UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05511

Variable Insurance Products Fund II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | December 31, 2020 |

Item 1.

Reports to Stockholders

Fidelity® Variable Insurance Products:

Index 500 Portfolio

Annual Report

December 31, 2020

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company’s separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended December 31, 2020 | Past 1 year | Past 5 years | Past 10 years |

| Initial Class | 18.24% | 15.09% | 13.78% |

| Service Class | 18.13% | 14.98% | 13.66% |

| Service Class 2 | 17.95% | 14.81% | 13.49% |

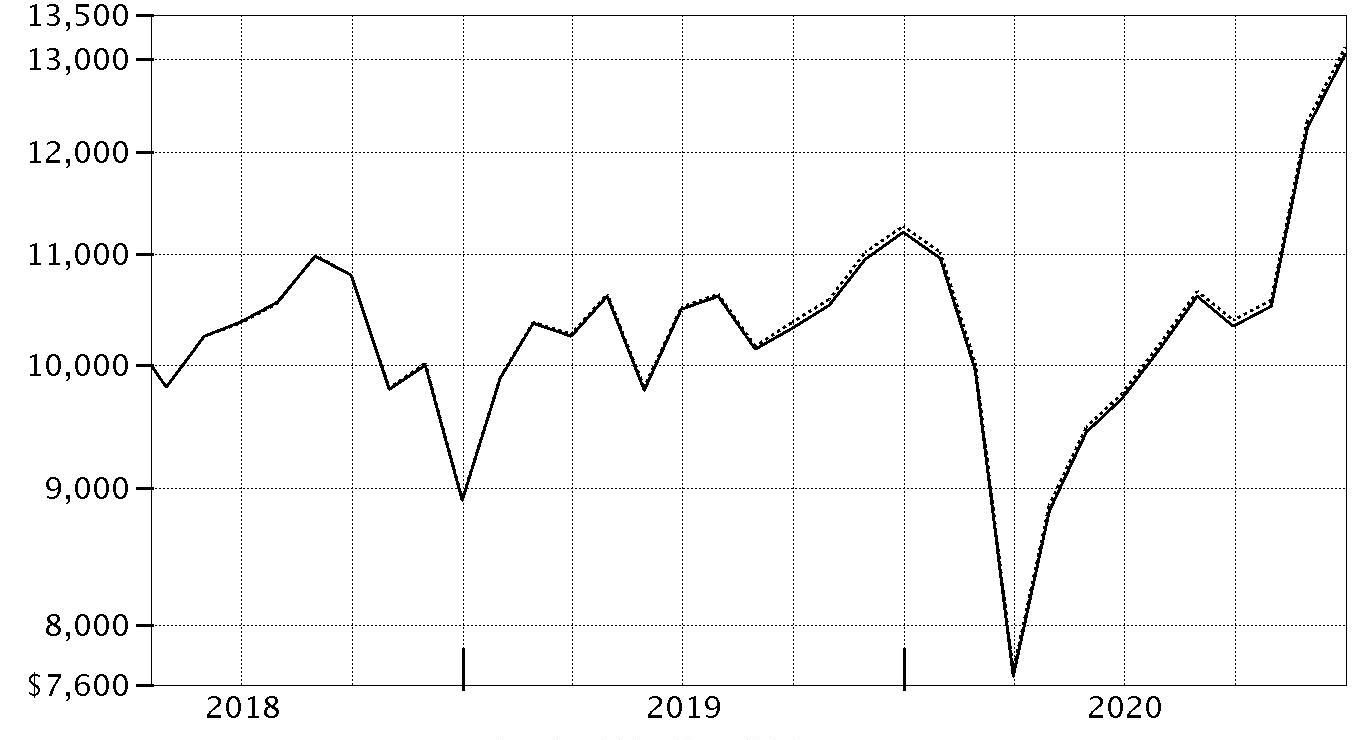

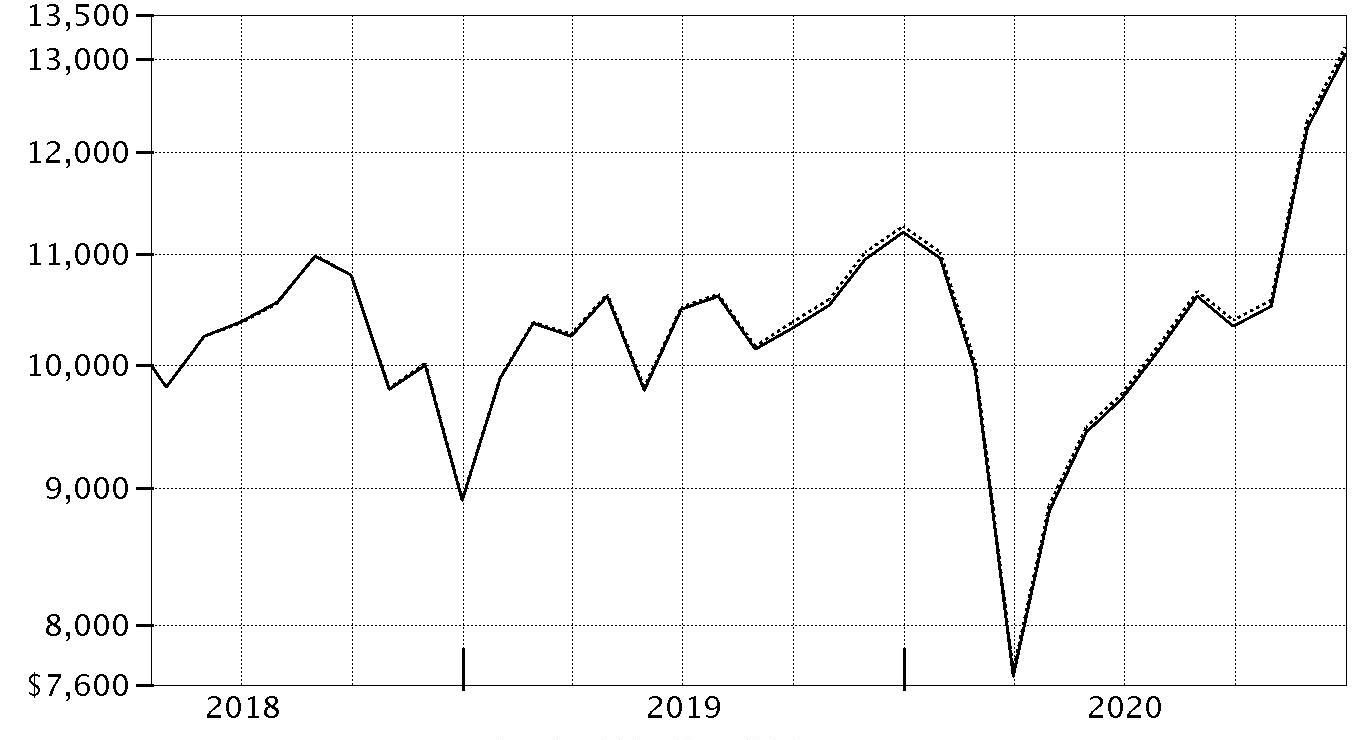

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in VIP Index 500 Portfolio - Initial Class on December 31, 2010.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values |

| $36,353 | VIP Index 500 Portfolio - Initial Class |

| $36,700 | S&P 500® Index |

Management's Discussion of Fund Performance

Market Recap: The S&P 500

® index gained 18.40% in 2020, a highly volatile and unpredictable year that will be remembered by most investors for the impact of the coronavirus pandemic. The early-2020 outbreak and spread of COVID-19 resulted in stocks suffering one of the quickest declines on record, through March 23, followed by a historic rebound that culminated with the index closing the year at an all-time high. The crisis and containment efforts caused broad contraction in economic activity, along with extreme uncertainty and dislocation in financial markets. A rapid and expansive U.S. monetary/fiscal-policy response partially offset the economic disruption and fueled the market surge, as did resilient corporate earnings and the potential for a COVID-19 vaccine breakthrough. The rally slowed in early September, when the S&P 500 began a two-month retreat amid Congress’s inability to reach a deal on additional fiscal stimulus, as well as concerns about election uncertainty, indications the U.S. economic recovery was stalling and a new wave of COVID-19 cases. November (+11%) was a much different story, however, as investors reacted favorably to election results. The momentum continued in December (+4%), driven by regulatory approvals for two COVID-19 vaccines in the U.S. By sector for the full year, information technology (+44%) and consumer discretionary (+33%) led the way, boosted by a handful of large growth stocks. In contrast, energy shares (-34%) struggled along with global oil demand and pricing

