EXHIBIT 99.2

Edison International Financial Outlook

Theodore F. Craver, Jr.

Executive Vice President and Chief Financial Officer Edison International

October 13, 2004

Forward-Looking Statements

This presentation contains forward-looking information. The words “expect,” “forecast,” “potential,” “projected,” “anticipated,” “predict,” “targeted,” and similar expressions identify forward-looking information that involves risks and uncertainties. Actual results or outcomes could differ materially because of important factors such as:

actions of the California Public Utilities Commission, Federal Energy Regulatory Commission, and other regulatory bodies regarding market structure, customer rates, cost recovery, capital expenditures, and other matters; changes in prices of electricity, natural gas, coal, and other fuels and in other operating costs; the operation on a merchant basis of Mission Energy Holding Company’s plants that do not have long-term contracts for the sale of their output; actions of securities rating agencies affecting the credit ratings of Edison International or its subsidiaries; the ability of Edison International and its subsidiaries to refinance existing obligations and obtain new financing on reasonable terms as needed; the continued operation of Edison International’s tax allocation arrangements as contemplated; the possibility of future state or federal legislation changing the structure or operation of electricity markets or otherwise affecting Edison International’s subsidiaries ; the effects of environmental laws and regulations that may require capital expenditures, increased operating costs, or limitations on the operation of power generating facilities ; the effects of increased competition in energy-related businesses; and the risks of constructing and operating nuclear-, coal-, and gas-fired generating plants and other large and complex energy facilities.

Additional details and factors are set forth in this presentation and reports filed by Edison International, Southern California Edison, and Mission Energy Holding Company on Forms 10-K, 10-Q, and 8-K.

Certain non-GAAP information appears in this presentation. The reconciliations to GAAP that are required by SEC Regulation G are located in the appendix at the end of this presentation.

2

Edison International —

Key Milestones Achieved in the Last Year

SCE achieved investment grade ratings by Moody’s and S&P in late 2003, and Moody’s further upgraded in 2004 MEHC completed a number of critical restructuring steps

Refinanced Midwest Generation debt

Entered into sale agreements for the international assets

Contact Energy sale closed

Edison Capital resumed investing

Moody’s upgraded EIX to investment grade EIX resumed a common stock dividend

3

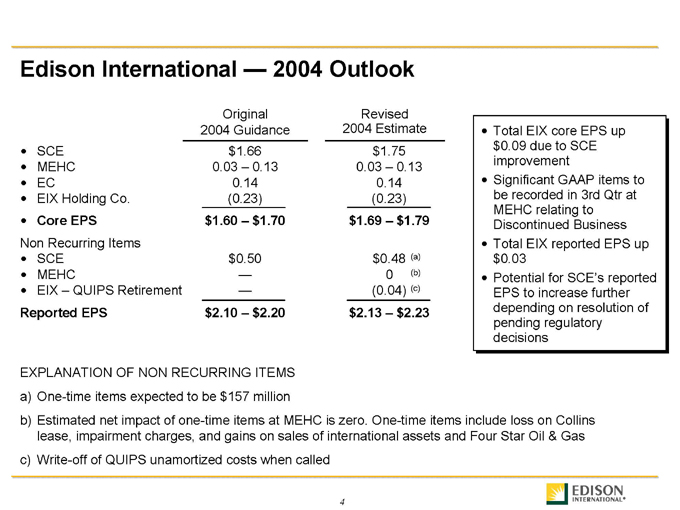

Edison International — 2004 Outlook

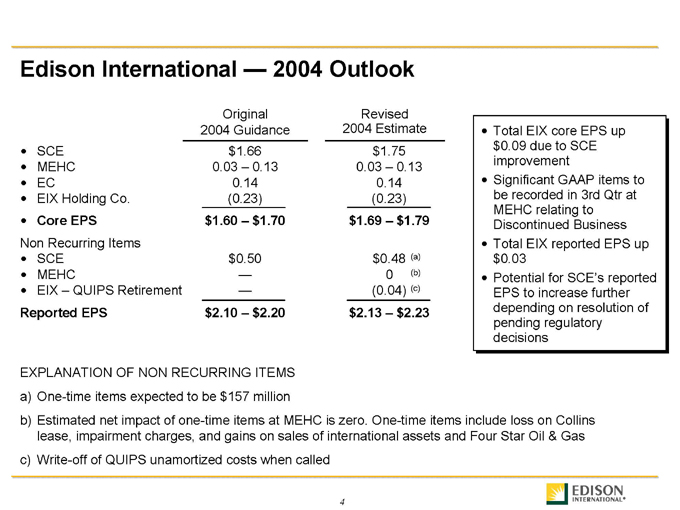

Original Revised

2004 Guidance 2004 Estimate

SCE $1.66 $1.75

MEHC 0.03 – 0.13 0.03 – 0.13

EC 0.14 0.14

EIX Holding Co. (0.23) (0.23)

Core EPS $1.60 – $1.70 $1.69 – $1.79

Non Recurring Items

SCE $0.50 $0.48 (a)

MEHC — 0 (b)

EIX – QUIPS Retirement — (0.04) (c)

Reported EPS $2.10 – $2.20 $2.13 – $2.23

Total EIX core EPS up $0.09 due to SCE improvement

Significant GAAP items to be recorded in 3rd Qtr at MEHC relating to Discontinued Business

Total EIX reported EPS up $0.03

Potential for SCE’s reported EPS to increase further depending on resolution of pending regulatory decisions

EXPLANATION OF NON RECURRING ITEMS a) One-time items expected to be $157 million b) Estimated net impact of one-time items at MEHC is zero. One-time items include loss on Collins lease, impairment charges, and gains on sales of international assets and Four Star Oil & Gas c) Write-off of QUIPS unamortized costs when called

