Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

June 30, 2010

Phone: 1-800-860-3863

E-mail: fund@muhlenkamp.com

Website: www.muhlenkamp.com

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus of the Muhlenkamp Fund. Please call 1-800-860-3863 for a current copy of the prospectus. Read it carefully before you invest.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

Dear Fellow Shareholders:

The trends we discussed in our Annual Report continue. In the U.S., the economy is growing, (the recession is over), but the growth is at a subdued pace. The U.S. credit markets are gradually normalizing (e.g. Troubled Asset Relief Program (TARP) dollars are being paid back). Unemployment remains high, which we expect to continue. Job creation requires two people in partnership: an employee who’s willing to work, and an employer who’s willing and able to pay him. Today, employers are facing increases in taxes, regulations, and health insurance costs, each of which decreases their ability to pay wages.

Yet, when we look at existing companies and their stock prices, we see good values. Revenues are improving, earnings are holding up, and some stock prices represent good value. But it’s not enough.

In 2008, stock and bond prices got cheap, and then got cheaper. We believe forced selling by hedge funds and other investors played a major role in the selloff. As a consequence, in monitoring the markets, we now ask “Who might have to sell, and how much?”

There may have been some forced selling of securities by European banks, although it’s hard to get good numbers on the amounts. We do know that they’re in a squeeze and we’re monitoring a number of the “street signs,” including LIBOR (London Inter-Bank Offer Rate) and bond rates. Lately, the rates are moderating so the worst of the squeeze may be past.

The European political leadership is attempting to deal with their problems, (many years of spending more than they’re earning — sound familiar?), but we don’t yet know whether their proposals will be accepted by the public. In the U.S., our politicians seem to think that past European actions should be emulated, and we continue to spend far more than we take in. And we’re seeing more signs that our government is looking to tax or otherwise penalize any company that it thinks is making too much money. The new finance bill penalizes VISA and MasterCard for making too much money on credit cards and services. Folks, no one is forced to use a credit card. Other actions target for-profit trade schools and colleges.

If we were coming out of a normal cyclical recession, we’d be fully invested in good companies at the current stock prices. But the larger uncertainties make us more cautious. The net of all this is that we’ve raised cash to 25%-30%, and we’re watching the road signs for the opportunity to put it to work.

In Footnote #11 of this Semi-Annual Report, you’ll see a discussion of the factors and processes which the independent trustees and their counsel undertook relative to the annual review of the Investment Advisory Contract. The annual review of the contract, prior to renewal, is required by law. The extent of the review is guided by the regulators, apparently in the belief that shareholders and their elected trustees are not themselves capable of making such judgments. As you know, ours is an open-end mutual fund with no fees or penalties for moving money in or out; and in the last several years, a significant number of our shareholders have chosen to move money out.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

Anyway, this year, the direct cost to you, the shareholder, in the extra meetings and legal fees dedicated to this review, exceeded $32,000.

Ronald H. Muhlenkamp

President, August 2010

Past performance does not guarantee future results.

Opinions expressed are those of Ronald H. Muhlenkamp and are subject to change, are not guaranteed, and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. The Fund may invest in smaller companies which involve additional risks such as limited liquidity and greater volatility. The Fund may also invest in foreign securities which involve political, economic, and currency risks, greater volatility and differences in accounting methods.

While the fund is no-load, management fees and other expenses still apply. Please refer to the prospectus for further details.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

Average Annual Total Returns (Unaudited)

as of June 30, 2010

| | One | | Three | | Five | | Ten | | Fifteen | | Since |

| Muhlenkamp Fund | Year | | Year | | Year | | Year | | Year | | Inception* |

| Return Before Taxes | 13.24% | | 314.10% | | 36.42% | | 2.90% | | 8.52% | | 9.51% |

| Return After Taxes on | | | | | | | | | | | |

| Distributions** | 13.22% | | 314.88% | | 36.98% | | 2.49% | | 8.13% | | 9.09% |

| Return After Taxes on | | | | | | | | | | | |

| Distributions and Sale of | | | | | | | | | | | |

| Fund Shares** | 8.64% | | 311.47% | | 35.18% | | 2.56% | | 7.68% | | 8.66% |

| S&P 500*** | 14.43% | | 39.81% | | 30.79% | | 31.59% | | 6.24% | | 8.60% |

Performance data quoted, before and after taxes, represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.muhlenkamp.com.

Investment returns can vary significantly between returns before taxes and returns after taxes.

The Muhlenkamp Fund is providing the returns in the above table to help our shareholders understand the magnitude of tax costs and the impact of taxes on the performance of the Fund.

| | * | Operations commenced on November 1, 1988. |

| | ** | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your situation and may differ from those shown. The Fund’s return after taxes on distributions and sale of Fund shares may be higher than its return before taxes and its return after taxes on distributions because it may include a tax benefit resulting from the capital losses that would have resulted. Furthermore, the after-tax returns shown are not relevant to those who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Remember, the Fund’s past performance, before and after taxes, is not necessarily how the Fund will perform in the future. |

The calculation for the One Year “Return After Taxes on Distributions and Sale of Fund Shares” assumes the following:

| | 1. | You bought shares of the Fund at the price on 6/30/09. |

| | 2. | You received dividends (and income distributions) at year end, and paid a 15% tax on these dividends on the payable date. |

| | 3. | You reinvested the rest of the dividend when received, increasing your cost basis for tax purposes. |

| | 4. | You sold the entire position on 6/30/10 and paid tax on ordinary income at a tax rate of 35%. |

| *** | The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. The figures for the S&P 500 Index reflect all dividends reinvested but do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. |

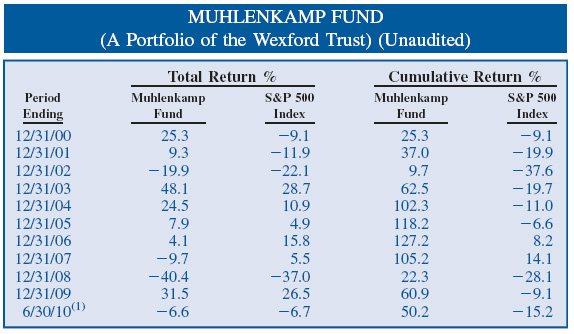

(1) Total Return is for the six months ending June 30, 2010.

