| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

Six Months Ended June 30, 2013

12. ANNUAL APPROVAL OF INVESTMENT ADVISORY AGREEMENT

The Board of Trustees of The Wexford Trust (the “Board”) oversees the management of the Fund and, as required by law, determines annually whether to approve the continuance of the Fund’s Amended Investment Advisory Agreement (the “Agreement”) with the Adviser. At a meeting held on May 16, 2013, the Board including all of the Independent Trustees, approved the continuance of the Agreement between the Fund and the Adviser for another year, effective June 30, 2013.

The Independent Trustees thanked the Adviser for the responses which it had provided to the inquiries raised by the Independent Trustees, as well as the analysis from U.S. Bancorp and the memo from the Fund’s legal counsel. The Independent Trustees reported that they had met three times in executive session with legal counsel to discuss the renewal of the Agreement prior to the discussion at a meeting of the full Board. To facilitate their deliberative process, the Adviser provided materials relevant to the Independent Trustees’ consideration of the Agreement, including, among other things, the Adviser’s Form ADV and Code of Ethics, information regarding the Adviser’s compliance program, personnel and financial condition, and memoranda prepared by the Fund’s legal counsel. During their deliberations the Independent Trustees also reviewed comparative performance, fees and expenses provided by an independent third party. The Adviser provided written and verbal responses to a detailed request submitted by the Independent Trustees. The Independent Trustees also discussed relevant case law and information received periodically throughout the year to the extent relevant to their consideration of the Agreement, including performance, management fee and other expense information. After consideration of all of the factors, and based on their business judgment, the Independent Trustees determined that the renewal of the Agreement is in the best interest of the Fund and its shareholders, and that the compensation to be paid to the Adviser under the Agreement is fair and reasonable.

What follows is a summary of the material factors and the conclusions that formed the basis for the full Board’s approval of the Contract. No particular factor was controlling and not every factor was given the same weight by each Trustee.

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

Six Months Ended June 30, 2013

The Nature, Extent and Quality of the Adviser’s Services

The Board reviewed the services provided and required by the Adviser to the Fund under the Agreement. The Board determined that the Adviser is providing services in accordance with the terms of the Agreement. The Board assessed and considered the Adviser’s significant role in establishing the Fund and the construction of its investment objective, principal strategies, and fee structure, and noted the Adviser’s overall reputation and positive name recognition. The Board reviewed information and received written and oral responses from the Adviser, Chief Compliance Officer of the Fund and others on the performance of the Fund, the income and expenses of the Fund, the fees charged by the Adviser to its private clients, the services provided by the Adviser to the Fund and its private clients, the Adviser’s key personnel, and the Adviser’s compliance with the Fund’s investment restrictions and its other policies and procedures. The Board considered the Adviser’s responsibilities for ensuring the Fund’s compliance with applicable requirements under the securities laws. The Board reviewed the organizational structure of the Adviser and credentials of the officers and employees of the Adviser who provide investment advisory services to the Fund. The Board noted the continuing substantial efforts taken by the Adviser to promote the Fund and to retain shareholders. The Board considered various issues, such as the Adviser’s existing personnel and the process for identifying securities to be purchased and sold by the Fund. Based on its review of these factors, the Board concluded that the overall services provided by the Adviser are satisfactory and in accordance with the terms of the Agreement, and the Fund was likely to continue to benefit from the services provided under the Agreement. The Board, including a majority of the Independent Trustees, concluded that the nature, extent and quality of services provided by the Adviser were appropriate and consistent with the types of services customarily provided by investment advisers to mutual funds.

