) (0.06) (0.03) EEG — Lower corporate expenses 0.01 Impact from share dilution 0.01 Core EPS $ 1.50 $ 1.56 $ (0.06) Total core drivers $ (0.03) Non-core items 3 0.01 Total $ (0.02) 1. See Earnings Non-GAAP reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Includes SCE's contributions to Wildfire Insurance Fund in third quarter 2019 and impact from the approval of the Revised San Onofre Settlement Agreement in the third quarter 2018. 3. Loss on sale of SoCore Energy 4. 2019 EPS drivers are reported at a consistent share count of 325.8 million (2019 QTD weighted-average shares outstanding is 347.1 million) 5. Includes $0.20 of tax benefits refunded to customers Note: Diluted earnings were $1.35 and $1.57 per share for the three months ended September 30, 2019 and 2018, respectively. October 30, 2019 43

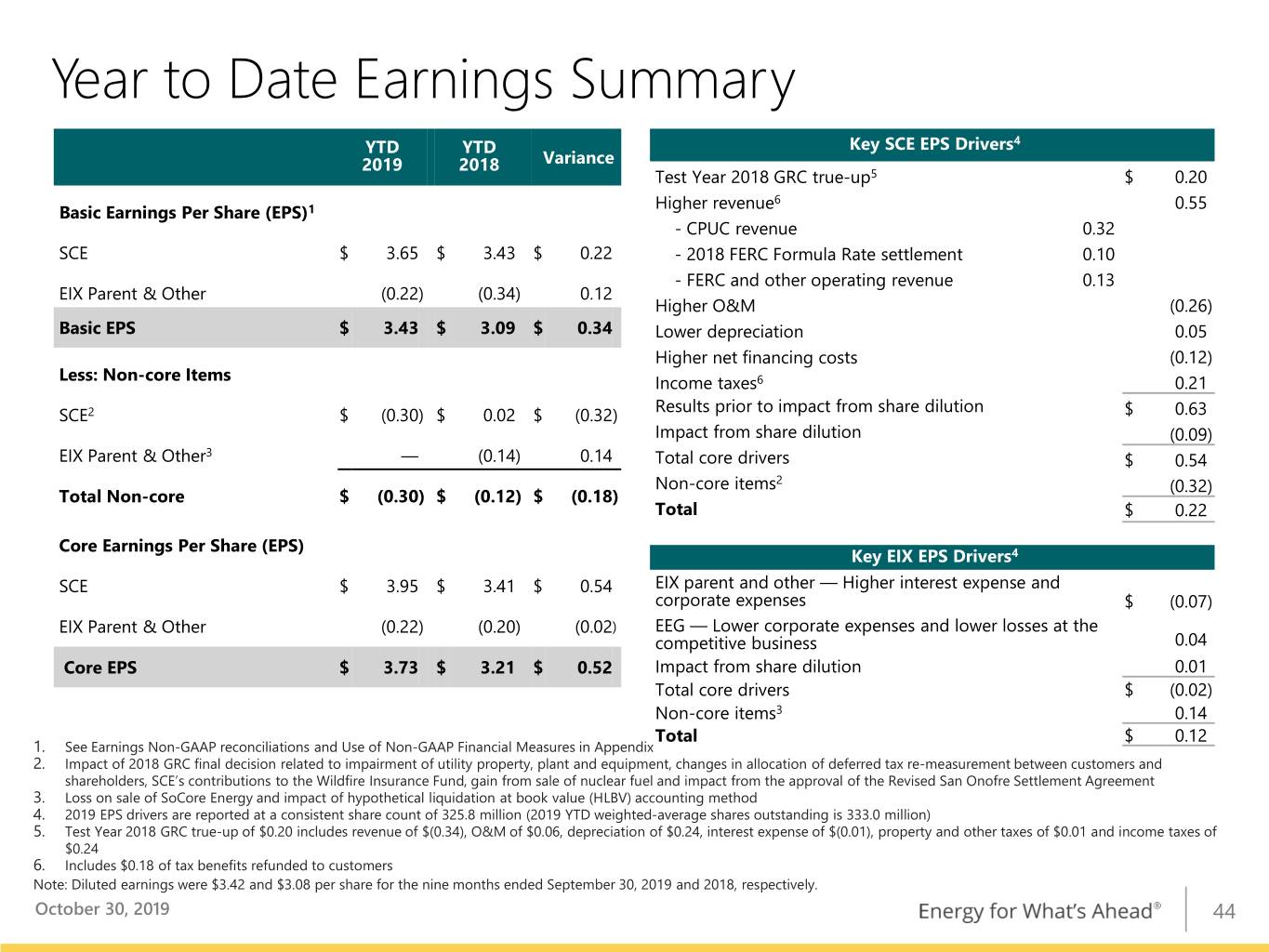

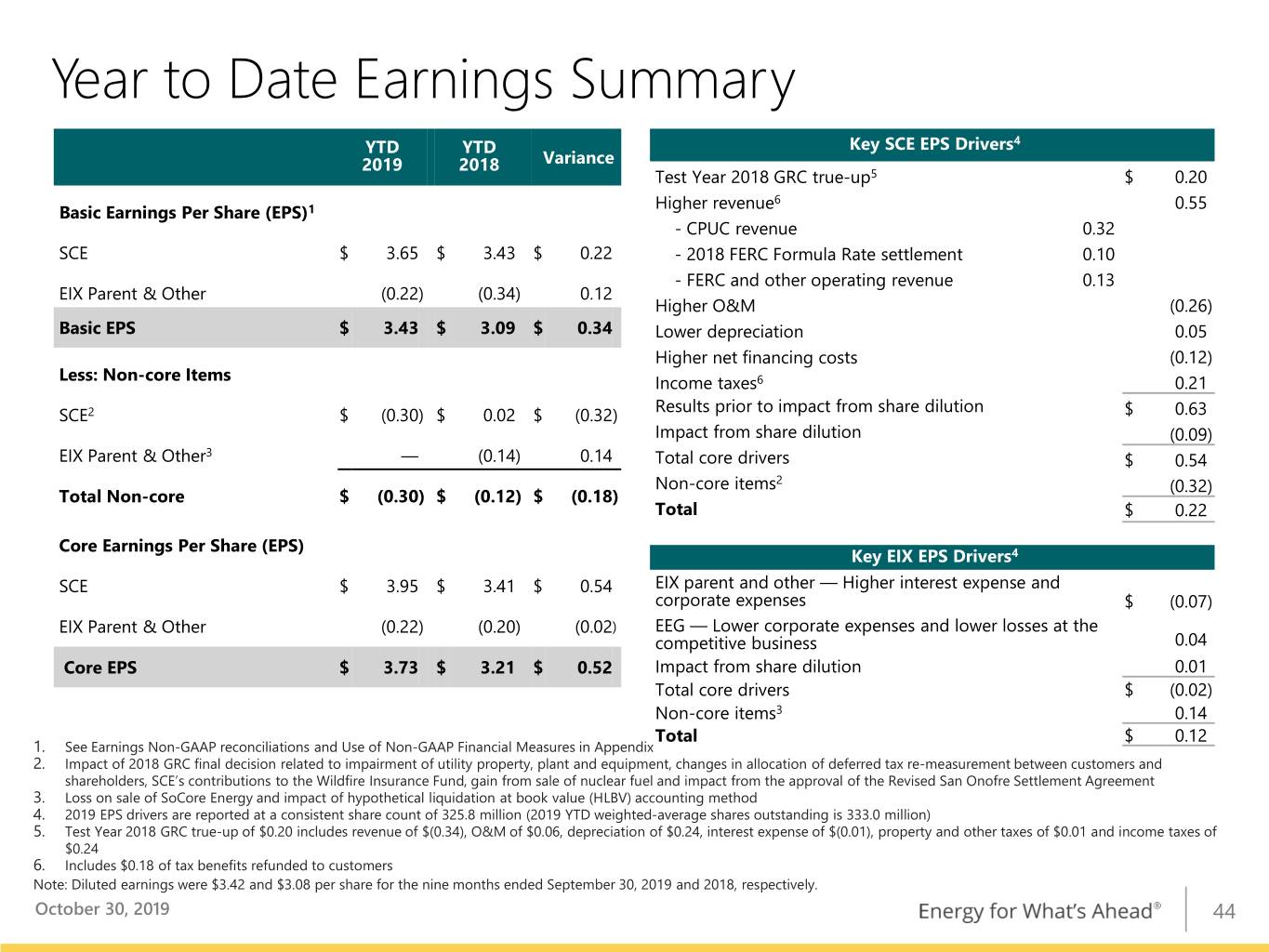

