| |

| |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| |

FORM 10-Q |

| |

(Mark One) |

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2006 |

OR |

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from | | To |

Commission File Number: 1-9916 |

| |

|

| |

Freeport-McMoRan Copper & Gold Inc. |

| (Exact name of registrant as specified in its charter) |

Delaware | 74-2480931 |

| (State or other jurisdiction of | (IRS Employer Identification No.) |

| incorporation or organization) | |

| | |

1615 Poydras Street | |

New Orleans, Louisiana | 70112 |

| (Address of principal executive offices) | (Zip Code) |

| |

| |

(504) 582-4000 |

| (Registrant's telephone number, including area code) |

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. R Yes ÿ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one): Large accelerated filer R Accelerated filer ÿ Non-accelerated filer ÿ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ÿ Yes R No

On June 30, 2006, there were issued and outstanding 187,159,910 shares of the registrant’s Class B Common Stock, par value $0.10 per share.

FREEPORT-McMoRan COPPER & GOLD INC.

| | |

| | Page |

| 3 |

| | |

| |

| | |

| 3 |

| | |

| 4 |

| | |

| 5 |

| | |

| 6 |

| | |

| 16 |

| | |

| |

| 17 |

| | |

| 45 |

| | |

| 45 |

| | |

| 45 |

| | |

| 45 |

| | |

| 45 |

| | |

| 47 |

| | |

| 47 |

| | |

| 48 |

| | |

| 48 |

| | |

| E-1 |

| | |

FREEPORT-McMoRan COPPER & GOLD INC.

FREEPORT-McMoRan COPPER & GOLD INC.

| | | June 30, | | | December 31, | |

| | | 2006 | | | 2005 | |

| | | (In Thousands) | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 357,751 | | | $ | 763,599 | |

| Accounts receivable | | | 685,275 | | | | 687,969 | |

| Inventories | | | 790,942 | | | | 565,019 | |

| Prepaid expenses and other | | | 18,534 | | | | 5,795 | |

| Total current assets | | | 1,852,502 | | | | 2,022,382 | |

| Property, plant, equipment and development costs, net | | | 3,104,806 | | | | 3,088,931 | |

| Deferred mining costs | | | - | | | | 285,355 | |

| Other assets | | | 111,661 | | | | 119,999 | |

| Investment in PT Smelting | | | 40,570 | | | | 33,539 | |

| Total assets | | $ | 5,109,539 | | | $ | 5,550,206 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 581,022 | | | $ | 573,560 | |

| Accrued income taxes | | | 94,563 | | | | 327,041 | |

| Current portion of long-term debt and short-term borrowings | | | 89,683 | | | | 253,350 | |

| Unearned customer receipts | | | 56,900 | | | | 57,184 | |

| Accrued interest payable | | | 29,828 | | | | 32,034 | |

| Rio Tinto share of joint venture cash flows | | | 26,251 | | | | 125,809 | |

| Total current liabilities | | | 878,247 | | | | 1,368,978 | |

| Long-term debt, less current portion: | | | | | | | | |

| Senior notes | | | 612,900 | | | | 624,365 | |

| Convertible senior notes | | | 307,663 | | | | 323,667 | |

| Equipment and other loans | | | 47,764 | | | | 54,529 | |

| Atlantic Copper debt | | | 13,841 | | | | 37 | |

| Total long-term debt, less current portion | | | 982,168 | | | | 1,002,598 | |

| Accrued postretirement benefits and other liabilities | | | 236,710 | | | | 210,259 | |

| Deferred income taxes | | | 852,209 | | | | 902,386 | |

| Minority interests | | | 218,849 | | | | 222,991 | |

| Stockholders' equity: | | | | | | | | |

| Convertible perpetual preferred stock | | | 1,100,000 | | | | 1,100,000 | |

| Class B common stock | | | 30,011 | | | | 29,696 | |

| Capital in excess of par value of common stock | | | 2,357,782 | | | | 2,212,246 | |

| Retained earnings | | | 1,202,295 | | | | 1,086,191 | |

| Accumulated other comprehensive income | | | 199 | | | | 10,749 | |

| Common stock held in treasury | | | (2,748,931 | ) | | | (2,595,888 | ) |

| Total stockholders’ equity | | | 1,941,356 | | | | 1,842,994 | |

| Total liabilities and stockholders’ equity | | $ | 5,109,539 | | | $ | 5,550,206 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

FREEPORT-McMoRan COPPER & GOLD INC.

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30, | | | June 30, | |

| | | 2006 | | | 2005 | | | 2006 | | | 2005 | |

| | | (In Thousands, Except Per Share Amounts) | |

| Revenues | $ | 1,426,202 | | $ | 902,909 | | $ | 2,512,324 | | $ | 1,705,974 | |

| Cost of sales: | | | | | | | | | | | | |

| Production and delivery | | 605,607 | | | 390,586 | | | 1,083,522 | | | 755,592 | |

| Depreciation and amortization | | 43,355 | | | 54,159 | | | 86,605 | | | 111,085 | |

| Total cost of sales | | 648,962 | | | 444,745 | | | 1,170,127 | | | 866,677 | |

| Exploration expenses | | 2,778 | | | 2,342 | | | 5,354 | | | 4,262 | |

| General and administrative expenses | | 35,135 | | | 25,379 | | | 65,766 | | | 46,993 | |

| Total costs and expenses | | 686,875 | | | 472,466 | | | 1,241,247 | | | 917,932 | |

| Operating income | | 739,327 | | | 430,443 | | | 1,271,077 | | | 788,042 | |

| Equity in PT Smelting earnings | | 2,006 | | | 2,562 | | | 5,565 | | | 5,158 | |

| Interest expense, net | | (21,024 | ) | | (35,292 | ) | | (43,695 | ) | | (72,840 | ) |

| (Losses) gains on early extinguishment and | | | | | | | | | | | | |

| conversion of debt | | (267 | ) | | - | | | (2,240 | ) | | 37 | |

| Other income, net | | 14,616 | | | 8,143 | | | 19,574 | | | 16,095 | |

| Income before income taxes and minority | | | | | | | | | | | | |

| interests | | 734,658 | | | 405,856 | | | 1,250,281 | | | 736,492 | |

| Provision for income taxes | | (310,244 | ) | | (188,684 | ) | | (531,966 | ) | | (352,712 | ) |

| Minority interests in net income of | | | | | | | | | | | | |

| consolidated subsidiaries | | (42,034 | ) | | (26,800 | ) | | (69,160 | ) | | (47,888 | ) |

| Net income | | 382,380 | | | 190,372 | | | 649,155 | | | 335,892 | |

| Preferred dividends | | (15,125 | ) | | (15,125 | ) | | (30,250 | ) | | (30,250 | ) |

| Net income applicable to common stock | $ | 367,255 | | $ | 175,247 | | $ | 618,905 | | $ | 305,642 | |

| | | | | | | | | | | | | |

| Net income per share of common stock: | | | | | | | | | | | | |

| Basic | | $1.95 | | | $0.98 | | | $3.29 | | | $1.71 | |

| Diluted | | $1.74 | | | $0.91 | | | $2.97 | | | $1.62 | |

| | | | | | | | | | | | | |

| Average common shares outstanding: | | | | | | | | | | | | |

| Basic | | 188,506 | | | 178,324 | | | 188,211 | | | 178,822 | |

| Diluted | | 222,111 | | | 219,990 | | | 221,794 | | | 220,516 | |

| | | | | | | | | | | | | |

| Dividends paid per share of common stock | | $1.0625 | | | $0.25 | | | $1.875 | | | $1.00 | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

FREEPORT-McMoRan COPPER & GOLD INC.

| | | Six Months Ended June 30, | |

| | | 2006 | | | 2005 | |

| | | (In Thousands) | |

| Cash flow from operating activities: | | | | | | | | |

| Net income | | $ | 649,155 | | | $ | 335,892 | |

| Adjustments to reconcile net income to net cash provided by | | | |

| operating activities: | | | | | | | | |

| Depreciation and amortization | | | 86,605 | | | | 111,085 | |

| Minority interests' share of net income | | | 69,160 | | | | 47,888 | |

| Deferred income taxes | | | 63,295 | | | | 5,327 | |

| Stock-based compensation | | | 24,824 | | | | 1,826 | |

| Long-term compensation and postretirement benefits | | | 10,590 | | | | 9,802 | |

| Losses (gains) on early extinguishment and conversion of debt | | | 2,240 | | | | (37 | ) |

| Equity in PT Smelting earnings | | | (5,565 | ) | | | (5,158 | ) |

| Increase in deferred mining costs | | | - | | | | (52,810 | ) |

| (Recognition) elimination of profit on PT Freeport Indonesia | | | | | | | | |

| sales to PT Smelting | | | (12,979 | ) | | | 25 | |

| Provision for inventory obsolescence | | | 3,000 | | | | 3,000 | |

| Other | | | 4,806 | | | | 1,067 | |

| (Increases) decreases in working capital: | | | | | | | | |

| Accounts receivable | | | (1,790 | ) | | | 123,278 | |

| Inventories | | | (218,373 | ) | | | 25,155 | |

| Prepaid expenses and other | | | (2,845 | ) | | | (2,406 | ) |

| Accounts payable and accrued liabilities | | | 29,655 | | | | (8,100 | ) |

| Rio Tinto share of joint venture cash flows | | | (99,558 | ) | | | (334 | ) |

| Accrued income taxes | | | (226,292 | ) | | | 25,011 | |

| (Increase) decrease in working capital | | | (519,203 | ) | | | 162,604 | |

| Net cash provided by operating activities | | | 375,928 | | | | 620,511 | |

| | | | | | | | | |

| Cash flow from investing activities: | | | | | | | | |

| PT Freeport Indonesia capital expenditures | | | (104,163 | ) | | | (53,428 | ) |

