| |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| |

FORM 10-Q |

| |

(Mark One) |

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2005 |

OR |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from | | to |

Commission File Number: 1-9916 |

|

Freeport-McMoRan Copper & Gold Inc. |

| (Exact name of registrant as specified in its charter) |

Delaware | 74-2480931 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| | |

1615 Poydras Street | |

New Orleans, Louisiana* | 70112 |

| (Address of principal executive offices) | (Zip Code) |

| |

(504) 582-4000 |

| (Registrant's telephone number, including area code) |

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No __

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes X No __

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No X

On September 30, 2005, there were issued and outstanding 184,044,962 shares of the registrant’s Class B Common Stock, par value $0.10 per share.

* In the aftermath of Hurricane Katrina, Freeport-McMoRan Copper & Gold Inc. has temporarily moved its corporate headquarters to 5353 Essen Lane, Suite 350, Baton Rouge, Louisiana 70809, office telephone (225) 765-2200.

FREEPORT-McMoRan COPPER & GOLD INC.

| | |

| | Page |

| 3 |

| | |

| |

| | |

| 3 |

| | |

| 4 |

| | |

| 5 |

| | |

| 6 |

| | |

| 11 |

| | |

| 12 |

| | |

| |

| 13 |

| | |

| 37 |

| | |

| 37 |

| | |

| 37 |

| | |

| 37 |

| | |

| 38 |

| | |

| 38 |

| | |

| 38 |

| | |

| E-1 |

| | |

Table of ContentsFREEPORT-McMoRan COPPER & GOLD INC.

FREEPORT-McMoRan COPPER & GOLD INC.

| | | September 30, | | | December 31, | |

| | | 2005 | | | 2004 | |

| | | (In Thousands) | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 392,845 | | | $ | 551,450 | |

| Restricted cash | | | 500 | | | | 500 | |

| Accounts receivable | | | 418,689 | | | | 435,062 | |

| Inventories | | | 450,031 | | | | 466,712 | |

| Prepaid expenses and other | | | 13,129 | | | | 6,223 | |

| Total current assets | | | 1,275,194 | | | | 1,459,947 | |

| Property, plant, equipment and development costs, net | | | 3,120,311 | | | | 3,199,292 | |

| Deferred mining costs | | | 289,025 | | | | 220,415 | |

| Other assets | | | 142,097 | | | | 159,539 | |

| Investment in PT Smelting | | | 51,154 | | | | 47,802 | |

| Total assets | | $ | 4,877,781 | | | $ | 5,086,995 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 440,229 | | | $ | 386,590 | |

| Current portion of long-term debt and short-term borrowings | | | 195,581 | | | | 78,214 | |

| Accrued income taxes | | | 160,641 | | | | 92,346 | |

| Rio Tinto share of joint venture cash flows | | | 68,292 | | | | 60,224 | |

| Unearned customer receipts | | | 57,570 | | | | 33,021 | |

| Accrued interest payable | | | 15,635 | | | | 47,167 | |

| Total current liabilities | | | 937,948 | | | | 697,562 | |

| Long-term debt, less current portion: | | | | | | | | |

| Senior notes | | | 746,021 | | | | 911,336 | |

| Convertible senior notes | | | 386,565 | | | | 575,000 | |

| Equipment and other loans | | | 57,901 | | | | 67,624 | |

| Atlantic Copper debt | | | 33 | | | | 4,426 | |

| Redeemable preferred stock | | | - | | | | 179,880 | |

| PT Puncakjaya Power bank debt | | | - | | | | 135,426 | |

| Total long-term debt, less current portion | | | 1,190,520 | | | | 1,873,692 | |

| Accrued postretirement benefits and other liabilities | | | 204,177 | | | | 200,228 | |

| Deferred income taxes | | | 909,141 | | | | 932,416 | |

| Minority interests | | | 187,976 | | | | 219,448 | |

| Stockholders' equity: | | | | | | | | |

| Convertible perpetual preferred stock | | | 1,100,000 | | | | 1,100,000 | |

| Class B common stock | | | 29,310 | | | | 28,496 | |

| Capital in excess of par value of common stock | | | 2,090,782 | | | | 1,852,816 | |

| Retained earnings | | | 762,823 | | | | 604,680 | |

| Accumulated other comprehensive income | | | 7,181 | | | | 11,342 | |

| Common stock held in treasury | | | (2,542,077 | ) | | | (2,433,685 | ) |

| Total stockholders’ equity | | | 1,448,019 | | | | 1,163,649 | |

| Total liabilities and stockholders’ equity | | $ | 4,877,781 | | | $ | 5,086,995 | |

The accompanying notes are an integral part of these financial statements.

Table of ContentsFREEPORT-McMoRan COPPER & GOLD INC.

| | | Three Months Ended | | | Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | | 2005 | | | 2004 | | | 2005 | | | 2004 | |

| | | (In Thousands, Except Per Share Amounts) | |

| Revenues | $ | 983,270 | | $ | 600,556 | | $ | 2,689,244 | | $ | 1,447,075 | |

| Cost of sales: | | | | | | | | | | | | |

| Production and delivery | | 434,368 | | | 368,016 | | | 1,189,960 | | | 1,015,307 | |

| Depreciation and amortization | | 61,646 | | | 55,755 | | | 172,731 | | | 123,755 | |

| Total cost of sales | | 496,014 | | | 423,771 | | | 1,362,691 | | | 1,139,062 | |

| Exploration expenses | | 2,159 | | | 1,963 | | | 6,421 | | | 6,977 | |

| General and administrative expenses | | 25,546 | | | 26,186 | | | 72,539 | | | 64,322 | |

| Total costs and expenses | | 523,719 | | | 451,920 | | | 1,441,651 | | | 1,210,361 | |

| Operating income | | 459,551 | | | 148,636 | | | 1,247,593 | | | 236,714 | |

| Equity in PT Smelting earnings (losses) | | 1,315 | | | 2,678 | | | 6,473 | | | (228 | ) |

| Interest expense, net | | (33,330 | ) | | (37,848 | ) | | (106,170 | ) | | (110,577 | ) |

| Losses on early extinguishment and | | | | | | | | | | | | |

| conversion of debt | | (38,416 | ) | | (11 | ) | | (38,379 | ) | | (14,011 | ) |

| Other income, net | | 3,605 | | | 373 | | | 19,700 | | | 3,547 | |

| Income before income taxes and minority | | | | | | | | | | | | |

| interests | | 392,725 | | | 113,828 | | | 1,129,217 | | | 115,445 | |

| Provision for income taxes | | (186,712 | ) | | (71,343 | ) | | (539,424 | ) | | (127,894 | ) |

| Minority interests in net income of | | | | | | | | | | | | |

| consolidated subsidiaries | | (25,083 | ) | | (10,227 | ) | | (72,971 | ) | | (12,914 | ) |

| Net income (loss) | | 180,930 | | | 32,258 | | | 516,822 | | | (25,363 | ) |

| Preferred dividends | | (15,125 | ) | | (15,125 | ) | | (45,375 | ) | | (30,366 | ) |

| Net income (loss) applicable to common stock | $ | 165,805 | | $ | 17,133 | | $ | 471,447 | | $ | (55,729 | ) |

| | | | | | | | | | | | | |

| Net income (loss) per share of common stock: | | | | | | | | | | | | |

| Basic | | $0.93 | | | $0.10 | | | $2.64 | | | $(0.30 | ) |

| Diluted | | $0.86 | | | $0.10 | | | $2.48 | | | $(0.30 | ) |

| Average common shares outstanding: | | | | | | | | | | | | |

| Basic | | 177,895 | | | 177,137 | | | 178,513 | | | 183,426 | |

| Diluted | | 219,824 | | | 179,805 | | | 220,285 | | | 183,426 | |

| | | | | | | | | | | | | |

| Dividends paid per share of common stock | | $0.75 | | | $0.20 | | | $1.75 | | | $0.60 | |

The accompanying notes are an integral part of these financial statements.

Table of ContentsFREEPORT-McMoRan COPPER & GOLD INC.

| | | Nine Months Ended | |

| | | September 30, | |

| | | 2005 | | | 2004 | |

| | | (In Thousands) | |

| Cash flow from operating activities: | | | | | | | | |

| Net income (loss) | | $ | 516,822 | | | $ | (25,363 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by | | | |

| (used in) operating activities: | | | | | | | | |

| Depreciation and amortization | | | 172,731 | | | | 123,755 | |

| Losses on early extinguishment and conversion of debt | | | 38,379 | | | | 14,011 | |

| Deferred income taxes | | | (24,085 | ) | | | 76,107 | |

| Equity in PT Smelting (earnings) losses | | | (6,473 | ) | | | 228 | |

| Minority interests' share of net income | | | 72,971 | | | | 12,914 | |

| Increase in deferred mining costs | | | (68,610 | ) | | | (81,383 | ) |

| Amortization of deferred financing costs | | | 5,979 | | | | 6,509 | |

| Currency translation gains | | | (4,924 | ) | | | (1,086 | ) |

| Elimination of profit on PT Freeport Indonesia sales to PT Smelting | | | 3,120 | | | | 2,473 | |

