As filed with the Securities and Exchange Commission on [date]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-05518

Investment Company Act file number

The RBB FUND, INC.

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Salvatore Faia, President

c/o U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 765-5366

Registrant's telephone number, including area code

Date of fiscal year end: August 31

Date of reporting period: February 28, 2018

Item 1. Reports to Stockholders.

Abbey Capital Futures Strategy Fund

of

THE RBB FUND, INC.

Semi-Annual Report

February 28, 2018

(Unaudited)

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution unless preceded or accompanied by a current prospectus for the Fund.

Abbey Capital Futures Strategy Fund

Semi-Annual Investment Adviser’s Report

February 28, 2018 (Unaudited)

Dear Shareholder,

The Abbey Capital Futures Strategy Fund (the “Fund”) Class I Shares returned +1.43% net of fees for the six-month period ended February 28, 2018. The positive performance was driven by strong trends in equities, energy and interest rates over the period, with some partially offsetting losses from trading in bonds and major currencies. The presence of strong trends in some markets supported the Fund’s core allocation to trendfollowing systems, through its investment in Abbey Capital Offshore Fund Limited (the “ACOF”), a wholly-owned subsidiary of the Fund. The Fund invests up to 25% of its assets into the ACOF and its remaining assets in a fixed income strategy consisting primarily of U.S. Treasury obligations.

| 2018

YTD | MAR. 1, 2017 TO

FEB. 28, 2018 | SEPT. 1, 2017 TO

FEB. 28, 2018 | ANNUALIZED

SINCE INCEPTION

ON JULY 1, 2014 TO

FEB. 28, 2018 |

Class I Shares | -2.07% | -2.57% | 1.43% | 4.20% |

Class A Shares* | -2.16% | -2.84% | 1.25% | 3.94% |

Class A Shares (max load)* | -7.76% | -8.43% | -4.56% | 2.27% |

Class C Shares** | -2.28% | -3.56% | 0.91% | 3.18% |

BofA Merrill Lynch 3-Month T-Bill Index | 0.21% | 0.99% | 0.58% | 0.40% |

S&P 500® Total Return Index | 1.83% | 17.10% | 10.84% | 11.58% |

Barclay CTA Index | -1.02% | 0.09% | 0.34% | 1.03% |

Source: Abbey Capital and Bloomberg

Performance quoted is past performance and does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. Visit www.abbeycapital.com for returns updated daily. Call (US Toll Free) 1-844-261-6484 or (international callers) + 1-508-871-3276 for returns current to the most recent month-end.

Please note the above is shown for illustrative purposes only; the Fund is not benchmarked against any of the indices referenced.

* | Class A Shares performance prior to its inception on August 29, 2014 is the performance of Class I Shares, adjusted for the Class A Shares expense ratio. There is a maximum sales charge (load) imposed on purchases (as a percentage of offering price) of 5.75% in Class A Shares. |

** | Class C Shares performance prior to its inception on October 6, 2015 is the performance of Class I Shares, adjusted for the Class C Shares expense ratio. |

The Barclay CTA Index is derived from data which is self-reported by investment managers based on the performance of privately managed funds. In contrast, the S&P 500® Total Return Index and the Bank of America Merrill Lynch 3-Month T-Bill Index are comprised of publicly traded securities. As a result of these differences, these indices may not be directly comparable and the above is shown for illustrative purposes only.

Abbey Capital Limited (the “Adviser”) has contractually agreed to waive its advisory fee and/or reimburse expenses in order to limit total annual Fund operating expenses (excluding acquired fund fees and expenses, brokerage commissions, extraordinary items, interest or taxes) to 1.79%, 2.04% and 2.79% of the Fund’s average daily net assets attributable to Class I Shares, Class A Shares, and Class C Shares, respectively. This contractual limitation is in effect until December 31, 2018, and may not be terminated without the approval of the Board of Directors of The RBB Fund, Inc. In addition, the Adviser may recoup any waived or reimbursed amounts from the Fund within three years from the date on which such waiver or reimbursement was made by the Adviser, provided such reimbursement does not cause the Fund to exceed expense limitations that were in effect at the time of the waiver or reimbursement. In determining the Adviser’s obligation to waive its investment advisory fees and/or reimburse expenses, the following expenses are not taken into account: acquired fund fees and expenses, brokerage commissions, extraordinary items, interest or taxes. Without the

1

Abbey Capital Futures Strategy Fund

Semi-Annual Investment Adviser’s Report (Continued)

February 28, 2018 (Unaudited)

limitation agreement, the expense ratios are 1.93%. 2.18% and 2.93% of the Fund’s average daily net assets attributable to Class I Shares, Class A Shares, and Class C Shares, respectively, as stated in the current prospectus dated December 31, 2017, as supplemented (and which may differ from the actual expense ratios for the period covered by this report). The quoted performance would have been lower without the expense limitation.

Please refer to the prospectus for further information on expenses and fees.

Market Commentary

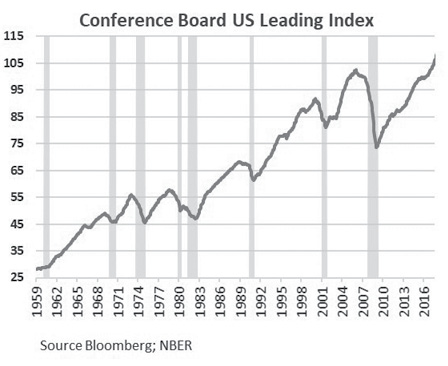

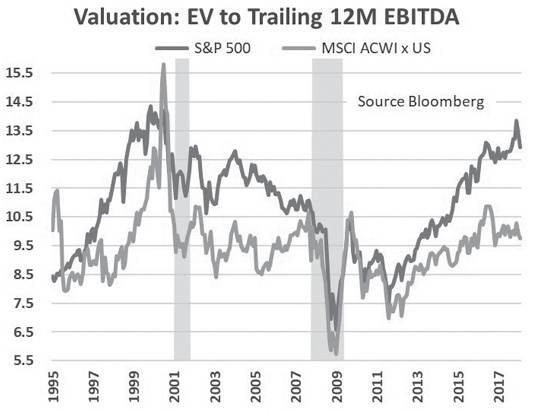

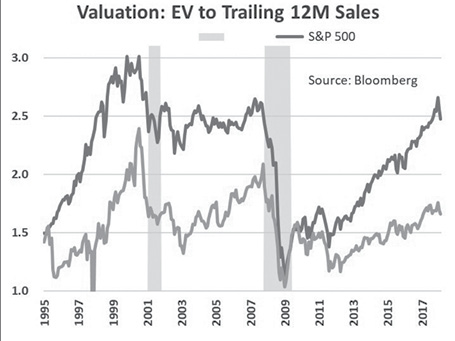

In general, investor sentiment was positive over the six-month period ended February 28, 2018 and this supported risk assets amid signs of an uptick in global growth; however this positive sentiment did appear to unwind somewhat in late January and February on signs of building inflationary pressures.

Global equities rallied over the period, supported by solid earnings growth, signs of improving economic conditions and the passing of U.S. tax reform. While most developed market equity indices were positive for the period, gains were pared from late January onwards as worries that mounting inflationary pressures could lead to a more aggressive pace of central bank tightening weighed on risk appetite.

Signs of higher inflation also impacted U.S. Treasuries. The Federal Reserve (“Fed”) began its balance sheet normalisation program in September 2017 and hiked interest rates in December 2017, and this, along with some hawkish Fed signals and higher inflation expectations, resulted in a decline in U.S. Treasury prices as the market priced a steeper path of monetary tightening. In Europe, the European Central Bank began tapering its asset purchase program in January 2018, and this helped to push bond yields in the region higher. The re-appointment of Kuroda as Bank of Japan Governor together with the re-affirmation of the central bank’s commitment to accommodative monetary policy and its yield targeting program meant that Japanese bond yields were largely range-bound over the period.

Despite the improving yield differential of U.S. Treasuries versus other developed market bonds and forecasts of more aggressive Fed rate hikes, the USD weakened over the period. Worries that tax reform could lead to a larger budget deficit weighed on demand for the greenback, as did uncertainty about the U.S. government’s views on currency strength. The EUR was supported by signs of stronger growth in the eurozone, while GBP benefited from reports of progress in Brexit negotiations and forecasts of rate hikes by the Bank of England in 2018.

Signs of stronger global growth were generally supportive of commodity markets, as was the overall weakness in the USD. Crude oil rallied over the period, boosted by the extension of OPEC supply cuts and projections of stronger global demand, however gains were pared somewhat in February as U.S. production reached a 47-year high. Stronger global growth was generally supportive of base metals prices, while in precious metals, the benefits from a weaker USD were offset by signs of a reduction in safe-haven demand. In agricultural commodities, both wheat and soybeans benefited late in the period from concerns about growing conditions in the U.S. and Argentina, respectively, while sugar dropped on concerns of a global supply glut.

Performance Attribution

Returns for the ACOF were driven by gains in equities, interest rates and energy. Within equities, strong upward trends in prices generated profits from long positions, however these gains unwound somewhat later in the period amid sharp corrections in equity markets. Within equities, the S&P 500®, Nikkei 225 and NASDAQ 100 were the top-performing positions, with ACOF’s Diversified Trendfollowing (“Trendfollowing”) sub-advisors (sub-advisors are also known as “Trading Advisors”) generating the largest gains. Profits from energy were generated mostly by Trendfollowing sub-advisors via long positions in crude oil and distillates. In interest rates, the ACOF’s Global Macro and Trendfollowing sub-advisors performed positively, with mostly short positions in 3-month Eurodollar contracts the primary driver. In major currencies, a short position in USD/NOK was the worst performer, with Value sub-advisors seeing the largest

2

Abbey Capital Futures Strategy Fund

Semi-Annual Investment Adviser’s Report (Concluded)

February 28, 2018 (Unaudited)

losses in this currency pair. Trendfollowing sub-advisors saw the largest losses in bonds, with primarily long positions in UK and eurozone contracts the largest detractors, while Value sub-advisors saw some partially offsetting profits through short positions in U.S. Treasury contracts as U.S. rate hike expectations increased.

