UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05547

Laudus Trust

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Laudus Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: March 31

Date of reporting period: September 30, 2021

Item 1: Report(s) to Shareholders.

Semiannual Report | September 30, 2021

Laudus® U.S. Large Cap Growth Fund

Adviser

Charles Schwab Investment Management, Inc.

Subadviser

BlackRock Investment Management, LLC

Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM)

Distributor: Charles Schwab & Co., Inc. (Schwab)

The industry/sector classification of the fund’s portfolio holdings uses the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Schwab. The Industry classifications used in the Portfolio Holdings are sub-categories of Sector classifications.

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/laudusfunds_prospectus.

| Total Return for the 6 Months Ended September 30, 2021 |

| Laudus U.S. Large Cap Growth Fund (Ticker Symbol: LGILX) | 13.41% 1 |

| Russell 1000® Growth Index | 13.23% |

| Performance Details | page 4 |

All fund and index figures on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Fund expenses may have been partially absorbed by CSIM. Without these reductions, the fund’s return would have been lower. This return does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| 1 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

The Investment Environment

For the six-month reporting period ended September 30, 2021, U.S. equity markets posted mostly positive returns, with several key equity market indices hitting record highs in early September before falling back in the final weeks of the reporting period. Despite persisting COVID-19 pandemic-driven stresses on the global economy and the emergence and rapid spread of the Delta variant during the summer, U.S. equity markets rose through most of the period on strong earnings, ongoing fiscal stimulus measures, and optimism related to increased COVID-19 vaccination rates before weakening in September amid growing evidence of a slowing economy and concerns that higher inflation may be more persistent than previously anticipated. For the reporting period, the S&P 500® Index, a bellwether for the overall U.S. stock market, returned 9.18%. U.S. large-cap stocks outperformed small-cap stocks, with the Russell 1000® Index and Russell 2000® Index returning 8.76% and -0.25%, respectively. Among U.S. large-cap stocks, growth stocks outperformed value stocks, with the Russell 1000® Growth Index and Russell 1000® Value Index returning 13.23% and 4.39%, respectively.

Bolstered by the extensive emergency rescue and fiscal stimulus measures passed by the U.S. Congress and U.S. Federal Reserve (Fed) beginning in March 2020, the U.S. economy began to recover from the dramatic impact of the COVID-19 pandemic beginning in the third quarter of 2020. U.S. gross domestic product (GDP) grew at an annualized rate of 6.7% for the second quarter of 2021. Unemployment, which skyrocketed in April 2020 but began falling starting in May 2020, fell over the reporting period. Inflation, which had remained well below the Fed’s traditional 2% target until it jumped in March 2021, continued to rise through June 2021 and remained elevated through September 2021, largely due to imbalances in the labor market, supply chain bottlenecks, increased consumer demand, particularly for travel-related services early in the reporting period, and higher energy costs.

For the most part, central banks around the world maintained the low—and for some international central banks, negative—interest rates instituted prior to, and in response to, the COVID-19 pandemic. In the U.S., despite improving economic data, the Fed reiterated several times during the reporting period its intention to continue its support of the economy for as long as needed to achieve a full recovery, while acknowledging that it was keeping an eye on rising inflation. The Fed maintained the federal funds rate in a range of 0.00% to 0.25% throughout the reporting period. By the end of the reporting period, the Fed signaled that, due to significant progress made on its twin goals of maximum employment and price stability, it would likely begin reducing its bond purchase as early as late 2021 and could begin to raise interest rates in the next 18 months.

Among the sectors in the Russell 1000® Growth Index, all posted positive returns for the reporting period. The financials sector was the top performer, driven in part by higher-than-expected trading revenues and lower-than-expected loan defaults, along with ongoing fiscal and monetary stimulus measures and the potential for a steepening yield curve that would increase banks’ profits. The weakest sector was the materials sector, which was constrained during the reporting period by moderating economic growth, weaker demand in China, ongoing supply-chain bottlenecks and inflationary pressures.

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Past performance is not an indication of future results.

For index definitions, please see the Glossary.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund as of September 30, 2021

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The performance information does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.schwabassetmanagement.com/laudusfunds_prospectus.

Average Annual Total Returns

| Fund and Inception Date | 6 Months | 1 Year | 5 Years | 10 Years |

| Laudus U.S. Large Cap Growth Fund (10/14/97)* | 13.41% 1 | 24.82% | 22.55% | 19.32% |

| Russell 1000® Growth Index | 13.23% | 27.32% | 22.84% | 19.68% |

| Fund Expense Ratio2: 0.72% |

| Fund Characteristics | |

| Number of Securities | 52 |

| Weighted Average Market Cap (millions) | $645,349 |

| Price/Earnings Ratio (P/E) | 40.14 |

| Price/Book Ratio (P/B) | 10.75 |

Portfolio Turnover

(One-year trailing) | 36% |

| Fund Overview | |

| | Fund |

| Inception Date | 10/14/1997 * |

| Ticker Symbol | LGILX |

| Cusip | 51855Q549 |

| NAV | $33.19 |

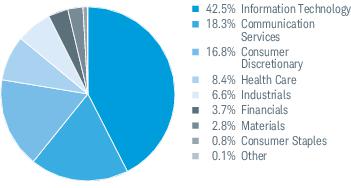

Sector Weightings % of Investments

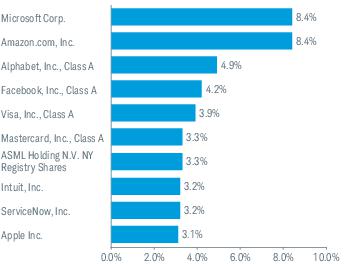

Top Equity Holdings % of Net Assets3

Total returns include change in share price and reinvestment of distributions. Total returns may reflect the waiver of a portion of the fund’s advisory fees for certain periods since the inception date. In such instances, and without the waiver of fees, total returns would have been lower. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Portfolio holdings may have changed since the report date.

| * | Inception date is that of the fund’s predecessor fund, the Class Y Shares of the UBS U.S. Large Cap Growth Fund. |

| 1 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 2 | As stated in the prospectus. Reflects the total annual fund operating expenses without contractual fee waivers. For actual expense ratios during the period, refer to the Financial Highlights section of the Financial Statements. |

| 3 | This list is not a recommendation of any security by the investment adviser or subadviser. |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Fund Expenses (Unaudited)

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, transfer agent and shareholder services fees, and other fund expenses.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in the fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for the period beginning April 1, 2021 and held through September 30, 2021.

