Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

| Check the appropriate box: | |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

| Interstate Bakeries Corporation | ||

| (Name of Registrant as Specified In Its Charter) | ||

| Interstate Bakeries Corporation | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

Table of Contents

To the Stockholders:

The Annual Meeting of Stockholders of Interstate Bakeries Corporation (the “Company”) will be held on September 24, 2002, at 10:00 a.m., in the City Stage Theater of Union Station, 30 West Pershing, Kansas City, Missouri 64108, for the following purposes:

| 1. To elect three Class III directors to serve a term of three years expiring in 2005; | |

| 2. To ratify the appointment of Deloitte & Touche LLP as the independent auditors of the books and accounts of the Company for the fiscal year ending May 31, 2003; and | |

| 3. To transact such other business as may properly come before the meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on August 9, 2002, are entitled to notice of and to vote at the meeting or any adjournment thereof.

All stockholders are cordially invited to attend the meeting. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A postage prepaid envelope is enclosed for that purpose. The prompt return of proxies will assure a quorum and save the Company the expense of further solicitation. If you attend the meeting, you may vote personally on all matters, and in that event, the proxy will not be voted.

| By Order of the Board of Directors | |

| |

| KENT B. MAGILL | |

| Corporate Secretary |

Table of Contents

INTERSTATE BAKERIES CORPORATION

This Proxy Statement, which is being mailed to stockholders on or about August 26, 2002, is furnished in connection with the solicitation by the board of directors of Interstate Bakeries Corporation (the “Company”) of proxies to be voted at the Annual Meeting of Stockholders (the “Meeting”) to be held on September 24, 2002, commencing at 10:00 a.m. in the City Stage Theater of Union Station, 30 West Pershing, Kansas City, Missouri 64108. A stockholder may revoke his or her proxy by delivering a written notice to the Corporate Secretary of the Company at any time prior to the voting or by attending the Meeting and voting the shares in person. The Company’s principal executive offices are located at 12 East Armour Boulevard, Kansas City, Missouri 64111, and its telephone number is 816/502-4000.

The Company will bear the entire cost of solicitation of proxies in the enclosed form, including preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any additional information furnished to stockholders. Original solicitation of proxies by mail may be supplemented by telephone, telegram, facsimile or personal solicitation by directors, officers or other regular employees of the Company, and the Company may reimburse brokers or other persons holding stock in their names or in the names of nominees for their expenses in sending proxy soliciting materials to beneficial owners. No additional compensation will be paid to directors, officers or other regular employees of the Company for such services.

The board of directors has fixed the close of business on August 9, 2002, as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting or any adjournment thereof and only stockholders of record at the close of business on that date will be entitled to vote. On August 9, 2002, the Company had outstanding 44,038,430 shares of common stock, $.01 par value per share (the “Common Stock”), entitled to one vote per share.

A copy of the Company’s Annual Report containing financial statements for the fiscal year ended June 1, 2002 is being provided to each stockholder of record as of the close of business on August 9, 2002.The Company’s Annual Report on Form 10-K to be filed with the Securities and Exchange Commission for the fiscal year ended June 1, 2002, will be mailed upon request, free of charge, to all persons who are record or beneficial holders of the Common Stock as of August 9, 2002. To obtain a copy of such report, written request should be made to the Company (Attention: Mr. Kent B. Magill, Corporate Secretary) at 12 East Armour Boulevard, Kansas City, Missouri 64111.

1

Table of Contents

VOTING PROCEDURES

Shares represented by a properly signed proxy received pursuant to this solicitation will be voted in accordance with instructions thereon. If the proxy is properly signed and returned and no instructions are given on the proxy with respect to the matters to be acted upon, the shares represented by the proxy will be voted at the Meeting FOR the election, as directors of the Company, of the nominees hereinafter named and FOR the ratification of the appointment of Deloitte & Touche LLP as independent auditors of the Company. Each of the nominees hereinafter named has indicated his willingness to serve if elected, and it is not anticipated that any of them will become unavailable for election.

The proxy confers discretionary authority, with respect to the voting of the shares represented thereby, on any other business that may properly come before the Meeting. The board of directors is not aware that any such other business, other than as set forth in this Proxy Statement and except for matters incident to the conduct of the Meeting, is to be presented for action at the Meeting and does not itself intend to present any such other business; however, if any such other business does come before the Meeting, shares represented by proxies, properly signed and returned pursuant to this solicitation, will be voted in accordance with the judgment of the person voting such proxies.

A majority of the outstanding shares entitled to vote must be represented in person or by proxy at the Meeting in order to take action on the proposals presented in this Proxy Statement. If such a majority is represented at the Meeting, then the three nominees for director receiving the greatest number of votes at the Meeting will be elected as directors. Any shares not voted (whether by abstention, broker non-vote or otherwise) have no impact on the election of directors except to the extent the failure to vote for an individual results in another individual receiving a larger proportion of the total votes. The ratification of the appointment of independent auditors requires the affirmative vote of a majority of shares present in person or represented by proxy, and entitled to vote on the matter. For purposes of determining the outcome of the vote on the proposal to ratify the appointment of independent auditors, an instruction to “abstain” from voting on such proposal will be treated as shares present and entitled to vote, and will have the same effect as a vote against such proposal. “Broker non-votes,” which occur when brokers are prohibited from exercising discretionary voting authority for beneficial owners who have not provided voting instructions, are not counted for the purpose of determining the number of shares present in person or represented by proxy on a voting matter and will have no effect on the outcome of the vote on the ratification of appointment of the independent auditors.

