OMB APPROVAL

OMB Number: 3235-0570

Expires: October 31, 2006

Estimated average burden hours per response: 19.3

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-5451

USLICO Series Fund

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

CT Corporation System, 101 Federal Street, Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2004 |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2004

USLICO Series Fund |

§ | The Asset Allocation Portfolio |

§ | The Bond Portfolio |

§ | The Money Market Portfolio |

§ | The Stock Portfolio |

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. | |

|

PROXY VOTING INFORMATION

A description of the policies and procedures that the Registrant uses to determine how to vote proxies related to portfolio securities is available (1) without charge, upon request, by calling Shareholder Services toll-free at 800-992-0180; (2) on the Registrant’s website at www.ingfunds.com and (3) on the SEC’s website at www.sec.gov. Information regarding how the Registrant voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Registrant’s website at www.ingfunds.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Registrant files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Registrant’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Registrant’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330; and is available upon request from the Registrant by calling Shareholder Services toll-free at 800-992-0180.

(THIS PAGE INTENTIONALLY LEFT BLANK)

| Dear Shareholder: |

|

The past year has brought about numerous changes in the mutual funds industry, including requests for additional disclosures. I would like to draw your attention to some additional information you will now see in the reports due, in part, to these new requirements: |

|

• You will see a new section entitled “Shareholder Expense Examples”. These examples are intended to illustrate for you the ongoing costs of investing in a mutual fund and to provide a method to compare those costs with the ongoing costs of investing in other mutual funds. |

• In addition to the normal performance tables included in the Portfolio Managers’ Reports, there are now additional graphical or tabular presentations, which illustrate the current holdings of the funds as of the period-end. |

|

• Each fund now also files its complete schedule of portfolio holdings with the Securities Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. These Forms are available for shareholders to view on the SEC’s website at www.sec.gov. |

We welcome these changes and believe that they will provide valuable information to our shareholders. We hope you will find these additional disclosures beneficial and easy to understand.

On behalf of ING Funds, I thank you for your continued support and confidence and look forward to serving you in 2005 and beyond.

Sincerely, |

|

|

|

James M. Hennessy |

President |

ING Funds |

January 25, 2005 |

1

In our semi-annual report, we referred to sharp swings in sentiment as investors took stock after the handsome gains of 2003. By the middle of the year, the markets had not done much of anything; however, over the next six months sentiment would change twice more and in the end major asset classes posted respectable returns for the year, if not better.

Global equities gained 10.8% in the six months ended December 31, 2004, according to the Morgan Stanley Capital International (“MSCI”) World Index(1), including net reinvested dividends, and 14.7% for entire year. Nearly one quarter of the annual gain was due to dollar weakness, the main story in the currency markets. The dollar was ahead for most of the year, but by mid October had succumbed to continuing concern over the United States twin budget and trade deficits and whether overseas investors would continue to finance them, raising the nightmare of a disorderly slide in the dollar. In 2004, the euro gained 7.6%, a new record. The yen rose 4.5% to a level not seen since early 2000, while the pound stood 7.4% higher, at a remarkable 12-year peak.

Perhaps the most notable feature in investment grade U.S. fixed income markets in the second six months was the curious “curve flattening” trend. Short-term interest rates drifted up as the Federal Open Market Committee (“FOMC”) raised the Federal Funds rate four times, by 1% in all, while bond yields ignored this and fell in the face of weak economic data and continued foreign central bank purchases. Contrary to earlier fears, tame inflation was a backdrop throughout, while the influential employment reports were weak in July, August, October and December. On December 15, the spread between the yields on the 10-year Note and the 90-day Treasury Bill fell to a three-year low. For the six months, the yield on 10-year Treasury Notes fell by 40 basis points to 4.22%, but the yield on 13-week Treasury Bills soared 88 basis points to 2.18%. More broadly, the Lehman Brothers Aggregate Bond Index(2) gained 4.18% for the six months. For the whole year, the Index returned 4.34%, underscoring the dominance of the second half in driving market movement, and implying not much underlying price change over the year.

Prices rose on riskier asset classes, however, as investors chased more attractive returns than investment grade bonds were offering. The Lehman Brothers U.S. Corporate High Yield Bond Index(3) for example, returned a robust 9.64% in the six months through December and 11.13% for the year.

U.S. equities in the form of the Standard & Poor’s (“S&P”) 500 Index(4), rose 7.2% including dividends for the six months ended December 31, 2004, breaching and holding levels not seen since before September 11, 2001. By year end, the market was trading at a price to earnings level of just under 16½ times 2005 estimated earnings. For the entire year, the Index returned 10.88%. From the middle of the year, equity investors were disappointed by the weak employment reports referred to above and distracted by surging oil prices as well as bad news affecting individual stocks. The market reached its lowest point in mid-August. But after oil prices climbed over $56 per barrel on October 22, and then slumped, equities squeezed out a narrow gain for the month in the last few days. In November, oil prices continued their retreat and the market powered ahead, cheered by this, the clear presidential election result, perceived as business and shareholder friendly, and at last a powerful employment report. By month end, sentiment was further bolstered by an upward revision to third quarter gross domestic product (“GDP”) growth to 4%, which was doubtless encouraging. But the data released also showed that the engine of growth, the U.S. consumer, was only saving at the rate of 0.5% per annum, which many regard as unsustainable. In addition, the rate of corporate profits growth was already falling and in 2005 may not reach double digits. It is hard to see then what dynamic propelled the S&P 500 Index to another 3.5% gain in December. And while many commentators celebrated this break out and the fact that smaller-cap indices had by then scaled all-time high levels, others feared a reversal before 2005 was very old.

International markets had mixed returns in the second half, but all were inflated in dollar terms by the weakness of that currency. Nonetheless even in local currency terms, Europe’s markets regained mid-2002 levels. Japan equities rose 4.6% in dollar terms during the period, based on the MSCI Japan Index(5) plus net dividends, but fell 1.7% in yen. For the year, Japan returned 15.9% in dollars. First half optimism about GDP growth was dashed as growth collapsed or was revised down as the year wore on.

European excluding (“ex”) UK markets advanced 18.2% in the second half of 2004, according to the MSCI Europe ex UK Index(6)

(in dollars including net dividends), about one third due to currency. For all of 2004, the region returned 21.6% in dollars. Profits did grow strongly and markets remain cheap, but given all the issues surrounding low domestic demand,

2

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2004

unemployment at 8.9% for the last 20 months and inflexible labor markets, arguably they deserve to be.

The UK market returned 15.7% in the six months through December, based on the MSCI UK Index(7) including net dividends, about 40% due to currency. For the whole year, the UK rose 19.6% in dollars. Contrary to the rest of Europe, the Bank of England has been trying to cool consumer demand and a property boom with five interest rate increases in 12 months. They seem to be succeeding for the most part.

(1) The MSCI World Index measures the performance of over 1,400 securities listed on exchanges in the United States, Europe, Canada, Australia, New Zealand and the Far East.

(2) The Lehman Brothers Aggregate Bond Index is composed of securities from the Lehman Brothers Government/Corporate Bond Index, Mortgage-Backed Securities Index, and the Asset-Backed Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment.

(3) The Lehman Brothers U.S. Corporate High Yield Bond Index is generally representative of corporate bonds rated below investment-grade.

(4) The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

(5) The MSCI Japan Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(6) The MSCI Europe ex UK Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(7) The MSCI UK Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 366-0066 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of the Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

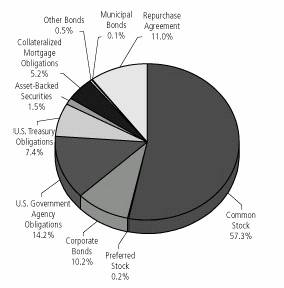

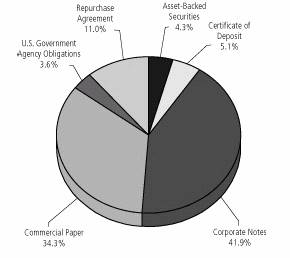

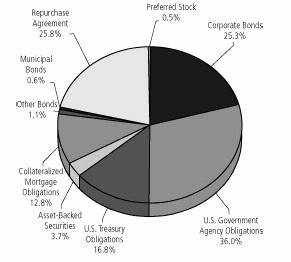

Investment Types*

as of December 31, 2004

(as a percent of net assets)

* Excludes other assets and liabilities of -7.6% of net assets.

