| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM 10-Q |

| |

| (Mark One) |

| [X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended March 31, 2009 |

| OR |

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from | | To |

| Commission File Number: 1-9916 |

| |

|

| |

| Freeport-McMoRan Copper & Gold Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 74-2480931 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) | |

| | |

| One North Central Avenue | |

| Phoenix, AZ | 85004-4414 |

| (Address of principal executive offices) | (Zip Code) |

| |

| (602) 366-8100 |

| (Registrant's telephone number, including area code) |

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer R Accelerated filer oÿ Non-accelerated filer o Smaller reporting company oÿ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ÿ0 Yes R No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ÿo Yes ÿo No

On April 30, 2009, there were issued and outstanding 411,754,522 shares of the registrant’s common stock, par value $0.10 per share.

FREEPORT-McMoRan COPPER & GOLD INC.

TABLE OF CONTENTS

| | |

| | Page |

| 3 |

| | |

| |

| | |

| 3 |

| | |

| 4 |

| | |

| 5 |

| | |

| 6 |

| | |

| 7 |

| | |

| 19 |

| | |

| |

| 20 |

| | |

| 49 |

| | |

| 49 |

| | |

| 50 |

| | |

| 50 |

| | |

| 50 |

| | |

| 50 |

| | |

| 50 |

| | |

| 51 |

| | |

| E-1 |

| | |

FREEPORT-McMoRan COPPER & GOLD INC.

FREEPORT-McMoRan COPPER & GOLD INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

| | | March 31, | | | December 31, | |

| | | 2009 | | | 2008 | |

| | | (In Millions) | |

| | | | | | | | | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 644 | | | $ | 872 | |

| Trade accounts receivable | | | 880 | | | | 374 | |

| Other accounts receivable | | | 830 | | | | 838 | |

| Product inventories and materials and supplies, net | | | 2,195 | | | | 2,192 | |

| Mill and leach stockpiles | | | 571 | | | | 571 | |

| Other current assets | | | 280 | | | | 386 | |

| Total current assets | | | 5,400 | | | | 5,233 | |

| Property, plant, equipment and development costs, net | | | 16,211 | | | | 16,002 | |

| Long-term mill and leach stockpiles | | | 1,147 | | | | 1,145 | |

| Intangible assets, net | | | 359 | | | | 364 | |

| Trust assets | | | 139 | | | | 142 | |

| Other assets | | | 452 | | | | 467 | |

| Total assets | | $ | 23,708 | | | $ | 23,353 | |

| | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 1,941 | | | $ | 2,766 | |

| Accrued income taxes | | | 442 | | | | 163 | |

| Current portion of reclamation and environmental liabilities | | | 178 | | | | 162 | |

| Current portion of long-term debt and short-term borrowings | | | 87 | | | | 67 | |

| Total current liabilities | | | 2,648 | | | | 3,158 | |

| Long-term debt, less current portion: | | | | | | | | |

| Senior notes | | | 6,883 | | | | 6,884 | |

| Project financing, equipment loans and other | | | 257 | | | | 250 | |

| Revolving credit facility | | | – | | | | 150 | |

| Total long-term debt, less current portion | | | 7,140 | | | | 7,284 | |

| Deferred income taxes | | | 2,471 | | | | 2,339 | |

| Reclamation and environmental liabilities, less current portion | | | 1,967 | | | | 1,951 | |

| Other liabilities | | | 1,400 | | | | 1,520 | |

| Total liabilities | | | 15,626 | | | | 16,252 | |

| Equity: | | | | | | | | |

| FCX stockholders’ equity: | | | | | | | | |

| 5½% Convertible Perpetual Preferred Stock | | | 832 | | | | 832 | |

| 6¾% Mandatory Convertible Preferred Stock | | | 2,875 | | | | 2,875 | |

| Common stock | | | 53 | | | | 51 | |

| Capital in excess of par value | | | 14,760 | | | | 13,989 | |

| Accumulated deficit | | | (8,224 | ) | | | (8,267 | ) |

| Accumulated other comprehensive loss | | | (237 | ) | | | (305 | ) |

| Common stock held in treasury | | | (3,409 | ) | | | (3,402 | ) |

| Total FCX stockholders’ equity | | | 6,650 | | | | 5,773 | |

| Noncontrolling interests in subsidiaries | | | 1,432 | | | | 1,328 | |

| Total equity | | | 8,082 | | | | 7,101 | |

| Total liabilities and equity | | $ | 23,708 | | | $ | 23,353 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

FREEPORT-McMoRan COPPER & GOLD INC. CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

| | | | | | | | | | | | | |

| | | | Three Months Ended | |

| | | | March 31, | |

| | | | | | 2009 | | 2008 | |

| | | | | | (In Millions, Except Per | |

| | | | | | Share Amounts) | |

| | | | | | | | | | | | | |

| Revenues | | | | | | | $ | 2,602 | | $ | 5,672 | |

| Cost of sales: | | | | | | | | | | | | |

| Production and delivery | | | | | | | | 1,562 | | | 2,721 | |

| Depreciation, depletion and amortization | | | | | | | | 232 | | | 418 | |

| Lower of cost or market inventory adjustments | | | | | | | | 19 | | | 1 | |

| Total cost of sales | | | | | | | | 1,813 | | | 3,140 | |

| Selling, general and administrative expenses | | | | | | | | 62 | | | 84 | |

| Exploration and research expenses | | | | | | | | 30 | | | 52 | |

| Restructuring and other charges | | | | | | | | 25 | | | – | |

| Total costs and expenses | | | | | | | | 1,930 | | | 3,276 | |

| Operating income | | | | | | | | 672 | | | 2,396 | |

| Interest expense, net | | | | | | | | (131 | ) | | (165 | ) |

| Losses on early extinguishment of debt | | | | | | | | – | | | (6 | ) |

| Other income and expense, net | | | | | | | | (14 | ) | | 2 | |

| Income before income taxes and equity in affiliated companies’ | | | | | | | | |

| net earnings | | | | | | | | 527 | | | 2,227 | |

| Provision for income taxes | | | | | | | | (331 | ) | | (729 | ) |

| Equity in affiliated companies’ net earnings | | | | | | | | 11 | | | 7 | |

| Net income | | | | | | | | 207 | | | 1,505 | |

| Net income attributable to noncontrolling interests in subsidiaries | | | | | | (104 | ) | | (319 | ) |

| Preferred dividends | | | | | | | | (60 | ) | | (64 | ) |

| Net income applicable to common stock | | | | | | | $ | 43 | | $ | 1,122 | |

| | | | | | | | | | | | | |

| Net income per share of common stock attributable to FCX common | | | | | | | | |

| stockholders: | | | | | | | | | | | | |

| Basic | | | | | | | $ | 0.11 | | $ | 2.93 | |

| Diluted | | | | | | | $ | 0.11 | | $ | 2.64 | |

| | | | | | | | | | | | | |

| Average common shares outstanding: | | | | | | | | | | | | |

| Basic | | | | | | | | 400 | | | 383 | |

| Diluted | | | | | | | | 401 | | | 449 | |

| | | | | | | | | | | | | |

| Dividends declared per share of common stock | | | | | | | $ | – | | $ | 0.4375 | |

The accompanying notes are an integral part of these consolidated financial statements.

FREEPORT-McMoRan COPPER & GOLD INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

| | | Three Months Ended | |

| | | March 31, | |

| | | 2009 | | | 2008 | |

| | | (In Millions) | |

| | | | | | | | | |

| Cash flow from operating activities: | | | | | | | | |

| Net income | | $ | 207 | | | $ | 1,505 | |

| Adjustments to reconcile net income to net cash (used in) provided by | | | | | | | | |

| operating activities: | | | | | | | | |

| Depreciation, depletion and amortization | | | 232 | | | | 418 | |

| Lower of cost or market inventory adjustments | | | 19 | | | | 1 | |

| Stock-based compensation | | | 33 | | | | 47 | |

| Charges for reclamation and environmental liabilities, including accretion | | | 67 | | | | 41 | |

| Losses on early extinguishment of debt | | | – | | | | 6 | |

| Deferred income taxes | | | 73 | | | | (48 | ) |

| Increase in long-term mill and leach stockpiles | | | (3 | ) | | | (47 | ) |

| Amortization of intangible assets/liabilities and other, net | | | 33 | | | | 48 | |

| (Increases) decreases in working capital: | | | | | | | | |

| Accounts receivable | | | (455 | ) | | | (950 | ) |

| Inventories | | | (35 | ) | | | (81 | ) |

| Other current assets | | | 77 | | | | 1 | |

| Accounts payable and accrued liabilities | | | (731 | ) | | | (505 | ) |

| Accrued income and other taxes | | | 249 | | | | 216 | |

| Settlement of reclamation and environmental liabilities | | | (24 | ) | | | (37 | ) |

