EXHIBIT 99.1

Edison International Business Overview and Strategy

John E. Bryson

Chairman, President and Chief Executive Officer Edison International

October 13, 2004

Forward-Looking Statements

This presentation contains forward-looking information. The words “expect,” “forecast,” “potential,” “projected,” “anticipated,” “predict,” “targeted,” and similar expressions identify forward-looking information that involves risks and uncertainties. Actual results or outcomes could differ materially because of important factors such as:

actions of the California Public Utilities Commission, Federal Energy Regulatory Commission, and other regulatory bodies regarding market structure, customer rates, cost recovery, capital expenditures, and other matters; changes in prices of electricity, natural gas, coal, and other fuels and in other operating costs; the operation on a merchant basis of Mission Energy Holding Company’s plants that do not have long-term contracts for the sale of their output; actions of securities rating agencies affecting the credit ratings of Edison International or its subsidiaries; the ability of Edison International and its subsidiaries to refinance existing obligations and obtain new financing on reasonable terms as needed; the continued operation of Edison International’s tax allocation arrangements as contemplated; the possibility of future state or federal legislation changing the structure or operation of electricity markets or otherwise affecting Edison International’s subsidiaries; the effects of environmental laws and regulations that may require capital expenditures, increased operating costs, or limitations on the operation of power generating facilities; the effects of increased competition in energy-related businesses; and the risks of constructing and operating nuclear-, coal-, and gas-fired generating plants and other large and complex energy facilities.

Additional details and factors are set forth in this presentation and reports filed by Edison International, Southern California Edison, and Mission Energy Holding Company on Forms 10-K, 10-Q, and 8-K.

Certain non-GAAP information appears in this presentation. The reconciliations to GAAP that are required by SEC Regulation G are located in the appendix at the end of this presentation.

2

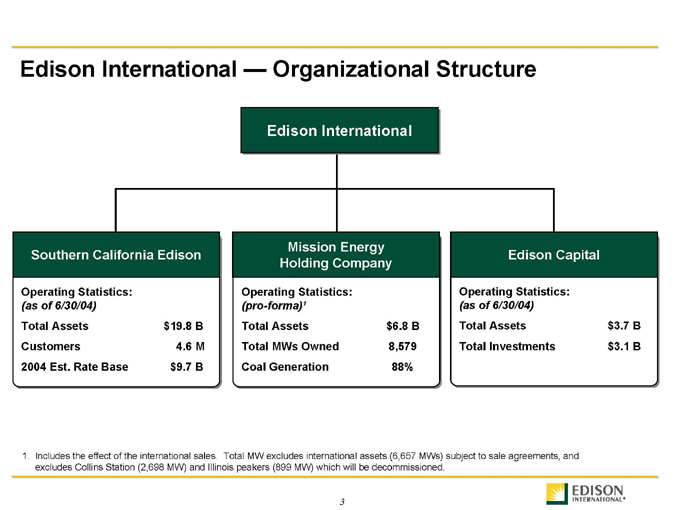

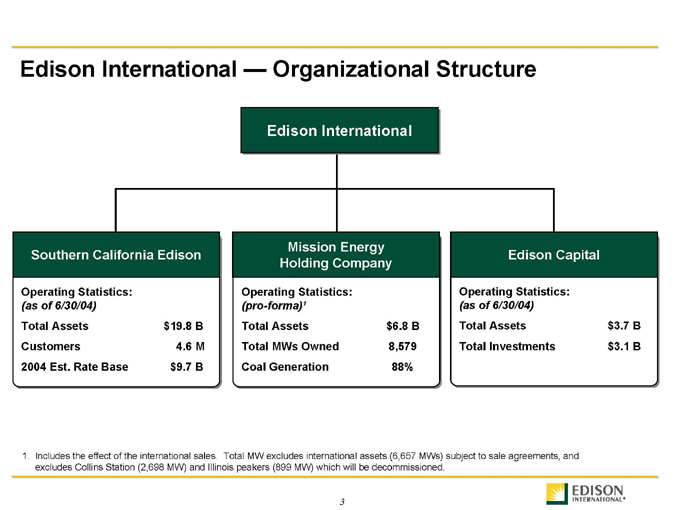

Edison International — Organizational Structure

Edison International

Southern California Edison

Operating Statistics:

(as of 6/30/04)

Total Assets $19.8 B

Customers 4.6 M

2004 Est. Rate Base $9.7 B

Mission Energy Holding Company

Operating Statistics:

(pro-forma)¹

Total Assets $6.8 B

Total MWs Owned 8,579

Coal Generation 88%

Edison Capital

Operating Statistics:

(as of 6/30/04)

Total Assets $3.7 B

Total Investments $3.1 B

1. Includes the effect of the international sales. Total MW excludes international assets (6,657 MWs) subject to sale agreements, and excludes Collins Station (2,698 MW) and Illinois peakers (899 MW) which will be decommissioned.

