UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-05447 |

| | |

| AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 06-30 |

| | |

| Date of reporting period: | 06-30-2018 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| ANNUAL REPORT | |

| JUNE 30, 2018 |

| |

|

|

AC Alternatives® Disciplined Long Short Fund |

| Investor Class (ACDJX) |

| I Class (ACDKX) |

| A Class (ACDQX) |

| C Class (ACDHX) |

| R Class (ACDWX) |

|

| | |

| President's Letter | 2 |

|

| Performance | 3 |

|

| Portfolio Commentary | |

|

| Fund Characteristics | |

|

| Shareholder Fee Example | |

|

| Schedule of Investments | |

|

| Statement of Assets and Liabilities | |

|

| Statement of Operations | |

|

| Statement of Changes in Net Assets | |

|

| Notes to Financial Statements | |

|

| Financial Highlights | |

|

| Report of Independent Registered Public Accounting Firm | |

|

| Management | |

|

| Approval of Management Agreement | |

|

| Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended June 30, 2018. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

Volatility’s Return Challenged Financial Markets

Broad U.S. and global stock market indices generally rallied for the first half of the 12-month period. A favorable backdrop of robust corporate earnings results, improving global economic growth, and relatively low interest rates, combined with the effects of U.S. tax reform, drove stock prices higher. For the six months ended December 31, 2017, U.S. stocks (S&P 500 Index) returned 11.42%. U.S. bond returns were also positive, but much more subdued, as the Federal Reserve (the Fed) continued its rate-normalization efforts and interest rates edged higher. The Bloomberg Barclays U.S. Aggregate Bond Index returned 1.24% for the six-month period.

In early February, a force that was largely dormant during 2017—volatility—re-emerged, as better-than-expected economic data triggered expectations for rising inflation, higher interest rates, and a more-hawkish Fed. In response, U.S. Treasury yields climbed to their highest levels in several years, and stock prices plunged. Economic data released in subsequent months were more in line with market expectations, while corporate earnings results remained healthy. These factors helped calm the market unrest, and stocks generally recovered their earlier losses. Nevertheless, rising interest rates, geopolitical tensions, and the mounting threat of a global trade war continued to provide periodic headwinds for investors.

Despite the return of volatility, U.S. stocks (S&P 500 Index) gained14.37% for the 12-month period. Meanwhile, rising U.S. Treasury yields, particularly in the second half of the period, took a toll on bonds and other interest-rate-sensitive investments, including gold, utilities stocks, and real estate investment trusts (REITs). Investment-grade bonds (Bloomberg Barclays U.S. Aggregate Bond Index) returned -0.40% for the 12 months.

With volatility resurfacing, inflationary pressures building, Treasury yields rising, and the implications of U.S. tariff and trade policy still unfolding, investors likely will face new opportunities and challenges in the months ahead. We believe this scenario warrants a disciplined, diversified, and risk-aware approach, using professionally managed portfolios in pursuit of investment goals. We appreciate your continued trust and confidence in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | |

| Total Returns as of June 30, 2018 |

| | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | Since Inception | Inception Date |

| Investor Class | ACDJX | 5.06% | 11.26% | 12.34% | 10/31/11 |

| HFRX Equity Hedge Index | — | 6.28% | 3.04% | 3.35% | — |

| Russell 1000 Growth Index | — | 22.51% | 16.35% | 16.31% | — |

| I Class | ACDKX | 5.22% | 11.48% | 12.55% | 10/31/11 |

| A Class | ACDQX | | | | 10/31/11 |

| No sales charge | | 4.77% | 10.98% | 12.05% | |

| With sales charge | | -1.26% | 9.67% | 11.06% | |

| C Class | ACDHX | 3.97% | 10.15% | 11.22% | 10/31/11 |

| R Class | ACDWX | 4.54% | 10.70% | 11.78% | 10/31/11 |

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

|

|

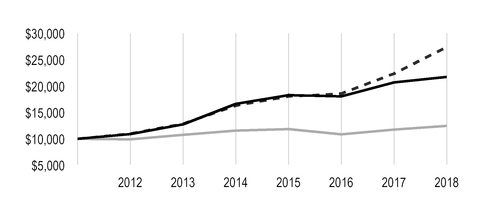

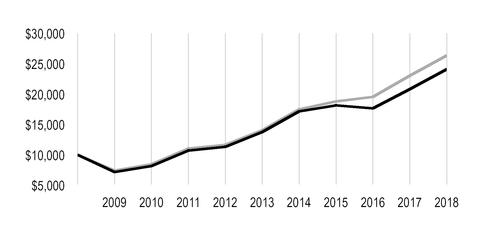

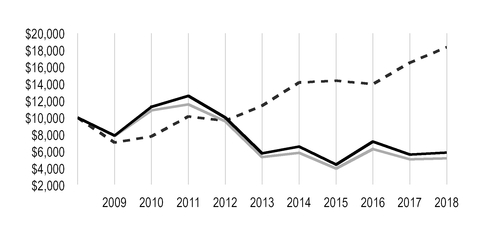

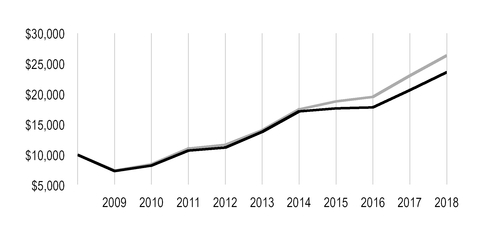

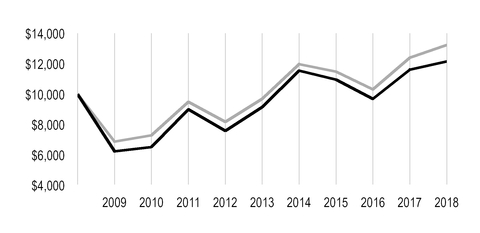

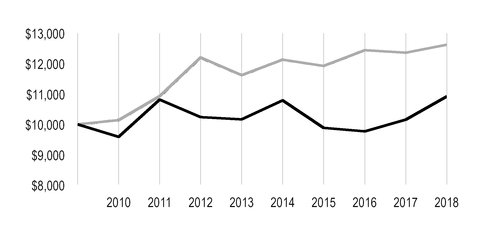

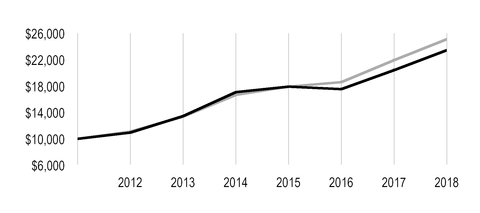

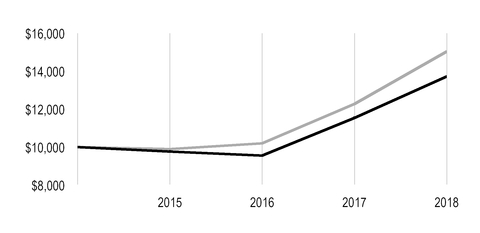

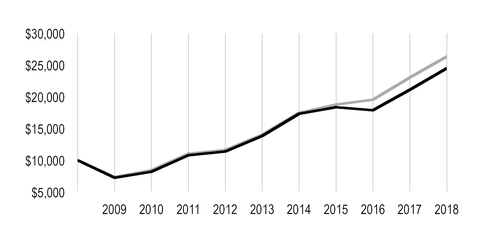

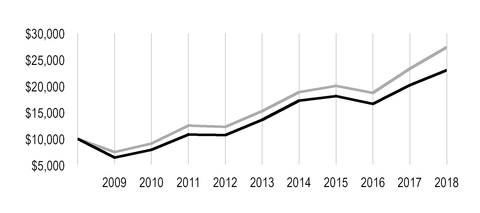

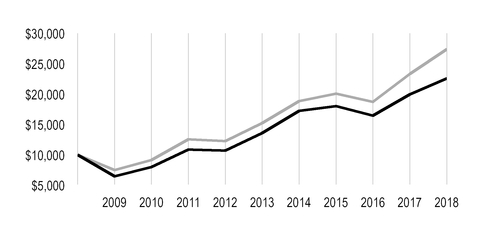

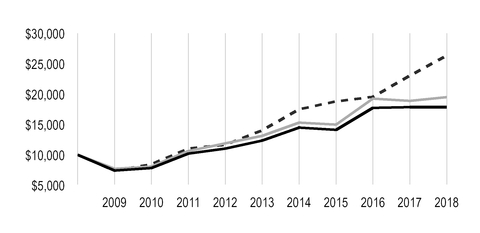

| Growth of $10,000 Over Life of Class |

| $10,000 investment made October 31, 2011 |

| Performance for other share classes will vary due to differences in fee structure. |

|

| |

| Value on June 30, 2018 |

| | Investor Class — $21,725 |

| |

| | HFRX Equity Hedge Index — $12,455 |

| |

| | Russell 1000 Growth Index — $27,392 |

| |

|

| | | | |

| Total Annual Fund Operating Expenses |

| Investor Class | I Class | A Class | C Class | R Class |

| 2.05% | 1.85% | 2.30% | 3.05% | 2.55% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Yulin Long and Tsuyoshi Ozaki

During the period, Tsuyoshi Ozaki joined the fund's management team.

