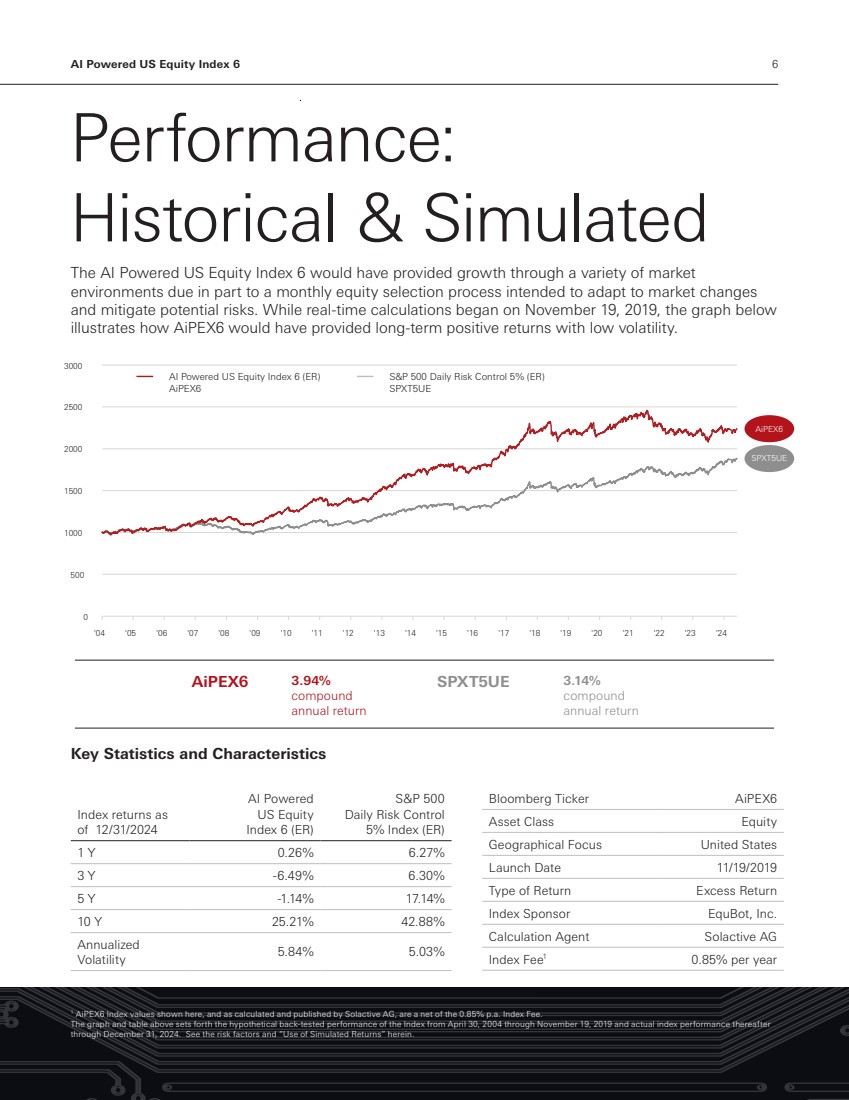

| AI Powered US Equity Index 6 10 The strategy tracked by AiPEX6 and the Base Index and the views implicit in AiPEX6 and the Base Index are not guaranteed to succeed. The strategies tracked by AiPEX6 and its underlying index, the Al Powered US Equity Base Index (the “Base Index”), are not guaranteed to be successful. It is impossible to predict whether and the extent to which AiPEX6, the Base Index or the underlying constituents of the Base Index will yield positive or negative results. AiPEX6 adjusts its exposure to the Base Index based on historical economic relationships which may not hold true in the future. You should seek your own advice as necessary to assess AiPEX6, the Base Index and their respective strategies. AiPEX6 and the Base Index were recently launched and have limited operating history. AiPEX6 was launched on November 19, 2019 and therefore has limited historical performance. The Base Index has also recently launched and has similarly limited historical performance. As a result, limited actual historical performance information is available for you to consider in making an independent investigation of AiPEX6, which may make it more difficult for you to evaluate the historical performance of AiPEX6 and make an informed investment decision than would be the case if AiPEX6 and the Base Index had a longer trading history. Hypothetical back-tested performance prior to the launch of AiPEX6 and the Base Index provided in this document refers to simulated performance data created by applying AiPEX6’s and the Base Index’s calculation methodologies to historical prices of the equities that comprise the Base Index and LIBOR levels. Such simulated performance data has been produced by the retroactive application of a back-tested methodology in hindsight, and may give more preference towards equities that have performed well in the past. Hypothetical back-tested results are neither an indicator nor a guarantor of future results. The hypothetical back-tested performance of AiPEX6 prior to November 19, 2019 cannot fully reflect the actual results that would have occurred had AiPEX6 actually been calculated during that period, and should not be relied upon as an indication of AiPEX6’s future performance. A longer history of actual performance could be helpful in providing more reliable information on which to assess AiPEX6. AiPEX6 may not approximate the Target Volatility. No assurance can be given that AiPEX6 will maintain a realized volatility that approximates the Target Volatility, and the actual realized volatility of AiPEX6 may be greater or less than the Target Volatility. AiPEX6 seeks to maintain a realized volatility approximately equal to the Target Volatility of 6% by rebalancing its exposures to the Base Index on each day based on two measures of realized volatility. However, there is no guarantee that trends exhibited by any such measures will continue in the future. The volatility-targeting feature may cause AiPEX6 to perform poorly during certain market conditions. AiPEX6 allocates exposure to the Base Index based on two measures of realized volatility. Realized volatility is not the same as implied volatility, which is an estimation of future volatility, and may better reflect market volatility expectation. Because exposure is adjusted based on historic levels and trends, AiPEX6 may not meaningfully reduce its exposure to the Base Index until a down-turn has already occurred, and by the time reduced exposure does take effect, the recovery may have already begun. AiPEX6 varies its exposure to the Base Index. As a result, exposure to the Base Index may be limited and the performance of AiPEX6 may be adversely affected. AiPEX6, on each day on which it is calculated, adjusts its exposure to the Base Index in an attempt to maintain a historical volatility approximately equal to the Target Volatility. If the exposure to the Base Index is less than 100%, AiPEX6 will include an uninvested position that does not earn interest or any other return. AiPEX6 may include an uninvested position even when the Base Index is performing favorably. As a result, AiPEX6 may underperform a similar index that does not include an uninvested position. The performance of AiPEX6 will be reduced by the performance of the reference rate and the embedded fees. AiPEX6 is an excess return index. The return of AiPEX6 is determined by reference to the performance of the Base Index (as adjusted based on the applicable exposure) in excess of the level of a reference rate, which, as of April 5, 2023, is the daily secured overnight financing rate (“SOFR”) plus 0.26161%. Prior to April 5, 2023, the reference rate was 3-month U.S. dollar LIBOR. The level of AiPEX6 also reflects an embedded index fee of 0.85% per annum. The level of the reference rate and the embedded fees will offset, in whole or in part, any positive performance and increase any negative performance of the Base Index. As a result, any return on AiPEX6 may be reduced or eliminated. When AiPEX6 is uninvested (i.e. the exposure to the Base Index is less than 100%), the negative effect of the embedded fees will be magnified, and the return on AiPEX6 may be negative even while the level of the Base Index increases. The change in the reference rate from U.S. dollar LIBOR to SOFR may have an adverse effect on the level of AiPEX6. On April 5, 2023, the administrator of AiPEX6, Solactive, changed the reference rate from 3-month U.S. dollar LIBOR to daily SOFR plus 0.26161%. U.S. dollar LIBOR ceased publication on June 30, 2023. HSBC cannot say whether or not this change has adversely affected, or will adversely affect, the level of AiPEX6 as compared to using another interest rate as the reference rate. The Base Index selects and weights its underlying constituents based on Al models; the strategies and views implicit in such models and in the Base Index are not guaranteed to succeed. The strategy of the Al models, and therefore the Base Index, is not guaranteed to be successful. It is impossible to predict whether and the extent to which any underlying constituents of the Base Index will yield positive or negative results. The method by which the Base Index reweights the underlying constituents and the reallocation period may negatively affect the level of the Base Index. The underlying constituents are reviewed and the Base Index is rebalanced monthly. At the end of each month, the Al models are used to recalculate the Al scores for each eligible constituent, and these scores are used by the index sponsor to select and weight the underlying constituents, subject to pre-determined constraints. The weight of each underlying constituent selected from the eligible constituents is subject to a cap (equal to 7.50% unless a lower cap is applicable based on the liquidity of such underlying) and any excess weight is allocated to the iShares• 1-3 Year Treasury Bond ETF (“the ETF Constituent”). The allocation rules, including the cap, will be followed even where they limit the Base Index’s exposure to positively performing underlying constituents or increase the Base Index’s exposure to negatively performing underlying constituents, and may result in lower returns on the Base Index. The Base Index is exposed to equity risk, including from mid-capitalization companies. The Base Index is linked to the performance of the underlying constituents, which include U.S. large-capitalization and mid-capitalization stocks. The level of the Base Index can rise or fall sharply due to factors specific to the underlying constituents, such as stock price volatility, earnings and financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general market volatility and levels, interest rates and economic and political conditions. Changes in U.S. Treasury rates and the perceived creditworthiness of the United States may affect the level of the Base Index. Because the value of the Base Index is linked, in part, to the ETF Constituent which tracks the value of U.S. Treasury bonds, changes in U.S. Treasury rates may affect the level of the Base Index. AiPEX6 and the Base Index are purely notional. The exposures to the underlying constituents are purely notional and will exist solely in the records maintained by or on behalf of Solactive AG. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. Consequently, you will not have any claim against any of the underlying assets that are referenced by AiPEX6 or the Base Index. Solactive AG administers, calculates and publishes AiPEX6 and the Base Index. Solactive AG has the authority to determine whether certain events affecting AiPEX6 or the Base Index have occurred including, but not limited to, events affecting the reference rate or the underlying equity constituents of the Base Index. Potential investors in any financial instrument of which AiPEX6 or the Base Index is an underlying need to be aware that any determination or calculation made by Solactive may affect the level of AiPEX6 or the Base Index, as applicable, and, as appropriate, the performance of any instruments linked to the performance of AiPEX6 or the Base Index. Solactive AG has no obligation to consider the interest of investors in any such instruments when making any determination or calculation. Such discretion in the decisions taken by Solactive AG (in the absence of manifest or proven error) are binding on all investors and holders of such instruments. The level of the Base Index, and therefore AiPEX6, may be determined by reference to the SPDR• S&P 500• ETF (“SPY”) if the Al models become unavailable. In the event that EquBot Inc., the provider of the Al models, no longer provides the applicable Al scores with respect to the eligible constituents, the shares of SPY will be selected as the sole underlying constituent of the Base Index with a weight of 100%. In such an event, the value of the Base Index, and therefore AiPEX6, will be determined by reference to SPY. Risks Associated with the AI Powered US Equity Index 6 (“AiPEX6”) |