| Net cash (used in) provided by operating activities | | | (258 | ) | | | 615 | |

| | | | | | | | | |

| Cash flow from investing activities: | | | | | | | | |

| Capital expenditures: | | | | | | | | |

| North America copper mines | | | (72 | ) | | | (151 | ) |

| South America copper mines | | | (74 | ) | | | (63 | ) |

| Indonesia | | | (55 | ) | | | (115 | ) |

| Africa | | | (251 | ) | | | (143 | ) |

| Other | | | (67 | ) | | | (36 | ) |

| Proceeds from the sale of assets and other, net | | | 3 | | | | 21 | |

| Net cash used in investing activities | | | (516 | ) | | | (487 | ) |

| | | | | | | | | |

| Cash flow from financing activities: | | | | | | | | |

| Net proceeds from sale of common stock | | | 740 | | | | – | |

| Proceeds from debt | | | 101 | | | | 473 | |

| Repayments of revolving credit facility and other debt | | | (225 | ) | | | (118 | ) |

| Cash dividends paid: | | | | | | | | |

| Common stock | | | – | | | | (169 | ) |

| Preferred stock | | | (60 | ) | | | (64 | ) |

| Noncontrolling interests | | | – | | | | (49 | ) |

| Net payments for stock-based awards | | | (7 | ) | | | (8 | ) |

| Excess tax benefit from stock-based awards | | | – | | | | 12 | |

| Bank fees and other | | | (3 | ) | | | – | |

| Net cash provided by financing activities | | | 546 | | | | 77 | |

| | | | | | | | | |

| Net (decrease) increase in cash and cash equivalents | | | (228 | ) | | | 205 | |

| Cash and cash equivalents at beginning of year | | | 872 | | | | 1,626 | |

| Cash and cash equivalents at end of period | | $ | 644 | | | $ | 1,831 | |

The accompanying notes are an integral part of these consolidated financial statements.

FREEPORT-McMoRan COPPER & GOLD INC. CONSOLIDATED STATEMENT OF EQUITY (Unaudited)

| | | Freeport-McMoRan Copper & Gold Inc. Stockholders’ Equity | | | | | | |

| | | Convertible Perpetual | | Mandatory Convertible | | | | | | | | | | Common Stock | | | | | | |

| | | Preferred Stock | | Preferred Stock | | Common Stock | | | | | | Accumulated | | Held in Treasury | | Noncontrolling | | | | |

| | | Number | | | | Number | | | | Number | | | | Capital in | | Accumu- | | Other | | Number | | | | Interests | | | | |

| | | of | | At Par | | of | | At Par | | of | | At Par | | Excess of | | lated | | Comprehensive | | of | | At | | in | | Total | |

| | | Shares | | Value | | Shares | | Value | | Shares | | Value | | Par Value | | Deficit | | Loss | | Shares | | Cost | | Subsidiaries | | Equity | |

| | | (In Millions) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2008 | | 1 | | $ | 832 | | | 29 | | $ | 2,875 | | | 505 | | $ | 51 | | $ | 13,989 | | $ | (8,267 | ) | $ | (305 | ) | | 121 | | $ | (3,402 | ) | $ | 1,328 | | $ | 7,101 | |

| Sale of common stock | | – | | | – | | | – | | | – | | | 27 | | | 2 | | | 738 | | | – | | | – | | | – | | | – | | | – | | | 740 | |

| Exercised and issued stock-based awards | | – | | | – | | | – | | | – | | | 1 | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | |

| Stock-based compensation costs | | – | | | – | | | – | | | – | | | – | | | – | | | 33 | | | – | | | – | | | – | | | – | | | – | | | 33 | |

| Tender of shares for stock-based awards | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | (7 | ) | | – | | | (7 | ) |

| Dividends on preferred stock | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | (60 | ) | | – | | | – | | | – | | | – | | | (60 | ) |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | 103 | | | – | | | – | | | – | | | 104 | | | 207 | |

| Other comprehensive income, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| net of taxes: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Unrealized gains on securities | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | 1 | | | – | | | – | | | – | | | 1 | |

| Defined benefit plans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net gain during period, net of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| taxes of $40 million | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | 62 | | | – | | | – | | | – | | | 62 | |

| Amortization of unrecognized amounts | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | 5 | | | – | | | – | | | – | | | 5 | |

| Other comprehensive income | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | 68 | | | – | | | – | | | – | | | 68 | |

| Total comprehensive income | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | 275 | |

| Balance at March 31, 2009 | | 1 | | $ | 832 | | | 29 | | $ | 2,875 | | | 533 | | $ | 53 | | $ | 14,760 | | $ | (8,224 | ) | $ | (237 | ) | | 121 | | $ | (3,409 | ) | $ | 1,432 | | $ | 8,082 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

FREEPORT-McMoRan COPPER & GOLD INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

The accompanying unaudited consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all information and disclosures required by generally accepted accounting principles (GAAP) in the United States (U.S.). Therefore, this information should be read in conjunction with Freeport-McMoRan Copper & Gold Inc.’s (FCX) consolidated financial statements and notes contained in its 2008 Annual Report on Form 10-K. The information furnished herein reflects all adjustments which are, in the opinion of management, necessary for a fair statement of the results for the interim periods reported. All such adjustments are, in the opinion of management, of a normal recurring nature. Operating results for the three-month period ended March 31, 2009, are not necessarily indicative of the results that may be expected for the year ending December 31, 2009. FCX changed Phelps Dodge Corporation’s (Phelps Dodge) legal name to Freeport-McMoRan Corporation (FMC) in 2008.

| 2. | RESTRUCTURING AND OTHER CHARGES |

During the fourth quarter of 2008, there was a dramatic decline in copper and molybdenum prices. After averaging $3.05 per pound in 2006, $3.23 per pound in 2007 and $3.61 per pound for the first nine months of 2008, London Metal Exchange (LME) spot copper prices declined to a four-year low of $1.26 per pound in December 2008, averaged $1.78 per pound in the fourth quarter of 2008 and closed at $1.32 per pound on December 31, 2008. Additionally, while molybdenum markets have been strong in recent years with prices averaging approximately $25 per pound in 2006, $30 per pound in 2007 and $33 per pound for the first nine months of 2008, molybdenum prices declined significantly to a four-year low of $8.75 per pound in November 2008, averaged approximately $16 per pound in the fourth quarter of 2008 and closed at $9.50 per pound on December 31, 2008.

While FCX’s long-term strategy of developing its resources to their full potential remains in place, the decline in copper and molybdenum prices in the fourth quarter of 2008 and the deterioration of the economic and credit environment have limited FCX’s ability to invest in growth projects and required FCX to make adjustments to its near-term operating plans. FCX responded to the sudden downturn and uncertain near-term outlook by revising its near-term strategy to protect liquidity while preserving its mineral resources and growth options for the longer term. Accordingly, operating plans were revised in the fourth quarter of 2008 and January 2009 to reflect: (i) curtailment of copper production at higher-cost North America operations and of molybdenum production at the Henderson molybdenum mine; (ii) capital cost reductions; (iii) aggressive cost control, including workforce reductions, reduced equipment purchases that were planned to support expansion projects, a reduction in material and supplies inventory and reductions in exploration, research and administrative costs; and (iv) suspension of FCX’s annual common stock dividend.

Charges recognized in first-quarter 2009 in connection with FCX’s revised operating plans in the fourth quarter of 2008 and January 2009 include restructuring charges of $34 million ($31 million to net income applicable to common stock or $0.07 per diluted share) for contract termination costs, other project cancellation costs, employee severance and benefit costs; partially offset by pension and postretirement gains of $9 million ($9 million to net income applicable to common stock or $0.02 per diluted share) for special retirement benefits and curtailments. The restructuring charge reflects workforce reductions (approximately 3,000 employees related to fourth-quarter 2008 revised operating plans and approximately 1,500 employees related to January 2009 revised operating plans) and other charges that reflect an approximate 50 percent total reduction in mining and crushed-leach rates at the Morenci mine in Arizona, an approximate 50 percent reduction in mining and stacking rates at the Safford mine in Arizona, an approximate 50 percent reduction in the mining rate at the Tyrone mine in New Mexico, suspension of mining and milling activities at the Chino mine in New Mexico (with limited residual copper production from leach operations), and an approximate 40 percent reduction in annual production (an approximate 25 percent reduction began in the fourth quarter of 2008) at the Henderson molybdenum mine in Colorado. In addition, the revised operating plans included decisions to defer certain capital projects, including the (i) incremental expansion projects at the Sierrita and Bagdad mines in Arizona, the Cerro Verde mine in Peru and the sulfide project at the El Abra mine in Chile, (ii) the restart of the Miami mine in Arizona and (iii) the restart of the Climax molybdenum mine in Colorado.