Portfolio holdings are subject to change daily.

The ING USLICO Asset Allocation Portfolio (the “Portfolio” or “Asset Allocation Portfolio”) seeks to obtain high total return with reduced risk over the long-term by allocating its assets among stocks, bonds, and short-term instruments. The equity portion of the Portfolio is managed by James A. Vail, CFA, Vice President and Senior Portfolio Manager, the money market portion of the Portfolio is managed by David S. Yealy, Portfolio Manager, and the bond portion of the Portfolio is managed by James Kauffmann, Portfolio Manager, ING Investment Management Co. — the Sub-Adviser.

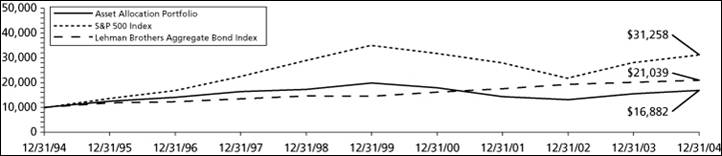

Performance: For the year ended December 31, 2004, the Portfolio provided a total return of 8.61% compared to 10.88% for the Standard & Poor’s (“S&P”) 500 Index(1) and 4.34% for the Lehman Brothers Aggregate Bond Index(2).

Portfolio Specifics: The primary contributors to the equity performance was strong stock selection in the health care and consumer discretionary sectors. Performance was negatively impacted by our overweight in energy and underweight in telecommunications and energy. Specific contributors in the best performing sector health care were Biogen IDEC, Inc., Zimmer Holdings, Inc., Inamed Corp. and Celgene Corp. An underweight in Merck & Co., Inc. also benefited results. Strong performers in the industrial sector included Tyco Intl. Ltd., Rockwell Automation, Inc., and Paccar, Inc. Finally, in the consumer discretionary sector, strong relative gains were posted by eBay, Inc., Carnival Corp., Harley-Davidson Corp. and previously held Coach, Inc. Previously held NVIDIA Corp. was a poor performer; while an underweight in Exxon Mobil Corp. also hurt performance.

Performance of the fixed income portion of the Portfolio benefited from a short duration posture and yield curve exposure. For most of the period, the Portfolio was well positioned for a rising rate environment in which the yields on shorter maturities rise more than those of longer maturities. Our underweight in five-year maturities was particularly helpful. Nevertheless, we brought the Portfolio back to a neutral duration stance as the year came to a close. Overweights in the outperforming securitized sectors — mortgage-backed securities, asset-backed securities, and commercial mortgage-backed securities — also helped. We maintained our increased allocation to credit, and this sector posted the highest excess returns during the period. Exposure to high yield and emerging markets debt were also significant contributors to performance.

Current Strategy and Outlook: After a strong performance in the final quarter of 2004, we believe the equity market, as measured by the S&P 500 Index, could consolidate these gains within a narrow range as the economic and earnings data is reviewed early in the new year. At the time of this writing, there has been broad selling pressure in energy, materials, and information technology as recent indications from the Federal Reserve (“Fed”) point to continued rate increases and growing inflation fears. We have reduced the Portfolio’s energy exposure, as we believe near-term pressure should prevail. Longer term, however, we believe energy supply and demand are likely to remain out of balance, keeping commodity prices higher than recent trends. The cash position will be redeployed as attractive opportunities present themselves.

While the bond market has renewed its focus on the improving economic releases, we do not believe that the yields on shorter maturity Treasuries fully reflect the pace of economic activity nor likely Fed tightenings. Some projections place a neutral overnight rate around 4% or 5%, indicating that monetary policy is still highly accommodative. Tactically, the Portfolio was neutral duration as the year came to a close; however, we continue to believe that the improving domestic economy, signs of increasing inflation, and enduring dollar weakness point to higher rates in the near future. We are neutral home mortgages, overweight asset-backed and commercial mortgage-backed securities, and underweight the intermediate and front ends of the yield curve, which appear most vulnerable in a tightening cycle. We are also underweight agencies, which had witnessed intense regulatory criticism. While stretched valuations in investment-grade credit still warrant caution, credit continues to post positive excess returns, and we have moved closer to neutral credit on a contribution-to-duration basis. Exposures to emerging markets debt and crossover high yield remain intact.

Top Ten Industries

as of December 31, 2004

(as a percent of net assets)

Federal National Mortgage Association | | 9.9 | % |

Diversified Financial Services | | 7.4 | % |

Banks | | 6.1 | % |

Pharmaceuticals | | 5.3 | % |

U.S. Treasury Bonds | | 5.0 | % |

Federal Home Loan Mortgage Corporation | | 3.9 | % |

Miscellaneous Manufacturing | | 3.6 | % |

Aerospace/Defense | | 3.3 | % |

Chemicals | | 3.3 | % |

Retail | | 3.2 | % |

Portfolio holdings are subject to change daily.

4

PORTFOLIO MANAGERS’ REPORT | THE USLICO ASSET ALLOCATION PORTFOLIO |

| Average Annual Total Returns for the Periods Ended December 31, 2004 | |

| | | 1 Year | | 5 Year | | 10 Year | | |

| | | | | | | | | |

| Asset Allocation Portfolio | | 8.61 | % | (3.28 | )% | 5.77 | % | |

| S&P 500 Index(1) | | 10.88 | % | (2.30 | )% | 12.07 | % | |

| Lehman Brothers Aggregate Bond Index(2) | | 4.34 | % | 7.71 | % | 7.72 | % | |

| | | | | | | | | |

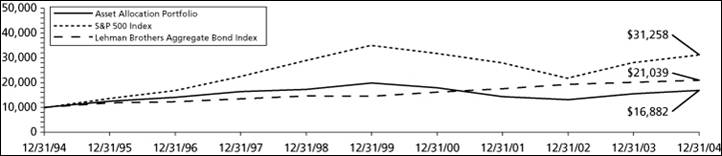

Based on a $10,000 initial investment, the graph and table illustrate the total return of Asset Allocation Portfolio against the S&P 500 Index and the Lehman Brothers Aggregate Bond Index. The Indices are unmanaged and have no cash in their portfolios, impose no sales charges and incur no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

Total returns reflect that the Investment Manager may have waived or recouped fees and expenses otherwise payable by the Portfolio.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 366-0066 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500 Index is an unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets.

(2) The Lehman Brothers Aggregate Bond Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

5

THE USLICO BOND PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

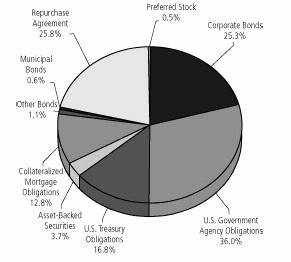

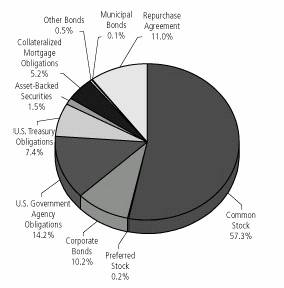

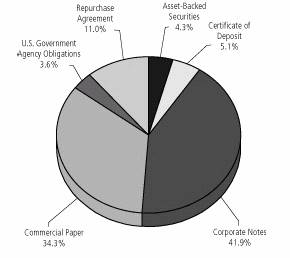

Investment Types*

as of December 31, 2004

(as a percent of net assets)

* Excludes other assets and liabilities of -22.6% of net assets.

Portfolio holdings are subject to change daily.

The ING USLICO Bond Portfolio (the “Portfolio” or “Bond Portfolio”) seeks to obtain a high level of income consistent with prudent risk and the preservation of capital. The Portfolio is managed by James Kauffmann, Portfolio Manager, ING Investment Management Co. — the Sub-Adviser.