Performance Summary

The AC Alternatives Disciplined Long Short Fund returned 5.06%* for the fiscal year ended June 30, 2018, while the HFRX Equity Hedge Index, the fund's benchmark, returned 6.28%. By comparison, the Russell 1000 Growth Index, a measure of U.S. large-cap growth equity market performance, returned 22.51%.

The portfolio’s stock selection process incorporates factors of valuation, quality, growth, and sentiment. Within the fund, growth, sentiment, and quality insights were supportive, while valuation signals detracted from results.

The fund seeks to participate in strong markets, with the expectation that it will deliver somewhat lower-than-market returns during a sustained rally. It also seeks to protect in down markets, with the goal of outperforming during market declines. During the reporting period, stocks rose sharply, and the fund participated in the rally, but trailed large-cap growth stocks, which made up the best-performing segment of the market. The fund’s performance reflects gains by long positions, while short positions underperformed in a strong, rising market.

The fund’s largest exposure was to the information technology sector, which was the leading contributor by far to absolute performance. Notable contributions to performance also came from positions in the industrials and financials sectors, among others. Positions in the health care sector were the largest detractors from absolute return.

Information Technology Contributed the Most

Reflecting the enduring strength of large-cap technology stocks in recent years, once again during the period the information technology sector made the leading contribution to performance. Four of the five largest individual contributing long positions on average during the period were technology stocks—Alphabet (the parent of Google), Microsoft, Apple, and Facebook. Adobe Systems, Texas Instruments, Intel, and VMware were other sources of strength. As a group, these stocks scored highly on multiple metrics and were among the largest individual contributors to performance during the period.

Other Key Contributors

Stock selection within the industrials sector also contributed meaningfully to results. Aerospace and defense giant Boeing’s stock rose on the back of strong new orders, which drove earnings and cash flow growth. The stock was attractive along every dimension we track. Holdings within the professional services industry were another source of strength, as human resource management companies Robert Half International and Insperity benefited from a tight job market.

* All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund's benchmark, other share classes may not. See page 3 for returns for all share classes.

Financial stocks also made significant contributions to total return, led by savings and loan Charter Financial and insurer Infinity Property & Casualty. Both benefited from solid economic growth and rising rates. Stronger economic activity translates into greater lending and underwriting volumes, while higher interest rates benefit banks’ spread lending business and insurers invest capital at new, higher rates. Charter Financial was eliminated during the period after sizable gains.

Online retail giant Amazon.com was another leading contributor to performance, benefiting from rapid growth in its public cloud business and increasing volume of transactions across its retail platform. Other notable contributors were managed health care company UnitedHealth Group and medical device maker Globus Medical, which both posted significant gains during the period.

Notable Detractors

On a sector basis, health care stocks detracted the most, led by a short position in biotechnology company AveXis. The gene therapy company was acquired by Novartis during the period at a premium, which meant our short position detracted. A short position in medical instrument and device company ICU Medical was another source of weakness. Other short positions in the sector that detracted from performance included medical device company Insulet and biotechnology firms AxoGen and Neurocrine Biosciences, among others. We closed out our short positions in ICU Medical and Neurocrine Biosciences. Elsewhere in the sector, biotechnology company Celgene was a long position, which underperformed as investors worried about generic competition for some of the firm’s leading drugs.

Information technology services firm WEX was a key detractor from performance. The stock scored particularly poorly for quality and sentiment, but our short position in this corporate payment processor and service provider hurt as the company reported strong revenue growth. Internet retailer Overstock.com was another source of weakness, as our short position detracted. We closed out the position.

Portfolio Positioning

Our disciplined, objective, and systematic investment strategy is designed to take advantage of opportunities at the individual company level in both the long and short portions of the portfolio. We believe this approach is the most powerful way to capitalize on market inefficiencies that lead to the mispricing of individual stocks. Our broad sector exposures reflect the net effect of the underlying individual long and short positions.

At period-end, we held significant exposure to information technology, health care, consumer discretionary, and industrials. In information technology, stocks in the software and services and semiconductors and semiconductor equipment industry groups are attractive along multiple dimensions of our stock selection process. Our health care long positions are led by holdings in the pharmaceuticals and biotechnology and health care equipment and services industry groups. The consumer discretionary and industrials sectors long positions reflect allocations to the capital goods and retailing industry groups, respectively. Conversely, we found materials and real estate among less attractive sectors, with sizable net short positions. These stocks generally scored poorly on our measures of growth and quality.

|

| |

| JUNE 30, 2018 |

| Top Ten Long Holdings | % of net assets |

| Alphabet, Inc.* | 3.58% |

| Microsoft Corp. | 1.95% |

| Amazon.com, Inc. | 1.90% |

| Apple, Inc. | 1.89% |

| Facebook, Inc., Class A | 1.85% |

| Ingersoll-Rand plc | 1.79% |

| UnitedHealth Group, Inc. | 1.74% |

| PS Business Parks, Inc. | 1.61% |

| Adobe Systems, Inc. | 1.46% |

| Las Vegas Sands Corp. | 1.39% |

*Includes all classes of the issuer held by the fund.

| |

| | |

| Top Five Short Holdings | % of net assets |

| Gartner, Inc. | (1.51)% |

| Pinnacle Financial Partners, Inc. | (1.39)% |

| Crown Castle International Corp. | (1.26)% |

| John Bean Technologies Corp. | (1.06)% |

| Healthcare Services Group, Inc. | (1.06)% |

| | |

| Types of Investments in Portfolio | % of net assets |

| Common Stocks | 103.6% |

| Common Stocks Sold Short | (54.6)% |

| Temporary Cash Investments | 49.8% |

| Other Assets and Liabilities | 1.2% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2018 to June 30, 2018.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| | Beginning

Account Value

1/1/18 | Ending

Account Value

6/30/18 | Expenses Paid

During Period(1)

1/1/18 - 6/30/18 | Annualized

Expense Ratio(1) |

| Actual |

| Investor Class | $1,000 | $1,016.80 | $11.95 | 2.39% |

| I Class | $1,000 | $1,017.30 | $10.95 | 2.19% |

| A Class | $1,000 | $1,014.70 | $13.19 | 2.64% |

| C Class | $1,000 | $1,011.30 | $16.91 | 3.39% |

| R Class | $1,000 | $1,014.40 | $14.43 | 2.89% |

| Hypothetical |

| Investor Class | $1,000 | $1,012.94 | $11.93 | 2.39% |

| I Class | $1,000 | $1,013.94 | $10.94 | 2.19% |

| A Class | $1,000 | $1,011.70 | $13.17 | 2.64% |

| C Class | $1,000 | $1,007.98 | $16.88 | 3.39% |

| R Class | $1,000 | $1,010.46 | $14.41 | 2.89% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses. |