An investment in the Abbey Capital Futures Strategy Fund is speculative and involves substantial risk and conflicts of interest. It is possible that an investor may lose some or all of their investment. Except for fund returns, the portfolio statistics shown in this presentation are based only on the open forward, future and option contracts held by Abbey Capital Offshore Fund Limited (a wholly-owned and controlled subsidiary of the Fund) and does not take into account any other assets held by the Fund (primarily cash and cash-equivalents). The Fund may invest up to 25% of its total assets in the Abbey Capital Offshore Fund Limited which is a multi-advisor fund that invests in managed futures and foreign exchange. All investments in securities involve risk of the loss of capital. An investment in the Fund includes the risks inherent in an investment in securities, as well as specific risks associated with this open-ended investment product. Among the risks associated with investing in this Fund are Commodity Sector Risk, Counter-Party Risk, Credit Risk, Currency Risk, Derivatives Risk, Manager and Management Risks, Advisory Risk, Subsidiary Risks, Tax Risks, Emerging Markets Risk, Leveraging Risks, Foreign Investment Risks, Fixed Income Securities Risks, Short Sale Risk and Portfolio Turnover Risks. The Fund may invest in or utilize derivative investments, futures contracts, and hedging strategies. A portfolio of hedge funds may increase the potential for losses or gains. One or more underlying managers, from time to time, may invest a substantial portion of the assets managed in a specific industry sector. As a result, the underlying manager’s investment portfolio (as well as the Fund’s) may be subject to greater risk and volatility than if investments had been made in the securities of a broader range of issuers. Trading in futures is not suitable for all investors given its speculative nature and the high level of risk involved. There can be no assurance that the Fund’s or an underlying manager’s strategy (hedging or otherwise) will be successful or that it will employ such strategies with respect to all or any portion of its portfolio. The value of the Fund’s portfolio investments should be expected to fluctuate. Investing in managed futures is not suitable for all investors given its speculative nature and the high level of risk involved. The Fund is appropriate only for investors who can bear the risks associated with the product. Investors may lose some or all of their investment. This brief statement cannot disclose all of the risks and other factors necessary to evaluate a participation in the Fund. Investors are urged to take appropriate investment advice and to carefully consider their investment objectives, personal situation, and factors such as net worth, income, age, risk tolerance and liquidity needs before investing in the Fund. Before investing, investors should carefully consider the Fund’s investment objectives, risks, conflicts, tax considerations, charges and expenses. It is not possible to invest directly in an index.

Fund holdings and sector allocations are subject to change and should not be considered recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of fund holdings.

Earnings growth is not representative of the Fund’s future performance.

3

Abbey Capital Futures Strategy Fund

Performance Data

February 28, 2018 (Unaudited)

Average Annual Total Returns for the Periods Ended February 28, 2018 |

| | Six

Months† | One

Year | Three

Years | Since

Inception†† |

Class A Shares (without sales charge) (Pro forma July 1, 2014 to August 29, 2014) | 1.25% | -2.84% | -3.03% | 3.94%* |

Class A Shares (with sales charge) (Pro forma July 1, 2014 to August 29, 2014) | -4.56% | -8.43% | -4.93% | 2.27%* |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | 0.58% | 0.99% | 0.48% | 0.40%** |

S&P 500® Total Return Index | 10.84% | 17.10% | 11.14% | 11.58%** |

Barclay CTA Index | 0.34% | 0.09% | -1.92% | 1.03%** |

†† | Inception date of Class A Shares of the Fund was August 29, 2014. |

* | Class A Shares performance prior to its inception on August 29, 2014 is the performance of Class I Shares, adjusted for the Class A Shares expense ratio. |

** | Performance is from the inception date of the Fund and is not the inception date of the index itself. The above is shown for illustrative purposes only the Fund is not benchmarked against any of the indices referenced. |

The Fund charges a 5.75% maximum sales charge on purchases (as a percentage of offering price) of Class A Shares. The performance data quoted reflects fee waivers in effect and would have been less in their absence. The Adviser has contractually agreed to waive its advisory fee and/or reimburse expenses in order to limit total annual Fund operating expenses (excluding acquired fund fees and expenses, brokerage commissions, extraordinary items, interest or taxes) to 2.04% of the Fund’s average daily net assets attributable to Class A Shares. Without the limitation arrangement, the gross expense ratios are 2.18% for Class A Shares as stated in the current prospectus (and which may differ from the actual expense ratios for the period covered by this report). This contractual limitation is in effect until December 31, 2018 and may not be terminated without the approval of the Board of Directors of The RBB Fund, Inc. Please see the Consolidated Financial Highlights for current figures.

4

Abbey Capital Futures Strategy Fund

Performance Data (Continued)

February 28, 2018 (Unaudited)

Average Annual Total Returns for the Periods Ended February 28, 2018 |

| | Six

Months† | One

Year | Three

Years | Since

Inception†† |

Class I Shares | 1.43% | -2.57% | -2.80% | 4.20% |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | 0.58% | 0.99% | 0.48% | 0.40%* |

S&P 500® Total Return Index | 10.84% | 17.10% | 11.14% | 11.58%* |

Barclay CTA Index | 0.34% | 0.09% | -1.92% | 1.03%* |

†† | Inception date of Class I Shares of the Fund was July 1, 2014. |

* | Performance is from the inception date of the Fund and is not the inception date of the index itself. The above is shown for illustrative purposes only, the Fund is not benchmarked against any of the indices referenced. |

The performance data quoted reflects fee waivers in effect and would have been less in their absence. The Adviser has contractually agreed to waive its advisory fee and/or reimburse expenses in order to limit total annual Fund operating expenses (excluding acquired fund fees and expenses, brokerage commissions, extraordinary items, interest or taxes) to 1.79% of the Fund’s average daily net assets attributable to Class I Shares. Without the limitation arrangement, the gross expense ratio is 1.93% for Class I Shares, as stated in the current prospectus (and which may differ from the actual expense ratios for the period covered by this report). This contractual limitation is in effect until December 31, 2018 and may not be terminated without the approval of the Board of Directors of The RBB Fund, Inc. Please see the Consolidated Financial Highlights for current figures.

5

Abbey Capital Futures Strategy Fund

Performance Data (Continued)

February 28, 2018 (Unaudited)

Average Annual Total Returns for the Periods Ended February 28, 2018 |

| | Six

Months† | One

Year | Three

Years | Since

Inception†† |

Class C Shares (Pro forma July 1, 2014 to October 6, 2015) | 0.91% | -3.56% | N/A | 3.18%* |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | 0.58% | 0.99% | 0.48% | 0.40%** |

S&P 500® Total Return Index | 10.84% | 17.10% | 11.14% | 11.58%** |

Barclay CTA Index | 0.34% | 0.09% | -1.92% | 1.03%** |

†† | Inception date of Class C Shares of the Fund was October 6, 2015. |

* | Class C Shares performance prior to its inception on October 6, 2015 is the performance of Class I Shares, adjusted for the Class C Shares expense ratio. |

** | Performance is from the inception date of the Fund and is not the inception date of the index itself. The above is shown for illustrative purposes only the Fund is not benchmarked against any of the indices referenced. |

The performance data quoted reflects fee waivers in effect and would have been less in their absence. The Adviser has contractually agreed to waive its advisory fee and/or reimburse expenses in order to limit total annual Fund operating expenses (excluding acquired fund fees and expenses, brokerage commissions, extraordinary items, interest or taxes) to 2.79% of the Fund’s average daily net assets attributable to Class C Shares. Without the limitation arrangement, the gross expense ratio is 2.93% for Class C Shares, as stated in the current prospectus (and which may differ from the actual expense ratios for the period covered by this report). This contractual limitation is in effect until December 31, 2018 and may not be terminated without the approval of the Board of Directors of The RBB Fund, Inc. Please see the Consolidated Financial Highlights for current figures.

Performance quoted is past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. Visit www.abbeycapital.com for returns updated daily. Call (US Toll Free) 1-844-261-6484 or (international callers) + 1-508-871-3276 for returns current to the most recent month-end.

The Barclay CTA Index is derived from data which is self-reported by investment managers based on the performance of privately managed funds. In contrast, the S&P 500® Total Return Index and the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index are comprised of publicly traded securities. As a result of these differences, these indices may not be directly comparable, are not available for direct investment and the above is shown for illustrative purposes only.

6

Abbey Capital Futures Strategy Fund

Performance Data (Concluded)

February 28, 2018 (Unaudited)

The S&P 500® Total Return Index

The S&P 500® Total Return Index is the total return version of the S&P 500® Index. Dividends are reinvested on a daily basis and all regular cash dividends are assumed reinvested in the index on the ex-dividend date.

S&P 500® Index

The S&P 500® Index is a market-capitalization-weighted index of 500 US stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500® Index is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. The S&P 500® Index was first introduced on the 1st of January, 1923, though expanded to 500 stocks on March 4, 1957.

Nasdaq 100 Index

Launched in January 1985, the Nasdaq-100 Index includes 100 of the largest US domestic and international non-financial companies listed on the Nasdaq stock market. The Nasdaq-100 Index is calculated under a modified capitalization-weighted methodology. The index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

Barclay CTA Index

The Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. There are currently 541 programs included in the calculation of the Barclay CTA Index for 2018. The Barclay CTA Index is equally weighted and rebalanced at the beginning of each year.

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

Hang Seng Index

The Hang Seng Index is a market capitalization-weighted index of 40 of the largest companies that trade on the Hong Kong Exchange. The Hang Seng Index is maintained by a subsidiary of Hang Seng Bank, and has been published since 1969.

Nikkei 225 Index

The Nikkei 225 Index is a price-weighted index comprised of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Portfolio composition is subject to change. It is not possible to invest directly in an index.

7

Abbey Capital Futures Strategy Fund

Fund Expense Examples

February 28, 2018 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, (if any) and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the six-month period from September 1, 2017 through February 28, 2018, and held for the entire period.

ACTUAL EXPENSES

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the accompanying table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments (if any). Therefore, the second line of the accompanying table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Class A Shares |

| | Beginning

Account Value

September 1, 2017 | Ending

Account Value

February 28, 2018 | Expenses Paid

During Period* |

Actual | $ 1,000.00 | $ 1,012.50 | $ 10.18 |

Hypothetical (5% return before expenses) | 1,000.00 | 1,014.68 | 10.19 |

| | Class I Shares |

| | Beginning

Account Value

September 1, 2017 | Ending

Account Value

February 28, 2018 | Expenses Paid

During Period** |

Actual | $ 1,000.00 | $ 1,014.30 | $ 8.94 |

Hypothetical (5% return before expenses) | 1,000.00 | 1,015.92 | 8.95 |

8

Abbey Capital Futures Strategy Fund

Fund Expense Examples (Concluded)

(Unaudited)

| | Class C Shares |

| | Beginning

Account Value

September 1, 2017 | Ending

Account Value

February 28, 2018 | Expenses Paid

During Period*** |

Actual | $ 1,000.00 | $ 1,009.10 | $ 13.90 |

Hypothetical (5% return before expenses) | 1,000.00 | 1,010.96 | 13.91 |

* | Expenses are equal to an annualized expense ratio for the period September 1, 2017 to February 28, 2018 of 2.04% for the Class A Shares of the Fund, which includes waived fees or reimbursed expenses (including interest expense), multiplied by the average account value over the period, multiplied by the number of days (181) in the most recent fiscal half-year then divided by 365 to reflect the one-half year period. The Fund’s ending account value on the first line in the table is based on the actual six-month total investment return for the Class A Shares of the Fund of 1.25%. |

** | Expenses are equal to an annualized expense ratio for the period September 1, 2017 to February 28, 2018 of 1.79% for the Class I Shares of the Fund, which includes waived fees or reimbursed expenses (including interest expense), multiplied by the average account value over the period, multiplied by the number of days (181) in the most recent fiscal half-year then divided by 365 to reflect the one-half year period. The Fund’s ending account value on the first line in the table is based on the actual six-month total investment return for the Class I Shares of the Fund of 1.43%. |

*** | Expenses are equal to an annualized expense ratio for the period September 1, 2017 to February 28, 2018 of 2.79% for the Class C Shares of the Fund, which includes waived fees or reimbursed expenses (including interest expense), multiplied by the average account value over the period, multiplied by the number of days (181) in the most recent fiscal half-year then divided by 365 to reflect the one-half year period. The Fund’s ending account value on the first line in the table is based on the actual six-month total investment return for the Class C Shares of the Fund of 0.91%. |

9

Abbey Capital Futures Strategy Fund

Consolidated Portfolio Holdings Summary Table

February 28, 2018 (Unaudited)

The following table presents a consolidated summary of the portfolio holdings of the Fund at February 28, 2018.

| | | % of Net

Assets | | | Value | |

| SHORT-TERM INVESTMENTS: | | | | | | |

| U.S. Treasury Obligations | | | 94.8 | % | | $ | 894,516,988 | |

| PURCHASED OPTIONS | | | 0.9 | | | | 8,638,070 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES | | | | | | | | |

| (including futures, forward foreign currency contracts and written options) | | | 4.3 | | | | 40,926,049 | |

| NET ASSETS | | | 100.0 | % | | $ | 944,081,107 | |

Portfolio holdings are subject to change at any time.