A Hypothetical $10,000 Investment in the Muhlenkamp Fund (Unaudited)

The Standard & Poor’s 500 Stock Index (“S&P 500 Index”) is a market value-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on 12/31/99. The line graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all dividends. Past performance does not guarantee future results.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

EXPENSE EXAMPLE

June 30, 2010 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. The expense example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (1/1/10 – 6/30/10).

Actual Expenses

The first line of the table provides information about actual account values and actual expenses. Although the Fund charges no sales load, redemption fees or other transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. Individual Retirement Accounts (“IRAs”) will be charged a $15.00 annual maintenance fee. For any direct registered shareholder of the Fund having an IRA balance exceeding $50,000, the amount of such IRA annual maintenance fee will be a Fund expense. To the extent the Fund invests in shares of other investment companies as par t of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses or other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “ Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

EXPENSE EXAMPLE (Continued)

June 30, 2010 (Unaudited)

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expen ses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | | Ending | | Expenses Paid | |

| | Account Value | | Account Value | | During Period | |

| | 1/1/10 | | 6/30/10 | | 1/1/10 – 6/30/10* | |

| Actual | $1,000.00 | | $ 933.70 | | $5.90 | |

| Hypothetical | | | | | | |

| (5% return before | | | | | | |

| expenses) | 1,000.00 | | 1,018.70 | | 6.16 | |

| | | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 1.23% multiplied by the average account value over the period multiplied by 181/365 (to reflect the one-half year period). |

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

ALLOCATION OF PORTFOLIO ASSETS

(Calculated as a percentage of net assets)

June 30, 2010 (Unaudited)

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

STATEMENT OF ASSETS & LIABILITIES (Unaudited)

June 30, 2010

| ASSETS |

| INVESTMENTS, AT VALUE (Cost $544,740,369) | $ | 548,244,677 |

| CASH | | 84,982,856 |

| RECEIVABLE FOR INVESTMENTS SOLD | | 875,431 |

| RECEIVABLE FOR FUND SHARES SOLD | | 502,956 |

| DIVIDENDS RECEIVABLE | | 514,837 |

| OTHER ASSETS | | 135,033 |

| Total assets | | 635,255,790 |

| | | |

| LIABILITIES |

| WRITTEN OPTIONS, AT VALUE (Premiums received $4,116,690) | | 900,000 |

| PAYABLE FOR FUND SHARES REDEEMED | | 514,520 |

| INVESTMENTS PAYABLE | | — |

| PAYABLE TO ADVISER | | 545,164 |

| ACCRUED EXPENSES AND OTHER LIABILITIES | | 363,235 |

| Total liabilities | | 2,322,919 |

| NET ASSETS | $ | 632,932,871 |

| | | |

| NET ASSETS |

| PAID IN CAPITAL | $ | 642,973,429 |

| ACCUMULATED INVESTMENT LOSS | | (383,836) |

| ACCUMULATED NET REALIZED LOSS ON INVESTMENTS | | |

| SOLD AND WRITTEN OPTION CONTRACTS EXPIRED OR | | |

| CLOSED | | (16,377,720) |

| NET UNREALIZED APPRECIATION ON: | | |

| Investments | | 3,504,308 |

| Written option contracts | | 3,216,690 |

| NET ASSETS | $ | 632,932,871 |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING | | |

| (unlimited number of shares authorized, $0.01 par value) | | 13,372,452 |

| NET ASSET VALUE AND OFFERING PRICE PER SHARE | $ | 47.33 |

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2010 (Unaudited)

| INVESTMENT INCOME: | | | | | |

| Dividends | | | | $ | 3,932,648 |

| Interest | | | | | 15,450 |

| Total investment income | | | | | 3,948,098 |

| | | | | | |

| EXPENSES: | | | | | |

| Investment advisory fees | $ | 3,531,474 | | | |

| Shareholder servicing and accounting costs | | 314,159 | | | |

| Reports to shareholders | | 50,082 | | | |

| Federal & state registration fees | | 21,657 | | | |

| Custody fees | | 20,114 | | | |

| Administration fees | | 232,067 | | | |

| Trustees’ fees and expenses | | 65,037 | | | |

| Auditor fees | | 10,945 | | | |

| Legal fees | | 67,942 | | | |

| Other | | 49,464 | | | |

| Total operating expenses before expense reductions | | 4,362,941 | | | |

| Expense reductions (see Note 9) | | (31,007) | | | |

| Total expenses | | | | | 4,331,934 |

| NET INVESTMENT LOSS | | | | | (383,836) |

| REALIZED AND UNREALIZED GAIN (LOSS) ON | | | | | |

| INVESTMENTS | | | | | |

| Net realized gain on: | | | | | |

| Investments sold | | 18,021,665 | | | |

| Written option contracts expired or closed | | 1,968,562 | | | |

| | | | | | 19,990,227 |

| Change in unrealized appreciation (depreciation) on: | | | | | |

| Investments | | (67,404,777) | | | |

| Written option contracts | | 3,384,030 | | | |

| | | | | | (64,020,747) |

| Net realized and unrealized loss on investments | | | | | (44,030,520) |

| NET DECREASE IN NET ASSETS RESULTING | | | | | |

| FROM OPERATIONS | | | | $ | (44,414,356) |

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | |

| | | June 30, 2010 | | | Year Ended |

| | | (Unaudited) | | | December 31, 2009 |

| | | | | | |

| OPERATIONS: | | | | | |

| Net investment income (loss) | $ | (383,836) | | $ | 940,939 |

| Net realized gain (loss) on investments sold | | | | | |

| and written option contracts expired or | | | | | |

| closed | | 19,990,227 | | | (31,615,145) |

| Change in unrealized appreciation | | | | | |

| (depreciation) on investments and written | | | | | |

| option contracts | | (64,020,747) | | | 207,072,491 |

| Net increase (decrease) in net assets | | | | | |

| resulting from operations | | (44,414,356) | | | 176,398,285 |

| CAPITAL SHARE TRANSACTIONS: | | | | | |

| Proceeds from shares sold | | 28,639,093 | | | 51,478,828 |

| Dividends reinvested | | — | | | 912,689 |

| Redemption fees | | — | | | 1,929 |

| Cost of shares redeemed | | (66,987,034) | | | (120,093,539) |

| Net decrease in net assets resulting from | | | | | |

| capital share transactions | | (38,347,941) | | | (67,700,093) |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | |

| From net investment income | | — | | | (951,404) |

| From realized gains | | — | | | — |

| Net decrease in net assets resulting from | | | | | |

| distributions to shareholders | | — | | | (951,404) |

| Total increase (decrease) in net assets | | (82,762,297) | | | 107,746,788 |

| NET ASSETS: | | | | | |

| Beginning of period | | 715,695,168 | | | 607,948,380 |

| End of period | $ | 632,932,871 | | $ | 715,695,168 |

| ACCUMULATED NET INVESTMENT | | | | | |

| INCOME | $ | (383,836) | | $ | — |

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | |

| | Six Months Ended | | | | | | Year Ended December 31, | | | |

| | June 30, 2010 | | | | | | | | | | | | | | | |

| | (Unaudited) | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 |

| | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, | | | | | | | | | | | | | | | | | |

| BEGINNING OF PERIOD | $ | 50.69 | | $ | 38.60 | | $ | 65.00 | | $ | 87.15 | | $ | 84.44 | | $ | 78.97 |

| INCOME FROM INVESTMENT | | | | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.03) | | | | | | 0.17(1) | | | 0.58(2) | | | 0.64(1) | | | 0.76(1) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | |

| gains (losses) on investments | | (3.33) | | | 12.09 | | | (26.43) | | | (8.91) | | | 2.81 | | | 5.47 |

| Total from investment | | | | | | | | | | | | | | | | | |

| operations | | (3.36) | | | 12.16 | | | (26.26) | | | (8.33) | | | 3.45 | | | 6.23 |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | |

| From net investment income | | — | | | (0.07) | | | (0.14) | | | (0.49) | | | (0.74) | | | (0.76) |

| From realized gains | | — | | | — | | | — | | | (13.33) | | | — | | | — |

| Total distributions | | — | | | (0.07) | | | (0.14) | | | (13.82) | | | (0.74) | | | (0.76) |

| NET ASSET VALUE, END OF | | | | | | | | | | | | | | | | | |

| PERIOD | $ | 47.33 | | $ | 50.69 | | $ | 38.60 | | $ | 65.00 | | $ | 87.15 | | $ | 84.44 |

| | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | -6.63%(4) | | | 31.49% | | | -40.39% | | | -9.66% | | | 4.08% | | | 7.88% |

| NET ASSETS, END OF PERIOD | | | | | | | | | | | | | | | | | |

| (in millions) | $ | 633 | | $ | 716 | | $ | 608 | | $ | 1,491 | | $ | 2,880 | | $ | 3,084 |

| RATIO OF OPERATING | | | | | | | | | | | | | | | | | |

| EXPENSES TO AVERAGE NET | | | | | | | | | | | | | | | | | |

ASSETS(3) | | 1.23%(5) | | | 1.25% | | | 1.18% | | | 1.15% | | | 1.06% | | | 1.06% |

| RATIO OF NET INVESTMENT | | | | | | | | | | | | | | | | | |

| INCOME TO AVERAGE NET | | | | | | | | | | | | | | | | | |

| ASSETS | | (0.11%)(5) | | | 0.15% | | | 0.28% | | | 0.57% | | | 0.69% | | | 1.02% |

| PORTFOLIO TURNOVER RATE | | 27.71%(4) | | | 64.78% | | | 39.88% | | | 22.30% | | | 11.58% | | | 6.05% |

| (1) | Net investment income per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (2) | Net investment income per share is calculated using ending balances after consideration of adjustments for permanent book and tax differences. |

| (3) | The operating expense ratio includes expense reductions for minimum account maintenance fees deposited into the Fund. The ratios excluding expense reductions for the six months ended June 30, 2010 and the years ended December 31, 2009, 2008, 2007, 2006 and 2005 were 1.24%, 1.26%, 1.18%, 1.15%, 1.06% and 1.06% respectively (See Note 9 of Notes to Financial Statements). |

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

SCHEDULE OF INVESTMENTS

June 30, 2010 (Unaudited)