| Atlantic Copper and other capital expenditures | | | (6,182 | ) | | | (5,863 | ) |

| Sale of assets | | | 2,887 | | | | - | |

| Investment in PT Smelting and other | | | (1,152 | ) | | | 131 | |

| Proceeds from insurance settlement | | | - | | | | 2,016 | |

| Net cash used in investing activities | | | (108,610 | ) | | | (57,144 | ) |

| | | | | | | | | |

| Cash flow from financing activities: | | | | | | | | |

| Proceeds from debt | | | 53,135 | | | | 65,647 | |

| Repayments of debt | | | (223,303 | ) | | | (235,249 | ) |

| Redemption of step-up preferred stock | | | - | | | | (215 | ) |

| Purchases of FCX common shares | | | (99,783 | ) | | | (80,227 | ) |

| Cash dividends paid: | | | | | | | | |

| Common stock | | | (352,493 | ) | | | (179,658 | ) |

| Preferred stock | | | (30,250 | ) | | | (30,251 | ) |

| Minority interests | | | (56,802 | ) | | | (71,425 | ) |

| Net proceeds from exercised stock options | | | 13,830 | | | | 2,016 | |

| Excess tax benefit from exercised stock options | | | 22,522 | | | | - | |

| Other | | | (22 | ) | | | (21 | ) |

| Net cash used in financing activities | | | (673,166 | ) | | | (529,383 | ) |

| Net (decrease) increase in cash and cash equivalents | | | (405,848 | ) | | | 33,984 | |

| Cash and cash equivalents at beginning of year | | | 763,599 | | | | 551,450 | |

| Cash and cash equivalents at end of period | | $ | 357,751 | | | $ | 585,434 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

FREEPORT-McMoRan COPPER & GOLD INC.

The accompanying unaudited consolidated financial statements should be read in conjunction with Freeport-McMoRan Copper & Gold Inc.’s (FCX) consolidated financial statements and notes contained in its 2005 Annual Report on Form 10-K. The information furnished herein reflects all adjustments which are, in the opinion of management, necessary for a fair statement of the results for the periods. All such adjustments are, in the opinion of management, of a normal recurring nature. Operating results for the six-month period ended June 30, 2006, are not necessarily indicative of the results that may be expected for the year ending December 31, 2006. All significant intercompany transactions have been eliminated. Certain prior year amounts have been reclassified to conform to the 2006 presentation. Changes in the accounting principles applied during 2006 are discussed below in Notes 2 and 3.

| 2. | STOCK-BASED COMPENSATION |

Accounting for Stock-Based Compensation. As of June 30, 2006, FCX has four stock-based employee compensation plans and two stock-based director compensation plans. Prior to January 1, 2006, FCX accounted for options granted under all of its plans under the recognition and measurement principles of Accounting Principles Board (APB) Opinion No. 25, “Accounting for Stock Issued to Employees,” and related interpretations, as permitted by Statement of Financial Accounting Standards (SFAS) No. 123, “Accounting for Stock-Based Compensation.” APB Opinion No. 25 required compensation cost for stock options to be recognized based on the difference on the date of grant, if any, between the quoted market price of the stock and the amount an employee must pay to acquire the stock (i.e., the intrinsic value). Because all the plans require that the option exercise price be at least the market price on the date of grant, FCX recognized no compensation cost on the grant or exercise of its employees’ options through December 31, 2005. Other awards under the plans did result in compensation costs being recognized in earnings based on the intrinsic value on the date of grant for restricted stock units and the intrinsic value on the reporting or exercise date for cash-settled stock appreciation rights (SARs).

Effective January 1, 2006, FCX adopted the fair value recognition provisions of SFAS No. 123 (revised 2004), “Share-Based Payment” or “SFAS No. 123R,” using the modified prospective transition method. Under that transition method, compensation cost recognized in 2006 includes: (a) compensation costs for all stock option awards granted to employees prior to, but not yet vested as of January 1, 2006, based on the grant-date fair value estimated in accordance with the original provisions of SFAS No. 123, and (b) compensation cost for all stock option awards granted subsequent to January 1, 2006, based on the grant-date fair value estimated in accordance with the provisions of SFAS No. 123R. In addition, other stock-based awards charged to expense under SFAS No. 123 continue to be charged to expense under SFAS No. 123R. These include restricted stock units and SARs. Results for prior periods have not been restated. FCX has elected to recognize compensation costs for awards that vest over several years on a straight-line basis over the vesting period. FCX’s stock option awards provide for employees to receive an additional year of vesting after an employee retires. For awards granted after January 1, 2006, to retirement-eligible employees, FCX records one year of amortization of the awards’ value on the date of grant. Certain restricted stock units are performance based awards with accelerated vesting upon retirement. Therefore, in accordance with SFAS No. 123R and consistent with prior years’ accounting, FCX recognizes the compensation cost for restricted stock units granted to retirement-eligible employees in the period during which the employee performs the service related to the grant. The services are performed in the calendar year preceding the date of grant. In addition, prior to adoption of SFAS No. 123R, FCX recognized forfeitures as they occurred in its SFAS No. 123 pro forma disclosures. Beginning January 1, 2006, FCX includes estimated forfeitures in its compensation cost and updates the estimated forfeiture rate through the final vesting date of the awards.

As a result of adopting SFAS No. 123R on January 1, 2006, FCX’s income before income taxes and minority interests for the three months ended June 30, 2006, was $6.8 million lower and net income was $4.0 million ($0.02 per basic and diluted share) lower, and FCX’s income before income taxes and minority interests for the six months ended June 30, 2006, was $15.9 million lower and net income was

$9.3 million ($0.05 per basic share and $0.04 per diluted share) lower than if it had continued to account for share-based compensation under APB Opinion No. 25.

Prior to the adoption of SFAS No. 123R, FCX presented all tax benefits resulting from the exercise of stock options as operating cash flows in its Consolidated Statements of Cash Flows. SFAS No. 123R requires the cash flows generated by tax benefits resulting from tax deductions in excess of the compensation cost recognized for those options (excess tax benefits) to be classified as financing cash flows. The $22.5 million excess tax benefit classified as a financing cash inflow in the Consolidated Statements of Cash Flows for the six months ended June 30, 2006, would have been classified as an operating cash inflow if FCX had not adopted SFAS No. 123R.

Stock-Based Compensation Plans. As discussed above, FCX currently has six stock-based compensation plans and all are shareholder approved. As of June 30, 2006, only four of the plans, which are discussed below, have awards available for grant.

FCX’s 1999 Stock Incentive Plan (the 1999 Plan) and 2003 Stock Incentive Plan (the 2003 Plan) provide for the issuance of stock options, SARs, restricted stock units and other stock-based awards. Each plan allows FCX to grant awards for up to 8.0 million common shares to eligible participants. In May 2004, FCX’s shareholders approved the 2004 Director Compensation Plan (the 2004 Plan). The 2004 Plan authorizes awards of options and restricted stock units for up to 1.0 million shares and the one-time grant of 66,882 SARs. In May 2006, FCX’s shareholders approved the 2006 Stock Incentive Plan (the 2006 Plan). The 2006 Plan provides for the issuance of stock options, SARs, restricted stock units and other stock-based awards. The 2006 Plan allows FCX to grant awards for up to 12.0 million common shares to eligible participants.

Awards granted under all of the plans generally expire 10 years after the date of grant and vest in 25 percent annual increments beginning one year from the date of grant. The plans provide for employees to receive the following year’s vesting after retirement and provide for accelerated vesting if there is a change in control (as defined in the plans). Awards for 12.0 million shares under the 2006 Plan, 0.5 million shares under the 2004 Plan, 1.1 million shares under the 2003 Plan and 0.1 million shares under the 1999 Plan were available for new grants as of June 30, 2006.

FCX also has a restricted stock program that allows FCX senior executives to elect to receive restricted stock units under each plan in place of all or part of their cash incentive compensation. Restricted stock unit grants vest over three years and are valued on the date of grant at 50 percent above the cash incentive compensation that the employee elects to replace. Dividends on restricted stock units accrue and are subject to the awards vesting. Stock option and SAR awards do not receive dividends.