2

Table of Contents

SECURITY OWNERSHIP

Principal Stockholders

The following table sets forth information as of July 31, 2002, regarding the ownership of the Company’s Common Stock by each person known to the Company to be the beneficial owner of more than 5% of the Company’s Common Stock.

| Amount and Nature of | Percentage | ||||||||

| Name and Address of Beneficial Owners | Beneficial Ownership | Held | |||||||

| Private Capital Management, Inc.(1) | 6,650,089 | 15.10 | % | ||||||

| 8889 Pelican Bay Blvd., Suite 500 | |||||||||

| Naples, FL 34108 | |||||||||

| Barclays Global Investors, N.A.(2) | 3,429,861 | 7.79 | |||||||

| 45 Fremont Street | |||||||||

| San Francisco, CA 94105 | |||||||||

| (1) | As reported to the Company by Private Capital Management, Inc., on July 31, 2002. Private Capital’s increase in share ownership did not cause the preferred share purchase rights under the Company’s rights agreement to become exercisable as the increase resulted from a reduction in the number of outstanding shares upon the Company’s purchase of Common Stock from Tower Holding Company, Inc. on April 25, 2002. |

| (2) | The ownership reported is based upon information provided to the Company by Barclays Global Investors, N.A. on July 25, 2002. |

3

Table of Contents

Common Stock Owned By Management

The number of shares of Common Stock of the Company beneficially owned as of July 31, 2002, by the directors, the Named Executive Officers (as defined below) and all directors and executive officers as a group, are set forth below:

| Amount and Nature | ||||||||

| of Beneficial | Percentage | |||||||

| Name | Ownership | Held | ||||||

| Charles A. Sullivan | 757,503 | (1)(2) | 1.70 | % | ||||

| Michael D. Kafoure | 483,034 | (1) | 1.09 | |||||

| Michael J. Anderson | 50,550 | (3) | * | |||||

| G. Kenneth Baum | 216,312 | (4) | * | |||||

| Leo Benatar | 96,810 | (5) | * | |||||

| E. Garrett Bewkes, Jr. | 105,000 | (5) | * | |||||

| Robert B. Calhoun | 92,732 | (5) | * | |||||

| James R. Elsesser | 99,100 | (5) | * | |||||

| Frank E. Horton | 66,000 | (6) | * | |||||

| Richard L. Metrick | 40,000 | (7) | * | |||||

| Frank W. Coffey | 102,834 | (1) | * | |||||

| Ray Sandy Sutton(8) | 135,326 | (1) | * | |||||

| Robert P. Morgan | 130,001 | (1) | * | |||||

| All directors and executive officers as a group (20 persons) | 2,906,395 | (1)(2) | 6.27 | |||||

* Less than 1%

| (1) | Of the shares indicated, 212,334 (Mr. Sullivan), 471,740 (Mr. Kafoure), 78,334 (Mr. Coffey), 135,001 (Mr. Sutton), 125,001 (Mr. Morgan) and 2,087,167 (all directors and executive officers as a group) are attributable to currently exercisable employee stock options or stock options exercisable within 60 days. | |

| (2) | Pursuant to a deferred share award granted under the 1996 Stock Incentive Plan (“1996 Plan”) on September 23, 1997, the Company granted Mr. Sullivan the right to receive in the future 200,000 shares of Common Stock. Mr. Sullivan’s right to receive the Common Stock vested pro rata over three years and is now fully vested. The shares, which are accruing dividends in the form of additional shares, will be issued to Mr. Sullivan on the first day of the fiscal year following the fiscal year in which his employment terminates. | |

| (3) | Of the shares indicated, 50,000 are attributable to currently exercisable stock options. | |

| (4) | Mr. Baum is a director and Chairman of the Board of George K. Baum Group, Inc. Mr. Baum is also the majority stockholder of George K. Baum Group, Inc. Of the 216,312 shares indicated, 90,000 are attributable to currently exercisable stock options and 77,858 of such shares are held by George K. Baum Group, Inc. Mr. Baum may be deemed to beneficially own all 77,858 shares of the Common Stock held by George K. Baum Group, Inc. |

4

Table of Contents

| (5) | Of the shares indicated, 90,000 are attributable to currently exercisable stock options. | |

| (6) | Of the shares indicated, 60,000 are attributable to currently exercisable stock options. | |

| (7) | Of the shares indicated, 30,000 are attributable to currently exercisable stock options. | |

| (8) | Mr. Sutton retired as Vice President, General Counsel and Corporate Secretary on June 1, 2002, and will continue as an employee through fiscal 2004 under special assignment. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires executive officers and directors of the Company, and persons who beneficially own more than ten percent (10%) of the Common Stock (“reporting persons”), to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission (“SEC”). Executive officers, directors and greater than ten percent (10%) beneficial owners are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely upon a review of copies of such forms and amendments thereto furnished to the Company and written representations from the executive officers and directors, to the Company’s knowledge, all forms required to be filed by reporting persons of the Company were timely filed pursuant to Section 16(a) of the Exchange Act.

5

Table of Contents

COMMON STOCK PRICE PERFORMANCE

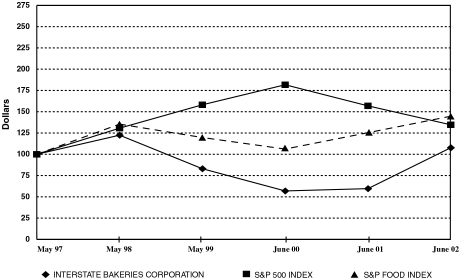

The graph set forth below compares the yearly percentage change in cumulative stockholder return of the Company’s Common Stock since May 31, 1997 against the cumulative return of the Standard and Poor’s Composite 500 Stock Index (“S&P 500 Index”) and the Standard and Poor’s Packaged Foods & Meat Index (“S&P Food Index”) covering the same time period. The graph is based on $100 invested on May 31, 1997, in the Company’s Common Stock, the S&P 500 Index and the S&P Food Index, each assuming dividend reinvestment. The historical stock price performance shown on this graph is not necessarily indicative of future performance.

PERFORMANCE GRAPH

| 5/31/97 | 5/30/98 | 5/29/99 | 6/03/00 | 6/02/01 | 6/01/02 | |||||||||||||||||||

| Interstate Bakeries Corporation | 100.00 | 122.44 | 83.02 | 56.92 | 59.62 | 107.70 | ||||||||||||||||||

| S&P 500 Index | 100.00 | 130.69 | 158.16 | 181.69 | 156.90 | 134.67 | ||||||||||||||||||

| S&P Food Index | 100.00 | 135.44 | 119.70 | 106.13 | 125.38 | 144.72 | ||||||||||||||||||

6

Table of Contents

EXECUTIVE OFFICERS

Set forth below is the name, age and present principal occupation or employment and five-year employment history of each executive officer of the Company and certain officers of its wholly owned subsidiaries, Interstate Brands Corporation and Interstate Brands West Corporation (such subsidiaries collectively referred to herein as “Brands”). The executive officers of the Company and Brands serve at the pleasure of the respective boards of directors. The business address of each person listed below is 12 East Armour Boulevard, Kansas City, Missouri 64111.