Comments from the Geode Capital Management, LLC, passive equity index team: For the fiscal year ending December 31, 2020, the fund's share classes gained about 18%, roughly in line with the 18.40% advance of the benchmark S&P 500

® Index. By sector, information technology rose 44% and contributed most, followed by consumer discretionary, which gained about 33%, benefiting from the retailing industry (+47%). The communication services sector rose 24%, boosted by the media & entertainment industry (+32%), health care gained roughly 14%, and industrials advanced approximately 11%. Other notable contributors included the consumer staples (+11%), materials (+21%) and utilities (+1%) sectors. Conversely, stocks in the energy sector returned roughly -33% and detracted most. Financials (-2%) and real estate (-2%) also hurt. Turning to individual stocks, the top contributor was Apple (+82%), from the technology hardware & equipment category. In retailing, Amazon.com (+76%) was helpful, and Microsoft (+43%) from the software & services group also contributed. Alphabet, within the media & entertainment segment, rose 31% and Nvidia, within the semiconductors & semiconductor equipment industry, gained 123% and boosted performance. Conversely, the biggest individual detractor was Exxon Mobil (-36%), from the energy sector, followed by Wells Fargo (-42%), which is in the banks category. Within telecommunication services, AT&T returned about -21% and hurt. Other detractors were Boeing (-34%), a stock in the capital goods segment, and Chevron (-26%), from the energy sector.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Ten Stocks as of December 31, 2020

| | % of fund's net assets |

| Apple, Inc. | 6.7 |

| Microsoft Corp. | 5.3 |

| Amazon.com, Inc. | 4.3 |

| Facebook, Inc. Class A | 2.1 |

| Tesla, Inc. | 1.7 |

| Alphabet, Inc. Class A | 1.6 |

| Alphabet, Inc. Class C | 1.6 |

| Berkshire Hathaway, Inc. Class B | 1.4 |

| Johnson & Johnson | 1.3 |

| JPMorgan Chase & Co. | 1.2 |

| | 27.2 |

Top Market Sectors as of December 31, 2020

| | % of fund's net assets |

| Information Technology | 27.4 |

| Health Care | 13.3 |

| Consumer Discretionary | 12.6 |

| Communication Services | 10.7 |

| Financials | 10.4 |

| Industrials | 8.3 |

| Consumer Staples | 6.5 |

| Utilities | 2.7 |

| Materials | 2.6 |

| Real Estate | 2.4 |

Asset Allocation (% of fund's net assets)