Stock-Based Compensation Cost. Compensation cost charged against earnings for stock-based awards is shown below (in thousands). FCX did not capitalize any stock-based compensation costs to fixed assets during the periods presented.

| | | Three Months Ended | | Six Months Ended | |

| | | June 30, | | June 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| Stock options awarded to employees (including directors) | | $ | 6,849 | | $ | 526 | a | $ | 15,877 | | $ | 1,034 | a |

| Stock options awarded to nonemployees | | | 372 | | | 268 | | | 859 | | | 587 | |

| Restricted stock units in lieu of cash awards | | | 4,351 | | | 3,042 | | | 6,829 | | | 6,063 | |

| Restricted stock units awarded to directors | | | 870 | | | 57 | | | 956 | | | 99 | |

| Stock appreciation rights | | | (327 | ) | | (430 | ) | | 952 | | | 99 | |

Total stock-based compensation costb | | | 12,115 | | | 3,463 | | | 25,473 | | | 7,882 | |

| Tax benefit | | | (4,038 | ) | | (918 | ) | | (8,955 | ) | | (2,220 | ) |

| Minority interest share | | | (595 | ) | | (136 | ) | | (1,319 | ) | | (330 | ) |

| Impact on net income | | $ | 7,482 | | $ | 2,409 | | $ | 15,199 | | $ | 5,332 | |

| | | | | | | | | | | | | | |

| a. | Represents amortization of the intrinsic value of FCX’s Class A stock options that were converted to Class B stock options in 2002. |

| b. | Amounts are before Rio Tinto’s share of joint venture reimbursements for employee exercises of in-the-money stock options which reduced general and administrative expenses by $2.6 million in the 2006 quarter, $0.1 million in the 2005 quarter, $7.1 million in the 2006 six-month period and $3.0 million in the 2005 six-month period. |

The following table illustrates the effect on net income and earnings per share for the three months ended June 30, 2005 and the six months ended June 30, 2005, if FCX had applied the fair value recognition provisions of SFAS No. 123 to stock-based awards granted under FCX’s stock-based compensation plans (in thousands, except per share amounts):

| | | Three Months | | | Six Months | |

| | | Ended | | | Ended | |

| | | June 30, 2005 | | | June 30, 2005 | |

| Net income applicable to common stock, as reported | | $ | 175,247 | | | $ | 305,642 | |

| Add: Stock-based employee compensation expense | | | | | | | | |

| included in reported net income for stock option | | | | | | | | |

| conversions, SARs and restricted stock units, | | | | | | | | |

| net of taxes and minority interests | | | 1,898 | | | | 4,457 | |

| Deduct: Total stock-based employee compensation | | | | | | | | |

| expense determined under fair value-based method | | | | | | | | |

| for all awards, net of taxes and minority interests | | | (5,339 | ) | | | (10,754 | ) |

| Pro forma net income applicable to common stock | | $ | 171,806 | | | $ | 299,345 | |

| | | | | | | | | |

| Earnings per share: | | | | | | | | |

| Basic - as reported | | $ | 0.98 | | | $ | 1.71 | |

| Basic - pro forma | | $ | 0.96 | | | $ | 1.67 | |

| | | | | | | | | |

| Diluted - as reported | | $ | 0.91 | | | $ | 1.62 | |

| Diluted - pro forma | | $ | 0.89 | | | $ | 1.56 | |

| | | | | | | | | |

For the pro forma computations, the values of option grants were calculated on the dates of grant using the Black-Scholes-Merton option pricing model and amortized to expense on a straight-line basis over the options’ vesting periods. No other discounts or restrictions related to vesting or the likelihood of vesting of stock options were applied. The following table summarizes the calculated average fair values and weighted-average assumptions used to determine the fair value of FCX’s stock option grants under SFAS No. 123 during the 2005 periods presented.

| | Three Months | | | Six Months | |

| | Ended | | | Ended | |

| | June 30, 2005 | | | June 30, 2005 | |

| Fair value per stock option | $ | 12.90 | | | $ | 13.97 | |

| Risk-free interest rate | | 3.7 | % | | | 3.9 | % |

| Expected volatility rate | | 45 | % | | | 46 | % |

| Expected life of options (in years) | | 6 | | | | 6 | |

| Assumed annual dividend | $ | 1.00 | | | $ | 1.00 | |

Options and SARs. A summary of options outstanding as of June 30, 2006, including 145,871 SARs, and changes during the six months ended June 30, 2006 follow:

Table of Contents

| | | | | | Weighted | | | |

| | | | | | Average | | Aggregate | |

| | | | Weighted | | Remaining | | Intrinsic | |

| | Number of | | Average | | Contractual | | Value | |

| | Options | | Option Price | | Term (years) | | ($000) | |

| Balance at January 1 | 7,355,612 | | $ | 31.43 | | | | | | |

| Granted | 1,116,250 | | | 62.96 | | | | | | |

| Exercised | (2,545,133 | ) | | 26.62 | | | | | | |

| Expired/Forfeited | (61,574 | ) | | 38.99 | | | | | | |

| Balance at June 30 | 5,865,155 | | | 39.47 | | 8.13 | | $ | 101,904 | |

| | | | | | | | | | | |

| Vested and exercisable at June 30 | 567,860 | | | 22.10 | | 7.10 | | $ | 18,918 | |

| | | | | | | | | | | |

The fair value of each option award is estimated on the date of grant using a Black-Scholes-Merton option valuation model. The assumptions used to value stock option awards during the six months ended June 30, 2006, are noted in the following table. Expected volatility is based on implied volatilities from traded options on FCX’s stock and historical volatility of FCX’s stock. FCX uses historical data to estimate future option exercises, forfeitures and expected life of the options. When appropriate, separate groups of employees that have similar historical exercise behavior are considered separately for valuation purposes. The expected dividend rate is calculated as the annual dividend (excludes supplemental dividends) at the date of grant divided by the average stock price for the one-year period preceding the grant date. The risk-free interest rate is based on Federal Reserve rates in effect for bonds with maturity dates equal to the expected term of the option at the grant date.

| Expected volatility | | 33.3%-42.2 | % | |

| Weighted average volatility | | 37.7 | % | |

| Expected life of options (in years) | | 4.0 | | |

| Expected dividend rate | | 2.9 | % | |

| Risk-free interest rate | | 4.4 | % | |

The grant-date fair value of options granted during the three months ended March 31, 2006, was $17.93 per option and during the three months ended June 30, 2006, was $15.25 per option. The total intrinsic value of options exercised during the three months ended June 30, 2006, was $32.2 million and during the six months ended June 30, 2006, was $93.8 million. As of June 30, 2006, FCX had $60.9 million of total unrecognized compensation cost related to unvested stock options expected to be recognized over a weighted average period of 1.3 years.

The following table includes amounts related to exercises of stock options and SARs and vesting of restricted stock units during the periods presented (in millions, except shares tendered for taxes):

| | Three Months Ended | | Six Months Ended | |

| | June 30, | | June 30, | |

| | 2006 | | 2005 | | 2006 | | 2005 | |

| FCX shares tendered to pay the exercise price | | | | | | | | | | | | |

and/or the minimum required taxesa | | 451,743 | | | - | | | 809,634 | | | 524,907 | |

| Cash received from stock option exercises | $ | 10.1 | | $ | 0.5 | | $ | 35.3 | | $ | 7.7 | |

| Actual tax benefit realized for the tax deductions | | | | | | | | | | | | |

| from stock option exercises | $ | 10.3 | | $ | 0.2 | | $ | 29.9 | | $ | 6.1 | |

| Amounts FCX paid for employee taxes related | | | | | | | | | | | | |

| to stock option exercises | $ | 7.5 | | $ | - | | $ | 21.5 | | $ | 5.7 | |

| Amounts FCX paid for exercised SARs | $ | 0.2 | | $ | 0.1 | | $ | 2.0 | | $ | 0.1 | |

| a. | Under terms of the related plans, upon exercise of stock options and vesting of restricted stock units, employees may tender FCX shares to FCX to pay the exercise price and/or the minimum required taxes. |

Restricted Stock Units. As discussed above, FCX has a restricted stock program that allows FCX senior executives to elect to receive restricted stock units in place of all or part of their annual cash incentive compensation. The annual cash incentive is a function of FCX’s consolidated operating cash flows for the preceding year. These awards of restricted stock units are considered performance-based awards. To compensate for certain restrictions and the risk of forfeiture, the restricted stock units are awarded at a 50 percent premium to the market value on the date of grant. The awards vest ratably over three years and vesting accelerates upon retirement. For retirement-eligible executives, the fair value of the restricted stock units is estimated based on projected operating cash flows for the year and is charged to expense ratably over the year the cash flows are generated.

FCX grants restricted stock units to its directors under the 2004 Plan. The restricted stock units vest over four years and are valued on the date of grant based on the average high and low price of FCX common stock. The fair value of the restricted stock units is amortized over the four-year vesting period or the period until the director becomes retirement-eligible, whichever is shorter. Upon a director’s retirement, all unvested restricted stock units immediately vest. For retirement-eligible directors, the fair value of restricted stock units is recognized on the date of grant.

FCX granted 20,000 restricted stock units in the three months ended June 30, 2006, 20,000 restricted stock units in the three months ended June 30, 2005, 352,677 restricted stock units in the six months ended June 30, 2006 and 143,044 restricted stock units in the six months ended June 30, 2005. A summary of outstanding unvested restricted stock units as of June 30, 2006, and activity during the six months ended June 30, 2006 is presented below:

| | | | Weighted | | | |

| | | | Average | | Aggregate | |

| | Number of | | Remaining | | Intrinsic | |

| | Restricted | | Contractual | | Value | |

| | Stock Units | | Term (years) | | ($000) | |

| Balance at January 1 | 317,258 | | | | | | |

| Granted | 352,677 | | | | | | |

| Vested | (139,350 | ) | | | | | |

| Forfeited | - | | | | | | |

| Balance at June 30 | 530,585 | | 2.55 | | $ | 29,400 | |

| | | | | | | | |

The grant-date fair value of restricted stock units granted during the three months ended March 31, 2006, was $21.2 million. Because this is a performance-based award and the requisite service period under SFAS No. 123R is considered to be the calendar year prior to the grant date, the entire value of this award on the date of grant was charged to expense during the calendar year prior to the date of grant.

