UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

x Definitive Proxy Statement | ||

¨ Definitive Additional Materials | ||

¨ Soliciting Material Pursuant to §240.14a-12 |

INTERSTATE BAKERIES CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

INTERSTATE BAKERIES CORPORATION

12 East Armour Boulevard

Kansas City, Missouri 64111

(816) 502-4000

Dear Stockholder:

I cordially invite you to attend the Annual Meeting of Stockholders of Interstate Bakeries Corporation. We will hold the meeting on Tuesday, September 23, 2003, at the City Stage Theater of Union Station, 30 West Pershing, Kansas City, Missouri 64108, commencing at 10:00 a.m. I hope you will be able to attend.

Enclosed you will find a notice that sets forth the business expected to come before the meeting, the Proxy Statement, a form of Proxy and a copy of our 2003 Annual Report to Stockholders for the fiscal year ended May 31, 2003. At this year’s meeting, the agenda includes the election of three Class I directors and a proposal to ratify the appointment of our independent auditors. Our Board of Directors recommends that you vote FOR the election of directors and the ratification of the appointment of our independent auditors.

The shares eligible to vote at this meeting were determined on the record date of August 8, 2003. Whether or not you plan to attend the meeting in person, your shares should be represented and voted. After reading the enclosed Proxy Statement, please complete, sign, date and promptly return the Proxy card in the self-addressed pre-paid envelope that we have included for your convenience. No postage is required if it is mailed in the United States. Submitting the Proxy before the date of the annual meeting will not preclude you from voting in person at the annual meeting should you decide to attend.

Your vote is important. I encourage you to read the enclosed Proxy Statement and vote your shares. As always, many thanks for your involvement in our Company.

Sincerely, | ||

| ||

JAMES R. ELSESSER | ||

August 25, 2003 | Chief Executive Officer | |

INTERSTATE BAKERIES CORPORATION

12 East Armour Boulevard

Kansas City, Missouri 64111

(816) 502-4000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held September 23, 2003

TIME | 10:00 a.m., Central Time, on Tuesday, September 23, 2003 | |||

PLACE | Union Station City Stage Theater 30 West Pershing Kansas City, Missouri 64108 | |||

ITEMS OF BUSINESS | (1) | To elect three Class I directors to serve a term of three years expiring in 2006; | ||

(2) | To ratify the appointment of Deloitte & Touche LLP as the independent auditors of Interstate Bakeries Corporation for the fiscal year ending May 29, 2004; and | |||

(3) | To transact such other business as properly may come before the meeting or any adjournment thereof. | |||

RECORD DATE | You may vote if you were a stockholder of record on August 8, 2003. | |||

VOTING BY PROXY | Please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A self-addressed prepaid envelope is enclosed for that purpose. If you attend the meeting, you may vote personally on all matters, and in that event, the proxy will not be voted. | |||

DATE OF MAILING | This Notice and Proxy Statement is first being distributed to stockholders on or about August 25, 2003. | |||

By Order of the Board of Directors | ||

| ||

KENT B. MAGILL | ||

August 25, 2003 | Corporate Secretary | |

INTERSTATE BAKERIES CORPORATION

PROXY STATEMENT

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Interstate Bakeries Corporation (“Company”), for use at the Annual Meeting of Stockholders (the “Meeting”). The Meeting will be held on September 23, 2003, commencing at 10:00 a.m., in the City Stage Theater of Union Station, 30 West Pershing, Kansas City, Missouri 64108. The Board is soliciting your proxy for use at the Meeting. This Proxy Statement is first being sent to stockholders on or about August 25, 2003. Our Company’s principal executive offices are located at 12 East Armour Boulevard, Kansas City, Missouri 64111, and its telephone number is (816) 502-4000. Our Company’s wholly-owned operating subsidiaries are Interstate Brands Corporation, Interstate Brands West Corporation (collectively referred to herein as “Brands”) and IBC Trucking Corporation.

VOTING INFORMATION

Who May Vote?

You may vote at the Meeting if you owned shares of our Company’s common stock, $0.01 par value, at the close of business on August 8, 2003. You are entitled to one vote on each matter presented at the Meeting for each share you owned on that date. As of August 8, 2003, our Company had outstanding 44,804,515 shares of common stock, entitled to one vote per share.

What Am I Voting On?

You will be voting on the following matters:

| • | Election of three Class I directors; |

| • | Ratification of the appointment of Deloitte & Touche LLP as the independent auditors of our Company for the fiscal year ending May 29, 2004; and |

| • | Any other business properly coming before the Meeting. |

How Do I Vote Before The Meeting?

You may vote by completing, signing and returning the enclosed proxy card. If you hold your shares through an account with a bank or broker, please follow the directions that your bank or broker provides.

May I Vote At The Meeting?

You may vote your shares at the Meeting if you attend in person. If you hold your shares through an account with a bank or broker, you must obtain a legal proxy from the bank or broker in order to vote at the Meeting. Even if you plan to attend the Meeting, we encourage you to vote your shares by proxy.

Can I Change My Mind After I Vote?

You may change your vote at any time before the polls close at the Meeting. You may do this by:

| • | Signing another proxy card with a later date and returning it to us prior to the Meeting; or |

| • | Voting at the Meeting if you are a registered stockholder or have obtained a legal proxy from your bank or broker. |

What If I Return My Proxy Card But Do Not Provide Voting Instructions?

Proxies that are signed and returned but do not contain instructions will be voted as follows:

| • | FOR the election of the nominees for director hereinafter named; |

| • | FOR the ratification of the appointment of Deloitte & Touche LLP as the independent auditors of our Company; and |

1

| • | In accordance with the best judgment of the named proxies on any other matters properly brought before the Meeting. |

What Does It Mean If I Receive More Than One Proxy Card?

It means that you have multiple accounts with our transfer agent and/or banks or brokers. Please vote all of these shares. We recommend that you consolidate as many accounts as possible under the same name and address.

Will My Shares Be Voted If I Do Not Provide My Proxy Card?

If you are a registered stockholder and do not provide a proxy, you must attend the Meeting in order to vote your shares. If you hold shares through an account with a bank or broker, your shares may be voted even if you do not provide voting instructions on your proxy card. Brokerage firms have the authority under the New York Stock Exchange rules to vote shares for which their customers do not provide voting instructions on certain “routine” matters. The election of directors and the ratification of Deloitte & Touche LLP as the independent auditors of our Company are considered routine matters for which brokerage firms may vote without specific instructions. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a “broker non-vote.”

How Many Votes Must Be Present To Hold The Meeting?

Your shares are counted as present at the Meeting if you attend the Meeting and vote in person or if you properly return a proxy. In order for us to conduct our Meeting, a majority of our outstanding shares of common stock as of August 8, 2003 must be present in person or by proxy at the Meeting. This is referred to as a quorum. Abstensions and broker non-votes will be counted for purposes of establishing a quorum at the meeting.

How Many Votes Are Needed To Approve Our Company’s Proposals?

The three nominees for director receiving the greatest number of “For” votes at the Meeting will be elected as directors. This number is called a plurality. Shares not voted, whether by marking “Abstain” on your proxy card or otherwise, will have no impact on the election of directors except to the extent the failure to vote for an individual results in another individual receiving a larger proportion of the total votes. The proxy given will be voted “For” each of the nominees for director listed in this Proxy Statement unless the properly completed proxy card is marked “Withhold Authority” as to a particular nominee or nominees for director.

The ratification of the appointment of Deloitte & Touche LLP as our Company’s independent auditors for fiscal 2004 requires that a majority of the shares represented at the Meeting and entitled to vote on the matter be voted “For” the proposal. A properly completed proxy card marked “Abstain” with respect to the proposal will be treated as shares present and entitled to vote, and will have the same effect as a vote against such proposal. “Broker non-votes” are not counted for the purpose of determining the number of shares present in person or represented by proxy on the particular voting matter and will have no effect on the outcome of the vote on that matter.

BOARD OF DIRECTORS INFORMATION

What Is The Makeup Of The Board Of Directors And How Often Are Members Elected?