4

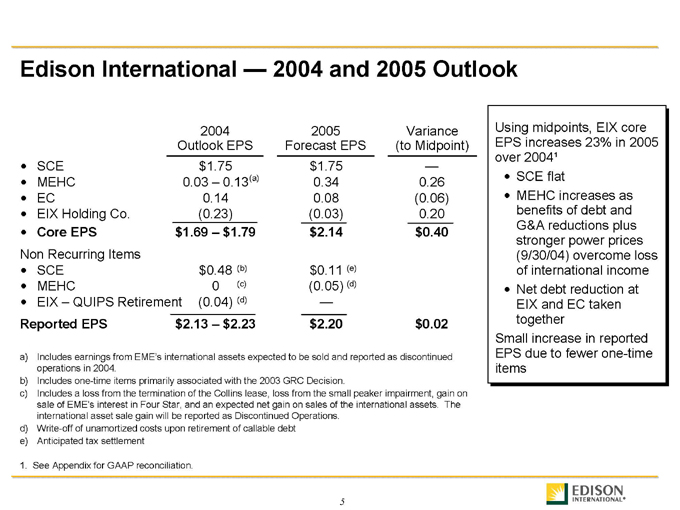

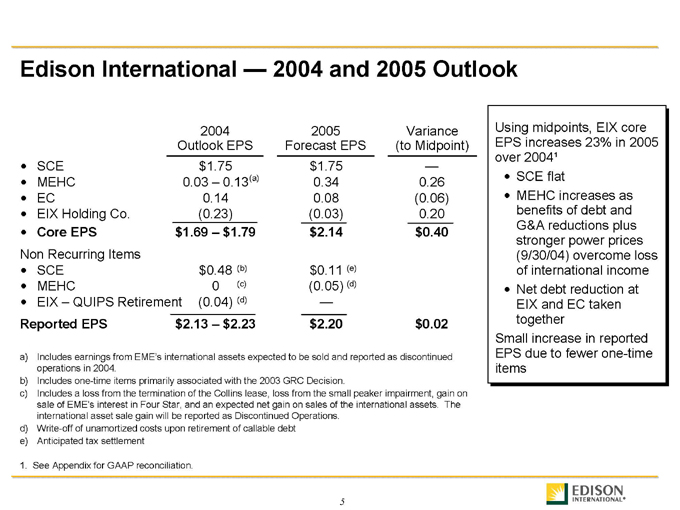

Edison International — 2004 and 2005 Outlook

2004 2005 Variance

Outlook EPS Forecast EPS (to Midpoint)

SCE $1.75 $1.75 —

MEHC 0.03 – 0.13(a) 0.34 0.26

EC 0.14 0.08 (0.06)

EIX Holding Co. (0.23) (0.03) 0.20

Core EPS $1.69 – $1.79 $2.14 $0.40

Non Recurring Items

SCE $0.48 (b) $0.11 (e)

MEHC 0 (c) (0.05) (d)

EIX – QUIPS Retirement (0.04) (d) —

Reported EPS $2.13 – $2.23 $2.20 $0.02

a) Includes earnings from EME’s international assets expected to be sold and reported as discontinued operations in 2004. b) Includes one-time items primarily associated with the 2003 GRC Decision. c) Includes a loss from the termination of the Collins lease, loss from the small peaker impairment, gain on sale of EME’s interest in Four Star, and an expected net gain on sales of the international assets. The international asset sale gain will be reported as Discontinued Operations. d) Write-off of unamortized costs upon retirement of callable debt e) Anticipated tax settlement

1. See Appendix for GAAP reconciliation.

Using midpoints, EIX core EPS increases 23% in 2005 over 2004¹

SCE flat

MEHC increases as benefits of debt and G&A reductions plus stronger power prices (9/30/04) overcome loss of international income

Net debt reduction at EIX and EC taken together Small increase in reported EPS due to fewer one-time items

5

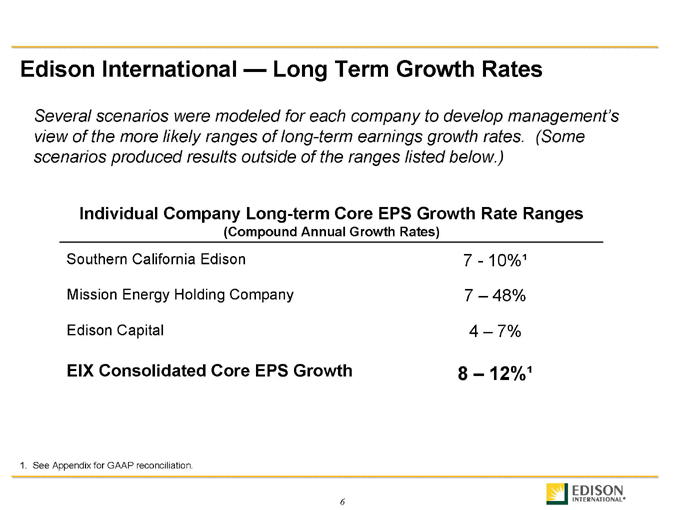

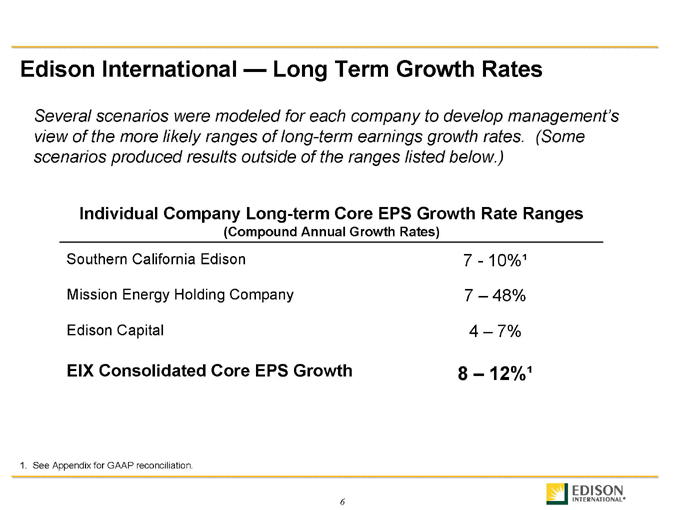

Edison International — Long Term Growth Rates

Several scenarios were modeled for each company to develop management’s view of the more likely ranges of long-term earnings growth rates. (Some scenarios produced results outside of the ranges listed below.)

Individual Company Long-term Core EPS Growth Rate Ranges

(Compound Annual Growth Rates)

Southern California Edison 7—10%¹ Mission Energy Holding Company 7 – 48% Edison Capital 4 – 7%