The grant-date fair value of restricted stock units granted during the three months ended June 30, 2006, was $1.1 million. The total intrinsic value of restricted stock units vesting during the three months ended June 30, 2006, was $0.4 million and during the six months ended June 30, 2006, was $8.7 million. As of June 30, 2006, FCX had $1.2 million of total unrecognized compensation cost related to unvested restricted stock units expected to be recognized over a weighted average period of 1.3 years.

On January 1, 2006, FCX adopted Emerging Issues Task Force Issue No. 04-6, “Accounting for Stripping Costs Incurred during Production in the Mining Industry” (EITF 04-6), which requires that stripping costs incurred during production be considered costs of the extracted minerals and included as a component of inventory to be recognized in cost of sales in the same period as the revenue from the sale of inventory. Upon adoption of EITF 04-6, FCX recorded its deferred mining costs asset ($285.4 million) at December 31, 2005, net of taxes, minority interest share and inventory effects ($135.9 million), as a cumulative effect adjustment to reduce its retained earnings on January 1, 2006. In addition, stripping costs incurred in 2006 and later periods are now charged to cost of sales as incurred. As a result of adopting EITF 04-6 on January 1, 2006, FCX’s income before income taxes and minority interests for the three months ended

June 30, 2006, was $5.9 million lower and net income was $3.2 million ($0.02 per basic share and $0.01 per diluted share) lower, and FCX’s income before income taxes and minority interests for the six months ended June 30, 2006, was $38.7 million lower and net income was $20.6 million ($0.11 per basic share and $0.09 per diluted share) lower than if it had not adopted EITF 04-6 and continued to defer stripping costs. Adoption of the new guidance has no impact on FCX’s cash flows.

FCX’s basic net income per share of common stock was calculated by dividing net income applicable to common stock by the weighted-average number of common shares outstanding during the year. The following is a reconciliation of net income and weighted-average common shares outstanding for purposes of calculating diluted net income per share (in thousands, except per share amounts):

| | | Three Months Ended | | Six Months Ended | |

| | | June 30, | | June 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| Net income before preferred dividends | | $ | 382,380 | | $ | 190,372 | | $ | 649,155 | | $ | 335,892 | |

| Preferred dividends | | | (15,125 | ) | | (15,125 | ) | | (30,250 | ) | | (30,250 | ) |

| Net income applicable to common stock | | | 367,255 | | | 175,247 | | | 618,905 | | | 305,642 | |

| Plus income impact of assumed conversion of: | | | | | | | | | | | | | |

| 5½% Convertible Perpetual Preferred Stock | | | 15,125 | | | 15,125 | | | 30,250 | | | 30,250 | |

| 7% Convertible Senior Notes | | | 5,070 | | | 10,287 | | | 10,175 | | | 20,609 | |

| Diluted net income applicable to common stock | | $ | 387,450 | | $ | 200,659 | | $ | 659,330 | | $ | 356,501 | |

| | | | | | | | | | | | | | |

| Weighted average common shares outstanding | | | 188,506 | | | 178,324 | | | 188,211 | | | 178,822 | |

| Add: | | | | | | | | | | | | | |

| Shares issuable upon conversion, exercise or vesting of: | | | | | | | | | | | | | |

| 5½% Convertible Perpetual Preferred Stock | | | 22,004 | | | 21,152 | | | 21,868 | | | 21,034 | |

| 7% Convertible Senior Notes | | | 9,995 | | | 18,625 | | | 10,077 | | | 18,625 | |

| Dilutive stock options | | | 881 | | | 1,408 | | | 966 | | | 1,555 | |

| Restricted stock | | | 725 | | | 481 | | | 672 | | | 480 | |

| Weighted average common shares outstanding for | | | | | | | | | | | | | |

| purposes of calculating diluted net income per share | | | 222,111 | | | 219,990 | | | 221,794 | | | 220,516 | |

| | | | | | | | | | | | | | |

| Diluted net income per share of common stock | | $ | 1.74 | | $ | 0.91 | | $ | 2.97 | | $ | 1.62 | |

| | | | | | | | | | | | | | |

Outstanding stock options with exercise prices greater than the average market price of FCX’s common stock during the period are excluded from the computation of diluted net income per share of common stock. FCX’s convertible instruments are also excluded when including the conversion of these instruments increases reported diluted net income per share. A recap of the excluded amounts follows (in thousands, except exercise prices):

| | Three Months Ended | | Six Months Ended | |

| | June 30, | | June 30, | |

| | 2006 | | 2005 | | 2006 | | 2005 | |

| Weighted average options | 1,006 | | 5,463 | | 842 | | 2,732 | |

| Weighted average exercise price | $63.77 | | $36.98 | | $63.77 | | $36.98 | |

| | | | | | | | | |

The components of inventories follow (in thousands):

| | | | June 30, | | December 31, | |

| | | | 2006 | | 2005 | |

| PT Freeport Indonesia: | Concentrates and stockpiles - | | | | | | | |

| | Average cost | | $ | 30,706 | | $ | 14,723 | |

| Atlantic Copper: | Concentrates - First in, first out (FIFO) | | | 245,708 | | | 137,740 | |

| | Work in process - FIFO | | | 197,892 | | | 144,951 | |

| | Finished goods - FIFO | | | 4,602 | | | 2,975 | |

| Total product inventories | | | 478,908 | | | 300,389 | |

| Total materials and supplies, net | | | 312,034 | | | 264,630 | |

| Total inventories | | $ | 790,942 | | $ | 565,019 | |

| | | | | | | | |

The average cost method was used to determine the cost of essentially all materials and supplies inventory. Materials and supplies inventory is net of obsolescence reserves totaling $17.2 million at June 30, 2006, and $16.6 million at December 31, 2005.

| 6. | DEBT AND EQUITY TRANSACTIONS |

As of June 30, 2006, FCX had total outstanding debt of $1.1 billion. Total debt was reduced by a net $184.1 million during the first six months of 2006, including $167.4 million for the mandatory redemption of FCX’s Gold-Denominated Preferred Stock, Series II in February 2006. The mandatory redemption was based on average gold prices at the time of redemption ($548.92 per ounce) and totaled $236.4 million, resulting in a $69.0 million loss recognized in revenues ($36.6 million to net income or $0.17 per share). Other debt reductions during the first six months of 2006 included:

| · | privately negotiated transactions to induce conversion of $16.0 million of 7% Convertible Senior Notes due 2011 into 0.5 million shares of FCX common stock and |

| · | purchases in open-market transactions of $11.5 million of 10⅛% Senior Notes due 2010 for $12.6 million. |

As a result of the induced conversions and open-market transactions, FCX recorded charges of $2.2 million ($1.5 million to net income, net of related reduction of interest expense, or $0.01 per share) in the first six months of 2006. In July 2006, FCX induced conversion of an additional $14.5 million of 7% Convertible Senior Notes due 2011 into 0.5 million shares of FCX common stock.

In July 2006, FCX and PT Freeport Indonesia entered into an amended credit agreement for a $465 million revolving credit facility compared with its previous $195 million facility that was scheduled to mature in September 2006. The new facility, which can be expanded to up to $500 million with additional lender commitments, matures in 2009 and no amounts are outstanding under the facility.

On August 1, 2006, FCX funded the final scheduled annual redemption payment on its Silver-Denominated Preferred Stock for $25.8 million. The mandatory redemption will result in a $12.5 million decrease in debt and a reduction of revenues of $13.3 million, $7.0 million to net income, in the third quarter of 2006.

Interest expense excludes capitalized interest of $2.3 million in the second quarter of 2006, $1.0 million in the second quarter of 2005, $4.1 million in the first six months of 2006 and $1.9 million in the first six months of 2005.