3

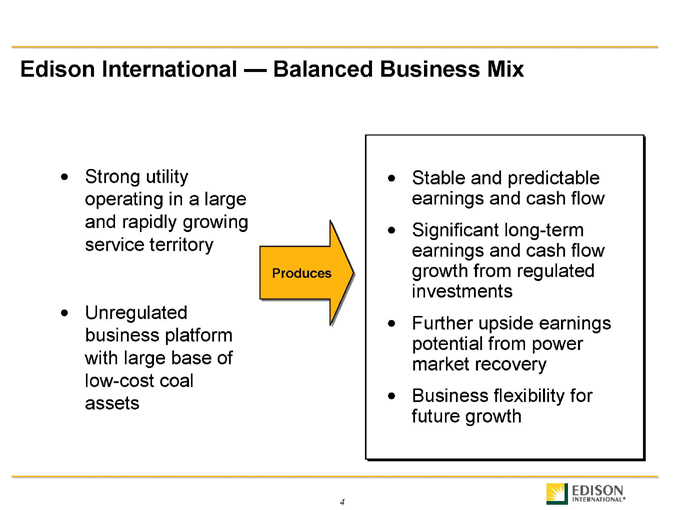

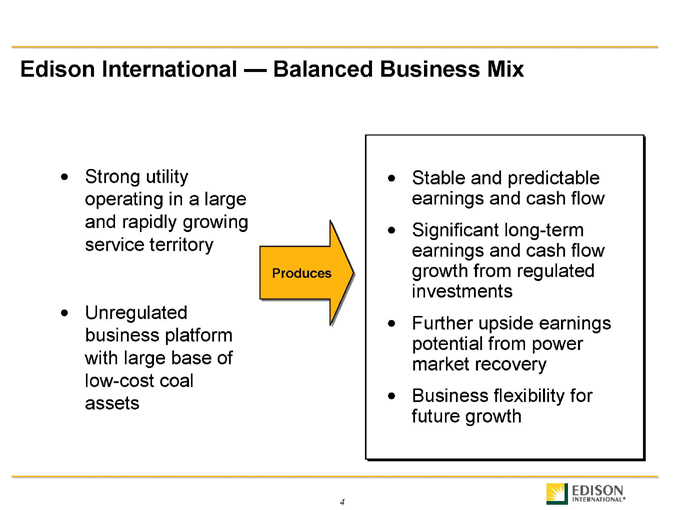

Edison International — Balanced Business Mix

Strong utility operating in a large and rapidly growing service territory

Unregulated business platform with large base of low-cost coal assets

Produces

Stable and predictable earnings and cash flow Significant long-term earnings and cash flow growth from regulated investments Further upside earnings potential from power market recovery Business flexibility for future growth

4

Edison International — Strategy

Our strategy seeks to create a balance among

Growth Dividends

Balance sheet strength

We expect to produce total returns above peer averages

5

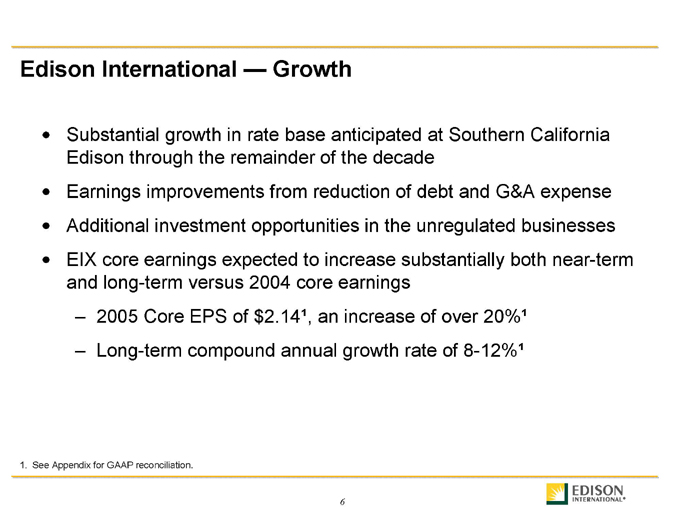

Edison International — Growth

Substantial growth in rate base anticipated at Southern California Edison through the remainder of the decade Earnings improvements from reduction of debt and G&A expense Additional investment opportunities in the unregulated businesses EIX core earnings expected to increase substantially both near-term and long-term versus 2004 core earnings