Year to Date Earnings Summary YTD YTD Key SCE EPS Drivers4 2019 2018 Variance Test Year 2018 GRC true-up5 $ 0.20 Higher revenue6 0.55 Basic Earnings Per Share (EPS)1 - CPUC revenue 0.32 SCE $ 3.65 $ 3.43 $ 0.22 - 2018 FERC Formula Rate settlement 0.10 - FERC and other operating revenue 0.13 EIX Parent & Other (0.22) (0.34) 0.12 Higher O&M (0.26) Basic EPS $ 3.43 $ 3.09 $ 0.34 Lower depreciation 0.05 Higher net financing costs (0.12) Less: Non-core Items Income taxes6 0.21 Results prior to impact from share dilution SCE2 $ (0.30) $ 0.02 $ (0.32) $ 0.63 Impact from share dilution (0.09) 3 EIX Parent & Other — (0.14) 0.14 Total core drivers $ 0.54 Non-core items2 (0.32) Total Non-core $ (0.30) $ (0.12) $ (0.18) Total $ 0.22 Core Earnings Per Share (EPS) Key EIX EPS Drivers4 SCE $ 3.95 $ 3.41 $ 0.54 EIX parent and other — Higher interest expense and corporate expenses $ (0.07) EIX Parent & Other (0.22) (0.20) (0.02) EEG — Lower corporate expenses and lower losses at the competitive business 0.04 Core EPS $ 3.73 $ 3.21 $ 0.52 Impact from share dilution 0.01 Total core drivers $ (0.02) Non-core items3 0.14 