Actual Return lines in the table below provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Return lines in the table below provide information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | EXPENSE RATIO

(ANNUALIZED) 1 | BEGINNING

ACCOUNT VALUE

AT 4/1/21 | ENDING

ACCOUNT VALUE

(NET OF EXPENSES)

AT 9/30/21 | EXPENSES PAID

DURING PERIOD

4/1/21-9/30/212 |

| Laudus U.S. Large Cap Growth Fund | | | | |

| Actual Return | 0.71% | $1,000.00 | $1,135.50 | $3.80 |

| Hypothetical 5% Return | 0.71% | $1,000.00 | $1,021.51 | $3.60 |

| 1 | Based on the most recent six-month expense ratio. |

| 2 | Expenses for the fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by the 183 days of the period, and divided by the 365 days of the fiscal year. |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Financial Statements

FINANCIAL HIGHLIGHTS

| | 4/1/21–

9/30/21* | 4/1/20–

3/31/21 | 4/1/19–

3/31/20 | 4/1/18–

3/31/19 | 4/1/17–

3/31/18 | 4/1/16–

3/31/17 |

| Per-Share Data |

| Net asset value at beginning of period | $29.23 | $19.61 | $21.31 | $20.47 | $18.12 | $15.76 |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | (0.05) | (0.07) | (0.04) | 0.02 | 0.00 2 | 0.00 2 |

| Net realized and unrealized gains (losses) | 4.01 | 11.21 | 0.23 | 2.35 | 4.99 | 2.63 |

| Total from investment operations | 3.96 | 11.14 | 0.19 | 2.37 | 4.99 | 2.63 |

| Less distributions: | | | | | | |

| Distributions from net investment income | — | — | (0.02) | — | — | — |

| Distributions from net realized gains | — | (1.52) | (1.87) | (1.53) | (2.64) | (0.27) |

| Total distributions | — | (1.52) | (1.89) | (1.53) | (2.64) | (0.27) |

| Net asset value at end of period | $33.19 | $29.23 | $19.61 | $21.31 | $20.47 | $18.12 |

| Total return | 13.55% 3 | 56.98% | (0.06%) | 12.78% | 28.52% | 16.85% |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 0.71% 4 | 0.72% | 0.74% | 0.75% | 0.75% 5 | 0.76% |

| Gross operating expenses | 0.71% 4 | 0.72% | 0.74% | 0.75% | 0.75% 5 | 0.76% |

| Net investment income (loss) | (0.28%) 4 | (0.25%) | (0.18%) | 0.07% | 0.01% 5 | 0.03% |

| Portfolio turnover rate | 18% 3 | 37% | 40% | 53% | 49% | 73% |

| Net assets, end of period (x 1,000) | $3,271,361 | $2,942,805 | $1,980,826 | $2,250,995 | $1,953,049 | $1,667,059 |

| * | Unaudited. |

| 1 | Calculated based on the average shares outstanding during the period. |

| 2 | Per-share amount was less than $0.005. |

| 3 | Not annualized. |

| 4 | Annualized. |

| 5 | The ratio of net operating expenses and gross operating expenses would have been 0.76% and 0.76%, respectively, and the ratio of net investment income would have been less than 0.005%, excluding a custody out-of-pocket fee reimbursement from the custodian. |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Portfolio Holdings as of September 30, 2021 (Unaudited)

This section shows all the securities in the fund’s portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT Part F. The fund’s Form N-PORT Part F is available on the SEC’s website at www.sec.gov. You can also obtain this information at no cost on the fund’s website at www.schwabassetmanagement.com/laudusfunds_prospectus, by calling 1-866-414-6349, or by sending an email request to orders@mysummaryprospectus.com. The fund also makes available its complete schedule of portfolio holdings 30 days after the end of the calendar quarter on the fund’s website.

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| COMMON STOCKS 100.0% OF NET ASSETS |

| |

| Capital Goods 3.3% |

| Fortive Corp. | 340,413 | 24,022,945 |

| Roper Technologies, Inc. | 108,605 | 48,451,949 |

| TransDigm Group, Inc. * | 57,867 | 36,141,992 |

| | | 108,616,886 |

| |

| Commercial & Professional Services 2.2% |

| CoStar Group, Inc. * | 337,352 | 29,032,513 |

| TransUnion | 381,689 | 42,867,492 |

| | | 71,900,005 |

| |

| Consumer Durables & Apparel 4.0% |

| LVMH Moet Hennessy Louis Vuitton SE ADR | 356,467 | 51,074,592 |

| NIKE, Inc., Class B | 546,269 | 79,334,647 |

| | | 130,409,239 |

| |

| Consumer Services 0.6% |

| Domino's Pizza, Inc. | 42,511 | 20,276,047 |

| |

| Diversified Financials 3.7% |

| Morgan Stanley | 243,267 | 23,672,312 |

| S&P Global, Inc. | 230,463 | 97,921,424 |

| | | 121,593,736 |

| |

| Health Care Equipment & Services 4.1% |

| Danaher Corp. | 187,138 | 56,972,293 |

| Intuitive Surgical, Inc. * | 26,701 | 26,544,799 |

| UnitedHealth Group, Inc. | 124,319 | 48,576,406 |

| | | 132,093,498 |

| |

| Household & Personal Products 0.8% |

| Olaplex Holdings, Inc. * | 1,061,248 | 26,000,576 |

| |

| Materials 2.8% |

| Ball Corp. | 400,635 | 36,045,131 |

| Freeport-McMoRan, Inc. | 531,088 | 17,276,292 |

| The Sherwin-Williams Co. | 140,786 | 39,382,068 |

| | | 92,703,491 |

| |

| Media & Entertainment 17.6% |

| Alphabet, Inc., Class A * | 59,351 | 158,676,086 |

| Facebook, Inc., Class A * | 406,398 | 137,927,417 |

| Match Group, Inc. * | 303,559 | 47,655,728 |

| Netflix, Inc. * | 134,301 | 81,969,272 |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Sea Ltd. ADR * | 213,110 | 67,924,550 |

| Snap, Inc., Class A * | 1,100,120 | 81,265,864 |

| | | 575,418,917 |

| |

| Pharmaceuticals, Biotechnology & Life Sciences 4.3% |

| AstraZeneca plc ADR | 286,884 | 17,230,253 |

| Eli Lilly & Co. | 69,244 | 15,998,826 |

| Lonza Group AG ADR | 441,254 | 33,014,624 |

| Thermo Fisher Scientific, Inc. | 40,576 | 23,182,286 |

| Zoetis, Inc. | 268,788 | 52,182,503 |

| | | 141,608,492 |

| |

| Retailing 12.2% |

| Amazon.com, Inc. * | 83,305 | 273,660,257 |

| Etsy, Inc. * | 249,727 | 51,933,227 |

| MercadoLibre, Inc. * | 43,919 | 73,757,569 |

| | | 399,351,053 |

| |

| Semiconductors & Semiconductor Equipment 9.4% |

| Analog Devices, Inc. | 370,886 | 62,115,987 |

| ASML Holding N.V. NY Registry Shares | 143,374 | 106,829,401 |

| Marvell Technology, Inc. | 1,177,645 | 71,023,770 |

| NVIDIA Corp. | 326,700 | 67,679,172 |

| | | 307,648,330 |

| |

| Software & Services 30.1% |

| Adobe, Inc. * | 157,702 | 90,792,195 |

| Autodesk, Inc. * | 17,356 | 4,949,411 |

| Crowdstrike Holdings, Inc., Class A * | 71,631 | 17,605,467 |

| Intuit, Inc. | 192,702 | 103,964,656 |

| Mastercard, Inc., Class A | 311,962 | 108,462,948 |

| Microsoft Corp. | 972,519 | 274,172,557 |

| PayPal Holdings, Inc. * | 202,741 | 52,755,236 |

| ServiceNow, Inc. * | 166,728 | 103,749,833 |

| Shopify, Inc., Class A * | 27,016 | 36,627,752 |

| Twilio, Inc., Class A * | 108,797 | 34,711,683 |

| Visa, Inc., Class A | 566,671 | 126,225,965 |

| Wix.com Ltd. * | 150,522 | 29,497,796 |

| | | 983,515,499 |

| |

| Technology Hardware & Equipment 3.1% |

| Apple Inc. | 717,080 | 101,466,820 |

| |

| Telecommunication Services 0.7% |

| T-Mobile US, Inc. * | 172,287 | 22,011,387 |

| |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Portfolio Holdings as of September 30, 2021 (Unaudited) (continued)