| Present Principal Occupation or Employment | ||||||

| Name | Age | and Five-Year Employment History | ||||

| Charles A. Sullivan | 67 | Chairman of the Board and Chief Executive Officer of the Company and Brands for more than the past five years; director of the Company since August 1989. | ||||

| Michael D. Kafoure | 53 | President and Chief Operating Officer of the Company and Brands for more than the past five years. | ||||

| Thomas S. Bartoszewski | 59 | Executive Vice President of the Eastern Division of Brands since August 2002; Senior Vice President of the North Central Region of Brands from May 1999 to July 2002 and Division Controller for the South Central Region of Brands for more than two years prior thereto. | ||||

| Robert P. Morgan | 46 | Executive Vice President of the Central Division of Brands since April 1999; Executive Vice President of the Eastern Division of Brands from February 2002 to August 2002 and Senior Vice President of the North Central Region of Brands for more than two years prior thereto. | ||||

| Richard D. Willson | 54 | Executive Vice President of the Western Division of Brands since June 1999 and Senior Vice President of the Northwest Region of Brands for more than two years prior thereto. | ||||

| Frank W. Coffey | 59 | Senior Vice President and Chief Financial Officer (“CFO”) of the Company and Brands since May 1999; Vice President of Corporate Development of Brands from January 1999 to May 1999; President and co-owner of My Bread Baking Company for more than two years prior thereto. | ||||

| Mark D. Dirkes | 55 | Senior Vice President and Director of Corporate Marketing of Brands for more than the past five years. | ||||

7

Table of Contents

| Present Principal Occupation or Employment | ||||||

| Name | Age | and Five-Year Employment History | ||||

| Brian E. Stevenson | 47 | Senior Vice President and Director of Purchasing of Brands for more than the past five years. | ||||

| Kent B. Magill | 49 | Vice President, General Counsel and Corporate Secretary of the Company and Brands since June 2002; Associate General Counsel of Brands from November 2000 to June 2002; Vice President, General Counsel and Corporate Secretary of Layne Christensen Company for more than four years prior thereto. | ||||

| Paul E. Yarick | 63 | Vice President and Treasurer of the Company and Brands for more than the past five years. | ||||

| Laura D. Robb | 44 | Vice President and Corporate Controller of the Company and Brands since July 2002; Assistant Corporate Controller of Brands for more than five years prior thereto. | ||||

EXECUTIVE COMPENSATION

The Compensation and Stock Incentive Committee (the “Compensation Committee”), which consists of three non-employee directors, recommends to the full board of directors the compensation of the Chief Executive Officer. The Compensation Committee also approves and monitors compensation guidelines for the Company’s other executive officers as recommended by the Chief Executive Officer. The Compensation Committee’s report for fiscal 2002 is set forth below.

Compensation Committee Report

The Compensation Committee believes that it is in the best interest of the stockholders for the Company to attract, maintain and motivate dedicated and talented management personnel, especially its executive officers, by offering a competitive compensation package that maintains an appropriate relationship between executive pay and the creation of stockholder value. The general philosophy of the Compensation Committee is to integrate (i) reasonable levels of annual base salary, (ii) annual incentive bonus awards based upon achievement of short-term corporate goals and individual performance such that executive compensation levels will be higher in years in which performance goals are achieved or exceeded and (iii) equity-based grants, to ensure that management has a continuing stake in the long-term success of the Company in return of value to its stockholders.

The Compensation Committee recognizes that it must maintain base salary levels approximately commensurate with other comparable companies in the food industry with whom the Company competes for management personnel including, but not limited to, those included in the S&P Food Index (the “Comparable Companies”). However, the Compensation Committee believes that the compensation program for its executive officers and key management personnel should be primarily based upon performance. Therefore, base salaries for executive officers and other key management personnel are maintained at a level slightly below the mid-range level of such base salaries at the Comparable Companies. When appropriate, the

8

Table of Contents

Compensation Committee utilizes external salary surveys to establish base salaries in reference to the Comparable Companies and other major corporations. In addition to these external salary surveys, the individual executive’s level of responsibility, prior experience, breadth of knowledge and overall skills are factors considered by the Chief Executive Officer when making recommendations to the Compensation Committee relating to the base salaries for each individual executive officer or key manager. Base salaries are adjusted annually to reflect individual performance, the operating performance of the Company for the preceding fiscal year and increases among the Comparable Companies. Operating performance of the Company includes such measures as sales volumes, market share performance, operating and net income margin trends, growth in earnings and cash flow per share, returns on capital and equity and increases in the value of the Common Stock. Additional adjustments to reflect changes in the market or in individual responsibilities may be appropriate from time to time.

All executive officers and key management personnel of the Company are eligible to receive cash incentive bonuses under the Company’s Incentive Compensation Plan. Incentive bonus awards are based upon the Company achieving certain operating cash flow or earnings per share objectives. The Chief Executive Officer submits proposed minimum, target and maximum operating cash flow and earnings per share objectives to the board of directors for approval. Annual incentive bonus payments are calculated based on a formula which compares the Company’s actual operating cash flow and/or earnings per share levels achieved to the objectives approved by the board of directors. Payments range from zero to 200% of target bonus amounts for the Chief Executive Officer and the divisional and corporate officers and zero to 150% for bakery management.

Awards granted pursuant to the Company’s 1996 Plan comprise the third element of the compensation program for executive officers and key management personnel. The Compensation Committee believes the Company’s executive officers and key management personnel should have a stake in the Company’s ongoing success through stock and other equity-based ownership.

The value of the stock options is related directly to the market price of the Common Stock and thus to the long-term performance of the Company. The exercise price (the “Exercise Price”) of stock options granted to employees under the 1996 Plan is the fair market value of the Common Stock on the date of grant. The Compensation Committee has complete discretion to select the optionees and to establish the terms and conditions of each option, subject in all cases to the provisions of the 1996 Plan. The 1996 Plan is designed to reward the executives for long-term results. The executives’ potential to receive value from stock options, which vest over a period of time, will occur only if the Company’s stock price increases above the Exercise Price. The number of stock options granted to any individual executive is generally based upon that executive’s level of responsibility.

During fiscal 2002, the Compensation Committee retained a national executive compensation consultant (the “Consultant”) to review the Company’s compensation and benefits policies and practices as they relate to the Company’s executive officers in order to determine whether the Company’s current policies and practices were competitive with the Company’s peer group and companies of similar size and complexity, such that the Company would be able to attract and retain qualified executives. The Consultant undertook an extensive

9

Table of Contents

review of the overall executive compensation practices of a peer group of 14 companies as well as general executive compensation practices among other major corporations. As a result of that review, the Consultant concluded that the Company’s executive compensation practices should be adjusted to remain competitive and, as a result, made a number of recommendations to the Compensation Committee for changes to the Company’s compensation and benefits policies.