Our Company’s Board of Directors consists of nine directors; although as a result of E. Garrett Bewkes, Jr.’s resignation in July 2003, there presently is one vacancy on the Board. The Board of Directors is divided into three classes: Class I, Class II and Class III. Directors in each class are elected for three-year terms, with each class standing for election in successive years. At the Meeting, three Class I directors will be elected to serve until the 2006 Annual Meeting of Stockholders. The vacancy among the Class III directors resulting from Mr. Bewkes’ resignation will be filled by the Board of Directors as provided in our Company’s Bylaws.

What If A Nominee Is Unwilling Or Unable To Serve?

Each of the nominees listed in this Proxy Statement has indicated his willingness to serve if elected, and it is not anticipated that any of them will become unavailable for election. If for some unforeseen reason a nominee becomes unwilling or unable to serve, proxies will be voted for a substitute nominee selected by the Board of Directors.

2

How Are Directors Compensated?

Directors who are not salaried employees of, or consultants to, our Company are entitled to an annual retainer of $24,000 plus $2,000 for each board meeting attended in person and $1,000 for each telephonic board meeting. In addition, directors who are members of committees of the Board of Directors and who are not salaried employees of, or consultants to, our Company are entitled to receive $1,000 for each committee meeting attended in person that is not conducted in conjunction with a meeting of the full Board of Directors and $750 for each committee meeting attended in person that is conducted on the same day as a meeting of the full Board of Directors. For telephonic committee meetings, each committee member is entitled to receive $500. The Chairman of each committee is entitled to receive an annual retainer of $2,500. In addition, non-employee directors are eligible for awards of stock options and restricted or unrestricted shares of common stock pursuant to our 1996 Stock Incentive Plan (“1996 Plan”). For fiscal 2002, each of the non-employee directors was granted an immediately exercisable option to purchase 10,000 shares of common stock at an exercise price of $27.72 per share, which was the closing sales price of our Company’s common stock on the July 9, 2002 grant date. For fiscal 2003, they also were granted an immediately exercisable option to purchase 10,000 shares of common stock at an exercise price of $10.00 per share, which was the closing sales price of our Company’s common stock on the May 6, 2003 grant date, except that G. Kenneth Baum received an immediately exercisable option to purchase 10,000 shares of common stock at an exercise price of $11.80 per share, which was the closing sales price of our Company’s common stock on the July 9, 2003 grant date. Directors may also elect to receive their retainers in the form of common stock pursuant to the 1996 Plan.

How Often Did The Board Meet In Fiscal 2003?

During the 2003 fiscal year, the Board of Directors held seven meetings. All directors attended at least 75% of the total number of Board of Directors’ meetings and Board of Directors’ Committee meetings on which the respective directors served.

What Are The Committees Of The Board?

The Board of Directors has appointed an Audit Committee, a Compensation Committee and a Nominating/Corporate Governance Committee to assist in handling the various functions of the Board.

The Audit Committee members are Michael J. Anderson, Leo Benatar and Frank E. Horton. Mr. Anderson serves as Chairman of the Audit Committee. The Audit Committee hires our Company’s independent auditors, reviews with the auditors the scope and results of the audit, reviews with our Company’s internal auditors the scope and results of our Company’s internal audit procedures, reviews the independence of the auditors and non-audit services provided by the auditors, considers the range of audit and non-audit fees, reviews with our Company’s independent auditors and management the effectiveness of our Company’s system of internal accounting controls and makes inquiries into other matters within the scope of its duties. The Audit Committee held four meetings during the 2003 fiscal year. The Committee Chair, as a representative of the committee, discussed the financial information contained in each quarterly earnings announcement and related SEC filing with the Principal Financial Officer, General Counsel, Treasurer, Corporate Controller and independent auditors prior to public release of each announcement.

The members of the Compensation Committee are Robert B. Calhoun, Frank E. Horton and Richard L. Metrick. Mr. Calhoun serves as Chairman of the Compensation Committee. The Compensation Committee recommends to the full Board of Directors remuneration arrangements for senior management and directors and determines the number and terms of awards granted under our Company’s 1996 Plan. The Compensation Committee held ten meetings during the 2003 fiscal year.

The Nominating/Corporate Governance Committee members are Richard L. Metrick, Michael J. Anderson, Leo Benatar and Robert B. Calhoun. Mr. Metrick serves as Chairman of the Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee recommends to the full Board of Directors all director nominees and committee appointments, reviews the independence of non-management directors and provides corporate governance oversight. The Nominating/Corporate Governance Committee will consider nominees recommended by stockholders in accordance with our Company’s Bylaws, which require timely notice providing, among other things, the name and address of each nominee and the stockholder making the recommendation and the number of shares of common stock owned by each nominee and such stockholder. The Nominating/Corporate Governance Committee held two meetings during the 2003 fiscal year.

3

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Who Are This Year’s Nominees?

The three persons standing for election as Class I directors at the Meeting are Charles A. Sullivan, Leo Benatar and Richard L. Metrick. Each of these nominees presently serves as a Class I director of our Company. If re-elected, these persons would hold office until the 2006 Annual Meeting of Stockholders of our Company. Proxies may not be voted for more than three persons in the election of Class I directors at the Meeting. The following table sets forth certain information with respect to the three nominees, the Class II directors (whose terms expire in 2004) and the Class III directors (whose terms expire in 2005).

Nominees For Election As Class I Directors For A Three-Year

Term Expiring At The 2006 Annual Meeting

Name | Age | Director Since | Principal Occupation or Employment for the Last Five Years and Directorships | |||

Charles A. Sullivan | 68 | 1989 | Chairman of the Board of our Company and Brands for more than the past five years. Chief Executive Officer of our Company and Brands for more than five years prior to October 2002. Mr. Sullivan is a director of UMB Bank, n.a. and The Andersons, Inc. | |||

Leo Benatar(1)(3) | 73 | 1991 | Principal for Benatar & Associates for more than the past five years; Chairman of the Board of Engraph, Inc. (a subsidiary of Sonoco Products Company) and Senior Vice President of Sonoco Products Company from October 1993 until May 1996. Mr. Benatar is a director of Mohawk Industries, Inc., PAXAR Corporation and Aaron Rents, Inc. and was Chairman and Director of the Federal Reserve Bank of Atlanta until January 1996. | |||

Richard L. Metrick(2)(3) | 62 | 2000 | Senior Managing Director in the Investment Banking Department of Bear Stearns & Co., Inc. for more than the past five years. | |||

| Class II Directors Continuing In Office Whose Terms Expire At The 2004 Annual Meeting | ||||||

Name | Age | Director Since | Principal Occupation or Employment for the Last Five Years and Directorships | |||

Michael J. Anderson(1)(3) | 52 | 1998 | President and Chief Executive Officer of The Andersons, Inc. since 1999; President and Chief Operating Officer for more than one year prior thereto. Mr. Anderson is a director of The Andersons, Inc. and Fifth Third BancCorp of Northwest Ohio. | |||

Robert B. Calhoun(2)(3) | 60 | 1991 | Managing Director of Monitor Clipper Partners for more than the past five years. Mr. Calhoun is a director of Avondale Mills, Inc. and The Lord Abbett Family of Funds. | |||

Frank E. Horton(l)(2) | 64 | 1992 | Principal Associate, Horton & Associates, Consultants in Higher Education, Bayfield, Colorado, since 1999; Interim Dean of Biological Sciences, University of Missouri - Kansas City, August 2002 to February 2003; Interim President, Southern Illinois University, February 2000 to October 2000; and President, the University of Toledo for more than one year prior to 1999. | |||

4

Class III Directors Continuing In Office Whose Terms Expire At The 2005 Annual Meeting

Name | Age | Director Since | Principal Occupation or Employment for the Last Five Years and Directorships | |||

G. Kenneth Baum | 73 | 1988 | Chairman of the Board of George K. Baum Group, Inc. for more than the past five years. Mr. Baum is a director of H & R Block, Inc. | |||

James R. Elsesser | 59 | 1995 | Chief Executive Officer of our Company and Brands since October 2002; Financial Consultant from March 2002 through September 2002; and Vice President and Chief Financial Officer of Ralston Purina Company for more than four years prior thereto. | |||

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nominating/Corporate Governance Committee |

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR EACH OF THE THREE NOMINEES TO THE BOARD OF DIRECTORS IDENTIFIED ABOVE.