| As of December 31, 2020 * |

| | Stocks and Equity Futures | 100.0% |

* Foreign investments - 3.1%

Schedule of Investments December 31, 2020

Showing Percentage of Net Assets

| Common Stocks - 99.2% | | | |

| | | Shares | Value |

| COMMUNICATION SERVICES - 10.7% | | | |

| Diversified Telecommunication Services - 1.4% | | | |

| AT&T, Inc. | | 2,252,995 | $64,796,136 |

| CenturyLink, Inc. | | 314,533 | 3,066,697 |

| Verizon Communications, Inc. | | 1,308,543 | 76,876,901 |

| | | | 144,739,734 |

| Entertainment - 2.3% | | | |

| Activision Blizzard, Inc. | | 244,343 | 22,687,248 |

| Electronic Arts, Inc. | | 91,744 | 13,174,438 |

| Live Nation Entertainment, Inc. (a) | | 45,733 | 3,360,461 |

| Netflix, Inc. (a) | | 139,648 | 75,511,863 |

| Take-Two Interactive Software, Inc. (a) | | 36,548 | 7,594,309 |

| The Walt Disney Co. | | 572,244 | 103,679,168 |

| | | | 226,007,487 |

| Interactive Media & Services - 5.4% | | | |

| Alphabet, Inc.: | | | |

| Class A (a) | | 95,140 | 166,746,170 |

| Class C (a) | | 91,666 | 160,587,832 |

| Facebook, Inc. Class A (a) | | 759,938 | 207,584,664 |

| Twitter, Inc. (a) | | 251,314 | 13,608,653 |

| | | | 548,527,319 |

| Media - 1.3% | | | |

| Charter Communications, Inc. Class A (a) | | 46,120 | 30,510,686 |

| Comcast Corp. Class A | | 1,443,127 | 75,619,855 |

| Discovery Communications, Inc.: | | | |

| Class A (a)(b) | | 48,233 | 1,451,331 |

| Class C (non-vtg.) (a) | | 95,064 | 2,489,726 |

| DISH Network Corp. Class A (a) | | 79,485 | 2,570,545 |

| Fox Corp.: | | | |

| Class A | | 106,803 | 3,110,103 |

| Class B | | 47,399 | 1,368,883 |

| Interpublic Group of Companies, Inc. | | 123,833 | 2,912,552 |

| News Corp.: | | | |

| Class A | | 122,171 | 2,195,413 |

| Class B | | 41,101 | 730,365 |

| Omnicom Group, Inc. | | 68,508 | 4,272,844 |

| ViacomCBS, Inc. Class B | | 177,371 | 6,608,843 |

| | | | 133,841,146 |

| Wireless Telecommunication Services - 0.3% | | | |

| T-Mobile U.S., Inc. | | 184,458 | 24,874,161 |

|

| TOTAL COMMUNICATION SERVICES | | | 1,077,989,847 |

|

| CONSUMER DISCRETIONARY - 12.6% | | | |

| Auto Components - 0.1% | | | |

| Aptiv PLC | | 85,387 | 11,125,072 |

| BorgWarner, Inc. | | 76,070 | 2,939,345 |

| | | | 14,064,417 |

| Automobiles - 2.0% | | | |

| Ford Motor Co. | | 1,235,155 | 10,857,012 |

| General Motors Co. | | 398,076 | 16,575,885 |

| Tesla, Inc. (a)(b) | | 239,711 | 169,156,861 |

| | | | 196,589,758 |

| Distributors - 0.1% | | | |

| Genuine Parts Co. | | 46,019 | 4,621,688 |

| LKQ Corp. (a) | | 87,438 | 3,081,315 |

| Pool Corp. | | 12,615 | 4,699,088 |

| | | | 12,402,091 |

| Hotels, Restaurants & Leisure - 1.7% | | | |

| Carnival Corp. | | 234,639 | 5,082,281 |

| Chipotle Mexican Grill, Inc. (a) | | 8,847 | 12,268,223 |

| Darden Restaurants, Inc. | | 41,565 | 4,951,223 |

| Domino's Pizza, Inc. | | 12,369 | 4,743,017 |

| Hilton Worldwide Holdings, Inc. | | 87,697 | 9,757,168 |

| Las Vegas Sands Corp. | | 103,390 | 6,162,044 |

| Marriott International, Inc. Class A | | 84,044 | 11,087,084 |

| McDonald's Corp. | | 235,642 | 50,564,060 |

| MGM Resorts International | | 128,787 | 4,058,078 |

| Norwegian Cruise Line Holdings Ltd. (a)(b) | | 101,207 | 2,573,694 |

| Royal Caribbean Cruises Ltd. | | 58,829 | 4,393,938 |

| Starbucks Corp. | | 371,113 | 39,701,669 |

| Wynn Resorts Ltd. | | 30,463 | 3,437,140 |

| Yum! Brands, Inc. | | 95,490 | 10,366,394 |

| | | | 169,146,013 |

| Household Durables - 0.4% | | | |

| D.R. Horton, Inc. | | 104,429 | 7,197,247 |

| Garmin Ltd. | | 46,846 | 5,605,592 |

| Leggett & Platt, Inc. | | 42,826 | 1,897,192 |

| Lennar Corp. Class A | | 86,351 | 6,582,537 |

| Mohawk Industries, Inc. (a) | | 19,252 | 2,713,569 |

| Newell Brands, Inc. | | 121,723 | 2,584,179 |

| NVR, Inc. (a) | | 1,095 | 4,467,447 |

| PulteGroup, Inc. | | 84,004 | 3,622,252 |

| Whirlpool Corp. | | 19,848 | 3,582,366 |

| | | | 38,252,381 |

| Internet & Direct Marketing Retail - 4.9% | | | |

| Amazon.com, Inc. (a) | | 134,820 | 439,099,303 |

| eBay, Inc. | | 207,002 | 10,401,851 |

| Etsy, Inc. (a) | | 39,852 | 7,090,069 |

| Expedia, Inc. | | 42,620 | 5,642,888 |

| The Booking Holdings, Inc. (a) | | 12,946 | 28,834,237 |

| | | | 491,068,348 |

| Leisure Products - 0.0% | | | |

| Hasbro, Inc. | | 40,654 | 3,802,775 |

| Multiline Retail - 0.5% | | | |

| Dollar General Corp. | | 77,469 | 16,291,731 |

| Dollar Tree, Inc. (a) | | 74,318 | 8,029,317 |

| Target Corp. | | 158,336 | 27,951,054 |

| | | | 52,272,102 |

| Specialty Retail - 2.2% | | | |

| Advance Auto Parts, Inc. | | 21,359 | 3,364,256 |

| AutoZone, Inc. (a) | | 7,323 | 8,680,977 |

| Best Buy Co., Inc. | | 72,806 | 7,265,311 |

| CarMax, Inc. (a) | | 52,060 | 4,917,588 |

| Gap, Inc. | | 66,097 | 1,334,498 |

| L Brands, Inc. | | 72,919 | 2,711,858 |

| Lowe's Companies, Inc. | | 231,588 | 37,172,190 |

| O'Reilly Automotive, Inc. (a) | | 22,893 | 10,360,685 |

| Ross Stores, Inc. | | 112,465 | 13,811,827 |

| The Home Depot, Inc. | | 340,361 | 90,406,689 |

| Tiffany & Co., Inc. | | 34,477 | 4,532,002 |

| TJX Companies, Inc. | | 379,412 | 25,910,045 |

| Tractor Supply Co. | | 36,709 | 5,160,551 |

| Ulta Beauty, Inc. (a) | | 17,993 | 5,166,870 |

| | | | 220,795,347 |

| Textiles, Apparel & Luxury Goods - 0.7% | | | |

| Hanesbrands, Inc. | | 112,546 | 1,640,921 |

| NIKE, Inc. Class B | | 396,562 | 56,101,626 |

| PVH Corp. | | 22,969 | 2,156,559 |

| Ralph Lauren Corp. | | 15,394 | 1,596,974 |

| Tapestry, Inc. | | 86,026 | 2,673,688 |

| Under Armour, Inc.: | | | |

| Class A (sub. vtg.) (a) | | 59,654 | 1,024,259 |

| Class C (non-vtg.) (a) | | 62,831 | 934,925 |

| VF Corp. | | 100,845 | 8,613,171 |

| | | | 74,742,123 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 1,273,135,355 |