Table of Contents

The components of net periodic pension benefit cost for the three months ended June 30, 2006 and 2005 follow (in thousands):

| | FCX | | PT Freeport Indonesia | | Atlantic Copper | |

| | 2006 | | 2005 | | 2006 | | 2005 | | 2006 | | 2005 | |

| Service cost | $ | (17 | ) | $ | 165 | | $ | 958 | | $ | 900 | | $ | - | | $ | - | |

| Interest cost | | 463 | | | 596 | | | 1,240 | | | 940 | | | 1,164 | | | 1,239 | |

| Expected return on plan assets | | 39 | | | (234 | ) | | (617 | ) | | (353 | ) | | - | | | - | |

| Amortization of prior service cost | | 1,051 | | | 1,019 | | | 238 | | | 225 | | | - | | | - | |

| Amortization of net actuarial loss | | 14 | | | - | | | 136 | | | 178 | | | 230 | | | 231 | |

| Net periodic benefit cost | $ | 1,550 | | $ | 1,546 | | $ | 1,955 | | $ | 1,890 | | $ | 1,394 | | $ | 1,470 | |

| | | | | | | | | | | | | | | | | | | |

The components of net periodic pension benefit cost for the six months ended June 30, 2006 and 2005 follow (in thousands):

| | FCX | | PT Freeport Indonesia | | Atlantic Copper | |

| | 2006 | | 2005 | | 2006 | | 2005 | | 2006 | | 2005 | |

| Service cost | $ | 92 | | $ | 344 | | $ | 1,904 | | $ | 1,831 | | $ | - | | $ | - | |

| Interest cost | | 861 | | | 1,114 | | | 2,466 | | | 1,912 | | | 2,278 | | | 2,528 | |

| Expected return on plan assets | | 379 | | | (256 | ) | | (1,226 | ) | | (718 | ) | | - | | | - | |

| Amortization of prior service cost | | 2,102 | | | 1,963 | | | 472 | | | 457 | | | - | | | - | |

| Amortization of net actuarial loss | | 28 | | | - | | | 270 | | | 362 | | | 451 | | | 472 | |

| Net periodic benefit cost | $ | 3,462 | | $ | 3,165 | | $ | 3,886 | | $ | 3,844 | | $ | 2,729 | | $ | 3,000 | |

| | | | | | | | | | | | | | | | | | | |

FCX has two operating segments: “mining and exploration” and “smelting and refining.” The mining and exploration segment consists of FCX’s Indonesian activities including PT Freeport Indonesia’s copper and gold mining operations, PT Puncakjaya Power’s power-generating operations (after eliminations with PT Freeport Indonesia) and FCX’s Indonesian exploration activities. The smelting and refining segment includes Atlantic Copper’s operations in Spain and PT Freeport Indonesia’s equity investment in PT Smelting in Gresik, Indonesia. The segment data presented below were prepared on the same basis as FCX’s consolidated financial statements.

| | | Mining and Exploration | | Smelting and Refining | | Eliminations and Other | | FCX Total | |

| | | (In Thousands) | |

| Three months ended June 30, 2006: | | | | | | | | | | | | | |

| Revenues | | $ | 1,035,168 | a | $ | 593,134 | | $ | (202,100 | ) | $ | 1,426,202 | |

| Production and delivery | | | 281,308 | | | 560,375 | | | (236,076 | )b | | 605,607 | |

| Depreciation and amortization | | | 33,910 | | | 7,410 | | | 2,035 | | | 43,355 | |

| Exploration expenses | | | 2,709 | | | - | | | 69 | | | 2,778 | |

| General and administrative expenses | | | 55,689 | c | | 3,529 | | | (24,083 | )c | | 35,135 | |

| Operating income | | $ | 661,552 | | $ | 21,820 | | $ | 55,955 | | $ | 739,327 | |

| Equity in PT Smelting earnings | | $ | - | | $ | 2,006 | | $ | - | | $ | 2,006 | |

| Interest expense, net | | $ | 1,608 | | $ | 4,824 | | $ | 14,592 | | $ | 21,024 | |

| Provision for income taxes | | $ | 237,001 | | $ | - | | $ | 73,243 | | $ | 310,244 | |

| Capital expenditures | | $ | 56,392 | | $ | 2,669 | | $ | (838 | ) | $ | 58,223 | |

| Total assets | | $ | 3,890,148 | d | $ | 1,035,415 | e | $ | 183,976 | | $ | 5,109,539 | |

| | | | | | | | | | | | | | |

| | | Mining and Exploration | | Smelting and Refining | | Eliminations and Other | | FCX Total | |

| | | (In Thousands) | |

| Three months ended June 30, 2005: | | | | | | | | | | | | | |

| Revenues | | $ | 678,386 | a | $ | 331,897 | | $ | (107,374 | ) | $ | 902,909 | |

| Production and delivery | | | 223,355 | | | 321,909 | | | (154,678 | )b | | 390,586 | |

| Depreciation and amortization | | | 44,217 | | | 7,141 | | | 2,801 | | | 54,159 | |

| Exploration expenses | | | 2,272 | | | - | | | 70 | | | 2,342 | |

| General and administrative expenses | | | 18,425 | c | | 2,901 | | | 4,053 | c | | 25,379 | |

| Operating income (loss) | | $ | 390,117 | | $ | (54 | ) | $ | 40,380 | | $ | 430,443 | |

| Equity in PT Smelting earnings | | $ | - | | $ | 2,562 | | $ | - | | $ | 2,562 | |

| Interest expense, net | | $ | 5,897 | | $ | 4,387 | | $ | 25,008 | | $ | 35,292 | |

| Provision for income taxes | | $ | 138,007 | | $ | - | | $ | 50,677 | | $ | 188,684 | |

| Capital expenditures | | $ | 29,939 | | $ | 3,139 | | $ | (33 | ) | $ | 33,045 | |

| Total assets | | $ | 3,870,969 | d | $ | 717,707 | e | $ | 369,588 | | $ | 4,958,264 | |

| | | | | | | | | | | | | | |

| Six months ended June 30, 2006: | | | | | | | | | | | | | |

| Revenues | | $ | 1,831,951 | a | $ | 1,109,238 | | $ | (428,865 | ) | $ | 2,512,324 | |

| Production and delivery | | | 567,985 | | | 1,051,812 | | | (536,275 | )b | | 1,083,522 | |

| Depreciation and amortization | | | 67,683 | | | 14,816 | | | 4,106 | | | 86,605 | |

| Exploration expenses | | | 5,246 | | | - | | | 108 | | | 5,354 | |

| General and administrative expenses | | | 137,995 | c | | 7,304 | | | (79,533 | )c | | 65,766 | |

| Operating income | | $ | 1,053,042 | | $ | 35,306 | | $ | 182,729 | | $ | 1,271,077 | |

| Equity in PT Smelting earnings | | $ | - | | $ | 5,565 | | $ | - | | $ | 5,565 | |

| Interest expense, net | | $ | 4,881 | | $ | 10,271 | | $ | 28,543 | | $ | 43,695 | |

| Provision for income taxes | | $ | 381,692 | | $ | - | | $ | 150,274 | | $ | 531,966 | |

| Capital expenditures | | $ | 105,332 | | $ | 6,182 | | $ | (1,169 | ) | $ | 110,345 | |

| | | | | | | | | | | | | | |

| Six months ended June 30, 2005: | | | | | | | | | | | | | |

| Revenues | | $ | 1,365,784 | a | $ | 604,013 | | $ | (263,823 | ) | $ | 1,705,974 | |

| Production and delivery | | | 417,233 | | | 585,486 | | | (247,127 | ) | | 755,592 | |

| Depreciation and amortization | | | 91,142 | | | 14,230 | | | 5,713 | | | 111,085 | |

| Exploration expenses | | | 4,164 | | | - | | | 98 | | | 4,262 | |

| General and administrative expenses | | | 51,607 | c | | 5,905 | | | (10,519 | )c | | 46,993 | |

| Operating income (loss) | | $ | 801,638 | | $ | (1,608 | ) | $ | (11,988 | ) | $ | 788,042 | |

| Equity in PT Smelting earnings | | $ | - | | $ | 5,158 | | $ | - | | $ | 5,158 | |

| Interest expense, net | | $ | 11,624 | | $ | 8,192 | | $ | 53,024 | | $ | 72,840 | |

| Provision for income taxes | | $ | 283,326 | | $ | - | | $ | 69,386 | | $ | 352,712 | |

| Capital expenditures | | $ | 53,508 | | $ | 5,863 | | $ | (80 | ) | $ | 59,291 | |

| | | | | | | | | | | | | | |

| a. | Includes PT Freeport Indonesia’s sales to PT Smelting totaling $325.4 million in the 2006 quarter, $194.9 million in the 2005 quarter, $607.9 million in the 2006 six-month period and $429.0 million in the 2005 six-month period. |

| b. | Includes deferral (recognition) of intercompany profits on 25 percent of PT Freeport Indonesia’s sales to PT Smelting, for which the final sale to third parties has not occurred, totaling $7.8 million in the 2006 quarter, $(2.6) million in the 2005 quarter and $(13.0) million in the 2006 six-month period. |

| c. | Includes charges to the mining and exploration segment for the in-the-money value of FCX stock option exercises which are eliminated in consolidation totaling $29.4 million in the 2006 quarter, $0.7 million in the 2005 quarter, $85.5 million in the 2006 six-month period and $17.4 million in the 2005 six-month period. |

| d. | Includes PT Freeport Indonesia’s trade receivables with PT Smelting totaling $257.6 million at June 30, 2006, and $71.9 million at June 30, 2005. |

| e. | Includes PT Freeport Indonesia’s equity investment in PT Smelting totaling $40.6 million at June 30, 2006, and $52.9 million at June 30, 2005. |

A summary of FCX’s comprehensive income is shown below (in thousands).

| | | Three Months Ended | | Six Months Ended | |

| | | June 30, | | June 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| Net income | | $ | 382,380 | | $ | 190,372 | | $ | 649,155 | | $ | 335,892 | |

| Other comprehensive income (loss): | | | | | | | | | | | | | |

| Change in unrealized derivatives’ fair value, net of taxes | | | | | | | | | | | | | |

| of $1.4 million for the three months ended June 30, | | | | | | | | | | | | | |

| 2006, $0.8 million for the three months ended June 30, | | | | | | | | | | | | | |

| 2005, $(0.1) million for the six months ended June 30, | | | | | | | | | | | | | |

| 2006 and $1.0 million for the six months ended June 30, | | | | | | | | | | | | | |

| 2005 | | | (12,846 | )a | | (1,047 | ) | | (10,805 | ) | | (1,345 | ) |

| Reclass to earnings, net of taxes of $0.5 million | | | | | | | | | | | | | |

| for the three months ended June 30, 2006, $1.0 million | | | | | | | | | | | | | |

| for the six months ended June 30, 2006 and $0.1 million | | | | | | | | | | | | | |

| for the 2005 periods | | | 1,055 | | | (192 | ) | | 340 | | | (95 | ) |

| Total comprehensive income | | $ | 370,589 | | $ | 189,133 | | $ | 638,690 | | $ | 334,452 | |

| | | | | | | | | | | | | | |

| a. | Relates to unrealized losses on PT Smelting’s hedging contracts to fix a portion of its revenues through 2007. At June 30, 2006, FCX had $10.9 million in accumulated other comprehensive income related to these contracts. |

| 11. | RATIO OF EARNINGS TO FIXED CHARGES |

The ratio of earnings to fixed charges for the first six months of 2006 was 26.5 to 1 compared with 10.7 to 1 for the 2005 period. For this calculation, earnings consist of income from continuing operations before income taxes, minority interests and fixed charges. Fixed charges include interest and that portion of rent deemed representative of interest.