| | | | | |

| Name of Issuer or Title of Issue | Shares | | | Value |

| | | | | |

| COMMON STOCK — 74.8% | | | | |

| Aerospace & Defense — 3.5% | | | | |

| Innovative Solutions and Support, Inc. (a) | 540,000 | | $ | 2,376,000 |

| Lockheed Martin Corporation | 267,000 | | | 19,891,500 |

| | | | | 22,267,500 |

| Airlines — 2.3% | | | | |

| Allegiant Travel Company (a)(c) | 340,000 | | | 14,514,600 |

| Automobiles & Components — 4.9% | | | | |

| Ford Motor Company (a) | 1,150,000 | | | 11,592,000 |

| Fuel Systems Solutions Inc. (a) | 320,000 | | | 8,304,000 |

| Sonic Automotive, Inc. (a) | 950,000 | | | 8,132,000 |

| Westport Innovations Inc. (a)(b) | 180,000 | | | 2,824,200 |

| | | | | 30,852,200 |

| Banks — 3.2% | | | | |

| Bank of America Corp. | 1,431,335 | | | 20,568,284 |

| Coal — 1.1% | | | | |

| CONSOL Energy Inc. | 200,000 | | | 6,752,000 |

| Communications Equipment — 3.4% | | | | |

| Cisco Systems, Inc. (a) | 910,000 | | | 19,392,100 |

| DragonWave Inc. (a)(b) | 344,000 | | | 2,060,560 |

| | | | | 21,452,660 |

| Computers & Equipment — 1.3% | | | | |

| Intel Corp. | 416,000 | | | 8,091,200 |

| PC Connection, Inc. (a) | 60,000 | | | 363,600 |

| | | | | 8,454,800 |

| Data Processing & Outsourced Services — 1.2% | | | | |

| Alliance Data Systems Corporation (a)(c) | 100,000 | | | 5,952,000 |

| iGATE Corporation | 103,300 | | | 1,324,306 |

| | | | | 7,276,306 |

| Health Care Providers & Services — 11.7% | | | | |

| Amedisys, Inc. (a) | 315,000 | | | 13,850,550 |

| Kinetic Concepts Inc. (a) | 325,715 | | | 11,891,855 |

| Laboratory Corporation of America Holdings (a) | 290,000 | | | 21,851,500 |

| UnitedHealth Group, Inc. | 931,200 | | | 26,446,080 |

| | | | | 74,039,985 |

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2010 (Unaudited)

| | | | | |

| Name of Issuer or Title of Issue | Shares | | | Value |

| | | | | |

| Household Durables — 0.3% | | | | |

| Stanley Furniture Co., Inc. (a) | 420,800 | | $ | 1,708,448 |

| Information Software & Services — 3.4% | | | | |

| Oracle Corp. | 1,000,000 | | | 21,460,000 |

| Insurance — 9.0% | | | | |

| Berkshire Hathaway Inc. — Class B (a) | 271,800 | | | 21,659,742 |

| The Hartford Financial Services Group, Inc. | 730,000 | | | 16,154,900 |

| Principal Financial Group, Inc. (c) | 810,000 | | | 18,986,400 |

| | | | | 56,801,042 |

| Oil, Gas & Consumable Fuels — 2.7% | | | | |

| Chesapeake Energy Corp. (c) | 600,000 | | | 12,570,000 |

| Helix Energy Solutions Group Inc. (a)(c) | 200,000 | | | 2,154,000 |

| Transocean Ltd. (a)(b) | 50,000 | | | 2,316,500 |

| | | | | 17,040,500 |

| Pharmaceuticals & Biotechnology — 7.5% | | | | |

| Abbott Laboratories | 400,000 | | | 18,712,000 |

| Hospira, Inc. (a) | 130,691 | | | 7,508,198 |

| Marshall Edwards, Inc. (a) | 7,560 | | | 9,450 |

| Novogen, Ltd. — ADR (a)(b) | 250,360 | | | 142,705 |

| Pfizer, Inc. | 1,500,000 | | | 21,390,000 |

| | | | | 47,762,353 |

| Retail — 2.5% | | | | |

| Aeropostale, Inc. (a) | 560,000 | | | 16,038,400 |

| Technology Hardware & Equiptment — 5.4% | | | | |

| Corning Incorporated | 762,200 | | | 12,309,530 |

| Hewlett-Packard Co. | 410,000 | | | 17,744,800 |

| MEMC Electronic Materials (a) | 225,000 | | | 2,223,000 |

| MIPS Technologies, Inc. (a) | 355,000 | | | 1,814,050 |

| | | | | 34,091,380 |

| Telecommunication Services — 3.2% | | | | |

| AT&T Inc. | 840,000 | | | 20,319,600 |

| Tobacco — 5.0% | | | | |

| Philip Morris International, Inc. (c) | 690,580 | | | 31,656,187 |

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2010 (Unaudited)

| | | | | | |

| Name of Issuer or Title of Issue | | Shares | | | Value |

| | | | | | |

| Trading Companies & Distributors — 3.2% | | | | | |

| Rush Enterprises, Inc. — Class A (a) | | 299,907 | | $ | 4,006,757 |

| Rush Enterprises, Inc. — Class B (a) | | 31,407 | | | 365,892 |

| WESCO International, Inc. (a)(c) | | 470,000 | | | 15,824,900 |

| | | | | | 20,197,549 |

| Total Common Stocks | | | | | |

| (Cost $469,749,486) | | | | | 473,253,794 |

| | | | | | |

| | | | | | |

| | | Principal | | | |

| Name of Issuer or Title of Issue | | Amount | | | Value |

| | | | | | |

| SHORT-TERM INVESTMENTS — 11.8% | | | | | |

| Citigroup Commercial Paper, | | | | | |

| 0.356%, 8/2/2010 | $ | 25,000,000 | | | 24,992,192 |

| General Electric Commercial Paper, | | | | | |

| 0.174%, 7/12/2010 | | 25,000,000 | | | 24,998,691 |

| JPMorgan Chase Commercial Paper, | | | | | |

| 0.103%, 7/1/2010 | | 25,000,000 | | | 25,000,000 |

| Total Short-Term Investments | | | | | |

| (Cost $74,990,883) | | | | | 74,990,883 |

| TOTAL INVESTMENTS | | | | | |

| (Cost $544,740,369) — 86.6% | | | | | 548,244,677 |

| ASSETS IN EXCESS OF OTHER | | | | | |

| LIABILITIES — 13.4% | | | | | 84,688,194 |

| TOTAL NET ASSETS — 100.0% | | | | $ | 632,932,871 |

ADR American Depository Receipt

| (a) | Non-income producing security. |

| (c) | Shares are held as collateral for all or a portion of a corresponding written option contract. |