After a thorough review and discussion of the Consultant’s recommendations, the Compensation Committee concluded that it was in the best interests of the Company and its operating companies to adopt some, but not all, of the Consultant’s recommendations, including the adoption of a supplemental executive retirement plan for certain of its key executives and managers, referred to as the SERP and described in more detail in this Proxy Statement.

As with all executive officers of the Company, the compensation of the Chief Executive Officer is reviewed by the Compensation Committee on a regular basis in comparison to compensation paid to executives holding comparable positions of responsibility including those employed at Comparable Companies and other major corporations. When recommending compensation for the Chief Executive Officer, the Compensation Committee utilizes the same factors applied to the other executives of the Company. Mr. Sullivan’s minimum base salary of $400,000 is established under the terms of an Employment Agreement (the “Employment Agreement”) with the Company, as amended in 1992, but the board of directors has discretion to set his base salary at an amount greater than the minimum. Although the Compensation Committee specifically discusses the Chief Executive Officer’s contributions toward achieving the overall Company performance results, there are no unique criteria applied to the compensation of the Chief Executive Officer that are not also applied to other key executives and managers of the Company.

As was the case during the immediately preceding three fiscal years, Mr. Sullivan’s base compensation was not increased during fiscal 2002. In addition, Mr. Sullivan was not granted an award of stock options during fiscal 2002. Mr. Sullivan’s fiscal 2002 incentive compensation was determined in accordance with the Company’s compensation policy which provides that executive compensation levels will be higher in years in which performance goals are achieved or exceeded. As previously discussed, incentive compensation is based on earnings per share objectives defined with minimum, target and maximum levels. Fiscal 2002 performance exceeded the maximum level, therefore, Mr. Sullivan was eligible for and received a cash incentive bonus for fiscal 2002. In addition, Mr. Sullivan is eligible to participate in the SERP.

Section 162(m) of the Internal Revenue Code of 1986 (the “IRC”) imposes a $1 million cap on the deductibility of compensation (other than certain performance-based compensation) to certain executive officers of public companies. The Compensation Committee evaluates the impact of the cap on its compensation policies so as to conform such policies of the Company, to the extent practicable, to the IRC. However, in any such evaluation, other considerations, such as the retention of key personnel, may be determined to be of more importance than tax savings.

| COMPENSATION COMMITTEE | |

| E. Garrett Bewkes, Jr.,Chairman | |

| G. Kenneth Baum | |

| Frank E. Horton |

10

Table of Contents

Summary Compensation Table

The following table sets forth information concerning compensation received for each of the last three fiscal years by (i) the Chief Executive Officer of the Company as of June 1, 2002 and (ii) the four other most highly compensated executive officers of the Company and Brands as of June 1, 2002, whose annual compensation exceeded $100,000 for the fiscal year ended June 1, 2002 (the individuals in (i) and (ii) are collectively referred to as the “Named Executive Officers”).

| Long-Term | |||||||||||||||||||||

| Compensation | |||||||||||||||||||||

| Annual Compensation | Shares | ||||||||||||||||||||

| Fiscal | Underlying | All Other | |||||||||||||||||||

| Name and Principal Position | Year | Salary | Bonus | Options(#) | Compensation(1) | ||||||||||||||||

| Charles A. Sullivan(2) | 2002 | $ | 800,000 | $ | 1,120,000 | — | $ | 23,264 | |||||||||||||

| Chairman of the Board and | 2001 | 800,000 | — | 35,000 | 16,372 | ||||||||||||||||

| Chief Executive Officer | 2000 | 815,385 | — | 40,000 | 17,443 | ||||||||||||||||

| Michael D. Kafoure | 2002 | 443,385 | 506,000 | — | 18,274 | ||||||||||||||||

| President and Chief | 2001 | 426,308 | — | 25,000 | 13,600 | ||||||||||||||||

| Operating Officer | 2000 | 433,173 | — | 30,000 | 14,073 | ||||||||||||||||

| Frank W. Coffey | 2002 | 258,077 | 195,926 | — | 19,786 | ||||||||||||||||

| Senior Vice President and | 2001 | 250,576 | — | 25,000 | 15,148 | ||||||||||||||||

| Chief Financial Officer | 2000 | 254,808 | — | 30,000 | 15,724 | ||||||||||||||||

| Ray Sandy Sutton(3) | 2002 | 239,200 | 195,926 | — | 22,031 | ||||||||||||||||

| Vice President, General Counsel | 2001 | 230,707 | 7,500 | 20,000 | 15,976 | ||||||||||||||||

| and Corporate Secretary | 2000 | 234,423 | — | 20,000 | 16,894 | ||||||||||||||||

| Robert P. Morgan | 2002 | 197,538 | 213,337 | — | 19,484 | ||||||||||||||||

| Executive Vice President | 2001 | 190,539 | 40,000 | 20,000 | 13,960 | ||||||||||||||||

| Central Division | 2000 | 173,269 | 15,000 | 20,000 | 14,086 | ||||||||||||||||

| (1) | All other compensation for the fiscal year ended June 1, 2002, includes the Company’s contributions in the amounts of $17,930, $18,274, $18,238, $19,655 and $18,944, which accrued during such fiscal year for the accounts of Messrs. Sullivan, Kafoure, Coffey, Sutton and Morgan, respectively, under the Company’s Retirement Income Plan and the imputed income for term life insurance provided by the Company for the benefit of Messrs. Sullivan, Coffey, Sutton and Morgan in the amounts of $5,334, $1,548, $2,376 and $540, respectively. |

11

Table of Contents

| (2) | The Employment Agreement between the Company and Mr. Sullivan provides that Mr. Sullivan will serve as Chairman of the Board of the Company and Chief Executive Officer of the Company and Brands. The Employment Agreement, which is automatically renewed on May 31 of each year unless terminated by the Company and Brands or Mr. Sullivan, further provides that Mr. Sullivan will receive a minimum annual salary of $400,000 and will be eligible for an annual bonus, each to be determined by the board. | |

| In the event Mr. Sullivan’s employment with the Company is terminated without his consent, the Employment Agreement limits Mr. Sullivan’s ability to compete with the Company and provides for full salary and benefits for a period of two years from the date of such termination and a lump sum payment equal to the aggregate annual bonuses paid to Mr. Sullivan for the two most recent fiscal years prior to such termination. | ||

| Mr. Sullivan has announced his intention to retire following the appointment of his successor, a search for which is currently underway by the board of directors. The Company anticipates that Mr. Sullivan will continue to serve as Chairman for a transitional period following the appointment of his successor. | ||

| (3) | Ray Sandy Sutton retired as Vice President, General Counsel and Corporate Secretary on June 1, 2002, and will continue as an employee through fiscal 2004 under special assignment. |

Stock Options

The following two tables set forth information for the last completed fiscal year relating to (i) the grant of stock options to the Named Executive Officers and (ii) the exercise and appreciation of stock options held by the Named Executive Officers.