The Investment Performance of the Fund and the Adviser

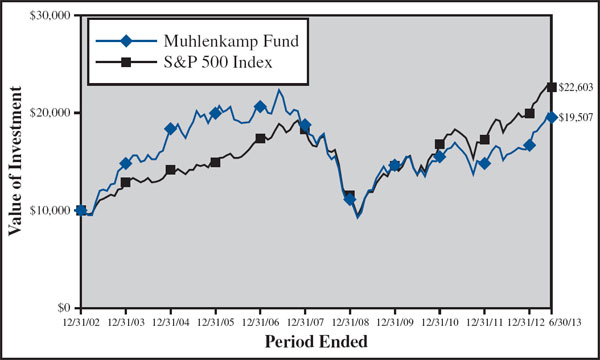

The Board reviewed the performance of the Fund during the past quarter, year, and for the 1, 3, 5, 10 and 15 year periods against the performance of two separate groups of funds (one group containing funds with 12b-l fees and investment strategies comparable to those of the Fund and one group which did not contain 12b-l fees), a Morningstar Index comprised of every All Cap Value, Mid-Cap Value and Large Cap Value Funds (“Morningstar Value Index”), and S&P 500 Index. The Board examined and compared it to similar data for the select group of other funds. The Board added that while the performance of the Fund in the one year, three year, five year and ten year periods was down, vis-à-vis other comparable funds, the Fund’s performance over the longer term was not, and the performance of the Fund measured over 15 years was generally in line with the median performance of other comparable funds and the Morningstar Index and the S&P 500 Index. The Board noted that current performance has improved and that the Fund has outperformed the S&P 500 Index. None of these comparisons was definitive as to the Board’s final determination but they did provide one point of reference from which performance could be evaluated. The Board requested and received additional statistical information on the Fund’s performance/management and Adviser commentary on the statistical information to aid in their evaluation. The Board also considered the Adviser’s quarterly portfolio commentaries and reviews explaining the Fund’s performance. The Board expressed its confidence in the Adviser and its team, and in particular, Ronald Muhlenkamp. The Board considered the overall performance of the Adviser in addition to providing investment advisory services to the Fund and concluded that such performance was satisfactory. The Board found that policies and procedures are promptly implemented and monitored for compliance, and that no ethical or other concerns have been raised as to the Adviser or its staff. Based on this review, the Board concluded that, although past performance is not a guarantee of future results, the Fund and its shareholders were likely to benefit from the Adviser’s continued investment management of the Fund.

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

Six Months Ended June 30, 2013

Costs of Services to Be Provided

The Board compared the Fund’s management fees, non-management expenses and total expense ratio to a group of funds with investment strategies reasonably comparable to the Fund and found them reasonable when compared against the group. The Board also compared the Fund’s management fees and total expense ratio with the Morningstar Value Index and noted that the fees were reasonable. The Board further reviewed information regarding the nature of services and management fee rates offered by the Adviser to other clients, including separately managed accounts. In evaluating the comparisons of fees, the Board noted that the fee rates charged to the Fund and other clients vary, among other things, because of the different services involved and the additional regulatory and compliance requirements associated with registered investment companies, such as the Fund. Accordingly, the Board considered the differences in the product types, including, but not limited to, the services provided, the structure and operations, product distribution and costs thereof, portfolio investment policies, investor profiles, account sizes and regulatory requirements. The Board noted and discussed the extent of the significant additional services provided to the Fund that the Adviser did not provide in the other separately managed accounts. Those services included certain administrative services, oversight of the Fund’s other service providers, trustee support, risk management, regulatory compliance and various other services. The Board noted, in particular, that the range of services provided to the Fund (as discussed above) is much more extensive than that provided to separately managed accounts. Given the inherent differences in the products, particularly the extensive services provided to the Fund, the Board believes such facts justify the different levels of fees.

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

Six Months Ended June 30, 2013

Expense Limitations

The Adviser has contractually agreed to limit the total annual operating expenses of the Fund to 1.50% of daily net assets. This expense limitation in the Agreement, upon renewal, will remain in effect until June 30, 2014. Given the effect this expense limitation could have on the Fund’s expenses, the Board considers it potentially beneficial to the Fund and its shareholders.

Economies of Scale

The Agreement provides that when the Fund’s net assets exceed $1 billion, the investment advisory fee on amounts over $1 billion is reduced from 1% to 0.9%. The Board considered that the Fund had in the past experienced reduced fees at higher asset levels, thereby reflecting economies of scale. Thus, should the Fund’s size increase to more than $1 billion in net assets, these economies of scale would again be realized, resulting in significant benefits to the shareholders.

Profitability and Soundness of the Adviser

The Board reviewed the Adviser’s financial statements and considered the profitability of the Adviser and its financial condition. The Board concluded that the Adviser’s current level of profitability was reasonable considering the quality of management, the Adviser fee breakpoint, expense limitation and payments for service fees charged by financial intermediaries to the Fund. The Board concluded that the Adviser’s financial position remains strong and it will be able to fully discharge its obligations under the Agreement.