PROPOSAL NO. 2—APPOINTMENT OF AUDITORS

What Am I Voting On?

Stockholders are asked to ratify the appointment of Deloitte & Touche LLP as independent auditors of our Company for the fiscal year ending May 29, 2004. The Audit Committee of the Board of Directors has appointed Deloitte & Touche LLP to serve as independent auditors. Although our Company’s governing documents do not require the submission of the selection of independent auditors to the stockholders for approval, the Board of Directors considers it desirable that the appointment of Deloitte & Touche LLP be ratified by the stockholders.

What Services Do The Independent Auditors Provide?

Audit services provided by Deloitte & Touche LLP for fiscal 2003 included the examination of the consolidated financial statements of our Company and services related to periodic filings made with the SEC. These services are more fully described in this Proxy Statement under the captions “Audit Committee Report” and “Fees Paid to Independent Auditors.”

Will A Representative Of Deloitte & Touche LLP Be Present At The Meeting?

One or more representatives of Deloitte & Touche LLP plan to attend the Meeting. The representatives will have an opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions from stockholders.

What If This Proposal Is Not Approved?

If the appointment of Deloitte & Touche LLP is not ratified, the Audit Committee will reconsider the appointment.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE RATIFICATION OF DELOITTE & TOUCHE LLP AS OUR COMPANY’S INDEPENDENT AUDITORS.

5

STOCK OWNERSHIP

Holdings of Principal Stockholders

The following table sets forth information regarding the ownership of our Company’s common stock by each person known to our Company to be the beneficial owner of more than 5% of our Company’s common stock.

Name and Address of Beneficial Owners | Amount and Nature of Beneficial Ownership | Percentage Held | ||

Barclays Global Investors, N.A.(1) | 5,411,347 | 12.08% | ||

Merrill Lynch Asset Management, Inc.(2) | 3,776,181 | 8.43% |

| (1) | The information concerning this beneficial owner was obtained from a Schedule 13G report of Barclays Global Investors, N.A. filed with the Securities and Exchange Commission (“SEC”) on May 12, 2003. |

| (2) | The information concerning this beneficial owner was reported to our Company by Merrill Lynch Asset Management, Inc. on August 7, 2003. |

Holdings of Officers and Directors

The number of shares of common stock of our Company beneficially owned as of August 11, 2003, by the directors, the Named Executive Officers (as defined under “Executive Compensation”) and all directors and executive officers as a group, are set forth below:

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage Held | ||||

James R. Elsesser | 257,434 | (1)(2) | * | |||

Michael D. Kafoure | 513,734 | (1) | 1.13 | % | ||

Charles A. Sullivan | 264,169 | * | ||||

Michael J. Anderson | 59,570 | (3) | * | |||

G. Kenneth Baum | 226,312 | (4) | * | |||

Leo Benatar | 104,805 | (3) | * | |||

Robert B. Calhoun | 102,732 | (3) | * | |||

Frank E. Horton | 66,000 | (3) | * | |||

Richard L. Metrick | 50,000 | (3) | * | |||

Frank W. Coffey | 32,000 | (5) | * | |||

Kent B. Magill | 38,634 | (1) | * | |||

Thomas S. Bartoszewski | 55,334 | (1) | * | |||

Robert P. Morgan | 156,668 | (1) | * | |||

All directors and executive officers as a group (18 persons) | 2,478,912 | (1) | 5.20 | % |

| * | Less than 1% |

| (1) | Of the shares indicated, 173,334 (Mr. Elsesser), 506,740 (Mr. Kafoure), 38,334 (Mr. Magill), 151,668 (Mr. Morgan), 55,334 (Mr. Bartoszewski) and 1,904,167 (all directors and executive officers as a group) are attributable to currently exercisable employee stock options or stock options exercisable within 60 days. |

| (2) | Includes 50,000 shares to be vested within 60 days pursuant to a deferred share award granted under the 1996 Plan. |

| (3) | Of the shares indicated, 58,000 (Mr. Anderson), 100,000 (Mr. Benatar), 100,000 (Mr. Calhoun), 60,000 (Dr. Horton) and 40,000 (Mr. Metrick), respectively, are attributable to currently exercisable stock options. |

| (4) | Mr. Baum is a director and Chairman of the Board of George K. Baum Group, Inc. Mr. Baum is also the majority stockholder of George K. Baum Group, Inc. Of the 226,312 shares indicated, 100,000 are attributable to currently exercisable stock options and 77,858 of such shares are held by George K. Baum Group, Inc. Mr. Baum may be deemed to beneficially own all 77,858 shares of the common stock held by George K. Baum Group, Inc. |

| (5) | Mr. Coffey retired as Senior Vice President and Chief Financial Officer on May 10, 2003. Of the shares indicated, 30,000 shares are attributable to currently exercisable stock options. |

6

EXECUTIVE OFFICERS

Set forth below is the name, age and present principal occupation or employment and five-year employment history of each executive officer of our Company and certain officers of Brands. The executive officers of our Company and Brands serve at the pleasure of the respective Boards of Directors. The business address of each person listed below is 12 East Armour Boulevard, Kansas City, Missouri 64111, except for the business addresses of Mr. Bartoszewski, which is 140 Dupree Street, Charlotte, North Carolina 28208, and Mr. Willson, which is 4100 East Broadway, Suite 150, Phoenix, Arizona 85040.

Name | Age | Present Principal Occupation or Employment and Five-Year Employment History | ||

James R. Elsesser | 59 | Chief Executive Officer of our Company and Brands since October 2002; Financial Consultant from March 2002 through September 2002; and Vice President and Chief Financial Officer of Ralston Purina Company for more than four years prior thereto. | ||

Michael D. Kafoure | 54 | President and Chief Operating Officer of our Company and Brands for more than the past five years. | ||

Thomas S. Bartoszewski | 60 | Executive Vice President of the Eastern Division of Brands since August 2002; Senior Vice President of the North Central Region of Brands from May 1999 to July 2002; and Division Controller for the South Central Region of Brands for more than one year prior thereto. | ||

Robert P. Morgan | 47 | Executive Vice President of the Central Division of Brands since April 1999; Executive Vice President of the Eastern Division of Brands from February 2000 to August 2002; and Senior Vice President of the North Central Region of Brands for more than one year prior thereto. | ||

Richard D. Willson | 55 | Executive Vice President of the Western Division of Brands since June 1999 and Senior Vice President of the Northwest Region of Brands for more than one year prior thereto. | ||

Paul E. Yarick | 64 | Senior Vice President-Finance and Treasurer of our Company and Brands since April 2003; and Vice President and Treasurer of our Company and Brands for more than five years prior thereto. | ||

Mark D. Dirkes | 56 | Senior Vice President and Director of Corporate Marketing of Brands for more than the past five years. | ||

Brian E. Stevenson | 48 | Senior Vice President-Program SOAR since April 2003; Senior Vice President and Director of Purchasing of Brands for more than five years prior thereto. | ||

Kent B. Magill | 50 | Vice President, General Counsel and Corporate Secretary of our Company and Brands since June 2002; Associate General Counsel of Brands from November 2000 to June 2002; and Vice President, General Counsel and Corporate Secretary of Layne Christensen Company for more than three years prior thereto. | ||

Laura D. Robb | 45 | Vice President and Corporate Controller of our Company and Brands since July 2002; and Assistant Corporate Controller of Brands for more than four years prior thereto. |

7

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning compensation received for each of the last three fiscal years by (i) the two persons who served as Chief Executive Officer of our Company during our fiscal year ended May 31, 2003, (ii) the four other most highly compensated executive officers of our Company as of May 31, 2003, and (iii) one individual for whom disclosure would have been provided but for the fact that he was not serving as an executive officer of our Company on May 31, 2003 (the individuals in (i), (ii) and (iii) are collectively referred to as the “Named Executive Officers”).