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Transportation 1.1% |

| Uber Technologies, Inc. * | 417,908 | 18,722,278 |

| Union Pacific Corp. | 92,577 | 18,146,018 |

| | | 36,868,296 |

Total Common Stocks

(Cost $1,604,340,248) | 3,271,482,272 |

| | | |

| SHORT-TERM INVESTMENTS 0.1% OF NET ASSETS |

| |

| Money Market Funds 0.1% |

| State Street Institutional U.S. Government Money Market Fund, Premier Class 0.03% (a) | 1,870,447 | 1,870,447 |

Total Short-Term Investments

(Cost $1,870,447) | 1,870,447 |

Total Investments in Securities

(Cost $1,606,210,695) | 3,273,352,719 |

| * | Non-income producing security. |

| (a) | The rate shown is the 7-day yield. |

| ADR — | American Depositary Receipt |

The following is a summary of the inputs used to value the fund’s investments as of September 30, 2021 (see financial note 2(a) for additional information):

| DESCRIPTION | QUOTED PRICES IN

ACTIVE MARKETS FOR

IDENTICAL ASSETS

(LEVEL 1) | OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) | SIGNIFICANT

UNOBSERVABLE INPUTS

(LEVEL 3) | TOTAL |

| Assets | | | | |

| Common Stocks1 | $3,271,482,272 | $— | $— | $3,271,482,272 |

| Short-Term Investments1 | 1,870,447 | — | — | 1,870,447 |

| Total | $3,273,352,719 | $— | $— | $3,273,352,719 |

| 1 | As categorized in the Portfolio Holdings. |

Fund investments in mutual funds are classified as Level 1, without consideration to the classification level of the underlying securities held by the mutual funds, which could be Level 1, Level 2 or Level 3.

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Statement of Assets and Liabilities

As of September 30, 2021; unaudited

| Assets |

| Investments in securities, at value - unaffiliated (cost $1,606,210,695) | | $3,273,352,719 |

| Receivables: | | |

| Investments sold | | 25,683,998 |

| Fund shares sold | | 1,265,689 |

| Foreign tax reclaims | | 222,046 |

| Dividends | | 190,417 |

| Prepaid expenses | + | 51,533 |

| Total assets | | 3,300,766,402 |

| Liabilities |

| Payables: | | |

| Investments bought | | 22,286,208 |

| Fund shares redeemed | | 4,961,098 |

| Investment adviser fees | | 1,696,411 |

| Sub-accounting and sub-transfer agent fees | | 303,460 |

| Independent trustees’ fees | | 1,071 |

| Accrued expenses | + | 157,326 |

| Total liabilities | | 29,405,574 |

| Net assets | | $3,271,360,828 |

| Net Assets by Source |

| Capital received from investors | | $1,247,268,987 |

| Total distributable earnings | + | 2,024,091,841 |

| Net assets | | $3,271,360,828 |

| Net Asset Value (NAV) |

| Net Assets | ÷ | Shares

Outstanding | = | NAV |

| $3,271,360,828 | | 98,568,740 | | $33.19 |

| | | | | |

| | | | | |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Statement of Operations

| For the period April 1, 2021 through September 30, 2021; unaudited |

| Investment Income |

| Dividends received from securities - unaffiliated (net of foreign withholding tax of $76,157) | | $6,987,803 |

| Expenses |

| Investment adviser fees | | 9,764,664 |

| Sub-accounting and sub-transfer agent fees | | 1,512,253 |

| Accounting and administration fees | | 52,751 |

| Shareholder reports | | 43,035 |

| Registration fees | | 41,692 |

| Independent trustees’ fees | | 41,281 |

| Professional fees | | 31,483 |

| Transfer agent fees | | 23,327 |

| Custodian fees | | 16,188 |

| Other expenses | + | 15,999 |

| Total expenses | – | 11,542,673 |

| Net investment loss | | (4,554,870) |

| Realized and Unrealized Gains (Losses) |

| Net realized gains on sales of securities - unaffiliated | | 148,635,285 |

| Net change in unrealized appreciation (depreciation) on securities - unaffiliated | + | 249,664,160 |

| Net realized and unrealized gains | | 398,299,445 |

| Increase in net assets resulting from operations | | $393,744,575 |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Statement of Changes in Net Assets

For the current and prior report periods

Figures for the current period are unaudited

| OPERATIONS |

| | 4/1/21-9/30/21 | 4/1/20-3/31/21 |

| Net investment loss | | ($4,554,870) | ($6,754,526) |

| Net realized gains | | 148,635,285 | 291,071,501 |

| Net change in unrealized appreciation (depreciation) | + | 249,664,160 | 845,317,794 |

| Increase in net assets from operations | | $393,744,575 | $1,129,634,769 |

| DISTRIBUTIONS TO SHAREHOLDERS |

| Total distributions | | $— | ($151,866,592) |

| TRANSACTIONS IN FUND SHARES |

| | 4/1/21-9/30/21 | 4/1/20-3/31/21 |

| | | SHARES | VALUE | SHARES | VALUE |

| Shares sold | | 6,460,455 | $212,500,567 | 21,504,281 | $570,122,715 |

| Shares reinvested | | — | — | 4,381,621 | 125,708,707 |

| Shares redeemed | + | (8,565,033) | (277,689,330) | (26,212,855) | (711,620,716) |

| Net transactions in fund shares | | (2,104,578) | ($65,188,763) | (326,953) | ($15,789,294) |

| SHARES OUTSTANDING AND NET ASSETS |

| | 4/1/21-9/30/21 | 4/1/20-3/31/21 |

| | | SHARES | NET ASSETS | SHARES | NET ASSETS |

| Beginning of period | | 100,673,318 | $2,942,805,016 | 101,000,271 | $1,980,826,133 |

| Total increase (decrease) | + | (2,104,578) | 328,555,812 | (326,953) | 961,978,883 |

| End of period | | 98,568,740 | $3,271,360,828 | 100,673,318 | $2,942,805,016 |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Financial Notes, unaudited

1. Business Structure of the Fund:

Laudus U.S. Large Cap Growth Fund is the only series of Laudus Trust (the trust), a no-load, open-end management investment company organized April 1, 1988. The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the 1940 Act).

The Laudus U.S. Large Cap Growth Fund offers one share class. Shares are bought and sold at closing net asset value per share (NAV), which is the price for all outstanding shares of the fund.