OPTION GRANTS IN THE FISCAL YEAR ENDED JUNE 1, 2002

No stock options were granted in fiscal 2002 to any of the Named Executive Officers.

AGGREGATED OPTION EXERCISES IN FISCAL 2002 AND

| Number of Shares | ||||||||||||||||||||||||

| Underlying Unexercised | Value of Unexercised | |||||||||||||||||||||||

| Shares | Options at Fiscal | In-the-Money Options | ||||||||||||||||||||||

| Acquired | Year-End | at Fiscal Year-End(1) | ||||||||||||||||||||||

| on | Value | |||||||||||||||||||||||

| Name | Exercise | Realized | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||||||||

| Charles A. Sullivan | 0 | 0 | 212,334 | 36,666 | $ | 2,253,452 | $ | 470,958 | ||||||||||||||||

| Michael D. Kafoure | 0 | 0 | 461,740 | 36,666 | 2,758,963 | 375,791 | ||||||||||||||||||

| Frank W. Coffey | 0 | 0 | 78,334 | 26,666 | 620,809 | 342,391 | ||||||||||||||||||

| Ray Sandy Sutton | 0 | 0 | 128,335 | 26,665 | 557,127 | 279,385 | ||||||||||||||||||

| Robert P. Morgan | 0 | 0 | 125,001 | 19,999 | 518,492 | 257,121 | ||||||||||||||||||

| (l) | The value of unexercised, in-the-money options is the difference between the exercise price of the options and the closing price of the Company’s Common Stock on June 1, 2002 ($27.09). |

12

Table of Contents

Equity Compensation Plan Information

The following table sets forth certain information as of June 1, 2002, concerning the Company’s only equity compensation plan approved by stockholders, the 1996 Plan. The Company had no equity compensation plans which had not been approved by stockholders as of June 1, 2002.

Equity Compensation Plan Information as of June 1, 2002

| Number of Securities | |||||||||||||

| Number of | Remaining Available for | ||||||||||||

| Securities | Weighted-average | Future Issuance Under | |||||||||||

| to Be Issued | Exercise Price of | Equity Compensation | |||||||||||

| Upon Exercise of | Outstanding | Plans (Excluding | |||||||||||

| Outstanding Options, | Options, Warrants | Securities Reflected in | |||||||||||

| Plan Category | Warrants and Rights | and Rights | Column(a)) | ||||||||||

| (a) | (b) | (c) | |||||||||||

| Equity compensation plans approved by security holders | 7,384,867 | (1) | $ | 22.27 | (1) | 6,525,605 | |||||||

| Equity compensation plans not approved by security holders | N/A | N/A | N/A | ||||||||||

| Total | 7,384,867 | 22.27 | 6,525,605 | ||||||||||

| (1) | Includes 212,636 shares vested under a deferred share award granted to Mr. Sullivan on September 23, 1997, under the 1996 Plan. For purposes of calculating the weighted-average exercise price, these shares were valued at $0. Excluding these shares, the weighted-average exercise price would be $22.93. |

IBC Supplemental Executive Retirement Plan

The Company has adopted, effective June 2, 2002, the IBC Supplemental Executive Retirement Plan (“SERP”), an unfunded, non-tax-qualified supplemental retirement plan. Under the SERP, the Company will pay certain key executives and managers who retire after age 60, including the Named Executive Officers, an annual retirement benefit equal to 1.8% of the participant’s average annual base salary received during the sixty (60) months immediately preceding retirement, for each year of service to the Company, up to 20 years (the “Benefit”). As a result, the maximum Benefit is 36% of the participant’s average annual base salary for the preceding 60 months. Upon termination of the participant’s service for any reason other than disability or death after the participant reaches 60 years of age, one-twelfth of the Benefit will be paid each month, if the participant is not married at retirement, until the date of the participant’s death. If the participant is married at retirement, one-twelfth of the Benefit will be paid each month for the participant’s lifetime, unless the participant dies before receiving 300 monthly payments in which event payments will continue to be made to his or her spouse until the earlier of the spouse’s death or the payment of a total of 300 monthly payments to both the participant and the spouse. The SERP includes certain provisions, exercisable at the participant’s election, for the payment of a reduced joint and survivor monthly benefit payable for the surviving spouse’s lifetime if the participant is married on the date of his or her retirement.

13

Table of Contents

A participant is entitled to a disability benefit, determined and paid in the same manner as the Benefit, if termination of employment results from total and permanent disability prior to age 60 and if the participant has 20 or more years of service with the Company as of the date of disability. Payment begins the month following the month during which the participant reaches 60 years of age and is payable for the participant’s lifetime, unless the participant is married on the date of disability and dies before receiving 300 monthly payments, in which event payments will continue to be made to his or her spouse until the earlier of the spouse’s death or the payment of a total of 300 monthly payments to both the participant and the spouse. Alternatively, if the participant is married on the date of disability, he or she can elect the reduced joint and survivor annuity described above.

A participant’s surviving spouse, if any, will be entitled to receive a death benefit, determined and paid in the same manner as the Benefit, upon the participant’s death if the participant dies after reaching 60 years of age but before retirement, or if the participant dies after 20 or more years of service with the Company, regardless of age. This death benefit begins the month following the month during which the participant would have reached 60 years of age or the month following his death, whichever is later, and is payable for the lesser of 300 months or until the death of the spouse.

As of June 1, 2002, Messrs. Sullivan, Kafoure, Coffey, Sutton and Morgan had accredited service to the Company of 19, 6, 10, 31 and 26 years, respectively. Based on each person’s salary for fiscal 2002, each of Messrs. Sullivan, Kafoure, Coffey, Sutton and Morgan would receive an annual retirement benefit in the amount of $273,600, $103,752, $51,099, $86,112 and $71,114, respectively, under this plan if such person were to retire after reaching 60 years of age or, in the case of Messrs. Sullivan and Sutton, 67 and 64 years of age, respectively.