Name and Principal Position | Fiscal Year | Annual Compensation | Long-Term Compensation | All Other Compensation($)(1)(2) | ||||||

| Salary($) | Bonus($) | Shares Underlying | ||||||||

James R. Elsesser(3) | 2003 2002 2001 | 468,461 — — | 245,000 — — | 340,000 — 10,000 | 6,623 — — | |||||

Charles A. Sullivan(4) | 2003 2002 2001 | 264,615 800,000 800,000 | — 1,120,000 — | — — 35,000 | 9,571,953 23,264 16,372 | |||||

Michael D. Kafoure | 2003 2002 2001 | 461,415 443,385 426,308 | — 506,000 — | 100,000 — 25,000 | 21,926 18,274 13,600 | |||||

Kent B. Magill(5) | 2003 2002 2001 | 215,662 175,672 88,269 | 30,000 145,704 5,000 | 85,000 — 30,000 | 23,215 19,795 5,223 | |||||

Robert P. Morgan | 2003 2002 2001 | 204,538 197,538 190,539 | 20,000 213,337 40,000 | 70,000 — 20,000 | 22,634 19,484 13,960 | |||||

Thomas S. Bartoszewski | 2003 2002 2001 | 179,878 147,366 142,382 | 40,000 123,831 — | 70,000 — 15,000 | 22,839 16,424 13,600 | |||||

Frank W. Coffey(6) | 2003 2002 2001 | 254,807 258,077 250,576 | — 195,926 — | 30,000 — 25,000 | 23,630 19,786 15,148 | |||||

| (1) | All other compensation for the fiscal year ended May 31, 2003, includes our Company’s contributions in the amounts of $6,171, $15,755, $21,926, $22,988, $22,462, $21,291 and $22,082, which accrued during such fiscal year for the accounts of Messrs. Elsesser, Sullivan, Kafoure, Magill, Morgan, Bartoszewski and Coffey, respectively, under our Company’s Retirement Income Plan and the imputed income for term life insurance provided by our Company for the benefit of Messrs. Elsesser, Sullivan, Magill, Morgan, Bartoszewski and Coffey in the amounts of $452, $8,572, $227, $172, $1,548 and $1,548, respectively. |

| (2) | In addition to the amounts listed in footnote (1) above, all other compensation for Mr. Sullivan includes the following amounts: (i) 213,163 shares issued upon Mr. Sullivan’s retirement pursuant to the deferred share award granted on September 23, 1997; (ii) 133,000 shares granted pursuant to a Share Award Agreement dated October 1, 2002; (iii) $533,336 for consulting fees, as described under “General—Certain Relationships and Related Transactions” and (iv) $205,717 paid pursuant to the IBC Supplemental Executive Retirement Plan (“SERP”). The market value of the shares described in (i) and (ii) above is calculated by reference to the closing price of the shares on the dates of issuance, or $25.60 on October 21, 2002 and $25.20 on October 16, 2002, respectively. |

| (3) | Mr. Elsesser became Chief Executive Officer on October 1, 2002. The employment agreement between our Company and Mr. Elsesser is described below under “ James R. Elsesser Employment Agreement.” |

| (4) | Mr. Sullivan retired from his position as Chief Executive Officer on September 30, 2002. |

| (5) | Mr. Magill joined our Company in November 2000. |

| (6) | Mr. Coffey retired as Senior Vice President and Chief Financial Officer effective May 10, 2003. |

8

Stock Options

The following two tables set forth information for the last completed fiscal year relating to (i) the grant of stock options to the Named Executive Officers and (ii) the exercise and appreciation of stock options held by the Named Executive Officers.

Option Grants in the Fiscal Year Ended May 31, 2003

Name | Number of Shares Options Granted (1) | Percent of Total Options Granted to Employees in FY | Exercise of Base Price ($/Sh) | Expiration Date | Potential Realizable Value of Stock Price Appreciation (2) | ||||||||||

| 5% | 10% | ||||||||||||||

James R. Elsesser | 10,000 250,000 80,000 | 0.29 7.14 2.29 | $

| 27.72 27.00 10.00 | 7/09/12 10/1/12 5/06/13 | $

| 174,330 3,837,815 503,116 | $

| 441,785 10,109,326 1,274,994 | ||||||

Charles A. Sullivan | — | — | — | — | — | — | |||||||||

Michael D. Kafoure | 50,000 50,000 | 1.43 1.43 |

| 27.72 10.00 | 7/09/12 5/06/13 |

| 871,648 314,447 |

| 2,208,927 796,871 | ||||||

Kent B. Magill | 30,000 25,000 30,000 | 0.86 0.71 0.86 |

| 27.72 26.75 10.00 | 7/09/12 6/03/12 5/06/13 |

| 522,989 420,573 188,668 |

| 1,325,356 1,065,815 478,123 | ||||||

Robert P. Morgan | 40,000 30,000 | 1.14 0.86 |

| 27.72 10.00 | 7/09/12 5/06/13 |

| 697,318 188,668 |

| 1,767,142 478,123 | ||||||

Thomas S. Bartoszewski | 20,000 20,000 30,000 | 0.57 0.57 0.86 |

| 27.72 25.28 10.00 | 7/09/12 8/05/12 5/06/13 |

| 348,659 317,969 188,668 |

| 883,571 805,796 478,123 | ||||||

Frank W. Coffey | 30,000 | 0.86 | 27.72 | 5/10/06 | 171,140 | 367,018 | |||||||||

| (l) | All stock options were granted at an exercise price equal to the fair market value of the underlying common stock on the date of grant. Options for 10,000 shares granted to Mr. Elsesser as a director, before becoming Chief Executive Officer of our Company, are exercisable immediately. All other stock options become exercisable over a three-year period, with one-third becoming exercisable on each of the first, second and third anniversaries of the date of grant. |

| (2) | Potential realizable value is based on the assumption that the price of our Company’s common stock appreciates at the annual rate shown (compounded annually) from the date of option grant until the end of the ten-year option term. There can be no assurance that the potential realizable values shown in the table will be achieved. |

Aggregated Option Exercises in Fiscal 2003 and

Option Values at May 31, 2003

Name | Shares Acquired On Exercise | Value Realized | Number of Shares Underlying Unexercised Options at Fiscal Year-End | Value of Unexercised In-the-Money Options at Fiscal Year-End(1) | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

James R. Elsesser | — | — | 90,000 | 330,000 | — | $ | 238,400 | ||||||||

Charles A. Sullivan | 35,667 | $ | 196,464 | — | — | — | — | ||||||||

Michael D. Kafoure | — | — | 490,073 | 108,333 | $ | 225,008 | 149,000 | ||||||||

Kent B. Magill | — | — | 20,000 | 95,000 | — | 89,400 | |||||||||

Robert P. Morgan | — | — | 138,334 | 76,666 | — | 89,400 | |||||||||

Thomas S. Bartoszewski | — | — | 42,000 | 75,000 | — | 89,400 | |||||||||

Frank W. Coffey | 50,000 | 427,614 | 76,667 | — | — | — | |||||||||

| (l) | The value of unexercised, in-the-money options is the difference between the exercise price of the options and the $12.98 closing price of our Company’s common stock on May 31, 2003. |

9

IBC Supplemental Executive Retirement Plan

In June 2002, our Company adopted the SERP, an unfunded, non-tax-qualified supplemental retirement plan. Under the SERP, our Company will pay certain key executives and managers who retire after age 60 (the normal retirement age), including the Named Executive Officers, an annual retirement benefit equal to 1.8% of the participant’s average annual base salary received during the 60 months immediately preceding retirement, for each year of service to our Company, up to 20 years (the “Benefit”). For purposes of this formula, “base salary” means the salary amount set forth in the Salary column of the Summary Compensation Table. As a result, the maximum Benefit is 36% of the participant’s average annual base salary for the preceding 60 months. Upon termination of the participant’s service for any reason other than disability or death after the participant reaches 60 years of age, one-twelfth of the Benefit will be paid each month, if the participant is not married at retirement, until the date of the participant’s death. If the participant is married at retirement, one-twelfth of the Benefit will be paid each month for the participant’s lifetime, unless the participant dies before receiving 300 monthly payments in which event payments will continue to be made to his or her spouse until the earlier of the spouse’s death or the payment of a total of 300 monthly payments to both the participant and the spouse. The SERP includes certain provisions, exercisable at the participant’s election, for the payment of a reduced joint and survivor monthly benefit payable for the surviving spouse’s lifetime if the participant is married on the date of his or her retirement.