The following table reflects first-quarter 2009 activities associated with the liabilities (included in accounts payable and accrued liabilities) incurred in connection with the fourth quarter of 2008 restructuring (in millions):

| | December 31, | | Additions/ | | | | March 31, | |

| | 2008 | | Adjustments | | Payments | | 2009 | |

| North America Copper Mines | | | | | | | | | | | | |

| Morenci | | | | | | | | | | | | |

| Employee severance and benefit costs | $ | 2 | | $ | – | | $ | (1 | ) | $ | 1 | |

| Contract cancellation and other costs | | – | | | 5 | a | | (5 | ) | | – | |

| Other mines | | | | | | | | | | | | |

| Employee severance and benefit costs | | 12 | | | (2 | ) | | (7 | ) | | 3 | |

| Contract cancellation and other costs | | 1 | | | 6 | | | (2 | ) | | 5 | |

| | | 15 | | | 9 | a | | (15 | ) | | 9 | |

| | | | | | | | | | | | | |

| South America Copper Mines | | | | | | | | | | | | |

| Cerro Verde | | | | | | | | | | | | |

| Contract cancellation and other costs | | 1 | | | – | | | (1 | ) | | – | |

| Other mines | | | | | | | | | | | | |

| Employee severance and benefit costs | | 6 | | | – | | | (3 | ) | | 3 | |

| Contract cancellation and other costs | | – | | | 6 | | | (3 | ) | | 3 | |

| | | 7 | | | 6 | | | (7 | ) | | 6 | |

| | | | | | | | | | | | | |

| Africa | | | | | | | | | | | | |

| Employee severance and benefit costs | | 2 | | | – | | | – | | | 2 | |

| | | | | | | | | | | | | |

| Molybdenum | | | | | | | | | | | | |

| Employee severance and benefit costs | | 1 | | | 1 | | | (2 | ) | | – | |

| | | | | | | | | | | | | |

| Rod & Refining | | | | | | | | | | | | |

| Employee severance and benefit costs | | 4 | | | – | | | (3 | ) | | 1 | |

| | | | | | | | | | | | | |

| Corporate & Other | | | | | | | | | | | | |

| Employee severance and benefit costs | | 6 | | | – | | | (5 | ) | | 1 | |

| Contract cancellation and other costs | | 3 | | | – | | | (3 | ) | | – | |

| | | 9 | | | – | | | (8 | ) | | 1 | |

| | | | | | | | | | | | | |

| Total | $ | 38 | | $ | 16 | a | $ | (35 | ) | $ | 19 | |

| a. | Excludes $3 million for the write off of other current assets in connection with a lease cancellation. |

The following table reflects first-quarter 2009 activities associated with the liabilities (included in accounts payable and accrued liabilities) incurred in connection with the January 2009 restructuring (in millions):

| | 2009 | | | | March 31, | |

| | Additions | | Payments | | 2009 | |

| North America Copper Mines | | | | | | | | | |

| Morenci | | | | | | | | | |

| Employee severance and benefit costs | $ | 12 | | $ | (2 | ) | $ | 10 | |

| Contract cancellation and other costs | | 3 | | | (1 | ) | | 2 | |

| Total | $ | 15 | | $ | (3 | ) | $ | 12 | |

| | | | | | | | | | |

| 3. | PENSION AND POSTRETIREMENT BENEFITS |

During the first quarter of 2009, FCX remeasured its plan assets and benefit obligations for the FMC Retirement Plan and the FMC Retiree Medical Plan as a result of employee reductions caused by FCX’s revised operating plans.

Information as of and for the three months ended March 31, 2009, on the FMC Retirement Plan and the FMC Retiree Medical Plan follows (in millions):

| | | FMC | | FMC | |

| | | Retirement | | Retiree | |

| | | Plan | | Medical Plan | |

| Change in benefit obligation: | | | | | | | |

| Benefit obligation at beginning of period | | $ | 1,289 | | $ | 222 | |

| Service cost | | | 6 | | | – | |

| Interest cost | | | 19 | | | 3 | |

| Actuarial gains | | | (165 | ) | | (9 | ) |

Special retirement benefits and curtailmentsa | | | (9 | ) | | (3 | ) |

| Benefits paid, net of employee contributions and | | | | | | | |

| Medicare Part D subsidy (retiree medical plan) | | | (29 | ) | | (6 | ) |

| Benefit obligation at end of period | | | 1,111 | | | 207 | |

| | | | | | | | |

| Change in plan assets: | | | | | | | |

| Fair value of plan assets at beginning of period | | | 924 | | | – | |

| Actual return on plan assets | | | (57 | ) | | – | |

| Employer contributions | | | – | | | 6 | |

| Benefits paid, net of employee contributions | | | (29 | ) | | (6 | ) |

| Fair value of plan assets at end of period | | | 838 | | | – | |

| | | | | | | | |

| Funded status | | $ | (273 | ) | $ | (207 | ) |

| | | | | | | | |

| Discount rate assumption | | | 7.30 | % | | 6.90 | % |

| a. | Resulted from reductions in the workforce caused by the revised mine operating plans (see Note 2 for further discussion). |

Following is a reconciliation of the benefit obligation, fair value of plan assets and funded status as of December 31, 2008, for FCX’s pension plans (as reported in FCX’s 2008 Annual Report on Form 10-K) to the FMC Retirement Plan beginning balances shown above (in millions):

| | | | | Fair Value | | | |

| | | Benefit | | of Plan | | Funded | |

| | | Obligation | | Assets | | Status | |

| FCX’s pension plans as reported | | $ | 1,412 | | $ | 959 | | $ | (453 | ) |

| Less: FMC plans other than the FMC Retirement Plan, | | | | | | | | | | |

| and FCX’s SERP, director and excess benefit plans | | | (123 | ) | | (35 | ) | | 88 | |

| FMC Retirement Plan | | $ | 1,289 | | $ | 924 | | $ | (365 | ) |

| | | | | | | | | | | |

Following is a reconciliation of the benefit obligation, fair value of plan assets and funded status as of December 31, 2008, for FCX’s postretirement medical and life insurance benefit plans (as reported in FCX’s 2008 Annual Report on Form 10-K) to the FMC Retiree Medical Plan beginning balances shown above (in millions):

| | | | | Fair Value | | | |

| | | Benefit | | of Plan | | Funded | |

| | | Obligation | | Assets | | Status | |

| FCX’s postretirement medical and life insurance | | | | | | | | | | |

| benefit plans as reported | | $ | 257 | | $ | – | | $ | (257 | ) |

| Less: FCX’s medical and life insurance benefit plans | | | | | | | | | | |

| other than the FMC Retiree Medical Plan | | | (35 | ) | | – | | | 35 | |

| FMC Retiree Medical Plan | | $ | 222 | | $ | – | | $ | (222 | ) |

| | | | | | | | | | | |

The components of net periodic benefit cost for pension and postretirement benefits for the three-month periods ended March 31, 2009 and 2008, follow (in millions):

| | | | | Three Months Ended | |

| | | | | March 31, | |

| | | | | | | 2009 | | 2008 | |

| Service cost | | | | | | | | $ | 9 | | $ | 9 | |

| Interest cost | | | | | | | | | 27 | | | 27 | |

| Expected return on plan assets | | | | | | | | | (20 | ) | | (32 | ) |

| Amortization of prior service cost | | | | | | | | | – | | | 2 | |

| Amortization of net actuarial loss | | | | | | | | | 8 | | | – | |

| Curtailments | | | | | | | | | (4 | ) | | – | |

| Special retirement benefits | | | | | | | | | (5 | ) | | – | |

| Net periodic benefit costs | | | | | | | | $ | 15 | | $ | 6 | |

| | | | | | | | | | | | | | |

Net periodic benefit costs increased as a result of a decrease in the expected return on plan assets ($12 million) and amortization of actuarial losses ($8 million) primarily in connection with the losses on plan assets, partially offset by gains on special retirement benefits and curtailments ($9 million) resulting from workforce reductions caused by the revised mine operating plans.