|

| CONSUMER STAPLES - 6.5% | | | |

| Beverages - 1.6% | | | |

| Brown-Forman Corp. Class B (non-vtg.) | | 57,417 | 4,560,632 |

| Constellation Brands, Inc. Class A (sub. vtg.) | | 53,425 | 11,702,746 |

| Molson Coors Beverage Co. Class B | | 59,741 | 2,699,696 |

| Monster Beverage Corp. (a) | | 116,846 | 10,805,918 |

| PepsiCo, Inc. | | 436,989 | 64,805,469 |

| The Coca-Cola Co. | | 1,222,763 | 67,056,323 |

| | | | 161,630,784 |

| Food & Staples Retailing - 1.4% | | | |

| Costco Wholesale Corp. | | 139,508 | 52,563,824 |

| Kroger Co. | | 244,739 | 7,772,911 |

| Sysco Corp. | | 160,961 | 11,952,964 |

| Walgreens Boots Alliance, Inc. | | 226,999 | 9,052,720 |

| Walmart, Inc. | | 438,313 | 63,182,819 |

| | | | 144,525,238 |

| Food Products - 1.0% | | | |

| Archer Daniels Midland Co. | | 175,923 | 8,868,278 |

| Campbell Soup Co. | | 63,080 | 3,049,918 |

| Conagra Brands, Inc. | | 153,356 | 5,560,689 |

| General Mills, Inc. | | 193,367 | 11,369,980 |

| Hormel Foods Corp. | | 89,678 | 4,179,892 |

| Kellogg Co. | | 80,130 | 4,986,490 |

| Lamb Weston Holdings, Inc. | | 46,489 | 3,660,544 |

| McCormick & Co., Inc. (non-vtg.) | | 78,638 | 7,517,793 |

| Mondelez International, Inc. | | 452,476 | 26,456,272 |

| The Hershey Co. | | 46,673 | 7,109,698 |

| The J.M. Smucker Co. | | 36,484 | 4,217,550 |

| The Kraft Heinz Co. | | 204,403 | 7,084,608 |

| Tyson Foods, Inc. Class A | | 92,857 | 5,983,705 |

| | | | 100,045,417 |

| Household Products - 1.6% | | | |

| Church & Dwight Co., Inc. | | 78,134 | 6,815,629 |

| Clorox Co. | | 39,835 | 8,043,483 |

| Colgate-Palmolive Co. | | 271,152 | 23,186,208 |

| Kimberly-Clark Corp. | | 107,539 | 14,499,483 |

| Procter & Gamble Co. | | 784,096 | 109,099,117 |

| | | | 161,643,920 |

| Personal Products - 0.2% | | | |

| Estee Lauder Companies, Inc. Class A | | 71,633 | 19,067,988 |

| Tobacco - 0.7% | | | |

| Altria Group, Inc. | | 587,440 | 24,085,040 |

| Philip Morris International, Inc. | | 492,384 | 40,764,471 |

| | | | 64,849,511 |

|

| TOTAL CONSUMER STAPLES | | | 651,762,858 |

|

| ENERGY - 2.3% | | | |

| Energy Equipment & Services - 0.2% | | | |

| Baker Hughes Co. Class A | | 215,480 | 4,492,758 |

| Halliburton Co. | | 280,332 | 5,298,275 |

| National Oilwell Varco, Inc. | | 125,346 | 1,721,001 |

| Schlumberger Ltd. | | 437,359 | 9,547,547 |

| TechnipFMC PLC | | 136,194 | 1,280,224 |

| | | | 22,339,805 |

| Oil, Gas & Consumable Fuels - 2.1% | | | |

| Apache Corp. | | 122,014 | 1,731,379 |

| Cabot Oil & Gas Corp. | | 128,433 | 2,090,889 |

| Chevron Corp. | | 608,140 | 51,357,423 |

| Concho Resources, Inc. | | 62,690 | 3,657,962 |

| ConocoPhillips Co. | | 336,685 | 13,464,033 |

| Devon Energy Corp. | | 123,663 | 1,955,112 |

| Diamondback Energy, Inc. | | 50,839 | 2,460,608 |

| EOG Resources, Inc. | | 183,821 | 9,167,153 |

| Exxon Mobil Corp. | | 1,335,691 | 55,057,183 |

| Hess Corp. | | 85,846 | 4,531,810 |

| HollyFrontier Corp. | | 48,217 | 1,246,409 |

| Kinder Morgan, Inc. | | 613,743 | 8,389,867 |

| Marathon Oil Corp. | | 255,631 | 1,705,059 |

| Marathon Petroleum Corp. | | 205,233 | 8,488,437 |

| Occidental Petroleum Corp. | | 263,815 | 4,566,638 |

| ONEOK, Inc. | | 141,635 | 5,435,951 |

| Phillips 66 Co. | | 137,627 | 9,625,632 |

| Pioneer Natural Resources Co. | | 51,771 | 5,896,199 |

| The Williams Companies, Inc. | | 382,981 | 7,678,769 |

| Valero Energy Corp. | | 128,649 | 7,277,674 |

| | | | 205,784,187 |

|

| TOTAL ENERGY | | | 228,123,992 |

|

| FINANCIALS - 10.4% | | | |

| Banks - 3.9% | | | |

| Bank of America Corp. | | 2,407,158 | 72,960,959 |

| Citigroup, Inc. | | 658,171 | 40,582,824 |

| Citizens Financial Group, Inc. | | 133,652 | 4,779,396 |

| Comerica, Inc. | | 43,124 | 2,408,907 |

| Fifth Third Bancorp | | 223,405 | 6,159,276 |

| First Republic Bank | | 55,080 | 8,092,904 |

| Huntington Bancshares, Inc. | | 320,234 | 4,044,555 |

| JPMorgan Chase & Co. | | 963,792 | 122,469,049 |

| KeyCorp | | 305,923 | 5,020,196 |

| M&T Bank Corp. | | 40,583 | 5,166,216 |

| Peoples United Financial, Inc. | | 137,423 | 1,776,879 |

| PNC Financial Services Group, Inc. | | 134,021 | 19,969,129 |

| Regions Financial Corp. | | 302,998 | 4,884,328 |

| SVB Financial Group (a) | | 16,369 | 6,348,389 |

| Truist Financial Corp. | | 426,242 | 20,429,779 |

| U.S. Bancorp | | 433,692 | 20,205,710 |

| Wells Fargo & Co. | | 1,307,038 | 39,446,407 |

| Zions Bancorp NA | | 50,678 | 2,201,452 |

| | | | 386,946,355 |

| Capital Markets - 2.7% | | | |

| Ameriprise Financial, Inc. | | 37,280 | 7,244,622 |

| Bank of New York Mellon Corp. | | 257,613 | 10,933,096 |

| BlackRock, Inc. Class A | | 44,841 | 32,354,575 |

| Cboe Global Markets, Inc. | | 33,960 | 3,162,355 |

| Charles Schwab Corp. | | 471,474 | 25,006,981 |

| CME Group, Inc. | | 113,518 | 20,665,952 |

| Franklin Resources, Inc. | | 86,128 | 2,152,339 |

| Goldman Sachs Group, Inc. | | 108,715 | 28,669,233 |

| Intercontinental Exchange, Inc. | | 177,539 | 20,468,471 |

| Invesco Ltd. | | 121,501 | 2,117,762 |

| MarketAxess Holdings, Inc. | | 12,007 | 6,850,714 |

| Moody's Corp. | | 51,089 | 14,828,071 |

| Morgan Stanley | | 451,716 | 30,956,097 |

| MSCI, Inc. | | 26,205 | 11,701,319 |

| NASDAQ, Inc. | | 35,964 | 4,773,861 |

| Northern Trust Corp. | | 65,442 | 6,095,268 |

| Raymond James Financial, Inc. | | 38,873 | 3,718,980 |

| S&P Global, Inc. | | 76,087 | 25,012,080 |

| State Street Corp. | | 111,460 | 8,112,059 |

| T. Rowe Price Group, Inc. | | 71,626 | 10,843,460 |

| | | | 275,667,295 |

| Consumer Finance - 0.5% | | | |

| American Express Co. | | 206,285 | 24,941,919 |

| Capital One Financial Corp. | | 144,622 | 14,295,885 |

| Discover Financial Services | | 96,956 | 8,777,427 |

| Synchrony Financial | | 170,389 | 5,914,202 |

| | | | 53,929,433 |

| Diversified Financial Services - 1.4% | | | |

| Berkshire Hathaway, Inc. Class B (a) | | 615,319 | 142,674,017 |

| Insurance - 1.9% | | | |

| AFLAC, Inc. | | 206,669 | 9,190,570 |

| Allstate Corp. | | 96,175 | 10,572,518 |

| American International Group, Inc. | | 272,011 | 10,298,336 |

| Aon PLC | | 72,292 | 15,273,131 |

| Arthur J. Gallagher & Co. | | 60,555 | 7,491,259 |

| Assurant, Inc. | | 18,570 | 2,529,605 |

| Chubb Ltd. | | 142,683 | 21,961,767 |

| Cincinnati Financial Corp. | | 46,993 | 4,105,778 |

| Everest Re Group Ltd. | | 12,487 | 2,923,082 |

| Globe Life, Inc. | | 30,305 | 2,877,763 |

| Hartford Financial Services Group, Inc. | | 114,173 | 5,592,194 |