TO THE BOARD OF DIRECTORS AND STOCKHOLDERS OF

FREEPORT-McMoRan COPPER & GOLD INC.

We have reviewed the condensed consolidated balance sheet of Freeport-McMoRan Copper & Gold Inc. and its subsidiaries as of June 30, 2006 and the related consolidated statements of income for the three-month and six-month periods ended June 30, 2006 and 2005, and the consolidated statements of cash flows for the six-month periods ended June 30, 2006 and 2005. These financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Freeport-McMoRan Copper & Gold Inc. as of December 31, 2005, and the related consolidated statements of income, stockholder’s equity, and cash flows for the year then ended (not presented herein), and in our report dated February 24, 2006, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2005, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

ERNST & YOUNG LLP

New Orleans, Louisiana

August 1, 2006

OVERVIEW

In management’s discussion and analysis, “we,” “us” and “our” refer to Freeport-McMoRan Copper & Gold Inc. (FCX) and its consolidated subsidiaries. References to “aggregate” amounts mean the total of our share and Rio Tinto plc’s share as our joint venture partner. You should read this discussion in conjunction with our financial statements, the related discussion and analysis of financial condition and results of operations and the discussion of our “Business and Properties” in our Form 10-K for the year ended December 31, 2005, filed with the Securities and Exchange Commission. The results of operations reported and summarized below are not necessarily indicative of future operating results. References to “Notes” are Notes included in our “Notes to Consolidated Financial Statements.” Per share amounts are on a diluted basis unless otherwise noted.

Through our majority-owned subsidiary, PT Freeport Indonesia, we have one of the world’s largest copper and gold mining and production operations in terms of reserves and production. Our principal asset is a majority ownership interest in the Grasberg minerals district, which, based on the latest available data, contains the largest single copper reserve and the largest single gold reserve of any mine in the world.

PT Freeport Indonesia, our principal operating subsidiary, operates under an agreement, called a Contract of Work, with the Government of Indonesia. The Contract of Work allows us to conduct exploration, mining and production activities in a 24,700-acre area called Block A located in Papua, Indonesia. Under the Contract of Work, PT Freeport Indonesia also conducts exploration activities (which are currently suspended, but are under review for resumption) in an approximate 500,000-acre area called Block B in Papua. All of our proven and probable mineral reserves and current mining operations are located in Block A.

We own 90.64 percent of PT Freeport Indonesia, including 9.36 percent owned through our wholly owned subsidiary, PT Indocopper Investama. The Government of Indonesia owns the remaining 9.36 percent of PT Freeport Indonesia. In July 2004, we received a request from the Indonesian Department of Energy and Mineral Resources that we offer to sell shares in PT Indocopper Investama to Indonesian nationals at fair market value. In response to this request and in view of the potential benefits of having additional Indonesian ownership in our project, we have agreed to consider a potential sale of an interest in PT Indocopper Investama at fair market value. Neither our Contract of Work nor Indonesian law requires us to divest any portion of our ownership interest in PT Freeport Indonesia or PT Indocopper Investama.

We also operate through a majority-owned subsidiary, PT Puncakjaya Power (Puncakjaya Power), and through Atlantic Copper, S.A. (Atlantic Copper) and PT Irja Eastern Minerals (Eastern Minerals), our other principal wholly owned subsidiaries. Puncakjaya Power’s sole business is to supply power to PT Freeport Indonesia’s operations. Atlantic Copper’s operations are in Spain and involve the smelting and refining of copper concentrates and the marketing of refined copper and precious metals in slimes. Eastern Minerals conducts mineral exploration activities (which are currently suspended) in Papua, Indonesia. PT Freeport Indonesia owns a 25 percent interest in PT Smelting, an Indonesian company which operates a copper smelter and refinery in Gresik, Indonesia.

In 1996, we established joint ventures with Rio Tinto, an international mining company with headquarters in London, England. One joint venture covers PT Freeport Indonesia’s mining operations in Block A and gives Rio Tinto, through 2021, a 40 percent interest in certain assets and future production exceeding specified annual amounts of copper, gold and silver in Block A, and, after 2021, a 40 percent interest in all production from Block A. Operating, nonexpansion capital and administrative costs are shared proportionately between PT Freeport Indonesia and Rio Tinto based on the ratio of (a) the incremental revenues from production from our expansion completed in 1998 to (b) total revenues from Block A, including production from PT Freeport Indonesia’s previously existing reserves. PT Freeport Indonesia receives 100 percent of the cash flow from specified annual amounts of copper, gold and silver through 2021, calculated by reference to its proven and probable reserves as of December 31, 1994, and 60 percent of all remaining cash flow.

Outlook

PT Freeport Indonesia’s share of annual sales in 2006 is currently projected to approximate 1.2 billion pounds of copper and 1.7 million ounces of gold, compared with previous estimates of 1.3 billion pounds and 1.7 million ounces. The reduction in estimated copper sales primarily reflects operational issues experienced in the second quarter and the impact of mine plan revisions to incorporate geotechnical data. Efforts are under way to improve productivity of mining activities, which would increase mining rates and advance timing of metal production. At the Grasberg open-pit mine, the sequencing in mining areas with varying ore grades causes fluctuations in the timing of ore production, resulting in varying quarterly and annual copper and gold sales. During 2006, approximately 63 percent of copper and 55 percent of gold sales are expected in the second half of the year, including 280.0 million pounds of copper and 320,000 ounces of gold in the third quarter and 475.0 million pounds of copper and 610,000 ounces of gold in the fourth quarter of 2006. The achievement of PT Freeport Indonesia’s sales estimates will be dependent, among other factors, on the achievement of targeted mining rates, the successful operation of PT Freeport Indonesia’s production facilities and the impact of weather conditions at the end of fiscal periods on concentrate loading activities.

Our mine plans are based on latest available data and studies, which take into account factors such as mining and milling rates, ore grades and recoveries, economic conditions and geologic/geotechnical considerations. We update these plans to incorporate new data and conditions, with the objective of operating safely, managing risks and maximizing economic values. While ongoing analyses may alter current expectations, we have revised in July 2006 our five-year mine plan as follows:

| | | PT Freeport Indonesia’s Share of Sales | |

| | | Previous Estimate | | Current Estimate | |

| Year | | Copper | | Gold | | Copper | | Gold | |

| | | (Billion Lbs.) | | (Million Ozs.) | | (Billion Lbs.) | | (Million Ozs.) | |

| 2006 | | 1.3 | | 1.7 | | 1.2 | | 1.7 | |

| 2007 | | 1.2 | | 2.0 | | 1.1 | | 1.8 | |

| 2008 | | 1.5 | | 2.4 | | 1.4 | | 1.9 | |

| 2009 | | 1.2 | | 1.6 | | 1.2 | | 1.8 | |

| 2010 | | 1.3 | | 1.9 | | 1.3 | | 2.1 | |

| Total | | 6.5 | | 9.6 | | 6.2 | | 9.3 | |

| | | | | | | | | | |

| 5-Year Average | | 1.3 | | 1.9 | | 1.24 | | 1.9 | |

| | | | | | | | | | |

| Percent Change | | | | | | (4.6 | )% | (3.1 | )% |

| | | | | | | | | | |

These revisions include updated estimates for 2006 and design changes to incorporate recent geotechnical data, resulting in deferral of production of certain high-grade ore from 2007 and 2008 into future periods. The revised mine plans also incorporate an anticipated expansion of the Deep Ore Zone (DOZ) underground mine to 80,000 metric tons of ore per day. The preliminary economics of this project appear highly attractive. The mine plan changes affect the timing of metal production and do not impact ultimate recoverable reserves. PT Freeport Indonesia’s initiatives to improve productivity and mining rates are an important factor in the ability to meet or potentially to exceed these plans.

We are also continuing to analyze our longer range mine plans to assess the optimal design of the Grasberg open pit, which may affect the timing of our development of the Grasberg underground block cave ore body. Our previous plan included the transition from the Grasberg open pit to the Grasberg underground block cave ore body in 2015. We expect to complete the current studies on longer range plans by year-end 2006.