FCX’s basic net income per share of common stock was calculated by dividing net income applicable to common stock by the weighted-average shares of common stock outstanding during the period. The following is a reconciliation of net income and weighted-average shares of common stock outstanding for purposes of calculating diluted net income per share for the three months ended March 31, 2009 and 2008 (in millions, except per share amounts):

| | | | | | | | | | | | | | |

| | | | | Three Months Ended | |

| | | | | March 31, | |

| | | | | | | 2009 | | 2008 | |

| Net income | | | | | | | | $ | 207 | | $ | 1,505 | |

| Net income attributable to noncontrolling interests in | | | | | | | | | | | | | |

| subsidiaries | | | | | | | | | (104 | ) | | (319 | ) |

| Preferred dividends | | | | | | | | | (60 | ) | | (64 | ) |

| Net income applicable to common stock | | | | | | | | | 43 | | | 1,122 | |

| Plus income impact of assumed conversion of: | | | | | | | | | | | | | |

| 6¾% Mandatory Convertible Preferred Stock | | | | | | | | | – | | | 49 | |

| 5½% Convertible Perpetual Preferred Stock | | | | | | | | | – | | | 15 | |

| Diluted net income applicable to common stock | | | | | | | | $ | 43 | | $ | 1,186 | |

| | | | | | | | | | | | | | |

| Weighted-average shares of common stock outstanding: | | | | | | | | | 400 | | | 383 | |

| Add stock issuable upon conversion, exercise or | | | | | | | | | | | | | |

| vesting of: | | | | | | | | | | | | | |

6¾% Mandatory Convertible Preferred Stocka | | | | | | | | | – | b | | 39 | |

| 5½% Convertible Perpetual Preferred Stock | | | | | | | | | – | b | | 23 | |

| Dilutive stock options | | | | | | | | | – | | | 2 | |

| Restricted stock | | | | | | | | | 1 | | | 2 | |

| Weighted-average shares of common stock outstanding | | | | | | | | | | | | | |

| for purposes of calculating diluted net income per share | | | | | | | | | 401 | | | 449 | |

| | | | | | | | | | | | | | |

| Diluted net income per share of common stock | | | | | | | | | | | | | |

| attributable to FCX stockholders | | | | | | | | $ | 0.11 | | $ | 2.64 | |

| a. | Preferred stock will automatically convert on May 1, 2010, into between approximately 39 million and 47 million shares of FCX common stock at a conversion rate that will be determined based on FCX’s common stock price. Prior to May 1, 2010, holders may convert at a conversion rate of 1.3654 or approximately 39 million shares. |

| b. | Potential additional shares of common stock of approximately 39 million shares for the 6¾% Mandatory Convertible Preferred Stock and 18 million shares for the 5½% Convertible Perpetual Preferred Stock were excluded for the three months ended March 31, 2009, because they were anti-dilutive. |

FCX’s convertible instruments are excluded from the computation of diluted net income per share of common stock when including the conversion of these instruments results in an anti-dilutive effect on earnings per share (see footnote b above). The quarterly dilution threshold for the 5½% Convertible Perpetual Preferred Stock is $0.64 per share and for the 6¾% Mandatory Convertible Preferred Stock is $1.24 per share. Outstanding stock options with exercise prices greater than the average market price of FCX’s common stock during the period are also excluded from the computation of diluted net income per share of common stock. Excluded amounts were approximately nine million stock options with a weighted-average exercise price of $67.00 for first-quarter 2009. No stock options were excluded for first-quarter 2008.

| 5. | INVENTORIES, AND MILL AND LEACH STOCKPILES |

The components of inventories follow (in millions):

| | | March 31, | | December 31, | |

| | | 2009 | | 2008 | |

| Mining Operations: | | | | | | | |

| Raw materials | | $ | 1 | | $ | 1 | |

| Work-in-process | | | 145 | | | 128 | |

Finished goodsa | | | 700 | | | 703 | |

| Atlantic Copper: | | | | | | | |

| Raw materials (concentrates) | | | 134 | | | 164 | |

| Work-in-process | | | 132 | | | 71 | |

| Finished goods | | | 5 | | | 1 | |

| Total product inventories | | | 1,117 | | | 1,068 | |

Total materials and supplies, netb | | | 1,078 | | | 1,124 | |

| Total inventories | | $ | 2,195 | | $ | 2,192 | |

| a. | Primarily includes copper concentrates, anodes, cathodes and rod, and molybdenum. |

| b.�� | Materials and supplies inventory is net of obsolescence reserves totaling $21 million at March 31, 2009, and $22 million at December 31, 2008. |

The following summarizes mill and leach stockpiles (in millions):

| | | March 31, | | December 31, | |

| | | 2009 | | 2008 | |

| Current: | | | | | | | |

| Mill stockpiles | | $ | 22 | | $ | 10 | |

| Leach stockpiles | | | 549 | | | 561 | |

| Total current mill and leach stockpiles | | $ | 571 | | $ | 571 | |

| | | | | | | | |

Long-terma: | | | | | | | |

| Mill stockpiles | | $ | 333 | | $ | 340 | |

| Leach stockpiles | | | 814 | | | 805 | |

| Total long-term mill and leach stockpiles | | $ | 1,147 | | $ | 1,145 | |

| a. | Metals in stockpiles not expected to be recovered within the next 12 months. |

FCX recorded charges for lower of cost or market (LCM) molybdenum inventory adjustments of $19 million ($19 million to net income applicable to common stock or $0.05 per diluted share) in first-quarter 2009 resulting from lower molybdenum prices.

FCX’s first-quarter 2009 income tax provision resulted from taxes on international operations ($330 million) and U.S. operations ($1 million). FCX’s effective tax rate for 2009 is expected to be highly sensitive to changes in commodity prices and the mix of income between U.S. and international operations. Taxes provided on income generated from FCX’s South America and Indonesia operations are recorded at the applicable statutory rates. However, at certain commodity prices, FCX does not record a tax benefit for losses generated in the U.S., and these losses cannot be used to offset income generated from international operations. These factors have caused FCX’s consolidated effective tax rate of 63 percent to be substantially higher than the U.S. federal statutory rate of 35 percent.

FCX’s first-quarter 2008 income tax provision resulted from taxes on international operations ($579 million) and U.S. operations ($150 million). The difference between FCX’s consolidated effective income tax rate of approximately 33 percent for first-quarter 2008 and the U.S. federal statutory rate of 35 percent primarily was attributable to a U.S. benefit for percentage depletion, partially offset by withholding taxes and incremental U.S. income tax accrued on foreign earnings.

Capitalized interest totaled $45 million in first-quarter 2009 and $22 million in first-quarter 2008.

| 8. | DERIVATIVE FINANCIAL INSTRUMENTS AND FAIR VALUE MEASUREMENT |

Derivative Financial Instruments. FCX and its subsidiaries do not purchase, hold or sell derivative financial instruments unless there is an existing asset or obligation or if FCX anticipates a future activity that is likely to occur and will result in exposure to market risks. FCX does not enter into any derivative financial instruments for speculative purposes. FCX and its subsidiaries have entered into derivative financial instruments in limited instances to achieve specific objectives. These objectives principally relate to managing risks associated with commodity price, foreign currency and interest rate risks. The fair values of FCX’s derivative financial instruments are based on widely published market prices.

Summarized below are unrealized gains/losses on derivative financial instruments that are designated and qualify as fair value hedge transactions under Statement of Financial Accounting Standards (SFAS) No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended, for the three months ended March 31, 2009, along with the unrealized gains (losses) on the related hedged item (in millions):

| | | Derivative | | Hedged Item | |

| Commodity contracts: | | | | | | | |

Copper futures and swap contractsa | | $ | 5 | | $ | (5 | ) |

| a. | Gains (losses) on derivative financial instruments as well as the offsetting gains (losses) on the hedged items (unrecognized firm commitments) are recorded in revenues. Additionally, FCX realized gains of $3 million during first-quarter 2009 from matured derivative financial instruments that qualify for hedge accounting. |

Summarized below are the realized and unrealized gains recognized in income before income taxes and equity in affiliated companies’ net earnings for derivative financial instruments, including embedded derivatives, which do not qualify for hedge accounting under SFAS No. 133, as amended, for the three months ended March 31, 2009 (in millions):

| Commodity contracts: | | | | |

Embedded derivatives in provisional sales contractsa | | $ | 313 | |

Embedded derivatives in provisional purchase contractsb | | | 1 | |

Copper forward contractsb | | | 4 | |

Copper futures and swap contractsa | | | 32 | |

| a. | Amounts recorded in revenues. |

| b. | Amounts recorded in cost of sales as production and delivery costs. |

Summarized below are the fair values of unsettled derivative financial instruments recorded on the consolidated balance sheet at March 31, 2009 (in millions):

| Derivatives designated as hedging instruments under | | | | | | | |

| SFAS No. 133, as amended | | | | | | | |

| Commodity contracts: | | | | | | | |

| Copper futures and swap contracts: | | | | | | | |

Asset positiona | | | | | $ | 5 | |

| | | | | | | | |

| Derivatives not designated as hedging instruments under | | | | | | | |

| SFAS No. 133, as amended | | | | | | | |

| Commodity contracts: | | | | | | | |

Embedded derivatives in provisional sales/purchases contracts:b | | | | | | | |

| Asset position | | | | | $ | 220 | |

| Liability position | | | | | | (10 | ) |

| Copper forward contracts: | | | | | | | |

Liability positionc | | | | | | (1 | ) |

Copper futures and swap contracts:d | | | | | | | |

Asset positiona | | | | | | 5 | |

Liability positione | | | | | | (25 | ) |

| a. | Amounts recorded in other current assets. |

| b. | Amounts recorded either as a net accounts receivable or a net accounts payable except for Atlantic Copper’s copper purchases, which are recorded to product inventories ($(7) million). |

| c. | Amounts recorded in accounts payable and accrued liabilities. |

| d. | At March 31, 2009, FCX had paid $26 million to brokers for margin requirements, which is recorded in other current assets. |

| e. | Amounts recorded in accounts payable and accrued liabilities ($23 million) and long-term liabilities ($2 million). |

Commodity Contracts. From time to time, FCX has entered into forward, futures and swap contracts to hedge the market risk associated with fluctuations in the prices of commodities it purchases and sells. Derivative financial instruments used by FCX to manage its risks do not contain credit risk-related contingent provisions. As of March 31, 2009, FCX had no price protection contracts relating to its future mine production. A discussion of FCX’s derivative commodity contracts and programs follows.