Total $ 0.12 1. See Earnings Non-GAAP reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Impact of 2018 GRC final decision related to impairment of utility property, plant and equipment, changes in allocation of deferred tax re-measurement between customers and shareholders, SCE’s contributions to the Wildfire Insurance Fund, gain from sale of nuclear fuel and impact from the approval of the Revised San Onofre Settlement Agreement 3. Loss on sale of SoCore Energy and impact of hypothetical liquidation at book value (HLBV) accounting method 4. 2019 EPS drivers are reported at a consistent share count of 325.8 million (2019 YTD weighted-average shares outstanding is 333.0 million) 5. Test Year 2018 GRC true-up of $0.20 includes revenue of $(0.34), O&M of $0.06, depreciation of $0.24, interest expense of $(0.01), property and other taxes of $0.01 and income taxes of $0.24 6. Includes $0.18 of tax benefits refunded to customers Note: Diluted earnings were $3.42 and $3.08 per share for the nine months ended September 30, 2019 and 2018, respectively. October 30, 2019 44

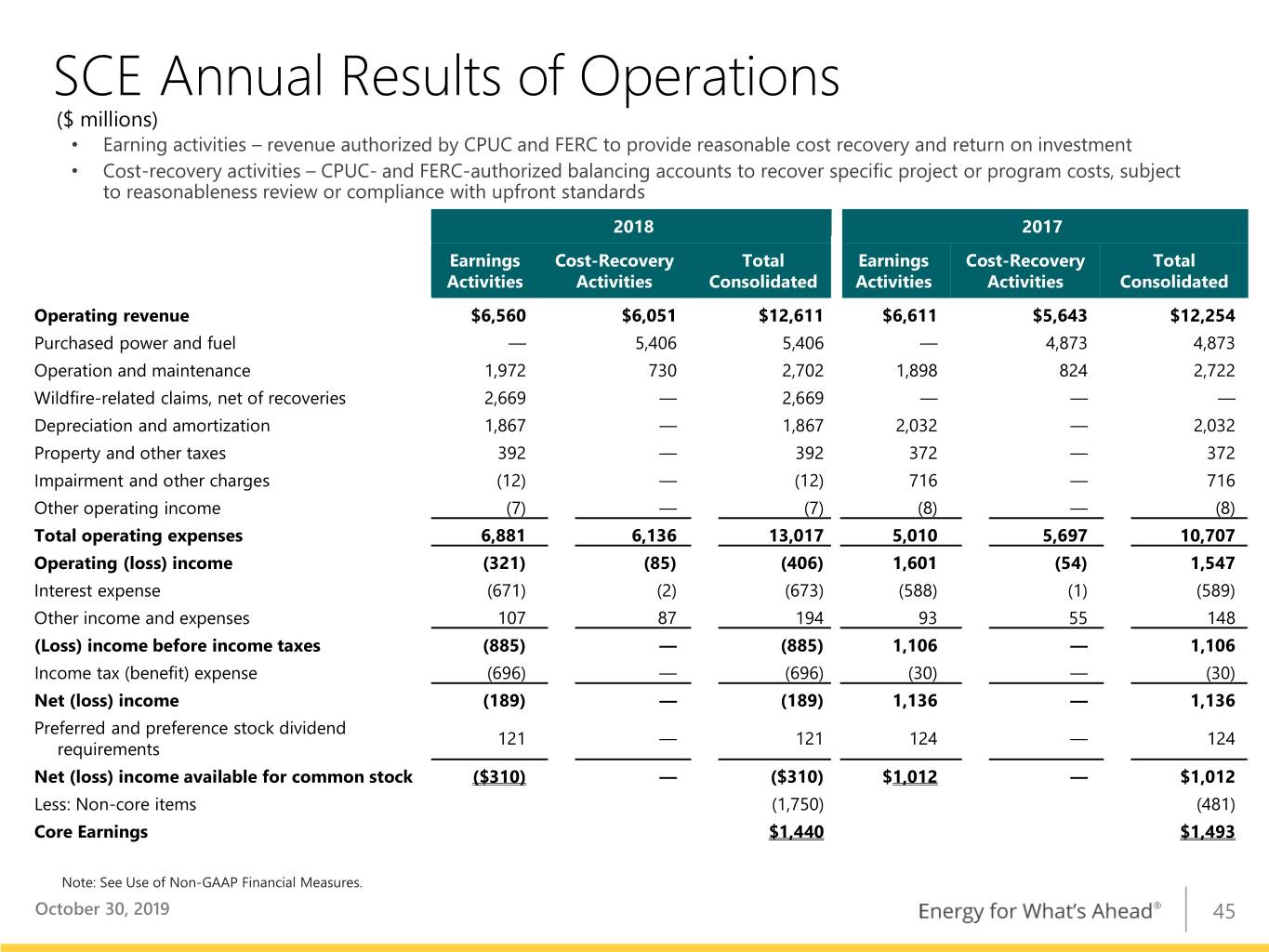

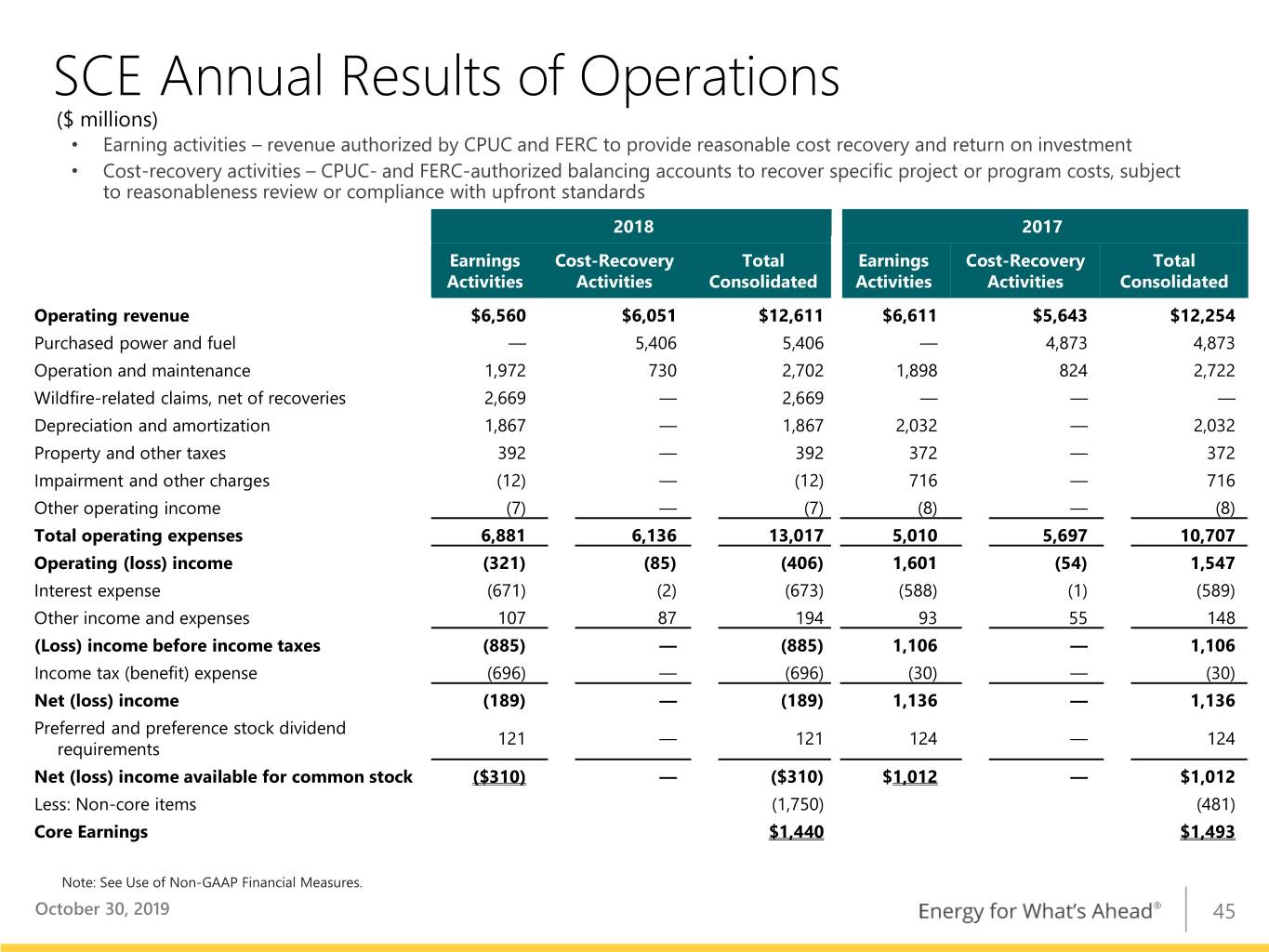

SCE Annual Results of Operations ($ millions) • Earning activities – revenue authorized by CPUC and FERC to provide reasonable cost recovery and return on investment • Cost-recovery activities – CPUC- and FERC-authorized balancing accounts to recover specific project or program costs, subject to reasonableness review or compliance with upfront standards 2018 2017 Earnings Cost-Recovery Total Earnings Cost-Recovery Total Activities Activities Consolidated Activities Activities Consolidated Operating revenue $6,560 $6,051 $12,611 $6,611 $5,643 $12,254 Purchased power and fuel — 5,406 5,406 — 4,873 4,873 Operation and maintenance 1,972 730 2,702 1,898 824 2,722 Wildfire-related claims, net of recoveries 2,669 — 2,669 ― ― ― Depreciation and amortization 1,867 — 1,867 2,032 — 2,032 Property and other taxes 392 — 392 372 — 372 Impairment and