2005 Core EPS of $2.14¹, an increase of over 20%¹

Long-term compound annual growth rate of 8-12%¹

1. See Appendix for GAAP reconciliation.

6

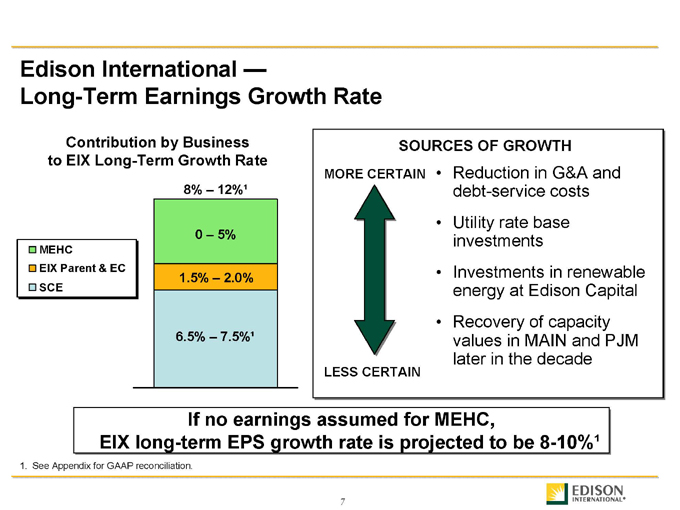

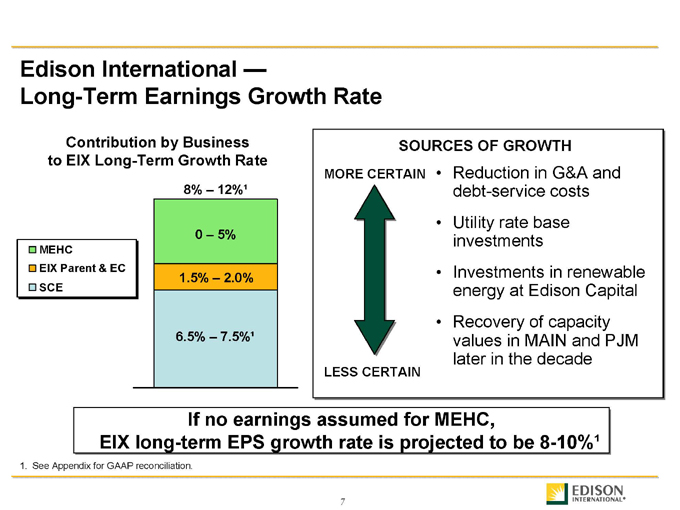

Edison International —

Long-Term Earnings Growth Rate

Contribution by Business to EIX Long-Term Growth Rate

MEHC

EIX Parent & EC SCE

8% – 12%¹ 0 – 5% 1.5% – 2.0%

6.5% – 7.5%¹

SOURCES OF GROWTH

MORE CERTAIN

LESS CERTAIN

Reduction in G&A and debt-service costs Utility rate base investments Investments in renewable energy at Edison Capital Recovery of capacity values in MAIN and PJM later in the decade

If no earnings assumed for MEHC,

EIX long-term EPS growth rate is projected to be 8-10%¹

1. See Appendix for GAAP reconciliation.

7

Edison International — Dividends

Dividend philosophy is centered around:

Maintaining a competitive dividend

Balancing dividends with the cash needed to fund robust growth

Maintaining a strong balance sheet

Current annual dividend rate of $0.80/share

Payout ratio is 46% of projected 2004 core earnings¹ Expect to maintain a similar payout ratio for 2005

Plan to recommend a 2005 dividend of $1.00/share to the Board Longer-term, targeting a payout ratio range of 45–55% excluding MEHC earnings

With projected earnings, the target range can provide steady increases in the dividend after 2005

1. See Appendix for GAAP reconciliation.

8

Edison International — Balance Sheet Strength

Sufficient cash generation to support a large investment program producing substantial earnings growth, and a competitive and growing dividend

The projected long-term growth rate does not assume additional equity

MEHC will continue to reduce debt over the long-term to address excess leverage

Expect to maintain SCE capital structure of 48% equity

Edison Capital and the EIX Parent will focus on reducing their cost of debt, improving financing flexibility and reducing overall debt levels while providing for the projected growth at Edison Capital Over the long term, EIX consolidated debt-to-capital is targeted to decline from approximately 60% to 50%¹

Excluding MEHC, debt to capital is targeted to stay in the range of 45–50%¹

1. See Appendix for GAAP reconciliation.

9

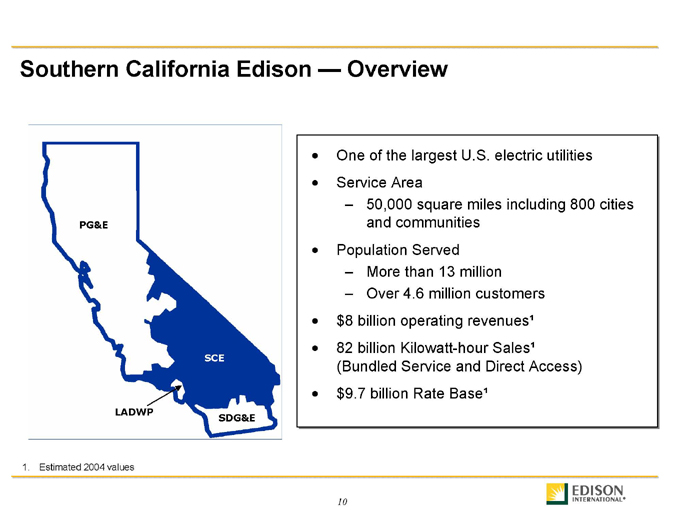

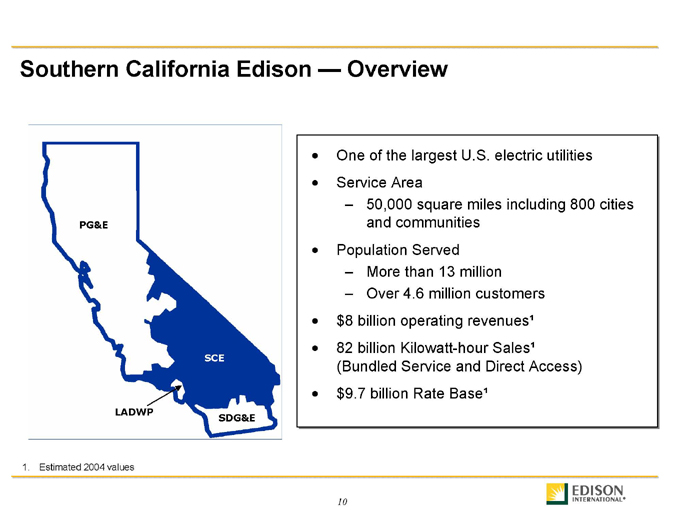

Southern California Edison — Overview

One of the largest U.S. electric utilities Service Area

50,000 square miles including 800 cities and communities Population Served

More than 13 million

Over 4.6 million customers $8 billion operating revenues¹ 82 billion Kilowatt-hour Sales¹ (Bundled Service and Direct Access) $9.7 billion Rate Base¹

10

Southern California Edison

Southern California Edison provides substantial value for EIX shareholders

SCE provides a large base of stable earnings and cash flow

Expected to grow at a rate above the utility industry average from rate base investments

Investments across the distribution, transmission, and generation segments

Equity component for planned expenditures can be funded from utility generated cash