Refer to the Consolidated Portfolio of Investments for a detailed listing of the Fund’s holdings.

The accompanying notes are an integral part of the consolidated financial statements.

10

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments

February 28, 2018 (Unaudited)

| | | Coupon* | | | Maturity

Date | | Par

(000’s) | | | Value | |

| Short-Term Investments — 94.8% | | | | | | | | | | | |

| U.S. Treasury Obligations — 94.8% | | | | | | | | | | | |

| U.S. Treasury Bills | | | 1.086 | % | | 03/01/18 | | $ | 51,370 | | | $ | 51,370,000 | |

| U.S. Treasury Bills | | | 1.133 | % | | 03/08/18 | | | 4,825 | | | | 4,823,898 | |

| U.S. Treasury Bills | | | 1.167 | % | | 03/22/18 | | | 24,525 | | | | 24,505,776 | |

| U.S. Treasury Bills | | | 1.192 | % | | 03/29/18 | | | 2,990 | | | | 2,986,576 | |

| U.S. Treasury Bills | | | 1.226 | % | | 04/05/18 | | | 20,784 | | | | 20,754,498 | |

| U.S. Treasury Bills | | | 1.226 | % | | 04/12/18 | | | 4,690 | | | | 4,681,707 | |

| U.S. Treasury Bills | | | 1.252 | % | | 04/19/18 | | | 7,874 | | | | 7,857,524 | |

| U.S. Treasury Bills | | | 1.242 | % | | 04/26/18 | | | 23,948 | | | | 23,891,329 | |

| U.S. Treasury Bills | | | 1.374 | % | | 05/10/18 | | | 57,543 | | | | 57,369,292 | |

| U.S. Treasury Bills | | | 1.382 | % | | 05/17/18 | | | 63,050 | | | | 62,838,781 | |

| U.S. Treasury Bills | | | 1.412 | % | | 05/24/18 | | | 61,218 | | | | 60,990,524 | |

| U.S. Treasury Bills | | | 1.421 | % | | 05/31/18 | | | 10,731 | | | | 10,687,124 | |

| U.S. Treasury Bills | | | 1.438 | % | | 06/07/18 | | | 40,754 | | | | 40,576,216 | |

| U.S. Treasury Bills | | | 1.477 | % | | 06/14/18 | | | 70,880 | | | | 70,544,059 | |

| U.S. Treasury Bills | | | 1.509 | % | | 06/21/18 | | | 18,150 | | | | 18,057,677 | |

| U.S. Treasury Bills | | | 1.549 | % | | 06/28/18 | | | 25,087 | | | | 24,950,172 | |

| U.S. Treasury Bills | | | 1.563 | % | | 07/05/18 | | | 9,518 | | | | 9,461,576 | |

| U.S. Treasury Bills | | | 1.601 | % | | 07/12/18 | | | 77,940 | | | | 77,443,328 | |

| U.S. Treasury Bills | | | 1.610 | % | | 07/19/18 | | | 97,200 | | | | 96,535,912 | |

| U.S. Treasury Bills | | | 1.613 | % | | 07/26/18 | | | 42,912 | | | | 42,604,106 | |

| U.S. Treasury Bills | | | 1.635 | % | | 08/02/18 | | | 52,611 | | | | 52,219,399 | |

| U.S. Treasury Bills | | | 1.746 | % | | 08/09/18 | | | 27,306 | | | | 27,091,071 | |

| U.S. Treasury Bills | | | 1.826 | % | | 08/16/18 | | | 12,858 | | | | 12,750,068 | |

| U.S. Treasury Bills | | | 1.831 | % | | 08/23/18 | | | 90,319 | | | | 89,526,375 | |

| | | | | | | | | | | | | | 894,516,988 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | | | |

| (Cost $894,901,865) | | | | | | | | | | | | | 894,516,988 | |

| Total Purchased Options — 0.9%** | | | | | | | | | | | | | | |

| (Cost $4,027,045) | | | | | | | | | | | | | 8,638,070 | |

| Total Investments — 95.7% | | | | | | | | | | | | | | |

| (Cost $898,928,910) | | | | | | | | | | | | | 903,155,058 | |

| | | | | | | | | | | | | | | |

| Other Assets in Excess of Liabilities — 4.3% | | | | | | | | | | | | | 40,926,049 | |

| Net Assets — 100.0% | | | | | | | | | | | | $ | 944,081,107 | |

* | Short-term investments reflect the annualized effective yield on the date of purchase for discounted investments. |

** | See page 19 for detailed information regarding the Purchased Options. |

The accompanying notes are an integral part of the consolidated financial statements.

11

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments (Continued)

February 28, 2018 (Unaudited)

Futures contracts outstanding as of February 28, 2018 were as follows:

| Long Contracts | | Expiration

Date | | Number of

Contracts | | | Notional

Amount | | | Value and

Unrealized Appreciation/ (Depreciation) | |

| 10-Year Mini Japanese Government Bond Futures | | Mar-18 | | | 46 | | | $ | 4,311,355 | | | $ | 4,836 | |

| 2-Year Euro Swapnote Futures | | Mar-18 | | | 47 | | | | 5,734,015 | | | | (4,301 | ) |

| 3-Month Euro Euribor | | Jun-18 | | | 10 | | | | 3,050,008 | | | | 1,525 | |

| 3-Month Euro Euribor | | Sep-18 | | | 8 | | | | 2,440,006 | | | | 732 | |

| 3-Month Euro Euribor | | Dec-18 | | | 247 | | | | 75,335,196 | | | | 4,789 | |

| 3-Month Euro Euribor | | Mar-19 | | | 25 | | | | 7,625,020 | | | | 137 | |

| 3-Month Euro Euribor | | Jun-19 | | | 340 | | | | 103,700,270 | | | | (28,182 | ) |

| 3-Month Euro Euribor | | Sep-19 | | | 11 | | | | 3,355,009 | | | | (1,189 | ) |

| 5-Year Euro Swapnote Futures | | Mar-18 | | | 12 | | | | 1,464,004 | | | | (16,372 | ) |

| 90-DAY Bank Bill | | Jun-18 | | | 48 | | | | 37,281,553 | | | | (588 | ) |

| 90-DAY Bank Bill | | Sep-18 | | | 516 | | | | 400,776,699 | | | | 22,880 | |

| 90-DAY Bank Bill | | Dec-18 | | | 112 | | | | 86,990,291 | | | | (1,708 | ) |

| 90-DAY Bank Bill | | Mar-19 | | | 22 | | | | 17,087,379 | | | | 341 | |

| 90-DAY Eurodollar Futures | | Dec-18 | | | 694 | | | | 173,500,000 | | | | (1,063,613 | ) |

| 90-DAY Eurodollar Futures | | Jun-21 | | | 1 | | | | 250,000 | | | | (63 | ) |

| 90-DAY Eurodollar Futures | | Sep-21 | | | 2 | | | | 500,000 | | | | (163 | ) |

| 90-DAY Sterling Futures | | Jun-18 | | | 10 | | | | 1,720,886 | | | | (2,925 | ) |

| 90-DAY Sterling Futures | | Sep-18 | | | 7 | | | | 1,204,620 | | | | (2,409 | ) |

| Amsterdam Index Futures | | Mar-18 | | | 61 | | | | 7,968,170 | | | | 179,572 | |

| AUD/USD Currency Futures | | Mar-18 | | | 215 | | | | 16,684,774 | | | | (435,738 | ) |

| BP Currency Futures | | Mar-18 | | | 366 | | | | 31,464,492 | | | | (471,590 | ) |

| Brent Crude Futures | | May-18 | | | 160 | | | | 10,356,800 | | | | (41,850 | ) |

| Brent Crude Futures | | Jun-18 | | | 18 | | | | 1,160,280 | | | | 3,030 | |

| Brent Crude Futures | | Jul-18 | | | 14 | | | | 897,820 | | | | 4,430 | |

| Brent Crude Futures | | Aug-18 | | | 12 | | | | 765,360 | | | | (1,020 | ) |

| Brent Crude Futures | | Sep-18 | | | 3 | | | | 190,320 | | | | (5,040 | ) |

| Brent Crude Futures | | Oct-18 | | | 3 | | | | 189,210 | | | | (5,720 | ) |

| CAC40 10 Euro Futures | | Mar-18 | | | 117 | | | | 7,592,360 | | | | 187,228 | |

| CAD Currency Futures | | Mar-18 | | | 49 | | | | 3,817,835 | | | | (49,481 | ) |

| Cattle Feeder Futures | | Mar-18 | | | 9 | | | | 651,375 | | | | (12,000 | ) |

| Cattle Feeder Futures | | Apr-18 | | | 15 | | | | 1,102,500 | | | | (14,275 | ) |

| Cattle Feeder Futures | | May-18 | | | 19 | | | | 1,411,225 | | | | (1,425 | ) |

| CHF Currency Futures | | Mar-18 | | | 87 | | | | 11,515,248 | | | | (186,084 | ) |

| Cocoa Futures | | May-18 | | | 73 | | | | 1,619,140 | | | | 85,310 | |

| Cocoa Futures | | Jul-18 | | | 8 | | | | 179,280 | | | | 6,850 | |

| Cocoa Futures | | Sep-18 | | | 3 | | | | 67,710 | | | | 2,000 | |

| COP/USD Futures | | Mar-18 | | | 107 | | | | 3,733,061 | | | | 97,877 | |

| Copper Futures | | May-18 | | | 101 | | | | 7,909,563 | | | | (178,075 | ) |

| Copper Futures | | Jul-18 | | | 10 | | | | 788,000 | | | | (30,388 | ) |

| Copper Futures | | Sep-18 | | | 1 | | | | 79,238 | | | | (1,575 | ) |

| Corn Futures | | May-18 | | | 61 | | | | 1,165,100 | | | | (64,163 | ) |

| Cotton No.2 Futures | | May-18 | | | 146 | | | | 6,053,890 | | | | (36,780 | ) |

| DAX Index Futures | | Mar-18 | | | 7 | | | | 2,654,346 | | | | (267,104 | ) |

| EUR Foreign Exchange Currency Futures | | Mar-18 | | | 86 | | | | 13,110,236 | | | | (2,063,836 | ) |

| Euro E-Mini Futures | | Mar-18 | | | 29 | | | | 2,210,447 | | | | (40,600 | ) |

| Euro STOXX 50 | | Mar-18 | | | 18 | | | | 754,987 | | | | (188,478 | ) |

| Euro/CHF 3-Month Futures ICE | | Jun-18 | | | 1 | | | | 264,718 | | | | (26 | ) |

| Euro/CHF 3-Month Futures ICE | | Sep-18 | | | 4 | | | | 1,058,873 | | | | (26 | ) |

The accompanying notes are an integral part of the consolidated financial statements.