INDEPENDENT AUDITORS

General

Deloitte & Touche LLP served as independent auditors for the purpose of auditing the Company’s consolidated financial statements for the fiscal year ended June 1, 2002 and, upon shareholder approval, will continue to serve as the Company’s independent auditors for the fiscal year ending May 31, 2003.

Audit Committee Charter

The board of directors adopted a written charter for its Audit Committee as of May 8, 2000, which was amended on August 2, 2002. A copy of the charter, as amended, is attached as Appendix A.

Independence of the Audit Committee

It has been determined by the board of directors that the members of the Audit Committee are independent as that term is defined in Section 303.01 of the New York Stock Exchange Listed Company Manual.

14

Table of Contents

Audit Committee Report

The following Audit Committee Report is provided in accordance with the rules and regulations of the SEC. Pursuant to such rules and regulations, this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, subject to Regulation 14A or 14C promulgated by the SEC or subject to the liabilities of Section 18 of the Exchange Act, as amended.

In accordance with its written charter adopted by the board of directors (the “Board”), the Audit Committee of the Board (the “Committee”) assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. During the fiscal year ended June 1, 2002, the Committee met three times, and the Committee chair, as a representative of the Committee, discussed the interim financial information contained in each quarterly earnings announcement with the CFO, General Counsel, Treasurer, Corporate Controller and independent auditors prior to public release of each announcement.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board No. 1, “Independence Discussion with Audit Committees,” discussed with the auditors any relationships that may impact their objectivity and independence and satisfied itself as to the auditors’ independence. The Committee also discussed with management, the internal auditors and the independent auditors the quality and adequacy of the Company’s internal controls and the internal audit function’s organization, responsibilities, budget and staffing. The Committee reviewed with both the independent and the internal auditors their audit plans, audit scope and identification of audit risks.

The Committee discussed and reviewed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees,” and discussed and reviewed the results of the independent auditors’ examination of the financial statements. The Committee also discussed the results of the internal audit examinations.

The Committee reviewed the audited financial statements of the Company as of and for the fiscal year ended June 1, 2002, with management and the independent auditors. Management has the responsibility for the preparation of the Company’s financial statements and the independent auditors have the responsibility for the examination of those statements.

15

Table of Contents

Based on the above-mentioned review and discussions with management and the independent auditors, the Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended June 1, 2002, for filing with the SEC. The Committee also recommended the reappointment, subject to shareholder approval, of the independent auditors and the Board concurred in such recommendation.

| AUDIT COMMITTEE | |

| Michael J. Anderson,Chairman | |

| E. Garrett Bewkes, Jr. | |

| Frank E. Horton |

Fiscal 2002 Audit Firm Fee Summary

During fiscal 2002, the Company retained its principal auditor, Deloitte & Touche LLP, to provide services in the following categories and amounts:

Audit Fees

Deloitte & Touche LLP has billed the Company $415,406, in the aggregate, for professional services it rendered for the audit of the Company’s annual financial statements for the fiscal year ended June 1, 2002 and the reviews of the interim financial statements included in Forms 10-Q filed during the fiscal year ended June 1, 2002.

Financial Information Systems Design and Implementation Fees

Deloitte & Touche LLP has not billed the Company for financial information design and implementation fees described in paragraph (c) (4) (ii) of Rule 2-01 of Regulation S-X, since it did not render any of those services for the Company during the fiscal year ended June 1, 2002.

All Other Fees

Deloitte & Touche LLP billed the Company $914,950, in the aggregate, for all other professional services it rendered during the fiscal year ended June 1, 2002, primarily for review of and required procedures related to an SEC filing on Form S-3 and related consents and comfort letters, income tax compliance and related tax services. Deloitte Consulting did not provide any services to the Company during the fiscal year ended June 1, 2002.

The audit committee has concluded that the provision of non-audit services by our principal auditor is compatible with maintaining auditor independence.

16

Table of Contents

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In 1995, the Company acquired Continental Baking Company (“CBC”) from Ralston Purina Company (now known as Nestlé Purina PetCare Company, an affiliate of Nestlé S.A. (“Nestlé”)) for cash and shares of the Company’s Common Stock. In connection with the acquisition, the Company entered into a shareholder agreement with Nestlé which, among other matters, required the Company to register, at its expense, certain shares of the Company’s Common Stock held by Nestlé upon its request. Since July 2000, Nestlé had held approximately 29% of the Company’s Common Stock.

On April 1, 2002, the Company entered into an agreement to purchase from Nestlé 7,348,154 shares of the Company’s Common Stock for a negotiated price of $21.50 per share, for a total purchase price of approximately $158 million. This purchase was completed on April 25, 2002. Nestlé also exercised its demand registration right for its remaining 7,500,000 shares of the Company’s Common Stock. Those shares were sold in an underwritten public offering on May 14, 2002, at a cost to the Company of approximately $700,000. As a result of these transactions, Nestlé no longer owns shares of the Company’s Common Stock.

The Company, through its operating subsidiaries, purchases flour at market prices from Cereal Food Processors, Inc. (“Cereal Food”), a long-standing supplier, in the regular course of the Company’s business under a contract terminating in 2005. G. Kenneth Baum, a current director and nominee for reelection as a director of the Company, beneficially owns more than ten percent equity interest in Cereal Food. During fiscal 2002, the Company’s flour purchases from Cereal Food totaled approximately $70 million.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

The Company’s board of directors currently consists of nine members, divided into three classes: Class I, Class II and Class III. Directors in each class are elected for three-year terms, with each class standing for election in successive years. At the Meeting, three Class III directors will be elected to serve until the third succeeding Annual Meeting of the Stockholders of the Company. Proxies may not be voted for more than three persons in the election of Class III directors at the Meeting. G. Kenneth Baum, E. Garrett Bewkes, Jr. and James R. Elsesser, current Class III directors of the Company, have been nominated for re-election. The following table sets forth certain information with respect to the three current nominees, the Class I directors (whose terms expire in 2003) and the Class II directors (whose terms expire in 2004).