JUNE 30, 2018

|

| | | | | |

| | Shares | Value |

| COMMON STOCKS — 103.6% | | |

| Aerospace and Defense — 4.3% | | |

Boeing Co. (The)(1) | 614 |

| $ | 206,003 |

|

Curtiss-Wright Corp.(1) | 2,604 |

| 309,928 |

|

General Dynamics Corp.(1) | 2,286 |

| 426,133 |

|

| Hexcel Corp. | 1,215 |

| 80,652 |

|

Lockheed Martin Corp.(1) | 1,483 |

| 438,123 |

|

Raytheon Co.(1) | 2,198 |

| 424,610 |

|

| Textron, Inc. | 3,696 |

| 243,603 |

|

| | | 2,129,052 |

|

| Auto Components — 0.9% | | |

| Tenneco, Inc. | 744 |

| 32,706 |

|

Visteon Corp.(2) | 3,214 |

| 415,378 |

|

| | | 448,084 |

|

| Banks — 4.9% | | |

| Cambridge Bancorp | 1,403 |

| 121,416 |

|

Central Pacific Financial Corp.(1) | 20,546 |

| 588,643 |

|

First Financial Northwest, Inc.(1) | 20,640 |

| 402,893 |

|

Franklin Financial Network, Inc.(1)(2) | 11,369 |

| 427,474 |

|

| Hanmi Financial Corp. | 7,745 |

| 219,571 |

|

| Independent Bank Corp. | 3,370 |

| 85,935 |

|

RBB Bancorp(1) | 4,645 |

| 149,197 |

|

West Bancorporation, Inc.(1) | 15,247 |

| 383,462 |

|

| | | 2,378,591 |

|

| Beverages — 0.4% | | |

| Constellation Brands, Inc., Class A | 855 |

| 187,134 |

|

| Biotechnology — 4.5% | | |

AbbVie, Inc.(1) | 3,113 |

| 288,419 |

|

Acorda Therapeutics, Inc.(2) | 1,531 |

| 43,940 |

|

Akebia Therapeutics, Inc.(2) | 3,216 |

| 32,096 |

|

Alexion Pharmaceuticals, Inc.(2) | 2,059 |

| 255,625 |

|

Amgen, Inc.(1) | 2,193 |

| 404,806 |

|

Arbutus Biopharma Corp.(2) | 11,121 |

| 81,183 |

|

Biogen, Inc.(2) | 1,157 |

| 335,808 |

|

Celgene Corp.(1)(2) | 2,816 |

| 223,647 |

|

CytomX Therapeutics, Inc.(2) | 1,954 |

| 44,668 |

|

Emergent BioSolutions, Inc.(2) | 1,368 |

| 69,070 |

|

Genomic Health, Inc.(2) | 1,984 |

| 99,994 |

|

Ionis Pharmaceuticals, Inc.(2) | 1,366 |

| 56,921 |

|

Pieris Pharmaceuticals, Inc.(2) | 4,727 |

| 23,966 |

|

Protagonist Therapeutics, Inc.(2) | 6,405 |

| 43,042 |

|

Regeneron Pharmaceuticals, Inc.(2) | 311 |

| 107,292 |

|

Surface Oncology, Inc.(2) | 2,865 |

| 46,728 |

|

|

| | | | | |

| | Shares | Value |

Vertex Pharmaceuticals, Inc.(2) | 161 |

| $ | 27,363 |

|

| | | 2,184,568 |

|

| Building Products — 0.1% | | |

Trex Co., Inc.(2) | 614 |

| 38,430 |

|

| Capital Markets — 1.4% | | |

| Cboe Global Markets, Inc. | 1,136 |

| 118,224 |

|

| Evercore, Inc., Class A | 528 |

| 55,678 |

|

| Federated Investors, Inc., Class B | 1,420 |

| 33,114 |

|

| Piper Jaffray Cos. | 511 |

| 39,270 |

|

SEI Investments Co.(1) | 4,996 |

| 312,350 |

|

| Silvercrest Asset Management Group, Inc., Class A | 7,043 |

| 114,801 |

|

| | | 673,437 |

|

| Chemicals — 1.6% | | |

| Huntsman Corp. | 4,889 |

| 142,759 |

|

Kraton Corp.(2) | 1,138 |

| 52,507 |

|

LyondellBasell Industries NV, Class A(1) | 2,252 |

| 247,382 |

|

| Praxair, Inc. | 646 |

| 102,165 |

|

WR Grace & Co.(1) | 3,066 |

| 224,769 |

|

| | | 769,582 |

|

| Commercial Services and Supplies — 1.4% | | |

| Brady Corp., Class A | 2,321 |

| 89,474 |

|

| Herman Miller, Inc. | 2,423 |

| 82,140 |

|

McGrath RentCorp(1) | 2,582 |

| 163,363 |

|

MSA Safety, Inc.(1) | 2,879 |

| 277,363 |

|

| Quad/Graphics, Inc. | 4,288 |

| 89,319 |

|

| | | 701,659 |

|

| Communications Equipment — 1.2% | | |

Arista Networks, Inc.(2) | 146 |

| 37,594 |

|

ARRIS International plc(2) | 7,640 |

| 186,760 |

|

F5 Networks, Inc.(1)(2) | 1,563 |

| 269,539 |

|

Palo Alto Networks, Inc.(2) | 236 |

| 48,491 |

|

| Plantronics, Inc. | 317 |

| 24,171 |

|

| | | 566,555 |

|

| Construction and Engineering — 1.1% | | |

EMCOR Group, Inc.(1) | 7,247 |

| 552,076 |

|

| Consumer Finance — 1.3% | | |

American Express Co.(1) | 2,483 |

| 243,334 |

|

Elevate Credit, Inc.(2) | 10,110 |

| 85,530 |

|

Enova International, Inc.(2) | 3,267 |

| 119,409 |

|

| Synchrony Financial | 5,121 |

| 170,939 |

|

| | | 619,212 |

|

| Diversified Consumer Services — 1.2% | | |

Cambium Learning Group, Inc.(2) | 8,207 |

| 91,508 |

|

Grand Canyon Education, Inc.(1)(2) | 2,295 |

| 256,145 |

|

| H&R Block, Inc. | 8,264 |

| 188,254 |

|

| Liberty Tax, Inc. | 3,707 |

| 29,934 |

|

| | | 565,841 |

|

|

| | | | | |

| | Shares | Value |

| Diversified Financial Services — 0.1% | | |

| Marlin Business Services Corp. | 1,756 |

| $ | 52,417 |

|

| Diversified Telecommunication Services — 0.4% | | |

Ooma, Inc.(2) | 7,535 |

| 106,620 |

|

Vonage Holdings Corp.(2) | 8,954 |

| 115,417 |

|

| | | 222,037 |

|

| Electrical Equipment — 1.0% | | |

AMETEK, Inc.(1) | 3,430 |

| 247,509 |

|

Generac Holdings, Inc.(1)(2) | 4,454 |

| 230,405 |

|

| | | 477,914 |

|

| Electronic Equipment, Instruments and Components — 1.1% | | |

Coherent, Inc.(2) | 645 |

| 100,891 |

|

| National Instruments Corp. | 694 |

| 29,134 |

|

Trimble, Inc.(2) | 2,013 |

| 66,107 |

|

Zebra Technologies Corp., Class A(1)(2) | 2,376 |

| 340,362 |

|

| | | 536,494 |

|

| Energy Equipment and Services — 1.3% | | |

Halliburton Co.(1) | 14,396 |

| 648,684 |

|

| Equity Real Estate Investment Trusts (REITs) — 5.2% | | |

Gaming and Leisure Properties, Inc.(1) | 13,299 |

| 476,104 |

|

| GEO Group, Inc. (The) | 3,533 |

| 97,299 |

|

MedEquities Realty Trust, Inc.(1) | 27,754 |

| 305,849 |

|

PotlatchDeltic Corp.(1) | 12,159 |

| 618,285 |

|

PS Business Parks, Inc.(1) | 6,125 |

| 787,063 |

|

Tanger Factory Outlet Centers, Inc.(1) | 11,540 |