EIX Consolidated Core EPS Growth 8 – 12%¹

1. See Appendix for GAAP reconciliation.

6

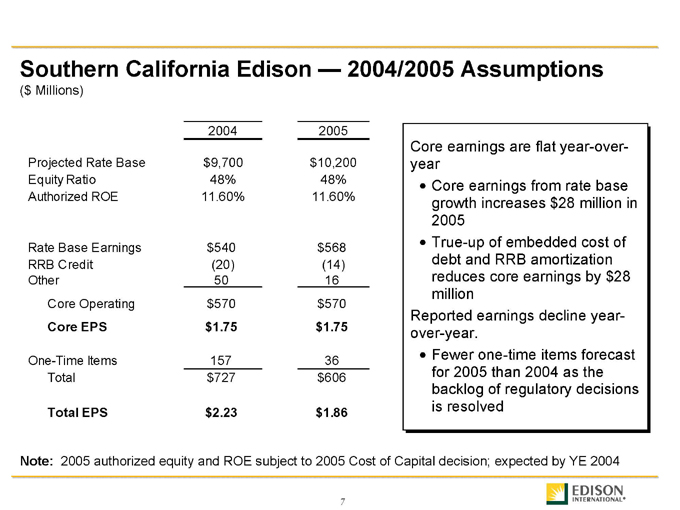

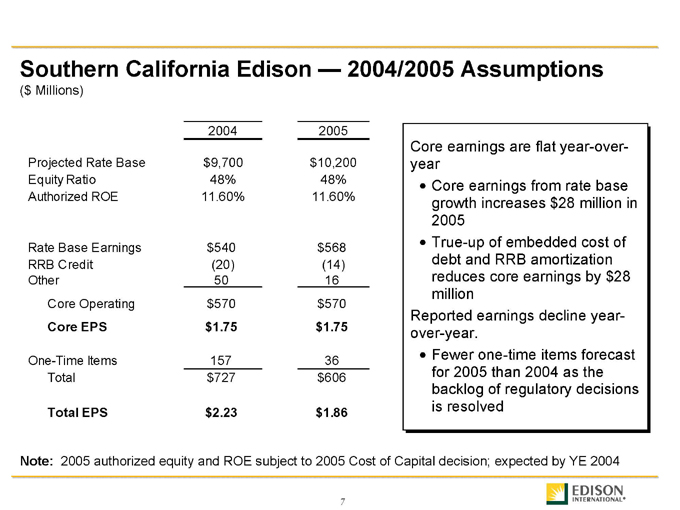

Southern California Edison — 2004/2005 Assumptions

($ Millions)

2004 2005

Projected Rate Base $ 9,700 $ 10,200

Equity Ratio 48% 48%

Authorized ROE 11.60% 11.60%

Rate Base Earnings $ 540 $ 568

RRB Credit (20) (14)

Other 50 16

Core Operating $ 570 $ 570

Core EPS $ 1.75 $ 1.75

One-Time Items 157 36

Total $ 727 $ 606

Total EPS $ 2.23 $ 1.86

Core earnings are flat year-over-year

Core earnings from rate base growth increases $28 million in 2005

True-up of embedded cost of debt and RRB amortization reduces core earnings by $28 million Reported earnings decline year-over-year.

Fewer one-time items forecast for 2005 than 2004 as the backlog of regulatory decisions is resolved

Note: 2005 authorized equity and ROE subject to 2005 Cost of Capital decision; expected by YE 2004

7

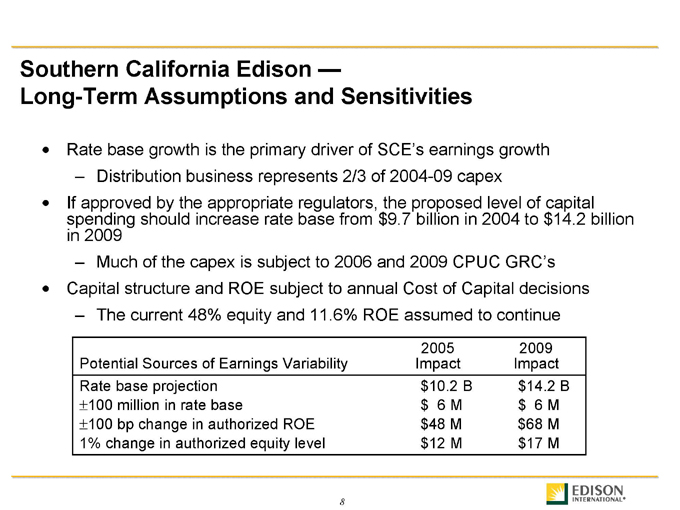

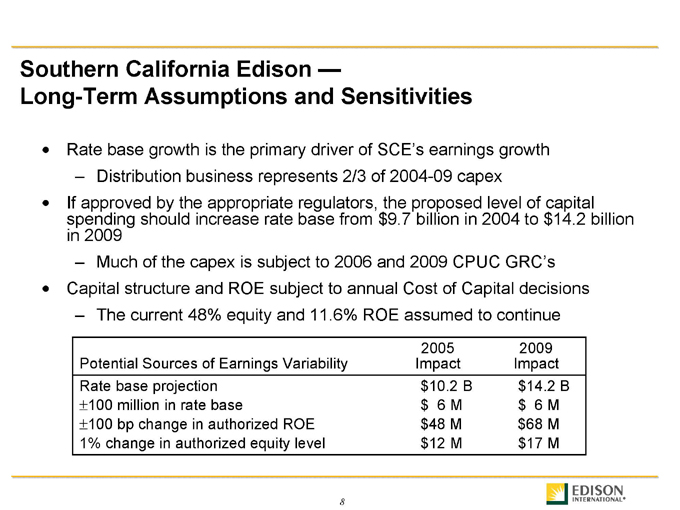

Southern California Edison —

Long-Term Assumptions and Sensitivities

Rate base growth is the primary driver of SCE’s earnings growth

Distribution business represents 2/3 of 2004-09 capex

If approved by the appropriate regulators, the proposed level of capital spending should increase rate base from $9.7 billion in 2004 to $14.2 billion in 2009

Much of the capex is subject to 2006 and 2009 CPUC GRC’s

Capital structure and ROE subject to annual Cost of Capital decisions

The current 48% equity and 11.6% ROE assumed to continue

2005 2009 Potential Sources of Earnings Variability Impact Impact Rate base projection $10.2 B $14.2 B

± 100 million in rate base $ 6 M $ 6 M

± 100 bp change in authorized ROE $48 M $68 M

1% change in authorized equity level $12 M $17 M

8

Southern California Edison — Other Long-Term Assumptions

Other long-term assumptions

Rate Reduction Bond amortization charges will be $8 million in 2006, $2 million in 2007, and $0 from 2008 and beyond

Other core earnings items assumed to offset RRB impacts

e.g.- disallowances, rewards and incentives, financing and tax

One-time regulatory items (part of reported earnings; excluded from core earnings) e.g.- backlogged prior-period events resolved by CPUC decisions