| Provision for inventory obsolescence | | | 4,500 | | | | 3,050 | |

| Other | | | 17,888 | | | | 5,825 | |

| (Increases) decreases in working capital: | | | | | | | | |

| Accounts receivable | | | 5,582 | | | | (60,280 | ) |

| Inventories | | | 7,772 | | | | (59,879 | ) |

| Prepaid expenses and other | | | (5,696 | ) | | | (43,299 | ) |

| Accounts payable and accrued liabilities | | | 56,084 | | | | 35,394 | |

| Rio Tinto share of joint venture cash flows | | | 8,068 | | | | (31,994 | ) |

| Accrued income taxes | | | 82,919 | | | | (39,866 | ) |

| (Increase) decrease in working capital | | | 154,729 | | | | (199,924 | ) |

| Net cash provided by (used in) operating activities | | | 883,027 | | | | (62,884 | ) |

| Cash flow from investing activities: | | | | | | | | |

| PT Freeport Indonesia capital expenditures | | | (85,793 | ) | | | (90,111 | ) |

| Atlantic Copper and other capital expenditures | | | (9,814 | ) | | | (18,295 | ) |

| Proceeds from insurance settlement | | | 2,016 | | | | - | |

| Investment in PT Smelting and other | | | - | | | | (1,463 | ) |

| Sale of restricted investments | | | - | | | | 21,804 | |

| Decrease in Atlantic Copper restricted cash | | | - | | | | 11,000 | |

| Net cash used in investing activities | | | (93,591 | ) | | | (77,065 | ) |

| Cash flow from financing activities: | | | | | | | | |

| Net proceeds from sale of senior notes | | | - | | | | 344,354 | |

| Proceeds from other debt | | | 47,308 | | | | 80,208 | |

| Repayments of debt | | | (447,808 | ) | | | (379,427 | ) |

| Redemption of preferred stock | | | (12,716 | ) | | | (13,664 | ) |

| Net proceeds from sale of convertible perpetual preferred stock | | | - | | | | 1,067,000 | |

| Purchase of FCX common shares from Rio Tinto | | | - | | | | (881,868 | ) |

| Purchases of other FCX common shares | | | (80,227 | ) | | | (99,477 | ) |

| Cash dividends paid: | | | | | | | | |

| Common stock | | | (312,936 | ) | | | (109,406 | ) |

| Preferred stock | | | (45,376 | ) | | | (20,345 | ) |

| Minority interests | | | (104,773 | ) | | | (1,172 | ) |

| Net proceeds from exercised stock options | | | 8,508 | | | | 5,765 | |

| Bank credit facilities fees and other | | | (21 | ) | | | (1,561 | ) |

| Net cash used in financing activities | | | (948,041 | ) | | | (9,593 | ) |

| Net decrease in cash and cash equivalents | | | (158,605 | ) | | | (149,542 | ) |

| Cash and cash equivalents at beginning of year | | | 551,450 | | | | 463,652 | |

| Cash and cash equivalents at end of period | | $ | 392,845 | | | $ | 314,110 | |

The accompanying notes are an integral part of these financial statements.

Table of ContentsFREEPORT-McMoRan COPPER & GOLD INC.

| 1. | NEW ACCOUNTING STANDARDS |

Deferred Mining Costs. In the mining industry, the costs of removing overburden and waste material to access mineral deposits are referred to as “stripping costs.” Currently, Freeport-McMoRan Copper & Gold Inc. (FCX) applies the deferred mining cost method in accounting for its post-production stripping costs, which FCX refers to as overburden removal costs. The deferred mining cost method is used by some companies in the metals mining industry; however, industry practice varies. The deferred mining cost method matches the cost of production with the sale of the related metal from the open pit by assigning each metric ton of ore removed an equivalent amount of overburden tonnage, thereby averaging overburden removal costs over the life of the mine. The mining cost capitalized in inventory and the amounts charged to cost of goods sold do not represent the actual costs incurred to mine the ore in any given period. The application of the deferred mining cost method has resulted in an asset on FCX’s balance sheets (“Deferred Mining Costs”) totaling $289.0 million at September 30, 2005, and $220.4 million at December 31, 2004. For further information, see Note 1 in FCX’s 2004 Annual Report on Form 10-K.

In March 2005, the Financial Accounting Standards Board (FASB) ratified Emerging Issues Task Force (EITF) Issue No. 04-6, “Accounting for Stripping Costs Incurred during Production in the Mining Industry,” (EITF 04-6) which requires that stripping costs be considered costs of the extracted minerals and recognized as a component of inventory to be recognized in cost of sales in the same period as the revenue from the sale of inventory. As a result, capitalization of stripping costs is appropriate only to the extent product inventory exists at the end of a reporting period. The guidance in EITF 04-6 is effective for financial statements issued for fiscal years beginning after December 15, 2005, with early adoption permitted. Companies may apply this guidance either by recognition of a cumulative effect adjustment to beginning retained earnings in the period of adoption or by restating prior period financial statements. FCX expects to adopt the guidance on January 1, 2006, with the most significant impacts of adoption being the deferred mining costs asset on FCX’s balance sheet on that date will be recorded, net of taxes and minority interest share, as a cumulative effect adjustment to reduce beginning retained earnings and future stripping costs will effectively be charged to cost of sales as incurred. Adoption of the new guidance will have no impact on FCX’s cash flows. The pro forma impact of applying EITF 04-6 to the periods reported in this quarterly report on Form 10-Q would be to reduce net income by $7.9 million or $0.04 per diluted share for the third quarter of 2005, $14.5 million or $0.08 per share for the third quarter of 2004 and $36.0 million or $0.16 per diluted share for the 2005 nine-month period, and to increase the net loss by $42.5 million or $0.23 per share for the 2004 nine-month period. These pro forma amounts are not necessarily indicative of what charges may be for future periods.

Stock-Based Payments. Refer to Note 1 in FCX’s 2004 Annual Report on Form 10-K for FCX’s accounting for share-based payments, including stock options. Through September 30, 2005, FCX has accounted for grants of employee stock options under the recognition principles of Accounting Principles Board (APB) Opinion No. 25, “Accounting for Stock Issued to Employees,” and related interpretations, which require compensation costs for stock-based employee compensation plans to be recognized based on the difference on the date of grant, if any, between the quoted market price of the stock and the amount an employee must pay to acquire the stock. If FCX had applied the fair value recognition provisions of Statement of Financial Accounting Standards (SFAS) No. 123, “Accounting for Stock-Based Compensation,” which requires stock-based compensation to be recognized based on the use of a fair value method, FCX’s net income would have been reduced by $3.2 million, $0.02 per basic share and no change in earnings per diluted share, for the third quarter of 2005, $1.5 million, $0.01 per share, for the third quarter of 2004 and $9.5 million, $0.05 per basic share and $0.03 per diluted share, for the first nine months of 2005. FCX’s net loss for the first nine months of 2004 would have been increased by $3.7 million, $0.02 per share.

In December 2004, the FASB issued SFAS No. 123 (revised 2004), “Share-Based Payment” (SFAS No. 123R). SFAS No. 123R requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values. SFAS No. 123R’s effective date is fiscal periods beginning after June 15, 2005. FCX is still reviewing the provisions of SFAS No. 123R and expects to adopt SFAS No. 123R on January 1, 2006. Based on currently outstanding employee stock options, FCX currently estimates the pro forma charge to earnings before taxes and minority interest sharing for the full year 2005 would total approximately $22 million, and the pro forma reduction in net income would be approximately $13 million, $0.07 per share using average basic shares outstanding for the third quarter of 2005. These 2005 pro forma amounts are not necessarily indicative of what charges may be for future periods.

FCX basic net income (loss) per share of common stock was calculated by dividing net income (loss) applicable to common stock by the weighted average number of common shares outstanding during the period. The following is a reconciliation of net income (loss) and weighted average common shares outstanding for purposes of calculating diluted net income (loss) per share (in thousands, except per share amounts):

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

| Net income (loss) before preferred dividends | | $ | 180,930 | | $ | 32,258 | | $ | 516,822 | | $ | (25,363 | ) |

| Preferred dividends | | | (15,125 | ) | | (15,125 | ) | | (45,375 | ) | | (30,366 | ) |

| Net income (loss) applicable to common stock | | | 165,805 | | | 17,133 | | | 471,447 | | | (55,729 | ) |

| Plus income impact of assumed conversion of: | | | | | | | | | | | | | |

| 5½% Convertible Perpetual Preferred Stock | | | 15,125 | | | - | | | 45,375 | | | - | |

| 7% Convertible Senior Notes | | | 9,177 | | | - | | | 29,786 | | | - | |

| Diluted net income (loss) applicable to common stock | | $ | 190,107 | | $ | 17,133 | | $ | 546,608 | | $ | (55,729 | ) |

| | | | | | | | | | | | | | |

| Weighted average common shares outstanding | | | 177,895 | | | 177,137 | | | 178,513 | | | 183,426 | |

Add: Shares issuable upon conversion of: | | | | | | | | | | | | | |

| 5½% Convertible Perpetual Preferred Stock | | | 21,224 | | | - | | | 21,097 | | | - | |

| 7% Convertible Senior Notes | | | 18,410 | | | - | | | 18,553 | | | - | |

| Dilutive stock options | | | 1,817 | | | 2,188 | | | 1,642 | | | - | |

| Restricted stock | | | 478 | | | 480 | | | 480 | | | - | |

| Weighted average common shares outstanding for | | | | | | | | | | | | | |

| purposes of calculating diluted net income (loss) | | | | | | | | | | | | | |

| per share | | | 219,824 | | | 179,805 | | | 220,285 | | | 183,426 | |

| | | | | | | | | | | | | | |

| Diluted net income (loss) per share of common stock | | $ | 0.86 | | $ | 0.10 | | $ | 2.48 | | $ | (0.30 | ) |

| | | | | | | | | | | | | | |

Stock options representing 2.3 million shares and unvested restricted stock representing 0.4 million shares in the 2004 nine-month period that otherwise would have been included in that period’s earnings per share calculation were excluded because of the net loss reported for the period.

