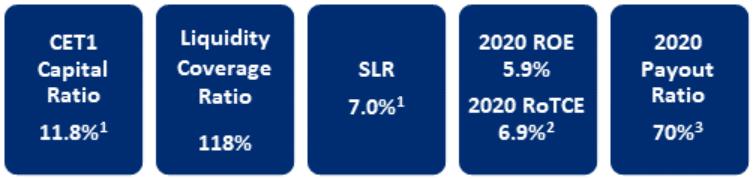

FOURTH QUARTER 2020: NET INCOME OF $4.6 BILLION ($2.08 PER SHARE) REVENUES OF $16.5 BILLION RETURNED $1.1 BILLION OF CAPITAL TO COMMON SHAREHOLDERS ($7.2 BILLION IN FULL YEAR 2020 BOOK VALUE PER SHARE OF $86.59 TANGIBLE BOOK VALUE PER SHARE OF $73.834 New York, January 15, 2021 – Citigroup Inc. today reported net income for the fourth quarter 2020 of $4.6 billion, or $2.08 per diluted share, on revenues of $16.5 billion. This compared to net income of $5.0 billion, or $2.15 per diluted share, on revenues of $18.4 billion for the fourth quarter 2019. Revenues decreased 10% from the prior-year period, primarily reflecting lower revenues in Global Consumer Banking (GCB), Institutional Clients Group (ICG), and Corporate / Other. Net income declined 7% from the prior-year period, driven by the lower revenues, an increase in expenses, and a higher effective tax rate, partially offset by the lower cost of credit. Earnings per share of $2.08 decreased 3% from the prior-year period, primarily reflecting the decline in net income. For the full year 2020, Citigroup reported net income of $11.4 billion on revenues of $74.3 billion, compared to net income of $19.4 billion on revenues of $74.3 billion for the full year 2019. Percentage comparisons throughout this press release are calculated for the fourth quarter 2020 versus the fourth quarter 2019, unless otherwise specified. | | Michael Corbat, Citi CEO, said, “We ended a tumultuous year with a strong fourth quarter. As a sign of the strength and durability of our diversified franchise, our revenues were flat to 2019, despite the massive economic impact of COVID-19. For the year, we generated $11 billion in net income despite our credit reserves increasing by $10 billion as a result of the pandemic and the impact of CECL. “We remain very well capitalized with robust liquidity to serve our clients. Our CET 1 ratio increased to 11.8%, well above our regulatory minimum of 10%. Our Tangible Book Value per share increased to $73.83, up 5% from a year ago. Given the Federal Reserve decision regarding share repurchases as we have excess capital we can return to shareholders, we plan to resume buybacks during the current quarter. “Looking back, I am proud of the progress the firm has made since I became CEO. We have streamlined our consumer business and embraced the shift to digital so we can serve our clients the way they want to be served. We have re-established Citi as a go-to bank for our institutional clients through our global network. “Before the pandemic slowed our progress, we had steadily improved our returns and dramatically increased the return of capital to our shareholders. Notably, we went from having a one penny dividend to returning over $85 billion in capital since 2013 and we have reduced our share-count by 30%. Jane has a great foundation to build upon and I am certain great things are in store for Citi and all its stakeholders,” Mr. Corbat concluded. |