17

Table of Contents

| Director | Principal Occupation or Employment | |||||||||

| Name | Age | Since | for the Last Five Years and Directorships | |||||||

| G. Kenneth Baum(2) | 72 | 1988 | Chairman of the Board of George K. Baum Group, Inc. for more than the past five years. Mr. Baum is a director of H & R Block, Inc. | |||||||

| E. Garrett Bewkes, Jr.(1)(2) | 75 | 1991 | Consultant and Chairman for a number of UBS PaineWebber mutual funds for more than the past five years; formerly Chairman of American Bakeries Company. | |||||||

| James R. Elsesser | 58 | 1995 | Financial Consultant since March 2002; Vice President and Chief Financial Officer of Ralston Purina Company for more than five years prior thereto. | |||||||

| Director | Principal Occupation or Employment | |||||||||

| Name | Age | Since | for the Last Five Years and Directorships | |||||||

| Charles A. Sullivan | 67 | 1989 | Chairman of the Board and Chief Executive Officer of the Company and Brands for more than the past five years. Mr. Sullivan is a director of UMB Bank, n.a. and The Andersons, Inc. | |||||||

| Leo Benatar | 72 | 1991 | Associated Consultant for A.T. Kearney, Inc. and Principal for Benatar & Associates for more than the past five years; Chairman of the Board of Engraph, Inc. (a subsidiary of Sonoco Products Company) and Senior Vice President of Sonoco Products Company from October 1993 until May 1996. Mr. Benatar is a director of Mohawk Industries, Inc., PAXAR Corporation and Aaron Rents, Inc., and was Chairman and Director of the Federal Reserve Bank of Atlanta until January 1996. | |||||||

| Richard L. Metrick | 61 | 2000 | Senior Managing Director in the Investment Banking Department of Bear Stearns & Co., Inc. for more than the past five years. | |||||||

18

Table of Contents

| Director | Principal Occupation or Employment | |||||||||

| Name | Age | Since | for the Last Five Years and Directorships | |||||||

| Michael J. Anderson(1) | 51 | 1998 | President and Chief Executive Officer of The Andersons, Inc. since 1999; President and Chief Operating Officer for more than two years prior thereto. Mr. Anderson is a director of The Andersons, Inc. and Fifth Third BancCorp of Northwest Ohio. | |||||||

| Robert B. Calhoun | 59 | 1991 | Managing Director of Monitor Clipper Partners for more than the past five years. Mr. Calhoun is a director of Avondale Mills, Inc. and The Lord Abbett Family of Funds. | |||||||

| Frank E. Horton(l)(2) | 63 | 1992 | Principal Associate, Horton & Associates, Consultants in higher education, Denver, Colorado, since 1999; Interim President, Southern Illinois University, February 2000 to October 2000; President, The University of Toledo for more than two years prior thereto. Dr. Horton is a director of GAC Corp. | |||||||

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

During the 2002 fiscal year, the board of directors held five meetings. All directors attended more than 75% of the aggregate number of board of directors’ meetings and board of directors’ Committee meetings on which the respective directors served.

Committees of the Board

The board of directors has appointed an Audit Committee and a Compensation Committee to assist in handling the various functions of the Board.

The Audit Committee members are Michael J. Anderson, E. Garrett Bewkes, Jr. and Frank E. Horton. Mr. Anderson serves as Chairman of the Audit Committee. The Audit Committee recommends to the full board of directors the engagement of independent auditors, reviews with the auditors the scope and results of the audit, reviews with the Company’s internal auditors the scope and results of the Company’s internal audit procedures, reviews the independence of the auditors and non-audit services provided by the auditors, considers the range of audit and non-audit fees, reviews with the Company’s independent auditors and management the effectiveness of the Company’s system of internal accounting controls and makes inquiries into other matters within the scope of its duties. The Audit Committee held three meetings during the

19

Table of Contents

2002 fiscal year. All members of the Audit Committee attended all of the meetings, with the exception of Messrs. Anderson and Benatar, a member of the Audit Committee during the 2002 fiscal year, who were not in attendance at one meeting. The Committee Chair, as a representative of the committee, discussed the interim financial information contained in each quarterly earnings announcement with the CFO, General Counsel, Treasurer, Corporate Controller and independent auditors prior to public release of each announcement.

The Compensation Committee members are E. Garrett Bewkes, Jr., G. Kenneth Baum and Frank E. Horton. Mr. Bewkes serves as Chairman of the Compensation Committee. The Compensation Committee recommends to the full board of directors remuneration arrangements for senior management and directors, and determines the number and terms of awards granted under the Company’s 1996 Plan which was originally approved by the stockholders at the 1996 Annual Meeting. The Compensation Committee held eight meetings during the 2002 fiscal year. All members of the Compensation Committee attended each of the meetings.

The Company does not have a standing nominating committee.

Directors’ Fees and Related Information

Directors who are not salaried employees of, or consultants to, the Company are entitled to an annual retainer of $24,000 plus $2,000 for each board meeting attended. In addition, directors who are members of committees of the board of directors and who are not salaried employees of, or consultants to, the Company are entitled to receive $1,000 for each committee meeting attended that is not conducted in conjunction with a meeting of the full board of directors and $750 for each committee meeting attended that is conducted on the same day as a meeting of the full board of directors. In addition, non-employee directors are eligible for awards of stock options and restricted or unrestricted shares of Common Stock pursuant to the 1996 Plan. In fiscal 2002, no stock option grants were made to non-employee directors. Directors may also elect to receive their retainers in the form of Common Stock pursuant to the 1996 Plan.

Compensation Committee Interlocks and Insider Participation

During fiscal 2002, the members of the Compensation Committee were Messrs. Bewkes, Baum and Horton. No member of the Compensation Committee was an officer, employee or a former officer or employee of the Company or any of its subsidiaries during the last fiscal year nor was formerly an officer of the Company during the last fiscal year. Mr. Baum beneficially owns more than ten percent equity interest in one of the Company’s suppliers. See “Certain Relationships and Related Transactions”.

The Board of Directors recommends a vote FOR this Proposal.

20

Table of Contents

PROPOSAL NO. 2 —APPOINTMENT OF AUDITORS

Stockholders are asked to ratify the appointment of Deloitte & Touche LLP as independent auditors of the books and accounts of the Company for the fiscal year ending May 31, 2003.

Representatives of Deloitte & Touche LLP plan to attend the Meeting and will have an opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR this Proposal.

SUBMISSION OF STOCKHOLDERS’ PROPOSALS AND OTHER MATTERS

Proposals of stockholders intended to be presented at the 2003 Annual Meeting must be made in compliance with the rules and regulations of the Securities and Exchange Commission and be received by the Corporate Secretary, Interstate Bakeries Corporation, 12 East Armour Boulevard, Kansas City, Missouri 64111, no later than April 29, 2003, in order to be eligible for inclusion in the Company’s fiscal year 2003 proxy materials. Stockholder proposals for the 2003 Annual Meeting that are submitted to the Company prior to July 11, 2003 may, at the discretion of the Company, be voted on at the 2003 Annual Meeting of Stockholders. All proposals received after July 11, 2003 will be considered untimely.