| 271,075 |

|

| | | 2,555,675 |

|

| Food Products — 0.1% | | |

Hostess Brands, Inc.(2) | 2,415 |

| 32,844 |

|

| Health Care Equipment and Supplies — 4.1% | | |

| Atrion Corp. | 107 |

| 64,136 |

|

Boston Scientific Corp.(2) | 2,581 |

| 84,399 |

|

| CONMED Corp. | 2,291 |

| 167,701 |

|

Edwards Lifesciences Corp.(2) | 1,043 |

| 151,829 |

|

Globus Medical, Inc., Class A(1)(2) | 6,863 |

| 346,307 |

|

Haemonetics Corp.(2) | 2,095 |

| 187,880 |

|

Hill-Rom Holdings, Inc.(1) | 2,381 |

| 207,956 |

|

IDEXX Laboratories, Inc.(2) | 627 |

| 136,648 |

|

Integer Holdings Corp.(2) | 2,158 |

| 139,515 |

|

Intuitive Surgical, Inc.(1)(2) | 477 |

| 228,235 |

|

NuVasive, Inc.(2) | 1,821 |

| 94,910 |

|

Orthofix International NV(2) | 1,891 |

| 107,447 |

|

STAAR Surgical Co.(2) | 2,793 |

| 86,583 |

|

| | | 2,003,546 |

|

| Health Care Providers and Services — 4.2% | | |

Cigna Corp.(1) | 2,709 |

| 460,394 |

|

Express Scripts Holding Co.(2) | 395 |

| 30,498 |

|

| Humana, Inc. | 447 |

| 133,041 |

|

|

| | | | | |

| | Shares | Value |

Tivity Health, Inc.(2) | 2,774 |

| $ | 97,645 |

|

UnitedHealth Group, Inc.(1) | 3,476 |

| 852,802 |

|

WellCare Health Plans, Inc.(1)(2) | 1,885 |

| 464,162 |

|

| | | 2,038,542 |

|

| Health Care Technology — 0.6% | | |

athenahealth, Inc.(2) | 205 |

| 32,624 |

|

Cerner Corp.(2) | 2,440 |

| 145,887 |

|

| HealthStream, Inc. | 4,175 |

| 114,019 |

|

| | | 292,530 |

|

| Hotels, Restaurants and Leisure — 2.7% | | |

| Choice Hotels International, Inc. | 361 |

| 27,292 |

|

| Extended Stay America, Inc. | 9,114 |

| 196,953 |

|

Las Vegas Sands Corp.(1) | 8,908 |

| 680,215 |

|

Marriott International, Inc., Class A(1) | 1,930 |

| 244,338 |

|

| Wynn Resorts Ltd. | 1,081 |

| 180,895 |

|

| | | 1,329,693 |

|

| Household Durables — 1.6% | | |

KB Home(1) | 9,479 |

| 258,208 |

|

NVR, Inc.(2) | 9 |

| 26,733 |

|

PulteGroup, Inc.(1) | 11,196 |

| 321,885 |

|

Toll Brothers, Inc.(1) | 4,674 |

| 172,891 |

|

| | | 779,717 |

|

| Household Products — 1.2% | | |

Kimberly-Clark Corp.(1) | 5,522 |

| 581,687 |

|

| Independent Power and Renewable Electricity Producers — 0.8% | |

NRG Energy, Inc.(1) | 12,365 |

| 379,605 |

|

| Insurance — 1.8% | | |

Infinity Property & Casualty Corp.(1) | 4,718 |

| 671,607 |

|

| Progressive Corp. (The) | 3,304 |

| 195,432 |

|

| | | 867,039 |

|

| Internet and Direct Marketing Retail — 2.3% | | |

Amazon.com, Inc.(1)(2) | 548 |

| 931,490 |

|

| Nutrisystem, Inc. | 2,662 |

| 102,487 |

|

Shutterfly, Inc.(2) | 850 |

| 76,526 |

|

| | | 1,110,503 |

|

| Internet Software and Services — 6.3% | | |

Alphabet, Inc., Class A(1)(2) | 803 |

| 906,740 |

|

Alphabet, Inc., Class C(1)(2) | 757 |

| 844,547 |

|

Care.com, Inc.(2) | 6,975 |

| 145,638 |

|

Endurance International Group Holdings, Inc.(2) | 5,925 |

| 58,954 |

|

Facebook, Inc., Class A(1)(2) | 4,657 |

| 904,948 |

|

| LogMeIn, Inc. | 857 |

| 88,485 |

|

SPS Commerce, Inc.(2) | 495 |

| 36,373 |

|

Stamps.com, Inc.(2) | 205 |

| 51,875 |

|

TrueCar, Inc.(2) | 3,139 |

| 31,672 |

|

| | | 3,069,232 |

|

| | | |

|

| | | | | |

| | Shares | Value |

| IT Services — 2.8% | | |

Acxiom Corp.(2) | 5,564 |

| $ | 166,642 |

|

CSG Systems International, Inc.(1) | 945 |

| 38,622 |

|

International Business Machines Corp.(1) | 2,175 |

| 303,848 |

|

MasterCard, Inc., Class A(1) | 1,597 |

| 313,842 |

|

| Paychex, Inc. | 1,423 |

| 97,262 |

|

Syntel, Inc.(2) | 3,079 |

| 98,805 |

|

| Total System Services, Inc. | 2,072 |

| 175,125 |

|

Unisys Corp.(2) | 3,960 |

| 51,084 |

|

| Visa, Inc., Class A | 1,081 |

| 143,179 |

|

| | | 1,388,409 |

|

| Leisure Products — 0.3% | | |

MCBC Holdings, Inc.(2) | 1,753 |

| 50,749 |

|

Nautilus, Inc.(2) | 3,474 |

| 54,542 |

|

| Polaris Industries, Inc. | 400 |

| 48,872 |

|

| | | 154,163 |

|

| Machinery — 3.5% | | |

Caterpillar, Inc.(1) | 2,139 |

| 290,198 |

|

Columbus McKinnon Corp.(1) | 5,479 |

| 237,570 |

|

Harsco Corp.(2) | 8,332 |

| 184,137 |

|

Ingersoll-Rand plc(1) | 9,782 |

| 877,739 |

|

Toro Co. (The)(1) | 2,489 |

| 149,962 |

|

| | | 1,739,606 |

|

| Media — 1.0% | | |

DISH Network Corp., Class A(2) | 5,928 |

| 199,240 |

|

| Emerald Expositions Events, Inc. | 4,304 |

| 88,663 |

|

| Entravision Communications Corp., Class A | 26,776 |

| 133,880 |

|

tronc, Inc.(2) | 3,140 |

| 54,259 |

|

| | | 476,042 |

|

| Multiline Retail — 0.5% | | |

Dollar Tree, Inc.(1)(2) | 2,783 |

| 236,555 |

|

| Oil, Gas and Consumable Fuels — 1.7% | | |

Continental Resources, Inc.(1)(2) | 3,914 |

| 253,471 |

|

Evolution Petroleum Corp.(1) | 42,175 |

| 415,424 |

|

Isramco, Inc.(2) | 249 |

| 30,602 |

|

Newfield Exploration Co.(2) | 4,046 |

| 122,391 |

|

Westmoreland Coal Co.(2) | 201,127 |

| 28,158 |

|

| | | 850,046 |

|

| Paper and Forest Products — 0.6% | | |

Louisiana-Pacific Corp.(1) | 10,758 |

| 292,833 |

|

| Personal Products — 0.1% | | |

| Nu Skin Enterprises, Inc., Class A | 551 |

| 43,083 |

|

| Pharmaceuticals — 4.5% | | |

Allergan plc(1) | 1,927 |

| 321,269 |

|

| Bristol-Myers Squibb Co. | 6,241 |

| 345,377 |

|

Eli Lilly & Co.(1) | 5,443 |

| 464,451 |

|

Endo International plc(2) | 4,215 |

| 39,748 |

|

|

| | | | | |

| | Shares | Value |

Horizon Pharma plc(2) | 4,743 |

| $ | 78,544 |

|

Innoviva, Inc.(2) | 2,422 |