Fair Value Hedges

Copper Futures and Swap Contracts. Some of FCX’s U.S. copper rod customers request a fixed market price instead of the New York Mercantile Exchange (COMEX) average price in the month of shipment. FCX hedges this price exposure in a manner that allows it to receive the COMEX average price in the month of shipment while the customers pay the fixed price they requested. FCX accomplishes this by entering into copper futures and swap contracts and then liquidating the copper futures contracts and settling the copper swap contracts during the month of shipment, which generally results in FCX receiving the COMEX average price in the month of shipment. Hedge gains or losses from these copper futures and swap contracts are recorded in revenues. FCX did not have any significant gains or losses during the three months ended March 31, 2009, resulting from ineffectiveness. At March 31, 2009, FCX held copper futures and swap contracts for 34 million pounds at an average price of $1.69 per pound, with maturities through January 2011.

Other Derivative Financial Instruments

Derivative financial instruments that do not meet the criteria to qualify under FSAS No. 133, as amended, for hedge accounting are discussed below.

Embedded Derivatives. As described in Note 1 to FCX’s 2008 Annual Report on Form 10-K under “Revenue Recognition,” certain FCX copper concentrate, copper cathode and gold sales contracts provide for provisional pricing primarily based on LME or COMEX prices at the time of shipment as specified in the contract. Similarly, FCX purchases copper and molybdenum under contracts that provide for provisional pricing. FCX applies the normal purchase and sale exception under SFAS No. 133, as amended, to the host sales agreements since the contracts do not allow for net settlement and always result in physical delivery. Under SFAS No. 133, as amended,

sales and purchases with a provisional sales price contain an embedded derivative (i.e., the price settlement mechanism that is settled after the time of delivery) that is required to be bifurcated from the host contract. The host contract is the sale or purchase of the metals contained in the concentrates or cathodes at the then-current LME or COMEX price. Mark-to-market price fluctuations recorded through the settlement date are reflected in revenues for sales contracts and in cost of sales as production and delivery costs for purchase contracts. At March 31, 2009, FCX had embedded derivatives on 407 million pounds of copper sales (net of noncontrolling interests), with maturities through August 2009 and 57 million pounds of copper purchases, with maturities through July 2009.

In order to reduce short-term price volatility in earnings and cash flows, FCX entered into copper forward sales contracts (not included in the table above) in early April 2009 to lock in prices at an average of $1.86 per pound on 355 million pounds of PT Freeport Indonesia’s provisionally priced copper sales at March 31, 2009. These economic hedge transactions are scheduled to final price from April 2009 through July 2009. From time to time, FCX may enter into similar transactions to lock in pricing on provisionally priced sales, but FCX does not intend to change its long-standing policy of not hedging future copper production.

Copper Forward Contracts. Atlantic Copper enters into forward copper contracts designed to hedge its copper price risk whenever its physical purchases and sales pricing periods do not match. These economic hedge transactions are intended to hedge against changes in copper prices, with the mark-to-market hedging gains or losses recorded in cost of sales. At March 31, 2009, Atlantic Copper held forward copper purchase contracts for 8 million pounds at an average price of $1.69 per pound, with maturities through May 2009.

Copper Futures and Swap Contracts. In addition to the contracts that qualify for fair value hedge accounting that are discussed above, FCX also has similar contracts with its U.S. copper rod customers that do not qualify for hedge accounting because of certain terms in the sales contracts. Gains and losses for these economic hedge transactions are recorded in revenues. At March 31, 2009, FCX held copper futures and swap contracts for 49 million pounds at an average price of $2.27 per pound, with maturities through December 2010.

From time to time, FCX or its subsidiaries may enter into foreign currency exchange contracts to lock in or minimize the effects of fluctuations in exchange rates or interest rate swaps to manage its exposure to interest rate changes on a portion of its debt. FCX had no outstanding foreign currency exchange contracts or interest rate swaps at March 31, 2009. Refer to Note 17 in FCX’s 2008 Annual Report on Form 10-K for further discussion.

Fair Value Measurement. In September 2006, the Financial Accounting Standards Board (FASB) issued SFAS No. 157, “Fair Value Measurements,” which provides enhanced guidance for using fair value to measure assets and liabilities. SFAS No. 157 does not require any new fair value measurements under U.S. GAAP; rather this statement establishes a common definition of fair value, provides a framework for measuring fair value under U.S. GAAP and expands disclosure requirements about fair value measurements. In February 2008, FASB issued FASB Staff Position (FSP) No. FAS 157-2, which delayed the effective date of SFAS No. 157 for nonfinancial assets or liabilities that are not required or permitted to be measured at fair value on a recurring basis to fiscal years beginning after November 15, 2008, and interim periods within those years. FCX adopted SFAS No. 157 for financial assets and liabilities recognized at fair value on a recurring basis effective January 1, 2008. This partial adoption of SFAS No. 157 did not have a material impact on FCX’s financial reporting and disclosures as its financial assets are measured using quoted market prices, or Level 1 inputs. FCX adopted SFAS No. 157 for nonfinancial assets or liabilities not valued on a recurring basis (at least annually) effective January 1, 2009, with no material impact on its financial reporting and disclosures.

SFAS No. 157 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 inputs) and the lowest priority to unobservable inputs (Level 3 inputs). The three levels of the fair value hierarchy under SFAS No. 157 are described below:

| Level 1 | Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities; |

| Level 2 | Quoted prices in markets that are not active, quoted prices for similar assets or liabilities in active markets, inputs other than quoted prices that are observable for the asset or liability, or inputs that are derived principally from or corroborated by observable market data by correlation or other means; |

| Level 3 | Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

The following table sets forth FCX’s financial assets and liabilities measured at fair value on a recurring basis (in millions):

| | | Fair Value at March 31, 2009 | |

| | | Total | | Level 1 | | Level 2 | | Level 3 | |

| Cash equivalents | | $ | 612 | | $ | 612 | | $ | – | | $ | – | |

| Trust assets (current and long-term) | | | 230 | | | 230 | | | – | | | – | |

| Available-for-sale securities | | | 68 | | | 68 | | | – | | | – | |

| Embedded derivatives in provisional sales/purchases | | | | | | | | | | | | | |

| contracts | | | 210 | | | 210 | | | – | | | – | |

| Other derivative financial instruments, net | | | (16 | ) | | (16 | ) | | – | | | – | |

| | | $ | 1,104 | | $ | 1,104 | | $ | – | | $ | – | |

| | | | | | | | | | | | | | |

| 9. | NEW ACCOUNTING STANDARDS |

Noncontrolling Interests in Consolidated Financial Statements. In December 2007, FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements – an amendment of ARB No. 51,” which clarifies that noncontrolling interests (minority interests) are to be treated as a separate component of equity and any changes in the ownership interest (in which control is retained) are to be accounted for as capital transactions. However, a change in ownership of a consolidated subsidiary that results in a loss of control is considered a significant event that triggers gain or loss recognition, with the establishment of a new fair value basis in any remaining ownership interests. SFAS No. 160 also provides additional disclosure requirements for each reporting period. SFAS No. 160 applies to fiscal years beginning on or after December 15, 2008, with early adoption prohibited. This statement is required to be adopted prospectively, except for the following provisions, which are to be applied retrospectively: (i) the reclassification of noncontrolling interests to equity in the consolidated balance sheets and (ii) the adjustment to consolidated net income to include net income attributable to both the controlling and noncontrolling interests. FCX adopted SFAS No. 160 effective January 1, 2009.

Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion. In May 2008, FASB issued FSP No. APB 14-1, “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement),” which changes the accounting treatment for convertible debt securities that the issuer may settle fully or partially in cash. FSP No. APB 14-1 requires bifurcation of convertible debt instruments into a debt component that is initially recorded at fair value and an equity component that represents the difference between the initial proceeds from issuance of the instrument and the fair value allocated to the debt component. The debt component is subsequently accreted (as a component of interest expense) to par value over its expected life. FSP No. APB 14-1 is effective for fiscal years and interim periods beginning after December 15, 2008, and must be retrospectively applied to all prior periods presented, even if an instrument has matured, converted, or otherwise been extinguished as of the FSP’s effective date. FSP No. APB 14-1 did not have an impact on FCX’s financial reporting.

Employers’ Disclosures about Postretirement Benefit Plan Assets. In December 2008, FASB issued FSP No. FAS 132(R)-1, “Employers’ Disclosures about Postretirement Benefit Plan Assets,” which provides enhanced guidance on an employer’s disclosures about plan assets of a defined benefit pension or other postretirement plan. FSP FAS 132(R)-1 revises disclosure requirements on pension and postretirement plan assets from those required in the original SFAS No. 132 after the FASB decided disclosures about fair value measurements for postretirement plan assets were not within the scope of SFAS No. 157. The disclosures about plan assets required by FSP FAS 132(R)-1 are effective for fiscal years ending after December 15, 2009, with early application permitted. Upon initial application, disclosures are not required for earlier periods that are presented for comparative purposes. FCX is currently evaluating the impact that the adoption of FSP No. FAS 132(R)-1 will have on its financial disclosures.

FCX has organized its operations into five primary divisions – North America copper mines, South America copper mines, Indonesia mining, Africa mining and Molybdenum operations. Notwithstanding this structure, FCX internally reports information on a mine-by-mine basis. Therefore, in accordance with SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information,” FCX concluded that its operating segments include individual mines. Operating segments that meet certain SFAS No. 131 thresholds are reportable segments. In accordance with this guidance, beginning in first-quarter 2009, Sierrita is no longer a reportable segment.

In third-quarter 2008, FCX revised its presentation of the operating divisions to better reflect management’s view of the consolidated FCX operations. Accordingly, FCX has revised its segment disclosures for the three months ended March 31, 2008, to conform with the current period presentation.

Further discussion of the reportable segments included in FCX’s primary operating divisions, as well as FCX’s other reportable segments – Rod & Refining and Atlantic Copper Smelting & Refining – follows.

North America Copper Mines. FCX has five operating copper mines in North America – Morenci, Sierrita, Bagdad and Safford in Arizona and Tyrone in New Mexico. The North America copper mines include open-pit mining, sulfide ore concentrating, leaching, and solution extraction and electrowinning (SX/EW) operations. A majority of the copper produced at the North America copper mines is cast into copper rod by FCX’s Rod & Refining operations. The North America mines division includes the Morenci copper mine as a reportable segment.

Morenci. The Morenci open-pit mine, located in southeastern Arizona, primarily produces copper cathodes. FCX owns an 85 percent undivided interest in Morenci through an unincorporated joint venture.

Other Mines. Other mines include FCX’s other operating southwestern U.S. copper mines – Sierrita, Bagdad, Safford and Tyrone. In addition to copper, the Sierrita and Bagdad mines produce molybdenum concentrates as a by-product. Other mines also include FCX’s southwestern U.S. copper mines that are currently on care-and-maintenance status.

South America Copper Mines. FCX has four operating copper mines in South America – Cerro Verde in Peru, and Candelaria, Ojos del Salado and El Abra in Chile. These operations include open-pit and underground mining, sulfide ore concentrating, leaching and SX/EW operations. The South America mines division includes the Cerro Verde copper mine as a reportable segment.

Cerro Verde. The Cerro Verde open-pit copper mine, located near Arequipa, Peru, produces copper cathodes and copper concentrates. In addition to copper, the Cerro Verde mine produces molybdenum concentrates as a by-product. FCX owns a 53.56 percent interest in Cerro Verde.

Other Mines. Other mines include FCX’s Chilean copper mines – Candelaria, Ojos del Salado and El Abra – which include open-pit and underground mining, sulfide ore concentrating, leaching and SX/EW operations. In addition to copper, the Candelaria and Ojos del Salado mines produce gold and silver as by-products. FCX owns an 80 percent interest in both the Candelaria and Ojos del Salado mines, and owns a 51 percent interest in the El Abra mine.

Indonesia. Indonesia mining includes PT Freeport Indonesia’s Grasberg minerals district. PT Freeport Indonesia produces copper concentrates, which contain significant quantities of gold and silver. FCX owns 90.64 percent of PT Freeport Indonesia, including 9.36 percent owned through PT Indocopper Investama. In 1996, FCX established an unincorporated joint venture with Rio Tinto, which covers PT Freeport Indonesia’s mining operations in Block A and gives Rio Tinto, through 2021, a 40 percent interest in certain assets and future production exceeding specified annual amounts of copper, gold and silver. After 2021, Rio Tinto will have a 40 percent interest in all production from Block A.

Africa. Africa mining includes the Tenke Fungurume copper and cobalt mining concessions in the Katanga province of the Democratic Republic of Congo. Construction progressed during first-quarter 2009, and the first copper cathode was produced in late March 2009 as the project entered the commissioning and start-up phase. FCX owns an effective 57.75 percent interest in Tenke Fungurume.

Molybdenum. The Molybdenum segment is an integrated producer of molybdenum, with mining, sulfide ore concentrating, roasting and processing facilities that produce high-purity, molybdenum-based chemicals, molybdenum metal powder and metallurgical products, which are sold to customers around the world, and includes the wholly owned Henderson molybdenum mine in Colorado and related conversion facilities. The Henderson underground mine produces high-purity, chemical-grade molybdenum concentrates, which are typically further processed into value-added molybdenum chemical products. This segment also includes a sales company that purchases and sells molybdenum from the Henderson mine as well as from FCX’s North and South America copper mines that produce molybdenum as a by-product. In addition, at times this segment roasts and/or processes material on a toll basis. Toll arrangements require the tolling customer to deliver appropriate molybdenum-bearing material to FCX’s facilities for processing into a product that is returned to the customer, who pays FCX for processing its material into the specified products. The Molybdenum segment also includes FCX’s wholly owned Climax molybdenum mine in Colorado, which has been on care-and-maintenance status since 1995.

Rod & Refining. The Rod & Refining segment consists of copper conversion facilities located in North America, and includes a refinery, three rod mills and a specialty copper products facility. These operations process copper produced at the North America mines and purchased copper into copper cathode, rod and custom copper shapes. At times these operations refine copper and produce copper rod and shapes for customers on a toll basis. Toll arrangements require the tolling customer to deliver appropriate copper-bearing material to FCX’s facilities for processing into a product that is returned to the customer, who pays FCX for processing its material into the specified products.

Atlantic Copper Smelting & Refining. Atlantic Copper, S.A. (Atlantic Copper), FCX’s wholly owned smelting unit in Spain, smelts and refines copper concentrates and markets refined copper and precious metals in slimes. PT Freeport Indonesia and the South America copper mines generally sell a portion of their concentrate and cathode (South America) production to Atlantic Copper.

Intersegment Sales. Intersegment sales between FCX’s operations are based on similar arms-length transactions with third parties at the time of the sale. Intersegment sales may not be reflective of the actual prices ultimately realized because of a variety of factors, including additional processing, timing of sales to unaffiliated customers and transportation premiums.

Allocations. FCX allocates certain operating costs, expenses and capital to the operating divisions and individual segments. However, not all costs and expenses applicable to a mine or operation are allocated. All U.S. federal and state income taxes are recorded and managed at the corporate level, whereas foreign income taxes are recorded and managed at the applicable mine or operation. In addition, most exploration and research activities are managed at the corporate level, and those costs along with some selling, general and administrative costs are not allocated to the operating divisions or segments. Accordingly, the following segment information reflects management determinations that may not be indicative of what the actual financial performance of each operating division or segment would be if it was an independent entity.