| Lincoln National Corp. | | 58,408 | 2,938,506 |

| Loews Corp. | | 73,461 | 3,307,214 |

| Marsh & McLennan Companies, Inc. | | 160,468 | 18,774,756 |

| MetLife, Inc. | | 241,735 | 11,349,458 |

| Principal Financial Group, Inc. | | 81,370 | 4,036,766 |

| Progressive Corp. | | 185,206 | 18,313,169 |

| Prudential Financial, Inc. | | 125,048 | 9,762,497 |

| The Travelers Companies, Inc. | | 80,101 | 11,243,777 |

| Unum Group | | 65,915 | 1,512,090 |

| W.R. Berkley Corp. | | 44,582 | 2,961,136 |

| Willis Towers Watson PLC | | 40,763 | 8,587,949 |

| | | | 185,603,321 |

|

| TOTAL FINANCIALS | | | 1,044,820,421 |

|

| HEALTH CARE - 13.3% | | | |

| Biotechnology - 1.8% | | | |

| AbbVie, Inc. | | 558,062 | 59,796,343 |

| Alexion Pharmaceuticals, Inc. (a) | | 69,135 | 10,801,652 |

| Amgen, Inc. | | 184,004 | 42,306,200 |

| Biogen, Inc. (a) | | 48,619 | 11,904,848 |

| Gilead Sciences, Inc. | | 396,246 | 23,085,292 |

| Incyte Corp. (a) | | 59,368 | 5,163,829 |

| Regeneron Pharmaceuticals, Inc. (a) | | 33,134 | 16,007,367 |

| Vertex Pharmaceuticals, Inc. (a) | | 82,133 | 19,411,313 |

| | | | 188,476,844 |

| Health Care Equipment & Supplies - 3.8% | | | |

| Abbott Laboratories | | 560,310 | 61,348,342 |

| Abiomed, Inc. (a) | | 14,358 | 4,654,864 |

| Align Technology, Inc. (a) | | 22,683 | 12,121,342 |

| Baxter International, Inc. | | 161,071 | 12,924,337 |

| Becton, Dickinson & Co. | | 91,685 | 22,941,421 |

| Boston Scientific Corp. (a) | | 452,434 | 16,265,002 |

| Danaher Corp. | | 199,907 | 44,407,341 |

| Dentsply Sirona, Inc. | | 69,563 | 3,642,319 |

| DexCom, Inc. (a) | | 30,340 | 11,217,305 |

| Edwards Lifesciences Corp. (a) | | 197,008 | 17,973,040 |

| Hologic, Inc. (a) | | 81,233 | 5,916,199 |

| IDEXX Laboratories, Inc. (a) | | 26,978 | 13,485,493 |

| Intuitive Surgical, Inc. (a) | | 37,160 | 30,400,596 |

| Medtronic PLC | | 425,504 | 49,843,539 |

| ResMed, Inc. | | 45,828 | 9,741,200 |

| STERIS PLC | | 27,181 | 5,151,887 |

| Stryker Corp. | | 103,339 | 25,322,189 |

| Teleflex, Inc. | | 14,628 | 6,020,446 |

| The Cooper Companies, Inc. | | 15,444 | 5,611,114 |

| Varian Medical Systems, Inc. (a) | | 28,806 | 5,041,338 |

| West Pharmaceutical Services, Inc. | | 23,261 | 6,590,074 |

| Zimmer Biomet Holdings, Inc. | | 65,476 | 10,089,197 |

| | | | 380,708,585 |

| Health Care Providers & Services - 2.6% | | | |

| AmerisourceBergen Corp. | | 46,342 | 4,530,394 |

| Anthem, Inc. | | 78,608 | 25,240,243 |

| Cardinal Health, Inc. | | 93,581 | 5,012,198 |

| Centene Corp. (a) | | 183,167 | 10,995,515 |

| Cigna Corp. | | 114,164 | 23,766,662 |

| CVS Health Corp. | | 413,710 | 28,256,393 |

| DaVita HealthCare Partners, Inc. (a) | | 23,298 | 2,735,185 |

| HCA Holdings, Inc. | | 83,406 | 13,716,951 |

| Henry Schein, Inc. (a) | | 45,431 | 3,037,517 |

| Humana, Inc. | | 41,841 | 17,166,107 |

| Laboratory Corp. of America Holdings (a) | | 30,697 | 6,248,374 |

| McKesson Corp. | | 50,761 | 8,828,353 |

| Quest Diagnostics, Inc. | | 42,435 | 5,056,979 |

| UnitedHealth Group, Inc. | | 299,948 | 105,185,765 |

| Universal Health Services, Inc. Class B | | 24,725 | 3,399,688 |

| | | | 263,176,324 |

| Health Care Technology - 0.1% | | | |

| Cerner Corp. | | 96,489 | 7,572,457 |

| Life Sciences Tools & Services - 1.2% | | | |

| Agilent Technologies, Inc. | | 96,692 | 11,457,035 |

| Bio-Rad Laboratories, Inc. Class A (a) | | 6,831 | 3,982,063 |

| Illumina, Inc. (a) | | 46,129 | 17,067,730 |

| IQVIA Holdings, Inc. (a) | | 60,551 | 10,848,923 |

| Mettler-Toledo International, Inc. (a) | | 7,521 | 8,571,533 |

| PerkinElmer, Inc. | | 35,259 | 5,059,667 |

| Thermo Fisher Scientific, Inc. | | 125,271 | 58,348,726 |

| Waters Corp. (a) | | 19,741 | 4,884,318 |

| | | | 120,219,995 |

| Pharmaceuticals - 3.8% | | | |

| Bristol-Myers Squibb Co. | | 714,109 | 44,296,181 |

| Catalent, Inc. (a) | | 52,470 | 5,460,553 |

| Eli Lilly & Co. | | 250,951 | 42,370,567 |

| Johnson & Johnson | | 832,197 | 130,971,164 |

| Merck & Co., Inc. | | 799,810 | 65,424,458 |

| Perrigo Co. PLC | | 44,108 | 1,972,510 |

| Pfizer, Inc. | | 1,756,920 | 64,672,225 |

| Viatris, Inc. (a) | | 380,663 | 7,133,625 |

| Zoetis, Inc. Class A | | 150,212 | 24,860,086 |

| | | | 387,161,369 |

|

| TOTAL HEALTH CARE | | | 1,347,315,574 |

|

| INDUSTRIALS - 8.3% | | | |

| Aerospace & Defense - 1.6% | | | |

| General Dynamics Corp. | | 73,471 | 10,933,954 |

| Howmet Aerospace, Inc. | | 122,841 | 3,505,882 |

| Huntington Ingalls Industries, Inc. | | 13,018 | 2,219,309 |

| L3Harris Technologies, Inc. | | 66,432 | 12,556,977 |

| Lockheed Martin Corp. | | 77,868 | 27,641,583 |

| Northrop Grumman Corp. | | 49,013 | 14,935,241 |

| Raytheon Technologies Corp. | | 479,919 | 34,319,008 |

| Teledyne Technologies, Inc. (a) | | 11,603 | 4,548,144 |

| Textron, Inc. | | 72,533 | 3,505,520 |

| The Boeing Co. | | 167,728 | 35,903,856 |

| TransDigm Group, Inc. | | 17,199 | 10,643,601 |

| | | | 160,713,075 |

| Air Freight & Logistics - 0.7% | | | |

| C.H. Robinson Worldwide, Inc. | | 43,005 | 4,036,879 |

| Expeditors International of Washington, Inc. | | 53,559 | 5,093,996 |

| FedEx Corp. | | 76,361 | 19,824,843 |

| United Parcel Service, Inc. Class B | | 226,109 | 38,076,756 |

| | | | 67,032,474 |

| Airlines - 0.3% | | | |

| Alaska Air Group, Inc. | | 39,471 | 2,052,492 |

| American Airlines Group, Inc. (b) | | 192,631 | 3,037,791 |

| Delta Air Lines, Inc. | | 201,601 | 8,106,376 |

| Southwest Airlines Co. | | 186,839 | 8,708,566 |

| United Airlines Holdings, Inc. (a) | | 91,765 | 3,968,836 |

| | | | 25,874,061 |

| Building Products - 0.4% | | | |

| A.O. Smith Corp. | | 43,520 | 2,385,766 |

| Allegion PLC | | 29,407 | 3,422,387 |

| Carrier Global Corp. | | 257,273 | 9,704,338 |

| Fortune Brands Home & Security, Inc. | | 44,465 | 3,811,540 |

| Johnson Controls International PLC | | 228,111 | 10,627,691 |

| Masco Corp. | | 83,358 | 4,578,855 |

| Trane Technologies PLC | | 75,803 | 11,003,563 |

| | | | 45,534,140 |

| Commercial Services & Supplies - 0.4% | | | |

| Cintas Corp. | | 27,874 | 9,852,344 |

| Copart, Inc. (a) | | 65,454 | 8,329,022 |

| Republic Services, Inc. | | 66,276 | 6,382,379 |

| Rollins, Inc. | | 68,679 | 2,683,289 |

| Waste Management, Inc. | | 123,025 | 14,508,338 |

| | | | 41,755,372 |

| Construction & Engineering - 0.1% | | | |

| Jacobs Engineering Group, Inc. | | 40,670 | 4,431,403 |

| Quanta Services, Inc. | | 44,549 | 3,208,419 |

| | | | 7,639,822 |