California’s regulatory and political environment has improved

CPUC decisions supportive of the restoration of SCE’s creditworthiness

AB57 provides important procurement and credit protections

11

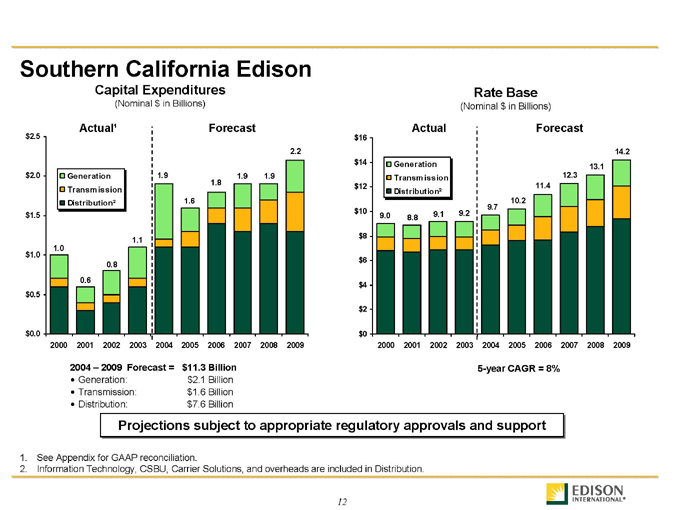

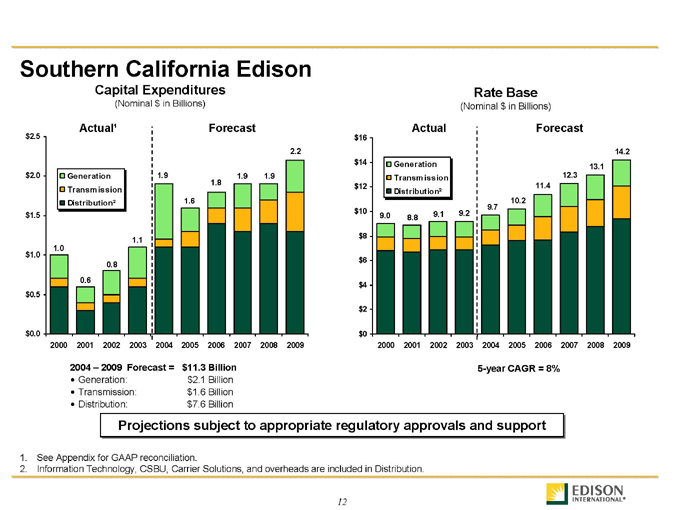

Southern California Edison

Capital Expenditures

(Nominal $ in Billions)

Actual¹ Forecast

Generation Transmission Distribution² $2.5 $2.0 $1.5 $1.0 $0.5 $0.0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

1.0

0.6

0.8

1.1

1.9

1.6

1.8

1.9

1.9

2.2

2004 – 2009 Forecast = $11.3 Billion

Generation: $2.1 Billion

Transmission: $1.6 Billion

Distribution: $7.6 Billion

Rate Base

(Nominal $ in Billions)

Actual Forecast $16 $14 $12 $10 $8 $6 $4 $2 $0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

5-year CAGR = 8%

Generation Transmission Distribution²

9.0 8.8

9.1 9.2

9.7

10.2

11.4

12.3

13.1

14.2

Projections subject to appropriate regulatory approvals and support

1. See Appendix for GAAP reconciliation.

2. Information Technology, CSBU, Carrier Solutions, and overheads are included in Distribution.

12

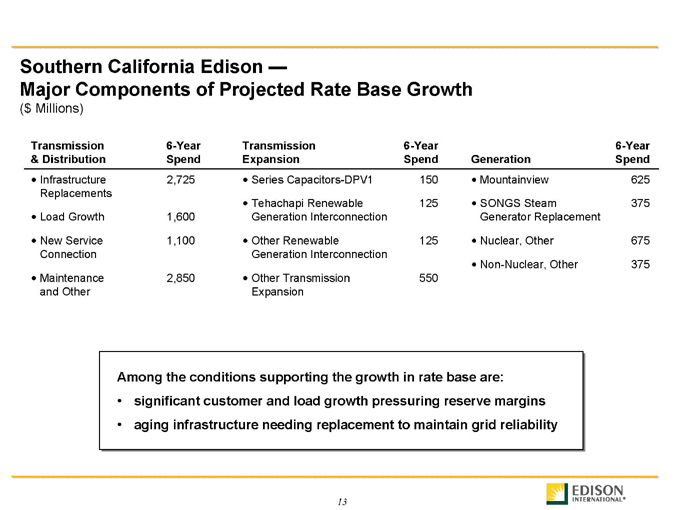

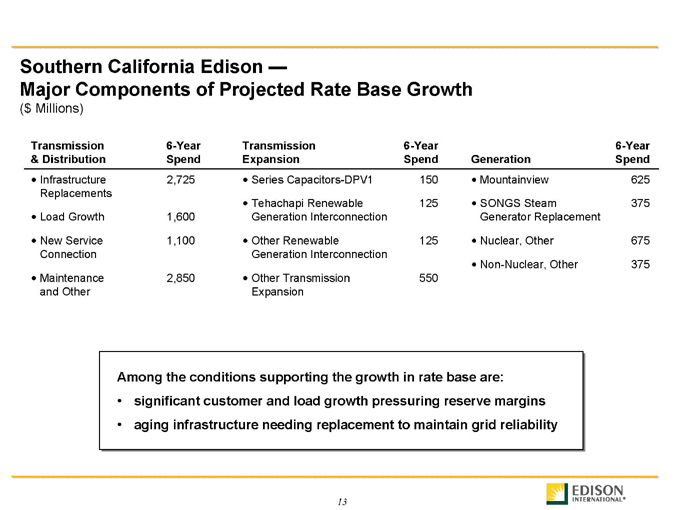

Southern California Edison —

Major Components of Projected Rate Base Growth

($ Millions)