Business Segments

| (In Millions) | North America Copper Mines | | South America Copper Mines | | Indonesia | | Africa | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | Atlantic | | | | | |

| | | | | | | | | | | | | | | | | | | | | | Copper | | | | | |

| | | | | | | | | | | | | | | | | | | | | | Smelting | | | | | |

| | Morenci | | | | Total | | | | | | Total | | Grasberg | | Tenke | | | | | | & Refining | | | | | |

| First-Quarter 2009 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Unaffiliated customers | $ | 21 | | $ | 23 | | $ | 44 | | $ | 246 | | $ | 338 | | $ | 584 | | $ | 920 | a | $ | – | | $ | 146 | | $ | 613 | | $ | 292 | | $ | 3 | | $ | 2,602 | |

| Intersegment | | 212 | | 362 | | 574 | | 77 | | 41 | | 118 | | 202 | | – | | – | | 6 | | – | | (900 | ) | – | |

| Production and delivery | | 190 | | 363 | | 553 | | 149 | | 218 | | 367 | | 350 | | 16 | | 119 | | 614 | | 293 | | (750 | ) | 1,562 | |

| Depreciation, depletion and amortization | | 36 | | 39 | | 75 | | 35 | | 30 | | 65 | | 65 | | 3 | | 9 | | 2 | | 8 | | 5 | | 232 | |

| LCM inventory adjustments | | – | | – | | – | | – | | – | | – | | – | | – | | 19 | | – | | – | | – | | 19 | |

| Selling, general and administrative expenses | | – | | – | | – | | – | | – | | – | | 18 | | – | | 4 | | – | | 2 | | 38 | | 62 | |

| Exploration and research expenses | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | 30 | | 30 | |

Restructuring and other chargesb | | 24 | | (2 | ) | 22 | | – | | 6 | | 6 | | – | | – | | (1 | ) | (2 | ) | – | | – | | 25 | |

| Operating income (loss) | | (17 | ) | (15 | ) | (32 | ) | 139 | | 125 | | 264 | | 689 | | (19 | ) | (4 | ) | 5 | | (11 | ) | (220 | ) | 672 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense, net | | 1 | | 2 | | 3 | | – | | 1 | | 1 | | 1 | | (24 | ) | – | | – | | 1 | | 149 | | 131 | |

| Provision for (benefit from) income taxes | | – | | – | | – | | 47 | | 37 | | 84 | | 288 | | (1 | ) | – | | – | | – | | (40 | ) | 331 | |

| Total assets at March 31, 2009 | | 2,079 | | 4,072 | | 6,151 | | 4,002 | | 2,401 | | 6,403 | | 4,765 | | 3,013 | | 1,755 | | 268 | | 875 | | 478 | | 23,708 | |

| Capital expenditures | | 29 | | 43 | | 72 | | 37 | | 37 | | 74 | | 55 | | 251 | | 44 | | 3 | | 6 | | 14 | | 519 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| First-Quarter 2008 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Unaffiliated customers | $ | 134 | | $ | 111 | | $ | 245 | | $ | 612 | | $ | 861 | | $ | 1,473 | | $ | 887 | a | $ | – | | $ | 719 | | $ | 1,680 | | $ | 665 | | $ | 3 | | $ | 5,672 | |

| Intersegment | | 464 | | 787 | | 1,251 | | 117 | | 17 | | 134 | | 165 | | – | | – | | 8 | | – | | (1,558 | ) | – | |

| Production and delivery | | 279 | | 366 | | 645 | | 162 | | 270 | | 432 | | 399 | | 3 | | 460 | | 1,676 | | 651 | | (1,545 | ) | 2,721 | |

| Depreciation, depletion and amortization | | 81 | | 103 | | 184 | | 43 | | 87 | | 130 | | 45 | | 1 | | 39 | | 2 | | 9 | | 8 | | 418 | |

| LCM inventory adjustments | | – | | 1 | | 1 | | – | | – | | – | | – | | – | | – | | – | | – | | – | | 1 | |

| Selling, general and administrative expenses | | – | | – | | – | | – | | – | | – | | 37 | | – | | 6 | | – | | 8 | | 33 | | 84 | |

| Exploration and research expenses | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | 52 | | 52 | |

| Operating income (loss) | | 238 | | 428 | | 666 | | 524 | | 521 | | 1,045 | | 571 | | (4 | ) | 214 | | 10 | | (3 | ) | (103 | ) | 2,396 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense, net | | 1 | | 3 | | 4 | | 1 | | – | | 1 | | 1 | | (9 | ) | – | | 1 | | 4 | | 163 | | 165 | |

| Provision for income taxes | | – | | – | | – | | 173 | | 160 | | 333 | | 239 | | – | | – | | – | | – | | 157 | | 729 | |

| Goodwill at March 31, 2008 | | 1,912 | | 2,299 | | 4,211 | | 763 | | 366 | | 1,129 | | – | | 2 | | 703 | | – | | – | | 3 | | 6,048 | |

| Total assets at March 31, 2008 | | 6,960 | | 11,922 | | 18,882 | | 5,464 | | 4,833 | | 10,297 | | 3,932 | | 1,666 | | 4,179 | | 604 | | 994 | | 1,274 | | 41,828 | |

| Capital expenditures | | 77 | | 74 | | 151 | | 17 | | 46 | | 63 | | 115 | | 143 | | 12 | | 3 | | 5 | | 16 | | 508 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| a. | Includes PT Freeport Indonesia’s sales to PT Smelting totaling $263 million in first-quarter 2009 and $464 million in first-quarter 2008. |

| | |

| b. | The following table summarizes restructuring and other charges: |

| | |

| | Restructuring charges | $ | 23 | | $ | 4 | | $ | 27 | | $ | – | | $ | 6 | | $ | 6 | | $ | – | | $ | – | | $ | 1 | | $ | – | | $ | – | | $ | – | | $ | 34 | |

| | Special retirement benefits and curtailments | | 1 | | (6 | ) | (5 | ) | – | | – | | – | | – | | – | | (2 | ) | (2 | ) | – | | – | | (9 | ) |

| | Restructuring and other charges | $ | 24 | | $ | (2 | ) | $ | 22 | | $ | – | | $ | 6 | | $ | 6 | | $ | – | | $ | – | | $ | (1 | ) | $ | (2 | ) | $ | – | | $ | – | | $ | 25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

TO THE BOARD OF DIRECTORS AND STOCKHOLDERS OF

FREEPORT-McMoRan COPPER & GOLD INC.

We have reviewed the condensed consolidated balance sheet of Freeport-McMoRan Copper & Gold Inc. as of March 31, 2009, and the related consolidated statements of income and cash flows for the three-month periods ended March 31, 2009 and 2008, and the consolidated statement of equity for the three-month period ended March 31, 2009. These financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Freeport-McMoRan Copper & Gold Inc. as of December 31, 2008, and the related consolidated statements of income, cash flows, and stockholders’ equity for the year then ended (not presented herein), and in our report dated February 18, 2009, we expressed an unqualified opinion on those consolidated financial statements and which report included an explanatory paragraph for the Company’s adoption of FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109,” effective January 1, 2007; and SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106 and 132R,” effective December 31, 2006. As described in Note 9, on January 1, 2009, Freeport-McMoRan Copper & Gold Inc. adopted SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements,” on a retrospective basis resulting in revisions of the December 31, 2008, consolidated balance sheet. We have not audited and reported on the revised balance sheet reflecting the adoption of SFAS No. 160.

ERNST & YOUNG LLP

Phoenix, Arizona

May 4, 2009

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

OVERVIEW and OUTLOOK

In Management’s Discussion and Analysis of Financial Condition and Results of Operations, “we,” “us” and “our” refer to Freeport-McMoRan Copper & Gold Inc. (FCX) and its consolidated subsidiaries, including, except as otherwise stated, Phelps Dodge Corporation (Phelps Dodge) and its subsidiaries, which we acquired on March 19, 2007. You should read this discussion in conjunction with our financial statements, the related Management’s Discussion and Analysis of Financial Condition and Results of Operations and the discussion of our “Business and Properties” in our Form 10-K for the year ended December 31, 2008, filed with the U.S. Securities and Exchange Commission (SEC). The results of operations reported and summarized below are not necessarily indicative of future operating results. References to “Notes” are Notes included in our “Notes to Consolidated Financial Statements.” Throughout Management's Discussion and Analysis of Financial Condition and Results of Operations all references to earnings or losses per share are on a diluted basis, unless otherwise noted. FCX changed Phelps Dodge’s legal name to Freeport-McMoRan Corporation (FMC) in 2008; therefore, references to FMC and Phelps Dodge represent the same entity.

We are one of the world’s largest copper, gold and molybdenum mining companies in terms of reserves and production. Our portfolio of assets includes the Grasberg minerals district in Indonesia, which contains the largest single recoverable copper reserve and the largest single gold reserve of any mine in the world based on the latest available reserve data provided by third-party industry consultants; significant mining operations in North and South America; and the Tenke Fungurume minerals district in the Democratic Republic of Congo (DRC), which we believe is one of the world’s highest potential copper and cobalt concessions. We also operate Atlantic Copper, our wholly owned copper smelting and refining operation in Spain. Refer to “Operations” for further discussion.