| Electrical Equipment - 0.5% | | | |

| AMETEK, Inc. | | 72,637 | 8,784,719 |

| Eaton Corp. PLC | | 125,950 | 15,131,633 |

| Emerson Electric Co. | | 188,897 | 15,181,652 |

| Rockwell Automation, Inc. | | 36,715 | 9,208,489 |

| | | | 48,306,493 |

| Industrial Conglomerates - 1.2% | | | |

| 3M Co. | | 182,305 | 31,865,091 |

| General Electric Co. | | 2,767,820 | 29,892,456 |

| Honeywell International, Inc. | | 221,714 | 47,158,568 |

| Roper Technologies, Inc. | | 33,124 | 14,279,425 |

| | | | 123,195,540 |

| Machinery - 1.6% | | | |

| Caterpillar, Inc. | | 171,693 | 31,251,560 |

| Cummins, Inc. | | 46,788 | 10,625,555 |

| Deere & Co. | | 99,072 | 26,655,322 |

| Dover Corp. | | 45,272 | 5,715,590 |

| Flowserve Corp. | | 42,153 | 1,553,338 |

| Fortive Corp. | | 106,489 | 7,541,551 |

| IDEX Corp. | | 24,097 | 4,800,122 |

| Illinois Tool Works, Inc. | | 91,072 | 18,567,759 |

| Ingersoll Rand, Inc. (a) | | 118,480 | 5,397,949 |

| Otis Worldwide Corp. | | 128,764 | 8,698,008 |

| PACCAR, Inc. | | 109,482 | 9,446,107 |

| Parker Hannifin Corp. | | 40,679 | 11,081,366 |

| Pentair PLC | | 53,508 | 2,840,740 |

| Snap-On, Inc. | | 16,993 | 2,908,182 |

| Stanley Black & Decker, Inc. | | 50,625 | 9,039,600 |

| Westinghouse Air Brake Co. | | 56,233 | 4,116,256 |

| Xylem, Inc. | | 56,634 | 5,764,775 |

| | | | 166,003,780 |

| Professional Services - 0.3% | | | |

| Equifax, Inc. | | 38,426 | 7,410,070 |

| IHS Markit Ltd. | | 117,809 | 10,582,782 |

| Nielsen Holdings PLC | | 115,369 | 2,407,751 |

| Robert Half International, Inc. | | 35,498 | 2,217,915 |

| Verisk Analytics, Inc. | | 51,448 | 10,680,090 |

| | | | 33,298,608 |

| Road & Rail - 1.0% | | | |

| CSX Corp. | | 241,822 | 21,945,347 |

| J.B. Hunt Transport Services, Inc. | | 26,155 | 3,574,081 |

| Kansas City Southern | | 29,586 | 6,039,390 |

| Norfolk Southern Corp. | | 80,306 | 19,081,509 |

| Old Dominion Freight Lines, Inc. | | 30,294 | 5,912,783 |

| Union Pacific Corp. | | 213,042 | 44,359,605 |

| | | | 100,912,715 |

| Trading Companies & Distributors - 0.2% | | | |

| Fastenal Co. | | 181,037 | 8,840,037 |

| United Rentals, Inc. (a) | | 22,996 | 5,333,002 |

| W.W. Grainger, Inc. | | 14,366 | 5,866,212 |

| | | | 20,039,251 |

|

| TOTAL INDUSTRIALS | | | 840,305,331 |

|

| INFORMATION TECHNOLOGY - 27.4% | | | |

| Communications Equipment - 0.8% | | | |

| Arista Networks, Inc. (a) | | 17,120 | 4,974,558 |

| Cisco Systems, Inc. | | 1,335,905 | 59,781,749 |

| F5 Networks, Inc. (a) | | 19,705 | 3,466,898 |

| Juniper Networks, Inc. | | 102,565 | 2,308,738 |

| Motorola Solutions, Inc. | | 53,594 | 9,114,196 |

| | | | 79,646,139 |

| Electronic Equipment & Components - 0.6% | | | |

| Amphenol Corp. Class A | | 94,551 | 12,364,434 |

| CDW Corp. | | 44,921 | 5,920,139 |

| Corning, Inc. | | 241,205 | 8,683,380 |

| FLIR Systems, Inc. | | 42,342 | 1,855,850 |

| IPG Photonics Corp. (a) | | 11,496 | 2,572,690 |

| Keysight Technologies, Inc. (a) | | 58,521 | 7,730,039 |

| TE Connectivity Ltd. | | 104,478 | 12,649,151 |

| Vontier Corp. (a) | | 43,480 | 1,452,232 |

| Zebra Technologies Corp. Class A (a) | | 16,832 | 6,469,043 |

| | | | 59,696,958 |

| IT Services - 5.4% | | | |

| Accenture PLC Class A | | 200,338 | 52,330,289 |

| Akamai Technologies, Inc. (a) | | 51,041 | 5,358,795 |

| Automatic Data Processing, Inc. | | 135,577 | 23,888,667 |

| Broadridge Financial Solutions, Inc. | | 36,797 | 5,637,300 |

| Cognizant Technology Solutions Corp. Class A | | 169,029 | 13,851,927 |

| DXC Technology Co. | | 82,127 | 2,114,770 |

| Fidelity National Information Services, Inc. | | 196,160 | 27,748,794 |

| Fiserv, Inc. (a) | | 181,770 | 20,696,332 |

| FleetCor Technologies, Inc. (a) | | 26,342 | 7,186,888 |

| Gartner, Inc. (a) | | 28,538 | 4,571,502 |

| Global Payments, Inc. | | 94,609 | 20,380,671 |

| IBM Corp. | | 281,671 | 35,456,745 |

| Jack Henry & Associates, Inc. | | 23,898 | 3,871,237 |

| Leidos Holdings, Inc. | | 42,690 | 4,487,573 |

| MasterCard, Inc. Class A | | 278,108 | 99,267,870 |

| Paychex, Inc. | | 101,227 | 9,432,332 |

| PayPal Holdings, Inc. (a) | | 370,369 | 86,740,420 |

| The Western Union Co. | | 128,528 | 2,819,904 |

| VeriSign, Inc. (a) | | 31,749 | 6,870,484 |

| Visa, Inc. Class A (b) | | 536,062 | 117,252,841 |

| | | | 549,965,341 |

| Semiconductors & Semiconductor Equipment - 5.1% | | | |

| Advanced Micro Devices, Inc. (a) | | 380,175 | 34,865,849 |

| Analog Devices, Inc. | | 116,870 | 17,265,205 |

| Applied Materials, Inc. | | 288,770 | 24,920,851 |

| Broadcom, Inc. | | 127,909 | 56,004,956 |

| Intel Corp. | | 1,295,509 | 64,542,258 |

| KLA-Tencor Corp. | | 48,848 | 12,647,236 |

| Lam Research Corp. | | 45,530 | 21,502,453 |

| Maxim Integrated Products, Inc. | | 84,081 | 7,453,781 |

| Microchip Technology, Inc. | | 82,297 | 11,366,039 |

| Micron Technology, Inc. (a) | | 351,931 | 26,458,173 |

| NVIDIA Corp. | | 195,679 | 102,183,574 |

| Qorvo, Inc. (a) | | 35,906 | 5,970,091 |

| Qualcomm, Inc. | | 357,566 | 54,471,604 |

| Skyworks Solutions, Inc. | | 52,525 | 8,030,022 |

| Teradyne, Inc. | | 52,249 | 6,264,133 |

| Texas Instruments, Inc. | | 290,359 | 47,656,623 |

| Xilinx, Inc. | | 77,498 | 10,986,891 |

| | | | 512,589,739 |

| Software - 8.5% | | | |

| Adobe, Inc. (a) | | 151,658 | 75,847,199 |

| ANSYS, Inc. (a) | | 27,145 | 9,875,351 |

| Autodesk, Inc. (a) | | 69,524 | 21,228,458 |

| Cadence Design Systems, Inc. (a) | | 88,222 | 12,036,127 |

| Citrix Systems, Inc. | | 38,666 | 5,030,447 |

| Fortinet, Inc. (a) | | 42,303 | 6,283,265 |

| Intuit, Inc. | | 83,083 | 31,559,078 |

| Microsoft Corp. | | 2,390,050 | 531,594,921 |

| NortonLifeLock, Inc. | | 185,785 | 3,860,612 |

| Oracle Corp. | | 599,825 | 38,802,679 |

| Paycom Software, Inc. (a) | | 15,431 | 6,978,670 |

| Salesforce.com, Inc. (a) | | 289,247 | 64,366,135 |

| ServiceNow, Inc. (a) | | 61,693 | 33,957,678 |

| Synopsys, Inc. (a) | | 48,259 | 12,510,663 |

| Tyler Technologies, Inc. (a) | | 12,643 | 5,518,922 |

| | | | 859,450,205 |

| Technology Hardware, Storage & Peripherals - 7.0% | | | |

| Apple, Inc. | | 5,052,080 | 670,360,492 |

| Hewlett Packard Enterprise Co. | | 410,775 | 4,867,684 |

| HP, Inc. | | 434,443 | 10,682,953 |

| NetApp, Inc. | | 69,993 | 4,636,336 |

| Seagate Technology LLC (b) | | 70,452 | 4,379,296 |

| Western Digital Corp. | | 95,718 | 5,301,820 |

| Xerox Holdings Corp. | | 52,238 | 1,211,399 |

| | | | 701,439,980 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 2,762,788,362 |