Transmission 6-Year Transmission 6-Year 6-Year

& Distribution Spend Expansion Spend Generation Spend

Infrastructure Replacements 2,725 Series Capacitors-DPV1 150 Mountainview 625

Load Growth 1,600 Tehachapi Renewable Generation Interconnection 125 SONGS Steam Generator Replacement 375

New Service Connection 1,100 Other Renewable Generation Interconnection 125 Nuclear, Other 675

Non-Nuclear, Other 375

Maintenance and Other 2,850 Other Transmission Expansion 550

Among the conditions supporting the growth in rate base are:

significant customer and load growth pressuring reserve margins

aging infrastructure needing replacement to maintain grid reliability

13

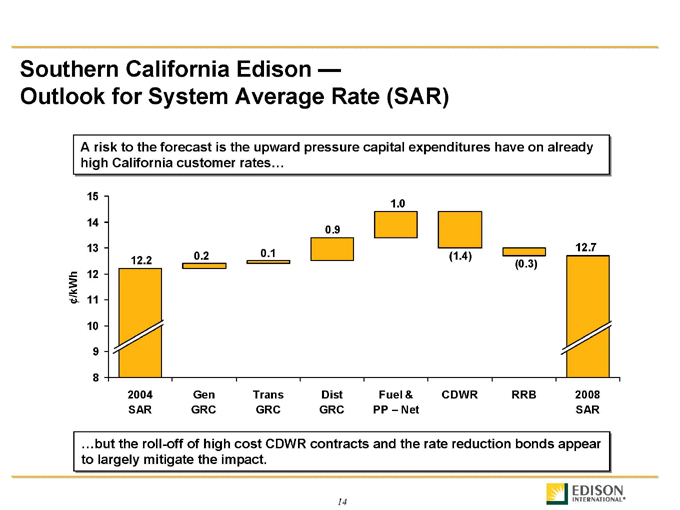

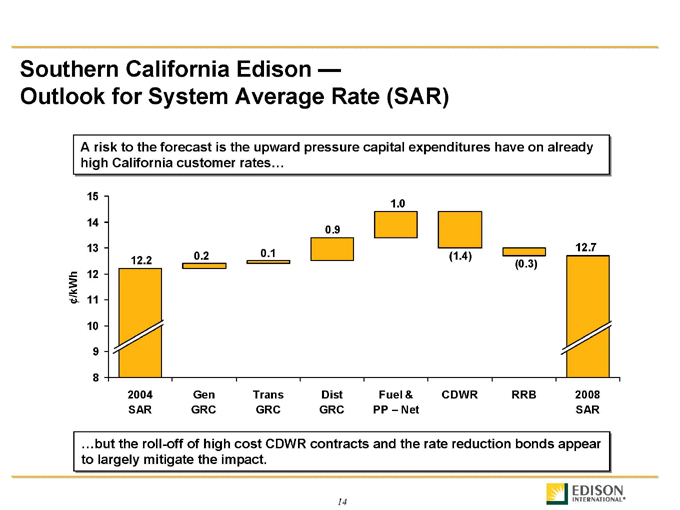

Southern California Edison —

Outlook for System Average Rate (SAR)

A risk to the forecast is the upward pressure capital expenditures have on already high California customer rates…

¢/kWh

15 14 13 12 11 10 9 8

2004 SAR

Gen GRC

Trans GRC

Dist GRC

Fuel & PP – Net

CDWR

RRB

2008 SAR

12.2

0.2

0.1

0.9

1.0

(1.4)

(0.3)

12.7

…but the roll-off of high cost CDWR contracts and the rate reduction bonds appear to largely mitigate the impact.

14

Southern California Edison — Regulatory Environment

Reasonable regulatory decisions are essential to SCE achieving its targeted growth

CPUC decisions since the Energy Crisis demonstrate an understanding of the importance of financially healthy IOUs in solving the State’s energy problems 2003 GRC approved 98% of capital forecast and established attrition mechanisms to meet planned capital investments and cost escalation Pending cases

2005 Cost of Capital

2006 General Rate Case

Procurement

Long-term solicitation

Future customer load

Reliability and cost responsibility

15

Mission Energy Holding Company — Overview

Before After

Asset Profile Restructuring Restructuring ¹

MWs 18,833 8,579

Fuel Mix

Coal 9,035 MW / 48% 7,545 MW / 88%

Gas/Oil 6,530 MW / 34% 1,034 MW / 12%

Hydro 2,950 MW / 16%

Other 318 MW / 2%

Percent Merchant 2 72% 87%

Assets $ 12.1 billion $6.8 billion

Recourse and Non-Recourse Debt $8.1 billion $4.8 billion

Net Debt to Recourse Capital 86% 72%

Midwest Generation 5,621 MW’s

Homer City 1,884 MW’s

964 MW’s

1. After sales of international assets (6,657 MW), and decommissioning Collins Station (2,698 MW) and Illinois peakers (899 MW).

2. Pro forma January 2005 with Exelon contracts expired.

16

Mission Energy Holding Company —MEHC Contribution to EIX

Successful execution of the Restructuring Plan substantially addresses MEHC’s survivability. Execution of the strategic plan and solid performance at MEHC will add value for EIX shareholders.