The Global Industry Classification Standard (GICS») was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

| | Contracts | | | |

| Name of Issuer or Title of Issue | (100 Shares Per Contract) | | | Value |

| | | | | |

| WRITTEN CALL OPTIONS — (0.1%) | | | | |

| Allegiant Travel Company | | | | |

| Expiration October 2010 | | | | |

| Exercise Price $60.00 | 1,000 | | $ | 10,000 |

| Alliance Data Systems Corporation | | | | |

| Expiration September 2010 | | | | |

| Exercise Price $75.00 | 1,000 | | | 85,000 |

| Chesapeake Energy Corp. | | | | |

| Expiration October 2010 | | | | |

| Exercise Price $24.00 | 6,000 | | | 492,000 |

| Helix Energy Solutions Group Inc. | | | | |

| Expiration September 2010 | | | | |

| Exercise Price $17.50 | 1,000 | | | 11,000 |

| Philip Morris International, Inc. | | | | |

| Expiration September 2010 | | | | |

| Exercise Price $50.00 | 2,000 | | | 132,000 |

| Principal Financial Group, Inc. | | | | |

| Expiration October 2010 | | | | |

| Exercise Price $30.00 | 2,000 | | | 80,000 |

| WESCO International, Inc. | | | | |

| Expiration October 2010 | | | | |

| Exercise Price $40.00 | 1,000 | | | 90,000 |

| Total Options Written | | | | |

| (Premiums Received $4,116,690) | | | $ | 900,000 |

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS

Six Months Ended June 30, 2010 (Unaudited)

The Wexford Trust (the “Trust”) was organized as a Massachusetts Business Trust on September 21, 1987 and operations commenced on November 1, 1988. The Trust is registered under the Investment Company Act of 1940, as amended. The Muhlenkamp Fund (the “Fund”) is a portfolio of the Trust and is currently the only fund in the Trust.

The Fund operates as a diversified open-end mutual fund that continuously offers its shares for sale to the public. The Fund manages its assets to seek a maximum total return to its shareholders, primarily through a combination of interest and dividends and capital appreciation by holding a diversified list of publicly traded stocks. The Fund may acquire and hold fixed-income or debt investments as market conditions warrant and when, in the opinion of its Adviser, it is deemed desirable or necessary in order to attempt to achieve its investment objective.

The primary focus of the Fund is long-term and the investment options are diverse. This allows for greater flexibility in the daily management of Fund assets. However, with flexibility also comes the risk that assets will be invested in various classes of securities at the wrong time and price.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

A summary of significant accounting policies applied by management in the preparation of the accompanying financial statements is as follows:

| a. | Investment Valuations — Stocks, bonds, options and warrants are valued at the latest sales price on the last business day of the fiscal period as reported by the securities exchange on which the issue is traded. If no sale is reported, the security is valued at the last quoted bid price. Short-term debt instruments (those with remaining maturities of 60 days or less) are valued at amortized cost, which approximates fair value. Restricted securities, private placements, other illiquid securities and other securities for which market value quotations are not readily available are valued at fair value as determined by a designated Pricing Committee, comprised of personnel of the Adviser, under the supervision of the Board of Trustees, in accordance with pricing procedures approved by the Board. For each applicable investment that is fair valued, the Pricing Committee considers, to the extent applicable, various factors including, but not limited to, the financial condition of the company or limited partnership, operating results, prices paid in follow-on rounds, comparable companies in the public market, the nature and duration of the restrictions for holding the securities, and other relevant factors. |

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

Additionally, the Fund’s investments will be valued at fair value by the Pricing Committee if the Adviser determines that an event impacting the value of an investment occurred between the closing time of a security’s primary market or exchange (for example, a foreign exchange or market) and the time the Fund’s share price is calculated. Significant events include, but are not limited to the following: significant fluctuations in domestic markets, foreign markets or foreign currencies; occurrences not directly tied to the securities markets such as natural disasters, armed conflicts or significant governmental actions; and major announcements affecting a single issuer or an entire market or market sector. In responding to a significant event, the Pricing Committee would determine the fair value of affected securi ties considering factors including, but not limited to: index options and futures traded subsequent to the close; ADRs, GDRs or other related receipts; currency spot or forward markets that trade after pricing of the foreign exchange; other derivative securities traded after the close such as WEBs and SPDRs; and alternative market quotes on the affected securities.

The Fund performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — Quoted prices in active markets for identical securities.

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s net assets as of June 30, 2010:

| | Level 1 | | Level 2 | | Level 3 | | Total | |

| | | | | | | | | | | | | |

| Common Stocks* | $ | 473,253,794 | | $ | — | | $ | — | | $ | 473,253,794 | |

| Short-Term Investments | | — | | | 74,990,883 | | | — | | | 74,990,883 | |

| | | | | | | | | | | | | |

| Total Investments | $ | 473,253,794 | | $ | 74,990,883 | | $ | — | | $ | 548,244,677 | |

| | | | | | | | | | | | | |

| Written Option | | | | | | | | | | | | |

| Contracts | $ | 900,000 | | $ | — | | $ | — | | $ | 900,000 | |

| | | | | | | | | | | | | |

| | * | Please refer to the Schedule of Investments to view Common Stocks segregated by industry type. |

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

The Fund did not invest in any Level 3 investments during the period. There were no transfers into or out of Level 1 or Level 2 during the period.

| b. | Foreign Securities — Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in U.S. companies and the U.S. government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government. |

| c. | Foreign Currency Translations — The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) fair value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market price of such securities. However, for federal income tax purposes the Fund does isolate and treat the effect of changes in foreign exchange rates on realized gain or loss from the sale of equity securities and payables/receivables arising from trade date and settlement date differences as ordinary income. |

| d. | Investment Transactions and Related Investment Income — Investment transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recorded daily on the yield to maturity basis. The Fund uses the specific identification method in computing gain or loss on the sale of investment securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. |

| e. | Federal Taxes — It is the Fund’s policy to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. |

Therefore, no federal income tax provision is recorded. In addition, the Fund plans to make sufficient distributions of its income and realized gains, if any, to avoid the payment of any federal excise taxes. Accounting principles generally accepted in the United States of America require that permanent differences between financial reporting and tax reporting be reclassified between various components of net assets.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on the tax return for the fiscal year-end December 31, 2009, or for any other tax years which are open for exam. As of December 31, 2009, open tax years include the tax years ended December 31, 2006 through 2009. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next year (or twelve months). The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

| f. | Dividends and Distributions to Shareholders of Beneficial Interest — Dividends from net investment income, if any, are declared and paid at least annually. |

Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income dividends and capital gain distributions are recorded on the ex-dividend date. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividends paid deduction. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and financial reporting purposes.

| g. | Use of Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Actual results could differ from those estimates. In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. |

| h. | Options Transactions — The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund may use written option contracts to hedge against the changes in the value of equities. The Fund may write put and call options only if it (i) owns an offsetting position in the underlying security or (ii) maintains cash or other liquid assets in an amount equal to or greater than its obligation under the option. |

When the Fund writes a call or put option, an amount equal to the premium received is included in the Statement of Assets & Liabilities as a liability. The amount of the liability is subsequently adjusted to reflect the current fair value of the option. If an option expires on its stipulated expiration date or if the Fund enters into a closing purchase transaction, a gain or loss is realized. If a written call option is exercised, a gain or loss is realized for the sale of the underlying security and the proceeds from the sale are increased by the premium originally received. If a written put option is exercised, the cost of the security acquired is decreased by the premium originally received. As writer of an option, the Fund has no control over whether the underlying securities are subsequently sold (call) or purchased (put ) and, as a result, bears the market risk of an unfavorable change in the price of the security underlying the written option.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

As of June 30, 2010, the Fund held written option contracts as hedging instruments. Written option contracts are a liability on the Statement of Assets and Liabilities with a fair value of $900,000 and premiums received of $4,116,690. On the Statement of Operations, there was a realized gain of $1,968,562 and a change in unrealized appreciation of $3,384,030 for written option contracts. Written call options expose the Fund to minimal counterparty risk since they are exchange traded and the exchange’s clearinghouse guarantee the options against default. See Note 6 for additional disclosure related to transactions in written option contracts during the year.

The Fund may purchase call and put options. When the Fund purchases a call or put option, an amount equal to the premium paid is included in the Statement of Assets & Liabilities as an investment, and is subsequently adjusted to reflect the fair market value of the option. If an option expires on the stipulated expiration date or if the Fund enters into a closing sale transaction, a gain or loss is realized. If the Fund exercises a call option, the cost of the security acquired is increased by the premium paid for the call. If the Fund exercises a put option, a gain or loss is realized from the sale of the underlying security, and the proceeds from such a sale are decreased by the premium originally paid. Written and purchased options are non-income producing securities. The Fund did not purchase any options during the year.

| 3. | INVESTMENT ADVISORY AND OTHER AGREEMENTS |

Muhlenkamp & Company, Inc. (the “Adviser”), an officer/stockholder of which is a trustee of the Trust, receives a fee for investment management. The Adviser charges a management fee equal to 1% per annum of the average daily market value of the Fund’s net assets up to $1 billion and 0.90% per annum of those net assets in excess of $1 billion. Under terms of the advisory agreement, which is approved annually, total annual Fund operating expenses cannot under any circumstances exceed 1.50% of the Fund’s net assets. Should actual expenses incurred ever exceed the 1.50% limitation, such excess expenses shall be reimbursed by the Adviser. The Fund has no obligation to reimburse the Adviser for such payments. U.S. Bancorp Fund Services, LLC serves as transfer agent, administrator and accounting services agent for the Fund. During the six months ended June 30, 2010, total expenses of $515,219, related to such services were paid to U.S. Bancorp Fund Services, LLC. U.S. Bank, N.A. serves as custodian for the Fund.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

The Fund has established an unsecured Line of Credit agreement (“LOC”) with U.S. Bank, N.A., which expires April 30, 2011, to be used for temporary or emergency purposes, primarily for financing redemption payments. Borrowings of the Fund are subject to a $26 million cap on the total LOC. The interest rate paid by the Fund on outstanding borrowing is equal to the Prime Rate, which was 3.25% as of June 30, 2010. The Fund did not have any borrowings outstanding under the LOC as of and during the six months ended June 30, 2010.

| 5. | CAPITAL SHARE TRANSACTIONS |

Transactions in capital shares of the Fund were as follows:

| | Six Months Ended | | | Year Ended |

| | June 30, 2010 | | | December 31, 2009 |

| | | | | |

| Shares outstanding, beginning of period | 14,118,833 | | | 15,750,271 |

| Shares sold | 547,508 | | | 1,238,585 |

| Dividends reinvested | — | | | 17,801 |

| Shares redeemed | (1,293,889) | | | (2,887,824) |

| Shares outstanding, end of period | 13,372,452 | | | 14,118,833 |

| 6. | WRITTEN OPTION CONTRACTS |

The number of written option contracts and the premiums received by the Fund during the six months ended June 30, 2010, were as follows:

| | Number of Contracts | | | Premium Amount |

| | | | | |

| Options outstanding, beginning of period | 3,000 | | $ | 2,082,660 |

| Options written | 20,000 | | | 5,027,159 |

| Options closed | (3,500) | | | (2,139,660) |

| Options exercised | (2,000) | | | (237,497) |

| Options expired | (3,500) | | | (615,972) |

| Options outstanding, end of period | 14,000 | | $ | 4,116,690 |

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

| 7. | INVESTMENT TRANSACTIONS |

Purchases and sales of investment securities, excluding short-term securities and options, for the six months ended June 30, 2010, were as follows:

| Purchases | | Sales |

| U.S. Government | | Other | | U.S. Government | | Other |

| | | | | | | |

$ — | | $166,970,249 | | | | $281,260,964 |

| 8. | FEDERAL TAX INFORMATION |

The Fund intends to utilize provisions of the federal income tax laws which allow it to carry a realized capital loss forward for eight years following the year of loss and offset such losses against any future realized capital gains. Capital gain distributions will resume in the future to the extent gains are realized in excess of the available carryover. The capital loss carryover as of December 31, 2009 were as follows:

| | | Capital Loss |

| Capital Loss | | Carryover |

| Carryover | | Expiration |

| (4,752,802) | | 12/31/2016 |

| (31,615,145) | | 12/31/2017 |

As of December 31, 2009, the components of distributable earnings on a tax basis were as follows:

| Tax cost of investments | $ | 638,860,511 |

| Gross tax unrealized appreciation | $ | 133,298,097 |

| Gross tax unrealized depreciation | | (62,389,012) |

| Net unrealized appreciation | $ | 70,909,085 |

| Undistributed ordinary income | $ | — |

| Undistributed long term capital gains | | — |

| Total distributable earnings | $ | — |

| Other accumulated losses | $ | (36,535,287) |

| Total accumulated gain | $ | 34,373,798 |

The Fund plans to distribute substantially all of the net investment income and net realized gains that it has realized on the sale of securities. These income and gains distributions will generally be paid once each year, on or before December 31. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial reporting and tax reporting purposes.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