Benefits of Soft Dollars to the Adviser

The Board considered the benefits realized by the Adviser as a result of its relationship with the Fund, including brokerage transactions with unaffiliated broker dealers in which brokerage fees paid by the Fund are used to pay for research and execution services. It determined that such products and services, although providing some benefit to the Adviser, have been used for legitimate purposes relating to the Fund by providing assistance in the investment decision-making process. The Board regularly reviews these arrangements during the year and deemed them to be appropriate and reasonable and provide benefit to the Fund.

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

Six Months Ended June 30, 2013

Other Factors and Current Trends

The Board considered the governance and compliance regulations applicable to the Fund, and the Adviser’s efforts to operate the Fund in accordance with required policies and procedures. The Board determined there has consistently been a good faith effort on the part of the Adviser to adhere to the highest ethical standards. The Board believed that the Fund generally benefits from its association with the Adviser and the use of the “Muhlenkamp” name.

Summary

In summary, the Board and the Independent Trustees considered each of the factors which they believed to be relevant to the consideration of the approval of the Agreement. The Board and the Independent Trustees determined based on their overall review that the compensation proposed in the Agreement is not excessive and is fair and reasonable. The Board and the Independent Trustees determined that each of the factors discussed above supported the renewal of the Agreement and that a renewal of the Agreement is in the best interest of the shareholders of the Fund.

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

ADDITIONAL INFORMATION (Unaudited)

Six Months Ended June 30, 2013

1. BROKER COMMISSIONS

Some people have asked how much the Muhlenkamp Fund pays in commissions: For the six months ended June 30, 2013, the Fund paid $163,452 in broker commissions. These commissions are included in the cost basis of investments purchased, and deducted from the proceeds of securities sold. This accounting method is the industry standard for mutual funds. Were these commissions itemized as expenses, they would equal two cents (2¢) per Fund share and would have increased the operating expense ratio from 1.26% to 1.34%.

2. QUALIFIED DIVIDEND INCOME PERCENTAGE

The Fund designated 100% of dividends declared and paid during the year ended December 31, 2012 from net investment income as qualified dividend income under the Jobs Growth and Tax Relief Reconciliation Act of 2003.

3. CORPORATE DIVIDENDS RECEIVED DEDUCTION PERCENTAGE

Corporate shareholders may be eligible for a dividends received deduction for certain ordinary income distributions paid by the Fund. The Fund designated 100% of dividends declared and paid during the year ended December 31, 2012 from net investment income as qualifying for the dividends received deduction. The deduction is a pass through of dividends paid by domestic corporations (i.e. only equities) subject to taxation.

4. SHORT-TERM CAPITAL GAIN

For the period ended December 31, 2012, the percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(C) for the Fund was 58.46%.

5. INFORMATION ABOUT PROXY VOTING

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge upon request by calling toll-free at 1-800-860-3863 or by accessing the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve month period ending June 30 is available on the SEC’s website at www.sec.gov or by calling the toll-free number listed above.

6. AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULE

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The filing will be available, upon request, by calling 1-800-860-3863. Furthermore, you will be able to obtain a copy of the filing on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling the SEC’s Office of Investor Advocacy at 1-202 551-8090.

INVESTMENT ADVISER

Muhlenkamp & Company, Inc.

5000 Stonewood Drive, Suite 300

Wexford, PA 15090

ADMINISTRATOR AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

CUSTODIAN

U.S. Bank, N.A.

Custody Operations

1555 North RiverCenter Drive, Suite 302

Milwaukee, WI 53212

DISTRIBUTOR

Quasar Distributors, LLC

615 E. Michigan Street

Milwaukee, WI 53202

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There is no nominating committee charter and there have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President/Chief Executive Officer and Treasurer/Chief Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Filed herewith |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Wexford Trust

By (Signature and Title)* /s/ Ronald H. Muhlenkamp

Ronald H. Muhlenkamp, President

Date 8/26/2013

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Ronald H. Muhlenkamp

Ronald H. Muhlenkamp, President

Date 8/26/2013

By (Signature and Title)* /s/ Anthony Muhlenkamp

Anthony Muhlenkamp, Treasurer

Date 8/26/2013 ��

* Print the name and title of each signing officer under his or her signature.