MEHC can contribute meaningfully to EIX earnings growth with reasonable confidence

Continued reduction in high cost debt and G&A expense contributes to earnings

Low cost coal portfolio takes advantage of favorable gas/coal spread

Significant growth in earnings probable from recovery in capacity markets

Current long-term forecasts do not assume or rely on new project investments

Given the hybrid system of electricity regulation in the U.S., EIX benefits from having both a utility and a competitive generator

MEHC provides EIX with a potentially valuable option as a vehicle for discretionary investments and growth

17

Mission Energy Holding Company — Strategy

Reduce business and financial risk by improving financial strength, operating efficiency, and predictability of cash flow and earnings

Complete the Restructuring Plan

Close the sale of the international generation facilities maximizing net after-tax proceeds

Pay off the “BV” bridge loan

Continually reduce leverage using cash flow from operations

Manage fuel supply, emissions, and environmental controls to protect operating margins

Reduce overhead expenses in the aftermath of the asset sales Build a laddered, diversified portfolio of power and fuel supply contracts and hedges to lock in margins and reduce earnings and cash flow volatility

18

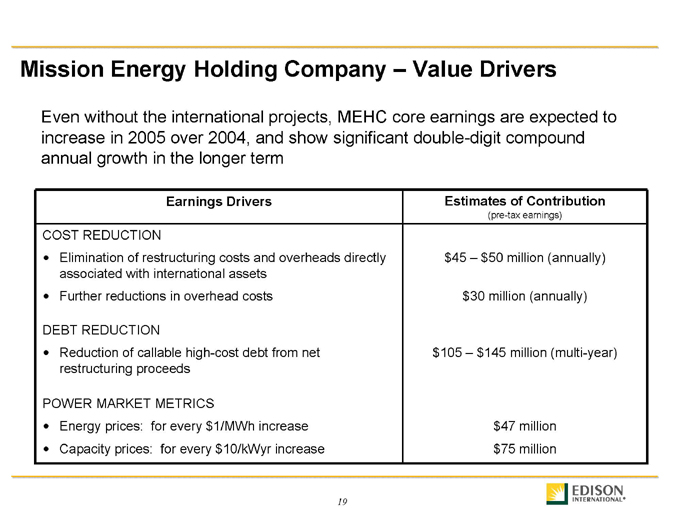

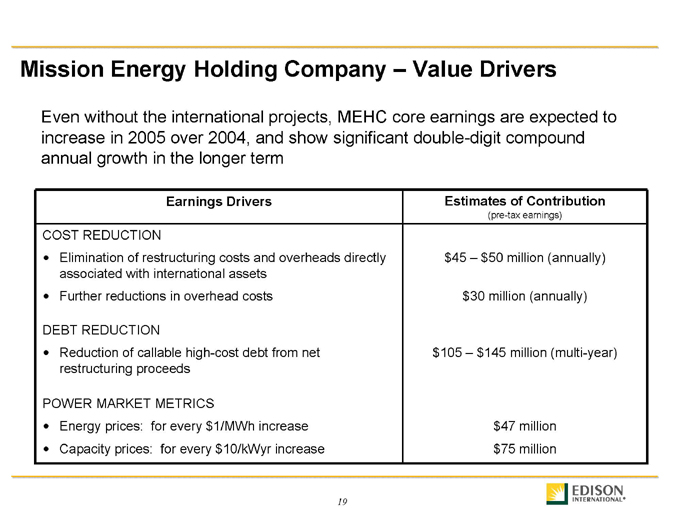

Mission Energy Holding Company – Value Drivers

Even without the international projects, MEHC core earnings are expected to increase in 2005 over 2004, and show significant double-digit compound annual growth in the longer term

Earnings Drivers Estimates of Contribution (pre-tax earnings)

COST REDUCTION

Elimination of restructuring costs and overheads directly associated with international assets $45 – $50 million (annually)

Further reductions in overhead costs $30 million (annually)

DEBT REDUCTION

Reduction of callable high-cost debt from net restructuring proceeds $105 – $145 million (multi-year)

POWER MARKET METRICS

Energy prices: for every $ 1/MWh increase $47 million

Capacity prices: for every $10/kWyr increase $75 million

19

Mission Energy Holding Company —Potential Upsides and Risks

Additional future upside potential from:

Contracting for cash and earnings stabilization

New generation investments

Consolidations, providing cost reduction opportunities

Risks

Collapse in gas prices, or a spike in coal and emissions prices

Homer City coal supply contracts progressively rolling off post 2006

Illinois coal plants (78% of MEHC’s coal burn) insulated due to use of abundant Powder River Basin coal and transportation contracted for remainder of decade

Credit and collateral requirements to support hedging and contracting

Competes with ability to retire debt early

Environmental regulations requiring additional capex

Approximately $300 million in environmental capex at Homer City in the 5-year outlook for mercury control and SO2

Potential future mercury controls expenditures at MWG plants, but expenditures more likely to be in the next decade