None assumed

Influences other than rate base on core earnings are assumed to net to zero

9

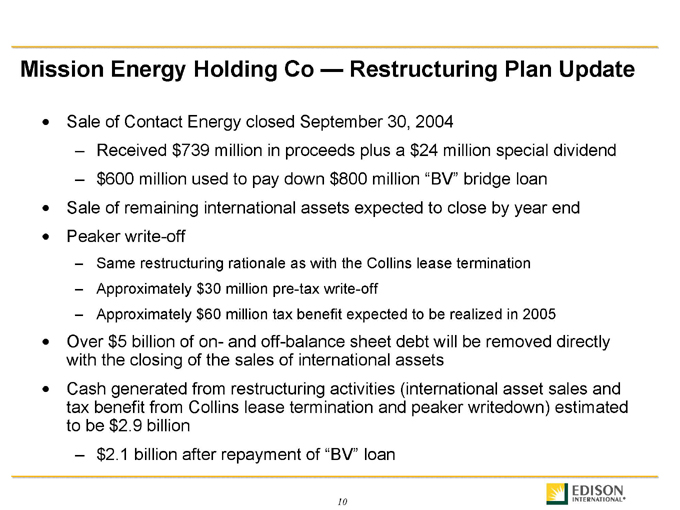

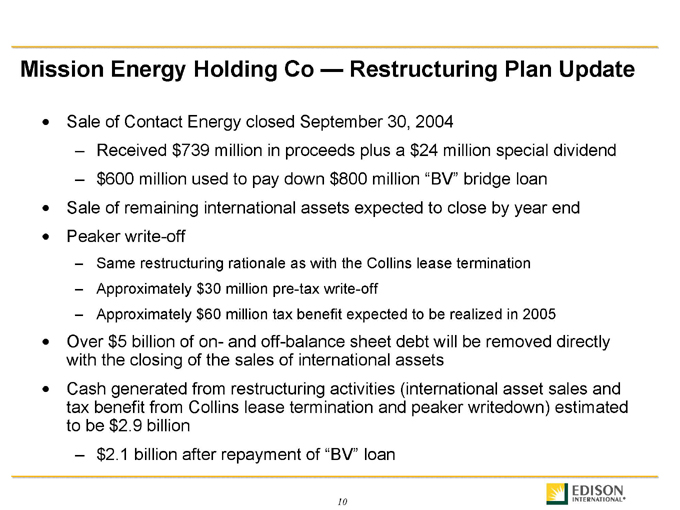

Mission Energy Holding Co — Restructuring Plan Update

Sale of Contact Energy closed September 30, 2004

Received $739 million in proceeds plus a $24 million special dividend

$600 million used to pay down $800 million “BV” bridge loan Sale of remaining international assets expected to close by year end Peaker write-off

Same restructuring rationale as with the Collins lease termination

Approximately $30 million pre-tax write-off

Approximately $60 million tax benefit expected to be realized in 2005

Over $5 billion of on- and off-balance sheet debt will be removed directly with the closing of the sales of international assets Cash generated from restructuring activities (international asset sales and tax benefit from Collins lease termination and peaker writedown) estimated to be $2.9 billion

$ 2.1 billion after repayment of “BV” loan

10

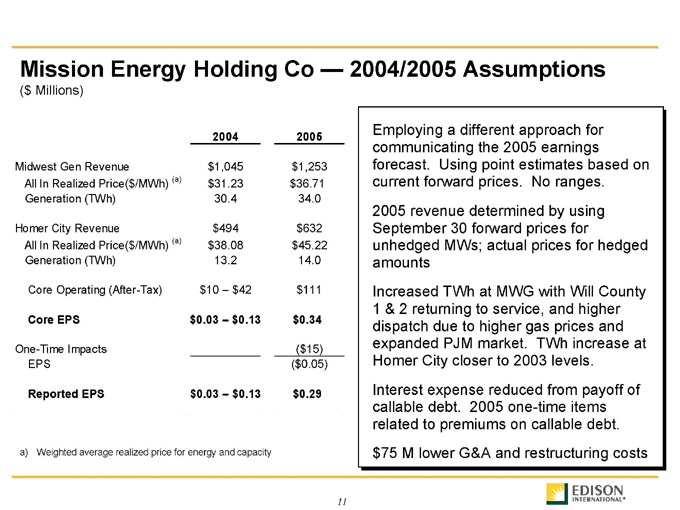

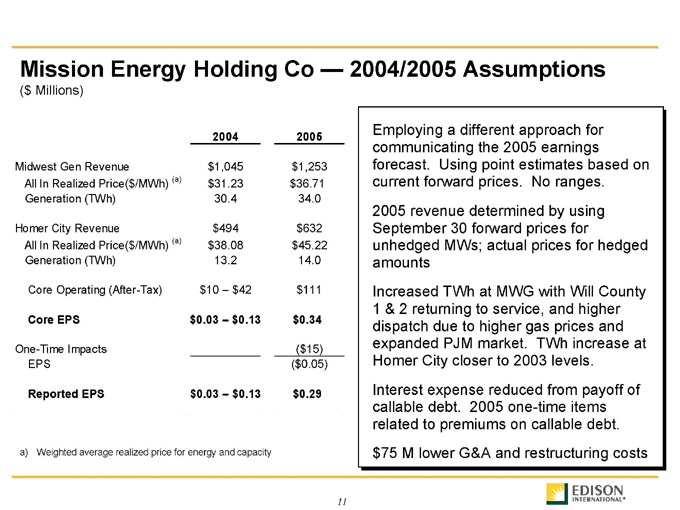

Mission Energy Holding Co — 2004/2005 Assumptions

($ Millions)

2004 2005

Midwest Gen Revenue $1,045 $1,253

All In Realized Price($/MWh) (a) $31.23 $36.71

Generation (TWh) 30.4 34.0

Homer City Revenue $494 $632

All In Realized Price($/MWh) (a) $38.08 $45.22

Generation (TWh) 13.2 14.0

Core Operating (After-Tax) $10 – $42 $111

Core EPS $0.03 – $0.13 $0.34

One-Time Impacts ($15)

EPS ($0.05)

Reported EPS $0.03 – $0.13 $0.29

a) Weighted average realized price for energy and capacity

Employing a different approach for communicating the 2005 earnings forecast. Using point estimates based on current forward prices. No ranges. 2005 revenue determined by using September 30 forward prices for unhedged MWs; actual prices for hedged amounts Increased TWh at MWG with Will County 1 & 2 returning to service, and higher dispatch due to higher gas prices and expanded PJM market. TWh increase at Homer City closer to 2003 levels.