| 33,424 |

|

Johnson & Johnson(1) | 5,554 |

| 673,922 |

|

Zoetis, Inc.(1) | 2,928 |

| 249,436 |

|

| | | 2,206,171 |

|

| Professional Services — 3.3% | | |

ASGN, Inc.(1)(2) | 3,291 |

| 257,323 |

|

Dun & Bradstreet Corp. (The)(1) | 2,784 |

| 341,458 |

|

Insperity, Inc.(1) | 2,969 |

| 282,797 |

|

| Kforce, Inc. | 1,952 |

| 66,954 |

|

Robert Half International, Inc.(1) | 8,397 |

| 546,645 |

|

TrueBlue, Inc.(2) | 2,833 |

| 76,349 |

|

WageWorks, Inc.(2) | 732 |

| 36,600 |

|

| | | 1,608,126 |

|

| Real Estate Management and Development — 0.5% | | |

Newmark Group, Inc., Class A(1) | 18,271 |

| 259,996 |

|

| Road and Rail — 0.3% | | |

| ArcBest Corp. | 1,755 |

| 80,204 |

|

Avis Budget Group, Inc.(2) | 2,675 |

| 86,937 |

|

| | | 167,141 |

|

| Semiconductors and Semiconductor Equipment — 4.3% | | |

Advanced Energy Industries, Inc.(2) | 925 |

| 53,733 |

|

Amkor Technology, Inc.(2) | 3,827 |

| 32,874 |

|

Applied Materials, Inc.(1) | 7,704 |

| 355,848 |

|

| Broadcom, Inc. | 382 |

| 92,688 |

|

| Cabot Microelectronics Corp. | 988 |

| 106,269 |

|

| Cypress Semiconductor Corp. | 4,558 |

| 71,014 |

|

| Intel Corp. | 627 |

| 31,168 |

|

| KLA-Tencor Corp. | 791 |

| 81,101 |

|

| Lam Research Corp. | 925 |

| 159,886 |

|

Lattice Semiconductor Corp.(2) | 9,585 |

| 62,878 |

|

Micron Technology, Inc.(2) | 624 |

| 32,723 |

|

| MKS Instruments, Inc. | 1,805 |

| 172,738 |

|

Nanometrics, Inc.(2) | 1,160 |

| 41,076 |

|

| NVIDIA Corp. | 1,341 |

| 317,683 |

|

ON Semiconductor Corp.(1)(2) | 11,591 |

| 257,726 |

|

Qorvo, Inc.(2) | 1,102 |

| 88,347 |

|

Rudolph Technologies, Inc.(2) | 1,465 |

| 43,364 |

|

| Texas Instruments, Inc. | 988 |

| 108,927 |

|

| | | 2,110,043 |

|

| Software — 10.5% | | |

A10 Networks, Inc.(2) | 3,848 |

| 23,973 |

|

Activision Blizzard, Inc.(1) | 6,126 |

| 467,536 |

|

Adobe Systems, Inc.(1)(2) | 2,923 |

| 712,657 |

|

Aspen Technology, Inc.(1)(2) | 2,947 |

| 273,305 |

|

Cadence Design Systems, Inc.(1)(2) | 6,118 |

| 264,971 |

|

| CDK Global, Inc. | 1,708 |

| 111,105 |

|

|

| | | | | |

| | Shares | Value |

Citrix Systems, Inc.(2) | 558 |

| $ | 58,501 |

|

Electronic Arts, Inc.(1)(2) | 1,986 |

| 280,066 |

|

Fair Isaac Corp.(1)(2) | 1,097 |

| 212,072 |

|

| Intuit, Inc. | 523 |

| 106,851 |

|

Microsoft Corp.(1) | 9,673 |

| 953,854 |

|

Oracle Corp.(New York)(1) | 5,436 |

| 239,510 |

|

Paylocity Holding Corp.(2) | 419 |

| 24,662 |

|

| Pegasystems, Inc. | 1,321 |

| 72,391 |

|

Progress Software Corp.(1) | 4,920 |

| 190,994 |

|

Rosetta Stone, Inc.(2) | 1,970 |

| 31,579 |

|

salesforce.com, Inc.(1)(2) | 2,613 |

| 356,413 |

|

| Symantec Corp. | 2,441 |

| 50,407 |

|

Synopsys, Inc.(1)(2) | 4,931 |

| 421,946 |

|

Ultimate Software Group, Inc. (The)(2) | 174 |

| 44,772 |

|

Verint Systems, Inc.(2) | 1,794 |

| 79,564 |

|

VMware, Inc., Class A(2) | 343 |

| 50,411 |

|

Zendesk, Inc.(2) | 1,192 |

| 64,952 |

|

Zix Corp.(2) | 7,216 |

| 38,894 |

|

| | | 5,131,386 |

|

| Specialty Retail — 1.9% | | |

Asbury Automotive Group, Inc.(2) | 1,308 |

| 89,664 |

|

AutoZone, Inc.(1)(2) | 391 |

| 262,334 |

|

Burlington Stores, Inc.(2) | 278 |

| 41,847 |

|

Conn's, Inc.(2) | 797 |

| 26,301 |

|

Five Below, Inc.(2) | 448 |

| 43,774 |

|

J. Jill, Inc.(2) | 2,888 |

| 26,974 |

|

Ross Stores, Inc.(1) | 3,615 |

| 306,371 |

|

| Tailored Brands, Inc. | 5,106 |

| 130,305 |

|

| | | 927,570 |

|

| Technology Hardware, Storage and Peripherals — 2.5% | | |

Apple, Inc.(1) | 5,006 |

| 926,661 |

|

| NetApp, Inc. | 1,773 |

| 139,234 |

|

| Western Digital Corp. | 2,196 |

| 169,992 |

|

| | | 1,235,887 |

|

| Textiles, Apparel and Luxury Goods — 2.3% | | |

| Columbia Sportswear Co. | 1,641 |

| 150,102 |

|

Deckers Outdoor Corp.(1)(2) | 4,488 |

| 506,650 |

|

Michael Kors Holdings Ltd.(2) | 3,739 |

| 249,018 |

|

| Oxford Industries, Inc. | 1,231 |

| 102,148 |

|

| Tapestry, Inc. | 2,666 |

| 124,529 |

|

| | | 1,132,447 |

|

| Thrifts and Mortgage Finance — 1.9% | | |

Essent Group Ltd.(2) | 1,228 |

| 43,987 |

|

FS Bancorp, Inc.(1) | 3,312 |

| 209,484 |

|

Luther Burbank Corp.(1) | 17,607 |

| 202,568 |

|

| Merchants Bancorp | 4,171 |

| 118,999 |

|

|

| | | | | |

| | Shares | Value |

Sterling Bancorp, Inc.(1) | 26,371 |

| $ | 352,317 |

|

| | | 927,355 |

|

| Tobacco — 0.1% | | |

| Turning Point Brands, Inc. | 2,070 |

| 66,033 |

|

| Trading Companies and Distributors — 1.1% | | |

HD Supply Holdings, Inc.(2) | 3,719 |

| 159,508 |

|

| Kaman Corp. | 1,354 |

| 94,360 |

|

| MSC Industrial Direct Co., Inc., Class A | 1,400 |

| 118,790 |

|

| W.W. Grainger, Inc. | 576 |

| 177,639 |

|

| | | 550,297 |

|

| Wireless Telecommunication Services — 0.8% | | |

T-Mobile US, Inc.(1)(2) | 6,421 |

| 383,655 |

|

TOTAL COMMON STOCKS

(Cost $43,450,442) | | 50,679,224 |

|

| TEMPORARY CASH INVESTMENTS — 49.8% | | |

| Repurchase Agreement, BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 1.375% - 3.75%, 2/15/19 - 11/15/47, valued at $13,542,654), in a joint trading account at 1.75%, dated 6/29/18, due 7/2/18 (Delivery value $13,271,194) | | 13,269,259 |

|

| Repurchase Agreement, Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 2.75%, 2/15/28, valued at $11,281,334), at 0.90%, dated 6/29/18, due 7/2/18 (Delivery value $11,059,829) | | 11,059,000 |