Outstanding stock options with exercise prices greater than the average market price of the common stock during the period are excluded from the computation of diluted net income per share of common stock. FCX’s convertible instruments are also excluded when including the conversion of these instruments increases reported diluted net income per share or when FCX reports a net loss for the period. A recap of the excluded amounts follows (in thousands, except exercise prices):

| | Three Months Ended | | Nine Months Ended | |

| | September 30, | | September 30, | |

| | 2005 | | 2004 | | 2005 | | 2004 | |

| Weighted average outstanding options | - | | 1,161 | | 1,821 | | 1,169 | |

| Weighted average exercise price | - | | $36.77 | | $36.98 | | $36.34 | |

| | | | | | | | | |

| Dividends on 5½% Convertible Perpetual Preferred Stock | - | | $15,125 | | - | | $30,418 | a |

| Weighted average shares issuable upon conversion | - | | 20,682 | | - | | 13,936 | a |

| | | | | | | | | |

| Interest on 7% Convertible Senior Notes | - | | $10,357 | b | - | | $31,072 | b |

| Weighted average shares issuable upon conversion | - | | 18,625 | | - | | 18,625 | |

| | | | | | | | | |

| Interest on 8¼% Convertible Senior Notes | N/A | | $466 | b | N/A | | $3,829 | b |

| Weighted average shares issuable upon conversion | N/A | | 1,364 | | N/A | | 4,097 | |

| | | | | | | | | |

| a. | FCX’s 5½% Convertible Perpetual Preferred Stock was issued on March 30, 2004. |

| b. | Amounts are net of the effective United States federal alternative minimum tax rate of two percent. |

Stock-Based Compensation Plans. As of September 30, 2005, FCX has four stock-based employee compensation plans and two stock-based director compensation plans, which are more fully described in Note 7 of FCX’s 2004 Annual Report on Form 10-K. As discussed in Note 1, FCX accounts for options granted under all of its plans using the recognition and measurement principles of APB Opinion No. 25 and related interpretations. Because all the plans require that the option exercise price be at least the market price on the date of grant, FCX recognizes no compensation expense on the grant or exercise of its employees’ and directors’ options. The following table illustrates the effect on net income and earnings per share if FCX had applied the fair value recognition provisions of SFAS No. 123, as discussed in Note 1 (in thousands, except per share amounts).

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

| Net income (loss) applicable to common stock, as reported | | $ | 165,805 | | $ | 17,133 | | $ | 471,447 | | $ | (55,729 | ) |

| Add: Stock-based employee compensation expense | | | | | | | | | | | | | |

| included in reported net income (loss) for stock option | | | | | | | | | | | | | |

| conversions, stock appreciation rights (SARs) and | | | | | | | | | | | | | |

| restricted stock units, net of taxes and minority interests | | | 4,675 | | | 2,252 | | | 9,132 | | | 2,626 | |

| Deduct: Total stock-based employee compensation | | | | | | | | | | | | | |

| expense determined under fair value-based method for | | | | | | | | | | | | | |

| all awards, net of taxes and minority interests | | | (7,892 | ) | | (3,766 | ) | | (18,646 | ) | | (6,349 | ) |

| Pro forma net income (loss) applicable to common stock | | $ | 162,588 | | $ | 15,619 | | $ | 461,933 | | $ | (59,452 | ) |

| | | | | | | | | | | | | | |

| Earnings (loss) per share: | | | | | | | | | | | | | |

| Basic - as reported | | $ | 0.93 | | $ | 0.10 | | $ | 2.64 | | $ | (0.30 | ) |

| Basic - pro forma | | $ | 0.91 | | $ | 0.09 | | $ | 2.59 | | $ | (0.32 | ) |

| | | | | | | | | | | | | | |

| Diluted - as reported | | $ | 0.86 | | $ | 0.10 | | $ | 2.48 | | $ | (0.30 | ) |

| Diluted - pro forma | | $ | 0.86 | | $ | 0.09 | | $ | 2.45 | | $ | (0.32 | ) |

| | | | | | | | | | | | | | |

For the pro forma computations, the values of option grants were calculated on the dates of grant using the Black-Scholes option pricing model. No other discounts or restrictions related to vesting or the likelihood of vesting of stock options were applied. The following table summarizes the calculated average fair values and weighted-average assumptions used to determine the fair value of FCX’s stock option grants under SFAS No. 123 during the periods presented.

| | Three Months Ended | | Nine Months Ended | |

| | September 30, | | September 30, | |

| | 2005 | | 2004a | | 2005 | | 2004 | |

| Fair value per stock option | $ | 14.52 | | | N/A | | $ | 13.97 | | $ | 15.00 | |

| Risk-free interest rate | | 3.8 | % | | N/A | | | 3.9 | % | | 3.7 | % |

| Expected volatility rate | | 45 | % | | N/A | | | 46 | % | | 49 | % |

| Expected life of options (in years) | | 6 | | | N/A | | | 6 | | | 6 | |

| Assumed annual dividend | $ | 1.00 | | | N/A | | $ | 1.00 | | $ | 0.80 | |

| a. | No options were granted in the third quarter of 2004. |

See Note 1 above and Note 1 in FCX’s Annual Report on Form 10-K for a discussion of SFAS No. 123R.

FCX has two operating segments: “mining and exploration” and “smelting and refining.” The mining and exploration segment consists of FCX’s Indonesian activities including PT Freeport Indonesia’s copper and gold mining operations, PT Puncakjaya Power’s power-generating operations (after eliminations with PT Freeport Indonesia) and FCX’s Indonesian exploration activities. The smelting and refining segment includes Atlantic Copper’s operations in Spain and PT Freeport Indonesia’s equity investment in PT Smelting in Gresik, Indonesia. The segment data presented below were prepared on the same basis as FCX’s consolidated financial statements.

Table of Contents

| | | Mining and Exploration | | Smelting and Refining | | Eliminations and Other | | FCX Total | |

| | | (In Thousands) | |

| Three months ended September 30, 2005: | | | | | | | | | | | | | |

| Revenues | | $ | 771,190 | a | $ | 378,412 | | $ | (166,332 | ) | $ | 983,270 | |

| Production and delivery | | | 247,001 | | | 351,517 | | | (164,150 | )b | | 434,368 | |

| Depreciation and amortization | | | 51,143 | | | 7,415 | | | 3,088 | | | 61,646 | |

| Exploration expenses | | | 2,099 | | | - | | | 60 | | | 2,159 | |

| General and administrative expenses | | | 38,394 | c | | 2,268 | | | (15,116 | )c | | 25,546 | |

| Operating income | | $ | 432,553 | | $ | 17,212 | | $ | 9,786 | | $ | 459,551 | |

| Equity in PT Smelting earnings | | $ | - | | $ | 1,315 | | $ | - | | $ | 1,315 | |

| Interest expense, net | | $ | 5,342 | | $ | 4,140 | | $ | 23,848 | | $ | 33,330 | |

| Provision for income taxes | | $ | 146,610 | | $ | - | | $ | 40,102 | | $ | 186,712 | |

| Capital expenditures | | $ | 32,447 | | $ | 1,444 | | $ | 2,425 | | $ | 36,316 | |

| Total assets | | $ | 3,889,800 | d | $ | 723,149 | e | $ | 264,832 | | $ | 4,877,781 | |

| | | | | | | | | | | | | | |

| Three months ended September 30, 2004: | | | | | | | | | | | | | |

| Revenues | | $ | 447,876 | a | $ | 222,184 | | $ | (69,504 | ) | $ | 600,556 | |

| Production and delivery | | | 198,872 | | | 223,384 | | | (54,240 | )b | | 368,016 | |

| Depreciation and amortization | | | 46,135 | | | 7,114 | | | 2,506 | | | 55,755 | |

| Exploration expenses | | | 1,939 | | | - | | | 24 | | | 1,963 | |

| General and administrative expenses | | | 21,451 | c | | 3,248 | | | 1,487 | c | | 26,186 | |

| Operating income (loss) | | $ | 179,479 | | $ | (11,562 | ) | $ | (19,281 | ) | $ | 148,636 | |

| Equity in PT Smelting earnings | | $ | - | | $ | 2,678 | | $ | - | | $ | 2,678 | |

| Interest expense, net | | $ | 5,133 | | $ | 3,300 | | $ | 29,415 | | $ | 37,848 | |

| Provision for income taxes | | $ | 62,729 | | $ | - | | $ | 8,614 | | $ | 71,343 | |

| Capital expenditures | | $ | 30,526 | | $ | 3,038 | | $ | 2 | | $ | 33,566 | |

| Total assets | | $ | 3,713,690 | d | $ | 723,839 | e | $ | 345,535 | | $ | 4,783,064 | |

| | | | | | | | | | | | | | |

| Nine months ended September 30, 2005: | | | | | | | | | | | | | |

| Revenues | | $ | 2,136,974 | a | $ | 982,425 | | $ | (430,155 | ) | $ | 2,689,244 | |

| Production and delivery | | | 664,234 | | | 937,003 | | | (411,277 | )b | | 1,189,960 | |

| Depreciation and amortization | | | 142,285 | | | 21,645 | | | 8,801 | | | 172,731 | |