A participant is entitled to a disability benefit, determined and paid in the same manner as the Benefit, if termination of employment results from total and permanent disability prior to age 60 and if the participant has 20 or more years of service with our Company as of the date of disability. Payment begins the month following the month during which the participant reaches 60 years of age and is payable for the participant’s lifetime, unless the participant is married on the date of disability and dies before receiving 300 monthly payments, in which event payments will continue to be made to his or her spouse until the earlier of the spouse’s death or the payment of a total of 300 monthly payments to both the participant and the spouse. Alternatively, if the participant is married on the date of disability, he or she can elect the reduced joint and survivor annuity described above.

A participant’s surviving spouse, if any, will be entitled to receive a death benefit, determined and paid in the same manner as the Benefit, upon the participant’s death if the participant dies after reaching 60 years of age but before retirement, or if the participant dies after 20 or more years of service with our Company, regardless of age. This death benefit begins the month following the month during which the participant would have reached 60 years of age or the month following his death, whichever is later, and is payable for the lesser of 300 months or until the death of the spouse.

The following table sets forth the annual estimated Benefits payable upon retirement to participants in the SERP in the specified compensation and years of service classifications. The Benefits, including those payable upon death or disability, are not reduced for Social Security or any other offset amounts.

Pension Plan Table

Annual Average Earnings Over the Last 60 Months of Employment | Years of Service | |||||||||||

| 5 | 10 | 15 | 20 | |||||||||

$100,000 | $ | 9,000 | $ | 18,000 | $ | 27,000 | $ | 36,000 | ||||

200,000 | 18,000 | 36,000 | 54,000 | 72,000 | ||||||||

300,000 | 27,000 | 54,000 | 81,000 | 108,000 | ||||||||

400,000 | 36,000 | 72,000 | 108,000 | 144,000 | ||||||||

500,000 | 45,000 | 90,000 | 135,000 | 180,000 | ||||||||

600,000 | 54,000 | 108,000 | 162,000 | 216,000 | ||||||||

700,000 | 63,000 | 126,000 | 189,000 | 252,000 | ||||||||

800,000 | 72,000 | 144,000 | 216,000 | 288,000 | ||||||||

As of May 31, 2003, Messrs. Elsesser, Sullivan, Kafoure, Magill, Morgan, Bartoszewski and Coffey had accredited service to our Company of approximately 1, 20, 8, 3, 27, 42 and 12 years, respectively. Based on each person’s salary for fiscal 2003, each of Messrs. Elsesser, Kafoure, Magill, Morgan and Bartoszewski would receive an annual retirement benefit in the amount of $25,200, $116,277, $38,608, $73,779 and $64,756, respectively, under this plan if such person were to retire after reaching 60 years of age. Messrs. Sullivan and Coffey currently receive an annual retirement benefit in the amount of $274,289 and $47,839, respectively, under this plan.

10

Equity Compensation Plan Information

Our Company has only one equity compensation plan for eligible employees under which options, rights or warrants may be granted, the 1996 Stock Incentive Plan. See Note 7 to our consolidated financial statements, contained in the Annual Report on Form 10-K, which accompanies this Proxy Statement, for further information on the material terms of this plan. The following is a summary of the shares reserved for issuance pursuant to outstanding options, rights or warrants granted under our 1996 Plan as of May 31, 2003:

Equity Compensation Plan Information as of May 31, 2003

Plan Category | Number of Securities to Be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted-average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column(a)) | ||||

| (a) | (b) | (c) | |||||

Equity compensation plans approved by security holders | 9,583,831 | $ | 21.96 | 3,204,235 | |||

Equity compensation plans not approved by security holders | N/A | N/A | N/A | ||||

Total | 9,583,831 | $ | 21.96 | 3,204,235 | |||

James R. Elsesser Employment Agreement

Our Company has entered into an employment agreement with James R. Elsesser. The agreement expires on October 1, 2005, subject to automatic renewal for successive one-year periods unless our Company or Mr. Elsesser gives timely notice that the term will not be extended. The agreement provides for the employment of Mr. Elsesser as Chief Executive Officer of our Company at an annualized base salary during the term of the agreement of at least $700,000, subject to annual review. In addition to base salary, the agreement provides for an annual bonus under our Incentive Compensation Plan (“IC Plan”) at the level available to the Chairman of the Board and Chief Executive Officer immediately prior to October 1, 2002. However, for fiscal 2003, Mr. Elsesser was guaranteed a minimum bonus equal to one-half of the target level bonus payable under the IC Plan. The agreement also provides for the grant to Mr. Elsesser of a deferred share award during fiscal 2003, pursuant to which he has the right to receive 150,000 shares of our Company’s common stock vesting over three years at the rate of 50,000 shares per year. In addition, the agreement provides for Mr. Elsesser to receive a non-qualified option grant of 250,000 shares of common stock, vesting over three years, with an exercise price equal to the closing sales price of the common stock on the date of the grant. The agreement terminates in the event of death or permanent disability. In either such case, or in the event that employment is terminated by our Company without Mr. Elsesser’s consent, Mr. Elsesser will continue to receive his regular salary payments, continued health, medical, disability and insurance coverage and continued accrual of retirement and supplemental retirement benefits during the longer of (i) the balance of the agreement term, or (ii) one year following the termination date. The agreement provides that Mr. Elsesser will be a member of our Board of Directors, and will be nominated for re-election, during the term of his employment, and requires Mr. Elsesser to maintain the confidentiality of our Company’s confidential information prior to public disclosure by our Company.

Other Employment Agreements

Our Company has entered into employment agreements with Michael D. Kafoure, Thomas S. Bartoszewski and Robert P. Morgan. The agreements expire on January 1, 2005, subject to automatic renewal for successive one-year periods unless our Company or the employee gives timely notice that the term will not be extended. The agreements provide for annualized base salaries during the term of the agreements of at least the following amounts: $460,000 for Mr. Kafoure; $185,000 for Mr. Bartoszewski; and $204,000 for Mr. Morgan; in each case, subject to annual review. In addition to base salary, the agreements provide for an annual bonus under the IC Plan at the specified level under the IC Plan for the employee’s job title. Each agreement terminates in the event of death or permanent disability. In either such case, or in the event that employment is terminated by our Company without the employee’s consent (other than for a felony conviction, guilty plea or plea of nolo contendere to a felony), the employee will continue to receive his regular salary payments, continued health, medical, disability and insurance coverage and continued accrual of retirement and supplemental retirement benefits during the balance of the agreement term. The employees will not be entitled to receive any benefits under the

11

employment agreements to the extent that payments are made under a management continuity agreement following a change in control. The agreements prevent the employees from competing with our Company or soliciting customers for a competitive business during the term of the agreement and during the balance of the agreement term following termination and require the employees to maintain the confidentiality of our Company’s confidential information prior to public disclosure by our Company.