12

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments (Continued)

February 28, 2018 (Unaudited)

| Long Contracts | | Expiration

Date | | Number of

Contracts | | | Notional

Amount | | | Value and

Unrealized Appreciation/ (Depreciation) | |

| Euro/CHF 3-Month Futures ICE | | Dec-18 | | | 4 | | | $ | 1,058,873 | | | $ | 26 | |

| Euro/CHF 3-Month Futures ICE | | Mar-19 | | | 2 | | | | 529,437 | | | | 79 | |

| Euro/JPY Futures | | Mar-18 | | | 7 | | | | 1,067,112 | | | | (48,315 | ) |

| Euro-BTP Futures | | Mar-18 | | | 114 | | | | 13,908,036 | | | | (99,833 | ) |

| Euro-BTP Futures | | Jun-18 | | | 19 | | | | 2,318,006 | | | | (695 | ) |

| Euro-Bund Futures | | Jun-18 | | | 3 | | | | 366,001 | | | | 11,773 | |

| Euro-Oat Futures | | Mar-18 | | | 26 | | | | 3,172,008 | | | | 11,053 | |

| Euro-Schatz Futures | | Mar-18 | | | 134 | | | | 16,348,043 | | | | (1,659 | ) |

| FTSE 100 Index Futures | | Mar-18 | | | 51 | | | | 5,073,530 | | | | (286,941 | ) |

| FTSE 250 Index Futures | | Mar-18 | | | 46 | | | | 2,493,437 | | | | (50,576 | ) |

| FTSE/JSE TOP 40 | | Mar-18 | | | 60 | | | | 2,610,722 | | | | (68,009 | ) |

| FTSE/MIB Index Futures | | Mar-18 | | | 33 | | | | 4,549,794 | | | | (145,388 | ) |

| Gasoline RBOB Futures | | Apr-18 | | | 196 | | | | 15,843,307 | | | | (363,661 | ) |

| Gasoline RBOB Futures | | May-18 | | | 21 | | | | 1,710,463 | | | | (60,203 | ) |

| Gasoline RBOB Futures | | Jul-18 | | | 2 | | | | 161,557 | | | | (4,339 | ) |

| Gold 100 Oz Futures | | Apr-18 | | | 507 | | | | 66,817,530 | | | | (1,109,860 | ) |

| Gold 100 Oz Futures | | Jun-18 | | | 16 | | | | 2,117,920 | | | | (15,410 | ) |

| Hang Seng China Enterprises Index Futures | | Mar-18 | | | 115 | | | | 9,072,567 | | | | (210,538 | ) |

| Hang Seng Index Futures | | Mar-18 | | | 93 | | | | 18,260,366 | | | | (276,760 | ) |

| IBEX 35 Index Futures | | Mar-18 | | | 25 | | | | 2,999,500 | | | | 32,550 | |

| ILS/USD Futures | | Mar-18 | | | 16 | | | | 4,604,250 | | | | (31,460 | ) |

| INR/USD Futures | | Mar-18 | | | 295 | | | | 9,049,177 | | | | (12,492 | ) |

| JPN 10-Year Bond (Osaka Securities Exchange) | | Mar-18 | | | 139 | | | | 130,277,895 | | | | 342,284 | |

| JPY Currency Futures | | Mar-18 | | | 313 | | | | 36,692,476 | | | | 444,218 | |

| Lean Hogs Futures | | Jun-18 | | | 7 | | | | 225,892 | | | | (13,550 | ) |

| Live Cattle Futures | | Apr-18 | | | 107 | | | | 5,276,176 | | | | (69,010 | ) |

| Live Cattle Futures | | Jun-18 | | | 49 | | | | 2,265,760 | | | | (13,180 | ) |

| Live Cattle Futures | | Aug-18 | | | 22 | | | | 994,180 | | | | (12,280 | ) |

| LME Aluminum Forward | | Mar-18 | | | 1,471 | | | | 78,312,363 | | | | (469,874 | ) |

| LME Aluminum Forward | | Apr-18 | | | 34 | | | | 1,810,500 | | | | (123,133 | ) |

| LME Aluminum Forward | | May-18 | | | 6 | | | | 319,725 | | | | (54,916 | ) |

| LME Aluminum Forward | | Jun-18 | | | 292 | | | | 15,581,850 | | | | (371,282 | ) |

| LME Copper Forward | | Mar-18 | | | 1 | | | | 172,588 | | | | 183,525 | |

| LME Copper Forward | | Apr-18 | | | 34 | | | | 5,878,388 | | | | (270,456 | ) |

| LME Copper Forward | | May-18 | | | 1 | | | | 173,194 | | | | (2,981 | ) |

| LME Copper Forward | | Jun-18 | | | 156 | | | | 27,077,700 | | | | (646,276 | ) |

| LME Lead Forward | | Mar-18 | | | 8 | | | | 500,000 | | | | 20,873 | |

| LME Lead Forward | | Apr-18 | | | 11 | | | | 687,775 | | | | (30,001 | ) |

| LME Lead Forward | | May-18 | | | 4 | | | | 250,000 | | | | (5,800 | ) |

| LME Nickel Forward | | Mar-18 | | | 5 | | | | 412,575 | | | | 815,626 | |

| LME Nickel Forward | | Apr-18 | | | 19 | | | | 1,569,438 | | | | 84,478 | |

| LME Nickel Forward | | May-18 | | | 7 | | | | 578,970 | | | | 3,921 | |

| LME Nickel Forward | | Jun-18 | | | 80 | | | | 6,626,400 | | | | (459 | ) |

| LME Zinc Forward | | Mar-18 | | | 10 | | | | 865,000 | | | | 646,862 | |

| LME Zinc Forward | | Apr-18 | | | 23 | | | | 1,986,625 | | | | 17,555 | |

| LME Zinc Forward | | May-18 | | | 9 | | | | 776,588 | | | | (9,756 | ) |

| LME Zinc Forward | | Jun-18 | | | 60 | | | | 5,169,750 | | | | (45,831 | ) |

| Low Sulphur Gasoil G Futures | | Apr-18 | | | 185 | | | | 10,706,875 | | | | (155,725 | ) |

| Low Sulphur Gasoil G Futures | | May-18 | | | 38 | | | | 2,197,350 | | | | (29,625 | ) |

| Low Sulphur Gasoil G Futures | | Jun-18 | | | 5 | | | | 288,000 | | | | (5,550 | ) |

The accompanying notes are an integral part of the consolidated financial statements.

13

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments (Continued)

February 28, 2018 (Unaudited)

| Long Contracts | | Expiration

Date | | Number of Contracts | | | Notional

Amount | | | Value and

Unrealized Appreciation/ (Depreciation) | |

| Mini HSI Index Futures | | Mar-18 | | | 24 | | | $ | 942,471 | | | $ | (16,157 | ) |

| MSCI EAFE Index Futures | | Mar-18 | | | 29 | | | | 2,952,925 | | | | (98,445 | ) |

| MSCI Emerging Markets Index Futures | | Mar-18 | | | 62 | | | | 3,667,300 | | | | (13,460 | ) |

| MSCI Singapore Exchange ETS | | Mar-18 | | | 180 | | | | 5,443,820 | | | | (14,335 | ) |

| MSCI Taiwan Index Futures | | Mar-18 | | | 118 | | | | 4,697,580 | | | | (6,080 | ) |

| MXN Currency Futures | | Mar-18 | | | 386 | | | | 10,247,751 | | | | (33,425 | ) |

| Nasdaq 100 E-Mini | | Mar-18 | | | 280 | | | | 38,444,000 | | | | (6,050 | ) |

| Natural Gas Futures | | Nov-18 | | | 1 | | | | 28,400 | | | | (570 | ) |

| Nikkei 225 (Chicago Mercantile Exchange) | | Mar-18 | | | 10 | | | | 1,096,000 | | | | (35,750 | ) |

| Nikkei 225 (Singapore Exchange) | | Mar-18 | | | 67 | | | | 6,940,508 | | | | (424,575 | ) |

| Nikkei 225 Mini | | Mar-18 | | | 191 | | | | 3,956,230 | | | | (217,709 | ) |

| NY Harbor Ultra-Low Sulfur Diesel Futures | | Apr-18 | | | 174 | | | | 13,910,778 | | | | (616,224 | ) |

| NY Harbor Ultra-Low Sulfur Diesel Futures | | May-18 | | | 13 | | | | 1,040,130 | | | | (48,476 | ) |

| NY Harbor Ultra-Low Sulfur Diesel Futures | | Jun-18 | | | 23 | | | | 1,838,588 | | | | (57,288 | ) |

| NZD Currency Futures | | Mar-18 | | | 367 | | | | 26,442,256 | | | | (437,435 | ) |

| OMX Stockholm 30 Index Futures | | Mar-18 | | | 30 | | | | 569,154 | | | | 10,783 | |

| Palladium Futures | | Jun-18 | | | 19 | | | | 1,971,440 | | | | 20,850 | |

| Platinum Futures | | Apr-18 | | | 76 | | | | 3,754,780 | | | | (85,120 | ) |

| PLN/USD Futures | | Mar-18 | | | 46 | | | | 6,716,544 | | | | 92,270 | |

| RUB Currency Futures | | Mar-18 | | | 62 | | | | 2,754,162 | | | | 116,125 | |

| Russell 2000 E-Mini | | Mar-18 | | | 112 | | | | 8,462,720 | | | | (231,340 | ) |

| S&P 500 E-Mini Futures | | Mar-18 | | | 122 | | | | 16,557,840 | | | | (553,868 | ) |