New Source Review

20

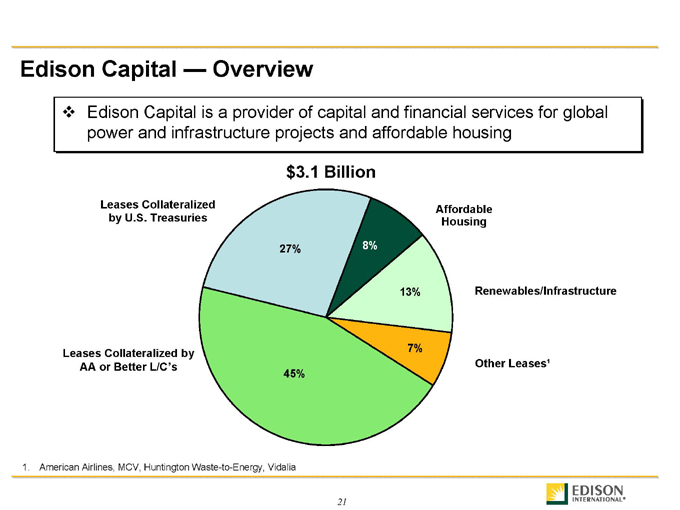

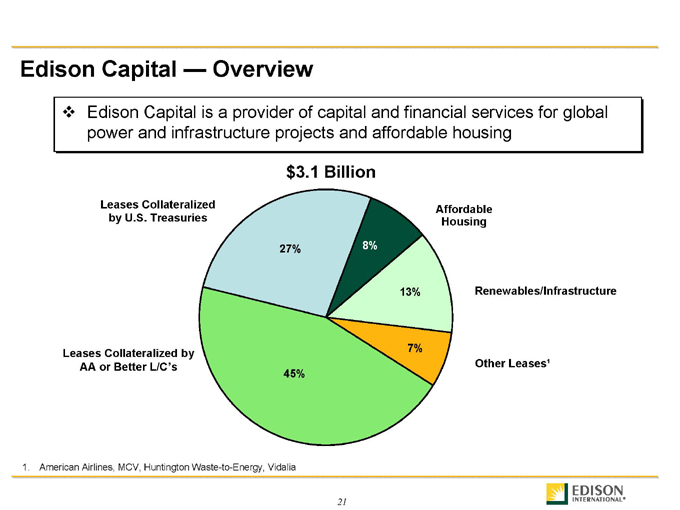

Edison Capital — Overview

Edison Capital is a provider of capital and financial services for global power and infrastructure projects and affordable housing

$3.1 Billion

Affordable Housing

Renewables/Infrastructure

Other Leases¹

Leases Collateralized by U.S. Treasuries

Leases Collateralized by AA or Better L/C’s

45%

7%

13%

8%

27%

1. American Airlines, MCV, Huntington Waste-to-Energy, Vidalia

21

Edison Capital — Value Drivers

Flexible growth vehicle

Focus is building on the existing 226 MW Renewables portfolio

Resumed investing in 2004

Targeting investments building to $250 million annually

22

EIX Parent — Contributes to Improving Earnings

Reduction of debt at the Parent lowers earnings drag

Actions to improve financial efficiency and liquidity are in process

The earnings drag of $0.25 in 2003 and $0.23 in 2004 is forecast to be reduced to $0.03 in 2005

23

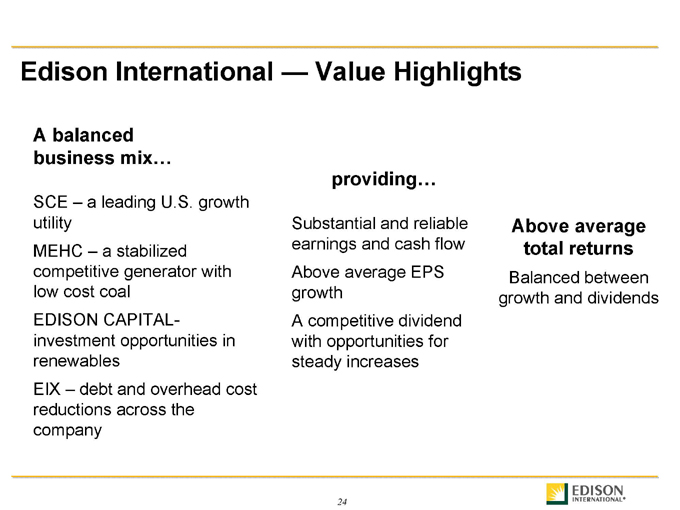

Edison International — Value Highlights

A balanced business mix…

SCE – a leading U.S. growth utility MEHC – a stabilized competitive generator with low cost coal EDISON CAPITAL-investment opportunities in renewables EIX – debt and overhead cost reductions across the company providing…

Substantial and reliable earnings and cash flow Above average EPS growth A competitive dividend with opportunities for steady increases

Above average total returns

Balanced between growth and dividends

24

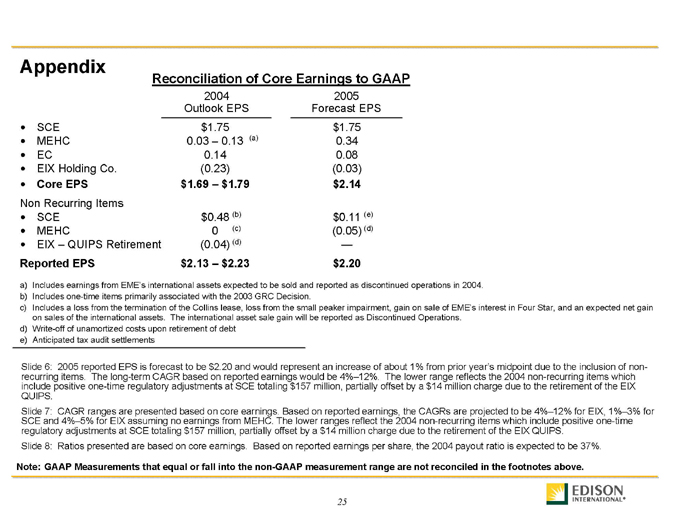

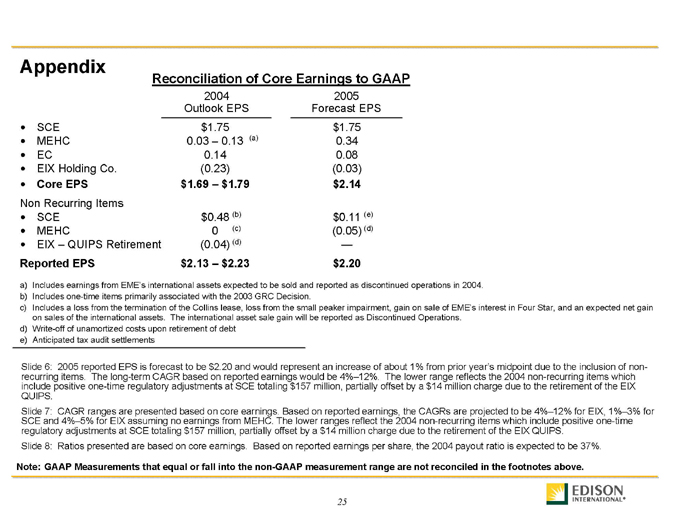

Appendix

Reconciliation of Core Earnings to GAAP

2004 2005 Outlook EPS Forecast EPS

SCE $1.75 $1.75

MEHC 0.03 – 0.13 (a) 0.34

EC 0.14 0.08

EIX Holding Co. (0.23) (0.03)