| Exploration expenses | | | 6,263 | | | - | | | 158 | | | 6,421 | |

| General and administrative expenses | | | 90,001 | c | | 8,173 | | | (25,635 | )c | | 72,539 | |

| Operating income (loss) | | $ | 1,234,191 | | $ | 15,604 | | $ | (2,202 | ) | $ | 1,247,593 | |

| Equity in PT Smelting earnings | | $ | - | | $ | 6,473 | | $ | - | | $ | 6,473 | |

| Interest expense, net | | $ | 16,966 | | $ | 12,332 | | $ | 76,872 | | $ | 106,170 | |

| Provision for income taxes | | $ | 429,936 | | $ | - | | $ | 109,488 | | $ | 539,424 | |

| Capital expenditures | | $ | 85,955 | | $ | 7,307 | | $ | 2,345 | | $ | 95,607 | |

| | | | | | | | | | | | | | |

| Nine months ended September 30, 2004: | | | | | | | | | | | | | |

| Revenues | | $ | 965,901 | a | $ | 605,137 | | $ | (123,963 | ) | $ | 1,447,075 | |

| Production and delivery | | | 525,387 | | | 637,042 | | | (147,122 | )b | | 1,015,307 | |

| Depreciation and amortization | | | 96,738 | | | 21,209 | | | 5,808 | | | 123,755 | |

| Exploration expenses | | | 6,807 | | | - | | | 170 | | | 6,977 | |

| General and administrative expenses | | | 114,802 | c | | 9,344 | | | (59,824 | )c | | 64,322 | |

| Operating income (loss) | | $ | 222,167 | | $ | (62,458 | ) | $ | 77,005 | | $ | 236,714 | |

| Equity in PT Smelting losses | | $ | - | | $ | 228 | | $ | - | | $ | 228 | |

| Interest expense, net | | $ | 16,346 | | $ | 10,071 | | $ | 84,160 | | $ | 110,577 | |

| Provision for income taxes | | $ | 80,672 | | $ | - | | $ | 47,222 | | $ | 127,894 | |

| Capital expenditures | | $ | 90,229 | | $ | 18,295 | | $ | (118 | ) | $ | 108,406 | |

| | | | | | | | | | | | | | |

| a. | Includes PT Freeport Indonesia’s sales to PT Smelting totaling $214.1 million in the 2005 quarter, $181.6 million in the 2004 quarter, $643.1 million in the 2005 nine-month period and $474.8 million in the 2004 nine-month period. |

| b. | Includes deferral of intercompany profits on 25 percent of PT Freeport Indonesia’s sales to PT Smelting, for which the final sale to third parties has not occurred, totaling $3.1 million in the 2005 quarter, $0.5 million in the 2004 quarter, $3.1 million in the 2005 nine-month period and $2.5 million in the 2004 nine-month period. |

| c. | Includes charges to the mining and exploration segment for the in-the-money value of FCX stock option exercises which are eliminated in consolidation totaling $16.7 million in the 2005 quarter, $2.4 million in the 2004 quarter, $34.1 million in the 2005 nine-month period and $69.3 million in the 2004 nine-month period. |

| d. | Includes PT Freeport Indonesia’s trade receivables with PT Smelting totaling $98.2 million at September 30, 2005, and $59.0 million at September 30, 2004. |

| e. | Includes PT Freeport Indonesia’s equity investment in PT Smelting totaling $51.2 million at September 30, 2005, and $56.6 million at September 30, 2004. |

The components of inventories follow (in thousands):

| | | | September 30, | | December 31, | |

| | | | 2005 | | 2004 | |

| PT Freeport Indonesia: | Concentrates - Average cost | | $ | 9,468 | | $ | 11,830 | |

| Atlantic Copper: | Concentrates - First in, first out (FIFO) | | | 101,222 | | | 148,246 | |

| | Work in process - FIFO | | | 93,254 | | | 86,710 | |

| | Finished goods - FIFO | | | 1,127 | | | 6,479 | |

| Total product inventories | | | 205,071 | | | 253,265 | |

| Total materials and supplies, net | | | 244,960 | | | 213,447 | |

| Total inventories | | $ | 450,031 | | $ | 466,712 | |

The average cost method was used to determine the cost of essentially all materials and supplies inventory. Materials and supplies inventory is net of obsolescence reserves totaling $17.2 million at September 30, 2005 and $17.1 million at December 31, 2004.

| 5. | DEBT AND EQUITY TRANSACTIONS |

As of September 30, 2005, FCX had total outstanding debt of $1.39 billion. Debt was reduced by $565.8 million during the first nine months of 2005, primarily reflecting the following transactions:

| · | first-quarter prepayment of $187.0 million of bank debt associated with PT Puncakjaya Power’s power-generating facilities at PT Freeport Indonesia’s mining operations; |

| · | first-quarter purchases in open market transactions of $11.0 million of 7.50% Senior Notes due 2006 and 7.20% Senior Notes due 2026; |

| · | third-quarter purchases in open market transactions of $149.9 million of 10⅛% Senior Notes due 2010 and $4.5 million of 7.5% Senior Notes due 2006; and |

| · | third-quarter privately negotiated transactions to induce conversion of $188.4 million of 7% Convertible Senior Notes due 2011 into 6.1 million shares of FCX common stock. |

FCX recorded net charges of $38.4 million, $30.3 million to net income or $0.14 per share, in the third quarter and first nine months of 2005 as a result of these transactions. On August 1, 2005, FCX funded the seventh of eight scheduled annual redemption payments on its Silver-Denominated Preferred Stock for $17.5 million. The mandatory redemption resulted in a $12.5 million decrease in debt and a reduction of revenues of $5.0 million, $2.6 million to net income or $0.01 per share, in the third quarter of 2005.

In October 2005, FCX induced conversion of an additional $21.0 million of 7% Convertible Senior Notes due 2011 into 0.7 million shares of FCX common stock and purchased in open market transactions an additional $18.4 million of 10⅛% Senior Notes due 2010. FCX expects to record a net charge of $4.4 million, $3.4 million to net income, in the fourth quarter of 2005 as a result of these transactions.

The components of net periodic pension benefit cost for the three months ended September 30, 2005 and 2004 follow (in thousands):

| | FCX | | PT Freeport Indonesia | | Atlantic Copper | |

| | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | |

| Service cost | $ | 180 | | $ | 213 | | $ | 850 | | $ | 810 | | $ | - | | $ | - | |

| Interest cost | | 480 | | | 901 | | | 888 | | | 812 | | | 1,199 | | | 1,266 | |

| Expected return on plan assets | | (118 | ) | | (300 | ) | | (333 | ) | | (441 | ) | | - | | | - | |

| Amortization of prior service cost | | 1,057 | | | 944 | | | 212 | | | 234 | | | - | | | - | |

| Amortization of net actuarial loss | | - | | | - | | | 168 | | | 69 | | | 224 | | | 223 | |

| Net periodic benefit cost | $ | 1,599 | | $ | 1,758 | | $ | 1,785 | | $ | 1,484 | | $ | 1,423 | | $ | 1,489 | |

The components of net periodic pension benefit cost for the nine months ended September 30, 2005 and 2004 follow (in thousands):

| | FCX | | PT Freeport Indonesia | | Atlantic Copper | |

| | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | |

| Service cost | $ | 524 | | $ | 497 | | $ | 2,681 | | $ | 2,512 | | $ | - | | $ | - | |

| Interest cost | | 1,594 | | | 1,894 | | | 2,800 | | | 2,519 | | | 3,727 | | | 3,809 | |

| Expected return on plan assets | | (374 | ) | | (369 | ) | | (1,052 | ) | | (1,369 | ) | | - | | | - | |

| Amortization of prior service cost | | 3,020 | | | 2,832 | | | 668 | | | 725 | | | - | | | - | |

| Amortization of net actuarial loss | | - | | | - | | | 531 | | | 215 | | | 696 | | | 672 | |

| Net periodic benefit cost | $ | 4,764 | | $ | 4,854 | | $ | 5,628 | | $ | 4,602 | | $ | 4,423 | | $ | 4,481 | |

Interest expense excludes capitalized interest of $1.1 million in the third quarter of 2005, $0.8 million in the third quarter of 2004, $2.9 million in the first nine months of 2005 and $1.9 million in the first nine months of 2004.

A summary of FCX’s comprehensive income is shown below (in thousands).

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

| Net income (loss) | | $ | 180,930 | | $ | 32,258 | | $ | 516,822 | | $ | (25,363 | ) |

| Other comprehensive income (loss): | | | | | | | | | | | | | |

| Change in unrealized derivatives’ fair value, net of taxes | | | | | | | | | | | | | |

| of $1.8 million for the three months ended | | | | | | | | | | | | | |

| September 30, 2005, $(0.9) million for the three months | | | | | | | | | | | | | |

| ended September 30, 2004, $2.9 million for the nine | | | | | | | | | | | | | |

| months ended September 30, 2005 and $(0.8) million for | | | | | | | | | | | | | |

| the nine months ended September 30, 2004 | | | (2,387 | ) | | 1,103 | | | (3,732 | ) | | 989 | |

| Reclass to earnings, net of taxes of $0.2 million | | | | | | | | | | | | | |

| for the nine months ended September 30, 2005 and | | | | | | | | | | | | | |

| none for the other periods | | | (20 | ) | | 319 | | | (115 | ) | | 1,301 | |

| Total comprehensive income (loss) | | $ | 178,523 | | $ | 33,680 | | $ | 512,975 | | $ | (23,073 | ) |

| | | | | | | | | | | | | | |

| 9. | RATIO OF EARNINGS TO FIXED CHARGES |

The ratio of earnings to fixed charges for the first nine months of 2005 and 2004 was 11.1 to 1 and 2.0 to 1, respectively. For this calculation, earnings consist of income from continuing operations before income taxes, minority interests and fixed charges. Fixed charges include interest and that portion of rent deemed representative of interest.