| S&P Mid 400 E-Mini Futures | | Mar-18 | | | 28 | | | | 5,220,600 | | | | (173,410 | ) |

| S&P/TSX 60 IX Futures | | Mar-18 | | | 70 | | | | 9,957,762 | | | | (308,180 | ) |

| SGX Nifty 50 | | Mar-18 | | | 294 | | | | 6,185,172 | | | | 5,628 | |

| Soybean Futures | | May-18 | | | 257 | | | | 13,563,175 | | | | 246,075 | |

| Soybean Futures | | Jul-18 | | | 2 | | | | 106,425 | | | | 725 | |

| Soybean Futures | | Sep-18 | | | 1 | | | | 52,275 | | | | (88 | ) |

| Soybean Meal Futures | | May-18 | | | 214 | | | | 8,446,580 | | | | 461,270 | |

| Soybean Meal Futures | | Jul-18 | | | 46 | | | | 1,803,660 | | | | 56,950 | |

| Soybean Meal Futures | | Aug-18 | | | 5 | | | | 193,050 | | | | 5,190 | |

| SPI 200 Futures | | Mar-18 | | | 194 | | | | 22,605,709 | | | | 30,369 | |

| Swiss Federal Bond Futures | | Mar-18 | | | 20 | | | | 2,117,747 | | | | (39,814 | ) |

| Topix Index Futures | | Mar-18 | | | 59 | | | | 9,776,653 | | | | (230,048 | ) |

| TRY/USD Futures | | Mar-18 | | | 29 | | | | 3,812,579 | | | | 10,265 | |

| WTI Crude Futures | | Apr-18 | | | 312 | | | | 19,231,680 | | | | 109,250 | |

| WTI Crude Futures | | May-18 | | | 183 | | | | 11,249,010 | | | | (277,520 | ) |

| WTI Crude Futures | | Jun-18 | | | 10 | | | | 611,400 | | | | (15,230 | ) |

| WTI Crude Futures | | Jul-18 | | | 2 | | | | 121,340 | | | | (3,180 | ) |

| WTI Crude Futures | | Aug-18 | | | 6 | | | | 360,840 | | | | 21,390 | |

| WTI Crude Futures | | Sep-18 | | | 6 | | | | 357,480 | | | | (4,050 | ) |

| WTI Crude Futures | | Oct-18 | | | 1 | | | | 59,040 | | | | (1,680 | ) |

| WTI Crude Futures | | Nov-18 | | | 1 | | | | 58,560 | | | | (1,770 | ) |

| | | | | | | | | | | | | $ | (9,880,388 | ) |

The accompanying notes are an integral part of the consolidated financial statements.

14

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments (Continued)

February 28, 2018 (Unaudited)

| Short Contracts | | Expiration

Date | | Number of

Contracts | | | Notional

Amount | | | Value and

Unrealized Appreciation/ (Depreciation) | |

| 3-Month Euro Euribor | | Dec-19 | | | 1,083 | | | $ | (330,315,859 | ) | | $ | 227,238 | |

| 3-Month Euro Euribor | | Mar-20 | | | 4 | | | | (1,220,003 | ) | | | (717 | ) |

| 3-Month Euro Euribor | | Jun-20 | | | 19 | | | | (5,795,015 | ) | | | (3,248 | ) |

| 3-Month Euro Euribor | | Sep-20 | | | 1 | | | | (305,001 | ) | | | (31 | ) |

| 3-Month Euro Euribor | | Dec-20 | | | 1 | | | | (305,001 | ) | | | (76 | ) |

| 90-DAY Eurodollar Futures | | Mar-18 | | | 72 | | | | (18,000,000 | ) | | | 94,838 | |

| 90-DAY Eurodollar Futures | | Jun-18 | | | 224 | | | | (56,000,000 | ) | | | 220,300 | |

| 90-DAY Eurodollar Futures | | Sep-18 | | | 295 | | | | (73,750,000 | ) | | | 251,900 | |

| 90-DAY Eurodollar Futures | | Mar-19 | | | 298 | | | | (74,500,000 | ) | | | 268,725 | |

| 90-DAY Eurodollar Futures | | Jun-19 | | | 1,827 | | | | (456,750,000 | ) | | | 2,445,483 | |

| 90-DAY Eurodollar Futures | | Sep-19 | | | 209 | | | | (52,250,000 | ) | | | 252,038 | |

| 90-DAY Eurodollar Futures | | Dec-19 | | | 2,549 | | | | (637,250,000 | ) | | | 2,649,125 | |

| 90-DAY Eurodollar Futures | | Mar-20 | | | 77 | | | | (19,250,000 | ) | | | 66,963 | |

| 90-DAY Eurodollar Futures | | Jun-20 | | | 71 | | | | (17,750,000 | ) | | | 62,537 | |

| 90-DAY Eurodollar Futures | | Sep-20 | | | 1 | | | | (250,000 | ) | | | (125 | ) |

| 90-DAY Eurodollar Futures | | Dec-20 | | | 132 | | | | (33,000,000 | ) | | | 143,325 | |

| 90-DAY Eurodollar Futures | | Mar-21 | | | 2 | | | | (500,000 | ) | | | (75 | ) |

| 90-DAY Sterling Futures | | Dec-18 | | | 1,512 | | | | (260,197,971 | ) | | | 62,933 | |

| 90-DAY Sterling Futures | | Mar-19 | | | 145 | | | | (24,952,848 | ) | | | (688 | ) |

| 90-DAY Sterling Futures | | Jun-19 | | | 223 | | | | (38,375,759 | ) | | | (12,291 | ) |

| 90-DAY Sterling Futures | | Sep-19 | | | 271 | | | | (46,636,012 | ) | | | 20,302 | |

| 90-DAY Sterling Futures | | Dec-19 | | | 416 | | | | (71,588,860 | ) | | | 109,338 | |

| 90-DAY Sterling Futures | | Mar-20 | | | 252 | | | | (43,366,328 | ) | | | 14,920 | |

| 90-DAY Sterling Futures | | Jun-20 | | | 273 | | | | (46,980,189 | ) | | | 40,763 | |

| 90-DAY Sterling Futures | | Sep-20 | | | 8 | | | | (1,376,709 | ) | | | 120 | |

| 90-DAY Sterling Futures | | Dec-20 | | | 220 | | | | (37,859,493 | ) | | | 104,819 | |

| Australian 10-Year Bond Futures | | Mar-18 | | | 88 | | | | (6,834,951 | ) | | | (50,167 | ) |

| Australian 3-Year Bond Futures | | Mar-18 | | | 19 | | | | (1,475,728 | ) | | | (12,751 | ) |

| Bank Acceptance Futures | | Jun-18 | | | 13 | | | | (2,532,731 | ) | | | (3,419 | ) |

| Bank Acceptance Futures | | Sep-18 | | | 59 | | | | (11,494,701 | ) | | | 2,445 | |

| Bank Acceptance Futures | | Dec-18 | | | 85 | | | | (16,560,162 | ) | | | 18,937 | |

| Canadian 10-Year Bond Futures | | Jun-18 | | | 358 | | | | (27,899,002 | ) | | | (215,578 | ) |

| Canola Futures (Winnipeg Commodity Exchange) | | May-18 | | | 1 | | | | (8,167 | ) | | | (401 | ) |

| Canola Futures (Winnipeg Commodity Exchange) | | Jul-18 | | | 5 | | | | (41,225 | ) | | | (1,897 | ) |

| Cocoa Futures | | May-18 | | | 69 | | | | (1,502,788 | ) | | | (113,207 | ) |

| Cocoa Futures | | Jul-18 | | | 22 | | | | (484,299 | ) | | | (53,471 | ) |

| Coffee 'C' Futures | | May-18 | | | 325 | | | | (14,868,750 | ) | | | 253,144 | |

| Coffee 'C' Futures | | Jul-18 | | | 45 | | | | (2,094,188 | ) | | | 67,781 | |

| Coffee 'C' Futures | | Sep-18 | | | 10 | | | | (473,250 | ) | | | 3,769 | |

| Coffee Robusta Futures | | May-18 | | | 72 | | | | (1,241,280 | ) | | | 77,340 | |

| Coffee Robusta Futures | | Jul-18 | | | 30 | | | | (526,200 | ) | | | 120 | |

| Corn Futures | | Sep-18 | | | 25 | | | | (493,750 | ) | | | (28,525 | ) |

| DJIA Mini E-CBOT | | Mar-18 | | | 60 | | | | (7,511,400 | ) | | | (431,385 | ) |

| Dollar Index | | Mar-18 | | | 3 | | | | (300,000 | ) | | | (4,448 | ) |

| E-Mini Natural Gas | | Apr-18 | | | 16 | | | | (106,675 | ) | | | (1,780 | ) |

| Euro BUXL 30-Year Bond Futures | | Mar-18 | | | 17 | | | | (2,074,005 | ) | | | (53,241 | ) |

| Euro/CHF 3-Month Futures ICE | | Mar-18 | | | 1 | | | | (264,718 | ) | | | (132 | ) |

| Euro-Bobl Futures | | Mar-18 | | | 444 | | | | (54,168,141 | ) | | | (96,917 | ) |

| Euro-Bobl Futures | | Jun-18 | | | 186 | | | | (22,692,059 | ) | | | (20,740 | ) |

| Euro-Bund Futures | | Mar-18 | | | 193 | | | | (23,546,061 | ) | | | (388,546 | ) |

The accompanying notes are an integral part of the consolidated financial statements.