Core EPS $1.69 – $1.79 $2.14

Non Recurring Items

SCE $0.48 (b) $0.11 (e)

MEHC 0 (c) (0.05) (d)

EIX – QUIPS Retirement (0.04) (d) —

Reported EPS $2.13 – $2.23 $2.20

a) Includes earnings from EME’s international assets expected to be sold and reported as discontinued operations in 2004. b) Includes one-time items primarily associated with the 2003 GRC Decision. c) Includes a loss from the termination of the Collins lease, loss from the small peaker impairment, gain on sale of EME’s interest in Four Star, and an expected net gain on sales of the international assets. The international asset sale gain will be reported as Discontinued Operations. d) Write-off of unamortized costs upon retirement of debt e) Anticipated tax audit settlements

Slide 6: 2005 reported EPS is forecast to be $2.20 and would represent an increase of about 1% from prior year’s midpoint due to the inclusion of non-recurring items. The long-term CAGR based on reported earnings would be 4%–12%. The lower range reflects the 2004 non-recurring items which include positive one-time regulatory adjustments at SCE totaling $157 million, partially offset by a $14 million charge due to the retirement of the EIX QUIPS.

Slide 7: CAGR ranges are presented based on core earnings. Based on reported earnings, the CAGRs are projected to be 4%–12% for EIX, 1%–3% for SCE and 4%–5% for EIX assuming no earnings from MEHC. The lower ranges reflect the 2004 non-recurring items which include positive one-time regulatory adjustments at SCE totaling $157 million, partially offset by a $14 million charge due to the retirement of the EIX QUIPS.

Slide 8: Ratios presented are based on core earnings. Based on reported earnings per share, the 2004 payout ratio is expected to be 37%.

Note: GAAP Measurements that equal or fall into the non-GAAP measurement range are not reconciled in the footnotes above.

25

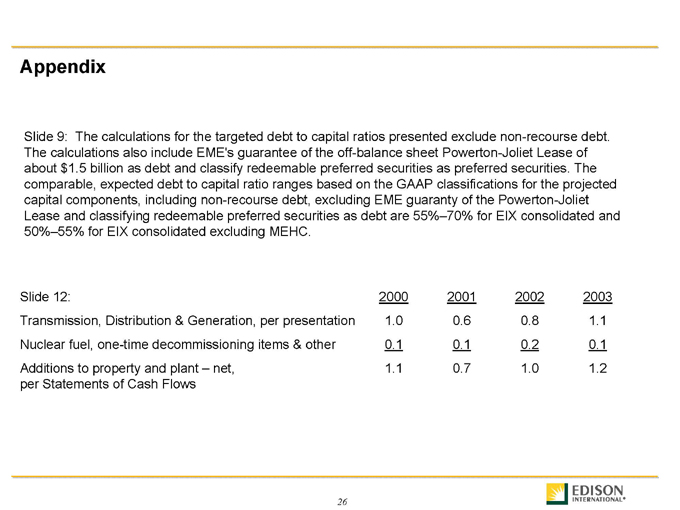

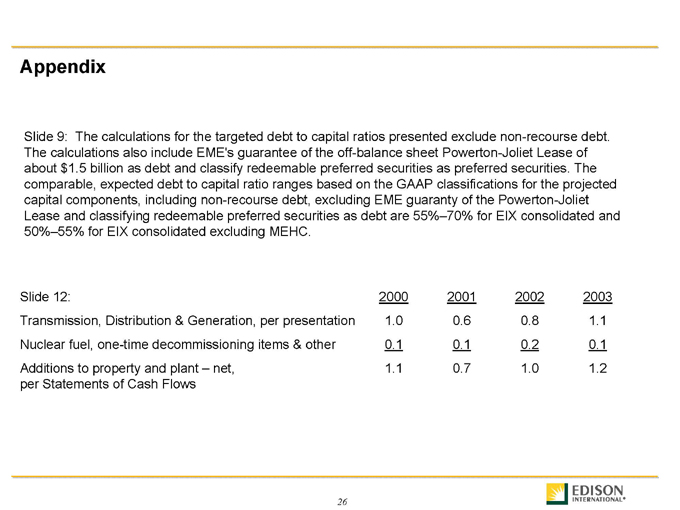

Appendix

Slide 9: The calculations for the targeted debt to capital ratios presented exclude non-recourse debt. The calculations also include EME’s guarantee of the off-balance sheet Powerton-Joliet Lease of about $1.5 billion as debt and classify redeemable preferred securities as preferred securities. The comparable, expected debt to capital ratio ranges based on the GAAP classifications for the projected capital components, including non-recourse debt, excluding EME guaranty of the Powerton-Joliet Lease and classifying redeemable preferred securities as debt are 55%–70% for EIX consolidated and 50%–55% for EIX consolidated excluding MEHC.

Slide 12: 2000 2001 2002 2003

Transmission, Distribution & Generation, per presentation 1.0 0.6 0.8 1.1

Nuclear fuel, one-time decommissioning items & other 0.1 0.1 0.2 0.1

Additions to property and plant – net, 1.1 0.7 1.0 1.2

per Statements of Cash Flows

26