Sales volumes may vary from these estimates depending on the areas being mined within the Grasberg open pit. Quarterly variations in sales volumes are expected to be significant. Based on current estimated sales volumes for the remainder of 2006 and copper prices of approximately $3.00 per pound and gold prices of approximately $600 per ounce, we expect to generate operating cash flows approximating $1.6

billion in 2006, with over $1.2 billion in the second half of the year. The impact on our projected 2006 cash flows for each $0.10 per pound change in copper prices in the balance of the year would approximate $38 million, including the effects of price changes on related royalty costs, and for each $25 per ounce change in gold prices in the balance of the year would approximate $12 million.

Copper and Gold Markets

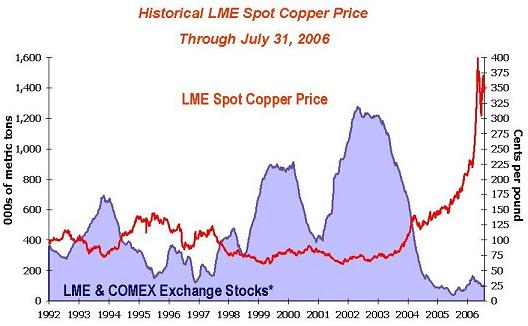

As shown in the graphs below, world metal prices for copper have fluctuated during the period from 1992 through July 2006 with the London Metal Exchange (LME) spot copper price varying from a low of approximately $0.60 per pound in 2001 to a record high of approximately $3.99 per pound on May 12, 2006, and world gold prices have fluctuated during the period from 1998 through July 2006 from a low of approximately $250 per ounce in 1999 to a high of approximately $726 per ounce on May 12, 2006. Current copper and gold prices reflect significantly higher levels of direct investment by commodity investors. This high level of activity can be expected to result in higher levels of volatility in copper and gold prices and in the share prices of FCX and other commodity producers. Copper and gold prices are affected by numerous factors beyond our control as described further in our Form 10-K for the year ended December 31, 2005.

* Excludes Shanghai stocks, producer, consumer and merchant stocks.

The graph above presents LME spot copper prices and reported stocks of copper at the LME and New York Commodity Exchange (COMEX) through July 31, 2006. Since 2003 and through 2005, global demand has exceeded supply, evidenced by the decline in warehouse inventories. LME and COMEX inventories have risen from the 2005 lows in recent months but combined stocks of approximately 100,000 metric tons at June 30, 2006 represent less than two days of global consumption. Copper prices averaged $3.29 per pound in the second quarter of 2006, with prices ranging from $2.52 per pound to a record high of $3.99 per pound. Copper prices have remained strong in July 2006 and the LME spot price closed at $3.56 per pound on July 31, 2006. Disruptions associated with strikes, unrest and other operational issues have resulted in a continuation of low levels of inventory. Future copper prices are expected to continue to be influenced by demand from China, economic performance in the United States (U.S.) and other industrialized countries, the timing of the development of new supplies of copper,

production levels of mines and copper smelters and the level of direct participation by investors. We consider the current underlying supply and demand conditions in the global copper markets to be positive for our company.

The environment for gold continues to be positive with gold prices recently reaching new 25-year highs above $700 per ounce before declining to $600 per ounce. Gold prices continue to be supported by increased investment demand for gold, ongoing geopolitical tensions, a weak U.S. dollar, inflationary pressures, falling production from older mines, limited development of new mines and actions by gold producers to reduce hedge positions. Gold prices averaged $628 per ounce in the second quarter of 2006, with prices ranging from $567 per ounce to $726 per ounce. The London gold price closed at $633 per ounce on July 31, 2006.

CONSOLIDATED RESULTS

Summary comparative results for the second-quarter and six-month periods follow (in millions, except per share amounts):

| | Second Quarter | | Six Months | |

| | 2006 | | 2005 | | 2006 | | 2005 | |

| Revenues | $ | 1,426.2 | | $ | 902.9 | | $ | 2,512.3 | | $ | 1,706.0 | |

| Operating income | | 739.3 | | | 430.4 | | | 1,271.1 | | | 788.0 | |

| Net income applicable to common stock | | 367.3 | | | 175.2 | | | 618.9 | | | 305.6 | |

| Diluted net income per share of common stock | | 1.74 | | | 0.91 | | | 2.97 | | | 1.62 | |

Consolidated revenues include PT Freeport Indonesia’s sale of copper concentrates, which also contain significant quantities of gold and silver, and the sale by Atlantic Copper of copper anodes, copper cathodes, and gold in anodes and slimes. Consolidated revenues for the second quarter of 2006 and the first six months of 2006 were higher than consolidated revenues for the 2005 periods, reflecting substantially higher copper and gold prices than the 2005 periods, partly offset by lower PT Freeport Indonesia sales volumes. PT Freeport Indonesia mined lower grade ore and reported lower production and sales in the second quarter of 2006 and the first six months of 2006, compared with the 2005 periods.

At June 30, 2006, we had consolidated embedded derivatives on copper sales totaling 185.1 million pounds recorded at an average price of $3.34 per pound. Final prices on these sales will be established over the next several months pursuant to terms of sales contracts. We estimate that a five-cent change in the average price used for these embedded derivatives and realized prices for these sales would have an approximate $9 million impact on our 2006 consolidated revenues and an approximate $5 million impact on our 2006 consolidated net income.

Second-quarter 2006 consolidated revenues included net additions of $146.6 million ($77.7 million to net income or $0.35 per share) primarily for final pricing of concentrates sold in prior quarters, compared with $12.6 million ($6.7 million to net income or $0.03 per share) to second-quarter 2005 revenues. Six-month 2006 consolidated revenues included net additions of $137.9 million ($73.1 million to net income or $0.33 per share) compared with $8.7 million ($4.6 million to net income or $0.02 per share) for the six-month 2005 period, primarily for final pricing of concentrates sold in prior years.

Consolidated revenues and net income vary significantly with fluctuations in the market prices of copper and gold, sales volumes and other factors. Based on PT Freeport Indonesia’s projected share of copper sales for the remainder of 2006 (755.0 million pounds) and assuming an average price of $3.00 per pound of copper, each $0.10 per pound change in the average price realized in the balance of the year would have an approximate $76 million impact on our annual revenues and an approximate $38 million impact on our annual net income. A $25 per ounce change in the average price realized in the balance of the year on PT Freeport Indonesia’s projected share of gold sales for the remainder of 2006 (930,000 ounces) would have an approximate $23 million impact on our annual revenues and an approximate $12 million impact on our annual net income.

We currently have no copper or gold price protection contracts relating to our mine production. We had outstanding gold-denominated and silver-denominated preferred stock with dividends and redemption amounts determined by commodity prices. Our Gold-Denominated Preferred Stock, Series II was redeemed in February 2006, resulting in a $69.0 million reduction in revenues ($36.6 million to net income or $0.17 per share), and the final scheduled redemption of our Silver-Denominated Preferred Stock occurred on August 1, 2006 (see “Capital Resources and Liquidity - Financing Activities”).

Consolidated production and delivery costs were higher for the 2006 periods than the 2005 periods. The increases were primarily because of higher costs of concentrate purchases at Atlantic Copper caused by higher metals prices and higher production costs at PT Freeport Indonesia primarily caused by the adoption of Emerging Issues Task Force Issue No. 04-6, “Accounting for Stripping Costs Incurred during Production in the Mining Industry” (EITF 04-6). See Note 3 and “New Accounting Standards.”

Consolidated depreciation and amortization expense decreased to $43.4 million in the second quarter of 2006 and $86.6 million in the first six months of 2006, compared with $54.2 million in the second quarter of 2005 and $111.1 million in the first six months of 2005, primarily because of lower copper sales volumes at PT Freeport Indonesia during the 2006 periods. Exploration expenses increased to $2.8 million in the second quarter of 2006 and $5.4 million in the first six months of 2006 from $2.3 million in the second quarter of 2005 and $4.3 million in the first six months of 2005 (see “Mining and Exploration - PT Freeport Indonesia Exploration Activities”). Consolidated general and administrative expenses increased to $35.1 million in the second quarter of 2006 and $65.8 million in the first six months of 2006 from $25.4 million in the second quarter of 2005 and $47.0 million in the first six months of 2005 (see “Other Financial Results”).

Net interest expense decreased to $21.0 million in the second quarter of 2006 and $43.7 million in the first six months of 2006 from $35.3 million in the second quarter of 2005 and $72.8 million in the first six months of 2005 primarily because of lower debt levels. In the first six months of 2006, we induced conversion of $16.0 million of 7% Convertible Senior Notes due 2011 into 0.5 million shares of FCX common stock and purchased in open market transactions $11.5 million of 10⅛% Senior Notes due 2010 for $12.6 million. As a result of the induced conversions and open market transactions, we recorded losses on early extinguishment and conversion of debt totaling $2.2 million ($1.5 million to net income, net of related reduction of interest expense, or $0.01 per share) in the first six months of 2006 (see “Capital

Resources and Liquidity - Financing Activities”). We are continuing to assess opportunities to repay debt in advance of scheduled maturities.