Interest expense reduced from payoff of callable debt. 2005 one-time items related to premiums on callable debt. $75 M lower G&A and restructuring costs

a) Weighted average realized price for energy and capacity

11

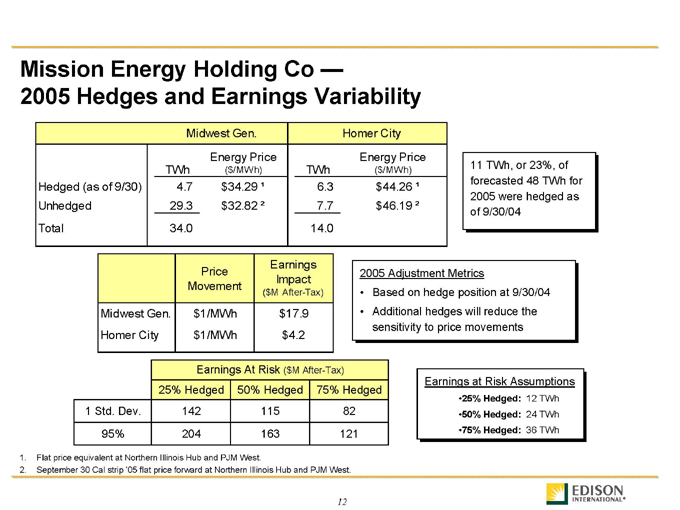

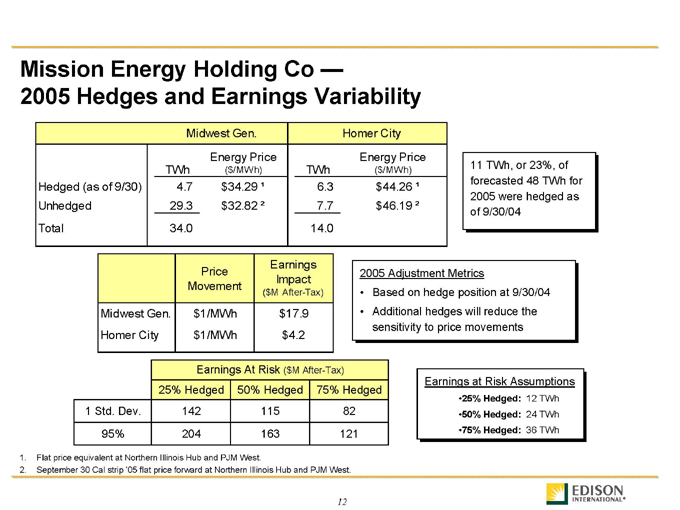

Mission Energy Holding Co — 2005 Hedges and Earnings Variability

Midwest Gen. Homer City

TWh Energy Price ($/MWh) TWh Energy Price ($/MWh)

Hedged (as of 9/30) 4.7 $34.29 ¹ 6.3 $44.26 ¹

Unhedged 29.3 $32.82 ² 7.7 $46.19 ²

Total 34.0 14.0

11 TWh, or 23%, of forecasted 48 TWh for 2005 were hedged as of 9/30/04

Price Movement Earnings Impact ($M After-Tax)

Midwest Gen. $1/MWh $17.9

Homer City $1/MWh $4.2

2005 Adjustment Metrics

Based on hedge position at 9/30/04

Additional hedges will reduce the sensitivity to price movements

Earnings At Risk ($M After-Tax)

25% Hedged 50% Hedged 75% Hedged

1 Std. Dev. 142 115 82

95% 204 163 121

Earnings at Risk Assumptions

25% Hedged: 12 TWh

50% Hedged: 24 TWh

75% Hedged: 36 TWh

1. Flat price equivalent at Northern Illinois Hub and PJM West.

2. September 30 Cal strip ‘05 flat price forward at Northern Illinois Hub and PJM West.

12

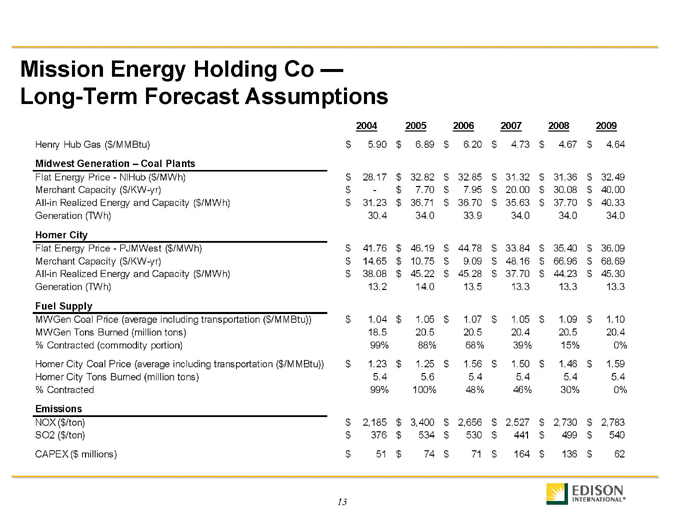

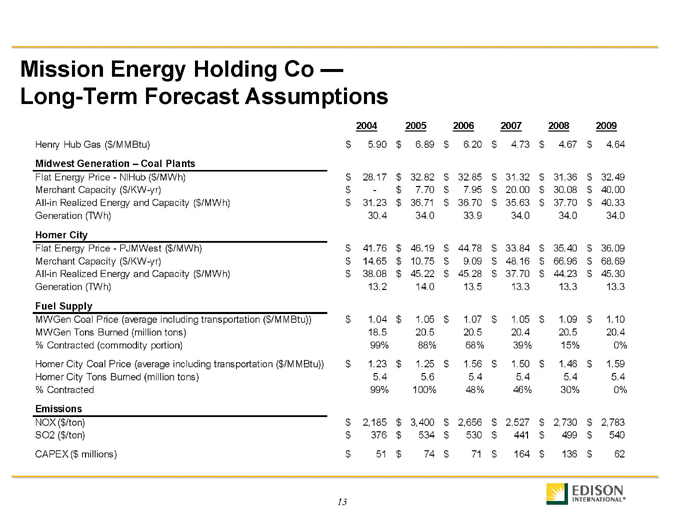

Mission Energy Holding Co — Long-Term Forecast Assumptions

2004 2005 2006 2007 2008 2009

Henry Hub Gas ($/MMBtu) $5.90 $6.89 $6.20 $4.73 $4.67 $4.64

Midwest Generation – Coal Plants

Flat Energy Price—NIHub ($/MWh) $28.17 $32.82 $32.85 $31.32 $31.36 $32.49

Merchant Capacity ($/KW-yr) $- $7.70 $7.95 $20.00 $30.08 $40.00

All-in Realized Energy and Capacity ($/MWh) $31.23 $36.71 $36.70 $35.63 $37.70 $40.33

Generation (TWh) 30.4 34.0 33.9 34.0 34.0 34.0

Homer City

Flat Energy Price—PJMWest ($/MWh) $41.76 $46.19 $44.78 $33.84 $35.40 $36.09

Merchant Capacity ($/KW-yr) $14.65 $10.75 $9.09 $48.16 $66.96 $68.69

All-in Realized Energy and Capacity ($/MWh) $38.08 $45.22 $45.28 $37.70 $44.23 $45.30

Generation (TWh) 13.2 14.0 13.5 13.3 13.3 13.3

Fuel Supply

MWGen Coal Price (average including transportation ($/MMBtu)) $1.04 $1.05 $1.07 $1.05 $1.09 $1.10

MWGen Tons Burned (million tons) 18.5 20.5 20.5 20.4 20.5 20.4

% Contracted (commodity portion) 99% 88% 68% 39% 15% 0%

Homer City Coal Price (average including transportation ($/MMBtu)) $1.23 $1.25 $1.56 $1.50 $1.46 $1.59