----------------------

The information furnished herein should be read in conjunction with FCX's financial statements contained in its 2004 Annual Report on Form 10-K. The information furnished herein reflects all adjustments which are, in the opinion of management, necessary for a fair statement of the results for the periods. All such adjustments are, in the opinion of management, of a normal recurring nature.

TO THE BOARD OF DIRECTORS AND STOCKHOLDERS OF

FREEPORT-McMoRan COPPER & GOLD INC.

We have reviewed the condensed consolidated balance sheet of Freeport-McMoRan Copper & Gold Inc. (a Delaware Corporation) and subsidiaries as of September 30, 2005 and the related consolidated statements of operations for the three-month and nine-month periods ended September 30, 2005 and 2004, and the consolidated statements of cash flows for the nine-month periods ended September 30, 2005 and 2004. These financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures to financial data, and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with United States generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Freeport-McMoRan Copper & Gold Inc. as of December 31, 2004, and the related consolidated statements of income, stockholder’s equity, and cash flows for the year then ended (not presented herein), and in our report dated March 9, 2005, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2004, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

ERNST & YOUNG LLP

New Orleans, Louisiana

October 25, 2005

Table of Contents

OVERVIEW

In management’s discussion and analysis, “we,”“us” and “our” refer to Freeport-McMoRan Copper & Gold Inc. (FCX) and its consolidated subsidiaries. References to “aggregate” amounts mean the total of our share and Rio Tinto plc’s share as our joint venture partner. You should read this discussion in conjunction with our financial statements, the related discussion and analysis of financial condition and results of operations and the discussion of our “Business and Properties” in our Form 10-K for the year ended December 31, 2004, filed with the Securities and Exchange Commission. The results of operations reported and summarized below are not necessarily indicative of future operating results.

We operate through our majority-owned subsidiaries, PT Freeport Indonesia and PT Puncakjaya Power (Puncakjaya Power), and through Atlantic Copper, S.A. (Atlantic Copper) and PT Irja Eastern Minerals (Eastern Minerals), our principal wholly owned subsidiaries. PT Freeport Indonesia, our principal operating subsidiary, conducts exploration, mining and production activities in a 24,700-acre area called Block A located in Papua, Indonesia. PT Freeport Indonesia also conducts exploration activities (which are currently suspended, but are under review for resumption) in an approximate 500,000-acre area called Block B in Papua. Puncakjaya Power’s sole business is to supply power to PT Freeport Indonesia’s operations. Our principal asset is the Grasberg minerals district, which contains the largest single gold reserve and the second-largest copper reserve of any mine in the world.

Atlantic Copper’s operations are in Spain and involve the smelting and refining of copper concentrates and the marketing of refined copper and precious metals in slimes. PT Freeport Indonesia owns a 25 percent interest in PT Smelting, an Indonesian company which operates a copper smelter and refinery in Gresik, Indonesia. Eastern Minerals conducts mineral exploration activities (which are currently suspended) in Papua, Indonesia.

We own 90.64 percent of PT Freeport Indonesia, of which 9.36 percent is owned through our wholly owned subsidiary, PT Indocopper Investama. The Government of Indonesia owns the remaining 9.36 percent of PT Freeport Indonesia. In July 2004, we received a request from the Indonesian Department of Energy and Mineral Resources that we offer to sell shares in PT Indocopper Investama to Indonesian nationals at fair market value. In response to this request and in view of the potential benefits of having additional Indonesian ownership in our project, we have agreed to consider a potential sale of an interest in PT Indocopper Investama at fair market value. Neither our Contract of Work nor Indonesian law requires us to divest any portion of our ownership interest in PT Freeport Indonesia or PT Indocopper Investama.

Outlook

Annual sales are expected to approximate 1.47 billion pounds of copper and 2.8 million ounces of gold in 2005, increases of nearly 50 percent for copper and nearly 100 percent for gold compared with 2004. PT Freeport Indonesia expects its fourth-quarter operations to benefit from access to higher grade material and more flexible set-ups for its mining equipment in the high-grade areas of the Grasberg mine than in the third quarter, which we currently anticipate would allow PT Freeport Indonesia to generate sales estimated to approximate 480 million pounds of copper and 1.1 million ounces of gold, 39 percent more than third-quarter copper sales and more than twice the third quarter gold sales. Achieving this high level of production and sales is dependent, among other factors, on the successful operations of PT Freeport Indonesia production facilities and systems, and sales volumes could be reduced if year-end weather conditions or other factors delay concentrate loading operations, which would defer sales volumes to 2006.

Using estimated sales volumes for the fourth quarter of 2005 and assuming average fourth-quarter 2005 prices of $1.75 per pound of copper and $465 per ounce of gold, we would generate operating cash flows approximating $1.4 billion in 2005, with approximately $500 million in the fourth quarter. Each $0.10 per pound change in copper prices in the fourth quarter is currently estimated to affect 2005 cash flows by approximately $24 million and each $25 per ounce change in gold prices is currently estimated to affect 2005 cash flows by approximately $14 million.

At the Grasberg mine, the sequencing in mining areas with varying ore grades causes fluctuations in the timing of ore production, which impacts sales volumes, particularly for gold. Based on its current mine plan, PT Freeport Indonesia estimates its share of sales for 2006 will approximate 1.4 billion pounds of copper and 1.9 million ounces of gold. Average annual sales volumes over the five-year period from 2005 through 2009 are expected to approximate 1.35 billion pounds of copper and 2.2 million ounces of gold.

Sales volumes may vary from these estimates depending on the areas being mined within the Grasberg open pit. Quarterly variations in sales volumes are expected to vary significantly. Based on current estimates of average annual sales volumes over the next five years and copper prices of approximately $1.75 per pound and gold prices of approximately $465 per ounce, the impact on our annual cash flow for each $0.10 per pound change in copper prices would approximate $69 million, including the effects of price changes on related royalty costs, and for each $25 per ounce change in gold prices would approximate $28 million.

Copper and Gold Markets

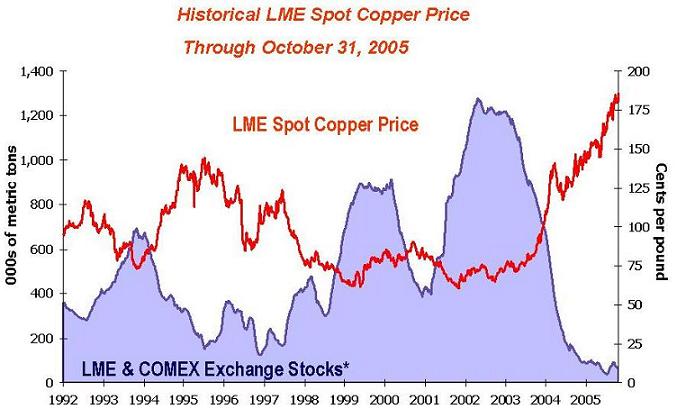

As shown in the graphs below, world metal prices for copper have fluctuated during the period from 1992 through October 2005 with the London Metal Exchange (LME) spot copper price varying from a low of approximately $0.60 per pound in 2001 to a high of $1.90 per pound on October 20, 2005, and world gold prices have fluctuated during the period from 1998 through October 2005 from a low of approximately $250 per ounce in 1999 to a high of approximately $479 per ounce on October 12, 2005. Copper and gold prices are affected by numerous factors beyond our control as described further in our Form 10-K for the year ended December 31, 2004.

* Excludes Shanghai stocks, producer, consumer and merchant stocks.

The graph above presents LME spot copper prices and reported stocks of copper at the LME and New York Commodity Exchange (COMEX) through October 31, 2005. Market fundamentals for copper continued to be positive in the first nine months of 2005. LME and COMEX inventories are at levels of less than 75,000 metric tons. Copper prices averaged $1.70 per pound in the third quarter of 2005, with prices ranging from $1.56 per pound to $1.80 per pound. The LME spot copper price closed at $1.86 per pound on October 31, 2005. Global copper demand in the first nine months of 2005 has been lower than expectations; however, disruptions associated with strikes and other operational issues have reduced copper supply and continue to keep inventories at very low levels. Many market analysts expect copper supplies to increase in the near term as smelter capacity is projected to increase and project lower than current prices once supplies begin to grow. Nevertheless, analysts’ price expectations for 2006 are generally higher than they were earlier in the year, partly because of the disruptions discussed above. Future copper prices are expected to continue to be determined by demand from China, economic performance in the United States (U.S.) and other industrialized countries, the timing of the development of new supplies of copper, production levels of mines and copper smelters and other factors. We consider the underlying supply and demand conditions in the global copper markets to be positive for our company.

Table of Contents

The environment for gold continues to be positive with gold prices recently reaching new 17-year highs supported by ongoing geopolitical tensions, investment demand for gold as a hedge against inflation, increasing jewelry demand, falling production for older mines, limited development of new mines and actions by gold producers to reduce hedge positions. Gold prices averaged $440 per ounce in the third quarter of 2005, with prices ranging from $418 per ounce to $473 per ounce. The London gold price closed at approximately $471 per ounce on October 31, 2005.