Management Continuity Agreements

Our Company has entered into management continuity agreements with Messrs. Elsesser, Kafoure, Magill, Bartoszewski and Morgan. These agreements provide that if, within two years after a change in control (as defined below), our Company or any purchaser of our Company’s business terminates the executive’s employment other than by reason of (i) a transfer of employment to a related entity or such purchaser under substantially the same employment terms, (ii) the executive’s death, or (iii) the executive’s voluntary termination if the executive has continued to enjoy substantially the same employment terms, the executive will be entitled to receive:

| • | an amount equal to two years of the executive’s salary (based on the executive’s monthly base salary immediately prior to the change in control or the employment termination date, whichever is greater) and bonus (equal to the target bonus under the IC Plan or the most recent annual bonus received by the executive, whichever is greater); |

| • | continued life, health, accident and disability benefits for two years following the employment termination date; |

| • | immediate and full vesting under our SERP and at least two additional years of credited service under the SERP (except that the adjustment cannot result in the years of credited service exceeding 20 years); and |

| • | up to $15,000 of outplacement counseling services. |

Our Company will reimburse the executive for any excise taxes imposed by Section 4999 of the Internal Revenue Code of 1986, and will make a gross-up payment to reimburse the executive for any income or other tax attributable to the gross-up payment and to the tax reimbursement payments themselves.

A “change in control” generally is defined to take place when (a) there is a change in the membership of the Board of Directors in which the present directors (and persons nominated or appointed by the directors) cease to constitute at least a majority of the Board, (b) a person or group (other than our Company and various affiliated persons or entities) becomes the beneficial owner, directly or indirectly, of 50% or more of the total voting power of our Company’s outstanding securities, (c) a sale of all or substantially all of our assets, (d) a merger, share exchange, reorganization or consolidation involving our Company in which at least 50% of the total voting power of the voting securities of the surviving corporation is held by persons who were not previously stockholders of our Company, or (e) a finding by a majority of the present directors (and persons nominated or appointed by the directors) that a sale, disposition, merger or other transaction or event that they determine constitutes a change in control has occurred.

COMPENSATION COMMITTEE REPORT

The Compensation Committee, which consists of three non-employee directors, recommends to the full Board of Directors the compensation of the Chief Executive Officer. The Compensation Committee also approves and monitors compensation guidelines for our Company’s other executive officers, as recommended by the Chief Executive Officer. The Compensation Committee’s report for fiscal 2003 is set forth below.

Components Of Executive Compensation

Three critical elements comprise our compensation programs for executive officers:

| • | Base Salaries: The Compensation Committee recognizes that it must maintain base salary levels approximately commensurate with other comparable companies in the food industry with whom our Company competes for management personnel including, but not limited to, those included in the S&P Packaged Foods & Meat Index (the “Comparable Companies”). However, the Compensation Committee believes that the compensation program for its executive officers and key management personnel should be primarily based upon performance. Therefore, base salaries for executive officers and other key management personnel are maintained at a level slightly below the mid-range level of such base salaries at the Comparable Companies. When appropriate, the Compensation Committee utilizes external |

12

salary surveys to establish base salaries in reference to the Comparable Companies and other major corporations. In addition to these external salary surveys, the individual executive’s level of responsibility, prior experience, breadth of knowledge and overall skills are factors considered by the Chief Executive Officer when making recommendations to the Compensation Committee relating to the base salaries for each individual executive officer or key manager. Base salaries are adjusted annually to reflect individual performance, the operating performance of our Company for the preceding fiscal year and increases among the Comparable Companies. Operating performance of our Company includes such measures as sales volumes, market share performance, operating and net income margin trends, growth in earnings and cash flow per share, returns on capital and equity and increases in the value of the common stock. Additional adjustments to reflect changes in the market or in individual responsibilities may be appropriate from time to time. |

| • | Annual Incentive Bonus: All executive officers and key management personnel of our Company are eligible to receive cash incentive bonuses under our Company’s Incentive Compensation Plan (“IC Plan”). Incentive bonus awards are based upon our Company achieving certain operating cash flow or earnings per share objectives. The Chief Executive Officer submits proposed minimum, target and maximum operating cash flow and earnings per share objectives to the Board of Directors for approval. Annual incentive bonus payments are calculated based on a formula that compares our Company’s actual operating cash flow and earnings per share levels achieved to the objectives approved by the Board of Directors. Payments range from zero to 200% of target bonus amounts for the Chief Executive Officer and the divisional and corporate officers and zero to 150% for bakery management. |

| • | Stock Options: Awards granted pursuant to our Company’s 1996 Stock Incentive Plan (“1996 Plan”) comprise the third element of the compensation program for executive officers and key management personnel. The Compensation Committee believes our Company’s executive officers and key management personnel should have a stake in our Company’s ongoing success through stock and other equity-based ownership. |

The value of the stock options is related directly to the market price of the common stock and thus to the long-term performance of our Company. The exercise price of stock options granted to employees under the 1996 Plan is the fair market value of the common stock on the date of grant. The Compensation Committee has complete discretion to select the optionees and to establish the terms and conditions of each option, subject in all cases to the provisions of the 1996 Plan. The 1996 Plan is designed to reward the executives for long-term results. The executives’ potential to receive value from stock options, which vest over a period of time, will occur only if our Company’s stock price increases above the exercise price. The number of stock options granted to any individual executive is generally based upon that executive’s level of responsibility.

Executive Compensation Philosophy

The Compensation Committee believes that it is in the best interest of the stockholders of our Company to attract, maintain and motivate dedicated and talented management personnel, especially the executive officers, by offering a competitive compensation package that maintains an appropriate relationship between executive pay and the creation of stockholder value. The general philosophy of the Compensation Committee is to integrate (i) reasonable levels of annual base salary, (ii) annual incentive bonus awards based upon achievement of short-term corporate goals and individual performance such that executive compensation levels will be higher in years in which performance goals are achieved or exceeded and (iii) equity-based grants, to ensure that management has a continuing stake in the long-term success of our Company in return of value to the stockholders.

Compensation Of The Chief Executive Officer

As with all executive officers of our Company, the compensation of the Chief Executive Officer is reviewed by the Compensation Committee on a regular basis in comparison to compensation paid to executives holding comparable positions of responsibility, including those employed at Comparable Companies and other major corporations. When recommending compensation for the Chief Executive Officer, the Compensation Committee utilizes the same factors applied to the other executives of our Company. Although the Compensation Committee specifically discusses the Chief Executive Officer’s contributions toward achieving the overall Company performance results, there are no unique criteria applied to the compensation of the Chief Executive Officer that are not also applied to other key executives and managers of our Company.

The Compensation Committee, taking into account the report of a national executive compensation consulting firm retained during fiscal 2002, approved an employment agreement with Mr. Elsesser as Chief Executive Officer of our Company and Brands, and the employment agreement was entered into on September 4, 2002 (the “Employment Agreement”). Mr. Elsesser’s base compensation for fiscal 2003 was set at $700,000, which is the minimum base salary

13

established under the Employment Agreement. The Board of Directors has discretion to set Mr. Elsesser’s base salary at an amount greater than the minimum, but, recognizing that he has not yet served for a full year under the terms of the Employment Agreement, the Compensation Committee determined not to increase his base salary during fiscal 2003. In addition, the Employment Agreement provides that Mr. Elsesser is entitled to receive an annual bonus under the terms of the IC Plan at the level available to the Chairman of the Board and Chief Executive Officer of our Company immediately prior to October 1, 2002. However, pursuant to the terms of his Employment Agreement, Mr. Elsesser was guaranteed a minimum bonus equal to one-half of the target level bonus payable under the IC Plan for fiscal 2003 (or $245,000). It is anticipated that in future years, Mr. Elsesser’s incentive compensation will be determined in accordance with the IC Plan which provides that executive compensation levels will be higher in years in which performance goals are achieved or exceeded. Incentive compensation for the Chief Executive Officer is based on earnings per share objectives defined with minimum, target and maximum levels. Under the Employment Agreement, Mr. Elsesser also was granted a deferred share award during fiscal 2003, pursuant to which he has the right to receive 150,000 shares of our Company’s common stock vesting over three years at the rate of 50,000 shares per year. In addition, Mr. Elsesser received non-qualified option grants of 250,000 shares and 80,000 shares of common stock, vesting over three years, with an exercise price equal to the closing sales price of the common stock on the date of each grant. Finally, Mr. Elsesser is eligible to participate in the SERP.