On December 29, 2009, a dividend distribution of $0.07 per share, was declared and paid to shareholders of record as of December 28, 2009.

The tax character of distributions paid were as follows:

| | Six Months Ended | | Year Ended | |

| | June 30, 2010 | | December 31, 2009 | |

| | | | | | | |

| Ordinary income | $ | — | | $ | 951,404 | |

| Long-term capital gain | | — | | | — | |

| | $ | — | | $ | 951,404 | |

Beginning in 2000, expenses are reduced through the deposit of minimum account maintenance fees into the Fund. By November 30th of each year, all accounts must have net investments (purchases less redemptions) totaling $1,500 or more, an account value greater than $1,500, or be enrolled in the Automatic Investment Plan. Accounts that do not meet one of these three criteria will be charged a $15 fee. These fees are used to lower the Fund’s expense ratio. For the six months ended June 30, 2010, the Fund’s expenses were reduced $31,007 by utilizing minimum account maintenance fees pertaining to account balances as of November 30, 2009, resulting in a decrease in the expenses being charged to shareholders.

| 10. | GUARANTEES AND INDEMNIFICATIONS |

In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

| 11. | ANNUAL APPROVAL OF INVESTMENT ADVISORY CONTRACT |

The Board of Trustees of The Wexford Trust (the “Board”) oversees the management of the Fund and, as required by law, determines annually whether to approve the continuance of the Fund’s Amended Investment Advisory Contract (the “Contract”) with the Adviser. At a meeting held on May 20, 2010, the Board, including all of the Independent Trustees, approved the continuance of the Contract between the Fund and the Adviser for another year, effective June 30, 2010.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

The Independent Trustees met on four occasions to discuss the renewal of the Contract prior to the discussion at a meeting of the full Board. They reviewed the information which had been supplied to them in response to three written requests directed to the Adviser. They also reviewed other detailed information related to the Fund and the Adviser, and the factors set forth below. After consideration of all of these factors, and based on their business judgment, the Independent Trustees determined that the renewal of the Contract is in the best interest of the Fund and its shareholders, and that the compensation to be paid to the Adviser under the Contract is fair and reasonable. What follows is a summary of the material factors and the conclusions that formed the bases for the full Board’s approval of the Contract. No partic ular factor was controlling.

The Nature, Extent and Quality of the Adviser’s Services

The Board reviewed the services provided by the Adviser to the Fund under the Contract. The Independent Trustees requested and received from the Adviser and others, including the Chief Compliance Officer of the Fund, written and oral information on the performance of the Fund, the income and expenses of the Fund, the fees charged by the Adviser to its private clients, the extent of services provided by the Adviser to the Fund and its private clients, the Adviser’s key personnel, and the Adviser’s compliance with the Fund’s investment restrictions and its other policies and procedures. The Board reviewed the services required to be provided by the Adviser under the Contract. They compared the data and information they had gathered with other investment vehicles and the Adviser’s private separately managed ac counts (“SMAs”). The Board, including a majority of the Independent Trustees, concluded that the nature, extent and quality of services provided by the Adviser were appropriate and consistent with the types of services customarily provided by investment advisers to mutual funds. The Adviser currently is providing services in accordance with the terms of the Contract. The Board reviewed the organizational structure of the Adviser and credentials of the officers and employees of the Adviser who provide investment advisory services to the Fund. They noted the continuing substantial efforts taken by the Adviser to promote the Fund and to retain shareholders. They considered various issues, such as the Adviser’s existing personnel, and the process for identifying stocks to be purchased and sold by the Fund. Based on their review of these factors, the Board concluded that the overall services provided by the Adviser are satisfactory and in accordance with the terms of the Contract.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

The Investment Performance of the Fund and the Adviser

The Board reviewed the performance of the Fund during the past year and for the 1, 3, 5, 10 and 15 year periods against the performance of funds with investment strategies comparable to those of the Fund. They reviewed a detailed analysis of performance and expenses of the Fund, and similar data for this select group of other funds. They noted that the Fund, although it has decreased substantially in size, continues to be recommended by noted industry sources. While the performance of the Fund in the one year, three year and five year periods was down, vis-a-vis other comparable funds, the Fund’s performance over the longer term was not. The performance of the Fund measured over 10 and 15 years was generally consistent with the median performance of other comparable funds and substantially better than the S&P 500 Index. 2007 and 2008 were difficult years for most mutual funds. Performance in 2009 was up as the market rebounded. 2010 started strong, but some of the gains were lost as the market again weakened. The Independent Trustees have confidence in the Adviser and its team, and in particular, Ronald Muhlenkamp. The Board continues to believe that the performance of the Fund will improve as the general markets improve. The Board considered the overall performance of the Adviser in addition to providing investment advisory services to the Fund and concluded that such performance was satisfactory. They received prompt responses to requests made to the Adviser and its staff. Policies and procedures are promptly implemented and monitored for compliance. No ethical or other concerns have been raised as to the Adviser or its staff. Based on this review, the Board concluded that the Fund and its shareholders were benefiting from the Adviser’s investment management of the Fund, and no changes were needed to the Fund’ s portfolio management at this time.