Management does not intend to bring any other matters before the Meeting and is not aware of any matters to come before the Meeting other than those referred to in the Proxy Statement. However, if any other matters should properly come before the Meeting, it is intended that the proxies solicited hereby will be voted thereon in accordance with the judgment of the person voting such proxies.

| By Order of the Board of Directors | |

| |

| KENT B. MAGILL | |

| Corporate Secretary |

21

Table of Contents

APPENDIX A

AUDIT COMMITTEE CHARTER

The primary function of the Audit Committee of the Board of Directors of Interstate Bakeries Corporation (the “Board”) is to assist the Board in fulfilling its oversight responsibilities by reviewing the quality and integrity of financial information provided to the shareholders and others, the adequacy of the system of internal controls established by management, and the internal and external audit processes. The Audit Committee is expected to maintain and encourage free and open communication with the independent auditors, the internal auditors, management of the Corporation and the Board.

Composition of the Audit Committee

The Audit Committee shall be comprised of three or more independent directors as determined by the Board. Each member shall be free of any relationship that, in the opinion of the Board, would interfere with their exercise of independent judgment as a member of the Committee. All members of the Committee shall have a working knowledge of basic finance, accounting and auditing practices, and at least one member shall have accounting or related financial management expertise.

The Board shall appoint one member of the Committee as the Chairperson. The Chairperson shall be responsible for the overall leadership of the Committee, including presiding over the meetings, reporting to the Board and acting as a liaison with the Chief Executive Officer, the lead independent audit partner and the Director of Internal Audit.

Meeting Requirements

The Audit Committee shall meet at least three times annually, or more frequently as circumstances dictate. During at least two of these meetings, separate executive sessions will be held with the independent auditors, the Director of Internal Audit, and corporate management to discuss privately any matters these groups or the Committee deem necessary.

Responsibilities and Authority Related to the Independent Auditors

Appointment, compensation, and oversight of the work of the independent accountants employed by the Corporation for the purpose of preparing and issuing an audit report or related work. The independent accountants shall report directly to the Audit Committee.

Resolution of disagreements between management and the independent accountants regarding financial reporting, if any.

Obtain a written statement from the independent auditors on an annual basis confirming their complete independence in relation to the Corporation.

22

Table of Contents

Review the overall nature and scope of the audit process, receive and review all reports and recommendations of the independent auditors and provide the auditors complete access to the Committee and the Board to discuss all appropriate matters. The independent auditors shall, in all respects, be accountable to the Audit Committee and the Board.

Discuss with management and the independent auditors the content of the Corporation’s financial statements including quality of earnings, review of reserves and accruals, suitability of accounting principles, quality and adequacy of internal controls, review of highly judgmental areas, recorded and unrecorded audit adjustments and other inquiries as may be appropriate.

Review the annual financial statements of the corporation with management and the independent auditors to determine that they are satisfied with the disclosures and content of the financial statements for presentation to the shareholders and others.

The Committee or, in the alternative, the Chairperson of the Audit Committee or designee Committee member, and other members as deemed appropriate by the Chairperson, shall review the quarterly financial reports with management and the independent auditors to determine that they are satisfied with the content and quality of the quarterly financial information presented to shareholders and others.

Responsibilities Related to the Internal Auditors

Maintain free and open communication between the Committee and the Internal Audit Department to confirm and ensure their continual independence and objectivity.

Review the overall internal audit function of the corporation including the Internal Audit Charter, reporting obligations and the qualifications of the department employees.

Review the proposed internal audit plan on an annual basis, and continually monitor the department’s performance against the plan.

Review all internal audit reports to be aware of any potentially significant issues or control weaknesses and corporate management’s responses to these issues.

Other Responsibilities

Prepare minutes of all Audit Committee meetings and report all Committee activities to the full Board of Directors with the issuance of an annual Audit Committee Report to be included in the proxy statement for submission to the shareholders.

Review with corporate management, the independent auditors and the internal auditors any legal matters, risks or exposures that could have a significant impact on the financial statements and what steps management has taken to minimize the corporation’s exposure.

The Committee is empowered to investigate any matter brought to its attention, with full power to retain outside counsel or other experts for this purpose, as deemed necessary.

Review and reassess the adequacy of the Audit Committee Charter on an annual basis.

23

Table of Contents

FORM OF PROXY

Cut or tear along perforated edge.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints PAUL E. YARICK, KENT B. MAGILL and LINDA L. THOMPSON, in the order named, as proxies (each with the power to act alone and with power of substitution) to vote, as directed below, all shares of common stock of INTERSTATE BAKERIES CORPORATION (the “Company”) which the undersigned would be entitled to vote if personally present at the Annual Meeting of Stockholders to be held on Tuesday, September 24, 2002, at 10:00 a.m. in the City Stage Theater of Union Station, 30 West Pershing, Kansas City, Missouri, or any adjournment thereof, as follows:

| 1. | ELECTION OF DIRECTORS | [ ] | FOR all nominees listed below (except as marked to the contrary below) | [ ] | WITHHOLD AUTHORITY to vote for all nominees below |

G. Kenneth Baum, E. Garrett Bewkes, Jr., James R. Elsesser

INSTRUCTION: To withhold authority to vote for any individual nominee, write that nominee’s name in the space provided below:

| 2. | RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP as independent auditors of the Company for the fiscal year ending May 31, 2003. |

| [ ] FOR | [ ] AGAINST | [ ] ABSTAIN |

| 3. | In accordance with their discretion upon such other matters as may properly come before the meeting and any adjournment thereof. |

Table of Contents

Cut or tear along perforated edge

When properly executed, this proxy will be voted in the manner directed by the undersigned stockholder. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF DIRECTORS AND FOR RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS AUDITORS OF THE COMPANY. The Board of Directors recommends a vote FOR proposals 1 and 2. None of the proposals are related to or conditioned on the approval of other matters, and each proposal has been proposed by the Company.

Please sign exactly as name appears below.

| DATED , 2002. | |

| (Signature) | |

| | |

| (Signature if held jointly) | |

| Please sign here exactly as name appears at the left. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. Each joint owner or trustee should sign the proxy. | |

| PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE |