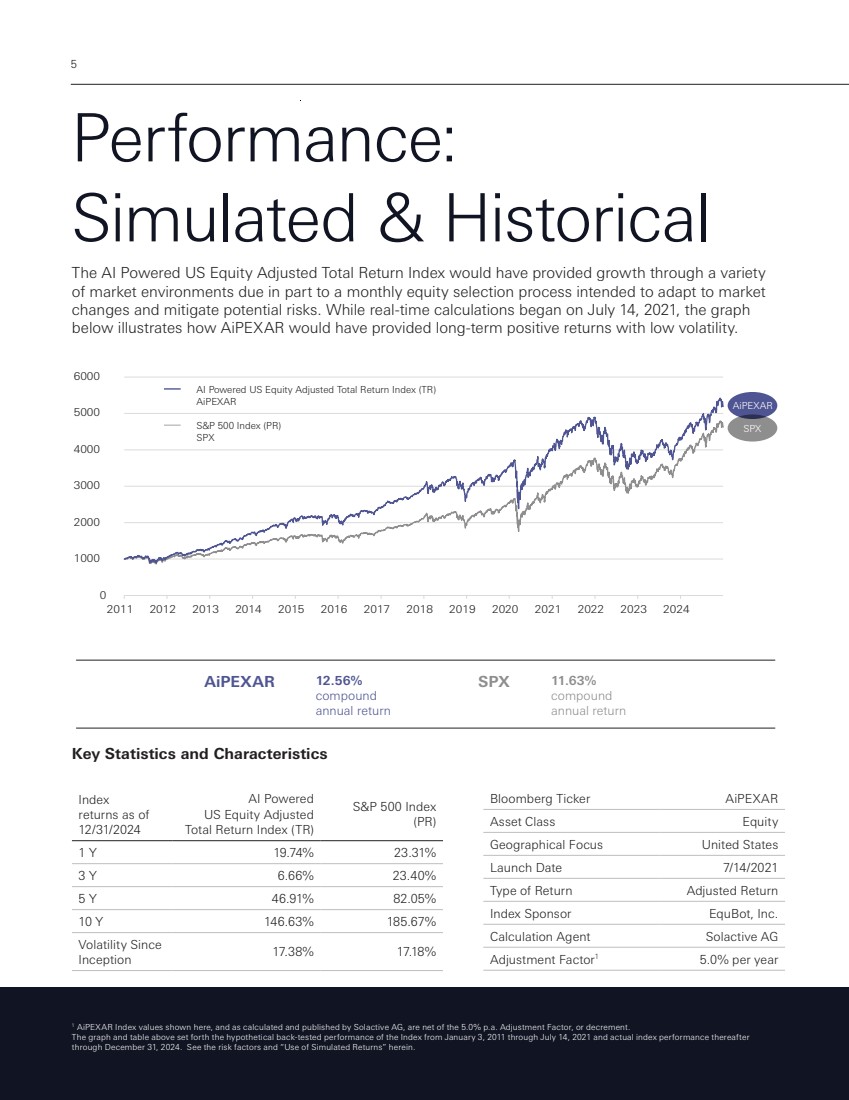

| AI Powered US Equity Adjusted Total Return Index 10 Disclosure HSBC USA Inc. and HSBC Bank USA, N.A. (together, “we” or “HSBC”), are members of the HSBC Group. Any member of the HSBC Group may from time to time underwrite, make a market or otherwise buy and sell, as principal, structured investments, or together with their directors, officers and employees may have either long or short positions in the structured investments, or stocks, commodities or currencies to which the structured investments are linked, or may perform or seek to perform investment banking services for those linked assets mentioned herein. These activities may be in conflict with the interests of investors of debt obligations or certificates of deposit issued by members of the HSBC Group. The Index is subject to a decrement. The strategy tracks the adjusted return of a notional dynamic basket of equities, subject to a monthly Rebalancing Fee and an Adjustment Factor, or decrement, of 5.00% per annum (deducted daily). As such, the Index will always underperform the aggregate performance of the equities included in its Notional Portfolio. Accordingly, the Index’s level may decline even if such aggregate performance is positive. Important Disclaimer Information This document is for informational purposes only and intended to provide a general overview of the Index and does not provide the terms of any specific issuance of structured investments. The material presented does not constitute and should not be construed as a recommendation to enter into a securities or derivatives transaction. Prior to any decision to invest in a specific structured investment, investors should carefully review the disclosure documents for such issuance, which contain a detailed explanation of the terms of the issuance as well as the risks, tax treatment and other relevant information. Investing in financial instruments linked to the Index is not equivalent to a direct investment in any part of the Index. Investments linked to the Index require investors to assess several characteristics and risk factors that may not be present in other types of transactions. In reaching a determination as to the appropriateness of any proposed transaction, clients should undertake a thorough independent review of the legal, regulatory, credit, tax, accounting and economic consequences of such transaction in relation to their particular circumstances. This document contains market data from various sources other than us and our affiliates, and, accordingly, we make no representation or warranty as to the market data’s accuracy or completeness and we are not obligated to update any market data presented in this document. All information is subject to change without notice. We or our affiliated companies may make a market or deal as principal in the investments mentioned in this document or in options, futures or other derivatives based thereon. HSBC USA Inc. has filed a registration statement (including a prospectus and prospectus supplement) with the Securities and Exchange Commission for any offering to which this free writing prospectus may relate. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents HSBC USA Inc. has filed with the SEC for more complete information about HSBC USA Inc. and any related offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, HSBC Securities (USA) Inc. or any dealer participating in the related offering will arrange to send you the prospectus and prospectus supplement if you request them by calling toll-free 1-866-811-8049. Solactive AG Solactive is the administrator and calculation agent of the Index. The financial instruments that are based on the Index are not sponsored, endorsed, promoted or sold by Solactive in any way and Solactive makes no express or implied representation, guarantee or assurance with regard to: (a) the advisability in investing in the financial instruments; (b) the quality, accuracy and/or completeness of the Index; and/or (c) the results obtained or to be obtained by any person or entity from the use of the Index. Solactive does not guarantee the accuracy and/or the completeness of the Index and shall not have any liability for any errors or omissions with respect thereto. Solactive reserves the right to change the methods of calculation or publication and Solactive shall not be liable for any miscalculation of or any incorrect, delayed or interrupted publication with respect to the Index. Solactive shall not be liable for any damages, including, without limitation, any loss of profits or business, or any special, incidental, punitive, indirect or consequential damages suffered or incurred as a result of the use (or inability to use) of the Index. Use of Simulated Returns The Index was launched on July 14, 2021 and therefore has limited historical performance. As a result, limited actual historical performance information is available for you to consider in making an independent investigation of the Index, which may make it more difficult for you to evaluate the historical performance of the Index and make an informed investment decision than would be the case if the Index had a longer trading history. Hypothetical back-tested performance prior to the launch of the Index provided in this document refers to simulated performance data created by applying the Index’s calculation methodology to historical prices of the underlying constituents. Such simulated performance data has been produced by the retroactive application of a back-tested methodology in hindsight, and may give more preference towards underlying constituents that have performed well in the past. Hypothetical back-tested results are neither an indicator nor a guarantor of future results. The hypothetical back-tested performance of the Index prior to July 14, 2021 cannot fully reflect the actual results that would have occurred had the Index actually been calculated during that period, and should not be relied upon as an indication of the Index’s future performance. Because of the lack of actual historical performance data, your investment in any structured investment linked to the Index may involve a greater risk than investing in a security or other instrument linked to one or more indices with an established record of performance. HSBC operates in various jurisdictions through its affiliates, including, but not limited to, HSBC Securities (USA) Inc., member of NYSE, FINRA and SIPC. © 2025 HSBC USA Inc. All rights reserved. All Sources: Solactive, EquBot, HSBC, Bloomberg, from January 3, 2011 to December 31, 2024. |