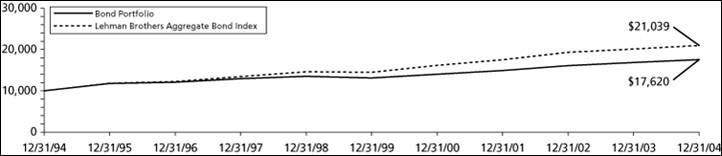

Performance: For the year ended December 31, 2004, the Portfolio provided a total return of 4.29% compared to 4.34% for the Lehman Brothers Aggregate Bond Index(1).

Portfolio Specifics: Throughout the year ended December 31, 2004, the Federal Reserve (“Fed”) was true to its oft-stated “measured pace” guidance with 25 basis points moves starting in June. Yields on shorter-term Treasuries moved higher, while those of 10- and 30-year bonds dropped. The widely watched Lehman Brothers Aggregate Bond Index rallied a 4.34% return for the year. All spread sectors notched positive returns above comparable duration Treasuries lead by the non-investment-grade emerging market and high yield sectors. BBB-rated bonds outperformed higher rated securities in the investment-grade universe. Within that universe, the credit sector garnered the highest excess returns during the period at 1.59% followed by mortgages and asset-backed securities. Commercial mortgage-backed securities also posted excess returns of 1.18%. Despite repeated headline risk in the agency arena, the sector outperformed by 0.78%, and the departure of two senior managers at FNMA had little or no impact on the issuer’s bonds.

Performance during the period benefited from the Portfolio’s short duration posture and yield curve exposure. For most of the period, the Portfolio was well positioned for a rising rate environment in which the yields on shorter maturities rise more than those of longer maturities. Our underweight in five-year maturities was particularly helpful. Nevertheless we brought the Portfolio back to a neutral duration stance as the year came to a close. Overweights in the outperforming securitized sectors — mortgage-backed securities, asset-backed securities, and commercial mortgage-backed securities — also helped. We maintained our increased allocation to credit, and this sector posted the highest excess returns during the period. Exposure to high yield and emerging market debt were also significant contributors to performance.

Current Strategy and Outlook: Uncertainty about the twin U.S. deficits, the geo-political and currency situations, and the level and direction of energy costs present portfolio managers with quite a set of wildcards; nevertheless, most measures of volatility remain surprisingly low. While the bond market has renewed its focus on the improving economic releases, we do not believe that the yields on shorter maturity Treasuries fully reflect the pace of economic activity nor likely Fed tightenings. Some projections place a neutral overnight rate around 4% or 5%, indicating that monetary policy is still highly accommodative.

Tactically, the Portfolio was neutral duration as the year came to a close; however, we continue to believe that the improving domestic economy, signs of increasing inflation, and enduring dollar weakness point to higher rates in the near future. We are neutral home mortgages, overweight asset-backed and commercial mortgage-backed securities, and underweight the intermediate and front ends of the yield curve, which appear most vulnerable in a tightening cycle. We are also underweight agencies, which had witnessed intense regulatory criticism. While stretched valuations in investment-grade credit still warrant caution, credit continues to post positive excess returns, and we have moved closer to neutral credit on a contribution-to-duration basis. Exposures to emerging markets debt and crossover high yield remain intact.

Top Ten Industries

as of December 31, 2004

(as a percent of net assets)

Federal National Mortgage Association | | 25.2 | % |

U.S. Treasury Bonds | | 12.9 | % |

Federal Home Loan Mortgage Corporation | | 9.8 | % |

Whole Loan Collaterallized Mortgage Obligations | | 7.0 | % |

Banks | | 6.5 | % |

Commercial Mortgage-Backed Securities | | 5.3 | % |

Diversified Financial Services | | 4.2 | % |

U.S. Treasury Notes | | 3.2 | % |

Electric | | 3.2 | % |

Oil and Gas | | 2.1 | % |

Portfolio holdings are subject to change daily.

6

PORTFOLIO MANAGERS’ REPORT | THE USLICO BOND PORTFOLIO |

| Average Annual Total Returns for the Years Ended December 31, 2004 | | |

| | | 1 Year | | 5 Year | | 10 Year | | |

| | | | | | | | | |

| Bond Portfolio | | 4.29 | % | 5.09 | % | 5.75 | % | |

| Lehman Brothers Aggregate Bond Index(1) | | 4.34 | % | 7.71 | % | 7.72 | % | |

| | | | | | | | | |

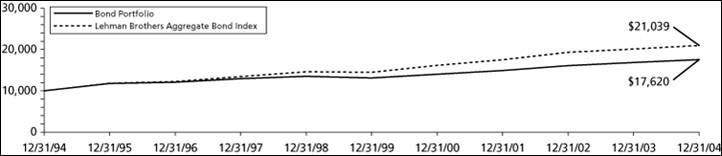

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Bond Portfolio against the Lehman Brothers Aggregate Bond Index. The Index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

Total returns reflect that the Investment Manager may have waived or recouped fees and expenses otherwise payable by the Portfolio.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 366-0066 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The manager’s views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Lehman Brothers Aggregate Bond Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

7

THE USLICO MONEY MARKET PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

Investment Types*

as of December 31, 2004

(as a percent of net assets)

* Excludes other assets and liabilities of -0.2% of net assets.

Portfolio holdings are subject to change daily.

The ING USLICO Money Market Portfolio (the “Portfolio” or “Money Market Portfolio”) seeks maximum current income consistent with preservation of capital and liquidity. The Portfolio is managed by David S. Yealy, Portfolio Manager, ING Investment Management Co. — the Sub-Adviser.

Portfolio Specifics: The market for money market securities as represented by the LIBOR (London InterBank Offered Rate) curve started the year pricing in very modest expectations for the Federal Open Market Committee (“FOMC”) to start raising the Federal Reserve (“Fed”) funds rate and discount rate in the latter part of the year. Our strategy of maintaining a slightly long weighted average maturity and barbell structure early in the year enhanced the yield for the fund.

The non-farm payroll numbers released in early April indicated an improving labor market. The improvement in the labor market was confirmed by the early May non-farm payroll data release. The markets quickly started to anticipate that the FOMC might act sooner and more aggressively than previously expected. The LIBOR one-month to twelve-month curve steepened to over 100 basis points by mid-June from only 34 basis points at the beginning of the year.

We restructured the Portfolio in May by reducing our holdings of longer maturity securities, shortening the weighted average maturity, eliminating the barbell, increasing our holding of interest sensitive floating rate securities and shifting new purchases to very short maturity securities. This strategy shift worked well during the second half of the year as the FOMC raised the Fed funds rate by 25 basis points five times starting at the end of June. The Fed funds rate ended the year at 2.25% up from 1.00% at the start of the year.

Current Strategy and Outlook: The market as of the end of December was building in significant additional rate increases for 2005. The consensus expectation is for the Fed funds rate to be at 3.50% at the end of 2005. Our strategy heading into 2005 is similar to that employed since May of 2004. We are continuing to focus new purchases to the next FOMC meeting, maintaining a high exposure to floating rate notes, and making selective purchases in the three-month and under maturity sector where yield levels fully price in 25 basis point increases at each of the Fed meetings in between the purchase date and the maturity date. To the extent that the markets start to price in a more aggressive Fed, we are prepared to extend the weighted average maturity of the Fund by purchasing longer maturity corporate securities in the nine-month to thirteen-month sector. We will maintain a weighted average maturity shorter than the majority of our competitors until that time.

8

PORTFOLIO MANAGERS’ REPORT | ING USLICO MONEY MARKET PORTFOLIO |

Principal Risk Factor(s): An investment in the Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Portfolio seeks to preserve the value of your investment, it is possible to lose money by investing in the Portfolio.

The views expressed in this report reflect those of the portfolio managers only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

9

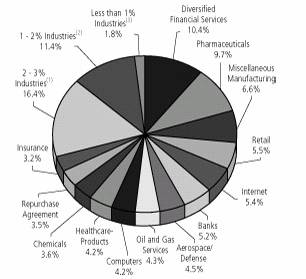

THE USLICO STOCK PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

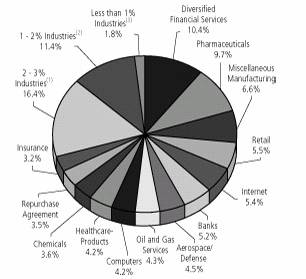

Industry Allocation*

as of December 31, 2004

(as a percent of net assets)

* Excludes other assets and liabilities of 0.1% net assets.