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 17,900 |

| 17,900 |

|

TOTAL TEMPORARY CASH INVESTMENTS

(Cost $24,346,159) | | 24,346,159 |

|

TOTAL INVESTMENT SECURITIES BEFORE SECURITIES SOLD SHORT — 153.4%

(Cost $67,796,601) | 75,025,383 |

|

| COMMON STOCKS SOLD SHORT — (54.6)% | | |

| Aerospace and Defense — (1.4)% | | |

| BWX Technologies, Inc. | (7,943 | ) | (495,008 | ) |

| Kratos Defense & Security Solutions, Inc. | (9,901 | ) | (113,961 | ) |

| Mercury Systems, Inc. | (1,488 | ) | (56,633 | ) |

| | | (665,602 | ) |

| Air Freight and Logistics — (0.2)% | | |

| Air Transport Services Group, Inc. | (5,378 | ) | (121,489 | ) |

| Airlines — (0.1)% | | |

| Allegiant Travel Co. | (227 | ) | (31,542 | ) |

| Auto Components — (1.1)% | | |

| Fox Factory Holding Corp. | (1,092 | ) | (50,833 | ) |

| Lear Corp. | (171 | ) | (31,773 | ) |

| Standard Motor Products, Inc. | (9,220 | ) | (445,695 | ) |

| | | (528,301 | ) |

| Banks — (5.6)% | | |

| Allegiance Bancshares, Inc. | (1,153 | ) | (49,983 | ) |

| Blue Hills Bancorp, Inc. | (13,459 | ) | (298,790 | ) |

| Equity Bancshares, Inc., Class A | (4,264 | ) | (176,871 | ) |

| First Foundation, Inc. | (3,180 | ) | (58,957 | ) |

| Green Bancorp, Inc. | (5,099 | ) | (110,138 | ) |

| HarborOne Bancorp, Inc. | (14,623 | ) | (276,960 | ) |

|

| | | | | |

| | Shares | Value |

| Home BancShares, Inc. | (11,893 | ) | $ | (268,306 | ) |

| Howard Bancorp, Inc. | (7,143 | ) | (128,574 | ) |

| LegacyTexas Financial Group, Inc. | (1,906 | ) | (74,372 | ) |

| Pinnacle Financial Partners, Inc. | (11,068 | ) | (679,022 | ) |

| Texas Capital Bancshares, Inc. | (4,126 | ) | (377,529 | ) |

| Triumph Bancorp, Inc. | (5,870 | ) | (239,202 | ) |

| | | (2,738,704 | ) |

| Biotechnology — (3.2)% | | |

| Acceleron Pharma, Inc. | (905 | ) | (43,911 | ) |

| Aimmune Therapeutics, Inc. | (4,030 | ) | (108,367 | ) |

| Alnylam Pharmaceuticals, Inc. | (517 | ) | (50,919 | ) |

| AnaptysBio, Inc. | (715 | ) | (50,794 | ) |

| Audentes Therapeutics, Inc. | (2,724 | ) | (104,084 | ) |

| Biohaven Pharmaceutical Holding Co. Ltd. | (695 | ) | (27,466 | ) |

| Bluebird Bio, Inc. | (151 | ) | (23,699 | ) |

| Blueprint Medicines Corp. | (2,336 | ) | (148,289 | ) |

| Celcuity, Inc. | (4,316 | ) | (107,123 | ) |

| Deciphera Pharmaceuticals, Inc. | (2,109 | ) | (82,989 | ) |

| Fate Therapeutics, Inc. | (3,566 | ) | (40,438 | ) |

| Fennec Pharmaceuticals, Inc. | (2,323 | ) | (24,252 | ) |

| FibroGen, Inc. | (1,037 | ) | (64,916 | ) |

| G1 Therapeutics, Inc. | (1,395 | ) | (60,627 | ) |

| Global Blood Therapeutics, Inc. | (977 | ) | (44,160 | ) |

| Immunomedics, Inc. | (1,768 | ) | (41,849 | ) |

| Insmed, Inc. | (1,806 | ) | (42,712 | ) |

| Iovance Biotherapeutics, Inc. | (4,052 | ) | (51,866 | ) |

| Madrigal Pharmaceuticals, Inc. | (335 | ) | (93,696 | ) |

| Natera, Inc. | (1,221 | ) | (22,979 | ) |

| Sage Therapeutics, Inc. | (877 | ) | (137,277 | ) |

| Sarepta Therapeutics, Inc. | (1,403 | ) | (185,449 | ) |

| | | (1,557,862 | ) |

| Building Products — (1.2)% | | |

| AAON, Inc. | (12,084 | ) | (401,793 | ) |

| Insteel Industries, Inc. | (5,058 | ) | (168,937 | ) |

| | | (570,730 | ) |

| Capital Markets — (1.8)% | | |

| Eaton Vance Corp. | (1,764 | ) | (92,063 | ) |

| Hamilton Lane, Inc., Class A | (5,138 | ) | (246,470 | ) |

| Moelis & Co., Class A | (1,144 | ) | (67,095 | ) |

| T Rowe Price Group, Inc. | (2,068 | ) | (240,074 | ) |

| Virtu Financial, Inc., Class A | (1,920 | ) | (50,976 | ) |

| Virtus Investment Partners, Inc. | (1,406 | ) | (179,898 | ) |

| | | (876,576 | ) |

| Chemicals — (1.8)% | | |

| Albemarle Corp. | (456 | ) | (43,014 | ) |

| Chase Corp. | (1,895 | ) | (222,189 | ) |

| Ecolab, Inc. | (518 | ) | (72,691 | ) |

|

| | | | | |

| | Shares | Value |

| HB Fuller Co. | (6,905 | ) | $ | (370,660 | ) |

| NewMarket Corp. | (227 | ) | (91,822 | ) |

| Quaker Chemical Corp. | (517 | ) | (80,068 | ) |

| | | (880,444 | ) |

| Commercial Services and Supplies — (2.1)% | | |

| Brink's Co. (The) | (4,380 | ) | (349,305 | ) |

| Healthcare Services Group, Inc. | (12,024 | ) | (519,316 | ) |

| Multi-Color Corp. | (2,335 | ) | (150,958 | ) |

| | | (1,019,579 | ) |

| Construction and Engineering — (1.1)% | | |

| MasTec, Inc. | (5,716 | ) | (290,087 | ) |

| MYR Group, Inc. | (7,039 | ) | (249,603 | ) |

| | | (539,690 | ) |

| Construction Materials — (0.7)% | | |

| Vulcan Materials Co. | (2,543 | ) | (328,200 | ) |

| Containers and Packaging — (0.1)% | | |

| Crown Holdings, Inc. | (644 | ) | (28,826 | ) |

| Graphic Packaging Holding Co. | (2,281 | ) | (33,097 | ) |

| | | (61,923 | ) |

| Distributors — (0.2)% | | |

| Core-Mark Holding Co., Inc. | (5,434 | ) | (123,352 | ) |

| Diversified Consumer Services — (0.3)% | | |

| Bright Horizons Family Solutions, Inc. | (1,298 | ) | (133,071 | ) |

| Diversified Telecommunication Services — (0.4)% | | |

| Zayo Group Holdings, Inc. | (5,339 | ) | (194,767 | ) |

| Electrical Equipment — (0.3)% | | |

| AZZ, Inc. | (3,250 | ) | (141,213 | ) |

| Electronic Equipment, Instruments and Components — (2.2)% | | |

| Badger Meter, Inc. | (6,592 | ) | (294,662 | ) |

| FARO Technologies, Inc. | (1,347 | ) | (73,210 | ) |

| II-VI, Inc. | (7,842 | ) | (340,735 | ) |

| Mesa Laboratories, Inc. | (438 | ) | (92,453 | ) |

| Napco Security Technologies, Inc. | (8,289 | ) | (121,434 | ) |

| PAR Technology Corp. | (3,747 | ) | (66,247 | ) |

| Park Electrochemical Corp. | (4,863 | ) | (112,773 | ) |

| | | (1,101,514 | ) |

| Equity Real Estate Investment Trusts (REITs) — (3.0)% | | |

| Crown Castle International Corp. | (5,727 | ) | (617,485 | ) |

| Digital Realty Trust, Inc. | (3,323 | ) | (370,780 | ) |

| Equinix, Inc. | (466 | ) | (200,329 | ) |

| Iron Mountain, Inc. | (7,348 | ) | (257,254 | ) |

| | | (1,445,848 | ) |

| Food and Staples Retailing — (0.2)% | | |

| PriceSmart, Inc. | (1,337 | ) | (120,999 | ) |

| Health Care Equipment and Supplies — (2.4)% | | |

| AxoGen, Inc. | (2,703 | ) | (135,826 | ) |

| CryoLife, Inc. | (9,274 | ) | (258,281 | ) |

|

| | | | | |

| | Shares | Value |

| Insulet Corp. | (3,123 | ) | $ | (267,641 | ) |

| Integra LifeSciences Holdings Corp. | (1,396 | ) | (89,916 | ) |

| iRhythm Technologies, Inc. | (3,932 | ) | (319,003 | ) |

| Tactile Systems Technology, Inc. | (1,665 | ) | (86,580 | ) |

| | | (1,157,247 | ) |

| Health Care Providers and Services — (1.3)% | | |

| Henry Schein, Inc. | (6,367 | ) | (462,499 | ) |

| LHC Group, Inc. | (2,126 | ) | (181,964 | ) |

| | | (644,463 | ) |

| Hotels, Restaurants and Leisure — (2.3)% | | |

| Aramark | (1,054 | ) | (39,103 | ) |

| Belmond Ltd., Class A | (20,216 | ) | (225,408 | ) |

| Caesars Entertainment Corp. | (5,068 | ) | (54,228 | ) |

| Churchill Downs, Inc. | (839 | ) | (248,764 | ) |

| Chuy's Holdings, Inc. | (3,947 | ) | (121,173 | ) |

| Drive Shack, Inc. | (20,499 | ) | (158,252 | ) |

| Golden Entertainment, Inc. | (2,984 | ) | (80,538 | ) |

| Lindblad Expeditions Holdings, Inc. | (5,979 | ) | (79,222 | ) |

| Potbelly Corp. | (7,775 | ) | (100,686 | ) |

| | | (1,107,374 | ) |

| Household Durables — (0.7)% | | |