Limitations On The Deductibility Of Compensation

Section 162(m) of the Internal Revenue Code of 1986 (the “IRC”) imposes a $1 million cap on the deductibility of compensation (other than certain performance-based compensation) to certain executive officers of public companies. The Compensation Committee evaluates the impact of the cap on its compensation policies so as to conform such policies of our Company, to the extent practicable, to the IRC. However, in any such evaluation, other considerations, such as the retention of key personnel, may be determined to be of more importance than tax savings.

COMPENSATION COMMITTEE |

Robert B. Calhoun,Chairman |

Frank E. Horton |

Richard L. Metrick |

14

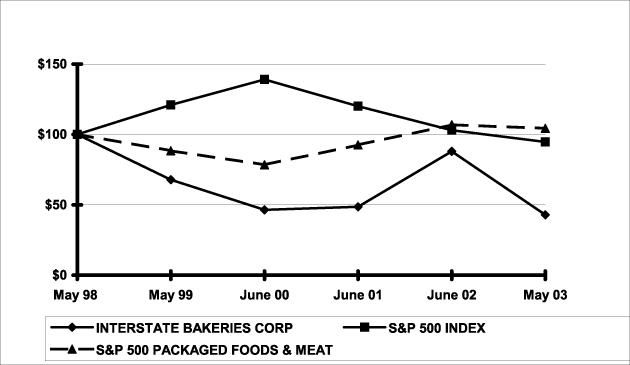

STOCK PERFORMANCE GRAPH

The graph set forth below compares the yearly percentage change in cumulative stockholder return of our Company’s common stock since May 30, 1998 against the cumulative return of the Standard and Poor’s Composite 500 Stock Index (“S&P 500 Index”) and the Standard and Poor’s Packaged Foods & Meat Index (“S&P Food Index”) covering the same time period. The graph is based on $100 invested on May 30, 1998, in our Company’s common stock, the S&P 500 Index and the S&P Food Index, each assuming dividend reinvestment. The historical stock price performance shown on this graph is not necessarily indicative of future performance.

PERFORMANCE GRAPH

TOTAL STOCKHOLDER RETURNS

| 5/30/98 | 5/29/99 | 6/03/00 | 6/02/01 | 6/01/02 | 5/31/03 | |||||||

Interstate Bakeries Corporation | 100.00 | 67.80 | 46.48 | 48.61 | 87.96 | 42.87 | ||||||

S&P 500 Index | 100.00 | 121.03 | 139.03 | 120.06 | 103.05 | 94.74 | ||||||

S&P Food Index | 100.00 | 88.38 | 78.36 | 92.58 | 106.86 | 104.33 |

AUDIT COMMITTEE REPORT

Composition Of The Audit Committee

The current members of the Audit Committee are Michael J. Anderson, Leo Benatar and Frank E. Horton. The Board of Directors has determined that each member of the Audit Committee is independent under the rules of the New York Stock Exchange.

Audit Committee Charter

The Board of Directors adopted a written charter for its Audit Committee as of May 8, 2000, which most recently was amended on July 9, 2003. A copy of the Audit Committee Charter, as presently in effect, is attached to this Proxy Statement as Appendix A.

15

Function Of The Audit Committee

In accordance with its written charter adopted by the Board of Directors, the Audit Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of our Company. During the fiscal year ended May 31, 2003, the Committee met four times, and the Committee chair, as a representative of the Committee, discussed the financial information contained in each quarterly earnings announcement and related SEC filing with the Principal Financial Officer, General Counsel, Treasurer, Corporate Controller and independent auditors prior to public release of each announcement.

The Independent Auditors

Deloitte & Touche LLP served as independent auditors for the purpose of auditing our Company’s consolidated financial statements for the fiscal year ended May 31, 2003 and, upon stockholder approval, will continue to serve as our Company’s independent auditors for the fiscal year ending May 29, 2004.

The Audit Committee’s Review Of Our Company’s Audited Financial Statements

The Audit Committee discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees,” and discussed and reviewed the results of the independent auditors’ examination of the financial statements. The Committee also discussed the results of the internal audit examinations. The Committee reviewed with management the audited financial statements of our Company as of and for the fiscal year ended May 31, 2003. Management has the responsibility for the preparation of our Company’s financial statements, and the independent auditors have the responsibility for the examination of those statements.

The Independence Of Our Company’s Auditors

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and our Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussion with Audit Committees,” discussed with the auditors any relationships that may affect their objectivity and independence and satisfied itself as to the auditors’ independence. The Committee also discussed with management, the internal auditors and the independent auditors the quality and adequacy of our Company’s internal controls and the internal audit function’s organization, responsibilities, budget and staffing. The Committee reviewed with both the independent and the internal auditors their audit plans, audit scope and identification of audit risks.

Recommendation Of The Audit Committee

Based on the above-mentioned review and discussions with management and the independent auditors, the Committee recommended to the Board that our Company’s audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended May 31, 2003, for filing with the SEC. The Committee also made the reappointment, subject to stockholder approval, of the independent auditors.

The Audit Committee’s Review Of Fees Paid To The Independent Accountants

The Audit Committee has reviewed and discussed the fees paid to Deloitte & Touche LLP during fiscal 2003 for audit, audit-related, tax and other services, which are set forth in this Proxy Statement under “Fees Paid to Independent Auditors.” The Audit Committee has determined that the provision of the non-audit services is compatible with Deloitte & Touche LLP’s independence.

AUDIT COMMITTEE |

Michael J. Anderson,Chairman |

Leo Benatar |

Frank E. Horton |

16

FEES PAID TO INDEPENDENT AUDITORS

What Fees Are Paid To Our Company’s Independent Auditors?

For the years ended May 31, 2003 and June 1, 2002, professional services were performed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte & Touche”). Audit and audit-related fees aggregated $494,536 and $535,485 for the years ended May 31, 2003 and June 1, 2002, respectively and were comprised of the following:

| • | Audit Fees. The aggregate fees billed for the audit of our Company’s annual financial statements for the fiscal years ended May 31, 2003 and June 1, 2002 and for the reviews of the financial statements included in our Company’s Quarterly Reports on Form 10-Q were $450,936 and $491,885, respectively. The fees for fiscal year ended May 31, 2003 include $54,586 for work on the review of documents filed with the SEC and consultation on financial accounting and reporting standards arising during the course of the audit or reviews. The fees for fiscal year ended June 1, 2002 include $113,260 for required procedures related to an SEC filing on Form S-3 and related consents and comfort letters and consultation on financial accounting and reporting standards arising during the course of the audit or reviews. |

| • | Audit-Related Fees. The aggregate fees billed for audit-related services for the fiscal years ended May 31, 2003 and June 1, 2002 were $43,600 and $43,600, respectively. These fees relate to audits of various benefit plans for the fiscal years ended May 31, 2003 and June 1, 2002. |

| • | Tax Fees. The aggregate fees billed for tax services for the fiscal years ended May 31, 2003 and June 1, 2002 were $2,900 and $794,871, respectively. These fees relate to a tax consulting project for the fiscal year ended May 31, 2003 and to tax planning, preparation of tax returns and tax research for the fiscal year ended June 1, 2002. |

| • | All Other Fees. The aggregate fees for services not included above were $0 for the fiscal years ended May 31, 2003 and June 1, 2002. |

Has The Audit Committee Established A Pre-Approval Policy Of Audit And Permissible Non-Audit Services?

Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the independent auditor. In recognition of this responsibility, the Audit Committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent auditor. The Audit Committee has approved all permissible non-audit services consistent with SEC requirements.