Homer City Tons Burned (million tons) 5.4 5.6 5.4 5.4 5.4 5.4

% Contracted 99% 100% 48% 46% 30% 0%

Emissions

NOX ($/ton) $2,185 $3,400 $2,656 $2,527 $2,730 $2,783

SO2 ($/ton) $376 $534 $530 $441 $499 $540

CAPEX ($ millions) $51 $74 $71 $164 $136 $62

13

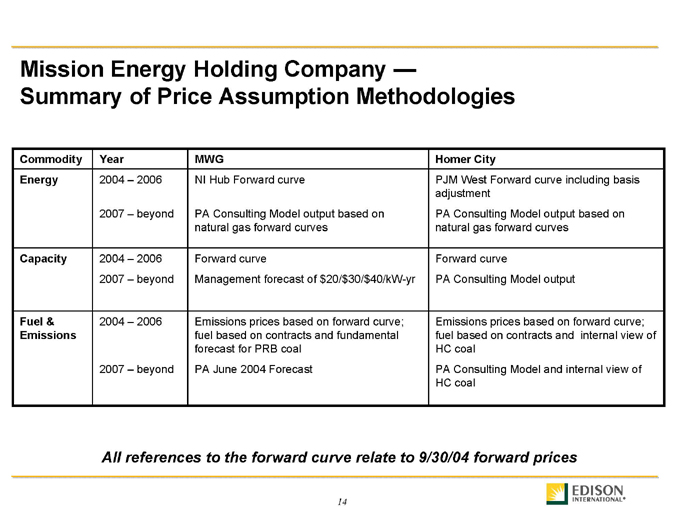

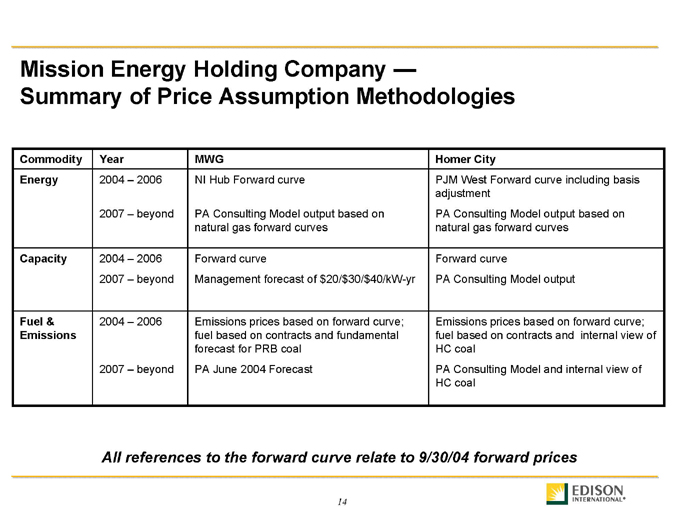

Mission Energy Holding Company —

Summary of Price Assumption Methodologies

Commodity Year MWG Homer City

Energy 2004 – 2006 NI Hub Forward curve PJM West Forward curve including basis adjustment

2007 – beyond PA Consulting Model output based on natural gas forward curves PA Consulting Model output based on natural gas forward curves

Capacity 2004 – 2006 Forward curve Forward curve

2007 – beyond Management forecast of $20/$30/$40/kW-yr PA Consulting Model output

Fuel & Emissions 2004 – 2006 Emissions prices based on forward curve; fuel based on contracts and fundamental forecast for PRB coal Emissions prices based on forward curve; fuel based on contracts and internal view of HC coal

2007 – beyond PA June 2004 Forecast PA Consulting Model and internal view of HC coal

All references to the forward curve relate to 9/30/04 forward prices

14

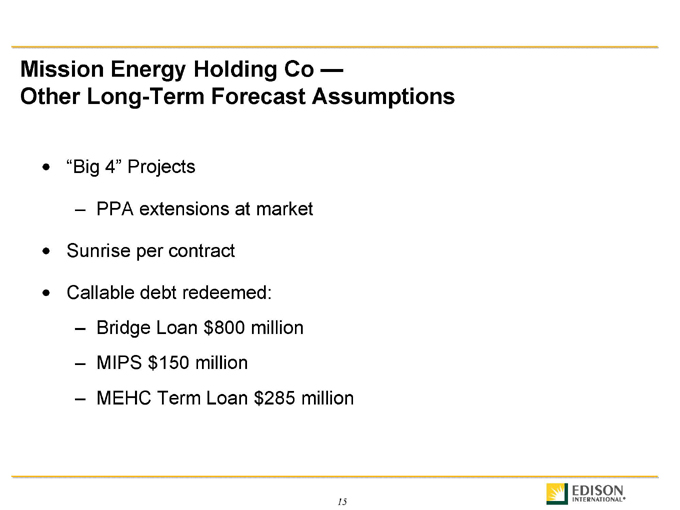

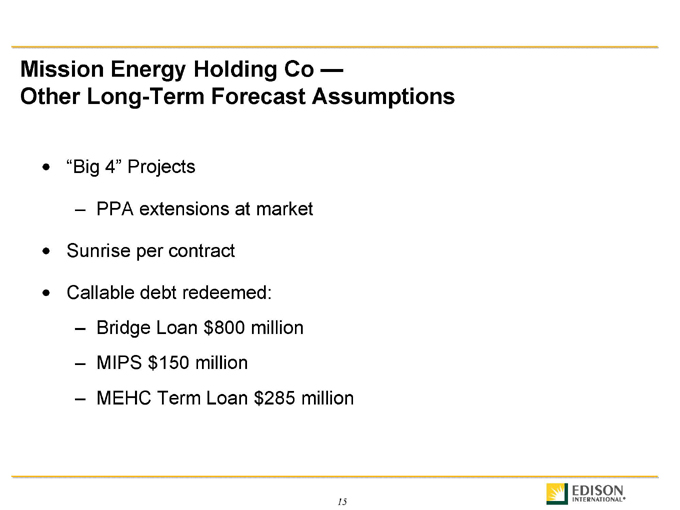

Mission Energy Holding Co —

Other Long-Term Forecast Assumptions

“Big 4” Projects

PPA extensions at market

Sunrise per contract

Callable debt redeemed:

Bridge Loan $800 million

MIPS $150 million

MEHC Term Loan $285 million

15

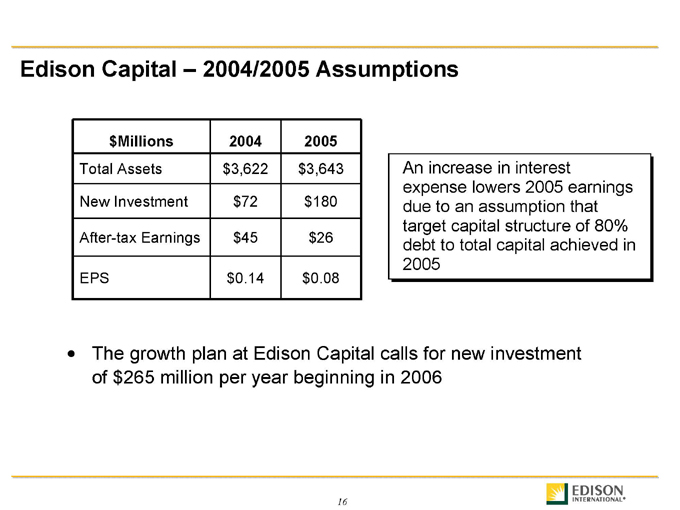

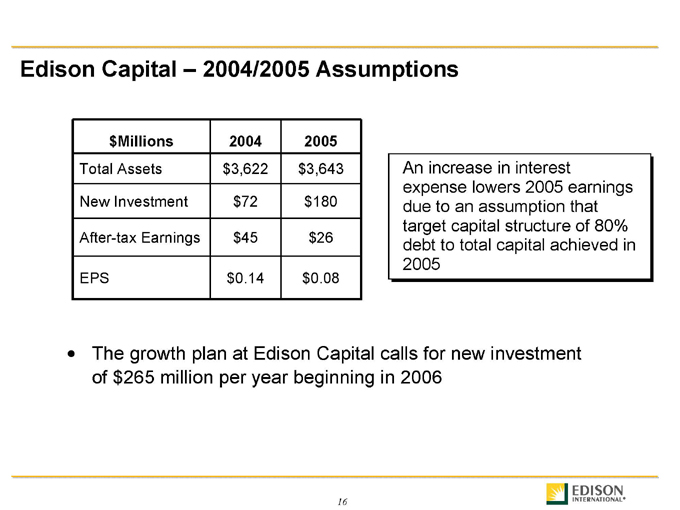

Edison Capital – 2004/2005 Assumptions

$Millions 2004 2005

Total Assets $3,622 $3,643

New Investment $72 $180

After-tax Earnings $45 $26

EPS $0.14 $0.08

An increase in interest expense lowers 2005 earnings due to an assumption that target capital structure of 80% debt to total capital achieved in 2005

The growth plan at Edison Capital calls for new investment of $265 million per year beginning in 2006

16

Edison Capital — Long-Term Forecast Assumptions

Credit Risk

The majority of the Lease Portfolio is supported by high quality collateral to mitigate credit risk

The forecast assumes two “watchlist” credits - American Airlines (AMR) and Midland Cogeneration Venture (MCV) - continue to meet their contractual obligations

Tax Risk

Primary risk within the Lease Portfolio is the outcome of tax audits involving the timing of tax payments on certain cross border structures the Company has utilized

The forecast reflects the Company will be successful in defending its position

Reinvestment Risk

17

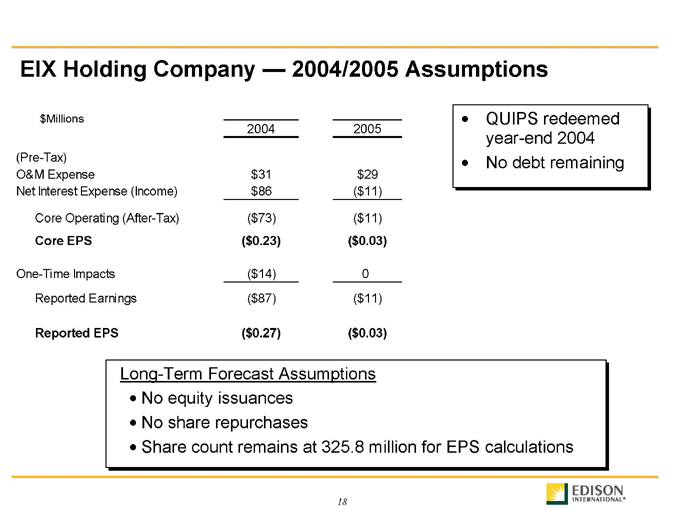

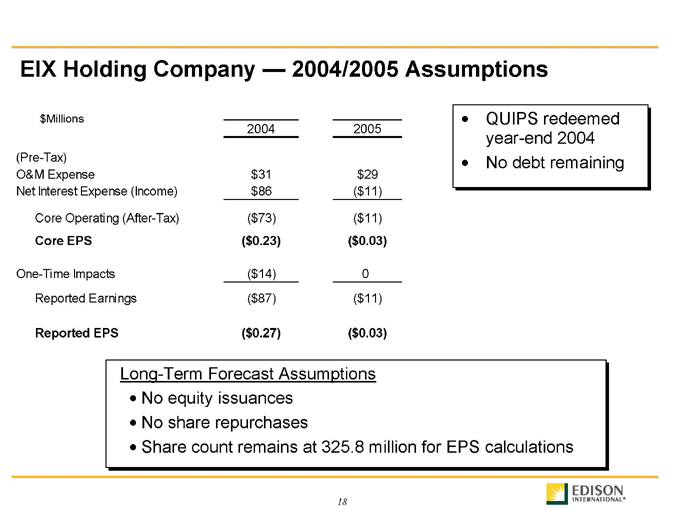

EIX Holding Company — 2004/2005 Assumptions

$Millions

2004 2005

(Pre-Tax)

O&M Expense $31 $29

Net Interest Expense (Income) $86 ($11)

Core Operating (After-Tax) ($73) ($11)

Core EPS ($0.23) ($0.03)

One-Time Impacts ($14) 0

Reported Earnings ($87) ($11)

Reported EPS ($0.27) ($0.03)