Costs of Services to Be Provided

The Board noted that the Adviser serves as an adviser to private clients separately managed accounts (“SMAs”), with investment strategies comparable to those of the Fund. The Independent Trustees requested and received from the Adviser detailed information concerning fees charged by the Adviser to private clients and the total income received by the Adviser from those clients. They sent follow-up inquiries and received responses thereto. They also reviewed the Adviser’s financial statements. The Independent Trustees asked detailed questions of the Adviser and the Chief Compliance Officer to assist them in determining the similarities and differences between the services offered to Fund shareholders and those offered to SMAs, and the expenses attributable to each. The Board believes, based on its review and the responses from the Adviser, that there are a significant number of expenses attributable to Fund shareholders, particularly costs related to regulation and compliance, which are not present when dealing with SMAs. Similarly, there are distinct differences in many instances in the services that are actually provided by the Adviser to the Fund shareholders on the one hand, and the SMAs on the other. For most SMAs, the Board found the rates charged by the Adviser are comparable to the rates charged to the Fund’s shareholders. In instances in which the Adviser’s SMAs are paying lower percentage fees than those paid by Fund shareholders, the Board believes that these differences can be largely explained by the differences in services provided and the costs attributable thereto. Shareholder accounts are on average much smaller in size and greater in number. Redemptions are more frequent. Marketing, administrative, re gulatory compliance, and legal costs are generally higher for the Fund than for SMAs.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

Profitability and Soundness of the Adviser

The Board reviewed information concerning the profitability of the Adviser and its financial condition. It believes that the Adviser continues to remain financially strong, and that it will be able to fully discharge all of its obligations under the Contract.

Expense Limitations

The Adviser has contractually agreed to limit the total annual operating expenses of the Fund to 1.5% of daily net assets. The Board considered the contractual and voluntary nature of this expense limitation and noted that the Contract, upon renewal, will remain in effect until June 30, 2011. It considered the effect this expense limitation could have on the Fund’s expenses and concluded that the expense limitation was beneficial to the Fund and its shareholders.

Economies of Scale

For amounts over $1 billion, the investment advisory fee is reduced from 1% to 0.9%, thereby resulting in significant shareholder benefits when the Fund assets have exceeded $1 billion. In recent years, however, assets have decreased to below $1 billion; thus this discount has not been applicable. The Board concluded that the Fund had in the past experienced reduced fees at higher asset levels, thereby reflecting economies of scale. If the Fund increases in size to more than $1 billion, these economies of scale would again be realized.

Benefits of Soft Dollars to the Adviser

The Board considered the benefits realized by the Adviser as a result of brokerage transactions in which brokerage fees paid by the Fund are used to pay for research and execution services. The Adviser sometimes pays higher brokerage fees in exchange for research or industry expertise which the Adviser deems to be important. This research is used by the Adviser in making certain decisions for the Fund, and possibly for separately managed accounts (“SMAs”) of the Adviser. The Board regularly reviews these arrangements during the year. Such arrangements appeared to be appropriate and reasonable and provide benefit to the Fund, as well as the Adviser.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2010 (Unaudited)

Other Factors and Current Trends

The Board considered the governance and compliance regulations applicable to funds, and the fact that the Adviser has undertaken to cause the Fund to operate in accordance with required policies and procedures. The Board determined there has consistently been a good faith effort on the part of the Adviser to adhere to the highest ethical standards, and that the current regulatory environment to which the Adviser is subject should not prevent the Board from continuing the Contract.

Summary

In summary, the Board considered each of the factors which it believes relevant to the consideration of the approval of the Contract. It determined based on its overall review that the compensation proposed in the Contract is not excessive and is fair and reasonable under the circumstances, and that the renewal of the Contract is in the best interest of the shareholders of the Fund.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

ADDITIONAL INFORMATION (Unaudited)

Six Months Ended June 30, 2010

Some people have asked how much the Muhlenkamp Fund pays in commissions:

For the six months ended June 30, 2010, the Fund paid $342,575 in broker commissions. These commissions are included in the cost basis of investments purchased, and deducted from the proceeds of securities sold. This accounting method is the industry standard for mutual funds. Were these commissions itemized as expenses, they would equal three cents (3¢) per Fund share and would have increased the operating expense ratio from 1.23% to 1.32%.

| 2. | QUALIFIED DIVIDEND INCOME PERCENTAGE |

The Fund designated 100% of dividends declared and paid during the year ended December 31, 2009 from net investment income as qualified dividend income under the Jobs Growth and Tax Relief Reconciliation Act of 2003.

| 3. | CORPORATE DIVIDENDS RECEIVED DEDUCTION PERCENTAGE |

Corporate shareholders may be eligible for a dividends received deduction for certain ordinary income distributions paid by the Fund. The Fund designated 100% of dividends declared and paid during the year ended December 31, 2009 from net investment income as qualifying for the dividends received deduction. The deduction is a pass through of dividends paid by domestic corporations (i.e. only equities) subject to taxation.

| 4. | SHORT-TERM CAPITAL GAIN |

For the period ended December 31, 2009, the percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(C) for the Fund was 0.00%.

| 5. | INFORMATION ABOUT PROXY VOTING |

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge upon request by calling toll-free at 1-800-860-3863 or by accessing the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve month period ending June 30 is available on the SEC’s website at www.sec.gov or by calling the toll-free number listed above.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

| 6. | AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULE |

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The filing will be available, upon request, by calling 1-800-860-3863. Furthermore, you will be able to obtain a copy of the filing on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-202-551-8090.

INVESTMENT ADVISER

Muhlenkamp & Company, Inc.

5000 Stonewood Drive, Suite 300

Wexford, PA 15090

ADMINISTRATOR AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

CUSTODIAN U.S. Bank, N.A.

Custody Operations

1555 North RiverCenter Drive, Suite 302

Milwaukee, WI 53212

DISTRIBUTOR

Quasar Distributors, LLC

615 E. Michigan Street

Milwaukee, WI 53202

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

800 Westpoint Pkwy., Suite 1100

Westlake, OH 44145