CONSOLIDATED RESULTS

Summary comparative results for the third-quarter and nine-month periods follow (in millions, except per share amounts):

| | Third Quarter | | Nine Months | |

| | 2005 | | 2004 | | 2005 | | 2004 | |

| Revenues | $ | 983.3 | | $ | 600.6 | | $ | 2,689.2 | | $ | 1,447.1 | |

| Operating income | | 459.6 | | | 148.6 | | | 1,247.6 | | | 236.7 | |

| Net income (loss) applicable to common stock | | 165.8 | | | 17.1 | | | 471.4 | | | (55.7 | ) |

| Diluted net income (loss) per share of common stock | | 0.86 | | | 0.10 | | | 2.48 | | | (0.30 | ) |

Consolidated revenues include PT Freeport Indonesia’s sale of copper concentrates, which also contain significant quantities of gold, and the sale by Atlantic Copper of copper anodes, copper cathodes, and gold in anodes and slimes. Consolidated revenues for the third quarter of 2005 and the first nine months of 2005 were significantly higher than consolidated revenues for the 2004 periods, reflecting substantially higher copper and gold sales volumes and prices than the 2004 periods. Third-quarter and nine-month 2004 results were adversely affected by lower ore grades and reduced mill throughput as PT Freeport Indonesia completed efforts to restore safe access to the higher-grade ore areas in its Grasberg open-pit mine following the fourth-quarter 2003 slippage and debris flow events. In addition, Atlantic Copper’s scheduled major maintenance turnaround adversely affected its nine-month 2004 revenues.

At September 30, 2005, we had consolidated embedded derivatives on copper sales totaling 298.6 million pounds recorded at an average price of $1.74 per pound. Final prices on these sales will be established over the next several months pursuant to terms of sales contracts. We estimate that a two-cent change in the average price used for these embedded derivatives and realized prices for these sales would have an approximate $6 million impact on our 2005 consolidated revenues and an approximate $3 million impact on our 2005 consolidated net income.

Third-quarter 2005 consolidated revenues included net additions of $48.8 million ($25.9 million to net income or $0.12 per share) primarily for final pricing of concentrates sold in prior quarters, compared with $13.6 million ($7.0 million to net income or $0.04 per share) to third-quarter 2004 revenues. Nine-month 2005 consolidated revenues included net additions of $8.6 million ($4.5 million to net income or $0.02 per share) compared with $7.3 million ($3.7 million to net income or $0.02 per share), primarily for final pricing of concentrates sold in prior years.

Consolidated revenues and net income vary significantly with fluctuations in the market prices of copper and gold and other factors. Based on PT Freeport Indonesia’s projected share of copper sales for the fourth quarter of 2005 (480 million pounds) and assuming an average price of $1.75 per pound of copper, each $0.10 per pound change in the average price realized in the fourth quarter of 2005 would have an approximate $48 million impact on our fourth-quarter revenues and an approximate $24 million impact on our fourth-quarter net income. A $25 per ounce change in the average price realized in the fourth quarter on PT Freeport Indonesia’s projected share of gold sales for the fourth quarter of 2005 (1.1 million ounces) would have an approximate $28 million impact on our fourth-quarter revenues and an approximate $14 million impact on our fourth-quarter net income.

On limited past occasions, in response to market conditions, we have entered into copper and gold price protection contracts for a portion of our expected future mine production to mitigate the risk of adverse price fluctuations. We currently have no copper or gold price protection contracts relating to our mine production. We have outstanding gold-denominated and silver-denominated preferred stock with dividends and redemption amounts determined by commodity prices. Our gold-denominated preferred stock is mandatorily redeemable in February 2006 and the final scheduled redemption for our silver-denominated preferred stock is in August 2006 (see “Capital Resources and Liquidity - Financing Activities”).

Consolidated production and delivery costs were higher for the 2005 periods than the 2004 periods primarily because of higher production costs at PT Freeport Indonesia and higher costs of concentrate purchases at Atlantic Copper caused by increased production volumes and higher metals prices. Consolidated depreciation and amortization expense increased to $61.6 million in the third quarter of 2005 and $172.7 million in the first nine months of 2005, compared with $55.8 million in the third quarter of 2004 and $123.8 million in the first nine months of 2004, primarily because of higher copper sales volumes at PT Freeport Indonesia during the 2005 periods. Exploration expenses totaled $2.2 million in the third quarter of 2005 and $6.4 million in the first nine months of 2005 compared with $2.0 million in the third quarter of 2004 and $7.0 million in the first nine months of 2004 (see “Mining and Exploration - Exploration Activities”). Consolidated general and administrative expenses decreased to $25.5 million in the third quarter of 2005 from $26.2 million in the third quarter of 2004 and increased to $72.5 million in the first nine months of 2005 from $64.3 million in the first nine months of 2004 (see “Other Financial Results”).

Net interest expense decreased to $33.3 million in the third quarter of 2005 from $37.8 million in the third quarter of 2004 primarily because of lower debt levels. Losses on early extinguishment and conversion of debt totaled $38.4 million ($30.3 million to net income or $0.14 per share, net of related reduction of interest expense), for the third quarter and first nine months of 2005 resulting from the open-market purchases of our 10⅛% Senior Notes and 7.5% Senior Notes and the early conversions of our 7% Convertible Senior Notes (see “Capital Resources and Liquidity - Financing Activities”). Losses on early extinguishment and conversion of debt totaled $14.0 million ($7.4 million to net income or $0.04 per share, net of related reduction of interest expense), for the first nine months of 2004 resulting primarily from the early conversions of our 8¼% Convertible Senior Notes (see “Capital Resources and Liquidity - Financing Activities”).

Other income includes interest income of $4.7 million in the third quarter of 2005, $1.0 million in the third quarter of 2004, $11.7 million in the first nine months of 2005 and $4.2 million in the first nine months of 2004. Other income also includes the impact of translating into U.S. dollars Atlantic Copper’s net euro-denominated liabilities, primarily its retiree pension obligations. Changes in the U.S. dollar/euro exchange rate require us to adjust the dollar value of our net euro-denominated liabilities and record the adjustment in earnings. The exchange rate was $1.36 per euro at December 31, 2004, $1.21 per euro at June 30, 2005 and $1.20 per euro at September 30, 2005. Exchange rate effects on our net income from euro-denominated liabilities were gains (losses) of $(1.3) million in the third quarter of 2005, $(0.8) million in the third quarter of 2004, $4.9 million in the first nine months of 2005 and $1.1 million in the first nine months of 2004.

PT Freeport Indonesia’s Contract of Work provides for a 35 percent corporate income tax rate. PT Indocopper Investama pays a 30 percent corporate income tax on dividends it receives from its 9.36 percent ownership in PT Freeport Indonesia. In addition, the tax treaty between Indonesia and the U.S. provides for a withholding tax rate of 10 percent on dividends and interest that PT Freeport Indonesia and PT Indocopper Investama pay to their parent company, FCX. Prior to 2005, we also incurred a U.S. alternative minimum tax at an effective rate of two percent based primarily on consolidated income, net of smelting and refining results. As a result of the enactment of the American Jobs Creation Act of 2004, the 90 percent limitation on the use of foreign tax credits to offset the U.S. federal alternative minimum tax liability has been repealed effective January 1, 2005. The removal of this limitation will reduce our U.S. federal taxes beginning in 2005. In 2004, our U.S. federal alternative minimum tax liability totaled $8.2 million. We currently record no income taxes at Atlantic Copper, which is subject to taxation in Spain, because it has not generated significant taxable income in recent years and has substantial tax loss carryforwards for which we have provided no financial statement benefit. We receive no consolidated tax benefit from these losses because they cannot be used to offset PT Freeport Indonesia’s profits in Indonesia.

Parent company costs consist primarily of interest, depreciation and amortization, and general and administrative expenses. We receive minimal tax benefit from these costs, including interest expense, primarily because our parent company generates no taxable income from U.S. sources. As a result, our provision for income taxes as a percentage of our consolidated income before income taxes and minority interests will vary as PT Freeport Indonesia’s income changes, absent changes in Atlantic Copper and parent company costs. Summaries of the approximate significant components of the calculation of our consolidated provision for income taxes are shown below (in thousands, except percentages).

| | Three Months Ended | | Nine Months Ended | |

| | September 30, | | September 30, | |

| | 2005 | | 2004 | | 2005 | | 2004 | |

Mining and exploration segment operating incomea | $ | 449,248 | | $ | 181,896 | | $ | 1,268,335 | | $ | 291,427 | |

| Mining and exploration segment interest expense, net | | (5,342 | ) | | (5,133 | ) | | (16,966 | ) | | (16,346 | ) |

| Intercompany operating profit (deferred) recognized | | (1,904 | ) | | (15,056 | ) | | (17,124 | ) | | 23,563 | |

| Income before taxes | | 442,002 | | | 161,707 | | | 1,234,245 | | | 298,644 | |

| Indonesian corporate income tax rate (35%) plus U.S. | | | | | | | | | | | | |

| alternative minimum tax rate (2%) for 2004 | | 35 | % | | 37 | % | | 35 | % | | 37 | % |

| Corporate income taxes | | 154,701 | | | 59,832 | | | 431,986 | | | 110,498 | |

| | | | | | | | | | | | | |

| Approximate PT Freeport Indonesia net income | | 287,301 | | | 101,875 | | | 802,259 | | | 188,146 | |

| Withholding tax on FCX’s equity share | | 9.064 | % | | 9.064 | % | | 9.064 | % | | 9.064 | % |

| Withholding taxes | | 26,041 | | | 9,234 | | | 72,717 | | | 17,054 | |

| | | | | | | | | | | | | |

| PT Indocopper Investama corporate income tax | | 9,840 | | | 3,005 | | | 30,921 | | | 3,005 | |

| Other, net | | (3,870 | ) | | (728 | ) | | 3,800 | | | (2,663 | ) |

| FCX consolidated provision for income taxes | $ | 186,712 | | $ | 71,343 | | $ | 539,424 | | $ | 127,894 | |

| | | | | | | | | | | | | |

| FCX consolidated effective tax rate | | 48 | % | | 63 | % | | 48 | % | | b | |

| | | | | | | | | | | | | |

| a. | Excludes charges for the in-the-money value of FCX stock option exercises, which are eliminated in consolidation, totaling $16.7 million for the 2005 quarter, $2.4 million for the 2004 quarter, $34.1 million for the 2005 nine-month period and $69.3 million for the 2004 nine-month period. |

| b. | Rate is not meaningful given the small amount of consolidated income before taxes and minority interests for the 2004 nine-month period. |