15

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments (Continued)

February 28, 2018 (Unaudited)

| Short Contracts | | Expiration

Date | | Number of

Contracts | | | Notional

Amount | | | Value and

Unrealized Appreciation/ (Depreciation) | |

| Euro-Oat Futures | | Jun-18 | | | 37 | | | $ | (4,514,012 | ) | | $ | (451 | ) |

| Kansas City Hard Red Winter Wheat Futures | | May-18 | | | 22 | | | | (574,475 | ) | | | (46,025 | ) |

| Kansas City Hard Red Winter Wheat Futures | | Jul-18 | | | 58 | | | | (1,563,100 | ) | | | (131,925 | ) |

| Lean Hogs Futures | | Apr-18 | | | 92 | | | | (2,473,880 | ) | | | 67,880 | |

| Lean Hogs Futures | | Jul-18 | | | 1 | | | | (32,880 | ) | | | (850 | ) |

| LME Aluminum Forward | | Mar-18 | | | 1,471 | | | | (78,312,363 | ) | | | 447,614 | |

| Long Gilt Futures | | Jun-18 | | | 306 | | | | (42,127,290 | ) | | | (131,710 | ) |

| Mill Wheat Euro | | Mar-18 | | | 1 | | | | (10,172 | ) | | | (427 | ) |

| Mill Wheat Euro | | May-18 | | | 180 | | | | (1,847,390 | ) | | | 10,217 | |

| Mill Wheat Euro | | Sep-18 | | | 118 | | | | (1,239,859 | ) | | | (30,454 | ) |

| Natural Gas Futures | | Apr-18 | | | 533 | | | | (14,215,200 | ) | | | (54,980 | ) |

| Natural Gas Futures | | May-18 | | | 207 | | | | (5,580,700 | ) | | | (28,220 | ) |

| Natural Gas Futures | | Jun-18 | | | 20 | | | | (547,000 | ) | | | (9,070 | ) |

| Natural Gas Futures | | Jul-18 | | | 14 | | | | (389,100 | ) | | | (7,290 | ) |

| Natural Gas Futures | | Aug-18 | | | 6 | | | | (167,500 | ) | | | (3,740 | ) |

| Natural Gas Futures | | Sep-18 | | | 1 | | | | (27,700 | ) | | | (700 | ) |

| Nikkie 225 (Osaka Securities Exchange) | | Mar-18 | | | 5 | | | | (1,035,662 | ) | | | (6,467 | ) |

| Rapeseed Euro | | May-18 | | | 94 | | | | (2,067,112 | ) | | | (55,998 | ) |

| Rapeseed Euro | | Aug-18 | | | 62 | | | | (1,345,450 | ) | | | (4,514 | ) |

| Rapeseed Euro | | Nov-18 | | | 6 | | | | (131,211 | ) | | | (4,133 | ) |

| Silver Futures | | May-18 | | | 97 | | | | (7,957,400 | ) | | | 84,795 | |

| Silver Futures | | Jul-18 | | | 5 | | | | (412,450 | ) | | | 3,125 | |

| Soybean Futures | | Aug-18 | | | 3 | | | | (159,488 | ) | | | (11,975 | ) |

| Soybean Oil Futures | | May-18 | | | 98 | | | | (1,895,124 | ) | | | 74,262 | |

| Soybean Oil Futures | | Jul-18 | | | 88 | | | | (1,712,304 | ) | | | 36,042 | |

| Sugar No. 11 (World) | | May-18 | | | 355 | | | | (5,319,888 | ) | | | 78,299 | |

| Sugar No. 11 (World) | | Jul-18 | | | 314 | | | | (4,744,163 | ) | | | 37,094 | |

| Sugar No. 11 (World) | | Oct-18 | | | 22 | | | | (340,278 | ) | | | 1,042 | |

| U.S. Treasury 10-Year Notes (Chicago Board of Trade) | | Jun-18 | | | 1,559 | | | | (152,323,900 | ) | | | 54,609 | |

| U.S. Treasury 2-Year Notes (Chicago Board of Trade) | | Jun-18 | | | 694 | | | | (136,276,340 | ) | | | 63,813 | |

| U.S. Treasury 5-Year Notes (Chicago Board of Trade) | | Jun-18 | | | 2,012 | | | | (192,733,675 | ) | | | 242,054 | |

| U.S. Treasury Long Bond (Chicago Board of Trade) | | Jun-18 | | | 246 | | | | (29,597,586 | ) | | | (106,570 | ) |

| U.S. Treasury Ultra Long Bond (Chicago Board of Trade) | | Jun-18 | | | 22 | | | | (2,432,024 | ) | | | (26,164 | ) |

| USD/CZK Futures | | Mar-18 | | | 30 | | | | (3,000,000 | ) | | | 60,939 | |

| USD/HUF Futures | | Mar-18 | | | 29 | | | | (2,900,000 | ) | | | (26,120 | ) |

| USD/NOK Futures | | Mar-18 | | | 1 | | | | (100,000 | ) | | | (49,036 | ) |

| USD/SEK Futures | | Mar-18 | | | 3 | | | | (300,000 | ) | | | (6,266 | ) |

| Wheat (Chicago Board of Trade) | | May-18 | | | 53 | | | | (1,311,750 | ) | | | (200,038 | ) |

| Wheat (Chicago Board of Trade) | | Jul-18 | | | 10 | | | | (253,625 | ) | | | (21,400 | ) |

| White Sugar ICE | | May-18 | | | 111 | | | | (2,005,215 | ) | | | 4,280 | |

| White Sugar ICE | | Aug-18 | | | 51 | | | | (914,175 | ) | | | 43,860 | |

| White Sugar ICE | | Oct-18 | | | 3 | | | | (54,210 | ) | | | (30 | ) |

| | | | | | | | | | | | | $ | 6,310,719 | |

| Total Futures Contracts | | | | | | | | | | | | $ | (3,569,669 | ) |

The accompanying notes are an integral part of the consolidated financial statements.

16

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments (Continued)

February 28, 2018 (Unaudited)

Forward foreign currency contracts outstanding as of February 28, 2018 were as follows:

| Currency Purchased | | Currency Sold | | Expiration

Date | Counterparty | | Unrealized Appreciation/ (Depreciation) | |

| AUD | | | 28,207,023 | | USD | | | 21,925,673 | | Mar 21 2018 | BOA | | $ | (16,788 | ) |

| AUD | | | 62,391,000 | | USD | | | 49,588,180 | | Mar 23 2018 | BOA | | | (1,127,841 | ) |

| AUD | | | 66,000 | | USD | | | 51,293 | | Mar 28 2018 | BOA | | | (29 | ) |

| BRL | | | 35,100,283 | | USD | | | 10,635,697 | | Mar 21 2018 | BOA | | | 150,069 | |

| BRL | | | 4,083,438 | | USD | | | 1,250,000 | | Jun 20 2018 | BOA | | | (6,969 | ) |

| CAD | | | 411,008 | | USD | | | 320,712 | | Mar 01 2018 | BOA | | | (408 | ) |

| CAD | | | 43,572,010 | | USD | | | 34,524,849 | | Mar 21 2018 | BOA | | | (554,833 | ) |

| CAD | | | 35,824,000 | | USD | | | 28,619,060 | | Mar 23 2018 | BOA | | | (688,285 | ) |

| CAD | | | 83,000 | | USD | | | 64,710 | | Mar 28 2018 | BOA | | | 10 | |

| CHF | | | 18,249,000 | | USD | | | 19,460,315 | | Mar 23 2018 | BOA | | | (95,082 | ) |

| CHF | | | 2,108,000 | | USD | | | 2,257,788 | | Mar 28 2018 | BOA | | | (19,671 | ) |

| CLP | | | 9,543,488,344 | | USD | | | 15,089,803 | | Mar 21 2018 | BOA | | | 945,930 | |

| CLP | | | 5,739,651,730 | | USD | | | 9,700,000 | | Jun 20 2018 | BOA | | | (67,079 | ) |

| CNH | | | 35,398,277 | | USD | | | 5,450,000 | | Mar 21 2018 | BOA | | | 136,056 | |

| EUR | | | 1,211,918 | | USD | | | 1,492,251 | | Mar 01 2018 | BOA | | | (13,617 | ) |

| EUR | | | 351,108 | | USD | | | 428,352 | | Mar 02 2018 | BOA | | | 53 | |

| EUR | | | 7,000,000 | | HUF | | | 2,193,803,866 | | Mar 21 2018 | BOA | | | 15,246 | |

| EUR | | | 20,200,000 | | NOK | | | 198,381,048 | | Mar 21 2018 | BOA | | | (452,959 | ) |

| EUR | | | 4,200,000 | | PLN | | | 17,540,487 | | Mar 21 2018 | BOA | | | 6,001 | |

| EUR | | | 32,900,000 | | SEK | | | 326,224,377 | | Mar 21 2018 | BOA | | | 773,199 | |

| EUR | | | 57,430,978 | | USD | | | 68,993,607 | | Mar 21 2018 | BOA | | | 1,190,419 | |

| EUR | | | 40,911,000 | | USD | | | 49,034,498 | | Mar 23 2018 | BOA | | | 970,126 | |

| EUR | | | 51,000 | | JPY | | | 6,636,865 | | Mar 28 2018 | BOA | | | 28 | |

| EUR | | | 1,598,000 | | USD | | | 1,967,381 | | Mar 28 2018 | BOA | | | (13,303 | ) |

| GBP | | | 187,872 | | USD | | | 262,411 | | Mar 01 2018 | BOA | | | (3,758 | ) |

| GBP | | | 629,759 | | USD | | | 868,438 | | Mar 02 2018 | BOA | | | (1,393 | ) |

| GBP | | | 40,902,068 | | USD | | | 55,339,182 | | Mar 21 2018 | BOA | | | 1,027,891 | |

| GBP | | | 28,572,000 | | USD | | | 38,718,816 | | Mar 23 2018 | BOA | | | 660,764 | |

| HUF | | | 1,209,335,168 | | EUR | | | 3,900,000 | | Mar 21 2018 | BOA | | | (58,811 | ) |

| HUF | | | 871,004,193 | | USD | | | 3,331,682 | | Mar 21 2018 | BOA | | | 58,616 | |

| ILS | | | 60,457,605 | | USD | | | 17,400,000 | | Mar 21 2018 | BOA | | | 2,551 | |

| INR | | | 1,592,111,220 | | USD | | | 24,581,464 | | Mar 21 2018 | BOA | | | (204,581 | ) |

| INR | | | 464,187,362 | | USD | | | 7,050,000 | | Jun 20 2018 | BOA | | | (12,507 | ) |

| JPY | | | 132,243,069 | | USD | | | 1,235,398 | | Mar 01 2018 | BOA | | | 4,116 | |

| JPY | | | 33,394,981 | | USD | | | 313,074 | | Mar 02 2018 | BOA | | | (47 | ) |

| JPY | | | 13,734,831,293 | | USD | | | 123,792,616 | | Mar 22 2018 | BOA | | | 5,146,085 | |

| JPY | | | 7,665,381,000 | | USD | | | 70,211,719 | | Mar 23 2018 | BOA | | | 1,754,740 | |

| JPY | | | 754,889,850 | | EUR | | | 5,756,000 | | Mar 28 2018 | BOA | | | 51,666 | |

| JPY | | | 269,445,000 | | USD | | | 2,529,742 | | Mar 28 2018 | BOA | | | 1,005 | |

| KRW | | | 15,558,251,318 | | USD | | | 14,321,492 | | Mar 21 2018 | BOA | | | 50,069 | |

| KRW | | | 6,203,926,766 | | USD | | | 5,800,000 | | Jun 20 2018 | BOA | | | (54,855 | ) |

| MXN | | | 247,139,302 | | USD | | | 12,925,820 | | Mar 21 2018 | BOA | | | 138,374 | |

| MXN | | | 42,318,000 | | USD | | | 2,234,541 | | Mar 23 2018 | BOA | | | 1,700 | |

| NOK | | | 1,995,841 | | USD | | | 253,054 | | Mar 02 2018 | BOA | | | (316 | ) |

| NOK | | | 182,185,533 | | EUR | | | 18,850,000 | | Mar 21 2018 | BOA | | | 50,467 | |

| NOK | | | 76,291,950 | | USD | | | 9,469,998 | | Mar 21 2018 | BOA | | | 197,602 | |

| NZD | | | 567,875 | | USD | | | 411,550 | | Mar 01 2018 | BOA | | | (2,005 | ) |

| NZD | | | 646,453 | | USD | | | 466,752 | | Mar 02 2018 | BOA | | | (543 | ) |

| NZD | | | 29,127,323 | | USD | | | 20,780,991 | | Mar 21 2018 | BOA | | | 221,313 | |

The accompanying notes are an integral part of the consolidated financial statements.