other charges (12) — (12) 716 — 716 Other operating income (7) — (7) (8) — (8) Total operating expenses 6,881 6,136 13,017 5,010 5,697 10,707 Operating (loss) income (321) (85) (406) 1,601 (54) 1,547 Interest expense (671) (2) (673) (588) (1) (589) Other income and expenses 107 87 194 93 55 148 (Loss) income before income taxes (885) — (885) 1,106 — 1,106 Income tax (benefit) expense (696) — (696) (30) — (30) Net (loss) income (189) — (189) 1,136 — 1,136 Preferred and preference stock dividend 121 — 121 124 — 124 requirements Net (loss) income available for common stock ($310) — ($310) $1,012 — $1,012 Less: Non-core items (1,750) (481) Core Earnings $1,440 $1,493 Note: See Use of Non-GAAP Financial Measures. October 30, 2019 45

Earnings Per Share Non-GAAP Reconciliations Reconciliation of EIX Basic Earnings Per Share Guidance to EIX Core Earnings Per Share Guidance EPS Attributable to Edison International 2019 Low Midpoint High SCE $4.83 EIX Parent & Other (0.32) Basic EPS1 $4.41 $4.51 $4.61 Non-Core Items SCE2,3 (0.29) (0.29) (0.29) EIX Parent & Other — — — Total Non-Core1 (0.29) (0.29) (0.29) Core EPS SCE $5.12 EIX Parent & Other (0.32) Core EPS1 $4.70 $4.80 $4.90 1. EPS is calculated on the assumed weighted-average share count for 2019. Please see 2019 EIX Core Earnings Guidance slide for more information. 2. Includes impact of 2018 GRC final decision related to impairment of utility property, plant and equipment, changes in allocation of deferred tax re-measurement between customers and shareholders and SCE’s contributions to the Wildfire Insurance Fund 3. Includes $0.01 per share as a result of share count dilution October 30, 2019 46

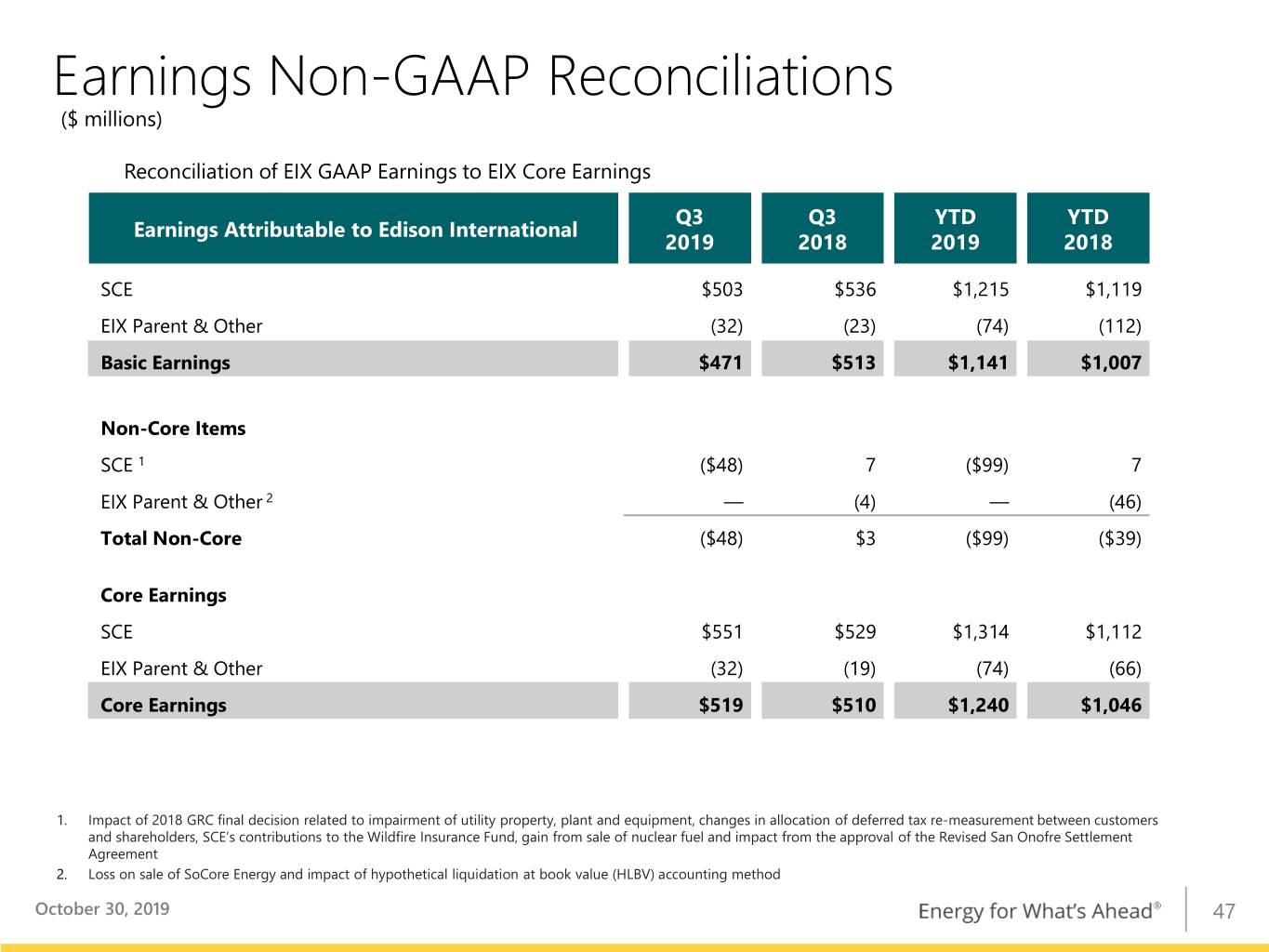

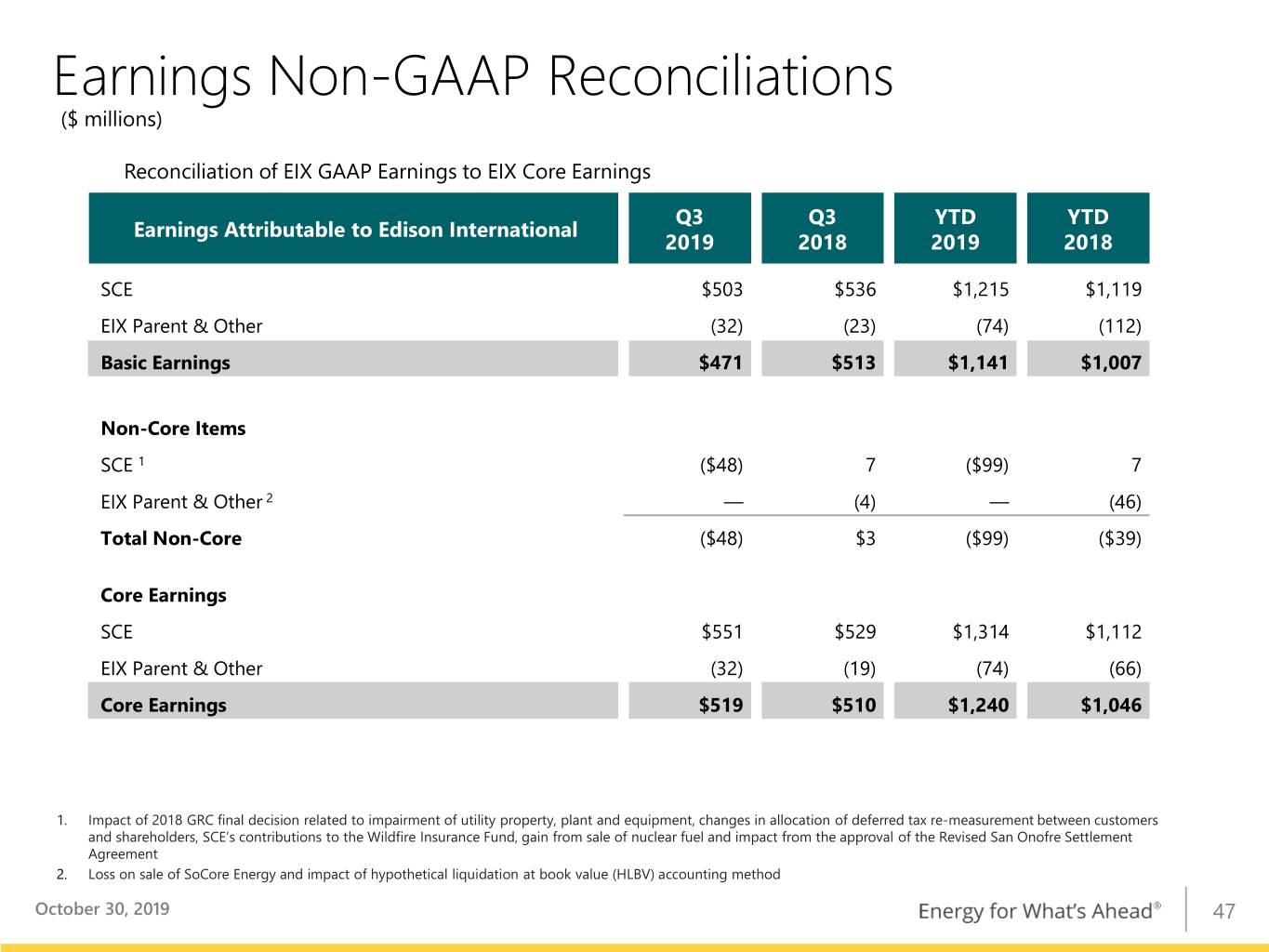

Earnings Non-GAAP Reconciliations ($ millions) Reconciliation of EIX GAAP Earnings to EIX Core Earnings Q3 Q3 YTD YTD Earnings Attributable to Edison International 2019 2018 2019 2018 SCE $503 $536 $1,215 $1,119 EIX Parent & Other (32) (23) (74) (112) Basic Earnings $471 $513 $1,141 $1,007 Non-Core Items SCE 1 ($48) 7 ($99) 7 EIX Parent & Other 2 — (4) — (46) Total Non-Core ($48) $3 ($99) ($39) Core Earnings SCE $551 $529 $1,314 $1,112 EIX Parent & Other (32) (19) (74) (66) Core Earnings $519 $510 $1,240 $1,046 1. Impact of 2018 GRC final decision related to impairment of utility property, plant and equipment, changes in allocation of deferred tax re-measurement between customers and shareholders, SCE’s contributions to the Wildfire Insurance Fund, gain from sale of nuclear fuel and impact from the approval of the Revised San Onofre Settlement Agreement 2. Loss on sale of SoCore Energy and impact of hypothetical liquidation at book value (HLBV) accounting method October 30, 2019 47

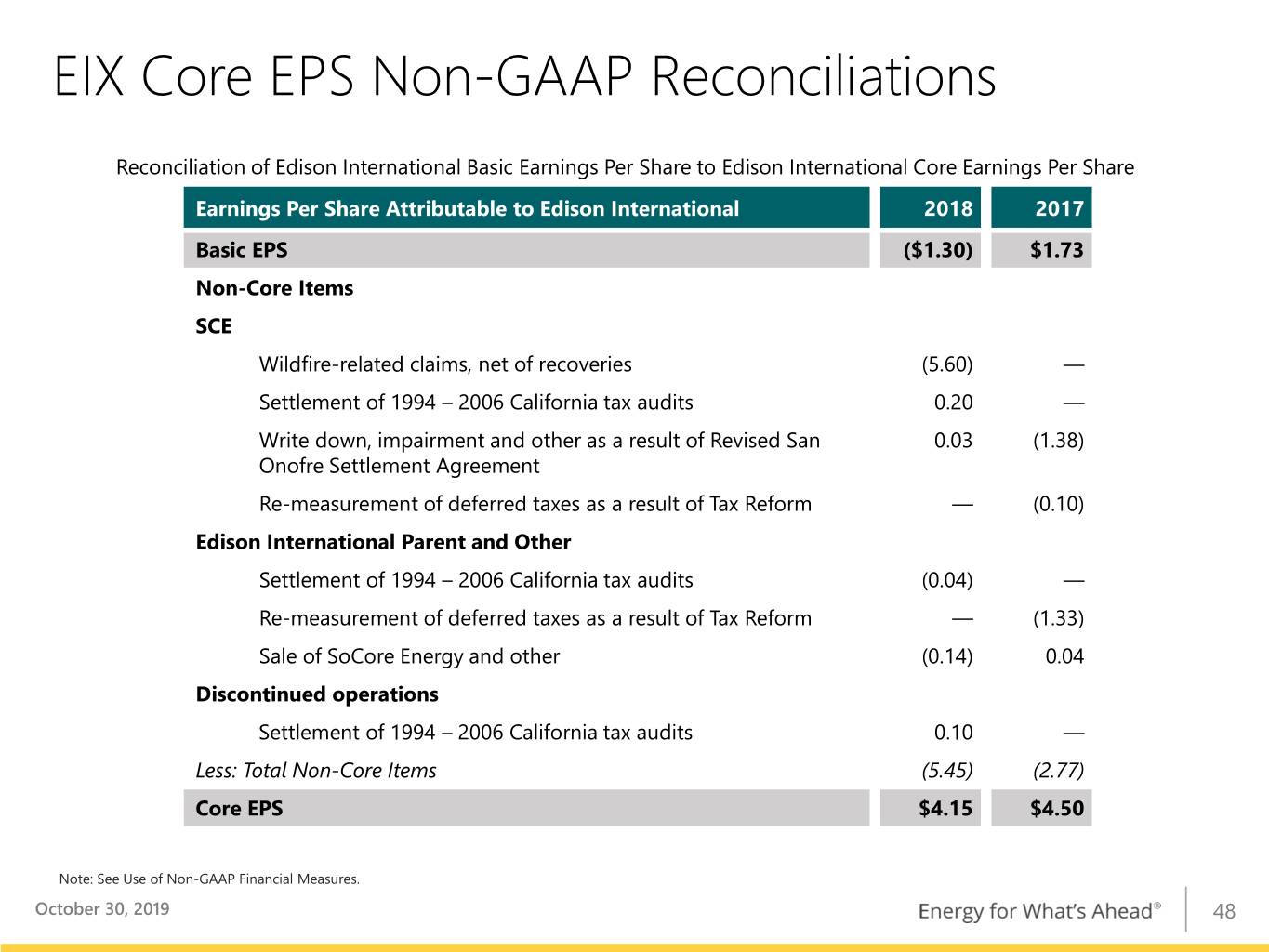

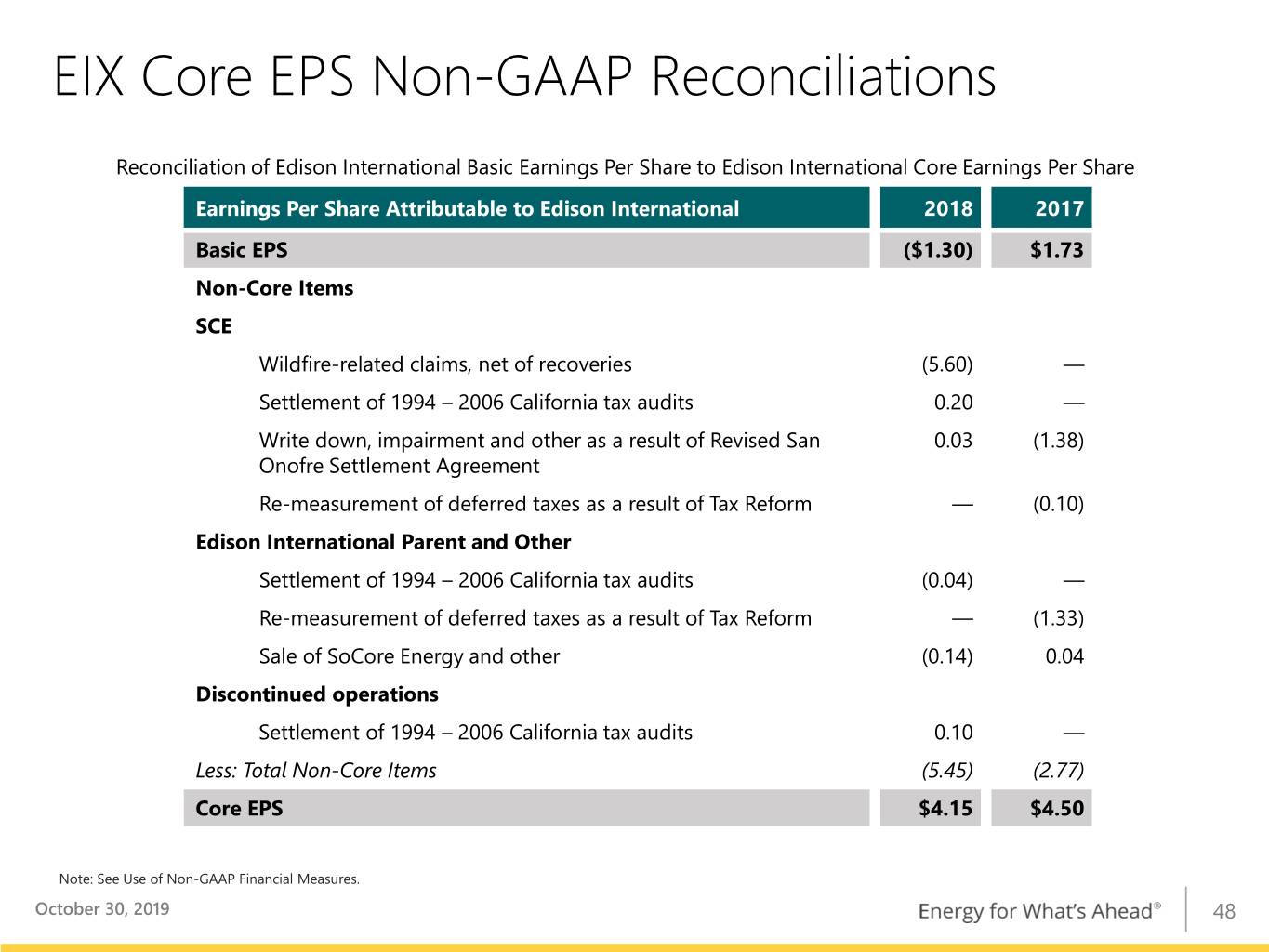

EIX Core EPS Non-GAAP Reconciliations Reconciliation of Edison International Basic Earnings Per Share to Edison International Core Earnings Per Share Earnings Per Share Attributable to Edison International 2018 2017 Basic EPS ($1.30) $1.73 Non-Core Items SCE Wildfire-related claims, net of recoveries (5.60) — Settlement of 1994 – 2006 California tax audits 0.20 — Write down, impairment and other as a result of Revised San 0.03 (1.38) Onofre Settlement Agreement Re-measurement of deferred taxes as a result of Tax Reform — (0.10) Edison International Parent and Other Settlement of 1994 – 2006 California tax audits (0.04) — Re-measurement of deferred taxes as a result of Tax Reform — (1.33) Sale of SoCore Energy and other (0.14) 0.04 Discontinued operations Settlement of 1994 – 2006 California tax audits 0.10 — Less: Total Non-Core Items (5.45) (2.77) Core EPS $4.15 $4.50 Note: See Use of Non-GAAP Financial Measures. October 30, 2019 48

Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. EIX Investor Relations Contact Sam Ramraj, Vice President (626) 302-2540 sam.ramraj@edisonintl.com Allison Bahen, Principal Manager (626) 302-5493 allison.bahen@edisonintl.com October 30, 2019 49