RESULTS OF OPERATIONS

We have two operating segments: “mining and exploration” and “smelting and refining.” The mining and exploration segment consists of our Indonesian activities including PT Freeport Indonesia’s copper and gold mining operations, Puncakjaya Power’s power generating operations (after eliminations with PT Freeport Indonesia) and our Indonesian exploration activities, including those of Eastern Minerals. The smelting and refining segment includes Atlantic Copper’s operations in Spain and PT Freeport Indonesia’s equity investment in PT Smelting. Summary comparative operating income (loss) data by segment follow (in millions):

| | Third Quarter | | Nine Months | |

| | 2005 | | 2004 | | 2005 | | 2004 | |

Mining and explorationa | $ | 432.6 | | $ | 179.5 | | $ | 1,234.2 | | $ | 222.2 | |

| Smelting and refining | | 17.2 | | | (11.6 | ) | | 15.6 | | | (62.5 | ) |

Intercompany eliminations and othera, b | | 9.8 | | | (19.3 | ) | | (2.2 | ) | | 77.0 | |

| FCX operating income | $ | 459.6 | | $ | 148.6 | | $ | 1,247.6 | | $ | 236.7 | |

| | | | | | | | | | | | | |

| a. | Includes charges to the mining and exploration segment for the in-the-money value of FCX stock option exercises, which are eliminated in consolidation, totaling $16.7 million in the 2005 quarter, $2.4 million in the 2004 quarter, $34.1 million for the 2005 nine-month period and $69.3 million for the 2004 nine-month period. |

| b. | We defer recognizing profits on PT Freeport Indonesia’s sales to Atlantic Copper and on 25 percent of PT Freeport Indonesia’s sales to PT Smelting until their sales of final products to third parties. Changes in the amount of these deferred profits impacted operating income by $(1.9) million in the third quarter of 2005, $(15.1) million in the third quarter of 2004, $(17.1) million in the first nine months of 2005 and $23.6 million in the first nine months of 2004. Our consolidated earnings can fluctuate materially depending on the timing and prices of these sales. At September 30, 2005, our deferred profits to be recognized in future periods’ operating income totaled $98.0 million, $52.0 million to net income, after taxes and minority interest sharing. |

MINING AND EXPLORATION

PT Freeport Indonesia Operating Results

| | | | Third Quarter | | Nine Months | |

| | | | 2005 | | 2004 | | 2005 | | 2004 | |

PT Freeport Indonesia Operating Data, Net of Rio Tinto’s Interest | | | | | | |

| Copper (recoverable) | | | | | | | | | | |

| Production (000s of pounds) | | | 344,500 | | 256,400 | | 982,400 | | 572,800 | |

| Production (metric tons) | | | 156,300 | | 116,300 | | 445,600 | | 259,800 | |

| Sales (000s of pounds) | | | 346,300 | | 261,900 | | 988,100 | | 572,400 | |

| Sales (metric tons) | | | 157,100 | | 118,800 | | 448,200 | | 259,600 | |

| Average realized price per pound | | | $1.73 | | $1.34 | | $1.67 | | $1.31 | |

| Gold (recoverable ounces) | | | | | | | | | | |

| Production | | | 472,100 | | 337,000 | | 1,672,800 | | 827,200 | |

| Sales | | | 475,000 | | 350,000 | | 1,686,700 | | 824,900 | |

| Average realized price per ounce | | | $445.79 | | $398.89 | | $431.88 | | $396.33 | |

| | | | | | | | | | | |

PT Freeport Indonesia, 100% Aggregate Operating Data | | | | | | | | |

| Ore milled (metric tons per day) | | | 216,300 | | 194,000 | | 209,200 | | 170,100 | |

| Average ore grade | | | | | | | | | | |

| Copper (percent) | | | 1.06 | | .83 | | 1.06 | | .73 | |

| Gold (grams per metric ton) | | | 1.16 | | .79 | | 1.40 | | .73 | |

| Recovery rates (percent) | | | | | | | | | | |

| Copper | | | 87.8 | | 87.8 | | 88.3 | | 87.1 | |

| Gold | | | 80.6 | | 81.3 | | 82.5 | | 81.4 | |

| Copper (recoverable) | | | | | | | | | | |

| Production (000s of pounds) | | | 394,700 | | 275,900 | | 1,134,200 | | 623,800 | |

| Production (metric tons) | | | 179,100 | | 125,200 | | 514,500 | | 283,000 | |

| Sales (000s of pounds) | | | 396,600 | | 282,000 | | 1,140,500 | | 622,900 | |

| Sales (metric tons) | | | 179,900 | | 127,900 | | 517,300 | | 282,500 | |

| Gold (recoverable ounces) | | | | | | | | | | |

| Production | | | 590,700 | | 358,600 | | 2,082,000 | | 873,500 | |

| Sales | | | 594,400 | | 372,300 | | 2,096,200 | | 872,000 | |

Third-quarter sales of 346.3 million pounds of copper and 475,000 ounces of gold were lower than previous estimates of 380 million pounds and 575,000 ounces. Third quarter mining activities included the mining of overburden and low-grade material that will enable large-scale production of high-grade ore during the fourth quarter and the subsequent continuation of the previously announced long-term mine plan for the Grasberg operations, resulting in reduced mining rates in the “6 South” high grade section of the Grasberg open pit and lower than expected ore grades. Production was also affected by an extension to a planned maintenance shutdown of one of PT Freeport Indonesia’s semi-autogenous grinding mills. PT Freeport Indonesia expects fourth quarter operations will benefit from more flexible mining set-ups and access to higher grade material, allowing PT Freeport Indonesia to offset the third quarter shortfall substantially. Fourth-quarter sales are expected to approximate 480 million pounds of copper and 1.1 million ounces of gold.

Mill throughput, which varies depending on ore types being processed, averaged 216,300 metric tons of ore per day in the third quarter of 2005, 194,000 metric tons of ore in the third quarter of 2004, 209,200 metric tons of ore in the first nine months of 2005 and 170,100 metric tons of ore in the first nine months of 2004. Mill rates in the third quarter of 2005 were negatively affected by mill maintenance activities as discussed above. Mill rates are projected to average in excess of 220,000 metric tons of ore per day during the fourth quarter of 2005. Approximate average daily throughput processed at our mill facilities from each of our producing mines follows (metric tons of ore per day):

| | Third Quarter | | Nine Months | |

| | 2005 | | 2004 | | 2005 | | 2004 | |

| Grasberg open pit | 174,500 | | 150,800 | | 167,200 | | 125,400 | |

| Deep Ore Zone underground mine | 41,800 | | 43,200 | | 42,000 | | 44,700 | |

| Total mill throughput | 216,300 | | 194,000 | | 209,200 | | 170,100 | |

Third-quarter 2005 copper ore grades averaged 1.06 percent, compared with 0.83 percent for the third quarter of 2004. Third-quarter 2005 copper recovery rates were 87.8 percent, approximating the year-ago period. For the third quarter of 2005, gold ore grades averaged 1.16 grams per metric ton (g/t), compared with 0.79 g/t for the third quarter of 2004. Gold recovery rates averaged 80.6 percent for the third quarter of 2005, compared with 81.3 percent for the third quarter of 2004. The 2005 grades reflect the return to normal mining operations at Grasberg, including accessing higher grade material in accordance with our mine plan.

Production from the Deep Ore Zone (DOZ) underground mine averaged 41,800 metric tons of ore per day in the third quarter of 2005, representing 19 percent of mill throughput as it continued to perform above design capacity of 35,000 metric tons of ore per day. PT Freeport Indonesia is expanding the capacity of the DOZ underground operation to a sustained rate of 50,000 metric tons per day with the installation of a second crusher and additional ventilation, which are expected to be completed by 2007. PT Freeport Indonesia’s share of capital expenditures for the DOZ expansion totaled $9.2 million in the first nine months of 2005 and is expected to approximate $37 million through the projected 2007 ramp-up, with approximately $7.5 million estimated for the fourth quarter of 2005. The DOZ mine, a block cave operation, is one of the world’s largest underground mines.

In 2004, PT Freeport Indonesia commenced its “Common Infrastructure” project, which will provide access to its large undeveloped underground ore bodies located in the Grasberg minerals district through a tunnel system located approximately 400 meters deeper than its existing underground tunnel system. PT Freeport Indonesia’s share of capital expenditures for its Common Infrastructure project totaled $13.1 million in the first nine months of 2005 and is estimated to total approximately $5 million for the fourth quarter of 2005. The Common Infrastructure project is progressing according to plan.