17

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments (Continued)

February 28, 2018 (Unaudited)

| Currency Purchased | | Currency Sold | | Expiration

Date | Counterparty | | Unrealized Appreciation/ (Depreciation) | |

| NZD | | | 26,641,000 | | USD | | | 19,503,897 | | Mar 23 2018 | BOA | | $ | (294,674 | ) |

| PHP | | | 152,928,179 | | USD | | | 3,000,000 | | Mar 21 2018 | BOA | | | (67,139 | ) |

| PHP | | | 52,708,000 | | USD | | | 1,000,000 | | Jun 20 2018 | BOA | | | 5,739 | |

| PLN | | | 59,357,624 | | EUR | | | 14,100,000 | | Mar 21 2018 | BOA | | | 117,720 | |

| PLN | | | 41,783,161 | | USD | | | 11,878,179 | | Mar 21 2018 | BOA | | | 333,993 | |

| RUB | | | 697,612,030 | | USD | | | 11,850,000 | | Mar 21 2018 | BOA | | | 491,484 | |

| RUB | | | 582,127,294 | | USD | | | 10,300,000 | | Jun 20 2018 | BOA | | | (95,873 | ) |

| SEK | | | 102,050,745 | | EUR | | | 10,300,000 | | Mar 21 2018 | BOA | | | (251,770 | ) |

| SEK | | | 55,748,129 | | USD | | | 6,835,933 | | Mar 21 2018 | BOA | | | (97,350 | ) |

| SGD | | | 18,595,366 | | USD | | | 13,921,309 | | Mar 21 2018 | BOA | | | 119,601 | |

| THB | | | 281,887,053 | | USD | | | 8,750,000 | | Mar 21 2018 | BOA | | | 235,164 | |

| TRY | | | 92,811,563 | | USD | | | 23,922,279 | | Mar 21 2018 | BOA | | | 332,803 | |

| TWD | | | 141,365,177 | | USD | | | 4,837,566 | | Mar 21 2018 | BOA | | | 9,586 | |

| TWD | | | 13,005,450 | | USD | | | 450,000 | | Jun 20 2018 | BOA | | | (1,327 | ) |

| USD | | | 19,565,650 | | AUD | | | 25,093,248 | | Mar 21 2018 | BOA | | | 75,288 | |

| USD | | | 44,176,625 | | AUD | | | 56,848,000 | | Mar 23 2018 | BOA | | | 21,646 | |

| USD | | | 3,725,832 | | AUD | | | 4,784,000 | | Mar 28 2018 | BOA | | | 9,972 | |

| USD | | | 8,847,371 | | BRL | | | 28,935,944 | | Mar 21 2018 | BOA | | | (44,190 | ) |

| USD | | | 321,789 | | CAD | | | 411,008 | | Mar 01 2018 | BOA | | | 1,486 | |

| USD | | | 31,434,971 | | CAD | | | 39,648,157 | | Mar 21 2018 | BOA | | | 524,105 | |

| USD | | | 44,962,240 | | CAD | | | 56,987,000 | | Mar 23 2018 | BOA | | | 531,381 | |

| USD | | | 4,766,897 | | CAD | | | 6,079,000 | | Mar 28 2018 | BOA | | | 26,738 | |

| USD | | | 17,011,798 | | CHF | | | 16,644,000 | | Mar 23 2018 | BOA | | | (650,263 | ) |

| USD | | | 10,953,013 | | CHF | | | 10,287,000 | | Mar 28 2018 | BOA | | | 31,046 | |

| USD | | | 14,800,000 | | CLP | | | 8,868,988,180 | | Mar 21 2018 | BOA | | | (102,383 | ) |

| USD | | | 1,150,000 | | CNH | | | 7,330,709 | | Mar 21 2018 | BOA | | | (6,829 | ) |

| USD | | | 1,483,788 | | EUR | | | 1,211,918 | | Mar 01 2018 | BOA | | | 5,154 | |

| USD | | | 428,615 | | EUR | | | 351,108 | | Mar 02 2018 | BOA | | | 210 | |

| USD | | | 59,106,325 | | EUR | | | 48,486,598 | | Mar 21 2018 | BOA | | | (147,144 | ) |

| USD | | | 28,729,544 | | EUR | | | 23,458,000 | | Mar 23 2018 | BOA | | | 57,342 | |

| USD | | | 11,520,132 | | EUR | | | 9,383,000 | | Mar 28 2018 | BOA | | | 46,343 | |

| USD | | | 260,932 | | GBP | | | 187,872 | | Mar 01 2018 | BOA | | | 2,279 | |

| USD | | | 872,316 | | GBP | | | 629,759 | | Mar 02 2018 | BOA | | | 5,272 | |

| USD | | | 46,249,538 | | GBP | | | 33,729,682 | | Mar 21 2018 | BOA | | | (233,282 | ) |

| USD | | | 27,658,457 | | GBP | | | 19,905,000 | | Mar 23 2018 | BOA | | | 224,236 | |

| USD | | | 2,314,604 | | HUF | | | 599,008,928 | | Mar 21 2018 | BOA | | | (16,979 | ) |

| USD | | | 11,600,000 | | ILS | | | 40,282,107 | | Mar 21 2018 | BOA | | | 4,909 | |

| USD | | | 20,649,868 | | INR | | | 1,336,353,258 | | Mar 21 2018 | BOA | | | 188,906 | |

| USD | | | 50,000 | | INR | | | 3,307,516 | | Jun 20 2018 | BOA | | | (145 | ) |

| USD | | | 1,230,443 | | JPY | | | 132,243,069 | | Mar 01 2018 | BOA | | | (9,071 | ) |

| USD | | | 311,734 | | JPY | | | 33,394,981 | | Mar 02 2018 | BOA | | | (1,294 | ) |

| USD | | | 98,816,578 | | JPY | | | 10,953,406,181 | | Mar 22 2018 | BOA | | | (4,010,893 | ) |

| USD | | | 51,519,027 | | JPY | | | 5,703,270,000 | | Mar 23 2018 | BOA | | | (2,026,145 | ) |

| USD | | | 13,401,378 | | KRW | | | 14,391,319,609 | | Mar 21 2018 | BOA | | | 107,742 | |

| USD | | | 9,136,033 | | MXN | | | 175,545,983 | | Mar 21 2018 | BOA | | | (143,619 | ) |

| USD | | | 7,904,221 | | MXN | | | 154,908,000 | | Mar 23 2018 | BOA | | | (281,694 | ) |

| USD | | | 253,470 | | NOK | | | 1,995,841 | | Mar 02 2018 | BOA | | | 731 | |

| USD | | | 8,291,714 | | NOK | | | 67,238,070 | | Mar 21 2018 | BOA | | | (228,592 | ) |

| USD | | | 412,815 | | NZD | | | 567,875 | | Mar 01 2018 | BOA | | | 3,269 | |

| USD | | | 467,453 | | NZD | | | 646,453 | | Mar 02 2018 | BOA | | | 1,244 | |

| USD | | | 17,986,186 | | NZD | | | 25,480,884 | | Mar 21 2018 | BOA | | | (386,847 | ) |

The accompanying notes are an integral part of the consolidated financial statements.

18

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments (Continued)

February 28, 2018 (Unaudited)

| Currency Purchased | | Currency Sold | | Expiration

Date | Counterparty | | Unrealized Appreciation/ (Depreciation) | |

| USD | | | 10,865,269 | | NZD | 15,391,000 | | Mar 23 2018 | BOA | | $ | (232,256 | ) |

| USD | | | 3,000,000 | | PHP | 154,804,442 | | Mar 21 2018 | BOA | | | 31,156 | |

| USD | | | 9,195,286 | | PLN | 31,764,012 | | Mar 21 2018 | BOA | | | (88,539 | ) |

| USD | | | 12,437,693 | | RUB | 697,612,030 | | Mar 21 2018 | BOA | | | 96,209 | |

| USD | | | 5,149,397 | | SEK | 41,633,135 | | Mar 21 2018 | BOA | | | 116,972 | |

| USD | | | 4,417,203 | | SGD | 5,862,398 | | Mar 21 2018 | BOA | | | (9,352 | ) |

| USD | | | 3,200,000 | | THB | 101,847,261 | | Mar 21 2018 | BOA | | | (46,387 | ) |

| USD | | | 13,415,657 | | TRY | 52,288,666 | | Mar 21 2018 | BOA | | | (249,298 | ) |

| USD | | | 5,140,721 | | TWD | 152,408,122 | | Mar 21 2018 | BOA | | | (85,073 | ) |

| USD | | | 5,986,475 | | ZAR | 74,065,828 | | Mar 22 2018 | BOA | | | (271,782 | ) |

| ZAR | | | 177,193,588 | | USD | 14,000,133 | | Mar 22 2018 | BOA | | | 971,996 | |

| ZAR | | | 19,636,000 | | USD | 1,688,550 | | Mar 28 2018 | BOA | | | (30,988 | ) |

| Total Forward Foreign Currency Contracts | | | | | | $ | 4,778,960 | |

| | | Put/Call | | | Counterparty | | | Number

Of Contracts | | | Notional

Amount | | Value | |

| Purchased Options — 0.9% | | | | | | | | | | | | | | |

| 3-Month Euro Euribor, Expires 12/16/19, Strike Price $99.50 | | | Put | | | | BAML | | | | 4,356 | | | EUR 173,996,064 | | $ | 963,223 | |

| EURO Currency Futures, Expires 4/06/18, Strike Price $1.20 | | | Put | | | | BAML | | | | 561 | | | EUR 70,125,000 | | | 203,363 | |

| IMM Eurodollar Futures, Expires 12/17/18, Strike Price $97.625 | | | Put | | | | BAML | | | | 2,420 | | | EUR 94,350,960 | | | 1,376,375 | |

| IMM Eurodollar Futures, Expires 12/17/18, Strike Price $97.875 | | | Put | | | | BAML | | | | 4,699 | | | EUR 183,204,612 | | | 5,022,056 | |

| IMM Eurodollar Futures, Expires 3/19/18, Strike Price $98 | | | Put | | | | BAML | | | | 1,753 | | | EUR 68,636,962 | | | 514,944 | |

| U.S. 10-Year Treasury Bond, Expires 3/23/18, Strike Price $119 | | | Put | | | | BAML | | | | 1,508 | | | USD 181,035 | | | 282,750 | |

| USD JPY Currency Futures, Expires 4/06/18, Strike Price $103 | | | Put | | | | BAML | | | | 111,032,000 | | | JPY 111,032,000 | | | 275,359 | |

| TOTAL PURCHASED OPTIONS (COST $4,027,045) | | | | | | | | | $ | 8,638,070 | |

The accompanying notes are an integral part of the consolidated financial statements.