| Leggett & Platt, Inc. | (1,680 | ) | (74,995 | ) |

| Mohawk Industries, Inc. | (979 | ) | (209,770 | ) |

| Universal Electronics, Inc. | (1,049 | ) | (34,670 | ) |

| | | (319,435 | ) |

| Household Products — (0.5)% | | |

| WD-40 Co. | (1,665 | ) | (243,506 | ) |

| Insurance — (2.1)% | | |

| Arch Capital Group Ltd. | (14,421 | ) | (381,580 | ) |

| Arthur J Gallagher & Co. | (370 | ) | (24,154 | ) |

| Aspen Insurance Holdings Ltd. | (1,423 | ) | (57,916 | ) |

| Marsh & McLennan Cos., Inc. | (1,548 | ) | (126,889 | ) |

| RLI Corp. | (6,785 | ) | (449,099 | ) |

| | | (1,039,638 | ) |

| Internet and Direct Marketing Retail — (0.8)% | | |

| Gaia, Inc. | (9,739 | ) | (197,215 | ) |

| TripAdvisor, Inc. | (779 | ) | (43,398 | ) |

| Wayfair, Inc., Class A | (1,232 | ) | (146,312 | ) |

| | | (386,925 | ) |

| Internet Software and Services — (1.1)% | | |

| 2U, Inc. | (6,112 | ) | (510,719 | ) |

| GTT Communications, Inc. | (1,028 | ) | (46,260 | ) |

| | | (556,979 | ) |

| IT Services — (4.1)% | | |

| Gartner, Inc. | (5,544 | ) | (736,798 | ) |

| Genpact Ltd. | (13,794 | ) | (399,060 | ) |

| Global Payments, Inc. | (2,366 | ) | (263,785 | ) |

|

| | | | | |

| | Shares | Value |

| StarTek, Inc. | (3,803 | ) | $ | (23,921 | ) |

| WEX, Inc. | (752 | ) | (143,241 | ) |

| Worldpay, Inc., Class A | (5,296 | ) | (433,107 | ) |

| | | (1,999,912 | ) |

| Machinery — (2.6)% | | |

| Albany International Corp., Class A | (995 | ) | (59,849 | ) |

| CIRCOR International, Inc. | (4,478 | ) | (165,507 | ) |

| Evoqua Water Technologies Corp. | (5,105 | ) | (104,652 | ) |

| John Bean Technologies Corp. | (5,843 | ) | (519,443 | ) |

| Middleby Corp. (The) | (1,995 | ) | (208,318 | ) |

| NN, Inc. | (3,259 | ) | (61,595 | ) |

| Sun Hydraulics Corp. | (2,594 | ) | (125,005 | ) |

| Welbilt, Inc. | (1,268 | ) | (28,289 | ) |

| | | (1,272,658 | ) |

| Media — (2.4)% | | |

| GCI Liberty, Inc., Class A | (3,093 | ) | (139,433 | ) |

| Hemisphere Media Group, Inc. | (7,918 | ) | (103,726 | ) |

| Live Nation Entertainment, Inc. | (7,079 | ) | (343,827 | ) |

| Loral Space & Communications, Inc. | (3,589 | ) | (134,946 | ) |

| New York Times Co. (The), Class A | (9,010 | ) | (233,359 | ) |

| Reading International, Inc., Class A | (15,334 | ) | (244,577 | ) |

| | | (1,199,868 | ) |

| Oil, Gas and Consumable Fuels — (0.4)% | | |

| Cheniere Energy, Inc. | (859 | ) | (55,998 | ) |

| Diamondback Energy, Inc. | (967 | ) | (127,228 | ) |

| | | (183,226 | ) |

| Personal Products — (0.2)% | | |

| Coty, Inc., Class A | (6,892 | ) | (97,177 | ) |

| Pharmaceuticals — (0.6)% | | |

| Aerie Pharmaceuticals, Inc. | (1,421 | ) | (95,989 | ) |

| Catalent, Inc. | (2,313 | ) | (96,892 | ) |

| MyoKardia, Inc. | (1,339 | ) | (66,481 | ) |

| Zogenix, Inc. | (800 | ) | (35,360 | ) |

| | | (294,722 | ) |

| Professional Services — (1.3)% | | |

| Forrester Research, Inc. | (6,736 | ) | (282,575 | ) |

| Franklin Covey Co. | (4,702 | ) | (115,434 | ) |

| InnerWorkings, Inc. | (6,351 | ) | (55,190 | ) |

| TriNet Group, Inc. | (3,392 | ) | (189,749 | ) |

| | | (642,948 | ) |

| Real Estate Management and Development — (0.2)% | | |

| Consolidated-Tomoka Land Co. | (528 | ) | (32,477 | ) |

| Kennedy-Wilson Holdings, Inc. | (2,282 | ) | (48,265 | ) |

| | | (80,742 | ) |

| Semiconductors and Semiconductor Equipment — (0.8)% | | |

| Alpha & Omega Semiconductor Ltd. | (7,923 | ) | (112,824 | ) |

| Monolithic Power Systems, Inc. | (508 | ) | (67,904 | ) |

|

| | | | | |

| | Shares | Value |

| NVE Corp. | (1,281 | ) | $ | (156,000 | ) |

| PDF Solutions, Inc. | (6,230 | ) | (74,635 | ) |

| | | (411,363 | ) |

| Software — (0.5)% | | |

| 8x8, Inc. | (5,109 | ) | (102,435 | ) |

| Guidewire Software, Inc. | (1,732 | ) | (153,767 | ) |

| | | (256,202 | ) |

| Specialty Retail — (0.2)% | | |

| At Home Group, Inc. | (2,215 | ) | (86,717 | ) |

| National Vision Holdings, Inc. | (795 | ) | (29,073 | ) |

| | | (115,790 | ) |

| Technology Hardware, Storage and Peripherals — (0.9)% | | |

| Cray, Inc. | (3,357 | ) | (82,582 | ) |

| Super Micro Computer, Inc. | (1,352 | ) | (31,975 | ) |

| USA Technologies, Inc. | (24,502 | ) | (343,028 | ) |

| | | (457,585 | ) |

| Textiles, Apparel and Luxury Goods — (0.6)% | | |

| NIKE, Inc., Class B | (3,487 | ) | (277,844 | ) |

| Thrifts and Mortgage Finance — (0.4)% | | |

| Kearny Financial Corp. | (5,672 | ) | (76,288 | ) |

| Western New England Bancorp, Inc. | (9,368 | ) | (103,048 | ) |

| | | (179,336 | ) |

| Trading Companies and Distributors — (1.1)% | | |

| Beacon Roofing Supply, Inc. | (562 | ) | (23,953 | ) |

| SiteOne Landscape Supply, Inc. | (5,391 | ) | (452,682 | ) |

| Veritiv Corp. | (1,447 | ) | (57,663 | ) |

| | | (534,298 | ) |

| Water Utilities — (0.1)% | | |

| California Water Service Group | (1,275 | ) | (49,661 | ) |

TOTAL COMMON STOCKS SOLD SHORT — (54.6)%

(Proceeds $25,119,817) | | (26,690,305 | ) |

| OTHER ASSETS AND LIABILITIES — 1.2% | | 589,715 |

|

| TOTAL NET ASSETS — 100.0% | | $ | 48,924,793 |

|

|

| | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| |

| (1) | Security, or a portion thereof, has been pledged at the custodian bank or with a broker for collateral requirements on securities sold short. At the period end, the aggregate value of securities pledged was $33,296,694. |

See Notes to Financial Statements.

|

|

| Statement of Assets and Liabilities |

|

| | | |

| JUNE 30, 2018 |

| Assets |

| Investment securities, at value (cost of $43,468,342) | $ | 50,697,124 |

|

| Repurchase agreements, at value (cost of $24,328,259) | 24,328,259 |

|

| Total investment securities, at value (cost of $67,796,601) | 75,025,383 |

|

| Receivable for investments sold | 603,543 |

|

| Receivable for capital shares sold | 368,525 |

|

| Dividends and interest receivable | 16,921 |

|

| | 76,014,372 |

|

| | |

| Liabilities | |

| Securities sold short, at value (proceeds of $25,119,817) | 26,690,305 |

|

| Payable for investments purchased | 178,633 |

|

| Payable for capital shares redeemed | 129,943 |

|

| Accrued management fees | 56,882 |

|

| Distribution and service fees payable | 2,196 |

|

| Dividend expense payable on securities sold short | 9,663 |

|

| Fees and charges payable on borrowings for securities sold short | 21,957 |

|

| | 27,089,579 |

|

| | |

| Net Assets | $ | 48,924,793 |

|

| | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $ | 42,282,555 |

|

| Accumulated net investment loss | (114,435 | ) |

| Undistributed net realized gain | 1,098,379 |

|

| Net unrealized appreciation | 5,658,294 |

|

| | $ | 48,924,793 |

|

|

| | | | | | |

| | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Investor Class, $0.01 Par Value |

| $39,702,001 |

| 2,190,168 |

| $18.13 |

| I Class, $0.01 Par Value |

| $5,055,103 |

| 278,066 |

| $18.18 |

| A Class, $0.01 Par Value |

| $1,583,350 |

| 88,487 |

| $17.89* |

| C Class, $0.01 Par Value |

| $1,817,395 |

| 106,892 |

| $17.00 |

| R Class, $0.01 Par Value |

| $766,944 |

| 43,508 |

| $17.63 |

*Maximum offering price $18.98 (net asset value divided by 0.9425).