|

| MATERIALS - 2.6% | | | |

| Chemicals - 1.8% | | | |

| Air Products & Chemicals, Inc. | | 69,843 | 19,082,504 |

| Albemarle Corp. U.S. | | 33,992 | 5,014,500 |

| Celanese Corp. Class A | | 36,742 | 4,774,255 |

| CF Industries Holdings, Inc. | | 68,901 | 2,667,158 |

| Corteva, Inc. | | 235,336 | 9,112,210 |

| Dow, Inc. | | 234,179 | 12,996,935 |

| DuPont de Nemours, Inc. | | 231,677 | 16,474,551 |

| Eastman Chemical Co. | | 42,964 | 4,308,430 |

| Ecolab, Inc. | | 78,481 | 16,980,149 |

| FMC Corp. | | 40,666 | 4,673,743 |

| International Flavors & Fragrances, Inc. (b) | | 34,204 | 3,722,763 |

| Linde PLC | | 165,880 | 43,711,039 |

| LyondellBasell Industries NV Class A | | 81,172 | 7,440,226 |

| PPG Industries, Inc. | | 74,588 | 10,757,081 |

| Sherwin-Williams Co. | | 25,836 | 18,987,135 |

| The Mosaic Co. | | 111,033 | 2,554,869 |

| | | | 183,257,548 |

| Construction Materials - 0.1% | | | |

| Martin Marietta Materials, Inc. | | 19,526 | 5,544,798 |

| Vulcan Materials Co. | | 41,776 | 6,195,799 |

| | | | 11,740,597 |

| Containers & Packaging - 0.4% | | | |

| Amcor PLC | | 492,740 | 5,799,550 |

| Avery Dennison Corp. | | 26,624 | 4,129,649 |

| Ball Corp. | | 103,403 | 9,635,092 |

| International Paper Co. | | 123,539 | 6,142,359 |

| Packaging Corp. of America | | 30,304 | 4,179,225 |

| Sealed Air Corp. | | 50,164 | 2,297,010 |

| WestRock Co. | | 83,546 | 3,636,757 |

| | | | 35,819,642 |

| Metals & Mining - 0.3% | | | |

| Freeport-McMoRan, Inc. | | 459,150 | 11,947,083 |

| Newmont Corp. | | 254,038 | 15,214,336 |

| Nucor Corp. | | 94,685 | 5,036,295 |

| | | | 32,197,714 |

|

| TOTAL MATERIALS | | | 263,015,501 |

|

| REAL ESTATE - 2.4% | | | |

| Equity Real Estate Investment Trusts (REITs) - 2.3% | | | |

| Alexandria Real Estate Equities, Inc. | | 39,281 | 7,000,660 |

| American Tower Corp. | | 140,487 | 31,533,712 |

| AvalonBay Communities, Inc. | | 44,193 | 7,089,883 |

| Boston Properties, Inc. | | 44,601 | 4,216,133 |

| Crown Castle International Corp. | | 136,429 | 21,718,133 |

| Digital Realty Trust, Inc. | | 88,620 | 12,363,376 |

| Duke Realty Corp. | | 116,690 | 4,664,099 |

| Equinix, Inc. | | 28,194 | 20,135,591 |

| Equity Residential (SBI) | | 107,826 | 6,391,925 |

| Essex Property Trust, Inc. | | 20,587 | 4,887,766 |

| Extra Space Storage, Inc. | | 40,448 | 4,686,305 |

| Federal Realty Investment Trust (SBI) | | 22,100 | 1,881,152 |

| Healthpeak Properties, Inc. | | 168,598 | 5,096,718 |

| Host Hotels & Resorts, Inc. | | 220,241 | 3,222,126 |

| Iron Mountain, Inc. (b) | | 89,722 | 2,645,005 |

| Kimco Realty Corp. | | 133,395 | 2,002,259 |

| Mid-America Apartment Communities, Inc. | | 36,521 | 4,626,845 |

| Prologis (REIT), Inc. | | 233,849 | 23,305,391 |

| Public Storage | | 48,210 | 11,133,135 |

| Realty Income Corp. | | 110,292 | 6,856,854 |

| Regency Centers Corp. | | 50,719 | 2,312,279 |

| SBA Communications Corp. Class A | | 35,154 | 9,917,998 |

| Simon Property Group, Inc. | | 103,156 | 8,797,144 |

| SL Green Realty Corp. | | 23,504 | 1,400,368 |

| UDR, Inc. | | 94,186 | 3,619,568 |

| Ventas, Inc. | | 117,722 | 5,773,087 |

| Vornado Realty Trust | | 50,348 | 1,879,994 |

| Welltower, Inc. | | 131,942 | 8,526,092 |

| Weyerhaeuser Co. | | 236,070 | 7,915,427 |

| | | | 235,599,025 |

| Real Estate Management & Development - 0.1% | | | |

| CBRE Group, Inc. (a) | | 105,716 | 6,630,508 |

|

| TOTAL REAL ESTATE | | | 242,229,533 |

|

| UTILITIES - 2.7% | | | |

| Electric Utilities - 1.7% | | | |

| Alliant Energy Corp. | | 79,598 | 4,101,685 |

| American Electric Power Co., Inc. | | 156,920 | 13,066,728 |

| Duke Energy Corp. | | 232,695 | 21,305,554 |

| Edison International | | 119,495 | 7,506,676 |

| Entergy Corp. | | 63,047 | 6,294,612 |

| Evergy, Inc. | | 72,488 | 4,023,809 |

| Eversource Energy | | 108,387 | 9,376,559 |

| Exelon Corp. | | 308,133 | 13,009,375 |

| FirstEnergy Corp. | | 172,714 | 5,286,776 |

| NextEra Energy, Inc. | | 619,351 | 47,782,930 |

| NRG Energy, Inc. | | 75,784 | 2,845,689 |

| Pinnacle West Capital Corp. | | 35,857 | 2,866,767 |

| PPL Corp. | | 242,645 | 6,842,589 |

| Southern Co. | | 334,062 | 20,521,429 |

| Xcel Energy, Inc. | | 166,161 | 11,077,954 |

| | | | 175,909,132 |

| Gas Utilities - 0.0% | | | |

| Atmos Energy Corp. | | 39,345 | 3,754,693 |

| Independent Power and Renewable Electricity Producers - 0.1% | | | |

| The AES Corp. | | 208,393 | 4,897,236 |

| Multi-Utilities - 0.8% | | | |

| Ameren Corp. | | 78,062 | 6,093,520 |

| CenterPoint Energy, Inc. | | 174,170 | 3,769,039 |

| CMS Energy Corp. | | 90,033 | 5,492,913 |

| Consolidated Edison, Inc. | | 108,697 | 7,855,532 |

| Dominion Energy, Inc. | | 258,142 | 19,412,278 |

| DTE Energy Co. | | 61,002 | 7,406,253 |

| NiSource, Inc. | | 119,477 | 2,740,802 |

| Public Service Enterprise Group, Inc. | | 160,055 | 9,331,207 |

| Sempra Energy | | 91,221 | 11,622,468 |

| WEC Energy Group, Inc. | | 99,982 | 9,201,343 |

| | | | 82,925,355 |

| Water Utilities - 0.1% | | | |

| American Water Works Co., Inc. | | 57,478 | 8,821,149 |

|

| TOTAL UTILITIES | | | 276,307,565 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $3,429,379,451) | | | 10,007,794,339 |

|

| Money Market Funds - 1.3% | | | |

| Fidelity Cash Central Fund 0.11% (c) | | 72,138,917 | 72,153,345 |

| Fidelity Securities Lending Cash Central Fund 0.11% (c)(d) | | 55,722,448 | 55,728,020 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $127,878,688) | | | 127,881,365 |

| TOTAL INVESTMENT IN SECURITIES - 100.5% | | | |

| (Cost $3,557,258,139) | | | 10,135,675,704 |

| NET OTHER ASSETS (LIABILITIES) - (0.5)% | | | (49,675,440) |

| NET ASSETS - 100% | | | $10,086,000,264 |

| Futures Contracts | | | | | |

| | Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) |

| Purchased | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini S&P 500 Index Contracts (United States) | 447 | March 2021 | $83,785,680 | $1,785,859 | $1,785,859 |

The notional amount of futures purchased as a percentage of Net Assets is 0.8%

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $158,436 |

| Fidelity Securities Lending Cash Central Fund | 200,953 |

| Total | $359,389 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $1,077,989,847 | $1,077,989,847 | $-- | $-- |

| Consumer Discretionary | 1,273,135,355 | 1,273,135,355 | -- | -- |

| Consumer Staples | 651,762,858 | 651,762,858 | -- | -- |

| Energy | 228,123,992 | 228,123,992 | -- | -- |

| Financials | 1,044,820,421 | 1,044,820,421 | -- | -- |

| Health Care | 1,347,315,574 | 1,347,315,574 | -- | -- |

| Industrials | 840,305,331 | 840,305,331 | -- | -- |

| Information Technology | 2,762,788,362 | 2,762,788,362 | -- | -- |

| Materials | 263,015,501 | 263,015,501 | -- | -- |

| Real Estate | 242,229,533 | 242,229,533 | -- | -- |

| Utilities | 276,307,565 | 276,307,565 | -- | -- |

| Money Market Funds | 127,881,365 | 127,881,365 | -- | -- |

| Total Investments in Securities: | $10,135,675,704 | $10,135,675,704 | $-- | $-- |

| Derivative Instruments: | | | | |

| Assets | | | | |

| Futures Contracts | $1,785,859 | $1,785,859 | $-- | $-- |

| Total Assets | $1,785,859 | $1,785,859 | $-- | $-- |

| Total Derivative Instruments: | $1,785,859 | $1,785,859 | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of December 31, 2020. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| Equity Risk | | |

| Futures Contracts(a) | $1,785,859 | $0 |

| Total Equity Risk | 1,785,859 | 0 |

| Total Value of Derivatives | $1,785,859 | $0 |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | December 31, 2020 |

| Assets | | |

Investment in securities, at value (including securities loaned of $54,851,009) — See accompanying schedule:

Unaffiliated issuers (cost $3,429,379,451) | $10,007,794,339 | |

| Fidelity Central Funds (cost $127,878,688) | 127,881,365 | |

| Total Investment in Securities (cost $3,557,258,139) | | $10,135,675,704 |

| Segregated cash with brokers for derivative instruments | | 4,829,000 |

| Cash | | 3 |

| Receivable for fund shares sold | | 3,551,492 |

| Dividends receivable | | 7,403,864 |

| Distributions receivable from Fidelity Central Funds | | 15,980 |

| Receivable for daily variation margin on futures contracts | | 545,363 |

| Other receivables | | 18,983 |

| Total assets | | 10,152,040,389 |

| Liabilities | | |

| Payable for fund shares redeemed | $9,065,162 | |

| Accrued management fee | 371,600 | |

| Distribution and service plan fees payable | 423,121 | |

| Other affiliated payables | 454,178 | |

| Other payables and accrued expenses | 18,984 | |

| Collateral on securities loaned | 55,707,080 | |

| Total liabilities | | 66,040,125 |

| Net Assets | | $10,086,000,264 |

| Net Assets consist of: | | |

| Paid in capital | | $3,432,653,701 |

| Total accumulated earnings (loss) | | 6,653,346,563 |

| Net Assets | | $10,086,000,264 |

| Net Asset Value and Maximum Offering Price | | |

| Initial Class: | | |

| Net Asset Value, offering price and redemption price per share ($7,930,737,772 ÷ 21,342,477 shares) | | $371.59 |

| Service Class: | | |

| Net Asset Value, offering price and redemption price per share ($138,694,515 ÷ 374,731 shares) | | $370.12 |

| Service Class 2: | | |

| Net Asset Value, offering price and redemption price per share ($2,016,567,977 ÷ 5,498,745 shares) | | $366.73 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended December 31, 2020 |

| Investment Income | | |

| Dividends | | $157,030,333 |

| Interest | | 10,472 |

| Income from Fidelity Central Funds (including $200,953 from security lending) | | 359,389 |