(1) Includes seven industries, which each represent 2 - 3% of net assets.

(2) Includes eight industries, which each represent 1 - 2% of net assets.

(3) Includes three industries, which each represent less than 1% of net assets.

Portfolio holdings are subject to change daily.

The ING USLICO Stock Portfolio (the “Portfolio” or “Stock Portfolio”) seeks intermediate and long-term growth of capital. The Portfolio’s secondary objective is to receive a reasonable level of income. The Portfolio is managed by James A. Vail, CFA, Vice President and Senior Portfolio Manager, ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2004, the Portfolio provided a total return of 10.90% compared to 10.88% for the Standard & Poor’s (“S&P”) 500 Index(1).

Portfolio Specifics: The primary contributors to the Portfolio’s outperformance was strong stock selection in the health care and consumer discretionary sectors. Performance was negatively impacted by our underweight in telecommunications and energy. Specific contributors in the best performing sector health care were Biogen IDEC, Inc., Zimmers Holdings, Inc., Inamed Corp. and Celgene Corp. An underweight in Merck & Co., Inc. also benefited results. Strong performers in the industrial sector included Tyco Intl. Ltd., Rockwell Automation, Inc., and PACCAR, Inc. Finally, in the consumer discretionary sector, strong relative gains were posted by eBay, Inc., Carnival Corp., Harley-Davidson, Inc. and previously held Coach, Inc. Some of the poorest performers included Par Pharmaceuticals Cos., Inc. and previously held NVIDIA Corp., while an underweight in Exxon Mobil Corp. also hurt performance.

Current Strategy and Outlook: After a strong performance in the final quarter of 2004, we believe the market, as measured by the S&P 500 Index, could consolidate these gains within a narrow range as the economic and earnings data early in the new year. At the time of this writing, there has been broad selling pressure in energy, materials, and information technology as recent indications from the Federal Reserve Bank point to continued rate increases and growing inflation fears.

We have reduced the Portfolio’s energy exposure, as we believe near-term pressure should prevail. Longer term, however, we believe energy supply and demand are likely to remain out of balance, keeping commodity prices higher then recent trends. The cash position will be redeployed as attractive opportunities present themselves.

Top Ten Holdings

as of December 31, 2004

(as a percent of net assets)

General Electric Co. | | 3.5 | % |

Yahoo!, Inc. | | 2.7 | % |

eBay, Inc. | | 2.7 | % |

Citigroup, Inc. | | 2.7 | % |

Nabors Industries, Ltd. | | 2.5 | % |

Wal-Mart Stores, Inc. | | 2.4 | % |

Microsoft Corp. | | 2.3 | % |

Goldman Sachs Group, Inc. | | 2.3 | % |

American Intl. Group, Inc. | | 2.2 | % |

North Fork Bancorp, Inc. | | 2.0 | % |

Portfolio holdings are subject to change daily.

10

PORTFOLIO MANAGERS’ REPORT | THE USLICO STOCK PORTFOLIO |

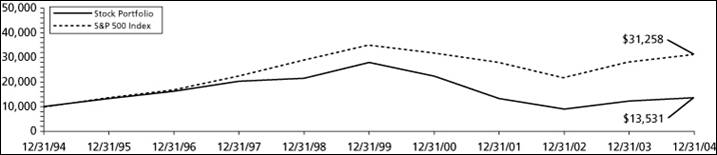

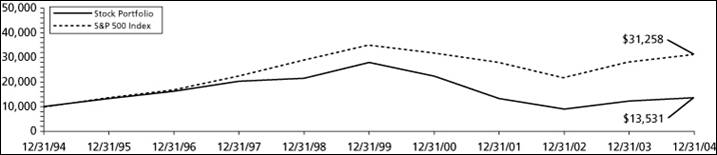

| Average Annual Total Returns for the Years Ended December 31, 2004 | | |

| | | 1 Year | | 5 Year | | 10 Year | | |

| | | | | | | | | |

| Stock Portfolio | | 10.90 | % | (12.75 | )% | 3.50 | % | |

| S&P 500 Index(1) | | 10.88 | % | (2.30 | )% | 12.07 | % | |

| | | | | | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Stock Portfolio against the S&P 500 Index. The Index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

Total returns reflect that the Investment Manager may have waived or recouped fees and expenses otherwise payable by the Portfolio.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 366-0066 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The manager’s views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500 Index is an unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets.

11

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution [and/or service] (12b-1) fees; and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2004 to December 31, 2004.

Actual Expenses

The first section of the table shown, “Actual Fund Return”, provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table shown, “Hypothetical 5% Return”, provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| USLICO Series Fund | | Beginning

Account

Value

July 1, 2004 | | Ending

Account

Value

December 31, 2004 | | Annualized

Expense

Ratio | | Expenses Paid

During the Six

Months Ended

December 31, 2004* | |

| Actual Fund Return | | | | | | | | | |

| Asset Allocation Portfolio | | $ | 1,000.00 | | $ | 1,046.80 | | 0.90 | % | $ | 4.63 | |

| Bond Portfolio | | 1,000.00 | | 1,042.80 | | 0.90 | | 4.62 | |

| Money Market Portfolio | | 1,000.00 | | 1,004.40 | | 0.85 | | 4.28 | |

| Stock Portfolio | | 1,000.00 | | 1,051.50 | | 0.90 | | 4.64 | |

| Hypothetical (5% return before expenses) | | | | | | | | | |

| Asset Allocation Portfolio | | $ | 1,000.00 | | $ | 1,020.61 | | 0.90 | % | $ | 4.57 | |

| Bond Portfolio | | 1,000.00 | | 1,020.61 | | 0.90 | | 4.57 | |

| Money Market Portfolio | | 1,000.00 | | 1,020.86 | | 0.85 | | 4.32 | |

| Stock Portfolio | | 1,000.00 | | 1,020.61 | | 0.90 | | 4.57 | |

* Expenses are equal to each Fund’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

12

The Board of Trustees and Shareholders

USLICO Series Fund

We have audited the accompanying statements of assets and liabilities of Stock Portfolio, Money Market Portfolio, Bond Portfolio, and Asset Allocation Portfolio, each a series of USLICO Series Fund, including the portfolios of investments, as of December 31, 2004, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2004 by correspondence with the custodian and brokers, or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the aforementioned portfolios as of December 31, 2004, the results of their operations, the changes in their net assets, and the financial highlights for the periods specified in the first paragraph above, in conformity with accounting principles generally accepted in the United States of America.

Boston, Massachusetts

February 11, 2005

13

| | The

Asset Allocation

Portfolio | | The

Bond

Portfolio | | The

Money Market

Portfolio | | The

Stock

Portfolio | |

ASSETS: | | | | | | | | | |

Investments in securities at value* | | $ | 12,579,708 | | $ | 2,774,485 | | $ | — | | $ | 15,731,865 | |

Short-term investments at amortized cost | | — | | — | | 5,208,143 | | — | |

Repurchase agreement | | 1,433,000 | | 741,000 | | 647,000 | | 566,000 | |

Cash | | 7,711 | | 822 | | 537 | | 789 | |

Receivables: | | | | | | | | | |

Fund shares sold | | — | | — | | 6,964 | | — | |

Investment securities sold | | 110,957 | | 32,692 | | — | | 98,511 | |

Dividends and interest | | 47,229 | | 20,247 | | 16,503 | | 16,297 | |

Prepaid expenses | | 37 | | — | | 18 | | 35 | |

Total assets | | 14,178,642 | | 3,569,246 | | 5,879,165 | | 16,413,497 | |

| | | | | | | | | |

LIABILITIES: | | | | | | | | | |

Payable for investment securities purchased | | 1,085,076 | | 686,107 | | — | | — | |

Income distribution payable | | — | | — | | 6,964 | | — | |

Payable to affiliates | | 15,975 | | 2,868 | | 1,774 | | 41,764 | |

Payable for trustee fees | | 5,041 | | 1,643 | | 4,197 | | 2,250 | |

Other accrued expenses and liabilities | | 44,208 | | 12,062 | | 23,205 | | 50,635 | |