Our mining revenues for first-quarter 2009 include sales of copper (approximately 71 percent), gold (approximately 17 percent) and molybdenum (approximately 5 percent). We currently have five operating copper mines in North America, four in South America, the Grasberg minerals district in Indonesia, and in late March 2009, the first copper cathode was produced at the Tenke Fungurume minerals district in the DRC as the project entered the commissioning and start-up phase. We also have one operating primary molybdenum mine in North America. During first-quarter 2009, approximately 66 percent of our consolidated copper production was from our Grasberg, Cerro Verde and Morenci mines, and approximately 57 percent of our mined copper was sold in concentrate, approximately 23 percent as rod (principally from our North America operations) and approximately 20 percent as cathodes. We produce gold as a by-product at our copper mines, primarily at the Grasberg minerals district in Indonesia, which accounted for approximately 96 percent of our consolidated gold production in first-quarter 2009. During first-quarter 2009, approximately half of our consolidated molybdenum production was from our Henderson molybdenum mine and half was produced as a by-product primarily at our North America copper mines. Refer to “Operations” for further discussion of our mining operations.

Because of the significant reduction in debt following our March 2007 acquisition of Phelps Dodge and historically high prices for copper, molybdenum and gold, our financial policy during most of 2008 was designed to use our cash flow to invest in growth projects with anticipated high rates of return and to return excess cash flows to shareholders in the form of dividends and share purchases. However, the dramatic declines in copper and molybdenum prices and the deterioration of the economic and credit environment have limited our ability to invest in growth projects and required us to make adjustments to our near-term plans. Our near-term strategy has been designed to protect liquidity while preserving our large mineral resources and growth options for the longer term. Revisions made to our operating and financial plans in late 2008 and early 2009 include:

| · | Curtailment of copper production at higher cost North America operations and of molybdenum production at the Henderson molybdenum mine (refer to “Operations” for further discussion); |

| · | Capital cost reductions, including deferral of most of our project development activities and also reduced capital spending on the remaining development projects in the Grasberg minerals district and at Tenke Fungurume (refer to “Development Projects” for further discussion); |

| · | Aggressive cost control, including workforce reductions, reduced equipment purchases that were planned to support expansion projects, a reduction in material and supplies inventory and reductions in exploration, research and administrative costs; and |

| · | The suspension of our annual common stock dividend. |

The completion in February 2009 of a public offering of 26.8 million shares of FCX common stock at an average price of $28.00 per share generated total proceeds of $750 million (net proceeds of $740 million after fees and expenses). Refer to “Capital Resources and Liquidity – Financing Activities” for further discussion.

While we view the long-term outlook for our business positively, supported by limitations on supplies of copper and by the requirements for copper in the world’s economy, we have responded to the sudden downturn and uncertain near-term outlook and will continue to adjust our operating strategy as market conditions change.

At March 31, 2009, we had $644 million in consolidated cash ($445 million of which was available to our parent company). We also had no borrowings and $74 million of letters of credit issued under our $1.5 billion revolving credit facilities, resulting in availability of approximately $1.4 billion. From time to time we may use the facilities for working capital and short-term funding requirements.

The sharp declines in copper and molybdenum prices have significantly impacted our consolidated financial results in first-quarter 2009, compared to first-quarter 2008. Refer to “Consolidated Results” for further discussion of our consolidated financial results for the three month periods ended March 31, 2009 and 2008.

Outlook

Consolidated sales from mines are expected to approximate 3.9 billion pounds of copper, 2.3 million ounces of gold and 50 million pounds of molybdenum for 2009, including 955 million pounds of copper, 650 thousand ounces of gold and 11 million pounds of molybdenum for second-quarter 2009. Achievement of these sales volume estimates is dependent on the achievement of targeted mining rates, the successful operation of production facilities, the impact of weather conditions and other factors.

Consolidated revenues, operating cash flows and net income vary significantly with fluctuations in the market prices of copper, gold and molybdenum, sales volumes and other factors. Based on the above projected consolidated sales volumes for 2009 and assuming average prices of $2.00 per pound of copper, $900 per ounce of gold and $8 per pound of molybdenum for the remainder of 2009, our consolidated operating cash flows would approximate $2.5 billion in 2009, net of an estimated $0.6 billion for working capital requirements principally reflecting settlements with customers in first-quarter 2009 of prior year provisionally priced sales. Operating cash flows for 2009 would be impacted by approximately $240 million for each $0.10 per pound change in copper prices, $75 million for each $50 per ounce change in gold prices and $30 million for each $1 per pound change in molybdenum prices.

Assuming average prices of $2.00 per pound of copper, $900 per ounce of gold and $8.00 per pound of molybdenum for the remainder of 2009, and using recent prices for commodity-based input costs, we estimate our consolidated unit net cash costs related to our copper mining operations (after by-product credits) would average approximately $0.70 per pound of copper in 2009, compared with $1.16 per pound of copper in 2008. Estimated consolidated unit net cash costs for 2009 are lower when compared to 2008 primarily because of the effects of lower operating rates and reduced energy prices and other commodity-based input costs. Refer to “Consolidated Results – Production and Delivery Costs” for further discussion of consolidated unit net cash costs.

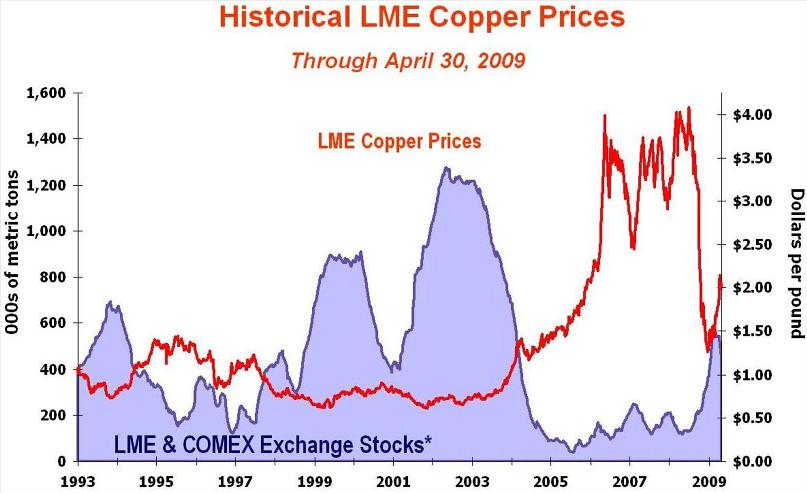

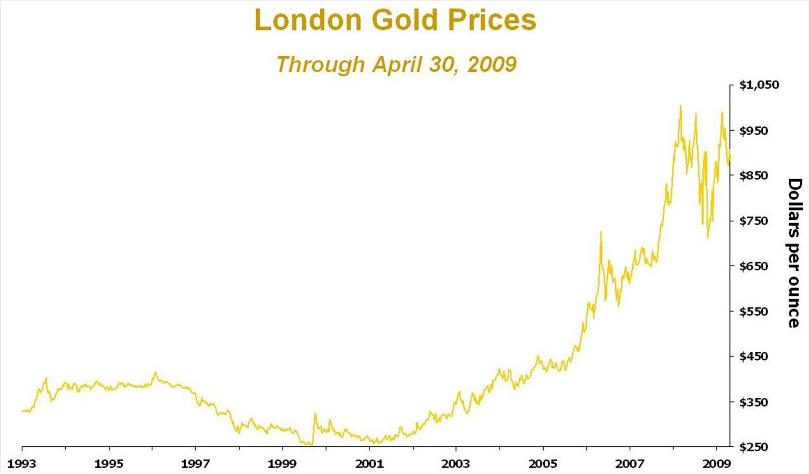

COPPER, GOLD AND MOLYBDENUM MARKETS

The graphs below illustrate the movements in metals prices from January 1993 through April 2009. World prices for copper, gold and molybdenum have fluctuated significantly during this period. The London Metal Exchange (LME) spot copper price varied from a low of $0.60 per pound in 2001 to a high of $4.08 per pound in July 2008, the London gold price fluctuated from a low of approximately $250 per ounce in 1999 to a high of $1,011 per ounce in March 2008, and the average weekly Metals Week Molybdenum Dealer Oxide price ranged from $1.87 per pound in January 1993 to a high of $39.25 per pound in June 2005. Copper, gold and molybdenum prices are affected by numerous factors beyond our control as described further in our “Risk Factors” contained in Part I, Item 1A of our Form 10-K for the year ended December 31, 2008.

* Excludes Shanghai stocks, producer, consumer and merchant stocks.

The graph above presents LME spot copper prices and reported stocks of copper at the LME and the New York Mercantile Exchange (COMEX) from January 1993 through April 2009. During the period 2003 to 2006, global consumption exceeded production, evidenced by the decline in exchange warehouse inventories. Disruptions associated with strikes and other operational issues, combined with growing demand from China and other emerging economies resulted in low levels of inventory from 2006 through most of 2008. However, slowing consumption has led to increases in inventory levels, with combined LME and COMEX stocks rising to approximately 540 thousand metric tons at March 31, 2009.