| Total income | | 157,400,194 |

| Expenses | | |

| Management fee | $3,936,929 | |

| Transfer agent fees | 4,811,802 | |

| Distribution and service plan fees | 4,273,284 | |

| Independent trustees' fees and expenses | 49,685 | |

| Legal | 56 | |

| Interest | 15,666 | |

| Commitment fees | 20,218 | |

| Total expenses before reductions | 13,107,640 | |

| Expense reductions | (1,837) | |

| Total expenses after reductions | | 13,105,803 |

| Net investment income (loss) | | 144,294,391 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 73,084,569 | |

| Fidelity Central Funds | 12,629 | |

| Futures contracts | (387,845) | |

| Total net realized gain (loss) | | 72,709,353 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 1,241,211,756 | |

| Fidelity Central Funds | (1,980) | |

| Futures contracts | 903,559 | |

| Total change in net unrealized appreciation (depreciation) | | 1,242,113,335 |

| Net gain (loss) | | 1,314,822,688 |

| Net increase (decrease) in net assets resulting from operations | | $1,459,117,079 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended December 31, 2020 | Year ended December 31, 2019 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $144,294,391 | $154,794,469 |

| Net realized gain (loss) | 72,709,353 | 46,079,613 |

| Change in net unrealized appreciation (depreciation) | 1,242,113,335 | 1,991,220,335 |

| Net increase (decrease) in net assets resulting from operations | 1,459,117,079 | 2,192,094,417 |

| Distributions to shareholders | (181,638,785) | (278,671,068) |

| Share transactions - net increase (decrease) | (466,996,900) | 536,384,329 |

| Total increase (decrease) in net assets | 810,481,394 | 2,449,807,678 |

| Net Assets | | |

| Beginning of period | 9,275,518,870 | 6,825,711,192 |

| End of period | $10,086,000,264 | $9,275,518,870 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

VIP Index 500 Portfolio Initial Class

| Years ended December 31, | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $320.35 | $252.46 | $271.18 | $227.46 | $206.43 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | 5.43 | 5.54 | 5.09 | 4.71 | 4.42 |

| Net realized and unrealized gain (loss) | 52.57 | 72.46 | (17.22) | 44.36 | 20.06 |

| Total from investment operations | 58.00 | 78.00 | (12.13) | 49.07 | 24.48 |

| Distributions from net investment income | (5.72) | (5.82) | (5.28)B | (4.57) | (3.23) |

| Distributions from net realized gain | (1.04) | (4.29) | (1.31)B | (.78) | (.22) |

| Total distributions | (6.76) | (10.11) | (6.59) | (5.35) | (3.45) |

| Net asset value, end of period | $371.59 | $320.35 | $252.46 | $271.18 | $227.46 |

| Total ReturnC,D | 18.24% | 31.35% | (4.49)% | 21.71% | 11.86% |

| Ratios to Average Net AssetsE,F | | | | | |

| Expenses before reductions | .10% | .10% | .10% | .10% | .10% |

| Expenses net of fee waivers, if any | .10% | .10% | .10% | .10% | .10% |

| Expenses net of all reductions | .10% | .10% | .10% | .10% | .10% |

| Net investment income (loss) | 1.70% | 1.90% | 1.82% | 1.89% | 2.07% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $7,930,738 | $7,294,879 | $5,719,086 | $6,139,813 | $5,001,375 |

| Portfolio turnover rateG | 8% | 7% | 5% | 5% | 6% |

A Calculated based on average shares outstanding during the period.

B The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

VIP Index 500 Portfolio Service Class

| Years ended December 31, | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $319.14 | $251.57 | $270.23 | $226.70 | $205.82 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | 5.09 | 5.23 | 4.79 | 4.44 | 4.19 |

| Net realized and unrealized gain (loss) | 52.34 | 72.18 | (17.13) | 44.21 | 19.97 |

| Total from investment operations | 57.43 | 77.41 | (12.34) | 48.65 | 24.16 |

| Distributions from net investment income | (5.41) | (5.55) | (5.01)B | (4.34) | (3.07) |

| Distributions from net realized gain | (1.04) | (4.29) | (1.31)B | (.78) | (.22) |

| Total distributions | (6.45) | (9.84) | (6.32) | (5.12) | (3.28)C |

| Net asset value, end of period | $370.12 | $319.14 | $251.57 | $270.23 | $226.70 |

| Total ReturnD,E | 18.13% | 31.22% | (4.59)% | 21.59% | 11.75% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | .20% | .20% | .20% | .20% | .20% |

| Expenses net of fee waivers, if any | .20% | .20% | .20% | .20% | .20% |

| Expenses net of all reductions | .20% | .20% | .20% | .20% | .20% |

| Net investment income (loss) | 1.60% | 1.80% | 1.72% | 1.79% | 1.97% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $138,695 | $117,666 | $89,704 | $92,965 | $77,697 |

| Portfolio turnover rateH | 8% | 7% | 5% | 5% | 6% |

A Calculated based on average shares outstanding during the period.

B The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

C Total distributions per share do not sum due to rounding.

D Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

VIP Index 500 Portfolio Service Class 2

| Years ended December 31, | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $316.37 | $249.51 | $267.78 | $224.72 | $204.25 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | 4.61 | 4.77 | 4.34 | 4.04 | 3.88 |

| Net realized and unrealized gain (loss) | 51.78 | 71.54 | (16.96) | 43.79 | 19.76 |

| Total from investment operations | 56.39 | 76.31 | (12.62) | 47.83 | 23.64 |

| Distributions from net investment income | (4.99) | (5.16) | (4.34)B | (3.99) | (2.95) |

| Distributions from net realized gain | (1.04) | (4.29) | (1.31)B | (.78) | (.22) |

| Total distributions | (6.03) | (9.45) | (5.65) | (4.77) | (3.17) |

| Net asset value, end of period | $366.73 | $316.37 | $249.51 | $267.78 | $224.72 |

| Total ReturnC,D | 17.95% | 31.02% | (4.73)% | 21.41% | 11.58% |

| Ratios to Average Net AssetsE,F | | | | | |

| Expenses before reductions | .35% | .35% | .35% | .35% | .35% |

| Expenses net of fee waivers, if any | .35% | .35% | .35% | .35% | .35% |

| Expenses net of all reductions | .35% | .35% | .35% | .35% | .35% |

| Net investment income (loss) | 1.45% | 1.65% | 1.57% | 1.64% | 1.82% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $2,016,568 | $1,862,974 | $1,016,922 | $1,502,688 | $1,215,228 |

| Portfolio turnover rateG | 8% | 7% | 5% | 5% | 6% |

A Calculated based on average shares outstanding during the period.

B The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended December 31, 2020

1. Organization.

VIP Index 500 Portfolio (the Fund) is a fund of Variable Insurance Products Fund II (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares, Service Class shares and Service Class 2 shares. All classes have equal rights and voting privileges, except for matters affecting a single class.

Effective January 1, 2020:

Investment advisers Fidelity Investments Money Management, Inc., FMR Co., Inc., and Fidelity SelectCo, LLC, merged with and into Fidelity Management & Research Company. In connection with the merger transactions, the resulting, merged investment adviser was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to "Fidelity Management & Research Company LLC".

Broker-dealer Fidelity Distributors Corporation merged with and into Fidelity Investments Institutional Services Company, Inc. ("FIISC"). FIISC was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to "Fidelity Distributors Company LLC".

Fidelity Investments Institutional Operations Company, Inc. converted from a Massachusetts corporation to a Massachusetts LLC, and changed its name to "Fidelity Investments Institutional Operations Company LLC".

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds ,including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of December 31, 2020 is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) for certain Funds, certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in affiliated mutual funds, are marked-to-market and remain in a fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees presented below are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, as applicable.

| VIP Index 500 Portfolio | $18,983 |

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of December 31, 2020, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, market discount, certain deemed dividends, deferred trustees compensation and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $6,746,779,662 |

| Gross unrealized depreciation | (189,022,297) |

| Net unrealized appreciation (depreciation) | $6,557,757,365 |

| Tax Cost | $3,577,918,339 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $40,068,157 |

| Undistributed long-term capital gain | $55,540,023 |

| Net unrealized appreciation (depreciation) on securities and other investments | $6,557,757,365 |

The tax character of distributions paid was as follows:

| | December 31, 2020 | December 31, 2019 |

| Ordinary Income | $157,435,503 | $ 189,954,446 |

| Long-term Capital Gains | 24,203,281 | 88,716,622 |

| Total | $181,638,784 | $ 278,671,068 |

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment.

|