QUIPS redeemed year-end 2004 No debt remaining

Long-Term Forecast Assumptions

No equity issuances

No share repurchases

Share count remains at 325.8 million for EPS calculations

18

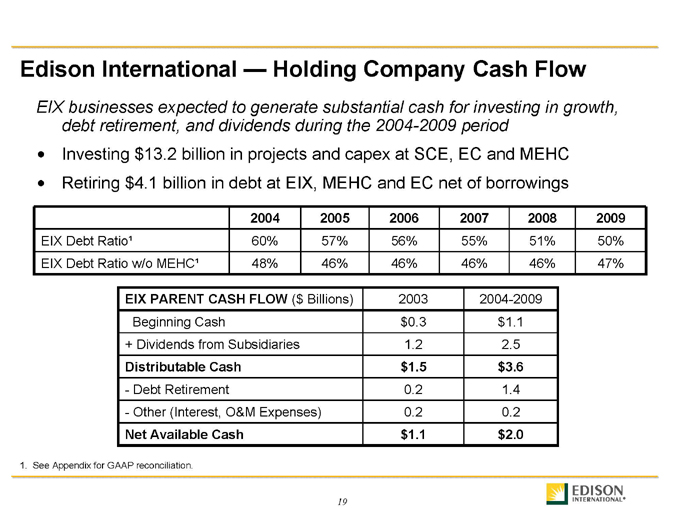

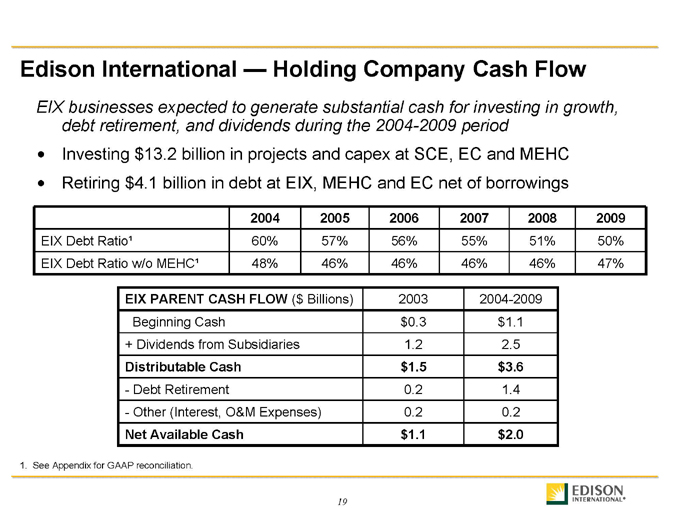

Edison International — Holding Company Cash Flow

EIX businesses expected to generate substantial cash for investing in growth, debt retirement, and dividends during the 2004-2009 period

Investing $13.2 billion in projects and capex at SCE, EC and MEHC Retiring $4.1 billion in debt at EIX, MEHC and EC net of borrowings

2004 2005 2006 2007 2008 2009

EIX Debt Ratio¹ 60% 57% 56% 55% 51% 50% EIX Debt Ratio w/o MEHC¹ 48% 46% 46% 46% 46% 47%

EIX PARENT CASH FLOW ($ Billions) 2003 2004-2009 Beginning Cash $0.3 $1.1 + Dividends from Subsidiaries 1.2 2.5

Distributable Cash $1.5 $3.6

Debt Retirement 0.2 1.4

Other (Interest, O&M Expenses) 0.2 0.2

Net Available Cash $1.1 $2.0

1. See Appendix for GAAP reconciliation.

19

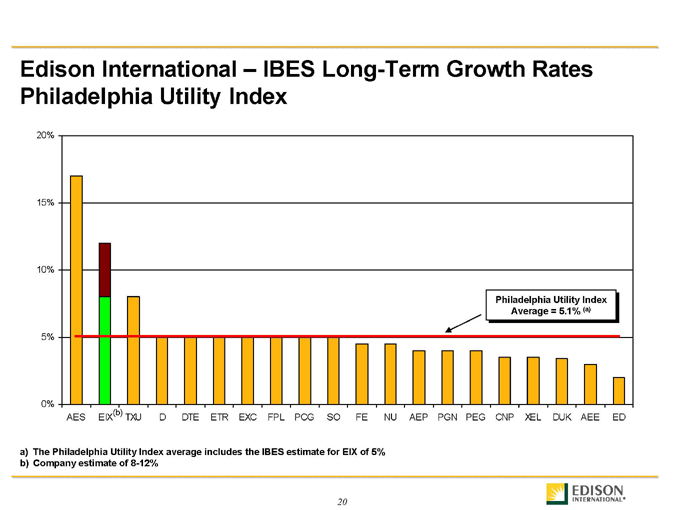

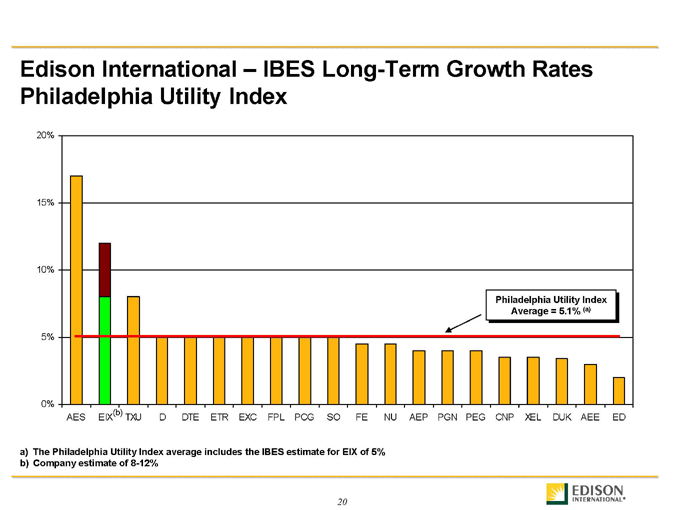

Edison International – IBES Long-Term Growth Rates Philadelphia Utility Index

20% 15% 10% 5% 0%

(b)

AES EIX TXU D DTE ETR EXC FPL PCG SO FE NU AEP PGN PEG CNP XEL DUK AEE ED

Philadelphia Utility Index Average = 5.1% (a)

a) The Philadelphia Utility Index average includes the IBES estimate for EIX of 5% b) Company estimate of 8-12%

20

Appendix

Slide 5: 2005 reported EPS is forecast to be $2.20 and would represent an increase of about 1% from the prior year’s midpoint due to the inclusion of non-recurring items.

Slide 6: Based on reported earnings, the individual company long-term CAGR ranges are from 2%–3% for SCE and 4%–12% for EIX consolidated. The lower ranges reflect the 2004 non-recurring items which include positive one-time regulatory adjustments at SCE totaling $157 million, partially offset by a $14 million charge due to the retirement of the EIX QUIPS.

Slide 19: The calculations for the targeted debt to capital ratios presented exclude non-recourse debt. The calculations also include EME’s guarantee of the off-balance sheet Powerton-Joliet Lease of about $1.5 billion as debt and classify redeemable preferred securities as preferred securities. The comparable, expected debt to capital ratios based on the GAAP classifications for the projected capital components, including non-recourse debt, excluding EME guarantee of the Powerton-Joliet Lease and classifying redeemable preferred securities as debt are for the EIX debt ratio 69% for 2004, 63% for 2005, 61% for 2006, 2007, and 2008, and 58% for 2009. For the EIX debt ratio without MEHC the ratios are 52% for 2004, 51% for 2005, 52% for 2006, 2007, and 2008, and 53% for 2009.

Note: GAAP Measurements that equal or fall into the non-GAAP measurement range are not reconciled in the footnotes above.

21