PT Freeport Indonesia is also proceeding with plans to develop Big Gossan, a high-grade deposit located near the existing milling complex. Our Board of Directors has approved this project and aggregate capital expenditures from 2006 to 2009 for Big Gossan are expected to total approximately $225 million ($195 million net to PT Freeport Indonesia, with approximately $50 million in 2006). Production is expected to ramp up to 7,000 metric tons per day by 2010 (average annual aggregate incremental production of 135 million pounds of copper and 65,000 ounces of gold, with PT Freeport Indonesia receiving 60 percent of these amounts). The Big Gossan mine is expected to be an open-stope mine with cemented backfill, which is a higher-cost mining method than the block-cave method used at the DOZ mine.

PT Freeport Indonesia Revenues

A summary of changes in PT Freeport Indonesia revenues between the periods follows (in millions):

| | Third | | Nine | |

| | Quarter | | Months | |

| PT Freeport Indonesia revenues - prior year period | $ | 447.9 | | $ | 965.9 | |

| Sales volumes: | | | | | | |

| Copper | | 113.1 | | | 545.0 | |

| Gold | | 49.9 | | | 341.5 | |

| Price realizations: | | | | | | |

| Copper | | 134.3 | | | 358.7 | |

| Gold | | 22.3 | | | 60.0 | |

| Adjustments, primarily for copper pricing on prior period open sales | | 46.1 | | | (1.5 | ) |

| Treatment charges, royalties and other | | (42.4 | ) | | (132.6 | ) |

| PT Freeport Indonesia revenues - current year period | $ | 771.2 | | $ | 2,137.0 | |

| | | | | | | |

Treatment charges vary with the volume of metals sold and the price of copper, and royalties vary with the volume of metals sold and the prices of copper and gold. In addition, treatment charges vary based on PT Freeport Indonesia’s customer mix as sales to PT Smelting are subject to a minimum rate (see below). Market rates for treatment and refining charge rates began to increase significantly in late 2004, and PT Freeport Indonesia expects its average 2005 rate to slightly exceed its average 2004 rate. Royalties totaled $20.3 million in the third quarter of 2005 and $56.9 million in the first nine months of 2005 compared with $11.6 million in the third quarter of 2004 and $24.3 million in the first nine months of 2004, reflecting higher sales volumes and metal prices.

Substantially all of PT Freeport Indonesia’s concentrate sales contracts provide final copper pricing in a specified future period based on prices quoted on the LME. PT Freeport Indonesia records revenues and invoices its customers based on LME prices at the time of shipment. Under accounting rules, these terms create an “embedded derivative” in our concentrate sales contracts which must be adjusted to fair value through earnings each period until the date of final copper pricing. PT Freeport Indonesia’s third-quarter 2005 revenues include net additions of $74.7 million for adjustments to the fair value of embedded copper derivatives in concentrate sales contracts, compared with $41.8 million in the third quarter of 2004. PT Freeport Indonesia’s nine-month 2005 revenues included net additions of $96.8 million for adjustments to the fair value of embedded derivatives in concentrate sales contracts, compared with $41.0 million in the 2004 period.

PT Freeport Indonesia expects its share of sales to approximate 1.47 billion pounds of copper and 2.8 million ounces of gold for 2005. PT Freeport Indonesia expects its fourth-quarter operations to benefit from access to higher grade material and more flexible set-ups for its mining equipment in the high-grade areas of the Grasberg mine than in the third quarter, which we currently anticipate would allow PT Freeport Indonesia to generate sales estimated to approximate 480 million pounds of copper and 1.1 million ounces of gold, 39 percent more than third-quarter copper sales and more than twice the third quarter gold sales. Achieving this high level of production and sales is dependent, among other factors, on the successful operations of PT Freeport Indonesia production facilities and systems, and sales volumes could be reduced if year-end weather conditions or other factors delay concentrate loading operations, which would defer sales volumes to 2006.

PT Freeport Indonesia has long-term contracts to provide approximately 60 percent of Atlantic Copper’s copper concentrate requirements at market prices and nearly all of PT Smelting’s copper concentrate requirements. Under the PT Smelting contract, for the first 15 years of PT Smelting’s operations beginning December 1998, the treatment and refining charges on the majority of the concentrate PT Freeport Indonesia provides will not fall below specified minimum rates, subject to renegotiation in 2008. The rate was $0.23 per pound during the period from the commencement of PT Smelting’s operations in 1998 until April 2004, when it declined to a minimum of $0.21 per pound. Market rates for 2005, excluding price participation, under long-term contracts settled in late 2004 approximate $0.21 per pound. Including price participation at current copper prices of approximately $1.86 per pound, PT Smelting’s rates exceed the minimum $0.21 per pound (see “Smelting and Refining”).

PT Freeport Indonesia Costs

Gross profit (loss) per pound of copper (¢)/per ounce of gold and silver ($): | | | | |

Three Months Ended September 30, 2005 | | | | | | | | | | | | |

| Pounds of copper sold (000s) | | 346,300 | | | 346,300 | | | | | | | |

| Ounces of gold sold | | | | | | | | 475,000 | | | | |

| Ounces of silver sold | | | | | | | | | | | 1,065,500 | |

| | | | | | | |

| | | By-Product | | | Co-Product Method | |

| | | Method | | | Copper | | | Gold | | | Silver | |

| Revenues, after adjustments shown below | | 172.8 | ¢ | | 172.8 | ¢ | | $445.79 | | | $5.25 | |

| | | | | | | | | | | | | |

| Site production and delivery, before net non- | | | | | | | | | | | | |

| cash and nonrecurring costs shown below | | 70.6 | a | | 51.7 | b | | 133.52 | b | | 2.09 | b |

| Gold and silver credits | | (62.9 | ) | | - | | | - | | | - | |

| Treatment charges | | 24.9 | | | 18.2 | | | 47.06 | | | 0.74 | |

| Royalty on metals | | 5.9 | | | 4.3 | | | 11.11 | | | 0.17 | |

Unit net cash costsc | | 38.5 | | | 74.2 | | | 191.69 | | | 3.00 | |

| Depreciation and amortization | | 14.8 | | | 10.8 | | | 27.92 | | | 0.44 | |

| Noncash and nonrecurring costs, net | | 0.7 | | | 0.5 | | | 1.35 | | | 0.02 | |

| Total unit costs | | 54.0 | | | 85.5 | | | 220.96 | | | 3.46 | |

| Revenue adjustments, primarily for pricing | | | | | | | | | | | | |

| on prior period open sales and silver hedging | | 17.8 | | | 19.3 | | | (2.90 | ) | | (2.95 | ) |

| PT Smelting intercompany profit elimination | | (0.9 | ) | | (0.7 | ) | | (1.69 | ) | | (0.03 | ) |

| Gross profit (loss) per pound/ounce | | 135.7 | ¢ | | 105.9 | ¢ | | $220.24 | | | $(1.19 | ) |

| | | | | | | | | | | | | |

Three Months Ended September 30, 2004 | | | | | | | | | | | | |

| Pounds of copper sold (000s) | | 261,900 | | | 261,900 | | | | | | | |

| Ounces of gold sold | | | | | | | | 350,000 | | | | |

| Ounces of silver sold | | | | | | | | | | | 837,800 | |

| | | | | | | |

| | | By-Product | | | Co-Product Method | |

| | | Method | | | Copper | | | Gold | | | Silver | |

| Revenues, after adjustments shown below | | 134.0 | ¢ | | 134.0 | ¢ | | $398.89 | | | $5.25 | |

| | | | | | | | | | | | | |

| Site production and delivery, before net non- | | | | | | | | | | | | |

| cash and nonrecurring costs shown below | | 75.1 | d | | 53.0 | e | | 158.95 | e | | 2.49 | e |

| Gold and silver credits | | (55.4 | ) | | - | | | - | | | - | |

| Treatment charges | | 19.6 | | | 13.9 | | | 41.52 | | | 0.65 | |

| Royalty on metals | | 4.4 | | | 3.1 | | | 9.38 | | | 0.15 | |

Unit net cash costsc | | 43.7 | | | 70.0 | | | 209.85 | | | 3.29 | |

| Depreciation and amortization | | 17.6 | | | 12.4 | | | 37.29 | | | 0.58 | |

| Noncash and nonrecurring costs, net | | 0.9 | | | 0.6 | | | 1.81 | | | 0.03 | |

| Total unit costs | | 62.2 | | | 83.0 | | | 248.95 | | | 3.90 | |

| Revenue adjustments, primarily for pricing | | | | | | | | | | | | |

| on prior period open sales and silver hedging | | 5.7 | | | 6.1 | | | 0.89 | | | (0.70 | ) |

| PT Smelting intercompany profit elimination | | (0.2 | ) | | (0.1 | ) | | (0.42 | ) | | (0.01 | ) |

| Gross profit per pound/ounce | | 77.3 | ¢ | | 57.0 | ¢ | | $150.41 | | | $0.64 | |

| | | | | | | | | | | | | |

| a. | Net of deferred mining costs totaling $15.8 million or 4.6¢ per pound. Upon adoption of Emerging Issues Task Force (EITF) Issue No. 04-6 (EITF 04-6) (see Note 1 of Notes to Consolidated Financial Statements), mining costs will no longer be deferred. |