19

Abbey Capital Futures Strategy Fund

Consolidated Portfolio of Investments (Concluded)

February 28, 2018 (Unaudited)

| | | Put/Call | | | Counterparty | | | Number Of

Contracts | | | Notional

Amount | | Value | |

| Written Options — (0.6)% | | | | | | | | | | | | | | | | | | |

| 3-Month Euro Euribor, Expires 12/16/19, Strike Price $99.375 | | | Put | | | | BAML | | | | 4,356 | | | EUR 173,996,064 | | $ | (697,506 | ) |

| IMM Eurodollar Futures, Expires 12/17/18, Strike Price $97.5 | | | Put | | | | BAML | | | | 2,420 | | | EUR 94,350,960 | | | (892,375 | ) |

| IMM Eurodollar Futures, Expires 12/17/18, Strike Price $97.75 | | | Put | | | | BAML | | | | 4,699 | | | EUR 183,204,612 | | | (3,788,569 | ) |

| U.S. 10-Year Treasury Bond, Expires 3/23/18, Strike Price $118 | | | Put | | | | BAML | | | | 1,508 | | | USD 181,035 | | | (70,687 | ) |

| USD JPY Currency Futures, Expires 4/06/18, Strike Price $100 | | | Put | | | | BAML | | | | 111,032,000 | | | JPY 111,032,000 | | | (79,499 | ) |

| TOTAL WRITTEN OPTIONS (PREMIUMS RECEIVED $2,164,490) | | | | | | | | | $ | (5,528,636 | ) |

AUD | Australian Dollar |

BAML | Bank of America Merrill Lynch |

BOA | Bank of America |

BRL | Brazilian Real |

CAD | Canadian Dollar |

CBOT | Chicago Board of Trade |

CHF | Swiss Franc |

CLP | Chilean Peso |

CNH | Chinese Yuan Renminbi |

COP | Colombian Peso |

CZK | Czech Koruna |

DAX | Deutscher Aktienindex |

DJIA | Dow Jones Industrial Average |

EUR | Euro |

FTSE | Financial Times Stock Exchange |

GBP | British Pound |

HUF | Hungarian Forint |

IBEX | Index of the Bolsa de Madrid |

ICE | Intercontinental Exchange |

ILS | Israeli New Shekel |

IMM | International Monetary Market |

INR | Indian Rupee |

JPY | Japanese Yen |

KRW | Korean Won |

LME | London Mercantile Exchange |

MXN | Mexican Peso |

NOK | Norwegian Krone |

NZD | New Zealand Dollar |

PHP | Philippine Peso |

PLN | Polish Zloty |

RBOB | Reformulated Blendstock for Oxygenate Blending |

RUB | Russian Ruble |

SEK | Swedish Krona |

SGD | Singapore Dollar |

SGX | Singapore Exchange |

THB | Thai Baht |

TRY | Turkish Lira |

TSX | Toronto Stock Exchange |

TWD | Taiwan Dollar |

USD | United States Dollar |

WTI | West Texas Intermediate |

ZAR | South African Rand |

The accompanying notes are an integral part of the consolidated financial statements.

20

Abbey Capital Futures Strategy Fund

Consolidated Statement of Assets And Liabilities

February 28, 2018 (Unaudited)

| ASSETS | | | |

| Investments, at value (cost $898,928,910) | | $ | 903,155,058 | |

| Cash | | | 17,881,937 | |

| Deposits with broker for forward foreign currency contracts | | | 10,935,448 | |

| Deposits with brokers for futures contracts | | | 66,187,979 | |

| Receivables for: | | | | |

| Capital shares sold | | | 9,860,916 | |

| Unrealized appreciation on forward foreign currency contracts | | | 18,285,818 | |

| Unrealized appreciation on futures contracts | | | 13,172,628 | |

| Prepaid expenses and other assets | | | 65,644 | |

| Total assets | | | 1,039,545,428 | |

| LIABILITIES | | | | |

| Options written, at value (premiums received $2,164,490) | | | 5,528,636 | |

| Due to broker | | | 2,395,078 | |

| Payables for: | | | | |

| Investments purchased | | | 55,379,630 | |

| Advisory fees | | | 1,211,443 | |

| Capital shares redeemed | | | 432,956 | |

| Administration and accounting services fees | | | 72,108 | |

| Unrealized depreciation on forward foreign currency contracts | | | 13,506,858 | |

| Unrealized depreciation on futures contracts | | | 16,742,297 | |

| Other accrued expenses and liabilities | | | 195,315 | |

| Total liabilities | | | 95,464,321 | |

| Net assets | | $ | 944,081,107 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Par value | | $ | 83,096 | |

| Paid-in capital | | | 921,161,000 | |

| Accumulated net investment income/(loss) | | | (13,674,585 | ) |

| Accumulated net realized gain/(loss) from investments, futures contracts, foreign currency transactions, forward foreign currency contracts and written options | | | 34,401,388 | |

| Net unrealized appreciation/(depreciation) on investments, futures contracts, foreign currency translation, forward foreign currency contracts and written options | | | 2,110,208 | |

| Net assets | | $ | 944,081,107 | |

| | | | | |

| CLASS A SHARES: | | | | |

| Net assets | | $ | 13,107,496 | |

| Shares outstanding ($0.001 par value, 100,000,000 shares authorized) | | | 1,160,554 | |

| Net asset value and redemption price per share | | $ | 11.29 | |

| Maximum offering price per share (100/94.25 of $11.29) | | $ | 11.98 | |

| | | | | |

| CLASS I SHARES: | | | | |

| Net assets | | $ | 921,700,371 | |

| Shares outstanding ($0.001 par value, 300,000,000 shares authorized) | | | 81,101,363 | |

| Net asset value, offering and redemption price per share | | $ | 11.36 | |

| | | | | |

| CLASS C SHARES: | | | | |

| Net assets | | $ | 9,273,240 | |

| Shares outstanding ($0.001 par value, 100,000,000 shares authorized) | | | 834,273 | |

| Net asset value, offering and redemption price per share | | $ | 11.12 | |

The accompanying notes are an integral part of the consolidated financial statements.

21

Abbey Capital Futures Strategy Fund

Consolidated Statement of Operations

For the Six Months Ended

February 28, 2018 (Unaudited)

| INVESTMENT INCOME | | | |

| Interest | | $ | 4,773,127 | |

| Total investment income | | | 4,773,127 | |

| EXPENSES | | | | |

| Advisory fees (Note 2) | | | 7,678,675 | |

| Administration and accounting services fees (Note 2) | | | 194,293 | |

| Legal fees | | | 93,565 | |

| Registration and filing fees | | | 53,329 | |

| Transfer agent fees (Note 2) | | | 47,853 | |

| Printing and shareholder reporting fees | | | 46,579 | |

| Distribution fees (Class C Shares) (Note 2) | | | 35,797 | |

| Distribution fees (Class A Shares) (Note 2) | | | 17,217 | |

| Audit and tax service fees | | | 31,245 | |

| Directors fees | | | 26,945 | |

| Officers fees | | | 16,127 | |

| Custodian fees (Note 2) | | | 8,765 | |

| Other expenses | | | 32,113 | |

| Total expenses before waivers and reimbursements | | | 8,282,503 | |

| Less: waivers and reimbursements (Note 2) | | | (447,424 | ) |

| Net expenses after waivers and reimbursements | | | 7,835,079 | |

| Net investment income/(loss) | | | (3,061,952 | ) |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) FROM INVESTMENTS | | | | |

| Net realized gain/(loss) from: | | | | |

| Investments | | | 2,242,234 | |

| Futures contracts | | | 37,972,930 | |

| Foreign currency transactions | | | 71,372 | |

| Forward foreign currency contracts | | | (4,566,810 | ) |

| Written options | | | (1,313,894 | ) |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

| Investments | | | 4,447,722 | |

| Futures contracts | | | (26,263,709 | ) |

| Foreign currency translation | | | 38,915 | |

| Forward foreign currency contracts | | | 2,465,906 | |

| Written options | | | (3,416,396 | ) |

| Net realized and unrealized gain/(loss) from investments | | | 11,678,270 | |

| NET INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 8,616,318 | |

The accompanying notes are an integral part of the consolidated financial statements.

22

Abbey Capital Futures Strategy Fund

Consolidated Statements of Changes in Net Assets

| | | For the

Six Months Ended

February 28, 2018

(Unaudited) | | | For the

Year Ended

August 31, 2017 | |

| INCREASE/(DECREASE) IN NET ASSET FROM OPERATIONS: | | | | | | |

| Net investment income/(loss) | | $ | (3,061,952 | ) | | $ | (10,879,903 | ) |

| Net realized gain/(loss) from investments, futures contracts, foreign currency transactions, forward foreign currency contracts and written options | | | 34,405,832 | | | | (50,609,874 | ) |

| Net change in unrealized appreciation/(depreciation) on investments, futures contracts, foreign currency translation, forward foreign currency contracts and written options | | | (22,727,562 | ) | | | 20,193,769 | |

| Net increase/(decrease) in net assets resulting from operations | | | 8,616,318 | | | | (41,296,008 | ) |

| capital SHARE TRANSACTIONS: | | | | | | | | |

| Class A Shares | | | | | | | | |

| Proceeds from shares sold | | | 1,754,722 | | | | 9,247,071 | |

| Shares redeemed | | | (4,206,562 | ) | | | (10,029,596 | ) |

| Total from Class A Shares | | | (2,451,840 | ) | | | (782,525 | ) |

| Class I Shares | | | | | | | | |

| Proceeds from shares sold | | | 340,278,315 | | | | 561,507,438 | |

| Shares redeemed | | | (199,363,200 | ) | | | (489,198,240 | ) |

| Total from Class I Shares | | | 140,915,115 | | | | 72,309,198 | |

| Class C Shares | | | | | | | | |

| Proceeds from shares sold | | | 1,068,532 | | | | 6,146,653 | |

| Shares redeemed | | | (1,342,971 | ) | | | (4,447,796 | ) |

| Total from Class C Shares | | | (274,439 | ) | | | 1,698,857 | |

| Net increase/(decrease) in net assets from capital share transactions | | | 138,188,836 | | | | 73,225,530 | |

| Total increase/(decrease) in net assets | | | 146,805,154 | | | | 31,929,522 | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 797,275,953 | | | | 765,346,431 | |

| End of period | | $ | 944,081,107 | | | $ | 797,275,953 | |

| Accumulated net investment income/(loss), end of period | | $ | (13,674,585 | ) | | $ | (10,612,633 | ) |

The accompanying notes are an integral part of the consolidated financial statements.

23

Abbey Capital Futures Strategy Fund

Consolidated Statements of Changes in Net Assets (Concluded)

| | | For the

Six Months Ended

February 28, 2018

(Unaudited) | | | For the