Total liabilities | | 1,150,300 | | 702,680 | | 36,140 | | 94,649 | |

NET ASSETS | | $ | 13,028,342 | | $ | 2,866,566 | | $ | 5,843,025 | | $ | 16,318,848 | |

| | | | | | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | |

Paid-in capital | | $ | 16,604,042 | | $ | 2,934,094 | | $ | 5,843,661 | | $ | 29,040,750 | |

Undistributed net investment income | | — | | 293 | | 8 | | — | |

Accumulated net realized loss on investments and options | | (4,774,422 | ) | (71,866 | ) | (644 | ) | (14,890,834 | ) |

Net unrealized appreciation on investments and options | | 1,198,722 | | 4,045 | | — | | 2,168,932 | |

NET ASSETS | | $ | 13,028,342 | | $ | 2,866,566 | | $ | 5,843,025 | | $ | 16,318,848 | |

| | | | | | | | | |

| |

* Cost of investments in securities | | $ | 11,380,986 | | $ | 2,770,440 | | $ | — | | $ | 13,562,933 | |

| | | | | | | | | |

Net Assets | | $ | 13,028,342 | | $ | 2,866,566 | | $ | 5,842,956 | | $ | 16,318,848 | |

Shares authorized | | unlimited | | unlimited | | unlimited | | unlimited | |

Par value | | $ | 0.001 | | $ | 0.001 | | $ | 0.001 | | $ | 0.001 | |

Shares outstanding | | 1,371,563 | | 288,566 | | 5,843,730 | | 2,184,265 | |

Net asset value and redemption price per share | | $ | 9.50 | | $ | 9.93 | | $ | 1.00 | | $ | 7.47 | |

See Accompanying Notes to Financial Statements

14

| | The

Asset Allocation

Portfolio | | The

Bond

Portfolio | | The

Money Market

Portfolio | | The

Stock

Portfolio | |

INVESTMENT INCOME: | | | | | | | | | |

Dividends, net of foreign taxes withheld* | | $ | 98,404 | | $ | 715 | | $ | — | | $ | 170,844 | |

Interest | | 225,197 | | 114,566 | | 87,055 | | 9,684 | |

Total investment income | | 323,601 | | 115,281 | | 87,055 | | 180,528 | |

| | | | | | | | | |

EXPENSES: | | | | | | | | | |

Investment management fees | | 64,584 | | 14,728 | | 30,170 | | 74,574 | |

Transfer agent fees | | 1,955 | | 1,516 | | 807 | | 2,807 | |

Administrative service fees | | 12,916 | | 2,946 | | 6,034 | | 14,915 | |

Shareholder reporting expense | | 15,036 | | 1,856 | | 10,069 | | 8,603 | |

Professional fees | | 18,258 | | 7,662 | | 14,535 | | 7,694 | |

Custody and accounting expense | | 18,845 | | 6,866 | | 9,440 | | 2,996 | |

Trustee fees | | 7,610 | | 996 | | 2,274 | | 7,705 | |

Miscellaneous expense | | 1,154 | | 358 | | 537 | | 1,660 | |

Total expenses | | 140,358 | | 36,928 | | 73,866 | | 120,954 | |

Net recouped (waived and reimbursed) fees | | (23,654 | ) | (10,391 | ) | (20,919 | ) | 12,713 | |

Net expenses | | 116,704 | | 26,537 | | 52,947 | | 133,667 | |

Net investment income | | 206,897 | | 88,744 | | 34,108 | | 46,861 | |

| | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND OPTIONS: | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | |

Investments | | 1,110,364 | | 65,226 | | (644 | ) | 2,203,641 | |

Options | | (2,571 | ) | — | | — | | (5,036 | ) |

Net realized gain (loss) on investments and options | | 1,107,793 | | 65,226 | | (644 | ) | 2,198,605 | |

Net change in unrealized appreciation or depreciation on: | | | | | | | | | |

Investments | | (254,049 | ) | (32,155 | ) | — | | (670,305 | ) |

Options | | (2,440 | ) | — | | — | | (4,880 | ) |

Net change in unrealized appreciation or depreciation on investments and options | | (256,489 | ) | (32,155 | ) | — | | (675,185 | ) |

Net realized and unrealized gain (loss) on investments and options | | 851,304 | | 33,071 | | (644 | ) | 1,523,420 | |

Increase in net assets resulting from operations | | $ | 1,058,201 | | $ | 121,815 | | $ | 33,464 | | $ | 1,570,281 | |

| | | | | | | | | |

| |

* Foreign taxes withheld | | $ | 18 | | $ | — | | $ | — | | $ | 125 | |

See Accompanying Notes to Financial Statements

15

| | The Asset Allocation Portfolio | | The Bond Portfolio | |

| | Year

Ended

December 31,

2004 | | Year

Ended

December 31,

2003 | | Year

Ended

December 31,

2004 | | Year

Ended

December 31,

2003 | |

FROM OPERATIONS: | | | | | | | | | |

Net investment income | | $ | 206,897 | | $ | 222,669 | | $ | 88,744 | | $ | 112,733 | |

Net realized gain on investments and options | | 1,107,793 | | 642,224 | | 65,226 | | 41,841 | |

Net change in unrealized appreciation or depreciation on investments and options | | (256,489 | ) | 1,258,624 | | (32,155 | ) | (19,376 | ) |

Net increase in net assets resulting from operations | | 1,058,201 | | 2,123,517 | | 121,815 | | 135,198 | |

| | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | |

Net investment income | | (221,813 | ) | (216,849 | ) | (95,495 | ) | (108,697 | ) |

Total distributions | | (221,813 | ) | (216,849 | ) | (95,495 | ) | (108,697 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | |

Net proceeds from sale of shares | | 57,686 | | — | | — | | — | |

Dividends reinvested | | 221,813 | | 216,849 | | 95,495 | | 108,697 | |

| | 279,499 | | 216,849 | | 95,495 | | 108,697 | |

Cost of shares redeemed | | (1,238,181 | ) | (575,963 | ) | (246,394 | ) | (230,065 | ) |

Net decrease in net assets resulting from capital share transactions | | (958,682 | ) | (359,114 | ) | (150,899 | ) | (121,368 | ) |

Net increase (decrease) in net assets | | (122,294 | ) | 1,547,554 | | (124,579 | ) | (94,867 | ) |

| | | | | | | | | |

NET ASSETS: | | | | | | | | | |

Beginning of year | | 13,150,636 | | 11,603,082 | | 2,991,145 | | 3,086,012 | |

End of year | | $ | 13,028,342 | | $ | 13,150,636 | | $ | 2,866,566 | | $ | 2,991,145 | |

Undistributed net investment income at end of year | | $ | — | | $ | 5,820 | | $ | 293 | | $ | 4,036 | |

See Accompanying Notes to Financial Statements

16

STATEMENTS OF CHANGES IN NET ASSETS

| | The Money Market Portfolio | | The Stock Portfolio | |

| | Year

Ended

December 31,

2004 | | Year

Ended

December 31,

2003 | | Year

Ended

December 31,

2004 | | Year

Ended

December 31,

2003 | |

FROM OPERATIONS: | | | | | | | | | |

Net investment income (loss) | | $ | 34,108 | | $ | 17,877 | | $ | 46,861 | | $ | (28,209 | ) |

Net realized gain (loss) on investments and options | | (644 | ) | (69 | ) | 2,198,605 | | 1,044,281 | |

Net change in unrealized appreciation or depreciation on investments and options | | — | | — | | (675,185 | ) | 2,720,022 | |

Net increase in net assets resulting from operations | | 33,464 | | 17,808 | | 1,570,281 | | 3,736,094 | |

| | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | |

Net investment income | | (34,100 | ) | (17,877 | ) | (46,861 | ) | — | |

Return of capital | | — | | — | | (33,220 | ) | — | |

Total distributions | | (34,100 | ) | (17,877 | ) | (80,081 | ) | — | |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | |

Net proceeds from sale of shares | | 17,915 | | — | | 536,541 | | 412,117 | |

Dividends reinvested | | 28,447 | | 17,877 | | 80,081 | | — | |

| | 46,362 | | 17,877 | | 616,622 | | 412,117 | |

Cost of shares redeemed | | (387,653 | ) | (282,842 | ) | (70,495 | ) | (5,854 | ) |