Prior to engagement of the independent auditor for the next year’s audit, management will submit to the Audit Committee for approval an aggregate of services expected to be rendered during that year for each of four categories of services.

| • | Audit services include audit work performed in the preparation of financial statements, as well as work that generally only the independent auditor can reasonably be expected to provide, including comfort letters, statutory audits and attest services and consultation regarding financial accounting and/or reporting standards. |

| • | Audit-Related services are for assurance and related services that are traditionally performed by the independent auditor, including due diligence related to mergers and acquisitions, employee benefit plan audits and special procedures required to meet certain regulatory requirements. |

| • | Tax services include all services performed by the independent auditor’s tax personnel, except those services specifically related to the audit of the financial statements, and include fees in the areas of tax compliance, tax planning and tax advice. |

| • | Other Fees are those associated with services not captured in the other categories. |

Prior to engagement, the Audit Committee pre-approves these services by category of service. The fees are budgeted and the Audit Committee requires the independent auditor and management to report actual fees versus the budget periodically throughout the year by category of service. During the year, circumstances may arise when it may become

17

necessary to engage the independent auditor for additional services not contemplated in the original pre-approval. In those instances, the Audit Committee requires specific pre-approval before engaging the independent auditor.

The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting.

The percentage of audit-related fees, tax fees and all other fees that were approved by the audit committee pursuant to 17 CFR 210.2-01(c)(7)(i)(C) for fiscal 2003 is 9.3% of the total fees incurred.

GENERAL

Certain Relationships and Related Transactions.

Our Company, through its operating subsidiaries, purchases flour at market prices from Cereal Food Processors, Inc., a long-standing supplier, in the regular course of our Company’s business under a contract terminating in 2005. G. Kenneth Baum, a current director, beneficially owns more than a 10% equity interest in Cereal Food Processors. During fiscal 2003, our Company’s flour purchases from Cereal Food Processors totaled approximately $78 million.

On October 2, 2002, our Company and Brands entered into a consulting agreement with Charles A. Sullivan that expires on May 28, 2005. The agreement replaced Mr. Sullivan’s employment agreement with our Company, which was scheduled to expire on May 31, 2003. The new agreement provides for Mr. Sullivan to assist our Company in connection with issues unique to the baking industry and our Company’s operations, and the development and assessment of a strategic plan for our Company. For his services under the agreement, Mr. Sullivan is entitled to receive (i) fees equal to $533,333, the remaining eight months of salary under his employment agreement, paid in monthly installments through May 31, 2003, (ii) for June 1, 2003 through May 28, 2005, fees equal to $800,000, payable in 24 equal monthly installments, (iii) 133,000 shares of our Company’s common stock issued pursuant to a share award agreement, (iv) medical insurance coverage equivalent to that provided to participating employees and (v) reasonable office accommodations and secretarial support. The agreement requires Mr. Sullivan to maintain the confidentiality of our Company’s confidential information prior to public disclosure by our Company. In addition, he is prohibited from competing with our Company during the term of the agreement and for one year thereafter. In addition, the agreement amended the Deferred Share Award Notice dated as of September 23, 1997 to provide for the issuance of the 213,163 shares of common stock granted under the deferred share award within a reasonable period of time following Mr. Sullivan’s retirement instead of on June 1, 2003.

Section 16(a) Beneficial Ownership Reporting Compliance.

Section 16(a) of the Securities Exchange Act of 1934 requires executive officers and directors of our Company, and persons who beneficially own more than 10% of the common stock (“reporting persons”), to file initial reports of ownership and reports of changes in ownership with the SEC. Executive officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish our Company with copies of all Section 16(a) forms they file.

Based solely upon a review of copies of such forms and amendments thereto furnished to our Company and written representations from the executive officers and directors, to our Company’s knowledge, all forms required to be filed by reporting persons of our Company were timely filed pursuant to Section 16(a) of the Exchange Act, except that Michael J. Anderson inadvertently was late in filing a Form 4 report with respect to one transaction.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee were Messrs. Bewkes, Baum and Horton during fiscal 2003 and currently are Messrs. Calhoun, Horton and Metrick. No member of the Compensation Committee was an officer, employee or a former officer or employee of our Company or any of its subsidiaries during the last fiscal year nor was formerly an officer of our Company during the last fiscal year. Mr. Baum beneficially owns more than 10% equity interest in one of our Company’s suppliers. See “Certain Relationships and Related Transactions.”

18

Availability of Form 10-K Annual Report to Stockholders

Copies of our Company’s 2003 Annual Report to Stockholders, which includes the Annual Report on Form 10-K for the year ended May 31, 2003, are being mailed to stockholders together with this Proxy Statement. Additional copies of the Annual Report may be obtained by making a written request to our Company at 12 East Armour Boulevard, Kansas City, Missouri 64111, Attention: Corporate Secretary.

Submission of Stockholders’ Proposals

To be considered for inclusion in next year’s Proxy Statement, stockholder proposals must be submitted in writing by April 28, 2004. Any stockholder proposal to be considered at next year’s meeting, but not included in the Proxy Statement, must be submitted in writing by July 10, 2004, or the persons appointed as proxies may exercise their discretionary voting power with respect to the proposal. Recommendations for nominees to stand for election at the 2004 Annual Meeting of Stockholders must be received no earlier than June 25, 2004 and no later than July 25, 2004. All written proposals or nominations should be submitted to Interstate Bakeries Corporation, 12 East Armour Boulevard, Kansas City, Missouri 64111, Attention: Corporate Secretary.

Other Proposed Actions

Management does not intend to bring any other matters before the Meeting and is not aware of any matters to come before the Meeting other than those referred to in the Proxy Statement. However, if any other matters should properly come before the Meeting, the proxies received will be voted on those matters in accordance with the discretion of the person voting such proxies.

Solicitation by Board; Expenses of Solicitation

Our Board of Directors has sent you this Proxy Statement. Our Company will bear the entire cost of solicitation of proxies in the enclosed form, including preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any additional information furnished to stockholders. Original solicitation of proxies by mail may be supplemented by telephone, telegram, facsimile or personal solicitation by directors, officers or other regular employees of our Company, and our Company may reimburse brokers or other persons holding stock in their names or in the names of nominees for their expenses in sending proxy soliciting materials to beneficial owners. No additional compensation will be paid to directors, officers or other regular employees of our Company for such services.

By Order of the Board of Directors |

|

KENT B. MAGILL |

| Corporate Secretary |

PLEASE COMPLETE AND RETURN YOUR PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE.

19

Appendix A

AMENDED AND RESTATED AUDIT COMMITTEE CHARTER

Adopted September 24, 2002

Revised July 9, 2003

I. Purpose.

The primary purposes of the Audit Committee of the Board of Directors (the “Board”) of Interstate Bakeries Corporation (the “Corporation”) are to (A) assist the Board in fulfilling its oversight of (1) the integrity of the Corporation’s financial statements, (2) the Corporation’s compliance with legal and regulatory requirements, (3) the independent auditor qualifications and independence, (4) the performance of the Corporation’s internal auditor function and independent auditors and (5) the system of internal controls and disclosure controls and procedures established by management and (B) prepare the report required by Securities and Exchange Commission (“SEC”) proxy rules to be included in the Corporation’s annual proxy statement. The Audit Committee is expected to maintain and encourage free and open communication with the independent auditors, the internal auditors, management of the Corporation and the Board and should foster adherence to the Corporation’s policies, procedures and practices at all levels.

II. Composition of the Audit Committee.

A.Independence. The Audit Committee shall be comprised of three or more independent directors appointed by the Board. All members of the Audit Committee shall satisfy the independence standards required by the SEC, the New York Stock Exchange listed company rules and any other legal requirements as shall from time to time be in effect. There shall be an annual review of the independence of each member of the Audit Committee.

B.Qualifications. All members of the Audit Committee shall have a working knowledge of basic finance, accounting and auditing practices and shall be capable of reading and understanding fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement or will be able to do so within a reasonable period of time after his or her appointment to the Audit Committee. At least one member of the Audit Committee shall have accounting or related financial management expertise, as required by the New York Stock Exchange listing standards and as such qualification is interpreted by the Board in its business judgment.

No director may serve as a member of the Audit Committee if such director serves on the audit committee of more than two other public companies, unless the Board determines that such simultaneous service would not impair the ability of such director to effectively serve on the Audit Committee.