See Notes to Financial Statements.

|

| | | |

| YEAR ENDED JUNE 30, 2018 |

| Investment Income (Loss) |

| Income: | |

| Dividends | $ | 631,734 |

|

| Interest | 202,747 |

|

| | 834,481 |

|

| | |

| Expenses: | |

| Dividend expense on securities sold short | 212,109 |

|

| Fees and charges on borrowings for securities sold short | 225,716 |

|

| Management fees | 658,321 |

|

| Distribution and service fees: | |

| A Class | 4,668 |

|

| C Class | 20,823 |

|

| R Class | 3,150 |

|

| Directors' fees and expenses | 2,805 |

|

| | 1,127,592 |

|

| | |

| Net investment income (loss) | (293,111 | ) |

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions | 7,445,928 |

|

| Securities sold short transactions | (5,073,727 | ) |

| | 2,372,201 |

|

| | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | 440,282 |

|

| Securities sold short | (414,069 | ) |

| | 26,213 |

|

| | |

| Net realized and unrealized gain (loss) | 2,398,414 |

|

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 2,105,303 |

|

See Notes to Financial Statements.

|

|

| Statement of Changes in Net Assets |

|

| | | | | | |

| YEARS ENDED JUNE 30, 2018 AND JUNE 30, 2017 |

| Increase (Decrease) in Net Assets | June 30, 2018 | June 30, 2017 |

| Operations | | |

| Net investment income (loss) | $ | (293,111 | ) | $ | (33,936 | ) |

| Net realized gain (loss) | 2,372,201 |

| 4,701,387 |

|

| Change in net unrealized appreciation (depreciation) | 26,213 |

| 799,589 |

|

| Net increase (decrease) in net assets resulting from operations | 2,105,303 |

| 5,467,040 |

|

| | | |

| Distributions to Shareholders | | |

| From net investment income: | | |

| Investor Class | — |

| (14,589 | ) |

| I Class | — |

| (906 | ) |

| From net realized gains: | | |

| Investor Class | (2,804,255 | ) | — |

|

| I Class | (130,005 | ) | — |

|

| A Class | (135,710 | ) | — |

|

| C Class | (152,548 | ) | — |

|

| R Class | (49,146 | ) | — |

|

| Decrease in net assets from distributions | (3,271,664 | ) | (15,495 | ) |

| | | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | 9,245,912 |

| (7,641,652 | ) |

| | | |

| Net increase (decrease) in net assets | 8,079,551 |

| (2,190,107 | ) |

| | | |

| Net Assets | | |

| Beginning of period | 40,845,242 |

| 43,035,349 |

|

| End of period | $ | 48,924,793 |

| $ | 40,845,242 |

|

| | | |

| Accumulated net investment loss | $ | (114,435 | ) | — |

|

See Notes to Financial Statements.

|

|

| Notes to Financial Statements |

JUNE 30, 2018

1. Organization

American Century Quantitative Equity Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. AC Alternatives Disciplined Long Short Fund (the fund) is one fund in a series issued by the corporation. The fund’s investment objective is to seek long-term capital growth.

The fund offers the Investor Class, I Class, A Class, C Class and R Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price.

Open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost, which approximates fair value.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the Board of Directors. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s net asset value per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. If significant fluctuations in foreign markets are identified, the fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Securities Sold Short — The fund enters into short sales, which is selling securities it does not own, as part of its normal investment activities. Upon selling a security short, the fund will segregate cash, cash equivalents or other appropriate liquid securities in at least an amount equal to the current market value of the securities sold short until the fund replaces the borrowed security. Interest earned on segregated cash for securities sold short, if any, is reflected as interest income. The fund is required to pay any dividends or interest due on securities sold short. Such dividends and interest are recorded as an expense. The fund may pay fees or charges on the assets borrowed for securities sold short. These fees are calculated daily based upon the value of each security sold short and a rate that is dependent on the availability of such security. Liabilities for securities sold short are valued daily and changes in value are recorded as change in net unrealized appreciation (depreciation) on securities sold short. The fund records realized gain (loss) on a security sold short when it is terminated by the fund and includes as a component of net realized gain (loss) on securities sold short transactions.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investment securities and other financial instruments. ACIM monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for collateral requirements.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid semiannually. Distributions from net realized gains, if any, are generally declared and paid annually. The fund may elect to treat a portion of its payment to a redeeming shareholder, which represents the pro rata share of undistributed net investment income and net realized gains, as a distribution for federal income tax purposes (tax equalization).

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, expenses on securities sold short, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class's daily net assets and paid monthly in arrears. The difference in the fee among the classes is a result of their separate arrangements for non-Rule 12b-1 shareholder services. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the fund’s assets, which do not vary by class. The fee consists of (1) an Investment Category Fee based on the daily net assets of the fund and certain other accounts managed by the investment advisor that are in the same broad investment category as the fund and (2) a Complex Fee based on the assets of all the funds in the American Century Investments family of funds.

The Investment Category Fee range, the Complex Fee range and the effective annual management fee for each class for the period ended June 30, 2018 are as follows:

|

| | | |

| | Investment Category Fee Range | Complex Fee Range | Effective Annual

Management Fee |

| Investor Class | 1.1180% to 1.3000% | 0.2500% to 0.3100% | 1.44% |

| I Class | 0.0500% to 0.1100% | 1.24% |

| A Class | 0.2500% to 0.3100% | 1.44% |

| C Class | 0.2500% to 0.3100% | 1.44% |

| R Class | 0.2500% to 0.3100% | 1.44% |

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the period ended June 30, 2018 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Directors. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. During the period, the interfund purchases and sales were $1,044,684 and $921,145, respectively. The effect of interfund transactions on the Statement of Operations was $93,476 in net realized gain (loss) on investment transactions.

4. Investment Transactions

Purchases and sales of investment securities and securities sold short, excluding short-term investments, for the period ended June 30, 2018 were $117,802,701 and $116,003,151, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

|

| | | | | | | | | | |

| | Year ended

June 30, 2018 | Year ended

June 30, 2017 |

| | Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 50,000,000 |

| | 50,000,000 |

| |

| Sold | 1,274,754 |

| $ | 23,619,522 |

| 709,766 |

| $ | 12,888,344 |

|

| Issued in reinvestment of distributions | 148,786 |

| 2,664,762 |

| 817 |

| 14,306 |

|

| Redeemed | (1,165,589 | ) | (21,437,057 | ) | (936,332 | ) | (16,384,723 | ) |

| | 257,951 |

| 4,847,227 |

| (225,749 | ) | (3,482,073 | ) |

| I Class/Shares Authorized | 25,000,000 |

| | 25,000,000 |

| |

| Sold | 275,796 |

| 5,086,168 |

| 2,782 |

| 48,694 |

|

| Issued in reinvestment of distributions | 7,247 |

| 130,005 |

| 52 |

| 906 |

|

| Redeemed | (26,606 | ) | (487,271 | ) | (1,098 | ) | (20,133 | ) |

| | 256,437 |

| 4,728,902 |

| 1,736 |

| 29,467 |

|

| A Class/Shares Authorized | 20,000,000 |

| | 20,000,000 |

| |

| Sold | 26,419 |

| 483,482 |

| 35,143 |

| 620,552 |

|

| Issued in reinvestment of distributions | 7,335 |

| 129,830 |

| – |

| – |

|

| Redeemed | (51,825 | ) | (945,562 | ) | (261,037 | ) | (4,661,858 | ) |

| | (18,071 | ) | (332,250 | ) | (225,894 | ) | (4,041,306 | ) |

| C Class/Shares Authorized | 15,000,000 |

| | 15,000,000 |

| |

| Sold | 13,593 |

| 239,127 |