Net increase (decrease) in net assets resulting from capital share transactions | | (341,291 | ) | (264,965 | ) | 546,127 | | 406,263 | |

Net increase (decrease) in net assets | | (341,927 | ) | (265,034 | ) | 2,036,327 | | 4,142,357 | |

| | | | | | | | | |

NET ASSETS: | | | | | | | | | |

Beginning of year | | 6,184,952 | | 6,449,986 | | 14,282,521 | | 10,140,164 | |

End of year | | $ | 5,843,025 | | $ | 6,184,952 | | $ | 16,318,848 | | $ | 14,282,521 | |

Undistributed net investment income at end of year | | $ | 8 | | $ | — | | $ | — | | $ | — | |

See Accompanying Notes to Financial Statements

17

Selected data for a share of beneficial interest outstanding throughout each period.

| | Year Ended December 31, | |

| | 2004 | | 2003 | | 2002 | | 2001(1) | | 2000 | |

Per Share Operating Performance: | | | | | | | | | | | |

Net asset value, beginning of year | $ | 8.90 | | 7.64 | | 8.64 | | 11.04 | | 12.68 | |

Income (loss) from investment operations: | | | | | | | | | | | |

Net investment income | $ | 0.15 | | 0.15 | | 0.19 | | 0.22 | | 0.18 | |

Net realized and unrealized gain (loss) on investments | $ | 0.61 | | 1.25 | | (0.94 | ) | (2.43 | ) | (1.41 | ) |

Total from investment operations | $ | 0.76 | | 1.40 | | (0.75 | ) | (2.21 | ) | (1.23 | ) |

Less distributions from: | | | | | | | | | | | |

Net investment income | $ | 0.16 | | 0.14 | | 0.25 | | 0.19 | | 0.18 | |

Net realized gain on investments | $ | — | | — | | — | | — | | 0.23 | |

Total distributions | $ | 0.16 | | 0.14 | | 0.25 | | 0.19 | | 0.41 | |

Net asset value, end of year | $ | 9.50 | | 8.90 | | 7.64 | | 8.64 | | 11.04 | |

Total Return(2) | % | 8.61 | | 18.54 | | (8.72 | ) | (20.09 | ) | (9.80 | ) |

Ratios and Supplemental Data: | | | | | | | | | | | |

Net assets, end of year (000’s) | $ | 13,028 | | 13,151 | | 11,603 | | 12,752 | | 15,591 | |

Ratios to average net assets: | | | | | | | | | | | |

Net expenses after expense reimbursement(3) | % | 0.90 | | 0.91 | | 0.90 | | 0.90 | | 0.90 | |

Gross expenses prior to expense reimbursement | % | 1.09 | | 1.07 | | 1.34 | | 1.76 | | 1.18 | |

Net investment income after expense reimbursement(3) | % | 1.60 | | 1.81 | | 2.42 | | 2.37 | * | 1.44 | |

Portfolio turnover rate | % | 252 | | 210 | | 258 | | 354 | | 243 | |

(1) Effective May 11, 2001, ING Investments, LLC ceased serving as the Sub-Adviser to the Portfolio and began serving as Investment Manager to the Portfolio.

(2) Total return is calculated assuming reinvestment of all dividends and capital gain distributions at net asset value. Total returns for periods less than one year are not annualized.

(3) The Investment Manager has agreed to limit expenses, (excluding interest, taxes, brokerage and extraordinary expenses) subject to possible recoupment by ING Investments, LLC within three years.

* Had the Asset Allocation Portfolio not amortized premiums and accreted discounts the ratio of net investment income to average net assets would have been 2.09%.

See Accompanying Notes to Financial Statements.

18

THE USLICO BOND PORTFOLIO | FINANCIAL HIGHLIGHTS |

Selected data for a share of beneficial interest outstanding throughout each period.

| | Year Ended December 31, | |

| | 2004 | | 2003 | | 2002 | | 2001(1) | | 2000 | |

Per Share Operating Performance: | | | | | | | | | | | |

Net asset value, beginning of year | $ | 9.84 | | 9.75 | | 9.41 | | 9.21 | | 9.01 | |

Income from investment operations: | | | | | | | | | | | |

Net investment income | $ | 0.30 | | 0.36 | | 0.39 | | 0.48 | | 0.40 | |

Net realized and unrealized gain on investments | $ | 0.12 | | 0.08 | | 0.35 | | 0.11 | | 0.20 | |

Total from investment operations | $ | 0.42 | | 0.44 | | 0.74 | | 0.59 | | 0.60 | |

Less distributions from: | | | | | | | | | | | |

Net investment income | $ | 0.33 | | 0.35 | | 0.40 | | 0.39 | | 0.40 | |

Total distributions | $ | 0.33 | | 0.35 | | 0.40 | | 0.39 | | 0.40 | |

Net asset value, end of year | $ | 9.93 | | 9.84 | | 9.75 | | 9.41 | | 9.21 | |

Total Return(2) | % | 4.29 | | 4.57 | | 8.07 | | 6.47 | | 6.74 | |

Ratios and Supplemental Data: | | | | | | | | | | | |

Net assets, end of year (000’s) | $ | 2,867 | | 2,991 | | 3,086 | | 2,846 | | 2,881 | |

Ratios to average net assets: | | | | | | | | | | | |

Net expenses after expense reimbursement(3) | % | 0.90 | | 0.91 | | 0.89 | | 0.90 | | 0.90 | |

Gross expenses prior to expense reimbursement | % | 1.25 | | 1.52 | | 1.37 | | 2.15 | | 1.83 | |

Net investment income after expense reimbursement(3) | % | 3.01 | | 3.65 | | 4.20 | | 5.02 | * | 4.30 | |

Portfolio turnover rate | % | 463 | | 368 | | 159 | | 215 | | 49 | |

(1) Effective May 11, 2001, ING Investments, LLC ceased serving as the Sub-Adviser to the Portfolio and began serving as Investment Manager to the Portfolio.

(2) Total return is calculated assuming reinvestment of all dividends and capital gain distributions at net asset value. Total returns for periods less than one year are not annualized.

(3) The Investment Manager has agreed to limit expenses, (excluding interest, taxes, brokerage and extraordinary expenses) subject to possible recoupment by ING Investments, LLC within three years.

* Had the Bond Portfolio not amortized premiums and accreted discounts the ratio of net investment income to average net assets would have been 4.56%.

See Accompanying Notes to Financial Statements.

19

THE USLICO MONEY MARKET PORTFOLIO | FINANCIAL HIGHLIGHTS |

Selected data for a share of beneficial interest outstanding throughout each period.

| | Year Ended December 31, | |

| | 2004 | | 2003 | | 2002 | | 2001(1) | | 2000 | |

Per Share Operating Performance: | | | | | | | | | | | |

Net asset value, beginning of year | $ | 1.00 | | 1.00 | | 1.00 | | 1.00 | | 1.00 | |

Income from investment operations: | | | | | | | | | | | |

Net investment income | $ | 0.01 | | 0.00 | * | 0.01 | | 0.03 | | 0.05 | |

Total from investment operations | $ | 0.01 | | 0.00 | * | 0.01 | | 0.03 | | 0.05 | |

Less distributions from: | | | | | | | | | | | |

Net investment income | $ | 0.01 | | 0.00 | * | 0.01 | | 0.03 | | 0.05 | |

Total distributions | $ | 0.01 | | 0.00 | * | 0.01 | | 0.03 | | 0.05 | |

Net asset value, end of year | $ | 1.00 | | 1.00 | | 1.00 | | 1.00 | | 1.00 | |

Total Return(2) | % | 0.57 | | 0.28 | | 0.88 | | 3.14 | | 5.59 | |

Ratios and Supplemental Data: | | | | | | | | | | | |

Net assets, end of year (000’s) | $ | 5,843 | | 6,185 | | 6,450 | | 6,400 | | 6,331 | |

Ratios to average net assets: | | | | | | | | | | | |

Net expenses after expense reimbursement(3) | % | 0.88 | | 0.90 | | 0.78 | | 0.90 | | 0.90 | |

Gross expenses prior to expense reimbursement | % | 1.22 | | 1.11 | | 1.03 | | 1.63 | | 1.34 | |

Net investment income after expense reimbursement(3) | % | 0.57 | | 0.28 | | 0.97 | | 3.13 | | 5.45 | |

(1) Effective May 11, 2001, ING Investments, LLC ceased serving as the Sub-Adviser to the Portfolio and began serving as Investment Manager to the Portfolio.