Other income includes interest income of $4.8 million in the second quarter of 2006, $3.3 million in the second quarter of 2005, $11.8 million in the first six months of 2006 and $7.0 million in the first six months of 2005. Other income also includes the impact of translating into U.S. dollars Atlantic Copper’s net euro-denominated liabilities, primarily its retiree pension obligations. Changes in the U.S. dollar/euro exchange rate require us to adjust the dollar value of our net euro-denominated liabilities and record the adjustment in earnings. The exchange rate was $1.18 per euro at December 31, 2005, $1.21 per euro at March 31, 2006 and $1.27 per euro at June 30, 2006. Exchange rate effects on our net income from euro-denominated liabilities were gains (losses) of $(0.4) million in the second quarter of 2006, $3.4 million in the second quarter of 2005, $(1.6) million in the first six months of 2006 and $6.3 million in the first six months of 2005. In the second quarter of 2006, Atlantic Copper recorded an $8.6 million ($8.6 million to net income or $0.04 per share) gain to other income for the disposition of land in a transaction with the local Spanish government. In the transaction, the provincial government granted Atlantic Copper development rights estimated to be worth $8.6 million in exchange for property owned by Atlantic Copper. Atlantic Copper expects to sell these development rights and certain non-operating properties in the third quarter of 2006 for an amount in excess of its book value.

PT Freeport Indonesia’s Contract of Work provides for a 35 percent corporate income tax rate. PT Indocopper Investama pays a 30 percent corporate income tax on dividends it receives from its 9.36 percent ownership in PT Freeport Indonesia. In addition, the tax treaty between Indonesia and the U.S. provides for a withholding tax rate of 10 percent on dividends and interest that PT Freeport Indonesia and PT Indocopper Investama pay to their parent company, FCX. We currently record no income taxes at Atlantic Copper, which is subject to taxation in Spain, because it has not generated significant taxable income in recent years and has substantial tax loss carryforwards for which we have provided no net financial statement benefit. We receive no consolidated tax benefit from these losses because they cannot be used to offset PT Freeport Indonesia’s profits in Indonesia, but can be utilized to offset Atlantic Copper’s future profits.

Parent company costs consist primarily of interest, depreciation and amortization, and general and administrative expenses. We receive minimal, if any, tax benefit from these costs, including interest expense, primarily because our parent company normally generates no taxable income from U.S. sources. As a result, our provision for income taxes as a percentage of our consolidated income before income taxes and minority interests will vary as PT Freeport Indonesia’s income changes, absent changes in Atlantic Copper and parent company costs. Summaries of the approximate significant components of the calculation of our consolidated provision for income taxes are shown below (in thousands, except percentages).

Table of Contents

| | Three Months Ended | | Six Months Ended | |

| | June 30, | | June 30, | |

| | 2006 | | 2005 | | 2006 | | 2005 | |

Mining and exploration segment operating incomea | $ | 690,977 | | $ | 390,780 | | $ | 1,138,504 | | $ | 819,087 | |

| Mining and exploration segment interest expense, net | | (1,608 | ) | | (5,897 | ) | | (4,881 | ) | | (11,624 | ) |

| Intercompany operating profit recognized (deferred) | | 34,208 | | | 48,350 | | | 108,419 | | | (15,220 | ) |

| Income before taxes | | 723,577 | | | 433,233 | | | 1,242,042 | | | 792,243 | |

| Indonesian corporate income tax rate | | 35 | % | | 35 | % | | 35 | % | | 35 | % |

| Corporate income taxes | | 253,252 | | | 151,632 | | | 434,715 | | | 277,285 | |

| | | | | | | | | | | | | |

| Approximate PT Freeport Indonesia net income | | 470,325 | | | 281,601 | | | 807,327 | | | 514,958 | |

| Withholding tax on FCX’s equity share | | 9.064 | % | | 9.064 | % | | 9.064 | % | | 9.064 | % |

| Withholding taxes | | 42,630 | | | 25,524 | | | 73,176 | | | 46,676 | |

| | | | | | | | | | | | | |

| PT Indocopper Investama corporate income tax | | 11,247 | | | 6,957 | | | 16,870 | | | 21,081 | |

| Other, net | | 3,115 | | | 4,571 | | | 7,205 | | | 7,670 | |

| FCX consolidated provision for income taxes | $ | 310,244 | | $ | 188,684 | | $ | 531,966 | | $ | 352,712 | |

| | | | | | | | | | | | | |

| FCX consolidated effective tax rate | | 42 | % | | 46 | % | | 43 | % | | 48 | % |

| | | | | | | | | | | | | |

| a. | Excludes charges for the in-the-money value of FCX stock option exercises, which are eliminated in consolidation, totaling $29.4 million for the 2006 quarter, $0.7 million for the 2005 quarter, $85.5 million for the 2006 six-month period and $17.4 million for the 2005 six-month period. |

RESULTS OF OPERATIONS

We have two operating segments: “mining and exploration” and “smelting and refining.” The mining and exploration segment consists of our Indonesian activities including PT Freeport Indonesia’s copper and gold mining operations, Puncakjaya Power’s power generating operations (after eliminations with PT Freeport Indonesia) and our Indonesian exploration activities, including those of Eastern Minerals. The smelting and refining segment includes Atlantic Copper’s operations in Spain and PT Freeport Indonesia’s equity investment in PT Smelting. Summary comparative operating income (loss) data by segment follow (in millions):

| | Second Quarter | | Six Months | |

| | 2006 | | 2005 | | 2006 | | 2005 | |

Mining and explorationa | $ | 661.5 | | $ | 390.1 | | $ | 1,053.0 | | $ | 801.6 | |

| Smelting and refining | | 21.8 | | | (0.1 | ) | | 35.3 | | | (1.6 | ) |

Intercompany eliminations and othera, b | | 56.0 | | | 40.4 | | | 182.8 | | | (12.0 | ) |

| FCX operating income | $ | 739.3 | | $ | 430.4 | | $ | 1,271.1 | | $ | 788.0 | |

| | | | | | | | | | | | | |

| a. | Includes charges to the mining and exploration segment for the in-the-money value of FCX stock option exercises, which are eliminated in consolidation, totaling $29.4 million in the 2006 quarter, $0.7 million in the 2005 quarter, $85.5 million for the 2006 six-month period and $17.4 million for the 2005 six-month period. |

| b. | We defer recognizing profits on PT Freeport Indonesia’s sales to Atlantic Copper and on 25 percent of PT Freeport Indonesia’s sales to PT Smelting until their sales of final products to third parties. Changes in the amount of these deferred profits impacted operating income by $34.2 million in the second quarter of 2006, $48.3 million in the second quarter of 2005, $108.4 million in the first six months of 2006 and $(15.2) million in the first six months of 2005. Our consolidated earnings can fluctuate materially depending on the timing and prices of these sales. At June 30, 2006, our deferred profits to be recognized in future periods’ operating income totaled $114.2 million, $60.5 million to net income, after taxes and minority interest sharing. |

MINING AND EXPLORATION

PT Freeport Indonesia Operating Results

| | | | Second Quarter | | Six Months | |

| | | | 2006 | | 2005 | | 2006 | | 2005 | |

PT Freeport Indonesia Operating Data, Net of Rio Tinto’s Interest | | | | | | |

| Copper (recoverable) | | | | | | | | | | |

| Production (000s of pounds) | | | 237,100 | | 302,300 | | 458,400 | | 637,900 | |

| Production (metric tons) | | | 107,500 | | 137,100 | | 207,900 | | 289,300 | |

| Sales (000s of pounds) | | | 220,100 | | 313,700 | | 445,300 | | 641,800 | |

| Sales (metric tons) | | | 99,900 | | 142,300 | | 202,000 | | 291,100 | |

| Average realized price per pound | | | $3.33 | | $1.53 | | $3.27 | | $1.54 | |

| Gold (recoverable ounces) | | | | | | | | | | |

| Production | | | 307,300 | | 591,300 | | 769,100 | | 1,200,700 | |

| Sales | | | 278,000 | | 616,400 | | 750,500 | | 1,211,700 | |

| Average realized price per ounce | | | $613.77 | | $428.23 | | $492.73 | a | $427.54 | |

| | | | | | | | | | | |

PT Freeport Indonesia, 100% Aggregate Operating Data | | | | | | | | |

| Ore milled (metric tons per day) | | | 223,700 | | 211,800 | | 220,200 | | 205,600 | |

| Average ore grade | | | | | | | | | | |

| Copper (percent) | | | 0.72 | | 0.98 | | 0.72 | | 1.06 | |

| Gold (grams per metric ton) | | | 0.67 | | 1.43 | | 0.79 | | 1.52 | |

| Recovery rates (percent) | | | | | | | | | | |

| Copper | | | 84.1 | | 87.4 | | 83.3 | | 88.5 | |

| Gold | | | 76.4 | | 83.8 | | 78.8 | | 83.3 | |

| Copper (recoverable) | | | | | | | | | | |

| Production (000s of pounds) | | | 258,800 | | 349,200 | | 505,400 | | 739,500 | |

| Production (metric tons) | | | 117,300 | | 158,400 | | 229,200 | | 335,400 | |

| Sales (000s of pounds) | | | 239,900 | | 362,500 | | 491,200 | | 743,900 | |

| Sales (metric tons) | | | 108,800 | | 164,400 | | 222,800 | | 337,400 | |

| Gold (recoverable ounces) | | | | | | | | | | |