The fund maintains its own account for purposes of holding assets and accounting, and is considered a separate entity for tax purposes. Within its account, the fund may also keep certain assets in segregated accounts, as required by securities law.

2. Significant Accounting Policies:

The following is a summary of the significant accounting policies the fund uses in its preparation of financial statements. The fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 Financial Services — Investment Companies. The accounting policies are in conformity with accounting principles generally accepted in the United States of America (GAAP).

The fund may invest in certain mutual funds, which are referred to as "underlying funds". For more information about the underlying funds’ operations and policies, please refer to those funds’ semiannual and annual reports, which are filed with the U.S. Securities and Exchange Commission (SEC) and are available on the SEC’s website at www.sec.gov.

(a) Security Valuation:

Under procedures approved by the fund’s Board of Trustees (the Board), the investment adviser has formed a Pricing Committee to administer the pricing and valuation of portfolio securities and other assets and to ensure that prices used for internal purposes or provided by third parties reasonably reflect fair value. Among other things, these procedures allow the fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

The fund values the securities in its portfolio every business day. The fund uses the following policies to value various types of securities:

• Securities traded on an exchange or over-the-counter: Traded securities are valued at the closing value for the day, or, on days when no closing value has been reported, at the mean of the most recent bid and ask quotes. Securities that are primarily traded on foreign exchanges are valued at the official closing price or the last sales price on the exchange where the securities are principally traded with these values then translated into U.S. dollars at the current exchange rate, unless these securities are fair valued as discussed below.

• Foreign equity security fair valuation: The Board has adopted procedures to fair value foreign equity securities that are traded in markets that close prior to the fund valuing its holdings. By fair valuing securities whose prices may have been affected by events occurring after the close of trading, the fund seeks to establish prices that investors might expect to realize upon the current sales of these securities. This methodology is designed to deter “arbitrage” market timers, who seek to exploit delays between the change in the value of the fund’s portfolio holdings and the NAV of the fund’s shares, and seeks to help ensure that the prices at which the fund’s shares are purchased and redeemed are fair and do not result in dilution of shareholder interest or other harm to shareholders. When fair value pricing is used at the open or close of a reporting period, it may cause a temporary divergence between the return of the fund and that of its comparative index or benchmark. The Board regularly reviews fair value determinations made by the fund pursuant to these procedures.

• Mutual funds: Mutual funds are valued at their respective NAVs.

• Securities for which no quoted value is available: The Board has adopted procedures to fair value the fund’s securities when market prices are not “readily available” or are unreliable. For example, the fund may fair value a security when it is de-listed or its trading is halted or suspended; when a security’s primary pricing source is unable or unwilling to provide a price; or when a security’s primary trading market is closed during regular market hours. The fund makes fair value determinations in good faith in accordance with the fund’s valuation procedures. The Pricing Committee considers a number of factors, including unobservable market inputs, when arriving at fair value. The Pricing Committee may employ techniques such as the review of related or comparable assets or liabilities, related market activities, recent transactions, market multiples, book values, transactional back-testing, disposition analysis and other relevant information. The Pricing Committee regularly reviews these

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

inputs and assumptions to calibrate the valuations. Due to the subjective and variable nature of fair value pricing, there can be no assurance that the fund could obtain the fair value assigned to the security upon the sale of such security. The Board convenes on a regular basis to review fair value determinations made by the fund pursuant to the valuation procedures.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the fund discloses the fair value of its investments in a hierarchy that prioritizes the significant inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements). If inputs used to measure the financial instruments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the valuation. If the fund determines that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and management judgment will be required to estimate fair value.

The three levels of the fair value hierarchy are as follows:

• Level 1 — quoted prices in active markets for identical securities — Investments whose values are based on quoted market prices in active markets, and whose values are therefore classified as Level 1 prices, include active listed equities and mutual funds. Investments in mutual funds are valued daily at their NAVs, which are classified as Level 1 prices, without consideration to the classification level of the underlying securities held by an underlying fund.

• Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) — Investments that trade in markets that are not considered to be active, but whose values are based on quoted market prices, dealer quotations or valuations provided by alternative pricing sources supported by observable inputs are classified as Level 2 prices. These generally include U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, less liquid listed equities, and state, municipal and provincial obligations. In addition, international securities whose markets close hours before the fund values its holdings may require fair valuations due to significant movement in the U.S. markets occurring after the daily close of the foreign markets. The Board has approved a vendor that calculates fair valuations of international equity securities based on a number of factors that appear to correlate to the movements in the U.S. markets.

• Level 3 — significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments) — Investments whose values are classified as Level 3 prices have significant unobservable inputs, as they may trade infrequently or not at all. When observable prices are not available for these securities, the fund uses one or more valuation techniques for which sufficient and reliable data is available. The inputs used by the fund in estimating the value of Level 3 prices may include the original transaction price, quoted prices for similar securities or assets in active markets, completed or pending third-party transactions in the underlying investment or comparable issuers, and changes in financial ratios or cash flows. Level 3 prices may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the fund in the absence of market information. Assumptions used by the fund due to the lack of observable inputs may significantly impact the resulting fair value and therefore the fund’s results of operations.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The levels associated with valuing the fund’s investments as of September 30, 2021 are disclosed in the Portfolio Holdings.

(b) Security Transactions:

Security transactions are recorded as of the date the order to buy or sell the security is executed. Realized gains and losses from security transactions are based on the identified costs of the securities involved.

Assets and liabilities denominated in foreign currencies are reported in U.S. dollars. For assets and liabilities held on a given date, the dollar value is based on market exchange rates in effect on that date. Transactions involving foreign currencies, including purchases, sales, income receipts and expense payments, are calculated using exchange rates in effect on the transaction date. Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the differences between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange appreciation or depreciation arises from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period. These realized and unrealized foreign exchange gains or losses are

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

reported in foreign currency transactions or translations on the Statement of Operations. The fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Gains realized by the fund on the sale of securities in certain foreign countries may be subject to non-U.S. taxes. In those instances, the fund records a liability based on unrealized appreciation to provide for potential non-U.S. taxes payable upon the sale of these securities.

(c) Investment Income:

Interest income is recorded as it accrues. Dividends and distributions from portfolio securities and underlying funds are recorded on the date they are effective (the ex-dividend date), although the fund records certain foreign security dividends on the date the ex-dividend date is confirmed. Any distributions from underlying funds are recorded in accordance with the character of the distributions as designated by the underlying funds.

Income received from foreign sources may result in withholding tax. Withholding taxes are accrued at the same time as the related income if the tax rate is fixed and known, unless a tax withheld is reclaimable from the local tax authorities in which case it is recorded as receivable. If the tax rate is not known or estimable, such expense or reclaim receivable is recorded when the net proceeds are received.

(d) Expenses:

Expenses that are specific to the fund are charged directly to the fund. Expenses that are common to more than one fund in the trusts generally are allocated among those funds in proportion to their average daily net assets.

(e) Distributions to Shareholders:

The fund makes distributions from net investment income and net realized capital gains, if any, once a year.

(f) Accounting Estimates:

The accounting policies described in this report conform to GAAP. Notwithstanding this, shareholders should understand that in order to follow these principles, fund management has to make estimates and assumptions that affect the information reported in the financial statements. It’s possible that once the results are known, they may turn out to be different from these estimates and these differences may be material.

(g) Federal Income Taxes:

The fund intends to meet federal income and excise tax requirements for regulated investment companies under subchapter M of the Internal Revenue Code, as amended. Accordingly, the fund distributes substantially all of its net investment income and net realized capital gains, if any, to its shareholders each year. As long as the fund meets the tax requirements, it is not required to pay federal income tax.

(h) Foreign Taxes:

The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, corporate events, foreign currency exchanges and capital gains on investments. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in foreign markets in which the fund invests. These foreign taxes, if any, are paid by the fund and are disclosed in the Statement of Operations. Foreign taxes accrued as of September 30, 2021, if any, are reflected in the fund’s Statement of Assets and Liabilities.

(i) Indemnification:

Under the fund’s organizational documents, the officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business the fund enters into contracts with its vendors and others that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the fund. However, based on experience, the fund expects the risk of loss attributable to these arrangements to be remote.

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Financial Notes, unaudited (continued)

Investing in the fund may involve certain risks, as described in the fund’s prospectus, including, but not limited to, those described below. Any of these risks could cause an investor to lose money.

• Market Risk. Financial markets rise and fall in response to a variety of factors, sometimes rapidly and unpredictably. Markets may be impacted by economic, political, regulatory and other conditions, including economic sanctions and other government actions. In addition, the occurrence of global events, such as war, terrorism, environmental disasters, natural disasters and epidemics, may also negatively affect the financial markets. As with any investment whose performance is tied to these markets, the value of an investment in the fund will fluctuate, which means that an investor could lose money over short or long periods.

• Management Risk. As with all actively managed funds, the fund is subject to the risk that its subadviser will select investments or allocate assets in a manner that could cause the fund to underperform or otherwise not meet its investment objective. The fund’s subadviser applies its own investment techniques and risk analyses in making investment decisions for the fund, but there can be no guarantee that they will produce the desired results.

• Equity Risk. The prices of equity securities rise and fall daily. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. In addition, equity markets tend to move in cycles, which may cause stock prices to fall over short or extended periods of time.

• Market Capitalization Risk. Securities issued by companies of different market capitalizations tend to go in and out of favor based on market and economic conditions. During a period when securities of a particular market capitalization fall behind other types of investments, the fund’s performance could be impacted.

• Large-Cap Company Risk. Large-cap companies are generally more mature and the securities issued by these companies may not be able to reach the same levels of growth as the securities issued by small- or mid-cap companies.

• Growth Investing Risk. Growth stocks can be volatile. Growth companies usually invest a high portion of earnings in their businesses and may lack the dividends of value stocks that can cushion stock prices in a falling market. The prices of growth stocks are based largely on projections of the issuer’s future earnings and revenues. If a company’s earnings or revenues fall short of expectations, its stock price may fall dramatically. Growth stocks may also be more expensive relative to their earnings or assets compared to value or other stocks.

• Foreign Investment Risk. The fund’s investments in securities of foreign issuers involve certain risks that may be greater than those associated with investments in securities of U.S. issuers. These include risks of adverse changes in foreign economic, political, regulatory and other conditions; changes in currency exchange rates or exchange control regulations (including limitations on currency movements and exchanges); the imposition of economic sanctions or other government restrictions; differing accounting, auditing, financial reporting and legal standards and practices; differing securities market structures; and higher transaction costs. These risks may negatively impact the value or liquidity of the fund’s investments, and could impair the fund’s ability to meet its investment objective or invest in accordance with its investment strategy. There is a risk that investments in securities denominated in, and/or receiving revenues in, foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged, resulting in the dollar value of the fund’s investment being adversely affected. Foreign securities also include American Depositary receipts (ADRs), Global Depositary receipts (GDRs) and European Depositary receipts (EDRs) which may be less liquid than the underlying shares in their primary trading market and GDRs, many of which are issued by companies in emerging markets, may be more volatile. These risks may be heightened in connection with investments in emerging markets or securities of issuers that conduct their business in emerging markets.

• Derivatives Risk. The fund may, but is not required to, use derivatives to earn income and enhance returns, to manage or adjust the risk profile of the fund, to replace more traditional direct investments, or to obtain exposure to certain markets. A future is an agreement to buy or sell a financial instrument at a specific price on a specific day. An option is the right, but not the obligation, to buy or sell an instrument at a specific price on or before a specific date. A forward currency agreement involves an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. The fund’s use of derivatives involves risks different from or possibly greater than the risks associated with investing directly in securities and other traditional investments. Certain of these risks, such as leverage risk, market risk, liquidity risk and management risk, are discussed elsewhere in this section. The fund’s use of derivatives is also subject to credit risk, lack of availability risk, valuation risk, correlation risk and tax risk. Credit risk is the risk that the counterparty to a derivative may not fulfill its contractual obligations. Lack of availability risk is the risk that suitable derivative transactions may not be available in all circumstances for risk management or other purposes. Valuation risk is the risk that a particular derivative may be valued incorrectly. Correlation risk

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Financial Notes, unaudited (continued)

3. Risk Factors (continued):

is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Tax risk is the risk that the use of derivatives may cause the fund to realize higher amounts of short-term capital gains. The fund’s use of derivatives could reduce the fund’s performance, increase the fund’s volatility, and could cause the fund to lose more than the initial amount invested. However, these risks are less severe when the fund uses derivatives for hedging rather than to enhance the fund’s returns or as a substitute for a position or security. The use of derivatives that are subject to regulation by the Commodity Futures Trading Commission (CFTC) could cause the fund to become a commodity pool, which would require the fund to comply with certain CFTC rules.

• Leverage Risk. Certain fund transactions, such as derivatives transactions, may give rise to a form of leverage and may expose the fund to greater risk. Leverage tends to magnify the effect of any increase or decrease in the value of the fund’s portfolio securities, which means even a small amount of leverage can have a disproportionately large impact on the fund.

• Liquidity Risk. The fund may be unable to sell certain securities, such as illiquid securities, readily at a favorable time or price, or the fund may have to sell them at a loss.

Please refer to the fund’s prospectus for a more complete description of the principal risks of investing in the fund.

4. Affiliates and Affiliated Transactions:

Investment Adviser

Charles Schwab Investment Management, Inc. (CSIM or the investment adviser), a wholly owned subsidiary of The Charles Schwab Corporation, serves as the fund’s investment adviser pursuant to an Investment Advisory Agreement (Advisory Agreement) between CSIM and the trust. BlackRock Investment Management, LLC (BlackRock), the fund’s subadviser, provides day-to-day portfolio management services to the fund, subject to the supervision of CSIM.

For its advisory services to the fund, CSIM is entitled to receive an annual fee, payable monthly, based on a percentage of the fund’s average daily net assets described as follows:

| AVERAGE DAILY NET ASSETS | |

| First $500 million | 0.700% |

| $500 million to $1 billion | 0.650% |

| $1 billion to $1.5 billion | 0.600% |

| $1.5 billion to $2 billion | 0.575% |

| Over $2 billion | 0.550% |

For the period ended September 30, 2021, the aggregate net advisory fee paid to CSIM was 0.60% for the fund, as a percentage of the fund’s average daily net assets.

CSIM (not the fund) pays a portion of the advisory fees it receives to BlackRock in return for its portfolio management services.

Shareholders Services

The trustees have authorized the fund to reimburse, out of the assets of the fund, financial intermediaries, including Charles Schwab & Co., Inc. (a broker-dealer affiliate of CSIM, Schwab) (together, “service providers”) that provide sub-accounting and sub-transfer agency services in connection with the fund’s shares in an amount of up to 0.10% of the average daily net assets of the fund on an annual basis. The sub-accounting and sub-transfer agency fee paid to a particular service provider is made pursuant to its written agreement with Schwab, as distributor of the fund (or, in the case of payments made to Schwab acting as a service provider, pursuant to Schwab’s written agreement with the fund), and the fund will pay no more than 0.10% of the average annual daily net asset value of the fund shares owned by shareholders holding shares through such service provider. Payments are made as described above without regard to whether the fee is more or less than the service provider’s actual cost of providing the services, and if more, such excess may be retained as profit by the service provider.

Expense Limitation

CSIM has contractually agreed, until at least July 30, 2022, to limit the total annual fund operating expenses charged, excluding interest, taxes and certain non-routine expenses of the fund to 0.77%.

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Financial Notes, unaudited (continued)

4. Affiliates and Affiliated Transactions (continued):

Investments from Affiliates

Certain funds in the Fund Complex (for definition refer to Trustees and Officers section) may own shares of other funds in the Fund Complex. The table below reflects the percentage of shares of the fund that are owned by other funds in the Fund Complex as of September 30, 2021:

| | UNDERLYING FUND |

| Schwab Balanced Fund | 3.6% |

| Schwab Target 2025 Fund | 0.2% |

| Schwab Target 2030 Fund | 0.7% |

| Schwab Target 2035 Fund | 0.6% |

| Schwab Target 2040 Fund | 1.7% |

| Schwab Target 2045 Fund | 0.4% |

| Schwab Target 2050 Fund | 0.5% |

| Schwab Target 2055 Fund | 0.3% |

| Schwab Target 2060 Fund | 0.1% |

| Schwab Target 2065 Fund | 0.0%* |

5. Board of Trustees:

The trust’s Board oversees the general conduct of the trust and the fund.

The Board may include people who are officers and/or directors of CSIM or its affiliates. Federal securities law limits the percentage of such “interested persons” who may serve on a trust’s board, and the trust was in compliance with these limitations throughout the report period. The trust did not pay any of these interested persons for their services as trustees, but it did pay non-interested persons (independent trustees), as noted in the fund’s Statement of Operations. For information regarding the trustees, please refer to Trustees and Officers table at the end of this report.

6. Borrowing from Banks:

During the period, the fund was a participant with other funds in the Fund Complex in a joint, syndicated, committed $850 million line of credit (the Syndicated Credit Facility), which matured on September 30, 2021. On September 30, 2021 the Syndicated Credit Facility was amended to run for a new 364 day period with the line of credit amount remaining unchanged, maturing on September 29, 2022. Under the terms of the Syndicated Credit Facility, in addition to the interest charged on any borrowings by the fund, the fund paid a commitment fee of 0.15% per annum on its proportionate share of the unused portion of the Syndicated Credit Facility.

During the period, the fund was a participant with other funds in the Fund Complex in a joint, unsecured, uncommitted $400 million line of credit (the Uncommitted Credit Facility), with State Street Bank and Trust Company, which matured on September 30, 2021. On September 30, 2021, the Uncommitted Credit Facility was amended to run for a new 364 day period with the line of credit amount remaining unchanged, maturing on September 29, 2022. Under the terms of the Uncommitted Credit Facility, the fund pays interest on the amount it borrows. There were no borrowings from either line of credit during the period.

The fund also has access to custodian overdraft facilities. The fund may have utilized the overdraft facility and incurred an interest expense, which is paid by the fund. The interest expense is determined based on a negotiated rate above the current Federal Funds Rate.

7. Purchases and Sales of Investment Securities:

For the period ended September 30, 2021, purchases and sales of securities (excluding short-term obligations) were as follows:

PURCHASES

OF SECURITIES | SALES

OF SECURITIES |

| $590,409,337 | $661,868,171 |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Financial Notes, unaudited (continued)

As of September 30, 2021, the tax basis cost of the fund’s investments and gross unrealized appreciation and depreciation were as follows:

| TAX COST | GROSS UNREALIZED

APPRECIATION | GROSS UNREALIZED

DEPRECIATION | NET UNREALIZED

APPRECIATION

(DEPRECIATION) |

| $1,608,284,165 | $1,686,279,987 | ($21,211,433) | $1,665,068,554 |

Capital loss carryforwards may be used to offset future realized capital gains for federal income tax purposes. As of March 31, 2021, the fund had no capital loss carryforwards.

The tax-basis components of distributions and components of distributable earnings on a tax basis are finalized at fiscal year-end; accordingly, tax basis balances have not been determined as of September 30, 2021. The tax-basis components of distributions paid during the fiscal year ended March 31, 2021, were as follows:

| Long-term capital gains | $151,866,592 |

As of March 31, 2021, management has reviewed the tax positions for open periods (for federal purposes, three years from the date of filing and for state purposes, four years from the date of filing) as applicable to the fund, and has determined that no provision for income tax is required in the fund’s financial statements. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the fiscal year ended March 31, 2021, the fund did not incur any interest or penalties.

9. Subsequent Events:

Management has determined there are no subsequent events or transactions through the date the financial statements were issued that would have materially impacted the financial statements as presented.

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Liquidity Risk Management Program (Unaudited)

The Fund has adopted and implemented a liquidity risk management program (the “program”) as required by Rule 22e-4 under the Investment Company Act of 1940, as amended. The Fund’s Board of Trustees (the “Board”) has designated the Fund’s investment adviser, Charles Schwab Investment Management, Inc. (“CSIM”) as the administrator of the program. Personnel of CSIM or its affiliates conduct the day-to-day operation of the program.

Under the program, CSIM manages a Fund’s liquidity risk, which is the risk that the Fund could not meet shareholder redemption requests without significant dilution of remaining shareholders’ interests in the Fund. The program is reasonably designed to assess and manage a Fund’s liquidity risk, taking into consideration the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its historical redemption history and shareholder concentrations; and its cash holdings and access to other funding sources, including the custodian overdraft facility and lines of credit. CSIM’s process of determining the degree of liquidity of each Fund’s investments is supported by third-party liquidity assessment vendors.

The Fund’s Board reviewed a report at its meeting held on September 20, 2021 prepared by CSIM regarding the operation and effectiveness of the program for the period June 1, 2020, through May 31, 2021, which included individual Fund liquidity metrics. No significant liquidity events impacting the Fund were noted in the report. In addition, CSIM provided its assessment that the program had been operating effectively in managing the Fund’s liquidity risk.

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Approval of Renewal of Investment Advisory and Sub-Advisory Agreements

The Investment Company Act of 1940, as amended (the 1940 Act), requires that the continuation of a fund’s investment advisory agreement must be specifically approved (1) by the vote of the trustees or by a vote of the shareholders of the fund, and (2) by the vote of a majority of the trustees who are not parties to the investment advisory agreements or “interested persons” of any party (the Independent Trustees), cast in person at a meeting called for the purpose of voting on such approval. In connection with such approvals, the fund’s trustees must request and evaluate, and the investment adviser is required to furnish, such information as may be reasonably necessary to evaluate the terms of the investment advisory agreements.

The Board of Trustees (the Board or the Trustees, as appropriate) calls and holds one or more meetings each year that are dedicated, in whole or in part, to considering whether to renew the investment advisory agreement between Laudus Trust (the Trust) and Charles Schwab Investment Management, Inc. (CSIM), and the subadvisory agreement between CSIM and BlackRock Investment Management LLC (BlackRock) (such investment advisory and sub-advisory agreements, collectively, the Agreements) with respect to Laudus U.S. Large Cap Growth Fund (the Fund) and to review certain other agreements pursuant to which CSIM provides investment advisory services to certain other registered investment companies. In preparation for the meeting(s), the Board requests and reviews a wide variety of materials provided by CSIM and BlackRock, including information about their affiliates, personnel, business goals and priorities, profitability, third-party oversight, corporate structure and operations. The Board also receives data provided by an independent provider of investment company data. This information is in addition to the detailed information about the Fund that the Board reviews during the course of each year, including information that relates to the Fund’s operations and performance, legal and compliance matters, risk management, portfolio turnover, and sales and marketing activity. In considering the renewal, the Independent Trustees receive advice from Independent Trustees’ legal counsel, including a memorandum regarding the responsibilities of trustees for the approval of investment advisory agreements. In addition, the Independent Trustees participate in question and answer sessions with representatives of CSIM and meet in executive session outside the presence of Fund management.

As part of the renewal process and ongoing oversight of the advisory and sub-advisory relationships, the Independent Trustees’ legal counsel, on behalf of the Independent Trustees, sends an information request letter to CSIM and CSIM sends an information request letter to BlackRock seeking certain relevant information. The responses by CSIM and BlackRock are provided to the Trustees in the Board materials for their

review prior to their meeting, and the Trustees are provided with the opportunity to request any additional materials.

The Board, including a majority of the Independent Trustees, considered information specifically relating to the continuance of the Agreements with respect to the Fund at meetings held on May 12, 2021 and June 8, 2021, and approved the renewal of the Agreements with respect to the Fund for an additional one-year term at the meeting on June 8, 2021 called for the purpose of voting on such approval.1

The Board’s approval of the continuance of the Agreements was based on consideration and evaluation of a variety of specific factors discussed at these meetings and at prior meetings, including:

| 1. | the nature, extent and quality of the services provided to the Fund under the Agreements, including the resources of CSIM and its affiliates, and BlackRock, dedicated to the Fund; |

| 2. | the Fund’s investment performance and how it compared to that of certain other comparable mutual funds and benchmark data; |

| 3. | the Fund’s expenses and how those expenses compared to those of certain other similar mutual funds; |

| 4. | the profitability of CSIM and its affiliates, including Charles Schwab & Co., Inc. (Schwab), with respect to the Fund, including both direct and indirect benefits accruing to CSIM and its affiliates, as well as the profitability of BlackRock; and |

| 5. | the extent to which economies of scale would be realized as the Fund grows and whether fee levels in the Agreements reflect those economies of scale for the benefit of Fund investors. |

Nature, Extent and Quality of Services. The Board considered the nature, extent and quality of the services provided by CSIM to the Fund and the resources of CSIM and its affiliates dedicated to the Fund. In this regard, the Trustees evaluated, among other things, CSIM’s experience, track record, compliance program, resources dedicated to hiring and retaining skilled personnel and specialized talent, and information security resources. The Trustees also considered information provided by CSIM and BlackRock relating to services and support provided with respect to the Fund’s portfolio management team, portfolio strategy, and internal investment guidelines, as well as trading infrastructure, liquidity management, product design and analysis, shareholder communications, securities valuation, fund accounting and custody, and vendor and risk oversight. The Trustees also considered investments CSIM has made in its infrastructure, including modernizing CSIM’s technology and use of data, increasing expertise in key areas, and improving

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

business continuity, cybersecurity, due diligence, risk management processes, and information security programs, which are designed to provide enhanced services to the Fund and its shareholders. The Trustees considered CSIM’s effective implementation of its business continuity plan in response to the COVID-19 pandemic and government-mandated restrictions during the prior year. The Trustees also considered Schwab’s reputation in connection with the OneSource mutual fund offering and its overall financial condition. The Board also considered the nature, extent and quality of the sub-advisory services provided by BlackRock to the Fund and the resources it dedicates to the Fund. Following such evaluation, the Board concluded, within the context of its full deliberations, that the nature, extent and quality of services provided by CSIM and BlackRock to the Fund and the resources of CSIM and its affiliates including the ability of Schwab and BlackRock to maintain consistent operations and service levels during recent periods of remote work and market volatility and the resources of BlackRock dedicated to the Fund supported renewal of the Agreements.

Fund Performance. The Board considered the Fund’s performance in determining whether to renew the Agreements with respect to the Fund. Specifically, the Trustees considered the Fund’s performance relative to a peer category of other mutual funds and an applicable index/benchmark, in light of portfolio yield and market trends, as well as in consideration of the Fund’s investment style and strategy attributes and disclosures. As part of this review, the Trustees considered the composition of the peer category, selection criteria and the reputation of the independent provider of investment company data who prepared the peer category analysis. In evaluating the performance of the Fund, the Trustees considered the risk profile for the Fund and the appropriateness of the benchmark used to compare the performance of the Fund. The Trustees further considered the level of Fund performance in the context of their review of Fund expenses and adviser profitability discussed below and also noted that the Board and a designated committee of the Board review performance throughout the year. Following such evaluation, the Board concluded, within the context of its full deliberations, that the performance of the Fund supported renewal of the Agreements with respect to the Fund.

Fund Expenses. With respect to the Fund’s expenses, the Trustees considered the rate of compensation called for by the Agreements and the Fund’s net operating expense ratio, in each case, in comparison to those of other similar mutual funds, such peer category and comparison having been selected and calculated by an independent provider of investment company data. CSIM reported to the Board, and the Board took into account, the risk assumed by CSIM in the development of the Fund and provision of services as well as the competitive marketplace for financial products. The Trustees considered the effects of CSIM’s contractual waivers of management and other fees to prevent total Fund expenses from exceeding a specified cap. The Trustees also considered

fees charged by CSIM and BlackRock to other mutual funds and to other types of accounts, but, with respect to such other types of accounts, accorded less weight to such comparisons due to the different legal, regulatory, compliance and operating features of mutual funds as compared to these other types of accounts and any differences in the nature and scope of the services CSIM provides to these other accounts, as well as differences in the market for these types of accounts. Following such evaluation, the Board concluded, within the context of its full deliberations, that the expenses of the Fund are reasonable and supported renewal of the Agreements with respect to the Fund.