(2) Total return is calculated assuming reinvestment of all dividends and capital gain distributions at net asset value. Total returns for periods less than one year are not annualized.

(3) The Investment Manager has agreed to limit expenses, (excluding interest, taxes, brokerage and extraordinary expenses) subject to possible recoupment by ING Investments, LLC within three years.

* Amount is less than $0.01 per share.

See Accompanying Notes to Financial Statements.

20

THE USLICO STOCK PORTFOLIO | FINANCIAL HIGHLIGHTS |

Selected data for a share of beneficial interest outstanding throughout each period.

| | Year Ended December 31, | |

| | 2004 | | 2003 | | 2002 | | 2001(1) | | 2000 | |

Per Share Operating Performance: | | | | | | | | | | | |

Net asset value, beginning of year | $ | | 6.77 | | 4.96 | | 7.32 | | 12.42 | | 16.06 | |

Income (loss) from investment operations: | | | | | | | | | | | |

Net investment income (loss) | $ | | 0.02 | | (0.01 | ) | (0.04 | ) | (0.05 | ) | (0.02 | ) |

Net realized and unrealized gain (loss) on investments | $ | | 0.72 | | 1.82 | | (2.32 | ) | (5.05 | ) | (3.18 | ) |

Total from investment operations | $ | | 0.74 | | 1.81 | | (2.36 | ) | (5.10 | ) | (3.20 | ) |

Less distributions from: | | | | | | | | | | | |

Net investment income | $ | | 0.02 | | — | | — | | — | | — | |

Net realized gain on investments | $ | | — | | — | | — | | — | | 0.44 | |

Return of capital | $ | | 0.02 | | — | | — | | — | | — | |

Total distributions | $ | | 0.04 | | — | | — | | — | | 0.44 | |

Net asset value, end of year | $ | | 7.47 | | 6.77 | | 4.96 | | 7.32 | | 12.42 | |

Total Return(2) | % | 10.90 | | 36.49 | | (32.24 | ) | (41.06 | ) | (19.94 | ) |

Ratios and Supplemental Data: | | | | | | | | | | | |

Net assets, end of year (000’s) | $ | | 16,319 | | 14,283 | | 10,140 | | 14,972 | | 26,513 | |

Ratios to average net assets: | | | | | | | | | | | |

Net expenses after expense reimbursement/recoupment(3) | % | 0.90 | | 0.90 | | 0.90 | | 0.90 | | 0.62 | |

Gross expenses prior to expense reimbursement/recoupment | % | 0.81 | | 1.08 | | 1.47 | | 1.42 | | 0.87 | |

Net investment income (loss) after expense reimbursement/recoupment(3) | % | 0.31 | | (0.24 | ) | (0.59 | ) | (0.61 | ) | (0.11 | ) |

Portfolio turnover rate | % | 110 | | 189 | | 418 | | 510 | | 365 | |

(1) Effective May 11, 2001, ING Investments, LLC began serving as Investment Manager to the Portfolio.

(2) Total return is calculated assuming reinvestment of all dividends and capital gain distributions at net asset value. Total returns for periods less than one year are not annualized.

(3) The Investment Manager has agreed to limit expenses, (excluding interest, taxes, brokerage and extraordinary expenses) subject to possible recoupment by ING Investments, LLC within three years.

See Accompanying Notes to Financial Statements.

21

NOTE 1 — ORGANIZATION

Organization. USLICO Series Fund (the “Fund”) is an open-end, diversified management investment company registered under the Investment Company Act of 1940 and consists of four separate portfolios. The four portfolios of the Fund are as follows: The Stock Portfolio (“Stock Portfolio”), The Money Market Portfolio (“Money Market Portfolio”), The Bond Portfolio (“Bond Portfolio”) and The Asset Allocation Portfolio (“Asset Allocation Portfolio”). Each Portfolio has its own investment objectives and policies which are detailed in the Prospectus. The Fund was organized as a business trust under the laws of Massachusetts on January 19, 1988. Shares of the Portfolio are sold only to separate accounts of ReliaStar Life Insurance Company (ReliaStar Life) and ReliaStar Life Insurance Company of New York (ReliaStar Life of New York, a wholly owned subsidiary of ReliaStar Life) to serve as the investment medium for variable life insurance policies issued by these companies. The separate accounts invest in shares of one or more of the Portfolios, in accordance with allocation instructions received from policyowners. Each Portfolio share outstanding represents a beneficial interest in the respective Portfolio.

ING Investments, LLC (“ING Investments”), an Arizona limited liability company, serves as the Investment Manager to the Portfolios. ING Investments has engaged ING Investment Management Co. (“ING IM”), a Connecticut corporation, to serve as the Sub-Adviser to the Portfolios. ING Funds Distributor, LLC (the “Distributor”) is the principal underwriter of the Portfolios. ING Funds Services, LLC serves as the administrator to each Portfolio. ING Investments, ING IM, the Distributor and ING Funds Services, LLC are indirect wholly-owned subsidiaries of ING Groep N.V. (“ING Groep”). ING Groep is a global financial institution active in the fields of banking, insurance and asset management.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies are consistently followed by the Portfolios in the preparation of their financial statements. Such policies are in conformity with accounting principles generally accepted in the United States of America for investment companies.

A. Security Valuation. Investments in equity securities traded on a national securities exchange are valued at the last reported sale price. Securities reported by NASDAQ are valued at the NASDAQ official closing prices. Securities traded on an exchange or NASDAQ for which there has been no sale and securities traded in the over-the-counter-market are valued at the mean between the last reported bid and ask prices. All investments quoted in foreign currencies will be valued daily in U.S. dollars on the basis of the foreign currency exchange rates prevailing at that time. Debt securities are valued at prices obtained from independent services or from one or more dealers making markets in the securities and may be adjusted based on the Portfolios’ valuation procedures. U.S. Government obligations are valued by using market quotations or independent pricing services that use prices provided by market-makers or estimates of market values obtained from yield data relating to instruments or securities with similar characteristics.

Securities and assets for which market quotations are not readily available (which may include certain restricted securities which are subject to limitations as to their sale) are valued at their fair values as determined in good faith by or under the supervision of the Board of Trustees (“Board”), in accordance with methods that are specifically authorized by the Board. Securities traded on exchanges, including foreign exchanges, which close earlier than the time that a Portfolio calculates its net asset value may also be valued at their fair values as determined in good faith by or under the supervision of the Board, in accordance with methods that are specifically authorized by the Board. If a significant event which is likely to impact the value of one or more foreign securities held by Portfolio occurs after the time at which the foreign market for such security(ies) closes but before the time that the Portfolio’s net asset value is calculated on any business day, such event may be taken into account in determining the fair value of such security(ies) at the time the Portfolio calculates its net asset value. For these purposes, significant events after the close of trading on a foreign market may include, among others, securities trading in the U.S. and other markets, corporate announcements, natural and other disasters, and political and other events. Among other elements of analysis, the Board has authorized the use of one or more research services to assist with the determination of the fair value of foreign securities. Research services use statistical analyses and quantitative models to help determine fair value as of the time a Portfolio calculates its net asset value. Unlike the closing price of a security on an exchange, fair

22

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2004 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

value determinations employ elements of judgment, and the fair value assigned to a security may not represent the actual value that a Portfolio could obtain if it were to sell the security at the time the close of the NYSE. Investments in securities maturing in 60 days or less are valued at amortized cost, which, when combined with accrued interest, approximates market value.

B. Security Transactions and Revenue Recognition. Securities transactions are accounted for on the trade date. Realized gains and losses are reported on the basis of identified cost of securities sold. Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date, or for certain foreign securities, when the information becomes available to the Portfolios. Premium amortization and discount accretion are determined by the effective yield method.

C. Purchases and Sales. Purchases and sales of Portfolio shares are made on the basis of the net asset value per share prevailing at the close of business on the preceding business day.

D. Distributions to Shareholders. The Portfolios record distributions to their shareholders on ex-dividend date. Dividends from net investment income and capital gains, if any, are declared and paid annually by the Portfolios. The Portfolios may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code. The characteristics of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States of America for investment companies.

E. Federal Income Taxes. It is the policy of the Portfolios to comply with subchapter M of the Internal Revenue Code and related excise tax provisions applicable to regulated investment companies and to distribute substantially all of their net investment income and any net realized capital gains to their shareholders. Therefore, no federal income tax provision is required. No capital gain distributions shall be made until any capital loss carryforwards have been fully utilized or expired.

F. Use of Estimates. Management of the Portfolios has made certain estimates and assumptions relating to the reporting of assets, liabilities, income, and expenses to prepare these financial statements in conformity with accounting principles generally accepted in the United States of America for investment companies. Actual results could differ from these estimates.

G. Repurchase Agreements. Each Portfolio may invest in repurchase agreements only with government securities dealers recognized by the Board of Governors of the Federal Reserve System. Under such agreements, the seller of the security agrees to repurchase it at a mutually agreed upon time and price. The resale price is in excess of the purchase price and reflects an agreed upon interest rate for the period of time the agreement is outstanding. The period of the repurchase agreements is usually short, from overnight to one week, while the underlying securities generally have longer maturities. Each Portfolio will receive as collateral securities acceptable to it whose market value is equal to at least 100% of the carrying amount of the repurchase agreements, plus accrued interest, being invested by the Portfolio. The underlying collateral is valued daily on a mark to market basis to assure that the value, including accrued interest is at least equal to the repurchase price. If the seller defaults, a Portfolio might incur a loss or delay in the realization of proceeds if the value of the security collateralizing the repurchase agreement declines, and it might incur disposition costs in liquidating the collateral.

H. Illiquid and Restricted Securities. The Portfolios may not invest more than 10% of their net assets in illiquid securities. Illiquid securities are not readily marketable. Disposing of illiquid investments may involve time-consuming negotiation and legal expenses, and it may be difficult or impossible for the Portfolios to sell them promptly at an acceptable price. Each Portfolio may also invest in restricted securities, which include those sold under Rule 144A of the Securities Act of 1933 (“1933 Act”) or securities offered pursuant to Section 4(2) of the 1933 Act, and/or are subject to legal or contractual restrictions on resale and may not be publicly sold without registration under the 1933 Act. Certain restricted securities may be considered liquid pursuant to procedures adopted by the Board or may be deemed to be illiquid because they may not be readily marketable. Illiquid and restricted securities are valued using market quotations when readily available. In the absence of market quotations, the securities are valued based upon their fair value determined under procedures approved by the Board.

I. Delayed Delivery Transactions. The Portfolios may purchase or sell securities on a when-issued or

23

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2004 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

forward commitment basis. The price of the underlying securities and date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The market value of such is identified in each Portfolio’s Portfolio of Investments. Losses may arise due to changes in the market value of the securities or from the inability of counterparties to meet the terms of the contract. In connection with such purchases, the Portfolios are required to segregate liquid assets sufficient to cover the purchase price.

J. Mortgage Dollar Roll Transactions. In connection with a Portfolio’s ability to purchase or sell securities on a when-issued basis, the Portfolios may engage in dollar roll transactions with respect to mortgage-backed securities issued by Government National Mortgage Association, Federal National Mortgage Association and Federal Home Loan Mortgage Corp. In a dollar roll transaction, a Portfolio sells a mortgage-backed security to a financial institution, such as a bank or broker/dealer, and simultaneously agrees to repurchase a substantially similar (i.e., same type, coupon, and maturity) security from the institution on a delayed delivery basis an agreed upon price. The mortgage-backed securities that are repurchased will bear the same interest rate as those sold, but generally will be collateralized by different pools of mortgages with different prepayment histories. The Portfolios account for dollar roll transactions as purchases and sales.

K. Options Contracts. Stock and Asset Allocation Portfolios may purchase put and call options and may write (sell) call options on debt and other securities in standardized contracts traded on national securities exchanges or boards of trade. Option contracts are valued daily and unrealized gains or losses are recorded based upon the last sales price on the principal exchange on which the options are traded. The Portfolios will realize a gain or loss upon the expiration or closing of the option contract. When an option is exercised, the proceeds on sales of the underlying security for a written call option, the purchase cost of the security for a written put option, or the cost of the security for a purchased put or call option is adjusted by the amount of premium received or paid. Realized and unrealized gains or losses on option contracts are reflected in the accompanying financial statements. The risk in writing a call option is that the Portfolios give up the opportunity for profit if the market price of the security increases and the option is exercised. The risk in writing a put option is that the Portfolios may incur a loss if the market price of the security decreases and the option is exercised. The risk in buying an option is that the Portfolios pay a premium whether or not the option is exercised. Risks may also arise from an illiquid secondary market or from the inability of counterparties to meet the terms of the contract.

NOTE 3 — INVESTMENT TRANSACTIONS

For the year ended December 31, 2004, the cost of purchases and the proceeds from the sales of securities, excluding short-term securities, were as follows:

| | Purchases | | Sales | |

Asset Allocation Portfolio | | $ | 10,578,241 | | $ | 8,984,502 | |

Bond Portfolio | | 1,727,727 | | 1,919,868 | |

Stock Portfolio | | 16,138,135 | | 15,824,750 | |

| | | | | | | |

U.S. Government securities not included above were as follows:

| | Purchases | | Sales | |

Asset Allocation Portfolio | | $ | 20,416,702 | | $ | 22,986,673 | |

Bond Portfolio | | 11,449,897 | | 11,311,905 | |

| | | | | | | |

NOTE 4 — INVESTMENT MANAGEMENT AND ADMINISTRATIVE FEES

The Portfolios have entered into an Investment Management Agreement with ING Investments (the “Investment Manager”). The Investment Management Agreement compensates the Investment Manager with a fee, computed daily and payable monthly, based on the average daily net assets of each Portfolio, at the annual percentage rate of 0.50% on the first $100 million of average daily net assets and 0.45% of average daily net assets in excess thereof.

The Investment Manager entered into a Sub-Advisory Agreement with ING IM. Subject to such policies as the Board or the Investment Manager may determine, ING IM manages the Portfolios’ assets in accordance with the Portfolios’ investment objectives, policies, and limitations.

The Investment Manager has contractually agreed to waive management fees charged to each of the Portfolios to the extent they exceed 0.25% of the average daily net assets of each Portfolio. The insurance companies pay any management fees above that amount. The Investment Manager has also agreed to limit expenses of each Portfolio, excluding management fees, interest, taxes, brokerage and extraordinary expenses, that are subject to the limitation, to 0.65% of the average net assets of each Portfolio.

The Investment Manager may at a later date recoup from a Portfolio for management fees waived and other expenses assumed by the Investment Manager

24

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2004 (CONTINUED)

NOTE 4 — INVESTMENT MANAGEMENT AND ADMINISTRATIVE FEES (continued)

during the previous 36 months, but only if, after such reimbursement, the Portfolios’ expense ratio does not exceed the percentage described above. Waived and reimbursed fees net of any recoupment by the Investment Manager of such waived and reimbursed fees are reflected on the accompanying Statements of Operations.

As of December 31, 2004, the amounts of waived and reimbursed fees that are subject to possible recoupment by the Investment Manager and the related expiration dates are as follows:

| | December 31, | | | |

| | 2005 | | 2006 | | 2007 | | Total | |

Asset Allocation Portfolio | | $ | 15,221 | | $ | 20,632 | | $ | — | | $ | 35,853 | |

Bond Portfolio | | 6,712 | | 18,852 | | 3,027 | | 28,591 | |

Money Market Portfolio | | — | | 13,311 | | 5,834 | | 19,145 | |

Stock Portfolio | | — | | 8,947 | | — | | 8,947 | |

| | | | | | | | | | | | | |

The Expense Limitation Agreement is contractual and shall renew automatically for one-year terms unless ING Investments provides written notice of the termination of the Expense Limitation Agreement within 90 days of the end of the then current term.