Profitability. With regard to profitability, the Trustees considered the compensation flowing to CSIM and its affiliates, directly or indirectly and the compensation flowing to BlackRock, directly or indirectly. In this connection, the Trustees reviewed management’s profitability analyses. The Trustees also reviewed profitability of CSIM relating to the Schwab fund complex as a whole, noting the benefits to Fund shareholders of being part of the Schwab fund complex, including the allocations of certain fixed costs across the Fund and other funds in the complex. The Trustees also considered any other benefits derived by CSIM and BlackRock from their relationships with the Fund, such as whether, by virtue of their management of the Fund, CSIM or BlackRock obtains investment information or other research resources that aid it in providing advisory services to other clients. With respect to CSIM and BlackRock, and their respective affiliates, the Trustees considered whether the varied levels of compensation and profitability with respect to the Fund under the Agreements and other service agreements were reasonable and justified in light of the quality of all services rendered to the Fund by CSIM and BlackRock and their respective affiliates. The Trustees noted that CSIM continues to invest substantial sums in its business in order to provide enhanced services and systems to benefit the Fund. With respect to the profitability of BlackRock, the Board also considered that BlackRock is compensated by CSIM and not by the Fund directly, and such compensation reflects an arms-length negotiation between CSIM and BlackRock. Based on this evaluation, the Board concluded, within the context of its full deliberations, that the profitability of CSIM and BlackRock is reasonable and supported renewal of the Agreements with respect to the Fund.

Economies of Scale. Although the Trustees recognized the difficulty of determining economies of scale with precision, the Trustees considered the potential existence of any economies of scale and whether those are passed along to the Fund’s shareholders through (i) the enhancement of services provided to the Fund in return for fees paid, including through investments by CSIM in CSIM’s infrastructure, including modernizing CSIM’s technology and use of data, increasing expertise and capabilities in key areas, and improving business continuity, cybersecurity, due diligence and information security programs, which are designed to provide enhanced

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

services to the Fund and its shareholders; (ii) graduated investment advisory fee schedules or unitary fee structures, fee waivers, or expense caps by CSIM and its affiliates for those funds with such features; and (iii) pricing a fund to scale and keeping overall expenses down as the fund grows. The Trustees acknowledged that CSIM has shared any economies of scale with the Fund by investing in CSIM’s infrastructure, as discussed above, over time and that CSIM’s internal costs of providing investment management, technology, administrative, legal and compliance services to the Fund continue to increase as a result of regulatory or other developments. The Trustees considered that CSIM and its affiliates have previously committed resources to minimize the effects on shareholders of diseconomies of scale during periods when Fund assets were relatively small through contractual expense waivers. For example, such diseconomies of scale may particularly affect newer funds or funds with investment strategies that are from time to time out of favor, but shareholders may benefit from the continued availability of such funds at subsidized expense

levels. The Trustees also considered the existing contractual investment advisory fee schedule for the Fund that includes lower fees at higher graduated asset levels. Based on this evaluation, the Board concluded, within the context of its full deliberations, that the Fund obtains reasonable benefits from economies of scale.

In the course of their deliberations, the Trustees may have accorded different weights to various factors and did not identify any particular information or factor that was all important or controlling. Based on the Trustees’ deliberation and their evaluation of the information described above, the Board, including all of the Independent Trustees, approved the continuation of the Agreements with respect to the Fund and concluded that the compensation under the Agreements with respect to the Fund is fair and reasonable in light of the services provided and the related expenses borne by CSIM and its affiliates and such other matters as the Trustees considered to be relevant in the exercise of their reasonable judgment.

| 1 | The meeting on June 8, 2021 was held by means of videoconference in reliance on exemptive relief from the in-person voting requirement under the 1940 Act as provided by the Securities and Exchange Commission. |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

Trustees and Officers

The tables below give information about the trustees and officers of Laudus Trust, which includes the fund covered in this report. The “Fund Complex” includes The Charles Schwab Family of Funds, Schwab Capital Trust, Schwab Investments, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust. The Fund Complex includes 103 funds.

The address for all trustees and officers is 211 Main Street, San Francisco, CA 94105. You can find more information about the trustees and officers in the Statement of Additional Information, which is available free by calling 1-877-824-5615.

| Independent Trustees |

Name, Year of Birth, and

Position(s) with the trust

(Terms of office, and

length of Time Served1) | Principal Occupations

During the Past Five Years | Number of

Portfolios in

Fund Complex

Overseen by

the Trustee | Other Directorships |

Robert W. Burns

1959

Trustee

(Trustee of Schwab Strategic Trust since 2009; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2016) | Retired/Private Investor (Jan. 2009 – present). Formerly, Managing Director, Pacific Investment Management Company, LLC (PIMCO) (investment management firm) and President, PIMCO Funds. | 103 | None |

John F. Cogan

1947

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2008; Laudus Trust since 2010; Schwab Strategic Trust since 2016) | Senior Fellow (Oct. 1979 – present), The Hoover Institution at Stanford University (public policy think tank); Senior Fellow (2000 – present), Stanford Institute for Economic Policy Research; Professor of Public Policy (1994 – 2015), Stanford University. | 103 | Director (2005 – 2020), Gilead Sciences, Inc. |

Nancy F. Heller

1956

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2018) | Retired. President and Chairman (2014 – 2016), TIAA Charitable (financial services); Senior Managing Director (2003 – 2016), TIAA (financial services). | 103 | None |

David L. Mahoney

1954

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) | Private Investor. | 103 | Director (2004 – present), Corcept Therapeutics Incorporated

Director (2009 – present), Adamas Pharmaceuticals, Inc.

Director (2003 – 2019), Symantec Corporation |

Jane P. Moncreiff

1961

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2019) | Consultant (2018 – present), Fulham Advisers LLC (management consulting); Chief Investment Officer (2009 – 2017), CareGroup Healthcare System, Inc. (healthcare). | 103 | None |

Laudus U.S. Large Cap Growth Fund | Semiannual Report

Laudus U.S. Large Cap Growth Fund

| Independent Trustees (continued) |

Name, Year of Birth, and

Position(s) with the trust

(Terms of office, and

length of Time Served1) | Principal Occupations

During the Past Five Years | Number of

Portfolios in

Fund Complex

Overseen by

the Trustee | Other Directorships |

Kiran M. Patel

1948

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) | Retired. Executive Vice President and General Manager of Small Business Group (Dec. 2008 – Sept. 2013), Intuit, Inc. (financial software and services firm for consumers and small businesses). | 103 | Director (2008 – present), KLA-Tencor Corporation |

Kimberly S. Patmore

1956

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2016) | Consultant (2008 – present), Patmore Management Consulting (management consulting). | 103 | None |

J. Derek Penn

1957

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2021) | Head of Equity Sales and Trading (2006 – 2018), BNY Mellon (financial services). | 103 | None |

| Interested Trustees |

Name, Year of Birth, and

Position(s) with the trust

(Terms of office, and

length of Time Served1) | Principal Occupations